- 1Department of Accounting, College of Business Administration, Princess Nourah bint Abdulrahman University, Riyadh, Saudi Arabia

- 2Business School, Dublin City University, Dublin, Ireland

- 3Department of Accountancy and Business Finance, School of Business, University of Dundee, Dundee, Scotland

Although a considerable number of empirical studies have been conducted in developed markets to examine dividend signaling effects, very few comparable studies have been carried out in the Saudi market context. This study deeply investigates how the Saudi exchange market may have reacted to dividend news during an eight-year study period from a total sample of 280 dividend announcements made by 99 Saudi-listed companies. Results demonstrate that a company’s share price reacts to the announcement of a cash dividend during the event window. Besides, findings reveal a significant positive reaction in the share price at the time of the announcement of an increase in the dividend payment level. Furthermore, results demonstrate that the abnormal return is negative but not significantly different from zero at the time of the announcement of a decrease in the dividend payment level. Likewise, findings show that the shareholders earn just normal returns on the announcement day and that the abnormal return is not statistically different from zero for the dividend, not change group. The findings suggest potential information leakage before dividend announcements, raising concerns about insider trading. This highlights the need for stronger regulatory oversight and stricter disclosure enforcement. Companies should also use alternative communication channels to improve transparency and consider corporate social responsibility initiatives to signal their quality to investors.

1 Introduction

Dividend announcements (DAs) have long been a focal point in financial and accounting research due to their potential to influence share prices and serve as a mechanism for conveying information about a company’s financial performance and management expectations. Grounded in the dividend signaling hypothesis, these announcements reflect management’s confidence in the firm’s future profitability, thereby helping to bridge the information asymmetry between managers and shareholders. Consequently, understanding the relationship between dividend announcements and stock price movements remains a central theme in financial economics.

Numerous studies have explored the role of dividend policy as a signaling tool by analyzing share price reactions to changes in dividend announcements around the declaration date [(e.g., 1–4)]. Findings from these studies reveal a significant association between dividend announcements and share price movements. Specifically, announcements of dividend increases typically lead to upward share price adjustments, whereas announcements of dividend decreases tend to prompt declines in share prices.

The Saudi Arabian financial market, characterized by its rapid development and increasing prominence, provides an intriguing setting for examining the impact of dividend announcements on stock performance. The Saudi Stock Exchange (Tadawul), one of the largest markets in the Middle East, has undergone substantial reforms in recent years, including enhanced transparency, greater foreign investor participation, and integration into global indices. These advancements underscore the importance of understanding how informational events, such as dividend announcements, are interpreted by market participants in this distinct emerging market context. Therefore, investigating dividend payment decisions in emerging markets, particularly Saudi Arabia, is of significant academic and practical interest.

This study aims to address gaps in the existing literature on Saudi Arabia’s financial market, where only a limited number of studies have examined the relationship between dividend announcements and share prices. Prior research [(e.g., 5–7)] has often relied on small samples and short timeframes, resulting in fragmented insights. Furthermore, prior studies offer conflicting conclusions regarding the applicability of the dividend signaling theory in Saudi Arabia. Additionally, previous analyses measured the impact of dividend decisions over relatively brief periods, ranging from a few quarters to 4 years, and often relied on small sample sizes, which limits the generalizability of their findings.

This study seeks to overcome these limitations by conducting a comprehensive investigation into the information content of dividend announcements over an extended eight-year period. Such a timeframe is expected to yield deeper insights into how Saudi investors incorporate dividend signals into their decision-making processes. Saudi Arabia’s unique tax environment, which exempts dividends and capital gains from taxation, provides a distinctive setting for isolating the signaling effect of dividends without the confounding influence of tax considerations. In contrast, most developed markets impose higher taxes on dividends relative to capital gains, making it challenging to disentangle signaling effects from tax distortions (8, 9).

Moreover, the Saudi market is characterized by high levels of family ownership, tax-free dividends, and pronounced information asymmetry (5). According to Frankfurter and Wood (10), the foundation of dividend signaling theory lies in its ability to mitigate information asymmetry between management and investors through unexpected changes in dividend payments. The theory posits that greater information asymmetry amplifies the reliance on dividends as signals of future prospects (11).

The primary objective of this study is to analyze the dividend payment decisions of companies listed on the Saudi Stock Exchange and empirically assess the informational content of dividend announcements and their effect on stock prices. Based on the signaling hypothesis, share price reactions are expected to vary with the direction of dividend changes (4, 12). Announcements of dividend increases are anticipated to generate positive abnormal returns, while decreases are expected to lead to negative abnormal returns. Announcements indicating no change in dividend payments are assumed to elicit neutral market responses (12). The findings of this study are anticipated to provide a nuanced understanding of the role of dividends as signals in the Saudi context.

This research contributes to the literature, theory, and practice in several key ways. First, it addresses a critical gap by focusing on an emerging market with distinct characteristics, including regulatory frameworks, investor profiles, and socio-economic conditions. Second, it builds upon prior studies of the Saudi market by examining a larger sample over a longer timeframe, thereby offering more robust and generalizable conclusions. Third, the study considers the implications of Saudi Arabia’s economic diversification initiatives, such as Vision 2030, which have reshaped the market landscape. These features make the Saudi market an ideal setting for testing the signaling hypothesis in an emerging economy.

The findings are expected to offer practical insights for policymakers, corporate managers, and investors seeking to navigate and understand the dynamics of the Saudi financial market. Specifically, this study may help managers and regulators recognise the strategic importance of dividend decisions and their potential influence on investor behaviour. Additionally, investors could benefit from the results when making investment decisions based on dividend announcements.

This paper is organised into six sections. The second section reviews the theoretical literature, examining the conceptual underpinnings of the relationship between dividend announcements and stock value. The third section outlines the empirical methodology employed in the analysis. Section four presents the results and provides a critical discussion of the findings. The fifth section draws key conclusions from the analysis and highlights the study’s practical and theoretical implications. The sixth and final section discusses the study’s limitations and proposes directions for future research.

2 Literature review

This section aims to build a robust theoretical framework for this paper by examining the literature on dividend phenomena in different regions.

2.1 Theoretical background

The following sections detail the most common theories related to dividend policy.

In 1961, Miller and Modigliani’s influential paper was the first to assert an irrelevance proposition. The authors argued that under the restrictive assumptions of perfect markets, rational investors and perfect certainty, dividend policy is irrelevant to the value of a company’s shares and its shareholders’ wealth. Under these circumstances, the dividend decision for a company operating in a perfect market would not be a significant factor in determining its valuation. Instead, the company’s investment policy and future earnings power would be the significant determinants of its valuation.

An alternative view of dividend irrelevance theory is the bird in the hand theory, which assumes that dividend policy is relevant to a company’s value and is reflected in its share price. Gordon (13) asserted that investors prefer regular dividend payments over retained earnings because of uncertainty regarding the company’s future cash flow. He concluded that dividends are more relevant than earnings when valuing a company’s shares. Walter (14) supported Gordon’s view (13) and noted that when the imperfection assumption is relaxed, a company’s dividend policy nearly always affects the company’s value.

In many cases, the tax rates a country imposes on dividends are higher than capital gains; this may result in investors preferring retained earnings, which gives rise to the clientele effect (15). Al-Malkawi et al. (16) noted that, in reality, investors are interested in after-tax income, which may affect their decisions regarding receiving cash dividends. Farrar and Selwyn (17) considered a complex tax structure in a valuation model and concluded that investors prefer capital gains over cash dividend payments because of individual income tax. Subsequently, Brennan (18) suggested that a company with a high-yield stock may sell its stock at a lower price than non-dividend-paying companies due to the tax disadvantages associated with dividend yields.

The relationship between dividend policy and the tax preferences of shareholders results in the clientele effect, whereby each company tends to attract specific types of investors (clientele) who prefer a company’s dividend policy that is appropriate for their tax rates (19–21). Consequently, shareholders in high tax brackets are attracted to companies with low dividend payouts, whereas those in low tax brackets prefer companies with high dividend payouts (20).

In the presence of informational asymmetry, agency cost has been proposed to explain a company’s dividend payment decisions (10). Jensen and Meckling (22) described the agency relationship as an agreement between shareholders (owners) and managers (agents), where the former utilises the latter to manage their business, which requires delegating some tasks and decision-making authority to managers. Several studies have observed that the payment of dividends mitigates the conflicts of interest between managers and shareholders (23, 24). Jensen (24) noted that engagement in growth ventures increases management’s power over a company’s resources, giving managers more control over free cash. Further, the author reported that managers with fundamental free cash flow would either invest it in a project with a present negative value or waste it on inefficient activities. Thus, the increase in dividend payouts can reduce the amount of free cash under managers’ control, which implies a reduction of agency conflicts between management and shareholders.

