- School of Digital Commerce, Changzhou Vocational Institute of Textile and Garment, Changzhou, China

Introduction: As a new enterprise development model, digitalization is an important driver for improving energy efficiency and can provide carbon reduction services across the entire chain.

Methods: In this study, we utilize the panel data of relevant listed firms from 2009 to 2022 to investigate the causal impact of digital transformation on corporate energy efficiency at each node of the supply chain and discuss the moderating effects of digital finance and public environmental concern.

Results: The empirical results indicate that digital transformation can enhance corporate energy efficiency, and has a forward spillover efficiency-enhancing effect. Further, when a firm adopts digital transformation, it has stronger green innovation and better energy structure leading to higher energy efficiency, and improves the energy efficiency of downstream firms through enhanced green innovation. Moreover, both digital finance and public environmental concern show significant positive moderating effects, and digital finance can positively moderate the contribution of corporate digital transformation to the energy efficiency of downstream firms. Finally, we investigate the heterogeneous treatment impact across different firms, and find that the positive effect is more pronounced in a subsample of state-owned and eastern firms, short-distance downstream firms and downstream firms with low-resource endowments.

Discussion: Therefore, a platform should be provided for enterprises to promote digital transformation and unblock the conduction path of green innovation and energy structure in order to realize the green transformation of the entire supply chain.

1 Introduction

Carbon dioxide emissions are the main cause of global warming, negatively affecting human settlements, ecosystems and economic development (Song and Zhang, 2020). In response to climate change, countries around the world have been successively pursuing carbon emission reduction policies and low-carbon economic transformation, with a view to improving the people's lives, pollution control, and eco-environmental protection. As a developing country, China has long relied on large-scale resource inputs to achieve rapid industrialization and urbanization, leading to rapid economic growth. Nevertheless, China's primitive development model, distinguished by extensive energy utilization and severe pollution, has exacerbated the contradiction between energy supply and demand. As a result, China has emerged as the preeminent carbon emitter globally (Yang et al., 2022). In 2023, its carbon dioxide emissions accounted for around 34% of global carbon dioxide emissions, maintaining its position as the leading emitter worldwide. Moreover, China's carbon emissions have outpaced the cumulative emissions of developed countries since 2020 and exceeded them by 15% in 2023. The latest China Energy Development Report indicates that China's total energy consumption in 2023 amounted to 5.72 billion tons of standard coal, with coal comprising 3.17 billion tons, which accounts for 55.4% of total consumption. This statistic demonstrates that coal predominates in China's energy system. At this stage, its energy efficiency ranks 73rd in the world, lagging far behind not only developed countries such as Australia and France, but also developing countries such as Russia and India. To alleviate the growing challenges of energy scarcity and environmental pollution, the Chinese government has exerted significant efforts in energy saving and emission control, and established a series of energy strategies for sustainable growth (Cong et al., 2021). Increasing the energy efficiency of firms and realizing a low-carbon transition is crucial for China to achieve its dual-carbon goals. Specifically, improving energy efficiency not only reduces energy consumption and eases the pressure on energy supply, but also cuts down the production of greenhouse gases and effectively mitigates the adverse effects of climate change on China, while guaranteeing stable economic growth and enhancing people's living conditions (Shi et al., 2022; Bhadoriya et al., 2022; Chen et al., 2023). However, enhancing the structure of energy supply and augmenting energy utilization efficiency has emerged as a significant challenge for China's existing environmental quality regulation.

In the past decade, the booming development of the digital economy has generated a new incentive for economic progress (Baskerville et al., 2020). As an emerging country, China has improved its overall layout based on industrial foundations and advocated its deep integration with the real economy. The scale of China's digital economy reached 53.9 trillion yuan in 2023, accounting for 42.8% of the GDP, and increasing by 1.3 percentage points from the previous year. Currently, the global economy is undergoing a new phase of digital revolution. It relies on cutting-edge digital technologies that are expanding globally, representing an emerging industrial revolution. The exponential growth and accessibility of digital technologies have alleviated environmental pressures and created new endogenous engines of growth (Ritala et al., 2021). As digital technologies are increasingly integrated into products, services, and processes (Lange et al., 2020), digital transformation based on digital switching and digital upgrading is taking place in an increasing number of firms. By combing through the announcements disclosed by listed firms in Wind, we found that more than 700 mainboard firms in China had actively implemented digital transformation. The number of these firms has been growing at an average annual rate of more than 150%, covering almost all industries. Moreover, technological innovation is recognized as a crucial driver of energy efficiency in all industries. More importantly, corporate digital transformation refers to using digital tools to optimize resource allocation, promoting technological innovation and improving productivity (Huang et al., 2023). Nevertheless, previous research has not been sufficient to provide a complete framework to tackle the question of whether digital transformation can contribute to corporate energy efficiency. Therefore, this research answers three specific questions. First, does digital transformation improve corporate energy efficiency? Second, if the effects are verified, what are the mechanisms that underlie it? Finally, is there a non-negligible bridging role for digital finance and public environmental concern in the enhancing effect of digital transformation on corporate energy efficiency? And what are the differences in the effects in terms of firm characteristics and geographical location? Examining these challenges is crucial for China to strategically and comprehensively harness the eco-environment benefit of digital transformation, promoting the energy efficiency of firms and achieving energy-saving and emission reduction.

The fundamental characteristics of digital transformation, such as reshaping business operations, increasing productivity and enhancing innovation (Ren et al., 2021), can have a profound impact on corporate energy efficiency. Moreover, accelerating the application of digital technologies can guide green technological innovation and energy utilization planning (Wang et al., 2021), thereby changing consumption patterns, and promoting the realization of energy saving and emission control goals. Existing studies have mainly explored the impact and mechanism of digital transformation on business performance (Kaur and Sood, 2017; Ribeiro-Navarrete et al., 2021; Llopis-Albert et al., 2021; Kraus et al., 2021; Li et al., 2023; Liu and Xiu, 2015), and have not yet focused on the impact of digital transformation on corporate energy efficiency and how this impact varies upstream and downstream in a company's supply chain (Shah et al., 2016; Chaudhari et al., 2023; Shah et al., 2025). Hence, the primary contribution of this research is threefold: first, this paper uses textual analysis to evaluate firm-level digital transformation, and analyzes the effects of firms' digital transformation on their energy efficiency and that of their upstream and downstream firms from the perspective of supply chain network (Shah et al., 2017; Jani et al., 2021; Ghosh et al., 2022), bring diverse perspectives to scholars exploring the limited but emerging literature. Second, this study adds to a more thorough comprehension of the mechanisms through which digital transformation affects corporate energy efficiency by investigating the mediating roles of green innovation and energy structure, supporting the green development of firms empowered by digital transformation. Finally, digital finance and public environmental concern are selected as moderating variables to test whether and what kind of moderating effects exist in the process of digital transformation affecting corporate energy efficiency. Moreover, this research considers corporate heterogeneity to deepen our investigation by identifying the impacts in terms of ownership type, region, distance and resource endowment. This elicits some meaningful experiences for optimizing corporate digital transformation policies and sustainable economic development and providing a reference for developing countries to upgrade traditional energy-intensive firms to achieve energy structure transformation.

The subsequent sections of this study are structured as follows. Section 2 shows a literature review and hypothesis development. Section 3 introduces data, variables and methods. Section 4 summarizes and discusses the research results. Section 5 proposes the conclusions and policy implications.

2 Literature review and hypothesis development

2.1 Literature review

There is no uniform conclusion on the definition of digital transformation within discussions in academia. Reis et al. (2018) argues that digital transformation is the leveraging of digital technologies to facilitate substantial business revolution within an enterprise and directly impact the lives and work of its users. Vial (2019) believes that digital transformation is a process in which an organization seeks paths to enhance its value creation in response to the influence of digital technology and addresses barriers that negatively affect the organization. Verhoef et al. (2021) consider that digital transformation is the process of analyzing collected data and converting it into actionable information that can be used to evaluate and build new digital business models to improve performance and competitiveness. The definition of digital transformation by Fitzgerald et al. (2014) is well-received. They believe digital transformation is “using cutting-edge digital technologies to achieve substantial business revolution including the growth of operational efficiency, the improvement of customer satisfaction, and the creation of new business models.” Coincidentally, Piccinini et al. (2015) and Majchrzak et al. (2016) define it similarly to Fitzgerald et al. (2014). This study follows Fitzgerald et al.'s (2014) definition of the use of digital technologies in operations, business model innovation, or digital strategy to create value for the enterprise. Digital transformation mainly consists of three aspects. First, it is the application of one or more digital technologies to enhance the operational capabilities of an organization (Majchrzak et al., 2016). Second, it profoundly changes the production method, organizational structure and commercial model of a firm through digital technologies (Bharadwaj, 2013). Moreover, it goes beyond operational efficiency improvements to broader process improvements. Thirdly, Verhoef et al. (2021) believe that the digital transformation of a company builds on its digital technologies to develop new digital business models that help create business value. In this process, firms use digital transformation to implement strategic behavioral modifications by balancing their corporate resources and the external environment to achieve a competitive advantage in the marketplace.

At present, there is a lack of research on whether digital transformation can improve the energy performance of firms, with similar studies focusing on its economic consequence. Some studies have pointed out that digital transformation can significantly affect firm performance, but the research findings differ. Kaur and Sood (2017) document a firm's performance can be enhanced via digital transformation. Hajli et al. (2015) suggest that digital transformation can raise regional GDP. Ribeiro-Navarrete et al. (2021) apply social networks and training in digital technologies to measure the metrics of digital transformation and identify that these factors can promote performance in the service industry. Llopis-Albert et al. (2021) conclude that digital transformation can improve performance, competitiveness and stakeholder satisfaction in the automotive industry. Some scholars point out that a higher quality of digital transformation in a firm contributes to higher production efficiency (Andriushchenko et al., 2020; Ribeiro-Navarrete et al., 2021). Digital technology can reshape the value-generating mechanism of stakeholders in the traditional business system based on the personalized needs of users, thus improving the quality of enterprise products and services (Kraus et al., 2021). The rapid development of digital technologies has transformed enterprise in significant ways (Li et al., 2023), such as reducing costs (Adamides and Karacapilidis, 2020), increasing efficiency (Liu and Xiu, 2015) and fostering innovation (Galindo-Martín et al., 2019). In addition, some studies have articulated that digital technology has no significant impact on business performance (Curran, 2018).

