- International Business School, Shaanxi Normal University, Xi'an, China

This study investigates the impact of China’s green financial reform pilot zones on urban green development, with the aim of identifying whether financial instruments can effectively promote sustainable urbanization. Using panel data from 286 prefecture-level cities during 2010–2022, a multi-period Difference-in-Differences (DID) approach is applied, supplemented by dynamic effect analysis, robustness checks, and mediation testing. The findings show that green financial policies significantly enhance urban green development, with effects emerging after a time lag and accumulating steadily over the medium to long term. Mechanism analysis reveals that green technology innovation acts as a critical mediator, indicating that financial support for innovation facilitates environmental performance improvements. Moreover, heterogeneity tests suggest stronger policy effects in economically less-developed cities, reflecting higher marginal returns in regions with weaker green foundations. Overall, the study concludes that green finance serves as an effective institutional tool to correct market failures and accelerate sustainable urban transformation. The implications are twofold: policymakers should strengthen financial innovation and green technology support, and adopt region-specific strategies to maximize policy effectiveness while enhancing the quality of urban green development.

Introduction

With the advent of the “Paris Agreement 2.0” era, urbanization has emerged as a decisive arena for achieving global sustainability goals. According to the United Nations World Urbanization Prospects (UN-HABITAT, 2022), 56% of the world’s population now resides in cities, which are responsible for 78% of final energy consumption and nearly 70% of global carbon emissions. In response, developed economies have increasingly integrated financial instruments with urban climate strategies. For instance, the European Union has linked green bonds with urban renewal projects through its Sustainable Finance Action Plan, while global metropolises such as New York and Tokyo have leveraged carbon accounting systems to drive energy-efficiency transitions in the building sector. Together, these initiatives demonstrate a governance paradigm that combines “policy instruments + market incentives.”

Nevertheless, developing economies continue to face a widening “green gap.” Evidence shows that each 1% increase in the urbanization rate in developing countries generates 2.3 times more carbon emissions compared to developed countries (IPCC, 2022). China exemplifies this challenge. Its urbanization rate soared from less than 20% in 1980 to 65.2% in 2022, yet energy consumption per unit of urban area remains 1.8 times higher than in comparable EU cities (Mukim and Roberts, 2023). To reconcile the so-called “Stiglitz Dilemma”—the trade-off between economic growth and environmental quality—China launched the Green Finance Reform and Innovation Pilot Zones in 2017. This large-scale institutional experiment established a five-pillar framework encompassing green credit standards, environmental information disclosure, and financial product innovation. By 2022, the initiative had mobilized more than RMB 2.8 trillion in green credit, accounting for 52% of the country’s total green financing, making it the most extensive green finance pilot worldwide.

Theoretical and empirical studies have consistently underscored the positive role of green finance in advancing sustainable development. At the environmental level, green finance policies have been shown to constrain emissions from heavily polluting enterprises (Zhang and Lu, 2022; Huiyu et al., 2023) and, more broadly, to reduce energy intensity and pollutant emissions at the macro level (Huang and Zhang, 2021). At the industrial level, green finance facilitates structural upgrading, enhances green technology efficiency, and promotes industrial eco-efficiency, thereby fostering the green economy (Gu et al., 2021; Gao et al., 2022; Li and Gan, 2020; Soundarrajan and Vivek, 2016). Despite these insights, systematic empirical evidence on the direct effects of green finance policies on green urbanization remains scarce. Only a limited number of studies have begun to highlight the mutually reinforcing relationship between green finance and green urbanization (Dong et al., 2021; Liu et al., 2023). This knowledge gap leaves important questions unanswered regarding the causal impacts and underlying mechanisms of green finance in shaping urban sustainability.

This paper aims to contribute to the literature in three ways. First, it expands the analytical lens of green finance by explicitly linking financial policy instruments to the quality of green urbanization, providing a systematic assessment of their comprehensive impacts at the city level. Second, it investigates the mediating role of green technological innovation, clarifying how financial resources are transformed into urban sustainability outcomes through technological progress. Third, it explores the heterogeneous effects of policy implementation across regions with different levels of economic development, thereby enriching our understanding of regional green transitions and offering policy insights for emerging economies.

The remainder of the paper is organized as follows: Section 2 develops the theoretical framework and hypotheses; Section 3 introduces the data and methodology; Section 4 presents the empirical results; Section 5 discusses key findings and policy implications; Section 6 concludes; and Section 7 outlines limitations and directions for future research.

Theoretical analysis and hypotheses

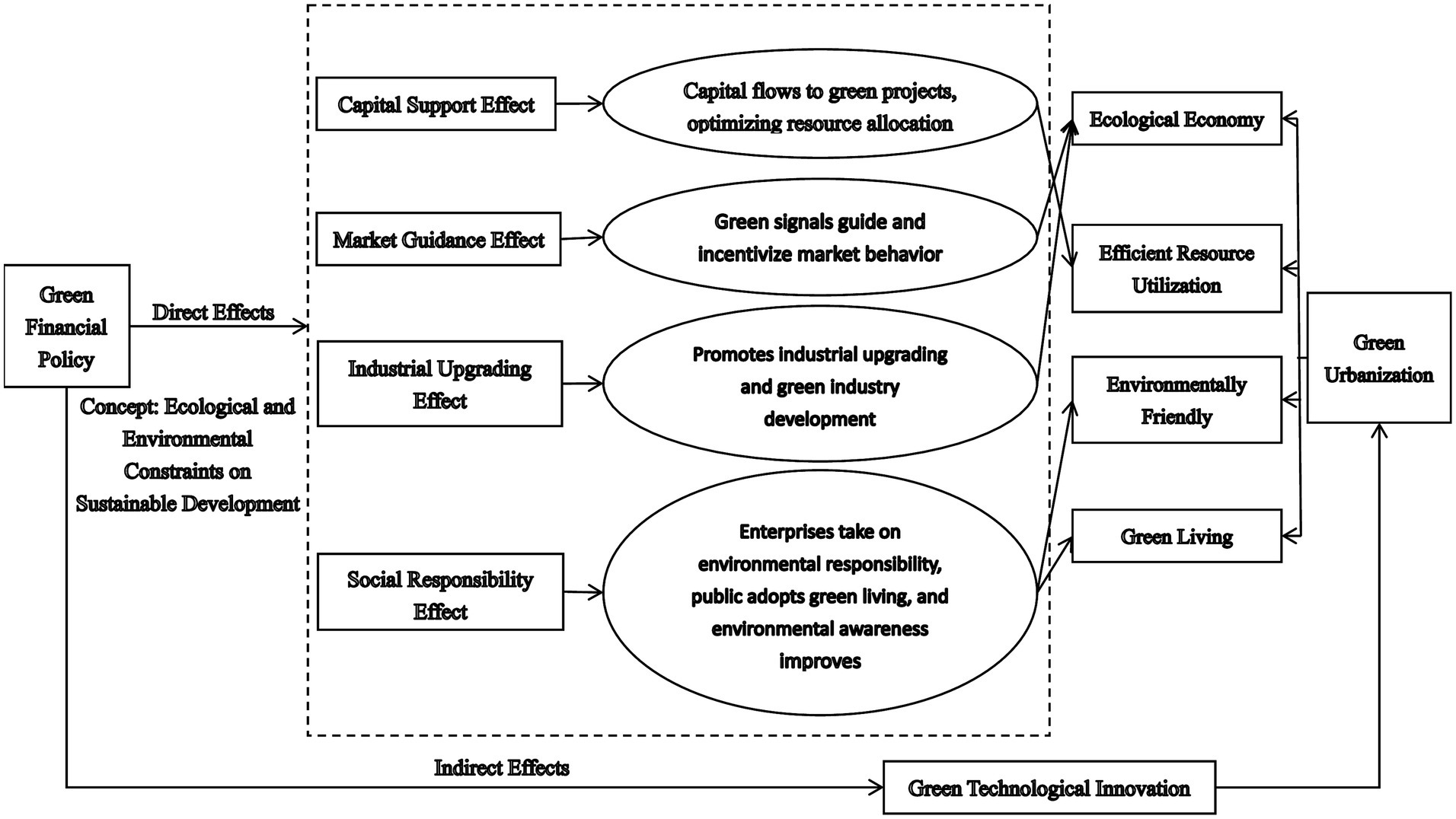

This study seeks to disentangle the mechanisms through which green finance policies influence the development of green urbanization. In recent years, China has increasingly emphasized the use of market-based environmental policy instruments such as green finance. By transmitting governmental guidance and green signals, green finance policies catalyze and support the green finance market. Through a comprehensive application of multiple green financial instruments, these policies promote green urbanization both directly and indirectly. The conceptual framework is illustrated in Figure 1.

The direct impact of green finance policies on green urbanization

Green finance policies are considered to directly affect green urbanization through four channels: financial support, market guidance, industrial upgrading, and social responsibility. Drawing upon the Porter Hypothesis (Porter and van der Linde, 1995) and the theory of green growth (OECD, 2011), green finance not only addresses environmental externalities but also stimulates innovation, efficiency gains, and social transformation, thereby providing institutional support for sustainable urban development.

Financial support effect

According to sustainable finance theory, green financial instruments can ease the financing constraints of long-term, high-risk green projects, reduce capital costs, and correct underinvestment driven by externalities (Weber, 2017). Consistent with the Porter Hypothesis, such financial support improves ecological performance while also enhancing economic returns. In practice, pilot zones of green finance have provided funding for environmental infrastructure, green buildings, and renewable energy projects through green loans, green bonds, and green funds. These financial injections reduce start-up costs, improve project feasibility, and, through the leverage effect of green bonds, attract private capital, thereby accelerating the green transition of urbanization. Meanwhile, innovations in financial products, such as the development of the green bond market, continue to evolve in response to technological progress and policy changes, creating a virtuous cycle between capital and green projects.

