- 1South China University of Technology, Guangzhou, China

- 2Guizhou Minzu University, Guiyang, China

- 3Guangzhou City University of Technology, Guangzhou, China

- 4Guangdong Education Big Data Research Center, Guangdong University of Technology, Guangzhou, China

- 5New Engineering Education Research Center of Guangdong University of Technology, Guangzhou, China

This paper discusses the impact of digital finance development on the continuous technological innovation and its mechanism in China’s energy companies. Analyzing the data of A-share listed energy companies in China’s Shanghai and Shenzhen stock markets from 2011 to 2018, using a fixed effects model, we find that digital finance development played a positive role in stimulating continuous technological innovation in Chinese energy companies. Moreover, we find that risk-taking plays a mediating effect, which is the development of digital finance encourages Chinese energy companies to carry out continuously innovative activities by increasing the level of corporate risk-taking. Finally, we find that in non-state-owned, small and highly externally funded energy companies, digital finance development shows a stronger effect in driving continuous technological innovation in Chinese energy companies through risk-taking. Our results highlight the role of risk-taking as an important mediator in the relationship between digital finance development and continuous technological innovation. It has enlightenment for China to make better use of digital finance to empower energy companies to continue to innovate.

1 Introduction

The continuous technological innovation of energy companies is important to lead the energy transition and develop sustainable economic. Throughout the historical development trajectory of global innovative companies, most of their growth process cannot be separated from the strong support of financial development (Wang et al., 2019). Continuous technological innovation is a long-term, high-risk activity with large capital requirements, irreversible processes, and uncertain output. The traditional financial system with commercial banks generally has a low level of risk-taking (Huang, 2018), which cannot match high-risk continuous technological innovation activities. This makes innovative companies with development potential often meet “financial discrimination” problems. Therefore, discussing how to provide stable and adequate financial support for continuous technological innovation of energy companies has become a major theoretical and practical problem of governments, companies and academia.

The dilemmas faced by traditional financial development need to be addressed by innovative financial models. Driven by emerging technologies such as big data, cloud computing, and the Internet, China’s digital finance has achieved rapid development in recent years. Digital finance refers to the use of digital technology by traditional financial institutions and Internet companies to realize financing, payment, investment and other new financial business models (Tang et al., 2020). As a new service format with high efficiency and low price, digital finance has the advantages of cross-temporal, low-cost, and information visualization (Huang, 2018). It breaks through many limitations of traditional financial and provides new ideas for making up for the shortcomings of traditional financial services (Huang, 2018). Given the relatively short history of digital finance, there is little literature on whether and by what mechanisms digital finance helps to incentivize corporate innovation. In the evaluation of the impact effects, existing literature mainly provides two viewpoints. One view holds that the “inclusive” and “grassroots” characteristics of digital finance can significantly promote corporate innovation, especially small and micro enterprises (Tang et al., 2020; Liang and Zhang, 2019; Li et al., 2020; Yao et al., 2021). The other point of view is that the development history of digital finance is short, and it is difficult to effectively match digital financial products with innovative activities (Gomber et al., 2018). In terms of mechanism, existing literature reveals that digital finance can stimulate enterprise innovation through financing channels including financing constraint mitigation and financing cost reduction (Liang and Zhang, 2019; Li et al., 2020; Tang et al., 2020; Chen and Yoon, 2021).

In conclusion, the existing literature reveals that digital finance may stimulate corporate innovation, and proposes financing mitigation and financing cost reduction as specific mechanisms. However, there are still some shortcomings in the existing literature that need to be filled. First, existing research focuses on general technological innovation, and has not analyzed the impact of digital finance on continuous technological innovation. Second, the existing research only analyzes the financing mechanism, and lacks the discussion of other mechanisms. Third, most of the samples used in existing researches are full samples including all industries, they do not take into account the effects of industry heterogeneity.

Specifically, energy technology innovation activities tend to have higher uncertainty and risk (Noailly and Smeets, 2016), and continuous technological innovation by energy companies requires more long-term and continuous investment (Yu and Fan, 2021). Therefore, the continuous innovation of energy companies is more dependent on financial support, and digital finance is more likely to play a role in making up for the insufficiency of traditional finance. Meanwhile, the innovation process consists of four stages: innovation willingness-innovation resource input-innovation management-Innovation output. The lack of any stage will lead to the inability of innovation to be carried out effectively. For high-risk and long-term projects such as continuous technological innovation, before companies decide to invest “real money”, they must first stimulate their willingness to innovate. Increasing the level of risk taking can help stimulate a firm’s willingness to innovate (García-Granero et al., 2015; Roper and Tapinos, 2016). Therefore, stimulating risk-taking is the front-end mechanism of promoting corporate innovation. This paper empirically examines the impact of digital finance development on the continuous technological innovation of Chinese energy companies, and further examines the mechanism from the perspective of risk-taking. It can further expand related research in the field of financial development and continuous technological innovation, and at the same time, it has important policy implications for Chinese energy companies to make better use of digital finance to enhance continuous innovation.

This paper discusses the impact of digital finance development on the continuous technological innovation and its mechanism in China’s energy companies. Compared with existing research, the marginal contribution of this research is mainly reflected in three aspects: First, we provide a pioneering discussion how the development of digital finance affects the continuous technological innovation of Chinese energy companies. With China’s increasing focus on ecological issues, continuous technological innovation in energy companies has become a key concern for society. Given the scale of digital finance development in China and its leadership in world technological practice, it is important to select Chinese energy companies to study the impact of digital finance development on their continuous technological innovation. In recent years, some literature has begun to focus on the impact of digital financial development on general technological innovation, but there is no literature that takes continuous technological innovation as the research object. We found that the development of digital finance helps to stimulate the continuous technological innovation of Chinese listed energy companies, indicating that digital finance can facilitate the innovation transformation of energy companies and contribute to the implementation of China’s innovation-driven strategy.

Second, this paper extends the literature by empirically exploring the mechanisms of risk-taking to explain how digital finance development affect continuous technological innovation in Chinese listed energy companies. Existing studies have focused on testing the impact of digital finance on general technological innovation. As for the mechanism, the discussion mainly focuses on the mitigation of financing constraints and the reduction of financing costs. This study reveals that the development of digital finance can motivate Chinese energy companies to continue to innovate by increasing their level of risk-taking. Therefore, we fill the gap in the research on risk-taking mechanism.

Finally, this paper examines individual differences between state-owned and non-state-owned enterprises, small and large enterprises, high dependence on external finance and low dependence on external finance. Our results show that in non-state-owned energy companies, small energy companies, and energy companies that highly rely on external funds, digital financial development is more effective in promoting continuous technological innovation through risk-taking mechanisms. This paper clarifies the conditions and boundaries of the risk-taking mechanism that digital finance affects the continuous innovation of Chinese energy companies.

The rest of this paper is organized as follows. Section 2 is literature review and research hypotheses. Section 3 includes data sources, variable definitions and empirical model settings. Section 4 presents the empirical results. Section 5 demonstrates the heterogeneous effects from enterprises’ attributes. Finally, Section 6 concludes.

