- 1School of Business and Management, Jiaxing Nanhu University, Jiaxing, Zhejiang, China

- 2Department of International Trade and Logistics, Chung-Ang University, Seoul, Republic of Korea

- 3Graduate School of Management of Technology Pukyong National University, Busan, Republic of Korea

- 4Department of Logistics Management, School of Marketing and Logistics Management, Nanjing University of Finance and Economics, Nanjing, China

Its reliance on energy from individual countries has seriously affected its energy security and foreign policy. Therefore, reducing dependence on energy from specific countries and decomposing energy import channels have become crucial goals in China’s efforts to resolve its energy crisis and ensure its national energy security. This study aims to analyze the impact of energy factors on the location determinants of China’s energy OFDI to help reduce energy dependence and improve China’s energy security. Simultaneous equation models and panel data from 162 target countries for the period 2005–2020 are used to examine the coincidental relationship between volatile and non-volatile energy and intermediary factors in investment target countries and China’s energy OFDI. The simultaneous equation model, comprising a system of equations, constitutes a multifaceted modeling approach that allows examination of two or more dependent variables. This study provides insights into energy investment in China through simultaneous equation modelling, it guides the implementation strategies for home and target countries of energy investment.

Highlights

• Nonvolatile energy in the target country affects China’s energy OFDI more than volatile energy.

• Resource curse hinders target countries’ economic development and political improvements.

• Logistics factors play an important intermediary role between energy factors and energy OFDI.

• Theoretical advancements are made through the application of simultaneous equation modeling and the exploration of compound relationships.

1 Introduction

As their economies expand and their status as the world’s factories solidifies, China is transforming into significant players in the global economy, meaning that require more energy than developed economies (Rogers et al., 2007; Wang and Chen, 2020; Zhao et al., 2020). Although China is also a major energy producer, increasing domestic energy demand is causing the gap between the energy it produces and the energy it needs to continually grow (Rogers et al., 2007; Urdinez et al., 2014; Song et al., 2020). Moreover, ; since 2001, China has transformed from a net exporter of energy resources to a net importer (Urdinez et al., 2014). In 2016, it became the world’s largest energy consumer, and in 2020, its primary energy consumption reached 145.46 trillion joules, accounting for 26.13% of the world’s energy consumption (British Petroleum, 2020). Meanwhile, China’s dependence on fossil fuels grew from 60% in 1971 to 85% in 2020 (Huang et al., 2021). Its reliance on energy from individual countries has seriously affected its energy security and foreign policy. Therefore, reducing dependence on energy from specific countries and decomposing energy import channels have become crucial goals in China’s efforts to resolve its energy crisis and ensure its national energy security. In this context, China has embraced outward foreign direct investment (OFDI) as the primary way to seek more overseas energy (Song et al., 2020; Wang and Chen, 2020; Song et al., 2021). This provides practical and policy motivations for our research.

As a practical and effective method, China actively promotes OFDI in other energy-rich countries to reduce dependence on energy oligarchs. China has become an active global investor and OFDI is a crucial way to enter foreign markets and acquire natural resources (Buckley et al., 2018; Fu et al., 2020). From Dunning’s (1998) perspective, one of the main objectives of these investments is the pursuit of resources. American Enterprise Institute (AEI) data shows China’s OFDI flow reached $90.45 billion USD, ranking first globally in 2021. Energy OFDI accounts for 36.5% of China’s total OFDI, the most among all industries. Its annual growth rate has reached as high as 8.35% (AEI, 2022).

While the surge in China’s energy OFDI is attracting attention from researchers, most existing studies have focused on the total amount of OFDI (Frenkel et al., 2004; Demir and Duan, 2018; Aleksanyan et al., 2021), tending to ignore the characteristics of the energy industry. In addition, regarding location determinants for OFDI, Chinese companies tend to strongly prefer resource-seeking OFDI (Cheung and Qian, 2009; Kolstad and Wiig, 2012; Ramasamy et al., 2012; Chang, 2014; Liu and Deseatnicow, 2016). Although the location determinants of OFDI are similar across different sectors and industries, the energy OFDI motivations and location selections are closely related to the energy industry’s characteristics (Tan et al., 2021). As a unique commodity, energy OFDI must consider volatile energy products (e.g., oil and natural gas) and nonvolatile energy (e.g., coal and ores). In addition, energy OFDI is closely related to the economic, infrastructural, and political development levels of investment target countries (Li et al., 2016; Yao et al., 2018). With the continuous improvement of its OFDI capabilities, China is gradually focusing on improving the quality of foreign investment, especially in the energy sector (Liu et al., 2020). However, the significant role of “composite relationships” in energy OFDI has not yet been explored in existing research. It offers academic motivations for our study.

Therefore, this study holds significant implications for reducing dependence on specific countries for energy, diversifying import channels, and subsequently enhancing energy security. By examining the locational selection factors of energy investment, particularly investigating the direct impacts of both volatile and nonvolatile energy, and analyzing the indirect effects through economic, transportation infrastructure, and policy factors, this research contributes to a comprehensive understanding of energy investment decisions. This study aims to analyze the impact of energy factors on the location determinants of China’s energy OFDI to help reduce energy dependence and improve China’s energy security. Focus on the energy investment environment of the target country, the external environment conducive to energy development, and the synchronous relationship with China’s energy OFDI. Unlike previous studies, this study deeply analyzes the impact of volatile and nonvolatile energy sources on energy OFDI, focusing on the characteristics and classification of energy sources. This paper uses a simultaneous equation model and panel data of 162 target countries during 2005–2020 to analyze the coincidental relationship between energy environment factors and other environmental factors (economics, logistics, and politics) of target countries and China’s energy OFDI. Diverging from the majority of econometric models that analyze a single dependent variable, simultaneous equation models constitute a system of equations capable of examining two or more dependent variables. In this study, a simultaneous equation model is employed to analyze the direct impacts of volatile and nonvolatile energy on energy outward foreign direct investment (OFDI). Simultaneously, the study examines the indirect effects of energy factors through economic, logistical, and political factors on energy OFDI.

This study provides a more comprehensive understanding of China’s energy OFDI by combining energy factors (volatile and nonvolatile) and intermediary factors (economics, logistics, and politics). Theoretically, this study proposes a new perspective in the energy economics literature by examining the relationship between energy (volatile and nonvolatile), energy OFDI, and intermediary factors (economic, logistic, and political). Furthermore, this study provides insights into energy investment in China through simultaneous equation modelling, enriching the research literature in this field. In practice, it guides the implementation strategies for home and target countries of energy investment. The remainder of this paper is organized as follows. Section 2 reviews related literature, Section 3 introduces the relevant variables and methods, Section 4 reports the results of single and simultaneous equations, and Section 5 concludes the paper by offering recommendations for China’s energy OFDI in target countries.

2 Literature review

2.1 Direct impact of energy on OFDI

Resource endowment is a fundamental factor attracting Foreign Direct Investment (FDI) from host countries (Aleksynska and Havrylchyk, 2013; Dunning, 2014; Tan et al., 2021). Nations engage in FDI to access scarce or high-cost natural resources, with abundant resources serving as a magnet for business investments in target countries (Navaretti et al., 2010). The primary driver for this trend is the unequal global distribution of energy consumption and production, leaving many countries and regions without adequate resources to meet domestic energy demands. However, a reliable source of renewable energy is pivotal for the performance of any economic system. To ensure economic progress and energy security, nations often invest in countries rich in energy resources (Morck et al., 2008; Wu, 2014; Liu et al., 2020). Additionally, the international energy market is oligopolistic, characterized by volatile prices influenced by the world economy and futures markets. Furthermore, this market is dominated by oligarchs, prompting energy companies to invest substantial amounts overseas to bolster their reserves and enhance resilience to globalization-related risks.

Access to high-quality natural resources remains a primary driver of Foreign Direct Investment (FDI) for emerging economies (Kalotay and Sulstarova, 2010; Kang and Jiang, 2012; Beerannavar, 2013). Emerging economies commonly acquire natural resources from other countries through investments, adopting less corporatized and formal approaches that align better with the host country’s environment than the Western model (Bhaumik and Gelb, 2005). The relationship between energy consumption and FDI is nuanced. While Mielnik and Goldemberg (2000) and Sadorsky (2010) found a positive correlation between energy intensity and FDI in developing countries, Bekhet and Othman (2011) demonstrated a causal relationship between electricity consumption and foreign direct investment. Conversely, Bento (2011) highlighted a negative impact of FDI on energy consumption.

