- Institute of Climate and Finance (ICE), SIMAD University, Mogadishu, Somalia

This study investigates key determinants influencing donor fulfillment rates (DFR) in the context of global climate finance. Using panel data analysis, the study examines the impact of pledged and deposited funds, EU membership, and fund type on donor fulfillment. The Random Effects model was validated through a Hausman test and used to interpret the main results. The analysis reveals that higher pledged amounts are significantly associated with lower fulfillment rates, while actual deposited funds positively and strongly affect DFR. EU membership consistently improves donor fulfillment, suggesting that institutional alignment matters, whereas fund type showed no significant influence in the RE model. The findings suggest a need for more realistic pledging practices, stronger monitoring and accountability mechanisms, and institutional frameworks that promote follow-through on financial commitments. This study introduces a novel empirical variable—EU membership—to assess how regional affiliation influences donor behavior. This study offers a new lens to evaluate the effectiveness of international climate finance commitments. The research advances the Principal–Agent Theory, Institutional Theory, and Rational Choice Theory to explain donor behavior. It fills a critical gap in empirical literature by distinguishing between the effects of pledges versus actual deposits, highlighting the role of regional institutional contexts.

1 Introduction

Climate finance has emerged as a cornerstone of international efforts to address climate change, particularly by supporting mitigation and adaptation initiatives in developing countries (Nor and Mohamed, 2024). Instruments such as the Green Climate Fund (GCF) have been mobilized to facilitate the transfer of resources from developed to developing nations, aiming to support sustainable transitions and build climate resilience. Despite growing global recognition of climate change as an urgent threat, and substantial financial pledges made through multilateral channels, a persistent gap remains between the funds promised and those ultimately delivered (Buchner et al., 2014). This discrepancy has raised critical questions about the reliability, efficiency, and institutional effectiveness of current climate finance mechanisms.

The mobilization of climate finance is not only a question of volume but also one of accountability, transparency, and institutional design. Delays, partial disbursements, and unmet commitments are symptomatic of deeper operational challenges, including bureaucratic inefficiencies, weak absorptive capacities, and fragmented governance structures across donors and implementing agencies (Bracking and Leffel, 2021). These issues are compounded by asymmetries in regulatory environments and the diverse motivations of donor countries, which often result in inconsistent financial flows. As a result, many developing countries—those most vulnerable to climate impacts—are unable to access the timely and adequate resources needed for climate action (Chenet et al., 2021).

Existing studies on climate finance often focus on aggregate flows or project-level effectiveness but tend to overlook the structural and institutional factors that influence the rate at which pledged funds are actually fulfilled. A fragmented landscape of donors, funds, and governance mechanisms further complicates the tracking and coordination of financial resources, leading to inefficiencies and reduced impact. These gaps underscore the importance of moving beyond outcome-based evaluations to investigate the systemic determinants of donor fulfillment — that is, the degree to which financial commitments are realized in practice (Nor and Mohamed, 2024; Nor and Mussa, 2024).

Unlike prior studies that emphasize overall finance volumes or project outputs, this research focuses explicitly on the fulfillment gap—the difference between what is promised and what is delivered—and the institutional and economic determinants that shape this gap. By incorporating both static and dynamic predictors of donor behavior, this study contributes to a more granular understanding of climate finance effectiveness. Its findings aim to inform policymakers, multilateral institutions, and climate fund administrators on how to structure more reliable and responsive funding mechanisms.

Finally, the current body of literature lacks empirical assessments of how institutional affiliation (e.g., EU membership) and regulatory frameworks influence fulfillment outcomes. This study fills this void by offering a comprehensive panel data analysis across a 20-year span (2003–2023), leveraging data from the Climate Funds Update (CFU) platform. Through this lens, the study aims to examine the critical factors influencing the donor fulfillment rates of climate finance flows, with the aim of enhancing their effectiveness and impact in combating climate change.

2 Literature review

2.1 Essential aid models

The literature on international aid and climate finance provides several theoretical perspectives to explain donor behavior. Two dominant frameworks—the donor interest model and the recipient needs (merit) model—are widely used to understand how and why donor countries make, and ultimately fulfil, their financial commitments. These models provide the conceptual foundation for investigating donor fulfillment rates (DFR) in global climate finance and guide the development of our research hypotheses.

2.1.1 Donor interest model

The donor interest model posits that the allocation and fulfillment of international aid and climate finance are primarily driven by the strategic, political, and economic interests of donor countries rather than the developmental needs of recipients. Under this framework, donors often prioritize countries that offer potential economic returns, geopolitical leverage, or alignment with their foreign policy objectives (Alesina and Dollar, 2000). For instance, wealthier nations may direct funds toward regions with trade potential, resource access, or strategic alliances rather than those experiencing the most acute climate vulnerabilities. In the context of global climate finance, the donor interest model suggests that climate funding decisions may reflect a desire to secure influence in negotiations, strengthen bilateral relationships, or gain economic advantages through technology transfer and market access (Dreher et al., 2021). Recent empirical studies show that industrialized countries often channel a significant portion of their climate finance toward middle-income nations with stronger economic ties rather than least developed countries (Pauw et al., 2016). This tendency highlights a potential mismatch between pledges and actual deposits, where political and economic incentives override purely environmental or humanitarian considerations.

2.1.2 Recipient needs (merit) model

In contrast, the recipient needs model—also referred to as the merit-based model—argues that aid and climate finance should be allocated primarily according to the needs and vulnerabilities of recipient countries rather than the strategic interests of donors. From this perspective, funding decisions should prioritize nations most affected by climate change, least capable of financing their own adaptation and mitigation strategies, and most dependent on external support to achieve sustainable development (Collier and Dollar, 2002). Proponents of this model highlight equity, fairness, and developmental justice as central to effective global climate finance (Berthélemy, 2006). For example, climate-vulnerable small island developing states and least developed countries are often considered high-priority recipients due to their heightened exposure to extreme weather events and limited adaptive capacity (Weikmans and Roberts, 2019). Within this framework, donor fulfillment rates (DFR) become an important indicator of whether climate finance mechanisms are functioning as intended—ensuring that pledged funds are effectively deposited and directed to those who need them most. Empirical evidence suggests, however, that despite international commitments under agreements like the Paris Agreement, actual climate finance flows still fall short of the amounts required to meet the adaptation needs of the most vulnerable countries (Roberts and Weikmans, 2017).

