- 1SIMAD University, Mogadishu, Somalia

- 2Institute of Climate and Environment-ICE, Mogadishu, Somalia

This study explores the integration of Somalia’s unregulated exchange rate market with regional and global financial systems and investigates how climate-induced shocks influence currency resilience in a fragile, post-conflict context. The research utilizes time series data from 1995 to 2017 and employs advanced econometric techniques including the Johansen cointegration test, vector error correction model (VECM), Granger causality tests, impulse response functions, and variance decomposition. The model incorporates climate shock indicators to assess short-and long-run dynamics in exchange rate behavior. The results reveal significant long-term cointegration between the Somali Shilling and major regional and global currencies, suggesting deep financial integration. Short-term fluctuations are largely driven by regional currency movements. Climate shocks intensify exchange rate volatility, especially through channels such as agriculture, remittances, and trade, indicating structural vulnerabilities within the unregulated exchange system. The findings highlight the vulnerability of Somalia’s unregulated exchange market to external climate shocks, underscoring the need for formal integration of this system into national monetary frameworks. Policy actions should focus on strengthening institutional oversight, promoting transparent exchange rate mechanisms, and incorporating climate resilience strategies into monetary planning. In particular, a phased regulatory approach that aligns informal currency markets with regional and global financial systems could help stabilize exchange rate volatility and improve the country’s macroeconomic resilience. This is one of the first empirical studies to analyze the intersection of climate shocks and unregulated exchange rate systems in a post-conflict setting. It offers a novel framework for understanding informal financial systems within global economic networks. The study expands the literature on climate-finance linkages, informal currency markets, and post-conflict monetary systems by demonstrating how unregulated exchange structures interact with both environmental shocks and formal global markets.

1 Introduction

Exchange rate dynamics play a pivotal role in shaping international trade, capital flows, and macroeconomic stability (Demir and Razmi, 2022; Lal et al., 2023). In both global and regional contexts, exchange rates are influenced by monetary policies, inflation, political conditions, and market expectations (Nor et al., 2020; Sanusi and Kapingura, 2022). Major currencies, such as the US dollar, Euro, and Japanese yen, often set the tone for global exchange rate movements, impacting both developed and emerging markets (Mundell, 2012; Tripathi et al., 2021). Regionally, exchange rates are influenced by intraregional trade agreements, economic integration efforts, and shared economic challenges or strengths (Asante and Stanley, 2022; Geda and Seid, 2015b). Understanding these dynamics is crucial because they have direct implications for countries with less formalized financial systems, such as Somalia, where the integration of unregulated exchange rates with these broader markets remains a topic of significant interest and importance.

Global economic shocks, such as fluctuations in oil prices, significantly influence exchange rates through their impact on trade balances, inflation, and investor sentiment. For oil-importing countries, rising oil prices typically increase the cost of imports, leading to a deterioration in the trade balance and downward pressure on the domestic currency. Conversely, oil-exporting nations often benefit from higher oil revenues, which can strengthen their currencies as demand for their exports increases (Chen and Rogoff, 2003; Choudhri and Hakura, 2015; Zou et al., 2022). Additionally, oil price volatility affects inflation expectations, prompting central banks to adjust monetary policies, which in turn influences currency values (Reboredo, 2012; Reboredo et al., 2021). Investor sentiment also plays a critical role; during periods of heightened uncertainty due to oil price shocks, capital often flows toward perceived safe-haven currencies, further altering exchange rate dynamics (Bodenstein et al., 2012; Khalil, 2022). Therefore, oil price changes act as critical transmission mechanisms for broader global economic shocks to exchange rates.

Climate change represents a profound economic shock that could exert significant and multifaceted impacts on exchange rates. For countries heavily reliant on climate-sensitive sectors, such as agriculture or tourism, the increased frequency and intensity of climate-related disasters may undermine economic stability and reduce export revenues, depreciating their currencies (Cheema-Fox et al., 2022; Dell et al., 2012). Furthermore, the transition to a low-carbon economy could create trade imbalances, particularly for nations dependent on fossil fuel exports, as global demand shifts toward renewable energy sources (Tian et al., 2022). Investors may also reassess risks associated with climate-vulnerable regions, leading to capital flight and further currency depreciation. On the other hand, countries with advanced green technologies or diversified economies may attract investment, strengthening their currencies. Thus, the economic disruptions caused by climate change, coupled with varying levels of resilience across nations, are poised to shape exchange rate dynamics in complex and unpredictable ways.

Since the collapse of Somalia’s central government in 1991, the country has operated without a functioning central bank or formal monetary authority. Remarkably, the Somali Shilling has continued to circulate, despite the absence of legal backing or regulatory oversight. This unique economic phenomenon has raised critical questions about currency resilience and market self-regulation in a stateless context (Luther, 2015; Nor and Masron, 2017). Prior research has documented the survival of the Somali currency system through informal institutions, diaspora networks, and religious norms (Luther and White, 2011; Shortland et al., 2013). However, little is known about whether and how this unregulated exchange rate system is integrated with global markets or reacts to exogenous shocks such as oil price volatility and climate change.

In periods of severe climate stress, such as droughts that reduce food and livestock production, the unregulated exchange rate market becomes a lifeline, enabling the rapid flow of foreign currency from diaspora remittances, international aid, and trade (Shortland, 2012). The resilience of Somali Shilling during these climate shocks demonstrates an adaptation mechanism in the absence of formal governance, where unregulated networks play a key role in maintaining currency stability despite the economic instability caused by environmental pressures (Luther and White, 2011). Thus, climate vulnerability intersects with the dynamics of Somalia’s unregulated currency market, creating a unique context that underscores the need to examine the broader implications of climate resilience for unregulated financial systems (Geda and Seid, 2015).

Somalia is among the countries most vulnerable to the effects of climate change, with increasing frequency and severity of droughts, floods, and extreme weather events disrupting key economic sectors such as agriculture, livestock, and trade. According to the FAO and SWALIM, over 80% of Somalia’s population depends on climate-sensitive livelihoods, making economic stability highly susceptible to environmental shocks. Recurrent droughts have led to widespread crop failures, food insecurity, displacement, and reduced export earnings, particularly in pastoral and agro-pastoral regions. The United Nations Development Program (UNDP) has further noted that climate variability contributes to inflation, exchange rate volatility, and trade imbalances, exacerbating existing macroeconomic fragilities. These impacts underscore the urgency of examining how unregulated financial systems respond to climate shocks, especially in a context where formal institutions are weak or underdeveloped. This study addresses this gap by empirically investigating the interaction between climate shocks and currency resilience within Somalia’s informal exchange market, offering new insights for economic stabilization and climate adaptation strategies.

This study is motivated by two interrelated factors: (1) the unique structure of Somalia’s unregulated exchange rate market, and (2) the emerging importance of climate shocks as a macroeconomic transmission channel. While oil price fluctuations have long been recognized as drivers of exchange rate movements through their effects on trade balances and inflation (Bodenstein et al., 2012; Chen and Rogoff, 2003), climate-induced disruptions—such as droughts and floods—are increasingly shaping macroeconomic conditions, especially in vulnerable, agriculture-dependent economies (Adom and Amoani, 2021; Dell et al., 2012). Somalia’s heavy reliance on remittances, informal trade, and climate-sensitive sectors positions it at the intersection of these two global forces.

While much of the existing literature focuses on formal and regulated exchange rate systems, there remains limited understanding of how unregulated currency markets—particularly in fragile and stateless economies—respond to global economic forces and environmental shocks. This paper addresses that gap by examining the integration and responsiveness of Somalia’s unregulated exchange rate system within broader regional and global exchange rate dynamics.

This study makes a significant contribution to the existing literature by offering novel insights into exchange rate dynamics within the unique context of Somalia’s stateless and unregulated financial environment. First, it provides rare empirical evidence on how exchange rates function in the absence of formal monetary institutions, addressing a notable gap in the literature on fragile and post-conflict economies. Second, the study conducts a comprehensive cointegration analysis between the Somali Shilling and a selection of regional and global currencies, including those of major oil-importing and oil-exporting nations, thereby highlighting Somalia’s monetary interlinkages and external dependencies. Finally, it explores the sensitivity of Somalia’s exchange rate system to exogenous shocks—specifically climate-related disruptions and oil price volatility—offering critical insights into the macro-financial vulnerabilities that such fragile economies face in an increasingly uncertain global environment.

Hence, this study investigates the extent to which Somalia’s unregulated exchange rate system is integrated with regional and global currency markets, and whether this integration is sensitive to exogenous shocks such as oil prices and climate variability. Using monthly data from 1995 to 2017, this study seeks to understand the causal relationships and adjustment mechanisms at play. Understanding these dynamics is essential for multiple stakeholders—from humanitarian organizations and central banks in neighboring countries to international investors and Somali policymakers. By uncovering how an unregulated currency system behaves under global and environmental stress, this study offers broader lessons on the resilience and limitations of informal financial systems in times of crisis.

2 Literature review

2.1 Global economic shocks and exchange rate dynamics

Global exchange rates are strongly influenced by macroeconomic shocks, with oil price volatility serving as a particularly important transmission channel. Rising oil prices typically improve trade balances for oil-exporting countries—leading to currency appreciation—while simultaneously increasing import costs for oil-dependent nations, resulting in depreciation (Chen and Rogoff, 2003). These effects are transmitted through trade balances, inflation expectations, and capital flows, positioning oil as a key intermediary between global shocks and currency movements (Allegret et al., 2015; Ren et al., 2024).

Investor behavior also responds to oil shocks, prompting shifts in portfolio allocations that affect demand for different currencies. Central banks often adjust interest rates in response to oil-driven inflationary pressures, amplifying exchange rate movements (Bodenstein et al., 2012; Lyu et al., 2021). These complex interactions underscore the importance of accounting for oil price volatility when analyzing exchange rate systems—especially in fragile or unregulated economies where conventional monetary tools may be absent or ineffective.

2.2 Climate shocks and exchange rate vulnerability

Climate change has emerged as a critical source of macroeconomic shocks, particularly for economies dependent on agriculture, tourism, or natural resources. Events such as droughts, floods, and erratic weather patterns disrupt production, diminish export earnings, and increase import reliance, leading to exchange rate depreciation (Ciccarelli and Marotta, 2024; Sahin, 2022). These shocks also strain public resources, drive up inflation, and can contribute to capital flight—further destabilizing currencies.

Recent studies have highlighted how climate vulnerability shapes investor risk perception, capital flows, and sovereign creditworthiness [see for instance, Naifar, 2023, Klusak et al., 2023, Kling et al., 2021, Krueger et al., 2020, and Alam et al., 2024]. Countries with strong climate adaptation strategies may attract green investment and enhance currency stability, while others face intensified exchange rate volatility. However, the role of climate shocks in shaping exchange rate dynamics remains underexplored in unregulated or stateless economies, where formal monetary responses are absent.

2.3 Unregulated exchange rate markets

In many developing countries, parallel or unregulated exchange rate markets have emerged as a response to capital controls, political instability, and weak institutions. These informal markets operate outside official banking systems and often diverge significantly from formal exchange rates (Aksonov, 2023; Kamin and Ericsson, 2003; Pinto, 1991). Their dynamics are shaped more by informal trade, remittances, and community trust than by central bank actions.

The literature points to the difficulty such markets pose for effective monetary and fiscal policy, particularly in states with low institutional capacity [see for instance, Noorbakhsh and Shahrokhi (1993), Baliamoune-Lutz (2010), Miller and Ndhlela (2022), Malla and Pathranarakul (2022), and Nor (2012)]. While most studies examine how these parallel markets emerge and interact with formal systems, fewer explore their responsiveness to global economic or environmental shocks, or how they connect with broader regional and global currency markets.

2.4 Somalia’s currency system in context

Somalia offers a unique case of a fully unregulated currency market functioning in the absence of a central bank since 1991. Despite prolonged state collapse, the Somali Shilling continues to circulate, supported by informal institutions, cross-border trade, and remittance flows (Luther and White, 2011; Nor and Masron, 2017). Scholars such as Little (2021) and Menkhaus (2006) have examined the resilience of Somalia’s informal financial systems, highlighting their adaptability in maintaining economic activity.

What remains understudied, however, is whether and how Somalia’s informal currency system is integrated with regional or global exchange markets, and how it responds to external shocks such as oil price volatility or climate disruptions. Given Somalia’s dependence on remittances, climate-sensitive sectors like agriculture and livestock, and its engagement in informal cross-border trade, the country provides an important case for analyzing how informal exchange rate systems function under global pressure.

2.5 Theoretical frameworks: informal exchange rate dynamics

2.5.1 Dual market theory and Somalia’s informal exchange system

Dual Market Theory suggests that the labor market is divided into two segments: a primary market offering stable, well-paying jobs with advancement opportunities, and a secondary market characterized by low wages, instability, and limited mobility (Doeringer and Piore, 1971). This theory emphasizes structural barriers that prevent workers in the secondary market from transitioning into the primary sector (Reich et al., 1973). Dual Market Theory offers a critical lens through which to view Somalia’s decentralized and unregulated exchange market. In the absence of a formal monetary authority, Somalia’s currency system operates through informal channels driven by real economic activity—remittances, trade, and aid—rather than central bank policy. This theory explains how prices are set and maintained in informal currency markets, and how these markets are responsive to both domestic and external economic forces. In Somalia, the informal exchange rate market is not peripheral—it is the core mechanism of currency valuation.

2.5.2 Balance of payments theory and external dependence

The Balance of Payments (BoP) Theory posits that exchange rates are determined by a country’s balance of payments position, where a surplus leads to currency appreciation and a deficit leads to depreciation (Johnson, 1972). It emphasizes that international trade and capital flows are key drivers of exchange rate movements in the long run (Mundell, 1968). BoP theory is particularly useful for analyzing Somalia’s exchange rate in the context of external financial flows. In a country where remittances, humanitarian aid, and informal exports function as the main financial inflows, shifts in these components heavily influence the exchange rate. Climate-related shocks that reduce export earnings or increase import dependency often cause depreciation, while post-disaster surges in remittances and aid can drive temporary appreciation. BoP theory allows us to understand these movements even in the absence of a formal current account framework.

2.5.3 Asset market approach: risk and perception in currency valuation

The Asset Market Approach argues that exchange rates are determined by the supply and demand for financial assets, with investors choosing currencies based on expected returns and risks (Dornbusch, 1976). This theory highlights the importance of interest rates, inflation expectations, and investor sentiment in influencing currency values (Frankel and Froot, 1987). The Asset Market Approach provides further insight into how Somalia’s exchange rate is shaped by market expectations and risk perception. Even without formal markets, actors within Somalia—remittance agents, traders, and consumers—respond to perceived risks such as political instability, droughts, or reduced aid flows. These perceptions influence the demand for foreign currency and, by extension, exchange rates. This approach frames the Somali Shilling as a de facto financial asset, subject to speculative dynamics shaped by informal expectations.

2.5.4 Research gap and contribution

While a broad literature addresses exchange rate behavior in formal systems and an emerging body of work examines climate-related financial risks, there is a clear lack of empirical research on how unregulated exchange rate systems—particularly in fragile or stateless contexts like Somalia—respond to external economic and environmental shocks. This study aims to fill that gap by examining the cointegration and responsiveness of Somalia’s informal exchange rate to oil price shocks, climate variability, and regional currency movements. In doing so, it contributes to both the theoretical and empirical understanding of exchange rate behavior in unregulated financial environments.

