Abstract

Pavements are critical components of highway assets, but accurately estimating their value can be challenging due to the lack of connection between valuation and long-term service performance degradation. To address this issue, the replacement cost and condition-based valuation methods were introduced using the Yunnan province highway in China as an example, which divided pavement into four performance states based on service stages. The rationality of maintenance decisions and the impact of preventive maintenance investment on life cycle assessments were also considered. The results indicate that there are issues of irrational allocation of maintenance funds of the highway in Yunnan province, and a higher proportion of preventive maintenance investment is required. Moreover, it is recommended to balance the maintenance funds for bridge and tunnel engineering in the following year, focusing on bridge engineering with a rapid decline in the newness rate. The implementation of preventive maintenance has a positive correlation with the replacement cost and newness rate of the road sections. Through comparison, it was found that the road surface renewal rate in 2019 was lower than that in 2018, and some highway management departments in certain regions need to adjust their preventive maintenance strategies. Overall, the condition-based pavement asset valuation method comprehensively considers each stage of pavement operation and can serve as an effective tool for evaluating pavement asset depreciation. This research finding can promote the sustainable development of road infrastructure.

1 Introduction

Highway assets refer to the infrastructure assets that are formed through construction and are an essential part of government assets. Non-toll highway assets include the land used for highways, highways (including highway bridges, road tunnels, and road ferries, etc.), structures, traffic engineering, and roadside facilities (including traffic safety facilities, management facilities, service facilities, and green environmental protection facilities), as well as other assets that constitute an indispensable part of the normal use of the road. Due to the increment in service life, highway assets inevitably face the issue of depreciation (Alshboul et al., 2021; Amin et al., 2022; Yuan et al., 2023). It is necessary to evaluate and calculate the value of non-toll highway assets combined with the actual situation of the transportation industry (Ivannikov and Dollery, 2020). Moreover, understanding the correlation between the dynamic changes in the value of non-toll highway assets and the level of road condition detection and maintenance can provide data support for asset management, financial management, budget management, and performance management, thereby enhancing the asset management level of highway infrastructure (Sun et al., 2017; Li and McNeil, 2021; Jiang et al., 2022).

Asset depreciation and valuation are generally recognized features in private sector accounting that are utilized to justify fund investment (Kuroki, 2022). The valuation of assets is crucial in various systems of worldwide asset conservancy since it converts the conditions of the infrastructure into financial terminology, like equity or public wealth. Road networks are critical infrastructure assets possessed and maintained by regional governments, and the valuation of highway assets has gained considerable attention in recent decades (Hwangbo et al., 2020). The world’s leading economies have built up regulations or specifications for asset valuation to enhance asset management practices. For instance, the Government Accounting Standard Board (GASB) in the United States mandated regional authorities to report the value of the assets that they possess and provided representative valuation methods to select from through Statement No. 34 in 1999. The Institute of Public Works Engineering Australasia (IPWEA) in Australia collaborates with the Australasian Road Transport and Traffic Bureau to develop the Management Manual of International Infrastructure, which includes comprehensive guidelines and financial plans for the asset management of regional institutions. Similarly, the Chartered Institute of Public Finance and Accounting (CIPFA) designed a practice criterion for transportation infrastructure assets in Great Britain, offering references for allocating financial values to substantial assets. In China, administrative institutions are also required to conduct the enrolment and management of transportation infrastructure in alignment with specified standards.

Asset valuation is a crucial aspect of highway asset management, and numerous researches have been conducted to explore the potential for incorporating asset valuation into transport asset management plans. However, traditional valuation methods treat assets as homogeneous units and neglect valuation criteria reflecting asset users’ and agencies’ perspectives, such as asset service life and condition (Dojutrek et al., 2012). To address these limitations, a new methodology called elemental decomposition and multi-criteria (EDMC) has been developed (Dojutrek et al., 2014). This approach recognized that each element of transportation infrastructure assets may deteriorate at a different rate and conducted separate valuations of these elements, providing a more comprehensive and accurate valuation compared to traditional methods. Amekudzi-Kennedy et al. (Amekudzi-Kennedy et al., 2019) reviewed asset valuation methodologies with transportation applications and proposed innovative paths and future orientation to enhance existing capabilities in capturing an expanding notion of transportation infrastructure value. Hoang et al. (Hoang et al., 2020) proposed a comprehensive model integrating economic and utility concepts for bridge valuation. The specific performance measures in this model involve average annual daily traffic (AADT), safety, mobility, physical condition, and direct time savings. Lim et al. (Lim et al., 2019; Porras-Alvarado et al., 2015) employed utility theory and developed a productivity-based asset valuation method that reflects not only the actual conditions of the highway, but also its functionality and overall level of use.

Among the various highway assets, pavement is a vital component of highway infrastructure, and the valuation method employed can significantly influence asset value and decision-making outcomes, depending on the mathematical formulations and assumptions employed. Therefore, selecting an appropriate method to determine the value of existing infrastructure assets is crucial for highway asset management and maintenance decision-making. The replacement cost method is commonly used internationally to calculate the value of highway assets among the multiple methods (Sirirangsi et al., 2003; Lee and Lee, 2014; Sun et al., 2023). The key parameters include the total replacement cost and depreciation (substantive, economic, and functional). Substantive depreciation is related to asset performance and service levels and can be divided into three evaluation methods: straight-line method, S-shaped performance depreciation method, and condition-based depreciation method (Howe, 2004). The first two methods calculate depreciation based on service life, establishing a linear relationship between service life and depreciation. The condition-based depreciation method measures asset depreciation based on service level, using indicators such as pavement performance and capital input to indirectly consider the value of physical depreciation (Lombardi et al., 2021). Depreciation only occurs when asset performance falls below predetermined standards. When asset performance deteriorates significantly, there may also be situations of scrapping.

Regrettably, the current body of research concerning the valuation and assessment of pavement assets in highway infrastructure is scant. Furthermore, relating the degradation of pavement performance to the replacement costs at each stage is a formidable task since it necessitates identifying the appropriate maintenance strategy and the optimal allocation of the available budget for pavement throughout its lifecycle (Fwa and Farhan, 2012; Xian and Yuanshun, 2018; Santos et al., 2022). As a result, it is imperative to conduct condition-based valuation and assessment in tandem with engineering practices to furnish data to grasp the dynamic shifts of pavement assets and to provide decision-making recommendations for enhancing the maintenance level of highways.

2 Objective and scope

This study aims to establish a connection between the valuation of pavement assets and their performance degradation, through the utilization of the replacement cost and condition-based valuation approach. Using the Yunnan province highway in China as an example, pavements were divided into four stages according to their performance during use. The scheme for this research is detailed in

Figure 1. The specific objectives are as follows:

1) Evaluate the rationality of maintenance strategies employed by the management department;

2) Analyze the impact of preventive maintenance investment on pavement assets;

3) Provide suggestions for the maintenance strategies of highway assets under the jurisdiction of the Yunnan Provincial Highway Bureau.

4) Establish a correlation between changes in the value of transportation infrastructure and the annual work of management organizations through asset management systems, and establish performance evaluation indicators for internal management work.

FIGURE 1

Scheme for this research.

3 Depreciation methodology and overall calculation method

3.1 Depreciation and replacement cost

3.1.1 Depreciation

Depreciation D) refers to the loss of asset value, including functional depreciation, economic depreciation, and substantive depreciation. Wherein:

Functional depreciation is the loss of asset value resulting from the relative obsolescence of asset function due to advancements in technology. In the calculation of full replacement price, functional depreciation is often not considered, as total replacement price is typically used.

Economic depreciation is the loss of asset value due to external factors such as idle assets, declining earnings, and changes in the broader economic environment. Non-toll roads, as “public infrastructure” generally occupy a dominant position in the overall road network and are typically not impacted by external factors such as political influences and macroeconomic policies. As a result, economic depreciation was not considered in the valuation of such assets as well.

