- Management Department, BINUS Business School Doctor of Research in Management, Bina Nusantara University, Jakarta, Indonesia

The present study focuses on stakeholder pressures and the green dynamic capabilities of achieving green innovation and financial performance in various sectors in Indonesia. Data were collected from 120 top management representing their companies involved in this study, and path analysis was applied to test the hypothesis. The study results reveal that stakeholder pressures strengthen organizational green dynamic capabilities and innovation. Moreover, the study finds that stakeholder pressures significantly and positively predict green innovation through green dynamic capabilities and corporate financial performance through sequential mediation involving both green dynamic capabilities and green innovation. This study underscores the significance of green initiatives across various sectors, positioning them as essential components of corporate strategy in the modern business landscape.

1 Introduction

Over the past decade, there has been a notable increase in scholarly and professional attention toward environmental safety, which aligns closely with the Sustainable Development Goals (SDGs) established by the United Nations (Nilsson et al., 2016). This campaign emphasizes organizations’ need to adopt sustainable practices that meet regulatory requirements and address broader societal expectations regarding environmental stewardship. The green environment campaign began to be considered important by companies in their operational and management activities as a step to contribute to the campaign to promote environmental quality improvement. Similarly, consumers increasingly value sustainability and green practices such as energy efficiency, waste reduction, and environmental management systems, which can significantly enhance a company’s market share and customer loyalty (Alkhodary, 2023). Hence, environmentally oriented in business practices are considered a strategic tool to achieve a higher financial performance and competitive advantage (Al-Qudah et al., 2022; Chen et al., 2006; Qiu et al., 2020; Shuwaikh et al., 2023).

Prior researchers have agreed that green innovation has a primary focus on mitigating environmental pollution and reducing conserving natural resources, which have an impact on environmental damage (Wang, 2011). This action promotes sustainable development by ensuring that economic activities have as little environmental impact as possible. Green innovation can further open up new markets for ecofriendly products (Shuwaikh et al., 2023), while reducing waste and energy consumption costs. Various governments also support campaigns for green innovation implementations by tightening all environmental regulations and sanctioning companies that violate regulations (Doran et al., 2023). In addition to pressure from the government, companies face pressure from consumers who are increasingly aware and want environmentally friendly products (Melander, 2018). Hence, companies are faced with external (i.e., environmental regulations, market pressures, and societal expectations) and internal (i.e., organizational characteristics, such as a commitment to sustainability, human, financial, and technological capital) pressures to adopt green innovations (Domadenik et al., 2020; Li M. et al., 2022; Thi Ngoc Thuyen and Nhu Bich, 2024).

The present study aims to explain the performance of green innovation through stakeholder pressure and dynamic green capability and how green innovation affects financial performance. First, several studies have been conducted on stakeholder pressures and green innovation relationship (Baah et al., 2021; Li et al., 2017; Ma and Chen, 2025; Sahoo, 2024; Singh et al., 2022; Wang et al., 2022). However, considering the novelty of the green innovation issue, most of the research is still concentrated in specific regions, such as China, India, Malaysia, and Ghana, which may limit the generalizability of findings to other regions (Baah et al., 2021; Ma and Chen, 2025; Sahoo, 2024; Wang et al., 2022). Moreover, most prior studies focus on manufacturing sectors, potentially overlooking insights from other industries (Ma and Chen, 2025; Sahoo, 2024; Singh et al., 2022). In other words, more empirical studies are needed to validate the current findings, particularly in diverse geographical and industrial contexts (Adnan et al., 2025). Thus, this study aims to bridge this literature gap by taking various sectors (i.e., manufacturing, finance and insurance, general trading and maintenance, and health service) in Indonesia to expand cross-sector generalization. Furthermore, the current study extends the research of Wang et al. (2022), who took two sectors (e.g., manufacturing and service) and firm size as control variables. The present study covers more sectors and uses firm size and entity (local and foreign corporates) as control variables to study green innovation and financial performance in the context of stakeholder pressures and green dynamic capabilities. Therefore, it provides a more comprehensive explanation and robust results on the relationship between variables.

Second, the present study addresses a literature gap regarding the ambiguous relationship between stakeholder pressures, green innovation, and financial performance. For instance, several studies indicate that green innovation can improve firm performance by enhancing reputation and environmental performance, ultimately leading to financial benefits (Baah et al., 2021; Ha and Nguyen, 2022; Liu L. et al., 2024; Liu M. et al., 2024; Singh et al., 2022). In contrast, other studies have revealed a negative relationship between green innovation and financial performance, where implementing green innovation requires significant technological investments, which can strain financial resources, increase operational risk, and negatively impact short-term financial performance (Ai et al., 2024; Casciello et al., 2024; Khan et al., 2021; Xie et al., 2022). Another study categorized two types of green innovations that improve environmental performance, but their impact on financial performance varies. Substantive green innovation significantly improves financial performance, while strategic green innovation has the opposite effect (Liu L. et al., 2024; Liu M. et al., 2024). Moreover, a meta-analysis reveals that the link between green innovation and financial performance is more dominant in fast-paced, close-to-consumer industries and countries with low corruption (Yi et al., 2023). Hence, the current study contributes to resolving inconsistencies in the existing literature and provides valuable insights for practitioners to navigate the multifaceted challenges of financial performance in their green strategies.

In short, this study seeks to investigate (1) the direct relationship between stakeholder pressures and both green dynamic capabilities and green innovation, (2) the indirect relationship between stakeholder pressures and green innovation mediated by green dynamic capabilities, and (3) the indirect relationship between stakeholder pressures and financial performance through a sequential mediation model that includes green dynamic capabilities and green innovation. In general, the results of this study provide a more comprehensive explanation of how stakeholder pressure can influence green dynamic capability and green innovation in organizations, as well as its impact on financial performance, especially in Indonesia.

2 Literature review and hypothesis development

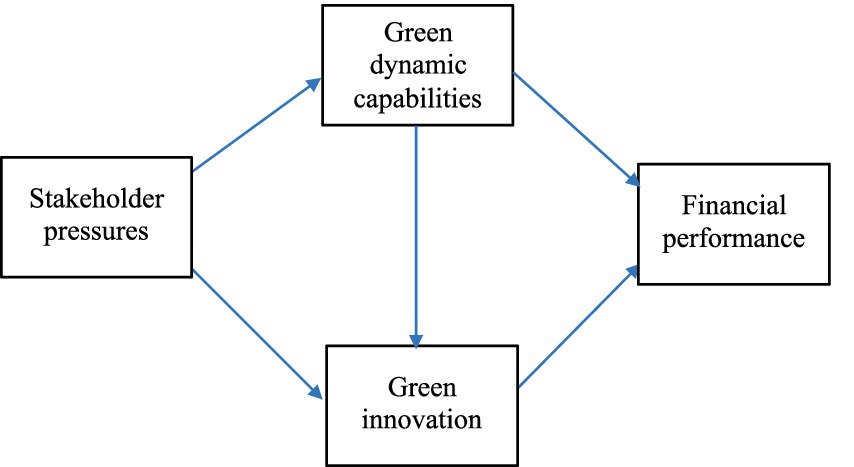

This study uses two theories to explain the proposed model (Figure 1). First, institutional theory (Meyer and Rowan, 1977) elucidates how external pressures drive corporate sustainability practices. Formal institutions, through green financial policies and regulatory frameworks, create normative and coercive pressures that incentivize firms to improve their financial performance (Lei and Yu, 2024; Wang and Xu, 2025). This institutional perspective highlights how macro-level actors and policies shape organizational behavior toward sustainability. Complementing institutional theory, the Resource Based View (RBV) (Barney, 1991) emphasizes internal firm-specific factors that enable green implementation. Firms that strategically allocate resources toward ESG practices mitigate financing constraints and build unique capabilities in green technologies (Li and Li, 2025; Mohy-ud-Din, 2024). From clean production processes to sustainable supply chain management, these capabilities become valuable, rare, and imperfectly imitable resources that confer long-term competitive advantage (Barney, 1991). RBV thus explains heterogeneity in green innovation adoption, as firms with superior resource management can transform sustainability investments into market differentiation. These theories provide a multi-level framework: Institutional Theory explains why firms pursue green implementation (external legitimacy, stakeholder pressure). In contrast, RBV explains how they successfully implement it (internal capabilities: green dynamic capability and green innovation). This synergy is critical for understanding how policy interventions (e.g., green subsidies) and firm-level resource mobilization jointly advance corporate sustainability transitions.

