- 1Faculty of Economics and Business, Universiti Malaysia Sarawak, Sarawak, Malaysia

- 2Economics Program, School of Social Sciences, Universiti Sains Malaysia, Penang, Malaysia

This paper investigates the relationship between electricity consumption, output, and price in the manufacturing sector in Malaysia. We find that electricity consumption, output, and price are cointegrated in the long run. In addition, it has been found that the relationship between electricity consumption and output is positive. In the long run, we find a unidirectional causality from manufacturing output to electricity consumption. This result indicates that the development of manufacturing sector stimulates greater demand for electricity. Government needs to make sure that the planning of electricity supply in the future is in line with the economic development planning to avoid shortage in electricity supply. In the short run, a unidirectional relationship runs from electricity consumption to output is found. A decrease of energy usage in production might reduce the output growth in short run. Hence, we suggest improving the efficiency of electricity usage and some cost-effective sources of energy.

Introduction

Manufacturing sector is the second largest contributor of Malaysia’s GDP. There are five main types of energy used in Malaysia namely petroleum product, natural gas, coal and coke, electricity, and biodiesel. To be specific, petroleum product is the highest energy used (70%) followed by electricity (15%), natural gas (11%), coal and coke (3.22%), and biodiesel (0.01%)1. Industrial sector uses electricity the most for production activities compares to other sectors. Particularly, the average growth of electricity consumption in industrial sector was 7% for the period of 1978–2011. Besides, the average growth of electricity generation was 7.6% for the same period of time. These statistics show that the supply of electricity meets its demand.

However, if we compare the output growth with electricity consumption, it clearly shows that the average growth of electricity consumption is greater than the average output growth. The average output growth was 5.9% from 1979 to 2011 while the average output growth in manufacturing sector was only 1.4%. Hence, we can say that the growth of electricity consumption did not drive the economic development much in the country as well as the manufacturing sector.

Numerous studies have researched the relationship between energy consumption and economic growth at the macro level. However, little studies have focused at the micro level such as manufacturing sector. Lean and Smyth (2010a,b) called for further research to explore the impact of energy consumption in the manufacturing sector. Thus far, we found three related studies. Soytas and Sari (2007) used production function to investigate the impact of electricity consumption on output in the Turkish manufacturing sector. Kouakou (2011) used bivariate model to empirically study the relationship between electricity consumption and value added (VA) in the industrial sector in Ivory Coast. Same goes to Bekhet and Harun (2012) who explore the relationship between energy consumption and output in the Malaysian manufacturing sector.

This paper extends the current literature in particular Bekhet and Harun (2012) by examining the relationship between electricity consumption and economic growth in Malaysian manufacturing sector. The two objectives of this paper are (1) to examine the long-run relationship between electricity consumption, output, and price in the manufacturing sector in Malaysia; and (2) to explore the short-run causal relationship between the three variables.

Instead of using total energy consumption as in Bekhet and Harun (2012), we examine electricity consumption in particular because electricity is used heavily in the manufacturing sector (Saidur et al., 2009). According to, manufacturing sector is highly depending on electricity to produce the output. If there are any weaknesses in the energy policy, this would give negative impact not only to the industrial development but the country’s economic growth as a whole. Furthermore, Chandran and Munusamy (2009) documented that the Malaysian economy is known as an industrial-led growth economy, which is highly depending on the performance of manufacturing sector in order to sustain its economic growth. Thus, it is crucial that a study on electricity consumption and output has to be done in the manufacturing sector in order to get some robust empirical evidences for a better energy planning in the sector.

On the other hand, we employ the demand function instead of using the production function with bivariate framework model. Jamil and Ahmad (2010) argued that price is an important determinant of electricity consumption; so, it is included in the model to avoid the problem of omitted variables.

The empirical results of this paper may give important implications to both policy makers and manufacturing firms. Electricity consumption may improve forecast of manufacturing sector’s contribution to the economic growth in Malaysia. If electricity consumption can explain the manufacturing output, then the firms should enhance the capacity of electricity generation and increase the efficiency of electricity usage in the production. The policy makers can plan an appropriate energy policy and industrial policy to promote sustainable economic growth in Malaysia. On the other hand, if output Granger causes electricity consumption, then the energy conversation policies are expected to have no adverse effect on output growth. Therefore, the industrial policies are recommended to encourage the development in the manufacturing sector.

