- 1Department of Politics and Government, Diponegoro University, Semarang, Indonesia

- 2Graduate School of International Development, Nagoya University, Nagoya, Japan

This paper contributes to the ongoing debate on the relationship between governance systems and development by focusing on foreign direct investment (FDI) at the sub-national level in Indonesia. Following the implementation of political decentralization in 2005, provincial and district governments gained greater authority in drafting local regulations. The number of local bylaws increased significantly, especially after the introduction of the Local Tax Law in late 2009. However, the lack of a robust governance framework in the formulation of these regulations raised concerns at the national level. In response, the central government attempted to revoke numerous local laws, citing their adverse impact on the investment climate. As the proxy for governance quality, we used the number of problematic local regulations at the province level. Using a difference-in-difference estimation for the period 2005 to 2017, we found that provinces with weaker governance systems experienced a long-term decline in FDI growth of approximately 26–30% compared to the control group. Our event-study estimator confirmed that this negative trend persisted following the enactment of the local tax law. Further analysis revealed that the impact of governance on FDI is more pronounced in non-Java provinces and less severe in provinces with fewer natural resources. By considering provinces’ level of development and endowment, these findings suggest that poor governance practices and limited public participation in local decision-making are key factors undermining FDI performance.

1 Introduction

Scholarly debates in establishing causal relationships between good governance and economic growth have lasted for decades. On the one hand, proponents of strong institutions argue that growth relies on state determination and less on public participation, implying that democratic form of governance is not as necessary at the early stage of development (Amsden, 1989; Wade, 1990; Barro, 1999). Meanwhile, the Lipsetian view stresses on the growing middle-class as the determinant of democracy (Claassen, 2020; Huber et al., 1993; Lipset, 1959). The state is understood as the agent that knows best on how to distribute resources for the good of the people. Typically, the success case of East Asia during their high growth period from 1970s through 1990s serve as the vindication of this paradigm.

Strands of studies that put emphasis on the importance of democratic institution believes that growth comes through institution (Acemoglu et al., 2001, 2019; Robinson and Acemoglu, 2012; North, 1979, 1990) and the creation of good governance system (Gründler and Potrafke, 2019; Kaufmann et al., 2000). Democratic form of governance, according to Acemoglu et al. (2019), is argued to increase income per capita by large margin in the long run. Others argue that growth under democracy is U-shaped, that democratization is attributed to lower growth at first due to factors such as political instability (Coricelli et al., 2022). Further investigation on the form of deeper governance, which involves larger role of sub-national government in the process known as decentralization, revealed modest yet positive correlation on growth (Martinez-Vazquez and McNab, 1997; Martinez-Vazquez and McNab, 2003; Blöchliger and Rabesona, 2009; see also Hankla (2009); Rao and Singh, 2007; Olaoye and Olaniyi, 2022; Gurgur and Shah, 2014).

As Cheema and Rondinelli (2007) stated “Good governance came to be seen as transparent, representative, accountable, and participatory systems of institutions.” Thus, good governance entails systematic public involvement in the process of decision making, as argued also previously by Sen (2014). In this sense, then, further decentralized form of governance is argued more efficient for promoting development as local governments are closer to the public (Oates, 1999; Wallis and Oates, 1988; Tiebout, 1961). However, contentious views exist. Prud’Homme (1995) and Tanzi (2002) argue that decentralization brings the risk of inefficient resource allocation that leads to poor growth. A number of empirical findings support this concern (Woller and Phillips, 1998; Bardhan, 2002; Joumard and Kongsrud, 2003) or non-conclusive (Davoodi and Zou, 1998).

Despite the contentions, few would encourage the practice of bad governance. For Rose and Peiffer (2019), bad governance implies corruption or corrupt practices. At the very least, Freeland (1994) defines this as involving “weak legal guarantees for investment, and taxes that are both impossibly high and haphazardly imposed.” Such conditions not only deter private investment but also erode public trust in institutions. In this article we define bad regulation as rules or policies that hinder rather than support economic and social development, often due to poor design, lack of transparency, or inconsistent enforcement. Empirical findings discussing the relationship between regulatory governance and economic performance found positive (Amoroso et al., 2024) or negative result (Woodside et al., 2012). Considering the importance of a good governance system on development as described above, this research aims to investigate the nexus between good governance system and quality of local regulations, and how they relate to investment growth at the province level in Indonesia. Since the enforcement of democratic decentralization in 2005, and with the introduction of Local Tax Law of 2009, provinces and districts have been primarily responsible for the making of local bylaws. The change incites competition between regions in attracting productive investment which comes in the form of foreign direct investment (FDI). Our research is the first to establish a causal relationship between governance, regulation, and investment growth based on empirical data in Indonesia between 2007 and 2016. Moreover, the ongoing global shifts in political institutions and decentralization policies highlight the need for updated, context-specific analyses, including those based on country case studies.

There are three main goals of this research. First, we aim to reveal the reality of the system of governance at the sub-national level in Indonesia. Higher proportion of bad regulations is an indication of weak system. Second, we aim to establish a causal relationship of the impact of local regulation quality, which is the product of the governance system, on investment growth in Indonesia. Third, we aim to propose policy recommendations for the decision makers at the central or local level in order to optimize investment activities.

The rest of the paper is structured as the following. Section 2 briefly outlines the institutional context of Indonesia’s decentralization process and describes the evolution of local regulatory authority, with a particular focus on the introduction of the local tax law. Section 4 provides an overview of foreign investment growth particularly since 2005. Section 5 details the data sources, variable construction, and empirical strategy, including our use of difference-in-difference and event study estimators. Section 6 presents the main findings, demonstrating the negative impact of weak local governance on FDI inflows, along with heterogeneity analyses by region and resource endowment. Finally, Section 7 concludes by summarizing the key contributions of the paper and suggesting directions for future research.

2 Governance and local regulations in Indonesia

In 1998, amidst the third wave of democratization (Huntington, 1991) Indonesia was one of the countries that attempted to shift its political institutions. Not only is it becoming more democratic, as the people toppled its authoritarian leader Soeharto, but also the decision making mechanism is further decentralized with the introduction of Law no. 22 in 1999, later renewed with Law no. 32 in 2004. This law paved the way for direct local election in the following year. This gives the local government larger political and economic responsibility in setting up regulations. Based on data from the Ministry of Law and Human Rights (Kemenkumham), the number of local government regulations increased significantly in the periods after the first round of local elections (2005–2008). Furthermore, the introduction of Law no. 28 in 2009 regarding local tax and retributions contributes to the exponential rise of local government regulations.

Prior to 2009, under President Soeharto’s heavily centralized ‘new order’ regime, enactment of local tax regulations was governed under Law no. 18 of 1997. Despite enabling local government in creating local laws, severe restrictions apply. Central government, through the Ministry of Home Affairs with considerations from Ministry of Finance, controlled the enactment of local ordinances (Ismail, 2018). Following the reform and the first decentralization law in 1999, the law was renewed with Law no. 34 in 2000. This gives more authority to the local governments compared to the previous. However, this has not affected the growth of local regulations dramatically, let over the growth of problematic regulations.

We acknowledge that there is no single and easy measurement of local institutional quality that can reflect a good governance system at the provincial level in Indonesia. One way to do it is by utilizing the central government’s document list of attempted to be revoked local regulations. Through its ministry of Home Affairs, in 2016 the central government gathered more than 3,000 local regulations that were deemed inefficient and attempted to cancel them. Mostly the reasoning for this attempt was economic as these regulations are considered hurting the investment climate (Jefriando, 2016), which resonate with the argument of Freeland (1994). However, due to the deeply decentralized institution that allows bigger power to the local government, the central government’s effort was fruitless. In this research we interchangeably use the term ‘bad regulation’ and ‘problematic regulation’ to refer to these local regulations. We also use the term ‘weak governance’ to reflect the quality of local governance based on the number of problematic regulations.

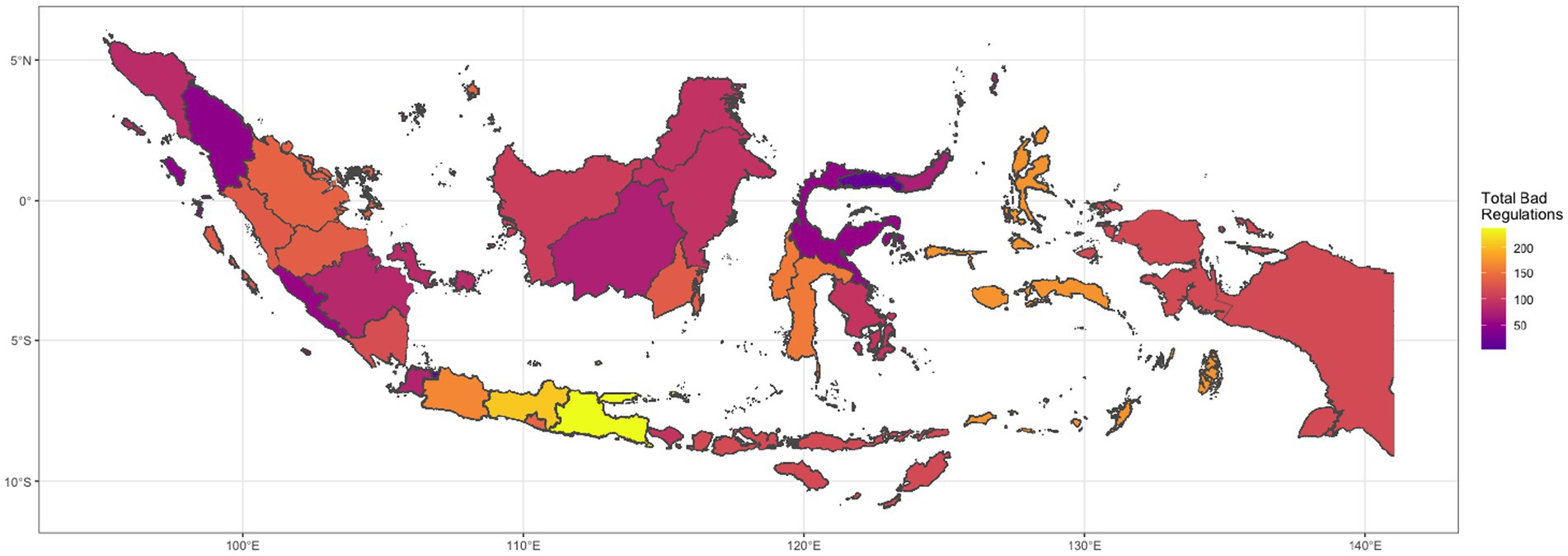

Figure 1 shows the distribution of bad regulations at the province level divided by the number of districts. We can observe that the provinces of East Java and Central Java are among provinces with the highest number of bad regulations. Jakarta and Gorontalo, is shown as having lower count of bad regulations per district.

