- 1Center for International and Comparative Studies, ETH Zürich, Zürich, Switzerland

- 2Department of Political Science, University of Houston, Houston, TX, United States

Global value chains and trade in intermediates have been proposed as one of the most important systemic changes in the global economic order. Besides their implication for the international trade, investment, and growth, we propose that they also have significant implications for the enforcement of sanctions. Intermediate trade allows economic actors to export and import products split into parts, later to be reassembled in another destination. Moreover, parts and components can also be classified differently in border crossings than final goods. In turn, these factors allow states to avoid enforcing sanctions that would negatively affect their own firms, while allowing firms to more safely export to sanction targets. We estimate United States’ trade with partners using disaggregated trade data and show that indeed, US exports disproportionately more in intermediates to sanctioned countries than to trade partners without sanctions. We conclude the report by proposing several propositions that pave the way for future research.

1 Introduction

Recent decades have seen a growing body of political economy research on the geographically-dispersed patterns of internationally joined-up production broadly referred as “global value chains” (GVCs) (e.g., Gereffi et al., 2005; Elms and Low, 2013; Eckhardt and Lee, 2018; Kim et al., 2019; Osgood, 2017, 2018; Zeng, 2021). Scholars have proposed that trade in parts and components—wherein countries and firms operating cross-nationally produce various intermediate inputs before delivering final goods and services—characterizes one the most important developments in international economic relations (e.g., Gereffi et al., 2005; Jensen et al., 2015; Baldwin, 2012). Over two-thirds of global merchandise trade takes place across GVCs (European Parliament, 2023) and approximately half of exports between Group of 20 (G20) members consist of parts and components trade (OECD, WTO, and UNCTAD, 2013). This shift in international trade patterns underscores the central role played by intermediate products and GVCs in contemporary trade governance (Johnson and Noguera 2017; Miroudot et al., 2009).

The implications of internationalization of production have led to a burgeoning literature across social and political sciences. While diverse in scope, key findings highlight that trade in parts and components increases demand for open trade policies (Lanz and Miroudot, 2011; Blanchard et al., 2016; Eckhardt and Poletti, 2018; Yildirim, 2017, 2020; Jensen et al., 2015), increases support for trade liberalization through preferential trade agreements (PTAs) (Orefice and Rocha, 2014; Antràs and Staiger, 2012; Eckhardt and Lee, 2018; Baccini et al., 2018), and helps contain protectionist interests in the aftermath of crises (Gawande et al., 2015).

Our study contributes to this literature by highlighting the implications of GVCs on complicating sanction enforcement. We argue that trade in industrial intermediate products provides firms with a channel to bypass sanction enforcement. Products that are disassembled to their parts and components can in the future be re-assembled into finished commodities that might otherwise be banned. By exporting products classified as intermediate goods, firms in sanctioning countries can circumvent enforcement of sanctions and maintain compliance with their legal obligations.

Recent research in economic sanctions has examined how black knights can undermine sanctions through trade (Early, 2011; Early, 2015), how firms can use foreign direct investment to obtain indirect access to markets (Barry and Kleinberg, 2015), and how states can use illicit means (such as smuggling) to move goods into sanctioned states (Chestnut, 2007). Scholars have suggested that sanctioning states can mitigate these issues through the use of secondary sanctions (Peterson, 2021), punishing violators (Early and Peterson, 2022), and encouraging firms to engage in de-risking behaviors, such as overcompliance (Early and Peterson, 2024).

Sanctions research has yet to connect GVCs with enforcement systematically. Le et al. (2022) show that sanctions reduce developing countries’ GVC participation but do not address enforcement or sender circumvention. Poletti and Sicurelli (2022) link GVC integration to EU sanction hesitancy but focus on domestic politics. Akoto et al. (2020) examine intra-industry trade’s effect on vulnerability, but not imposition. Therefore, despite GVCs’ impact on global trade, their role in sanctions remains underexplored. Our study fills this gap by analyzing how intermediate trade enables sanction circumvention.

We test our argument by analyzing United States (US) trade with partners from 1995 to 2019, showing that exports to sanctioned countries are disproportionately concentrated in industrial intermediate goods relative to final or non-industrial products. We focus on the U. S. as it is the world’s largest economy, the greatest trader in intermediates, and a hub for multinational firms sustaining GVCs. To assess this dynamic in detail, we use the OECD’s Trade in Value Added (TiVA) database and the Global Sanctions Database (GSDB) (Felbermayr et al., 2020), which offer detailed sector-level and sanctions data.

We begin below with a theoretical account of GVC trade and its implications for sanctions enforcement. We then test our explanation, examining US trade flows with partner states between 1995 and 2019.1 This is followed by a discussion of our findings and their broader relevance. We conclude by outlining the implications of our study for the literature on sanctions and global value chains, and by identifying avenues for future research.

2 Overview of the theoretical framework

This section outlines three interrelated dynamics in our theoretical framework: sanctions design and implementation, the nature of intermediate trade, and actor incentives. We begin with the designs and implementation of US sanctions. These range from complete embargoes (e.g., the US embargo on Cuba) to targeted sanctions on sectors and entities (e.g., US sanctions on Iran, the financial sanctions imposed on Russia). While sanctions may be imposed via executive orders or Acts of Congress (through the International Emergency Economic Powers Act), these orders are generally vague. Outside of complete embargoes, they rarely specify which trade is prohibited. Specific prohibitions and licensing requirements are instead handled by the U.S. Department of Commerce, Bureau of Industry and Security (2025), through its Commerce Control List (CCL).2 This list informs exporters of the restrictions and licensing requirements for various items. Importantly, the classification of the item is the duty of the exporter.3

In some cases, the classification of an export is clear. Finished products (such as automobiles or aircraft) will have an obvious classification that may depend only upon their design (e.g., whether an aircraft is military or civilian in nature). For parts and components, this is less obvious. While the CCL does restrict certain parts, these tend to be those components designed for a purpose. For example, paragraph 0A501.c restricts “‘parts’ and ‘components’ if ‘specially designed’ for” certain types of non-automatic firearms. Yet, not all components that have proscribed applications are “specially designed” for those applications. As an example, following the 2022 sanctions, the Russian military reportedly began using computer chips from dishwashers and refrigerators to repair tanks and other military equipment (Whalen, 2022). These parts have potential military applications but can be classified as civilian exports.

