- Management Department, BINUS Business School Doctor of Research in Management, Bina Nusantara University, Jakarta, Indonesia

This study investigates the role of environmental, social, and governance (ESG) activities in driving green innovation and achieving sustainable competitive advantage, with a comparative analysis of private and public companies. Data were collected from 114 companies (79 private and 35 public) in Indonesia between August and September 2024. Data were collected through purposive sampling and analyzed using Partial Least Squares Structural Equation Modeling (PLS-SEM) with Multi-Group Analysis (MGA) conducted via the Smart PLS 4.0 software. The findings reveal that ESG activities are positively directly associated with sustainable competitive advantage, and this connection is only significant for private companies. ESG activities are also directly related to green innovation, and this relationship is more pronounced in public companies. Green innovation is positively associated with sustainable competitive advantage, and this relationship is notably stronger in public company groups. Additionally, green innovation plays a mediating role in the relationship between ESG activities and sustainable competitive advantage, and this model is more dominant in the sample group of public companies. This study provides valuable insights for managers and policymakers in developing countries on leveraging ESG activities as a strategic tool to enhance green innovation and competitive advantage. Furthermore, it offers a refined understanding of how organizational types (public versus private) shape these outcomes.

1 Introduction

In recent years, environmental, social, and governance (ESG) activities have significantly increased among companies, with many now publishing standalone ESG reports to showcase their commitment to sustainability and responsible business practices. This ESG initiation was triggered by a growing demand from stakeholders, including consumers and investors, for companies to adopt and report on ESG activities and increase awareness of environmental and social issues (Sharma et al., 2023). By 2021, over 75% of large US firms had published such reports despite the lack of regulatory requirements. Although companies initially adopted ESG practices voluntarily, the trend was later supported by stronger regulations and initiatives, particularly in Europe, which are pushing firms to integrate ESG into their strategies (Cho, 2023). As a result, ESG implementation in European countries has grown more significantly than in developing countries in other regions such as Asia and Africa.

In line with problems in other developing countries, the implementation of ESG in Indonesia is still relatively low. Several studies have found that the main problems include the financial resources of internal companies and policy support (Lubis and Rokhim, 2021; Saraswati et al., 2024). For example, enforcement mechanisms often fall short in environmental legislation due to inadequate resources and lack of coordination among stakeholders (Alicia, 2024). This regulatory inconsistency creates a challenging environment for companies to comply with ESG standards effectively. On the other hand, companies often struggle to balance economic growth with environmental preservation, particularly in industries like mining and palm oil, where economic activities can lead to significant environmental degradation (Alicia, 2024; Putri et al., 2022). Hence, the issue of ESG implementation and its consequences for companies is interesting to explore further, especially in the context of companies in Indonesia.

Researchers have studied the effects of ESG factors on companies, particularly in the environmental and social areas; these factors are believed to be connected to improved innovation outcomes (Lian et al., 2023; Qin and Lee, 2024; Ren et al., 2024). However, the most significant limitation of companies is addressing environmental challenges through innovative solutions, which can improve their overall performance (Lee et al., 2024). On the other hand, ESG activities are also often associated with financial and non-financial performance (Xie et al., 2019), which mainly produce mixed results and vary by sector. For example, in China, ESG activities have negatively impacted firm performance, particularly for non-state-owned enterprises (Ruan and Liu, 2021). Other research highlights that ESG disclosure can strengthen corporate sustainability performance and create competitive advantages (Alsayegh et al., 2020; Hsu and Chen, 2024).

The present study specifically explores the relationship between ESG activities, green innovation, and sustainable competitive advantage in companies operating in Indonesia. ESG activities in Indonesia are gaining traction, although they are still in the early stages compared to more developed frameworks in Western countries (Saraswati et al., 2024; Singhania and Saini, 2022). For example, a study analyzing 472 corporate sustainability reports from 2021 found that companies in Indonesia typically show satisfactory ESG ratings and transparency in their disclosures (Saraswati et al., 2024). Nevertheless, there is still potential for enhancement, particularly in terms of more substantial support from government and regulatory bodies to promote the broader adoption of ESG practices among companies in Indonesia.

Apart from the implementation of ESG, which is only at an early stage in Indonesia, this research is also motivated by conflicting study results regarding the impact of ESG activities on companies. For instance, although ESG practices can boost firm value, especially in the energy sector, there are cases where environmental and governance disclosures have negatively impacted financial performance (Soesetio et al., 2024). Moreover, investments in ESG initiatives can have both favorable and unfavorable effects on innovation performance, as the impact of ESG factors on financial and non-financial results has been shown to differ considerably across various industries (Dranev, 2023; Jung and Lee, 2022). Another study highlights that adopting ESG-related initiatives can expand access to a broader range of funding opportunities. However, this may also pose challenges for companies as they work to meet growing expectations for sustainability practices and navigate rising ESG-related risks (Dranev, 2023). Hence, companies must carefully manage the distribution of resources between green innovation investments and ESG initiatives, as the interplay between these factors can create complexities in future resource allocation decisions (Khan and Liu, 2023).

This research provides two significant insights into the current literature on ESG activities and competitive advantage. First, while most prior research has focused on ESG activities in the energy sector (Li et al., 2023; Ren et al., 2024), in this study, we adopt a different approach by examining how organizational characteristics, such as ownership structure (private vs. public), influence the effectiveness of ESG activities in driving green innovation and competitive advantage in several sectors. Second, this study builds on earlier research that has explored the mediating role of green innovation in connecting ESG activities to various outcomes, including financial and non-financial performance (Chouaibi et al., 2022; Martínez-Falcó et al., 2025), digital transformation and institutional environment (Li and Rasiah, 2024; Long et al., 2023), risk reduction, positive market reactions (Liu and Lyu, 2022; Zhai et al., 2022), and environmental performance and corporate reputation (Chouaibi et al., 2022; Martínez-Falcó et al., 2025). As such, this study provides an alternative explanation regarding the indirect relationship of ESG activities on competitive advantage through green innovation, particularly in developing countries.

