- Department of Accounting and Finance, Prince Mohammad bin Fahd University, Khobar, Saudi Arabia

This study measures the effects of corporate governance (CG) and corporate social responsibility (CSR) on bank risk. The data were collected from DataStream from 2010 to 2021 from the World Development Indicators. The analysis in this study utilized the fixed effects model, where multiple parameters were found to be negatively associated with credit risk, such as board independence, board size, and board meetings. By contrast, ownership concentration can positively affect bank credit risk. Additionally, applying CSR can decrease credit risk. Finally, this study sheds light on the implementation of governance, which leads to a reduction in credit risk. Our findings have significant policy implications for credit risk management in the banking sector, emphasizing that a one-size-fits-all approach is inadequate. Governance practices effective in one context may not produce the same outcomes in another. The evidence suggests that banks in emerging economies are making meaningful strides in establishing and strengthening effective governance frameworks.

1 Introduction

Corporate governance (GC) is essential for strengthening the relationship between the board of directors and stakeholders to ensure the elimination of financial risk decisions at all levels. An efficient GC system has the advantage of protecting the organization from external upset and providing stability to achieve its financial goals, which is essential for banking organizations (Bhagat and Jefferis 2005; Bauwhede, 2009). Effective CG practices guide organizations to the best of their interests and enhance their materiality assessment disclosures to become more responsible for shareholders. Strong CG practices can financially enhance a firm’s strategic decisions to reduce credit risk and to become more creditworthy (Gennaioli et al., 2012).

CG includes credit risk strategies to ensure operational banking stability. A well-organized mechanism is essential for managing financial risk to avoid bankruptcy (Singhania et al., 2022). These strategies allow organizations to become more transparent and trusted with their CSR.

In the modern business era, organizations must invest in social and environmental targets, in addition to their financial goals, to be competitive and committed to sustainable development and social contributions (Farooq and de Villiers, 2018). Social responsibilities reduce default risk as they increase overall transparency. A bank’s directors may change their decisions based on the organization’s CSR reports, which may lead to increased bank credit. It is worth highlighting that limited research addresses the relationship between CSR, CS, and credit risk.

CSR practices have a positive impact on an organization by brightening its image positively as they contribute to society (Liu et al., 2021). These practices can effectively control risk-related activities. As CG focuses on shareholders’ interests, CSR focuses on both shareholders’ and stakeholders’ interests. CSR has an impact on credit risk either positively or negatively. It is important to explore the impact of CG and CSR on credit risk simultaneously rather than separately. Therefore, this study links the literature by investigating the impacts of CG and CSR on credit risk in the Asian banking sector. Despite the increasing research on the concepts of CG and CSR, the literature that links good CG and CSR practices in the banking sector, is limited and shallow. The banking sector plays a crucial role in developing countries, as it is an important part of their economies (Nisar et al., 2018). In fact, there are banks in Asian countries that lack CSR practices and CG policies. Unlike in developed countries, banks have value created for their societies by dual money transfers between lenders and borrowers, which contain financial risks (Belasri et al., 2020). The application of stringent risk management practices is essential for controlling credit risk. This is the main focus of bank survival and success (Hunjra et al., 2020).

It is important to explore the impact of the main CG components on credit risk, such as board meetings and ownership structures. Banks have a negative effect on risk-taking operations in emerging countries due to high competition. Since most research focuses on the US and European markets, studies on international markets are limited and lack empirical evidence relating to the role of CSR in debt markets. It is important to consider comparative analyses between geographical regions for various reasons such as standards and regulations. Therefore, this study explores CG and CSR and their impact on bank credit risk in the banking sectors of emerging Asian countries. To the best of our knowledge, this study is the first to investigate the banking sector in emerging Asian countries in the context of CG, CSR, and credit risk. The banking sector is a vital pillar of any economy, playing a crucial role in national development. In emerging markets, it holds particular significance, as a strong and stable banking system is essential for sustained economic growth (Nisar et al., 2018). However, many banks in the Asian region still lack comprehensive CSR practices and the effective implementation of CG policies.

Moreover, this study considers board gender diversity (BGD) as a channel for CG and credit risk. We consider the role of culture in board gender diversity (BGD) as an additional channel linking CG and credit risk, as previous research suggests that the presence of women on boards significantly influences CG and firm decision-making. Female representation on boards also plays a moderating role in the relationship between CG and firm risk-taking. This study considered both static and dynamic analysis techniques for data from 224 listed banks to examine certain hypotheses. The findings show a significant and inverse effect of certain CG measures on credit risk. By contrast, ownership concentration is positively correlated with bank credit risk. We employed static and dynamic panel analysis methods to evaluate our hypotheses and mitigate endogeneity problem. The following sections provide a brief review of the literature, details of the methodology, overview of the empirical findings, and summary of the study.

2 Literature review

In the past several years, there has been a recent evolution in literature to reflect on the dynamics of CG, CSR, and, more specifically, credit risk due to the fast-evolving environment after the COVID era along with many regulation changes, for instance, the Basel IV implementation. The current study would be based on the aggregation of previous research, especially from empirical studies that have been focused on Asian economies in the recent period.

Having been prompted by the sudden global economic shocks as a result of COVID-19, the topic of ESG integration is now recognized as a crucial factor in financial resilience. The basic assumption that ESG can act as a countermeasure to systemic risk was confirmed by Kaminskyi et al. (2025), who showed that ESG banks that are well anchored in ESG guidelines have lower volatility of credit risk exposure during economic shocks. This supports the hypothesis that engagement in CSR brings in a positive contribution to the stability of financial institutions (Al Amosh and Khatib, 2023).

The role of board structure and diversity of the corporations have been increasingly emphasized in terms of CG. An empirical study focused on banks in ASEAN countries found that board gender diversity and independence decrease NPLs and enhance CARs. The findings demonstrate that in line with frameworks including the CG in risk models, the substantial moderating effect of board gender diversity should be considered (Ho et al., 2024).

Regulatory change especially relating to Basel IV and sustainability reporting are reorienting governance practices for emerging markets. After post-Basel IV regimes, strengthening risk governance structures has facilitated mid-sized Asian banks to strengthen credit risk management practices.

It also brings digital governance tools into CG and credit risk relationships as a new phenomenon. Its governance has expanded beyond normal administration of the board to include integrating AI that boosts the use of credit scoring and FinTech monitoring systems. In data-sustaining emerging market contexts that AI-enhanced transparency and data analytics have enhanced the board’s ability to monitor risk exposure as well as guarantee CSR compliance (Hariharan Pappil Kothandapani, 2022).

Keeping these new developments in mind, it is now time to put forward this study’s theoretical framework in a new context, one which takes into consideration the deepening confluence between CG, CSR, and technological innovation. To make the study more explanatory and in line with current empirical evidence, the insights from recent literature are incorporated.

Banks’ risk-taking activities are one of the major focuses of the study conducted by Hunjra, who utilized empirical and theoretical methods to investigate the factors that affect the behavior of banks (the financial system) in taking risks. Several studies have demonstrated relationships between CSR theories and CG, bank credit risk, and CSR. Hunjra examined the relationship between bank credit risk and multiple theories, such as agency theory, stewardship theory, stakeholder theory, and resource dependency theory.

Agency theory examines the relationship between shareholders as a principal and management as agents, ensuring that agents will not act in their own interests rather than in the interests of the organization. Agency theory aims to align the interests of shareholders and management through a well-established mechanism. Additionally, agency theory supports the vision of structuring a mechanism to link compensation with performance in a win–win situation. Moreover, this model maximizes commitment to a huge project that will neither add value financially nor have other positive impacts on the firm and can place the firm in a very risky situation. Benefits both parties and reduces the issues that may occur. Jensen and Meckling showed that management may act and make decisions in their best interests, mainly because of separation of ownership. For example, committing to a huge project that will neither add financial value nor have other positive impacts on the firm can place the firm in a risky situation. Thus, applying CG applications will ensure sufficient monitoring in a high-level view to protect all parties, which will reduce agency issues. Ayadi expressed that having a minimum number of board members can be effective in terms of decision making, coordination, and applying all control mechanisms across the organization.

On the other hand, the stewardship theory suggests that a firm’s management is motivated to act in the best interest of the firm and its stakeholders. Additionally, this theory suggests that a firm’s management is a steward of the firm, and ensures the creation of a healthy environment across management, shareholders, and others. Moreover, the stewardship theory suggests that managers ignore their personal interests in the decisions made, which shows that stewards are a great tool for firms to improve their overall financial profitability and efficiency. Furthermore, this theory suggests that a firm’s executives make decisions based on the interests of its shareholders, ensuring a successful journey for the firm.

Stewardship theory suggests that a firm’s executives and managers will ensure improvement in non-financial aspects, as it suggests that they will be self-driven, which will increase their motives to act to the best of the firm, hitting the fact that the non-financial aspect is one of the key segments. Moreover, this theory suggests that a firm’s management will act ethically in the best interest of the firm, seeking a long-term relationship, and by this, this theory assumes that managers will create a collaborative environment among the employees, which will foster a healthy and competitive work environment to reach the planned goals. Furthermore, ignoring self-interest is one of the main objectives of this theory, which suggests that managers will increase the wellbeing of employees in the firm and utilize its goods and resources in the best benefit of the company to drive the firm to its best interest by increasing its employees’ morale, which will support the firm’s goals. Furthermore, stewardship theory suggests that executives act as stewards for the firm and positively take care of its stakeholders’ best benefits and interests. Stewardship theory also claims that a better added value will occur in the firm, where managers will not only focus on the financial benefits but also on the non-financial aspect by motivating employees, spreading positive work ethics, and increasing the satisfaction level.

Stakeholder theory suggests that a firm’s CG should be extended to cover all stakeholders, as it promotes succession to be chain-linked and interconnected with all group members, such as employees, suppliers, the community, and all stakeholders in the firm. Moreover, stakeholder theory aims to create a win-win situation for all parties, as it ensures sustainable CSR. In other words, stakeholder theory is similar to agency theory in concept; however, it focuses on all stakeholders rather than only shareholders. In other words, the consideration segment for stakeholder theory is much larger than that for agency theory, which focuses more on all stakeholders, as it focuses on multiple beneficiaries; however, agency theory focuses on stockholders, which are represented by one segment. Moreover, stakeholder theory suggests that firms must balance the interests of all stakeholders and ensure an evenly distributed impact across all players as this affects the overall firm’s achievements. In other words, this theory suggests that all stakeholders (owners, customers, employees, suppliers, competitors, local authorities, governments, etc.) can impact on an organization’s overall goals and performance, where having a strategic alliance and agreement that will fit all parties can benefit the main organizational goal and drive the organization. In other words, the overall benefit to all stakeholders is interconnected with the goals of each individual, which enables stakeholders to work together to achieve the targeted goal, as this will achieve the personal goal, which will reflect positive performance. The stakeholder theory promotes sustainable CSR among all stakeholders, which supports the creation of value for broader groups to ensure successful partnerships.