2 Literature Review and Research Hypothesis

2.1 Literature Review

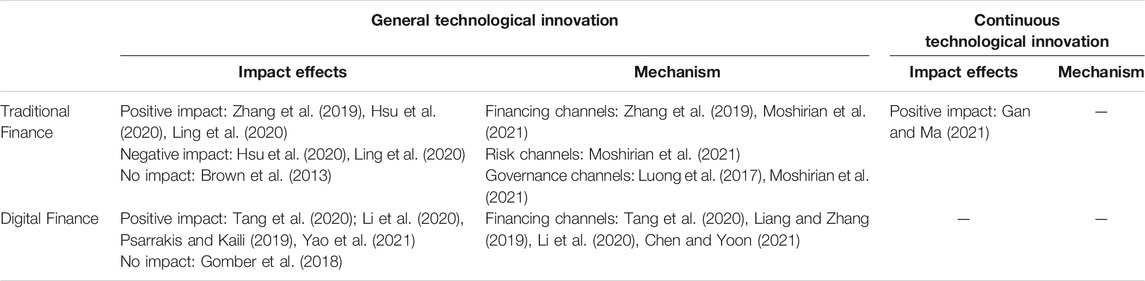

Continuous technological innovation refers to the nature and tendency of companies to have feedback, accumulation and lock-in effects in terms of technology, etc., to keep subsequent technological innovation activities going over time (Geroski et al., 1997). Continuous technological innovation not only contributes to long-term economic growth, but is also important for firms to build dynamic competitive advantage (Kang et al., 2017). Allen et al. (2005) argues that because the competitive environment in product markets is constantly changing, firms must sustain innovation through long-term capital investment to maintain a competitive advantage. Financial markets are an important source of funding for continuous technological innovation. As indicated in Table 1, existing literature has extensively explored the impact of traditional financial development on the general technological innovation of enterprises, and the theoretical views obtained from the research mainly include three categories: 1) Commercial bank credit and commercial bank competition can make a positive impact on the quantity and quality of corporate innovation by alleviating financing constraints (Zhang et al., 2019); 2) The development of the credit market has no significant impact on corporate innovation investment (Brown et al., 2013); 3) The credit market will have a negative impact on innovative activities in high-tech industries that rely on external financing (Hsu et al., 2020). How the stock market, as a direct financing channel, affects corporate innovation has also attracted scholars’ attention. How the stock market as a direct financing channel affects corporate innovation has also attracted scholars’ attention. Most of the existing studies believe that the stock market has a more positive impact on enterprise innovation through the risk redistribution function, the pricing function and the unsecured feature (Levine and Schmukler, 2006; Brown et al., 2009; Brown et al., 2013; Zhong and Wang, 2017). Moshirian et al. (2021) and Luong et al. (2017) proposed that the mechanism of stock market liberalization to promote innovation may include financing channels, risk channels and corporate governance channels. There is little literature on how traditional financial markets affect continuous technological innovation. Gan and Ma (2021) suggest that strengthen credit support for SMEs, reduce financial discrimination in the credit market, and ensure that small and micro enterprises (SMEs) have a fair and favorable competitive environment, thereby promoting continuous technological innovation of SMEs.

As for digital finance, existing literature has not discussed whether it will affect the continuous technological innovation of enterprises. At present, it is only analyzed whether the development of digital finance can empower the general technological innovation, and the results are divergent. Some studies believe that the development of digital finance is conducive to promoting corporate innovation. Zhang and Chi (2018) believe that digital finance can significantly promote the innovation input and innovation frequency of SMEs. Psarrakis and Kaili (2019) found that digital finance can enhance the willingness of companies to initiate cutting-edge technology projects. Liang and Zhang (2019) found that digital finance can promote the innovation output of SMEs. Li et al. (2020) found that digital financial inclusion can significantly promote the innovation of Chinese companies from the perspective of inclusiveness. Tang et al. (2020) found that the development of digital finance has a better and more stable effect on the technological innovation of enterprises, and this promotion effect is universal, especially has a significant impact on the technological innovation of enterprises in areas with weak traditional financial development. Yao et al. (2021) find that digital inclusive finance contributes to innovation, reflected in the number of patents. However, some studies have pointed out that digital finance is difficult to make a significant impact on innovation activities (Gomber et al., 2018). With the deepening of research, the mechanism by which the digital finance affects enterprise innovation is also an important topic that academic try to discuss. Existing literature reveals that digital finance can stimulate enterprise innovation through financing channels including financing constraint mitigation and financing cost reduction. Specifically, Liang and Zhang (2019) found that the development of digital inclusive finance can reduce the cost of debt financing and ease external financing constraints for SMEs, which in turn boosts firms’ innovation output. Li et al. (2020) finds that digital finance can significantly promote corporate innovation by alleviating financing constraints and increasing the amount of tax rebates. Chen and Yoon (2021) demonstrate that digital finance can help stimulate innovation by easing financing constraints and reducing debt financing costs.

2.2 Research Hypothesis

Existing literature indicates that risk-taking is an important driving factor for stimulating the enthusiasm of corporate innovation. R&D and innovation investment has a high degree of risk and uncertainty and is different from general scale investment. The typical feature of risk-taking is the willingness to venture into unknown areas for exploration, which coincides with the high risk and high uncertainty of R&D and innovation projects (Guo and Jiang, 2020). The willingness to take risks will increase the possibility of the creation and implementation of creative ideas (Salvi and Bowden, 2020). Therefore, raising the level of risk-taking is important to stimulate the enthusiasm of corporate innovation. Guo and Jiang (2020) found that companies with high risk-taking levels will respond to market changes with a positive attitude through a study of Chinese manufacturing companies. They are more willing to take action to find new technology and market opportunities in the external environment, and then invest resources into the long-term risky projects with high returns and high probability of failure. Games and Rendi (2019) analyzed the data of 165 small business owners in Indonesia’s creative industry and found that risk-taking is an important driving factor affecting the innovation of small and medium companies, which also plays an important role in reducing negative innovation behaviors. Cai et al. (2015) researched 235 new companies in China and found that risk-taking positively regulates the relationship between market orientation and innovation radicalness, and risk-taking has a positive impact on radical innovation of new companies. In addition, risk-taking can also bring more resource support for companies. Hilary and Hui (2009) found that risk-taking companies are more likely to be favored by funds, and R&D and innovation activities can be better funded, which will further strengthen corporate innovation. On the other hand, Castillo-Vergaraa and García-Pérez-de-Lemab (2021) found that risk-taking helps small and medium-sized companies to transform creativity into product innovation based on the study of 139 small and medium-sized industrial companies in Chile. Nguyen and Dang (2019) found that risk-taking is an intermediary variable for bond liquidity to affect corporate innovation, and the increase in risk-taking level can promote the increase of corporate innovation output. It can be seen that risk-taking also has a positive impact on corporate innovation performance.

Finance is a core component of the corporate innovation environment. Its development helps to improve the external financing environment, ease financing constraints and optimize the allocation of financial resources by stimulating corporate risk-taking willingness (Chen, 2020; Li et al., 2013; Yan et al., 2019). Compared with traditional finance, digital finance has the advantages of lower cost, faster speed and wider services (Huang and Huang, 2018), which has a more positive impact on corporate risk-taking. First of all, digital finance relies on the Internet and big data technology to absorb social idle funds and turn them into effective financial supplies. It provides companies with diversified financing channel options in addition to traditional finance, broadening the sources of corporate funds and stabilizing the corporate capital chain. It helps to increase the level of corporate risk-taking from the financing supply side. Secondly, the inclusive characteristics of digital finance can reduce the cost and threshold for companies to obtain financial services (Guo and Jiang, 2020). At the same time, digital finance will also force the transformation and upgrading of traditional financial institutions, and optimize the products of traditional financial institutions. The structure provides more convenient and low-cost credit products for financing companies (Huang and Huang, 2018), which helps to increase the level of corporate risk-taking from the perspective of financing threshold and cost. Finally, digital finance relies on powerful information collection, information processing, information screening. Risk discrimination capabilities rely on big data technology to achieve rapid information matching between different entities. They usually implement more accurate risk assessments for companies (Huang, 2018). The information asymmetry in the process, the avoidance of adverse selection and moral hazard problems in the financial market (Demertzis et al., 2018), and the improvement of corporate risk management capabilities (Norden et al., 2014) can increase the level of corporate risk-taking.

Based on the above analysis, this research concludes that the digital finance development can promote the continuous technological innovation of energy companies. The risk-taking plays an intermediary role in the process of digital finance influencing the continuous technological innovation of companies. The digital finance development encourages companies to carry out continuous R&D and innovation activities more actively by increasing the level of corporate risk-taking.

