- Faculty of Social Sciences and Humanities, Mahidol University, Nakhonpathom, Thailand

Digital transformation is rapidly reshaping insurance markets, creating unprecedented regulatory challenges that require balancing innovation with market protection. This study develops a theoretical model integrating new public management (NPM) principles, technology acceptance factors, and collaborative governance to explain the emergence of sustainable digital insurance ecosystems powered by open data. Using structural equation modeling with data from 368 professionals (121 regulatory stakeholders, 178 industry professionals, and 69 technology enablers), we investigated how NPM principles and technology adoption factors influence behavioral intention, use behavior, and principled participation in open data initiatives. The results revealed dual pathways to sustainable outcomes: technological adoption (β = 0.27) and collaborative governance through open data sharing, with principled engagement demonstrating stronger influence (β = 0.45). Performance expectancy emerged as the strongest predictor of behavioral intention, while accountability and market-driven services significantly enhanced stakeholder engagement in open data platforms. Multigroup analysis showed differential effects across stakeholder categories, with regulatory stakeholders less influenced by efficiency considerations but more likely to translate technology use into collaborative engagement. This study contributes to public administration theory by demonstrating complementarities between NPM and collaborative governance in open data contexts, extends technology adoption frameworks to regulatory technology contexts, and provides evidence-based guidance for developing balanced digital regulatory approaches. The stronger influence of principled engagement on sustainable outcomes suggests that collaborative governance mechanisms are particularly critical for sustainability, challenging technocentric perspectives that prioritize digital tools over relational dimensions of regulatory governance in open data initiatives. By illuminating the complex interplay between managerial principles, technological factors, and collaborative mechanisms in open data ecosystems, this research offers a comprehensive framework to navigate the digital transformation in insurance regulation.

1 Introduction

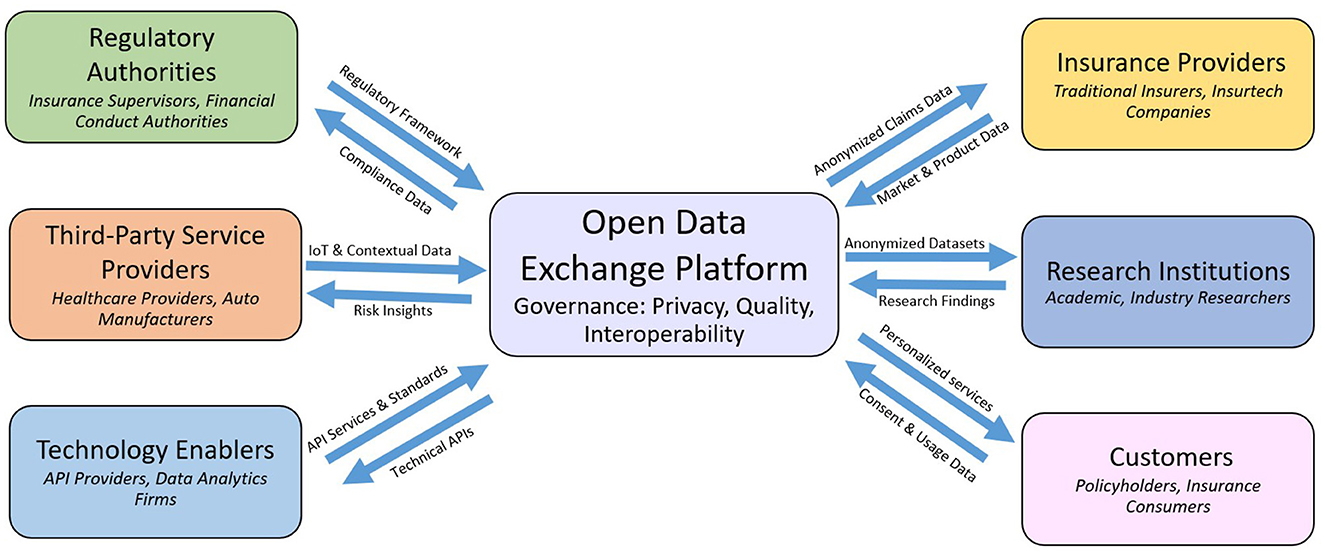

The insurance industry is at a pivotal crossroads where digital transformation forces are reshaping market dynamics, customer expectations, and regulatory approaches simultaneously (Eling and Schaper, 2023). As artificial intelligence, predictive analytics, and platform ecosystems transform insurance operations, the gap between technological innovation and regulatory frameworks continues to widen (Bzhalava et al., 2022; Wilson et al., 2021). This divergence presents significant challenges for both policymakers and industry participants: inadequate consumer protection in novel digital contexts, regulatory arbitrage opportunities that undermine market stability, and missed innovation opportunities due to regulatory uncertainty. Recent research indicates that 67% of compliance failures in digital insurance initiatives stem from insufficient collaboration between regulators and insurers during the implementation phases (EIOPA, 2024). Despite recognition of these challenges, the frameworks for effective public-private cooperation in digital insurance regulation remain underdeveloped, leaving stakeholders struggling to balance innovation facilitation with necessary market protections (Brăgaru, 2022; Porrini and Ramella, 2020). In addition, open data, the concept that certain data should be freely available for use, reuse, and redistribution by anyone, has emerged as a critical enabler for addressing these challenges. The European Insurance and Occupational Pensions Authority (EIOPA) has been exploring the concept of “open insurance,” which involves accessing and sharing insurance-related data, usually via Application Programming Interfaces (APIs) to foster innovation and enhance consumer protection (EIOPA, 2023). Open insurance has the potential to transform the value chain by enabling new business models, improving risk assessment, and facilitating more personalized products and services. However, as noted by the European Commission in their Data Governance Act (DGA), which came into force in June 2022, effective open data initiatives require robust governance frameworks that balance innovation with data protection, privacy concerns, and market stability (European Commission, 2022). Furthermore, traditional regulatory approaches often fail to accommodate the speed and complexity of technological change and open data initiatives, while purely market-driven initiatives frequently neglect broader social concerns regarding data privacy, algorithmic fairness, and service inclusiveness (Martin and Murphy, 2022; Yeung, 2023). Without adequate frameworks to govern open data flows between stakeholders in the insurance ecosystem, the benefits of data sharing may be outweighed by risks to consumer protection, market integrity, and fair competition. As highlighted by the Financial Data Access (FIDA) framework proposed in 2023, open insurance requires clear standards and protocols for secure, efficient, and responsible data sharing (European Commission, 2023). A comprehensive review by Pum and Sukma (2024) identified several critical gaps in current approaches to insurance regulation in the age of artificial intelligence and open data, highlighting the need for collaborative regulatory frameworks that can balance innovation with consumer protection. Their research emphasizes that the transformative potential of AI and open data in insurance, from underwriting and pricing to claims processing and fraud detection, requires new regulatory models that facilitate responsible innovation while maintaining market integrity.

This study proposes that addressing these challenges requires an integrated theoretical framework that combines the principles of New Public Management (NPM) with technology adoption factors and collaborative governance approaches, all supported by open data principles. The insurance regulatory context provides an ideal setting to examine this integration, as it involves complex interactions between public authorities, private enterprises, and technological innovations that shape fundamental market dynamics (Thouvenin et al., 2021). By developing a comprehensive model that bridges managerial, technological, and collaborative perspectives with open data principles, our goal is to advance both theoretical understanding and practical guidance for sustainable digital insurance ecosystems.

This research is based on three complementary theoretical streams in the context of open data governance. First, New Public Management offers valuable information through its emphasis on efficiency, market-driven services, and accountability in regulatory contexts (Gong and An, 2023). These principles potentially enhance stakeholders' intentions to adopt digital regulatory approaches and participate in open data initiatives, though critics note that they may sometimes undermine relational dimensions necessary for effective collaboration (Christensen et al., 2023). Second, technology adoption theories, particularly the Unified Theory of Acceptance and Use of Technology (UTAUT), provide frameworks for understanding how stakeholders embrace technological innovations in regulatory contexts and open data platforms (Dwivedi et al., 2022). By incorporating performance expectancy, effort expectancy, social influence, and facilitating conditions, we can better understand the drivers of digital adoption in insurance regulation. Sukma and Leelasantitham (2022a) demonstrated in their study of electronic government systems that both performance expectancy and facilitation conditions significantly influence users' behavioral intention and continuance intention. Their findings in public service contexts suggest potential parallels in regulatory technology adoption, reinforcing the applicability of the UTAUT framework to our research domain. Finally, collaborative governance theories highlight the importance of principled engagement among diverse stakeholders to address complex regulatory challenges through open data sharing (Emerson and Gerlak, 2023; Ansell and Gash, 2022), offering pathways through which behavioral intentions translate into sustainable ecosystem outcomes.

