- 1Chinese Academy of Labour and Social Security, Beijing, China

- 2School of Economics and Management, Wenzhou University of Technology, Wenzhou, China

- 3Xingzhi College, Zhejiang Normal University, Jinhua, China

- 4School of Management, Zhejiang University of Technology, Hangzhou, China

To realize the development goals of environmental governance and low-carbon emission reduction, the effect of local environmental protection fiscal expenditure on carbon emissions needs to be assessed. This paper utilizes the panel data of 30 provinces in mainland China except Tibet from 2007 to 2019 and empirically examines the baseline effect, the mechanism, the nonlinear effect, and the spatial spillover effect of the local environmental protection fiscal expenditures affecting the intensity of carbon emissions by using the fixed-effects model, the FGLS model, the threshold panel model, and the spatial Durbin model. The results indicate that local environmental fiscal expenditure significantly lowers carbon emissions, generating a carbon reduction effect, and this finding remains robust under various checks; the mechanism analysis reveals that local environmental fiscal expenditure facilitates industrial structure upgrading, thereby indirectly producing a carbon reduction effect; the threshold analysis shows that the carbon reduction effect of local environmental fiscal expenditure exhibits a diminishing marginal tendency, and as the industrial structure continues to upgrade, the carbon reduction effect of local environmental fiscal expenditure displays an “Inverted U-shaped” pattern; the spatial analysis demonstrates that local environmental fiscal expenditure and carbon emissions have positive spatial autocorrelation, and local environmental fiscal expenditure in one region will induce a decline in carbon emissions in neighboring regions through spatial spillover effect. Based on the above results, this paper puts forward policy suggestions in terms of constructing a reasonable growth mechanism for local environmental protection financial expenditures, creating an ecological environment for low-carbon transformation, and constructing a reasonable regional coordination mechanism for carbon emission reduction.

1 Introduction

As the world’s second-largest economy, China also faces the challenges of high energy consumption and carbon dioxide emissions. According to the BP Statistical Yearbook of World Energy (2021), China’s GDP reached 101.60 trillion yuan in 2020, with a per capita GDP of 72,000 yuan, reflecting the rapid economic development that satisfies the increasing material demands of the population and provides a solid basis for achieving common prosperity. However, this development mode, which relies on high pollution, high energy consumption, and high investment, has also resulted in severe environmental degradation and ecological damage. China’s energy consumption in 2020 accounted for 26.13% of the global total, of which coal consumption accounted for 54.33%, far exceeding other countries and regions. China’s carbon dioxide emissions also accounted for 30.66% of the global total, making it the largest carbon emitter in the world. Therefore, the reduction of China’s carbon emissions has an extremely important and far-reaching impact on global carbon reduction.

Local governments and local environmental fiscal expenditure are key actors in advancing carbon emission reduction (Fulai, 1997; López et al., 2011). The central government has delegated the authority and expenditure responsibilities of low-carbon governance to local governments, enabling them to leverage their informational advantage for carbon emission reduction. The State Council of China issued a notice on the reform program for the division of fiscal authority and expenditure responsibility between the central and local governments in the field of ecology and environment, which clarifies the division of fiscal authority and expenditure responsibility between the central and local governments in the field of ecology and environment, and further establishes the governance authority of local governments in ecological environmental protection and low-carbon development. Local fiscal expenditure, as a major funding source for local low-carbon governance, provides fiscal support for local governments to exercise their governance initiative and is an important instrument for achieving local government governance transformation (Peng et al., 2021). A longitudinal analysis of the fiscal data reveals that the environmental protection expenditure in China has experienced substantial growth since 2007, the year when the “Environmental Protection” fiscal account was established. The total environmental expenditure of the central and local governments increased from 99.582 billion yuan in 2007 to 633.340 billion yuan in 2020, with a net increase of 533.758 billion yuan, representing 2% of the national fiscal expenditure in 2007 and 2.58% in 2020. The local environmental fiscal expenditure also rose from 96.124 billion yuan in 2007 to 598.914 billion yuan in 2020, accounting for 2.51% and 2.84% of the local general public budget expenditure respectively. Moreover, the local government’s share of the national environmental protection expenditure has remained above 90% since 2007, indicating that the local fiscal expenditure plays a vital role in financing ecological conservation and low-carbon transition.

From the above analysis, it is clear that to achieve the vision of carbon emission reduction, China needs to mobilize local governments to reduce carbon emissions and increase fiscal spending on environmental protection. However, this solution implies a basic assumption that increasing local fiscal spending on environmental protection will reduce carbon emissions. This basic assumption does not always hold, and in-depth research is needed to make a judgment, which is the important research significance of this paper. Therefore, the main research question is how local environmental fiscal expenditures affect carbon emission reduction outcomes. Alternatively, the paper asks whether local environmental fiscal expenditures significantly impact carbon emission reduction. A related sub-question is what are the underlying mechanisms and non-linear features of this impact. This question is relevant to China’s carbon peaking and neutrality targets and the global sustainable development agenda.

Despite the importance of local environmental governance systems, in which environmental fiscal expenditures play a key role, in China’s low-carbon transition, there is a lack of empirical evidence on how local environmental fiscal expenditures influence carbon emissions. Basoglu and Uzar (2019) (Basoglu and Uzar, 2019) based on environmental data in Europe, found that although full-caliber public financial expenditures do not have a significant effect on the ecological environment and even deteriorate the environmental situation to some extent, in terms of environmental protection expenditures, increasing environmental protection expenditures has a significant positive impact on reducing the ecological deficit as well as improving environmental quality. Halkos (2017) (Halkos and Paizanos, 2017) used international panel data to analyze in depth the extent of the direct impact of government expenditure on air quality, and the results of the study showed that government public expenditure has a significant inhibitory effect on air pollutants such as sulfur dioxide, and economic growth is a positive moderator of this effect. Huang’s (2018) (Huang, 2018) study also further confirmed that government environmental protection expenditure can effectively reduce the emission of pollutants such as sulfur dioxide, and it was also found that the introduction of foreign capital has a significant positive effect on environmental governance, that is, the reduction of pollutants gradually increases as the degree of foreign capital introduction increases. Further, Adewuyi (2016) (Adewuyi, 2016) showed that there is a significant difference in the effect of government expenditure and private expenditure on carbon emissions, with private investment increasing carbon emissions, while public expenditure exhibits a carbon abatement effect. In addition, the existing literature has extensively studied topics related to local fiscal spending on economic development (Huang et al., 2022), fiscal decentralization affecting the haze problem (Wang et al., 2022), and federal-local fiscal interaction (Koethenbuerger, 2011), which form a useful reference for this paper. However, it should be pointed out that there are relatively few studies in the existing literature on the carbon emission reduction effect of local environmental protection financial expenditures. Moreover, the existing studies tend to adopt a simplistic approach to constructing carbon emission indicators, which may not capture the full picture of China’s carbon emissions, and thus compromise the robustness of their findings. Therefore, this paper constructs a comprehensive carbon dioxide emission inventory that includes both energy consumption and cement production emissions for each region, and empirically examines the link between local environmental fiscal expenditure and carbon emission intensity from the perspective of industrial upgrading, using various econometric methods such as the mediation effect model, the threshold panel model, and the spatial Durbin model to conduct a multi-dimensional empirical analysis.

The innovations of this paper are: first, local environmental protection fiscal expenditure and carbon emission intensity are included in a unified analytical framework for theoretical analysis by taking industrial structure upgrading as a link, which is a supplement to the existing research. Second, the impact of local environmental protection fiscal expenditure on carbon emission intensity under different levels of local environmental protection fiscal expenditure and industrial structure is examined based on the threshold model, thus expanding the study on the nonlinear characteristics of the carbon emission reduction effect of local environmental protection fiscal expenditure. Third, the spatial spillover effect of local environmental protection fiscal expenditure on carbon emission intensity is examined based on the spatial econometric model, which provides empirical evidence for the synergistic realization of inter-regional carbon emission reduction.

2 Theoretical framework and literature review

2.1 How local government environmental protection spending influences carbon emission intensity: A mechanism analysis

Carbon emission reduction effectiveness refers to the degree to which low-carbon emission reduction policy instruments can achieve the emission reduction goal, which is manifested at the macro level by the persistent decline of the overall carbon emission level, and at the micro level by the continuous improvement of production processes and low-carbon technological innovation of firms (Sinha and Chaturvedi, 2019). Local environmental protection fiscal spending, which includes expenditure items such as pollution prevention and control, pollution abatement, circular economy, and others, aims to foster the development of a circular economy and enhance the intensity of air pollution prevention and thus has a direct impact on carbon emission reduction.