3 Research Design

3.1 Data Sources

The digital financial inclusion index is contained from 2011 to 2018, and we download the data from China’s energy industry listed companies. This paper discusses the impact of digital finance development on the continuous technological innovation and its mechanism in China’s energy companies by cross-level matching. We collect prefecture-level city-level digital financial inclusion index from the Digital Finance Research Center of Peking University; We gather continuous technological innovation, finance and corporate governance index from CSMAR database. In addition, we perform basic processing on some outliers in the sample, such as deleting samples values that cannot be obtained. After excluding ST enterprises, we finally collect 1,388 observations in enterprises-year level.

3.2 Variable Setting

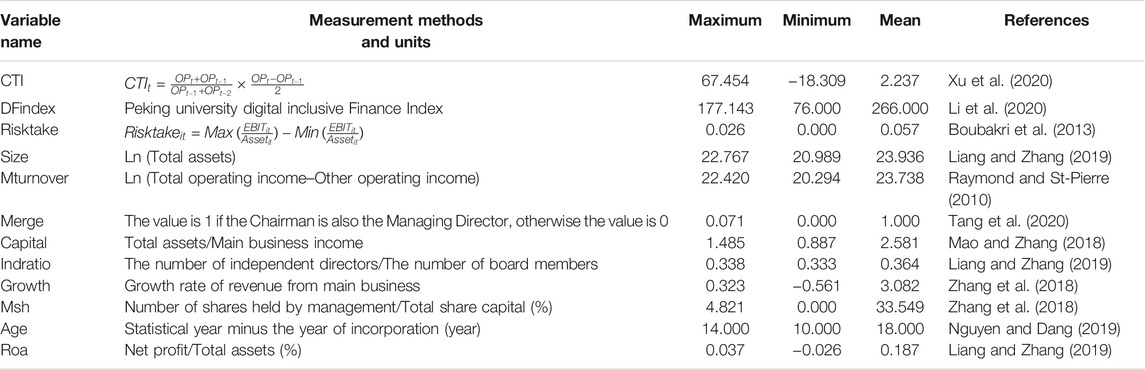

3.2.1 Continuous Technological Innovation

Existing research mainly measures the continuous technological innovation of companies based on the perspective of input or output. Input indicators mainly include total R&D expenditure and R&D intensity (total R&D expenditure accounts for the proportion of operating income), etc. The output indicators mainly include patent applications or authorizations, and intangibles. The increase in assets accounts for the ratio of the company’s total assets at the end of the period. Since innovation output can reflect a company’s innovation capability, we mainly measure the continuous technological innovation of energy companies from the perspective of output. With reference to the research of Xu et al. (2020), this paper uses Eq. 1 to measure the level of continuous technological innovation of Chinese energy companies.

In Eq. 1, OPt, OPt-1 and OPt-2 represent the number of invention patent applications of the sample companies in t, t-1 and t-2, respectively.

3.2.2 Digital Financial Development (DFindex)

At present, relevant studies mainly adopt two methods to measure the degree of digital finance development: one is to match the relevant keywords of digital finance (digital finance, internet finance, financial technology, equity crowdfunding financing, digital currency, blockchain, smart financial contracts and smart investment advisors, etc.) with the name of the region to obtain the search term of “digital financial keywords + region”. The number of news items retrieved in Baidu News is used as the proxy variable of the regional digital financial development level (Li et al., 2020). The second is to use the Digital Finance Index released by the Digital Finance Research Center of Peking University to measure the level of regional digital finance development (Xie et al., 2018; Tang et al., 2020). In comparison, the Digital Financial Inclusive Index released by the Digital Finance Research Center of Peking University has the advantages of support by big data technology, which spans long-time and covers wide area (Guo and Jiang, 2020). Therefore, this study adopts the prefecture-level city-level digital financial inclusion index to measure the digital financial development environment.

3.2.3 Risk-Taking Level

On the basis of relevant studies, we use corporate risk-taking to analyze the willingness to invest in projects with uncertain returns (Zhou et al., 2019). Existing research shows that companies operating under higher investment risks have greater volatility in their return on investment (John et al., 2008). Therefore, at present, researchers generally use earnings volatility to measure the level of corporate risk-taking. This study refers to the measurement method of Boubakri et al. (2013), and uses the fluctuation range of the ratio of earnings before interest and taxes (EBIT) to total assets to measure the level of corporate risk taking. The calculation method is shown in Eq. 2:

Among them: i is the company serial number, t is the year, EBITit is the profit before interest and tax, and Assetit is the total assets at the end of the year. EBITit does superposition calculations for four consecutive years, Assetit does not perform superposition calculations.

3.2.4 Control Variables

In this study, control variables include the size of the company (Size), main business income (Mturnover), proportion of independent directors (Indratio), corporate growth capability (Growth), merger of two positions (Merge), capital intensity (Capital), management shareholding ratio (Msh), company age (Age), corporate profitability (Roa), year (Year) and industry (Ind) (Zhang and Chi, 2018).

The definitions and descriptive statistics of the main variables in this paper are shown in Table 2.

3.3 Model Setting

3.3.1 The Test Model for the Impact of the Development of Digital Finance on the Continuous Technological Innovation

According to Gan and Xu (2019), the panel data fixed-effect approach is useful to exclude the influence from the unobserved and invariable enterprises’ heterogeneity. This approach also alleviates the endogenous problems caused by missing variables, which could not be overcome by other methods such as dynamic GMM methodologies (Gan and Xu, 2019). The Hausman test was used to select a suitable estimation model, and the results showed that the fixed effect model was most reliable and valid. Specifically, we construct a panel data fixed-effect model as Eq. 3 for estimating the impact of the development of digital finance on the continuous technological innovation of Chinese energy companies:

Where the subscripts i, j and t represent the serial number of the company, prefecture-level city and year, respectively. The dependent variable CTIit represents the continuous technological innovation level of the company. The independent variable DFindexjt represents the level of digital finance development at the prefecture-level city level. Controlsit represents a number of control variables defined in the previous section. Year and Ind represent year and industry effects, respectively. α0, α1, and α2 represent parameters to be estimated. εit is a random error term. This study is mainly based on the estimation results of α1 to determine the impact of the development of digital finance. When α1 is significantly positive (negative), it means that digital finance development has the effect of promoting (inhibiting) the continuous technological innovation of Chinese energy companies; otherwise, the impact of digital finance development on the continuous technological innovation is not significant.

3.3.2 The Test Model for Risk-Taking Mechanism

Referring to the method proposed by Wen and Ye (2014), this paper constructs the models shown in Eqs 4–6, and tests the mediating effect of corporate risk-taking:

The Risktakeit represents the intermediate variable corporate risk-taking level. We construct Model (4) to explore the total impact of the digital finance development on the continuous technological innovation. The coefficient α1 measures the size and significance of the total impact. The coefficient β1 in model (5) reflects the influence of the development of digital finance on the level of corporate risk-taking. The coefficient γ1 in model (6) reflects the direct effect of the development of digital finance on the continuous technological innovation, and β1×γ1 reflects the effect intensity of the development level of digital finance that affects the corporate continuous technological innovation through corporate risk-taking.