In conclusion, the existing literature provides crucial insights for comprehending the relationship between digital transformation and corporate energy efficiency. It still has some gaps to discuss. Specifically, previous research mostly examines the influence of digital transformation on firms' performance and innovation, with the effects of digital transformation on corporate energy efficiency seldom discussed. In addition, few relevant studies have explored the effects of corporate digital transformation on the economic performance of individual nodes in the supply chain (Shah et al., 2016; Chaudhari et al., 2023; Shah et al., 2025). Hence, there is still room to investigate the impact of digital transformation on corporate energy efficiency from the perspective of the supply chain network.

2.2 Hypothesis development

The supply chain network is a functional network with input-output relationships formed by connecting suppliers, manufacturers, distributors, retailers and users through precise control of logistics, information and financial flows (Wiedmer and Griffis, 2021). It consists of subject elements and structural elements, that is, node elements and inter-subjective relationship elements. Listed firms, as key nodes and the most active central links in the supply chain network, have obvious advantages in technology, scale and market, with high supply chain dominant control and industry visibility (Nakkas and Xu, 2019); moreover, not only do they have the foundations for digital transformation, but they also have strong network externalities that can influence the structural elements of the supply chain. Thus, it is necessary to explore in depth whether a firm's digital transformation can increase energy efficiency and affect the energy efficiency of upstream and downstream firms through the supply chain.

The theory of resource constraints assumes that resources are finite. Under the condition that resources are efficient, firms need to utilize them effectively to increase productivity. Firms can handle large amounts of data through digital transformation strategies to calculate energy demand and enhance energy utilization. Specifically, firms can develop intelligent energy management strategies based on in-depth calculations of historical data to reduce resource wastage. The digital transformation of energy-intensive firms can also facilitate the development of advanced energy management software to monitor in real time and optimize the specific use of energy. In addition, firms undergoing digital transformation can leverage cutting-edge digital technologies, such as the Internet of Things and sensor networks, to monitor the operation of energy systems and equipment in real time (Zhang et al., 2023). This not only allows firms to accurately capture energy consumption patterns during the production process and identify potential waste in a timely manner, but also enables real-time optimization of energy utilization through an intelligent control system, thereby improving energy efficiency. Therefore, the data, analytical tools and intelligent control systems provided by digital transformation enable firms to manage energy utilization in a sophisticated and intelligent way, resulting in significant improvements in energy efficiency. Furthermore, compared with upstream firms, downstream firms have closer ties with listed firms to promote technological innovation and market competitiveness, and have a stronger willingness to carry out energy saving and emission reduction (Wei et al., 2024; Du and Jiang, 2022). On the one hand, digital technologies can break through the limitation of geographic space and expand the geographical distribution of the supply chain, and promote the downstream firms to strengthen the cooperation with listed firms in production, research and development to consolidate the innovation network and promote long-term stable cooperation. On the other hand, downstream firms are weaker than upstream firms in terms of scale, technology, management and have a stronger ability and willingness to absorb and transform knowledge spillover from listed firms. This can greatly accelerate the digital transformation of downstream firms, thus increasing their energy efficiency and accelerating sustainable development. Hence, this study poses:

Hypothesis 1. Digital transformation can enhance the energy efficiency of firms and their downstream firms.

As digital transformation is characterized by openness, sharing and collaboration, it can boost the green innovation of firms by promoting their interaction with external innovation resources through digital platforms, digital sharing and partnerships (Rupeika-Apoga et al., 2022). Green innovation requires the introduction of new ideas, behaviors, products and processes that can reduce environmental damage and meet the goal of ecologically sustainable development (Yuan and Cao, 2022). Specifically, firms' digital transformation can accelerate the widespread use of digital technologies and promote the linkage, penetration and reconfiguration among multiple technological fields in the process of enterprise innovation, thereby enhancing green innovation. Furthermore, in line with the theory of circular economy, green innovation can improve corporate productivity and decrease energy consumption and curb carbon emissions through the improvement of product design and the application of circular thinking (Thakur and Wilson, 2024). This suggests that the green innovation competence of firms is also a significant determinant of energy efficiency. On the one hand, the embedding of digital technology can help firms acquire and reintegrate resources and promote green technology innovation to generate advantages in resource allocation (Li H. L. et al., 2021). Specifically, the advancement of digital technology diminishes the cooperation expenses between innovative organizations, promotes the rapid integration of knowledge, and provides an effective guarantee for expanding the knowledge supply of high-quality green technological innovation for firms. On the other hand, digital transformation requires employees to have digital skills, including data analysis and information technology. Thus, firms can accumulate rich human capital by cultivating and upgrading the digital skills of their employees, which will in turn boost green innovation. In addition, the improvement of firms' information utilization ability can assist them in understanding market preferences and government policies to proactively adjust the demand for different energy sources, produce green products with low energy consumption to meet market demand, and further stimulate green innovation technology in the reproduction process, thus effectively improving total energy efficiency.

Digital transformation can provide firms with a large amount of real-time and historical data through big data technology, establishing an accurate information basis for enterprise energy decision-making, thereby effectively alleviating the information asymmetry of energy factor inputs in the production process. Specifically, in the absence of information on energy utilization, firms may make decisions that are not based on actual demand and energy efficiency, resulting in wasteful and inefficient use of energy resources; moreover, information asymmetry prevents firms from obtaining detailed information on clean and traditional energy sources, thus reducing their ability to optimize energy structure and inhibiting overall energy efficiency (Kang et al., 2022). Nevertheless, with the rapid advancement of digital technology, firms can track energy utilization and pollution control in the production process in real time, promoting the efficient matching of information between the demand side and the application side. Furthermore, energy digital technology can accelerate the intelligent transformation of the energy production process and the upgrading of the enterprise production management system (Wang et al., 2022), thus enhancing the recycling of energy and improving energy utilization efficiency. In addition, firms are not only concerned about the energy utilization in the production process but also expect to improve the structure of energy consumption, that is, to reduce the share of traditional energy sources used such as coal and oil, and to weaken their dependence on limited natural resources. Firms supported by digital transformation can continuously improve their energy structure, gradually replace traditional energy-intensive equipment and technology, and shift to using clean and renewable energy, which is also a crucial way to achieve sustainable growth and strengthen market competitiveness.

Corporate digital transformation not only directly impacts its energy efficiency, but also indirectly contributes to the energy efficiency of its upstream and downstream firms by influencing green innovation. The influence of corporate digital transformation on the energy efficiency of upstream and downstream firms in the supply chain network is mainly manifested in the way of enterprise knowledge spillover and the ability of upstream and downstream firms to absorb and transform the knowledge spillover (Fan et al., 2023; Schilling and Seuring, 2024; Ghosh et al., 2021). Specifically, corporate digital transformation can break through the geographical and spatial limitations, not only promoting their green innovation, but also generating knowledge spillovers in the supply chain network to promote knowledge innovation and technological progress of other firms, thus providing an innovative basis for the energy efficiency improvement of upstream and downstream firms in the supply chain network. Whether the upstream and downstream firms can absorb the knowledge spillover from the supply chain network depends on the way of knowledge spillover and the ability of upstream and downstream firms to absorb and transform the knowledge spillover (Saha et al., 2024; Ghosh et al., 2025). However, there is an asymmetry in the market structure and input-output relationship of the production network, and there are two kinds of differences in the knowledge spillovers from corporate digital transformation to upstream and downstream firms (Ishfaq et al., 2022; Ghosh et al., 2023; Orellano and Tiss, 2024). One of them is the spillover approach. Corporate digital transformation can promote green product innovation, which enters downstream firms in the form of intermediate goods and promotes rental spillovers to them; moreover, firms undergoing digital transformation can also generate pure knowledge spillovers to their downstream firms in the process of patent application and technological innovation, which accelerates their pace of achieving green innovation and improving energy efficiency. However, due to the limitations of input-output linkages, the upstream firms have no basis for capturing rent spillovers and knowledge spillovers. The second is the capacity for absorption and transformation. As there are obvious differences in the scope of R&D and technological fields between the listed firms and their upstream and downstream firms, there are also differences in the ability of upstream and downstream firms to absorb and transform knowledge spillovers from their listed firms and recombine them into their technologies. Compared with upstream firms, downstream firms have a higher degree of similarity in technological innovation with listed firms and are more likely to absorb and transform knowledge spillovers from listed firms. Therefore, this study proposes:

Hypothesis 2a. Digital transformation can enhance corporate energy efficiency via its effects on green innovation and energy structure.

Hypothesis 2b. Corporate digital transformation can enhance downstream firms' energy efficiency via its effects on green innovation.

Adequate funding can guarantee the successful implementation of corporate digital transformation (Peng and Tao, 2022). When a firm has high financing constraints, it is difficult to raise funds quickly from the external environment, which may even increase the costs of financing and have a negative impact on its business decisions. Specifically, firms will be unable to make optimal decisions when facing financing difficulties, thus distorting the allocation of production resources and hindering the digital transformation process. However, digital finance, as a new form of finance in which digital technology continues to penetrate the financial field, is highly compatible with the digital economy and can effectively alleviate capital mismatch and broaden financing channels, thus providing financial assistance for the digital transformation strategy of firms. In addition, public environmental concern can reflect the public's environmental preferences and play a moderating role in how digital transformation affects corporate energy efficiency. On the one hand, the public's concern for environmental issues can be transformed into a preference for green products, increasing the competitiveness of green products in the market (Hasan et al., 2018). As the public's environmental preference increases, they are more willing to pay for green products, leading to a decline in profits for firms using polluting technologies. However, digital technologies can precisely provide support for firms' research and development for green products. As a result, these firms then tend to adopt digital transformation to improve production processes and achieve cleaner production in response to public interest. On the other hand, the public's concern for environmental issues can leverage the power of public opinion to exert pressure on firms to protect the environment and increase their risk of non-compliance (Liao and Shi, 2018; Ren et al., 2018). Thus, to cultivate long-term competitive advantages, firms are more inclined to apply digital technologies in energy conservation and emission control to improve energy efficiency. Furthermore, firms are leveraging digital finance to increase their financial investment in digital transformation and are willing to strengthen digital technology partnerships with their downstream firms to enhance their ability to utilize energy resources and reduce carbon emissions. Accordingly, this study assumes:

Hypothesis 3a. Both digital finance and public environmental concern can enhance the positive effect of digital transformation on corporate energy efficiency.

