- 1Tunku Puteri Intan Safinaz School of Accountancy, College of Business, Universiti Utara Malaysia, Sintok Kedah, Malaysia

- 2Department of Financial, Chaohu University, Hefei, Anhui, China

This research explores the effect of environmental, social, and corporate governance (ESG) performance on cash holdings using panel data from A-share listed firms in China between 2018 and 2023. The results show that firms with good ESG performance are positively associated with corporate cash holdings; however, the relationship is of relatively low magnitude. Moreover, this study finds that internal control can mediate the relationship between ESG performance and cash holdings. It provides empirical insights to help firms optimize ESG strategies, enhance financial stability, and improve cash management through effective internal controls and managerial mechanisms, supporting policymakers, investors, and businesses in adapting to China’s evolving ESG regulations and sustainability goals. Furthermore, this study is among the first to incorporate internal control mechanisms to effectively influence the effect of ESG performance on corporate cash holdings efficiently in emerging economies, including China.

1 Introduction

With the intensification of global environmental problems and extreme weather, the frequency and intensity of natural disasters have been increasing alongside the rise in global temperatures. This trend has triggered widespread concern and prompted in-depth thinking on a global scale. In response to the increasing climate risks, an increasing number of companies are improving their corporate social responsibility (CSR) efforts. Environmental, social, and corporate governance (ESG) has emerged as an important factor influencing the global economy and corporate strategy. Currently, many countries and regions view ESG as central to national governance and corporate management (Kao, 2023). The United Nations Global Compact formally integrated ESG dimensions in 2004, introducing the concept of ESG performance (Wang et al., 2024). As corporate managers increasingly prioritize ESG performance and sustainable financial management, cash holdings have been recognized as a key indicator of financial health, liquidity, and risk management, playing a critical role in corporate financial strategy (Guo et al., 2020).

Many renowned corporations have shown a close association between ESG performance and cash holdings, highlighting the growing importance of sustainable practices in financial management. For instance, Unilever in the United Kingdom has brought green design into its main business lines, such as personal care or nutrition, resulting in improved brand loyalty and operational efficiencies that boost cash flow (Sroufe and Jernegan, 2020). Similarly, Apple has focused on reducing its environmental impact through initiatives such as renewable energy usage, which not only enhances its ESG ratings but also strengthens its financial position, allowing for higher cash reserves (Son and Kim, 2022). Tesla also exemplified this connection, as its commitment to sustainable energy and innovative practices attracts investment and drives revenue, ultimately increasing its cash holdings (Valadkhani and O'Mahony, 2025).

ESG development was initiated relatively late in emerging countries such as China compared to many developed countries. An increasing number of listed companies disclosed ESG information in their CSR reports (renamed ESG reports in 2018) to improve their competitiveness (Chen et al., 2023). Since 2018, CSR reports issued by firms have been increasing, reflecting a growing awareness of sustainability. Businesses increasingly shifted from profit-driven models to strategies that focused on sustainable growth. For example, Huawei has also integrated environmental considerations into its operations by focusing on energy efficiency and waste reduction, which has bolstered its financial stability and liquidity (Xiao and Lin, 2024). BYD, which is a leader in electric vehicles, prioritizes sustainability and innovation, attracting investment and improving cash holdings through its green initiatives (Peng and Sun, 2024).

While the topic of ESG performance and corporate cash holdings has been receiving increasing attention in academia, internal control remains crucially understudied. Corporate internal control mechanisms enhance governance, decision-making, and CSR, potentially influencing ESG practices and cash holdings (Ho and Lu, 2024). Internal control systems enhance financial transparency and accountability, which could improve the reliability of ESG practices (Boulhaga et al., 2022). This reliability, in turn, fosters greater investor confidence and increases cash holdings as companies with robust internal controls are observed as more financially stable and responsible. Effective internal controls positively promote the impact of ESG performance on cash management (Yao et al., 2024). Thus, this research explores how ESG performance, reflecting a firm’s commitment to sustainability, affects its cash holdings. In addition, it introduces internal control as a mediating variable to uncover the mechanisms through which ESG performance impacts cash management.

This empirical study analyzes Chinese non-financial firms from 2018 to 2023, employing the panel data regression. The key findings provide valuable insights into the relationship between ESG performance and corporate financial management. The role of internal control on ESG performance and cash holdings also warrants attention. As ESG performance positively influences internal control, its effect on cash holdings decreases. This study suggests that ESG performance positively affects internal control, which leads to more careful and effective cash management.

This research contributes to the literature from three aspects compared to previous studies. First, this study expands the prior studies on ESG performance to examine its effects on cash holdings. It contributes to enriching the research framework on the financial performance from ESG performance. Second, this study initially provides fresh insight into cash sustainable management for listed firms by introducing internal control to deeply explore the mutual intersection between ESG performance and cash holdings. Third, the findings practically provide actionable insights for firms, suggesting that enhancing internal control systems in decision-making could optimize cash management strategies associated with ESG performance.

After the “Introduction” section, this article is structured as follows: the second section examines the relevant literature and develops the hypotheses. The third section describes the sample and data used. Moreover, the fourth section analyzes the empirical findings. Finally, the fifth section offers the conclusion of the study.

2 Literature review and hypothesis development

2.1 Institutional setting

As the biggest emerging market, China has made significant contributions to global economic growth since its reform and opening up. Understanding China’s influence on the world’s economy is essential, particularly as the long-term sustainability of businesses plays a vital role in economic development. However, imperfections in China’s capital market and prevalent information asymmetry impose substantial financing constraints for these enterprises. In an increasingly uncertain environment, such constraints impede access to external funding, limiting businesses’ ability to secure adequate capital and reducing their financial flexibility in navigating adverse conditions. This finding poses serious challenges to sustainable development (Zhang and Liu, 2022). Furthermore, China’s transformation and development are characterized by significant government intervention, an imperfect legal framework, and an underdeveloped factor market, all of which further complicate the financing landscape for enterprises (Yan et al., 2023).

2.2 ESG performance and cash holdings

Recently, the ESG concept has been a key determinant in shaping corporate financial affairs, particularly regarding cash holdings. The relationship between ESG performance, corporate sustainability, and cash holdings has been explored across various regions, leading to consistent and divergent findings. Saleh et al. (2023) examined 797 companies across 19 European countries between 2013 and 2019 and found a significant negative correlation between ESG disclosure and cash holdings. Their study also highlighted the mediating role of earnings management practices, indicating that firms with higher ESG disclosure tend to engage less in earnings management, which, in turn, reduces the need for excessive cash reserves.

