- 1Department of Anthropology & Department of Earth and Environmental Science, University of Pennsylvania, Philadelphia, PA, United States

- 2Shanghai Institute of AI for Education, East China Normal University, Shanghai, China

- 3Department of Psychology, University of Minnesota-Twin Cities, Minneapolis, MN, United States

- 4Department of Management, Baruch College, City University of New York, New York, NY, United States

- 5Stanford University, Stanford, CA, United States

Much research has been devoted to how environmental sustainability of organizations is related to organizational reputation and financial performance, but little is known about whether and how organizational environmental sustainability relates to longevity of organizations. We quantitatively examined the relation between organizational longevity and environmental sustainability of organizations, hypothesizing a positive relationship. Using two large samples of organizations—one from the U.S., and another from multiple regions (Europe, the Middle East and North Africa, and Asia, analyzed separately)—results indicate a significant, replicable positive relation between organizational longevity and environmental sustainability performance. Statistically controlling for organizational wealth and size of workforces did not appreciably diminish relations. Additionally, older organizations demonstrated better resource use and management, operational eco-efficiency, climate strategy, and environmental reporting. However, differences in innovation were less pronounced, though still favored older organizations. We discuss the implications for human resources and evolutionary theories of organizations, suggesting it is not the largest companies that endure, nor the wealthiest, but those most committed to environmental sustainability.

Introduction

The environmental sustainability principle established by the Brundtland Commission (World Commission on Environment and Development, 1987), specifies humanity's goal of meeting the needs of the present without compromising the ability of future generations to meet their own needs. Environmental sustainability refers to the responsible consumption of natural resources at a rate below their natural regeneration or through the use of sustainable substitutes, while minimizing emissions and avoiding activities that degrade ecosystems (Kleindorfer et al., 2005). Environmental sustainability requires long term thinking (Elkington, 1998; Wackernagel et al., 2002). The global decline in biodiversity and ecosystem integrity since the 1970s highlights the need for transformative solutions (Díaz et al., 2019). Global environmental calamities demand a future-focused approach to ensure quality of life on Earth. Yet, many organizations still operate under a growth-oriented, linear (“take-make-waste”) economic model, often disconnected from ecological realities while also having significant, long-term impact on climate change and ecological outcomes (Sariatli, 2017). Unlike individuals, whose efforts may be constrained by shorter life spans and thus may have limited influence on broader systems, organizations have enduring structures and far-reaching impact. As Amel et al. (2017) noted, the roots of many environmental problems lie in humanity's large-scale systems, including its corporations. In this context, companies can decimate ecosystems, hasten climate change, and harm the natural environment, but they are also capable of driving substantial positive environmental change through their policies, processes, and practices. For example, given that a small number of companies are responsible for a significant portion of global emissions, even moderate improvements in their environmental sustainability efforts can yield immense environmental benefits over time. Furthermore, organizations provide a framework within which individual behavior occurs, shaping the daily actions of employees through institutionalized norms and policies (Amel et al., 2017; Zacher et al., 2023).

By studying organizational longevity, we can observe how environmental practices have been implemented, maintained, and expanded across generations of workforces, extending the impact beyond the limits of individual lifespans. Organizations are not only vital players in the current ecological landscape but also have the capacity for being resilient vehicles for achieving long-term sustainability. By jointly examining organizational environmental sustainability performance and organizational longevity, we gain insight into practical pathways for enhancing ecological outcomes. Thus, this research has the potential to inform sustainable business models that highlight long-term commitments to sustainable practices (e.g., circular economy principles to reduce resource consumption and environmental impact, Centobelli et al., 2020).

Organizational environmental sustainability is a multidimensional construct. The International Organization for Standardization (2021) defines it as the result of an organization's management of its environmental aspects, representing a consensus definition that integrates existing academic definitions. Organizational longevity pertains to the ability of a firm to maintain themselves over time, that is, its long-term survival (Riviezzo et al., 2015).

The oldest publicly held corporations in the U.S. date back to the time of its founding (e.g., Philadelphia Contributionship, founded by Benjamin Franklin in 1752 and incorporated in 1768; Cigna, est. 1792; Jim Beam, est. 1795; JPMorgan Chase, est. 1799). Worldwide, there are over 5,500 companies that are more than 200 years old, with most being in Japan (3,146), Germany (837), The Netherlands (222), and France (196, see Kang, 2022). Although people's life expectancies around the world are increasing, life expectancies of organizations are declining—the mean age of companies listed on the S&P 500 has fallen from 50+ years in the 1950s to less than 20 years today (Viguerie et al., 2021). Despite their decreasing longevity, corporations have grown especially in two areas: size and environmental footprint. In this research, we sought to examine the relation between organizational longevity and environmental sustainability of organizations, hypothesizing a positive relationship.

At the micro level, although prior research has examined the relations between environmental sustainability (e.g., Employee Green Behavior; pro-environmental behavior) and age of individuals (Wiernik et al., 2013, 2016), the macro-level relation between organizational longevity and environmental sustainability remains unexamined. Yet, the impact of employees—and perhaps more importantly, organizations—on the natural environment is shaped by the duration of their actions. Over time, organizations accumulate environmental footprints, institutionalize sustainability practices (or unsustainable ones), and develop long-term strategies that influence their overall environmental impact. Whether or not environmental sustainability and organizational longevity are linked, in which direction (i.e., negatively or positively), and to what degree (i.e., magnitude of the effect) is unknown. We make an empirical contribution addressing this glaring gap. As our backdrop, we draw on several theoretical frameworks that highlight evolutionary dynamic forces. Our theoretical evolutionary perspective emphasizes that organizational survival is not a matter of chance but a result of successful adaptations to external demands, including environmental, social, and economic ones (Sarta et al., 2021).

Theoretical framework

First, we outline the theoretical foundations that inform our understanding of the relations between organizational longevity and environmental sustainability. Drawing on established macro and micro-organizational theories, we explain why older organizations are likely to develop superior environmental sustainability practices as an adaptive response to ecological demands and resource constraints. These complementary perspectives collectively suggest that longevity and sustainability are interconnected through evolutionary processes that favor organizations capable of balancing immediate needs with long-term environmental considerations.

Population Ecology Theory (Hannan and Freeman, 1977; see Chen et al., 2023 for a recent review) describes how organizations evolve and persist by aligning themselves with their external environments: survival is determined by an organization's ability to adapt to environmental pressures. Organizations that have persisted over time have done so because they adapted successfully to previous economic, societal, and environmental challenges. Long-lived organizations, having already survived such pressures, are likely to have effective strategies, know-how, and practices that enable them to continue adapting to ecological demands (e.g., scarcities, natural disasters), contributing to their environmental sustainability. In turn, organizations with better environmental sustainability performance are better adapted to handle current and future challenges through their long-term thinking.

We also draw on Resource Dependence Theory (Hillman et al., 2009), which explains how organizations navigate resource scarcity by developing structures and practices to secure and manage critical resources effectively (see Tashman's, 2021, application to natural resource scarcity). Over time, these adaptations enable firms to withstand external pressures and thrive. Natural resources that many organizations rely on are finite or of limited quantity (e.g., water, lumber, minerals/rare earths, fossil fuels, land, biological organisms used in products). If these resources are not carefully conserved and managed, they can become scarce. This scarcity can impact organizations that rely on these resources for their operations. Without adequate resources, organizations may face challenges in maintaining their production processes, leading to potential financial difficulties. Therefore, it is important for organizations to adopt sustainable practices to ensure the long-term availability (and/or regeneration) of natural resources to support their operations. Thus, organizational longevity demands careful attention to environmental sustainability.

Dynamic Capabilities Theory further illustrates how long-lived organizations build, reconfigure, and leverage internal and external resources to proactively innovate and respond to shifting environmental demands. Perhaps the most consistent demands across place and time are ecological demands. Recent reviews highlight the role of dynamic capabilities in integrating sustainability into corporate strategy (Correggi et al., 2024) and identify 16 specific dynamic capabilities for long-term sustainability goals (de Almeida Barbosa Franco et al., 2024).

Finally, we incorporated insights from Cybernetic Trait Complexes Theory (CTCT; Stanek and Ones, 2023) to complement these perspectives by offering a framework for understanding how organizations balance stability and change to achieve long-term adaptability. While originally formulated to describe micro level relations between personality traits and cognitive abilities in individuals, CTCT's core principles—particularly the regulation of goal-directed action through dynamic feedback mechanisms—can be extended to organizational contexts. Just as individuals develop stable trait bundles and flexible strategies to navigate changing environments, organizations cultivate enduring capabilities while simultaneously adapting to evolving economic, societal, and ecological pressures. By applying CTCT at the organizational level, we draw parallels between adaptive trait complexes in individuals and clusters of adaptive organizational competencies that emerge in response to external demands. We offer this perspective as a novel lens for examining how organizations sustain themselves over time, continuously optimizing between long-term resilience and immediate adaptation to maintain environmental sustainability and overall longevity.1

Together, these frameworks illustrate how evolutionary pressures drive the development of sustainability strategies and practices in organizations. Longevity is achieved not simply by existing the longest but by adapting successfully to an intricate mix of environmental, societal, and economic challenges. As a result, the relation between longevity and sustainability is profoundly interwoven with survival strategies and the accumulation of adaptive expertise.

