- 1School of Emergency Management, Wuxi University, Wuxi, China

- 2School of Digital Economics and Management, Wuxi University, Wuxi, China

How to better promote green credit is the focus of commercial banks’ development concerns. This paper studies the impact of green credit implementation on the competitiveness of commercial banks and is based on the panel data of 12 Chinese commercial banks from 2011 to 2020. It looks at 8 research indicators, such as green credit ratio. The generalized method of moments (GMM) method is used for regression. The empirical study shows that the implementation of green credit has a certain positive effect in the short term, but the effect is quite small, about 0.0032, 0.0012, 1.4857 and 0.4028. The reason may be the pressure to concentrate on short-term operational performance and the lack of drive commercial banks display in fulfilling their social responsibility. As a result, commercial banks have often failed to timely and effectively carry out green credit business in line with their own development status. However, when relevant control variables are introduced, including gross domestic product (GDP) of total assets, non-performing loan ratio and GDP growth rate, the results show that if the commercial banks implement green credit, they can effectively improve their return on total assets. When the relationship between the control variables is considered, the promotion effect is even more obvious, which proves that the implementation of green credit can promote competitiveness among China’s commercial banks in terms of business performance.

1 Introduction

According to the Intergovernmental Panel on Climate Change (IPCC) reports, the worldwide excessive emissions of greenhouse gases and the consequent global rise in temperatures has highlighted the problem of climate change; indeed, it stands to affect the sustainable development of mankind. This problem has become so serious that all countries need to face the challenge together. Since the United Nations Framework Convention on Climate Change (UNFCCC), adopted by the United Nations General Assembly in 1992, the concept of eco-environmental protection, energy savings and emissions reduction has been deemed of great importance. In recent years, China too has put more emphasis on the concept of sustainable development. The report of the 19th National Congress of the Communist Party of China stated that ‘Green mountains and clear water are equal to mountains of gold and silver’, and made clear that environmental and resource protection should go hand in hand with economic development. Since the concept of green finance was first formalized in the 1990s (1), studies have clearly pointed out that developing green finance does promote green and sustainable economic development (2, 3). Green finance emphasizes sustainable development, also known as sustainable finance, which forces corporate governance (including commercial banks) to shift from pursuing a single economic benefit goal to balancing multiple objectives (4). The implementation paradigm of sustainable finance has gradually shifted from emphasizing corporate social responsibility (CSR) (5) to focusing on Environmental, Social and Governance (ESG) (6). ESG disclosure has a positive effect on social responsibility performance (7), while Li and Zheng’s (8) study suggests that ESG practices can promote corporate value growth. Commercial banks have also begun to incorporate ESG practices as an important part of information disclosure, objectively promoting the development of green credit business. Today, the area of green finance is being given more and more attention in academic circles. Green finance includes green credit, green securities, green insurance, green venture capital, carbon emissions trading systems and other financial instruments (9).

In 2002, the International Finance Corporation (IFC), an arm of the World Bank, led the drafting of the Equator Principles, the most influential framework for green credit; it has since become a widely accepted environmental and social risk management tool for commercial banks. Developed countries such as the United States, Japan, and Germany have all encouraged and pushed for the development of green credit in their countries by developing various incentive policies and laws (10). Since 2007, when the People’s Bank of China and the China Banking Regulatory Commission promulgated the opinions on implementing environmental policies and regulations to prevent credit risks, government departments implemented a series of policies aimed at green credit. Implementing green credit is becoming a major green finance practice in China (11).

However, there are drawbacks; the development history of green credit in China’s banks is short, the implementation of relevant policies is not comprehensive, the sense of social responsibility is not strong and the implementation of green credit is generally utilitarian. It is therefore of some urgency to improve the enthusiasm of commercial banks to implement green credit. We believe that this study on the effectiveness of green credit to enhance the competitiveness of commercial banks will help commercial banks fully understand the benefits of implementing green credit and thus promote the implementation of Green Credit policy.

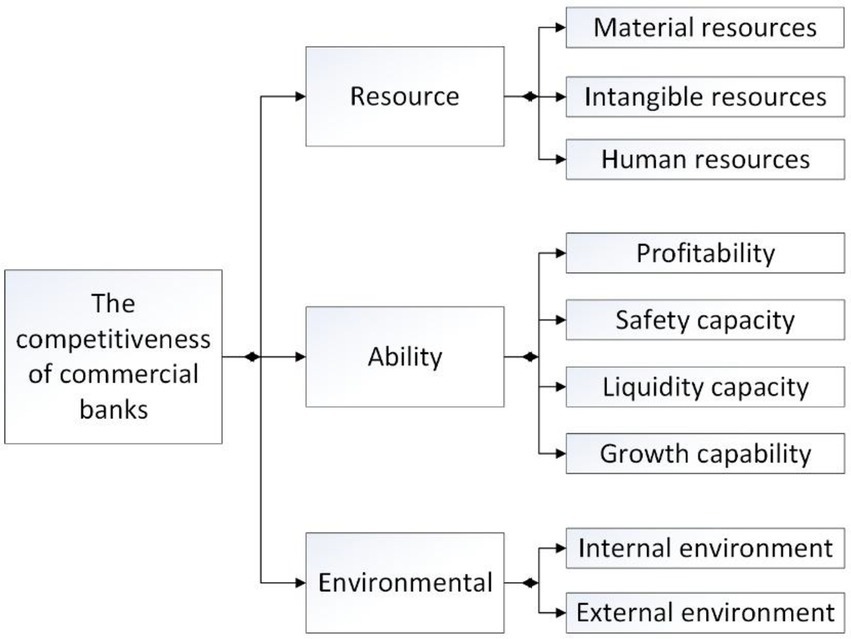

Traditional research often focuses on the single impact of green credit on the profitability or risk management capabilities of commercial banks. Based on the “resource capability environment” three-dimensional model of commercial bank competitiveness, this article preliminarily explores the ways in which green credit can enhance the competitiveness of commercial banks, and focuses on the core dimension of competitiveness-capability. Empirical research is conducted based on panel data from the four aspects of profitability, safety, liquidity, and growth capability, quantitatively revealing the role of green credit in influencing the core competitiveness of commercial banks.

To sum up, this paper plans to study the internal relationship between the implementation of green credit and the competitiveness of commercial banks in China. Based on the data of 12 Chinese commercial banks, this paper quantitatively discusses the impact of green credit on their business competitiveness. The findings of this paper provide useful references for Chinese commercial banks to firmly implement green credit policies and operations.

2 Literature review

2.1 Study on green credit

Since the ‘Equator Principle’ was put forward in 2002, green credit has been widely used when banks and other financial institutions offer credit. Jeucken believes that the combined transformation of commercial banks and green credit will have an impact on the environment and, along with increased public awareness of green issues, will greatly boost support for green industries (12). According to Sonia and Rodney, the daily operation of commercial banks is affected by environmental problems, so prudence dictates we should take environmental factors into account in the daily deposit and loan business (13). Thompson and Cowton point out that commercial banks need to incorporate green elements into their standard system processes for lending and investment strategies (14). Aguilera et al. (15), Sullivan and Dwyer (16), Macve and Chen (17) analyze the interaction between ‘Equator’ principles and commercial banks from a qualitative perspective. Scholtens and Dam focused on the Quantitative Analysis approach, examining the differences between 51 banks that adopted the Equator principles and 56 that did not (18). Even though those commercial banks that operate on the Equator principles take on more social responsibility, their lending risks are reduced. With regard to the sustainability of financial development, Egmond advocated the restructuring of the financial system, mainly to meet both social purpose needs and subsequent economic development (19). On the other hand, Olaf (20) points out that the problems faced by financial institutions regarding scale effect, service awareness and financial product innovation do affect their sustainable development. With the promotion of green credit, enterprises and other economic subjects have begun to actively undertake the environmental aspects of social responsibility. According to a study by Aupperle et al., socially responsible firms have, to some extent, greater competitive advantages (21). Chami et al. noted that, not only is the enhancement of the economic value of enterprises related to the implementation of green finance, but that it also effectively ad-dresses the moral hazard and management efficiency of enterprises (22). Volz (23) argues that a transition to green finance is necessary if the economy is to move on to a sustainable path.