3 Methods and materials

3.1 Data and measurement of variables

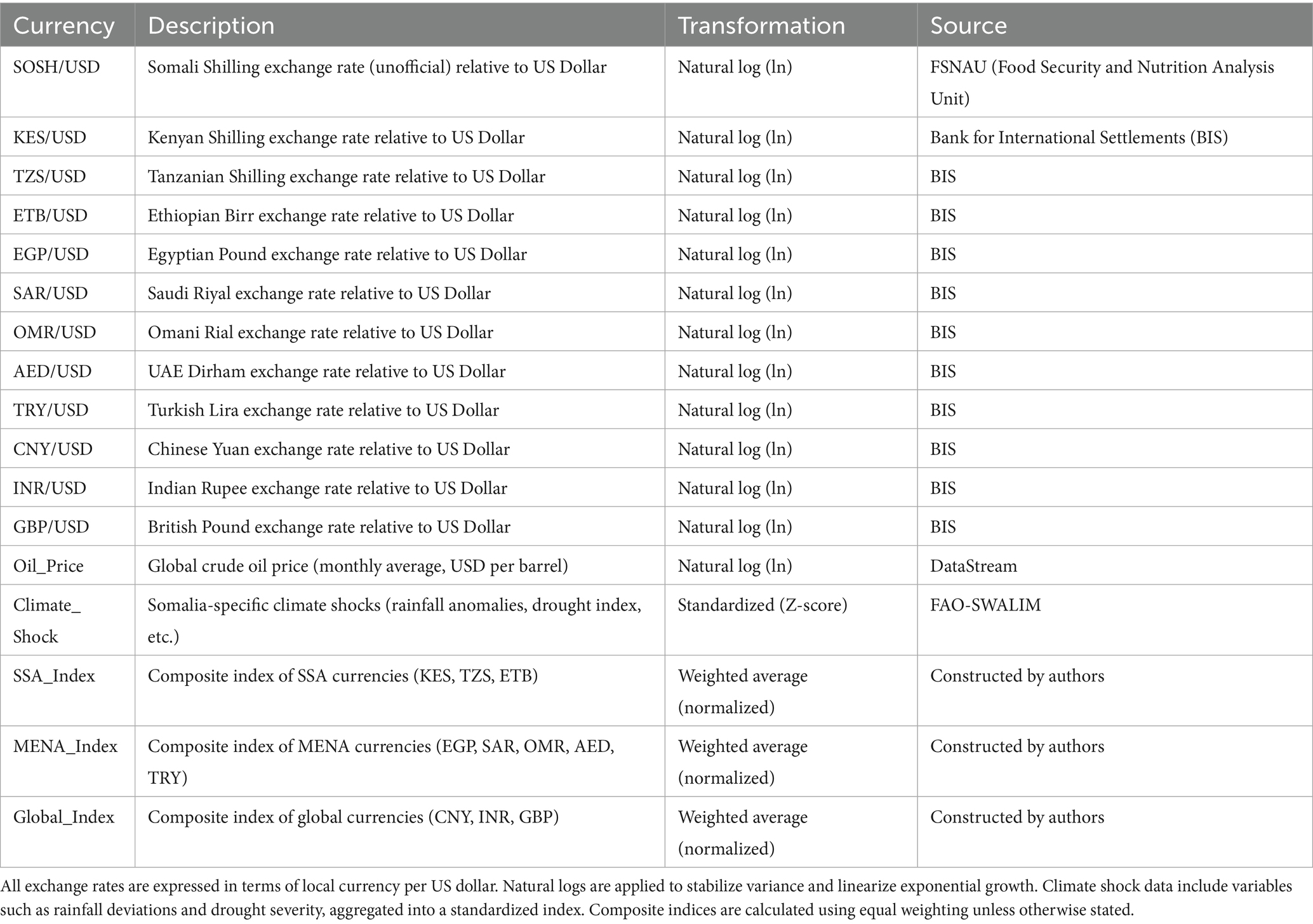

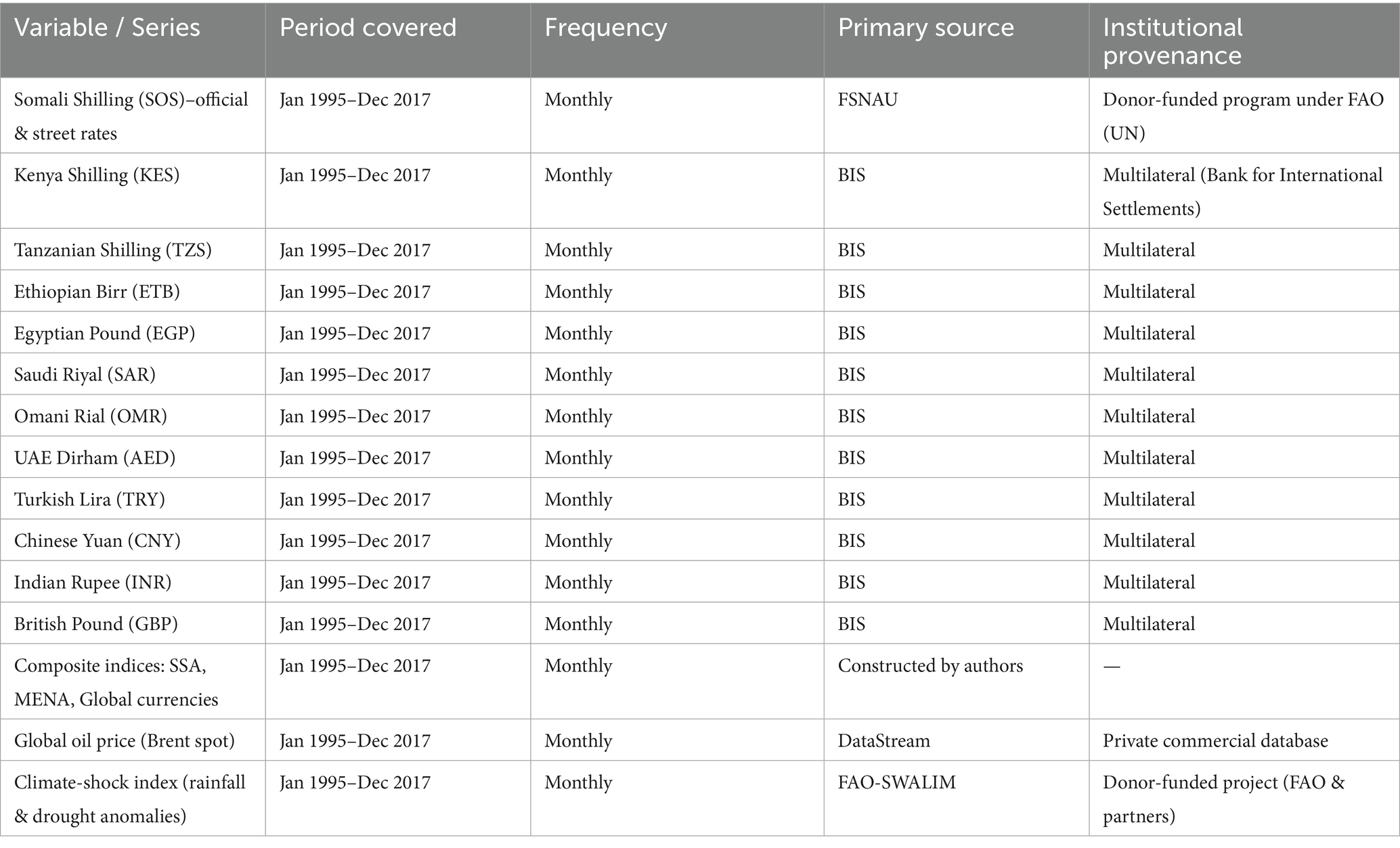

This study investigates the integration of Somalia’s unregulated exchange rate system with regional and global currency markets, with particular emphasis on its sensitivity to global economic shocks and the effects of climate-induced disruptions. The analysis uses monthly data from January 1995 to December 2017 (see Table 1). The primary variable of interest is the Somali Shilling, analyzed against three categories of currencies:

• Sub-Saharan Africa (SSA): Kenya, Tanzania, and Ethiopia.

• Middle East and North Africa (MENA): Egypt, Saudi Arabia, Oman, the United Arab Emirates, and Türkiye.

• Global Economies: China, India, and the United Kingdom.

In addition to exchange rates, two external variables are incorporated:

• Global oil prices (proxy for global economic shocks), and

• Somalia-specific climate shocks (representing local environmental stressors).

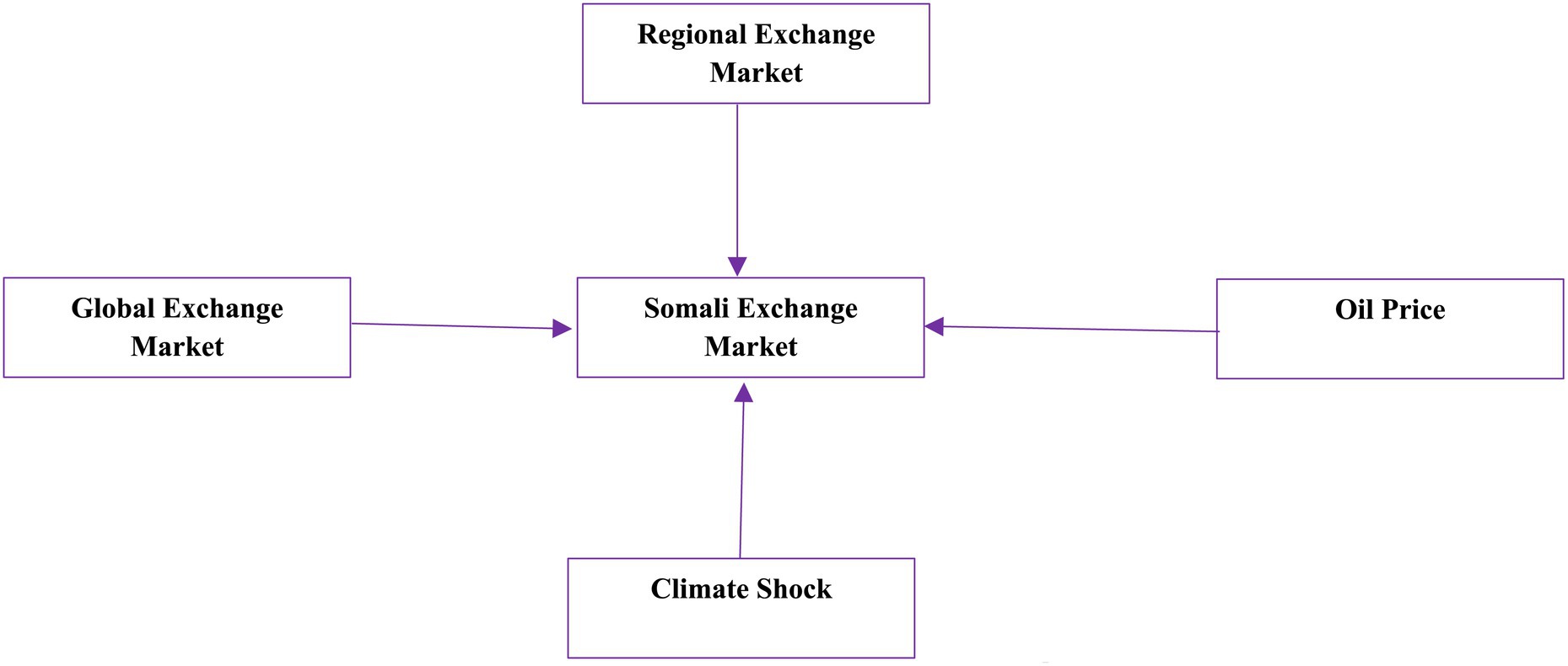

Exchange rate data were sourced from the Food Security and Nutrition Analysis Unit (FSNAU) and the Bank for International Settlements (BIS). Oil prices were retrieved from DataStream, and climate data were obtained from the Somalia Water and Land Information Management (SWALIM) program under the Food and Agriculture Organization (FAO). All exchange rates are expressed relative to a consistent base currency (USD) to ensure comparability across series. Composite indices were created for SSA, MENA, and global currencies in one of the models to reduce dimensionality and capture broader market trends (see Table 2; Figure 1).

3.2 Unit root tests

To determine the stationarity properties of the time series, the study employs the Augmented Dickey–Fuller (ADF) test. This test is critical for validating the time series integration order and ensuring appropriate modeling strategies. Stationarity is a prerequisite for cointegration analysis and vector error correction modeling. If variables are integrated of order one, I(1), they are suitable candidates for cointegration analysis.

3.3 Model specifications

The study develops four model configurations to isolate the effects of different regional and global markets on the Somali exchange rate system:

Model 1: Somalia = f(Kenya, Tanzania, Ethiopia, Climate Shock, Oil Price).

Model 2: Somalia = f(Egypt, Saudi Arabia, Oman, UAE, Türkiye, Climate Shock, Oil Price).

Model 3: Somalia = f(China, India, UK, Climate Shock, Oil Price).

Model 4: Somalia = f(SSA Index, MENA Index, Global Index, Climate Shock, Oil Price).

For Model 4, exchange rate indices were constructed for each region using normalized and weighted average exchange rate movements of the constituent countries.

3.4 Estimation strategy

To examine both short-term and long-term dynamics between Somalia’s exchange rate and the selected variables, the study applies a suite of time series econometric techniques:

1. Johansen Cointegration Test—to detect the presence of long-run equilibrium relationships.

2. Vector Error Correction Model (VECM)—to estimate short-run dynamics and the speed of adjustment to long-run equilibrium.

3. Granger Causality Test—to identify directional causality among variables.

4. Impulse Response Functions (IRFs)—to assess the dynamic effect of shocks over time.

5. Variance Decomposition Analysis—to determine the relative importance of each variable in explaining fluctuations in the Somali Shilling.

This methodology is well-suited for exploring exchange rate interdependence in a context where markets are unregulated and formal transmission mechanisms may be weak or absent. Alternative methods such as Time-Varying Parameter VAR (TVP-VAR), wavelet coherence, and DECO-GARCH could offer richer nonlinear insights, but the current methods offer more transparency and tractability for capturing both equilibrium dynamics and immediate responses to shocks—key for a frontier market like Somalia.

3.5 Cointegration analysis

The Johansen cointegration test is applied to identify stable long-run relationships among Somalia’s exchange rate, regional/global currencies, oil prices, and climate shocks. The test assumes all series are I(1) and estimates whether linear combinations exist that are stationary (I(0)):

Where:

• Y_t = (Y_{1 t}, Y_{2 t},., Y_{kt})’ is a vector of non-stationary time series (I(1)).

• β = (β₁, β₂,., β_k)’ is the cointegrating vector.

• Z_t is the linear combination of Y_t that is stationary, i.e., I(0).

This study investigates the cointegration of Somali Shilling with regional and global currencies, oil prices, and climate shocks. It seeks to uncover the nuanced and interconnected dynamics between Somali Shilling and these influencing factors. Using cointegration analysis, the research identifies nonstationary variables with significant coefficients, applying normalization techniques to resolve potential ambiguities. The aim is to derive a unique and robust solution that captures the long-term relationships governing these economic and environmental variables.

3.6 Vector error correction model

Upon confirming cointegration, a VECM is specified to model both short-term fluctuations and long-term adjustments. The VECM incorporates an error correction term that captures the deviation from long-run equilibrium and indicates how quickly the system returns to balance. The VECM addresses both short-term fluctuations and long-term equilibrium, providing a comprehensive understanding of exchange rate dynamics. The model is based on the Granger representation theorem, highlighting its importance in explaining the adjustment process toward long-term equilibrium. According to Granger, if a system is cointegrated, then an error correction model exists. On the other hand, the existence of an error correction model indicates a cointegrated system. This model is rooted in the Granger Representation Theorem and is specified as:

Where:

• α represents the speed of adjustment vector, determining how quickly the system returns to equilibrium after a shock.

• β′Yt − 1 is the error correction term, which captures the long-run equilibrium relationship between the variables.

• Γi (for i = 1,…,p − 1i = 1, \dots, p-1i = 1,…,p − 1) captures the short-run dynamics or deviations from the long-run path.

This study uses VECM parameters to analyze market adjustments, revealing both immediate reactions and gradual realignments to equilibrium, providing a comprehensive understanding of interconnectedness and interdependencies within international currency markets.

3.7 Granger causality analysis

Granger causality tests are employed within the VECM to determine whether past values of one variable statistically forecast another. This test is critical in identifying the directionality of influence—for example, whether oil price shocks precede changes in Somalia’s exchange rate, or vice versa. The conceptual framework, introduced by Granger in 1969, suggests that if a variable (or a group of variables) enhances the ability to forecast another variable, it is said to ‘Granger-cause’ the latter. According to Granger (1969), if a variable (or set of variables), Y1, is useful for predicting another variable (or set of variables), Y2, Y1 is said to Granger cause Y2. Otherwise, it is said to fail to Granger cause Y2. Conversely, a scalar random variable { } is said not to Granger cause { } if its forecast remains the same regardless of past values This issue can be simplified with the following bivariate VAR:

This research adopts a vector error correction model (VECM) framework to investigate the correlations and causalities between currencies. By exploring these intricate relationships, this study provides a deeper understanding of how currency fluctuations influence one another, offering valuable insights into the interconnected dynamics of the global foreign exchange market.