Hypothesis 3b. Digital finance can enhance the positive effect of corporate digital transformation on downstream firms' energy efficiency.

The relative impact of obstacles or drivers of corporate advancement may vary with firm-related structure characteristics and geographic location. On the one hand, compared with non-state-owned firms (NSOFs), state-owned firms (SOFs) not only face the market constraint of energy saving and emission control but also the political task of energy saving and emission control to a greater extent. Conversely, SOFs can obtain more tax incentives and credit subsidies, and face fewer financing constraints and lower financing costs (Chen and Zhou, 2017; Feng et al., 2020). Thus, SOFs tend to invest more funds in digitalization to promote sustainable development. Furthermore, differences in economic growth, industrial scale and structure, and policy orientation of regions will affect the quality and progress of corporate digital transformation. Specifically, the eastern region is ahead of the whole country in terms of economic development level, abundant in talents and capital, and faster in the development of high-end manufacturing industry, especially with the advantages of perfect digital technology facilities, abundant data resource elements, and higher conversion rate of digital technology results. Thus, firms in the eastern region are more motivated to undergo digital transformation and play a role in promoting their energy efficiency. Conversely, due to the relative stagnation of economic growth, the central and western regions are forced to absorb a large number of high-energy-consuming and high-emission manufacturing firms transferred from the eastern region, resulting in greater difficulty in the overall low-carbon transformation of the regions (Pan et al., 2022). Moreover, corporate digital transformation in the central and western regions is not sufficiently motivated, and there is relatively little room for improving energy efficiency. On the other hand, corporate digital transformation can overcome geographical constraints and facilitate the dissemination of explicit knowledge over long distances. However, if two enterprises are too far apart, it may not be conducive to the spillover of tacit knowledge (Sorescu and Schreier, 2021; Zhu et al., 2020). Tacit knowledge belongs to a kind of diverse, complex and difficult-to-encode knowledge that can only be acquired through direct face-to-face learning and is difficult to be routinized and spread over long distances through information or digital technologies. Compared with explicit knowledge, tacit knowledge may play a vital role in corporate innovation. Thus, the proximity of firms implementing digital transformation to downstream firms affects their energy efficiency improvement. In addition, differences in resource endowment in the regions where firms are located also impact energy efficiency improvement. Based on differences in resource endowments, firms can be divided into two categories: firms with high-resource endowments and firms with low-resource endowments. Specifically, regions with high-resource endowments usually prioritize the development of resource-based industries, which are prone to waste of resources and lack of digital transformation atmosphere. However, when faced with the dilemma of resource scarcity, firms in low-resource endowment regions tend to enhance digital transformation and promote knowledge spillover, thereby improving resource utilization efficiency. Correspondingly, we further propose:

Hypothesis 4a. Digital transformation has heterogeneous effects on corporate energy efficiency across firms' ownership types and regions.

Hypothesis 4b. Corporate digital transformation has heterogeneous effects on the energy efficiency of downstream firms across firms' geographical distance and resource endowment.

3 Data, variables, and methods

3.1 Data

Listed firms are the most active center of the supply chain network. We use A-share manufacturing firms in Shanghai and Shenzhen Stock Exchanges from 2009 to 2022 as the samples of this empirical study. The beginning of 2009 aims to evade the consequences of the global financial crisis in 2008 that may affect a firm's digital transformation strategy or energy efficiency. This paper obtains the legal person code of listed firms based on the industrial and commercial registration information data of listed firms, and accurately matches the financial information data of listed firms with the tax survey data based on the legal person code and the year to obtain the matching data of listed firms from 2009 to 2022. Moreover, the supplier list of listed firms is matched with the national tax survey data based on the firm name and the year to obtain the matching data of the upstream firms of listed firms from 2009 to 2022, and the customer list of listed firms is matched with the national tax survey data based on the firm name and the year to obtain the matching data of the downstream firms of listed firms from 2009 to 2022. Considering the availability and comparability of data information, we remove firms: 1) in the financial industries, 2) having financial distress, 3) firms with missing data, 4) ST (Special Treatment, firms have incurred operating losses for 2 consecutive years) and *ST (firms operating losses for three consecutive years). The final sample contains 20,034 listed firm-years, 12,572 upstream firm-years and 18,340 downstream firm-years. The accounting and financial data is collected from the CSMAR database. We obtain data on digital transformation through textual analysis of enterprise annual reports. Moreover, we winsorize firms' continuous variables at the 1% and 99% levels to eliminate the effects of outliers.

3.2 Variables

3.2.1 Measurement of energy efficiency

The explained variable is corporate energy efficiency (CEE). Data Envelopment Analysis (DEA) mainly consists of traditional and derived models (Farrell, 1957). Traditional models have inherent flaws, such as the CCR model, which relies on the unrealistic assumption of constant returns to scale, and the BCC model, which allows for variations in returns to scale but ignores the negative externalities caused by the production process on the environment, that is, undesired outputs. Compared with traditional models, derived models, such as the SBM model, can consider the relaxation of input and output and include unexpected outputs (Tone, 2002). Thus, the SBM model aligns more closely with actual production conditions and is extensively used in assessing energy efficiency (Choi et al., 2012). However, the SBM model is unable to distinguish between the effective decision-making units (DMUs). Tone proposed a super-efficient SBM model based on unexpected output, which combines the advantages of the super-efficient model and the SBM model to reorder the effective DMUs. Specifically, it is assumed that a production system has n DMUs, and each DMU has m input, S1 expected output, and S2 unexpected output. The vector form is expressed as x ∈ Rm„, where x, and are matrices; , , . The super-efficient SBM model considering the undesirable output is as follows:

where the objective function value of ρ* is the efficiency value of the DMU. λ is the weight vector.

With reference to Li S. et al. (2021) and Shi et al. (2022), this study considers 3 input indicators and 2 output indicators for the measurement of corporate energy efficiency. Specifically, the number of employees in each firm is chosen to measure labor input, the fixed asset in each firm is chosen to denote the capital input, and the consumption of natural resources including coal, oil and natural gas in each firm is used to denote the energy input. Furthermore, this paper selects the revenue in each firm as the desirable output and the waste water, waste gas and fume emissions in each firm as the undesirable output.

3.2.2 Construction of the digital transformation index

The digital transformation (DT) is the explanatory variable. Firm-level digital transformation is not simply the digital processing of production materials but requires the use of emerging technologies to promote the digitalization of enterprise production materials and the whole manufacturing process, thereby achieving the goal of improving quality and efficiency. Based on GitHub open-source code, we conduct textual analysis on annual reports using Python software. Then, we define DT as the natural logarithm of 1 plus the total number of word frequencies of related keywords. An annual report is one of the important channels for firms to convey the strategic direction of corporate development to the public, and the keywords used in the annual report are an important characterization of the direction of corporate management and development. Hence, this proxy indicator is reliable and secure. In terms of keyword selection, Verhoef et al. (2021) believe that corporate digital transformation has three elements: digital technology application, business model innovation and digital development strategy. The last element is built on the first two. Hence, we follow Gal et al. (2019) to focus on the first two elements to measure a firm's level of DT. Specifically, a dictionary of 64 and 10 keywords related to digital technology adoption and business model innovation is used for textual analysis.

3.2.3 Mediation variables

This study selects green innovation (GI) and energy structure (ES) as the mediation variables. The permeability of digital technologies facilitates the integration of green technologies with multidisciplinary technologies, which can enhance a firm's existing green technologies and contribute to improving its energy efficiency. Considering that the number of patent applications is a better indicator reflecting the level of corporate green innovation than the number of authorized patents, and that the application process consumes a longer period of time (Wang et al., 2021), we adopt the natural logarithm of 1 plus the total number of green invention patent applications and green utility model patent applications to represent it. In addition, digital transformation can optimize the structure of energy utilization in a firm's production process and thus improve its energy efficiency. The energy structure of enterprises is heavily dependent on traditional fossil fuels, with coal, oil and natural gas being the most common forms of energy (Bejarano et al., 2019). Accordingly, we explore the influence of digital transformation on each of the three types of energy utilization to analyze how digital transformation affects energy structure. Coal consumption (COAL), oil consumption (OIL) and natural gas consumption (GAS) are used to represent energy structure. Specifically, COAL, OIL, and GAS are characterized by the ratio of coal, oil, and natural gas usage to total energy consumption, respectively.

3.2.4 Moderating variables

Based on the previous analysis, digital finance (DF) and public environmental concern (PC) are selected to explore their moderating effects on the relationship between digital transformation and corporate energy efficiency. Specifically, digital finance is measured by the Digital Financial Inclusion Index compiled by Peking University and divided by 100. The natural logarithm of the annual average of Baidu's “haze” search index (mobile and PC searches) is used to represent public environmental concern by matching the firm's place of registration.

3.2.5 Control variables

The control variables selected for this research include (1): Firm size (SIZE). Firm size is defined as the natural log of firm assets. (2) Firm age (AGE). Firm age is measured as the years the firm has been in. (3) Nature of shareholding (SOE). State control is a binary variable equal to 1 if the firm is state-owned, and 0 otherwise. (4) Capital intensity (CI). The ratio of net fixed assets to the number of employees measures capital intensity. (5) Region financial development level (FIN). The ratio of deposits and loans of provincial banking financial institutions to GDP is used for this measure. (6) Stability of shareholdings (SOS). We adopt the difference between the shareholding ratio of the second largest and the first largest shareholders to denote the stability of shareholdings. Specifically, the smaller the difference is, the higher the possibility of the second largest shareholder replacing the first largest shareholder, and the more unstable the shareholding structure of firms is considered to be (Cui et al., 2021; Sun et al., 2020; Yao et al., 2021).

3.3 Econometric methods

To empirically analyze the relationship between digital transformation and corporate energy efficiency, this paper develops the following benchmark model:

where the explained variablerepresents the energy efficiency of the i-th firm in year t; the core explanatory variable DTit is digital transformation; Controlit is a set of control variables; μi, δt indicates the individual and time fixed effects respectively; εit indicates the random disturbance term.

