- Department of Marketing, University of Finance and Economics, Ulaanbaatar, Mongolia

The systematic review looks at the elements that influence consumer switching behavior in the retail banking industry, which includes fintech companies, online platforms, and traditional banks. Financial institutions must concentrate on pricing tactics, service quality, and cutting-edge product offerings in a competitive market to keep clients. Key factors influencing consumer switching behavior, including service quality, pricing competitiveness, digital banking capabilities, and customer satisfaction, are identified in this study through a systematic literature review (SLR) of six chosen papers published between 2020 and 2024. It also draws attention to retention obstacles like subpar customer service and a lack of alignment with customer values. The study suggests methods for lowering customer attrition in order to address these issues, such as raising service standards, cutting banking costs, enhancing digital products, and matching customer expectations. This review identifies gaps in the literature and provides retail banks with actionable suggestions to reduce attrition and enhance customer loyalty by combining insights from various geographic contexts. For financial institutions looking to adjust to changing customer preferences and cultivate enduring partnerships in the retail banking sector, the findings offer insightful advice.

1 Introduction

Retail banking is a competitive and dynamic atmosphere in which customer loyalty is highly fragile (Berger et al., 2020; Kamath et al., 2020). Financial institutions are striving to cope with the demands of consumers, and awareness of the factors that impact the ability of consumers to switch banks has become significant (Zhou et al., 2020). The switching behavior denotes the process of terminating their relationship with the bank and re-establishing their account with the other banks. This behavior impacts the profitability of banks as well as their market share. It is necessary for banks to cope with action by means of motivation. Customer switching behavior in retail banking is a vital idea that directly influences a bank’s stock and share in the market (Zhou et al., 2020). Translating customer attrition entails educating findings on multiple parameters, such as service quality, charges, advancements in technology, and customer situations in the Middle East (Sangeetha, 2021). Service quality is a significant factor in the consumer retention as well as switching behavior. As the bond between banks and their customers deepens, it is becoming more evident that emotional ties play a vital role in driving customer satisfaction and loyalty across the world. This highlights the importance for banks to focus on providing high-quality service and fostering positive emotional relationships with their clients.

In the modern era, numerous factors have contributed to the bank switching behavior of consumers (Lu and Wung, 2021). The rapid evolution of technology has resulted in consumer interactions with banking institutions (Heckel and Waldenberger, 2022). The emergence of digital banking has provided consumers with high access to information as well as services. It permits them to construe the decision associated with the banking relationship. In addition, the competition among financial institutions has led to aggressive marketing strategies (Roberts-Lombard and Petzer, 2021). This resulted in the attraction of new consumers and thereby increased the loyalty of the consumers.

Service industry contributes to a greater proportion of the world economy (Mainardes et al., 2020). Service providers are highly concerned with the retention of consumers (Völcker and Stenfelt, 2021). This is due to the negative impact of consumer switching, likely the minimized market share, high costs and impaired profitability. In addition, the retention of the consumer resulted in the perceptual, motivational and consequences of behavior that benefitted banking institutions. Loyal consumers are less likely to be inspired by the search for information on the basis of alternatives, are resistant to persuasion in terms of competitors and are engaged in WOM in Nigeria (Mukerjee, 2020). These factors have significant impacts and provide the reason for the switching of consumers in Indonesia (Afandi, 2020). Switching behavior, consumer loyalty and retention are interrelated. Loyalty and retention have positive effects on banking institutions. In China, the negative consequence is the switching of the consumer from one bank to another (Zhao et al., 2024).

Most banks face challenges in retaining the consumer for regulating their marketing strategy. Pricing tactics are important in affecting customer decision to change banks. Customers are now more aware of fees and costs, and may opt for banks with better prices or extra services. In India, acquiring new customers costs more than keeping current ones. Banks need to find a good balance between pricing tactics and the value they provide to customers, in order to keep them loyal and prevent them from leaving. Additionally, attracting new consumers is four to five times more expensive and necessitates greater effort than the growing relationship with consumers in India (Kamath et al., 2020). The associations among consumer and banking institutions are substantial in India (Biswas et al., 2022). It needs to be sustained continuously in a consistent manner and thereby permits consumer loyalty. Hence, loyalty aids in retaining reliable consumers. Additionally, consumer attraction is necessary for the growth of banks. In the case of an economic crisis, stable consumers can detect strata and support the maintenance of a reliable business.

Accelerating global development has resulted in the hurdles of banking institutions among potential as well as existing consumers. Stable action is to be ensured in the competing global market, and thereby, banks develop strategies according to consumer orientation. It denotes the uninterrupted interaction among the bank and the consumers. These relationships should be started and maintained consistently. The key for retaining consumers is to ensure that they are satisfied in the way that they would desirably travel with the bank in the long term, buy greater numbers of products as well as services according to their needs and recommend their banks among peer groups in South Korea (Yoon and Lim, 2021). Moreover, consumer loyalty aids in improvising the image of banks and acts as an advertisement source that can cope with the similar products and services of the competing bank even if they deliver a high number of favorable services, which are likely grace periods as well as high interest rates in Romania (Mistrean, 2021).

The manifestation of switching intention lies in the usage behavior of consumers. The intention is demonstrated as the willingness to switch, and it concentrates on the act of switching behavior. When there is higher satisfaction, the switching variable does not have a noteworthy effect on consumer transactions with retail banks. In contrast, with lower satisfaction, switching behavior does not have a noteworthy effect on the user intention of retail banks. The knowledge of the switching behavior is crucial since it leads to the loss of the revenue transaction from the specific consumer (Haralayya, 2021).

Customer loyalty, retention, and switching behavior are closely connected. Loyalty and retention benefit banking institutions, whereas switching behavior can have adverse effects. Customers who are loyal are less likely to be influenced by rival banks and are more inclined to spread positive feedback. Recent studies in Nigeria have demonstrated the significant impact of word-of-mouth on customer perceptions and decisions. Understanding the relationship between these aspects is crucial for banks aiming to create effective retention strategies. Intentions to switch can be observed in consumer behavior, indicating a readiness to change banks. Awareness of switching behavior can help banks identify opportunities for enhancement and create focused retention strategies.

The push-pull-mooring model is used as a theoretical framework to explain customer switching behavior in retail banking. This model divides factors affecting switching decisions into push factors (e.g., dissatisfaction), pull factors (e.g., better offers), and mooring factors (e.g., inertia or perceived costs). Implementing this model in future research on customer behavior in retail banking can help financial institutions improve their strategies to boost customer loyalty and reduce attrition. This model explains the interaction between dissatisfaction, alternative attraction, and change barriers. In contrast, the Theory of Planned Behavior highlights the role of psychological and social factors in determining behavior. It argues that behavior switching is determined by consumers’ attitude toward switching (e.g., perceived benefits or penalties), subjective norms (e.g., social influence or advice from friends), and perceived behavioral control (e.g., difficulty or simplicity of switching). Together, these theories offer a complete conceptual framework for understanding the determinants and inhibitors of consumer switching in retail banking, both external factors and internal decision-making patterns.

Hence, a systematic literature review of consumer switching behavior in the retail bank industry will provide a briefer understanding of consumer behavior, which will aid in identifying the factors impacting the consumer decision to switch over banks. The synthesized outcomes of the research studies support defining the factors that guide banks for further development in the areas that are actually needed. It aids in pin-pointing the challenges that permit banks to frame strategies for retaining consumers and thereby mitigating their attrition. Regulations and policies might be transformed to align consumer security and promote fair competencies in the global market. Effectual marketing strategies can be implemented to improve the performance of banks against competitors.

The novelty of this research lies in its holistic and integrative approach to understanding consumer switching behavior in the retail banking sector. The conventional studies have examined individual factors influencing switching, this systematic review provides a comprehensive and synthesized overview of the key drivers, considering their interplay and relative prominence. It provide updated knowledge in the diverse geographical context. Hence, this cross-contextual perspective improvise the generalizability of the findings.

1.1 Research questions

An SLR must begin with a well-formulated research question that is composed of interventions to aid in decision-making procedures. This, in turn, determines the articles to be incorporated into the review. Systematic reviews focus on identifying overall studies that address a particular question; hence, they provide an unbiased and balanced summary of existing scholarly works. The techniques utilized to recognize the studies for inclusion in SLR, created in a specific way to identify adverse studies that might be published in conference with marginal impact journals and not indexed in the bibliographic databases. This, in turn, reduces the number of undesirable studies in SLR because it can affect the outcomes of SLR. The search protocol or strategies for an SLR should be formulated so that it can answer the research question. This, in turn, implies that the search strategy should be delicate instead of specific. Alternative techniques need to be addressed; sometimes, widely held evidence usually comes from research design, which is not considered the highest level of evidence for a specific research question. Hence, the search strategy and protocol should be designed in a flexible manner for an SLR to answer the research questions. The duty of the investigator is to frame appropriate research questions.