China’s research on green credit began in 2007, focusing on the impact of green credit policies on China’s economic entities, financial sectors, government agencies and other future sustainable development areas. Zhang and Yang argue that green credit has not been fully implemented in China because of unclear policy details and a lack of environmental standards (24). By building a non-linear threshold panel model, Xiu et al. found that green credit regulatory measures are conducive to achieving energy conservation and emissions reduction under the constraints of industrial growth (25). Wang et al. built a DSGE (Dynamic Stochastic General Equilibrium) model with green finance to discuss the choice of green credit incentive policy (26). Luo et al. advocated the international analysis and comparison of green credit research, combining the advanced foreign experience and China’s green credit policy, the paper puts forward some policy suggestions that focus on China’s special problems and aims to promote the development and perfection of green credit in China (27). When Zhang and Lu used the PSM-DID model to analyze the relationship between green credit policies and the in-novation performance of Chinese A-share listed companies from 2010 to 2019, it pointed out that green credit can significantly improve the innovation performance of restrictive enterprises, especially in state-owned enterprises, large-scale enterprises and enterprises with low financing constraints (28). Some studies have focused on analyzing the current situation of green credit development in China and the problems faced in its implementation and put forward improvement measures and suggestions. For example, Su and Weng analyzed the current situation and summarized the existing problems of green credit in China, including institution-building, product innovation, implementation effects, information disclosure and financing constraints. The implementation of green credit needs both Chinese governments at all levels and the commercial banks to play a role (29).

2.2 Green credit and the competitiveness of commercial banks

With the rapid development of the economy and an ever more competitive environment facing commercial banks, research on the competitiveness of commercial banks mainly focuses on the theory of corporate social responsibility and environmental management. From the perspective of social responsibility theory, commercial banks should actively undertake social responsibility, implement green credit measures and achieve green and sustainable development in terms of resources, capabilities and environment of commercial banks. They should also improve the level of business competitiveness. The environmental risks of commercial banks mainly focus on reputation, credit and compensation risks. Green credit plays an increasingly important role in the environmental protection risk control of commercial banks; commercial banks should reasonably deploy credit access mechanisms, credit management mechanisms, risk early-warning mechanisms and dynamic exit mechanisms. Cilliers et al. believes that green credit can effectively enhance the operational competitiveness of commercial banks and promote their sustainable development (30).

By building models, a lot of research has been done on the impact of green credit on the operational competitiveness of commercial banks. He et al. based their research on green credit balance and return on total assets, pointing out that green credit by commercial banks can effectively increase the return on total assets (31). On the other hand, based on the data of non-performing loan rates, total assets and other control variables, the impact of green credit on commercial banks is more obvious; A combination of in-ternal and external policies can greatly improve the competitiveness of management as the comprehensive effect of internal and external policies is greater than that of a single policy. Through the Principle Component Analysis Method Gao and Gao took 20 commercial banks in China as research objects, to do research into commercial bank management competitiveness. Regression analysis shows the impact of green credit scale and bank competitiveness with results generally showing that the implementation of green credit at the 95% confidence level will have a positive impact on the competitiveness of commercial banks (32).

2.3 Summary

Based on the above review, research papers in the literature basically discuss the relationship between green credit and the competitiveness of commercial banks. Due to different research methods and different competitiveness evaluation indicators, the corresponding conclusions are also different, which needs further discussion. In order to enrich the research content in related fields, this paper uses the method of combining theory with practice to study the impact of green credit on commercial bank operation competitiveness.

3 The theoretical basis of the impact of green credit on the competitiveness of commercial banks

Jin (33) points out that the self-development ability of commercial banks is related to the ability of enterprises to more effectively provide high-quality products and services to their customers. Operational competitiveness is the ability of a firm to achieve an average return on investment above the cost of capital (34). As a special financial enterprise model, commercial banks must have a unique operation model if they want to enhance their competitiveness. The study also shows that the rational use of internal and external environmental factors can effectively enhance the competitiveness of commercial banks, enhance their own sustainable development capabilities and better meet customer customization requirements. By improving the quality of the products and business services, firms can surpass their competitors.

In the context of global carbon emissions reduction, this paper makes reference to the research of Wang (35) on business competitiveness, research which focuses on the construction of quantitative evaluation indicators. The influencing factors are summarized as resource, capability and environment (Figure 1). Clearly, from the perspective of social responsibility theory, commercial banks can achieve green and sustainable development in terms of their resources, capabilities and environment by actively assuming and practicing social responsibility through the implementation of green credit and improving the level of business competitiveness.

In addition, from the perspective of environmental risk control theory, commercial banks must take a series of measures to reduce, transfer, avoid or eliminate environmental risks. Green credit plays an important role in the environmental risk control of commercial banks. Through the rational deployment of green credit access mechanisms, green credit management mechanisms, risk early-warning mechanisms and dynamic exit mechanisms, commercial banks can comprehensively control the environmental risks, thus reducing or eliminating the adverse effects of frequent environmental abuses by some lending enterprises.

In conclusion, the implementation of green credit by commercial banks can pro-mote banks to optimize the allocation of resource factors, thus improving their profitability, security, mobility and growth. It can also enhance the level of environmental risk control. Theoretically, the multi-dimensional promotion of green credit to commercial banks can effectively enhance the competitiveness of commercial banks.

4 Evaluating green credit effects on Chinese bank performance

Based on panel data modeling, this section further explores the impact of green credit on the business competitiveness of commercial banks, analyzes the relationship between green credit and commercial banks and studies the mechanism by which the implementation of green credit affects the competitiveness of commercial banks.