This paper's theoretical foundation aligns closely with the “seven generations” principle, originating in the Haudenosaunee confederacy (see Graham, 2008), highlighting the importance of long-term thinking and sustainability for enduring success. Specifically, it aligns with our argument that longevity often results from the ability to adapt to changing environmental, social, and economic conditions. Older organizations that have endured across generations exemplify this adaptive capacity: the necessity of balancing immediate societal needs with the long-term wellbeing of future generations when approaching the natural environment.

Explaining environmental sustainability-organizational longevity relations

Younger organizations, by their nature, have had limited time to develop a full understanding of their environmental impact or to adapt their practices in response to evolving sustainability demands. Early-stage companies often lack the experience and resources needed to effectively address environmental challenges, potentially limiting their sustainability efforts (Orlitzky et al., 2003). In contrast, older and more mature organizations have had more time to adapt and refine their strategies for managing environmental pressures, accumulating tangible and intangible (e.g., knowledge, cultural, structural) resources, and developing capabilities to support environmental sustainability. Such adaptations likely emerge from a continuous process of navigating resource constraints, economic conditions, and societal expectations through time, which may influence the evolution of sustainability contributions over time.

This process of adaptation is also manifested in the relation between economic performance and organizational longevity, where financially successful organizations have been shown to have a higher likelihood of surviving over time (Panza et al., 2018). The availability of financial resources can help companies manage external pressures and invest in sustainability initiatives as well, not just for immediate gains but as part of a long-term strategy for resilience. However, we propose that the relations between environmental sustainability and organizational longevity may extend beyond mere resource availability. We suspect that ongoing adaptation to better navigate diverse stakeholder demands and respond proactively to environmental challenges also promotes environmental sustainability performance.

A reviewer of this manuscript suggested an alternate view: “Older organizations were built on unstainable business models and have rigid structures that are difficult to change. Younger organizations on the other hand, start fresh and can incorporate environmental sustainability from the beginning.” The theoretical frameworks reviewed above imply that older organizations, by virtue of their longevity, often have greater opportunities to adapt their practices to align with environmental sustainability. While we agree that younger organizations may have an advantage in starting with more flexible structures and sustainability-oriented models, at least at this point in history, we suggest that longevity itself reflects a demonstrated capacity for adaptation. Older organizations that have survived significant environmental, societal, and economic shifts have necessarily evolved and refined their practices to align with changing external demands. Scholars have argued that the ability to learn and adapt is critical for explaining organizational longevity (Grashuis, 2018). In the context of this paper, adaptability often extends to their ability to conserve the natural environment and adopt sustainability practices. While some older organizations may face challenges due to legacy systems (e.g., rigid structures), it would be a mistake to assume that this is a universal attribute. The theoretical frameworks we utilized suggest that many long-lived organizations have demonstrated remarkable adaptability over time, leveraging institutional knowledge and accumulated experience to evolve their practices, including those related to sustainability. The idea that older organizations are inherently tied to unsustainable business models is an oversimplification of a complex historical process. Many of the unsustainable practices often associated with legacy industries—such as heavy reliance on coal, oil, and other polluting technologies—emerged and proliferated only within the last 150 years. These practices coincided with industrialization, the rise of electricity and modern transportation, and other technological advancements that significantly shaped global markets. However, the existence of unsustainable business models does not negate the fact that some older organizations have managed to adapt and thrive. While many companies fail early or mid-way through organizational lifecycles, a subset demonstrates remarkable longevity and vitality. This endurance is not due to stagnation or rigidity but rather to their capacity to evolve and adapt to external needs, including environmental sustainability-related demands. While younger organizations may have the advantage of designing sustainability practices from the outset, they often face significant resource constraints and pressures to prioritize short-term survival over long-term sustainability. This can limit their ability to implement extensive or key sustainability initiatives compared to wiser (i.e., know-how rich, strategically experienced), older organizations.

Empirical studies consistently show that while organizational mortality is common—whether due to market dynamics, mismanagement, or external shocks—organizations that survive demonstrate key adaptive capabilities. Most companies die young. For example, only about half of newly founded European companies survive more than 5 years (Napolitano et al., 2015). Even large corporations have finite lifespans; the life expectancy of Fortune 500 companies, for instance, was estimated at 40–50 years during the late 20th century. According to Kwee et al. (2011), organizational survival hinges on strategic renewal processes that align the organization with its environment. Organizations that endure for decades or centuries have done so by continuously evolving. We believe that their longevity reflects their ability to learn, innovate, and align with societal expectations, including those related to environmental sustainability. Far from being rigid, such organizations often embody the principles of dynamic capabilities (Teece et al., 1997), institutional adaptation (Scott, 2005), and resource management (Hillman et al., 2009). Thus, in our theoretical framework, adaptation is the key to survival: Longevity is fundamentally tied to adaptability.

In sum, the relation between sustainability and longevity is interdependent. Long-lived organizations often develop sustainability practices as part of their broader strategy to secure resources, build legitimacy, and navigate complex external demands. Their historical adaptability challenges the notion that they are inherently less capable of embracing sustainability. Younger organizations may have the advantage of starting fresh with sustainability built into their initial business models. However, they also face significant resource constraints, market pressures, and short-term survival challenges, which can limit their ability to implement sustainability strategies comprehensively. Older organizations, while potentially burdened by legacy systems, often possess substantial resources, institutional knowledge, and established stakeholder networks, enabling them to adapt to sustainability pressures over time.

Hypotheses

Overall, adaptation to environmental challenges can both contribute to and reflect an organization's longevity. In this research, our primary focus is on how longevity relates to sustainability. We believe that the relation is likely reciprocal. Companies with a strong sustainability orientation may, in turn, bolster their longevity by building resilience, reputation, and stakeholder trust over time. While our data cannot directly test such causal pathways, we note this bidirectionality and state our hypotheses without implied directionality. Our main hypothesis is that longevity and environmental sustainability of organizations are non-negligibly positively related.

Hypothesis 1: Organizational longevity will be positively related to environmental sustainability performance.

Hypothesis 1 articulates the general relation we aim to test between organizational longevity and environmental sustainability performance. Hypotheses 1a and 1b are more specific extensions of Hypothesis 1. That is, Hypotheses 1a and 1b are fundamentally the same as Hypothesis 1, with the exception that they open the door for testing the same basic hypothesis in two specific, but differing ways.

Hypothesis 1a: Organizations with greater longevity will exhibit significantly higher environmental sustainability performance compared with those with shorter longevity.

Hypothesis 1b: The difference in environmental sustainability performance will be particularly large2 when comparing the oldest and youngest organizations.

Hypothesis 1a specifies this relation further by positing that organizations with greater longevity will perform better on sustainability measures compared with younger organizations. Hypothesis 1b adds an additional layer of specificity by focusing on the contrast between the extremes of the distribution—comparing the oldest and youngest organizations. Thus, Hypothesis 1a suggests positive correlation, and 1b an investigation of group mean differences.

Our research focused on large organizations, defined as those included in business rankings such as the Fortune 500, Forbes Global 2000, and regional lists of leading companies,3 because they have a broader and more substantial ecological footprint than smaller enterprises due to the scale of their operations, resource use, and emissions, while also having the ability to impart wider reaching environmental benefits. In our investigation, we focused on companies from the key regions of the U.S., Europe, the Middle East and North Africa (MENA), and Asia, whose practices shape the planet's ecological future. Their operations account for a significant share of global resource use and emissions. We examined these regions separately as well as jointly. Area-based conservation varies by region due to differences in policies, ecological representation, biodiversity priorities, and effectiveness (Maxwell et al., 2020). Given the role of governance, funding, and local priorities in environmental sustainability, analyzing regions separately can reveal variations by region. Additionally, the diversity in cultures, economies, and legal systems in these regions allows us to assess the replicability and generalizability of our findings.

Research Question 1: Do organizational longevity and environmental sustainability performance show a replicable positive relation across companies from the U.S., Europe, MENA, and Asia?

