Abstract

Introduction:

The economic value realization of blue carbon is crucial for promoting ocean sustainable development and addressing global climate change. In today's blue carbon development context, the synergy between green finance and technological innovation is increasingly prominent, serving as a key channel to activate the latent value of blue carbon resources.

Methods:

This study examines the coupling of green finance and technological innovation in nine Chinese coastal provinces from 2005 to 2021 by constructing an indicator system and a coupling coordination model, and analyzes how they jointly enhance marine carbon sink value.

Results:

Research findings reveal that the interaction between green finance and technological innovation exhibits a U-shaped effect on realizing marine carbon sink value. Specifically, the U-shaped influence of the coupling coordination degree between green finance and technological innovation on marine carbon sink value is mediated through marine carbon sink efficiency and marine aquaculture structure. Moreover, this influence exhibits distinct regional heterogeneity.

Discussion:

Based on these findings, this paper proposes policy recommendations to formulate differentiated green finance policies, innovate marine carbon sink financial instruments, and promote corporate technological synergy and management optimization. These measures aim to enhance the synergistic effects between green finance and technological innovation, thereby further unlocking the potential for marine carbon sequestration.

1 Introduction

Given the widespread recognition that excessive carbon emissions from human activities are the primary driver of global warming, the escalating environmental crisis underscores that reducing carbon emissions has become the core imperative for addressing this crisis and advancing global sustainable development. Among the various pathways for carbon reduction, the function of marine carbon sinks is becoming increasingly crucial (Raven and Falkowski, 1999; Xiang and Cao, 2024). Ocean carbon sink, referred to as “blue carbon sink”, represents a process where marine operations and bio capture atmospheric carbon dioxide and sequester it within the ocean (Bopp et al., 2005; Steinberg and Landry, 2017). As research deepens, its strategic importance has become increasingly evident, making it a focal point of international attention.

Marine carbon sinks have both significant environmental benefits and immense economic value. From an environmental perspective, studies have consistently demonstrated their crucial significance in mitigating global warming, protecting marine biodiversity, and maintaining the stability of marine ecosystems (Ridge and McKinley, 2021). For example, aquaculture systems composed of shellfish and algae can efficiently capture and store carbon, demonstrating remarkable carbon sequestration capabilities. They make a significant contribution to reducing atmospheric carbon dioxide concentrations and alleviating climate change pressures (Gu et al., 2022; Jia et al., 2023).

However, while the ecological advantages of marine carbon sinks have garnered broad acknowledgment, their economic gains have yet to be fully unlocked, and their capacity to draw investment and generate value appreciation is markedly deficient. They are beset by a host of hurdles in realizing their economic worth: a thoroughgoing value evaluation has not been initiated on a wide scale, economic returns are tough to present in a straightforward manner, and the duration required for investment recouping is exceedingly extended (Ullman et al., 2013). Furthermore, the scarcity of data and the shortcomings inherent in current assessment approaches (Hauck et al., 2020) compound the issue. These elements combine to make it arduous for investors to precisely gauge project risks and value-determining factors, thereby diminishing the allure of investment.

From a sustainable development perspective, the environmental and economic benefits of marine carbon sinks are mutually reinforcing and complementary. Realizing the economic value of marine carbon sinks not only helps fully tap their potential economic benefits and provide necessary funding for related projects, but also enhances the sustainability of these initiatives, thereby ensuring their environmental benefits continue to be realized. Conversely, if the economic value of marine carbon sinks cannot be effectively realized, the maintenance and expansion of their environmental benefits will lack a solid economic foundation and sustained momentum, severely constraining the sustainable development of marine carbon sinks. Therefore, it is imperative to thoroughly explore pathways and mechanisms for realizing the economic value of marine carbon sinks, overcome the challenges encountered in this process, promote the healthy development of the marine carbon sink industry, and achieve a virtuous cycle between environmental protection and economic growth.

2 Literature review

Green finance and technological innovation can effectively empower the realization of carbon sink value through institutional innovation and technological embedding, as respectively (Anthony et al., 2023; Wu et al., 2023; Xu and Zhu, 2024). green finance can enable the provision of essential financial backing ocean carbon sink projects by establishing a financial system centered on financial instruments and promote the integration of green financial policies with the blue carbon economy industry (Belgacem et al., 2023). Innovative technologies are also instrumental in boosting the efficiency of marine carbon sinks (Lichtschlag et al., 2021). By optimizing aquaculture and adopting digital solutions, marine organisms’ carbon sequestration efficiency can be effectively enhanced and marine carbon sinks can be accurately monitored and assessed. Furthermore, new carbon capture, storage and conversion technologies can transform marine carbon sinks into carbon products with high economic value, broadening their application scope and market potential (Almomani et al., 2023).

However, green finance and technological innovation do not exist in isolation; they are closely coupled and coordinated (Cheng et al., 2022; Irfan et al., 2022; Wan et al., 2023; Anwar et al., 2024). In marine exploitation, blue marine carbon sinks struggle to fully demonstrate their economic value due to underutilized resource development potential and room for improvement in carbon sequestration conversion efficiency. Green finance and technological innovation, through three synergistic mechanisms, inject new vitality into realizing this value and ensuring sustainable development. From the perspective of capital-technology synergy, marine carbon sequestration projects feature long investment cycles, high risks, and uncertain returns, making traditional finance ill-suited to meet their financing needs (Xu et al., 2024). Green finance addresses this by deploying innovative financial instruments and policy incentives that mitigate risks while providing low-cost, long-term stable capital (Acheampong, 2019; van Veelen, 2021; Hanif and Zheng, 2025). Technological innovation, in turn, enhances carbon capture efficiency, reduces transaction costs, and strengthens investment return expectations, creating a virtuous cycle between the two. At the institutional-market dynamics level, governments formulate policies to foster collaboration between financial institutions and research organizations, driving the translation of technological achievements into practical applications. Market mechanisms optimize resource allocation through price signals and competitive effects (Liu et al., 2022; Rasoulinezhad and Taghizadeh-Hesary, 2022; Yi et al., 2023). Carbon trading markets and green finance markets jointly facilitate the realization of carbon sequestration value (Wei and Wang, 2024), with institutional forces and market forces synergistically building an ecosystem for realizing the value of marine carbon sinks. At the risk-return equilibrium level, marine carbon sink projects face multiple risk challenges. Green finance provides risk mitigation mechanisms (Zhong et al., 2024), while technological innovation enhances project success rates and profitability (Tsakiridis et al., 2020). Together, they establish a balanced mechanism of “risk sharing and profit sharing,” thereby strengthening the sustainability of such projects.

In summary, existing theoretical analyses on the coordinated development of green finance and technological innovation in low-carbon economic sectors provide a solid theoretical foundation for this study. However, relevant research remains largely qualitative, lacking empirical evidence capable of identifying causal relationships regarding the impact of the coupling and coordination between green finance and technological innovation on blue carbon sinks. Furthermore, existing studies predominantly assume linear relationships, overlooking the unique characteristics of the marine carbon sink sector. Marine carbon sink projects are constrained by multiple factors, including marine natural disasters, lengthy technology transfer cycles, and variations in policy and market environments (Ullman et al., 2013; Hauck et al., 2020). These factors contribute to the sector’s inherent high risk, extended project timelines, and significant uncertainty, suggesting that the effects of green finance and technological innovation on marine carbon sink projects may exhibit nonlinear characteristics.

