- Escuela Profesional de Ingeniería Económica, Universidad Nacional del Altiplano, Puno, Peru

This study evaluates the determinants of public spending efficiency at the provincial level in Peru by integrating Data Envelopment Analysis (DEA) with two alternative econometric models: a bootstrapped random-effects Tobit model and a spatial Durbin model. Using panel data from 196 provinces over 7 years, DEA efficiency scores under constant returns to scale (CRS) and variable returns to scale (VRS) were estimated and analyzed to assess the impact of intergovernmental transfers, local tax revenues, and spatial interdependencies. The Tobit model accounts for the bounded nature of efficiency scores and shows that FONCOMUN transfers significantly improve both technical efficiency (VRS_TE) and scale efficiency, while canon transfers primarily enhance scale efficiency due to their infrastructure-oriented allocation but have limited effects on managerial performance. Local tax revenues positively influence technical efficiency, reflecting better expenditure management in fiscally autonomous municipalities, but they have no significant effect on scale efficiency. In contrast, the spatial Durbin model captures spatial dependencies and reveals significant negative spillover effects, indicating that higher efficiency in neighboring provinces can reduce local efficiency due to competition for resources and overlapping administrative functions. These findings contribute to the literature by providing robust empirical evidence on the interplay between fiscal transfers, managerial capacity, and spatial interdependencies, offering actionable insights for policymakers seeking to optimize local government performance and improve public service delivery.

Introduction

Local governments are considered essential actors in the implementation and integration of laws and policies at the local level (Mishi et al., 2022; Blom-Hansen, 2010). Their success is crucial to alleviating poverty and providing services to communities. However, inadequate financial management often poses a significant obstacle to achieving these goals (Fusco and Allegrini, 2020; Vidoli and Fusco, 2018).

In Latin America, municipalities typically operate with limited budgets, which hampers their ability to deliver quality public services (Ardanaz et al., 2022). Approximately 70% of citizens in the region express dissatisfaction with the quality of municipal services, highlighting major issues such as irregular waste collection, delays in infrastructure maintenance, and poor administration of social programs (Connolly et al., 2018; Lalama Franco and Bravo Lalama, 2019).

Peru has a decentralized administrative structure composed of 1,678 district municipalities, 196 provincial local governments, and 2,678 municipal governments for population centers (Herrera Catalán and Francke Ballve, 2009). Over the past five years, cumulative fiscal transfers to subnational governments have amounted to approximately S/192.54 billion. Of this total, 82% (S/158.72 billion) was allocated to local governments, while the remaining 18% (S/33.82 billion) was directed to regional governments. These figures underscore the significant budgetary role that local governments play within Peru’s fiscal policy framework.

Between 2017 and 2023, Peru’s provincial local governments experienced a considerable increase of 19.9% in their allocated budgets. However, the annual budget execution rate consistently remained below 73%, positioning them as the level of government with the lowest execution performance over the past 6 years.

The substantial fiscal transfers, together with the devolution of functions and competences within the framework of Peru’s decentralization policy, have intensified the demand for rigorous evaluation of municipal economic performance both at the national level (Herrera Catalán and Francke Ballve, 2009) and, more specifically, at the subnational level through disaggregated, activity-based assessments (Herrera and Cozzubo, 2017; Herrera and Urzúa, 2022; Herreras, 2007).

The theory of efficient marginal investment posits that the allocative efficiency of public investment is contingent upon the balance between its marginal cost and marginal social benefit (Bastani, 2023). Within this framework, public expenditure on basic service provision can be considered economically efficient only when its implementation costs do not exceed the expected welfare gains for the local population. Such gains are expected to materialize through continuous improvements in both municipal inputs (financial and administrative resources allocated by provincial governments) and service delivery outputs, including solid waste management, healthcare services, public security, and local economic development initiatives (Barraud and Torres, 2016; Pariatón Zurita, 2018).

A growing body of literature has applied Data Envelopment Analysis (DEA) to assess the relative efficiency of local governments in the allocation of public resources. These studies typically identify public expenditure, capital investment, and infrastructure development as primary input variables (Álvarez Sánchez, 1969). On the output side, the indicators frequently include measures of local economic activity—such as trade fair promotion—environmental sustainability through solid waste management, the delivery of preventive healthcare services, social protection schemes like the DEMUNA child welfare program and the “Vaso de Leche” nutrition initiative, as well as the provision of public security services (Afonso and Venâncio, 2020; Barraud and Torres, 2016; Tung and Loan, 2023; Voorn et al., 2017; Worthington and Dollery, 2000).

The efficiency scores reported in these assessments typically range from 0.41 to 0.72 (Agbidinoukoun et al., 2023; Mishi et al., 2022; Ngobeni and Breitenbach, 2020), suggesting a moderate to high level of technical efficiency in the conversion of fiscal inputs into public service outputs. This aligns with theoretical expectations from public finance literature, which emphasize the importance of minimizing allocative inefficiencies and maximizing social welfare through the optimal deployment of public resources (Feldman, 1971; Feldstein and Metcalf, 1987; Geys and Moesen, 2009; Tung and Loan, 2023). However, significant cross-sectional disparities persist across subnational jurisdictions, highlighting variations in institutional capacity and fiscal management practices that influence the marginal productivity of public investments (Yu, 2023).

When technical efficiency scores fall below the optimal threshold of 1, this indicates the presence of an efficiency gap, quantifiable as (1 − efficiency score), which highlights the potential for resource reallocation and performance improvement within the evaluated unit (Núñez, 2019). In this context, the efficiency scale is bounded between 0 and 1, where a value of 1 represents full efficiency and any deviation reflects suboptimal resource utilization (Kosor et al., 2019). Lower-performing municipal units can theoretically improve their fiscal and operational efficiency by adopting best practices and policy frameworks implemented by the frontier units identified as efficient (Halásková et al., 2022).

Moreover, as Yu and Meng (2022) emphasize, the enhancement of public service delivery remains constrained by persistent financial limitations, a constraint also observed by Jopen Sánchez (2017), who underscores the chronic budgetary insufficiencies affecting municipal management. The variability in technical efficiency across subnational entities further suggests systemic divergences in administrative capacity and financial governance, as units frequently report efficiency scores significantly below the efficiency frontier (Ouertani et al., 2018). Nonetheless, this performance gap also reveals that municipalities could achieve improved service delivery outcomes through more efficient allocation of their existing fiscal resources (Tu et al., 2018), progressively moving closer to the efficiency frontier as highlighted by Hallaert and Primus (2022).

Municipal units operating below the efficiency frontier do not necessarily require additional financial resources to achieve their institutional objectives (Brikci et al., 2024; Pérez et al., 2017). Instead, improving the provision of municipal services often demands that policymakers adopt redistributive policy frameworks designed to guide the strategic reallocation of public resources toward more efficient uses (Sikayena et al., 2022). Such resources must be allocated and managed efficiently to maximize their contribution to local welfare and development outcomes (Pula and Elshani, 2022).

Over time, subnational policy frameworks have evolved to align with broader sustainable development goals, prompting structural adjustments in resource distribution and governance practices at the municipal level (Mutuku and Korir, 2019). In this context, this study aims to provide empirical evidence to assist policymakers in refining local government management strategies and enhancing the efficiency of public expenditure. Specifically, the objective of this research is to analyze the technical efficiency of public spending across provincial municipalities in Peru during the period 2017–2022.

The theoretical foundation for understanding the efficiency of spending at the municipal level, especially in the context of an input–output model, necessitates a comprehensive analysis of various economic factors and frameworks that influence local government expenditures. Efficiency in government spending is paramount as it determines how optimized the allocation of resources is towards achieving desired outcomes in public services and infrastructural development.

The model of input–output in local government expenditures

An input–output (I–O) model serves as a critical analytical tool for municipalities to assess the interdependencies of different sectors and how local expenditures contribute to economic outcomes. The input–output framework allows for the examination of how municipal expenditures (inputs) generate impacts on economic activity (outputs) within various sectors, such as health, education, and infrastructure. According to Hauner and Kyobe (2010) emphasize that the efficiency of government spending is crucial for delivering public services without excessively burdening taxpayers. Their analysis underscores the need for municipalities to enhance their fiscal performance to respond to growing demands on public services.

Factors impacting efficiency of expenditure

Several key factors impact the efficiency of municipal spending. For instance, Afonso and Fernandes highlight that efficiency can be quantitatively measured using various models, including Data Envelopment Analysis (DEA), which evaluates performance relative to best practices in peer municipalities (Afonso and Fernandes, 2006; Afonso and Venâncio, 2020). Suseno et al. further corroborate this by identifying inefficiencies in public expenditures across districts, which illuminates the gaps in optimizing local government resources (Suseno et al., 2022). Such empirical evidence highlights the importance of municipalities regularly assessing their expenditure patterns to identify inefficiencies that can be rectified, thereby fostering sustainable economic growth.

Policy implications of expenditure efficiency

The effectiveness of local government capital expenditures is significantly influenced by policies regarding fiscal decentralization and regional financial management. Zein et al. (2024) propose that effective regional financial management is crucial for improving financial performance and capital expenditure (Giménez et al., 2016). Furthermore, Qoriiba et al. argue that optimizing the allocation of general and special funds leads to enhanced efficiency in development projects, thus stimulating local economic growth (Qoriiba et al., 2021). These findings highlight the importance of policy frameworks that ensure funds are allocated efficiently and directed towards areas of greatest need, ultimately leading to improved public welfare.

From an analytical perspective, municipalities can be described using a fundamental input–output equation to assess efficiency:

where:

• Y = Total output generated by the economy.

• A = Input–output coefficients representing technical relationships between inputs and outputs.

• X = Vector of inputs, representing various sectors’ expenditures like health, education, and infrastructure.

Moreover, to analyze efficiency, the following equation can be adapted to depict the relationship between inputs and the outcomes they produce:

where:

• E = Efficiency of expenditure.

High values of (E) indicate that a municipality is achieving more output per unit of input, which is desirable for optimal performance. The efficiency of local government expenditures is deeply intertwined with the effective application of input–output models and the presence of robust fiscal management policies. It is critical for municipal authorities to continuously evaluate their financing strategies, employing quantitative assessment techniques such as the DEA, to enhance their service delivery. Literature indicates that combining strategic policy implications with theoretical frameworks can guide municipalities towards achieving financial sustainability and better public welfare outcomes.

In understanding the theoretical foundation of expenditure efficiency in local government contexts using an input–output model, it is essential to recognize that municipalities operate under constraints that influence how effectively they can allocate resources. Local governments are unique in their fiscal dynamics, particularly how interdependencies in decisions affect expenditure patterns. Municipalities often engage in cooperative arrangements, which can create efficiencies through economies of scale and collaborative fiscal management, as discussed by Frère et al. (2013). This highlights the importance of spatial interactions and intermunicipal cooperation in improving local public spending efficiency.

Moreover, the Data Envelopment Analysis (DEA) method provides a non-parametric approach to assess the efficiency of local government expenditure by comparing different municipalities. It allows for the evaluation of relative efficiency without the need for a specific functional form (Boetti et al., 2012). This technique, as evidenced by studies such as that conducted by da Motta and Moreira (2009), can pinpoint inefficient spending patterns and guide municipalities in optimizing their outcomes.

Further, the correlation between local government fiscal policies and public expenditure efficiency illustrates the significant impact of the political context, as noted in the work by Gutiérrez-Monsalve et al. (2021). Fiscal populism can often lead to inefficiencies, as seen through excessive patronage and suboptimal revenue collection mechanisms, hindering effective resource allocation. Thus, a careful assessment of the political factors, alongside economic performance indicators, is essential in a comprehensive analysis of municipal spending efficiency.

Finally, it is important to recognize the interplay of structural attributes like jurisdiction size and governmental form, which affect spending levels. Evidence shows no systematic effects on spending due to municipal amalgamations (Blom-Hansen et al., 2016), but there is nuance regarding how different governmental structures may affect spending responsiveness to community needs (Eskridge and French, 2011). Amalgamation and cooperation across municipalities can also contribute significantly to expenditure efficiency, as shown in the analysis of Danish local government reforms.