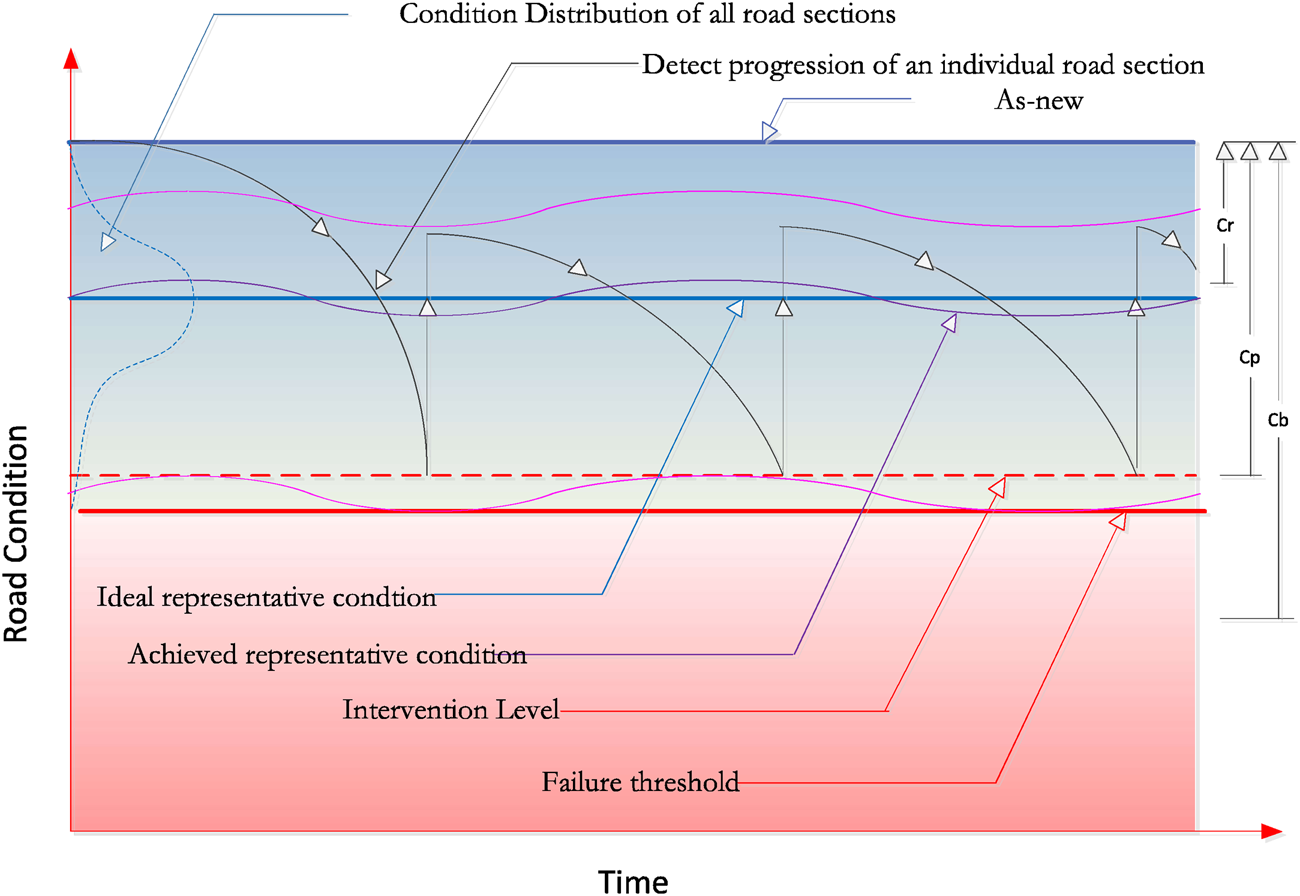

Due to China’s regulations, all provinces are required to monitor the technical condition of the national highway network every year. Highways with poor road surface technical conditions will be repaired in the same year, and there are rarely cases of roadbed damage due to severe road surface damage and long-term lack of repair. Through years of monitoring data investigation throughout the province, it has been found that the majority of highways use semi-rigid roadbeds, which meet industry standards for long-term performance and pavement structural strength, and meet functional requirements. Therefore, depreciation is not considered for the roadbeds in this asset evaluation. Substantive depreciation refers to the loss of value of assets caused by the degradation or deterioration of the physical properties of assets due to use and natural forces. To measure substantive depreciation, methods such as the service life method, observation method, and rehabilitation expense method are commonly employed. The pavement engineering-performance valuation method is a calculation method for highway engineering depreciation that considers the technical condition of highway assets and the influence of asset performance on value. This method is an advanced application of the rehabilitation expense method in the evaluation of highway engineering value. The basic principle of the pavement engineering-performance valuation method is to restore pavement performance to its optimal level, with substantive depreciation of pavement assets considered equal to the rehabilitation expense required to achieve this level (Snaith and Orr, 2006), as shown in Figure 2.

FIGURE 2

Composition of pavement engineering rehabilitation expense.

From

Figure 2, it can be found that there are four types of working state according to the performance:

1) Best performance state: The status of new construction, reconstruction, and expansion.

2) Normal service condition: Pavement performance is at a normal service level.

3) Optimal maintenance time: This state is appropriate for implementing pavement repair measures when the road surface performance is lower than the intermediate maintenance standard and within the range of intervention level.

4) Structural rehabilitation state: Pavement performance is lower than the set heavy maintenance standard. The structural overhaul is necessary to restore its normal service level.

Based on the varying state of each pavement section of a highway network, the rehabilitation expense of the overall pavement can be calculated as follows:

a. For pavement sections in the highway network at the best performance state, the rehabilitation expense is zero.

b. For pavement sections in the network at normal service conditions, the level of pavement conditions tends to be higher in those sections in use. The rehabilitation expense of this pavement section is based on the level of the overall highway network. The proportion of the pavement repair cost with the optimal maintenance time is taken as the principle of pavement repair cost to calculate and can be represented by Cr.

c. In terms of pavement section at optimal maintenance time in the highway network, the required maintenance activities can be determined as per performance status to calculate the required maintenance engineering cost, which can be represented by Cp.

d. In terms of pavement section at structural rehabilitation state in the highway network, an overhaul or even an upgrade is required to restore its performance, the amount of capital required for optimal maintenance time tends to be bulky, and the cost of this part is expressed by Cb.

It can be concluded that the substantive depreciation of pavement engineering is equivalent to its rehabilitation expense, which is the sum of the costs for each of the four working states described above.

where

Cis the depreciation amount of pavement engineering, the cost of rehabilitating the pavement to best performance state;

Cris the rehabilitation expense required by the pavement at normal service conditions;

Cpis the rehabilitation expense required by the pavement at optimal maintenance time;

Cbis the rehabilitation expense required by the pavement at structural rehabilitation state.

(1) Calculation method of substantive depreciation at normal state

The rehabilitation expense for a certain proportion of pavement rehabilitation expense during optimal maintenance time can be used as the pavement’s rehabilitation expense by comparing it to the overall road network level. The formula is as follows:

where p is the proportion of daily maintenance pavement section, which is set as a percentage. The value here is 33%, that is, the proportion of the area requiring daily maintenance is 33%;

Upis the unit price of functional maintenance project;

Sris the total area of normal service road section.

(2) Calculation method of substantive depreciation at optimal maintenance time

A highway network with a high maintenance level tends to have relatively stable capital investment. The section area in the road network with the optimal maintenance time shall be a fixed proportion of the total area of the road network, according to which the required cost of maintenance activities can be determined. This part of the maintenance work cost is expressed as functional maintenance work cost.

The calculation formula is as follows:

where

Cpis the functional maintenance work cost is the maintenance cost of functional maintenance of the road network;

Upis the state/city functional maintenance project unit price;

Spis the total area of road section at optimal maintenance time.

(3) Calculation method of substantive depreciation at structural repair state

In terms of road section at structural repair state in the highway network, an overhaul or even an upgrade is required to restore its performance. The cost of structural maintenance work for each section is the substantive depreciation of the section. The formula is as follows:

where Cb is the maintenance cost for structural rehabilitation of the road network; Ub is the structural maintenance project unit price of each state/city can be adjusted according to local conditions every year of each state/city by using relevant parameters; Sb is the total area of road section at structural repair (PQI < 70). The pavement quality index (PQI) is a comprehensive index used to evaluate pavement technical condition. It includes the corresponding sub-indexes: pavement damage condition index (PCI), pavement driving quality index (RQI), pavement rut depth index (RDI), pavement jumping index (PBI), pavement wear index (PWI), pavement skid resistance index (SRI), and pavement structural strength index (PSSI).

3.1.2 Total replacement price

Total replacement price (TRP) is a financial metric that represents the total cost of purchasing or constructing an asset that would perform identically to the one being evaluated under present conditions. It typically comprises two components: restoration and renewal replacement costs. Restoration replacement cost is the cost required to recover the expenditure incurred in the acquisition and construction of the top-performance road property at current prices, using the same materials, construction, or manufacturing standards, designs, formats, and techniques as those of the original route. Renewal replacement cost, on the other hand, refers to the cost of producing or building new roads with the same functionality at current prices by using top-performance materials and adhering to modern standards, designs, and formats. In this study, the renewal replacement cost is used. The formula for calculating the total replacement price is as follows:where is the total replacement price of assessed assets; Q is the number of projects of different types of assets (volume, length, etc.); U is the technical-economic indicator of the quantity (volume and length) per unit of projects of different types of assets.