In this paper, we constructed an evaluation indicator system and employed a coupling coordination model to analyze the synergistic effects between green finance and technological innovation. We aim to reveal the nonlinear impact mechanism of their coupled coordination on realizing marine carbon sink value, while identifying critical thresholds and inflection points. This provides scientific decision support for optimizing marine carbon sink project investment and financing mechanisms and overcoming technological conversion bottlenecks. This research not only expands the application boundaries of coupled coordination theory between green finance and technological innovation but also offers a Chinese solution for realizing global blue carbon sink value.

3 Data and method

3.1 Data source

The study uses panel data, spanning from 2005 to 2021, encompassing the provincial level across China’s 9 coastal regions. The data arises from sources including the “China Fisheries Statistics Yearbook”, “China Science and Technology Statistical Yearbook”, “China Energy Statistics Yearbook”, “China Financial Yearbook”, “China Agricultural Statistics Yearbook”, “China Industrial Statistical Yearbook”, “China Tertiary Industry Statistical Yearbook”, “China Marine Economy Statistical Yearbook” and various regional statistical yearbooks.

3.2 Evaluation indicator system

The majority of studies assess the extent of green financial development employing metrics such as green credit, green securities, and carbon finance as indicators (Muganyi et al., 2021; Angelina and He, 2025). The green credit indicator focuses on financial institutions’ support of environmental protection projects, while the green securities indicator measures the performance of green bonds in the market. The green insurance indicator focuses on the risk protection provided by insurance companies for the green industry, while the green investment indicator reflects the extent of investors’ direct participation in green projects. In addition, the carbon finance development indicator assesses carbon trading market activity and carbon financial products degree of innovation. Here, we further expand the index system to include green support and green funds, which are associated with green capital.

For technological innovation, studies have used a variety of methods such as the entropy method (Cheng et al., 2022; Xu et al., 2022) or using the number of patents as proxy (Dong et al., 2024; Nepal et al., 2025; Zeb et al., 2025). This paper draws upon existing research to measure technological innovation from input and output dimensions: On the input side, it employs the number of personnel employed by marine research institutions (including Marine Basic Scientific Research, Marine Engineering Technology Research, Marine Information Service, and Marine Technology Service Industry) and funding revenue as indicators to quantify resource inputs for technological innovation (Ali et al., 2025); The output dimension focuses on the number of scientific papers published and patents granted by marine research institutions to measure the actual outcomes and contributions of technological innovation (Dabbous and Aoun Barakat, 2023). The comprehensive evaluation index system is illustrated in Table 1.

Table 1

| Primary indicators | Secondary indicators | Measurement metrics | Attribute |

|---|---|---|---|

| Green Finance | Green Credit | Total environmental protection project loans in the province/Total loans in the province | + |

| Green Investment | Ratio of investment in pollution control to GDP | + | |

| Green Insurance | Environmental pollution liability insurance premium income/Total premium income | + | |

| Green Bonds | Total green bond issuance/Total bond issuance | + | |

| Green Support | Fiscal environmental protection expenditures/Fiscal general budget expenditures | + | |

| Green Fund | Total market value of green funds/Total market value of all funds | + | |

| Carbon Finance | Ratio of equity trading volume such as carbon trading | + | |

| Technological Innovation | Innovation Inputs | Number of personnel employed by marine research institutions | + |

| Total funding income of marine research institutions | + | ||

| Innovation outputs | Number of marine science and technology papers published | + | |

| Number of marine science and technology patents granted | + |

Evaluation index system.

3.3 Coupled coordination model

3.3.1 Coupling degree

The coupling degree reflects how much two or more systems or elements influence one another through their interplay. The formula for the coupling degree of green finance and technological innovation is:

Where and denote green finance and technological innovation, respectively. The value of lies within the interval of 0 to 1. A greater value of indicates a stronger connection between green finance and technological innovation.

3.3.2 Coupling coordination degree

Since the coupling degree does not recognize the overall effectiveness and synergy of the systems. In particular, when the development levels of the systems are minimal and similar, the use of the coupling degree model will lead to an erroneous evaluation that implies a high coupling degree within the total system. Therefore, when constructing the coupling degree model, the development level of the total system should be included. The coupling coordination degree model is constructed as:

D denotes the degree of synergy between green finance and technological innovation. The value varies between 0 and 1. As the value increases, the degree of coordination between the two variables becomes greater, and the reverse is also true. In this study, green finance and technological innovation are regarded as equally significant, thereby assigning equal weights () to both factors.

3.3.3 Coupled coordination degree classification

Similar to the study conducted by (Yao and Wang, 2024), we classified the coupled coordination degree into ten levels (Table 2).

Table 2

| C | D | Coupled coordination level |

|---|---|---|

| [0.0,0.1] | 1 | Extreme disorder |

| [0.1,0.2] | 2 | Severe disorder |

| [0.2,0.3] | 3 | Moderate disorder |

| [0.3,0.4] | 4 | Mildly dysfunctional |

| [0.4,0.5] | 5 | Nearly dysfunctional |

| [0.5,0.6] | 6 | Barely coordinated |

| [0.6,0.7] | 7 | Elementary coordination |

| [0.7,0.8] | 8 | Intermediate coordination |

| [0.8,0.9] | 9 | Good coordination |

| [0.9,1.0] | 10 | Quality coordination |

Coupling coordination degree classification.

3.4 Ocean carbon sink value model

3.4.1 Quality assessment of marine carbon sinks

Within the field of studying carbon sinks in fisheries, fish and crustaceans do not fall into the category of fisheries with carbon sinks, given that they require bait inputs in the aquaculture process. Additionally, since mangroves in the study area account for less than 5% of the total area of blue carbon ecosystems, and data is unavailable. Therefore, in this paper, the mariculture carbon sink specifically denotes the carbon sequestration capacity attributed to shellfish and algae. Following previous studies (Tang et al., 2011; Liu et al., 2022), we measure the carbon sinks of shellfish and algae using the following formula:

Where is the quality of carbon sinks, is the total shellfish carbon sink and is the total algae carbon sink.

Among them, represents the carbon sequestration amount of the i-th type of shellfish, as the annual total production of the i-th type of shellfish, as the moisture-dry conversion coefficient for shellfish; as the shell ratio, as the carbon sequestration coefficient of shells; as the soft tissue ratio, and the carbon sequestration coefficient of soft tissues. The coefficients for carbon sequestration accounting of marine-cultured shellfish are shown in Table 3.

Table 3

| Variety | Soft tissue dry mass ratio | Carbon content of soft tissue | Mass ratio of dried shells | Carbon content of shells | Wet/dry coefficient |

|---|---|---|---|---|---|

| Ostreidae | 6.14% | 45.98% | 93.86% | 12.68% | 65.10% |

| Mytilidae | 8.47% | 44.40% | 91.53% | 11.76% | 75.28% |

| scallop | 14.35% | 42.84% | 85.65% | 11.40% | 63.89% |

| Veneridae | 7.54% | 44.90% | 92.46% | 11.40% | 52.55% |

| Other shellfish | 10.10% | 43.93% | 90.61% | 11.93% | 64.21% |

Percentage of dry mass and carbon content of different shellfish species.

Where represents the annual total production of the i-th type of algae; the percentage of carbon content in the i-th type of algae; and 20% is the conversion coefficient for dry weight of algae. Table 4 presents the coefficients utilized in the accounting of carbon sequestration by marine-cultured algae.