2 Theoretical background

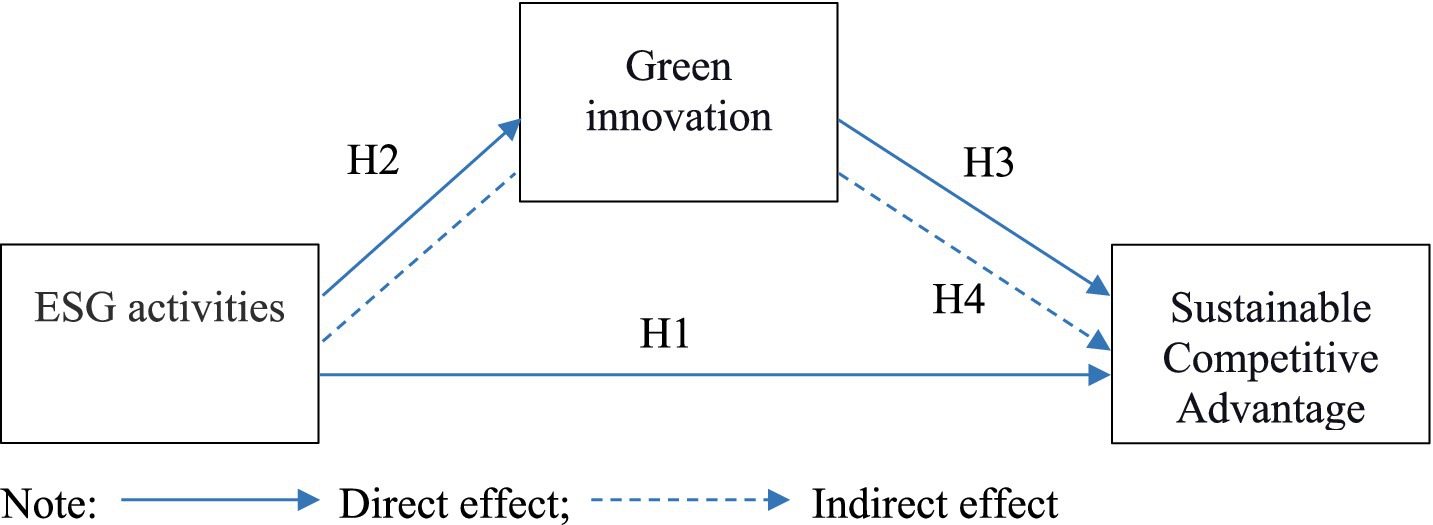

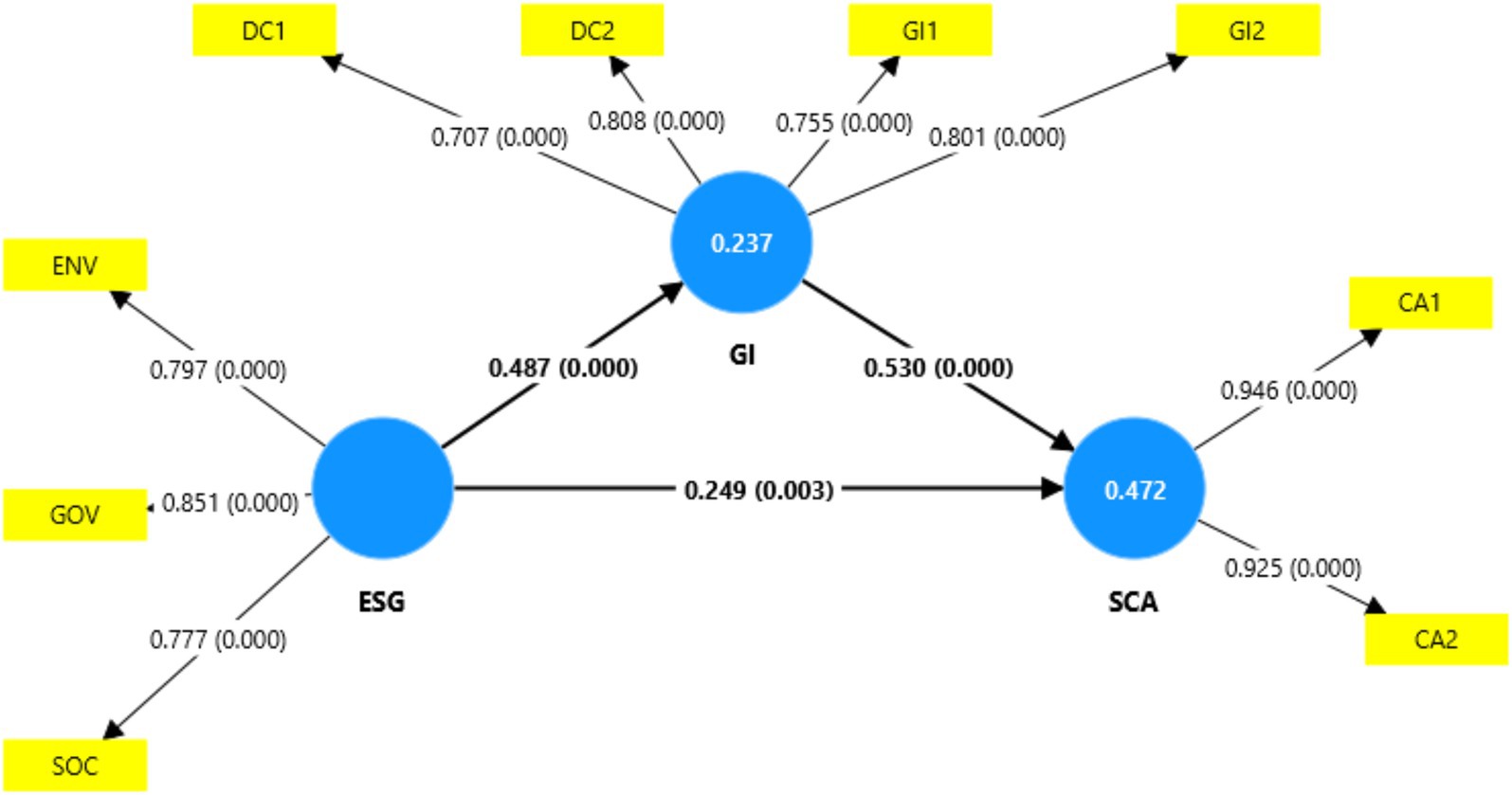

According to the proposed model (Figure 1), this study combines the Resource-Based View (RBV) and Institutional Theory to explain the relationship between ESG activities, green innovation, and sustainable advantage. First, RBV (Barney, 1991) assumes that competitive advantage can be formed from unique resources owned by the company, including green technologies, innovation orientation, human resources, green market orientation, and sustainable supply chains (Bhatti et al., 2023; Li and Li, 2025; Mohy-ud-Din, 2024). These unique resources can create value through unique processes and product creation, increasing their market competitiveness. Furthermore, Institutional Theory (Meyer and Rowan, 1977) complements RBV by highlighting how external pressures, such as regulations and stakeholder expectations, influence public and private firms differently in viewing ESG, where public firms prioritize compliance due to coercive pressures, while private firms focus on strategic alignment with their resource strengths. RBV generally explains firm-specific capabilities that drive innovation and competitiveness. In contrast, institutional theory explains sectoral differences in ESG strategies and practices.

2.1 ESG activities and sustainable competitive advantage

Sustainable competitive advantage denotes a firm’s capacity to maintain superior market positioning relative to competitors over extended periods. Grounded in resource-based view theory, such advantage derives from attributes that are valuable, rare, inimitable, and non-substitutable (VRIN), constituting fundamental determinants of organizational resilience and long-term viability (Baaij et al., 2004; Gillen and Chung, 2005). While direct empirical examination of the ESG–ESG-competitive advantage relationship remains nascent in the literature, extant research suggests three primary explanatory mechanisms. First, ESG implementation fosters stakeholder engagement with employees, suppliers, and communities, which enhances human capital retention, improves financing opportunities, and strengthens overall market competitiveness (Resta et al., 2018). Second, ESG adoption positively influences brand equity and ethical reputation, drives innovation and product performance (Saleem and Bashir, 2024), and optimizes talent retention and capital accessibility (Resta et al., 2018). Third, ESG integration enables firms to attract sustainable investment, catalyze innovation-driven growth, and mitigate operational risks—collectively contributing to durable competitive positioning (Castellano et al., 2024). In other words, ESG practices can facilitate the development of green dynamic capabilities that enhance ecological efficiency and green product success. The long-term effect creates market differentiation essential for long-term sustainability (Saleem and Bashir, 2024).

Furthermore, previous research has also considered company characteristics variations when examining ESG activities’ effects on different outcomes (Prado Muci De Lima and Costa Fernandes, 2024; Sang et al., 2024; Xi and Wang, 2024). For example, private companies have greater flexibility than public companies in designing and implementing ESG practices, including implementing their ESG strategies to align more closely with their specific business models and stakeholder expectations (Prado Muci De Lima and Costa Fernandes, 2024; Xi and Wang, 2024). Furthermore, private companies face less scrutiny, allowing them to pursue more innovative and customized ESG strategies than public companies. Private companies can experiment with new methods and integrate ESG more thoroughly into their business models, resulting in more significant competitive advantages than public companies (Sang et al., 2024; Xi and Wang, 2024). Hence, the proposed hypothesis is:

H1: ESG activities positively related to sustainable competitive advantage (a), and this relationship may differ between private and public companies (b).

2.2 ESG activities and green innovation

The initial movement of ESG laid the groundwork for the modern focus on sustainability and corporate responsibility, which began gaining momentum in the 19th century with the conservation of natural resources and public health initiatives (Montague and Pellerano, 2014). The formal concept of ESG was introduced in 2004 as a milestone in integrating environmental, social, and governance principles into corporate and investment frameworks. In this period, experts began a systematic approach to incorporate these principles into business practices. Ten years after its introduction, ESG has been increasingly integrated into academic research and practical business strategies. Scholars have explored various theoretical foundations of ESG, including the sustainability of competitive advantage, governance accountability, and sustainable capital allocation (Au et al., 2023). For instance, by 2013, there were 134 individual policies across 45 countries and regions embedding sustainability reporting into policy and regulation (Lindsey et al., 2014). Globally, ESG gained substantial momentum when the UN introduced the Sustainable Development Goals (SDGs) in 2015, leading governments to advocate for sustainable business practices increasingly.

Today, ESG criteria are critical indicators for evaluating an investment’s long-term sustainability and societal impact. The environmental dimension focuses on corporate practices related to natural resource management, energy efficiency, waste reduction, and pollution control. The social component evaluates stakeholder relations, encompassing labor conditions, health and safety standards, and diversity initiatives. Meanwhile, governance scrutinizes leadership effectiveness through executive compensation structures, audit integrity, and shareholder rights protection (Kocmanová and Šimberová, 2014; Qin and Lee, 2024). Complementing ESG principles, green innovation represents developing environmentally sustainable products, processes, or operational practices that reconcile ecological preservation with business growth. This innovation paradigm requires balancing economic objectives with environmental and social responsibilities to address multifaceted stakeholder expectations. Current scholarship categorizes green innovation into two primary forms: (1) product innovation, involving eco-friendly goods or services, and (2) process innovation, involving sustainable production methods. Both approaches aim to mitigate environmental harm while embedding ecological considerations into core business strategies (Qin et al., 2025; Thomas et al., 2022).

According to RBV theory, companies that implement ESG have unique resources to implement environmentally friendly technology and skilled human capital. These resources can enhance their ability to innovate in processes and product production in environmentally friendly ways. In line with RBV, numerous studies suggest that strong ESG performance significantly boosts green innovation. For example, ESG performance helps alleviate financing constraints, strengthens corporate human capital, and reduces management short-termism, positively contributing to green innovation (Lu et al., 2025). Most studies also indicate that higher ESG ratings are linked to greater levels of green innovation, especially in firms with more substantial resource advantages and greater media visibility (Wang et al., 2023; Zhou et al., 2024; Zhou et al., 2023). Previous studies also indicate that the impact of ESG on green innovation may vary based on the type of company, whether private or public. Public companies, especially those listed on stock exchanges, tend to have better access to capital markets and are subject to more stringent regulatory and disclosure requirements. This environment encourages them to adopt and report on ESG activities more rigorously, promoting green innovation (Lian et al., 2023; Ma et al., 2022; Ruan et al., 2024; Zhan et al., 2025). While private firms also benefit from ESG activities, the impact is generally less pronounced than public firms (Zhu and Yang, 2024). Hence, the proposed hypothesis is:

H2: ESG activities positively related to green innovation (a), and this relationship may differ between private and public companies (b).