The aforementioned theoretical studies indicate that green innovation and energy structure are essential mediating factors in the process of digital transformation affecting corporate energy efficiency. Consequently, based on the classical mediating effect model, we construct the following model using stepwise regression:

where Medit represents the mediation variables. formula (3) calculates the impact of digital transformation on mediation variables and formula (4) calculates the impact of digital transformation and the mediation variables on corporate energy efficiency. When β1 is significant, it indicates that digital transformation can significantly affect corporate energy efficiency, and then we observe whether θ1, ϕ1 and ϕ2 are significant. If θ1 and ϕ1 are both significant, but ϕ2 is not significant, a complete mediation effect is considered. If ϕ2 is also significant, a partial mediation effect is considered. If either θ1 orare not significant, we should use bootstrap sampling to test for the presence of a mediation effect.

To further investigate the moderating role of digital finance and public environmental concern in the process of digital transformation affecting corporate energy efficiency, we introduce an interaction term between the core explanatory variable and the moderating variables to construct the following model:

where Modit represents the moderating variables.

4 Results analysis and discussion

4.1 Baseline findings

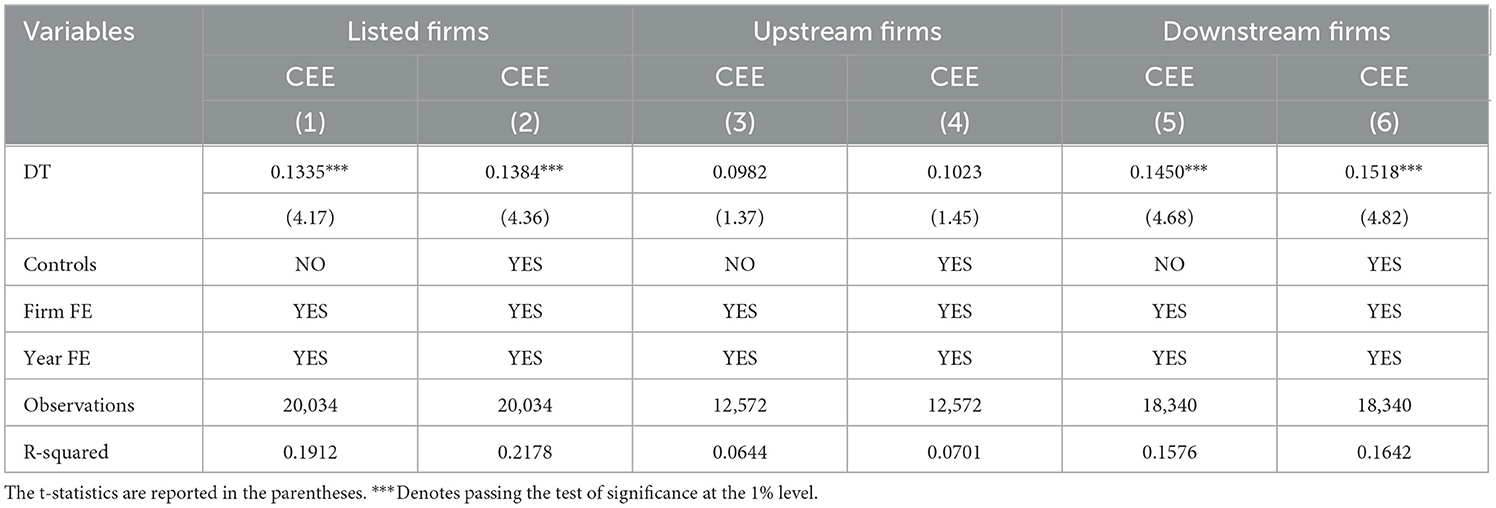

We first use the empirical model (1) to examine the impact of digital transformation on corporate energy efficiency. From the findings of column (1) in Table 1, it can be seen that when only firm and year fixed effects are both controlled, the regression coefficient of digital transformation is significantly positive, revealing that when a firm engages in digital transformation, its energy efficiency is higher than a firm without digital transformation. Moreover, the findings of column (2), containing all control variables, indicate that firms that undergo digital transformation exhibit 0.001% points higher energy efficiency than those that do not. Therefore, the findings support Hypothesis 1, which proposes that accelerating the process of corporate digital transformation will drive energy efficiency.

The supply chain network formed by listed firms and upstream and downstream firms can reflect the characteristics of a vast number of firms cooperating with many different types of suppliers and customers. Small changes in the supply chain network can trigger ripple effects (Yuan et al., 2020; Shang et al., 2023). As a key node in the supply chain network, corporate digital transformation can cause a chain reaction upstream and downstream through the supply chain network. Therefore, we further examine the relationship between the digital transformation of firms and the energy efficiency of upstream and downstream firms. The findings of columns (3)-(6) in Table 1, regardless of whether control variables are added or not, illustrate that the digital transformation of firms positively influences the energy efficiency of their downstream firms, that is, the forward spillover effect is significant. However, the impact of corporate digital transformation on the energy efficiency of upstream firms fails to pass the test, that is, the backward spillover effect is not significant. Therefore, the promotion effect of corporate digital transformation on energy efficiency does not significantly spill over to upstream firms.

4.2 Robustness checks

4.2.1 Alternative sample and future energy efficiency

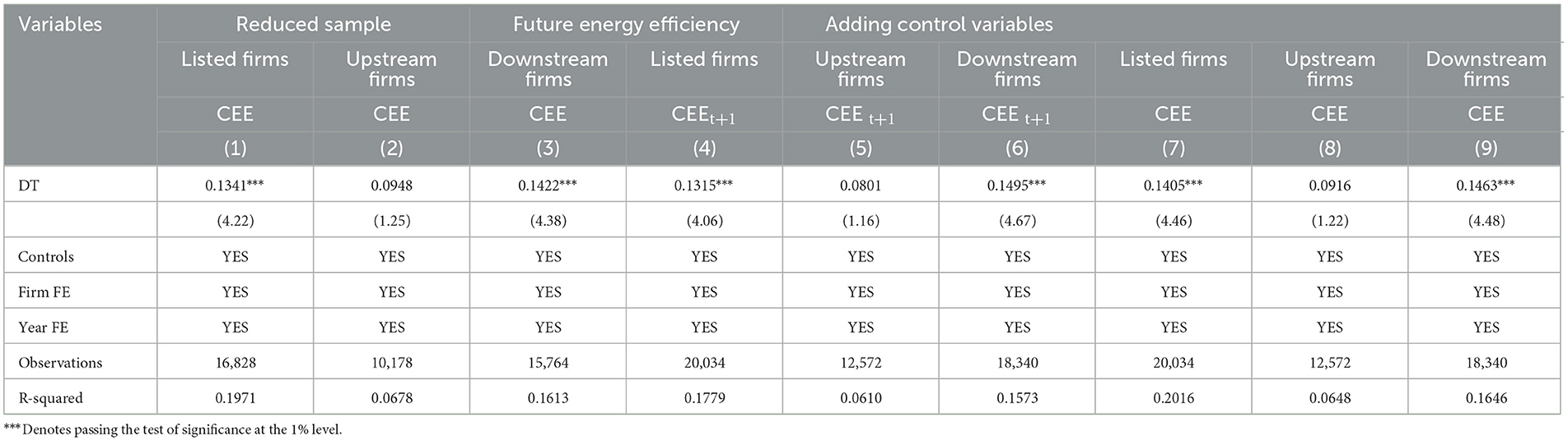

Municipalities in China with special political and economic characteristics possess additional resources to facilitate firms' digital transformation. We exclude sample data from firms in Beijing, Shanghai, Guangzhou and Shenzhen for robustness. In addition, considering the time lag impact of digital transformation on corporate energy efficiency, we use the energy efficiency metric at t+1 for robustness. The findings are tabulated in columns (1)-(6) of Table 2. Across all six columns, the coefficients of digital transformation continue to be significantly positive for listed firms and their upstream firms, but insignificant for downstream firms, demonstrating that the baseline findings are robust to alternative sample and future energy efficiency. Hypothesis 1 is again supported.

Table 2. Robustness test results with alternative sample, future energy efficiency, and control variable addition.

4.2.2 Adding control variables

Innovation is a critical determinant of firms' energy efficiency. It was not controlled for in the above study as it may act as an intermediary variable in the transmission path from digital transformation to corporate energy efficiency and should not be controlled for. Accordingly, R&D intensity is included to test for robustness, which is calculated by the ratio of R&D expenditure to total assets. Moreover, the concentration of shareholding (the sum of the top 5 shareholders' shareholdings) is added to the baseline model. According to columns (7)-(9) in Table 2, the coefficients of DT obtained are highly consistent with those of the baseline model.