Market guidance effect

From the perspective of environmental economics, markets often fail to adequately address environmental externalities, necessitating policy intervention (Bovenberg and de Mooij, 1997). Green finance policies provide such institutional arrangements, guiding financial resources toward sustainable projects in line with the green growth paradigm (OECD, 2011). In practice, instruments such as green credit guidelines, green bond standards, and tax incentives shape market expectations and reduce transaction costs for green projects (Wang and Zhi, 2016). For instance, green credit promotes corporate transformation through incentive and penalty mechanisms; green bond standards ensure that funds are allocated to environmentally friendly projects; and tax incentives lower the cost of green investment. Over time, financial markets, driven by these policies, increasingly internalize environmental factors into decision-making, achieving a “win–win” outcome of environmental protection and economic growth.

Industrial upgrading effect

Green growth theory emphasizes that environmental regulation and green finance can facilitate industrial restructuring and technological progress, thereby promoting sustainable urbanization (OECD, 2011; Acemoglu et al., 2012). Empirical evidence shows that financing constraints often hinder green innovation, whereas preferential green credit alleviates firms’ funding bottlenecks and promotes industrial upgrading (Ling et al., 2020; Altenburg and Rodrik, 2017). In practice, under the dual pressures of green-oriented regulation and commercial incentives, financial institutions restrict financing to highly polluting industries, accelerating the exit of outdated capacity, while simultaneously extending preferential credit to firms and projects that meet green standards. This “suppress the backward + support the advanced” dual mechanism pushes the industrial structure of cities toward greening and upgrading, thereby accelerating the process of green urbanization.

Social responsibility effect

From the perspective of socioeconomics, green finance is not only a mechanism for capital allocation but also a key driver in internalizing social responsibility and environmental values. Theories of corporate social responsibility and sustainable development suggest that the financial sector can promote environmental accountability through risk internalization and normative transmission (Carroll, 1999; Scholtens, 2006). Specifically, green finance policies require financial institutions and enterprises to conduct rigorous environmental risk assessments prior to investment, ensuring that projects generate ecological benefits alongside economic returns. Moreover, green finance supports community environmental projects and the improvement of public services, enhancing residents’ quality of life and environmental awareness. By fostering green consumption and sustainable lifestyles, green finance promotes a shift in social values, further accelerating the process of green urbanization.

Hypothesis 1: Green finance policies positively enhance green urbanization.

The mediating role of green technological innovation

According to Mueser’s theory of technological innovation (Mueser, 1985), innovation is a dynamic process whereby new ideas and discontinuous technological activities gradually evolve into practical applications and successful transformation over time. In the relationship between green finance and green urbanization, this study posits that green technological innovation plays a key mediating role. Green finance not only provides financial support but also creates favorable conditions for green technological innovation through risk-sharing mechanisms and market incentives (Hall and Lerner, 2010; Aghion et al., 2016). In turn, green technological innovation serves as a critical driver of urban green transformation (Porter and van der Linde, 1995; Costantini and Mazzanti, 2012).

First, green finance effectively alleviates financing constraints on green technological innovation. Given the high risk, uncertainty, and strong positive externalities of green innovation, such projects often face “difficult and costly financing.” Green finance provides long-term, stable funding through instruments such as green credit, green bonds, and green funds, while risk-sharing mechanisms reduce the uncertainty costs borne by firms (Eyraud et al., 2013; Campiglio, 2016). At the same time, green finance sends clear market signals, directing capital flows toward low-carbon and sustainable sectors, and incentivizing firms to increase their R&D investment in green technologies (Falcone and Sica, 2019).

Second, green technological innovation enhances green urbanization through multiple pathways. On the one hand, in terms of energy utilization and resource efficiency, it drives the upgrading of production processes and equipment, thereby promoting energy conservation, emission reduction, and efficiency gains (Horbach et al., 2012). On the other hand, in terms of environmental governance, it reduces pollutant generation through “source control” and improves waste management through “end-of-pipe treatment,” thereby enhancing ecological quality and residents’ living standards (Rennings, 2000; De Marchi, 2012). These effects jointly advance the ecological, economic, and social dimensions of green urbanization.

Finally, from the perspective of innovation economics, there exists an “induced effect” between green finance and green technological innovation. Induced innovation theory posits that policy intervention, by providing market incentives and reducing risks, steers firms toward innovation investment (Acemoglu et al., 2012). Within the institutional framework of green finance (e.g., environmental regulation, green certification systems), green innovation not only secures funding support but also mitigates potential losses associated with innovation failure. This dual incentive of policy and market ensures that green technological innovation more effectively contributes to the process of green urbanization.

Hypothesis 2: Green finance policies indirectly enhance green urbanization by promoting green technological innovation.

Data and methodology

Data sources and variable selection

We collect data on “green finance policies” and green urbanization for 286 Chinese cities from 2010 to 2022. The starting year of 2010 is chosen for two main reasons: (1) China’s pilot policy on green finance was launched in 2017; to allow for valid estimation, pre-policy samples must be retained; and (2) The sampling interval should not be excessively long; otherwise, other concurrent policies may confound the estimation results.

Dependent variable

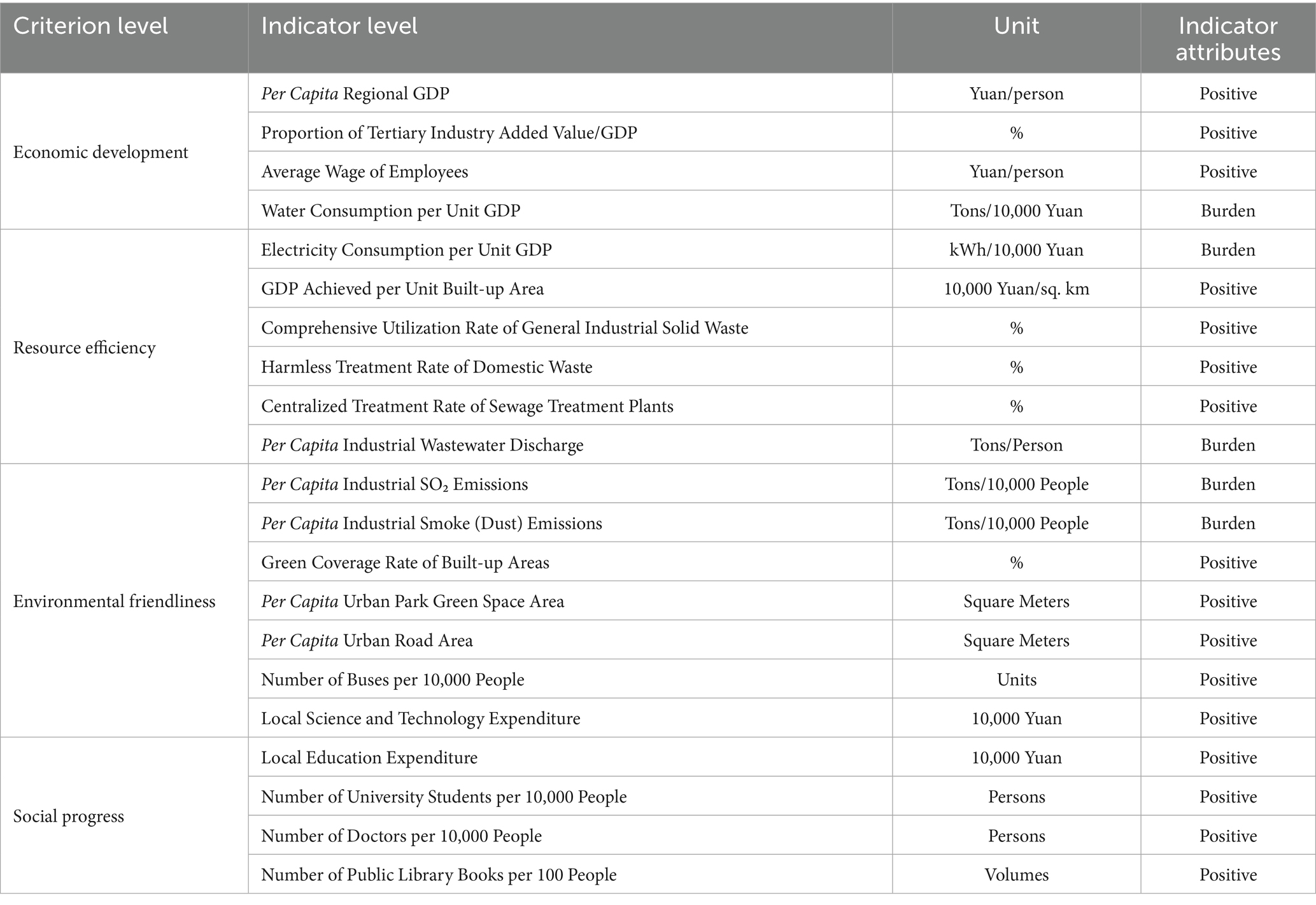

Drawing on the work of Dong et al. (2021), and incorporating insights from environmental economics (Acemoglu et al., 2012), sustainable finance theory (Carroll, 1999), the Porter Hypothesis (Porter and van der Linde, 1995), and green growth theory (OECD, 2011), this study constructs a comprehensive evaluation index system of green urbanization from four dimensions: economic development, resource efficiency, environmental friendliness, and social progress (see Table 1). The index system follows the principles of systematicity, operability, comprehensiveness, and sustainability, aiming to measure the level of green urbanization in 286 prefecture-level cities in China during 2010–2022.