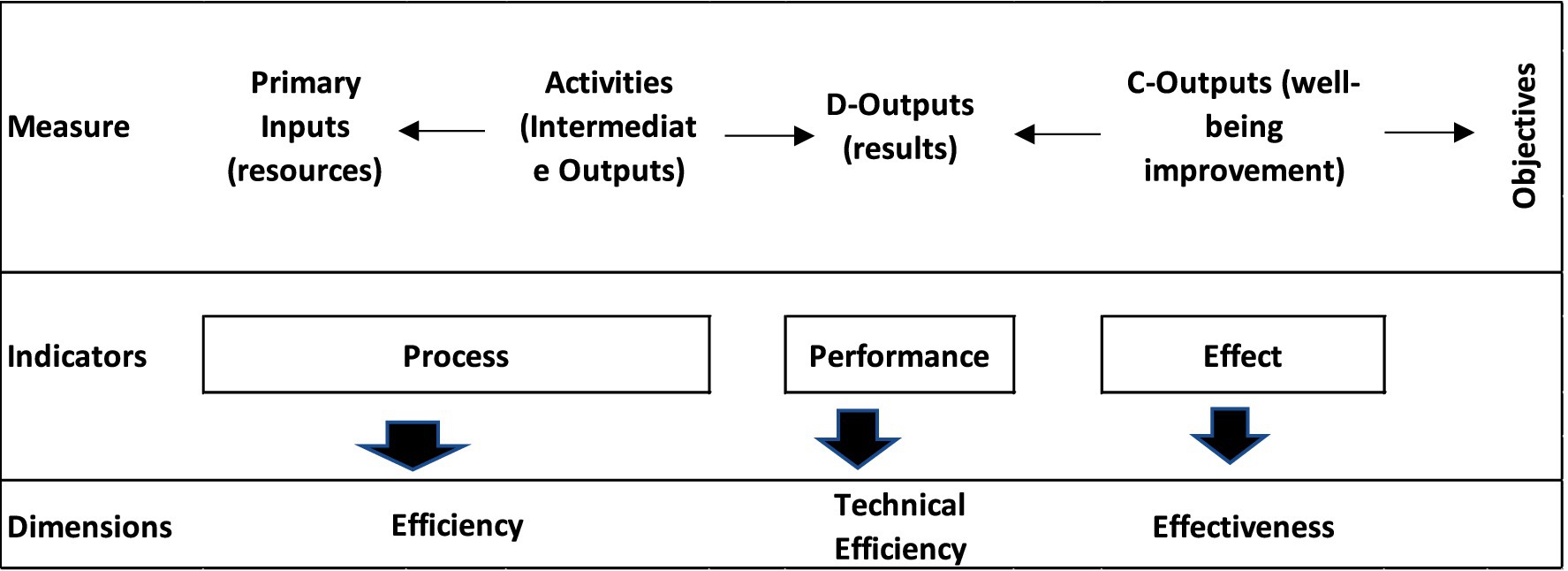

According to microeconomic theory, the producer is the entity that maximizes profits by minimizing costs subject to constraints, while aiming to produce the highest output posible (Snyder, 2021). Municipal management systems, based on this theory (Aturupane, 2017), transform inputs into outputs. The primary objective of local governments is to deliver essential services such as solid waste management, basic healthcare, security, and social assistance. The production function seeks to relate inputs (public expenditure) (Soleimanipirmorad and Vural, 2018) that influence the outcomes of municipal interventions, such as waste management, basic health services, social welfare, and citizen security, as evidenced by results from standardized tests (Oluwatayo et al., 2023). Local governments are responsible for executing this transformation process, as illustrated below (Hien, 2018). Figure 1 illustrates how performance in public management is measured along the value chain. It begins with inputs (financial, human, and material resources) that enable the execution of activities. These activities generate outputs, such as infrastructure, services, or programs, which in turn should lead to improvements in the well-being of the population. In this process, efficiency evaluates whether resources are being used appropriately to transform inputs into outputs—for example, how many projects are completed with a given budget. Within efficiency, technical efficiency assesses whether the maximum possible level of outputs is being produced with the available resources, that is, whether production is taking place on the “productive frontier.” Finally, effectiveness examines whether outputs actually achieve the intended objectives and generate an impact on population well-being, such as improving health, reducing poverty, or expanding educational coverage. Thus, the figure demonstrates that sound public performance requires not only being efficient in the use of resources but also being effective in generating real changes in society.

According to Guo et al. (2019) local government spending on the provision of basic services aims to reduce economic backwardness, increase labor productivity, and improve income distribution. Poor spending, however, results in a loss of wellbeing for the population, deterioration of quality of life, and a rise in violence (Serrano Rodríguez et al., 2023). Building on Farrell’s work (Ferro and D‘elia, 2020), multiple inputs and outputs were incorporated, followed by various studies and the application of different methodologies for measurement. As noted by Dincă et al. (2021), an efficient system generates more outputs with a given set of inputs, while keeping other factors constant.

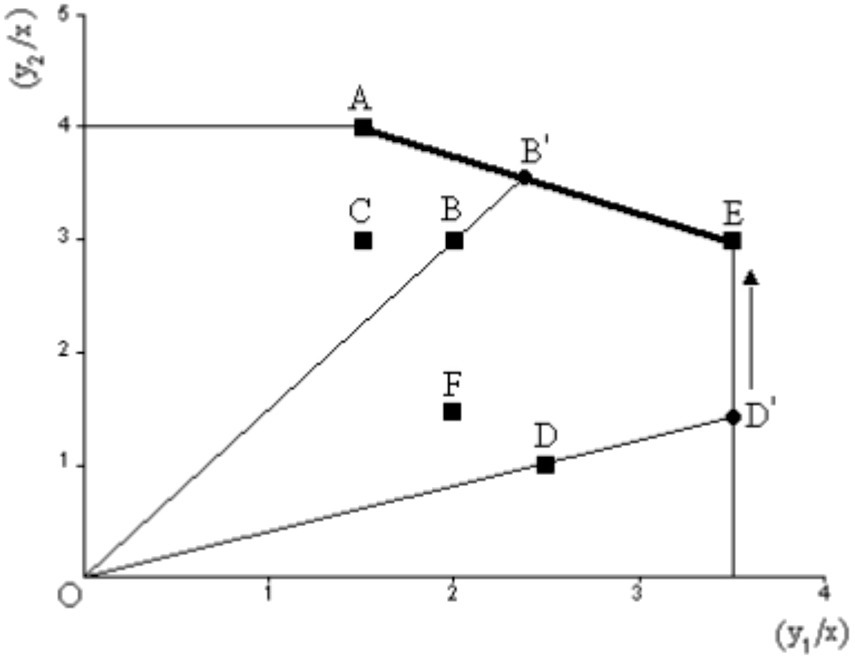

Understanding the success of an organization as achieving the maximum output or service with a given cost derived from a specific combination of factors (output orientation) (Hamsahtun Siregar and Aceh, 2021), with non-parametric methodology being the most suitable for its measurement (Cristóbal et al., 2021). This is done through Data Envelopment Analysis (DEA), which constructs an efficiency frontier from the set of observations considered, without requiring any knowledge of the functional relationship between inputs and outputs (Tong Soo, 2019). In the context of technical efficiency, the efficiency of the education production function can be observed in the following figure: it considers one input (x) and two outputs (y1, y2) (Ji and Lee, 2010). Regions A and E are technically efficient, while the regions that lie below the efficient frontier are considered technically inefficient (Figure 2).

The study focuses on Peru because it reflects a high degree of heterogeneity among its provinces, both in terms of population size and in socioeconomic characteristics and access to services. Panel data from 196 provinces were used over a period of 7 years, resulting in a large overall sample size (1,372 observations) and ensuring full territorial coverage. Given the relatively large number of cross-sectional units (196 provinces) and the relatively short period of analysis (7 years), the dataset generates a substantial sample size. However, estimating efficiency parameters using DEA under these conditions involves significant computational challenges, which constrained the implementation of more complex non-radial models. Importantly, the dataset includes years both before and after the COVID-19 pandemic, allowing the study to capture significant changes in regional efficiency over time. The diversity among provinces further enhances the representativeness of the sample by encompassing distinct local realities within the country.

Methodology

This study applies Data Envelopment Analysis (DEA) to measure the relative efficiency of local public spending across 196 Peruvian provinces. DEA is a non-parametric method that evaluates the performance of decision-making units (DMUs) by comparing their inputs and outputs without assuming a specific functional form. The model is output-oriented and operates under Variable Returns to Scale (VRS), which is appropriate given the heterogeneity in population size, resource availability, and service responsibilities among provinces.

Inputs were selected based on municipal functions over which local governments have direct control—specifically, per capita spending in environmental management, health, social protection, and security. Corresponding outputs reflect tangible service delivery and public outcomes. The exclusion of sectors like education and transport is justified by their centralized management and lack of reliable, comparable indicators at the municipal level.

The DEA framework is complemented by econometric analysis using Tobit and spatial panel models to explore how different funding sources and spatial interactions influence efficiency. This integrated approach allows us to not only benchmark performance but also identify key determinants of variation in local government efficiency across time and space.

DEA model formulation

This study applies Data Envelopment Analysis (DEA) to evaluate the relative efficiency of 196 provinces (Decision-Making Units, DMUs) in Peru. The model considers four input variables representing per capita municipal expenditures and four output variables reflecting service provision and public outcomes.

Given n = 196 DMUs, each province uses m = 4 inputs to produce s = 4 outputs. The DEA model is specified as output-oriented under Variable Returns to Scale (VRS), as municipalities differ in terms of size, population, and available resources.

DEA is a non-parametric linear programming method used to estimate the relative efficiency of decision-making units (DMUs).

The selection of inputs in the DEA analysis focused on functions that municipalities carry out directly and autonomously, specifically per capita spending on environmental management, health, social protection, and citizen security, as these areas allow for a clear link between the resources used and the services provided, with indicators that are available and comparable at the provincial level. Education and transportation functions were not included because their management is primarily the responsibility of the national and regional governments, which limits the municipalities’ ability to influence related outcomes directly; furthermore, these functions lack homogeneous and consistent output indicators at the local level, which would compromise the technical validity of the model and hinder an accurate assessment of relative efficiency across municipalities.

• Inputs (x):

○ x1: Municipal expenditure in environmental management

○ x2: Municipal expenditure in health

○ x3: Municipal expenditure in social protection

○ x4: Municipal expenditure in security

• Outputs (y):

○ y1: Solid waste treated per day

○ y2: Beneficiaries of the “Vaso de Leche” program

○ y3: Health campaigns coordinated with MINSA

○ y4: Municipal security equipment and services

We applied an input-oriented DEA model with VRS because municipalities operate at different scales and resource availability varies across provinces.

Primal (Envelopment) Formulation—Output-Oriented, VRS.

For a given province ooo, the model is:

Subject to:

Where:

• ϕ = proportional expansion factor of outputs.

• λj = intensity variable for province j

• xij = amount of input i used by province j

• yrj = amount of output r produced by province j

• θ: efficiency score (≤1, efficient if = 1)

• λj: weights used to construct a composite DMU

• Efficiency scores for each municipality (between 0 and 1)

• Efficient DMUs: score = 1 → on the efficiency frontier

• Inefficient DMUs: score < 1 → have room to reduce spending or improve outputs

At the same time, to assess efficiency in relation to the allocation of resources from different funding sources, the Tobit model was used.

Where: i represents the units of analysis (DMUs), t denotes time (years), Efficiency is the estimated provincial local efficiency, canon, FONCOMUN represent resource transfers, represents liabilities acquired by the municipalities, and IM is municipal income. The Tobit model is estimated using the maximum likelihood method, assuming that the error term follows a normal distribution (Çağlar Onbaşıoğlu, 2021).

The study focuses on Peru because it reflects a high degree of heterogeneity among its provinces, both in terms of population size and in socioeconomic characteristics and access to services. Panel data from 196 provinces were used over a period of 7 years, resulting in a large overall sample size (1,372 observations) and ensuring full territorial coverage.