Resource dependency theory emphasizes the importance of establishing CSR with external parties as firms are considered dependent. This suggests that a firm is dependent on the environment in which it operates. Creating and developing strong relationships with other partners is a major factor in the resource dependency theory. Resource dependency theory suggests that one of the main responsibilities of a firm’s management is to establish a powerful linkage between the firm and the environment in which they operate. Resource dependency theory states that creating strong relationships and links will ensure the sustainability of the firm and will support the firm to react to external changes effectively and efficiently. Additionally, the resource dependency theory calls for a large number of board members with a large number of external links to increase the linkages and strategic relationships between the firm and the outside environment to ensure resource availability and stability to achieve much higher performance.

According to Hunjra, investors have multiple factors to decide whether to invest, one of which is the return on investment. However, another major factor is the level of risk of the investment. Thus, having a well-structured firm that fully implements CG will drive the firm to a much lower risk than firms that do not implement CG. Additionally, implementing CG will ensure a higher return on investment while reducing the risk to a lower level. A study was conducted by Chen and Lin in 2016 where they studied banks in 43 countries, where they discovered that reducing investment risks is linked with implementing CG. Another study conducted by Permatasari (2020) on Indonesian banks revealed that implementing CG can reduce market, operational, and other types of risk.

Board size is one of the main factors that improve a firm’s governance. Jensen shows that board size affects firm efficiency. Belgacem discussed that the ability to monitor is greater in firms with large boards; thus, they showed that it is important to have a large board size. On the other hand, Adams and Mehran showed that large board-size firms have low risk, and their study showed that boards in the UK are much larger than those in US banks. Moreover, a study conducted by Moussa showed that a large board size will result in higher credit risks, where this study was conducted in Tunisia from to 2000–2014.

Drawing on agency theory, AlHares (2020) argues that managers often act in their self-interest, leading to potential conflicts with owners due to the separation of ownership and control. This misalignment can result in managers pursuing unproductive projects or misallocating resources, thereby increasing the firm’s risk. The implementation of CG practices helps mitigate these agency problems through effective monitoring and also reassures shareholders and investors, who tend to favor firms with strong governance structures. A smaller board size can be beneficial, as it promotes better communication and coordination among members, ultimately reducing conflicts between management and owners by enhancing internal control mechanisms.

Board size has a positive relationship with improving governance and lowering agency costs. Moreover, board size has a positive impact on organizational efficiency because large boards have more monitoring capabilities and provide more effective advice (Boubaker and Nguyen, 2014). In addition, a large board size has a positive impact on risk reduction because of independence (Cheng, 2008). A study conducted in Tunisia on selected banks showed that banks have a higher credit risk because of a larger board (Moussa, 2019). Moreover, another study analyzed the impact of board size and found that large board sizes had a significant effect on credit risk (Korzeb et al., 2025).

H1: Board size hurts bank credit risk.

Agency theory assumes that a board primarily consists of independent directors. Monitoring organizational activities performed by independent directors is more effective than monitoring those performed by insider directors (Abiad et al., 2025). Stakeholder theory expands upon agency theory by shifting the focus from stockholders to a broader range of stakeholders. In response to the evolving business environment, organizations are expected to consider and balance the interests of various parties including owners, employees, customers, suppliers, competitors, environmental advocates, government bodies, and local communities, as each plays a role in influencing the organization’s ability to achieve its objectives. According to stakeholder theory, the board of directors should act in the interests of all stakeholders and align their decisions and actions accordingly.

Independent directors minimize risks and costs because they do not prefer self-interest (De Andres and Vallelado, 2008). A study conducted for 212 banks in the US for 7 years starting from 1997 observed a negative relationship with the bank risk as a result of the independent directors.

H2: Independent directors on the board hurt bank credit risk.

Stewardship theory suggests that managers prioritize the overall wellbeing of the organization over their interests. Senior executives, acting as stewards, are motivated to serve the best interests of shareholders. They are driven by a sense of responsibility and a desire to create long-term value for the organization. This rational and purpose-driven behavior contributes to improved profitability. Moreover, stewardship theory acknowledges that managers are motivated not only by financial rewards but also by non-financial factors such as recognition, personal fulfillment, and strong work ethics.

The number of board meetings conducted annually has a positive impact on the performance and efficiency of the board of directors as well as smooth operations and monitoring advantages (Nguyen, 2022). Furthermore, meetings with the board of directors are essential for discussing enhancements in monitoring activities and strategies. To ensure the effectiveness of directors’ meetings, the board of directors should meet as a group at an organized frequency (AlHares and Al-Hares, 2020). Moreover, having all relevant information available and ready for discussion is essential to satisfy the objective of sharing ideas and monitoring organizational strategies (Francis et al., 2008).

H3: Board meeting hurts bank credit risk.

Resource dependency theory posits that organizations benefit from having larger boards with extensive external connections, as these linkages provide access to valuable resources and high-quality guidance, ultimately enhancing firm performance. Large shareholders help monitor managers with lower agency costs and mitigate conflicts of interest (Álvarez-Botas et al., 2022). Moreover, large shareholders play an effective role in controlling organizational matters in a way that mitigates conflicts of interest (Mansour, 2025). Owners can affect managers because of ownership concentration, as highlighted by agency theory (Jensen and Meckling, 1976). Concentrated owners can help provoke risky decisions by managers. Organizational performance is negatively affected by the board of directors who share a large portion of their shares (Shleifer and Vishny, 1997).

H4: Ownership concentration hurts bank credit risk.

Agency theory considers CSR practices as a cover for organizational misconduct, which increases organizational risk. Thus, CSR practices are an important performance measure for identifying credit risks. Environmental factors in CSR hurt credit risk in US organizations, as per a study conducted from 2003 to 2018 (Bannier et al., 2022). Resource dependency theory suggests that organizations are inherently interdependent with the external environment in which they operate. From this perspective, corporate boards can extend their function beyond internal governance by establishing strong connections with external entities, thereby incorporating and managing outside influences to support the organization’s goals.

CSR practices have a positive impact on workers’ attitudes toward activities performed under financial constraints. Moreover, a study conducted by Luo and Bhattacharya (2009) reveals a negative relationship between CSR and bank credit risk. In addition, organizations that contribute to CSR are leaning toward minimizing bank credit risk (Hunjra et al., 2020). However, banks are worried about participating in CSR because of the financial expenses incurred to comply with CSR policies (Belasri et al., 2020).

H5: CSR has a significant negative impact on bank credit risk.

3 Theoretical framework

This article uses a multi-theoretical approach to analyze the relationship between CG, CSR, and credit risk of emerging market banks. This research integrates economic and ethical dimensions of governance through agency, stakeholder, resource dependency, and stewardship theories to explain how CG and CSR practices are associated with credit risk. Using a pluralistic theoretical approach responds to calls from the literature to go beyond mono-theoretical assumptions in the context of the complexity of institutional environments prevalent in emerging markets (Berber et al., 2019).

3.1 Agency theory

This framework is based on the Western economic perspective; agency theory when the objectives of principals (shareholders) differ from the objectives of agents (managers). In particular, such agency conflicts are rather acute in banking, given that (i) financial operations in banking are highly opaque and (ii) the high leverage that is typical for banks (Gwala and Mashau, 2023). Both governance mechanisms of board independence and ownership concentration therefore are crucial to tie management behavior to the interests of the shareholder. Independent boards are more likely to exercise oversight of executive decision-making, enforce risk limits, and decrease the amount of opportunistic behaviors by the executive, thereby decreasing a bank’s credit risk profile. Agency Theory has been critiqued widely because it emphasizes only financial return and assumes managerial opportunism but forgets other stakeholder interests (Al Lawati and Sanad, 2023).

3.2 Stakeholder theory

This theory argues for a richer definition of the entities that are being affected by organizational activities. There are two sides to these perspectives, the CG and CSR will require trust, legitimacy, and social capital with every stakeholder such as regulators, customers, employees, and communities. Reputational risks resulting from stakeholders’ dissatisfaction in the banking sector may directly affect creditworthiness and access to capital. Informal risk mitigation mechanisms can be found in CSR initiatives that align with stakeholder expectations (depending on the case in point, this can be ethical lending, community development, or transparent disclosure) (Kalra, 2024). In fact, in the context of market emerging, where legal enforcement, as well as regulation capacity, is still not guaranteed, stakeholder trust takes on an even more important role. Although many have criticized Stakeholder Theory for its lack of specificity in identifying which of all the stakeholder interests should be prioritized at the expense of strategic focus, the theory has variants for dividing stakeholder interests based on the degree of control (Awa et al., 2024).

3.3 Resource dependency theory

Filling in the last theoretical gap is Resource Dependency Theory which enhances the strategic role of the board to facilitate access to external resources and legitimacy in general. Taş and Öztürk (2023) agree that the organization is dependent on external actors for such resources as capital, information, and legitimacy, and boards are critical liaisons between the organizations and these environments. Gender diversity on the board is viewed as a very strategic asset in this regard. The breadth of gender diversity: diversity of the board to bring in different perspectives and problem-solving capacity which in itself may further bolster investor confidence and regulatory approval. As empirical evidence in emerging markets indicates, female representation on boards is positively linked to increased transparency and decreased risk-taking and, as such, contributes indirectly to lower credit risk. Therefore, some scholars caution that diverse boards could be suppressed by tokenism, that is, the absence of inclusion would undermine the contribution of diversity to substantive governance performance (Menicucci and Paolucci, 2021).

3.4 Stewardship theory

This theory complements the economic rationale of Agency Theory and provides a less pessimistic view of managerial behavior. Stewardship Theory postulates that managers are guided by proactive and socially oriented attitudes when they are empowered and supported by their trust-based governance mechanism. Given this perspective, when managers operate under a transparent, ethically founded CSR framework there is a greater likelihood of their actions being in the interest of their firm and the broader spectrum of stakeholders within it (Simão and Beuren, 2022). For example, stewardship behaviors handling in the banking context, prudent risk management, ethical lending, and long-term strategic planning will reduce credit risk. Specifically, this figure applies to emerging markets, where formal monitoring mechanisms may be limited or in which firms are reliant on intrinsic motivation and ethical leadership. However, opponents of the Stewardship Theory contend that its premises can be idealistic beyond common understanding as well as less substantiated in the evidence taken in the market settings (Kamara, 2024).