To ensure comparability and reproducibility, all indicators are first standardized using the following mean-standardization method (Equation 1):

where is the original value of indicator in city at time , and and are the mean and standard deviation across all sample years, respectively. Extreme values are winsorized at the top and bottom 1%, while missing values are interpolated using the mean of adjacent years, so as to minimize potential bias in index computation.

After normalization, the entropy method is applied to objectively determine the weight of each indicator. The steps are as follows:

Calculate the proportion of each indicator in Equation 2:

Calculate the entropy value of each indicator in Equation 3:

where .

Calculate the weight of each indicator in Equation 4:

where .

Finally, the green urbanization index is obtained through weighted summation in Equation 5:

To verify the robustness of the index, we also compute the green urbanization level for the same period using min–max normalization and principal component analysis (PCA). The results are consistent with those of the entropy method, suggesting that the constructed index is highly reliable and replicable.

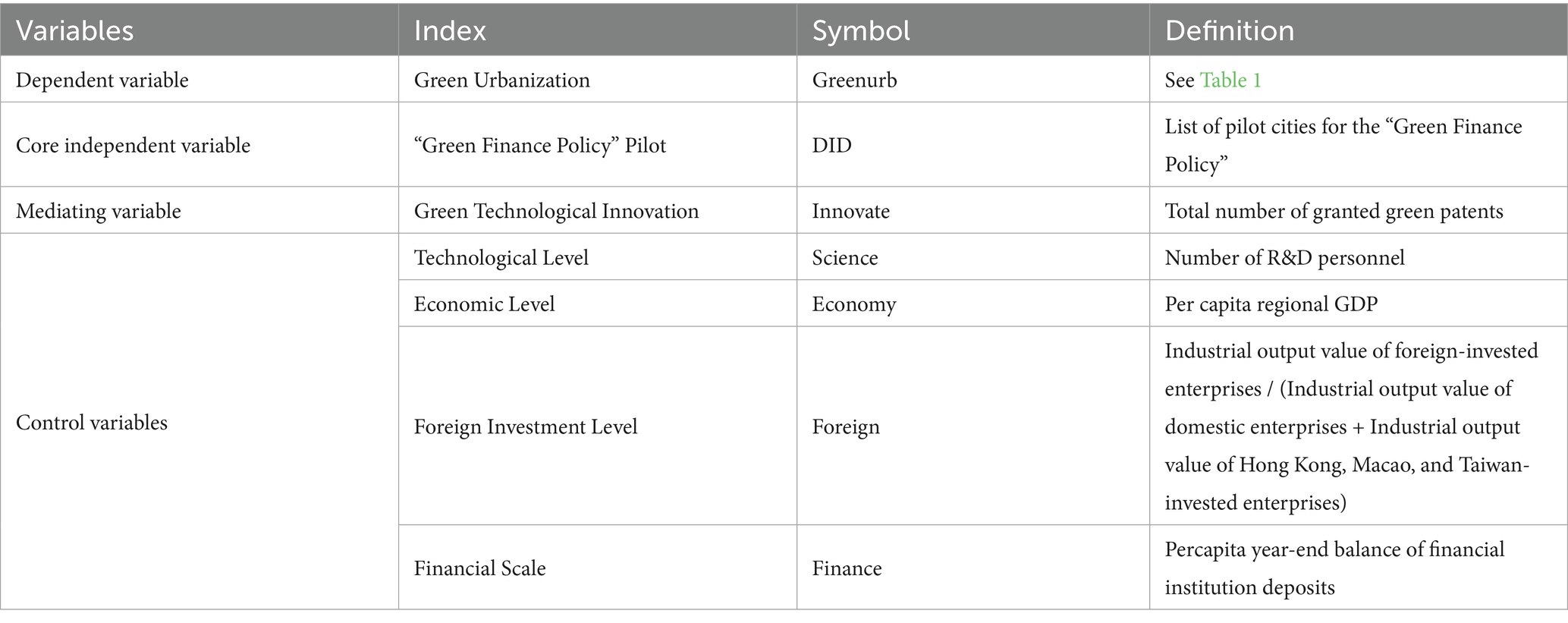

Core explanatory variable

The core explanatory variable in this study is the DID term, constructed as the interaction between the policy treatment dummy variable (treat) and the policy implementation time dummy variable (time). It captures the policy effect of the green finance pilot policy on green urbanization, representing the difference-in-differences estimator. Specifically, treat indicates whether a city belongs to a green finance pilot province. Cities in pilot provinces (Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang Uygur Autonomous Region) are assigned a value of 1, while those in non-pilot provinces are assigned 0. The variable time reflects the policy implementation period: years from 2017 onward (including 2017) are coded as 1, while years prior to 2017 are coded as 0.

Mechanism variable

Following previous studies (Yang et al., 2023), we select green technological innovation as the mechanism variable. Data on green technological innovation are obtained from the China National Intellectual Property Administration (CNIPA). Using the World Intellectual Property Organization (WIPO) green patent list as a reference, we filter patent classification codes to identify and compile the total number of authorized green patents.

Control variables

Based on prior literature, we include the following control variables: technological level, economic development level, foreign direct investment (FDI) level, and financial scale. Data for the control variables are drawn from the China City Statistical Yearbook (2010–2021) and the WIND database. See Table 2 for detailed definitions and descriptions.

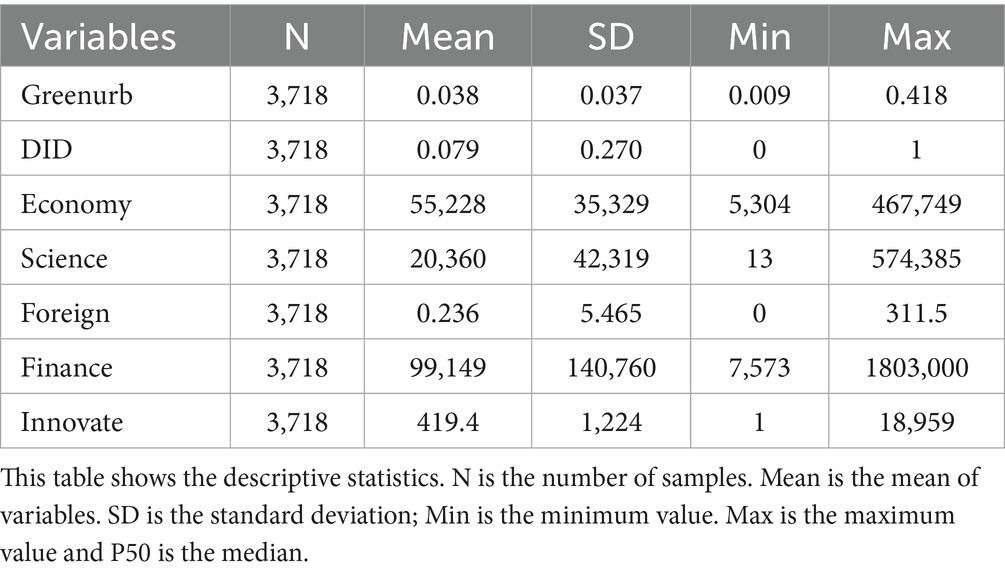

Descriptive statistics

Table 3 reports the descriptive statistics of the variables. The mean value of Greenurb is 0.038, indicating that the average level of green urbanization in the sample cities during 2010–2022 is 0.038. The minimum and maximum values of Greenurb are 0.009 and 0.418, respectively. The maximum is approximately 11 times the mean and 46 times the minimum, suggesting that most cities still have considerable room for improvement in green urbanization.

In the subsequent econometric analysis, all raw data in the table are normalized. The normalization formula for positive indicators is given in Equation 6:

The normalization formula for negative indicators is given in Equation 7:

where and represent the normalized values of positive and negative indicators, respectively, and and denote the minimum and maximum values of indicator .

Regression model

Since there are two rounds of green finance policy pilots implemented at different points in time, we adopt a multi-period DID model. The baseline regression model is specified as follows (Equation 8):

where denote city and year, respectively; represents the level of green urbanization; is the core explanatory variable, which equals 1 if city in year falls under the green finance policy pilot, and 0 otherwise. The coefficient measures the marginal contribution of the green finance pilot to green urbanization. A positive coefficient indicates that the pilot policy exerts a positive effect on green urbanization. is a set of control variables, and represent city fixed effects and year fixed effects, respectively, and is the random error term.

