- 1School of Management, Xi’an University of Architecture and Technology, Xi’an, China

- 2Laboratory of Neuromanagement in Engineering, Xi’an University of Architecture and Technology, Xi’an, China

The most important issue related to the establishment of carbon emission trading in China is how to motivate the owners of public buildings to participate. However, Existing research few considered the characteristics of public building owners and the influence of various uncertain factors in carbon emission trading investments. To fill this gap, this study constructs a carbon emission trading investment decision model of public building owners to study the mechanism that encourages them to participate, incorporating these characteristics and uncertain factors. The findings are as follows. First, carbon price is important in adjusting the emission reductions of different owners to minimize the total social cost of emission-reduction measures. Second, the price of carbon-emission permits has a significant impact on the investment threshold and decision-making behavior of public building owners. Finally, reducing the cost of energy-conservation and emission-reduction technologies in public buildings and appropriately subsidizing owners for their emission-reduction investment were effective methods to motivate them to participate in carbon emission trading. The results were used to quantitatively analyze the impact of a carbon emission trading mechanism on the decision-making behavior of public building owners and to construct the carbon emission trading mechanism used in China’s public building industry.

Introduction

At present, one of the biggest environmental problems that humans face on a global scale is climate change caused by the high concentration of greenhouse gases (GHG) in the atmosphere from fossil fuels and industrial processes (Burciaga, 2020). Controlling GHG emissions is an important goal for human societies. As early as 1997, the Kyoto Protocol indicated that there are six GHGs of anthropogenic origin that must be reduced: carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbon (HFC), perfluorocarbons (PFC), and sulfur hexafluoride (SF6). In this sense, CO2 is the main anthropogenic GHG, composing approximately 76% of the total GHGs considered by the Kyoto Protocol (IPCC, 2014). Meanwhile, the Kyoto Protocol established a series of innovative cooperation mechanisms with the aim of decreasing the costs of GHG mitigation, namely, International Emission Trade, Joint Implementation, and Clean Development Mechanisms. These three mechanisms involve carbon emission trading between countries (Liu and Dai, 2004). Since then, the carbon emission trading mechanism has become an important means to effectively decrease energy consumption. Internationally, there are large-scale trading platforms, such as the European Union Emissions Trading System (EU-ETS) and the Regional Greenhouse Gas Initiative. Following the official launch of carbon emission trading in China at the end of 2007, the carbon trading market completed 4,340.09 million tons of CO2 trading volume in 2020.

At present, the three fields with the highest energy consumption in China are industry, transportation, and construction. In the construction industry, public buildings consume a relatively large amount of energy. Carbon emissions for the whole process of construction in China amounted to 4.93 billion tCO2, or 51.3% of the national carbon emissions as of 2018. In addition, China’s energy consumption in the building sector increased from 460 million tons to 2.23 billion tons, with an annual growth rate of 9.2% from 2000 to 2018. The rigid growth trend of carbon emissions in the construction sector is obviously higher than the growth rate of energy carbon emissions in industry and transportation (Li et al., 2021; Luo et al., 2021; Luo and Liu, 2021). The energy-consumption permit trading scheme (ECPTS) was proposed by the National Development and Reform Commission and the National Education Association in 2016 to achieve the dual energy control targets, selecting Zhejiang, Fujian, Henan, and Sichuan provinces as the pilot areas. By the end of 2020, nearly 1,000 enterprises in the four pilot provinces had participated in the ECPTS, with a volume of approximately five million tons of standard coal equivalent (Mtce), the value of which exceeded 110 million CNY (Zhang et al., 2021). With continuing urbanization, people’s demand for public services will increase and the area occupied by public buildings will continue to grow. Predictably, the high energy consumption of public buildings will become increasingly severe. Therefore, introducing an appropriate carbon emission trading mechanism into the public building market can effectively decrease energy consumption in this sector. This issue involves the system builder (government), the GHG emission controller (public building owners), and transaction service providers (transaction agency, verification agency, and intermediary). The government is the representative of social interests, and its support for the establishment of the mechanism is self-evident. Service providers will emerge as needed when the mechanism has been established. Since the owners of public buildings are used to the current profit model and their concept of sustainable development is weak, the key issue, particularly at the outset, is to motivate them to participate in the mechanism.

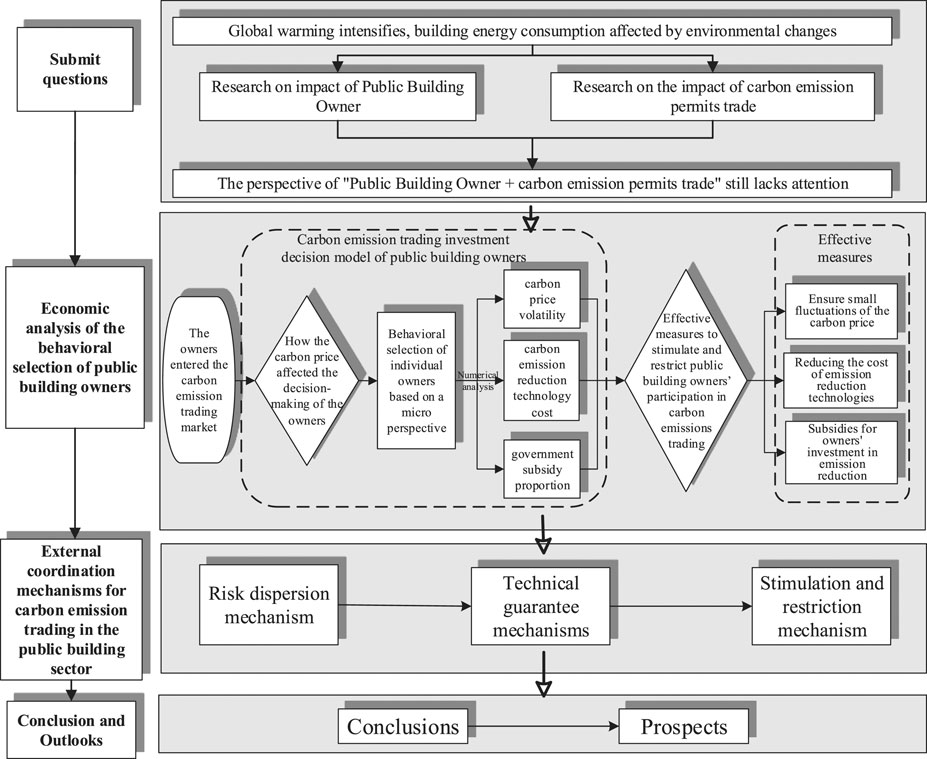

Based on this, we studied the incentive and coordination mechanism of China’s public carbon emission trading market. The rest of this paper is organized as follows. First, the literature review shows the theoretical influence mechanism of the carbon emission trading market. Literature Review presents an economic analysis of the behavioral decisions of public building owners. In this section, we investigate how carbon price affects the decision-making of owners after they enter the carbon emission trading market. Then, considering several uncertain factors, an emission-reduction-investment decision model was established under the constraint of a total amount, which was based on the real-option characteristics and several adjustable uncertain factors of public building owners’ investments in carbon emission trading. This model was applied to further explore the impact of carbon prices on the decision-making behavior of individual public building owners. Economic Analysis of the Behavior Decision-Making of Public Building Owners discusses external coordination mechanisms for carbon emission trading in the public building sector. While also considering effective measures of public building owners who participate in carbon emission trading, this paper establishes a series of external coordination mechanisms. These include a risk-diversification mechanism, a technical-guarantee mechanism for trading media, an incentive-and-restraint mechanism for trading behaviors, and a policy-support mechanism for trading activities. These tools ensure smooth progress in the decision-making of owners to the final transactions. Finally, Conclusion and Outlook concludes the paper and offers future research prospects. The research framework of this study is shown in Figure 1.

