- Department of Business Administration, College of Business and Economics, Qassim University, Buraydah, Saudi Arabia

This study examines the pivotal roles of entrepreneurship and international business in promoting environmental sustainability, with a focus on the contributions of green and innovative technologies. Grounded in the context of Saudi Arabia from 2000 to 2022. The analysis reveals that both entrepreneurship and international business currently exert negative environmental pressures, notably through rising CO₂ emissions. However, integrating green and technological innovation significantly alters these dynamics. Green technologies help mitigate the environmental impact of entrepreneurship and enhance overall environmental performance in international business, particularly when their adoption exceeds key threshold levels. Similarly, innovative technologies strengthen entrepreneurship’s ability to reduce emissions, though their moderating effect on international business is more nuanced. These findings underscore the conditional nature of economic–environmental linkages and highlight the transformative potential of technology in steering economies toward sustainable pathways. The results offer valuable insights for policymakers, businesses, and stakeholders committed to advancing sustainable development through innovation and environmentally responsible strategies.

1 Introduction

The pursuit of environmental sustainability has become an urgent global priority, driven by mounting evidence of ecological degradation, climate instability, and biodiversity loss. Countries worldwide face the challenge of reducing their environmental footprint while maintaining economic growth and social development. In this context, the United Nations’ Sustainable Development Goals (SDGs)—particularly SDG 13 (Climate Action), SDG 9 (Industry, Innovation, and Infrastructure), and SDG 12 (Responsible Consumption and Production)—stress the integration of environmental protection with inclusive economic progress. Among the forces shaping the sustainability agenda, entrepreneurship and international business (IB) have become pivotal drivers that influence production structures, energy use, and innovation dynamics, making them central to the global transition toward a greener economy (Omri and Afi, 2020; Albitar et al., 2023; Singh et al., 2023). However, their contributions to sustainability remain contested and context-dependent, shaped by institutional, financial, and technological conditions (Ben Youssef et al., 2018; Slimani et al., 2024).

The environmental implications of entrepreneurship illustrate these ambiguities. From a Schumpeterian perspective, entrepreneurs act as agents of creative destruction, fostering eco-innovations, cleaner technologies, and sustainable consumption models that accelerate ecological modernization (Schumpeter, 2013; Wen et al., 2022; Le et al., 2023). Yet in many developing and transitional economies, necessity-driven and informal ventures often worsen ecological outcomes due to limited access to green finance, weak regulation, and reliance on polluting production systems (Altwaijri et al., 2024; Nakamura and Managi, 2020). Evidence shows that without strong institutional and innovation ecosystems, entrepreneurship’s net impact on the environment is frequently negative (Khezri et al., 2024; Omri, 2018; Uche et al., 2023; Khan et al., 2025). This highlights the heterogeneous nature of entrepreneurial activity and the need to examine enabling conditions that transform entrepreneurship into a force for sustainability.

International business, particularly foreign direct investment (FDI), reveals similar contradictions. Classical economic theory and the Porter Hypothesis suggest that FDI fosters cleaner technologies, productivity gains, and sustainable industrial upgrading when paired with adequate regulation (Duodu et al., 2021). Conversely, the Pollution Haven Hypothesis (PHH) warns that multinational firms may relocate polluting activities to countries with weak environmental oversight, thereby externalizing ecological costs (Bokpin, 2017; Tsoy and Heshmati, 2024). While this debate has shaped much of the literature, recent contributions suggest that outcomes are less determined by the binary PHH-versus-Porter framing and more by the institutional and technological context of host countries. In emerging economies where regulatory systems are evolving, FDI may reinforce unsustainable practices unless accompanied by innovation and strong governance. This recognition calls for moving beyond polarized debates to explore how moderating mechanisms shape the nexus between international business and the environment.

Innovation represents one such mechanism that can amplify or mitigate environmental pressures from entrepreneurship and international business. Green innovation focuses on products, processes, and services that directly reduce ecological harm, while broader technological innovation enhances productivity, energy efficiency, and compliance (Uche et al., 2023; Albitar et al., 2023). Theoretical frameworks such as Ecological Modernization Theory (EMT) and Endogenous Growth Theory posit that innovation, under adequate institutional support, can decouple economic activity from environmental degradation. Empirical findings support this claim: green technologies offset the environmental burdens of FDI and industrial expansion (Le et al., 2023), while technological innovation enhances entrepreneurial ecosystems’ capacity to reduce emissions (Singh et al., 2023; Khan et al., 2025). Nevertheless, most studies examine entrepreneurship and international business separately, neglect the joint role of green and technological innovation, and remain concentrated on advanced economies with mature regulatory systems. This overlooks emerging economies where institutional weaknesses and resource constraints pose distinct challenges.

Taken together, the literature suffers from several gaps. First, entrepreneurship and IB are rarely integrated into a unified framework, despite their intertwined effects on environmental outcomes. Second, the moderating roles of green and technological innovation are often treated in isolation, which limits our understanding of how they jointly shape sustainability trajectories. Third, research has disproportionately focused on advanced economies, leaving emerging contexts—where regulatory and innovation systems are less developed—underexplored. Fourth, excessive reliance on the PHH-versus-Porter debate risks oversimplifying the complex and conditional nature of IB’s environmental impact, diverting attention from how governance and technology determine outcomes. Addressing these gaps is essential to providing a more nuanced, policy-relevant analysis of how entrepreneurship and IB interact with innovation to influence sustainability. Saudi Arabia presents a compelling context for addressing these issues. As a resource-rich emerging economy, it faces high carbon emissions, energy-intensive industries, and dependence on fossil fuels, while simultaneously pursuing ambitious economic reforms under Vision 2030. This strategy prioritizes entrepreneurship, foreign investment, and the development of green and digital technologies as pathways toward diversification and sustainability. Despite these developments, empirical studies examining how entrepreneurship and IB, moderated by innovation, affect environmental sustainability in Saudi Arabia remain limited. Accordingly, this study seeks to answer the following research questions: (1) How do entrepreneurship and international business influence environmental sustainability in Saudi Arabia? (2) To what extent do green and technological innovation moderate these relationships?

This article makes several significant contributions to the literature on environmental sustainability, international business, and entrepreneurship. First, it extends prior work by jointly assessing the impact of entrepreneurship and international business on environmental sustainability, a relationship typically examined in isolation. By analyzing both drivers within a single empirical framework, the study provides a more comprehensive understanding of how economic globalization and entrepreneurial dynamics jointly influence ecological outcomes in Saudi Arabia from 2000 to 2022. This study focuses on Saudi Arabia as a case study due to its unique combination of environmental challenges and ambitious economic transformation goals. As a resource-rich and emerging economy, Saudi Arabia has long grappled with high carbon emissions, energy-intensive industries, and dependence on fossil fuel exports. These structural conditions position the country as a critical test case for examining whether entrepreneurship and international business can evolve in environmentally sustainable ways. Moreover, Saudi Arabia is actively pursuing an ambitious reform agenda under its Vision 2030 framework, which emphasizes economic diversification, innovation, and environmental stewardship. This policy shift has spurred a notable rise in entrepreneurial activity, inward foreign direct investment, and investments in green and digital technologies—offering a fertile empirical context to assess the conditional impacts of these factors on sustainability outcomes. Despite these developments, the environmental consequences of such transitions remain underexplored in the empirical literature. By focusing on Saudi Arabia from 2000 to 2022, this study contributes novel insights into how emerging economies can align economic globalization and entrepreneurship with sustainable development, particularly in settings characterized by institutional reforms and evolving innovation ecosystems. Second, the article emphasizes the moderating roles of green technologies and technological innovation, contributing to the relatively underexplored literature on conditional effects. While prior research has considered the direct impacts of innovation or finance on sustainability, this study uniquely examines how innovation alters the intensity and direction of environmental externalities associated with economic activity. Third, the research contributes to theory by integrating insights from the PHH, EMT, and Endogenous Growth Theory into a unified conceptual model, thereby advancing the theoretical foundations of sustainability research. Ultimately, the study provides actionable policy implications by identifying the conditions under which entrepreneurship and international business can be leveraged to advance environmental progress rather than cause ecological harm. In doing so, it equips policymakers and practitioners with a framework for aligning economic expansion with sustainability imperatives through innovation-driven strategies.

The remainder of the article reviews relevant literature, outlines the data and methodology, presents empirical results with discussion, and concludes with key findings and policy implications.

2 Theory and hypotheses development

2.1 Entrepreneurship and environmental sustainability

The relationship between entrepreneurship and environmental sustainability has garnered increasing attention within the sustainability science and innovation literature. Drawing on both the Environmental Kuznets Curve (EKC) hypothesis and Schumpeterian growth theory, scholars have sought to understand whether entrepreneurial activity can serve as a catalyst for ecological improvement or contribute to environmental degradation. The EKC hypothesis posits that environmental degradation initially rises with income and industrialization but eventually declines as economies mature, regulations strengthen, and cleaner technologies are adopted. Within this framework, entrepreneurship can play a transitional role by driving economic development in early stages and potentially enabling decoupling through innovation in later stages. Meanwhile, Schumpeterian theory conceptualizes entrepreneurship as a force of creative destruction, where innovative firms disrupt incumbent polluting industries by introducing cleaner, more efficient technologies. However, the actual impact of entrepreneurship on the environment is not uniform and depends heavily on the type, scale, and orientation of entrepreneurial ventures, as well as the institutional, regulatory, and technological environment in which they operate. Theoretical contributions such as those of Ben Youssef et al. (2018) and Omri and Afi (2020) emphasize that while entrepreneurship holds promise for sustainability, this potential is conditional and must be facilitated by enabling institutions, access to green technologies, and complementary human capital.

Empirical evidence on the environmental consequences of entrepreneurship paints a mixed, often context-specific picture. A growing number of studies suggest that in many developing and transitional economies, entrepreneurship is predominantly necessity-driven and concentrated in informal, low-technology, and resource-intensive sectors. Under such conditions, entrepreneurial activity tends to exacerbate environmental degradation, increasing carbon emissions, energy use, and material consumption. For instance, Le et al. (2023) utilize panel data from Asia-Pacific economies to demonstrate that higher rates of new business formation are associated with rising CO₂ emissions and declining environmental performance, unless offset by the adoption of green technologies. These patterns have been reaffirmed in more recent empirical assessments: Omri et al. (2025) find that entrepreneurship significantly deteriorates environmental performance when it is not accompanied by innovation or institutional oversight. Likewise, Chishty et al. (2025) report that increased entrepreneurial activity in middle-income countries is associated with worsening ecological footprints, particularly in regions where startups rely on conventional energy sources and lack incentives to implement environmental standards.