4 Empirical Results and Analysis

4.1 Test Results of the Impact of the Development of Digital Finance on the Continuous Technological Innovation

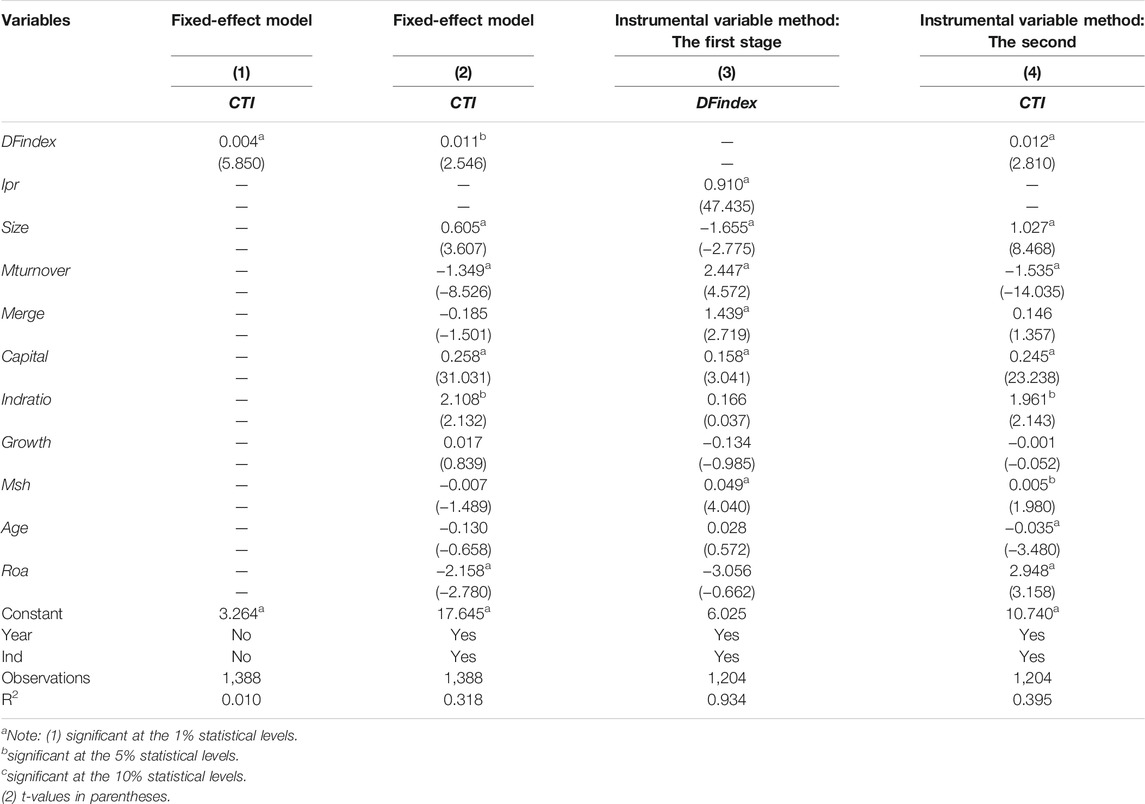

Columns (1) and (2) of Table 3 report the benchmark results of the impact of the development of digital finance on the continuous technological innovation of Chinese energy companies. The column (1) shows the estimation result without considering any control variables. The estimated coefficient of DFindex is 0.004 (t statistic is 5.850), which is highly significant at the 1% level. The column (2) shows the estimated results considering the control variables. The estimated coefficient of DFindex is 0.011 (t statistic is 2.546), which is significant at the 5% level. It can be seen that, regardless of whether the control variables are considered, the regression coefficients between DFindex and CTI are significantly positive, indicating that the development level of digital finance is significantly positively correlated with the continuous technological innovation intensity of Chinese energy companies. By comparing with the existing literature, it can be found that digital finance can make up for the deficiencies of traditional finance in supporting enterprise innovation to a certain extent. It has been argued that bank credit is biased towards supporting low-tech innovation (Zhang et al., 2018). Some studies even found that bank credit will hinder the technological innovation of enterprises (Zhang et al., 2019; Ling et al., 2020). However, our findings suggest that digital finance can well support the continuous innovation of Chinese energy companies. This shows that, with its advantages of “crossing time and space, low cost, and information visualization”, digital finance has broken through many limitations of traditional financial services and provided a new source of financing options for enterprises to continue scientific and technological innovation.

TABLE 3. Estimation of the impact of digital finance development on the continuous technological innovation of Chinses energy companies.

We test the instrumental variable (IV) to exclude the effect of endogeneity. We select Internet penetration rate (Ipr) as an instrumental variable for digital financial development according to Xie et al. (2018). We also adopt 2SLS instrumental variable regression method to alleviate the endogenous problems that may exist in the empirical model. The two-stage estimation results based on the instrumental variable method are reported in columns (3) and (4) of Table 3 respectively. In the first stage estimation results shown in column (3), the Internet penetration rate Ipr is highly correlated with the development level of digital finance DFindex (coefficient is 0.910, t statistic is 47.435). The empirical test result shows that the regression coefficient of the Internet penetration rate is significantly positive. According to the second-stage estimation results shown in column (4), the regression result shows that the regression coefficient of instrumental variable is significantly positive at the level of 1%. These results indicate that the results obtained from the previous tests are less affected by endogeneity problems.

The benchmark regression and instrumental variable regression test results show that the development of regional digital finance does have a significant positive effect on the continuous technological innovation of Chinese energy companies.

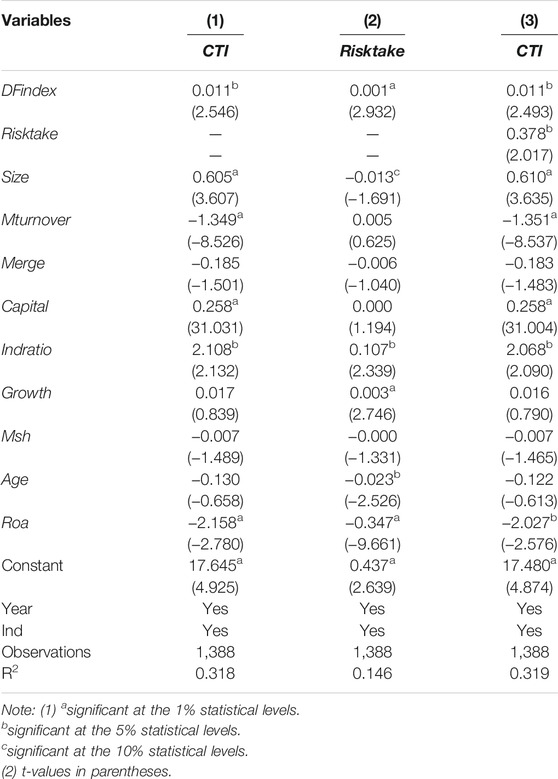

4.2 Test Results of Risk-Taking Mechanism

In this paper, we use the stepwise regression model of Eqs 4–6 to further empirically test whether digital finance affects the continuous innovation of Chinese energy companies through corporate risk-taking, and the test results are reported in Table 4. According to the test procedure of the mediation effect, the first step is to test the total impact of the development of digital finance on continuous technological innovation. The test results in the column (1) of Table 4 show that the estimated coefficient of DFindex (α1 = 0.011, t = 2.546) is significantly positive, indicating that the total impact effect of digital finance development on continuous technological innovation is significantly positive. The second step is to examine the impact of digital finance development on mediator—risk-taking levels. The test results in column (2) of Table 4 show that the estimated coefficient of DFindex (β1 = 0.001, t = 2.932) is highly significantly positive at the 1% level, indicating that the development of digital finance helps to increase the level of corporate risk-taking. The third step is to test whether risk-taking plays a mediating effect in the process of digital financial development affecting continuous technological innovation of Chinese energy companies. The test results in column (3) of Table 4 show that the estimated coefficients (γ1, γ2) of DFindex and Risktake are 0.011 and 0.378, respectively, and both of them are significant at the statistical levels of 5%, indicating that risk-taking plays a significant mediating effect in the process of digital financial development affecting the continuous technological innovation of Chinese energy companies.

Existing literature proposes that the development of traditional financial markets such as stock market liberalization spurs innovation through encouraging firms’ risk-taking activities (Moshirian et al., 2021). Our findings are consistent with their conclusion that the digital finance also encourages risk-taking and incentivize enterprises to innovate continuously. Some recent literature finds that digital finance can stimulate corporate innovation through financing channels such as ease of financing constraints and lower financing costs (Li et al., 2020; Chen and Yoon, 2021). This paper finds that the development of digital finance has the effect of encouraging firms’ risk-taking activities, and thus discovers a new mechanism for the impact of digital finance on continuous innovation.