Signaling theory focuses on the relationship between a company’s dividend announcements and share returns. Studies by Lintner (25), Bhattacharya (26), DeAngelo et al. (1) and Koch and Shenoy (27) also have approved of such relationships, finding that company managers use dividend announcements as a tool to signal information about the prospects of their companies. However, other studies have minimally supported this position (7, 21, 28), particularly in the Saudi stock market, because of the presence of high levels of asymmetric information (5).

The implication of dividend signaling is that outside shareholders will perceive an increase (initiate) in the dividend levels as good news or a good sign about the company’s prospects, whereas they view a decrease (cut or omission) in dividend payments as bad news regarding the company’s future profitability (4, 12, 29).

2.2 Empirical literature

Many studies have investigated the effect of dividend policy as a signaling tool by exploring the reaction of share prices to changes in dividend announcements surrounding the announcement date. For example, Chaabouni (6) used an event study for ten dividend announcements from 2014 to 2015. The author found a signaling effect of dividend announcements and their positive reflection on share prices in the Saudi stock market. Anwar et al. (30) employed an event study methodology with a sample of 228 Indian manufacturing companies and 605 cash dividend announcements. The impact of dividend announcements on share returns was examined for 30 days as an event window. The findings showed significant positive abnormal returns associated with dividend announcements. Similarly, Felimban et al. (31) found evidence of using a dividend change as a signaling tool. An event study investigated stock market reactions to 1,092 dividend announcements from 299 companies listed on the Gulf Cooperation Council countries’ stock markets between January 2010 and June 2015. The results revealed that although the Gulf Cooperation Council countries’ stock markets operate in a tax-free environment, the announcement of dividend changes significantly affects a company’s performance in such markets. Ozo and Arun (32) employed an event study that used 252 cash dividends announced by Nigerian listed companies from the beginning of January 2008 to the end of December 2012. The findings showed that the information content hypothesis of cash dividend announcements works in the Nigerian stock market. Similarly, Nazarova et al. (33) employed an event study and regression models to examine the share price reaction to a company’s dividend announcement from 2008 to 2021. The findings support the idea that the Russian market reacts to dividend announcements. Similarly, Halife and Karroum (34) investigated the Istanbul Stock Exchange’s reaction to dividend announcements by conducting an event study to determine abnormal returns using a sample of 8 banks that announced 32 dividends from 2011 to 2017. The results showed that announcements regarding dividends significantly influenced share prices. Suidarma et al. (35) investigated the reaction of stock prices to dividend announcements in the Indonesian market, focusing specifically on the IDX High Dividend 20 Index. Their findings revealed a significant positive shift in stock yields following these announcements, thereby supporting the information content hypothesis. This study underscores the notion that dividend disclosures act as a signaling mechanism within emerging markets.

In contrast with the above studies, Uddin and Osman (7) examined how dividends affect shareholder value in the Saudi Stock Exchange; they employed an event study using the market-adjusted model. The study chose a window period of 61 days for 28 Saudi-listed companies that declared 178 dividend announcements from 2001 to 2005. The results revealed that dividend payment policies do not affect company value. Similarly, Ali and Chowdhury (36) used an event study methodology with a 44-day event window to examine the effects of dividend announcements on the listed private commercial banks in Bangladesh. The findings are not consistent with the dividend signaling hypothesis. Altiok-Yilmaz and Akben-Selcuk (37) examined Turkish share price responses to the announcement of a dividend change level with a sample that included 184 announcements of dividend changes made by 46 companies. The results for a short event window showed significant positive cumulative abnormal returns for companies with an increased and decreased dividend. However, the cumulative abnormal returns for longer event windows were insignificant. Using an empirical approach, Al Qudah and Badawi (5) examined the implementation of signaling theory in the Saudi stock market. The sample included 47 companies that declared first-time dividend announcements, totalling 47 dividend announcements in the third quarter of 2013. The result indicates that a company’s share price is unresponsive to the Saudi stock market dividend announcements. Lotfi (38) empirically investigated the relationship between dividend announcements and share prices. Using an event study, the author analysed 39 companies listed in the Tunisian market that announced 196 dividends between 1996 and 2004. The findings indicate that the results are not consistent with the signaling theory. Similarly, Seyedimany (39) used an event study with a sample of 5 companies listed on NASDAQ from 2014 to 2018 to investigate the information content of dividend announcements. The findings revealed that dividend announcements did not signal information about the company’s future earnings. AlGhazali et al. (40) analysed dividend changes among Omani firms from 2001 to 2021. Their research revealed minimal support for the signaling theory, particularly in relation to dividend reductions. Instead, the study highlighted that current profitability and firm-specific factors played a more significant role in influencing dividend changes, indicating that dividends do not always serve as reliable indicators of future earnings.

Based on the above review of the literature, this study predicts the following two main hypotheses:

H1: A company’s share price reacts to the announcement of a cash dividend during the event window.

H2: A company’s share price reacts in the same direction as the announcement of a change in dividend payment levels during the event window.

The second hypothesis is divided into three sub-hypotheses according to the direction of change in the dividend level.

H2.1: There is a significant positive reaction in terms of the share price at the time of the announcement of an increase in the dividend payment level.

H2.2: There is a significant negative reaction in terms of the share price at the time of the announcement of a decrease in the dividend payment level.

H2.3: There is no significant reaction in terms of the share price at the time of the announcement of no change in the dividend payment level.

3 Methodology

One of the well-known tools for use in assessing the impact of company events on share price performance is the event study method. It is defined as ‘an empirical investigation of the relationship between security prices and economic events’ [(41), p. 533]. Many researchers have used this method to measure the effect of a particular event (e.g., dividend announcements, earnings announcements, stock splits and acquisitions/mergers) on a company’s value (5, 7, 8, 29, 30, 42–46). This study includes an event study using the general process suggested by MacKinlay (46) and McWilliams and Siegel (47).

3.1 Data and sample

The sample includes all companies listed on the Saudi Stock Exchange that announced cash dividends from 1 January 2011 to 31 December 2018. The initial sample consists of all companies that announced annual cash dividends, dividend announcement dates, dividend per share (DPS), earning per share (EPS) dates and stock price information. Multiple sources were used to collect the required data, including the Eikon database, Bloomberg, Tadawul, Argaam and companies’ websites. The inclusion criteria for companies in the sample were as follows:

• Daily market closing share prices and daily market closing index prices had to be available for calculating the AR. The closing prices of shares and index data were obtained from the Tadawul website and cross-checked with the Argaam database.

• The shares of the selected companies had to be traded in the market for 201 days prior to the DA date to calculate the expected returns of a stock.

• Companies should not have had any other announcements around the cash DA date, such as earnings news, stock dividends, merger or acquisition disclosures, or any information that might affect the company’s share price in the event window. The data concerning confounding events were available from the Eikon database and double-checked with the data published on the Tadawul website.

• Companies had to announce more than one annual cash dividend to ensure that the sample did not focus on dividend initiation but dividend change announcements.

A total of 99 listed companies made a total of 687 DAs from 2011 to 2018. As mentioned in the above selection criteria, the current study focuses on the annual DAs totalling 400. Any other announcements of quarterly or semi-annual dividends were excluded from the sample to focus on annual dividend payments. For example, during the sample years, 194 semi-annual DAs, 37 DAs three times annually, 52 DAs four times annually and four DAs five times annually were excluded from the final sample.

Applying the above four inclusion criteria, the total population of 400 DAs was reduced to 280 pure cash DAs after excluding the following confounding events around the time of the DA date: EPS releases (45 events), scrip (share) DAs (34 events) and dividend initiation (17 events). Furthermore, any company whose share price had traded for less than 201 days before the date of the DA was removed from the sample (24 events). These 280 dividend announcements were spread relatively evenly across the 8 years being studied; however, there were slightly more DAs in 2017 and 2018 because the economy recovered and more companies started to declare a dividend.