3.8 Impulse response functions

IRFs are used to trace the response of Somalia’s exchange rate to a one-standard-deviation shock in other variables, over time. To isolate structural shocks, a Cholesky decomposition is applied. While the ordering assumes Somali variables react faster to global shocks than the reverse (which is subject to limitation), robustness checks with alternative orderings are recommended for future studies. This study employs the impulse response function (IRF) to examine exchange rate dynamics, focusing on the relationship between Somali Shilling and key factors such as regional and global currencies, oil prices, and climate shocks. Understanding IRFs requires careful consideration, as other disturbances must maintain a consistent size. Cholesky decomposition is a technique used to identify and distinguish shocks, improving the understanding of immediate effects and long-term connections between currencies (Hatemi-J, 2014). This makes impulse response functions (IRFs) crucial in macroeconomic modeling and exchange rate analysis.

3.9 Variance decomposition

Variance decomposition provides insights into the relative contribution of each shock (currency, oil, or climate) to the forecast error variance of Somalia’s exchange rate. It highlights which factors most influence exchange rate variability over different time horizons. This study uses Variance Decomposition within the framework of Vector Autoregressive (VAR) models to analyze the dynamic interconnections between Somali Shilling and critical factors, including regional and global currencies, oil prices, and climate shocks. This study employs the residual covariance matrix to orthogonalize impulses via Cholesky’s inverse Cholesky factor, ensuring independence. This technique simplifies the analysis of currency interactions and impacts. The arrangement of variables allocates common components to the first variable, establishing a specific sequence. Variance decomposition offers insights into international exchange rate interconnectedness, providing a quantitative framework for understanding relationships. This analysis is beneficial for economic analysis and policymaking in currency markets.

4 Results of the study

4.1 Unit root tests

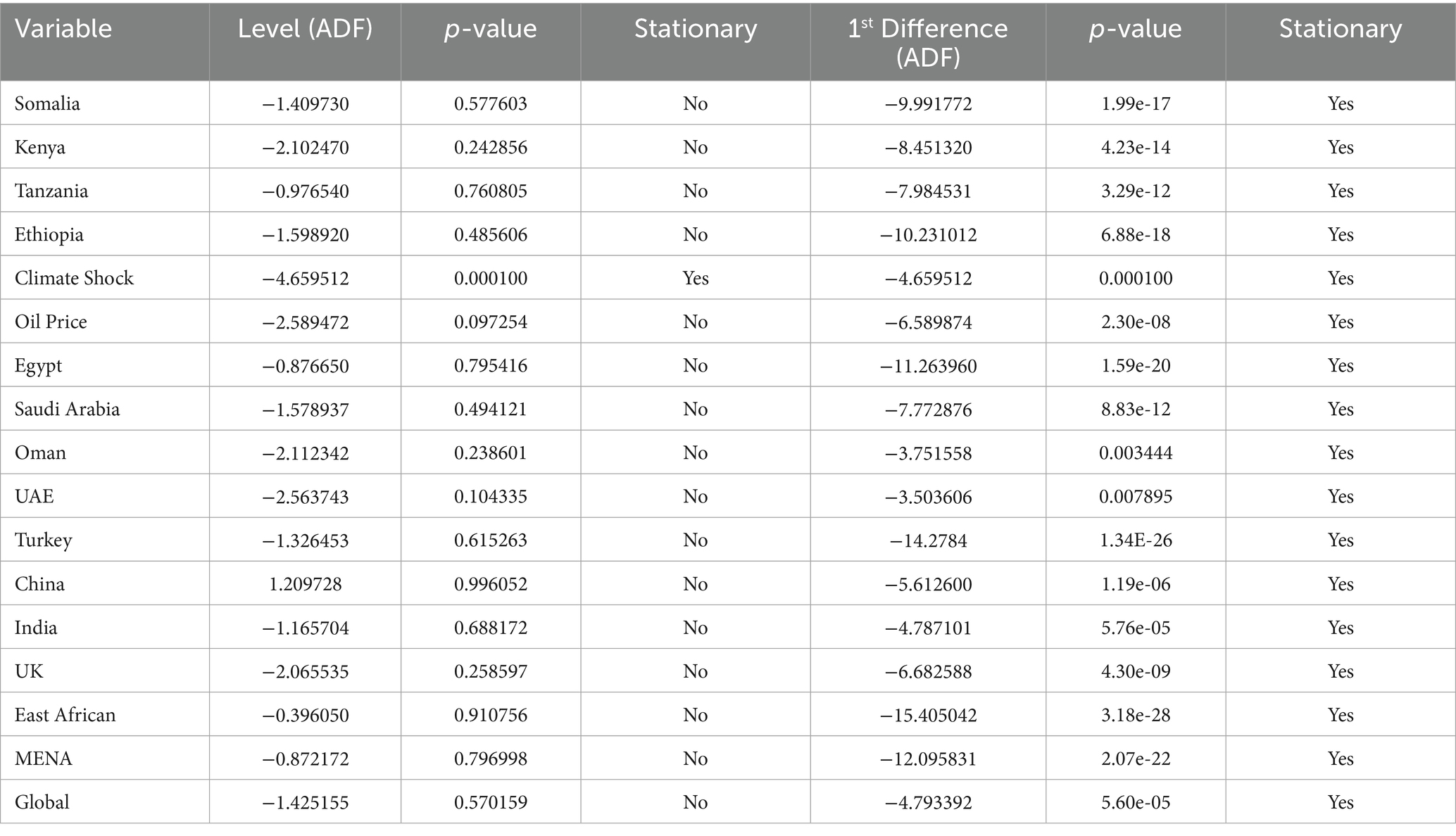

The augmented Dickey-Fuller (ADF) test results indicate that all exchange rate variables and oil prices are nonstationary in levels, with p-values exceeding 0.05, while the climate shock variable is stationary at level (p = 0.0001). After first differencing, all nonstationary variables became stationary, confirming that most variables are integrated of order one, I(1). These results validate the suitability of cointegration analysis and vector error correction modeling (see Table 3).

4.2 Cointegration analysis

The Johansen cointegration test was conducted for four different models. Results show strong evidence of long-term equilibrium relationships between Somalia’s unregulated exchange rate and various regional/global factors, with climate shocks consistently playing a critical role.

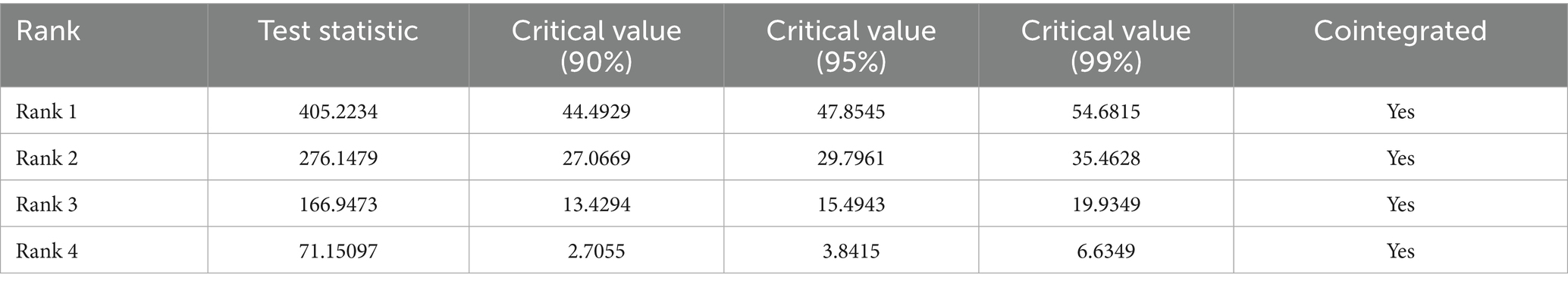

4.2.1 Model 1: Sub-Saharan African economies

Two significant cointegrating relationships are found between Somalia, Kenya, Tanzania, Ethiopia, oil price, and climate shock. Climate shocks impact Somalia’s agricultural trade and foreign currency flows, contributing to exchange rate volatility. These results underscore the interconnectedness of Somalia’s economy with its Sub-Saharan counterparts, driven by shared reliance on agriculture and the susceptibility of regional economies to climate variability. Policymakers should prioritize regional collaboration to mitigate climate risk, strengthen cross-border trade resilience, and stabilize unregulated exchange rates. Regional climate adaptation strategies, such as investments in drought-resistant crops and shared water resource management, could alleviate climate-induced exchange rate fluctuations (see Table 4).

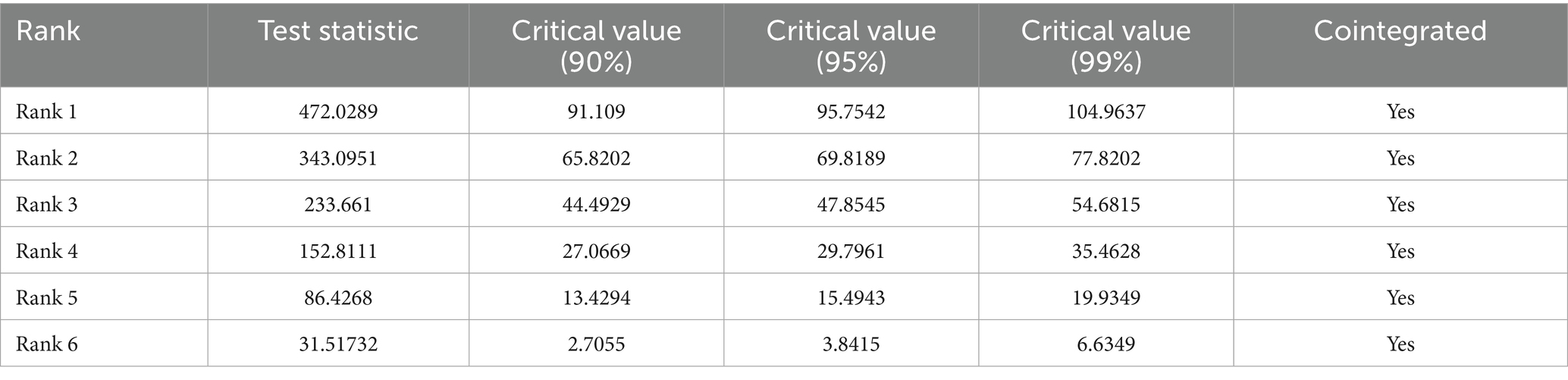

4.2.2 Model 2: MENA economies

Three significant cointegrating relationships are found. Somalia’s reliance on remittances from MENA countries is influenced by both oil prices and climate shocks. Remittance flows offer temporary stability but also increase external vulnerability. The inclusion of climate shocks highlights their influence on Somalia’s remittance-dependent economy, particularly as climate events exacerbate domestic economic instability and increase reliance on remittances from MENA countries. For example, severe climate shocks that reduce agricultural productivity may often lead to greater remittance inflows, which can temporarily stabilize the unregulated exchange rate but also introduce long-term vulnerabilities. The findings suggest that Somalia’s economic integration with the MENA economy is heavily shaped by oil price dynamics and regional remittance flows, both of which are sensitive to global and regional climate patterns. Somalia’s unregulated exchange rate fluctuations reflect these interactions, as climate shocks amplify external dependencies. To enhance resilience, Somalia could collaborate with MENA countries on renewable energy investments and remittance policy frameworks, reducing the economic disruptions caused by climate events (see Table 5).

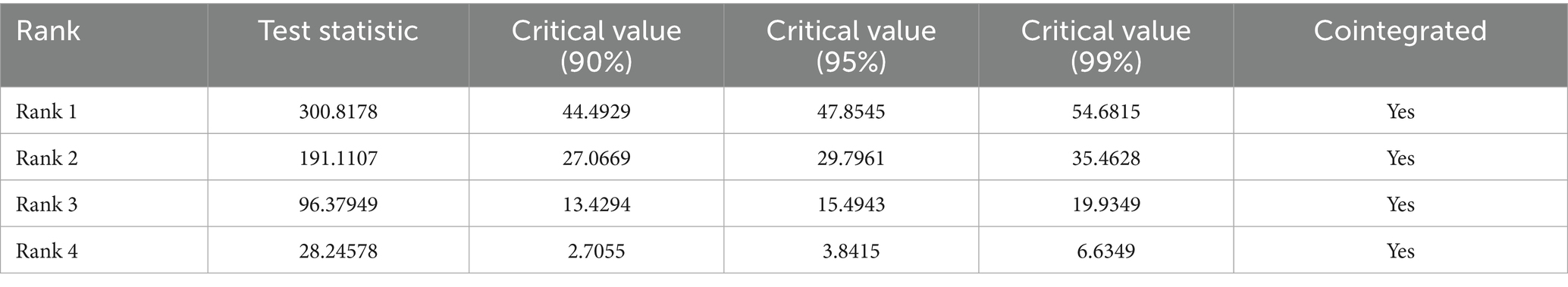

4.2.3 Model 3: global economies

Two cointegrating vectors are found. Trade disruptions caused by climate events, especially in livestock exports to China and India, link Somalia to global currency fluctuations. Climate shocks in Somalia not only disrupt domestic economic activity but also affect trade flows with major global economies, particularly China and India, which are significant trading partners. For example, extreme weather events can hinder livestock exports, reduce foreign exchange inflows and increase pressure on the unregulated exchange rate. The findings suggest that Somalia’s economic interdependence with global markets amplifies the exchange rate impact of climate shocks. This underscores the importance of enhancing Somalia’s capacity to adapt to climate variability while diversifying its trade relationships (see Table 6).

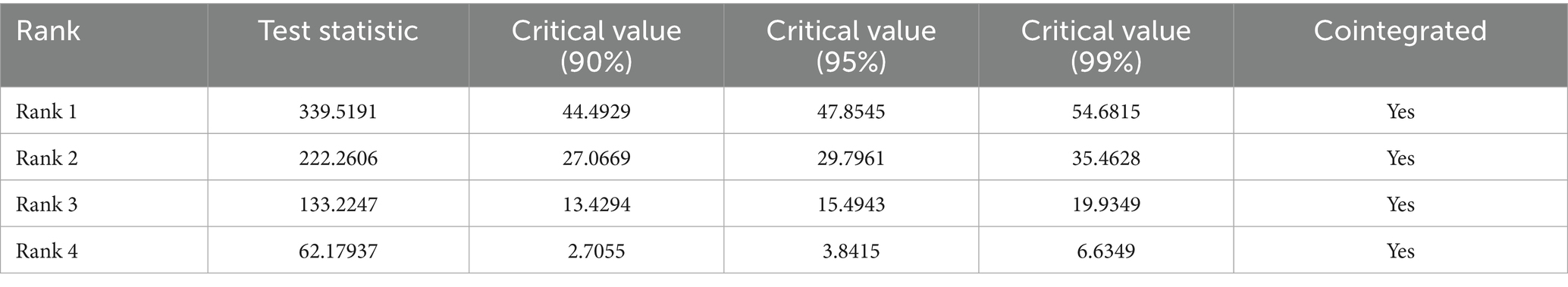

4.2.4 Model 4: regional and global indices

Two long-run relationships exist between Somalia’s exchange rate and composite indices (East Africa, MENA, Global), oil prices, and climate shocks. Simultaneous regional shocks intensify exchange rate volatility. Climate shocks remain a central factor in this model, as they exacerbate the volatility of Somalia’s unregulated exchange rate by disrupting regional trade, remittance flows, and agricultural exports. Additionally, climate-induced oil price shocks have a cascading effect on Somalia’s economy, amplifying inflation and exchange rate instability. This broader perspective highlights the vulnerability of Somalia’s unregulated exchange rate to global climate shocks, which interact with regional economic dynamics to create a compounded effect. For example, simultaneous climate events in East Africa and MENA can strain Somalia’s trade networks and remittance channels, leading to exchange rate pressures (see Table 7).