3 Growth of foreign direct investment

Indonesia is one of the largest recipients of foreign direct investment (FDI) in the Southeast Asian region. In the past, FDI has been a motor of development during the Soeharto era, contributing to around 2.7–4% of GDP in the 1970s, similar to the neighboring countries of Thailand and The Philippines. However this growth stopped as the country was hit by the 1997 Asian crisis. This affected negative GDP growth for several years, until macroeconomic stability was established again in the early 2000s (Otsubo, 2015). Japan, Singapore, and South Korea contribute the larges amount of FDI measured by value (USD) between 2004 and 2010. Outside of Asia, UK and The Netherlands are listed as the major source (BPS Indonesia, 2025).

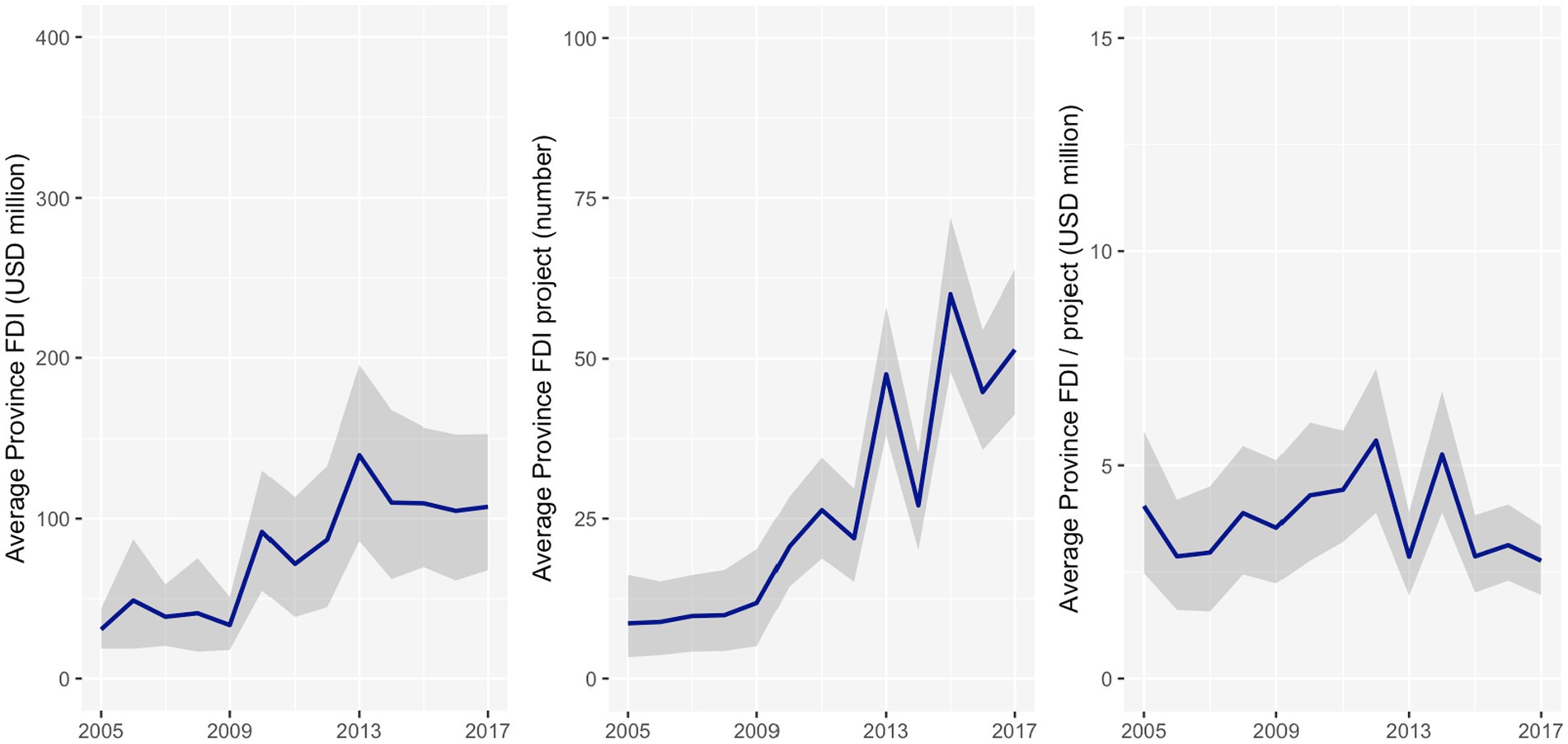

In general the growth of FDI inflow to Indonesia has been positive for over a decade, as shown in Figure 2 (left), but with a slight dip starting in 2014. Number of FDI projects has been increasing significantly with some dynamics. By 2017, the average number of FDI is around 50 projects per province. The enactment of the New Investment Law in 2007 (UU No. 25 tahun 2007) in part managed to attract a higher number of investments to the provinces. However, in terms of average FDI value per project, the size is getting smaller for the same period. Figure 2 (center) illustrates the dynamics between FDI value and number of projects between 2005 and 2017, the average FDI value per province has been declining slightly, especially starting in 2016.

4 Data and methodology

The following section explains our research methods for answering issues stated as our problem statements in two parts. In the first part we will describe our data collection method and its descriptive statistics. Then in the second one we detailed our estimation strategy under event study design.

4.1 Data

Our regulatory data is sourced from the list of “Perda Bermasalah” (Problematic Local Regulation) provided by the Ministry of Home Affairs, which covers the period between 1951 and 2015. This dataset contains detailed information regarding local regulations that were attempted to be revoked, offering insight into the quality of governance at the subnational level in Indonesia. As mentioned above, we use the other term ‘bad regulation’ to refer to these problematic local laws. Additionally, the ministry periodically compiles this list, enabling observers to understand the changes of the local regulations over time. Total number of sub-national (provinces and districts) regulations deemed problematic in the list is 3,042, which is our bad regulation variable. The original list includes 111 of central government regulations, which we do not employ in our specifications as typically they are not nested at the local level.

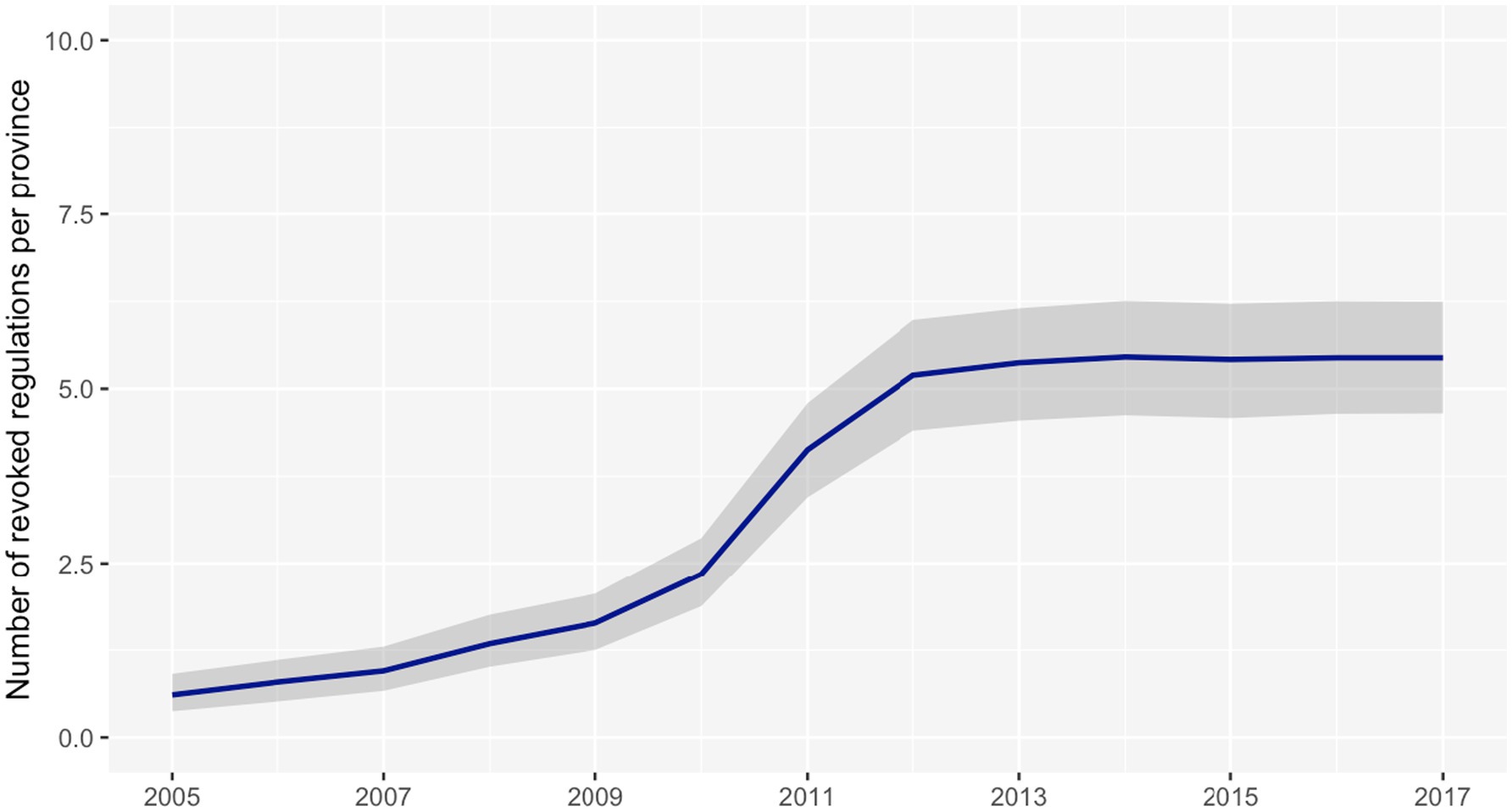

Since the number of regulations at the provincial level varies significantly, primarily due to differences in the number of districts across provinces, we resort to use per district average number of local regulations. This helps to level the data and allows for a more nuanced comparison across regions, as provinces with higher numbers of districts naturally tend to have a higher number of local regulations. Figure 3 shows the growth of the number of revoked local regulations per province between 2005 and 2017. We can observe a structural break around 2010, during which the local regulation law in 2009 has been in full effect. The average number of regulations kept increasing, albeit slower, until 2014 before the central government attempted to curb them in the following year.