RQ1: How has the retail banking landscape evolved specifically focusing on the digital technologies, competing pressure and consumer expectations?

RQ2: What are the factors that impact consumer switching behavior in retail banking?

RQ3: How does the implementation of consumer relationship strategies impacting the consumer loyalty in retail banking?

RQ4: Which strategies should be adopted for consumer retention in retail banking?

2 Research method

The well-known research approach is a systematic literature review. The most significant research endeavor is SLR, which is not simply a review of existing works. It responds to particular research questions. In other words, the SLR is a methodology that identifies studies; chooses and assesses contributions, analyses and synthesis data; and documents the evidence in such a manner, which in turn permits the conclusions to be drawn about what is known and not known. The SLR is different from the other narrative reviews in that it adopts a more well-defined and rigorous review process, which in turn involves following the standards for comprehensive searches for every significant study. In addition, the replicability of the SLR allows the audit trail of all the investigators’ research procedures to be delivered in a transparent and scientific manner. The SLR utilizes rigorous and well-defined criteria to recognize, evaluate and amalgamate the list of studies published in peer-reviewed literature. In addition, the SLR can also use the gray literature. The gray literature is described as any material not easily recognized by means of a well-established bibliographic database or index such as a thesis, on-going research papers, reports or newsletters. The SLR intends to resolve specific research questions, test theories and hypotheses, and restrict systematic bias or error at similar times. Therefore, the SLR is a scientific tool rather than a simple discussion of the literature (Thomé et al., 2016). This SLR follows the PRISMA guidelines for performing review.

The PRISMA (Preferred Reporting Items for Systematic reviews and Meta-Analyses) has been established recently to increase systematic review reporting quality and is utilized by the majority of journals and academic institutions across the world. The most commonly utilized reporting guidance for the SLR that encompasses the literature search component is the PRISMA statement (Parums, 2021). The PRISMA statement of the 2009 checklist involves the three items associated with the SLR. Primarily, it includes the reporting of a literature search that involves a description of the information sources, such as databases with coverage dates. Furthermore, it involves the entire electronic search strategy for the chosen database, which includes the limits utilized so that the process can be repeated. Third, the number of scholarly works selected for the review process and the reasons behind this selection are depicted in a flow diagram (Rethlefsen et al., 2021).

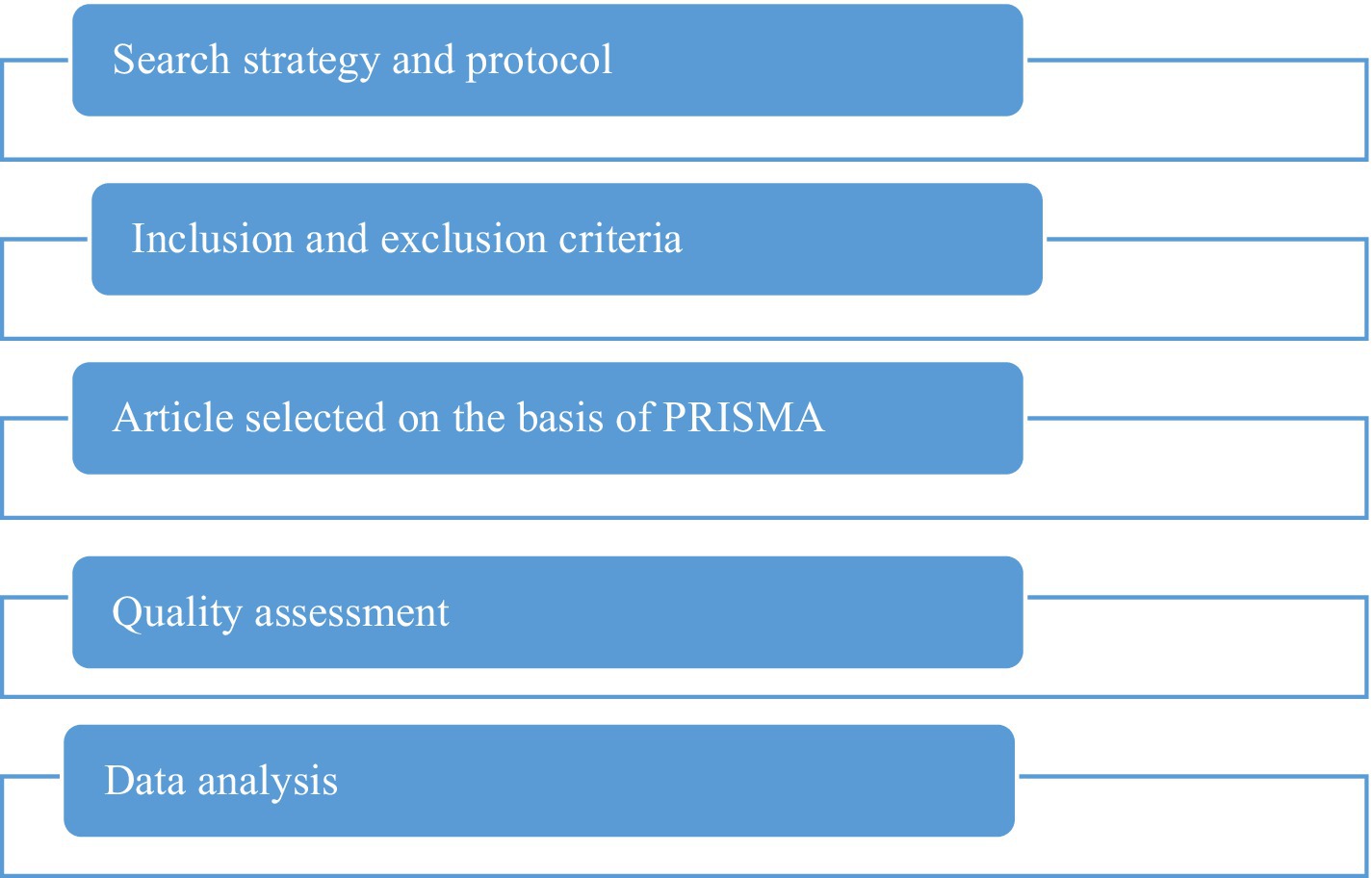

The phases involved in the SLR protocol are enumerated in the following sections:

• Phase 1: search strategy and protocol

This phase involves the identification of investigation data sources and the definition of search terms utilized.

• Phase 2: inclusion criteria (IC) and exclusion criteria (EC)

This step involves the inclusion criteria and exclusion criteria to assign examination boundaries and abstract the most related studies.

• Phase 3: article selection on the basis of PRISMA guidelines

The studies included in the SLR will be those that satisfy the criteria defined in phase two.

• Phase 4: quality assessment

The selected studies are critically evaluated and assessed on the basis of certain principles.

• Phase 5: data analysis

On the basis of this analysis, the chosen papers are classified into various broad areas, such as consumer switching behavior in retail banking.

