- 1Mobility, Arcadis, London, United Kingdom

- 2Transport and Project Management Department, Civil Engineering School, Aristotle University of Thessaloniki, Thessaloniki, Greece

Rail freight reportedly makes for an environmentally friendly means of transport. It also has significant potential for making a lucrative business, a stark contrast to rail passenger transport. Yet in Europe rail freight has long been displaced over its road equivalent and grown at rates inferior to overall land goods freight. Sustainable, profitable rail freight operations depend not only on goods volume, travel distance and pricing, but further on other key aspects permeating goods transportation by rail. Our research demonstrates that the choice for railway undertakings, infrastructure owners, and regulators alike, is in practice a complex one as depending on many, often competing factors. In fact, the key questions usually raised v.a.v. rail freight operations may be summed up to the following: (a) Mixed passenger and freight train operation or dedicated train corridors? (b) Conventional or heavy axle loads for freight trains? (c) Unitized wagonload or integrated trainload services? (d) Dangerous goods land shipping by rail or road? (e) Autonomous or manned freight train operation? Despite many individual contributions in the field, there is currently no single framework addressing the problem holistically. This paper breaks down what is seemingly a hard-to-balance decision-making process for rail freight players. It records and analyzes the forces and dynamics behind the dilemmas above and allows to: provide those partaking in the decision-making process with a robust framework identifying the key drivers behind sustainable rail freight growth; help them individually and collectively make more sound decisions regarding rail operations as a whole–including, in particular, strategic decisions regarding policy and/or investment; and, eventually, to enable them to craft and pursue viable, sustainable transport and business strategies. The research is underpinned by literature data review.

Introduction

Rail freight transport refers to “any movement of goods by rail” (Pyrgidis, 2016) because of goods available at one geographical location being required at another location for processing, sorting or consumption. Rail freight is a vital contributor to the global economy: in 2020, its value neared $54b in the US (down ~11 percent since 2019), $28.2b in China (down ~9 percent since 2019), $16.8b in India (down ~9 percent since 2019), $18.2b in EU27 (down ~12 percent since 2019) with $5.8b in Germany alone (down ~12.5 percent since 2019) (MarketLine, 2021a,b,c,d,e; CER, 2022). Compared to road, rail freight has a societal cost footprint that is six-times lower, thanks to lower energy consumption per ton-kilometer (TKM) and proven higher safety levels (RFF, 2018). Despite its lower environmental footprint, rail freight in Europe has been consistently losing share to road since circa the 1950's: from ~60 percent in the 1950's (Vassallo and Fagan, 2007), to ~30 percent in the 1980's, and roughly ~18 percent today, driven mainly by large industry shifts (EC, 2020). UIC reports that Russia currently holds 60 percent of total modal share, with the United States and China at 55 and 50 percent respectively (UIC, 2019).

Market research suggests that the European land transport freight market will grow by “30 percent by 2030 and volume growth will most likely have a high affinity to road” (RFF, 2018). If the current modal shift persists, annual CO2 emissions will increase to 355 million tons by 2030. This is likely to materially threaten attainment of Paris 2030 goals (RFF, 2018) and endanger European Commission's (EC) Green Deal plans aiming to “transform Europe into the first carbon-neutral continent by 2050 and enhance Europe's CO2-emission targets from 40 percent to 50 percent by 2030 in comparison to 1990 levels” (CER, 2020). Considering the challenge, Rail Freight Forward (RFF), an industry initiative pulling together 90 percent of the European rail freight market, committed in 2018 to an increase of rail modal share that would see freight rail volumes growing by circa 6 percent p.a. in terms of ton-kilometers (TKM) by 2030 – nearly five times the average annual increase between 2012 and 2019 – to balance the negative societal and environmental impact of the forecasted land-based transport growth (CER, 2020).

To achieve these ambitious targets, Railway Operating Companies (ROC) alongside Railway Infrastructure Managers (RIM) and regulators, will have to address, in the not so far future, several challenges requiring both solid finances and sustainable, profitable operations. This is not an easy feat: successful, profit-turning rail freight operations depend not only on goods volume, travel distance and pricing, but further on other key aspects permeating goods transport by rail. Appreciating the level of the challenge requires understanding three things. First, the intrinsic characteristics of the stakeholder landscape and market forces. Second, the importance of overarching trends and the threat of substitutes. And third, the sheer complexity of rail freight operations.

This paper aims to break down what is seemingly a hard-to-balance decision-making process for rail freight players. Whilst it touches on all three key areas enumerated above, it focusses on rail freight operations and aspects that railway undertakings alongside infrastructure owners and regulators at national level can influence themselves. As such, this paper is intended to: better inform those partaking in the decision-making process on the main angles worth considering when dealing with key operational dilemmas; help them individually and collectively make more sound decisions regarding rail operations as a whole– including, in particular, strategic decisions regarding policy and/or investment; and, eventually, to enable them to craft and pursue viable, sustainable transport and business strategies.

The research is underpinned by literature data review. Future research and applications in connection with the key issues dealt with in this paper will be covered in future publications.

Rail freight: Market and industry dynamics, trends, and operational challenges

A complex stakeholder landscape

The key actors involved in and influencing rail freight transport are (Pyrgidis, 2016; MarketLine, 2021a):

• Customers: Users of the transport service provided by railway undertakings –predominantly corporate clients (such as manufacturers, ports, retailers and 3/4PL providers) – exist on either end. On the one hand, “cargo shippers” drive freight demand and are by default responsible for modal selection; as such, they play a key role in shaping rail freight market share. On the other hand, “cargo recipients” influence demand for rail freight based on the level of customer satisfaction attained by the service provided.

• Railway undertakings: Railway Operating (or Freight) Companies (RO(F)C) are responsible for rolling stock supply and rail freight operations. They may be private or state-owned; freight-only (Carriers) or integrated logistic operators (Logistics Service Providers). Their choices define, within the limits of the operational rules set by railway regulators and infrastructure owners, the very nature of the services on offer (e.g., block vs. unit trains etc.), service frequency, reach, and service interoperability. Considering the level of investment required and that ROC are compelled to operate within a specific set of rules and be licensed – in Europe, EU directive 91/440 sets out specific rules for member states – considerable entry barriers may exist for new entrants.

• Infrastructure owners: Railway Infrastructure Managers (RIM) affect the supply and quality of services on offer being responsible for ensuring an agreed railway infrastructure – consisting of the permanent way, signaling, telecommunications, power supply and electrification equipment, along with warehouses, freight terminals and marshaling yards, etc. – service level. Infrastructure owners are usually either public or private, not-for-dividend companies that operate as monopolies.

• Regulators: Railways is a heavily regulated industry and the institutional and legal framework in place largely affects the rail freight sector. In Europe, for instance, the European Commission (EC), through its various institutions, issues Directives and administers the granting of funds in specific research fields or industry sectors that may significantly affect rail freight supply either directly or indirectly. Respectively, at a national level, national authorities are responsible for adapting EU Directives to suit national conditions and for monitoring their implementation.