2.1 Stakeholder pressure

Stakeholder pressure encompasses the multifaceted influences exerted by diverse internal and external groups with vested interests in organizational conduct and outcomes, including employees, management, customers, suppliers, regulators, and communities (Mungai et al., 2023; Wang et al., 2020). These pressures manifest through four primary channels: (1) internal pressure from organizational members, particularly leadership and staff, which drives environmental strategy formulation and implementation; (2) coercive pressure imposed by regulatory bodies through legislation, penalties, and compliance mandates (Wang et al., 2020); (3) market pressure from competitive forces, supply chain partners, and consumer demands that shape strategic positioning (Mousavi and Mousavi, 2023); and (4) social pressure from civil society, media, and public sentiment, which increasingly influences corporate reputation and legitimacy (Wang et al., 2020). Collectively, these pressures create an institutional ecosystem that compels organizations to adopt sustainable practices while balancing competing stakeholder expectations.

2.2 Green dynamic capabilities

Green dynamic capabilities represent an organization’s strategic capacity to systematically integrate, reconfigure, and upgrade internal and external resources to address environmental sustainability challenges (Teece, 2007, 2014). These meta-capabilities serve as critical drivers for green innovation and sustainable performance enhancement across industries, manifesting through three interdependent dimensions: (1) resource integration - the strategic combination and deployment of green assets and stakeholder knowledge (Abbas, 2024; Li, 2022); (2) environmental insight - the ability to anticipate and adapt to ecological trends, regulatory changes, and sustainability market signals (Abbas, 2024; Li, 2022); and (3) organizational learning - the mechanisms for absorbing, recombining, and applying green knowledge to foster continuous eco-innovation (Amaranti et al., 2019). These components enable firms to transform environmental constraints into sustainable competitive advantages while maintaining dynamic alignment with evolving ecological demands.

2.3 Green innovation

The foundations of green innovation emerged alongside the late 20th-century concept of sustainable development, initially focusing on technologies to reduce environmental impact and improve resource efficiency (Tambovceva et al., 2019; Xu et al., 2019). Early terminology, such as “eco-innovation” and “environmental innovation,” highlighted different aspects of this movement. However, these terms gradually converged under the broader umbrella of green innovation, encompassing products, processes, and societal awareness (Liu and Ho, 2018; Martínez-Falcó et al., 2024). Green Innovation encompasses developing and implementing environmentally sustainable solutions across products, processes, services, and systems. Synthesizing existing definitions, green innovation is a strategic organizational effort to harmonize economic objectives with ecological and social sustainability (Marco-Lajara et al., 2023; Martínez-Falcó et al., 2024).

The literature converges on three core dimensions of green innovation: (1) product-oriented innovation, which focuses on designing goods with reduced environmental footprints (Thomas et al., 2022); (2) process-oriented innovation, involving cleaner production methods that enhance resource efficiency and minimize pollution (Xu et al., 2019); and (3) systemic innovation, which integrates ecological principles into broader business models and value chains to drive sustainable development (Xu et al., 2019). Collectively, these dimensions aim to address pressing environmental challenges while maintaining competitiveness. A unifying theme across studies is the emphasis on intergenerational equity—green innovation seeks to mitigate immediate environmental harm and ensure long-term wellbeing by preserving natural resources for future societies (Gugissa et al., 2021). Hence, green innovation is viewed as a multidimensional construct that bridges technical advancements, organizational strategies, and societal benefits.

Despite its transformative potential, the innovation adoption process has historically been protracted, marked by multi-stage development and gradual market penetration. For example, technological milestones—from Edison’s light bulb to digital cameras—illustrate that innovations universally progress through iterative phases (e.g., conceptualization, gestation, and incubation) before achieving commercial viability (Graßhoff, 2021; Namatame et al., 2009). Furthermore, the impact of innovation sometimes takes time to manifest. It may have undesirable effects, especially in the context of technological innovation (Warburton, 2021). Copying and disseminating existing technologies proved more viable than creating new ones, making diffusion the cornerstone of successful technical advances (Warburton, 2021). Moreover, successful innovation requires striking a balance between technical advancement and market acceptance, necessitating iterative design adjustments (Graßhoff, 2021). In the same vein, market validation is highly time-sensitive, as seen in the volatile financial performance of green technologies (Desalegn and Tangl, 2022). For example, a study reports that the impact of green innovation on financial performance can vary over time; a positive and significant impact was only found in the short run, but an insignificant effect was observed in the long run (Desalegn and Tangl, 2022). Similarly, proactive green product innovation improves long-term financial performance but does not improve short-term performance (Qing et al., 2022). Another study employing a longitudinal design found that an excessive focus on green innovation hurts accounting and stock market performance (Przychodzen et al., 2020).

Furthermore, a critical barrier is the resource and capability gap—transitioning to sustainable practices often demands new competencies, technologies, and infrastructure that diverge from existing organizational capabilities (Calza et al., 2017). This challenge is exacerbated in developing countries, where supplier firms struggle with inadequate technological, financial, and institutional support, alongside pressure from buyer firms to adopt green strategy (Khattak, 2019). Financial and economic constraints further hinder green strategy adoption. High upfront costs and unpredictable returns discourage organizations, tiny and medium-sized enterprises (SMEs) with limited financial resources (Grant and Marshburn, 2014; Khan et al., 2023; Wang et al., 2023). The issue is intensified by insufficient dedication from management, as limited support from senior leaders obstructs strategic alignment and employee involvement, both essential for successful green implementation (Jóhannsdóttir et al., 2015; Khan et al., 2023). Finally, technological inadequacies pose a persistent obstacle. Many firms lack the infrastructure or expertise to develop or integrate green solutions, creating a reliance on external knowledge partners—a dependency that may not be feasible for all organizations (Calza et al., 2017; Khan et al., 2023).

2.4 The relationship between stakeholder pressure and green dynamic capabilities

Green dynamic capability refers to a firm’s ability to integrate, build, and reconfigure internal and external resources to address environmental sustainability challenges. This capability enables firms to adapt their business processes and innovate in response to environmental issues, thereby contributing to sustainable development and competitive advantage (Borah et al., 2025; Li, 2022; Singh et al., 2022). On the other hand, stakeholder pressures, including those from customers, competitors, regulations from the government, and the general public, can play an important role in forming a company’s dynamic capabilities as an adaptive response from a company. The impact of stakeholder pressures on green dynamic capabilities can be explained based on several reasons: First, stakeholder pressures can directly influence the development of green dynamic capabilities by compelling firms to integrate environmental considerations into their strategies and operations (Huang et al., 2024; Sahoo, 2024; Singh et al., 2022; Yu and Ramanathan, 2015). Second, government regulations can enforce stricter environmental standards, prompting firms to enhance their green dynamic capabilities (Ma and Chen, 2025; Zhang and Zhu, 2019). Third, stakeholder pressures in the context of consumer demand for sustainable products drive firms to innovate and improve their green practices (Cheng et al., 2025; Huang et al., 2024). Hence, stakeholder pressure is a key factor in forming green dynamic capability. The hypothesis proposed is:

H1: Stakeholder pressures positively related to green dynamic capabilities

2.5 The relationship between stakeholder pressure and green innovation

The following hypothesis proposed is that stakeholder pressure significantly influences green innovation. Firms adopt green technologies primarily for cost savings, competitive advantage (ecoefficiency/effectiveness), and environmental responsibility. Early adopters often achieve favourable outcomes, creating peer pressure for industry-wide adoption (Ashton et al., 2017; Molla and Abareshi, 2012). At the same time, pollution prevention investments can enhance both ecological and financial performance (Molla and Abareshi, 2012). Governments play a dual role: enforcing regulations (e.g., carbon emission limits) and incentivising adoption through subsidies, particularly for small and medium-sized enterprises (SMEs), as part of national green growth strategies (Lee et al., 2015; Priyan, 2023). Simultaneously, consumer demand for sustainable products, including a willingness to pay premiums for green buildings, pushes firms toward eco-innovation (Chatterjee and Sur, 2025; Li T. et al., 2022). In sum, these drivers, including economic, regulatory, and market-based, create a synergistic ecosystem to align preferences and encourage firms to enhance the adoption of green technologies. Additionally, it is anticipated that in contexts such as China, green competition will emerge as the most influential factor driving green innovation practices, outpacing formal institutions, informal institutions, and customer green demands as motivating forces for firms to engage in sustainable practices (Adomako et al., 2023; Chen and Liang, 2023; Kawai et al., 2018; Sahoo, 2024; Zewen et al., 2017). The hypothesis proposed is:

H2: Stakeholder pressures positively related to green innovation

2.6 The relationship between green dynamic capabilities and green innovation

Green innovation involves creating and applying products, processes, and practices designed to reduce environmental harm and foster sustainability substantially. This strategy can manifest as developing new or enhanced eco-friendly products to decrease plastic consumption (Borah et al., 2025; Qiu et al., 2020) and developing new methods or improving existing processes to minimize environmental harm (Martínez-Falcó et al., 2024; Yuan and Cao, 2022). Green innovation can also use advancing technologies that align with ecological principles (e.g., using non-fossil fuels) and sustainable development (Wang, 2011; Xu et al., 2019). According to the dynamic capabilities theory (Teece, 2014), businesses need to cultivate their abilities to identify potential opportunities and threats, capitalize on these opportunities, and sustain their competitive edge by reorganizing their resources effectively (Fan et al., 2024; Guo, 2023; Li, 2022). Empirical studies indicate that firms with strong green dynamic capabilities—skills that enable them to detect and capitalize on environmental opportunities—are more effective in pursuing green innovation in process and product. These capabilities allow organizations to adapt to various external demands that are increasingly aware of environmental conditions and then integrate sustainability into their strategies to continue to innovate. Hence, leveraging green dynamic capabilities is key to fostering successful green innovation initiatives (Borah et al., 2025; Yu et al., 2022; Yuan and Cao, 2022). In other words, firms with strong green dynamic capabilities are more likely to successfully develop environmentally friendly products and optimize their processes for sustainability; thus, the hypothesis proposed is:

H3: Green dynamic capabilities are positively associated with green innovation.

2.7 The role of green dynamic capabilities as mediator

Green dynamic capabilities are the firm’s abilities to absorb, adapt, integrate, build, and reconfigure internal and external competencies to address rapidly changing environments, particularly in the context of environmental sustainability (Arshad et al., 2023; Huang et al., 2024; Lin and Su, 2024; Singh et al., 2022). These capabilities enable firms to innovate in environmentally friendly ways, such as developing green products or processes (Huang et al., 2024; Singh et al., 2022). The direct relationship between stakeholder pressures and green dynamic capabilities (Huang et al., 2024; Lin and Su, 2024; Singh et al., 2022) is also confirmed indirectly through green dynamic capabilities. Thus, the pressures from stakeholders lead to the development of green dynamic capabilities, which then facilitate green innovation (Huang et al., 2024; Lin and Su, 2024; Singh et al., 2022; Yuan and Cao, 2022).

H4: Green dynamic capabilities mediates the link between stakeholder pressures and green innovation.

2.8 Stakeholder pressures on financial performance

The study posits that green dynamic capability and innovation sequentially mediate the relationship between stakeholder pressures and firm performance, suggesting that stakeholder pressures lead to enhancements in green dynamic capabilities, which in turn foster green innovation, ultimately resulting in improved firm performance overall (Huang et al., 2024; Singh et al., 2022). First, stakeholder pressures enhance green dynamic capabilities (Huang et al., 2024; Sahoo, 2024; Singh et al., 2022). Moreover, dynamic capabilities facilitate green innovation (Ma and Chen, 2025; Sahoo, 2024; Singh et al., 2022). Green innovation offers numerous benefits, such as cost savings from more efficient resource utilization, improved operational efficiency that minimizes waste, and increased competitiveness by addressing consumer demand for sustainable practices. These advantages can significantly enhance a firm’s overall performance and profitability (Huang et al., 2024; Ma and Chen, 2025; Singh et al., 2022). Hence, stakeholder pressures indirectly affect financial performance by enhancing green dynamic capabilities and innovation, which improves financial performance (see Figure 1).

H5: Stakeholder pressures indirectly influence financial performance through the sequential mechanisms of green dynamic capabilities and green innovation.

3 Materials and methods

3.1 Sample and data collection procedure

The target sample in this study was top management from various companies in Indonesia, which was determined based on a purposive approach. The doctoral program of Bina Nusantara University supervised this study, and the internal ethics committee approved the research. First, more than 300 companies were contacted by the researcher to be involved voluntarily as respondents. After receiving a positive response, 120 questionnaires were sent via email. All respondents were involved voluntarily and were not compensated. Data was collected for 3 months, from June 2023 to August 2023.

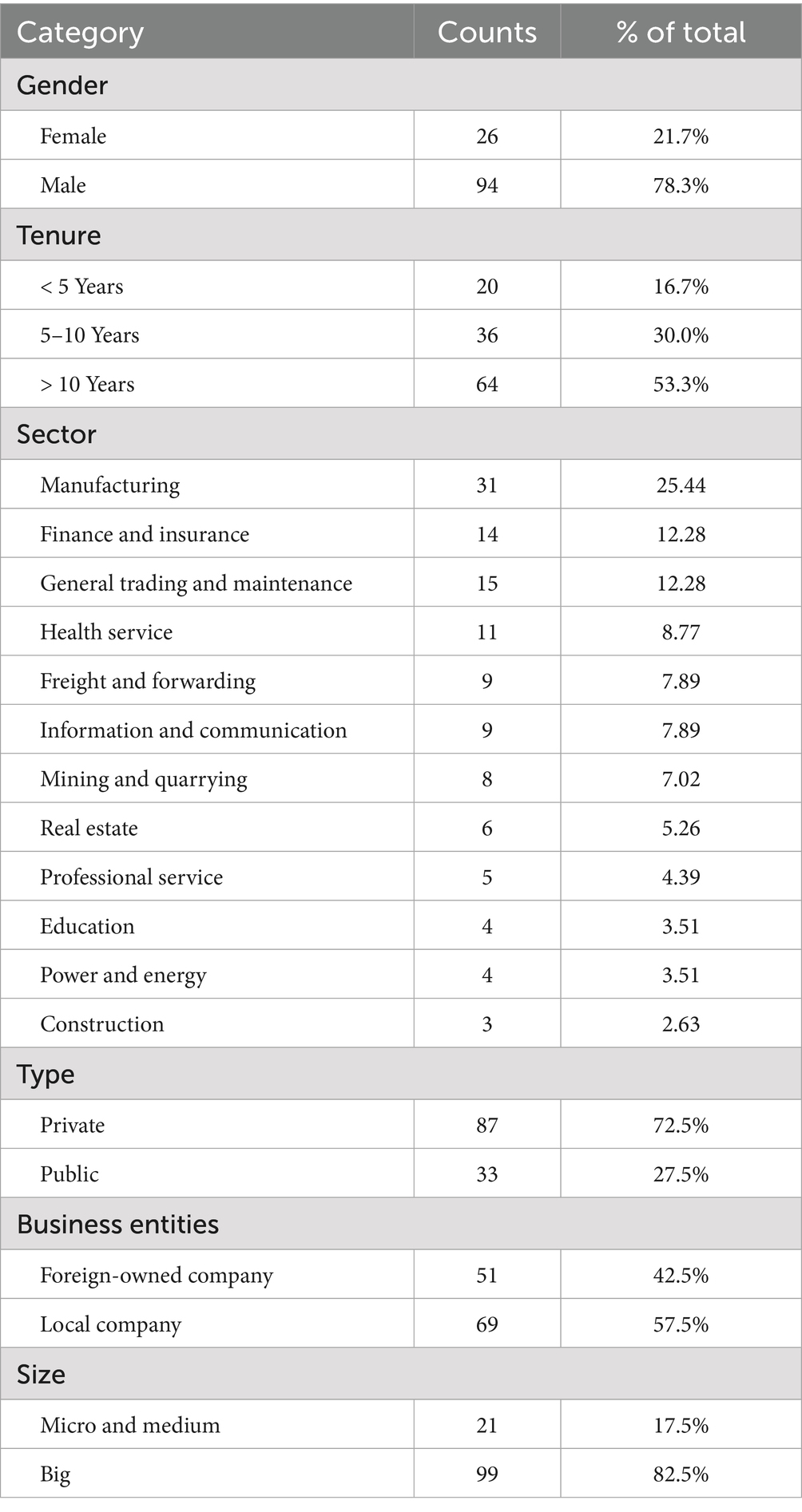

After checking the completeness of the data, all data were used for further analysis. Of the 120 top management people representing their companies, 78.3 percent were male, and the majority of respondents (53.3%) had more than 10 years of service. Based on company type, 72.5% were private, and 27.5% were public. The sectoral distribution highlights the dominance of the manufacturing sector (25.44%), followed by finance and insurance (12.28%), general trading and maintenance (12.28%), health service (8.77%), Freight and Forwarding (7.89%), information and communication (7.89%%), and Mining and Quarrying (7.02%). The remaining real estate, professional service, education, power and energy, and construction companies comprise 2.6–5.26% of the total sample. More than half (57.5%) of the companies were local, and 57.5% were foreign-owned. Finally, the size of the companies in the large category was 82.2, and 17.5% of the companies were in the medium category (see Table 1).

