- Transition Engineering Lab, Heriot-Watt University, Stromness, Scotland, United Kingdom

International oil companies (IOCs) face competing pressures to reduce production to meet climate targets while delivering expected shareholder value. These competing pressures create a dissonance surrounding the future business strategy of IOCs. The Systems Transition Engineering approach brings experts together to work through an Interdisciplinary Transition Invention, Management and Engineering (InTIME) Design Sprint, to generate novel concepts for business options that relieve competing pressures in complex and unsustainable systems. This article details a case study of an InTIME Design Sprint conducted with oil industry experts involving a series of investigative workshops. The aim of the sprint is to generate foresight for IOC business pivot opportunities that resolve the dissonance surrounding IOC futures in a climate-safe world. A pivot opportunity represents a profitable business strategy within the bounds of what is feasible and socially acceptable. A theoretical oil company was used to test out hypothetical business scenarios throughout the steps of the sprint. The design sprint was successful in moving the oil industry experts beyond the dissonance and facilitating the foresight of viable and climate-safe business pivot opportunities for an IOC. This result represents a breakthrough that was previously considered unthinkable by the sprint participants. This work contributes a novel use case of the InTIME Design Sprint to an upstream energy system and introduces novel applications of tools to navigate cognitive dissonance and complexity within InTIME Design Sprints.

1 Introduction

Techno-economic development pathways to mitigate climate disruptions require significant oil production decline starting now and continuing into the coming decades (Calverley and Anderson, 2022; Lamboll et al., 2023; Climate Analytics et al., 2023). Climate models for climate-safe emissions reduction pathways, such as pathways that are compliant with Paris Agreement commitments, clearly require sustained oil production decline under a wide range of assumptions. As a result, oil and gas companies are experiencing pressures from governments, the public, and shareholders (Van de Graaf, 2018; Zhong and Bazilian, 2018; Shojaeddini et al., 2019; Kenner and Heede, 2021; Midttun et al., 2022). In response to these pressures, international oil companies (IOCs) have adopted new strategies. IOCs have increased dialog about climate change and almost all IOCs have set some form of net zero or decarbonisation target (Bisel et al., 2024). IOCs have made investments into renewable energy assets and associated “green” technologies (Zhong and Bazilian, 2018; Shojaeddini et al., 2019). However, these alternative investments by IOCs are small in magnitude compared to their continued investments in future oil and gas production (Li et al., 2022). No oil major is on track to reduce oil production in line with what is required for the Paris agreement (Tong and Trout, 2024), and there is no evidence that these “green” energy investments are leading to a decrease in oil and gas investments by IOCs (Green et al., 2021; Li et al., 2022). IOC business models are highly reliant on oil and gas operations and oppose significant production decline (Green et al., 2021; Li et al., 2022). Recently, the underperformance of these diversification investments in relation to traditional oil and gas assets has been seen to threaten the business stability of IOCs. As a result, IOCs have been withdrawing from these diversification investments and reaffirming their commitment to oil and gas (Bousso, 2023; Tomlinson, 2023). Declarations of net zero targets by IOCs may temporarily extend social license to operate and alleviate political pressures (Midttun et al., 2022), but there are no IOCs with a published strategy to simultaneously deliver production decline and business stability. This gap between the rhetoric and performance of IOCs gives rise to accusations of greenwashing (Li et al., 2022).

Two opposing facts are present in discussions about the future of the oil industry, oil production must decline for climate safety and IOC business strategy requires continued production and seeks growth. These two concurrently held and opposing facts create dissonance for employees, business leaders, investors and policy-makers. Oil industry workers appear unable or unwilling to move beyond this dissonance. When confronted with the gap between IOC performance and the production decline required to mitigate climate change, most oil industry workers display defensive or overly optimistic sensemaking (Ferns et al., 2017; Rajak, 2020; Halttunen et al., 2022) rather than a willingness to explore for new strategies which resolve the dissonance of IOC futures. Pivoting IOC business models to resolve the contradiction that exists for IOC futures is a wicked problem.