Findings

Stylized facts

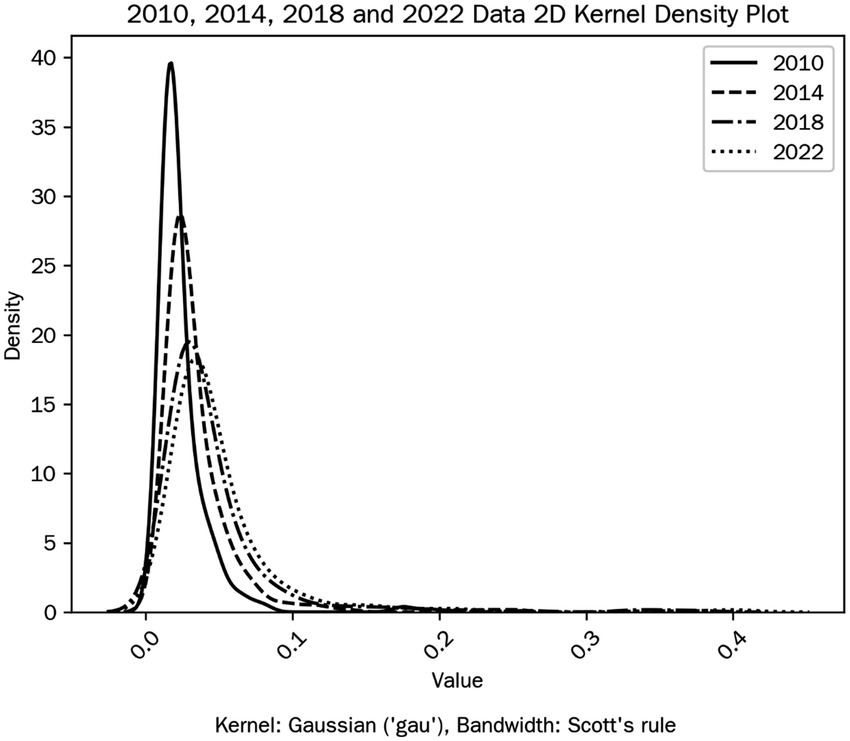

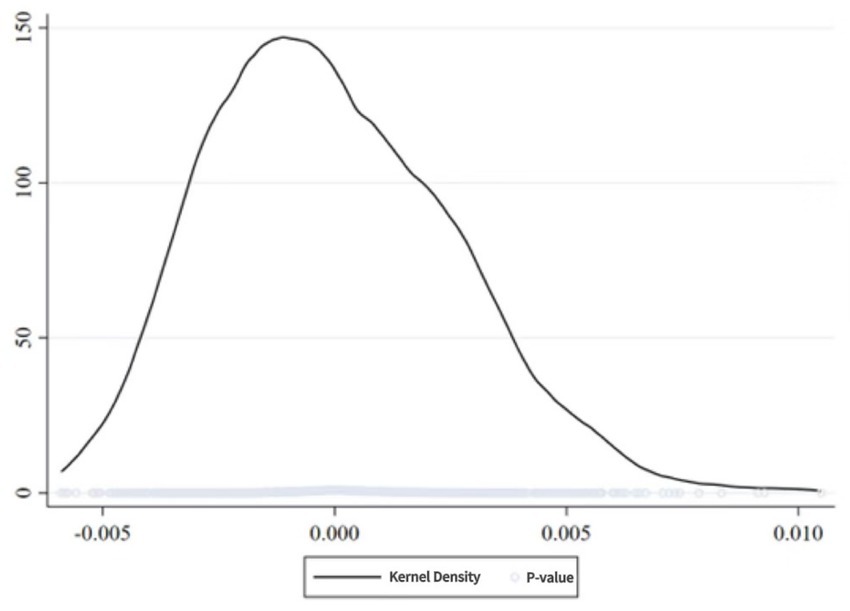

As shown in Figure 2, the green urbanization of 286 Chinese cities from 2010 to 2022 exhibits the following dynamic evolutionary characteristics:

(1) Overall improvement. The center of the kernel density estimation curve gradually shifts to the right, indicating that cities have continuously increased investment in ecological protection, resource utilization, and infrastructure. This has facilitated industrial transformation and significantly enhanced the level of green urbanization from low to high.

(2) Expanding regional disparities. The peak of the kernel density curve changes from sharp in 2010 to relatively flat in subsequent years, with the peak value declining. This reflects differences in resources, economic development, and policy implementation across regions, leading to divergent growth rates and thus widening spatial disparities in green urbanization among cities.

(3) No polarization. During the sample period, the number of peaks in the kernel density curves remains stable, maintaining a unimodal distribution. This suggests that under the guidance of national policies and regional coordination strategies, no significant polarization into two extreme groups of high and low green urbanization has occurred, and overall development remains relatively balanced.

Parallel trend test

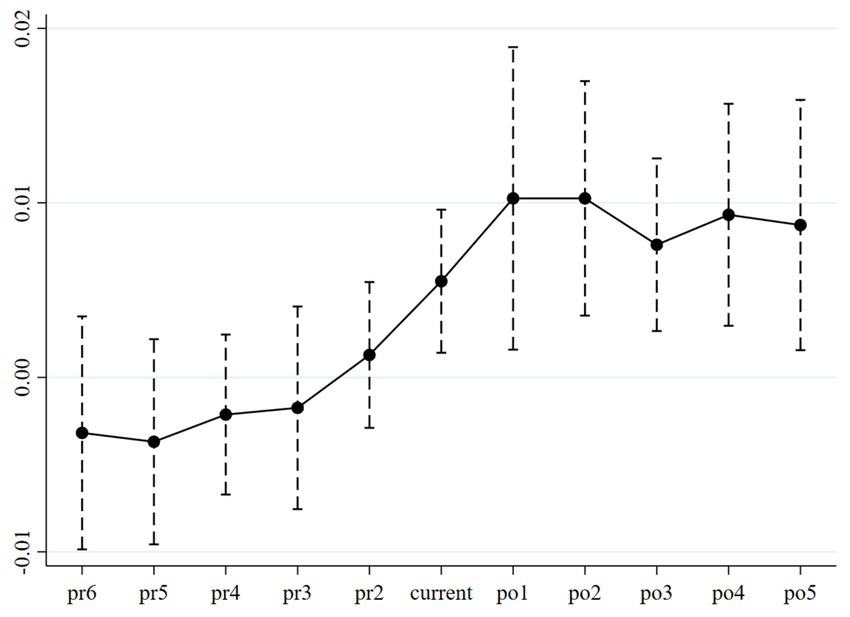

We apply an event study approach to test the parallel trend assumption, thereby ensuring the validity of DID identification. Following the method of Jacobson (1993), we construct the following econometric model (Equation 9):

where is the dummy variable for the green finance policy pilot. For the parallel trend test, we select a time window covering 6 years before and 5 years after policy implementation. The coefficients capture the difference in green urbanization between the treatment and control groups before and after the pilot policy.

Figure 3 reports the estimated coefficients with 95% confidence intervals. The results show that prior to the implementation of the policy, the estimated coefficients fluctuate around zero, indicating no significant difference in green urbanization between the treatment and control groups. This satisfies the parallel trend assumption, i.e., in the absence of policy intervention, the green urbanization trends of the two groups would have been similar. After policy implementation, although some fluctuations exist, the estimated coefficients remain consistently at relatively higher levels, suggesting that the positive effect of the green finance policy on green urbanization persists for a period of time.

In sum, the parallel trend test is passed, supporting the validity of the research design. The findings confirm that the green finance policy exerts a significant positive impact on green urbanization both during the year of implementation and in subsequent years, thereby facilitating the process of green urbanization.