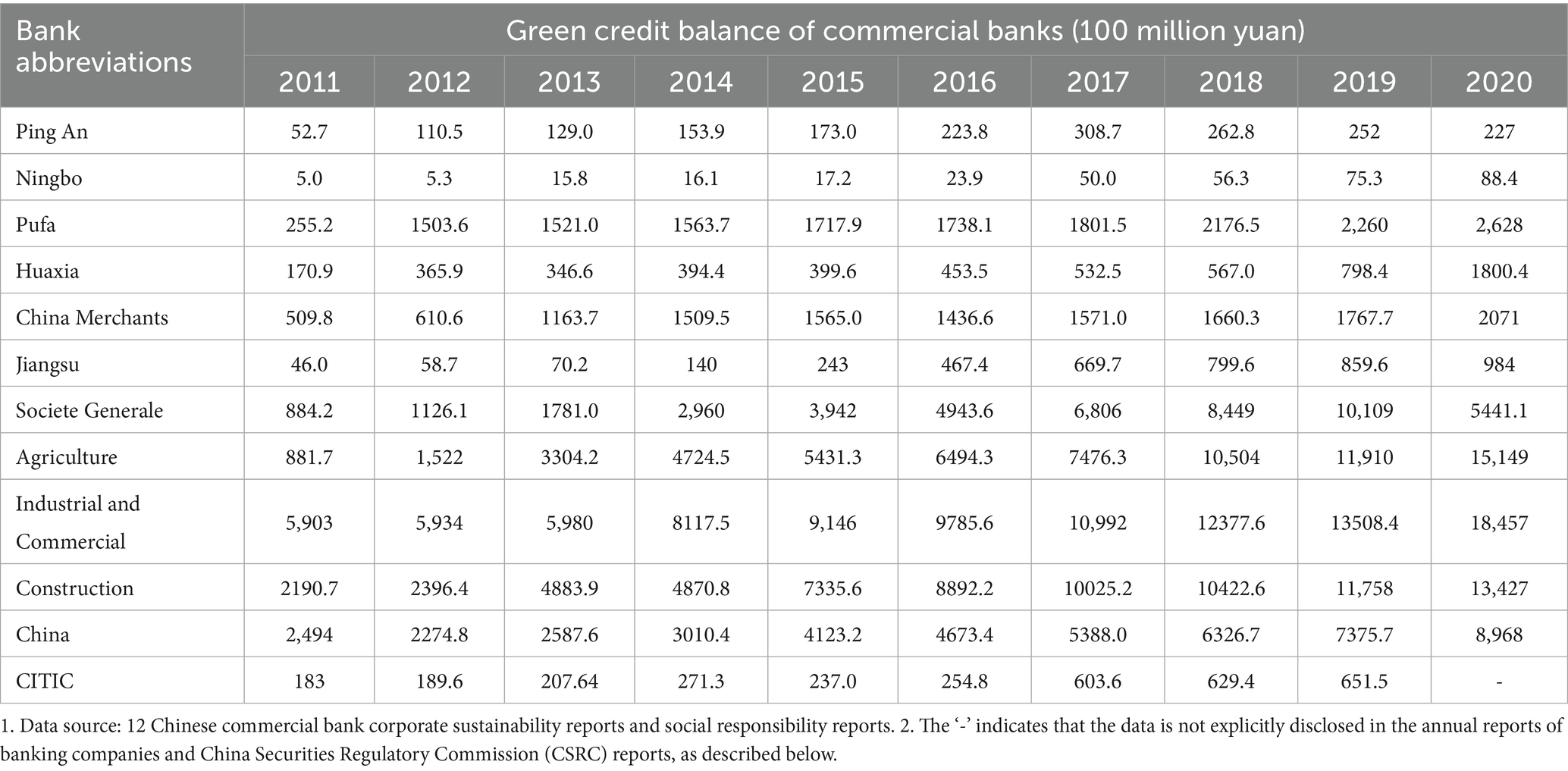

From Table 1, we can see that, since 2011, green credit balances have been increasing year by year, with the growth rate rising steadily since the release of the Green Credit Guidelines in 2012. This largely reflects the strategic and positive guiding role of the Green Credit Guidelines and is a milestone in the history of green credit development in China. While this is inseparable from the Chinese banking industry’s initiative to implement green credit, it is more a function of the state’s full support for energy conservation, environmental protection and other green projects.

By 2021, the green credit balance of 12 major banking and financial institutions in China rose from RMB 1,357,614.63 billion in 2011 to RMB 6,924,086 billion in 2020, rep-resenting an increase of about 410% over the past decade. Their operations cover a wide range of green industries and sectors. According to the data published by the CSRC, the implementation of green credit can save 300 million tons of standard coal and reduce the equivalent of 700 million tons of carbon dioxide each year. It can be seen that the effect of implementing green credit is great and, consequentially, green credit is being looked at more often.

4.1 Variable selection

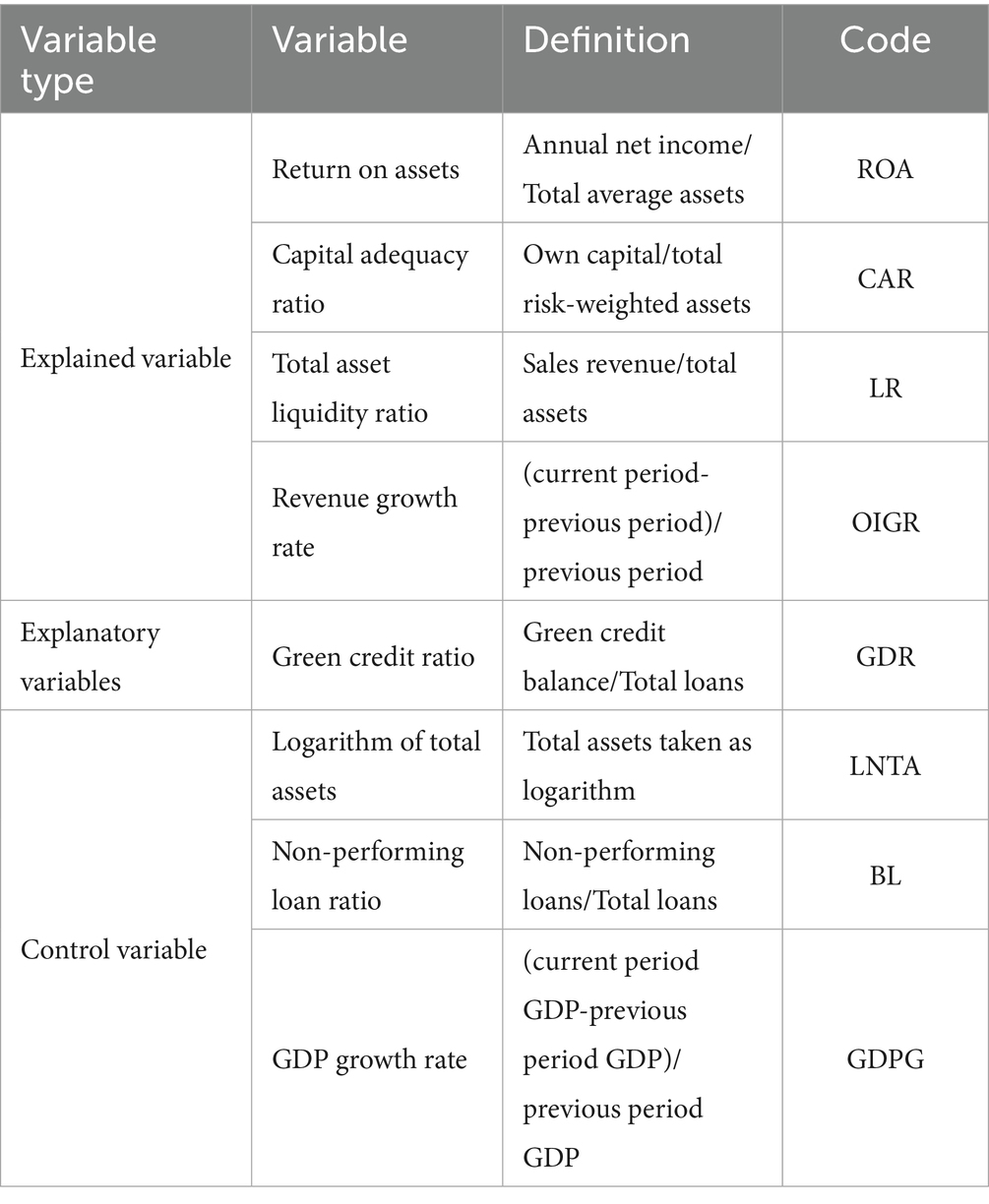

We refer to the table of green credit statistical standards set by the CSRC. These include the structure of specific names of green credit projects, calculation of statistical methods and statistical standards of green credit balances. In addition to the relevant statistics disclosed in the annual social responsibility reports of commercial banks, the effectiveness of green credit is mainly reflected through the observation of new policy evaluation and implementation effects. The main criteria to measure whether they really support green enterprises and industries are whether commercial banks fund green projects and reduce lending to polluting projects. Wang (35) showed that the implementation of green credit by commercial banks is based mainly on the green credit ratio, which is the ratio of commercial bank green credit balance to total loans. The accuracy and robustness of the model regression can be better achieved by introducing control variables into the research process. The three indicators of total asset GDP, non-performing loan ratio BL and GDP growth rate GDPG are commonly used control variables (Table 2) (36).