3.2 Event study methodology

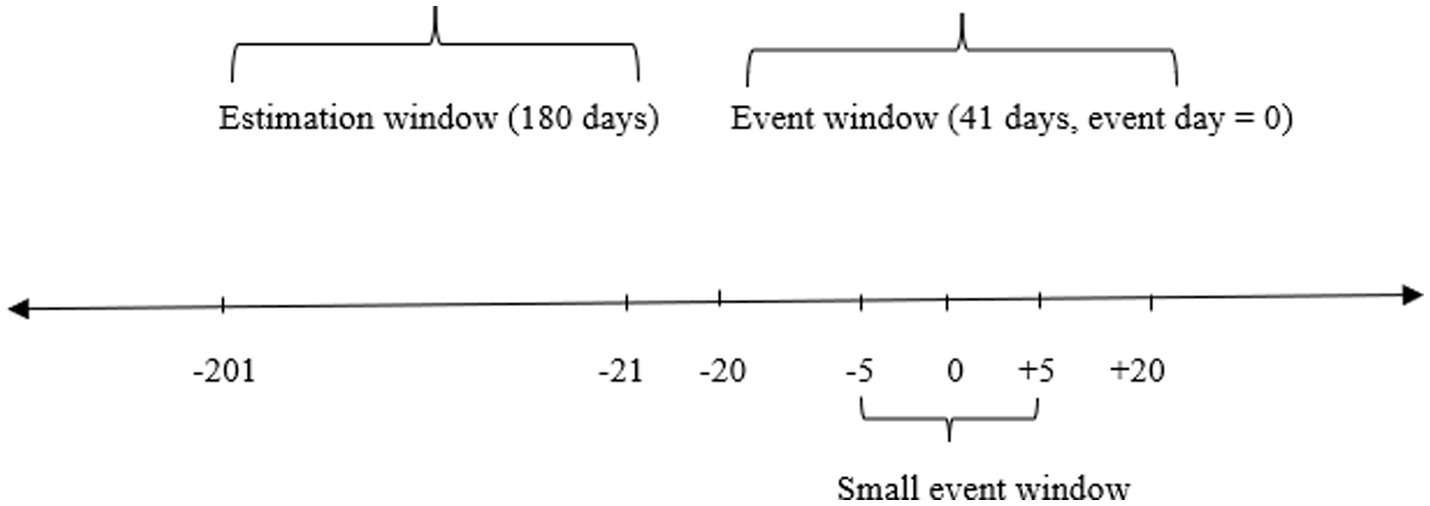

The current study follows the common procedures suggested by MacKinlay (46) and McWilliams and Siegel (47). An event window is defined as a period during which the stock return (actual return) is affected by the event that has been announced. It is essential to examine the period around the event day to assess the stock price performance and its reaction to the announced event. In this regard, MacKinlay (46) reports that in the real world, an event window is extended to a number of days after the event occurred to observe the impact of the announcement event on the company’s stock price; this news might be released after the market has closed on a specific day. Furthermore, in some cases, leakage of information related to the announcement may occur before the announcement date, which can be examined by observing the stock returns before the event date (46). In the current study, returns for a 41-day window (including the announcement date) around the announcement date were investigated (event day = 0, pre-event = t − 20 and post-event = t + 20). Furthermore, a smaller event window was used to obtain a better understanding of the abnormal returns (if any) associated with the announcement of cash dividends (event day = 0, smaller pre-event = −5 and smaller post-event = +5).

Another vital window that must be determined to calculate abnormal returns is the estimation window, which is used as a period before the event window to calculate the expected stock returns without the influence of the announced event. In the present study, 180 trading days (from day t − 201 to day t − 21) were used as the estimation period prior to the event window to measure the expected returns.

Figure 1 shows the estimation window and the event window.

The first step in measuring abnormal returns is the calculation of actual stock returns. The current study uses the discrete return method to ensure comparability with other research studies (5–7). The actual return is computed for each company’s stock during the window period (41 days) using the discrete returns formula in Equation 1:

where Rit is the actual daily return of stock (i) on a date (t), Pit is the closing stock price of a stock (i) on a date (t), and Pit − 1 is the closing stock price of a stock (i) on a date (t − 1).

Various models can be utilised to estimate the expected return for any stock at any time, such as the constant mean return model, the multi-factor model (market and industry indexes), the market model, the market-adjusted return model and economic models, including the capital asset pricing model and the arbitrage pricing theory (APT). In the current study, the market model was considered the best method with which to calculate the abnormal return. The market model suggests a linear relationship between a stock’s expected return and the market index (48).

To compute the expected return, two calculation methods are employed: the market model and the market-adjusted returns. First, the market model benchmark (41) is used to estimate the expected return on each stock and the market portfolio using Equation 2:

where E(Rit) is the expected return on stock (i) on a date (t), Rmt is the return on the market portfolio on a date (t) (return on Tadawul All Share Index [TASI]), αi and βi are the market model parameters of stock (i)’s return over the estimation window and et is an error term equal to zero.

Like the calculations of daily stock returns, the daily market returns are computed using the discrete returns formula in Equation 3:

where It is the market index on day t and It − 1 is the market index on day t − 1 (7).

The second measure used to obtain the expected return is the market-adjusted returns; to calculate, the excess returns were used as a robustness test to ensure that the results obtained from the abnormal returns were not related to any errors in the beta risk estimate. For excess returns, β equals 1, and α equals 0 for all sample shares, and the difference between the actual daily returns of shares and market returns is the excess return (41), as calculated using Equation 4:

where ExRit is the excess returns of stock (i) on date (t), Rit is the actual daily returns of stock (i) on date (t), and Rmt is the return on the market portfolio on date (t) (return on TASI).

The abnormal return on each of the 41 days for each stock can be calculated by subtracting the expected return E(Rit) from the actual return (Rit) using Equation 5:

where ARit is the abnormal return of stock (i) on date (t), Rit is the actual return of stock (i) on date (t), and E(Rit) is the expected return of stock (i) on the same day i.

Here, AR will be aggregated for certain companies on specific days across all firms under examination and then over a particular period. This enables the researcher to draw a general conclusion regarding the event in question because similar events impact multiple companies in the market (45). The AR is calculated based on Equations 6, 7:

where AARt is the average abnormal return for each date/time (t) during the event period for all companies, CAAR(t1, t2) is the cumulative average abnormal return for (t1 = −20, t2 = +20) during the event period for all companies and N is the number of observations in the sample.

4 Results

4.1 Descriptive statistics

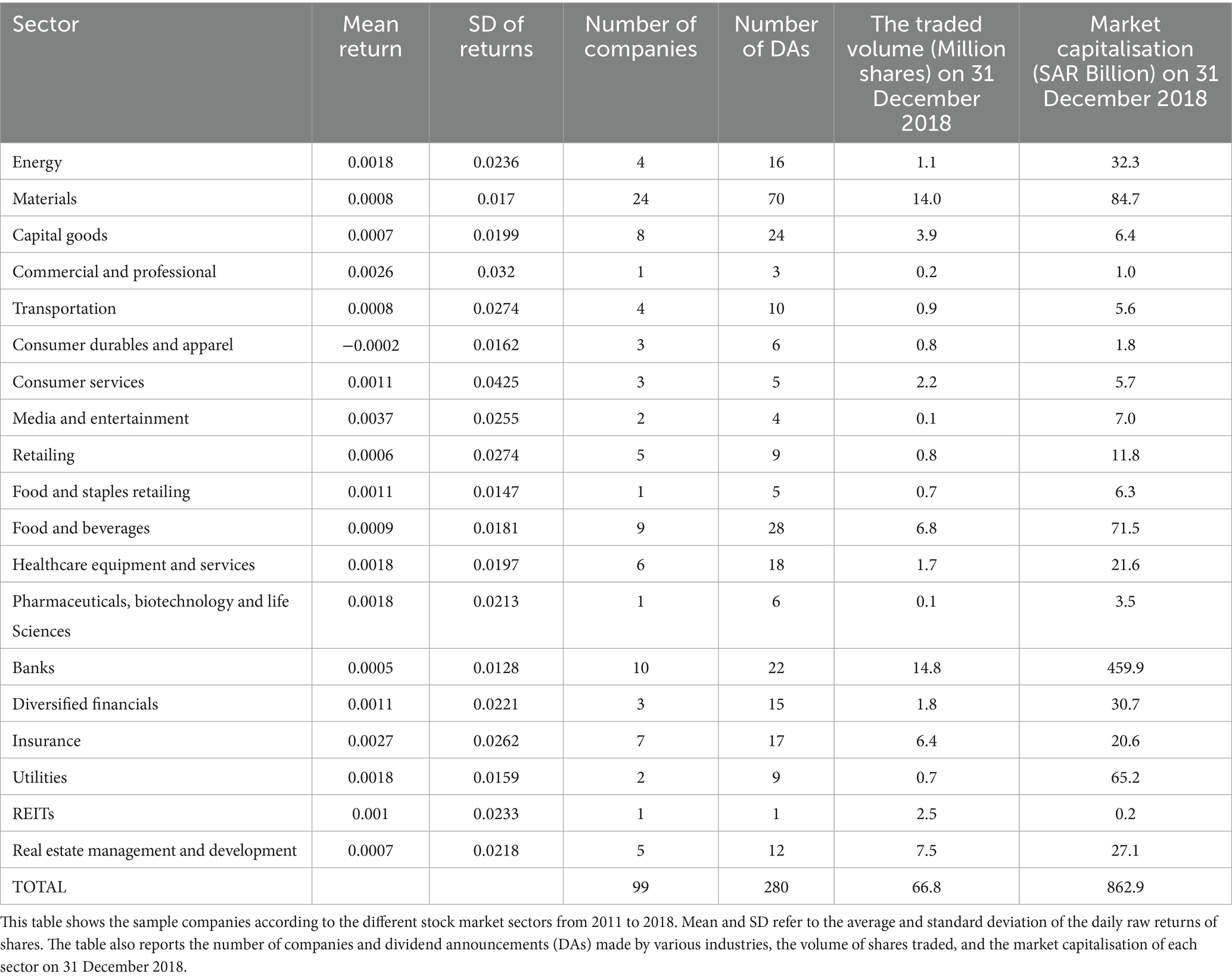

Table 1 shows the background information of the sample companies that made the 280 annual cash DAs, here based on their market sector categorisations; the sample characteristics are described in terms of the number of companies, the number of DAs, the volume of shares traded and the market capitalisation of the companies as of 31 December 2018. The table also provides descriptive statistical information about the sample companies’ raw returns, such as standard deviation and mean values.

