- Jinling Institute of Technology, Nanjing, China

Against the backdrop of global sustainable development, how to translate environmental performance under the ESG framework into tangible corporate outcomes remains a pressing issue that warrants in-depth investigation. Drawing on data from China’s A-share listed firms from 2006 to 2022, this study empirically examines the impact of ESG environmental performance on corporate performance. The results reveal that ESG environmental performance significantly enhances corporate performance. This finding remains robust after addressing potential endogeneity by employing analyst attention as an instrumental variable and treating the implementation of the Environmental Protection Law as a quasi-natural experiment. The mechanism analysis indicates that green innovation serves as a crucial channel through which ESG environmental performance promotes corporate performance. Further, the moderating analysis shows that firms with stronger market competitiveness amplify the positive effect of ESG environmental performance on corporate performance. This amplification arises from the dual mechanism of strengthening the contribution of green innovation to firm performance while simultaneously weakening the driving effect of ESG environmental performance on green innovation. The heterogeneity analysis demonstrates that the positive impact of ESG environmental performance on corporate performance is more pronounced among non-state-owned enterprises, firms with executives holding green backgrounds, companies without environmental penalties, and those operating in non-high-tech and non-high-pollution industries. Overall, this study provides theoretical support for corporate green transformation and offers valuable policy implications for optimizing sustainable development strategies.

1 Introduction

Environmental, Social, and Governance (ESG) performance has emerged as a critical area of research in recent years due to its profound implications for sustainable business practices and long-term corporate competitiveness. The growing emphasis on sustainability has spurred research into how ESG factors, particularly environmental performance, impact a firm’s financial outcomes. While much of the literature has established a positive relationship between environmental performance and corporate success, there is still a need for a deeper understanding of the mechanisms at play, particularly regarding how green innovation mediates this relationship.

Previous research, such as Adardour et al. (2025), explores the role of ESG in family-owned businesses, highlighting the moderating influence of Corporate Social Responsibility (CSR) committees on corporate risk-taking behaviors. Their findings indicate that family-owned businesses, with their long-term strategic focus, are particularly adept at integrating ESG practices into their core operations, fostering innovation, and ultimately improving firm performance. While these findings are valuable, they are mainly limited to family-owned firms and do not comprehensively address how green innovation bridges the gap between ESG performance and overall corporate success. Our study extends Adardour et al. (2025) by showing that green innovation is a key mechanism that translates higher ESG performance into tangible corporate outcomes, particularly within China’s A-share listed firms.

Additionally, Barguilla Sanclaudio et al. (2025) emphasize that ESG practices are not only a competitive advantage but a catalyst for innovation within family businesses. Their work demonstrates that adopting sustainable practices in response to both market and environmental pressures drives innovation. Our study builds on this by further exploring the role of green innovation in enhancing both operational efficiency and market competitiveness, contributing to superior financial performance. By doing so, we advance the understanding of how ESG investments drive business success through innovation and sustainability.

Despite these important contributions, the literature still lacks a comprehensive exploration of the specific pathways through which ESG environmental performance influences corporate performance, especially in emerging markets like China. Previous studies have largely focused on developed economies, leaving a gap in our understanding of how ESG practices operate within different institutional and regulatory contexts. Our research addresses this gap by investigating the role of market competitiveness and green innovation in the relationship between ESG environmental performance and corporate outcomes. This nuanced approach provides a more detailed understanding of how these factors interact in emerging markets, offering practical insights for firms operating in such environments.

To further strengthen this analysis, we draw upon the Resource-Based View (RBV), which provides a solid theoretical foundation for understanding how firms leverage green innovation to gain competitive advantages. According to Barney (1991), firms can achieve sustained competitive advantage by utilizing rare, valuable, and inimitable resources. In the context of ESG, green innovation capabilities represent such strategic resources, enabling firms to differentiate themselves in the market and enhance their long-term performance. This theory supports our hypothesis that green innovation plays a mediating role between ESG environmental performance and corporate success.

In conclusion, while existing studies have established a robust connection between ESG performance and corporate outcomes, our research offers a significant contribution to the literature by emphasizing the crucial role of green innovation as a mediator in this relationship. Additionally, we provide insights into how market competitiveness moderates this effect, adding depth to our understanding of the dynamics at play. By incorporating perspectives from Adardour et al. (2025) and Barguilla Sanclaudio et al. (2025), we extend the theoretical foundations of ESG research and present a more comprehensive framework for understanding how environmental performance drives sustainable corporate success. Based on the above theoretical analysis, this study proposes the following hypothesis:

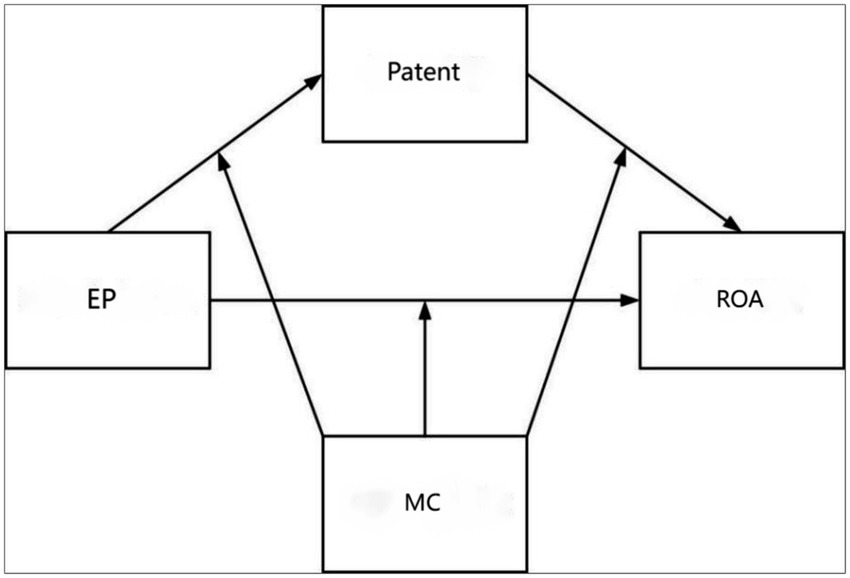

H1: ESG environmental performance enhances corporate performance through the mechanism of green innovation.

2 The moderating role of market competitive position

1. The enhancement of a firm’s market competitive position may weaken the positive relationship between environmental performance and green innovation. This moderating effect can be explained through the lens of agency theory. According to this theory, under conditions of information asymmetry and a short-term profit orientation, managers often prefer to reduce investment in long-term, high-risk green innovation projects and instead allocate resources to activities that yield immediate returns (Jensen and Meckling, 2019). As firms’ market positions strengthen, this inhibitory effect may become more pronounced.

Although firms with higher market positions possess greater resource reserves, their management teams often focus on maintaining existing market shares and maximizing short-term profits. Consequently, environmental investment tends to remain at the level of regulatory compliance rather than progressing toward breakthrough green innovations. A strong competitive position may, therefore, reinforce path dependence and reduce the intrinsic motivation for strategic transformation through green innovation. Based on the above analysis, the following hypothesis is proposed:

H2a: A firm’s market competitive position weakens the positive effect of ESG environmental performance on green innovation.

1. The facilitating effect of market competitive position on the relationship between green innovation and corporate performance. Conversely, an improved market competitive position may strengthen the positive relationship between green innovation and corporate performance. This moderating effect can be interpreted through the dynamic capability theory, which argues that green innovation is not merely a technological response to environmental regulation but also a key manifestation of a firm’s dynamic capability—its ability to integrate, reconfigure, and deploy internal and external resources systematically to adapt to market trends and build sustainable competitive advantages (Teece et al., 1997).

Within this theoretical framework, firms with higher market competitive positions typically possess richer resource endowments, stronger strategic execution capabilities, and broader market influence, allowing them to translate green innovation outcomes more efficiently into financial performance and market value. Therefore, market competitive position serves as an important contextual factor that strengthens the role of green innovation in value creation, enabling it to drive sustained performance growth in dynamic and competitive markets. Based on the above reasoning, this study proposes the following hypothesis:

H2b: A firm’s market competitive position strengthens the positive effect of green innovation on corporate performance.

1. The overall moderating effect of market competitive position in the ESG–performance linkage. The above analysis suggests that a firm’s market competitive position plays a dual and complex moderating role in the pathway from ESG environmental performance to corporate performance: on one hand, it weakens the effect of ESG environmental performance on green innovation; on the other, it strengthens the impact of green innovation on corporate performance. Whether the overall moderating effect of market competitive position reinforces or weakens the positive influence of ESG environmental performance on corporate performance depends on the relative strength of these two opposing effects.

If the enhancement effect of market competitive position on the green innovation–performance linkage outweighs its inhibitory effect on the ESG–innovation linkage, then market competitive position will overall strengthen the positive impact of ESG environmental performance on corporate performance. Conversely, if the inhibitory effect dominates, the overall influence will be weakened. In other words, although firms with stronger market positions may lack motivation to convert ESG inputs into green innovation, their superior resource integration capabilities, mature supply chain control, and significant market power enable them to translate achieved green innovation outcomes into actual performance gains, thereby compensating for weaker innovation incentives and even reinforcing the overall transmission mechanism. Conversely, when the inhibitory effect on green innovation is excessive, the mediating role of innovation is substantially constrained, and the overall ESG–performance pathway may be weakened despite strong post-innovation transformation capabilities. Based on this theoretical reasoning, the following hypothesis is proposed:

H2c: When the positive moderating effect of market competitive position on the relationship between green innovation and corporate performance exceeds its negative moderating effect on the relationship between ESG environmental performance and green innovation, market competitive position will overall strengthen the positive impact of ESG environmental performance on corporate performance; otherwise, it will weaken this impact.

The above hypotheses and the relationships among the main variables are illustrated in Figure 1.

3 Research design

3.1 Research sample and data collection

Based on the annual data of A-share listed firms in China from 2006 to 2022, this study excludes companies in the financial sector, delisted firms, and those under special treatment (*ST). In the Chinese market, *ST status is assigned to firms that face significant financial distress, such as consecutive years of losses or violations of listing regulations. These firms are subjected to heightened scrutiny by the stock exchanges, and their trading is often restricted. Due to the unique financial and operational challenges faced by *ST firms, they are treated separately in this study. Specifically, these companies are excluded from the analysis to avoid potential bias that could arise from their distressed financial conditions, which do not align with the core focus of this study on stable, actively trading firms. By excluding *ST firms, we aim to ensure that the sample accurately reflects firms with stable financial performance, thereby enhancing the robustness and validity of the results. Continuous variables are winsorized at the 1st and 99th percentiles to mitigate the influence of outliers, yielding a total of 13,820 valid firm-year observations. The explanatory variable (EP) is obtained from the environmental pillar (E) score of Bloomberg’s ESG database. The mediating variable (patent) is sourced from the China Research Data Service Platform (CNRDS), and the moderating variable (MC) is manually measured. The dependent variable (ROA) and all control variables are primarily collected from the China Stock Market and Accounting Research (CSMAR) database. Detailed measurement methods are described below.