To integrate these four theoretical perspectives, this study creates a comprehensive model that explains the intricate relations that contribute to credit risk. The role of governance structure to manage risk then has a strong economic rationale grounded in Agency Theory and Resource Dependency Theory, while Stakeholder and Stewardship Theories emphasize the ethical and relational aspects of CSR. The rationale is that such an integration facilitates the development of rich hypotheses, for instance, that the independence of the board or gender diversity mitigates credit risk directly, and in turn, the same is mediated by the strength of CSR practices. The multi-theoretical framework also allows greater contextual understanding, as is needed for the study of emerging market banks with their respective institutional, cultural, and regulatory environments.

A combination of the multiple theoretical frameworks provides a better, more complete look into the CG and CSR interaction driving credit risk. It goes beyond the limitations of an approach based on a single theory and reflects on instrumental and normative dimensions of corporate behavior. Since formal governance structures are seldom present in most emerging markets, such an approach is essential to grasp the risk landscape in emerging markets.

4 Methodology

A study was conducted to analyze the CG and CSR of banks’ credit risk, using 224 samples collected from Asian banks. The banking system is a critical aspect in every country that plays a major role in its development, as well as in forming a strong economy. Additionally, a profitable banking and financial system indicates that the country’s overall economy is healthy. Developed countries have very strong banking systems that capitalize on strong CSR. On the other hand, Asian banks have very low CSR implementation, which increases the risk of financial impact. The data for this study were collected from DataStream from 2010 to 2021 from the World Development Indicators (WDI).

There are still differences in the number of user accounts a subscription offers, how a provider pre-processes and cleans data, whether the service permits bulk downloading, and what data coverage a basic subscription includes, even if these trustworthy data were available for comparable data products. Actually, for extra costs, the majority of vendors offer optional add-on services with more thorough data. It is consequently quite difficult to incorporate all of these contractual aspects into a thorough cost study. Additionally, the study utilized panel data regression as part of the methodology to test the stated hypothesis. Utilizing such a model allows us to test the coefficients under multiple effects such as common, fixed, and random effects. As a result, the fixed-effects model was utilized for this study as a result of the significant p-value. Moreover, the choice of databases can vary depending on the paper’s subject. For example, credit risk requires different data than CG. To account for topic-specific variation, Berninger et al. (2021) apply a Latent Dirichlet Allocation (LDA) clustering algorithm, identifying 20 topic clusters. LDA assigns each article a probability distribution across these topics, with the paper’s primary topic defined as the one with the highest probability. However, Berninger et al. (2021) do not label or interpret the 20 topics, relying solely on the algorithm’s output. Building on their method, we adopt a similar clustering approach but go further by classifying each cluster and merging those that are thematically similar.

To ensure robustness and validity of the empirical model, this study combines fixed effects and GMM techniques for two steps; system and Generalized Method of Moments (GMM).

4.1 Fixed effects model and Hausman test

Thus, the fixed effects model is first used to deal with the unobserved time invariant heterogeneity across banks that is particularly important when dealing with panel data with firm specific characteristics that are not observed in the covariates (Wooldridge, 2010). Formally, the Hausman specification test is conducted to test the appropriateness of the fixed effects model over the random effects alternative (χ2 = 24.63, p < 0.01) where result indicates a statistically significant difference between the models and hence the use of the fixed effects is preferred (Hausman, 1978).

4.2 Addressing endogeneity with system GMM

Since there are potential concerns of reverse causality and omitted variable bias, especially in the relationship between the CG, CSR, and credit risk, the study also uses a two step system GMM estimator of Arellano and Bover (1995) and Blundell and Bond (1998). The advantage of this approach is that lagged endogenous variable can be employed as instruments, it has control for autocorrelation and heteroskedasticity and the finite sample efficiency of the estimator is improved (Roodman, 2009).

4.3 Diagnostic tests for instrument validity

Hansen J test for overidentifying restrictions is used to confirm instrument validity and the results show that there is no significant instrument misspecification (p > 0.1). Second order serial correlation (AR(2)) is checked via the Arellano Bond test with a p value which is greater than 0.05 and suggests that there is no serial correlation. The study also limits the number of instruments to prevent instrument proliferation in order that the instruments per panels ratio does not exceed one (Roodman, 2009).

4.4 Summary of methodological rigor

The combined use of fixed effects and system GMM improves the methodological quality of the study by reducing the most common econometric difficulties, such as omitted variable bias, simultaneity, dynamic endogeneity. The hybrid approach strengthens the veracity of the conclusions on the effects of CG and CSR on credit risk in emerging market banks.

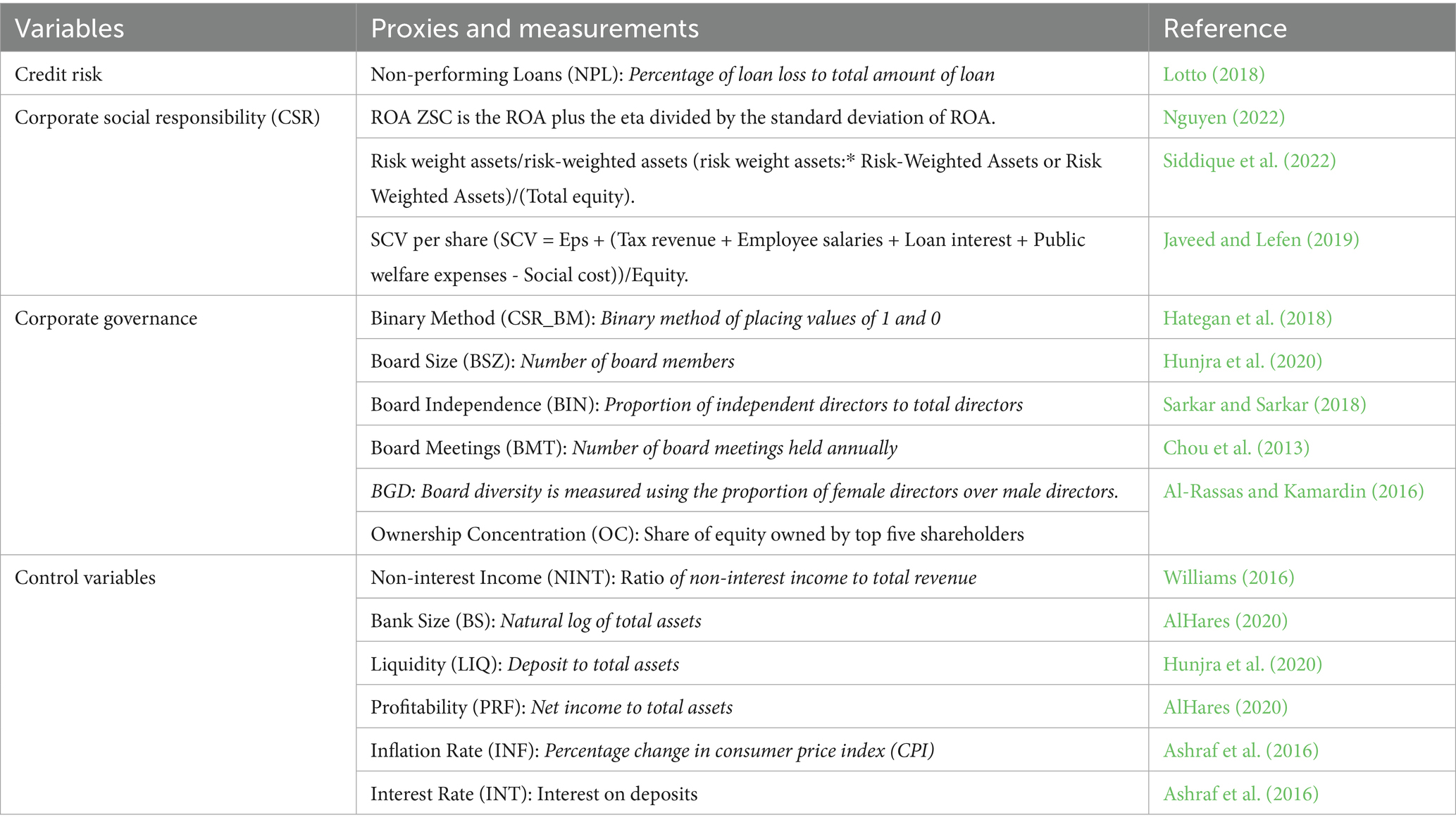

In this study, bank credit risk was utilized as the dependent variable (DV), and CG and CSR as independent variables, where three different factors were utilized. The first factor is NPL, which refers to non-performing loans; Lotto states that non-performing loans reflect the percentage of loan loss to the total loan amount. Additionally, Koju applied stated IV in his 2018 research. The Z-scores were the second factor utilized in this study, where they provide insight and prediction of bankruptcy, which can show financial health (Koju et al., 2018). Moreover, as explained by Lepetit and Strobel (in their study), a higher Z-score indicates a strong, stable financial system with a low possibility (Lepetit and Strobel, 2015). The capital adequacy ratio, represented by risk-weighted assets over total equity, was used as the third factor in this study (Siddique et al., 2022). CSR is divided into two measures. The first measure includes the social contribution value (SCV) per share, which considers the environmental, economic, and social aspects of CSR. The following equation was used to calculate this measure:

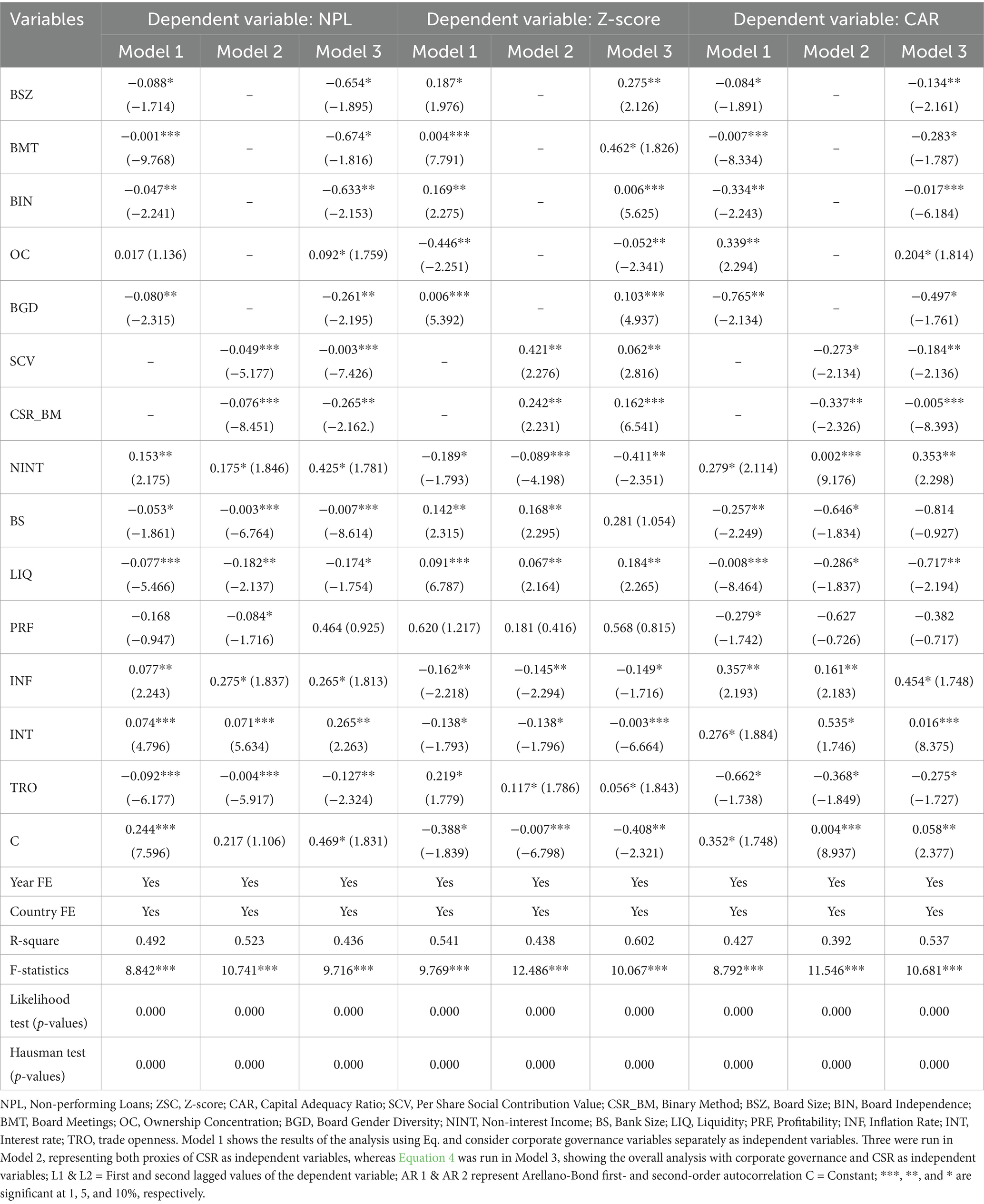

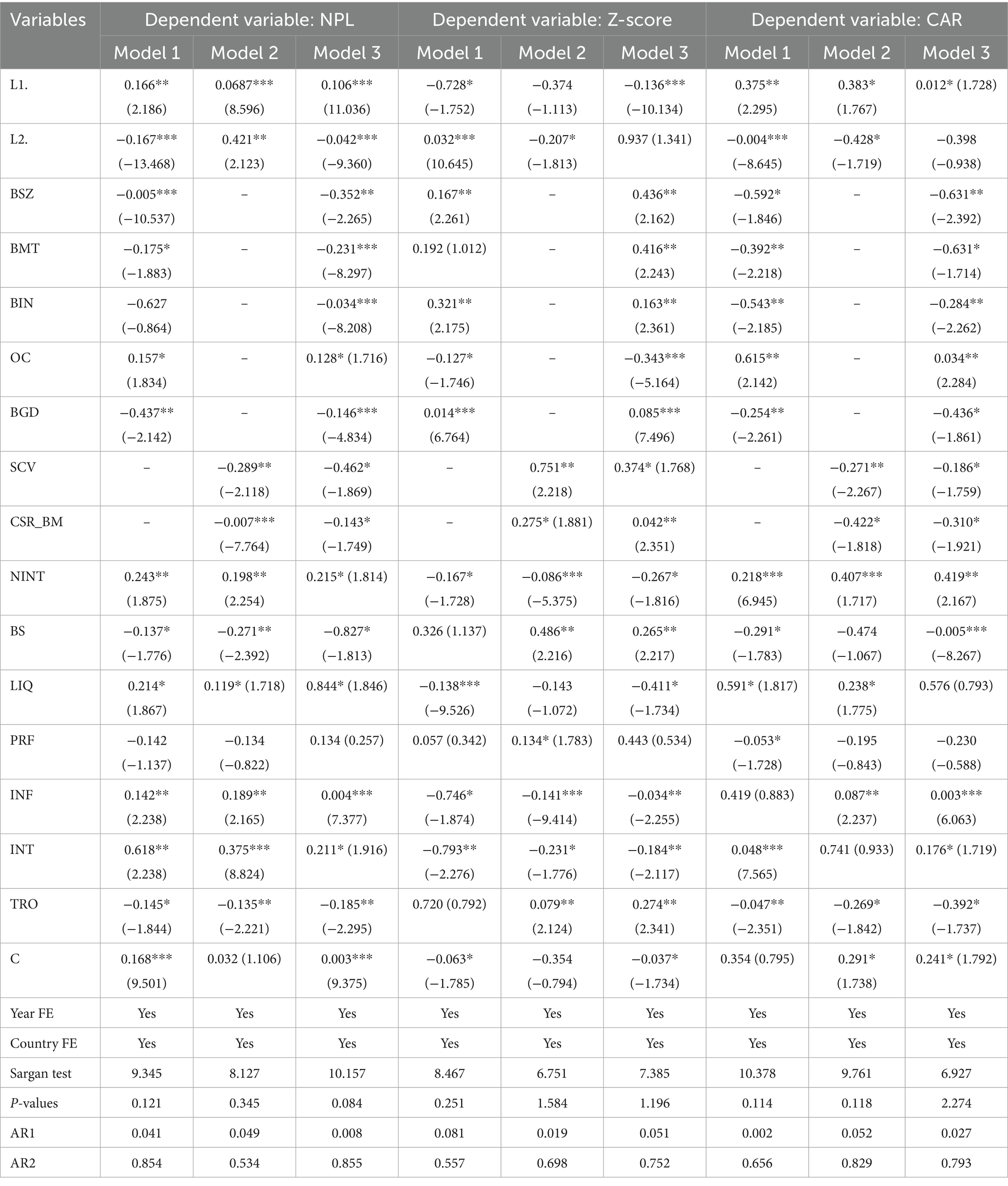

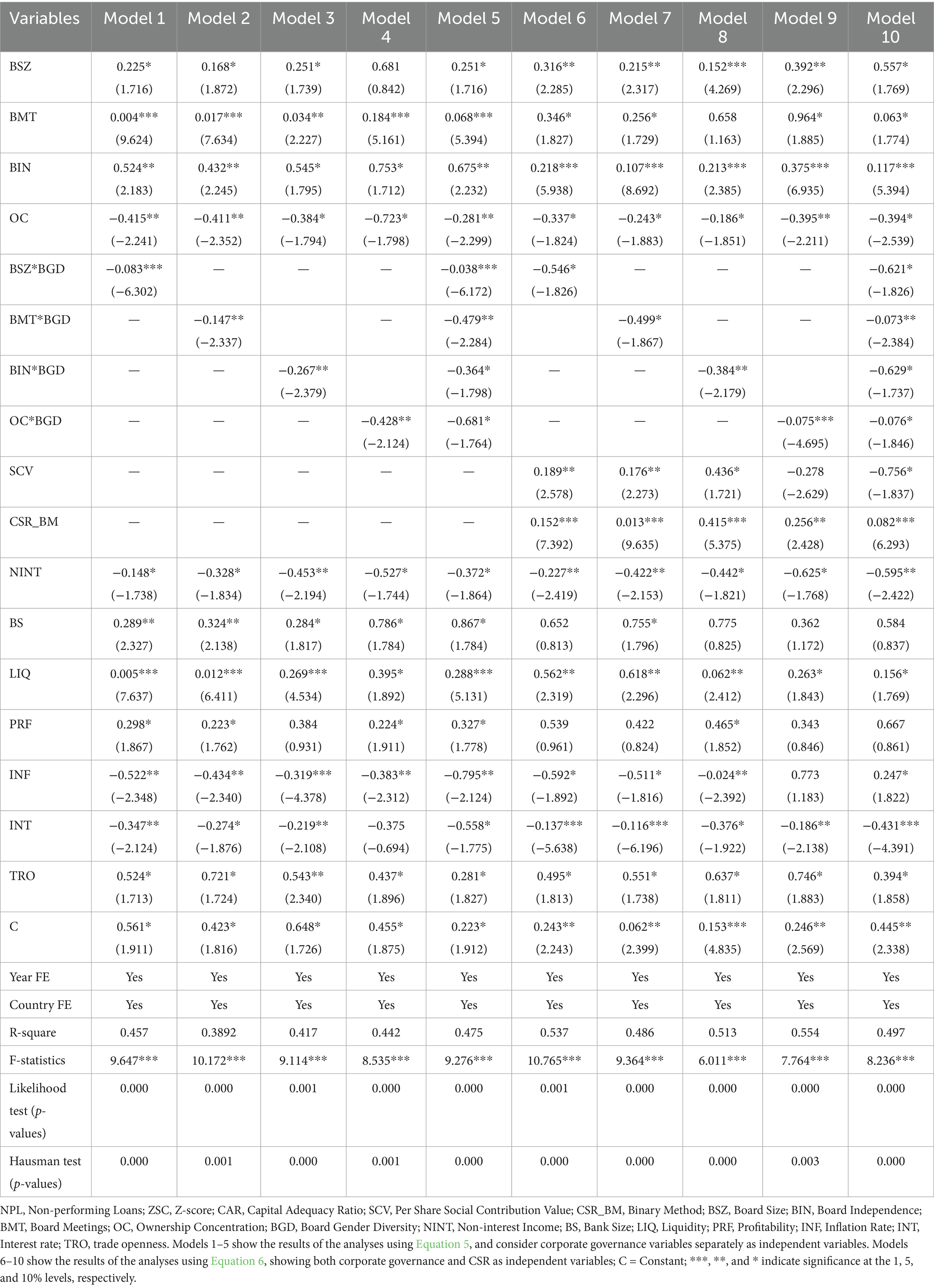

In this study, the binary method was utilized to calculate the second measure, following the study released by Hategan et al. (2018). Moreover, in this measure, banks that were involved in social activities were assigned a value of one, and banks that were not involved in such activities were assigned a value of zero. Additionally, CG is measured by the concentration of ownership, board size, board meetings, and independence. Non-interest income is calculated as the percentage of non-interest income over total revenue. Bank size was calculated following Nadeem’s method using the natural log of the total number of assets (Nadeem et al., 2019). The GMM model is employed to address the autoregressive nature of the dependent variable, as well as to handle endogeneity issues related to the independent variables and unobserved heterogeneity (Tables 1–5).