4.2 Empirical findings

This section presents the empirical results of the event study analysis. The findings are organised to correspond directly to the hypotheses outlined in Section 2. The discussion is structured as follows: Section 4.2.1 examines hypothesis H1, which tests the overall market reaction to dividend announcements; Sections 4.2.2, 4.2.3, and 4.2.4 evaluate hypotheses H2.1, H2.2, and H2.3, respectively, by analysing the market response to dividend increases, decreases, and no-change scenarios. The results for each hypothesis are presented with supporting statistical evidence, including both parametric and non-parametric tests.

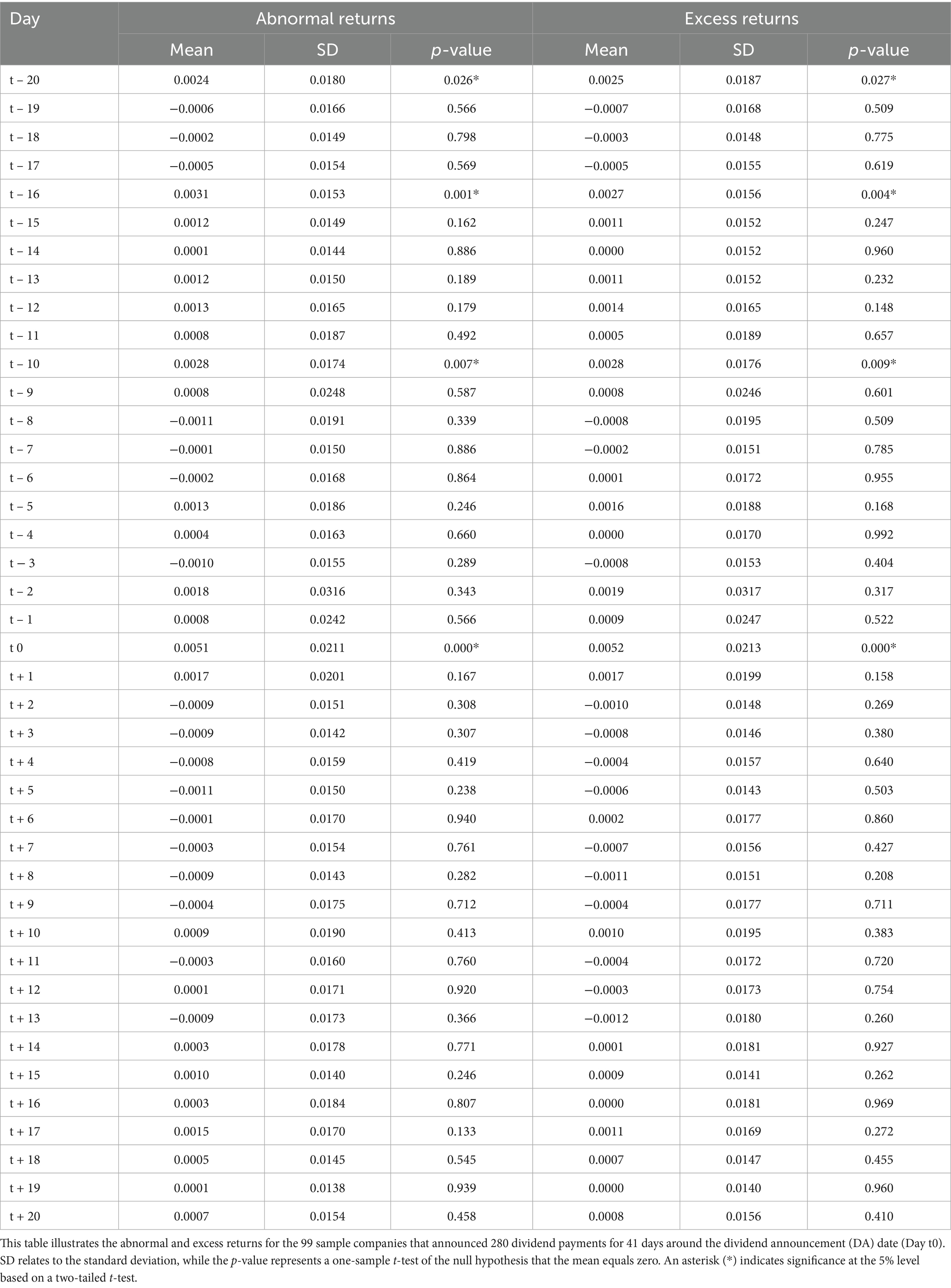

4.2.1 Share price reaction surrounding the 41-day event window

Table 2 records the relevant data on AR and excess returns calculated for the sample companies over the 41-day event window surrounding the DA dates. The data show the mean values and the standard deviation around the mean values for the entire sample of dividend changes. A one-sample, two-tailed test was employed to examine hypothesis H1, which states that a company’s share price reacts to the announcement of a cash dividend during the event window. In particular, the average abnormal return (AAR) and the average excess return (AExR) are not equal to zero. In addition to a one-sample t-test, Supplementary Table S1 reports the results of a non-parametric Wilcoxon signed-rank test, which was used to investigate whether the median values are equal to zero. The reason for reporting median values is to overcome data outliers that may bias the reported average values.

Table 2 reveals several observations. First, there is a significant positive share price response to DA news on day t0 (6, 29, 30). Throughout the event period, there are 24 days with positive AR and 17 days with negative AR over the event period. However, the largest mean AR of 0.51% was documented on day t0, which was highly significant with a p-value of 0.00. Similarly, the AExR on the announcement day of 0.52% was the highest and most statistically significant. Thus, the first hypothesis (H1) can be accepted: a company’s share price reacts to the announcement of a cash dividend during the event window.

The acceptance of this hypothesis implies that the findings support the notion that dividends seem to signal good news to outside investors on the day of the announcement; this might explain the significant positive AR investors gain from their ownership of the sample companies’ shares. Further, because 58% of the events are related to dividend increases, it is not surprising that the AAR is positive. The results from the current study are similar to Chaabouni’s (6) results for the Saudi market; they are also similar in character to the findings of Anwar et al. (30) for an Indian sample and of McCluskey et al. (29) for Irish data; these researchers find significant returns on the day of DAs. In relation to market efficiency, the results support the semi-strong form of the efficient market hypothesis, which is that, on average, the capital market effectively responds to new dividend news. Nearly all the price adjustments took place on the announcement date, or t0 (12).

Second, regarding the 20-day pre-announcement period before the official disclosure of the dividend information, three statistically significant ARs are uncovered; there seem to be news leaks before the date of a DA (6). For example, the market reaction to dividend news as measured by the AR was positive and significant on day t − 10, day t − 16 and day t − 20, with mean values of 0.28, 0.31 and 0.24%, respectively. The pattern of the excess returns on the pre-announcement days is similar to that reported for the AR over the same period. In particular, the excess returns were positive and statistically significant on day t − 10. Such positive returns indicate that stock price movements represent, in effect, the upcoming dividend signal and that the market expects the news to be favourable. It also suggests that the betas are close to one.

Third, it is evident from Table 2 that there are 10 positive ARs and 10 negative ARs in the post-announcement period, but none of them are statistically significant. There appears to be a quick response from the Saudi market to the information included in the DA, and the share prices reflected the dividend news immediately on the event day (day t0), with the maximum AR occurring on that day. This is evidence that no shareholders can make a gain over the normal returns by using information about dividends after dividends day t0 (7, 29). Again, the findings from the analysis of excess returns in the post-announcement period provided a similar scenario to the AR results, indicating that the Saudi market seems to be of a semi-strong form and efficient when it comes to the announcements of dividend information (29). Finally, Table 2 also shows that, during the event window, the standard deviation values varied throughout the sample, suggesting high sample volatility. The standard deviation for the AR ranged from a low of 0.013 on day t + 19 to a high of 0.0316 on day t − 2. Some of this variability may be because the sample includes firms that increased, decreased and did not change their dividends. A clearer picture of the market reaction may emerge once the total sample is split into the three sub-groups. We may also be able to indicate whether the market responds to all three dividend changes equally or whether the dividend cuts elicit a more strident investor response because of disappointment over the news that the firm cannot maintain its previously determined disbursement policy.

