- School of Economics and Management, Yunnan Nationalities University, Kunming, China

Given the pivotal role of climate risk in fostering sustainable corporate growth, this factor warrants further investigation in the context of low-carbon innovation. Drawing on firm-level data from Chinese enterprises during the 2007–2022 period, our research establishes climate risk as a significant driver of corporate low-carbon innovation, with transition risk proving more influential than physical risk. The analysis of underlying mechanisms reveals that climate risk stimulates low-carbon technological innovation primarily through two channels: increased research and development expenditures and enhanced environmental certification efforts. Examination of heterogeneous effects demonstrates that climate risk’s innovation-enhancing potential is particularly pronounced among three distinct groups: enterprises not designated as key pollution monitoring units, firms operating in less polluting industries, and businesses located in China’s eastern regions. These insights provide valuable implications for policymakers and businesses on leveraging climate risk to drive low-carbon innovation while achieving balanced sustainable development in terms of Research and Development investment and pollution control dimensions.

1 Introduction

Global climate change has led to a surge in extreme weather events (Ghaemi Asl et al., 2023). The IPCC projects that global temperature increases may exceed the 1.5°C threshold by 2030, exposing firms to physical risks such as asset damage and supply chain disruptions (Andrews et al., 2023). 2023 stands as the hottest year on record, with continuously rising greenhouse gas concentrations driving accelerated glacial melt and sea level rise, posing a systemic threat to human society. The “China Climate Change Blue Book (2024)” further highlights the accelerated warming of China’s climate system and the escalating climate risk (CR). To address these challenges, China has established clear policy targets, aiming to achieve carbon peaking by 2030 and carbon neutrality by 2060 (Zhu et al., 2025). China has now established a comprehensive policy framework covering all sectors including energy, industry, and transport to achieve its carbon peaking and carbon neutrality goals. Over 50 new policies were introduced in 2024 alone, ranging from dual control of carbon emissions and renewable energy expansion to the management of non CO2 gases, establishing a systematic approach to emission reduction. However, these policies may profoundly influence corporate transitions toward low-carbon practices. Attaining these dual-carbon goals necessitates prioritizing low-carbon innovation (LCI) as a core driver to mitigate emissions and environmental degradation (Li and Zhang, 2023). As primary agents of LCI, firms must advance technological breakthroughs and product upgrades to ensure sector-wide sustainability (Chen, 2023). However, the reality is that despite net-zero commitments from ninety-two major global digital technology companies, the sector’s total carbon emissions still increased by 1.4% year-on-year in 2023, highlighting a significant disconnect between stated goals and concrete actions.

Climate risk manifests in two distinct forms for firms: “physical risk” and “transition risk” (Adeabah and Pham, 2025). Climate physical risks primarily stem from extreme weather events, natural disasters, and other phenomena directly caused by climate change. These risks inflict immediate damage on corporate assets but exert limited influence in driving low-carbon innovation. Conversely, climate transition risks arise from the gradual shift towards a low-carbon economy (Zhou et al., 2023), manifesting as policy pressures such as the expansion of the national carbon market, mandatory product carbon footprint disclosure standards, and mechanisms like the EU Carbon Border Adjustment Mechanism. Notably, plans exist to establish 100 such product carbon footprint standards before 2027. These policy pressures and market signals significantly catalyze innovation, although their effectiveness depends heavily on analyst scrutiny and media oversight. Proactive corporate measures can mitigate CR’s adverse effects (Huang et al., 2022). Moreover, market concerns about CR enhance the returns on firms’ environmental performance (Huynh and Xia, 2021).

While substantial academic research has examined climate risk’s impact on innovation, significant divergence and ongoing debate persist regarding its effect on green low-carbon innovation. One group of scholars supports risk aversion theory, arguing that extreme weather events directly threaten corporate physical assets (Deng et al., 2024). Physical damage to production facilities and supply chain disruptions caused by climate risks increase direct operational costs, eroding firms’ financial capacity to invest in long-term green projects and consequently constraining their ability to innovate sustainably. Concurrently, unusually high temperature rises prompt firms to increase short-term environmental expenditures, diverting resources from research and development. This inhibitory effect proves particularly pronounced for non-state-owned enterprises and manufacturing firms. Another group endorses the Porter Hypothesis, contending that risks like climate change intensify environmental regulatory pressures on firms (Porter and Linde, 1995). This heightened pressure stimulates the development of green innovation technologies and enhances corporate performance. Analyst scrutiny, media oversight, and corporate digital transformation can amplify climate risk’s positive influence on green innovation, with this amplification effect more evident in state-owned enterprises.

China offers a compelling empirical setting for investigating how climate risk drives corporate low-carbon innovation. Emerging economies face mounting threats from climate change and environmental pollution; consequently, fostering corporate low-carbon innovation and environmental engagement is critical for global economic and environmental sustainability. As a leading emerging market, China confronts severe climate challenges. Accelerating low-carbon innovation capabilities and addressing persistent environmental issues remain imperative for achieving its dual carbon goals. Current progress demonstrates a 36.7 percent reduction in CO2 emissions per unit of GDP since 2012. Installed wind and solar capacity now exceeds 800 million kilowatts, while new energy vehicle penetration has surpassed 50 percent, indicating a solid foundation exists for scaling green technology applications. Since the early 2000s, firms have increasingly recognized climate risk’s impact on corporate value and ESG performance (Naseer et al., 2024). However, industry leaders in high-emission sectors have yet to achieve absolute emission reductions, and supply chain emissions disclosure remains critically insufficient. This is illustrated by the top ten carbon emitters accounting for over 53 percent of reported emissions. China’s distinctive combination of ambitious climate goals, measurable green transition progress, concentrated emissions profiles, and persistent corporate disclosure gaps provides a robust empirical environment and data foundation for examining climate risk’s role in advancing corporate low-carbon innovation.

Translating perceived climate risk into concrete low-carbon innovation strategies represents a complex and non-automated decision-making process for firms. Climate risk encompasses both physical threats stemming from extreme weather events and transition pressures arising from evolving regulations, policies, and market shifts. Management’s interpretation of these risks is crucial. When climate challenges are viewed as strategic opportunities to reshape the value chain, secure green competitive advantages, or avoid higher future compliance costs, rather than merely as immediate financial burdens, firms demonstrate a stronger inclination to initiate innovation agendas. This cognitive shift prompts companies to reassess their resource allocation priorities, directing increased R&D funding and human resources towards exploring and applying low-carbon technologies. Examples include developing more energy-efficient production processes or creating new products compliant with carbon footprint standards. Simultaneously, external pressures exert a powerful influence. Professional assessments from analysts and heightened media scrutiny amplify the potential reputational damage and market value loss associated with climate inaction. This compels firms to integrate low-carbon innovation into their core strategic considerations in response to stakeholder expectations. Consequently, the transformation of risk perception into innovative action fundamentally hinges on three internal factors within the firm: the strategic foresight of management, the commitment to resource reallocation, and the capacity to respond effectively to external oversight pressures.

This paper contributes twofold: First, it expands the CR-LCI literature by identifying CR’s dual channels—boosting Research and Development (R&D) investment and environmental certifications—to inform policymaking. Second, heterogeneity analyses reveal stronger LCI effects in eastern China and among non-key monitored firms, whereas heavily polluting firms exhibit diminished marginal benefits due to pre-existing regulatory constraints.

Using data from Chinese listed companies spanning 2007 to 2022, this study examines how climate risk influences corporate low-carbon innovation. Our empirical findings reveal that climate risk promotes low-carbon innovation within firms primarily through two channels: by increasing R&D investment to enhance innovation capacity, and by affecting firms’ environmental credentials through their attainment of environmental certifications. Heterogeneity analysis indicates that the impact of climate risk on low-carbon innovation is more pronounced in eastern China. Furthermore, as heavily polluting enterprises already operate under stringent policy scrutiny, firms designated as key pollution-monitoring units derive significantly lower marginal benefits from climate risk compared to non-key units. This translates into a weaker stimulative effect on their low-carbon innovation activities.

The paper proceeds as follows: Section 2 develops hypotheses; Section 3 describes data and methodology; Section 4 presents empirical results; Sections 5–6 examine mechanisms and heterogeneity; and Section 7 concludes with policy implications.

2 Literature review and hypothesis development

2.1 The logic of climate risk driving low-carbon innovation

Low-carbon innovation aims to reduce environmental pollution through developing innovative low-carbon green products and technologies (Xu et al., 2024). As an innovation activity targeting ecological protection, it emphasizes building green, low-carbon, and circular production systems (Lyu et al., 2024). This implies that low-carbon innovation extends beyond end-of-pipe emission reduction technologies to encompass a comprehensive green transformation of the entire value chain. This transformation includes greening raw material sourcing, optimizing production processes, and managing the carbon footprint throughout a product’s lifecycle. The primary driver lies in increasingly stringent carbon emission constraints, such as tightening carbon quotas or rising carbon prices. These constraints directly translate into higher operational costs for firms, compelling them to pursue technological breakthroughs aimed at reducing compliance expenses and maintaining competitiveness (Ma, 2024). However, a firm’s perception of this climate-induced pressure—whether stemming from the threat of asset loss due to physical risks or the rising costs of policy compliance driven by transition risks—merely represents the starting point of the low-carbon innovation process. The critical factor is how firms transform this risk perception into concrete innovation strategies. This transformation typically involves management reinterpreting the risks as opportunities for technological upgrading or market expansion. Consequently, they strategically direct R&D resources towards green technology initiatives. For instance, a firm might increase its R&D budget for energy-efficient technologies or renewable energy applications. Alternatively, it could seek environmental management system certification to enhance its sustainability credentials and meet regulatory requirements.

