- Business Administration Division, Mahidol University International College, Salaya, Thailand

Private city models—encompassing Charter Cities, Free Private Cities, Seasteads, Startup Cities, and Special Economic Zones (SEZs)—are emerging as innovative alternatives to traditional urban governance. This article examines the discussion of these private urban experiments through the lens of blockchain technology and cryptocurrency. We present a structured taxonomy of private city models and analyze case studies to illustrate how blockchain can facilitate governance, economic transactions, and transparency in these contexts. Drawing on peer-reviewed literature, we examine how distributed ledger technologies enable new forms of decentralized governance and finance (e.g., local cryptocurrencies and decentralized finance for city services) while also identifying critical challenges and limitations. Comparisons with traditional public-sector urban governance highlight the potential efficiency gains and transparency improvements of blockchain-powered private cities, as well as concerns regarding accountability, inclusivity, and regulatory integration. Finally, we discuss future prospects for integrating blockchain in urban development, including the concept of networked “crypto cities,” and outline key areas for further research. The analysis balances theoretical propositions with empirical insights, ultimately finding that blockchain can augment private city models by enhancing transparency and enabling novel economic systems, but it is not a panacea for governance and must be implemented with careful consideration of social and legal frameworks.

1 Introduction

Recent years have witnessed growing interest in privately governed cities and zones as laboratories for governance innovation and economic development (Bell, 2018). These “private city” models—ranging from Charter Cities to seasteading projects—propose that new cities with autonomous legal systems and governance structures can accelerate growth and improve public services. In parallel, blockchain technology and cryptocurrencies have risen to prominence as tools for enabling decentralized and transparent record-keeping, fueling speculation that they could provide the “operating system” for the next generation of cities (Rejeb et al., 2022). Scholars and practitioners have begun exploring the convergence of these trends, asking how blockchain’s features (distributed ledgers, smart contracts, decentralized finance) might support or transform the governance of Charter Cities, Free Private Cities, SEZs, and other semi-autonomous urban experiments (Atzori, 2015; Rejeb et al., 2022). This article aims to provide a comprehensive analysis at the intersection of private urban governance and blockchain technology.

While multiple studies have examined blockchain in public governance and smart city contexts (Shen and Pena-Mora, 2018; Rejeb et al., 2022; Clifton et al., 2023), and others have analyzed emergent private city models (Romer, 2010; Bell, 2018; Fortes, 2020; Mason et al., 2021), there remains a lack of research bridging these two domains. Existing surveys and taxonomies of blockchain applications tend to focus on government-led implementations or general smart city use-cases (e.g., land registries in e-government: Shang and Price, 2019), and the discourse on private cities rarely addresses the role of new digital technologies in governance. This review addresses that gap by specifically examining how blockchain can serve as a governance infrastructure across various private city models, synthesizing insights from both the technological and urban governance perspectives.

Following this introduction, Section 2 discusses related work, including existing literature on blockchain in urban governance and a taxonomy of private city models that defines key concepts and contexts. Section 3 outlines the methodology of the study. Section 4 then presents case studies to illustrate real-world (or proposed) implementations of blockchain in these private city contexts, critically examining outcomes and challenges. Section 5 provides a broader discussion of cross-cutting themes, comparing blockchain-empowered private governance with traditional city governance to discern relative advantages and drawbacks, and it also addresses challenges such as regulatory hurdles, technological limitations, and social implications, drawing on theoretical and empirical perspectives. Finally, Section 6 offers concluding remarks and highlights future prospects for integrating blockchain in urban development, including the potential for decentralized finance to fund city projects and the vision of “network states” built on blockchain communities. Throughout, we strive for academic rigor and balance, recognizing the potential benefits of blockchain (e.g., enhanced transparency and efficiency) while critically appraising its limitations and the complexity of real-world implementation (Jutel, 2021).

Given the nascent stage of blockchain implementation in private city projects, this study adopts an exploratory conceptual review approach. Most initiatives examined are either in early implementation phases or remain at the proposal stage, limiting the availability of empirical data and long-term outcomes. This exploratory framework is appropriate for emerging phenomena where theoretical understanding must precede empirical validation. By synthesizing available evidence from case studies, pilot programs, and theoretical propositions, this review aims to establish a foundational understanding of how blockchain technology might transform private urban governance, while acknowledging the preliminary nature of many observations.

2 Preliminaries

2.1 Private city models

Private city models can be classified into several types, distinguished by their governance frameworks and origins. Special Economic Zones (SEZs) are a well-established concept: designated areas within a country that have different economic regulations (e.g., lower taxes or fewer trade barriers) to attract investment. SEZs are typically created by governments, but they form the economic template upon which many private city models build. Many Free Private City proposals start as an agreement with a host nation to create a special jurisdiction (Bell, 2018).

Charter Cities are a model popularized by economist Paul Romer, wherein a new city is established with a special charter that grants it a high degree of autonomy from the host nation’s laws (Romer, 2010). In Romer’s vision, a Charter City is akin to a city-scale Special Economic Zone with distinct rules to encourage investment and development, often administered in partnership with or guaranteed by an outside government or entity (Romer, 2010). The core idea is to “import” good institutions and governance to jump-start economic growth in underdeveloped regions (Romer, 2010). For example, Romer highlighted how Hong Kong’s unique charter under British administration fostered prosperity in Asia (Romer, 2010).

Free Private Cities (FPCs), a concept developed by legal scholar Titus Gebel, push autonomy further. An FPC is a sovereign or semi-autonomous jurisdiction run entirely by a private operating company that provides governmental services on a for-profit basis (Gebel, 2018). In Gebel’s formulation, residents become customers who enter into a “citizens’ contract” with the city operator, defining mutual rights and obligations in lieu of traditional democratic governance (Gebel, 2018). This model envisions governance as a service and emphasizes voluntary participation and competition among private cities (Gebel, 2018).

Seasteads represent another category, imagined as floating cities at sea. Championed by entrepreneurs like Patri Friedman and Joe Quirk, seasteads are essentially autonomous marine colonies with their own legal systems (Quirk and Friedman, 2017). The seasteading movement sees the ocean as the next frontier for creating new jurisdictions “without politicians,” allowing experimental governance and social systems isolated from existing states (Quirk and Friedman, 2017). While Charter Cities and FPCs are usually land-based (often within a host country’s territory but under special rules), seasteads aim for extraterritorial sovereignty by situating communities in international waters (Quirk and Friedman, 2017).

Startup Cities is a more loosely defined category, referring to privately driven new-city projects that innovate in governance, technology, and economics. Sometimes overlapping with Charter City initiatives, Startup Cities are often backed by entrepreneurs or coalitions (rather than governments) and emphasize a startup-like approach to city-building. These might be smaller communities or company towns that experiment with new governance models, and they frequently leverage cutting-edge technologies (from IoT to blockchain) to manage city services.