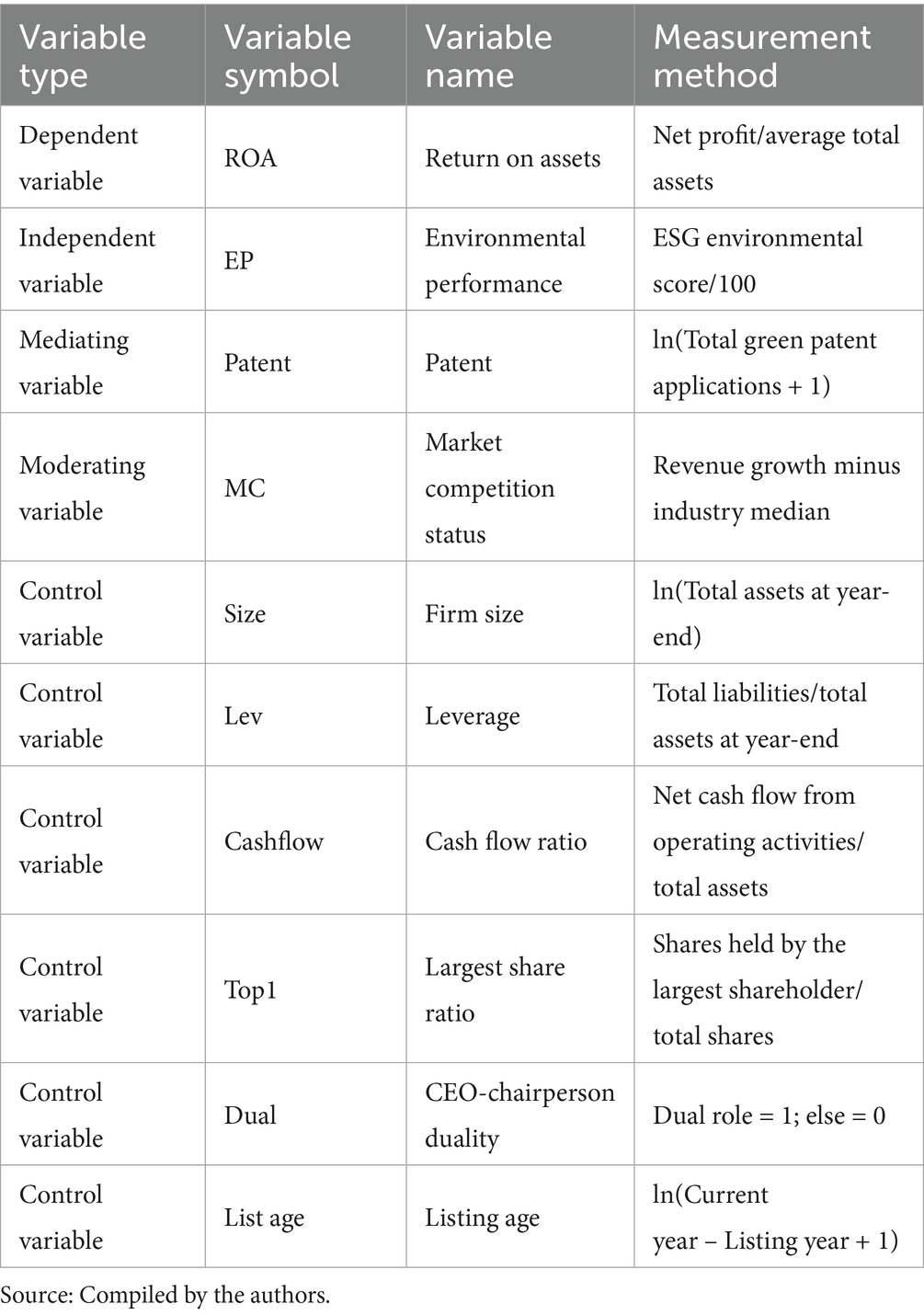

3.2 Variable measurement

1. Explanatory variable. This study uses the environmental performance score published by Bloomberg (hereafter referred to as “EP”) as the benchmark indicator to measure firms’ environmental performance. The score evaluates firms’ performance across various dimensions, including greenhouse gas emission management, sustainable product development, environmental management systems, and water resource management. It is a continuous variable ranging from 0 to 100, with higher values indicating better environmental performance. To enhance the interpretability of regression coefficients, the EP score is normalized by dividing it by 100, thereby adjusting the value to the range of 0 to 1. This normalization allows one unit of change to correspond directly to a one-point increase in the original score.

2. Dependent variable. Return on Assets (ROA) is used as the key indicator of corporate performance, calculated as net profit divided by average total assets. ROA is widely recognized for measuring profitability and operational efficiency, indicating how well a company uses its assets to generate earnings. ROA was chosen because it provides a comprehensive view of firm performance, reflecting both profitability and asset management. It is particularly suitable for evaluating the long-term effects of ESG practices and green innovation. Additionally, ROA, based on publicly available data, ensures objectivity and comparability across firms, making it an ideal metric for assessing the financial impact of ESG initiatives. In line with Ma et al. (2021), this study adopts ROA to represent corporate performance. A higher ROA value indicates stronger firm performance.

3. Mediating variable. Previous research often combines the number of green invention patents and green utility model patents to measure firms’ green innovation levels, emphasizing actual outcomes. To improve explanatory accuracy, Bai et al. (2019) applied the natural logarithm of one plus the patent count. Following this approach, this study measures green innovation (patent) as ln(1 + total number of green patent applications). A higher patent value reflects greater investment in or output of green innovation and indicates stronger firm capability in sustainable innovation.

4. Moderating variable. Market competitive position (MC) represents a firm’s relative advantage within its industry and the degree of competition it faces. Following existing research, this study measures MC as the difference between a firm’s annual operating revenue growth rate and the industry’s annual median. A larger MC value indicates that the firm occupies a stronger and more stable position in the market.

5. Control variables. Drawing on previous literature, the following control variables are included: firm size (Size)—the natural logarithm of total assets at year-end, reflecting firm resources and capacity; leverage (Lev)—the ratio of total liabilities to total assets at year-end; cash flow ratio (Cashflow)—net cash flow from operating activities divided by total assets; largest shareholder ownership (Top1)—the shareholding ratio of the largest shareholder; CEO duality (Dual)—a dummy variable equal to 1 if the CEO concurrently serves as board chair and 0 otherwise; and listing age (ListAge)—the natural logarithm of the difference between the current year and the listing year, representing firm growth and maturity (Table 1).

3.3 Model construction

To examine the impact of environmental performance on corporate performance, this study first constructs Model (1) to test Hypothesis H1. In this model, denotes corporate performance, denotes environmental performance, it denotes the linear combination of control variables, and represent firm and year fixed effects, respectively;i denotes the firm, and t denotes time.

Subsequently, to further examine the mediating role of green innovation in the relationship between environmental performance and corporate performance, Models (2) and (3) introduce the green innovation variable and are jointly used with Model (1) to test Hypothesis H2. In this context, represents green innovation, and definitions of other related variables remain consistent with those described earlier.

To explore the role of market competition status in the relationships among environmental performance, green innovation, and corporate performance, moderating effect Models (4), (5), are constructed to test Hypotheses H2a, H2b, and H2c, respectively. In these models, denotes market competition status, and the definitions of other related variables remain consistent with those in Equations 1–3.

4 Empirical analysis

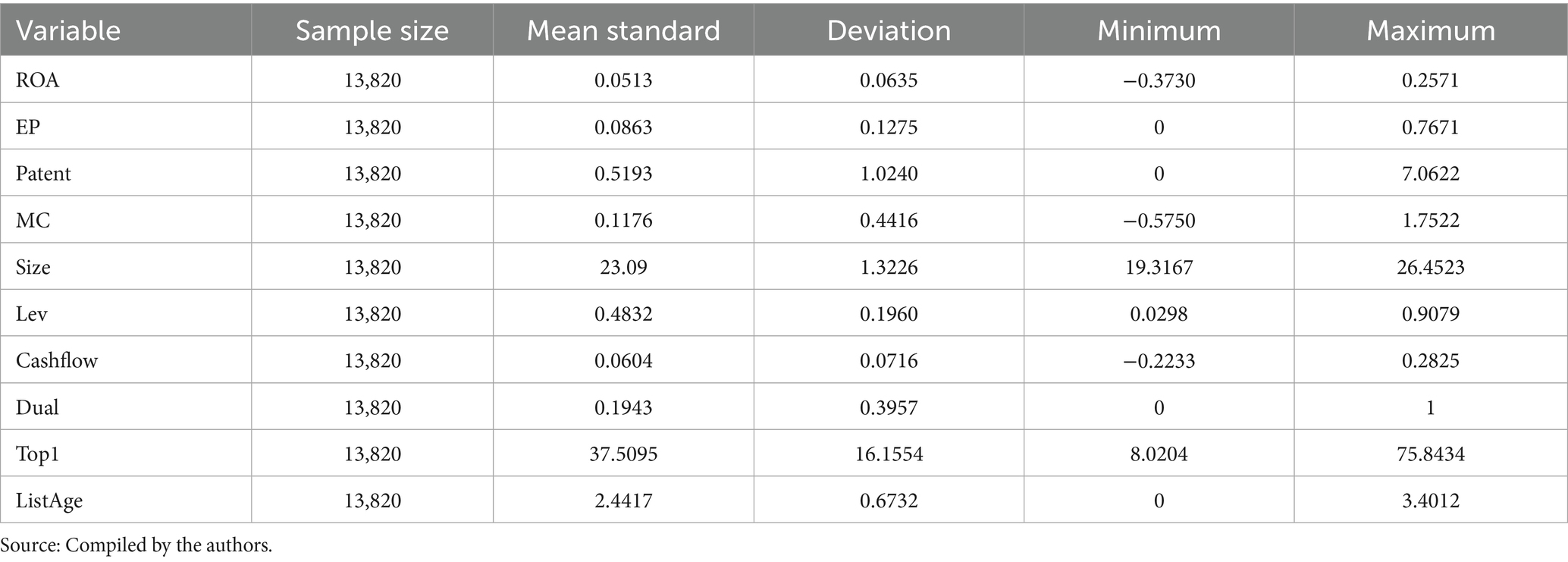

4.1 Descriptive statistics and multicollinearity test

Table 2 presents the results of the descriptive statistical analysis. The mean value of corporate performance (ROA) is 0.0513, with a range from −0.3730 to 0.2571 and a standard deviation of 0.0635, indicating that there remains considerable room for performance improvement among the sampled firms. The mean of ESG environmental performance (EP) is 0.0863, with a minimum of 0 and a maximum of 0.7671, suggesting substantial variation across firms and providing empirical support for examining the heterogeneous effects of environmental performance. The mean value of green innovation (patent) is 0.5193, ranging from 0 to 7.0622, with a standard deviation of 1.0240, reflecting significant differences in green innovation capability among firms. Finally, the mean value of market competitive position (MC) is 0.1176, ranging from −0.5750 to 1.7522, with a standard deviation of 0.4416, revealing considerable variation in firms’ market competitiveness.