Tang et al. (2017), Duan et al. (2018), and Zhao et al. (2020) argue that FDI in the energy sector serves as a tool for China to enhance its energy security. Cheung and Qian (2009) and Buckley et al. (2007) emphasize that China’s FDI is driven by both market-seeking and resource-seeking behaviors. Despite possessing some natural resources, China’s per capita availability is limited, prompting Chinese companies to engage in FDI to secure these resources (Deng, 2004). China’s FDI in Africa predominantly targets natural resources, extending even to developed countries like Australia, with a primary goal of meeting domestic energy demands. Scholars suggest that China invests in nations abundant in natural resources to secure coal, iron ore, and other minerals (Deng, 2004; Hong and Sun, 2006; Morck et al., 2008; Cheng and Ma, 2009). The technology spillover impact of FDI, previously reported in studies, is affirmed by Kimura and Kiyota (2006), Melitz and Ottaviano (2008), and Mayer et al. (2016).

As China increasingly integrates with the global economy, it has shifted focus to improving the quality of FDI, particularly in the energy sector (Liu et al., 2020). Regarding the location determinants of FDI, China tends to invest in countries with superior natural resource endowments and higher energy efficiency. However, these efforts are also influenced by institutional environments, political risks, and state relations (Wang et al., 2019; Tan et al., 2021). Other studies have identified that host country GDP, policies, trade links with China, and geographic distance directly impact China’s energy FDI (Zhou and Liu, 2010; Omri and Kahouli, 2014).

While past research has made pioneering analyses of the relationship between China’s FDI and target countries’ investment climates, the majority of existing literature has concentrated on the total amount of FDI, neglecting the unique characteristics of the energy industry (Frenkel et al., 2004; Demir and Duan, 2018; Aleksanyan et al., 2021). Despite similarities in FDI location determinants across different industries, investment motivations and location determinants are intricately connected to industry characteristics. Focusing on energy characteristics and classifications, our in-depth analysis uses a simultaneous equation model to determine whether investment target countries’ volatile and nonvolatile energy impacts China’s energy OFDI. Hypothesis 1-1 and one to two are set as follows:

Hypothesis 1–1. (H1-1): The volatile energy factor is positively correlated with China’s energy OFDI.

Hypothesis 1–2. (H1-2): The nonvolatile energy factor is positively correlated with China’s energy OFDI.

2.2 Indirect impact of energy OFDI

Apergis and Payne (2010), Sharma (2010), and Omri (2013) have demonstrated that energy consumption significantly impacts FDI inflows, particularly in high-income countries. The determinant role of energy consumption in GDP growth in these nations implies that elevated economic growth correlates with heightened energy demand. Conversely, in low-income countries, a one-way causal relationship exists between energy consumption and economic development, aligning with the findings of Altinay and Karagol (2004), Bekhet and Othman (2011), and Lee (2013). Omri and Kahouli (2014) utilized a simultaneous equation model to showcase the positive effects of energy consumption and Outward Foreign Direct Investment (OFDI) on economic growth. Existing research indicates that GDP per capita positively influences FDI inflows, signaling to potential foreign investors amid higher economic growth.

Enhancing transportation infrastructure remains a pivotal determinant for OFDI, particularly in developing countries where substantial competitive advantages can be gained (Percoco, 2014; Bensassi et al., 2015; Halaszovich and Kinra, 2020). Energy efficiency plays a crucial role in logistics and supply chain management, with the impact of energy prices on logistics being unavoidable (Halldórsson and Kovács, 2010). The current consequences of rising energy prices significantly affect logistics and supply chains. The notion that fuel prices are internalized in “transportation costs” aligns with Rogers et al.'s (2007) assertion that supply chains were built on the assumption that “petroleum-based fuel would be inexpensive and plentiful for a long time.” Similarly, Tanowitz & Rutchik (2008) acknowledged that rising fuel costs impact overall supply chain costs, emphasizing the need for companies to reevaluate the fundamental assumptions underlying their supply chain strategies. Access to abundant and affordable fuel has always been crucial for building successful supply chains for logistics and transportation managers (Colgan, 2014).

Energy OFDI is notably susceptible to political factors in target countries, as energy policies and sectoral reforms are rarely immune to political influence, especially in developing countries (Khodr and Ruble, 2013). Recalde (2006) analyzed the relationship between energy and the political dimension of development, attributing many deficiencies in energy policy to failures of political systems constrained by national political and administrative procedures. Dubash (2002) demonstrated that energy resources often function as political tools, while Kesselman et al. (2010) highlighted political barriers when oil and coal producers make substantial economic contributions and exert significant political influence. Particularly, oligopolistic corporations may use their political power to influence or block specific energy policies (Low, 2011). Consequently, host countries’ political environments significantly impact energy OFDI, but only a few studies have explored the substantial role of such effects in the energy sector.

Prior studies have predominantly employed a single model to describe the impact of investment environments on OFDI. While there is precedent for using simultaneous equations to analyze OFDI, researchers have primarily applied this approach to indirect effects between OFDI and economic and carbon emissions (Gong et al., 2019; Hao et al., 2020; Yang et al., 2021) or to the relationship between OFDI and domestic employment (Liao et al., 2021). No study has focused on the indirect impact of the investment climate on OFDI.

This study conducts a comprehensive analysis of the impact of different energy sources based on their characteristics and classifications. Our focus on volatile and nonvolatile energy sources arises from their unique status as indispensable production factors for economic development, closely intertwined with political and logistical factors (Li et al., 2016; Yao et al., 2018). Unlike existing studies that concentrate on the direct impact of investment environmental factors on OFDI, this research utilizes simultaneous equations to explore whether energy factors indirectly affect China’s energy OFDI through economic, logistics, and political factors. Focusing on the previous discussion, we propose the hypothesis regarding the indirect impacts of energy on OFDI are as follows:

Hypothesis 2–1. (H2-1): Volatile energy is positively correlated with energy OFDI because it promotes economic growth in target countries.

Hypothesis 2–2. (H2-2): Nonvolatile energy is positively correlated with energy OFDI because it promotes economic growth in target countries.

Hypothesis 3–1. (H3-1): Volatile energy is positively correlated with energy because it promotes logistics development in target countries.

Hypothesis 3–2. (H3-2): Nonvolatile energy is positively correlated with energy OFDI because it promotes logistics development in target countries.

Hypothesis 4–1. (H4-1): Volatile energy is positively correlated with energy OFDI because it reduces political risk in target countries.

Hypothesis 4–2. (H4-2): Nonvolatile energy is positively correlated with energy OFDI because it reduces political risk in target countries.

The simultaneous equations model (SEM), as a potent analytical tool in the field of economics, plays a pivotal role in examining interdependencies within multivariate systems. Its introduction aims to surpass traditional univariate analyses, enabling a more comprehensive understanding of the inherent complexity of economic phenomena. Existing literature has established a rich and profound theoretical framework for the study of SEM. Economists have employed this model to explore crucial issues such as market behavior, macroeconomic relationships, and policy effects. Lee (1989) employed the Simultaneous Equations Model (SEM) to investigate the relationships among migration, income, and fertility in Malaysia, particularly in the context of limited dependent variables. Cracolici et al. (2010) utilized SEM to assess the economic, social, and environmental performance of nations, showcasing the interdisciplinary application of SEM. Its introduction offers an innovative approach for a comprehensive evaluation of national performance. Hensher (2013) utilized SEM to explore the relationship between public perceived acceptability and referendum support for various road pricing schemes. Bibow’s (2013) study employed SEM to delve into Keynesian monetary policy, finance, and uncertainty theory, particularly amid the backdrop of the global financial crisis. The use of SEM facilitates the simultaneous consideration of multiple variables, providing a more holistic understanding of Keynesian theory in complex environments. In recent research, Hao et al. (2020) investigated the impact of China’s Outward Foreign Direct Investment (OFDI) on its domestic environmental quality through SEM. Furthermore, Sims' (1980) contribution expands the application scope of SEM, introducing the concept of “impulse response functions” and allowing researchers to more precisely analyze the economic system’s responses to external shocks. In conclusion, the significance of the simultaneous equations model in economic research is steadily growing, and its evolving theoretical framework and application methods continue to provide profound economic insights.

Unlike existing studies that analyze only simple relationships, this study is dedicated to addressing the energy challenges faced by China and the national security concerns associated with them. By incorporating the simultaneous equations model (SEMs), the analysis delves into the complex relationship between energy factors and the determinants of China’s Outward Foreign Direct Investment (OFDI) in the energy sector. Employing the SEM, this research comprehensively examines various variables influencing China’s energy OFDI. The utilized SEM comprises a series of equations, allowing for an in-depth understanding of the simultaneous impact of volatile and non-volatile energy factors alongside intermediary elements in the investment target countries. Using panel data covering 162 target countries, this study seeks to reveal the intricate dynamics involved in China’s energy investments. The application of SEM provides a comprehensive analytical framework, elucidating the interactive relationships between various energy factors and the determinants of China’s energy OFDI. Through this approach, the study aims to gain a profound understanding of the various complex factors influencing China’s energy investments. The combined use of empirical analysis and SEM contributes to a more nuanced comprehension of the multilayered factors affecting China’s energy security and global energy investments.