Table 4

| Variety | Carbon content of algae | Wet/dry coefficient |

|---|---|---|

| Laminaria japonica | 31.20% | 20.00% |

| Undaria pinntifida | 26.40% | 20.00% |

| Porphyra | 27.39% | 20.00% |

| Gracilaria | 20.60% | 20.00% |

| Other algae | 27.76% | 20.00% |

Percentage of dry mass and carbon content of different algae species.

3.4.2 Assessment of the value of marine carbon sinks

The value of oceanic carbon dioxide absorption is considered as the economic value or climate regulation value saved by ocean carbon sinks. Here, we calculate the economic benefit of carbon storage in sink fisheries using artificial afforestation and carbon tax methodologies (Ge et al., 2023). For carbon tax calculations, we reference the internationally accepted standard proposed by the Swedish government. Using the 2021 average exchange rate of 6.9:1, we convert the carbon tax of $150 per ton to approximately RMB 1,035. Since the unit cost of oceanic carbon dioxide absorption remains undefined, we adopt the average transaction price of the national carbon market in 2021—RMB 279.73 per ton of carbon—as the cost benchmark for artificial afforestation in absorbing carbon dioxide. The calculation formula is as follows:

Where OCS represents the value of fishery carbon sequestration, r as the carbon tax, and C as the economic cost value per unit of carbon emission reduction.

4 Results

4.1 Temporal-spatial evolution of the coupled coordination degree

First, the entropy weight method is applied to calculate the comprehensive score of green finance and technological innovation of each province and then the coupling coordination degree of g the two is calculated by using (Equations 1–3). The results are shown in Figure 1.

Figure 1

Coupled coordination degree of green finance and technological innovation.

The overall trend from 2005 to 2021 shows that synergistic growth of green finance and technological innovation has been observed in all provinces. However, some provinces need to further strengthen synergistic development to improve the overall level of coordination and ultimately achieve sustainable economic development and environmental protection.

Most provinces have moved beyond the dissonance stage and reached coordination stage. Among them, Jiangsu, Zhejiang and Guangdong Provinces are leading in the degree of coupled coordination. This is primarily due to their strategic development supported in funding by the national government and additional valuable resources that allow their degree of coupled coordination to exist at high levels. It is also worth noting that Hainan Province, although their degree of coordination was relatively low in the early stages, we are witnessing rapid growth in their later stages, appearing as a promising late bloomer. This remarkable growth may be attributed to Hainan’s geographical advantages and resources, a well-developed green financial policy system, and an aggressive product innovation strategy, providing a robust basis for the synergistic development between the two.

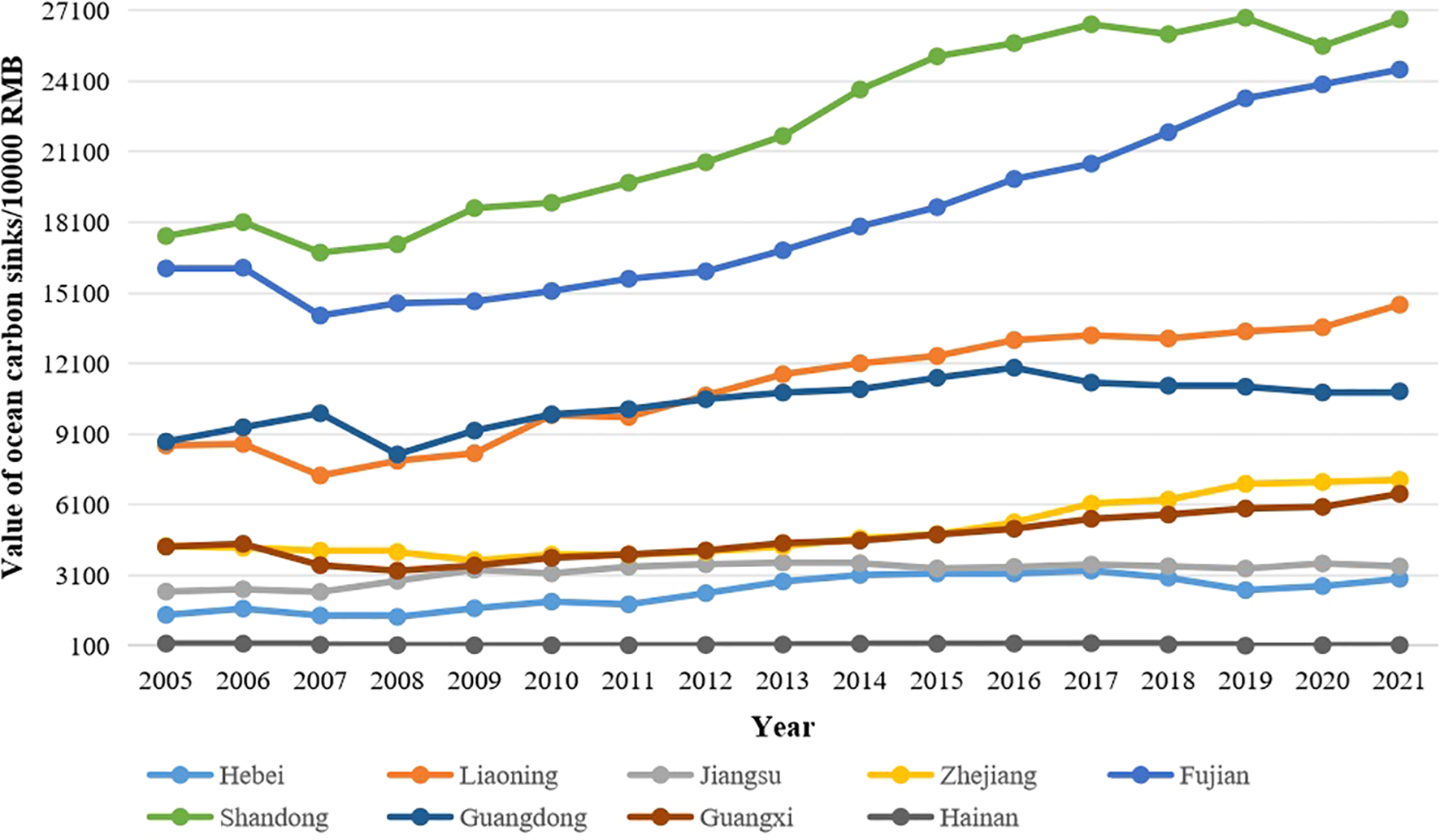

4.2 Value of ocean carbon sinks

To calculate the value of marine carbon sinks, we collected shellfish and algae-related data from nine coastal provinces in China between 2005 and 2021, and computed the results using Equations 4-8. Figure 2 shows a steady increase in the value of China’s marine farmed shellfish carbon sinks. This is mainly due to policies that have enhanced the development potential of marine resources and bolstered the marine economy. These measures have, in turn, driven the rise in shellfish cultivation, amplified carbon sequestration through shellfish populations over time, and ensured consistent economic gains within the marine aquaculture sector.

Figure 2

Value of marine carbon sequestration.

At the provincial level, Fujian and Shandong exhibit higher marine carbon sink values, attributable to their abundant marine resources and proactive exploration in marine ranch development. Shellfish farming in Shandong accounts for approximately 30% of the total aquaculture area, significantly enhancing the role of shellfish in carbon sequestration. Fujian, meanwhile, leverages the scale advantages of algae cultivation (such as laver and kelp) and their high carbon absorption capacity to boost blue carbon sink contributions. In contrast, Zhejiang, Liaoning, Guangdong, Guangxi and other provinces are at the mid-range, showing certain development potential. These provinces have attained notable progress in marine resource development, utilization, and ecosystem protection and restoration, thereby increasing marine carbon sink value. By contrast, Hebei and Hainan Provinces have comparatively low marine carbon sink value. Hainan Province, despite its excellent marine environment and tertiary-industry oriented marine economic structure, is ranked relatively low due to its relatively small area of shellfish and algae cultivation, which results in the carbon sink capacity not being fully realized.