Regression results and analysis

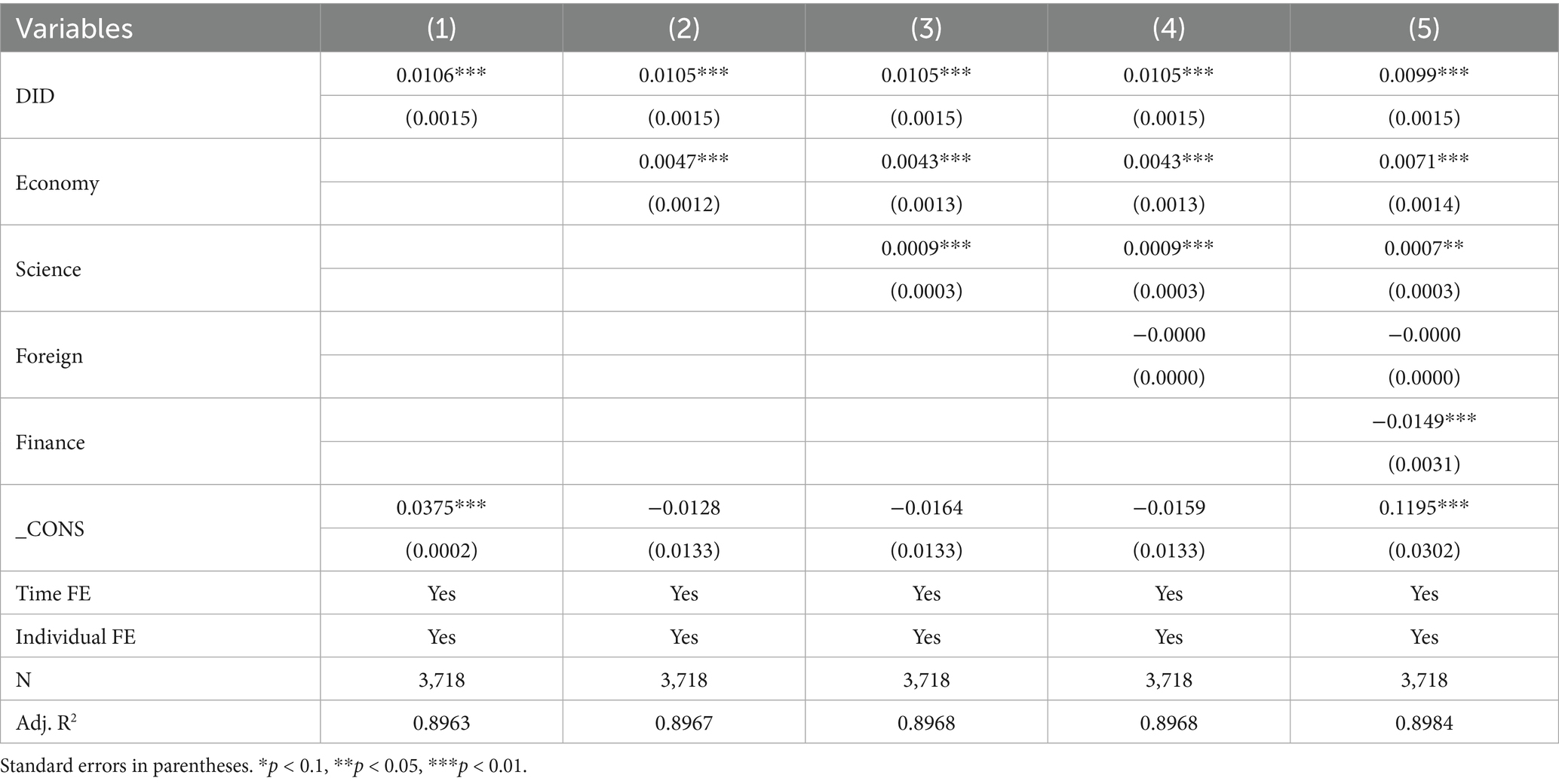

Baseline regression results

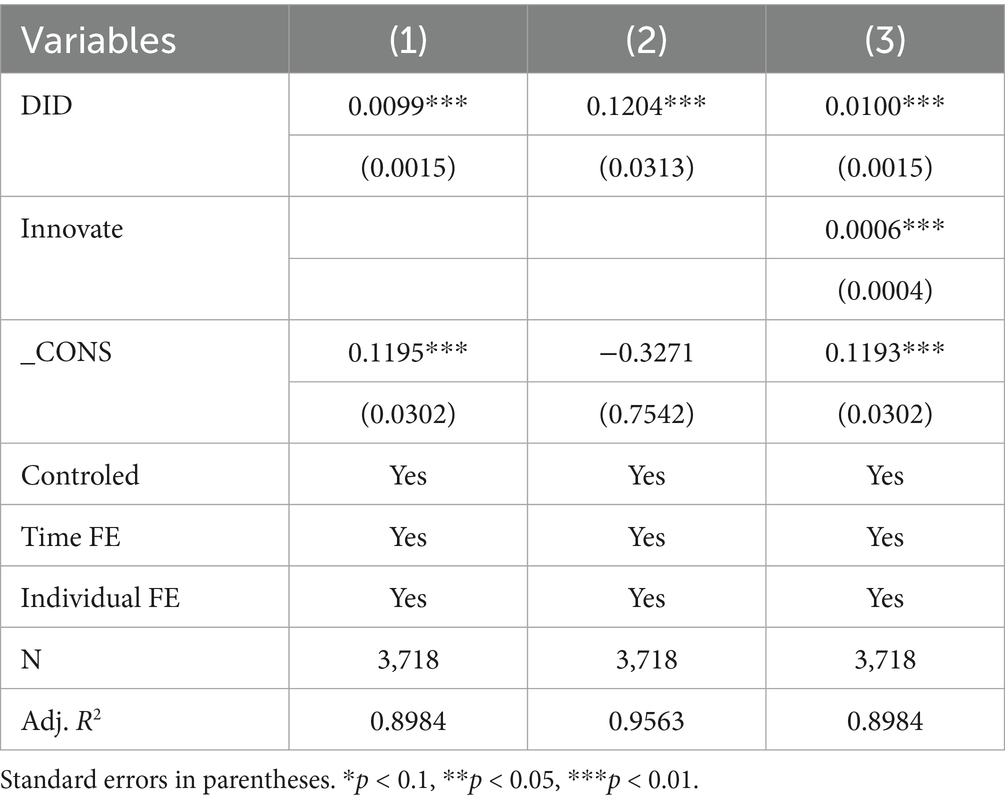

Table 4 reports the baseline regression results of the green finance policy pilots on green urbanization. Model (1) uses the DID policy variable as the sole explanatory variable without controlling for time and individual fixed effects. Model (2) incorporates both time and individual fixed effects on the basis of Model (1), while Model (3) further adds control variables. The model fit improves slightly as more controls are included.

The results from Model (3) show that a 1% increase in the intensity of the green finance policy pilot leads to a 0.0099 percentage point increase in green urbanization. This finding indicates that the green finance policy pilots effectively promote the advancement of green urbanization, thereby confirming Hypothesis 1.

In addition, higher levels of technological development and economic development are found to significantly enhance green urbanization, whereas larger financial scale has a significant negative effect. The impact of foreign direct investment (FDI) on green urbanization is not statistically significant.

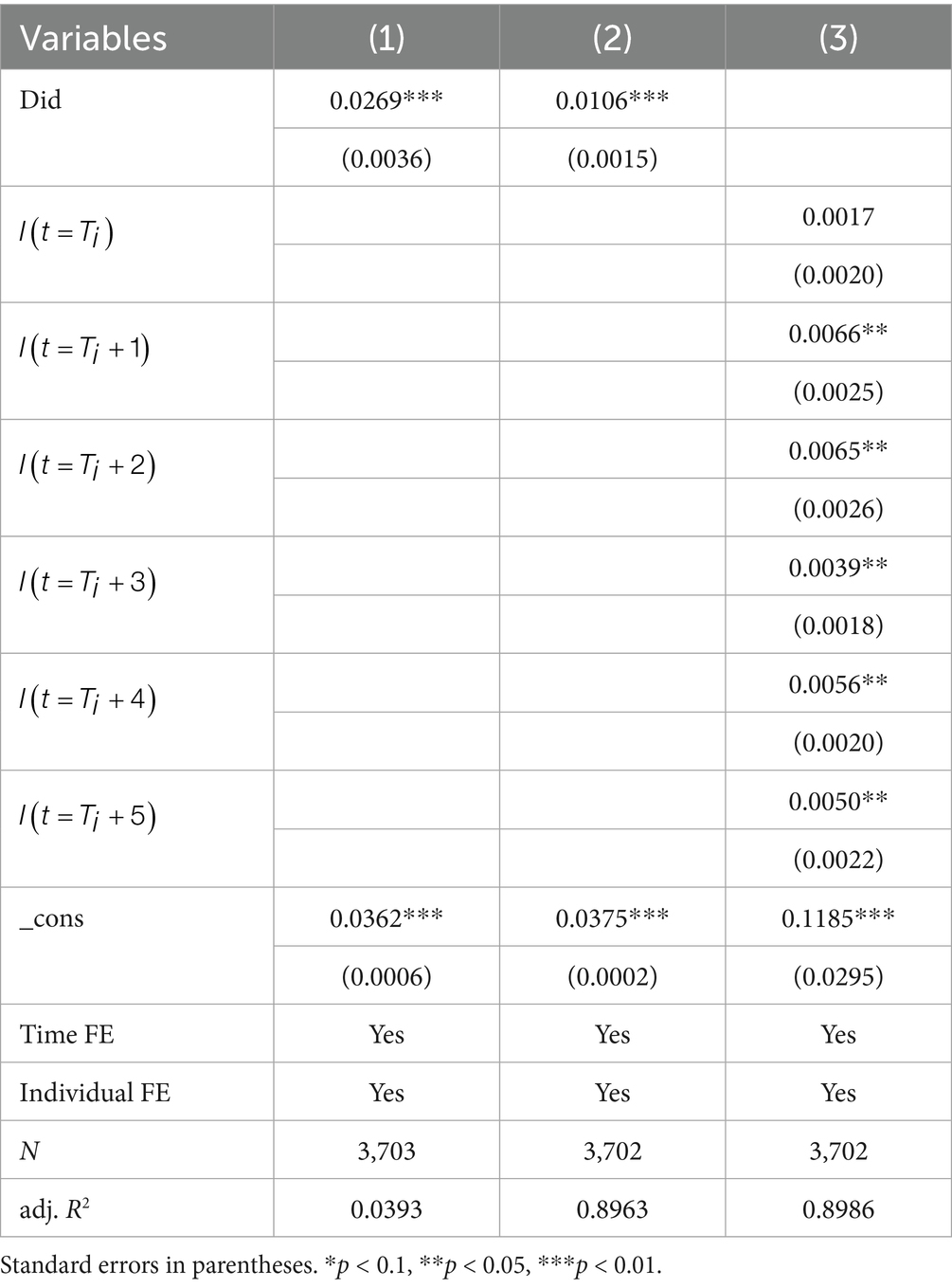

Dynamic policy effects

Equation (10) assumes that the policy effect of all pilot cities remains constant (δ) across years. However, this assumption lacks solid theoretical grounding and contradicts economic intuition. In practice, the promotion effect of a policy on green urbanization cannot materialize immediately upon implementation. Economic agents need time to become familiar with, understand, and adapt to the policy, which in turn affects their expectations and decision-making behaviors. This adjustment process usually results in heterogeneous policy effects over time. To capture such heterogeneity, the following model is employed:

In this specification, denotes the year when a city becomes a green finance reform and innovation pilot zone, while for non-pilot cities, = ∞. is an indicator function that equals 1 if the condition in parentheses holds, and 0 otherwise. Represents the maximum number of years during which the policy lasted for the earliest pilot cities in the sample. Unlike Equation (10), this model does not impose a constant policy effect. Instead, the effect evolves with the number of years since implementation: the effect in the year of implementation is , in the subsequent year is , and so forth. By observing ~ how the estimated values and their significance change over time, this framework enables identification of short-term, medium-term, and long-term policy effects.

Table 5 presents the estimation results of Equation (10), confirming the temporal heterogeneity of the policy effects of establishing green finance reform and innovation pilot zones on green urbanization. The regression results indicate that in the year of implementation and the following year, the coefficients are positive but statistically insignificant, suggesting that the policy effect had not yet fully emerged in the short term. Beginning in 2018, however, the policy effect turned significantly positive and persisted over the following years: green urbanization increased by approximately 0.66 and 0.65 percentage points in 2018 and 2019, respectively. The effect declined slightly to 0.39 percentage points in 2020 but rose again to 0.56 and 0.50 percentage points in 2021 and 2022.