Literature Review

Since 1968, when Dales (2002) first proposed the “emission market” to address global climate change, many scholars have suggested that the use of market trading can better lead to a reduction of pollution emissions. For example, using economics theory, Montgomery (1972) proved that the carbon emission trading market can optimize the allocation of environmental resources and thus minimize total emission costs for society. Chen and Tseng (2008), Chèze et al. (2009), and Anger (2010) analyzed carbon emission market mechanisms in the fields of power, industry, and aviation, respectively. Since 2010, an increasing number of scholars has focused on the carbon emission trading framework and its concrete operation. Based on issues in the US market, Kumarappan et al. (2011) constructed the carbon market trading framework.

Perino and Willner (2017) examined the impact of the market stability reserve (MSR) on the price and emission path of the EU emission trading system. They showed that the MSR will adjust the quota of the auction according to the surplus size, shifting the quota issue date to the future for large surpluses. Cansino et al. (2016) used the structural decomposition model to study the influencing factors of Spanish carbon emissions, and obtained six factors, including technology, energy intensity, and consumption mode. Jin et al. (2021) studied the impact of carbon trading prices on emissions and emission efficiency, and addressed the problem with a classic six-unit system. At the same time, with the expansion of building energy consumption, an increasing number of scholars are paying more attention to carbon emission trading in the field of building construction. For example, Chen et al. (2015) showed that carbon emission trading can promote building energy conservation and emission reduction, and further proposed steps to establish the carbon emission trading market in construction. Song et al. (2018) found the probability of local prosecution, the punishment of violations, and the loss of the owner’s reputation to be the key factors affecting the owner’s behavior. Their multi-objective model provides a quantitative theoretical basis for promoting the construction of the ETS market in the construction industry.

Despite these contributions, few studies have addressed the investment decision-making behavior of carbon emission trading entities in China and internationally. However, research on the investment decision-making behaviors of energy conservation entities is similar to studies of the investment decision-making behaviors of carbon emission trading entities, such as the incentive policies for new buildings and analyses of stakeholders in energy-conservation renovations of existing buildings. This involves energy-saving building-renovation entities, energy-saving building developers, and energy-saving building consumers. Their willingness to participate is based on the investment income ratio (e.g., cost distribution and profit sharing). Therefore, research on the investment behaviors of public building owners participating in the carbon emission trading mechanism is of great significance. Qi et al. (2021), using the differentiation model and a series of robustness tests, examined whether the carbon trading market would produce the Porter effect. Astiaso Garcia et al. (2016) focused on the cost–benefit idea and explored the effects of different interventions (e.g., active or passive energy-conservation technologies) on different types of public buildings. Furthermore, they investigated the feasibility of an integrated power grid, new energy, and renewable energy for public buildings. Based on life-cycle costs, energy savings, carbon emissions, and indoor comfort, the energy-conservation renovation scheme was optimized to ensure the active application of energy-conservation technologies by different stakeholders, such as governments, developers, and consumers (Liu et al., 2020; Luo et al., 2021).

Compared with general carbon emissions trading, relatively little research has addressed the carbon emissions trading mechanism in the public building sector. The available research mainly focuses on theoretical explanations of the proposals and the feasibility of the trading framework in the construction sector. Essentially, scholars in this field have studied how to incorporate buildings into carbon emission trading from the perspective of the trading mechanism; however, they lack a quantitative analysis of the influence of this mechanism on public building owners’ decision-making. The researchers also do not offer specific solutions for current problems in the field of public building energy conservation. In addition, domestic research on the investment decisions of public building owners tends to focus on a cost–benefit analysis. Most use traditional technical economic indicators, such as the net present value, the internal rate of return, and the dynamic investment payback period. However, few have considered the option characteristics of energy-conservation and emission-reduction investment based on total control. Furthermore, few have clarified public building owners’ investment decision-making behavior under the influence of various uncertain factors.

Therefore, this paper analyzes the influence of social and economic factors on carbon emission trading to illustrate the importance of this practice in Chinese cities from the macro perspective. Furthermore, we use economics to analyze how the carbon price affects the carbon emission trading market from the macro perspective. Then, from the micro perspective, a carbon-emission-reduction investment model is built, and a numerical analysis of public building owners is applied under the constraint of a total amount. This is done to further explore the impact of carbon price on individual public building owners’ emission-reduction-investment decision-making, and it provides a theoretical basis for the construction of carbon emission trading mechanisms for public buildings. Combined with the analysis of effective incentives to promote the participation of public building owners in carbon emission trading, an external coordination mechanism of carbon emission trading for public buildings is constructed. The findings contribute to the quantitative analysis of the influence of the carbon emission trading mechanism on public building owners’ decision-making behaviors. Furthermore, the carbon emissions trading mechanism in the public building sector in China is constructed.

Economic Analysis of the Behavior Decision-Making of Public Building Owners

Behavioral Decision-Making of Owner Groups Based on a Macro Perspective

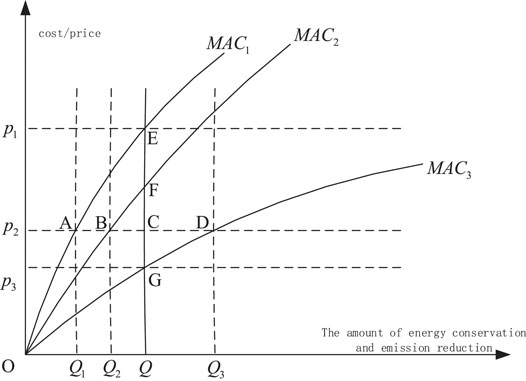

Normally, the energy consumption of public buildings varies, and the cost of energy conservation per unit also differs. If carbon-emission permits can be transferred for a fee, public building owners, who are subject to relatively low costs of energy conservation and emission reduction, may be willing to engage in substantial transfers, thus benefiting from selling surplus carbon-emission permits. Consequently, they are economically motivated. Public building owners with relatively high costs of energy conservation and emission reduction must purchase carbon-emission permits because the cost of taking steps to improve energy conservation is higher than that of purchasing the permits. Therefore, they are economically constrained. Carbon price can be used as an important means for the government to regulate motivation and constrain energy-consumption management during the operation of public buildings. The specific behavioral strategies of public building owners based on carbon emission trading are illustrated in Figure 2.