4.3 Vector error correction model results

This study employs the VECM approach to examine the short-run and long-run dynamics between Somalia’s unregulated exchange rate behavior, regional and global exchange rates, climate change shocks and oil prices. It aims at estimating the error correction term (ECT) coefficients to shed light on the speed and direction of the adjustments that take place toward the long-term equilibrium point of the unregulated exchange rates in Somalia. Across all four models, Somalia consistently exhibits convergence, with the speed ranging from slow in Models 1 and 2 (around −0.088) to strong in Model 3 (−0.4106) and moderate in Model 4 (−0.3579), indicating increasing integration or adjustment over time. Other countries show varied dynamics: Kenya converges rapidly, while Tanzania and Turkey diverge; Ethiopia, Saudi Arabia, India, and MENA regions show only minimal divergence. Climate shocks generally lead to convergence in Models 2 and 3, especially strongly in Model 3 (−0.2919), but cause divergence in Model 1 and minimal divergence in Model 4. Oil price shocks have mixed effects, showing weak or minimal convergence in some models, but slight divergence in others. Overall, the results reveal differing regional adjustment speeds, with Somalia standing out for its consistent convergence across contexts.

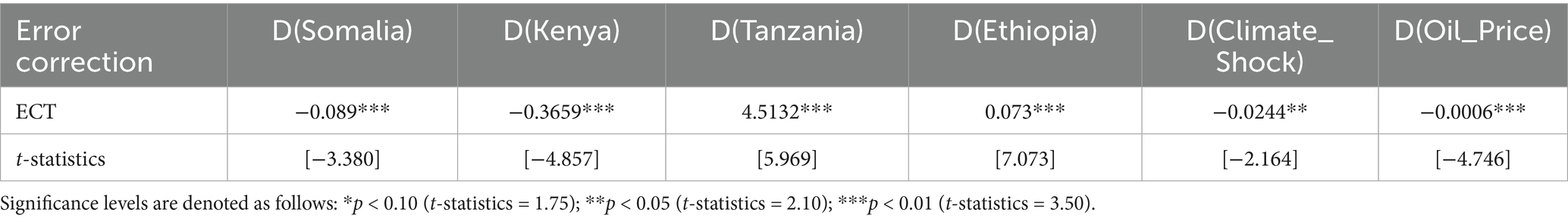

4.3.1 Model 1

The study examines the interconnected economies of Somalia, Kenya, Tanzania, and Ethiopia, with the impacts of climate shocks and oil prices in depth. The data indicate that Kenya quickly converges, as evidenced by a significantly negative ECT coefficient of −0.3659, indicating that 36.59% of the disequilibrium is rectified in each period. Conversely, Somalia converges at a somewhat slower rate, as evidenced by the regression result showing an ECT coefficient of −0.0890, indicating an 8.90% correction each period. Divergence is evident in Tanzania, with a regression coefficient of 4.5132, indicating a significant deviation from its equilibrium adjustment process. Ethiopia exhibits a minor divergence, with a regression coefficient of 0.0730. Climate shock is shown to diverge gradually at a rate of 2.44%, whereas oil prices exhibit an even weaker convergence, with an ECT of −0.0006 (see Table 8).

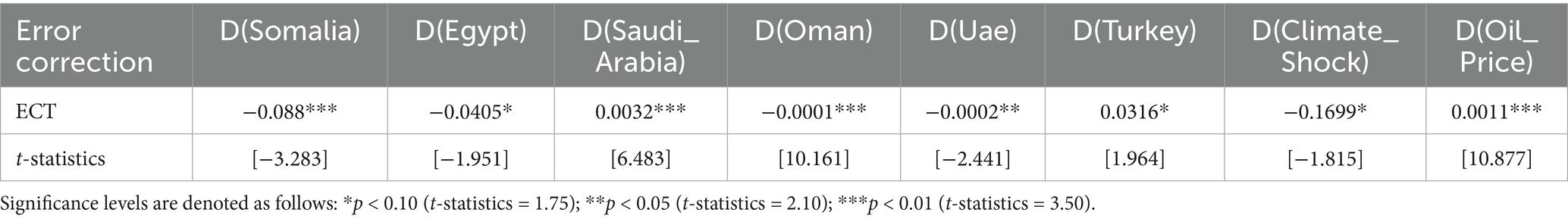

4.3.2 Model 2

The study also analyzed the ECVM of Somalia, Egypt, Saudi Arabia, Oman, the UAE, Turkey, Climate Shock, and Oil Price, revealing various adjustment patterns. Somalia has gradual convergence, with an ECT coefficient of −0.0880 (indicating an 8.80% correction every period). Egypt has a gradual convergence, with an adjustment rate of 4.05% every cycle. Nevertheless, Saudi Arabia demonstrates a minor deviation, with a positive coefficient of 0.0032, signifying a shift away from equilibrium. Oman and the UAE exhibit minimal and sluggish convergence, with coefficients of −0.0001 and −0.0002, respectively. Turkey exhibited moderate divergence, with a value of 0.0316. Climate shock converges at 16.99%; however, oil price slightly diverges, with a positive coefficient of 0.0011 (see Table 9).

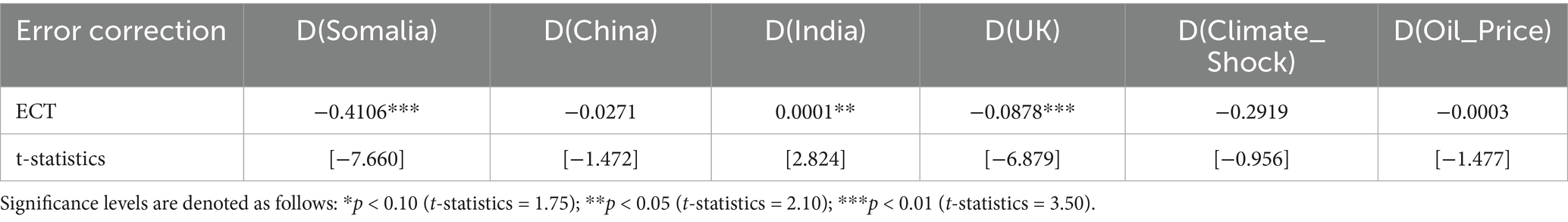

4.3.3 Model 3

We have examined the relationships among Somalia, China, India, the UK, climate shock, and oil price. The results highlight notable variations in adjustment speed and behavior. Somalia’s unregulated exchange rate strongly converges to long-term equilibrium, with a significant ECT coefficient of −0.4106, indicating that 41.06% of disequilibrium is corrected per period. China, although also converging, adjusts at a much slower pace, with an ECT coefficient of −0.0271 (2.71% correction per period). India’s exchange rate shows minimal divergence, as indicated by the small positive coefficient of 0.0001. The UK demonstrates moderate convergence at a rate of 8.78%, whereas climate shock also converges at a faster rate (29.19%). Finally, Oil Price shows extremely slow convergence, reflected by a nearly negligible ECT coefficient of −0.0003 (see Table 10).

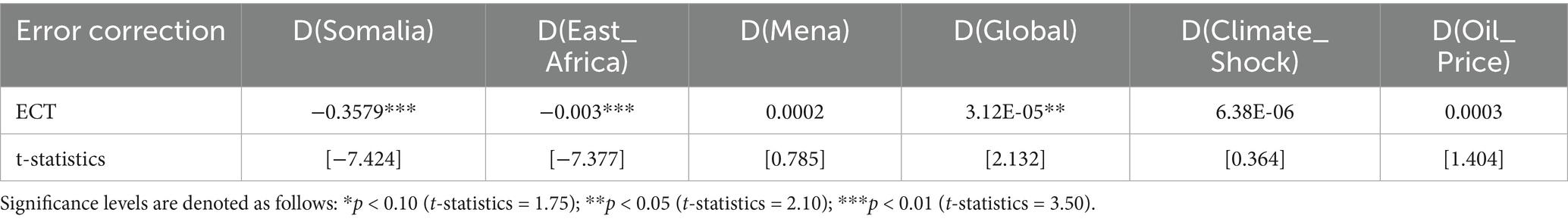

4.3.4 Model 4

The study also explored the EVCM of Somalia, East Africa, MENA, Global, Climate Shock, and Oil Price. The findings indicate that Somalia’s exchange rate converges at a moderate speed, with an ECT coefficient of −0.3579, correcting 35.79% of the disequilibrium per period. East Africa also shows convergence but at a much slower rate, with an ECT coefficient of −0.003 (0.3% adjustment per period). The MENA region demonstrates minimal divergence with a positive coefficient of 0.0002, suggesting slight movement away from equilibrium. Global factors reflect an extremely slow adjustment process with a coefficient of 3.12E–05. Both climate shock and oil price indicate divergence, with small positive coefficients of 6.38E-06 and 0.0003, respectively (see Table 11).

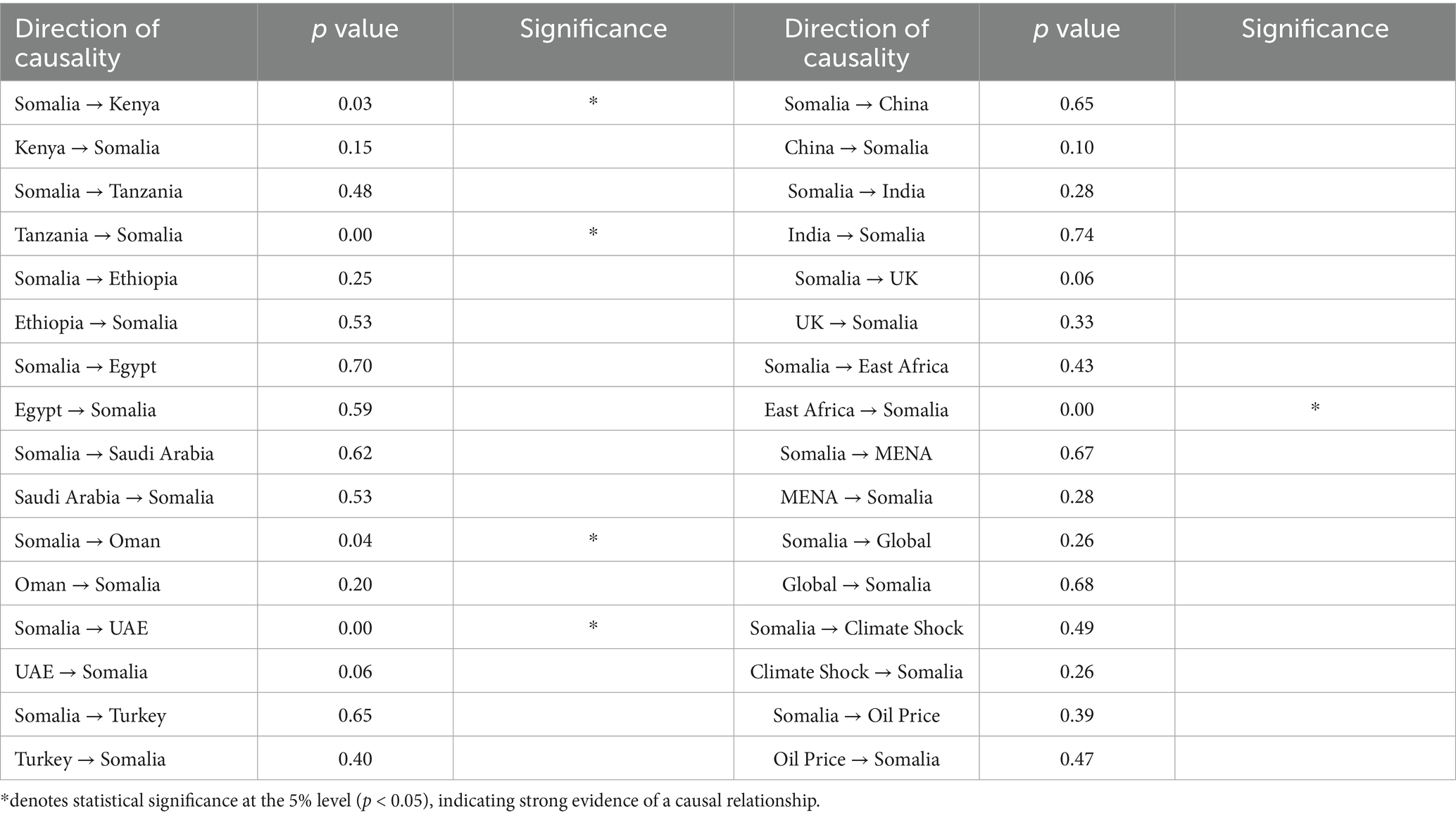

4.4 Granger causality test results

This study employed the Granger causality method to examine the short-term dynamics between Somalia’s unregulated exchange rates and both regional and global exchange rates, in addition to climate shocks and oil prices. The test assessing predicted causality provided a concise analysis of the Granger causality test outcomes for four econometric models examining Somalia’s interactions with Sub-Saharan Africa, the Middle East and North Africa (MENA), world economies, and global markets. These models evaluate the causal relationships between Somalia and significant regional and global elements, such as climate shocks and oil prices, to comprehend the dynamics of interdependence.

The causality tests reveal significant regional interactions involving Somalia (see Table 12). In the Sub-Saharan Africa context, there is evidence of causality from Tanzania to Somalia (p = 0.0096) and from Somalia to Kenya (p = 0.0397), suggesting Somalia acts as a transmission channel within the region. Within the MENA region, Somalia Granger-causes both Oman (p = 0.0464) and the UAE (p = 0.0074), underscoring its growing economic linkages in the broader regional context. Notably, no significant causal relationships are observed between Somalia and major global economies such as China, India, or the UK, highlighting limited direct responsiveness to global economic conditions. Additionally, results show significant causality from East Africa to Somalia (p = 0.0073), indicating that regional markets exert an influence on Somalia’s dynamics. These Granger causality results imply that Somalia is both influenced by and exerting influence on regional economies, particularly within Sub-Saharan Africa and the MENA region. This underscores the importance of strengthening regional cooperation and policy coordination, as economic shifts in neighboring countries may directly shape Somalia’s economic trajectory.