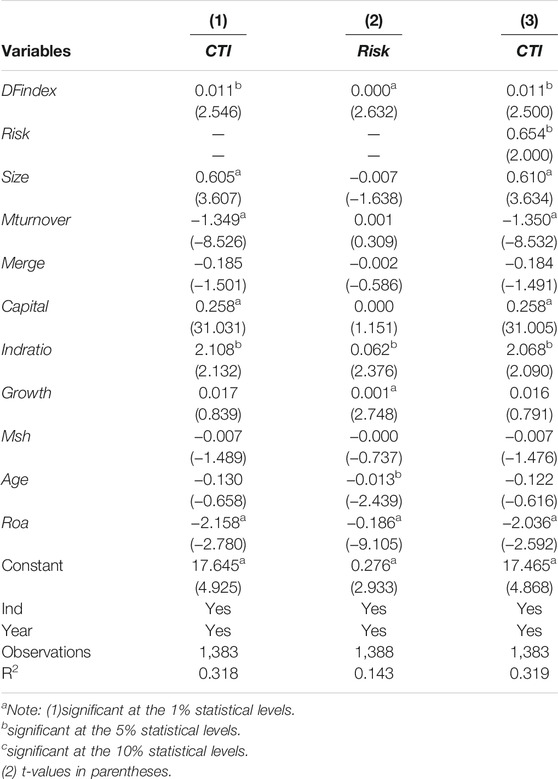

Referring to the measurement of John et al. (2008) and Boubakri et al. (2013), this paper uses Eq. 7 to make an alternative measurement of the level of corporate risk-taking:

In order to further test the reliability of the research results, we select alternative variables and put them into the model for the regression analysis again. The test results are shown in Table 5. From the test results shown in Table 5, we can see that the regression results are consistent with the original results. Therefore, the risk-taking mechanism is robustness.

5 Further Research

In order to explore the specific conditions and boundaries for the digital finance development on the continuous technological innovation of energy companies through risk-taking, we further examine the impact of situational factors such as the nature of ownership, scale, and external financing dependence based on the corporate dimension.

5.1 Analysis of the Moderating Effect of Property Rights

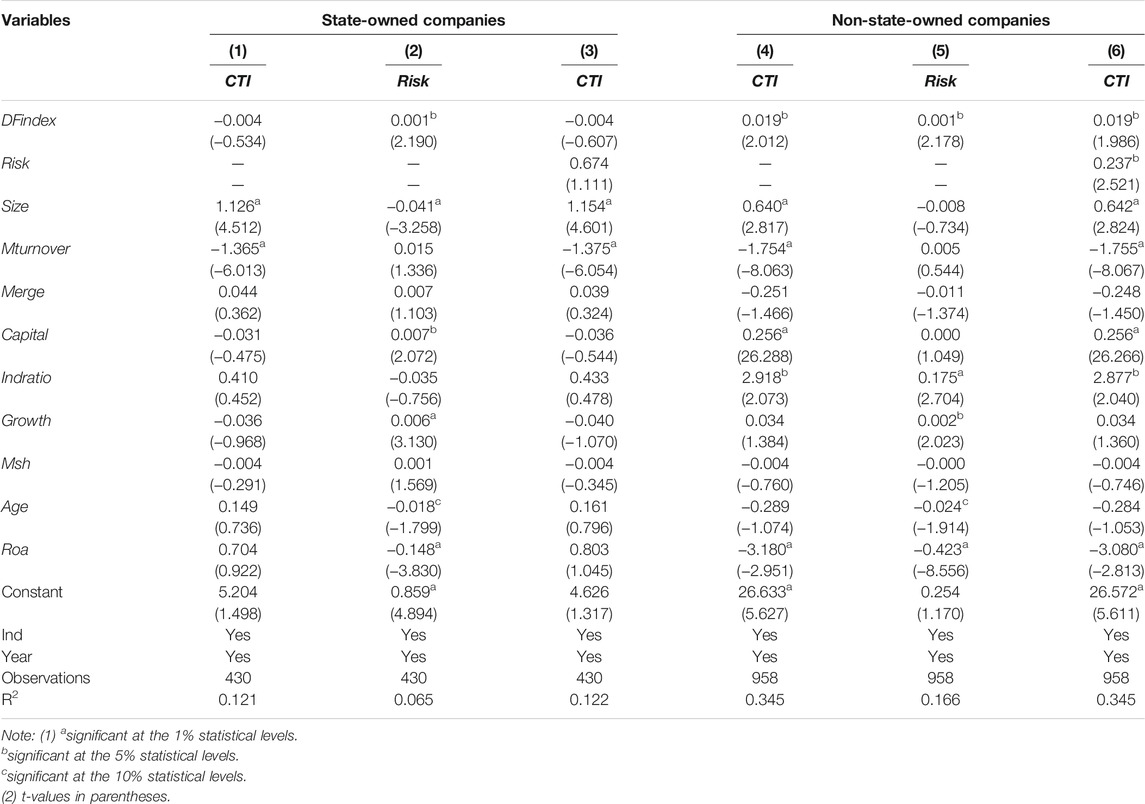

According to the nature of property rights, our research sample is divided into two groups: state-owned energy companies and non-state-owned energy companies, and then the grouping test is carried out. The results of the grouping test are shown in Table 6. According to the results reported in columns (1)–(3) of Table 6, the estimated coefficient of DFindex to Risktake is 0.001, which is significant at the 5% level. However, the estimated coefficient of DFindex to CTI is −0.004 and not significant. This result shows that the digital finance development can increase the level of risk-taking of state-owned energy companies, but the impact of digital finance development on the continuous technological innovation intensity of state-owned energy companies is not significant. Therefore, the risk-taking mechanism does not work in state-owned energy companies. According to the results shown in columns (4)–(6) of Table 6, the coefficients of DFindex and Risktake are all significantly positive (

5.2 Analysis of the Moderating Effect of Company Scale

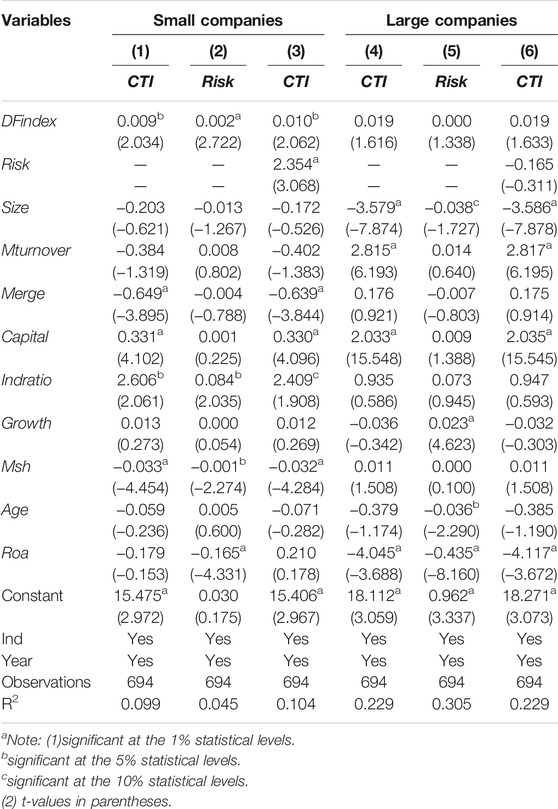

This study uses the median of corporate size (measured by year-end total assets) as a benchmark, and divides the research sample into two groups: large and small energy companies, and examines the moderating effect of company scale. According to the results shown in columns (1) and (4) of Table 7, the regression coefficients of DFindex estimated by using small and large energy companies are 0.009 and 0.019, respectively, but only the former is significant. It can be seen that the development of digital finance has a significant role in promoting the continuous technology innovation of small energy companies, but the impact on the continuous technology innovation of large energy companies is not significant. The results reported in columns (2) and (5) of Table 7 show that the estimated coefficients of DFindex are 0.002 and 0.000, respectively, but only the former is significant. These results show that the development of digital finance has a positive impact on the risk-taking level of small energy companies, but has no significant impact on the risk-taking of large energy companies. Finally, according to the results reported in columns (3) and (6) of Table 7, it can be seen that the estimated coefficients of DFindex are all positive, but the latter is not significant. In summary, it can be seen that the risk-taking mechanism only works in small energy companies, indicating that the development of digital finance has broadened the financing channels for small energy companies, enriched the sources of innovative funds for small energy companies, stabilized small companies’ capital chain, and reduced the cost and threshold of financial services for small companies. This all can provide more innovation capital guarantees for small companies, thereby increasing the level of risk-taking by small companies and ultimately having a positive impact on the continuous technological innovation of small energy companies. It is not difficult to see that the above research results are consistent with the existing literature such as Liang and Zhang (2019), revealing that the inclusive nature of digital finance is effective in supporting the innovation activities of small, medium and micro enterprises.

