Abstract

Introduction:

This study examines the uneven impact of financial technology (Fintech) on economic resilience with empirical case of Chinese cities.

Results:

The results reveal a U-shaped relationship between Fintech development and economic resilience: while early-stage Fintech may have limited or even adverse effects, mature Fintech development level significantly enhance resilience. Mechanism analysis shows that Fintech promotes resilience by expanding financial scale and easing financing constraints. Furthermore, the impact of Fintech is found to be heterogeneous: it is more pronounced in cities with lower innovation capacity, smaller populations, and less population density.

Discussion:

These findings underscore the transformative but uneven role of digital finance in promoting urban resilience, offering policy-relevant insights for fostering inclusive and regionally balanced development.

1 Introduction

Regional economic development refers to the growth and prosperity of cities and metropolitan areas and the processes and strategies that facilitate this growth. Within this context, economic resilience, which is a city’s ability to withstand and recover from economic shocks and disruptions, such as recessions, natural disasters, or technological changes (Corodescu-Roșca et al., 2023). Economic resilience depends on a variety of factors, including the diversity of the local economy, the strength of local institutions and governance, the availability of human capital, and the level of social and environmental sustainability (Feng et al., 2023; Hu et al., 2022; Wang and Wei, 2021). Understanding the sources of economic resilience is essential for policymakers, urban planners, and local communities to develop effective strategies and policies for promoting sustainable and inclusive economic development.

Economic resilience is a key attribute that enables an economic system to achieve long-term, sustained improvement (Martin et al., 2016; Reggiani et al., 2002). It has long been a focal point for both academia and governments, particularly following the COVID-19 pandemic, which has led to a rapid increase in related research. Current studies on economic resilience primarily focus on industrial, economic, and cultural perspectives (Brown and Greenbaum, 2017; Cowell, 2013; Huggins and Thompson, 2015), while research from a financial perspective remains limited and somewhat narrow. Fintech is an important driver of business innovation and industrial upgrading (Yang and Wang, 2022), and such innovation and shifts in industrial structure are key indicators and sources of economic resilience (Bristow and Healy, 2018).

Financial technology (Fintech) refers to using technology to provide financial services to individuals and businesses, disrupting traditional financial systems and offering innovative solutions for financial transactions. To some extent, it leverages technological advancements to address inherent issues in traditional finance, such as inefficiency and lack of fairness (Gabor and Brooks, 2017; Gomber et al., 2017). It has become a rapidly growing industry in recent years. With its innovative solutions and disruptive technologies, Fintech has the potential to improve access to finance, enhance risk management, and promote innovation and competition. Furthermore, Fintech has an important effect in driving various industries to deeply participate in low-carbon emission reduction (Chen et al., 2024). Through electronic payment and green credit, paper waste can be reduced, efficiency can be improved, and green industry upgrading of small and medium-sized enterprises can be promoted. Additionally, Fintech can promote business innovation and drive industrial structure upgrades (Wu, 2024). During the process of economic development, industrial upgrading and green innovation can further enhance economic resilience.

Starting from the basic functions of Fintech, its influence on traditional finance lies in its ability to offer greater efficiency and fairness (Zhou and Li, 2022). The development of Fintech can provide more capital and a wider range of financial products to support market activities such as financial institution operations and business innovation. It offers broader services to small and micro enterprises, breaking down traditional financial barriers such as collateral requirements and providing more inclusive and efficient financial support for market activities.

While much of the existing literature explores Fintech’s impact at the micro level (e.g., firm performance or entrepreneurial activity), its broader implications for regional economic resilience remain underexplored. Cities and regions are complex economic systems where interactions among firms, institutions, and financial actors determine the overall capacity to absorb and adapt to shocks. Therefore, investigating Fintech’s impact from a meso- to macro-level perspective can reveal how digital financial development reshapes the structural foundations of regional economies. This study, therefore, addresses the following research question: How does the development of Fintech influence regional economic resilience, and through what mechanisms does this influence occur?

To answer this question, we use panel data from 284 prefecture-level cities in China between 2010 and 2020. China offers a compelling case for several reasons. As the world’s largest developing country, it has demonstrated considerable capacity to withstand and recover from multiple economic crises. From 1978 to the present, China’s economy has seen 35 years of continuous growth, achieving a 9.11% growth rate even during the subprime mortgage crisis. In 2020, during the COVID-19 crisis, China’s economic growth was only 2.24%, with nearly all cities experiencing substantial disruption to production and daily life, yet 90% of cities still maintained positive economic growth. Therefore, researching the factors influencing China’s economic resilience holds considerable value. In China, the process of building resilient cities is complex, constrained by factors such as industrial upgrading, economic development, and population migration (Shi et al., 2022). Among these, changes in the financial sector are particularly notable. Fintech development in China is highly advanced and rapidly evolving, playing a key role in driving the country’s digital economy, and China is considered a global leader in Fintech innovation and adoption (Zhou and Li, 2022). The country’s large, highly connected population has created fertile ground for Fintech, with major players like Alibaba’s Ant Group and Tencent’s WeChat Pay leading the industry. Mobile payments, peer-to-peer lending, and other Fintech services are widespread, and Fintech companies are increasingly partnering with traditional financial institutions to provide a broad range of financial services to both consumers and businesses. Hence, we chose China as the focus for our empirical investigation.

Methodologically, this study first constructs an economic resilience index using changes in GDP growth rates, observing and dynamically describing shifts in economic resilience from a regional perspective and identifying the intrinsic links between these shifts and economic cycles as well as spatial positioning. Second, it empirically examines the impact of Fintech on economic resilience using city panel data from 2010 to 2020, with a focus on Fintech’s roles in aggregating capital and alleviating financial constraints as mechanisms through which it influences economic resilience. Third, it explores heterogeneity across cities, conducting differentiated studies based on factors such as urban innovation capacity, city size, population scale, and population density.

This research contributes to the literature in four ways. First, it extends the understanding of Fintech’s economic implications from firm-level analysis to the meso-level, enriching discussions on the structural drivers of resilience. Second, by integrating spatial correlation analysis from geography with econometric causal inference, it offers a more comprehensive analytical framework. Third, it uncovers the mechanisms through which Fintech enhances regional resilience via financial scale expansion and financing constraint mitigation. Finally, it identifies heterogeneous effects across cities, providing empirical evidence to inform differentiated policy design for promoting urban resilience.

The remainder of this paper is organized as follows. Section 2 reviews the literature and proposes the research hypotheses. Section 3 introduces the methodology, including resilience measurement, model specification, and data sources. Section 4 presents the resilience assessment and its correlation with Fintech development. Section 5 discusses the empirical and mechanism analysis results. Section 6 concludes with key findings and policy implications.

2 Literature review and research hypotheses

2.1 Definition and measurement of economic resilience

Economic resilience refers to the ability of a regional economy to withstand recessions and recover from shocks or crises (Giannakis and Bruggeman, 2020; Tan et al., 2020). It consists of two main aspects: recession resistance during crises and recoverability in post-crisis periods (Mai et al., 2021). The research on economic and human nature first came at the beginning of the 21st century, starting from the interdisciplinary research of multiple disciplines, and it was not until 2010 that many studies on regional economic resilience emerged.

In defining economic resilience, where, in the words of Cross et al. (2012), “memories” (or “remnants”) of recessions can last longer in some regions than others. Regions may have different degrees of resilience to recessions because regional economies have different resilience capabilities (Martin et al., 2016; Brakman et al., 2015; Ghouchani et al., 2021; Martin, 2012). At present, the calculation of economic resilience mainly includes quantitative measurement of economic resilience (Martin et al., 2016; Brakman et al., 2015; Ghouchani et al., 2021; Martin, 2012) regime switching model (Wang and Wei, 2021), and composite index based on socio-economic indicators. In 2012, Martin proposed to use the rate of change of the employed population to measure economic resilience, which has become the calculation basis for economic resilience (Martin et al., 2016). Subsequently, other scholars also proposed to use the number of unemployed, GDP, trade volume of countries and so on to measure economic resilience (Brakman et al., 2015; Davies, 2011; Van Bergeijk et al., 2017). This study introduces specific modifications to Martin’s proposed calculation method, utilizing the variations in the GDP growth rates of Chinese cities as a proxy variable to investigate economic resilience.

2.2 Factors influencing economic resilience

Economic resilience is influenced by various factors, primarily categorized into economic, institutional, cultural, and financial factors, among others. Economic factors constitute a multifaceted aspect of analysis. Currently, scholars emphasize the significance of regional economic development (Cowell, 2013), human resources (Ashmawy, 2021; de Graaf-Zijl et al., 2015; Liu et al., 2023), financial situation, and market size (Christopherson et al., 2010) and other influences on regional economic resilience. Institutional factors include the economic development model (Whitley, 2000), industrial structure (Brown and Greenbaum, 2017), policy environment, etc. Cultural factors include entrepreneurship (Huggins and Thompson, 2015), innovation capacity (Bristow and Healy, 2018; Jiang et al., 2023), entrepreneurship (Gherhes et al., 2018; Williams and Vorley, 2014), green development (Derissen et al., 2011), etc. Environmental quality interacts with regional resilience, but pollution undermines economic resilience (Liu et al., 2023; Yang et al., 2022).

Regarding finance, changes in financial components tend to influence various aspects of the economy and society, thereby exerting both direct and indirect effects on economic resilience. From a direct perspective, existing research indicates that financial policies have a direct impact on economic resilience (Oprea et al., 2020). In the process of urban development, particularly when cities face major transformations or stages of economic recovery, not only is credit support from the financial sector necessary (Rousseau, 2002), but there is also a need for the capacity to use various financial tools for intertemporal resource allocation and risk-sharing (Levine, 1991). The rapid digitalization of finance, services, and governance will enhance regional economic resilience (Tian and Guo, 2023). The accumulation of financial resources, such as increased savings and loans, will further strengthen a region’s ability to withstand economic risks (Shi et al., 2023).