The table summarizes all variables, proxies, and their methods of measurement.

The following model were used to perform the required analysis:

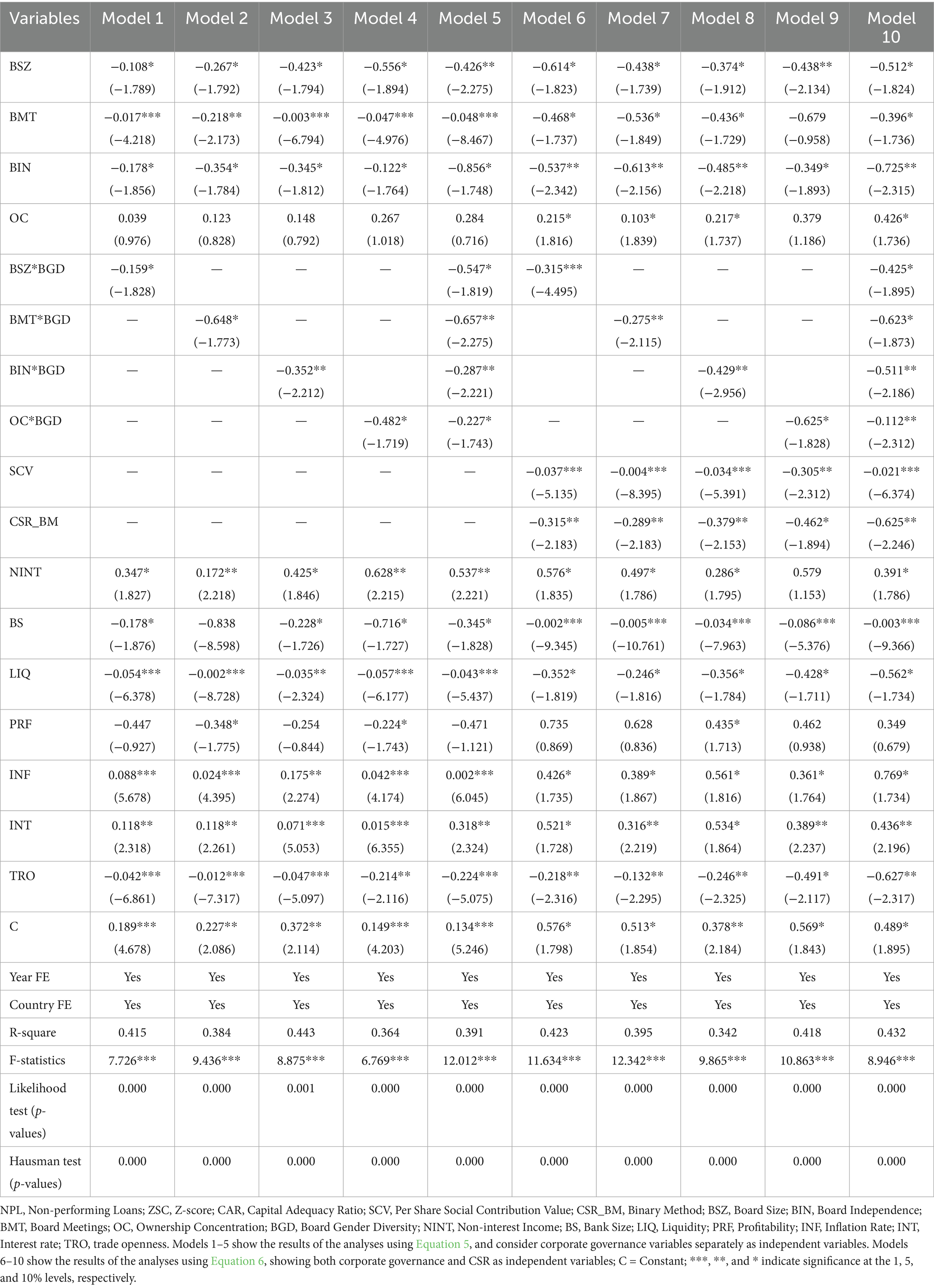

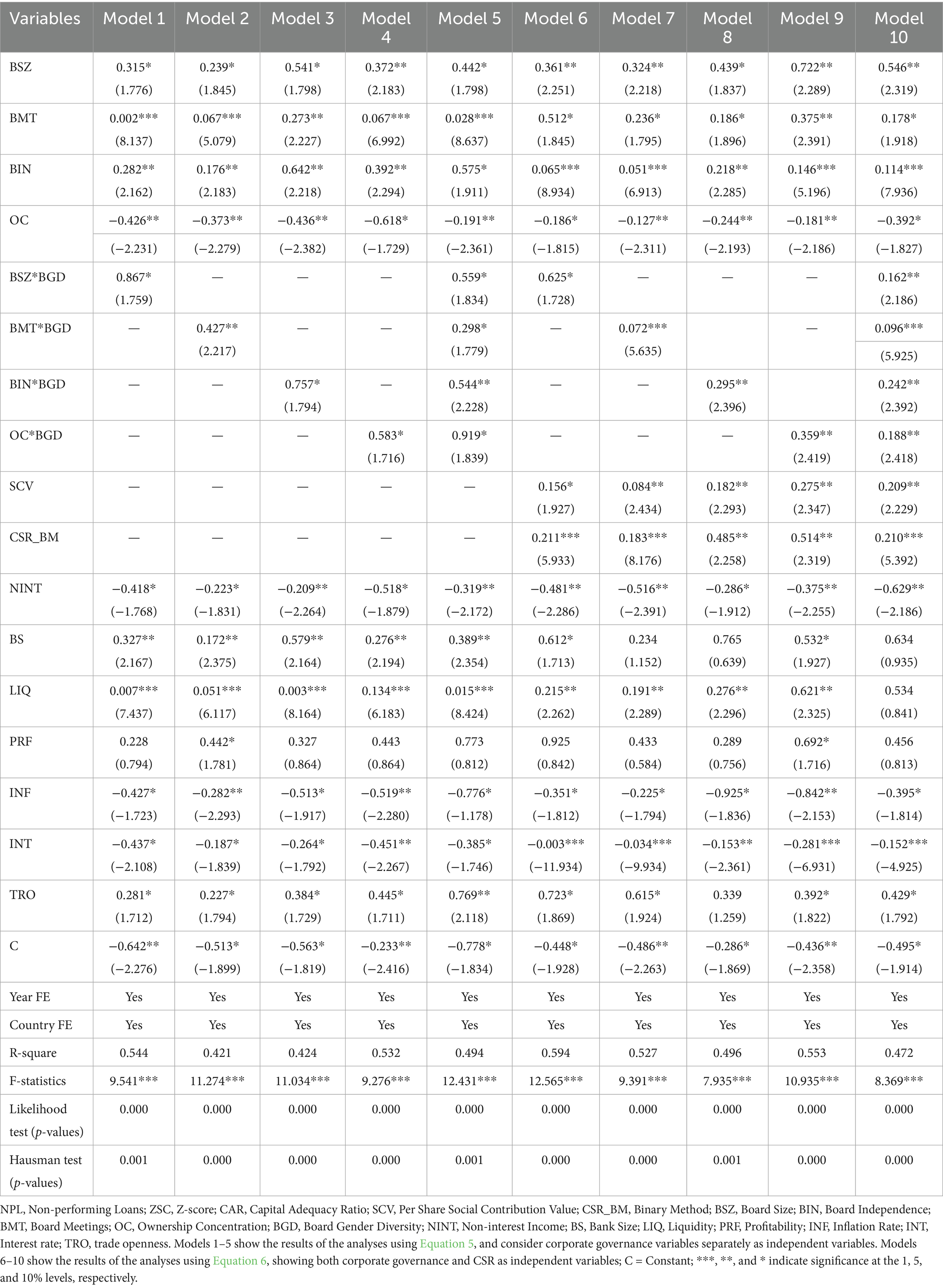

Moreover, the below 2 equations were added to measure the board gender diversity (BGD), where its effect were measured for each element of the CG and credit risk (Sila et al., 2016).