4.2 Baseline regression

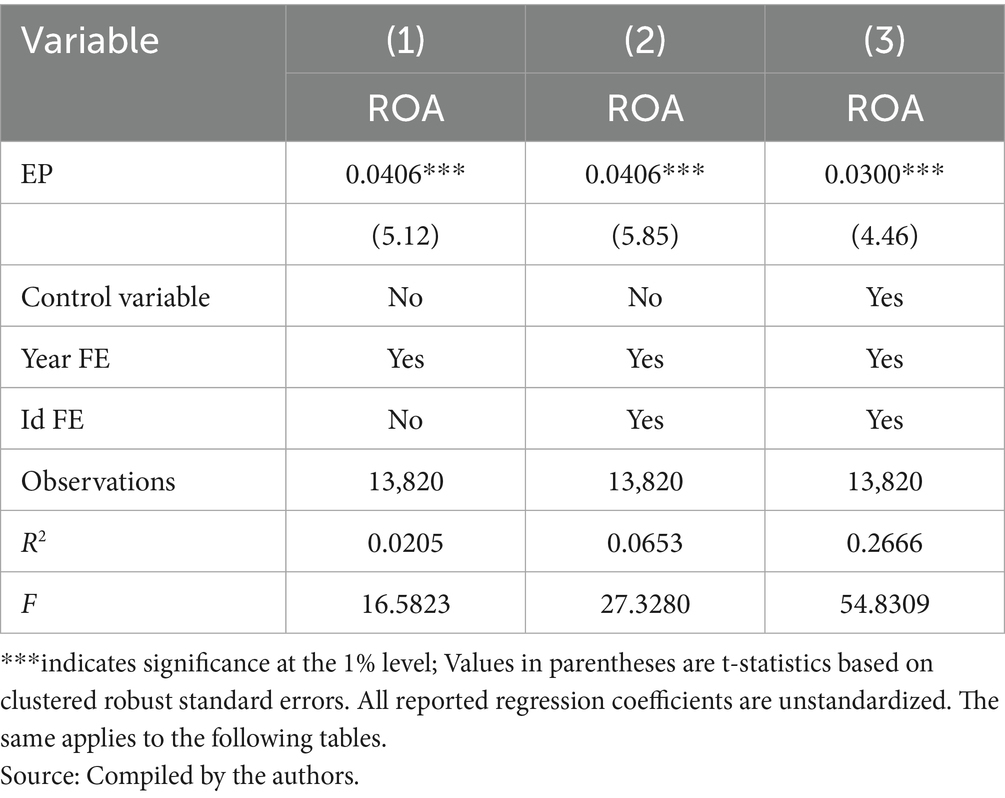

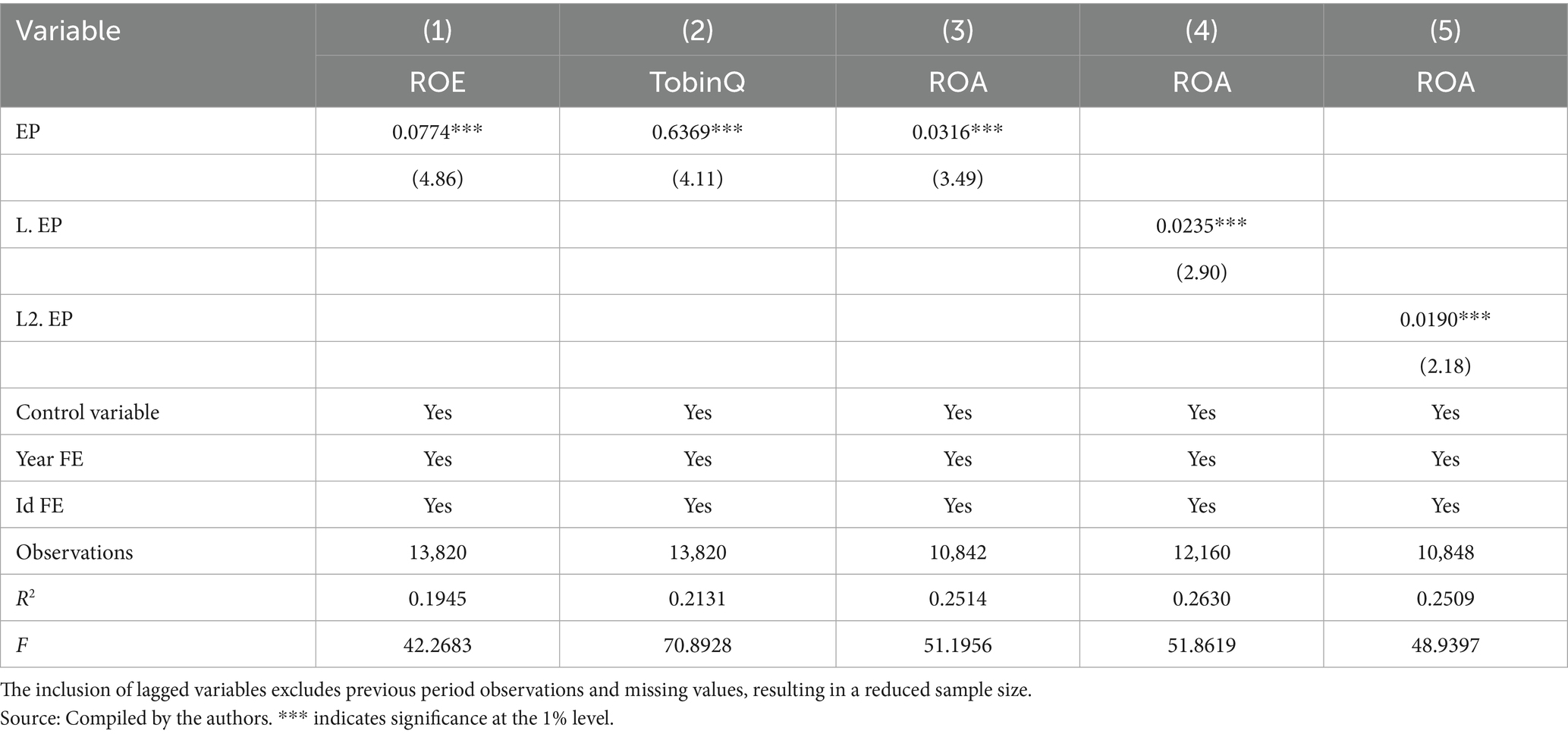

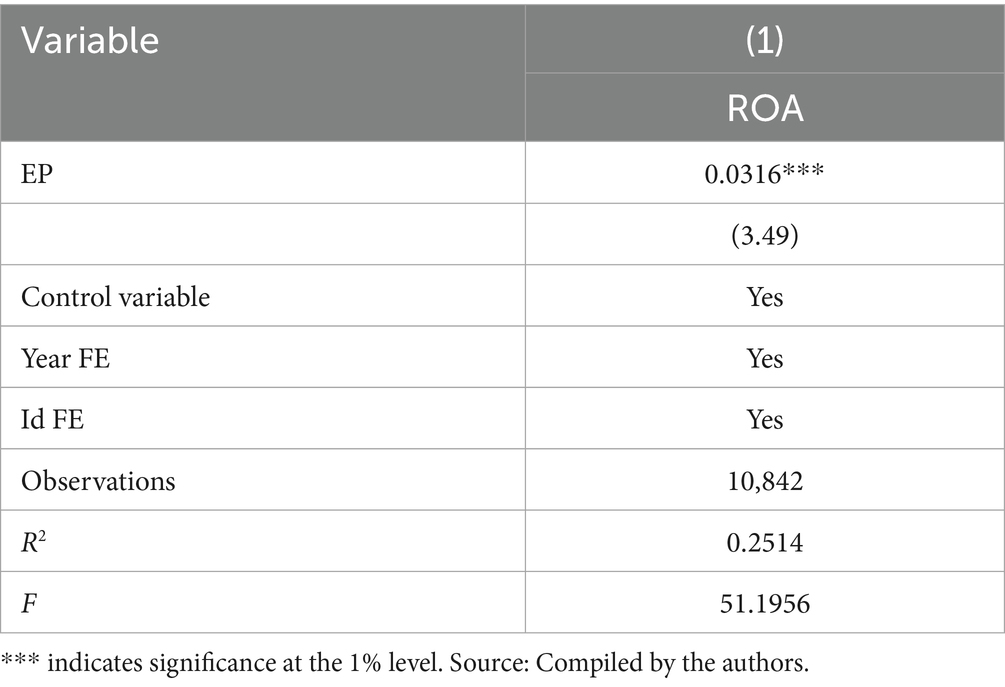

This study employs a panel fixed-effects model to estimate Equation 1, and the regression results are presented in Table 3. Column (1) includes only year fixed effects, Column (2) additionally controls for firm fixed effects, and Column (3) further incorporates control variables based on the previous model settings. The analysis of regression results is primarily based on Column (3), which includes all control variables.

Specifically, the estimation results in Column (3) show that the coefficient of EP is significantly positive, indicating that ESG environmental performance has a statistically significant positive impact on corporate performance. To further examine the economic significance of this effect, this study combines the descriptive statistics with the estimated coefficient of EP reported in Table 3. The calculation results show that a one–standard-deviation increase in EP leads to a 7.46% increase in ROA relative to the sample mean (≈0.0300 × 0.1275/0.0513). This finding suggests that improvements in ESG environmental performance not only enhance corporate performance statistically but also exert economically meaningful effects.