4.1.1 Explained variable: business competitiveness of commercial banks

The main factor that affects the competitiveness of commercial banks is capability. Usually the capability element of commercial banks contains the four major elements of profitability, safety, liquidity and growth capability so the return on assets index ROA, the capital adequacy ratio index CAR, the total asset liquidity ratio index LR and the revenue growth rate index OIGR are selected as the explanatory variables.

4.1.2 Explanatory variable: green credit ratio

Commercial banks refer to the ratio of green credit balances to total loans as the Green Credit Ratio Index, and the size of the level of the Credit Ratio Index reflects the real situation of commercial banks as to the implementation of green credit.

4.1.3 Control variables: total assets LNTA, non-performing loan ratio BL and GDP growth rate GDPG

Operating scale performance is an important manifestation of commercial bank competitiveness, referring to the fact that the larger the commercial bank is when it generates economies of scale, the better the profitability in the long run, the lower the long-term management costs and the more prominent the competitive advantages. Although the academic community has not yet reached a consensus on the optimal size of commercial banks, many commercial banks still actively incorporate the benefit maximization strategy of economies of scale into practical applications. Referring to Wu and Wang, to eliminate data heteroskedasticity, the logarithmic value of total assets of commercial banks, LNTA, is chosen as a control variable reflecting the performance of operating scale (37).

The size of losses of commercial banks is closely related to the percentage of non-performing loans. The larger the percentage of non-performing loans, the less competitive the commercial bank is; on the contrary, the smaller its percentage, the more outstanding its competitiveness. The non-performing loan ratio BL is chosen as the control variable.

Changes in the internal and external environment affect the business management model of commercial banks and their profitability and thus affect their competitiveness. GDP can reflect the changes in the external economic environment over time, so GDP growth rate gdpg is selected as the control variable (38). The results of green credit variables selection are shown in Table 2.

4.2 Data sources and descriptive statistics

4.2.1 Sample selection and data sources

The listed commercial banks in China are surveyed with data based on the principle of scientific and complete disclosure of selected information. For the research objects of this paper, only the 2011–2020 data of 12 Chinese commercial banks are selected for data regression analysis. The selection involves three major categories of state-owned commercial banks, national joint-stock commercial banks and local urban commercial banks. The reasons for selecting the 2011–2020 statistical data for analysis for are as follows.

First, in 2007, the government and its related departments introduced the concept of green credit. After the concept of green credit was introduced, some enterprises and industries did not fully understand green credit. The data after 2011 were selected for the study because the relevant data before 2011 were not very rigorous and the lag phenomenon was prominent. The green credit data were not studied and analyzed after 2020 because the disclosure of green credit data was incomplete in 2021 due to the impact of Corona virus.

Secondly, many Chinese listed commercial banks have inaccurate data and lack timely and complete disclosures of green credit data. In view of the principle of availability and continuity of empirical data research, 12 commercial banks with relatively comprehensive disclosure of green credit information are selected for research and analysis.

Finally, although the data sample size is small, the study is conducted based on the first-hand green credit data of commercial banks, with the findings having practical reference significance for the development of green credit by Chinese commercial banks.

4.2.2 Descriptive statistics

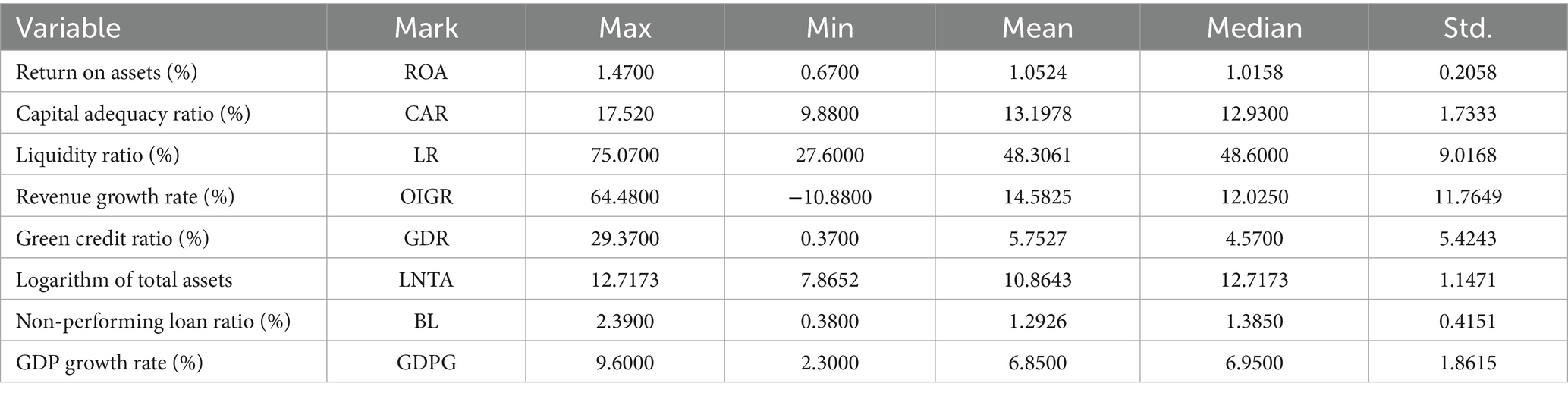

The results of the analysis of descriptive statistics variables are summarized in Table 3.

The basic operating characteristics of commercial banks are as follows:

First, there are quantitative differences in the return on assets, total asset liquidity ratio and revenue growth rates. According to regulatory standards of CSRC, the capital adequacy ratio of Chinese state-owned banks and local commercial banks should be maintained above 8% and the minimum capital adequacy ratio available for statistical use is 9.88%, which meets the regulatory ratio requirement.

Second, the data shows that the green credit ratio is relatively low, with 5–10% being the most common. Among domestic commercial banks, Industrial Bank was the first bank to adopt the Equator Principles. The data study shows that this bank has always had the highest green credit ratio, as high as 29.37%, which far exceeds the green credit ratio of other commercial banks.

Third, in the study of state-owned commercial banks, joint-stock commercial banks and urban commercial banks, although the assets of commercial banks are large, their non-performing loan ratios are generally relatively low. The maximum ratio distribution of 2.39% is significantly lower than the critical number of 5%, reflecting that commercial banks do not have significant credit risks. They have strict risk control management and their assets are healthy indicators in the long term.

4.3 Empirical test of the impact of green credit on the competitiveness of commercial banks

4.3.1 Model construction

The study shows that the measures of competitiveness are mainly focused on return on assets ROA, capital adequacy ratio CAR, total assets liquidity ratio LR and revenue growth rate OIGR; these show that the explanatory variables are convincing. The explanatory variable is the green credit ratio GDR, which is analyzed and studied by describing the ratio of green credit balance to total loans. In the hypothesis, in addition to the above factors, the model control variables include the logarithm of asset size LNTA, the non-performing loan ratio BL and the national GDP growth rate GDPG. Because they also have a significant impact on the competitiveness of commercial bank operations, these indicators are allowed to appear as control variables in the model. At the same time, the selection of the model should follow the regression principles of accuracy and comprehensiveness, so a reasonable model selection requires modeling assessment by testing the appropriate model. The basic model construction is as follows:

Where in the Equations 1–4 above: denotes the bank (=1,2, …, n); denotes year (=1,2, …, n), represents unobservable fixed effects and represents random disturbance terms; – , – , – , – represent coefficients of model1–4, respectively.

