- Faculty of Applied Economics, University of Chinese Academy of Social Sciences (UCASS), Beijing, China

Environmental, Social and Governance (ESG) reflects a company’s sustainable development capabilities, and equity incentives, as an important means of internal corporate governance, can enhance ESG performance by alleviating agency conflicts. This study, based on data from Chinese A-share listed companies from 2010 to 2023, using a two-way fixed-effect estimator to probe whether and how a firm’s executive shareholding influences the ESG performance. The results indicate: First, executive shareholding significantly promotes corporate ESG performance, and the conclusion remains robust after a series of robustness tests. Second, mechanism analysis shows that executive shareholding enhances corporate ESG performance by promoting green innovation, encouraging charitable donations, and improving management efficiency. Third, heterogeneity analysis reveals that executive shareholding has a more significant promoting effect on the ESG performance in non-state-owned enterprises, high-pollution enterprises, low-equity concentration enterprises, and non-CEO duality enterprises. The study provide new insights for companies to enhance their ESG performance through internal institutional design and offer important implications for promoting high-quality economic development in China.

1 Introduction

China’s economy has transitioned from a phase of high-speed growth to one of high-quality development. The report of the 20th National Congress of the Communist Party of China emphasizes that “accelerating the green transformation of development patterns and promoting the green and low-carbon development of the economy and society are key steps to achieving high-quality development.” High-quality development at the macroeconomic level requires the sustainable development of micro-level enterprises as its foundation. The new development philosophy of “innovation, coordination, green development, openness, and shared benefits” propagates that enterprises, while pursuing economic profits, also assume environmental responsibilities and demonstrate humanistic care toward society. The Environmental, Social and Governance (ESG) concept aligns closely with the goal of high-quality enterprise development (Li et al., 2021). It requires enterprises to consider not only short-term economic interests but also the comprehensive impact on the ecological environment, employee well-being, social responsibility, and the transparency and fairness of internal governance. By actively fulfilling their social and environmental responsibilities, enterprises can enhance their sustainable development capabilities, contribute to building a greener, more harmonious, and sustainable social environment, and achieve a win-win situation between economic and social benefits (Qing et al., 2024).

Separation of ownership and management is a significant characteristic of modern enterprises. This institutional arrangement has dual effects: on one hand, it facilitates the optimization of investors’ capital allocation, promotes the managerial capabilities, and enhances overall economic efficiency; on the other hand, it may lead to conflicts and efficiency losses due to the differing objectives between capital owners and managers, resulting in agency problems between shareholders and management (Jensen and Meckling, 1976). Since managers control the company’s operational activities but their actions are difficult to observe, the monitoring costs for owners increase, necessitating the design of a reasonable and effective incentive mechanism. Optimal contract theory posits that the board of directors, acting as supervisors of executives, can design an optimal incentive contract that aligns with maximizing shareholder value, thereby mitigating the agency problem between shareholders and managers (Abernethy et al., 2015; Pinto and Widdicks, 2014). Jensen and Meckling (1976) were the first to explore solutions to the principal-agent problem from the perspective of equity incentives, arguing that equity incentives have an alignment effect, which helps align the interests of executives with those of external shareholders, effectively resolving agency issues. Equity incentives are a long-term incentive mechanism targeting directors, senior executives, core employees, and other key personnel, utilizing the company’s stock as the object for incentives. Its ultimate goal is to align the interests of the incentive recipients with the company’s profits and risks, motivating them to operate the company in accordance with the principle of maximizing shareholder value and reducing or eliminating short-term behaviors (Lu et al., 2009).

The executive team, as the core of the corporate governance structure and the actual controllers of strategic planning and daily operations, directly determines whether an enterprise can effectively implement ESG principles (Shleifer and Vishny, 1990). In practice, implementing ESG principles involves long investment cycles, high sunk costs, and does not yield significant economic returns in the short term. This often leads executives, under pressure from short-term operational demands, to lack the motivation to actively engage in ESG initiatives, exacerbating conflicts of interest between shareholders and executives. To address this, equity incentives for executives can play an effective role. By having the executive team hold a certain number of company shares, their personal interests become closely aligned with the company’s long-term value, reducing principal-agent costs and leveraging the effect of shared interests. This encourages management to make decisions from the perspective of the company’s long-term development when formulating and implementing environmental strategies (Jensen and Murphy, 1990). ESG performance, as a crucial indicator of enterprise quality and long-term competitiveness, reflects a positive corporate image and is highly correlated with company valuation. Shareholding status motivates executives to cultivate the company’s long-term ESG value and enhances the company’s performance in environmental, social, and governance aspects. Therefore, thoroughly investigating the relationship between executives’ shareholding and corporate ESG performance is of significant practical importance for promoting corporate green transformation and uncovering the micro-level drivers of high-quality economic development.

Given this, this study using a two-way fixed-effect estimator, utilizes panel data from Chinese A-share listed companies from 2010 to 2023 to examine the impact of executives’ shareholding on corporate ESG performance. The results indicate that executive shareholding significantly promotes corporate ESG performance, and the conclusion remains robust after a series of robustness tests. Mechanism analysis shows that executive shareholding enhances corporate ESG performance by promoting green innovation, encouraging charitable donations, and improving management efficiency. Heterogeneity analysis reveals that executive shareholding has a more significant promoting effect on the ESG performance in non-state-owned enterprises, high-pollution enterprises, low-equity concentration enterprises, and non-CEO duality enterprises. The potential marginal contributions of this study are as follows.

First, existing research primarily focuses on the various impacts of ESG on corporate innovation (Tang, 2022), investment (Zhang et al., 2022), financing (Kim and Li, 2021), value (Zheng et al., 2022), and performance (Gao et al., 2023), with limited attention to the influencing factors of corporate ESG performance. This study explores the impact of executives’ shareholding on corporate ESG performance, thereby enriching the research on the influencing factors of corporate ESG performance.

Second, existing studies mainly investigate the impact of executives’ shareholding on single factors such as corporate R&D investment (Hu et al., 2025), and innovation performance (Yang et al., 2023). This study employs ESG theory to incorporate the single impacts of executives’ shareholding on the environmental, social, and governance dimensions into a unified analytical framework, directly exploring the relationship between executives’ shareholding and corporate ESG performance. This clarifies the overall role of executives’ shareholding in promoting corporate sustainable development and extends the relevant research on the economic effects of executives’ shareholding.

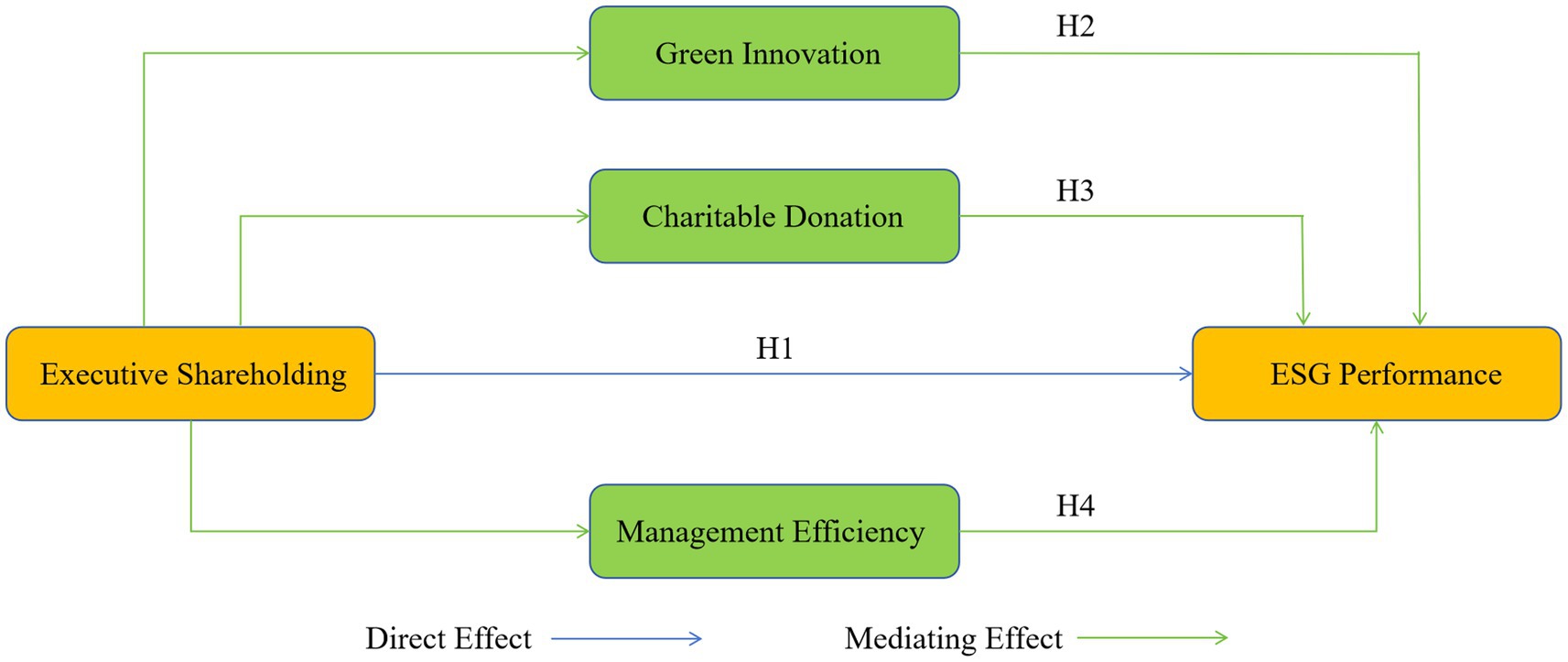

Third, this study delves into the mechanisms through which executives’ shareholding influences corporate ESG performance through three pathways: green innovation, charitable donations, and management efficiency. It reveals the internal drivers for improving ESG performance and provides new empirical evidence on the impact of executives’ shareholding on corporate ESG performance. This offers decision-making insights for corporate ESG practices and references for policymakers regarding ESG disclosure, thereby contributing to the advancement of ESG practices and policies.

The organization of the remaining sections of this study is structured as follows. Section 2 outlines the literature review. Section 3 elaborates the hypotheses. Section 4 details the data, variables, and empirical model. Section 5 examines and interprets the main empirical results. Section 6 discusses the results. Section 7 provides conclussions and policy recommendations.

2 Literature review

The most relevant literature to this paper includes the influencing factors of corporate ESG performance, as well as the economic effects of executive equity incentives.