Given the relatively large number of cross-sectional units (196 provinces) and the relatively short period of analysis (7 years), the dataset generates a substantial sample size. However, estimating efficiency parameters using DEA under these conditions involves significant computational challenges, which constrained the implementation of more complex non-radial models.

Importantly, the dataset includes years both before and after the COVID-19 pandemic, allowing the study to capture significant changes in regional efficiency over time. The diversity among provinces further enhances the representativeness of the sample by encompassing distinct local realities within the country.

Econometric model specification: spatial panel with random effects

Let the dependent variable TEit denote the technical efficiency score (either CRS_TE, VRS_TE, or SCALE) for municipality ii in year tt, which is bounded between 0 and 1. The model can be specified as:

Where:

• TEit∗ is the latent (unobserved) efficiency score.

• TEit = TEit∗ if 0 < TEit∗ < 1 < 1; censored at 0 and 1 otherwise.

• log(Canonit): log of canon transfers.

• log(FONCOMUNit): log of FONCOMUN (common fund) transfers.

• log(IMit): log of municipal tax revenue.

• WTEit: spatial lag of the dependent variable (captures spillover effects from neighboring municipalities).

• Wεit: spatial autocorrelation in the error term.

• ρ: coefficient on the spatial lag (direct spatial dependence).

• λ: spatial error autocorrelation parameter (indirect spatial dependence).

• ui: random effect capturing unobserved municipality-specific heterogeneity.

• εit: idiosyncratic error term.

• W: spatial weights matrix (typically based on geographic contiguity or distance).

The spatial weights matrix W is a fundamental component in spatial econometric modeling, as it defines the spatial structure of interdependence between provinces by indicating which units are considered neighbors. This is typically based on first-order contiguity, where wij = 1 if provinces i and j share a border, and 0 otherwise. In this study, which includes 196 provinces in Peru, the use of a contiguity-based matrix is appropriate because neighboring provinces often share infrastructure, administrative responsibilities, and access to public services. These connections generate spatial interactions that can influence the efficiency of public spending.

The spatial weights matrix allows the model to account for both direct effects within each province and indirect or spillover effects from neighboring provinces. This reflects the fact that efficiency improvements or deficiencies in one province may have consequences for surrounding areas. If these spatial relationships are ignored, as in non-spatial models like OLS, the estimates produced are likely to be biased and inefficient. To properly capture these interdependencies, the spatial econometric model used in this study includes both a spatial lag of the dependent variable and spatial autocorrelation in the error terms. This specification allows for a more accurate analysis by accounting for both observed and unobserved spatial effects.

In this framework, the direct effect measures the immediate impact of a variable on the outcome within the same province. In contrast, the indirect or spillover effect captures the influence of explanatory variables in neighboring provinces on the outcome in a given province. These effects result from the spatial relationships encoded in the weights matrix.

The coefficient on the spatial lag term indicates whether the efficiency level in one province is influenced by the efficiency levels in neighboring provinces. A significant coefficient suggests the presence of spatial dependence, while a non-significant coefficient implies spatial randomness, where outcomes in one province are not systematically related to outcomes in others.

The spatial error component is included to detect whether the residuals of the model are spatially correlated. This occurs when the unobserved factors affecting efficiency follow a spatial pattern, meaning that provinces close to each other tend to have similar unmeasured influences. Accounting for this spatial error structure ensures that the model produces more reliable estimates and reflects the true nature of spatial processes in the data. Overall, the inclusion of the spatial weights matrix and spatial econometric techniques provides a robust framework for understanding how public spending efficiency is shaped not only by internal characteristics of each province but also by regional dynamics and inter-provincial interactions.