Acknowledging that organizational environmental sustainability is not a monolithic construct, we also examined relations for specific components of environmental sustainability performance. Unpacking the longevity-environmental sustainability performance relation by including more specific components can provide insight into the relation between the two. For example, older companies may excel in certain areas, such as resource management or environmental reporting, while younger organizations may be stronger in reducing emissions in their operations by using newer technologies or innovations. Analyzing these components separately will clarify how various aspects of environmental sustainability evolve with organizational age. Lacking strong theoretical justification for which environmental sustainability components would be more or less strongly related to longevity, we posed this as a research question.

Research Question 2: How do relations between organizational longevity and environmental sustainability performance vary across distinct environmental domains?

Methods

Samples

We used separate samples to examine relations between environmental sustainability and longevity of organizations: Sample 1 includes company data from the U.S., and Sample 2 includes data for companies in Europe, MENA, and Asia.

All data in this research are based on 2018 as the reporting year for company-level variables. 2018 was a time of relative stability in terms of operations and reporting for large international companies, compared with the following years that were characterized by disruptions due to the COVID-19 pandemic. Using 2019–2020 data (often contained in 2020–2021 company reports) would have introduced substantial variability, uncertainty, and anomalies in both sustainability and financial indicators. Data from the two following years would have reflected the height of the pandemic, a period marked by widespread operational disruptions, economic instability, and unique environmental challenges during which organizations struggled to adapt to rapidly changing circumstances, making them less suitable for establishing generalizable trends. Later data (2022–2023) still present challenges as organizations and countries normalized their operations at different rates following the pandemic. This period was marked by uneven recoveries and continued volatility in sustainability and financial performance metrics, further complicating the creation of a stable and comparable dataset. Lastly, 2024 data will not become fully available until the middle of 2025. As such, the 2018 dataset provides the most recent and robust foundation for analyzing organizational longevity and environmental sustainability performance.

Sample 1: U.S. companies

The first sample contained all companies listed on the 2018 Fortune 500 list. The Fortune 500 is a list compiled annually by Fortune magazine that includes the top 500 U.S. companies based on gross revenue from the previous fiscal year. Data from these companies are frequently used in management and organizational behavior research due to their significant economic influence as well as leadership in key areas of organizational practice. Examples include research on financial performance (e.g., Hillman et al., 2000; Taher, 2023), ethical leadership (e.g., Banks et al., 2023; Brown and Trevino, 2006; Kesner et al., 1986), HR policy (e.g., Ahmed et al., 2024; Kaufman and Petts, 2022), transparency in organizational practices (e.g., Adams, 2004), and corporate social responsibility (Lee, 2023), among others.

We selected Fortune 500 companies because they represent a significant portion of the U.S. economy (about two-thirds of GDP) and are often at the forefront of innovation in many areas of practice (Zhou et al., 2017). In addition, given their size, financial capacity, and strategic vision, they are more likely to implement extensive environmental sustainability initiatives. Furthermore, their environmental sustainability performance tends to be important not only for the U.S. but also have a broader impact around the globe (e.g., Christmann, 2004).

Sample 2: companies from Europe, MENA, and Asia

Economic structures, regulatory environment, and national culture may influence organizational environmental sustainability performance as well as longevity. Therefore, we sought a second sample representing greater economic, regulatory, and cultural diversity to examine whether the findings from U.S. companies generalized to diverse sample of organizations from different world regions. In this effort, we culled European, Middle Eastern, North African, and Asian companies from lists similar to the Fortune 500 but appropriate for the regions we wished to include.

For Europe, organizations were drawn from the Forbes Global 2000 list (2018), which ranks companies based on assets, market value, profits, and sales in the previous year (Murphy et al., 2018). European companies on the Forbes Global 2000 list were headquartered in Austria, Belgium, Cyprus, Czechia, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

Many organizations from Asia and MENA regions are not represented on the Forbes Global 2000 list due to its focus on “the largest companies in the world”. Therefore, relying solely on that list did not present a viable alternative for investigations in Asia and MENA. Therefore, we supplemented global Forbes listings with regional lists for Asia and MENA. That is, additional companies were sampled from the Middle East and North Africa and were curated from “The Top 100 Companies in the Arab World 2018” list by Forbes Middle East, which ranks companies based on financial performance indicators such as sales and total assets. Organizations from Bahrain, Egypt, Jordan, Kuwait, Lebanon, Morocco, Oman, Qatar, Saudi Arabia, and the United Arab Emirates were included. For Turkey, the analysis included companies from “The Top 100 Companies in Turkey in 2018” as reported by Forbes Turkey, based on the same financial metrics, as well as their subsidiaries. For far east and southeast Asia, we used the same source as for Europe and relied on the Forbes Global 2000 list. Organizations were headquartered in 11 Asian countries and regions: China (Mainland and Hong Kong), Taiwan, Japan, South Korea, Singapore, Malaysia, Thailand, Philippines, Indonesia, and Vietnam. For southeast Asia, additional company names were acquired through the most recently available Association of South Asian Nations (ASEAN) Corporate Governance Scorecard Report (Asian Development Bank, 2017), which includes the top 50 organizations in each country based on their market values. Table 1 lists the number of organizations which were included for each country by region. Overall, companies were headquartered in 46 countries. Supplementary Table S1a provides names of U.S. companies included in Sample 1. Supplementary Table S1b provides names and countries of companies included in Sample 2.

Measures

Environmental sustainability performance

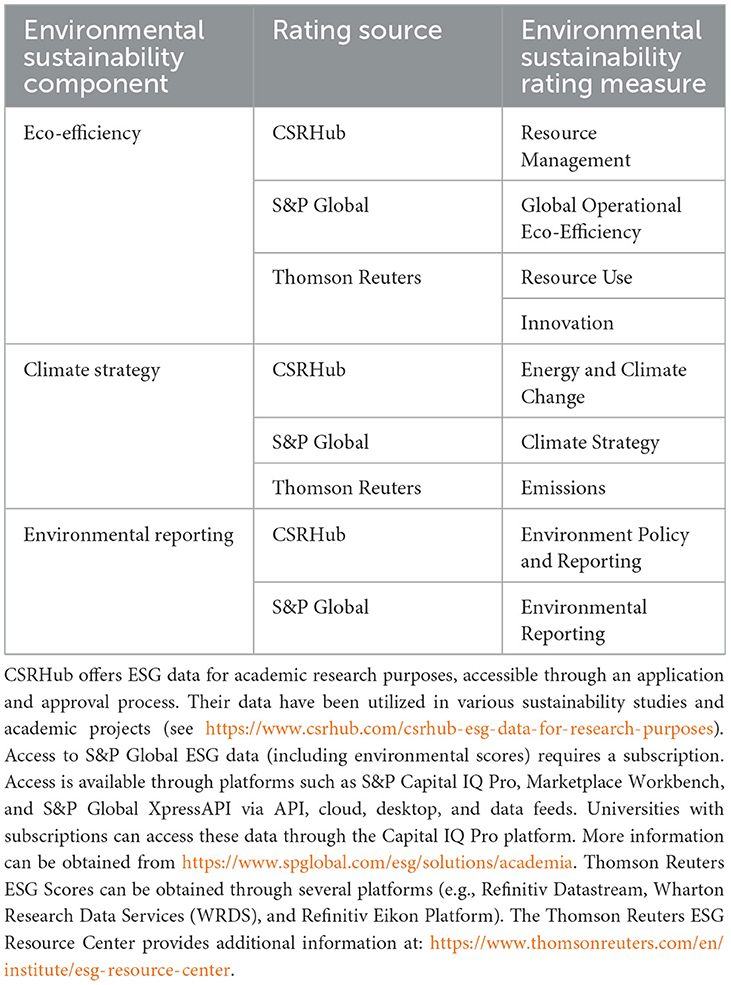

We sought to obtain environmental sustainability performance scores of companies in our database from third-party Environmental, Social, and Governance (ESG) ratings. Investigations into the efficacy of third-party sustainability ratings have consistently revealed limitations when only one assessment is used, as ratings from a single source may not provide a comprehensive view of organizations' sustainability performance (Chatterji and Levine, 2006; Chatterji et al., 2016; Delmas and Blass, 2010). Therefore, we obtained multiple ratings from different sources. Sources and information for research access to each source are provided in the note to Table 2.

Ratings from CSRHub environmental performance ratings

CSRHub ratings provides ESG ratings on a total of 18,760 organizations by systematically aggregating data from 677 different data sources. Some examples include the Carbon Disclosure Project (CDP), Dow Jones Sustainability (DJS) indexes, Global Reporting Initiative (GRI), and Corporate Responsibility Index (CRI). Information from each data source is first evaluated and mapped into one of four dimensions: environment, community, employees, and governance. We used CSRHub's Environment ratings which capture the degree to which organizations report both positive and negative environmental performance in a timely and transparent manner and the degree to which they adhere to various reporting standards (Environment Policy & Reporting), their energy and resource efficiency during product manufacturing and/or service delivery processes (Resource Management), and the effectiveness of addressing climate change by establishing policies and strategies, adopting energy-saving operations, and developing renewable energy and other environmental technologies (Energy & Climate Change). CSRHub calculates scores ranging from 0 to 100, using data from multiple sources. These scores are combined into composite scores for each subdimension, with weights assigned based on the credibility and relevance of the respective sources. Scores are provided only for organizations when sufficient information is available. CSRHub offers ESG data for academic research purposes, accessible through an application and approval process.