3.2 Measurement

This research employs a modified scale from previous studies with several adjustments based on content validity and assessment from panel experts, including three professors and four doctors in the finance and strategic management field. First, stakeholder pressures consist of six items to measure the pressures faced by companies from government, competitors, and customers (Helmig et al., 2016; Pratama et al., 2023; Sun et al., 2025). Cronbach’s alpha of 0.88 indicates that this scale has met the cut-off value 0.70 (Nunnally and Bernstein, 1994).

Second, green dynamic capability is measured based on three items, including acquired new technologies, upgraded current technologies that are environmentally friendly, the ability to understand and foresee environmental trends and challenges, and the ability to absorb and integrate green knowledge (Borah et al., 2025; Li, 2022). The Cronbach’s alpha of 0.756 indicates that this scale has met adequate internal consistency.

Third, green innovation is measured using four items that lead to technological innovation activity that adheres to the eco-economic development requirements, including acquiring more efficient materials, reducing waste generation, energy-efficient products, and implementing a waste recycling program. Cronbach alpha for green innovation is 0.775. Finally, financial performance is assessed using return on assets (ROA) (Zheng et al., 2022). Except for ROA, all items were measured with 5-point Likert-type items, where respondents were asked to provide a rating: 1 = very low/strongly disagree to 5 = very high/strongly agree.

Control variables: this study uses three control variables: firm size, entities, and type. Firm size is coded as medium (1) and large (2) based on total assets, where companies stated as medium have assets of 10 billion IDR or less and large assets category have assets of more than 10 billion IDR. Next, business entities are categorized into 1 = local and 2 = foreign. Firm type is categorized into two: 1 = private, 2 = public.

3.3 Data analysis

This study employed process procedures using Smart PLS software to assess the direct and indirect relationships among variables. Data analysis includes control variables to adjust for confounding effects and ensure the independent variable’s estimated effect is unbiased (Mehta, 2015; Wysocki et al., 2022). Additionally, the data from this study was analyzed with and without control variables to identify possible concerns such as p-hacking and the robustness of the findings (Sturman et al., 2022). Next, bootstrapping analysis was applied to verify the confidence interval and the accuracy of the path estimates.

4 Results

4.1 Descriptive statistics and correlation

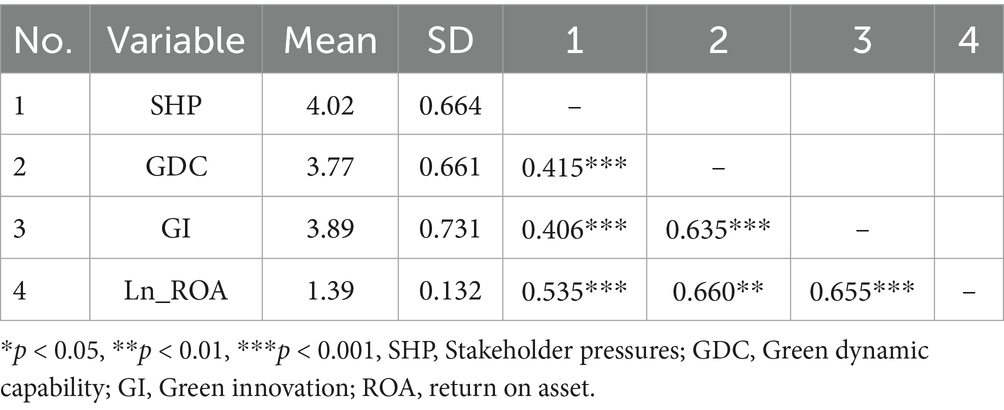

Table 2 presents the descriptive statistics and correlations between variables. The mean of stakeholder pressures is 4.02 (SD = 0.664), green dynamic capability has a mean of 3.77 (SD = 0.661), green innovation (mean = 3.89, SD = 0.731), and ROA has a mean of 1.39 (SD = 0.132). Next, Table 2 also shows a significant positive correlation between stakeholder pressures and green dynamic capability of r = 0.415 (p < 0.001), green innovation (r = 0.406, p < 0.05), and ROA (r = 0.535, p < 0.001). Return on assets also exhibits strong positive correlations with stakeholder pressures (r = 0.535, p < 0.001), green dynamic capability (r = 0.660, p < 0.05), and green innovation at r = 0.655 (p < 0.001). These findings demonstrate a significant relationship between stakeholder pressures, green dynamic capabilities, green innovation, and financial performance, as assessed by ROA.