The paper is organized as follows. Next section reviews the literature; Section “Data and Methodology” explains the data and methodology used in this study. Section “Empirical Results” presents the empirical results and Section “Conclusion and Policy Implication” concludes.

Literature Review

There are two major groups of literature that employing two different models, i.e., production function and demand function, to examine the relationship of energy consumption and economic growth in the country level. The former includes Apergis and Payne (2009), Lean and Smyth (2010a), Menyah and Wolde-Rufael (2010), Sadorsky (2010), Eggoh et al. (2011), Halicioglu (2011), Zhang and Ren (2011), and Sadorsky (2012). These studies found a mix causal relationship between energy (electricity) consumption and economic growth. A unidirectional relationship from economic growth to energy (electricity) consumption is found in Menyah and Wolde-Rufael (2010) while Apergis and Payne (2009) found adverse unidirectional relationship running from energy (electricity) consumption to economic growth. However, Lean and Smyth (2010a), Halicioglu (2011), Sadorsky (2010), Sadorsky (2012), and Zhang and Ren (2011) found a bi-directional relationship between energy (electricity) consumption and economic growth. Nevertheless, Yoo (2006), Tang (2008, 2009), Chandran (2009), and Lean and Smyth (2010a) are among the studies for the case of Malaysia. They found bi-directional relationship between electricity consumption and economic growth in Malaysia.

On the other hand, Mahadevan and Asafu-Adjaye (2007), Rafiq and Salim (2009), Jamil and Ahmad (2010), Odhiambo (2010), and Belke et al. (2011) employed demand function to explore the importance of energy in production by taking into account the factor of price in the model. Lean and Smyth (2010b) argued that price is an important factor that influences energy consumption and income. Nevertheless, the impact of price on energy consumption and output is still under debate respect to its inconsistent conclusion in the previous studies. Jamil and Ahmad (2010) found a unidirectional causal relationship from electricity consumption to price in Pakistan. Odhiambo (2010) also found the same result in Congo in both short and long runs. Conversely, Chandaran et al. (2010) and Mahadevan and Asafu-Adjaye (2007) found that the price is not significant to electricity consumption and output in most of the developed and developing countries as well as Malaysia.

It is essential to explore the impact of energy consumption on output in some particular sectors, especially the energy based sectors like manufacturing sector. Different sector has different energy intensity and it may affect differently the performance of each sector. To the best of our knowledge, the first study that examines the impact of energy consumption in manufacturing sector is Soytas and Sari (2007), follows by Kouakou (2011) and Bekhet and Harun (2012) while Turkekul and Unakitan (2011) in agriculture sector. Indeed, there are limited studies have been done at the sector level.

Soytas and Sari (2007) used multivariate production function to discover the relationship between energy consumption and production output in Turkish manufacturing industry. They found long-run unidirectional relationship from electricity consumption to production output and no significant short-run causality. Kouakou (2011) supported the finding of Soytas and Sari (2007) on the existence of long-run relationship running from electricity consumption to output. He also found a short-run causal relationship running from electricity consumption to output in Ivory Coast.

Bekhet and Harun (2012) is the only paper we encounter thus far that examined the relationship of energy consumption and production output in Malaysian manufacturing sector. They explored the causal relationship between production output and energy consumption in manufacturing sector from 1978 to 2009. They used production function and found only unidirectional causality from energy consumption to production output in the long-run and no short-run Granger causality.

We extend Bekhet and Harun (2012) to explore the impact of energy consumption on output in the manufacturing sector by using energy demand function. Considering the arguement of Jamil and Ahmad (2010) and Lean and Smyth (2010b) that price is an important factor of consumption and output, we include price in the model. Theoretically, the change of price will give a direct impact on consumption and production cost and consequently contracted output (Lean and Smyth, 2010b; Odhiambo, 2010).

Data and Methodology

Following Mahadevan and Asafu-Adjaye (2007), Jamil and Ahmad (2010), and Odhiambo (2010), demand function is employed to explore the relationship between electricity consumption, output, and price. VA in manufacturing sector is used to represent the output. Soytas and Sari (2007) and Kouakou (2011) used VA as an output variable in their studies. According to Soytas and Sari (2007), VA is more significant in representing the output in manufacturing sector and it does not have aggregation problem2. This study uses consumer price index (CPI) to proxy electricity price because there is no time series data of electricity price in Malaysia. The use of CPI has been supported by Mahadevan and Asafu-Adjaye (2007) and Lean and Smyth (2010b). The model of demand function can be written as follows:

where L refers to natural logarithms; EC, electricity consumption in the manufacturing sector (ktoe); VA, value added from manufacturing sector (constant at 2000, RM); P, consumer price index (constant at 2000, RM).

