- Department of Public Administration and Management, University of the Free State, Bloemfontein, South Africa

Background: Corporate governance has become an increasingly important area of inquiry in recent years, as organisations worldwide strive to establish effective governance structures and processes that foster long-term prosperity.

Purpose: This review aimed to explore the implementation of corporate governance in state-owned enterprises (SOEs).

Methods: The article adopted a qualitative research methodology, employing a scoping review approach. This involved systematically searching relevant databases, screening studies, extracting data, and performing analyses.

Results: The search revealed that the effective implementation of corporate governance is attainable and can enhance the performance of state-owned enterprises (SOEs) and minimise their financial dependency. However, despite the potential benefits of effective implementation of corporate governance in SOEs, the study highlighted the challenges associated with its implementation. These challenges include the exclusion of investors from the governance framework, the regular oversight of policies and procedures for internal control, the lack of political will, and the absence of effective monitoring and enforcement mechanisms. Therefore, the study suggested that policymakers should provide a clear SOE purpose, improve SOE governance regulations, and enhance financing capacity.

1 Introduction

SOEs play a crucial role in fostering economic development (Zhou, 2023). The persistent service delivery deficiencies, coupled with an absence of economic transformation aimed at promoting prosperity, have been noted among Namibian SOEs. These observations seem to stem from inadequate service provision, resource misappropriation, maladministration, and pervasive cultural deceitfulness (Haimbili, 2018; Hoban et al., 2020; Pfanelo and Chinomona, 2024). Corporate governance has become a critical area of research, particularly for SOEs, due to its potential to enhance their performance and long-term sustainability (Trullen et al., 2020a,b,c). Despite an increasing body of literature, studies have revealed that much of the existing research is insufficient, fragmented, and deficient in certain aspects. A notable gap exists in the literature regarding the implementation strategies explicitly tailored for SOEs contexts. While prior research has underscored the benefits of corporate governance frameworks (Trullen et al., 2020a,b,c), these benefits often fall short in addressing the unique enabling factors necessary to navigate individual challenges faced by several SOEs. The hindrances to corporate governance implementation extend but are not limited to political interference, lack of transparency, and accountability issues. These challenges can hinder the effectiveness of corporate governance practices (Zhou, 2019). Particularly, barriers are not universally applicable, and a one-size-fits-all approach to corporate governance does not adequately address the nuances of SOEs (Genin A. L. et al., 2021; Genin J. J. et al., 2021). Therefore, the prevailing literature’s fragmented approach often results in ambiguous guidance for policymakers and practitioners determined to achieve effective corporate governance in these SOEs. The study implications are multi-dimensional. Policymakers (politicians), regulators (boards), and implementers (management) can gain a comprehensive understanding of governance frameworks, rooted in a theoretically sound and grounded practical dimension. The review aims to foster informed decision-making that can potentially lead to improved governance processes and outcomes. Effective corporate governance is not only critical for SOEs’ sustainability and long-term success, but it also empowers SOEs to operate efficiently and contribute to the economic stability and growth of a country like Namibia (Trullen et al., 2020a,b,c). Therefore, the review sought to provide a comprehensive perspective to unlock SOEs’ full potential and to inform future research and practices.

2 Theoretical perspective on state-owned enterprises

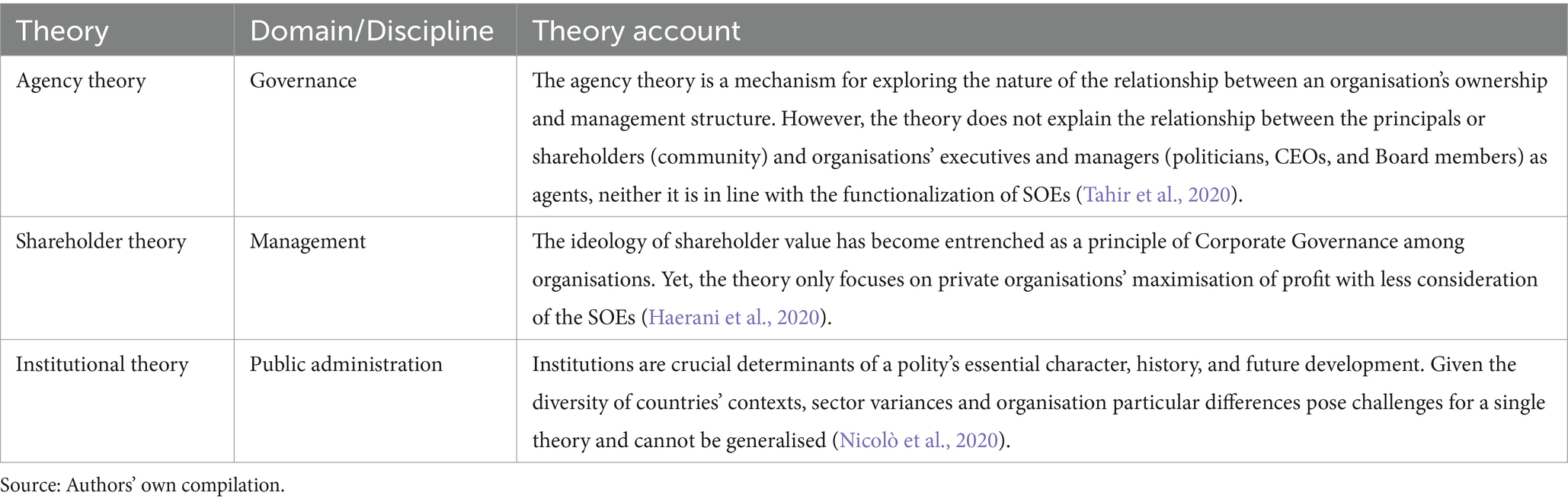

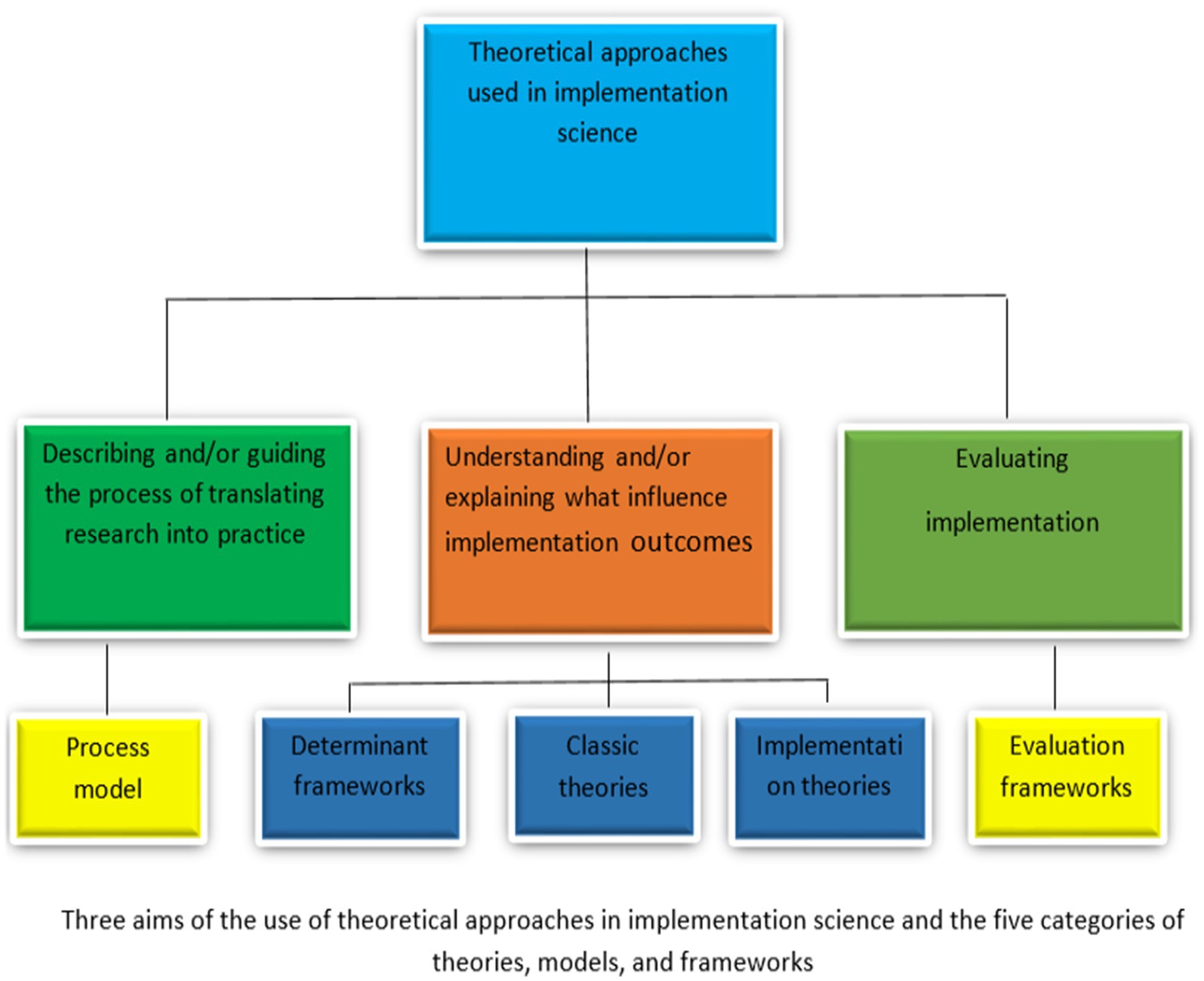

The research borrows a taxonomy conceptual framework developed by Nilsen in 2015 as a theoretical framework for enabling the implementation of evidence-based practice. This framework is based on the Promoting Action on Research Implementation Strategies in Health Services (PARIHS) framework, a theoretical model used to explore factors that contribute to successful implementation in the healthcare sector (Moullin et al., 2019). Nilsen’s framework (Nilsen, 2015), breaks down implementation determinants into three crucial areas. The first is evidence, which considers the quality, strength, and relevance of research guiding the implementation (Kitson et al., 2008). The second area, context, focuses on the surrounding environment, including political, cultural, and economic factors that can impact implementation success (Joshi and Wong, 2023). Finally, facilitation views the processes and strategies used to support and guide the implementation of evidence-based practices (Nilsen, 2015). See Figure 1, which explains Nilsen’s (2015) taxonomy.

Figure 1. Nilsen’s taxonomy. Source: Nilsen (2015, p. 4).