Results

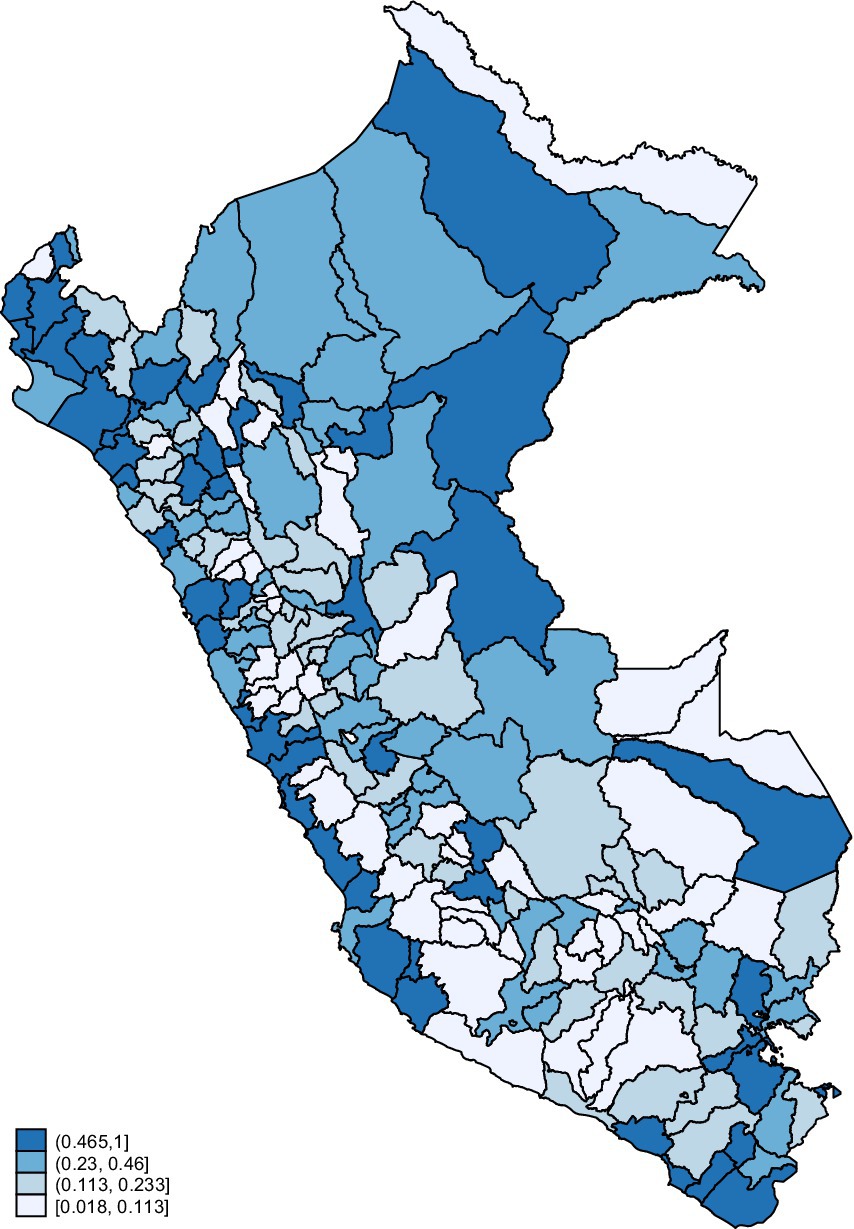

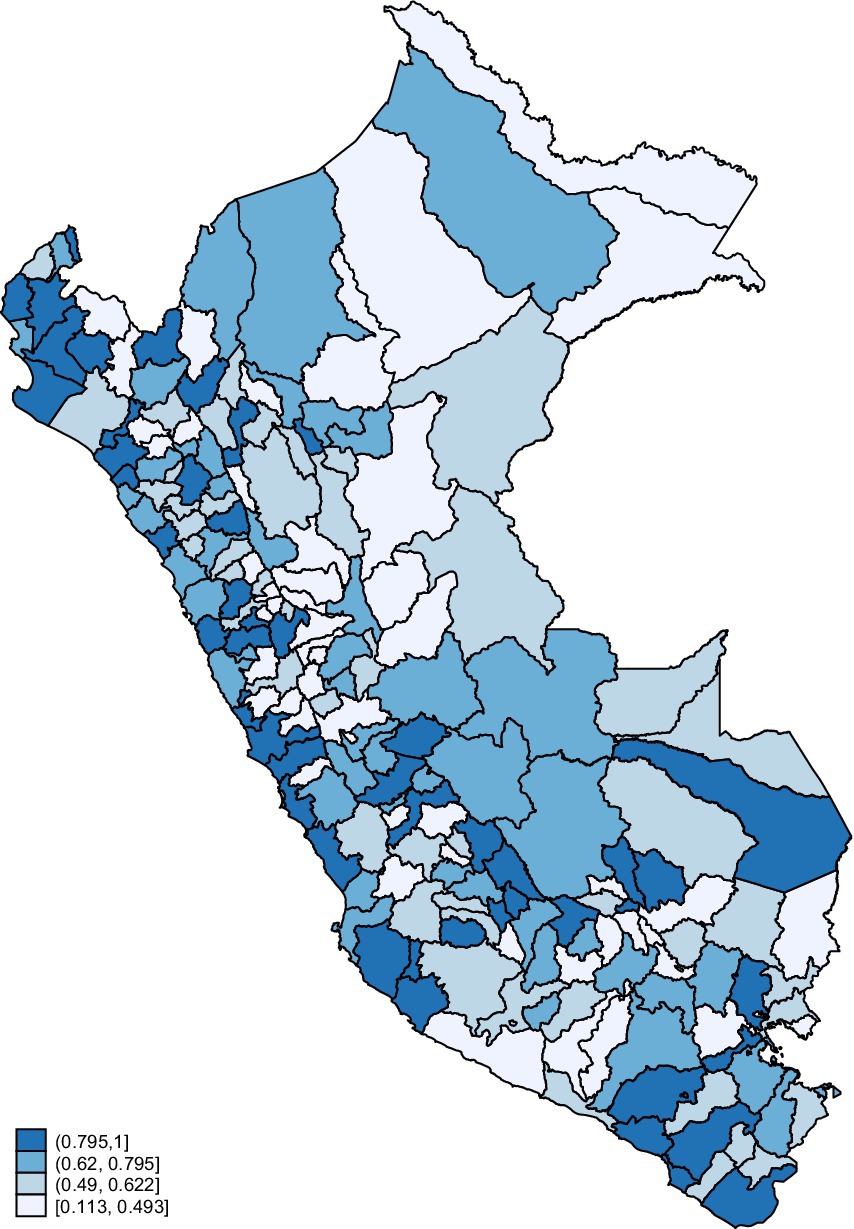

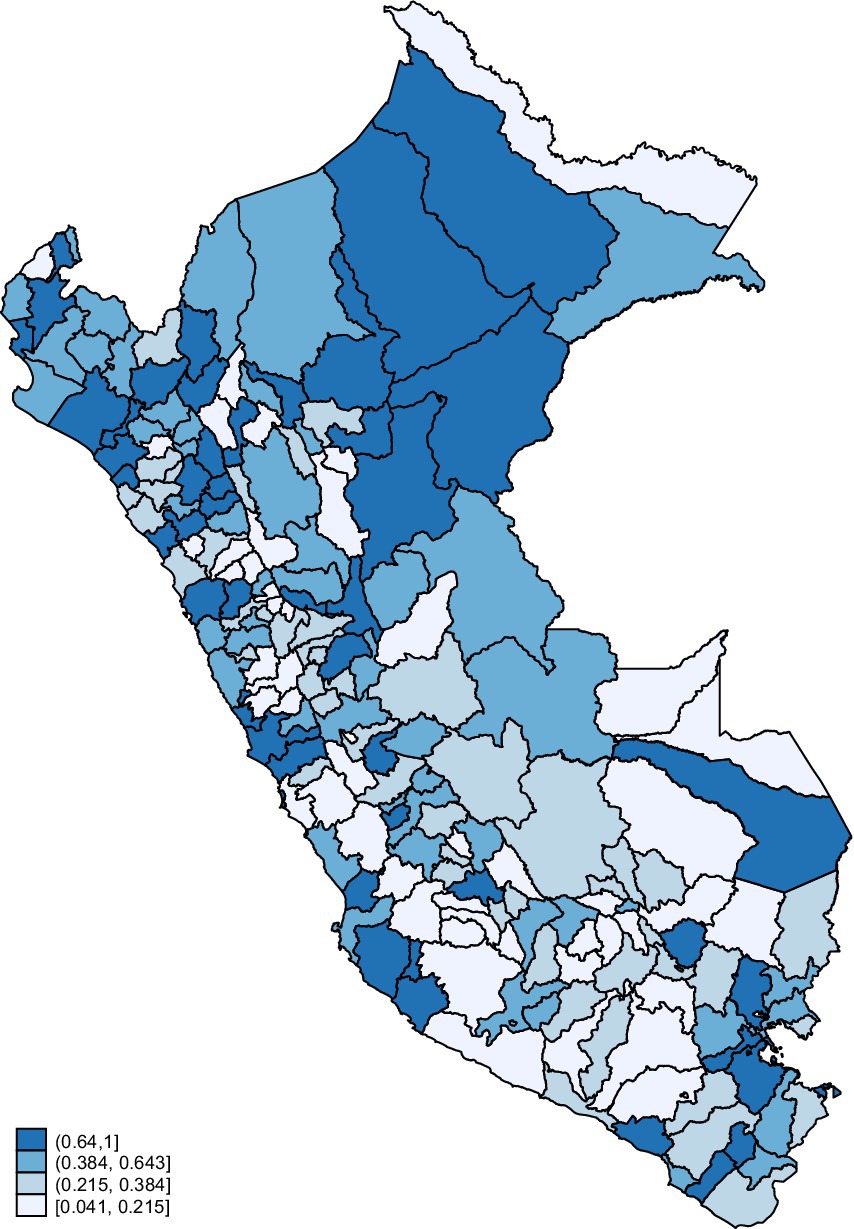

The results section presents the estimation and analysis of the technical efficiency of Peru’s provincial municipalities for the period 2017–2023, using Data Envelopment Analysis (DEA) under assumptions of constant returns to scale (CRS), variable returns to scale (VRS), and scale efficiency. The analysis begins by defining the input variables as municipal per capita expenditures across key functional areas: environment, health, social protection, and security, and output variables as measurable public service outcomes, such as solid waste treatment, beneficiaries of the “Vaso de Leche” program, health campaigns, and municipal security equipment. Descriptive statistics for the efficiency scores were calculated, showing that the average CRS efficiency was 0.282, while the VRS efficiency was higher at 0.623, indicating that a large portion of inefficiency stems from suboptimal scale rather than managerial practices. Scale efficiency averaged 0.419, confirming that most municipalities operated below optimal size. Additionally, the study examined annual variations, finding that efficiency scores under CRS remained consistently low across the years, while VRS efficiency stayed relatively stable around 0.60–0.64, suggesting persistent structural inefficiencies. Finally, efficiency was analyzed by municipal function, revealing that the security function performed best with an average VRS score of 0.565, while the health, environmental, and social protection functions displayed notably low efficiency scores, highlighting the need for improved resource allocation and institutional capacity in these essential areas.

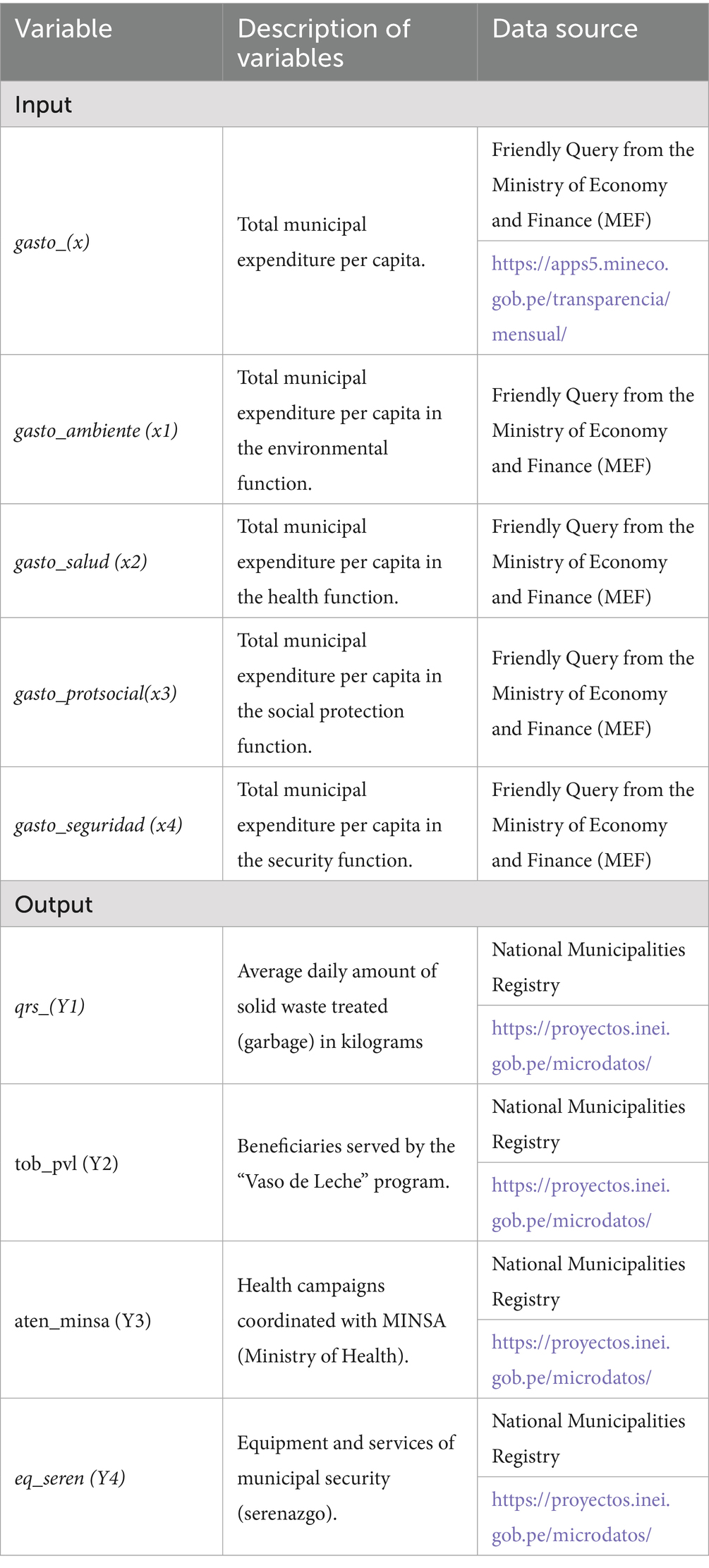

Table 1 shows a set of input and output variables to evaluate the efficiency of provincial municipalities in Peru. The input variables include total municipal expenditure per capita (gasto_), as well as disaggregated expenditures for four specific functions: environmental management (gasto_ambiente), health services (gasto_salud), social protection programs (gasto_protsocial), and public security (gasto_seguridad). All expenditure data were obtained from the Friendly Query system of the Ministry of Economy and Finance (MEF) of Peru. The output variables measure the delivery of public services: the average daily amount of solid waste treated in kilograms (qrs_), the number of beneficiaries of the “Vaso de Leche” nutritional program (tob_pvl), the number of health campaigns coordinated with the Ministry of Health (aten_minsa), and the availability of equipment and services for municipal security (eq_seren). The output data were sourced from the National Municipalities Registry, maintained by the National Institute of Statistics and Informatics (INEI).