From an indirect perspective, financial development influences multiple aspects of economic resilience. A substantial body of theoretical and empirical research shows that financial development can drive economic growth by promoting capital accumulation, optimizing resource allocation, and improving credit availability (King and Levine, 1993).

In sum, the literature underscores the considerable complexity involved in defining, measuring, and influencing economic resilience factors. While progress has been made in these areas, further research is warranted in multiple domains. In China’s case, the scale and pace of Fintech development in the country outpace that of many other nations globally. Consequently, this paper focuses on investigating China’s regional economic resilience, examining the direct and concise impact of Fintech on economic resilience within the context of Fintech development. It also explores the impact mechanisms of Fintech on economic resilience by considering financial scale and financial constraints, thereby contributing to the enrichment of theoretical research and empirical findings in the field of economic resilience.

2.3 Theoretical analysis of Fintech impact on economic resilience

Recent years have witnessed growing scholarly interest in the relationship between Fintech development and economic resilience. However, the literature presents two major areas of divergence. First, regarding the direction of impact, some studies argue that Fintech enhances resilience by mitigating information asymmetry, expanding financial inclusion, and fostering innovation-driven growth (Tian and Guo, 2023; Shi and Lu, 2024). Others, however, caution that in its early stages, Fintech may amplify economic volatility through insufficient regulation, data risks, and the rapid transmission of financial shocks, such as the collapse of peer-to-peer (P2P) lending platforms (Yao et al., 2021). Second, in terms of mechanism pathways, most studies emphasize Fintech’s role in stimulating technological innovation and industrial upgrading (Chen et al., 2024; Wu, 2024), yet relatively few explore its more fundamental financial attributes: the expansion of financial scale and the alleviation of financing constraints. These two channels: capital accumulation and liquidity support are central to the financial system’s stabilizing function and thus form the backbone of regional economic resilience (King and Levine, 1993). Building upon these debates, this study asks: Does Fintech exert a nonlinear influence on economic resilience, and through what mechanisms does this influence operate? Moreover, do these effects differ across cities with distinct characteristics?

2.3.1 Nonlinear dynamics of Fintech development

Fintech’s evolution is inherently uneven and dynamic. In its nascent phase, Fintech often develops alongside immature regulatory systems, fragmented platforms, and limited integration with traditional financial institutions. These conditions can increase systemic risk and reduce macroeconomic stability (Arner et al., 2017). Early-stage Fintech innovations, particularly in loosely supervised credit markets may intensify financial fragility rather than resilience (Yao et al., 2021). As the sector matures, however, Fintech’s contribution shifts toward enhancing financial efficiency and transparency, supporting the real economy, and fostering adaptive capacity. Mature Fintech ecosystems promote technological diffusion, strengthen financial inclusiveness, and support diversified risk-sharing, thereby enhancing cities’ ability to absorb and recover from shocks (Philippon, 2016; Demirgüç-Kunt et al., 2022). This dynamic trajectory suggests that Fintech’s effect on economic resilience is nonlinear, potentially negative in the early stage but positive once institutional and technological integration is achieved.

Therefore, we propose the following hypotheses:

H1: Fintech exerts a nonlinear impact on regional economic resilience, initially weakening but subsequently strengthening it as the industry matures.

2.3.2 Expanding financial scale through Fintech

In times when information technology and transportation were underdeveloped, long distances implied higher time and commuting costs, hindering communication between financial service providers and consumers and restricting the accumulation and circulation of capital. Typically, regions with greater financial agglomeration are home to more financial institutions, which concentrate capital and have a more pronounced positive effect on economic and urban development (Kindleberger, 1973). In the later stages of financial agglomeration, economies of scale emerge, attracting more financial institutions, auxiliary services, and specialized labor into the geographic area (Tschoegl, 2000). This enriches the industrial structure of the region and strengthens its ability to withstand risks.

The development of Fintech has broken geographic barriers, enabling the broader and more widespread provision of financial funds and services. On one hand, Fintech applications have significantly increased available capital for banks (Mashamba and Gani, 2023). Banks that adopt Fintech have experienced higher loan and deposit growth, offering innovative deposit products, increasing deposit rates, and expanding wholesale financing. On the other hand, Fintech facilitates the provision of new financial resources to customers. For example, through shared financing, app-based transfers, electronic contract signatures, and marketplace lending and crowdfunding, Fintech connects investors, lenders, and borrowers through the internet (Song and Appiah-Otoo, 2022). This increased availability of financial resources directly promotes business innovation and enhances innovation efficiency at the regional level, strengthening cities’ ability to resist risks (Yang and Wang, 2022).

Therefore, we propose the following hypotheses:

H2: Fintech plays an indirect role in influencing regional economic resilience by bolstering financial scale.

2.3.3 Alleviating financing constraints through Fintech

A large body of literature suggests that enhancing a company’s innovation capacity helps strengthen the real economy’s ability to withstand risks, thereby increasing economic resilience (Bristow and Healy, 2018; He et al., 2023). Alleviating societal financing constraints helps businesses overcome financing challenges, boosting innovation (Yang and Wang, 2022). One of Fintech’s primary roles is reducing market frictions, increasing the likelihood that businesses and individuals can access financial products and services (Jagtiani and Lemieux, 2019). Due to information asymmetry, small and medium-sized enterprises (SMEs) often face financing discrimination from traditional financial institutions because they are unable to provide adequate collateral (Stiglitz and Weiss, 1981). With the help of artificial intelligence and automated processes, Fintech allows financial institutions such as banks to more efficiently create new products and services, expanding corporate financing channels (Milian et al., 2019). Additionally, Fintech significantly improves loan approval efficiency, shortens the time companies need to access funds, and reduces their opportunity costs. Especially for startups, Fintech increases banks’ willingness to provide financing support to higher-risk ventures within their risk tolerance, as it enhances financial institutions’ ability to screen information, enabling banks to take on higher levels of risk (Cheng and Qu, 2020). In summary, the application of Fintech can alleviate corporate financing constraints, thereby enhancing economic resilience.

Therefore, we propose the following hypotheses:

H3: Fintech plays an indirect role in influencing regional economic resilience by alleviating financial constraints.

3 Materials and methods

3.1 Economic resilience measurement and its correlation with Fintech level

In this research, economic resilience is chosen as the explanatory variable. Economic resilience refers to the ability of an economy to withstand and recover from external shocks or disturbances, such as economic downturns, natural disasters, or pandemics. It encompasses the capacity of an economic system to adapt to changing circumstances, minimize the negative impact of shocks, and quickly recover to pre-crisis levels. Economic resilience is measured by indicators such as GDP growth rates, employment rates, and productivity levels, as well as by factors such as diversification of economic activities, availability of resources, and sound institutional and governance frameworks.

Drawing on Martin et al. (2016), we calculate the national economic performance during the downward and upward periods as the resistance and recovery process in the economic cycle. Other things being equal, economic growth in each region will contract (during a recession) and expand (during a recovery) at the same rate as the nation. Thus, the expected change in, for example, the employment rate in region r during a recession or recovery for a period of duration k is:

where ERi is the economic resilience of region i in period t to t + k, and period t to t + k is a period of economic upswing or downswing. ERit is the economic growth rate of region i in period t, and ERNt is the national economic growth rate in period t. ERi takes on the following meanings:

ERi equals 0, the change in economic growth in city i is the same as in the national economy.

ERi greater than 0, high economic resilience: the change in economic growth in city i is greater than the change in the national economy in an upward period and less than the change in the national economy in a downward period. The larger the ERi, the more resilient the economy.

ERi is smaller than 0, has low economic resilience, and the change in economic growth in city i is smaller than the change in the national economy in an upward period and more prominent than the change in the national economy in a downward period. The smaller the ERi, the less resilient the economy.