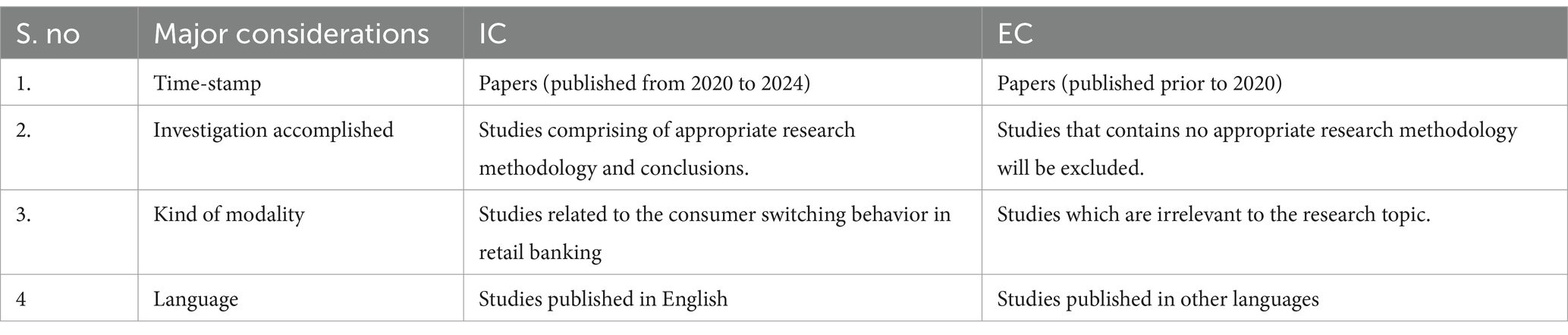

2.1 Search strategy and protocol

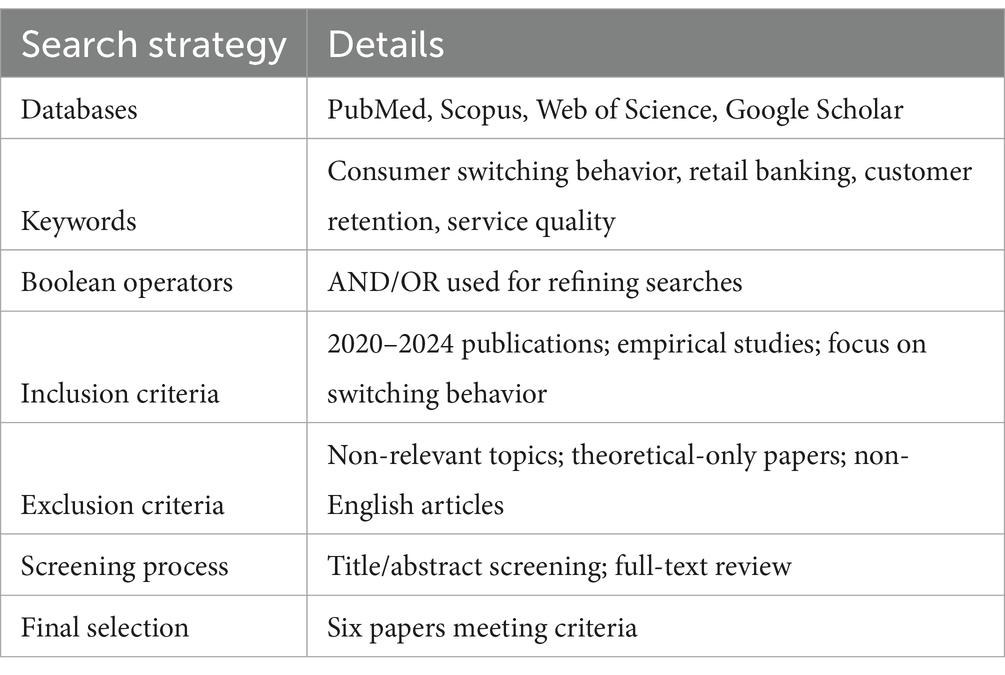

The search strategy was organized by choosing the source databases and appropriate search terms. The search for the SLR has been performed by means of probe commands, “(customer satisfaction) or (service quality) AND (banks) or (bank switching) AND (retail banking) OR (switching behavior) OR (bank switching) NOT (corporate banking). Additionally, all the papers for the SLR were included on the basis of particular inclusion criteria, such as articles relevant to the research topic; moreover, the specific papers were removed with respect to specific exclusion criteria, such as papers published before 2020 and papers in languages other than English. The inclusion and exclusion criteria for the current study are presented in Tables 1, 2.

2.2 Inclusion and exclusion criteria

IC:

The inclusion criteria were utilized to determine which articles must be included in the SLR for analysis, and the criteria utilized in this SLR are listed below:

• The paper must consider research papers, literature reviews and review papers that were published after 2020 and should contain the appropriate content.

• The complete research work should be associated with the research area or the objectives of research.

Therefore, only academic papers published from 2020 to 2024 were taken into account for the SLR. This specific time frame was chosen to focus on the most recent research and trends concerning consumer switching behavior. The studies had to exhibit a suitable research methodology and deliver clear conclusions to be considered for inclusion. This requirement guarantees that the chosen papers are grounded in strong research principles and offer valuable insights on the subject. Articles needed to be relevant to consumer switching behavior in the retail banking sector to be included in the review. This ensures that the focus of the review remains on the specific area of interest. Only studies that were published in English were incorporated into the review. This choice was likely made to align with the language proficiency of the researchers and maintain a uniform understanding of the selected papers. Conversely, papers released before 2020 were not part of the review. This decision was probably made to provide an up-to-date analysis of the topic, reflecting recent developments in the banking industry and consumer behavior. Studies that lacked a suitable research methodology were excluded from consideration. This helps to eliminate papers that may be poorly executed, lack rigor, or produce unreliable results. Studies that were not pertinent to the research topic were also excluded. This step prevents the inclusion of papers that may have tangential connections but do not directly address consumer switching behavior in retail banking. Studies published in languages other than English were not included in the review. This could narrow the scope of the review but ensures consistency and avoids potential translation challenges.

EC:

The exclusion criteria must be utilized to determine which articles must be omitted from the SLR. The exclusion criteria are as follows:

• Articles or papers that were duplicate reports or papers of similar research studies were included.

• Informal literature reviews have no suitable research questions, no defined search process or proper data extraction process.

• If the paper or research work is written in other languages instead of English.

The inclusion and exclusion criteria for the SLR are depicted in Table 1 below.

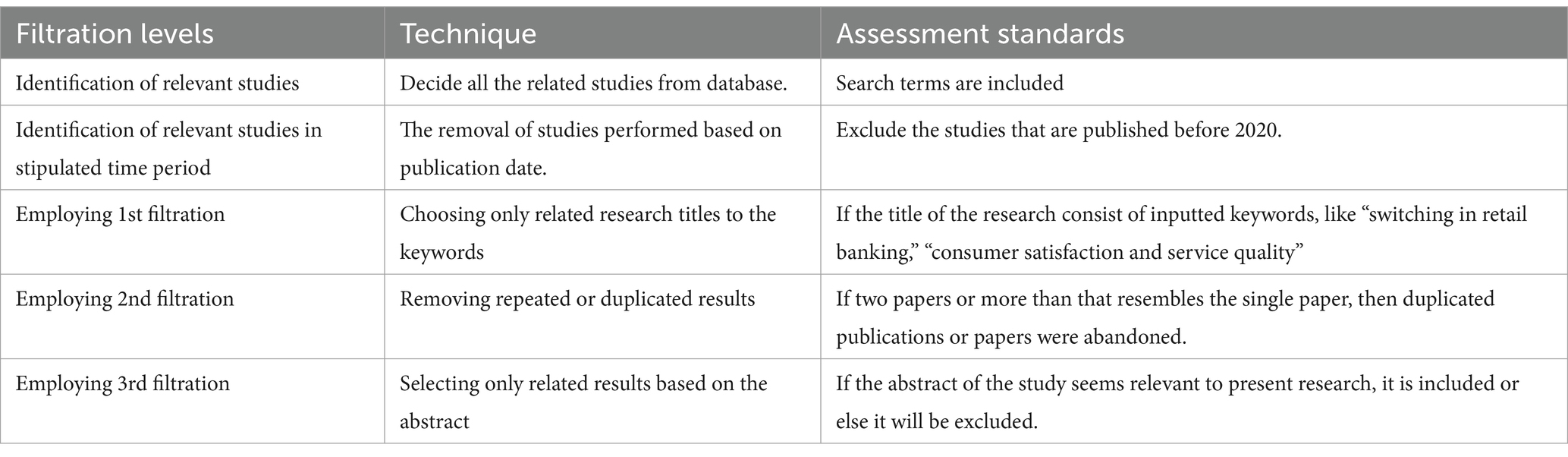

2.3 Article selection on the basis of PRISMA guidelines

The table below lists the steps involved in evaluating and selecting the relevant papers, articles or reviews for the SLR. The filtration levels or stages used to refine all the papers are described in Table 2.