4.3 Endogeneity test

4.3.1 Instrumental variable approach

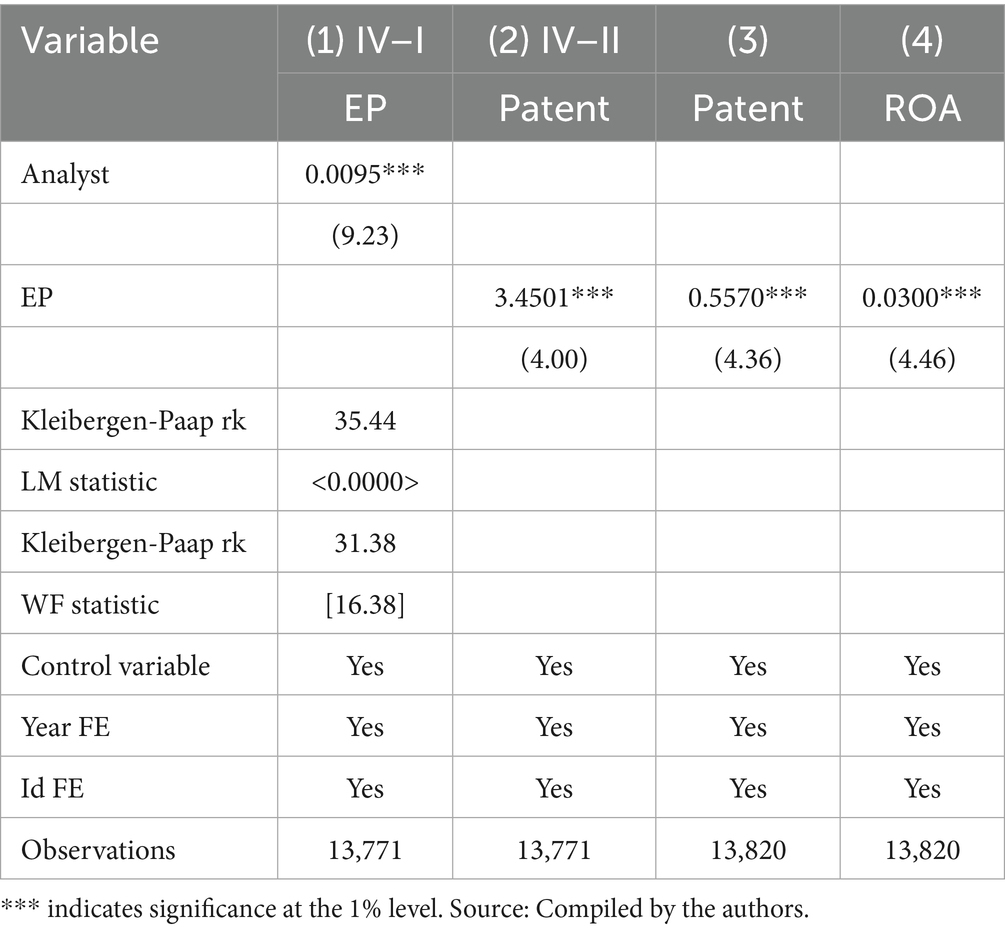

To address the potential endogeneity between ESG environmental performance and corporate performance, this study employs analyst attention as an instrumental variable. Specifically, analyst attention (Analyst) is measured as the natural logarithm of one plus the number of financial analysts following a firm (ln(1 + number of analysts following the firm)).

From the perspective of relevance, analyst attention serves as an important external monitoring mechanism and is closely related to a firm’s ESG environmental performance. Through information interpretation and supervision, analysts enhance the transparency of corporate environmental governance and strengthen compliance pressure, thereby motivating firms to adopt more proactive and standardized environmental practices. From the perspective of exogeneity, analyst attention affects corporate performance only indirectly through its influence on ESG environmental performance, without exerting a direct impact on firm outcomes.

This logic resonates with classical Chinese philosophical thought, particularly the Mohist ideas of jian ai (“impartial care”), fei gong (“non-aggression”), and he er bu. tong (“harmony without uniformity”). The principle of jian ai advocates impartial and independent treatment of all entities, while fei gong emphasizes non-interference and the avoidance of imposing one’s will or creating conflicts of interest. By analogy, analyst attention functions as an external stimulus influencing ESG environmental behavior but does not directly intervene in corporate performance.

From an economic standpoint, analyst attention primarily reflects capital market interest in a firm, driven by external factors such as industry characteristics, firm size, and reputation. For instance, firms in emerging industries may attract extensive analyst coverage due to market attention, even though their financial performance remains unstable. Conversely, mature firms in traditional industries may demonstrate strong and stable performance while attracting fewer analysts. This asymmetry embodies the notion of he er bu. tong, mei mei yu gong—harmony in diversity—implying that while analyst attention influences environmental performance, it does not directly affect corporate performance; the two remain harmoniously independent.

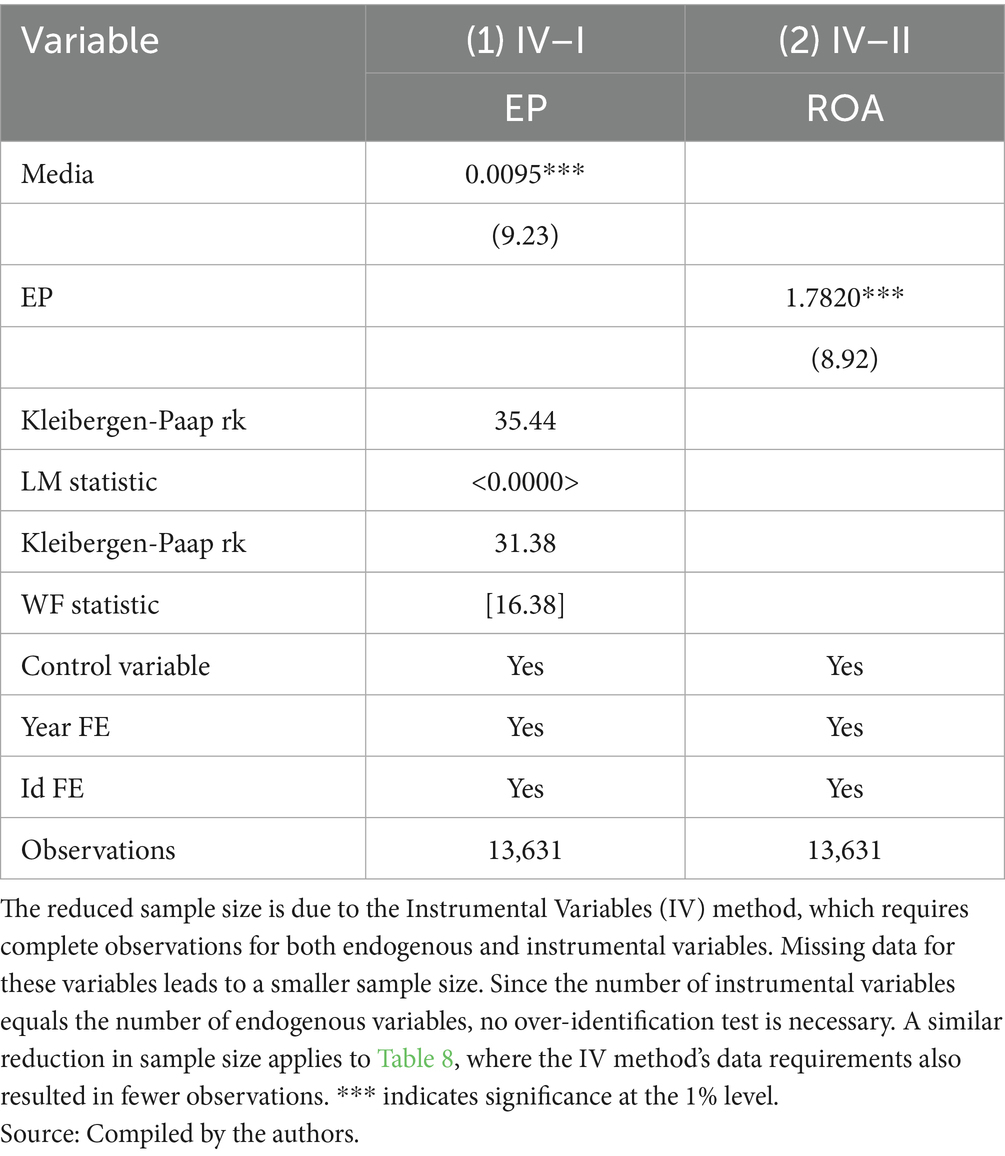

Table 4 reports the regression results using the instrumental variable method. Column (1) shows that the coefficient of Analyst is 0.0095, which is statistically significant at the 1% level. Combined with the results of weak instrument and identification tests, the instrumental variable satisfies the required statistical standards. Column (2) shows that the coefficient of EP is 1.7820, also significant at the 1% level, indicating that even after controlling for potential endogeneity, ESG environmental performance continues to significantly enhance corporate performance, further reinforcing the conclusions of the baseline regression.

4.3.2 Difference-in-Differences (DID) method

To address the potential endogeneity between ESG environmental performance and corporate performance, this study employs a Difference-in-Differences (DID) approach, utilizing the revision of the Environmental Protection Law (EPL) as a quasi-natural experiment. The rationale for using the new EPL is that its implementation significantly strengthened legal constraints and regulatory enforcement, thereby increasing firms’ environmental compliance pressure and, consequently, improving their ESG environmental performance. This policy reform provides an exogenous shock, enabling causal identification of the effect of ESG environmental performance on corporate performance.

To analyze the impact of this policy, two variables are defined: Treat and Post. Following the Guidelines for Industry Classification of Listed Companies revised by the China Securities Regulatory Commission (CSRC) in 2012, firms in high-pollution industries are categorized using industry codes (e.g., B06, B07, B08, B09, C17, C19, C22, C25, C26, C28, C29, C30, C31, C32, D44). The variable Treat is assigned a value of 1 if a firm belongs to one of these high-pollution industries, and 0 otherwise. Post represents the post-policy period, taking a value of 1 for the years 2015 and beyond, and 0 for earlier years. The interaction term Treat × Post is used to capture the policy’s exogenous effect.

To evaluate the robustness of the core findings in response to the policy shock, Model (6) is introduced. In this model, the interaction term captures the differential impact of the policy on high-polluting firms. The term , it represents the linear combination of control variables, while and denote firm and year fixed effects, respectively. Here, i refers to the firm and t refers to time.