FIGURE 2. Behavioral strategies of owner groups in carbon emissions permit trading in the public building sector.

In Figure 2, the horizontal axis represents the energy-conservation and emission-reduction amount of each public building owner, while the vertical axis represents the marginal cost of energy conservation and emission reduction. The figure assumes that AC + BC = CD (i.e., QQ1 + QQ2 = Q3Q), and that the carbon-emission market consists of three public building owners (1, 2, and 3), with carbon-emission permits traded between them. Based on the research on the marginal cost of emission reduction in China (Li et al., 2021), their marginal cost curves can be assumed as MAC1, MAC2, and MAC3, respectively. According to the atmospheric environment quality requirements, the volume of energy conservation and emission reduction should be 3Q. Initially, the government equally allocates carbon-emission permits to the three owners. Therefore, the three owners hold 3Q fewer carbon-emission permits than their current carbon emissions.

According to Figure 2, the behavioral strategies of the public building owner group are categorized as three cases based on different carbon prices:

• Case 1: Carbon price of P1. P1 is higher than the marginal cost of public building Owners 2 and 3 when the amount of energy conservation and emission reduction is Q. Owners 2 and 3 are willing to decrease their carbon emissions and sell their carbon-emission permits. For Owner 1, P1 is equal to the marginal cost when the amount of energy conservation and emission reduction is Q; therefore, the owner does not need to purchase carbon-emission permits.

• Case 2: Carbon price of P3. P3 is lower than the marginal cost of public building Owners 1 and 2 when the amount of energy conservation and emission reduction is Q. Owners 1 and 2 are willing to purchase carbon-emission permits. For Owner 3, P3 is equal to the marginal cost when the amount of energy conservation and emission reduction is Q, and Owner 3 will not decrease more to sell the carbon-emission permit.

• Case 3: Carbon price of P2. P2 is lower than the marginal cost of public building Owners 1 and 2 when the amount of energy conservation and emission reduction is Q. Owners 1 and 2 will decrease emissions Q1 and Q2, respectively. The carbon-emission permits they purchase from the trading market are QQ1 and QQ2, respectively. For Owner 3, P2 is higher than the marginal cost when the amount of energy conservation and emission reduction is Q3; therefore, the owner is willing to decrease emissions Q3 and sell carbon-emission permits Q3–Q. Consequently, QQ1 + QQ2 = Q3Q. At this point, the carbon emission trading market of the public building sector reaches a balance between supply and demand.

Further analysis of the abatement costs and social costs undertaken by the public building owners in the above three cases is presented in Table 1, which compares the abatement costs in the case of carbon emission trading and non-carbon emission trading.

TABLE 1. Comparison of carbon-emission reduction between owner participating in trade and not participating in trade.

Consequently,

If the price of carbon-emission permits fluctuates around P2 between P1 and P3, the emission reduction of different owners can be adjusted by the carbon price. Thus, the total social cost of emission reduction is minimized. From the macro perspective of the public building owner group, price fluctuation indicates the process of regulating the supply and demand of carbon-emission permits among public building owners in the trading market. During this process, the allocation of permits in the field of public building energy conservation is continuously optimized.

Behavioral Decision-Making of Individual Owners Based on a Micro Perspective

The carbon-emission-reduction investment of public building owners, under the constraint of a total amount, has clear real-option characteristics. Individual owners have two main ways to reduce emissions: one is to purchase carbon-emission permits from the market, and the other is to voluntarily reduce emissions. If owners adopt energy-conservation technology to decrease carbon emissions, they need to invest in technology, which is an investment choice. Its realization is affected by the income of future carbon emission trading (return), which, in turn, is affected by further uncertainties. Therefore, this section considers uncertain factors by using the real option theory. An emission-reduction-investment decision model of public building owners is established under the constraint of a total amount. This further explores the impact of carbon price on the investment behavior of individual owners.

The following presents the variable settings and basic assumptions:

1) The investment cost of public building owners’ emission reduction measures is

2) The proportion of government subsidies for emission reduction is θ, and the probability is λ. The government switches between implementing subsidies and not implementing subsidies. This process fits a Poisson distribution with the parameter λ (i.e., during the period of dt→0, the probability of governmental implementation of subsidies is λdt).

3) The carbon-emission reduction is Qc = Qc0 − Qc1, where Qc0 represents the carbon emissions before the emission-reduction measures are implemented, and Qc1 represents the carbon emissions after the measures are implemented.

4) The price of a carbon emissions permit is Pc. We assume that it obeys a Brownian motion (i.e., dPc = μcPcdc + бcPcdWc, where μc represents the carbon price growth rate, and бc represents the carbon price volatility).

5) r represents the risk-free interest rate of public building owners’ carbon-emission reduction investment: r > 0.

According to the above variable settings and assumptions, the value function V of the carbon-emission reduction investment of public building owners is:

The impact of the amount of emission reduction on the owners’ investment income is clear, and a positive correlation exists between them. To simplify calculations, the carbon price is used to characterize the income of carbon-emission reduction investment. Let Qc = Qc0 − Qc1 = 1 and

In this equation, C does not change with time, and the emission-reduction investment is equal at any time. Pc obeys the Brownian motion:

Therefore, the investment value can be expressed as:

The Bellman equation of Eq. 5 is:

where E(dV) represents expectations. From the above, the probability that the government subsidizes the emission-reduction behavior of public building owners is λdt. Using Ito to develop E(dV) yields:

The Bellman equation of

The corresponding characteristic equation of Eq. 8 is:

Let T = 0, and the positive solution of the characteristic equation is:

Then, the general form of the solution of Eq. 8 can be expressed as:

Assuming value matching and smooth conditions:

Equations 11, 12 yield:

Equation 13 shows that, only when the permit price

Numerical Analysis of the Influencing Factors of Owners’ Behavioral Decision-Making

Based on the investment decision model established above, this section uses data from real cases to illustrate the influence of various uncertain factors, such as carbon price volatility, technology emission-reduction cost C, government subsidy proportion, and government subsidy probability, on the investment decision point of emission reduction.

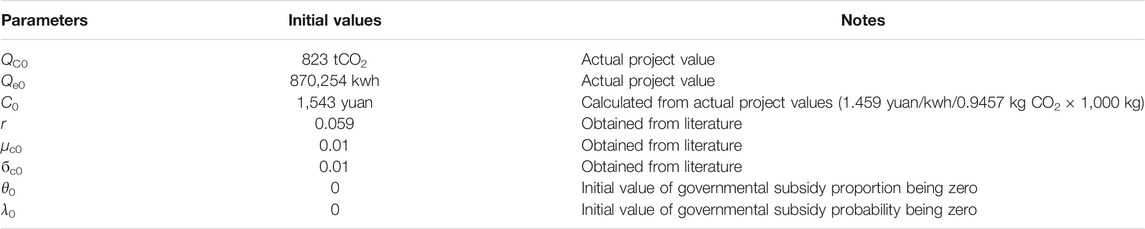

The investment for the renovation of solar water heating technology for a public building in Xi’an is used as example. The initial investment cost, corresponding to unit power savings, is about 1.459 yuan/kwh (calculated via the total initial emission-reduction investment divided by the annual electricity savings). The annual electricity savings are 870,254 kwh, and the annual carbon-emission reduction is 823 t of CO2. The adopted electricity price is the first level of public building electricity price in Xi’an in 2016. With regard to the setting of parameter values of μc and бc0, please refer to the relevant literature (Gülay Zorer Gedik et al., 2017; Xu and Wang, 2018; Luo Xi, et al., 2019). The initial values of each parameter are listed in Table 2.