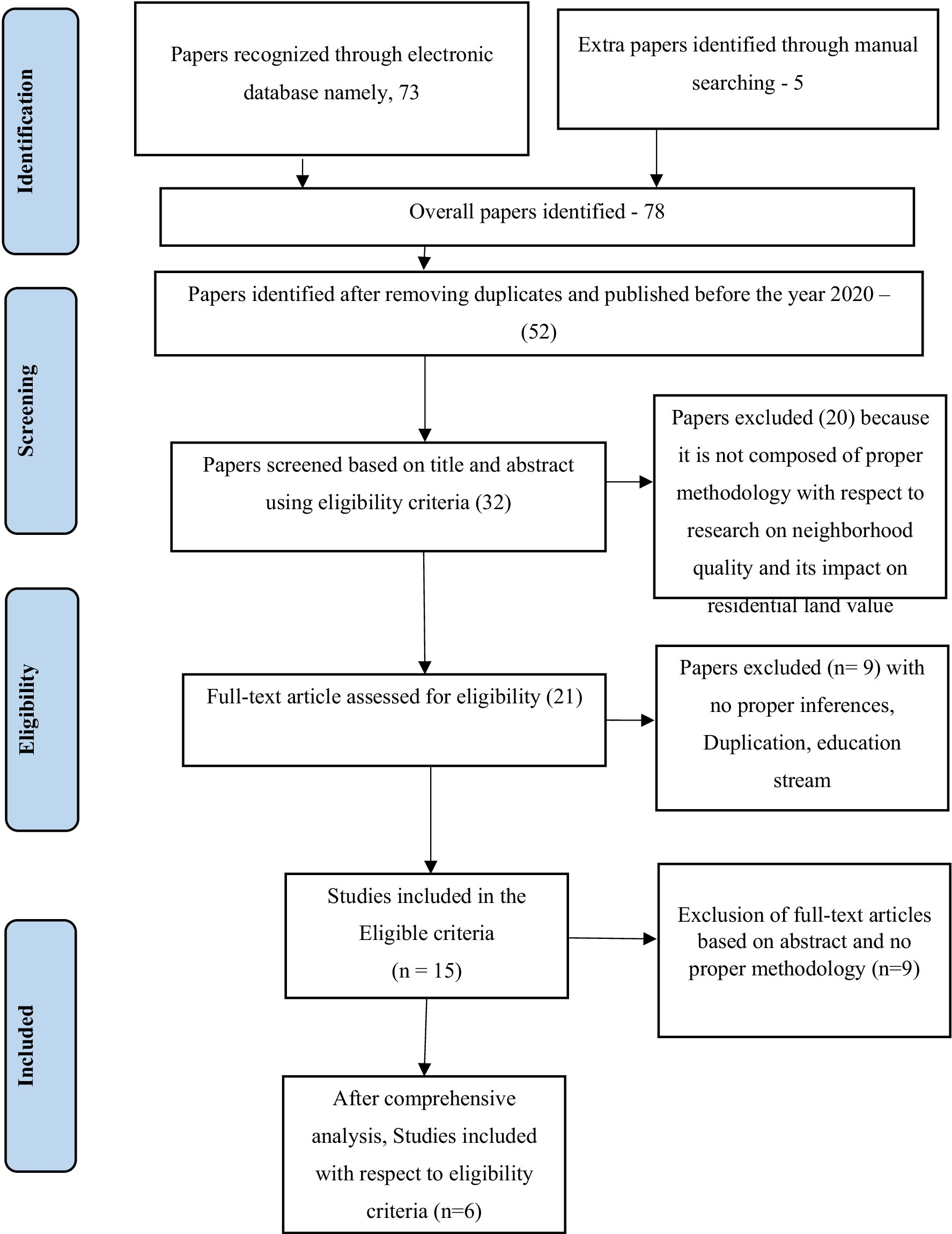

In accordance with the process of study selection, which is illustrated in Figure 1, nearly 78 papers were identified after the publication venues were identified. Among those research papers, few papers are neglected or excluded on the basis of publication date and other languages, and approximately 52 research papers are considered. Furthermore, the studies are eliminated on the basis of appropriate input keywords and titles to 32 papers. The papers are refined on the basis of the title and abstract using the eligibility criteria. Moreover, by applying the fourth filtration, the studies were refined to 15 papers as the final ones. In this stage, the abstracts of the studies are read and then assessed to exclude irrelevant research papers. Once this evaluation was performed, the number of research papers was minimized and refined for review analysis to 6. Figure 2 illustrates the PRISMA guidelines for the search process.

This SLR follows PRISMA guidelines to perform the review. Systematic reviews usually lack awareness of standard guidelines, which in turn makes the review scientifically acceptable and replicable. The PRISMA delivers the typical peer-accepted methodology, which utilizes a checklist of guidelines. The PRISMA guidelines followed by this SLR provide quality assurance of the revision procedure. This SLR executes on the basis of the selection of study criteria, search procedures, and data extraction and analysis techniques. Figure 3 represents the PRISMA guidelines for the search process, detailing the flow of papers through identification, screening, eligibility assessment, and final inclusion, beginning with 73 papers identified through electronic databases and 5 additional papers through manual searching. After removing duplicates and papers published before 2020, 52 papers were identified. Screening based on title and abstract using eligibility criteria resulted in 32 papers, with 20 being excluded for lacking proper methodology. Full-text articles were assessed for eligibility, resulting in 21 papers, and after excluding 9 papers with no proper inferences, duplication, or focus on education, 6 studies were included with respect to the eligibility criteria.

2.4 Quality evaluation

The topic relevancy was appraised in accordance with the exclusion and inclusion criteria. All 78 selected papers are carefully considered with specific parameters. Each of the eligible papers encompasses an analysis of consumer switching behavior and the factors impacting consumers’ attitudes toward switching in retail banking.

All appropriate papers for review perform the empirical analysis. Their outcomes are tabularized. These are projected as graphs in the following sections. Tables and graphs are produced through the use of several parameters that follow the research questions, which are framed below. The 15 papers selected from this selection knowledge are retrieved and evaluated critically on the basis of three kinds of quality evaluation questions, as described below.

Q1: Do the paper cover out relevant research work and does it explore research topics comprehensively?

Q2: Does paper offers clear implication with justifiable outcomes and their conclusions?

Q3: Do the articles, papers or reviews provide future directions?

Any selected paper from among those 15 papers that had “yes answers to three of these evaluation criteria” questions was included in the SLR. Of the 15 selected papers, 6 fulfil these norms.

These research studies show that there are various important factors that can impact a customer’s choice to change banks, such as their satisfaction, trust, service quality, fees, circumstances that force them to switch, and the appeal of other options. Demographic traits, service errors, pricing problems, refusals of service, ease of use, and the range of products available also have a significant influence on this decision. It is crucial for banks to comprehend these factors if they want to improve customer loyalty and draw in new clients by providing an open, prompt, and effective banking service.

2.5 Data analysis

Every single selected paper selected for this SLR study is analysed in accordance with scope, topic area, summary of research questions and answers, and author and country information. On the basis of this analysis, the chosen papers are classified into various broad areas, such as implications and prospects regarding consumer switching behavior in retail banking.