Moreover, as industrial structure upgrading influences carbon emission intensity, local environmental fiscal expenditures can also indirectly affect carbon emission intensity by facilitating industrial structure upgrading. Specifically, the rise of local environmental fiscal expenditure will reinforce the execution of local government environmental protection policies and stimulate industrial structure upgrading by using constraints and incentives. Regarding constraints, the expenditures for environmental monitoring and supervision, ecological environment monitoring and information, ecological environment law enforcement and supervision, etc., in the local environmental fiscal expenditures will intensify the environmental protection supervision in the region, which will increase the environmental costs of regional enterprises, thus creating a “crowding out effect” on the regional polluting enterprises (Greenstone and Hanna, 2014; Du et al., 2021) and leading to the relocation of highly polluting enterprises to the neighboring areas. The environmental regulation effect brought by local environmental fiscal expenditure will also lower the profitability of enterprises, thus decreasing the production capacity of high-energy-consuming industries and advancing the production process of greening (Acemoglu et al., 2012). From an incentive perspective, the recent enhancement of the promotion evaluation mechanism and the rising importance of environmental protection indicators, ecological civilization construction indicators, and green development indicators in the supervision of local governments, the evaluation of leading cadres and the exit audits, especially the implementation of the environmental protection inspection system, have created a “pressure mechanism” to prioritize environmental protection and low-carbon development. Environmental protection and low-carbon development have been designated as key tasks, and local governments will increase their support for high-tech enterprises with high knowledge and technology intensity, provide environmental funding support for green industries through the establishment of science and technology parks, and promote the transformation of the regional industrial structure by using “targeted incentives” (Heberer T and Senz, 2011).

In addition, the following mechanisms link industrial structure to carbon emission intensity: first, upgrading industrial structure can lower energy consumption levels. The secondary industry has a high concentration of energy-intensive sectors, making it the main source of carbon emissions among the three industries. Therefore, optimizing and upgrading the industrial structure and shifting the leading sectors to the service industry, which has lower energy consumption and carbon emissions, can help reduce the total energy consumption intensity and energy dependence of the economy. Furthermore, the granularity of industrial structure affects carbon emission levels, and the more fine-grained the industrial divisions are, the larger the impact of industrial structure on carbon emissions (Zhu and Zhang, 2021). Second, upgrading the industrial structure can enhance overall production efficiency. As the dominant industry changes, factors of production such as labor and capital flow across industries, resulting in a more optimal allocation of resources. This improves the production efficiency of enterprises and also advances their green transformation process, enabling them to increase their product competitiveness while fulfilling their ecological and environmental protection responsibilities (Zhang and Dilanchiev, 2022). This is beneficial for improving their market share and also for lowering their carbon emission intensity, thus achieving an effective integration of economic efficiency and low-carbon efficiency. In addition, the industrial structure upgrading will facilitate the development of new sectors. As the industrial structure upgrading progresses, new sectors will emerge and new technologies and business models will be adopted and applied. These new sectors have high value-added and low energy consumption, which can effectively replace the old sectors with high energy consumption and pollution, thereby lowering the carbon emission intensity (Zhang et al., 2022).

Based on this analysis, we propose the following research hypotheses:

H1. The local environmental fiscal expenditure can help reduce the carbon emission intensity.

H2. The industrial structure upgrading is a key mechanism for the local environmental fiscal expenditure to achieve the carbon emission reduction effect.

2.2 Non-linear analysis of the effect of local environmental fiscal expenditure on carbon emission intensity

Local environmental fiscal expenditure, as a key policy instrument to influence environmental management and low-carbon emission reduction, will exert direct and indirect effects on carbon emission intensity. Given the variations in the predominant effect of local environmental fiscal expenditure on carbon emissions under different levels of local environmental fiscal expenditure, local environmental fiscal expenditure may be a non-linear determinant of its capacity to lower carbon emission intensity.

The central government has intensified its efforts to safeguard the ecology and environment and has reinforced the legitimacy of its environmental policies through the central ecological and environmental protection inspection. This has prompted the local government to assume more responsibility for local environmental protection and to enhance the overall effectiveness of local environmental fiscal expenditure (Bai et al., 2018). In the initial phase of increasing local environmental fiscal expenditure, the priority of local environmental fiscal expenditure is on high-energy consumption and high-pollution industries, and by augmenting the environmental monitoring and supervision of this sector, it can substantially lower the level of environmental pollution and carbon emissions (Feiock and Stream, 2001). Concurrently, in this phase, the central ecological and environmental protection supervision is also more robust, employing two mechanisms of vertical intervention and horizontal assimilation to strengthen the environmental functions of local governments. The local government reduces the degree of substitutional implementation and tacit collusion or rent-seeking with enterprises, optimizes the government-enterprise interaction in the environmental field, and regulates polluting enterprises more effectively by allocating fiscal resources to environmental management in pollution-intensive areas (Ding et al., 2022), which helps to realize the marginal carbon-reduction effect of environmental protection expenditures.

This paper examines the impact of local environmental protection finance on carbon emissions reduction, taking into account the heterogeneity of expenditure allocation and the non-linearity of the effect. We argue that local environmental protection finance plays a significant role in mitigating carbon emissions by investing in key sectors and highly polluted areas that are subject to strict environmental regulation (Nabatchi and Amsler, 2014). However, the marginal effect of local environmental protection finance on carbon emissions reduction decreases as the expenditure scale increases and the expenditure scope expands to non-key sectors and less polluted areas. Moreover, we suggest that local environmental protection finance may have a negative “crowding out effect” on private sector innovation (Mullins and Joyce, 1996) and investment in environmental protection, which may weaken the overall effect of local environmental protection finance on carbon emissions reduction.

Based on this analysis, we propose the following research hypotheses:

H3. Local environmental protection finance has a diminishing marginal effect on carbon emissions reduction.

To examine the diverse patterns of economic growth across developed and developing nations, it is crucial to understand the role of industrial structure upgrading, which is also a key element for achieving low-carbon emissions and high-quality development in China (Su and Fan, 2022). The environmental fiscal expenditures of local governments have a non-linear effect on carbon emission intensity under different industrial structures. The concept of industrial structure upgrading entails two aspects: one is the inter-industry variation in growth rates due to the differences in technological innovation, demand, and absorption capacity among industries, which leads to changes in the composition of the economy; the other is the shift of leading industries along the stages of economic development, which influences the production and consumption behavior of the economy and further stimulates the industrial structure upgrading, creating a virtuous cycle (You and Zhang, 2022).

The industrial structure of an economy transforms as it develops, shifting from a primary sector dominated by agriculture to a secondary sector dominated by low-value-added manufacturing industries that use large numbers of low-skilled workers. This transition entails a significant increase in energy consumption and carbon dioxide emissions, as well as a high carbon intensity due to the low value-added nature of the industries (Wang and Wang, 2021). Moreover, in this stage of development, economic growth is the primary objective of local governments, which reduces their incentives for environmental regulation and low-carbon policies. There is also a possibility that local governments may divert funds allocated for environmental protection to other productive expenditures (Abbott and Jones, 2023), resulting in higher carbon emissions. Hence, in the industrialization phase of development, the upgrading of industrial structure hurts the carbon emission reduction impact of local environmental fiscal expenditure, and may even increase the carbon emission intensity.

As the industrial structure evolves to an intermediate level, local governments balance the objectives of economic growth, energy consumption, and ecological environmental protection, and adjust the composition and magnitude of fiscal expenditure to leverage the restraining effect of local environmental fiscal expenditure on carbon emissions (Song et al., 2021). However, at this stage, the industrial structure is still dominated by high energy-consuming manufacturing industries, and the emerging service industry is still in its infancy, so the carbon emission reduction effect achieved by local environmental fiscal expenditure is counteracted by the increase in carbon emission level caused by the expansion of production capacity of high-energy-consuming and high-polluting enterprises, and the overall emission reduction effect is unsatisfactory. As the industrial structure advances to a high-end level, the share of labor- or capital-intensive manufacturing industries gradually declines, and the tertiary industry with low energy consumption and high added value as well as high-tech manufacturing industry become the predominant industries, and their share in the industrial structure continues to rise (Ge et al., 2022; Zhu, 2022). The industrial structure upgrade also extends the market boundary to the global market, and firms will invest more in R&D and environmental protection to gain a larger market share (Jiang et al., 2020). This facilitates the creation of a production collaboration network that enhances the production interaction among firms fosters knowledge production and diffusion and also facilitates the innovation of cleaner production technology under the guidance of differentiation strategies, thus continuously magnifying the carbon reduction effect of local environmental protection and fiscal expenditures. This also facilitates the innovation of cleaner production technology by firms under the guidance of differentiation strategies, thus continuously magnifying the carbon reduction effect of local environmental protection expenditure.