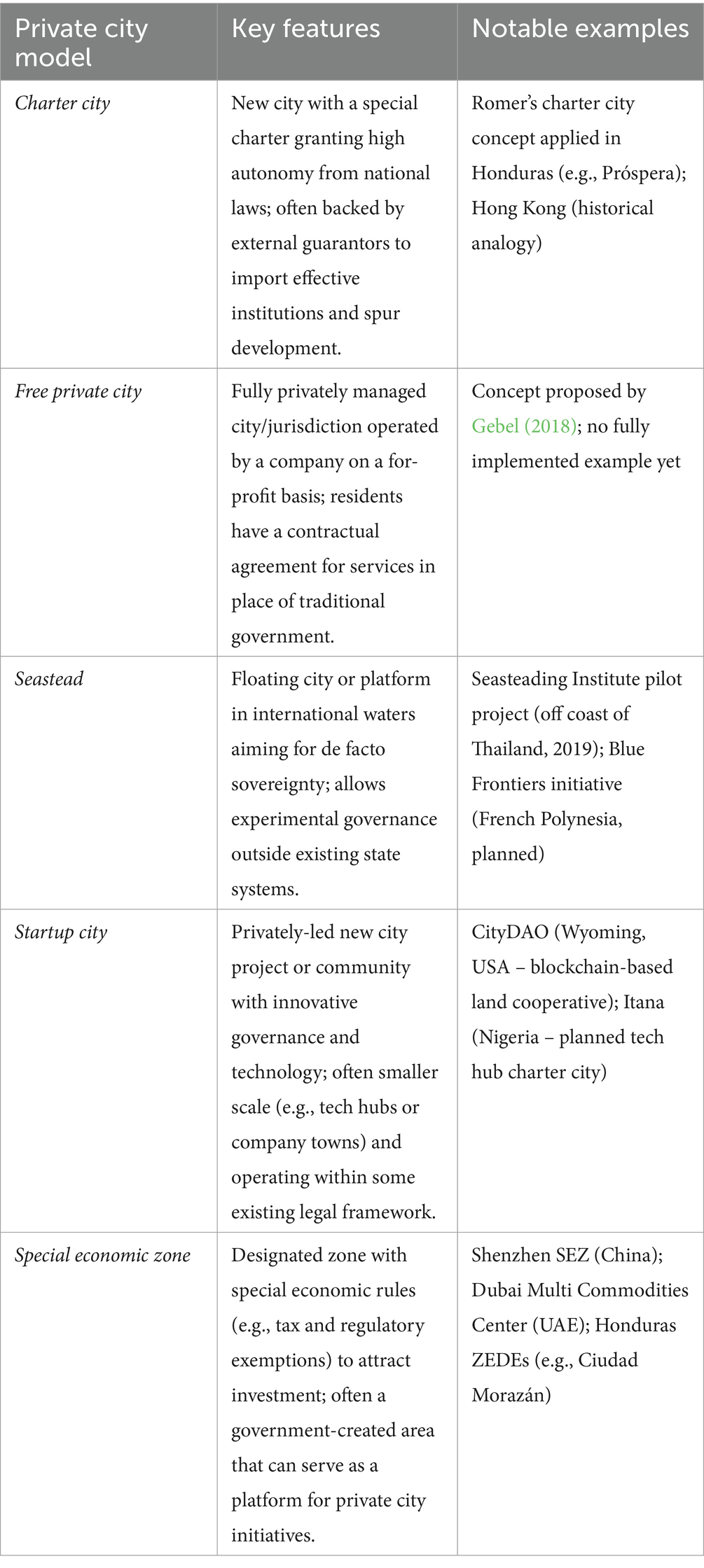

Together, these models form a continuum of private or semi-private governance in urban development, from public-private hybrids (Charter Cities) to fully privatized governance (FPCs and seasteads). Table 1 summarizes their key features. In all cases, questions of political authority, legal jurisdiction, and economic policy are central, and increasingly, proponents are considering blockchain technology as a tool to address these questions by enhancing transparency, security, and efficiency in governance.

2.2 Blockchain and urban governance

Blockchain technology has been increasingly explored in the context of government and urban governance. Atzori (2015) posed early questions about whether blockchain-based systems could enable decentralized governance and reduce the need for traditional state structures. Since then, a number of reviews and analyses have cataloged potential applications of blockchain in “smart cities” and public administration. For example, Shen and Pena-Mora (2018) conducted a systematic literature review on blockchain for cities, highlighting that while technical research (e.g., on improving blockchain protocols) has dominated early work, there is a severe gap between the technology’s purported potential and its practical application by urban policymakers. Similarly, Rejeb et al. (2022) provide a bibliometric overview of blockchain in smart city contexts, finding growing academic interest in areas such as energy management, transportation, and government services. Specific pilot implementations in the public sector lend some empirical support to blockchain’s value: for instance, blockchain-based land registry projects (piloted in countries like Georgia and Rwanda) have shown that distributed ledgers can streamline property transactions and bolster confidence in records (Vos, 2015; Shang and Price, 2019). Blockchain has also been explored for improving transparency in public procurement and budgeting, where an immutable ledger of bids, contracts, and expenditures can reduce corruption by increasing visibility and traceability (Clifton et al., 2023). That said, Clifton et al. (2023) found that beyond a few high-profile examples, the actual use of blockchain in government remains limited—often confined to experimental programs—due to regulatory uncertainties, integration challenges with legacy systems, and the still-maturing state of the technology.

Beyond practical applications, researchers have considered the governance implications of adopting blockchain. Cengiz (2023) distinguishes between blockchain governance (how blockchain networks themselves are governed) and governance via blockchain (using blockchain to execute governance functions in society), warning that the latter can create a facade of decentralization without truly shifting power structures. In other words, simply moving processes onto a blockchain does not guarantee democratic or accountable governance—much depends on who controls the platform and the rules encoded. This resonates with critical perspectives such as Jutel’s (2021) study of blockchain projects in the Pacific, which describes a phenomenon of “blockchain imperialism” where outside developers introduce blockchain-based systems that may entrench external control or technocratic decision-making rather than empower local communities. Such critiques underscore that blockchain is not a panacea; its impact on governance outcomes will hinge on institutional design and how inclusive and transparent the surrounding governance arrangements are. In the context of urban governance, the concept of blockchain-enabled cities or “crypto cities” has begun to appear in both policy discourse and academic speculation. Some visionaries (Bell, 2018) and technology enthusiasts imagine networked city-states or “network states” that originate as online communities (often organized as decentralized autonomous organizations, DAOs) and then materialize as physical settlements with blockchain as their institutional backbone.

While these ideas remain mostly theoretical, they highlight the growing intersection of urban experimentation with digital infrastructure. However, empirical research specifically examining blockchain in privately governed city initiatives is sparse. The majority of literature addresses either conventional smart cities (which are typically government-led) or the theoretical governance models of private cities without focusing on technology. Our review situates itself at this intersection: building on the above insights, we investigate how emerging private cities are leveraging blockchain (if at all) and how this technology might influence their governance structures. By examining existing cases and proposals, we aim to ground the discussion in concrete examples that connect the abstract potential of blockchain with the practical realities of urban governance innovation.

2.3 Blockchain architectures

Understanding the distinctions between various existing blockchain architectures is important for evaluating their suitability in urban governance contexts. Public blockchains (such as Bitcoin and Ethereum) offer complete transparency and decentralization, with no single entity controlling the network (Biasin and Delle Foglie, 2024; Zhu et al., 2024). These characteristics make them ideal for applications requiring maximum trust and immutability, such as cryptocurrency payments or public registries where citizen verification of records is paramount. However, public blockchains typically suffer from scalability constraints and higher transaction costs, potentially limiting their use for high-volume city operations.

Private blockchains, conversely, restrict participation to authorized entities and offer greater control over network governance (Alketbi et al., 2025). While sacrificing some decentralization, they provide higher transaction throughput, lower costs, and the ability to comply with data privacy regulations—advantages that might suit internal city operations or sensitive resident data management. Consortium blockchains represent a middle ground, where multiple organizations jointly manage the network. This model could be particularly relevant for private cities collaborating with host governments or multiple stakeholder groups, balancing transparency with operational efficiency (Zhu et al., 2024).

For private city implementations, the choice of blockchain type depends on specific governance objectives. Public blockchains suit applications requiring maximum transparency and global accessibility (e.g., property titles, public budgets), while private or consortium chains might better serve internal operations, identity management, or inter-organizational coordination where some degree of control and privacy is necessary.