4.2 Hypothesis testing

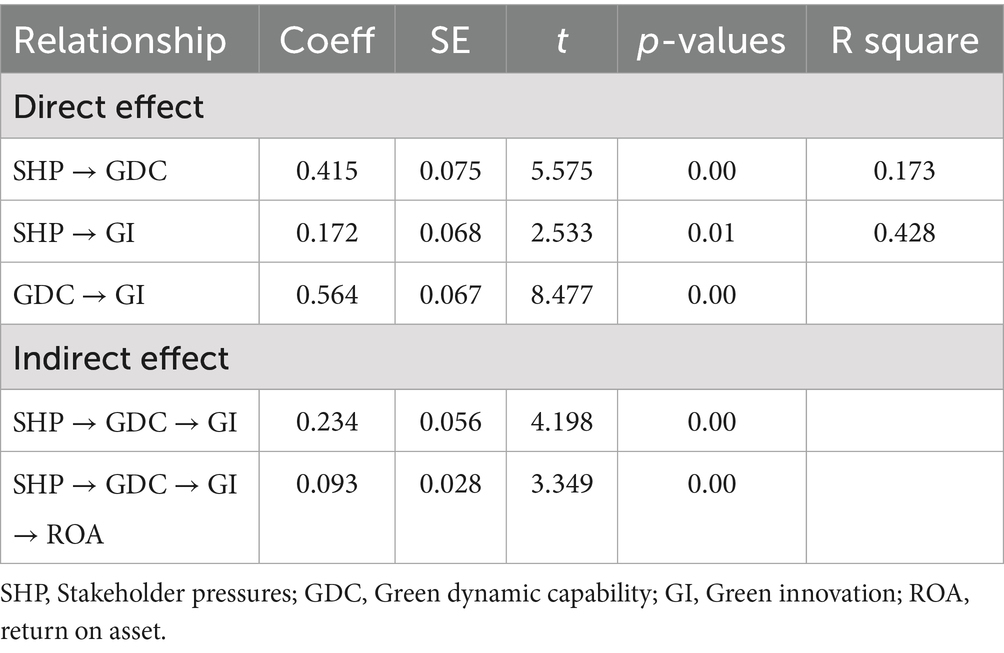

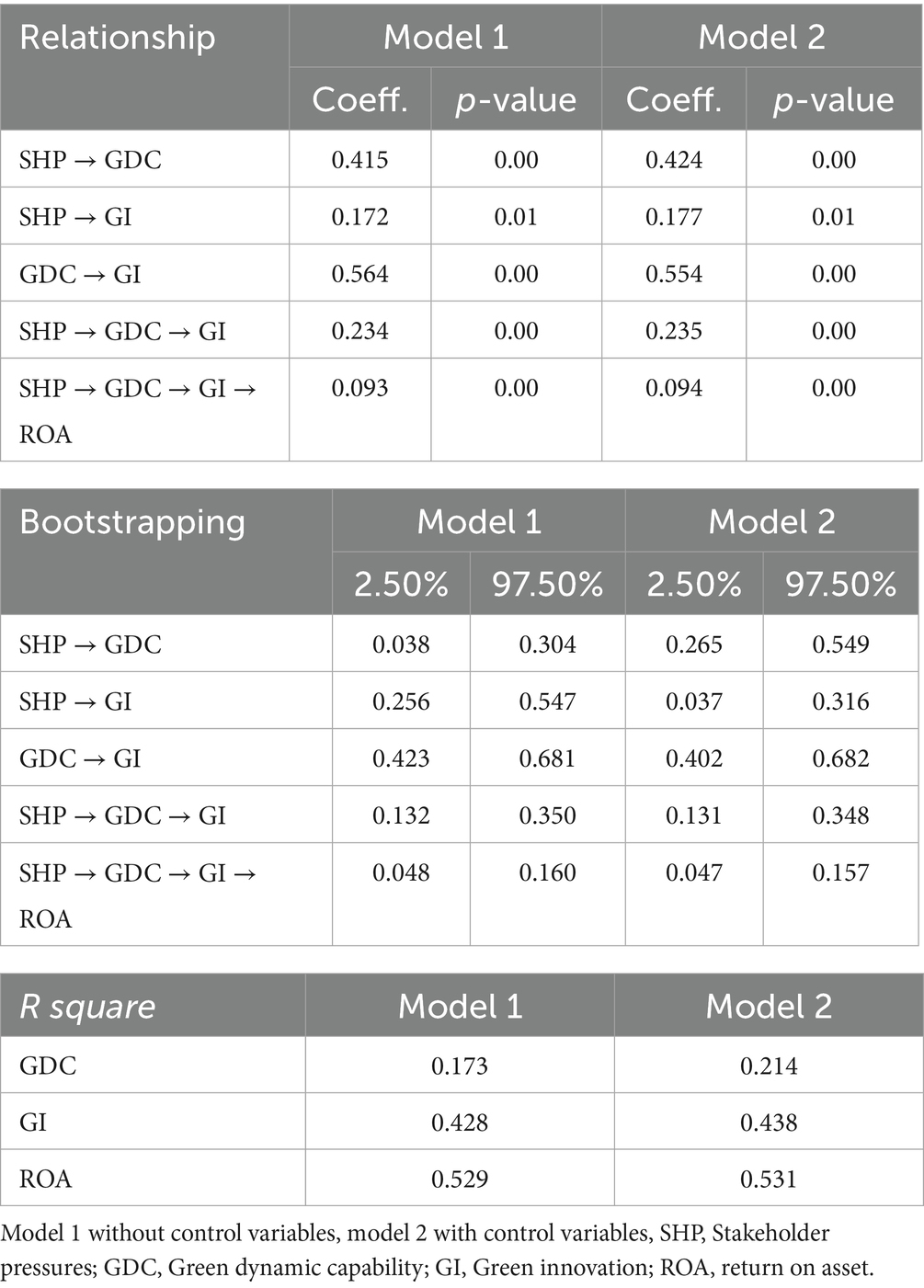

The path analysis (Table 3) explains all the hypotheses in this study. Four hypotheses examined the direct effect, and two examined the indirect effect. Firstly, the findings demonstrated a significant, direct, and positive influence of stakeholder pressures on green dynamic capabilities (β = 0.415, p < 0.01), supporting H1. The stakeholder pressures had a significant, direct, positive influence on green innovation (β = 0.172, p < 0.05), and green dynamic capabilities also confirmed a significant positive effect on green innovation (β = 0.564, p < 0.05), supporting H2 and H3. Hypothesis 4 tested the role of green dynamic capability as a mediator of the relationship between stakeholder pressures and green innovation based on this result was confirmed (β = 0.234, p < 0.01). Sequential mediation stakeholder pressures on financial performance via dynamic capabilities and green innovation have been confirmed (β = 0.093, p < 0.05). Hence, H5 is supported.

4.3 Robustness analysis

Table 4 indicates that the conclusion of the results is no difference between Model 1 (without control variables) and Model 2 (with control variables). For example, both models’ path coefficients and p-values lead to the same conclusions. Additionally, the bootstrapping resampling process results show that all path coefficients do not include zero values, indicating that the path coefficients are significant at a 5% confidence interval for both models. Finally, the R square value evaluation shows relatively equal results. For example, the R square for GDC is 0.173 (model 1) and 0.214 for model 2. Furthermore, for GI, the R square is 0.428 (model 1) and 0.438 (model 2), indicating that the inclusion of three control variables in model 2 does not significantly change the general conclusion of the results.

5 Discussion

The positive relationship in hypothesis 1 suggests that stakeholder pressures influence the development of green dynamic capabilities within firms. This result aligns with existing literature that recognizes the importance of external pressures from stakeholders, such as customers, regulators, and investors, in motivating organizations to enhance their capability to innovate in environmentally friendly ways (e.g., Huang et al., 2024; Sahoo, 2024; Singh et al., 2022; Yu and Ramanathan, 2015). In this research, the level of stakeholder pressure measures based on government, competitors, and customers shows that combining the three as external pressures compels firms to develop capabilities by using new technology or upgrading existing technology to operate more environmentally friendly. In other words, governments in the form of regulatory bodies impose strict environmental regulations that compel firms to develop green capabilities to comply with legal requirements (Ma and Chen, 2025; Zhang and Zhu, 2019). On the other hand, pressure from consumers who prefer environmentally friendly products pushes firms to enhance their capabilities to meet these expectations (Zhang and Zhu, 2019).

The confirmation of the second hypothesis (H2) indicates that stakeholder pressures positively affect green innovation. This finding aligns with previous studies that emphasize the role of stakeholder engagement in driving firms to pursue innovative and environmentally friendly solutions (Baah et al., 2021; Chen and Liang, 2023; Li et al., 2017; Ma and Chen, 2025; Sahoo, 2024; Singh et al., 2022; Wang et al., 2022). In other words, green innovation in adopting environmentally friendly practices can be increased through stakeholder pressure, where companies will try to meet these expectations (Adomako et al., 2023; Kawai et al., 2018; Sahoo, 2024). The higher the public pressure, the higher the green practices in process and product innovation. More specifically, this study is not solely about how stakeholder pressures affect green innovation but also about expanding previous studies focusing only on specific sectors. Hence, we confirm how implementing green innovation based on stakeholder pressure can apply to various sectors, especially in Indonesia.

The third hypothesis (H3), green dynamic capability, has been confirmed to affect green management, supported by previous studies (Borah et al., 2025; Yu et al., 2022; Yuan and Cao, 2022). In other words, firms with strong green dynamic capabilities—such as using new technology and reconfiguring and upgrading their resources in response to environmental challenges—are better equipped to implement and manage green innovation. The interplay between dynamic capability and green management indicates that organizations must prioritize developing these capabilities to foster robust environmental strategies. Moreover, the results of this study also found the role of intermediates green dynamic capability in the relationship between stakeholder pressures and green innovation (H4), indicating that stakeholder pressures stimulate green capability, which fosters green innovation in the next stage (Huang et al., 2024; Lin and Su, 2024; Singh et al., 2022; Yu et al., 2022; Yu and Ramanathan, 2015; Yuan and Cao, 2022).

Finally, this study shows how stakeholder pressures can influence financial performance through green dynamic capabilities and innovation (H5). The present study reveals that when organizations face increased stakeholder demands (government, customer, and competitor) to embrace sustainable practices, their first step is to boost their green dynamic capabilities. The improvements in green capabilities make green innovation easier to develop and implement, ultimately contributing to more substantial financial results. The sequential process in this hypothesis also emphasizes the need to see stakeholder pressures as challenges to meet and valuable opportunities to enhance strategic capabilities and drive innovation. Therefore, organizations that actively work to fulfill stakeholder expectations will have a more significant advantage in enhancing their value, providing them with a competitive benefit, and making their financial performance increase as the ultimate objective.

In sum, this study makes two contributions. First, the present study aims to explain the performance of green innovation through stakeholders and dynamic green capability and how green innovation affects financial performance. Furthermore, this study expanded previous studies related to the determinant of green innovation and its impact on more financial performance was examined in specific sectors (e.g., mining, manufacturing) (Adnan et al., 2025; Baah et al., 2021; Li et al., 2017; Ma and Chen, 2025; Sahoo, 2024; Singh et al., 2022; Wang et al., 2022). In addition, empirical evidence in this study presents that green innovation has a positive impact on financial performance so that it can be seen as an important strategy to achieve the company’s goals in the future (Baah et al., 2021; Ha and Nguyen, 2022; Singh et al., 2022).

5.1 Implications

The research finding highlights significant implications for managers, policymakers, and researchers. From a managerial standpoint, the findings of this study indicate that stakeholder pressures positively influence green dynamic capabilities and innovation, which in turn have an indirect effect on financial performance through the sequential mediation of green dynamic capabilities and green innovation. First, for managers, the empirical evidence from this study shows that it is essential to actively connect with stakeholders such as government officials and customers to improve green innovation capabilities and practices. Proactive actions to obtain information from stakeholders can provide valuable insights into the needs and preferences of their audience. Furthermore, looking into competitors’ actions can provide valuable ideas for strengthening their capabilities; this strategy helps organizations become more responsive to external pressures and aligns their efforts with the Sustainable Development Goals (SDGs).