By adopting this conceptual framework, the authors identify the pillars that influence the implementation of corporate governance in SOEs, the central focus of this review. This approach allows a comprehensive understanding of what influences implementation outcomes and permits the classification of their findings according to the three broad categories. Adopting Nilsen’s taxonomy, the research is classified under the determinant frameworks, which analyse factors influencing the implementation process. The research highlighted the potential pillars, benefits and challenges associated with implementing corporate governance in SOEs and providing an extensive overview of these endeavours. The research aligns with Nilsen’s taxonomy by establishing the evidence base for governance implementation, which corresponds to the evidence-determinant framework. The research underscored the contextual factors, including the political and economic aspects of relevant implementation, which align with context-determinant frameworks. Therefore, the research identifies critical influences on the process, such as the lack of political will and effective monitoring and enforcement mechanisms, contributing to a deeper explanation of the factors that may impact corporate governance.

Baron (2023) suggests that boards that are more involved and possess various skill sets contribute positively to effective governance. Though in many instances, boards may lack the essential independence to implement effective governance practices, which further complicates the corporate governance landscape. The convergence of these perceptions forms a comprehensive narrative of the factors as determinants (enablers and hindrances) that affect corporate governance implementation in SOEs. A habitual theme emphasised in Nilsen’s taxonomy cannot be overstated, as it directly stimulates the operationalisation of governance frameworks. Future investigations in this domain could further examine the distinctions of these relationships, predominantly in emerging economies, to build a more vigorous evidence base for effective governance in SOEs.

2.1 Stage 1: identifying the research objective

Building on the findings of the scoping review, this research review aims to achieve the following objectives:

2.1.1 Identify and analyse the specific pillars that influence the successful implementation of corporate governance in SOEs

This will involve a deeper exploration of the factors identified in the scoping review (e.g., investor inclusion, internal controls, political will, monitoring mechanisms) and potentially uncovering new ones.

To emphasise the multifaceted approach required for effective corporate governance in SOEs. The integration of these pillars is critical for fostering robust governance structures that can adapt to the dynamic demands of public service and shareholder expectations.

2.1.2 Identify potential challenges and propose solutions for overcoming them

The research can delve deeper into the challenges identified in the scoping review (e.g., political interference, lack of enforcement) and suggest practical solutions or mitigation strategies.

These objectives aim to expand the existing knowledge base by providing a more nuanced understanding of corporate governance implementation in SOEs and enhancing the efficiency and effectiveness of public administration and management. The research outcomes can offer valuable insights for policymakers, SOE management teams, and researchers in the field.

2.2 Stage 2: identifying the review rationale

The role of SOEs in national economies cannot be overstated. These SOEs often operate in sectors critical to national development, such as energy, transportation, and telecommunications. As such, they are expected to act as responsible corporate citizens, operating efficiently and effectively, and being accountable to their stakeholders (Olivieri et al., 2022). Corporate governance is crucial in ensuring that SOEs meet these expectations. However, despite the importance of corporate governance in the context of SOEs, a lack of research has explored what influences its implementation outcome. Numerous studies have explored the challenges and governance frameworks of SOEs, underscoring several corporate governance issues.

The research charted several literatures, including but not limited to that of the Indonesian SOEs with exclusive governance complexity formed by the principles of economic, statutory and administrative dynamics. Trihatmoko and Susilo (2023) explored these dynamics through the lens of institutional governance, highlighting how the supervisory framework and government oversight affect SOEs performance. The study accentuates the pressure between civic order and SOEs competence, providing crucial insight into Indonesia’s distinct governance scenery. The perception of Trihatmoko and Susilo (2024) meant to consolidate the analysis through strategic resource governance management employing “Indonesia Roya Incorporated.” The perspective exemplifies a unique view and comparative perception of that context, offering insights that diverge from the global West African setting. The study of Trihatmoko and Susilo (2023) emphasises operational governance setbacks, while their study in 2024 gives a shift discourse of broader economic stewardship. This distinction further underscores the unique governance challenges and strategies in SOEs globally and set the stage for examining explicit distinctions presented in this review.

The existing knowledge gap is challenging since it hinders the development of best practices that can enhance SOEs to operate more efficiently, effectively, and accountably. This is particularly important given that, in many cases, SOEs are major employers and key drivers of national economic activities (Meijón, 2019). This research presents an extensive review of existing literature to bridge these gaps in research by systematically exploring the enabling conditions and specific obstacles faced by SOEs in the Namibia, and thereby providing novel insights to the existing body of knowledge and to guide further research. The review found that there was a limited understanding of the unique challenges associated with implementing effective corporate governance in SOEs, particularly in emerging economies (Munteanu I. et al., 2020; Munteanu A. V. et al., 2020). The review provides a framework for future research to develop a better understanding of the challenges and opportunities associated with implementing effective corporate governance in SOEs. Through this, practitioners can better understand the potential benefits that may accrue from best practices. These benefits include improved operational efficiency, increased accountability, and better alignment with the national development agenda. Ultimately, the implementation of effective corporate governance in SOEs can contribute to the achievement of sustainable economic growth and development.

2.3 Stage 3: review strategies

The literature search was conducted using several databases, including PubMed, Scopus, Web of Science, and Google Scholar. The search strategy involved the use of various keywords, such as corporate governance, state-owned enterprises, implementation, challenges, potential, management, and board (Greenhalgh et al., 2016). The search was restricted to articles published in English and peer-reviewed journals. Furthermore, the reference lists of the retrieved articles were examined to identify additional relevant studies. The search was conducted from 2019 to 2024, and 45 articles were selected for inclusion in the review. The rationale for conducting the literature search solely between 2019 and 2024 was motivated by this timeframe, which aligns with current developments in corporate governance and SOEs, warranting that the research echoes the latest trends and challenges. The important worldwide events, including the COVID-19 pandemic and variations in regulatory policies, have reshaped corporate governance practices over the recent past, making current studies particularly pertinent. Thus, concentrating on literature from this period permits the inclusion of state-of-the-art study methodologies and advanced theoretical frameworks that older research may lack. The review prioritised high-quality, peer-reviewed journals, upholding the credibility, comprehensiveness of the literature and relevance of the findings.

2.4 Stage 4: data extraction

The review primarily focused on extracting key information from each selected study. This information included study design (Yin, 2018), sample size (Polit and Beck, 2017), and other relevant details about corporate governance implementation in SOEs.

Following a comprehensive literature review (Tranfield et al., 2003), the authors selected a sample size of 25 studies for their analysis, from the initial 45 identified for inclusion in the review. The review employed a systematic approach during the data extraction phase, using specific related keywords, corporate governance, and state-owned enterprises (Polit and Beck, 2017). The selection of 25 studies was based on several criteria: Relevance, Quality of Evidence, Diversity of data, Data Saturation, and Broader Coverage. The selected studies were more appropriate for the detailed analysis, permitting a focused yet comprehensive review (Creswell and Creswell, 2018). This selection illuminated the potential for implementing effective corporate governance in SOE while underscoring areas that needed further research (Kitchenham et al., 2007).

2.5 Stage 5: quality assessment

The review employed established tools and criteria to assess the methodological quality of the selected studies (Moher et al., 2009). These criteria were tailored to the specific research designs employed within the included studies (Greenhalgh et al., 2016). This quality assessment ensured the rigour of the review process and the trustworthiness of the extracted data (Grant and Booth, 2009). While the text mentioned a scoping review methodology, it’s already established in the previous section (2.4). Here, the focus is on the quality assessment within that methodology.

2.6 Stage 6: review relevance

The Scoping review titled “Corporate Governance Implementation: A Key Instrument for Effective Administration and Management of State-owned Enterprises” does not particularly focus on Namibian SOEs. Nevertheless, a comprehensive understanding of corporate governance practices can be applied to different contexts, including that of Namibian SOEs. Therefore, this scoping review is highly relevant to the study titled “A Corporate Governance Implementation Framework for Tier-3 Namibian State-Owned Enterprises.” The review intended to synthesise current literature on corporate governance in SOEs, exploring mechanisms that improve performance, accountability, and sustainability. The findings from this comprehensive study served as a general concept that can be contextualised and tailored to address particular nuances of the Namibian unique SOEs’ landscape. Both the review and the recommendation focused on improving the corporate governance practices in the Namibian SOEs, stemming from the need to create a contextually relevant framework that leverages best practices identified in the literature, rather than carrying out a new primary study in the country.

3 Results and findings

From the various studies reviewed, some determinants influencing the implementation of corporate governance in SOEs were identified. The six main themes identified from the review were: Corporate Governance Implementation, The Implementation Theory, Corporate Governance Models, The Pillars of Corporate Governance Implementation, The Implementation Theory and Challenges of Corporate Governance Implementation.

3.1 Theme 1: corporate governance implementation

Corporate governance implementation is a shared challenge among several SOEs (Kiranmai and Mishra, 2019). Various SOEs are predominantly threatened by “politically motivated ownership and unwarranted direct involvement,” and this has led to the weakening of accountability by top management (Szanyi-Gyenes, 2024). Szanyi-Gyenes (2024), further opined that, SOEs are typically safeguarded from, e.g., acquisition and insolvency, which are critical in regulating and controlling the capitalistic system. Accountability for most SOEs’ performance is hindered by the chain of proxy (the board, management, firm ownership, ministries, and the government hierarchical dominancy), which poses challenges for corporate governance implementation (Zhou, 2019). Therefore, the complexity of SOEs’ structure is the common frontier for accountability and competent decision-making, resulting in ineffective corporate governance implementation. While the government is a public agent in SOE ownership, cautious government assessment and careful disclosure of the public policy objectives that incentivise and persuade SOE ownership are indeed central (Cuervo-Cazurra, 2018).

Siswanto and Hutajulu (2019) agree with the view of Boros and Fogarassy (2019) that the justification for government ownership should be consistent, in that the principles and legal parameters of governance for SOEs should aim to provide a reliable basis that allows effective implementation of corporate governance to complement their determinations (Zumente I. and Bistrova J., 2021; Zumente F. B. and Bistrova J., 2021). Thus, the importance of ownership is derived from the agency theory, which gives an understanding of wealth maximisation for the shareholders. Wang and Cheng-Han (2020), argue that the investment opportunities for an SOE are the exclusive product of value, and how the SOE is funded and its shareholding is, therefore, not influential to the worth of the enterprise and remedial to effective corporate governance implementation. Nonetheless, Furqan A. et al. (2018) and Furqan M. A. et al. (2018) are in support of the view that monetary rationalisation could be the crucial reason for corporate reform that aims to result in shareholders’ higher returns.