To construct our good governance variable, we rank provinces based on the number of attempted-to-be-revoked regulations, or bad local regulations, divided by the number of districts. Those with lower numbers of average bad regulations are considered as having higher quality of regulatory governance, while those with higher average are categorized as lower. We then split our data into two groups, the treated and control, accordingly.

On the dependent variable side, province level investment data is gathered from the Ministry of Investment (formerly known as BKPM). Concurrent with our regulatory data, we collect our FDI data between 2005 and 2017. The main measurement used is value of investment (calculated in current USD) and volume of FDI project (number). Based on this information we calculate the FDI value per project for each province.

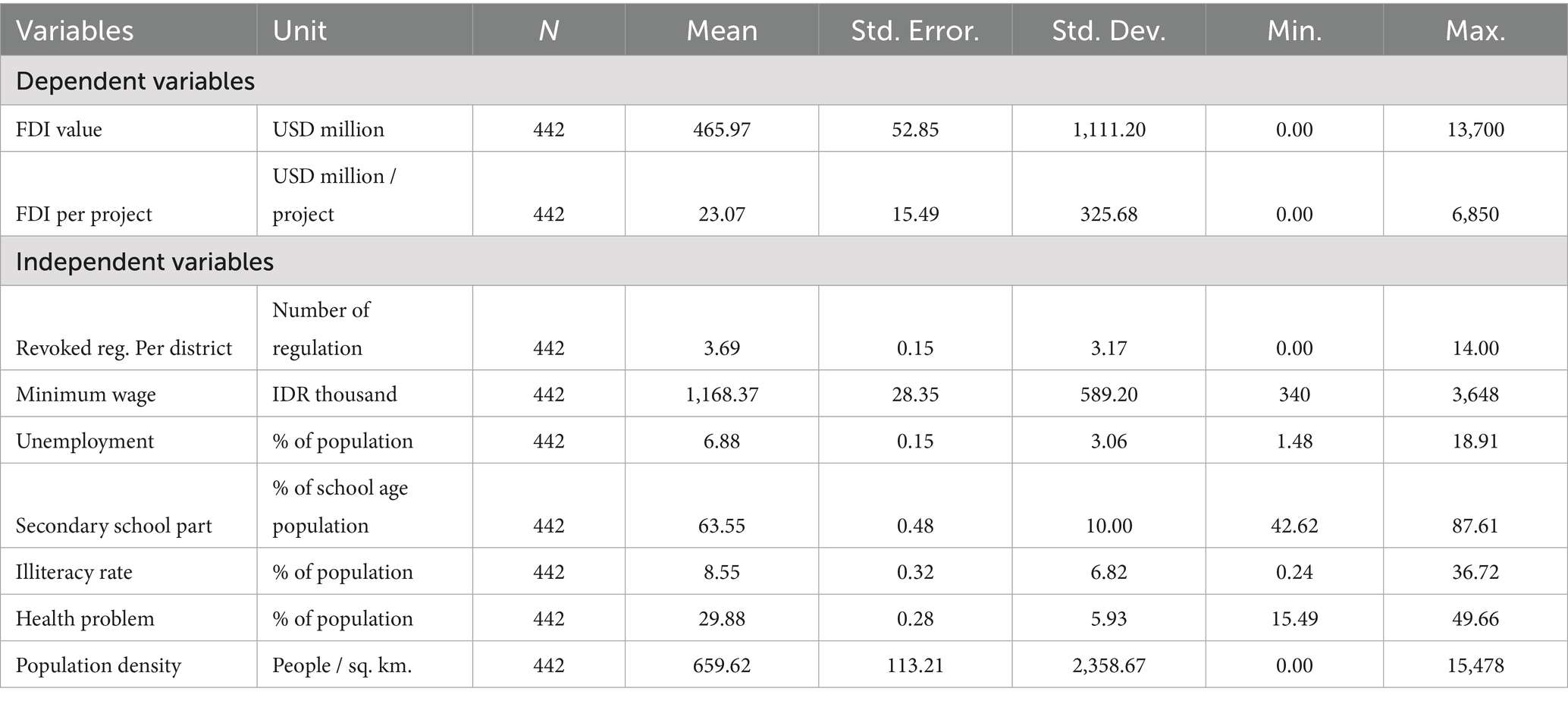

Following the foundational work of Levine and Renelt (1992); see also Borensztein et al. (1998), Nguyen and Bui (2022), and Yoon et al. (2024), we complement our model with relevant control variables that explains economic growth. These are gathered mainly from Statistics of Indonesia (BPS), that includes minimum wage (in IDR thousand), population density, unemployment, secondary school participation, and health level. Except for the first two, all of the covariates are measured as a share of their respective total value. Table 1 gives information on the unit of measurement as well as the summary statistics of our data. We do not detect strict abnormalities in our data.

4.2 Estimation strategy

Following data construction as described above, we proceed to estimate the effect of governance on FDI under event study estimation strategy. This approach is dubbed as an extension of difference-in-difference strategy (Clarke and Tapia-Schythe, 2021; see also Abadie, 2005; Donald and Lang, 2007; Angrist and Pischke, 2009; Miller, 2023), which has been a widely used method in impact evaluation studies across multiple disciplines (Card, 1992; Card and Krueger 1994; Angrist and Krueger, 1999; Blundell and Macurdy, 1999; Duflo, 2001; Bleakley, 2010; Hoynes et al., 2016). Event study design has a time dynamic attribute that provides better understanding of the impact of event or intervention overtime as demonstrated by MacKinlay (1997) and Gutmann et al. (2024), among others. Further application of event study that tackled the issue of different treatment time to a unit was carried out by Sun and Abraham (2021), Callaway and Sant’Anna (2021), Goodman-Bacon (2021), Callaway et al. (2024) and Nagengast and Yotov (2025).

Identification method utilizing event study has also been applied in previous research on Indonesia recently. Lukman et al. (2022) examines the impact of the new normal announcement on abnormal returns and trading volume activity of manufacturing sector stocks listed on the Indonesia Stock Exchange. Results show a significant difference in abnormal returns, indicating market reaction. Other studies in the field of finance were also carried out by Isynuwardhana and Putri (2021) and Talumewo et al. (2021). In the discipline of political economy, event study has been used to estimate the “Jokowi effect” (Nailiu, 2015). The findings indicated a significant and positive market reaction to the political change under President Joko Widodo in 2014.

Estimation strategy under event study starts with groups i and year periods t, following Miller (2023). Equation 1 describes our strategy under this design with the addition of two-way fixed effects (TWFE).

The output variable of this research is , which refers to the realized foreign investment (FDI) in Indonesia at the province between time which is from 2005 to 2017. We use two measures for ; total value of FDI and FDI value per project, both are reported in current USD million. On the right hand side of the equation, the term inside the brackets denote our event study term. D refers to a binary variable where 1 is given if province i exhibits higher-than average bad regulations in the year t, otherwise 0. is a parameter bearing coefficient before event D occurred for j < 0 and after the event occurred for j > 0. and are province and year fixed-effects, respectively, used to control for omitted variable bias unique to province and year event. Number of provinces employed in the dataset is at the previous 34. By 2022, this number has expanded to 38 provinces.

is a vector of control variables consisting of minimum wage (IDR thousand), secondary school participation (share of secondary school age population), unemployment rate (share of population), reported health problems (share of population), population density (people/km2), and average number of revoked regulations in a province. Lastly, is an error term.

However, the TWFE estimator is prone to inconsistency where the treatment effect is heterogeneous across groups and time. To test the robustness of our TWFE event study estimator, following (Braghieri et al., 2022) we employ alternative estimators introduced by Gardner (2022), Roth and Sant’anna (2021), and Sun and Abraham (2021).