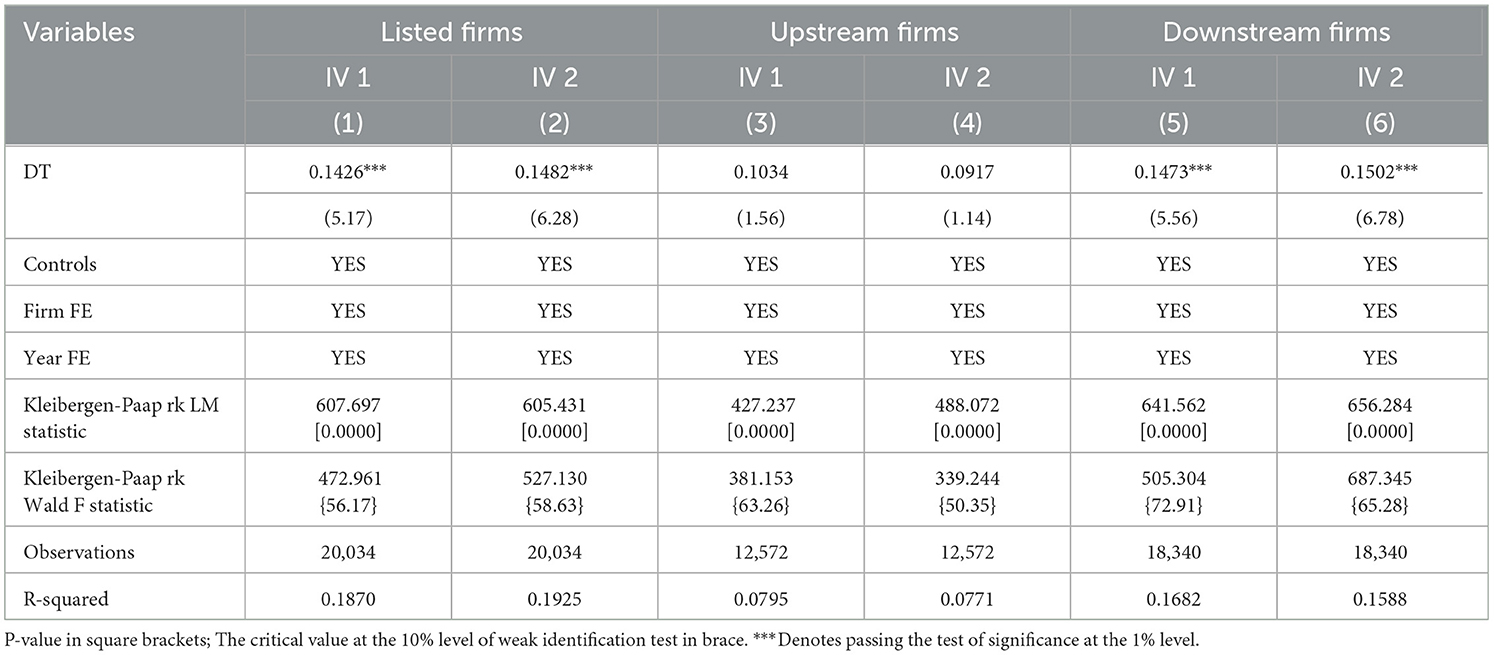

4.2.3 Instrumental variable

Identifying the causal effects of digital transformation on corporate energy efficiency can be confounded by potential endogeneity issues such as mutual causation and omitted variables. Endogeneity issues are better solved using an instrumental variable approach. The digital transformation level of other listed firms in the same region affects the digital transformation decisions of this listed firm, but cannot directly affect its energy efficiency. Therefore, the mean value of the digital transformation index of all listed firms in the same province, except this listed firm, is selected as the instrumental variable (IV 1), which can satisfy the premise of relevance and exogeneity. Moreover, the historical data is exogenous and cannot directly impact firms' energy efficiency. By referring to the relevant study (Nunn and Qian, 2014), we create the interaction term as another instrumental variable (IV 2) using the number of fixed-line telephones per ten thousand in 1984 and China's internet users in the previous year. The two-stage least square method is adopted for the estimation. Table 3 once again reveals that digital transformation significantly drives corporate energy efficiency after adopting the instrumental variables. The Kleibergen-Paap rk LM statistic and the Kleibergen-Paap rk Wald F statistic significantly reject the null hypothesis, demonstrating it has passed the endogenous test. The coefficients of the explanatory variable DT are significantly positive for listed firms and upstream firms, but not for downstream firms, which is consistent with the findings of the baseline model. In conclusion, our baseline findings are valid and reliable.

4.3 Transmission mechanisms

As noted in the hypothesis development section, we use a mediating effect model to test the mechanism by which corporate digital transformation influences its energy efficiency from two paths: green innovation and energy structure, and the mechanism by which corporate digital transformation influences the energy efficiency of its downstream firms from a green innovation perspective.

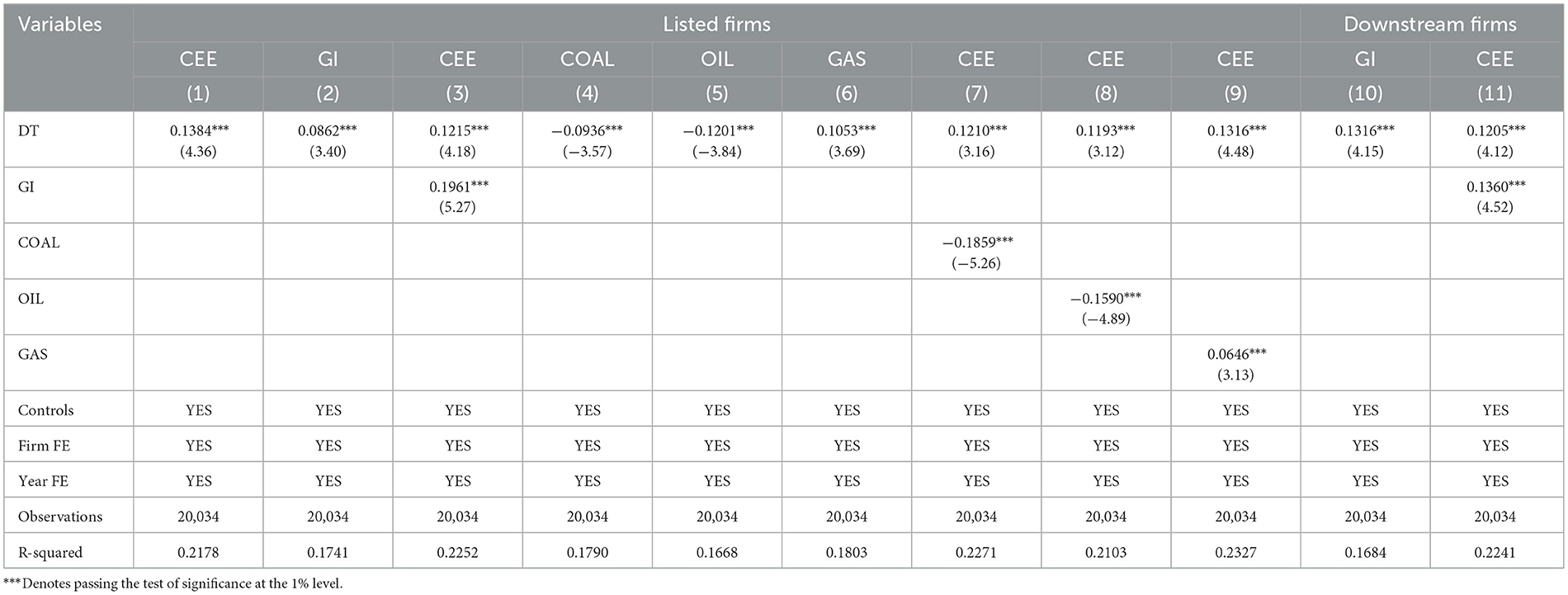

The findings in column (2) of Table 4 show that the coefficient of DT for GI is significantly positive, revealing that digital transformation can drive a firm's green innovation level. The findings in column (3) show that both green innovation and digital transformation have a significant positive effect on corporate energy efficiency. This result demonstrates that the mediating effect of corporate digital transformation on its energy efficiency is significant. A digital transformation strategy can enable firms to rapidly collect and organize technical data, and promote linkage, penetration and reconstruction between multiple technological fields in the process of corporate green innovation, thereby promoting their energy efficiency. In columns (4)-(6), the coefficients of DT for COAL and OIL are both significantly negative, but the coefficient of DT for GAS is significantly positive, indicating that if a firm adopts a digital transformation strategy, it can increase the use of low-pollution and low-consumption energy such as natural gas, and reduce the use of high-pollution and high-consumption energy such as coal and oil. Then, in columns (7)-(9), the coefficients of COAL, OIL, and GAS are significant with the corrected signs and the coefficients of DT carry the expected signs. These results demonstrate that digital transformation can improve corporate energy efficiency by optimizing the structure of energy utilization in the production process. The adoption of a digital transformation strategy by many firms can significantly contribute to establishing a digital governance system based on data mining, evaluation and application, identifying potential waste and opportunities for optimization (Reis et al., 2018). Moreover, it can incorporate renewable energy such as solar and wind into corporate energy structure and gradually replace traditional energy-intensive equipment and technologies.

As shown by the findings in column (10) of Table 4, the coefficient of DT for GI is significantly positive, indicating that corporate digital transformation can improve the green innovation of its downstream firms. Digital transformation and green innovation are also shown to be significantly positive in columns (11), revealing that the digital transformation and green innovation of firms can improve the energy efficiency of their downstream firms. These findings indicate that green innovation has intermediary effects on the impact of corporate digital transformation on the energy efficiency of its downstream firms. The digital transformation of firms will promote knowledge spillover and create preconditions for their downstream firms to absorb knowledge. Moreover, based on the market structure of the production network and the asymmetry of the input-output relationship, it is easier for downstream firms to absorb the pure knowledge overflow from the digital transformation of upstream firms. Accordingly, the digital transformation of firms can enhance the active absorption of overflow knowledge in the supply chain network by their downstream firms, which improves the green innovation of downstream firms, and thus contributes to the improvement of their energy efficiency.

In conclusion, corporate digital transformation can increase the energy efficiency of its listed firms by enhancing green innovation and optimizing energy structure. Moreover, it can improve the energy efficiency of its downstream firms by enhancing green innovation. Therefore, Hypothesis 2a and 2b are verified.