TABLE 2. Values of parameters in the carbon-emission reduction investment model of public building owners.

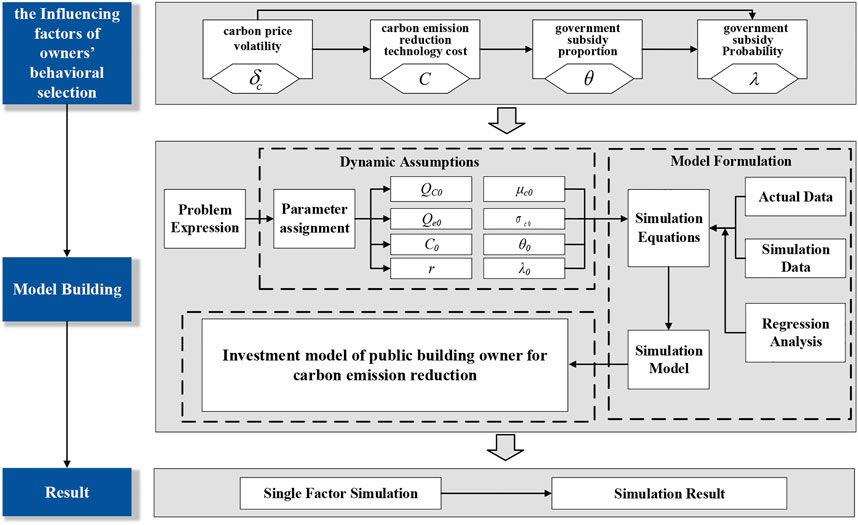

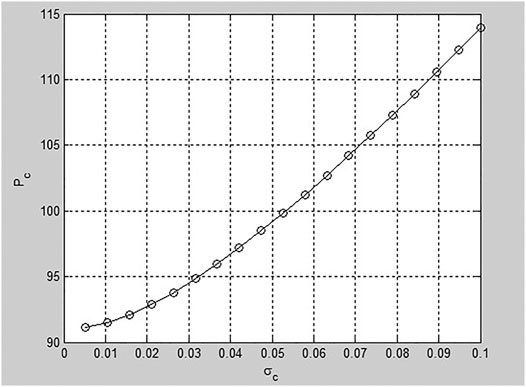

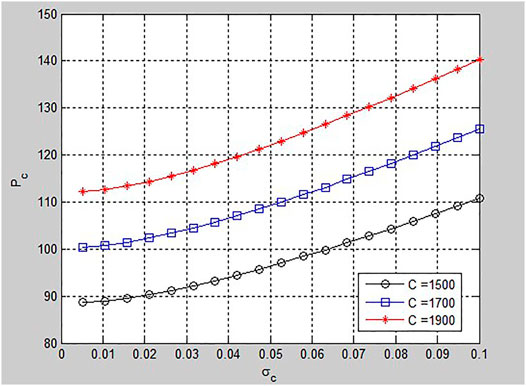

Matlab (R2012a) was used to simulate the carbon-emission reduction investment model of public building owners and to assess the impact of various uncertain factors on the investment decision point. The model-building process is shown in Figure 3, and the results are shown in Figures 4–7.

The Impact of Carbon Price Volatility on Investment Decisions

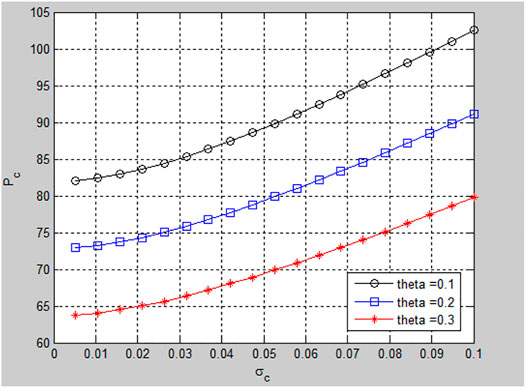

Let C0 = 1,543, r = 0.059, μc = 0.01, θ0 = 0, and λ0 = 0 to explore the impact of carbon price volatility (бc) on public building owners’ carbon-emission reduction investment decision point. The variation of the decision point

The Impact of Carbon-Emission Reduction Technology Cost on Investment Decisions

Let r = 0.059, μc = 0.01, θ = 0, and λ = 0; the impact of different technology costs on the decision point for owners’ carbon emission-reduction investment is explored in the case of carbon price fluctuations. The variation of the decision point

The Impact of Government Subsidy Proportion on Investment Decisions

Let C = 1,543, r = 0.059, μc = 0.01, and λ = 0.1; the impact of different government subsidy proportions on the decision point for owners’ carbon emission-reduction investment is explored in the case of carbon price fluctuations. The variation of the decision point

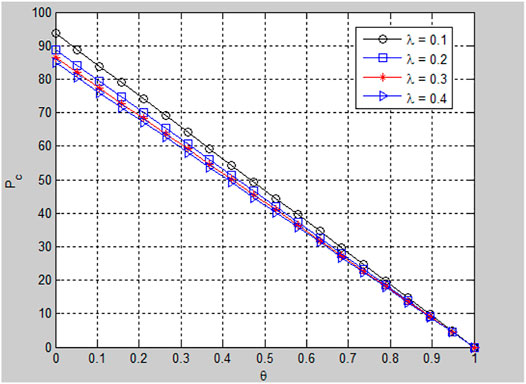

The Impact of Government Subsidy Probability on Investment Decisions

Let r = 0.059, μc = 0.01, and бc = 0.1; the impact of government subsidy probability (λ) on the decision point for owners’ emission-reduction investment is explored in the case of simultaneous changes in government subsidy probability and subsidy proportion. The variation of the decision point

Effective Measures to Stimulate and Restrict Public Building Owners’ Participation in Carbon Emissions Trading

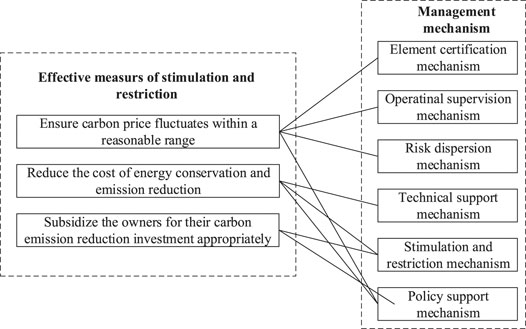

The above analysis of the impact of carbon price on public building owners’ trading behaviors and emission-reduction investment decisions from macro and micro perspectives indicates that the uncertainties affecting owners’ decision-making in emission-reduction investment can be identified. The following presents a summary of the effective measures to stimulate and restrict owners’ participation in carbon emissions trading.