However, contrasting results emerge when broadening the scope beyond ESG disclosure to corporate sustainability and CSR. Ho and Lu (2024) analyzed 12,494 firm-year observations from 31 countries between 2002 and 2018 and found that firms with superior corporate sustainability performance tend to hold more cash. This finding indicates that sustainability-focused firms may prioritize financial flexibility to support long-term investments, which is in contrast with the findings of Saleh et al. (2023). In addition, Metwally et al. (2024) studied 52 non-financial firms listed on the Egyptian Exchange from 2012 to 2021 and found a significant positive association between CSR and cash holdings. Their study also identified board gender diversity as a negative moderating factor, meaning that greater gender diversity weakens the positive relationship between CSR and cash reserves. Firms with strong ESG focus prioritize long-term sustainability and risk management, requiring more enormous cash reserves for R&D and green initiatives (Liu et al., 2023). Arouri and Pijourlet (2015) recommend that this positive relationship is contingent on institutional quality and shareholder protections in a given country. Furthermore, while ESG performance positively impacts cash holdings, the presence of a single female director negatively moderates this relationship, whereas boards with three or more female directors significantly enhance the positive effect (Marie et al., 2024). Overall, these discrepancies highlight the importance of regional differences, corporate priorities, and moderating factors such as financial constraints, industry conditions, and board diversity in shaping the dynamics of ESG and cash holdings.

Theoretical insights from agency theory indicate that robust corporate governance mechanisms could mitigate agency problems, with higher ESG scores reflecting improved governance and reduced conflicts (Liu et al., 2023; Jensen and Meckling, 1976). Strong ESG performance fosters better governance mechanisms, leading to fewer agency-related issues concerning cash reserves (Atif et al., 2022). The dilemma surrounding cash holdings highlights the importance of high-quality governance to either motivate or discipline managers in efficiently utilizing cash (Fresard and Salva, 2010) from the perspective of agency theory. This high-quality governance ensures alignment between managerial and shareholder interests, ultimately enhancing firm value (Deb et al., 2017). Firms focused on ESG are more likely to maintain higher levels of cash, as previous research has linked a commitment to social responsibility with strong corporate governance practices.

Overall, this study hypothesizes a positive relationship between ESG performance and firm cash holdings, positing that strong ESG performance signifies efficient resource utilization and stakeholder trust, ultimately bolstering a firm’s financial stability and liquidity. Thus, this hypothesis is formulated based on agency theory as below:

H1: Better ESG performance in listed firms shows more extensive corporate cash holdings in China.

2.3 The mediating role of internal control

The financial system of China has been primarily dominated by a large yet cumbersome banking sector, with rapidly developing capital markets that remain inefficient and inequitable. These underdeveloped systems lead to high costs of outside financial support. Managing working capital is one of the critical tasks, especially during an economic recession. The institutional environment in China offers a special context to explore the effect of internal controls on cash management (Chen et al., 2020). Companies adopt an internal control model that integrates sustainable development to enhance the effectiveness of their business activities and to ensure long-term growth (Li et al., 2022).

Companies with robust internal controls are not prone to abnormal cash reserves as they can accurately evaluate the trade-off of holding cash and effectively fulfil sustainable cash management policies (Chen et al., 2020).

Previous research has also identified the mediating role of internal control through difference approaches. For instance, ESG performance influences corporate innovation indirectly rather than having a direct effect on corporate governance; internal control serves as a mediating factor that influences innovation output activities (Zhu, 2016). The adoption of internal controls based on ESG principles helps reduce financing and operational risks for companies while promoting the enhancement of their internal control capabilities (Liu and Lin, 2022). Thus, the second hypothesis is as follows:

H2: Internal controls act as a mediator between ESG performance and corporate cash holdings.

3 Data and methodology

3.1 Sample and data

This study examined a sample of China’s A-share listed firms in Shanghai and Shenzhen from 2018 to 2023 and excluded the financial sector, missing data, and ST samples. Shrinkage at the 1–99% level is applied to continuous variables. A total of 19,569 firm observations are finally obtained. ESG data are obtained from the Huazheng ESG rating database. Cash holdings and other variables are obtained from the China Stock Market & Accounting Research Database (CSMAR) database.

In 2018, the China Securities Regulatory Commission (CSRC) changed the Code of Governance for Listed Firms to include environmental and social responsibility provisions. A basic structure for ESG disclosure was devised. In the same year, to further encourage the widespread of ESG in China, the Fund Industry Association (FIA) initiated an important indicator system for evaluating the ESG performance of listed firms (Wu et al., 2021).

3.2 Variable measurement

3.2.1 Dependent variable

Two commonly used measures of cash holdings (Cash) are cash and cash equivalents divided by total assets and cash and cash equivalents divided by net assets. This study draws on the study of Tran et al. (2024), who examined the ratio of cash and cash equivalents to net assets as a key measurement. The sum of all assets minus cash and cash equivalents are called net assets.

3.2.2 Independent variable

This study uses Huazheng ESG rating data to measure ESG performance. It assesses the ESG performance and risk level of A-share listed firms. In accordance with Zhang and Liu (2022), this study rates the provided ESG by giving each of the nine grades—C, CC, CCC, B, BB, BBB, A, AA, and AAA—a value between 1 and 9. The better the ESG performance, the higher the value.

3.2.3 Mediating variables

The mediating variable is internal control (IC). The process of strengthening the governance structure of a corporation not only involves the implementation of ESG but also affects the quality of internal control. With the establishment of a sound system of internal control, corporations could identify and assess risks more comprehensively (Mohammed et al., 2021) and thus hold a reasonable amount of cash holdings. Internal control in this study used the DIB index published by Shenzhen DIB Enterprise Risk Management Technology Company Limited (Zhu and Song, 2021). The DIB index is a comprehensive internal control evaluation system. It covers five major elements: internal environment, risk assessment, control activities, information and communication, and internal oversight. The index assesses the soundness and implementation effectiveness of the internal control system through quantification. It provides an objective and comprehensive measure of the quality of internal control (Chan et al., 2021). The DIB Index is an important indicator for assessing the level of internal control. The scale ranges from 0 to 1,000, with higher values representing better quality of a firm’s internal controls.