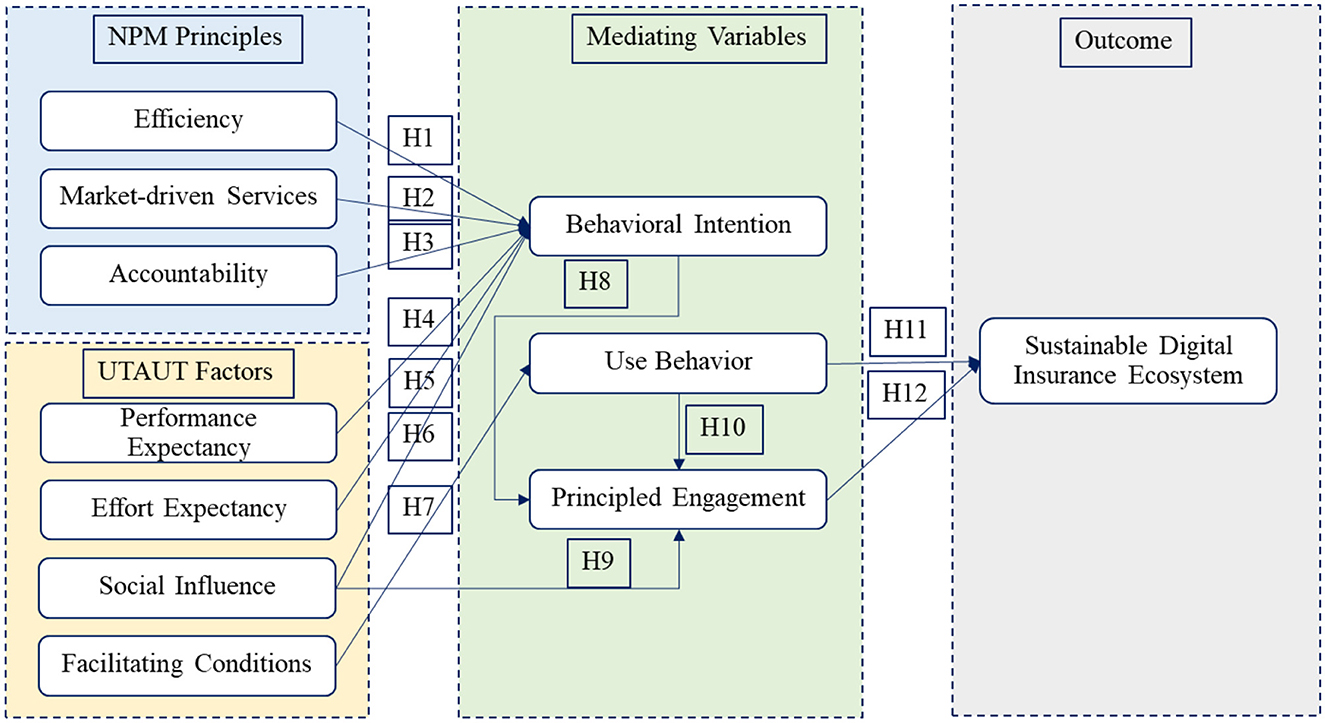

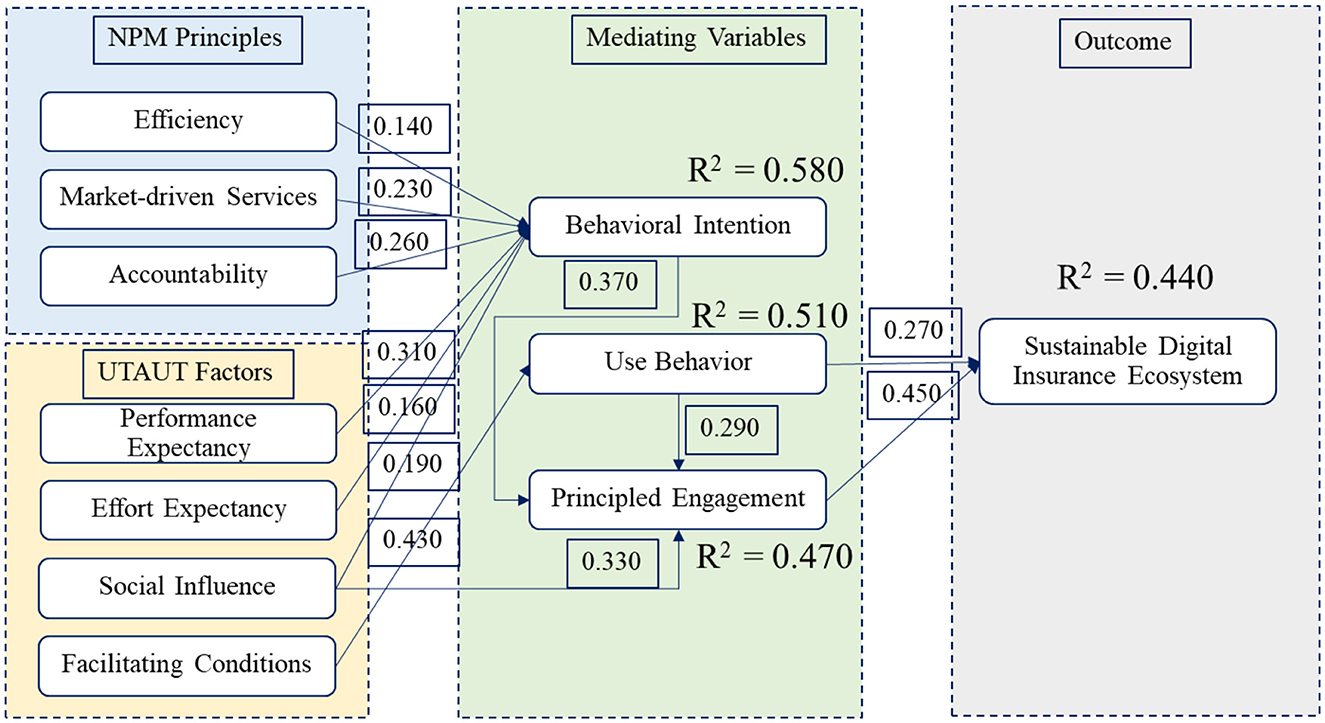

This proposed model (Figure 1) integrates these theoretical perspectives to explain how the principles of NPM and UTAUT factors influence the intention toward open data adoption, which subsequently shapes the use behavior and principled engagement in the regulation of digital insurance regulation. These intermediate outcomes then contribute to sustainable digital insurance ecosystems characterized by balanced innovation and protection, effective data governance, inclusive service provision, transparent algorithmic decision-making, adaptive regulatory frameworks, and collaborative problem solving between public and private stakeholders. By exploring the relationships between these elements, we address two critical research questions:

RQ1: how do NPM principles (efficiency, market-driven services, accountability) and technology adoption factors (performance expectation, effort expectation, social influence) influence behavioral intention toward open data adoption and digital regulatory approaches in insurance ecosystems?

RQ2: through what pathways do intention, use behavior, and principled participation in open data initiatives collectively contribute to sustainable digital insurance ecosystems?

These questions are particularly timely as insurance markets around the world navigate digital transformation while facing increased regulatory scrutiny. The European Insurance and Occupational Pensions Authority has identified collaborative regulatory approaches and open data sharing as essential to address emerging risks in digital insurance markets (EIOPA, 2024), while the International Association of Insurance Supervisors emphasizes the need for balanced innovation facilitation and consumer protection in regulatory frameworks (IAIS, 2022). Our research responds to these industry developments while also addressing important theoretical gaps at the intersection of public management, technology adoption, and collaborative governance in open data contexts. Consequently, Sukma and Namahoot (2024) have demonstrated that emerging technologies like artificial intelligence and machine learning are transforming decision-making processes in financial services, creating new challenges for regulatory frameworks. Their work on algorithmic systems illustrates how technological innovation can outpace regulatory mechanisms, suggesting important parallels to the insurance industry's digital transformation challenges. Similarly, Sukma and Leelasantitham (2022b) developed a sustainable business framework that emphasizes the importance of integrated approaches that combine technological, behavioral, and governance dimensions, an approach that aligns with our research objectives in the insurance regulatory context.

This study makes several significant contributions. First, it advances the theory of new public management by demonstrating how efficiency-oriented principles can complement rather than contradict collaborative approaches in regulatory contexts, specifically when applied to open data initiatives, addressing long-standing theoretical tensions between managerial and participatory governance paradigms. Second, it extends technology adoption frameworks to regulatory technology contexts and open data platforms, an application that remains underexplored in the existing literature. Third, it provides practical guidance for policymakers and industry stakeholders seeking to develop sustainable digital insurance ecosystems that balance innovation facilitation with necessary market protections through effective open data governance. By integrating these diverse perspectives, our research offers a comprehensive framework for understanding and navigating the complex landscape of digital insurance regulation in an era of open data. The paper proceeds as follows: we first develop our theoretical framework and hypotheses, integrating the principles of NPM, UTAUT factors, and collaborative governance concepts within an open data context. Then we present our research methodology, followed by results and analysis. Finally, we discuss theoretical and practical implications, acknowledge limitations, and suggest directions for future research.

2 Theoretical framework and hypotheses development

This theoretical framework integrates new public management principles, technology adoption factors, and collaborative governance concepts to explain how these elements collectively influence the development of sustainable digital insurance ecosystems through open data collaboration. For each theoretical component, we review the relevant literature and develop specific hypotheses that reflect the relationships depicted in our model, as presented in Figure 1.

2.1 New public management principles and behavioral intention in open data contexts

New Public Management (NPM) emerged in the 1980s as a paradigm that sought to transform public administration by introducing market-oriented principles, emphasizing outcomes over processes, and focusing on efficiency and performance measurement (Gong and An, 2023). In regulatory contexts, NPM manifests itself through risk-based supervision, cost-benefit analysis, and performance-based regulatory frameworks (Baldwin and Lodge, 2020; Black, 2020). In open data governance, NPM principles emphasize the creation of transparent, efficient and responsive data sharing mechanisms that balance public value with market needs (Attard et al., 2015; Harrison and Sayogo, 2023). We focus on three core NPM principles particularly relevant to digital insurance regulation and open data initiatives and propose specific hypotheses for their relationship with behavioral intention.

Efficiency refers to optimization of resource utilization and streamline of administrative processes in regulatory governance and data sharing. In digital insurance contexts with open data initiatives, efficiency manifests itself through automated compliance systems, risk-based supervision models, simplified reporting requirements, and standardized data exchange protocols. When regulatory agencies demonstrate efficiency through digital systems and open data platforms, they establish themselves as competent partners capable of reliable performance (Das and Teng, 2020). Janssen and Estevez (2023) found that efficient administrative processes positively influenced stakeholder adoption of e-government initiatives with open data components. Similarly, Seo and Kim (2022) demonstrated that perceived procedural efficiency enhanced willingness to participate in digital regulatory programs and data sharing frameworks. Similar patterns have been observed in other digital governance domains. Sukma and Leelasantitham (2022a) found that efficiency-related constructs significantly influenced user adoption of electronic government systems, particularly when stakeholders perceived direct benefits from streamlined processes. Their study of the regulation of the community water supply business showed that efficiency expectations played a key role in the formation of behavioral intentions toward digital governance approaches and the use of open data utilization.

H1: Efficiency in regulatory processes positively influences the behavioral intention to adopt open data and digital regulatory approaches.

Market-driven services represent the application of customer-oriented principles and competitive service provision to government functions, including data governance initiatives. In insurance regulation with open data, this approach manifests itself through responsive regulatory frameworks, user-centered digital interfaces, value-based service design, and market-responsive data sharing standards. By emphasizing responsiveness to stakeholder needs, market-driven regulatory approaches align public requirements with industry expectations for data utilization, creating value congruence (Koval and Pinkse, 2023). Empirical research by Fledderus and Honingh (2022) found that public services designed with customer orientation significantly increased stakeholder participation intention in open government data initiatives. Similarly, Wirtz and Müller (2023) demonstrated that citizen-centric digital services improved adoption rates in public sector digital transformations that incorporated open data principles.

Sukma and Leelasantitham (2022b) developed a conceptual framework that emphasizes that sustainable business models require alignment between regulatory systems, open data frameworks, and stakeholder needs. Their research suggests that market-responsive regulatory approaches to data governance can enhance adoption intentions by demonstrating sensitivity to industry contexts and operational realities in data sharing ecosystems.

H2: Market-driven services in regulatory governance positively influence the behavioral intention to adopt open data and digital regulatory approaches.

Accountability encompasses the obligation to explain decisions, provide performance information, and accept responsibility for results in both regulatory processes and data management. In digital insurance regulation with open data initiatives, accountability manifests itself through transparent decision-making processes, accessible performance metrics, clear delineation of regulatory responsibilities, and transparent data-sharing governance. These mechanisms reduce information asymmetry between regulators and regulated entities, potentially enhancing behavioral intention by mitigating vulnerability concerns in data-sharing arrangements (Grimmelikhuijsen et al., 2022). Studies have shown that accountability mechanisms build trust and enhance stakeholder intention to adopt government initiatives involving data sharing (Song et al., 2022). Meijer (2023) found that transparency-mediated technology-mediated accountability positively affected stakeholder intention to participate in digital governance frameworks with open data components. In their study on understanding online behavior toward community participation, Sukma and Leelasantitham (2022c) found that transparency and accountability were significant factors influencing user trust and participation intention on public service platforms with data sharing capabilities. This finding suggests that similar mechanisms may operate in insurance regulatory contexts, where transparency can enhance stakeholder confidence in digital approaches to open data governance.