2.2 The global landscape of climate finance

Climate finance has become an essential mechanism in the global response to climate change, particularly through its role in enabling developing countries to implement mitigation and adaptation strategies. Since the inception of the United Nations Framework Convention on Climate Change (UNFCCC) in 1992, industrialized nations have committed to mobilizing financial resources to support climate action in the Global South. A landmark in this trajectory was the pledge to mobilize USD 100 billion annually by 2020, highlighting the international community’s recognition of climate change as both a developmental and environmental crisis (Blaxekjær and Nielsen, 2015). Despite such commitments, a persistent gap remains between pledged amounts and actual disbursements, which continues to undermine the credibility and efficacy of the global climate finance regime (Bracking, 2021).

Critics argue that the institutional complexity of the climate finance architecture hampers its efficiency and responsiveness. The proliferation of channels—ranging from multilateral funds like the Green Climate Fund to bilateral and private sector pathways—creates fragmentation, overlapping mandates, and bureaucratic inefficiencies that delay disbursement and dilute accountability (Nor and Mohamed, 2024; Browne, 2022). Moreover, allocation criteria are often opaque, and reporting mechanisms remain inconsistent across donors and implementing agencies, complicating efforts to track funds and assess their impact (Clark et al., 2018; Bracking and Leffel, 2021). Without standardized frameworks for transparency and data sharing, it becomes difficult to ensure that climate finance is being used effectively and equitably.

The effectiveness of climate finance is further compromised by the lack of alignment between donor priorities and recipient country needs. Donors may impose conditionalities or strategic interests that divert funds from the most urgent or locally relevant climate initiatives. These structural weaknesses underscore the need to investigate not only how much funding is pledged, but also how and why funds are (or are not) fulfilled—an area where empirical research remains limited.

2.3 Regional dimensions and disparities

Climate finance outcomes vary significantly across regions, shaped by political, institutional, and socioeconomic contexts. In Latin America, climate finance has successfully supported initiatives in renewable energy and forest conservation, leveraging the region’s rich natural resources and biodiversity (Cárdenas et al., 2021; Villamizar et al., 2017). In Southeast Asia, the focus tends to be on large-scale infrastructure investments aimed at improving resilience to natural disasters such as floods, typhoons, and droughts (Aleluia et al., 2022; Shiiba, 2022). These regional variations highlight the importance of context-specific financial strategies that reflect both environmental needs and governance capacities.

Government capacity plays a crucial role in shaping the efficiency and impact of climate finance. Factors such as political stability, regulatory transparency, and institutional robustness significantly influence fund deployment and project success (Dafermos et al., 2018; Lamperti et al., 2019). In Africa, for instance, stark differences in governance quality result in uneven implementation and outcomes, even when funding levels are similar (Savvidou et al., 2021; Tamasiga et al., 2023). Development banks such as the African Development Bank and the Asian Development Bank have responded by designing regionally tailored instruments, yet coordination challenges with national institutions remain (Lee et al., 2022).

Importantly, regional disparities in climate finance access often mirror broader global inequalities. More politically influential and economically stable countries tend to receive larger shares of climate funds, while fragile or conflict-affected states struggle to attract consistent financial support. This imbalance raises critical questions about the equity of climate finance distribution and the need for corrective mechanisms to ensure fair access based on climate vulnerability and developmental need (Ciplet et al., 2022; Morgan and Petrou, 2023).

2.4 Theoretical foundations: explaining donor fulfillment behavior

Understanding why donors do or do not fulfill their climate finance pledges requires a multidimensional theoretical lens that captures the complexity of international financial commitments. This study draws on three complementary theories to explain donor behavior: Principal–Agent Theory, Institutional Theory, and Rational Choice Theory. Together, these frameworks provide insight into the dynamics of delegation, regulatory influence, and strategic decision-making in the climate finance landscape.

2.4.1 Principal–agent theory

Principal–Agent Theory (PAT) addresses the challenges that arise when one actor (the principal) delegates authority or responsibility to another (the agent), especially when their interests diverge and information is asymmetrically distributed (Ross, 1973; Meckling and Jensen, 1976). In the context of climate finance, donors act as principals who pledge financial resources with the expectation that implementing agencies or recipient governments (agents) will deploy them in accordance with shared climate goals. However, agents may have different priorities or operate under limited oversight, leading to moral hazard, inefficiencies, or misaligned outcomes.

This theoretical lens helps explain why donors may be hesitant to fully disburse pledged funds: without robust monitoring mechanisms or clear accountability structures, they may perceive a high risk of misallocation or ineffective use. PAT emphasizes the importance of transparency, performance incentives, and trust in shaping the fulfillment of donor commitments (Eisenhardt, 1989), and is central to understanding the fulfillment gap between pledges and actual deposits.

2.4.2 Institutional theory

Institutional Theory broadens the analysis by exploring how formal structures, informal norms, and shared rules influence organizational behavior (DiMaggio and Powell, 1983; Scott, 2017). It posits that actors are embedded within institutional environments that constrain and shape their actions. In climate finance, this theory helps explain how donors’ fulfillment behavior is influenced by regulatory frameworks, international agreements, and regional institutional pressures.

For instance, EU member states may experience greater regulatory alignment and normative expectations regarding climate finance due to supranational coordination, which can improve their performance in fulfilling pledges. Institutional Theory also accounts for how organizations adapt to external pressures—whether coercive (legal obligations), normative (professional expectations), or mimetic (emulation of peer behavior)—which can lead to more standardized practices across donor agencies and funds. This is particularly relevant in assessing why multilateral donors might behave differently from bilateral ones, or why certain institutional affiliations yield higher fulfillment rates.

2.4.3 Rational choice theory

Rational Choice Theory (RCT) complements the above frameworks by focusing on strategic, utility-maximizing behavior. It assumes that actors make decisions based on the costs, benefits, and expected outcomes of their actions (Snidal, 1985). In climate finance, RCT helps explain why donors may pledge funds for reasons such as geopolitical positioning, reputation building, or negotiation leverage, but delay or avoid fulfillment when perceived benefits decline or domestic constraints emerge.

This theory is particularly valuable in interpreting the pledge–deposit gap not as a failure of institutional design or oversight, but as a reflection of calculated choices based on shifting priorities, economic conditions, or strategic interests. It recognizes that fulfillment decisions are influenced by both external pressures and internal political or budgetary considerations, providing a behavioral-economic dimension to donor actions.