However, contrasting perspectives exist. Lee et al. (2025) and Wu (2025) demonstrate the inhibitory effect of climate risk on green innovation from different angles. Lee et al. focus primarily on climate physical risk, arguing that the direct damage caused by extreme weather events consumes substantial financial and operational resources for disaster recovery and emergency response, diverting funds away from long-term innovation investments. Wu, conversely, emphasizes the transition risk stemming from policy uncertainty, suggesting that ambiguous or frequently shifting policy signals weaken firms’ long-term return expectations for low-carbon technologies and increase investment risks. Ling and Gao (2023) further argue that climate risk may suppress corporate green innovation by reducing R&D investment, lowering resource allocation efficiency, and increasing corporate risk. This inhibitory effect is likely more pronounced for firms with constrained financial buffers or those located in areas highly exposed to physical climate risks.

On the other hand, several studies support a positive driving effect of climate risk on low-carbon innovation. Tian et al. (2024) posit that managerial perception and assessment of climate risk are crucial triggering factors. They find that the perception of climate risk drives corporate green innovation, an effect particularly strong in firms excelling in environmental governance, such as possessing mature environmental management systems, and proficient in applying digital technologies, such as utilizing big data and AI for carbon emission monitoring and management. These firms tend to proactively pursue green innovation to mitigate climate risk, capture first-mover advantages, or shape a green brand image, reflecting a cognitive shift among managers who view climate risk as a strategic opportunity rather than a mere threat. Complementing this, Zhong and Jin (2025) propose that climate risk disclosure significantly enhances green innovation capability through dual channels: increasing media attention and reducing agency costs. Specifically, high-quality disclosure attracts broader media coverage and public scrutiny, creating external pressure that compels management to prioritize environmental performance. Simultaneously, transparent disclosure reduces information asymmetry and conflicts of interest, namely agency costs, between shareholders and management regarding climate issues. This alignment allows management decisions to better reflect shareholder long-term value, including mitigating potential value losses from climate risk, making them more willing to invest in longer-cycle, strategically significant low-carbon innovation projects.

Hypothesis 1: Climate risk positively enhances corporate low-carbon innovation capabilities.

2.2 Mechanisms through which climate risk affects corporate low-carbon innovation

2.2.1 Research and development investment channel

Climate risk is a key factor driving firms to increase R&D investment for low-carbon innovation. To comply with climate policies and shifting market demands, firms must invest in R&D to reduce future compliance costs (Wen et al., 2023). Under ESG investment pressures, investor demand for low-carbon transitions further incentivizes firms to allocate capital toward green technology R&D, while climate risk disclosure strengthens financial commitments to low-carbon innovation. Additionally, aggressive climate policies lead institutional investors to increase funding for green projects, encouraging firms to adopt green initiatives to secure public investment and support (Yu et al., 2023). R&D investment accelerates innovation through internal knowledge accumulation and external collaboration, with government subsidies and tax policies amplifying its effects.

Hypothesis 2: Climate risk promotes low-carbon innovation by driving firms to increase R&D expenditure.

Extreme weather events significantly influence how firms adjust human resource strategies. Recent studies highlight the positive impact of Green Human Resource Management on environmental performance (Chaudhary, 2020). External pressures from institutions and stakeholders further intensify competition for low-carbon talent (Marrucci et al., 2023). Policies such as carbon pricing and green technology standards compel firms to expand their talent pools in low-carbon fields—for instance, the EU Carbon Border Adjustment Mechanism has accelerated the hiring of carbon management experts in high-emission industries. Moreover, uncertainties in low-carbon technology pathways force firms to adopt “talent redundancy” strategies to diversify innovation risks.

Human capital accumulation is critical for low-carbon innovation. Studies show that Green Human Resource Management practices positively affect green intellectual capital and green innovation (Shahzad et al., 2025; Song et al., 2021). Expanding R&D teams enhances knowledge spillover effects, creating an “innovation multiplier effect” through interdisciplinary collaboration. Diverse talent structures also improve organizational resilience, helping firms navigate climate technology uncertainties (Horbach, 2016).

Hypothesis 3: Climate risk promotes low-carbon innovation by driving firms to increase R&D personnel.

2.2.2 Environmental certification channel

Stringent environmental regulations and carbon pricing mechanisms compel firms to obtain environmental certifications to demonstrate compliance, avoid penalties, and secure policy support. Meanwhile, public concern about climate risk amplifies environmental governance pressures (Li and Tian, 2024), elevating the importance of certifications and shaping green investments. As consumers and investors increasingly favor low-carbon products, environmental certifications become tools for competitive differentiation (Yin and Schmeidler, 2009). Industry leaders require suppliers to hold such certifications, forcing upstream and downstream firms to jointly transition toward low-carbon practices (Qrunfleh and Tarafdar, 2014).

Environmental certifications necessitate systematic environmental management systems, driving process optimization and technological upgrades (Jiang et al., 2021). Energy audits during certification identify emission reduction potentials, stimulating process innovation. Certification bodies provide technical guidance and industry best practices, helping firms overcome innovation bottlenecks. Furthermore, certifications enhance corporate green reputations, attracting government subsidies, green financing, and R&D collaborations. Management system certifications act as catalysts for innovation performance, with social responsibility disclosure identified as a mediating factor (Zhang et al., 2024).

Hypothesis 4: Climate risk promotes low-carbon innovation by incentivizing firms to obtain environmental certifications.

3 Data and research design

3.1 Sample selection and data sources

This study utilizes a sample of A-share listed companies from 2007 to 2022. Climate risk indicators were obtained from the Wind database, while corporate low-carbon innovation application data were manually compiled from publicly disclosed information of listed companies. The data underwent the following processing steps: first, financial and utility companies were excluded; second, firms exhibiting financial anomalies or delisting during the sample period were removed; third, to minimize the impact of outliers, all continuous variables were winsorized at the 1% level.

The final sample comprises 820 stocks with a total of 6,133 observations.

3.2 Research design

To accurately identify the causal effect of climate risk on corporate low-carbon innovation, this study adopts the two-way fixed effects panel regression model following the approach of Lee et al. (2025). The model specification is given in Equation 1:

The subscript notation i corresponds to individual stocks, while t identifies the year in our panel data structure. The dependent variable (patent) quantifies low-carbon innovation performance, operationalized as the count of low-carbon patent applications filed by stock i during year t + 1. Concurrently, our key independent variable (CR) captures the climate risk exposure level for stock i in year t.

Variable X represents a set of control variables. Based on relevant studies of low-carbon innovation by Zhang J. et al. (2025), Ren et al. (2024), and Tian et al. (2024), these control variables include return on assets (ROA), Tobin’s Q, board size (Bo size), revenue growth rate (Growth), return on equity (ROE), firm age (Age), firm size (Size), asset-liability ratio (lev), equity nature (equity), and operating profit (profit).

To address possible common shocks occurring annually—such as changes in monetary policy, fiscal policy, and broader macroeconomic conditions—we integrated time fixed effects (year) into the model. Additionally, industry fixed effects (industry) were included to account for unobserved, time-varying factors at the sector level, reducing potential distortions caused by industry-specific influences. Lastly, the term denotes the random error component. Together, these elements constitute the core structure of our panel model, which functions as the primary regression framework for analyzing the influence of climate risk on low-carbon innovation.

3.3 Variable definition

This study measures corporate low-carbon innovation capability using the volume of green and low-carbon patent applications filed by enterprises. Unlike granted patents, patent applications are not subject to patent office examination and remain unaffected by bureaucratic processes. The core metrics comprise three categories: total green low-carbon patent applications, invention patents, and utility model patents. Compared with granted patents, patent applications provide more timely reflection of corporate innovation investment and willingness while being less influenced by external bureaucratic factors such as patent office processing efficiency. The data integrate original patent application records from the China National Intellectual Property Administration and are filtered according to the IPC Green Inventory published by the World Intellectual Property Organization, ensuring all identified patents fall within the green low-carbon technology domain. A rigorous data cleaning procedure was implemented. First, design patents and non-technological applications were excluded based on International Patent Classification codes. Second, patent applications were directly matched to listed companies using stock codes, with unmatched records removed from the sample. Finally, invention patents requiring substantive examination were distinguished from utility model patents undergoing only formal review, with each category used for baseline regression and robustness tests, respectively.

For climate risk measurement, this study employs a comprehensive firm-level Climate Risk Index constructed using Wind Financial Terminal data. The index incorporates environmental dimensions from corporate ESG rating systems, capturing both physical and transition risks. Physical risk assessment evaluates potential losses from extreme weather events and long-term climate pattern changes, including sudden disasters such as floods and droughts as well as persistent anomalies in temperature and precipitation. Transition risk measurement consists of two key components: policy sensitivity and market pressure. Policy sensitivity examines whether firms are listed as key pollution monitoring units, included in carbon market coverage, subject to environmental penalties, or face high environmental tax burdens. Market pressure considers corporate engagement in carbon trading markets and performance scores in environmental governance. By integrating multi-source data including environmental disclosures, meteorological records, and regulatory policy information, the index specifically accounts for institutional characteristics unique to emerging economies, such as key polluter supervision mechanisms and regional carbon market pilot policies. This approach effectively distinguishes between natural environmental exposure and policy-driven shocks in shaping corporate low-carbon innovation behavior.