The influencing factors of corporate ESG performance can be analyzed from both internal and external perspectives. From the internal perspective, factors such as firm size, profitability, ownership attributes, industry characteristics, and board features all impact ESG performance. Research indicates that larger firms, with broader stakeholder interests, place greater emphasis on ESG behaviors (Fahad and Nidheesh, 2020). Profitable firms have stronger financial capabilities to support ESG initiatives (Campanella et al., 2021). Compared to non-state-owned enterprises, state-owned enterprises (SOEs) not only bear more social responsibilities but also receive more strategic resource support, resulting in higher ESG participation enthusiasm (Boubakri, 2019). Relative to clean industries, heavily polluting industries are more likely to harm the environment, thus bearing greater ESG responsibilities in pollution control (Deng et al., 2024). Governance factors also significantly influence ESG performance; studies show that larger, more independent boards with higher gender diversity correlate with better ESG performance (Campanella et al., 2021). Additionally, organizational resilience (Liang and Li, 2023), digitalization (Fang et al., 2023), and mergers and acquisitions (M&A) also affect ESG performance (Tampakoudis and Anagnostopoulou, 2020). From the external perspective, differences in economic development levels, culture, institutional quality, and legal traditions across countries influence ESG practices and performance (Cai et al., 2016; Pinheiro, 2024). Domestically, political connections and social capital are considered key factors affecting ESG behavior and performance (Jha and Cox, 2015), while green financial policies (Xue, 2023) also positively impact ESG performance.

Regarding the economic effects of executive equity incentives, recent studies primarily focus on its impact on corporate R&D behavior, corporate performance and corporate social responsibility. In terms of corporate R&D behavior, research indicates that executives’ shareholding significantly promotes both R&D investment and output (Hu et al., 2025). Post-equity incentive implementation, companies experience increased R&D investment and patent approvals (Yang et al., 2023). Besides, studies find a positive correlation between equity incentives and coporate performance, in which executive entrepreneurship acts as an mediating factor (Ma and Wang, 2024). Furthermore, some studies explore the impact of executives’ shareholding on corporate social responsibility (CSR), revealing an inverse ‘U’ relationship between CSR commitment level and executives’ shareholding, where CSR commitment initially rises and then declines with increasing shareholding (Zhao et al., 2024).

Corporations, as independent legal entities, possess both economic and social functions. While pursuing profit objectives, they must fulfill their responsibilities as members of society (Aguinis and Glavas, 2012; Bénabou and Tirole, 2010). Currently, academia has conducted research from multiple single dimensions on how to achieve internal supervision through institutional design and incentivize enterprises to fulfill their social and environmental responsibilities. For instance, incorporating environmental performance into the performance evaluation of executives’ compensation to motivate them to focus on long-term value (Berrone and Gomez-Mejia, 2009), or linking corporate social responsibility (CSR) standards with the CEO’s compensation structure to encourage executives to actively assume social responsibilities (Deckop et al., 2006). However, there is limited research that integrates the effects of equity incentives on a company’s environmental performance, social responsibility, and corporate governance into a unified evaluation framework. Besides, regarding the influencing factors of corporate ESG performance, studies have shown that digital transformation can enhance ESG performance through channels such as promoting technological innovation, improving internal information transparency, and restraining the short-sightedness of management (Zhong et al., 2023). Other studies have explored the role of executives’ environmental backgrounds in promoting corporate ESG performance from the perspective of internal corporate governance (Zhang et al., 2024a; Deng et al., 2024). However, overall, there is relatively little research on the impact of equity incentives on corporate ESG performance.

3 Hypothesis

3.1 The direct impact of executive equity incentives on corporate ESG performance

ESG focuses on the long-term value of a company and does not yield significant short-term economic benefits. Under the traditional compensation system of companies, due to the existence of the principal-agent problem, short-term financial performance evaluations lead to a lack of long-term vision among management. The short-sighted management significantly constrains the improvement of a company’s ESG performance (Fan et al., 2024), while long-term incentives tied to equity can help alleviate this issue. Executive shareholding binds the personal interests of executives with the company’s long-term value, effectively reducing principal-agent costs and mitigating conflicts of interest between shareholders and management (Jensen and Meckling, 1976), enabling executives to make decisions from the shareholders’ perspective, voluntarily cultivate the company’s long-term ESG value, and achieve a win-win situation for both personal and company interests. In terms of environmental protection, companies with higher equity holdings are more focused on considering the long-term interests of the company, and are more inclined to invest in green technology R&D, develop clean energy technologies, and adopt circular economy models to address environmental issues (Sun et al., 2023). In terms of social responsibility, executive shareholding incentivizes risk-taking by companies, prompting them to invest more in social welfare projects, thereby enhancing the company’s long-term brand value and market competitiveness (Yang et al., 2023). In terms of corporate governance, the executive shareholding mechanism strengthens executives’ sense of responsibility and belonging, encouraging them to prioritize transparency and accountability in governance structures, thereby improving the company’s governance standards (Li et al., 2023). Companies with higher executive shareholding ratios are also more likely to gain the trust of investors, customers, and regulatory bodies, as stakeholders believe that reduced agency costs ensure the company’s long-term goals align with sustainable development objectives. This trust not only provides the company with more financing opportunities (Cheng et al., 2014) but also communicates a commitment to sustainable development to society, thereby enhancing the company’s ESG performance.

In summary, this paper proposes Hypothesis 1.

H1: Executive shareholding can enhance corporate ESG performance.

3.2 The mediation effect of green innovation

Green innovation refers to the research and development activities where enterprises introduce environmentally friendly technologies in production to reduce their negative environmental impact and improve resource utilization efficiency (Takalo and Tooranloo, 2021). Senior executives are the core decision-makers driving green R&D activities; however, due to the high costs, long cycles, and significant risks associated with R&D, executives tend to avoid the risks involved in green innovation to ensure short-term gains (Li and Wu, 2023; Cao et al., 2024; Lu et al., 2025). Equity incentives can reduce agency costs, mitigate managerial myopia, enhance the alignment of interests between executives and company shareholders, encourage executives to focus more on the company’s long-term development and value creation, improve their environmental attitudes and proactive engagement in environmental initiatives, and increase substantial environmental R&D investments (Wu et al., 2022; Sun et al., 2023; Hu and Hong, 2023). Research indicates that companies with lower agency costs exhibit higher governance quality and perform more prominently in terms of green technological innovation capabilities and the number of green patent applications (Amore and Bennedsen, 2016). Green innovation, as a crucial means of corporate environmental governance, promotes clean production by reducing carbon emissions, lowering energy consumption, and enhancing pollutant purification capabilities, providing technical support for enterprises to comprehensively improve environmental performance and fulfill their ESG responsibilities (Ullah et al., 2022).

In summary, this paper proposes Hypothesis 2.

H2: Executive shareholding enhances ESG performance by promoting corporate green innovation.

3.3 The mediation effect of charitable donation

Charitable donations refer to the act where enterprises voluntarily and gratuitously donate funds to individuals or groups in need to enhance social welfare (Gautier and Pache, 2015). The top executives’ equity holding mechanism closely integrates the personal interests of executives with the company’s interests, reducing their short-term behavior and encouraging them to consider the company’s social externalities and long-term reputation in decision-making, thereby motivating enterprises to allocate more resources to public fields such as education, healthcare, and poverty alleviation (Dai and Chen, 2020). Charitable donations demonstrate a more proactive assumption of social responsibility, reshaping stakeholders’ perceptions, and enhancing the company’s social reputation and brand value (Haider, 2024). By aligning charitable activities with core strategies, enterprises can build competitive advantages and create social value, achieving a win-win situation for social and economic benefits. Therefore, top executives’ equity holding can incentivize enterprises to engage in charitable donations. As an essential aspect of fulfilling corporate social responsibility, charitable donations enable enterprises to support public welfare and improve the social environment, significantly enhancing ESG performance.

In summary, this paper proposes Hypothesis 3.

H3: Top executives' equity holding enhances ESG performance by incentivizing corporate charitable donations.

3.4 The mediation effect of management efficiency

Management efficiency refers to a company’s ability to achieve maximum operational returns with minimal management costs by establishing a reasonable organizational structure and smooth communication channels within corporate governance. The executive stock ownership mechanism re-integrates corporate ownership and control, reducing losses in management efficiency (Li et al., 2016). This transformation stems from equity incentives altering the risk-bearing logic; under traditional compensation systems, executives tended to increase management levels to evade responsibility, whereas equity binding motivates them to proactively simplify processes to enhance management efficiency and improve corporate performance (Jurkonis and Petrusauskaitė, 2014). Enhancing management efficiency provides a solid foundation for strengthening corporate governance effectiveness (Yang and Yang, 2024). Improved management efficiency leads to transparent decision-making processes and effective oversight systems, aiding in strengthening internal controls, optimizing internal governance structures, and advancing corporate ESG performance (Figure 1).

In summary, this paper proposes Hypothesis 4.

H4: Executive stock ownership enhances ESG performance by improving corporate management efficiency.

4 Research design

4.1 Sample selection and data sources

Since Huazheng Index began assessing the ESG performance of A-share listed companies in 2009, this paper starts from 2010, using panel data from 2010 to 2023 for Chinese A-share listed companies, after considering the existance of missing value and data completeness. The ESG data of enterprises are sourced from the WIND database, while the data of other variables are from the CSMAR database and the Chinese Research Data Services Platform (CNRDS). The data processing steps are as follows: (1) To ensure sample comparability, enterprises with abnormal operations such as ST, *ST, and PT were excluded; (2) Due to the significant differences in financial data, all financial enterprises were excluded; (3) To ensure data quality, enterprises with missing key variable data were excluded; (4) To avoid the impact of outliers, a 1% winsorization was applied to all continuous control variables. Ultimately, 37,592 samples were retained.