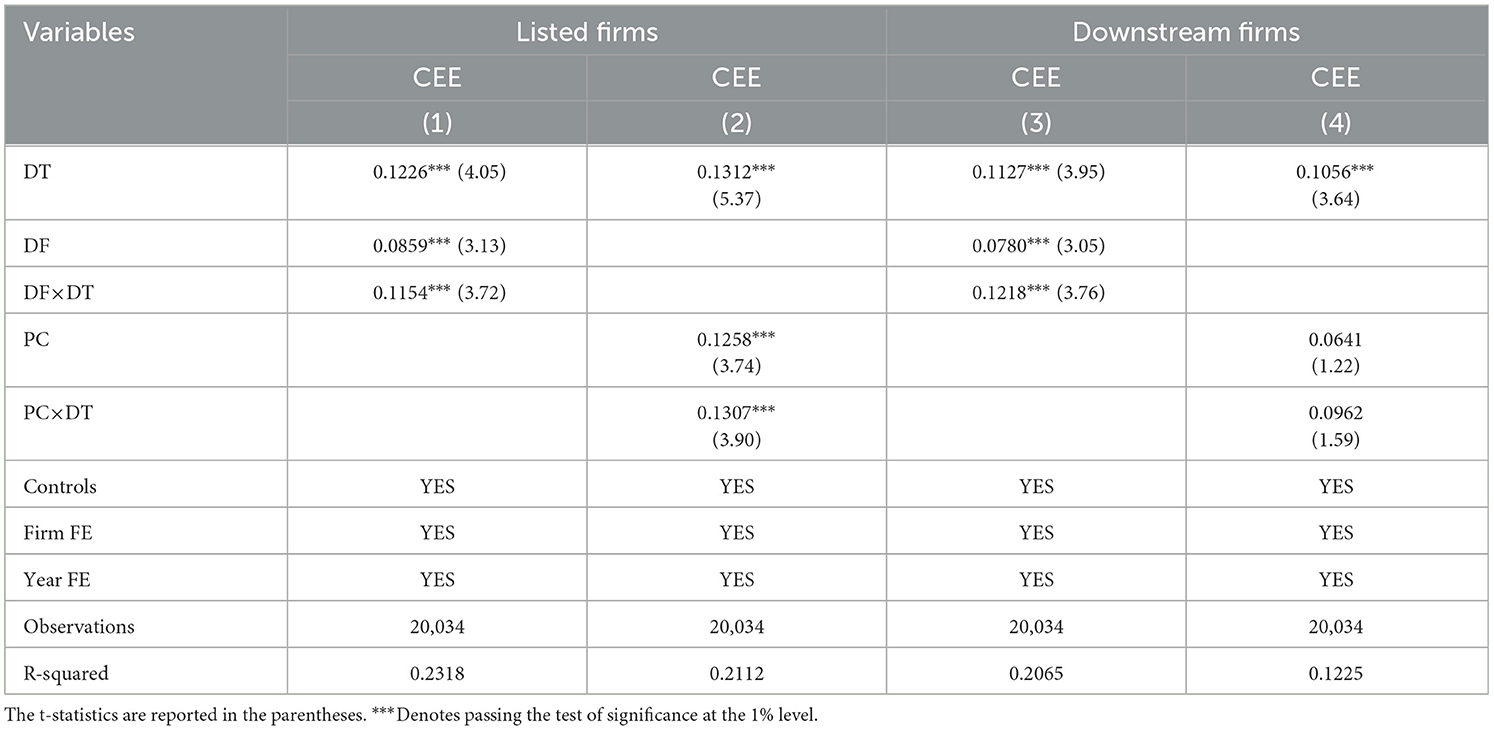

4.4 Moderating mechanisms

We use the empirical model (5) to investigate the moderating effects of digital finance and public environmental concern in the impact of digital transformation on corporate energy efficiency. Table 5 demonstrates the moderating regression results. As seen in column (1), the interaction term between digital transformation and digital finance is significantly positive, revealing that digital finance can positively moderate the contribution of digital transformation to corporate energy efficiency. The advancement of digital finance can alleviate financing constraints and provide sufficient financial support for the digital transformation and technological innovation of firms, thereby reinforcing the contribution of digital transformation to energy efficiency growth. Moreover, the results of column (2) reveal the positive moderating role of public environmental concern in the process of digital transformation promoting corporate energy efficiency. Increased public environmental concern can motivate firms to improve their processes through digital transformation to meet the public's demand and preference for green products, and increase environmental protection pressure, thus promoting the efficient use of energy in production. Hypothesis 3a is confirmed. Furthermore, the regression findings of columns (3)-(4) demonstrate that digital finance has a significant positive moderating effect, but the positive moderating effect of public environmental concern is not significant, indicating that only digital finance can significantly enhance the positive impact of the digital transformation of listed firms on the energy efficiency of their downstream firms. Hypothesis 3b is not supported. A possible reason for this phenomenon is that the degree of public participation in environmental protection supervision in China is lower, and the resulting informal environmental regulation is weak, which only enhances the promotion effect of corporate digital transformation on its energy efficiency, but has a dampening effect on the energy efficiency of its downstream firms.

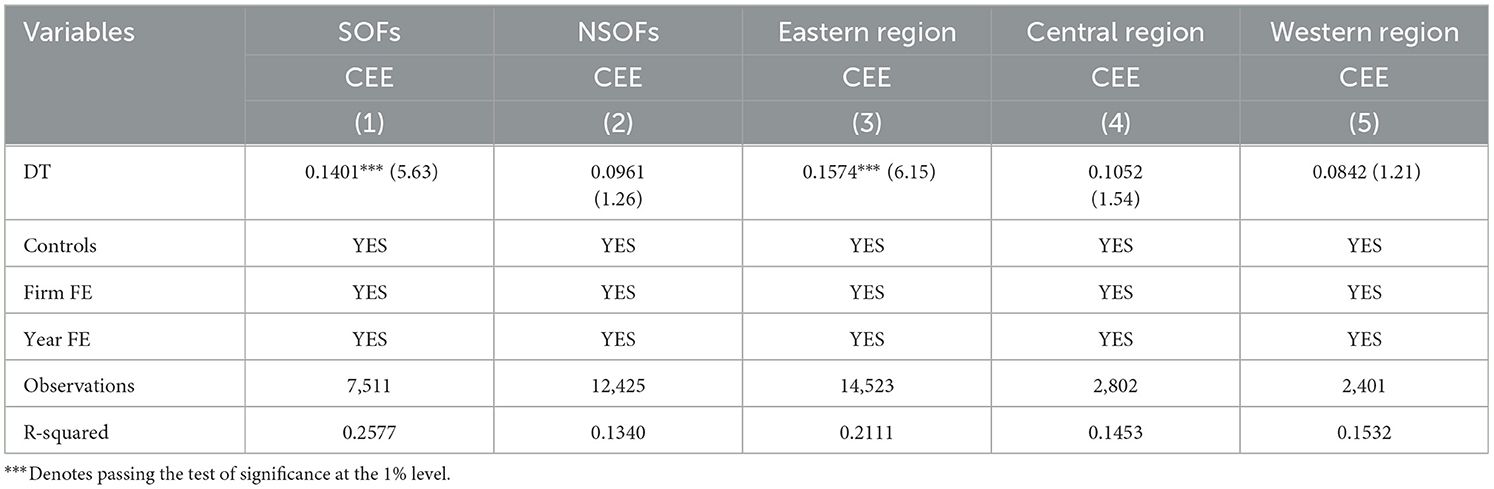

4.5 Heterogeneity analysis

First, we examine the heterogeneity of digital transformation impacting corporate energy efficiency according to ownership type and location region. The heterogeneity test findings are tabulated in Table 6. Columns (1)-(2) report the coefficient of digital transformation in the group of SOFs is significantly positive, while the same coefficient in the group of NSOFs does not pass the significance test. These findings suggest that digital transformation only contributes to the energy efficiency of SOFs. As explained in Section 2, corporate digital transformation is a long-term process covering production, operation and marketing, and requires continuous capital investment. Compared with NSOFs, SOFs can obtain more support from the government and have stronger risk resistance, and thus invest in digital transformation more persistently. The results of columns (3)-(5) indicate that the promoting effect of digital transformation is significant for firms in the eastern region, while it is not significant for firms in the central and western regions. This is mainly because the eastern region is more economically developed, with relatively well-developed infrastructure and cutting-edge digital technology, and firms located in that region can take advantage of these advantages to advance digital transformation. However, the relatively weak digital infrastructure and insufficient digital talent pool in the other regions have resulted in a slow digital transformation process for local firms and a weak drive for their energy efficiency.

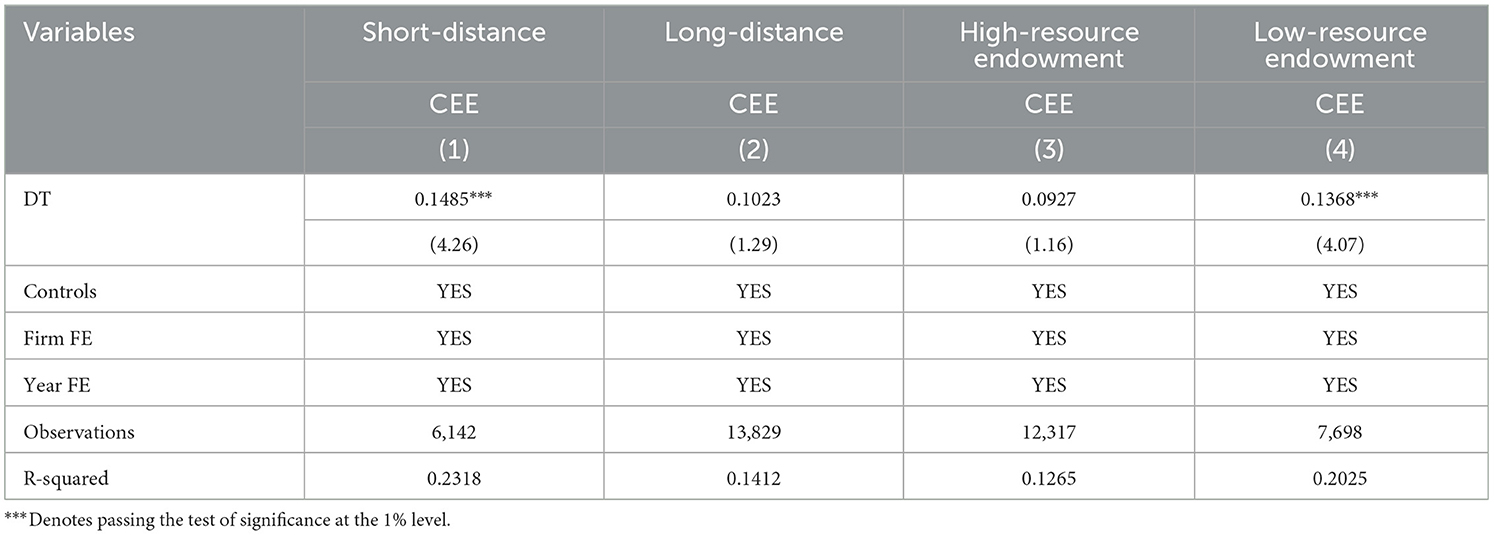

Second, the heterogeneity analysis results of firms' digital transformation affecting the energy efficiency of their downstream firms according to geographical distance and resource endowment are presented in Table 7. The results reveal that the promoting effect of digital transformation is significant for downstream firms with short distances and low-resource endowments. On the one hand, the spatial agglomeration of firms plays an important role in facilitating information interaction and knowledge sharing, and corporate digital transformation can only generate significant synergies and mutual reinforcement within a specific spatial scale. Thus, corporate digital transformation cannot significantly impact the energy efficiency of its distant downstream firms. On the other hand, firms in high-resource endowment regions are prone to resource dependence, leading to less efficient use of resources and a lack of incentives for digital transformation. Conversely, due to the lack of resource availability, firms with low resource endowments will increasingly realize the urgent requirement of digital transformation in production to improve their market competitiveness. Therefore, the conclusion above provides empirical support for Hypothesis 4.

Table 7. Heterogeneity analysis of firms' digital transformation affecting the energy efficiency of downstream firms.