3.1.3 Replacement cost

The replacement cost (RC) of non-toll highway assets is the asset value obtained by subtracting the real depreciation, functional depreciation, and economic depreciation of the asset from the total replacement price of the asset in its best performance state under current conditions (Deng et al., 2020; Junzhe et al., 2023). The basic formula for highway infrastructure replacement cost calculation is as follows:

4 Case study of Yunnan Province in China

4.1 Measuring range

Our team has completed the public infrastructure including land used for highways, highway (including highway Bridges and culverts, highway tunnels, and highway ferries, etc.) and structures, traffic engineering and facilities along the road (including traffic safety facilities, management facilities, service facilities, green and environmental protection facilities) was measured. However, it does not include buildings, equipment and vehicles used for management and maintenance which are independent of public infrastructure and do not constitute an indispensable part of its usage.

4.2 Calculation object

The total highway infrastructure (non-toll roads) from 2018 to 2019 under the jurisdiction of The Highway Bureau of Yunnan Province was investigated, as summarized in Table 1.

TABLE 1

| Name | Unit | National highway | Provincial highway | County highway | Total |

|---|---|---|---|---|---|

| as of 31 December 2018 | |||||

| Class I highway | Kilometer | 630.067 | 148.615 | 6.912 | 688.081 |

| Class II highway | 6811.300 | 3232.262 | 193.551 | 10237.113 | |

| Class III highway | 2726.449 | 1480.026 | 346.447 | 4552.922 | |

| Class IV highway | 1760.971 | 2628.969 | 407.211 | 4797.151 | |

| Substandard highway | 62.159 | 183.678 | 90.855 | 336.692 | |

| Total | 11893.433 | 7673.55 | 1044.976 | 20611.959 | |

| as of 31 December 2019 | |||||

| Grade I highway | Kilometer | 630.067 | 134.338 | 21.925 | 786.330 |

| Grade II highway | 7243.143 | 3281.010 | 277.638 | 10801.791 | |

| Grade III highway | 2736.328 | 1337.197 | 622.998 | 4696.523 | |

| Grade IV highway | 1415.045 | 2080.571 | 923.817 | 4419.433 | |

| Substandard highway | 0 | 55.797 | 113.784 | 169.581 | |

| Total | 12024.583 | 6888.913 | 1960.162 | 20873.658 | |

Basic information on highway infrastructure of Yunnan Province.

5 Results and discussion

5.1 Overall analysis of replacement cost

A measurement model for replacement cost was employed to determine the total replacement price of all non-toll highway infrastructure assets in Yunnan Province (excluding the value of public land), which has a total management and maintenance mileage of 20, 873.658 km. The results showed that the total replacement price was RMB 350, 013, 510, 622, which was depreciated to RMB 31, 728, 282, 253, resulting in a replacement cost of RMB 318, 285, 228, 369, as presented in Table 2. The newness rates for various infrastructure components were also calculated, such as 77.51% for pavement engineering, 100% for subgrade engineering, 50.08% for culvert engineering, 78.18% for bridge engineering, 77.38% for tunnel engineering, 67.25% for roadside facilities, and 90.94% for the overall newness rate.

TABLE 2

| Category | Total replacement price/RMB | Depreciation/RMB | Replacement cost/RMB | Newness rate/% |

|---|---|---|---|---|

| Pavement | 56, 594, 974, 587 | 12, 725, 819, 356 | 43, 869, 155, 231 | 77.51 |

| Subgrade | 222, 539, 847, 264 | 0 | 222, 539, 847, 264 | 100.00 |

| Culvert | 6, 332, 053, 974 | 3, 160, 815, 369 | 3, 171, 238, 605 | 50.08 |

| Bridge | 36, 398, 007, 756 | 7, 940, 686, 522 | 28, 457, 321, 234 | 78.18 |

| Tunnel | 13, 011, 979, 802 | 2, 943, 863, 301 | 10, 068, 116, 501 | 77.38 |

| Roadside facilities | 15, 136, 647, 239 | 4, 957, 097, 705 | 10, 179, 549, 534 | 67.25 |

| Total | 350, 013, 510, 622 | 31, 728, 282, 253 | 318, 285, 228, 369 | 90.94 |

Summary of highway asset replacement cost in Yunnan Province.

Furthermore, in comparison with 2018, the total mileage of Yunnan’s overall highway infrastructure assets increased by 261.699 km at the end of 2019. Additionally, the total replacement price increased by RMB 5, 459, 649, 034, while the depreciation increased by RMB 5, 775, 520, 402. Consequently, the final replacement cost decreased by RMB 315, 871, 368.

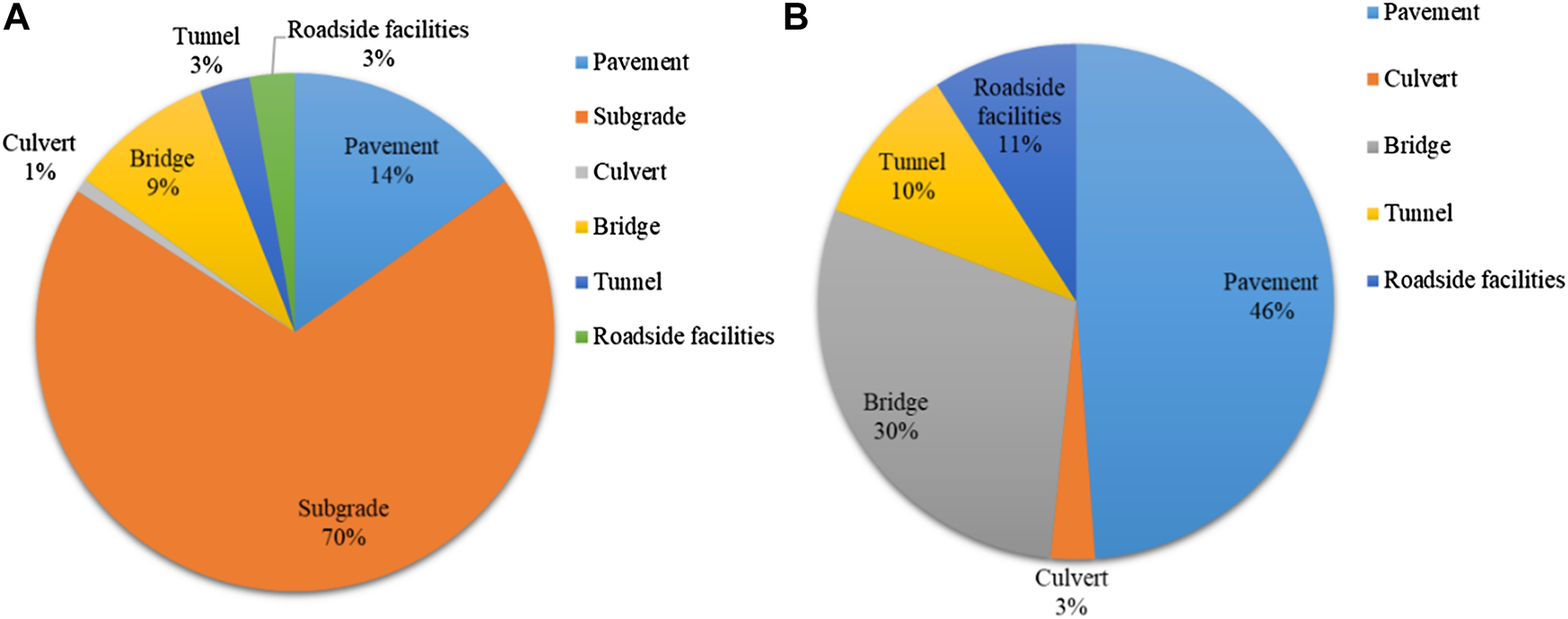

From Figure 3, it indicates that as of 31 December 2019, the replacement cost of highway infrastructure reconstruction of Yunnan Province was RMB 318, 285, 228, 369, where pavement engineering accounts for 14%, subgrade accounts for 70%, culvert accounts for 1%, bridge accounts for 9%, tunnels accounts for 3%, and roadside facilities accounts for 3%. The replacement cost of subgrade engineering accounts for more than 60%, which is not depreciated in the calculation. In other types of assets, pavement engineering accounts for the largest proportion of highway assets, implying that pavement section is the main direction of maintenance fund investment.

FIGURE 3

Proportions of each type of highway asset. (A) Include subgrade. (B) Exclude subgrade.

In addition to subgrade engineering, it can be seen that the replacement cost of the pavement represents the largest share of highway assets at 46%, followed by bridge engineering at 30%, tunnel engineering at 10%, and facilities along the road at 11%. These findings suggest that the maintenance fund allocation to pavement engineering is a critical component of the overall maintenance fund, which aligns with the importance principle.