Based on the above analysis, we propose the following research hypotheses:

H4. As the industrial structure upgrade continues, the carbon reduction effect of local environmental fiscal expenditures exhibits an “inverted U-shaped” feature.

3 Research strategy

3.1 Empirical model

To test the hypothesis that local environmental fiscal expenditure affects carbon emission intensity through industrial structure upgrading, we derive the following empirical model from the theoretical analysis in this section. The model specification is as follows:

We use CEI as the dependent variable to measure the regional carbon emission intensity. FEE is the key independent variable that captures the local environmental fiscal expenditure. ISU is the mediating variable that reflects the regional industrial structure upgrading.

To examine the possibility of a nonlinear moderating effect of local environmental fiscal expenditure and industrial structure upgrading on the carbon emission reduction effect of local environmental fiscal expenditure, we adopt the panel threshold model developed by Hansen (1999) (Bruce, 1999) and Wang (2015) (Wang, 2015). The model specification is as follows:

A single threshold model is specified in Eq. 4, where X denotes the threshold variable, is the threshold value, and I (·) is an indicator function that equals one if the condition in parentheses is met, and 0 otherwise. To test for the presence of multiple thresholds, we employ the likelihood-ratio test statistic developed by Hansen (1999) (Guan, 1996), and use the Bootstrap method to obtain the critical values of the test statistic with the following steps: Eq. 5

The variance of the error term can be consistently estimated by

3.2 Variable definitions

3.2.1 Carbon emission intensity (CEI)

We adopt the approach of Shan et al. (2020) (Shan et al., 2020) to construct a comprehensive carbon dioxide emission inventory that incorporates carbon emissions from both energy consumption and cement production. The calculation formula encompasses 26 kinds of fossil fuel consumption and carbon emissions from cement production, and covers 47 sectors in the national economic accounting system, ensuring a large scope and consistent data quality, which enhances the data basis for estimating the effects of carbon emission reduction. Following the IPCC carbon emission accounting method, the specific calculation formula is as follows:

Equation 6 is the carbon accounting equation for energy-related emissions, where

The production process generates carbon emissions, which mainly reflect the carbon dioxide released by the physicochemical reactions involved in the process, rather than the carbon emissions from fossil fuel combustion. Since cement production contributes to about 70% of the total carbon emissions from the process, and considering the data availability, we focus on estimating the carbon dioxide emissions from cement production. Specifically,

As Eq. 8 shows, we can obtain the total carbon emission

Equation 9 defines the carbon emission intensity, which is the ratio of the carbon emission

3.2.2 Local fiscal on environmental expenditure (FEE)

This paper examines the local environmental fiscal expenditure, which is defined as the portion of the general public budget expenditure allocated by the local government for ecological conservation and environmental management, to the changes in China’s fiscal budget system. This paper excludes the governmental fund budget expenditure, the state-owned capital operation budget expenditure, and the social insurance fund budget expenditure from the analysis. The indicator of the size of local environmental fiscal expenditure is the ratio of local environmental fiscal expenditure to the general public budget expenditure. The data source of local environmental protection expenditure follows the “energy-saving and environmental protection expenditure” category in the government revenue and expenditure classification issued by the Ministry of Finance of the People’s Republic of China.

3.2.3 Industrial structure upgrading (ISU)

This paper investigates how local environmental fiscal expenditure affects the upgrading and evolution of industrial structure, and how the upgrading of industrial structure influences carbon emission intensity. It highlights the alternating evolution of the leading industries, which drives the industrial structure to evolve towards non-agriculturalization. To measure this process, it uses the indicator of industrial structure upgrading. The indicator is based on the industrial structure hierarchy coefficient, which includes three industries and captures the structural upgrading and evolution of inter-industry and intra-industry. The specific calculation formula is as follows (Wu et al., 2021), Eq. 10:

The output value of each industry i, denoted by

3.2.4 Control variables

To further account for the effects of the economic environment on the regression outcomes, this paper considers the following control variables: fiscal self-reliance (FS), which is the ratio of general public budget revenue to general public budget expenditure; external openness (TO), which is the ratio of the sum of imports and exports to the regional GDP; nationalization rate (NAT), which is the share of state-owned enterprise employees in the total employed population; industrial concentration level (AGG), which is calculated using the location entropy index; and budget discrepancy (BD), which is the difference between the budget and final accounts of general public revenue as a percentage of the budget.

3.3 Data sources and descriptive statistics

The local environmental fiscal expenditure data before 2007 are not available, as they were not recorded separately but included in other accounts such as urban maintenance and construction expenditure. The independent accounting of environmental protection expenditure subjects started from 2007 onwards. Thus, this paper uses the panel data of 30 mainland provinces excluding Tibet from 2007 to 2019 for empirical analysis, considering the data accessibility and the panel balance.

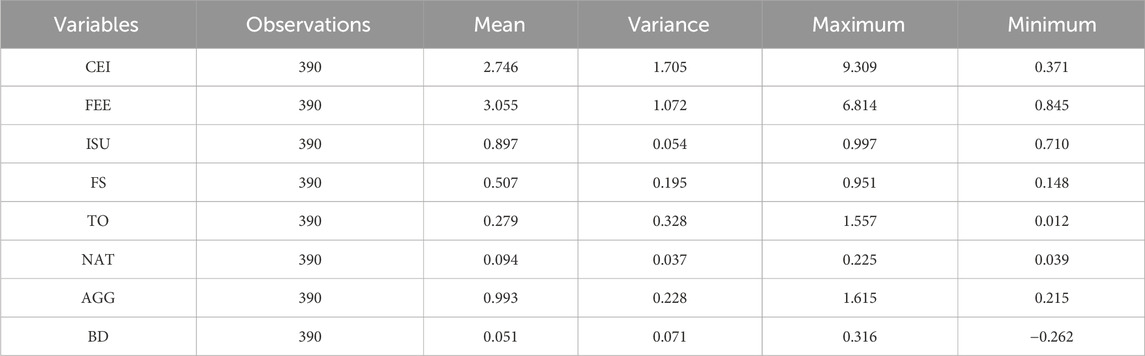

The data sources for this chapter are the China Statistical Yearbook, China Population and Employment Statistical Yearbook, China Fiscal Yearbook, China Taxation Yearbook, as well as the EPS Global Statistics Database and China Carbon Accounting Database. Table 1 presents the indicators used in this part and their descriptive statistics based on the above analysis.

4 Empirical analysis

4.1 Baseline model analysis

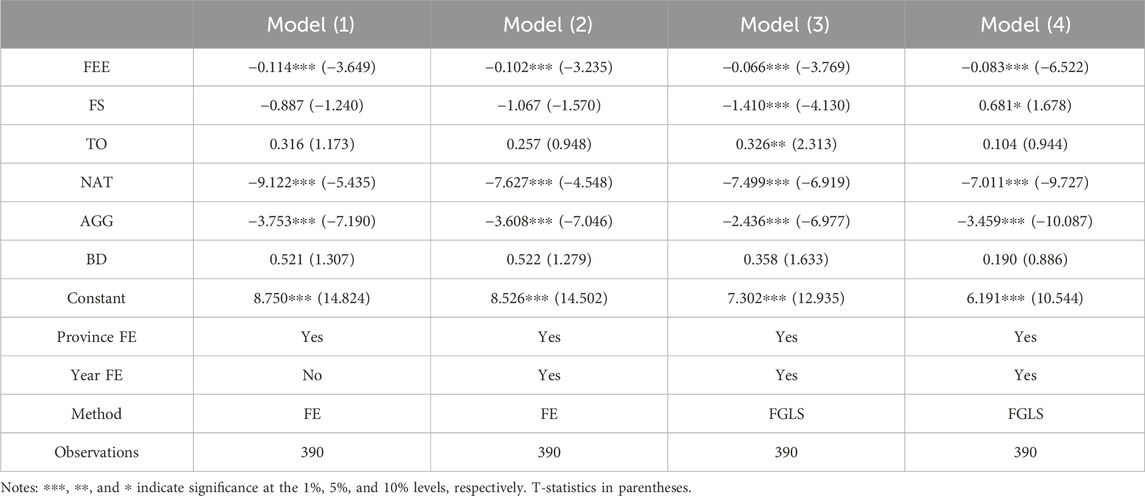

This paper examines how local environmental fiscal expenditure affects carbon emissions by estimating the model in Eq. 1. Table 2 reports the results, where Model (1) is based on the time fixed-effects model and Model (2) is based on the two-way fixed-effects model. To address potential heteroskedasticity and cross-sectional dependence in the model, Model (3) uses the FGLS estimator with heteroskedasticity correction, and Model (4) uses the FGLS estimator with both heteroskedasticity and cross-sectional dependence correction.