In light of the existing literature, it becomes evident that entrepreneurship, particularly when rooted in polluting sectors or informal economic structures, often has a negative impact on environmental sustainability. Multiple studies highlight a strong association between entrepreneurial activity and increased greenhouse gas emissions, land and water degradation, and unsustainable resource use. This is because many new ventures—particularly in developing contexts—lack access to clean technologies, operate outside regulatory oversight, and prioritize economic survival over ecological responsibility. Even in more structured economies, the proliferation of carbon-intensive start-ups in industries such as transportation, logistics, and construction can raise national emissions. Furthermore, small and medium enterprises (SMEs), which constitute the bulk of entrepreneurial ventures globally, often face financial and technical constraints that limit their ability to adopt sustainable practices. As a result, rather than serving as engines of green transformation, entrepreneurial activities may reinforce environmentally harmful production systems and consumption patterns. Based on this understanding, the following hypothesis is proposed:

2.2 International business and environmental sustainability

The interaction between international business and environmental sustainability has become a critical focal point in the global discourse on sustainable development. Central to this debate is the role of foreign direct investment, which has expanded rapidly across developing and emerging economies over the past few decades. From a theoretical standpoint, the environmental implications of international business can be interpreted through two competing lenses: the PHH and the Porter Hypothesis. The PHH suggests that multinational corporations tend to relocate polluting activities to countries with lax environmental regulations, thereby exacerbating ecological degradation in host nations. This theory suggests that FDI may serve as a channel for transferring environmental burdens to less developed economies, particularly when environmental governance is weak or enforcement is inconsistent. On the contrary, the Porter Hypothesis argues that FDI can enhance environmental quality by transferring cleaner production technologies, promoting environmental innovation, and introducing more stringent corporate standards and best practices. These theoretical perspectives suggest that the environmental outcomes of international business are not predetermined but vary across the regulatory, institutional, and technological environments of the host economy. Nonetheless, a growing body of empirical literature—particularly in the context of developing and transitional economies—points to the prevalence of the PHH as the dominant pattern, where FDI contributes to environmental degradation rather than improvement.

Recent empirical studies provide substantial evidence that international business, especially through FDI inflows, often exacerbates environmental degradation in host countries. Duodu et al. (2021) corroborate this view in their assessment of sub-Saharan Africa, where they observe that FDI inflows are positively associated with CO₂ emissions and environmental degradation, particularly in resource-extractive and industrial sectors. These results suggest that in many low- and middle-income countries, foreign investors are not subject to the same level of environmental scrutiny they face in their home countries, leading to “regulatory arbitrage” and the offshoring of environmentally harmful production. Moreover, Slimani et al. (2024) demonstrate that international capital flows—whether in the form of FDI, portfolio investment, or aid—tend to undermine progress toward environmental targets unless channeled through governance frameworks that prioritize sustainability and transparency. Their findings highlight the growing gap between financial globalization and environmental stewardship, particularly in economies still consolidating their environmental institutions.

Adding further depth to this empirical narrative, Uche et al. (2023) investigate the role of technological innovation in mediating the relationship between FDI and the environment. Their analysis, focused on developing and emerging economies, shows that while FDI has the potential to improve environmental outcomes via the transfer of green technologies, this effect is rarely realized in practice. In most cases, the absence of absorptive capacity, limited investment in local R&D, and weak enforcement of environmental standards diminish the potential for positive spillovers. Instead of fostering innovation, foreign firms often replicate existing polluting processes in the host country to minimize costs and maximize short-term returns. Even when cleaner technologies are introduced, their environmental benefits may be neutralized by the scale effects of increased production and resource use. Furthermore, the structural composition of FDI matters: investments concentrated in energy-intensive sectors such as manufacturing, mining, and heavy industry are more likely to exacerbate environmental harm. This is especially true in economies where the cost of environmental degradation is externalized and not reflected in market prices. As highlighted in the recent literature, the overwhelming trend remains one in which international business, rather than acting as a conduit for sustainability, perpetuates unsustainable growth models reliant on fossil fuels, natural resource extraction, and unregulated industrial expansion.

Taken together, these studies consistently show that international business—when detached from robust regulatory systems, effective environmental governance, and innovative policies—tends to generate more environmental harm than benefit. Rather than contributing to a sustainable development trajectory, FDI frequently exacerbates the ecological vulnerabilities of host countries, particularly in the Global South. The transfer of capital, technology, and production capacity does not automatically translate into improved environmental outcomes; instead, it often results in intensified carbon emissions, deforestation, biodiversity loss, and water and air pollution. These findings challenge the optimistic assumption that globalization and international capital flows inherently facilitate environmental modernization. On the contrary, they emphasize the importance of aligning international business strategies with the host country’s environmental objectives and regulations. Absent this alignment, FDI serves as a mechanism for exporting environmental externalities and amplifying global ecological imbalances.

2.3 Moderating roles: green and innovation technologies

Recent literature highlights the increasingly vital role of innovation in moderating the environmental effects of economic activity, particularly through two distinct but complementary channels: green technologies and technological innovation. Theoretically, these moderating effects are best understood through the lens of the EMT and Endogenous Growth Theory. EMT posits that technological advancements, when integrated with institutional and policy frameworks, can decouple economic growth from environmental degradation. Under this framework, innovations that prioritize environmental objectives—such as green technologies, clean energy systems, and circular production models—are viewed as tools to enhance environmental sustainability without compromising competitiveness (Uche et al., 2023; Du et al., 2019). Meanwhile, Endogenous Growth Theory emphasizes the role of technological progress as an internal engine of economic transformation, whereby productivity gains and innovation spur long-term development. In this context, both green and general-purpose technologies can alter the trajectory of growth and its environmental footprint (Khan et al., 2025; Raihan and Tuspekova, 2022). Taken together, these frameworks support the hypothesis that innovation—whether explicitly green or broadly technological—can significantly moderate the negative externalities associated with entrepreneurship and international business by introducing efficiency gains, cleaner production processes, and systemic sustainability improvements.

Empirical studies consistently show that green technologies play a moderating role in mitigating the environmental costs of entrepreneurship and FDI. For example, Uche et al. (2023) demonstrate that while FDI alone is often associated with rising CO₂ emissions in developing countries, its environmental footprint can be significantly reduced when accompanied by investments in green technologies. The moderating role of green technologies is also validated by Albitar et al. (2023), who show that business environmental innovation significantly reduces the carbon footprint of corporate operations in both developed and emerging markets. In the context of entrepreneurship, Wen et al. (2022) and Singh et al. (2023) provide robust evidence that the adoption of eco-technology enhances environmental performance by enabling resource-efficient operations and the deployment of clean technology, particularly among small and medium-sized enterprises. In other words, while entrepreneurial activity may initially drive environmental degradation due to scale and intensity effects, its negative externalities can be alleviated or reversed when green technologies are present. The effectiveness of this moderation depends not only on the volume of green technologies adopted but also on their diffusion and integration across economic sectors.

Parallel to the moderating role of green technologies, technological innovation also emerges as a powerful instrument for enhancing environmental outcomes associated with economic activities (Abban et al., 2025; Hassan and Khan, 2025). Unlike green technologies, which are explicitly environmental in their intent, technological innovation encompasses a broader set of advancements, including digitalization, automation, and process improvements, many of which can produce indirect environmental benefits. According to Khan et al. (2025), technological innovation contributes to sustainable growth by increasing energy efficiency and enabling the development of low-carbon technologies. Raihan and Tuspekova (2022) report similar findings for Kazakhstan, where technological innovation is shown to drive down CO₂ intensity in both production and consumption. Importantly, Ben Youssef (2020) distinguishes between resident and non-resident patents, concluding that local innovation ecosystems are critical for translating foreign technologies into sustainable outcomes. In the entrepreneurship–environment relationship, technological innovation moderates the harmful impact of new ventures by reducing their reliance on polluting inputs and increasing their access to environmentally sound business models. Singh et al. (2023) emphasize that technological innovation enhances entrepreneurial adaptation to environmental regulations, improves environmental reporting, and fosters low-impact business strategies. In the case of FDI, innovation enables foreign firms to adopt international environmental standards more quickly, particularly in countries with stringent regulatory systems. As shown by Ali et al. (2022), the integration of innovation capacity in FDI-receiving economies is essential for achieving environmental co-benefits and minimizing carbon leakage. Therefore, while entrepreneurship and international business may exert baseline pressure on ecological systems, technological innovation plays a crucial buffering role by increasing the sustainability returns on investment and reducing the marginal environmental cost of economic expansion.

Recent studies also suggest that the joint presence of green and technological innovation creates a synergistic environment that amplifies sustainability outcomes. For instance, Albitar et al. (2023) argue that green technologies are most effective when supported by a broad-based innovation infrastructure that includes R&D investment, digital capacity, and skill development. Similarly, Omri et al. (2025) show that environmental sustainability in G7 countries improves significantly when green finance, green technologies, and general-purpose technological advancements are implemented together. Their findings highlight the need for co-evolution between innovation systems: green technologies provide direct environmental benefits, while technological innovation offers the enabling conditions—such as data analytics, automation, and intelligent monitoring—that increase the efficiency and scalability of green solutions. This interplay is echoed by Singh et al. (2023), who emphasize the interaction between innovation and finance, where financial inclusion strengthens the effectiveness of innovation in achieving sustainability goals. In sum, the literature confirms that innovation does not merely operate as a background condition but functions as a moderating mechanism—capable of transforming the environmental impact of entrepreneurship and international business from negative to neutral or even positive, depending on the depth and direction of innovation uptake.