Overall, the establishment of green finance reform and innovation pilot zones significantly promoted green urbanization, with the policy effects displaying a dynamic pattern of “delayed emergence and steady accumulation.” Compared with the baseline regression, the estimated effects and their statistical significance remain robust after controlling for other explanatory variables. This evidence suggests that green finance reform not only promotes green urbanization effectively in the medium and long term but also operates through mechanisms that are sustainable and structural.

Robustness tests

Placebo test

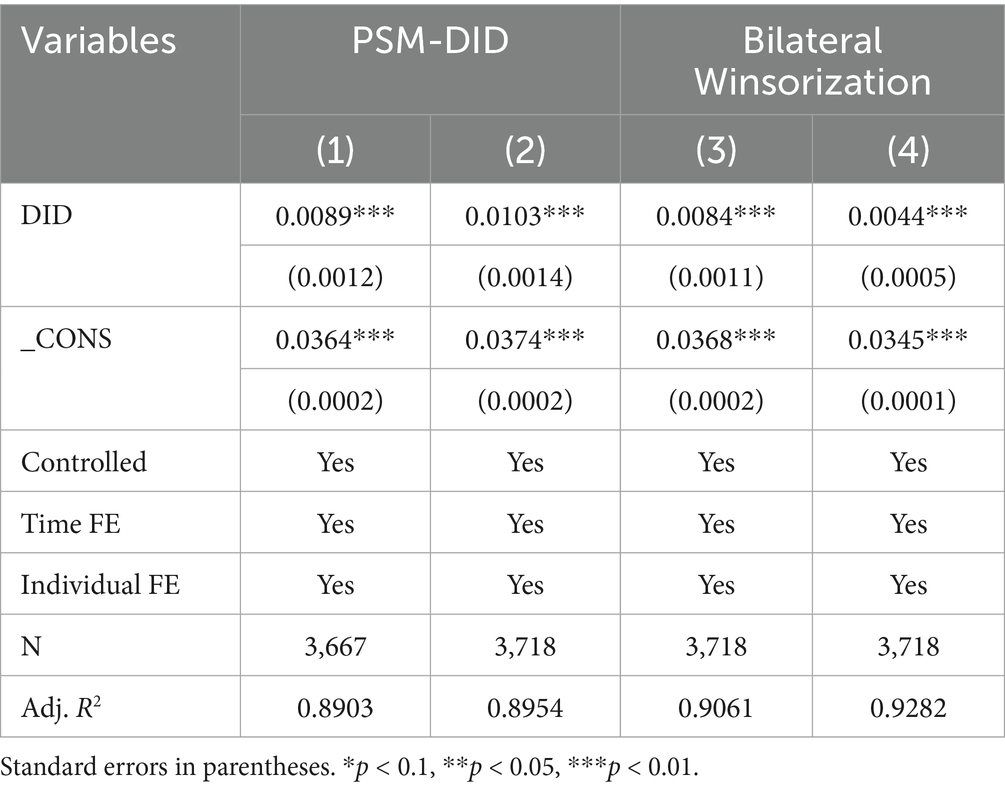

To rule out the possibility that unobservable omitted variables may bias the results, we conduct a placebo test using a bootstrap procedure. Specifically, we randomly assign the treatment group and repeat the random simulation 1,000 times.

As shown in Figure 4, the estimated coefficients from the 1,000 random simulations follow an approximately normal distribution, and most of them differ from the baseline regression estimates. Therefore, the randomly generated DID variable constructed through resampling has no significant impact on green urbanization, either statistically or economically. This confirms that the baseline regression results of this study are robust.

Alternative dependent variable

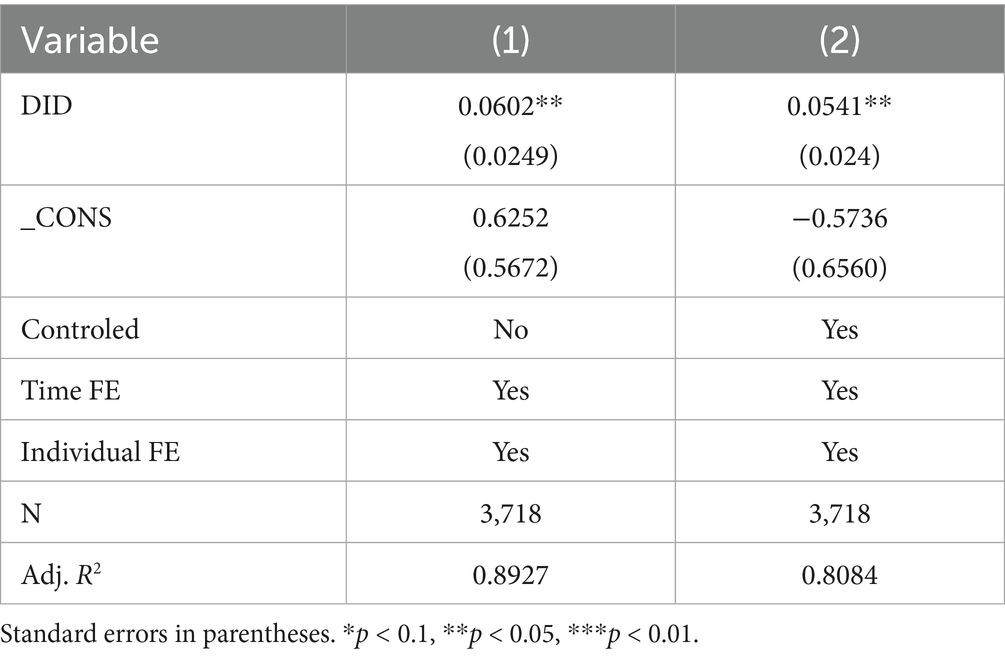

To further test the robustness of our findings, we recalculated the dependent variable using the principal component analysis (PCA) method and applied a 1% winsorization to mitigate the influence of extreme values. Table 6 reports the regression results of the green finance policy pilots on the newly constructed green urbanization index.

Model (1) includes the DID policy variable with time and individual fixed effects but does not include additional control variables. The results show that the green finance policy pilot has a significantly positive effect on green urbanization. Model (2) further incorporates control variables. Although the model fit slightly decreases after adding these controls, the estimated coefficient indicates that a 1% increase in the green finance policy pilot intensity raises green urbanization by 0.0541 percentage points. This result is consistent with the baseline regression, confirming the robustness of our baseline estimates.

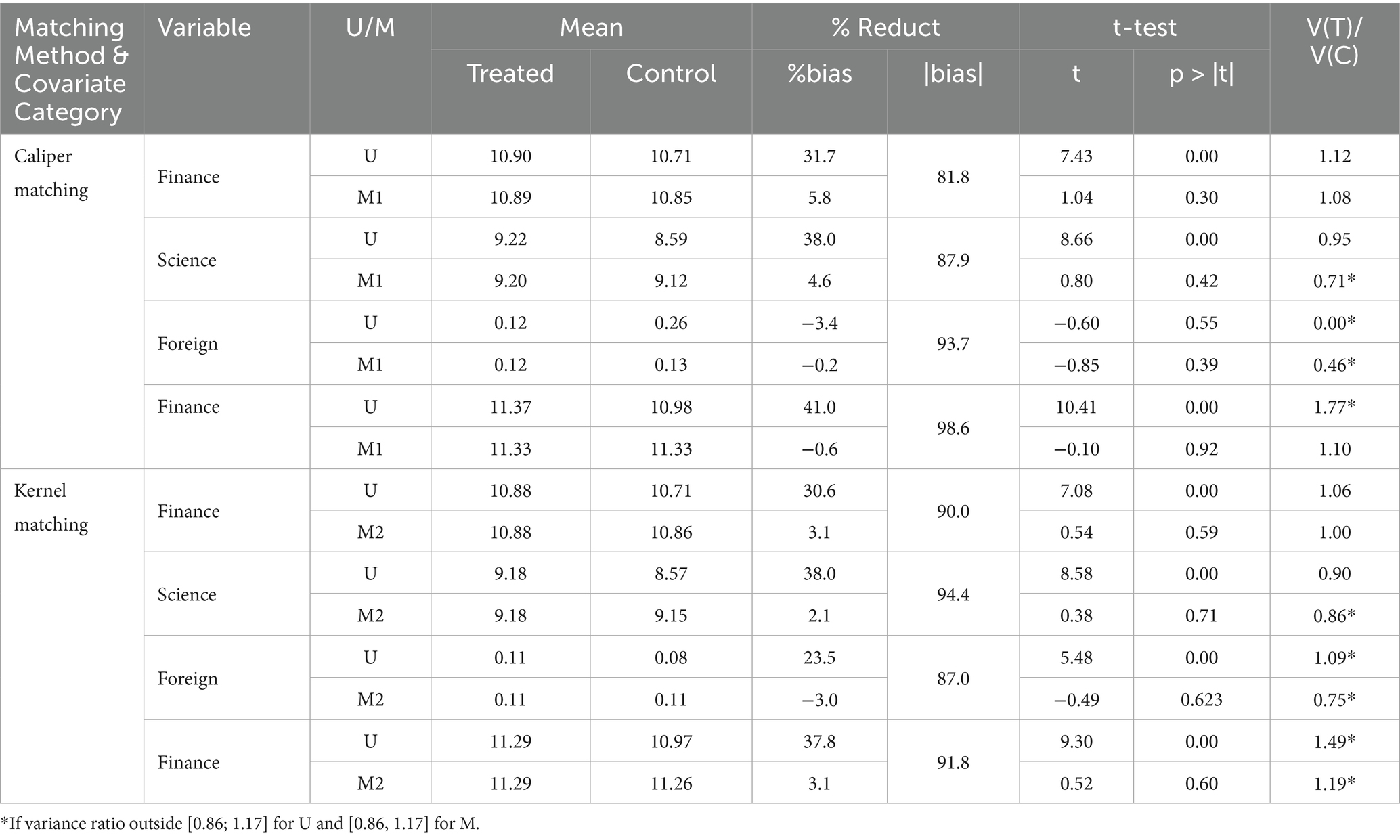

Propensity score matching-difference-in-differences test

Given the potential sample selection bias that may not be fully addressed by the DID method, we employ the propensity score matching (PSM) method to preprocess the sample, ensuring the validity and accuracy of the regression results. Before conducting the PSM-DID estimation, we first test the suitability of the PSM method, as shown in Table 7.