5.3 Analysis of Heterogeneity Based on the Dependence of External Funds

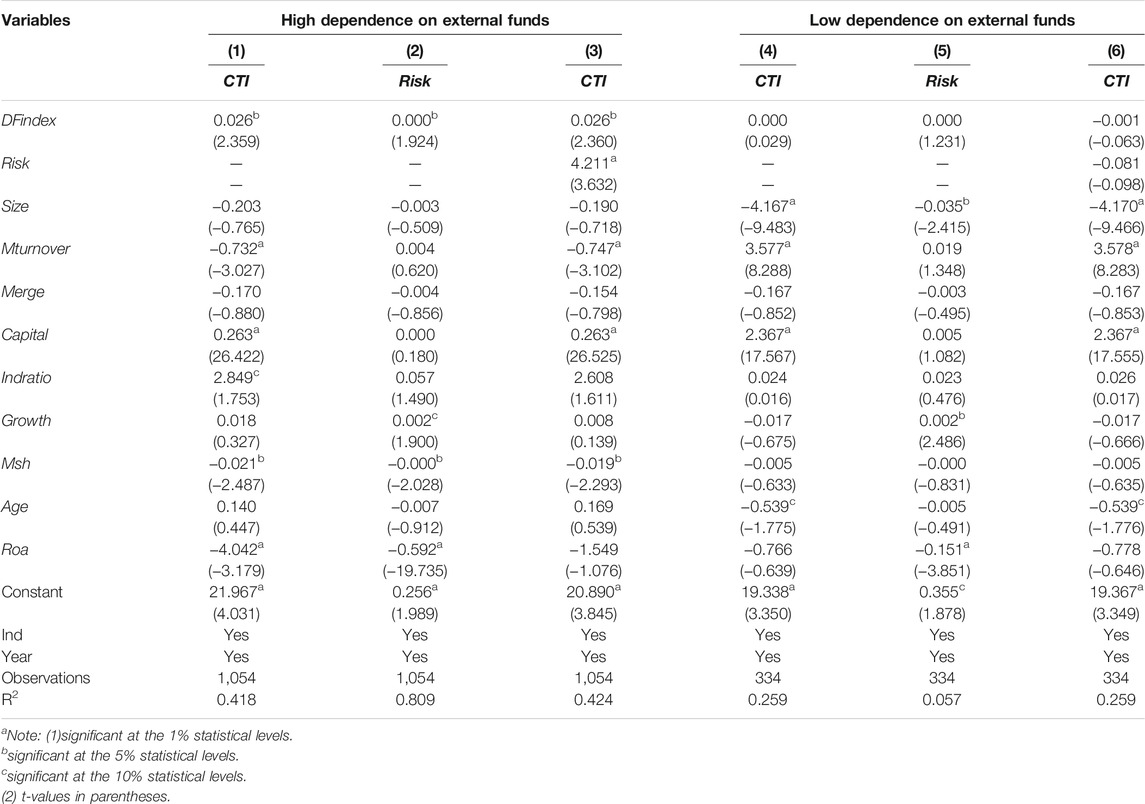

According to Maskus et al. (2012), financial development is more important for companies that are highly dependent on external funds. Therefore, whether the digital finance development would still continue this heterogeneous characteristic remains a problem. To answer this question, this study refers to the practice of Rajan and Zingales (1996) and adopts “ (Capital Expenditure-Operating Cash Flow)/Capital Expenditure” to measure the company’s external capital dependence. Taking the median of external financing dependence as a benchmark, the research sample is divided into two groups: high external financing dependence and low external financing dependence. This paper discusses the mechanism of digital finance development on the continuous technological innovation in China’s energy companies. The specific results are shown in Table 8.

Table 8 shows the result that for energy companies that are highly dependent on external funds. The risk-taking mechanism plays a significant role, and the digital finance development promotes its continuous technological innovation level by increasing the level of risk-taking. However, for energy companies with low dependence on external funds, the overall effect of the digital finance development on continuous technological innovation is significantly negative, and the intermediary effect of risk-taking is not significant. The investment cycle of innovation projects is long, the future cash flow is uncertain, and the huge and continuous technological funding needs to become a barrier to the continuous technological innovation of energy companies. According to the theory of orderly financing, endogenous financing has the advantages of lower cost and less restrictive conditions compared with exogenous financing. For energy companies with low dependence on external financing, their innovation funds mainly come from internal financing. It is naturally difficult for digital finance development to play a role in such companies through risk-taking mechanisms. Seeking external funds has become the only way for their innovation process, as using internal funds to support the continuous development of their R&D and innovation activities is not enough. Risk-taking behaviors such as R&D and innovation are resource-consuming activities, which are highly resource-dependent (Lu et al., 2013). The digital finance development can help ease financing constraints and reduce financing costs, which coincides with the resource dependence needs of external financing-dependent companies. Therefore, the development of digital finance can increase the risk-taking level of external financing-dependent energy companies and conduct innovation incentive effects.

6 Research conclusions and policy implications

The continuous technological innovation of energy companies is an important foundation and source of energy transformation and real economic growth. This study matches the Peking University Digital Financial Inclusive Index with the data of Chinese listed energy companies from 2011–2018, empirically test the impact of digital financial development on the continuous technological innovation and its risk-taking mechanism. The research conclusions mainly include: First, the development of digital finance has a positive impact on the continuous technological innovation of listed companies in China’s energy industry. The digital finance shows its financial innovation side, forms a useful supplement to the traditional financial market, and plays the essential financial function of empowering the development of the real economy based on the important dimension of innovation incentives. Secondly, risk-taking plays a mediating effect in the process of the development of digital finance affecting the continuous technological innovation of Chinese energy companies. To a certain extent, the development of digital finance has alleviated the pain points of traditional financial market, such as “difficult financing and expensive financing”, and provided new solutions for the financing of corporate risk-taking behaviors, thereby inspiring corporate risk-taking behaviors and encouraging companies to strengthen their continuous technological innovation. Finally, the nature of property rights, firm scale and external financing dependence have significant moderating effects on the risk-taking mechanism. Since non-state-owned enterprises and small, medium and micro enterprises have long been discriminated and treated differently by the traditional financial market, and the enterprises with low external financing dependence mainly rely on internal financing, the risk-taking mechanism is only applicable to non-state-owned enterprises, small enterprises and high external financing dependence energy companies.

Although the COVID-19 epidemic has had a great impact on the economies of countries around the world, it may provide an opportunity for the development of digital finance. First, the COVID-19 epidemic has boosted the wider rollout of the digital economy around the world. After the epidemic, the digital divide will be further bridged, and the consensus of the whole society on digital development will be further improved. Second, most retail businesses in banking, insurance, wealth management, securities and other fields require offline signatures and interviews. These businesses have been at a standstill throughout the epidemic and may be at risk of a slow recovery in the post-epidemic period. Facing the turbulent external environment, the online demand of enterprises will become more prominent. This will prompt regulators, enterprises and individuals to pay more attention to the digital construction of the economy in the future, and will also provide a new starting point for the development of digital finance. Third, the epidemic may accelerate the transformation of traditional finance to digital finance. Traditional financial institutions such as banks will accelerate innovation under the pressure of the epidemic. With the help of new digital and information technologies, they will follow customers from offline to online, and use big data to control risk to meet customers’ financial needs.