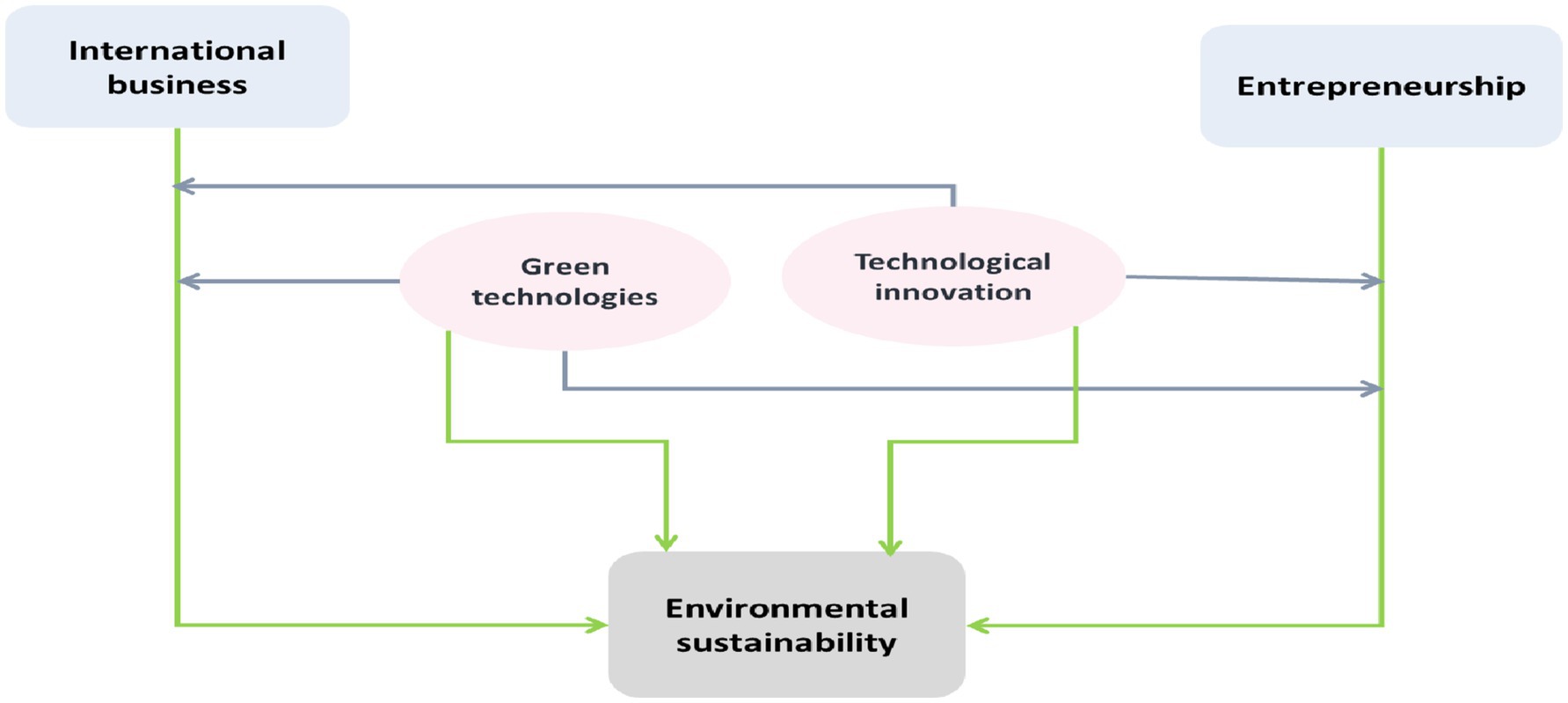

Despite increasing evidence on the moderating roles of green and technological innovation, the literature remains fragmented. Most studies examine the effects of entrepreneurship, international business, or innovation in isolation, overlooking how these forces interact to influence environmental outcomes. Green technologies are often analyzed for their direct environmental benefits, while their potential to offset the environmental costs of economic activity is less understood. Similarly, technological innovation is typically linked to productivity gains rather than sustainability moderation. These gaps limit our understanding of the mechanisms through which entrepreneurship and international business can effectively balance the sustainability trilemma. To address these limitations, this study proposes a conceptual model (Figure 1) that positions entrepreneurship and international business as independent variables influencing sustainable development (the dependent variable). At the same time, green and technological innovation serve as moderating variables. As shown in Figure 1, the framework captures the conditional interactions among these elements in shaping environmental outcomes. By empirically testing these relationships, the study aims to uncover the pathways through which entrepreneurship and international business can collectively contribute to sustainable development in resource-constrained settings.

3 Methodology and data

3.1 Data description

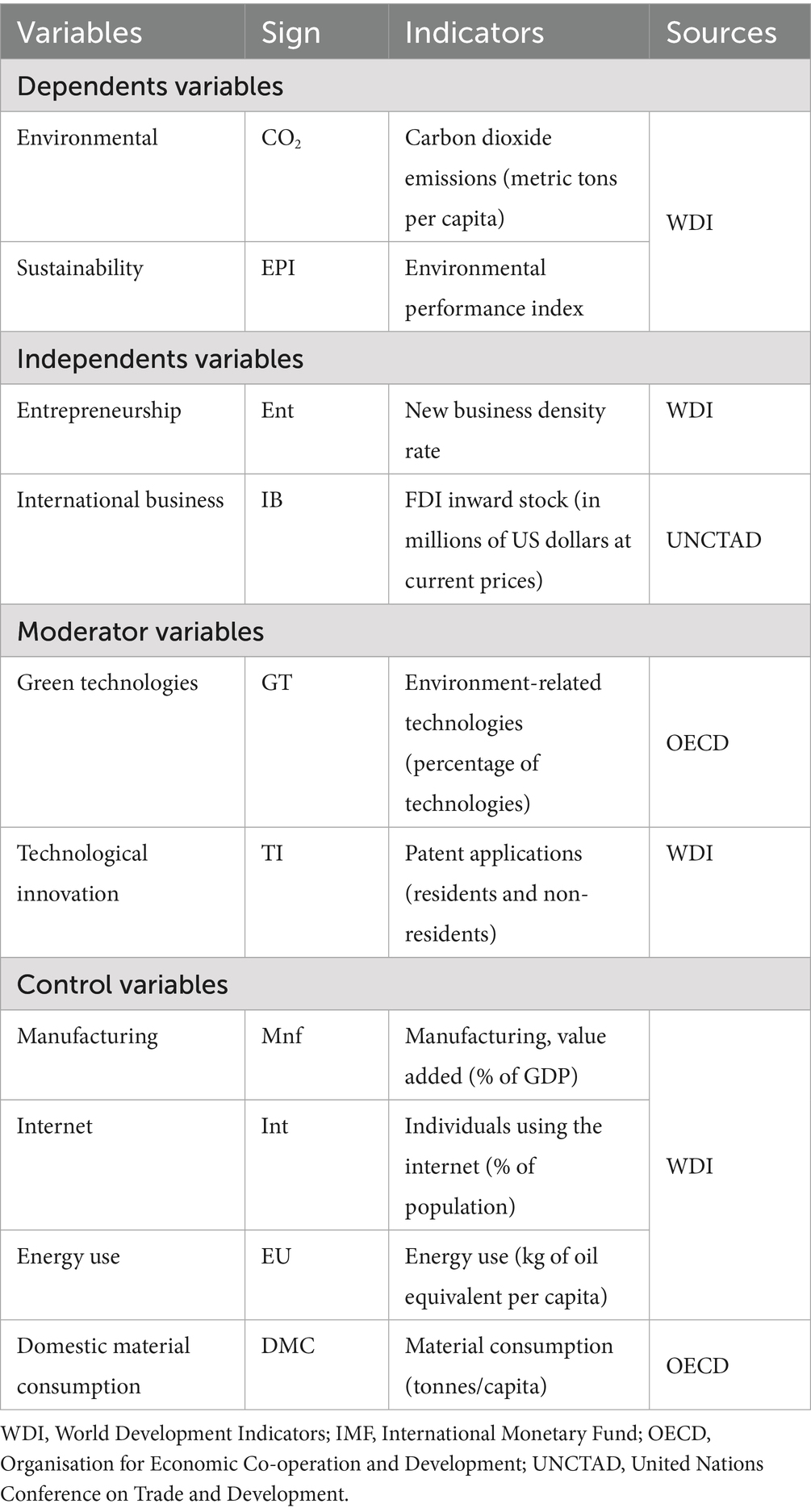

This research examines the influence of international business and entrepreneurship on environmental sustainability in Saudi Arabia, with a focus on green and innovative technologies, utilizing data from 2000 to 2022. The availability of reliable data restricts the timeframe that can be chosen. The dataset includes environmental sustainability as the dependent variable, entrepreneurial activity and international business as the independent variables, and green technologies and technological innovation as moderating variables, along with control variables such as energy use, manufacturing, domestic material consumption, and internet usage. Detailed definitions and sources of these variables are provided in Table 1.

3.1.1 Dependent variable

Environmental sustainability is measured using two indicators: per capita CO2 emissions and the Environmental Performance Index (EPI). Per capita CO2 emissions, expressed in metric tons per person, are obtained from the World Bank’s databases. The EPI, developed by Yale and Columbia Universities, evaluates environmental performance through criteria such as air quality, water management, and climate change mitigation, with higher scores indicating greater sustainability. EPI data are sourced from biennial reports published by Yale and Columbia. These indicators are widely validated in the literature, notably by Hundie et al. (2025), Omri et al. (2022), Aldieri et al. (2024), Albitar et al. (2023), Zhang and Wu (2022), Zeng and Ren (2022), and Alfehaid et al. (2024), confirming their relevance for assessing environmental sustainability.

3.1.2 Independent variables

3.1.2.1 Independent variables of interest

• Entrepreneurial activity is evaluated using the new business density rate, defined as the number of newly registered businesses per 1,000 individuals of working age (15–64 years). The data are derived from the World Development Indicators (WDI). This indicator has been used by several authors to assess the impact of entrepreneurship on environmental sustainability, notably Le et al. (2023), Omri (2018), Omri and Afi (2020), Khezri et al. (2024), Altwaijri et al. (2024), Nakamura and Managi (2020), and Ben Youssef et al. (2018). Based on these studies, a positive effect of entrepreneurial activity on environmental sustainability is expected, particularly through reductions in CO2 emissions and improvements in Environmental Performance Index (EPI) scores. By adopting this indicator, our study aligns with the existing literature to examine how entrepreneurial activity, as the primary driver, influences environmental sustainability in the Saudi context.

• International business is included as the second key independent variable, measured by FDI inward stock in millions of US dollars at current prices, with data obtained from the United Nations Conference on Trade and Development (UNCTAD). This indicator measures the cumulative value of foreign investments in Saudi Arabia, reflecting their impact on environmental sustainability. The use of FDI inward stock as a proxy is consistent with prior research, including Bokpin (2017), Duodu et al. (2021), Ali et al. (2022), Tsoy and Heshmati (2024), Slimani et al. (2024), and Zeng et al. (2024). A positive or negative sign is expected depending on whether FDI promotes sustainable practices or exacerbates environmental degradation.

3.1.2.2 Moderator variables

• Green technologies are proxied by the ratio of environment-related inventions to all domestic inventions across all technologies, are sourced from OECD data, and serve as a moderating variable in the relationships between international business and environmental sustainability, as well as between entrepreneurship and environmental sustainability. This indicator reflects the extent of environment-focused technological advancements, capturing their potential to enhance sustainable outcomes by facilitating eco-friendly practices. This measure is consistent with prior studies, including Du et al. (2019); Abid et al. (2022); Wen et al. (2022); Ali et al. (2022); Uche et al. (2023); Singh et al. (2023); Zeng et al. (2024); and Chishty et al. (2025). Based on the existing literature, a positive moderating effect is expected, as green innovation may amplify the environmental benefits of international business and entrepreneurial activities when aligned with sustainable technologies.

• Technological innovation, as a moderating variable, is measured by patent applications of residents and non-residents and derived from WDI data. This measure has been used in previous research, including Saqib (2022), Raihan and Tuspekova (2022), Kayani et al. (2024), and Khan et al. (2025). This indicator measures the extent of innovative activity in Saudi Arabia, reflecting advancements that could impact environmental sustainability. A positive moderating effect is anticipated, as technological innovation can enhance the environmental benefits of international business and entrepreneurial activities by promoting eco-efficient technologies.

3.1.3 Control variables

To account for factors influencing environmental sustainability beyond the primary independent and moderating variables, this study includes several control variables. Manufacturing is measured as value added (% of GDP). ICT use is represented by the percentage of individuals using the Internet (% of population). Energy use is quantified as kg of oil equivalent per capita. These three variables are sourced from WDI. Domestic material consumption, measured as tonnes per capita from OECD data. These variables are expected to have varying impacts on environmental sustainability, with higher manufacturing and energy use potentially exerting negative effects, while ICT use may have a positive influence through efficiency gains (Siripi et al., 2024; Kayani et al., 2024; Usman et al., 2022; Alola et al., 2021; Khan et al., 2022, and Raihan et al., 2022).