Wicked problems are non-linear, involve complexity, have no clear solution, and can be perceived differently by different stakeholders (Elia and Margherita, 2018). Actors cannot tackle a systemic wicked problem, even though they know that the something must change, because the way to change is not known. Wicked problems often arise when trying to develop future strategy for a complex system that is unsustainable but currently works well in meeting an essential need (Krumdieck, 2019). The wicked problem of viable and climate safe IOC future strategy involves dissonance, complexity, uncertainty, and no attractive solutions. Pressures for change grow, yet no pathways for IOCs appear to deliver shareholder value concomitantly with production decline (Asmelash and Gorini, 2021). The net zero targets set by IOCs imply a substantial level of change, yet business logic leads to the pursuit of business-as-usual asset management, exploration, and production. The dissonance surrounding the future direction of IOCs inhibits the generation of the ingenuity required to resolve the wicked problem (Gifford, 2011; Halttunen et al., 2022). The Interdisciplinary Transition, Invention, Management, and Engineering (InTIME) Design Approach is a seven-step systematic design approach to overcome wicked problems of unsustainability in complex systems (Ahrens et al., 2024). InTIME Design Sprints are a first exploration addressing specific wicked problems with system stakeholders and/or system experts.

In this work, for the first time, we conduct an InTIME Design Sprint on the upstream oil industry, tackling the wicked problem of viable energy transition business models for IOCs. The InTIME Design Sprint involved co-design workshops with oil industry experts. The aim of the design sprint was to break through the dissonance surrounding this real-world wicked problem, and to generate positive foresight to frame up an opportunity space for the future of IOCs. The opportunity space demarcates profitable, feasible, and socially acceptable business models (Hediger, 2000; Krumdieck and Hamm, 2009). During this design sprint, two tools from business strategy literature were applied in a new way in an InTIME Design Sprint to surmount the challenges of the oil futures dissonance. Overcoming this dissonance was found to be essential for enabling the industry experts to generate a positive foresight of a successful future opportunity space for IOCs in a climate-safe world. The main outcomes of this InTIME Design Sprint include the successful navigation of dissonance during co-design workshops, the foresight of an opportunity space by oil industry experts, and the proposition of a shift project concept to explore this opportunity space. This paper extends the work presented in a conference paper at the 31st ISTE International Conference on Transdisciplinary Engineering 2024 (Boulton and Krumdieck, 2024).

2 Literature review

2.1 Pressures faced by IOCs

The pressures currently faced by IOCs had been well explored in literature, covering pressures associated with mitigating climate change (Van de Graaf, 2018; Zhong and Bazilian, 2018; Shojaeddini et al., 2019; Kenner and Heede, 2021; Midttun et al., 2022; Tillotson et al., 2023; Sato et al., 2024), changing energy markets due to the energy transition (Fattouh et al., 2019; Hartmann et al., 2021; Salygin and Lobov, 2021), stranded assets (Chevallier et al., 2021; Riedl, 2021; Hansen, 2022), and financial pressures in the traditional oil and gas business (Weijermars et al., 2014; Rack, 2017). Considering multiple pressures, Halttunen et al. (2022) discuss the tension in the oil industry between social pressures related to climate change and pressures for financial returns from shareholders. Pickl (2021) outlines a trilemma facing oil companies, involving the three strategic objectives of “investing in the energy transition,” “maintaining investments in the core oil and gas business,” and “preserving dividend payments”. There appears to be an agreement in literature that social pressures for IOCs to decarbonise for climate mitigation reasons are currently small, having some impact, but are not significant enough to result in major change by IOCs to align with Paris Agreement consistent pathways (Christophers, 2019; Kenner and Heede, 2021; Tillotson et al., 2023; Sato et al., 2024). The changing energy market as a result of the energy transition presents a real pressure for IOCs to respond to, though literature appears to disagree on the scale, urgency, and certainty of this pressure (Van de Graaf, 2018; Fattouh et al., 2019; Shojaeddini et al., 2019; Hartmann et al., 2021). From the perspective of an IOC, the most important pressure to respond to continues to be the fiduciary duty to maximize shareholder value (Christophers, 2021; Pickl, 2021).