4 Empirical results

4.1 Descriptive statistics

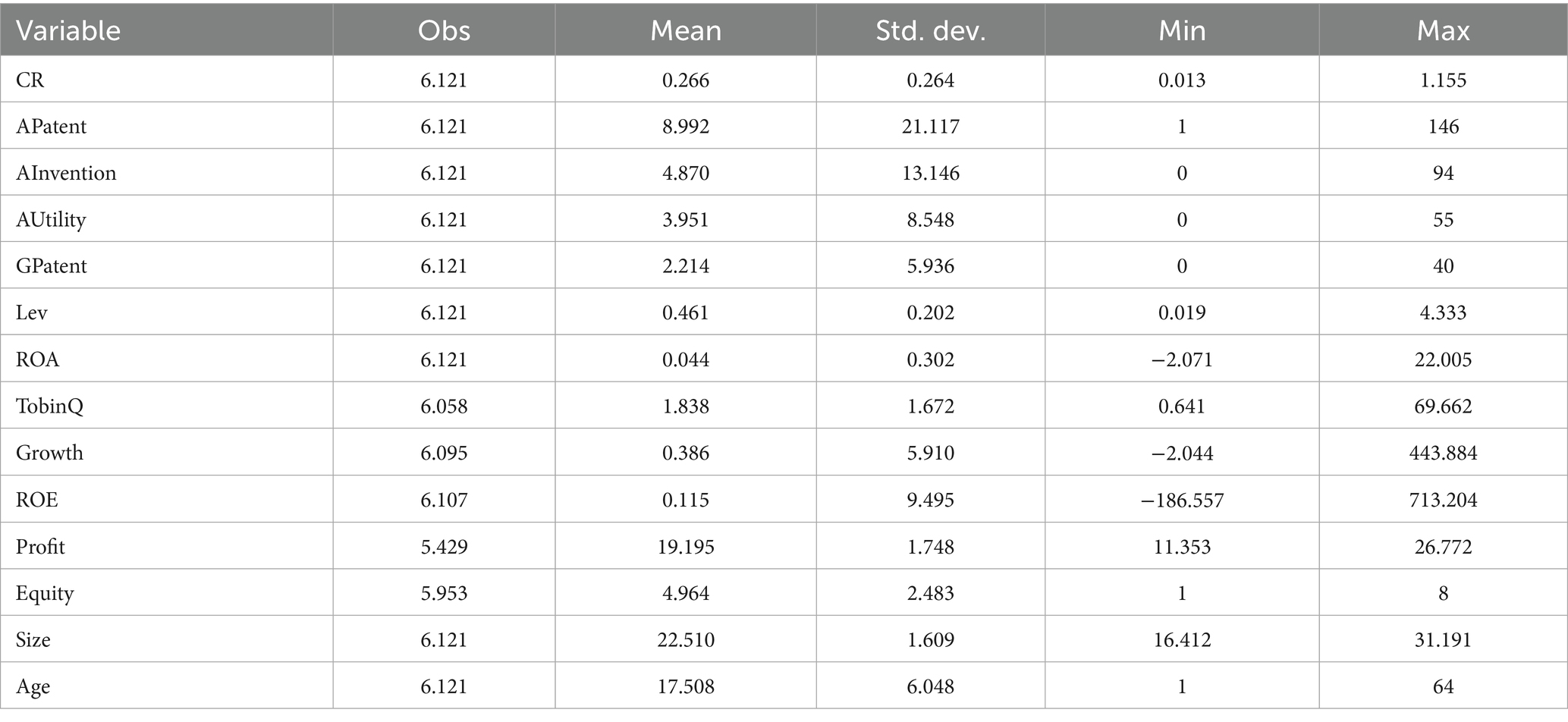

Table 1 presents the descriptive statistics. The average numbers of green low-carbon patent applications, green low-carbon invention patent applications, and green low-carbon utility model patent applications for the sample companies are 8.992, 4.870, and 3.951 respectively. The data reveals significant differences in green low-carbon innovation performance among firms, with zero values being the most frequent observation in the patent distribution—a trend frequently documented in innovation studies (Li et al., 2022). Meanwhile, the mean value of CR stands at 0.266. Other key financial indicators, including ROA, revenue growth rate, and leverage ratio, also display notable variations, establishing a robust basis for examining the link between CR and corporate low-carbon innovation.

4.2 Baseline model results

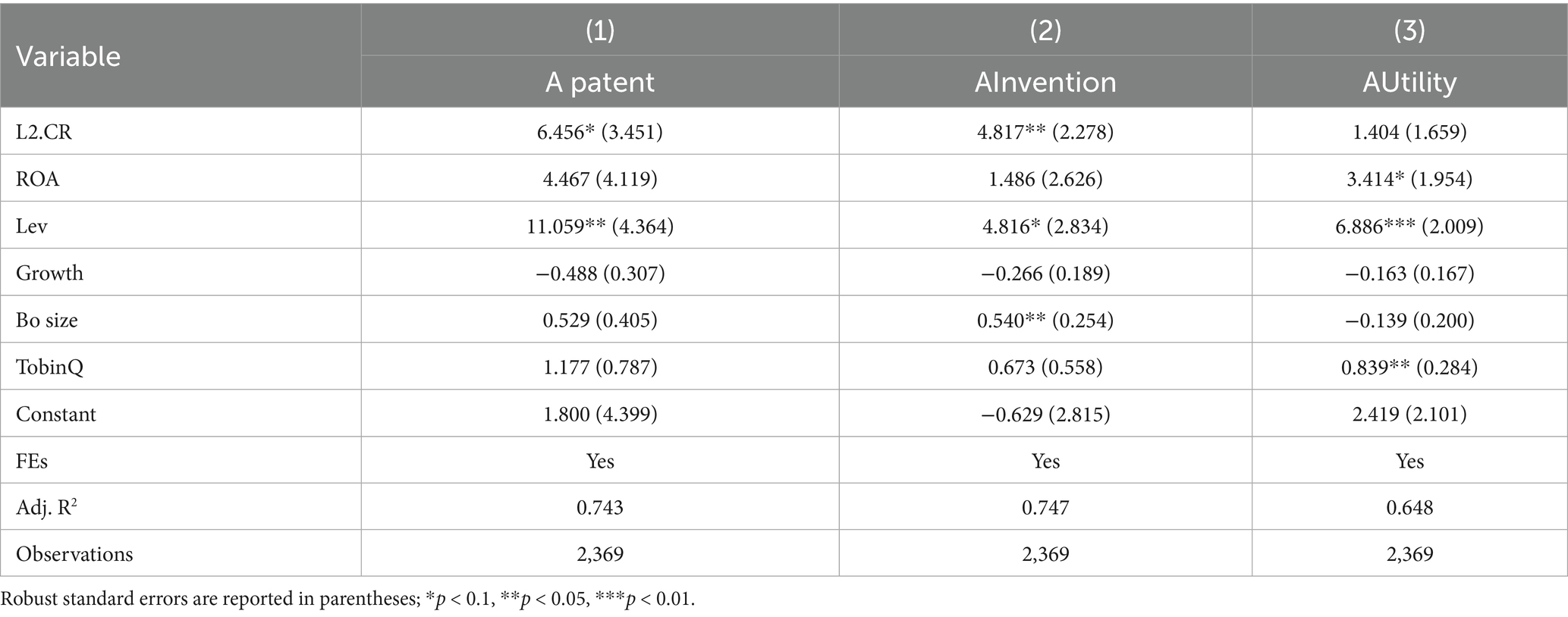

The first column in Table 2 displays the regression outcomes for our baseline model as specified in Equation 1. The results indicate that the climate risk variable shows statistical significance at the 10% confidence level, with a positive sign, indicating that climate risk plays a crucial role in enhancing corporate low-carbon innovation capabilities. These findings provide empirical support for Hypothesis 1. Our baseline regression results align with the conclusions drawn by Hu et al. (2025).

We implemented a two-period lag structure for the climate risk variable based on several theoretical considerations. First, low-carbon technology innovation fundamentally represents a cumulative knowledge production process, requiring a complete R&D cycle from risk perception to innovation output. Second, there exists a natural time lag between the introduction of new environmental policies and firms’ full comprehension of policy implications followed by strategic adjustments. Third, compared to contemporaneous or single-period lag models, the two-period lag specification more effectively mitigates potential endogeneity concerns. This methodological approach reduces estimation bias caused by reverse causality and helps distinguish between persistent climate risk effects and short-term fluctuations.