The Hausman test rejected the null hypothesis of time-fixed effects and suggested using the two-way fixed effects model for parameter estimation. However, both the time-fixed effects and the two-way fixed effects models show negative and significant coefficients at the 1% level. This implies that local environmental fiscal expenditure significantly lowers carbon emission intensity, holding other economic and social factors constant. Moreover, the results of Model (3) and Model (4) also confirm that local environmental fiscal expenditure has a significant negative impact on carbon emission intensity under other conditions, after accounting for heteroskedasticity and cross-sectional dependence and other violations of spherical error terms on top of the two-way fixed effects. The above results indicate that local environmental fiscal expenditure can effectively reduce carbon emission intensity, and thus has a significant carbon reduction effect. This verifies the research hypothesis H1 of this paper.

4.2 Robustness tests and endogeneity analysis

4.2.1 Robustness test

To verify the validity of the baseline regression model of the carbon emission effect of local fiscal expenditures, and to address the potential issues of dependent variable selection and other factors on the robustness of the research findings, this paper performs a robustness test of the baseline model by reconstructing the explanatory variables and the core explanatory variable. First, the absolute amount of carbon emissions from energy consumption and the carbon dioxide emission inventory of the cement production process are used as alternative explanatory variables instead of the relative amount of carbon emission intensity to re-estimate the carbon emission reduction effect of local environmental fiscal expenditures. Second, the proxy indicators of the core explanatory variable of local environmental fiscal expenditure are constructed for the robustness test. The absolute value of local environmental fiscal expenditures is used as a proxy indicator for the robustness test, which measures the carbon emission reduction effect brought by increasing one unit of local environmental fiscal expenditures, and it is another valid variable used to measure local environmental fiscal expenditures.

To address the potential issues of heteroskedasticity and cross-section correlation in the model, we use the FGLS model to perform a robustness check and report the results in Model (1) and Model (2) in Table 3. Specifically, Model (1) shows the estimation result after substituting the explanatory variable of carbon emission reduction intensity, and we observe that the regression coefficient of local environmental fiscal expenditure is significantly negative after controlling for other economic and social variables, which is in line with the finding of the baseline model. Model (2) presents the estimation result after substituting the key explanatory variable of local environmental fiscal expenditure, and we find that under the condition of other variables being constant, the local environmental fiscal expenditure has a significant effect on reducing carbon emissions, which is in agreement with the finding of the baseline model. Overall, the estimation results of the baseline model are robust based on the above tests.

4.2.2 Endogeneity analysis

This paper examines the bidirectional relationship between local environmental fiscal expenditure and carbon emission intensity. The hypothesis is that local environmental fiscal expenditure has an impact on carbon emission intensity, while carbon emission intensity also influences the intensity of local environmental protection expenditure. To address the endogeneity issue arising from this reverse causality, this section employs the lagged values of the key explanatory variables as proxies and instrumental variables.

To estimate the parameters under FGLS, we use the local environmental fiscal expenditure lagged by one period as a proxy variable, and then we use it as an instrumental variable for the two-step GMM estimation. Table 3 shows the results of Model (3) and Model (4). Model (3) uses the lagged local environmental fiscal expenditure as a proxy variable and its coefficient is significantly negative, which agrees with the benchmark model. Model (4) uses the two-step GMM estimation with the lagged local environmental fiscal expenditure as the instrumental variable for the main explanatory variables. The Anderson test and the Cragg-Donald Wald test indicate that the model is valid and does not suffer from weak instrument problems. The results show that the local environmental fiscal expenditure has a significant negative effect on carbon emission intensity, which is consistent with the benchmark model. Therefore, we can conclude that local environmental fiscal expenditure is the main driver of the causal relationship between local environmental fiscal expenditure and carbon emission intensity and that this negative relationship is not affected by endogeneity. The robustness of the model estimation is confirmed.

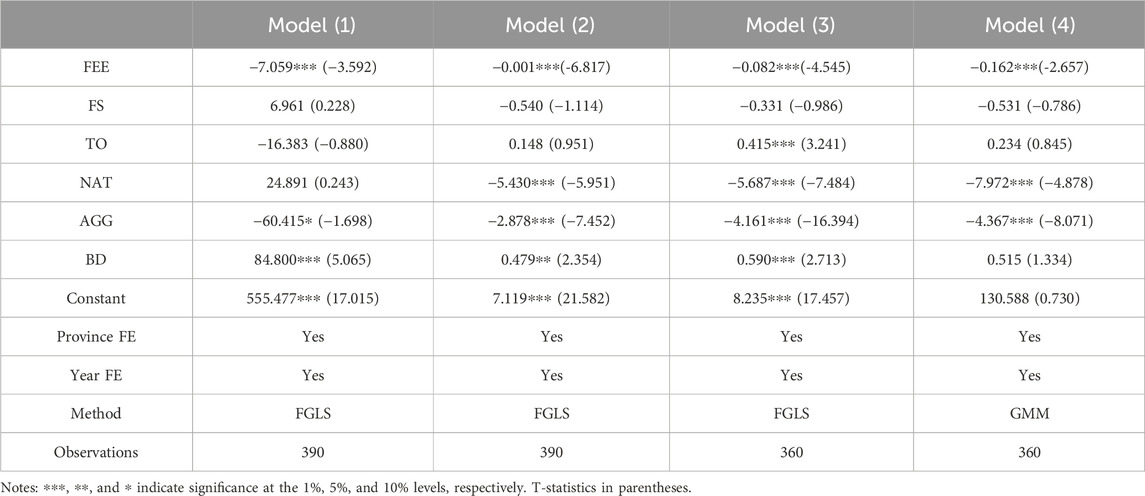

4.3 Mechanism analysis of industrial structure upgrading as a mediating variable

This section examines how local environmental fiscal expenditure influences carbon emission intensity through its impact on industrial structure, and tests the mediating effect of industrial structure upgrading on the carbon emission reduction effect of local environmental fiscal expenditure. To achieve this, the mediating variable is set as industrial structure, and Eqs. 1–3 are estimated jointly using the FGLS estimation method that accounts for heteroskedasticity and cross-section correlation under two-way fixed effects. The estimation results are shown in Table 4.

Using Table 4 as a reference, we find that model (1) confirms the negative relationship between local environmental fiscal expenditure and carbon emission intensity, controlling for other economic and social factors. This is in line with the existing literature. Model (2) indicates that local environmental fiscal expenditure has a positive effect on industrial structure upgrading, holding other economic and social conditions constant. Model (3) introduces the industrial structure as a mediator variable based on Model (1) and reveals that both local environmental fiscal expenditure and industrial structure upgrading contribute to lowering carbon emission intensity. Moreover, by comparing the coefficients, we observe that the impact of local environmental fiscal expenditure on carbon emission intensity is reduced after accounting for the industrial structure variable, but it remains significant. Thus, we infer that industrial structure upgrading partially mediates the influence of local environmental fiscal expenditure on carbon emission intensity, with a mediation effect of 10.18%. This suggests a mediation mechanism of “local environmental fiscal expenditure - industrial structure upgrading - carbon emission intensity.” This validates our research hypothesis H2.