H3: Accountability in regulatory processes positively influences the behavioral intention to adopt open data and digital regulatory approaches.

Despite NPM's potential benefits, critics note that its emphasis on efficiency and quantifiable results may sometimes undermine relational dimensions of effective regulation and data governance (Christensen et al., 2023). However, our model proposes that, when properly implemented within open data frameworks, NPM principles can enhance behavioral intention toward digital regulatory initiatives by demonstrating competence, alignment with stakeholder needs, and transparency, factors that collectively reduce perceived risks of adoption in complex data sharing environments.

2.2 Technology adoption factors and behavioral intention in open data platforms

The Unified Theory of Acceptance and Use of Technology (UTAUT) was developed by Venkatesh et al. (2003) to explain user intentions to adopt information systems. UTAUT integrates elements from eight previous technology acceptance models and has demonstrated strong predictive validity across various contexts. We incorporate the UTAUT framework into our model to understand the adoption of open data platforms in regulatory technology contexts and develop specific hypotheses for this environment.

Performance Expectancy represents the degree to which stakeholders believe that adopting digital regulatory systems and open data platforms will help them achieve gains in job performance, regulatory compliance, or service delivery. In insurance contexts with open data initiatives, this could include expectations about improved compliance accuracy, reduced reporting burdens, better market intelligence, improved product development capabilities, or more efficient claims processing through data sharing. Empirical research consistently demonstrates performance expectancy as a strong predictor of adoption intention across various technologies (Dwivedi et al., 2022). In regulatory contexts with open data specifically, Obal and Kunz (2020) found that expected performance improvements significantly influenced financial institutions' intention to adopt regulatory technology solutions with data-sharing components. Furthermore, Sukma et al. (2022) examined factors affecting the adoption of online community participation platforms and found that performance expectancy was the strongest predictor of behavioral intention, explaining 42% of variance in contexts involving data sharing. Their research suggests that stakeholders primarily adopt new technologies when they perceive clear performance benefits from data utilization, a finding likely applicable to insurance regulatory technologies in open data ecosystems.

H4: The performance expectation in relation to open data and digital regulatory technologies positively influences the behavioral intention to adopt these technologies.

Effort Expectancy refers to the perceived ease of use associated with digital regulatory systems and open data platforms. When stakeholders believe that digital compliance platforms, data sharing interfaces, or collaborative governance systems are intuitive and straightforward, they can demonstrate greater behavioral intention toward adoption. Research by Chaouali and El Hedhli (2023) in the adoption of financial technology with open data components found that the effort expectancy significantly predicted the intention of behavior, especially among stakeholders with limited technological expertise. Similarly, Kumar et al. (2022) demonstrated that perceived complexity negatively influenced the adoption of regulatory technologies and open data platforms among insurance companies. Therefore, Pum and Sukma (2024) noted in their comprehensive survey of AI in insurance that user-friendly interfaces and simplified technical implementations were critical success factors for regulatory technology adoption, particularly when involving complex data exchanges. Their research suggests that effort expectancy may be particularly important in complex insurance regulatory contexts where technical barriers could otherwise impede the adoption of open data initiatives.

H5: Expectancy of effort in open data and digital regulatory technologies positively influences behavioral intention to adopt these technologies.

Social influence encompasses the degree to which stakeholders perceive that important others (peers, industry leaders, regulators) believe they should use digital regulatory systems and participate in open data ecosystems. In insurance contexts, the adoption of regulatory technology and open data platforms often follows network effects, where value increases as more participants join the ecosystem. Venkatesh et al. (2003) found that social influence is particularly important in mandated technology contexts, such as regulatory compliance and industry-wide data sharing initiatives. Empirical research by Liang et al. (2020) demonstrated that institutional pressures significantly influenced the intention of adopting financial reporting technology and open data platforms in regulatory contexts. Additionally, Sukma and Leelasantitham (2022c) research on online community participation demonstrated that social influence had significant direct and indirect effects on behavioral intention, particularly in contexts where community norms and peer behavior regarding data sharing were visible. This suggests that social dynamics may play an important role in shaping regulatory technology adoption decisions in open data ecosystems.

H6: Social influence on open data and digital regulatory technologies positively influences the intention to adopt these technologies.

Facilitating conditions represent the degree to which stakeholders believe that organizational and technical infrastructure exists to support the use of digital regulatory technology and open data platforms. Unlike other UTAUT factors that influence behavior intention, facilitating conditions directly impact use behavior. Zhu et al. (2021) found that facilitating conditions predicted actual technology usage more strongly than behavioral intention in complex organizational environments with data sharing requirements. In regulatory contexts, Glaser et al. (2023) demonstrated that technical infrastructure and organizational support directly influenced the success of compliance technology implementation in open data initiatives. Furthermore, Sukma and Leelasantitham (2022a) found that facilitation of conditions significantly affected both behavior intention and continuance intention in e-government systems with data-sharing components, suggesting that adequate infrastructure support is crucial for sustainable technology adoption in open data ecosystems. Their findings indicate that facilitating conditions can play a dual role in regulatory technology contexts, influencing both initial adoption and continued use of open data platforms.

H7: Facilitating conditions positively influence use behavior with respect to open data and digital regulatory technologies.

The UTAUT framework has been extensively applied in the adoption contexts of consumer and enterprise technology, but its application to regulatory technology and open data platforms remains limited. Our model extends UTAUT to the regulatory domain, proposing that these technology adoption factors influence behavioral intention toward open data initiatives and, ultimately, sustainable digital insurance ecosystems.

2.3 Behavioral intention, social influence, and principled participation in open data collaboration

Our model integrates collaborative governance concepts with technology adoption frameworks by proposing relationships between behavioral intention, social influence, and principled engagement in open data ecosystems. Collaborative governance emphasizes stakeholder participation, deliberation, and joint problem solving through data sharing and collective intelligence (Emerson and Gerlak, 2023; Ansell and Gash, 2022). Principled engagement encompasses fair, inclusive, and deliberative interaction processes characterized by discovery, definition, deliberation, and determination supported by open data (Emerson et al., 2020). In open data digital insurance regulation, principled engagement manifests through structured stakeholder consultations, transparent policy development, inclusive digital platforms for regulatory dialogue, and collaborative data governance frameworks. Research has shown that the behavioral intention toward technological systems can translate into broader participatory behaviors in data-sharing ecosystems. For example, Venkatesh and Agarwal (2023) found that the intention of technology adoption was positively associated with participation in virtual communities with data sharing components. In regulatory contexts, Matheus and Janssen (2022) documented how intention to adopt open data platforms increased engagement in collaborative governance processes. Additionally, Sukma and Leelasantitham (2022b) developed a sustainable business framework showing that the behavioral intention toward technological systems can be translated into broader ecosystem participation through open data utilization. Their research on community water supply businesses demonstrated that the intention of adoption led to increased participation in collaborative governance activities involving data sharing, suggesting that similar patterns may exist in insurance regulatory contexts.

H8: The behavioral intention of adopting open data and digital regulatory approaches positively influences principled participation in collaborative regulatory processes.

Furthermore, social influence can directly affect principled participation in open data ecosystems, regardless of its effect on behavioral intention. Ansell and Bjork (2023) noted that social and institutional pressures often drive initial participation in collaborative governance with open data initiatives. Similarly, Scott and Thomas (2021) found that normative and mimetic pressures significantly influenced organizational participation in collaborative networks with data sharing components, regardless of technology adoption decisions. In their examination of online community participation with data sharing components, Sukma and Leelasantitham (2022c) found that social influence directly affected engagement behaviors beyond its effect on the initial adoption intention. Their findings suggest that social norms and peer expectations may play an independent role in driving collaborative engagement in regulatory contexts with open data platforms.

H9: Social influence positively affects principled participation in collaborative regulatory processes with open data initiatives.

This model also proposes a relationship between use behavior and principled engagement in open data ecosystems, creating a feedback loop within the collaborative process. As stakeholders gain experience with digital regulatory technologies and open data platforms, these experiences could shape how they engage in collaborative governance. Empirical research by Welch and Feeney (2021) documented how experience with e-Government technologies influenced subsequent participation in digital public engagement with open data components. Similarly, McNutt and Justice (2023) found that experience with collaborative platforms and open data systems reshaped stakeholder participation patterns in regulatory consultations.

Sukma and Namahoot (2024) observed in their study of algorithmic trading systems that actual use experience significantly influenced users' subsequent engagement with collaborative improvement processes involving data sharing. Their findings suggest that hands-on experience with technological systems can reshape engagement patterns in open data ecosystems, potentially increasing stakeholders' willingness to participate in collaborative governance mechanisms.

H10: The behavior of the use of open data and digital regulatory technologies positively influences the principled engagement in collaborative regulatory processes.

2.4 Pathways to sustainable digital insurance ecosystems through open data

The ultimate dependent variable in our model is the Sustainable Digital Insurance Ecosystem, which we conceptualize as a multidimensional outcome characterized by balanced innovation and consumer protection, effective data governance, inclusive access to services, transparent algorithmic decision-making, adaptive regulatory frameworks, and collaborative problem solving between public and private stakeholders through open data platforms. Our model proposes that this sustainable ecosystem emerges through two primary pathways: directly from use behavior of open data technologies and through principled engagement in open data collaboration. The direct technological pathway has been empirically supported by research that demonstrates immediate operational benefits of digital regulatory technologies and open data platforms. For example, Arner et al. (2022) documented how the implementation of regulatory technology with open data components improved compliance outcomes and market stability in financial services. Similarly, Treleaven and Batrinca (2021) showed how algorithmic regulation improved market protection while supporting innovation in insurance markets through data transparency. In addition, Sukma and Leelasantitham (2022b) developed a conceptual framework for sustainable business ecosystems that emphasized the importance of technological infrastructure and open data in creating sustainable outcomes. Their research suggests that effective implementation of technology provides a foundation for ecosystem sustainability through improved operational efficiency, transparency, and data-driven decision making.

H11: The behavior of open data and digital regulatory technologies positively influences the development of a sustainable digital insurance ecosystem.

The collaborative governance pathway through open data sharing has been supported by research showing how principled engagement contributes to sustainable regulatory outcomes. Emerson and Nabatchi (2022) found that collaborative governance processes with open data sharing produced more balanced regulatory approaches with greater legitimacy and implementation success. In insurance contexts specifically, van der Heijden (2022) demonstrated that collaborative governance facilitated by open data platforms enabled the development of new regulatory frameworks for innovative insurance products that balanced protection with innovation. Furthermore, Sukma and Leelasantitham (2022a) found that collaborative engagement in electronic government systems with open data components significantly improved sustainability outcomes in public service contexts. Their research demonstrates that stakeholder participation in open data ecosystems contributes to system improvements, policy refinements, and enhanced legitimacy, factors likely to be similarly important in insurance regulatory contexts.