Second, policymakers can use this study’s results to create policies encouraging transparency and accountability in sustainability efforts. Specifically, the study’s scope, which covered various sectors, shows that stakeholder pressures on how organizations operate to support environmental campaigns have a long-term impact on financial performance. Therefore, policymakers must simultaneously provide general regulations that support sustainability and economic growth for all sectors. Finally, researchers may find the insights derived from this study as initial findings on how financial performance can be achieved through green innovation and green dynamic capabilities for all sectors. Therefore, these findings can be initial ideas to explore industry-specific dynamics, learn more about external stress factors, and how distinct organizational contexts can shape the outcomes of these relationships.

Finally, in Indonesia’s context, severe environmental challenges— including deforestation, pollution, and being a top global emitter due to land-use changes—demand urgent and sustainable solutions. While international pressure (the Paris Agreement) and investor priorities drive green policy adoption, these efforts must address the intrinsic link between technological development and socioeconomic inequality as Feinman (2021) concluded that technological change often reinforces existing power structures rather than diminishing inequalities, thus creating a dual challenge for the government to achieve environmental sustainability while ensuring fair access to the benefits of green innovation (Feinman, 2021). Hence, this complexity requires clear commitment and policies to tackle ecological degradation while also promoting inclusive technological advancement.

5.2 Limitations

The study acknowledges several limitations that pave the way for future research opportunities. First, the research in Indonesia may limit the generalizability of the findings to other contexts or countries. Since variations in market dynamics, regulatory frameworks, and stakeholder expectations may differ, future studies should explore the relationships between stakeholder pressures, green capabilities, and innovation across countries to broaden the applicability of the findings. Second, the study measures stakeholder pressures based on government, competitors, and customers but does not consider other potential influences such as NGOs or community groups. Hence, future studies need to expand the measurement of stakeholder pressures by including various other elements, such as environmental NGOs or community groups, to provide a more comprehensive understanding of external pressures.

6 Conclusion

The study comprehensively analyzes how stakeholder pressures influence a firm’s strategy and operations, particularly regarding green dynamic capabilities, innovation, and financial performance. Specifically, this study emphasizes the direct effects of stakeholder pressures on developing green dynamic capabilities and innovation. Apart from that, it also examines the indirect effect of stakeholder pressures on green innovation through green dynamic capabilities and financial performance through sequential mediation of green dynamic capabilities and green innovation in the context of companies in Indonesia. This research confirmed that stakeholder pressures enhance green dynamic capabilities and innovation, ultimately impacting financial performance in subsequent phases. Organizations that proactively address stakeholder expectations will likely gain a competitive edge, leveraging sustainability as a driver for long-term strategic success. Moreover, this study contributes to the broader discourse on enhancing financial performance through green innovation; this topic has been widely debated in the existing literature. Specifically, our study underscores the significance of green initiatives across various sectors, positioning them as essential components of corporate strategy in the modern business landscape and highlighting firms’ need to integrate sustainability management into their operational frameworks to thrive in an increasingly environmentally conscious market.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

The studies involving humans were approved by DW (Head of Doctor of Research in Management, BINUS Business School Executive Dean, Bina Nusantara University). The studies were conducted in accordance with the local legislation and institutional requirements. Written informed consent for participation in this study was provided by the participants’ legal guardians/next of kin.

Author contributions

TW: Funding acquisition, Investigation, Writing – original draft, Formal analysis, Data curation, Conceptualization. TR: Methodology, Validation, Supervision, Writing – review & editing. DW: Writing – review & editing, Methodology, Supervision, Conceptualization. AF: Supervision, Methodology, Writing – review & editing, Validation.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fclim.2025.1599894/full#supplementary-material

References

Abbas, J. (2024). Does the nexus of corporate social responsibility and green dynamic capabilities drive firms toward green technological innovation? The moderating role of green transformational leadership. Technol. Forecast. Soc. Chang. 208:123698. doi: 10.1016/j.techfore.2024.123698

Adnan, M., Zhu, N., and Bilal, M. (2025). The nexus between female CEOs, government subsidies and green innovation: probing board diversity dynamics. Total Qual. Manag. Bus. Excell. 22, 1–29. doi: 10.1080/14783363.2024.2448560

Adomako, S., Simms, C., Vazquez-Brust, D., and Nguyen, H. T. T. (2023). Stakeholder green pressure and new product performance in emerging countries: a cross-country study. Br. J. Manag. 34, 299–320. doi: 10.1111/1467-8551.12595

Ai, M., Luo, F., and Bu, Y. (2024). Green innovation and corporate financial performance: insights from operating risks. J. Clean. Prod. 456:142353. doi: 10.1016/j.jclepro.2024.142353

Alkhodary, D. A. (2023). Encouraging sustainability through the implementation of green business practices. Inf. Sci. Lett. 12, 2511–2529. doi: 10.18576/isl/120627

Al-Qudah, A. A., Hamdan, A., Al-Okaily, M., and Alhaddad, L. (2022). The impact of green lending on credit risk: evidence from UAE’S banks. Environ. Sci. Pollut. Res. 30, 61381–61393. doi: 10.1007/s11356-021-18224-5

Amaranti, R., Irianto, D., and Govindaraju, R.. (2019). “The relationship between absorptive capacity, knowledge sharing capability, and green dynamic capability: A conceptual model,” in ICSECC 2019. International Conference on Sustainable Engineering and Creative Computing: New Idea, New Innovation, Proceedings, 426–431.

Arshad, M., Yu, C. K., Qadir, A., and Rafique, M. (2023). The influence of climate change, green innovation, and aspects of green dynamic capabilities as an approach to achieving sustainable development. Environ. Sci. Pollut. Res. 30, 71340–71359. doi: 10.1007/s11356-023-27343-0

Ashton, W., Russell, S., and Futch, E. (2017). The adoption of green business practices among small US Midwestern manufacturing enterprises. J. Environ. Plan. Manag. 60, 2133–2149. doi: 10.1080/09640568.2017.1281107

Baah, C., Opoku-Agyeman, D., Acquah, I. S. K., Agyabeng-Mensah, Y., Afum, E., Faibil, D., et al. (2021). Examining the correlations between stakeholder pressures, green production practices, firm reputation, environmental and financial performance: evidence from manufacturing SMEs. Sust. Prod. Consumption 27, 100–114. doi: 10.1016/j.spc.2020.10.015

Barney, J. (1991). Firm resources and sustained competitive advantage. J. Manag. 17, 99–120. doi: 10.1177/014920639101700108

Borah, P. S., Dogbe, C. S. K., and Marwa, N. (2025). Green dynamic capability and green product innovation for sustainable development: role of green operations, green transaction, and green technology development capabilities. Corp. Soc. Responsib. Environ. Manag. 32, 911–926. doi: 10.1002/csr.2993

Calza, F., Parmentola, A., and Tutore, I. (2017). Green innovation development: A multiple case study analysis. Proceedings of the European conference on innovation and entrepreneurship, ECIE, 2017-Septe. Available online at: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85054066097&partnerID=40&md5=78df87dadbadc402d6f342f1bce25375 (accessed September 12, 2017).

Casciello, R., Santonastaso, R., Prisco, M., and Martino, I. (2024). Green innovation and financial performance. The role of investments and ESG disclosure. Corp. Soc. Responsib. Environ. Manag. 31, 5372–5390. doi: 10.1002/csr.2862

Chatterjee, A. D., and Sur, S. (2025). Stakeholders’ pressure on green practices by firms: a systematic literature review. Sust. Bus. Ecosyst. Soc. Persp. 22, 165–186. doi: 10.4018/979-8-3693-8437-4.ch008

Chen, Y.-S., Lai, S.-B., and Wen, C.-T. (2006). The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 67, 331–339. doi: 10.1007/s10551-006-9025-5

Chen, Z., and Liang, M. (2023). How do external and internal factors drive green innovation practices under the influence of big data analytics capability: evidence from China. J. Clean. Prod. 404:136862. doi: 10.1016/j.jclepro.2023.136862

Cheng, P., Zhang, J., Chen, J., Zheng, Y., and Li, Z. (2025). Stakeholder attention and ambidextrous green innovation: evidence from China. Bus. Strateg. Environ. 34, 1007–1026. doi: 10.1002/bse.4032

Desalegn, G., and Tangl, A. (2022). Forecasting green financial innovation and its implications for financial performance in ethiopian financial institutions: evidence from Arima and ardl model. Nat. Account. Rev. 4, 95–111. doi: 10.3934/NAR.2022006

Domadenik, P., Pastore, F., Koman, M., and Redek, T. (2020). “Innovation for a greener and more profitable future: a conceptual approach” in Challenges on the path towards sustainability in Europe: Social responsibility and circular economy perspectives. eds. V. Zabkar and T. Redek (Bradford: Emerald Group Publishing), 127–145.