Supplementary Table S1 presents the results of a non-parametric Wilcoxon signed-rank test; the findings were the same as the results obtained from applying a one-sample, two-tailed t-test for the median abnormal and excess returns on the day of DAs t0, which were positive and significant. However, in the period after the DA, particularly day t + 3, the abnormal and excess returns were negative and significant for the Wilcoxon signed-rank test. In contrast, the results from a t-test for the same day were negative but insignificant, suggesting that the Saudi market responded to the dividend news even a few days after the disclosure of the change in dividends (6). In the 20 days prior to the DAs, the findings from both tests are generally the same; in particular, the AR on day t + 16 is statistically significant and positive (0.13%), indicating that there are some information leaks to the market before the actual DA (6, 7).

4.2.2 Share price reaction around the 41-day event window for the dividend increase announcements

Table 2 and Supplementary Table S1 show the results of the first analysis level, which examines the share response for the whole sample of DAs for a wider window. However, the signaling hypothesis implies that the share price reacts differently based on the direction of dividend change announcements (4, 12). In particular, an increase in the dividend level causes significant positive AR, a decrease in the dividend level leads to significant negative AR, and dividends with no change in the payment level are associated with normal returns (12). Thus, this section examines the information content hypothesis for the three DA sub-groups: the announcements of the dividend increase (DI) group, the announcements of the dividend decrease (DD) group, and the announcements with the dividend not changed group (DNC).

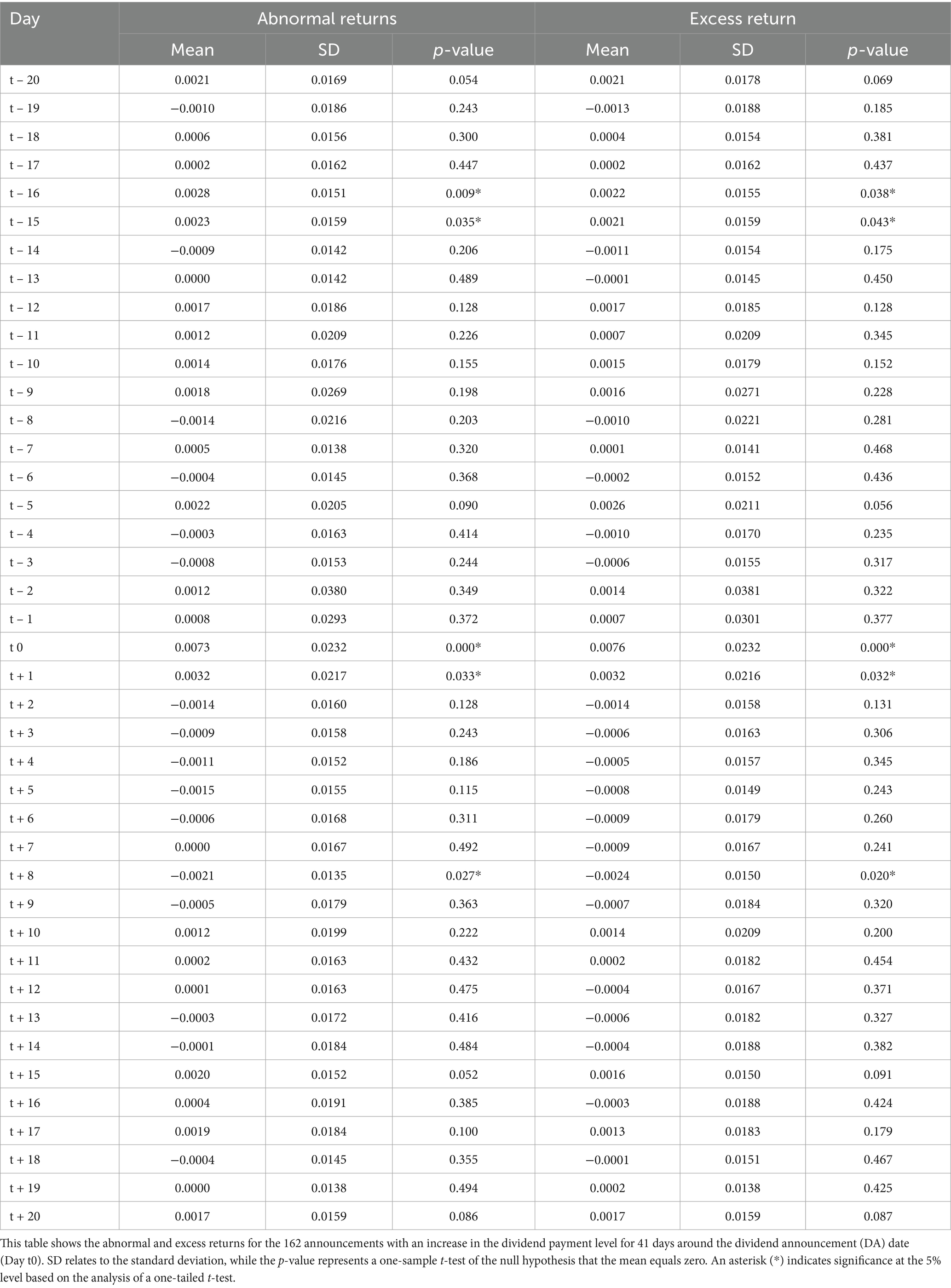

The information content hypothesis suggests that an increase in dividends reflects good news and should correlate with an anticipated statistically significant positive return. Table 3 and Supplementary Table S2 present the results of the DI group for the 41-day event window. Table 3 reflects a number of results. First, the mean AR was positive at 0.73% and significant at the 0.00 level on the day of DAs (t0). The analysis of the excess returns confirms this finding because the AExR on day t0 is large and positive at 0.76% with a p-value of 0.00. Therefore, the hypothesis (H2.1) that there is a significant positive reaction in the share price at the time of the announcement of an increase in the dividend payment level can be accepted (7).

Table 3. Share price performance around the 41-day event window for dividend increase companies using a parametric test.

As discussed in the literature review, this result is in line with the propositions of the information content hypothesis, which argues that the announcement of a dividend increase signals good news to the market and is associated with an increase in a company’s share prices and significant positive AR. The findings obtained in Table 3 and Supplementary Table S2 seem to support this scenario in the Saudi Stock Exchange.

Second, turning to the pre-announcement period, which relates to the 20 days prior to the announcement of dividend-increasing news, there were 14 days with positive ARs, but only two days (day t − 15 and day t − 16 with mean values of 0.23 and 0.28%, respectively) were statistically significant and 6 days with negative ARs and no statistical significance. The findings from the excess returns were similar to those obtained from the AR; particularly, the excess returns were positive and statistically significant on day t − 15 (mean 0.21% with a p-value of 0.04) and day t − 16 (mean 0.22% with a p-value of 0.04). As with the whole sample of dividend change announcements, the market predicts that the forthcoming dividend news will be optimistic, on average, which explains the positive returns on the shares price movements. In addition, the findings indicate that some information might be leaked to the stock market before the announcement of a dividend increase, especially on day t − 15 and day t − 16.

Third, in the post-announcement period, Table 3 reports that the AAR for the 18 days from the dividend declaration is positive nine times and negative nine times, but is never significant. The two remaining days indicate significant mean abnormal (excess) returns of 0.32% (0.32%) on day t + 1, the day immediately following the announcement. This shows that good information is incorporated in share prices soon after dividend releases. Also, on day t + 8, the mean abnormal (excess) returns of −0.21% (−0.24%) are negative and statistically significant, reflecting that the stock market takes 1 week after the announcement day to digest the dividend increase news.

The findings from using a non-parametric Wilcoxon signed-rank test are demonstrated in Supplementary Table S2; as with the results of the t-test, the median abnormal (0.34%) and excess returns (0.41%) on the day of dividend disclosure t0 are positive and significant. This supports the idea that the stock price positively reflects the effect of the news of a dividend increase. However, in the period after the DA, in particular, day t + 1, the abnormal (excess) returns are positive but not significant for the Wilcoxon signed-rank test, while the results from the t-test for the same day are positive and statistically significant. Nevertheless, both tests agreed that the market reacts to the news releases on day t0 and can still react even 1 week after the announcement of a dividend increase.

For the 20 pre-announcements days, the findings from both tests are generally the same in terms of there being some information leaks to the market before the actual DA (6, 7). However, the median excess return is positive (0.23%) and significant on day t − 14, while the mean abnormal (excess) returns are positive and statistically significant on day t − 15 and day t − 16. Overall, the findings from this section seem to be in line with the results from more developed stock markets, such as Lonie et al. (3) for UK data and McCluskey et al. (29) for the Irish market, as well as other developing markets, such as Uddin and Osman (7) for Saudi-listed companies and Al-Yahyaee et al. (8) for the Omani market, which suggests that the market reacts positively and share prices move upwards as a result of the good news signaled from dividend increase announcements. Also, these results support that the Saudi stock market is semi-strong and efficient based on its response to dividend increase change information (29).