3.2.4 Control variables

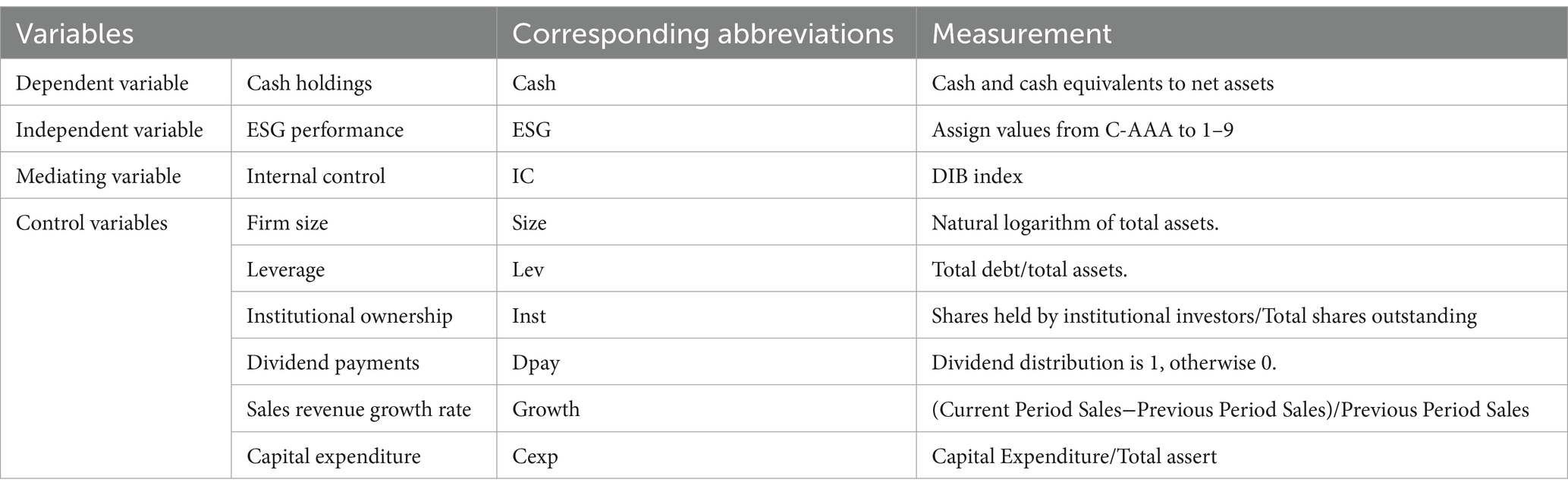

With the purpose of controlling the effects of other variables on cash holdings, firm size (Size), financial leverage (Lev), institutional ownership (Inst), dividend payout (Dpay), sales revenue growth rate (Growth), and capital expenditure (Cexp) were appropriately selected as control variables based on the previous scholars’ research results (Al-Haddad and Al-Ghoul, 2023). The specific variables were measured as shown in Table 1.

3.3 Model development

To test the relationship between ESG performance and cash holdings, this study conducted the Hausman test in the first step (p = 0.000, chi2(7) = 297.47). The results show that the fixed-effects model is better than the random-effects model. Therefore, estimates are based on the fixed-effects model with clustered adjusted standard errors at the firm level. Based on the above settings, model 1 is expressed as follows:

Second, this study also tests the role of internal control as a mediator in the relationship between ESG performance and cash holdings. This study adopts the three-step mediation effect as outlined by Dsouza et al. (2024); models 3 and 4 are constructed upon the foundation of Model 1:

= Firm Fixed Effects.

= Year Fixed Effects.

4 Results

4.1 Descriptive statistics

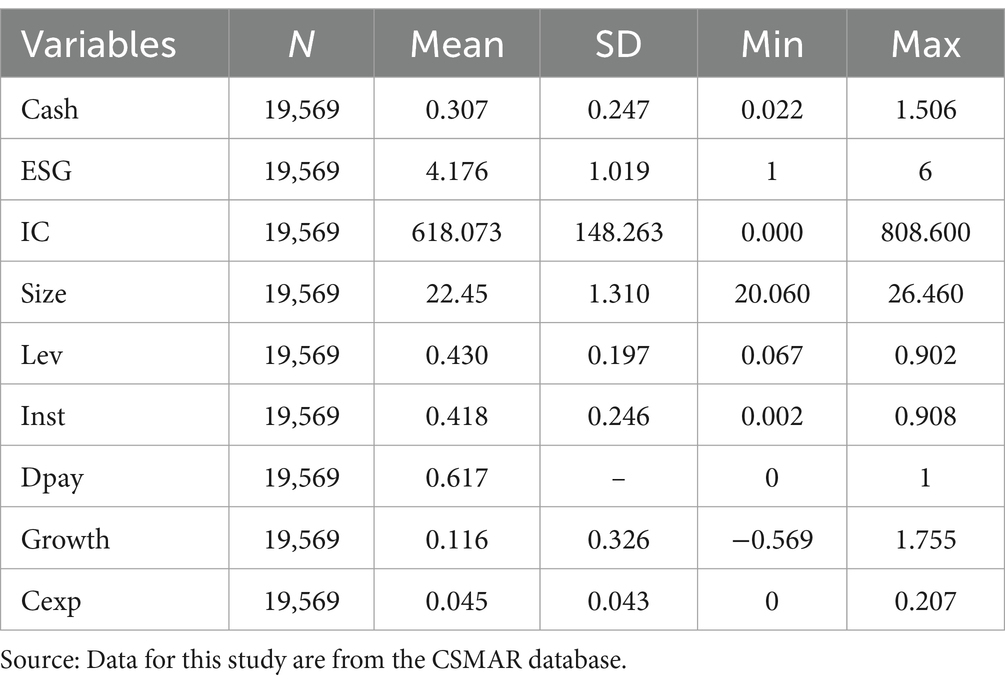

The outcomes of the descriptive analysis of primary variables, encompassing ESG performance and cash holdings, are presented in Table 2. The mean value of cash holding is 0.307, with a standard deviation of 0.247, a maximum value of 1.506, and a minimum value of 0.022. These findings indicate that there is a significant disparity in cash holdings across various firms in China. This result is consistent with the descriptive statistics reported by Liu et al. (2023). The mean ESG performance is 4.176, which falls between B and BB grades, indicating that publicly traded firms in China exhibit relatively low ESG performance. The ESG performance scores range from a high of 6 to a low of 1, revealing substantial variations across firms. These scores highlight the significant potential for improvement in the ESG capabilities of many corporations. Regarding internal control, the maximum value is 808.6, while the minimum is 0. This wide range indicates significant differences in the level of internal control among listed firms in China. The presence of firms with a value of 0 suggests that some firms lack a sound internal control mechanism, which may pose risks to their operational and financial integrity. These observations are in agreement with the previous findings (Zhou et al., 2022; Wang et al., 2025).