5 Results and discussion

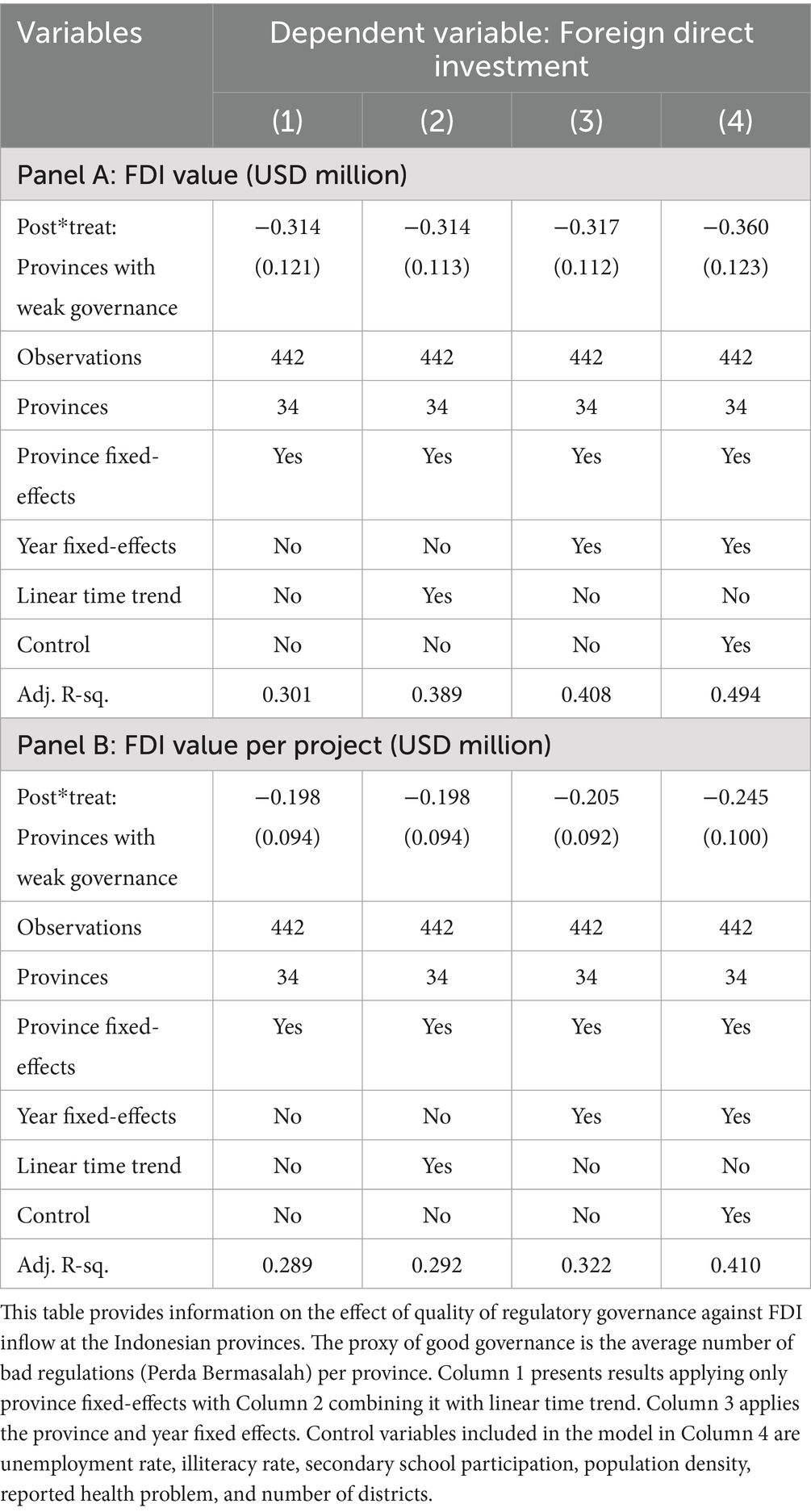

We first report our findings based on the standard TWFE model. Table 2 presents our baseline (Columns 1–3) as well as full specifications (Column 4). The simplest model in Column 1 employs only province fixed-effects, and in the next columns we add year fixed-effects or time trend. In all of the specifications we use FDI related data as the independent variable. Results on Panel A uses total FDI value per province, while in Panel B it is average value per project. In all columns, the total number of observations from 34 provinces stands at 442.

Our treatment variable under DID design, the estimate in Equation 1, shows a negative and significant impact on FDI in the first two models in both Panel A and Panel B, but its effect grew larger with the addition of more variables. Average treatment effect on the realized FDI inflow for Panel A is ranging between −0.31 to −0.36, which corresponds to 26–30% decrease. The year dummies show a consistent and significant negative trend in FDI, with the coefficient becoming more negative as the years progress. This suggests a significant decline in FDI over this period, especially after 2008, likely reflecting the global financial crisis and its long-term effects. For Panel B, despite the magnitude of the estimates being smaller, results are similar. The average treatment effect is ranging between – 0.20 for the baseline, to – 0.24 for the full model incorporating control variables. For each of the specifications, results are statistically significant at least at 5% level.

In terms of coefficient of determinations, the models generally show good explanatory power, with adjusted R-squared values at around 50% for the full specification (Column 4) in Panel A and at 40% for Panel B. This result suggests that the main and control variables considered in the models explain a substantial portion of the variation in FDI.

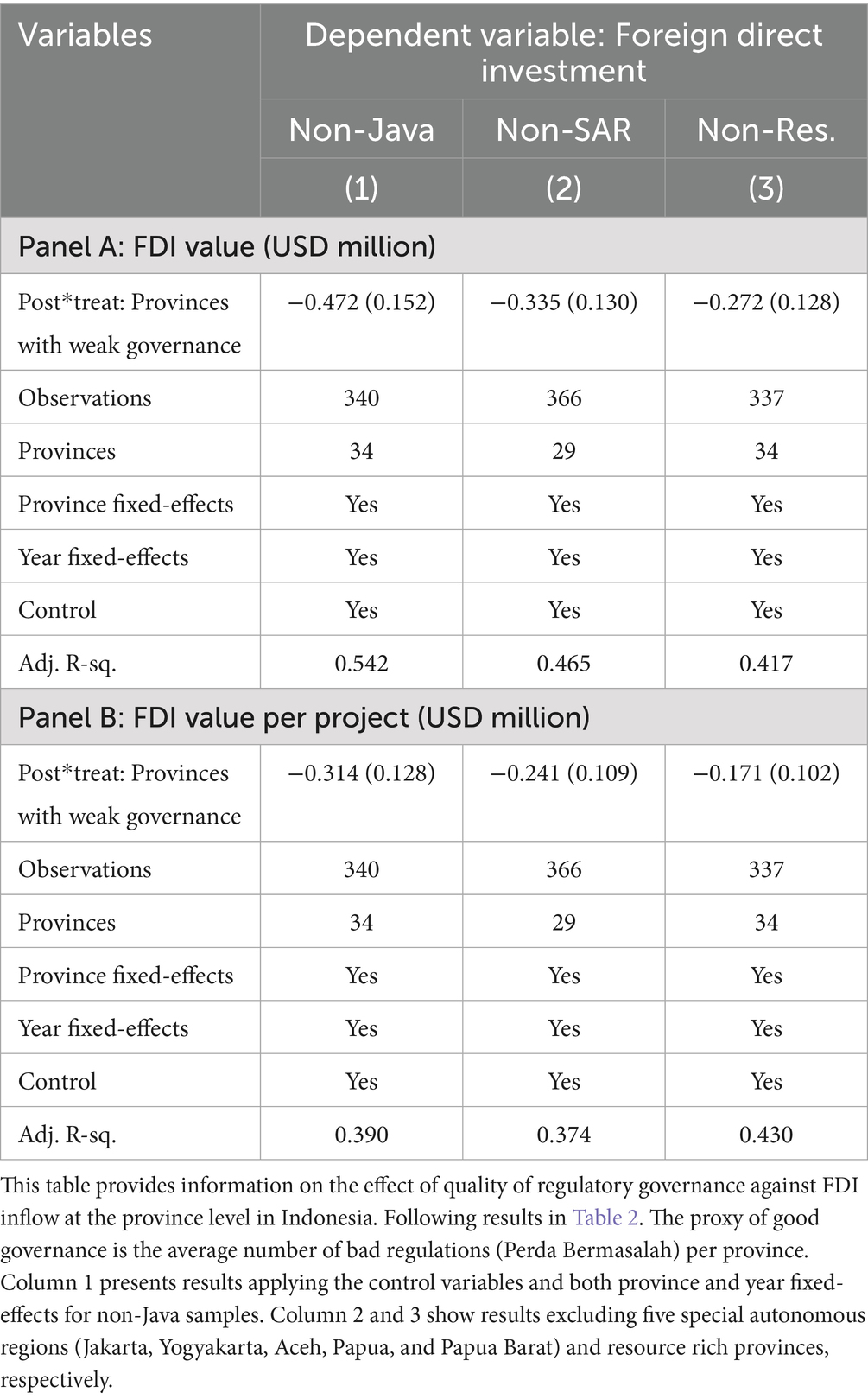

We further our analysis by controlling for several provinces characteristics. Table 3 presents the average treatment effects of three specifications. Column 1 investigates the effect of poor regulatory governance system on FDI inflow for samples from Non-Java region. Excluding the mostly industrialized Java region from the observation is important as Java provinces have huge economic and demographic endowment that might absorb the negative impact of poor regulatory governance. The estimation for Panel A returns a much larger negative and significant result at −0.47, which corresponds to a staggering 37% drop in FDI inflow compared to the control. Estimation in Panel B returns the same negative tendency. This suggests that the FDI consequences of bad governance is more severe in the less developed regions such as those outside of Java.

Column 2 and 3 in Table 3 shows results for the non Special Autonomous Regions (SAR) and non-resource rich provinces, respectively. For the first specification, the magnitude of the coefficient for Panel A and Panel B are slightly smaller than results in Table 2. This small difference captures the differences in the system of governance between the SAR and non-SAR provinces, with the latter suggesting a better effect on investment. Meanwhile, results in Column 3 show smaller effects at −0.27 for Panel A and −0.17 for Panel B, suggesting that some of the negative effects of governance are caused by provinces’ resource endowment.

The Adjusted R-squared of between 0.42 and 0.54 in Panel A indicates that the model moderately explains the variation in provinces’ FDI inflows, while results for Panel B yields smaller, but still at moderate level, coefficients of determination.