• Rail industry third parties, groups, and bodies: these include train manufacturers, rolling stock companies (ROSCO), logistics operators (e.g., specialist third party logistics (3PL) and infrastructure operators, such as Freightliner in the UK, and Union Pacific, which operates intermodal ramps, in the United States), investors, funders and funding bodies, as well as industry groups and bodies e.g., the Rail Delivery Group in the UK or the Community of European Railway Companies (CER) in the EU.

• Consumers: Users of the products being freighted may not be directly involved or obvious to pin down within the stakeholder landscape; yet are the ones indirectly driving the demand for freight services (“derived demand”) and the ones ultimately paying a (covert) premium for the service.

Competing interests between parties create a hard to navigate stakeholder landscape for ROC who are directly responsible for rail freight offerings and bound to operate for-profit. Depending on market fragmentation and relative stakeholder gravitas – within what is a rather slow-changing industry where legacy practices and behaviors prevail – railway undertakings need to adapt their strategic decisions and operational plans to cater for ways that put them at a competitive position to address present and future industry rivalry, buyer and supplier power.

Industry key success factors and overarching trends

The rail freight sector is characterized by heavy investments with long product life cycles. Investments in rolling stock, terminals, marshaling, and warehousing infrastructure have long financing and amortization cycles that often exceed 30 years. The rail industry's intrinsic difficulty in changing its prevailing operating model, at short notice, in response to changing market conditions, contrasts with other competing industries–road freight in particular–where reinvention may occur in months and product cycles may be counted in weeks. In recent years, digitalization has further magnified this gap, with road trucking coming at the focus of significant investment and research, which the rail sector has been unable to follow despite an increased emphasis on technological innovation (e.g., “Technologies for Sustainable and Attractive European Rail Freight” being one of the five Innovation Programmes (IPs) around which Shift2Rail is structured (Shift2Rail, 2015, 2019, 2020).

In Europe, road transport continues to be better positioned than rail in terms of pricing, flexibility, and reach. This should come as no surprise for several reasons (MDS, 2019). First, the mode's inherent flexibility and cost-effectiveness, particularly over shorter distances (<150 km) and for smaller consignments. Second, the low entry barriers into the road haulage sector due to lower start-up costs and a lower level of institutional and regulatory complexity compared to the railway industry. Third, the extent of routes available thanks to a well-developed road network with the vast majority of distribution centers being directly connected to. The challenge for rail freight has been exacerbated, in the recent years, by the fact that traditional customer industries that have long underpinned rail demand – such as coal, iron ore, and petrol – have been declining since ~2013–14 due to a dramatic reduction in coal volumes mainly. In the UK, for instance, coal supply fell from a high of 47 million tons in 2013–14 to 6 million tons in 2016–17 (DfT, 2016). On the other hand, changing consumer patterns in the face of internet shopping and next-day delivery, data proliferation and the rise of collaborative and sharing economy models (Masson and Harris, 2019) represent opportunities, which the rail freight industry can and should harness in transforming and extending its offering through e.g., ports and domestic intermodal movement of consumer goods and transporting of commodities such as construction materials.

Liberalization, interoperability, mass and very long-distance transportation, increased safety and security, environmental protection, reduced maintenance costs, increased running speeds, reduced delays at border stations, and increased network capacity (Pyrgidis, 2016) continue to be key assets designating the present and the near future of rail freight; yet they are not enough to drive a step change in rail freight's competitive positioning alone. Considering the high price sensitivity characterizing the core rail freight offering to customers (Lundberg, 2006; Flodén et al., 2017) for rail freight to gain in attractiveness and competitiveness vis-à-vis road in particular, additional factors such as transport/lead time, frequency, and punctuality (or reliability), all valued differently per case–a combination of behavioral aspects, such as past experience and legacy practices, the type of goods carried, carriers' attributes and distance/time requirements (Davies Gleave et al., 2015)–should be emphasized.

In this highly competitive landscape, the lack of level playing field continues to hamper rail freight, with track access charges representing a significant cost for the rail freight industry; even more staggeringly, rail's environmental and air quality benefits as well as nil impact on road congestion, relative to road freight are still being not considered when such policies are being drafted. As an example, the increase in track access fares between Control Period 4 an Control Period 5 for the entire UK industry amounted to 17 percent, with the level and trajectory of track access charges directly impacting on railway undertakings' ability to offer competitive prices to their customers and bolster their market share as a result. On the other hand, it is worth noting that greater regulation regarding air quality improvement in the coming years is likely to impact road freight more than rail, with “last mile” urban logistics in particular coming under the spotlight; hence potentially compromising road haulage's comparative advantage of door-to-door connectivity. Similarly, the emergence of local manufacturing and “re-shoring” as opposed to offshoring that soared during the years of globalization, is likely to beef up rail freight demand further, balancing the inherent complexity international rail freight shipping faces and eating off road haulage's, long established, competitive position.

Operational challenges

Rail freight faces operational challenges deriving on the one hand, from the qualification of service offered, and, on the other hand, the key features governing railway operations.

As regards the former, the following are key factors that affect rail freight operations and may be used to differentiate between service offerings (Pyrgidis, 2016):

• Type of freighted goods: Freight may be segmented into two main categories, i.e., “conventional” and “dangerous” goods transport, which may be further broken down with regards to the load's physical characteristics (e.g., “bulk,” “non-bulk”) and specific requirements as regards transport (e.g., refrigerated goods).

• Service reach: From a spatial perspective, freight rail may be classified as “local,” “national” (long-distance), “international” and “intercontinental.”

• Complementarity with other modes of transport: The use or not of other modes of transport, besides railways, at any point in the transport chain, makes for “combined (or intermodal) transport” and “transport exclusively by rail” respectively.

On the other hand, rail freight operations are governed by key features that largely affect their effectiveness all together, that is to say: their capacity to compete, to deliver, and to adapt (Pyrgidis, 2016):

• Axle load (Q): Trains under 25t per axle may be classified as “conventional,” while trains featuring 25 to 40t per axle may be classified as “heavy haul.”

• Train weight: Trains routed in Europe usually weigh around 1,500–2,000t. Only three countries, namely Russia, Sweden, and Norway, operate trains of 5,000t. On the contrary, in the USA, where freight trains predominantly use a wider track gauge, trains are of significantly higher weight, i.e., usually 3,000–5,000t. Heavier trains of the order of 5,000t are also routed in Australia, Canada, China, India, and South Africa.

• Train length: In Europe, train lengths can reach up to 750 m; albeit exceptions exist, such as in Estonia, Denmark, Germany, and specific corridors in France, where train length may reach up to 800 or even 1,000 m. Comparatively, in the United States, trains used for conventional loads are longer i.e., up to 2.5 km, whereas, in dedicated mine railways, such as those in Africa, their length can reach up to 4km for heavy haul rail transport (CER, 2016; Islam and Mortimer, 2017).