4.3 Empirical analysis

4.3.1 Variable selection

The value of ocean carbon sinks (OCS) is the dependent variable. The OCS value model above is adopted to calculate the value of ocean carbon sinks in nine coastal provinces of China from 2005 to 2021. The explanatory variable is the coupled coordination degree of green finance and technological innovation (Coord). It should be noted that data for specific years in certain provinces are missing, primarily due to the incompleteness of early statistical records. To address missing values and ensure the accuracy and reliability of research findings, linear interpolation was employed to fill in the gaps.

This study selects marine carbon sink efficiency (MCSE) and marine aquaculture structure (MFS) as mechanism variables to explore the impact mechanism of the coordinated coupling between green finance and technological innovation on realizing the value of marine carbon sinks. Specifically, marine carbon sink efficiency is quantified by the amount of marine carbon sinks per unit of economic output. This indicator intuitively reflects the carbon sink benefits generated per unit of marine economic activity, thereby measuring the utilization efficiency of marine carbon sink resources. The structure of marine aquaculture is characterized by the proportion of shellfish and algae production relative to total marine aquaculture output. This indicator aims to reflect the development status of shellfish and algae farming within the marine aquaculture sector, which possesses higher carbon sequestration capacity.

In addition to the effects of the above variables, other factors also play a role. To account for the impact of other factors, referencing related studies (Li et al., 2023; Ren and Xu, 2024; Shi et al., 2023), this paper selects disaster, mariculture economic output value, mariculture area, aquatic technology extension personnel culture and fishery industry structure as control variables. The natural logarithm was also applied to the disaster situation, economic output value of mariculture and mariculture area. See Table 5 for each variable’s description.

Table 5

| Variables | Names | Symbols | Definitions |

|---|---|---|---|

| Dependent variable | Value of ocean carbon sinks | OCS | Carbon sequestration value of marine cultured shellfish and algae |

| Explanatory variable | Coupling coordination degree of green finance and technological innovation | Coord | Coupling coordination degree between green finance and technological innovation |

| Mechanism variables | marine carbon sink efficiency | MCSE | The amount of marine carbon sinks per unit of economic output |

| marine aquaculture structure | MFS | the proportion of shellfish and algae production relative to total marine aquaculture output | |

| Control variables | Disaster | Disaster | Economic losses caused by fishery disasters |

| Mariculture economic output value | Value | Economic output value of marine aquaculture | |

| Mariculture area | Area | Area of marine aquaculture | |

| Aquatic technology extension personnel culture | Culture | Proportion of aquatic technology extension personnel with bachelor’s degree or above | |

| Fishery industry structure | Industry | Fishery tertiary sector/Fishery secondary sector |

Variable description table.

4.3.2 Model construction

A benchmark regression model is constructed to test the direct impact of the coupled coordination of green finance and technological innovation on the value of marine carbon sinks. To explore the nonlinear association between them, we use the second-degree term of the coupled coordination of green finance and technological innovation to construct a nonlinear fixed-effects model. The equation for the econometric model is presented in (Equation 9):

In the equation, represents different regions; represents different years; is the ocean carbon sequestration value of the i-th province in the t-th year; is the vector of intercept terms; is the coupled coordination level between green finance and technological innovation; is a set of control variables representing marine fishery economy quality; is an individual fixed-effects term; is a time fixed-effects term; and is a random perturbation term. Table 6 provides the descriptive statistics of each variable.

Table 6

| Variable | Observed value | Mean | Standard deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| OCS | 153 | 0.860 | 0.738 | 0.011 | 2.679 |

| Coord | 153 | 0.460 | 0.158 | 0.095 | 0.893 |

| MCSE | 153 | 0.052 | 0.032 | 0.001 | 0.221 |

| MFS | 153 | 0.557 | 0.146 | 0.083 | 0.679 |

| Disaster | 153 | 10.403 | 1.561 | 4.466 | 13.593 |

| Value | 153 | 5.197 | 0.927 | 2.962 | 6.978 |

| Area | 153 | 11.818 | 1.053 | 9.471 | 13.756 |

| Culture | 153 | 0.328 | 0.129 | 0.108 | 0.691 |

| Industry | 153 | 1.085 | 0.926 | 0.009 | 4.608 |

Descriptive statistics.

To further dissect the impact mechanism of coordination mechanisms on organizational coordination systems and address the inherent limitations of traditional mediation models in handling the potential endogeneity of explanatory and mediating variables, we constructed a mechanism effects model drawing on the research methodology of (Liu et al., 2024).

Where, denotes the intermediate variable, and are the corresponding variable coefficients.

4.3.3 Benchmark regression

To verify the effects of the coupled coordination of green finance and technological innovation on the value of marine carbon sinks, we conducted a regression analysis using (Equation 9), with the outcomes presented in Table 7.

Table 7

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| OCS | OCS | OCS | |

| Coord | -0.338 | -1.743*** | -2.573*** |

| (-1.033) | (-3.011) | (-4.774) | |

| Coord2 | 1.246*** | 2.150*** | |

| (2.879) | (4.984) | ||

| Disaster | -0.008 | -0.012 | |

| (-0.604) | (-0.982) | ||

| Value | -0.044 | -0.043 | |

| (-0.534) | (-0.575) | ||

| Area | 0.392*** | 0.404*** | |

| (4.570) | (5.154) | ||

| Culture | 0.213 | 0.053 | |

| (0.671) | (0.182) | ||

| Industry | -0.016 | -0.072*** | |

| (-0.665) | (-2.918) | ||

| Constant | -3.554*** | 1.092*** | -3.130*** |

| (-3.257) | (7.718) | (-3.125) | |

| N | 153 | 153 | 153 |

| R2 | 0.614 | 0.561 | 0.680 |

Benchmark regression results.

*, **, *** represent significance levels of 10%, 5% and 1%, respectively. Standard errors are shown in parentheses.

Among them, column (2) reflects the results without control variables. The regression coefficient of the primary term is negative, yet the regression coefficient of the secondary term is significantly positive after the inclusion of the secondary term. This suggests that the effect of the interaction between green finance and technological innovation on marine carbon sink value follows a U-shaped pattern.

To further verify the robustness of the U-shaped relationship, we use the UTEST method to assess the U-shaped relationship. We see that the extreme value is 0.589, which falls between 0.095 and 0.893; at the same time, the slope has the opposite sign in the interval. The results are displayed in Table 8. Therefore, at 1% statistical significance, we reject our hypothesis, suggesting that the U-shaped influence is real and effective.

Table 8

| Variable | Lower bound | Upper bound |

|---|---|---|

| Interval | 0.095 | 0.893 |

| Slope | -2.163 | 1.264 |

| t-value | -4.576 | 2.881 |

| P > |t| | 0.000 | 0.002 |

| Extreme value point | 0.598 | |

| Total test p-value | 0.002 | |

UTEST test.

Therefore, the impact of the coupling coordination degree between green finance and technological innovation on the value of marine carbon sinks exhibits a nonlinear relationship characterized by initial suppression followed by promotion, with a critical inflection point occurring at a coupling coordination degree of approximately 0.598. At low coupling levels, synergistic effects are negligible, and the mismatch between capital and technology constrains the enhancement of marine carbon sink value. Once the coupling coordination level exceeds 0.598, as categorized in Table 2, the relationship between the two gradually shifts from a state of imbalance toward coordination. Green finance then precisely supports technological innovation, while technological innovation in turn drives innovation in green financial products and services, significantly elevating marine carbon sink value.