4.2 Correlation matrix

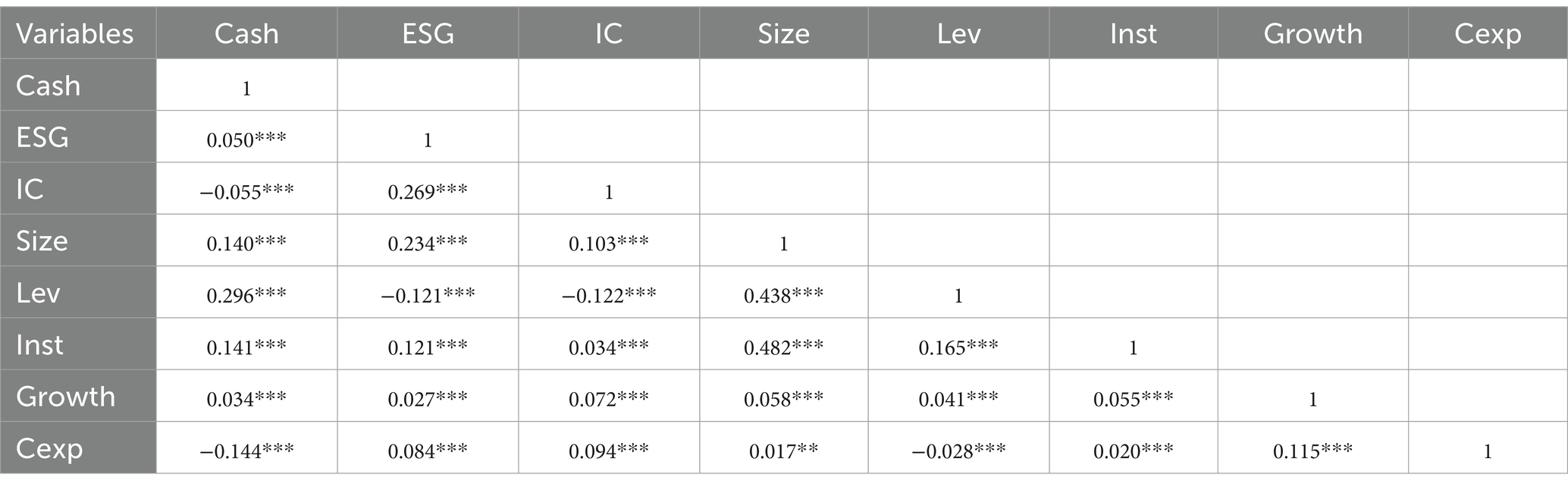

Before examining the relationship between ESG and cash holdings in depth, it is essential to carry out a correlation analysis between the main variables. Table 3 shows the correlation test between the main variables. The correlation analysis could not only initially reveal the direction and degree of association between variables but also determine whether there is a serious problem of multicollinearity in the model. The coefficient between ESG and cash holdings is positively correlated at the 1% significance level, which has a coefficient of 0.050, as shown in Table 3. This result shows that firms with superior ESG performance are inclined to maintain higher cash reserves. A preliminary test of hypothesis 1, which examines the correlation coefficients among variables, reveals that the highest coefficient observed between leverage and institutional ownership is 0.482. In general, if the correlation coefficient between variables is more than 0.8, there may be a serious multicollinearity problem (Midi et al., 2010). The results in Table 3 show that the correlation coefficients between the variables are less than 0.5. This result shows that the problem of multicollinearity between the variables in the model is not significant.

4.3 Baseline results

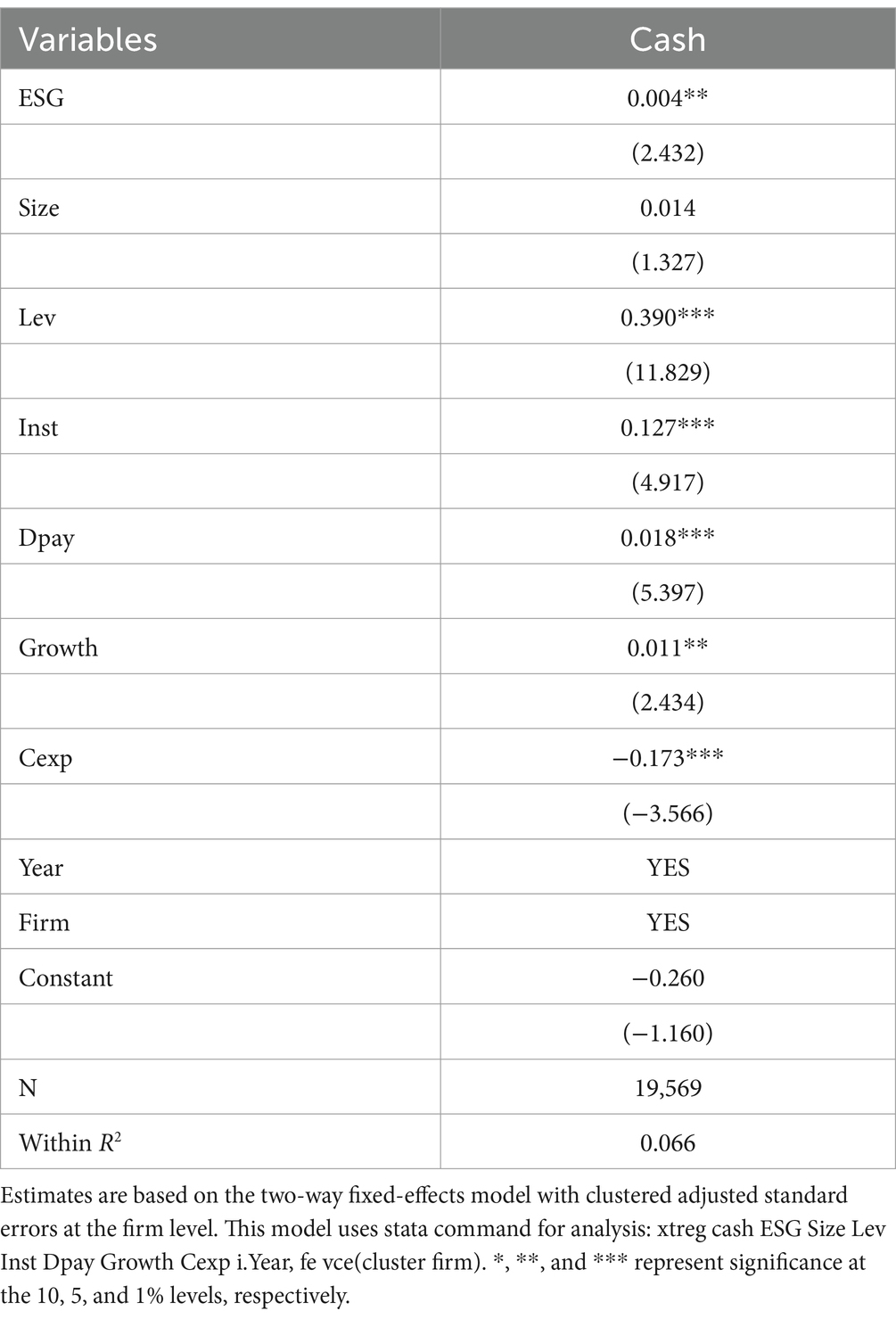

To examine the impact of ESG performance on cash holdings, this study uses the two-way fixed-effects estimator with clustered adjusted standard errors for the baseline regression analyzes. The regression results are shown in Table 4. ESG performance is positively correlated with cash holdings at the 5% level of significance with a coefficient of 0.004 and a t-value of 2.432. When ESG increases by one standard deviation, cash holdings increase by 0.004 units. However, the relationship is statistically significant, and the coefficient value is small. This small coefficient value suggests that the economic impact of ESG on cash holdings is limited. In the current context of sustainable development, good ESG performance demonstrates corporate responsibility to the outside society with the help of information regarding the protection of the environment and the responsibility of society. This represents an active message of corporate commitment to CSR, which could win the trust of investors (Bridoux et al., 2016). This message enhances financial stability and holds more cash holdings. In addition, ESG performing firms are more likely to receive bank loans and investor recognition. The relatively low cost of financing reduces reliance on external funding (Tang, 2022). While ESG performance may have a low direct impact on cash holdings, the positive effects in terms of increasing firm credibility and availability of finance may still indirectly motivate firms to increase their cash reserves to enhance financial flexibility.