Both weight and length are important factors impacting on rail freight's efficiency. The permissible train length is dictated by platform length and limitations in a train's braking system. On the other hand, brake and coupling system attributes impact on a train's permissible weight. As an example, adoption of the automatic coupler – Janney/Knuckle coupler in North America and China, and Willison/SA3 in the former USSR – effectively allowed for heavier and longer trains to operate in these countries, while the continued use of the screw coupler in Europe essentially led to shorter and lighter trains, directly reflecting on lower operational efficiency as a result. It is hoped that deployment of the Digital Automatic Coupler (DAC) across Europe (RFF, 2018) by 2030 will remove this major impediment for European rail freight bolstering its growth.

• Maximum train running speed (Vmax): Ranging between 100 and 120 km/h; heavy haul rail usually features lower running speeds (Vmax = 80–100 km/h).

• Longitudinal gradient: Operation is highly influenced by the line's longitudinal gradient. Gradients that exceed 16 permille limit a train's maximum weight and speed while they may further result in increased rolling stock requirements (available power, braking performance, etc.).

• Traffic composition: Depending on the share of freight trains operating on a given railway corridor, one may distinguish between “dedicated freight lines,” meaning lines where only freight trains operate; and “mixed traffic corridors,” where both freight and passenger train operation occurs – in which case, priority is by default granted to one of two types of traffic.

• Route density and network complexity: Rail freight requires platforms and handling terminals to be equipped with specialized facilities for goods handling. The average distance between small marshaling yards in Germany is around 160–200 km, between medium marshaling yards 800–1,200 km and between large marshaling yards 3,000–3,500 km (Jorgensen and Sorenson, 1997). Service reliability (or punctuality) may be affected by the route's length, complexity (e.g., no. of intermediate stops and marshaling points, including customs and shipment clearance requirements, etc.), and volatility (e.g., weather conditions, the state of performance of the underlying infrastructure, for instance signaling system reliability, etc.).

All attributes mentioned above jointly affect rolling stock requirements, the network's and/or railway's modus operandi–i.e., timetabling, operational rules, etc.– and the network's/route's railway infrastructure. While the former set effectively addresses the demand side of the service to be provided – i.e., What are we going to transport? Where are we going to operate? What type of services will we offer? – the latter represents the other side of the same coin, that is to say the supply side of the service to be provided that answers the “how” question. As such, they are complementary and to be jointly considered.

Rail freight: The main dilemmas

Market and industry dynamics and overarching trends rail freight players face are important elements of the challenges they need to be addressing as they fight for superior, sustainable business outcomes. Yet, railway undertakings, who are by default the stakeholder group responsible for shaping and administering the transport service offering and operating on a for-profit basis, have limited ability in influencing all or part of the underlying factors on their own alone. Even when able to do so, this is often a transient and potentially lengthy process. In this respect, market and industry challenges, although critical in embedding into strategy crafting, are no more than table stakes, which, nevertheless, if not accounted for, can prove very costly: McKinsey research suggests that “the value at stake from regulatory changes averages 45 to 55 percent of transportation and logistics companies' earnings before interest, taxes, depreciation, and amortization (EBITDA)” (Hausmann et al., 2015); what this means in practice is that as regulatory uncertainty increases, managing relationships with governments and regulators becomes ever more important. And not unsurprisingly, RFF's (RFF, 2018; UIC, 2019), strategic action plan caters for this intricacy being structured around three tiers:

• The first tier, involving railway undertakings alone, focusing on superior, innovative customer-centered solutions that cater for consumer preferences' shift and the entire supply chain's transformation as a result of industry 4.0 and the COVID-19 pandemic.

• The second tier, involving collaborative initiatives between railway undertakings and infrastructure owners, emphasizing infrastructure-enabling, user-friendly improvements.

• The third tier, involving railway undertakings, infrastructure managers and regulators, aiming to create a level playing field to close the gap with road freight in particular.

Our research indicates that, even with the above in mind, the choice for ROC, RIM, and regulators alike, is still in practice a complex one as depending on many, often competing factors.

In fact, the key questions usually raised v.a.v. rail freight operations may be summed up to the following:

• Mixed passenger and freight train operation or dedicated train corridors?

• Conventional or heavy axle loads for freight trains?

• Unitized wagonload or integrated trainload services?

• Dangerous goods land shipping by rail or road?

• Autonomous or manned freight train operation?

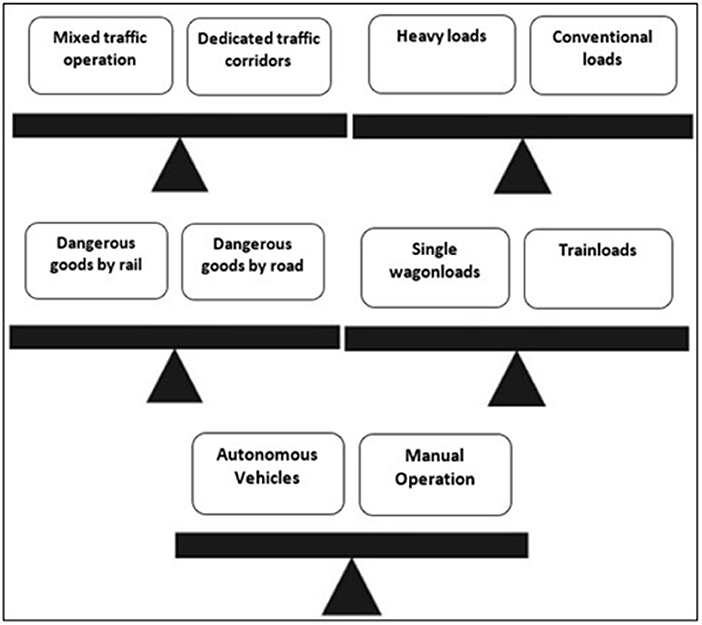

Some of these questions (Figure 1) involve trade-offs and strategic choices for which no univocal answer exists. Additionally, choices are not always solely up to single rail freight actors to decide as pointed previously. The next sections in this paper aim to shed more light on the nature of these dilemmas and the hard, often binary choices, rail freight players are faced with.

Network operations–mixed passenger and freight train operation or dedicated train corridors?

A question, which is a matter of concern to many railway undertakings and infrastructure managers alike is whether routing of freight trains along passenger trains (mixed traffic lines) is more profitable than segregated operation and under what circumstances.

In fact, the majority of railway networks worldwide feature mixed train operation (Batisse, 1994, 1995a,b; UIC, 2007); i.e., freight trains routed on the same track as express and local passenger trains. For many years, this practice has underpinned railways' operations globally: on the one hand, it allowed for economies of scale as the number of trains sharing the same infrastructure was maximized; on the other hand, it has always been at the origin of both operational and maintenance challenges, given the tremendous differences between the two services both in terms of rolling stock and operational constraints – train speed, axle load, route length and dwell and marshaling times to name a few.