2.2 Current IOC responses and strategies

The current strategies of oil and gas companies are analyzed from a range of perspectives in literature, mainly involving business management and strategy perspectives (Nilsen, 2017; Hartmann et al., 2021; Blondeel and Bradshaw, 2022). Halttunen et al. (2023) use semi-structured interviews with oil industry professionals and a literature review to analyse the corporate strategy and diversification options for IOCs. Herzog-Hawelka and Gupta (2023) examine oil company strategies in relation to the imperative of leaving fossil fuels underground. The current strategies of oil and gas companies are often categorized in literature according to their level of investment in renewable energy and associated “green” technologies (Nilsen, 2017; Pickl, 2019; Hartmann et al., 2021; Blondeel and Bradshaw, 2022; Halttunen et al., 2023). The transition of oil and gas companies is often considered to be linear transformation to a renewable energy company. Herzog-Hawelka and Gupta (2023) assert that oil company transition strategies can only be considered valid if the investments into renewable energy are replacing investments into fossil fuels. Much of this literature that investigates the transition strategies of oil and gas companies concludes that the current strategies are not sufficient to comply with climate goals such as the Paris Agreement (Nilsen, 2017; Halttunen et al., 2023; Herzog-Hawelka and Gupta, 2023).

Ørsted is often presented as the gold standard for business model transition in the oil and gas industry (Abraham-Dukuma, 2021; Blondeel and Bradshaw, 2022; Hartmann et al., 2021). Ørsted (formally DONG Energy) were a majority state owned Danish oil and gas company who have sold off their oil and gas assets and are now a major producer of offshore wind power (Herzog-Hawelka and Gupta, 2023). Halttunen et al. (2023) argue that the business transition of Ørsted is not comparable to other IOCs as Ørsted was a small majority state-owned company that was already an early mover in wind energy. It is also important to note that Ørsted's oil and gas assets were already underperforming and the declining assets were sold off to be produced by another oil company (IEA, 2020; Midttun et al., 2022).

Several recent research papers also investigate investments and business behavior of oil companies in relation to the energy transition (Zhong and Bazilian, 2018; Shojaeddini et al., 2019; Li et al., 2022; Midttun et al., 2022). The outcomes of these papers show evidence of a common theme. Oil companies have increased discourse about climate change and net zero transitions, often adopting climate related strategies or pledges. Some oil companies have made investments into renewables and technologies related to the energy transition, but the level of these investments is minor compared to investments into oil and gas assets and there is no evidence of a serious shift away from fossil fuels by oil companies. Green et al. (2021) conclude that oil and gas companies are not decarbonising, and instead are “hedging,” “greenwashing,” or “resisting”. These findings agree with the financial analysis of Li et al. (2022), which shows that the IOC business model is still highly dependent on oil and gas revenues and there is no evidence of a shift away from fossil fuels. Li et al. (2022) conclude that greenwashing is occurring. Midttun et al. (2022) show that while the strategic visions of European oil companies have progressed toward “net zero,” their revenue streams are still almost entirely reliant on oil and gas. Midttun et al. (2022) explain this mismatch between professed strategy and economic reality by pointing to the contradictory signals from politics and markets. Politicians in Europe are calling for net zero strategies, while markets are rewarding investment in oil and gas.

In the face of the pressures facing the IOCs, researchers have investigated how oil industry workers make sense of the misalignment between IOC rhetoric and IOC performance in relation to the energy transition and mitigating climate change (Ferns et al., 2017; Rajak, 2020; Halttunen et al., 2022). In response to this misalignment, oil industry members display defensive sensemaking attitudes which involve denying, ignoring, or projecting responsibility for climate change (Ferns et al., 2017; Halttunen et al., 2022). Some oil industry members demonstrate an awareness of the need for change within the industry, but these responses often rely on techno-optimism or a belief that “win–win” scenarios will enable the misalignment to be easily resolved. These strategic responses often ignore the realities of the large scale production decline that is required for Paris Agreement compliant pathways (Rajak, 2020; Halttunen et al., 2022). There is little evidence of oil industry members who are concerned with developing business strategies that are compatible with production decline. This sensemaking literature shows that oil industry members are caught in dissonance and are not seriously considering the large scale changes required to align IOC business operations with climate safe pathways.

