- 1Accounting Department, Faculty of Business Administration, Beirut Arab University, Beirut, Lebanon

- 2Accounting Department, Faculty of Business, Alexandria University, Alexandria, Egypt

Introduction: Environmental, Social, and Governance (ESG) dimensions have transitioned from being a specialized concern to a fundamental aspect influencing a company’s financial performance (FP). As stakeholders increasingly emphasize sustainability, organizations are compelled to integrate ESG considerations into their strategic frameworks. This study aims to investigate the role of ESG dimensions in driving the FP of publicly listed companies on the Egyptian Stock Exchange (EGX) from 2018 to 2022.

Methods: Data was gathered from the top 100 Egyptian firms rated by liquidity and activity using a quantitative research methodology covering 14 different industrial sectors. The analysis utilized financial statements, annual reports, sustainability reports, and corporate governance documents.

Results: It was found that the environmental dimension does not significantly influence FP, while the social dimension has a negative and significant effect. Additionally, the findings reveal a positive influence of the governance dimension on FP.

Discussion and conclusions: These results underscore the complex nature of ESG’s impact on a firm’s financial outcomes, emphasizing the necessity of examining specific ESG components. The insights derived from this study are valuable for stakeholders, including investors and policymakers, as they navigate the relationship between ESG dimensions and FP.

1 Introduction

The global economic downturn, combined with a series of climate change-induced natural disasters, has dramatically transformed stakeholder expectations regarding corporate accountability and transparency. As a result, the importance of non-financial information, particularly in the context of Environmental, Social, and Governance (ESG) criteria, has significantly increased (Şeker and Şengür, 2021). This transformation has compelled organizations to enhance their focus on the non-financial dimensions of their operations, establishing ESG as a critical global trend (Bassen and Kovács, 2020). ESG represents a framework for executing corporate management practices that align with legal and ethical standards while integrating environmental and social responsibilities (Chang and Lee, 2022). It addresses stakeholder needs related to environmental, social, and governance initiatives and provides essential information on these matters (Cek and Eyupoglu, 2020).

Publicly listed firms are increasingly aware of the necessity to disclose their ESG performance (PF), driven by demands to engage stakeholders, meet investor expectations, build credibility, respond to crises and competitive pressures, and uphold ethical standards (Rezaee, 2016; Olsen et al., 2021). Consequently, firms that adopt ESG strategies have been observed to achieve improvements in operational efficiency, cost reductions, customer loyalty, access to capital, and overall organizational reputation (Arrive et al., 2019). Additionally, the integration of ESG practices is associated with greater public trust and brand loyalty, which are crucial in today’s competitive markets (Eccles et al., 2014).

While ESG is gaining recognition in developing countries, its implementation is often not voluntary, and its potential benefits are frequently underestimated (Ghardallou, 2022). A substantial body of research has explored the link between ESG and financial performance (FP); however, findings remain mixed. Some studies assert that ESG positively influences FP (Aydoğmuş et al., 2022; Fu and Li, 2023; Xu and Zhu, 2024). Proponents of this view argue that effective ESG initiatives enhance corporate value and reputation, leading to improved FP over time (Mousiolis and Zaridis, 2014). The prevailing belief is that robust ESG practices correlate with increased returns and enhanced FP (Hill, 2020). Central to this perspective is the idea that engagement in sustainability (SUS) initiatives strengthens a firm’s ethical identity, fostering increased stakeholder satisfaction and subsequently enhancing FP (Okafor et al., 2021).

Conversely, other scholars propose that the relationship between ESG and FP may be negative or insignificant (Hussain et al., 2018; Kang and Jung, 2020; Sameer, 2021). Critics suggest that companies investing in sustainability often face higher costs, which can impede their financial outcomes (Friedman, 2007). A critical aspect of this argument is that when FP is robust, managers may reduce expenditures on social initiatives to maximize personal gains, while conversely investing in costly social initiatives to offset poor financial performance (Ghardallou, 2022). This duality highlights the complexity of the ESG-FP relationship and the need for nuanced understanding in different contexts.

Several theories have been proposed to explain the relationship between ESG dimensions and FP. The “value-destruction approach” and “trade-off theory” indicate a negative correlation when resources are allocated to less profitable sustainability initiatives (Endrikat et al., 2014; Escrig-Olmedo et al., 2017). In contrast, both the “resource-based view” (RBV) and “stakeholder theory” suggest a positive relationship. The RBV posits that firms with unique capabilities can leverage these assets to gain a competitive advantage, thereby enhancing FP (Haffar and Searcy, 2017). Stakeholder theory argues that addressing the needs of stakeholders—whether environmental (ENV), social (SOC), or governance (GOV)—can positively influence FP (Chernev and Blair, 2015). This dual theoretical framework underscores the mixed findings in the literature, as different contexts and firm-specific factors may lead to varying outcomes in the ESG-FP relationship. As a result, the literature presents mixed findings regarding the ESG-FP relationship, with prior research indicating that a universally applicable, unidirectional relationship between ESG and FP across all organizations and contexts is not feasible (Grewatsch and Kleindienst, 2017).

Despite the growing body of literature, significant research gaps regarding the relationships between ESG dimensions remain insufficiently addressed. A critical area for exploration is the influence of cultural and institutional factors on ESG implementation in developing contexts, which often differ from those in advanced economies. The connection between ESG and FP continues to be a contentious issue that warrants further investigation (El Khoury et al., 2023). Moreover, while there is an increasing focus on SUS in advanced economies, there is a notable lack of studies examining the current state of ESG dimensions and their effects on FP in developing economies like Egypt (Rahi et al., 2021). In the context of Egypt, existing ESG research has primarily focused on assessing the prevalence of corporate social responsibility (CSR) practices among firms listed on the EGX (Hanafi, 2006; Rizk et al., 2008) or investigating the determinants influencing firms’ decisions to adopt such practices (Salama, 2009; Elmaghrabi, 2018) as well as the variations in these practices across different firms (Hussainey et al., 2011; Srour, 2022). Consequently, very few studies have attempted to explore the implications of all dimensions of SUS practices on firms, leaving a substantial gap in understanding their comprehensive impact.

Therefore, the objective of this study is to investigate the relationship between ESG dimensions and FP using data from a selection of Egyptian companies listed on the EGX. Specifically, the study seeks to determine whether firms demonstrating strong ESG performance experience enhanced FP. The choice of Egyptian firms as the sample is justified by Egypt’s significance as a compelling market for analysis, particularly in light of its commitment to sustainability objectives (ESG, 2023).

This study contributes to the existing literature on ESG and FP in several ways. Firstly, it represents one of the most extensive examinations of the interaction between ESG practices and FP within a developing context, providing insights that are particularly relevant for emerging markets. Secondly, it expands upon previous research by investigating this relationship specifically in Egypt, a country with unique challenges and opportunities related to ESG implementation. Lastly, it lays the groundwork for further academic inquiry into sustainability issues in emerging markets. The anticipated outcomes of this study will encourage more companies to adopt sustainability practices, providing contemporary evidence regarding the implications of ESG dimensions for firms. As such, the findings are expected to interest regulators and standard-setters responsible for formulating regulations governing sustainability practices, which currently remain voluntary, allowing firms discretion in their disclosure of relevant information.

The subsequent sections are organized as follows: Section two discusses the relevant theories pertaining to ESG. Section three reviews the existing literature. Section four outlines the research methodology. Section five presents the findings. Finally, section six concludes the study by summarizing the principal findings and proposing potential avenues for future research.

2 Theoretical framework and hypotheses development

2.1 Related theories

Ullmann (1985) emphasizes the necessity for a comprehensive theory of SUS PF due to the varied and often contradictory results observed in research examining the connections between SUS disclosure, SUS PF, and the overall PF of firms. Within the current body of literature, two predominant perspectives have emerged regarding SUS PF: the “traditionalist perspective” and the “revisionist perspective.” Additionally, three key theories have garnered significant interest from investors in the context of SUS investment and reporting: “agency theory,” “legitimacy theory,” and “stakeholder theory.”

2.1.1 Traditionalist view

The “agency theory” serves as a theoretical basis for the “traditionalist perspective,” as articulated by Meckling and Jensen (1976). This theory posits that a primary responsibility of managers is to reconcile the interests of the company with those of its shareholders. In their examination of corporate SUS practices, Friedman and Allen (1970) apply “agency theory” to highlight potential conflicts between managerial and shareholder interests. They contend that managers may leverage SUS initiatives to fulfill their own social, corporate, political, and career aspirations. From this standpoint, investments in SUS are deemed more effectively allocated toward enhancing a company’s operational efficiency. Furthermore, they argue that expenditures on SUS initiatives represent the use of others’ funds, yielding minimal benefits for the organization as a whole. This perspective aligns with the “traditionalist view,” which anticipates that costs associated with ENV protection efforts, such as pollution control and emissions reduction, will elevate production expenses and consequently diminish overall firm PF. The “agency theory” has been empirically investigated in various studies exploring the association between SUS PF and overall PF. For instance, Wright and Ferris (1997) observed a negative market reaction to announcements regarding asset divestment in South Africa, interpreting this finding as supportive of “agency theory.” Similarly, research conducted by Freedman and Jaggi (1992) and King and Lenox (2001) identified a negative correlation between ENV PF and firm PF.

2.1.2 Revisionist view

The “legitimacy theory” and “stakeholder theory” serve as foundational elements for the “revisionist perspective.” This perspective, often referred to as the “Porter hypothesis,” was primarily articulated and expanded by Porter and Linde (1995). It posits that reducing pollution can lead to prospective financial savings through enhanced efficiency, lower compliance expenses, and diminished prospective obligations (King and Lenox, 2001), thereby augmenting the value of the firm. The “legitimacy theory,” first proposed by Davis (1973), asserts that “society grants legitimacy and power to business. In the long run, those who do not use power in a manner which society considers responsible will tend to lose it” (Davis, 1973: 314). This theory suggests that organizations are in a constant pursuit of operating within the accepted boundaries and the standards established by their communities (Deegan and Unerman, 2006). According to “legitimacy theory,” firms must demonstrate sustainable responsibility and accountability to society to maintain their legal operational status (Simnett et al., 2009).

The “stakeholder theory,” initially articulated by Freeman (1984), explores the relationships between external SH and the operational functions of a company. This theory postulates that managers engage in sustainable practices aimed at fulfilling their moral, ethical, and social responsibilities toward SH while also deliberately advancing corporate goals for the benefit of shareholders. Friedman and Miles (2006) characterize SH as “any group or individual who can affect or is affected by the achievement of the organization objectives.” Key SH identified include “customers,” “employees,” “local communities,” “suppliers,” “distributors,” “the public,” “regulators,” “government entities,” “policymakers,” and “shareholders.” Building upon the foundational “stakeholder theory,” Jensen (2002) introduced the “enlightened stakeholder theory”, also referred to as “enlightened value maximization.” This perspective advocates for managerial decision-making that considers the interests of all SH associated with a company. SH encompass all “individuals” or “groups” that can significantly influence or be influenced by the firm’s welfare, including not only “shareholders” and “creditors” but also “employees,” “customers,” “communities,” and “regulatory bodies.” The “stakeholder theory” has gained considerable traction and has been formally recognized by numerous professional organizations, interest groups, and governmental agencies, as highlighted by Shropshire and Hillman (2007). While corporate managers aim to serve the interests of SH, it is essential to navigate trade-offs to mitigate conflicts among various SH and key constituencies, as discussed by Shropshire and Hillman (2007).

2.2 Hypotheses development

The existing body of literature testing the empirical association between SUS PF and FP is intricate, with findings frequently yielding inconsistent results. Research has identified three primary factors that have hindered scholars from achieving significant insights into the association between SUS PF and FP: limited sample sizes, variations in PF metrics, and the lack of control for variables such as “firm size” and “industry classification” (Patten, 2002).