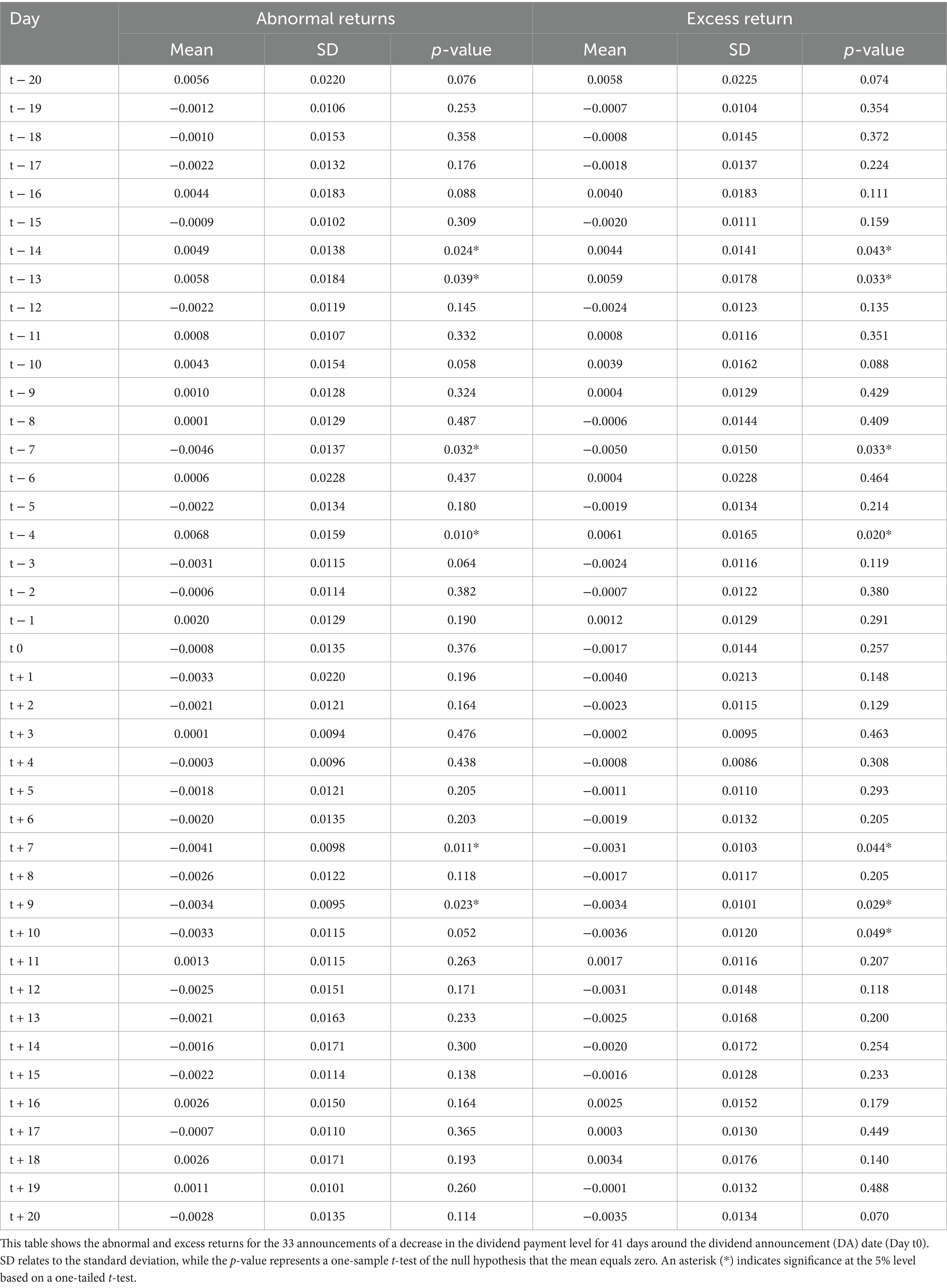

4.2.3 Share price reaction surrounding the 41-day event window for the dividend decrease announcements

The results throughout the 41-day event window for the DD sub-group companies are presented in Table 4 and Supplementary Table S3. Based on the discussion in the literature review, the announcement of a decrease in the dividend payment signals bad news about the company’s performance, which negatively affects the company’s share price. Therefore, the signalling information hypothesis indicates that abnormal (excess) returns on the announcement date should be below zero for companies lowering their dividends. Table 4 shows that the results tend to slightly confirm this argument in the Saudi context, with negative but not statistically significant mean abnormal (excess) returns of −0.08% (−0.17%) on the announcement day of a dividend decrease. Similarly, Supplementary Table S3 (the non-parametric Wilcoxon signed-rank test) presents the median abnormal (excess) returns on day t0 are negative at −0.28% (−0.22%), confirming the findings from the parametric test in Table 4. Consequently, sub-hypothesis H2.2, which argues that there is a significant negative reaction in the share price at the time a decrease in the dividend payment level is announced, is rejected at the 5% significance level.

Table 4. Share price performance around the 41-day event window for dividend decrease companies using a parametric test.

In the 20 days prior to the announcements of dividend cuts, the average abnormal (excess) returns are statistically significant and positive on days t − 4, t − 13 and t − 14, whereas they are negative on day t − 7. Regarding the 20 days after the disclosure of dividend decrease news, the mean abnormal (excess) returns are less than zero and significant at the 5% level on days t + 7 and t + 9. The results of the non-parametric test (Supplementary Table S3) report that the median abnormal (excess) returns on days t − 7 and t + 7 are negative and significant. Here, it is evident from the parametric and non-parametric tests that the Saudi shareholders take 1 week before and after the announcements of dividend decreases to respond, and they earned negative mean (median) ARs on day t − 7 of −0.46% (−0.24%) and day t + 7 of −0.41% (−0.45%). Also, the Saudi market either anticipates this cut in dividends or needs some time to take into account the dividend cut information into the stock price.

In brief, the findings in Table 4 (the parametric test) and Supplementary Table S3 (the non-parametric test) do not appear to confirm the hypothesis of the dividend information content because no statistically significant response from the market is found on the day when the dividend decrease is disclosed to the public. Such an observation could indeed clarify the general findings obtained from Table 2 (the parametric test) and Supplementary Table S1 (the non-parametric test), where the stock market response to the whole sample of dividend change news was statistically significant and positive on day t0. Clearly, the positive and unanticipated returns regarding the good information of the dividend increase are not dissipated by a reaction from the stock market to dividend decreases because no such adverse response has been uncovered. In contrast, the AR is negative and significant on day t + 7, indicating that shareholders in the Saudi market need a longer time to respond to dividend decrease news. A possible explanation for the absence of any reaction to a dividend decrease may be the lack of a significant financial analysis or that the company’s press releases is not sufficient to convince shareholders that the cuts in dividends really are an investment-related decision, not a portent of poor performance results (49).