2.4 Methodology

This mini review adopts a qualitative approach combining literature review and multiple case study analysis. As a foundation, we first developed the taxonomy of private city models (presented above) by drawing on existing classifications and definitions in the literature (Romer, 2010; Gebel, 2018; Quirk and Friedman, 2017; Bell, 2018). This provided clear conceptual boundaries for the types of initiatives under consideration. We then identified representative case studies for in-depth analysis. A case study method was chosen because it allows examination of contemporary phenomena within their real-world context, which is appropriate for exploring a novel, interdisciplinary topic like blockchain in private cities (Yin, 2014). The case study approach facilitates understanding the complex interactions of technology, governance, and context in each example, and enables cross-case comparison of patterns and differences.

Five case studies were selected to cover a range of private city models and contexts: two charter city projects (Próspera and Ciudad Morazán in Honduras), a national crypto-centric city project (Bitcoin City in El Salvador), a seasteading experiment (Blue Frontiers and related efforts), and a community-driven startup city initiative (CityDAO in the United States of America). These cases were chosen because they are prominent or illustrative instances where blockchain or cryptocurrency play a role in the city’s design or operations. Selection was also guided by the availability of information in peer-reviewed literature or credible reports. For example, the Honduran cases have been discussed in policy and legal analyses (Mason et al., 2021), and CityDAO (Rong, 2023) has been noted in reviews of blockchain and governance (Rejeb et al., 2022), providing sources to draw upon.

Our literature review component involved searching academic databases (e.g., Scopus, Web of Science, Google Scholar) for combinations of keywords such as blockchain, urban governance, smart cities, charter cities, special economic zones, and specific project names. We focused on peer-reviewed journal articles, conference papers, and reputable white papers or books. In reviewing this literature, we sought to understand the state of research on blockchain in government and cities, as well as analyses of private cities themselves. The insights from this background literature (summarized in the Related Work section) informed our analysis of the cases and helped in formulating the research questions (RQ) to ask of each case:

RQ1: What specific blockchain technologies and implementation models are being deployed in private city developments?

RQ2: To what extent are blockchain systems in private cities replacing, augmenting, or complementing traditional governance functions?

RQ3: What technical, regulatory, social, and operational challenges have emerged during blockchain implementation in private cities?

For each case study, we gathered information from a combination of academic sources, official documentation, and media reports. We examined how each project incorporates blockchain or cryptocurrency into its governance or services, and we noted any reported outcomes or controversies. The analysis of cases was conducted by identifying key themes within each case (such as uses of blockchain for transparency, economic innovation, resident participation, etc.) and then comparing these themes across cases. By using multiple cases, we increase the robustness of findings through literal replication (looking for commonalities) and theoretical replication (noting contrasts that might be explained by differing conditions) (Yin, 2014).

As an exploratory conceptual review, this study acknowledges several methodological limitations. The nascent nature of blockchain-enabled private cities means empirical data remains scarce, with most projects either in planning stages or early implementation. Quantitative metrics such as transaction volumes, adoption rates, or governance efficiency indicators are largely unavailable or proprietary. Therefore, our analysis relies primarily on qualitative assessment of documented cases, theoretical frameworks, and early pilot outcomes. This exploratory approach is appropriate for emerging phenomena where establishing conceptual foundations precedes systematic empirical investigation. Future research should build upon this foundation with longitudinal studies and quantitative assessments as these projects mature and generate measurable outcomes.

3 Case studies

To ground the above concepts in concrete examples, we examine several case studies where blockchain and cryptocurrency intersect with private city initiatives. Each case exemplifies a different model from our taxonomy, and together they provide insight into how blockchain is being applied (or envisioned) in practice.

3.1 Próspera (Honduras)

Próspera is a Charter City initiative under Honduras’s ZEDE (Zone for Employment and Economic Development) framework, which grants it sweeping legal and regulatory autonomy (Mason et al., 2021). Established on the island of Roatán, Próspera has its own governance institutions and the authority to set many of its policies. Notably, Próspera has embraced cryptocurrency as part of its economic system—it recognizes Bitcoin as a legal unit of account and has attracted blockchain startups to operate in its jurisdiction (Mason et al., 2021). By leveraging blockchain, Próspera aims to provide a transparent, efficient business environment and has even explored using decentralized autonomous organization (DAO) structures for some governance processes. This aligns with the idea of a “crypto-friendly” charter city, positioning blockchain as the financial infrastructure for a new city economy. Early observations suggest that using Bitcoin and other cryptocurrencies has helped Próspera market itself to international investors and residents seeking a liberal economic environment, though regulatory tensions with the Honduran government have also arisen (Honduras repealed the ZEDE law in 2022, casting uncertainty on Próspera’s future status) (Mason et al., 2021).

3.2 Ciudad Morazán (Honduras)

Another Honduran ZEDE, Ciudad Morazán, offers a contrast to Próspera—it is oriented toward local residents and industrial activity. While not as explicitly crypto-focused as Próspera, Morazán’s private administrators have nonetheless explored blockchain for land registries and secure record-keeping. Implementing a blockchain-based land title system could ensure property rights are transparently protected and reduce bureaucratic overhead, an important consideration in a country where traditional land registries have been prone to corruption or inefficiency (Vos, 2015; Shang and Price, 2019). If successful, this would provide an empirical example of improved urban governance via blockchain in a private city, though public data on Morazán’s technological infrastructure is limited (the project is less publicized internationally compared to Próspera). This case underscores that even without a full cryptocurrency emphasis, core governance functions like land administration in private cities could potentially benefit from blockchain’s transparency and security.

3.3 Bitcoin city (El Salvador)

Announced in 2021 by El Salvador’s President Nayib Bukele, Bitcoin City is an ambitious plan to build a new city funded by Bitcoin-backed bonds and powered by geothermal energy (to support Bitcoin mining) as a key economic activity (Rejeb et al., 2022). Although this is a state-led project (not privately developed), it mimics Charter City principles by planning a tax-free, highly business-friendly zone centered on cryptocurrency. The city’s governance is supposed to be pro-business and technologically advanced, with Bitcoin as its de facto currency. This case demonstrates how the idea of a crypto-driven city has reached even national governments. Bitcoin City’s promise lies in using blockchain (specifically, the Bitcoin network and potentially other blockchain platforms) as the basis for the city’s economy and financial system, potentially simplifying transactions and attracting global crypto investment. However, critics point out that relying on a volatile cryptocurrency for municipal finance is risky, and the project’s legal foundations and feasibility remain uncertain. As of 2024, Bitcoin City is still in the planning phase, illustrating the gap between visionary proposals and implementation. Its inclusion in this review provides a useful point of comparison—highlighting how even a national government might leverage blockchain in new city projects, and the skepticism and challenges such efforts face.

3.4 Seasteading and blue frontiers

In the case of seasteads, the first experimental platforms have been launched on a small scale. For instance, a pilot seastead was briefly established off the coast of Thailand in 2019 by a group called Ocean Builders, and the Seasteading Institute had an agreement in principle with French Polynesia to build a floating island with special governance provisions (Quirk and Friedman, 2017). These projects often planned to use blockchain for internal governance and finance. Blue Frontiers, a seasteading company, even launched an initial coin offering (ICO) for a token (“Varyon”) intended to be used for transactions in a future seastead community (Quirk and Friedman, 2017). The use of cryptocurrency is logical for seasteads given their desire for independence from any single nation’s financial system. For example, one could imagine a seastead using Ethereum-based smart contracts to create its own micro-legal system, where agreements between residents or between residents and the operating company are automatically enforced on-chain. While no large-scale seastead city exists yet, these early experiments show that blockchain is a central element in seasteaders’ plans for practical self-governance and a cashless, trust-minimized economy. The seasteading case studies highlight both the innovation of marrying blockchain with radical new jurisdictions and the significant barriers (legal and technical) that have so far kept these projects experimental.