As a matter of fact, mixed traffic railway networks exist to primarily serve passenger transport, with the resulting complications in terms of operation and maintenance being the trade-off for freight train routing in the absence of expensive and timely infrastructure upgrades. From an operational standpoint, this inevitably results, on the one hand, in few and highly constrained time paths for freight trains, and on the other hand, sacrificing to an extent network and/or route service reliability, a much-valued attribute of quality of service for time-poor passenger customers. Over the past decades, these dramatic differences in rail freight requirements vs. those for passenger services have driven the gradual segregation of railway networks and the emergence of dedicated (mainly) passenger and – to a much lesser extent – freight corridors. Indicatively, it is worth noting that:

• Large railway networks, particularly those in countries with significant industrial output, such as in China, Russia, India, etc., have been implementing or are planning to construct dedicated passenger and/or freight railway corridors (OECD, 2002; ADB, 2005; Woodburn et al., 2008; Railway Technology, 2021). It is fair to say that globalization has bolstered development of international dedicated rail freight corridors.

• The construction of dedicated passenger railway corridors in Japan and the turn toward dedicated rail freight operation in the US (BNSF, 2021; CPR, 2021) have proven to be especially successful.

• The World Bank (World Bank, 2017) recommends that railway organizations in distress separate passenger and freight transport operations.

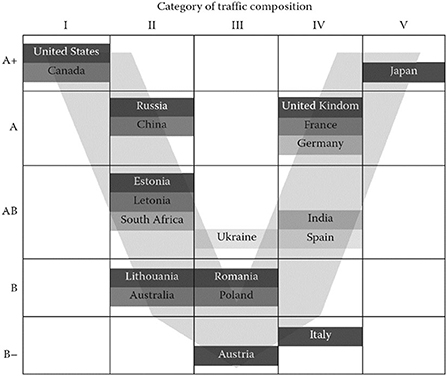

An essential prerequisite for the creation of dedicated rail freight corridors is connectivity and interoperability amongst networks to be served. In a survey conducted in 2007, based on data made available from railway organizations themselves, traffic composition was associated with network profitability (Christogiannis and Pyrgidis, 2013, 2014). Specifically, the following twenty networks were thoroughly examined: United States, Canada, Lithuania, Australia, Estonia, Latvia, Russia, Ukraine, China, South Africa, Poland, Austria, Romania, Germany, France, Spain, India, Italy, United Kingdom, Japan. Research results classified railway networks in the following five groups with regards to the type of rail traffic:

• I - Exclusive use by freight trains (freight-dedicated network/corridor);

• II - Mainly used by freight trains;

• III - Network/corridor with mixed traffic operation;

• IV - Mainly used by passenger trains;

• V - Exclusively used by passenger trains (passenger-dedicated network/corridor);

and, in addition, the following five groups in terms of ROI:

• A+: Very positive;

• A: Positive;

• AB: Neutral / Balanced;

• B: Negative;

• B-: Very negative.

Figure 2 illustrates the results. The following are worth noting:

• First, networks belonging to traffic categories I and V, i.e., networks with dedicated freight and passenger operation respectively feature (A+) economic profitability, i.e., very positive returns.

• Second, the majority of networks belonging to traffic category III, i.e., mixed traffic operation, present a negative or very negative economic profitability.

• Third, the majority of networks with emphasis on rail freight traffic show positive, balanced economic efficiency while no network seems to feature remarkably negative yield.

Figure 2. Correlation between traffic composition (“x” axis) and profitability (“y” axis) of a railway network (Christogiannis and Pyrgidis, 2013, 2014).

Interestingly, networks with emphasis on passenger train traffic, in their majority, reportedly do not feature negative returns. In summary, and as can be seen in Figure 2 from the translucent gray “V” shape, the more dedicated (passenger or freight) the traffic composition is, the larger the potential increase in a network's profitability. On the contrary, the more mixed the traffic composition tends to be, the more significant the decline in terms of economic viability.

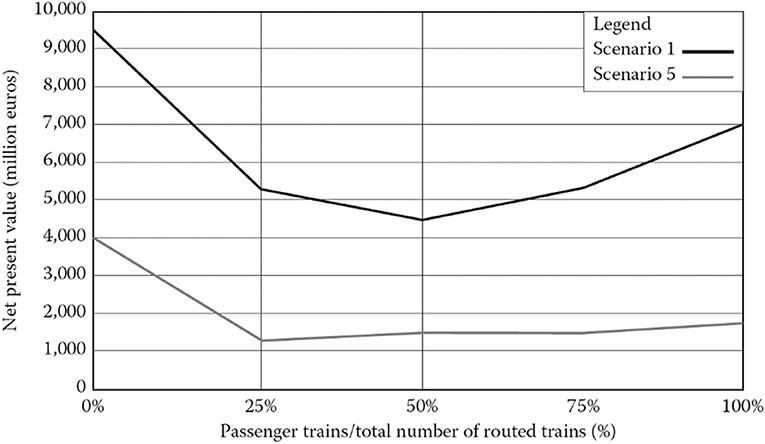

The impact of traffic composition on the profitability of a new railway corridor has also been investigated with the aid of a mathematical model in (Christogiannis and Pyrgidis, 2014) with modeling yielding similar results (Figure 3) as the form and lead of curves in Figures 2, 3 reveal. Whilst the resulting conclusion i.e., that dedicated freight corridors may be indeed the most efficient investment where significant transport volumes exist may not come as a surprise, it is fair to say there is hardly a univocal answer to the dilemma rail freight players face, as in most cases, all parties have to find ways, on the one hand, to leverage effectively an established, often large resource base and, on the other hand, to best address future risks and opportunities, with the final answer being a factor of several network and operation specific factors that are worth studying in depth separately.

Figure 3. Variation of the NPV in relation to the traffic composition – Scenarios S1 (double track) and S2 (single track) (Christogiannis and Pyrgidis, 2014).

Infrastructure and resource challenges–conventional or heavy haul freight trains?

The term “heavy haul” rail describes railway operations featuring an axle load (Q) equal or >25t (Q = 25–40t) (Pyrgidis, 2016). A question faced by many railway operators is under which conditions heavy haul rather than conventional axle load rail freight makes sense, when planning a new dedicated freight corridor.

From afar, it seems counterintuitive that heavy haul freight operation is a great means for economies of scale due to the trains' increased transport capacity. However, for the experienced observer, this strategic decision also increases both initial capital expenditure requirements and operation and maintenance costs of the railway – the permanent way in particular.

Indeed, high axle loads are at the origin of many technical challenges. Heavy haul loads result in increased rail stresses that are transferred through the track superstructure to the track substructure and from there to the subgrade. As a result, both maintenance costs and permanent way inspection frequencies need to be increased: as an example, it is worth noting that a 10 percent axle load increase reduces the MTBM (Mean Time Between Maintenance) by 30 percent (Liu, 2005), not considering impacts on design of heavy civils infrastructure at the outset (bridges, tunnels, ancillary civils etc.).