3 Materials and methods

This section outlines the methodological approach adopted to investigate the determinants of donor fulfillment in global climate finance. Guided by Principal–Agent Theory, Institutional Theory, and Rational Choice Theory, the methodology aims to rigorously quantify the factors influencing the gap between pledged and deposited funds. A panel data econometric framework is employed to assess donor behavior across multiple dimensions, capturing both temporal dynamics and structural characteristics of donor entities.

3.1 Data description

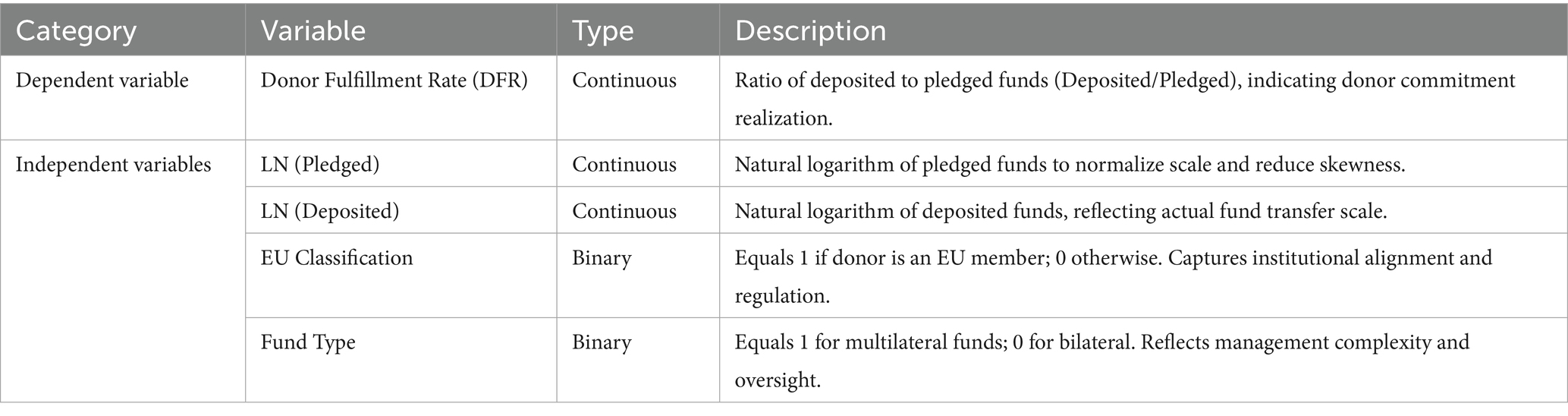

This study uses a panel dataset compiled from the Climate Funds Update (CFU) database, covering the period 2003 to 2023 (see Table 1). The CFU database provides annual information on pledged and deposited climate finance contributions by donor countries across multiple global climate funds. These data are widely recognized in climate finance research for their accuracy and comprehensiveness. The chosen time frame captures significant milestones in global climate finance, including the establishment of the Green Climate Investment Fund (2010), the signing of the Paris Agreement (2015), and the post-2020 implementation period. These institutional and policy developments make the selected period particularly relevant for examining donor behavior and fulfillment rates. The dataset was constructed at the donor-year level, with each observation representing a single donor’s contribution behavior in a given year. Specifically:

• Cross-sectional units: Donor countries

• Time dimension: Annual data from 2003 to 2023

• Panel structure: Unbalanced

• Number of years: 21

• Total observations: 522

This panel design allows the study to explore temporal dynamics in donor fulfillment behavior while capturing structural differences among donors, such as their institutional alignment (EU vs. non-EU).

A key explanatory variable in this study is EU membership status. Although EU membership is defined at the country level, it has been integrated into the donor-year panel by assigning a constant classification to each donor. For example, if a donor country is an EU member throughout the study period, it is consistently coded as EU = 1. This integration enables us to examine whether institutional alignment within the EU contributes to higher donor fulfillment rates.

The dataset contains 522 total records, of which 245 are classified as EU and 277 as non-EU. After removing redundancies, there are 68 unique funding sources, with 25 EU and 43 non-EU countries. Overall, while the raw data shows a close split, the unique dataset indicates that funding sources are more widely distributed across non-EU countries.

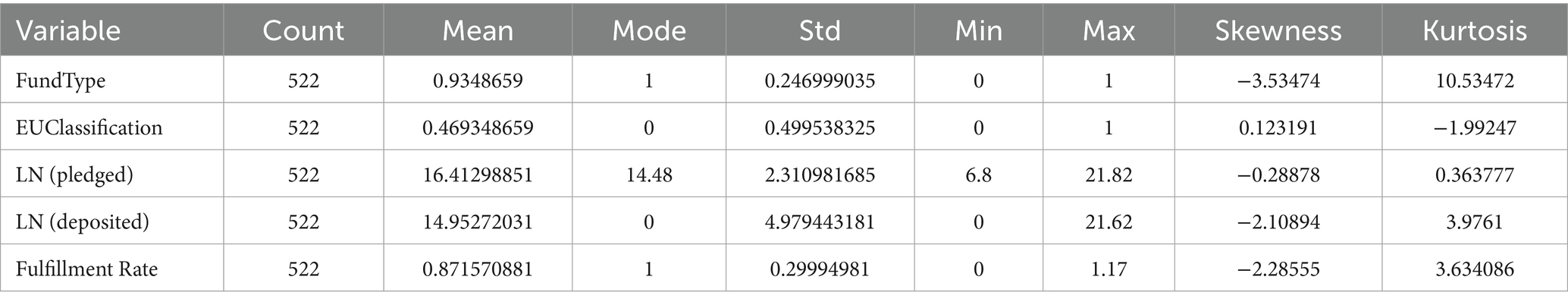

The dataset contains 522 observations across multiple cross-sectional units representing various funding programs, countries, and classifications. The descriptive statistics reveal substantial variation in pledged and deposited amounts, with high standard deviations indicating significant disparities between contributors. Additionally, measures of skewness and kurtosis suggest that funding distributions are highly right-skewed with heavy tails, reflecting the presence of a few large contributions alongside many smaller ones (see Table 2).

3.2 Variables and operationalization

From an economic perspective, including both ln(Pledged) and ln(Deposited) as explanatory variables is meaningful because they represent different dimensions of donor behavior. While Pledged Funds capture the initial financial commitment made by donors, Deposited Funds reflect the actual fulfillment of these commitments. Variations in the ratio of deposited to pledged amounts (DFR) can be influenced by the magnitude of pledges, donor reliability, and other unobserved institutional or country-specific factors. By incorporating both variables, the model captures these distinct effects rather than assuming a uniform relationship between pledging and depositing behavior. The VIF results supports the appropriateness of our model specification. The dependent and independent variables are constructed as follows:

The panel structure is organized by donor-year combinations, allowing for the exploration of trends over time and across donor types.