3.5 Startup cities and tech hub projects

Beyond the high-profile previous examples, numerous smaller projects are blending private governance and blockchain in a more incremental way. CityDAO in the United States is an experiment in collective land ownership: it is essentially a DAO (decentralized autonomous organization) registered in Wyoming that purchased a parcel of land, aiming to eventually form a blockchain-governed micro-community. Participants hold tokens representing stakes in the land and vote on regulations and decisions through smart contracts. Although CityDAO is not yet a full-fledged city, it demonstrates the building blocks of governance via blockchain: tokenized property rights and on-chain voting mechanisms for community decisions. In Africa, projects like Itana in Nigeria and Silicon Zanzibar in Tanzania are creating tech hubs with charter-city-like arrangements (Fortes, 2020). These projects have partnered with blockchain and fintech companies to attract investment and utilize cryptocurrency payments for services. For example, Itana is envisioned as a hub for African tech entrepreneurs and has explored issuing a local digital token for its community transactions (Fortes, 2020). Meanwhile, traditional SEZs such as those in Dubai have also begun to incorporate blockchain: the Dubai Multi Commodities Center (DMCC), a large free zone, created a regulatory framework to attract crypto-asset businesses, and the city of Dubai implemented a government-wide blockchain strategy for municipal services (Clifton et al., 2023). These examples show a broad spectrum—from grassroots initiatives (like CityDAO’s bottom-up approach) to government-led zone innovation (Dubai’s top-down strategy)—all leveraging blockchain in pursuit of more efficient, transparent urban management.

Collectively, these case studies reveal both the promise and the early pitfalls of integrating blockchain into city governance. On one hand, they illustrate potential benefits: Próspera’s use of Bitcoin to facilitate commerce, or CityDAO’s demonstration of direct democratic participation through a blockchain, echo the theoretical advantages of decentralization (Mason et al., 2021; Rejeb et al., 2022). On the other hand, they expose practical challenges: legal uncertainties (as seen in Honduras and the seasteading attempt in Thailand), technological barriers, and the necessity of off-chain frameworks to complement or enforce on-chain decisions. These real-world examples set the stage for a broader discussion of how blockchain functions as a governance tool, what challenges arise, and how these new models compare to traditional governance of cities.

4 Discussion

4.1 Blockchain as a tool for governance and economic transactions

A unifying theme across the cases is the role of blockchain in facilitating governance functions and economic transactions in private cities. Fundamentally, blockchain can serve as a platform for establishing trust in low-trust environments. By providing an immutable and transparent ledger of transactions and records, blockchain reduces opportunities for corruption or record-tampering in city administration (Rejeb et al., 2022). For instance, a city government or private city operator could record land titles, business licenses, and public contracts on a public or consortium blockchain. Once recorded, these entries become tamper-evident and auditable by stakeholders, which is particularly valuable in charter cities or SEZs in developing countries where public trust in institutions may be weak (Vos, 2015; Shang and Price, 2019). Empirical efforts support this potential: pilot projects digitizing land registries (e.g., in Georgia and Rwanda) have shown that blockchain can streamline property transactions and bolster confidence in the integrity of records (Shang and Price, 2019). In the context of a Free Private City model—where a private company provides services—blockchain could even be used to enforce the “citizens’ contract.” The terms of service between the city operator and residents (such as fee schedules, service levels, and rights protections) could be encoded in smart contracts. Those contracts would automatically execute obligations or penalties for non-compliance, adding credibility to the operator’s commitments (Gebel, 2018). For residents, such automation and transparency offer a safeguard independent of the operator’s goodwill—reducing the risk of arbitrary governance, at least in theory.

Blockchain technology also supports decentralized governance mechanisms like digital voting and proposal systems. A charter city might allow its residents or stakeholders to vote on certain ordinances via a blockchain-based voting platform, ensuring that votes are counted accurately and verifiably (Atzori, 2015). Some have proposed that DAOs could assume many governance functions in private cities, enabling what is essentially algorithmic or “smart” administration. While fully code-based city governance remains experimental, smaller-scale uses (such as community budgets decided by token-holder votes, as seen partially in CityDAO) are being tested. Economically, blockchain opens the door for local digital currencies and decentralized finance (DeFi) in these cities. Instead of relying solely on a national currency or traditional banks, a private city could issue a cryptocurrency or token for local use. This local currency might be used to pay for city services, employee salaries, or even grant citizens a form of equity stake in the city’s success. Some observers note that such currencies, if widely adopted, could increase local economic circulation and incentivize civic engagement (Rejeb et al., 2022). Decentralized finance platforms could enable residents or investors to fund urban infrastructure via tokenized bonds or to obtain peer-to-peer loans for businesses, bypassing conventional banks. A notable early example in the public city context is the city of Berkeley’s exploration of a tokenized municipal bond (an “initial community offering”) to fund affordable housing (Clifton et al., 2023). Although Berkeley’s pilot was in a traditional city, the same concept could allow private cities to raise capital globally by issuing crypto-securities, thereby democratizing city financing beyond what traditional municipal bonds can do.

Transparency is another oft-cited benefit: if all expenditures of a city administration (or operating company) were tracked on-chain, it would become easier for residents or investors to hold the governors accountable for the use of funds. Public procurement in a blockchain-governed city could similarly be made transparent; bids and contract awards recorded on a ledger would deter favoritism and enable real-time auditing (Rejeb et al., 2022). Indeed, research on blockchain in government procurement suggests it can reduce corruption by increasing visibility and traceability of transactions (Rejeb et al., 2022). For private cities, which must build trust to attract residents and businesses, showcasing incorruptible, blockchain-based processes can be a competitive advantage.

That said, it is essential to critically analyze whether blockchain’s theoretical benefits materialize in practice. Some scholars caution that who controls the blockchain and how it’s implemented matter greatly. A privately run ledger (fully controlled by the city operator) might not offer the same trust benefits as a truly public, decentralized blockchain (Cengiz, 2023). If the operating entity can alter the records or selectively validate transactions, the credibility of the system is compromised. Therefore, many private city projects opt to use well-established public blockchains (like Bitcoin or Ethereum) for crucial functions such as currency or identity verification, while exploring permissioned or consortium chains for internal records where some degree of control is needed. Blockchain technology offers private city models a toolkit to enhance governance in three key areas: administration (through transparent record-keeping and smart contracts), participation (through e-voting and DAO-like structures), and economy (through local cryptocurrencies and integrated DeFi). These align with longstanding goals in urban governance to improve efficiency, accountability, and citizen empowerment. Yet, realizing these benefits is contingent on overcoming significant challenges and not overestimating technology’s capacity to solve inherently political problems.

4.2 Challenges and limitations

Implementing blockchain in the context of urban governance and private cities is not without substantial challenges. A first set of challenges is technological and operational. Blockchains—especially leading public networks like Ethereum—face issues of scalability; current transaction throughput may not support the high volume of micro-transactions or data logging that a city administration might generate (Rejeb et al., 2022). While newer blockchain protocols and “layer-2” scaling solutions are improving throughput, there is also the issue of interoperability: a city might end up using multiple blockchain systems for different tasks (one for currency, one for land registry, another for voting), which then need to be integrated seamlessly. Managing digital identity is another operational challenge. A robust system is required for residents to authenticate and interact with city blockchain services (likely through cryptographic keys or digital ID tokens). If not designed with usability in mind, such systems could exclude those who are less tech-savvy, raising concerns about a digital divide. Indeed, studies of pilot projects in developing regions have found that limited internet access and low blockchain literacy can prevent local populations from fully using these systems (Jutel, 2021). Thus, without parallel investment in digital infrastructure and education, blockchain-based governance might end up empowering external stakeholders (tech developers, investors) more than the residents it’s meant to serve (Jutel, 2021).