4.4 Non-linear effect empirical results

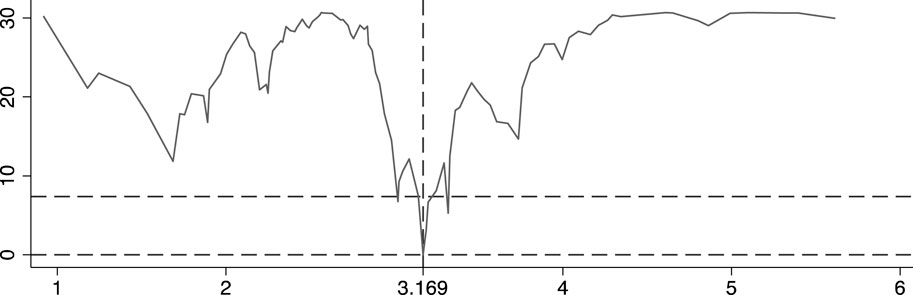

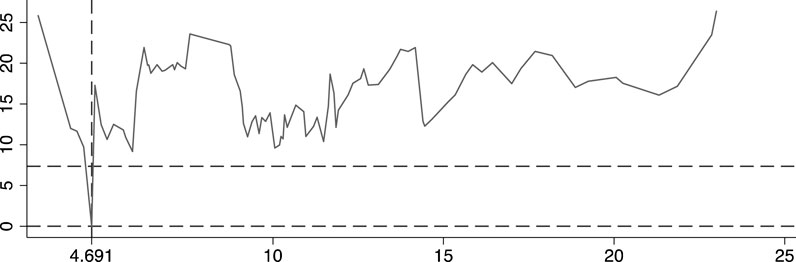

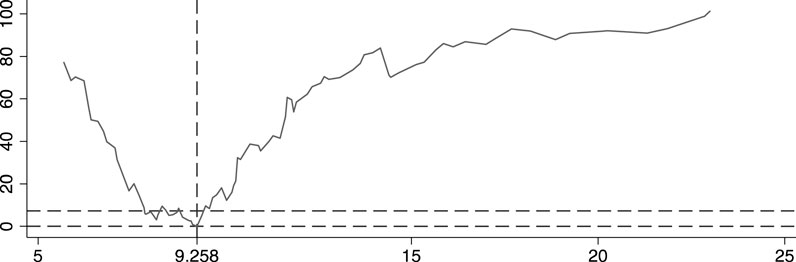

Using a panel threshold model, this paper examines the nonlinear features of the carbon reduction effect of local fiscal spending, taking into account the marginal diminishing impact of such spending and the moderating role of industrial structure upgrading. To test for the presence of threshold values, this section uses local environmental fiscal expenditure and industrial structure upgrading as threshold variables and performs 300 Bootstrap tests for single, double, and triple threshold models. The results indicate that the two threshold variables of local environmental fiscal expenditure and industrial structure upgrading pass the single and double threshold tests, respectively, but not the triple threshold test. Moreover, the validity of the threshold estimates is verified by the least squares likelihood ratio statistic LR value. The likelihood ratio function plots provide a visual representation of the estimation results with local environmental fiscal expenditure as the single threshold and industrial structure upgrading as the double threshold and estimate their corresponding 95% confidence intervals. The test results are displayed in Figures 1- 3, respectively.

The validity of the single threshold model is confirmed by Figure 1, which shows that the local environmental fiscal expenditure has a single threshold value of γ = 3.169 when LR = 0. This value is lower than the upper dashed line (LR = 7.352) (Wang, 2015) in the figure, which represents the 95% confidence interval for the single threshold value. Therefore, the single threshold model is consistent with the data.

As shown in Figure 2, the first threshold value of industrial structure upgrading, denoted by

Figure 2. Likelihood ratio function plot for the first threshold of the industrial structure upgrading threshold model.

Figure 3. Likelihood ratio function plot for the second threshold of the industrial structure upgrading threshold model.

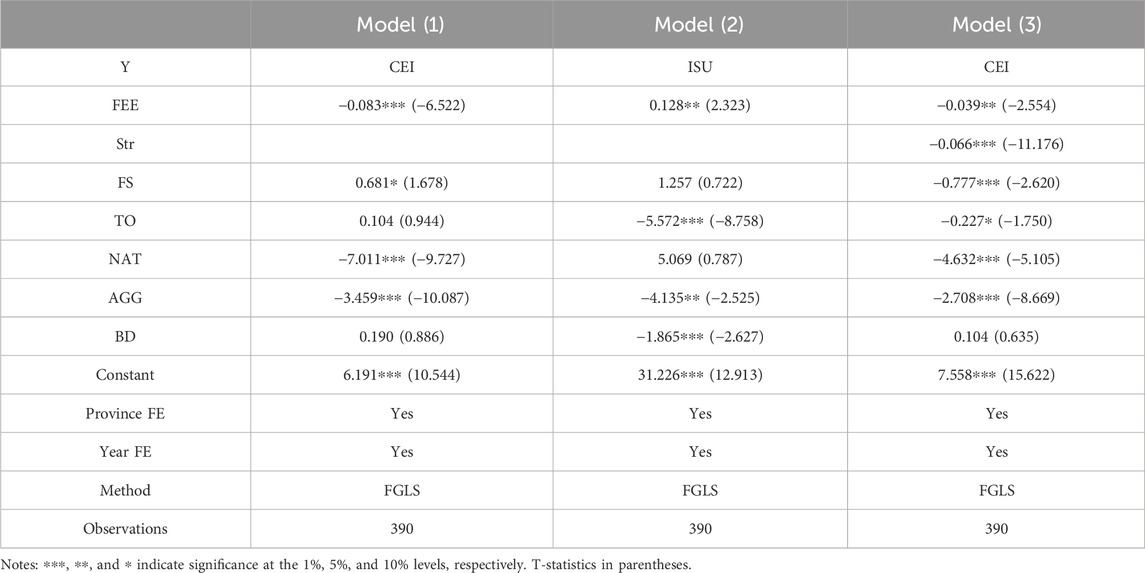

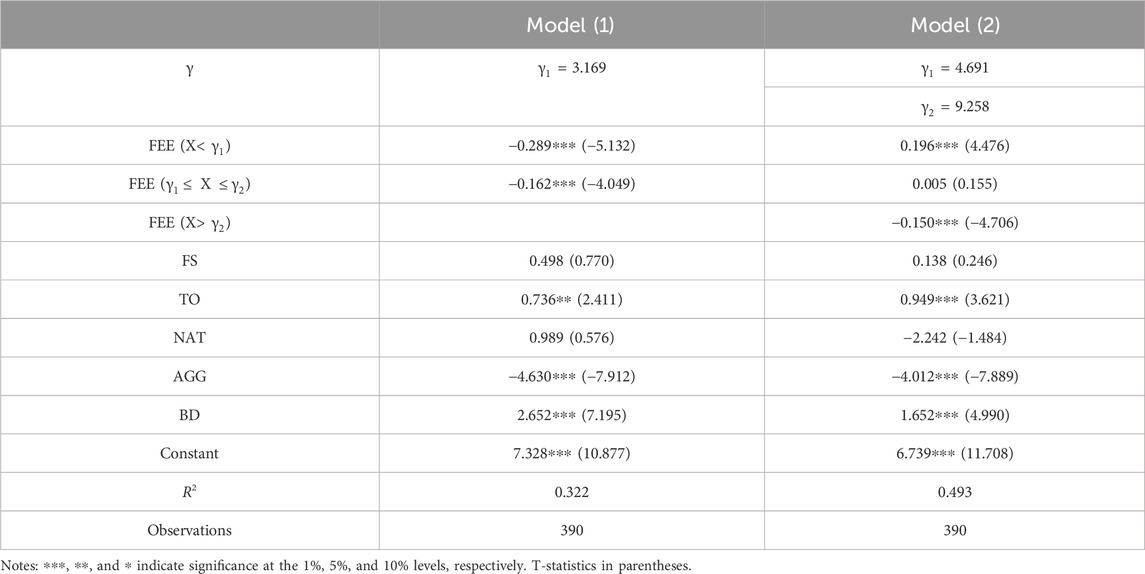

To examine the effects of local environmental fiscal expenditure and industrial structure upgrading on environmental quality, we conduct regression analysis using single-threshold and double-threshold variables respectively. Table 5 reports the estimation results.

Using model (1) in Table 5, we examine the impact of local environmental fiscal expenditure on carbon emission intensity, controlling for other economic and social factors. We find that the impact is nonlinear and depends on the level of local environmental fiscal expenditure. Specifically, the coefficient of FEE (q<γ) is −0.289 and significant at the 1% level, indicating that when local environmental fiscal expenditure is below 3.169, it reduces carbon emission intensity. However, when local environmental fiscal expenditure is above 3.169, the coefficient of FEE (q≥γ) is −0.162 and also significant at the 1% level, indicating that the reduction effect is smaller. We also conduct an F-test to compare the coefficients of FEE (q<γ) and FEE (q≥γ) and reject the null hypothesis of equality with an F-statistic of 23.79 and a p-value of 0.000. This suggests that local environmental fiscal expenditure exhibits diminishing marginal returns in terms of carbon emission reduction. This confirms our research hypothesis H3.