Based on the above research findings, this study puts forward the following policy recommendations. First, during the critical period when the economy is transforming from high-rate growth to high-quality development, China should actively follow the trend of rapid technological development and give sufficient policy support to the development of digital finance to facilitate its development. In terms of policy implementation, the government should promote the construction of a diversified financial services industry, realize the precise match between finance and SMEs, thus lowering the service threshold of finance, promoting the majority of enterprises to obtain financial services at a lower cost and in a more convenient way, and better play the role of digital finance development in driving innovation, enhancing the efficiency of economic growth and leading to the release of new dynamic energy for economic growth.

Secondly, Chinese energy companies should be guided and encouraged to use digital finance to encourage their level of risk-taking and thus promote continuous technological innovation. In the process of financial services, the advantages of artificial intelligence and other technologies should be fully linked to financial products so as to provide comprehensive financial services with added value for enterprises and to empower their continuous technological innovation activities; in the process of risk control afterwards, the advantages of big data analytics should be considered as well. In the post-event risk control process, the advantages of data technology should be leveraged to build a dynamic early warning risk control system.

Finally, the COVID-19 epidemic continues to spread, and the shortage of funds is the main obstacle hindering the continuous innovation of energy companies, especially small and medium-sized energy companies. In terms of financial support policies, it is recommended to open up re-lending to digital financial companies with technological capabilities to help them more accurately target non-state-owned and small, medium and micro energy companies. Government departments and financial institutions should make full use of digital financial technology, through big data analysis and machine learning and other financial technologies, to accurately grasp the operating conditions, credit records and future prospects of energy companies, solve loan risk control problems, and accurately match financial resources to energy companies with continuous innovation potential.

Data Availability Statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author Contributions

ZG: Conceptualization, writing the original manuscript and revising. YP: Methodology development, model design, writing the original manuscript and revising. YP: data analysis, results discussion and language polish.

Funding

This study was supported by the National Social Science Foundation Project of China (19BJL068), Humanities and Social Science Research General Project of the Ministry of Education (21YJA630006), Guangdong Provincial Natural Science Foundation Project (2021A1515011923), Guangdong Provincial Philosophy and Social Science “13th Five-Year Plan” Project (GD20CGL21, GD20CYJ10).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Allen, F., Qian, J., and Qian, M. (2005). Law, finance, and economic growth in China. Journal of financial economics 77 (1), 57–116. doi:10.1016/j.jfineco.2004.06.010

Boubakri, N., Cosset, J.-C., and Saffar, W. (2013). The role of state and foreign owners in corporate risk-taking: Evidence from privatization. Journal of Financial Economics 108 (3), 641–658. doi:10.1016/j.jfineco.2012.12.007

Brown, J. R., Fazzari, S. M., and Petersen, B. C. (2009). Financing Innovation and Growth: Cash Flow, External Equity, and the 1990s R&D Boom. The Journal of Finance 64 (1), 151–185. doi:10.1111/j.1540-6261.2008.01431.x

Brown, J. R., Martinsson, G., and Petersen, B. C. (2013). Law, Stock Markets, and Innovation. J. Finance 68 (4), 1517–1549. doi:10.1111/jofi.12040

Cai, L., Yu, X., Liu, Q., and Nguyen, B. (2015). Radical Innovation, Market Orientation, and Risk-Taking in Chinese New Ventures: an Exploratory Study. Ijtm 67 (1), 47–76. doi:10.1504/ijtm.2015.065896

Castillo-Vergaraa, M., and García-Pérez-de-Lemab, D. (2021). Product Innovation and Performance in SME’s: The Role of the Creative Process and Risk Taking [J]. Innovation 23 (4), 470–488.

Chen, H., and Yoon, S. S. (2021). Does Technology Innovation in Finance Alleviate Financing Constraints and Reduce Debt-Financing Costs? Evidence from China. Asia Pac. Business Rev. 2021, 1–26. doi:10.1080/13602381.2021.1874665

Chen, S. (2020). Financial Development, Financing Constraints and Employment Growth of Private Enterprises: an Empirical Analysis Based on the Data of Private Listed Companies. Enterprise Economy 39 (07), 145–153.

Demertzis, M., Merler, S., and Wolff, G. B. (2018). Capital Markets Union and the Fintech Opportunity. J. financial Regul. 4 (1), 157–165. doi:10.1093/jfr/fjx012

Games, D., and Rendi, R. P. (2019). The Effects of Knowledge Management and Risk Taking on SME Financial Performance in Creative Industries in an Emerging Market: the Mediating Effect of Innovation Outcomes. J. Glob. Entrepreneurship Res. 9 (1), 1–14. doi:10.1186/s40497-019-0167-1

Gan, Q., and Ma, L. (2021). Bank Credit, Government and Business Relations and Innovation of Small and Micro Businesses. Sust. Dev. 11 (4), 491–504.

Gan, W., and Xu, X. (2019). Does Anti-corruption Campaign Promote Corporate R&D Investment? Evidence from China. Finance Res. Lett. 30 (9), 292–296. doi:10.1016/j.frl.2018.10.012

García-Granero, A., Llopis, Ó., Fernández-Mesa, A., and Alegre, J. (2015). Unraveling the Link between Managerial Risk-Taking and Innovation: The Mediating Role of a Risk-Taking Climate. J. Business Res. 68 (5), 1094–1104. doi:10.1016/j.jbusres.2014.10.012

Geroski, P. A., Van Reenen, J., and Walters, C. F. (1997). How Persistently Do Firms Innovate? Res. Pol. 26 (1), 33–48. doi:10.1016/s0048-7333(96)00903-1

Gomber, P., Kauffman, R. J., Parker, C., and Weber, B. (2018). On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 35 (01), 220–265. doi:10.1080/07421222.2018.1440766

Guo, Z., and Jiang, W. (2020). Risk-taking for Entrepreneurial New Entry: Risk-Taking Dimensions and Contingencies. Int. Entrep Manag. J. 16 (2), 739–781. doi:10.1007/s11365-019-00567-8

Hilary, G., and Hui, K. W. (2009). Does Religion Matter in Corporate Decision Making in America? J. financial Econ. 93 (3), 455–473. doi:10.1016/j.jfineco.2008.10.001

Hsu, C., Ma, Z., Wu, L., and Zhou, K. (2020). The Effect of Stock Liquidity on Corporate Risk-Taking. J. Account. Auditing Finance 35 (4), 748–776. doi:10.1177/0148558x18798231

Huang, H. (2018). The Formation and Challenges of Digital Financial Ecosystem Experience from China. Economist 4, 80–85.

Huang, Y. P., and Huang, Z. (2018). The Development of Digital Finance in China: Present and Future. China Econ. Q. 17 (4), 205–218.

John, K., Litov, L., and Yeung, B. (2008). Corporate Governance and Risk-Taking. J. Finance 63 (4), 1679–1728. doi:10.1111/j.1540-6261.2008.01372.x

Kang, T., Baek, C., and Lee, J.-D. (2017). The Persistency and Volatility of the Firm R&D Investment: Revisited from the Perspective of Technological Capability. Res. Pol. 46 (9), 1570–1579. doi:10.1016/j.respol.2017.07.006

Levine, R., and Schmukler, S. L. (2006). Internationalization and Stock Market Liquidity*. Rev. Finance 10 (1), 153–187. doi:10.1007/s10679-006-6981-7

Li, J., Jiang, J. N., and Chen, C. M. (2020). Relationship between Digital Financial Inclusion and Corporate Innovation from the Perspective of Inclusion: Evidence Based on Chinese A-Share Listed Companies. J. Manag. Sci. 33 (06), 16–29.