5 Conclusion and policy implications

From a supply chain network perspective, this research adopts a sample of Chinese listed firms to deeply investigate the influencing mechanisms of digital transformation on corporate energy efficiency. The results provide evidence to verify the hypothesis that corporate digital transformation can improve energy efficiency for itself and its downstream firms. The findings are robust to alternative sample and future energy efficiency, adding control variables, and after accounting for endogeneity. In addition, we argue that green innovation and optimization of the energy structure play a mediating role in the promoting effect of digital transformation on corporate energy efficiency, and green innovation play a mediating role in the promoting effect of corporate digital transformation on the energy efficiency of its downstream firms. Furthermore, both digital finance and public environmental concern play a positive moderating effect in the process of digital transformation improving corporate energy efficiency, and digital finance positively enhances the contribution of corporate digital transformation to the energy efficiency of its downstream firms. Finally, the promoting effect of corporate digital transformation on energy efficiency is significant for state-owned firms and firms in the eastern region, and corporate digital transformation contributes significantly to neighboring downstream firms and downstream firms with low resource endowments.

Some policy implications arise from the research findings. First, providing a platform to firms for adopting a digital transformation strategy to achieve the green transformation of the whole supply chain. Given that the digital transformation strategy is costly and challenging for firms, the government should increase the supportive policies for corporate digital transformation and build an inclusive and precise supportive policy system to accelerate the process of corporate digital transformation. In addition, it should further outline the blockage of the spillover effect of digital transformation on corporate energy efficiency in the supply chain network, and leverage the green effects of corporate digital transformation in the supply chain network to drive the cleaner transformation of the supply chain. Second, the transmission path of green innovation and energy structure should be unblocked to accelerate the low-carbon transformation of firms. On the one hand, it should vigorously promote green innovation in enterprises, encourage them to broaden the channels of green technology development and increase the conversion efficiency of green research and development outcomes, thereby realizing the green transformation of the industrial chain. On the other hand, based on the endowment of energy resources, it should accelerate the green transformation of the energy structure and speed up the construction of a new type of energy system to enhance firms' energy utilization efficiency and clean energy substitution rate. Third, the government's role in macro-control should be strengthened to actively guide and support corporate digital transformation and to maintain the external environment for sustainable development. Governments at all levels should promote the healthy development of digital finance by building digital financial facilities and improving the financial regulatory system. Moreover, the public should be incentivized to engage in environmental governance and buy green products and pay attention to enterprise production process, thus motivating firms to actively implement digital transformation strategies to increase energy efficiency. Finally, firms' heterogeneous characteristics should be fully considered, and the leading role of key firms should be strengthened to maximize the effects. Specifically, vigorously enhancing the digital transformation of key firms, such as state-owned firms and eastern firms, can not only accelerate the realization of their efficient use of energy but also strengthen the leading role of energy saving and emission control for other firms, thus achieving high-quality economic development.

As with any empirical study, some research limitations must be considered. First, this study adopts the strategy of combining theoretical hypotheses and empirical tests for the corresponding research, which can be explored from different perspectives. Future research can try to develop a theoretical model to explain the incentive impact of digital transformation on corporate energy efficiency from the perspective of supply chain spillover. Second, due to the lack of data, our findings come from Chinese A-share listed manufacturing enterprises. Domestic non-listed manufacturing enterprises and manufacturing enterprises not in the A-share market are excluded from the study. In order to validate our findings, it would be better to use more manufacturing enterprises as the study sample. In addition, the impact of digital transformation may change over time. Therefore, future research may expand the indicators and measures of digital transformation. Finally, using only China as an example may limit the generalizability of the findings. It would be meaningful to use this model to study how digital transformation affects corporate energy efficiency in other emerging countries.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

FS: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adamides, E., and Karacapilidis, N. (2020). Information technology for supporting the development and maintenance of open innovation capabilities. J. Innov. Knowl. 5, 29–38. doi: 10.1016/j.jik.2018.07.001

Andriushchenko, K., Buriachenko, A., Rozhko, O., Lavruk, O., Skok, P., Hlushchenko, Y., et al. (2020). Peculiarities of sustainable development of enterprises in the context of digital transformation. Entrep. Sustain. Iss. 7:2255. doi: 10.9770/jesi.2020.7.3(53)

Baskerville, R. L., Myers, M. D., and Yo, Y. (2020). Digital first: the ontological reversal and new challenges for information systems research. Mis Quart. 44, 509–523. doi: 10.25300/MISQ/2020/14418

Bejarano, M. D., Sordo-Ward, A., Gabriel-Martin, I., and Garrote, L. (2019). Tradeoff between economic and environmental costs and benefits of hydropower production at run-of-river-diversion schemes under different environmental ?ows scenarios. J. Hydrol. 572, 790–804. doi: 10.1016/j.jhydrol.2019.03.048

Bhadoriya, A., Jani, M. Y., and Chaudhari, U. (2022). Combined effect of carbon emission, exchange scheme, trade credit, and advertisement efforts in a buyer's inventory decision. Proc. Integr. Optim. 6, 1043–1061. doi: 10.1007/s41660-022-00269-9

Bharadwaj, I. (2013). Organization sustainability. NHRD Network J. 6, 30–35. doi: 10.1177/0974173920130405

Chaudhari, U., Bhadoriya, A., Jani, M. Y., and Sarkar, B. (2023). A generalized payment policy for deteriorating items when demand depends on price, stock, and advertisement under carbon tax regulations. Math. Comput. Simulat. 207, 556–574. doi: 10.1016/j.matcom.2022.12.015

Chen, J., and Zhou, Q. (2017). City size and urban labor productivity in China: new evidence from spatial city-level panel data analysis. Econ. Syst. 41, 165–178. doi: 10.1016/j.ecosys.2016.07.002

Chen, T. Q., Zhang, Y., Jiang, C. L., and Li, H. (2023). How does energy efficiency affect employment? Evidence from Chinese cities. Energy 280:128071. doi: 10.1016/j.energy.2023.128071

Choi, Y., Zhang, N., and Zhou, P. (2012). Efficiency and abatement costs of energy-related CO2 emissions in China: a slacks-based efficiency measure. Appl. Energy 98, 198–208. doi: 10.1016/j.apenergy.2012.03.024

Cong, R., Lo, A. Y., and Yu, W. (2021). The distribution and regional determinants of nationally financed emissions-reduction projects in China. Energ. Policy 152:112215. doi: 10.1016/j.enpol.2021.112215

Cui, Y., Khan, S. U., Li, Z., Zhao, M., and France, N. (2021). Environmental effect, price subsidy and financial performance: evidence from Chinese new energy enterprises. Energ. Policy 149:112050. doi: 10.1016/j.enpol.2020.112050

Curran, D. (2018). Risk, innovation, and democracy in the digital economy. Eur. J. Soc. Theory 21, 207–226. doi: 10.1177/1368431017710907

Du, X. Y., and Jiang, K. Q. (2022). Promoting enterprise productivity: the role of digital transformation. Borsa Istanb. Rev. 22, 1165–1181. doi: 10.1016/j.bir.2022.08.005

Fan, Z. F., Xu, W. Y., and Zhang, W. (2023). Research on digital transformation strategy and subsidy mechanism of manufacturing supply chain based on differential game. Aims Math. 8, 23850–23870. doi: 10.3934/math.20231216

Farrell, M. J. (1957). The measurement of productive efficiency. J. Royal Stat. Soc.: Ser. A 120, 253–281. doi: 10.2307/2343100

Feng, Y. H., Chen, S. L., and Failler, P. (2020). Productivity effect evaluation on market-type environmental regulation: a case study of SO2 emission trading pilot in China. Int. J. Environ. Res. Public Health 17:8027. doi: 10.3390/ijerph17218027

Fitzgerald, M., Kruschwitz, N., Bonnet, D., and Welch, M. (2014). Embracing digital technology: a new strategic imperative. Mit Sloan Manage. Rev. 55, 1–12. Available online at: https://www.mendeley.com/catalogue/5923e03e-eeb4-359e-a575-a44df9dfcded/

Gal, P., Nicoletti, G., Rüden, C. V., Sorbe, S., and Renault, T. (2019). Digitalization and productivity: in search of the holy grail: firm-level empirical evidence from European countries. Int. Prod. Mon. 37, 39–71. Available online at: https://www.csls.ca/ipm/37/OECD.pdf

Galindo-Martín, M., Castan~o-Martínez, M., and M'endez-Picazo, M. (2019). Digital transformation, digital dividends and entrepreneurship: a quantitative analysis. J. Bus. Res. 101, 522–527. doi: 10.1016/j.jbusres.2018.12.014

Ghosh, P. K., Manna, A. K., Dey, J. K., and Kar, S. (2021). Supply chain coordination model for green product with different payment strategies: a game theoretic approach. J. Clean. Prod. 290:125734. doi: 10.1016/j.jclepro.2020.125734

Ghosh, P. K., Manna, A. K., Dey, J. K., and Kar, S. (2022). A deteriorating food preservation supply chain model with downstream delayed payment and upstream partial prepayment. RAIRO-Oper. Res. 56, 331–348. doi: 10.1051/ro/2021172

Ghosh, P. K., Manna, A. K., Dey, J. K., and Kar, S. (2023). Optimal policy for an inventory system with retailer's hybrid payment strategy and supplier's price discount facility under a supply chain management. Optimization 12, 1–40. doi: 10.1080/02331934.2023.2284969

Ghosh, P. K., Manna, A. K., Dey, J. K., and Kar, S. (2025). Pricing strategies of the green product with warranty and product insurance based on the consumer's opinion in a supply chain model. Environ. Dev. Sustain. 2, 1–46. doi: 10.1007/s10668-025-05961-7

Hajli, M., Sims, J. M., and Ibragimov, V. (2015). Information technology (IT) productivity paradox in the 21st century. Int. J. Prod. Perform. Manag. 64, 457–478. doi: 10.1108/IJPPM-12-2012-0129

Hasan, M. A., Nahiduzzaman, K. M., and Aldosary, A. S. (2018). Public participation in EIA: a comparative study of the projects run by government and non-governmental organizations. Environ. Impact Assess. Rev. 72, 12–24. doi: 10.1016/j.eiar.2018.05.001

Huang, H. S., Wang, C. T., Wang, L. K., and Yarovaya, L. (2023). Corporate digital transformation and idiosyncratic risk: based on corporate governance perspective. Emerg. Mark. Rev. 56:101045. doi: 10.1016/j.ememar.2023.101045