As shown in Table 5, Model (2) estimates the nonlinear impact of local environmental fiscal expenditures (FEE) on carbon emission intensity (C) after controlling for other economic and social factors. The results indicate that the effect of FEE on C depends on the level of industrial structure upgrading (ISU). Specifically, when ISU is below 4.691, FEE has a positive and significant coefficient of 0.196 at the 1% level, implying that FEE increases C; when ISU is between 4.691 and 9.258, FEE has an insignificant coefficient, suggesting that FEE does not affect C; when ISU is above 9.258, FEE has a negative and significant coefficient of −0.150 at the 1% level, indicating that FEE reduces C. Furthermore, the F-tests for the null hypotheses of equal coefficients of FEE across different ranges of ISU all reject the null at the 1% level, confirming the existence of nonlinearities in the relationship between FEE and C. A causal relationship between local environmental fiscal expenditure and carbon emission intensity is moderated by the level of industrial structure upgrading. When the latter is low, the former fails to reduce carbon emission intensity and may even increase it. Only when the level of industrial structure upgrading surpasses a threshold, local environmental fiscal expenditure becomes effective in lowering carbon emission intensity. This implies an “inverted U-shaped” pattern of the moderating effect of industrial structure upgrading on the causal relationship between local environmental fiscal expenditure and carbon emission intensity. This confirms hypothesis H4 of this study.

5 Further analysis

One of the key factors that explain China’s remarkable economic growth is the role of local governments and their competitive behavior. Local governments compete with each other under a decentralized system that sets clear criteria for promotion and evaluates them based on common indicators and diverse strategies. This competition is effective because many localities achieve the targets that qualify them for the “promotion tournament”, which involves choosing the optimal policy mix to maximize their regional welfare given their resource endowment (Solé-Ollé, 2006; Zhang et al., 2021). This optimal choice depends on the actions of other local governments, especially in the area of carbon emission reduction, which has a spatial spillover effect (Deng et al., 2012). The market conditions in the low carbon emission reduction sector are imperfectly competitive, which further enhances the strategic interaction among local governments.

This paper argues that the central government plays a crucial role in shaping the environmental protection spending and low-carbon emission reduction actions of local governments. While local governments have some autonomy in the central-local relations game (Jimenez, 2009), they are constrained by the environmental protection and low-carbon assessment standards set by the central government, which is the dominant actor in the central-local relations and local decision-making, and local governments cannot opt out of the competition (Schuknecht, 1998). This implies that the central government can limit the options of local governments in low carbon emission reduction, but it does not alter the reality of competition and strategic interaction among local governments.

Given the competition and strategic interaction among local governments in the area of carbon emission reduction, it is important to further examine the spatial spillover effect of local environmental fiscal expenditures in the area of carbon emission reduction and its determinants, which will help to address the current challenges of China’s low-carbon emission reduction from the perspective of local government interaction and provide adequate empirical support for improving the design of the top-level system as well as facilitating the inter-regional cooperation on emission reduction.

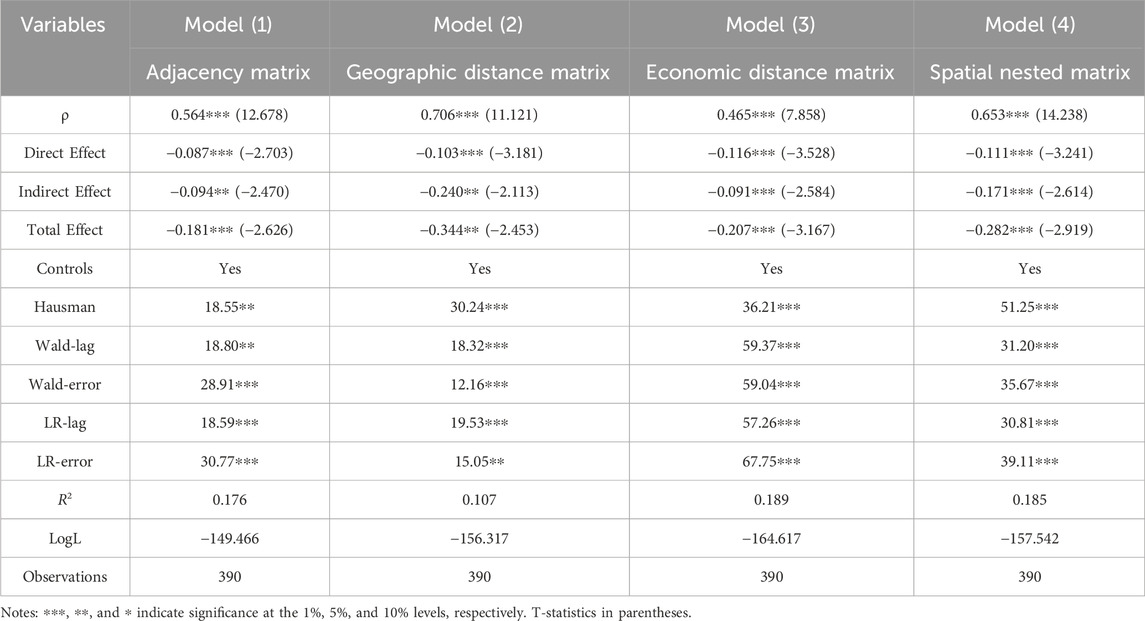

This section examines the spatial spillover effect of local environmental fiscal expenditure on carbon emission intensity by building a spatial econometric model. The spatial Durbin model (SDM) is more general than the spatial lag model (SAR) and the spatial error model (SEM), so this section constructs the spatial Durbin model by adding the spatial interaction term based on Eq. 1, and the specific model settings are as follows Mur et al. (2006), Eq. 11:

Where ρ is the spatial autoregressive coefficient, and W is the spatial weight matrix. This paper adopts four kinds of spatial weight matrices to examine the spatial effects of local environmental fiscal expenditure and carbon emission reduction, namely, adjacency matrix, geographic distance matrix, economic distance matrix, and spatial nested matrix. The choice of the appropriate model among SDM, SAR, and SEM can be determined by using the Wald test and the likelihood ratio (LR) test.

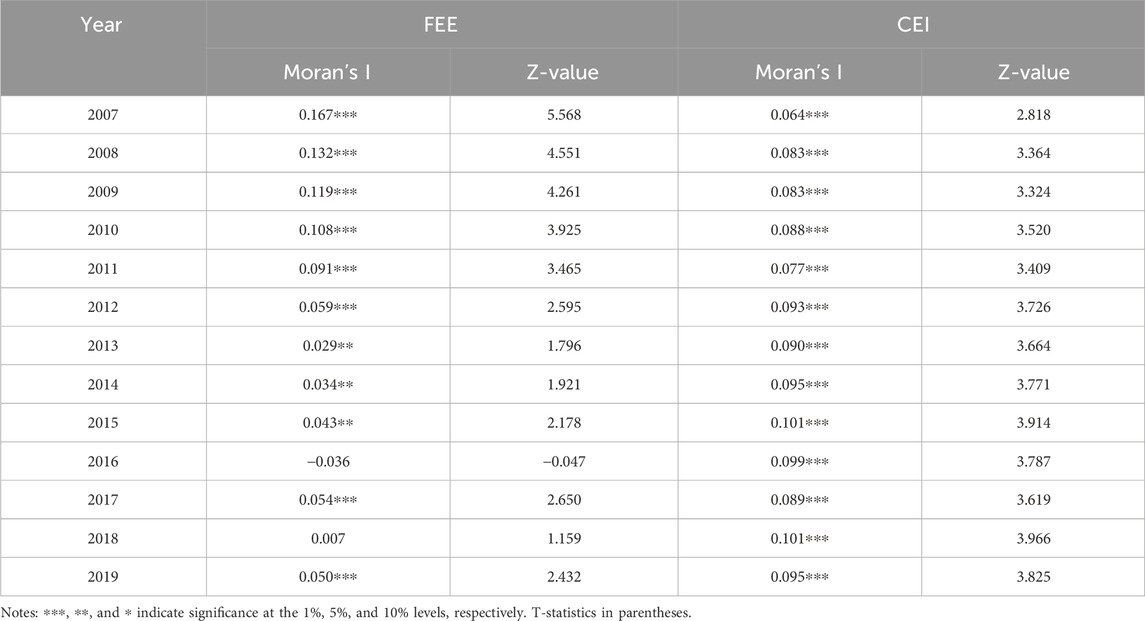

To examine the spatial spillover effect of local environmental fiscal expenditure on carbon emission intensity, we first conduct a spatial autocorrelation test on both variables following the steps of the spatial autocorrelation test. Based on the theoretical analysis of the spatial autocorrelation test, we use the global Moran’s I index method to compute the spatial autocorrelation under the geographic weight matrix for each year from 2007 to 2019, and we present the results in Table 6.