H12: Principled participation in collaborative regulatory processes through open data initiatives positively influences the development of sustainable digital insurance ecosystems.

Taken together, our hypotheses propose that NPM principles and UTAUT factors influence behavioral intention toward open data adoption, which subsequently shapes both use behavior and principled engagement in open data ecosystems. These intermediate outcomes then contribute to sustainable digital insurance ecosystems through complementary pathways. By integrating these diverse theoretical perspectives within an open data framework, our model provides a comprehensive account of how managerial, technological, and collaborative factors collectively shape the digital regulatory transformation in insurance markets.

3 Research methodology

3.1 Research design and approach

This study employs a quantitative research design with a deductive approach to test the hypothesized relationships in our NPM-Based Open Data Collaboration Model. A cross-sectional survey methodology was selected for its ability to capture the complex multivariate relationships proposed in our theoretical framework while allowing generalizable findings regarding public-private collaboration in insurance regulation through open data initiatives. The deductive approach aligns with our objective of testing and evaluating an integrated theoretical model against empirical evidence collected from various stakeholders in the insurance regulatory ecosystem.

The quantitative approach is particularly appropriate for this research for several reasons. First, it allows systematic testing of multiple hypothesized relationships simultaneously through structural equation modeling (SEM), which is essential given the complexity of our proposed model. SEM is widely recognized as a powerful technique for analyzing complex relationships between observed and latent variables while accounting for measurement error (Kline, 2023). Recent methodological advances in SEM have improved its capability to handle complex models with multiple mediating pathways (Bollen et al., 2023), making it ideal for examining the direct and indirect effects proposed in our theoretical framework.

Second, SEM enables the evaluation of direct and indirect pathways between constructs, supporting our investigation of mediating relationships through behavioral intention, use behavior, and principled engagement in open data ecosystems. This capability is crucial for understanding the complex mechanisms through which NPM principles and technology adoption factors influence sustainable outcomes in digital insurance regulation. As noted by Ansell and Gash (2008), SEM is particularly valuable when investigating theoretical models with multiple interrelated dependent variables and mediating relationships.

Third, SEM facilitates the comparison of relative effect sizes between different model paths, providing information on which factors most significantly influence sustainable digital insurance ecosystems through open data collaboration. This comparative capability allows us to identify the most impactful levers for promoting sustainable outcomes in regulatory contexts, which has important implications for policy and practice. According to Hershberger et al. (2022), the ability to compare standardized coefficients across different paths is a key advantage of SEM over other multivariate techniques when evaluating complex theoretical models.

3.2 Target population and sampling

3.2.1 Population and sampling frame

The target population for this research includes stakeholders involved in insurance regulation and digital transformation initiatives in three main categories. The first category includes regulatory stakeholders, such as insurance supervisors, financial conduct authorities, and policymakers who are responsible for developing and implementing open data and insurance regulation policies. The second category encompasses industry stakeholders including traditional insurers, intermediaries, insurtech companies, and industry associations that are subject to regulatory requirements and actively engaged in open data initiatives. The third category consists of technology enablers, including regulatory technology providers, consultants, and digital transformation specialists who support regulatory compliance, innovation, and open data implementation in the insurance sector.

To ensure the validity of the responses, we established several inclusion criteria for participant selection. All participants were required to have at least 2 years of professional experience in insurance or insurance regulation to ensure adequate domain knowledge. They needed to be directly involved in regulatory compliance, policy development, open data initiatives, or the implementation of regulatory technology to provide relevant insights into the research questions. In addition, participants were required to have experience with digital transformation initiatives in insurance to ensure familiarity with the technological aspects of regulatory change. Finally, they needed to have sufficient seniority or experience to provide informed perspectives on regulatory relationships and data governance mechanisms in the insurance ecosystem.

We employ a stratified random sampling approach to ensure appropriate representation across stakeholder categories while maintaining randomization within each stratum. This approach allowed us to capture diverse perspectives while preserving the proportional representation of key stakeholder groups in the insurance regulatory ecosystem. The sampling frame was developed using multiple sources including industry databases, regulatory directories, professional association memberships, and participation lists from insurance regulatory forums and conferences specifically focused on digital transformation and open data initiatives. This comprehensive approach to the development of the sampling frame helped ensure adequate coverage of the target population in different geographical regions and organizational types.

3.2.2 Sample size and characteristics

Based on established structural equation modeling literature, we determined that our research model comprising 12 hypothesized relationships with seven exogenous and four endogenous constructs required a robust sample size to achieve sufficient statistical power (Hair et al., 2019). Recent advances in SEM methodology have provided more nuanced approaches to sample size determination, considering model complexity, expected effect sizes, and desired power levels (McNeish and Wolf, 2021). Using these contemporary guidelines, we determined that a minimum sample of 300 was necessary to detect medium effect sizes (0.3) with 80% power at a significance level of 0.05, while accounting for the complexity of our model. To accommodate potential non-response and incomplete submissions, we targeted an initial sample of 500 potential respondents through our multichannel distribution strategy.

The final sample comprised 368 valid responses, providing an adequate response rate of 73.6% and exceeding our minimum threshold for robust statistical analysis. These responses were distributed among stakeholder categories to ensure comprehensive representation of the insurance ecosystem: regulatory stakeholders constituted 33% of the sample (121 participants), industry stakeholders represented 48% (178 participants) and technology enablers accounted for 19% (69 participants). This distribution aligns with the relative proportions of these stakeholders in the broader insurance ecosystem, and industry representatives naturally form the largest group. The geographical distribution of the participants reflected the global nature of insurance regulation and digital transformation, with 43% of European markets, 31% from North America, 18% from Asia-Pacific regions, and 8% from other territories. This international composition ensures that our findings are not limited to a single regulatory jurisdiction, while acknowledging the predominance of established insurance markets in the sample.

Participants demonstrated substantial relevant experience, with an average professional tenure in insurance or regulation of 9.6 years (SD = 5.8), indicating a sample with significant domain expertise. Furthermore, 74% of the participants reported direct participation in digital transformation initiatives over the past 3 years, and 62% indicated specific involvement in open data initiatives or data sharing projects within their organizations. This high level of engagement with digital transformation and open data in particular improves the validity of our findings regarding adoption factors and collaborative governance mechanisms in open data ecosystems.

3.3 Measurement instrument development

3.3.1 Construct operationalization

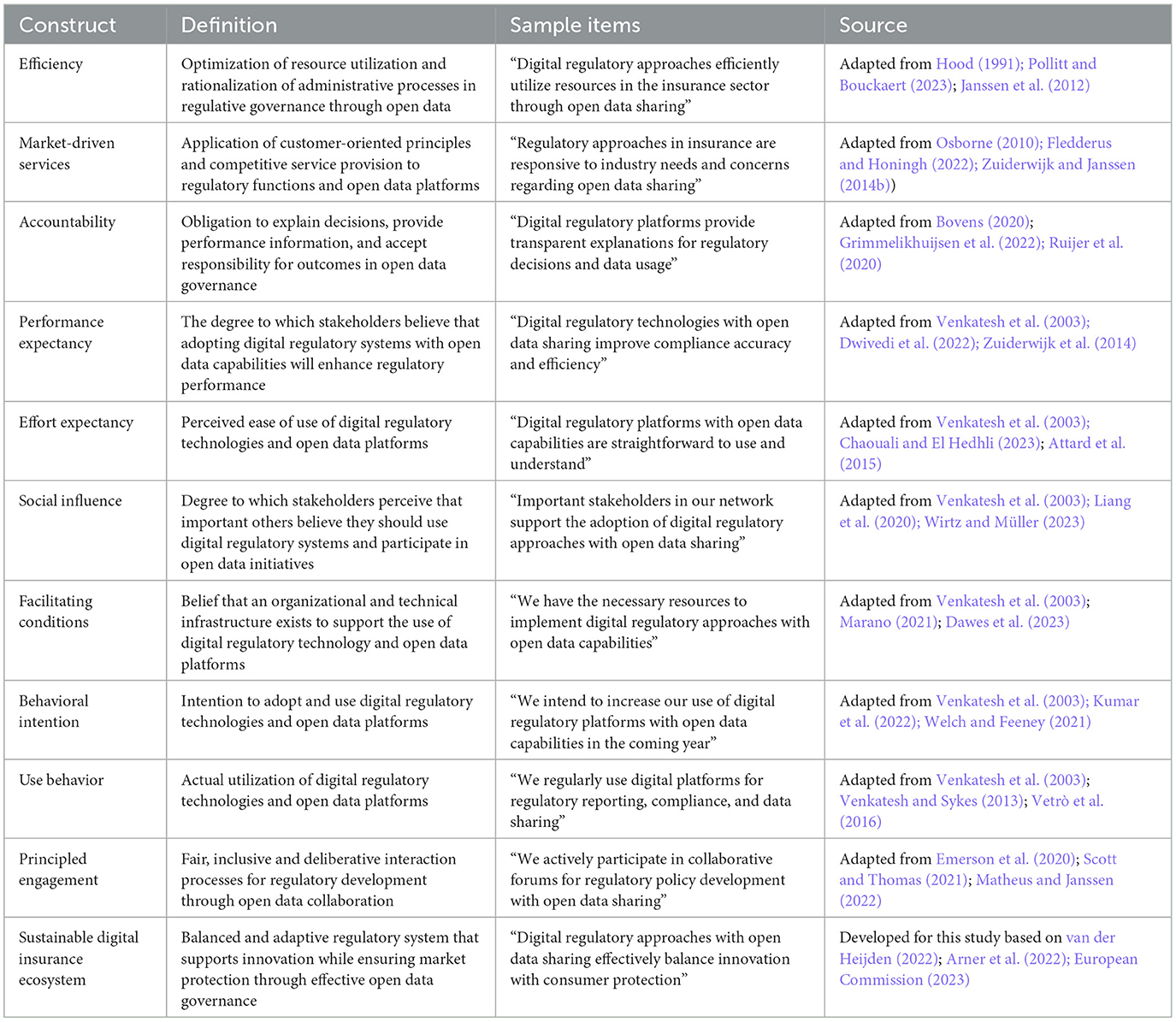

We developed a structured questionnaire to measure all the constructs in our theoretical framework as presented in Table 1. Where possible, measurement elements were adapted from validated scales in previous research, with modifications to reflect the specific context of digital insurance regulation and open data collaboration. For constructs without established measures in the regulatory context, new items were developed based on theoretical definitions and validated through expert reviews and pilot testing.

All items were measured using 7-point Likert scales (1 = strongly disagree, 7 = strongly agree) to capture the intensity of respondents' perceptions with sufficient granularity for statistical analysis. Each construct was measured with multiple items (3–5 per construct) to ensure content validity, reliability, and adequate identification for structural equation modeling. For open data-specific constructs, we incorporated items that explicitly addressed aspects of data sharing, standardization, interoperability, and governance to ensure proper measurement of these dimensions within our theoretical framework.