3.3 Model specification

To evaluate the impact of the specified variables on donor fulfillment, three panel data estimation models are applied: Pooled OLS, Fixed Effects (FE), and Random Effects (RE). The base econometric model is:

Where:

• DFR it : Dependent variable for fund i at time t

• ln(Pledged it ): Natural log of pledged amount

• ln(Deposited it ): Natural log of deposited amount

• EU it : Dummy variable indicating EU-membership

• FundTypeIY it : Categorical variable representing the type of fund

• ui: Entity-specific effect (captures unobserved heterogeneity)

• ε it : Idiosyncratic error term

3.4 Estimation strategy

3.4.1 Pooled ordinary least squares (OLS)

Pooled OLS treats all observations as part of a single homogeneous dataset, disregarding donor-specific characteristics. While straightforward, it assumes that unobserved heterogeneity across donors is either negligible or uncorrelated with the regressors. Given the likely institutional and political differences among donors, this model serves primarily as a baseline for comparison. This model aggregates all available data and conducts a straightforward ordinary least squares (OLS) regression using the unified dataset:

3.4.2 Fixed effects (FE) model

The fixed effects model accounts for time-invariant heterogeneity by allowing each donor to have a unique intercept. This controls for unobservable characteristics (e.g., political stability, institutional quality) that may affect donor behavior but remain constant over time. FE is preferred when these unobserved effects are correlated with the explanatory variables. It is especially useful for isolating the effect of time-varying factors such as EU membership status or fund type over time. The model accounts for characteristics that do not change over time by including a distinct intercept for each income group.

where ui represents the fund-specific effects, capturing all time-invariant differences between income groups.

3.4.3 Random effects (RE) model

The random effects model assumes that unobserved heterogeneity is uncorrelated with the regressors. Unlike FE, RE utilizes both within-group and between-group variation, making it more efficient when its assumptions hold. Unlike the fixed effects model, which controls for all time-invariant differences by allowing each group to have its own intercept, the random effects model assumes that these group-specific effects are randomly distributed and not systematically related to the independent variables. This assumption enables the model to utilize the entire dataset more efficiently, providing a balance between the fixed effects model’s control for unobserved heterogeneity and the pooled OLS model’s simplicity, potentially leading to more efficient estimates if the assumption holds true. This model includes a composite error term:

In this model, ui is assumed to be randomly distributed across the income groups.

4 Empirical findings

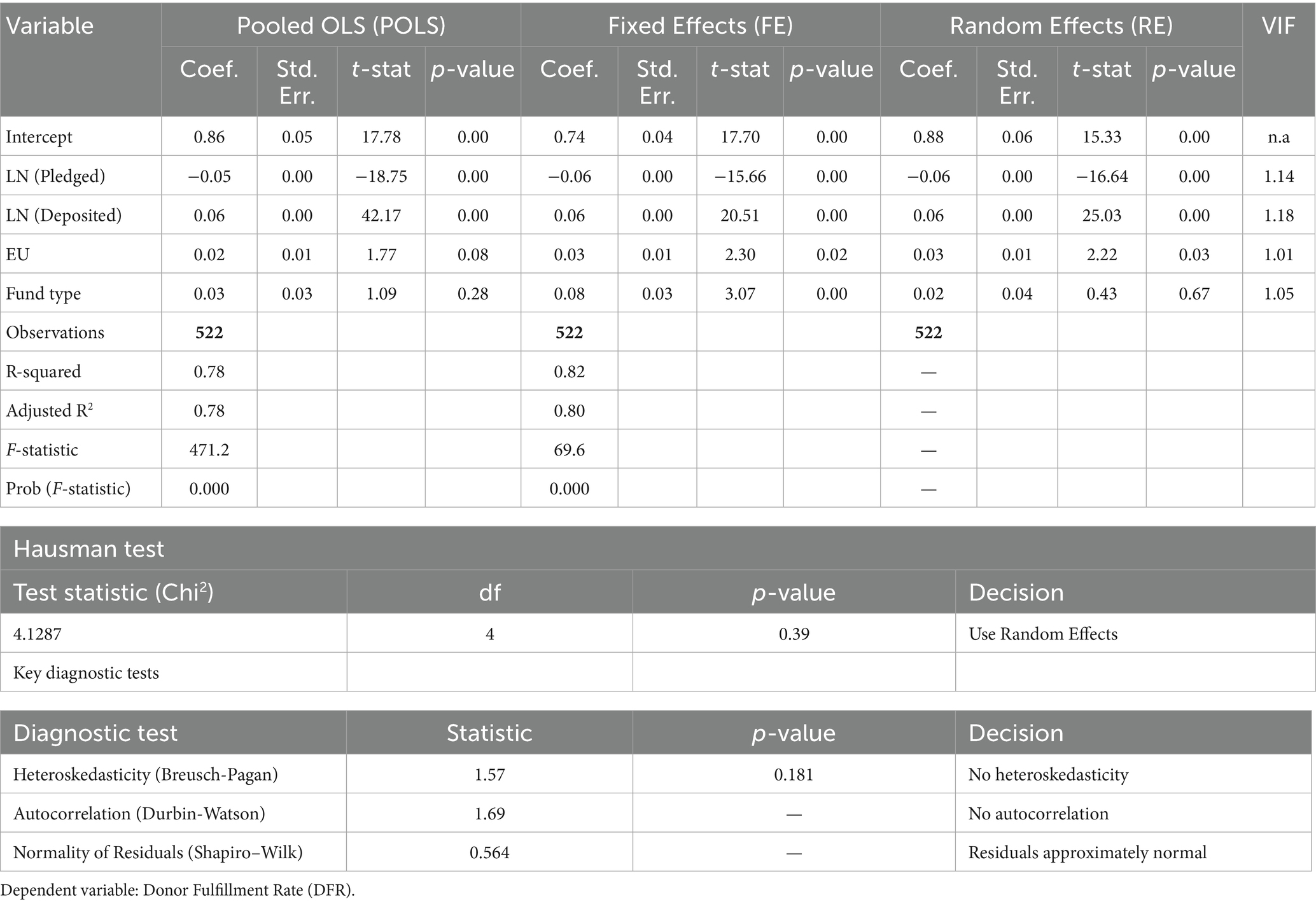

This study aims to identify the key determinants of donor fulfillment rates (DFR) in the context of global climate finance. Using panel data and a set of econometric models—Pooled Ordinary Least Squares (OLS), Fixed Effects (FE), and Random Effects (RE)—the analysis finds that actual deposited amounts significantly enhance DFR, while larger pledged amounts tend to reduce fulfillment (see Table 3). Additionally, EU membership and fund type show varying effects depending on the model specification.