2.2.1 Environmental dimension and financial performance

The existing literature examining the connection between the ENV aspect of SUS and FP presents a lack of consensus. Some researchers posit that the ENV dimension positively influences business PF, while others argue for a “negative” or “neutral” correlation. For example, Jaggi and Freedman (1992) identified a negative association between pollution PF index and FP within the pulp and paper sector. Similarly, Cordeiro and Sarkis (1997) demonstrated a negative association between ENV PF and FP for 523 U. S. firms. An analysis conducted by Molloy et al. (2002) on S&P 500 manufacturing firms revealed that poor ENV PF had a positive effect on returns, while good ENV PF had a negative effect. Rassier and Earnhart (2011) concluded that reduced emissions enhance FP. Horváthová (2012) explored the relationship between ENV PF and FP in the Czech Republic, discovering a negative correlation between them. Adediran and Alade (2013) established a negative association between ENV accounting and earnings per share and return on capital (ROC). Furthermore, Chang (2015) reported that ENV PF adversely affects the Tobin’s Q value in heavy-pollution industries in China. Omnamasivaya and Prasad (2017) identified a negative correlation between ENV accounting and FP. Ezeagba et al. (2017) similarly demonstrated a negative association between ENV accounting and ROC and net profit margin. Mikial et al. (2019) observed that the disclosure of ENV information adversely affects FP, suggesting that enhanced compliance with disclosure guidelines incurs significant costs, ultimately diminishing FP. Abughniem and Hamdan (2019) provided evidence of a negative impact of ENV responsibility on return on assets (ROA) and Tobin’s Q in Jordan. Ma et al. (2020) indicated that ENV management negatively influences labor productivity, which can lead to reduced FP. Indriastuti (2021) found that ENV PF negatively affects FP in mining companies in Indonesia. Vaihekoski and Yahya (2023) reported a negative association between ENV dimension and profitability in firms operating within environmentally sensitive industries. These findings regarding the adverse effects of ENV factors on FP align with “neoclassical firm theory,” which supports the “short-run perspective hypothesis,” positing that firms in sectors with elevated ENV compliance costs experience competitive disadvantages, as the costs associated with compliance exceed the value added to the company.

A different perspective within ENV studies posits that enhanced ENV PF can serve as a significant source of competitive advantage. This enhancement may result in enhanced operational procedures, heightened productivity levels, decreased compliance expenditures, and the creation of novel market prospects. Cormier et al. (1993) explored the correlation between market valuation and a pollution index, revealing a positive association between ENV PF and FP. Hart (1995) argued that achieving SUS necessitates that companies mitigate ENV harm resulting from their value creation activities while also addressing community social needs. David Diltz (1995) identified a positive association between ENV PF and stock market returns. Hart and Ahuja (1996) investigated the association between ENV PF and FP, assessed through ROA and return on equity (ROE), finding a positive link between the two variables. Russo and Fouts (1997) concluded that superior ENV PF correlates with improved FP in terms of ROA and firm growth. Bhat (1998) suggested a positive relationship between the level of compliance and profit margins. Konar and Cohen (2001) found that inadequate ENV PF diminishes the intangible asset value of manufacturing firms. Furthermore, Sroufe (2003) established a positive connection between earnings management systems and ENV practices and PF, based on survey data. Montabon et al. (2007) reported a positive association between ENV management practices and PF indicators. Lo and Sheu (2010) discovered that the Tobin’s Q of U. S. companies surpassed that of their non-sustainable counterparts. Nakao et al. (2007) concluded that ENV PF positively influences FP in Japan. Moneva and Ortas (2010) investigated the link between ENV PF and FP of European firms, showing that companies with higher ENV PF ratings tend to exhibit superior FP in subsequent periods. Clarkson et al. (2011), in their study of industries with high pollution levels, found a positive association between FP and ENV PF. Guenster et al. (2011) identified a positive correlation between eco-efficiency and firm value. Albertini (2013) established a positive association between ENV PF and FP. Muhammad et al. (2015) explored the association between ENV PF and FP among firms in Australia. The findings indicated a positive association was exist between the two variables. Küçükbay and Fazlılar (2016) demonstrated a positive correlation between FP and ENV PF among Turkish listed firms. Alheet (2019) highlighted a positive effect of SUS scores on the ROA in Jordan. Liu (2020) identified a positive relationship between ENV PF and FP, noting variations attributable to company- and industry-specific differences. Abban and Hasan (2021) found a positive link between ENV PF and FP in Australia. Bassetti et al. (2021) also reported a positive relationship between ENV PF and ROA for firms in the United States. Furthermore, Gull et al. (2022) indicated that improved waste management practices, characterized by reduced waste generation and increased recycling, contribute to enhanced FP. Carnini Pulino et al. (2022) established a positive association between ENV disclosure and FP among the largest publicly listed companies in Italy over a decade from 2011 to 2020.

Given the mixed findings regarding the impact of the ENV dimension on FP, the following hypothesis is proposed:

H1: There is a significant relationship between ENV dimension and FP.

2.2.2 Social dimension and financial performance

The interplay between the SOC dimension and FP remains a contentious topic within the CSR literature, with various theoretical frameworks and empirical findings suggesting that this relationship can be characterized as “positive,” “negative,” or “neutral.” For example, Preston and O’bannon (1997) identified three SOC dimensions of SUS PF: “employees, customers, and the community.” Their findings indicated a positive correlation between SOC factors and FP. Waddock and Graves (1997) explored the reciprocal influences of CSR on FP and vice versa, for S&P 500 firms. Their results demonstrated a bidirectional positive relationship. In a comprehensive meta-analysis encompassing 53 studies, Orlitzky et al. (2003) affirmed a positive correlation between CSR and FP, noting that CSR, as assessed by the organizational reputation index, exhibited a stronger relationship with accounting metrics compared to market metrics. Furthermore, Margolis et al. (2007) concluded that CSR positively affects accounting and market-based profits. Eccles et al. (2014) investigated the effect of SUS practices on the FP of U. S. companies, revealing a positive association between the SOC dimension and FP. Lu and Taylor (2016) established that SOC SUS has a favorable influence on FP, suggesting that the market tends to reward firms demonstrating strong corporate SUS PF over time. Wang et al. (2016) recognized a positive correlation between CSR and FP. Nollet et al. (2016) investigated the effects of CSR on the FP of S&P 500 companies, concluding that CSR positively influences FP in the long term. Lassala et al. (2017) explored the connection between SOC PF and overall PF, discovering a positive link between the SOC dimensions of SUS outcomes and FP. Busch and Friede (2018) indicated a positive association between SOC PF and FP. Kim et al. (2018) examined the contingent role of CSR on the relationship with FP among 113 software firms in the U. S. Their research indicated that firms exhibiting a high degree of competitive action experienced a beneficial impact on FP through their CSR initiatives. Ikram et al. (2020) performed a longitudinal study that inspected the impact of CSR initiatives on FP within SMEs in Pakistan. The results indicated a positive association between CSR and FP, particularly highlighting the roles of corporate reputation and employee commitment. The implementation of CSR strategies contributes to an enhanced corporate image and increased consumer satisfaction, which in turn positively influences FP. Similarly, Wang et al. (2022) found that SOC orientation directly fosters its SOC PF, encompassing both employee-focused and community-focused outcomes, which can subsequently improve the FP of manufacturing firms in the U. S. This body of research advocates that firms that integrate CSR into their operational and strategic frameworks are more likely to exhibit SOC responsibility. Such practices create a favorable perception of the organization among various SH, including “employees,” “suppliers,” “lenders,” and “the public.” Consequently, these efforts bolster the firm’s reputation and enhance FP, steering the organization toward greater success (Mumtaz and Pirzada, 2014). This perspective aligns with “stakeholder theory,” which postulates that companies that cultivate positive relationships with their SH tend to achieve greater success over time, as each SH group can influence the economic PF and future viability of the firm (Delmas and Toffel, 2004; Barnett, 2019).

From a theoretical perspective, “classical economists” maintain that the primary objective of companies is to maximize economic value and profits for their shareholders (Ghardallou and Alessa, 2022). Correspondingly, the “shift of focus hypothesis” posits that engagement in CSR can shift focus away from the primary objective of maximizing profits, thereby establishing a negative correlation between CSR and FP (Galant and Cadez, 2017). Additionally, the “tradeoff hypothesis” suggests that there is a negative association between CSR and FP, attributed to the heightened costs associated with CSR investments. Hirigoyen and Poulain-Rehm (2015) explored the CSR-FP relationship across U. S., Europe, and Asia and concluded that CSR engagement does not correlate with improved FP, and conversely, FP negatively influences CSR. Furthermore, Mukherjee et al. (2018) indicated that firms that began investing in CSR activities—mandated by new regulations—exhibited a negative association between CSR spending and profitability, signifying that amplified expenditures do not translate into financial gains for these organizations. Sekhon and Kathuria (2019) indicated a detrimental effect of CSR on FP in India, asserting that increased CSR expenditures could erode shareholder value. Lin et al. (2019) indicated that improved FP outcomes led to a stronger commitment to CSR; however, a robust CSR commitment did not necessarily translate into enhanced FP. Additionally, they reported a significant negative effect of CSR on various FP metrics, particularly return on invested capital, ROA, and ROE. D’Amato and Falivena (2020) conducted an examination of firm-level moderators, specifically focusing on firm size and age, to enhance the understanding of the association between CSR and FP in Western Europe. Their moderation analysis revealed a negative association between CSR and FP in smaller and/or younger firms, which may be attributed to these firms’ limited experience, resources, and reputation.

Given the mixed findings regarding the influence of the SOC dimension on FP, the following hypothesis is proposed:

H2: There is a significant relationship between SOC dimension and FP.

2.2.3 Governance dimension and financial performance

Previous research examining the connection between GOV practices and FP has yielded inconclusive findings. For example, Soana (2011) identified a positive correlation between corporate governance (CG) and FP of banks in Italy. Similarly, Fallatah and Dickins (2012) investigated the link between CG and a firm’s PF, asserting.

that the implementation of CG strategies leads to a notable enhancement in PF among the firms studied. Esteban-Sanchez et al. (2017) reported a positive association between CG and bank FP for banks from developed countries. Rachmawati et al. (2018) analyzed the association between CG and FP across various sectors in Indonesia and discovered that CG positively influenced FP in all sectors examined, with a more pronounced effect in sectors characterized by stricter regulations. Muda et al. (2018) conducted a similar study in Malaysia, utilizing institutional theory, and found that CG positively affected FP across all sectors. Miras-Rodríguez et al. (2018) focused on publicly listed companies to assess the influence of robust CG on firm PF, concluding that firms with a strong CG philosophy tend to exhibit superior PF. Boubakri et al. (2021) explored the interplay between CG and FP among Russian firms, finding a positive impact of CG on FP. In contrast, Guney et al. (2019) demonstrated that the quality of CG exhibited a negative and significant relationship with FP of U. S. companies across 10 industries from 2002 to 2014. Qin et al. (2019) examined the connection between CG and FP in U. S. and China. Their findings indicated that CG positively influences FP. Rahi et al. (2021) reported a positive correlation between GOV and ROA of financial institutions across the Nordic countries. AlSurayyi and AlSughayer (2021) established a causal link between CG and firm PF, demonstrating a strong and significant relationship. Al Amosh et al. (2023) discovered that GOV PF affects the ROA of non-financial firms in Levant countries from 2012 to 2019, which was marked by political instability. Affes and Jarboui (2023) found that the adoption of effective CG practices enhances FP, as measured by the ROE of 160 United Kingdom companies from 2005 to 2018, while considering the unique characteristics of various business sectors. The relationship between CG and FP can be elucidated through “agency theory” (Ross, 1973; Kochhar, 1996), which posits that top executives exhibit a higher propensity to reveal company activities to demonstrate their commitment to SH (Watson et al., 2002). Firms with robust CG frameworks may mitigate conflicts between SH and management, whereas those with inadequate GOV practices often experience heightened agency conflicts and diminished profitability (Miras-Rodríguez et al., 2018).