3.3.2 Instrument validation

We conducted a comprehensive validation process to ensure the reliability and validity of the measurement instrument, with particular attention to the open data dimensions of our constructs. This rigorous validation approach involved multiple phases to establish content validity, ensure reliability, and confirm construct validity before full-scale data collection.

For the content validity assessment, the initial set of measurement items was reviewed by 10 subject matter experts with diverse expertise in the insurance regulatory ecosystem. This expert panel included three academics who specialize in regulatory governance, three senior insurance regulators, two insurtech executives, and two open data specialists with experience in financial services. Each expert independently evaluated the relevance, clarity and completeness of the measurement items using a structured assessment protocol (Polit and Beck, 2023). This panel specifically assessed whether the items adequately captured the open data aspects of each construct, ensuring a comprehensive coverage of the dimensions of data sharing, governance, and interoperability dimensions. Based on the quantitative and qualitative feedback received, the elements were refined to improve clarity, contextual relevance, and alignment with current open data frameworks and standards. This expert validation process substantially improved the content validity of our instrument by incorporating diverse perspectives from both theory and practice (Velinov et al., 2023). After content validation, we conducted pilot tests with 45 participants representing various stakeholder categories with experience in open data initiatives. The pilot sample included 15 regulatory officials, 20 industry representatives, and 10 technology specialists to ensure balanced representation. Reliability analysis using Cronbach's alpha showed strong internal consistency for all constructs, with values ranging from 0.78 to 0.92, well above the recommended 0.7 threshold (Taber, 2018). This strong reliability indicates a consistent measurement of the open data dimensions across all constructs in our framework. The item-total correlations were also examined, with all items showing correlations >0.50, confirming their contribution to their respective scales. Furthermore, qualitative feedback from pilot participants led to minor language adjustments for clarity, particularly with respect to technical terminology related to data governance and APIs, enhancing the comprehensibility of the instrument for diverse stakeholders.

For the construct validity assessment, we performed exploratory factor analysis on the pilot data using principal axis factoring with oblique rotation to examine the underlying structure of the measurement elements (Watkins, 2018). Special attention was paid to how open data items loaded on their respective constructs to ensure proper alignment with theoretical expectations. The factor analysis revealed a clear pattern of loadings consistent with our conceptual framework, with items loading strongly on their intended factors (loadings > 0.60) and showing minimal cross-loadings (<0.30) on other factors. Items that showed problematic loading patterns were either refined or eliminated to ensure a clean factor structure. Through this iterative refinement process, the final instrument was streamlined to 42 elements in 11 constructs, with additional elements specifically addressing open data components that emerged as important during the validation process. This comprehensive validation approach substantially improved the measurement quality of our instrument, providing a solid foundation for testing our theoretical model.

3.4 Data collection procedures

Data were collected using a web-based survey platform optimized for both mobile and desktop devices to maximize accessibility for busy professionals in the insurance ecosystem. We implemented a comprehensive data collection strategy with multiple complementary components to ensure high-quality responses and maximize participation rates (Dillman et al., 2023). Our outreach process began with carefully personalized targeted invitations based on stakeholder category, organizational role, and known involvement in open data initiatives. Each invitation included a detailed explanation of the purpose of the study, potential benefits for the regulatory ecosystem, and the specific value of the participant's unique perspective on open data collaboration in insurance regulation. This personalized approach has been shown to increase response rates by establishing relevance and creating stakeholder buy-in (Tourangeau et al., 2022). To enhance reach and credibility, we distribute survey invitations through multiple complementary channels beyond direct email outreach. These channels included professional associations focused on insurance innovation, regulatory forums that address digital transformation, open data communities in financial services, and industry networks dedicated to regulatory technology and insurtech. This multichannel approach helped ensure representation from diverse stakeholders actively engaged in the intersection of insurance regulation and open data (Groves et al., 2021).

To maximize response rates, we implemented a carefully designed follow-up protocol based on best practices in survey methodology (Sauermann and Roach, 2023). Non-respondents received up to two follow-up reminders at 2-week intervals, with each communication emphasizing different benefits of participation and highlighting the importance of capturing diverse perspectives on open data governance in insurance. The first reminder emphasized the opportunity to contribute to regulatory innovation, while the second highlighted the value of executive summary findings for strategic planning. This varied messaging approach has been shown to resonate with different motivational factors that influence participation decisions (Lynn, 2022). To address potential concerns about sensitive regulatory opinions, participants received explicit assurances regarding anonymity and confidentiality. All responses were anonymized during data processing and reported only in aggregate form, without individual or organizational identifiers retained in the final dataset. These confidentiality provisions were prominently communicated in all materials to encourage candid responses about regulatory preferences and data sharing concerns (Singer and Couper, 2023).

As an incentive for participation, respondents were offered an executive summary of research findings, including insights into best practices for open data collaboration in insurance regulation. This non-monetary incentive approach is particularly effective with professional populations who value industry knowledge and strategic insights (Rose et al., 2022). In addition, we implemented targeted sampling procedures to ensure adequate representation of stakeholders with direct experience in open data initiatives, including focused outreach to participants in open insurance pilot programs and regulatory sandboxes dedicated to data sharing. This specialized outreach helped secure the participation of individuals with the most relevant experience for our research questions, improving the validity of our findings regarding open data adoption and governance (Baker et al., 2022).

3.5 Data analysis strategy

3.5.1 Preliminary analysis

Before hypothesis testing, we conducted several rigorous preliminary analyzes to ensure data quality and methodological soundness. Data screening procedures were implemented to identify and address potential problems that could affect statistical conclusions. We examined the data set for missing values using Little's MCAR test to determine the randomness of missing data patterns (Little and Rubin, 2020). Missing values, which comprised <3% of data points, were addressed using robust expectation maximization algorithms with auxiliary variables to improve the accuracy and maintain sample representativeness. Multivariate outliers were assessed using both Mahalanobis distances and Cook's distance metrics, with particular attention to extreme responses on open data-related items to ensure that unusual cases did not unduly influence model parameters (Tabachnick and Fidell, 2022). Additionally, we examined normality data using formal tests (Shapiro-Wilk) and visual inspection of Q-Q plots, finding moderate deviations from normality that were addressed through robust estimation methods in the subsequent SEM analysis. Since all data were collected using a single survey instrument, we implemented multiple techniques to assess potential common method bias that could artificially inflate relationships between constructs (Podsakoff et al., 2023). Harman's single-factor test was conducted as an initial assessment, revealing that the first unrotated factor explained only 28.4% of variance, well below the 50% threshold suggesting serious common-method bias. We supplemented this with the more sophisticated marker variable technique, using a theoretically unrelated construct (environmental awareness) as a marker. The average correlation between this marker variable and the study constructs was minimal 0.08, and controlling for this correlation did not significantly change the magnitude or significance of the relationships in our model. Additionally, we implemented the more rigorous common latent factor approach recommended in recent methodological literature (Liu et al., 2024), which revealed that common method variance accounted for only 12.4% of total variance in our model, well below the problematic threshold. These multiple convergence assessments provide strong evidence that common-method bias does not substantially threaten the validity of our findings, particularly for relationships involving open data constructs.

We calculated comprehensive descriptive statistics including means, standard deviations, and correlations for all variables to provide an initial understanding of the patterns and relationships. These preliminary analyzes included additional examinations of open data-specific items to identify potential patterns based on stakeholder categories and experience levels. Furthermore, we conducted supplementary descriptive analyzes to understand participants' engagement with open data initiatives, creating categorizations based on participation in data sharing projects to facilitate later subgroup analyses. These preliminary analyzes provided a solid foundation for the subsequent assessment of the measurement model and hypothesis testing while ensuring that data quality issues were adequately addressed before inferential analysis (Hair et al., 2022).

3.5.2 Evaluation of the measurement model

We employed confirmatory factor analysis (CFA) using the latest methodological approaches to evaluate the measurement model with several key indicators. This rigorous assessment was essential to ensure that our constructs were properly measured before testing substantive relationships, particularly since many of our constructs were adapted or developed for the open data context in insurance regulation (Brown, 2022).

For the assessment of convergence validity, we examined multiple complementary indicators following contemporary best practices in measurement evaluation (Hair et al., 2022). Factor loadings with a target threshold above 0.7 were assessed to ensure items adequately represented their respective constructs. The extracted average variance (AVE) was calculated for each construct with a minimum acceptable value of 0.5, indicating that the constructs explain at least 50% of the variance in their indicators. Composite reliability (CR) was evaluated with a threshold of 0.7 to ensure adequate internal consistency. Following recent recommendations by Kline (2023), we also examined the significance of factor loadings and the magnitude of standard errors to provide additional evidence of measurement quality. Special attention was paid to items measuring open data aspects of each construct, with separate examinations of their psychometric properties to ensure that they contributed meaningfully to their respective theoretical constructs. Furthermore, discriminant validity was evaluated using traditional and contemporary approaches to provide comprehensive evidence of construct distinctiveness (Voorhees et al., 2022). The Fornell-Larcker criterion was applied by comparing the square root of AVE for each construct with its correlations with other constructs, ensuring that the constructs share more variance with their own indicators than with other constructs. Furthermore, we implemented the more rigorous heterotrait-monotrait (HTMT) correlation ratio with a conservative threshold of 0.85 as recommended by the contemporary methodological literature (Henseler et al., 2023). This approach provides a more stringent assessment of discriminant validity that addresses the limitations of traditional approaches. Particular attention was paid to discriminant validity between open data-specific aspects of different constructs to ensure that they were empirically distinguishable despite their conceptual relationships.

The overall fit of the measurement model was evaluated through multiple complementary indices to provide a comprehensive evaluation (Shi et al., 2022). Traditional fit indices included the chi-square to degrees-of-freedom ratio (χ2/df < 3), comparative fit index (CFI > 0.95), Tucker-Lewis index (TLI > 0.95), standardized root mean square residual (SRMR < 0.08), and root mean square error of approximation (RMSEA < 0.06 with a narrow confidence interval). In addition, we applied newer fit indices such as gamma hat and weighted root mean square residual (WRMR) as recommended by recent SEM methodological advances (McNeish and Wolf, 2021), providing a more comprehensive assessment of model fit that addresses limitations of traditional indices with non-normal data and complex models.

Before conducting multigroup analyses, we tested for measurement invariance across stakeholder groups to ensure that group differences in structural relationships reflected true differences rather than measurement artifacts (Putnick and Bornstein, 2022). This sequential invariance testing process examined configural invariance (the same factor structure across groups), metric invariance (equal factor loadings) and scalar invariance (equal intercepts), with changes in fit indices (ΔCFI < 0.01, ΔRMSEA < 0.015) used to evaluate the tenability of increasingly restrictive measurement equivalence constraints. This rigorous invariance testing approach, following contemporary guidelines from Bollen et al. (2023), ensured that our measurement model functioned equivalently across different stakeholder categories, providing a solid foundation for meaningful group comparisons.