Table 7 indicates that M1 and M2 correspond to propensity score matching results obtained using caliper matching and kernel matching, respectively. Prior to matching, significant differences exist between the treatment and control groups across covariates. After matching, the T-values of these variables decrease substantially, and the standard deviations are reduced to varying degrees, indicating that PSM effectively balances the sample. Thus, the PSM-DID approach is appropriate for evaluating the effect of the green finance policy pilots on green urbanization.

Subsequently, we perform regression on the matched samples. Columns (1) and (2) in Table 7 report the results for caliper-matched and kernel-matched samples, respectively. In both cases, the DID coefficients remain significantly positive at the 1% level, consistent with the baseline regression results. This further confirms that the green finance policy pilots exert a positive and robust effect on green urbanization.

Two-sided winsorization

To examine whether outliers in the sample have a significant impact on the regression results, all continuous variables are subjected to two-sided winsorization at the 1 and 5% levels. The regression results are reported in columns (3) and (4) of Table 8. The estimated DID coefficients remain significantly positive at the 1% level, indicating that outliers have minimal influence on the results. These findings further confirm the robustness of the baseline regression.

Mechanism test

The analyses above indicate that the green finance policy pilots have a positive effect on green urbanization. We further investigate the specific mechanism through which this effect occurs. According to Hypothesis 2, green finance policies may enhance green urbanization via green technological innovation. To test this potential channel, we employ a mediating effect model.

The basic equations for the mediation test follow the framework proposed by Wen and Ye (2014), as detailed below:

Here, denotes the mediating variable, namely green technological innovation, , , represent random error terms. Equation 11 is used to estimate the total effect of the green finance policy pilots on green urbanization. Equation 12 estimates the effect of the green finance policy pilots on the mediating variable, i.e., green technological innovation. Equation 13 estimates the effect of the green finance policy pilots on green urbanization controlling for the mediating variable.

The regressions conducted in the above form yield the mediation test results presented in Table 8.

In Table 9, Models (2) and (3) present the results for the mediating variable, green technological innovation. Model (2) shows that the mechanism via green technological innovation is positive and significant, indicating that the green finance policy significantly enhances the level of green technological innovation. In Model (3), the coefficients of DID and Innovate remain significantly positive, suggesting that the green finance policy pilots can promote green urbanization through facilitating green technological innovation, thereby supporting Hypothesis 2.

Heterogeneity analysis

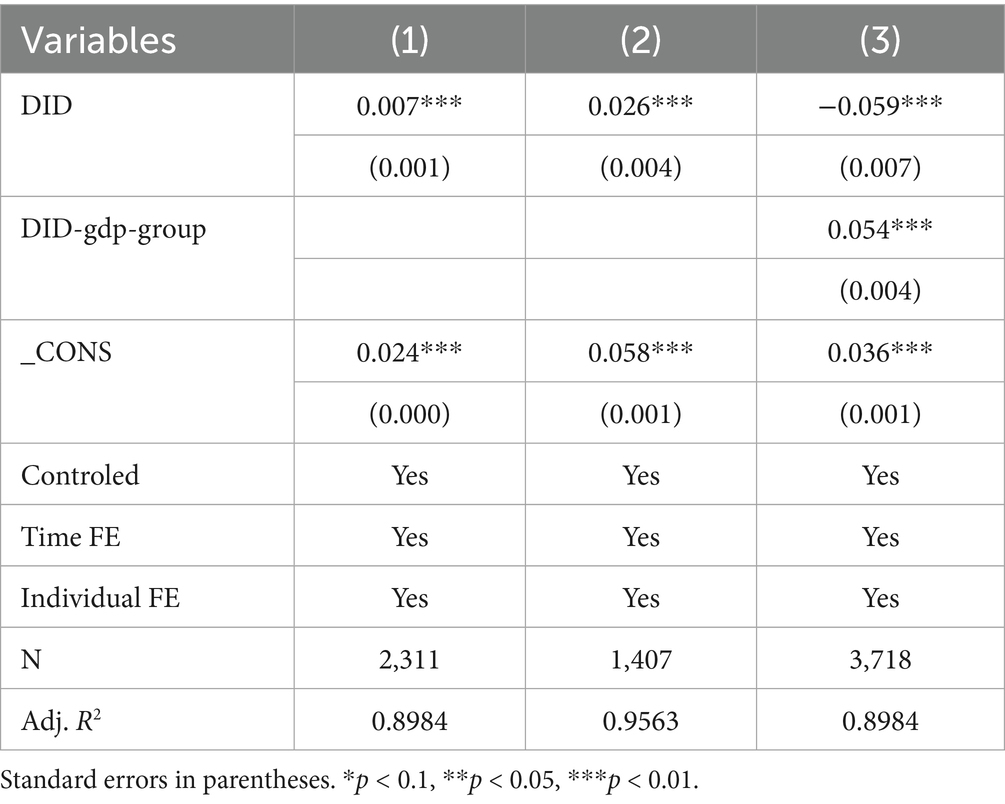

To examine whether the effect of green finance policy pilots on green urbanization varies with the economic level of cities, we divide the 286 cities into high-economic and low-economic groups based on the average per capita GDP from 2010 to 2022, yielding 2,311 and 1,407 observations, respectively. The regression results are reported in Columns (1)–(2) of Table 10.

It can be seen that the green finance policy pilots have a positive and significant effect on green urbanization in high-economic cities at the 1% significance level, with a regression coefficient of 0.007. In contrast, the effect in low-economic cities has a larger coefficient of 0.028, indicating that green finance policies have a more pronounced promoting effect in low-economic regions. This may be because low-economic regions generally have weaker green infrastructure and environmental technologies, so policy interventions generate higher marginal benefits. By comparison, high-economic regions already have relatively high levels of green urbanization, and the marginal effect of the policy is correspondingly smaller.

In Column (3), the interaction term between the green finance policy and the group variable has a coefficient of −0.059, suggesting that the promoting effect of green finance policies on green urbanization gradually diminishes as economic development increases. This result further supports the conclusion that policy effects are stronger in low-economic regions and also reveals a nonlinear relationship between economic development and policy effectiveness. High-economic regions may have relatively mature market mechanisms, limiting the scope for policy intervention, whereas low-economic regions rely more heavily on policy to drive green transformation.

These findings indicate that green finance policies exhibit significant heterogeneous effects in promoting green urbanization. Policymakers should focus on low-economic regions, enhancing policy support to maximize effectiveness. Meanwhile, high-economic regions should emphasize the improvement of market mechanisms and technological innovation to further enhance the quality of green urbanization.

Discussion

Based on a multi-period DID model, this study systematically examines the mechanism through which green finance policies influence green urbanization in China. The results indicate that green finance policies not only significantly enhance the overall level of green urbanization but also exert an intermediary effect through green technological innovation, while exhibiting pronounced heterogeneous effects across regions with different economic development levels. These findings provide new evidence for understanding the role of financial instruments in urban sustainable development.

First, the results validate the core expectations of environmental economics and sustainable finance theory, namely that financial policies can promote green development by reallocating resources and correcting market externalities through market signals. The robustness of green finance policies in enhancing urban green performance highlights the importance of institutional innovation in addressing market failures and improving the green financing environment.

Second, the mediation analysis reveals the “finance–technology–urbanization” logic chain. Green finance policies alleviate firms’ financing constraints and reduce the risks associated with green R&D, thereby promoting green patent output and generating tangible benefits in energy saving, emission reduction, and environmental governance. This extends the existing literature on the relationship between green finance and innovation, further confirming that green technological innovation is a key channel through which policies exert their effects.

Finally, the heterogeneity analysis shows that policy effects are more pronounced in low-economic regions. This aligns with the law of diminishing marginal returns, indicating that in areas with weaker green infrastructure and technological foundations, green finance policies yield higher marginal benefits. The finding underscores the importance of differentiated policy design, suggesting that different regions require tailored policy tools and incentive mechanisms.

Conclusion

Using panel data from 286 Chinese cities from 2010 to 2022 and a multi-period DID approach, this study systematically evaluates the causal effects of green finance policies on green urbanization. The main findings are as follows:

Green finance policies significantly enhance green urbanization, and the results remain robust across various robustness checks.

Green technological innovation acts as a mediator, indicating that green finance indirectly promotes green urbanization by alleviating financing constraints and sharing innovation risks.

Policy effects exhibit regional heterogeneity, with more pronounced impacts in low-economic regions, while marginal benefits are relatively limited in high-economic regions.

Based on these findings, the study proposes several policy implications:

Deepen financial instrument innovation: Continuously improve the green credit, green bond, and green fund systems, and expand emerging tools such as green insurance and carbon finance to mitigate the high-risk, long-term characteristics of green projects.