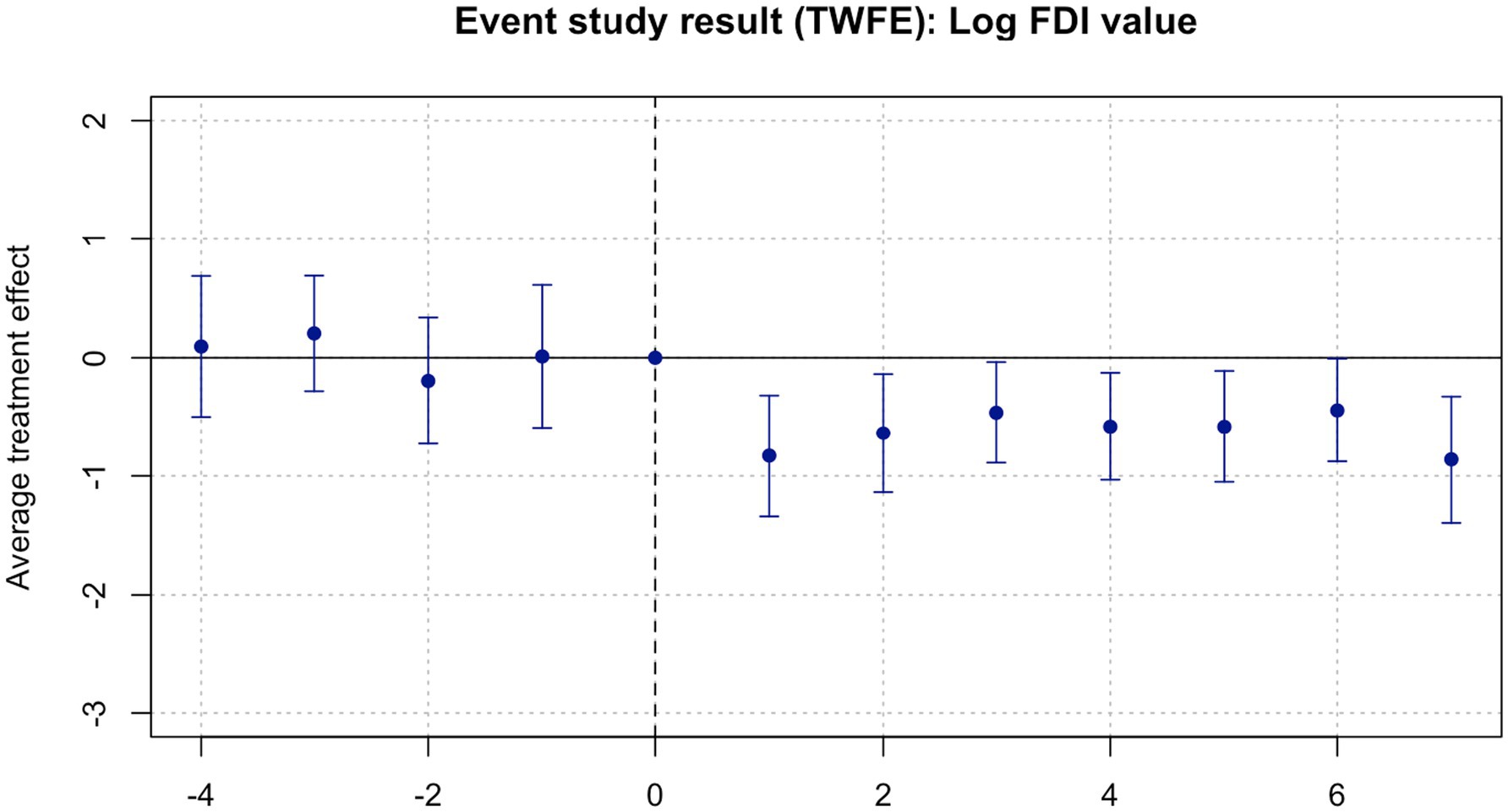

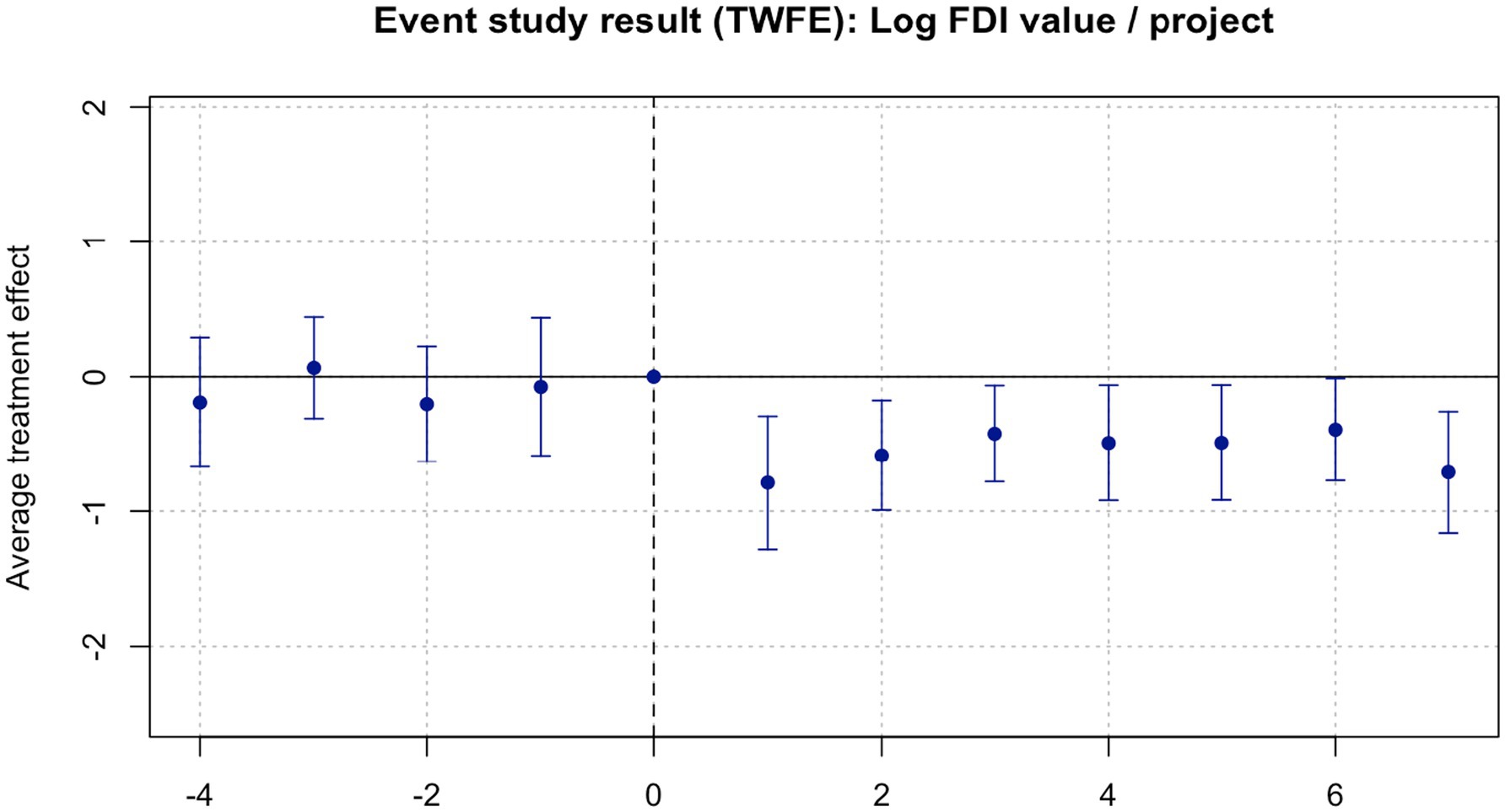

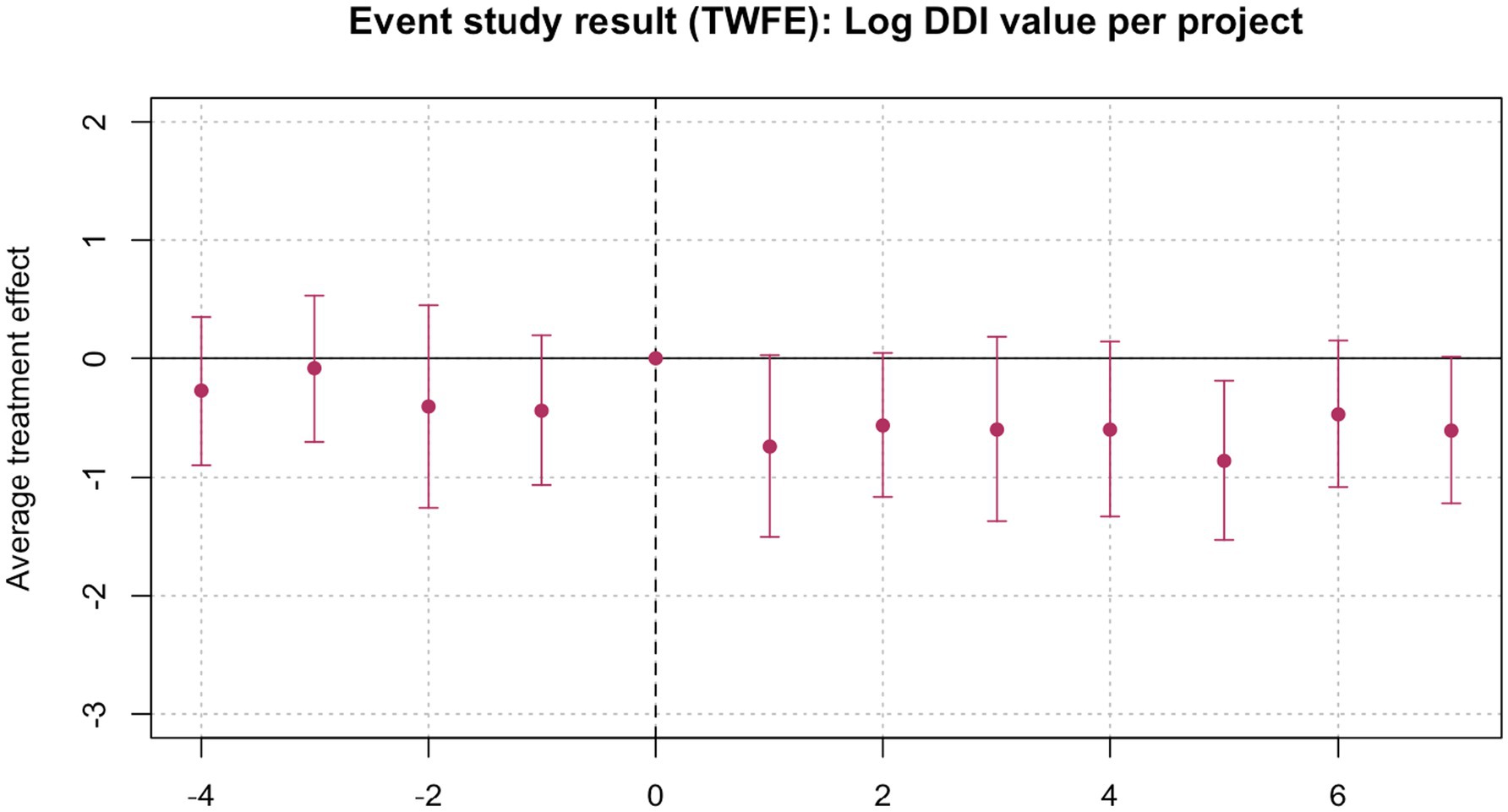

In the next step, we check our generalized DID design beyond the 2 by 2 dimension, applying the event study design as laid out in Equation 1. Doing this allows us to observe time-varying differences between the pre-treatment period and the post. Figure 4 presents the graphical results based on the full specification in Table 2. We can see the negative results on total FDI value persist in the period after the change of governance quality at the province level compared to the pre period. The sign of the coefficients are relatively unchanged at least 7 years after the change of governance. We observe similar event study results using per project FDI value (Figure 5), where the post periods are also showing significantly negative coefficients for the same number of years with Figure 4.

Figure 4. Impact of weak governance on FDI (total value, current USD). The outcome variable is the Log FDI value, measured in USD. The time variable is ranging from the year when political decentralization starts in 2005 until 2017. The treatment group is provinces with lowest quality of governance, measured in the number of bad regulations. Treatment period is year 0 which corresponds to the year of local tax law introduction in 2009. Conversely the control group is provinces with the lowest number of bad regulations. The bars with blue color represent 95% confidence intervals. Standard errors are clustered at the province level.

Figure 5. Impact of weak governance on FDI (value per project, current USD). The outcome variable is the Log FDI value per project, measured in USD. The time variable is ranging from the year when political decentralization starts in 2005 until 2017. The treatment group is provinces with lowest quality of governance, measured in the number of bad regulations. Treatment period is year 0 which corresponds to the year of local tax law introduction in 2009. Conversely the control group is provinces with the lowest number of bad regulations. The bars with blue color represent 95% confidence intervals. Standard errors are clustered at the province level.

One important feature of the event study method is the ability to check for pre-treatment trends. This helps validate the parallel trends assumption, which is critical for obtaining unbiased estimates (Clarke and Tapia-Schythe, 2021). Through plotting the coefficients for each year before the event, we can visually and statistically assess whether treated and control groups followed similar paths prior to the intervention. Both Figures 4, 5 show similar visual results that the pre-event coefficients are much closer to zero and are statistically not significant, which means that there are no differences between the treatment and the control, compared to the post-event one.

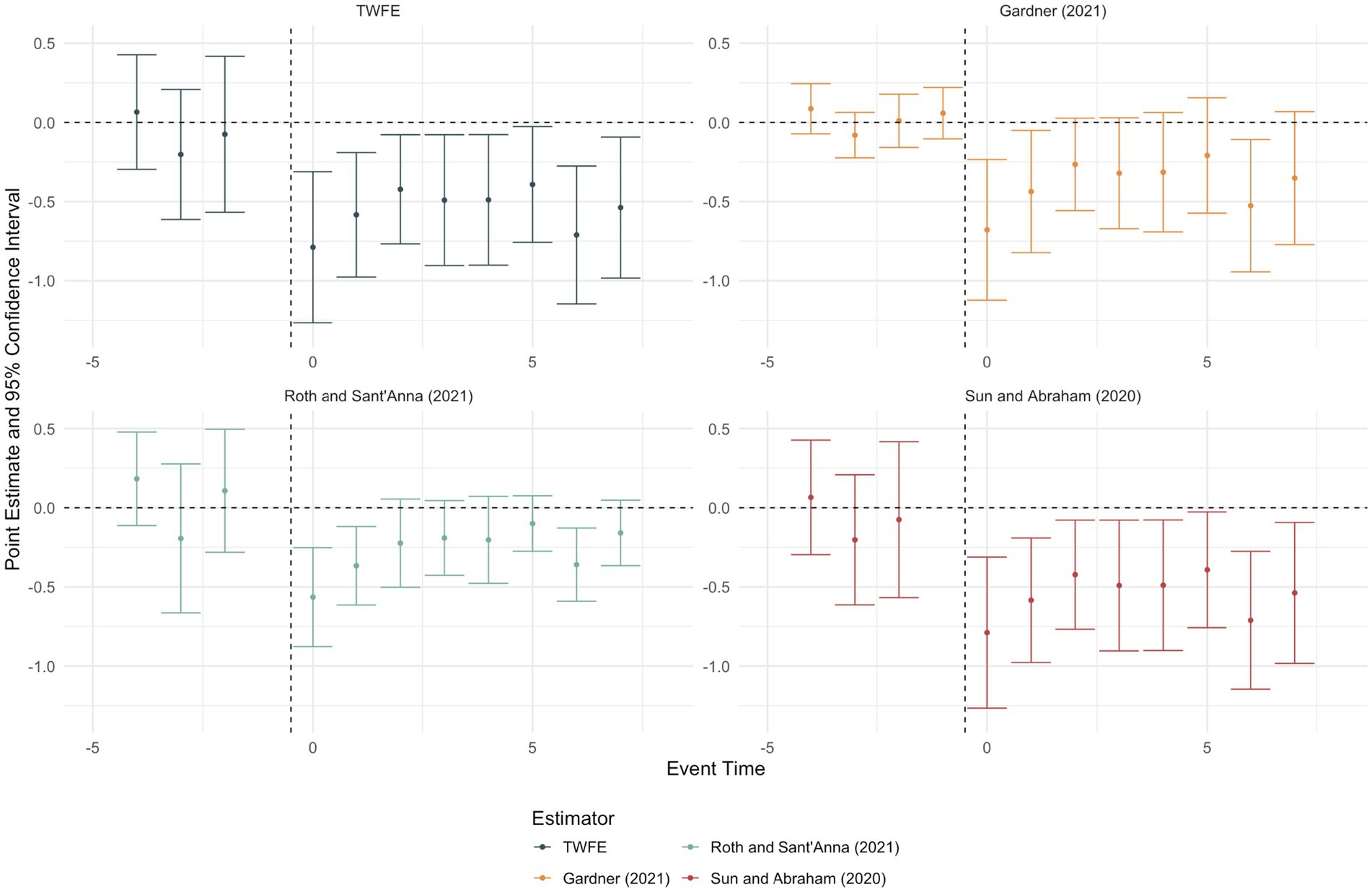

The above results suggest that there has been a significant drop in foreign investment rate after the introduction of local tax law in 2009, the event which contributed to the increasing number of bad regulations. Weak governance system is argued to be the underlying cause of the problem according to institutionalist perspectives (Kaufmann et al., 2000). In Indonesia where economic decision making was deeply decentralized starting in 2005, the system of regulatory governance has been inconsistent across places. The promise of efficient public service delivery (Oates, 1999; Tiebout, 1961; Wallis and Oates, 1988), therefore, has not been true in this case. To further prove that this phenomenon is caused by a weak system of governance and not due to other interference affecting the level of foreign investment, we test our model using domestic direct investment (DDI) data. Figure 6 illustrates the result, where we can observe a similar trend in at least 2 years of the post-event period. Like in the previous figure, the pre-event coefficients are statistically insignificant.