This type of classification is made possible by the nature of trade in intermediates, which facilitates interchangeability and reassembly across borders. Since many types of goods— especially industrial goods—are ultimately assembled from smaller parts, sanctions often involve products that cross borders, which can be traded as intermediate inputs. By engaging in intermediate trade, firms can classify their goods in ways that align with customs and border regulations, taking advantage of disassembled products’ classification as intermediates. Breaking down products into such parts and components allows firms in sanctioning countries to bypass sanctions, as they can export disassembled goods classified as intermediates, later reassembling them into restricted commodities. This distinction between finished and intermediate goods is therefore key in enabling trade between sender and target states and it is particularly helpful when it comes to industrial products, which have a high degree of interchangeability.4

Exporting parts and components also aligns with the incentives of both firms and states. Firms can lower their risk of breaching sanction law while continuing to trade, and states can gain plausible deniability in overlooking sanction enforcement. From the perspective of firms in sanctioning countries, profit incentives are likely to remain stable regardless of sanctions. In cases where they face restrictions to trade, firms have been observed to breach sanction law and states themselves have been shown to refrain from enforcing sanctions under certain conditions (Bapat and Kwon, 2015). This is particularly true, as members of the public care more about the long-run potential for sanctions than their immediate impact (Heinrich et al., 2017). Given this context, both firms and states often prefer to avoid full sanction enforcement when viable alternatives exist.

From the perspective of sanctioning states, trade in intermediates allows them to avoid imposing sanctions on their own firms. States often have structural disincentives to enforce sanctions as their own firms will lose profits and market share in the target country. However, as products are classified differently at the borders as intermediates, disassembled exports can more easily flow between senders and targets. This expectation implies that we should observe disproportionately higher trade in intermediates between sanctioning states and target economies, particularly with components that are more interchangeable and easier to assemble, like industrial goods. To test the validity of this proposition, we proceed with a comprehensive analysis below.

3 Methods

To examine broader patterns underlying the relationship between intermediate trade and economic sanctions, we draw data from three primary sources. Our dependent variables are based on exports of intermediate trade between the US and a partner country. The data come from the Trade in Value Added (TiVA) dataset, compiled by the OECD.5 TiVA has the highest temporal and cross-country coverage regarding in intermediate trade, with available data between 1995 and 2019. We create three sets of dependent variables, all using the same unit of analysis: the US-partner dyad-year. These variables represent a tiered approach to our research question, with each level reflecting more precision.

Our first set of dependent variables looks at total exports (in logged USD) from the US to its partners.6 We begin with total exports, then disaggregate to intermediate goods, and then further into industrial intermediates and non-industrial intermediates.7 This allows us to examine whether sanctions influence trade across different categories.

Our second set of dependent variables goes further, investigating the possibility that sanctions may dampen trade overall, but leave intermediates untouched. Therefore, we calculate the percentage of US manufacturing exports to a given country accounted for by all manufacturing intermediates, industrial intermediates, and non-industrial intermediates, respectively. This lets us assess whether intermediate exports increase in importance as a result of the sanctions.

Finally, we examine five manufacturing sectors that are particularly easy to break down and reclassify. If our theoretical proposition is correct, then these are the types of areas in which we should see change. For each of, we compute the percentage of US industrial exports to the target accounted for by that sector. This approach allows us to assess the relationship between intermediate trade and sanctions with increased precision and granularity.