Ensure Small Fluctuations of the Carbon Price Within a Reasonable Range

Large carbon price fluctuations will cause public building owners to expect higher risks in the emission trading market, thus raising the threshold for emission-reduction investment and hindering both energy conservation and emission reduction of public buildings. Therefore, corresponding management measures should be taken to regulate the carbon price, which will ensure that fluctuations remain within a reasonable range. The aim is to reduce the risk expectations of public building owners in carbon-emission reduction investment to promote investment and applications of energy-conservation and emission-reduction technologies.

Reduce the Cost of Energy-Conservation and Emission-Reduction Technologies

Reducing the cost of energy-conservation and emission-reduction technologies can lower the decision point of owners with regard to emission-reduction investment. Consequently, they are still willing to invest in emission reduction at a lower carbon price. Furthermore, to utilize the energy-conservation potential of public buildings, conserve energy, and improve energy efficiency, the model relies heavily on energy-conservation technologies. These can significantly improve energy efficiency, decrease energy consumption, reduce costs, and increase the possibility that public building owners will participate in the emission trading market. Moreover, imitative innovation plays an important role in emission reduction, while the introduction of technology does not work very well, and original innovation even increases carbon emissions.

Appropriately Subsidize Owners for Their Carbon-Emission Reduction Investment

Providing government subsidies to public building owners who invest in energy conservation and emission reduction can decrease their investment decision point. Consequently, they can invest at a lower carbon price. The greater the probability of the government’s subsidies, the more likely owners will be to have good expectations for emission-reduction investment, leading them to make investment decisions accordingly. However, excessive governmental subsidies create fiscal pressures for the government; therefore, subsidies should remain within a reasonable range to encourage owners to implement market-oriented energy conservation and emission reduction.

For the above measures to effectively stimulate and restrict public building owners, a corresponding management mechanism is required, as shown in Figure 8. Based on the decision-making pattern of owners, all management mechanisms should stimulate their participation in emissions trading.

FIGURE 8. Management mechanism to stimulate public building owners to participate in carbon emissions permit trading.

External Coordination Mechanisms for Carbon Emission Trading in the Public Building Sector

Risk Dispersion Mechanism of Public Building Owners’ Trading Decisions

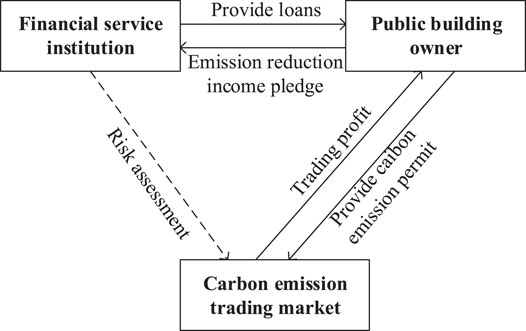

Investment Risk Dispersion

Uncertainties affect both the application of energy-conservation and emission-reduction technologies and the participation of public building owners in carbon emission trading. The discount period for the incremental cost of carbon emission reduction and carbon emission trading (the incremental benefits, in particular) can be extended to about 50 years or more. This puts many public building owners at significant investment risk. To disperse these risks, owners should count on the capital advantages of financial institutions, such as banks, investment companies, insurance companies, and fund securities companies, to jointly disperse the investment risks.

The first method is to provide a wealth of financial services. First, financial institutions jointly provide loans for large-scale energy-conservation and emission-reduction projects with promising potential. After the carbon emission trading has been completed, the benefits can be used to pay for the costs of carbon emission-reduction measures and for carbon emission trading activities. Then, financial institutions can allow owners to pledge the carbon-emission-reduction benefits to be earned. They can also be provided with early funds to help smaller public building projects overcome problems associated with front-end investment. The specific model is shown in Figure 9.

FIGURE 9. Pattern of dispersing carbon-emission reduction investment and transaction risk of financial institutions.

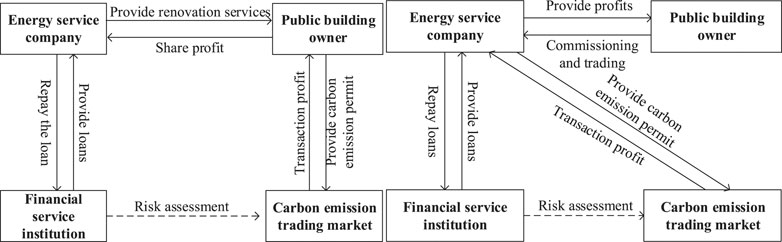

The second method is to encourage energy service companies to participate in carbon emission trading, which is a new type of financing mode. These companies provide energy-conservation renovation services for public building owners, gain benefits by selling the remaining carbon-emission permits, and then invest the money in the renovation project to overcome the funding problem. To promote this trading model and attract participants, the investment risk dispersion model, after adding the energy service company, is shown in Figure 10.

FIGURE 10. Pattern of dispersing carbon-emission reduction investment and transaction risk of financial institutions and energy service companies.

The third method is to cultivate carbon finance professionals in the public building sector. To propose a reasonable and effective carbon finance policy, it is necessary to have a good grasp of public building energy conservation, carbon emission trading, and financial knowledge. However, the introduction of carbon emission trading mechanisms to the public building sector is still new, and professional talents are rare. Therefore, both the energy-conservation-management department and the carbon-emission-trading-management department should jointly organize training programs and offer opportunities to study at mature international carbon financial institutions. Consequently, professional talents could be cultivated to provide personnel support for making financial policies, enriching financial services, and innovating financial instruments and products.

Emission Reduction Risk Dispersion

Unlike industrial buildings, it is more complicated for public buildings to measure energy consumption and determine energy savings. Thus, owners need to take great risks. Therefore, to reduce this uncertainty, first, methodology should be developed with regard to carbon emission trading in the field of public building energy conservation. The existing Kyoto Protocol framework treats energy conservation in the public building sector and other industrial fields as equal. However, this approach is questionable because the basic methods of energy use and emission reduction differ; they cannot simply be treated as equal. It should be noted that public building energy conservation is the combined result of various technical factors. Using the government’s energy-conservation and energy-consumption standards as a reference, appropriate methods should be adopted to develop methodologies to determine the baseline of energy consumption for public buildings and calculate emission reductions. Second, professional energy-conservation-monitoring agencies should be established to provide accurate energy-consumption data and energy-savings data for owners.

Technical-Guarantee Mechanisms for the Trading Medium of Public Building Owners

The medium with which public building owners can conduct carbon emission trading is the carbon emissions permit (i.e., a quota). The determination of such a carbon emissions permit is closely related to the energy-consumption levels of public buildings. Therefore, to protect the carbon emission permit to which public building owners are entitled, it is necessary to monitor energy-consumption levels of public buildings accurately and scientifically using the appropriate energy-consumption monitoring technology.