Conversely, Ahmed and Hamdan (2015) reported a lack of connection between CG and FP in their examination of the relationship between these two variables. Similarly, Atan et al. (2018) observed that GOV dimension had an insignificant effect on FP within Malaysian firms. Shakil et al. (2019) concluded that GOV dimension did not affect the FP of banks in emerging markets. Treepongkaruna and Suttipun (2024) found no correlation between GOV reporting and corporate PF in Thailand. One possible explanation for the observed insignificance in the relationship between GOV dimension and FP is that managers may sometimes prioritize personal interests by overinvesting in ESG initiatives, potentially to mitigate negative publicity, enhance their market image, or attract media attention, which may not necessarily translate into improved FP. In contrast, Yahya and Vaihekoski (2021) discovered a negative association between GOV and ROA in the Nordic region. Buallay et al. (2021) identified a negative correlation between CG and both financial and operational PF in the banking sector. Hira et al. (2023) highlighted a significant negative effect of GOV factors on ROA and ROE in Pakistan.

Given the varied findings concerning the influence of the GOV dimension of SUS on FP, the following hypothesis is proposed:

H3: There is a significant relationship between GOV dimension and FP.

2.3 Research framework

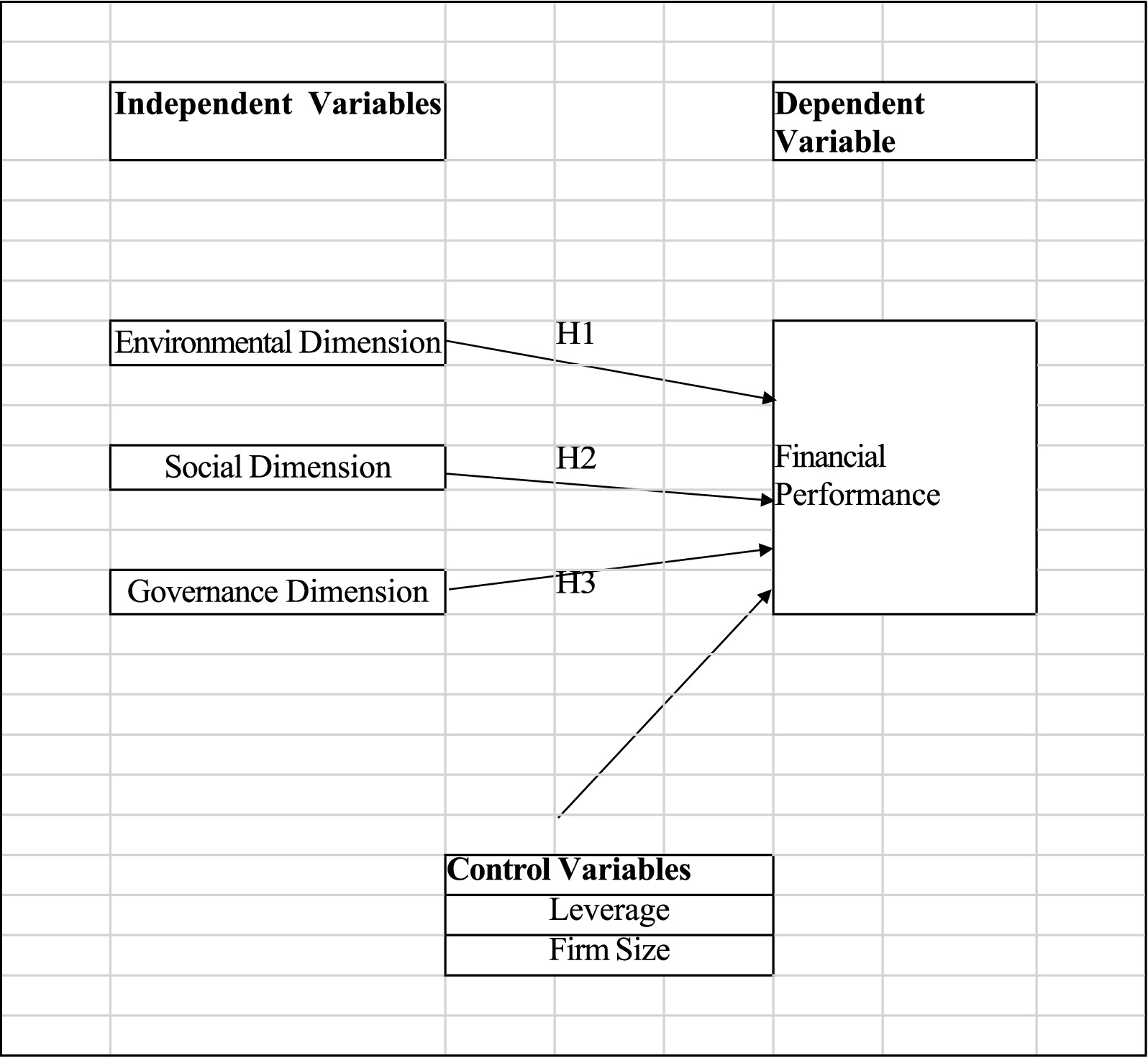

The research framework incorporates one dependent variable, three independent variables, and two control variables, as illustrated in Figure 1.

3 Research methodology

3.1 Data collection

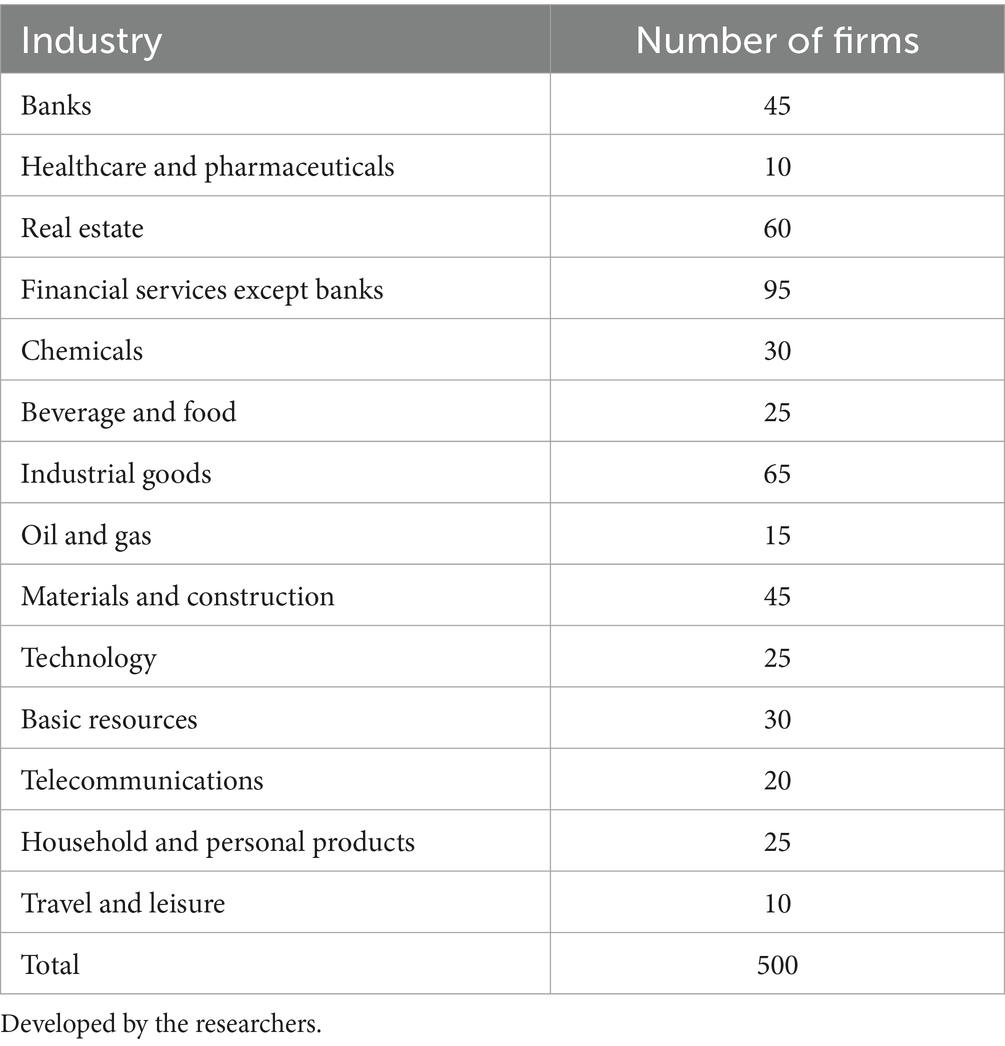

The focus of this study is on the top 100 Egyptian companies ranked by liquidity and activity, as listed on the EGX from 2018 to 2022. The analysis encompasses 14 distinct industry sectors, which include “Industrial Goods, Oil and Gas, Materials and Construction, Banks, Beverage and Food, Real Estate, Basic Resources, Telecommunications, Household and personal Products, Technology, Chemicals, Healthcare and Pharmaceuticals, Financial Services except Banks, and Travel and Leisure” (Table 1). Data was gathered from a diversity of sources, as “financial statements, annual reports, reports from the board of directors, sustainability reports, corporate governance documents, company websites, the EGX, and the Mubasher website”.”

3.2 Measurement of Variables

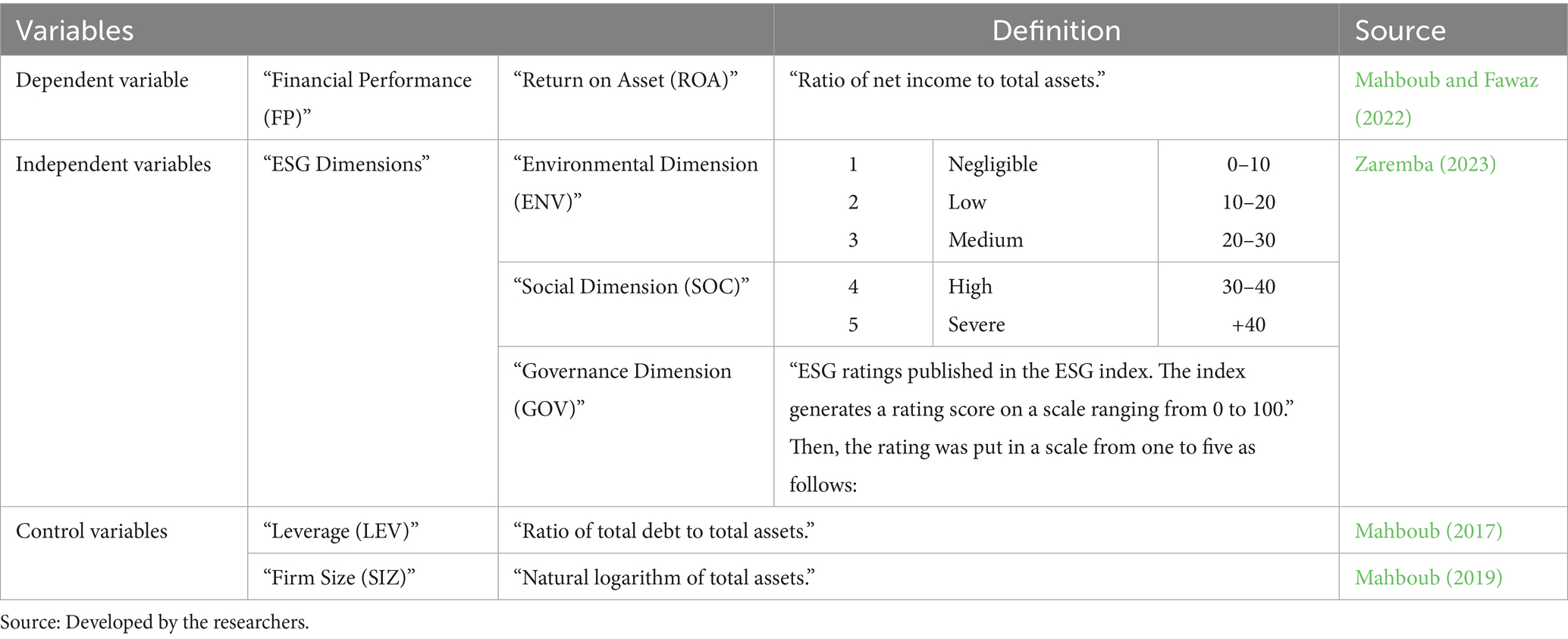

This study aims to examine the impact of ESG dimensions on the FP of firms within the context of Egyptian companies. The Table 2 outlines the measurement methods employed for the “dependent, independent, and control variables” pertinent to this research.