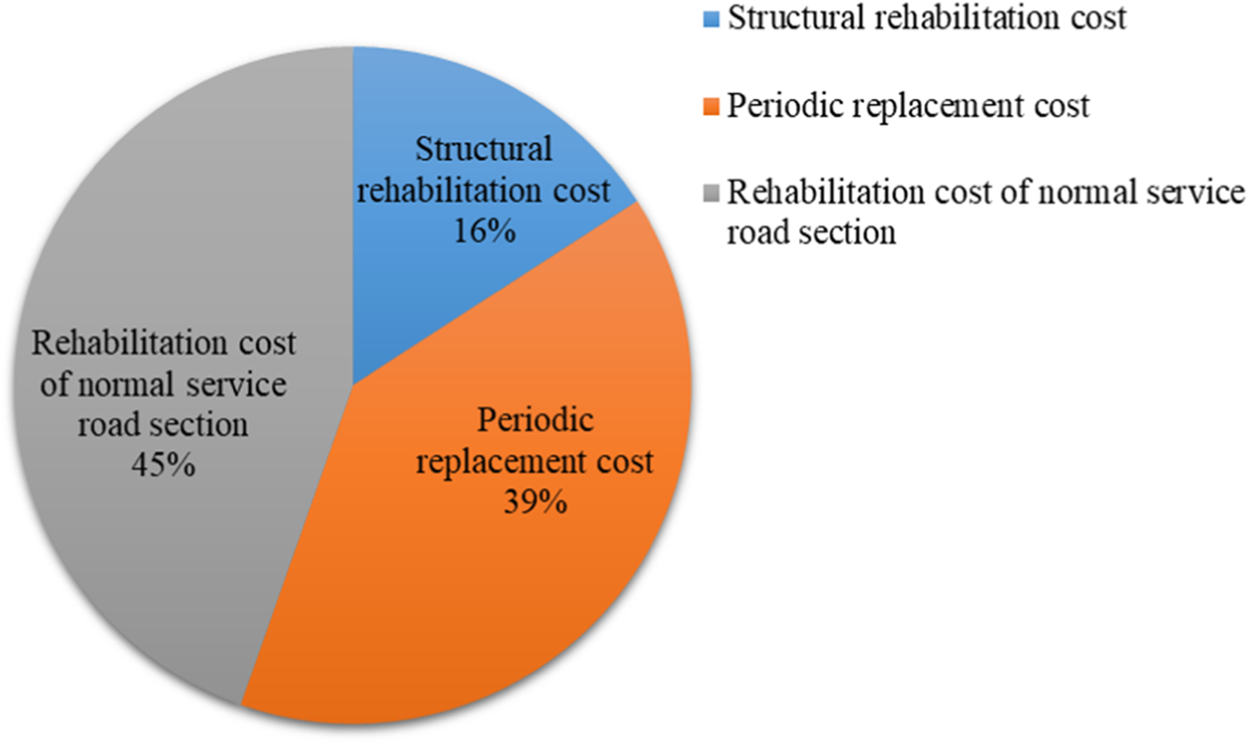

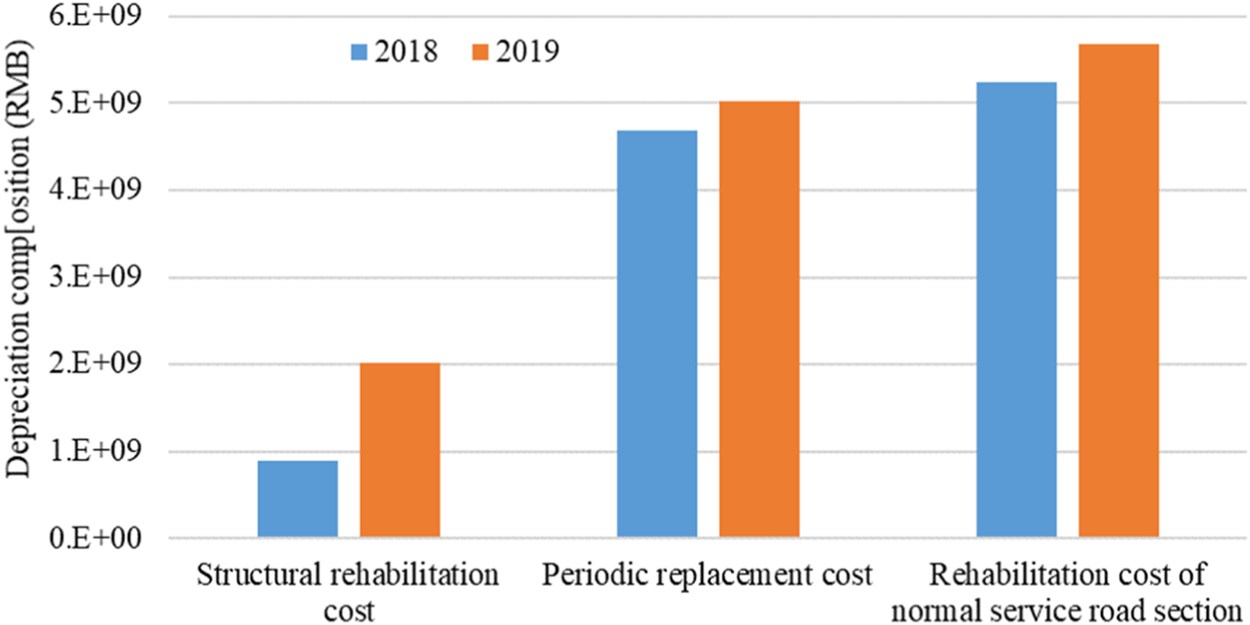

In terms of asset depreciation, it is noteworthy that pavement engineering experiences the most significant substantive depreciation, indicating that investment in pavement engineering constitutes the primary direction of maintenance fund allocation. With respect to pavement repair cost composition in Figure 4, major repair or structural rehabilitation cost constitutes approximately 16%, medium repair or periodic replacement cost constitutes around 39%, and normal service section repair cost accounts for about 45%. This breakdown better reflects the annual maintenance demand in terms of its scale and composition.

FIGURE 4

Cost composition of pavement rehabilitation.