4.3.4 Robustness test

The benchmark regression results may exhibit certain issues that lead to endogeneity problems, causing the regression results to be biased. We introduce explanatory variables lagged by one period as instrumental variables into the model (Bellemare et al., 2017; Dong et al., 2024) and conduct regression analysis using the two-stage least squares method. (Table 9).

Table 9

| Variable | First stage | Second stage | |

|---|---|---|---|

| Coord | Coord2 | OCS | |

| Coord | -2.935*** | ||

| (-3.146) | |||

| Coord2 | 2.380*** | ||

| (3.821) | |||

| L.Coord | 0.676*** | ||

| (9.593) | |||

| L.Coord2 | 0.836*** | ||

| (14.599) | |||

| Controls | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 144 | 144 | 144 |

| R2 | 0.937 | 0.945 | 0.662 |

| Kleibergen-Paap rk LM | 22.154*** | ||

| Kleibergen-Paap rk Wald F | 38.639 [7.03] | ||

| Cragg-Donald Wald F | 27.418 [7.03] | ||

Results of endogeneity test.

*, **, *** represent significance levels of 10%, 5% and 1% respectively. Values in parentheses are standard errors. The LM statistic test results are significant, indicating no issues with instrument variable under-identification. The Wald F statistic is greater than 7.03 (10% maximum IV size), suggesting there are no problems with weak instrument correlation.

According to the first-stage estimation, the instrumental variables are significantly positively correlated with explanatory variables. Subsequently, we replace the second - stage estimation with the first - stage regression’s fitted values. In the second-stage estimation, the coupled coordination of green finance and technological innovation first inhibits and then promotes marine carbon sink value realization, aligning with the benchmark regression’s conclusion.

A series of robustness tests are performed to further verify our findings:

-

Replacing explanatory variables: The coupling coordination degree between green finance and technological innovation was recalculated using the revised coupling coordination model. The revised coupling coordination model further optimized the indicator system and weight settings to more accurately reflect the coupling coordination relationship between green finance and technological innovation. Test results indicate that after replacing explanatory variables, the U-shaped relationship was validated (Column 1, Table 10).

-

Segmented Regression Analysis: Since Guangdong and six other regions launched carbon emissions trading pilots in 2011, this policy drew more attention to carbon trading post-2011, possibly changing market environments and policy mechanisms. Using 2011 as the cutoff, this study redefined the sample to 2005-2011, re-estimated the baseline model, and found robustness test results largely consistent with prior findings (Column 2, Table 10).

-

To minimize the impact of outliers on data analysis, we conducted a regression analysis after performing a 1% winsorization on the data. According to Column (3) within Table 10, after winsorizing the samples, the regression coefficients and significance do not change significantly, indicating that the winsorization treatment does not alter the original conclusions and the baseline regression still exhibits high robustness.

-

Considering the possible lag effect of policy rollout and market response, the data of the starting year (2005) and the ending year (2021) may contain incomplete information or be influenced by external factors. Therefore, we repeat the analysis by excluding the data of the start and end years to reflect the medium-term trend more accurately (Column 4, Table 10). The results demonstrate the validity and reliability of the basic regression model.

Table 10

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| OCS | OCS | OCS | OCS | |

| Coord | -1.572 | -0.524 | -2.649*** | -2.630*** |

| (-1.627) | (-0.937) | (-4.749) | (-4.158) | |

| Coord2 | 1.250* | 1.674** | 2.240*** | 2.412*** |

| (1.720) | (2.269) | (5.006) | (4.505) | |

| Constant | -3.229*** | -0.178 | -3.357*** | -2.591** |

| (-2.829) | (-0.237) | (-3.318) | (-2.273) | |

| Controls | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 153 | 63 | 153 | 135 |

| R2 | 0.623 | 0.556 | 0.682 | 0.664 |

Robustness test results.

*, **, *** represent significance levels of 10%, 5%, and 1%, respectively. Standard errors are shown in parentheses.

4.4 Further analysis

4.4.1 Mechanism test

Based on examining the nonlinear relationship between OCS and Coord, this study explores its influencing mechanisms from two perspectives: marine carbon sink efficiency (MCSE) and marine aquaculture structure (MFS). Using Equation 10 for regression analysis, Table 11 reports the results of the mechanism tests.

Table 11

| Variable | (1) | (2) |

|---|---|---|

| MCSE | MFS | |

| Coord | 2.143 | -0.328*** |

| (1.611) | (-3.905) | |

| Coord2 | -2.206** | 0.155** |

| (-2.067) | (2.300) | |

| Constant | -7.557*** | 0.310** |

| (-3.132) | (2.030) | |

| Controls | Yes | Yes |

| City FE | Yes | Yes |

| Year FE | Yes | Yes |

| N | 153 | 153 |

| R2 | 0.420 | 0.539 |

Mechanism test.

*, **, *** represent significance levels of 10%, 5%, and 1%, respectively. Standard errors are shown in parentheses.

Theoretically, enhancing marine carbon sink efficiency increases carbon sink output, expanding market scale and elevating value based on supply-demand theory. Practically, it increases tradable quotas in carbon markets and boosts project attractiveness, directly enhancing carbon sink value. Further analysis of marine carbon sink efficiency mechanisms reveals that column (1) in Table 11 shows a significantly positive coefficient for Coord2, indicating an inverted U-shaped effect of coordination on marine carbon sink efficiency. At low coordination levels, insufficient integration of capital and technology constrains efficiency gains, hindering value enhancement. As coordination increases, capital precisely supports technological innovation, significantly boosting carbon sink efficiency and driving value growth. However, excessively high coordination leads to resource overconcentration or technological bottlenecks, causing diminishing marginal returns in efficiency gains and weakening the positive impact on carbon sink value. Analysis indicates that Coordination exerts a U-shaped influence on OCS through marine carbon sink efficiency.

Optimizing marine aquaculture structures, particularly by shifting to low-carbon methods like shellfish and algae farming, directly enhances carbon sequestration and indirectly boosts marine carbon sink value by improving biodiversity. In-depth analysis of this mechanism (Table 11, Column 2) shows a significantly positive coefficient for the coordination index (Coord), indicating a U-shaped relationship. At low coordination levels, insufficient green finance support hinders structural optimization, and traditional energy-intensive farming may dominate, reducing carbon sink value. As coordination improves, green finance drives low-carbon technological innovations, such as promoting algae farming and improving shellfish cultivation techniques. This optimizes structures, cuts pollution emissions, and strengthens carbon sequestration, significantly raising marine carbon sink value. Therefore, Coord exerts a U-shaped influence on OCS by affecting marine aquaculture structures.

4.4.2 Heterogeneity analysis

The level of development of green finance and technological innovation varies across regions depending on geography and available resources, there are also variations in the potential for enhancing the value of marine carbon sequestration. Therefore, this study adopts the methodology of Sun and Gao (2021), using the 2021 provincial marine economic output value to measure the scale of marine economies. Based on the average marine economic scale, the complete sample is divided into two regional groups: those with larger economic scales and those with smaller economic scales. Grouped regression is employed to conduct heterogeneity analysis (Table 12).