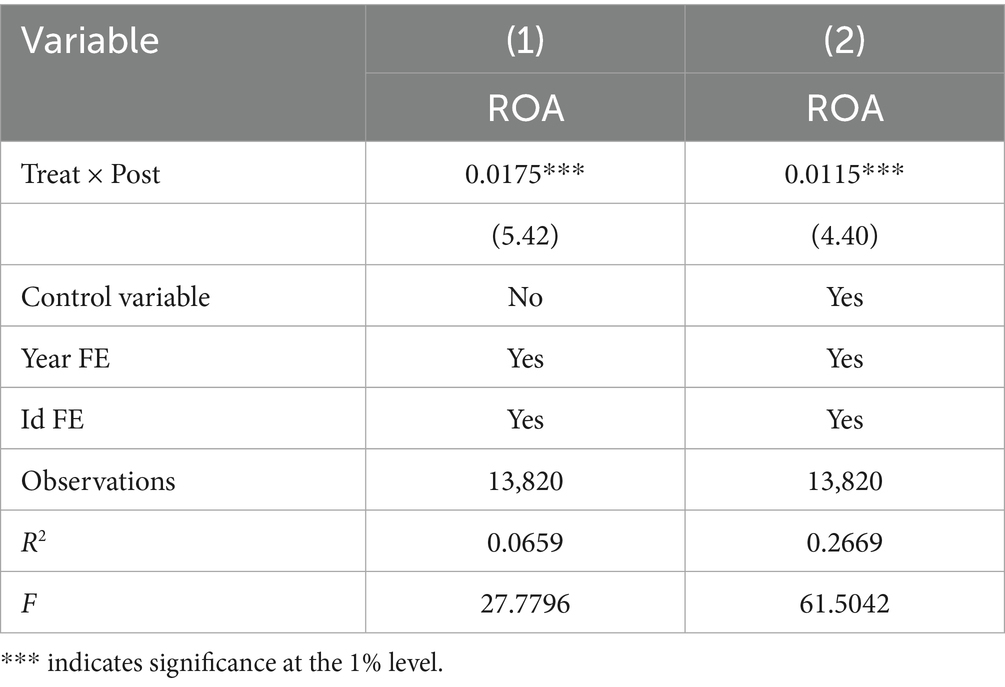

Table 5 presents the regression results under this quasi-natural experimental setting. In Column (1), without including control variables, the estimated coefficient of Treat × Post is 0.0175 and is statistically significant at the 1% level. In Column (2), after incorporating control variables, the coefficient decreases to 0.0115 but remains significant at the 1% level, indicating that even after considering the exogenous policy shock, the main conclusion of this study remains robust.

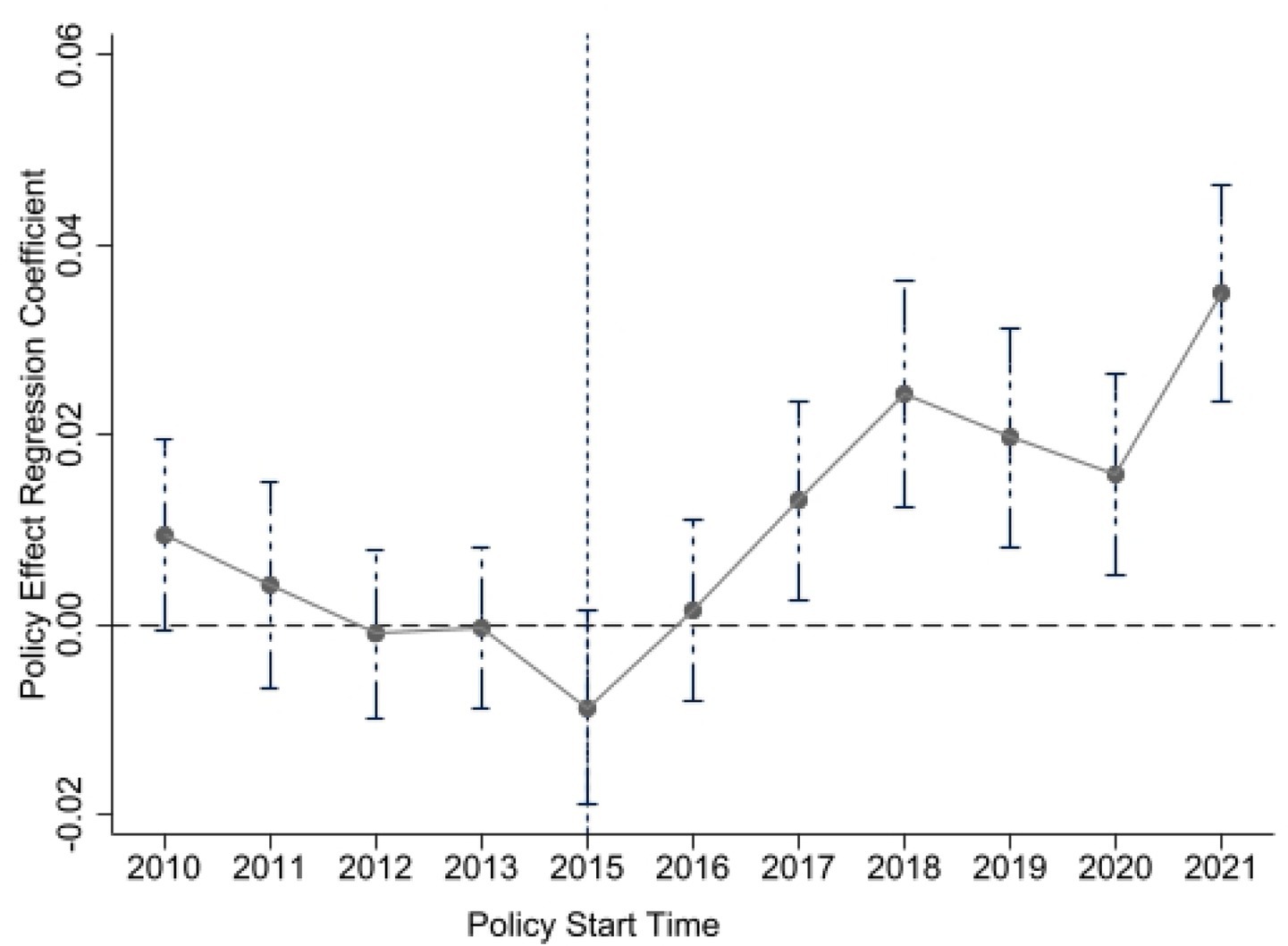

As shown in Figure 2, the parallel trends assumption holds, as there is no significant difference between the treatment and control groups before the policy implementation. Post-policy, the treatment group shows a clear upward trend, confirming the policy’s effective intervention.

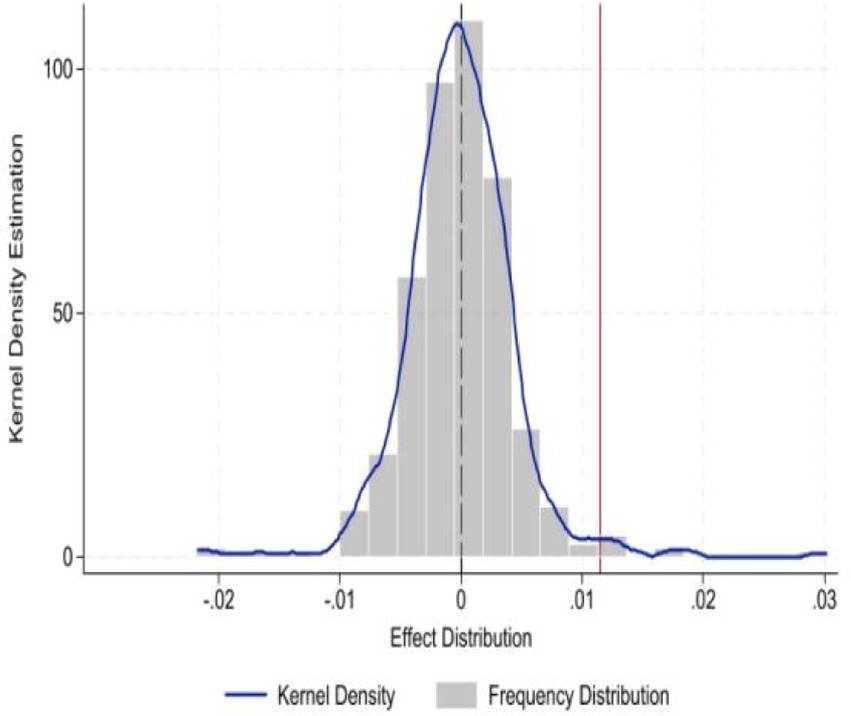

To further verify the robustness of the policy shock and eliminate potential omitted-variable bias, Figure 3 presents the placebo test results. A 500-round random sampling process generates pseudo-policy variables, keeping all control variables constant. The randomly assigned policy implementation time yields a coefficient of 0.0115, within the range of low-probability events, suggesting that omitted-variable bias has a negligible impact on the core findings.

5 Computational complexity discussion

Regarding the computational cost, the DID methodology applied in this study is computationally feasible using commonly available statistical software such as Stata or R. The models and placebo tests presented in Figures 2 and 3 were executed efficiently even with a large sample size, thanks to the straightforward implementation of the DID regression, which requires basic estimation of fixed effects and interaction terms. Given the structure of the models and the nature of the data, the computational resources needed for generating these figures are modest and well within the capabilities of standard software packages, ensuring quick computation and robust results.

5.1 Robustness test

5.1.1 Alternative variable

Tobin’s Q, by comparing the sum of a firm’s market value and total liabilities with its total assets, not only reflects the firm’s growth potential but also provides key information to stakeholders regarding its market valuation. Specifically, the market value of non-tradable shares is estimated by multiplying net asset value per share by the number of non-tradable shares, while net debt is calculated by deducting items such as employee compensation payable, taxes payable, dividends payable, other payables, and deferred income tax liabilities from total liabilities.

Because Tobin’s Q emphasizes the evaluation of long-term corporate performance, and Return on Equity (ROE) serves as an important indicator of a firm’s capital utilization efficiency, reflecting its ability to generate profits from shareholders’ equity, this study employs Tobin’s Q and ROE as alternative measures of corporate performance.

As shown in Table 6, from the perspectives of shareholder return (ROE), market value (Tobin’s Q), and profitability (ROA), the coefficient of ESG environmental performance (EP) remains significantly positive across all models. This finding suggests that environmental performance not only enhances firms’ current performance but also exerts a persistent dynamic effect, indicating that the optimization of environmental governance can comprehensively strengthen corporate performance.