2.3 Forward looking IOC strategy research

There is a body of literature which provides forward looking strategic recommendations for oil and gas companies in the context of the energy transition and climate change mitigation (Fattouh et al., 2019; Abraham-Dukuma, 2021; Cherepovitsyn and Rutenko, 2022; Moncreiff et al., 2024). This includes business model innovation and sustainable business model approaches which have been applied to the oil and gas industry in general (Sletten et al., 2023), and in relation to offshore operations and infrastructure (Basile et al., 2021; Czachorowski, 2021). There is a smaller body of literature which outlines strategies that could be adopted by oil companies (Hunt et al., 2022; Halttunen et al., 2023) and oil exporting countries (Van de Graaf, 2018) in response to the energy transition and efforts to mitigate climate change.

For a large portion of this research, the primary motivation is concerned with how an oil company could respond to the changing market conditions caused by the energy transition, looking for new opportunities or ways to survive in a changing environment (Van de Graaf, 2018; Fattouh et al., 2019; Basile et al., 2021; Cherepovitsyn and Rutenko, 2022; Sletten et al., 2023). The level of business model change discussed by this literature is comparatively small, often not addressing the level of production decline required for climate safe pathways or the existential change this implies for the current oil and gas business model. A smaller part of this forward looking oil company strategy literature appears to be primarily motivated by climate mitigation within climate safe limits and directly investigates the large scale shift required to pivot an oil company business model away from fossil fuels (Abraham-Dukuma, 2021; Halttunen et al., 2023). An exception to this trend is Hunt et al. (2022) who appear motivated by a changing energy market, but in response explore drastic business model shifts away from fossil fuels, e.g., a transition toward a hydrogen economy.

Of the literature that proposes strategic recommendations for IOCs to shift away from fossil fuels, much of the suggestions involve strategies that have already been trialed by IOCs, such as slowly diversifying into a renewable energy provider, or investing in associated “green” technologies. Halttunen et al. (2023) recognizes that current strategies of oil and gas companies will not result in the rapid production decline trends required for climate safety and deliberately considers all strategic options available to oil and gas companies. Strategies for IOCs to pivot their operations away from fossil fuels within climate safe pathways is an underdeveloped research area. Work on developing breakthrough strategies for IOCs is inhibited by the dissonance surrounding the future direction of IOCs. There is a gap in the literature for investigating how an IOC can overcome the dissonance surrounding their future and explore for strategies which are viable and adhere to climate safe pathways. To contribute to this research gap, this article presents a case study of a design sprint conducted with oil industry experts. For the first time, this design sprint directly confronts the wicked problem of IOC futures with oil industry experts, utilizing tools to overcome the dissonance present in the system and initiate the design of viable IOC strategies within a climate safe world.