5 Empirical analysis

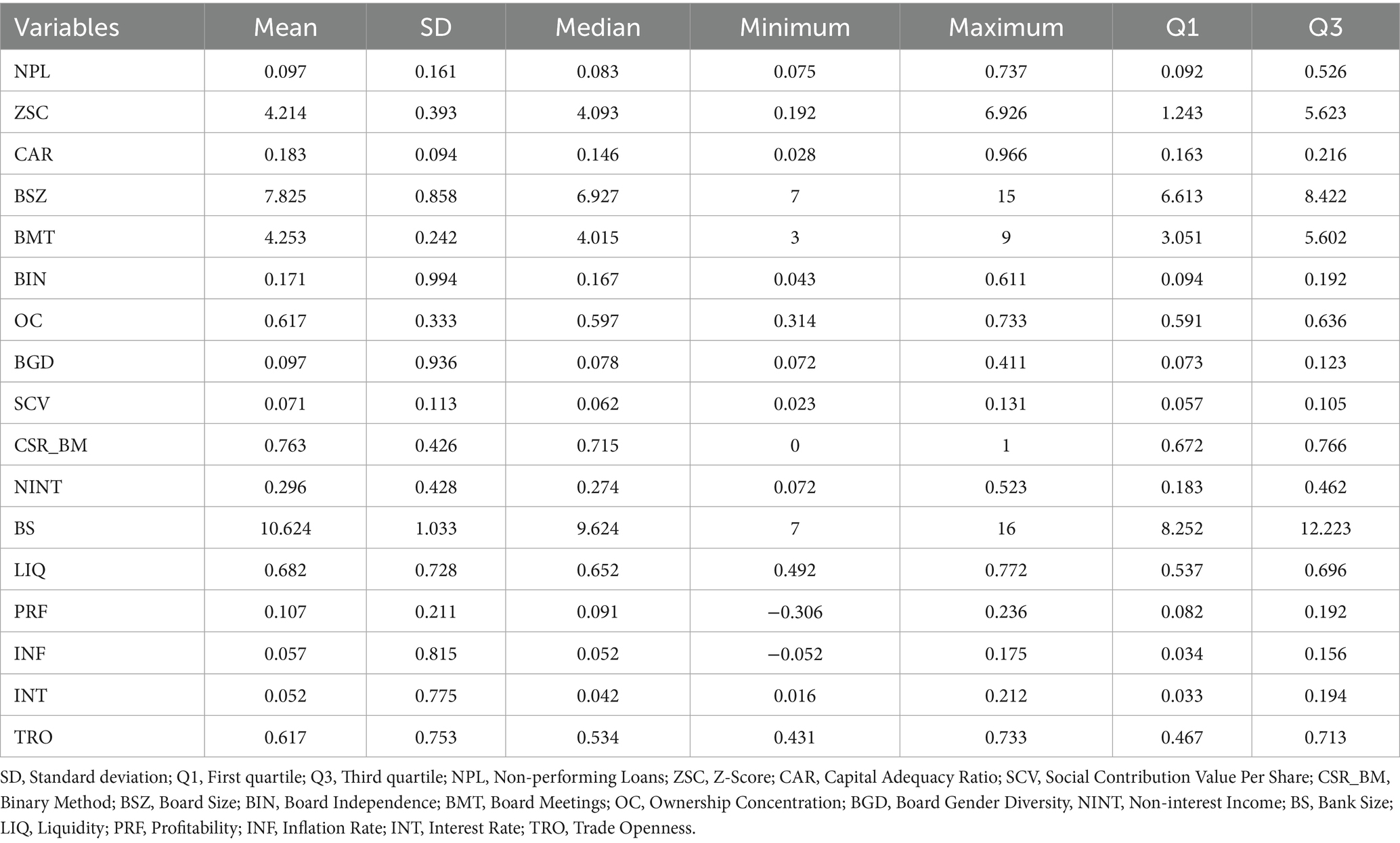

As shown by the data summarized above, credit risk has a low average value. Banks focus on debtor efficiency and consider credit risk management. The ZSC identifies bank financial situations. The above statistics show higher ZSC values, reflecting a lower risk. Banks in emerging countries have minimized credit risks because they work efficiently to survive in business. The average CAR value indicates the capital value that is sufficient to invest in risk-based assets. Few banks have boards of directors with seven to eight board members, and the above data shows that few banks have many board members. The optimal board size for good functioning is eight members for well-functioning (Kiel and Nicholson, 2003). Board meetings were conducted quarterly, as indicated by the mean values. Most ownership types are large shareholders. Conflicts of interest are minimized by shareholders with a large number of shares as proof of agency theory principles. Banks contribute to social activities, along with their traditional earnings, as indicated by the mean values of SCV and CSR_BM. Banks in emerging Asian countries tend to earn income from traditional sources, as indicated by the mean value of non-interest income. Bank size is stable in terms of investment in total assets. Banks have a low level of liquidity risk, as indicated by their high deposit-to-total asset ratio. The inflation rate is well controlled; however, there is little variation because emerging countries suffer from price increase problems. The average interest rate is low because of the slow progress in these countries. Greater variation in the level of trade openness in emerging countries is shown by standard variation.

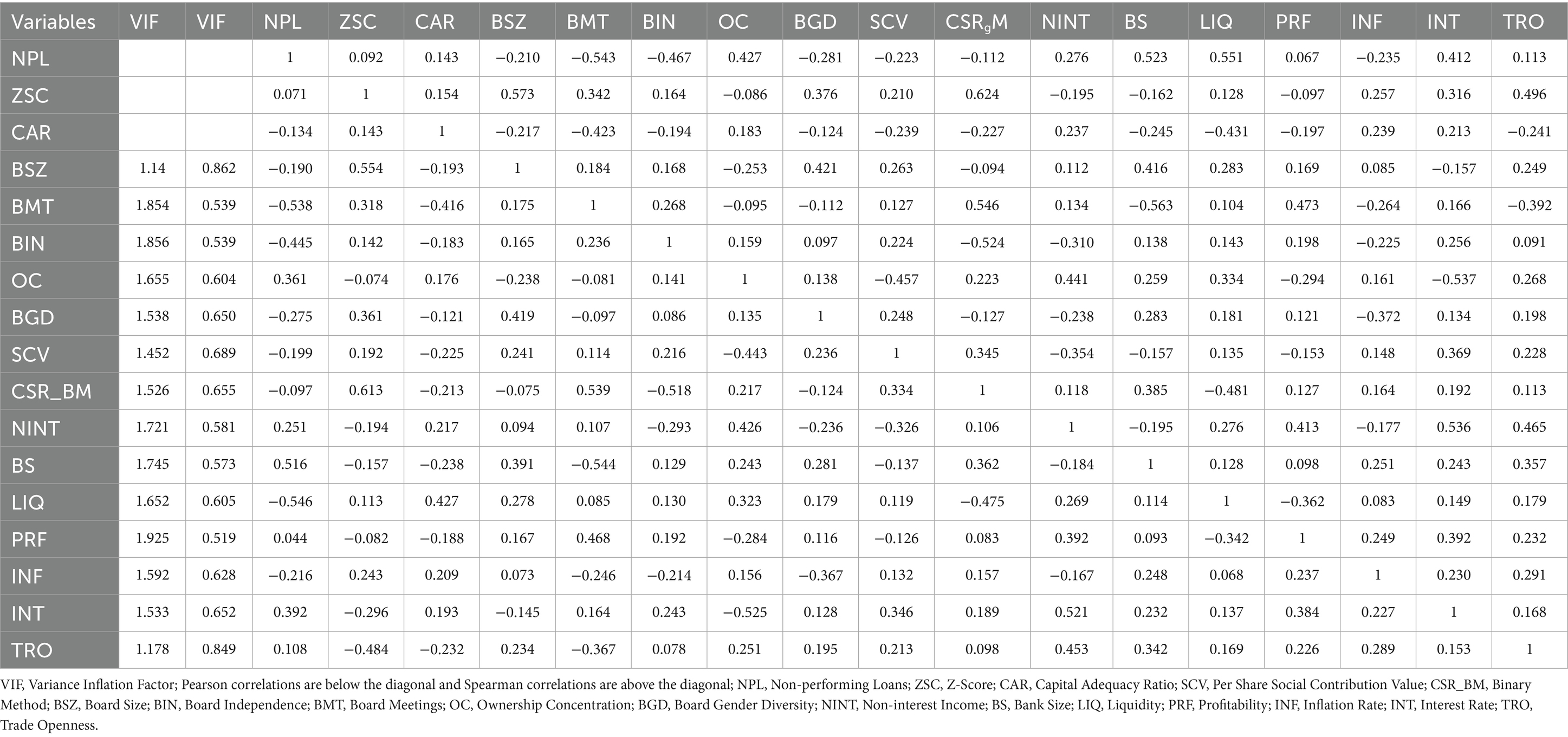

A multicollinearity test was applied and the VIF values were found to be less than 10, which confirms that multicollinearity does not exist among the independent variables (Nguyen et al., 2014). Moreover, the table clarifies the correlation analysis among the study variables, where no strong correlation was found, confirming the absence of multicollinearity in this model.

Large board size has a significant impact on reducing bank risk-taking, indicating a more monitoring and advisory role for managing credit risk. This finding indicates that board size can improve organizational performance and tends to agree with the resource dependency theory. Frequent board meetings lead to frequent communication among critical subjects, which helps resolve problems and accordingly minimizes credit risk. Moreover, frequent board meetings help enhance organizational performance by making more proactive decisions (Francis et al., 2008).

Increasing the number of independent directors on bank boards significantly enhances the performance of an organization as a result of an improved board’s effectiveness in terms of controlling management activities, which include effective monitoring and supervision that lead to a reduction in credit risk.

Risk-taking is inversely proportional to board independence and positively proportional to ownership concentration. Moreover, risk taking is inversely proportional to large shareholders, as they are empowered to take the role of control. It has been observed that risk-taking is inversely proportional when a female is on the board of directors, as stated by the agency theory (Chalermchatvichien et al., 2014). Furthermore, credit risk is inversely proportional to organizations that are active in social activities. Bannier et al. (2022) highlight that the impact of CSR on credit risk depends on sector-specific factors, with some differences in countries proving that CSR does not always minimize credit risk. Authorities are expected to enhance the rule of law for engaging in CSR in developing countries. Risk increases when banks engage in non-interest income.

However, this study finds that bank size has a negative relationship with credit risk, as large banks are more capable of efficiently utilizing resources (Ashraf et al., 2016). Moreover, the interest and inflation rates have a significant and positive impact on credit risk. Furthermore, this study observes that liquidity supports bank stability and minimizes credit risks. In addition, we find no relationship between profitability and credit risk. This study suggests that a widening trade openness increases bank stability and reduces credit risk.

6 Robustness check

Table 6 shows strong figures when Generalized Method Moments (GMM) was applied. This type of technique is helpful in resolving internally originating issues. This method was developed by Arellano and Bond (1991) and Arellano and Bover (1995).

This method supports the handling of autoregressive properties of dependent variables in a model and its resolution of internal challenges along with unabsorbed firm-related characteristics (Pérez-González and Yun, 2013).

The outcomes of the fixed-effects model were similar to those of the GMM. Additionally, Sargan tested the validity of the instruments used in this study. Furthermore, the Arellano–Bond test was used to check for autocorrelation. The results show significant p-values for AR1, whereas insignificant p-values for AR2 confirm no autocorrelation in the second lag.

It is also possible that the main findings of the study may have been biased by the sample’s self-selection approach. For example, the availability of women on boards of firms may vary and could lead to different conclusions due to gender diversity. The credit risk of the firm may be affected by the viability of the women rather than the board size.

Following Sila et al. (2016) and Loy and Rupertus (2022), we apply propensity score matching (PSM), which helps match gender-diverse and non-gender-diverse firms with similar features. To use PSM, we followed Gull et al.

Propensity score matching (PSM) was also applied to determine the treatment group following Gull et al. (2018). However, the results remained the same for both groups, one of whom consisted of one woman and the other of whom had no women, as presented in Table 7.

Tables 8–10 report the regression results of the interaction terms to assess the interactive effect of board gender diversity on the relationship between CG elements and credit risk. The findings reveal that the interaction between board gender diversity and CG significantly reduces the credit risk. The presence of a woman on the board has a positive impact on

• Resolving challenges

• Increase a firm’s value (Khandelwal et al., 2023; AlHares et al., 2021).