3.3 Regression models

This study examined the effect of ESG dimensions on FP among publicly listed firms s in Egypt using multiple regression models. The models are developed as follows:

The choice of multiple regression analysis is based on its ability to simultaneously assess the impacts of several independent variables controlling for possible confounding variables, notably LEV and SIZ. Including LEV as a major predictor of financial risk affects business profitability and capital structure decisions (Titman and Wessels, 1988). Likewise, SIZ is seen as a major determinant since bigger companies usually have more resources and market power, which clearly affects their financial success (Rajan and Zingales, 1996).

Isolating each ESG dimension in separate models enables us to thoroughly evaluate their individual contributions to FP. Consistent with conclusions by Eccles et al. (2014) that indicate distinct ESG components may have different effects on financial results. Especially in an emerging economy like Egypt, where the integration of ESG policies is still underway (El Ghoul et al., 2011), this separation is essential for understanding the nuanced relationships s between ESG dimensions and FP. Furthermore, enhancing the robustness of the findings is controlling for LEV and SIZ, so guaranteeing that the recorded effects of ESG aspects are not confused by these major factors. This methodical approach not only supports the legitimacy of the results but also offers insightful ideas for stakeholders, so helping them to be informed about ESG investments and policies.

3.4 Analytical techniques

Endogeneity is a major problem in econometric studies, particularly when analyzing the associations between ESG dimensions and FP. This problem can arise from several sources such as “omitted variables,” “measurement errors,” and “bidirectional causality.” In response to the concerns regarding endogeneity, several steps were taken to mitigate its impact on the analysis of the relationships between ESG dimensions and FP. First, to address omitted variable bias, additional control variables were included in the regression models. These variables encompass relevant factors such as firm size and leverage, which are likely to influence both ESG scores and FP. By incorporating these controls, the analysis accounts for potential confounding effects and provides a clearer understanding of the direct impacts of ESG dimensions. Second, measurement errors were minimized by utilizing standardized data sources for ESG ratings and financial metrics. Reliable databases were employed to ensure the accuracy of the data, reducing the likelihood of biased estimates. Third, to tackle the issue of bidirectional causality, robustness checks were conducted using fixed effects models. This technique further validated the findings by controlling for unobserved heterogeneity and addressing potential endogeneity in the models.

4 Analysis and results

4.1 Descriptive statistics

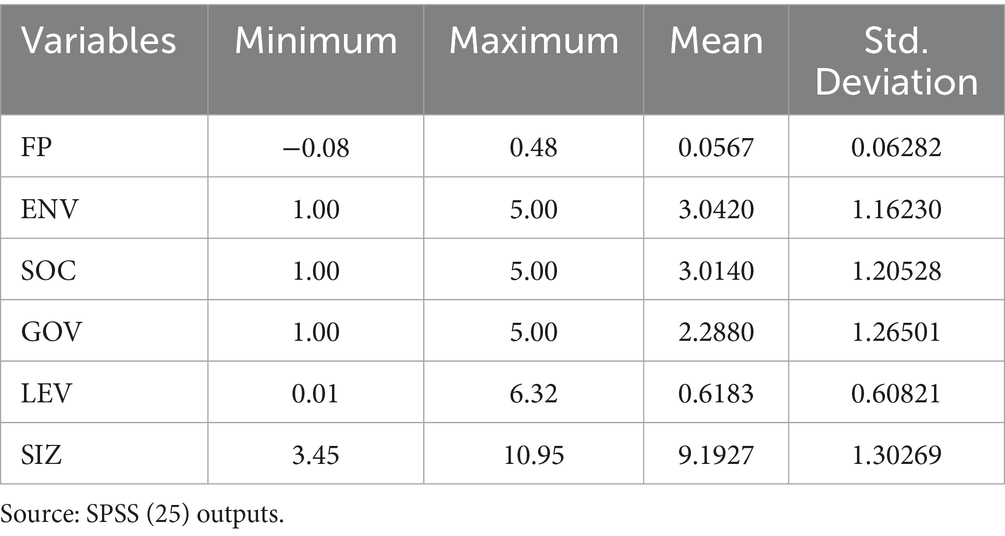

The descriptive statistics detailed in Table 3. The ENV score is notably robust, with a mean of 3.042 and a range from 1 to 5. Similarly, the SOC score also reflects strength, averaging 3.014 and spanning the same range. In contrast, the GOV score presents an average of 2.288, suggesting a moderate level of GOV PF. The dataset encompasses firms of diverse sizes, with a minimum size of 3.45 and a maximum of 10.95, resulting in an average size of 9.1927, which indicates considerable variability in SIZ among the sample. Concerning LEV, the firms demonstrate a moderate LEV level, with values between 0.01 and 6.32 and a mean of 0.6183. Finally, the analysis of ROA reveals significant variation, with values ranging from a minimum of 0.08 to a maximum of 0.48, and an average ROA of 0.0567.

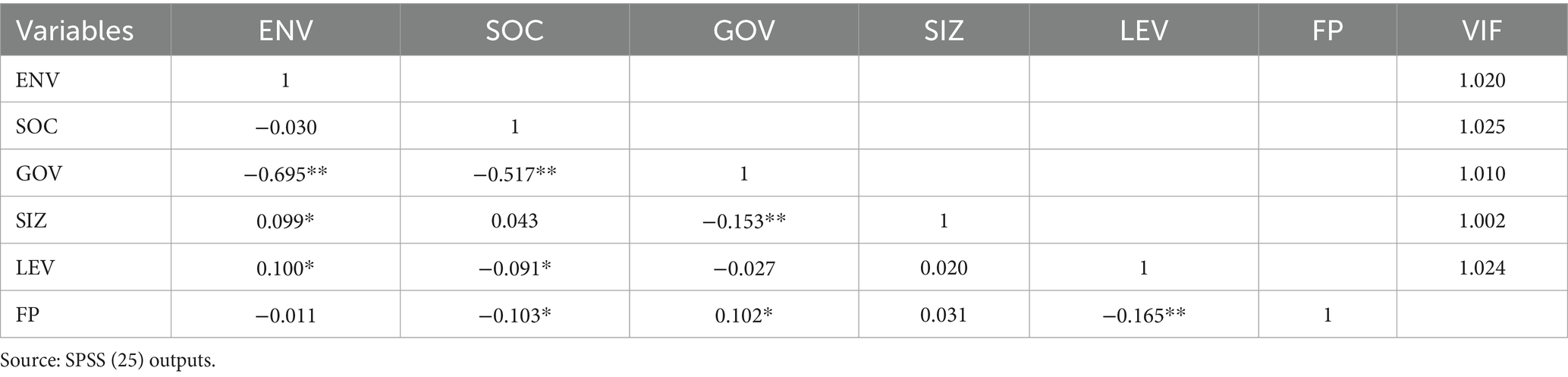

4.2 Correlation analysis

Table 4 illustrates the findings from the correlation. The correlation coefficients for each variable are below 0.695, indicating a clear differentiation among them. A notably positive correlation coefficient is found between ROA and GOV (β = 0.102, p < 0.05), which implies a positive relationship between GOV dimension and FP. Conversely, a significantly negative correlation coefficient is identified between ROA and SOC (β = −0.103, p < 0.05), indicating a negative relationship between SOC dimension and FP. Furthermore, the variance inflation factor (VIF) values for all variables, ranging from 1.002 to 1.025, remains below the critical threshold of 10 (Mahboub, 2022).

4.3 Regression analysis

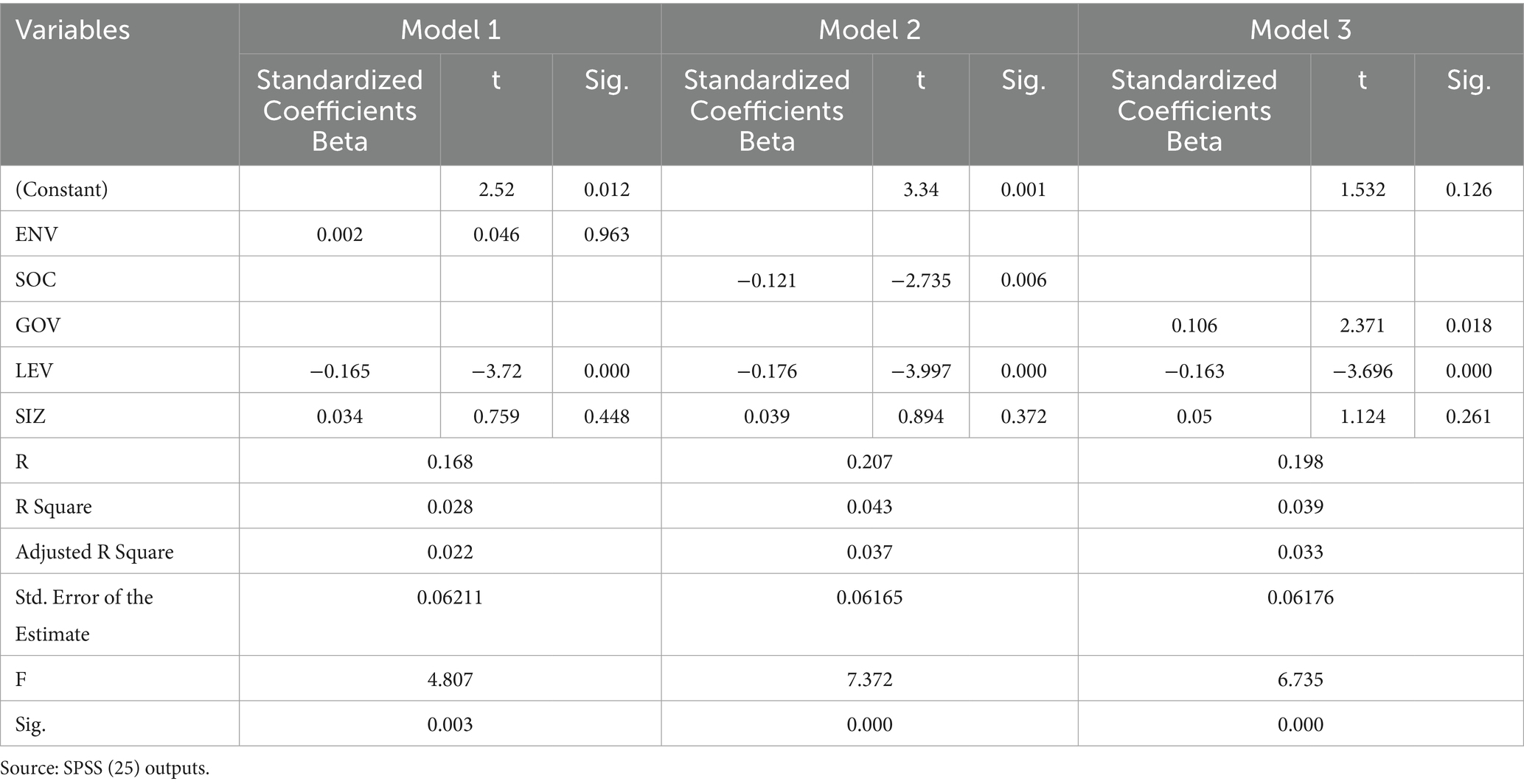

Table 5 presents the regression outcomes for all the variables. The findings from the three models reveal R2 values of 0.028, 0.043, and 0.039, respectively. The F- statistic demonstrates significance at the 5% confidence level. These metrics suggest that the regression models employed to assess the influence of ESG dimensions on FP are statistically robust and valid.