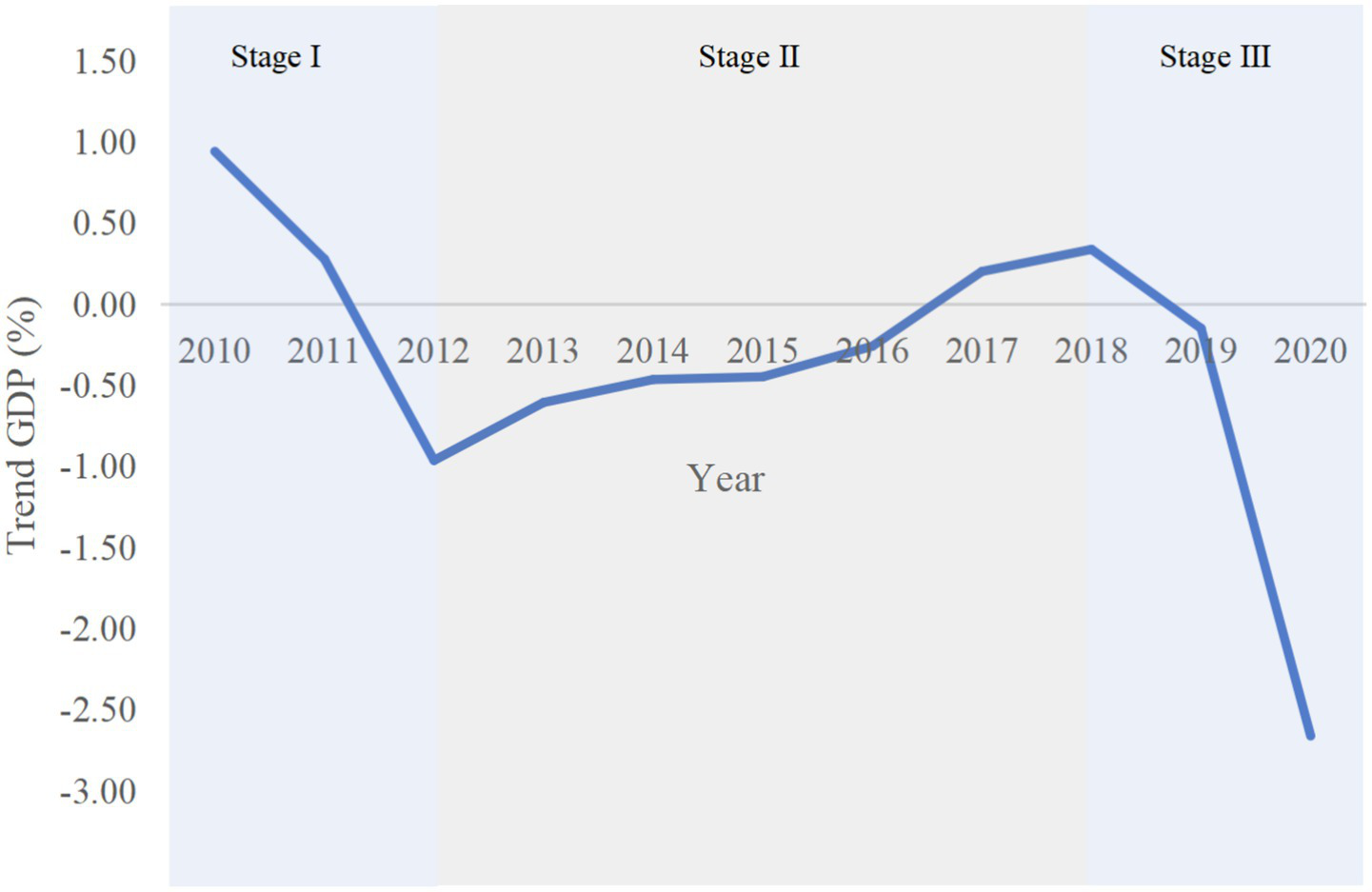

Regarding the division of economic cycles, this research uses the HP filtering method (Cogley and Nason, 1995). The Stata software is used to filter the analysis of China’s GDP growth rate from 2010 to 2020, and as annual data were used, the calibration parameter λ was set to 100 (Backus et al., 1992). The output denotes the cycling term (Figure 1). The cycle component variables decomposed using the HP filter represent the gap between the actual and potential values of the variable, with an increasing gap indicating that it is in an upward cycle and a decreasing gap indicating that it is in a downward cycle. Therefore, the economic cycle division for 2010–2020 is shown in Figure 1.

Figure 1

HP filer analysis results on economic cycles.

With Equation 1, this study calculates the economic resilience of 284 cities in China during the period of declining economic growth (2010–2012, 2018–2020) and the period of ascending economy (2012–2018), respectively. The results are presented in Section 4. Spatial autocorrelation analysis methods (Anselin et al., 2002) are applied to examine the spatial clustering of economic resilience and Fintech development level. The results are also presented in Section 4, with Local Indicators of Spatial Association (LISA) (Anselin, 2010) used to assess local spatial autocorrelation. While spatial autocorrelation only shows the correlation between economic resilience and Fintech level, we further develop an econometric model analysis to investigate the causation. The empirical strategies are presented in the following subsection.

3.2 Empirical strategy

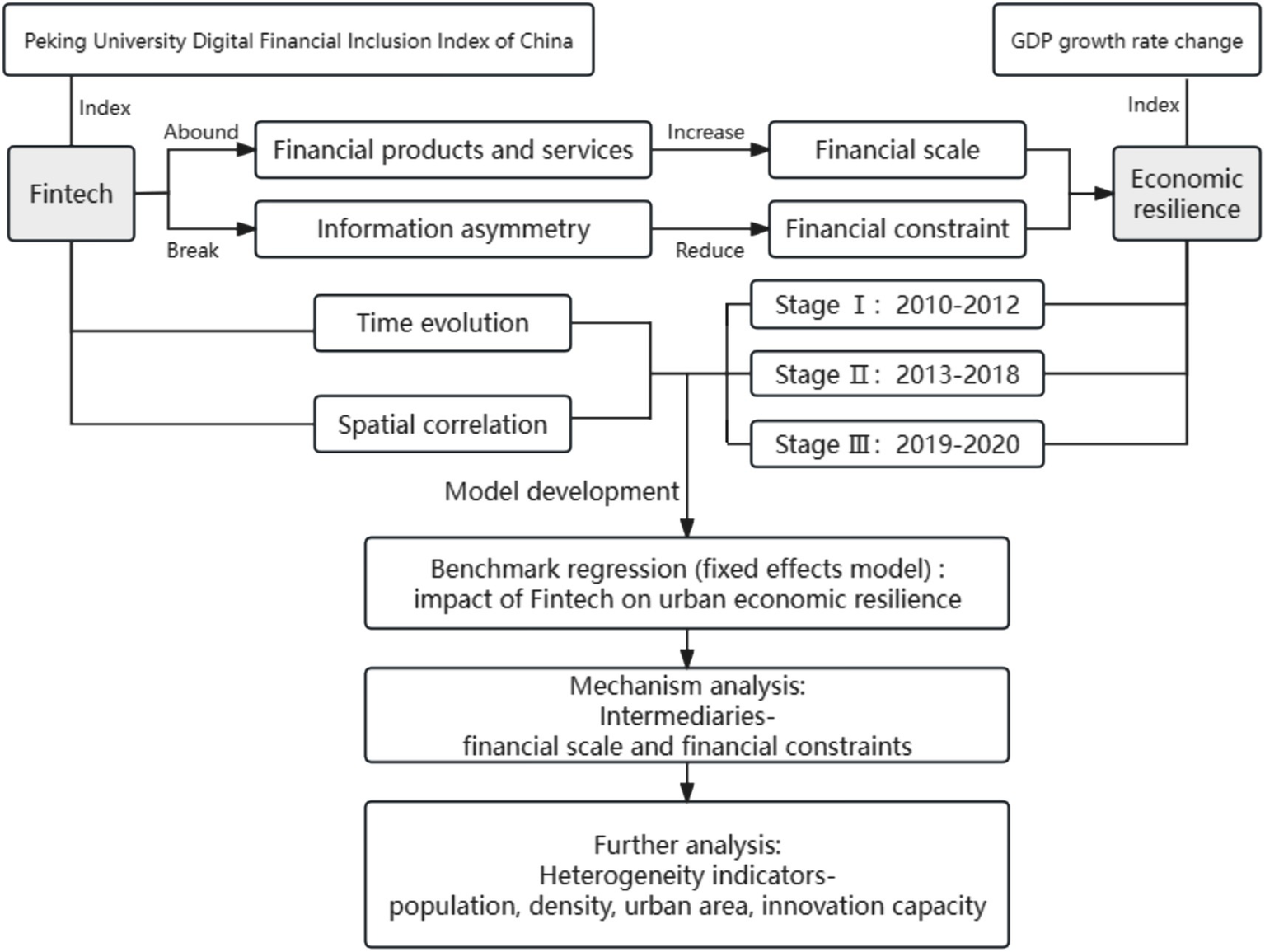

Figure 2 shows the theoretical framework of the empirical exploration of this study. This paper calculates economic resilience in the three stages of 2010–2012, 2013–2018 and 2019–2020, discusses the impact of Fintech development on economic resilience, constructs a fixed effect model as a benchmark model, takes financial scale and financial constraints as intermediary variables, and tests the role of intermediary mechanism. Population, density, urban area, and innovation are selected as indicators for heterogeneity analysis, and the impact of Fintech on economic resilience is comprehensively discussed.

Figure 2

Theoretical framework.

3.2.1 Variable setting

Explained variable: the economic resilience calculated in Section 3.1 is chosen as the explanatory variable.

Explanatory variables: the Digital Financial Inclusion Index1 published by Peking University is used as the core explanatory variable, and this index is taken as the natural logarithm to reduce heteroscedasticity and enhance the reliability of the results.

Mediating variables:

Financial scale: The scale of financial institutions directly reflects the volume of financial resources, and the increase in the number of financial institutions has a direct impact on high-quality economic development, which is especially important in rural areas (Zhou and Wang, 2023). Through the expansion of financial institutions, financial resources and services can provide more financial security for residents’ lives and enterprises and promote high-quality economic development. This paper uses the number of new financial institutions in a city each year as the proxy variable of financial scale to test the mediating effect of financial scale on the role of Fintech in promoting economic resilience.

Financial constraints: The development of Fintech can alleviate information asymmetry (Mudambi et al., 2017) so that enterprises and individuals can obtain more financial resources and services at a lower cost, meet the capital needs of residents’ consumption and enterprises’ operation and production, and have substantial advantages in providing financial services for low-income and vulnerable groups (Xie et al., 2018). In addition, Liu and Lu (2023) found that regional financial foundations, such as deposits and loans of financial institutions, have a significant role in promoting regional economic resilience (Liu and Lu, 2023). This paper argues that improving financial scale is one of the mediating effects of Fintech on economic resilience. Household deposit in financial institutions is the proxy variable for financial constraints to indicate the availability of capital.

Control variables include factors that tend to impact economic resilience.

Openness: open economies are more exposed to external shocks than closed systems. However, the relationship between openness and resilience becomes more complex during the adjustment period after a shock as the system is more accessible to resources for recovery (Pechynakis et al., 2022). The openness of a city is measured by the proportion of the actual amount of foreign capital used to GDP.

Human capital: On the one hand, highly skilled human resources typically have higher income levels and consumption capacity, which can help the economy shift toward reliance on domestic demand and stabilize fluctuations in the face of external shocks, thereby acting as a shock absorber (Ashmawy, 2021; de Graaf-Zijl et al., 2015; Liu et al., 2023). On the other hand, abundant human capital is the foundation for regional innovation and industrial restructuring and upgrading (Ashmawy, 2021). Only adaptive and dynamic structural adjustments can provide a sustainable source of regional economic resilience. The number of university students per thousand people is used as a measure.

Economic development: GDP is widely used as a measure of the size and health of an economy and can provide valuable information on the overall economic conditions of a region or country. By controlling for GDP in the regression analysis, the impact of other variables on economic resilience can be more accurately estimated, as the effects of economic development (changes in GDP) are already accounted for.