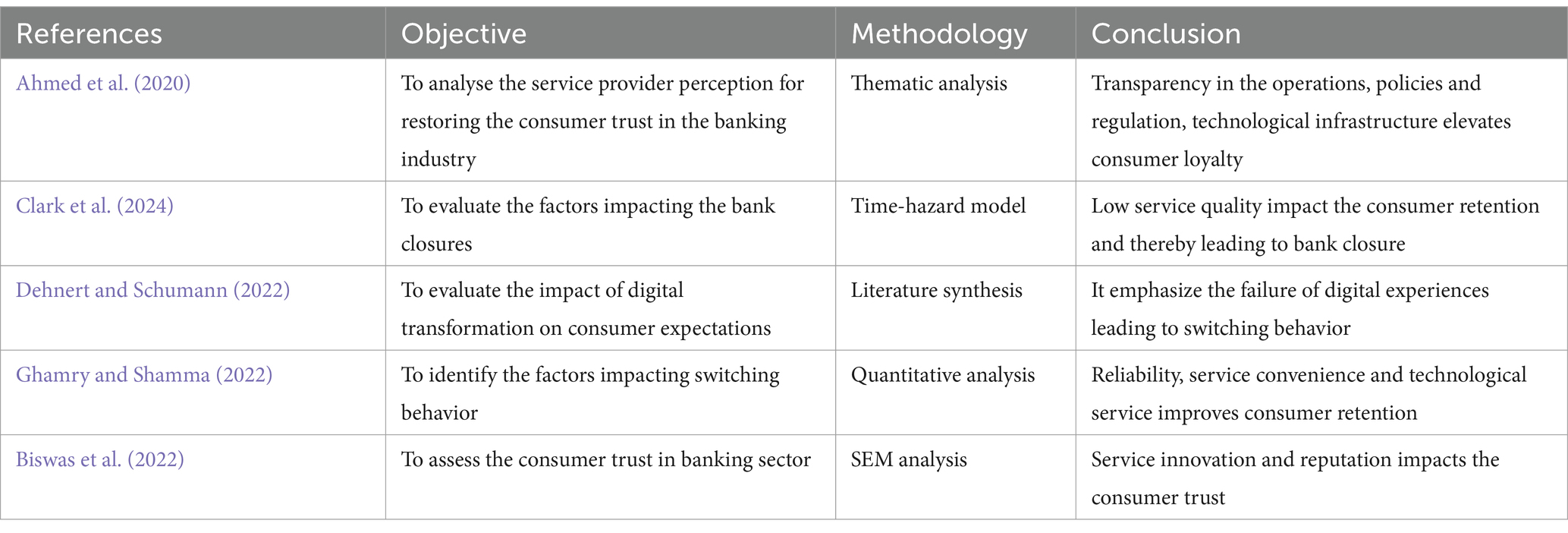

The guiding principles of selecting six papers for the systematic literature review (SLR) rested on the exercise of due diligence to formulate a systematic, transparent and repeatable process in accordance with PRISMA guidelines. The key selection consideration was that these were papers published between 2020 and 2024 to reflect recent thinking around consumer switching behavior in retail banking and to also ensure the papers responded directly to the research question querying the factors that drive switching behavior. There was an emphasis placed upon methodological rigor, and only studies that employed robust analytical tools, including frameworks, such as the Push-Pull-Mooring Model and the logistic regression, were included. The papers presented studies in diverse geographical contexts (Malaysia, Kuwait, Cyprus, India and the UK), and offered a comparative lens on consumer behavior across different banking markets. In addition to this, only empirical studies with robustly documented data collection processes were selected for the purposes of ensuring that studies were based on observable findings, rather than conjecture. Taken together, the selected papers represent a wide variety of factors effecting switching behavior, including service quality, pricing, technology adoption and emotional attachments. The selected papers also demonstrated diversity in methodological sophistication, while recognizing multiple global contexts. These papers make the literature review richer, but also offer a high degree of representation of what is happening in the overall academic landscape on consumer switching behavior in retail banking (Table 3).

The process of shortlisting six papers for the SLR was done in a rigorous and transparent manner to reduce selection bias and provide an inclusive representation of consumer switching behavior in retail banking. Following PRISMA guidelines, we adopted stringent inclusion criteria that were limited to empirical studies with direct application to our research question, giving importance to critical determinants like service quality, price, technology, and emotional connections. The search was made in several databases (e.g., PubMed, Scopus, Web of Science) using a well-selected set of keywords and Boolean operators, facilitating the capture of a broad range of relevant studies but excluding less methodologically sound studies or studies related to other issues. In addition, the chosen articles provide varied geographic settings namely, Malaysia, Kuwait, Cyprus, India, and the UK providing insights into consumer conduct in various banking markets and minimizing geographic bias. By giving priority to recent articles that have been published between 2020 and 2024, the present study was able to ensure that our results are representative of the current trends and issues in the sector. Overall, these papers cover prevalent drivers of switching behavior, and together they present a balanced investigation of both classic and new drivers. Therefore, even though few studies were reviewed, the systematic approach guarantees that the chosen papers give a solid platform for interpreting consumer switching behavior in retail banking.

3 Comprehensive analysis of articles concerning the assessment of the switching behavior of consumers in retail banking

3.1 Factors impacting consumer switching behavior in the banking industry

The growth and maintenance of sustainable associations with consumers are necessary for banking institutions to construe their profits and cope with the competing environment. An existing study conducted in Malaysia (Zhao et al., 2022) explored the determinants impacting the switching behavior of individuals in retail banking. An analysis of the 312 respondents provided a framework for retaining consumers. The analysis was conducted through CFA, EFA and the logit and probit systems. The outcome concludes that switching costs, inconvenience, effectual advertising from competitors and price factors impact consumer retention behavior in the retail banking industry. Furthermore, a prevailing study conducted in Kuwait (Ghamry and Shamma, 2022) revealed that with increasing competition, banks face numerous challenges in consumer retention, as they have several opportunities to switch one bank to another. Banks deliver similar products as well as services, and consumers prefer banks that provide favorable services. Logistic regression is employed to evaluate the factors impacting the switching behavior of consumers. Empirical research reveals that service reliability, service convenience and technology are significant factors impacting the switching behavior of consumers in Cyprus (Georgiou et al., 2024). Compared with new fresh consumers, loyal consumers are considered highly profitable, as they utilize services and WOM and can resist the offers provided by competitors. These factors help bank managers direct their resources to the effectual pathway for retaining consumers and thereby increasing profits in India (Sandhu and Arora, 2022).

Digital transformation is also a substantial factor impacting switching behavior in Italy (Filotto et al., 2021). Mobile platforms such as e-commerce platforms exhibit a transfer cost law. The prevailing studies conducted in China (Yang et al., 2020) have adopted the VSL framework to explore the determinants of risk in e-commerce applications. An online survey was conducted to demonstrate user loyalty, transfer intention and costs. The outcome of the analysis concludes that the greater the perceived value is, the lower the perceived risk, leading to higher satisfaction among the users in Greece (Krasonikolakis et al., 2020). User satisfaction increases user loyalty. In contrast, the greater transfer cost with user loyalty ultimately minimizes the transfer intention of the users.

3.2 Consumer relationship management in retail banking

Information technology has become a significant driver of the economic development of the nation. In numerous industries, such as banking, power has transitioned from producers to consumers in terms of services, goods, distribution channels and promotions. To survive in the competing industry, the bank is not only required to increase service quality and satisfies the nonfinancial requirements of consumers to retain loyalty and trust. Research in Vietnam (Nguyen et al., 2020) has investigated the associations and impacts of switching costs, consumer satisfaction and service quality on consumer trust in the retail banking industry. Multivariate linear regression was used to evaluate the five main factors of service quality, namely, responsiveness, reliability, empathy, service capacity and tangibility. These factors are positively correlated with consumer satisfaction. By increasing the quality of services with the five main factors, the tangibility and capacity of retail banks can be improved. It can satisfy the consumer better. Additionally, consumer satisfaction is positively correlated with consumer loyalty. If consumers are satisfied with banking services, they not only continue their relationship with banks but also suggest banks to their peer groups. In conclusion, consumer loyalty has a positive correlation with switching behavior, which means that consumers tend to be loyal to their favorable bank if the barrier to switching banks is elevated in Zimbabwe (Makudza, 2020).

Satisfaction refers to consumers’ feelings when their consumption satisfies their expectations, needs and goals in an interesting and pleasant way in Australia (Ferm and Thaichon, 2021a). These concepts prove that satisfaction is the intermediate among consumer expectations and perceived quality in the Euro area (Klein, 2020). The satisfaction level relies on the differential level between the perceived expectation and performance. The consumer will be dissatisfied when perceived performance is comparatively less than the expectation of the consumer. Loyalty is the result of satisfaction, which has been mentioned in numerous studies. Consumer satisfaction has been directly associated with loyalty through commitments. It is termed the predominant factor of consumer loyalty. The cost of attracting new consumers is 5 times greater than that of consumer retention in banking. Moreover, the profit of the bank is closely related to consumer loyalty and retention. Henceforth, banks should develop sustainable and profitable relationships with consumers to survive in the competitive environment. An in-depth association between profitability and consumer loyalty in the banking industry has been reported. Specifically, consumer loyalty is considered enterprise property in retail banking.

3.3 Consumer retention in retail banking

In the digital era, trust violations are severe factors that eliminate trust. Research conducted in the United Kingdom (Ahmed et al., 2020) investigated service provider perceptions of banking institutions and the restoration of consumer trust in retail banks. Almost 20 frontline employees are responsible for consumer management at banking institutions. The thematic analysis reveals that the outcomes are in the form of a restoration model. The themes provide the framework for the restoration of consumer trust. Initially, banks adopt transparency in operations. It reveals the key factors of appropriation on the basis of lending and supplementary banking actions. Policies and regulations subsequently aid in strengthening the banking relationship, which improves consumer engagement to support small businesses. Additionally, the efficacy of the operation can be promoted through sufficient investment in technological deployment. Some of the practices implemented by retail banking are complicated, and it is tedious for consumers to understand them in Bangladesh (Hossain et al., 2023). Finally, sales before service are considered to be more incompatible with the industrial compliance of financial regulations.

Consumer retention in financial institutions can be achieved on the basis of the following criteria.

• The strategic importance of the consumer in retail banking should be considered. The bank must provide priorities to portfolio consumers, who are considered to be strategically significant. They should provide high-value relationships to such clients. The retention costs of consumers might increase considerably because of their demands in banking institutions to implement services according to their requirements. It might negatively impact attractiveness and depreciate the strategic significance of consumers.