Table 12

| Variable | Larger economic scales | Smaller economic scales | |

|---|---|---|---|

| OCS | OCS | OCS | |

| Coord | 1.696 | 1.087* | -2.592*** |

| (0.854) | (2.001) | (-4.462) | |

| Coord2 | -0.415 | 3.648*** | |

| (-0.319) | (5.874) | ||

| Constant | -8.519*** | -8.250*** | 0.787 |

| (-3.778) | (-3.976) | (1.102) | |

| Controls | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 85 | 85 | 68 |

| R2 | 0.837 | 0.836 | 0.846 |

Heterogeneity analysis.

*, **, *** represent significance levels of 10%, 5%, and 1%, respectively. Standard errors are shown in parentheses.

Among them, the U-shaped relationship is not significant in the group with larger economic scales, while the coupled coordination between green finance and technological innovation has a statistically significant positive effect on the realization of marine carbon sequestration value. In contrast, the U-shaped relationship is statistically significant in the group with smaller economic scales. The possible reasons are as follows: regions with larger economic scales tend to have more mature financial markets, more comprehensive technological innovation systems and abundant resource endowments. These regions may already be at a relatively advanced stage. Therefore, the impact of their coupled coordination on the realization of marine carbon sequestration value may be more direct and positive, rather than following a complex U-shaped relationship. For the group of regions with smaller economic scales, the combined effects of resource constraints, technological bottlenecks, policy implementation lags and market flexibility result in obstacles to the realization of marine carbon sequestration value in the initial stages of green finance and technological innovation. However, once both fields reach maturity, the realization of marine carbon sequestration value also accelerates, forming a significant U-shaped relationship.

5 Discussion

Against the backdrop of an intensifying global climate crisis, the ocean—as Earth’s largest carbon sink system—has emerged as a critical natural solution for achieving carbon neutrality through its blue carbon functions (Heinze, 2014). Yet the potential of marine carbon sink remains largely untapped, with its strategic value accelerating as global carbon pricing mechanisms mature. Concurrently, the global green finance sector continues to expand, while technological innovation is reshaping the boundaries of low-carbon technologies, providing new tools for realizing blue carbon’s value. As the world’s largest carbon emitter, China’s development of a blue carbon economy is both an imperative for fulfilling international climate commitments and a vital pathway for unlocking marine resource potential and cultivating new drivers of green growth. In recent years, China has made positive strides in advancing blue carbon development through policy guidance, financial innovation, and technological breakthroughs (Mao et al., 2023; Li et al., 2024). Examples include piloting the “Marine Carbon Sink Ecological Compensation System,” launching innovative products like “Blue Carbon Loans” and “Marine Carbon Sink Insurance,” and developing efficiency-enhancing technologies such as “Cold-Tolerant Algae Carbon Sequestration Technology” and the “intelligent aquaculture carbon sink monitoring systems” to enhance carbon sink efficiency. However, China’s blue carbon economy still faces contradictions. The coupling mechanism between green finance and technological innovation has yet to be established, preventing the formation of a closed-loop system where “capital drives technological breakthroughs—technology enhances carbon sink returns—returns reinvest in financial innovation.” This mismatch between initial high investment and long-term returns inhibits the sustainability of the blue carbon economy.

This study constructs a coupling coordination evaluation model for “green finance - technological innovation” and systematically investigates the intrinsic mechanism by which their coupling coordination relationship influences blue carbon value realization, using nine coastal provinces in China from 2005 to 2021 as the research sample. The findings reveal a pronounced U-shaped relationship between the level of coupling coordination and blue carbon value realization: at lower coordination levels, insufficient technology transfer and immature application, compounded by fragmented and imprecise green finance resource allocation, result in suboptimal returns for blue carbon projects, thereby inhibiting value realization. However, once the coupling coordination level surpasses a critical threshold, the capital allocation function of green finance and the technological empowerment role of innovation form deep synergy. Their combined enabling effects are significantly unleashed, effectively driving blue carbon value realization into an accelerated growth phase. Previous studies have largely focused on the isolated effects of either green finance or technological innovation, neglecting their synergistic interactions. Alternatively, they have assumed a linear relationship between green finance and technological innovation’s impact on the low-carbon economy, lacking in-depth exploration of nonlinear dynamics (Song and Du, 2024; Li et al., 2025). The findings of this paper precisely address this research gap.

The U-shaped impact of the coupling coordination degree between green finance and technological innovation on marine carbon sink value is transmitted through marine carbon sink efficiency and marine aquaculture structure. Specifically, this U-shaped effect is mediated by two key variables: The coupling coordination degree exhibits an inverted U-shaped effect on marine carbon sink efficiency, where efficiency first increases then decreases as coupling coordination improves. This dynamic shift is ultimately transformed into a U-shaped impact on marine carbon sink value through the expansion of carbon trading market scale and adjustments to tradable quotas. Simultaneously, coupling coordination exerts a U-shaped effect on marine aquaculture structure, driving optimization from traditional high-energy-consumption models toward low-carbon shellfish-algae-based approaches. This transformation enhances carbon sequestration capacity directly and improves biodiversity indirectly, similarly yielding a U-shaped impact on marine carbon sink value. This finding deepens understanding of the coupling mechanism between these factors and enriches the literature on transmission pathways for capital-technology synergies.

Furthermore, this study reveals regional heterogeneity in the impact of coupling coordination on realizing the value of marine carbon sinks. In economically larger regions, mature financial markets and well-established science and technology innovation systems enable more efficient integration of green financial resources and technological innovations, amplifying the direct role of coupling coordination in enhancing marine carbon sink value. For instance, Guangdong, with its abundant financial resources and numerous research institutions, can rapidly convert capital and technology into tangible productivity, driving the development of blue carbon projects. In regions with smaller economies, despite initial resource and technological constraints, the realization of marine carbon sink value accelerates as coordination levels improve. This is achieved through policy guidance, technology introduction, and talent cultivation. This finding underscores the importance of regional customization and precision management in policy design, providing crucial insights for achieving balanced national blue carbon economic development.

Overall, this study not only provides a phased, differentiated scientific basis for blue carbon policy formulation but also contributes a new theoretical perspective for overcoming practical bottlenecks in blue carbon economic development.

6 Conclusion and implications

This paper explores how the interplay of green finance and technological innovation drives the realization of marine carbon sequestration value. Using empirical data from nine coastal Chinese provinces (2005–2021), we draw these key conclusions: First, green finance and technological innovation do not act independently on marine carbon sink value; instead, a complex and nonlinear U-shaped relationship exists between their coupling coordination and marine carbon sink value. Second, marine carbon sink efficiency and marine aquaculture structure serve as key mechanisms through which the coupling coordination of green finance and technological innovation exerts a U-shaped influence on marine carbon sink value. Moreover, the impact of the coordination between green finance and technological innovation on realizing marine carbon sink value exhibits significant regional heterogeneity: in economically smaller regions, constrained by factors such as insufficient financial resources and weaker technology transfer capabilities, the influence of their coordination on marine carbon sink value realization also follows a U-shaped pattern. In regions with larger economies, supported by mature financial markets and comprehensive technological innovation systems, the direct promotional effect of their coordination on realizing marine carbon sink value is more pronounced.

Considering the above analyses, we put forward the following proposals:

-

Develop differentiated green finance policies: For regions with significant marine carbon sink enhancement potential but low coordination levels, establish dedicated green finance support funds to provide preferential credit and fiscal assistance, thereby stimulating corporate innovation. For regions with high coordination levels and notable marine carbon sink achievements, implement dynamic policy evaluations. Flexibly adjust policies based on core metrics such as carbon sink increment, capital efficiency, and outcome conversion rates to promote deep integration between green finance and technological innovation.