Fiscal autonomy: China’s relatively centralized fiscal system is represented by fiscal decentralization. It is the primary expression of governments’ capacity, and the structure of expenditures is directly related to the region’s ability to cope with risks. Fiscal Expenditure/Fiscal Revenue is used to represent the degree of fiscal decentralization, i.e., fiscal autonomy (Barbera et al., 2017).

Market size: it is generally believed that the scale advantage possessed by an economy is the foundation for its ability to resist external shocks and recover quickly. This is because the more extensive the market size of an economy, the better it can absorb negative impacts and the more easily it can rely on the domestic market size to achieve adjustments (Christopherson et al., 2010). The “total retail sales of consumption goods” indicates the overall market size.

Ecological environment: Ecological environment is an essential aspect of regional development. At present, the benign interaction between built-up areas and natural resources makes the regional spatial structure more reasonable and can achieve sustainable development. On the one hand, the urban green space area reflects the importance of ecology and people’s spiritual life in regional development. On the other hand, establishing a sustainable ecological environment system can effectively improve the city’s ability to resist external impacts such as natural disasters and climate change (Chen et al., 2023). Therefore, this paper selects the percentage of the green coverage area of the urban built-up area in built-up area as the control variable to measure the ecological environment (Table 1).

Table 1

| Variable type | Definition | Abbreviation | Variable measurement |

|---|---|---|---|

| Explained variable | Economic resilience | ER | Equation 1 |

| Explanatory variable | Fintech level | finindex | Peking University Digital Financial Inclusion Index of China (ln) |

| fi | Baidu Fintech index for each city | ||

| Control variable | Openness | FDI | Actual amount of foreign capital used (10,000 RMB)/GDP |

| Human capital | stud | Number of college students per 1,000 population (ln) | |

| Economic development | gdp | GDP (10,000 RMB) (ln) | |

| Fiscal autonomy | fisdec | Fiscal Expenditure/Fiscal Revenue | |

| Market size | consu | Total retail sales of consumption goods (10,000 RMB) (ln) | |

| Ecological environment | greenrate | Percentage of green coverage in built-up area of urban built-up area | |

| Mediating variable | Financial scale | citybank | Number of new financial institutions in cities (ln) |

| Financial constraint | savings | Deposits in financial institutions (10,000 RMB) (ln) | |

| City heterogeneity variable | City innovation index | innovation | Index of Regional Innovation and Entrepreneurship in China (IRIEC) |

| City area | area | City area (square kilometers) | |

| Population | population | Household population by year-end (10,000 persons) | |

| Population density | popden | Household population by year-end/City area |

Variable definition and description.

3.2.2 Model setting

We first construct a panel model, as shown in Equation 2, to analyze the relationship between Fintech and economic resilience.

where i is the prefecture city, and t is the year. ER is the explained variable, economic resilience. is the constant term. Fintech is the core explanatory variable, i.e., the level of financial technology. X is the vector of control variables affecting economic resilience. is the individual effect, is the time effect, and ε is the random error term, which follows a normal distribution. is the crucial coefficient of this research, indicating the effect of financial technology on economic resilience. is the vector of coefficients of the effect of control variables on economic resilience.

To further explore the mechanism of Fintech affecting economic resilience, we further construct two sets of Equations 3, 4, where FS is the financial scale, and FC is financial constraint. and is the random error terms.

3.3 Data

This study selects 284 prefecture-level cities2 in China as a case study to empirically assess the impact of Fintech on economic resilience. It uses the panel data of the 284 prefecture-level cities in China from 2011 to 2020 as the research sample. Economic resilience is calculated based on the GDP growth rate. Fintech data are from “the Peking University Digital Financial Inclusion Index of China.” The city panel data are obtained from each province’s China City Statistical Yearbook and the Statistical Yearbook. After excluding the missing sample variables, the final data of 284 prefecture-level cities was obtained, with 2,840 observations3 and a study period of 2011–2020. All data are logged, and the summary statistics are shown in Table 2. All data are winsorized by 1%. There is a significant deviation in economic resilience between cities. The data distribution is scientifically sound. To test for potential multicollinearity in the model, this study calculated the Variance Inflation Factor (VIF) for the control variables. The results show that all variables have VIF values below 10, with an average VIF of only 2.99, indicating that the model does not suffer from severe multicollinearity and that the regression estimates are reliable (Appendix).

Table 2

| Variable | Obs | Mean | Std. dev. | Min | Max |

|---|---|---|---|---|---|

| ER | 2,840 | −1.224 | 3.332 | −12.13 | 8.030 |

| finindex2 | 2,840 | 25.82 | 4.811 | 12.66 | 32.41 |

| finindex | 2,840 | 5.056 | 0.505 | 3.558 | 5.693 |

| fi2 | 2,840 | 12.26 | 8.864 | 0 | 39.11 |

| fi | 2,840 | 3.243 | 1.321 | 0 | 6.254 |

| gdp | 2,840 | 7.305 | 0.957 | 5.266 | 9.878 |

| stud | 2,801 | 10.44 | 1.478 | 6.211 | 13.70 |

| consu | 2,828 | 15.60 | 1.028 | 13.26 | 18.20 |

| fisdec | 2,839 | 0.456 | 0.220 | 0.0964 | 0.999 |

| FDI | 2,835 | 186.9 | 212.4 | 0 | 1,220 |

| greenrate | 2,814 | 0.398 | 0.0586 | 0.179 | 0.558 |

| citybank | 2,838 | 3.783 | 1.019 | 1.099 | 5.838 |

| savings | 2,552 | 16.26 | 0.893 | 14.40 | 18.78 |

| area | 2,840 | 15,581 | 14,347 | 1,596 | 90,021 |

| population | 2,838 | 443.0 | 277.2 | 46 | 1,397 |

| popden | 2,835 | 436.7 | 335.7 | 18.13 | 1928 |

| innovation | 2,830 | 0.518 | 0.147 | 0.0973 | 4.890e+08 |

Summary statistics of variables.

4 Spatiotemporal changes in economic resilience and Fintech level

4.1 The evolution trend of economic resilience

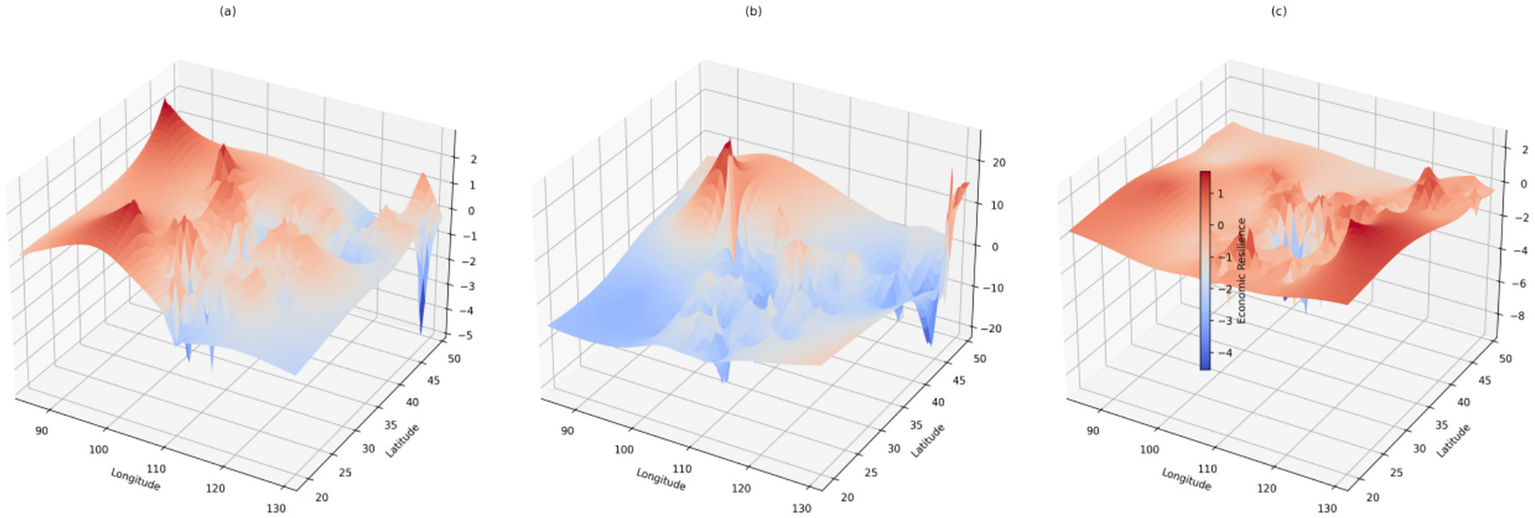

During the study period, China’s regional economic resilience shows significant spatial differences, with many “peak” and “valley” centers forming a multi-core cluster spatial distribution pattern (Figure 3). The XY axis represents longitude and latitude, and the Z axis represents economic resilience. It can be seen from Figure 3 that the resilience index shows obvious volatility in the three stages. In the first stage (2010–2012), economic resilience shows an obvious “ladder” form, with high-value areas concentrated in the western region and low-value areas concentrated in the northeast and southern regions. In the second stage (2013–2018), the overall economic resilience shows an obvious “peak-like” shape, and the regions with high economic resilience are concentrated in the northwest and northeast, while other regions show low economic resilience. In the third stage (2019–2020), economic resilience shows a relatively obvious “N-shaped” form. The economic resilience of all cities has significantly improved, and the low-value regions are concentrated in the central region.

Figure 3

The evolution trend of economic resilience of 284 prefectural cities in China from 2011 to 2020 (a) 2011–2012, (b) 2013–2018, (c) 2019–2020.