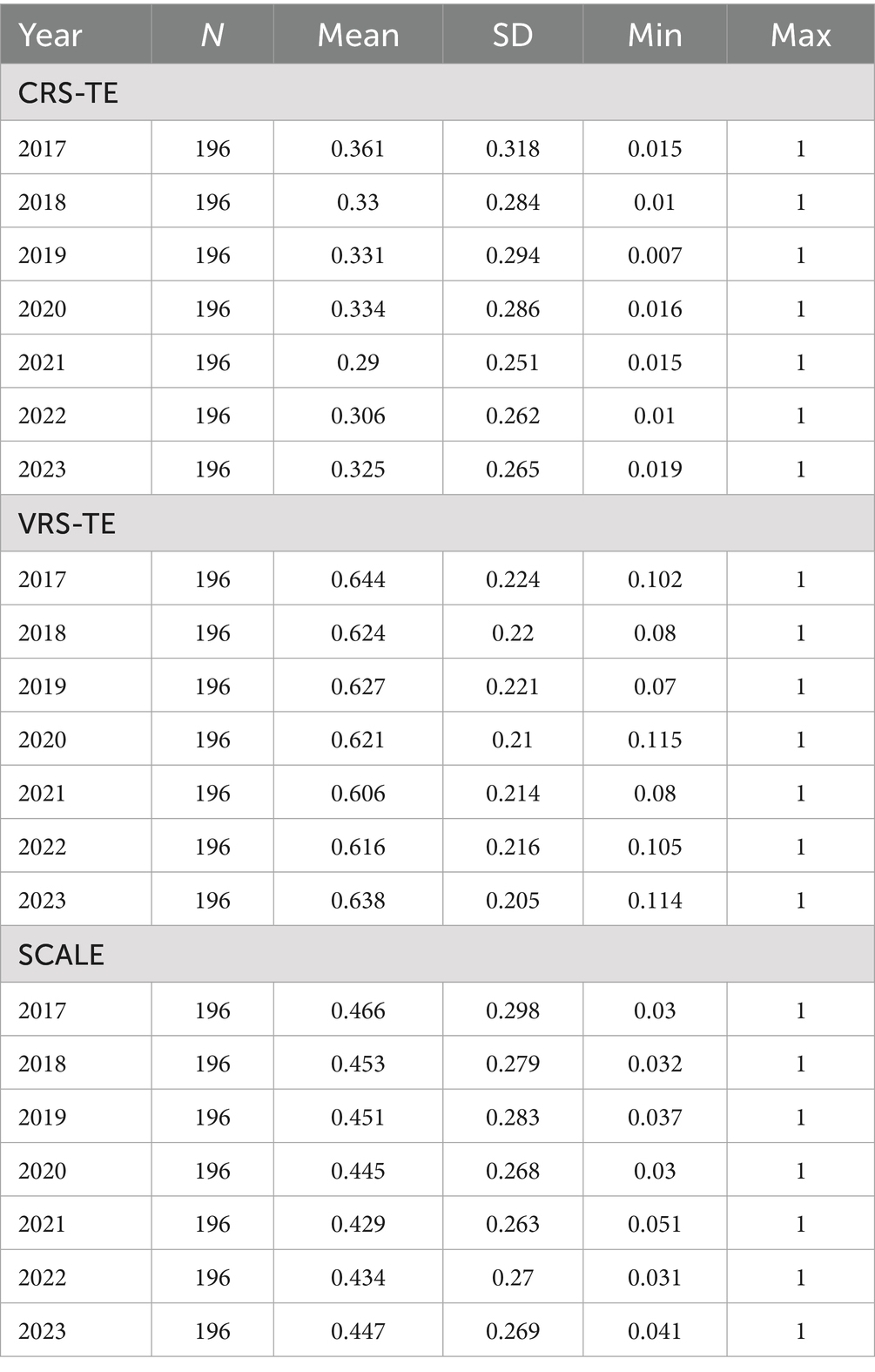

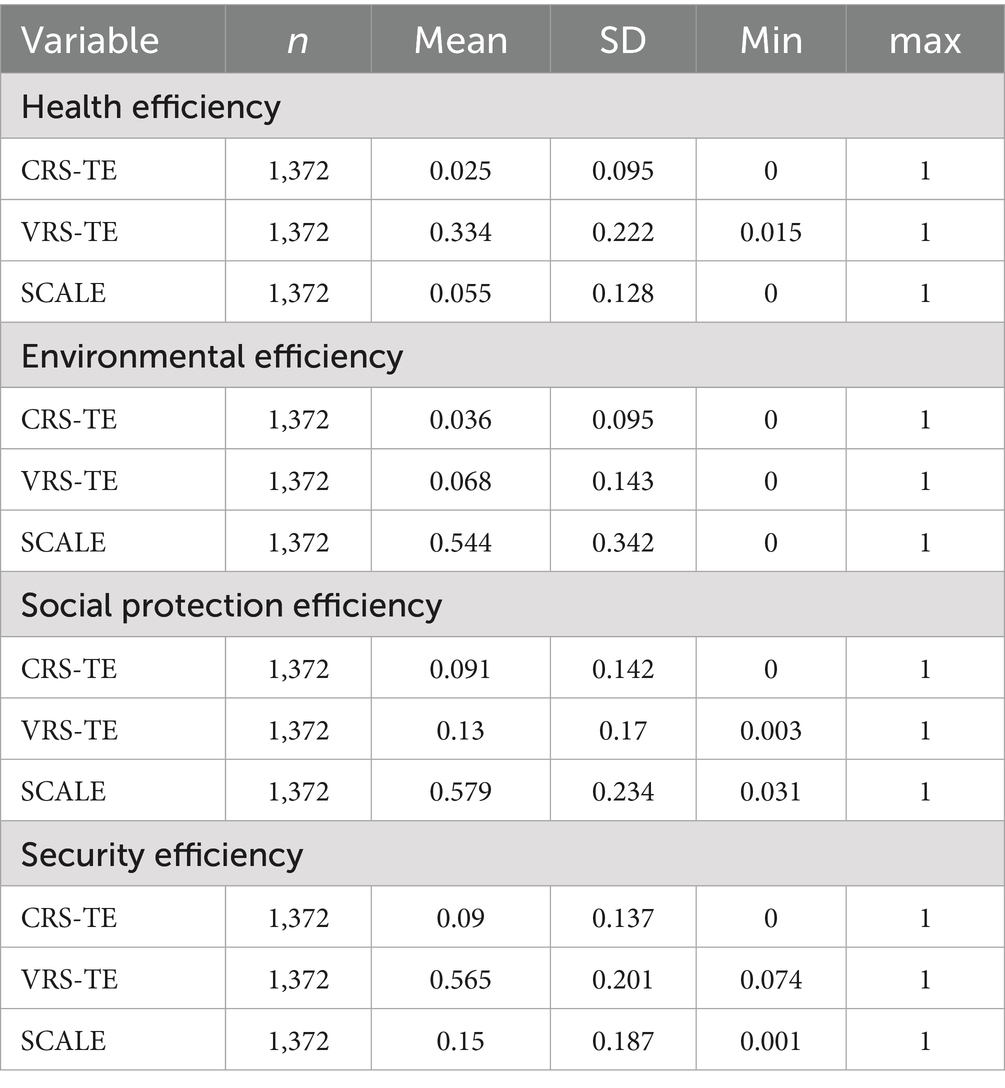

Table 2 presents the descriptive statistics for the variables CRS-TE, VRS-TE, and SCALE over the period 2017–2023, based on 1,372 observations. On average, the CRS-TE (constant returns to scale technical efficiency) is 0.325, indicating that, under the assumption of constant returns to scale, municipalities are utilizing only about 32.5% of their potential efficiency, with values ranging from 0.007 to 1. In contrast, the VRS-TE (variable returns to scale technical efficiency) shows a higher average of 0.625, suggesting that when scale effects are considered, municipalities operate closer to the efficiency frontier, reaching up to 100% efficiency in some cases. The SCALE variable, with a mean of 0.446, highlights that scale inefficiencies account for a significant portion of the overall inefficiency observed. The relatively high standard deviations across the three measures indicate substantial heterogeneity in efficiency levels among municipalities, suggesting that structural and contextual factors play an important role in explaining these differences. These findings provide valuable insights for policymakers by identifying efficiency gaps and potential areas for optimizing resource allocation.

Table 3 summarizes the descriptive statistics of technical efficiency under constant returns to scale (CRS-TE), variable returns to scale (VRS-TE), and scale efficiency (SCALE) for 196 municipalities in Peru during the period 2017–2023. From an economic perspective, the results reveal three key insights regarding the efficiency of public spending, temporal dynamics, and scale effects.

First, the average levels of CRS-TE are relatively low, ranging from 0.29 in 2021 to 0.36 in 2017. This suggests that, under constant returns to scale, municipalities could produce the same level of public services using approximately 64–71% fewer resources, indicating significant inefficiencies in resource utilization. In contrast, VRS-TE, which measures pure managerial efficiency without considering the optimal production scale, is considerably higher, fluctuating between 0.606 and 0.644. The gap between CRS-TE and VRS-TE implies that a large portion of the observed inefficiency arises from scale-related constraints rather than deficiencies in internal management practices.

Regarding scale efficiency, the average values range from 0.429 to 0.466, indicating that many municipalities are operating either below or above their optimal size. Economically, this suggests that some local governments are unable to exploit economies of scale, while others may face diseconomies of scale, leading to suboptimal outcomes in public service provision. The relatively high standard deviations, particularly in CRS-TE and SCALE, also highlight significant heterogeneity among municipalities, reflecting disparities in fiscal capacity, administrative efficiency, and infrastructure development.

From a policy perspective, these findings underscore the need for a dual strategy to enhance the efficiency of public spending. On one hand, strengthening local managerial and planning capacities is essential to improve pure technical efficiency. On the other hand, revising the allocation of fiscal transfers, such as the canon minero and other intergovernmental funds, is crucial to ensure that municipalities operate closer to their optimal production scale. The consistently higher VRS-TE compared to CRS-TE further suggests that inefficiency is not solely driven by poor administration but is also linked to structural imbalances in resource distribution and local economic capacity.

Table 4 reports the average efficiency scores of provincial local governments across their core functional areas for the 2017–2023 period. Under the assumption of variable returns to scale (VRS), only the security function demonstrated relatively satisfactory performance, with an average efficiency score of 0.565, indicating that 56.5% of the allocated resources were utilized effectively. In contrast, the health, environmental, and social protection functions recorded significantly lower efficiency scores—0.334, 0.068, and 0.130, respectively—suggesting persistent inefficiencies in the management and allocation of public resources across these essential services. These findings highlight a pressing need for provincial governments to strengthen institutional capacity and optimize resource distribution, particularly in the areas of health, environment, and social protection, to improve public service delivery and reduce existing welfare disparities.

Overall, Table 5 reveals significant heterogeneity in efficiency levels across Peruvian provinces, demonstrating that improving the effectiveness of public spending requires a dual approach: increasing financial resources while simultaneously enhancing local governments’ capacity to manage them. These findings provide valuable insights for policymakers seeking to optimize the impact of fiscal transfers, reduce regional disparities, and strengthen the long-term socioeconomic development of Peru (Figures 3–5).

Robustness analysis of DEA efficiency estimates

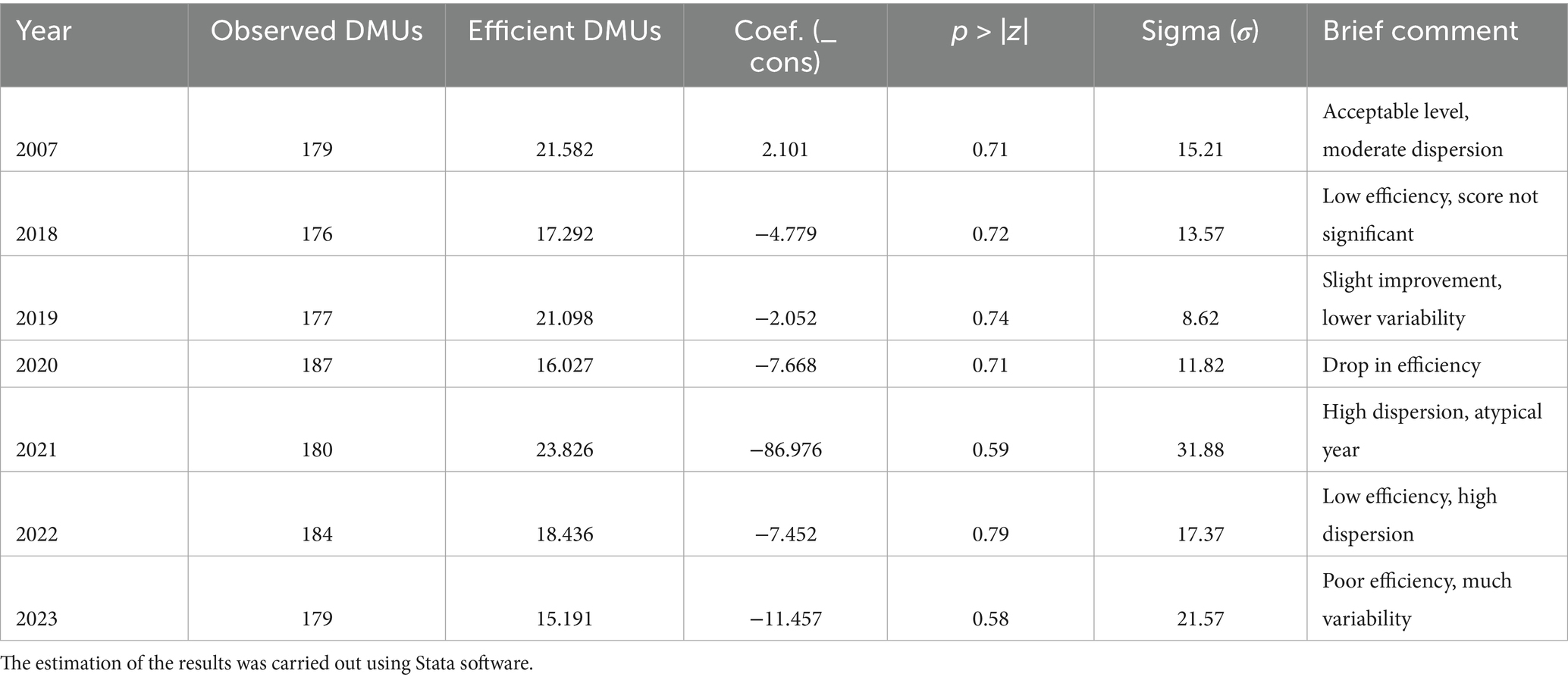

The analysis of the table shows a general improvement in the efficiency levels of decision-making units (DMUs) between 2007 and 2023 after applying a 10% increase to the number of efficient DMUs. In 2007, efficiency remains at an acceptable level, with 21.58 efficient DMUs and a positive coefficient of 2.10, indicating stable performance and moderate dispersion. This year serves as a reference point for subsequent periods since it combines relatively high efficiency with controlled variability (Table 6).

In 2018, although the number of efficient DMUs increased to 17.29, the negative coefficient (−4.78) and a p > |z| value of 0.72 indicate that the improvement is not statistically significant. However, 2019 shows positive signs of recovery, with 21.09 efficient DMUs, reduced variability (σ = 8.62), and a less negative coefficient (−2.05), suggesting a better operational efficiency among the DMUs.

In 2020, despite an increase in efficient DMUs to 16.03, overall efficiency declined, reflected in a negative coefficient (−7.66) and moderate variability (σ = 11.82). In contrast, 2021 stands out as an atypical year, showing the highest number of efficient DMUs (23.83) but also an extremely negative coefficient (−86.97) and significant dispersion (σ = 31.88), indicating an unusual and possibly unstable economic context.

In 2022, efficient DMUs increased to 18.43, but the high variability (σ = 17.37) and a negative coefficient (−7.45) reveal persistent structural inefficiencies. Finally, in 2023, a slight improvement is observed with 15.19 efficient DMUs, although variability remains high (σ = 21.57), suggesting the need for targeted policy interventions to stabilize and enhance efficiency levels.