3 Methodology

3.1 Research model

In this study, we adopt Dunning and Buckley’s theory to divide investment environment impacts on OFDI into energy, economic, logistical, and political effects (Dunning, 1998; Buckley et al., 2007; Dunning, 2014; Buckley et al., 2018). In contrast to existing research, we use simultaneous equation modeling to analyze the relationship between energy factors, other investment factors (economic, logistical, and political), and energy OFDI flows for 162 countries (Jia and Wang, 2021; Tan et al., 2021; Liu et al., 2023a; Liu et al., 2023b). We use the widely popular 3SLS method to develop a simultaneous equation model that analyzes the three-way energy-investment climate-OFDI link in the investment target countries (Hao et al., 2020) because this method reveals correlations between unobserved disturbances across various equations (Yang et al., 2021) and is arguably more efficient asymptotically than single-equation estimates (Bakhsh et al., 2017). The simultaneous equation model, comprising a system of equations, constitutes a multifaceted modeling approach that allows examination of two or more dependent variables. This distinguishes it from the majority of econometric models in quantitative economics, which typically analyze only a single dependent variable (Yilanci et al., 2022a; Yilanci et al., 2022b).

The equation representing the effects of energy and investment environment factors on OFDI can be expressed as follows:

Where E stands for economic of target country as represented in PGDP (Zhou and Liu, 2010; Liu et al., 2023a); L stands for logistics of target country as described in PTRA (Halldórsson and Kovács, 2010; Liu et al., 2023b); P stands for policy of target country where COCO is used to indicate the politics of the target country (Wang et al., 2019; Tan et al., 2021; Liu et al., 2023a; Liu et al., 2023b); V stands for volatile energy, represented as PORE; and N stands for nonvolatile energy, denoted by PFUE. Adding a logarithm to both sides of the equation to reduce the effect of potential heteroscedasticity, the equation becomes:

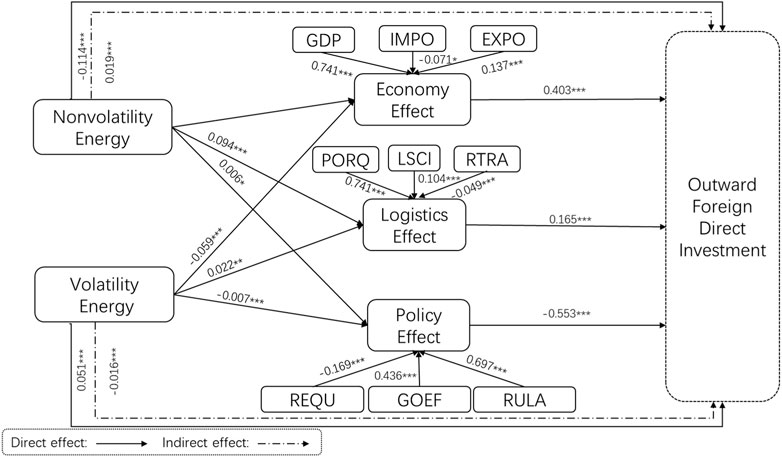

In the analysis, we break down volatile and non-volatile energy’s indirect impact on OFDI into three components (economy, logistics, policy), and the equation is as follows:

Where i represents the country and t represents time. Eq. 3 represents the total effect of the equation. Eqs 3–5 represent the economic, logistical, and policy effects of energy changes (Liu et al., 2023a; Liu et al., 2023b), respectively. The export of volatile and nonvolatile energy is essentially a capital outflow that directly affects the capital stock of the home country, which in turn affects the economy, logistical capacities, and political corruption in the host country. The impact of energy on OFDI corresponds to this study’s framework, as illustrated in Figure 1.

3.2 Research variable

Our sample consists of panel data from 162 investee countries in China for the 2005–2020 period. Since investment in tax havens is mainly used for reinvestment and data regarding the investment environments of certain investment target countries is not available, we exclude Tax haven countries such as the Cook Islands, the British Virgin Islands, the Solomon Islands, and some countries with missing data. Table 1 shows the variables’ definitions and prediction symbols.

4 Empirical analysis

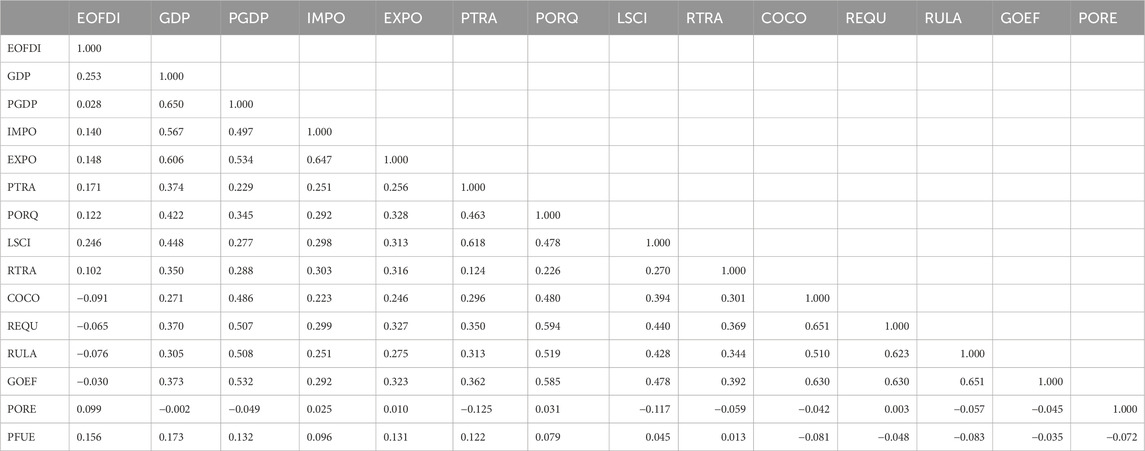

Table 2 shows descriptive statistics and Table 3 shows the correlation matrix of the variables. The correlation coefficient matrix provides an intuitive method for quantifying the linear relationships among variables. The correlation coefficient values range between −1 and 1, where negative values indicate a negative correlation, positive values indicate a positive correlation, and 0 signifies no correlation. Due to its simplicity and intuitiveness, the correlation coefficient matrix finds widespread applications across various domains, including economics, biology, and social sciences. On the other hand, inflation factor analysis is primarily employed to detect multicollinearity, highlighting instances where independent variables exhibit high levels of correlation. This is particularly crucial for multivariate regression analysis. By mitigating or eliminating multicollinearity, inflation factor analysis enhances the stability and reliability of regression models. In summary, both the correlation coefficient matrix and inflation factor analysis possess distinct advantages, and in this study, both methods are concurrently utilized to accurately assess the correlations among variables. Except for individual variables, the correlation matrix results were mainly <0.7, and the variance inflation factor (VIF) was mainly <10, suggesting that multicollinearity was not a major problem. The Jarque–Bera test assesses the goodness of fit of sample data to a normal distribution in terms of skewness and kurtosis. By combining tests for skewness and kurtosis, it provides a more comprehensive evaluation of the normality of the data. The Jarque–Bera test is relatively simple to use and is particularly sensitive to deviations from normality in small sample sizes, making it effective in detecting such deviations even with limited data. In our results, the Jarque-Bera test indicates that the jarque-bera probability for all variables is greater than 10%, suggesting that the data adheres to the assumption of a normal distribution.

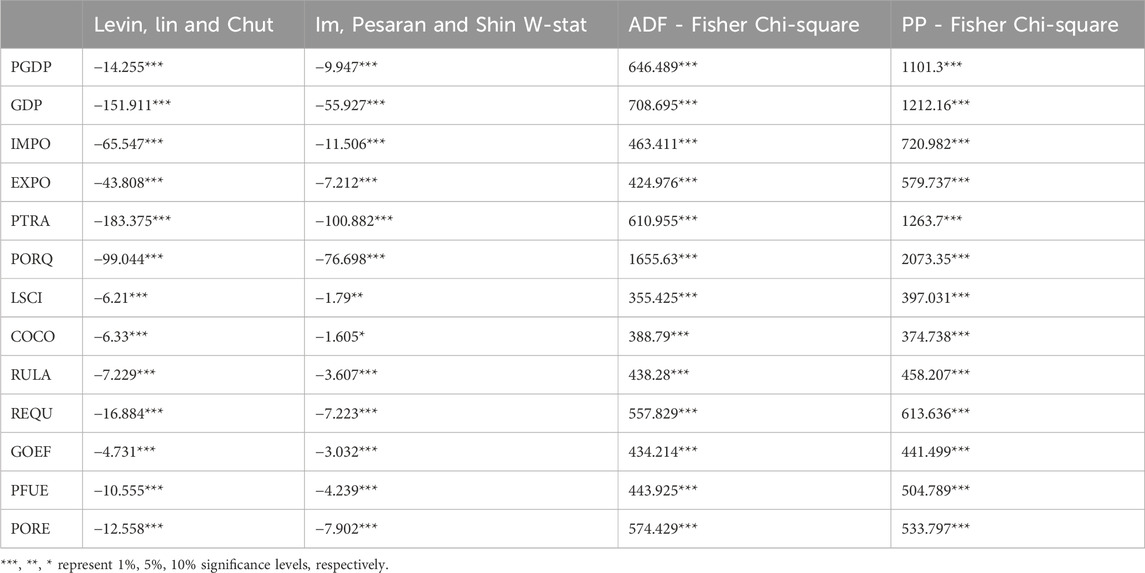

The panel unit root test aims to examine whether variables in panel data exhibit a unit root, indicating non-stationarity along the time series dimension. The correlation matrix is presented in Table 4. We conduct panel unit root tests on the variables initially to assess their stability and to mitigate potential issues of spurious regression (Li et al., 2018; Liu et al., 2023a). There are two categories of panel unit root tests: the Breitung t-statistic, LLC test, and IPS statistic are employed for testing the same root process, while the PP-Fisher and ADF-Fisher Chi-square tests are applied for testing different root processes (Dickey and Fuller, 1979; Breitung, 2001; Levin et al., 2002; Im et al., 2003). We employ four different analytical approaches, and the results are presented in Table 4. The findings confirm that the majority of variables in this study are statistically significant at the 1% level.