Green innovation focuses on developing new products, processes, or environmentally friendly practices and aims to reduce negative environmental impacts. It represents a shift in business paradigms where social, environmental, and societal issues are balanced with economic goals (Thomas et al., 2022). Previous studies confirmed that green innovation encompasses both green product and process innovation, and this strategy focuses on creating sustainable solutions to achieve environmental and customer concerns (Thomas et al., 2022). Another study indicates a positive correlation between green product innovation and competitive advantage. Companies that engage in green innovation (including reducing carbon emissions) often see improvements in their market position and overall performance (Qiu et al., 2020).

However, the research also highlighted that the link between green innovation and sustainable competitive advantage may be different based on the characteristics of companies, whether private or public, aligning with earlier research (Gao et al., 2021; Purnomo et al., 2024; Song and Yu, 2018). Several factors contribute to this trend, such as government subsidies, strict environmental regulations, financial incentives, corporate culture, and increasing expectations from stakeholders (Fang et al., 2021; Guo et al., 2023; Kou et al., 2024; Liao and Xiao, 2025; Sun et al., 2022). For instance, prior studies (Fang et al., 2021; Sun et al., 2022) have shown that environmental regulations significantly boost green innovation in public firms, often facing more intense regulatory oversight and public accountability. For instance, public companies listed on the capital market typically have more excellent capabilities in terms of financial resources, making them more likely to invest in new, greener technologies. In contrast, private companies face restrictions on financial resources, which can restrict their ability to innovate to the same extent.

H3: Green innovation positively related to sustainable competitive advantage (a), and this relationship may differ between private and public companies (b).

This study posits that green innovation mediates the relationship between ESG activities and the attainment of sustainable competitive advantage. This means that ESG activities directly contribute to sustainable competitive advantage but indirectly enhance it by fostering green innovation. Previous research has extensively highlighted the intermediary role of green innovation, including its impact on the connections between ESG and sustainable performance, digital transformation, and institutional environment, risk reduction, positive market reactions, and environmental performance and corporate reputation (Chouaibi et al., 2022; Li and Rasiah, 2024; Liu and Lyu, 2022; Long et al., 2023; Martínez-Falcó et al., 2025; Zhai et al., 2022). Moreover, previous studies have confirmed that green innovation is a significant mediator that links ESG practices to improved financial and non-financial performance via corporate reputation and reduces financing constraints, thus contributing to a sustainable competitive edge (Chouaibi et al., 2022; Khan and Liu, 2023; Zeng et al., 2024). Recently, research on Spanish wineries indicates that green product and process innovation partially mediates the relationship between ESG strategy and sustainable performance, suggesting that innovation is a key channel through which ESG activities translate into competitive advantages (Martínez-Falcó et al., 2025). Hence, the hypothesis proposed is:

H4: Green innovation mediates the link between ESG activities and sustainable competitive advantage (a), and this relationship may differ between private and public companies (b).

3 Materials and methods

3.1 Sample and procedures

The present study explores the factors influencing sustainable competitive advantage at the firm level, explicitly focusing on companies that have assets of more than 500 million IDR to 10 billion IDR (medium) and large assets category (>10 billion IDR). The respondents selected were top management at each company to address critical issues such as ESG (environmental, social, and governance) activities, green dynamic capabilities, and sustainable competitive advantage—key areas central to this research. This study uses a purposive sampling strategy to select the relevance and quality of the data. In the first stage, 300 representatives from top management were invited to participate in the study via a formal letter or direct call. However, of 300, only 114 agreed to participate in this study. Participation in this study was voluntary and uncompensated. The questionnaire was designed to consist of three parts: first, a cover letter describing the study’s objectives, an anonymity guarantee, and some instructions for completing the questionnaire. The second part consists of the questions asked. In contrast, the third part includes informed consent obtained from participants after they completed the questionnaire.

Table 1 provides information on the characteristics of the study participants and companies. First, most respondents are male (78.07%) and female with 25 participants (21.93%). Regarding tenure, the largest group, representing 54.39% of participants (tenure of >10 years), followed by those with over 5–10 years of experience at 29.82%. Furthermore, based on business type, most participants (69.30%) are affiliated with private companies, while 30.70% are associated with public companies. Regarding business ownership, local companies represent the majority at 57.02%, compared to 42.98% for foreign-owned companies. Based on company size, most companies are in the big company category (81.58%), and only 18.42% are in the medium company category. Finally, the sectoral distribution highlights the dominance of the manufacturing sector (25.44%), followed by finance and insurance (12.28%), general trading and maintenance (12.28%), health service (8.77%), Freight and Forwarding (7.89%), information and communication (7.89%%), and Mining and Quarrying (7.02%). The remaining real estate, professional service, education, power and energy, and construction companies comprise 2.6–5.26% of the total sample.

3.2 Measures

All scales used in this study were adapted from established previous studies (Liu et al., 2022; Sellitto et al., 2020; Skordoulis et al., 2022; Tan and Zhu, 2022), with several modifications to ensure their relevance to the specific context of this research. To ensure accuracy and cultural appropriateness, we employed a rigorous three-stage back-translation process (Brislin, 1980). First, a professional translator translated the original English scale items into Indonesian. Next, two independent experts back-translated the Indonesian items into English to ensure consistency and alignment with the original meaning. Finally, an expert panel comprising five practitioners and four academics (including two Ph.D. holders and two professors) in the management field reviewed and validated the content, ensuring accuracy and relevance. Respondents were asked to provide ratings using a five-point Likert type on the items asked, ranging from 1 (strongly disagree/very low) to 5 (strongly agree/very high).

First, ESG activities were measured using items adapted from Liu et al. (2022), comprising three core dimensions: (1) environmental performance (2 items), assessing ecological conservation and pollution prevention; (2) social responsibility (2 items), evaluating stakeholder relations and community impact; and (3) governance quality (2 items), examining leadership accountability and decision-making processes.

Second, green innovation was operationalized through a four-item scale derived from Tan and Zhu (2022), Skordoulis et al. (2022), and Sellitto et al. (2020), capturing two distinct dimensions: (1) green product innovation (2 items) measuring the development of environmentally sustainable offerings, and (2) green process innovation (2 items) assessing eco-efficient production methods. Finally, sustainable competitive advantage was measured using two items adapted from Liu et al. (2022) that evaluate financial and non-financial market outperformance indicators. Following a rigorous validation process incorporating feedback from a panel of domain experts, the final instrument comprised three items for ESG activities (one per dimension), four items for green innovation (two per dimension), and two items for sustainable competitive advantage (see Appendix 1 for complete measurement items).

3.3 Data analysis procedures

The data analysis approach employed in this study is component-based Structural Equation Modeling (SEM), specifically utilizing Partial Least Squares-Structural Equation Modeling (PLS-SEM) with Multi-Group Analysis (MGA). This method was selected to address all research objectives, mainly to compare the relationship models between ESG practices, green innovation, and competitive sustainability advantages in private and public companies. Following Hair et al. (2019), Matthews (2017), and Cheah et al. (2023), the analysis was conducted in several steps. The first step involved data preparation and group division, where private companies were coded as “1,” and public companies were coded as “2.” The second step is evaluating the measurement model (Hair et al., 2019, 2020). The third step involved assessing measurement invariance using the Measurement Invariance of Composite Models (MICOM) approach. As outlined in this study, before performing the Multi-Group Analysis (MGA) to compare path coefficients between private and public companies, an invariance test using the Measurement Invariance of Composite Models (MICOM) approach was conducted (Henseler et al., 2016). This test aimed to determine whether the construct measurements were interpreted similarly across private and public companies. The MICOM test consisted of three procedures: configural invariance, compositional invariance, and equality of mean values and variances of composites (Henseler et al., 2016). Finally, the structural model was evaluated to explain the relationships between exogenous and endogenous variables. This structural model testing was conducted in two stages. First, a combined model was analyzed, followed by Multi-Group Analysis (MGA) to identify any significant differences in path coefficients between private and public companies.

4 Results

4.1 Common methods variance evaluation

Since the data in this study were gathered from a single source, there is a potential risk of common method bias (CMB). To mitigate this concern, we applied two statistical tests to evaluate whether the data displayed significant CMB issues: the Harman Single Factor Test (Podsakoff et al., 2012) and the Full Collinearity Assessment Approach (Kock et al., 2021). The Harman Single Factor Test results revealed that the single factor accounted for an average variance extracted (AVE) value of 0.243, below the threshold of 0.50, indicating no significant CMB. Additionally, the variance inflation factor (VIF) values for the inner and outer models were below 3.3 (Kock et al., 2021; Kock, 2017), confirming the absence of collinearity issues. Based on these findings, we concluded that the data in this study are free from serious CMB concerns and are suitable for further analysis.