The view about SOE denationalisation or Public-Private Partnership (PPP) is primarily aimed at increasing efficiency through transparency and effective management of public resources that would maximise returns for the citizens (Calugareanu, 2019). The convergence of opinion has taken centre stage as patronage of the notion that change of ownership may help SOEs realise their commercialisation purposes, which are to increase the profit margin as they are managed to the advantage of shareholders (general public) through effective implementation of corporate governance. Furthermore, SOEs are primarily formed and delegated to deliver public services and help spur economic growth through job creation and infrastructural development. Therefore, the establishment of a progressive incentive employing a change in ownership arrangement would be anticipated to increase SOEs’ value to the stakeholders (Tien et al., 2019). Some divergent understanding of the change of ownership theory advises that the change of ownership of an SOE may have little or no influence on its corporate governance implementation (Varottil, 2020). However, SOEs’ reformation has also been at the helm of government top officials in Namibia, in an attempt to improve management and intensify public administration efficiency as an aftermath of effective implementation of corporate governance (Haimbili, 2018). Some theories, such as Agency Theory and Risk Management Theory, emphasise risk management and accountability traits of corporate governance implementation (Dias, 2017). This enforces the objective of safeguarding the ‘accountability’ of the chief executive and the board of directors whilst ensuring that effective control systems and risk management exist (Qobo, 2017). SOEs are, therefore, established and preserved with the determination to legislate this accountability function (Deruytter et al., 2022). One of the fundamental objectives is to strengthen board effectiveness and enforce director integrity in encouraging good governance and reliable quality provision of services to the public (Chatterjee, 2022).

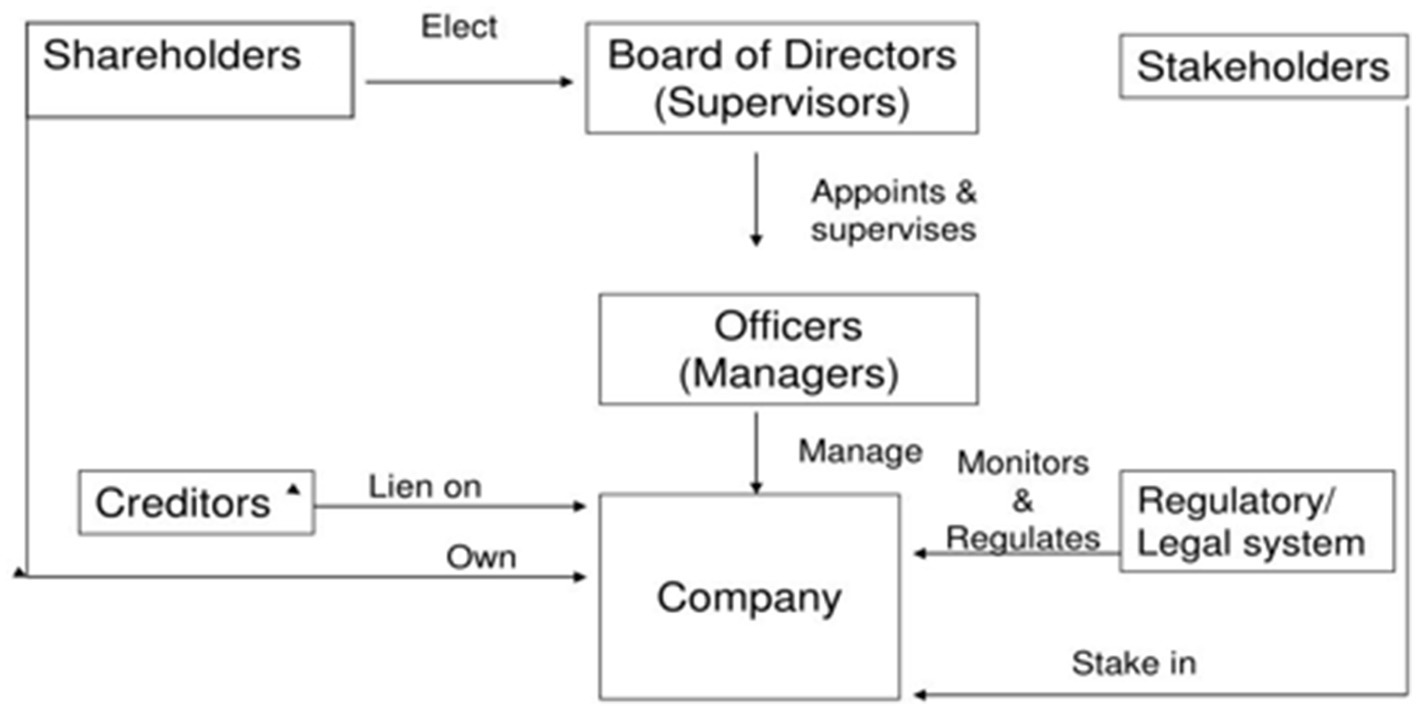

It is opined that the leadership of SOEs should be answerable to the government as representative organs, such as parliament, based on the clearly defined roles between the board as overseer, SOEs and management executives as implementers, the government as a proxy, and the public as owners (Khan M. et al., 2019; Khan S. U. et al., 2019). Although several government bodies, ministries, administrations, or agencies may have diverse roles vis-à-vis the SOEs, the relationship between the role and ownership of these role-players should be well-defined (Postuła and Wieczorek, 2021). The aim is to maintain public confidence in the government, which represents the public in the management, control, and ownership of SOEs; different roles should be simplified and clarified to the owner-general public. Therefore, answerability should be held to those acting on behalf and in the best interests of its shareholders (Whitley, 2018). Whitley further stressed the shareholders’ accessibility to accurate and timely financial information to reduce information asymmetry, as stressed in the Agency theory. The maximisation of shareholders’ wealth, and efficient, effective management of firms to identify and mitigate risks, allocate resources wisely, and ultimately make sound investment decisions, agree with the Shareholder theory. Thus, compliance with legal, regulatory requirements, and ethical standards about the responsible and ethical use of public funds in a bid to gain legitimacy in the eyes of the public and other stakeholders is recommended; this is also accentuated in the Institutional theory. The findings of this study can be useful for policymakers (politicians), regulators (boards), and implementers (managements) of SOEs to enhance their understanding of the potential benefits and challenges of implementing corporate governance effectively.

3.2 Theme 2: theories underpinning corporate governance

The study takes a multi-theoretical view by employing three theories: agency, shareholder, and institutional theory in the context of governance, administration, and management. These theories are in line with and in support of the Taxonomy of Theoretical Approaches used in Implementation Science. According to Monks and Minow (2011) there are numerous theories of Corporate Governance in the literature because of their complex, multi-paradigmatic, and highly interdisciplinary nature. The theories attempt to emphasize different aspects occurring in internal and external relationships of organizations, which could be of different or similar problem areas (de Villiers and Dimes, 2021). The theories, therefore, explain the vast influential factors and models devoid of flaws generated by social scientists’ scope and concerns (Whitley, 2010). Thus, the theories are in support of governance, public administration, and management, and a brief overview of the relevance of each theory is given below. In Table 1.

3.2.1 Agency theory

The agency theory was proposed to deal with the challenges emanating from the separation of ownership and control. In the agency theory, the agent, that is the organisation’s executives and managers, has the propensity to give in to self-interests, opportunistic behaviour, and falling short of congruence between the aspirations of the principal and the agent’s pursuits (Tahir et al., 2020). Tekin A. and Polat S. (2021) and Tekin H. and Polat A. Y. (2021) elucidate that the agency theory is a mechanism for exploring the nature of the relationship between an organisation’s ownership and managementstructure.

The underlying problem of Corporate Governance implementation in this theory stems from the principal-agent relationship, which arises from the separation of beneficial ownership and executive decision-making (Cherian et al., 2020). This separation causes the organisation’s behaviour to diverge from the profit-maximising ideal. The inference of the above is that the interests and objectives of the principal (the investors) and the agent (the managers) differ when there is a separation of ownership and control. Tien et al. (2019) state that since managers are not the owners of the organisation, they do not bear the full costs or reap the full benefits of their actions. Therefore, although investors are interested in maximising shareholder value, managers may have other objectives, such as maximising their salaries, growth in market share, or an attachment to particular investment projects. The shareholders, who are the firm’s owners or proprietors, pay the agents to execute labour, according to this point of view. The directors or managers, who act as agents for the shareholders, are delegated business management by the principals (Husni A. et al., 2020; Husni T. et al., 2020). From this perception, shareholders, the true owners of the SOEs, appoint agents to manage the enterprises on their behalf. Nevertheless, this delegation of authority can result in conflicts if the executives act in ways that do not prioritise the benefits to the shareholders (Husni A. et al., 2020; Husni T. et al., 2020). Subsequently, effective corporate governance instruments are crucial to align the welfare of the numerous stakeholders, mitigate agency costs, and ensure that SOEs operate efficiently and per their intended objectives. This arrangement is crucial for attaining sustainable performance and satisfying accountability in the management of public resources.

3.2.2 Shareholder theory

According to Zumente I. and Bistrova J. (2021) and Zumente F. B. and Bistrova J. (2021), the ideology of shareholder value has become entrenched as a principle of Corporate Governance among organisations based in the United States of America and Britain. The rhetoric of shareholder value has further become prominent in the Corporate Governance debates in European nations such as Germany, France, and Sweden. Arguments for maximising shareholder value have even achieved prominence in Japan (Webber, 2020). The shareholder theory argues that corporations should be about maximising shareholder returns (Zumente I. and Bistrova J., 2021; Zumente F. B. and Bistrova J., 2021). The shareholder theory posits that the primary objective of a business is to maximise shareholder wealth (Nielsen, 2021). The study aims to implement a corporate governance framework for Tier-3 Namibian SOEs to enhance their performance and ultimately maximise shareholder value. The study recognises that the implementation of corporate governance can lead to increased profitability, improved financial performance, and reduced financial dependency. All of these outcomes are in line with the shareholder theory, which advocates for the maximisation of shareholder wealth. Furthermore, the study emphasises the need for SOEs to provide timely and accurate financial information to shareholders to reduce information asymmetry and enable them to make informed investment decisions. This is a core tenet of the shareholder theory, which emphasises the importance of transparency and accountability to shareholders.