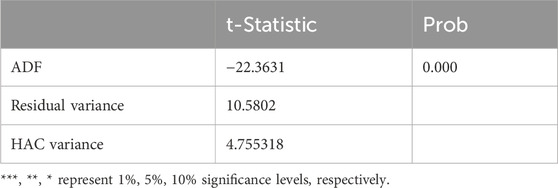

We conducted panel cointegration analysis to examine the long-term equilibrium relationship between outward foreign direct investment (OFDI) in the energy sector and the recipient country’s investment in energy and other variables. We employed the Kao (1999) cointegration test method, and the results of the panel cointegration test are presented in Table 5. The cointegration test results decisively reject the null hypothesis of no cointegration relationship. This indicates that there exists a long-term equilibrium relationship between energy OFDI and the target country’s investment in energy, as well as other investment environments.

4.1 Single-equation models analysis

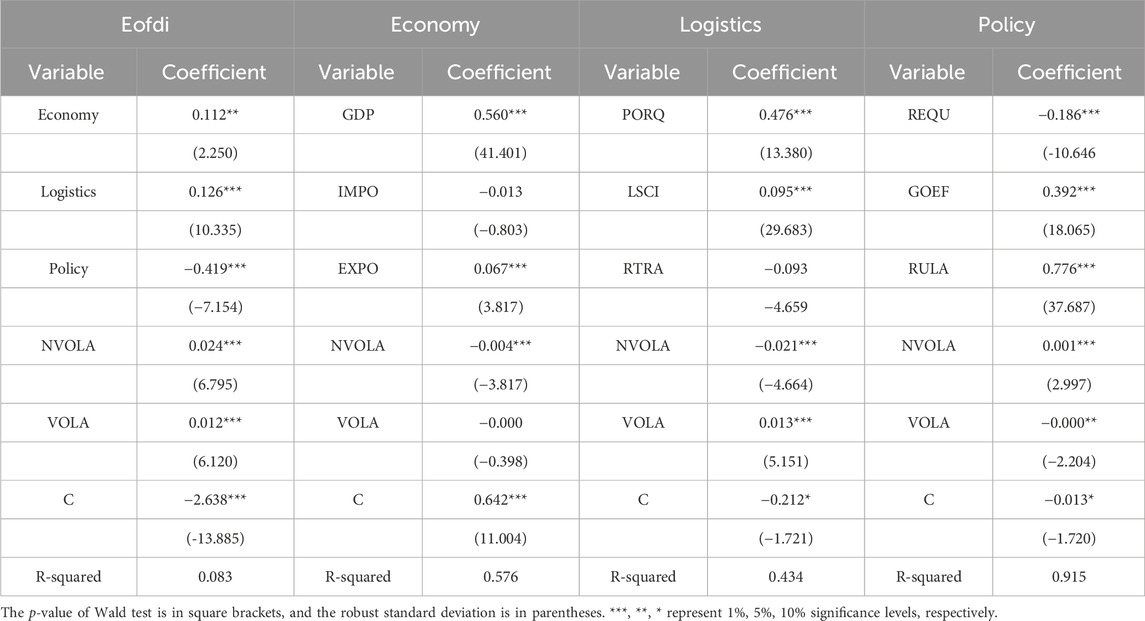

In this section, we estimate the energy factors’ direct and indirect effects using single- and simultaneous-equation models. Although the single-equation model may have endogeneity issues, its calculated results can be compared with those of the simultaneous-equation model. Table 6 shows the regression results of the single-equation model of China’s energy OFDI for two different types of resources. Most of the variable coefficients in the regression model show positive significance. The volatile and nonvolatile energy, economic, logistical, political, and other investment environment factors are statistically significant for China’s energy OFDI. In addition, we find that most of the effects of energy factors on the economic, logistical, and political factors are statistically significant.

4.2 Simultaneous equation model analysis results and discussion

The primary findings from our direct effect model align consistently with earlier research, indicating that, on the whole, positive influences stem from economic and logistical environments on OFDI (Buckley et al., 2007; Solarin and Shahbaz, 2015; Saidi et al., 2020). Conversely, political factors exhibit a negative impact on China’s energy OFDI, a pattern noted in prior studies (Erdener and Shapiro, 2005). It is well-established that China’s energy OFDI is predominantly undertaken by state-owned enterprises. The inclination of state-owned enterprises to mitigate political risk may contribute to the observed negative effect of political factors (Morck et al., 2008; Cheung and Qian, 2009; Holtbrugge and Kreppel, 2012). Moreover, the impact of energy-related factors on OFDI is nuanced, with volatile energy demonstrating a significant positive influence and nonvolatile energy having a notable adverse effect. These empirical findings underscore China’s preference for engaging in OFDI in countries with underdeveloped institutions but expansive markets, well-established logistics infrastructure, and volatile resources. Given China’s substantial oil deficit, with an oil import dependence rate reaching 83.3% (AEI, 2022), energy security, particularly concerning oil, has become a paramount concern for Chinese policymakers (Zhao et al., 2020).

Our indirect effect model reveals a noteworthy negative association between the central variable, volatile energy, and the economic effect, whereas nonvolatile energy exhibits an insignificantly positive correlation. This relationship between energy and the economy reflects a nuanced perspective, echoing the observations made by Costantini and Martini (2010). To elaborate, a 1% increase in volatile energy corresponds to a 0.059% reduction in economic growth. This implies that volatile energy resources do not foster economic development in the target countries. The intricate interplay arises from the dual dynamics where heightened economic growth demands increased energy consumption, yet more efficient energy utilization necessitates elevated economic growth levels. Furthermore, income derived from energy exports in investment target countries proves detrimental to their economic growth. Such income fails to contribute to the development of the energy industry chain or foster more efficient energy production. Notably, the control variables, GDP and EXPO, exhibit significant positive impacts on economic factors, in line with findings from previous studies (Guntukula, 2018; Hassouneh, 2019; Sultanuzzaman et al., 2019).

Concerning logistical factors, our analysis reveals that both pivotal variables—volatile energy and nonvolatile energy—demonstrate noteworthy positive correlations with the indirect effects on logistics. This signifies that both volatile energy and nonvolatile energy contribute positively to the advancement of logistics in the target countries. Energy plays a crucial role in logistics and supply chain management, and for logistics and transportation managers in China, access to abundant and affordable fuel has been a pivotal factor in constructing successful supply chains, as highlighted by studies such as Rogers et al. (2007) and Halldórsson and Kovács (2010). Within the realm of control variables, PORQ, LSCI, and RTRA emerge as pivotal indicators of the logistics effect. Notably, PORQ and LSCI exhibit significant positive impacts on the logistics effect, aligning with findings from studies by Yeo et al. (2008), Gordon et al. (2005), Munim and Schramm (2018), and del Rosal and Moura (2022). However, it is noteworthy that logistics factors have an adverse impact on RTRA, representing land transportation.

Concerning political effects, our findings indicate a noteworthy negative correlation between the core variable, volatile energy, and political factors, whereas nonvolatile energy exhibits a significant positive correlation with political factors. To be specific, a 1% increase in volatile energy results in a 0.007% decrease in political effects, while a 1% increase in nonvolatile energy leads to a 0.005% increase in political effects. Petropolitics exerts a substantial influence globally and domestically, particularly in developing countries (Colgan, 2014). Oil revenues render oil-producing “petro-states” susceptible to the resource curse, characterized by enduring authoritarianism, diminished political accountability, and increased instances of domestic violence (Haber and Menaldo, 2011; Ross, 2012). The presence of a resource curse in politics often translates into obstacles to democratic reforms, as most oil-rich countries are deemed “rental states” lacking democracy (Boonstra et al., 2008). Among the control variables, REQU, GOEF, and RULA emerge as crucial indicators of political effects. Notably, Government Effectiveness (GOEF) and Rule of Law (RULA) exhibit significant positive impacts on political factors, while Regulatory Quality (REQU) exerts a significant negative effect on political factors.