Figure 6. Impact of weak governance on DDI (value per project, current IDR). The outcome variable is the Log DDI value, measured in million IDR. The time variable is ranging from the year when political decentralization starts in 2005 until 2017. The treatment group is provinces with lowest quality of governance, measured in the number of bad regulations. Treatment period is year 0 which corresponds to the year of local tax law introduction in 2009. Conversely the control group is provinces with the lowest number of bad regulations. The bars with blue color represent 95% confidence intervals. Standard errors are clustered at the province level.

In order to check the validity of our findings, we perform alternative approaches to the TWFE. Recently developed event study estimators by Gardner (2022), Roth and Sant’anna (2021), and Sun and Abraham (2021) are employed. Results are shown in Figure 7, with the original TWFE estimator on the top left. In the three alternatives we see quite similar results where the post-event coefficients are significantly lower than the pre periods and the signs are consistently negative. Although differences exist they are not departing largely from the TWFE model, in the case of Garner two-stage method for example, the result is not significant at year six and eight.

Figure 7. Robustness test under different estimation methods. The outcome variable is the Log DDI value per project, measured in million USD. The time variable is ranging from the year when political decentralization starts in 2005 until 2017. The treatment group is provinces with lowest quality of governance, measured in the number of bad regulations. Treatment period is year 0 which corresponds to the year of local tax law introduction in 2009. Conversely the control group is provinces with the lowest number of bad regulations. The bars with blue color represent 95% confidence intervals. Standard errors are clustered at the province level.

The weakness of the local regulations in Indonesia and how it affects economic performances, including those related to the governance of local regulations, has been consistent with a number of studies (Hidayat et al., 2025; McCulloch and Malesky, 2011; Wiryawan and Otchia, 2022). In the case of local regulations, lack of systematic public involvement in the policy making process seems to have significant effects. Our specification allows us to identify quality of regulatory governance based on the average number of bad regulations. Although this does not indicate levels of public involvement and how it affects the quality of local regulations, the contemporary theory of governance suggests a positive relationship (Cheema and Rondinelli, 2007). Local community participation in Indonesia, which is mostly restricted or controlled, often comes in the late stage as pointed out by Chowdhury and Afriansyah (2016) in the case of environmental impact assessment regulation. More often than not, public participation in the formulation of local regulation is a mere formality. This results in poor public involvement in local decision making. The situation could then be connected to the lack of transparency and accountability, features that are utmost important in building good governance, in public decision making in decentralized Indonesia. Thus, the absence of good regulatory governance system would only result in bad local ordinances.