Table 6 demonstrates that local environmental fiscal expenditure exhibits significant positive spatial autocorrelation for most of the years between 2007 and 2019, as indicated by the positive and statistically significant global Moran’s I index. This implies that China’s local environmental fiscal expenditure is spatially clustered. However, the global Moran’s I index declines over time, suggesting that the spatial disparity of local environmental fiscal expenditure is gradually reduced. Regarding carbon emission intensity, the global Moran’s I index is also positive and significant for each year from 2007 to 2019, indicating that China’s carbon emission intensity is spatially dependent. Furthermore, the global Moran’s I index increases over time, implying that the spatial correlation of carbon emission intensity becomes stronger, i.e., the spatial pattern of high-high or low-low concentration of carbon emission intensity becomes more pronounced. Therefore, to examine the effect of local environmental fiscal expenditure on carbon emission intensity accurately, it is essential to use spatial econometric models for further analysis.

To verify the robustness of the estimation model outcomes, the spatial model underwent a series of systematic examinations, such as the Hausman test, LR test, and Wald test, using both “Specific-to-General” and “General-to-Specific” approaches (Elhorst, 2012). The outcomes are presented in Table 7. Based on the outcomes of the Hausman test, LR test, and Wald test, this section employs the fixed effects SDM model to estimate the spatial spillover effect. Table 7 also displays the parameter estimation outcomes of the fixed effects of the SDM model.

Using the SDM model and four different spatial weighting matrices, we estimate the spatial autoregressive coefficients of carbon emission intensity in Table 7. They are all positive and significant at the 1% level, implying a positive spatial spillover effect of the carbon emission intensity of each province in China, ceteris paribus. In other words, a region’s carbon emission will induce an increase in the carbon emission of the neighboring regions. Table 7 also shows that the direct effect of local environmental protection expenditure under different spatial weight matrices is significantly negative, meaning that local environmental protection expenditure has a significant dampening effect on the intensity of carbon emissions in the region, which corroborates our hypothesis H1. Regarding the spatial effect of local environmental protection expenditure on carbon emissions, we find that the spillover effect of local environmental protection expenditure under the four spatial weight matrices is negative and significant at the 1% or 5% level, suggesting that the local environmental fiscal expenditure in this region helps reduce the carbon emission intensity in neighboring regions. A possible explanation for this phenomenon is the local ecological environmental protection and low-carbon emission reduction under the pressure of increasing evaluation standards. When the local environmental fiscal expenditure rises, the neighboring regions will also adjust their governance structure and enhance their environmental protection investment to avoid falling behind in the low-carbon environmental protection evaluation. Therefore, the local environmental fiscal expenditure has a significant spatial spillover effect on the low-carbon emission reduction of the neighboring regions. This confirms our research hypothesis H4.

6 Conclusion and implications

This paper investigates the impact of local environmental fiscal expenditure on carbon emission intensity, considering the role of industrial structure upgrading as a mediating factor. Using a panel data set of Chinese provinces from 2007 to 2019, we construct a carbon emission inventory to measure carbon emission intensity and use a mediation effect model and a threshold panel model to estimate the direct and indirect effects of local environmental fiscal expenditure on carbon emission intensity. We also use a spatial Durbin model to examine the spatial spillover effects of local environmental fiscal expenditure on carbon emission intensity. Our results indicate that local environmental fiscal expenditure has a significant negative effect on carbon emission intensity and this effect is robust to various sensitivity checks. Furthermore, we find that local environmental fiscal expenditure facilitates industrial structure upgrading, which in turn reduces carbon emission intensity indirectly. Finally, we show that local environmental fiscal expenditure has positive spatial spillover effects on carbon emission intensity reduction. The threshold effect analysis indicates that the marginal impact of local environmental fiscal expenditure on carbon emission reduction diminishes over time, and that the industrial structure upgrade leads to an “inverted U-shape” pattern of the carbon emission reduction effect of local environmental fiscal expenditure. The spatial effect analysis reveals that there is a significant positive spatial autocorrelation between local environmental fiscal expenditure and carbon emission intensity and that local environmental fiscal expenditure in a region can reduce the carbon emission intensity in neighboring regions through the spatial spillover effect.

This paper proposes three policy recommendations for enhancing the role of local environmental fiscal expenditures in facilitating the transition to a low-carbon economy.

First, we find that local environmental protection financial expenditure has a positive effect on reducing carbon emission intensity. Therefore, to realize the goal of reducing carbon emissions, it is necessary to build a reasonable growth mechanism for local environmental protection financial expenditure to comprehensively help the process of carbon emission reduction. Local governments, as key actors in implementing low-carbon environmental policies, should further stimulate their motivation and innovation in reducing carbon emissions, continuously improve the allocation of local fiscal expenditures, and increase the fiscal resources available for low-carbon emission reduction, to ensure the timely achievement of the carbon peak and carbon neutrality targets.

Second, we find that industrial knot upgrading is an important mechanism for local environmental protection financial expenditure to realize the carbon emission reduction effect, therefore, it is necessary to create a low-carbon transition ecological environment as a breakthrough. and leveraging the local environmental fiscal expenditures to promote the upgrading of the industrial structure. We argue that local governments should further guide the selection of technological innovation modes by enterprises, constantly enhance the innovation service system, establish high-tech industrial parks with high-tech enterprises as the driving force, attract enterprises with strong industrial linkages, foster a low-carbon industrial structure that is based on technological complementarity and industrial synergy, fully exploit the knowledge spillover effect and the collaborative innovation effect, and continuously optimize the regional industrial structure.

Third, this paper finds that local environmental protection financial expenditure has a positive spatial spillover effect on carbon emissions, so it should be based on the spatial spillover effect of local environmental protection financial expenditure to build a reasonable regional coordination mechanism for carbon emission reduction. To facilitate the attainment of carbon peak and carbon neutrality objectives, regional environmental protection policies should be devised according to the specific development needs of each region, while enhancing interregional communication and collaboration on environmental protection expenditure policies, and fostering interregional synergy of local environmental fiscal expenditure on low-carbon emission reduction. The horizontal allocation of rights and expenditure responsibilities in the low-carbon emission reduction synergy mechanism should be clarified, taking into account the spatial spillover of local environmental fiscal expenditure and low-carbon governance, and coordinating the establishment of a low-carbon emission accountability system. Moreover, the horizontal low-carbon fiscal compensation system should be improved to reflect the explicit and direct costs of low-carbon governance, following the principle of “beneficiaries pay, protectors receive".

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Author contributions

XZ: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing–original draft, Writing–review and editing. LM: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Supervision, Validation, Visualization, Writing–original draft, Writing–review and editing, Software.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbott, A., and Jones, P. (2023). The cyclicality of government environmental expenditure: political pressure in economic upturns and in recessions. J. Environ. Econ. Policy 12, 209–228. doi:10.1080/21606544.2022.2110162

Acemoglu, D., Aghion, P., Bursztyn, L., and Hemous, D. (2012). The environment and directed technical change. Am. Econ. Rev. 102, 131–166. doi:10.1257/aer.102.1.131

Adewuyi, A. O. (2016). Effects of public and private expenditures on environmental pollution: a dynamic heterogeneous panel data analysis. Renew. Sustain. Energy Rev. 65, 489–506. doi:10.1016/j.rser.2016.06.090

Bai, J., Lu, J., and Li, S. (2018). Fiscal pressure, tax competition and environmental pollution. Environ. Resour. Econ. 73, 431–447. doi:10.1007/s10640-018-0269-1

Basoglu, A., and Uzar, U. (2019). An empirical evaluation about the effects of environmental expenditures on environmental quality in coordinated market economies. Environ. Sci. Pollut. Res. 26, 23108–23118. doi:10.1007/s11356-019-05567-3

Bruce, H. (1999). Threshold effects in non-dynamic panels: estimation, testing, and inference. J. Econ. 93, 345–368. doi:10.1016/s0304-4076(99)00025-1

Deng, H. Z. X., Huang, N., and Li, F. (2012). Strategic interaction in spending on environmental protection-spatial evidence from Chinese cities. China & World Econ. 20, 103–120. doi:10.1111/j.1749-124x.2012.01304.x

Ding, Z., Gao, X., Qian, X., and Wang, H. (2022). Governmental inspection and local legislation on environmental protection: evidence from China. J. Econ. Surv. 36, 728–763. doi:10.1111/joes.12431

Du, K., Cheng, Y., and Yao, X. (2021). Environmental regulation, green technology innovation, and industrial structure upgrading: the road to the green transformation of Chinese cities. Energy Econ. 98, 105247. doi:10.1016/j.eneco.2021.105247

Elhorst, J. P. (2012). Matlab software for spatial panels. Int. Regional Sci. Rev. 37, 389–405. doi:10.1177/0160017612452429

Feiock, R. C., and Stream, C. (2001). Environmental protection versus economic development: a false trade-off? Public Adm. Rev. 61, 313–321. doi:10.1111/0033-3352.00032

Fulai, S. (1997). Public environmental expenditures: a conceptual framework. Macroeconomics for sustainable development program office. Gland, Switzerland, World Wide Fund For Nature.