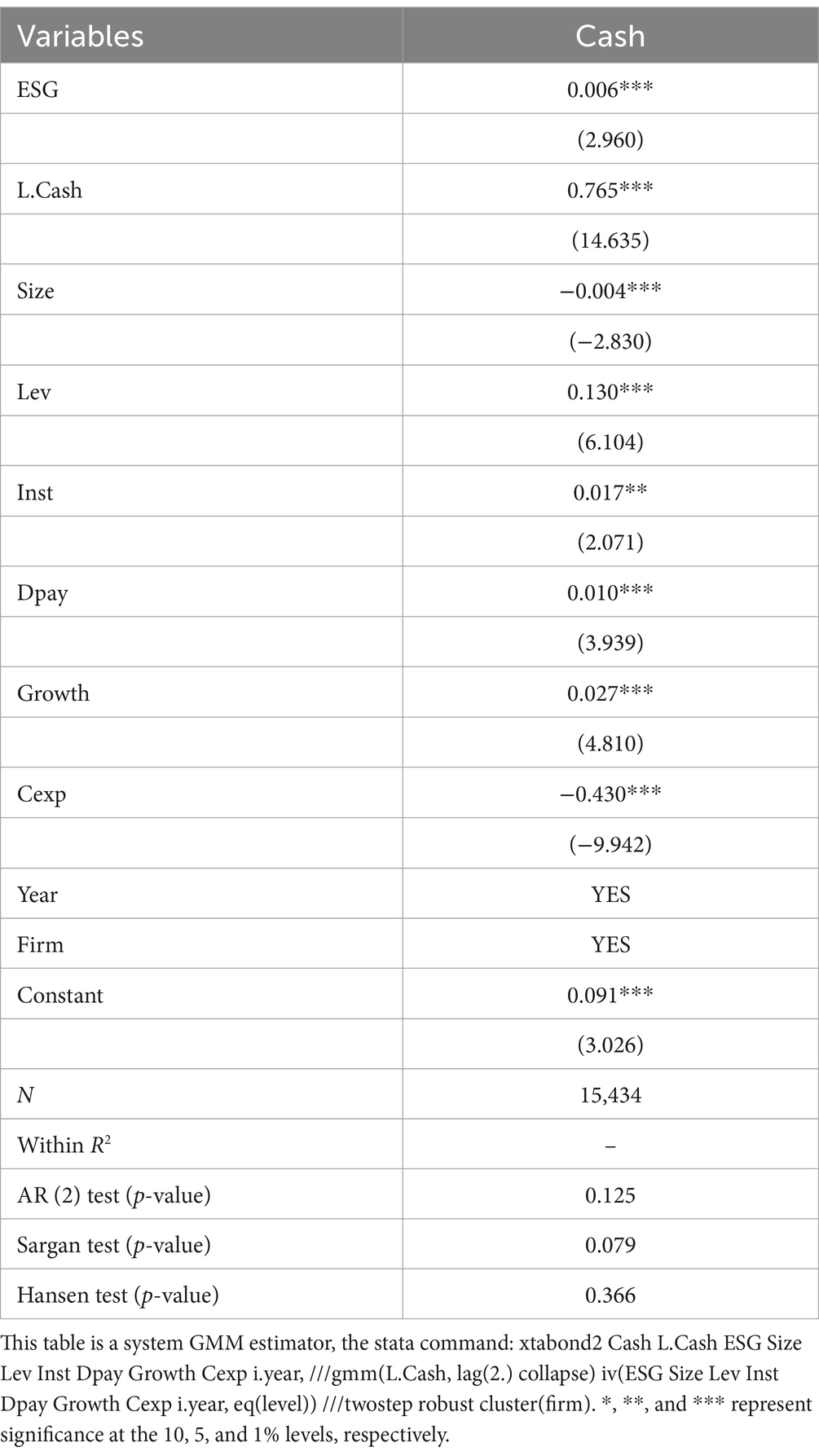

4.4 Endogeneity test

In this study, the baseline Equation 1 is re-estimated using a System Generalized Method of Moments (System GMM) estimator to control for possible endogeneity issues. In the estimation process, the lagged period of the dependent variable cash is included in the independent variable to account for the dynamic characteristics of cash holdings. This study employs the two-step estimator because the two-step method is asymptotically more efficient than the one-step method. However, traditional two-step standard errors often suffer from significant underestimation. Therefore, the finite sample correction method for two-level covariance matrices was developed by Windmeijer (2005) to obtain more robust inference results.

In the systematic GMM estimator of this study, the second and higher order lag terms of L.Cash are used as instrumental variables for the difference equations. After implementing the collapse treatment, the number of instrumental variables is reduced to 2. For the level equations, ESG, Size, Lev, Inst, Dpay, Growth, and Cexp are used as instrumental variables. Additionally, five dummy variables are included for a year. In summary, the total number of instrumental variables used for the system GMM estimator is 14.

Column (3) of Table 5 shows that ESG and cash are significantly positive at the 1% level, with a coefficient of 0.006. This finding suggests that, in the short run, ESG performance enhancement rapidly positively affects firms’ cash holdings. For every unit increase in ESG, there is a corresponding increase of 0.006 units in cash holdings. The coefficient of L.Cash is 0.765, which shows that, for every unit increase in ESG, the cash holdings increase by 0.0255 (0.006/(1–0.765)) units. The long-run effect of ESG is significantly larger than the short-run effect. This difference suggests that the effect of ESG on cash holdings becomes more significant over time. ESG may contribute to cash accumulation in the long run by increasing their financing ability, reducing financial constraints, or improving internal governance.

In addition, the validity test of the dynamic panel data model indicates that the p-value of the AR(2) test is 0.125, suggesting that there is no second-order serial correlation. This result is consistent with the assumptions of the system GMM estimation. It shows that the estimation results are reliable. The p-value of the Sargan test is 0.079, which further validates the instrumental variables. The p-value of the Hansen test is 0.366, demonstrating that there is no over-identification of instrumental variables. This finding indicates that the system GMM estimator is valid and that there is no serious endogeneity problem.