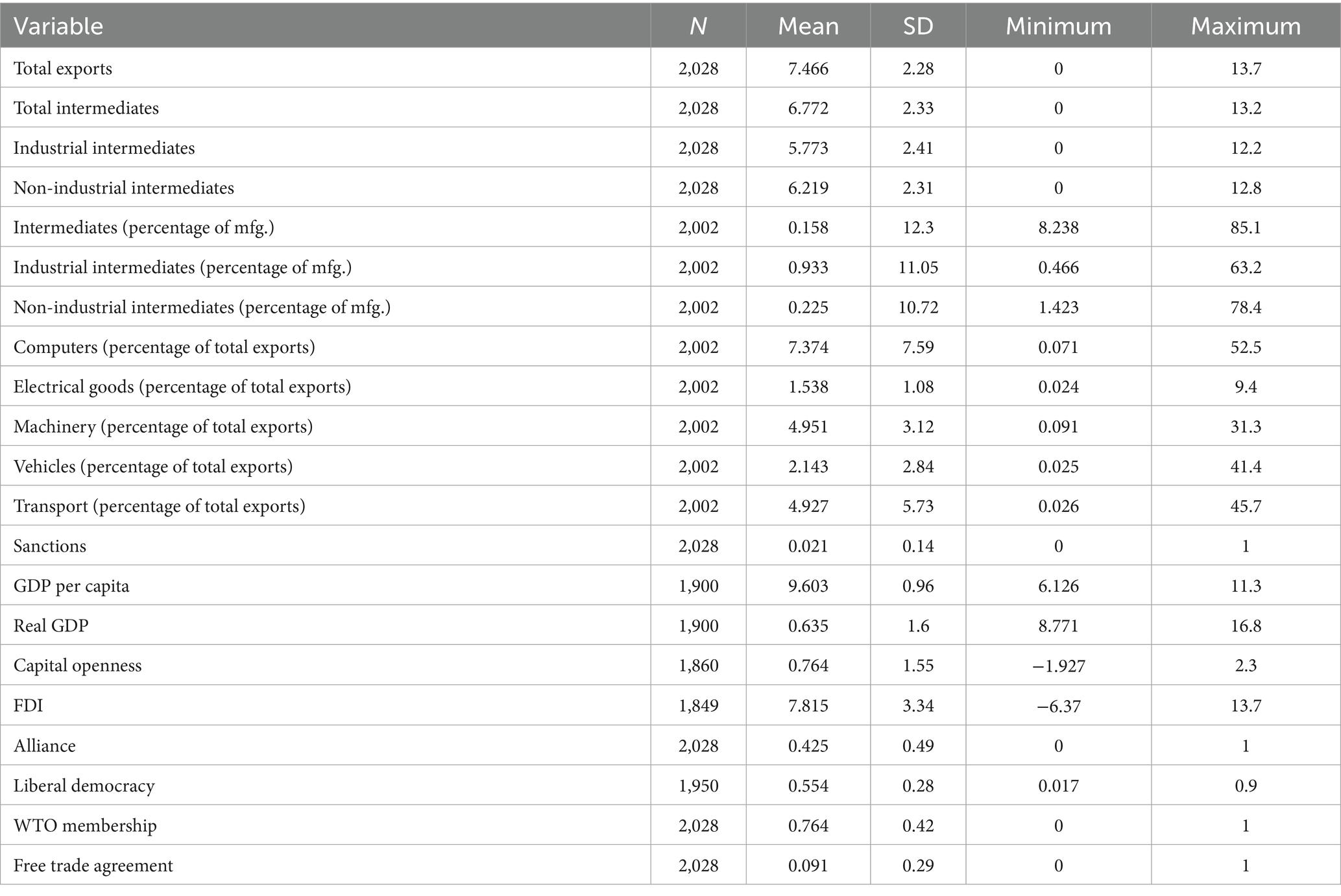

Our key independent variable is the imposition of economic sanctions. We draw from the GSDB (Felbermayr et al., 2020) which covers all episodes of economic sanctions between 1950 and 2019.8 We include a dummy variable that takes a value of 1 if the US had sanctions on a partner state in any part of a given year and 0 if it did not.9 In addition to sanctions, we control for several variables that may be related to trade. To account for economic and trade-related factors, we include logged measures of both real GDP and per capita GDP in the partner state (Feenstra et al., 2015), capital openness in the partner country (Chinn and Ito, 2006), and logged US foreign direct investment in the partner country (Anderson et al., 2019). To control for political considerations, we include a dummy variable for whether the US was involved in a defensive alliance with the partner country (Leeds et al., 2002), and the partner nation’s level of liberal democracy, as measured by the Varieties of Democracy project (Coppedge et al., 2021). Finally, we consider whether the partner is a member of the WTO and whether the US has a free trade agreement with the partner in force in a given year. We then run an OLS regression of the relevant dependent variable on sanctions and our set of control variables.10 To account for the possibility of spurious correlation due to idiosyncratic factors (such as the types of goods produced by states), global trends in the international economy, or shifts in the US, we include fixed effects for partner state and year. Finally, we report standard errors clustered on partner state. Table 1 below outlines the summary statistics for the variables used in the analysis. The OLS equation that we estimate is given by:

Where 𝛼𝑖 is a vector of country-level fixed effects and 𝛾𝑡 is a vector of temporal fixed effects.

4 Results

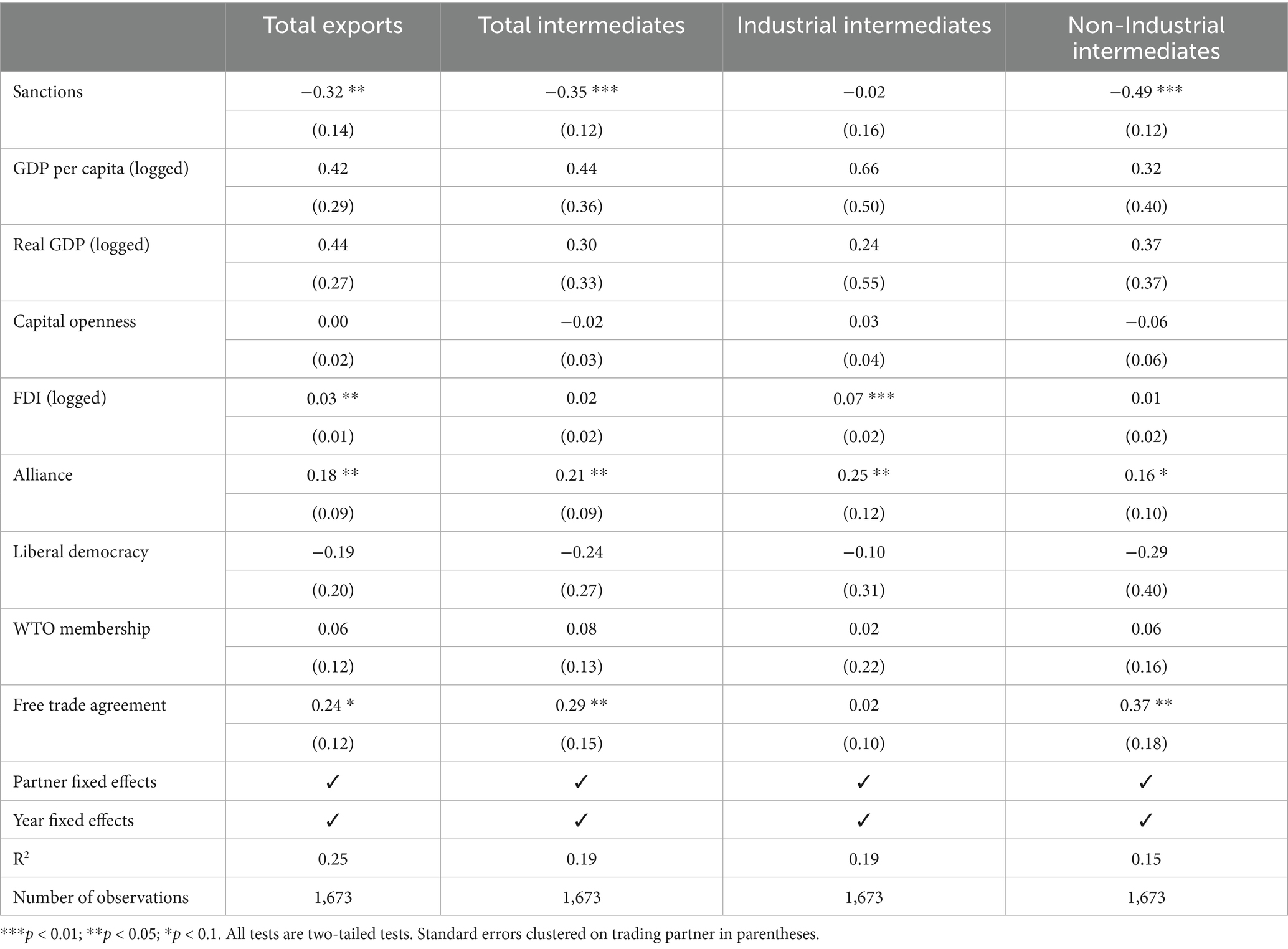

The results of our regression of intermediate exports on sanctions and control variables are reported in Table 2.11 All four columns concern US exports to a partner state, divided by type of export. We start with total exports in column 1, to examine the effects of sanctions on all trade. Column 2 examines all intermediate goods, and columns 3 and 4 break apart intermediates into industrial and non-industrial. Industrial intermediate goods (column 3) are the most easily interchangeable and reclassifiable, and therefore most relevant to our theory. Non-industrial intermediates (column 4) have broader possibilities for classification, but are not as easy to assemble and disassemble.