4.2 Variable definition

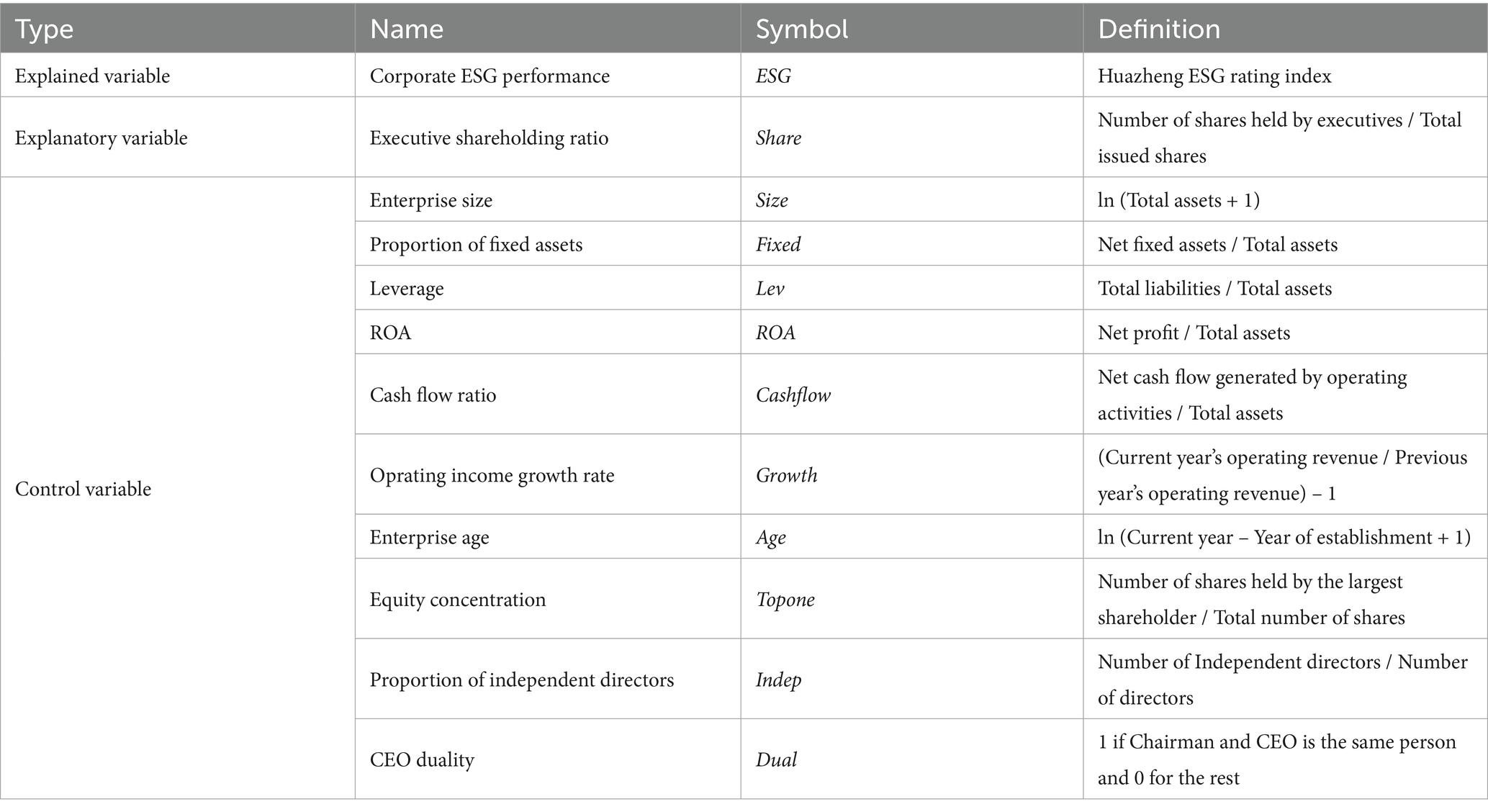

Table 1 shows the definition of variables in this article.

4.2.1 Dependent variable: corporate ESG performance

This paper refers to the research of Zhang (2025) and uses the Huazheng ESG rating indicators to measure the ESG performance of enterprises (ESG). This rating system divides the annual ESG performance of enterprises into nine grades, ranging from the highest AAA to the lowest C. Following the approach of Mao and Wang (2023), this paper assigns values from 1 to 9 to these nine grades, with higher values indicating better ESG performance of the enterprises.

4.2.2 Independent variable: executive equity incentives

This paper refers to the approach of Tian (2022) to measure the proportion of executives’ shareholding (Share) by calculating the ratio of the number of shares held by executives to the total issued shares of the company. Executive shareholding aligns executives’ wealth with the company’s market value, enhances the alignment of interests between executives and shareholders, motivates executives to focus more on the company’s long-term value and sustainable development capabilities, and drives improvements in the company’s ESG performance.

4.2.3 Control variables

Considering the potential impact of factors other than executive stock ownership on corporate ESG performance, this paper refers to the research of Christensen et al. (2022) and controls the following variables: firm size (Size), fixed asset ratio (Fixed), debt-to-equity ratio (Lev), return on assets (ROA), cash flow ratio (Cashflow), revenue growth rate (Growth), firm age (FirmAge), ownership concentration (Topone), proportion of independent directors (Indep), and whether the roles of chairman and CEO are combined (Dual). Additionally, the paper controls for year fixed effects (Year) and industry fixed effects (Industry).

4.3 Model setting

We build on the two-way fixed effects regression approach used by Qing et al. (2024) to investigate the impact of executive shareholding on corporate ESG performance, as shown in Equation 1. Chaisemartin and Haultfoeuille (2020) and Imai and Kim (2021) found that the fixed effects model is a superior estimator in terms of consistency and efficiency in measurement. This is because it effectively deals with issues such as omitted variable difficulties and unobserved heterogeneity.

In the equation, subscript i represents firms, t represents years, and k represents industries. The dependent variable is the ESG performance of firms, denoted as ESGi,t. The key explanatory variable is the shareholding ratio of top executives, denoted as Sharei,t, with its coefficient β1 indicating the impact of executives’ shareholding on firms’ ESG performance. Xi,t represents a set of control variables, θt represents year fixed effects, δk represents industry fixed effects, and εi,t represents the error term. Additionally, this study uniformly applies cluster-robust standard errors at the firm level.

5 Empirical analysis results

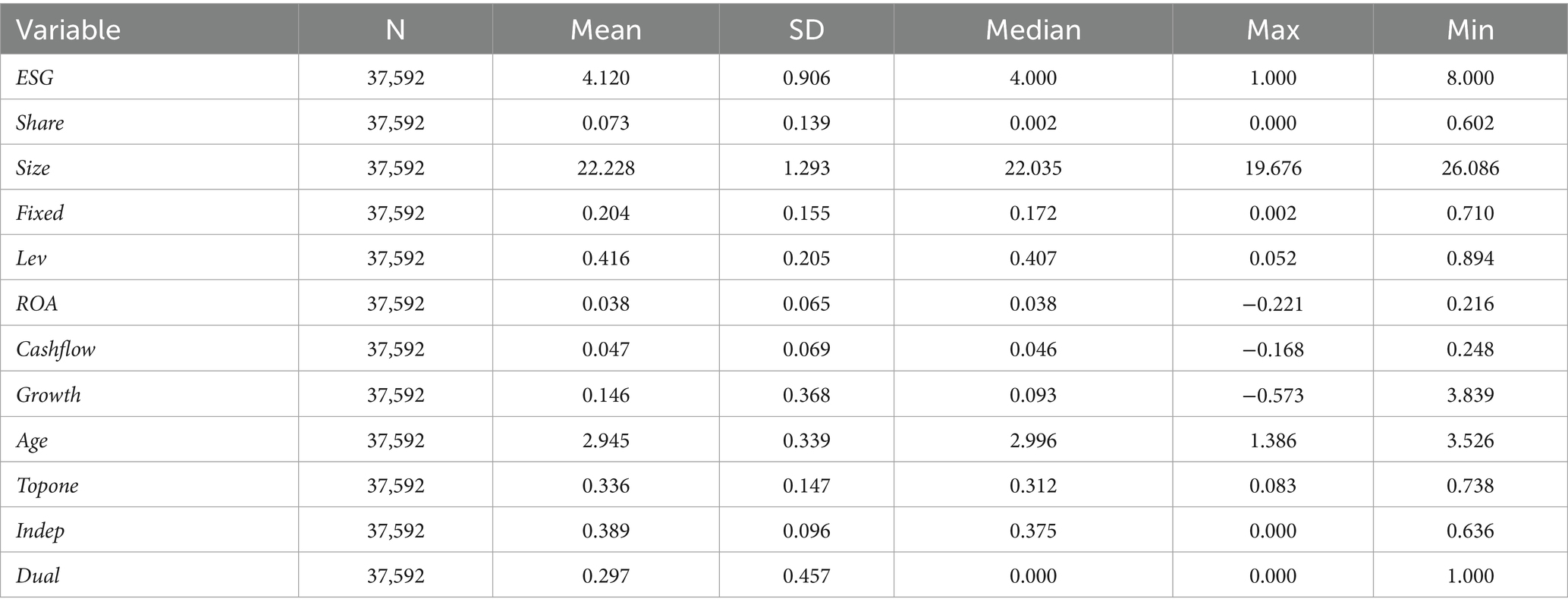

5.1 Descriptive statisitcs

Table 2 presents the descriptive statistics of the main variables. As shown in the table, the average value of the dependent variable ESG is 4.120, indicating that the average ESG rating is at the B level, suggesting that most companies still have room for improvement in environmental, social, and corporate governance aspects. The standard deviation is 0.906, which reflects that companies have varying degrees of emphasis on ESG principles, resulting in significant differences in their attention and investment. The average value of the core explanatory variable Share is 7.3%, with a median of 0.2%, which is notably lower than the mean, indicating a highly skewed distribution to the right. This suggests that the shareholding levels of senior executives in listed companies in China are generally low, leaving significant room for the application of equity incentive plans in the future. The distributions of the other control variables are all within reasonable ranges and consistent with existing literature.