5.2 Benefit analysis of road network maintenance fund investment

5.2.1 Maintenance fund gap

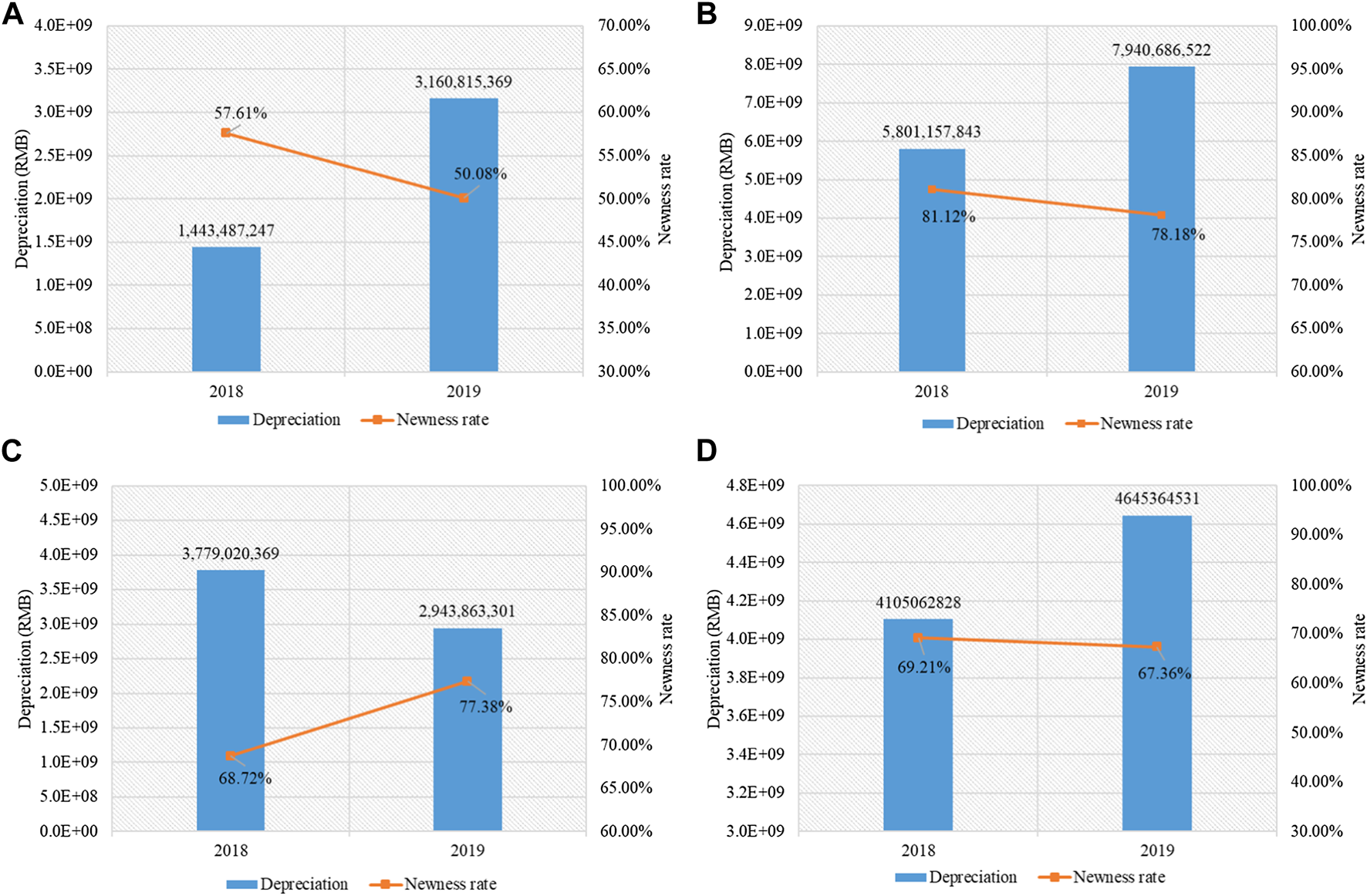

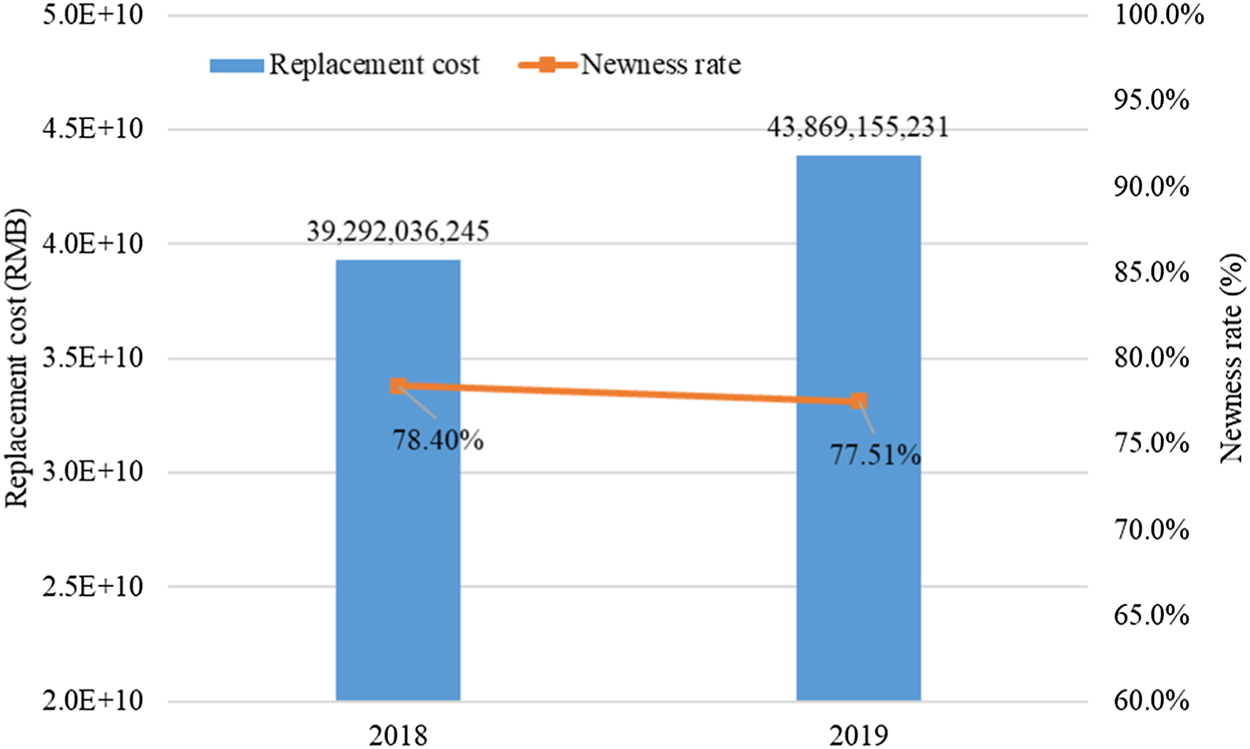

Upon analyzing the newness rates of various types of assets in Figure 5, it is found that the newness rate of pavement engineering was 77.51% in 2019, indicating a slight decrease from 78.40% in 2018. This suggests that the newness rate of pavement assets declined by 0.89% during the study period. To estimate the maintenance fund gap, it is necessary to maintain the new rate in 2019 at the level of 2018 (78.40%), which would require an additional investment of RMB 503, 695, 274.

FIGURE 5

Depreciation and newness rate of various projects. (A) Culvert. (B) Bridge. (C) Tunnel. (D) Roadside facilities.

Similarly, the newness rate of culvert engineering decreased from 57.61% in 2018 to 50.08% in 2019, implying a 7.53% reduction in newness rate. To maintain the new rate in 2019 at the level of 2018, an additional investment of RMB 476, 803, 664 will be necessary.

In addition, the newness rate of bridge engineering was 78.18% in 2019 and 81.12% in 2018, indicating a newness rate decline of 2.94%. To maintain the new rate in 2019 at the level of 2018, an additional investment of RMB 1, 070, 101, 428 is required.

Moreover, the newness rate of tunnel assets increased from 68.72% in 2018 to 77.38% in 2019, with a newness rate increase of 8.66%. The value increment of tunnel assets estimated by the newness rate is RMB 1, 126, 837, 451.

Finally, the newness rate of roadside facilities was 67.25% in 2019, compared to 69.21% in 2018, with a newness rate decrease of 1.96%. To maintain the new rate in 2019 at the level of 2018 (69.21%), an additional investment of RMB 296, 678, 286 is required.

Based on the fund gap estimation of the newness rate of various projects, the total fund gap was RMB 2, 314, 162, 131 under the premise that the newness rate of overall projects in 2019 was kept the same as that in 2018. Bridge engineering was the part with the largest estimated fund gap, and tunnel engineering was the only type of engineering whose replacement rate had increased compared with that of the previous year. It is suggested that maintenance funds for bridge engineering and tunnel engineering should be balanced in the next year, focusing on bridge engineering with the rapid decline of the newness rate. It is worth noting that the newness rate of the tunnel has increased by 8.66% and it is not conducive to the rational allocation of funds to achieve the goal of maintaining the overall performance of the road network system in terms of value engineering. There may be excessive function phenomenon and the fund gap between bridge and tunnel projects can be solved by rational allocation of funds. The fund gap between pavement engineering and culvert engineering is second only to that of bridge engineering, indicating that new maintenance funds need to be injected into pavement engineering and culvert engineering. The number of road sections requiring overhaul increases sharply, and the pavement performance indexes of several sections decline dramatically. Therefore, the necessity and timeliness of maintenance fund investment are given higher priority than other types of projects.

5.2.2 Deployment of maintenance fund

After the maintenance fund is replenished in place, the fund should be allocated and used scientifically and rationally to maximize the use benefit of the fund according to the calculation results of the gap of the maintenance fund. For this purpose, the maintenance decision analysis was carried out with the pavement projects.

The comparison of pavement asset depreciation for the 2 years in Figure 6 shows that structural rehabilitation costs have increased exponentially in 2019 compared to 2018, while the periodic replacement costs, as well as the rehabilitation costs of the normal service section, are within the normal range of increase compared to 2018. The significant increase in structural rehabilitation costs corresponds to a decrease of 1.13 points in PQI (from 88.50 points to 87.37 points), which is attributed to the lag in the allocation of the normal service section rehabilitation costs from the maintenance costs. The majority of maintenance funds are taken up by structural rehabilitation and periodic replacement projects, while the total maintenance funds cannot support extensive structural rehabilitation and periodic replacement projects. As a result, the normal service section with the largest proportion cannot be funded for preventive maintenance and there is a decline in the overall performance of the road network.

FIGURE 6

Depreciation composition of highway assets in 2018 and 2019.

Developing scientific maintenance strategies based on predetermined maintenance objectives can help maximize the benefits of maintenance funds. Through an analysis of the technical characteristics of Yunnan’s road network, this paper proposes maintenance strategy recommendations for the highway assets under the jurisdiction of the Yunnan Provincial Highway Bureau:

1) Continue to implement rehabilitation and maintenance on the substandard roads in the road network until basic eliminating the substandard roads present in the network;

2) Combining with the current technical condition of the general road network, it is necessary to vigorously implement preventive maintenance and increase the proportion of preventive maintenance in maintenance projects to prevent the rapid deterioration of road conditions and achieve the goal of a virtuous cycle of the road network;

3) For road sections with a road condition level between preventive and rehabilitation maintenance, daily maintenance work should be strengthened, and road surface distresses should be treated in a timely manner to decelerate the rate of deterioration of road conditions. Rehabilitation and maintenance should be scheduled for the following year based on the road conditions.