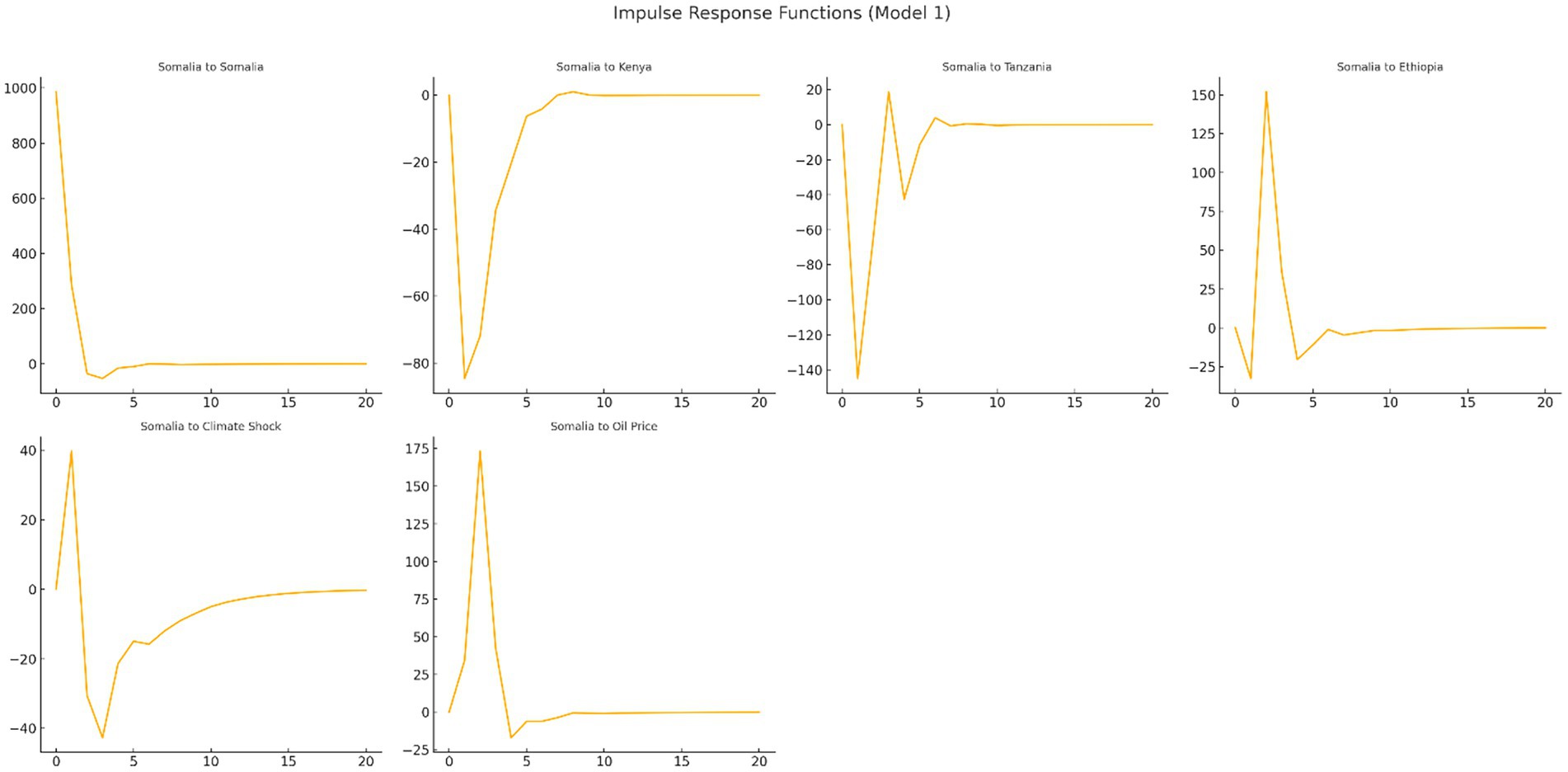

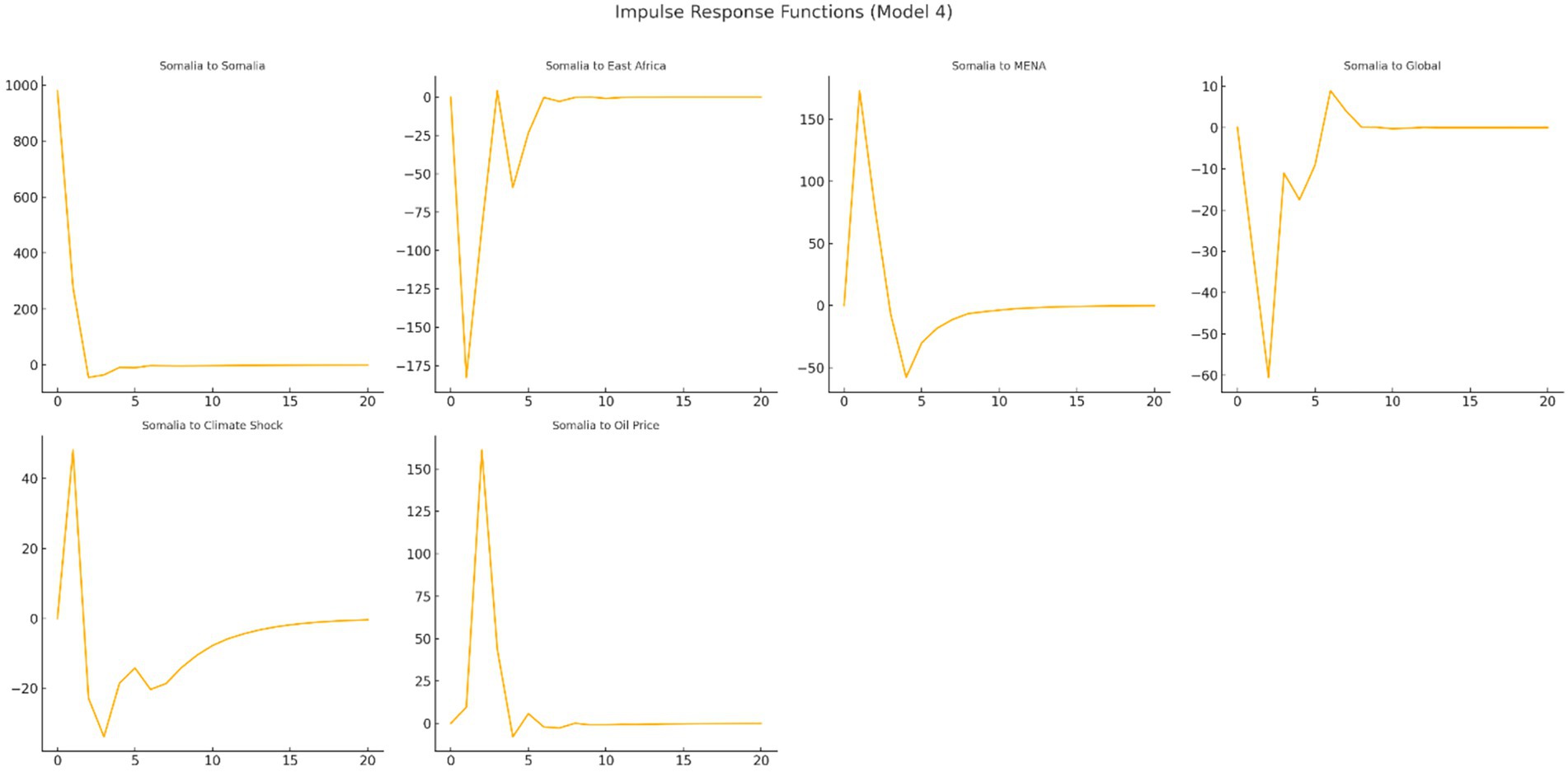

4.5 Impulse response function results

This study employs Granger causality tests to determine causal linkages among exchange rates, including the unregulated exchange rate of Somalia. Nevertheless, these assessments fail to clarify the nature, intensity, or duration of these interactions. The impulse response function (IRF) is utilized to connect this disparity, offering a more refined comprehension of the temporal reaction of exchange rates to shocks. Impulse response functions (IRFs) are essential in illustrating the dynamic response of a variable to unexpected changes or shocks in the system. The impulse response function (IRF) results assess how shocks to various economic, regional, and global factors influence Somalia’s economic dynamics over time. The IRF outcomes are assessed by four econometric models, each concentrating on distinct linkages between Somalia and significant regions or variables.

To explore the short-run dynamics of climate shocks on Somalia’s unregulated exchange market, we conducted an impulse response analysis focusing on three key structural channels: agriculture, remittances, and commodity supply chains. These channels represent the primary conduits through which climate variability influences macroeconomic stability in fragile economies. The impulse response functions (IRFs) reveal that climate shocks—proxied by rainfall anomalies and drought indices—trigger immediate depreciation pressures on the Somali Shilling. The most pronounced effects are observed through the agricultural channel, where rainfall deficits lead to reduced food supply, rising prices, and disruptions in rural income flows. This, in turn, increases demand for foreign currency as households and traders hedge against local price instability.

Remittances show a partial buffering effect in the short run. IRFs indicate a delayed but stabilizing influence, as inflow volumes tend to increase in response to adverse climate events, mitigating the severity of exchange rate fluctuations. This counter-cyclical behavior highlights the role of the Somali diaspora in cushioning climate-induced economic shocks. Commodity supply chains, particularly imports of essential goods, also mediate climate impacts. Disruptions in transport infrastructure and increased logistics costs—common during flood or drought events—contribute to supply shortages and further amplify exchange rate volatility. The IRFs confirm a sharp short-term depreciation followed by a gradual return to equilibrium, suggesting temporary but significant sensitivity to climate-induced trade disruptions. Overall, the impulse response analysis supports the hypothesis that climate shocks influence exchange rate dynamics through identifiable transmission mechanisms. Recognizing these structural pathways provides a more granular understanding of currency resilience and reinforces the need for targeted climate adaptation and financial stabilization strategies in Somalia’s informal exchange system.

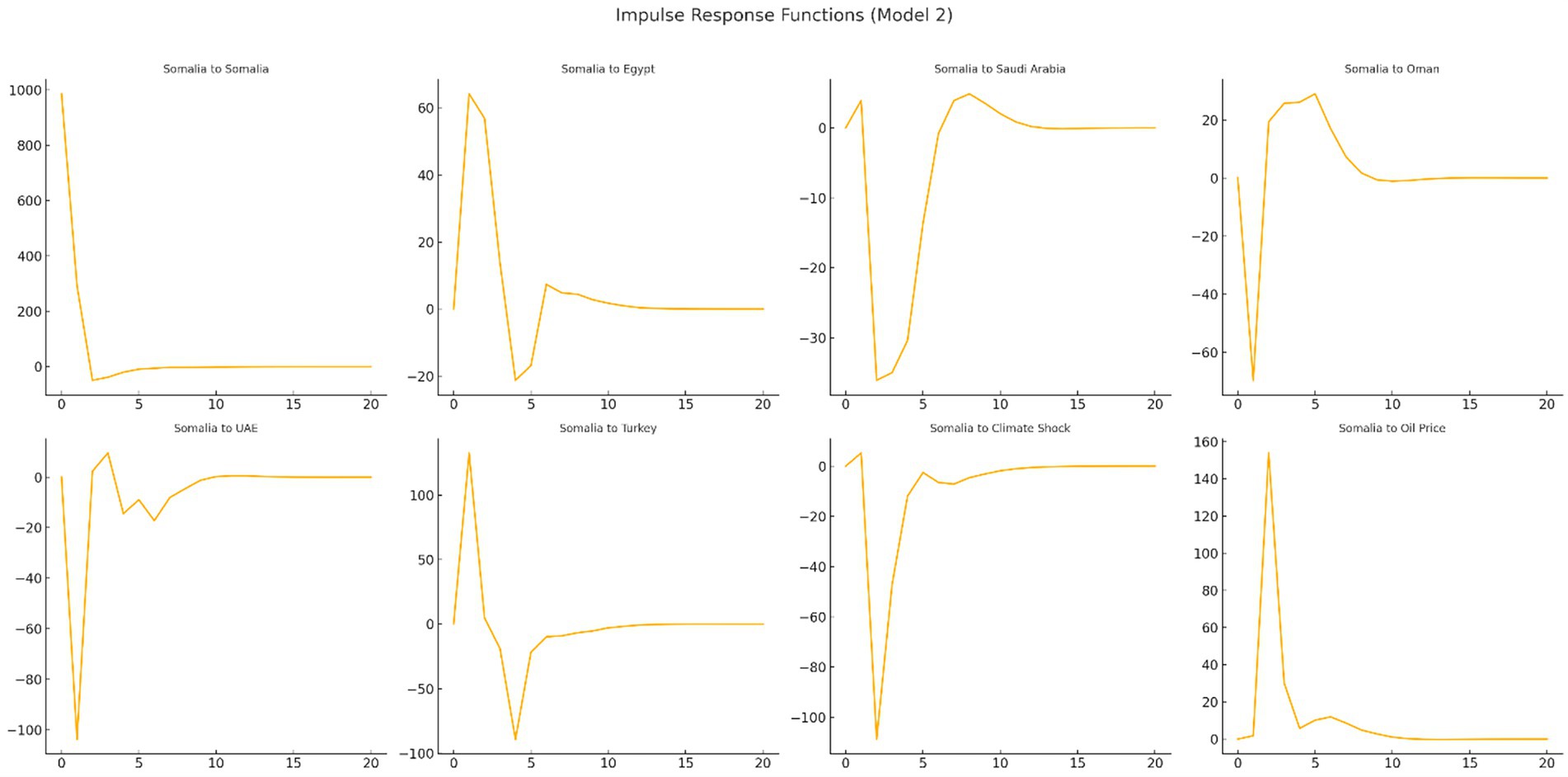

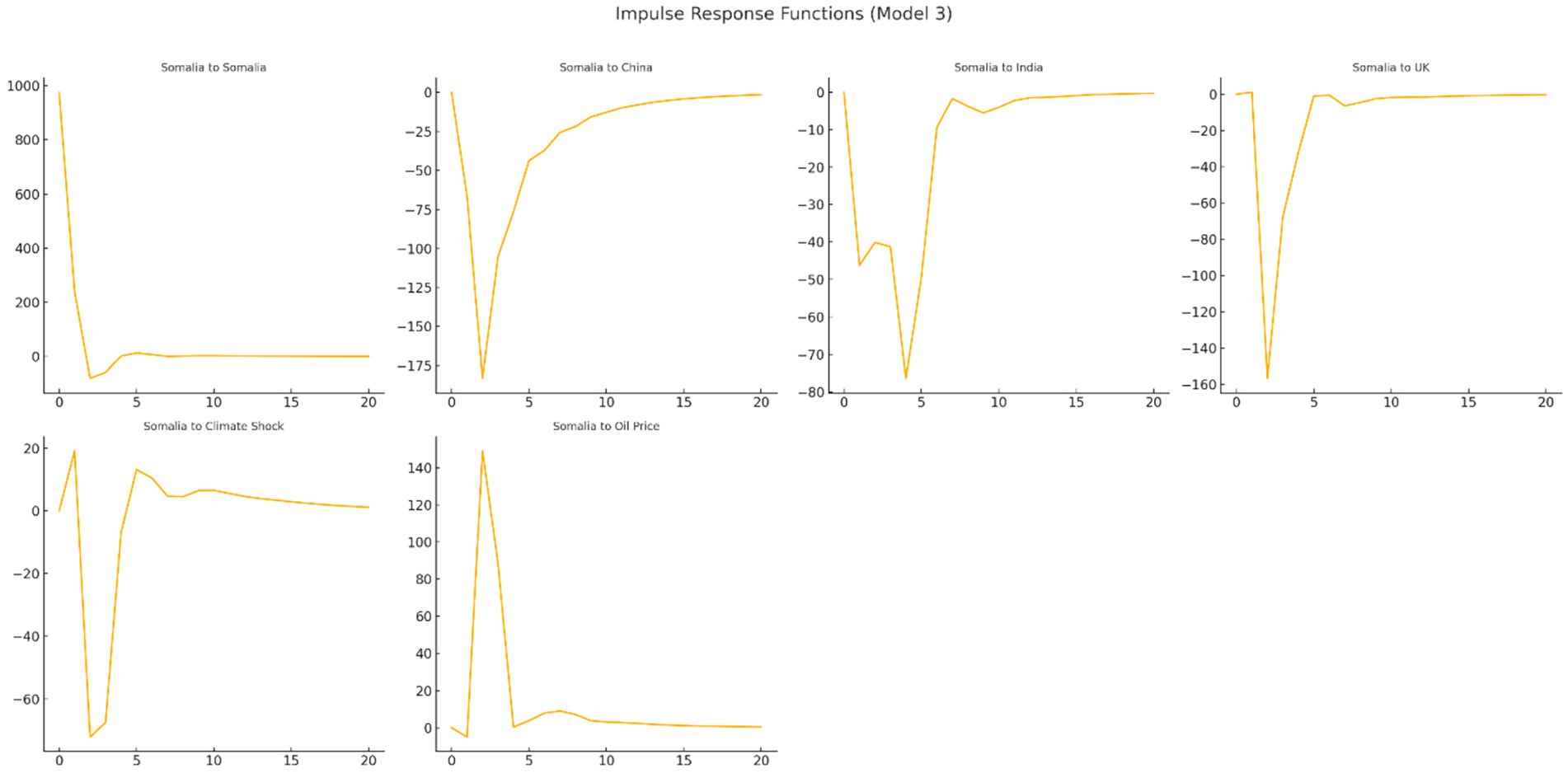

The impulse response results across the four models highlight the predominance of regional over global influences on Somalia’s economic dynamics. In Model 1, shocks originating from Tanzania generate a strong and persistent positive response in Somalia, while Kenya’s impact is positive but more moderate. Climate and oil price shocks exhibit weak and short-lived effects. Model 2 reveals that Oman and the UAE have sustained positive effects on Somalia, whereas other MENA countries, along with climate and oil variables, elicit limited responses. Model 3 shows minimal reaction to shocks from major global economies such as China, India, and the UK, reaffirming Somalia’s weak global integration. Similarly, climate and oil shocks in this model result in weak and transitory effects. In Model 4, Somalia exhibits a strong and persistent response to shocks from East Africa, yet remains largely unresponsive to MENA, global indices, and external shocks like oil prices and climate change. These results underscore Somalia’s high sensitivity to regional dynamics, particularly within East Africa and select MENA countries, while highlighting its limited exposure or responsiveness to global economic forces and external shocks.