4.2 Measurement model assessment

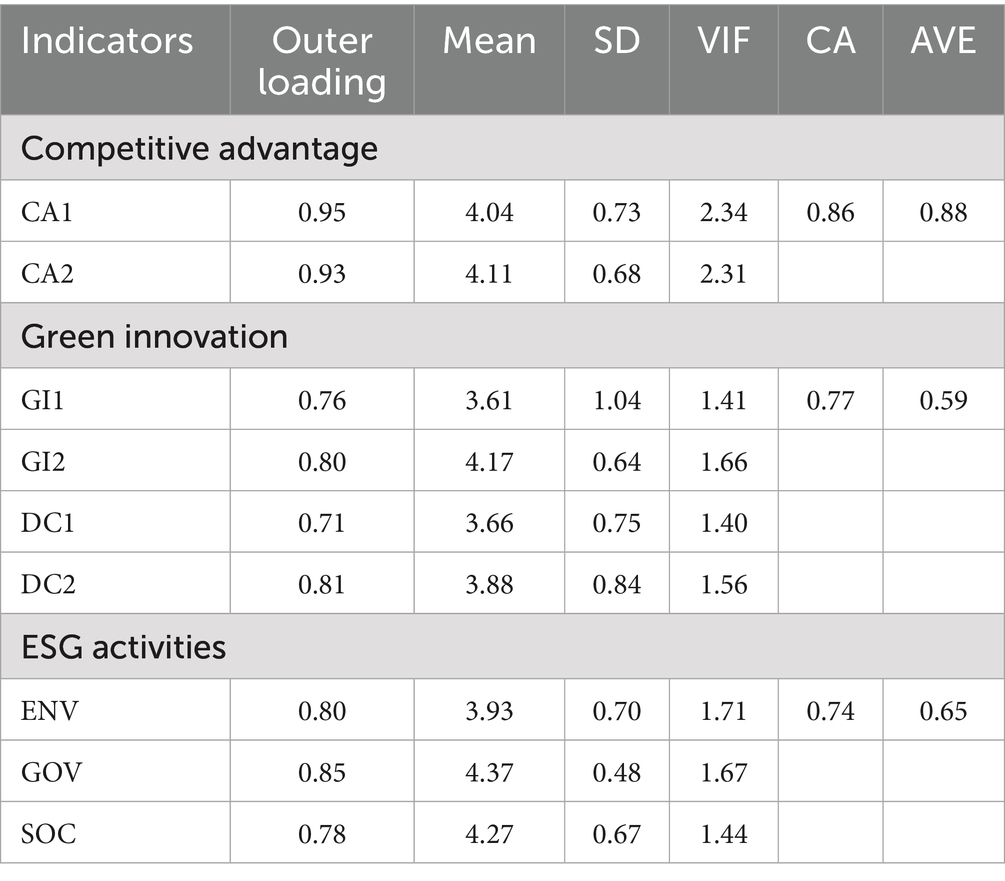

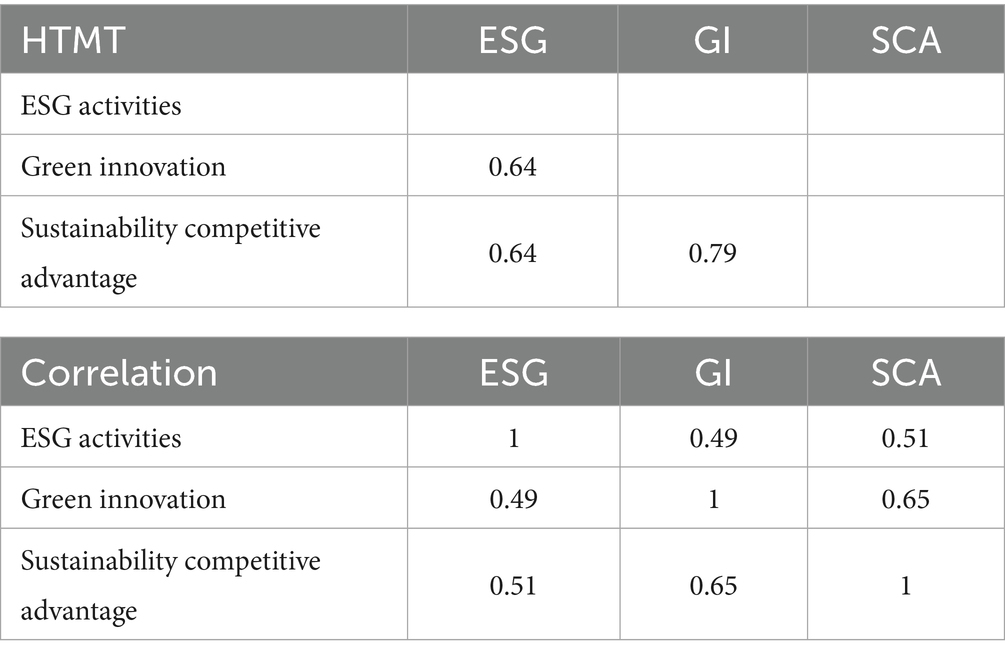

In this study, all constructs were initially evaluated. As shown in Table 2, all item loadings exceed the recommended threshold of 0.7, the CA and CR values obtained are above 0.7, and the AVE values surpass the minimum requirement of 0.5 (Cheah et al., 2023; Hair et al., 2019; Nunnally and Bernstein, 1994). As illustrated in Table 3, no discriminant validity issues were identified in the complete dataset. All HTMT values were below the threshold of 0.85, as recommended by Henseler et al. (2016). Moreover, the inner construct correlations among the constructs were all below 0.7, further confirming adequate discriminant validity for the complete dataset and the datasets derived from the two different types of companies.

4.3 Measurement invariance using MICOM

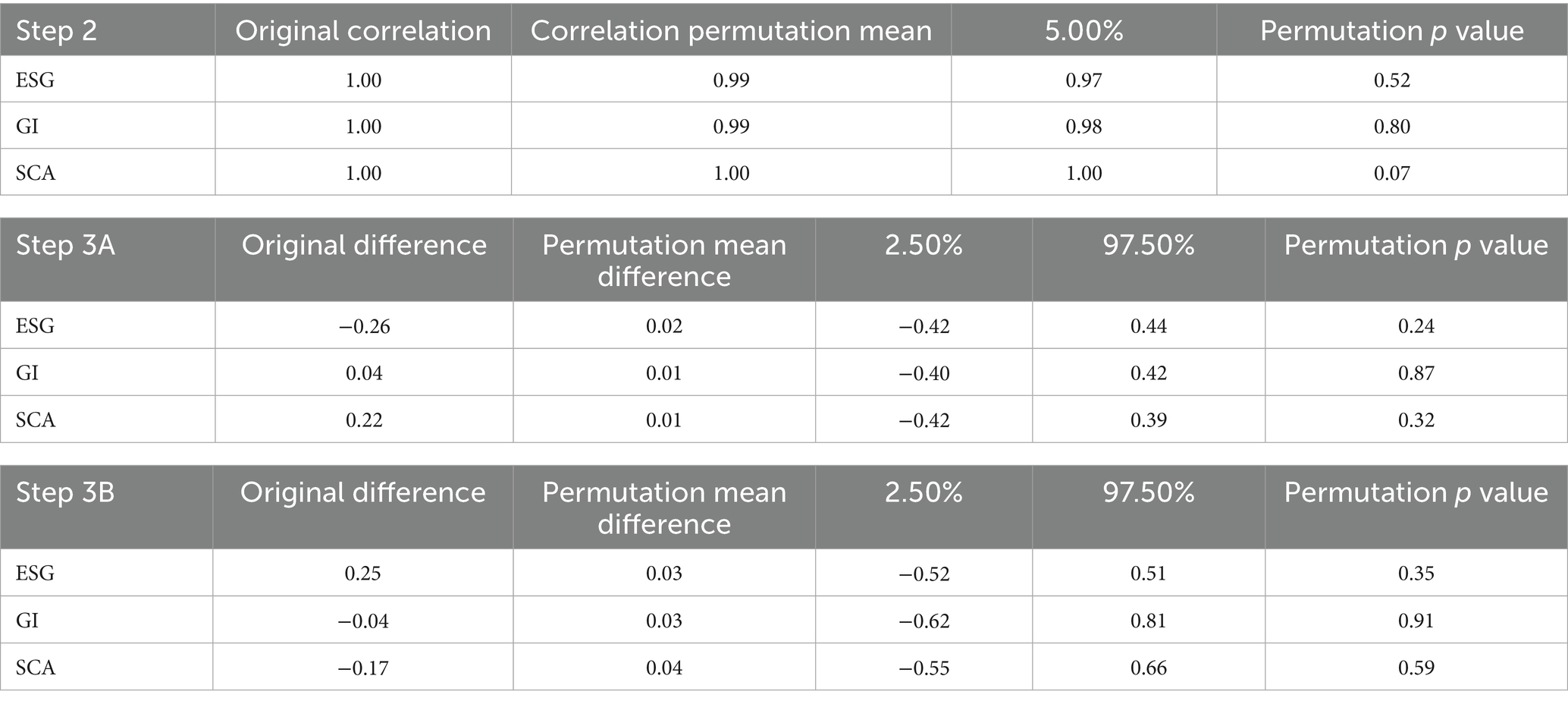

Since this study involves comparing model estimates across groups (private and public companies), ensuring that the construct measures are invariant between groups is the first condition that must be met. This study conducts an invariance test using the MICOM (Measurement Invariance of Composite Models) approach to determine whether the construct measurements are consistent across two sample groups: private and public companies (Henseler et al., 2016). The MICOM procedure consists of three main stages: (1) assessing configural invariance, (2) evaluating compositional invariance, and (3) testing the equality of mean values and variances of the composites, as recommended by Henseler et al. (2016).