Strengthen support for green technological innovation: Promote the linkage between financial resources and green innovation through R&D subsidies, fast-track green patent examination, and intellectual property protection, thereby improving the quality and applicability of green patents.

Implement region-specific policies: Prioritize support for green infrastructure and green transformation of traditional industries in low-economic regions through dedicated financing instruments. In high-economic regions, leverage market-based mechanisms, such as carbon trading and green consumption incentives, to further enhance the quality of green urbanization.

Promote international cooperation and knowledge sharing: Align with international green finance standards and share China’s policy experience through platforms such as the Belt and Road Initiative, providing a reference for other emerging economies to bridge the “green gap” and achieve sustainable transitions.

Limitations and future research

Despite theoretical and empirical contributions, this study has several limitations:

Data timeliness and coverage: The sample period ends in 2022, which may not fully capture the effects of the most recent policies. The study focuses solely on urban areas, leaving rural regions and specific sectors (e.g., agriculture and manufacturing) insufficiently examined. Future research could extend the time series and broaden data coverage.

Limited mediation analysis: This study measures green technological innovation by the number of green patents, without differentiating patent quality or specific technology fields, nor examining the direct scale effects of green credit or green bonds. Future research could incorporate indicators such as patent quality and green investment intensity for greater explanatory power.

Sample heterogeneity and external validity limitations: The sample in this study only covers 286 prefecture-level cities in China, and the policy effects may be influenced by local institutional environments, economic structures, and industrial bases. Therefore, the generalizability of the findings to other countries or regions is limited. Future research could incorporate international data or cross-regional comparisons to examine the universality and external applicability of green finance policies on green urbanization.

Future research could further develop in the following directions: First, constructing a multi-level analytical framework that integrates urban, industrial, and community-level green transitions. Second, combining natural experiments and international comparisons to examine the adaptability of green finance policies under different institutional contexts. Third, placing greater emphasis on the interaction between green finance and social behavior, such as green consumption and the evolution of low-carbon lifestyles among residents.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

RM: Data curation, Conceptualization, Investigation, Software, Methodology, Formal analysis, Writing – original draft, Project administration. CX: Methodology, Supervision, Resources, Visualization, Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acemoglu, D., Aghion, P., Bursztyn, L., and Hemous, D. (2012). The environment and directed technical change. Rev. Econ. Stud. 79, 1–19. doi: 10.1093/restud/rdr004

Aghion, P., Dechezleprêtre, A., Hemous, D., Martin, R., and Van Reenen, J. (2016). Carbon taxes, path dependency, and directed technical change: Evidence from the auto industry. J. Political Econ. 124, 1–51. doi: 10.1086/684581

Altenburg, T., and Rodrik, D. (2017). Green industrial policy: accelerating structural change towards wealthy green economies. In: T. Altenburg and C. Assmann (Eds.) Green Industrial Policy. Concept, policies, country experiences (pp. 1–20). Bonn, Germany: German Development Institute/UN Environment. Avilable online at:https://drodrik.scholar.harvard.edu/files/dani-rodrik/files/altenburg_rodrik_green_industrial_policy_webversion.pdf

Bovenberg, A. L., and de Mooij, R. A. (1997). Environmental tax reform and endogenous growth. J. Environ. Econ. Manag. 34, 130–150.

Campiglio, E. (2016). Beyond carbon pricing: the role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol. Econ. 121, 220–230. doi: 10.1016/j.ecolecon.2015.03.020

Carroll, A. B. (1999). Corporate social responsibility: evolution of a definitional construct. Bus. Soc. 38, 268–295.

Costantini, V., and Mazzanti, M. (2012). On the green and innovative side of trade competitiveness? The impact of environmental policies and innovation on EU exports. Res. Policy 41, 132–153. doi: 10.1016/j.respol.2011.08.004

De Marchi, V. (2012). Environmental innovation and R&D cooperation: empirical evidence from Spanish manufacturing firms. Res. Policy 41, 614–623. doi: 10.1016/j.respol.2011.10.002

Dong, G., Ge, Y., and Zhu, W. (2021). Coupling coordination and spatiotemporal dynamic evolution between green urbanization and green finance: a case study in China[J]. Frontiers in environmental. Science 8:621846. doi: 10.3389/fenvs.2020.621846

Eyraud, L., Clements, B., and Wane, A. (2013). Green investment: trends and determinants. Energy Policy 60, 852–865. doi: 10.1016/j.enpol.2013.04.039

Falcone, P. M., and Sica, E. (2019). Assessing the opportunities and challenges of green finance in Italy: an analysis of the biomass production sector. Sustainability 11:517. doi: 10.3390/su11020517

Gao, L., Tian, Q., and Meng, F. (2022). The impact of green finance on industrial reasonability in China: empirical research based on the spatial panel Durbin model. Environ. Sci. Pollut. Res. 30, 61394–61410. doi: 10.1007/s11356-022-18732-y

Gu, B., Chen, F., and Zhang, K. (2021). The policy effect of green finance in promoting industrial transformation and upgrading efficiency in China: analysis from the perspective of government regulation and public environmental demands. Sustainability 28, 47474–47491. doi: 10.1007/s11356-021-13944-0

Hall, B. H., and Lerner, J. (2010). “The financing of R&D and innovation” in Handbook of the economics of innovation. eds. B. H. Hall and N. Rosenberg, vol. 1 (Netherland: Elsevier), 609–639.

Horbach, J., Rammer, C., and Rennings, K. (2012). Determinants of eco-innovations by type of environmental impact—the role of regulatory push/pull, technology push and market pull. Ecol. Econ. 78, 112–122. doi: 10.1016/j.ecolecon.2012.04.005

Huang, H., and Zhang, J. (2021). Research on the environmental effect of green finance policy based on the analysis of pilot zones for green finance reform and innovations. Sustainability 13:3754. doi: 10.3390/su13073754

Huiyu, C., Baozhu, W., and Ying, X. (2023). Green financial innovation, financial resource allocation, and corporate pollution reduction. China Industrial Economy. 10, 118–136. doi: 10.19581/j.cnki.ciejournal.2023.10.004

Jacobson, S. K. (1993). The impact of economic policy on energy and the environment in developing countries. Annu. Rev. Energy Environ. 18, 207–230.

Li, C., and Gan, Y. (2020). The spatial spillover effects of green finance on ecological environment—empirical research based on spatial econometric model. Environ. Sci. Pollut. Res. 28, 5651–5665. doi: 10.1007/s11356-020-10961-3

Ling, S., Han, G., An, D., Hunter, W. C., and Li, H. (2020). The impact of green credit policy on technological innovation of firms in pollution-intensive industries: Evidence from China. Sustainability 12:4493. doi: 10.3390/su12114493

Liu, H., Zhu, Q., Khoso, W. M., and Khoso, A. K. (2023). Spatial pattern and the development of green finance trends in China. Renew. Energy 211, 370–378. doi: 10.1016/j.renene.2023.05.014

Mukim, M., and Roberts, M. (2023). Thriving: Making cities green, resilient, and inclusive in a changing climate. Washington, DC: World Bank.

Organisation for Economic Co-operation and Development (OECD). (2011). Towards Green Growth. OECD Publishing. Available online at: https://www.oecd.org/en/publications/towards-green-growth_9789264111318-en.html (Accessed August 20, 2024).

Porter, M. E., and van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9, 97–118.

Rennings, K. (2000). Redefining innovation—eco-innovation research and the contribution from ecological economics. Ecol. Econ. 32, 319–332. doi: 10.1016/S0921-8009(99)00112-3

Scholtens, B. (2006). Finance as a driver of corporate social responsibility. J. Bus. Ethics 68, 19–33. doi: 10.1007/s10551-006-9037-1

Soundarrajan, P., and Vivek, N. (2016). Green finance for sustainable green economic growth in India. Agric. Econ. 62, 35–44. doi: 10.17221/174/2014-AGRICECON

UN-HABITAT (2022). World cities report 2022: Envisaging the future of cities [9789210054386]. Nairobi: UN-Habitat.

Wang, Y., and Zhi, Q. (2016). The role of green finance in environmental protection: two aspects of market mechanism and policies. J. Clean. Prod. 163, 1484–1492. doi: 10.1016/j.jclepro.2015.07.129

Weber, O. (2017). Corporate sustainability and financial performance of Chinese banks. Sustain. Account. Manag. Policy J. 8, 358–385. doi: 10.1108/SAMPJ-09-2016-0066

Wen, Z., and Ye, B. (2014). Mediation effect analysis: methods and model development. Adv. Psychol. Sci. 22, 731–745. doi: 10.3724/SP.J.1042.2014.00731

Yang, A., Huan, X., Teo, B. S. X., and Li, W. (2023). Has green finance improved China's ecological and livable environment? Environ. Sci. Pollut. Res. Int. 30, 45951–45965. doi: 10.1007/s11356-023-25484-w

Keywords: green finance, green urbanization, green technological innovation, Difference-in-Differences, China

Citation: Ma R and Xi C (2025) Can green financial policies promote green urbanization? Evidence from China. Front. Sustain. Cities. 7:1637944. doi: 10.3389/frsc.2025.1637944

Edited by:

Sameh Al-Shihabi, University of Sharjah, United Arab EmiratesReviewed by:

Weifeng Gong, Qufu Normal University, ChinaYanbin Chen, Shandong Normal University, China

Copyright © 2025 Ma and Xi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Cunhu Xi, MTQ2NDAzNDQ4N0BxcS5jb20=

†These authors have contributed equally to this work

Rong Ma

Rong Ma Cunhu Xi

Cunhu Xi