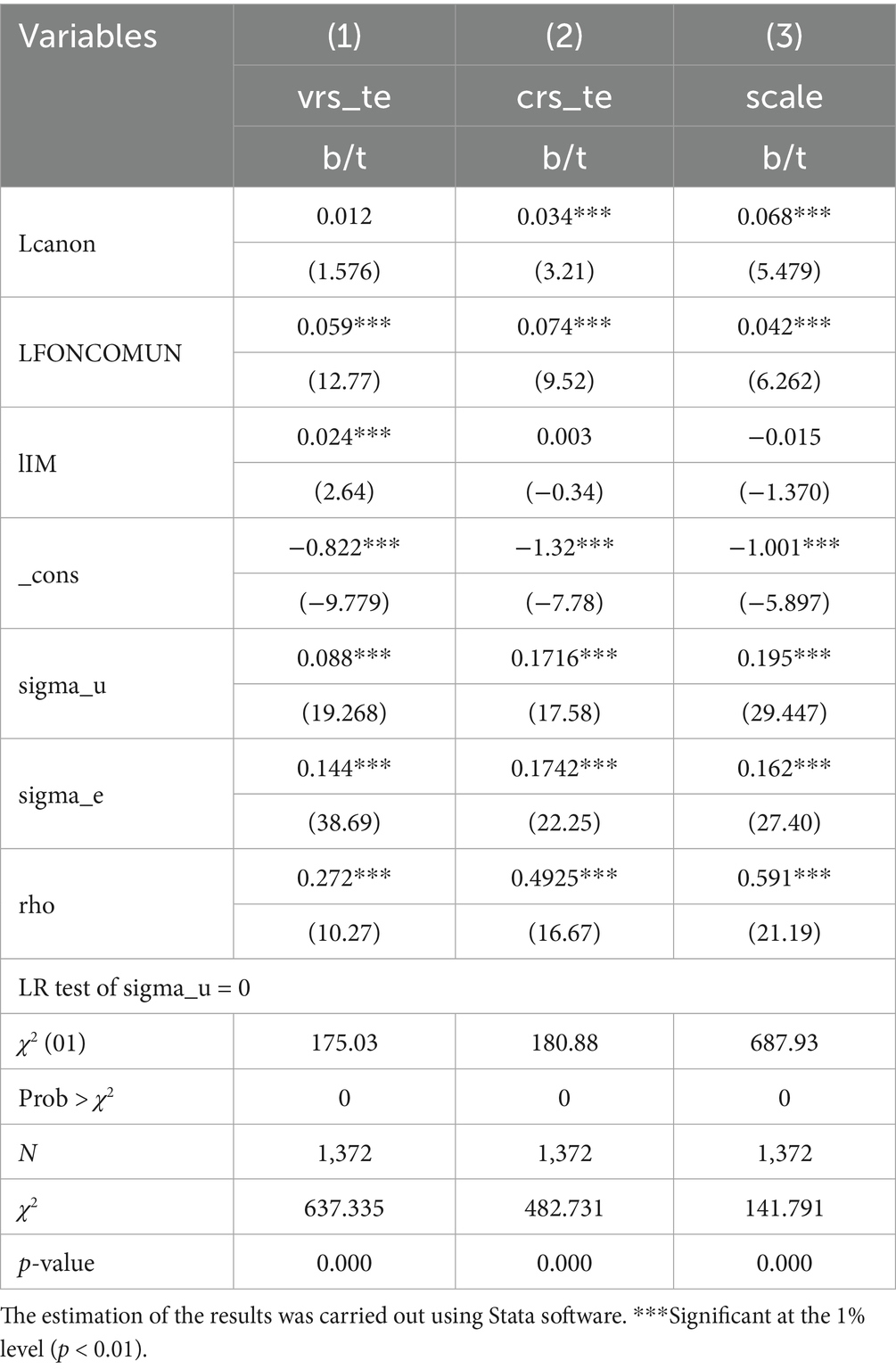

Public spending efficiency determinants using bootstrapped random-effects Tobit models

The results presented in Table 7 examine the determinants of public spending efficiency at the provincial level in Peru, focusing on two key dependent variables: technical efficiency under variable returns to scale (VRS_TE) and scale efficiency (SCALE). These efficiency scores, derived from DEA models, are bounded between 0 and 1, which makes the use of standard linear models inappropriate. To address this, the estimations were performed using panel Tobit models with random effects (xttobit), which are specifically suited for censored dependent variables in panel data settings.

To improve the robustness and reliability of the estimated coefficients and standard errors, all models were estimated using bootstrapping with 500 replications. This approach is particularly valuable in the presence of potential non-normality or heteroskedasticity in the residuals, which are common in efficiency data. By using bootstrapped standard errors, the analysis avoids underestimating the variability of the estimates and provides more dependable inference.

In the first model, technical efficiency under variable returns to scale (VRS_TE) is the dependent variable. This variable captures the ability of municipalities to optimize resource use independently of scale effects. The model accounts for the bounded nature of the dependent variable (censored at zero) and includes random effects to capture unobserved heterogeneity at the provincial level. The results indicate that transfers from the common fund (lFONCOMUN) have a strong and highly significant positive effect on VRS_TE. Specifically, a 1% increase in FONCOMUN transfers is associated with a 0.059 point increase in efficiency, suggesting that this flexible funding source supports improved municipal management and service delivery.

In contrast, canon transfers (lcanon) do not exhibit a statistically significant effect in this model, which implies that although canon funds may be substantial, they do not directly influence operational efficiency unless managed effectively. Meanwhile, local tax revenue (lIM) shows a statistically significant positive effect, indicating that provinces with stronger tax bases tend to manage their resources more efficiently under variable returns to scale.

The second model evaluates scale efficiency, which is defined as the ratio between constant returns to scale (CRS) and variable returns to scale (VRS) technical efficiency scores. This model also uses bootstrapped xttobit estimation with censoring at both 0 and 1. The findings reveal that canon transfers have a strong and statistically significant positive impact on scale efficiency, with a coefficient of 0.068. This suggests that canon funding helps municipalities operate closer to their optimal scale, possibly by enabling investments in infrastructure or long-term planning. Transfers from FONCOMUN also have a positive and significant effect, though somewhat smaller, indicating their broader role in improving both operational and structural efficiency. Local tax revenue, however, has a negative but statistically insignificant coefficient, which may imply that higher tax revenues are not necessarily associated with operating at an optimal scale.

Regarding model diagnostics, the variance components representing unobserved heterogeneity (sigma_u) and idiosyncratic error (sigma_e) are statistically significant in both models. This supports the use of a random effects Tobit framework. The intra-class correlation coefficient (rho) points to a notable degree of persistent heterogeneity at the provincial level, especially for scale efficiency. The likelihood ratio test strongly rejects the null hypothesis that sigma_u equals zero, confirming that unobserved heterogeneity is an important factor and that pooled models would be inadequate. Finally, the Wald chi-squared statistics are highly significant, indicating that the explanatory variables included in the models have strong predictive power.

In summary, this analysis applies a robust methodological framework to estimate the determinants of public spending efficiency at the provincial level. The use of random-effects Tobit models with bootstrapped standard errors and appropriate censoring accounts for the bounded nature of efficiency scores, unobserved heterogeneity, and potential irregularities in the error terms. The results highlight that transfers from FONCOMUN are the most consistent and significant contributors to both technical and scale efficiency. Canon transfers play an important role in enhancing scale efficiency but do not appear to affect pure technical efficiency. Municipal tax revenue positively influences technical efficiency under variable returns but has no significant impact on scale efficiency. These findings underscore the critical role of intergovernmental transfers, especially those with flexible usage like FONCOMUN, in improving the performance of local governments. Moreover, the rigorous estimation approach ensures that these conclusions are well-founded and not artifacts of model mis-specification or data limitations.

In evaluating public spending efficiency determinants at the provincial level in Peru, the analysis employs a robust methodological approach characterized by the use of bootstrapped random-effects Tobit models. This approach is particularly well-suited for handling censored data, which is a common feature in efficiency analyses that derive efficiency scores from Data Envelopment Analysis (DEA) models. Efficiency scores typically range between 0 and 1, making standard linear models inappropriate due to the bounded nature of the dependent (Samut and Cafri, 2015; Wang and Griswold, 2016).

The methodological foundation is reinforced by bootstrapping, which enhances the reliability of coefficient estimates by addressing potential non-normality and heteroskedasticity present in the residuals of efficiency data (Wang and Griswold, 2016). Bootstrapped standard errors, achieved through 500 replications, provide a more accurate representation of the variability in estimates, thereby improving inference robustness. This methodological rigor is essential in panel data contexts, where violations of assumptions about the distribution of errors can lead to misleading outcomes (Samut and Cafri, 2015).

The first model analysis reveals that intergovernmental transfers, particularly from the common fund (FONCOMUN), exhibit a strong positive correlation with technical efficiency under variable returns to scale (VRSTE). Specifically, a 1% increase in FONCOMUN transfers correlates with a 0.059 point rise in efficiency. This suggests that more flexible funding sources can significantly enhance municipal management and service delivery, acting as a critical determinant of operational efficiency (Samut and Cafri, 2015). Conversely, canon transfers were not statistically significant in impacting VRSTE, indicating that although these funds might be substantial, they require effective management to yield improvements in operational efficiency (Samut and Cafri, 2015).

In evaluating scale efficiency, defined as the ratio of constant returns to scale (CRS) technical efficiency to VRS technical efficiency, the model indicates that canon transfers have a significant positive effect, suggesting that their provision supports municipalities in achieving operational optimization potentially through targeted investments in infrastructure or strategic planning (Samut and Cafri, 2015). Interestingly, local tax revenues demonstrate a statistically insignificant negative correlation with scale efficiency, an outcome that points to the nuanced relationship between revenue generation and optimal operational scaling, possibly hinting at inefficiencies in how tax revenues are utilized despite their apparent abundance.

Diagnosis of the models indicates significant variance components for unobserved heterogeneity and idiosyncratic error, reinforcing the appropriateness of employing a random-effects Tobit framework. The significance of the Wald chi-squared statistics further substantiates that the included explanatory variables have strong predictive capabilities in the analysis, thus confirming the reliability of the results.

The analysis of public spending efficiency determinants at the provincial level in Peru, utilizing bootstrapped random-effects Tobit models, reveals significant insights into how different funding sources influence municipalities’ efficiency. This study focuses on two key dependent variables: technical efficiency under variable returns to scale (VRS_TE) and scale efficiency (SCALE). Efficiency scores, derived from Data Envelopment Analysis (DEA) models, range from 0 to 1, necessitating the use of Tobit models due to their censored nature (Khan S. et al., 2016). Specifically, postulating the existence of unobserved heterogeneity within this framework allows for a comprehensive consideration of the relationships under scrutiny, making the random-effects Tobit model particularly apt for this investigation (Bhatia and Mahendru, 2015).

The findings indicate that transfers from the common fund (FONCOMUN) significantly enhance technical efficiency, with every 1% increase in such transfers correlating to a 0.059 point uptick in efficiency scores. This suggests that flexible funding sources can lead to meaningful improvements in municipal management and service delivery (Khan J. R. et al., 2016). In contrast, local tax revenue also demonstrates a positive influence on VRS_TE, signifying that municipalities with stronger tax bases manage resources more effectively (Khan J. R. et al., 2016). However, the lack of statistically significant effects from canon transfers on this efficiency variable illuminates that the impact of financing may hinge on effective management practices rather than sheer availability of funds (Bhatia and Mahendru, 2019).

When examining scale efficiency, the Tobit model reveals that canon transfers positively influence the efficiency of municipalities’ scale operations, suggesting they support investments in infrastructure essential for operational growth. This distinct behavior underlines the idea that while canon funds can facilitate scaling, they must be strategically administered to realize efficiency enhancements (Bhatia and Mahendru, 2019). Notably, although the impact of local tax revenue is statistically insignificant regarding scale efficiency, its negative coefficient suggests a more complex interaction that necessitates further exploration into how higher revenues might not inherently align with optimal operational scaling.

The results from the bootstrapped Tobit models highlight critical factors impacting public spending efficiency in Peru’s provincial-level municipalities. They reveal that both flexible intergovernmental transfers and local tax revenues are crucial in shaping technical efficiency. However, the evidence suggests a more differentiated role of canon transfers, pointing to the need for effective asset management to leverage financial resources for optimal operational scale.