Table 4 reveals that the p-value is non-significant, suggesting that partial measurement invariance has been achieved through the permutation technique in the MICOM test, as none of the p-values indicate significant differences. Additionally, Table 4 (Step 3a) illustrates that the original mean differences for all sub-scales—ESG activities, green innovation, and sustainability competitive advantage—are within the 95% CI, bounded by the lower (2.5%) and upper (97.5%) percentiles. Similarly, the results for the original variance differences in Step 3b indicate that all values fall within the 2.5–97.5% range, confirming no significant differences between the two groups (private and public) across all latent variables. Furthermore, all permutation p-values are >0.05 for each variable, supporting this model’s establishment of full measurement invariance.

4.4 Analyze the PLS-SEM and the MGA test

The analysis in this study was carried out in two phases: first, the model was estimated using the complete dataset, and subsequently, a multi-group analysis (MGA) was conducted to examine model differences in the path coefficients between private and public companies. Before evaluating the structural model, multicollinearity evaluation is carried out. As shown in Table 3, all constructs exhibited VIF scores below the threshold of 3.3, confirming that multicollinearity is not a serious problem in this model (Hair et al., 2019). Next, evaluation determination of R2 and f2 values for the model’s explanatory power and effect size. Based on the bootstrapping technique with 5,000 samples, the path coefficients for the entire dataset were positively significant for private and public companies (see Table 5 and Figure 2).

The effect sizes (f2) of the paths, as recommended by Cohen (1988), are also presented in Table 5. For the entire dataset, the effect sizes were f2 = 0.31, 0.09, and 0.41. For private companies, the values were f2 = 0.28, 0.13, and 0.37, while for public companies, they ranged from f2 = 0.55, 0.05, and 0.51. These results indicate that the effect sizes for the relationships between ESG activities, green innovation, and sustainable competitive advantage range from low to large, in line with Cohen’s (1988) guidelines (f2 ≥ 0.02 for minor effects, ≥0.15 for medium, and ≥0.35 for large). Table 5 also summarizes the R2 values for each sample group, representing the proportion of variance explained by the model. These values offer insights into the model’s predictive power for the dependent variables across different groups. For the entire dataset, the R2 values were 0.24 for green innovation and 0.47 for sustainable competitive advantage. This results implies that 24% of the variance in green innovation can be attributed to ESG activities, while the combined effects of ESG activities and green innovation explain 47% of the variance in sustainable competitive advantage. These R2 values are considered moderate for sustainable competitive advantage and weak for green innovation. Similar findings were noted for private companies, with R2 values of 0.22 (green innovation) and 0.47 (sustainable competitive advantage), indicating weak and moderate explanatory power, respectively. In contrast, public companies exhibited higher R2 values of 0.35 (green innovation) and 0.54 (sustainable competitive advantage), reflecting moderate to substantial explanatory power.

4.5 Hypothesis testing

Hypothesis 1 examines the link between ESG activities and sustainable competitive advantage. The results reveal a significant positive relationship for the overall sample (β = 0.25, p-value < 0.01) as well as for private companies (β = 0.29, p-value < 0.01). However, this relationship is not significant for public companies (β = 0.19, p-value > 0.05), suggesting that the impact of ESG activities on sustainable competitive advantage may vary by company type. Hypothesis 2 proposes a positive relationship between ESG activities and green innovation across all samples. The results support this hypothesis, showing a positive coefficient (β = 0.49, p-value < 0.01) for the overall sample. When examining the data by company type, the relationship remains significant and positive for both private companies (β = 0.49, p-value < 0.01) and public companies (β = 0.59, p-value < 0.01).

Hypothesis 3 investigates the relationship between green innovation and sustainable competitive advantage. The results demonstrate a significant positive relationship across all groups: the overall sample (β = 0.53, p-value < 0.01), private companies (β = 0.50, p-value < 0.01), and public companies (β = 0.61, p-value < 0.01). Finally, hypothesis 4 explores the indirect effect of ESG activities on sustainable competitive advantage through green innovation. As shown in Table 5, the indirect effect is significant for all groups. Specifically, the overall sample exhibits a significant indirect effect (β = 0.26, p-value < 0.01), as do private companies (β = 0.23, p-value < 0.01) and public companies (β = 0.36, p-value < 0.01). These findings underscore the mediating role of green innovation in connecting ESG activities to sustainable competitive advantage.

5 Discussion

This study aims to examine the direct relationship between ESG activities and sustainable competitive advantage, as well as the indirect relationship through green innovation. Using a sample of 114 companies, PLS-SEM Multi-Group Analysis provides empirical evidence that shows ESG Activities can directly increase sustainable competitive advantage or indirectly through green innovation. On the other hand, the dynamics of the relationship varies based on the type of company (private vs. public).

First, the results indicate that ESG activities positively contribute to sustainable competitive advantage for all samples. As general, this finding aligns with stakeholder and shared value theories and indicates that ESG disclosures create a competitive advantage by strengthening corporate sustainability (Alsayegh et al., 2020). Moreover, companies that integrate ESG factors into their business models can attract investment, innovate for growth, and reduce business risks, leading to long-term competitive advantages (Castellano et al., 2024). However, the MGA analysis found that the relationship between ESG activities and sustainable competitive advantage was only significant for the private companies group. Two reasons can explain this difference: First, private companies have greater flexibility than public companies in designing and implementing ESG practices, including implementing their ESG strategies to align more closely with their specific business models and stakeholder expectations (Prado Muci De Lima and Costa Fernandes, 2024; Xi and Wang, 2024). Second, private companies face less scrutiny, allowing them to pursue more innovative and customized ESG strategies than public companies. In other words, the flexibility in private companies enables them to experiment with new approaches and integrate ESG more deeply into their business models, which can lead to more significant competitive advantages than public companies (Sang et al., 2024; Xi and Wang, 2024). Hence, the present study findings emphasize the need for tailored ESG activities and highlight the importance of balancing compliance with innovation so that public companies can fully realize the potential of ESG initiatives.

Second, the findings of this study support the hypothesis that ESG activities positively influence green innovation. This relationship is consistent across all samples, including private and public companies. The results suggest that companies committed to ESG practices are more likely to develop and implement green innovations, such as acquiring more efficient materials and reducing waste generation in daily operational activities. These findings align with prior studies (Lian et al., 2023; Wang et al., 2023; Zhan et al., 2025; Zhou et al., 2023), which have demonstrated that ESG ratings and practices generally promote green innovation by increasing the output of green invention patents and enhancing the quality of green innovation. Specifically, companies with more vigorous ESG activities tend to exhibit better green innovation outcomes, particularly public enterprises and those with more significant financial resources than private companies.

In particular, this study also highlights the differences in the effects of ESG activities on green innovation between private and public companies. This finding is consistent with prior empirical evidence, particularly the work of Zhan et al. (2025), which establishes that the positive correlation between ESG performance and green innovation output is more pronounced in publicly listed firms—especially those with higher concentrations of institutional ownership and dominant shareholders (Zhan et al., 2025), providing support for institutional theory. In other words, as entities subject to stringent disclosure requirements and continuous market surveillance, public companies face amplified pressure from institutional investors, analysts, and ESG rating agencies to demonstrate sustainable leadership (Ruan et al., 2024). In addition, the visibility afforded by stock exchange listings creates strategic incentives for these firms to leverage green innovation as a tool for enhancing ESG ratings, attracting sustainable investment capital, and aligning with shifting public and regulatory expectations (Wang et al., 2023). Another factor that may explain this difference is that the capital market ecosystem—where ESG metrics increasingly influence valuation and cost of capital—compels public firms to institutionalize sustainability-driven R&D and product development. In contrast to public companies, private companies have weaker external pressures (e.g., stakeholder pressure) and may focus more on operational flexibility due to their limited financial resources. Therefore, ESG practices may be slower to move than public companies. These findings underscore the critical interplay between organizational visibility, investor activism, and regulatory exposure in amplifying the ESG-green innovation nexus.