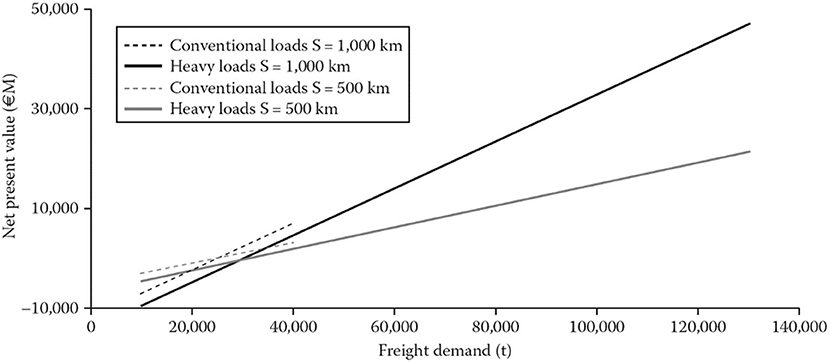

Research in (Liu, 2005; Pyrgidis and Christogiannis, 2013) attempted to investigate, by means of analytical models, the economic efficiency of a heavy haul railway, featuring an axle load of 30t vs. that of conventional rail freight, i.e., 22.5t axle load, for a new single track, standard gauge, dedicated freight traffic corridor, considering a wide range of tonnage borne – 10,000–130,000t per day per direction – and corridor lengths (S) – varying from S = 500–1,000 km. The study assumed that RIM and ROC are effectively the same organization, and economic efficiency was expressed by means of the initial capital expenditure's NPV. Figure 4 illustrates the NPV as a function of the tonnage borne and the route's length.

Figure 4. NPV as a function of freight demand expressed in tonnage borne for a conventional axle-load and a heavy haul line – length of connection S = 500 to 1,000 km (Pyrgidis and Christogiannis, 2013).

Resulting from this study were the following conclusions:

• The conventional load freight-dedicated corridor can serve up to around 40,000t daily for each direction, while the heavy-haul rail corridor can cater for roughly three times that volume.

• Both systems have a negative Net Present Value (NPV) for a daily tonnage borne of up to ~20,000t per direction.

• For daily freights per direction of up to 40,000t, that may be served by either system, conventional load corridors seem financially more sustainable.

• For heavy haul rail corridors with a daily freight >around 30,000t, the increase in the connection's length results in significant increases in profitability that translates effectively to almost a doubling of the NPV.

• The increase in the route's length also positively affects profitability of conventional freight, however, the breakeven point is in this case lower at around 25,000t.

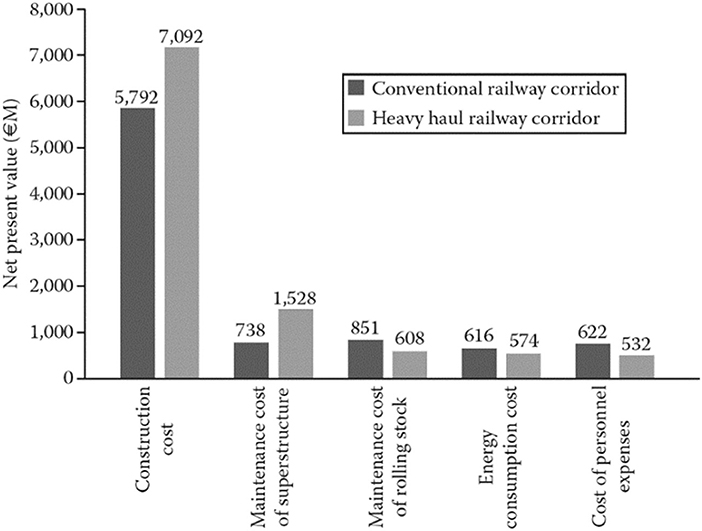

The histogram in Figure 5 further presents the breakdown of different costs assumed to be incurred for two of the operational scenarios been studied, considering daily freight volumes per direction equal to 30,000t and a connection length of 1,000 km.

Figure 5. Construction, maintenance, and operational costs for conventional and heavy axle-load lines – length of connection S = 1,000 km, demand for freight = 30,000 t per day per direction (Pyrgidis and Christogiannis, 2013).

Whilst the previous provide for useful insights on the dilemma set at the beginning of this section, the large majority of real life cases that infrastructure undertakings together with infrastructure owners have to face nowadays remain unanswered for the following reasons: first, dedicated freight corridors still remain, effectively, a fragment of railway networks overall; confusion with mining networks is not to be made as both industry organizational structure and financing constraints differ significantly; last, but not least, more than ever, following the COVID-19 pandemic, rail freight players need to take into consideration the rise in international trade barriers and the resulting new global economic trend of goods traffic regionalization. As a result, the question of heavy haul vs. conventional axle loads remains largely open and therefore worth investigating further.

The call to best serve demand and add customer value–unitized wagonload or integrated trainload services?

Traditional freight services involve Single Wagonload (SWL) services i.e., cargo movements using single wagon trains where wagons – each wagon containing loads of single or multiple shippers/consignees – start their journey from different origin points or end their journey at different destinations. This concept necessitates that wagons pass through intermediary marshaling yards. It is also likely that some wagons need to change trains during the journey (intermediate marshaling operations) (Guglielminetti et al., 2017).

Trainload (TL) services (or block trains), on the other end, refer to trains consisting of wagons that have common origin and destination, which results in nil marshaling requirements and a direct, no-stop connection between origin and destination points. As a result, train routing becomes much simpler within the limits provides by the network's timetable, especially for national consignments (Zanuy, 2013). Small, individual consignments, on the other hand, face a series of issues, which have long been hampering demand for this kind of service, yet in the wake of the pandemic and change in consumer preferences, this is a challenge that railway undertakings need to address. Indicatively (Ringeisen, 2010; CER, 2016):

• SWL still fail to meet nowadays modern transport quality standards and client expectations. Unsurprisingly, SWL often provide nil or negative returns to railway undertakings.

• Goods protection remains an issue, as delays may force stop and long dwelling of individual wagons at intermediate stops.

• Goods transported exclusively by rail and using individual wagons, mainly i.e., “captive” commodities, such as minerals and chemicals, have been and still face a definitive reduction in terms of demand.

From the above it is obvious that block trains are clearly more efficient than SWL. Yet some of the aforementioned issues can be softened and SWL can rise to a development lever for rail freight. Indeed, research shows (Ringeisen, 2010; Guglielminetti et al., 2017) that in countries where rail freight has a strong SWL presence, rail freight modal share is far stronger. The rise of automation and digitalization is very likely to support this growth even further with opportunities mainly in marshaling and coupling operations. Yet what needs to be further investigated per case is the sweet spot where the investment is worth the return.

Leveraging rail's competitive advantage–dangerous goods shipping by rail under which conditions?

The term “dangerous goods” covers materials and products, transportation of which is allowed only under certain conditions (Pyrgidis, 2016). The transport of dangerous goods is subject to specific regulatory measures which are imposed by the competent international and national authorities, and in many instances the railway undertaking companies themselves. Dangerous goods' transport by means of rail has the following advantages:

• Providing mass and safe transport including increased weather conditions resilience;

• Superior environmental performance;

• A single degree of freedom that facilitates the automation of several of train functions.

The main disadvantage of freight railway transport is the lack of door-to-door service. Moreover, important disadvantages, when compared with road freight transport in particular, include the low number of scheduled routes and relatively high vehicle age. On the contrary, the main disadvantages of road freight transport are the following (UIC, 2012):

• Inability to support mass transport (especially in the case of liquid goods). Yet all this is likely to change in the near future as the road haulage industry leverages the benefits of collaborative ecosystems with tech firms and increased funding aimed to enable road freight highways and unsupervised, autonomous vehicle (AV) operation.