This research borrows from Miralles-Quirós et al. (2019), the assumptions of the shareholder theories focus on private organisations’ maximisation of profit with little consideration for the SOEs. This is giving rise to advanced rethinking and demand for newer approaches that apply to SOEs (Haerani et al., 2020). Therefore, the factors that may influence governance outcomes in SOEs are regarded as determinants for implementation success or failure. The explored elements will enhance Corporate Governance implementation consciousness amongst the board members and management staff, and enable them to manage SOEs in the best interest of the shareholders, and this suggests the importance of the shareholder theory to this study. The research posits that innumerable determinants influencing governance outcomes within SOEs are critical factors of successful implementation. Jia et al. (2019), assert that by enhancing the consciousness of corporate governance among board members and management staff, SOEs can be guided to function in accordance with the best interests of shareholders. This aligns with the central ideologies of shareholder theory and emphasises its significance in this context.

3.2.3 Institutional theory

Wiedenhöft et al. (2020), advance that institutions are of a polity’s essential character, history, and future development. Therefore, organisational culture determines public and political life, societal structures, and dynamics in SOEs to a great extent. It is authoritative to conclude that, according to the institutional theory, governance issues are centred on organisational culture, beliefs, and norms. However, the stability within an organisation culminating in political and social institutions continues to be disrupted by rapid societal changes (Muslih and Halliawan, 2021). Nicolò et al. (2020) argue that organisations should adopt cultures, beliefs, and norms to remain stable. The continuing SOE management pitfalls and the much-deliberated financial crisis of 2007–2008 in the USA and the UK suggest a shortfall of institutional theory and demand deliberations through the following research question: What is the role of the board and management in the implementation of the King IV Report and NamCode?

Considering the reviewed literature, no universal and one-size-fits-all framework for corporate governance implementation exists. Nonetheless, before the 2007–2008 financial crisis, existing frameworks and models were narrowly foretold, limited to financial and legal contemplations (Sadeh et al., 2021). In the present day, frameworks demand collective, inclusive socioeconomic, environmental, political, public administration, and management considerations (Muslih and Halliawan, 2021). Scholars like Nicolò et al. (2020), are of the view that Corporate Governance implementation frameworks have become equally contextualised and are cognisance of the context of countries, sectors, and organisations’ particular differences. These differences were previously ignored and posed numerous challenges for policymakers and practitioners in emerging economies, countries, sectors, and organisation-specific environments. Thus, institutional theory offers a critical lens through which to appreciate the intricacies of governance implementation in SOEs, highlighting the need for social adaptability, contextual consciousness, and a synthesis of various theoretical frameworks to navigate present-day challenges effectively.

3.3 Theme 3: model discussion of corporate governance

3.3.1 Anglo-Saxon model

The Anglo-Saxon model is predominantly used in the United Kingdom, the United States of America, Canada, Australia, and New Zealand. The model is characterised by the absence of dominant shareholders (Gacem et al., 2020). The organisation’s share capital is divided among numerous participants with an average share of 2–5%; consequently, no one can demand special rights or privileges from shareholders. Lee et al. (2020) explained that in the Anglo-Saxon CG model, the majority of shares belong to institutional investors such as mutual and pension funds (see Figure 2).

Figure 2. Anglo-Saxon model. Source: Hall (2014).

U-Din (2023) posit that continuous change among shareholders is common for this model, as owning a small share makes the selling process easier, compared to owning a significant share. Panicker et al. (2023) asserted that there is a dependency on outsiders, investors not affiliated with the corporation, and a well-developed legal framework defining the rights and responsibilities of three key players, namely: management, directors, and shareholders. A comparatively uncomplicated procedure exists for interaction between shareholders and corporations as well as among shareholders (Kiranmai and Mishra, 2019). In the Anglo-Saxon model, the key role in an organisation’s management is played by the CEO, who makes all decisions on business activities (Joura et al., 2023). The Anglo-American model of corporate governance focuses on the primary objective of maximising shareholder value, and in the absence of a legal duty, other interests are ignored to the extent they conflict with the primary objective (Brychko and Semenog, 2018). The Anglo-Saxon model showcases a governance framework that emphasises shareholder dynamics and CEO leadership, grounded in legal meanings that support effective management and administration, predominantly in SOEs.

3.3.2 Continental European model

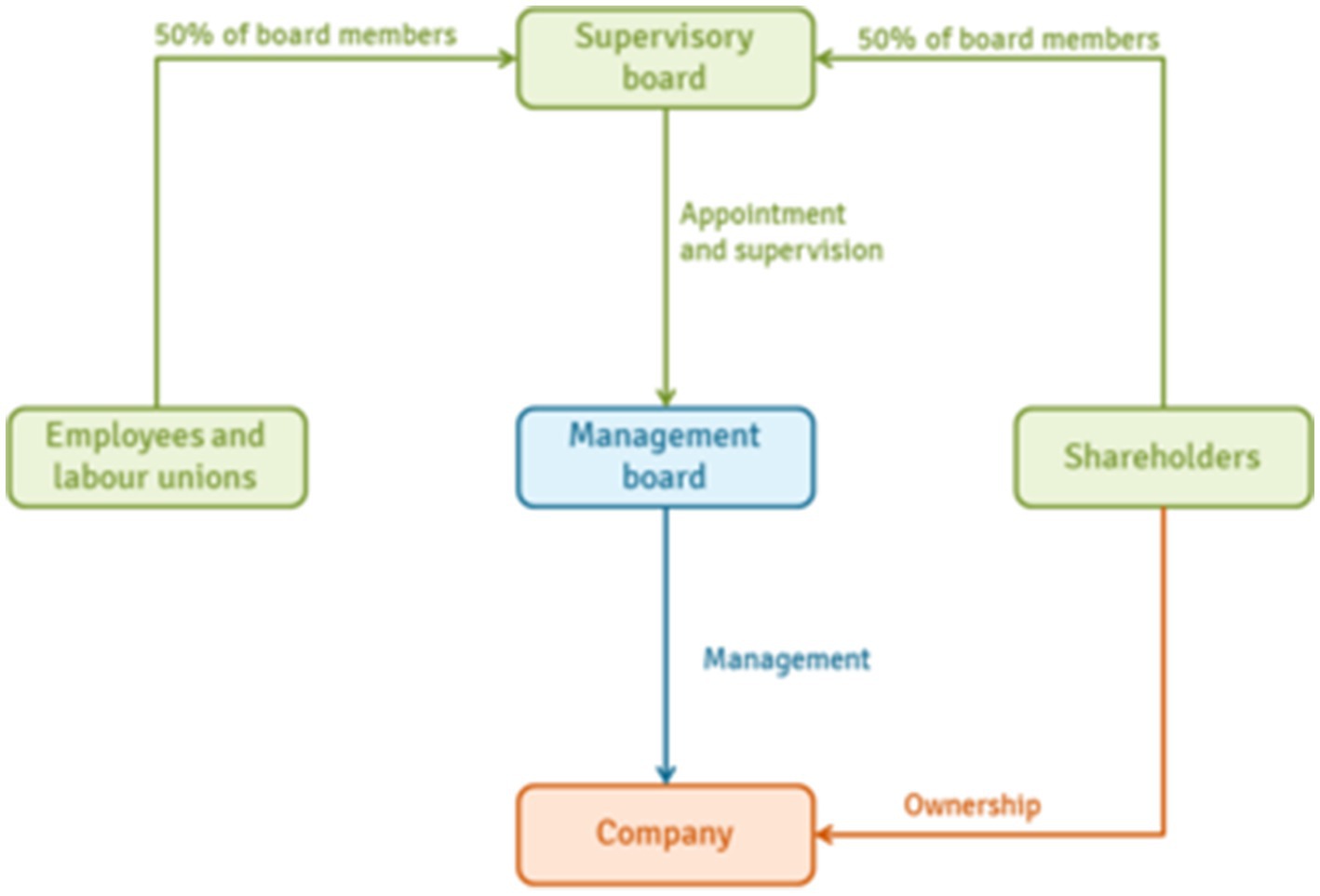

The Continental European model is known for its high concentration of capital (Schwienbacher, 2019). According to Dal Mas et al. (2020), shareholders in the Continental European model share common interests with the organisation and participate in its management. Managers are not only responsible for shareholders but a wider group of stakeholders such as customers, business partners, the community, and labour unions (Brin and Nehme, 2019) (see Figure 3).

Figure 3. Continental European model. Source: Whitley (2010).

Ramezanian Bajgiran et al. (2020) pointed out that the unique elements of the Continental European model are the existence of a two-tiered board structure, the size of the supervisory board, and voting rights restrictions. A two-tiered board structure consists of a management board and a supervisory board (Umbrello, 2021). Okigbo and Bagheri (2020), indicated that the Continental European model traditionally preferred bank financing over equity financing; therefore, stock market capitalization is small. Therefore, notes that in the Continental European model, Corporate Governance structures are geared towards preserving relationships between the key players, notably banks and corporations (El Khatib, 2021). The Continental European model of corporate governance integrates shareholder interests, employs a twofold board system, and relies on bank financing, which jointly aim to foster effective administration and management within SOEs. This model demonstrates a governance framework that prioritises relationships and accountability.