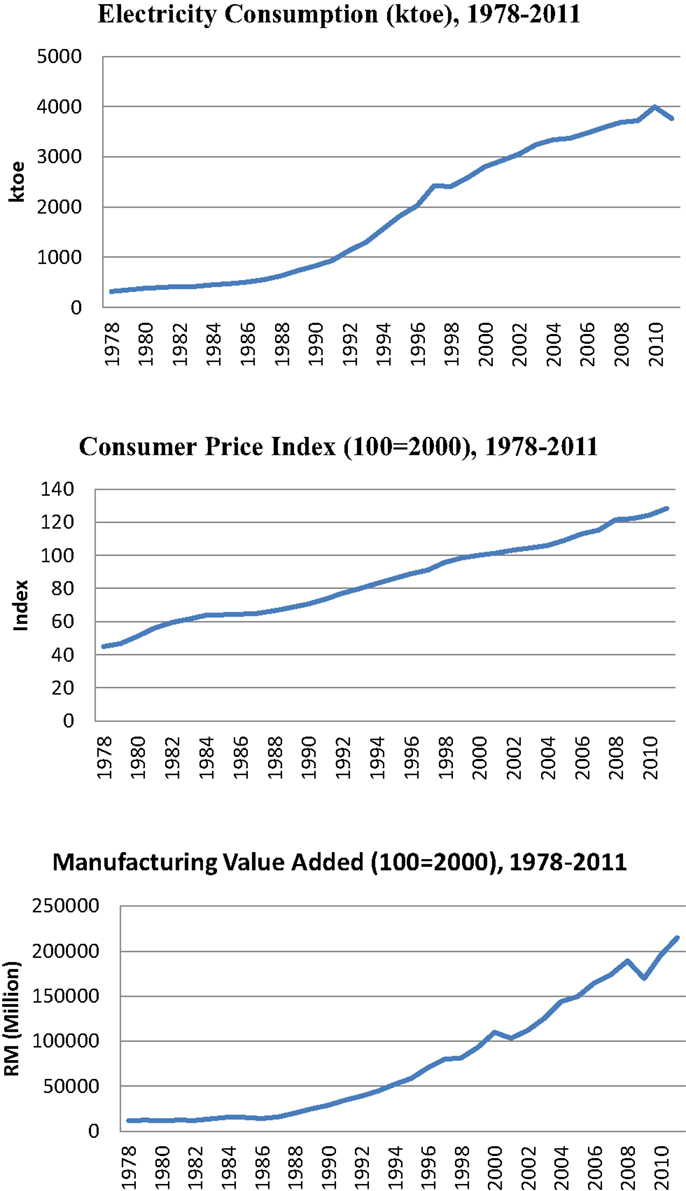

We use annual time series data for the sample period from 1978 to 2011. The data for VA and CPI are taken from Department of Statistics Malaysia and EC is taken from Malaysian Energy Information Hub’s database. Figure 1 shows the time series plots for each variable. All variables are in upward trend.

Phillips and Perron (1988) unit root test is employed for stationary test before conducting the cointegration and Granger causality tests. Johansen and Juselius (1990) cointegration test is employed to identify the existence of long-run relationship among the variables in the model. However, Johansen and Juselius (1990) cointegration test has limitation that the model cannot be regressed if some variables are stationary at level and some are not. Hence, we also employ bounds testing approach for cointegration by Pesaran et al. (2001). The advantages of this approach is that it is suitable for small sample size and it is able to examine long-run relationship even though the model has mixed variables of I(0) and I(1).

The bounds testing approach is employed by estimating an unrestricted error correction model (UECM) via ordinary least squares (OLS) as below:

where π1, π2, and π3 are the long-run parameters and εt is the error terms. In order to capture the long-run relationship, the model is restricted by the lagged level variables.