• Non-efficient vehicles as it relates to the processes of specific services (including the washing of empty tanks).

• Increased risk of accidents due to road congestion primarily, and in some instances, adverse weather conditions.

Whilst 100 million tons of dangerous goods were transported in 2012 (UIC, 2012), the trend for rail freight in the latter years is reportedly negative (RFF, 2018). In order for the railway to bolster its competitiveness, the relevant policies should revolve around the following (RFF, 2018; UIC, 2019):

• Differentiation from the rest of freight transport services: Through the development of attractive rail and multimodal solutions, digitalization and technical innovation;

• Creation of safe transport conditions: Through process and regulatory standardization; simple yet effective communications; easy, reliable and fast planning.

• Special measures to protect the environment, including drafting of contingency plans.

Railways are a safer transport mode compared to road; RSSB suggests 'a train journey is still over 20 times safer than traveling the same distance by car' (RSSB, 2021). In Europe and for freight this reportedly reflected on only 0.1 deaths over 1 billion ton-kilometers in 2001 which is 10 times lower than the mortality risk during road transport of dangerous goods (Pyrgidis and Basbas, 2000; Basbas and Pyrgidis, 2001)– and as such it should be considered as the go-to-mode for transporting dangerous goods. Whilst statistics may be compelling in advocating for rail, this argument alone is not enough. Risk, i.e., the joint consideration of likelihood of potentially harmful events (hazards) in relation to their potential impact (severity of consequences) is a more relevant measure. Further research is therefore required in understanding which factors and to what extent – whether in provenance of the goods being transported, the route, the rolling stock, the railway's modus operandi or timeliness of the service being demanded– may weigh on providing a robust response to the dilemma identified in the outset.

Leveraging technological innovation – autonomous or manned freight train operation?

Focus on automation and digitalization in the rail freight industry has been increasing (RFF, 2018; Goverde, 2020) over the last decade (Shift2Rail, 2015, 2019, 2020) yet at a pace that is significantly lower than in the road haulage industry. Railway automation, as in several other contexts, aims to improve capacity, reliability, energy efficiency, flexibility, safety, and cost effectiveness (Goverde, 2020) with the key initiatives in Shift2Rail's portfolio being:

• Generalization of grade of automation (GoA) at L2, i.e., semi-automatic train operation;

• Obstacle detection to reduce risk of collisions and increase safety in operations;

• Automatic coupling, a key technological component that will contribute great time to the automation of shunting operations;

• Distributed power for long trains, a solution that is expected to enable the possibility to increase the length of trains through radio-remote controlled distributed power technology;

• Full electric last mile propulsion;

• Real - time yard management, and,

• Intelligent video gates (IGV) underpinned by radio frequency identification (RFID) technology to identify and verify incoming trains to marshaling yards automatically.

While the impact potential for all above-mentioned opportunities is undisputable, one needs to critically consider, in the fortunate event where any or all of these research and development projects come to fruition, how they are to be implemented considering: first, the relatively slower pace of rail industry compared e.g., to road all together; second, the inability of several railway organizations to change their practices or retrofit their existing asset base in a day – both for reasons pertaining to limited resources, but equally as a result of supply chain and industry ties imposing, in most cases, irrevocable constraints for moving forward (Christensen, 1997); and third, the fragmentation of the rail freight industry when looked at through the micro-lens pertaining to logistics operations (freight and marshaling yards and 3PL operations).

As a result, understanding where and how impact can be delivered through automation, in particular as it relates to autonomous rail freight operation requires a joint understanding of: first, the route's characteristics; second, the current state of play and how this relates to potential innovation roll outs – noting that whilst autonomous operation may appear a feat on its own, it needs to be considered together with other enabling technological and process innovations; third, where, payoffs are likely to yield most e.g., plain line or marshaling yards. In summary, to answer the question set out at the beginning of this section pertinently, considerable further research is required in the future to capture and address effectively aspects that seem to have emerged and slowly developing only recently.

Discussion

Rail freight can be a cost-effective means of transport, even over short distances (i.e., <100 km) under specific conditions. It is by design the safest mode of land transport and far safer than road haulage (EC, 2020); and can also provide (DfT, 2016; MDS, 2019):

• Economic and flexible transport chains for higher-value goods when transported in containers within intermodal transport chains;

• Transport of large volumes of cargo in “one move”;

• Delivery and receipt of cargo at specific times and in a timely manner, which avoids road congestion;

• Lower greenhouse gas and other emissions per unit moved so that, where organizations are required to report them, the use of rail can either off-set emissions elsewhere or contribute to a reduction of overall emissions, as well as help in meeting corporate social responsibility objectives; and

• Greater levels of security.

To leverage this potential and effectively compete with road haulage, railway undertakings, infrastructure owners and regulators – albeit the latter to a lesser extent, need to work together to answer specific questions – what was termed in this paper “dilemmas” – that require synergy building and a deep understanding of industry, market, regulatory and system operational aspects affecting freight railways. This being a bold ambition that defies current practice, future research needs to identify collaborative frameworks and principles that can bolster distributed value creation.

As demonstrated through the analysis in the previous sections, the decision-making process for rail freight industry stakeholders is a highly complex one and may be summarized in a framework of five key elements – so called “dilemmas” in the previous – Railway Operating Companies, Railway Infrastructure Managers and regulators alike need to be dealing with:

• Mixed passenger and freight train operation vs. dedicated train corridors;

• Conventional vs. heavy axle loads for freight trains;

• Unitized wagonload vs. integrated trainload services;

• Dangerous goods land shipping by rail vs. road;

• Autonomous vs. manned freight train operation.

Whilst the above provides for a holistic approach in dealing with the problem identified, the forces and dynamics behind those key questions, captured through this research, have been found to be both numerous and spanning a large array of specialist areas, from technical to financial and operational. Whilst the literature data review undertaken identified the key factors and angles Railway Operating Companies, Railway Infrastructure Managers and regulators alike need to be jointly considering when called to make a call on strategic decisions regarding policy and/or investment in particular, further research is required to pin down and understand concisely the relevance and likely impact of the enumerated key factors and the conditions under which the balance, when looking at responding to any of the dilemmas identified, would shift to one or the other side. Factoring in that several of these questions cannot be answered in isolation as policy crafting and strategic decision-making ought always to be put in context avoiding generalizations that could prove both misplaced and highly costly in hindsight.

Furthermore, considering the rigid nature of rail infrastructure and rolling stock investments, questions arise as to how rail industry players can balance the short – often quarterly results focus - with the mid and long term when intending to move away from their established modus operandi. This is further exacerbated by regional differences in terms of railway operations and operational business outcomes as seen in e.g., EU vs. the large networks in the US (BNSF, 2021; CPR, 2021) already mentioned in the previous sections. We hence see this as an opportunity for future research to look into ways for adapting the proposed framework to account for regional and time-bound constraints and a chance to establish relevant decision-making tools adapted to railway networks' specific needs and intricacies.