Ratings from S&P Global

The S&P Global ESG ratings and its predecessor, the RobeccoSAM index, evaluate organizations' sustainable practices around the world through an annual corporate sustainability assessment (CSA). The results of this assessment serve as the starting point for the well-known Dow Jones Sustainability (DJS) Index, where the top 10% of performers are included and further evaluated. Each organization included in CSA is invited to respond to a questionnaire with general as well as industry-specific questions on their (1) environmental, (2) social, and (3) economic/governance practices. The questions on each dimension cover both qualitative and quantitative aspects of performance. For example, a quantitative question on organizations' operational eco-efficiency is “Please provide your company's total direct greenhouse gas emissions (DGHG SCOPE 1) for the part of your company's operations for which you have a reliable and auditable data acquisition and aggregation system.” In contrast, a qualitative question on organizations' climate strategy is “Do you provide incentives for the management of climate change issues, including the attainment of targets? [If Yes:] Please provide further details on the climate change-related incentives provided, starting from the highest management level.” For each question, a score ranging from 0 to 100 is assigned by the analysts and scores on all questions are then aggregated in a three-step manner. First, depending on the domain that questions belong to, they are mechanically weighted to generate a composite score for that domain. Second, the domain-level scores are adjusted based on results from a Media and Stakeholder Analysis (MSA), which examines organizations' involvement in and responses to environmental, social and governance incidents (e.g., oil spills, human right abuses, corruption) reported by media and stakeholder stories. The results of the MSA are used to make downward adjustments to organizations' corresponding criterion scores, such that those with high MSA impact are penalized more in their ratings. Third, all sub-scores within a single dimension (e.g., environment) are aggregated to obtain the dimension-level score. The Environment dimension comprises a set of common criteria that apply to organizations in all industries, along with a few industry-specific criteria. It has three common criteria: Operational Eco-Efficiency, Climate Strategy, and Environmental Reporting.4 The criterion weights and the maximum score of dimensions vary by industry. For example, the weight of the Operational Eco-efficiency criterion is 8 out of 39 for Electric Utilities companies but is 3 out of 13 for Banks. Access to S&P Global ESG data requires a subscription. Access is available through platforms such as S&P Capital IQ Pro, Marketplace Workbench, and S&P Global XpressAPI via API, cloud, desktop, and data feeds. Universities with subscriptions can access these data through the Capital IQ Pro platform.

Ratings from Thomson Reuters

Thomson Reuters ESG is the latest and updated version of the commonly used ASSET4 ESG database. More than 150 trained content research analysts analyze each organization's annual reports, websites, CSR reports, and additional information from news sources and NGO websites to generate over 450 ESG indicators, of which the most relevant and comparable 186 are used in the calculation of ESG scores. The number of indicators ranges from 70 to 170 depending on the organization's industry. The approach adopted by Thomson Reuters includes both environmental initiatives (e.g., does the company have a water efficiency policy) and outcomes (e.g., how much water does the company recycle?). These indicators are mechanically aggregated into three category scores for the Environment: Resource Use (energy, water, material usage, and effective supply chain management), Emissions (carbon and other pollutant emission during production and operational processes), and Innovation (innovative and environmental-friendly products, technologies, and processes). A percentile rank score is calculated for each category by comparing organizations to peers within their industry groups. Category scores are further differentially weighted using a materiality matrix. In other words, a category considered to have more impact on organizations (i.e., more material) from a certain industry is assigned a higher weight. ESG Scores can be obtained through several platforms (e.g., Refinitiv Datastream, Wharton Research Data Services [WRDS], and Refinitiv Eikon Platform).

Taken together, the CSRHub, S&P Global, and Thomson Reuters ratings cover three areas: Eco-Efficiency, Climate Strategy, and Environmental Reporting. Eco-efficiency refers to an organization's ability to produce goods and services with a reduced environmental impact while using fewer resources. This includes measures to reduce resource use, improve operational eco-efficiency, and foster innovation in processes that minimize waste and emissions. Climate Strategy is the approach an organization takes to manage and reduce its climate impact. This encompasses the strategic planning and actions taken to mitigate energy-related emissions, manage risks and opportunities associated with climate change, and contribute to the transition to a low-carbon economy. It includes systematic efforts to reduce greenhouse gas emissions, implement energy-efficient technologies, and develop policies that align with global climate objectives. Finally, Environmental Reporting is the practice of disclosing information about an organization's environmental performance and impact. It involves the collection, analysis, and communication of data related to environmental policy, resource management, and sustainability practices. This component reflects the transparency and accountability of an organization in sharing information about its environmental footprint, policy initiatives, and progress in sustainability with stakeholders and the public. Table 2 provides an overview of the third-party environmental sustainability ratings used in this research as they relate to each of these 3 components. Supplementary Tables S2a, b provide the descriptive statistics for environmental sustainability ratings for the samples used in this research; Supplementary Table S3 presents data availability by country (i.e., inverse of missingness).

Due to licensing agreements and subscription terms, we are unable to publicly share environmental sustainability ratings for the companies examined. These data are proprietary to the organizations supplying them and subject to licensing agreements that prohibit broad public redistribution. While research publications allow us to share findings and analysis derived from these data, we cannot share the datasets that would reproduce the providers' proprietary information. Researchers interested in replicating or extending this study may obtain access to the same data sources by contacting the respective data providers directly or through their institutional subscriptions (see note to Table 2 for more information). Each provider offers various access options for academic and research purposes, subject to their specific licensing terms and conditions.

Longevity

We operationalized longevity in two different ways, once using the present year and subtracting the establishment date (establishment longevity) and once using the incorporation date when applicable (incorporation longevity). The former indicates the age of the organization since its founding, whereas the latter indicates its age since its formal registration as a corporate entity. Longevity information was obtained from the S&P Capital database. Establishment dates indicate when an organization started operations, while incorporation dates mark its formal registration as a corporate entity. For both these variables, their distributions indicated a strong right skew (see Supplementary Figures S1–S8 and descriptive statistics presented in Supplementary Table S4), indicating there are more new companies than old. For Sample 1 (U.S. companies), the median company establishment and incorporation age were 85.5 (SD = 50.21), and 38.0 (SD = 34.62), respectively. For Sample 2 the median company establishment and incorporation ages were as follows: European companies 100.0 (SD = 73.37) and 32.0 (SD = 43.40); Middle Eastern and North African companies 48.0 (SD = 30.20) and 33.0 (SD = 21.94); Asian companies 46.0 (SD = 41.94) and 37.0 (SD = 30.39).

Control variables

We controlled for organizational total assets and number of employees in examining organizational environmental sustainability performance's relations with longevity. Controlling for total assets accounts for organizational financial capacity and size differences. It minimizes the influence of a company's resource availability, as larger and wealthier companies can be more likely to survive. Controlling for total assets provides a clearer assessment of organizational environmental sustainability and longevity, independent of financial scale. Information about total assets was obtained from the Compustat database.

Controlling for the number of employees addresses the influence of organizational workforce size, which can affect management practices and sustainability initiatives. By controlling for it, we aimed to account for variations in the ability to implement and manage environmental sustainability initiatives due to differences in sheer workforce size. This is distinct from the control afforded by financial assets described above. Information about workforce size was obtained from the Compustat database.

Analyses

To examine the relations between sustainability and longevity, we computed correlations between each of the environmental sustainability measures and company longevity after log transforming the longevity scores due to previously noted skew. We report relations with and without the controls described above.

While we report correlation results for clarity and accessibility, the findings we present (where total assets and number of employees are controlled for in the relations between organizational longevity and environmental sustainability) are derived from multivariate regression analyses. These regression models allowed us to control for potential confounding variables and isolate the unique relation between longevity and environmental sustainability performance. That is, partial correlations are a direct extension of regression analyses. They quantify the strength and direction of the relation between two variables (e.g., longevity and environmental sustainability) while statistically controlling for the influence of other variables (e.g., total assets and number of employees). Thus, the partial correlations we report are the standardized results from regression models, reflecting the relation between longevity and sustainability after accounting for the controlled factors. We chose to report these partial correlations for simplicity and to focus on the strength of the core relationship, but the underlying analyses were based on multivariate regression models.

To highlight the differences in environmental sustainability performance among the oldest and youngest companies, we also computed standardized mean differences.