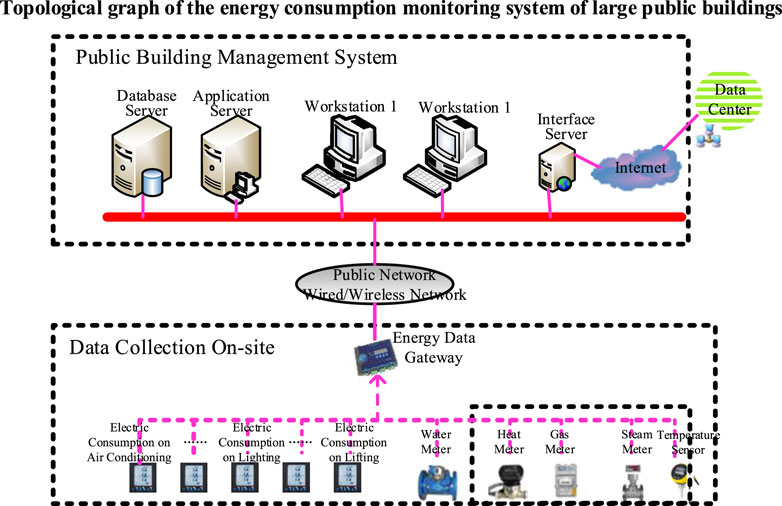

This requires the full utilization of the energy-consumption monitoring platform of public buildings; it is also important to establish energy consumption data monitoring platforms in various provinces and cities, and achieve real-time monitoring of equipment with high energy consumption in public buildings. Via remote transmission, the energy consumption data can be collected, classified (e.g., electricity, gas, and water), and itemized (air conditioning electricity, lighting socket electricity, power electricity, and electricity for special uses), as shown in Figure 11. Regular surveys of public buildings need to be conducted, and online monitoring and dynamic analysis of energy consumption need to be realized to achieve accurate control of energy consumption and to optimize energy management. Work needs to be coordinated with public building owners, property sectors, and energy departments to improve data reporting efficiency, strengthen energy-consumption data management, and provide both accurate and reliable data for trading through manual and digital collections.

FIGURE 11. Topological graph of the energy-consumption monitoring system. Source: Energy-consumption monitoring platform of Xi’an

Stimulation-And-Restriction Mechanism for the Trading Behaviors of Public Building Owners

As a post-evaluation system for the entire trading activity, the stimulation-and-restriction mechanisms evaluate public building owners’ trading behavior after a certain performance period. The government rewards owners who follow the transaction rules, and it punishes those who do not. It also allocates quotas for the next performance period based on their performance according to the contract. In this way, the carbon emission trading market will play a significant role in the stimulation and restriction of public building owners’ behavior in emissions reduction.

Diversified Stimulation Methods

When the benefits from the carbon emission trading market are inadequate to appropriately stimulate the participation of traders, the government can apply different stimulating measures for the public building energy-conservation stakeholders who are involved in carbon emission trading. With the applied measures and the “profit-driven” effect, the carbon emission trading market in the public building sector can function smoothly.

The first measure is to issue goal-oriented stimulation policies that aim to formulate targeted carbon emission trading incentive policies in the public building sector. Successful examples from other countries indicate that, instead of being generalized and mutually contradictory, all policies of emission reduction and energy conservation are independent and aimed to achieve corresponding goals. The British carbon fund, for example, was established to undertake the responsibilities as outlined in the Kyoto Protocol to reduce GHG emissions. Therefore, supportive documents about finance, regulation, stimulation, and inspection should be presented prior to introducing the carbon emission trading mechanism in the public building sector. This will clarify the obligations and responsibilities of carbon emission trading stakeholders, such as public building owners, property sectors, construction units, materials and equipment suppliers, design units, and government regulatory agencies.

The second measure establishes special funds for carbon emission trading in the public building sector. Here, trading participants who are actively engaged in energy conservation and emission reductions should receive priority when subsidizing. These can be identified through energy-conservation renovation, construction of green buildings, green low-carbon technologies, and use of renewable energy. Currently, the application of energy-conservation technologies introduced by local governments is subsidized by area. For example, the subsidy for solar energy projects is 200 yuan/m2 by the collector area. For demonstration projects of renewable energy buildings that use ground source heat pump technology, the subsidy is 30 yuan/m2 by the load area. This subsidy method is not based on energy savings; therefore, when subsidizing public buildings that are involved in carbon emission trading, the energy savings and costs of related energy-conservation technologies need to be considered.

For public building owners, the appropriate subsidy amount can be estimated by the energy-conservation and emission-reduction-investment decision model established as Eq. 14:

The solar water heating technology of a public building in Xi’an is used as an example. The proportion of subsidy that the government should provide for the owners when the carbon price is fixed is calculated. Let

According to Eq. 14, the subsidy amount is related to the carbon price and the technology-based emission-reduction cost. Let C = 1,543 yuan, and observe the change of θ with Pc. The results are shown in Table 3. When the carbon price decreases, higher government subsidies are required to encourage emission-reduction investment by public building owners. However, when the carbon price increases to a certain level, the owners will be willing to invest and participate in the carbon emission trading even without governmental subsidies.

TABLE 3. The proportion of government giving subsidies to owner for investment of carbon-emission reduction under different carbon prices.

Let Pc = 80 yuan/t of CO2; the change of θ with C is shown in Table 4. After the costs of technology-based emission reduction have been lowered to a certain level, even without government subsidies, public building owners will still choose to invest in emission reduction and participate in carbon emission trading.

TABLE 4. The proportion of government giving subsidies to owner for investment of carbon-emission reduction under different technical costs.

The construction-related management department shall, in combination with the carbon emission trading management department, conduct research on the costs corresponding to energy savings per unit of various energy-conservation technologies. Relevant standards should be introduced so that public building owners can better invest in emission reduction and make appropriate trading decisions.

The third method is to provide tax preference or convenient loan services. Proper tax preference or subsidies should be directed to owners who are actively engaged in carbon emission trading and who invest in emission reductions. Alternatively, subsidized funds can be used to help trading agents purchase quotas for their participation in carbon emission trading. This not only stimulates the demands of the trading market, but also realizes subsidization. Furthermore, financial institutions are encouraged to provide loans to public building owners or energy service companies that actively participate in carbon-emission reduction.

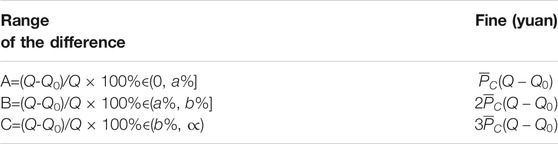

Multi-Level Punitive Measures

The carbon emission trading mechanism for public buildings is still in its pilot stage, which lacks the protection of laws and regulations. Therefore, to achieve the goals of energy conservation and emission reduction, the policies, regulations, laws, rules, and systems concerning public building energy conservation must be comprehensively considered, and corresponding punitive measures must be taken.