Third, the findings confirm that green innovation is a significant driver of sustainable competitive advantage across all types of companies (private and public), supporting previous studies (Gao et al., 2021; Purnomo et al., 2024; Song and Yu, 2018). These findings indicate that investing in green technologies, processes, and products can effectively achieve long-term competitiveness. Notably, the study reveals that the impact of green innovation is more pronounced in public companies than in private firms. This dominance can be attributed to several factors, including government subsidies, stringent environmental regulations, financial incentives, organizational culture, and heightened stakeholder expectations (Fang et al., 2021; Guo et al., 2023; Kou et al., 2024; Liao and Xiao, 2025; Sun et al., 2022). For instance, prior research (i.e., Fang et al., 2021; Sun et al., 2022) has demonstrated that environmental regulations significantly enhance green innovation in public companies, as these firms are often subject to greater regulatory scrutiny and public accountability. Therefore, public companies possess more financial resources and are more likely to invest in substantial green initiatives and advanced technologies to bolster their green strategies. In contrast, private companies often face resource limitations, making them more limited in allocating resources to green technology.

Finally, the results of this study reveal that green innovation plays a key role as a mediator linking ESG activities with sustainable competitive advantage, where ESG practices not only have a direct impact but also have an indirect effect through encouraging green innovation (Zhai et al., 2022). The implementation of ESG practices can significantly enhance a company’s reputation by attracting sustainable investors, mitigating business risks, and improving market confidence. In other words, the high of green innovation may reduce the cost of capital and alleviate funding constraints, thereby allowing for a more substantial allocation of resources toward the advancement of innovative and sustainable solutions. In addition, strong ESG performance that leads to green innovation greatly improves a company’s image. It establishes market differentiation through eco-friendly products and processes, creating a mutually strengthening positive cycle among ESG practices, innovation ability, and a long-term sustainable competitive edge (Khan and Liu, 2023). Hence, the present study emphasizes the importance of an integrated approach between ESG strategy and green innovation as a mechanism for sustainable value creation, thereby exchanging sustainable competitive advantage in the modern business era.

5.1 Theoretical implications

Drawing on the RBV and institutional theory, this study contributes to the ESG literature by examining how ESG activities enhance corporate competitiveness through green innovation. First, this study extends the scope of ESG research, which has predominantly focused on the energy sector (Li et al., 2023; Ren et al., 2024), by adopting a novel approach that investigates the role of organizational characteristics in the public sector. This research helps us better understand how a company’s characteristics influence its ability to translate ESG commitments into tangible green innovations and enduring competitive advantages. In other words, what is particularly interesting is how it reveals why public and private companies approach ESG differently—public firms often respond to outside pressures; in contrast, private firms tend to align ESG with their core strengths. Similarly, these patterns illustrate what institutional theory predicts about how organizations adapt to their external environments.

Second, this finding extends previous research that has examined the intermediate role of green innovation in linking ESG activities to various outcomes, such as financial performance (Chouaibi et al., 2022), sustainable performance (Martínez-Falcó et al., 2025), digital transformation and institutional environment (Li and Rasiah, 2024; Long et al., 2023), risk reduction, positive market reactions (Liu and Lyu, 2022; Zhai et al., 2022), and environmental performance and corporate reputation (Chouaibi et al., 2022; Martínez-Falcó et al., 2025). Hence, this study contributes to the literature by empirically demonstrating that green innovation is a critical mediator between ESG activities and sustainable competitive advantage. While prior research has confirmed the importance of ESG activities on various outcomes in organizations, this study focuses on green innovation as a mechanism through which ESG practices enhance sustainable competitiveness advantage across private and public companies. As such, this study provides an alternative explanation regarding the indirect relationship of ESG activities on competitive advantage through green innovation, particularly in developing countries.

5.2 Practical implications

The results of this study have several practical implications for managers, policymakers, and stakeholders who intend to improve the effectiveness of ESG activities in promoting green innovation and sustainable competitive advantage. First, the companies should focus on embedding ESG practices into their business strategy, given that these activities are critical to green innovation and sustainable competitive advantage. Public companies should leverage access to financial resources, government subsidies, and regulatory support to embark on large-scale green initiatives and advanced technologies. Public companies should also enhance transparency and stakeholder engagement to respond to increased scrutiny and protect their reputation. Private companies, on the other hand, should take advantage of the flexibility to tailor ESG strategies to fit their business model and stakeholder expectations. In addition, with limited resources, private firms can provide insights into green innovation by introducing a sustainability culture and encouraging employee involvement.

Second, regulators should understand the differences in the needs of public and private corporations when crafting regulations and other incentives to drive ESG behavior and green innovation. For public companies, focused investment and support for large-scale green initiatives can magnify their effects. Resource constraints for private firms can be alleviated by providing access to capacity-building programs and incentives for incremental green innovations. Additionally, policymakers should encourage the media and the public to focus on ESG practices to create accountability and motivate companies to invest in green innovation.

5.3 Limitations

This study presents several limitations that future research should consider. Firstly, the sample size of 114 companies in Indonesia may limit the broader applicability of the findings. Although this sample provides important insights relevant to the Indonesian context, it might not comprehensively represent the variety of industries, regions, or organizational structures, which could constrain the generalizability of the findings to other developing or developed markets. Second, the complexity of the partial least squares multi-group analysis (PLS-MGA) approach presents sample size considerations. While we have employed rigorous validation techniques (including effect size estimation and MICOM procedures), the model’s statistical power could be strengthened through larger, more balanced samples that account for greater data variability across sectors. Moreover, we recommend that future studies incorporate power analysis during research design to optimize sample size determination and apply PLS-Predict in statistical analysis. Third, the cross-sectional research design limits our ability to capture temporal dynamics. A longitudinal approach would enable a more robust examination of the evolving relationships between ESG practices, green innovation, and sustainable competitive advantage, particularly in tracking how these constructs interact over business cycles and regulatory changes. Finally, the reliance on self-reported measures introduces potential response biases, including social desirability effects and perceptual inaccuracies. Although our statistical tests indicated no significant CMB, future studies could strengthen findings through methodological triangulation—incorporating objective metrics from financial reports, sustainability disclosures, and other archival data sources to complement survey responses.

6 Conclusion

This study examines the impact of ESG activities on green innovation and sustainable competitive advantage, explicitly comparing private and public companies in Indonesia. Data was collected from 114 companies, and several important points were produced. Firstly, the study confirms that ESG activities are positively linked to sustainable competitive advantage, and this relationship is predominantly significant for private companies. Second, the study results revealed a positive relationship between ESG activities and green innovation, which was notably more pronounced in public companies than in private ones. Thirdly, the study reveals that green innovation has a positive impact on sustainable competitive advantage, with this relationship being more substantial in public companies compared to private ones. Finally, green innovation mediates ESG activities and sustainable competitive advantage, demonstrating a more significant mediating effect in public organizations.

Data availability statement

The data analyzed in this study is subject to the following licenses/restrictions: the data that support the findings of this study are available on request from the corresponding author. The data are not publicly available due to privacy or ethical restrictions. Requests to access these datasets should be directed to Tjatur Widyantoro, dGphdHVyLndpZHlhbnRvcm9AYmludXMuYWMuaWQ=.

Ethics statement

The studies involving humans were approved by Prof. Dezie Leonarda Warganegara, Ph.D (BINUS Business School Executive Dean, Bina Nusantara University). The studies were conducted in accordance with the local legislation and institutional requirements. Written informed consent for participation in this study was provided by the participants’ legal guardians/next of kin.

Author contributions

TW: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Software, Validation, Writing – original draft. TR: Methodology, Supervision, Writing – review & editing. DW: Supervision, Writing – review & editing. AF: Supervision, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frsus.2025.1592076/full#supplementary-material

References

Alicia, F. R. (2024). Implementation of environmental pollution and damage prevention instruments in Indonesia: issues and challenges. Indonesian J. Environ. Law Sustain. Dev. 3, 125–156. doi: 10.15294/ijel.v3i1.78892

Alsayegh, M. F., Abdul Rahman, R., and Homayoun, S. (2020). Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustain. For. 12:3910. doi: 10.3390/su12093910

Au, A. K. M., Yang, Y.-F., Wang, H., Chen, R.-H., and Zheng, L. J. (2023). Mapping the landscape of ESG strategies: a bibliometric review and recommendations for future research. Sustainability (Switzerland) 15:16592. doi: 10.3390/su152416592,

Baaij, M., Greeven, M., and Van Dalen, J. (2004). Persistent superior economic performance, sustainable competitive advantage, and schumpeterian innovation: leading established computer firms 1954-2000. Eur. Manag. J. 22, 517–531. doi: 10.1016/j.emj.2004.09.010

Barney, J. (1991). Firm resources and sustained competitive advantage. J. Manage. 17, 99–120. doi: 10.1177/014920639101700108

Bhatti, S. M., Al Mamun, A., Wu, M., Naznen, F., Kanwal, S., and Makhbul, Z. K. M. (2023). Modeling the significance of green orientation and culture on green innovation performance: moderating effect of firm size and green implementation. Environ. Sci. Pollut. Res. 30, 99855–99874. doi: 10.1007/s11356-023-29353-4,

Brislin, R. (1980). “Translation and content analysis of oral and written material” in Handbook of cross-cultural psychology. eds. H. Triandis and J. Berry. 2nd ed (Boston: Allyn & Bacon).