5.1.2 Controlling for other factors

In the financial field, the long-tail effect is an important phenomenon that highlights the potential impact of low-probability tail events on overall economic activities. To eliminate the influence of the exogenous shock caused by the COVID-19 pandemic, this study shortens the sample period to 2006–2019 and re-conducts the empirical tests. The results indicate that ESG environmental performance (EP) continues to exert a significantly positive effect on corporate performance, confirming the robustness of the main findings even after excluding pandemic-related distortions (Table 7).

6 Transmission mechanism and inter-group difference analysis

6.1 Mechanism testing

The preceding analysis has comprehensively revealed the effect of environmental performance on corporate performance, and the theoretical discussion suggests that environmental performance may enhance firm performance through green innovation. To empirically verify this mechanism, this study conducts a mediation analysis to test whether the linkage between environmental performance and corporate performance operates through green innovation.

If environmental performance contributes to the implementation of green innovation, it can indirectly indicate that green innovation serves as an important conduit through which environmental performance improves firm performance. Following the variable definition introduced earlier, green innovation is measured by the natural logarithm of one plus the total number of green patent applications. The regression results are presented in Table 8. Column (4) reports the baseline regression, the details of which have been discussed previously. Column (3) shows the results for the impact of environmental performance on green innovation. The coefficient of EP is 0.5570 and statistically significant at the 1% level, suggesting that environmental performance effectively promotes firms’ green innovation activities, which in turn enhance corporate performance.

To address the potential endogeneity of the mediating variable (patent), this study employs media attention as an instrumental variable for further analysis. Specifically, media attention is measured as the natural logarithm of one plus the annual frequency of media reports concerning a firm. Media attention exerts a significant influence on corporate green technological innovation through information dissemination and public opinion supervision. On one hand, it strengthens social pressure, encouraging firms to pay greater attention to environmental governance and green R&D. On the other hand, by improving transparency, it enhances firms’ financing efficiency and technological cooperation opportunities in capital markets, thereby promoting the growth of green patent applications.

From a perspective of traditional Chinese philosophy, the mechanism of media attention resonates with the Daoist principle of “wu wei” (governing by non-interference). Daoism emphasizes conformity with natural order rather than forced intervention; “non-action” does not imply passivity but achieving effective governance through indirect guidance. In a similar way, media attention creates an environment of pressure and incentives through external supervision, without directly intervening in firms’ performance generation process—an embodiment of the “wu wei” principle in modern corporate environmental governance.

Furthermore, from the perspective of the Confucian concept of “yi–li distinction” (righteousness versus profit), media attention tends to emphasize a firm’s righteousness—the moral expectation for fulfilling environmental responsibility—rather than the direct pursuit of profit (economic performance). By reinforcing firms’ environmental accountability, media attention guides resource allocation toward green innovation without directly affecting financial outcomes. This “righteousness-driven” mechanism further ensures the exogeneity of media attention as an instrumental variable, thereby meeting the identification requirement for valid instrumentation.

The regression results, shown in Columns (1) and (2) of Table 8, confirm that the results remain robust under this setting. In conclusion, these findings provide strong empirical support for Hypothesis H1, verifying that green innovation serves as a significant mediating channel through which ESG environmental performance improves corporate performance.

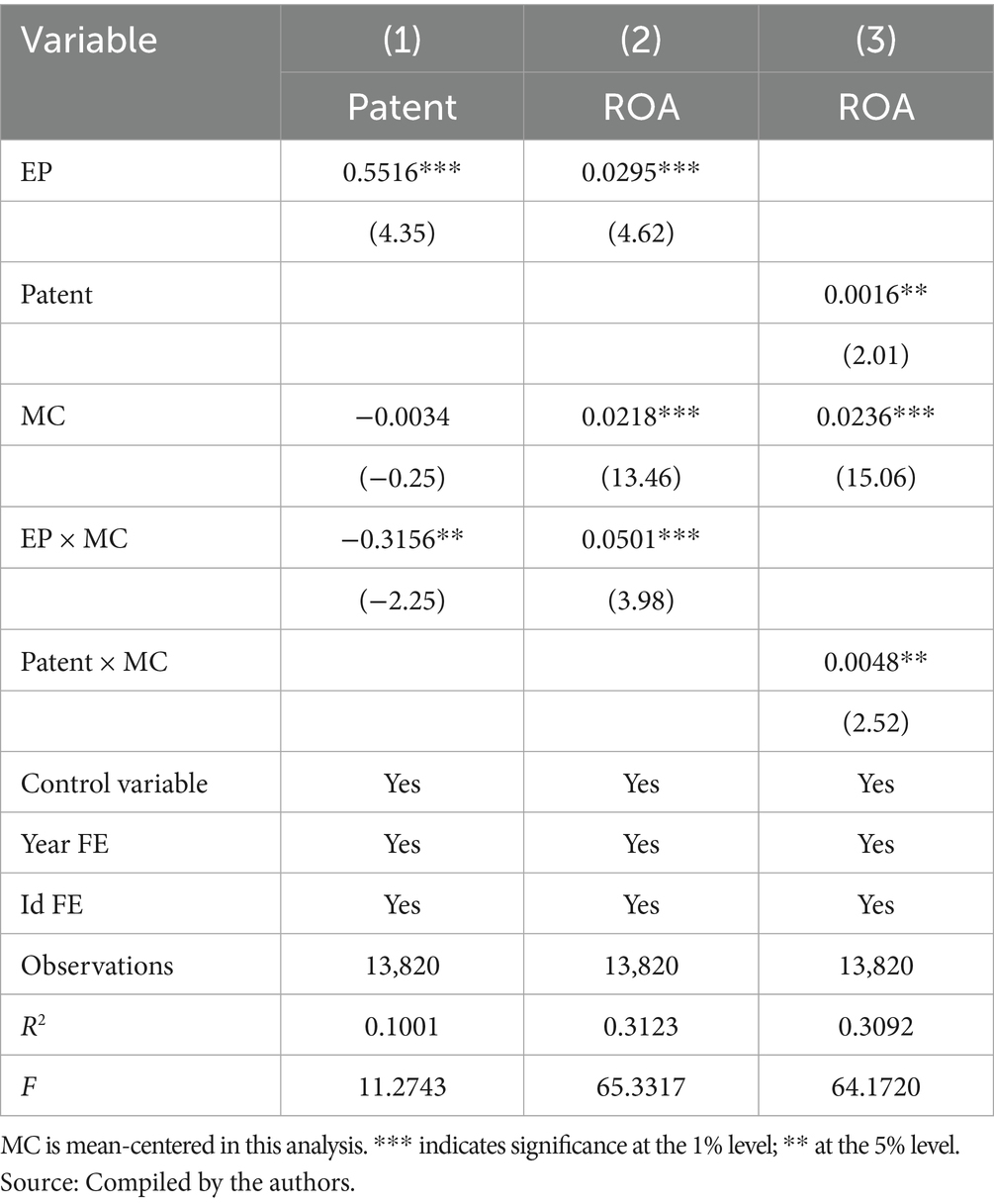

6.1.1 Moderation effect analysis

This section conducts empirical tests based on Equations 4 and 5. The regression results are reported in Columns (1)–(3) of Table 9.

As shown in Column (1), the coefficient of the interaction term EP × MC is −0.3156, which is statistically significant at the 5% level. This indicates that market competitive position significantly weakens the positive effect of environmental performance on green innovation. In highly competitive markets, firms tend to prioritize short-term financial outcomes and reduce resource allocation to long-term, high-risk green innovation projects, thereby limiting the potential of environmental performance to translate into green innovation. These results provide empirical support for Hypothesis H2a.

In Column (2), the coefficient of the interaction term Patent × MC is 0.0048, significant at the 5% level. This finding suggests that market competitive position significantly strengthens the mediating effect of green innovation in the relationship between environmental performance and corporate performance. Consistent with the dynamic capability theory, firms with stronger competitive positions can achieve technological breakthroughs and accumulate intellectual property through green innovation. Such firms not only enhance the conversion efficiency of green innovation but also optimize resource allocation, thereby expanding the pathways through which environmental performance improves corporate performance. Hence, Hypothesis H2b is supported.

In Column (3), the coefficient of the interaction term EP × MC is 0.0501, which is statistically significant at the 1% level. This result indicates that the positive impact of environmental performance on corporate performance is more pronounced among firms with higher market competitive positions. Furthermore, this finding implies that the positive moderating effect of market competitive position on the relationship between green innovation and corporate performance (H2b) exceeds its negative moderating effect on the relationship between environmental performance and green innovation (H2a). Therefore, Hypothesis H2c is also verified.

6.2 Heterogeneity analysis

Although the preceding analyses have comprehensively examined the impact of environmental performance on corporate performance and its underlying mechanisms, the discussion thus far has mainly focused on the overall sample and has not fully accounted for potential heterogeneity among firms with different characteristics. To further test the universality of the effect of ESG environmental performance and explore variations across different firm groups, this study classifies the sample according to ownership structure, internal versus external driving forces, and industry characteristics, and performs group-based regressions to examine cross-group differences.