4.1 Pooled OLS regression results

A pooled ordinary least squares (OLS) regression was conducted to examine the relationship between Donor Fulfillment Rate (DFR) and key predictors: Pledged funds, Deposited funds, EU membership, and Fund Type. The results indicated that Pledged funds were a significant negative predictor of DFR, b = −0.05, SE = 0.00, t = −18.75, p < 0.001, suggesting that higher pledge amounts are associated with lower fulfillment rates. In contrast, Deposited funds had a significant positive effect on DFR, b = 0.06, SE = 0.00, t = 42.17, p < 0.001, indicating that actual deposits are strongly linked to increased fulfillment. EU membership showed a marginally significant positive relationship with DFR, b = 0.02, SE = 0.01, t = 1.77, p = 0.08. Fund Type was not a statistically significant predictor, b = 0.03, SE = 0.03, t = 1.09, p = 0.28.

The overall model explained a substantial proportion of the variance in donor fulfillment outcomes, with an R2 of 0.78 and an adjusted R2 of 0.78, indicating that 78% of the variability in DFR was accounted for by the predictors. The model was statistically significant, F = 471.20, p < 0.001, confirming that the predictor variables reliably explained changes in donor fulfillment rates. These findings emphasize the critical role of actual Deposited funds in driving fulfillment, while higher Pledged funds may reflect unrealistic commitments. EU membership showed a modest positive effect, and Fund Type did not appear to significantly influence fulfillment.

4.2 Fixed effects model results

A fixed effects model was estimated to examine the impact of financial and institutional factors on Donor Fulfillment Rate (DFR), while controlling for time-invariant characteristics across entities. The analysis revealed that Pledged funds remained a significant negative predictor of DFR, b = −0.06, SE = 0.00, t = −15.66, p < 0.001, reinforcing the notion that higher pledges may reflect over-commitment or unrealistic expectations. Deposited funds continued to exert a strong positive influence on fulfillment rates, b = 0.06, SE = 0.00, t = 20.51, p < 0.001, indicating that actual financial follow-through is a critical driver of fulfillment. EU membership emerged as a statistically significant positive factor in this specification, b = 0.03, SE = 0.01, t = 2.30, p = 0.02, suggesting that donors from EU countries tend to exhibit higher levels of fulfillment.

Fund Type, which was previously non-significant in the pooled model, became a statistically significant predictor in the fixed effects model, b = 0.08, SE = 0.03, t = 3.07, p < 0.001. This result indicates that variations in fund structure may influence donor behavior when unobserved heterogeneity is accounted for. The model demonstrated strong explanatory power, with an R2 of 0.82 and an adjusted R2 of 0.80. The overall model was statistically significant, F = 69.60, p < 0.001, confirming the robustness of the fixed effects specification in explaining variance in donor fulfillment rates.

4.3 Random effects model results

A random effects model was estimated to assess the influence of financial commitments and institutional characteristics on Donor Fulfillment Rate (DFR), while accounting for both within-entity and between-entity variation. The results were consistent with previous models, showing that Pledged funds had a significant negative association with DFR, b = −0.06, SE = 0.00, t = −16.64, p < 0.001. Deposited funds continued to demonstrate a strong positive effect on DFR, b = 0.06, SE = 0.00, t = 25.03, p < 0.001, reinforcing their critical role in driving fulfillment outcomes.

EU membership remained statistically significant in this specification, b = 0.03, SE = 0.01, t = 2.22, p = 0.03, indicating a consistent and positive relationship with donor fulfillment. In contrast, Fund Type was not a significant predictor, b = 0.02, SE = 0.04, t = 0.43, p = 0.67, suggesting it does not meaningfully affect DFR in the random effects framework.

4.4 Hausman test

To assess the suitability of the Fixed Effects versus Random Effects model, a Hausman test was conducted. The results indicated that the Random Effects model was appropriate, as the test yielded a chi-square statistic of 4.13 (χ2(4) = 4.13, p = 0.39). Since the p-value exceeded the conventional threshold of 0.05, the null hypothesis—that the individual effects are uncorrelated with the regressors—could not be rejected. This finding supports the use of the Random Effects model, which provides consistent and efficient estimates by accounting for both within-entity and between-entity variation.

4.5 Diagnostic tests

To ensure the validity of the Random effect model, several diagnostic tests were conducted. Multicollinearity was evaluated using the Variance Inflation Factor (VIF), with all predictor values well below the commonly accepted threshold (maximum VIF = 1.18), indicating no concerns regarding multicollinearity. Heteroskedasticity was assessed using the Breusch-Pagan test, which yielded a non-significant result (p = 0.181), suggesting that the residuals are homoscedastic and that the assumption of constant variance holds.

Autocorrelation was examined using the Durbin-Watson statistic (DW = 1.69), which falls within the acceptable range and indicates no substantial evidence of serial correlation. However, the assumption of normally distributed residuals was not met, as the Shapiro–Wilk test produced a W-statistic of 0.564 (p < 0.001). This result leads to the rejection of the null hypothesis of normality. Although the residuals deviate from normality, the use of robust standard errors is advisable, particularly in large samples, to strengthen the reliability of statistical inference.

5 Discussion

The aim of this study is to investigate the key factors that influence donor fulfillment rates (DFR) in climate finance, with the goal of enhancing the effectiveness and impact of international funding mechanisms in combating climate change. Using panel data and a comparative econometric approach—including pooled ordinary least squares (OLS), fixed effects (FE), and random effects (RE) models—this study identifies the primary financial and institutional determinants of donor fulfillment behavior.

The main findings from the preferred Random Effects model show that higher pledged amounts (Lpledged) are significantly and negatively associated with DFR, while actual deposited amounts (Ldeposited) have a strong and positive effect. EU membership also demonstrates a consistent positive influence on donor fulfillment rates, whereas Fund Type does not appear to have a statistically significant impact.