In summary, the effects of both volatile and nonvolatile energy variables on logistics are positive, but their impacts on economic and political factors exhibit notable variations. Corresponding to the findings from the single-equation models, volatile energy positively influences economic and political aspects, albeit with a significant negative impact. On the other hand, nonvolatile energy sources consistently demonstrate positive effects on both economic and political factors.

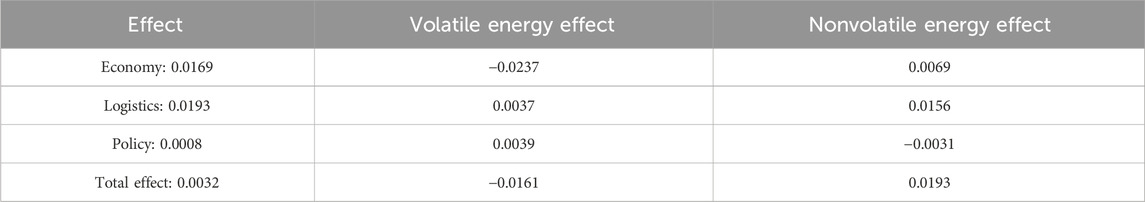

The outcomes regarding the impacts of volatile and nonvolatile energy on OFDI are outlined in Table 7 and Figure 2. In contrast to the outcomes from the single-equation models, the simultaneous-equation results reveal variations in the signs of the energy variables’ effects on OFDI. Consequently, we conduct a detailed analysis of the decomposition effect of volatile and nonvolatile energy variables on OFDI, and this analysis substantiates the findings of our empirical investigation. Concerning economic factors, nonvolatile energy exhibits a positive coefficient, volatile energy displays a negative coefficient, and the overall energy factor demonstrates a negative coefficient. This implies that the energy factor cannot indirectly attract investment by stimulating economic effects.

The coefficients for both volatile and nonvolatile energy are positive in relation to the logistics factor, resulting in a significantly positive overall coefficient. This suggests that both volatile and nonvolatile energy factors can indirectly attract OFDI by fostering logistics factors. In alignment with the observations of Halldórsson and Kovács (2010), our results regarding the impact of logistics factors on OFDI underscore the crucial role of energy in logistics and supply chain management. Furthermore, in line with Khadaroo and Seetanah (2008), Talley et al. (2014), and Saidi et al. (2020), our findings emphasize the significance of high-quality logistics systems in attracting foreign investment to target countries.

Concerning political factors, volatile energy displays a positive coefficient, nonvolatile energy exhibits a negative coefficient, and the overall energy factor demonstrates a positive coefficient. This indicates that the energy factor can indirectly attract investment by fostering the development of political factors. Our discovery that political factors have a direct impact on OFDI is consistent with the findings of Hajzler (2014), Buckley et al. (2007), Ramasamy et al. (2012), and Kolstad and Wiig (2012), highlighting the “lubricating effect” of corruption on OFDI. Therefore, target countries with underdeveloped political environments are likely to attract OFDI, contrary to traditional perspectives, including those of Habib and Zurawicki (2002), Bhaumik et al. (2010), and Duanmu (2011).

Table 8 presents the indirect effects of volatile and nonvolatile energy on OFDI. Our results suggest that both volatile and nonvolatile energy sources exert statistically significant effects on OFDI through three pathways. The distinction lies in the negative indirect effect of volatile energy, whereas nonvolatile energy exhibits a positive indirect effect. The commonality is that both volatile and nonvolatile energy have positive indirect impacts on OFDI through logistical factors. In summary, volatile energy manifests a significant negative indirect effect on OFDI, while nonvolatile energy displays a significant positive indirect effect on OFDI.

The findings of this study regarding China’s energy OFDI bear practical implications for addressing the energy crisis and ensuring national energy security. Presently, the Chinese government actively supports the overseas investments of domestic companies, particularly in resource-rich countries.

5 Conclusion and policy implications

China’s increasing demand for overseas energy has led to a growing importance of Energy Outward Foreign Direct Investment (OFDI) as a means to secure energy resources globally. This study significantly contributes to the energy economics literature by introducing a novel perspective, examining the intricate relationship between different energy types (volatile and nonvolatile), energy OFDI, and intermediary factors such as economic, logistic, and political considerations. By utilizing panel data covering China’s OFDI across 162 target countries from 2005 to 2020, the study employs a simultaneous equation model to scrutinize the direct and indirect effects of volatile and nonvolatile energy on China’s energy OFDI. The findings of the study reveal substantial direct and indirect impacts of both volatile and nonvolatile energy on China’s energy OFDI. Notably, nonvolatile energy, including fossil fuels, exhibits a more pronounced influence on China’s energy OFDI than volatile energy. However, it is essential to recognize that the resource curse acts as a hindrance to the economic development and political advancements of target countries. The study underscores the adverse impacts of economic and political factors on volatile and nonvolatile energy, respectively. Furthermore, it sheds light on the positive intermediary role played by logistics factors in both volatile and nonvolatile energy scenarios. While this study provides valuable insights into the complexities of China’s energy OFDI, it is essential to acknowledge potential contradictions with existing research. The study may align with research emphasizing the pivotal role of nonvolatile energy in shaping China’s energy OFDI. However, it may diverge from perspectives downplaying the significance of economic and political factors or overlooking the nuanced impact of logistics in volatile and nonvolatile energy scenarios. The nuanced examination of the relationships between these variables opens avenues for further discussion and exploration in the realm of energy economics.

5.1 Theoretical contributions

This study yields several noteworthy theoretical contributions. Firstly, it broadens the landscape of research on energy Outward Foreign Direct Investment (OFDI) by introducing a novel theoretical model. This model extends the established theoretical framework of location determinants in OFDI, offering a more intricate understanding of how energy factors impact the intricate location decisions associated with OFDI. The proposed model presents a more holistic elucidation of the driving forces that govern energy OFDI location choices.

Secondly, it provides a fresh lens through which to scrutinize energy OFDI by distinguishing between volatile and non-volatile energy factors. The examination of the influence exerted by these distinct energy factors on investment behavior underscores their significance as catalysts for energy OFDI, thereby enriching the theoretical framework underpinning OFDI.

Furthermore, this study pioneers the investigation of “compound relationships” in the context of energy OFDI. By introducing simultaneous equation modeling to the study of energy OFDI, it brings a higher level of sophistication to our understanding of this subject matter.

Lastly, extending beyond economic and policy considerations, the study underscores the pivotal role of logistical factors as influential determinants in shaping the location choices of energy OFDI. By delving into the mediating effect of logistical factors within the location determinants of energy OFDI, this research enhances our comprehension of the multifaceted factors steering energy OFDI location choices.

In conclusion, this study significantly contributes to a more comprehensive comprehension of China’s energy OFDI by integrating energy factors (volatile and non-volatile) and intermediary factors (economic, logistical, and political). Theoretical advancements are achieved through the innovative application of simultaneous equation modeling and the exploration of compound relationships.

5.2 Policy implication

The primary policy implications arising from these findings are outlined as follows:

Firstly, the study asserts that both volatile and nonvolatile energy sources exert a significant influence on China’s energy investment. Given China’s status as a net importer heavily reliant on resources such as oil, natural gas, and coal, the study recommends the formulation of pertinent laws and policies to fortify national energy security (Song et al., 2020). Investment target countries, particularly those rich in energy resources, are encouraged to leverage China’s foreign investment policies to advance energy-related technologies, research and development (R&D), and the enhancement of energy commodities (Wang and Chen, 2020; Song et al., 2021). As energy assumes an increasingly pivotal role globally, the study contends that energy investment will emerge as a crucial facet of the international investment market. Sustainable development and cooperation, the study argues, hinge on aligning the economic, logistical infrastructure, and international relations development of the investment target country. Additionally, cooperation in energy projects is posited as a strategic means to diversify China’s energy dependence and enhance collaboration with the destination country (Chang, 2014; Liu and Deseatnicow, 2016).

Secondly, the research finds that both volatile and nonvolatile energy indirectly influence China’s energy investment through logistical factors. This implies that investment target countries can capitalize on the opportunity to introduce Chinese infrastructure, construction technology, and equipment while attracting Chinese energy investment (Bensassi et al., 2015; Liu et al., 2023a). Facilitating Chinese investment in infrastructure maintenance or new construction is suggested as a pathway to integrate Chinese port operation methods and equipment through international cooperation or port leasing (Percoco, 2014; Liu et al., 2023b). Simultaneously, the study recommends that, as a country heavily reliant on energy, China can establish energy processing industries in areas related to energy mining or port-affiliated activities to alleviate its consumption of volatile energy. This involves transforming primary energy into secondary forms such as liquefied petroleum gas, electricity, and hydrogen energy, thereby addressing energy consumption challenges associated with transportation in a more environmentally friendly and efficient manner. The construction of energy-processing facilities is anticipated to offer infrastructure support to investment target countries and foster their industrial development (Zhang, 2015; Liu et al., 2023a).