4.3.2 Model estimation and analysis of results

4.3.2.1 Unit root test

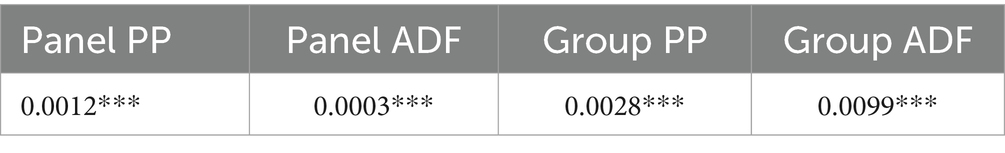

First, in order to avoid pseudo-regression findings, statistical data need to be judged by unit root tests. These are derived by using the Fisher-ADF and the Fisher-PP tests (39), where, in the underlying series, forms of the research variables involved are all first-order single-integer series. Table 4 shows the results of the unit root test for the statistical data.

The results of the analysis using the green credit balance indicator variable are basically consistent with the above findings, reflecting the stability and reliability of the thesis model at the beginning of its establishment. Furthermore, the research regression has good robustness, which makes the regression results more convincing.

The comparison of the two explanatory variables shows both that the green credit business of commercial banks does have a significant effect on business competitiveness and that the results of the empirical study also indicate that the development of green credit business has improved the competitiveness of commercial banks. However, since the new concept of “green credit” is still new, we need to continue our efforts to explore more accurately the relationship between the competitiveness of commercial bank green credit policies while responding to the national policy.

4.3.2.2 Panel co-integration test

Secondly, on the premise of satisfying the stability of the variables, the study of the equilibrium relationship of different variables is combined with the data test of the variables of interest and the panel test. The results are shown in Table 5.

The results in the above table show that the p-value is much less than the critical value of 0.05 and that different variables can have co-integrating relationships. Based on this study, the following research analysis can be conducted on the relevant data.

4.3.2.3 Model estimation and analysis of results

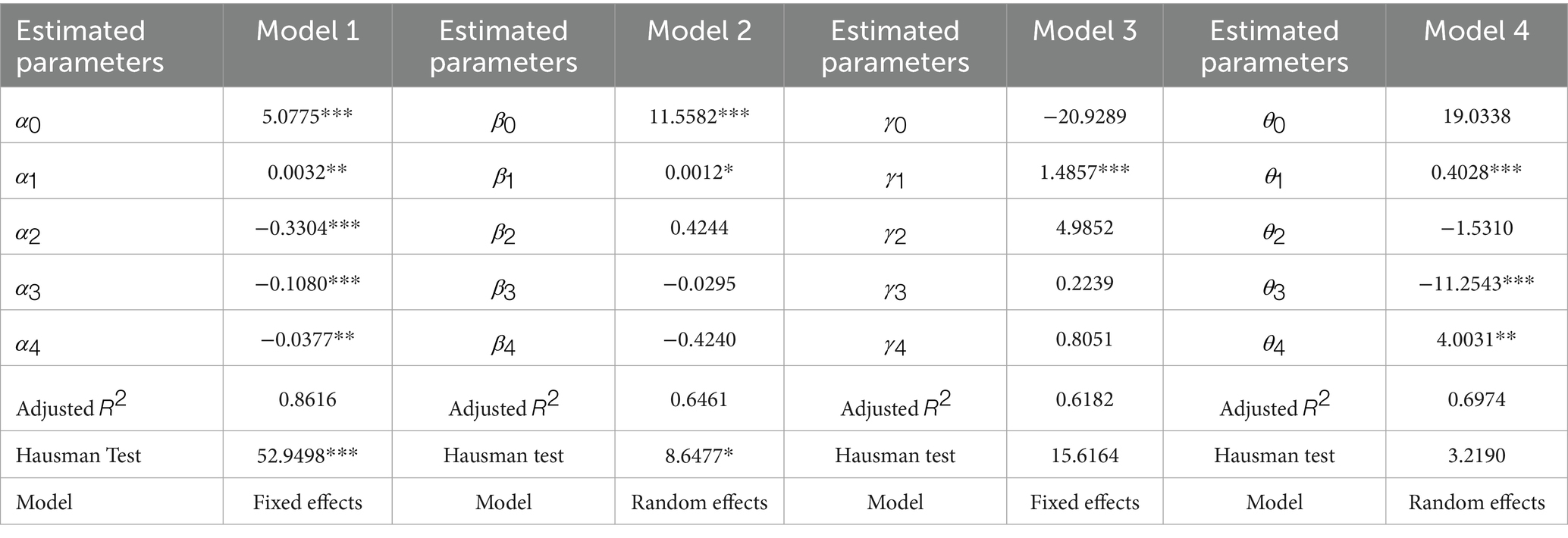

Finally, when the model is selected, the Hausman test is used for analysis to obtain the most appropriate modeling data analysis model. And, due to the influence of data availability, it is difficult to avoid endogeneity issues caused by missing key variables in this article. At the same time, there is a certain bidirectional causal relationship between data, such as between GDR and ROA, which can also lead to endogeneity issues. The generalized method of moments (GMM) regression method can effectively solve endogeneity problems, so this paper adopts this method to solve the model. The test and regression results of this study are shown in Table 6.

In the above analysis, to study the business competitiveness of green credit commercial banks, the return on assets ROA, capital adequacy ratio CAR, total assets liquidity ratio LR and revenue growth rate OIGR are analyzed as key indicators. The explanatory variables are analyzed, based on these four variables, using Models 1, 2, 3 and 4. From the results of model estimation in Table 6, it can be seen that:

First, the explanatory variable in Model 1 is the return on capital, which represents the profitability of commercial banks. The study of the observed data shows that the green credit ratio based on the ROA explanatory variable has a positive and significant effect on the return on assets. The coefficient of significance is 0.0032 with the analyzed data at a 5% level of significance, meaning that for every 1% increase in green credit ratio, the return on ROA increases on average by 0.0032%. Calculated based on the total assets of China’s banking industry at the end of 2024, which is approximately 444.6 trillion yuan (42), and the average ROA is 1.05% (Table 3), it is equivalent to an increase of approximately 15 billion yuan in profits. The theoretical analysis combining green credit on commercial bank operational competitiveness agrees with the expected theoretical research. A research perspective based on social responsibility theory or a research perspective based on environmental risk management can conclude that, in the long run, the benefits of commercial banks themselves actively practicing green credit outweigh the disadvantages. This is because, in the short term analysis, the costs to the commercial banks when implementing green credit are often taken into account. A large number of empirical studies at home and abroad show that the competitive advantage of commercial banks implementing green policies is much higher than the cost factor. He et al. pointed out that the short period of time for commercial banks to implement green credit is a key factor in the current market credit promotion effect having little benefit (31). Moreover, not only do green credit projects generally have a long delivery time period, but neither the profit benefit, nor the competitive advantage, is always obvious in the short term.