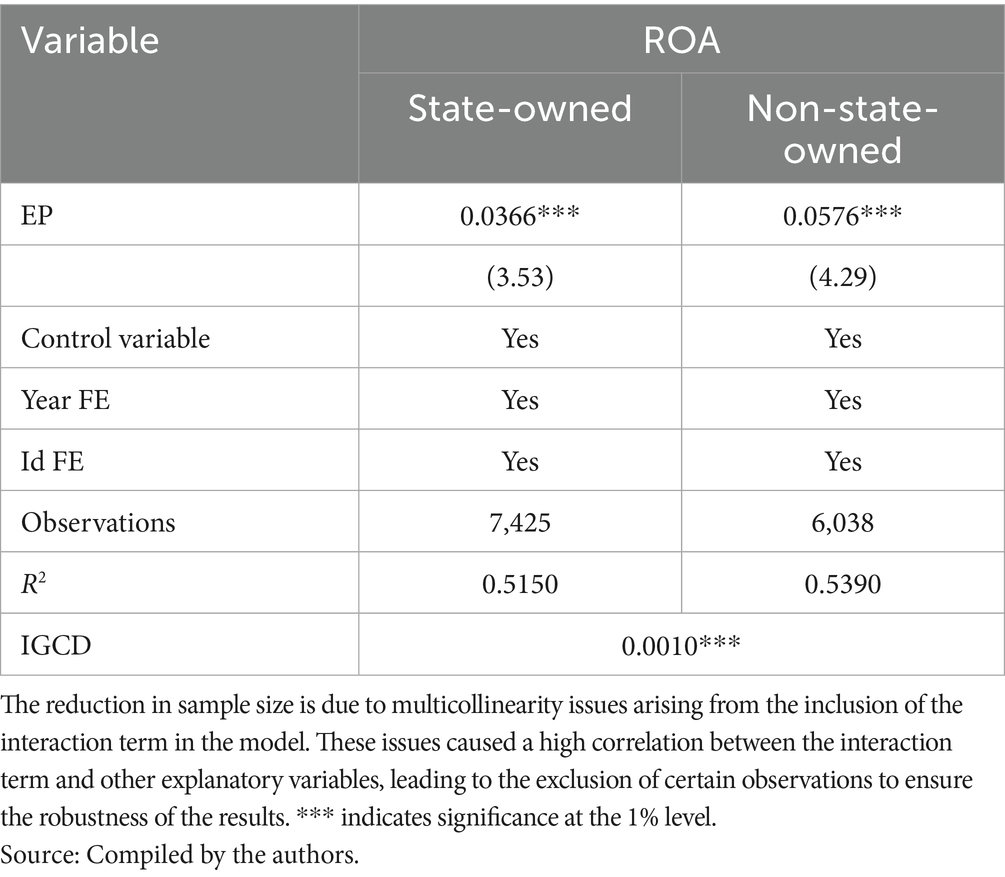

6.2.1 Ownership type

To analyze whether the effect of environmental performance on corporate performance (ROA) differs across ownership types, firms are divided into state-owned enterprises and non-state-owned enterprises (non-SOEs). The group regression results are presented in Table 10.

The findings reveal that the positive impact of ESG environmental performance on firm performance is more pronounced among non-SOEs. This may be because non-state-owned enterprises tend to be more market-oriented and sensitive to sustainability-driven reputation effects. By actively fulfilling environmental responsibilities, these firms can enhance their corporate image, attract investment, and strengthen their market competitiveness, thereby converting environmental performance into performance gains more efficiently.

In contrast, while state-owned enterprises also exhibit a positive relationship between environmental performance and corporate performance, the effect is relatively weaker. The reason may lie in their relatively abundant access to resources and policy support, which may reduce market-driven incentives for proactive environmental responsibility. Consequently, the conversion efficiency of environmental performance into tangible performance outcomes is lower in SOEs compared with non-SOEs.

Overall, this divergence reflects the market-driven advantages of non-SOEs in green transformation while highlighting the need for SOEs to improve the efficiency of translating environmental performance into performance outcomes. These findings provide valuable implications for optimizing firm-specific strategies and policy frameworks to promote differentiated yet coordinated green development.

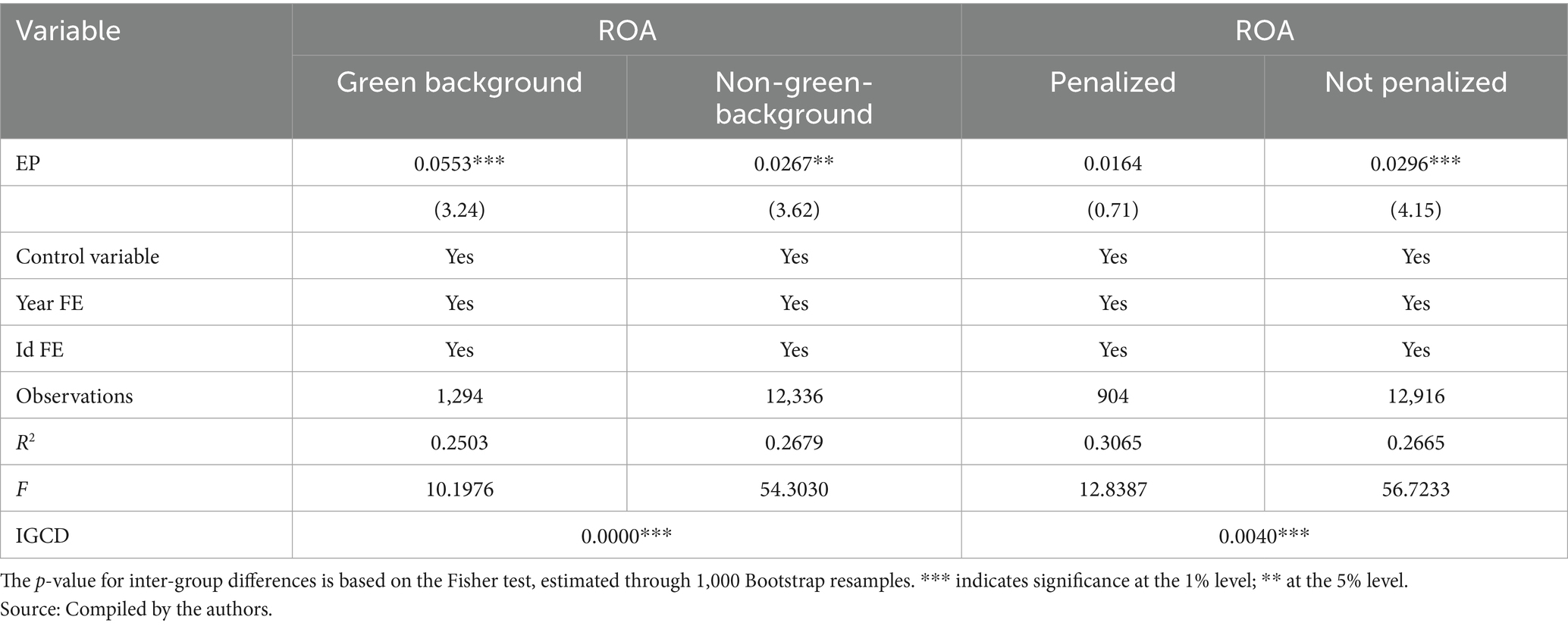

6.2.2 Internal drivers and external constraints

The influence of internal driving forces and external constraints on ESG environmental performance is particularly significant. In this study, data related to executives’ environmental backgrounds were manually extracted from publicly available résumé information on the Sina Finance website. The specific identification criteria are as follows: if the résumé of a top executive contains keywords such as “environment,” “environmental protection,” “low carbon,” or “green,” the executive is considered to possess an environmental background. In addition, based on the data released by the Ministry of Ecology and Environment (MEE) and the Institute of Public and Environmental Affairs (IPE), we determine whether a firm has a record of environmental penalties. The environmental background of executives and the existence of penalty records serve as indicators of internal driving and external constraints, respectively, and both are assigned a value of 1 if present and 0 otherwise.

As shown in Table 11, the promoting effect of ESG environmental performance on corporate performance is strongest in firms whose chairpersons have a green background. The coefficient is 0.0553, significant at the 1% level. In firms without such a background, the coefficient decreases to 0.0267 and remains significant only at the 5% level. The results of the Fisher test further confirm the significant difference between the two groups, indicating that chairpersons with green backgrounds can more effectively promote the implementation of environmental responsibility strategies, enhance firms’ resource integration capabilities, and improve market recognition—thereby amplifying the positive impact of ESG environmental performance on corporate performance.

For firms without environmental penalty records, ESG environmental performance significantly improves firm performance, with a coefficient of 0.0296, significant at the 1% level. However, in firms that have been penalized, this effect is substantially weakened, with the coefficient dropping to 0.0164 and becoming statistically insignificant. The Fisher test again shows a significant difference between the two groups, suggesting that firms penalized for environmental violations suffer reputational damage, which undermines their credibility in capital markets and reduces their ability to secure policy support. Furthermore, such firms are forced to divert resources toward fines and remediation rather than long-term performance improvement. The market’s negative perception of penalized firms further diminishes their ability to enhance firm value through environmental performance, highlighting the critical role of environmental compliance in the transformation of environmental performance into economic outcomes.

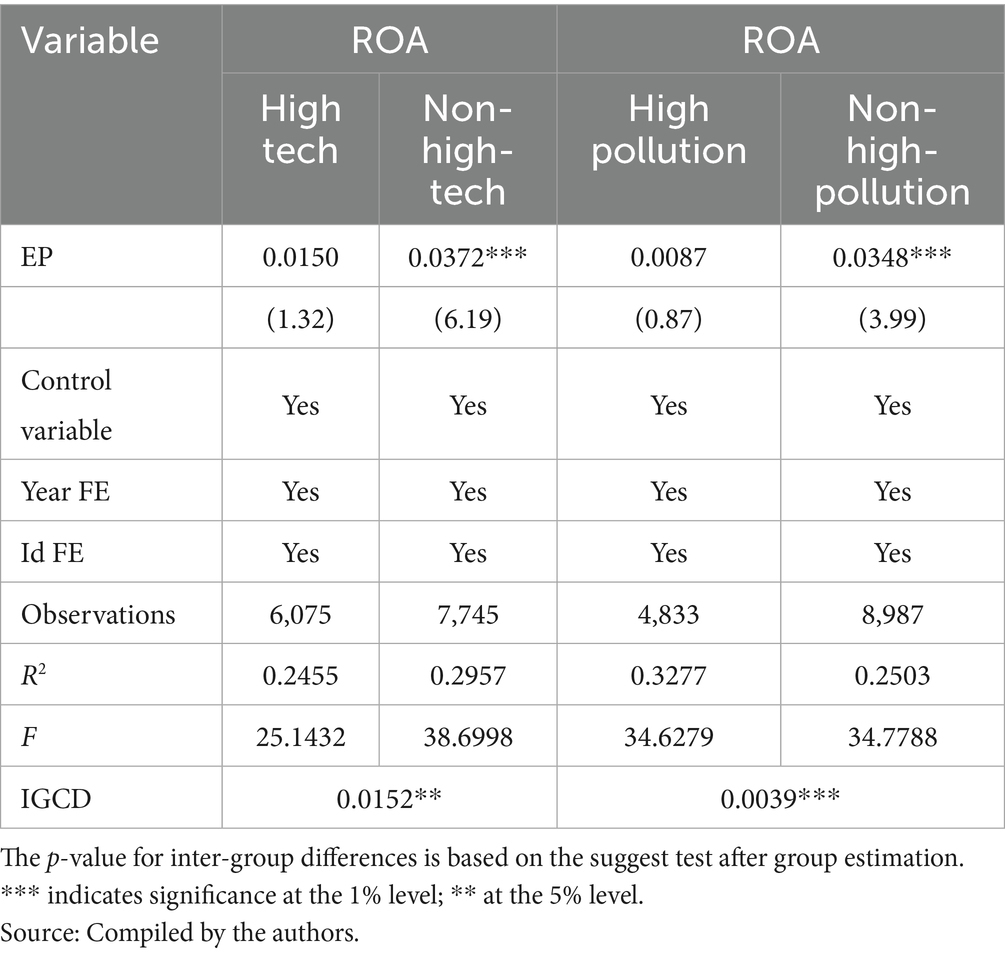

6.2.3 Industry characteristics

Given that significant differences exist across industries in terms of environmental governance, the impact of ESG environmental performance on corporate performance may vary depending on industry characteristics. To more comprehensively examine the relationship between ESG environmental performance and firm performance, this study further divides firms into high-tech versus non–high-tech enterprises and high-pollution versus non–high-pollution enterprises for comparative analysis.