Author contributions

ND contributed to conception and design of the study. ND authored the text whilst CP peer reviewed the first draft. All authors contributed to data mining and research, manuscript revision, read, and approved the submitted version.

Conflict of interest

Author ND was employed by Arcadis.

The remaining author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The review editor FK declared a shared affiliation with the author(s) CP at the time of review.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

ADB (2005). Technical Assistance – People's Republic of China : Railway Passenger and Freight Policy Reform Study. Asian Development Bank, Project Number: 37628. Available online at: https://www.adb.org/sites/default/files/project-document/68861/37628-prc-tar.pdf (accessed March 21, 2022).

Basbas, S., and Pyrgidis, C. (2001). Model development for rail transportation of hazardous materials in Greece. J. Environ. Prot. Ecol. 2, 418−427.

Batisse, F.. (1994). Les Grandes Tendances du Trafic Ferroviaire Dans le Monde. Rail International, 15–22.

Batisse, F.. (1995a). Le Trafic de Masse, Atout du Chemin de Fer (1ère partie). Rail International. 26–33.

Batisse, F.. (1995b). Le Trafic de Masse, Atout du Chemin de Fer (2ème partie). Rail International. 23–29.

BNSF (2021). Annual Report 2021, Burlington Northern Santa Fe LLC, 2021. Available online at: https://www.bnsf.com/about-bnsf/financial-information/form-10-k-filings/ (accessed March 21, 2022).

CER (2016). Longer Trains Facts and Experiences in Europe, Community of European Railway Companies (CER), Results of the CER Working Group on Longer and Heavier Trains, 2016. Available online at: https://www.cer.be/sites/default/files/publication/160525_Longer%20Trains_Facts%2~0and%20Experiences%20in%20Europe_final_0.pdf (accessed March 21, 2022).

CER (2020). 30 by 2030 – How Rail Freight Achieves its Goals, Community of European Railway Companies (CER), Rail Freight Forward, Joint Position Paper, 2020. Available online at: https://www.railfreightforward.eu (accessed March 21, 2022).

CER (2022). Latest CER COVID Impact Tracker: Railways Lose € 50 billion since the Start of the Pandemic, Community of European Railway Companies (CER), Press Release, 10th Feb 2022. Available online at: https://www.cer.be/media/press-releases/latest-cer-covid-impact-tracker-railways-lose-%E2%82%AC50-billion-start-pandemic-0 (accessed March 21, 2022).

Christensen, C. M.. (1997). The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail. Boston, MA: Harvard Business School Press.

Christogiannis, E., and Pyrgidis, C. (2013). An investigation into the relationship between the traffic composition of a railway network and its economic profitability. Rail Eng. Int. 1, 13−16.

Christogiannis, E., and Pyrgidis, C. (2014). Investigation of the Impact of Traffic Composition on the Economic Profitability of a New Railway Corridor. J. Rail Rapid Transit. 228, 389–401.

CPR (2021). Annual Report 2021, Canadian Pacific Railway Limited, 2021. Available online at: https://investor.cpr.ca/financials/default.aspx (accessed March 21, 2022).

Davies Gleave, S., Dionori, F., Casullo, L., Ellis, S., Ranghetti, D., Bablinski, K., et al. (2015). Freight on Road: Why EU Shippers Prefer Truck to Train, Directorate General for Internal Policies, Policy Department, Structural and Cohesion Policies, Transport and Tourism, Study, European Parliament. Available online at: https://www.europarl.europa.eu/RegData/etudes/STUD/2015/540338/IPOL_STU(2015)540338_EN.pdf (accessed March 21, 2022).

DfT (2016). Rail Freight Strategy – Moving Britain Ahead, Department for Transport, September 2016, Crown Copyright. Available online at: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/552492/rail-freight-strategy.pdf (accessed March 21, 2022).

EC (2020). EU Transport in Figures 2020 – Statistical Pocketbook 2020, Publications Office of the European Union, Brussels, 2020, Available online at: http://publications.europa.eu/resource/cellar/da0cd68e-1fdd-11eb-b57e-01aa75ed71a1.0001.03/DOC_1 (accessed March 21, 2022).

Flodén, J., Bärthel, F., and Sorkina, E. (2017). Transport buyers choice of transport service - a literature review of empirical results. Res. Trans. Bus. Manag. 23, 35–45. doi: 10.1016/j.rtbm.2017.02.001

Goverde, R.. (2020). Trends and Developments in the Automation of Heavy Rail Operations, Global Railway Review. Available online at: https://www.globalrailwayreview.com/article/97734/trends-developments-automation-heavy-rail/ (accessed March 21, 2022).

Guglielminetti, P., Piccioni, C., Fusco, G., Licciardello, R., and Musso, A. (2017). Rail Freight Network in Europe: Opportunities Provided by Relaunching, World Conference on Transport Research - WCTR 2016, Shanghai. Available online at: https://www.researchgate.net/publication/323844367_Rail_Freight_Network_in_Europe_Opportunities_Provided_by_Re-launching_the_Single_Wagonload_System (accessed March 21, 2022).

Hausmann, L., Netzer, T., and Rothkopf, M. (2015). Pathway to Value Creation– A Perspective on How Transportation and Logistics Businesses can Increase Their economic Profit, McKinsey and Co., Travel, Transport and Logistics, September 2015. Available online at: https://www.mckinsey.com/~/media/mckinsey/industries/travel%20transport%20and%20logistics/our%20insights/creating%20value%20in%20transportation%20and%20logistics/pathway%20to%20value%20creation.pdf (accessed March 21, 2022).

Islam, D., and Mortimer, P. (2017). Longer, faster and heavier freight trains: is this the solution for european railways? Findings from a case study. Benchmark. Int. J. 24, 994–1012. doi: 10.1108/BIJ-05-2015-0051

Jorgensen, M., and Sorenson, S. (1997). Estimating Emissions for Air Railway Traffic, Report for the Project MEET: Methodologies for Estimating Air Pollutant Emissions from Transport, Department of Energy Engineering, Technical University of Denmark, Lyngby, Denmark. Available online at: www.inrets.fr/infis/cost319/MEETDeliverable17.pdf (accessed March 21, 2022).

Liu, Z.. (2005). Track Deterioration and Countermeasure After Running 10,000 ton Heavy Haul Fleet on Daqin Coal Line of China, Railway Engineering, London.

Lundberg, S.. (2006). Godskunders Värderingar av Faktorer Som Har Betydelse på Transportmarknaden (Freight Customers' Valuation of Factors of Importance in the Transportation Market), Licentiate Thesis (in Swedish), KTH Royal Institute of Technology, Sweden, Stockholm, 127. Available online at: http://kth.diva-portal.org/smash/record.jsf?pid=diva2%3A10064anddswid=245 (accessed March 21, 2022).

MarketLine (2021a). Global Rail Freight Sector – Supply Chain Analysis. Reference Code: MLVC001-091, January 2022. Available online at: www.marketline.com (accessed March 21, 2022).