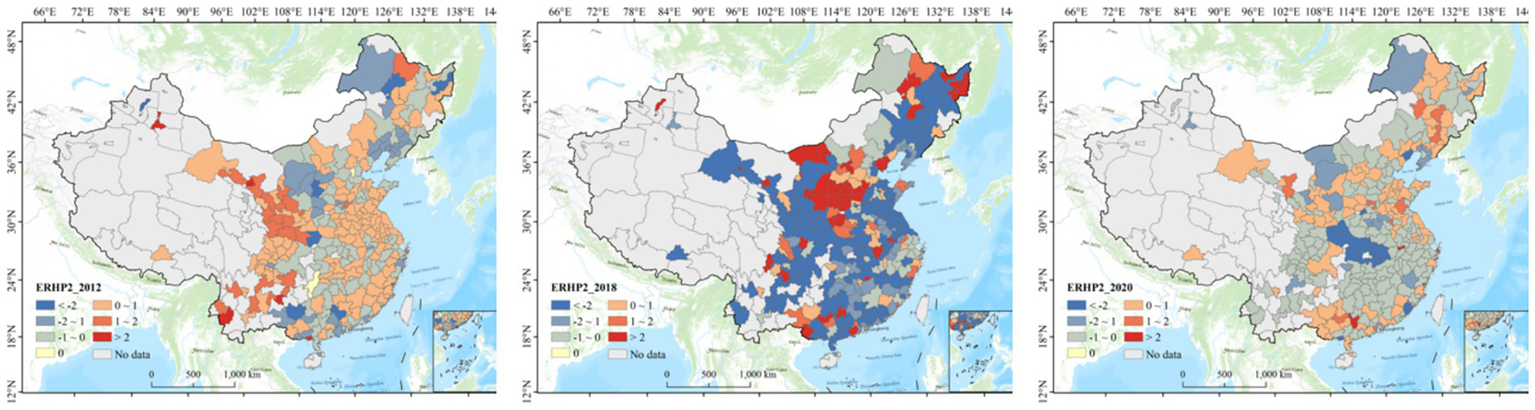

4.2 Spatial and temporal disparities of economic resilience in Chinese cities

Figure 4 presents the economic resilience assessment results in the three economic cycles during 2011–202 with the natural break method applied in the geographical visualization. During the research period, from the first economic downturn to the first economic upturn, the evolution of regional resilience showed a trend of two-level differentiation. More initially resilient regions became even more vital during the economic upturn, while less initially resilient regions became even weaker by the first economic upturn. By the second economic downturn, the resilience of all regions had decreased overall, falling below the level of the first period. It can be primarily attributed to the impact of the COVID-19 pandemic.

Figure 4

Economic resilience of 284 prefectural cities in China from 2011 to 2020.

The following reasons can explain the growing disparity in regional economic resilience during the economic upturn:

-

Unequal distribution of resources. During periods of economic growth, resources and investments tend to concentrate in regions with higher competitiveness and attractiveness. It leads to regions with greater economic resilience becoming even more vital during the economic upturn. On the other hand, weaker regions fall behind in competition and experience reduced investments, resulting in a decline in their economic resilience.

-

Technological advancements and innovation. During periods of economic growth, technological advancements and innovation play a crucial role in regional economic development. Generally, regions with stronger economic resilience tend to attract and nurture high-tech enterprises more efficiently, improving their technological levels and innovation capabilities. In contrast, weaker regions often perform poorly in this aspect, leading to a decline in economic resilience.

-

Policy factors. Government policies play a significant role in economic development. The government may sometimes formulate policies favorable to more substantial regions, thereby increasing regional disparities. During economic downturns, the government may adopt austerity measures, which negatively impact the economic resilience of all regions.

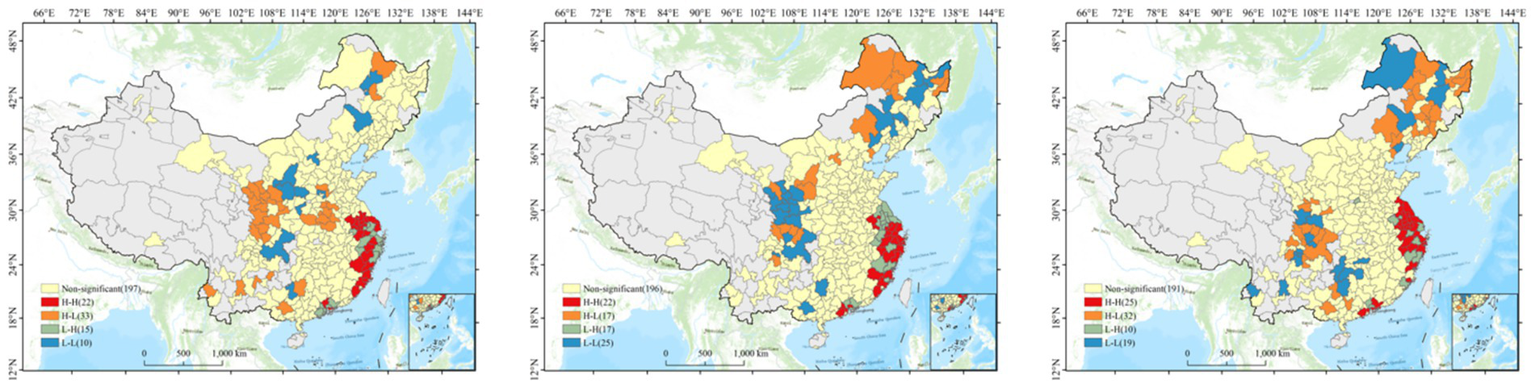

4.3 Spatial autocorrelation patterns of economic resilience and Fintech level

Further analysis of the spatial agglomeration of financial technology and economic resilience levels (Figure 5) shows that regions with high resilience and advanced financial technology development are concentrated in the southeastern coastal areas of China. The southeastern coastal areas of China have experienced rapid economic development in recent decades, driven by factors such as export-oriented manufacturing, foreign direct investment, and favorable government policies. This economic growth has facilitated the development of a robust financial infrastructure and the adoption of advanced financial technologies, contributing to higher economic resilience. Hangzhou, a central hub of Fintech in China located in this region, further contributes to Fintech development and economic growth.

Figure 5

LISA cluster of economic resilience and Fintech level in 284 prefectural cities in China in 2012, 2018 and 2020.

5 Regression results

5.1 Benchmark results

Table 3 presents the results of the benchmark regression, revealing a U-shaped relationship between Fintech development and economic resilience. Specifically, Fintech exerts a negative impact on economic resilience when its level is below 61.41, but a positive one when the level exceeds 61.41. Within our sample, 215 observations (7.57%) fall below this threshold, suggesting that for 92.43% of cities, Fintech development enhances economic resilience.

Table 3

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| ER | ER | ER | ER | ER | |

| finindex2 | 1.3849*** | 1.4015*** | 0.7116*** | 1.3753*** | 1.0235** |

| (6.5532) | (6.4168) | (2.7604) | (2.9108) | (2.0519) | |

| finindex | −13.8347*** | −13.9979*** | −7.7386*** | −10.9456*** | −8.4048** |

| (−6.8737) | (−6.7608) | (−3.1828) | (−2.7946) | (−2.1466) | |

| Control | NO | YES | YES | YES | YES |

| FE | NO | NO | YES | NO | YES |

| TE | NO | NO | NO | YES | YES |

| Constant | 32.9675*** | 33.7234*** | 25.5739*** | 23.7937*** | 28.4788*** |

| (6.9522) | (6.4993) | (3.2448) | (2.6670) | (3.0008) | |

| N | 2,840 | 2,758 | 2,758 | 2,758 | 2,758 |

| R-Square | 0.0251 | 0.0650 | 0.0859 | 0.1617 | 0.1717 |

The effects of Fintech on regional economic resilience.

Standard errors clustered at the city level in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

From a temporal perspective, cities with Fintech levels below 61.41 are largely concentrated in 2011, except for Dingxi and Longnan in Gansu Province and Guyuan in the Ningxia Hui Autonomous Region in 2012. By 2013, the Fintech development level of all cities had surpassed the threshold, indicating a transition point in the relationship between Fintech and resilience.

This pattern reflects the nonlinear, stage-dependent effect of Fintech on urban economic resilience. In the early phase of Fintech development, regulatory frameworks were lagging, technological risks were not yet well-managed, and industrial integration remained weak, leading to a negative impact on resilience. Once Fintech reached a more mature stage, identified in this study as a level above 61.41, its positive effects began to dominate, improving financial inclusion, expanding resource allocation efficiency, and ultimately strengthening economic resilience.

Further evidence supports the “stage theory” of Fintech development. Before 2013, China’s Fintech sector was still in its infancy, with most cities below the 61.41 threshold. During this period, the expansion of financial institutions was slow (an average increase of fewer than two new institutions per city per year), and deposit growth was limited (annual growth rate around 5%). The negative impact of Fintech on resilience during this stage primarily stemmed from technological and systemic risks that had not yet been offset by intermediary effects.

After 2013, however, as Fintech surpassed the critical threshold, these intermediary effects became fully activated, the number of financial institutions grew by an average of 15% annually, and deposit growth accelerated to 12%. The positive, resilience-enhancing role of Fintech became dominant, coinciding with the release of China’s Guiding Opinions on Promoting the Healthy Development of Internet Finance in 2013, which marked the beginning of Fintech’s regulated and inclusive expansion.

Together, these findings confirm Hypothesis 1, which posits that the relationship between Fintech and economic resilience is nonlinear, with the direction of impact shifting as Fintech develops from an early exploratory stage to a mature, regulated phase.

5.2 Robustness check and endogeneity treatment

To ensure the reliability of our findings, we conducted a series of robustness tests using the following approaches:

-

Adjusting the dependent variable: We recalculated economic resilience based on employment data instead of economic growth, following the method proposed by Martin. The regression results are reported in Table 4, Columns (1) and (2), where Column (1) excludes control variables and Column (2) includes them.

-

Lagging control variables: To mitigate potential endogeneity, we lagged all control variables by one period. The results are shown in Table 4, Column (3).

-

Adjusting the regression sample: We excluded the four municipalities directly under the central government, namely Beijing, Tianjin, Shanghai, and Chongqing from the regression sample. The corresponding results are presented in Table 4, Column (4).

-

Group regressions: To test for heterogeneity across city types, we divided the sample into provincial capital cities and non-capital cities. The results for provincial capitals are reported in Table 4, Column (5), and those for non-capital cities in Table 4, Column (6).