The results in Table 2 demonstrate that trade sanctions do reduce exports from the US to sanctioned countries.12 Exports tend to fall by nearly 30% (nearly half a billion USD at the mean).13 Column 2 shows that this effect comes at least partially from intermediate goods, as sanctions are also associated with a reduction in intermediate exports of nearly 30%. This is equivalent to around $257 million at the mean. However, when we break down intermediate goods into industrial and non-industrial categories, we see that this difference is driven primarily by non- industrial intermediates. The estimated decrease for industrial intermediates is small and statistically indistinguishable from zero, while for non-industrial goods, sanctions are associated with a reduction in exports of nearly 40% (about $195 million at the mean). Therefore, we proceed to a second set of tests to compare trade percentages as a function of sanctions.

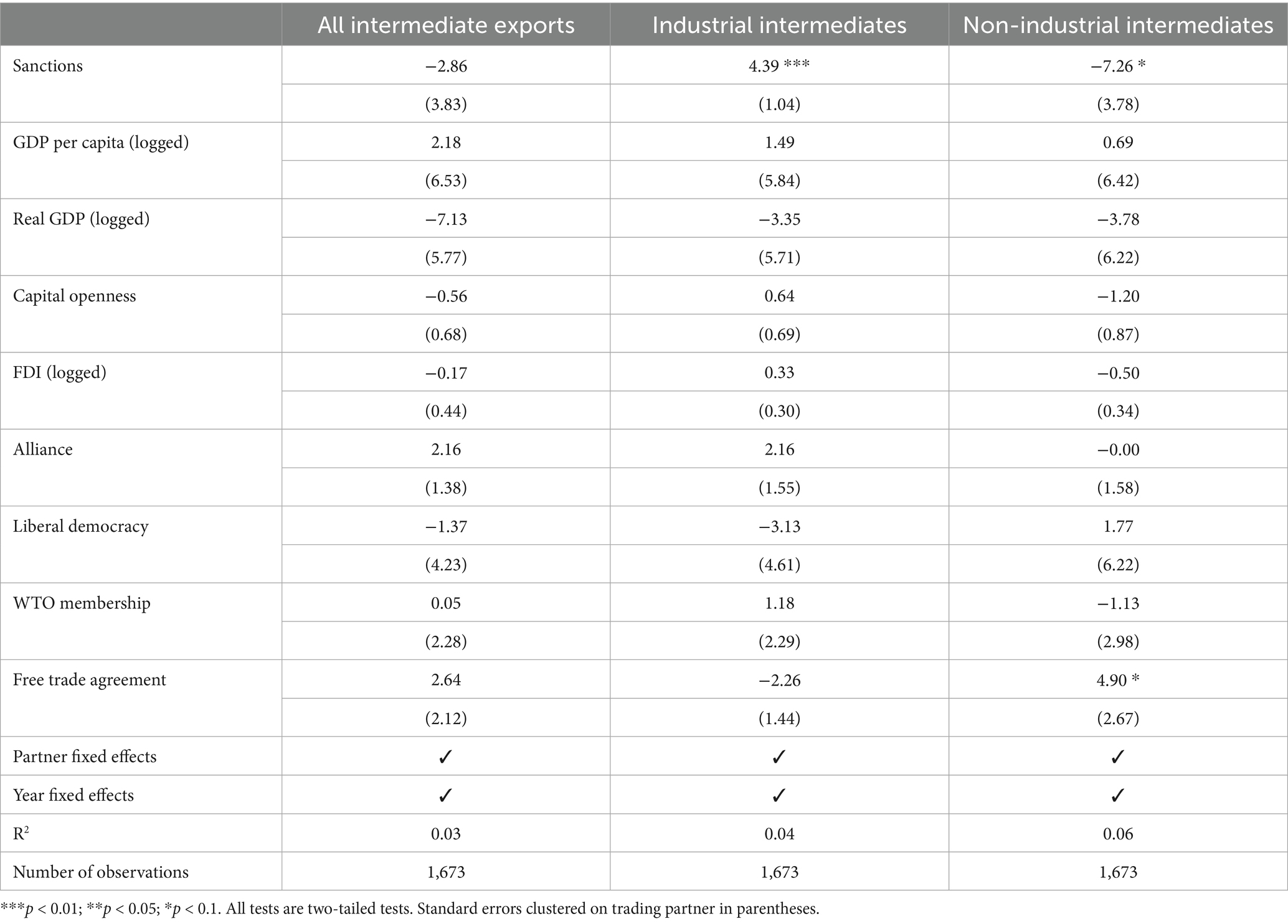

Table 3 looks at percentages of manufacturing exports. Column 1 examines the share of all such exports accounted for by intermediate goods. Here, we find a negative, but non-significant effect, suggesting that, among manufactured goods, the share accounted for by intermediates versus finished goods remains unchanged in the wake of economic sanctions. Columns 2 and 3 explore the reasoning behind this lack of finding. They show the offsetting effects of sanctions upon the percentage of manufactured goods made up by industrial and non-industrial intermediates, respectively.14

The estimated coefficients explain the lack of impact on total intermediates. Column 2 shows that industrial intermediates make up a significantly larger percentage of all manufactured goods in the wake of economic sanctions, leading to an increase in industrial intermediate goods of 4.39 percentage points. At the mean, this is equivalent to about a 21% increase in such commodities. Meanwhile, we see a decrease of 7.26 percentage points in the amount of manufactured goods accounted for by non-industrial intermediates. This is equivalent to a reduction of about 24% at the mean.