Doran, J., Ryan, G., McCarthy, N., and O’Connor, M. (2023). Green innovation launch versus expansion: do the public policy supports needed vary by firm size? Int. J. Innov. Manag. 27:299. doi: 10.1142/S1363919623500299

Fan, Z., Long, R., and Shen, Z. (2024). Regional digitalization, dynamic capabilities and green innovation: evidence from e-commerce demonstration cities in China. Econ. Model. 139:106846. doi: 10.1016/j.econmod.2024.106846

Feinman, G. (2021). “Flying cars and polychrome vases: cross-cultural perspectives on technological innovations and their connection to social Inequalit” in Contextualising ancient technology. eds. F. Klimscha, S. Hansen, and J. Renn (Cham: Springer), 87–103.

Grant, N. C., and Marshburn, D. G. (2014). “Understanding the enablers and inhibitors of decision to implement green information systems: A theoretical triangulation approach,” in 20th Americas Conference on Information Systems, AMCIS 2014.

Graßhoff, G. (2021). “Technological Innovations” in Contextualising ancient technology. eds. F. Klimscha, S. Hansen, and J. Renn (Cham: Springer), 11–24.

Gugissa, D. A., Ingenbleek, P. T. M., van Trijp, H. C. M., Teklehaimanot, M. L., and Tessema, W. K. (2021). When natural resources run out, market knowledge steps in: lessons on natural resource deployment from a longitudinal study in a resource-scarce region of Ethiopia. Bus. Strateg. Environ. 30, 1598–1609. doi: 10.1002/bse.2696

Guo, Y. (2023). External knowledge acquisition and green innovation in Chinese firms: unveiling the impact of green dynamic capabilities. SAGE Open 13:5093. doi: 10.1177/21582440231185093

Ha, N. M., and Nguyen, P. A. (2022). A stakeholder approach on the impacts of green innovation on firm performance. J. Syst. Manag. Sci. 12, 341–362. doi: 10.33168/JSMS.2022.0124

Helmig, B., Spraul, K., and Ingenhoff, D. (2016). Under positive pressure: how stakeholder pressure affects corporate social responsibility implementation. Bus. Soc. 55, 151–187. doi: 10.1177/0007650313477841

Huang, S., Tian, H., and Cheablam, O. (2024). Promoting sustainable development: multiple mediation effects of green value co-creation and green dynamic capability between green market pressure and firm performance. Corp. Soc. Responsib. Environ. Manag. 31, 1063–1078. doi: 10.1002/csr.2613

Jóhannsdóttir, L., Ólafsson, S., and Davidsdottir, B. (2015). Leadership role and employee acceptance of change implementing environmental sustainability strategies within Nordic insurance companies. J. Organ. Change Manag. 28, 77–96. doi: 10.1108/JOCM-12-2013-0238

Kawai, N., Strange, R., and Zucchella, A. (2018). Stakeholder pressures, EMS implementation, and green innovation in MNC overseas subsidiaries. Int. Bus. Rev. 27, 933–946. doi: 10.1016/j.ibusrev.2018.02.004

Khan, P. A., Johl, S. K., and Akhtar, S. (2021). Firm sustainable development goals and firm financial performance through the lens of green innovation practices and reporting: a proactive approach. J. Risk Financial Manag. 14:605. doi: 10.3390/jrfm14120605

Khan, N. R., Khan, M. R., Ahmad, W., and Jafar, R. M. S. (2023). “Barriers and challenges in green concepts implementation” in Entrepreneurship and green finance practices: Avenues for sustainable business start-ups in Asia. eds. N. R. Khan, M. R. Khan, W. Ahmad, and R. M. S. Jafar (Bradford: Emerald Group Publishing), 141–161.

Khattak, A. (2019). Green innovation in South Asia’s clothing industry: issues and challenges. Sust. Econ. Emerging Markets 22, 172–183. doi: 10.4324/9780429325144-11

Lee, S.-H., Park, S., and Kim, T. (2015). Review on investment direction of green technology R & D in Korea. Renew. Sust. Energ. Rev. 50, 186–193. doi: 10.1016/j.rser.2015.04.158

Lei, X., and Yu, J. (2024). Striving for sustainable development: green financial policy, institutional investors, and corporate ESG performance. Corp. Soc. Responsib. Environ. Manag. 31, 1177–1202. doi: 10.1002/csr.2630

Li, H. (2022). Green innovation, green dynamic capability, and Enterprise performance: evidence from heavy polluting manufacturing Enterprises in China. Complexity 2022:964. doi: 10.1155/2022/7755964

Li, Z., and Li, M. (2025). Does environmental, social, and governance performance affect corporate green innovation? Evidence from China. Pol. J. Environ. Stud. 34, 2273–2283. doi: 10.15244/pjoes/187600

Li, Y., Li, M., Sang, P., Chen, P.-H., and Li, C. (2022). Stakeholder studies of green buildings: A literature review. J. Building Eng. 54:104667. doi: 10.1016/j.jobe.2022.104667

Li, M., Tian, Z., Liu, Q., and Lu, Y. (2022). Literature review and research Prospect on the drivers and effects of green innovation. Sustainability 14:858. doi: 10.3390/su14169858

Li, D., Zheng, M., Cao, C., Chen, X., Ren, S., and Huang, M. (2017). The impact of legitimacy pressure and corporate profitability on green innovation: evidence from China top 100. J. Clean. Prod. 141, 41–49. doi: 10.1016/j.jclepro.2016.08.123

Lin, X., and Su, W. (2024). External green pressure, dynamic capability, and green innovation: the regulating effect of executive environmental attention. Environ. Soc. Psychol. 9:3069. doi: 10.59429/esp.v9i10.3069

Liu, L., Feng, A., and Liu, M. (2024). The effect of green innovation on corporate financial performance: does quality matter? Financ. Res. Lett. 62:105255. doi: 10.1016/j.frl.2024.105255

Liu, J. S., and Ho, M. H. C0 (2018). “Smart innovation: A consolidated framework for innovation,” in Towards Sustainable Technologies and Innovation-Proceedings of the 27th Annual Conference of the International Association for Management of Technology, IAMOT 2018.

Liu, M., Liu, L., and Feng, A. (2024). The impact of green innovation on corporate performance: an analysis based on substantive and strategic green innovations. Sustainability 16:2588. doi: 10.3390/su16062588

Ma, Y., and Chen, B. (2025). Impact of stakeholder pressure on green innovation: a moderated mediation model. J. Environ. Plan. Manag. 68, 1165–1186. doi: 10.1080/09640568.2023.2284124

Marco-Lajara, B., Zaragoza-Saez, P., and Martínez-Falcó, J. (2023). Green innovation: balancing economic efficiency with environmental protection. Res. Anthol. Bus. Law Policy Soc. Resp. 4, 916–931. doi: 10.4018/979-8-36932045-7.ch048

Martínez-Falcó, J., Sánchez-García, E., Marco-Lajara, B., and Millán-Tudela, L. A. (2024). Green innovation: integrating economic growth with environmental stewardship. Green Supply Chain Manage. Prac. :2024, 150–167. doi: 10.4018/979-8-36933486-7.ch008

Mehta, P. D. (2015). “Control variables in research” in International encyclopedia of the Social & Behavioral Sciences. eds. N. J. Smelser and P. B. Baltes (Amsterdam: Elsevier), 840–843.

Melander, L. (2018). Improving green product innovation through collaboration. IEEE Eng. Manag. Rev. 46, 133–137. doi: 10.1109/EMR.2018.2833861

Meyer, J. W., and Rowan, B. (1977). Institutionalized organizations: formal structure as myth and ceremony. Am. J. Sociol. 83, 340–363. doi: 10.1086/226550

Mohy-ud-Din, K. (2024). ESG reporting, corporate green innovation and interaction role of board diversity: a new insight from US. Innov. Green Dev. 3:100161:100161. doi: 10.1016/j.igd.2024.100161

Molla, A., and Abareshi, A. (2012). Organizational green motivations for information technology: empirical study. J. Comput. Inf. Syst. 52, 92–102. doi: 10.1080/08874417.2012.11645562

Mousavi, M. D., and Mousavi, M. D. (2023). The effect of stakeholder’s pressure on firm market performance and the mediating role of corporate responsibility, sustainable supplier selection, and marketing capability. Corp. Reput. Rev. 26, 179–191. doi: 10.1057/s41299-022-00149-5

Mungai, E. M., Ndiritu, S. W., and Rajwani, T. (2023). Environmental dilemma? Explicating stakeholder engagement in Kenyan firms. J. Afr. Bus. 24, 404–426. doi: 10.1080/15228916.2022.2100745

Namatame, A., Morita, H., and Matsuyama, K. (2009). “Agent-based modeling for the study of diffusion dynamics,” in Spring Simulation Multiconference 2009- Co-Located with the 2009 SISO Spring Simulation Interoperability Workshop.