Castellano, R., Cini, F., and Ferrari, A. (2024). Value creation and sustainable business model: are ESG ratings a matter of class? Ann. Oper. Res. doi: 10.1007/s10479-024-05859-z

Cheah, J.-H., Amaro, S., and Roldán, J. L. (2023). Multigroup analysis of more than two groups in PLS-SEM: a review, illustration, and recommendations. J. Bus. Res. 156:113539. doi: 10.1016/j.jbusres.2022.113539

Cho, D.-S. (2023). “Environmental, social, and governance (ESG): where has it come from, and where will it go?” in Competitiveness of nations 2, the: government policies and business strategies for environmental, social, and governance (Esg), Singapore: World Scientific Publishing Company. 103–121.

Chouaibi, S., Chouaibi, J., and Rossi, M. (2022). ESG and corporate financial performance: the mediating role of green innovation: UK common law versus Germany civil law. EuroMed J. Bus. 17, 46–71. doi: 10.1108/EMJB-09-2020-0101

Cohen, J. E. (1988). Statistical Power Analysis for the Behavioral Sciences. Hillsdale, NJ: Lawrence Erlbaum Associates, Inc.

Dranev, Y. (2023). Impact of ESG activities on the innovation development and financial performance of firms. J. Corp. Financ. Res. 17, 152–159. doi: 10.17323/j.jcfr.2073-0438.17.3.2023.152-159

Fang, Z., Kong, X., Sensoy, A., Cui, X., and Cheng, F. (2021). Government’s awareness of environmental protection and corporate green innovation: a natural experiment from the new environmental protection law in China. Econ. Anal. Policy 70, 294–312. doi: 10.1016/j.eap.2021.03.003

Gao, Y., Sun, Y., Yuan, Y.-H., Xue, X., and Sheng, F. (2021). Exploring the influence of resource management between green innovation strategy and sustainable competitive advantage: the differences between emerging and traditional industries. Int. J. Technol. Manag. 85, 101–126. doi: 10.1504/ijtm.2021.10037960

Gillen, M. C., and Chung, E. (2005). An initial investigation of employee stress related to caring for elderly and dependent relatives at home. Int. J. Sociol. Soc. Policy 25, 78–93. doi: 10.1108/01443330510791199

Guo, M., Wang, H., and Kuai, Y. (2023). Environmental regulation and green innovation: evidence from heavily polluting firms in China. Financ. Res. Lett. 53:103624. doi: 10.1016/j.frl.2022.103624

Hair, J. F., Howard, M. C., and Nitzl, C. (2020). Assessing measurement model quality in PLS-SEM using confirmatory composite analysis. J. Bus. Res. 109, 101–110. doi: 10.1016/j.jbusres.2019.11.069

Hair, J. F., Risher, J. J., Sarstedt, M., and Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 31, 2–24. doi: 10.1108/EBR-11-2018-0203

Henseler, J., Ringle, C. M., and Sarstedt, M. (2016). Testing measurement invariance of composites using partial least squares. Int. Mark. Rev. 33, 405–431. doi: 10.1108/IMR-09-2014-0304

Hsu, B.X., and Chen, Y.M. (2024). Does corporate social responsibility influence performance persistence? A signal extraction approach with evidence from fortune 500 companies. Technol. Forecast. Soc. Change 200:123154. doi: 10.1016/j.techfore.2023.123154

Jung, A. R., and Lee, M. J. (2022). A study on the effect on ESG performance on the speed of the stock price process: focused on stock price delay. Korean Account. Rev. 47, 185–231. doi: 10.24056/KAR.2022.08.006

Khan, U., and Liu, W. (2023). The link between green innovations, corporate performance, ESG activities, and sharing economy. Environ. Sci. Pollut. Res. 30, 78763–78775. doi: 10.1007/s11356-023-27722-7,

Kock, N. (2017). Common method Bias: a full collinearity assessment method for PLS-SEM BT - partial least squares path modeling: basic concepts, methodological issues and applications. Partial least squares path modeling. eds. H. Latan and R. Noonan (Springer, Cham:Springer International Publishing), 245–257. doi: 10.1007/978-3-319-64069-3_11

Kock, F., Berbekova, A., and Assaf, A. G. (2021). Understanding and managing the threat of common method bias: detection, prevention and control. Tour. Manag. 86:104330. doi: 10.1016/j.tourman.2021.104330

Kocmanová, A., and Šimberová, I. (2014). Determination of environmental, social and corporate governance indicators: framework in the measurement of sustainable performance. J. Bus. Econ. Manag. 15, 1017–1033. doi: 10.3846/16111699.2013.791637

Kou, M., Zhang, L., Wang, H., Wang, Y., and Shan, Z. (2024). The heterogeneous impact of green public procurement on corporate green innovation. Resour. Conserv. Recycl. 203:107441. doi: 10.1016/j.resconrec.2024.107441

Lee, J., Kim, J., and Cho, J. (2024). The impact of ESG participation on firm innovation: empirical findings from international data. SAGE Open 14:1–20. doi: 10.1177/21582440241253424

Li, Z., and Li, M. (2025). Does environmental, social, and governance performance affect corporate green innovation? Evidence from China. Pol. J. Environ. Stud. 34, 2273–2283. doi: 10.15244/pjoes/187600

Li, J., Lian, G., and Xu, A. (2023). How do ESG affect the spillover of green innovation among peer firms? Mechanism discussion and performance study. J. Bus. Res. 158:113648. doi: 10.1016/j.jbusres.2023.113648

Li, M., and Rasiah, R. (2024). Can ESG disclosure stimulate corporations’ sustainable green innovation efforts? Evidence from China. Sustainability (Switzerland) 16:9390. doi: 10.3390/su16219390,

Lian, Y., Li, Y., and Cao, H. (2023). How does corporate ESG performance affect sustainable development: a green innovation perspective. Front. Environ. Sci. 11:1170582. doi: 10.3389/fenvs.2023.1170582

Liao, Z., and Xiao, L. (2025). Government environmental regulation, media attention, and corporate green innovation. Int. Rev. Econ. Finance 97:103751. doi: 10.1016/j.iref.2024.103751

Lindsey, C. O., Janus, B., and Murphy, H. (2014). “Growing expectations: the rising tide of sustainability reporting initiatives and their challenges for the oil and gas industry” in Society of Petroleum Engineers - SPE international conference on health, safety and environment 2014: The journey continues, vol. 1, 36–42.

Liu, Y., Kim, C. Y., Lee, E. H., and Yoo, J. W. (2022). Relationship between sustainable management activities and financial performance: mediating effects of non-financial performance and moderating effects of institutional environment. Sustain. For. 14:1168. doi: 10.3390/su14031168

Liu, H., and Lyu, C. (2022). Can ESG ratings stimulate corporate green innovation? Evidence from China. Sustainability (Switzerland) 14:12516. doi: 10.3390/su141912516,

Long, H., Feng, G.-F., and Chang, C.-P. (2023). How does ESG performance promote corporate green innovation? Econ. Change Restruct. 56, 2889–2913. doi: 10.1007/s10644-023-09536-2

Lu, C., Wu, C., Feng, L., Zhan, J., Shi, Y., and Chen, H. (2025). Does ESG performance enhance corporate green technological innovation? Micro evidence from Chinese-listed companies. Sustain. For. 17:636. doi: 10.3390/su17020636

Lubis, M. F. F., and Rokhim, R. (2021). The effect of environmental, social, and governance (ESG) disclosure and competitive advantage on companies performance as an implementation of sustainable economic growth in Indonesia for period of 2015-2019. IOP Conf. Ser. Earth Environ. Sci. 940:12059. doi: 10.1088/1755-1315/940/1/012059

Ma, X., Ock, Y.-S., Wu, F., and Zhang, Z. (2022). The effect of internal control on green innovation: corporate environmental investment as a mediator. Sustain. For. 14:1755. doi: 10.3390/su14031755

Martínez-Falcó, J., Sánchez-García, E., Marco-Lajara, B., and Millán-Tudela, L. A. (2025). Unraveling the relationship between ESG strategy and sustainable performance in the Spanish wine industry: a structural equation analysis. Soc. Responsib. J. 21, 962–986. doi: 10.1108/SRJ-12-2023-0682

Matthews, L. (2017). “Applying multigroup analysis in PLS-SEM: a step-by-step process” in Partial least squares path modeling (Springer, Cham: Springer International Publishing), doi: 10.1007/978-3-319-64069-3_10

Meyer, J. W., and Rowan, B. (1977). Institutionalized Organizations: Formal Structure as Myth and Ceremony. American Journal of Sociology 83, 340–363. doi: 10.1086/226550

Mohy-ud-Din, K. (2024). ESG reporting, corporate green innovation and interaction role of board diversity: a new insight from US. Innov. Green Dev. 3, 100161. doi: 10.1016/j.igd.2024.100161

Montague, P., and Pellerano, M. B. (2014). “History of the US environmental movement (revised 10 January 2012)” in Encyclopedia of toxicology. ed. M. B. Pellerano. Third ed, 918–943.