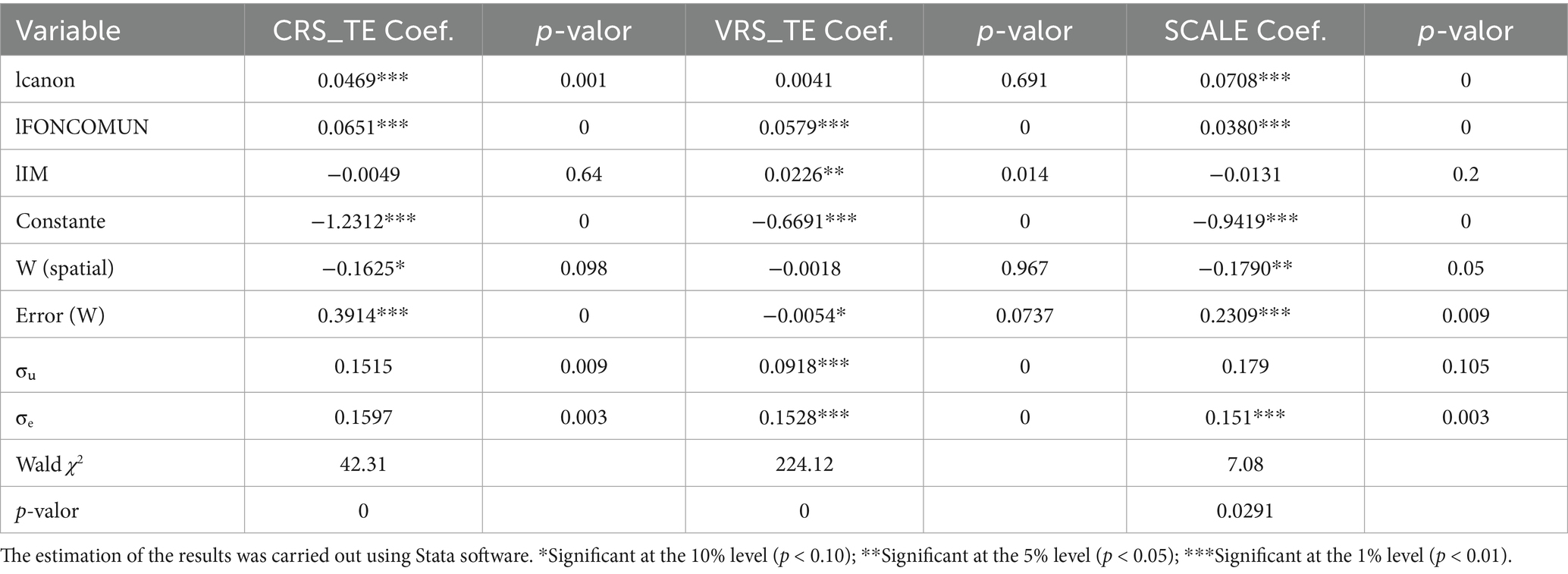

Determinants of technical efficiency under DEA models (CRS, VRS, and scale efficiency) with spatial effects

The results of Table 8 shows that transfers from the canon (lcanon) have a positive and statistically significant effect on technical efficiency under the assumption of constant returns to scale (CRS_TE), as well as on scale efficiency (SCALE). Specifically, a 1% increase in canon transfers is associated with an increase of approximately 0.047 percentage points in technical efficiency under CRS and 0.071 percentage points in scale efficiency. However, the effect is not statistically significant under variable returns to scale (VRS_TE), suggesting that canon transfers do not necessarily improve pure technical efficiency, but rather help municipalities operate closer to an optimal production scale.

Table 8. Determinants of technical efficiency under DEA models (CRS, VRS, and scale efficiency) with spatial effects.

In contrast, transfers from the common fund (lFONCOMUN) show positive and highly significant effects across all three models. A 1% increase in these transfers is associated with increases of 0.065, 0.058, and 0.038 percentage points in CRS_TE, VRS_TE, and SCALE, respectively. These results indicate that common fund transfers have a broad and consistent impact on efficiency, enhancing both technical operations and scale optimization. This may be due to the flexible nature of these funds, which allows municipalities to allocate them in ways that improve service delivery and institutional performance.

Regarding municipal tax revenue (lIM), its effect is more limited. It is only statistically significant in the VRS_TE model, where a 1% increase in local tax revenue is associated with a 0.023 percentage point increase in technical efficiency under variable returns to scale. This suggests that municipalities with higher local revenue capacities tend to manage resources more efficiently at the operational level. However, municipal tax revenue does not show significant effects under CRS or on scale efficiency, indicating that its impact may be confined to improving internal management rather than altering scale efficiency.

The constant term is negative and statistically significant across all three models, as is typical in log-linear specifications. While it lacks a direct economic interpretation, its significance reflects the presence of other unobserved structural factors that affect baseline efficiency levels when all explanatory variables are at their logarithmic means.

Turning to the spatial effects, we observe that both CRS_TE and SCALE exhibit evidence of spatial dependence. In the CRS_TE model, the spatial lag of the dependent variable (W) is negative and marginally significant, and it is significant at the 5 percent level in the SCALE model. This suggests that a municipality’s efficiency may be negatively influenced by the efficiency of neighboring municipalities, potentially due to competition for resources or overlapping functions. Additionally, the spatial error terms are positive and highly significant in both CRS_TE and SCALE, confirming the presence of spatial autocorrelation in the residuals and justifying the use of spatial econometric models. By contrast, in the VRS_TE model, neither the spatial lag nor the error term is statistically significant, implying that pure technical efficiency is not spatially correlated, and is instead driven more by internal, municipality-specific factors.

As for the variance components, both the inefficiency term (σᵤ) and the random error term (σe) are statistically significant in the CRS and VRS models, indicating that there is unobserved heterogeneity affecting municipal efficiency. However, in the SCALE model, the inefficiency component is not statistically significant, suggesting that variation in scale efficiency may be more random or influenced by factors not captured by the model.

Finally, the goodness-of-fit statistics (Wald χ2) confirm that all three models are statistically significant overall. The VRS_TE model provides the best overall fit, with the highest Wald statistic, followed by the CRS_TE model. While the scale efficiency model shows a lower explanatory power, it remains statistically significant at the 5 percent level.

Findings indicate that common fund transfers are the most consistent and significant determinant of both technical and scale efficiency among local governments. Canon transfers have more limited effects, primarily enhancing scale efficiency rather than pure technical performance. Municipal tax revenue contributes positively to technical efficiency under variable returns, but its effect is more modest. Moreover, spatial dynamics play a role in shaping efficiency patterns, especially under CRS assumptions and in scale efficiency, underscoring the importance of regional and inter-municipal interactions in local government performance.

The empirical findings highlight important aspects regarding the efficiency of local government spending, particularly in relation to fiscal transfers and the dynamics of municipal investments. Firstly, the results indicate that fiscal transfers such as canon and FONCOMUN significantly enhance municipal efficiency under various return-to-scale assumptions. This suggests a robust relationship where increased transfers bolster the ability of municipalities to convert allocated resources into effective public goods and services performance (Ranđelović and Vukanovic, 2021). Previous research has supported the notion that fiscal transfers can mitigate inefficiencies in local government by providing crucial financial resources that amplify operational capacities and ultimately foster local development alaguer (Balaguer-Coll et al., 2007).

In stark contrast, while credit availability lacks a statistically significant effect on technical efficiency, it plays a role in improving scale efficiency. This discrepancy indicates that external financing does not necessarily translate to better managerial practices or operational performance in the immediate term; however, it does aid in reaching optimal operational scales. This finding resonates with the existing literature asserting that access to financial resources can facilitate the structural expansion of municipal capabilities, allowing for increased scale without directly impacting short-term productivity (Ranđelović and Vukanovic, 2021).

Regarding municipal investment (IM), the mixed effects observed suggest its effectiveness is contingent upon the production context—it shows positive significance only when variable returns to scale are assumed. This indicates potential insufficiencies in planning, allocation, or execution of municipal projects, highlighting that investment alone is insufficient to guarantee efficiency (Narbón-Perpiñá et al., 2020). The necessity for strong institutional capacity, effective project management, and strategic planning emerges as a vital lesson from this analysis.

The findings reveal that canon transfers (lcanon) play a significant role in enhancing both CRS and SCALE efficiencies. Specifically, a 1% increase in canon transfers correlates with increases of approximately 0.047 and 0.071 percentage points in CRS_TE and SCALE, respectively. This suggests that funds earmarked for infrastructure investments facilitate municipalities in achieving a more optimal operational scale. It is noteworthy that such funds do not significantly enhance internal operational efficiency, as evidenced by their lack of a meaningful impact on VRS_TE scores. This differentiation indicates that while canon funds can strengthen the structural foundations required for more efficient service delivery, they alone do not rectify the day-to-day management issues facing municipalities (Frère et al., 2013).

Conversely, transfers from the common fund (lFONCOMUN) manifest a consistent and significant influence across all efficiency measures examined. The positive correlation with CRS_TE, VRS_TE, and SCALE outputs underscores the value of flexible, formula-based funding in bolstering municipal operational performance. Unlike canon resources, which are tied to specific investments, FONCOMUN funds allow municipalities to address recurrent needs and engage in institutional strengthening, thus enhancing overall efficiency (Soares, 2024).

The analysis further illustrates that municipal tax revenues (lIM) have a limited impact, predominantly reflected in the VRS_TE model where a 1% increase in revenue correlates to a 0.023 percentage point efficiency increase. This insight posits that while locally sourced revenues may foster operational efficiency by improving responsiveness and managerial autonomy, their broader implications for structural or investment-driven efficiency remain negligible. Thus, the role of local tax revenues appears confined to routine operations rather than enabling systemic improvements in municipal efficiency (Frère et al., 2013).

The analysis of constant terms indicates significant and negative values across all models, aligning with expectations in log-linear specifications and reinforcing the notion that unobserved structural factors substantially influence baseline efficiency. Moreover, the identification of spatial dependencies through significant negative spatial lag effects in CRS_TE and SCALE models suggests that efficiencies in neighboring municipalities may inversely affect individual performance. This paradox can be attributed to inter-municipal competition, possibly leading to inefficiencies as municipalities compete rather than cooperate or coordinate services (Frère et al., 2013).

The model diagnostics yield important insights into unobserved heterogeneities across municipalities, particularly with significant variance components extracted in both CRS_TE and VRS_TE models. This variance clarifies the need for nuanced analyses that account for longer-term planning and institutional constraints that may especially affect scale efficiency, which did not manifest significant unobserved inefficiency components.

The Wald statistics further confirm the overall relevance of the models applied, with the VRS_TE model demonstrating the highest explanatory power. This observation reinforces the conclusion that pure technical efficiency is primarily influenced by municipality-specific characteristics over regional or neighboring effects, emphasizing the importance of strategic local governance over merely reactive measures to external spatial influences (Wippel, 2023).

These findings illustrate the critical importance of intergovernmental transfers, particularly the flexible FONCOMUN transfers, which consistently improve both technical and scale efficiencies. Canon transfers, while instrumental in enabling municipalities to achieve optimal scale, do not directly address operational efficiencies. Local tax revenues carry targeted benefits for operational efficiency under variable returns, yet do not enhance scale efficiency. The spatial interactions observed have substantial implications for understanding how municipalities within regions interact and compete, which can either hinder or facilitate efficient public spending. Thus, these insights are crucial for guiding policy initiatives aimed at improving municipal finance management and public service provision.

The Data Envelopment Analysis (DEA) results presented in Table 7 provide important insights into the efficiency of public spending across Peruvian provinces and their implications for economic policy. The analysis evaluates technical efficiency under variable returns to scale (VRS_TE), constant returns to scale (CRS_TE), and scale efficiency (SCALE), offering a comprehensive understanding of how local governments transform public resources into services and infrastructure. Provinces such as Chiclayo, Barranca, and San Román, which exhibit high efficiency scores close to one in both VRS_TE and SCALE, demonstrate a strong capacity to manage resources effectively and deliver quality public services. These cases suggest that robust administrative practices and strategic planning can optimize public expenditure outcomes, even when resource levels are limited.

In contrast, Table 8 also highlights provinces such as Tacna, Nazca, and Huarmey, which, despite having access to significant fiscal transfers, display lower SCALE or CRS_TE scores, indicating inefficiencies in resource allocation or mismatches between operational size and demand. Similarly, provinces like Tumbes and Cajamarca operate close to the optimal scale but show relatively lower VRS_TE, suggesting weaknesses in managerial capacity and project prioritization. These discrepancies highlight the fact that resource availability, including revenues from mining-related transfers such as the canon minero, does not automatically translate into improved efficiency without accompanying institutional strengthening.