Results

Relations between environmental sustainability performance and organizational longevity

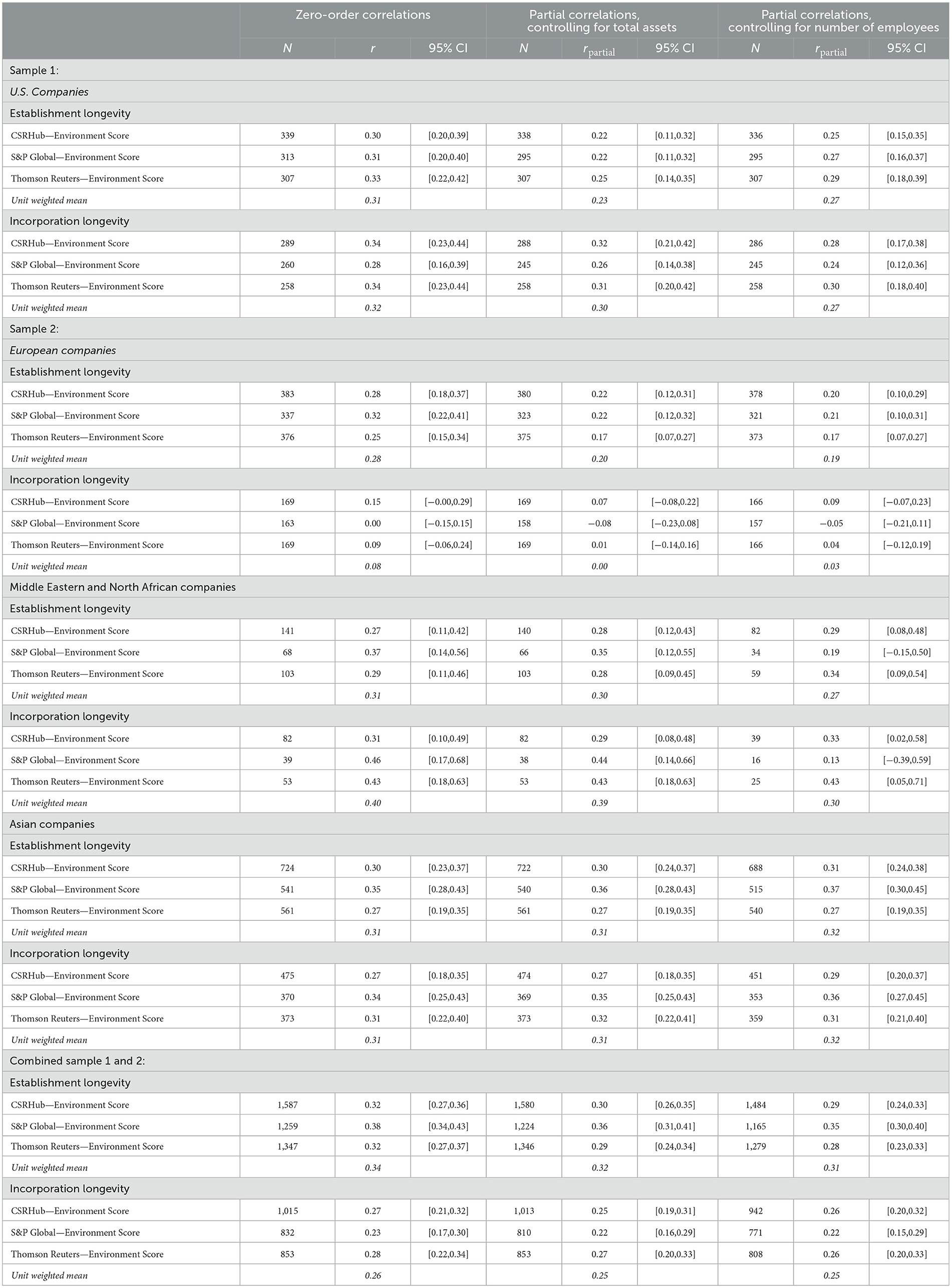

We hypothesized that older organizations (i.e., those with longer longevity) would have better environmental sustainability performance (Hypothesis 1 and 1a). Table 3 presents zero-order correlations for both establishment longevity and incorporation longevity, for U.S. companies (Sample 1) and for European, MENA, and Asian companies separately (Sample 2) (Research Question 1). Results combining all samples are also presented.

Across the board, findings provide strong, consistent support for the hypothesis that companies that have been around longer have better environmental sustainability scores. Among U.S. companies, establishment longevity correlated 0.30 to 0.33 (mean r = 0.31) with environmental sustainability scores provided by the three independent third-party sources. Controlling for total company assets and number of employees did not appreciably reduce the relations (mean r = 0.23 and 0.27, respectively). Relations with incorporation longevity were slightly stronger (mean r = 0.32). Controlling for total assets or number of employees negligibly reduced relations (mean correlations after controls were 0.30 and 0.27, respectively).

Among European companies, establishment longevity correlated 0.25 to 0.32 (mean r = 0.28) with environmental sustainability scores provided by the three independent third-party sources. Controlling for total company assets and number of employees moderately reduced the relations (mean r = 0.20 and 0.19, respectively). Relations with incorporation longevity were notably weaker (mean r = 0.08). Controlling for total assets or number of employees further reduced these already weak relations (mean correlations after controls were 0.00 and 0.03, respectively).

Among MENA companies, establishment longevity correlated 0.27 to 0.37 (mean r = 0.31) with environmental sustainability scores. These relations remained consistent when controlling for total company assets and number of employees (mean r = 0.30 and 0.27, respectively). Relations with incorporation longevity were stronger (mean r = 0.40). Controlling for total assets had minimal impact (mean r = 0.39), while controlling for number of employees moderately reduced the strength of the association (mean r = 0.30).

Among Asian companies, establishment longevity correlated 0.27 to 0.35 (mean r = 0.31) with environmental sustainability scores. These relations remained remarkably stable when controlling for total company assets and number of employees (mean r = 0.31 and 0.32, respectively). Relations with incorporation longevity were virtually identical (mean r = 0.31) and showed the same stability when controlling for organizational size (mean correlations after controls were 0.31 and 0.32, respectively).

Overall, establishment longevity showed remarkably consistent relations with environmental sustainability across all four regions examined. U.S. companies (mean r = 0.31), MENA companies (mean r = 0.31), and Asian companies (mean r = 0.31) demonstrated identical correlation strengths, while European companies showed a slightly weaker but still comparable relation (mean r = 0.28). When controlling for organizational size, Asian companies maintained the most stable relations (mean partial r = 0.31 to 0.32), MENA companies showed minimal attenuation (mean partial r = 0.27 to 0.30), U.S. companies experienced modest reduction (mean partial r = 0.23 to 0.27), and European companies demonstrated the greatest weakening (mean partial r = 0.19 to 0.20). Despite these minor variations in how the relations responded to control variables, no major inconsistencies were observed in the establishment longevity-sustainability relations across regions, suggesting this association represents a generalizable phenomenon.

The relation between incorporation longevity and environmental sustainability varied substantially across regions. MENA companies showed the strongest correlation (mean r = 0.40), followed by U.S. companies (mean r = 0.32) and Asian companies (mean r = 0.31), while European companies exhibited an especially weak relation (mean r = 0.08). When controlling for organizational size, these regional differences persisted: MENA companies maintained robust associations (mean partial r = 0.30 to 0.39), U.S. and Asian companies showed minimal attenuation (mean partial r = 0.27 to 0.30 and 0.31 to 0.32, respectively), while European companies' already weak correlations virtually disappeared (mean partial r = 0.00 to 0.03). This pattern represents a major inconsistency in the incorporation longevity-sustainability relation across regions, with European companies as a clear outlier. However, we note this disparity may be attributable to the limited availability of incorporation data for European firms. Only about 44% of European companies had available incorporation dates, compared to about 85% of U.S. companies, 58% of MENA companies, and 66% of Asian companies. This pattern likely indicates that in European countries, a greater proportion of the largest companies are privately held. Thus, among European companies, relations with incorporation longevity could be weaker because the absence of some privately held companies from the sample (a) reduces the overall representativeness and (b) creates range restriction in longevity scores. A comparison of standard deviations of incorporation to establishment longevity among U.S. and European companies indicated range restriction ratios (u values) of 0.69 and 0.59, respectively, suggesting greater range restriction in incorporation longevity among European companies. Comparative range restriction values for MENA and Asia were 0.73 and 0.72, respectively.

Pooling Samples 1 and 2, we find that the relations for organizational longevity, both when considered from the time of establishment as well as incorporation, are sizable and robust (mean r = 0.34 and 0.26, respectively), and controlling for either organizational wealth or workforce size does not meaningfully diminish these relations.