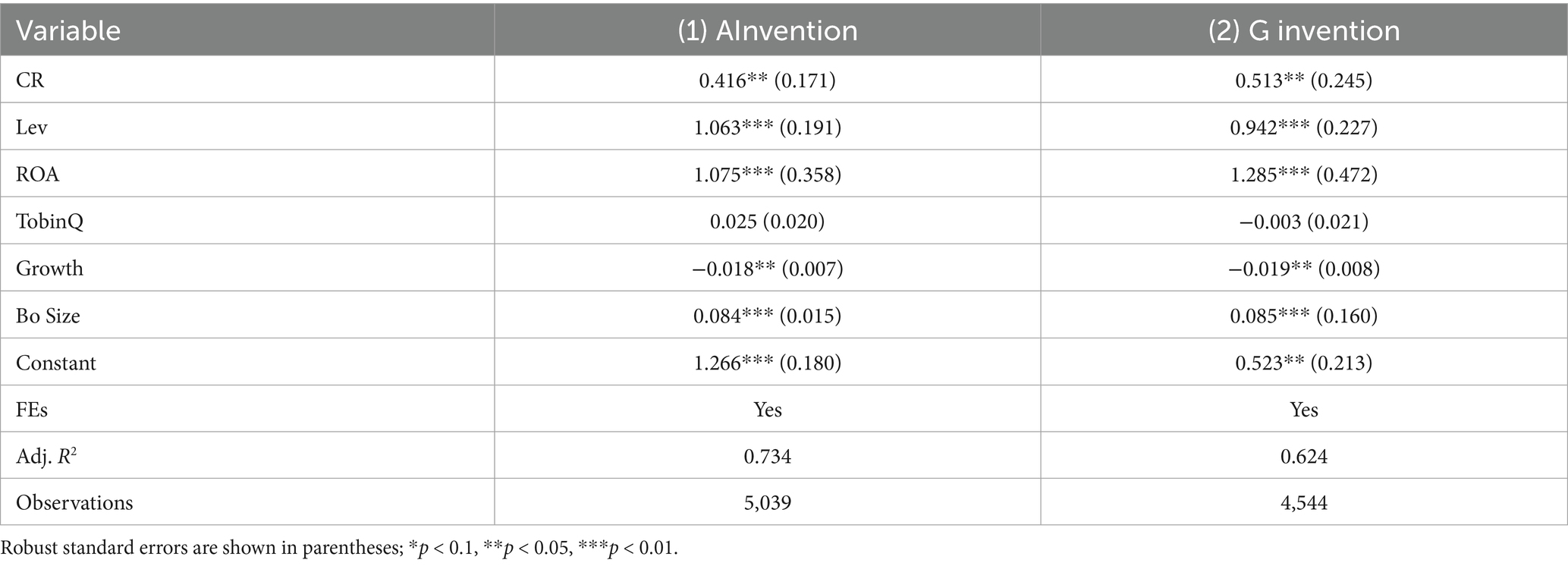

When examining climate risk impacts across different patent types, we observe divergent results. Green low-carbon invention patents show statistically significant positive effects at the 5% level, reflecting firms’ tendency to pursue substantive technological breakthroughs when facing environmental constraints. This strategic preference stems from invention patents’ stronger protection of core technologies and higher commercial value, which help build long-term competitive advantages against climate risks. In contrast, utility model patents demonstrate insignificant results, revealing deeper strategic considerations—while these incremental innovations involve lower costs, their limited technical barriers and easy imitability make them ineffective for establishing durable market advantages. Particularly in low-carbon transitions, firms prioritize high-quality invention patents that substantially improve energy efficiency or develop alternative technologies over marginal equipment modifications. This gradient response across patent types confirms that climate risk primarily drives fundamental emission-reducing technological changes rather than superficial adaptive adjustments.

We acknowledge, however, that relying solely on the volume of patent applications, including invention patents, as a measure of low-carbon innovation impact carries inherent limitations. Patent counts alone struggle to fully capture the actual environmental benefits achieved, the breadth of technological diffusion, or the depth of market transformation resulting from the innovation. For instance, a core emission-reduction invention patent may exert profound influence due to subsequent widespread citations, yet it might equally fail to generate substantial emission reductions if commercialization efforts stall. Therefore, future research could incorporate metrics based on patent citation frequency, technological coverage, or ultimate commercialization outcomes. Examples include the citation intensity of green patents or the market penetration rate of low-carbon technologies. Such complementary metrics would enable a more comprehensive assessment of the qualitative dimensions of climate risk’s true impact on low-carbon innovation. This enhanced measurement approach would deepen understanding of the efficacy of climate risk-driven innovation, particularly by offering more nuanced insights into distinguishing substantive technological breakthroughs from symbolic innovation.

4.3 Robustness tests

4.3.1 Differentiation between physical risk and transition risk

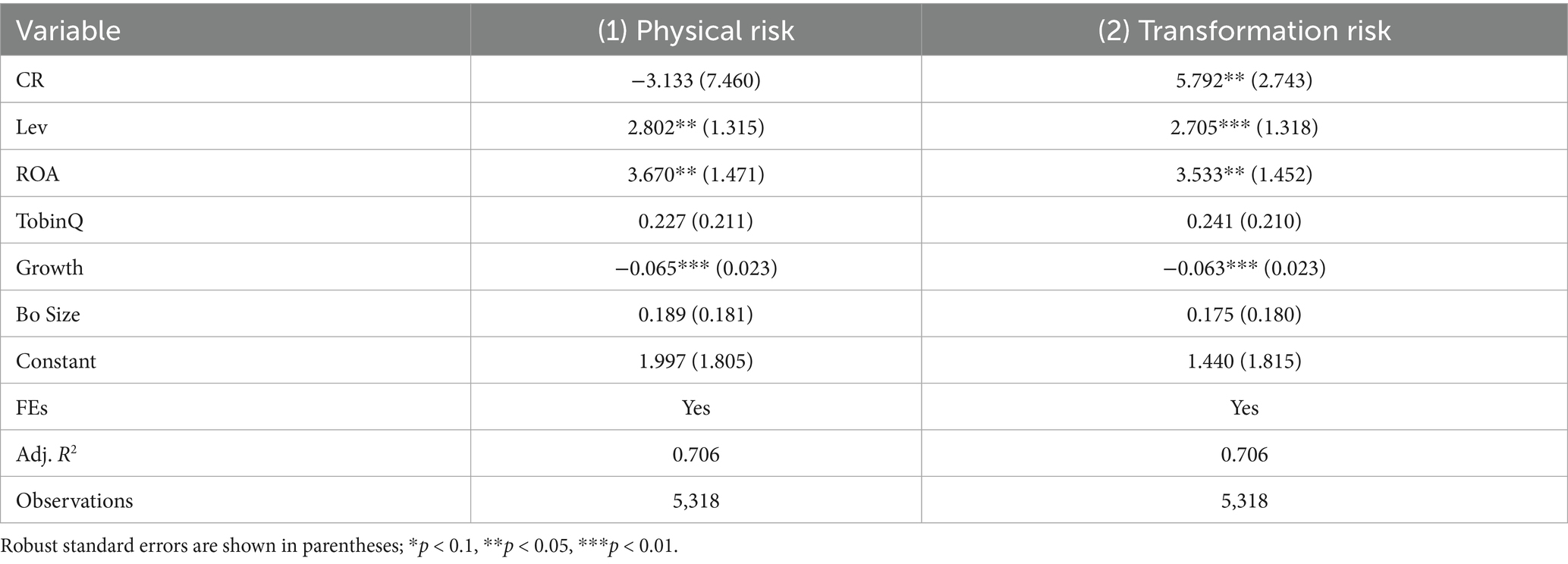

To precisely identify the distinct driving effects of different climate risk dimensions, this study decomposes the core explanatory variable into physical risk and transition risk for separate examination. Table 3 presents revealing results: transition risk demonstrates statistically significant positive effects on corporate low-carbon innovation at the 5% level, while physical risk fails to show statistically meaningful coefficients. This finding confirms that in the Chinese context, the primary driver of low-carbon innovation stems from transition pressures created by evolving policy regulations and shifting market rules, rather than direct threats from physical climate impacts. This divergence can be explained through two analytical dimensions: risk characteristics and corporate response mechanisms. Transition risk predominantly originates from policy changes and market signal shifts, featuring distinct policy orientation and long-term predictability. When confronted with carbon market expansion, carbon tax adjustments, or mandatory disclosure requirements, corporate management can transform these pressures into clear strategic objectives. They proactively respond through measures like increased R&D investment and optimized talent allocation to gain first-mover advantages. This innovation response triggered by institutional pressure aligns with the Porter Hypothesis, which posits that properly designed environmental regulations can stimulate innovation compensation effects.

In contrast, physical risk primarily manifests as sudden shocks like extreme weather events. Its unpredictable and destructive nature inclines firms toward passive defensive strategies. Physical risks often directly damage production facilities and supply chains, compelling enterprises to allocate limited resources to disaster recovery and operational continuity rather than long-cycle, high-uncertainty low-carbon technology development. Moreover, the regional concentration of physical risks may lead firms to prefer geographical relocation over technological innovation as a risk mitigation approach, further diminishing its potential to promote low-carbon innovation. These findings highlight that in China’s institutional environment, policy-driven transition risks prove more effective than natural disaster-related physical risks in guiding corporate low-carbon technological innovation. The evidence underscores how distinct risk characteristics shape fundamentally different corporate innovation behaviors, with transition mechanisms offering more reliable pathways for low-carbon transformation. This has important implications for policymakers seeking to design climate risk instruments that effectively stimulate green innovation while accounting for regional and sectoral variations in risk exposure profiles. The results particularly emphasize the need for policy frameworks that strengthen the predictability and signaling function of transition risks to maximize their innovation-inducing potential.