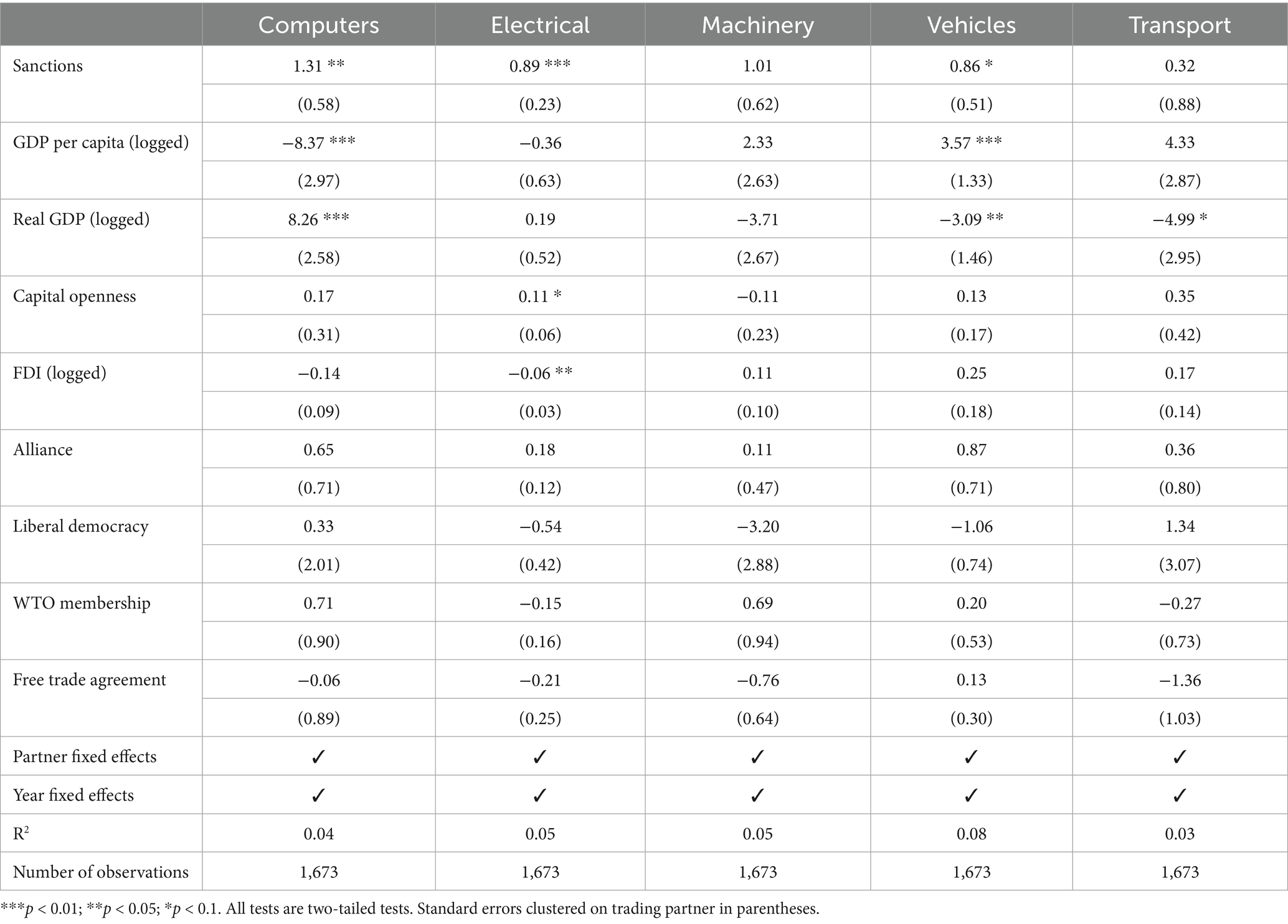

Given that industrial goods are the most easily substitutable and reclassifiable, these results are in line with our expectations. As a final step, we disaggregate industrial intermediates by sector to see which types of industrial goods are most likely to be sold to sanctioned countries.

Table 4 presents sector-level results based on TiVA categorizations: computers, electrical equipment, machinery, vehicles, and transport goods—arguably the most interchangeable sectors in terms of intermediate goods.15 We estimate positive coefficients across all five, finding significant results for three in particular: computers, electrical equipment, and vehicles. Sanctions raise the percentage of exports in these categories by 1.31 and 0.89, and 0.86 percentage points, respectively. While these numbers may seem small, they represent changes as a percentage of all exports. At these variables’ respective means, sanctions increase the percentage of exports accounted for by computers by nearly 18%, electrical goods by just under 58%, and vehicles by more than 40%. Importantly, these are the types of components that would be represented in the Russian case described above, as they are especially easily to repurpose for other uses.

5 Discussion

Across the three increasingly fine-grained analyses outlined above, the results are clear: intermediate goods provide a way for states (and their firms) to trade even under sanctions. The fact that such trade is focused on industrial goods—commodities that are most interchangeable and easily turned into other, potentially forbidden products— is particularly important. It provides evidence that there is a specific type of good that is exported by US firms during periods of economic sanctions. Indeed, economic sanctions aim to prevent target states from acquiring particular goods or services. We identify a key means by which sanctioned states can potentially acquire the goods that they desire in such a way that US firms are able to profit. By exploiting the prevalence of GVCs and the flow of intermediate goods, target states can import intermediate products, which they can then assemble into finished commodities that might otherwise be banned. This allows both states and firms to adhere to the letter of the law while skirting its spirit.

While our analysis focuses on the US, similar dynamics can be observed elsewhere. Firms often use both official and unofficial means to avoid imposed sanctions. For example, following President Trump’s 2018 withdrawal from the Iran nuclear deal, European firms and states sought ways to continue trade with Iran without violating US restrictions. One proposal in the EU was the Instrument in Support of Trade Exchanges (INSTEX), which would allow simultaneous transactions on non-SWIFT financial networks to simulate exchanges between European and Iranian firms without money actually moving across borders in violation of the US sanctions (Peel, 2019).