Public involvement and participation in the formulation of local regulations in Indonesia are addressed under Law No. 12 of 2011, which regulates the mechanisms for creating legislation at all levels. However, the law lacks clear and robust provisions to support systematic public engagement, leaving room for ambiguous interpretation. The law further stated that the participatory mechanisms is to be addressed separately, which we deem insufficient to warrant strong public involvement. As a result, public participation in the drafting of local regulations, especially at the sub-national level, remains weak. Despite being a general issue in Indonesia, the problem merits more attention at the local level as previously analyzed by Ramage (2007), Nusantara et al. (2022), and Wajdy et al. (2025). The problem could also be linked to other directly related local governance issues such as corruption (Ngatikoh et al., 2020) and nepotism (Simanihuruk and Sihombing, 2019). In the bigger sense, our findings align with the concern of Prud’homme (1995) and Tanzi (2002), among others, regarding the problems of decentralization of public affairs.

Finally, we find that negative economic impact caused by weak governance is also determined by level of development and resource endowment. First, this is reflected in the larger coefficient when we exclude the Java regions (Table 3). Investment in the non-Java region is less abundant and so it is more competitive. Provinces with fewer problematic regulations are gaining more investment. Secondly, the impact of a weak governance system is less apparent in the non-resource rich provinces, as the coefficient is smaller although still significant at 10% level. Based on the result we can also argue that some of the governance issues are linked to natural resource endowment. Investment in these provinces are more sensitive to policy change, and conversely less resource rich provinces seem to attract less-sensitive investment, possibly those working in the more labor-intensive sectors. On the other hand, the regulatory governance in the resource rich regions are prone to elite capture that may have contributed to the poor result.

We realize that there is no simple way of resolving this governance issue. This has been a growing complex issue that there seems to be no way out. The central government’s attempt of recentralization by issuing the new decentralization, law no. 23 in 2014, is barely enough and does not touch the underlying problem of local accountability (Lewis, 2023). Our proposition is to strengthen the local governance system, which has been either neglected or weakly implemented. Systematic public involvement in the policy making process would provide strong input that would increase the quality of regulations issued. However, this unfortunately will also have to rely on good political will of the local governments in Indonesia, which is still lacking.

In the broader context, our findings underscore the importance of establishing a robust system of good governance, aligning with the perspectives of new institutionalist theorists. The persistent issues of poor accountability and weak public participation reflect the concerns raised by good governance scholars such as Cheema and Rondinelli (2007) and Sen (2014). Furthermore, our research highlights the shortcomings of decentralization policies and their implementation. Although decentralization is theoretically intended to enhance the efficiency of local governments (Oates, 1999), in practice, it has often resulted in the proliferation of problematic local regulations. This later proved to affect investment growth, in contrast to the positive but modest effect argued by previous scholars (Martinez-Vazquez and McNab, 1997; Martinez-Vazquez and McNab, 2003; Blöchliger and Rabesona, 2009).

6 Conclusion

This research aims to investigate the nexus between the process of governance and FDI in Indonesia between 2005 and 2017. We argue that weak governance systems at the local level, which manifested in the form of poor local regulations, contribute to the issue. Our baseline estimation finds that despite increasing FDI inflow in general, provinces with higher bad regulations are lagging behind in the long run compared to the control group. The coefficient effect is significant at −0.31, which corresponds to 100*EXP(−0.31) = −26% drop in foreign investment. We further find that the coefficients are larger for the non-Java regions, suggesting that level of development has a substantial effect in less industrialized provinces, and are less pronounced in the non-resource rich provinces. Results are robust under alternative estimation methods, as well as when using domestic direct investment data.

The finding echoes a number of earlier studies on the impact of decentralization and local governance in Indonesia. These regulatory issues have, in turn, hindered investment growth, contradicting earlier claims of its general positive impact. We address the issue of weak local governance to the lack of public involvement in the policymaking process. Poor design of decentralization has been one of the underlying problems that has not been adequately addressed by the new decentralization law in 2014, to which we also argue that recentralization attempt would not be the ultimate solution. Improving the quality of governance requires the involvement of multiple stakeholders, but most importantly the participation of the public. In our case, systematic public involvement in the drafting of local regulations could provide a check and balance that might lessen its negative effects on investment. This requires good political will of the local government.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

TY: Investigation, Project administration, Conceptualization, Funding acquisition, Supervision, Formal analysis, Resources, Writing – review & editing, Writing – original draft. BW: Data curation, Writing – review & editing, Writing – original draft, Methodology, Visualization, Formal analysis, Project administration. SY: Writing – review & editing, Validation.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. The 2024 Joint Research International Collaboration provided by the Faculty of Social and Political Sciences, Diponegoro University.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abadie, A. (2005). Semiparametric difference-in-differences estimators. Rev. Econ. Stud. 72, 1–19. doi: 10.1111/0034-6527.00321

Acemoglu, D., Johnson, S., and Robinson, J. A. (2001). The colonial origins of comparative development: an empirical investigation. Am. Econ. Rev. 91, 1369–1401. doi: 10.1257/aer.91.5.1369

Acemoglu, D., Naidu, S., Restrepo, P., and Robinson, J. A. (2019). Democracy does cause growth. J. Polit. Econ. 127, 47–100. doi: 10.1086/700936

Amoroso, S., Herrmann, B., and Kritikos, A. S. (2024). The role of regulation and regional government quality for high-growth firms: the good, the bad and the ugly. Reg. Stud. 58, 1710–1727. doi: 10.1080/00343404.2024.2366289

Amsden, A. H. (1989). Asia's next giant: South Korea and late industrialization. Oxford: Oxford University Press.

Angrist, J. D., and Krueger, A. B. (1999). “Empirical strategies in labor economics” in Handbook of labor economics, eds. Ashenfelter and Card. vol. 3 (Elsevier), 1277–1366.

Angrist, J. D., and Pischke, J.-S. (2009). Mostly harmless econometrics: an empiricist’s companion. Princeton: Princeton University Press.

Bardhan, P. (2002). Decentralization of governance and development. J. Econ. Perspect. 16, 185–205. doi: 10.1257/089533002320951037

Bleakley, H. (2010). Malaria eradication in the Americas: a retrospective analysis of childhood exposure. Am. Econ. J. Appl. Econ. 2, 1–45. doi: 10.1257/app.2.2.1

Blöchliger, H., and Rabesona, J. (2009). The fiscal autonomy of sub-central governments. OECD Working Papers on Fiscal Federalism No. 9. Paris: OECD Publishing. doi: 10.1787/5k97b111wb0t-en

Blundell, R., and Macurdy, T. (1999). “Chapter 27—labor supply: a review of alternative approaches” in Handbook of labor economics. eds. O. C. Ashenfelter and D. Card, vol. 3 (Amsterdam: Elsevier), 1559–1695.

Borensztein, E., De Gregorio, J., and Lee, J.-W. (1998). How does foreign direct investment affect economic growth? J. Int. Econ. 45, 115–135. doi: 10.1016/S0022-1996(97)00033-0

BPS Indonesia (2025). Realisasi Investasi Penanaman Modal Luar negeri menurut negara - tabel statistik. Badan Pusat Statistik Indonesia. Available online at: https://www.bps.go.id/id/statistics-table/2/MTg0MyMy/realisasi-investasi-penanaman-modal-luar-negeri-menurut-negara.html (Accessed February 4, 2025).

Braghieri, L., Levy, R., and Makarin, A. (2022). Social media and mental health. Am. Econ. Rev. 112, 3660–3693. doi: 10.1257/aer.20211218

Callaway, B., Goodman-Bacon, A., and Sant'Anna, P. H. (2024). Difference-in-differences with a continuous treatment. Cambridge: National Bureau of Economic Research.

Callaway, B., and Sant’Anna, P. H. (2021). Difference-in-differences with multiple time periods. J. Econ. 225, 200–230. doi: 10.1016/j.jeconom.2020.12.001

Card, D. (1992). Do minimum wages reduce employment? A case study of California, 1987–89. ILR Rev. 46, 38–54.

Card, D., and Krueger, A. B. (1994). Minimum wages and employment: A case study of the fast-food industry in New Jersey and Pennsylvania. The American Economic Review, 84, 772–793.

Cheema, G. S., and Rondinelli, D. A. (2007). From government decentralization to decentralized governance. Decentralizing Gov. Emerg. Concepts Pract. 326:326.

Chowdhury, N., and Afriansyah, A. (2016). Public participation in environmental governance in India and Indonesia. TIC 1:11. doi: 10.1093/oso/9780199482139.003.0018

Claassen, C. (2020). Does public support help democracy survive? Am. J. Polit. Sci. 64, 118–134. doi: 10.1111/ajps.12452

Clarke, D., and Tapia-Schythe, K. (2021). Implementing the panel event study. Stata J. 21, 853–884. doi: 10.1177/1536867X211063144

Coricelli, F., Campos, N., and Frigerio, M. (2022). The political U: New evidence on democracy and income (No. 17551) : CEPR Discussion Papers. Paris & London: CEPR Press. Available at: https://cepr.org/publications/dp17551

Davoodi, H., and Zou, H. F. (1998). Fiscal decentralization and economic growth: a cross-country study. J. Urban Econ. 43, 244–257. doi: 10.1006/juec.1997.2042

Donald, S. G., and Lang, K. (2007). Inference with difference-in-differences and other panel data. Rev. Econ. Stat. 89, 221–233. doi: 10.1162/rest.89.2.221

Duflo, E. (2001). Schooling and labor market consequences of school construction in Indonesia: evidence from an unusual policy experiment. Am. Econ. Rev. 91, 795–813. doi: 10.1257/aer.91.4.795

Goodman-Bacon, A. (2021). Difference-in-differences with variation in treatment timing. J. Econ. 225, 254–277. doi: 10.1016/j.jeconom.2021.03.014

Gründler, K., and Potrafke, N. (2019). Corruption and economic growth: new empirical evidence. Eur. J. Polit. Econ. 60:101810. doi: 10.1016/j.ejpoleco.2019.08.001

Gurgur, T., and Shah, A. (2014). Localization and corruption: panacea or pandoras box. Ann. Econ. Financ. 32, 132–160.