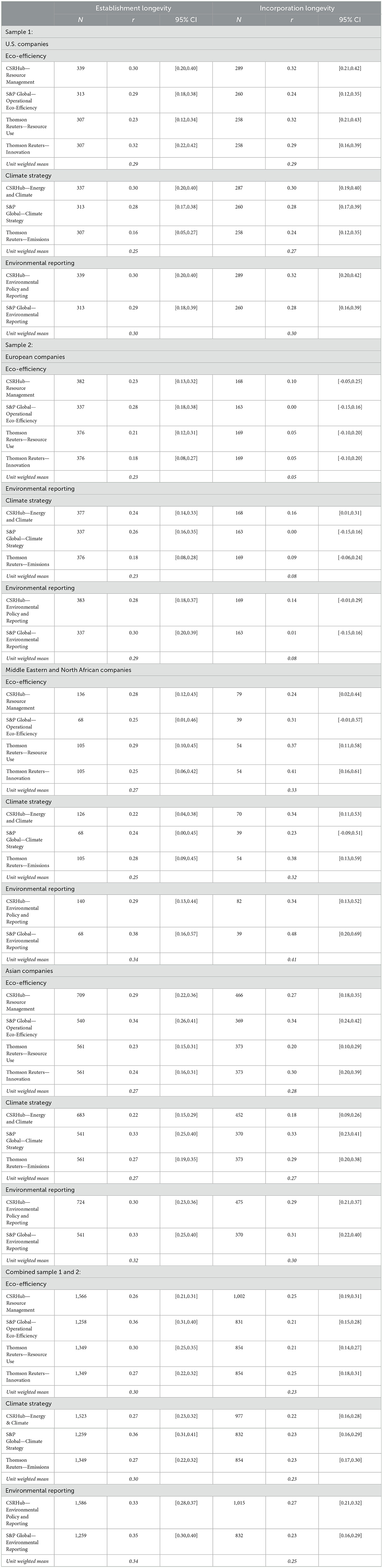

Relations with environmental sustainability performance components

We next examined whether environmental sustainability components related differentially to organizational longevity (Research Question 2). Results are presented in Table 4, and intercorrelations among environmental sustainability performance components and control variables are presented in Supplementary Tables S5a–d.

Eco-efficiency involves responsible resource use, eco-friendly operations, and using innovation to minimize environmental impact. Among U.S. companies, the mean relations with longevity were 0.29 for both establishment and incorporation longevity. Relations were somewhat larger for resource management and resource use for incorporation longevity (r = 0.32 for both), but not for establishment longevity, which displayed a weaker relation with resource use (r = 0.23). Relations with innovation were similarly potent for both establishment and incorporation longevity (r = 0.32 and 0.29, respectively) whereas relations were similar but somewhat weaker for operational eco-efficiency (r = 0.29 and 0.24, respectively).

Among European companies, eco-efficiency showed modest correlations with establishment longevity (mean r = 0.23) but notably weak relations with incorporation longevity (mean r = 0.05), due to the sample censoring and range restriction previously mentioned. For MENA companies, eco-efficiency demonstrated moderate correlations with establishment longevity (mean r = 0.27) and somewhat stronger relations with incorporation longevity (mean r = 0.33), with innovation showing the strongest incorporation longevity relation (r = 0.41). Asian companies exhibited consistent relations across both metrics, with eco-efficiency showing similar correlations for establishment longevity (mean r = 0.27) and incorporation longevity (mean r = 0.28), with operational eco-efficiency displaying the strongest relations (r = 0.34) for both longevity measures.

Climate strategy involves an organization's systematic approach to managing energy use, reducing emissions, and implementing policies that address climate risks, aiming to support the shift toward a low-carbon economy. Among U.S. companies, the Energy and Climate score from CSRHub had the highest correlation with both types of longevity (r = 0.30 for both), while Emissions had the weakest relationships (r = 0.16 for establishment, 0.24 for incorporation). Some regional differences emerged when examining climate strategy components. European companies showed moderate correlations with establishment longevity (mean r = 0.23), with similar patterns for MENA (mean r = 0.25) and Asian companies (mean r = 0.27). Notably, Climate Strategy scores correlated slightly more strongly with longevity in Asian companies (r = 0.33) than in U.S. firms (r = 0.28), while Emissions showed distinctly stronger relations in both MENA (r = 0.28) and Asian companies (r = 0.27) compared with U.S. companies (r = 0.16). For incorporation longevity, the pattern varied dramatically across regions: European relations were weak (mean r = 0.08)5, MENA companies showed robust correlations (mean r = 0.32) with notably strong Emissions relations (r = 0.38), and Asian companies had moderate associations (mean r = 0.27).

Environmental reporting involves transparently disclosing an organization's environmental policy, performance, and sustainability efforts, as well as highlighting its commitment to accountability in environmental sustainability and communicating its environmental impact. Relations with longevity were positive and sizable for U.S. companies (mean r = 0.30 for establishment and incorporation longevity). MENA companies demonstrated somewhat stronger relations (mean r = 0.34 for establishment and 0.41 for incorporation longevity) than Asian companies (mean r = 0.32 and 0.30). European companies showed comparable establishment longevity correlations (mean r = 0.29) but significantly weaker incorporation longevity relations (mean r = 0.08), reflecting the previously discussed sample censoring limitations.

Pooling data from Samples 1 and 2, the findings underscore that more mature organizations tend to exhibit better resource use, resource management, and innovation for sustainability. They are strong in embedding eco-efficiency into their operations. They have better energy, emission, and climate strategies as well. They also have superior environmental policy and reporting. Relations with these variables were reliably in the 0.25 to 0.35 range despite our reliance on three different third-party ratings of organizational environmental sustainability performance.