These results highlight the complex dynamics between aspirational commitments and actual disbursements in the context of climate finance. The negative association between pledged funds and DFR may suggest that overly ambitious or symbolic pledges are less likely to be fulfilled, possibly due to political, budgetary, or institutional constraints. This may also reflect a credibility gap where large pledges are made without realistic implementation pathways. Conversely, the positive effect of deposited funds affirms the importance of actual financial flows in driving fulfillment outcomes and underscores the value of focusing on tangible contributions rather than nominal commitments.

The significant positive coefficient for EU membership suggests that institutional affiliation with the European Union enhances donor credibility and follow-through. This may be attributable to the EU’s more coordinated climate finance architecture, stronger regulatory frameworks, and the presence of binding collective commitments. The finding adds a unique dimension to the literature by illustrating how regional institutional dynamics—not just national-level variables—can influence donor behavior in international finance.

Policy implications from these findings are clear: efforts should be directed toward realistic and actionable pledging strategies and mechanisms that encourage the conversion of commitments into deposits. Transparency and accountability must be strengthened across all stages of the finance cycle, from pledge to disbursement. EU policymakers, in particular, might consider how regional governance mechanisms can be further leveraged to improve compliance and foster peer accountability among member states.

Our findings on the gap between pledged and deposited climate finance align closely with prior evidence highlighting persistent “pledge–disbursement” discrepancies in international climate finance. Several studies demonstrate that actual disbursements often fall short of commitments due to procedural, institutional, and political factors (see Nor, 2025; UNEP, 2023; Bhattacharya et al., 2024; Stockholm International Peace Research Institute, 2024). For example, Nor (2025) shows that lengthy approval processes, rather than the size of grants, significantly influence disbursement performance, while the UNEP Adaptation Gap Report (2023) estimates that global adaptation finance needs are 10–18 times greater than current public flows. Moreover, EU Member States’ climate finance practices illustrate notable variations between pledged amounts and delivered contributions, largely driven by accounting methods and reporting inconsistencies (see CAN Europe, 2024; Dokk Smith, 2025). Differences across fund types in our results are also consistent with evidence showing that governance structures and institutional frameworks within multilateral funds substantially shape allocation and disbursement dynamics (see Xie, 2023; Bhattacharya et al., 2024). Finally, persistent underachievement of global financing targets—such as the missed US$100 billion annual mobilization goal—further underscores systemic challenges in translating commitments into realized climate action (see Stockholm International Peace Research Institute, 2024; UNEP, 2023).

These results are consistent with previous research that emphasizes the importance of realistic, trackable, and transparent climate finance commitments [see, for instance, Zamarioli et al. (2021), Carè and Weber (2023), Pauw et al. (2022), Ameli et al. (2021), Abi Suroso et al. (2022), and Nor and Mohamed (2024)]. However, this study contributes a novel perspective by empirically validating the role of regional institutional affiliation (EU membership) as a significant determinant of fulfillment rates—an area that has received limited attention in the empirical climate finance literature.

The findings of this study closely align with Principal–Agent Theory (PAT), which explains the dynamics between donors (principals) and implementing institutions (agents) in the climate finance ecosystem. The negative relationship between pledged amounts and donor fulfillment rates can be interpreted as a manifestation of agency problems, where ambitious pledges may be politically motivated but are not always supported by enforceable mechanisms or the operational capacity of agents to deliver. In this context, pledges become symbolic rather than actionable, reflecting a misalignment of goals and priorities between donors and implementing bodies. Conversely, the strong positive effect of deposited funds suggests that when financial transfers are actually made, they enhance transparency and reduce information asymmetries, thereby improving alignment and reinforcing the fulfillment of commitments—core concerns addressed by PAT.

From the perspective of Institutional Theory and Rational Choice Theory, the study further deepens the understanding of donor behavior. Institutional Theory explains the positive effect of EU membership on fulfillment rates by highlighting how formal rules, shared norms, and collective governance structures can influence organizational actions and foster greater compliance. EU donors are embedded within a regulatory framework that standardizes behavior, thereby reinforcing adherence to climate finance obligations. Meanwhile, Rational Choice Theory suggests that donors behave in ways that maximize their utility based on available information and constraints. The observed patterns—such as the preference for actual deposits over large pledges—indicate that rational actors weigh the reputational, political, and economic costs of non-fulfillment. In this light, realistic and achievable financial contributions reflect calculated decisions aimed at balancing international expectations with domestic capabilities. Together, these theoretical perspectives provide a multifaceted lens to interpret the study’s empirical results, emphasizing how individual decision-making, institutional constraints, and principal-agent relationships interact to shape climate finance outcomes.

Lastly, the study introduces a novel empirical dimension by incorporating EU classification as a variable, providing fresh insights into how regional affiliations influence donor compliance in climate finance. This innovation advances the literature on international finance agreements and underscores the importance of considering institutional geography in climate finance effectiveness. The findings ultimately enrich our understanding of how both financial realism and institutional alignment can drive more effective and accountable global climate funding systems.

6 Conclusion

This study explored the determinants of donor fulfillment rates (DFR) in the context of global climate finance, using panel data econometric approach. The Random Effects model, identified as the most appropriate specification based on the Hausman test, revealed that actual deposited funds significantly and positively influence DFR, while pledged amounts show a negative association. Additionally, EU membership was found to consistently improve fulfillment rates, whereas fund type did not have a significant effect.

The study contributes to theory by applying and integrating three frameworks—Principal–Agent Theory, Institutional Theory, and Rational Choice Theory—to climate finance. The findings support Principal–Agent Theory by demonstrating how misaligned incentives between donors and implementing agents can lead to over-pledging and under-delivery. Institutional Theory helps explain the role of EU membership as a structural influence that enhances compliance. Rational Choice Theory underscores the strategic behavior of donors who balance reputational incentives with resource constraints, favoring realistic and executable financial commitments.

Policymakers should place greater emphasis on encouraging realistic and actionable pledges, while designing mechanisms that incentivize actual fund deposition. Institutions such as the EU can serve as models for how regional coordination and shared norms can improve donor performance. Transparency mechanisms, performance tracking, and accountability structures are essential for closing the gap between commitments and disbursements.

The study’s findings can inform the design of climate finance frameworks, especially in multilateral funds and donor coordination platforms. Fund administrators can use these insights to better assess donor reliability, tailor engagement strategies, and align project pipelines with actual available resources. EU-level institutions might also leverage the findings to further consolidate compliance and peer learning mechanisms among member states.