Table 4

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| ER | ER | ER | ER | ER | ER | |

| finindex2 | 0.4387*** | 0.4686*** | 1.4794** | 1.0096** | 4.1873** | 1.3275*** |

| (4.5165) | (4.5916) | (2.1905) | (1.9843) | (2.4709) | (2.5931) | |

| finindex | −3.9318*** | −4.2297*** | −14.5948** | −8.4695** | −36.1308** | −11.6121*** |

| (−4.2773) | (−4.3879) | (−2.4790) | (−2.1168) | (−2.4525) | (−2.9450) | |

| Control | NO | YES | YES | YES | YES | YES |

| FE | YES | YES | YES | YES | YES | YES |

| TE | YES | YES | YES | YES | YES | YES |

| N | 2,658 | 2,582 | 2,499 | 2,719 | 302 | 2,456 |

| R-Square | 0.898 | 0.897 | 0.1523 | 0.1680 | 0.7102 | 0.5996 |

Robustness test results.

t-statistics in parentheses, ***p < 0.01, **p < 0.05, *p < 0.1.

All robustness models control for city and year fixed effects and use city-level clustered standard errors. Across all specifications, the results consistently demonstrate a significant nonlinear (inverted U-shaped) relationship between Fintech development and economic resilience, confirming the robustness of our benchmark findings.

To address potential endogeneity concerns, we employed the instrumental variable (IV) approach. In Table 5, Column (1), we used the second-order lag of Fintech (lagged two periods) as the instrumental variable, while in Table 5, Column (2), we used the provincial average level of Fintech as the instrument.

Table 5

| (1) ER | (2) ER | |

|---|---|---|

| finindex2 | 87.19*** | 46.30*** |

| (20.36) | (13.36) | |

| finindex | −7.947*** | −3.720** |

| (1.960) | (1.405) | |

| Control | YES | YES |

| FE&TE | YES | YES |

| N | 2,169 | 2,719 |

| R-Square | 0.255 | 0.262 |

| Kleibergen-PaaprkLM (p-value in parentheses) | 107.489 (0.000) | 47.482 (0.000) |

| Kleibergen-Paap rk Wald F statistic | 232.657 | 55.740 |

| Stock-Yogo10% Bias Critical Value | 7.03 | 7.03 |

Endogeneity treatment results.

***p < 0.01, **p < 0.05, *p < 0.1.

The first-stage results confirm the validity and strength of the chosen instruments. Specifically, the LM statistics for the under-identification test are 107.489 and 47.482, respectively, with p-values of 0.00, strongly rejecting the null hypothesis of under-identification. The Kleibergen–Paap Wald rk F-statistics are 232.657 and 55.740, both well above the Stock–Yogo 10% critical value of 7.03, indicating that weak instrument problems are unlikely to exist.

The second-stage regression results show that both the linear and quadratic terms of Fintech are significant at the 1% level, confirming a nonlinear inverted U-shaped relationship between Fintech development and economic resilience, consistent with the findings from the benchmark regression.

5.3 Mechanism analysis

To further uncover the mechanisms through which Fintech influences urban economic resilience, this study examines two potential mediating channels: the scale of financial institutions and the alleviation of financing constraints. First, we test the financial scale mechanism by using the number of newly established financial institutions in each city as a proxy. This indicator reflects not only the current size of the local financial system but, more importantly, its expansion capacity and institutional dynamism. The establishment of new financial institutions signifies an improved financial environment, greater competition, and enhanced access to financial services. Compared with static indicators such as the total number of financial institutions or loan balances, this dynamic measure better captures how Fintech facilitates financial diffusion, innovation, and market entry. In essence, Fintech development lowers transaction costs, encourages institutional innovation, and attracts new financial players, thereby expanding the financial system’s overall scale.

Second, to test the financing constraint mechanism, we use household deposits in financial institutions as a proxy variable. Household deposits are a key source of liquidity in the banking system and an important indicator of financial inclusiveness and public trust in financial services. A higher level of deposits suggests that financial resources are circulating more smoothly between households and institutions, improving capital availability and mitigating liquidity constraints in the market. Fintech, by promoting digital payments, mobile banking, and online savings platforms, facilitates broader participation in financial activities, increases deposit volume, and consequently reduces financing frictions in the economy.

Table 6 reports the results of the mechanism tests. The findings show that the number of financial institutions plays a significant mediating role in the relationship between Fintech and economic resilience. When the Fintech index exceeds 3.32, it exerts a positive and significant impact on the number of new financial institutions, indicating that Fintech encourages financial sector expansion and improves the structural resilience of the urban economy. Similarly, household deposits also demonstrate a mediating effect. When the Fintech index exceeds 1.47, it significantly promotes household deposits in financial institutions. This result suggests that Fintech enhances public access to financial services and strengthens the financial system’s liquidity base, thereby easing financing constraints. Notably, in our sample, no city exhibited a Fintech level below 3.32, implying that Fintech has reached a mature stage in most Chinese cities, where its positive effects on financial deepening and inclusiveness are fully realized. By expanding the scale of financial institutions and increasing household deposits, Fintech not only boosts the efficiency and inclusiveness of financial intermediation but also reinforces the capacity of urban economies to withstand and recover from shocks.

Table 6

| (1) | (2) | |

|---|---|---|

| Citybank | Savings | |

| finindex | 1.2013*** | 0.3965*** |

| (5.7122) | (7.6343) | |

| Control | YES | YES |

| Constant | −3.8959*** | 13.3204*** |

| (−3.1708) | (41.8812) | |

| FE | YES | YES |

| TE | YES | YES |

| N | 2,757 | 2,495 |

| R-Square | 0.2869 | 0.9378 |

The results of mediating effects.

***p < 0.01, **p < 0.05, *p < 0.1.

5.4 Heterogeneity analysis

To further examine the impact of Fintech on economic resilience, we conduct a heterogeneity analysis. Based on urban characteristics, sample cities are categorized by area, total population, population density, urban innovation degree, according to the median, and regression is carried out, respectively. The results, presented in Table 7, indicate that the inverted U-shaped relationship between Fintech and economic resilience is more pronounced in cities with lower innovation capacity, smaller geographical area, smaller population size, and lower population density. This suggests that the positive effect of Fintech on economic resilience is stronger in resource-constrained cities.

Table 7

| (1) Large area | (2) Small area | (3) High population | (4) Low population | (5) High population density | (6) Low population density | (7) High innovation | (8) Low innovation | |

|---|---|---|---|---|---|---|---|---|

| ER | ER | ER | ER | ER | ER | ER | ER | |

| finindex2 | 0.6715 | 1.3632** | 0.2494 | 1.9147** | 0.4275 | 1.6183** | 0.2895 | 2.0794*** |

| (0.9432) | (2.0842) | (0.4388) | (2.5334) | (0.7179) | (2.1141) | (0.4118) | (2.9841) | |

| finindex | −6.4457 | −10.6576** | −1.2018 | −16.7721*** | −3.2124 | −13.7242** | −2.5404 | −16.8337*** |

| (−1.1969) | (−2.0965) | (−0.2879) | (−2.8420) | (−0.7174) | (−2.2970) | (−0.4741) | (−3.2044) | |

| Control | YES | YES | YES | YES | YES | YES | YES | YES |

| Constant | 30.7775** | 34.2148*** | 17.3689* | 53.4584*** | 27.7979*** | 39.8482*** | 11.0564 | 59.7010*** |

| (2.5676) | (2.8880) | (1.8778) | (3.9889) | (2.6928) | (2.9729) | (0.8870) | (5.1724) | |

| FE | YES | YES | YES | YES | YES | YES | YES | YES |

| TE | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 1,376 | 1,382 | 1,382 | 1,376 | 1,390 | 1,368 | 1,375 | 1,383 |

| R-Square | 0.6213 | 0.5968 | 0.6536 | 0.6021 | 0.6289 | 0.6093 | 0.6448 | 0.6694 |

The results of heterogeneity test.

***p < 0.01, **p < 0.05, *p < 0.1.

One possible explanation for this finding is that Fintech may exert a greater influence in less developed cities, those with limited innovation capacity and lower population density, as such cities often face significant barriers to accessing traditional financial services and other resources critical for economic development. In these contexts, Fintech can help bridge gaps by offering alternative financing mechanisms and expanding access to financial services previously unavailable.

In contrast, in larger and more developed cities, where established financial institutions and broader access to finance already exist, the marginal impact of Fintech may be diminished. Furthermore, the heightened competition in these urban areas could present additional challenges for Fintech firms seeking to enter the market and scale their influence.

From a spatial perspective, this pattern has meaningful implications for regional economic convergence. In the early years of Fintech development (2011–2012), several western cities such as Dingxi in Gansu Province and Guyuan in the Ningxia Hui Autonomous Region had Fintech levels below the identified threshold, meaning that the mediating effects through financial expansion and liquidity improvement were not yet activated, resulting in relatively slow resilience growth. However, after 2013, these same cities experienced significant Fintech-driven progress, for example, the number of village and township banks nearly doubled, and household deposits grew substantially through online savings channels. Consequently, their economic resilience began to increase at a faster rate than that of some eastern cities.

6 Discussion and conclusion

6.1 Key findings

This study explored the impact of financial innovation on regional economic resilience in China using a sample of 284 prefecture-level cities from 2010 to 2020. The economic resilience assessment of this study shows a trend of two-level differentiation during the research period, with regions that were initially more resilient becoming even stronger during the economic upturn, while regions that were initially less resilient became even weaker by the first economic upturn. This can be attributed to the unequal distribution of resources, technological advancements and innovation, and government policies that favor stronger regions. Additionally, the spatial agglomeration of financial technology and economic resilience levels showed that regions with high resilience and advanced financial technology development are concentrated in the southeastern coastal areas of China.

This paper uses panel data from 284 Chinese cities between 2010 and 2020 to study the relationship between Fintech and economic resilience. The results show that Fintech is enhancing the economic resilience of most cities in China, with a U-shaped relationship between Fintech and economic resilience. According to the regression analysis, Fintech weakens economic resilience when its level is below 61.41 but enhances it when above 61.41. Observations indicate that by 2013, the Fintech development levels in all cities surpassed 61.41, suggesting that after 2013, the rising Fintech levels have been able to fully promote the enhancement of economic resilience.