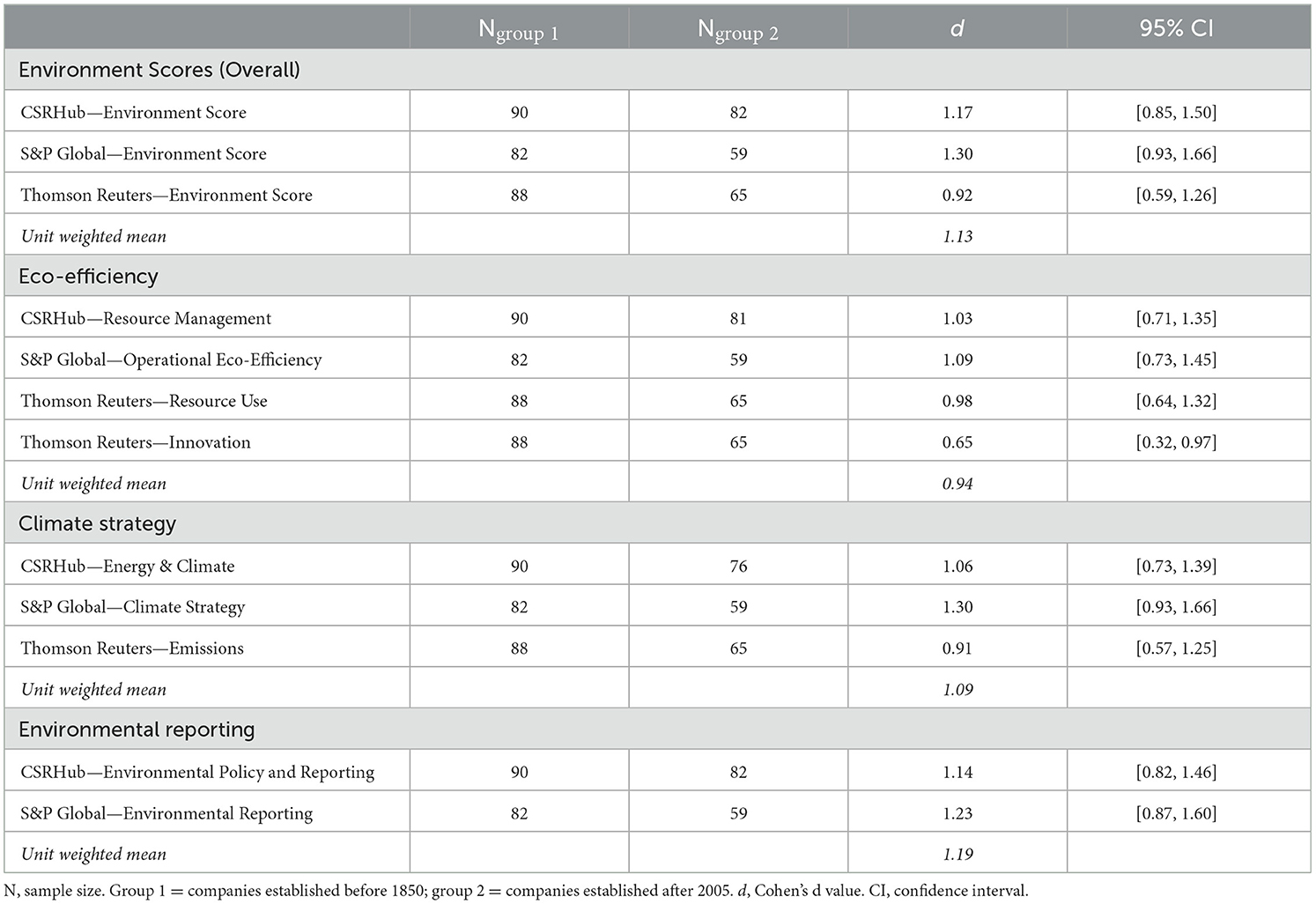

Contrasting oldest and youngest organizations

There are pervasive positive relations between environmental sustainability performance and longevity of organizations. To obtain a richer understanding of how the longest surviving organizations perform in the environmental sustainability area, we contrasted their performance with the youngest organizations. Hypothesis 1b stated that “the difference in environmental sustainability performance will be particularly large when comparing the oldest and youngest organizations.” In our samples, we identified 90 companies which were established before 1850. We then identified relatively younger companies which had been established after 2005 (N = 82). We contrasted environmental sustainability scores of these two groups of companies using standardized mean differences (Cohen's d). The results are presented in Table 5. Overall, the oldest companies scored one standard deviation or more higher in terms of their environmental sustainability performance (mean across indicators = 1.13). There were slight variations in the magnitudes of the differences, with the largest average difference found for Environmental Reporting (mean d = 1.19). Interestingly, the difference between oldest and youngest companies for the innovation facet of Eco-Efficiency also favored older companies (d = 0.65).6

Table 5. Mean differences in environmental sustainability performance between oldest and youngest companies.

Discussion

This study addressed a glaring gap in the scholarship on environmental sustainability of organizations, examining whether organizational longevity is connected to environmental sustainability performance. Although research has linked environmental sustainability of organizations to various external variables and outcomes such as financial performance, consumer and employee perceptions, and organizational strategy and practices, scholarship on environmental sustainability has failed to examine relations with organizational longevity. Based on samples of the world's largest and most impactful organizations from the U.S., Europe, MENA, and Asia, it is clear that the two are quite strongly linked, providing support for Hypothesis 1: Organizational longevity is positively related to environmental sustainability performance. Empirical evidence also supported Hypothesis 1a: Organizations with greater longevity exhibited significantly higher environmental sustainability performance compared with those with shorter longevity, as well as Hypothesis 1b: Most differences in environmental sustainability performance were very large (> 1.0 SD units) when comparing the oldest and youngest organizations.

A significant strength of our research is the replicability of findings across different third-party environmental sustainability performance assessments, demonstrating that the established effects are not dependent on a specific method of measuring organizational environmental sustainability performance.

Findings for establishment and incorporation longevity measures differed across regions. Incorporation dates were missing for a substantial proportion of European companies (56%), compared with only about 15% of U.S. companies, 42% of MENA companies, and 34% of Asian companies, necessitating caution in cross-regional comparisons using this measure. Establishment dates, which are more closely tied to our conceptual underpinnings (described in the introduction), provided more consistent data coverage and revealed remarkably similar relations with environmental sustainability across U.S., MENA, and Asian companies (all mean rs = 0.31), with slightly weaker but still substantial correlations for European firms (mean r = 0.28). These consistent relations across regions with diverse regulatory environments, cultural contexts, and market forces suggest that organizational longevity may be a universal, generalizable correlate of environmental sustainability of organizations. However, regional variations emerged in specific sustainability components, with MENA companies showing particularly strong relations between longevity and environmental reporting practices.

Regions differ in the diversity of their regulatory environments, cultural dimensions, and market and economic forces. The consistency of establishment longevity correlations across these diverse contexts suggests that the relation between organizational longevity and environmental sustainability transcends regional differences in such external pressures, though the specific manifestations of these relations vary by sustainability component. For example, MENA and Asian companies showed stronger relations in emissions management and climate strategy than their U.S. counterparts.

Future research should aim to disentangle the impacts of these external variables on these specific facets of environmental sustainability and their relations with organizational longevity. The sampling design of such research should systematically represent a diverse range of economic systems, national development levels and indicators, cultural dimensions, and regulatory factors to accurately model their respective impacts. We especially recognize the importance of exploring how economic and political systems shape specific approaches to environmental sustainability. However, empirically documenting these presents a challenge. Our dataset included companies spanning a wide range of economic and political contexts as well as centuries of organizational history. Over these time periods, the political and economic systems of many countries have undergone significant changes, sometimes abruptly (e.g., regime changes or wars) and other times gradually (e.g., shifts in economic policies or globalization). Capturing these shifts in a way that aligns with the lifespan of each organization is a complex endeavor that requires detailed, longitudinal data on historical political and economic systems, along with expertise from multiple disciplines, including economics, political science, and history. In addition, such analysis is further complicated by the entanglement of political and economic systems, as well as country contexts that are hard to classify into neat categories.7 We encourage future work in this area and believe it would benefit from interdisciplinary collaboration among management scholars, economists, political scientists, and historians. Such research could offer a more comprehensive understanding of how macro-level forces influence the sustainability practices of organizations over time.

Organizational wealth and workforce size do not appear to appreciably affect environmental sustainability-longevity relations, as we found that controlling for organizational total assets or number of employees largely did not diminish these relations. This finding is noteworthy because a reasonable expectation would have been that current financial and human resources would positively influence the environmental sustainability performance-longevity link through the allocation of slack resources for environmental sustainability initiatives.

When examining relations for components of organizational environmental sustainability, eco-efficiency, climate strategy, and environmental reporting showed regionally varying relations with longevity. U.S. firms exhibited moderate eco-efficiency-longevity links, with resource management and use strongly tied to incorporation longevity. MENA firms displayed stronger eco-efficiency and climate strategy ties to longevity, especially for emissions and innovation. Asian firms showed stable eco-efficiency-longevity links, with operational eco-efficiency as the strongest component. Environmental reporting consistently related to longevity across regions, with MENA firms showing the strongest incorporation longevity ties, while European firms had notably weaker relations. These patterns reflect institutional and regulatory differences shaping environmental sustainability's role in organizational longevity.

Our examination of environmental sustainability performance differences between the oldest and youngest organizations were revealing: the oldest, longest-surviving organizations outperform younger companies by a substantial margin in environmental sustainability, with the most pronounced differences in areas such as environmental reporting. This suggests that these organizations may have developed more comprehensive sustainability supporting structures and even practices, possibly due to their accumulated knowledge, experience, and established governance structures over time. Future research could use natural experiments, longitudinal studies, or comparative case studies to better determine which factors, such as accumulated knowledge or governance structures, are most influential.

The significant and very large difference between oldest and youngest organizations in environmental reporting (d = 1.19) highlights the importance of transparency and accountability, which may be more deeply ingrained in the oldest firms that would have faced the most public scrutiny. In contrast, the relatively smaller difference in innovation-related eco-efficiency (d = 0.65) suggests that while the oldest organizations are strong in adopting established sustainability structures and practices, they may not lead with a comparable margin in pioneering innovative environmental solutions. This finding indicates that the youngest firms may have agility advantages or may be more willing to experiment with cutting-edge eco-innovations, while the oldest companies are stronger in traditional aspects of sustainability. These results identify areas of weakness in environmental sustainability performance for firms at different life stages, pointing to where interventions and efforts may contribute the most to their organizational environmental sustainability performance.

Contributions and implications

Our research hypothesized a positive relation between organizational longevity and environmental sustainability performance, with specific expectations that this effect would be particularly pronounced when comparing oldest and youngest organizations. The data strongly supported these hypotheses, confirming that older organizations demonstrate superior environmental sustainability performance across global contexts. Our findings showed that the longevity-sustainability relation is remarkably consistent across diverse regions while revealing variations in specific sustainability facets.

Our study highlights a positive association between organizational longevity and environmental sustainability performance, and we recognize the likely bidirectional nature of this relation, as discussed in the introduction section. Older organizations may have had more opportunities to adapt and hone their strategies, know-how, and practices to support ecosystem preservation and environmental sustainability. We also suggest that strong environmental sustainability performance can contribute to long-term organizational survival.

In practice, for older organizations, longevity is a strategic asset. They can harness their accumulated experience, institutional knowledge, and resource networks to lead sustainability initiatives. Even though we document a positive association between longevity and sustainability, this does not mean that all older organizations fully draw on this strategic asset. By highlighting and further capitalizing on their long-term resilience and commitment to sustainability, older/mature organizations can strengthen their reputations and gain competitive advantages in markets increasingly driven by ESG considerations. Our recommendation to older organizations is to better utilize their strategic asset and maintain their adaptability by integrating dynamic capabilities that continue to align with sustainability demands.