As our sample size is small, it is more suitable to use the small sample critical values provided by Narayan (2005). If the computed F-statistic exceeds the upper critical bounds, it has enough evidence to reject the null hypothesis. It is considered as not enough evidence to reject the null hypothesis if the F-statistic is below the respective lower critical bounds. However, if the F-statistic is fall between the value of upper critical bound and lower critical bound, the result is inconclusive.

Once all variables in the model are cointegrated, we can figure out the coefficients using the approach proposed by Bardsen (1989). The long-run coefficient is derived by the coefficient of one lagged level independent variable divided by the coefficient of the one lagged level dependent variable and then times a negative sign. Thus, the long-run coefficients for LVA and LP are and , respectively. On the other hand, short run coefficient is computed by the total coefficients of the first difference of the respective variable. The short run coefficient for LP and LVA are and , respectively.

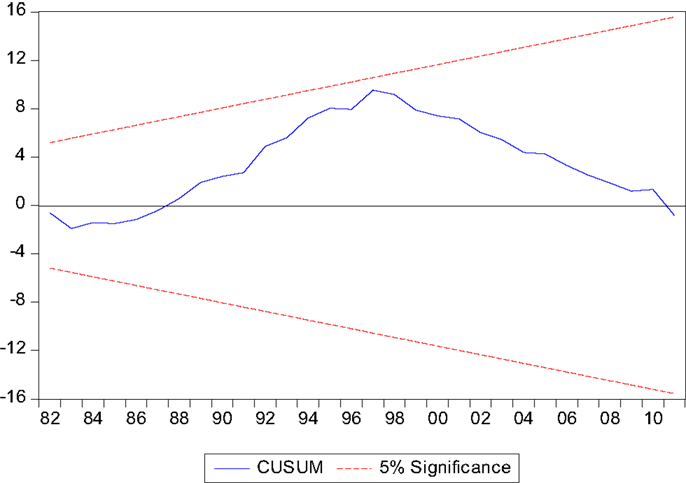

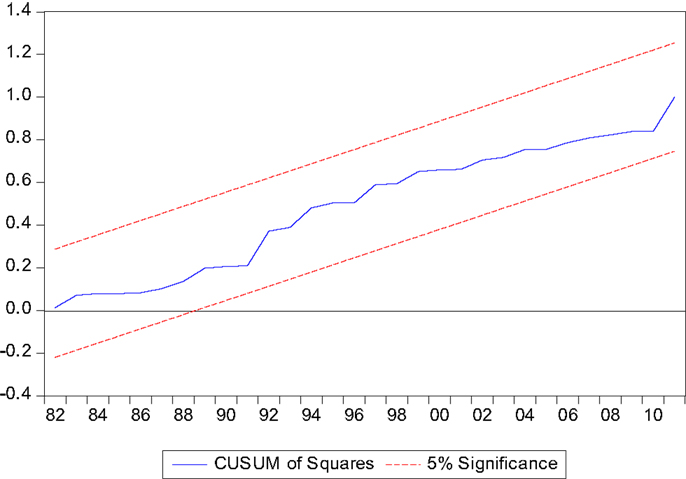

Both CUSUM and CUSUM of Squares tests by Brown et al. (1975) are employed to test the stability of parameters over the sample period. The parameter is considering stable if the plot of cumulative sum of square residual does not break the upper or lower bounds. Besides, some diagnostic tests are employed to ensure the model is with good specification.

Finally, we perform Granger (1988) causality test. The Granger causality test is based on the following regressions:

symbol Δ represents the first difference of variable, θn, μn, Φn (n = 1, 2, 3) are the coefficients that determine short-run causality. The symbol of k is the optimal length determined by Akaike’s Information Criterion (AIC). The significance of Granger causality is relied on the joint F-test of the coefficients. If the joint F-test of μ1i, i = 1, …, k is significant, it indicates that there is Granger causality runs from LVA to LEC. ECT refers to error correction term, Ωn (n = 1, 2, 3) are coefficients to determine the long-run causal relationship. If it is significant, the model has a long-run Granger causality (Eqs 2–4).

Empirical Results

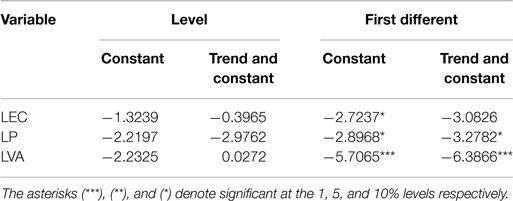

We start with the results of Phillips–Perron unit root test which are reported in Table 1; we find all variables are stationary at order 1. Since all variables are I(1), we can employ the Johansen and Juselius (1990) cointegration test. Choosing an appropriate lag length is required as the test is sensitive to the number of lag length selected. The lag length of 2 is selected based on the suggestion of Akaike’s information criterion.