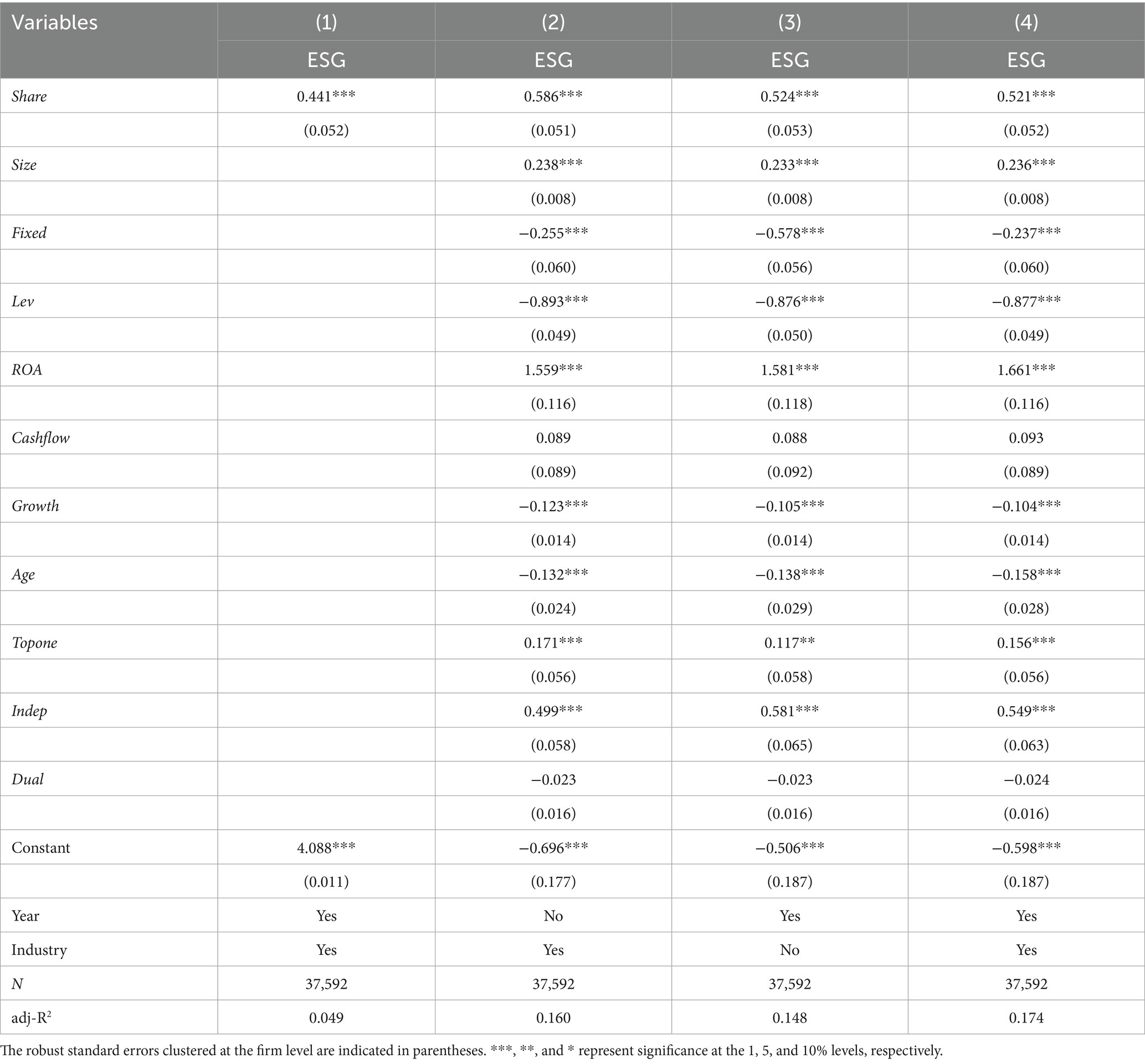

5.2 Benchmark regressions

Table 3 presents the benchmark regression results of the impact of top executives’ shareholding ratios on corporate ESG performance. In column (1), only the core explanatory variable is included while controlling for year fixed effects and industry fixed effects, with a coefficient of 0.441 for the core explanatory variable. Columns (2) to (4) incorporate all control variables, where column (2) controls only for industry fixed effects, column (3) controls only for year fixed effects, and column (4) controls for both industry fixed effects and year fixed effects, with a coefficient of 0.521 for the core explanatory variable. The results show that in columns (1) to (4), the coefficients of the core explanatory variable are all significantly positive at the 1% level. Therefore, top executives’ shareholding significantly enhances corporate ESG performance, and hypothesis 1 is validated.

5.3 Robustness tests

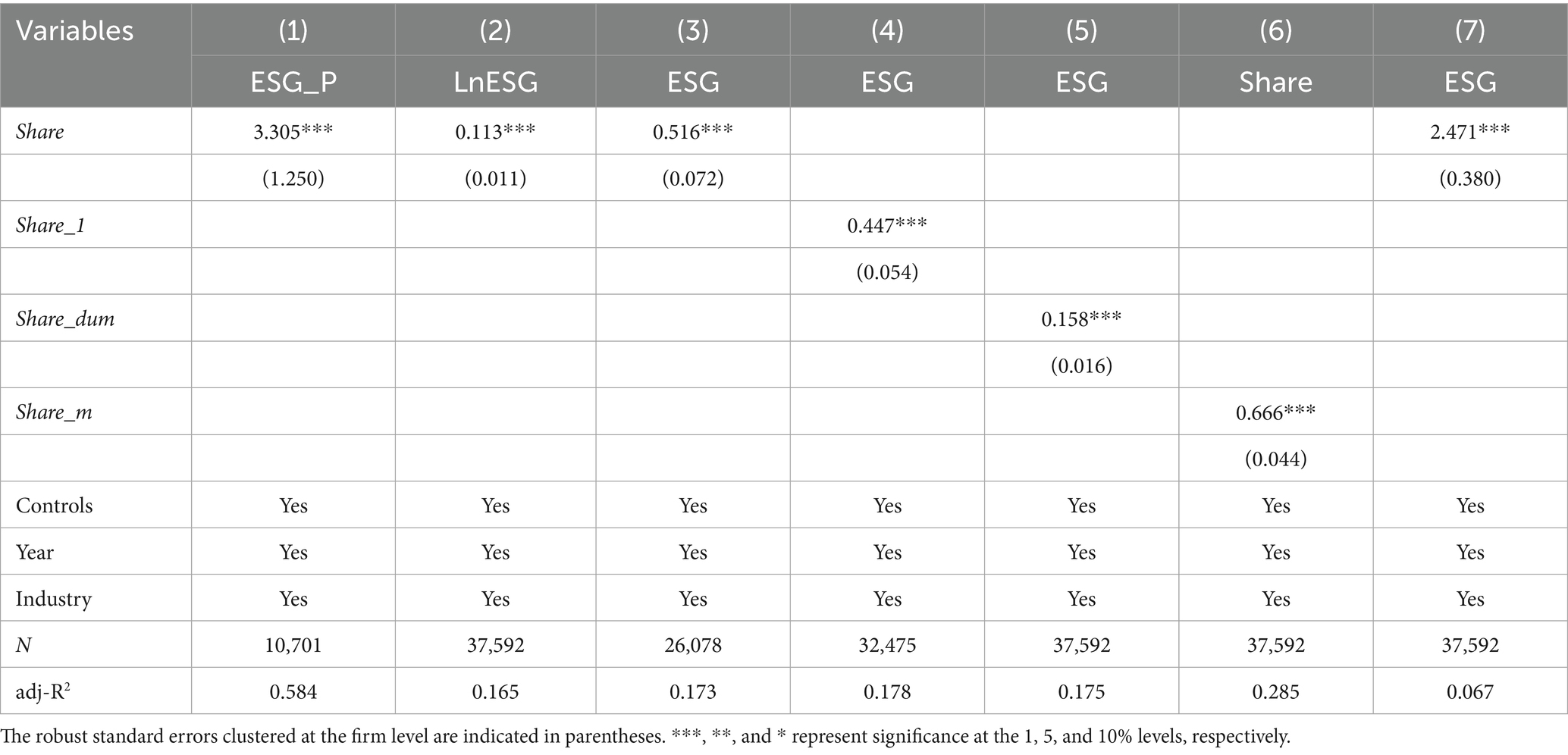

Table 4 reports a series of robustness tests for the benchmark regression.

5.3.1 Alter the measure of the dependent variable

In order to eliminate the interference caused by different ESG rating systems, this paper refers to the approach of Zhang et al. (2024b), replaces the dependent variable with the Bloomberg ESG rating index (ESG_P) and re-conducts the benchmark regression, as shown in Column (1). Columns (1) shows that the coefficients of the core explanatory variables is significantly positive at the 1% level, verifying the robustness of the benchmark results.

5.3.2 Take the logarithm of the dependent variable

In order to reduce heteroscedasticity and make the data distribution more uniformthe, dependent variable is transformed into the natural logarithm (LnESG) and the regression is re-conducted, as shown in Column (2). Columns (2) shows that the coefficients of the core explanatory variables is significantly positive at the 1% level, verifying the robustness of the benchmark results.

5.3.3 Limit the sample range

In order to eliminate the interference caused by the pandemic shock, the sample data from 2020 to 2022 is excluded in Column (3). Columns (3) shows that the coefficients of the core explanatory variables is significantly positive at the 1% level, verifying the robustness of the benchmark results.

5.3.4 Lag the independent variable

Considering the possible time lag of the impact of the executive shareholding on the company’s ESG performance, this paper draws on the approach of Sun et al. (2019), constructs a one-period-lagged executives’ shareholding ratio (Share_1) to replace the original core explanatory variable (Share) and re-conducts the regression, as shown in Column (4). Column (4) shows that the regression coefficients are still significantly positive at the 1% level, with minimal numerical changes, indicating that the regression results remain robust.

5.3.5 Construct dummy variable

In order to directly test whether executives’ shareholding affects the company’s ESG performance, this paper constructs a dummy variable for whether executives hold shares (Share_dum), assigns a value of 1 to companies with executive shareholding and 0 to those without, and uses it to replace the original core explanatory variable (Share) for re-regression, as shown in Column (5). Column (5) shows that companies with executive shareholding have an average ESG performance 0.158 higher than those without, and the coefficient is significantly positive at the 1% level, proving the robustness of the results.

5.3.6 Instrumental variable method

To eliminate endogeneity interference, this paper refers to the research of Yang and Yin (2018) and uses the industry-annual mean of executives’ shareholding ratio (Share_m) as an instrumental variable (IV) for two-stage least squares (2SLS) regression. The rationale for this approach is that the executives’ shareholding behavior of other companies within the same industry may influence the executives’ shareholding behavior of this company, satisfying the relevance condition; meanwhile, the executives’ shareholding behavior of other companies does not directly affect the ESG performance of this company, satisfying the exogeneity condition. The first-stage regression results are shown in Column (6), where the regression coefficient of the instrumental variable (Share_m) on the core explanatory variable (Share) is significantly positive at the 1% level, and the first-stage F statistic of 233.58 is far greater than the critical value, indicating that the instrumental variable is valid. The second-stage regression results are shown in Column (7), where the regression coefficient of the first-stage fitted value of executives’ shareholding ratio on the company’s ESG performance remains significantly positive at the 1% level, further proving the robustness of the research results.