The first measure is to impose a fine. For those who do not participate in carbon emission trading and who are responsible for illegal emissions, a penalty is specified based on the amount of illegal discharge. A bonus penalty strategy should be adopted (e.g., grading pricing is implemented for the part of carbon emissions that exceeds the emission quota). The higher the amount of excessive emissions, the higher the price will be. Suppose the average carbon price of the trading market is

Moreover, the typical carbon emission trading systems in foreign countries can be used as examples. For instance, in the EU market, if the carbon emissions of a trader exceed the assigned quota, the trader will be punished for excessive portions. The excess will be deducted from the quota of the next year. In New Zealand, if a trader who is forced to reduce carbon emissions intentionally fails to fulfill their obligations, they will be subject to legal accountability. Failing obligations due to negligence will be punished with a fine, which will be doubled if non-compliance occurs again. These negative incentives can effectively force public building owners to actively reduce energy consumption.

The second measure is to cause loss of reputation. Disclosure of public building owners who do not participate in carbon emission trading and who violate emission rules can cause loss of reputation and encourage financial institutions to cancel their loans.

A Policy-Support Mechanism for Trading Activities of Public Building Owners

Due to the large number of public building owners and various interest demands, their trading behaviors differ greatly. To guarantee the rights of traders, relevant policies and regulations are required to guide and protect them. The carbon emission trading market is strongly policy-oriented, highly risky, and professional, involving issues of environmental property rights. Only a sound legal and regulatory policy system can appropriately contribute to the formation of a carbon emission trading market; such a system would regulate and restrict the operation of the market to ensure fair and equitable trading. Therefore, prior to the formation of a national public building carbon emission trading market, relevant laws and regulations need to be issued. These include detailed rules for quota allocation, transaction procedures, verification methods, regulatory measures, incentive measures, and punitive measures. Legislation needs to come first and serve as a legal reference for trading behaviors, thus reducing poor trading behaviors.

Conclusion and Outlook

Based on the high energy consumption of the operation of public buildings, this paper uses the real option theory to construct a carbon-emission reduction investment decision model for public building owners from both macro and micro perspectives, and it assesses the impact of the characteristics of public buildings and various uncertainties on carbon trading investment. Furthermore, an external coordination mechanism for carbon emission trading in the public building sector is established to ensure efficiency for owners from decision-making to the close of transactions. Through this analysis, the following conclusions have been reached.

First, carbon price is important in adjusting the emission reduction of different owners to minimize the total social cost of emission-reduction measures. By applying economic theories from a macro perspective, this paper analyzed the impact of carbon price as an incentive for and constraint on the decision-making behavior of property owners after they enter the carbon emission trading market. Price fluctuations indicate the process of regulating the supply and demand of the carbon-emission permit among public building owners in the trading market. During this process, the allocation of carbon emission trading in the field of public building energy conservation is continuously optimized.

Second, the price of carbon-emission permits has a significant impact on the investment threshold and decision-making behavior of public building owners. Considering several uncertain factors, an emission-reduction investment-decision model was established under the constraint of a total amount, which was based on the micro perspective. Meanwhile, combined with a case study, this paper simulated and analyzed the factors of public building owners’ behavior decisions and explored the influence of carbon price on the emission-reduction-investment decision-making behavior of public building owners.

Third, based on the macro and micro perspectives of the impact of carbon price on the main trading behavior and emission-reduction-investment decisions, we identified effective means to encourage and restrain public building owners to participate in carbon emission trading. That is, to ensure the small fluctuation of carbon prices within a reasonable range, reduce the technical cost of energy conservation and emission reduction of public buildings and appropriately subsidize the owners’ emission-reduction investment.

Moreover, this paper constructs an external coordination mechanism for carbon emission trading for public buildings while fully considering the incentive and restraint behavior of the building owners. The includes the risk-analysis mechanism, the technical-guarantee mechanism, and the policy-support mechanism. Based on the current research results, the following issues can be further studied in the future. First, this study enables a comparative analysis of the behavioral strategies of public building owners who participate in carbon emission trading of different types, in different countries, and in different regions, according to prevailing socio-techno-economic conditions. Due to case limits, this paper only used one case to numerically analyze the behavioral strategies of these owners. However, conducting further comparative studies on owners’ decisions will help to set different carbon emission trading policies (Fu et al., 2020; Li et al., 2021). Also needed is an in-depth study of the risks associated with the introduction of carbon emission trading market mechanisms in the public building sector. The relationship between macro economy and carbon trading market still needs to be studied in the future. During the early phase of the carbon emissions trading market, environmental investment is associated with higher risk, and its payback period can reach 100 years or more. In contrast to general investment projects, the risk greatly impacts the formation of the carbon emissions trading market in the public building sector. Therefore, it is necessary to classify the risks that are introduced with the implementation of a carbon emission trading mechanism in the public building sector. Furthermore, to analyze the possible impacts in detail, a risk aversion system needs to be formulated, a basis for the government to formulate relevant policies needs to be provided, and public building owners require help to make investment decisions scientifically.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author Contributions

Conceptualization, LL; methodology, MD; software, XG; validation, LL; formal analysis, MD; data curation, YW; writing—original draft preparation, MD and LL; writing—review and editing, XG; visualization, LL and MD; supervision, LL; project administration, LL; and funding acquisition, LL. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the National Key R&D Program of China (grant no. 2018YFD1100202), the Ministry of Education Humanistic and Social Science Program of China (grant no. 19YJC630080), the General Project of Shaanxi Province Soft Science Research Program (grant no. 2019KRM197), the Philosophy and Social Science Research Program of Education Department of Shaanxi Province (grant no. 12JK0070), and the Shaanxi Social Science Fund General Project (grant no. 2015R006).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

The authors would like to thank the comments and suggestions of reviewers for their important help in improving the quality of this article.

References

Anger, A. (2010). Including Aviation in the European Emissions Trading Scheme: Impacts on the Industry, CO2 Emissions and Macroeconomic Activity in the EU. J. Air Transport Manag. 16 (2), 100–105. doi:10.1016/j.jairtraman.2009.10.009

Astiaso Garcia, D., Cumo, F., Tiberi, M., Sforzini, V., and Piras, G. (2016). Cost-Benefit Analysis for Energy Management in Public Buildings: Four Italian Case Studies. Energies 9 (7), 522. doi:10.3390/en9070522

Burciaga, U. M. (2020). Sustainability Assessment in Housing Building Organizations for the Design of Strategies against Climate Change. Hightech. Innov. J. 1 (4), 136–147. doi:10.28991/hij-2020-01-04-01

Cansino, J. M., Román, R., and Ordóñez, M. (2016). Main Drivers of Changes in CO2 Emissions in the Spanish Economy: A Structural Decomposition Analysis. Energy Policy 89, 150–159. doi:10.1016/j.enpol.2015.11.020

Chen, Y., and Tseng, C. L. (2008). Climate Policies and the Power Sector: Challenges and issues[J], Journal of Energy Engineering 134(2):31-32. doi:10.1061/(asce)0733-9402(2008)134:2(31)

Chen, Y., Jiang, P., Dong, W., and Huang, B. (2015). Analysis on the Carbon Trading Approach in Promoting Sustainable Buildings in China. Renew. Energ. 84, 130–137. doi:10.1016/j.renene.2015.06.062

Chèze, B., Chevallier, J., and Alberola, E. (2009). Emissions Compliances and Carbon Prices under the EU ETS: A Country Specific Analysis of Industrial sectors[J], Journal of Policy Modeling 31(3):446-462. doi:10.1016/j.jpolmod.2008.12.004

Dales, J. H. (2002). Pollution, Property & Prices: An Essay in Policy-Making and economics[M]. London UK: Edward Elgar Publishing.