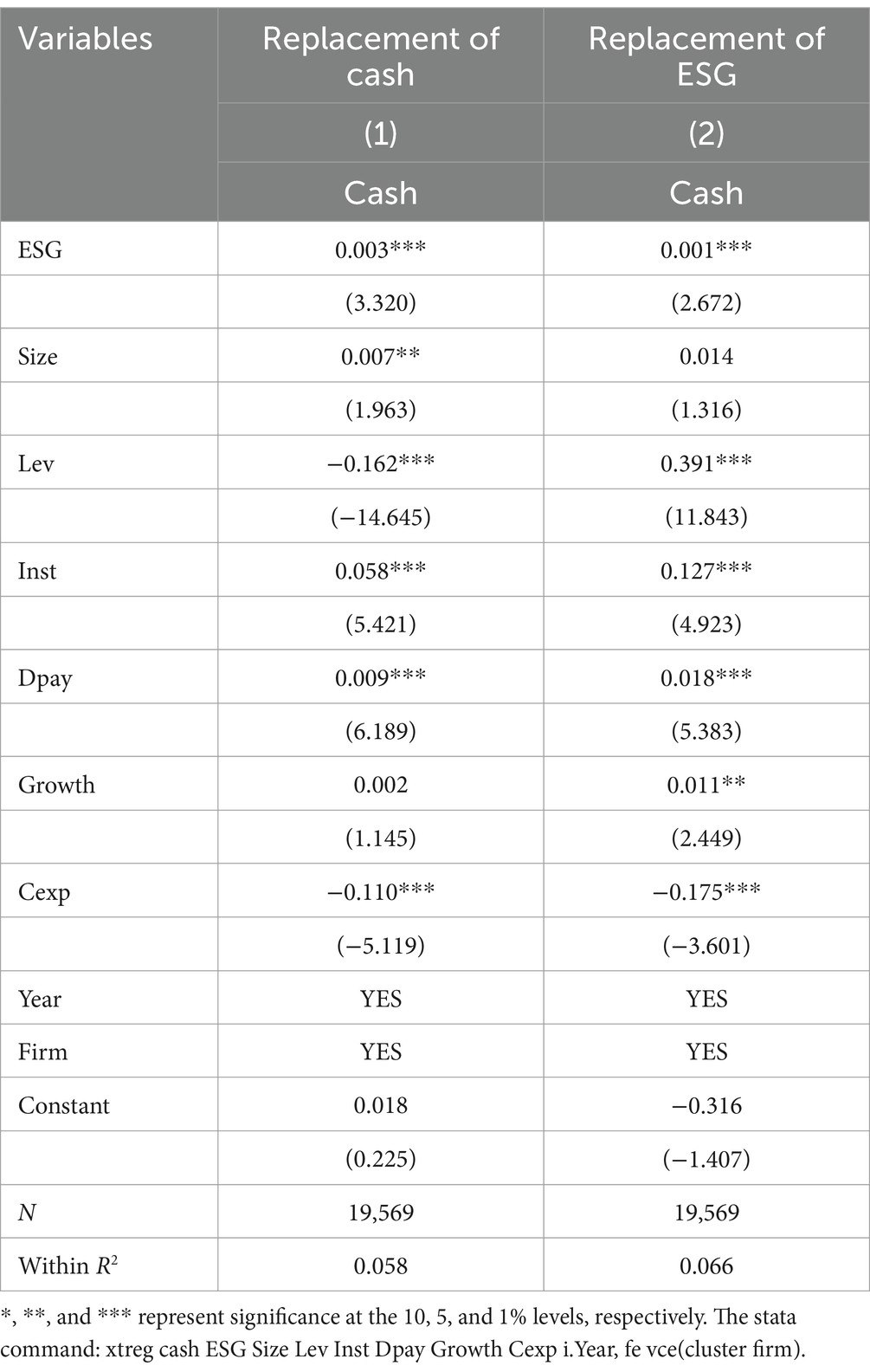

4.5 Robustness analysis

To ensure the robustness of the empirical results, this study conducts a robustness test of the relationship between ESG performance and cash holdings through a variety of methods. These results include replacing the dependent variable and alternating the independent variable. The regression results are shown in Table 6.

4.5.1 Replacement of dependent variable

Based on the study by Thi Tuyet Dao et al. (2023), the percentage of cash and cash equivalents to total assets serves as a metric for assessing cash holdings. Column (1) of Table 6 presents the results of regression with the dependent variable after replacement. ESG performance shows a significant and positive relationship with cash holdings, with a coefficient of 0.003 at the 1% significance level. This result demonstrates that strong ESG performance could significantly increase firms’ cash holdings even if they are measured in a different manner. Hypothesis 1 is strongly supported.

4.5.2 Replacement of independent variable

Building on the findings of Wang et al. (2022), this study measures ESG performance by selecting ESG scores from the Bloomberg database. This substitution makes the measure of ESG performance more comprehensive and authoritative. It helps to more accurately analyze the impact of ESG on cash holdings. As shown in Table 6 column (2), ESG and cash holdings are significant at the 1% significance level, with a coefficient of 0.001 and a t-value of 2.672. These results indicate that the findings are robust to the choice of ESG measures, providing further support for hypothesis 1.

4.6 Mediation effect

This section investigates the mediating effect of internal control between ESG performance and cash holdings. To examine this mediating effect, Equations 2 and 3 are constructed. The regression results are summarized in Table 7. At a significance level of 1%, the test of model 2 yielded a positive correlation between internal control and ESG performance, as shown in column (2). It illustrates that firms with stronger ESG performance also have high-quality internal controls, which may be due to the fact that ESG-performing firms place more emphasis on optimizing their governance structures. Thus, internal controls are enhanced. Second, column (3) presents the result of the test of model 3, indicating that ESG performance and cash holdings are significant at a 1% level. Internal control proves significant at the 10% level when combined with cash holdings. This result suggests that ESG could enhance the level of cash holdings. However, cash holdings may decrease when the quality of internal controls improves. This may be due to the fact that sound internal control reduces the agency cost and the uncertainty of capital holding so that the firm does not need to hoard much cash to cope with potential risks. Combining the results of Models 2 and 3 confirms that internal control partially mediates the relationship between ESG and cash holdings. Hypothesis 2 is confirmed. It follows that ESG performance may indeed influence cash holdings via the quality of internal controls. Embedding ESG in corporate financial decisions through internal control could strengthen corporate sustainability.

5 Discussion

As the concept of sustainable development has gained global prominence, ESG performance has increasingly become an issue of close attention for stakeholders such as governments and regulators, enterprises, and investors. Firms face challenges in implementing ESG strategies, including regulatory uncertainties, as evolving policies create compliance complexities and high costs, requiring investments in reporting, technology, and training. In addition, short-term financial pressures may deter firms from prioritizing long-term ESG goals (Zyznarska-Dworczak, 2022). Overcoming these barriers requires strong governance, managerial sustainability consciousness, and stakeholder collaboration to align ESG with financial performance.

This study selects listed firms from 2018 to 2023 as a sample to explore in depth the effect of ESG performance on cash holdings. Utilizing ESG performance as a focal point expands the study of the financial impact of ESG performance as well as the factors influencing cash holdings. The regression analysis reveals that ESG performance would increase cash holdings. The research findings still hold the same results after examining endogeneity and robustness tests, which align with the findings of prior research. The results indicate that cash holdings could be enhanced while improving the environment, proactively engaging in sustainability, and reinforcing corporate governance within the context of an environmentally friendly development framework. For instance, China’s mandatory ESG disclosure regulations for publicly listed companies and the promotion of green finance initiatives through tax incentives for sustainable investments are key measures that could drive ESG integration toward corporate strategies, including cash holding strategies.