• Greater engagement in monitoring activities (Adams and Ferreira, 2009).

• It has a positive influence on the value relevance and quality of financial reporting (Cimini, 2022).

7 Discussion

The study considered a list of control variables, country-specific variables, and bank-specific variables such as non-interest income, bank size, interest rate, and inflation. The statistics used in this study show that the credit risk has a low average value. Few banks have a board of directors between seven and eight board members, and the above data show that few banks have many board members. The optimal board size for good functioning is eight members for well-functioning (Kiel and Nicholson, 2003). Banks focus on debtor efficiency, and provide greater consideration for credit risk management. The Z-score identifies the banks’ financial situations. The results of the study showed higher Z-scores, which reflected a lower risk indication. Banks in emerging countries have minimized credit risk because they work efficiently to survive in business. The average value of Capital Adequacy Ratio indicates the capital value sufficient to invest in risk-based assets. Large board size has a significant impact on reducing bank risk-taking, indicating a more monitoring and advisory role for managing credit risk. Bank size is stable in terms of investment in total assets. This finding indicates that board size can improve organizational performance and tends to agree with the resource dependency theory.

Conflicts of interest are minimized by shareholders with a large number of shares as proof of agency theory principles. It has been observed that risk-taking is inversely proportional when females are on the board of directors, as stated by the agency theory (Chalermchatvichien et al., 2014). It was observed that increasing the number of independent directors on the boards of banks significantly enhances the performance of an organization as a result of having an improved board’s effectiveness in terms of controlling management activities, which includes effective monitoring and supervision that lead to a reduction in credit risk.

Board meetings are conducted quarterly, as shown by the study statistics, in which the majority of the ownership has large shareholders. Moreover, frequent board meetings help enhance organizational performance by making more proactive decisions (Francis et al., 2008). It was found that frequent board meetings lead to frequent communication among critical subjects, which helps resolve problems and accordingly minimizes credit risk.

Risk-taking is inversely proportional to board independence and positively proportional to ownership concentration. Moreover, risk taking is inversely proportional to large shareholders, as they are empowered to take the role of control.

Banks contribute to social activities along with their traditional earnings, as indicated by the study statistics data through the mean values of the Social Contribution Value (SCV) and CSR binary method. Bannier et al. (2022) highlight that the impact of CSR on credit risk is sector-specific, with some differences in countries in which proof of CSR does not always minimize credit risk. Credit risk is inversely proportional to organizations that are active in social activities. Authorities are expected to enhance the rule of law for engaging in CSR in developing countries. Banks in emerging Asian countries tend to earn income from traditional sources, as indicated by the mean value of non-interest income.

It is worth highlighting that banks have a low level of liquidity risk, as shown by their high deposit-to-total assets ratio. The inflation rate is well controlled; however, little variation due to emerging countries suffering from price increase problems. The average interest rate is low because of the slow progress in these countries. Greater variation in emerging countries is related to their level of trade openness, as shown by standard variation. Risk increases when banks engage in non-interest income.

However, this study finds that bank size has a negative relationship with credit risk, as large banks are more capable of efficiently utilizing resources (Ashraf et al., 2016). Moreover, the interest and inflation rates have a significant and positive impact on credit risk. Furthermore, this study observes that liquidity supports bank stability and minimizes credit risks. In addition, no relationship is found between profitability and credit risk. This study suggests that widening trade openness increases bank stability and reduces credit risk.

8 Conclusion

An investigation of the impact of CG and CSR on credit risk was carried out on 224 listed banks in 10 Asia emerging Asian economies for the period 2010–2021. The GMM technique was applied to analyze the data and found that a large board size leads to a decrease in bank credit risk, implying that board members have both monitoring power and an advisory role, and therefore, help management formulate policies to minimize credit risk. Furthermore, regular meetings throughout the year help minimize communication and coordination challenges as they can discuss and resolve credit risk-related problems.

Our findings have important policy implications for credit risk management in banks, highlighting that a one-size-fits-all approach is not effective. Governance practices that work well in one context may not yield the same results in another. The results indicate that banks in emerging economies are progressing in the implementation of effective governance frameworks. Moreover, the findings suggest that banks are increasingly attentive to governance-related issues, underscoring the potential to enhance credit risk management through stronger governance structures. In particular, banks should prioritize the appointment of independent directors with the authority to oversee and shape credit management policies.

In addition, banks with more independent directors have lower credit risk than banks with fewer independent directors. This is because it improves the board’s monitoring level, leading to reduced credit risk. By contrast, ownership concentration has a positive impact on banks’ credit risk. In addition, CSR measures show how crucial it is for banks to contribute to society for more efficient performance.

Upon concluding the study, it is important to acknowledge certain limitations. This research focused exclusively on the banking sector within the Asian region and examined the relationship between CG, CSR, and credit risk. Future studies could benefit from exploring specific dimensions of CSR—such as environmental protection, innovation, employee relations, and community engagement—which may offer deeper insights and open new avenues for research. Future research could benefit from examining the individual dimensions of CSR—such as environmental protection, innovation, employee relations, and community engagement—as these aspects may offer deeper insights and open new directions for study.

The results revealed that good governance practices may not be good for other concepts and perspectives. Moreover, in emerging economies, banks are progressing because of the implementation of effective governance systems.

The roles of ESG and banking risk are addressed in this study as this study contributes to the growing literature on ESG and its relationship with banking risk across 224 banks operating in 10 emerging Asian economies. Results show a negative relationship between board gender diversity and credit risk, and that credit risk is lowered by stronger governance and CSR engagement with this effect being strengthened by stronger governance. The study gives credence to empirical evidence of the importance of non financial indicators by using the panel fixed effects and robustness check of system GMM. Nevertheless, such residual endogeneity and the binary measurement of CSR are acknowledged. Overall, these findings reinforce the importance of ESG dimensions and the resulting issue of overlapping measurement and project selection criteria being integrated into credit risk models, particularly in emerging markets in and around the institutions. Future research could expand this framework by using additional granular ESG metrics and conduct experiments of the causal mechanisms via natural experiments and other quasi-experiments. By contrast, management with few directors makes decisions based on their interests, which leads to risks. The results of this study can encourage managers and owners to pay more attention to CSR activities. This study also provides guidelines for investors seeking to invest in banks that implement effective governance systems and that are involved in CSR activities.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Ethics statement

All procedures performed in this study involving human participants were in accordance with the ethical standards of the institutional and/or national research committee and with the 1964 Helsinki Declaration and its later amendments or comparable ethical standards.

Author contributions

AA: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author declares that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abiad, Z., Abraham, R., El-Chaarani, H., and Binsaddig, R. O. (2025). The impact of board of directors’ characteristics on the financial performance of the banking sector in gulf cooperation council (GCC) countries: the moderating role of bank size. J. Risk Financial Manag. 18:40. doi: 10.3390/jrfm18010040

Adams, R. B., and Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. J. Financ. Econ. 94, 291–309. doi: 10.1016/j.jfineco.2008.10.007

Al Amosh, H., and Khatib, S. F. A. (2023). COVID-19 impact, financial and ESG performance: evidence from G20 countries. Bus. Strategy Dev. 6, 310–321. doi: 10.1002/bsd2.240

Al Lawati, H., and Sanad, Z. (2023). Ownership concentration and audit actions. Adm. Sci. 13:206. doi: 10.3390/admsci13090206

AlHares, A. (2020). Corporate governance and cost of capital in OECD countries. Int. J. Account. Inf. Manag. 28, 1–21. doi: 10.1108/IJAIM-02-2019-0023

AlHares, A., Abu-Asi, T., Dominic, G., and Al Abed, R. (2021). The impact of corporate social responsibility on consumer’s relationship intention: evidence from MENA countries. J. Govern. Regul. 10, 8–14. doi: 10.22495/jgrv10i4art1

AlHares, A., and Al-Hares, O. M. (2020). The impact of corporate governance mechanisms on risk disclosure. Corp. Ownersh. Control. 17, 292–307. doi: 10.22495/cocv17i4siart7

Al-Rassas, A. H., and Kamardin, H. (2016). Earnings quality and audit attributes in high concentrated ownership market. Corp. Govern. 16, 377–399. doi: 10.1108/CG-08-2015-0110

Álvarez-Botas, C., Fernández-Méndez, C., and González, V. M. (2022). Large bank shareholders and terms of bank loans during the global financial crisis. J. Int. Financ. Manag. Account. 33, 107–133. doi: 10.1111/jifm.12137

Arellano, M., and Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 58, 277–297. doi: 10.2307/2297968

Arellano, M., and Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68, 29–51.

Ashraf, B. N., Arshad, S., and Hu, Y. (2016). Capital regulation and bank risk-taking behavior: evidence from Pakistan. Int. J. Financ. Stud. 4:16. doi: 10.3390/ijfs4030016

Awa, H. O., Etim, W., and Ogbonda, E. (2024). Stakeholders, stakeholder theory and corporate social responsibility (CSR). Int. J. Corp. Soc. Responsib. 9, 1–14. doi: 10.1186/s40991-024-00094-y

Bannier, C. E., Bofinger, Y., and Rock, B. (2022). Corporate social responsibility and credit risk. Financ. Res. Lett. 44:102052. doi: 10.1016/j.frl.2021.102052

Bauwhede, H. V. (2009). On the relation between corporate governance compliance and operating performance. Accounting and business research 39, 497–513.

Belasri, S., Gomes, M., and Pijourlet, G. (2020). Corporate social responsibility and bank efficiency. J. Multinatl. Financ. Manage. 54:100612. doi: 10.1016/j.mulfin.2020.100612

Berber, N., Slavić, A., and Aleksić, M. (2019). The relationship between corporate social responsibility and corporate governance. Ekonomika 65, 1–12. doi: 10.5937/ekonomika1903001B

Berninger, M., Kiesel, F., Schiereck, D., and Gaar, E. (2021). Citations and the readers’ information-extracting costs of finance articles. J. Bank. Finance 131:106188. doi: 10.1016/j.jbankfin.2021.106188

Bhagat, S., and Jefferis, R. H. (2005). The econometrics of corporate governance studies. Mit Press.

Blundell, R., and Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87, 115–143.

Boubaker, S., and Nguyen, D. K. (2014). Corporate governance and corporate social responsibility: emerging markets focus. London UK: World Scientific.