5.3 Impact of preventive maintenance investment on pavement assets

Taking pavement engineering as an example, this paper conducted a specialized and detailed analysis of the impact of preventive maintenance investment on pavement assets for the Highway Administration as the analysis unit, by comparing the changes in replacement costs between 2018 and 2019.

As shown in Figure 7, the replacement cost (initial assessment) of pavement assets in 2018 was RMB 39, 292, 036, 245. the corresponding value had witnessed an increase of 11.65% and reached RMB 43, 869, 155, 231 in 2019. This is due to the growth of the construction engineering price index and the grade improvement of several road sections, resulting in a faster growth rate of the replacement cost than the depreciation of pavement assets. The newness rate of pavement engineering decreased from 78.40% in 2018 to 77.51% in 2019, which is attributed to the decrease of 1.13 points in the PQI score for the entire road network.

FIGURE 7

Replacement cost and newness rate of pavement engineering in 2018 and 2019.

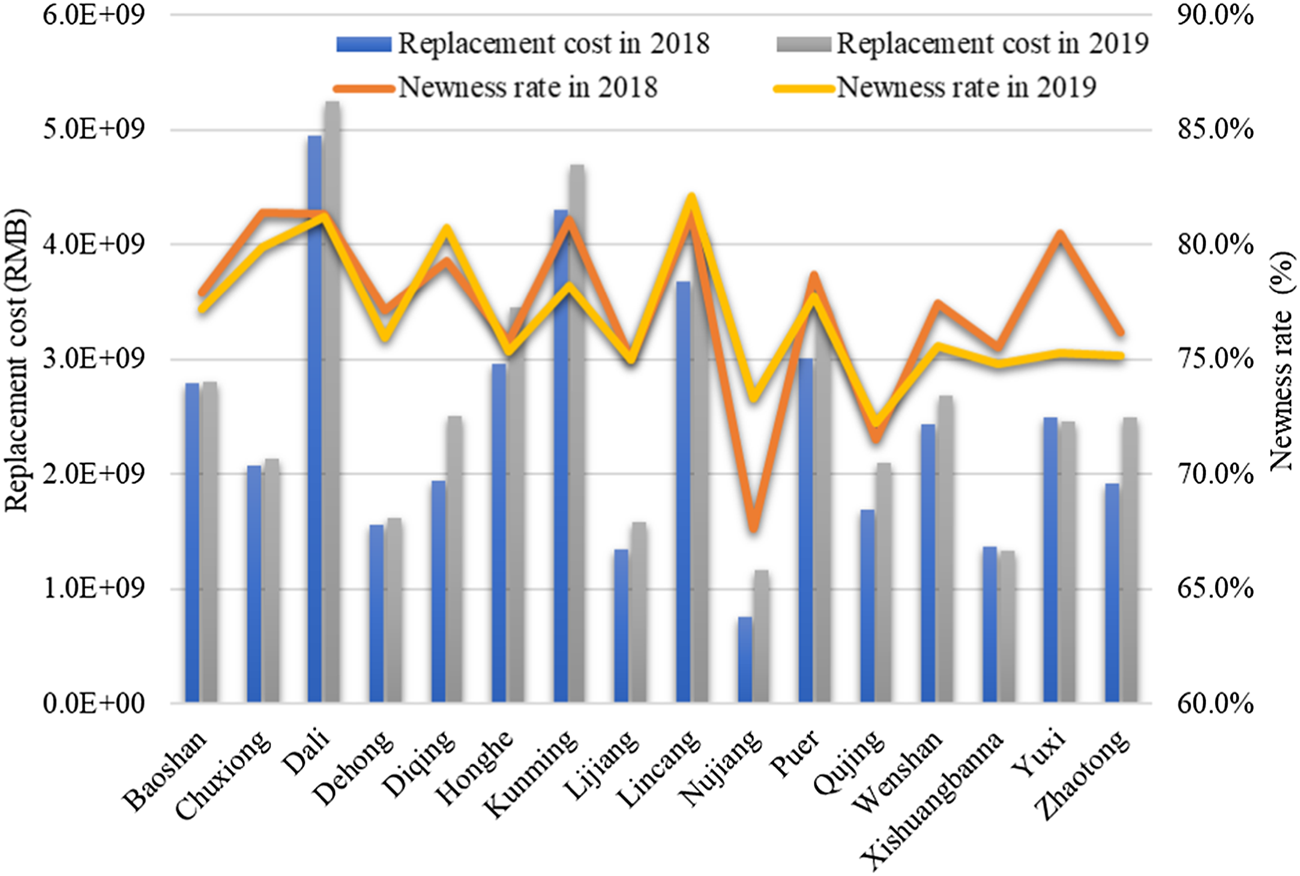

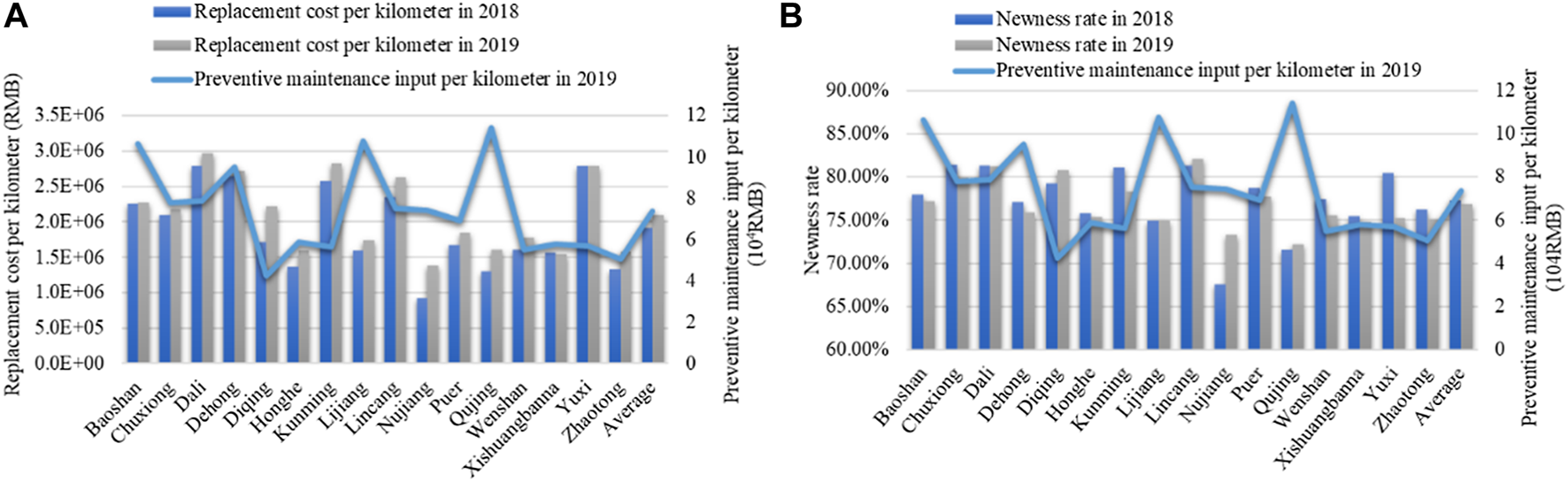

The detailed information on replacement cost and newness rate of each bureau is listed in Figure 8. It can be observed that in 2019, the newness rate of the pavement in Diqing and Nujiang showed an improvement, while in places such as Kunming, Wenshan, Xishuangbanna, Yuxi, and Zhaotong, there was a relatively significant decline in the newness rate of the pavement.

FIGURE 8

Replacement cost and newness rate of pavement asset in each bureau.