Younger organizations can draw valuable lessons from the practices of long-lived companies that have successfully adapted. By embedding sustainability into their core strategies early on, younger firms can position themselves for both immediate relevance and long-term survival. This includes the realization (learned from observing older organizations) that investment into sustainability yields a long-term return (in terms of economic success and longevity). For them, a key take away is that early investments in sustainability can not only fulfill some common regulatory and contemporary societal expectations but also build a foundation for longevity.

Policymakers can use these findings to develop targeted interventions that encourage sustainability across organizational lifecycles. For instance, incentives for younger firms to incorporate sustainability from the outset should be considered. Older firms should be supported to capture and make accessible their best sustainability system contributors. Along these lines, policy frameworks can support both the agility of younger organizations and the transformational capacity of older firms for environmental sustainability.

For stakeholders, a practical implication from the present findings is that environmental sustainability can be viewed as a signal of longevity. Investors, consumers, and other stakeholders may wish to interpret strong sustainability performance as one indicator of organizational adaptability and long-term viability. This creates an incentive for organizations to prioritize sustainability, not just as a moral imperative but as a strategic advantage. Investing in environmental sustainability is a signal of commitment to long-term goals, which align with stakeholder preferences and drives organizational success.

Ultimately, these findings close the loop between longevity and sustainability: sustainability and longevity are part of a reinforcing cycle. Longevity provides the experience and resources to adapt and implement sustainability practices, while sustainability initiatives enhance resilience, stakeholder support, and legitimacy, contributing to longevity. This dual perspective highlights that sustainability is both a byproduct of enduring success and a driver of future survival.

Micro insights and implications: human resources' role in sustained environmental performance

The consistent positive relation between organizational age and environmental sustainability across different regions and domains suggests that fundamental organizational processes are at work. These findings align with research on organizational learning, adaptation, and capability development over time. As organizations age, they develop internal structures, processes, and cultural elements that enable more effective environmental performance. This evolutionary advantage helps explain why longevity correlates with superior sustainability outcomes regardless of geographical context. The longevity-environmental sustainability relation is inherently linked to the role of HR practices and employee behaviors. Specifically, we highlight that older organizations, due to their extended operational timelines, have the advantage of embedding environmental priorities into their HR systems, leading to sustained environmental performance.

Organizations with long operational histories are likely to have human resources and HR practices that support their environmental sustainability performance over time. While explicitly “Green HRM” practices are a recent development, in their meta-analysis of 46 samples, Paillé (2024) found that the integration of HR practices that were aligned with environmental values correlated strongly with environmental sustainability performance (rc = 0.75). Older organizations have the advantage of time to incorporate environmentally supportive policies into their HR practices, which can gradually enhance their environmental sustainability performance.

The role of employee green behavior (EGB) in promoting organizational environmental sustainability is also supported by data (Ones and Dilchert, 2012, 2013; Ones et al., 2018). Katz et al. (2022), in a meta-analysis of 23 samples, found a positive correlation (rc = 0.40) between Green HRM practices and EGB. HR practices encouraging environmentally conscious employee behaviors can aggregate into meaningful environmental sustainability at the organizational level. Although these findings focus on individual behaviors, they imply that over years of consistent practice, employee actions can accumulate to elevate environmental performance and yield organizational environmental sustainability benefits (see also Norton et al., 2015).

Organizations with established histories, even before “Green HRM” was a formal concept, have benefited from embedding adaptive and sustainability-oriented values through traditional HR practices. For older firms, these longstanding HR frameworks can now incorporate explicit Green HRM practices, helping them respond effectively to changing environmental pressures (Paillé et al., 2023). Chaudhary (2020) further supports the role of Green HRM in fostering employee green behaviors, demonstrating its impact on both task-related and voluntary environmental performance. Findings suggest that organizational identification mediates this relation, reinforcing the importance of embedding sustainability dimensions into HR systems. By evolving their HR practices over decades, organizations improve individual employee behaviors and reach environmental sustainability goals. Longstanding cultures of environmental responsibility lead to better environmental sustainability performance (Amel et al., 2017). Employee behaviors, HR practices, and co-created eco-responsible cultures all likely play important roles in explaining why older organizations excel in environmental sustainability.

Macro insights and implications: an evolutionary lens on environmental sustainability of organizations

Social scientists have long tried to provide a rational explanation for why organizations should engage in activities which make contributions to environmental sustainability. Efforts to encourage greater environmental responsibility have ranged from highlighting potential financial returns to emphasizing prosocial and altruistic motivations. This research provides an entirely different rationale: survival of the greenest.

Organizational longevity and environmental sustainability relations have not been previously studied. By presenting empirical investigations of this relation and for different environmental sustainability facets across multiple regions, this research fills an important gap and substantiates an evolutionary lens on environmental sustainability of organizations.

As espoused by Population Ecology Theory (see Salimath and Jones, 2011), the external environment shapes organizational survival. Specifically, selection processes favor organizations that best fit their environmental conditions—selection and retention processes enhancing adaptability determine which organizations persist. These adaptations are based on organizations' abilities to effectively use their financial and human capital given their environment. Specifically, their ability to acquire and manage critical resources, adjusting their structures and practices in response to resource scarcity and power dynamics, is crucial for their ability to survive and thrive (see Resource Dependence Theory, cf. Hillman et al., 2009). Organizations also learn over time to integrate, build, and reconfigure internal and external resources in response to changing natural, institutional, and social environments (see Dynamic Capabilities Theory, cf. Bleady et al., 2018). Therefore, organizational evolution is also influenced by the need to conform to social expectations, norms, and regulations. In this regard, organizations evolve by adopting practices and structures that are perceived as legitimate (see Institutional Theory, cf. Scott, 2005). All these evolutionary pressures collectively result in variation among organizations and ultimately drive their survival.

Organizational longevity and environmental sustainability performance are also shaped by this continuous process. Survival is not a pure matter of chance; it favors organizations that effectively adjust to changing conditions. Long-lived companies excel at securing and managing resources, refining strategies, and adjusting structures to meet challenges such as resource scarcity, economic fluctuations, and societal demands. By continuously evolving, they develop the capacity to leverage their financial and human capital for sustainability. Adaptation goes beyond immediate response; it involves building dynamic capabilities, including knowledge and skills that enable organizations to reconfigure resources and innovate proactively. Evolutionary pressures such as adapting to external selection forces, managing critical resources, learning to innovate, and conforming to social norms, interact to shape the relationship between organizational longevity and environmental sustainability. Long-lived organizations are not simply those that have survived the longest; they are those that have continually adapted to a complex mix of environmental, economic, and societal pressures, leading to better environmental sustainability performance. For companies that have endured through the centuries, sustainability practices likely emerged from accumulated experience and higher internal environmental sustainability priorities, rather than direct societal or legal pressure. That is, these organizations' long histories of navigating complex challenges have ingrained adaptability and resourcefulness into their strategies and operations, enabling them to enhance their environmental performance over time. These companies are likely to have developed strategies, know-how, and practices that align with long-term environmental and societal needs, as these practices contribute to resilience and adaptability. This perspective draws from evolutionary principles, emphasizing that survival depends on effectively adapting to environmental conditions, including the natural environment. Firms that have endured over decades or centuries may have prioritized strategies that balance profitability with environmental stewardship, ensuring their actions support broader ecological concerns.

In the final analysis, re-visiting Stanek and Ones' Cybernetic Trait Complexes Theory (CTCT; 2023) as described in the introduction and applied to organizations, adaptive organizations that endure over time do so by continually balancing two goals: stability and change. This ongoing dual goal management leads to the formation of complex clusters of organizational capabilities and characteristics that confer adaptability. When survival is the goal, serving the wellbeing of all stakeholders (including investors, employees, customers, suppliers, communities, societies, the natural environment, and future generations) is beneficial. It is not the largest or most resource-rich organizations that endure, but those whose practices best respond to this sustainability demand.

Data availability statement

Publicly available datasets were analyzed in this study. Each variable was curated from the sources listed in the methods section from the organizations listed.

Author contributions

DH: Conceptualization, Data curation, Investigation, Methodology, Resources, Validation, Writing – original draft, Writing – review & editing. YW: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Project administration, Software, Validation, Visualization, Writing – original draft, Writing – review & editing. DO: Conceptualization, Investigation, Methodology, Project administration, Resources, Supervision, Writing – original draft, Writing – review & editing. SD: Conceptualization, Investigation, Project administration, Resources, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. YY: Data curation, Investigation, Project administration, Resources, Writing – original draft. KK: Data curation, Resources, Writing – review & editing.

Funding