Another major challenge is legal and regulatory. Private cities, almost by definition, operate with the permission (or at least tolerance) of host nations—except in the case of seasteads, which seek to exist outside any nation’s territory. National governments may impose restrictions on cryptocurrency use or blockchain operations that conflict with a private city’s plans (Mason et al., 2021). For example, if a country bans certain cryptocurrencies or smart contract platforms, a city within its borders cannot legally implement those tools without risking enforcement action. The dynamic nature of crypto regulation means private cities face uncertainty; the collapse of Honduras’s ZEDE regime after a change in political leadership demonstrates how national sentiment can swiftly jeopardize these projects regardless of the technology (Mason et al., 2021). There is also jurisdictional ambiguity when disputes arise. If a smart contract in a charter city automatically executes a penalty (say, confiscating a deposit after a tenant violates a rule), is that action enforceable under the host country’s law? The lack of legal precedent for many blockchain-based governance actions means conflicts could end up in uncharted legal territory, undermining the “self-governing” premise (Atzori, 2015).

Perhaps the most profound challenges are around governance and accountability. While blockchain can make certain processes transparent and rule-bound, it does not by itself ensure good governance or fairness. Private cities run by companies lack the democratic accountability of traditional municipalities (Cengiz, 2023). Residents might see their transactions and votes recorded on a ledger yet have no recourse if the decisions themselves—made by the city operator or a small group of token-holders—are not in their interest. As Cengiz (2023) argues, there is a risk that “governance via blockchain” could be conflated with genuine decentralization, when in fact the power structures remain top-down. In a worst-case scenario, blockchain could even entrench authoritarian governance: a private city operator might use an immutable ledger and smart contracts to rigorously enforce rules and payments, with penalties (fines, service cutoffs, even eviction) executing automatically without room for human discretion or appeals. Such concerns echo the concept of a “decentralized dystopia,” where technology empowers not the people, but rather unaccountable rulers in new ways (Atzori, 2015; Cengiz, 2023). The challenge, then, is to design governance frameworks where blockchain enhances accountability upward (of the governors to the governed), not just automates downward enforcement of rules.

Economic and financial risks also merit scrutiny. Cryptocurrencies are notoriously volatile, and tying a city’s economy to them can introduce instability. The experience of El Salvador’s national Bitcoin adoption illustrates the fiscal risk if a city or country holds large crypto reserves or if residents’ savings are predominantly in crypto: sharp downturns can erode wealth and budget capacity (Rejeb et al., 2022). Private cities might try to mitigate this by using stablecoins or baskets of tokens pegged to real assets, but those introduce counterparty risk (they rely on an issuer or mechanism to maintain the peg). DeFi platforms, while offering new capital sources, come with smart contract vulnerabilities and exposure to global market swings. A collapse or hack of a DeFi protocol used by a city could freeze essential funds overnight. These risks underscore the early-stage nature of integrating blockchain in city governance—many mechanisms are experimental and lack the safety nets (like lender-of-last-resort facilities or insurance schemes) that traditional financial and governance systems have developed.

Social acceptance is another potential limitation. Residents may be wary of a “crypto city” vision, associating it with tech elitism or speculative ventures. If local communities perceive that a private city is catering more to wealthy expatriates or cryptocurrency enthusiasts than to ordinary residents, it could generate social friction (Jutel, 2021). The digital divide could exacerbate inequality if key services become accessible mainly through digital means and those without smartphones or internet access struggle to participate. Ensuring inclusivity will require intentional policies, such as providing public internet access, user-friendly interfaces in local languages, and offline alternatives for essential services. Finally, there is the overarching question of scalability and replicability. While a small private city or pilot project can trial blockchain systems in a contained environment, scaling up to a metropolis of millions of people is a far greater challenge. Traditional cities have legacy systems and entrenched interests that resist radical change; private city initiatives often start fresh but face hurdles in growing beyond a certain size. Many private city projects, in fact, stall in early phases due to political opposition, funding shortfalls, or governance failures before they ever reach scale.

The path to realizing blockchain-integrated private cities is fraught with obstacles. The optimism of tech proponents must be tempered by lessons from public administration and development studies. As Jutel (2021) observes in the Pacific context, blockchain initiatives can sometimes serve as a form of technological solutionism that overrides local context and reproduces power imbalances. His notion of “blockchain imperialism” describes how external developers and capital might use techno-utopian projects to extend influence over local resources, rather than truly empower local communities. This critical perspective is a reminder that blockchain, like any technology, is not neutral—it can be deployed in ways that either enhance or undermine good governance depending on whose interests guide its implementation. Therefore, addressing the challenges above is not just a technical matter but a governance challenge in its own right: it requires inclusive design, transparency, community buy-in, and often cooperation with traditional authorities, rather than a wholesale replacement of existing governance structures.