4.3.2 Replace dependent variables

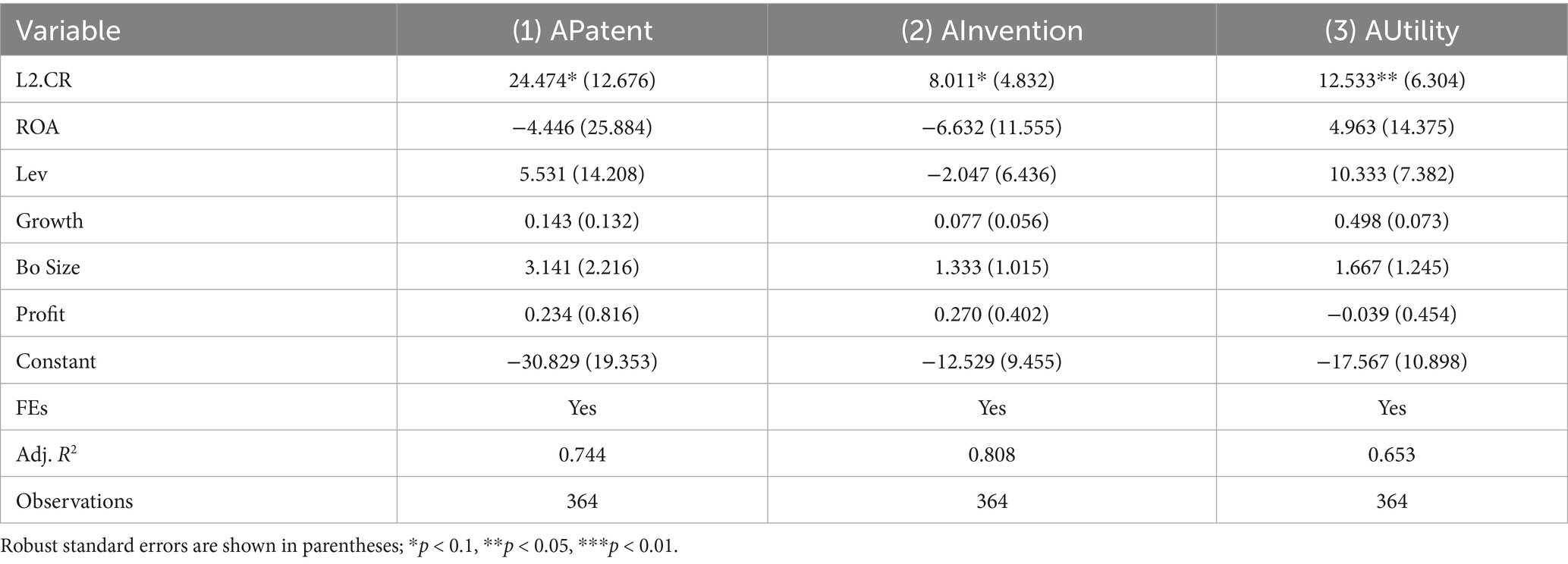

This section conducts robustness checks on the regression results presented in Table 2. First, we adjust the control variable specification by replacing Tobin’s Q, which measures investment opportunities, with the logarithm of operating profit. This modification considers two factors: operating profit more directly reflects actual operational conditions and discretionary resources, avoiding potential market valuation biases in Tobin’s Q; the logarithmic transformation reduces extreme value impacts for more robust estimates. Maintaining the two-period lag specification, the results in Table 4 show that total green low-carbon patents and invention patent applications remain significantly positive at the 10% level, while utility model patent significance improves to 5%. These findings confirm the stability of our core conclusions regarding climate risk’s innovation-promoting effects while suggesting that climate risk may simultaneously stimulate different innovation levels, though invention patents demonstrate more stable responses.

4.3.3 Poisson regression

Third, we employ Poisson regression to verify result reliability, given the count nature of patent data characterized by non-negative integers and over-dispersion. The Poisson model more accurately captures quantitative relationships between climate risk and low-carbon innovation. Results in Table 5 show that climate risk maintains 5% significance levels for both application and grant counts of green invention patents when keeping control variables consistent with the baseline model. Notably, coefficient directions and significance levels remain stable, confirming the baseline model’s adaptability and robustness. The significant response of invention patents fundamentally reflects climate risk’s differential impact on innovation depth versus breadth. Unlike utility models, invention patents require substantive technical advancements and systematic R&D investments. Facing climate risks, firms prioritize breakthrough technologies that enable fundamental emission reductions, as these innovations satisfy tightening environmental regulations while building sustainable competitive advantages. The dual significance in both applications and grants validates the genuine technological value of climate-driven innovations, effectively ruling out strategic patenting behaviors. In contrast, the insignificant utility model results highlight the unique value of high-quality innovations in addressing systemic environmental risks.

5 Mechanism tests

5.1 R&D investment channel

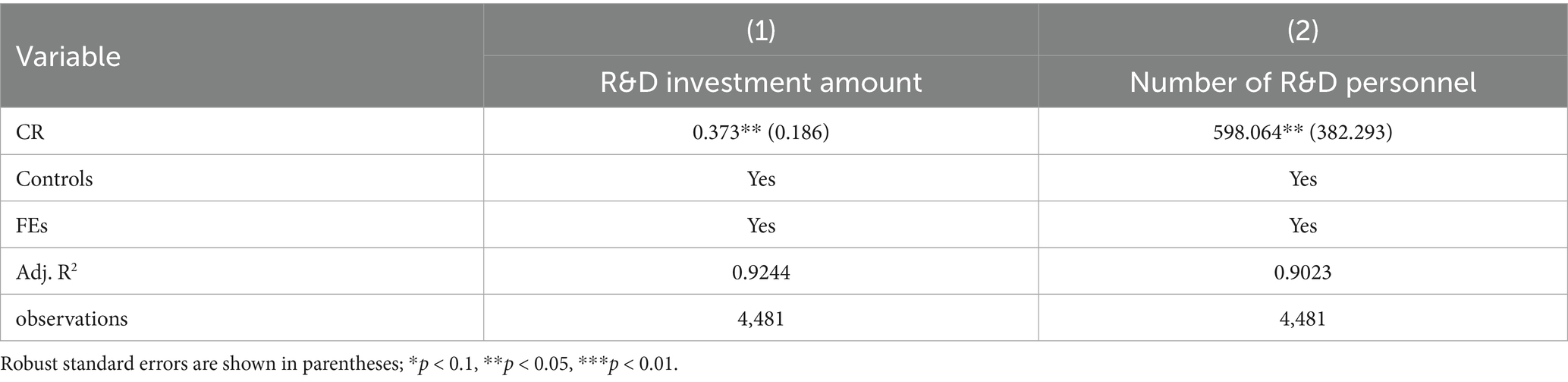

As discussed in Section 2.2.1, corporate R&D investment funding and the number of R&D personnel dedicated to low-carbon innovation projects play a crucial role in mediating the impact of climate risk on low-carbon innovation. Considering data availability, we utilize the R&D expenditure and R&D personnel counts from the CSMAR Listed Companies R&D Innovation Database for assessment. The empirical results presented in Table 6 provide direct support for the role of R&D expenditure and personnel allocation as key mechanisms. Column 1 demonstrates that the climate risk coefficient is positive and statistically significant at the 5 percent level. This indicates that firms facing elevated climate risk significantly increased their R&D expenditure, thereby validating Hypothesis 2. Similarly, Column 2 of Table 6 confirms a positive and statistically significant climate risk coefficient at the 5 percent level. This result establishes that firms responded to climate pressure by significantly increasing their number of R&D personnel, supporting Hypothesis 3.

5.2 Environmental certification channel

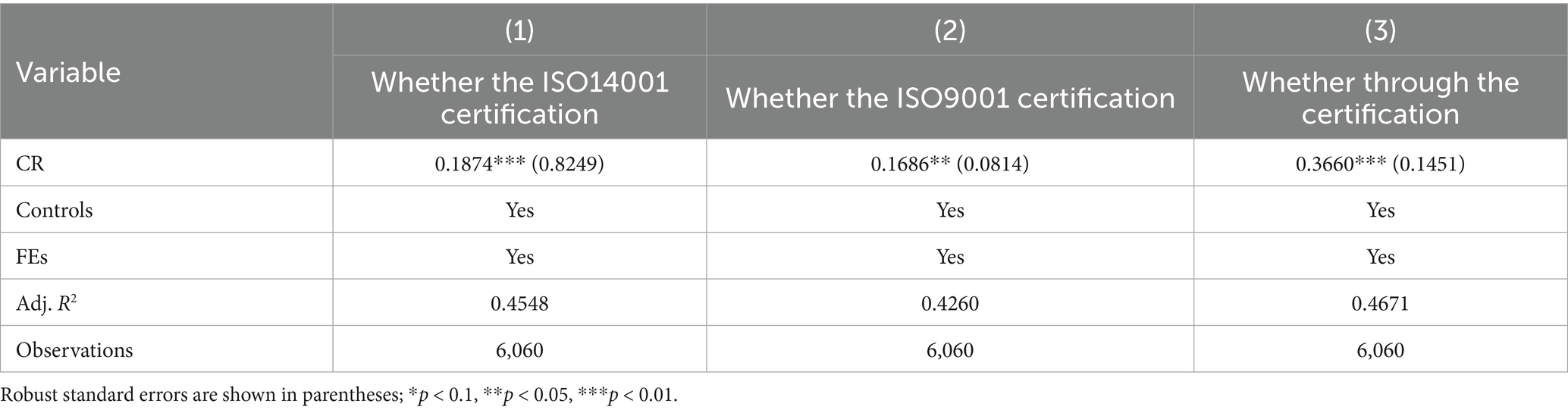

As outlined in Section 2.2.2, environmental certification constitutes another potential mechanism. We construct a binary indicator for environmental certification status using ISO 14001 and ISO 9001 certification records sourced from the CSMAR environmental database. The regression results presented in Table 7 provide clear empirical validation for this mechanism. Columns 1 through 3 consistently demonstrate that the climate risk coefficient is positive and statistically significant at the 1 percent level. This strongly supports Hypothesis 4, confirming that climate risk significantly promotes firms’ acquisition of environmental certification credentials. This finding empirically substantiates that obtaining environmental certification represents a significant behavioral response through which firms address climate risk and advance low-carbon innovation.