3.3.3 Japanese model

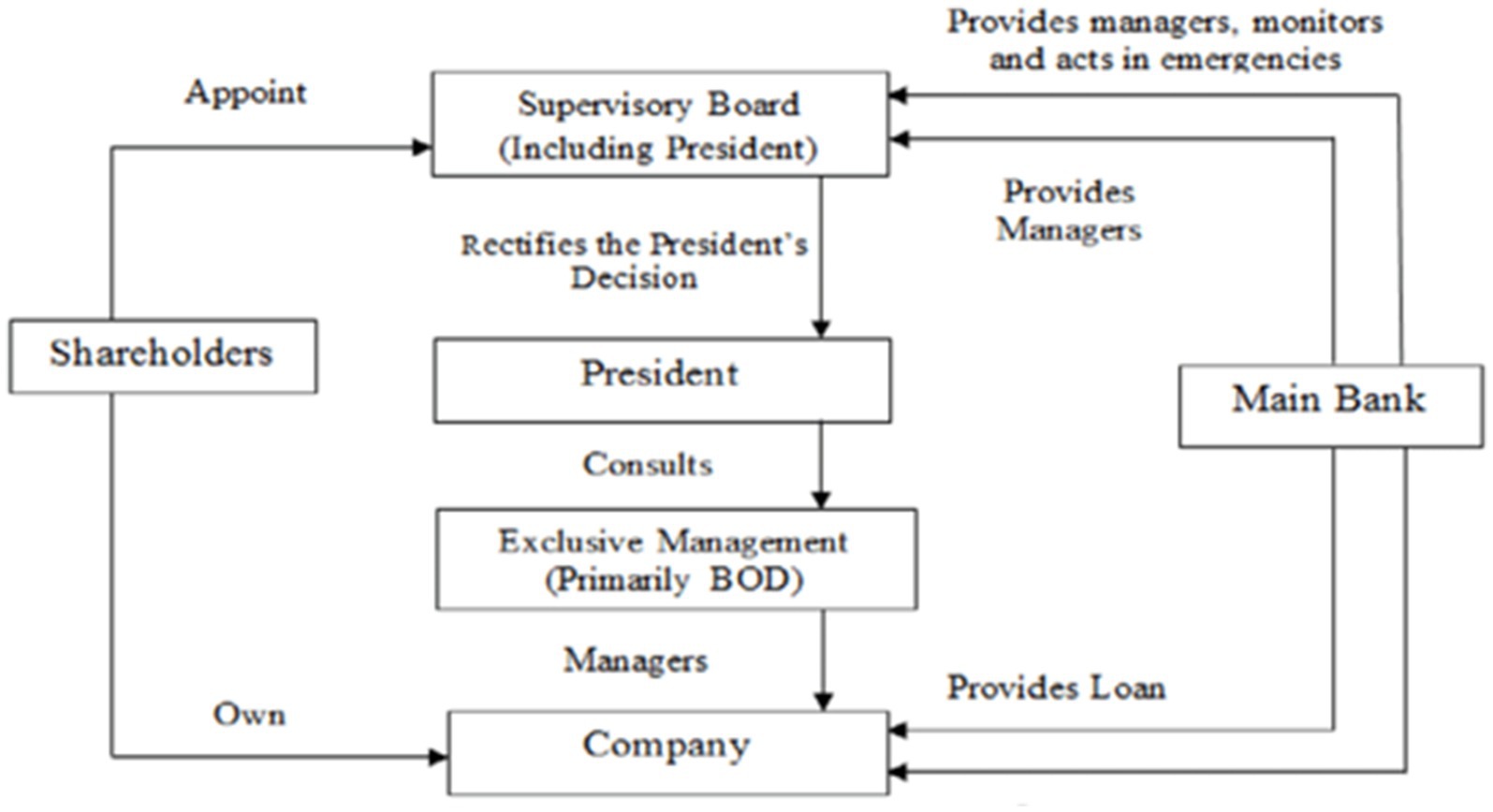

Commonly used in Asian countries, the Japanese model allows for the formation of industrial and financial conglomerates, where a big financial institution combines with an industrial organisation (Andreoni and Chang, 2019). Corporate structures are associated with loan usage and share capital, informal channels of communication and information sharing, and cross-shareholding (Sadeh et al., 2021) (see Figure 4).

Figure 4. Japanese model. Source: Whitley (2018).

The Japanese model illustrates how corporate governance can be tailored to enhance the management and administration of SOEs. By leveraging industrial-financial conglomerates, emphasising capital utilisation, and nurturing communication and collaboration, this model offers a feasible pathway for effective governance and operational victory in the realm of SOEs.

3.4 Theme 5: the implementation theory

Several theories have been advanced or adapted for possible use in implementation endeavours to attain an improved understanding and explanation of certain aspects of implementation (Nilsen, 2015). The proposed theories of implementation by Nilsen (2015) and Ciftci et al. (2019), provide guiding processes for the implementation of plans to improve the outcomes of decision-making processes for any notion of sound governance. Furqan A. et al. (2018) and Furqan M. A. et al. (2018) noted that implementation theories have improved towards academic approaches to provide clarifications and a better understanding of what influences implementation outcomes (success or failure). According to Nilsen’s theory of implementation science, some determinants describe domains of elements that are postulated or have been recognised to be stimuli of implementation outcomes. Each determinant encompasses several discrete barriers (hinders) as well as facilitators (enablers), which are independent variables that influence implementation outcomes (i.e., dependent variable). Determinant frameworks describe general types (also referred to as classes or domains) of determinants that are hypothesised or have been found to influence implementation outcomes, e.g., health care professionals’ behaviour change or adherence to a clinical guideline (Shopati, 2018).

The individual determinants classically encompass several discrete barriers (hinders, impediments) and enablers (facilitators), which are considered independent variables that affect implementation consequences, i.e., the dependent variable. There are three aims of using hypothetical approaches in implementation science and five groupings of theories, models, and frameworks. Nilsen (2015), argues that between these determinants, others identify such associations without illustrating these determinants. Evidence around what influences the implementation outcomes is theoretically worthwhile for designing and executing implementation policies that intend to change the appropriate determinants. Therefore, understanding and explaining what influences implementation outcomes (Determinant frameworks) is the objective of this review. The recent implementation of theoretical approaches tends to develop methodologies and suggest potential practical, structural, and developmental measurements of transformational implementation, focusing on Corporate Governance and other leadership and management standards. Accordingly, implementation theories are intended to influence the end-point, for improved Corporate Governance practices and outcomes; therefore, implementation theories should be proactive in applying theoretical approaches to guide planning, doing, and assessing implementation processes. The basis of the existing knowledge established in this theory provides relevance to the review, which deals with corporate governance implementation.

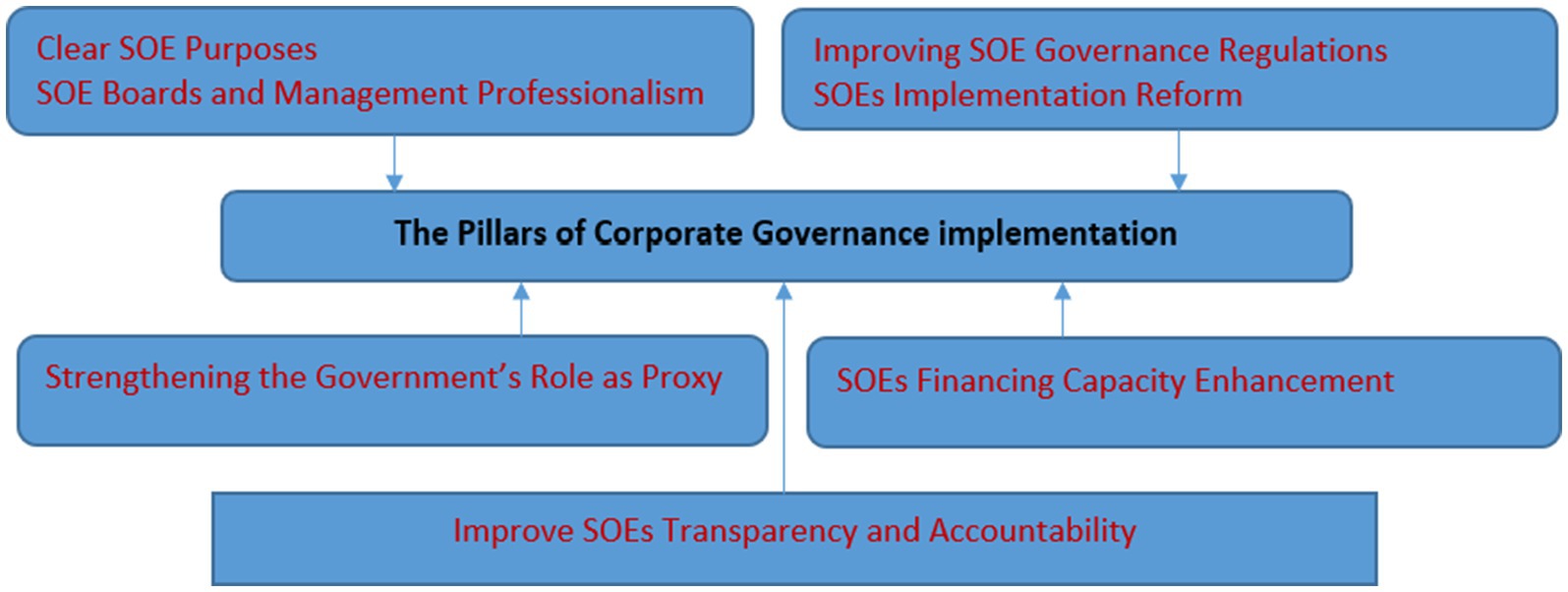

3.5 Theme 4: the pillars of corporate governance implementation

The authors have compiled the pillars (framework) of effective implementation of corporate governance by drawing from various theoretical perspectives, including the works of Garfinkel (2017, 2019), El Khatib (2020, 2021, 2022), and OECD (2016) (see Figure 5).

3.5.1 Clear SOE purposes

The OECD principles and international guidelines suggest that countries clarify SOEs’ functional objectives and reinforce management and boards to work towards progressive goals and public service commitments (Garfinkel, 2017). Balancing SOEs’ commercialisation objectives and comprehensive public policy objectives remains controversial and can lead to undesirable effects on efficiency and performance (Butzbach et al., 2021). SOEs have civic obligations to support industrialisation, create employment, provide services to underprivileged societies, offer services below average cost, and assist with transformation in pro-poor national development. However, lack of clarity in guidelines, non-uniformity of public policy aims, and undefined SOE purposes result in unstandardized policies that hinder corporate governance implementation (Kim, 2018). SOEs should aim at advancing a clear purpose through well-articulated guidance principles that outline their mandates and clearly define their objectives. Therefore, the guiding policy should aim at balancing SOEs’ commercial and non-commercial responsibilities and be reviewed as per the changing demand of shareholders’ priorities (Hlaváčková, 2020). According to Whitley (2010), performance checks against SOEs’ objectives, the balance between costs and funding arrangements, and advanced monitoring of performance are essential for accountability and transparency.

3.5.2 Improving SOE governance regulations

A broad legal structure could help reform the public sector and create a consistent and non-conflicting legal environment in which SOEs’ functions are no different from those of the private sector operations (Whitley, 2010). The regulation aims at articulating the hopes that SOEs can be achieved on shareholders’ behalf, the boards, management, the larger society, and all other stakeholders. However, the multiplicity of frameworks is habitually overlapping and contradictory, and the lack of consistency has led the management and leadership of SOEs to fall prey to misinterpretation and confusion in the application of the regulations that govern them. Therefore, a modernised framework for corporate governance implementation is critical in improving management and administration to enhance SOE performance (George and Seo, 2022). Developing a comprehensive and divergent approach in the implementation process. Thus, a modernised framework for corporate governance implementation is critical in improving the management and administration of SOEs (Rock, 2020). The development of a particular legislation that aims to guide SOEs may be necessary for improved governance. Therefore, SOE oversight and governance should be strengthened by formalising legislation that is open to the public as owners, and ensuring that implementation of corporate governance is well monitored and evaluated (Kakero, 2020).