6 Conclusion

In this research report, we investigated the implications of GVC trade for sanction enforcement. We argued that GVCs facilitate circumvention by allowing firms to export intermediate products that can be reassembled into finished goods that might otherwise be banned. To illustrate this, we analyzed disaggregated U. S. trade data from 1995 to 2019, focusing on changes in the composition of exports—particularly industrial intermediates—to sanctioned versus non-sanctioned countries.

Our study contributes to multiple strands of literature. First, we speak to the GVC literature by showing their unintended consequences for sanction enforcement. Second, we expand the sanctions literature by proposing and testing a novel mechanism of circumvention. We build on Akoto et al. (2020), who argue that intra-industry trade may make states more resilient to sanctions, even when such resilience does not prevent their threat or imposition. We offer a complementary explanation by focusing on sanction circumvention.

Our findings also have policy implications. In a world of fragmented production, sanctions must consider products that are resistant to reassembly and enforcement bypass. The Russia case shows how semiconductors from civilian appliances were used to repair military equipment. While this does not confirm firm-level circumvention in sender states, it highlights the centrality of parts and components trade in sanction effectiveness. Furthermore, as firms can exploit production fragmentation to maintain trade with target states, designing smart sanctions becomes imperative (Kavaklı et al., 2020).16

Finally, our findings point to new directions for research. For one, in-depth case studies would be particularly useful to better understand firm-level and product-level dynamics of sanction bypass. Focusing on specific firm behavior or product flows before and after sanctions would deepen our understanding of the mechanism in which GVC trade can bypass sanction enforcement. Second, our findings suggest that intermediate trade and assemblage through third countries may also lead to sanction busting (e.g., Early, 2009, 2011). While seemingly avoiding trade with sanctioned states, countries may first export parts and components to third countries, assemble it through export platforms, and finally export final products to a target state. Indeed, sources indicate that British firms may have done precisely this in 2023–24, exporting aircraft components to Indian companies who then assembled them and sent them onward to Russia (Boffey et al., 2025). Studies would thus benefit from focusing on sanction busting from export platforms and third countries, yielding important insights as to when economic coercion is more likely to succeed.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

AY: Conceptualization, Data curation, Funding acquisition, Investigation, Methodology, Resources, Validation, Visualization, Writing – original draft, Writing – review & editing. JC: Data curation, Investigation, Formal analysis, Methodology, Software, Validation, Visualization, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. Open access funding was provided by the ETH Zürich.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that Gen AI was used in the creation of this manuscript. We used generative AI (ChatGPT) as a discussion partner for minor language refinement and sentence trimming during the revision process. No text was generated autonomously, and all content was authored and reviewed by the authors.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^The purpose of this research note is to demonstrate a plausible means by which GVCs and economic sanctions can interact. As such, the analysis is meant to be an initial look at the phenomenon and is inherently limited. We focus on the US in particular as it is the world’s most prolific sanctioner (accounting for more than half of all economic sanctions) and is second only to China in terms of total trade volume.

2. ^The current CCL can be found at: https://www.bis.doc.gov/index.php/regulations/export-administration-regulations-ear

3. ^The BIS provides some guidance to exporters on how to classify their products online (U.S. Department of Commerce, Bureau of Industry and Security, 2025).

4. ^Such interchangeability has recently been demonstrated in investigations showing that Western-manufactured industrial components have been found in North Korean and Russian missiles. Reports highlight how microelectronics have been repurposed – and the difficulties in enforcing sanctions with international supply chains (Yatskova, 2024; Business and Human Rights Resource Centre, 2024).

5. ^TiVA is publicly available via https://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm.

6. ^In line with standard practices, we log the dependent variable because export values are large numbers that tend to be skewed and measured in units (USD) whose value is marginally decreasing. As discussed below, we do the same for independent variables measured in USD.

7. ^We use TiVA data reported as “intermediates” or “final products” and further aggregate “industrial” category as manufactured goods – Chapters 26, 27, 28, 29, and 30 in ISIC Rev. 4.

8. ^An alternative data set, which is widely used is the Threat and Imposition of Economic Sanctions (TIES) database (Morgan et al., 2014). While the TIES data are well known and high quality, their temporal coverage is shorter, ending in 2005. We use the GSDB data for its broader range.

9. ^The GSDB includes several types of sanctions. For our purposes, we limit the analysis to trade sanctions only.

10. ^Because our dependent variable is logged, coefficients can be interpreted as a one-unit (for linear variables) or one-percent (for logged variables) change in the independent variable being associated with a β̂%change in the dependent variable.

11. ^We recognize that across all models, our R2 values are relatively low, suggesting that little variance has been explained. We would argue that this is because trade tends to exhibit significant temporal autocorrelation. We could improve the model fit by including a lagged dependent variable; however, because we estimate a fixed effects model, this would lead to biased results (Nickell, 1981). Therefore, we opt to omit the lagged dependent variable and focus instead on explaining variation, rather than maximizing fit.

12. ^We note that sanctions are relatively rare within the data set. As indicated in Table 1, only about 2% of country- years involve US sanctions. Approximately 9% of partner countries in the data set experience sanctions at one point or another. Although these countries are relatively diverse with respect to our control variables, there is the possibility that the results are driven by a handful of observations. Thus, future research should examine our theoretical argument with a broader data set.

13. ^One might expect the total value of exports to decline simply due to firms substituting finished goods with cheaper intermediate components (e.g., excluding assembly costs). However, our results rely not only on export values but also on changes in composition—specifically, the relative increase in industrial intermediate goods. These patterns suggest a strategic shift in trade structure rather than a purely price-driven effect.

14. ^These categories are non-exhaustive, as remaining goods would be non-intermediate manufacturing exports.

15. ^In another analysis, not reported here, we looked at six other industrial sectors that we believed to be less closely aligned with our idea of interchangeable and reclassifiable goods: chemicals, pharmaceuticals, plastics, minerals, base metals, and fabricated metals. None of these exhibits a statistically significant effect.

16. ^Although smart sanctions may allow senders to address some of the issues discussed here, they bring their own problems. Some scholars suggest that smart sanctions are less effective than broader measures (see Drezner, 2011; Ashford, 2016), that they may harm civilians or strengthen authoritarian leaders (Peksen, 2011; Grauvogel and von Soest, 2014), and that they can adversely affect non-targeted firms (Sun et al., 2022). These are all issues for policymakers to consider as they move forward in this space.