6 Heterogeneity analysis

6.1 Classification of regulatory types

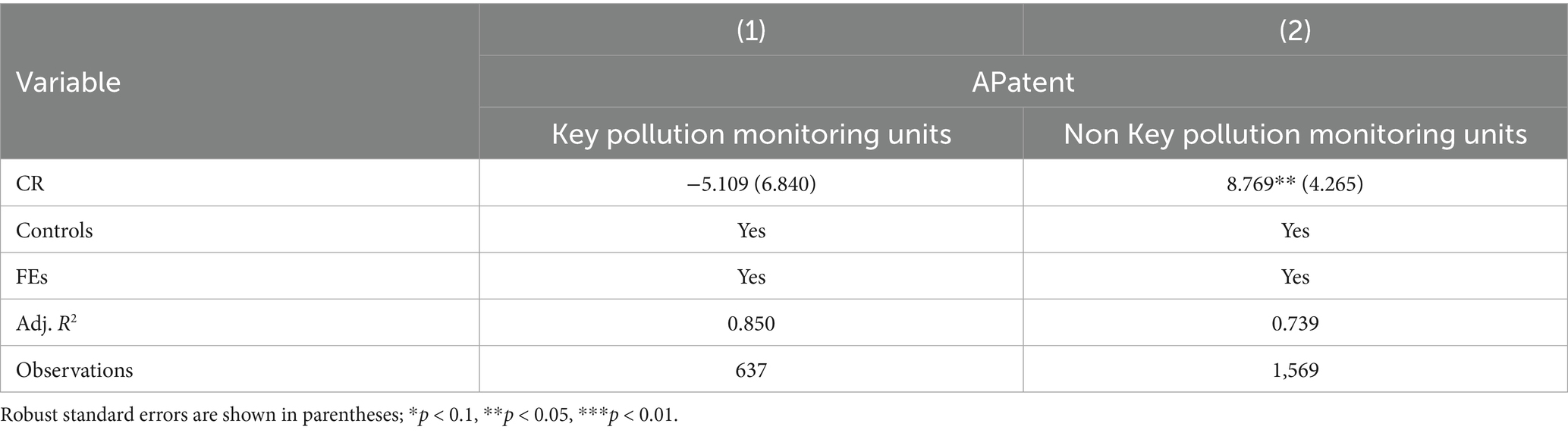

This study utilizes the CNDD database’s list of environmentally regulated firms to identify whether listed companies are designated as key polluting enterprises, enabling examination of climate risk’s differential impacts on low-carbon innovation under varying regulatory intensities. Columns 1 and 2 of Table 8 reveal a statistically significant positive effect of climate risk at the 5% level for non-key monitoring firms, while the coefficient remains insignificant for key monitoring firms. These findings align with perspectives from Zhang Q. et al. (2025) and Zhu et al. (2024). By concentrating specifically on low-carbon technological innovation instead of general green technology innovation, this research provides more targeted insights for realizing the dual carbon objectives. The divergence underscores how regulatory intensity profoundly modulates corporate risk response logic.

Key monitoring firms, constrained by long-term command-and-control environmental regulations, have their environmental management behaviors deeply anchored in mandatory compliance frameworks. While effective for controlling conventional pollutants, institutional mechanisms like the “Two Randomities, One Disclosure” inspection system and comprehensive online monitoring have channeled corporate resources toward administrative tasks—data compliance reporting, pollution control facility upgrades, and other mandated activities. This high-intensity compliance pressure creates triple constraints: management resource depletion crowds out strategic innovation space; environmental investments become locked into end-of-pipe facility updates; and firms develop “regulatory dependency,” perceiving climate risk as a distant concern rather than an immediate innovation driver. In contrast, non-key monitoring firms demonstrate greater responsiveness to market forces like carbon pricing signals and green supply chain pressures. Their flexible decision-making structures enable strategic resource reallocation toward low-carbon patenting, allowing them to either mitigate transition costs or gain technological first-mover advantages.

From a regulatory perspective, the weakened innovation response among key polluting firms reflects structural tensions between China’s immediate pollution control and long-term innovation objectives. The current regulatory framework, dominated by command-and-control instruments, prioritizes compliance through standardized emissions limits, frequent monitoring, and rigid penalties. While successful in rapid environmental quality improvement, this approach fosters a “compliance-first” corporate mentality. Firms concentrate resources on end-of-pipe retrofits and environmental reporting to meet administrative demands, creating path dependency that diminishes strategic perception of climate risks as innovation opportunities. This regulatory effect fundamentally connects to key industries’ macroeconomic roles. Sectors like power and steel, bearing critical supply chain responsibilities, face balanced policy objectives that slow carbon reduction incentives. For instance, while China’s national carbon market covers power generation, its weak price signal (consistently below ¥70/ton) fails to break carbon-intensive technology lock-in. Meanwhile, policies like the Key Pollutant Discharge Unit Catalog emphasize emission intensity control without targeted low-carbon R&D incentives, reinforcing firms’ risk response inertia.

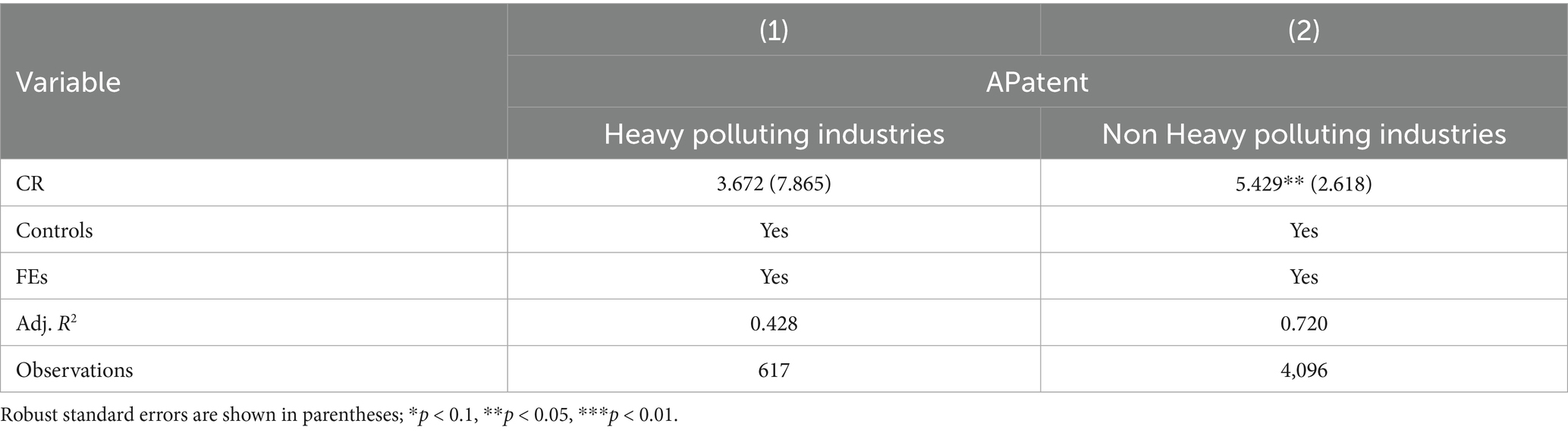

6.2 Classification by pollution intensity

Based on the heavy-polluting industry classification standards outlined in the China Securities Regulatory Commission’s Industry Classification Guidelines for Listed Companies and the Ministry of Ecology and Environment’s Key Pollutant Discharge Units Catalog, this study conducts grouped regression analysis according to pollution intensity levels. Table 9 demonstrates that climate risk’s promoting effect on low-carbon innovation achieves statistical significance at the 5% level for non-heavy-polluting firms, whereas heavy-polluting enterprises show neither statistical significance nor meaningful coefficient magnitude. These findings align with conclusions drawn by Quan et al. (2025) and Han et al. (2025). This divergence stems from industry-specific pollution characteristics shaping distinct transition constraint systems. For heavy-polluting firms, the fundamental constraint lies in the rigid coupling between their carbon-intensive technologies and pollution control requirements. As typical carbon-pollution co-dependent industries, their production system upgrades require simultaneous breakthroughs in both carbon reduction and pollution compliance technological lock-ins. Current environmental regulations, through continuously upgraded emission standards and mandatory clean production audits, compel these firms to channel substantial resources into end-of-pipe treatment facility upgrades, creating a cyclical dilemma where pollution control investments crowd out innovation resources. Meanwhile, climate risk becomes reinterpreted as mere compliance cost inflation rather than a strategic signal triggering technological transformationNon-heavy-polluting enterprises conversely exhibit remarkable response agility. Their modular production structures significantly lower technological substitution barriers, enabling rapid resource reallocation toward low-carbon R&D. Predominantly positioned downstream in global value chains, these firms demonstrate heightened sensitivity to international carbon border taxes and brand owners’ carbon neutrality commitments, effectively converting climate risk into technological competitive advantages.