Regarding the mechanisms through which Fintech affects economic resilience, this paper proposes two perspectives: increasing financial capital and alleviating financing constraints. The empirical results indicate that Fintech can increase the number of financial institutions in cities and ease financing constraints in the market. When the Fintech level exceeds 3.32, it positively impacts the number of financial institutions. Moreover, when the Fintech value is greater than 1.47, it significantly boosts financial institution deposits, promoting the circulation of capital. This cumulative effect benefits 100% of the cities in the sample. Moreover, the enhanced effect of Fintech on economic resilience is more potent in cities with less innovation capacity, smaller areas, smaller populations, and less population density.

6.2 Policy implications

The study’s findings have several policy implications for Chinese policymakers and city planners: Firstly, Fintech can be a critical tool for building economic resilience in Chinese cities. Policymakers and city planners should prioritize investment in Fintech to mitigate financial constraints and expand financial resources. Therefore, accelerating the development and application of digital technologies like blockchain and big data is essential. Promoting the integration of finance and technology will continuously enhance the level of Fintech in cities.

Secondly, the impact of Fintech on economic resilience is a dynamic process. Fintech’s influence varies across different phases of the economic cycle and at different stages of Fintech development. Policymakers must recognize economic cycles and, in the current phase, optimize mechanisms that support the real economy’s financial needs. It’s crucial to meet effective financing demands while considering the trends of economic downturns and the developmental differences between cities. Fintech policies should be adjusted to focus on resilient and emerging industries during economic downturns, such as healthcare, education, and digital media. By leveraging Fintech to promote business innovation, cities can enhance their economic resilience.

Thirdly, the study suggests that Fintech can be particularly effective in smaller, less developed cities, where its benefits are more pronounced. In regions where Fintech’s positive impact is more evident, active policy guidance is essential. This includes strengthening digital financial infrastructure and promoting Fintech applications in the financial sector through favorable policies. Additionally, tax incentives for Fintech companies and businesses can be used to direct financial resources back into the real economy, encouraging more investment in productive industries and further boosting economic resilience.

6.3 Limitation and future research directions

This study has several limitations that provide avenues for future research. First, although our analysis focuses on Chinese cities, future studies could expand the sample to include additional regions or cross-country comparisons to assess the generalizability of the findings across different institutional and economic contexts. Second, the measurement of economic resilience could be refined by incorporating multidimensional indicators to capture a more comprehensive picture of regional adaptability. Third, while this study highlights the positive impacts of Fintech, future research should also examine its potential adverse effects, including financial instability, digital exclusion, and data security risks that may offset some of its benefits. Moreover, future studies could investigate the interaction effects between Fintech and other contextual factors, such as government policies, regulatory frameworks, cultural norms, and historical development paths, to better understand how these dynamics jointly shape regional economic resilience.

In conclusion, this study contributes to the growing literature on the nexus between financial innovation and regional economic resilience in China. The results indicate that Fintech can substantially enhance the economic resilience of most Chinese cities by expanding financial scale and alleviating financing constraints. For policymakers and urban planners, these findings suggest that strategic investments in Fintech infrastructure and digital finance ecosystems can serve as an effective tool for strengthening local economies. However, the effect of Fintech is not uniform across all cities. It varies with differences in resource endowment, institutional capacity, and development stage. Recognizing and addressing these variations will be crucial for formulating targeted Fintech development strategies that maximize resilience benefits while minimizing systemic risks.

Statements

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

JLv: Methodology, Writing – original draft. JLi: Conceptualization, Writing – original draft, Writing – review & editing. HL: Data curation, Writing – review & editing. LL: Validation, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was funded by Hebei Provincial Social Science Foundation Project, grant number HB23ZT032; 2023 Soft Science Research Project of Tangshan Science and Technology Bureau, grant number 23110204f.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that Gen AI was used in the creation of this manuscript. To polish the English writing of this paper.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1.^ The Peking University Digital Financial Inclusion Index of China (PKU-DFIIC) is measured by coefficient of variation method and Analytic Hierarchy Process (AHP).

2.^ We exclude cities with missing data and come up with a sample of 284 prefecture-level cities.

3.^ Some control variables have missing values, and to ensure data quality, no imputation was performed. For unbalanced panel data, we introduce fixed effects in subsequent regressions to control for individual characteristics in the panel data, making the model more robust.

References

1

Anselin L. (2010). Local indicators of spatial association-LISA. Geogr. Anal.27, 93–115. doi: 10.1111/j.1538-4632.1995.tb00338.x

2

Anselin L. Syabri I. Smirnov O. (2002). Visualizing Multivariate Spatial Correlation with Dynamically Linked Windows. New Tools for Spatial Data Analysis: Proceedings of the Specialist Meeting, Santa Barbara.

3

Arner D. W. Barberis J. Buckley R. P. (2017). FinTech, regTech, and the reconceptualization of financial regulation. Northwest Univ Sch Law J. Available online at: https://scholarlycommons.law.northwestern.edu/njilb/vol37/iss3/2

4

Ashmawy I. K. I. M. (2021). Stakeholder involvement in community resilience: evidence from Egypt. Environ. Dev. Sustain.23, 7996–8011. doi: 10.1007/s10668-020-00894-9

5

Backus D. K. Kehoe P. J. Kydland F. E. (1992). International real business cycles. J. Polit. Econ.100, 745–775. doi: 10.1086/261838

6

Barbera C. Jones M. Korac S. Saliterer I. Steccolini I. (2017). Governmental financial resilience under austerity in Austria, England and Italy: how do local governments cope with financial shocks?Public Adm.95, 670–697. doi: 10.1111/padm.12350

7

Brakman S. Garretsen H. Van Marrewijk C. (2015). Regional resilience across Europe: on urbanisation and the initial impact of the great recession. Camb. J. Reg. Econ. Soc.8, 225–240. doi: 10.1093/cjres/rsv005

8

Bristow G. Healy A. (2018). Innovation and regional economic resilience: an exploratory analysis. Ann. Reg. Sci.60, 265–284. doi: 10.1007/s00168-017-0841-6

9

Brown L. Greenbaum R. T. (2017). The role of industrial diversity in economic resilience: an empirical examination across 35 years. Urban Stud.54, 1347–1366. doi: 10.1177/0042098015624870

10

Cheng M. Qu Y. (2020). Does bank FinTech reduce credit risk? Evidence from China. Pac-Basin Finance J63:101398. doi: 10.1016/j.pacfin.2020.101398

11

Chen W. Wang J. Ye Y. (2024). Financial technology as a heterogeneous driver of carbon emission reduction in China: evidence from a novel sparse quantile regression. J. Innov. Knowl.9:100476. doi: 10.1016/j.jik.2024.100476

12

Chen X. Jiang S. Xu L. Xu H. Guan N. (2023). Resilience assessment and obstacle factor analysis of urban areas facing waterlogging disasters: a case study of Shanghai, China. Environ. Sci. Pollut. Res.30, 65455–65469. doi: 10.1007/s11356-023-26861-1

13

Christopherson S. Michie J. Tyler P. (2010). Regional resilience: theoretical and empirical perspectives. Camb. J. Reg. Econ. Soc.3, 3–10. doi: 10.1093/cjres/rsq004

14

Cogley T. Nason J. M. (1995). Effects of the Hodrick-Prescott filter on trend and difference stationary time series implications for business cycle research. J. Econ. Dyn. Control.19, 253–278. doi: 10.1016/0165-1889(93)00781-X

15

Corodescu-Roșca E. Hamdouch A. Iațu C. (2023). Innovation in urban governance and economic resilience. The case of two Romanian regional metropolises: Timișoara and Cluj Napoca. Cities132:104090. doi: 10.1016/j.cities.2022.104090

16

Cowell M. M. (2013). Bounce back or move on: regional resilience and economic development planning. Cities30, 212–222. doi: 10.1016/j.cities.2012.04.001

17

Cross R. McNamara H. Pokrovskii A. V. (2012). Memory of recessions. J. Post Keynes. Econ.34, 413–430. doi: 10.2753/PKE0160-3477340302

18

Davies S. (2011). Regional resilience in the 2008-2010 downturn: comparative evidence from European countries. Camb. J. Reg. Econ. Soc.4, 369–382. doi: 10.1093/cjres/rsr019

19

de Graaf-Zijl M. van der Horst A. van Vuuren D. Erken H. Luginbuhl R. (2015). Long-term unemployment and the great recession in the Netherlands: economic mechanisms and policy implications. De Economist163, 415–434. doi: 10.1007/s10645-015-9263-y

20

Demirgüç-Kunt A. Klapper L. Singer D. Ansar S. (2022). The global Findex database 2021: Financial inclusion, digital payments, and resilience in the age of COVID-19. Chapter 1: Financial Access (English) Washington, D.C.: The World Bank. Available online at: http://documents.worldbank.org/curated/en/099833507072223098

21

Derissen S. Quaas M. F. Baumgärtner S. (2011). The relationship between resilience and sustainability of ecological-economic systems. Ecol. Econ.70, 1121–1128. doi: 10.1016/j.ecolecon.2011.01.003

22

Feng Y. Lee C.-C. Peng D. (2023). Does regional integration improve economic resilience? Evidence from urban agglomerations in China. Sustain. Cities Soc.88:104273. doi: 10.1016/j.scs.2022.104273

23

Gabor D. Brooks S. (2017). The digital revolution in financial inclusion: international development in the fintech era. New Polit. Econ.22, 423–436. doi: 10.1080/13563467.2017.1259298

24

Gherhes C. Vorley T. Williams N. (2018). Entrepreneurship and local economic resilience: the impact of institutional hysteresis in peripheral places. Small Bus. Econ.51, 577–590. doi: 10.1007/s11187-017-9946-7