The classification of high-tech enterprises follows the Administrative Measures for the Recognition of National High-Tech Enterprises and the Guidelines for Industry Classification of Listed Companies issued by the China Securities Regulatory Commission (CSRC). Firms that meet these criteria are identified as high-tech enterprises (assigned a value of 1), while others are assigned 0. Similarly, the definition of high-pollution enterprises is based on the CSRC’s Guidelines for Industry Classification of Listed Companies and the Catalogue for Environmental Verification of Listed Companies by Industry released by the Ministry of Ecology and Environment. Firms belonging to industries listed in these documents are classified as high-pollution enterprises (assigned a value of 1), and the rest are assigned 0.

As shown in Table 12, the impact of ESG environmental performance on corporate performance is insignificant among high-tech enterprises, with the coefficient of EP being 0.0150 and statistically insignificant. This suggests that the marginal improvement effect of environmental performance on high-tech firms’ performance is limited. The possible reason is that high-tech enterprises already possess strong technological capabilities and competitive advantages, making the incremental benefits of environmental improvements less evident.

In contrast, among non–high-tech enterprises, the coefficient of EP is 0.0372 and statistically significant, indicating that firms in traditional industries can more easily obtain capital market support and policy resources through improved environmental performance, thereby enhancing their overall performance.

For high-pollution enterprises, the promoting effect of environmental performance is weak and statistically insignificant, with the coefficient of EP being 0.0087. This may be because high-pollution firms allocate more resources toward compliance costs and pollution control, which diminishes the direct positive effect of environmental performance on firm performance. Furthermore, as the market holds higher environmental expectations for high-pollution firms, marginal improvements in environmental performance are less likely to translate into significant performance gains.

Conversely, among non–high-pollution enterprises, the coefficient of EP is 0.0348 and statistically significant, suggesting that these firms are more capable of converting environmental improvements into market trust and performance returns.

Overall, these results demonstrate that industry characteristics significantly influence the relationship between ESG environmental performance and corporate performance. The industry context plays a critical role in shaping the effectiveness of firms’ environmental management practices and their ability to convert environmental performance into economic outcomes.

7 Conclusion

7.1 Research conclusions

The empirical results of this study demonstrate that ESG environmental performance has a significant positive impact on corporate performance. Specifically, our findings indicate that a one-unit increase in ESG environmental performance (EP) leads to a 0.0300 unit increase in Return on Assets (ROA), a key measure of corporate profitability. This result is statistically significant and economically meaningful, suggesting that improvements in ESG practices—particularly those related to environmental management and green innovation—are not merely associated with enhanced financial performance but can also lead to substantial economic returns for firms.

From the perspective of the Resource-Based View (RBV), this result can be interpreted as reflecting the role of green innovation as a valuable, rare, and inimitable resource that can provide firms with a sustained competitive advantage. According to Barney (1991), firms can leverage unique capabilities, such as green innovation, to differentiate themselves in the market and achieve long-term success. Our study affirms that ESG environmental performance—especially in the form of green innovation—acts as a strategic resource that enhances firms’ financial health, enabling them to generate superior returns compared to their competitors.

Although statistical evidence robustly supports the relationship between ESG performance and corporate profitability, the economic significance of these findings is particularly noteworthy. A 0.0300 unit increase in ROA represents a substantial impact, especially for firms in highly competitive industries. For example, a company with a net profit of $10 million could see an increase of approximately $300,000 in profitability as a result of enhanced environmental practices. This finding provides clear evidence that ESG investments—particularly those aimed at improving environmental performance—are not just compliance costs, but essential drivers of long-term profitability and competitive advantage.

7.2 Comparing with similar studies

Our findings are consistent with other empirical studies that have examined the relationship between ESG performance and corporate financial outcomes. For instance, Adardour et al. (2025) found that family-owned firms, with their long-term focus, leverage ESG performance to drive both innovation and financial success. Similarly, Barguilla Sanclaudio et al. (2025) highlighted the role of ESG practices in enhancing innovation within family businesses, further strengthening the link between ESG initiatives and financial outcomes. Our study extends these findings by providing robust empirical evidence from China’s A-share listed firms, confirming that ESG environmental performance, especially in the form of green innovation, can have a direct and significant impact on corporate profitability.

In addition, our results are aligned with global studies showing that green innovation—enabled by strong ESG practices—leads to both cost savings and increased market share. Firms that engage in green innovation not only reduce operational costs through energy efficiency and resource conservation but also strengthen their brand reputation, which can lead to increased consumer demand and better access to financing.

7.3 Practical and policy implications

The economic significance of our findings has important implications for both practitioners and policymakers. For firms, the study suggests that investments in green innovation and enhanced environmental performance are not just ethical or regulatory obligations, but essential strategic moves that can significantly improve financial performance. Companies should view ESG investments as opportunities for long-term value creation, particularly in the form of cost savings, market differentiation, and customer loyalty. In practice, firms should incorporate sustainability goals into their core business strategies, aligning green innovation efforts with market trends and consumer expectations.

For policymakers, the results highlight the need for more targeted and differentiated support for firms investing in green innovation. Governments can facilitate this process by offering financial incentives, such as green bonds or R&D subsidies, to encourage firms to prioritize environmental sustainability. Additionally, creating a favorable policy environment for green technologies and renewable energy adoption can further stimulate innovation and reduce costs across industries. Policymakers should also consider the role of ESG performance in corporate tax incentives, aiming to reward firms that achieve significant environmental improvements.

Finally, investors should recognize the financial benefits of ESG performance and green innovation when making investment decisions. Focusing on companies with strong ESG practices can lead to better long-term returns, as these firms are more likely to thrive in an increasingly sustainability-conscious market.

7.4 Research prospects

Despite the valuable insights provided by this study, certain limitations remain, particularly in terms of data timeliness and indicator measurement. Bloomberg’s ESG data relies on voluntary corporate disclosure, which may be subject to reporting delays or data omissions. Additionally, due to constraints related to time, resources, and access, this study did not employ survey-based methods to collect primary data but instead used secondary databases to quantify key indicators. This approach limits the ability to capture dynamic, real-time changes at the firm level. Future research could incorporate industry-specific field surveys and case studies to obtain more comprehensive and dynamic data, thus deepening the understanding of the mechanisms through which environmental performance and green innovation drive corporate outcomes.

Furthermore, future research could extend the exploration of ESG controversies, particularly their long-term effects on corporate sustainability strategies and performance. For instance, Shakil (2024) and Alsayegh et al. (2020) note that ESG controversies not only affect environmental performance but may also undermine investor and societal trust, which, in turn, impacts long-term profitability and market performance. These findings highlight the need for a deeper theoretical understanding of how ESG controversies can influence firms’ financial stability and market position. Incorporating legitimacy theory, which emphasizes the importance of firms demonstrating transparency and ethical behavior to gain stakeholder trust, could provide valuable insights for future research on ESG controversies.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found at: http://data.csmar.com.

Author contributions

DW: Methodology, Validation, Formal analysis, Software, Resources, Writing – original draft, Writing – review & editing. QZ: Methodology, Data curation, Conceptualization, Investigation, Supervision, Writing – review & editing, Project administration, Validation.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adardour, Z., Ed-Dafali, S., Sbai, H., and Hussainey, K. (2025). ESG performance, family ownership, and corporate risk-taking: the moderating role of the CSR committee. Int. J. Finance Econ. 1–16. doi: 10.1002/ijfe.70026

Alsayegh, M. F., Abdul Rahman, R., and Homayoun, S. (2020). Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustainability 12:3910. doi: 10.3390/su12093910

Bai, Y., Song, S., Jiao, J., and Yang, R. (2019). The impacts of government R&D subsidies on green innovation: evidence from Chinese energy-intensive firms. J. Clean. Prod. 233, 819–829. doi: 10.1016/j.jclepro.2019.06.107

Barguilla Sanclaudio, M., Garcés-Galdeano, L., and Salazar Morales, I. A. (2025). Enhancing innovation through ESG practices: the superior impact on family businesses. J. Fam. Bus. Manag.

Barney, J. (1991). Firm resources and sustained competitive advantage. J. Manag. 17, 99–120. doi: 10.1177/014920639101700108

Jensen, M. C., and Meckling, W. H. (2019). “Theory of the firm: managerial behavior, agency costs and ownership structure” in Corporate governance. eds. M. C. Jensen and C. W. Smith Jr (Farnham: Gower), 77–132.

Ma, Y., Zhang, Q., and Yin, Q. (2021). Top management team faultlines, green technology innovation and firm financial performance. J. Environ. Manag. 285:112095. doi: 10.1016/j.jenvman.2021.112095

Shakil, M. H. (2024). Environmental, social and governance controversies: a bibliometric review and research agenda. Financ. Res. Lett. 70:106325. doi: 10.1016/j.frl.2024.106325

Keywords: SDGs goals, environmental dimension performance, green innovation, corporate performance, moderated mediation effect

Citation: Wu D and Zhu Q (2025) The impact of ESG environmental performance on corporate performance: evidence from China. Front. Sustain. 6:1654564. doi: 10.3389/frsus.2025.1654564

Edited by:

Hamid Mattiello, Fachhochschule des Mittelstands, GermanyReviewed by:

Sarat Chandra Mohapatra, University of Lisbon, PortugalSlimane Ed-dafali, Chouaib Doukkali University, Morocco

Ting-Kun Liu, Chaoyang University of Technology, Taiwan

Copyright © 2025 Wu and Zhu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Di Wu, d3VkaXBqeUBnbWFpbC5jb20=

Di Wu

Di Wu Qingxin Zhu

Qingxin Zhu