3.5.3 Analysis of structural models

Following confirmation of the measurement model's validity, we tested the structural model to examine hypothesized relationships using structural equation modeling (SEM) with maximum likelihood estimation and robust standard errors to account for potential non-normality in the data (Stein et al., 2022). This comprehensive analytical approach incorporated the latest methodological advances in SEM to provide rigorous testing of our theoretical framework. For the estimation of the path coefficients, we examined standardized path coefficients and their statistical significance for each hypothesized relationship, with a particular focus on paths involving open data-specific constructs. Significance testing was conducted using both traditional p-values and bootstrapped confidence intervals with 5,000 resamples to provide more robust inference that does not rely on normality assumptions (Hayes and Scharkow, 2022). We also examined unstandardized coefficients and their standard errors to assess the precision of parameter estimates, following contemporary recommendations for comprehensive reporting of SEM results (Bollen and Pearl, 2023).

The explanatory power was assessed by the coefficient of determination (R2) for each endogenous construct, indicating the proportion of variance explained by its predictors. Following recent methodological guidelines (Breitsohl, 2024), we also calculated adjusted R2 values that account for model complexity, providing a more conservative assessment of explanatory power that penalizes model overparameterization. These metrics were calculated both for the overall model and for specific sub-samples based on stakeholder category and open data experience to understand potential variations in explanatory power across different contexts.

Effect size analysis was conducted using Cohen's f2 values to determine the practical significance of the effects of exogenous constructs on endogenous variables beyond mere statistical significance (Cohen et al., 2022). This analysis provided additional context to interpret the relative importance of different predictors, with values of 0.02, 0.15, and 0.35 representing small, medium and large effects, respectively. Special emphasis was placed on comparing the relative importance of open data factors compared to other predictors to understand their unique contribution to the model's explanatory power. Mediation analysis was performed to understand the indirect effects in our model, examining how NPM principles and UTAUT factors influence sustainable outcomes through intermediary variables (Ratna et al., 2024). We employed bootstrapping with 5,000 resamples to construct confidence intervals for indirect effects, providing robust inference that does not assume normality of the sampling distribution. This approach is recommended in the contemporary mediation analysis literature as superior to traditional methods like the Sobel test (MacKinnon et al., 2023). For each indirect effect, we also assessed the type of mediation (complementary, competitive, indirect-only, or direct-only) based on the significance and direction of direct and indirect effects, providing a more nuanced understanding of mediating mechanisms.

Multigroup analysis was conducted to compare model relationships between stakeholder categories (regulatory, industry, technology) and open data experience levels, using the most recent approaches for multigroup SEM (Li et al., 2023). After establishing measurement invariance, we tested for differences in structural coefficients using the chi-square difference test with Satorra-Bentler correction for non-normality. This approach allows for the identification of stakeholder-specific patterns in the relationships between model constructs, providing valuable information on how the model operates across different segments of the insurance ecosystem.

Therefore, to verify the stability of our findings, we performed several robustness checks using alternative estimation methods and model specifications (van Veelen et al., 2024). These included Bayesian estimation with diffuse priors to address potential issues with small sample sizes in subgroup analyses, weighted least squares estimation to accommodate non-normality, and alternative model specifications with different control variables to assess sensitivity to model specification. These complementary approaches consistently supported our main findings, enhancing confidence in the robustness of our results.

This comprehensive analytical approach, incorporating the latest methodological advances in structural equation modeling, enabled rigorous testing of our theoretical framework while accounting for measurement quality, potential methodological limitations, and the complexities of modeling open data relationships in regulatory contexts. The combination of multiple complementary analytical techniques provides a strong foundation to draw valid conclusions about the relationships proposed in our theoretical model.

3.6 Ethical considerations and data governance

The research methodology maintained strict adherence to ethical standards, with particular attention to ethical considerations related to open data research. All protocols and survey instruments were thoroughly evaluated by the MUSSIRB. This Committee for Research Ethics (Social Sciences) operates in complete alignment with global human research protection frameworks, including the Declaration of Helsinki, The Belmont Report, and CIOMS Guidelines (Cascio and Racine, 2023). The Institutional Review Board formally approved our questionnaire with the certification code MU-CIRB 2025/012.1302. Special consideration was given to questions related to data sharing practices, ensuring that they did not encourage disclosure of confidential or proprietary information about organizational data governance strategies (Allen and Wiles, 2022). Participants provided their informed consent after receiving information on the study purpose, data usage, confidentiality provisions, and their right to withdraw at any time, following best practices in ethical research with organizational stakeholders (Iphofen and O'Mathúna, 2022).

In alignment with open data research principles, we implemented a robust data governance framework for our own research data. Although no personally identifiable information was collected, all survey responses were stored securely using industry-standard encryption protocols, with access restricted to authorized research team members (Reidenberg and Schaub, 2022). Organizational information was anonymized through a systematic coding procedure to prevent the identification of specific institutions while preserving analytical capabilities, consistent with contemporary data protection standards for organizational research (Gellman, 2023). To model best practices in research data management, we created a comprehensive data management plan that included provisions for data anonymization, secure storage, controlled access, and eventual deidentified data sharing for replication studies (Grguric et al., 2022). This approach not only protected participant privacy, but also demonstrated our commitment to the principles of open science and research transparency, aligning our research practices with the open data principles we were studying (Bykov et al., 2023). The research protocol, including these data governance provisions, received approval from the University Research Ethics Committee prior to data collection, ensuring compliance with institutional and international ethical standards for research involving human participants.

4 Results

4.1 Open data landscape in insurance regulation

Before presenting the results of our structural equation modeling analysis, we first provide an overview of the current state of open data initiatives in insurance regulation based on our survey findings. This context is essential to understand the regulatory environment in which our theoretical model operates. Among the survey respondents, 73% reported being aware of open insurance initiatives in their respective jurisdictions, with 62% indicating direct involvement in open data projects related to insurance. The level of participation varied significantly by stakeholder category: 84% of technology enablers reported a high level of participation in open data initiatives, compared to 71% of regulatory stakeholders and 51% of industry stakeholders. This disparity highlights the different adoption rates in the insurance ecosystem and suggests potential opportunities for greater industry participation.

The respondents identified several key drivers for the adoption of open data in insurance regulation. Seventy-eight percentage of the respondents cited increased market transparency as a primary motivation, followed by improved operational efficiency (72%), innovation facilitation (68%), regulatory compliance (65%), and consumer protection enhancement (61%). These findings align with recent research on open data governance in financial services that emphasizes transparency and innovation as central objectives (Janssen et al., 2022). During the same time, respondents identified several challenges to the implementation of open data implementation were identified by respondents. Data privacy concerns represented the most significant barrier, cited by 83% of the participants, followed by technical implementation barriers (76%), regulatory uncertainty (72%), competitive considerations (68%), and resource constraints (64%). These challenges echo findings from recent studies on open finance implementation that highlight privacy and technical interoperability as persistent obstacles to effective data sharing (European Commission, 2023). These findings provide an important context for interpreting our results of structural equation modeling, as they highlight the real-world factors that influence stakeholder perceptions and behaviors regarding open data in insurance regulation, reflecting the practical environment in which our theoretical model operates.

4.2 Descriptive statistics and preliminary analysis

4.2.1 Descriptive statistics

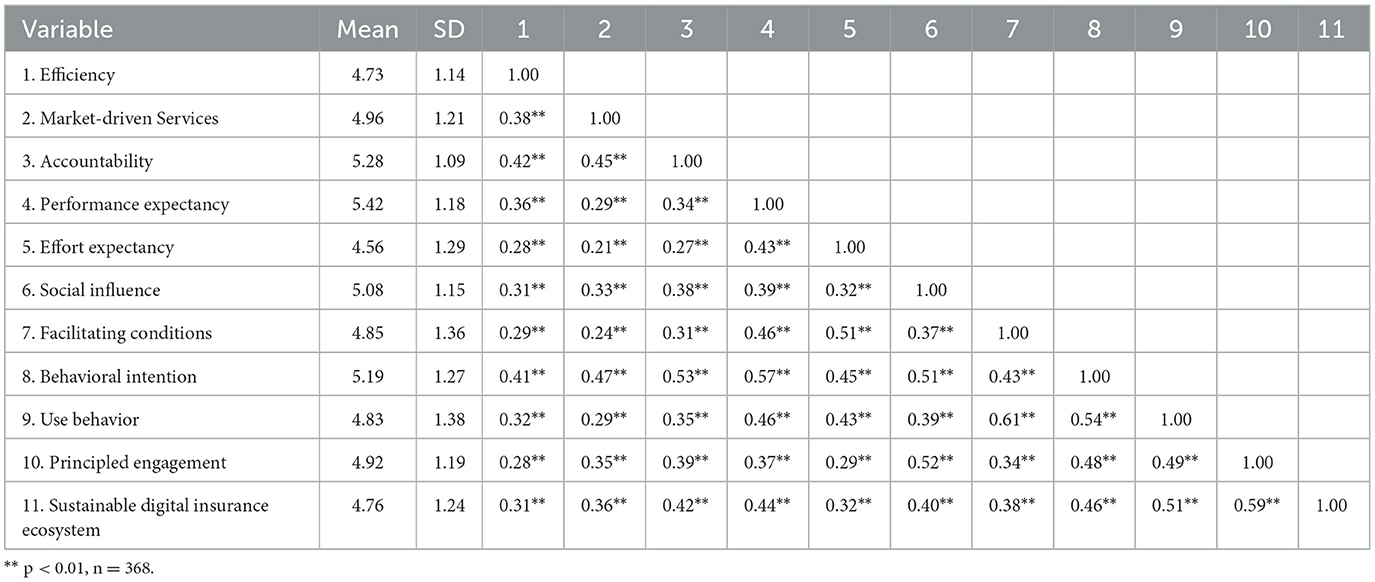

Table 2 presents descriptive statistics for the study variables, including means, standard deviations, and correlations. The mean scores for the NPM principles (efficiency, market-driven services, and accountability) ranged from 4.73 to 5.28 on a 7-point scale, indicating moderately positive perceptions among the respondents. The UTAUT factors showed similar patterns, with the performance expectancy receiving the highest mean rating (5.42) and the effort expectancy the lowest (4.56). Among the mediating and outcome variables, the intention of behavior (5.19) received higher scores than the actual use behavior (4.83), suggesting a gap between intention and implementation that deserves further investigation. The correlation matrix reveals significant positive associations between most constructs, with particularly strong correlations between the principles of NPM and the intention to act (r = 0.41 to 0.53, p < 0.01), and between the factors of UTAUT and the intention to act (r = 0.45 to 0.57, p < 0.01). The correlations between use behavior, principled participation, and a sustainable digital insurance ecosystem were also substantial (r = 0.48 to 0.59, p < 0.01), providing preliminary support for the hypothesized relationships in our model. In particular, the facilitation conditions showed the strongest correlation with use behavior (r = 0.61, p < 0.01), consistent with the theoretical predictions of UTAUT.