3.5.3 Strengthening the government’s role as a proxy

There is a need for a consolidated framework for the government’s proprietorship role in SOEs (Costa, 2020). The common arrangement involves multiple stakeholders, including line ministries, which may lead to fragmentation, lack of standardisation, and political intervention (Shafuda et al., 2020). The participation of various stakeholders also results in coordination deficiency and a poor standardised framework, leading to inconsistency and a lack of focus. Therefore, a merged policy would help distinguish the government’s proprietorship role between its policy-making and regulatory roles, permit transparency, better coordination, and consistency in the role of the government, and help to achieve government social and economic objectives (Shafuda et al., 2020).

3.5.4 SOE boards and management professionalism

The importance of having a properly composed board for effective corporate governance implementation in SOEs is critical, Mbidzo (2020). The board should consist of skilled and knowledgeable members hired through a transparent appointment process. The review highlights that the current guidelines for board appointments lack specific policies and may result in conflicting processes (Garfinkel, 2019). To avoid political intervention, there is a need for structured policy guidelines and a harmonised board recruitment exercise. Therefore, SOEs should have greater autonomy and considerable will to approve major resolutions, and boards should formulate and abide by the principle of good governance to exercise their responsibilities and fiduciary obligations effectively (Kabeyi, 2019).

3.5.5 SOEs financing capacity enhancement

The delay in delivering infrastructure and other critical services has caused significant financial difficulties for various State-Owned Enterprises (SOEs). These SOEs are undercapitalised and have a heritage of debt, making it difficult for them to participate in infrastructure development and maintain their existing capacity. As a result, they rely on government financial bailouts and support in various forms (Mo et al., 2021). Numerous SOEs are uncertain about their ability to meet future financial requirements without government backing (Munsanje, 2021). The PPP Review has made several recommendations to improve the supporting capacity of SOEs, including justifying government capital, centralizing the government’s proprietorship role, combining equity and debt finance, promoting direct investment through PPPs, and implementing an economic regulation framework (Khan M. et al., 2019; Khan S. U. et al., 2019).

3.5.6 Improve SOEs’ transparency and accountability

The importance of an effective performance monitoring system in ensuring the success of SOEs and promoting transparency and accountability in the utilisation of public resources is of paramount importance (James et al., 2022). The Organisation for Economic Cooperation and Development (OECD) Guidelines and international good practices stress the need for a solid performance monitoring system that establishes clear goals and benchmarks for SOE boards and management (Gikaria, 2021). The Performance Management System (PMS) regulations enforce that the system is based on strategic goals obtained from the SOE’s mandate, business strategy objectives of the authority the SOE reports, and national objectives. The accounting authority must thus, submit a three-year corporate plan annually to their supervising authority and Treasury, covering strategic objectives and outcomes, business initiatives, Key Performance Indicators, risk management tactics, fraud prevention plans, and financial strategies (Neshamba, 2019). SOE performance is measured at two levels: the strategic objectives achievement, and the impact on the state’s transformational agenda. Therefore, there is a need for a more aggressive process in setting strategic direction and defining objectives to ensure SOEs’ operational effectiveness and efficiency (Lipumbu, 2021).

3.5.7 SOEs implementation reform

The implementation of governance and other reforms in SOEs can enhance their performance, increase financial sustainability, and improve transparency and accountability. However, implementation of these reforms can be politically challenging and require careful attention to the reform process, including the development of public support, a well-defined strategy, establishment of institutions, political leadership, and monitoring systems (Genin A. L. et al., 2021; Genin J. J. et al., 2021). The PMS recommends the development of an in-depth roadmap and financial forecasts for SOE reform, sequencing reforms over time, identifying stakeholders, and designating responsible parties. Thus, the roles and responsibilities of different parties need to be clearly defined and their capacity strengthened (Long et al., 2020). These pillars emphasise the multifaceted approach essential for effective corporate governance in SOEs, recognising the interplay between legislative frameworks, stakeholder involvement and transparency in improving SOEs’ operational efficiencies and capacities (El Khatib, 2022). The combination of these pillars is critical for enhancing vigorous governance structures that can adapt to the varying demands of shareholder expectations and public service. Collectively, these pillars form a comprehensive context aimed at bolstering the corporate governance of SOEs, leading to improved performance and accountability.

3.6 Theme 5: challenges of corporate governance implementation

The article discusses the challenges and failures associated with corporate governance in SOEs. As espoused by Ahunwan (2021), a corrupt culture system often causes these issues, a lack of institutional ability to enforce corporate governance norms, and exclusion of investors from the governance framework. Furthermore, policies and procedures for maintaining effective internal controls are regularly overlooked, and there is a lack of strong selection processes for board members, CEOs, and management (Lu et al., 2019). According to Sawyer and Wagner (2020), the self-serving interests of board members, CEOs, and management also take precedence over SOEs and their shareholders’ interests. The text highlights the need for adequate yardsticks for evaluating board and management procedures and performance (Nwafor et al., 2020). The Government of Namibia adopted the Governance Framework on SOEs and the King III Model and Code, but non-compliance with corporate governance practices in SOEs continues to be a problem. There is a need to address conflicts and overlaps in governance structures to ensure effective implementation of corporate governance in SOEs (Siyaya, 2020). There are several challenges associated with its implementation, such as the exclusion of investors from the governance framework, the regular oversight of policies and procedures for internal control, the lack of political will, and the absence of effective monitoring and enforcement mechanisms (Ako-Nai and Singh, 2019).

4 Discussion

Corporate governance has become an increasingly important area of inquiry in recent years as organisations across the globe seek to implement effective governance structures and processes that promote long-term prosperity (Fenwick and Vermeulen, 2018). The scoping review, suggest that robust governance mechanisms has the potential to enhance the performance of SOEs and minimise their financial dependency. This review confirms that while SOEs are coupled with several challenges in corporate governance practices, there are also numerous implementation enablers, as highlighted by Haimbili (2018). The review thus highlighted the challenges associated with its implementation, such as political interference, lack of transparency, and accountability issues and they are not universal. These challenges can hinder the effectiveness of corporate governance frameworks in SOEs, as opined by Alami and Dixon (2020). It is therefore critical that SOEs in Namibia, the region and globally adopt contextualised governance structures and processes, particular to countries’ economic, political conditions and environmental circumstances. The review further notes that most literature reported that various SOEs are predominantly threatened by “politically motivated ownership and unwarranted direct involvement,” and this has led to the weakening of accountability by top management (Zumente I. and Bistrova J., 2021; Zumente F. B. and Bistrova J., 2021). Accountability for SOEs’ performance is hindered by the chain of proxy (the board, management, firm ownership, ministries, and the government hierarchical dominancy), which poses challenges for corporate governance implementation (Zhou, 2019). Therefore, the complexity of SOEs’ structure is the common frontier for accountability and competent decision-making, resulting in ineffective corporate governance implementation.

While the government is a general public agent in SOEs ownership, cautious government assessment and careful disclosure of the public policy objectives that incentivise and persuade SOEs ownership are indeed central (Sawyer and Wagner, 2020). Ciftci et al. (2019) are in support of the view of Chatterjee (2022) and Costa (2020), that, in most developing countries, SOEs’ performance has been severely weakened by overlaps in their proprietorship and administration arrangements, which could be the same challenges for the Namibian SOEs. Therefore, notable and comparable opinion seems to share a broad impression which suggests that Namibian SOEs’ poor performance results from a multiplicity of goals and contradicting objectives, which leads to a lack of service delivery (Joura et al., 2023). Several theoretical perspectives have been used to model SOEs, including the property rights school, public choice tradition, neoclassical approach, behavioural approach, and budget-maximising approach. Despite a long-standing interest in modelling SOEs and their significant impact on the global economy, developing a comprehensive theoretical understanding of SOEs remains a challenge (Ahunwan, 2021). Ahunwan, further argues that SOEs’ ownership by the state is a key factor in their efficiency. However, due to their ownership and control, SOEs are typically less efficient than privately owned and managed firms.

The analysis takes a multi-theoretical view by employing three theories and three models: agency, shareholder, and institutional theories, the Anglo-Saxon, Continental European, and Japanese models, in the context of governance, administration, and management. In line with these theories, models and by the support of the Taxonomy of Theoretical Approaches used in implementation science, the study recognises the importance of social norms and practices in shaping corporate governance structures. For illustration purposes, Institutional theory posits that organisations are influenced by the norms, values, and beliefs prevalent in the wider society. The study acknowledges this by advocating for a governance framework that aligns with Namibia’s cultural and institutional setting. It further highlights the importance of legitimacy and reputation in shaping organisational behaviour. Institutional theory suggests that organisations strive to maintain legitimacy and a positive reputation among their stakeholders. The study appreciates this by advocating for a governance framework that enhances transparency, accountability, and stakeholder engagement. By identifying corporate governance pillars, the review has recognised their positive implications in shaping overall governance, in Namibia, the region and in the global SOEs space.

This review provides policymakers, regulators, and implementers with a comprehensive understanding of the governance frameworks and processes that are most suitable for their SOEs. This will enable them to make informed decisions about the implementation of corporate governance in SOEs. It is essential to address the challenges associated with its implementation to ensure that SOEs operate efficiently and effectively in the long run. One of the review’s strengths is the utilisation of a systematic search of relevant databases, screening of studies, data extraction, and analysis, which ensured that the studies included in the review were relevant and of high quality. Additionally, the scoping review provides valuable insights into the potential benefits of corporate governance implementation in SOEs and highlights the challenges that must be addressed to achieve their full potential. However, there are some limitations of the review that must be acknowledged. The study is limited to a scoping review, which provides a broad overview of the subject matter and is not as in-depth as other systematic reviews. Additionally, the review focuses only on state-owned enterprises, and the findings may not be generalisable to other types of organisations. The review is a valuable contribution to the literature on corporate governance, public administration, and management. The review highlights the potential benefits of corporate governance implementation in SOEs and the challenges that must be addressed to achieve its full potential. Policymakers, regulators, and implementers can use the insights provided by the review to make informed decisions about implementing corporate governance in SOEs and ensuring their long-term success.