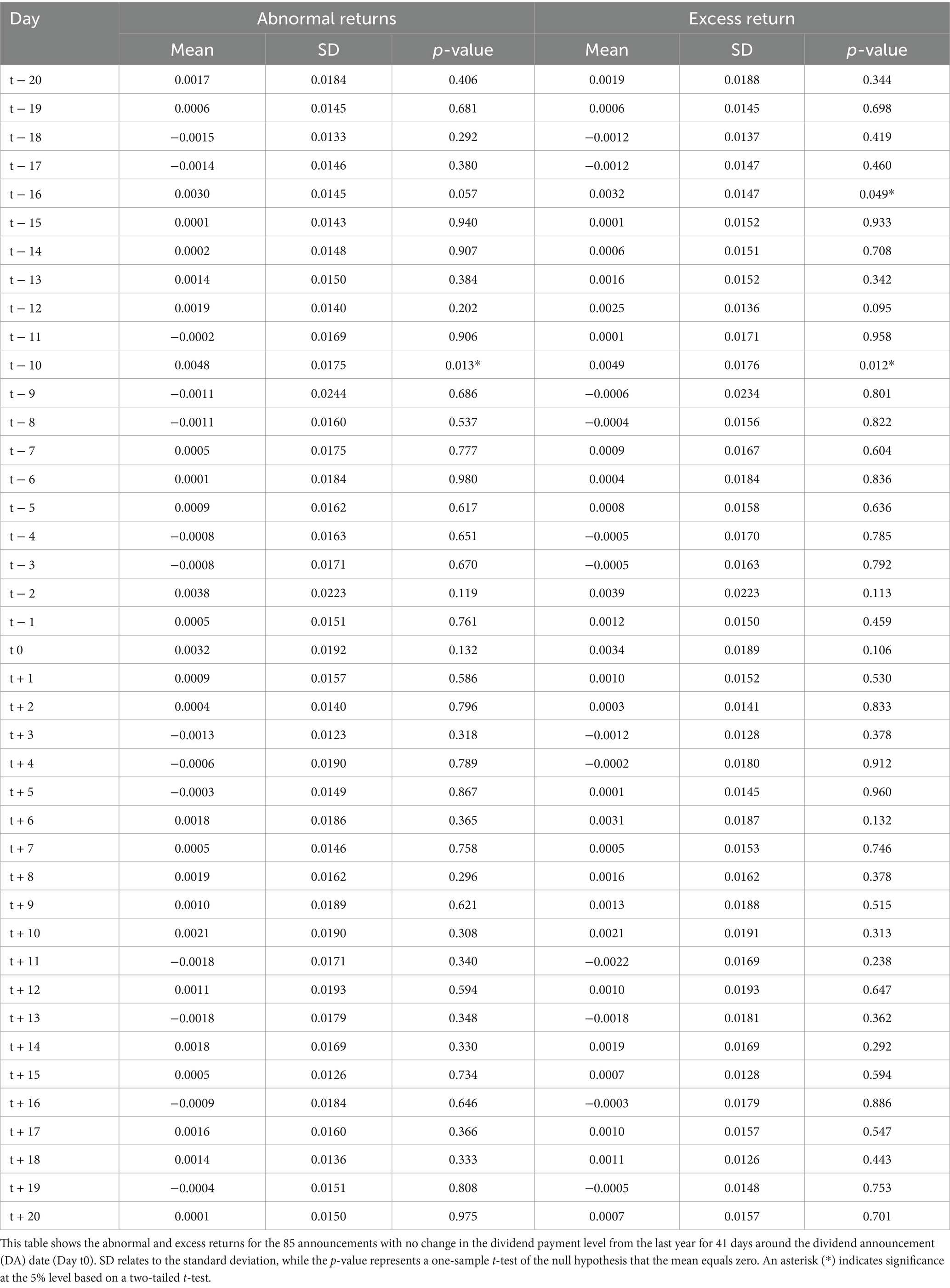

4.2.4 Share price reaction surrounding the 41-day event window for the dividend did not change announcements

The findings for the DNC sub-group companies are shown in Table 5 (the parametric test) and Supplementary Table S4 (the non-parametric test) over the 41-day event period. Based on the previous literature review, when companies decide not to change their dividend payment level, no new information is signaled to the outside market. Therefore, the signaling information hypothesis suggests that only normal returns on the announcement date are expected when no changes are made to the dividend level. Table 5 and Supplementary Table S4 show that the results seem to support this statement in the Saudi context, showing that the mean abnormal (excess) returns of 0.32% (0.34%) are positive on the announcement day of dividend no change but not statistically significant. Similarly, the median abnormal (excess) returns on day t0 are positive at 0.10% (0.22%), confirming the findings from the parametric test. Consequently, sub-hypothesis H2.3, which claims that there is no significant reaction in the share price at the time of the announcement of no change in the dividend payment level, can be accepted at the 5% significance level.

Table 5. Share price performance around the 41-day event window for the dividend no change announcements using a parametric test.

In the 20-day pre-announcement period, the mean abnormal (excess) returns are statistically significant and positive on day t − 10 at 0.48% (0.49%), whereas the median abnormal (excess) returns are also significant and negative on day t − 17 at −0.22% (−0.27%). Regarding the 20 days after the announcement of DNC news, the mean AR is positive in 13 cases and negative in seven cases but not statistically significant for all occasions. Similarly, the AExRs are positive on 14 days and negative on 6 days, but none of these days are at significant levels. The findings from the non-parametric test provide similar results about the insignificance of median abnormal (excess) returns on the 20-day post-announcement period.

5 Conclusion

This study reports how the Saudi exchange market may have reacted to dividend news during an eight-year study period from a total sample of 280 DAs made by 99 Saudi-listed companies. Although a considerable number of empirical studies have been conducted in developed markets to examine dividend signaling effects, very few comparable studies have been carried out in the Saudi market context. The results show that a company’s share price reacts to the announcement of a cash dividend during the event window, supporting the fact that the Saudi stock market responds to dividend news, in general, on the announcement date. The ARs for all 280 DAs differ significantly from null on the disclosure day. Besides, findings reveal a significant positive reaction in the share price at the time of the announcement of an increase in the dividend payment level, which confirms that the shareholders earn a significant positive AR on the dividend reporting day, particularly for companies that announced an increase in the dividend level. Furthermore, results demonstrate that the AR is negative but not significantly different from zero at the time of the announcement of a decrease in the dividend payment level. The Saudi market does not seem to react to the announcement of dividend decrease news. Likewise, findings show that the shareholders earn just normal returns on the announcement day and that the AR is not statistically different from zero for the DNC group.

The results of this study underscore the applicability of dividend signaling theory in the context of the Saudi capital market, suggesting that listed companies utilize dividend announcements to convey information about their future performance. This signaling behaviour highlights the informational role of dividends in an emerging market setting, where formal disclosure mechanisms may still be evolving. These findings offer practical implications for policymakers, such as the Capital Market Authority, by emphasising the importance of monitoring dividend practices to enhance market transparency. Strengthening disclosure requirements and governance standards related to dividend announcements could help reduce information asymmetry, bolster investor confidence, and support the overall integrity of the financial market.

The insights derived from this study also hold practical significance for corporate managers. Managers can enhance their information disclosure practices by understanding investor behaviour and the market’s response to dividend announcements. This, in turn, could help stabilize share price fluctuations and maintain investors’ trust. Lastly, for investors, the findings serve as a practical guide to making informed investment decisions by better understanding how dividend announcements influence a company’s share price performance.

In conclusion, this study provides critical insights into dividend signaling in the Saudi market, highlighting its implications for policymakers, managers, and investors. By contributing to the broader understanding of dividend announcements in emerging markets, the findings reinforce the importance of transparency, robust governance practices, and effective communication strategies in enhancing market efficiency and investor confidence.

6 Limitations and future research

While this study offers valuable insights into the stock market’s reaction to dividend announcements in Saudi Arabia, it should be acknowledged that it is subject to several limitations.

First, due to the lack of a unified national database, data were sourced from Eikon, Bloomberg, Tadawul, and Argaam, leading to occasional discrepancies. Tadawul was used as the primary source in such cases due to its accuracy and official standing. Second, the event study methodology required strict inclusion criteria, limiting the sample to 99 companies. While this may affect generalizability, the sample still represented 52% of all listed firms, 70% of dividend announcements, and 47% of market capitalisation in 2018. Despite these limitations, the study’s methodological rigour and the market coverage of the sample support the reliability and relevance of its findings within the context of emerging markets.

In light of these limitations, several directions for future research emerge that may further enrich understanding of dividend behaviour in emerging markets. First, sector-specific analyses are encouraged to investigate whether dividend behaviours differ across industries. In particular, focused studies on the banking and insurance sectors may uncover dividend behaviours that differ from those observed in the broader market. A comparative approach would help clarify whether the determinants of dividend decisions vary significantly across sectors. Second, future studies could enhance methodological robustness by employing alternative expected return models. For instance, the Fama and French (50) three-factor model, possibly adapted to include Islamic calendar-based effects (51), could provide new perspectives on abnormal returns following dividend announcements. Finally, extending the scope of this research to other emerging markets with institutional characteristics similar to Saudi Arabia would allow for cross-country comparisons. Such studies could test the generalizability of the findings and contribute to a broader understanding of dividend policy in developing capital markets.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

LA: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Project administration, Resources, Software, Validation, Visualization, Writing – original draft, Writing – review & editing. TM: Supervision, Writing – review & editing. DP: Supervision, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. Princess Nourah bint Abdulrahman University Researchers are acknowledged for Supporting Project number (PNURSP2025R547), Princess Nourah bint Abdulrahman University, Riyadh, Saudi Arabia.

Acknowledgments

Princess Nourah bint Abdulrahman University Researchers are acknowledged for Supporting Project number (PNURSP2025R547), Princess Nourah bint Abdulrahman University, Riyadh, Saudi Arabia.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fams.2025.1574134/full#supplementary-material

References

1. DeAngelo, H, DeAngelo, L, and Skinner, D. Dividends and losses. J Finance. (1992) 47:1837–63. doi: 10.1111/j.15406261.1992.tb04685.x

2. Joliet, R, and Muller, A. Dividends and foreign performance signaling. Multinatl Finance J. (2015) 19:77–107. doi: 10.17578/19-2-1

3. Lonie, A, Abeyratna, G, Power, D, and Sinclair, C. The stock market reaction to dividend announcements. J Econ Stud. (1996) 23:32–52. doi: 10.1108/01443589610106534

4. Pettit, R. Dividend announcements, security performance, and capital market efficiency. J Finance. (1972) 27:993–1007. doi: 10.1111/j.1540-6261.1972.tb03018.x

5. Al Qudah, A, and Badawi, A. The signaling effects and predictive powers of dividend announcements: evidence from the Kingdom of Saudi Arabia. J Bus Econ. (2015) 6:550–7. doi: 10.15341/jbe(2155-7950)/03.06.2015/012

6. Chaabouni, I. Impact of dividend announcement on stock return: a study on listed companies in the Saudi Arabian financial markets. Bus Manag. (2017) 9:37–44.

7. Uddin, H, and Osman, D. Effect of dividend announcement on shareholders’ value: evidence from Saudi Arabian stock exchange. Int J Bus Finance Res. (2008) 2:87–101.