Ge, T., Cai, X., and Song, X. (2022). How does renewable energy technology innovation affect the upgrading of industrial structure? The moderating effect of green finance. Renew. Energy 197, 1106–1114. doi:10.1016/j.renene.2022.08.046

Greenstone, M., and Hanna, R. (2014). Environmental regulations, air and water pollution, and infant mortality in India. Am. Econ. Rev. 104, 3038–3072. doi:10.1257/aer.104.10.3038

Guan, H. B. (1996). Inference when a nuisance parameter is not identified under the null hypothesis. J. Econ. Soc. 64, 413–430. doi:10.2307/2171789

Halkos, G. E., and Paizanos, E. A. (2017). The channels of the effect of government expenditure on the environment: evidence using dynamic panel data. J. Environ. Plan. Manag. 60, 135–157. doi:10.1080/09640568.2016.1145107

Heberer T, S. A., and Senz, A. (2011). Streamlining local behaviour through communication, incentives and control-a case study of local environmental policies in China. J. Curr. Chin. Aff. 40, 77–112. doi:10.1177/186810261104000304

Huang, J.-T. (2018). Sulfur dioxide (SO2) emissions and government spending on environmental protection in China - evidence from spatial econometric analysis. J. Clean. Prod. 175, 431–441. doi:10.1016/j.jclepro.2017.12.001

Huang, X., Huang, X. Y., Chen, M. H., and Sohail, S. (2022). Fiscal spending and green economic growth: fresh evidence from high polluted Asian economies. Econ. Research-Ekonomska Istraz. 35, 5502–5513. doi:10.1080/1331677x.2022.2029714

Jiang, M., Luo, S., and Zhou, G. (2020). Financial development, OFDI spillovers and upgrading of industrial structure. Technol. Forecast. Soc. Change 155, 119974. doi:10.1016/j.techfore.2020.119974

Jimenez, B. S. (2009). Fiscal stress and the allocation of expenditure responsibilities between state and local governments: an exploratory study. State Local Gov. Rev. 41, 81–94. doi:10.1177/0160323x0904100202

Koethenbuerger, M. (2011). How do local governments decide on public policy in fiscal federalism? Tax vs. expenditure optimization, J. Public Econ. 95, 1516–1522. doi:10.1016/j.jpubeco.2011.06.006

López, R., Galinato, G. I., and Islam, A. (2011). Fiscal spending and the environment: theory and empirics. J. Environ. Econ. Manag. 62, 180–198. doi:10.1016/j.jeem.2011.03.001

Mullins, D. R., and Joyce, P. G. (1996). Tax and expenditure limitations and state and local fiscal structure: an empirical assessment. Public Budg. Finance 16, 75–101. doi:10.1111/1540-5850.01061

Mur, J., and Angulo, A. (2006). The spatial Durbin model and the common factor tests. Spat. Econ. Anal. 1 (2), 207–226.

Nabatchi, T., and Amsler, L. B. (2014). Direct public engagement in local government. Am. Rev. Public Adm. 44, 63S–88S. doi:10.1177/0275074013519702

Peng, F., Peng, L., Mao, J., and Lu, P. (2021). The short-run effect of a local fiscal squeeze on pollution abatement expenditures: evidence from China’s VAT pilot program. Environ. Resour. Econ. 78, 453–485. doi:10.1007/s10640-021-00539-z

Schuknecht, L. (1998). Fiscal policy cycles and public expenditure in developing countries. Berlin, Germany: Springer. doi:10.30875/11fd21d5-en

Shan, Y., Huang, Q., Guan, D., and Hubacek, K. (2020). China CO2 emission accounts 2016–2017. Sci. data 7, 54. doi:10.1038/s41597-020-0393-y

Sinha, R. K., and Chaturvedi, N. D. (2019). A review on carbon emission reduction in industries and planning emission limits. Renew. Sustain. Energy Rev. 114, 109304. doi:10.1016/j.rser.2019.109304

Solé-Ollé, A. (2006). Expenditure spillovers and fiscal interactions: empirical evidence from local governments in Spain. J. Urban Econ. 59, 32–53. doi:10.1016/j.jue.2005.08.007

Song, Y., Zhang, X., and Zhang, M. (2021). The influence of environmental regulation on industrial structure upgrading: based on the strategic interaction behavior of environmental regulation among local governments. Technol. Forecast. Soc. Change 170, 120930. doi:10.1016/j.techfore.2021.120930

Su, Y., and Fan, Q.-m. (2022). Renewable energy technology innovation, industrial structure upgrading and green development from the perspective of China's provinces. Technol. Forecast. Soc. Change 180, 121727. doi:10.1016/j.techfore.2022.121727

Wang, F., He, J. Z., and Niu, Y. (2022). Role of foreign direct investment and fiscal decentralization on urban haze pollution in China. J. Environ. Manag. 305, 114287. doi:10.1016/j.jenvman.2021.114287

Wang, Q. (2015). Fixed-effect panel threshold model using Stata. Stata J. 15, 121–134. doi:10.1177/1536867x1501500108

Wang, X., and Wang, Q. (2021). Research on the impact of green finance on the upgrading of China's regional industrial structure from the perspective of sustainable development. Resour. Policy 74, 102436. doi:10.1016/j.resourpol.2021.102436

Wu, L., Sun, L., Qi, P., Ren, X., and Sun, X. (2021). Energy endowment, industrial structure upgrading, and CO2 emissions in China: revisiting resource curse in the context of carbon emissions. Resour. Policy 74, 102329. doi:10.1016/j.resourpol.2021.102329

You, J., and Zhang, W. (2022). How heterogeneous technological progress promotes industrial structure upgrading and industrial carbon efficiency? Evidence from China's industries. Energy 247, 123386. doi:10.1016/j.energy.2022.123386

Zhang, J., Lyu, Y., Li, Y., and Geng, Y. (2022). Digital economy: an innovation driving factor for low-carbon development. Environ. Impact Assess. Rev. 96, 106821. doi:10.1016/j.eiar.2022.106821

Zhang, J., Wang, J., Yang, X., Ren, S., Ran, Q., and Hao, Y. (2021). Does local government competition aggravate haze pollution? A new perspective of factor market distortion. Socio-economic Plan. Sci. 76, 100959. doi:10.1016/j.seps.2020.100959

Zhang, Y., and Dilanchiev, A. (2022). Economic recovery, industrial structure and natural resource utilization efficiency in China: effect on green economic recovery. Resour. Policy 79, 102958. doi:10.1016/j.resourpol.2022.102958

Zhu, B., and Zhang, T. (2021). The impact of cross-region industrial structure optimization on economy, carbon emissions and energy consumption: a case of the Yangtze River Delta. Sci. Total Environ. 778, 146089. doi:10.1016/j.scitotenv.2021.146089

Keywords: local environmental fiscal expenditure, industrial structure upgrading, carbon, carbon emission intensity, industrial structure advancement

Citation: Zhang X, He S and Ma L (2024) Local environmental fiscal expenditures, industrial structure upgrading, and carbon emission intensity. Front. Environ. Sci. 12:1369056. doi: 10.3389/fenvs.2024.1369056

Received: 12 January 2024; Accepted: 08 March 2024;

Published: 27 March 2024.

Edited by:

Zahid Hussain, Qilu University of Technology, ChinaReviewed by:

Wasim Abbas Shaheen, Quaid-i-Azam University, PakistanMahmood Ahmad, Shandong University of Technology, China

Copyright © 2024 Zhang, He and Ma. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shouchao He, hsc@wzut.edu.cn; Lindong Ma, malindong@zjnu.edu.cn

Xuesheng Zhang1

Xuesheng Zhang1 Shouchao He

Shouchao He Lindong Ma

Lindong Ma