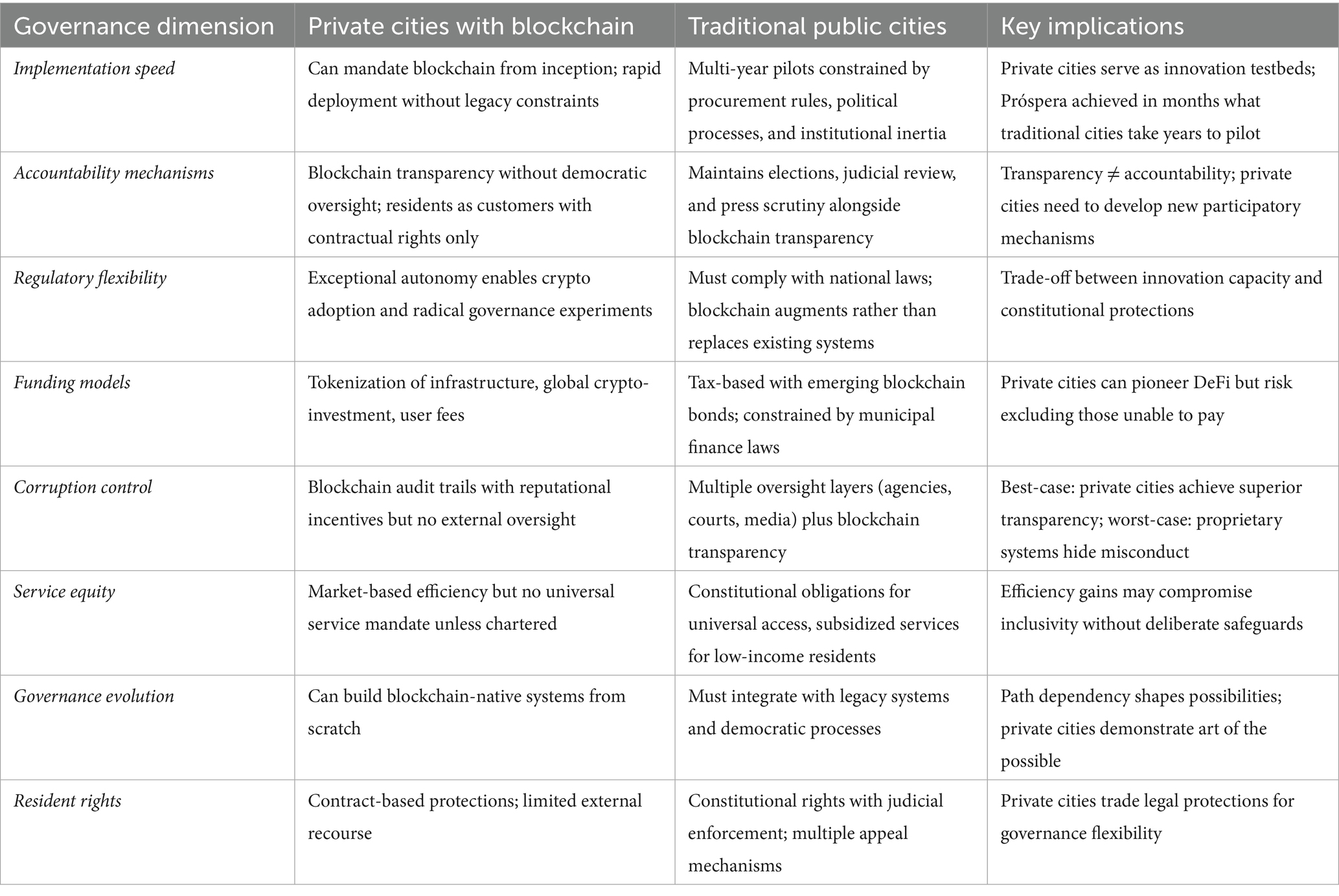

4.3 Comparison with traditional urban governance

Contrasting blockchain-enabled private city governance with the governance of traditional cities highlights both potential advantages and areas of concern. Traditional cities operate under the authority of public governments, with bureaucratic structures and political decision-making processes (e.g., elected city councils) and established accountability mechanisms (audits, press scrutiny, elections). Services are typically funded by taxation, and policy changes often require lengthy deliberation or legislative processes. Proponents of private cities argue that this traditional model can be inefficient, slow to innovate, and prone to political clientelism (Bell, 2018). They see private models as a chance to “start from scratch” with governance innovations, including the use of cutting-edge technologies for administration (Rejeb et al., 2022).

Traditional cities are increasingly experimenting with blockchain applications, though within existing governance constraints. Dubai’s government launched a comprehensive blockchain strategy in 2016, aiming to become the world’s first blockchain-powered government by 2020 (Alketbi et al., 2025). The emirate has implemented blockchain for business registration, real estate transactions, and healthcare records, demonstrating that public governments can adopt distributed ledger technology at scale (Biasin and Delle Foglie, 2024). Singapore’s Smart Nation initiative similarly incorporates blockchain for trade finance, identity verification, and inter-agency data sharing through its Government Technology Agency. However, both cases illustrate that even tech-forward traditional governments face constraints: they must ensure compatibility with existing legal frameworks, protect citizen data according to national laws, and maintain democratic accountability mechanisms. These implementations tend to augment rather than replace existing systems, contrasting with private cities’ ability to build blockchain-native governance from scratch.

4.3.1 Efficiency and speed

One clear difference is that private cities can potentially implement new systems (like blockchain-based services) more quickly than traditional municipalities. A conventional city government might pilot a blockchain land registry or digital currency over several years, hindered by procurement rules, political debates, and institutional inertia. In contrast, a startup city or zone can mandate such technologies from day one as part of its operational model. This agility is evidenced by projects like Próspera which, within a short span, built a digital governance portal including a cryptographic ID system for residents and crypto-payment options for fees, whereas many large established cities are still only in exploratory phases for similar ideas (Clifton et al., 2023). In this sense, private cities can serve as technology testbeds for urban governance, experimenting with blockchain-based voting, smart contract-managed public services, etc., faster than traditional public-sector environments typically allow.

4.3.2 Accountability and legitimacy

However, traditional governance comes with built-in legitimacy and checks-and-balances that private governance may lack. City governments, for all their flaws, are ultimately answerable to the public through elections and oversight by higher levels of government. If a public city mayor misuses funds or power, there are legal and political remedies (investigations, recall elections, removal from office, judicial review of decisions, etc.). In a private city, if the operator misuses funds or behaves negligently, the recourse for residents is more uncertain—residents are essentially customers or shareholders, and their rights are only what is specified in the contract or charter governing the city. Blockchain can improve transparency in this scenario (residents can see how funds flow or how decisions are made on-chain), but transparency alone does not guarantee accountability or voice. Traditional cities may not publish every transaction to a ledger, but they have public council meetings, free press coverage, and the ballot box to provide accountability. A private city could try to replicate some of these mechanisms (for instance, inviting resident representatives into decision-making or using on-chain voting for certain issues), but these practices are still evolving and not guaranteed. A comparative study by Fortes (2020) found that community engagement in governance correlates strongly with citizen satisfaction in new city projects; thus, private cities will need to incorporate participatory governance—potentially via blockchain-facilitated voting or forums—to approach the legitimacy that traditional cities derive from democratic processes.

4.3.3 Regulatory compliance vs. autonomy

Traditional cities are embedded in a hierarchy of laws (national constitutions, state or provincial laws, etc.), which can constrain their ability to, say, recognize a cryptocurrency as legal tender or to radically alter governance processes. Private cities often exist only because they obtained a legal carve-out (as a special zone or via a charter agreement) that grants them exceptional autonomy (Romer, 2010). This autonomy is a strength in that it allows implementing novel economic policies (like zero taxes, or adopting crypto for fees) that a normal city could not lawfully do (Bell, 2018). Private cities can push the envelope on economic freedom and administrative innovation — they can be more like Dubai or Shenzhen in their flexibility — whereas a traditional city is more constrained. That said, autonomy cuts both ways: residents in a traditional city have constitutional rights and can appeal to national courts if local authorities overstep, whereas residents in an extremely autonomous private city might find fewer external checks on the city’s rulers if their rights are infringed (Cengiz, 2023). Essentially, traditional cities trade flexibility for accountability, while private cities trade some external accountability for greater flexibility. The optimal balance may lie in hybrid arrangements (for example, private cities that still allow certain public laws or oversight to apply in areas like human rights).

4.3.4 Service delivery and economics

Traditional cities fund public goods (roads, parks, utilities) largely through taxation and sometimes by issuing municipal bonds. Private cities, lacking taxing authority in the usual sense, often rely on user fees, leases, and investment capital to fund infrastructure and services. Blockchain could enable innovative funding mechanisms for both models, but private cities have a stronger motive to pursue them. For instance, a private city might tokenize its infrastructure – selling tokens that represent a share of future revenue from the power grid or transit system to global investors – effectively crowdfunding development (Clifton et al., 2023). Traditional cities are also beginning to explore such ideas (as noted, some have looked at issuing bonds via blockchain or using tokenized public-private partnerships), but a private city with profit-driven management might push this approach more aggressively. One could compare a public utility run by a city government versus a decentralized utility token system in a private city: the latter might achieve efficiencies through market pricing and innovation, but it might also charge higher prices if unregulated, potentially reducing equity of access. Traditional governance often emphasizes universal service (ensuring even low-income residents have basic access to water, electricity, etc., sometimes through subsidies), while a purely private model might not provide that unless required by its charter or social contract (Fortes, 2020).

4.3.5 Corruption and transparency

Many traditional city governments, especially in developing countries, struggle with corruption and opaque practices. Private city advocates claim that a corporate-run city will have stronger incentives to run efficiently and honestly to maintain its reputation and attract customers (residents and businesses). They also argue that residents “opt in” to a private city expecting a more transparent, accountable experience. In theory, a well-run private city could indeed outperform a poorly governed public city in terms of corruption control, especially if it leverages blockchain to make all transactions and decisions auditable (Rejeb et al., 2022). However, if the private city’s leadership itself is not trustworthy, corruption risk does not vanish—it may simply take another form, such as exploitation (e.g., charging exorbitant fees, or officials of the operating company engaging in self-dealing with city assets). Traditional cities at least have external anti-corruption agencies, investigative journalism, and judicial oversight; a private city might lack those layers unless it voluntarily establishes them or is subject to them by agreement. In the best case, a private city with blockchain-based systems could achieve a level of transparency and real-time public auditability that surpasses even well-run public cities. But that outcome depends on the private operators choosing to be open and subject themselves to scrutiny. In the worst case, a private city could conceivably suppress information (if not using a public blockchain, or by limiting who can see what) and thereby conceal misdeeds behind proprietary systems, escaping the scrutiny that public officials would face (Cengiz, 2023).