3.2 Model specification and research method

3.2.1 Model specifications

This study adopts a dynamic regression framework to investigate the relationship between entrepreneurial activity and environmental sustainability in Saudi Arabia. In particular, it examines how this relationship is influenced by green technologies and technological innovation, which are introduced as moderating variables. To account for these moderating effects, interaction terms between entrepreneurial activity and each moderator are included in the model. Additionally, the analysis controls for key variables, including manufacturing activity, internet access, energy consumption, and domestic material consumption. The empirical model is specified as follows:

Equations 1, 2 were transformed into logarithmic formats for the econometric analysis. This adjustment enables the coefficients to be interpreted as elasticities, providing a clearer understanding of the relationships between variables. Furthermore, it helps reduce the impact of outliers by stabilizing the data’s variance. The transformed equations are presented below as Equations 3, 4:

Where ES represents CO2 emissions and the EPI, X includes entrepreneurship and international business, GT denotes green technologies, TI represents technological innovation, and Z is a vector of control variables.

To analyse the indirect impact of entrepreneurship and international business in combination with green technologies (GT) and technological innovation (TI) on environmental sustainability, Equations 3, 4 were extended with interaction terms between GI and X, and between TI and X. These augmented models, shown in Equations 5, 6, capture the complementary effects of these variables:

3.2.2 Estimation methods

To estimate the long-run relationship between entrepreneurial activity and environmental sustainability, this study employs the Fully Modified Ordinary Least Squares (FMOLS) method developed by Phillips and Hansen (1990). FMOLS is particularly advantageous in contexts where the variables are integrated of order one [I(1)] and exhibit cointegration, as it produces asymptotically unbiased and efficient parameter estimates even in the presence of endogeneity and serial correlation. Traditional OLS estimators often yield biased and inconsistent results in such settings because they fail to account for the feedback between regressors and the error term, as well as for dynamic persistence in the residuals. The FMOLS approach addresses these issues by applying semi-parametric corrections to both the error term and the regressors, thereby controlling for serial correlation and simultaneity, which ensures that the estimated coefficients reflect true long-run equilibrium relationships rather than spurious associations driven by common stochastic trends. Moreover, FMOLS adjusts for potential heteroskedasticity in the data, making it robust across a wide range of empirical conditions. Another strength of FMOLS is its applicability in panel data frameworks, where it effectively accounts for cross-sectional dependence and heterogeneity across units. Given the multi-country and multi-period dimension of our dataset, these features are critical for ensuring that the estimated coefficients capture consistent long-run effects while allowing for country-specific dynamics. To further strengthen the validity of our results, we conducted unit root and cointegration tests before estimation, confirming that the assumptions underlying FMOLS are satisfied. In addition to FMOLS, we employed the Dynamic Ordinary Least Squares (DOLS) estimator as a robustness check, since DOLS extends traditional cointegration analysis by incorporating leads and lags of the differenced regressors, thereby addressing potential endogeneity and small-sample bias more directly. The robustness results obtained with the DOLS method generally confirm the conclusions from the FMOLS estimates, while adding nuances to the magnitude and significance of the coefficients. This dual-estimation strategy strengthens the credibility of the findings, as the consistency across both methods reinforces confidence in the identified long-run relationships. By employing both FMOLS and DOLS, this study ensures that the empirical strategy is rigorous, transparent, and replicable, with each step of the estimation process thoroughly documented, including pre-testing procedures, lag-length selection, and robustness checks. This enhances the reliability of the results and provides a comprehensive framework for future replication studies.

4 Empirical results

4.1 Descriptive statistics and correlation

The descriptive statistics provide an overview of the main characteristics of the variables used in this study over the period 2000–2022 in Saudi Arabia (see Appendix table A). Carbon dioxide emissions per capita (CO₂) have a mean value of 8.705, with a minimum of 8.491 and a maximum of 8.859, indicating relative stability in emission levels. The EPI shows a mean of 1.778, ranging from 1.579 to 1.837, with low dispersion, suggesting a relatively consistent environmental performance. The new business density rate, which reflects entrepreneurial activity, has a mean of 0.462, with a minimum of 0.208 and a maximum of 0.898, highlighting considerable variability over time. Inward foreign direct investment stock (IB), representing international business, averages 4.981, with values ranging from 4.238 to 5.430, indicating notable changes in the country’s investment attractiveness. Green technologies (GT), measured by the share of environment-related technologies, have a mean of 1.809 and a wide range of 0.580 to 3.190, reflecting uneven progress in sustainable technological development. Technological innovation, as proxied by patent applications, has a mean of 3.119, with values ranging from 2.678 to 3.600, indicating a gradual increase in research and development efforts. Internet usage shows significant variability, with a mean of 1.506, a minimum of 0.344, and a maximum of 2.000, indicating progressive but uneven digital adoption. The manufacturing value added has a mean of 1.044, with a range of 0.965 to 1.159. Energy use per capita has a mean of 3.857, a minimum of 3.803, and a maximum of 3.902. Finally, domestic material consumption has a mean of 2.822, a minimum of 2.551, and a maximum of 2.960, indicating moderate and stable resource use.

The correlation matrix reveals several key relationships among the variables under study (see Appendix table B). Environmental sustainability, as represented by the EPI, is negatively correlated with carbon dioxide emissions (−0.5072), indicating that higher emissions are associated with lower environmental performance. A stronger negative correlation is observed between EPI and entrepreneurship (−0.6656), suggesting that entrepreneurial activity in Saudi Arabia may currently contribute to environmental degradation rather than improvement. Additionally, EPI is negatively correlated with technological innovation (−0.7162) and manufacturing (−0.6705), reinforcing the idea that economic and industrial expansion may not yet be aligned with sustainability goals. Green technologies are positively associated with EPI (0.3702), underlining their potential as a supportive factor for environmental sustainability. However, green technologies show negative correlations with entrepreneurship (−0.3091), international business (−0.3229), and carbon emissions (−0.2405), which may reflect a lack of integration of green technologies into core economic and business activities. Strong positive correlations are also observed between entrepreneurship and technological innovation (r = 0.5416) and between entrepreneurship and carbon emissions (r = 0.7314), indicating a growth-driven model where increased entrepreneurial activity and innovation are closely tied to environmental costs. Furthermore, energy use (0.7255) and domestic material consumption (0.6737) are highly correlated with carbon emissions, emphasizing the environmental burden of resource-intensive practices.

4.2 Unit root tests and cointegration

4.2.1 Unit root tests

Before analyzing the long-term relationships between variables, it is essential to confirm their integration order using unit root tests. This study uses the Augmented Dickey–Fuller (ADF) test, introduced by Dickey and Fuller (1979), and the Phillips–Perron (PP) test, developed by Phillips and Perron (1988), both of which are widely used to assess the stationarity of time series data. The ADF test enhances the original Dickey-Fuller approach by including additional lags of the dependent variable to address residual autocorrelation and by testing for a unit root via the coefficient on the lagged term in an extended regression model. The PP test, on the other hand, employs a non-parametric approach to address autocorrelation and heteroskedasticity in the errors, without requiring the addition of lag terms, thereby making it more flexible under certain conditions. The joint application of these two tests ensures the robustness of the results, confirming that all variables are integrated of order one [I(1)], a prerequisite for estimation using the FMOLS method.

The outcomes of the ADF and PP unit root tests are shown in Appendix table C. At their original levels, all series appear non-stationary, with test statistics falling below the 1%, 5%, or 10% critical values, failing to reject the null of a unit root. After first differencing, both tests indicate that all variables are stationary, as the test statistics at this stage are well below the critical values, supporting the rejection of the unit root null in favor of stationarity. This indicates that all variables are integrated of order one, I(1), fulfilling a key requirement for applying the FMOLS method to estimate long-run relationships.

4.2.2 Johansen cointegration test

The Johansen test is utilized to confirm the presence of a stable long-term equilibrium among the examined variables. This method, developed by Johansen (1988), determines the number of cointegrating vectors in a system of non-stationary variables that are integrated of order one, I(1). Unlike the Engle-Granger cointegration test, which is restricted to two variables, the Johansen test employs a vector error correction model (VECM) to analyze multiple long-term relationships simultaneously. Two key statistics are applied: the trace test, which assesses the maximum eigenvalue statistic, and the maximum eigenvalue test, which evaluates the number of cointegrating vectors against the alternative of more than r vectors. If the test statistics surpass the critical values at conventional significance levels (1, 5%), the null hypothesis is rejected, suggesting the existence of one or more cointegrating relationships.

The Johansen cointegration test results are detailed in Appendix table D, based on both the trace and maximum eigenvalue test statistics. According to this table, the null hypothesis of no cointegration vector (r = 0) is rejected at the 5% significance level, as the observed statistic exceeds the critical value at this threshold, with the associated probability very low (below 0.05). This indicates that the null hypothesis of no cointegration is rejected in all cases. These results confirm the existence of at least one stable long-term relationship between the variables considered.