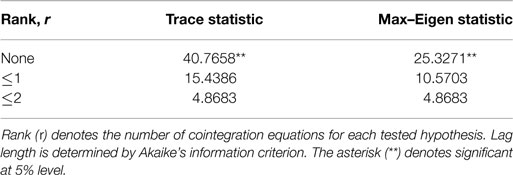

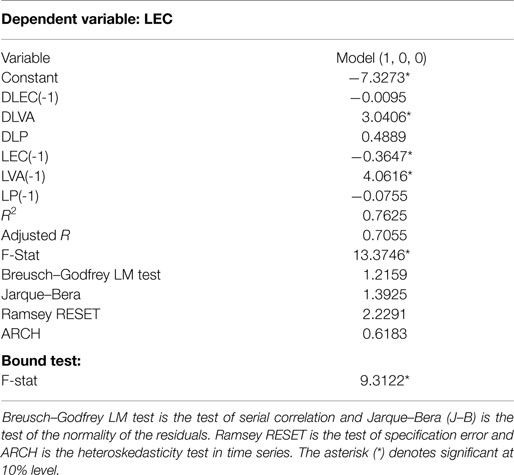

The results of Johansen and Juselius (1990) cointegration test are presented in Table 2. Both the maximum eigenvalue and trace statistics suggest that there is one cointegrating vector in the model. This implies that a long-run relationship is existed although the direction of causality is still not clear. Due to some limitations of the Johansen and Juselius (1990) cointegration test, we also employ ARDL bounds testing for cointegration. The result of bounds testing for cointegration is reported in Table 3. The UECM (1, 0, 0) is the appropriate model with optimum lag order suggested by Akaike’s Information Criteria. The F-statistic is significant at 1% significance level and we can reject the null hypothesis of no cointegration.

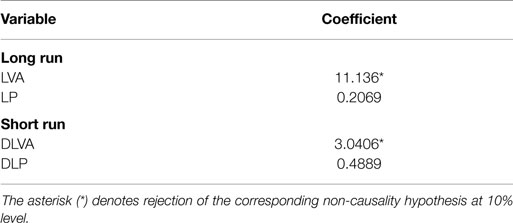

As all variables are cointegrated, we proceed to estimate the long-run and short-run coefficients using Bardsen (1989) method. The results are depicted in Table 4. It is found that electricity consumption responses positively to the change of manufacturing output in both long and short runs. The VA elasticity shows that a 1% increase in the manufacturing output will increase the electricity consumption for 11%. However, the price elasticity is not significant in both short and long runs.

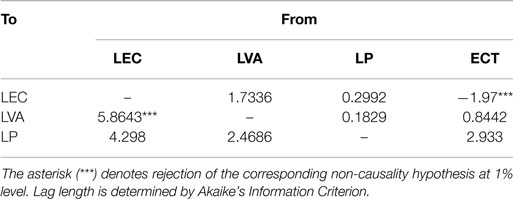

We also employ the VECM Granger causality test to capture the long-run and short-run causal relationships. The results of VECM Granger causality test are reported in Table 5. We find a unidirectional causal relationship from LVA to LEC in the long-run. This result is adverse to Soytas and Sari (2007), Kouakou (2011), and Bekhet and Harun (2012), who found a unidirectional relationship from electricity/energy consumption to output in the long-run. However, in the short-run, there is only one unidirectional causal relationship exists and it runs from LEC to LVA. Our result for short-run causality is consistent with Kouakou (2011).

There are several reasons of why our finding is different with these three related studies. First, Kouakou (2011) used bivariate model to explore the relationship between electricity consumption and output that cannot give robust result because it leads to omitted variable in the model. Second, although Bekhet and Harun (2012) used a multivariate model in their study but they used a mixed of aggregate and disaggregate time series data in the model. The data consistency is very important in time series analysis in order to have robust empirical result. Third, Soytas and Sari (2007) used Johansen and Juselius (1990) cointegration test in their time series analysis. One of the limitations for Johansen and Juselius cointegration test is that it is not suitable for a small sample dataset. Thus, we use ARDL in our time series analysis in respect to its advantage for small sample.