• Consumer loyalty is a supplementary factor. When a consumer provides a high degree of loyalty, the banking institution might spend little on consumer retention for such consumers. Alternatively, if the consumer does not provide a high level of commitment with the retail banks, then the bank should deliver offers to such consumers for attraction as well as retention.

• Several banking institutions are gaining more attention to retain consumers who have recently attracted more attention. The experts assessed that the consumer value over the lifetime relationship with the institution is greater for the recently attracted consumers than for the consumer who is attracted for the extended period. The elevated interest of new consumers is motivated because they are more prone to leave other institutions because they face dissatisfaction with their previous experience.

• The retention of the consumer is challenging if they are serviced by more than one bank simultaneously. The consumer decision to retain the consumer requires several aspects. They are consumer value for purchases, consumer share, and the ability to increase consumer value and high costs for maintaining consumer relationships with banks.

Differences in the regional context

• A study conducted in Kuwait (Ghamry and Shamma, 2022) emphasized the importance of delivering favorable services as a key factor in attracting and retaining customers in a highly competitive market.

• A research study in India (Sandhu and Arora, 2022) highlighted the profitability of loyal customers and the importance of directing resources toward effective consumer retention strategies.

• Studies in Zimbabwe (Makudza, 2020) and Australia (Ferm and Thaichon, 2021b) emphasize that consumer loyalty has a positive correlation with switching behavior.

Henceforth, the consumer satisfied with the services delivered by banks will never complain about them. The competitors might easily lure them by delivering better discounts, prices, and supplementary facilities, which helps them construct new relationships. These offers do not affect loyal consumers, as they wish to remain with the prevailing trusted bank and develop emotional bonds with them (Peong et al., 2021).

4 Research gaps

Few research gaps are identified in the prevailing studies on the factors impacting consumer switching behavior in the retail banking sector, and those gaps are as follows:

• The existing research (Ahmed et al., 2020) lacks a comprehensive analysis of the trust violation parameters, which are considered to be the antecedents of trust.

The present research has incorporate an analysis of trust violations as a critical factor influencing consumer decisions to switch banks. By exploring specific trust-related issues (e.g., service failures, data breaches), the present study aim to provide insights into how these factors can lead to customer attrition and inform strategies for rebuilding trust.

• The prevailing research (Clark et al., 2024) focuses on the closure of retail banks and factors such as diverse types of zones and neighborhoods that impact branch closure. In contrast, the opening and closure hours of banks are not estimated.

The present research has examine the impact of bank operating hours alongside other operational factors on switching behavior. By analyzing how accessibility affects customer satisfaction and retention, and aim to provide actionable recommendations for banks to optimize their service availability.

• The existing methods (Ferm and Thaichon, 2021b) involve the collection of a greater number of samples with irrelevant parameters. This may have caused the research to fail in the progress they attempted to achieve the effect of the switching behavior of retail banks.

The present study employ a targeted approach that focuses on relevant demographic and behavioral characteristics of consumers.

From, the above detailed analysis, the unresolved questions are extracted as follows:

• How will the technologies shape customer expectations and influence their decisions to switch banks?

• Which strategies are most effective in different contexts and for different customer segments?

• What are the consequences of high customer churn rates for banks, and how does switching behavior affect consumers’ financial well-being?

5 Bibliometric analysis

Overall, six papers were chosen for the current SLR with the aid of the PRISMA guidelines. The year wise flow of overall nominated papers that address consumer switching behavior in retail banking is depicted in Figure 4.

Figure 4 reveals that the most recent papers published between 2020 and 2024 are considered majorly for the present SLR analysis of the research factors impacting the switching behavior of consumers in retail banking. The figure highlights that the majority of the papers considered for the SLR were published between 2020 and 2024, emphasizing the focus on the most recent research concerning factors impacting consumer switching behavior in retail banking. Papers published between 2021 and 2022 (35%) were also significantly represented followed by 2022–2023 (34%) while a smaller number of papers from 2020 to 2021 (33%) were included in the analysis, indicating a comprehensive review of literature within the specified timeframe.

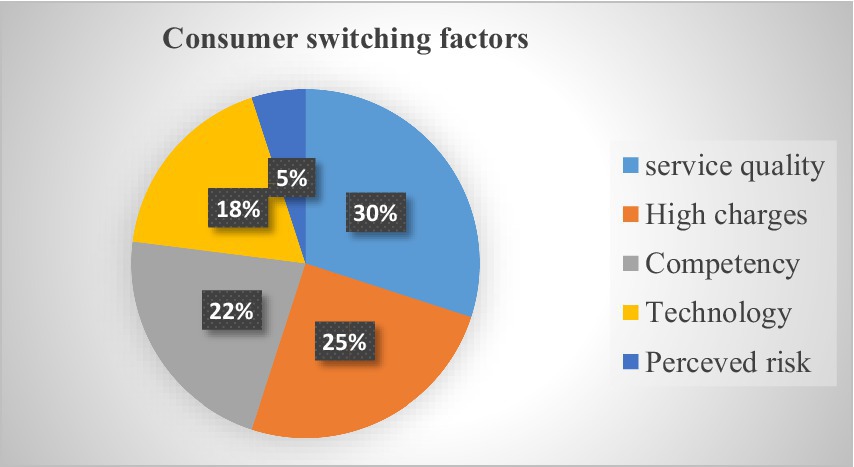

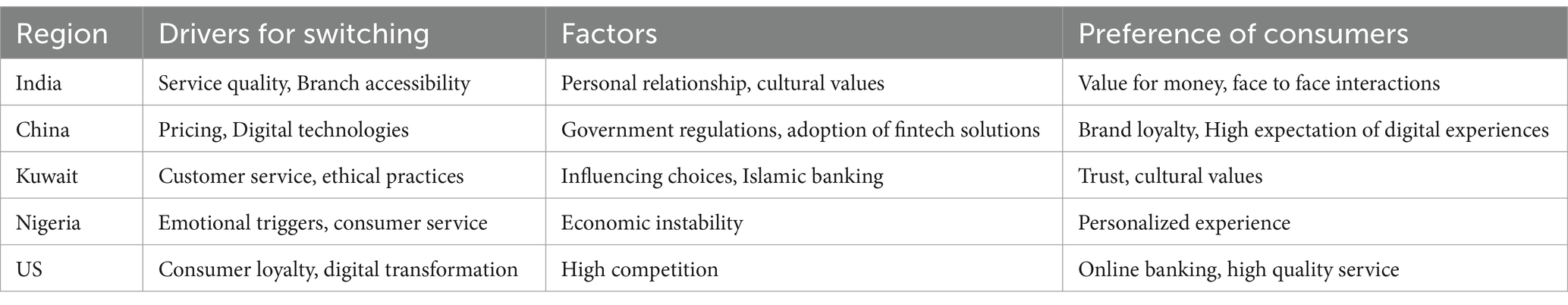

Figure 5 illustrates consumer switching behavior in the UK retail banking sector. Service quality is the most significant factor, accounting for 30% of the reasons consumers switch. High charges are also a major concern, representing 25% of the switching drivers. Competency (22%) and technology (18%) are also important, while perceived risk has the least impact, at 5%. This suggests that consumers prioritize reliable service and reasonable costs, and are also influenced by the competence and technological capabilities of the service provider. Perceived risk plays a smaller role in their decision to switch. Most of the studies indicate that service quality is a dominant factor, followed by high charges. Only a few studies reveal that competency, technology and perceived risk impact the ability of consumers to switch over other banks.

6 Discussion

Customer switching behavior in the retail banking industry is a complex occurrence affected by various interconnected factors. In order to enhance customer retention strategies in a growingly competitive market, banks need to comprehend these influences. The significant reason for switching banks in the retail banking sector. There are numerous key drivers for consumer switching behavior in retail banks to improve the retention strategies of consumers.

6.1 Service quality

Service quality is the dominant factor impacting the consumer’s ability to switch over banks. This encompasses a range of elements within the banking sector, from the efficiency and precision of transactions to the responsiveness and attentiveness of employees. Clients demand seamless and dependable service; failure to meet these demands may result in them looking for alternatives. Inadequate assistance, a lack of empathy, and impersonal communication from bank staff can be especially harmful. Clients appreciate feeling understood and valued; if interactions are seen as distant, purely transactional, or unhelpful, it may lead them to seek out a more customer-focused provider. Negative customer service experiences significantly influence switching behavior, highlighting the importance for banks to invest in training and empowering their workforce to provide exceptional service.