5 Strengths and limitations

The review provides policymakers, regulators, and implementers with a comprehensive understanding of the governance frameworks and processes that are most suitable for particular SOEs. The review draws on a theoretical model for understanding the factors that contribute to successful implementation, which adds credibility and precision to its findings. Moreover, the scoping review is well-structured and presents its arguments clearly and concisely, which enhances its readability and accessibility. However, the review’s findings are based on a limited number of studies, which may limit the generalizability of its conclusions. The review focuses exclusively on SOEs, which may limit its application to other types of organisations. Finally, the review did not provide a detailed analysis of the potential economic and social impacts of corporate governance implementation in SOEs, which could have been valuable for policymakers and other stakeholders.

6 Conclusion and recommendations

The review on Corporate Governance Implementation in SOEs aimed to explore the potential for effective governance frameworks and processes that promote long-term success. The review highlighted the benefits of implementing corporate governance in SOEs, such as achieving financial independence and enhancing their overall performance. However, the review also identified several challenges associated with its implementation, such as political interference, lack of transparency, and accountability issues. The study recommended that policymakers provide a clear SOE purpose, improve SOE governance regulations, and enhance financing capacity to address these challenges. Therefore, corporate governance frameworks, principles or models of countries and regions particular, can enhance openness, minimise political involvement, ensure accountability and improve the broader governance processes. The insufficiencies of service delivery, which limit the most desired economic revolution among Namibian SOEs are underscored, and a trailer-made framework is critical for effective implementation and for the greater success of the SOEs. The review identified pillars as governance enablers as a consideration in the bid to escalate service provision, resource appropriation, efficient administration, and enhance SOEs’ performance and long-term sustainability. The review contributes to the body of knowledge by bridging the gap of insufficient, fragmented research in respect of the implementation strategies, explicit and unique frameworks for specific SOEs. The theories and models were acknowledged for their sound and relevant contribution to the governance, public administration and management of SOEs in Namibia, the region and world-over.

Overall, the scoping review provides valuable insights into the potential benefits of corporate governance implementation in SOEs and highlights the challenges that must be addressed to achieve its full potential. Policymakers can improve the performance and accountability of SOEs by establishing a strong determination that aligns corporate governance with strategic goals. This simplicity aids decision-making and effective operation towards specific SOEs’ outcomes. Consolidating governance regulations forms a robust framework with clear strategies that minimise political interference, foster transparency, and simplify improved monitoring of SOE performance, which is crucial for building trust. Improving the financial dimensions of SOEs through expanded funding sources, increased private sector participation, and easier admission to capital markets permits greater autonomy and diminishes dependency on government support, allowing for development and innovation. These recommendations aim to address challenges recognised in the review and create a favourable environment for effective corporate governance, eventually enhancing SOEs’ performance, effectiveness, and contribution to the economy’s sustainability.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Ethics statement

A written informed consent was obtained from the University of the Free State’s General Human Research Ethics Committee (GHREC), Ethical Clearance number: UFS-HSD2023/2363, for the data collection. However, no potentially identifiable images were included because the review only used tables adopted from reviewed literature and the authors’ compilation.

Author contributions

FJ: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. CH: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. TM: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Acknowledgments

The scoping review recognises and acknowledges all sources that contributed to its development.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahunwan, O. O. (2021). Corporate governance and corruption in state-owned enterprises. London: Routledge.

Ako-Nai, R., and Singh, S. (2019). Corporate governance in state-owned enterprises in Africa: a review of practices and challenges. J. Econ. Struct. 8, 1–14.

Alami, A., and Dixon, R. (2020). The challenges of corporate governance in state-owned enterprises: a literature review. Corp. Gover. 20, 70–94.

Andreoni, A., and Chang, H. J. (2019). The political economy of industrial policy: structural interdependencies, policy alignment and conflict management. Struct. Chang. Econ. Dyn. 48, 136–150. doi: 10.1016/j.strueco.2018.10.007

Baron, D. P. (2023). The governance of state-owned enterprises: moving towards effective models. J. Bus. Ethics 175, 253–270.

Boros, P., and Fogarassy, G. (2019). State-owned enterprises and corporate governance in emerging markets. Cham, Switzerland: Springer.

Brin, P. V., and Nehme, M. N. (2019). Historical development of the corporate social responsibility concept. J. Bus. Ethics 150, 1–15.

Brychko, M. M., and Semenoh, A. Y. (2018). Efficiency as a new ideology of trust-building corporate governance.

Butzbach, M. R., Fuller, T., Schnyder, F., and Svystunova, A. (2021). Balancing commercialisation objectives and public policy objectives in state-owned enterprises. Public Adm. 99, 182–199.

Calugareanu, A. (2019). Public-private partnerships and corporate governance in state-owned enterprises. Antwerp, Belgium: University of Antwerp.

Chatterjee, B. (2022). Board effectiveness in state-owned enterprises: a stewardship perspective. Corp. Gov. 22, 222–240.

Cherian, J., Sial, M. S., Tran, D. K., Hwang, J., Khanh, T. H. T., and Ahmed, M. (2020). The strength of CEOs’ influence on CSR in Chinese listed companies. New insights from an agency theory perspective. Sustainability 12:2190.

Ciftci, H., Yildiz, F., and Ozdemir, A. N. (2019). A conceptual framework for implementation fidelity in educational contexts: a multi-level perspective. Educ. Manag. Admin. Leadersh. 47, 90–103.

Costa, D. A. (2020). The ownership influence on corporate governance and firm performance of state-owned enterprises: a review and future research directions. J. Manag. Gov. 24, 843–862.

Creswell, J. W., and Creswell, J. D. (2018). Research design: Qualitative, quantitative, and mixed methods approaches. 5th Edn. Thousand Oaks, California: Sage Publications.

Cuervo-Cazurra, A. (2018). The governance of state-owned enterprises and sovereign wealth funds: Ownership, control, and performance. Oxford, United Kingdom: Oxford University Press.

Dal Mas, F., Garcia-Perez, A., Sousa, M. J., da Costa, R. L., and Cobianchi, L. (2020). Knowledge translation in the healthcare sector. A structured literature reviews. Electronic. J. Knowl. Manag. 18, 198–211.

De Villiers, C., and Dimes, R. (2021). Determinants, mechanisms and consequences of corporate governance reporting: a research framework. J. Manag. Gov. 25, 7–26. doi: 10.1007/s10997-020-09530-0

Deruytter, K., Juwet, T., and Bassens, M. (2022). Accountability in state-owned enterprises: a review of the literature. J. Manag. Gov. 26, 1–25.

Dias, A. A. (2017). A more effective audit after COSO ERM 2017 or after ISO 31000: 2009. Rev. Perspect. Emp. 4, 73–82. doi: 10.16967/rpe.v4n2a8

El Khatib, A. V. (2020). Government as a shareholder: the role of the state in SOEs. Governance 33, 1–2.

El Khatib, A. V. (2021). Financing strategies for state-owned enterprises: Balancing fiscal constraints and growth. (World Bank policy research working paper no. 1234). Washington, D.C: World Bank.

El Khatib, A. V. (2022). Enhancing transparency in state-owned enterprises: an accountability framework. Public Manag. Rev. 24, 1–25.

Fenwick, D., and Vermeulen, F. (2018). Corporate governance: Theory and practice in an international context. Oxford, United Kingdom: Oxford University Press.

Furqan, A., Abdullah, R., Iqbal, Z., and Masdar, I. (2018). The corporate governance and firm performance of Malaysian listed state-owned enterprises. Corp. Gov. 18, 213–232.

Furqan, M. A., Abdullah, M. A., Iqbal, M. J., and Masdar, A. (2018). Factors affecting the implementation of corporate governance in Malaysian public-listed companies. Int. J. Econ. Commerce Manag. 6, 220–231.

Gacem, A., Monacelli, E., Wang, T., Rabreau, O., and Al-Ani, T. (2020). Assessment of wheelchair skills based on analysis of driving style. Cogn. Tech. Work 22, 193–207. doi: 10.1007/s10111-019-00563-6

Garfinkel, M. J. (2017). Defining the objectives of state-owned enterprises: a blueprint for effective governance. Public Adm. Rev. 7794, 1–12.

Garfinkel, M. J. (2019). Board dynamics in SOEs: achieving high standards of professionalism. J. Corp. Govern. 18, 1–15.

Genin, A. L., Tan, J., and Song, J. (2021). State governance and technological innovation in emerging economies: state-owned enterprise restructuring and institutional logic dissonance in China’s high-speed train sector. J. Int. Bus. Stud. 52, 621–645. doi: 10.1057/s41267-020-00342-w

Genin, J. J., van den Heuvel, H., and Slabbert, J. (2021). State-owned enterprise reform: a delicate dance. Public Adm. Rev. 81, 621–645.

George, G., and Seo, K. (2022). Corporate governance and firm performance of state-owned enterprises: a review of the literature and directions for future research. Sustain. For. 14, 1–26.

Gikaria, D. M. (2021). The role of performance management systems in state-owned enterprises [Doctoral dissertation]. Windhoek, Namibia: University of Namibia.

Grant, M. J., and Booth, A. (2009). A typology of reviews: an evidence-based approach to searching and rating. Health Inform. Lib. J. 26, 91–108. doi: 10.1111/j.1471-1842.2009.00848.x

Greenhalgh, T., Booth, A., and Pope, C. (2016). Choosing a review methodology: a primer for first-time reviewers. Health Inform. Lib. J. 33, 1–12.

Haerani, S., Sumardi, S., Hakim, W., Hartini, H., and Putra, A. H. P. K. (2020). Structural model of developing human resources performance: empirical study of Indonesia states owned enterprises. J. Asian Finance Econ. Bus. 7, 211–221. doi: 10.13106/jafeb.2020.vol7.no3.211

Haimbili, H. (2018). State-owned enterprise reform in Namibia: a critical analysis. Int. J. Public Sect. Manag. 31, 220–240.

Hall, P. (2014). Cities of tomorrow: An intellectual history of urban planning and design since 1880. John Wiley & Sons.

Hlaváčková, I. (2020). Balancing objectives of state-owned enterprises: a never-ending story? J. Manag. Gov. 24, 823–842.

Hoban, S., Bruford, M., Jackson, J., Lopes, I., Pritchard, D., and Sanderson, J. (2020). The challenge of corporate governance in state-owned enterprises. J. Bus. Res. 112, 1–12.

Husni, A., Rahim, R., and Aprayuda, R. (2020). Corporate governance, transparency, and financial reporting quality: evidence from Indonesia. J. Appl. Acc. Res. 21, 212–235.