By identifying financial and institutional predictors of donor fulfillment, this research adds empirical weight to ongoing debates about the credibility and efficiency of climate finance systems. It provides actionable insights for improving both donor accountability and the effectiveness of climate funding—critical for achieving international climate goals under the Paris Agreement and beyond.

While robust, this study is not without limitations. The analysis is limited by data availability, particularly regarding qualitative factors such as political will, donor motivations, and recipient performance. Additionally, fund type was treated categorically and may require a more nuanced breakdown in future research. The panel structure also restricts the study to observable variables, leaving unmeasured factors potentially unaccounted for.

Future studies could explore causal mechanisms in greater detail, potentially through case studies or mixed-methods research. Expanding the dataset to include non-EU regional groupings, recipient-country performance metrics, or donor-specific political variables could offer deeper insights. Examining how domestic political cycles, economic shocks, or geopolitical events affect donor behavior would also enrich the analysis.

In a time of urgent global climate action, understanding the mechanics of climate finance is more critical than ever. This study demonstrates that not all financial commitments are equal—and that actual fund delivery, institutional alignment, and regional cooperation are vital to turning climate pledges into real-world progress. Enhancing fulfillment rates is not just a matter of accountability; it is a prerequisite for climate resilience and sustainable development worldwide.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

MN: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was supported by Institute of Climate and Environment (ICE), SIMAD University, Somalia.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author declares that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abi Suroso, D. S., Setiawan, B., Pradono, P., Iskandar, Z. S., and Hastari, M. A. (2022). Revisiting the role of international climate finance (ICF) towards achieving the nationally determined contribution (NDC) target: a case study of the Indonesian energy sector. Environ. Sci. Pol. 131, 188–195. doi: 10.1016/j.envsci.2022.01.022

Aleluia, J., Tharakan, P., Chikkatur, A., Shrimali, G., and Chen, X. (2022). Accelerating a clean energy transition in Southeast Asia: role of governments and public policy. Renew. Sust. Energ. Rev. 159:112226. doi: 10.1016/j.rser.2022.112226

Alesina, A., and Dollar, D. (2000). Who gives foreign aid to whom and why? J. Econ. Growth 5, 33–63. doi: 10.1023/A:1009874203400

Ameli, N., Dessens, O., Winning, M., Cronin, J., Chenet, H., Drummond, P., et al. (2021). Higher cost of finance exacerbates a climate investment trap in developing economies. Nat. Commun. 12, 1–12.

Berthélemy, J.-C. (2006). Bilateral donors’ interest vs. recipients’ development motives in aid allocation. Rev. Dev. Econ. 10, 179–194. doi: 10.1111/j.1467-9361.2006.00311.x

Bhattacharya, A., Songwe, V., Soubeyran, E., and Stern, N. (2024). Raising ambition and accelerating delivery of climate finance (Third report of the Independent High-Level Expert Group on Climate Finance). Grantham Research Institute on Climate Change and the Environment. Available online at: https://www.lse.ac.uk/granthaminstitute/wp-content/uploads/2024/11/Raising-ambition-and-accelerating-delivery-of-climate-finance_Third-IHLEG-report.pdf

Blaxekjær, L. Ø., and Nielsen, T. D. (2015). Mapping the narrative positions of new political groups under the UNFCCC. Clim. Pol. 15, 751–766. doi: 10.1080/14693062.2014.965656

Bracking, S. (2021). “Climate finance and the promise of fake solutions to climate change” in Negotiating climate change in crisis. eds. S. Böhm and S. Sullivan (Cambridge, UK: Open Book Publishers).

Bracking, S., and Leffel, B. (2021). Climate finance governance: fit for purpose? Wiley Interdiscip. Rev. Clim. Chang. 12:e709. doi: 10.1002/wcc.709

Browne, K. E. (2022). Rethinking governance in international climate finance: structural change and alternative approaches. WIREs Clim. Change 13:e795. doi: 10.1002/wcc.795

Buchner, B., Stadelmann, M., Wilkinson, J., Mazza, F., Rosenberg, A., and Abramskiehn, D. (2014). Global landscape of climate finance 2019. Clim. Policy Initiat. 32, 1–38.

Cárdenas, M., Bonilla, J. P., and Brusa, F. (2021). Climate policies in Latin America and the Caribbean: success stories and challenges in the fight against climate change.

Carè, R., and Weber, O. (2023). How much finance is in climate finance? A bibliometric review, critiques, and future research directions. Res. Int. Bus. Finance 64:101886. doi: 10.1016/j.ribaf.2023.101886

Chenet, H., Ryan-Collins, J., and Van Lerven, F. (2021). Finance, climate-change and radical uncertainty: toward a precautionary approach to financial policy. Ecol. Econ. 183:106957. doi: 10.1016/j.ecolecon.2021.106957

Ciplet, D., Falzon, D., Uri, I., Robinson, S.-a., Weikmans, R., and Roberts, J. T. (2022). The unequal geographies of climate finance: climate injustice and dependency in the world system. Polit. Geogr. 99:102769. doi: 10.1016/j.polgeo.2022.102769

Clark, R., Reed, J., and Sunderland, T. (2018). Bridging funding gaps for climate and sustainable development: pitfalls, progress and potential of private finance. Land Use Policy 71, 335–346. doi: 10.1016/j.landusepol.2017.12.013

Climate Action Network Europe. (2024). Annual report 2024. Climate Action Network Europe. Available online at: https://caneurope.org/annual-report-2024/

Climate Investment Funds. (2010). Proceedings of the Climate Investment Funds. World Bank Open Knowledge Repository. Available online at: https://openknowledge.worldbank.org/entities/publication/aca743d0-fe87-51a7-ac65-152883cd42b8

Collier, P., and Dollar, D. (2002). Aid allocation and poverty reduction. Eur. Econ. Rev. 46, 1475–1500. doi: 10.1016/S0014-2921(01)00187-8

Dafermos, Y., Nikolaidi, M., and Galanis, G. (2018). Climate change, financial stability and monetary policy. Ecol. Econ. 152, 219–234. doi: 10.1016/j.ecolecon.2018.05.011

DiMaggio, P. J., and Powell, W. W. (1983). The iron cage revisited: institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 48, 147–160. doi: 10.2307/2095101

Dokk Smith, I. (2025). How donors integrate climate policy and development. Climate Policy. doi: 10.1080/14693062.2024.2390522