6.2 Pricing and fees

Unfavorable consumer service is a high impact factor for switching over an existing account provider. Second, excessive fees for provider services and transactions are another substantial determinant of retail banks (Ganderson, 2020). The high charge of banking accounts is a key reason for the switching of banks. The price of banking services is important in deciding whether customers switch banks. If customers feel like they are being charged too much for regular transactions or account maintenance, they may be unhappy. People are paying more attention to these fees, especially if they think they are unreasonable. Expensive bank accounts could be a big reason why customers change banks, especially for those with less money or who care a lot about prices. Fees is key in keeping customers happy and stopping them from leaving. Banks that have good prices and extra services are more likely to keep their customers.

6.3 Digital transformation

The digital transformation of the banking industry is an immense approach for providing seamless experiences to consumers (Borges et al., 2020; Sun, 2022). The digital transformation of the banking industry has dramatically altered customer expectations and behaviors. Customers now expect seamless, convenient, and personalized digital experiences. Retail banks that fail to provide digital banking risk losing customers to competitors, who provide effective technological solutions (Dehnert and Schumann, 2022; Nilsson and Fredholm, 2020). This involves user-friendly mobile applications, internet banking websites, and other digital resources that allow clients to efficiently and conveniently handle their finances. Banks need to put resources into innovative technologies and consistently enhance their digital services to cater to the changing demands of technology-savvy clients. Moreover, ensuring the security and confidentiality of online transactions is crucial for establishing trust and assurance in internet banking services.

6.4 Regional comparison

Furthermore, the proximity and accessibility of branches are crucial components of consumers. The location of the branches is a main reason for choosing the account provider. Consumers are seeking retail banks that align values, ethical practices and social responsibility (Adams et al., 2021; Ahmed et al., 2020; Biswas et al., 2021). Insufficient support, empathy deprivation and impersonal communication from bank employees are crucial factors in switching banks (Clark et al., 2024). Although digital banking has become more popular, physical branches are still important for customers. Many people like being able to do their banking online but also like having a branch nearby for more complicated transactions or help. The location of a bank’s branches can be a big factor in why someone chooses that bank, especially for those who prefer talking to someone in person or need unique services not offered online. Banks need to think about where they put their branches to make sure they are easy for customers to get to and meet their needs.

6.5 Findings

Switching costs involve the time, effort, and possible money lost when switching banks. This might include the inconvenience of moving accounts, changing direct deposits, and getting used to a new banking system. Inertia, however, is when customers stick with their current bank out of habit or because they lack the drive to make a change, even if they are not completely satisfied. Banks can use switching costs and inertia to their benefit by creating strong connections with customers, offering excellent service, and giving reasons to stay. By lowering the perceived costs of switching, banks can also encourage customers to have all their finances with one provider. Customer switching behavior in the retail banking sector is a complex issue driven by a variety of factors, including service quality, fees, digital capabilities, branch accessibility, values, switching costs, customer satisfaction, mergers and acquisitions, and reputation. Banks that prioritize customer needs, invest in innovation, and cultivate strong relationships are best positioned to retain their customer base in an increasingly competitive market (Tables 4, 5).

7 Conclusion

The study of customer switching behavior in retail banking reveals the most predominant reasons for consumers switching from one provider to another, including service quality, price, digital capabilities, emotional connections, and values fit. Service quality is the number one driver of one consumer switching to another, which encompasses responsiveness, efficiency of transactions, and empathic interaction. High fees and subpar digital offerings also contribute to consumer dissatisfaction, leading them to switch. This study emphasizes the need to build emotional connections with consumers and improve service delivery in efforts to improve satisfaction and loyalty. Overall, the results suggest that perceived effort and accrued benefits were very important elements in switching behavior, which further emphasizes the need for banks to do everything they can to lower the switching cost and to make the process easier. The recommendation for future research would be to fill the gaps in the literature associated with demographic influences, including age and income, and to add to the study of perceived effort and accrued benefits as influenced by emergent technologies such as artificial intelligence and blockchain technologies and the impact they have on consumer loyalty. Applying a thoughtful strategy based on the results of this study could assist retail banks in reducing customer attrition and strengthen customer retention strategies for a more competitive marketplace.

7.1 Practical implication

Specifically, banks will need to undertake efforts to initiate in-depth employee training programs in which empathy and responsiveness are strongly stressed to achieve enhanced service quality and customer satisfaction. Competitive pricing practices will ensure concerns over extra charges are solved, thus also preventing customer runoff. Investment in simple-to-use digital platforms would be essential for addressing the demand of tech-connected consumers, with the alignment of banking practices under ethical standards as well as in accordance with social responsibility helping develop stronger customer attachment. In addition, the future research section needs to be lengthened in order to suggest particular methodologies, i.e., surveys or interviews, to obtain primary data on consumer behavior and preferences. Investigating theoretical extensions that consider demographic factors such as age and income on switching behavior will offer further insight into consumer decision-making. Henceforth, the SLR can provide better advice for bank professionals and toward a better enrichment of knowledge for customer retention schemes in retail banks.

Author contributions

GB: Conceptualization, Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author declares that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adams, P., Hunt, S., Palmer, C., and Zaliauskas, R. (2021). Testing the effectiveness of consumer financial disclosure: experimental evidence from savings accounts. J. Financ. Econ. 141, 122–147. doi: 10.1016/j.jfineco.2020.05.009

Afandi, M. A. (2020). Switching intentions among millennial banking customers to fintech lending. IJIEF 3, 283–304. doi: 10.18196/ijief.3230

Ahmed, S., Bangassa, K., and Akbar, S. (2020). A study on trust restoration efforts in the UK retail banking industry. Br. Account. Rev. 52:100871. doi: 10.1016/j.bar.2019.100871

Berger, A. N., Molyneux, P., and Wilson, J. O. (2020). Banks and the real economy: an assessment of the research. J. Corp. Finan. 62:101513. doi: 10.1016/j.jcorpfin.2019.101513

Biswas, A., Jaiswal, D., and Kant, R. (2021). Augmenting bank service quality dimensions: moderation of perceived trust and perceived risk. Int. J. Product. Perform. Manag. 72, 469–490. doi: 10.1108/IJPPM-04-2021-0196

Biswas, A., Jaiswal, D., and Kant, R. (2022). Investigating service innovation, bank reputation and customer trust: evidence from Indian retail banking. Int. J. Qual. Serv. Sci. 14, 1–17. doi: 10.1108/IJQSS-03-2021-0042

Borges, G. L., Marine, P., and Ibrahim, D. Y. (2020). Digital transformation and customers services: the banking revolution. Int. J. Open Inf. Technol. 8, 124–128.

Clark, S., Newing, A., Hood, N., and Birkin, M. (2024). Retail banking closures in the United Kingdom. Are neighbourhood characteristics associated with retail bank branch closures? Trans. Inst. Br. Geogr. 49:e12656. doi: 10.1111/tran.12656

Dehnert, M., and Schumann, J. (2022). Uncovering the digitalization impact on consumer decision-making for checking accounts in banking. Electron. Mark. 32, 1503–1528. doi: 10.1007/s12525-022-00524-4

Ferm, L.-E. C., and Thaichon, P. (2021a). Customer pre-participatory social media drivers and their influence on attitudinal loyalty within the retail banking industry: a multi-group analysis utilizing social exchange theory. J. Retail. Consum. Serv. 61:102584. doi: 10.1016/j.jretconser.2021.102584

Ferm, L.-E. C., and Thaichon, P. (2021b). Value co-creation and social media: investigating antecedents and influencing factors in the US retail banking industry. J. Retail. Consum. Serv. 61:102548. doi: 10.1016/j.jretconser.2021.102548

Filotto, U., Caratelli, M., and Fornezza, F. (2021). Shaping the digital transformation of the retail banking industry. Empirical evidence from Italy. Eur. Manag. J. 39, 366–375. doi: 10.1016/j.emj.2020.08.004

Ganderson, J. (2020). To change banks or bankers? Systemic political (in) action and post-crisis banking reform in the UK and the Netherlands. Bus. Politics 22, 196–223. doi: 10.1017/bap.2019.34

Georgiou, M., Daskou, S., Siakalli, M., and Anastasiou, A. (2024). An explanatory study of predictive factors of customer retention with Cypriot retail banks. Int. J. Econ. Bus. Res. 27, 127–150. doi: 10.1504/IJEBR.2024.136166

Ghamry, S., and Shamma, H. M. (2022). Factors influencing customer switching behavior in Islamic banks: evidence from Kuwait. J. Islamic Market. 13, 688–716. doi: 10.1108/JIMA-01-2020-0021

Haralayya, B. (2021). Millennials and Mobile-savvy consumers are driving a huge shift in the retail banking industry. J. Adv. Res. Oper. Market. Manage. 4, 17–19.