5.4 Mechanism analysis

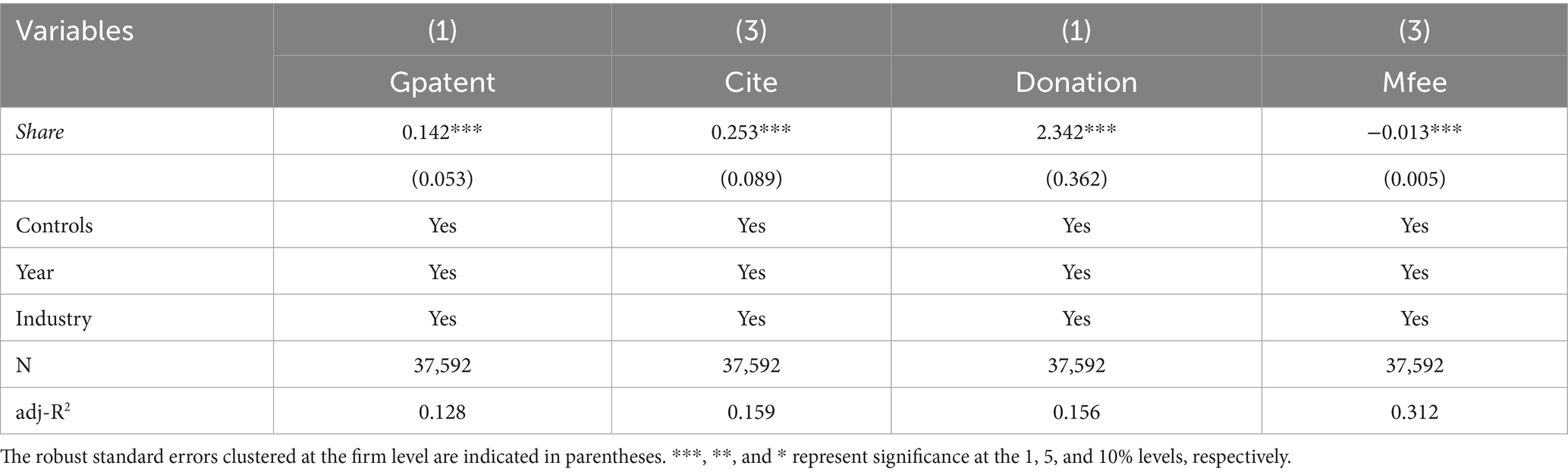

Based on theoretical analysis and research hypotheses, executive equity incentives can promote corporate green innovation, motivate corporate charitable donations, enhance corporate management efficiency, thereby improving corporate ESG performance. Next, this study refers to the operational recommendations on mechanism analysis of Jiang (2022) to further explore the influence mechanism of executive equity incentives on corporate ESG performance.

5.4.1 Green innovation

Top executives’ shareholding can enhance their environmental protection enthusiasm, promote corporate green innovation, and thereby improve ESG performance. To verify whether the green innovation mechanism holds, the following mechanism analysis will be conducted. The level of a company’s green technological innovation can be measured by the number of its green patents. The approval process for patents is lengthy, has high thresholds, and involves significant uncertainty; therefore, compared to the number of granted patents, the number of patent applications better reflects the timeliness and accurately indicates the extent to which top executives prioritize green R&D. Additionally, compared to utility model and design patents, the number of invention patents better reflects a company’s substantive innovation achievements (Li and Zheng, 2016). Therefore, this study refers to the approach of Tao et al. (2021), using the natural logarithm of the number of green invention patent applications filed by the company in a given year (Gpatnet) to measure the company’s level of green technological innovation. Furthermore, to better assess the quality of green R&D, this study draws on the approach of Zhao et al. (2023), using the natural logarithm of the number of citations for green invention patents filed by the company in a given year (Cite) to measure the company’s actual innovation quality.

The mechanism test results for green innovation are shown in Table 5. Column (1) shows that top executives’ shareholding significantly increases the number of green invention patent applications filed by the company, indicating that executives’ shareholding can actively promote the output of green innovation results. Column (2) shows that top executives’ shareholding significantly increases the number of citations for green invention patents filed by the company, indicating that executives’ shareholding helps improve the quality of green R&D. Green innovation is a very important influencing factor for a company’s ESG performance in the environmental dimension. Through green R&D, companies can master environmental protection technologies, achieve clean production, improve energy efficiency, reduce waste emissions, enhance environmental performance, and thereby improve the environmental dimension score in ESG performance. Therefore, top executives’ shareholding enhances both the quantity and quality of green R&D outcomes by incentivizing green innovation, improving the company’s environmental protection technology, driving active energy conservation and emission reduction to fulfill environmental responsibilities, and promoting ESG performance, thereby validating Hypothesis 2.

5.4.2 Charitable donation

Executive stock ownership makes executives more focused on the company’s long-term reputation, motivates corporate charitable donation behavior, and thereby enhances ESG performance. To validate whether the charitable donation mechanism holds, the following mechanism analysis will be conducted. Following the approach of Xu and Li (2016), this study measures the level of corporate charitable donations in a given year using the natural logarithm of the annual charitable donation amount (Donation).

The mechanism test results for charitable donations are shown in Table 5. Column (3) indicates that executive stock ownership significantly increases the amount of corporate charitable donations. Charitable donations are a very important factor influencing a company’s ESG performance in the social dimension. Through social donations, enterprises can support charitable causes, promote social equity, accumulate social reputation for the company, and consequently improve the company’s ESG performance score in the social dimension. Therefore, equity incentives weaken executives’ excessive focus on short-term performance, prompting enterprises to engage in more charitable donations, actively fulfill their social responsibilities, and thereby enhance corporate ESG performance, thus validating Hypothesis 3.

5.4.3 Management efficiency

Shareholding by senior executives can strengthen internal control within a company, improve management efficiency, and thereby enhance ESG performance. To verify whether the mechanism of management efficiency holds, the following analysis will be conducted. Drawing on the approach of Sun et al. (2018), this study uses the management fee rate (Mfee), which is the proportion of management expenses to operating revenue in a company’s annual financial statements, as a measure of management efficiency. A lower management fee rate indicates that each unit of management expenses generates a higher amount of operating revenue, reflecting better internal governance and higher management efficiency.

The results of the mechanism test for management efficiency are shown in Table 5. Column (4) indicates that shareholding by senior executives significantly reduces the management fee rate of enterprises. Management efficiency is a very important factor influencing a company’s ESG performance in the corporate governance dimension. Companies can improve their internal governance structures by optimizing decision-making processes and enhancing management efficiency, thereby unlocking management potential and ensuring sustainable future operations, which in turn improves the company’s ESG performance score in the corporate governance dimension. Therefore, shareholding status strengthens senior executives’ identification with and sense of responsibility for the company, enabling them to optimize decision quality and effectively reduce management fees, thereby enhancing internal governance efficiency and promoting ESG performance. Hypothesis 4 is thus validated.

5.5 Heterogeneity analysis

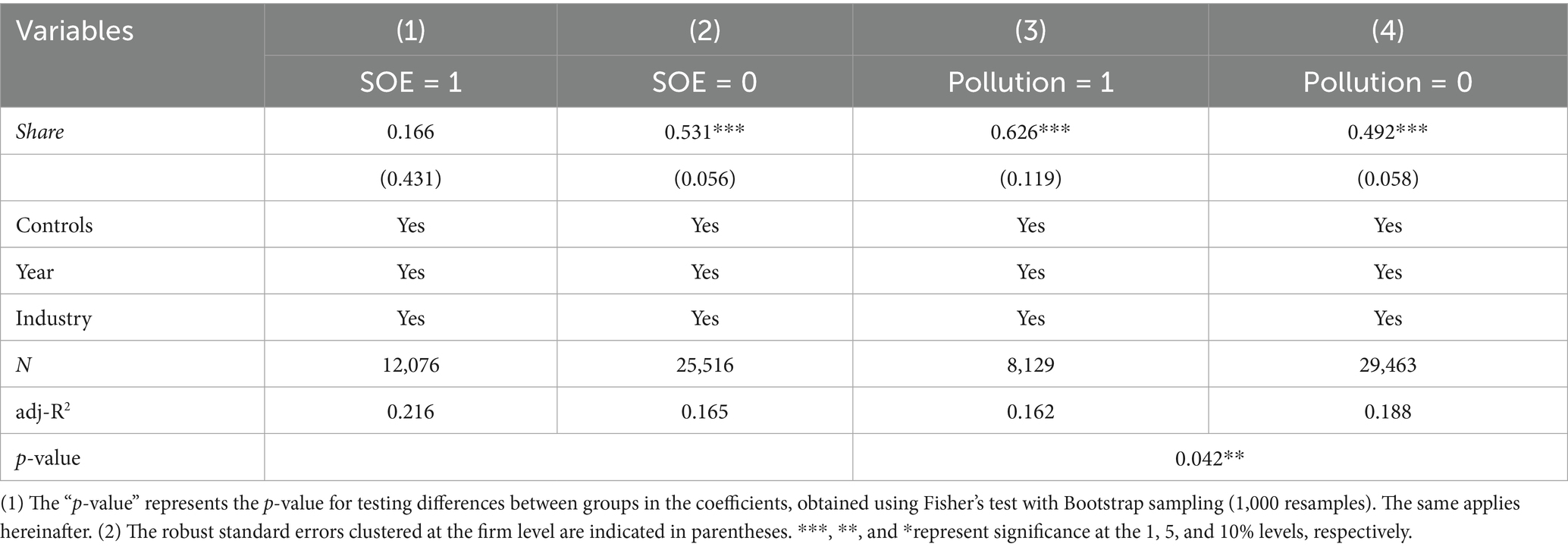

The analyses above demonstrate that executive stock ownership significantly enhances corporate ESG performance. However, the question remains: Does the impact of executive stock ownership on corporate ESG vary depending on different characteristics of the company group? Based on this, the following analysis further conducts a heterogeneity analysis of the benchmark regression results according to four dimensions: property rights attributes, pollution levels, shareholding concentration, and the duality of CEO and chairman roles.

5.5.1 Property rights

Compared to non-state-owned enterprises, state-owned enterprises pursue profit maximization while bearing more social responsibilities, hence their initial motivations for practicing ESG concepts may differ. To explore the impact of executive shareholding on corporate ESG performance under different property rights attributes, this paper divides the sample into state-owned and non-state-owned enterprises for grouped regressions. As shown in column (1) of Table 6, the regression coefficient for state-owned enterprises is not significant, indicating that executive shareholding in state-owned enterprises does not promote improvements in ESG performance. Column (2) shows that the regression coefficient for non-state-owned enterprises is 0.531 and significantly positive at the 1% level, suggesting that executive shareholding significantly enhances ESG performance in non-state-owned enterprises.