Second, this study investigates the role that internal control plays as a mediator in the connection between corporate cash holdings and ESG performance. A good ESG performance positively contributes to corporate cash holdings by enhancing internal control quality. This contribution suggests that corporate internal governance is strengthened in large part by ESG performance. This is a novelty that internal control, as a mediating variable, acts as a bridge between ESG performance and corporate cash holdings through specific corporate governance mechanisms such as enhancing transparency, reducing risks, optimizing resource allocation, and improving financial stability.

6 Conclusion

Based on the above discussions of empirical results, this research is an initial study incorporating internal control as the mediating role in the field of sustainable corporate financial performance, including corporate cash holding strategy. Combining top managerial leadership and internal control mechanisms could promote ESG performance effectively and manage cash holdings efficiently in emerging nations such as China.

The study’s findings have important implications for both enterprises and governments. Firms should incorporate ESG into their core strategies by committing to green production technologies and reducing carbon emissions. Additionally, they should increase the supervision and enforcement of ESG disclosure. High-quality reporting enhances corporate transparency and assists in gaining the trust of investors and customers. Governments, on the other hand, should actively promote the concept of sustainable development and further refine environmental regulations and incentives. By employing tax incentives and rewards, governments should encourage firms to engage in sustainability and social responsibility activities, prompting them to disclose ESG information proactively. For instance, China’s mandatory ESG disclosure regulations for publicly listed companies and the promotion of green finance initiatives through tax incentives for sustainable investments are key measures that could drive ESG integration.

This proactive approach is expected to foster enhancements in corporate ESG performance, which, in turn, could positively influence corporate financial performance or other aspects such as cash holdings, as evidenced in this study. Thus, this study offers empirical evidence to help firms optimize ESG strategies and enhance financial stability, providing practical insights for policymakers and investors. This study expects to encourage businesses to strengthen ESG practices, improve cash management, and adapt to China’s growing focus on sustainability and ESG regulations, enabling more informed financial decisions. Meanwhile, incorporating a well-established internal control mechanism is critical in influencing and enhancing the mutual relationship between ESG performance and corporate cash holding as a growing concern among listed firms.

This study has several limitations, and future recommendations should be acknowledged. First, the methodology primarily relies on secondary data from the CSMAR database for empirical analysis. The limited availability and accessibility of detailed firm-level ESG, cash holdings, and internal control data may constrain the depth of our investigation. Second, this study examines ESG performance as a whole without differentiating its environmental, social, and governance subdimensions. Given that each subdimension may have distinct effects on cash holdings, future research should consider analyzing them separately. In addition, the mediating role of internal control may vary across industries and firm characteristics, suggesting the need for further investigation into potential boundary conditions. We used panel data to control for omitted variable bias and a system GMM estimator to mitigate the endogeneity problem. However, the method may still be insufficient to eliminate endogeneity bias in ESG performance completely. In future studies, we could further use other approaches to deal more effectively with endogeneity issues. Furthermore, although firms’ proactive investment in ESG contributes to fulfilling social responsibility and enhancing financial stability, the magnitude of its impact on cash holdings remains relatively small. Future research should further explore potential underlying mechanisms, such as whether ESG indirectly affects cash holdings by improving corporate governance or reducing financing constraints.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

LY: Formal analysis, Methodology, Visualization, Writing – original draft, Writing – review & editing. MN: Writing – review & editing, Supervision, Validation. DK: Writing – review & editing, Validation, Supervision.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Al-Haddad, L., and Al-Ghoul, S. (2023). The impact of earnings quality on corporate cash holdings: evidence from an emerging economy. J. Financ. Report. Account. doi: 10.1108/JFRA-09-2022-0321 [Epub ahead of print].

Arouri, M., and Pijourlet, G. (2015). CSR performance and the value of cash holdings: international evidence. J. Bus. Ethics 140, 263–284. doi: 10.1007/s10551-015-2658-5

Atif, M., Liu, B., and Nadarajah, S. (2022). The effect of corporate environmental, social and governance disclosure on cash holdings: life-cycle perspective. Bus. Strateg. Environ. 31, 2193–2212. doi: 10.1002/bse.3016

Boulhaga, M., Bouri, A., Elamer, A. A., and Ibrahim, B. A. (2022). Environmental, social and governance ratings and firm performance: the moderating role of internal control quality. Corp. Soc. Responsib. Environ. Manag. 30, 134–145. doi: 10.1002/csr.2343

Bridoux, F., Stofberg, N., and Den Hartog, D. (2016). Stakeholders' responses to CSR tradeoffs: when other-orientation and trust trump material self-interest. Front. Psychol. 6:1992. doi: 10.3389/fpsyg.2015.01992

Chan, K. C., Chen, Y., and Liu, B. (2021). The linear and non-linear effects of internal control and its five components on corporate innovation: evidence from Chinese firms using the COSO framework. Eur. Account. Rev. 30, 733–765. doi: 10.1080/09638180.2020.1776626

Chen, L., Khurram, M. U., Gao, Y., Abedin, M. Z., and Lucey, B. (2023). ESG disclosure and technological innovation capabilities of the Chinese listed companies. Res. Int. Bus. Financ. 65:101974. doi: 10.1016/j.ribaf.2023.101974

Chen, H., Yang, D., Zhang, J. H., and Zhou, H. (2020). Internal controls, risk management, and cash holdings. J. Corp. Finan. 64:101695. doi: 10.1016/j.jcorpfin.2020.101695

Deb, P., David, P., and O'Brien, J. (2017). When is cash good or bad for firm performance? Strateg. Manag. J. 38, 436–454. doi: 10.1002/smj.2486

Dsouza, S., Momin, M., Habibniya, H., and Tripathy, N. (2024). Optimizing performance through sustainability: the mediating influence of firm liquidity on ESG efficacy in African enterprises. Cogent Bus. Manag. 11:2423273. doi: 10.1080/23311975.2024.2423273

Fresard, L., and Salva, C. (2010). The value of excess cash and corporate governance: Evidence from US cross-listings. J. Financ. Econ. 98, 359–384. doi: 10.1016/j.jfineco.2010.04.004

Guo, H., Legesse, T. S., Tang, J., and Wu, Z. (2020). Financial leverage and firm efficiency: the mediating role of cash holding. Appl. Econ. 53, 2108–2124. doi: 10.1080/00036846.2020.1855317

Ho, L., and Lu, Y. (2024). Does corporate sustainability performance matter for cash holdings? International evidence. Int. J. Manag. Financ. 21, 329–365. doi: 10.1108/IJMF-01-2024-0052

Jensen, M. C., and Meckling, W. H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. J. Financ. Econ. 3, 305–360. doi: 10.1016/0304-405X(76)90026-X

Kao, F. C. (2023). How do ESG activities affect corporate performance? Manag. Decis. Econ. 44, 4099–4116. doi: 10.1002/mde.3944

Li, S., Liu, Y., and Xu, Y. (2022). Does ESG performance improve the quantity and quality of innovation? The mediating role of internal control effectiveness and analyst coverage. Sustainability 15:104. doi: 10.3390/su15010104