The data statistics show that asset size and NPL ratio, as control variables in the study, have a negative effect on the return on total assets, although this is less significant given the relatively small coefficients. The negative relationship between asset size and total return on assets at the significant critical value level may be related to the unreasonable asset size sample selection. Because of the excessive concentration of commercial bank capital, the marginal rate of return on loans per unit of deposit shows a decreasing trend, which leads to the conclusion that total assets are negatively correlated with the rate of return; similarly, the NPL ratio of commercial banks is negatively correlated with the rate of return on total assets and the rate of return on total assets at the significant critical level. The study concludes that healthy assets affect not only, to a certain extent, the operational efficiency and resource allocation of financial institutions, but also the profitability status; the GDP growth rate of China’s gross domestic product has averaged 6.85% in the past 10 years, which can be obtained from the macro social and economic environment affecting the development of specific industries.

Second, the explanatory variable in Model 2 is the capital adequacy ratio, which represents the safety capacity of commercial banks. The coefficient of 0.0012 indicates that for every 1% increase in green credit ratio, the capital adequacy ratio increases by 0.0012%. At the end of the first quarter of 2025, the capital adequacy ratio of Chinese commercial banks increased by about 0.76% compared to the previous quarter (42), which means that banks can significantly promote the growth of capital adequacy ratio by significantly increasing the low green credit ratio (average 5.75%, Table 3). For example, a 100% increase in a quarter will lead to a 0.12% increase in capital adequacy ratio. The capital adequacy ratio is the ratio of capital and weighted risk assets held by banks. From the perspective of environmental risk management theory (35), the proportion of green credit is related to the size of the green credit balance. When the size of the green credit balance is large, the proportion of green credit is also relatively high. Green industries and enterprises that implement preferential policies are currently the main energy-saving credit targets of commercial bank green credit. The active implementation of green credit by commercial banks can reduce credit risk and the proportion of risky non-performing assets; this improves a bank’s ability to operate safely.

Third, the explanatory variable in Model 3 is the total asset liquidity ratio, which represents the liquidity capacity of commercial banks. From the perspective of the total asset liquidity ratio, the green credit ratio has a significant effect on the commercial bank total asset liquidity ratio. For every 1% increase in the green credit ratio, the total asset liquidity ratio will increase by nearly 1.5%, reflecting the active green credit activities in China from 2011 to 2020, with typical evidence being the rapid development of China’s electric vehicle industry. To a certain extent, green credit directs the flow of capital to reasonable industries and sectors, such as increasing investment in green and environmental protection enterprises and limiting capital support to high pollution, high energy consumption and overcapacity enterprises. The reasons for such initiatives by commercial banks are to reduce the proportion of their own bad debt risk and manage the probability of mismanagement and bankruptcy risks for the “two high and one surplus” enterprises that have increased in the context of the increasingly serious environmental problems. At the same time, Zhang et al. have pointed out that the government’s support of and, focus on, the green environmental protection industry chain can establish both a good management system and a sufficiently strong capital guarantee system (40). This makes commercial banks effectively reduce, avoid or eliminate the risks caused by the environment when conducting green credit, while also actively practicing a sense of social responsibility. The government will also increase its financial support in the future along with the gradual promotion of the “green” strategy. The factors of internal stability of assets are not unique, resulting in less significant application in the actual data statistical studies. In addition, the study (37) shows that the non-performing loan ratio among the control variables is an important indicator of commercial bank asset guarantee capacity. If the NPL ratio is relatively large, the asset quality of commercial banks deteriorates, which leads to a poorer asset liquidity ratio. At a significance level, the correlation can be considered as small since this association is not very strong and not very significant. In addition, from the empirical results, we see that GDP growth rate is also insignificant with respect to the total asset liquidity ratio. In addition, from the empirical results, both GDP growth rate and total assets liquidity ratio are not significant.

Fourth, the explanatory variable in Model 4 is the revenue growth rate which represents the growth capability of commercial banks. For every 1% increase in the green credit rate, the revenue growth rate will increase by 0.4%, indicating that commercial banks can promote their own revenue growth through the implementation of green credit, but this effect is relatively small. On the one hand, the reason is that green credit business is not yet the mainstream loan business of Chinese commercial banks, as evidenced by an average green credit ratio of 5.75%; On the other hand, it may be because green credit belongs to the preferential loan business launched by Chinese commercial banks, with long loan cycles and low loan interest rates, which also leads to its relatively small contribution to revenue growth rate.

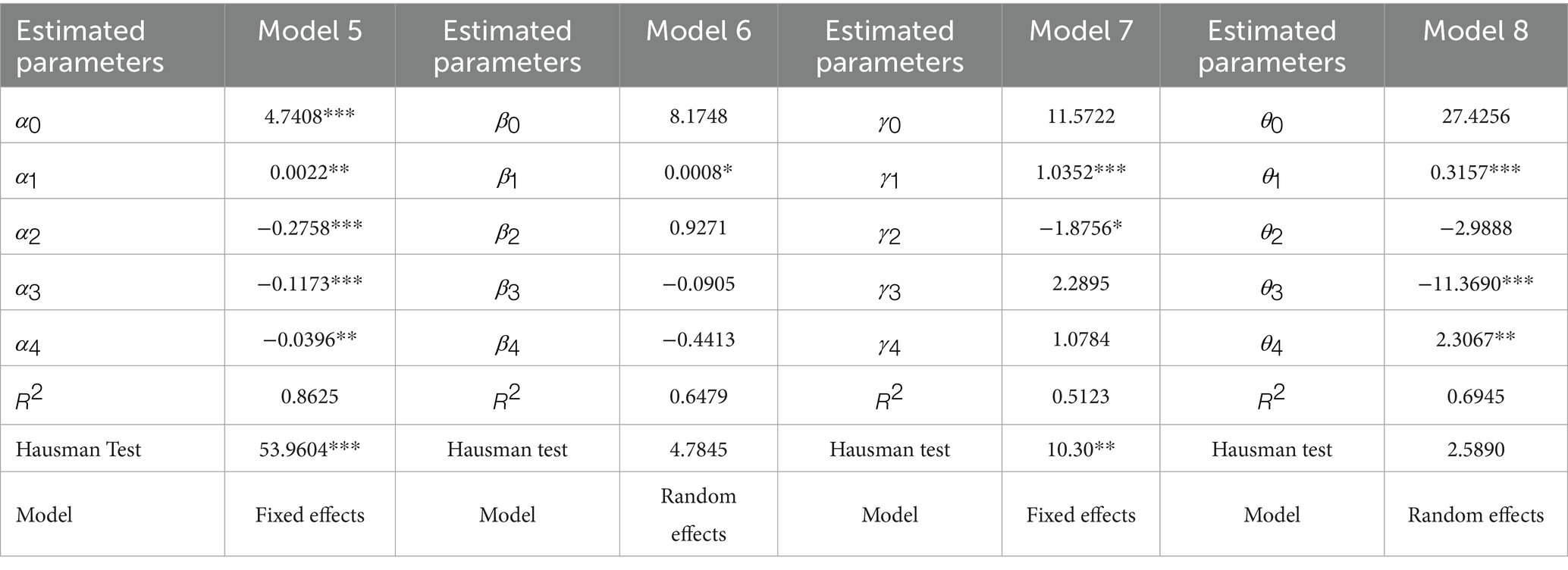

4.3.3 Robustness testing

The model set up needs to estimate the degree of robustness, so that the effect of heteroskedasticity is minimized before estimating the robustness criteria for the model. In the existing established model, in order to better measure the development trend of green credit in commercial banks, this paper will now adopt the green credit balance, instead of the explanatory variable green credit ratio used above, so as to go for the stability of the research purpose. Models 5–8 correspond to Models 1–4, respectively. With the results of robustness tests presented in Table 7.

The results of the analysis using the green credit balance indicator variable are basically consistent with the above findings, reflecting the stability and reliability of the thesis model at the beginning of its establishment. Furthermore, the research regression has good robustness, which makes the regression results more convincing.