-

Innovative marine carbon sink financial instruments: Launch blue carbon bonds with coupon rates and maturities tailored to project cycles and returns, incorporating third-party credit ratings to enhance market acceptance. Develop blue carbon insurance products by defining risk classifications and implementing scientifically-based pricing models, while strengthening collaboration with research institutions. Establish a financial support platform to pool resources and create an innovation fund, supporting the entire process from fundamental research to commercialization. For example, the Seychelles government issued the world’s first sovereign blue bond in 2018, specifically allocated for expanding marine protected areas and developing the blue economy. This initiative serves as a model for developing countries seeking to leverage blue finance instruments for ecological conservation.

-

Promoting technological synergy and management optimization: Establish an innovation incentive fund to reward R&D teams based on technological innovation and market potential. Collaborate with universities and research institutions to establish joint laboratories focused on fundamental research and applied development, while exploring international technology transfer. Implement a comprehensive management system for marine carbon sink projects, conduct regular ecological impact assessments, and achieve a balance between economic and ecological benefits through technological upgrades.

Although this study has yielded academically significant findings regarding the impact mechanism of the synergistic coordination between green finance and technological innovation on realizing the value of marine carbon sinks, a key limitation remains. The distribution of mangrove forests and seagrass beds exhibits pronounced regional and fragmented characteristics, resulting in limited data completeness and accessibility. Concurrently, existing research methodologies face certain constraints in accurately assessing the carbon sink functions of these ecosystems. Given these objective constraints, this study focused its marine carbon sink value assessment primarily on shellfish and algae, excluding other critical blue carbon ecosystems such as mangroves and seagrass beds. Consequently, the findings may not comprehensively and objectively reflect the true status of the entire blue carbon ecosystem. Future research should improve existing carbon sink calculation models and establish a comprehensive, integrated marine carbon sink value assessment system to provide stronger support for marine ecosystem conservation and value enhancement.

Statements

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

Author contributions

ZL: Data curation, Software, Validation, Visualization, Writing – original draft, Writing – review & editing. YZ: Conceptualization, Funding acquisition, Investigation, Project administration, Resources, Supervision, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research and/or publication of this article. This study was supported by the National Natural Science Foundation of China (42176218) and the Qingdao Science and Technology Innovation Strategic Research Program (25-1-4-zlyj-7-zhc).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1

Acheampong A. O. (2019). Modelling for insight: Does financial development improve environmental quality? Energy Econ83, 156–179. doi: 10.1016/j.eneco.2019.06.025

2

Ali S. Kartal M. T. Ullah S. (2025). Pathways to environmental sustainability: The asymmetric effects of green technology innovation, policy stringency, and industrialization in the United States. J. Cleaner Production502, 145376. doi: 10.1016/j.jclepro.2025.145376

3

Almomani F. Abdelbar A. Ghanimeh S. (2023). A review of the recent advancement of bioconversion of carbon dioxide to added value products: A state of the art. Sustainability15, 10438. doi: 10.3390/su151310438

4

Angelina K. He F. (2025). The effect of green finance on CO2 reduction in Kazakhstan. Environ. Dev. Sustain, 1–43. doi: 10.1007/s10668-025-06229-w

5

Anthony D. Siriwardana H. Ashvini S. Pallewatta S. Samarasekara S. M. Edirisinghe S. et al . (2023). Trends in marine pollution mitigation technologies: Scientometric analysis of published literature, (1990-2022). Regional Stud. Mar. Sci.66, 103156. doi: 10.1016/j.rsma.2023.103156

6

Anwar H. Waheed R. Aziz G. (2024). Importance of FinTech and green finance to achieve the carbon neutrality targets: a study of Australian perspective. Environ. Res. Commun.6, 115007. doi: 10.1088/2515-7620/ad853d

7

Belgacem S. B. Adam N. A. Khatoon G. Pawar P. S. (2023). Do green finance, low-carbon energy transition, and economic growth help in environmental investment?: Empirical evidence from emerging economies in Asia. Geological J.58, 3259–3267. doi: 10.1002/gj.4712

8

Bellemare M. F. Masaki T. Pepinsky T. B. (2017). Lagged explanatory variables and the estimation of causal effect. J. Politics79, 949–963. doi: 10.1086/690946

9

Bopp L. Aumont O. Cadule P. Alvain S. Gehlen M. (2005). Response of diatoms distribution to global warming and potential implications: A global model study. Geophysical Res. Lett.32, L19606. doi: 10.1029/2005GL023653

10

Cheng Q. Lai X. Liu Y. Yang Z. Liu J. (2022). The influence of green credit on China’s industrial structure upgrade: evidence from industrial sector panel data exploration. Environ. Sci. pollut. Res.29, 22439–22453. doi: 10.1007/s11356-021-17399-1

11

Dabbous A. Aoun Barakat K. (2023). The road towards environmental sustainability: Investigating the role of information and communication technologies and green technology innovations. J. Cleaner Production432, 139826. doi: 10.1016/j.jclepro.2023.139826

12

Dong H. Yan Z. Zhang J. (2024). Does green technology innovation improve carbon emission efficiency? Evidence from energy-intensive enterprises in China. Environ. Dev. Sustain1–33. doi: 10.1007/s10668-024-05785-x

13

Ge J. Zhang Z. Lin B. (2023). Towards carbon neutrality: How much do forest carbon sinks cost in China? Environ. Impact Assess. Rev.98, 106949. doi: 10.1016/j.eiar.2022.106949

14

Gu Y. Lyu S. Wang L. Chen Z. Wang X. (2022). Assessing the carbon sink capacity of coastal mariculture shellfish resources in China from 1981–2020. Front. Mar. Sci.9. doi: 10.3389/fmars.2022.981569

15

Hanif M. W. Zheng S. (2025). Assessing the economic impact of green finance and renewable energy use on environmental sustainability in high-polluting sectors. Renewable Energy247, 123017. doi: 10.1016/j.renene.2025.123017

16

Hauck J. Zeising M. Le Quéré C. Gruber N. Bakker D. C. E. Bopp L. et al . (2020). Consistency and challenges in the ocean carbon sink estimate for the global carbon budget. Front. Mar. Sci.7. doi: 10.3389/fmars.2020.571720

17

Heinze C. (2014). The role of the ocean carbon cycle in climate change. Eur. Rev.22, 97–105. doi: 10.1017/S1062798713000665

18

Irfan M. Razzaq A. Sharif A. Yang X. (2022). Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technol. Forecasting Soc. Change182, 121882. doi: 10.1016/j.techfore.2022.121882

19

Jia R. Li P. Chen C. Liu L. Li Z.-H. (2023). Shellfish-algal systems as important components of fisheries carbon sinks: Their contribution and response to climate change. Environ. Res.224, 115511. doi: 10.1016/j.envres.2023.115511

20

Li Q. Lei H. Yu M. (2025). Green finance, green innovation and carbon intensity. Int. Rev. Financial Anal.106, 104550. doi: 10.1016/j.irfa.2025.104550

21

Li P. Liu D. Liu C. Li X. Liu Z. Zhu Y. et al . (2024). Blue carbon development in China: realistic foundation, internal demands, and the construction of blue carbon market trading mode. Front. Mar. Sci.10. doi: 10.3389/fmars.2023.1310261

22

Li J. Ye S. Wang S. (2023). Spatial network analysis on the coupling coordination of digital finance and technological innovation. Sustainability15, 6354. doi: 10.3390/su15086354