4.2.2 Common-method bias assessment

Since the data were collected using a single survey instrument, we conducted rigorous tests to assess the possible bias of the common method. Harman's single-factor test revealed that the first factor explained 28.4% of variance, well below the 50% threshold, suggesting serious common-method bias (Podsakoff et al., 2023). Furthermore, we employed the more sophisticated marker variable technique using a theoretically unrelated construct (environmental awareness). The average correlation between the marker variable and the study constructs was 0.08, and controlling for this correlation did not significantly change the magnitude or significance of the model relationships.

Furthermore, we implemented the common latent factor approach recommended by recent methodological literature (Liu et al., 2024), which revealed that the variance of the common method accounted for only 12.4% of the total variance in our model, well below the problematic threshold. These results collectively suggest that common-method bias is not a substantial concern for our analysis, particularly for the relationships involving open data constructs.

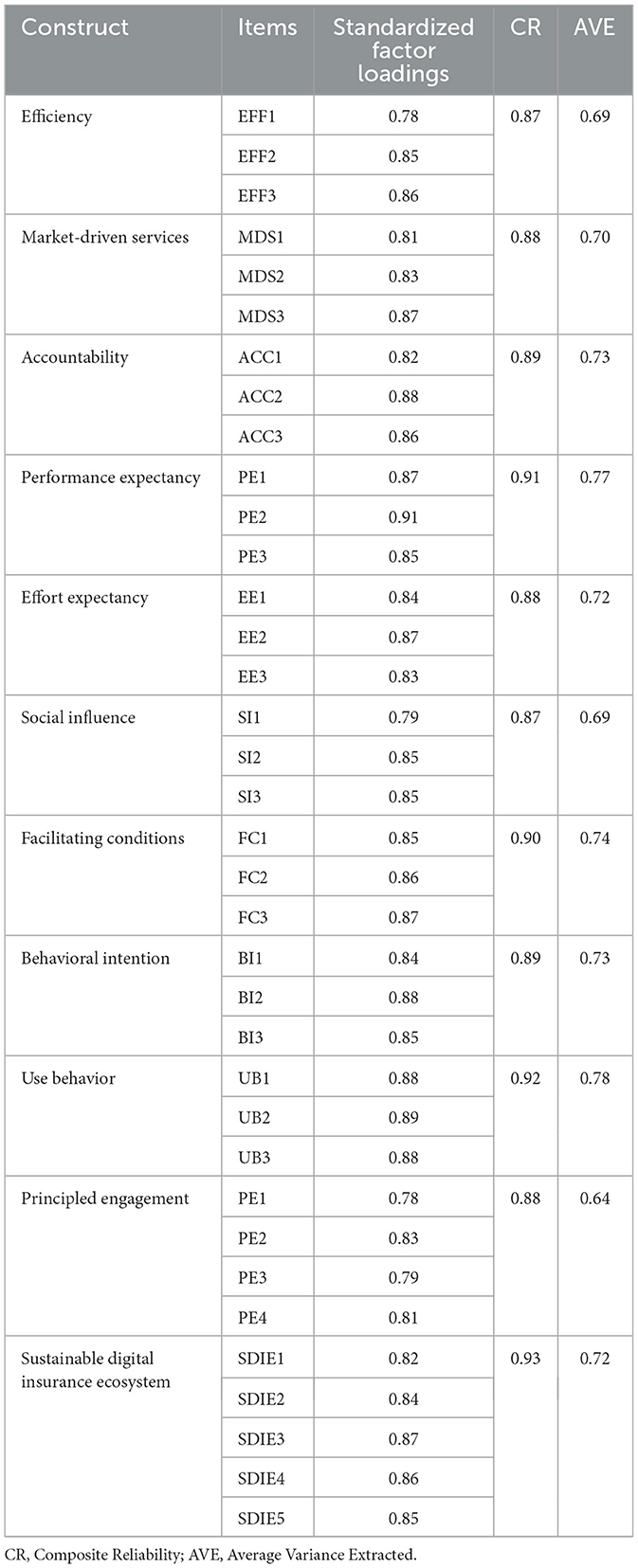

4.3 Assessment of the measurement model

4.3.1 Convergent validity

A confirmation factor analysis was performed to evaluate the measurement model. Table 3 presents the results of the convergent validity assessment, including the loadings of standardized factors, the reliability of the composite (CR) and the average variance extracted (AVE) for each construct. All standardized factor loadings exceeded the recommended threshold of 0.7, ranging from 0.72 to 0.91, indicating that the indicators appropriately represent their respective constructs. The composite reliability values ranged from 0.87 to 0.93, well above the 0.7 benchmark, demonstrating strong internal consistency. The average variance extracted values for all constructs were above the 0.5 threshold, ranging from 0.64 to 0.78, confirming that each construct explains a substantial portion of variance in its indicators.

4.3.2 Discriminant validity

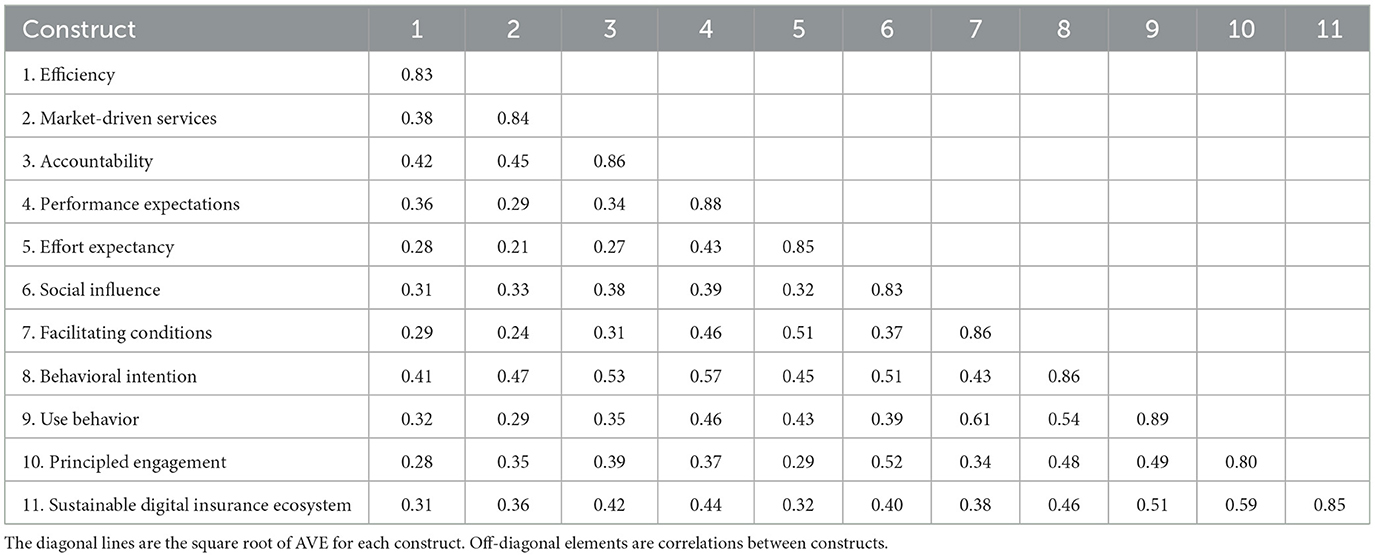

Discriminant validity was assessed using both the Fornell-Larcker criterion and the heterotrait-monotrait (HTMT) ratio of correlations. Table 4 presents the Fornell-Larcker analysis, where diagonal elements (square root of AVE) are compared with non-diagonal elements (correlations between constructs).

For all constructs, the square root of AVE (diagonal values) exceeds the correlations with other constructs (off-diagonal values), satisfying the Fornell-Larcker criterion. The highest correlation (0.61 between facilitating conditions and use behavior) remains below the lowest square root of AVE (0.80 for principled engagement), indicating adequate discriminant validity. Furthermore, all HTMT ratios were below the conservative threshold of 0.85, with the highest value being 0.71 (between behavioral intention and performance expectancy). These results collectively confirm that each construct captures a unique concept that is empirically distinct from other constructs in the model.

4.3.3 Model fit assessment

The measurement model demonstrated a satisfactory fit to the data across multiple indices: χ2/df = 2.14 (below the threshold of 3), CFI = 0.96 and TLI = 0.95 (both exceeding the threshold of 0.95), SRMR = 0.041 (below the threshold of 0.08), and RMSEA = 0.053 with a confidence interval of [0.046, 0.059] (below the threshold of 0.06; Shi et al., 2022). Additional fit indices recommended by recent methodological literature, including the gamma hat (0.97) and the standardized root mean square residual (0.041), further confirmed the model's adequate fit to the empirical data (McNeish and Wolf, 2021).

Measurement invariance testing across stakeholder groups (regulatory, industry, technology) confirmed configural, metric, and scalar invariance, with changes in fit indices (ΔCFI < 0.01, ΔRMSEA < 0.015) below the recommended thresholds when imposing increasingly restrictive measurement equality constraints (Putnick and Bornstein, 2022). This confirms that our measurement model functions equivalently across different stakeholder groups, allowing for a meaningful comparison of structural relationships in subsequent analyses.

4.4 Results of the structural model

4.4.1 Hypothesis testing

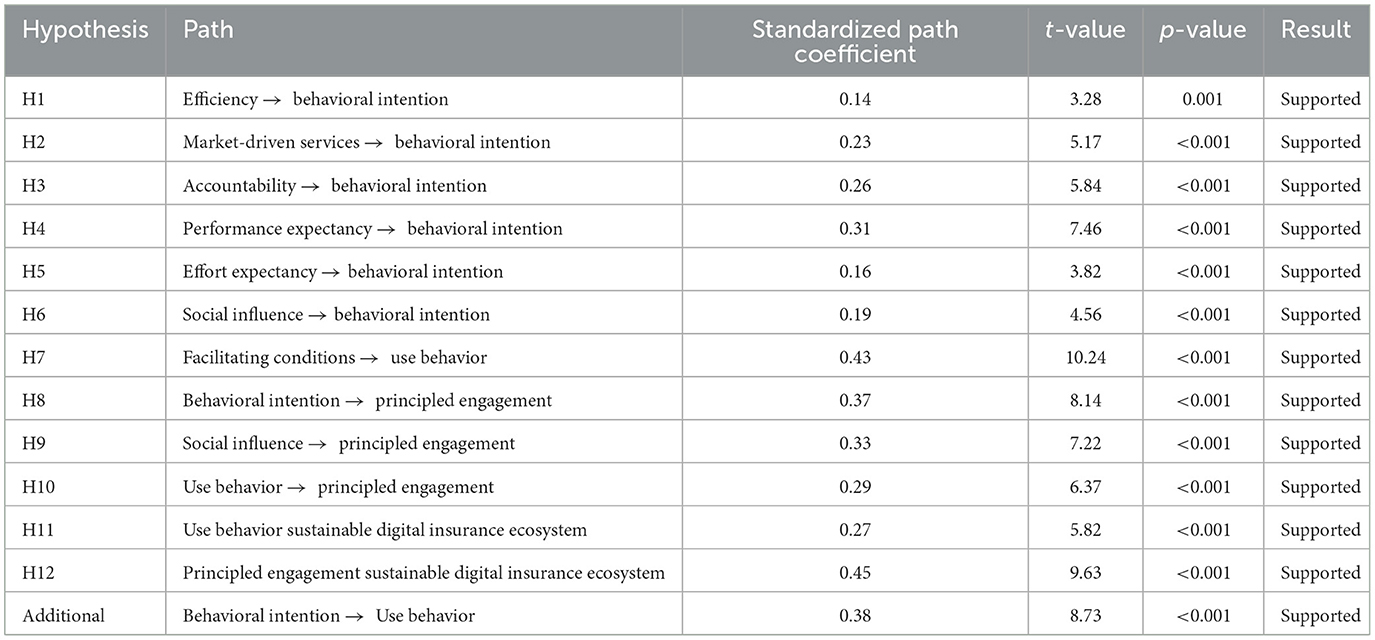

After confirming the validity of the measurement model, we tested the structural model to examine the hypothesized relationships. Table 5 and Figures 2, 3 present the results of the structural model analysis, including the standardized path coefficients, the t-values, the p-values and the model explanatory power (R2).