Liu, B., Johl, S., and Lasantha, R. (2023). ESG scores and cash holdings: the role of disciplinary trading. Financ. Res. Lett. 55:103854. doi: 10.1016/j.frl.2023.103854

Liu, Y., and Lin, M. (2022). Research on the influence of ESG information disclosure on enterprise financial risk: taking pharmaceutical industry as an example. Front. Bus. Econ. Manag. 5, 264–271. doi: 10.54097/fbem.v5i3.2033

Marie, M., Qi, B., Elamer, A. A., Khatatbeh, I. N., and Al-Fakir Al Rabab'a, E. (2024). How does board gender diversity drive the ESG performance-cash holdings relationship? Evidence from China. Int. J. Financ. Econ. 29, 1–19. doi: 10.1002/ijfe.3037

Metwally, A. B. M., Aly, S. A. S., and Ali, M. A. S. (2024). The impact of corporate social responsibility on cash holdings: the moderating role of board gender diversity. Int. J. Financ. Stud. 12:104. doi: 10.3390/ijfs12040104

Midi, H., Sarkar, S. K., and Rana, S. (2010). Collinearity diagnostics of binary logistic regression model. J. Interdiscip. Math. 13, 253–267. doi: 10.1080/09720502.2010.10700699

Mohammed, M. A., Al-Abedi, T. K., Flayyih, H. H., and Mohaisen, H. A. (2021). Internal control frameworks and its relation with governance and risk management: an analytical study. Stud. Appl. Econ. 39, 3–13. doi: 10.25115/eea.v39i11.6028

Peng, P., and Sun, M. (2024). Government subsidies and corporate environmental, social and governance performance: evidence from companies of China. Int. Stud. Econ. 19, 374–405. doi: 10.1002/ise3.79

Saleh, I., Abu Afifa, M., and Alkhawaja, A. (2023). Environmental, social, and governance (ESG) disclosure, earnings management and cash holdings: evidence from a European context. Bus. Ethics Environ. Responsib. 34, 295–308. doi: 10.1111/beer.12650

Son, S., and Kim, J. (2022). Environment, social, and governance performance and financial performance with national pension fund investment: evidence from Korea. Front. Psychol. 13:893535. doi: 10.3389/fpsyg.2022.893535

Sroufe, R., and Jernegan, L. (2020). “Making the intangible tangible: Integrated management and the social cost of carbon,” in Sustainability (Business and Society 360). eds. D. M. Wasieleski and J. Weber (Leeds: Emerald Publishing Limited) 4, 163–183.

Tang, H. (2022). The effect of ESG performance on corporate innovation in China: the mediating role of financial constraints and agency cost. Sustainability 14:3769. doi: 10.3390/su14073769

Thi Tuyet Dao, N., Guney, Y., and Hudson, R. (2023). Managerial overconfidence and corporate cash holdings: evidence from primary and secondary data. Res. Int. Bus. Financ. 65:101943. doi: 10.1016/j.ribaf.2023.101943

Tran, L. T. H., Tu, T. T. K., and Cong Nguyen To, B. (2024). Uncertainty and cash holdings: the moderating role of political connections. Int. J. Manag. Financ. 20, 1218–1243. doi: 10.1108/IJMF-05-2023-0245

Valadkhani, A., and O'Mahony, B. (2025). Sustainable investing in extreme market conditions: doing well while doing good. J. Econ. Stud. 52, 365–380. doi: 10.1108/JES-11-2023-0626

Wang, S., Liang, X., Huang, J., and Cao, P. (2025). Do academic executives influence corporate ESG performance? Evidence from China. Corp. Soc. Responsib. Environ. Manag. 32, 788–805. doi: 10.1002/csr.2919

Wang, J., Qi, B., Li, Y., Hossain, M. I., and Tian, H. (2024). Does institutional commitment affect ESG performance of firms? Evidence from the United Nations principles for responsible investment. Energy Econ. 130:107302. doi: 10.1016/j.eneco.2024.107302

Wang, W., Yu, Y., and Li, X. (2022). ESG performance, auditing quality, and investment efficiency: empirical evidence from China. Front. Psychol. 13:948474. doi: 10.3389/fpsyg.2022.948674

Windmeijer, F. (2005). A finite sample correction for the variance of linear efficient two-step GMM estimators. J. Econ. 126, 25–51. doi: 10.1016/j.jeconom.2004.02.005

Wu, S., Zhang, H., and Wei, T. (2021). Corporate social responsibility disclosure, media reports, and Enterprise innovation: evidence from Chinese listed companies. Sustainability 13:8466. doi: 10.3390/su13158466

Xiao, X., and Lin, Y. (2024). The power of culture: business nationalist culture and ESG performance. Sustainability 16:8452. doi: 10.3390/su16198452

Yan, D., Liu, C., and Li, P. (2023). Effect of carbon emissions and the driving mechanism of economic growth target setting: an empirical study of provincial data in China. J. Clean. Prod. 415:137721. doi: 10.1016/j.jclepro.2023.137721

Yao, S., Li, Y., and Ni, J. (2024). Does the disclosure of internal control material deficiency remediation information matter for ESG performance? Evidence from China. Heliyon 10:e32933. doi: 10.1016/j.heliyon.2024.e32933

Zhang, D., and Liu, L. (2022). Does ESG performance enhance financial flexibility? Evidence from China. Sustainability 14:11324. doi: 10.3390/su141811324

Zhou, D., Zhou, H., Bai, M., and Qin, Y. (2022). The COVID-19 outbreak and corporate cash-holding levels: evidence from China. Front. Psychol. 13:942210. doi: 10.3389/fpsyg.2022.942210

Zhu, Q. (2016). Institutional pressures and support from industrial zones for motivating sustainable production among Chinese manufacturers. Int. J. Prod. Econ. 181, 402–409. doi: 10.1016/j.ijpe.2015.11.009

Zhu, P., and Song, J. (2021). The role of internal control in firms’ coping with the impact of the COVID-19 pandemic: evidence from China. Sustainability 13:6294. doi: 10.3390/su13116294

Keywords: ESG performance, cash holdings, internal control, Chinese firms, sustainability

Citation: Yuan L, Nor MNM and Kadir DA (2025) Green cash flow: how ESG performance shapes corporate cash holding strategies. Front. Sustain. 6:1531206. doi: 10.3389/frsus.2025.1531206

Edited by:

Pier Luigi Marchini, University of Parma, ItalyReviewed by:

Otilia Manta, Romanian Academy, RomaniaKrishna Reddy, Toi Ohomai Institute of Technology, New Zealand

Copyright © 2025 Yuan, Nor and Kadir. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Leihong Yuan, MTg4NTUxMTEwNDVAMTYzLmNvbQ==

†ORCID: Leihong Yuan, orcid.org/0009-0001-2940-0396

Mohamad Naimi Mohamad Nor, orcid.org/0000-0002-2010-9287

Leihong Yuan

Leihong Yuan Mohamad Naimi Mohamad Nor1†

Mohamad Naimi Mohamad Nor1†