23

Lichtschlag A. Pearce C. R. Suominen M. Blackford J. Borisov S. M. Bull J. M. et al . (2021). Suitability analysis and revised strategies for marine environmental carbon capture and storage (CCS) monitoring. Int. J. Greenhouse Gas Control112, 103510. doi: 10.1016/j.ijggc.2021.103510

24

Liu C. Liu G. Casazza M. Yan N. Xu L. Hao Y. et al . (2022). Current status and potential assessment of China’s ocean carbon sinks. Environ. Sci. Technol.56, 6584–6595. doi: 10.1021/acs.est.1c08106

25

Liu X. Song M. Wang S. Xu X. Li H. (2024). On innovation infrastructure and industrial carbon emissions: Nonlinear correlation and effect mechanism. Appl. Energy375, 124079. doi: 10.1016/j.apenergy.2024.124079

26

Mao Z. Liu H. Zhang Z. (2023). Enhancing the ocean carbon sink capacity of Shandong province, China, under the “dual carbon” goal. Front. Mar. Sci.10. doi: 10.3389/fmars.2023.1305035

27

Muganyi T. Yan L. Sun H. (2021). Green finance, fintech and environmental protection: Evidence from China. Environ. Sci. Ecotechnology7, 100107. doi: 10.1016/j.ese.2021.100107

28

Nepal R. Zhao X. Dong K. Wang J. Sharif A. (2025). Can artificial intelligence technology innovation boost energy resilience? The role of green finance. Energy Econ142, 108159. doi: 10.1016/j.eneco.2024.108159

29

Rasoulinezhad E. Taghizadeh-Hesary F. (2022). Role of green finance in improving energy efficiency and renewable energy development. Energy Efficiency15, 14. doi: 10.1007/s12053-022-10021-4

30

Raven J. A. Falkowski P. G. (1999). Oceanic sinks for atmospheric CO2. Plant Cell Environ.22, 741–755. doi: 10.1046/j.1365-3040.1999.00419.x

31

Ren W. Xu Y. (2024). Evaluation and optimization of mariculture ecological efficiency under technological heterogeneity — New evidence from China’s coastal regions. Mar. pollut. Bull.205, 116563. doi: 10.1016/j.marpolbul.2024.116563

32

Ridge S. M. McKinley G. A. (2021). Ocean carbon uptake under aggressive emission mitigation. Biogeosciences18, 2711–2725. doi: 10.5194/bg-18-2711-2021

33

Shi X. Xu Y. Dong B. Nishino N. (2023). Mariculture carbon sequestration efficiency in China: Its measurement and socio-economic factor analysis. Sustain. Production Consumption40, 101–121. doi: 10.1016/j.spc.2023.06.003

34

Song M. Du J. (2024). Mechanisms for realizing the ecological products value: Green finance intervention and support. Int. J. Production Econ271, 109210. doi: 10.1016/j.ijpe.2024.109210

35

Steinberg D. K. Landry M. R. (2017). Zooplankton and the ocean carbon cycle. Annu. Rev. Mar. Sci.9, 413–444. doi: 10.1146/annurev-marine-010814-015924

36

Sun J. Gao Y. (2021). Research on China’s marine economic development. Reg. Econ. Rev., 38–47. doi: 10.14017/j.cnki.2095-5766.2021.0006

37

Tang Q. Zhang J. Fang J. (2011). Shellfish and seaweed mariculture increase atmospheric CO2 absorption by coastal ecosystems. Mar. Ecol. Prog. Ser.424, 97–104. doi: 10.3354/meps08979

38

Tsakiridis A. O’Donoghue C. Hynes S. Kilcline K. (2020). A comparison of environmental and economic sustainability across seafood and livestock product value chains. Mar. Policy117, 103968. doi: 10.1016/j.marpol.2020.103968

39

Ullman R. Bilbao-Bastida V. Grimsditch G. (2013). Including Blue Carbon in climate market mechanisms. Ocean Coast. Manage.83, 15–18. doi: 10.1016/j.ocecoaman.2012.02.009

40

van Veelen B. (2021). Cash cows? Assembling low-carbon agriculture through green finance. Geoforum118, 130–139. doi: 10.1016/j.geoforum.2020.12.008

41

Wan S. Lee Y. H. Sarma V. J. (2023). Is Fintech good for green finance? Empirical evidence from listed banks in China. Economic Anal. Policy80, 1273–1291. doi: 10.1016/j.eap.2023.10.019

42

Wei X. Wang Q. (2024). Policy suggestions for tapping the potential of ocean carbon sinks in the context of “double carbon” goals in China. Front. Mar. Sci.11. doi: 10.3389/fmars.2024.1298372

43

Wu F. Cui F. Liu T. (2023). Empirical study on green development of marine economy driven by marine scientific and technological innovation and its influencing factors. Front. Environ. Sci.11. doi: 10.3389/fenvs.2023.1092712

44

Xiang H. Cao Y. (2024). Research on hotspots and evolutionary trends of blue carbon sinks: a bibliometric analysis based on CiteSpace. Environ. Dev. Sustain. 27 (6), 14197–14221. doi: 10.1007/s10668-024-04522-8

45

Xu Y. Wei Z. Xu L. Zhou G. (2024). Double effect of ocean carbon sink trading and financial support: analysis based on BGG-DICE-DSGE model. Front. Mar. Sci.11. doi: 10.3389/fmars.2024.1473828

46

Xu Y. Zhang R. Fan X. Wang Q. (2022). How does green technology innovation affect urbanization? An empirical study from provinces of China. Environ. Sci. pollut. Res.29, 36626–36639. doi: 10.1007/s11356-021-18117-7

47

Xu W. Zhu Y. (2024). The effects of green finance on the carbon decoupling of marine fishery: analysis based on Tapio method and EKC model. Front. Environ. Sci.12. doi: 10.3389/fenvs.2024.1320318

48

Yao W. Wang X. (2024). A dynamic simulation and evaluation of the coupling coordination degree of the marine economy–resource–environment system in China. Water16, 2686. doi: 10.3390/w16182686

49

Yi H. Hao L. Liu A. Zhang Z. (2023). Green finance development and resource efficiency: A financial structure perspective. Resour. Policy85, 104068. doi: 10.1016/j.resourpol.2023.104068

50

Zeb A. Shuhai N. Ullah O. (2025). Navigating sustainability and economic growth: the dual influence of green economic growth and technological innovation on environmental outcomes in South Asia. Environ. Dev. Sustain, 1–26. doi: 10.1007/s10668-025-06088-5

51

Zhong T. Ma F. Sun F. Li J. (2024). Can green finance reduce corporate carbon risk? Finance Res. Lett.63, 105234. doi: 10.1016/j.frl.2024.105234

Summary

Keywords

green finance, technological innovation, marine carbon sink, coupled coordination, sustainable development

Citation

Li Z and Zhang Y (2025) A study of influence of coupled coordination of the green finance and technological innovation on the value realization of blue carbon. Front. Mar. Sci. 12:1694916. doi: 10.3389/fmars.2025.1694916

Received

29 August 2025

Accepted

15 October 2025

Published

29 October 2025

Volume

12 - 2025

Edited by

Chao Liu, Ministry of Natural Resources, China

Reviewed by

Fu Yufang, Zhejiang Ocean University, China; Chunjuan Wang, Ministry of Natural Resources, China

Updates

Copyright

© 2025 Li and Zhang.

This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ying Zhang, yzhang@ouc.edu.cn

Disclaimer

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.