Possible reasons include: State-owned enterprises’ social attributes result in stronger intrinsic motivation to engage in ESG initiatives, they often play a demonstration and leading role in ESG development. They already had a high level of ESG performance, therefore the marginal effect of executive equity incentives is limited. Therefore, the mechanism of executive shareholding has little effective promoting effect on ESG performance in state-owned enterprises. On the other hand, non-state-owned enterprises face intense market competition, often face challenges in resource capacity and lack of intrinsic motivation when engaging in ESG initiatives. Executive equity incentives can effectively address these capacity and motivation challenges, playing a more significant role in enhancing the ESG performance of non-state-owned enterprises.

5.5.2 Pollution level

To investigate the impact of executive equity incentives on corporate ESG performance under different pollution levels, this study follows the research of Pan et al. (2019) and identifies industries with codes B06, B07, B08, B09, C17, C19, C22, C25, C26, C28, C29, C30, C31, C32, and D44, as revised in the 2012 “Industry Classification Guidelines for Listed Companies” by the China Securities Regulatory Commission, as heavily polluting industries. The sample is thus divided into heavily polluting and non-heavily polluting enterprises for grouped regressions. As shown in columns (3) to (4) of Table 6, the regression coefficients for heavily polluting enterprises and non-heavily polluting enterprises are 0.626 and 0.492, respectively, both significantly positive at the 1% level. Fisher’s combined test’s empirical p-value indicates a significant difference between the two groups’ regression coefficients. This suggests that under different pollution levels, executive equity incentives significantly enhance corporate ESG performance, with a stronger promoting effect in heavily polluting industries.

Possible reasons include: First, heavily polluting industries typically face stricter environmental regulations and higher compliance costs, with government “dual carbon” goals and environmental protection laws imposing more direct constraints, such as carbon emission quotas and pollutant discharge standards. Executive equity incentives align personal interests with the company’s long-term value, prompting executives to focus on improving ESG performance to avoid regulatory risks and penalties or reputational losses due to environmental violations. Second, environmental governance in heavily polluting industries often relies on green technological innovation, and executive equity incentives can motivate management to increase R&D investment, reduce pollution control costs through technological upgrades, and simultaneously enhance ESG ratings. Third, heavily polluting enterprises are often capital-intensive with complex governance structures and long decision-making chains, and effective executive equity incentives can alleviate agency problems by curbing short-sighted managerial behaviors and promoting long-term ESG-related investments.

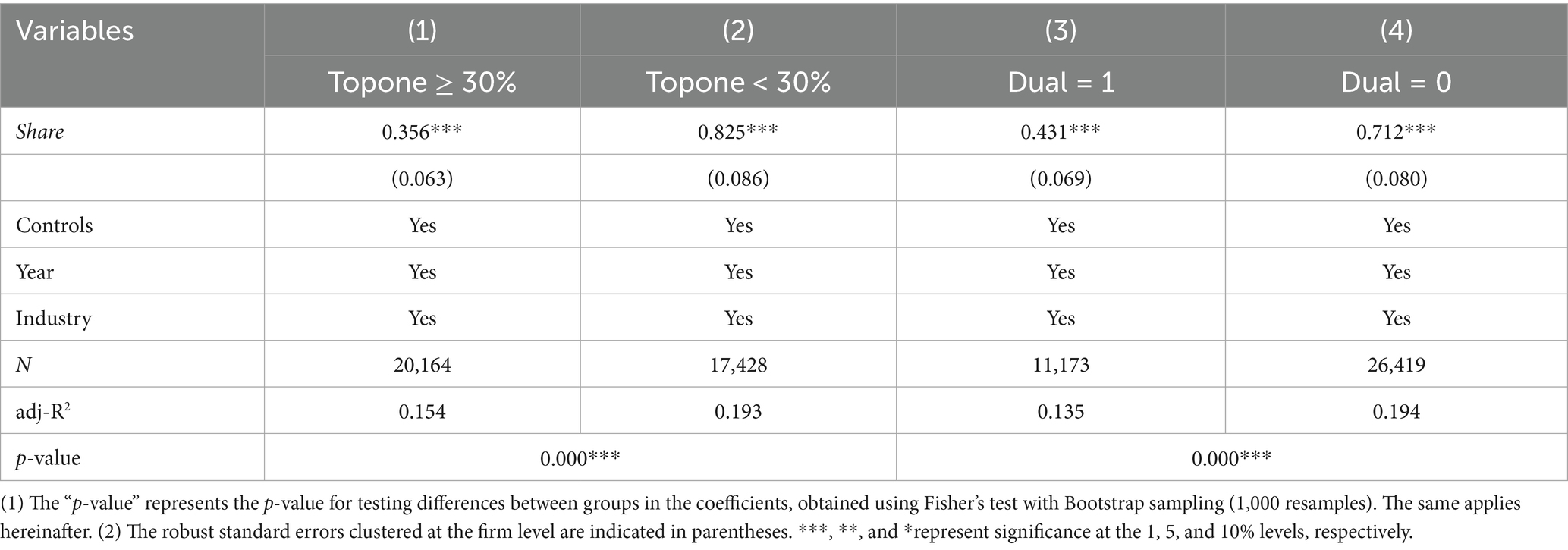

5.5.3 Equity concentration

To investigate the impact of executive equity incentives on corporate ESG performance under different equity structures, this study categorizes companies with a controlling shareholder holding 30% or more of the shares as high equity concentration firms, and those with less than 30% as low equity concentration firms, conducting grouped regressions. As shown in Table 7, columns (1) to (2), the regression coefficient for high equity concentration firms is 0.356, and for low equity concentration firms, it is 0.825, both significantly positive at the 1% level. The “empirical p-value” from Fisher’s combined test indicates a significant difference between the two groups’ regression coefficients. This suggests that under different equity structures, executive equity incentives significantly enhance corporate ESG performance, with a stronger promoting effect in firms with lower equity concentration.

Possible reasons include: For low equity concentration firms, due to their relatively dispersed equity, small shareholders tend to seek short-term direct benefits from the company, making it difficult for the board to reach a consensus and effectively implement ESG concepts. In such cases, shared equity can stimulate the stewardship conciousness of company executives, motivating them to lead the company in actively investing in environmental, social, and corporate governance sustainability initiatives, thereby significantly improving the companys ESG performance. On the other hand, for high equity concentration firms, major shareholders have greater autonomy and motivation to formulate and implement ESG strategies based on the company’s long-term development goals. Consequently, the scope for and effectiveness of executive equity incentives, as an internal policy tool, are relatively limited in such firms.

5.5.4 CEO duality

CEO duality refers to the situation where the chairman of the board and the chief executive officer (CEO) of a company are held by the same person. To investigate the impact of executive equity incentives on corporate ESG performance under different internal governance structures, this study categorizes the sample into CEO duality firms and non-CEO duality firms based on whether the company has CEO duality, and conducts grouped regressions. As shown in Columns (3) to (4) of Table 7, the regression coefficients for CEO duality firms and non-CEO duality firms are 0.431 and 0.712, respectively, and both are significantly positive at the 1% level. The “empirical p-value” from Fisher’s combined test indicates that the differences in regression coefficients between the two groups are significant. This suggests that, regardless of whether a company has CEO duality, executive equity incentives significantly enhance corporate ESG performance. However, the promoting effect of executive equity incentives on ESG performance is stronger for non-CEO duality firms.

Possible reasons include: For non-CEO duality firms, since the chairman and CEO are two different individuals, agency conflicts are more likely to arise. Specifically, CEOs may focus more on short-term financial performance, while chairpersons prioritize long-term value and ESG performance. In such cases, shared equity aligns the interests of executives and shareholders, enhancing the motivation of management to actively engage in ESG initiatives, thereby significantly improving corporate ESG performance. On the other hand, for firms where the chairman and CEO are the same person, ownership and control are already concentrated in one individual, resulting in minimal inherent agency conflicts. Consequently, the role of equity incentives is less impactful, leading to weaker effects on promoting ESG performance.

6 Discussion

This study finds out that executive shareholding significantly promotes corporate ESG performance by promoting green innovation, encouraging charitable donations, and improving management efficiency, and has a more significant effect in non-state-owned enterprises, high-pollution enterprises, low-equity concentration enterprises, and non-CEO duality enterprises. Theoretically, this study bridges two siloed literatures: ESG determinants (Fang et al., 2023; Liang and Li, 2023) and equity incentive outcomes (Yang et al., 2023; Zhao et al., 2024). We show that executive shareholding is not merely a financial tool but a governance lever for sustainable value creation.

The positive relationship between executive shareholding and ESG performance aligns with incentive alignment theory (Jensen and Meckling, 1976) but extends its application beyond financial outcomes to encompass environmental, social, and governance dimensions. Prior studies on equity incentives focused predominantly on R&D investment (Hu et al., 2025) or corporate financial performance (Ma and Wang, 2024), often treating CSR/ESG as a peripheral outcome. Our research demonstrates that equity ownership transforms executives from “agents” into “residual claimants” of long-term firm value, motivating them to internalize ESG activities as strategic investments rather than costs. This resolves a key tension in the literature: while Deckop et al. (2006) proposed linking CSR to CEO compensation, and Berrone and Gomez-Mejia (2009) advocated incorporating environmental metrics into pay structures, few studies empirically validated shareholding itself as a holistic tool to synchronize executive interests with multi-dimensional ESG objectives. By empirically confirming the mediating roles of green innovation (long-term environmental competitiveness), charitable donations (social legitimacy building), and management efficiency (governance optimization), we establish a tripartite mechanism through which equity incentives operationalize stakeholder theory at the executive level.

The amplified effect of executive shareholding on ESG in non-SOEs, high-pollution industries, low-equity concentration firms, and non-CEO duality enterprises underscores the contextual boundaries of incentive effectiveness. These findings resonate with but critically extend extant literature: First, state-owned enterprises face inherent institutional pressures to fulfill socio-political objectives (Boubakri, 2019), diluting the marginal impact of market-based incentives like shareholding. Non-SOEs, lacking such institutional “buffers,” rely more heavily on equity alignment to mobilize resources for ESG—supporting the view that ownership attributes moderate ESG drivers (Deng et al., 2024). Second, the stronger results in high-pollution industries validate the “risk mitigation” hypothesis. As polluters face stricter regulatory scrutiny and reputational risks (Campanella et al., 2021), equity-holding executives prioritize green innovation and environmental compliance to safeguard firm longevity, echoing findings by Berrone and Gomez-Mejia (2009) on eco-sensitive pay designs. Third, both low-equity concentration and non-CEO duality reflect weaker internal monitoring. In firms with dispersed ownership, equity incentives compensate for oversight deficits by directly motivating executives (Zhao et al., 2024). Similarly, separating CEO and board chair roles enhances board independence, allowing shareholding-induced ESG initiatives to flourish without autocratic suppression—complementing governance research on board structure (Campanella et al., 2021).