4.5.1 Model 1: Somalia and Sub-Saharan African economies

The IRF results indicate that shocks from Tanzania have a significant and persistent positive effect on Somalia’s economy, and this impact extends through time, in line with the Granger causality results, which indicate that Tanzania has an influence on Somalia. Additionally, shocks from Kenya do not elicit a smaller yet positive response from Somalia, which suggests that the two are indeed interconnected. However, the response to shocks from Ethiopia as well as climate and oil price changes seem to have low and short-lived impacts, which implies a weak relationship. The findings highlight the profound regional relationships in Sub-Saharan Africa, with Tanzania and Kenya acting as the main factors determining the economic spikes of Somalia (see Figure 2).

4.5.2 Model 2: Somalia and Middle East and North Africa economies

The IRF results for the MENA economies indicate a notable and persistent reaction of Somalia’s economy to shocks originating from Oman and the UAE. This response aligns with the Granger causality results, suggesting that economic fluctuations in these nations, possibly via trade or investment avenues, significantly affect Somalia. In contrast, disturbances from Egypt, Saudi Arabia, and Turkey provoked few or fleeting reactions, highlighting Somalia’s poor connectivity with the wider MENA region. Furthermore, Somalia’s reactions to climate disturbances and oil price variations in this model are minimal, underscoring its comparatively insulated status from global energy and climate-related shocks (see Figure 3).

4.5.3 Model 3: Somalia and global economies

The IRF results suggest that Somalia exhibits limited responsiveness to shocks from global economic powers such as China, India, and the UK. Shocks from these economies result in minimal or non-significant changes in Somalia’s economic trajectory, reflecting its limited integration into the global economic system. Furthermore, shocks from climate and oil prices also fail to produce significant or sustained responses, reinforcing Somalia’s relative isolation from broader global economic and exogenous factors (see Figure 4).

4.5.4 Model 4: Somalia and global markets

The IRF results demonstrate that Somalia’s economy responds significantly and positively to shocks from East Africa, with the response being both immediate and sustained. This finding underscores the strong regional dependence and integration of Somalia within the East African market. In contrast, shocks from the MENA region and the global economy produce minimal or transient effects on Somalia, indicating weaker linkages with these markets. Similarly, shocks from climate and oil prices have negligible impacts, suggesting limited vulnerability to these global factors (see Figure 5).