8. Al-Yahyaee, K, Pham, T, and Walter, T. The information content of cash dividend announcements in a unique environment. J Bank Finance. (2011) 35:606–12. doi: 10.1016/j.jbankfin.2010.03.004

9. Amihud, Y, and Murgia, M. Dividends, taxes, and signaling: evidence from Germany. J Finance. (1997) 52:397–408. doi: 10.1111/j.1540-6261.1997.tb03822.x

10. Frankfurter, G, and Wood, B Jr. Dividend policy theories and their empirical tests. Int Rev Financ Anal. (2002) 11:111–38. doi: 10.1016/S1057-5219(02)00071-6

11. Dionne, G, and Ouederni, K. Corporate risk management and dividend signaling theory. Finance Res Lett. (2011) 8:188–95. doi: 10.1016/j.frl.2011.05.002

12. Aharony, J, and Swary, I. Quarterly dividend and earnings announcements and stockholders’ returns: an empirical analysis. J Finance. (1980) 35:1–12. doi: 10.1111/j.1540-6261.1980.tb03466.x

13. Gordon, M. Dividends, earnings, and stock prices. Rev Econ Stat. (1959) 41:99–105. doi: 10.2307/1927792

14. Walter, J. Dividend policy: its influence on the value of the enterprise. J Finance. (1963) 18:280–91. doi: 10.1111/j.1540-6261.1963.tb00724.x

15. Baker, K, Saadi, S, Dutta, S, and Gandhi, D. The perception of dividends by Canadian managers: new survey evidence. Int J Manag Financ. (2007) 3:70–91. doi: 10.1108/17439130710721662

16. Al-Malkawi, H, Rafferty, M, and Pillai, R. Dividend policy: a review of the theories and empirical evidence. Int Bull Bus Adm. (2010) 9:171–200.

17. Farrar, D, and Selwyn, L. Taxes, corporate financial policy, and return to investors. Natl Tax J. (1967) 20:444–54. doi: 10.1086/NTJ41791571

18. Brennan, M. Taxes, market valuation and corporate financial policy. Natl Tax J. (1970) 23:417–27. doi: 10.1086/NTJ41792223

19. Allen, F, Bernardo, A, and Welch, I. A theory of dividends based on tax clienteles. J Finance. (2000) 55:2499–536. doi: 10.1111/0022-1082.00298

20. Elton, E, and Gruber, M. Marginal stockholder tax rates and the clientele effect. Rev Econ Stat. (1970) 52:68–74. doi: 10.2307/1927599

21. Miller, M, and Modigliani, F. Dividend policy, growth, and the valuation of shares. J Bus. (1961) 34:411–33. doi: 10.1086/294442

22. Jensen, M, and Meckling, W. Theory of the firm: managerial behaviour, agency costs, and ownership structure. J Financ Econ. (1976) 3:305–60. doi: 10.1016/0304-405X(76)90026-X

24. Jensen, M. Agency costs of free cash flow, corporate finance, and takeovers. Am Econ Rev. (1986) 76:323–9.

25. Lintner, J. Distribution of incomes of corporations among dividends, retained earnings, and taxes. Am Econ Rev. (1956) 46:97–113.

26. Bhattacharya, S. Imperfect information, dividend policy, and the bird in the hand fallacy. Bell J Econ. (1979) 10:259–70. doi: 10.2307/3003330

27. Koch, P, and Shenoy, C. The information content of dividend and capital structure policies. Financ Manage. (1999) 28:16–35. doi: 10.2307/3666301

28. Lipson, M, Maquieira, C, and Megginson, W. Dividend initiations and earnings surprises. Financ Manage. (1998) 27:36–45. doi: 10.2307/3666273

29. McCluskey, T, Burton, B, Power, D, and Sinclair, C. Evidence on the Irish stock market’s reaction to dividend announcements. Appl Financ Econ. (2006) 16:617–28. doi: 10.1080/09603100600639058

30. Anwar, S, Singh, S, and Jain, P. Impact of cash dividend announcements: evidence from the Indian manufacturing companies. J Emerg Market Finance. (2017) 16:29–60. doi: 10.1177/0972652716686238

31. Felimban, R, Floros, C, and Nguyen, A. The impact of dividend announcements on share price and trading volume. J Econ Stud. (2018) 45:210–30. doi: 10.1108/jes-03-2017-0069

32. Ozo, FK, and Arun, TG. Stock market reaction to cash dividends: evidence from the Nigerian stock market. Manag Financ. (2019) 45:366–80. doi: 10.1108/MF-09-2017-0351

33. Nazarova, V, Isaeva, A, and Chuprina, Y. Stock market reaction to dividend announcements: evidence from the Russian market. Корпоративные финансы. (2023) 17:72–92. doi: 10.17323/j.jcfr.2073-0438.17.3.2023.72-92

34. Halıfe, H, and Karroum, S. The impact of dividend distribution announcements on stock prices: an event study at the Istanbul stock exchange. J Econ Finance Account. (2023) 10:76–84. doi: 10.17261/Pressacademia.2023.1730

35. Suidarma, IM, Marjohan, M, Shankar, IMBD, Widiantari, KS, Sunarta, IN, and Sudiksa, IM. Changes in high dividend stock yields before and after dividend announcement: evidence from the IDX high dividend 20 index. Risk Governance Control Financ Mark Inst. (2025) 15:8–18. doi: 10.22495/rgcv15i2p1

36. Ali, MB, and Chowdhury, TA. Effect of dividend on stock price in emerging stock market: a study on the listed private commercial banks in DSE. Int J Econ Finance. (2010) 2:52–64. doi: 10.5539/ijef.v2n4p52

37. Altiok-Yilmaz, A, and Akben-Selcuk, E. Information content of dividends: evidence from the Istanbul stock exchange. Int Bus Res. (2010) 3:126–32. doi: 10.5539/ibr.v3n3p126

38. Lotfi, T. Dividend and stock repurchase announcement in Tunisia: a signaling approach. Global J Manage Bus. (2018) 18:33–52.

39. Seyedimany, A. Stock price reactions on NASDAQ stock exchange for special dividend announcements. Emerg Sci J. (2019) 3:382–8. doi: 10.28991/esj-2019-01200

40. AlGhazali, A, Al-Yahyaee, KH, Fairchild, R, and Guney, Y. What do dividend changes reveal? Theory and evidence from a unique environment. Rev Quant Finan Acc. (2024) 62:499–552. doi: 10.1007/s11156-023-01211-x

41. Strong, N. Modelling abnormal returns: a review article. J Bus Finance Account. (1992) 19:533–53. doi: 10.1111/j.1468-5957.1992.tb00643.x

42. Brown, S, and Warner, J. Measuring security price performance. J Financ Econ. (1980) 8:205–58. doi: 10.1016/0304-405X(80)90002-1

43. Brown, S, and Warner, J. Using daily stock returns: the case of event studies. J Financ Econ. (1985) 14:3–31. doi: 10.1016/0304-405X(85)90042-X

44. Fama, E, Fisher, L, Jensen, M, and Roll, R. The adjustment of stock prices to new information. Int Econ Rev. (1969) 10:1–21. doi: 10.2307/2525569

45. Liu, J, and Chi, D. Stock market reaction to various dividend announcements: which kind of dividend announcement is more significant? J Test Eval. (2014) 42:996–1006. doi: 10.1520/JTE20120327

47. McWilliams, A, and Siegel, D. Event studies in management research: theoretical and empirical issues. Acad Manag J. (1997) 40:626–57. doi: 10.2307/257056

48. Khan, N, Burton, B, and Power, D. Managerial views about dividend policy in Pakistan. Manag Financ. (2011) 37:953–70. doi: 10.1108/03074351111161600

49. Ghosh, C, and Woolridge, J. Stock-market reaction to growth-induced dividend cuts: are investors myopic? Managerial Decis Econ. (1989) 10:25–35. doi: 10.1002/mde.4090100104

50. Fama, E, and French, K. The cross‐section of expected stock returns. J Finance. (1992) 47:427–65. doi: 10.1111/j.1540-6261.1992.tb04398.x

Keywords: dividend policy, share price, event study, Saudi stock exchange, signaling theory, information asymmetry

Citation: Abaalkhail L, McCluskey T and Power D (2025) Dividend announcements and share price dynamics: new evidence from Saudi-listed companies using event study approach. Front. Appl. Math. Stat. 11:1574134. doi: 10.3389/fams.2025.1574134

Edited by:

Ionut Florescu, Stevens Institute of Technology, United StatesReviewed by:

Dragos Bozdog, Stevens Institute of Technology, United StatesAli Murad Syed, University of Bahrain, Bahrain

Copyright © 2025 Abaalkhail, McCluskey and Power. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Layla Abaalkhail, bG9hYmFhbGtoYWlsQGdtYWlsLmNvbQ==

Layla Abaalkhail

Layla Abaalkhail Thomas McCluskey2

Thomas McCluskey2