With regards to the Granger causal relationship between electricity consumption and price, our empirical result found that there is not enough evidence to prove the existence of causal relationship among the variable in the short run. However, a joint of price and output cause electricity consumption is found in the long run. Results of CUSUM and CUSUM of Squares in Figures 2 and 3 show that the model is stable. In addition, the diagnostics tests (Breusch–Godfrey LM, Jargue–Bera, Ramsey RESET, and ARCH) in Table 3 indicate that the model is in good fit.

Conclusion and Policy Implication

This paper examines the relationship of electricity consumption and output of manufacturing sector in Malaysia. Our empirical result shows that all variables are cointegrated. In addition, a unidirectional causality from manufacturing output to electricity consumption in long run is found. In the short run, we found a causal relationship from electricity consumption to output. The relationship between electricity consumption and manufacturing output is positive for both short and long runs.

The three related studies, Soytas and Sari (2007), Bekhet and Harun (2012), and Kouakou (2011), told us that manufacturing output is highly dependent on electricity consumption. However, the implication of our finding is different. Our empirical result suggests that the electricity consumption is not translated to manufacturing output growth in the long run. In fact, the output growth causes electricity consumption in the long run. On the other hand, the electricity consumption is found to cause output growth in the short run only.

Mahadevan and Asafu-Adjaye (2007) explained a low tariff and high subsidy on energy, especially in the net energy exporter countries will result wastage in electricity consumption and it might be a reason that the electricity consumption is not translated to output growth. Malaysian government subsidizes electricity to both consumers and producers. At the producer side, the government levy lower gas prices which cost about RM20 billion via Petronas3. In addition, the government also subsidizes imported gas to electricity generators to reduce the cost of generating electricity. At the consumer side, the government subsidizes household whom the electricity bill is RM20 or less per month and gives 10% discount on electricity bill for schools and welfare homes. These energy subsidies are not really effective in reducing the production cost because the subsidy may eventually transfer to other parties through the side effect of taxes and deadweight loss. It ends up with inefficiency subsidies that increase the burden in the society as a whole (The International Institute for Sustainable Development, 2013).

The long run result suggests that the manufacturing output growth will stimulate electricity consumption. As output increases, total production cost increases. Policymakers should plan and forecast the electricity capacity to match with the industrial development. It will minimize the problem of shortage in electricity supply (Jamil and Ahmad, 2010). We suggest that the policymakers can focus more on industrial development to promote rapid growth in the manufacturing sector since energy conversation is expected not to give an adverse impact to the output growth. Nevertheless, we also found that price causes electricity consumption in the long run. On the other hand, the short run result indicates a unidirectional causality from electricity consumption to manufacturing output. A decrease of energy usage in production might reduce the output growth. Hence, we suggest improving the efficiency of electricity usage and some cost-effective source of energy.

There is a reverse directional of long run and short run causality between output and electricity consumption. Electricity consumption causes output growth in the short run only but not in the long run. It may due to the short time period for firms to adjust their production plan if there have any shortage of input such as electricity. However, firms will have more time to adjust and recover in the long run.

Malaysia implements a long standing policy such as Industrial master plan (IMP) and export oriented industrialization (EOI) where it aims to encourage rapid development in manufacturing sector (Derashid and Zhang, 2003). By featuring various investment incentives and establishment of Free Trade Zone via a mix of industrial policies, manufacturing sector contributes 30% shares in the real GDP (Derashid and Zhang, 2003; Chandran and Munusamy, 2009). Hence, the demand of electricity is expected to increase as well. The government should increase the capacity of electricity supply in order to meet the current need in the industry. However, the government also needs to explore more efficient and cost-effective sources of energy in order to increase the electricity supply. Respond to this matter, the government restructures the national energy policy toward enhancing the capacity of electricity supply by ensuring minimal impact on the environment and also promoting efficiency utilization on energy consumption through Small Renewable Energy Program and Sarawak Corridor of Renewable Energy. These programs aim to enhance the capacity of electricity supply by depending more on renewable energy resources to avoid negative impact on environment (Keong, 2005; Bekhet and Harun, 2012).