The first hypothesis asserts that ENV dimension significantly influences FP. However, the results do not support this assertion, as ENV dimension does not exhibit a significant effect on FP (α = 0.002, p > 0.05), indicating a lack of impact. Conversely, LEV shows a significant effect on FP (p < 0.05). In contrast, SIZ does not demonstrate a significant effect on FP (p > 0.05). The findings of this research diverge from “stakeholder theory,” which posits that effective management of ENV risks can lead to enhanced opportunities and improved corporate PF. Additionally, the results are inconsistent with “legitimacy theory,” which suggests that management efforts to shape public perception through enhanced corporate image, including the communication of ENV PF, are crucial. The findings align with “agency theory,” which posits that agents and owners possess divergent objectives; specifically, agents prioritize personal benefits, such as enhancing their reputation, while owners focus on profit maximization. Consequently, firms often seek to reduce costs related to ENV initiatives, reallocating those resources to bolster profits for the owners (Setiawati and Hidayat, 2023). These results contrast with studies by Alheet (2019), Abban and Hasan (2021), Bassetti et al. (2021) and Gull et al. (2022) which indicate a positive correlation between a company’s ENV dimension and FP. Conversely, this research corroborates the findings of Handayani (2019), who concluded that ENV dimension does not significantly affect FP.

Hypothesis two asserts that SOC dimension significantly influences FP. The findings corroborate this hypothesis, revealing a significant negative impact of SOC dimension on FP (α = −0.121, p < 0.05), suggesting that enhanced SOC dimension adversely affects FP. The control variable, LEV demonstrates a significant effect on FP (p < 0.05). In contrast, SIZ does not exhibit a significant effect on FP (p > 0.05). These findings appear to validate the “Managerial Opportunism Hypothesis,” which contends that CSR negatively affects FP. This implies that managers may prioritize their personal interests over those of various SH, including employees and shareholders. In scenarios of robust FP, managers might be inclined to reduce SOC expenditures to enhance their own benefits. This pursuit of short-term utility could lead to a compensation structure that favors profit maximization over new SOC investments. Conversely, during periods of declining FP, managers may seek to offset poor FP through prominent SOC initiatives (Hirigoyen and Poulain-Rehm, 2015). Additionally, these results align with the “shareholder value theory” articulated by Milton Friedman (1970), who argues that CSR diverts and exhausts the organization’s limited resources without yielding substantial returns. This perspective posits that SOC initiatives incur costs that ultimately diminish profits. It is articulated that any SOC initiatives undertaken by a corporation should either be mandated by legal requirements or aimed at enhancing shareholder value (Mahboub and Fawaz, 2022). The findings of this investigation align with previous studies conducted by (2014), Mukherjee et al. (2018), Sekhon and Kathuria (2019), and Lin et al. (2019), which established that SOC dimension adversely affects FP. Conversely, these results contradict the findings of Busch and Friede (2018) and Wang et al. (2022), who identified a positive correlation between SOC dimension and FP.

Hypothesis three asserts that GOV dimension significantly influences FP. The findings corroborate this hypothesis, demonstrating that GOV dimension has a significant and positive impact on FP (α = 0.106, p < 0.05), suggesting that superior GOV dimension contributes to enhanced FP. LEV significantly affects FP (p < 0.05). In contrast, SIZ does not significantly influence FP (p > 0.05). The results indicate that effective CG enables managers to gain a clearer understanding of business operations, make informed decisions, and manage risks more effectively, thereby enhancing FP. Furthermore, robust CG fosters transparency and accountability, mitigates costs and risks, and bolsters shareholder value and corporate reputation. Furthermore, effective CG enhances oversight mechanisms and establishes incentives that encourage managers to improve their PF and generate increased economic value (Al-Ahdal et al., 2020; Yiheng et al., 2024). The positive correlation between GOV dimension and FP is corroborated by the research of Qin et al. (2019), Alsurayyi and Alsughayer (2021), Rahi et al. (2021) and Affes and Jarboui (2023), which indicates that GOV dimension positively influences accounting-based measures of company FP, particularly when assessed through ROA. In contrast, findings from studies conducted by Suttipun et al. (2023) and Buallay et al. (2021) suggest that GOV dimension does not significantly affect FP.

4.4 Robustness test

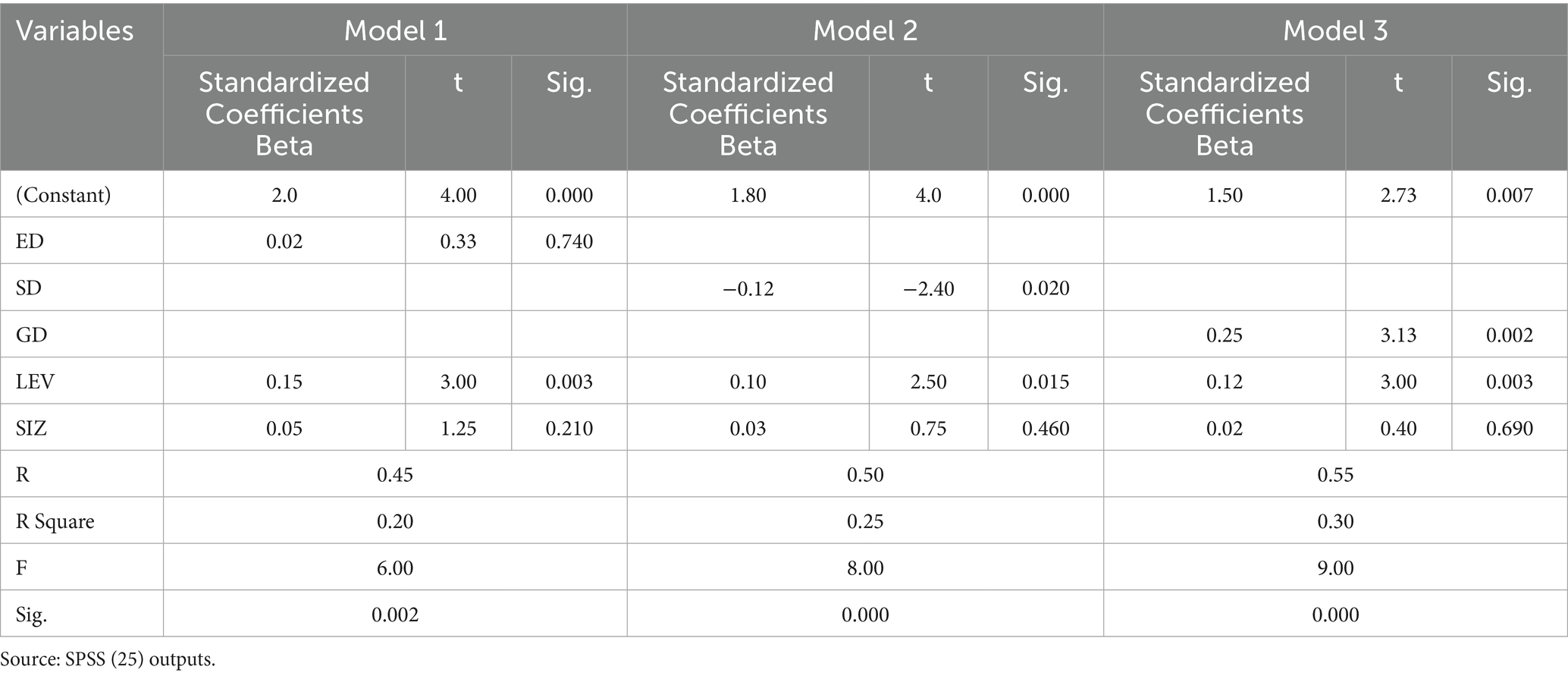

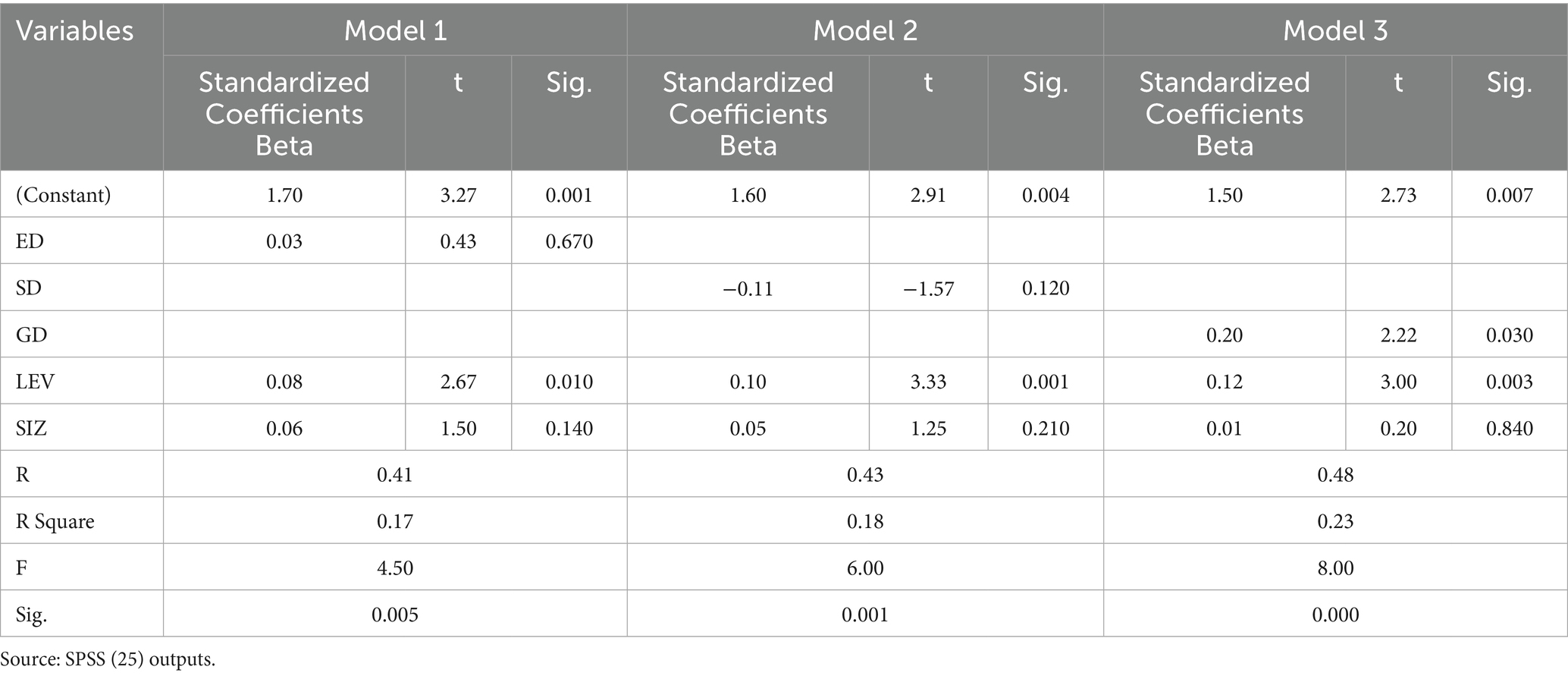

To validate the findings of the research on the effect of ESG dimensions on FP of Egyptian listed firms, additional robustness checks were carried out. ROA was the main indicator of FP employed in the first analysis. Alternative metrics of FP—Return on Equity (ROE) and Earnings Before Interest and Taxes (EBIT)—were used instead to guarantee the accuracy and reliability of the results. These robustness tests aim to assess the consistency of the relationships observed between ESG dimensions and FP across different metrics.