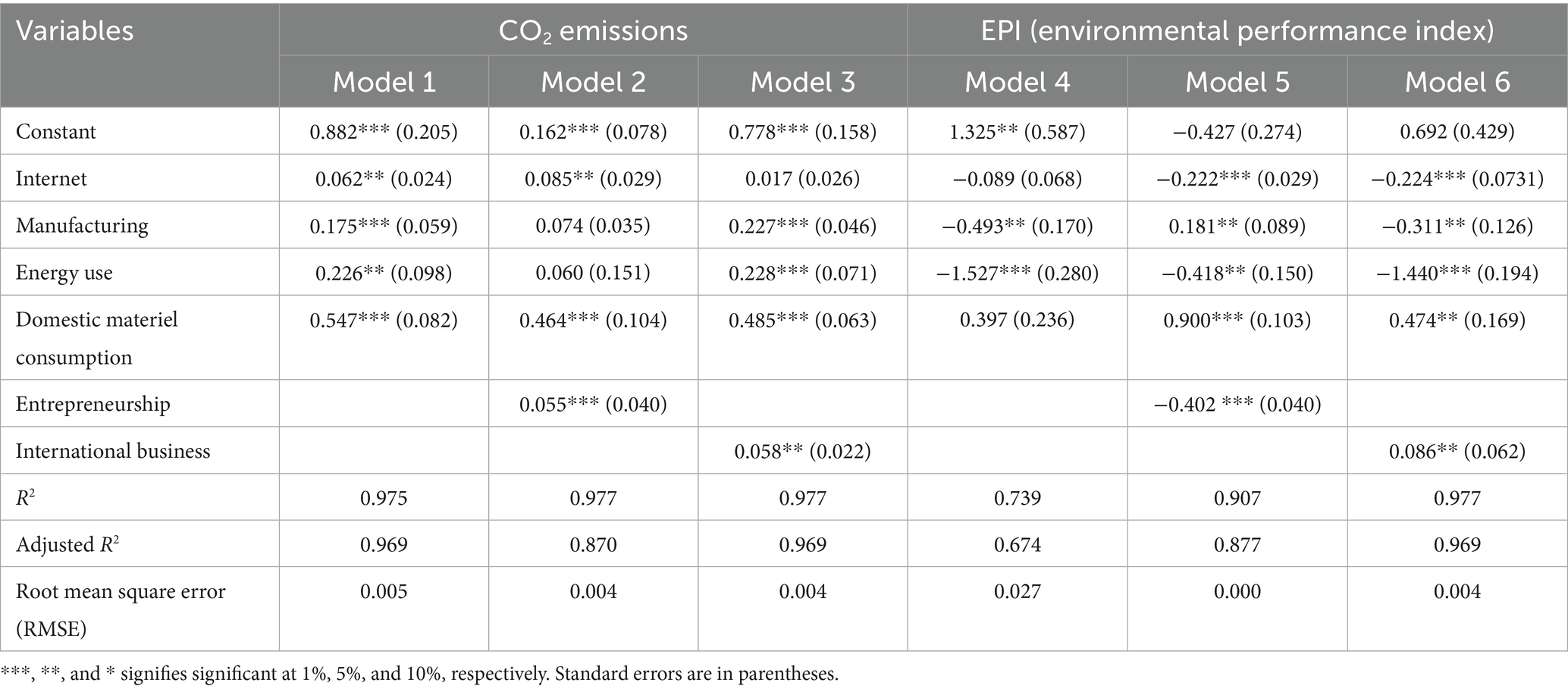

4.3 Conditional and unconditional effects of entrepreneurship and international business on environmental sustainability

Table 2 presents the results of the Fully Modified Ordinary Least Squares (FMOLS) method, which examines the effects of entrepreneurship and international business on environmental sustainability in Saudi Arabia over the period 2000–2022. Two indicators were used as dependent variables: CO₂ emissions and EPI, allowing us to capture both the direct environmental impact (pollution) and the overall environmental quality (policies, resources, health, etc.). Models (1) to (3) focus on CO₂ emissions. First, control variables such as internet use, the share of the manufacturing sector, energy consumption, and domestic demand all have a significant positive effect on emissions, indicating that the growth model remains heavily reliant on carbon. Regarding the main variables, Model (2) reveals that entrepreneurship has a positive and statistically significant effect (coefficient = 0.055, p < 1%) on CO₂ emissions, suggesting that current entrepreneurial activities contribute to increased pollution. This result can be attributed to the prevalence of entrepreneurship in unsustainable or poorly regulated sectors. Similarly, Model (3) shows that international business also has a significant positive effect (0.058, p < 5%) on emissions, which may reflect a scale effect, specialization in polluting industries, or a lack of environmental standards in trade practices.

Models (4–6), then explore the effect of the same variables on EPI. Here, the results are more mixed. Entrepreneurship (Model 5) has a highly significant negative effect (−0.402, p < 1%), confirming the idea that entrepreneurial activities in Saudi Arabia, as currently implemented, negatively affect overall environmental quality. In contrast, international business (Model 6) exhibits a positive and statistically significant effect (0.086, p < 0.05) on the EPI. This result can be interpreted as evidence that trade openness facilitates access to cleaner technologies, promotes the diffusion of international environmental standards, and enhances ecological governance through reputation effects or regulatory compliance. Finally, the high adjusted R2 values (ranging from 0.87 to 0.97 across models) and the low Root Mean Squared Errors (RMSEs) confirm the robustness of the estimates. These results confirm our first and second hypotheses, namely that entrepreneurship and international business, as currently practiced in Saudi Arabia, do not fully contribute to environmental sustainability, except in specific cases. Indeed, the FMOLS results show that entrepreneurship has a significant negative effect on environmental quality, as measured by the EPI, and a significant positive effect on CO₂ emissions, suggesting a generally unfavorable environmental impact.

These findings align with those of Omri and Afi (2020), who argue that in low- and middle-income countries, entrepreneurship—especially necessity-driven or informal—often generates pollution because it is concentrated in sectors with weak regulation. This conclusion is further supported by Le et al. (2023), who show that the environmental impact of entrepreneurship varies by income level, with more negative effects observed in middle-income countries such as Saudi Arabia. Moreover, Khezri et al. (2024) highlight the differentiated impact of various entrepreneurial indicators, showing that unchecked growth in entrepreneurship can increase the carbon footprint unless accompanied by targeted support policies (taxation, bureaucracy, social norms). This suggests that in Saudi Arabia, a shift toward opportunity-driven entrepreneurship (Altwaijri et al., 2024) and better integration with education and ICT could help reverse this trend.

Regarding the effect of international business, the results are more ambivalent. On one hand, it has a positive impact on CO₂ emissions, which could be interpreted as a scale effect or a shift toward polluting industries, in line with the findings of Bokpin (2017) and Duodu et al. (2021) in Africa. On the other hand, its positive effect on the EPI suggests that international business supports, in the long term, the diffusion of clean technologies and alignment with international environmental standards. These results indicate that international business can simultaneously increase CO₂ emissions while also improving the EPI, as these two indicators capture different aspects of environmental sustainability.

On the one hand, greater FDI and international trade often stimulate industrial activity, urbanization, and energy consumption in host countries. In resource- and energy-intensive economies, such as Saudi Arabia, this typically leads to higher fossil fuel use and, consequently, rising CO₂ emissions. Multinational enterprises in heavy industries, transport, and construction frequently rely on carbon-intensive processes, particularly in contexts where renewable energy penetration remains limited. On the other hand, the EPI is a comprehensive index that encompasses multiple dimensions of environmental performance, including air and water quality, waste management, biodiversity protection, and environmental health. International business may improve these areas even while CO₂ emissions rise. For instance, multinational firms often introduce stricter environmental management practices, advanced waste treatment technologies, and cleaner production methods that reduce local pollutants (e.g., sulfur dioxide, particulates, and chemical waste) and enhance regulatory compliance. These improvements boost a country’s EPI score, even if carbon emissions remain high or continue to grow. The broader organizational and behavioral spillovers associated with international business also matter: exposure to global standards and cross-border practices encourages firms and employees to adopt greener behaviors and knowledge systems. Recent studies emphasize the role of workplace learning, leadership, and pro-environmental behavior in driving such outcomes, showing that international engagement can indirectly promote environmental improvements through employees’ voluntary green actions (Mehmood et al., 2024) and through managerial practices that foster green creative behavior and knowledge sharing (Cai et al., 2024). In the Saudi Arabian context, this paradox reflects the dual role of international business under Vision 2030. Increased FDI has expanded industrial output and energy demand, thereby raising CO₂ emissions. At the same time, FDI has supported investments in renewable energy projects, waste recycling, water efficiency, and environmental governance reforms — all of which are captured positively in the EPI. Thus, while CO₂ emissions measure the narrow but critical dimension of carbon intensity, the EPI reflects broader ecological management, allowing both indicators to move in different directions.

This study does not limit itself to examining the direct (or unconditional) impact of entrepreneurship and international business on environmental sustainability; it also explores their conditional effects by introducing two key moderating variables: green technologies and technological innovation. This analytical approach enables the assessment of the extent to which these technologies can enhance or mitigate the impact of entrepreneurship and international business on two environmental indicators: CO₂ emissions and EPI. Based on methodological frameworks developed by Tchamyou (2019), Omri et al. (2025), and Slimani et al. (2024), the study calculates net effects that incorporate both the marginal effects of the moderating variables and their interactions with key economic variables. Regarding CO₂ emissions, a negative net effect indicates that entrepreneurship or international business has a favorable (reducing) impact on the environment, while a positive net effect indicates a weakening or reversal of this effect. For the EPI, the interpretation is reversed: a positive net effect reflects improved environmental performance, while a negative net effect suggests a weakening or contradiction of the expected impact. The analysis of net effects helps determine the extent to which green technologies enhance or reduce the environmental impact of economic activities.