Wolde-Rufael (2006) argued that electricity is just a small portion of GDP and it leads to a small impact on output. Some other variables such as export may put into account for future research because manufacturing sector is the biggest contributor in Malaysia’s export. We can also use international oil price instead of CPI because the international oil price will give bigger impact on electricity consumption especially a small economy which rely much on fossil as a source of generating electricity (Mahadevan and Asafu-Adjaye, 2007).

Conflict of Interest Statement

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Acknowledgments

The first author would like to acknowledge Universiti Malaysia Sarawak for the small grant scheme no. SGS03(S114)/896/2012(27).

Footnotes

- ^Average percentage share of energy mix that used for the period of 1978–2011. Detail information of energy mix used in the manufacturing sector is not available in Malaysia.

- ^Please refer to Soytas and Sari (2007) for further explanation.

- ^Petronas is asked to sell gas to electricity generator at lower price by the government (The International Institute for Sustainable Development, 2013).

References

Apergis, N., and Payne, J. E. (2009). Energy consumption and economic growth in central America: evidence from a panel cointegration and error correction model. Energy Econ. 31, 211–216. doi: 10.1016/j.eneco.2008.09.002

Bardsen, G. (1989). Estimation of long run coefficients in error-correction models. Oxf. Bull. Econ. Stat. 51, 345–350. doi:10.1111/j.1468-0084.1989.mp51003008.x

Bekhet, H. A., and Harun, N. H. (2012). Energy essential in the industrial manufacturing in Malaysia. Int. J. Econ. Finance 4, 129–137. doi:10.5539/ijef.v4n1p129

Belke, A., Dobnik, F., and Dreger, C. (2011). Energy consumption and economic growth: new insights into the cointegration relationship. Energy Econ. 33, 782–789. doi:10.1016/j.eneco.2011.02.005

Brown, R. L., Durbin, J., and Evans, J. M. (1975). Techniques for testing the constancy of regression relationship over time. J. R. Stat. Soc. 37, 149–192.

Chandaran, V. G. R., Sharma, S., and Madhavan, K. (2010). Electricity consumption-growth nexus: the case of Malaysia. Energy Policy 38, 606–612. doi:10.1016/j.enpol.2009.10.013

Chandran, V. G. R., and Munusamy. (2009). Trade openness and manufacturing growth in Malaysia. J. Pol. Model. 31, 637–647. doi:10.1016/j.jpolmod.2009.06.002

Derashid, C., and Zhang, H. (2003). Effective tax rates and the “industrial policy” hypothesis: evidence from Malaysia. J. Int. Account. Taxat. 12, 45–62. doi:10.1016/S1061-9518(03)00003-X

Eggoh, C. J., Bangake, C., and Rault, C. (2011). Energy consumption and economic growth revisited in African countries. Energy Policy 39, 7408–7421. doi:10.1016/j.enpol.2011.09.007

Granger, C. W. J. (1988). Some recent development in the concept of causality. J. Econom. 39, 199–211. doi:10.1016/0304-4076(88)90045-0

Halicioglu, F. (2011). A dynamic econometric study of income, energy and export in Turkey. Energy 36, 3348–3354. doi:10.1016/j.energy.2011.03.031

Jamil, F., and Ahmad, E. (2010). The relationship between electricity consumption, electricity price and GDP in Pakistan. Energy Policy 38, 6016–6025. doi:10.1016/j.enpol.2010.05.057

Johansen, S., and Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration – with applications to the demand for money. Oxf. Bull. Econ. Stat. 52, 169–210. doi:10.1111/j.1468-0084.1990.mp52002003.x

Keong, C. Y. (2005). Energy demand, economic growth, and energy efficiency – the Bakun. Energy Policy 33, 679–689. doi:10.1016/j.enpol.2003.09.017

Kouakou, A. K. (2011). Economic growth and electricity consumption in cote d’ivoire: evidence from time series analysis. Energy Policy 39, 3638–3644. doi:10.1016/j.enpol.2011.03.069

Lean, H. H., and Smyth, R. (2010a). On the dynamics of aggregate output, electricity consumption and exports in Malaysia: evidence from multivariate granger causality test. Appl. Energy 87, 1963–1971. doi:10.1016/j.apenergy.2009.11.017

Lean, H. H., and Smyth, R. (2010b). Multivariate granger causality between electricity generation, export, prices and gdp in Malaysia. Energy 35, 3640–3648. doi:10.1016/j.energy.2010.05.008