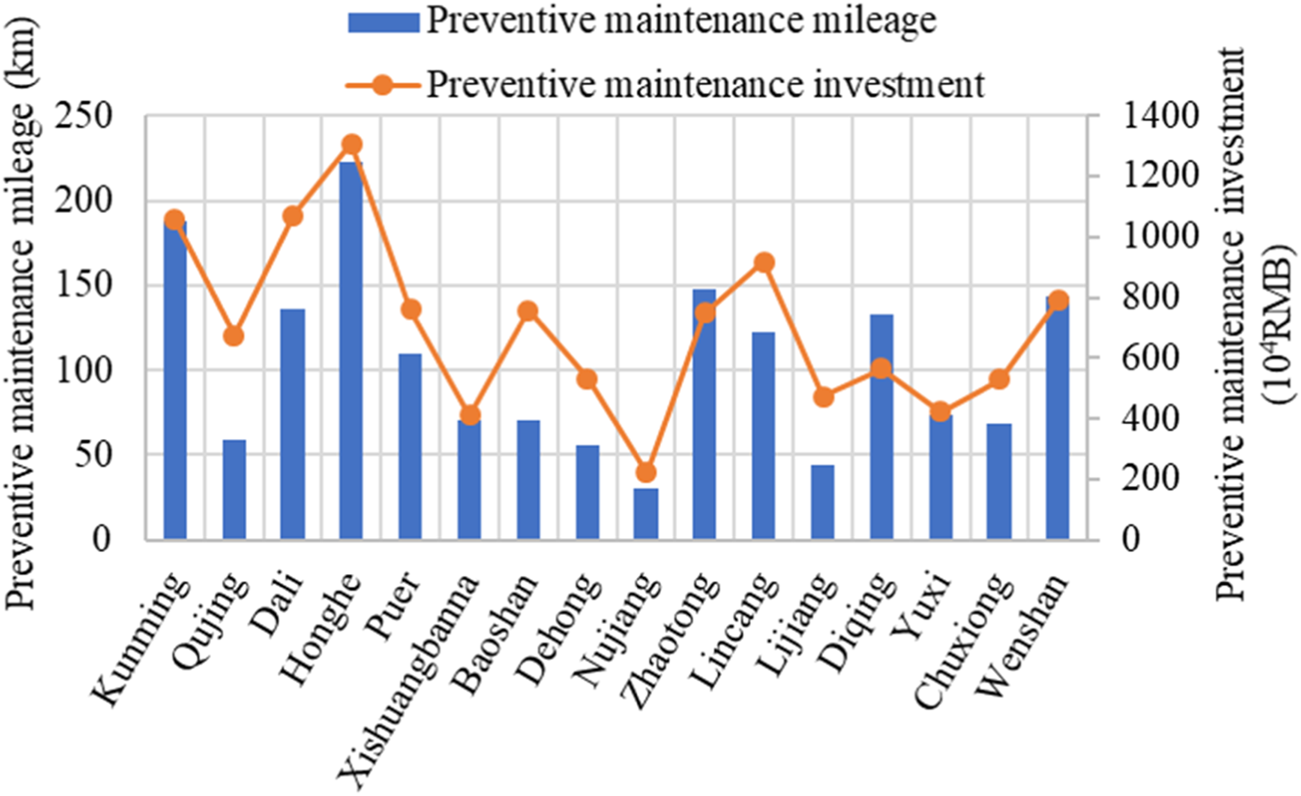

The preventive maintenance details of each highway Bureau are shown in Figure 9 below. In 2019, the Yunnan Provincial Highway Bureau implemented a total mileage of 1, 677 km of preventive maintenance, accounting for 8.03% of the total management and maintenance, with a total investment of RMB 112.49 million. Among them, Honghe Highway Bureau displayed the largest mileage of preventive maintenance with 223 km, while Nujiang Highway Bureau had the least mileage of preventive maintenance with 30 km. Honghe Highway Bureau also invested the most in preventive maintenance, with RMB 13.1 million, while Nujiang Highway Bureau invested the least with RMB 2.23 million.

FIGURE 9

Preventive maintenance statistics for 2019 of Highway Bureau of Yunnan Province.

Overall, the average cost of preventive maintenance per kilometer in 2019 was RMB 67, 078/km, as depicted in Figure 10. Among them, Qujing Highway Bureau had the highest investment in preventive maintenance per kilometer at RMB 114, 237/km, while Diqing Highway Bureau had the lowest investment at RMB 42,481/km. From the changes in replacement cost per kilometer in 2018 and 2019, the preventive maintenance investments have led to an increase in replacement cost per kilometer for 15 highway bureaus, including Baoshan, Chuxiong, Dali, Dehong, Diqing, Honghe, Kunming, Lijiang, Lincang, Nujiang, Pu’er, Qujing, Wenshan, Yuxi, and Zhaotong. Only Xishuangbanna Highway Bureau exhibited a slight decrease in replacement cost per kilometer.

FIGURE 10

Relationship between replacement cost, newness rate, and preventive maintenance investment. (A) Replacement cost. (B) Newness rate.

Regarding the changes in the newness rate from 2018 to 2019, the preventive maintenance investment led to an increase for five highway bureaus, including Diqing, Lijiang, Lincang, Nujiang, and Qujing. However, the newness rates of the other 11 highway bureaus had decreased. This indicates that preventive maintenance investment has achieved better results for Diqing, Lijiang, Lincang, Nujiang, and Qujing Highway Bureaus. The high proportion of preventive maintenance mileage in certain cities has led to an increase in replacement cost per kilometer, indicating a positive correlation between preventive maintenance mileage and replacement cost per kilometer. The overall trend is shown in the Figs below.

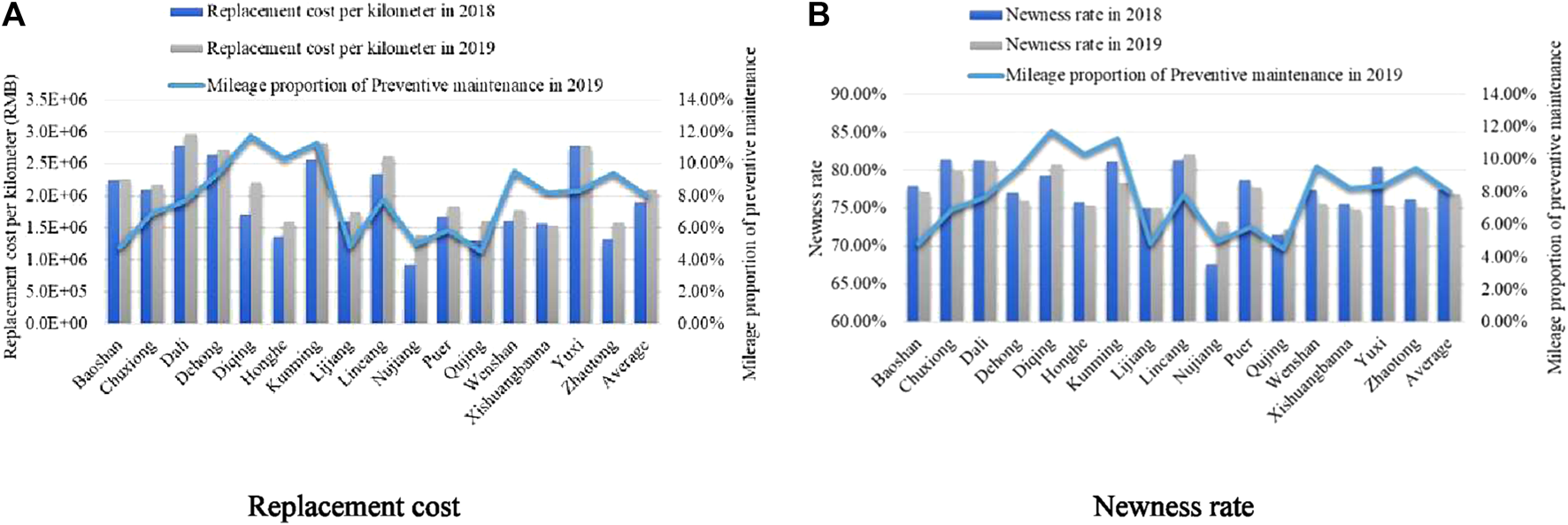

Comparing the changes in replacement cost per kilometer and the proportion of preventive maintenance mileage in Figure 11A, it can be seen that Diqing Highway Bureau possesses the highest proportion of preventive maintenance mileage implemented, accounting for 11.75%. Its replacement cost per kilometer has also increased the most, reaching RMB 497, 013 per kilometer, indicating that the implementation of preventive maintenance has a positive correlation with the replacement cost of the road sections.

FIGURE 11

Relationship between replacement cost, newness rate, and mileage proportion of preventive maintenance. (A) Replacement cost. (B) Newness rate.

Comparing the proportion of preventive maintenance mileage and the changes in newness rate in Figure 11B, it can be seen that the implementation of preventive maintenance in Lijiang Highway Bureau, Qujing Highway Bureau, Nujiang Highway Bureau, Lincang Highway Bureau, and Diqing Highway Bureau has achieved an increase in newness rate. Among them, the increase in the newness rate of Nujiang Highway Bureau is the most significant, reaching 5.67%. Preventive maintenance has achieved the best effects in Nujiang. Whereas the newness rates of Kunming and Yuxi reduce uncharacteristically, implying the preventive maintenance plans may not be suitable, and the mileage proportion of periodic replacement and even structural rehabilitation should be increased.

6 Conclusion

In this study, a condition-based valuation method was introduced to establish the connection between the valuation of pavement assets and their performance degradation. Using the highway of Yunnan province in China as an example, pavements were divided into four performance states based on service stages. The rationality of maintenance decisions and the impact of preventive maintenance investment on pavement assets were also considered. Throughout the entire analysis, the following conclusions can be summarized.

1) The replacement cost and condition-based pavement asset valuation method comprehensively considers each stage of pavement operation and can serve as an effective tool for evaluating pavement asset depreciation.