The comparison of the two explanatory variables shows both that the green credit business of commercial banks does have a significant effect on business competitiveness and that the results of the empirical study also indicate that the development of green credit business has improved the competitiveness of commercial banks. However, since the new concept of “green credit” is still new, we need to continue our efforts to explore more accurately the relationship between the competitiveness of commercial bank green credit policies while responding to the national policy.

5 Conclusion

Combining domestic and foreign research bases and, based on the evaluation index system of commercial bank competitiveness related to social responsibility and environmental risk management theory, this paper selects four state-owned commercial banks and eight joint-stock commercial banks from 2011 to 2020 to conduct the research. Eight research indicators, such as green credit ratio, are used as the research object, and the systematic GMM regression method is used to conduct empirical regression model analysis. This paper concludes that green credit has a positive impact of green credit on the competitiveness of commercial banks. Subsequently, the paper conducted robust-ness tests and it was likewise concluded that green credit has a positive impact on the business competitiveness of commercial banks. The empirical study found that:

First, the implementation of green credit has a positive effect in the short run, but the effect is fairly small, roughly 0.0032, 0.0012, 1.4857 and 0.4028. The reason for the small effect may be both that commercial banks are pressured to perform and that commercial banks lack awareness in fulfilling their social responsibility. This leads to their failure to carry out timely and effective green credit business in accordance with their own development status.

Secondly, when the relevant control variables are reasonably introduced, i.e., the variables, total assets GDP, non-performing loans rate BL and GDP growth rate, the research further indicates that it can effectively improve the return on total assets, etc. The promotion effect is more obvious when the relationship between the control variables is considered in full.

Finally, based on the above analysis and research and, in order to further improve the competitiveness of commercial banks, the government, as a macro-regulator, should actively coordinate, cooperate and support the implementation of green credit, assisting in developing a reasonable credit evaluation system, promulgating the implementation details of green credit policies and strengthening management and supervision. The commercial banks, as an important entity to support the implementation of green credit policy, should increase the diversification of credit products, actively train professional people, learn advanced foreign management techniques, innovate products and reduce risks.

6 Discussion

In September 2020, China set a clear goal of “peak carbon dioxide emissions” by 2030 and “carbon neutrality” by 2060, so the effectiveness of green credit implementation is related to China’s economic transformation and the realization of the carbon emission reduction target. As the main body of green credit policy implementation, the effect of green credit implementation by commercial banks reflects their competitiveness.

In this paper, an empirical study is conducted on twelve major commercial banks in China to quantitatively reveal the impact of green credit on the competitiveness of commercial banks, and the research sample and data in this paper are richer than similar studies (31). Since 2007, the Chinese government has implemented a series of green credit policies, compared with related studies (35, 37) and considered the lag effect of the green credit policy, this paper is based on the policy context of green credit implementation in China, which can better reveal the role of green credit.

The paper focuses on the impact of green credit on the capability dimension based on the evaluation system of commercial banks’ competitiveness (35), and four econometric models were constructed to reveal the effects of green credit on commercial banks’ profitability, safety, liquidity, and growth capacity, respectively. The data used is on the results of green credit, business competitiveness of commercial banks and related literature (31, 35, 37), combined with indicators such as green credit ratio, asset size and non-performing loan ratio. The study shows that green credit has a significant effect on improving commercial bank short-term profit, safety and growth ability, indicating that commercial banks can improve their business competitiveness to some extent by implementing green credit, although the effect has low significance. This may be related to the pursuit of profit maximization (3) and the failure of commercial banks as profit-making enterprises to assume timely social responsibility (2, 24).

However, the current conditions of some commercial banks do not allow them to immediately adopt a large number of green credit policies (2). This is because the profit return cycle of green credit is relatively long and the benefits minimal in the short term, Wang et al. pointed out that in the short term, economic indicators will be negatively impacted by the introduction of green credit policies (26). If commercial banks fail to adopt the right response strategies, they will be discouraged from implementing green credit, which will affect the long-term pace of conducting green credit business (3). In conclusion, the development of green credit is not only a reflection of the social responsibility of commercial banks, but is also an effective way to improve the sustainable competitiveness of commercial banks (41).

7 Study limitations and future perspectives

The paper can be revised and improved in the following ways. One of the main problems in the research of this paper is the small sample selected. Looking at the development of green credit in China, we can conclude that the late introduction of green credit, the relative lack of theoretical concepts, the lack of obvious implementation effects and the imperfect regulatory laws and regulations have brought about the in-complete and non-transparent disclosure of commercial banks in the area of green credit. This, in turn, has had certain impact on the selection of sample size in this paper. In particular, since the occurrence of the COVID-19 pandemic, commercial banks tend to be more opaque in their green credit disclosure. This is due to external factors related to the epidemic which increase the difficulty and availability of data for this paper. As for both the future development of green credit in China and the nature of green credit in the immediate COVID-19 post-pandemic period or even well after the end of the COVID-19 pandemic, further research is needed to collect future sample data.

In this paper, when constructing the business competitiveness system of commercial banks, only the more obvious indicators of commercial banks are selected for modeling analysis, with the return on assets index ROA, the capital adequacy ratio index CAR, the total assets liquidity ratio index LR and the revenue growth rate index OIGR chosen as the explanatory variables. In the theoretical foundation study of this paper, it is clearly proposed that social responsibility theory and environmental risk control theory may also potentially influence the operational competitiveness of commercial banks since it is really difficult to quantify in terms of undertaking social responsibility awareness. As a consequence, this paper does not take them into consideration when constructing the operational competitiveness models. As to whether the effect of social responsibility awareness on the competitiveness of commercial banks is obvious and, as to how it affects the competitiveness of commercial banks, we need to further attempt to quantify it in future research and explore the principle of its effect.

In addition, the reliability of panel data models depends on effective control of omitted variable biases, measurement errors, and policy endogeneity. This article lacks sufficient attention to these aspects, and future research needs to further integrate cutting-edge econometric methods with big data technology, such as extracting emotional tendencies from policy texts as instrumental variables through text analysis, or using satellite remote sensing data to correct measurement errors in corporate environmental performance. At the same time, it is necessary to enhance the transparency of method application, improve the credibility of causal inference through open code and data, and detailed reporting of robustness test results.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

NS: Writing – review & editing, Formal analysis, Methodology, Writing – original draft, Visualization, Investigation, Software, Validation, Conceptualization. JL: Software, Data curation, Writing – review & editing, Investigation, Conceptualization, Writing – original draft, Resources, Project administration, Methodology. JW: Visualization, Resources, Writing – original draft, Data curation, Validation, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. White, MA. Environmental finance: value and risk in an age of ecology. Bus Strat Environ. (1996) 3:198–206. doi: 10.1002/(SICI)1099-0836(199609)5:33.0.CO;2-4

2. Liu, RY, Wang, DQ, Zhang, L, and Zhang, LH. Can green financial development promote regional ecological efficiency? A case study of China. Nat Hazards. (2019) 95:325–41. doi: 10.1007/s11069-018-3502-x

3. Wen, SY, Liu, H, and Wang, H. Green finance, green innovation, and high-quality economic development. J Financ Res. (2022) 8:1–17.