Mahadevan, R., and Asafu-Adjaye, J. (2007). Energy consumption, economic growth and price: a reassessment using panel vecm for developed and developing countries. Energy Policy 35, 2481–2490. doi:10.1016/j.enpol.2006.08.019

Menyah, K., and Wolde-Rufael, Y. (2010). Energy consumption, pollutant emissions and economic growth in South Africa. Energy Econ. 32, 1374–1382. doi:10.1016/j.eneco.2010.08.002

Narayan, P. K. (2005). The saving and investement nexus for china: evidence from cointegrating test. Appl. Econ. 37, 1979–1990. doi:10.1080/00036840500278103

Odhiambo, N. M. (2010). Energy consumption, price and economic growth in the three SSA countries: a comparative study. Energy Policy 38, 2463–2469. doi:10.1016/j.enpol.2009.12.040

Pesaran, M. H., Shin, Y., and Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. 16, 289–326. doi:10.1002/jae.616

Phillips, P. C. B., and Perron, P. (1988). Testing for unit root in time series regression. Biometrika 75, 335–346. doi:10.1093/biomet/75.2.335

Pubmed Abstract | Pubmed Full Text | CrossRef Full Text | Google Scholar

Rafiq, S., and Salim, R. (2009). The linkage between energy consumption and income in six emerging economies of Asia. Int. J. Emerg. Market. 6, 50–73. doi:10.1108/17468801111104377

Sadorsky, P. (2010). Trade and energy consumption in the middle east. Energy Econ. 33, 739–749. doi:10.1016/j.eneco.2010.12.012

Sadorsky, P. (2012). Energy consumption, output and trade in South America. Energy Econ. 34, 476–488. doi:10.1016/j.eneco.2011.12.008

Saidur, R., Rahim, N. A., Masjuki, H. H., Ping, H. W., and Jamaluddin, M. F. (2009). End-use energy analysis in the Malaysian industrial sector. Energy 34, 153–158. doi:10.1016/j.energy.2008.11.004

Soytas, U., and Sari, R. (2007). The relationship between energy and production: evidence from Turkish manufacturing industry. Energy Econ. 29, 1151–1165. doi:10.1016/j.eneco.2006.05.019

Tang, C. F. (2008). Electricity consumption, income, foreign direct investment and population in Malaysia. J. Econ. Stud. 36, 371–382. doi:10.1108/01443580910973583

Tang, C. F. (2009). A re-examination of the relationship between electricity consumption and economic growth in Malaysia. Energy Policy 36, 3077–3085. doi:10.1016/j.enpol.2008.04.026

The International Institute for Sustainable Development. (2013). A Citizen’s Guide to Energy Subsidies in Malaysia. Manitoba: International Institute for Sustainable Development.

Turkekul, B., and Unakitan, G. (2011). A co-integration analysis of the price and income elasticities of energy demand in Turkish agriculture. Energy Policy 39, 2416–2423. doi:10.1016/j.enpol.2011.01.064

Wolde-Rufael, Y. (2006). Electricity consumption and economic growth: a time series experience for 17 African countries. Energy Policy 34, 1106–1114. doi:10.1016/j.enpol.2004.10.008

Yoo, S. H. (2006). The causal relationship between electricity consumption and economic growth in the ASEAN countries. Energy Policy 34, 3573–3582. doi:10.1016/j.enpol.2005.07.011

Keywords: electricity consumption, manufacturing output, granger causality, bounds testing for cointegration

Citation: Husaini DH and Lean HH (2015) Does electricity drive the development of manufacturing sector in Malaysia? Front. Energy Res. 3:18. doi: 10.3389/fenrg.2015.00018

Received: 26 February 2015; Paper pending published: 20 March 2015;

Accepted: 06 April 2015; Published: 22 April 2015

Edited by:

Bin Chen, Beijing Normal University, ChinaReviewed by:

Phouphet Kyophilavong, National University of Laos, LaosVinod Mishra, Monash University, Australia

Copyright: © 2015 Husaini and Lean. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) or licensor are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hooi Hooi Lean, Economics Program, School of Social Sciences, Universiti Sains Malaysia, Penang 11800 USM, MalaysiaaG9vaWxlYW5AdXNtLm15

Dzul Hadzwan Husaini

Dzul Hadzwan Husaini Hooi Hooi Lean

Hooi Hooi Lean