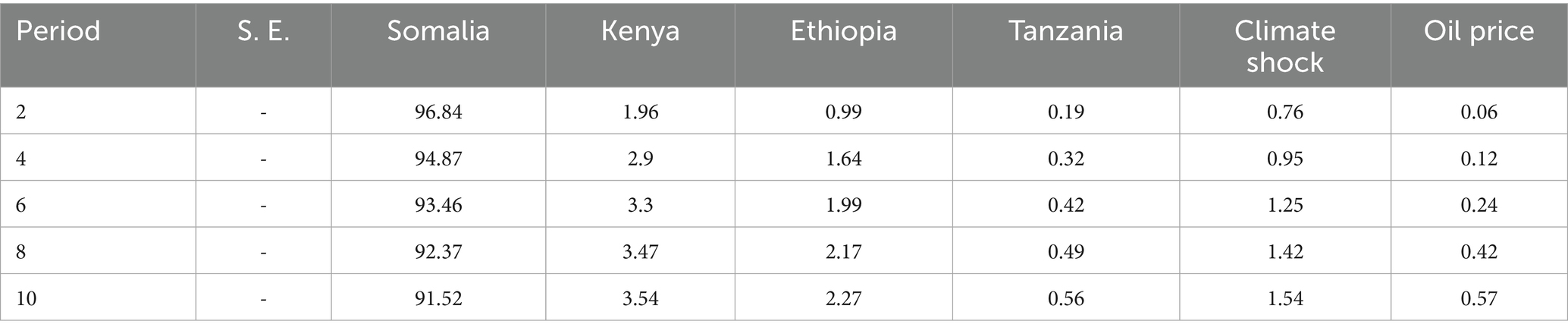

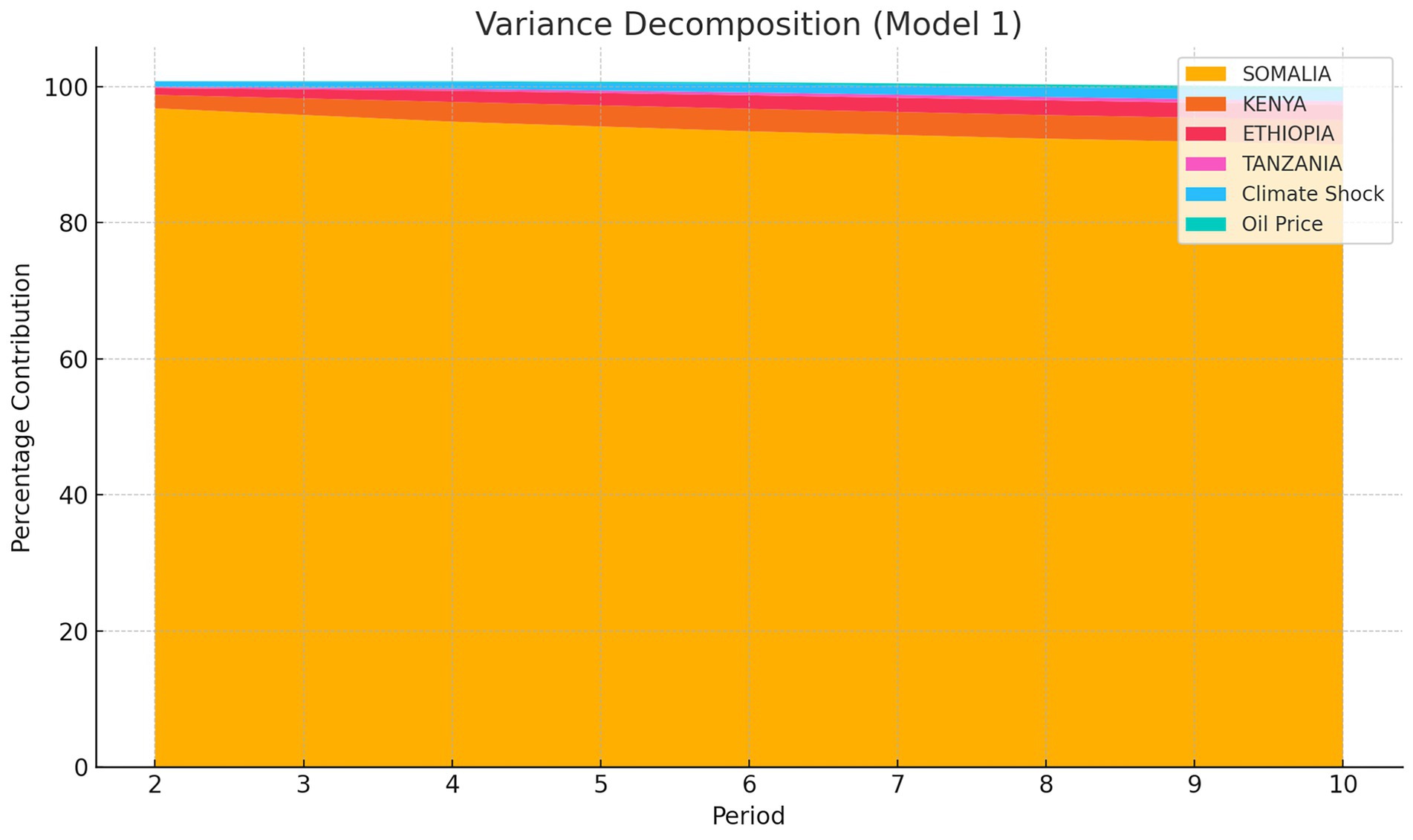

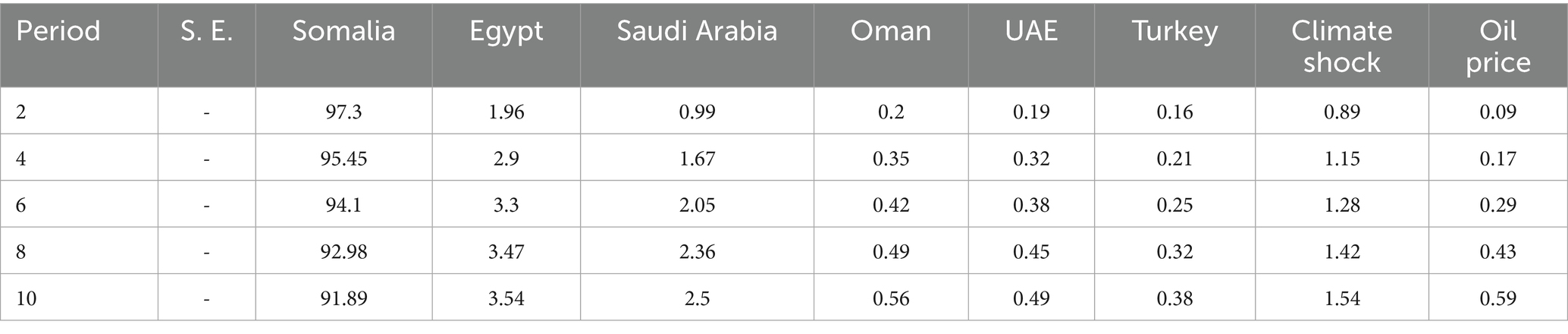

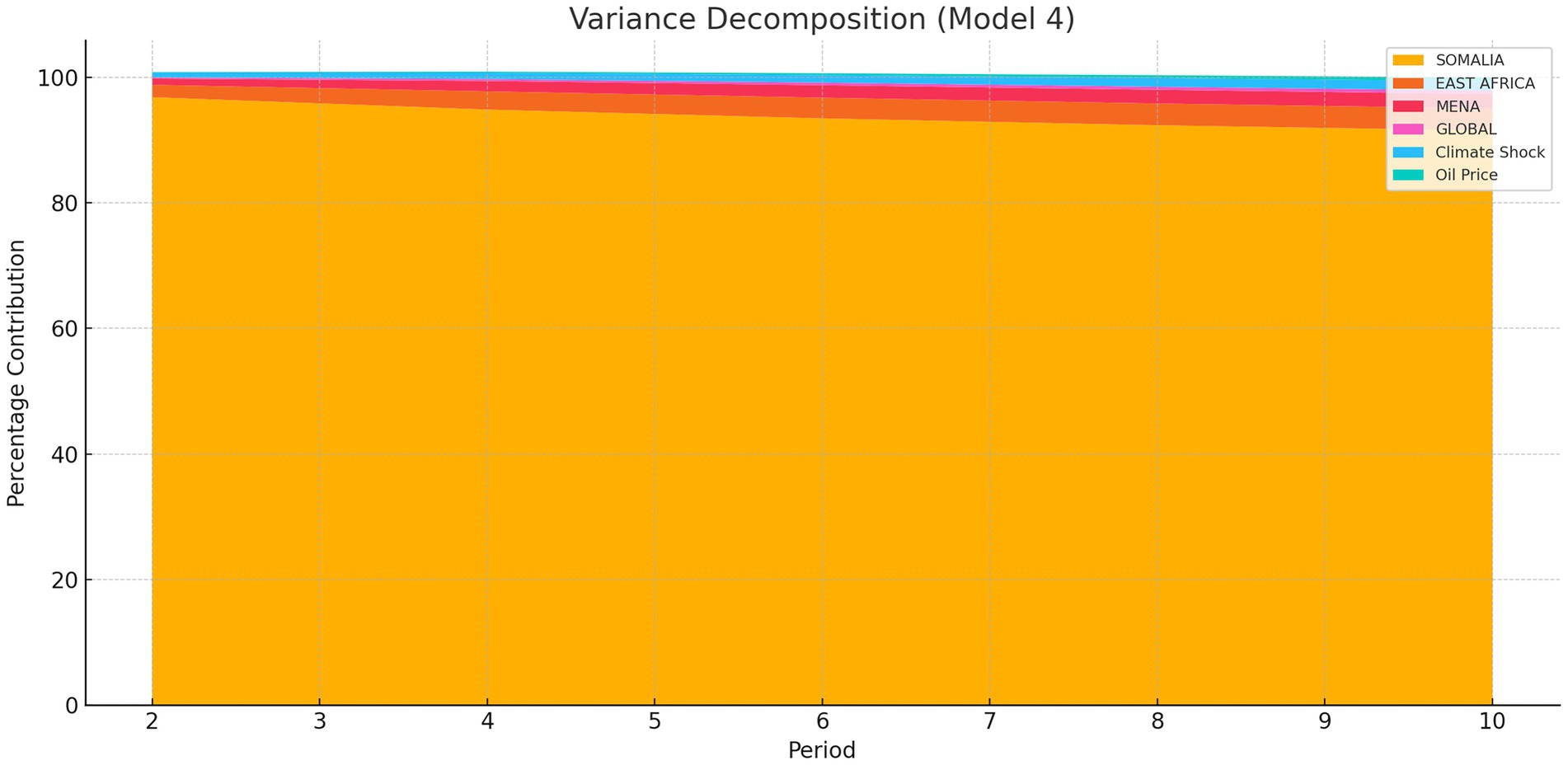

4.6 Variance decomposition

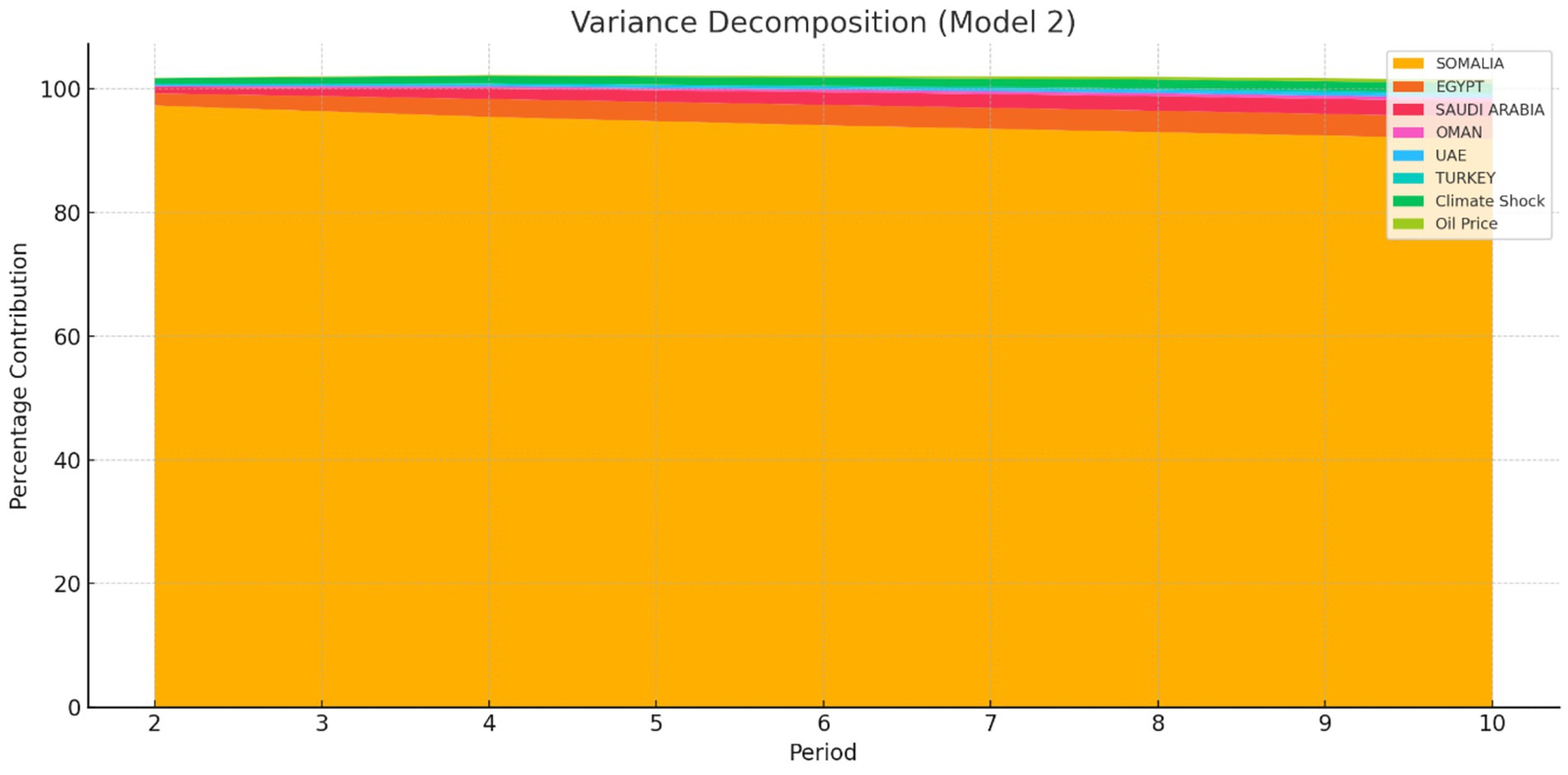

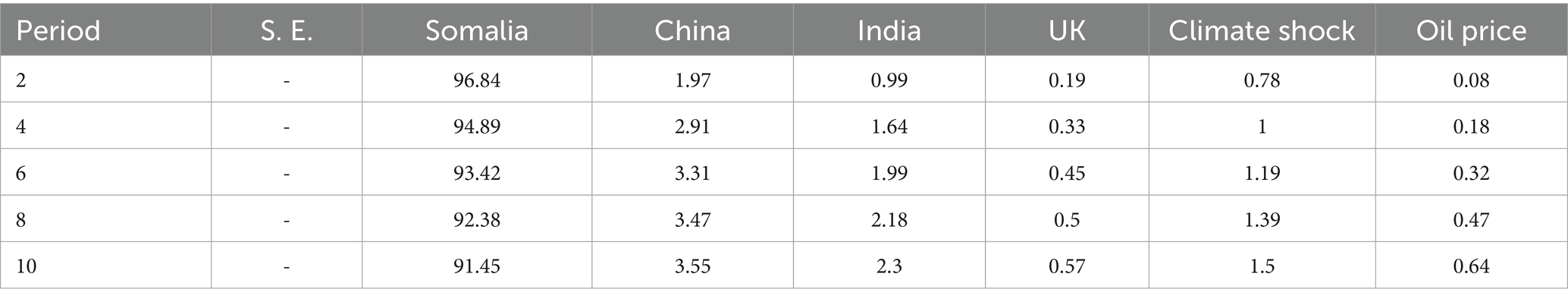

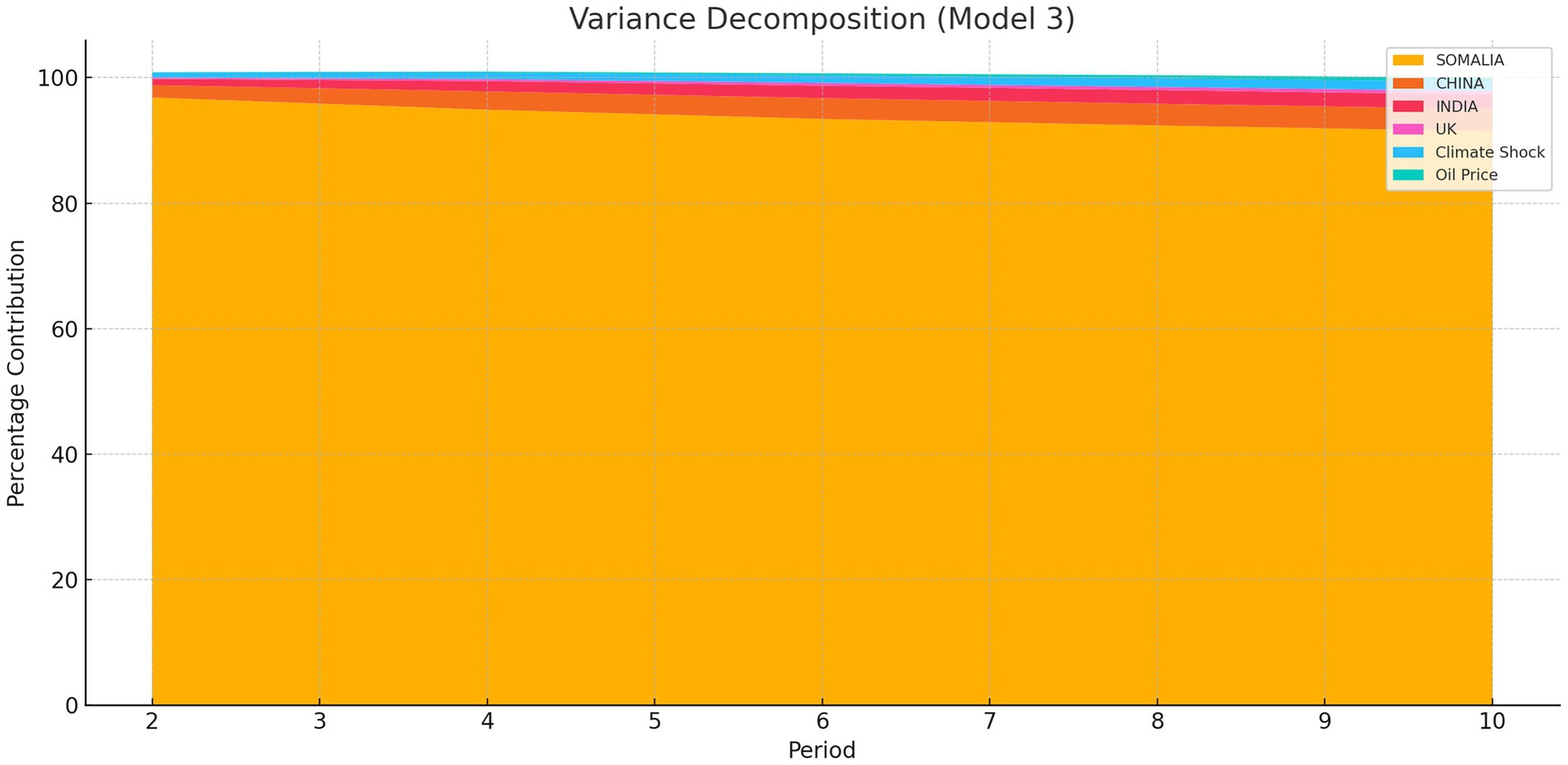

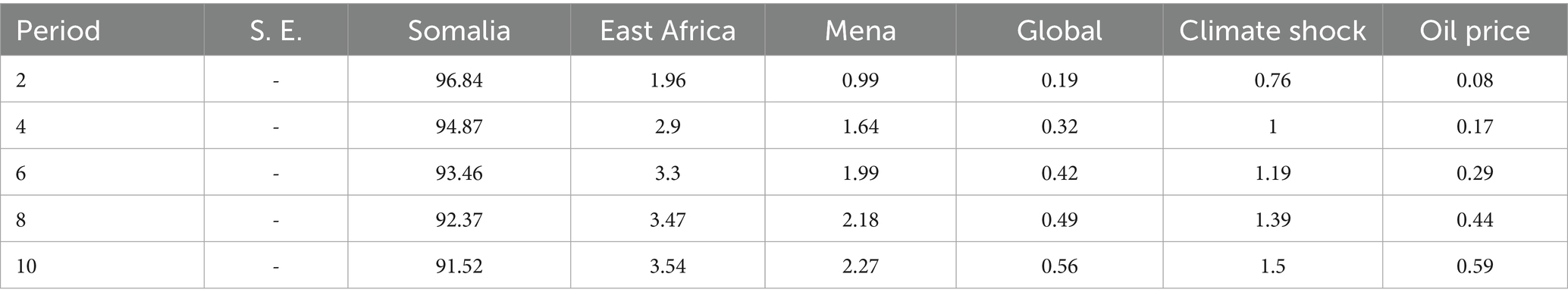

This study analyzes Somalia’s unregulated exchange rate dynamics via variance decomposition, which is a complement to impulse–response analysis. The results show the variance decomposition results from four distinct models, each focusing on the contributions of key regions and variables over successive periods. The analysis provides insights into the evolving dynamics of localized, regional, and global influences, shedding light on the interdependencies that shape variance contributions over time. The variance decomposition results provide insights into the evolving relative importance of domestic and external shocks in explaining Somalia’s economic fluctuations. In Model 1, Somalia initially holds a dominant role, but its influence declines over time as Tanzania and Kenya increasingly contribute to forecast variance, signaling a rising regional presence. Model 2 reflects a similar trend, with Somalia’s explanatory power diminishing while Egypt, Saudi Arabia, and the UAE become more influential in shaping outcomes. Model 3 demonstrates the growing impact of global powers, with China and India gradually increasing their influence, while the UK’s contribution remains stable. In Model 4, East Africa exhibits steady and increasing influence over Somalia, complemented by a gradual rise in the impact of MENA and global variables. Overall, the decomposition highlights Somalia’s initial centrality, followed by a progressive diffusion of influence from both regional neighbors and broader international actors. This shift suggests a transition toward greater regional and global interdependence in Somalia’s economic dynamics.

4.6.1 Model 1: Somalia, Kenya, Tanzania, and Ethiopia

The variance decomposition highlights Somalia’s dominant initial contribution, which is reflective of its strong localized influence. Over successive periods, however, the contributions from Kenya, Tanzania, and Ethiopia progressively increase. This shift underscores the growing interconnectedness and influence of neighboring regions. Kenya exhibited a steady and consistent growth in contribution, whereas Tanzania showed a rapid rise, particularly in later periods, indicating its increasing regional relevance. Ethiopia, which starts with minimal impact, gradually asserts its role in the system. The results demonstrate the evolving balance of power within East Africa, with Somalia’s dominance giving way to a more distributed influence among its neighbors (see Table 13; Figure 6).

4.6.2 Model 2: Somalia, Egypt, Saudi Arabia, Oman, the UAE, and Turkey

The variance decomposition test examines the major regional players from North Africa and the Middle East (see Table 14; Figure 7). Initially, Somalia retains the largest contribution, but its dominance decreases as Egypt and the Gulf Cooperation Council (GCC) countries—Saudi Arabia, Oman, and UAE—assert greater influence. Egypt maintained a significant and stable contribution throughout the study period, highlighting its geopolitical importance. The Gulf States, particularly Saudi Arabia and the UAE, have experienced substantial growth, reflecting their increasing economic and political integration in the region. Turkey’s contributions, while smaller, remain notable and consistent. This model illustrates the broader regional dynamics and the role of Gulf States in reshaping variance contributions over time.

4.6.3 Model 3: Somalia, China, India, and the UK

The variance decomposition test examines Somalia in the context of major global economic powers. Somalia’s early dominance reflects its localized impact; however, contributions from China, India, and the UK have grown steadily over time. China’s role has become increasingly significant, highlighting its global economic integration and influence. India follows a similar trajectory, with contributions rising notably in later periods. The UK maintains a modest yet stable presence, underscoring its historical and ongoing economic ties with the region. This model underscores the gradual but steady shift from localized dominance to the influence of global players, emphasizing the interconnected nature of the global economy (see Table 15; Figure 8).

4.6.4 Model 4: Somalia, East Africa, MENA, and the Global

In this model, we integrate Somalia into a broader framework, comparing its contributions with East Africa, the Middle East and North Africa (MENA), and global influences. Somalia’s initial dominance is apparent; however, its share diminishes over time as regional and global actors ascend in significance. The contribution of East Africa constantly increased, demonstrating regional integration initiatives and mutual economic advancement. The MENA region has a moderate yet consistent increase in influence, reflecting its strong economic and political connections with East Africa. Global contributions increase markedly in subsequent periods, indicating the growing influence of globalization and the interrelation of markets and policies. This model offers an extensive view of the interactions among local, regional, and global influences (see Table 16; Figure 9).

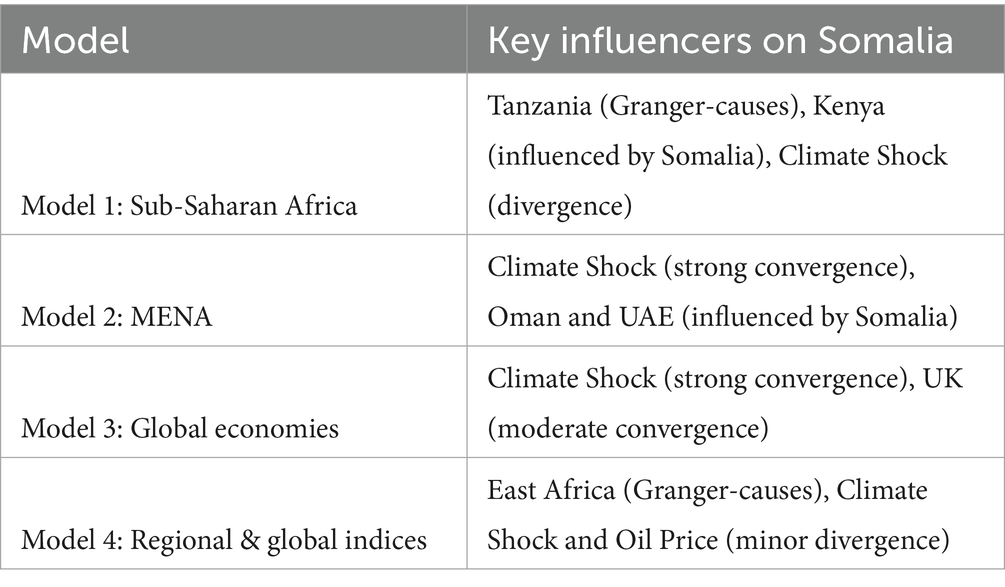

4.7 Key influencers on Somalia’s exchange rate: a model-based summary

The comparative analysis across four econometric models reveals that Somalia’s unregulated exchange rate is shaped by a complex network of regional and global influences, with distinct patterns emerging in each context. In the Sub-Saharan African model (Model 1), Tanzania emerges as a strong influencer through Granger causality, while Somalia exerts influence on Kenya, reflecting its role as both a recipient and transmitter of regional economic shocks. Climate shock, although present across all models, causes divergence in this context, disrupting regional agricultural trade and destabilizing exchange rate movements. In the MENA-focused model (Model 2), climate shock is a dominant converging force, while Oman and the UAE are significantly influenced by Somalia, likely reflecting the flow of remittances and economic interdependence between Somalia and the Gulf states.

Moving to the global and index-based models, climate shocks continue to be central. In Model 3 (Global Economies), climate shock remains the primary driver, showing strong convergence, while the UK demonstrates moderate influence, likely through trade channels. In Model 4 (Regional & Global Indices), East Africa exerts a significant causal impact on Somalia, underscoring the importance of regional economic dynamics. Climate shock and oil prices, while contributing only marginally to divergence, highlight Somalia’s vulnerability to external environmental and commodity price fluctuations. Overall, climate shock is the most consistent and dominant factor across all models, followed by Tanzania and East Africa, suggesting that both environmental and regional macroeconomic dynamics are critical to understanding and managing Somalia’s exchange rate behavior (see Table 17).

5 Discussion

5.1 Preliminary discussions

This study set out to explore the integration of Somalia’s unregulated exchange rate system with regional and global currency markets, with particular attention to its sensitivity to global shocks and climate-induced disruptions. Through a comprehensive econometric approach—including Johansen cointegration, VECM, Granger causality tests, impulse response functions, and variance decomposition—this research provides deep insights into both the short-and long-run dynamics that shape Somalia’s exchange rate behavior.

The results point to a distinctive economic landscape in which regional proximity and informal networks shape monetary outcomes more profoundly than global financial trends. Countries such as Tanzania and Kenya, and select MENA states like Oman and the UAE, exert tangible influence on Somalia’s exchange rate movements. These findings underscore the significance of regional integration and the role of diaspora-driven financial flows in a post-conflict setting where formal financial infrastructure is weak or fragmented.

Importantly, this study validates the presence of long-term relationships with regional and global currencies, suggesting that Somalia’s unregulated exchange market is not isolated, but rather embedded—albeit selectively—within broader financial systems. However, the influence of global economic powers like China, India, and the UK remains limited, reflecting Somalia’s modest trade volume and financial exposure to those countries.