Ishfaq, R., Davis-Sramek, E., and Gibson, B. (2022). Digital supply chains in omnichannel retail: a conceptual framework. J. Bus. Logist. 43, 169–188. doi: 10.1111/jbl.12277

Jani, M. Y., Chaudhari, U., and Sarkar, B. (2021). How does an industry control a decision support system for a long time? RAIRO-Oper. Res. 55, 3141–3152. doi: 10.1051/ro/2021063

Kang, J. J., Yu, C. Y., Xue, R., Yang, D., and Shan, Y. L. (2022). Can regional integration narrow city-level energy efficiency gap in China. Energ. policy 163:112820. doi: 10.1016/j.enpol.2022.112820

Kaur, N., and Sood, S. K. (2017). An energy-efficient architecture for the internet of things (IoT). Ieee Syst. J. 11, 796–805. doi: 10.1109/JSYST.2015.2469676

Kraus, S., Schiavone, F., Pluzhnikova, A., and Invernizzi, A. C. (2021). Digital transformation in healthcare: analyzing the current state-of-research. J. Bus. Res. 123, 557–567. doi: 10.1016/j.jbusres.2020.10.030

Lange, S., Pohl, J., and Santarius, T. (2020). Digitalization and energy consumption. Does ICT reduce energy demand? Ecol. Econ. 176:106760. doi: 10.1016/j.ecolecon.2020.106760

Li, H. L., Wu, Y., Cao, D. M., and Wang, Y. C. (2021). Organizational mindfulness towards digital transformation as a prerequisite of information processing capability to achieve market agility. J. Bus. Res. 122, 700–712. doi: 10.1016/j.jbusres.2019.10.036

Li, S., Liu, J. J., and Shi, D. Q. (2021). The impact of emissions trading system on corporate energy efficiency: Evidence from a quasi-natural experiment in China. Energy 233:121129. doi: 10.1016/j.energy.2021.121129

Li, S. G., Yang, Z., and Tian, Y. X. (2023). Digital transformation and corporate performance: evidence from China. China Econ. J. 16, 312–334. doi: 10.1080/17538963.2023.2254138

Liao, X., and Shi, X. (2018). Public appeal, environmental regulation and green investment: evidence from China. Ener. Pol. 119, 554–562. doi: 10.1016/j.enpol.2018.05.020

Liu, T. X., and Xiu, X. F. (2015). Can internet search behavior help to forecast the macro economy? Econ. Res. J. 50, 68–83.

Llopis-Albert, C., Rubio, F., and Valero, F. (2021). Impact of digital transformation on the automotive industry. Technol. Forecast Soc. Change 162:120343. doi: 10.1016/j.techfore.2020.120343

Majchrzak, A., Markus, M. L., and Wareham, J. (2016). Designing for digital transformation: lessons for information systems research from the study of ICT and societal challenges. Mis. Quart. 40, 267–277. doi: 10.25300/MISQ/2016/40:2.03

Nakkas, A., and Xu, Y. (2019). The impact of valuation heterogeneity on equilibrium prices in supply chain networks. Prod. Oper. Manag. 28, 241–257. doi: 10.1111/poms.12901

Nunn, N., and Qian, N. (2014). US food aid and civil con?ict. Am. Econ. Rev. 104, 1630–1666. doi: 10.1257/aer.104.6.1630

Orellano, M., and Tiss, S. (2024). Impact of digital transformation on supply chain efficiency: a parallel mediation model. J. Organ. Change. Manag. 37, 945–964. doi: 10.1108/JOCM-10-2023-0411

Pan, W. R., Xie, T., Wang, Z. W., and Ma, L. S. (2022). Digital economy: An innovation driver for total factor productivity. J. Bus. Res. 139, 303–311. doi: 10.1016/j.jbusres.2021.09.061

Peng, Y. Z., and Tao, C. Q. (2022). Can digital transformation promote enterprise performance?-From the perspective of public policy and innovation. J. Innov. Knowl. 7:100198. doi: 10.1016/j.jik.2022.100198

Piccinini, E., Hanelt, A., Gregory, R., and Kolbe, L. (2015). “Transforming industrial business: the impact of digital transformation on automotive organizations,” in Proceedings of the ICIS (Nanjing).

Reis, J., Amorim, M., Melão, N., and Matos, P. (2018). “Digital transformation: a literature review and guidelines for future research,” in World Conference on Information Systems and Technologies (Florianópolis). doi: 10.1007/978-3-319-77703-0_41

Ren, S., Hao, Y., Xu, L., Wu, H., and Ba, N. (2021). Digitalization and energy: How does internet development affect China's energy consumption? Energ. Econ. 98:105220. doi: 10.1016/j.eneco.2021.105220

Ren, S., Li, X., Yuan, B., Li, D., and Chen, X. (2018). The effects of three types of environmental regulation on eco-efficiency: a cross-region analysis in China. J. Clean. Prod. 173, 245–255. doi: 10.1016/j.jclepro.2016.08.113

Ribeiro-Navarrete, S., Botella-Carrubi, D., Palacios-Marqu'es, D., and Orero-Blat, M. (2021). The effect of digitalization on business performance: an applied study of KIBS. J. Bus. Res. 126, 319–326. doi: 10.1016/j.jbusres.2020.12.065

Ritala, P., Baiyere, A., Hughes, M., and Kraus, S. (2021). Digital strategy implementation: the role of individual entrepreneurial orientation and relational capital. Technol. Forecast. Soc. Change 171, 120961. doi: 10.1016/j.techfore.2021.120961

Rupeika-Apoga, R., Petrovska, K., and Bule, L. (2022). The effect of digital orientation and digital capability on digital transformation of SMEs during the COVID-19 pandemic. J. Theor. Appl. El. Comm. 17, 669–685. doi: 10.3390/jtaer17020035

Saha, S., Alrasheedi, A. F., and Khan, M. A. A. (2024). Optimal strategies for green investment, sharing contract and advertisement effort in a supply chain coordination problem. Ain. Shams. Eng. J. 15, 102595. doi: 10.1016/j.asej.2023.102595

Schilling, L., and Seuring, S. (2024). Linking the digital and sustainable transformation with supply chain practice. Int. J. Prod. Res. 62, 949–973. doi: 10.1080/00207543.2023.2173502

Shah, N. H., Chaudhari, U., and Jani, M. Y. (2016). Optimal policies for time-varying deteriorating item with preservation technology under selling price and trade credit dependent quadratic demand in a supply chain. Int. J. Appl. Comput. Math. 3, 1–17. doi: 10.1007/s40819-016-0141-3

Shah, N. H., Chaudhari, U., and Jani, M. Y. (2017). Supply chain inventory model for multi-tems with up-stream permissible delay under price sensitive quadratic demand. Investigacion Operacional 38, 492–509.

Shah, N. H., Chaudhari, U., and Jani, M. Y. (2025). Optimal control analysis for service, inventory and preservation technology investment. Int. J. Syst. Sci-open. 6, 130–142. doi: 10.1080/23302674.2018.1447167

Shang, Y., Raza, S. A., Huo, Z., Shahzad, V., and Zhao, X. (2023). Does enterprise digital transformation contribute to the carbon emission reduction? Micro-level evidence from China. Int. Rev. Econ. Financ. 86, 1–13. doi: 10.1016/j.iref.2023.02.019

Shi, D. Q., Yang, Z. J., and Ji, H. K. (2022). Energy target-based responsibility system and corporate energy efficiency: evidence from the eleventh Five Year Plan in China. Energ. Policy 169:113214. doi: 10.1016/j.enpol.2022.113214

Song, Y., and Zhang, M. (2020). Research on the gravity movement and mitigation potential of Asia's carbon dioxide emissions. Energy 170, 31–39. doi: 10.1016/j.energy.2018.12.110

Sorescu, A., and Schreier, M. (2021). Innovation in the digital economy: a broader view of its scope, antecedents, and consequences. J. Acad. Market. Sci. 49, 627–631. doi: 10.1007/s11747-021-00793-z

Sun, C., Zhan, Y., and Du, G. (2020). Can value-added tax incentives of new energy industry increase firm's profitability? Evidence from financial data of China's listed companies. Energy Econ. 86:104654. doi: 10.1016/j.eneco.2019.104654

Thakur, P., and Wilson, V. H. (2024). Circular innovation ecosystem: a multi-actor, multi-peripheral and multi-platform perspective. Environ. Dev. Sustain. 26, 14327–14350. doi: 10.1007/s10668-023-03196-y

Tone, K. (2002). A slacks-based measure of super-efficiency in data envelopment analysis. Eur. J. Oper. Res. 143, 32–41. doi: 10.1016/S0377-2217(01)00324-1

Verhoef, P. C., Broekhuizen, T., Bart, Y., Bhattacharya, A., Dong, Q., Fabian, N., et al. (2021). Digital transformation: a multidisciplinary reflection and research agenda. J. Bus. Res. 122, 889–901. doi: 10.1016/j.jbusres.2019.09.022

Vial, G. (2019). Understanding digital transformation: a review and a research agenda. J. Strategic Inf. Syst. 28, 118–144. doi: 10.1016/j.jsis.2019.01.003

Wang, H. R., Cui, H. R., and Zhao, Q. Z. (2021). Effect of green technology innovation on green total factor productivity in China: evidence from spatial durbin model analysis. J. Clean. Prod. 288:125624. doi: 10.1016/j.jclepro.2020.125624

Wang, J. Q., Ma, X. W., Zhang, J., and Zhao, X. (2022). Impacts of digital technology on energy sustainability: China case study. Appl. Energ. 323:119329. doi: 10.1016/j.apenergy.2022.119329

Wei, J. Y., Zhang, X. W., and Tamamine, T. (2024). Digital transformation in supply chains: assessing the spillover effects on midstream firm innovation. J. Innov. Knowl. 9:100483. doi: 10.1016/j.jik.2024.100483

Wiedmer, R., and Griffis, S. E. (2021). Structural characteristics of complex supply chain networks. J. Bus. Logist. 42, 264–290. doi: 10.1111/jbl.12283

Yang, Z. K., Zhang, M. M., Liu, L. Y., and Zhou, D. Q. (2022). Can renewable energy investment reduce carbon dioxide emissions? Evidence from scale and structure. Energ. Econ. 112:106181. doi: 10.1016/j.eneco.2022.106181