Podsakoff, P. M., MacKenzie, S. B., and Podsakoff, N. P. (2012). Sources of method Bias in social science research and recommendations on how to control it. Annu. Rev. Psychol. 63, 539–569. doi: 10.1146/annurev-psych-120710-100452,

Prado Muci De Lima, I., and Costa Fernandes, D. (2024). “ESG 2.0: the new perspectives for human rights due diligence” in CSR, sustainability, ethics and governance, vol. Part F3171, 231–243.

Purnomo, A., Rahayu, M., Rohyana, C., Lestiani, M. E., Supardi, E., and Yanto, R. T. Y. (2024). Leveraging green innovation and green ambidexterity for green competitive advantage: the mediating role of green resilient supply chain. Uncertain Supply Chain Manag. 12, 2683–2698. doi: 10.5267/j.uscm.2024.5.003

Putri, E. I. K., Dharmawan, A. H., Hospes, O., Yulian, B. E., Amalia, R., Mardiyaningsih, D. I., et al. (2022). The oil palm governance: challenges of sustainability policy in Indonesia. Sustainability (Switzerland) 14:1820. doi: 10.3390/su14031820,

Qin, M., and Lee, E. T. (2024). Does information transparency moderate the relationship between ESG and green innovation? Empirical evidence from China. Sustain. For. 16:10245. doi: 10.3390/su162310245

Qin, X., Muskat, B., Ambrosini, V., Mair, J., and Chih, Y.-Y. (2025). Green innovation implementation: a systematic review and research directions. J. Manage., 1–28. doi: 10.1177/01492063241312656

Qiu, L., Jie, X., Wang, Y., and Zhao, M. (2020). Green product innovation, green dynamic capability, and competitive advantage: evidence from Chinese manufacturing enterprises. Corp. Soc. Responsib. Environ. Manag. 27, 146–165. doi: 10.1002/csr.1780

Ren, M., Zhou, J., Si, J., Wang, G., and Guo, C. (2024). The impact of ESG performance on green innovation among traditional energy enterprises—evidence from listed companies in China. Sustain. For. 16:3542. doi: 10.3390/su16093542

Resta, B., Dotti, S., Ciarapica, F. E., De Sanctis, I., Fani, V., Bandinelli, R., et al. (2018). Leveraging environmental sustainability for competitive advantage in the Italian clothing and leather sector. Int. J. Fashion Des. Technol. Educ. 11, 169–186. doi: 10.1080/17543266.2017.1356380

Ruan, L., and Liu, H. (2021). Environmental, social, governance activities and firm performance: evidence from China. Sustainability (Basel) 13, 1–16. doi: 10.3390/su13020767

Ruan, L., Yang, L., and Dong, K. (2024). Corporate green innovation: the influence of ESG information disclosure. J. Innov. Knowl. 9:100628. doi: 10.1016/j.jik.2024.100628

Saleem, S., and Bashir, H. (2024). Environmental corporate social responsibility and green dynamic capability: the moderating role of slack resources. Corp. Soc. Responsib. Environ. Manag. 31, 3379–3394. doi: 10.1002/csr.2751

Sang, Y., Loganathan, K., and Lin, L. (2024). Digital transformation and firm ESG performance: the mediating role of corporate risk-taking and the moderating role of top management team. Sustain. For. 16:5907. doi: 10.3390/su16145907

Saraswati, E., Ghofar, A., Atmini, S., and Dewi, A. A. (2024). Clustering of companies based on sustainability performance using ESG materiality approach: evidence from Indonesia. Int. J. Energy Econ. Policy 14, 112–125. doi: 10.32479/ijeep.15393

Sellitto, M. A., Camfield, C. G., and Buzuku, S. (2020). Green innovation and competitive advantages in a furniture industrial cluster: a survey and structural model. Sustain. Prod. Consum. 23, 94–104. doi: 10.1016/j.spc.2020.04.007

Sharma, K., Bhattacharjee, P., Arora, R., Kumar, K., Kirola, M., Awaar, V. K., et al. (2023). Green and sustainable manufacturing with implications of ESG in energy sector: a comprehensive review. E3S Web Conf. 430:1183. doi: 10.1051/e3sconf/202343001183

Singhania, M., and Saini, N. (2022). Quantification of ESG regulations: a cross-country benchmarking analysis. Vision 26, 163–171. doi: 10.1177/09722629211054173

Skordoulis, M., Kyriakopoulos, G., Ntanos, S., Galatsidas, S., Arabatzis, G., Chalikias, M., et al. (2022). The mediating role of firm strategy in the relationship between green entrepreneurship, green innovation, and competitive advantage: the case of medium and large-sized firms in Greece. Sustain. For. 14:3286. doi: 10.3390/su14063286

Soesetio, Y., Siswanto, E., Fuad, M., Rudiningtyas, D. A., and Astutik, S. (2024). The role of internationalisation in moderating the impact of ESG disclosure on financial performance. Econ. Bus. Rev. 10, 112–141. doi: 10.18559/ebr.2024.3.1217

Song, W., and Yu, H. (2018). Green innovation strategy and green innovation: the roles of green creativity and green organizational identity. Corp. Soc. Responsib. Environ. Manag. 25, 135–150. doi: 10.1002/csr.1445

Sun, X., Tang, J., and Li, S. (2022). Promote green innovation in manufacturing Enterprises in the Aspect of government subsidies in China. Int. J. Environ. Res. Public Health 19:7864. doi: 10.3390/ijerph19137864,

Tan, Y., and Zhu, Z. (2022). The effect of ESG rating events on corporate green innovation in China: the mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 68:101906. doi: 10.1016/j.techsoc.2022.101906

Thomas, A., Palladino, R., Nespoli, C., d’agostino, M. T., and Russo, G. (2022). “Determinants and outcomes of green innovations: a conceptual model” in Handbook of research on building greener economics and adopting digital tools in the era of climate change. eds. A. Thomas, et al., 43–63.

Wang, J., Ma, M., Dong, T., and Zhang, Z. (2023). Do ESG ratings promote corporate green innovation? A quasi-natural experiment based on SynTao green finance’s ESG ratings. Int. Rev. Financ. Anal. 87:102623. doi: 10.1016/j.irfa.2023.102623

Xi, L., and Wang, H. (2024). The influence of green transformation on ESG management and sustainable competitive advantage: an empirical comparison of companies in the Pearl River Delta and Yangtze River Delta. Sustain. For. 16:7911. doi: 10.3390/su16187911

Xie, J., Nozawa, W., Yagi, M., Fujii, H., and Managi, S. (2019). Do environmental, social, and governance activities improve corporate financial performance? Bus. Strat. Environ. 28, 286–300. doi: 10.1002/bse.2224

Zeng, H., Yu, C., and Zhang, G. (2024). How does green manufacturing enhance corporate ESG performance? — empirical evidence from machine learning and text analysis. J. Environ. Manag. 370:122933. doi: 10.1016/j.jenvman.2024.122933,

Zhai, Y., Cai, Z., Lin, H., Yuan, M., Mao, Y., and Yu, M. (2022). Does better environmental, social, and governance induce better corporate green innovation: the mediating role of financing constraints. Corp. Soc. Responsib. Environ. Manag. 29, 1513–1526. doi: 10.1002/csr.2288

Zhan, H., Shen, H., and Guo, H. (2025). Research on the impact of ESG scores on corporate substantive and strategic green innovation. Innov. Green Dev. 4:100194. doi: 10.1016/j.igd.2024.100194

Zhou, Y., Huo, W., Bo, L., and Chen, X. (2023). Impact and mechanism analysis of ESG ratings on the efficiency of green technology innovation. Financ. Res. Lett. 58:104591. doi: 10.1016/j.frl.2023.104591

Zhou, J., Lei, X., and Yu, J. (2024). Esg rating divergence and corporate green innovation. Bus. Strateg. Environ. 33, 2911–2930. doi: 10.1002/bse.3636

Keywords: ESG activities, green innovation, sustainable competitive advantage, private companies, public companies, PLS-SEM, multi-group analysis

Citation: Widyantoro T, Rusmanto T, Warganegara DL and Furinto A (2025) How ESG activities foster green innovation and sustainable competitive advantage: insights from public and private companies using multi-group PLS-SEM. Front. Sustain. 6:1592076. doi: 10.3389/frsus.2025.1592076

Edited by:

Ding Li, Southwestern University of Finance and Economics, ChinaReviewed by:

Sadaf Akhtar, Jiangsu University, ChinaVidhu Gaur, Management Development Institute, India

Saad Mahmood Bhatti, University of Engineering and Technology, Lahore, Pakistan

Copyright © 2025 Widyantoro, Rusmanto, Warganegara and Furinto. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tjatur Widyantoro, dGphdHVyLndpZHlhbnRvcm9AYmludXMuYWMuaWQ=

Tjatur Widyantoro

Tjatur Widyantoro Toto Rusmanto

Toto Rusmanto Dezie Leonarda Warganegara

Dezie Leonarda Warganegara Asnan Furinto

Asnan Furinto