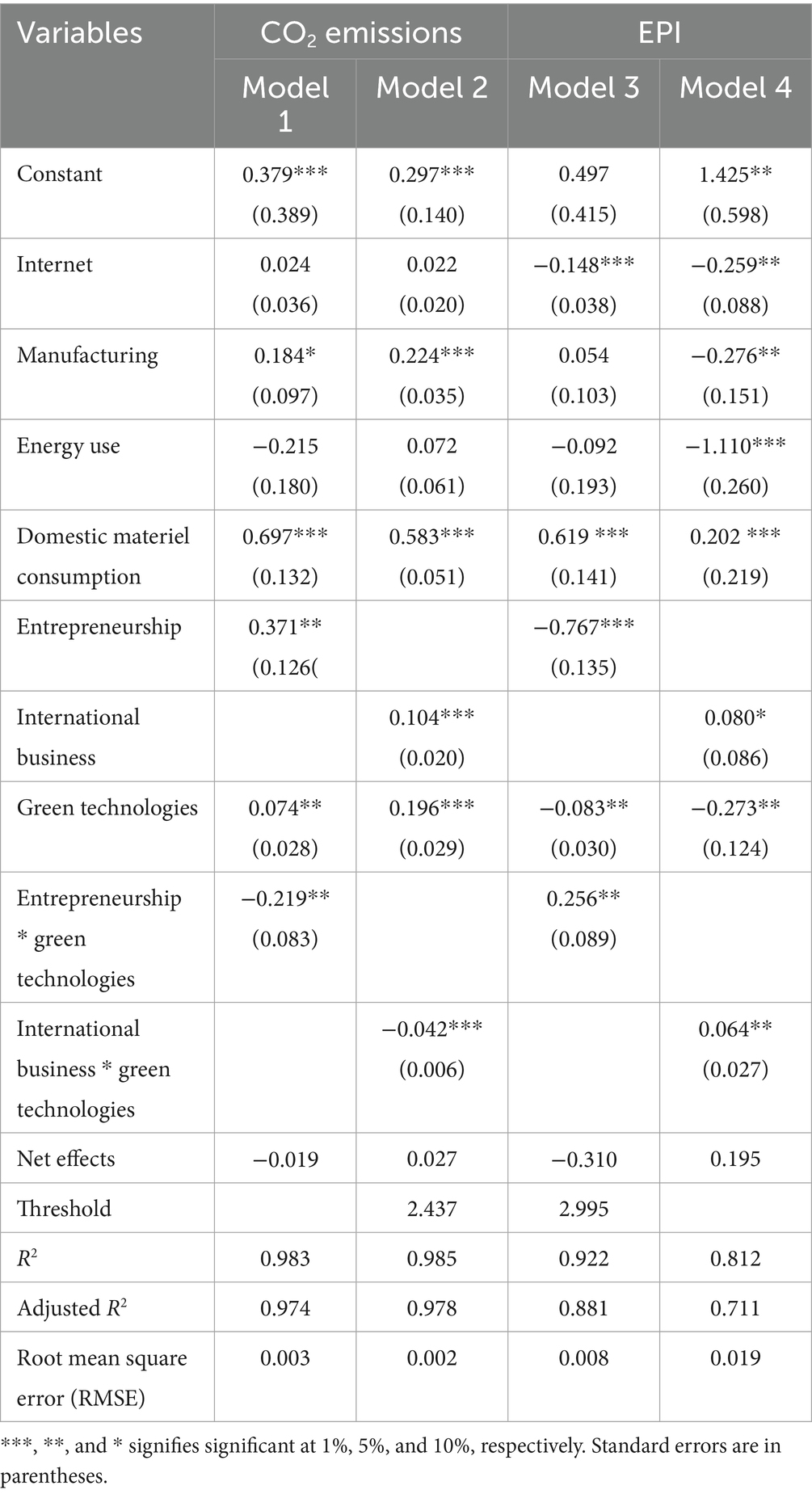

Table 3 presents the FMOLS estimation results examining the moderating role of green technologies in the relationships among economic variables, entrepreneurship, international business, and environmental sustainability. Specifically, Models (1) and (3) analyze the interaction between entrepreneurship and green technologies on CO₂ emissions and the EPI, while Models (2) and (4) assess the interaction between international business and green technologies on the same indicators. In Model (1), the net effect of the interaction between entrepreneurship and green technologies on CO₂ emissions is negative (−0.019), suggesting that green technologies enhance the beneficial impact of entrepreneurship by reducing pollution. This net effect was calculated as follows: (−0.219 × 1.785) + 0.371, where −0.219 represents the interaction coefficient (marginal effect of green technologies), 1.785 represents the average value of green technologies, and 0.371 represents the direct effect of entrepreneurship. This result highlights the positive moderating role of green technologies, which strengthen the favorable impact of entrepreneurial activity on environmental sustainability. Entrepreneurship becomes more environmentally friendly as green technologies are integrated. In Model (2), which examines the interaction between international business and green technologies regarding CO₂ emissions, the net effect is positive (0.0278). This suggests that although green technologies help mitigate the polluting effects of international business, this impact is only partially offset. The moderating effect exists, but it is insufficient to fully reverse the negative environmental consequences. This could result from the incomplete adoption of green technologies in sectors most affected by globalization, or from the persistence of a carbon-intensive business model. In this model, the calculated threshold is 2.437 = 0.3714/0.219, which represents the minimum level of green technologies required for entrepreneurship to begin having a reducing effect on CO₂ emissions. For this threshold to be economically meaningful, it must lie within the statistical range reported in the descriptive statistics. In this case, the threshold is politically relevant, as the range for green technologies is from 0.580 to 3.190. The threshold confirms that a level of green technologies below 2.437 is not sufficient for entrepreneurship to contribute positively to environmental sustainability, indicating that although Saudi Arabia has recently scaled up investments in green and digital technologies under Vision 2030, many industries—particularly petrochemicals, heavy manufacturing, and transport—remain highly dependent on fossil fuels.

Table 3. Effects of entrepreneurship, international business, and green technologies on environmental sustainability.

The threshold of 2.437 indicates that unless Saudi Arabia accelerates the diffusion and adoption of green technologies across these key sectors, the environmental impact of international business will remain harmful. In practical terms, this means that policy efforts should not only encourage foreign investment but also ensure that such investment is tied to the transfer of cleaner technologies, stricter environmental compliance, and sector-wide upgrading. The threshold, therefore, highlights a critical tipping point: below it, international business exacerbates CO₂ emissions; above it, international business could become a channel for sustainability transformation. This reinforces the urgency for Saudi policymakers to strengthen regulatory frameworks, expand incentives for green technology adoption, and prioritize sustainability criteria in FDI projects to ensure that globalization aligns with the Kingdom’s climate and development goals.

In Model (3), focusing on the EPI, the net effect of the interaction between entrepreneurship and green technologies is negative (−0.310). In this analysis, a negative net effect on the EPI indicates a weakening or a contradiction of the expected moderating role of green technologies. This means that, in their current state of diffusion or usage, green technologies do not enhance the positive environmental effects of entrepreneurship. On the contrary, they appear to limit or partially reverse this impact. This result may be attributed to the fragmented, inefficient, or misdirected use of green technologies in entrepreneurial sectors.

The estimated efficiency threshold of 2.995 suggests that green technologies can fully contribute to improving the EPI only when their adoption surpasses this level. Below this threshold, even entrepreneurship that incorporates “green” elements is insufficient to generate meaningful environmental gains, as the scale of adoption remains too limited to offset entrenched carbon-intensive practices. In the Saudi context, this finding is highly relevant. While the Kingdom has taken significant steps toward expanding renewable energy capacity, promoting smart cities, and fostering eco-innovation through Vision 2030, the adoption of green technologies across industries remains uneven. Key sectors such as energy, construction, and transportation remain dominated by conventional, resource-intensive practices, which restrict the ability of entrepreneurship to translate into measurable EPI improvements. The threshold of 2.995 underscores the necessity for Saudi Arabia to accelerate the pace and breadth of green technology adoption. It highlights that incremental or small-scale efforts are unlikely to produce significant progress; instead, widespread deployment and integration of advanced technologies are required to push the country past this critical tipping point. Once adoption levels exceed the threshold, entrepreneurial activity can effectively leverage innovation to improve environmental performance in line with Saudi Arabia’s international climate commitments and national sustainability objectives. This reinforces the policy priority of linking entrepreneurial support programs and foreign investment incentives directly to green innovation, ensuring that entrepreneurial ecosystems evolve in tandem with ambitious environmental targets.

Finally, in Model (4), the analysis examines the moderating effect of green technologies in the relationship between international business and environmental performance as measured by the EPI. The interaction is positive and significant, with a net effect of 0.195. In the context of the EPI, a positive net effect indicates a reinforcement of the positive impact of green technologies on environmental performance. In other words, the greater the level of international business activity and the greener the technologies are integrated, the greater the improvement in overall environmental quality. This finding suggests that international business, often seen as a source of environmental degradation, can become a driver of sustainability, provided it is accompanied by adequate adoption of green technologies.

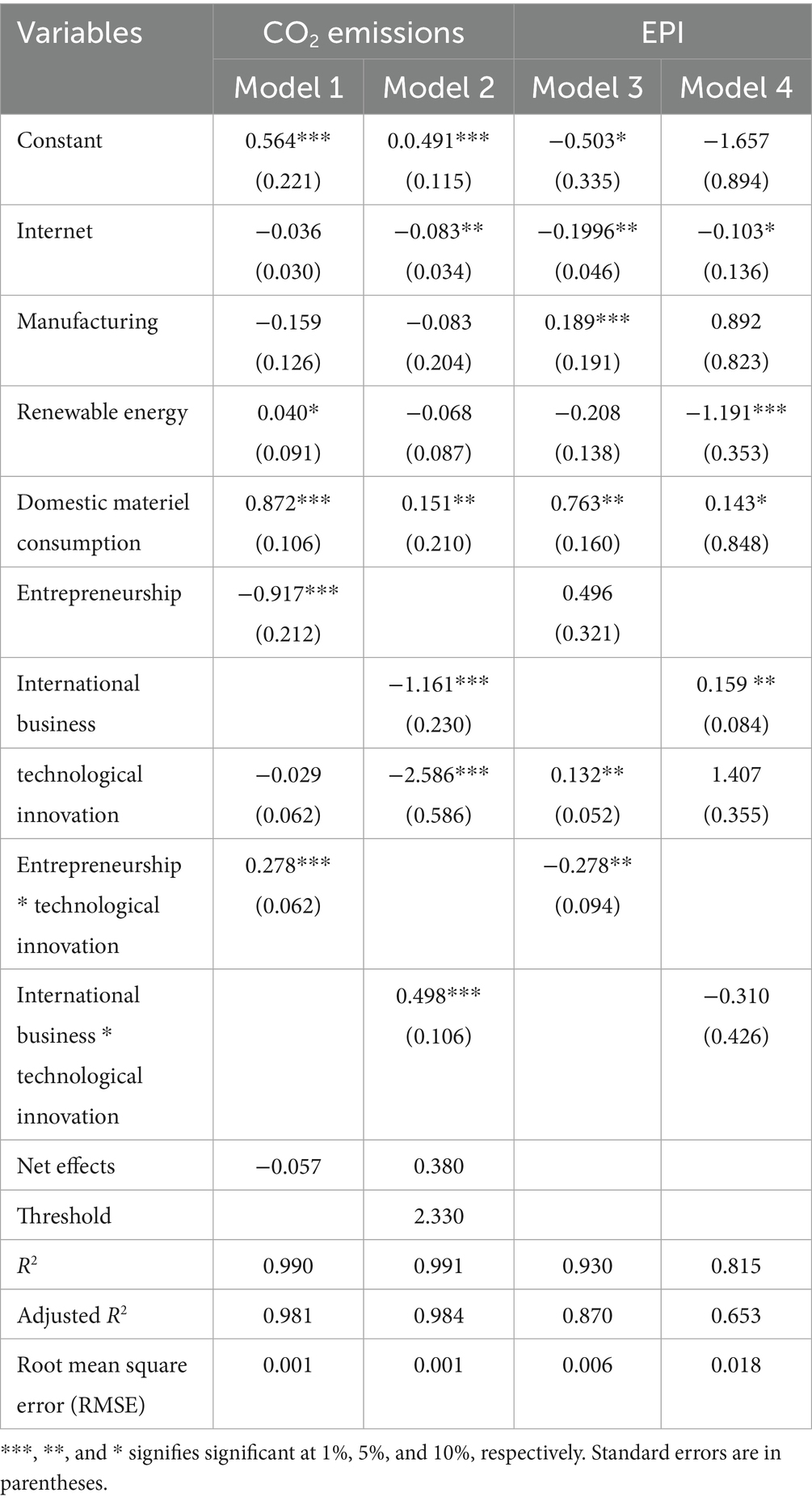

Table 4 examines the impact of technological innovation in conjunction with entrepreneurship and international business on environmental sustainability, as measured by CO₂ emissions and the EPI. Models (1) and (3) focus on the interaction between entrepreneurship and technological innovation, while Models (2) and (4) examine the interaction between international business and technological innovation. In Model (1), the net effect of the interaction between entrepreneurship and technological innovation on CO₂ emissions is negative (−0.0574). This result suggests that integrating technological innovation into entrepreneurial activities reduces pollution emissions, thereby enhancing the positive environmental impact of entrepreneurship. The net effect was calculated using the formula: (0.278 × 3.093) + (−0.917) = −0.057, where 0.278 represents the interaction coefficient between entrepreneurship and technological innovation, 3.093 represents the average level of technological innovation in the sample, and −0.917 represents the direct effect of entrepreneurship on CO₂ emissions. This finding highlights a positive moderating role of technological innovation: the higher their level of adoption, the more they enable entrepreneurship to contribute to emission reductions. Hence, transitioning toward an entrepreneurial economy centered on technological innovation represents a critical lever for improving environmental performance in the analyzed context. However, it is important to note that the interaction coefficient is positive, which could, in itself, indicate a tendency to dampen the direct effect of entrepreneurship. In this case, however, the high average level of technological innovation offsets this positive interaction, leading to an overall negative net effect on emissions. In other words, when sufficiently developed, technological innovation enables entrepreneurship to fully play its role in the ecological transition. This result highlights the importance of integrating technological innovation effectively and on a large scale into entrepreneurial strategies to achieve sustainable environmental benefits. Additionally, Model (2), which focuses on CO₂ emissions and the interaction between international business and technological innovation, reveals a positive net effect (0.380). This means that technological innovation, in this context, fails to offset the negative environmental impact of international business and may even lead to increased emissions. This result suggests that the technologies used may not be sufficiently environmentally oriented or may be applied ineffectively. Furthermore, the estimated threshold in this model is 2.330, indicating that technological innovation has a favorable effect on the relationship between international business and CO₂ emissions only when innovation exceeds this threshold. Below this level, innovation remains insufficient to neutralize the polluting effect of global business activities, as incremental or fragmented adoption cannot counterbalance the entrenched reliance on carbon-intensive processes.