From a public policy perspective, the DEA results underscore the necessity of designing strategies focused on three key dimensions. First, strengthening institutional capacity through technical assistance, managerial training, and better governance frameworks is crucial for improving local administrative performance. Second, intergovernmental transfer mechanisms should be restructured to incentivize efficiency, potentially linking portions of FONCOMUN and canon allocations to performance-based indicators. Third, promoting inter-municipal cooperation can help provinces with suboptimal SCALE scores to achieve economies of scale and improve collective service delivery.

Discussion

The examination of public spending efficiency at the provincial level in Peru through the employment of bootstrapped random-effects Tobit models provides significant insights into the determinants of technical efficiency under variable returns to scale (VRS_TE) and scale efficiency (SCALE). The methodological rigor of using Tobit models, which appropriately handle the bounded nature of efficiency scores derived from Data Envelopment Analysis (DEA), enhances the reliability of the findings while addressing common issues such as non-normality and heteroskedasticity in residuals (Ganelli and Tervala, 2020).

The results highlight that transfers from the common fund (FONCOMUN) have a strong and meaningful positive effect on VRS_TE, with an increase of 0.059 efficiency points per 1% increase in FONCOMUN transfers. This indicates that flexible funding, which can be allocated as needed by municipalities, is crucial for improving operational efficiency in managing resources and enhancing service delivery (El-Berry et al., 2022). Such flexibility allows municipalities to better respond to local needs and invest in critical operational areas, which aligns with the literature suggesting that unrestricted fiscal transfers can mitigate inefficiencies and enhance public service provision (Afonso and Fraga, 2023).

In contrast, canon transfers (Canon) reveal differing impacts across the efficiency measures. While they significantly influence scale efficiency (SCALE, 0.068 points), they do not show statistically significant effects on VRS_TE. This suggests that while canon funding is substantial for investments often earmarked for infrastructure, it may not directly enhance internal operational efficiency unless managed effectively. The lack of significant improvement in day-to-day management techniques could highlight the need for better managerial practices accompanying the influx of these funds (El-Berry et al., 2022).

Local tax revenue (lIM) presents a nuanced role, being statistically significant only in the context of VRS_TE. The observed positive correlation indicates that municipalities with stronger tax bases may manage their resources more effectively, potentially improving responsiveness and accountability. Nevertheless, its mixed impact on scale efficiency raises questions about how local revenues are utilized, suggesting inefficiencies in these processes or a mismatch between revenue generation and expenditure effectiveness (Soares, 2024). This inconsistency emphasizes the necessity for enhanced planning and strategic management to utilize revenue effectively to influence operational scale.

The constant terms in the analyses are significant and negative, indicating that unobserved structural factors likely influence baseline efficiency levels when all other variables are held constant. Such findings reinforce the understanding that there are inherent limitations and challenges in how provincial efficiencies are impacted by external factors, pointing to a need for a deeper analysis of local governance structures and unmet municipal needs (El-Berry et al., 2022).

Regarding spatial dynamics, the presence of spatial dependencies, particularly in the CRS_TE and SCALE models, suggests that municipal efficiency is affected by the performance of neighboring municipalities. This spatial lag indicates potential competition for resources or services, where higher efficiency in neighboring municipalities may inversely affect the efficiency of a given municipality (El-Berry et al., 2022). This phenomenon underscores the importance of collaboration and coordination among municipalities to enhance collective efficiency and mitigate competitive disadvantages.

Model diagnostics indicate significant variance components for both unobserved heterogeneity and idiosyncratic error, confirming the appropriateness of the random-effects Tobit framework employed. The substantial intra-class correlation coefficients further indicate persistent differences at the provincial level, justifying the need for models specifically accounting for such variances in public funding and management effectiveness (Ganelli and Tervala, 2020).

The results highlight the importance of strengthening flexible intergovernmental transfers—particularly FONCOMUN—which consistently improve both technical and scale efficiency. Policy should focus on maintaining its predictability and introducing performance-based incentives to encourage better municipal management. Canon transfers, while effective for improving scale efficiency, require stricter oversight and better planning frameworks to ensure their strategic use. Strengthening local tax administration is also key, but must be accompanied by institutional support to translate fiscal autonomy into operational efficiency. Given the spatial dependencies identified, promoting inter-municipal cooperation and shared service models is essential to achieve economies of scale and reduce inefficiencies. Finally, the volatility observed over time suggests the need for adaptive policies and fiscal stabilization tools to safeguard municipal performance during external shocks. These findings call for a coordinated, results-oriented approach to subnational public finance reform.

Conclusion

The analysis of public spending efficiency determinants at the provincial level in Peru, utilizing bootstrapped random-effects Tobit models, provides robust insights into the factors that influence the effectiveness of local government resource allocation. The study’s methodological rigor, characterized by the use of Tobit models to address the bounded nature of efficiency scores, highlights the importance of carefully selecting analytical approaches that can accurately capture the underlying dynamics of public spending efficiency.

The findings indicate that transfers from the common fund (FONCOMUN) play a crucial role in enhancing both technical efficiency under variable returns to scale (VRS_TE) and scale efficiency. Specifically, a 1% increase in FONCOMUN transfers corresponds to a significant improvement in municipal efficiency, underscoring the value of flexible funding sources in optimizing local management and service delivery. In contrast, while canon transfers exhibit a significant positive impact on scale efficiency, their effect on technical efficiency remains statistically insignificant, suggesting that effective management of these funds is vital for them to contribute to operational improvements.

Moreover, local tax revenue does have a positive effect on technical efficiency under variable returns, indicating that municipalities with more robust tax bases can maximize their resource management capabilities. However, this effect does not extend to scale efficiency, implying that higher revenues alone may not ensure optimal operational performance.

The presence of significant variance components reinforces the need to consider unobserved heterogeneity when analyzing public spending efficiency. The strong predictive power of the included explanatory variables, as indicated by the Wald chi-squared statistics, affirms that the selected model is effective in capturing the complexity of efficiency dynamics in this context.

Lastly, the results illustrate the complex interplay between intergovernmental transfers and municipal efficiency outcomes. The emphasis on the critical role of FONCOMUN transfers suggests a policy focus on enhancing these funding mechanisms to improve local government performance. This study contributes to the existing literature by elucidating the nuanced relationships between funding sources and efficiency, providing a foundation for future research and practical policy implications aimed at optimizing public sector resource allocation.

In summary, these findings not only contribute to the understanding of public sector efficiency in Peru but also offer valuable insights that can be leveraged to inform policy decisions aimed at strengthening the efficiency of municipal service delivery across various contexts. Moving forward, it is essential to further investigate the underlying mechanisms and potential interactions among funding types to fully harness their potential in fostering effective local governance.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

CL: Writing – review & editing, Investigation. RA: Writing – original draft. MP: Methodology, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Acknowledgments

We would like to thank the National University of Altiplano Puno for the financial support provided for the development of this research through the Special University Development Fund.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Afonso, A., and Fernandes, S. (2006). Measuring local government spending efficiency: evidence for the Lisbon region. Reg. Stud. 40, 39–53. doi: 10.1080/00343400500449937

Afonso, A., and Fraga, G. B. (2023). Government spending efficiency in Latin America. Empirica 51, 127–160. doi: 10.1007/s10663-023-09599-4

Afonso, A., and Venâncio, A. (2020). Local territorial reform and regional spending efficiency. Local Gov. Stud. 46, 888–910. doi: 10.1080/03003930.2019.1690995

Agbidinoukoun, T. A., Houssou, K. P., Agbokpanzo, A. T., Zogbasse, S., and Alinsato, A. S. (2023). Efficiency of public expenditure on education in Benin: a comparative analysis with the countries of WAEMU. Creat. Educ. 14, 1811–1825. doi: 10.4236/ce.2023.149116

Álvarez Sánchez, S. (1969). Hacia La Eficiencia En La Gestión Municipal. Revista Nacional de Administración 3, 49–76. doi: 10.22458/rna.v3i2.523

Ardanaz, M., Bonet, J. A., Garson, S., Huanqui Valcárcel, S., Muñoz Miranda, A., Pérez, G. J., et al. (2022). Municipal Fiscal Health in Latin America. Inter-American Development Bank. doi: 10.18235/0004251

Aturupane, H. (2017). Public investment in education: Benefits, challenges and opportunities. En U. Wagle (Ed.), Decentralization and Development of Sri Lanka Within a Unitary State (pp. 179–201). Springer Singapore. doi: 10.1007/978-981-10-4259-1_8

Balaguer-Coll, M. T., Prior, D., and Tortosa-Ausina, E. (2007). On the determinants of local government performance: a two-stage nonparametric approach. Eur. Econ. Rev. 51, 425–451. doi: 10.1016/j.euroecorev.2006.01.007

Barraud, A., and Torres, G. (2016). Una medición de la eficiencia del gasto público en las provincias argentinas. In V Jornadas Iberoamericanas de Financiación Local.

Bastani, S. (2023). The marginal cost of public funds: a brief guide (Working Paper). RePEc. Available online at: www.RePEc.org

Bhatia, A., and Mahendru, M. (2015). Assessment of technical efficiency of public sector banks in India using data envelopment analysis. Eurasian J. Bus. Econ. 8, 115–140. doi: 10.17015/ejbe.2015.015.06

Bhatia, A., and Mahendru, M. (2019). Determinants of the revenue efficiency of Indian scheduled commercial banks. Asian J. Account. Perspect. 12, 78–108. doi: 10.22452/ajap.vol12no1.4

Blom-Hansen, J. (2010). Municipal amalgamations and common pool problems: the Danish local government reform in 2007. Scand. Polit. Stud. 33, 51–73. doi: 10.1111/j.1467-9477.2009.00239.x

Blom-Hansen, J., Houlberg, K., Serritzlew, S., and Treisman, D. (2016). Jurisdiction size and local government policy expenditure: assessing the effect of municipal amalgamation. Am. Polit. Sci. Rev. 110, 812–831. doi: 10.1017/s0003055416000320

Boetti, L., Turati, G., and Piacenza, M. (2012). Decentralization and local governments’ performance: how does fiscal autonomy affect spending efficiency? Finanzarchiv Public Finance Anal. 68, 269–302. doi: 10.1628/001522112x653840

Brikci, N., Alao, R., Wang, H., Erlangga, D., and Hanson, K. (2024). Improving the efficiency in spending for health: a systematic review of evidence. SSM - Health Syst. 2:100008. doi: 10.1016/j.ssmhs.2024.100008

Çağlar Onbaşıoğlu, D. (2021). The Turkish Cypriot Municipalities’ Productivity and Performance: An Application of Data Envelopment Analysis and the Tobit Model. Journal of Risk and Financial Management 14:407. doi: 10.3390/jrfm14090407

Connolly, J. M., Bode, L., and Epstein, B. (2018). Explaining the Varying Levels of Adoption of E-government Services in American Municipal Government. State and Local Government Review 50, 150â–fi164. doi: 10.1177/0160323X18808561

Cristóbal, J., Ehrenstein, M., Domínguez-Ramos, A., Galán-Martín, Á., Pozo, C., Margallo, M., et al. (2021). Unraveling the links between public spending and sustainable development goals: insights from data envelopment analysis. Sci. Total Environ. 786:147459. doi: 10.1016/j.scitotenv.2021.147459

da Motta, R. S., and Moreira, A. (2009). Political factors and the efficiency of municipal expenditure in Brazil. Economia Aplicada 13, 353–371. doi: 10.1590/S1413-80502009000400001

Dincă, M. S., Dincă, G., Andronic, M. L., and Pasztori, A. M. (2021). Assessment of the European Union’s educational efficiency. Sustainability (Switzerland) 13, 1–29. doi: 10.3390/su13063116

El-Berry, N. A. M., Naert, F., and Goeminne, S. (2022). The impact of fiscal openness on public spending technical efficiency in developing countries. Public Perform. Manag. Rev. 45, 254–281. doi: 10.1080/15309576.2022.2040036