Dreher, A., Fuchs, A., Parks, B., Strange, A. M., and Tierney, M. J. (2021). Aid, China, and growth: evidence from a new global development finance dataset. Am. Econ. J. Econ. Policy 13, 135–174. doi: 10.1257/pol.20180631

Eisenhardt, K. M. (1989). Agency theory: an assessment and review. Acad. Manag. Rev. 14, 57–74. doi: 10.2307/258191

Lamperti, F., Bosetti, V., Roventini, A., and Tavoni, M. (2019). The public costs of climate-induced financial instability. Nat. Clim. Chang. 9, 829–833. doi: 10.1038/s41558-019-0607-5

Lee, C.-C., Li, X., Yu, C.-H., and Zhao, J. (2022). The contribution of climate finance toward environmental sustainability: new global evidence. Energy Econ. 111:106072. doi: 10.1016/j.eneco.2022.106072

Meckling, W. H., and Jensen, M. C. (1976). Theory of the firm. Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 3, 305–360. doi: 10.1016/0304-405X(76)90026-X

Morgan, E. A., and Petrou, K. (2023). Climate justice through climate finance? Lessons from Oceania. NPJ Clim. Action 2:24. doi: 10.1038/s44168-023-00061-6

Nor, M. I. (2025). Investigating the dynamics of climate finance disbursements: A panel data approach from 2003 to 2022. PLOS ONE, 20:e0318170. doi: 10.1371/journal.pone.0318170

Nor, M. I., and Mohamed, A. A. (2024). Investigating the complex landscape of climate finance in least developed countries (LDCs). Discover Environ. 2:76. doi: 10.1007/s44274-024-00102-9

Nor, M. I., and Mussa, M. B. (2024). Discovering the effectiveness of climate finance for Somalia’s climate initiatives: a dual-modeling approach with multiple regression and support vector machine. Front. Clim. 6:1449311. doi: 10.3389/fclim.2024.1449311

Paris Agreement. (2015). Paris Agreement under the United Nations Framework Convention on Climate Change. United Nations Framework Convention on Climate Change (UNFCCC). Available online at: https://unfccc.int/sites/default/files/english_paris_agreement.pdf

Pauw, W., Klein, R. J. T., Vellinga, P., and Biermann, F. (2016). Private finance for adaptation: do private realities meet public ambitions? Clim. Chang. 134, 489–503. doi: 10.1007/s10584-015-1539-3

Pauw, W., Moslener, U., Zamarioli, L., Amerasinghe, N., Atela, J., Affana, J. P. B., et al. (2022). Post-2025 climate finance target: how much more and how much better? Clim. Pol. 22, 1241–1251. doi: 10.1080/14693062.2022.2114985

Roberts, J. T., and Weikmans, R. (2017). Postface: fragmentation, failing trust and enduring tensions over what counts as climate finance. Int. Environ. Agreements 17, 129–137. doi: 10.1007/s10784-016-9347-4

Ross, S. A. (1973). The economic theory of agency: the principal's problem. Am. Econ. Rev. 63, 134–139.

Savvidou, G., Atteridge, A., Omari-Motsumi, K., and Trisos, C. H. (2021). Quantifying international public finance for climate change adaptation in Africa. Clim. Pol. 21, 1020–1036. doi: 10.1080/14693062.2021.1978053

Scott, W. R. (2017). “Institutional theory: Onward and upward” in The Sage handbook of organizational institutionalism. eds. R. Greenwood, C. Oliver, T. B. Lawrence, and R. E. Meyer (London: SAGE Publications).

Shiiba, N. (2022). “Financing climate-resilient coasts: tracking multilateral aid for ocean and coastal adaptation to climate change in Asia-Pacific” in Financing investment in disaster risk reduction and climate change adaptation: asian perspectives. eds. M. Ishiwatari and D. Sasaki (Singapore: Springer), 101–121.

Snidal, D. (1985). The limits of hegemonic stability theory. International Organization 39, 579–614. doi: 10.1017/S002081830002703X

Stockholm International Peace Research Institute. (2024). Climate change adaptation in areas beyond government control: Opportunities and limitations (SIPRI Insights on Peace and Security No. 2024/4). Available online at: https://www.sipri.org/publications/2024/sipri-insights-peace-and-security/climate-change-adaptation-areas-beyond-government-control-opportunities-and-limitations

Tamasiga, P., Molala, M., Bakwena, M., Nkoutchou, H., and Onyeaka, H. (2023). Is Africa left behind in the global climate finance architecture: redefining climate vulnerability and revamping the climate finance landscape—a comprehensive review. Sustainability 15:13036. doi: 10.3390/su151713036

United Nations Environment Programme. (2023). UNEP annual report 2023. UNEP. Available online at: https://www.unep.org/resources/unep-annual-report-2023

UNEP United Nations Environment Programme. (2023). Adaptation Gap Report 2023: Underfinanced. Underprepared. UNEP. Available online at: https://www.unep.org/resources/adaptation-gap-report-2023

Villamizar, A., Gutiérrez, M. E., Nagy, G. J., Caffera, R. M., and Leal Filho, W. (2017). Climate adaptation in South America with emphasis in coastal areas: the state-of-the-art and case studies from Venezuela and Uruguay. Clim. Dev. 9, 364–382. doi: 10.1080/17565529.2016.1146120

Weikmans, R., and Roberts, J. T. (2019). The international climate finance accounting muddle: is there hope on the horizon? Clim. Dev. 11, 97–111. doi: 10.1080/17565529.2017.1410087

Xie, Z. (2023). Xie Zhenhua expects social powers to tackle climate change. SDG-China. Available online at: https://sdg-china.net/en/Insight/info.aspx?itemid=69584

Keywords: climate finance, donor behavior, donor fulfillment rate, EU membership, panel data analysis

Citation: Nor MI (2025) Investigating donor fulfillment in global climate finance: the role of EU commitment. Front. Clim. 7:1629509. doi: 10.3389/fclim.2025.1629509

Edited by:

Pradyot Ranjan Jena, National Institute of Technology, Karnataka, IndiaReviewed by:

Nurul Mohammad Zayed, Daffodil International University, BangladeshMaria Basílio, Instituto Politécnico de Setúbal, Portugal

Copyright © 2025 Nor. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mohamed Ibrahim Nor, bS5pYnJhaGltQHNpbWFkLmVkdS5zbw==

Mohamed Ibrahim Nor

Mohamed Ibrahim Nor