The results of these robustness tests are shown in the Tables 6, 7, which also shed more light on the association between ESG dimensions and FP in the setting of Egyptian companies.

The ANOVA results for ENV model using ROE indicate that the model is statistically significant (p = 0.002). However, ENV shows no significant relationship with FP (p = 0.740). LEV is significant and positively affects FP P (p = 0.003). SIZ remains insignificant. The SOC model shows significant results (p = 0.000). The SOC has a significant negative coefficient (p = 0.020), indicating that higher SOC concerns negatively impact FP. LEV is significant and positively affects FP (p = 0.015), while SIZ remains insignificant. The GOV model is significant (p = 0.000). The GOV variable shows a positive significant relationship with FP (p = 0.002), confirming that GOV positively influences FP. LEV is significant and positively affects FP (p = 0.003). SIZ remains insignificant.

The ANOVA for ENV model using EBIT indicates a significant model (p = 0.005). However, ENV shows no significant relationship with FP (p = 0.670). LEV is positive and significant (p = 0.010), while SIZ remains insignificant. The SOC model is significant (p = 0.001). The SOC has a negative coefficient (p = 0.120), indicating a potential negative impact on FP, though it is not statistically significant. LEV is significant and positively affects FP (p = 0.001), while SIZ remains insignificant. The GOV model is significant (p = 0.000). The GOV shows a positive significant relationship (p = 0.030), confirming that GOV positively influences FP. LEV is also significant with a positive impact (p = 0.003), while SIZ remains insignificant.

The robustness checks using alternative measures of FP (ROE and EBIT) confirm the initial findings of the study. SOC continues to show a negative impact, while GOV maintains a positive influence on FP. The ENV dimension consistently shows no significant relationship, reinforcing the reliability of the results.

5 Discussion

This research examined the effect ESG dimensions have on the FP of publicly traded firms on the EGX from 2018 to 2022. The results point out a nuanced relationship between ESG dimensions and FP, stressing the difficulty of carrying out and evaluating ESG effects in an emerging economy.

5.1 Environmental dimension

The study found that the ENV dimension does not exhibit a significant effect on FP. This finding is at variance from some research in developed countries that points to a positive link between ENV performance and financial outcomes (El-Mohr et al., 2021). This negligible significance in the Egyptian context may be explained by a number of reasons. First, ENV awareness and laws can be less strict than developed countries, hence lessening market incentives for businesses to make investments in ENV sustainability. Companies in Egypt are not very concerned about other facets CSR including the “environment”; this may be ascribed to the inadequate CSR training of the Egyptian stakeholders (Pasha et al., 2024). Second, the expenses linked with ENV projects may exceed the perceived benefits in short term especially if stakeholders do not significantly compensate such efforts. This fits some studies showing how ENV protection efforts might be seen as extra costs without any immediate financial benefit (Pasha et al., 2024).

5.2 Social dimension

The SOC dimension had a significant and negative impact on FP. This result is especially intriguing since it departs from the more often reported positive or neutral associations in the extensive literature (El-Deeb et al., 2023; Ahmad et al., 2024). One possible reason is that SOC dimension including those about “human rights,” “community engagement,” or “human rights” might call for significant upfront investments that do not provide immediate financial returns (Hafez, 2015). Moreover, in the Egyptian context, a lack of stakeholder understanding and appreciation, cultural influences, or implementation issues could limit the impact of SOC initiatives (Wahyono et al., 2024). It is also possible that the market does not immediately compensate SOC performance (Shrestha et al., 2025).

5.3 Governance dimension

The GOV dimension showed a significant and positive influence on financial results. This finding supports several studies emphasizing how crucial strong GOV standards are for increasing financial stability and business value (Mohamed et al., 2013). Good CG systems—such as “board independence,” “transparency,” and “accountability”—can enhance decision-making, lower agency costs, and attract investors, thus improving FP (Shahwan, 2015). These results support the notion that companies primarily utilize GOV dimension to assist their financial operations strong CG techniques might indicate credibility and reliability to investors in the Egyptian environment, where legal systems are still evolving, therefore improving FP (Elshawarby, 2018).

6 Conclusion

The increasing acknowledgment and endorsement of sustainable development and responsible investment within global economies have resulted in the unavoidable emergence and proliferation of ESG investment frameworks. This study investigates the influence of ESG dimensions on FP by analyzing publicly listed companies on the EGX from 2018 to 2022. The findings indicate that the ENV aspect does not significantly affect FP, suggesting that enhanced pollution control measures do not correlate with improved or diminished corporate financial outcomes. In other words, the data does not support the notion that pollution mitigation through improved production techniques can reduce costs and, in turn, boost company profits. Additionally, the analysis reveals that the SOC dimension adversely affects FP, as it compels companies to incur unnecessary expenditures, ultimately harming profitability. Conversely, the GOV dimension demonstrates a notable positive correlation with FP, indicating that the establishment of effective GOV structures that facilitate prompt decision-making and efficient management practices may enhance FP.

This study contributes to the theoretical framework by expanding the current understanding of the interplay between ESG dimensions and FP, focusing specifically on Egypt. As the largest developing nation, Egypt has progressively integrated ESG considerations into its national policies, implementing a range of standards and regulations. Consequently, this study holds significant implications for the advancement of ESG practices and research within developing countries.

The findings present several practical recommendations for corporations, investors, and governmental bodies. For corporations: corporations are urged to improve their ESG performance by embracing sustainable policies and practices, hence balancing environmental stewardship, social obligations, and shareholder interests, therefore improving FP. Moreover, companies have to create a transparent and reliable reporting system so that they can appropriately share their ESG results with stakeholders, therefore building trust and increasing stakeholder involvement. For investors: Investors are advised to give corporate ESG performance top priority in their investing choices, choosing companies with excellent ESG credentials as possible investment targets. This may eventually improve the sustainability of their investment portfolios as well as their long-term returns. For governments: governments play a crucial role in this ecosystem by formulating and improving ESG-related laws and rules that motivate businesses to strengthen their ESG performance. Establishing a strong monitoring and evaluation system is also crucial for continuous evaluation of corporate ESG performance. Governments could, for example, provide incentives and tax advantages to encourage businesses to invest in and improve their ESG projects.

This study presents several limitations that warrant further investigation. The study utilizes a singular financial metric, ROA, to identify the relationship between ESG dimensions and FP, neglecting other significant variables. Consequently, future inquiries should aim to develop a more holistic and multidimensional assessment framework that can effectively elucidate the intricate relationships between these two constructs. Additionally, due to challenges associated with data acquisition, the research was confined to publicly listed companies that have made ESG disclosures. However, non-listed entities and SMEs are crucial to the economic landscape of Egypt, contributing significantly to employment and offering innovative products and services. Future research should incorporate SMEs and investigate which of the three ESG components most significantly influences their FP. Finally, this study is limited to a single national context (Egypt), and there is a notable scarcity of cross-country comparative analyses. Future studies should aim to replicate and evaluate existing models across diverse data environments, regulatory frameworks, and accounting practices to enhance the empirical foundation and enhance comprehension of the fundamental processes that regulate the relationships under consideration. Conducting comparative case studies or empirical research across different countries will facilitate the identification of both similarities and differences in the interplay between ESG and FP within varying institutional contexts.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

RM: Writing – original draft, Writing – review & editing. MG: Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abban, A. R., and Hasan, M. Z. (2021). The causality direction between environmental performance and financial performance in Australian mining companies-a panel data analysis. Resour. Policy 70:101894. doi: 10.1016/j.resourpol.2020.101894

Abughniem, M. S., and Hamdan, A. (2019). Corporate sustainability as an antecedent to the financial performance: an empirical study. Polish J. Manag. Stud. 20, 35–44. doi: 10.17512/pjms.2019.20.2.03

Adediran, S. A., and Alade, S. O. (2013). The impact of environmental accounting on corporate performance in Nigeria. Eur. J. Bus. Manag. 5, 141–151.

Affes, W., and Jarboui, A. (2023). The impact of corporate governance on financial performance: a cross-sector study. Int. J. Discl. Gov. 20, 374–394. doi: 10.1057/s41310-023-00182-8

Ahmad, S., Mohti, W., Khan, M., Irfan, M., and Bhatti, O. K. (2024). Creating a bridge between ESG and firm's financial performance in Asian emerging markets: catalytic role of managerial ability and institutional quality. J. Econ. Adm. Sci. 2024, 1026–4116. doi: 10.1108/JEAS-01-2024-0004

Ahmed, E., and Hamdan, A. (2015). The impact of corporate governance on firm performance: evidence from Bahrain bourse. Int. Manag. Rev. 11:21.

Al Amosh, H., Khatib, S. F., and Ananzeh, H. (2023). Environmental, social and governance impact on financial performance: evidence from the Levant countries. Corp. Gov. 23, 493–513. doi: 10.1108/CG-03-2022-0105

Al-Ahdal, W. M., Alsamhi, M. H., Tabash, M. I., and Farhan, N. H. (2020). The impact of corporate governance on financial performance of Indian and GCC listed firms: an empirical investigation. Res. Int. Bus. Finance 51:101083. doi: 10.1016/j.ribaf.2019.101083

Albertini, E. (2013). Does environmental management improve financial performance? A meta-analytical review. Organ. Environ. 26, 431–457. doi: 10.1177/1086026613510301

Alheet, A. F. (2019). Exploring the impact of environmental sustainability on firm performance in the manufacturing industry in Jordan. Bus. Manag. Econ. Res. 5, 110–117. doi: 10.32861/bmer.58.110.117

Alsurayyi, A. I., and Alsughayer, S. A. (2021). The relationship between corporate governance and firm performance: the effect of internal audit and enterprise resource planning (ERP). Open J. Account. 10, 56–76. doi: 10.4236/ojacct.2021.102006

Arrive, T. J., Feng, M., Yan, Y., and Chege, S. M. (2019). The involvement of telecommunication industry in the road to corporate sustainability and corporate social responsibility commitment. Corp. Soc. Responsib. Environ. Manage. 26, 152–158. doi: 10.1002/csr.1667

Atan, R., Alam, M. M., Said, J., and Zamri, M. (2018). The impacts of environmental, social, and governance factors on firm performance: panel study of Malaysian companies. Manag. Environ. Qual. 29, 182–194. doi: 10.1108/MEQ-03-2017-0033

Aydoğmuş, M., Gülay, G., and Ergun, K. (2022). Impact of ESG performance on firm value and profitability.Borsa Istanb. Rev, 22, S119–S127. doi: 10.1016/j.bir.2022.11.006

Barnett, M. L. (2019). The business case for corporate social responsibility: a critique and an indirect path forward. Bus. Soc. 58, 167–190. doi: 10.1177/0007650316660044

Bassen, A., and Kovács, A. M. (2020). Environmental, social and governance key performance indicators from a capital market perspective. Springer Fachmedien Wiesbaden, pp. 809–820.