3 Approach and methodology

3.1 Transition Engineering approach

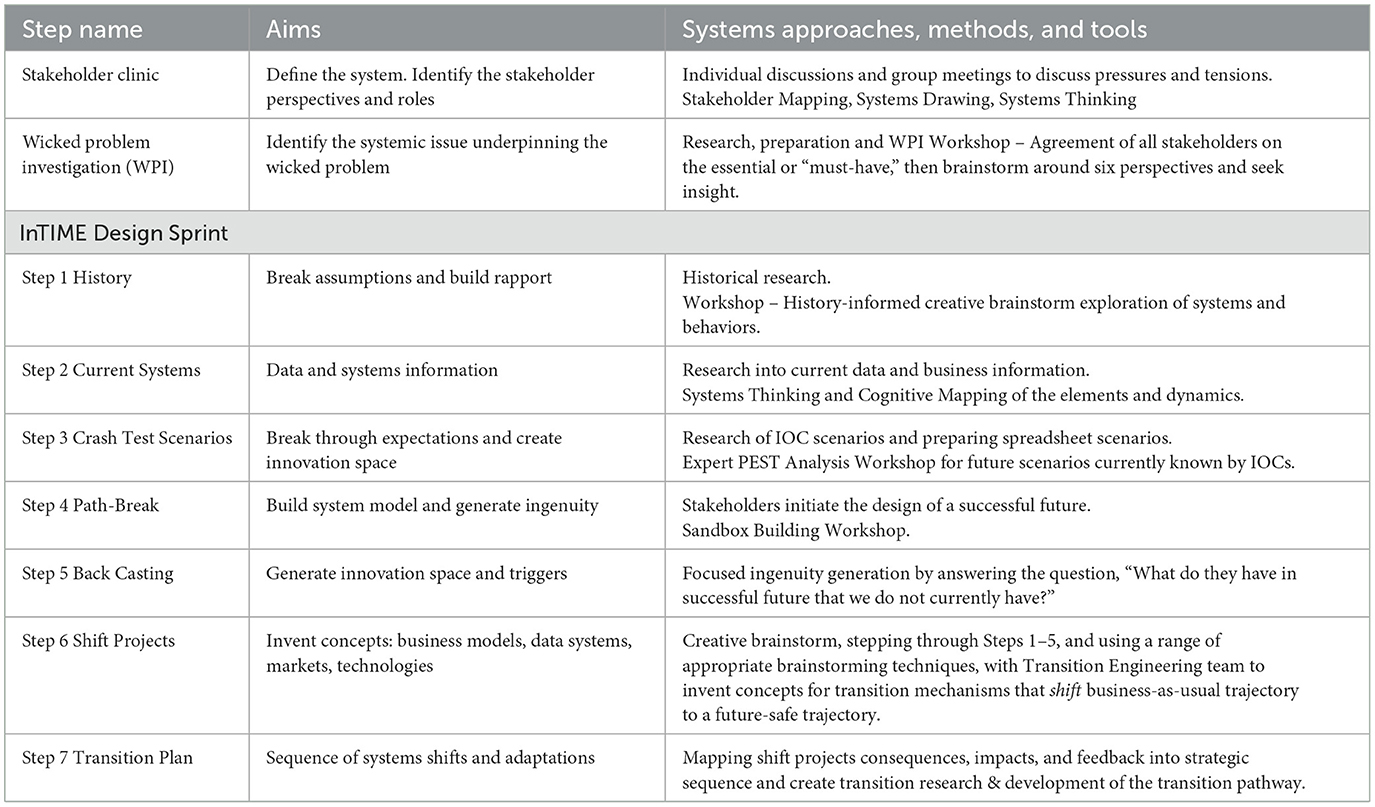

Engineering the transitions of systems requires transdisciplinary approaches to wicked problems (Wognum et al., 2018). Transition Engineering is a set of processes, shown in Table 1, that Transition Engineering consultants can use to help businesses and organizations tackle wicked problems of unsustainability in complex socio-technical-economic systems (Krumdieck, 2019). An InTIME Design Sprint follows a sequence of seven transdisciplinary systems approaches that explore different perspectives, across a 200 year time-frame, employing engineering science as set out in Table 1 (Ahrens et al., 2024).

Table 1. The transition engineering approach uses a sequence of investigations, bringing together transdisciplinary knowledge and generating ingenuity for breaking through wicked problems (table adapted from Boulton and Krumdieck, 2024).

The prior application of InTIME Design to wicked problems of unsustainability in complex systems makes InTIME Design an ideal methodology choice for this paper. Other transdisciplinary design processes exist for approaching sustainability transitions in socio-technical systems, sharing similar phases of problem definition, cocreation of solutions, and application of knowledge. The InTIME Design Approach was chosen for its focus on technical and biophysical feasibility of scenarios (Ahrens et al., 2024). A focus on feasibility is essential for the formation of an opportunity space and also important for this application to the oil industry on account of the mismatch between ambition and reality of IOC strategies. This section outlines how the InTIME Design Approach was applied during this co-design sprint case study on the future of IOCs. The InTIME Design Sprint involved four oil industry experts during a series of co-design studios and directly confronted the wicked problem of viable and climate safe futures for IOCs.