Li, J., Xia, J., and Zajac, E. J. (2018). On the Duality of Political and Economic Stakeholder Influence on Firm Innovation Performance: Theory and Evidence from Chinese Firms. Strat Mgmt J. 39 (1), 193–216. doi:10.1002/smj.2697

Li, K., Griffin, D., Yue, H., and Zhao, L. (2013). How Does Culture Influence Corporate Risk-Taking? J. Corporate Finance 23, 1–22. doi:10.1016/j.jcorpfin.2013.07.008

Liang, B., and Zhang, J. H. (2019). Can the Development of Digital Inclusive Finance Stimulate Innovation? Evidence from Chinese Cities and SMEs. Mod. Econ. Sci. 41 (05), 74–86.

Ling, S., Han, G., An, D., Akhmedov, A., Wang, H., Li, H., et al. (2020). The Effects of Financing Channels on Enterprise Innovation and Life Cycle in Chinese A-Share Listed Companies: An Empirical Analysis. Sustainability 12 (17), 6704.

Lu, X., Zheng, Y., and Li, J. (2013). Research on the Impact of Financing Constraints on Corporate R&D Investment: Evidence from the Hi-Tech Listed Companies in China. Account. Res. 17 (05), 51–58.

Luong, H., Moshirian, F., Nguyen, L., Tian, X., and Zhang, B. (2017). How Do Foreign Institutional Investors Enhance Firm Innovation? J. Financ. Quant. Anal. 52 (4), 1449–1490. doi:10.1017/s0022109017000497

Mao, C. X., and Zhang, C. (2018). Managerial Risk-Taking Incentive and Firm Innovation: Evidence from FAS 123R. J. Financ. Quant. Anal. 53 (2), 867–898. doi:10.1017/s002210901700120x

Maskus, K. E., Neumann, R., and Seidel, T. (2012). How National and International Financial Development Affect Industrial R&D. Eur. Econ. Rev. 56 (1), 72–83. doi:10.1016/j.euroecorev.2011.06.002

Moshirian, F., Tian, X., Zhang, B., and Zhang, W. (2021). Stock Market Liberalization and Innovation. J. Financial Econ. 139 (3), 985–1014. doi:10.1016/j.jfineco.2020.08.018

Nguyen, H. D., and Dang, H. T. H. (2019). Bond Liquidity, Risk Taking and Corporate Innovation. Ijmf 16 (1), 101–119. doi:10.1108/ijmf-02-2019-0060

Noailly, J., and Smeets, R. (2016). Financing Energy Innovation: The Role of Financing Constraints for Directed Technical Change from Fossil-Fuel to Renewable Innovation. Luxembourg: EIB Working Papers.

Norden, L., Silva Buston, C., and Wagner, W. (2014). Financial Innovation and Bank Behavior: Evidence from Credit Markets. J. Econ. Dyn. Control. 43 (6), 130–145. doi:10.1016/j.jedc.2014.01.015

Psarrakis, D., and Kaili, E. (2019). “Funding Innovation in the Era of Weak Financial Intermediation: Crowdfunding and ICOs for SMEs in the Context of the Capital Markets Union,” in New Models of Financing and Financial Reporting for European SMEs (Cham: Palgrave Macmillan), 71–82. doi:10.1007/978-3-030-02831-2_66

Rajan, R., and Zingales, L. (1996). Financial Dependence and Growth. Social Sci. Electron. publishing 88 (03), 559–586. doi:10.3386/w5758

Raymond, L., and St-Pierre, J. (2010). R&D as a Determinant of Innovation in Manufacturing SMEs: An Attempt at Empirical Clarification. Technovation 30 (1), 48–56. doi:10.1016/j.technovation.2009.05.005

Roper, S., and Tapinos, E. (2016). Taking Risks in the Face of Uncertainty: An Exploratory Analysis of green Innovation. Technol. Forecast. Soc. Change 112, 357–363. doi:10.1016/j.techfore.2016.07.037

Salvi, C., and Bowden, E. (2020). The Relation between State and Trait Risk Taking and Problem-Solving. Psychol. Res. 84 (5), 1235–1248. doi:10.1007/s00426-019-01152-y

Tang, S., Wu, X. C., and Zhu, J. (2020). Digital Finance and enterprise Technology Innovation: Structural Feature, Mechanism Identification and Effect Difference under Financial Supervision. Manag. World 36 (05), 52–66.

Wang, X., Zhang, J., and Wang, X. (2019). Fintech, Corporate Lifecycle, and Technological Innovation: Heterogeneous Characteristics, Mechanism Test and Governmental Regulation Performance Evaluation. Financial Econ. Res. 34 (05), 93–108.

Wen, Z., and Ye, B. (2014). Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 22 (05), 731–745. doi:10.3724/sp.j.1042.2014.00731

Wu, Y. (2012). The Dual Efficiency Losses in Chinese State-Owned Enterprises. Econ. Res. J. 3 (3), 15–27.

Xie, X., Shen, Y., and Zhang, H. (2018). Can Digital Finance Promote Entrepreneurship? —Evidence from China. China Econ. Q. 17 (4), 1557–1580.

Xu, Z., Chen, Z. Y. F., and Zhu, M. J. (2020). Does Innovation Persistence Always Benefit Corporate Performance? an Analysis Based on the Moderation Effect of Environmental Dynamics. Sci. Sci. Manag. S. T 41 (12), 3–19.

Yan, K., Yang, Z., and Zhao, X. F. (2019). Bank Regulation Relaxation, Regional Structural Competition and enterprise Risk Taking. Nankai Business Rev. 22 (01), 124–138.

Yao, Y., Zhou, Y., and Zhu, J. (2021). “Empirical Analysis on Digital Inclusive Finance, Development and Innovation,” in International Conference on Application of Intelligent Systems in Multi-Modal Information Analytics (Cham: Springer). doi:10.1007/978-3-030-74811-1_20

Yu, F., and Fan, X. (2021). TMT Cognition, Institutional Environment and Firm Innovation Persistence. Sci. Res. Manag. 11, 110.

Zhang, F., Yang, J., Xu, Z., and Zhu, G. (2018). Large Shareholder Participation Behaviors, Managers' Risk-Taking and Firm Innovation Performance. Nbri 9 (1), 99–115. doi:10.1108/nbri-04-2017-0017

Zhang, L., Zhang, S., and Guo, Y. (2019). The Effects of Equity Financing and Debt Financing on Technological Innovation. Bjm 14 (4), 698–715. doi:10.1108/bjm-01-2019-0011

Zhang, Y. M., and Chi, D. M. (2018). Internet Finance, Entrepreneur Heterogeneity and Small and Micro Enterprises’ Innovation. Foreign Econ. Manag. 40 (09), 42–54.

Zhong, T., and Wang, C. (2017). Financial Development and Firm-Level Innovation Output: a Perspective of Comparing Different Financing Patterns. J. Financial Res. 1 (12), 127–142.

Keywords: digital finance, energy companies, continuous technological innovation, risk-taking, mediating mechanism

Citation: Guo Z, Peng Y and Chen Y (2022) How Digital Finance Affects the Continuous Technological Innovation of Chinese Energy Companies?. Front. Energy Res. 10:833436. doi: 10.3389/fenrg.2022.833436

Received: 11 December 2021; Accepted: 07 February 2022;

Published: 17 March 2022.

Edited by:

Quande Qin, Shenzhen University, ChinaReviewed by:

Ehsan Rasoulinezhad, University of Tehran, IranRenjie Hu, Guangdong University of Foreign Studies, China

Copyright © 2022 Guo, Peng and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yulian Peng, cGVuZ3lsQGdjdS5lZHUuY24=

Zhongkun Guo1,2

Zhongkun Guo1,2 Yulian Peng

Yulian Peng