Bassetti, T., Blasi, S., and Sedita, S. R. (2021). The management of sustainable development: a longitudinal analysis of the effects of environmental performance on economic performance. Bus. Strat. Environ. 30, 21–37. doi: 10.1002/bse.2607

Bhat, V. N. (1998). Does environmental compliance pay? Ecotoxicology 7, 221–225. doi: 10.1023/A:1008938811813

Boubakri, N., El Ghoul, S., Guedhami, O., and Wang, H. H. (2021). Corporate social responsibility in emerging market economies: determinants, consequences, and future research directions. Emerg. Mark. Rev. 46:100758. doi: 10.1016/j.ememar.2020.100758

Buallay, A., Fadel, S. M., Alajmi, J., and Saudagaran, S. (2021). Sustainability reporting and bank performance after financial crisis: evidence from developed and developing countries. Compet. Rev. 31, 747–770. doi: 10.1108/CR-04-2019-0040

Busch, T., and Friede, G. (2018). The robustness of the corporate social and financial performance relation: a second-order meta-analysis. Corp. Soc. Responsib. Environ. Manag. 25, 583–608. doi: 10.1002/csr.1480

Carnini Pulino, S., Ciaburri, M., Magnanelli, B. S., and Nasta, L. (2022). Does ESG disclosure influence firm performance? Sustainability 14:7595. doi: 10.3390/su14137595

Cek, K., and Eyupoglu, S. (2020). Does environmental, social and governance performance influence economic performance? J. Bus. Econ. Manag. 21, 1165–1184. doi: 10.3846/jbem.2020.12725

Chang, K. (2015). The impacts of environmental performance and propensity disclosure on financial performance: empirical evidence from unbalanced panel data of heavy-pollution industries in China. J. Ind. Eng. Manag. 8, 21–36. doi: 10.3926/jiem.1240

Chang, Y. J., and Lee, B. H. (2022). The impact of ESG activities on firm value: multi-level analysis of industrial characteristics. Sustainability 14:14444. doi: 10.3390/su142114444

Chernev, A., and Blair, S. (2015). Doing well by doing good: the benevolent halo of corporate social responsibility. J. Consum. Res. 41, 1412–1425. doi: 10.1086/680089

Clarkson, P. M., Li, Y., Richardson, G. D., and Vasvari, F. P. (2011). Does it really pay to be green? Determinants and consequences of proactive environmental strategies. J. Account. Public Policy 30, 122–144. doi: 10.1016/j.jaccpubpol.2010.09.013

Cordeiro, J. J., and Sarkis, J. (1997). Environmental proactivism and firm performance: evidence from security analyst earnings forecasts. Bus. Strat. Environ. 6, 104–114. doi: 10.1002/(SICI)1099-0836(199705)6:2<104::AID-BSE102>3.0.CO;2-T

Cormier, D., Magnan, M., and Morard, B. (1993). The impact of corporate pollution on market valuation: some empirical evidence. Ecol. Econ. 8, 135–155. doi: 10.1016/0921-8009(93)90041-4

D’Amato, A., and Falivena, C. (2020). Corporate social responsibility and firm value: do firm size and age matter? Empirical evidence from European listed companies. Corp. Soc. Responsib. Environ. Manag. 27, 909–924. doi: 10.1002/csr.1855

David Diltz, J. (1995). The private cost of socially responsible investing. Appl. Financ. Econ. 5, 69–77. doi: 10.1080/758529174

Davis, K. (1973). The case for and against business assumption of social responsibilities. Acad. Manag. J. 16, 312–322. doi: 10.2307/255331

Delmas, M., and Toffel, M. W. (2004). Stakeholders and environmental management practices: an institutional framework. Bus. Strat. Environ. 13, 209–222. doi: 10.1002/bse.409

Eccles, R. G., Ioannou, I., and Serafeim, G. (2014). The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 60, 2835–2857. doi: 10.1287/mnsc.2014.1984

El Ghoul, S., Guedhami, O., Kwok, C. C., and Mishra, D. R. (2011). Does corporate social responsibility affect the cost of capital? J. Bank. Finance 35, 2388–2406. doi: 10.1016/j.jbankfin.2011.02.007

El Khoury, R., Nasrallah, N., and Alareeni, B. (2023). ESG and financial performance of banks in the MENAT region: concavity–convexity patterns. J. Sustain. Financ. Invest. 13, 406–430. doi: 10.1080/20430795.2021.1929807

El-Deeb, M. S., Ismail, T. H., and El Banna, A. A. (2023). Does audit quality moderate the impact of environmental, social and governance disclosure on firm value? Further evidence from Egypt. J. Humanit. Appl. Soc. Sci. 5, 293–322. doi: 10.1108/JHASS-11-2022-0155

Elmaghrabi, M. (2018). Corporate social reporting in Egypt: nature and determinants. J. Financ. Bus. Res. 19, 1–37. doi: 10.21608/jsst.2018.62737

El-Mohr, S. I., Elshahat, I., Elshahat, A., and Hassan, M. B. (2021). The association between environmental performance and financial performance: the case of Egypt. Acad. Account. Financ. Stud. J. 25, 1–16.

Elshawarby, M. (2018). The effect of environmental and social corporate governance on the financial performance with special focus on the Egyptian private sector companies. J. Account. Mark. 7:269. doi: 10.4172/2168-9601.1000269

Endrikat, J., Guenther, E., and Hoppe, H. (2014). Making sense of conflicting empirical findings: a meta-analytic review of the relationship between corporate environmental and financial performance. Eur. Manag. J. 32, 735–751. doi: 10.1016/j.emj.2013.12.004

Escrig-Olmedo, E., Rivera-Lirio, J. M., Muñoz-Torres, M. J., and Fernández-Izquierdo, M. Á. (2017). Integrating multiple ESG investors' preferences into sustainable investment: a fuzzy multicriteria methodological approach. J. Clean. Prod. 162, 1334–1345. doi: 10.1016/j.jclepro.2017.06.143

Esteban-Sanchez, P., de la Cuesta-Gonzalez, M., and Paredes-Gazquez, J. D. (2017). Corporate social performance and its relation with corporate financial performance: international evidence in the banking industry. J. Clean. Prod. 162, 1102–1110. doi: 10.1016/j.jclepro.2017.06.127

Ezeagba, C. E., Rachael, J. A. C., and Chiamaka, U. (2017). Environmental accounting disclosures and financial performance: a study of selected food and beverage companies in Nigeria (2006-2015). Int. J. Acad. Res. Bus. Soc. Sci. 7, 162–174. doi: 10.6007/IJARBSS/v7-i9/3315

Fallatah, Y., and Dickins, D. (2012). Corporate governance and firm performance and value in Saudi Arabia. Afr. J. Bus. Manage. 6, 10025–10034. doi: 10.5897/AJBM12.008

Freedman, M., and Jaggi, B. (1992). An investigation of the long-run relationship between pollution performance and economic performance: the case of pulp and paper firms. Crit. Perspect. Account. 3, 315–336. doi: 10.1016/1045-2354(92)90024-L

Friedman, M. (1970). The social responsibility of business is to increase its profits. New York Times, September 13th, pp. 122–126.

Friedman, M. (2007). “The social responsibility of a business is to increase its profits” in Corporate ethics and corporate governance. ed. M. Friedman (Berlin Heidelberg: Springer), 173–178.

Friedman, M., and Allen, G. C. (1970). The counter-revolution in monetary theory. First Wincott memorial lecture delivered at the senate house, Institute of Economic Affairs, University of London.

Friedman, A., and Miles, S. (2006). Stakeholders: Theory and practice. Oxford: Oxford University Press.

Fu, T., and Li, J. (2023). An empirical analysis of the impact of ESG on financial performance: the moderating role of digital transformation. Front. Environ. Sci, 11, 1256052. doi: 10.3389/fenvs.2023.1256052

Galant, A., and Cadez, S. (2017). Corporate social responsibility and financial performance relationship: a review of measurement approaches. Econ. Res. 30, 676–693. doi: 10.1080/1331677X.2017.1313122

Ghardallou, W. (2022). Corporate sustainability and firm performance: the moderating role of CEO education and tenure. Sustainability 14:3513. doi: 10.3390/su14063513

Ghardallou, W., and Alessa, N. (2022). Corporate social responsibility and firm performance in GCC countries: a panel smooth transition regression model. Sustainability 14:7908. doi: 10.3390/su14137908

Grewatsch, S., and Kleindienst, I. (2017). When does it pay to be good? Moderators and mediators in the corporate sustainability–corporate financial performance relationship: a critical review. J. Bus. Ethics 145, 383–416. doi: 10.1007/s10551-015-2852-5

Guenster, N., Bauer, R., Derwall, J., and Koedijk, K. (2011). The economic value of corporate eco- efficiency. Eur. Financ. Manag. 17, 679–704. doi: 10.1111/j.1468-036X.2009.00532.x

Gull, A. A., Saeed, A., Suleman, M. T., and Mushtaq, R. (2022). Revisiting the association between environmental performance and financial performance: does the level of environmental orientation matter? Corp. Soc. Responsib. Environ. Manage. 29, 1647–1662. doi: 10.1002/csr.2310

Guney, Y., Hernandez-Perdomo, E., and Rocco, C. M. (2019). Does relative strength in corporate governance improve corporate performance? Empirical evidence using MCDA approach. J. Oper. Res. Soc. 71, 1593–1618. doi: 10.1080/01605682.2019.1621216

Hafez, H. M. (2015). Corporate social responsibility and financial performance: an empirical study on Egyptian banks. Corp. Own. Control 12, 107–127. doi: 10.22495/cocv12i2p9

Haffar, M., and Searcy, C. (2017). Classification of trade-offs encountered in the practice of corporate sustainability. J. Bus. Ethics 140, 495–522. doi: 10.1007/s10551-015-2678-1

Hanafi, R. A. (2006). An exploration of corporate social and environmental disclosure in Egypt and the UK: A comparative study. (Doctoral dissertation, University of Glasgow).

Handayani, M. K. Y., (2019). The effect of ESG performance on economic performance in the high profile industry in Indonesia. J Int Bus Econ, 7, 112–121. doi: 10.15640/jibe.v7n2a12

Hart, S. L. (1995). A natural-resource-based view of the firm. Acad. Manag. Rev. 20, 986–1014. doi: 10.2307/258963

Hart, S., and Ahuja, G. (1996). Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Bus. Strat. Environ. 5, 30–37. doi: 10.1002/(SICI)1099-0836(199603)5:1<30::AID-BSE38>3.0.CO;2-Q

Hill, J. (2020). Environmental, social, and governance (ESG) investing: A balanced analysis of the theory and practice of a sustainable portfolio. Cambridge, MA: Academic Press.

Hira, N. U., Ahmad, W., Amanat, A., Khattak, S. H., Khan, M. T., Khan, S., et al. (2023). The impact of environmental, social and governance factors (ESG) on firms’ financial performance: evidence from Pakistan. J. Posit. Sch. Psychol. 1, 383–404.