Thirdly, the research demonstrates that energy factors wield an indirect influence on China’s energy Outward Foreign Direct Investment (OFDI) through political factors. Despite China’s preference for less advanced political environments, the study advocates for investment target countries to eliminate obstacles hindering collaboration with local companies, optimize the investment environment, and streamline entry-related procedures to guide the industrial layout of OFDI (Banik and Das, 2014). Notably, the study proposes that visits by national leaders above the ministerial level could facilitate the implementation of various projects and policies. Although the global pandemic has impeded many country visits, the study encourages officials at or above the ministerial level to actively engage in foreign visits and negotiations, fostering cooperation on major international projects (Kang and Jiang, 2012; Ramasamy et al., 2012). The promotion of additional agreements, such as investment agreements, and the facilitation of global investment policies are underscored as measures to bolster future collaborations (Kang and Jiang, 2012; Zhao and Lee, 2021).

5.3 Limitations and future research

Notwithstanding these significant findings, this study has several limitations that may lead to bias. We propose the concept of the “energy investment environment” to analyze the location determinants of energy investment based on the characteristics and classifications of volatile and nonvolatile energy sources. Future research can analyze energy investment from different categories to verify our conclusions. Second, this study does not subdivide investment target countries. Follow-up studies can examine the spillover effects of energy investment and the impact of geopolitical factors based on regional characteristics. Third, this study only analyzes China’s foreign energy investment, and the conclusions cannot be generalized to all countries. Future research can analyze energy investment from different countries’ perspectives to compare the findings’ differences. Last, external shocks (such as COVID-19) are also not fully considered. Hence, future research can supplement data to analyze the impact of external shocks such as COVID-19 on investment.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

YL: Writing–original draft, Writing–review and editing. MJ: Data curation, Methodology, Formal analysis, Writing–review and editing. SZ: Data curation, Formal analysis, Writing–review and editing. GQ: Funding acquisition, Writing–review and editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by 4th Maritime Port Logistics Training Project of the Ministry of Oceans and Fisheries, Korea. This work was supported by the National Natural Science Foundation of China under Grant (No. 72203088); and the Ministry of Education in China of Humanities and Social Science Project (No. 21YJC790055).

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

AEI (2022). China global investment tracker. https://www.aei.org/china-global-investment-tracker/(Accessed April 25, 2022).

Aleksanyan, M., Hao, Z., Vagenas-Nanos, E., and Verwijmeren, P. (2021). Do state visits affect cross-border mergers and acquisitions? J. Corp. Finance 66, 101800. doi:10.1016/j.jcorpfin.2020.101800

Aleksynska, M., and Havrylchyk, O. (2013). FDI from the south: the role of institutional distance and natural resources. Eur. J. Political Econ. 29, 38–53. doi:10.1016/j.ejpoleco.2012.09.001

Altinay, G., and Karagol, E. (2004). Structural break, unit root, and the causality between energy consumption and GDP in Turkey. Energy Econ. 26 (6), 985–994. doi:10.1016/j.eneco.2004.07.001

Apergis, N., and Payne, J. E. (2010). Renewable energy consumption and economic growth: evidence from a panel of OECD countries. Energy Policy 38 (1), 656–660. doi:10.1016/j.enpol.2009.09.002

Bakhsh, K., Rose, S., Ali, M. F., Ahmad, N., and Shahbaz, M. (2017). Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: new evidences from 3SLS. J. Environ. Manag. 196, 627–632. doi:10.1016/j.jenvman.2017.03.029

Banik, N., and Das, K. C. (2014). The location substitution effect: does it apply for China? Glob. Bus. Rev. 15 (1), 59–75. doi:10.1177/0972150913515595

Beerannavar, C. R. (2013). Indian outward FDI: an analysis. SSRN Electron. J. doi:10.2139/ssrn.2268444

Bekhet, H. A., and Othman, N. S. (2011). Causality analysis among electricity consumption, consumer expenditure, gross domestic product (GDP) and foreign direct investment (FDI): case study of Malaysia. J. Econ. Int. Finance 3 (4), 228–235. doi:10.5897/JEIF.9000022

Bensassi, S., Márquez-Ramos, L., Martínez-Zarzoso, I., and Suárez-Burguet, C. (2015). Relationship between logistics infrastructure and trade: evidence from Spanish regional exports. Transp. Res. Part A Policy Pract. 72, 47–61. doi:10.1016/j.tra.2014.11.007

Bento, J. P. (2011). Energy savings via foreign direct investment? -Empirical evidence from Portugal.

Bhaumik, S. K., Driffield, N., and Pal, S. (2010). Does ownership structure of emerging-market firms affect their outward FDI? The case of the Indian automotive and pharmaceutical sectors. J. Int. Bus. Stud. 41 (3), 437–450. doi:10.1057/jibs.2009.52

Bhaumik, S. K., and Gelb, S. (2005). Determinants of entry mode choice of MNCs in emerging markets: evidence from South Africa and Egypt. Emerg. Mark. Finance Trade 41 (2), 5–24. doi:10.1080/1540496x.2005.11052603

Bibow, J. (2013). Keynes on monetary policy, finance and uncertainty: liquidity preference theory and the global financial crisis. London, United Kingdom: Routledge.

Boonstra, J., Burke, E., and Youngs, R. (2008). The politics of energy: comparing Azerbaijan, Nigeria and Saudi arabia. Halle, Germany: Universitäts-und Landesbibliothek Sachsen-Anhalt.

Breitung, J. (2001). “The local power of some unit root tests for panel data,” in Nonstationary panels, panel cointegration, and dynamic panels. Leeds, Emerald Group Publishing Limited, 161–177.

Buckley, P. J., Clegg, L. J., Cross, A. R., Liu, X., Voss, H., and Zheng, P. (2007). The determinants of Chinese outward foreign direct investment. J. Int. Bus. Stud. 38, 499–518. doi:10.1057/palgrave.jibs.8400277

Buckley, P. J., Clegg, L. J., Voss, H., Cross, A. R., Liu, X., and Zheng, P. (2018). A retrospective and agenda for future research on Chinese outward foreign direct investment. J. Int. Bus. Stud. 49 (1), 4–23. doi:10.1057/s41267-017-0129-1

Chang, S. (2014). The determinants and motivations of China's outward foreign direct investment: a spatial gravity model approach. Glob. Econ. Rev. 43 (3), 244–268. doi:10.1080/1226508x.2014.930670

Cheung, Y. W., and Qian, X. (2009). Empirics of China's outward direct investment. Pac. Econ. Rev. 14 (3), 312–341. doi:10.1111/j.1468-0106.2009.00451.x

Colgan, J. D. (2014). Oil, domestic politics, and international conflict. Energy Res. Soc. Sci. 1, 198–205. doi:10.1016/j.erss.2014.03.005

Costantini, V., and Martini, C. (2010). The causality between energy consumption and economic growth: a multi-sectoral analysis using non-stationary cointegrated panel data. Energy Econ. 32 (3), 591–603. doi:10.1016/j.eneco.2009.09.013

Cracolici, M. F., Cuffaro, M., and Nijkamp, P. (2010). The measurement of economic, social and environmental performance of countries: a novel approach. Soc. Indic. Res. 95, 339–356. doi:10.1007/s11205-009-9464-3

Del Rosal, I., and Moura, T. G. Z. (2022). The effect of shipping connectivity on seaborne containerised export flows. Transp. Policy 118, 143–151. doi:10.1016/j.tranpol.2022.01.020

Demir, F., and Duan, Y. (2018). Bilateral FDI flows, productivity growth, and convergence: the north vs. the south. World Dev. 101, 235–249. doi:10.1016/j.worlddev.2017.08.006

Demirbas, A. (2008). Importance of biomass energy sources for Turkey. Energy Policy 36 (2), 834–842. doi:10.1016/j.enpol.2007.11.005

Deng, P. (2004). Outward investment by Chinese MNCs: motivations and implications. Bus. Horizons 47 (3), 8–16. doi:10.1016/s0007-6813(04)00023-0

Dickey, D. A., and Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 74 (366a), 427–431. doi:10.2307/2286348

Duan, F., Ji, Q., Liu, B. Y., and Fan, Y. (2018). Energy investment risk assessment for nations along China’s Belt and Road Initiative. J. Clean. Prod. 170, 535–547. doi:10.1016/j.jclepro.2017.09.152

Duanmu, J. L. (2011). The effect of corruption distance and market orientation on the ownership choice of MNEs: evidence from China. J. Int. Manag. 17 (2), 162–174. doi:10.1016/j.intman.2011.01.003

Dubash, N. (2002). Power politics: equity and environment in electricity reform. Washington, DC, USA: World Resource Institute.