MarketLine (2021b). Global Rail Freight Sector – Value Chain Analysis. Reference Code: MLVC001-091, January 2022. Available online at: www.marketline.com (accessed March 21, 2022).

MarketLine (2021c). Rail Freight in China, MarketLine Industry Profile, Reference Code: 0099-0193, April 2021. Available online at: www.marketline.com (accessed March 21, 2022).

MarketLine (2021d). Rail Freight in Germany, MarketLine Industry Profile, Reference Code: 0165-0193, April 2021, Available online at: www.marketline.com (accessed March 21, 2022).

MarketLine (2021e). Rail Freight in the United States, MarketLine Industry Profile, Reference Code: 0072-0193, April 2021, Available online at: www.marketline.com (accessed March 21, 2022).

Masson, A., and Harris, I. (2019). A Review of Freight and the Sharing Economy, Future of Mobility, Evidence Review, Foresight, Government Office for Science, 2019, Crown Copyright. Available online at: https://assets.publishing.service.gov.uk/government/uploads/~system/uploads/attachment_data/file/777699/fom_freight_sharing_economy.pdf (accessed March 21, 2022).

MDS (2019). Understanding the UK Freight Transport System, Future of Mobility, Evidence Review, Foresight, Government Office for Science, 2019, Crown Copyright. Available online at: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/777781/fom_understanding_freight_transport_system.pdf (accessed March 21, 2022).

OECD (2002). Railway Reform in China – Promoting Competition, Summary and recommendations of an OECD/DRC Seminar on Rail Reform, Beijing, 28-29 January. Available online at: https://www.oecd.org/china/34566769.pdf (accessed March 21, 2022).

Pyrgidis, C.. (2016). Railway Transportation Systems - Design, Construction and Operation, CRC Press, Taylor and Francis Group, 2016. Available online at: https://doi.org/10.1201/b19472 (accessed March 21, 2022).

Pyrgidis, C., and Basbas, S. (2000). Rail transportation of dangerous goods – action plan development for greek state railways. Rail Eng. Int. Netherlands 3, 8–11.

Pyrgidis, C., and Christogiannis, E. (2013). “Freight Dedicated Railway Corridors for Conventional and for Heavy Loads – A Comparative Assessment of the Economic Profitability of the Two Systems,” in 3rd International Conference on Recent Advances in Railway Engineering, ICRARE 2013. Iran University of Science and Technology, (Tehran).

Railway Technology (2021). India Proposes New Dedicated Freight Corridors in Budget, Railway Technology (online), 2nd Feb 2021. Available online at: https://www.railway-technology.com/news/india-proposes-new-dedicated-freight/ (accessed March 21, 2022).

RFF (2018). 30 by 2030 – Rail Freight Strategy to Boost Modal Shift, Rail Freight Forward, European Rail Freight Vision – White Paper, Brussels, 2018. Available online at: https://www.railfreightforward.eu (accessed March 21, 2022).

Ringeisen, M.. (2010). Xrail Wagonload – From a Domestic System to a European Quality Network. Milan: Xrail - The European Wagonload Alliance.

RSSB (2021). Annual Health and Safety Report', Rail Safety and Standards Board (RSSB), UK. Available online at: https://www.rssb.co.uk/safety-and-health/risk-and-safety-intelligence/annual-health-and-safety-report (accessed March 21, 2022).

Shift2Rail (2015). Shift2RailJoint Undertaking – Multi-Annual Action Plan, Brussels, November 2015. Available online at: https://www.shift2rail.org/wpcontent/uploads/2013/07/MAAP-final_final.pdf/ (accessed March 21, 2022).

Shift2Rail (2019). Shift2RailJoint Undertaking – Annual Activity Report 2018, June 2019. Available online at: https://shift2rail.org/wp-content/uploads/2019/07/S2R-JU-Annual-Activity-Report-2018~.pdf/ (accessed March 21, 2022).

Shift2Rail (2020). Shift2RailJoint Undertaking – Annual Activity Report 2019, June 2020. Available online at: https://shift2rail.org/wp-content/uploads/2020/06/GB-Decision-05-2020_AAR-2019_Annex_AAR-2019.pdf/ (accessed March 21, 2022).

UIC (2007). Statistics Data, International Union of Railways (UIC). Available online at: https://uic.org/support-activities/statistics/ (accessed March 21, 2022).

UIC (2012). Greening Transport: Reduce External Costs – Executive Summary. UIC and CER, Paris. Available online at: http://www.uic.org/spip.php?article1799 (accessed March 21, 2022).

UIC (2019). Activity Report 2019, International Union of Railways (UIC). Available online at: https://uic.org/IMG/pdf/uic_activity_report_2019.pdf (accessed March 21, 2022).

Vassallo, J. M., and Fagan, M. (2007). Nature or nurture: why do railroads carry greater freight share in the United States than in Europe? Transportation 34, 177–193. doi: 10.1007/s11116-006-9103-7

Woodburn, A., Allen, J., Browne, M., and Leonardi, J. (2008). The Impacts of Globalisation on International Road and Rail Freight Transport Activity – Past Trends and Future Perspectives. Transport Studies Department, University of Westminster, London. Available online at: http://www.oecd.org/dataoecd/52/29/41373591.pdf (accessed March 21, 2022).

World Bank (2017). Railway Reform: Toolkit for Improving Rail Sector Performance, International Bank for Reconstruction and Development. World Bank Group, Second Edition, Washington DC. Available online at: https://documents1.worldbank.org/curated/en/~529921469672181559/pdf/69256-REVISED-ENGLISH-PUBLIC-RR-Toolkit-EN-New-report-date-2017-12-27.pdf (accessed March 21, 2022).

Zanuy, A. C.. (2013). Future Prospects on Railway Freight Transportation - A Particular View of the Weight Issue on Intermodal Trains (PhD Thesis). Technische Universität Berlin, 219. Available online at: https://www.railways.tu-berlin.de/fileadmin/fg98/papers~/2013/PhD_Armando_Carrillo_Zanuy.pdf (accessed March 21, 2022).

Keywords: rail, freight, strategy, sustainability, growth

Citation: Demiridis N and Pyrgidis C (2022) Getting freight trains back on track–How railway undertakings, infrastructure owners and regulators can navigate the main dilemmas in freight business to drive sustainable growth. Front. Sustain. 3:903945. doi: 10.3389/frsus.2022.903945

Received: 24 March 2022; Accepted: 25 July 2022;

Published: 11 August 2022.

Edited by:

Maria Sartzetaki, Democritus University of Thrace, GreeceReviewed by:

Loukas Dimitriou, University of Cyprus, CyprusFotini Kehagia, Aristotle University of Thessaloniki, Greece

Umar Muhammad Modibbo, Modibbo Adama University of Technology, Nigeria

Desmond Ighravwe, Bells University of Technology, Nigeria

Copyright © 2022 Demiridis and Pyrgidis. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Christos Pyrgidis, cHlyZ2lkaXNAY2l2aWwuYXV0aC5ncg==

Nikolaos Demiridis

Nikolaos Demiridis Christos Pyrgidis

Christos Pyrgidis