Hirigoyen, G., and Poulain-Rehm, T. (2015). Relationships between corporate social responsibility and financial performance: what is the causality? J. Bus. Manag. 4, 18–43. doi: 10.12735/jbm.v4i1p18

Horváthová, E. (2012). The impact of environmental performance on firm performance: short-term costs and long-term benefits? Ecol. Econ. 84, 91–97. doi: 10.1016/j.ecolecon.2012.10.001

Hussain, N., Rigoni, U., and Cavezzali, E. (2018). Does it pay to be sustainable? Looking inside the black box of the relationship between sustainability performance and financial performance. Corp. Soc. Responsib. Environ. Manage. 25, 1198–1211. doi: 10.1002/csr.1631

Hussainey, K., Elsayed, M., and Razik, M. A. (2011). Factors affecting corporate social responsibility disclosure in Egypt. Corp. Own. Control. 8, 432–443. doi: 10.22495/cocv8i4c4art5

Ikram, M., Sroufe, R., Mohsin, M., Solangi, Y. A., Shah, S. Z. A., and Shahzad, F. (2020). Does CSR influence firm performance? A longitudinal study of SME sectors of Pakistan. J. Glob. Responsib. 11, 27–53. doi: 10.1108/JGR-12-2018-0088

Indriastuti, M. (2021). The effect of the carbon and environmental performance on sustainability report. Riset Akunt. Keuang. Indones. 6, 105–116. doi: 10.23917/reaksi.v6i1.13826

Jaggi, B., and Freedman, M. (1992). An examination of the impact of pollution performance on economic and market performance: pulp and paper firms. J. Bus. Finan. Account. 19, 697–713. doi: 10.1111/j.1468-5957.1992.tb00652.x

Jensen, M. C. (2002). Value maximization, stakeholder theory, and the corporate objective function. Bus. Ethics Q. 12, 235–256. doi: 10.2307/3857812

Kang, W., and Jung, M. (2020). Effect of ESG activities and firm’s financial characteristics. Korean J. Financ. Stud. 49, 681–707. doi: 10.26845/KJFS.2020.10.49.5.681

Kim, K. H., Kim, M., and Qian, C. (2018). Effects of corporate social responsibility on corporate financial performance: a competitive-action perspective. J. Manage. 44, 1097–1118. doi: 10.1177/0149206315602530

King, A. A., and Lenox, M. J. (2001). Does it really pay to be green? An empirical study of firm environmental and financial performance: an empirical study of firm environmental and financial performance. J. Ind. Ecol. 5, 105–116. doi: 10.1162/108819801753358526

Kochhar, R. (1996). Explaining firm capital structure: the role of agency theory vs. transaction cost economics. Strateg. Manage. J. 17, 713–728. doi: 10.1002/(SICI)1097-0266(199611)17:9<713::AID-SMJ844>3.0.CO;2-9

Konar, S., and Cohen, M. A. (2001). Does the market value environmental performance? Rev. Econ. Stat. 83, 281–289. doi: 10.1162/00346530151143815

Küçükbay, F., and Fazlılar, T. A. (2016). The relationship between firms’ environmental performance and financial performance: the case of Turkey. Kaposvár, Hungary.

Lassala, C., Apetrei, A., and Sapena, J. (2017). Sustainability matter and financial performance of companies. Sustainability 9:1498. doi: 10.3390/su9091498

Lin, W. L., Law, S. H., Ho, J. A., and Sambasivan, M. (2019). The causality direction of the corporate social responsibility–corporate financial performance nexus: application of panel vector autoregression approach. N. Am. J. Econ. Finance 48, 401–418. doi: 10.1016/j.najef.2019.03.004

Liu, Z. (2020). Unraveling the complex relationship between environmental and financial performance- a multilevel longitudinal analysis. Int. J. Prod. Econ. 219, 328–340. doi: 10.1016/j.ijpe.2019.07.005

Lo, S. F., and Sheu, H. J. (2010). Does corporate sustainability matter to investors? Afr. J. Bus. Manage. 4:2856.

Lu, W., and Taylor, M. E. (2016). Which factors moderate the relationship between sustainability performance and financial performance? A meta-analysis study. J. Int. Account. Res. 15, 1–15. doi: 10.2308/jiar-51103

Ma, Y., Zhang, Q., and Yin, H. (2020). Environmental management and labor productivity: the moderating role of quality management. J. Environ. Manag. 255:109795. doi: 10.1016/j.jenvman.2019.109795

Mahboub, R. M. (2017). Main determinants of financial reporting quality in the Lebanese banking sector. Eur. Res. Stud. J. 2017, 706–726. doi: 10.35808/ersj/922

Mahboub, R. M. (2019). The determinants of forward-looking information disclosure in annual reports of Lebanese commercial banks. Acad. Account. Financ. Stud. J. 23, 1–18.

Mahboub, R. M. (2022). Factors affecting accounting students’ performance at university in Lebanon. BAU J. 3, 1–28. doi: 10.54729/QBUM4617

Mahboub, R. M., and Fawaz, L. I. (2022). Impact of corporate social responsibility practices on financial performance: evidence from selected MENA region commercial banks. BAU J. 3, 1–17. doi: 10.54729/MOCW5159

Margolis, J. D., Elfenbein, H. A., and Walsh, J. P. (2007). Does it pay to be good? A meta-analysis and redirection of research on the relationship between corporate social responsibility and financial performance. Ann Arbor 1001, 41234–48109.

Meckling, W. H., and Jensen, M. C. (1976). Theory of the firm. Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 3, 305–360. doi: 10.1016/0304-405X(76)90026-X

Mikial, M., Marwa, T., Fuadah, L., and Meutia, I. (2019). The effects of environmental performance and environmental information disclosure on financial performance in companies listed on the Indonesia stock exchange. Arch. Bus. Res. 7, 67–77. doi: 10.14738/abr.711.7379

Miras-Rodríguez, M. D. M., Martínez-Martínez, D., and Escobar-Pérez, B. (2018). Which corporate governance mechanisms drive CSR disclosure practices in emerging countries? Sustainability 11:61. doi: 10.3390/su11010061

Mohamed, E., Basuony, M., and Badawi, A. (2013). The impact of corporate governance on firm performance in Egyptian listed companies. Corp. Own. Control. 11, 691–705. doi: 10.22495/cocv11i1c7art6

Molloy, J., Bell, B., Clout, M. N., de Lange, P. J., Gibbs, G. W., Given, D. R., et al. (2002). Classifying species according to threat of extinction-a system for New Zealand Dept. of Conservation. Biodiversity Recovery Unit, Threatened Species occasional publication, 22.

Moneva, J. M., and Ortas, E. (2010). Corporate environmental and financial performance: a multivariate approach. Ind. Manag. Data Syst. 110, 193–210. doi: 10.1108/02635571011020304

Montabon, F., Sroufe, R., and Narasimhan, R. (2007). An examination of corporate reporting, environmental management practices and firm performance. J. Oper. Manag. 25, 998–1014. doi: 10.1016/j.jom.2006.10.003

Mousiolis, D. T., and Zaridis, A. D. (2014). The effects in the structure of an organization through the implementation of policies from corporate social responsibility (CSR). Procedia Soc. Behav. Sci. 148, 634–638. doi: 10.1016/j.sbspro.2014.07.091

Muda, M., Azmi, N. F., and Haniffa, R. M. (2018). Corporate governance and firm performance in different economic sectors: evidence from Malaysia. J. Appl. Account. Res. 19, 297–318.

Muhammad, N., Scrimgeour, F., Reddy, K., and Abidin, S. (2015). The relationship between environmental performance and financial performance in periods of growth and contraction: evidence from Australian publicly listed companies. J. Clean. Prod. 102, 324–332. doi: 10.1016/j.jclepro.2015.04.039

Mukherjee, A., Bird, R., and Duppati, G. (2018). Mandatory corporate social responsibility: the Indian experience. J. Contemp. Account. Econ. 14, 254–265. doi: 10.1016/j.jcae.2018.06.002

Mumtaz, M., and Pirzada, S. S. (2014). Impact of corporate social responsibility on corporate financial performance. Res. Humanit. Soc. Sci. 4, 7–15.

Nakao, Y., Nakano, M., Amano, A., Kokubu, K., Matsumura, K., and Gemba, K. (2007). Corporate environmental and financial performances and the effects of information-based instruments of environmental policy in Japan. Int. J. Environ. Sustain. Dev. 6, 95–112. doi: 10.1504/IJESD.2007.012739

Nollet, J., Filis, G., and Mitrokostas, E. (2016). Corporate social responsibility and financial performance: a non- linear and disaggregated approach. Econ. Model. 52, 400–407. doi: 10.1016/j.econmod.2015.09.019

Okafor, A., Adeleye, B. N., and Adusei, M. (2021). Corporate social responsibility and financial performance: evidence from US tech firms. J. Clean. Prod. 292:126078. doi: 10.1016/j.jclepro.2021.126078

Olsen, B. C., Awuah-Offei, K., and Bumblauskas, D. (2021). Setting materiality thresholds for ESG disclosures: a case study of US mine safety disclosures. Resour. Policy 70:101914. doi: 10.1016/j.resourpol.2020.101914

Omnamasivaya, B., and Prasad, M. S. V. (2017). Does financial performance really improve the environmental accounting disclosure practices in India: an empirical evidence from nifty companies. Afr. J. Econ. Sustain. Dev. 6, 52–66. doi: 10.1504/AJESD.2017.082801

Orlitzky, M., Schmidt, F. L., and Rynes, S. L. (2003). Corporate social and financial performance: a meta- analysis. Organ. Stud. 24, 403–441. doi: 10.1177/0170840603024003910

Pasha, R., Wahba, H., and Farouk, N. E. (2024). The impact of environmental, social and governance firm-level rankings on determinants of firm value: an empirical evidence from Egypt. Arab J. Manag. 1:140. doi: 10.21608/aja.2024.293642.1659

Patten, D. M. (2002). The relation between environmental performance and environmental disclosure: a research note. Account. Organ. Soc. 27, 763–773. doi: 10.1016/S0361-3682(02)00028-4

Porter, M. E., and Linde, C. V. D. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9, 97–118. doi: 10.1257/jep.9.4.97

Preston, L., and O’Bannon, D. (1997). The corporate social-financial performance relationship. A typology and analysis. Bus. Soc. 36, 419–429. doi: 10.1177/000765039703600406

Qin, X., Heng, Y., and Zhou, Y. (2019). Corporate governance and firm performance: evidence from the technology industry. Technol. Soc. 58:101138.

Rachmawati, I. A., Basuki, T. M., and Yulianto, A. (2018). Corporate governance and firm performance in different economic sectors: evidence from Indonesia. J. Asian Financ. Econ. Bus. 5, 71–81.

Rahi, A. F., Akter, R., and Johansson, J. (2021). Do sustainability practices influence financial performance? Evidence from the Nordic financial industry. Account. Res. J. 35, 292–314. doi: 10.1108/ARJ-12-2020-0373

Rajan, R., and Zingales, L. (1996). Financial dependence and growth. NBER Working Paper Series, National Bureau of Economic Research, Cambridge.

Rassier, D. G., and Earnhart, D. (2011). Short-run and long-run implications of environmental regulation on financial performance. Contemp. Econ. Policy 29, 357–373. doi: 10.1111/j.1465-7287.2010.00237.x

Rezaee, Z. (2016). Business sustainability research: a theoretical and integrated perspective. J. Account. Lit. 36, 48–64. doi: 10.1016/j.acclit.2016.05.003

Rizk, R., Dixon, R., and Woodhead, A. (2008). Corporate social and environmental reporting: a survey of disclosure practices in Egypt. Soc. Responsib. J. 4, 306–323. doi: 10.1108/17471110810892839

Ross, S. A. (1973). The economic theory of agency: the principal's problem. Am. Econ. Rev. 63, 134–139.

Russo, M. V., and Fouts, P. A. (1997). A resource-based perspective on corporate environmental performance and profitability. Acad. Manag. J. 40, 534–559. doi: 10.2307/257052

Salama, A. (2009). “Egypt: social responsibility disclosure practices” in Global practices of corporate social responsibility. ed. A. Salama (Berlin, Heidelberg: Springer), 325–342.

Sameer, I. (2021). Impact of corporate social responsibility on organization’s financial performance: evidence from Maldives public limited companies. Future Bus. J. 7:29. doi: 10.1186/s43093-021-00075-8

Şeker, Y., and Şengür, E. D. (2021). The impact of environmental, social, and governance (ESG) performance on financial reporting quality: international evidence. Ekonomika 100, 190–212. doi: 10.15388/Ekon.2021.100.2.9

Sekhon, A. K., and Kathuria, L. M. (2019). Analyzing the impact of corporate social responsibility on corporate financial performance: evidence from top Indian firms. Corp. Gov. 20, 143–157. doi: 10.1108/CG-04-2019-0135