Husni, T., Rahim, R., and Aprayuda, R. (2020), Cash compensation, corporate governance, ownership, and dividend policy on banking performance. In Proceedings of the 6th annual international conference on management research, 212–218. University of Indonesia.

James, K., Patel, K., and Singh, A. (2022). India’s public financial management system: need for reforms and way forward. Indian Public Policy Rev. 3, 30–58. doi: 10.55763/ippr.2022.03.04.002

Jia, J., Huang, W., and Zhang, L. (2019). Corporate governance and the performance of state-owned enterprises: evidence from China. J. Bus. Res. 89, 193–206.

Joshi, A., and Wong, J. (2023). When Context Matters: What Shapes Implementation in Authoritarian vs. Democratic Settings? World Development, 171:106357.

Joura, E., Xiao, Q., and Ullah, S. (2023). The moderating effects of CEO power and personal traits on say-on-pay effectiveness: insights from the Anglo-Saxon economies. Int. J. Finance Econ. 28, 4055–4078. doi: 10.1002/ijfe.2636

Kabeyi, G. N. (2019). The challenges of corporate governance in state-owned enterprises in developing countries: a review of literature and a conceptual framework. Corp. Gover. 19, 632–651.

Kakero, O. (2020). The challenges of corporate governance in state-owned enterprises in developing countries: a case study of Kenya. J. Public Admin. Govern. 10, 123–142.

Khan, S. U., Khan, S., and Liu, J. (2019). The impact of corporate governance on firm performance: evidence from Pakistan. J. Bus. Res. 101, 340–353.

Khan, M., Makki, S., and Tian, G. (2019). Rethinking corporate governance in state-owned enterprises: a stakeholder perspective. Public Adm. 97, 434–448.

Kim, H. J. (2018). Corporate governance of state-owned enterprises in developing countries: a framework for improved performance. Corp. Govern. 18, 577–594.

Kitchenham, B., Budgen, D., Brereton, P., Turner, M., Charters, S., and Linkman, S. (2007). Large-scale software engineering questions–expert opinion or empirical evidence? IET software, 1, 161–171.

Kiranmai, P., and Mishra, D. (2019). Corporate governance challenges in state-owned enterprises: an Indian perspective. J. Asia Pac. Bus. 20, 71–88.

Kitson, R., Harvey, G., and Robson, K. (2008). The PARIHS framework: a framework for understanding the implementation of complex interventions in healthcare. Implement. Sci. 3, 1–12. doi: 10.1186/1748-5908-3-1

Lee, S. A., Jobe, M. C., Mathis, A. A., and Gibbons, J. A. (2020). Incremental validity of coronaphobia: coronavirus anxiety explains depression, generalised anxiety, and death anxiety. J. Anxiety Disord. 74:102268. doi: 10.1016/j.janxdis.2020.102268

Lipumbu, P. N. (2021). Enhancing the performance of state-owned Enterprises in Namibia. Windhoek, Namibia: University of Namibia Press.

Long, Y., Li, D., Wu, Y., and Song, M. (2020). State-owned enterprise reform in China: A multi-perspective framework. Cheltenham, UK: Edward Elgar Publishing.

Lu, J., Ren, Y., and Qiao, Y. (2019). The challenges of corporate governance in state-owned enterprises: a literature review. Corp. Govern. 19, 1–15.

Mbidzo, P. (2020). Corporate governance of state-owned enterprises in Africa: a review of the literature and a research agenda. J. Afr. Bus. 21, 1–22.

Meijón, F. (2019). State-owned enterprises and corporate governance in Latin America: Progress and challenges. Transl. Corp. 26, 109–134.

Miralles-Quirós, M. M., Miralles-Quirós, J. L., and Redondo, H. J. (2019). ESG performance and shareholder value creation in the banking industry: international differences. Sustain. For. 11:1404. doi: 10.3390/su11051404

Mo, H., Gao, X., and Zhou, P. (2021). Financial performance and influencing factors of state-owned enterprises: a systematic literature review. Sustain. For. 13, 1–20.

Moher, D., Liberati, A., Tetzlaff, J., and Altman, D. G. (2009). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Medicine, 6:e1000097. doi: 10.1371/journal.pmed.1000097

Monks, R. A. G., and Minow, N. (2011). Corporate Governance (5th ed.). Wiley. (Seminal textbook covering agency theory, stewardship theory, and comparative governance models).

Moullin, J. C., Dickson, K. S., Stadnick, N. A., Rabin, B., and Aarons, G. A. (2019). Systematic review of the Exploration, Preparation, Implementation, Sustainment (EPIS) framework. Implementation Science, 14:1. doi: 10.1186/s13012-018-0842-6

Munsanje, M. (2021). The challenges of financing state-owned enterprises in developing countries: the case of Zambia. J. Public Finance Budget Manag. 8, 189–202.

Munteanu, I., Grigorescu, A., Condrea, E., and Pelinescu, E. (2020). Convergent insights for sustainable development and ethical cohesion: an empirical study on corporate governance in Romanian public entities. Sustain. For. 12:2990. doi: 10.3390/su12072990

Munteanu, A. V., Grigorescu, A. M., Nistor, C. G., and Dima, A. M. (2020). Corporate governance in state-owned enterprises: a comparative analysis of Romania and Slovakia. Sustain. For. 12, 1–16.

Muslih, M., and Halliawan, P. (2021). Organisational culture and corporate governance as a performance driver of Indonesia state-owned enterprises (SOE). South-East Asia J. Contemp. Bus. Econ. Law 24, 56–65.

Neshamba, M. (2019). Public Financial Management in Namibia. Windhoek, Namibia: Namibia Institute of Public Administration and Management.

Nicolò, F., Zanellato, G., and Tiron-Tudor, A. (2020). Corporate governance and sustainability in state-owned enterprises: an empirical analysis. J. Clean. Prod. 247:119116.

Nielsen, P. (2021). The role of corporate governance in the performance of public enterprises in developing countries. Int. J. Public Sect. Manag. 34, 1–18.

Nilsen, P. (2015). Making sense of implementation theories, models, and frameworks. Implement. Sci. 10, 1–13. doi: 10.1186/s13012-015-0242-0

Nwafor, L. C., Virakul, B., and Russ-Eft, D. F. (2020). Factors influencing corporate governance of state-owned enterprises in Nigeria: the case of Imo state. J. Public Private Manag. 27, 67–82.

OECD (2016). The governance of state-owned enterprises: A survey of best practices. Paris, France: OECD Publishing.

Okigbo, M., and Bagheri, M. (2020). The application of the German model of company law to the banking sector: a private law measure to avert systemic risk. J. Corp. Law Stud. 20, 1–25.

Olivieri, G., Koop, G., Van Leeuwen, B., and Hofman, P. (2022). State-owned enterprises: from commercial to corporate citizenship. J. Clean. Prod. 330:129801.

Panicker, V. S., Upadhyayula, R. S., and Mitra, S. (2023). Lender representatives on the board of directors and internationalisation in firms: an institutionalised agency perspective. J. Manag. Gov. 27, 1–24.

Pfanelo, N., and Chinomona, E. (2024). Reforming competitive advantages and supply chain effectiveness in south African state-owned enterprises. J. Contemp. Manag. 21, 157–186. doi: 10.35683/jcm23.050.250

Polit, D. F., and Beck, C. T. (2017). Nursing research: Generating and assessing evidence for practice. 10th. Edn. Philadelphia, PA: Wolters Kluwer.

Postuła, I., and Wieczorek, A. (2021). Government officials as a quasi-body of polish state-owned companies. Studia Prawno-Ekonomiczne 119, 333–353. doi: 10.26485/SPE/2021/119/18

Qobo, M. (2017). Africa's foreign policy and nation branding: regional leadership and its discontents. Strat. Rev. Southern Africa 39, 39–56.

Ramezanian Bajgiran, N., Margaritis, D., and Salimifar, M. (2020). Board Decision Quality, Corporate Governance and Firm Performance: A Study of European Firms. Corporate Governance and Firm Performance: A Study of European Firms.

Rock, S. (2020). The state-owned enterprise governance conundrum: balancing private and public interests. Corporate Govern. 20, 221–238.

Sadeh, A., Radu, L., Feniser, R., and Borsa, I. (2021). Corporate governance and organisational performance: evidence from Romanian state-owned enterprises. J. Bus. Res. 125, 58–73.

Sawyer, A., and Wagner, J. (2020). State-owned enterprises and corporate social responsibility. Cheltenham, United Kingdom: Edward Elgar Publishing.

Schwienbacher, A. (2019). Equity crowdfunding: anything to celebrate. Ventur. Cap. 21, 65–74. doi: 10.1080/13691066.2018.1559010

Shafuda, I., Lenz, C., and Mirecki, J. (2020). Ownership types and corporate governance in state-owned enterprises: a multidimensional view. Transl. Corp. 27, 127–157.

Shopati, A. M. (2018). A review of the expanded RE-AIM framework for implementation research. Implement. Sci. 13, 1–17.

Siswanto, A., and Hutajulu, M. J. (2019). Government-owned enterprises (GOEs) in Indonesia’s competition law and practice. Yustisia 8, 93–108. doi: 10.20961/yustisia.v0ixx.21740

Siyaya, S. N. (2020). Corporate governance in state-owned enterprises: The Namibian experience. Windhoek, Namibia: NIPAM.

Szanyi-Gyenes, X. (2024). Analysis of the competitiveness of Hungarian companies from the perspective of internationalisation. Budapest, Hungary: Budapesti Corvinus Egyetem.

Tahir, S. H., Sadique, M. A. B., Syed, N., Rehman, F., and Ullah, M. R. (2020). Mediating role of liquidity policy on the corporate governance-performance link: evidence from Pakistan. J. Asian Finance Econ. Bus. 7, 15–23. doi: 10.13106/jafeb.2020.vol7.no8.015

Tekin, A., and Polat, S. (2021). Corporate governance practices and financial performance: evidence from Turkish state-owned enterprises. J. Bus. Res. 134, 1–9.

Tekin, H., and Polat, A. Y. (2021). Adjustment speed of debt maturity: evidence from financial crises in East Asia. Bull. Monet. Econ. Bank. 24, 71–92. doi: 10.21098/bemp.v24i1.1287

Tien, N. H., Anh, D. B. H., Ngoc, N. M., and Nhi, D. T. Y. (2019). Sustainable social entrepreneurship in Vietnam. Int. J. Entrepreneurship 23, 1–12.