Our linear positive relationship contrasts with Zhao et al. (2024) inverted-U curve between shareholding and CSR. This divergence may arise from methodological scope: while Zhao et al. (2024) examined CSR commitment as self-reported policies, we measure realized ESG performance as third-party ratings. More importantly, ESG encompasses governance efficiency—a dimension where higher ownership consistently aligns incentives. Thus, executive shareholding appears to foster sustainable long-termism across ESG pillars, countering concerns that excessive equity leads to risk aversion or financialization (Liang and Li, 2023). This supports Aguinis and Glavas (2012)‘s assertion that embedded incentives—like ownership—are more effective for substantive ESG integration than symbolic gestures.

7 Conlcusion

ESG not only reflects a company’s proactive assumption of social and environmental responsibilities but also serves as a crucial indicator for measuring long-term competitiveness and sustainable development capabilities. Exploring how to design mechanisms to achieve effective internal incentives to enhance corporate ESG performance holds significant practical value. This paper, based on panel data of Chinese A-share listed companies from 2010 to 2023, investigates the impact of executive equity incentives on corporate ESG performance. The research conclusions are as follows: First, the benchmark regression results indicate that executive equity incentives significantly promote corporate ESG performance, and the conclusion remains robust after a series of sensitivity tests. Second, the mechanism analysis reveals that executive equity incentives enhance corporate ESG performance by promoting green innovation, encouraging charitable donations, and improving management efficiency. Third, the heterogeneity analysis shows that the positive impact of executive equity incentives on ESG performance is more pronounced for non-state-owned enterprises, high-pollution enterprises, low-equity-concentration enterprises, and non-CEO duality enterprises.

7.1 Theoretical implications

Compared to existing research which is relatively limited in the analysis of the whole impact of executive equity incentives on corporate ESG performance, this study enriches the influencing factors of corporate ESG performance as well as the economic effects of executives shareholding, and reveals the internal drivers for improving ESG performance in three new avenues.

First, existing research primarily focuses on the various impacts of ESG on corporate innovation (Tang, 2022), investment (Zhang et al., 2022), financing (Kim and Li, 2021), value (Zheng et al., 2022), and performance (Gao et al., 2023), with limited attention to the influencing factors of corporate ESG performance. This study explores the impact of executives’ shareholding on corporate ESG performance, thereby enriching the research on the influencing factors of corporate ESG performance.

Second, existing studies mainly investigate the impact of executives’ shareholding on single factors such as corporate R&D investment (Hu et al., 2025), and innovation performance (Yang et al., 2023). This study employs ESG theory to incorporate the single impacts of executives’ shareholding on the environmental, social, and governance dimensions into a unified analytical framework, directly exploring the relationship between executives’ shareholding and corporate ESG performance. This clarifies the overall role of executives’ shareholding in promoting corporate sustainable development and extends the relevant research on the economic effects of executives’ shareholding.

Third, this study delves into the mechanisms through which executives’ shareholding influences corporate ESG performance through three pathways: green innovation, charitable donations, and management efficiency. It reveals the internal drivers for improving ESG performance and provides new empirical evidence on the impact of executives’ shareholding on corporate ESG performance. This offers decision-making insights for corporate ESG practices and references for policymakers regarding ESG disclosure, thereby contributing to the advancement of ESG practices and policies.

7.2 Practical implications

Based on the above research findings, this paper offers relevant recommendations to help enterprises improve their ESG performance and achieve sustainable development.

First, optimize the equity incentive system of enterprises to fully leverage the motivating role of executive equity incentives in enhancing corporate ESG performance. By reasonably designing equity incentive plans and appropriately increasing the equity holding ratio of executives, the personal interests of executives can be closely aligned with the long-term development of the enterprise. At the same time, ESG performance should be incorporated into the executive performance evaluation system to motivate management to actively implement green R&D, promote public welfare initiatives, and improve management systems, thereby comprehensively enhancing the enterprise’s ESG performance.

Second, actively guide enterprises to prioritize technological innovation, fulfill social responsibilities, and optimize governance structures. First, enterprises should promote green R&D to enhance environmental protection capabilities, reduce pollutant emissions during production processes, and achieve clean production. Second, enterprises should increase charitable donations, return surplus profits to society, and proactively fulfill their social responsibilities to cultivate a long-term reputation. Finally, enterprises should strengthen their internal control systems, improve operational efficiency, and promote transparency in decision-making processes.

Third, tailor strategies to the specific circumstances of each enterprise for precise incentives. Enterprises should develop differentiated ESG improvement strategies based on their ownership attributes, pollution levels, equity characteristics, and governance structures. For non-state-owned enterprises, high-pollution enterprises, low-equity concentration enterprises, and non-CEO duality enterprises, the equity holding ratio of management should be appropriately increased to fully utilize the role of equity incentives. For state-owned enterprises, low-pollution enterprises, high-equity concentration enterprises and CEO duality enterprises, other governance measures should be implemented, such as increasing the attention of major shareholders, chairman and CEO to ESG concepts, to motivate them to better lead the enterprise in fulfilling its ESG responsibilities.

7.3 Limitations and future research

Despite the valuable insights provided by this study, there are still some limitations. First, the non-linear relationship between executive equity incentives and corporate ESG performance merits further analysis. Given executive shareholding’s heterogeneity and ‘sharp peaks and thick tails’ character, future research could leverage machine learning and artificial intelligence tools like support vector machines, artificial neural networks, and decision trees to analyze non-linear effects. Second, this study is focused on China. Future research could expand this focus by comparing our findings to those of developed countries and other emerging economies. Third, in this analysis, we use a relatively short sampling period (2010–2023) for each firm due to the availability of only annual data. Future studies could potentially expand the scope by seeking less readily available quarterly data, such extension could reveal more robust, precise, and reliable results.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found below: https://data.csmar.com.

Author contributions

SZ: Writing – original draft, Software, Conceptualization, Methodology, Writing – review & editing. ZL: Validation, Supervision, Conceptualization, Writing – review & editing. LH: Validation, Supervision, Data curation, Conceptualization, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abernethy, A., Kuang, F., and Qin, B. (2015). The influence of CEO power on compensation contract design. Acc. Rev. 90, 1265–1306. doi: 10.2308/accr-50971

Aguinis, H., and Glavas, A. (2012). What we know and don’t know about corporate social responsibility: a review and research agenda. J. Manag. 38, 932–968. doi: 10.1177/0149206311436079

Amore, D., and Bennedsen, M. (2016). Corporate governance and green innovation. J. Environ. Econ. Manag. 75, 54–72. doi: 10.1016/j.jeem.2015.11.003

Bénabou, R., and Tirole, J. (2010). Individual and corporate social responsibility. Economica 77, 1–19. doi: 10.1111/j.1468-0335.2009.00843.x

Berrone, P., and Gomez-Mejia, L. R. (2009). Environmental performance and executive compensation: an integrated agency-institutional perspective. Acad. Manag. J. 52, 103–126. doi: 10.5465/amj.2009.36461950

Boubakri, N. (2019). Is privatization a socially responsible reform. J. Corp. Financ. 56, 129–151. doi: 10.1016/j.jcorpfin.2018.12.005

Cai, Y., Pan, C., and Statman, M. (2016). Why do countries matter so much in corporate social performance. J. Corp. Finan. 41, 591–609. doi: 10.1016/j.jcorpfin.2016.09.004

Campanella, F., Serino, L., Crisci, A., and D’Ambra, A. (2021). The role of corporate governance in environmental policy disclosure and sustainable development. Corp. Soc. Resp. Environ. Manag. 28, 474–484.

Cao, L., Jiang, H., and Niu, H. (2024). The co-inhibiting effect of managerial myopia on ESG performance-based green investment and continuous innovation. Sustainability 16:7983. doi: 10.3390/su16187983

Chaisemartin, C., and Haultfoeuille, X. (2020). Two-way fixed effects estimators with heterogeneous treatment effects. Amer. Econ. Rev. 110, 2964–2996.

Cheng, B., Ioannou, I., and Serafeim, G. (2014). Corporate social responsibility and access to finance. Strat. Manag. J. 35, 1–23. doi: 10.1002/smj.2131

Christensen, M., Serafeim, G., and Sikochi, A. (2022). Why is corporate virtue in the eye of the beholder? The case of ESG ratings. Acc. Rev. 97, 147–175. doi: 10.2308/TAR-2019-0506

Dai, Y., and Chen, Y. (2020). Do equity incentives promote charitable donations? Res. Fin. Econ. Issues 10, 55–63. doi: 10.19654/j.cnki.cjwtyj.2020.10.007

Deckop, J. R., Merriman, K. K., and Gupta, S. (2006). The effects of CEO pay structure on corporate social performance. J. Manag. 32, 329–342. doi: 10.1177/0149206305280113

Deng, M., Tang, H., and Luo, W. (2024). Can the green experience of CEO improve ESG performance in heavy polluting companies? Evidence from China. Manag. Decis. Econ. 45, 2373–2392. doi: 10.1002/mde.4149

Fahad, P., and Nidheesh, B. (2020). Determinants of CSR disclosure: an evidence from India. J. Indian Bus. Res. 13, 110–133.

Fan, Z., Chen, Y., and Mo, Y. (2024). Management myopia and corporate ESG performance. Int. Rev. Financ. Anal. 92:103071. doi: 10.1016/j.irfa.2024.103071

Fang, M., Nie, H., and Shen, X. (2023). Can enterprise digitization improve ESG performance? Econ. Model. 118:106101. doi: 10.1016/j.econmod.2022.106101

Gao, S., Meng, F., Wang, W., and Chen, W. (2023). Does ESG always improve corporate performance? Evidence from firm life cycle perspective. Front. Environ. Sci. 11:1105077. doi: 10.3389/fenvs.2023.1105077

Gautier, A., and Pache, C. (2015). Research on corporate philanthropy: a review and assessment. J. Bus. Ethics 126, 343–369. doi: 10.1007/s10551-013-1969-7

Haider, M. (2024). The role of corporate philanthropy in brand reputation. Kashf J. Multidiscip. Res. 1, 13–21.