Heckel, M., and Waldenberger, F. (2022). The future of financial systems in the digital age: Perspectives from Europe and Japan. Cham: Springer Nature.

Hossain, M. A., Jahan, N., and Kim, M. (2023). A multidimensional and hierarchical model of banking services and behavioral intentions of customers. Int. J. Emerg. Mark. 18, 845–867. doi: 10.1108/IJOEM-07-2020-0831

Kamath, P. R., Pai, Y. P., and Prabhu, N. K. (2020). Building customer loyalty in retail banking: a serial-mediation approach. Int. J. Bank Mark. 38, 456–484. doi: 10.1108/IJBM-01-2019-0034

Klein, M. (2020). Implications of negative interest rates for the net interest margin and lending of euro area banks. Frankfurt am Main: Deutsche Bundesbank.

Krasonikolakis, I., Tsarbopoulos, M., and Eng, T.-Y. (2020). Are incumbent banks bygones in the face of digital transformation? J. Gen. Manag. 46, 60–69. doi: 10.1177/0306307020937883

Lu, H.-P., and Wung, Y.-S. (2021). Applying transaction cost theory and push-pull-mooring model to investigate mobile payment switching behaviors with well-established traditional financial infrastructure. J. Theor. Appl. Electron. Commer. Res. 16, 1–21. doi: 10.4067/S0718-18762021000200102

Mainardes, E. W., Rosa, C. A. D. M., and Nossa, S. N. (2020). Omnichannel strategy and customer loyalty in banking. Int. J. Bank Mark. 38, 799–822. doi: 10.1108/IJBM-07-2019-0272

Makudza, F. (2020). Augmenting customer loyalty through customer experience management in the banking industry. J. Asian Bus. Econ Stu. 28, 191–203. doi: 10.1108/JABES-01-2020-0007

Mistrean, L. (2021). Customer orientation as a basic principle in the contemporary activity of the bank. J. Pub. Adm. Financ. Law 10, 39–51. doi: 10.47743/jopafl-2021-21-05

Mukerjee, K. (2020). Impact of self-service technologies in retail banking on cross-buying and word-of-mouth. Int. J. Retail Distrib. Manag. 48, 485–500. doi: 10.1108/IJRDM-08-2019-0261

Nguyen, D. T., Pham, V. T., Tran, D. M., and Pham, D. B. T. (2020). Impact of service quality, customer satisfaction and switching costs on customer loyalty. J. Asian Financ. Econ. Bus. 7, 395–405. doi: 10.13106/jafeb.2020.vol7.no8.395

Nilsson, P., and Fredholm, L. (2020). Competitors or Collaborators? A Qualitative Study of the Evolving Relationship Between Banks and FinTech Companies in the Swedish Retail Banking Industry. Published by: Lund University.

Parums, D. V. (2021). Review articles, systematic reviews, meta-analysis, and the updated preferred reporting items for systematic reviews and meta-analyses (PRISMA) 2020 guidelines. Med. Sci. Monitor: Int. Med. J. Exp. Clin. Res. 27, e934475–e934471.

Peong, K. K., Peong, K. P., and Tan, K. Y. (2021). Behavioural intention of commercial Banks' customers towards financial technology services. JFBR 5, 10–27. doi: 10.35609/jfbr.2021.5.4(2)

Rethlefsen, M. L., Kirtley, S., Waffenschmidt, S., Ayala, A. P., Moher, D., Page, M. J., et al. (2021). PRISMA-S: an extension to the PRISMA statement for reporting literature searches in systematic reviews. Syst. Rev. 10, 1–19. doi: 10.1186/s13643-020-01542-z

Roberts-Lombard, M., and Petzer, D. J. (2021). Relationship marketing: an S–O–R perspective emphasising the importance of trust in retail banking. Int. J. Bank Mark. 39, 725–750. doi: 10.1108/IJBM-08-2020-0417

Sandhu, S., and Arora, S. (2022). Customers' usage behaviour of e-banking services: interplay of electronic banking and traditional banking. Int. J. Financ. Econ. 27, 2169–2181. doi: 10.1002/ijfe.2266

Sangeetha, J. (2021). Influence of the dimensions of service quality, customer satisfaction and behavioural intentions on the respective constructs in retail banking: the Middle East context. Serbian J. Eng. Manage. 6, 54–62. doi: 10.5937/SJEM2102054S

Sun, X. (2022). Technology and innovation become the primary driving force behind the digital transformation of retail banking center. Front. Econ. Manage. 3, 150–161. doi: 10.6981/FEM.202211_3(11).0018

Thomé, A. M. T., Scavarda, L. F., and Scavarda, A. J. (2016). Conducting systematic literature review in operations management. Prod. Plan. Control 27, 408–420. doi: 10.1080/09537287.2015.1129464

Völcker, M., and Stenfelt, C. (2021). Modelling customer lifetime value in the retail banking industry. Published by: KTH Royal Institute of Technology.

Yang, Y., Yang, L., Chen, H., Yang, J., and Fan, C. (2020). Risk factors of consumer switching behaviour for cross-border e-commerce mobile platform. Int. J. Mob. Commun. 18, 641–664. doi: 10.1504/IJMC.2020.110881

Yoon, C., and Lim, D. (2021). Customers’ intentions to switch to internet-only banks: perspective of the push-pull-mooring model. Sustain. For. 13:8062. doi: 10.3390/su13148062

Zhao, C., Noman, A. H. M., and Abedin, M. Z. (2024). Service failure and negative word-of-mouth in Chinese retail banking: a moderated-mediation approach. Int. J. Bank Mark. 43, 82–105.

Zhao, C., Noman, A. H. M., and Asiaei, K. (2022). Exploring the reasons for bank-switching behavior in retail banking. Int. J. Bank Mark. 40, 242–262. doi: 10.1108/IJBM-01-2021-0042

Zhou, M., Geng, D., Abhishek, V., and Li, B. (2020). When the Bank comes to you: branch network and customer Omnichannel banking behavior. Inf. Syst. Res. 31, 176–197. doi: 10.1287/isre.2019.0880

Appendix

Search strategy

The search strategy was structured through the selection of the source databases and the relevant search terms. The present SLR study emphasized covering the relevant studies, and no particular data range was used. The specific selection of numerous online databases for the present SLR has been considered, such as Elsevier, ScienceDirect and Springer. Like any SLR, the present study emphasizes the need to review all relevant papers in the literature. The scientific databases were utilized to perform the analysis, and those databases were chosen for various reasons. Those reasons are that it delivers excellent coverage to associated literature and is the most famous scientific database. The selected databases are as follows:

• Springer Link (https://link.springer.com/)

• Science direct(https://www.sciencedirect.com/)

• Elsevier(https://www.elsevier.com/en-in)

• Taylor and Francis (https://www.tandfonline.com/)

• Google Scholar (https://scholar.google.com/)

Procedure of selecting studies

When the existing studies fulfil the search strategy and the inclusion criteria, the next step involves the selection of the studies. This step is usually performed in two stages. Initially, the reviewers examine the studies to determine whether they match the keywords and contain related content. In the second stage, the reviewers usually read the content of the abstract and check if it matches the SLR requirements. The standard process for choosing studies to be included in the review is as follows:

• Merging the search results

• Examine the titles and keywords

• Recovering the full texts of the selected articles

• Associate the links of multiple reports of the same research

• Read the abstract carefully and examine whether it satisfies the requirements of SLR

• Exploration of the full-text of the selected articles

• Inspecting whether the studies satisfy the inclusion criteria and reinvestigating if some content is missing or tampered with

• Refinement of studies

• Making a final decision regarding which studies need to be integrated into the research

• The selected studies are documented and reviewed.

Keywords: switching behavior, financial institutions, retail bank, consumers, attitude, attrition rate

Citation: Batmunkh G (2025) An investigation of the switching behavior and why customers switch banks in the retailing banking sector. Front. Commun. 10:1548050. doi: 10.3389/fcomm.2025.1548050

Edited by:

Rahul Pratap Singh Kaurav, Fore School of Management, IndiaReviewed by:

Claudiu Coman, Transilvania University of Brașov, RomaniaAman Rassouli, Bahçeşehir Cyprus University, Cyprus

Copyright © 2025 Batmunkh. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ganshagai Batmunkh, Z2Fuc2hhZ2FpLmJAdWZlLmVkdS5tbg==

Ganshagai Batmunkh

Ganshagai Batmunkh