4. Avramov, D, Cheng, S, Lioui, A, and Tarelli, A. Sustainable investing with ESG rating uncertainty. J Financ Econ. (2022) 145:642–64. doi: 10.1016/j.jfineco.2021.09.009

5. Cornett, MM, Erhemjamts, O, and Tehranian, H. Greed or good deeds: an examination of the relation between corporate social responsibility and the financial performance of U. S. Commercial banks around the financial crisis. J Bank Financ. (2016) 70:137–59. doi: 10.1016/j.jbankfin.2016.04.024

6. Brooks, C, and Oikonomou, I. The effects of environmental, social and governance disclosures and performance on firm value: a review of the literature in accounting and finance. Br Account Rev. (2018) 50:1–142. doi: 10.1016/j.bar.2017.11.005

7. Mervelskemper, L, and Streit, D. Enhancing market valuation of ESG performance: is integrated reporting keeping its promise? Bus Strateg Environ. (2017) 26:536–49. doi: 10.1002/bse.1935

8. Li, S, and Zheng, S. Does the implementation of ESG inhibited enterprise growth? On Econ Probl. (2022) 12:81–9. doi: 10.16011/j.cnki.jjwt.2022.12.015

9. Jiang, HL, Wang, WD, Wang, L, and Wu, JH. The effects of the carbon emission reduction of China’s green finance: an analysis based on green credit and green venture investment. Financ Forum. (2020) 11:39–48. doi: 10.16529/j.cnki.11-4613/f.2020.11.006

10. Jiang, XL, and Zhang, QB. Theory and practice review of green finance for developed country. China Popul Resour Environ. (2017) 5:323–6.

11. Guo, JJ, and Fang, Y. Green credit, financing structure and corporate environmental investment. J World Econ. (2022) 8:57–80. doi: 10.19985/j.cnki.cassjwe.2022.08.008

12. Jeucken, M. Sustainable finance and banking: The financial sector and the future of the planet. UK: Earthscan Publications Ltd (2001).

14. Thompson, P, and Cowton, CJ. Bringing the environment into bank lending: implications for environ-mental reporting. Br Account Rev. (2004) 36:197–218. doi: 10.1016/j.bar.2003.11.005

15. Aguilera, RV, Williams, CA, Conley, JM, and Rupp, D. Corporate governance and social responsibility: a comparative analysis of the UK and the US. Corp Gov Int Rev. (2006) 3:147–58. doi: 10.1111/j.1467-8683.2006.00495.x

16. O'Sullivan, N, and O'Dwyer, B. Stakeholder perspectives on a financial sector legitimation process: the case of NGOs and the equator principles. Account. (2009) 4:553–87. doi: 10.1108/09513570910955443

17. Macve, R, and Chen, X. The “equator principles”: a success for voluntary codes? Account Audit Account J. (2013) 9:890–919. doi: 10.1108/09513571011080171

18. Scholtens, B, and Dam, L. Banking on the equator. Are banks that adopted the equator principles different from non-adopters? World Dev. (2007) 8:1307–28. doi: 10.1016/j.worlddev.2006.10.013

21. Aupperle, KE, Carroll, AB, and Hatfield, JD. An empirical examination of the relationship between corporate social responsibility and profitability. Acad Manag J. (1985) 2:446–63. doi: 10.1023/A:1027334524775

22. Chami, R, Cosimano, TF, and Fullenkamp, C. Managing ethical risk: how investing in ethics adds value. J Bank Financ. (2002) 26:1697–718. doi: 10.1016/S0378-4266(02)00188-7

23. Volz, U. Fostering green finance for sustainable development in Asia. ADBI Work Papers. (2018). doi: 10.2139/ssrn.3198680

24. Zhang, B, Yang, Y, and Bi, J. Tracking the implementation of green credit policy in China: top-down perspective and bottom-up reform. J Environ Manag. (2011) 92:1321–7. doi: 10.1016/j.jenvman.2010.12.019

25. Xiu, J, Liu, HY, and Zang, XQ. The industrial growth and prediction under the background of green credit and energy saving and emission reduction. Model Econ Sci. (2015) 3:55–62.

26. Wang, Y, Pan, DY, Peng, YC, and Liang, X. China's incentive policies for green loans: a DSGE approach. J Financ Res. (2019) 11:1–18.

27. Luo, X, Xia, MY, and Chen, XJ. On risks and management strategies of commercial banks in developing green credit. Credit Reference. (2022) 3:72–80.

28. Zhang, JS, and Lu, SS. The influence of green credit policy on enterprise innovation performance. Statist Decis. (2022) 7:179–83. doi: 10.13546/j.cnki.tjyjc.2022.07.036

29. Su, L, and Weng, HZ. Research on the effect of green credit on enterprises’green innovation from the perspective of financing constraints. China For Econ. (2022) 2:141–5. doi: 10.13691/j.cnki.cn23-1539/f.2022.02.028

30. Cilliers, EJ, Diemont, E, and Stobbelaar, DJ. Sustainable green urban planning: the green credit tool. J Place Manag Dev. (2010) 1:57–66. doi: 10.1108/17538331011030275

31. He, LY, Wu, C, Zhong, ZQ, and Zhu, JR. Green credit, internal and external policies, and the competitiveness of commercial banks: an empirical study of nine listed commercial banks. Financ Econ Res. (2018) 1:91–103.

32. Gao, XY, and Gao, G. A study on the relation between the scale of green credit and the competitiveness of commercial banks. On Econ Probl. (2018) 7:21–7. doi: 10.16011/j.cnki.jjwt.2018.07.003

35. Wand, XR. Environmental improvement investment and quality of bank assets: an analysis based on green credit. Financ Forum. (2016) 11:12–9.

36. Yao, Z, and Shao, QH. Index selection for the evaluation of commercial banks’ competitiveness and its weight ascertainment. Sci Technol Prog Policy. (2005) 1:60–3.

37. Wu, XY, and Wang, F. Empirical study on the influence factors of new business strategy of bank strategic groups on performance based on panel data of 16 listed banks in China's banking industry. J Financ Res. (2012) 9:48–61.

38. Du, G, Cheng, JC, and Chen, WD. Study on analysis and evaluation of the core competence of the corporation. J Tianjin Univ (Soc Sci). (2000) 1:56–60.

39. Maddala, GS, and Wu, S. A comparative study of unit root tests with panel data and a new simple test. Oxf Bull Econ Stat. (1999) 61:631–52. doi: 10.1111/1468-0084.0610s1631

40. Zhang, ZG, Jin, XC, and Li, GQ. An empirical study on the interactive and inter-temporal influence between corporate social responsibility and corporate financial performance. Account Res. (2013) 8:32–9.

41. Campiglio, E, Dafermos, Y, Monnin, P, Ryan-Collins, J, Schotten, G, and Tanaka, M. Climate change challenges for central banks and financial regulators. Nat Clim Chang. (2018) 8:462–8. doi: 10.1038/s41558-018-0175-0

42. China Financial Regulatory Administration. Total assets and liabilities of the banking industry in 2024 (quarterly). Statistical Information. (2025). Available at: https://www.nfra.gov.cn/cn/view/pages/ItemDetail.html?docId=1164264&itemId=954&generaltype=0

Keywords: green credit, commercial bank, social responsibility, management competitiveness, generalized method of moments (GMM)

Citation: Sun N, Liu J and Wang J (2025) Can green credit enhance the competitiveness of commercial banks? Evidence from China. Front. Appl. Math. Stat. 11:1642815. doi: 10.3389/fams.2025.1642815

Edited by:

Athanasios Yannacopoulos, Athens University of Economics and Business, GreeceReviewed by:

Theodoros Daglis, University of Patras, GreecePhoebe Koundouri, Athens University of Economics and Business, Greece

Copyright © 2025 Sun, Liu and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jun Liu, d3h1c253QHllYWgubmV0

Ning Sun

Ning Sun Jun Liu

Jun Liu Junli Wang2

Junli Wang2