Hu, C., He, H., Wang, F., and Shin, Y. S. (2025). Management equity incentives, market dynamics, and corporate R&D investment. Fin. Res. Lett. 76:106998. doi: 10.1016/j.frl.2025.106998

Hu, B., and Hong, G. (2023). Management equity incentives, R&D investment on corporate green innovation. Fin. Res. Lett. 58:104533. doi: 10.1016/j.frl.2023.104533

Imai, K., and Kim, S. (2021). On the use of two-way fixed effects regression models for causal inference with panel data. Polit. Anal. 29, 405–415. doi: 10.1017/pan.2020.33

Jensen, C., and Meckling, H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. J. Financ. Econ. 3, 305–360. doi: 10.1016/0304-405X(76)90026-X

Jensen, C., and Murphy, J. (1990). Performance pay and top-management incentives. J. Polit. Econ. 98, 225–264. doi: 10.1086/261677

Jha, A., and Cox, J. (2015). Corporate social responsibility and social capital. J. Bank. Fin. 60, 252–270. doi: 10.1016/j.jbankfin.2015.08.003

Jiang, T. (2022). Mediating effects and moderating effects in causal inference. Chin. Ind. Econ. 5, 100–120. doi: 10.19581/j.cnki.ciejournal.2022.05.005

Jurkonis, L., and Petrusauskaitė, D. (2014). Effects of corporate governance on management efficiency of Lithuanian state-owned enterprises. Ekonomika 93, 77–97. doi: 10.15388/Ekon.2014.2.3545

Kim, S., and Li, Z. (2021). Understanding the impact of ESG practices in corporate finance. Sustainability 13:3746. doi: 10.3390/su13073746

Li, Z., Liu, H., and Jiang, Y. (2023). Equity incentive, separation of two rights and corporate performance: research on corporate governance based on two types of agency costs. J. Accounting Business Finance Research 16, 93–109. doi: 10.55217/102.v16i2.659

Li, T., Wang, K., Sueyoshi, T., and Wang, D. (2021). ESG: research progress and future prospects. Sustainability 13:11663. doi: 10.3390/su132111663

Li, Z., and Wu, Y. (2023). Does managerial myopia hinder green technological innovations? An examination based on Chinese-listed heavy polluters. Front. Environ. Sci. 11:1140171. doi: 10.3389/fenvs.2023.1140171

Li, J., Yang, B., and Pan, Z. (2016). Product market competition, managerial ownership and management efficiency: a study based on the panel data of manufacturing companies in China. J. Guangdong Uni. Fin. Econ 31, 72–83.

Li, W., and Zheng, M. (2016). Is it substantive innovation or strategic innovation? Impact of macroeconomic policies on micro-enterprises’ innovation. Econ. Res. J. 51, 60–73.

Liang, L., and Li, Y. (2023). The double-edged sword effect of organizational resilience on ESG performance. Corp. Soc. Responsib. Environ. Manag. 30, 2852–2872. doi: 10.1002/csr.2520

Lu, Q., Deng, J., Chen, S., and Hussain, Y. (2025). Managerial myopia and its barrier to green innovation in high-pollution enterprises: a machine learning approach. J. Environ. Manag. 376:124477. doi: 10.1016/j.jenvman.2025.124477

Lu, C., Zheng, H., and Yan, M. (2009). A study on the relations between the orientation in founding a business, the orientation of a small enterprise and the performance of an enterprise. Manag. World 9, 133–147.

Ma, J., and Wang, H. (2024). Research on the impact of equity incentive model on enterprise performance: a mediating effect analysis based on executive entrepreneurship. PLoS One 19:e0300873. doi: 10.1371/journal.pone.0300873

Mao, Q., and Wang, Y. (2023). Employment effects of ESG: evidence from Chinese listed companies. Econ. Res. J. 58, 86–103.

Pan, A., Liu, X., and Qiu, J. (2019). Can green M&A of heavy polluting enterprises achieve substantial transformation under the pressure of media. Chin. Ind. Econ. 2, 174–192. doi: 10.19581/j.cnki.ciejournal.20190131.005

Pinheiro, B. (2024). What drives environmental, social and governance (ESG) performance. Manag. Environ. Qual. 35, 427–444.

Pinto, H., and Widdicks, M. (2014). Do compensation plans with performance targets provide better incentives? J. Corp. Financ. 29, 662–694. doi: 10.1016/j.jcorpfin.2014.03.005

Qing, L., Dagestani, A., Nam, Y., and Wang, C. (2024). Does firm-level exposure to climate change influence inward foreign direct investment? Revealing the moderating role of ESG performance. Corp. Soc. Responsib. Environ. Manag. 31, 6167–6183.

Qing, L., Li, P., Woo, C., and Zhong, K. (2024). Does climate change exposure impact on corporate finance and energy performance? Unraveling the moderating role of CEOs’ green experience. J. Clean. Prod. 461:142653. doi: 10.1016/j.jclepro.2024.142653

Sun, P., Hou, X., and Sheng, B. (2018). Service opening, managerial efficiency and firm export. Econ. Res. J. 53, 136–151.

Sun, C., Luo, Y., and Yao, X. (2019). The effects of transportation infrastructure on air quality: evidence from empirical analysis in China. Econ. Res. J. 54, 136–151.

Sun, Y., Zhao, L., and Lin, C. (2023). The impacts of executive equity on green corporate innovation. Sustainability 15:9887. doi: 10.3390/su15139887

Takalo, S. K., and Tooranloo, H. S. (2021). Green innovation: a systematic literature review. J. Clean. Prod. 279:122474. doi: 10.1016/j.jclepro.2020.122474

Tampakoudis, I., and Anagnostopoulou, E. (2020). The effect of mergers and acquisitions on environmental, social and governance performance and market value: evidence from EU acquirers. Bus. Strat. Environ. 29, 1865–1875. doi: 10.1002/bse.2475

Tang, H. (2022). The effect of ESG performance on corporate innovation in China: the mediating role of financial constraints and agency cost. Sustainability 14:3769. doi: 10.3390/su14073769

Tao, F., Zhao, J., and Zhou, H. (2021). Does environmental regulation improve the quantity and quality of green innovation? Evidence from the target responsibility system of environmental protection. Chin. Ind. Econ. 2, 136–154. doi: 10.19581/j.cnki.ciejournal.2021.02.016

Tian, Z. (2022). Executive equity incentives, employee stock ownership plans, and enterprise performance: empirical evidence based on environmental uncertainty. Front. Environ. Sci. 10:962409. doi: 10.3389/fenvs.2022.962409

Ullah, S., Khan, U., and Ahmad, N. (2022). Promoting sustainability through green innovation adoption: a case of manufacturing industry. Environ. Sci. Pollut. Res. 29, 21119–21139. doi: 10.1007/s11356-021-17322-8

Wu, J., Liu, B., Zeng, Y., and Luo, H. (2022). Good for the firm, good for the society? Causal evidence of the impact of equity incentives on a firm’s green investment. Int. Rev. Econ. Fin. 77, 435–449. doi: 10.1016/j.iref.2021.10.013

Xu, N., and Li, Z. (2016). CEOs’ poverty experience and corporate philanthropy. Econ. Res. J. 51, 133–146.

Xue, Q. (2023). Local green finance policies and corporate ESG performance. Int. Rev. Financ. 23, 721–749. doi: 10.1111/irfi.12417

Yang, Y. R., Han, X. L., Wang, X., and Yu, J. Y. (2023). Research on executive equity incentives and corporate innovation performance: the role of corporate social responsibility. Chin. Manag. Stu. 17, 1014–1030. doi: 10.1108/CMS-10-2020-0447

Yang, R., and Yang, J. (2024). Impact of digital technology innovation on enterprise ESG performance. J. Stats. Info. 39, 93–104. doi: 10.20207/j.cnki.1007-3116.20241025.001

Yang, X., and Yin, X. (2018). How does mixed-ownership reform of state-owned enterprises affect company cash holdings. J. Manag. World 34, 93–107. doi: 10.19744/j.cnki.11-1235/f.2018.0008

Zhang, L. S. (2025). The impact of ESG performance on the financial performance of companies: evidence from China’s Shanghai and Shenzhen A-share listed companies. Front. Environ. Sci. 13:1507151. doi: 10.3389/fenvs.2025.1507151

Zhang, X., Li, W., Ji, T., and Xie, H. (2024a). The impact of ESG performance on firms’ technological innovation: evidence from China. Front. Environ. Sci. 12:1342420. doi: 10.3389/fenvs.2024.1342420

Zhang, Q., Tan, L., and Gao, D. (2024b). Leading sustainability: the impact of executives’ environmental background on the enterprise’s ESG performance. Sustainability 16:6952. doi: 10.3390/su16166952

Zhang, D., Zhao, Z., and Lau, C. K. M. (2022). Sovereign ESG and corporate investment: new insights from the United Kingdom. Technol. Forecast. Soc. Change 183:121899. doi: 10.1016/j.techfore.2022.121899

Zhao, S., Jiang, X., and Ahn, Y. (2024). Too much of a good thing: the dual effect of executive equity incentives on corporate social responsibility performance. J. Organ. Change Manag. 37, 881–908. doi: 10.1108/JOCM-05-2023-0184

Zhao, Y., Qi, N., and Meng, Q. (2023). Technology integration capability, green patent quality and firms’ sustainable innovation. Sci. Tech. Prog. Pol. 40, 11–21.

Zheng, Y., Wang, B., Sun, X., and Li, X. (2022). ESG performance and corporate value: analysis from the stakeholders’ perspective. Front. Environ. Sci. 10:1084632. doi: 10.3389/fenvs.2022.1084632

Keywords: ESG performance, executive shareholding, green innovation, charitable donations, management efficiency

Citation: Zhang S, Li Z and He L (2025) Executive equity incentives and corporate environmental, social and governance performance. Front. Sustain. 6:1637126. doi: 10.3389/frsus.2025.1637126

Edited by:

Nicola Cucari, Sapienza University of Rome, ItalyReviewed by:

Sarat Chandra Mohapatra, University of Lisbon, PortugalLingli Qing, Guangzhou College of Commerce, China

Copyright © 2025 Zhang, Li and He. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Li He, aGVsaTIwMjJAdWNhc3MuZWR1LmNu

Shengyang Zhang

Shengyang Zhang Zhuo Li

Zhuo Li Li He

Li He