Table 4. Effects of entrepreneurship, international business, and technological innovation on environmental sustainability.

The threshold is politically relevant, as it falls within the statistical range of technological innovation observed in the sample (2.677–3.599), suggesting that while Saudi Arabia is approaching this level, sustained efforts are still required to consistently surpass it across industries. For the Saudi context, this result underscores the importance of scaling up technological innovation as a structural driver of sustainability. Although Saudi Arabia has launched major initiatives under Vision 2030—such as investments in digital infrastructure, R&D, and industrial upgrading—much of this innovation remains concentrated in specific sectors, with uneven spillovers into energy-intensive and resource-intensive industries. The threshold of 2.330 underscores that unless technological innovation is disseminated more widely and integrated into international business activities, the environmental consequences of globalization will remain negative. Once innovation adoption exceeds this critical level, however, international business can become a channel for cleaner production, knowledge transfer, and improved compliance with environmental standards. This finding has direct policy relevance, underscoring the need for Saudi decision-makers to align FDI-attracting policies with innovation incentives, promote collaborative R&D partnerships with multinational enterprises, and strengthen intellectual property regimes to foster domestic technological capacity. In doing so, Saudi Arabia can leverage international business not as a source of additional emissions but as a catalyst for achieving its sustainability and climate goals.

The results obtained confirm our third hypothesis, which posits that green technologies and technological innovation play a significant moderating role in the relationship between entrepreneurship, international business, and environmental sustainability. This moderating role is powerful in the case of CO₂ emissions, where both green technologies (Model 1, Table 3) and technological innovation (Model 1, Table 4) help reduce the polluting impact of entrepreneurship. These findings are consistent with the work of Altwaijri et al. (2024) and Omri and Afi (2020), who show that the diffusion of clean and green technologies can transform the initially negative effects of entrepreneurship on the environment into positive ones, provided that these technologies are sufficiently developed and integrated into productive sectors. However, this moderating capacity is not systematic. In Model (3) of Table 3, which analyzes the interaction between entrepreneurship and green technologies on environmental performance, the net effect is negative (−0.310), indicating that green technologies, in their current state, are not sufficient to improve environmental quality through entrepreneurship. This result suggests a partial, inefficient, or poorly targeted use of these technologies in entrepreneurial sectors. The estimated threshold of 2.995 reinforces this interpretation: only adoption levels above this point enable green technologies to play their full environmental role in enhancing the EPI. Below this level, even entrepreneurship incorporating “green” elements does not yield significant environmental gains, as the scale of adoption remains insufficient to offset existing carbon-intensive practices.

This threshold logic is consistent with the findings of Tchamyou (2019) and Ben Youssef et al. (2018), who emphasize that the environmental benefits of new technologies depend on their intensity and sectoral diffusion. In the Saudi Arabian context, this implies that while progress has been made under Vision 2030 in promoting renewable energy, digital solutions, and eco-innovation, adoption has not yet reached the intensity required to shift environmental performance indicators significantly. The threshold thus points to the need for broad-based diffusion of green technologies across strategic industries—such as energy, construction, and transport—so that entrepreneurship and innovation can effectively contribute to measurable EPI improvements. From a policy perspective, surpassing this threshold requires stronger incentives for technology transfer, deeper integration of sustainability criteria into entrepreneurial programs, and targeted support to ensure that green technologies transition from niche applications to mainstream business practice.

Regarding international business, the results are more nuanced. While the interaction with green technologies slightly improves the EPI (Model 4, Table 3), it does not reverse the negative effect on CO₂ emissions (Model 2). Similarly, technological innovation (Model 2, Table 4) does not significantly mitigate the polluting effect of international business, with a net positive effect (0.380). This may reflect technological innovation that is still primarily geared toward productivity rather than sustainability, as suggested by Uche et al. (2023) and Tsoy and Heshmati (2024). The estimated threshold of 2.330 in this model confirms that a sufficiently high level of technological innovation is crucial for international business to contribute to emission reductions effectively. Below this level, innovation efforts remain too limited to offset the polluting effects of globalization. Still, once adoption surpasses the threshold, international business can shift from being a source of environmental pressure to a channel for cleaner production and knowledge transfer. In the Saudi Arabian context, this finding highlights the importance of accelerating technological upgrading under Vision 2030, as sustained investment in R&D, digital infrastructure, and innovation diffusion across carbon-intensive sectors is crucial to propel the country beyond this critical point. Achieving and maintaining innovation levels above the threshold would ensure that FDI and multinational activities align with national sustainability goals, transforming international business into a driver of low-carbon growth.

In summary, this analysis demonstrates that the intensity and quality of the technologies deployed strongly condition the environmental impacts of entrepreneurship and international business. The identified thresholds (2.437, 2.995, and 2.330) indicate that the effectiveness of economic activities in supporting environmental sustainability is only realized once a critical mass of green technologies or technological innovation has been achieved. Below these levels, entrepreneurial and international business activities continue to exert negative ecological pressures; above them, they can become drivers of sustainability. These findings are consistent with the conclusions of Nakamura and Managi (2020) and Khezri et al. (2024), who highlight the central role of a well-structured technological environment in facilitating sustainable transitions. In the Saudi Arabian context, the results underscore that incremental advances in technology adoption are insufficient; instead, a broad and accelerated diffusion of innovation across key sectors is required to surpass the thresholds. This reinforces the need for policies that directly link foreign investment and entrepreneurial initiatives to technology transfer, R&D incentives, and green infrastructure development, ensuring that economic diversification under Vision 2030 translates into tangible environmental benefits.