Dunning, J. H. (1998). Location and the multinational enterprise: a neglected factor? J. Int. Bus. Stud. 29 (1), 45–66. doi:10.1057/palgrave.jibs.8490024

Dunning, J. H. (2014). “Location and the multinational enterprise: a neglected factor?,” in Location of international business activities (London, United Kingdom: Palgrave Macmillan), 35–62.

Erdener, C., and Shapiro, D. M. (2005). The internationalization of Chinese family enterprises and Dunning's eclectic MNE paradigm. Manag. Organ. Rev. 1 (3), 411–436. doi:10.1111/j.1740-8784.2005.00021.x

Frenkel, M., Funke, K., and Stadtmann, G. (2004). A panel analysis of bilateral FDI flows to emerging economies. Econ. Syst. 28 (3), 281–300. doi:10.1016/j.ecosys.2004.01.005

Fu, X., Buckley, P. J., and Fu, X. M. (2020). The growth impact of Chinese direct investment on host developing countries. Int. Bus. Rev. 29 (2), 101658. doi:10.1016/j.ibusrev.2019.101658

Gong, M., Liu, H., Atif, R. M., and Jiang, X. (2019). A study on the factor market distortion and the carbon emission scale effect of two-way FDI. Chin. J. Popul. Resour. Environ. 17 (2), 145–153. doi:10.1080/10042857.2019.1574487

Gordon, J. R., Lee, P. M., and Lucas, H. C. (2005). A resource-based view of competitive advantage at the Port of Singapore. J. Strategic Inf. Syst. 14 (1), 69–86. doi:10.1016/j.jsis.2004.10.001

Guntukula, R. (2018). Exports, imports and economic growth in India: evidence from cointegration and causality analysis. Theor. Appl. Econ. 25 (2). doi:10.2139/ssrn.3250105

Haber, S., and Menaldo, V. (2011). Do natural resources fuel authoritarianism? A reappraisal of the resource curse. Am. Political Sci. Rev. 105 (1), 1–26. doi:10.1017/s0003055410000584

Habib, M., and Zurawicki, L. (2002). Corruption and foreign direct investment. J. Int. Bus. Stud. 33 (2), 291–307. doi:10.1057/palgrave.jibs.8491017

Hajzler, C. (2014). Resource-based FDI and expropriation in developing economies. J. Int. Econ. 92 (1), 124–146. doi:10.1016/j.jinteco.2013.10.004

Halaszovich, T. F., and Kinra, A. (2020). The impact of distance, national transportation systems and logistics performance on FDI and international trade patterns: results from Asian global value chains. Transp. Policy 98, 35–47. doi:10.1016/j.tranpol.2018.09.003

Halldórsson, Á., and Kovács, G. (2010). The sustainable agenda and energy efficiency: logistics solutions and supply chains in times of climate change. Int. J. Phys. Distribution Logist. Manag. 40, 5–13. doi:10.1108/09600031011018019

Hao, Y., Guo, Y., Guo, Y., Wu, H., and Ren, S. (2020). Does outward foreign direct investment (OFDI) affect the home country’s environmental quality? The case of China. Struct. Change Econ. Dyn. 52, 109–119. doi:10.1016/j.strueco.2019.08.012

Hassouneh, I. (2019). The causal relationship between exports, imports and economic growth in Palestine. J. Rev. Glob. Econ. 8, 258–268. doi:10.6000/1929-7092.2019.08.22

Hensher, D. A. (2013). Exploring the relationship between perceived acceptability and referendum voting support for alternative road pricing schemes. Transportation 40 (5), 935–959. doi:10.1007/s11116-013-9459-4

Holtbriigge, D., and Kreppel, H. (2012). Determinants of outward foreign direct investment from BRIC countries: an explorative study. Int. J. Emerg. Mark. 7 (1), 4–30. doi:10.1108/17468801211197897

Hong, E., and Sun, L. (2006). Dynamics of internationalization and outward investment: Chinese corporations' strategies. China Q. 187, 610–634. doi:10.1017/s0305741006000403

Huang, X., Chen, W., Wang, Y., and Wang, W. (2021). Annual development report on world energy. Paris, France: IEA, 2021–2109.

Im, K. S., Pesaran, M. H., and Shin, Y. (2003). Testing for unit roots in heterogeneous panels. J. Econ. 115 (1), 53–74. doi:10.1016/s0304-4076(03)00092-7

Jia, W., and Wang, Y. (2021). “From de-globalization to China's green OFDI: an empirical model analysis via energy sector investment data,” in 2021 4th International Conference on Information Management and Management Science, Chengdu, China, August, 2021, 231–236.

Kalotay, K., and Sulstarova, A. (2010). Modelling Russian outward FDI. J. Int. Manag. 16 (2), 131–142. doi:10.1016/j.intman.2010.03.004

Kang, Y., and Jiang, F. (2012). FDI location choice of Chinese multinationals in East and Southeast Asia: traditional economic factors and institutional perspective. J. World Bus. 47 (1), 45–53. doi:10.1016/j.jwb.2010.10.019

Kao, C. (1999). Spurious regression and residual-based tests for cointegration in panel data. J. Econ. 90 (1), 1–44. doi:10.1016/s0304-4076(98)00023-2

Kesselman, M., Krieger, J., and Joseph, W. A. (2009). Introduction to comparative politics. Ohio, Wadsworth.

Khadaroo, J., and Seetanah, B. (2008). The role of transport infrastructure in international tourism development: a gravity model approach. Tour. Manag. 29 (5), 831–840. doi:10.1016/j.tourman.2007.09.005

Khodr, H., and Ruble, I. (2013). Energy policies and domestic politics in the MENA region in the aftermath of the Arab upheavals: the cases of Lebanon, Libya, and KSA. Polit. Policy 41 (5), 656–689. doi:10.1111/polp.12033

Kimura, F., and Kiyota, K. (2006). Exports, FDI, and productivity: dynamic evidence from Japanese firms. Rev. World Econ. 142 (4), 695–719. doi:10.1007/s10290-006-0089-1

Kolstad, I., and Wiig, A. (2012). What determines Chinese outward FDI? J. World Bus. 47 (1), 26–34. doi:10.1016/j.jwb.2010.10.017

Lee, J. W. (2013). The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 55, 483–489. doi:10.1016/j.enpol.2012.12.039

Lee, K. S. (1989). Migration, income and fertility in Malaysia: a simultaneous equations model with limited dependent variables. Appl. Econ. 21 (12), 1589–1610. doi:10.1080/758531694

Levin, A., Lin, C. F., and Chu, C. S. J. (2002). Unit root tests in panel data: asymptotic and finite-sample properties. J. Econ. 108 (1), 1–24. doi:10.1016/s0304-4076(01)00098-7

Li, K. X., Jin, M., Qi, G., Shi, W., and Ng, A. K. (2018). Logistics as a driving force for development under the belt and road initiative–the Chinese model for developing countries. Transp. Rev. 38 (4), 457–478. doi:10.1080/01441647.2017.1365276

Li, Y., Shi, X., and Yao, L. (2016). Evaluating energy security of resource-poor economies: a modified principle component analysis approach. Energy Econ. 58, 211–221. doi:10.1016/j.eneco.2016.07.001

Liao, H., Yang, L., Dai, S., and Van Assche, A. (2021). Outward FDI, industrial structure upgrading and domestic employment: empirical evidence from the Chinese economy and the belt and road initiative. J. Asian Econ. 74, 101303. doi:10.1016/j.asieco.2021.101303

Liu, H., Wang, Y., Jiang, J., and Wu, P. (2020). How green is the “belt and road initiative”? –Evidence from Chinese OFDI in the energy sector. Energy Policy 145, 111709. doi:10.1016/j.enpol.2020.111709

Liu, H. Y., and Deseatnicov, I. (2016). Exchange rate and Chinese outward FDI. Appl. Econ. 48 (51), 4961–4976. doi:10.1080/00036846.2016.1167831

Liu, Y., Li, X., Zhu, X., Lee, M. K., and Lai, P. L. (2023b). The theoretical systems of OFDI location determinants in global north and global south economies. Humanit. Soc. Sci. Commun. 10 (1), 130–213. doi:10.1057/s41599-023-01597-y

Liu, Y., Su, M., Zhao, J., Martin, S., Yuen, K. F., and Lee, C. B. (2023a). The determinants of China’s outward foreign direct investment: a vector error correction model analysis of coastal and landlocked countries. Econ. Change Restruct. 56 (1), 29–56. doi:10.1007/s10644-022-09407-2

Low, S. C. (2011). Sustainable energy policy: barriers, policies and 3P partnership. Singapore: Nanyang Technological University.