25

Ghouchani M. Taji M. Yaghoubi Roshan A. Seifi Chehr M. (2021). Identification and assessment of hidden capacities of urban resilience. Environ. Dev. Sustain.23, 3966–3993. doi: 10.1007/s10668-020-00752-8

26

Giannakis E. Bruggeman A. (2020). Regional disparities in economic resilience in the European Union across the urban–rural divide. Reg. Stud.54, 1200–1213. doi: 10.1080/00343404.2019.1698720

27

Gomber P. Koch J.-A. Siering M. (2017). Digital finance and FinTech: current research and future research directions. J. Bus. Econ.87, 537–580. doi: 10.1007/s11573-017-0852-x

28

He D. Tang Y. Wang L. Mohsin M. (2023). Can increasing technological complexity help strengthen regional economic resilience?Econ. Change Restruct.56, 4043–4070. doi: 10.1007/s10644-023-09506-8

29

Huggins R. Thompson P. (2015). Local entrepreneurial resilience and culture: the role of social values in fostering economic recovery. Camb. J. Reg. Econ. Soc.8, 313–330. doi: 10.1093/cjres/rsu035

30

Hu X. Li L. Dong K. (2022). What matters for regional economic resilience amid COVID-19? Evidence from cities in Northeast China. Cities120:103440. doi: 10.1016/j.cities.2021.103440

31

Jagtiani J. Lemieux C. (2019). The roles of alternative data and machine learning in fintech lending: evidence from the LendingClub consumer platform. Financ. Manage.48, 1009–1029. doi: 10.1111/fima.12295

32

Jiang W. Wang K.-L. Miao Z. (2023). Can telecommunications infrastructure enhance urban resilience? Empirical evidence from a differences-in-differences approach in China. Environ. Dev. Sustain.27, 2379–2410. doi: 10.1007/s10668-023-03971-x

33

Kindleberger C. P. (1973). The formation of financial centers: a study in comparative economic history. (Massachusetts Institute of Technology, Department of Economics), Cambridge, M.I.T: Working paper. 114.

34

King R. G. Levine R. (1993). Finance and growth: Schumpeter might be right. Q. J. Econ.108, 717–737. doi: 10.2307/2118406

35

Levine R. (1991). Stock markets, growth, and tax policy. J. Finance46, 1445–1465. doi: 10.1111/j.1540-6261.1991.tb04625.x

36

Liu L. Lu S. (2023). Digital economy, financial development and economic resilience. Financ. Trade Res.34, 67–83. doi: 10.19337/j.cnki.34-1093/f.2023.07.006

37

Liu L. Meng Y. Wu D. Ran Q. Cao J. Liu Z. (2023). Impact of haze pollution and human capital on economic resilience: evidence from prefecture-level cities in China. Environ. Dev. Sustain.25, 13429–13449. doi: 10.1007/s10668-022-02625-8

38

Mai X. Zhan C. Chan R. C. K. (2021). The nexus between (re)production of space and economic resilience: an analysis of Chinese cities. Habitat Int.109:102326. doi: 10.1016/j.habitatint.2021.102326

39

Martin R. (2012). Regional economic resilience, hysteresis and recessionary shocks. J. Econ. Geogr.12, 1–32. doi: 10.1093/jeg/lbr019

40

Martin R. Sunley P. Gardiner B. Tyler P. (2016). How regions react to recessions: resilience and the role of economic structure. Reg. Stud.50, 561–585. doi: 10.1080/00343404.2015.1136410

41

Mashamba T. Gani S. (2023). Fintech, bank funding, and economic growth in sub-Saharan Africa. Cogent Econ. Finance11:2225916. doi: 10.1080/23322039.2023.2225916

42

Milian E. Z. Spinola M. D. M. Carvalho M. M. D. (2019). Fintechs: a literature review and research agenda. Electron. Commer. Res. Appl.34:100833. doi: 10.1016/j.elerap.2019.100833

43

Mudambi R. Mudambi S. M. Mukherjee D. Scalera V. G. (2017). Global connectivity and the evolution of industrial clusters: from tires to polymers in Northeast Ohio. Ind. Mark. Manag.61, 20–29. doi: 10.1016/j.indmarman.2016.07.007

44

Oprea F. Onofrei M. Lupu D. Vintila G. Paraschiv G. (2020). The determinants of economic resilience. The case of eastern European regions. Sustainability12:4228. doi: 10.3390/su12104228

45

Pechynakis K. Fragkos G. Zounis D. Belegris A. Veloukas Z. Charalampaki E. (2022). Openness, resilience and vulnerabilities in an uncertain world. Ir. Stud. Int. Aff.33, 65–90. doi: 10.1353/isia.0.0010

46

Philippon T. (2016). The FinTech opportunity. NBER. doi: 10.3386/w22476

47

Reggiani A. De Graaff T. Nijkamp P. (2002). Resilience: an evolutionary approach to spatial economic systems. Networks Spat. Econ.2, 211–229. doi: 10.1023/A:10153775156902

48

Rousseau P. L. (2002). Historical perspectives on financial development and economic growth. NBER Working Paper9333. doi: 10.3386/w9333

49

Shi C. Guo N. Gao X. Wu F. (2022). How carbon emission reduction is going to affect urban resilience. J. Clean. Prod.372:133737. doi: 10.1016/j.jclepro.2022.133737

50

Shi C. Lu J. (2024). Unlocking economic resilience: a new methodological approach and empirical examination under digital transformation. Land13:621. doi: 10.3390/land13050621

51

Shi Y. Zhang T. Jiang Y. (2023). Digital economy, technological innovation and urban resilience. Sustainability15:9250. doi: 10.3390/su15129250

52

Song N. Appiah-Otoo I. (2022). The impact of Fintech on economic growth: evidence from China. Sustainability14:6211. doi: 10.3390/su14106211

53

Stiglitz J. E. Weiss A. (1981). Credit rationing in markets with imperfect information. Am. Econ. Rev.71, 393–410.

54

Tan J. Hu X. Hassink R. Ni J. (2020). Industrial structure or agency: what affects regional economic resilience? evidence from resource-based cities in China. Cities106:102906. doi: 10.1016/j.cities.2020.102906

55

Tian Y. Guo L. (2023). Digital development and the improvement of urban economic resilience: evidence from China. Heliyon9:e21087. doi: 10.1016/j.heliyon.2023.e21087

56

Tschoegl A. E. (2000). International banking centers, geography, and foreign banks. Financ. Mark. Inst. Instrum.9, 1–32. doi: 10.1111/1468-0416.00034

57

Van Bergeijk P. A. G. Brakman S. Van Marrewijk C. (2017). Heterogeneous economic resilience and the great recession’s world trade collapse. Pap. Reg. Sci.96, 3–12. doi: 10.1111/pirs.12279

58

Wang Z. Wei W. (2021). Regional economic resilience in China: measurement and determinants. Reg. Stud.55, 1228–1239. doi: 10.1080/00343404.2021.1872779

59

Whitley R. (2000). The institutional structuring of innovation strategies: business systems, firm types and patterns of technical change in different market economies. Organ. Stud.21, 855–886. doi: 10.1177/0170840600215002

60

Williams N. Vorley T. (2014). Economic resilience and entrepreneurship: lessons from the Sheffield City region. Entrep. Reg. Dev.26, 257–281. doi: 10.1080/08985626.2014.894129

61

Wu Q. (2024). From bits to emissions: how FinTech benefits climate resilience?Empir. Econ.67, 2009–2037. doi: 10.1007/s00181-024-02609-9

62

Xie X. Shen Y. Zhang H. Guo F. (2018). Can digital finance promote entrepreneurship?--evidence from China (in Chinese). China Econ. Q.17, 1557–1580. doi: 10.13821/j.cnki.ceq.2018.03.12

63

Yang E. Kim J. Hwang C. S. (2022). The spatial moderating effect of environmental pollution on the relationship between tourism and community resilience. Tour. Manag.93:104554. doi: 10.1016/j.tourman.2022.104554

64

Yang L. Wang S. (2022). Do fintech applications promote regional innovation efficiency? Empirical evidence from China. Socio Econ. Plan. Sci.83:101258. doi: 10.1016/j.seps.2022.101258

65

Yao Y. Li J. Sun X. (2021). Measuring the risk of Chinese Fintech industry: evidence from the stock index. Financ. Res. Lett.39:101564. doi: 10.1016/j.frl.2020.101564

66

Zhou H. Li S. (2022). Effect of COVID-19 on risk spillover between fintech and traditional financial industries. Front. Public Health10:979808. doi: 10.3389/fpubh.2022.979808

67

Zhou J. Wang M. (2023). The role of government-industry-academia partnership in business incubation: evidence from new R&d institutions in China. Technol. Soc.72:102194. doi: 10.1016/j.techsoc.2022.102194

Appendix

VIF test results of control variables

| Variable | VIF | 1/VIF |

|---|---|---|

| gdp | 6.38 | 0.156658 |

| stud | 2.20 | 0.455518 |

| consu | 6.52 | 0.153486 |

| fisdec | 2.10 | 0.477036 |

| finindex | 1.29 | 0.772403 |

| FDI | 1.27 | 0.790247 |

| greenrate | 1.18 | 0.846439 |

| Mean VIF | 2.99 |

Summary

Keywords

economic resilience, Fintech, China, financial constraint, financial scale

Citation

Lyu J, Li J, Liu H and Liu L (2025) Digital finance for economic resilience: the uneven impact of Fintech across urban China. Front. Sustain. Cities 7:1671032. doi: 10.3389/frsc.2025.1671032

Received

22 July 2025

Accepted

16 October 2025

Published

10 November 2025

Volume

7 - 2025

Edited by

Sameh Al-Shihabi, University of Sharjah, United Arab Emirates

Reviewed by

Zhengjie Tian, Shandong University of Finance and Economics, China

Yiwei Wang, Postal Savings Bank of China, China

Updates

Copyright

© 2025 Lyu, Li, Liu and Liu.

This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jia Li, lijia01@cueb.edu.cn

Disclaimer

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.