Fu, H., Manogaran, G., Wu, K., Cao, M., Jiang, S., and Yang, A. (2020). Intelligent Decision-Making of Online Shopping Behavior Based on Internet of Things. Int. J. Inf. Manag. 50, 515–525. doi:10.1016/j.ijinfomgt.2019.03.010

IPCC (2014). Sobre el Cambio Climático P I. Cambio climático 2014: Impactos, Adaptación y Yulnerabilidad. Contribución del Grupo de Trabajo II al Quinto Informe de Evaluación del Grupo Intergubernamental de Expertos Sobre el Cambio Climático. Resumen para Responsables de Políticas[J]. 2014.

Jin, J., Zhang, X., Xu, L., Wen, Q., and Guo, X. (2021). Impacts of Carbon Trading and Wind Power Integration on Carbon Emission in the Power Dispatching Process. Energ. Rep. 7, 3887–3897. doi:10.1016/j.egyr.2021.06.077

Kumarappan, S., and Joshi, S. (2011). Trading Greenhouse Gas Emission Benefits from Biofuel Use in US Transportation: Challenges and Opportunities. Biomass and Bioenergy 35 (11), 4511–4518. doi:10.1016/j.biombioe.2011.09.018

Li, L., Sun, W., Hu, W., and Sun, Y. (2021a). Impact of Natural and Social Environmental Factors on Building Energy Consumption: Based on Bibliometrics. J. Building Eng. 37, 102136. doi:10.1016/j.jobe.2020.102136

Li, L., Wang, Y., Wang, M., Hu, W., and Sun, Y. (2021b). Impacts of Multiple Factors on Energy Consumption of Aging Residential Buildings Based on a System Dynamics Model--Taking Northwest China as an Example. J. Building Eng. 44, 102595. doi:10.1016/j.jobe.2021.102595

Li, W., Chien, F., Ngo, Q.-T., Nguyen, T.-D., Iqbal, S., and Bilal, A. R. (2021c). Vertical Financial Disparity, Energy Prices and Emission Reduction: Empirical Insights from Pakistan. J. Environ. Manage. 294, 112946. doi:10.1016/j.jenvman.2021.112946

Liu, J., Liu, Y., Yang, L., Liu, T., Zhang, C., and Dong, H. (2020). Climatic and Seasonal Suitability of Phase Change Materials Coupled with Night Ventilation for Office Buildings in Western China. Renew. Energ. 147, 356–373. doi:10.1016/j.renene.2019.08.069

Liu, W., and Dai, Y. (2004). A Review on the Emission Permits Trade of Carbon in China. Probl. For. Econ. 4, 001. doi:10.16832/j.cnki.1005-9709.2004.04.001

Luo, X., and Liu, Y. (2021). A Multiple-Coalition-Based Energy Trading Scheme of Hierarchical Integrated Energy Systems. Sust. Cities Soc. 64, 102518. doi:10.1016/j.scs.2020.102518

Luo, X., Liu, Y., Feng, P., Gao, Y., and Guo, Z. (2021). Optimization of a Solar-Based Integrated Energy System Considering Interaction between Generation, Network, and Demand Side. Appl. Energ. 294, 116931. doi:10.1016/j.apenergy.2021.116931

Luo, X., Liu, Y., Liu, J., and Liu, X. (2019). Energy Scheduling for a Three-Level Integrated Energy System Based on Energy Hub Models: A Hierarchical Stackelberg Game Approach. Sust. Cities Soc. 52, 101814. doi:10.1016/j.scs.2019.101814

Montgomery, W. D. (1972). Markets in Licenses and Efficient Pollution Control Programs. J. Econ. Theor. 5 (3), 395–418. doi:10.1016/0022-0531(72)90049-x

Perino, G., and Willner, M. (2017). EU-ETS Phase IV: Allowance Prices, Design Choices and the Market Stability reserve. Clim. Pol. 17 (7), 936–946. doi:10.1080/14693062.2017.1360173

Qi, S.-z., Zhou, C.-b., Li, K., and Tang, S.-y. (2021). The Impact of a Carbon Trading Pilot Policy on the Low-Carbon International Competitiveness of Industry in China: An Empirical Analysis Based on a DDD Model. J. Clean. Prod. 281, 125361. doi:10.1016/j.jclepro.2020.125361

Song, X., Lu, Y., Shen, L., and Shi, X. (2018). Will China's Building Sector Participate in Emission Trading System? Insights from Modelling an Owner's Optimal Carbon Reduction Strategies. Energy policy 118, 232–244. doi:10.1016/j.enpol.2018.03.075

Xu, L., and Wang, C. (2018). Sustainable Manufacturing in a Closed-Loop Supply Chain Considering Emission Reduction and Remanufacturing. Resour. Conservation Recycling 131, 297–304. doi:10.1016/j.resconrec.2017.10.012

Zhang, Y., Guo, S., Shi, X., Qian, X., and Nie, R. (2021). A Market Instrument to Achieve Carbon Neutrality: Is China's Energy-Consumption Permit Trading Scheme Effective?. Appl. Energ. 299, 117338. doi:10.1016/j.apenergy.2021.117338

Keywords: carbon emission trading market, public building owner, behavioral selection, carbon price, external coordination mechanism of trading

Citation: Li L, Duan M, Guo X and Wang Y (2021) The Stimulation and Coordination Mechanisms of the Carbon Emission Trading Market of Public Buildings in China. Front. Energy Res. 9:715504. doi: 10.3389/fenrg.2021.715504

Received: 27 May 2021; Accepted: 05 August 2021;

Published: 16 August 2021.

Edited by:

Yong-cong Yang, Guangdong University of Foreign Studies, ChinaReviewed by:

Fanlin Meng, University of Essex, United KingdomHadi Farabi-Asl, Research Institute for Humanity and Nature, Japan

Copyright © 2021 Li, Duan, Guo and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mimi Duan, ZHVhbm1pbWlAeGF1YXQuZWR1LmNu

Lingyan Li1

Lingyan Li1 Mimi Duan

Mimi Duan Xiaotong Guo

Xiaotong Guo