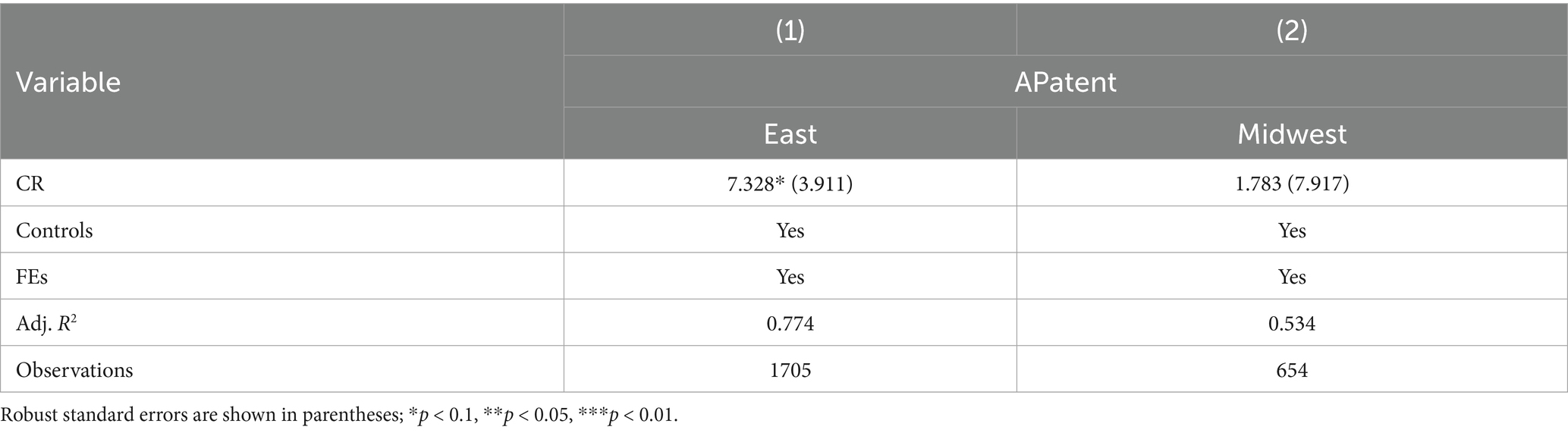

6.3 Geographic location

Table 10 demonstrates that climate risk exerts a statistically significant positive effect on green and low-carbon patent applications at the 10% level in eastern China, while showing no significant impact in central and western regions. This regional divergence fundamentally stems from systematic differences in industrial structure and financial resource accessibility between eastern and central-western China. The pronounced effect observed in eastern China benefits from its more resilient industrial structure and developed capital markets. The region’s highly diversified industrial composition, dominated by high-tech industries and modern services, substantially reduces sunk costs associated with technological transition. This structural advantage enhances firms’ sensitivity to climate risk signals, particularly market-oriented transition risks, enabling more effective conversion of risk pressures into low-carbon innovation momentum. Moreover, eastern China’s substantial financial resource accumulation and mature green finance system effectively alleviate financing constraints for low-carbon R&D through multiple channels including abundant venture capital, green credit availability, and innovative climate finance instruments, thereby providing essential capital support for climate risk-driven innovation activities. In contrast, central and western regions exhibit pronounced path dependence on heavy industrialization, with traditional high-carbon industries occupying substantial proportions. This industrial composition imposes high asset replacement costs and technological lock-in effects on corporate low-carbon transition, making climate risk more likely to manifest as survival pressure rather than innovation incentive. More critically, the relatively underdeveloped financial markets in these regions suffer from severe shortages in green capital supply, coupled with local financial institutions’ limited capacity for assessing low-carbon technology risks. Consequently, even when firms possess innovation intentions, substantial R&D investments remain constrained by formidable financing barriers.

7 Conclusion

Grounded in dynamic capability theory, this study elucidates how enterprises transform climate pressures into low-carbon innovation through strategic organizational restructuring. Successful firms not only augment R&D expenditures but also reconfigure human capital and upgrade knowledge management systems, thereby converting external constraints into sustainable competitive advantages. As carbon constraints evolve into definitive operational challenges, proactive enterprises are transitioning to low-carbon technology deployment—not merely as an ethical consideration but as an existential imperative. Those effectively channeling climate pressures into R&D momentum are establishing future-oriented technological barriers and market dominance. Low-carbon innovation has consequently emerged as a core strategic approach for policy risk mitigation and competitive positioning, underscoring climate risk’s pivotal role in driving corporate innovation.

Our analysis of Chinese firm-level data (2007–2022) demonstrates climate risk’s positive impact on low-carbon innovation, with transition risk exhibiting significantly greater influence than physical risk. Mechanism analysis reveals this effect operates primarily through two channels: enhanced R&D investment and environmental certification adoption. Heterogeneity examination indicates particularly pronounced effects among non-key monitoring enterprises, less polluting industries, and eastern regional firms—findings that align with dynamic capability theory’s postulations regarding institutional pressure responses. Enterprises construct new capability architectures through three principal mechanisms: targeted R&D resource allocation, specialized workforce expansion, and internal certification system optimization. Notably, non-monitored firms demonstrate superior adaptive flexibility due to reduced administrative constraints, while eastern enterprises benefit from mature factor markets that accelerate capability transformation. These insights necessitate tailored policy frameworks that balance rigorous oversight of key units with market-driven innovation cultivation.

As the preeminent emerging economy, China’s climate challenges and response strategies reveal both convergence and divergence with peers like India and Brazil. Distinctively, Chinese firms’ low-carbon innovation responds predominantly to domestic “dual-carbon” policy frameworks and vibrant carbon market signals, whereas Indian enterprises rely more heavily on international carbon finance mechanisms (e.g., CDM projects) and Brazilian firms prioritize sustainable forest management imperatives. This unique policy-market dual-driver model creates distinctive transition conditions. Common challenges across emerging economies include elevated emissions from rapid industrialization and increasing extreme weather frequency—pressures demanding balanced growth-emission strategies through technological innovation, industrial greening, regulatory enhancement, and international collaboration. These shared circumstances enhance our findings’ generalizability for emerging economy climate policy formulation.

This study systematically elucidates the mechanisms through which climate risk influences corporate low-carbon innovation while acknowledging several noteworthy limitations. First, while patent quantity effectively captures innovation output scale, it inadequately measures the substantive value and commercialization potential of technological breakthroughs, particularly regarding disruptive emission-reduction processes and carbon-neutral technology market penetration. Second, current climate risk measurements predominantly focus on objective exposure levels, insufficiently accounting for dynamic variations in managerial risk perception across firms. The significant differences in crisis awareness and strategic foresight among executives warrant deeper investigation into how these subjective factors shape innovation decisions. Third, the research sample concentrates primarily on large listed companies, leaving unexplored the non-patent innovation models prevalent among SMEs, such as process optimization improvements. Addressing this gap requires mixed-methods approaches combining qualitative and quantitative analyses.

Future research could be advanced through several promising directions. In patent analysis, constructing comprehensive evaluation metrics that examine patent citation network centrality, claim scope breadth, and international application ratios would help distinguish substantive innovation from strategic patenting behaviors. Text mining techniques could be employed to identify key breakthrough terminology in patent documents, enabling more accurate assessment of innovation radicalness. The research should incorporate behavioral economics perspectives to analyze how managerial cognitive biases influence innovation decision-making processes. The application potential of digital technologies in low-carbon innovation also warrants attention, particularly artificial intelligence for optimizing R&D resource allocation and blockchain for tracking product lifecycle carbon footprints. Special emphasis should be placed on investigating human capital mechanisms, specifically examining how climate pressures drive corporate adjustments to green skills training systems, how interdisciplinary teams facilitate technological breakthroughs, and how the mobility patterns of core technical personnel shape regional innovation clusters. These research avenues would contribute to a more comprehensive understanding of the intrinsic mechanisms through which climate risk affects corporate low-carbon innovation.

The findings of this study offer significant implications for corporate low-carbon transition practices and policy formulation. First, enterprises should adopt differentiated and time-phased action plans. Key pollution-monitored firms under stringent regulation should prioritize using government-issued low-carbon technology development bonds or green subsidies within the next one to three years to implement energy efficiency improvements such as smart energy management systems and establish internal carbon accounting frameworks. Within three to five years, these firms should explore instruments like carbon asset securitization to transform emission reduction achievements into sustained innovation funding. Non-key monitored enterprises, especially those in eastern China, should capitalize on market opportunities by completing product lifecycle carbon footprint certification through third-party agencies within six to twelve months and utilize local advanced green finance channels including carbon-neutral bonds and green technology venture capital to accelerate the commercialization of one or two core low-carbon technologies. Central and western region firms could join cross-regional low-carbon innovation alliances led by eastern industry leaders or research institutions within one to two years, sharing technology and financial resources while actively applying for national green technology transfer funds targeting less-developed regions to address local high-carbon industry substitution challenges.

Second, environmental certifications should be strategically leveraged as competitive advantages rather than mere compliance costs. By obtaining certifications such as carbon footprint and green product labels, enterprises can not only meet regulatory requirements but also communicate sustainable brand images to the market, enhancing consumer trust and competitive positioning. Human capital plays a pivotal role in this process. Companies need to develop multidisciplinary talent pipelines through upskilling existing employees and recruiting low-carbon specialists to establish a solid human resource foundation for innovation. Simultaneously, internalizing certification systems into corporate management processes and implementing incentive mechanisms like dedicated low-carbon innovation awards can foster organization-wide innovation engagement. This synergistic approach integrating R&D investment, talent development, and certification systems transforms environmental compliance into core competitiveness for building green technology barriers. For non-key monitored firms, proactively pursuing certifications essentially represents a dual-driven strategy combining R&D and human capital to convert climate risk into low-carbon innovation opportunities and secure first-mover advantages in green markets.

Finally, regulatory authorities should implement more refined climate governance strategies. Maintaining rigorous oversight of key monitored units while providing complementary positive incentives such as low-carbon technology R&D subsidies and fast-track green intellectual property channels can mitigate the crowding-out effect of compliance costs on innovation and stimulate proactive emission reduction initiatives. For non-key monitored firms and central/western regions, policymakers should focus on developing market-based instruments including carbon markets and green finance, combining mandatory environmental disclosure requirements with supportive fiscal policies like income tax reductions for low-carbon technology commercialization to stimulate endogenous innovation. Additionally, establishing a national corporate low-carbon innovation monitoring platform that integrates climate risk exposure, R&D intensity, and patent output data would provide real-time, precise decision-making support for differentiated policy formulation and facilitate coordinated low-carbon transformation across enterprises nationwide.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

SH: Software, Supervision, Resources, Formal analysis, Writing – original draft, Writing – review & editing, Methodology, Investigation, Data curation, Visualization, Funding acquisition, Project administration, Conceptualization, Validation.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Acknowledgments

The author is grateful to the editor and the referees for their highly constructive comments and suggestions.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author declares that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbreviations

CR, climate risk; LCI, low-carbon innovation; R&D investment, Research and Development investment; APatent, Green and low-carbon patent application volume; AInvention, Green and low-carbon invention patent application volume; AUtility, Green and low-carbon utility model patent application volume; GPatent, Number of green and low-carbon patent authorizations.