Mayer, T., Melitz, M. J., and Ottaviano, G. I. (2016). Product mix and firm productivity responses to trade competition. Rev. Econ. Statistics, 1–59. doi:10.2139/ssrn.2875415

Melitz, M. J., and Ottaviano, G. I. (2008). Market size, trade, and productivity. Rev. Econ. Stud. 75 (1), 295–316. doi:10.1111/j.1467-937x.2007.00463.x

Mielnik, O., and Goldemberg, J. (2000). Converging to a common pattern of energy use in developing and industrialized countries. Energy Policy 28 (8), 503–508. doi:10.1016/s0301-4215(00)00015-x

Morck, R., Yeung, B., and Zhao, M. (2008). Perspectives on China's outward foreign direct investment. J. Int. Bus. Stud. 39 (3), 337–350. doi:10.1057/palgrave.jibs.8400366

Munim, Z. H., and Schramm, H. J. (2018). The impacts of port infrastructure and logistics performance on economic growth: the mediating role of seaborne trade. J. Shipp. Trade 3 (1), 1–19. doi:10.1186/s41072-018-0027-0

Nadeem, F., Hussain, S. S., Tiwari, P. K., Goswami, A. K., and Ustun, T. S. (2018). Comparative review of energy storage systems, their roles, and impacts on future power systems. IEEE Access 7, 4555–4585. doi:10.1109/access.2018.2888497

Navaretti, G. B., Castellani, D., and Disdier, A. C. (2010). How does investing in cheap labour countries affect performance at home? Firm-level evidence from France and Italy. Oxf. Econ. Pap. 62 (2), 234–260. doi:10.1093/oep/gpp010

Omri, A. (2013). CO2 emissions, energy consumption and economic growth nexus in MENA countries: evidence from simultaneous equations models. Energy Econ. 40, 657–664. doi:10.1016/j.eneco.2013.09.003

Omri, A., and Kahouli, B. (2014). Causal relationships between energy consumption, foreign direct investment and economic growth: fresh evidence from dynamic simultaneous-equations models. Energy Policy 67, 913–922. doi:10.1016/j.enpol.2013.11.067

Percoco, M. (2014). Quality of institutions and private participation in transport infrastructure investment: evidence from developing countries. Transp. Res. Part A Policy Pract. 70, 50–58. doi:10.1016/j.tra.2014.10.004

Ramasamy, B., Yeung, M., and Laforet, S. (2012). China's outward foreign direct investment: location choice and firm ownership. J. World Bus. 47 (1), 17–25. doi:10.1016/j.jwb.2010.10.016

Recalde, M. (2006). Energy policy in developing countries: the Argentine case. Laxenburg Int. Inst. Appl. Syst. Analysis (IIASA). doi:10.1016/j.enpol.2011.04.022

Rogers, Z., Kelly, T. G., Rogers, D. S., and Carter, C. R. (2007). Alternative fuels: are they achievable? Int. J. Logist. Res. Appl. 10 (3), 269–282. doi:10.1080/13675560701478141

Ross, M. L. (2012). “The oil curse,” in The oil curse (Princeton, New Jersey, United States: Princeton University Press).

Sadorsky, P. (2010). The impact of financial development on energy consumption in emerging economies. Energy Policy 38 (5), 2528–2535. doi:10.1016/j.enpol.2009.12.048

Saidi, S., Mani, V., Mefteh, H., Shahbaz, M., and Akhtar, P. (2020). Dynamic linkages between transport, logistics, foreign direct investment, and economic growth: empirical evidence from developing countries. Transp. Res. Part A Policy Pract. 141, 277–293. doi:10.1016/j.tra.2020.09.020

Sharma, S. S. (2010). The relationship between energy and economic growth: empirical evidence from 66 countries. Appl. Energy 87 (11), 3565–3574. doi:10.1016/j.apenergy.2010.06.015

Solarin, S. A., and Shahbaz, M. (2015). Natural gas consumption and economic growth: the role of foreign direct investment, capital formation and trade openness in Malaysia. Renew. Sustain. Energy Rev. 42, 835–845. doi:10.1016/j.rser.2014.10.075

Song, M., Wang, S., and Zhang, H. (2020). Could environmental regulation and R&D tax incentives affect green product innovation? J. Clean. Prod. 258, 120849. doi:10.1016/j.jclepro.2020.120849

Song, M., Xie, Q., and Shen, Z. (2021). Impact of green credit on high-efficiency utilization of energy in China considering environmental constraints. Energy Policy 153, 112267. doi:10.1016/j.enpol.2021.112267

Sultanuzzaman, M. R., Fan, H., Mohamued, E. A., Hossain, M. I., and Islam, M. A. (2019). Effects of export and technology on economic growth: selected emerging Asian economies. Econ. Research-Ekonomska Istraživanja 32 (1), 2515–2531. doi:10.1080/1331677x.2019.1650656

Talley, W. K., Ng, M., and Marsillac, E. (2014). Port service chains and port performance evaluation. Transp. Res. Part E Logist. Transp. Rev. 69, 236–247. doi:10.1016/j.tre.2014.05.008

Tan, N., Chang, L., and Guo, R. (2021). China’s outward foreign direct investment in energy sector: the role of “intimate” relations between countries. PLOS One 16 (7), e0254199. doi:10.1371/journal.pone.0254199

Tang, B. J., Zhou, H. L., Chen, H., Wang, K., and Cao, H. (2017). Investment opportunity in China's overseas oil project: an empirical analysis based on real option approach. Energy Policy 105, 17–26. doi:10.1016/j.enpol.2017.02.023

Tanowitz, M., and Rutchik, D. (2008). Squeezing opportunity out of higher fuel costs. Supply Chain Manag. Rev. 12 (7).

Urdinez, F., Masiero, G., and Ogasavara, M. (2014). China’s quest for energy through FDI: new empirical evidence. J. Chin. Econ. Bus. Stud. 12 (4), 293–314. doi:10.1080/14765284.2014.952516

Wang, S., Zhang, H., and Hu, L. C. (2019). Research on location choice of clean energy investment in countries along Belt and Road Initiative. Int. Eng. Labor 2019 (01), 51–54. doi:10.1007/978-3-030-49829-0_12

Wang, Y., and Chen, X. (2020). Natural resource endowment and ecological efficiency in China: revisiting resource curse in the context of ecological efficiency. Resour. Policy 66, 101610. doi:10.1016/j.resourpol.2020.101610

Wu, K. (2014). China’s energy security: oil and gas. Energy Policy 73, 4–11. doi:10.1016/j.enpol.2014.05.040

Yang, T., Dong, Q., Du, Q., Du, M., Dong, R., and Chen, M. (2021). Carbon dioxide emissions and Chinese OFDI: from the perspective of carbon neutrality targets and environmental management of home country. J. Environ. Manag. 295, 113120. doi:10.1016/j.jenvman.2021.113120

Yao, L., Shi, X., and Andrews-Speed, P. (2018). Conceptualization of energy security in resource-poor economies: the role of the nature of economy. Energy Policy 114, 394–402. doi:10.1016/j.enpol.2017.12.029

Yeo, G. T., Roe, M., and Dinwoodie, J. (2008). Evaluating the competitiveness of container ports in Korea and China. Transp. Res. Part A Policy Pract. 42 (6), 910–921. doi:10.1016/j.tra.2008.01.014

Yilanci, V., Çütcü, İ., and Araci, S. (2022a). The causality relationship between trade and environment in G7 countries: evidence from dynamic symmetric and asymmetric bootstrap panel causality tests. Mathematics 10 (15), 2553. doi:10.3390/math10152553

Yilanci, V., Cutcu, I., and Cayir, B. (2022b). Is the environmental Kuznets curve related to the fishing footprint? Evidence from China. Fish. Res. 254, 106392. doi:10.1016/j.fishres.2022.106392

Zhang, L. (2015). The AIIB: making room for China in the global economy. http://www.china.org.cn/opinion/.

Zhao, J., and Lee, J. (2021). The Belt and Road Initiative, Asian infrastructure investment bank, and the role of enterprise heterogeneity in China’s outward foreign direct investment. Post-Communist Econ. 33 (4), 379–401. doi:10.1080/14631377.2020.1745560

Zhao, Y., Shi, X., and Song, F. (2020). Has Chinese outward foreign direct investment in energy enhanced China's energy security? Energy Policy 146, 111803. doi:10.1016/j.enpol.2020.111803

Keywords: volatile and nonvolatile energy, outward foreign direct investment, China, location determinant, simultaneous equation model

Citation: Liu Y, Jin M, Zhao S and Qi G (2024) How do volatile and non-volatile energy factors affect energy OFDI? evidence from simultaneous equation model. Front. Energy Res. 11:1302374. doi: 10.3389/fenrg.2023.1302374

Received: 28 September 2023; Accepted: 19 December 2023;

Published: 15 January 2024.

Edited by:

Shiv Prasad, Indian Agricultural Research Institute (ICAR), IndiaReviewed by:

Ibrahim Cutcu, Hasan Kalyoncu University, TürkiyeXue Li, Nanyang Technological University, Singapore

Jinjing Zhao, Northeastern University at Qinhuangdao, China

Copyright © 2024 Liu, Jin, Zhao and Qi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Guanqiu Qi, eGlhbzIwMTA3QGNhdS5hYy5rcg==

Yanfeng Liu

Yanfeng Liu Mengjie Jin4

Mengjie Jin4