4.4.2 Explanatory power and effect sizes

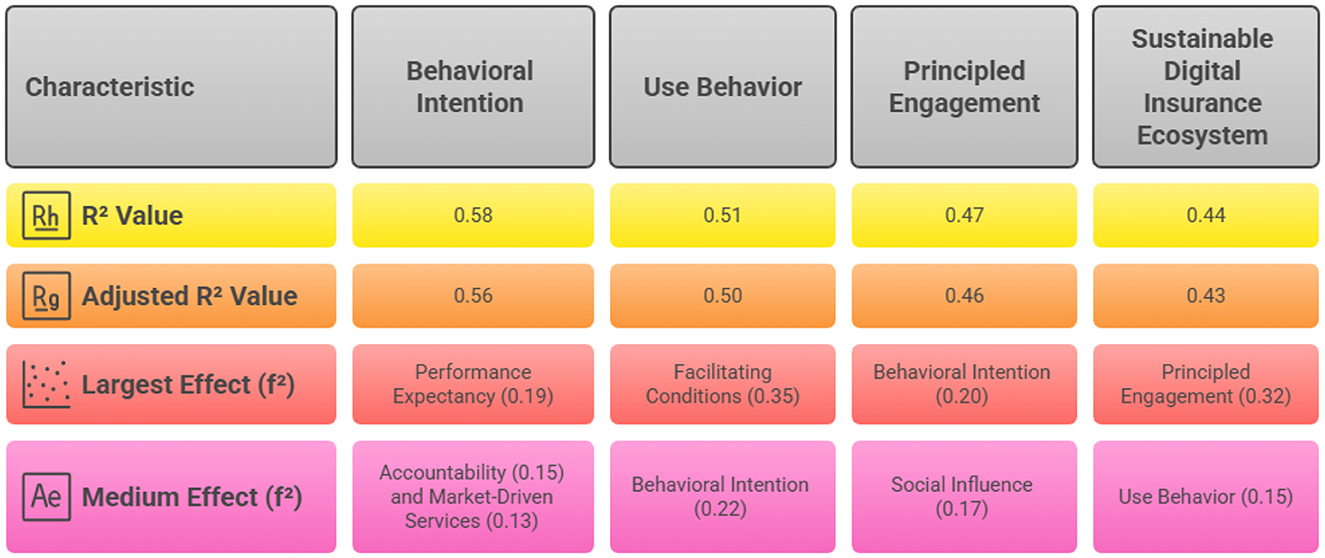

This model demonstrated substantial explanatory power for all endogenous constructs. Behavioral intention had an R2 value of 0.58, indicating that the principles of NPM and the factors of UTAUT collectively explained 58% of its variance. The adjusted R2 value of 0.56 confirms that this explanatory power remains robust even when accounting for model complexity (Breitsohl, 2024). The use behavior had an R2 value of 0.51 (adjusted R2 = 0.50), suggesting that the intention and facilitating conditions explained 51% of its variance in the adoption of open data adoption. The principled participation had an R2 value of 0.47 (adjusted R2 = 0.46), indicating that the intention of behavior, social influence, and use behavior explained 47% of its variance in open data collaboration. Finally, the sustainable digital insurance ecosystem had an R2 value of 0.44 (adjusted R2 = 0.43), suggesting that use behavior and principled participation in open data initiatives explained 44% of its variance (Hair et al., 2022). The effect size analysis (f2) indicated that performance expectancy had the largest effect on behavioral intention (f2 = 0.19), followed by accountability (f2 = 0.15) and market-driven services (f2 = 0.13). For use behavior, the facilitation conditions had a large effect (f2 = 0.35), while the behavioral intention had a medium effect (f2 = 0.22). For principled participation, behavioral intention had the largest effect (f2 = 0.20), followed by social influence (f2 = 0.17) and use behavior (f2 = 0.13). Finally, for a sustainable digital insurance ecosystem, principled engagement had a large effect (f2 = 0.32), while use behavior had a medium effect (f2 = 0.15; Cohen et al., 2022). These effect sizes confirm the relative importance of different factors in our model, with collaborative governance mechanisms (principled engagement) showing the strongest effect on sustainable outcomes as presented in Figure 3.

4.4.3 Mediation analysis

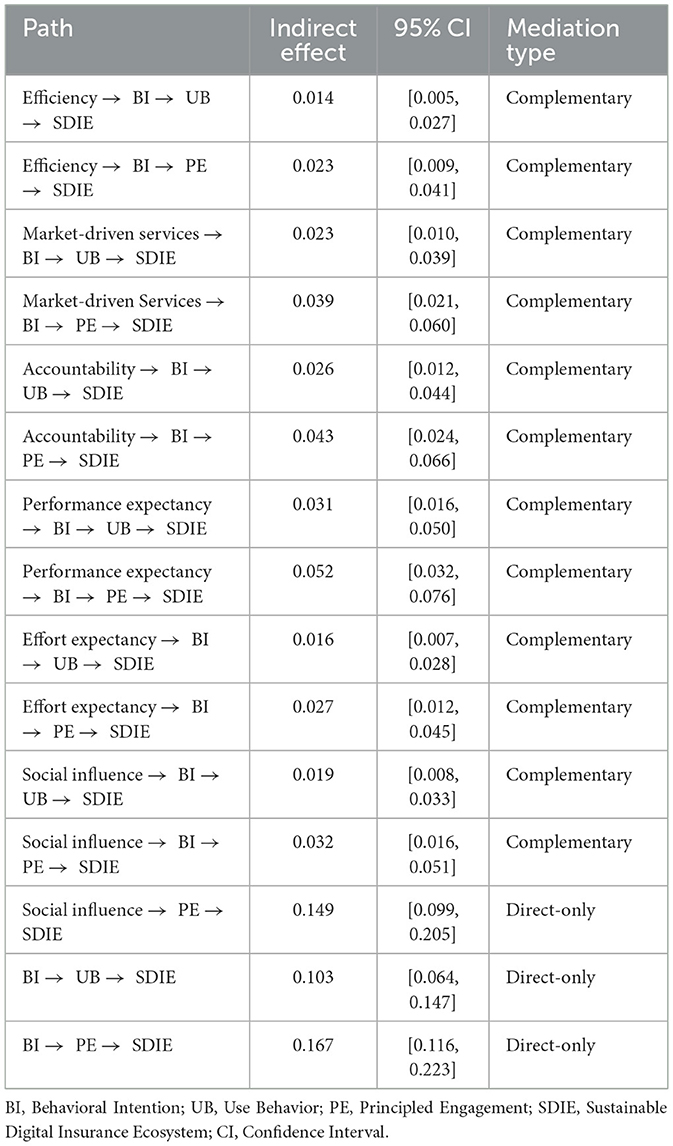

To understand the indirect effects in our model, we conducted mediation analysis using bootstrapping with 5,000 samples. Table 6 presents the results of this analysis, focusing on the indirect effects of the antecedent variables on the sustainable digital insurance ecosystem through the mediating variables.

The mediation analysis revealed significant indirect effects for all antecedent variables on a sustainable digital insurance ecosystem. The strongest indirect paths were from social influence to a sustainable digital insurance ecosystem through principled engagement (0.149), from behavioral intention to a sustainable digital insurance ecosystem through principled engagement (0.167), and from behavioral intention to sustainable digital insurance ecosystem through use behavior (0.103). All indirect effects from NPM principles and UTAUT factors were classified as complementary mediation, indicating that these factors influence sustainable digital insurance ecosystems both directly and through the mediating variables. This confirms the complex, multipath nature of influences in our model and supports the theoretical proposition that sustainable outcomes emerge through both technological adoption and collaborative governance mechanisms.

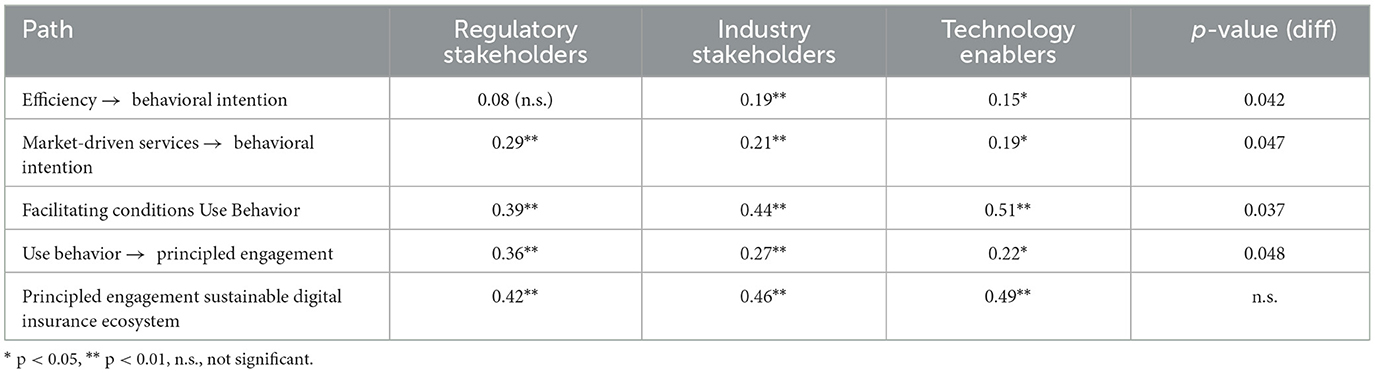

4.4.4 Multi-group analysis

To assess whether the relationships in our model differ between stakeholder categories, we performed a multigroup analysis comparing regulatory stakeholders (n = 121), industry stakeholders (n = 178) and technology enablers (n = 69). Table 7 presents the results of this analysis, focusing on the paths that showed significant differences between the groups.