Compared to traditional urban governance, blockchain-enabled private cities show potential improvements in efficiency, transparency, and innovation, but they must overcome deficits in legitimacy, inclusivity, and legal protection for residents. Rather than viewing one model as outright superior, it may be more productive to see the relationship as complementary. Traditional cities can learn from private experiments in digitization and streamlined services, while private cities can learn from the public sector about balancing profit motives with the public interest and ensuring accountability. It’s possible that successful elements of private city governance (such as particular blockchain applications that improve service delivery or reduce corruption) could be adopted by conventional cities, blurring the line between the two. Conversely, traditional frameworks provide a safety net of rights and norms (and often a fallback jurisdiction) that private projects would do well to incorporate if they wish to achieve long-term viability and social trust.

Table 2 synthesizes these contrasting approaches by comparing how blockchain implementation differs across key governance dimensions in private versus traditional public cities.

5 Future prospects

Looking forward, the intersection of blockchain technology with private city models is likely to deepen, raising intriguing possibilities for the future of urban governance. One emerging concept is the Network State or networked city – essentially cloud-based communities that coalesce digitally and then seek to establish a physical presence in clusters (Bell, 2018). These “network states” could be seen as a 21st-century evolution of private cities: groups of like-minded individuals form a DAO or online community, accumulate capital, and negotiate for land or charter city status across one or multiple host countries. Blockchain is the backbone of this concept, providing the governance infrastructure (through smart contracts for decision-making and membership) and the financial system (through decentralized finance to manage community assets) (Atzori, 2015). While true network states remain mostly theoretical, initial steps in this direction — such as private island or enclave projects like Satoshi Island in Vanuatu, and initiatives fostered by the Startup Societies Network — indicate momentum among certain communities of tech entrepreneurs and libertarians. In practice, we may see hybrid governance models proliferate. For instance, a charter city might evolve into a public-private partnership where a DAO composed of residents and global investors holds certain decision rights (like a digital town council) alongside a private development firm or local government (Rejeb et al., 2022). This would merge democratic participation with corporate efficiency, mediated by blockchain for transparency and security. Experiments with such hybrid models are likely; indeed, some proponents have floated the idea of “initial city offerings” where future residents buy tokens that fund a city’s construction and also confer voting power in its governance (Clifton et al., 2023).

Decentralized finance is poised to play a larger role in urban development finance moving forward. Beyond simple municipal tokens or bonds on blockchain, we might see city-specific yield-bearing crypto instruments. For example, a special economic zone could launch a decentralized investment fund where individuals globally stake cryptocurrency to finance local infrastructure (say, factories or solar farms) in return for a share of the projects’ profits (Clifton et al., 2023). This kind of global, peer-to-peer urban financing could supplement or bypass traditional development funding, though it will raise its own regulatory questions. Another prospect is data sovereignty for residents via blockchain. Smart cities of all kinds generate vast amounts of data (from sensors, services, transactions). A blockchain-based city could give individuals ownership of their personal data, allowing them to control access or even monetize it by sharing with service providers under certain conditions, as opposed to the typical model where either governments or corporations hoard urban data (Rejeb et al., 2022). This would align with broader trends in decentralized identity and personal data lockers, potentially making cities more citizen-centric in digital policy.

Interoperability among privately governed cities may also become relevant. We could imagine multiple charter cities or private communities forming a consortium blockchain to share credentials and trust networks—so that a citizen of one city can seamlessly travel, work, or do business in another using a digital ID or reputation score that is recognized across a network of semi-autonomous cities (Atzori, 2015). Such inter-city coordination might be the start of an ecosystem of allied private cities, or even a sort of confederation of networked cities that collectively present an alternative to the nation-state system in specific domains (like trade or citizen movement). However, realizing these prospects will require carefully addressing the limitations identified in our analysis. Municipal decisions on social policy illustrate the limits of “code-is-law.” In practice, only narrow, easily verifiable rules (e.g., eligibility thresholds or subsidy formulas) are safely embedded in smart contracts, while complex social trade-offs—zoning for affordability, policing priorities, or crisis intervention—still demand human deliberation and political accountability. U. S. pilots such as Wyoming’s CityDAO show that federal and state regulators retain override powers, tempering purely algorithmic governance; the blockchain offers transparency, but people decide norms and redistribution. Future private cities will therefore need a hybrid model: on-chain parameters for objective transfers, off-chain democratic or arbitral mechanisms for value-laden choices, and iterative feedback loops to align the two over time.

As current pilot projects mature, we expect more empirical research on outcomes. For example, do blockchain-based governance processes actually reduce corruption or improve service delivery in a city over a sustained period. Future studies could compare a blockchain-implementing private city with a similar city that uses conventional systems to quantify differences (Jutel, 2021). Longitudinal data will be extremely valuable in moving beyond conjecture.

It is also likely that traditional cities and governments will themselves adopt some of the innovations coming out of private cities, thereby blurring the line between “private” and “public” city models. An interesting scenario would be a large existing city establishing a “digital district” within itself that functions akin to a charter city, with its own local cryptocurrency and special governance rules to attract tech companies (Clifton et al., 2023). In effect, traditional cities might emulate their upstart counterparts once certain approaches are proven —a form of convergence. Meanwhile, global priorities like sustainability will shape how these technologies are used. Given the focus on sustainable development, any private cities that integrate blockchain will likely need to demonstrate alignment with environmental and social goals, not just economic ones. This could mean using blockchain to track and incentivize sustainability metrics (for instance, internal carbon credit markets within a city, or token rewards for residents who recycle or save energy) (Rejeb et al., 2022). It also means ensuring that energy-intensive blockchain operations (like cryptocurrency mining) are done in eco-friendly ways (e.g., using renewable energy, as touted in Bitcoin City’s geothermal plans).

Finally, we may see the concept of a “city as a platform” emerge, wherein a city (be it private or public) provides an open blockchain-based infrastructure upon which third-party developers can build urban applications and services (Atzori, 2015). In such a model, the city’s role is to set up and maintain the foundational ledgers and protocols (for identity, payments, voting, etc.), and external innovators create dApps (decentralized apps) that residents can choose to use for various needs (from transportation to education to healthcare). This parallels how smartphone operating systems foster app ecosystems. If cities become platforms in this way, the boundary between private and public provision may further blur, as governance becomes a mix of tech infrastructure and community-driven innovation.

The future may bring greater convergence between private, tech-enabled city models and mainstream urban governance. Blockchain and associated technologies will likely be key enablers in this process, but their role will be shaped by the lessons learned from the first generation of implementations. As early projects reveal what works well and what does not, we can expect a more nuanced understanding of how to harness decentralizing technologies for the public good in cities. The coming years will determine whether blockchain in city governance moves beyond hype to a stable, replicable model — or whether it remains a niche experiment applicable only in certain special conditions.