References

Akoto, W., Peterson, T. M., and Thies, C. G. (2020). Trade composition and acquiescence to sanction threats. Polit. Res. Q. 73, 526–539. doi: 10.1177/1065912919837608

Anderson, J. E., Larch, M., and Yotov, Y. V. (2019). Trade and investment in the global economy: a multi-country dynamic analysis. Eur. Econ. Rev. 120:103311. doi: 10.1016/j.euroecorev.2019.103311

Antràs, P., and Staiger, R. W. (2012). Offshoring and the role of trade agreements. Am. Econ. Rev. 102, 3140–3183. doi: 10.1257/aer.102.7.3140

Ashford, E. (2016). Not-so-smart sanctions: the failure of Western restrictions against Russia. Foreign Aff. 95, 114–123.

Baccini, L., Dür, A., and Elsig, M. (2018). Intra-industry trade, global value chains, and preferential tariff liberalization. Int. Stud. Q. 62, 329–340. doi: 10.1093/isq/sqy006

Baldwin, R. (2012). Global supply chains: why they emerged, why they matter, and where they are going. Working paper no. 2012–01. Hong Kong: Fung Global Institute.

Bapat, N., and Kwon, B. R. (2015). When are sanctions effective? A bargaining and enforcement framework. Int. Organ. 69, 131–162. doi: 10.1017/S0020818314000290

Barry, C. M., and Kleinberg, K. B. (2015). Profiting from sanctions: economic coercion and US foreign direct Investment in Third-Party States. Int. Organ. 69, 881–912. doi: 10.1017/S002081831500017X

Blanchard, E. J., Bown, C. P., and Johnson, R. C. (2016). Global supply chains and trade policy. No. w21883. Cambridge, MA: National Bureau of Economic Research.

Boffey, D., Matthews, C., and Joyner, E. (2025). British firms among companies to have exported aircraft parts that reached Russia. The Guardian. Available online at: https://www.theguardian.com/business/2025/feb/20/british-firms-among-those-that-exported-aircraft-parts-which-reached-russia (accessed February 20, 2025).

Business and Human Rights Resource Centre (2024). Western companies' recently manufactured components found in a north Korean missile shot down in Ukraine. Available online at: https://www.business-humanrights.org/en/latest-news/western-companies-recently-manufactured-components-found-in-a-north-korean-missile-shot-down-in-ukraine/ (accessed May 15, 2025).

Chestnut, S. (2007). Illicit activity and proliferation: north Korean smuggling networks. Int. Secur. 32, 80–111. doi: 10.1162/isec.2007.32.1.80

Chinn, M. D., and Ito, H. (2006). What matters for financial development? Capital controls, institutions, and interactions. J. Dev. Econ. 81, 163–192. doi: 10.1016/j.jdeveco.2005.05.010

Coppedge, M., Gerring, J., Knutsen, C. H., Lindberg, S. I., Teorell, J., and Altman, D. (2021). V-Dem Codebook v11.1. Varieties of Democracy Project.

Drezner, D. (2011). Sanctions sometimes smart: targeted sanctions in theory and practice. Int. Stud. Rev. 13, 96–108. doi: 10.1111/j.1468-2486.2010.01001.x

Early, B. R. (2009). Sleeping With Your Friends' Enemies: an explanation of sanctions-busting trade. Int. Stud. Q. 53, 49–71. doi: 10.1111/j.1468-2478.2008.01523.x

Early, B. R. (2011). Unmasking the black knights: sanctions busters and their effects on the success of economic sanctions. Foreign Policy Anal. 7, 381–402. doi: 10.1111/j.1743-8594.2011.00143.x

Early, B. R. (2015). Busted sanctions: Explaining why economic sanctions fail. Stanford, CA: Stanford University Press.

Early, B. R., and Peterson, T. M. (2022). Does punishing sanctions busters work? Sanctions enforcement and U.S. trade with sanctioned states. Polit. Res. Q. 75, 782–796. doi: 10.1177/10659129211025620

Early, B. R., and Peterson, T. M. (2024). The enforcement of U.S. economic sanctions and global De-risking behavior. J. Confl. Resolut. 68, 2048–2075. doi: 10.1177/00220027231214748

Eckhardt, J., and Lee, K. (2018). Global value chains, firm preferences and the Design of Preferential Trade Agreements. Glob Policy 9, 58–66. doi: 10.1111/1758-5899.12612

Eckhardt, J., and Poletti, A. (2018). Introduction: bringing institutions Back in the study of global value chains. Global Pol. 9, 5–11. doi: 10.1111/1758-5899.12613

Elms, D., and Low, P. (2013). Global value chains in a changing world. Geneva: World Trade Organization.

European Parliament (2023). Study by the international trade committee global value chains: Potential synergies between external trade policy and internal economic initiatives to address the strategic dependencies of the EU. Strasbourg: European Parliament.

Feenstra, R. C., Inklaar, R., and Timmer, M. P. (2015). The next generation of the Penn world Table. Am. Econ. Rev. 105, 3150–3182. doi: 10.1257/aer.20130954

Felbermayr, G., Kirilakha, A., Syropoulos, C., Yalcin, E., and Yotov, Y. V. (2020). The global sanctions database. Eur. Econ. Rev. 129:103561. doi: 10.1016/j.euroecorev.2020.103561

Gawande, K., Hoekman, B., and Cui, Y. (2015). Global supply chains and trade policy responses to the 2008 crisis. World Bank Econ. Rev. 29, 102–128. doi: 10.1093/wber/lht040

Gereffi, G., Humphrey, J., and Sturgeon, T. (2005). The governance of global value chains. Rev. Int. Polit. Econ. 12, 78–104. doi: 10.1080/09692290500049805

Grauvogel, J., and von Soest, C. (2014). Claims to legitimacy count: why sanctions fail to instigate democratisation in authoritarian regimes. Eur J Polit Res 53, 635–653. doi: 10.1111/1475-6765.12065

Heinrich, T., Kobayashi, Y., and Peterson, T. (2017). Sanction consequences and citizen support: a survey experiment. Int. Stud. Q. 61:sqw019. doi: 10.1093/isq/sqw019

Jensen, B., Quinn, D. P., and Weymouth, S. (2015). The influence of firm global supply chains and foreign currency Undervaluations on US trade disputes. Int. Organ. 69, 913–947. doi: 10.1017/S0020818315000247

Johnson, R. C., and Noguera, G. (2017). A portrait of trade in value-added over four decades. Rev. Econ. Stat. 99, 896–911.