References

Adeabah, D., and Pham, T. P. (2025). Asymmetric tail risk spillover and co-movement between climate risk and the international energy market. Energy Econ. 141:108122. doi: 10.1016/j.eneco.2024.108122

Andrews, T. M., Simpson, N. P., Mach, K. J., and Trisos, C. H. (2023). Risk from responses to a changing climate. Clim. Risk Manag. 39:100487. doi: 10.1016/j.crm.2023.100487

Chaudhary, R. (2020). Green human resource management and employee green behavior: an empirical analysis. Corp. Soc. Responsib. Environ. Manag. 27, 630–641. doi: 10.1002/csr.1827

Chen, W. (2023). Digital economy development, corporate social responsibility and low-carbon innovation. Corp. Soc. Responsib. Environ. Manag. 30, 1664–1679. doi: 10.1002/csr.2443

Deng, Q., Huang, G., Li, D., and Yang, S. (2024). The impact of climate risk on corporate innovation: an international comparison. J. Multinatl. Financ. Manag. 75:100870. doi: 10.1016/j.mulfin.2024.100870

Ghaemi Asl, M., Rashidi, M. M., Tiwari, A. K., Lee, C.-C., and Roubaud, D. (2023). Green bond vs. Islamic bond: which one is more environmentally friendly? J. Environ. Manag. 345:118580. doi: 10.1016/j.jenvman.2023.118580

Han, L., Liu, T., Lu, H., and Zhang, W. (2025). Climate risk disclosure, green innovation and enterprise value. Finance Res. Lett. 72:106553. doi: 10.1016/j.frl.2024.106553

Horbach, J. (2016). Empirical determinants of eco-innovation in European countries using the community innovation survey. Environ. Innov. Soc. Transit. 19, 1–14. doi: 10.1016/j.eist.2015.09.005

Hu, L., Qiu, Z., Chang, T., and Yao, W. (2025). From risk to opportunity: can climate risk promote green innovation in China’s A-share firms? Appl. Econ. 1–17, 1–17. doi: 10.1080/00036846.2025.2501811

Huang, H. H., Kerstein, J., Wang, C., and Wu, F. (Harry) (2022). Firm climate risk, risk management, and bank loan financing. Strateg. Manag. J. 43, 2849–2880. doi: 10.1002/smj.3437

Huynh, T. D., and Xia, Y. (2021). Climate change news risk and corporate bond returns. J. Financ. Quant. Anal. 56, 1985–2009. doi: 10.1017/S0022109020000757

Jiang, Z., Wang, Z., and Lan, X. (2021). How environmental regulations affect corporate innovation? The coupling mechanism of mandatory rules and voluntary management. Technol. Soc. 65:101575. doi: 10.1016/j.techsoc.2021.101575

Lee, C.-C., Li, M., and Zhang, J. (2025). How climate risk affects corporate green innovation: fresh evidence from China’s listed companies. Emerg. Mark. Finance Trade 61, 2302–2315. doi: 10.1080/1540496X.2024.2449463

Li, M., Li, N., Khan, M. A., Khaliq, N., and Rehman, F. U. (2022). Can retail investors induce corporate green innovation? -evidence from Baidu search index. Heliyon 8:e09663. doi: 10.1016/j.heliyon.2022.e09663

Li, X., and Tian, Q. (2024). Public perception of climate risk, environmental image, and corporate green investment. Ann. Am. Assoc. Geogr. 114, 1137–1155. doi: 10.1080/24694452.2024.2338098

Li, Y., and Zhang, Y. (2023). What is the role of green ICT innovation in lowering carbon emissions in China? A provincial-level analysis. Energy Econ. 127:107112. doi: 10.1016/j.eneco.2023.107112

Ling, S., and Gao, H. (2023). How does climate risk matter for corporate green innovation? Empirical evidence from heavy-polluting listed companies in China. Front. Energy Res. 11:1177927. doi: 10.3389/fenrg.2023.1177927

Lyu, Y., Bai, Y., and Zhang, J. (2024). Digital transformation and enterprise low-carbon innovation: a new perspective from innovation motivation. J. Environ. Manag. 365:121663. doi: 10.1016/j.jenvman.2024.121663

Ma, J. (2024). Carbon emissions and low-carbon innovation in firms. PLoS One 19:e0312759. doi: 10.1371/journal.pone.0312759

Marrucci, L., Daddi, T., and Iraldo, F. (2023). Institutional and stakeholder pressures on organisational performance and green human resources management. Corp. Soc. Responsib. Environ. Manag. 30, 324–341. doi: 10.1002/csr.2357

Naseer, M. M., Khan, M. A., Bagh, T., Guo, Y., and Zhu, X. (2024). Firm climate change risk and financial flexibility: drivers of ESG performance and firm value. Borsa Istanb. Rev. 24, 106–117. doi: 10.1016/j.bir.2023.11.003

Porter, M. E., and Linde, C. V. D. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9, 97–118. doi: 10.1257/jep.9.4.97

Qrunfleh, S., and Tarafdar, M. (2014). Supply chain information systems strategy: impacts on supply chain performance and firm performance. Int. J. Prod. Econ. 147, 340–350. doi: 10.1016/j.ijpe.2012.09.018

Quan, S., Cheng, P., and Zhai, J. (2025). Do climate risks impede green innovation? Int. Rev. Financ. Anal. 104:104295. doi: 10.1016/j.irfa.2025.104295

Ren, X., Li, W., and Li, Y. (2024). Climate risk, digital transformation and corporate green innovation efficiency: evidence from China. Technol. Forecast. Soc. Change 209:123777. doi: 10.1016/j.techfore.2024.123777

Shahzad, M. A., Chen, S., Iqbal, T., and Li, Z. (2025). Sustainable futures: leveraging green intellectual capital, HRM, innovation and leadership. J. Intellect. Cap. 26, 807–838. doi: 10.1108/JIC-03-2024-0091

Song, W., Yu, H., and Xu, H. (2021). Effects of green human resource management and managerial environmental concern on green innovation. Eur. J. Innov. Manag. 24, 951–967. doi: 10.1108/EJIM-11-2019-0315

Tian, Y., Chen, S., and Dai, L. (2024). How climate risk drives corporate green innovation: evidence from China. Finance Res. Lett. 59:104762. doi: 10.1016/j.frl.2023.104762

Wen, J., Zhao, X.-X., Fu, Q., and Chang, C.-P. (2023). The impact of extreme weather events on green innovation: which ones bring to the most harm? Technol. Forecast. Soc. Change 188:122322. doi: 10.1016/j.techfore.2023.122322

Wu, Y. (2025). The impact of climate risks on green technology innovation: an empirical study based on panel data of 269 cities in China. Front. Environ. Sci. 12:1510883. doi: 10.3389/fenvs.2024.1510883

Xu, C., Sun, G., and Kong, T. (2024). The impact of digital transformation on enterprise green innovation. Int. Rev. Econ. Finance 90, 1–12. doi: 10.1016/j.iref.2023.11.001

Yin, H., and Schmeidler, P. J. (2009). Why do standardized ISO 14001 environmental management systems lead to heterogeneous environmental outcomes? Bus. Strategy Environ. 18, 469–486. doi: 10.1002/bse.629

Yu, S., Zheng, Y., and Hu, X. (2023). How does climate change affect firms’ investment efficiency? Evidence from China’s listed renewable energy firms. Bus. Strategy Environ. 32, 3977–3996. doi: 10.1002/bse.3349

Zhang, Q., Lin, Y., Wang, Y., and Cao, Y. (2025). Band together or go it alone? Climate risk and corporate collaborative innovation. Humanit. Soc. Sci. Commun. 12:744. doi: 10.1057/s41599-025-05109-y

Zhang, J., Wang, M., and Li, M. (2024). Does environmental management system certification affect green innovation performance?—based on a moderated mediating effects model. Front. Psychol. 14:1264207. doi: 10.3389/fpsyg.2023.1264207

Zhang, J., Yu, C.-H., Zhao, J., and Lee, C.-C. (2025). How does corporate digital transformation affect green innovation? Evidence from China’s enterprise data. Energy Econ. 142:108217. doi: 10.1016/j.eneco.2025.108217

Zhong, W., and Jin, L. (2025). The impact of climate risk disclosure on corporate green technology innovation. Sustain. For. 17:2699. doi: 10.3390/su17062699

Zhou, Y., Wu, S., Liu, Z., and Rognone, L. (2023). The asymmetric effects of climate risk on higher-moment connectedness among carbon, energy and metals markets. Nat. Commun. 14:7157. doi: 10.1038/s41467-023-42925-9

Zhu, J., Li, X., and Shi, D. (2024). How does the development of the digital economy influence carbon productivity? The moderating effect of environmental regulation. Environ. Sci. Pollut. Res. 31, 31896–31910. doi: 10.1007/s11356-024-33382-y

Keywords: climate risk, low-carbon innovation, R&D investment, geographic location, environmental certification

Citation: He S (2025) The impact of climate risk on low-carbon innovation: evidence from listed companies in China. Front. Clim. 7:1646491. doi: 10.3389/fclim.2025.1646491

Edited by:

Olubayo Moses Babatunde, University of Lagos, NigeriaReviewed by:

Esther M. Folarin, Covenant University, NigeriaAdebayo Dosa, Durban University of Technology, South Africa

Michael Obolo, Independent Researcher, Aberdeen, United Kingdom

Copyright © 2025 He. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Siyuan He, MzI1ODk3NjkyNUBxcS5jb20=

Siyuan He

Siyuan He