Gutmann, J., Neuenkirch, M., and Neumeier, F. (2024). Do China and Russia undermine Western sanctions? Evidence from DiD and event study estimation. Rev. Int. Econ. 32, 132–160. doi: 10.1111/roie.12716

Hankla, C. R. (2009). When is fiscal decentralization good for governance? Publius: The Journal of Federalism, 39, 632–650. doi: 10.1093/publius/pjn034

Hidayat, A. R., Hospes, O., and Termeer, C. (2025). Why democratization and decentralization in Indonesia have mixed results on the ground: a systematic literature review. Public Adm. Dev. 45, 159–172. doi: 10.1002/pad.2095

Hoynes, H., Schanzenbach, D. W., and Almond, D. (2016). Long-run impacts of childhood access to the safety net. Am. Econ. Rev. 106, 903–934. doi: 10.1257/aer.20130375

Huber, E., Rueschemeyer, D., and Stephens, J. D. (1993). The impact of economic development on democracy. J. Econ. Perspect. 7, 71–86. doi: 10.1257/jep.7.3.71

Isynuwardhana, D., and Putri, M. L. (2021). Event study analysis before and after covid-19 in Indonesia. Acad Account, Financ. Stud. J. 25, 1–11. doi: 10.37531/sejaman.v4i2.2189

Jefriando, M. (2016). Presiden Jokowi perintahkan mendagri hapus 3.000 perda bermasalah. Detiknews. Available online at: https://news.detik.com/berita/d-3175657/presiden-jokowi-perintahkan-mendagri-hapus-3-000-perda-bermasalah (Accessed February 10, 2025).

Joumard, I., and Kongsrud, P. M. (2003). Fiscal relations across government levels. OECD Econ. Stud. 2003, 155–229.

Levine, R., and Renelt, D. (1992). A sensitivity analysis of cross-country growth regressions. Am. Econ. Rev. 82, 942–963.

Lewis, B. D. (2023). Indonesia’s new fiscal decentralisation law: a critical assessment. Bull. Indones. Econ. Stud. 59, 1–28. doi: 10.1080/00074918.2023.2180838

Lipset, S. M. (1959). Some social requisites of democracy: economic development and political legitimacy1. Am. Polit. Sci. Rev. 53, 69–105. doi: 10.2307/1951731

Lukman, R. Y., Kartini, K., and Rura, Y. (2022). Analisis event study new normal Terhadap Harga Saham di Bursa Efek Indonesia. Owner: Riset Dan Jurnal Akuntansi, 7, 1–12. doi: 10.33395/owner.v7i1.1231

Martinez-Vazquez, J., and McNab, R. (1997). “Fiscal decentralization, economic growth, and democratic governance” in USAID conference on economic growth and democratic governance, Working Paper 97–7. (Washington, DC, October), 9–10.

Martinez-Vazquez, J., and McNab, R. (2003). Fiscal decentralization and economic growth. World Dev. 31, 1597–1616. doi: 10.1016/S0305-750X(03)00109-8

McCulloch, N., and Malesky, E. (2011). Does better local governance improve district growth performance in Indonesia? IDS Working Papers 2011, 1–48. doi: 10.1111/j.2040-0209.2011.00369_2.x

Miller, D. L. (2023). An introductory guide to event study models. J. Econ. Perspect. 37, 203–230. doi: 10.1257/jep.37.2.203

Nagengast, A. J., and Yotov, Y. V. (2025). Staggered difference-in-differences in gravity settings: revisiting the effects of trade agreements. Am. Econ. J. Appl. Econ. 17, 271–296. doi: 10.1257/app.20230089

Nailiu, B. A. (2015). Pengaruh Pengumuman Pencapresan Jokowi 2014 Di Bursa Efek Indonesia (Event Study: “Jokowi Effect” Pada Saham LQ45). Jurnal Magister Manajemen, 1–17. Available at: https://repository.uajy.ac.id/id/eprint/6907/1/JURNAL.pdf

Ngatikoh, S., Kumorotomo, W., and Retnandari, N. D. (2020). Transparency in government: A review on the failures of corruption prevention in Indonesia. Proceedings of the Annual Conference of Indonesian Association for Public Administration (IAPA 2019), Vol. 122, Atlantis Press, Amsterdam. 181–200.

Nguyen, M.-L. T., and Bui, N. T. (2022). Government expenditure and economic growth: does the role of corruption control matter? Heliyon 8:e10822. doi: 10.1016/j.heliyon.2022.e10822

North, D. C. (1979). A framework for analyzing the state in economic history. Explor. Econ. Hist. 16, 249–259. doi: 10.1016/0014-4983(79)90020-2

North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge, US: Cambridge University Press.

Nusantara, B. D., Yuwono, T., and Yuniningsih, T. (2022). Collaborative analysis of the Bengkulu City regional government in overcoming waste at the tourism object. ARISTO 10, 598–609.

Oates, W. E. (1999). An essay on fiscal federalism. J. Econ. Lit. 37, 1120–1149. doi: 10.1257/jel.37.3.1120

Olaoye, F. O., and Olaniyi, R. B. (2022). Federal Allocation and Capital Budget Implementation in Nigeria. Fuoye J. Manag. Innov. Entrep. 1, 180–189.

Otsubo, S. T. (Ed.). (2015). Globalization and development volume II: Country experiences. London: Routledge.

Prud’Homme, R. (1995). The dangers of decentralization. World Bank Res. Obs. 10, 201–220. doi: 10.1093/wbro/10.2.201

Ramage, D. E. (2007). Indonesia: democracy first, good governance later. Southeast Asian Affairs 2007, 135–157. doi: 10.1355/SEAA07G

Rao, M. G., and Singh, N. (2007). The political economy of India's fiscal federal system and its reform. Publius J. Federalism 37, 26–44. doi: 10.1093/publius/pjl014

Robinson, J. A., and Acemoglu, D. (2012). Why nations fail: The origins of power, prosperity and poverty. London: Profile.

Roth, J., and Sant’Anna, P. H. C. (2021). Efficient estimation and inference in the synthetic control method. Journal of the American Statistical Association, 116, 1411–1429.

Sen, A. (2014). Development as freedom (1999). The globalization and development reader: Perspectives on development and global change, 525.

Simanihuruk, M., and Sihombing, T. (2019). Fiscal decentralization in villages: high nepotism low capacity 374:012029. doi: 10.1088/1755-1315/374/1/012029

Sun, L., and Abraham, S. (2021). Estimating dynamic treatment effects in event studies with heterogeneous treatment effects. J. Econ. 225, 175–199. doi: 10.1016/j.jeconom.2020.09.006

Talumewo, C. Y., Van Rate, P., and Untu, V. N. (2021). Reaksi pasar modal Indonesia sebelum dan sesudah pengumuman pemberlakuan new normal (Event study pada perusahaan BUMN yang terdaftar di Bursa Efek Indonesia). Jurnal EMBA: Jurnal Riset Ekonomi, Manajemen, Bisnis Dan Akuntansi 9, 166–175.

Tanzi, V. (2002). “Pitfalls on the road to fiscal decentralization” in Managing fiscal decentralization. Eds. Ahmad and Tanzi. (London: Routledge), 33–46.

Tiebout, C. M. (1961). “An economic theory of fiscal decentralization” in Public finances: Needs, sources, and utilization (Princeton: Princeton University Press), 79–96.

Wade, R. (1990). Governing the market: Economic theory and the role of government in East Asian industrialization.

Wajdy, M. F., Warsono, H., Yuwono, T., and Herawati, A. R. (2025). Reflecting on 20 years of regional development planning in Indonesia: a systematic literature review. J. Informat. Syst. Eng. Manage. 10, 76–89. doi: 10.52783/jisem.v10i12s.1716

Wallis, J. J., and Oates, W. E. (1988). “Decentralization in the public sector: an empirical study of state and local government” in Fiscal federalism: quantitative studies, ed. Rosen. (Chicago: University of Chicago Press), 5.

Wiryawan, B. A., and Otchia, C. (2022). The legacy of the reformasi: the role of local government spending on industrial development in a decentralized Indonesia. J. Econ. Struct. 11:3. doi: 10.1186/s40008-022-00262-y

Woller, G. M., and Phillips, K. (1998). Fiscal decentralisation and IDC economic growth: an empirical investigation. J. Dev. Stud. 34, 139–148. doi: 10.1080/00220389808422532

Woodside, A. G., Chang, M. L., and Cheng, C. F. (2012). Government regulations of business, corruption, reforms, and the economic growth of nations. International Journal of Business and Economics, 11, 127.

Keywords: governance, institution, decentralization, foreign investment, event study

Citation: Yuwono T, Wiryawan BA and Yuzuru S (2025) The effect of regulatory governance system on investment growth in decentralized Indonesia. Front. Polit. Sci. 7:1630368. doi: 10.3389/fpos.2025.1630368

Edited by:

Lloyd George Banda, Stellenbosch University, South AfricaReviewed by:

Victor Imanuel W. Nalle, Universitas Katolik Darma Cendika, IndonesiaAmelia Setiawan, Universitas Katolik Parahyangan Fakultas Ekonomi, Indonesia

Copyright © 2025 Yuwono, Wiryawan and Yuzuru. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Teguh Yuwono, dGVndWh5dXdvbm9AbGVjdHVyZXIudW5kaXAuYWMuaWQ=

Teguh Yuwono

Teguh Yuwono Bangkit A. Wiryawan

Bangkit A. Wiryawan Shimada Yuzuru2

Shimada Yuzuru2