Kavaklı, K. C., Chatagnier, J. T., and Hatipoglu, E. (2020). The power to hurt and the effectiveness of sanctions. J. Polit. 82, 879–894. doi: 10.1086/707398

Kim, I. S., Milner, H. V., Bernauer, T., Osgood, I., Spilker, G., and Tingley, D. (2019). Firms and global value chains: Identifying firms’ multidimensional trade preferences Int. Stud. Q. 63, 153–167.

Lanz, R., and Miroudot, S. (2011). “Intra-firm trade: patterns, determinants and policy implications” in Working paper 114. Trade policy papers (Paris: Organization for Economic Cooperation and Development (OECD)).

Leeds, B. A., Ritter, J. M., Mitchell, S. M., and Long, A. G. (2002). Alliance treaty obligations and provisions, 1815-1944. Int. Inter. 28, 237–260. doi: 10.1080/03050620213653

Le, H. T., Hoang, D. P., Doan, T. N., and Pham, C. H.To, T.T (2022). Global economic sanctions, global value chains and institutional quality: empirical evidence from cross-country data. J. Int. Trade Econ. Dev. 31, 427–449. doi: 10.1080/09638199.2021.1983634

Miroudot, S., Lanz, R., and Ragoussis, A. (2009). Trade in intermediate goods and services. OECD trade policy working paper no. 93, November 3. Available online at: https://www.oecd.org/trade/its/44056524.pdf (accessed November 3, 2009).

Morgan, T. C., Bapat, N., and Kobayashi, Y. (2014). Threat and imposition of economic sanctions 1945–2005: updating the TIES dataset. Confl. Manag. Peace Sci. 31, 541–558. doi: 10.1177/0738894213520379

Nickell, S. (1981). Biases in dynamic models with fixed effects. Econometrica 49, 1417–1426. doi: 10.2307/1911408

OECD, WTO, and UNCTAD (2013). Report on the implications of global value chains for trade, investment, development and jobs. Paris: OECD, WTO, and UNCTAD.

Orefice, G., and Rocha, N. (2014). Deep integration and production networks: an empirical analysis. World Econ. 37, 106–136. doi: 10.1111/twec.12076

Osgood, I. (2017). The breakdown of industrial opposition to trade: firms, product variety and reciprocal liberalization. World Polit. 69, 184–231. doi: 10.1017/S0043887116000174

Osgood, I. (2018). Globalizing the supply chain: firm and industrial support for US trade agreements. Int. Organ. 72, 455–484. doi: 10.1017/S002081831800005X

Peel, M. (2019). Can Europe’s new financial channel save the Iran nuclear deal? Financial Times. Available online at: https://www.ft.com/content/bd5a5046-27ad-11e9-88a4-c32129756dd8 (Accessed June 16, 2025).

Peksen, D. (2011). Economic sanctions and human security: the public health effect of economic sanctions. Foreign Policy Anal. 7, 237–251. doi: 10.1111/j.1743-8594.2011.00136.x

Peterson, T. M. (2021). Sanctions and third-party compliance with US foreign policy preferences: an analysis of dual-use trade. J. Confl. Resolut. 65, 1820–1846. doi: 10.1177/00220027211014945

Poletti, A., and Sicurelli, D. (2022). The political economy of the EU approach to the Rohingya crisis in Myanmar. Politics Gov. 10:4678. doi: 10.17645/pag.v10i1.4678

Sun, J., Makosa, L., Yang, J., Darlington, M., Yin, F., and Jachi, M. (2022). Economic sanctions and shared supply chains: a firm-level study of the contagion effects of smart sanctions on the performance of nontargeted firms. Eur. Manag. Rev. 19, 92–106. doi: 10.1111/emre.12497

U.S. Department of Commerce, Bureau of Industry and Security (2025). Classify your item. Available online at: https://www.bis.gov/licensing/classify-your-item (accessed May 13, 2025).

Whalen, J. (2022) Sanctions forcing Russia to use appliance parts in military gear’, The Washington Post. Available online at: https://www.washingtonpost.com/technology/2022/05/11/russia-sanctions-effect-military/ (accessed November 5, 2024).

Yatskova, S. (2024). Deadly chips: How integral bypasses sanctions and helps Russia keep the war going. Available online at: https://investigatebel.org/en/investigations/integral-pomoshch-rossii-voyna (accessed May 15, 2025).

Yildirim, A. B. (2017). Firms’ integration into value chains and compliance with adverse WTO panel rulings. World Trade Rev. 17, 1–31. doi: 10.1017/S1474745617000155

Yildirim, A. B. (2020). Value chains and WTO disputes: Compliance at the dispute settlement mechanism. New York, NY: Palgrave Macmillan.

Keywords: sanctions, international trade, global value chains, exports, United States

Citation: Yildirim AB and Chatagnier JT (2025) Global value chain trade and sanction bypass: evidence from the United States. Front. Polit. Sci. 7:1533226. doi: 10.3389/fpos.2025.1533226

Edited by:

Kilian Spandler, University of Gothenburg, SwedenReviewed by:

Mikhail Krivko, Czech University of Life Sciences Prague, Prague, CzechiaAlexander Jaax, Organisation for Economic Co-Operation and Development, France

José Firmino De Sousa Filho, Federal University of Bahia (UFBA), Brazil

Copyright © 2025 Yildirim and Chatagnier. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Aydin B. Yildirim, YXlkaW4ueWlsZGlyaW1AZXVwLmdlc3MuZXRoei5jaA==; J. Tyson Chatagnier, anRjaGF0YWduaWVyQHVoLmVkdQ==

Aydin B. Yildirim

Aydin B. Yildirim J. Tyson Chatagnier

J. Tyson Chatagnier