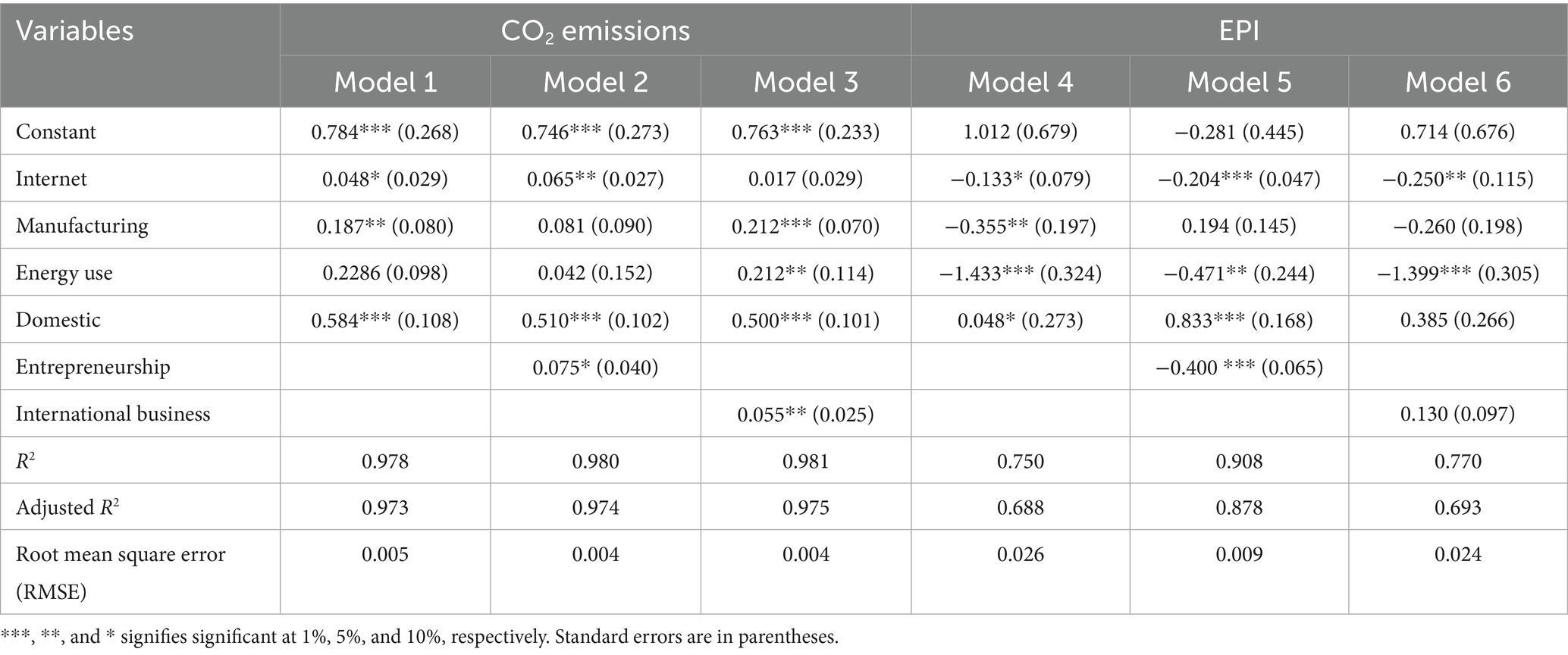

4.4 Robustness check

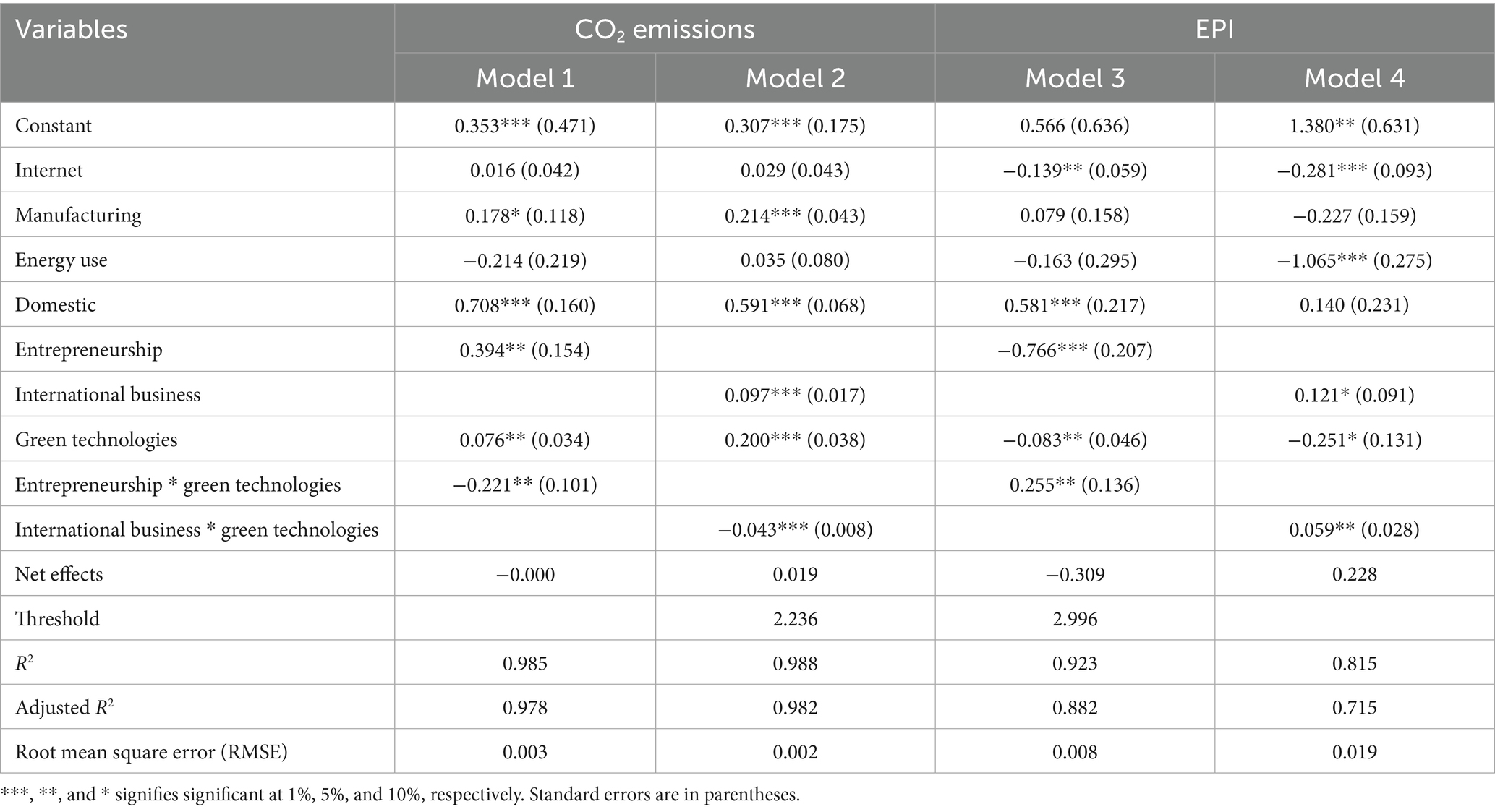

The robustness results obtained using the Dynamic Ordinary Least Squares (DOLS) method generally confirm the conclusions drawn from the FMOLS estimates, while adding some nuances. In Table 5, which examines the direct effects of entrepreneurship and international business, Models 1–3 show that entrepreneurship (0.075) and international business (0.055) have positive, statistically significant effects on CO₂ emissions, indicating that these activities contribute to increased pollution. These results, consistent with the FMOLS findings, suggest that entrepreneurship, often concentrated in less-regulated sectors, and international business, influenced by scale effects or specialization in polluting industries, negatively affect environmental sustainability. Control variables, such as energy consumption and domestic demand, reinforce the notion that the economy remains heavily reliant on carbon. Regarding the EPI (Models 4–6), entrepreneurship has a significantly negative effect (−0.400), confirming its detrimental impact on environmental quality. In contrast, international business shows a positive but non-significant effect (0.130), unlike in the FMOLS, where it was significant. This variability may stem from the temporal dynamics captured by DOLS. The high adjusted R2 values (0.688 to 0.975) and low RMSE (0.004 to 0.026) indicate the robustness of the estimates, although slightly lower than those of the FMOLS. Table 6 analyzes the moderating role of green technologies. For CO₂ emissions, Model 1 shows a net negative interaction effect (−0.000) between entrepreneurship and green technologies, indicating a slight reduction in emissions, though weaker than in the FMOLS (−0.019). In Model 2, the interaction with international business presents a net positive effect (0.019), indicating that green technologies do not fully offset the polluting impact of international business, consistent with the FMOLS (0.027).

Table 6. Effects of entrepreneurship, international business, and green technologies on environmental sustainability.

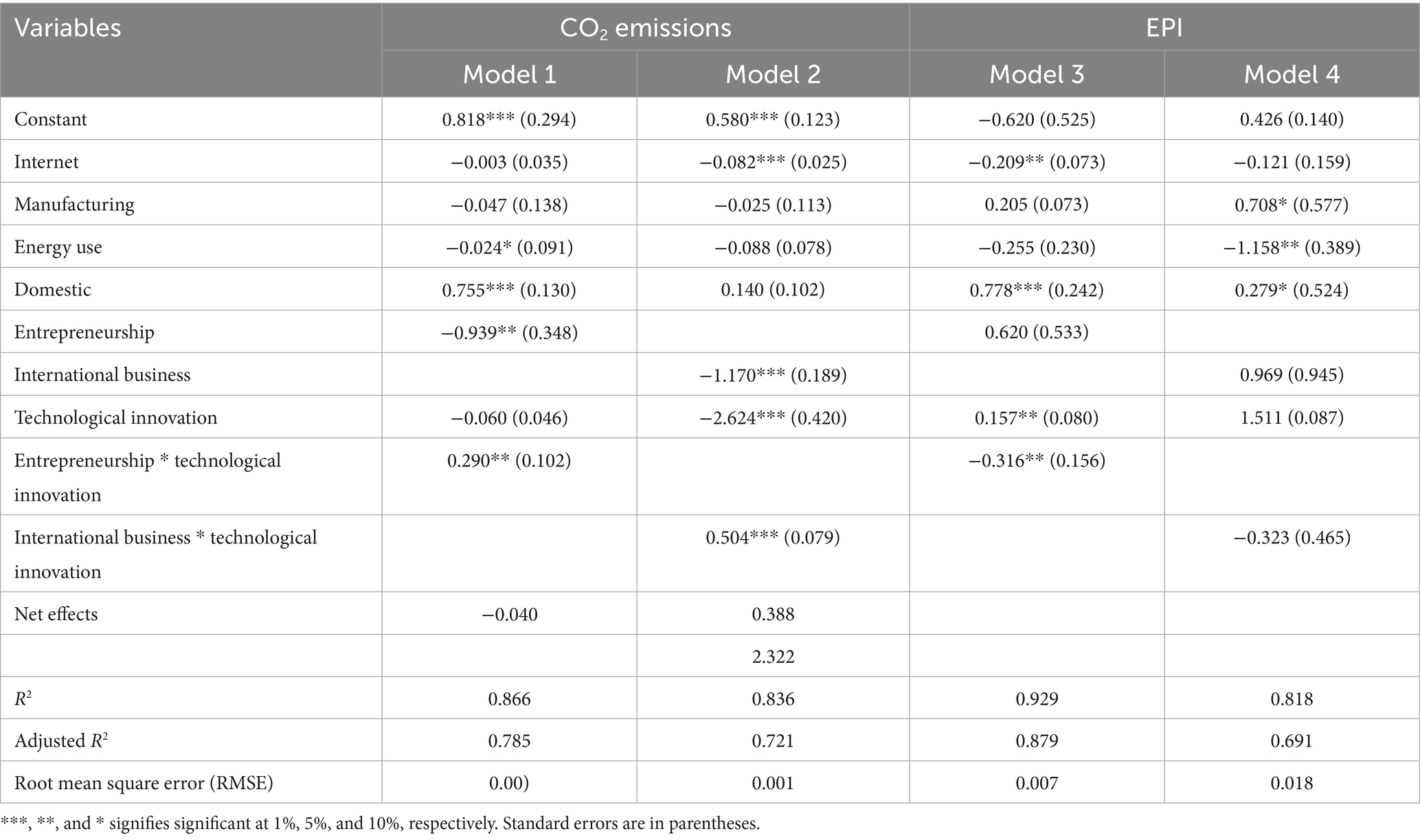

For the EPI, Model 3 shows a net negative effect (−0.309), indicating that green technologies do not amplify the positive impact of entrepreneurship on environmental quality, likely because they are adopted in a fragmented or ineffective manner. The threshold of 2.996, close to the FMOLS estimate (2.995), underscores the need for a high level of adoption. In contrast, Model 4 reveals a net positive effect (0.228) for international business, supporting the notion that green technologies enhance the EPI by promoting the adoption of international environmental standards, an outcome slightly stronger than observed in the FMOLS (0.195). Table 7 evaluates the moderating role of technological innovation. For CO₂ emissions, Model 1 shows a net negative effect (−0.040) for the interaction between entrepreneurship and innovation technologies, confirming their role in reducing emissions, though slightly less pronounced than in the FMOLS (−0.0574). In Model 2, the interaction with international business presents a net positive effect (0.388), similar to the FMOLS (0.380), indicating that technological innovation does not neutralize the polluting effect of international business. This is likely because technological innovations are more geared toward productivity than sustainability.

Table 7. Effects of entrepreneurship, international business, and technological innovation on environmental sustainability.

Overall, the DOLS results validate the main conclusions of the FMOLS: current entrepreneurship in Saudi Arabia increases CO₂ emissions and degrades the EPI, while international business has an ambivalent effect, negative on emissions but potentially positive on the EPI when supported by green technologies. Green technologies and technological innovation play a crucial moderating role; however, their effectiveness depends on achieving a sufficient level of adoption, as indicated by the estimated thresholds. Minor differences between DOLS and FMOLS, such as the insignificance of certain coefficients, may be attributed to DOLS’s methodological specificities. These results suggest clear policy implications: promoting entrepreneurship focused on green technologies, strengthening environmental standards in international business, and investing in education and technological infrastructure to maximize environmental benefits.

5 Conclusion and policy implications

In a global context where the transition to sustainable development has become a priority, this study aimed to investigate the role of entrepreneurship and international business in either enhancing or degrading environmental quality. The main objective was to analyze their direct and conditional effects on two key dimensions of sustainability: CO₂ emissions and EPI. The study focused on Saudi Arabia, a country undergoing a profound economic transformation as part of its Vision 2030. It covers the period from 2000 to 2022. To capture the long-term relationships between the variables, the FMOLS method was employed.

The results show that, in their current configuration, entrepreneurial and international business dynamics tend to exert negative environmental pressure, particularly by increasing greenhouse gas emissions. The effect of entrepreneurship on environmental performance appears to be unfavorable, while international business exhibits mixed effects, with a positive contribution to the improvement of certain aspects of environmental quality. However, the analysis goes beyond these direct effects by introducing two moderating variables: green technologies and technological innovation. These allow for an assessment of whether a more advanced technological context can mitigate the negative effects or enhance the positive effects of entrepreneurship and international business on the environment. The results also indicate that integrating green technologies can significantly reduce the environmental impact of entrepreneurial activities, provided their adoption is sufficient. Regarding international business, the moderating effect of green technologies is also positive, especially on overall environmental performance, although it remains limited in terms of directly reducing emissions. As for technological innovation, it enables entrepreneurship to become a vector for emission reduction when sufficiently developed. However, in international business, their effect remains ambivalent, suggesting that the innovations used are not yet adequately aligned with environmental goals. Finally, the analysis reveals that critical thresholds of technological adoption must be reached for these technologies to fully play their moderating role. Below these levels, their beneficial effects remain marginal or even non-existent.