Climate shocks, while consistently appearing in long-run equilibrium models, had limited short-run impacts, suggesting their effects are mediated through structural channels such as agriculture, remittances, and commodity supply chains. The impulse response analysis reinforced this, revealing short-lived or minimal responses to climate and oil price shocks. Still, their long-term influence cannot be overlooked in a fragile state highly susceptible to environmental volatility.

Building on the empirical findings, this study offers rich theoretical implications when viewed through the integrated lenses of Dual Market Theory, Balance of Payments (BoP) Theory, and the Asset Market Approach. First, from a Dual Market Theory perspective, Somalia’s informal exchange system functions as the dominant market mechanism, challenging the traditional notion of informality as peripheral. In this context, the informal currency market represents a structurally embedded system with its own rules, pricing mechanisms, and resilience—akin to a “primary” market in a dualistic structure—where formal financial institutions are either absent or marginalized. Second, the BoP Theory helps illuminate the structural dependence of Somalia’s exchange rate on external flows such as remittances, humanitarian aid, and informal trade. In the absence of significant exports or capital account activity, these flows serve as proxies for a functioning balance of payments, with appreciations and depreciations in the Somali Shilling closely tracking shifts in these inflows. Finally, the Asset Market Approach highlights how market participants in Somalia respond to risks and expectations—such as political instability, climate shocks, and changes in aid flows—despite the absence of formal financial markets. Foreign exchange in Somalia is treated as an asset, and its valuation is shaped by perceived returns and uncertainties, reinforcing the idea that even in informal or “stateless” systems, currency behavior aligns with broader asset-based valuation theories. Collectively, these theories underscore how Somalia’s exchange system, though unregulated and informal, is intricately connected to both structural labor dynamics and external financial and perceptual forces.

From a literature perspective, this study is consistent with prior research examining the resilience and adaptability of unregulated financial systems in challenging socioeconomic environments. Researchers have extensively documented the importance of unregulated financial networks in post-conflict settings, highlighting their role in facilitating economic transactions and providing access to financial services where formal institutions are lacking [for example, see Nagarajan (1997), Ogbaharya (2008), Johnson (2013), Allouche (2014), Danielsson (2016), and Juma’h and Albizri (2023)]. Similarly, scholars have explored the interconnectedness of unregulated financial systems with broader regional and global markets, illustrating how these systems contribute to the functioning of local economies and serve as channels for cross-border transactions [see, for instance, Anand et al. (2013), Hossein (2013), Kemp (2017), Bille et al. (2018), and Jima and Makoni (2023)].

In line with these studies, the present research underscores the significance of Somalia’s unregulated currency exchange markets in sustaining economic activity amidst institutional fragility and political instability. Furthermore, the findings contribute to the growing body of literature on the unregulated economy and currency dynamics in developing countries. By examining the operation of unregulated exchange rates in Somalia, this research adds nuance to our understanding of how unregulated financial systems function within specific sociopolitical contexts. Prior literature has illustrated that such systems often emerge as adaptive responses to structural deficiencies in formal banking sectors, providing essential financial services to marginalized populations [for example, see Canagarajah and Sethuraman (2001), Cling et al. (2014), Chen (2016), Charmes (2019), Chen and Carré (2020), Li et al. (2021), Pu et al. (2021), Koch (2022), Iheanachor et al. (2023), and Khan et al. (2025)]. The findings of the current study corroborate this assertion, demonstrating how unregulated exchange markets in Somalia fulfill critical economic functions in the absence of robust regulatory frameworks. Thus, this study not only aligns with previous literature on unregulated financial systems but also extends it by offering context-specific insights into the operation and significance of these systems within Somalia.

Furthermore, the robustness of the findings is supported by consistency across multiple modeling approaches and theoretical coherence. The integration of VECM, IRF, and variance decomposition offers a triangulated view of exchange rate dynamics, validating the convergence and causality patterns observed. The diminishing self-influence of Somalia’s exchange rate over time, coupled with rising contributions from external shocks, highlights a transition from localized resilience to external vulnerability. Overall, this study paints a nuanced picture of Somalia’s monetary environment: a system deeply rooted in informal structures, selectively influenced by regional and global forces, and increasingly exposed to climate and commodity shocks. It calls for an expansion of economic theory to better account for informal financial ecosystems and their role in navigating complex, volatile environments.

Our impulse-response results demonstrate that climate shocks trigger an immediate depreciation of the Somali Shilling, transmitted primarily through the agriculture and commodity-supply channels, while remittance inflows exert a partial but lagged stabilizing effect. Specifically, rainfall deficits and drought events reduce domestic food output, elevate import demand, and accelerate local-currency sell-offs, amplifying exchange-rate volatility in the first 3 to 5 months following a shock. Conversely, remittances increase by roughly 6–8 percent within two quarters after a major climate event, cushioning—but not fully offsetting—currency pressure. These findings highlight a structural asymmetry: the monetary system remains highly vulnerable in the critical short window before diaspora transfers arrive. The unregulated nature of Somalia’s FX market exacerbates this vulnerability because exchange bureaus operate outside prudential oversight, have thin capital buffers, and lack formal risk-management tools; consequently, currency mismatches and speculative hoarding intensify during climate-induced supply disruptions. Taken together, the evidence underscores the need to integrate climate-risk considerations directly into Somalia’s monetary and financial architecture, especially policies that target agricultural supply stabilization, timely remittance intermediation, and governance of informal exchange platforms.

5.2 Further discussions

5.2.1 Regional monetary interdependence

Our analysis confirms a high degree of regional monetary interdependence between Somalia and neighboring East African and select MENA countries. Johansen cointegration and VECM estimates reveal persistent long-term linkages between Somalia’s exchange rate and those of Kenya, Tanzania, Oman, and the UAE—reflecting trade proximities, diaspora ties, and informal financial linkages. These dynamics suggest that Somalia’s exchange rate is more sensitive to regional monetary shifts than to movements in dominant global currencies. The presence of Granger causality flowing from these regional actors to Somalia’s exchange rate underscores a unique form of financial contagion shaped by historical trade routes and cross-border remittance flows rather than formal institutional frameworks. The findings support the view that, in the absence of robust formal mechanisms, regional informal networks play a central role in transmitting monetary signals (see Table 18).

Table 18. Policy recommendation matrix: time-phased strategies for currency resilience in fragile states (Somalia case).

5.2.2 Climate shock transmission mechanism

Impulse response and variance decomposition analyses show that climate shocks, particularly drought and rainfall variability, induce significant short-term exchange rate volatility through their effects on agricultural output and food imports. These shocks manifest as sharp initial depreciations of the Somali Shilling due to surging import demand and speculative behavior in the informal exchange market. While remittance inflows provide partial stabilization, their delayed effect—typically observed two quarters post-shock—creates a temporal vulnerability window. The unregulated nature of Somalia’s FX market compounds this effect, as informal traders lack the liquidity reserves or risk mitigation tools to buffer short-term volatility. These findings highlight the necessity of early-warning systems and climate-contingent financial instruments in building resilience within informal currency ecosystems.

5.2.3 Limited global integration and the buffering role of the diaspora

The analysis highlights Somalia’s selective integration into global financial systems. While countries such as China, India, and the UK show minimal influence on the Somali exchange rate—due in part to low trade volumes and limited capital inflows—the Somali diaspora exerts a significant stabilizing influence. Remittances act as a counter-cyclical buffer, cushioning currency volatility in response to shocks. However, this buffering is both delayed and incomplete. The exchange market’s reliance on informal channels means that remittance effectiveness depends on the timing, scale, and liquidity of inflows. Thus, while the global financial footprint may be minimal, the social-financial infrastructure provided by the diaspora remains crucial for exchange rate stabilization in times of stress.

5.2.4 Theoretical reflection and informal system logic

This study’s findings reinforce and extend several theoretical frameworks. From the perspective of Dual Market Theory, Somalia’s informal FX market emerges not as a residual alternative, but as the de facto primary monetary mechanism, complete with its own rules, networks, and valuation norms. This challenges the conventional hierarchy between formal and informal systems and calls for a reconceptualization of informality in post-conflict economies. The Balance of Payments (BoP) Theory is also applicable, with Somalia’s exchange rate reflecting changes in remittance and aid inflows in lieu of traditional export or capital flows. Lastly, the Asset Market Approach is validated through observed market behavior: even in a stateless system, currency valuation responds to expectations around climate shocks, political risk, and external aid—mirroring dynamics typically observed in formalized capital markets.

6 Conclusion and policy implications

This study set out to investigate the integration of Somalia’s unregulated exchange rate system with regional and global currency markets, focusing particularly on its responsiveness to external shocks, including climate and oil price volatility. Using a comprehensive econometric framework, the findings reveal significant long-run cointegration between Somalia’s exchange rate and selected regional (Sub-Saharan Africa and MENA) and global (China, India, UK) currencies. Short-run dynamics, however, indicate stronger regional ties, with countries like Tanzania, Kenya, Oman, and the UAE emerging as key influencers.

Although Somalia operates outside a formal regulatory framework, its unregulated exchange rate system demonstrates resilience and connectivity to broader economic systems. Internal factors continue to dominate short-term fluctuations, but the influence of external shocks is growing—pointing to increasing economic interdependence. Climate shocks play a persistent long-run role, though their short-term impact remains muted, underscoring the structural nature of their influence.

In a climate-vulnerable setting such as Somalia, these findings highlight a dual pressure: the challenge of responding to global economic volatility while managing the escalating risks of environmental instability. The study shows that Somalia’s financial resilience is underpinned by adaptive unregulated networks and informal market mechanisms, which function in the absence of robust formal institutions.

Theoretically, this research contributes to debates on PPP and OCA theories by testing them in a nontraditional, post-conflict economic context. It suggests that unregulated currency systems can still exhibit market efficiency and external integration, but through unconventional channels such as remittances and informal networks rather than standard fiscal or monetary policy instruments.

6.1 Policy implications

• Acknowledge Informal Systems: Unregulated exchange markets in fragile states serve essential roles. Formal financial policy must recognize, engage, and gradually integrate these systems.

• Foster Regional Economic Cooperation: Stronger East African economic ties could buffer Somalia against global volatility and strengthen monetary stability.

• Promote Climate-Resilient Economic Policy: Somalia’s monetary system is increasingly vulnerable to climate shocks. Policy planning should incorporate climate adaptation strategies.

• Leverage Remittance Channels: With significant links to Gulf nations, facilitating transparent and efficient remittance flows can stabilize the exchange rate.

• Expand Financial Inclusion: Engage informal financial actors in policy discussions to promote inclusive growth and financial security.

6.2 Practical relevance

For financial strategists, investors, and development practitioners, this study offers actionable insights into navigating Somalia’s unique financial system. Understanding the blend of internal dynamics and external dependencies can inform investment strategies, aid delivery models, and monetary interventions tailored to fragile contexts.

7 Limitations and future research

7.1 Limitations

This study offers valuable insights into Somalia’s informal exchange rate market; however, several important limitations should be acknowledged:

1. Data Gaps and Informality: Somalia’s economy is predominantly informal, and much financial activity—including currency exchange—occurs outside official monitoring systems. This makes it difficult to obtain reliable, comprehensive data, leading to measurement gaps that may obscure key dynamics of the market.

2. Reliance on Secondary Data: The study depends on existing data sources that may lack the granularity needed to reflect real-world complexities. Many informal or undocumented transactions are excluded from available datasets, potentially introducing selection bias.

3. Limited Insight into Informal Dynamics: Informal exchange rate practices shaped by clan networks, hawala agents, and underground financial intermediaries are difficult to quantify. These actors play a central role in Somalia’s financial system but remain underrepresented in formal analyses.

4. Underexplored Non-Economic Factors: Political instability, insecurity, and governance challenges significantly influence market behavior and trust in institutions. These factors are not deeply integrated into the current analysis and warrant further examination.

5. Lack of Longitudinal or Real-Time Data: The absence of high-frequency or time-series data limits the ability to study short-term market fluctuations, crisis responses, and the durability of informal mechanisms over time.

6. Generalizability Constraints: Findings are specific to Somalia’s post-conflict, low-regulation environment. While informative, they may not be directly transferable to other fragile states without accounting for important contextual differences.

7. Structural Breaks Due to Conflict: Somalia’s ongoing conflict and economic disruptions have likely introduced structural breaks in market behavior. These discontinuities challenge assumptions of economic continuity and complicate long-term trend analysis.

8. Assumption of Linearity: Analytical models may rely on linear relationships between variables such as remittances, aid flows, and exchange rates. In practice, such relationships may be non-linear or subject to thresholds and regime changes, resulting in model misspecification.

7.2 Future research directions

To address these limitations and deepen understanding, future research should:

• Explore Transmission Mechanisms: Analyze how remittances, foreign aid, and global commodity price movements influence informal exchange rates in fragile economic contexts.

• Incorporate Non-Economic Variables: Integrate governance, conflict intensity, and security conditions into modeling frameworks to capture broader determinants of financial behavior.

• Gather Primary and Real-Time Data: Invest in ethnographic fieldwork, mobile money tracking, and other data collection methods that reflect real-time, grassroots financial activity.

• Apply Non-Linear and Structural Models: Utilize models that allow for non-linearity’s, structural breaks, and endogenous regime shifts to better represent the realities of informal and volatile markets.

• Conduct Comparative Studies: Examine similar informal financial systems in other post-conflict or low-regulation economies to identify commonalities, divergences, and transferable policy lessons.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

MN: Writing – review & editing, Writing – original draft.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work was supported by the Institute of Climate and Environment (ICE) of SIMAD University in Mogadishu, Somalia.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adom, P. K., and Amoani, S. (2021). The role of climate adaptation readiness in economic growth and climate change relationship: an analysis of the output/income and productivity/institution channels. J. Environ. Manag. 293:112923. doi: 10.1016/j.jenvman.2021.112923

Aksonov, M. (2023). Black market exchange rate and exchange rate path stability: A dynamic-stochastic model analysis for Ukraine. Kyiv, Ukraine: Kyiv School of Economics.

Alam, M. M., Mohamad Tahir, Y., and Saif-Alyousfi, Y. H. (2024). Climate change-induced firms’ initiatives and investors’ perceptions: evidence from Bursa Malaysia. Sustain. Accounting, Manag. Policy J. 15, 232–261. doi: 10.1108/SAMPJ-08-2021-0344

Allegret, J.-P., Mignon, V., and Sallenave, A. (2015). Oil price shocks and global imbalances: lessons from a model with trade and financial interdependencies. Econ. Model. 49, 232–247. doi: 10.1016/j.econmod.2015.04.009

Allouche, J. (2014). “The role of informal service providers in post-conflict reconstruction and state-building”, in Water and post-conflict peacebuilding. eds. E. Weinthal, J. Troell, and M. Nakayama (Earthscan), 219–240.

Anand, R., Mishra, M. S., and Peiris, M. S. J. (2013). Inclusive growth: measurement and determinants. International Monetary Fund. Available at: https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Inclusive-Growth-Measurement-and-Determinants-40613

Asante, G. N., and Stanley, A. (2022). “Prospect of economic unions on intra-regional trade in Africa” in Monetary and Financial Systems in Africa: Integration and economic performance. eds. A. A. Amin, R. N. Tawah, and A. Ntembe (Cham, Switzerland: Palgrave Macmillan), 369–393.

Baliamoune-Lutz, M. (2010). Black and official exchange rates in Morocco: an analysis of their long-run behaviour and short-run dynamics (1974–1992). Appl. Econ. 42, 3481–3490. doi: 10.1080/00036840802112463

Bille, T., Jensen, S., and Østergaard, J. (2018). The value of creative industries in Europe: cultural policy and sustainability. European Planning Studies 26, 305–326. doi: 10.1080/09654313.2017.1361588

Bodenstein, M., Guerrieri, L., and Kilian, L. (2012). Monetary policy responses to oil price fluctuations. IMF Econ. Rev. 60, 470–504. doi: 10.1057/imfer.2012.19

Canagarajah, S., and Sethuraman, S. V. (2001). Social protection and the informal sector in developing countries: challenges and opportunities. Social Protection Discussion Papers and Notes (No. 24080). World Bank. Available at: https://documents.worldbank.org/en/publication/documents-reports/documentdetail/403621468739509444

Charmes, J. (ed.). (2019). “Unpaid care work across the world as measured by time-use surveys,” in Dimensions of resilience in developing countries: Informality, solidarities and carework. Springer, 159–185.