6 Conclusion

Private city models such as Free Private Cities, Charter Cities, Seasteads, and other special jurisdictions represent bold experiments in reimagining how we govern urban spaces and deliver public services. This mini review has explored how blockchain and cryptocurrency can contribute to these experiments by providing new mechanisms for governance, finance, and transparency. We maintained a critical perspective throughout, recognizing that while blockchain can strengthen trust through decentralization and immutable record-keeping (Rejeb et al., 2022), it does not automatically resolve deeper political and social challenges (Jutel, 2021). Our taxonomy clarified the distinctions among various private city concepts and showed that all of them emphasize, to differing degrees, autonomy and innovation—fertile ground for the application of blockchain-based systems. The case studies illustrated the nascent real-world intersections of private cities and blockchain: from Próspera’s crypto-friendly charter city governance, to experiments with blockchain land records in Honduras, to the ambitious vision of El Salvador’s Bitcoin City (Mason et al., 2021; Rejeb et al., 2022).

In analyzing potential benefits, we found theoretical support for the idea that blockchain can enhance transparency, efficiency, and participation in city governance. Smart contracts might enforce rules impartially, and local cryptocurrencies can enable fluid economic transactions without reliance on distant central authorities or unstable national currencies (Rejeb et al., 2022). However, our analysis also underscored significant limitations and risks. Empirical evidence of long-term success is still scant; many projects are either ongoing or in very early stages, so any claims of success remain tentative. Meanwhile, critical perspectives, such as Jutel’s (2021) study of Pacific island projects, caution that without mindful design, blockchain might reinforce existing power disparities under a veneer of decentralization. Ultimately, the successful integration of blockchain in private city models will require interdisciplinary collaboration and careful institutional design. Technical solutions must be paired with sound legal frameworks, and economic innovations must go hand in hand with protections for rights and inclusivity.

This conclusion reinforces that blockchain is an enabler, not a guarantor, of better governance. The experiences of the projects reviewed suggest that blockchain can augment private city models by streamlining processes and introducing new economic tools, but it cannot substitute for good governance principles. Issues like accountability, equity, and community trust still need traditional attention—clear rules, oversight, and inclusion—whether or not a blockchain is involved. Going forward, pilot programs should be rigorously evaluated by independent researchers, and comparative studies should be conducted between blockchain-enhanced governance models and traditional ones on metrics like economic growth, social welfare, citizen participation, and sustainability. Such research will help determine which aspects of blockchain integration are genuinely beneficial and which are superficial or even detrimental.

However, this exploratory review has several limitations that should guide interpretation of its findings. First, the empirical base remains thin due to the nascent stage of most blockchain-enabled private city projects. Long-term outcomes, quantitative performance metrics, and systematic comparisons are not yet available for most cases examined. Second, the rapidly evolving nature of both blockchain technology and private city experiments means that some observations may quickly become outdated. Third, our analysis relies primarily on publicly available information, which may not capture proprietary developments or failed initiatives that could provide valuable lessons. Future research should address these limitations through longitudinal studies, systematic data collection, and comparative analyses as these projects mature and generate measurable outcomes.

In conclusion, blockchain technology holds promise as part of the toolbox for building the next generation of cities, especially those experimenting outside the usual bounds of government. It offers a new way to embed transparency, automate agreements, and connect communities financially on a global scale. The private city experiments of today are valuable learning grounds for this frontier. By studying them, we can glean insights into how decentralized technologies might reform or complement urban governance more broadly. The coming decade will likely see more convergence between these experimental models and mainstream practice, as traditional cities adopt successful innovations and private initiatives learn to incorporate the safeguards and legitimacy features of public governance. The overarching lesson is that technology and governance co-evolve: blockchain can reshape how we administer cities, but its ultimate impact will depend on human institutions, leadership, and community values that guide its use.

Author contributions

ND: Data curation, Funding acquisition, Validation, Project administration, Writing – original draft, Conceptualization, Formal analysis, Supervision, Writing – review & editing, Software, Investigation, Methodology, Resources, Visualization.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author declares that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Alketbi, S. A., Mahmuddin, M., and Ahmad, M. B. (2025). Blockchain technology and smart cities: a technological framework for innovation and sustainability in the UAE and beyond. Data Metadata 4:697. doi: 10.56294/dm2025697

Atzori, M. (2015). Blockchain technology and decentralized governance: is the state still necessary? J. Gov. Regul. 6, 45–62. doi: 10.2139/ssrn.2709713

Bell, T. W. (2018). Your next government? From the nation state to stateless nations. Cambridge, UK: Cambridge University Press.

Biasin, M., and Delle Foglie, A. (2024). Blockchain and smart cities for inclusive and sustainable communities: a bibliometric and systematic literature review. Sustain. For. 16:6669. doi: 10.3390/su16156669

Cengiz, F. (2023). Blockchain governance and governance via blockchain: decentralized utopia or centralized dystopia? Policy Des. Pract. 6, 446–464. doi: 10.1080/25741292.2023.2247203

Clifton, J., Fernández-Gutiérrez, M., and Cagigas, D. (2023). Beyond the hype — the actual use of blockchain in government. Policy Des. Pract. 6, 389–396. doi: 10.1080/25741292.2023.2272377

Fortes, P. R. B. (2020). Imagining bossa nova: possibilities and limits of charter cities. Rev. Estud. Inst. 6, 769–779.

Gebel, T. (2018). Free private cities: Making governments compete for you. Germany: Friedrich Naumann Stiftung (FNSt)/Wemding Thinka Verlag.

Jutel, O. (2021). Blockchain imperialism in the Pacific. Big Data Soc. 8, 1–13. doi: 10.1177/2053951720985249

Mason, J., Peterson, C., and Cano, D. I. (2021). The Honduran ZEDE law, from ideation to action. J. Spec. Jurisdictions 1, 107–150.

Quirk, J., and Friedman, P. (2017). Seasteading: How floating nations will restore the environment, enrich the poor, cure the sick, and liberate humanity from politicians. New York: Simon and Schuster.

Rejeb, A., Rejeb, K., and Zailani, S. (2022). Blockchain technology in the smart city: a bibliometric review. Qual. Quant. 56, 2875–2906. doi: 10.1007/s11135-021-01251-2

Romer, P. M. (2010). Technologies, rules, and progress: the case for charter cities. Center for Global Development, Working Paper No. 218.

Rong, H. (2023). Deep-dive into CityDAO: an experiment in collective land ownership and decentralized governance. Harvard Kennedy School Belfer Center for Science and International Affairs.

Shang, Q., and Price, A. (2019). A Blockchain-Based Land Titling Project in the Republic of Georgia: Rebuilding Public Trust and Lessons for Future Pilot Projects. Innovations: Technology, Governance, Globalization 12, 72–78. doi: 10.1162/inov_a_00276

Shen, C., and Pena-Mora, F. (2018). Blockchain for cities — a systematic literature review. IEEE Access 6, 76787–76819. doi: 10.1109/ACCESS.2018.2880744

Vos, J.. (2015) Blockchain-based Land Registry: Panacea, Illusion or Something in Between?. 7th ELRA Annual Publication. [online] Available from: https://www.elra.eu/wp-content/uploads/2017/02/10.-Jacques-Vos-Blockchain-based-Land-Registry.pdf

Yin, R. K. (2014). Case study research: Design and methods. 5th Edn. Thousand Oaks, CA: Sage Publications.

Keywords: blockchain technology, decentralization, transparency, urban governance, private cities

Citation: Dehouche N (2025) Blockchain as urban governance infrastructure in private cities: an exploratory review. Front. Sustain. Cities. 7:1594711. doi: 10.3389/frsc.2025.1594711

Edited by:

Claudio Schifanella, University of Turin, ItalyReviewed by:

Sowelu Avanzo, University of Turin, ItalyGábor Mélypataki, University of Miskolc, Hungary

Aurora Ascatigno, University of Studies G. d’Annunzio Chieti and Pescara, Italy

Copyright © 2025 Dehouche. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Nassim Dehouche, bmFzc2ltLmRlaEBtYWhpZG9sLmFjLnRo

Nassim Dehouche

Nassim Dehouche