Nilsson, M., Griggs, D., and Visbeck, M. (2016). Policy: map the interactions between sustainable development goals. Nature 534, 320–322. doi: 10.1038/534320a

Pratama, V. F., Deliana, Y., Bachrul, Y. S., and Rusgowanto, F. H. (2023). The effects of stakeholder pressure and financial performance on sustainability reporting in listed mining firms on the IDX in the period 2017–2019.

Priyan, S. (2023). Effect of green investment to reduce carbon emissions in an imperfect production system. J. Clim. Financ. 2:100007. doi: 10.1016/j.jclimf.2023.100007

Przychodzen, W., Leyva-de la Hiz, D. I., and Przychodzen, J. (2020). First-mover advantages in green innovation—opportunities and threats for financial performance: a longitudinal analysis. Corp. Soc. Responsib. Environ. Manag. 27, 339–357. doi: 10.1002/csr.1809

Qing, L., Chun, D., Dagestani, A. A., and Li, P. (2022). Does proactive green technology innovation improve financial performance? Evidence from listed companies with semiconductor concepts stock in China. Sustainability 14:600. doi: 10.3390/su14084600

Qiu, L., Jie, X., Wang, Y., and Zhao, M. (2020). Green product innovation, green dynamic capability, and competitive advantage: evidence from Chinese manufacturing enterprises. Corp. Soc. Responsib. Environ. Manag. 27, 146–165. doi: 10.1002/csr.1780

Sahoo, S. (2024). Assessing the impact of stakeholder pressure and green data analytics on firm’s environmental performance – understanding the role of green knowledge management and green technological innovativeness. R D Manag. 54, 3–20. doi: 10.1111/radm.12602

Shuwaikh, F., Benkraiem, R., and Dubocage, E. (2023). Investment in green innovation: how does it contribute to environmental and financial performance? J. Innov. Econ. Manag. 41, 107–149. doi: 10.3917/jie.pr1.0137

Singh, S. K., Del Giudice, M., Chiappetta Jabbour, C. J., Latan, H., and Sohal, A. S. (2022). Stakeholder pressure, green innovation, and performance in small and medium-sized enterprises: the role of green dynamic capabilities. Bus. Strateg. Environ. 31, 500–514. doi: 10.1002/bse.2906

Sturman, M. C., Sturman, A. J., and Sturman, C. J. (2022). Uncontrolled control variables: the extent that a researcher’s degrees of freedom with control variables increases various types of statistical errors. J. Appl. Psychol. 107, 9–22. doi: 10.1037/apl0000849

Sun, G., Sulemana, I., and Agyemang, A. O. (2025). Examining the impact of stakeholders’ pressures on sustainability practices. Manag. Decis. [ahead of print]. doi: 10.1108/MD-06-2023-1008

Tambovceva, T., Tereshina, M., and Samarina, V. (2019). Green innovations in regional economy. Eng. Rural Dev. 18, 1832–1839. doi: 10.22616/ERDev2019.18.N357

Teece, D. J. (2007). Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 28, 1319–1350. doi: 10.1002/smj.640

Teece, D. J. (2014). A dynamic capabilities-based entrepreneurial theory of the multinational enterprise. J. Int. Bus. Stud. 45, 8–37. doi: 10.1057/jibs.2013.54

Thi Ngoc Thuyen, T., and Nhu Bich, L. (2024). Green innovation practices: a case study of Vietnamese manufacturing companies. Cogent Bus Manag 11:603. doi: 10.1080/23311975.2024.2333603

Thomas, A., Palladino, R., Nespoli, C., d’agostino, M. T., and Russo, G. (2022). “Determinants and outcomes of green innovations: a conceptual model” in Handbook of research on building greener economics and adopting digital tools in the era of climate change. ed. P. Ordóñez de Pablos (London: IGI Global), 43–63.

Wang, J. (2011). Discussion on the relationship between green technological innovation and system innovation. Energy Procedia 5, 2352–2357. doi: 10.1016/j.egypro.2011.03.404

Wang, S., Abbas, J., Sial, M. S., Álvarez-Otero, S., and Cioca, L.-I. (2022). Achieving green innovation and sustainable development goals through green knowledge management: moderating role of organizational green culture. J. Innov. Knowl. 7:100272. doi: 10.1016/j.jik.2022.100272

Wang, L., Li, W., and Qi, L. (2020). Stakeholder pressures and corporate environmental strategies: a meta-analysis. Sustainability 12:1172. doi: 10.3390/su12031172

Wang, D., Si, R., and Fahad, S. (2023). Evaluating the small and medium sized enterprises motivating factors and influencing barriers about adoption of green practices. Environ. Dev. Sustain. 25, 3029–3041. doi: 10.1007/s10668-022-02166-0

Wang, Q., and Xu, Y. (2025). Can industry competition stimulate enterprises ESG performance? Int. Rev. Financ. Anal. 104:104274. doi: 10.1016/j.irfa.2025.104274

Warburton, D. A. (2021). “Why innovate?” in Contextualising ancient technology. eds. F. Klimscha, S. Hansen, and J. Renn (Cham: Springer), 25–41.

Wysocki, A. C., Lawson, K. M., and Rhemtulla, M. (2022). Statistical control requires causal justification. Adv. Methods Pract. Psychol. Sci. 5:823. doi: 10.1177/25152459221095823

Xie, Z., Wang, J., and Zhao, G. (2022). Impact of green innovation on firm value: evidence from listed companies in China’s heavy pollution industries. Front. Energ. Res. 9:806926. doi: 10.3389/fenrg.2021.806926

Xu, R., Chen, X., and Zhang, F. (2019). Green technology innovation and sustainable development based on data fusion mining. Ekoloji 28, 1825–1833.

Yi, Y., Zeng, S., Chen, H., and Shi, J. J. (2023). When does it pay to be good? A Meta-analysis of the relationship between green innovation and financial performance. IEEE Trans. Eng. Manag. 70, 3260–3270. doi: 10.1109/TEM.2021.3079098

Yu, W., and Ramanathan, R. (2015). An empirical examination of stakeholder pressures, green operations practices and environmental performance. Int. J. Prod. Res. 53, 6390–6407. doi: 10.1080/00207543.2014.931608

Yu, D., Tao, S., Hanan, A., Ong, T. S., Latif, B., and Ali, M. (2022). Fostering green innovation adoption through green dynamic capability: the moderating role of environmental dynamism and big data analytic capability. Int. J. Environ. Res. Public Health 19:10336. doi: 10.3390/ijerph191610336

Yuan, B., and Cao, X. (2022). Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 68:101868. doi: 10.1016/j.techsoc.2022.101868

Zewen, C., Xin, L., and Hongjun, C. (2017). Research on the influence of institutional pressures on green innovation strategy. IOP Confe. Series Earth Environ. Sci. 94:012162. doi: 10.1088/1755-1315/94/1/012162

Zhang, F., and Zhu, L. (2019). Enhancing corporate sustainable development: stakeholder pressures, organizational learning, and green innovation. Bus. Strateg. Environ. 28, 1012–1026. doi: 10.1002/bse.2298

Keywords: stakeholder pressure, green dynamic capabilities, green innovation, financial performance, business entities, firm size

Citation: Widyantoro T, Rusmanto T, Warganegara DL and Furinto A (2025) Enhancing green innovation and financial performance: the role of stakeholder pressures and green dynamic capabilities. Front. Clim. 7:1599894. doi: 10.3389/fclim.2025.1599894

Edited by:

Dickson Adom, Kwame Nkrumah University of Science and Technology, GhanaReviewed by:

Florian Klimscha, Lower Saxony State Museum, GermanyAbdelhak Alioune, University of Jijel, Algeria

Copyright © 2025 Widyantoro, Rusmanto, Warganegara and Furinto. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tjatur Widyantoro, dGphdHVyLndpZHlhbnRvcm9AYmludXMuYWMuaWQ=

Tjatur Widyantoro

Tjatur Widyantoro Toto Rusmanto

Toto Rusmanto Dezie Leonarda Warganegara

Dezie Leonarda Warganegara Asnan Furinto

Asnan Furinto