2) There are issues of irrational allocation of maintenance funds for the highway in Yunnan province, and a higher proportion of preventive maintenance investment is required to maintain the newness rate of pavements.

3) It is recommended to balance the maintenance funds for bridge and tunnel engineering in the following years, focusing on bridge engineering with a rapid decline in the newness rate.

4) The implementation of preventive maintenance has a positive correlation with the replacement cost and newness rate of the road sections. The preventive maintenance strategies adopted by Lijiang, Qujing, Nujiang, Lincang, and Diqing Highway Bureaus are highly effective. However, other highway bureaus such as Kunming and Yuxi need to adjust their preventive maintenance strategies based on their actual highway technical conditions. In cases where preventive maintenance cannot restore pavement performance, functional or structural repair projects should be chosen.

Overall, the condition-based pavement asset valuation method allows highway management departments to utilize asset attributes, performance, and investment amounts to estimate future maintenance capital investments and improve highway asset management. It is worth noting that there are multiple factors that affect the replacement cost and newness rate of pavement engineering, such as traffic volume, investment in major and intermediate rehabilitation, natural conditions, and Implementation quality of maintenance engineering. This paper singly analyzed the impact of preventive maintenance. Further items are required to be included in the following investigations.

Statements

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding authors.

Author contributions

LM: Conceptualization, Data curation, Investigation, Project administration, Writing–original draft, Writing–review and editing. JC: Conceptualization, Data curation, Writing–original draft. ZP: Data curation, Methodology, Project administration, Validation, Writing–original draft, Writing–review and editing. LG: Investigation, Methodology, Writing–original draft. HZ: Investigation, Writing–original draft, Writing–review and editing. YM: Conceptualization, Investigation, Methodology, Writing–original draft. GY: Investigation, Validation, Writing–review and editing. HW: Investigation, Methodology, Validation, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

Authors LM, JC, ZP, LG, HZ, YM, GY, and HW were employed by The RoadMAinT Co., Ltd.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1

Alshboul O. Shehadeh A. Hamedat O. (2021). Development of integrated asset management model for highway facilities based on risk evaluation. Int. J. Constr. Manag., 1–10. 10.1080/15623599.2021.1972204

2

Amekudzi-Kennedy A. Labi S. Singh P. (2019). Transportation asset valuation: pre-peri-and post-fourth industrial revolution. Transp. Res. Rec.2673, 163–172. 10.1177/0361198119846470

3

Amin M. A. Pan S. Zhang Z. (2022). Pavement maintenance and rehabilitation budget allocation considering multiple objectives and multiple stakeholders. Int. J. Pavement Eng.1-14. 10.1080/10298436.2022.2027941

4

Deng J. Han X. Pan Z. Wang J. Zhang H. Geng G. et al (2020). “Research on physical depreciation methods of non-toll road assets,” in CICTP 2020: Advanced Transportation Technologies and Development-Enhancing Connections - Proceedings of the 20th COTA International Conference of Transportation Professionals, 1011–1021.

5

Dojutrek M. S. Makwana P. A. Labi. S. (2012). A methodology for highway asset valuation in Indiana. West Lafayette, Indiana: Publication FHWA/IN/JTRP-2012/31. Joint Transportation Research Program, Indiana Department of Transportation and Purdue University.

6

Dojutrek M. S. Volovski M. Labi S. (2014). Elemental decomposition and multicriteria method for valuing transportation infrastructure. Transp. Res. Rec.2460, 137–145. 10.3141/2460-15

7

Fwa T. F. Farhan J. (2012). Optimal multiasset maintenance budget allocation in highway asset management. J. Transp. Eng.138, 1179–1187. 10.1061/(ASCE)TE.1943-5436.0000414

8

Hoang T. Han Z. Zhang Z. (2020). Integrating economic and utility concepts for a comprehensive bridge valuation model. Transp. Res. Rec.2674, 26–37. 10.1177/0361198120926509

9

Howe S. (2004). Condition-based depreciation - the engineering perspective. Aust. Acc. Rev.14, 48–55. 10.1111/j.1835-2561.2004.tb00240.x

10

Hwangbo W. Mohammadi A. Amador-Jimenez L. Kachua S. (2020). Value-based optimisation for cross-asset maintenance in a Canadian municipality. Asset Manag.7, 86–94. 10.1680/jinam.18.00036

11

Ivannikov I. Dollery B. (2020). Accounting problems in infrastructure asset valuation and depreciation in new south wales local government. Aust. Acc. Rev.30, 105–115. 10.1111/auar.12275

12

Jiang W. Yuan D. Shan J. Ye W. Lu H. Sha A. (2022). Experimental study of the performance of porous ultra-thin asphalt overlay. Int. J. Pavement Eng.23 (6), 2049–2061. 10.1080/10298436.2020.1837826

13

Junzhe W. Zhi C. Ming C. Jie Z. (2023). A study of condition based valuation method for pavement asset management. CICTP2023, 12–19.

14

Kuroki M. (2022). Impact of depreciation information on capital budgeting among local governments: a survey experiment. Acc. Rev.32, 201–213. 10.1111/auar.12355

15

Lee D.-Y. Lee M.-J. (2014). A study of the asset valuation method for efficient road facility maintenance. J. Asian Archit. Build. Eng.13, 279–286. 10.3130/jaabe.13.279

16

Li J. Q. McNeil S. (2021). Data envelopment analysis for highway asset investment assessment. J. Traffic Transp. Eng.8, 117–128. 10.1016/j.jtte.2019.06.001

17

Lim T. Porras-Alvarado J. D. Zhang Z. (2019). Pricing of highway infrastructure for transportation asset management. Built Environ. Proj. Asset Manag.9, 64–79. 10.1108/BEPAM-05-2018-0083

18

Lombardi R. Schimperna F. Smarra M. Sorrentino M. (2021). Accounting for infrastructure assets in the public sector: the state of the art in academic research and international standards setting. Public Money Manag.41, 203–212. 10.1080/09540962.2020.1840761

19

Porras-Alvarado J. D. Peters D. Han Z. Zhang Z. (2015). Novel utility-based methodological framework for valuation of road infrastructure. Transp. Res. Rec.2529, 37–45. 10.3141/2529-04

20

Santos J. Torres-Machi C. Morillas S. Cerezo V. (2022). A fuzzy logic expert system for selecting optimal and sustainable life cycle maintenance and rehabilitation strategies for road pavements. Int. J. Pavement Eng.23, 425–437. 10.1080/10298436.2020.1751161

21

Sirirangsi P. Amekudzi A. Herabat P. (2003). Capturing effects of maintenance practices in highway asset valuation: replacement-cost approach versus book-value method. Transp. Res. Rec.1824, 57–65. 10.3141/1824-07

22

Snaith M. S. Orr D. M. (2006). Condition-based capital valuation of a road network. Proc. Proc. Institution Civ. Engineers-Municipal Eng. Thomas Telford Ltd159, 91–95. 10.1680/muen.2006.159.2.91

23

Sun J. Luo S. Wang Y. Dong Q. Zhang Z. (2023). Pre-treatment of steel slag and its applicability in asphalt mixtures for sustainable pavements. Chem. Eng. J.476, 146802. 10.1016/j.cej.2023.146802

24

Sun J. Park K. Lee M. J. (2017). A multi-level asset management decision method considering the risk and value of bridges. J. Asian Archit. Build. Eng.16, 163–170. 10.3130/jaabe.16.163

25

Xian-Xun Y. Yuanshun L. (2018). Residual value risks of highway pavements in public–private partnerships. J. Infrastruct. Syst.24, 4018020. 10.1061/(ASCE)IS.1943-555X.0000438

26

Yuan D. Jiang W. Sha A. Xiao J. Wu W. Wang T. (2023). Technology method and functional characteristics of road thermoelectric generator system based on Seebeck effect. Appl. Energy331, 120459. 10.1016/j.apenergy.2022.120459

Summary

Keywords

highway assets, condition-based valuation method, pavement, maintenance strategy, newness rate, life cycle assessments

Citation

Ma L, Cao J, Pan Z, Guo L, Zhang H, Ma Y, Yang G and Wang H (2024) Use of condition-based valuation approach to evaluate the maintenance decision of pavement assets: a case study of Yunnan Province in China. Front. Energy Res. 11:1346005. doi: 10.3389/fenrg.2023.1346005

Received

28 November 2023

Accepted

20 December 2023

Published

15 January 2024

Volume

11 - 2023

Edited by

Meng Jia, Shandong University of Science and Technology, China

Reviewed by

Jia Sun, Southeast University, China

Yingxin Hui, Ningxia University, China

Updates

Copyright

© 2024 Ma, Cao, Pan, Guo, Zhang, Ma, Yang and Wang.

This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lei Ma, malei@roadmaint.com; Zongjun Pan, panzongjun@roadmaint.com

Disclaimer

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.