Chalermchatvichien, P., Jumreornvong, S., Jiraporn, P., and Singh, M. (2014). The effect of bank ownership concentration on capital adequacy, liquidity, and capital stability. J. Financ. Serv. Res. 45, 219–240. doi: 10.1007/s10693-013-0160-8

Cheng, S. (2008). Board size and the variability of corporate performance. J. Financ. Econ. 87, 157–176. doi: 10.1016/j.jfineco.2006.10.006

Chou, H. I., Chung, H., and Yin, X. (2013). Attendance of board meetings and company performance: evidence from Taiwan. J. Bank. Finance 37, 4157–4171. doi: 10.1016/j.jbankfin.2013.07.028

Cimini, R. (2022). The effect of female presence on corporate boards of directors on the value relevance of accounting amounts: empirical evidence from the European Union. J. Int. Financ. Manag. Account. 33, 134–153. doi: 10.1111/jifm.12138

De Andres, P., and Vallelado, E. (2008). Corporate governance in banking: the role of the board of directors. J. Bank. Finance 32, 2570–2580. doi: 10.1016/j.jbankfin.2008.05.008

Farooq, M. B., and de Villiers, C. (2018). The shaping of sustainability assurance through the competition between accounting and non-accounting providers. Account. Audit. Account. J. 32, 307–336. doi: 10.1108/AAAJ-10-2016-2756

Francis, J., Huang, A. H., Rajgopal, S., and Zang, A. Y. (2008). CEO reputation and earnings quality. Contemp. Account. Res. 25, 109–147. doi: 10.1506/car.25.1.4

Gennaioli, N., Shleifer, A., and Vishny, R. (2012). Neglected risks, financial innovation, and financial fragility. Journal of Financial Economics 104, 452–468.

Gull, A. A., Nekhili, M., Nagati, H., and Chtioui, T. (2018). Beyond gender diversity: how specific attributes of female directors affect earnings management. Br. Account. Rev. 50, 255–274. doi: 10.1016/j.bar.2017.09.001

Gwala, R. S., and Mashau, P. (2023). “Tracing the evolution of agency theory in corporate governance” in Governance as a catalyst for public sector sustainability. ed. N. Baporikar (Hershey, PA: IGI Global), 260–285.

Hariharan Pappil Kothandapani, (2022). Leveraging AI for credit scoring and financial inclusion in emerging markets. World J. Adv. Res. Rev. 15, 526–539. doi: 10.30574/wjarr.2022.15.3.0904

Hategan, C. D., Sirghi, N., Curea-Pitorac, R. I., and Hategan, V. P. (2018). Doing well or doing good: the relationship between corporate social responsibility and profit in Romanian companies. Sustain. For. 10:1041. doi: 10.3390/su10041041

Ho, T. N. T., Nguyen, D., Le, T., Nguyen, H. T., and Tran, S. (2024). Does board gender diversity affect bank financial stability? Evidence from a transitional economy. Gender Manag. Int. J. 40, 64–90. doi: 10.1108/gm-03-2023-0094

Hausman, J. A. (1978). Specification tests in econometrics. Econometrica: Journal of the Econometric Society, 1251–1271.

Hunjra, A. I., Tayachi, T., and Mehmood, R. (2020). Impact of ownership structure on risk-taking behavior of south Asian banks. Corp. Ownersh. Control. 17, 108–120. doi: 10.22495/cocv17i3art8

Javeed, S. A., and Lefen, L. (2019). An analysis of corporate social responsibility and firm performance with moderating effects of CEO power and ownership structure: a case study of the manufacturing sector of Pakistan. Sustain. For. 11:248. doi: 10.3390/su11010248

Jensen, M. C., and Meckling, W. H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. J. Financ. Econ. 3, 305–360. doi: 10.1016/0304-405X(76)90026-X

Kalra, P. (2024). Corporate social responsibility and stakeholder theory: an integrated review. J. Manag. Entrep. 18, 30–40.

Kamara, A. K. (2024). The study of credit risk in the breaking sector and its effect on financial performance case study of the zenith bank Sierra Leone. Eur. J. Econ. Financ. Res. 8, 110–136. doi: 10.46827/ejefr.v8i4.1732

Kaminskyi, A., Osetskyi, V., Almeida, N., and Nehrey, M. (2025). Investigating the relationship between ESG performance and financial performance during the COVID-19 pandemic: evidence from the hotel industry. J. Risk Financial Manag. 18:126. doi: 10.3390/jrfm18030126

Khandelwal, C., Kumar, S., Tripathi, V., and Madhavan, V. (2023). Joint impact of corporate governance and risk disclosures on firm value: evidence from emerging markets. Res. Int. Bus. Finance 66:102022. doi: 10.1016/j.ribaf.2023.102022

Kiel, G. C., and Nicholson, G. J. (2003). Board composition and corporate performance: how the Australian experience informs contrasting theories of corporate governance. Corp. Gov. Int. Rev. 11, 189–205. doi: 10.1111/1467-8683.00318

Koju, L., Koju, R., and Wang, S. (2018). Does banking management affect credit risk? Evidence from the Indian banking system. International Journal of Financial Studies 6:67.

Korzeb, Z., Karkowska, R., Matysek-Jędrych, A., and Niedziółka, P. (2025). How do ESG challenges affect default risk? An empirical analysis from the global banking sector perspective. Stud. Econ. Finance 42, 89–114. doi: 10.1108/SEF-09-2023-0540

Lepetit, L., and Strobel, F. (2015). Bank insolvency risk and Z-score measures: a refinement. Financ. Res. Lett. 13, 214–224. doi: 10.1016/j.frl.2015.01.001

Liu, B., Ju, T., and Gao, S. S. (2021). The combined effects of innovation and corporate social responsibility on firm financial risk. J. Int. Financ. Manag. Account. 32, 283–310. doi: 10.1111/jifm.12135

Lotto, J. (2018). The empirical analysis of the impact of bank capital regulations on operating efficiency. Int. J. Financ. Stud. 6:34. doi: 10.3390/ijfs6020034

Loy, T. R., and Rupertus, H. (2022). How does the stock market value female directors? International evidence. Bus. Soc. 61, 117–154. doi: 10.1177/0007650320949839

Luo, X., and Bhattacharya, C. B. (2009). The debate over doing good: Corporate social performance, strategic marketing levers, and firm-idiosyncratic risk. Journal of Marketing 73, 198–213.

Mansour, K. (2025). Working capital efficiency and capital structure decisions in Egypt: the effect of foreign currency exchange risk exposure under IAS 21. Asian J. Account. Res. 10, 103–124. doi: 10.1108/AJAR-12-2023-0411

Menicucci, E., and Paolucci, G. (2021). Gender diversity and bank risk-taking: an empirical investigation in Italy. Corp. Gov. 22, 317–339. doi: 10.1108/CG-11-2020-0498

Moussa, F. B. (2019). The influence of internal corporate governance on bank credit risk: an empirical analysis for Tunisia. Glob. Bus. Rev. 20, 640–667. doi: 10.1177/0972150919837078

Nadeem, M., Suleman, T., and Ahmed, A. (2019). Women on boards, firm risk and the profitability nexus: does gender diversity moderate the risk and return relationship? Int. Rev. Econ. Finance 64, 427–442. doi: 10.1016/j.iref.2019.08.007

Nguyen, Q. K. (2022). Determinants of bank risk governance structure: a cross-country analysis. Res. Int. Bus. Finance 60:101575. doi: 10.1016/j.ribaf.2021.101575

Nguyen, T., Locke, S., and Reddy, K. (2014). A dynamic estimation of governance structures and financial performance for Singaporean companies. Econ. Model. 40, 1–11. doi: 10.1016/j.econmod.2014.03.013

Nisar, S., Peng, K., Wang, S., and Ashraf, B. N. (2018). The impact of revenue diversification on bank profitability and stability: empirical evidence from south Asian countries. Int. J. Financ. Stud. 6:40. doi: 10.3390/ijfs6020040

Pérez-González, F., and Yun, H. (2013). Risk management and firm value: Evidence from weather derivatives. The Journal of Finance 68, 2143–2176.

Permatasari, I. (2020). Does corporate governance affect bank risk management? Case study of Indonesian banks. International Trade, Politics and Development 4, 127–139.

Roodman, D. (2009). How to do xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal 9, 86–136.

Sarkar, J., and Sarkar, S. (2018). Bank ownership, board characteristics and performance: evidence from commercial banks in India. Int. J. Financ. Stud. 6:17. doi: 10.3390/ijfs6010017

Shleifer, A., and Vishny, R. W. (1997). A survey of corporate governance. J. Finance 52, 737–783. doi: 10.1111/j.1540-6261.1997.tb04820.x

Siddique, A., Khan, M. A., and Khan, Z. (2022). The effect of credit risk management and bank-specific factors on the financial performance of the south Asian commercial banks. Asian J. Account. Res. 7, 182–194. doi: 10.1108/AJAR-08-2020-0071

Sila, V., Gonzalez, A., and Hagendorff, J. (2016). Women on board: does boardroom gender diversity affect firm risk? J. Corp. Financ. 36, 26–53. doi: 10.1016/j.jcorpfin.2015.10.003

Simão, D., and Beuren, I. M. (2022). Stewardship behavior and managerial performance in family businesses. Rev. Contab. Organ. 16. doi: 10.11606/issn.1982-6486.rco.2022.195446

Singhania, S., Singh, R. K., Singh, A. K., and Sardana, V. (2022). Corporate governance and risk management: a bibliometric mapping for future research agenda. Indian J. Corp. Govern. 15, 223–255. doi: 10.1177/09746862221126351

Taş, A., and Öztürk, O. (2023). Dependence as strategy: extending resource dependence theory and clarifying its understanding of the strategic options of dependent firms. Int. J. Organ. Anal. 32, 1982–2009. doi: 10.1108/IJOA-07-2023-3886

Williams, B. (2016). The impact of non-interest income on bank risk in Australia. J. Bank. Finance 73, 16–37. doi: 10.1016/j.jbankfin.2016.07.019

Keywords: corporate governance, corporate social responsibility, board size, credit risk, agency theory

Citation: AlHares A (2025) Impact of corporate governance and social responsibility on credit risk. Front. Sustain. 6:1588468. doi: 10.3389/frsus.2025.1588468

Edited by:

Hamid Mattiello, Fachhochschule des Mittelstands, GermanyReviewed by:

Marselino Wau, Airlangga University, IndonesiaTing-Kun Liu, Chaoyang University of Technology, Taiwan

Copyright © 2025 AlHares. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Aws AlHares, YWFsaGFyZXNAeWFob28uY28udWs=

Aws AlHares

Aws AlHares