3.2 Creative brainstorming methods

A stakeholder clinic involves individual and group interactions using guided questions, stakeholder engagement, free dialogue, stakeholder mapping, systems thinking, and exploratory framing from different perspectives. In this work stakeholder engagement resulted from voluntary contact with co-author S. Krumdieck on LinkedIn or through other acquaintance. The participants were self-selected through interest in ways that oil companies could positively respond to the energy trilemma (IEA, 2023). These types of challenges result in dialogues being dominated by recitations to the problems, failures, issues, and generally feelings of hopelessness. The purpose of the Stakeholder Clinic is to create the narrative framework that motivates moving forward in the investigation. Narrative stories as found in Krumdieck (2019) were used to create psychological distance between the normal way climate problems are framed and the intentional framing the participants were seeking. A new narrative framework was developed for the IOC future strategy discussions, as even self-selected oil industry experts interested in solutions tended to fall-back to negativity and hopelessness. The framework allowed discussion participants to better visualize and communicate the future business direction of IOCs. This new narrative framework is further developed and described in a forthcoming publication (Boulton and Krumdieck, In review).

The wicked problem investigation (WPI) is a stakeholder workshop process that has been designed to facilitate collective system learning, helping discussions from being derailed by dissonance. The WPI process is outlined in detail in Ahrens et al. (2024b). The WPI is carried out in a brainstorming workshop setting. At the outset of the WPI, participants agree to focus on a particular setting and an essential need, good, or activity. The setting for a WPI can include a physical place, system, and set of stakeholders. Essential needs are the fundamental goods or activities that are needed for humans and human societies to survive. The specific definition of essential needs can vary, but common categorisations arise from human-needs theory (Max-Neef, 1991; Foramitti, 2023) which categorizes needs as being objective, plural, non-substitutable, satiable, and cross-generational (Gough, 2017). Focusing on an essential need during the WPI frames the investigation through the perspective of the important purpose that the system is currently serving (or failing to serve). Examples of essential needs for households are food (Ahrens et al., 2022), electricity (Cherubini et al., 2024), and education (Ahrens et al., 2024a). Three paradoxes are then investigated by inviting participant responses, usually by using sticky notes and a canvas for organizing the responses. The first paradox is that the incumbent system works well for the stakeholders, while also being unsustainable. The second paradox is that stakeholders depend on the system to meet their needs, while also suffering from harms caused by the normal operation of the system. The third paradox is that there are green solutions being proposed, but the system resists change. After the responses are brought together, they are reviewed to look for common threads and to brainstorm what could be the underlying issue underpinning all the paradoxes. This underlying issue is then taken as the focus of the InTIME Design Sprint.

3.3 InTIME Design Sprint

An InTIME Design Sprint works with stakeholders to collectively understand the wicked problem system, break from path biases, and generate shift projects. Shift projects are actionable real-world projects that down-shift unsustainability and create new value creation opportunities. The work focuses on a specific issue underpinning resistance to transition as identified in the WPI. The Transition Engineering research team (InTIME Team) carries out research to gather data and provide analysis for each step, then works through the steps with the participants using systems learning cycles. The first steps draw on the expert knowledge of the stakeholders, setting the stage and inviting knowledge to flesh out the story of the past, present, and future plans. Step 1 Last Century, and Step 2 Present recast the understanding of the wicked problem and the wider system it operates within. A creative time travel brainstorm is used to explore the system 100 years ago using a systems perspective. The exploration then moves through key developments, decisions, and regulations that have influenced the current state of the system and the plans in the industry. The next steps are designed to generate new ingenuity about a successful future and how to drive the transition toward it. Step 3 Future Scenarios uses data and analytical future scenarios to come to a collective agreement that the current industry plans do not lead to the resolution of the wicked problem. Step 4 breaks from current path biases to creatively co-explore a future 100 years from now where the wicked problem has been resolved. The final stage guides participants through the Step 5 Back-Cast of how this successful future has elements that are feasible but currently not known. Actionable shift project concepts are then presented in Step 6. After the participants have examined the shift project concepts, contributed their ideas, and prototypes of the concepts have been developed, then Step 7 projects the systems impacts, feedbacks, new value creation, and unintended consequences that could be caused if the preferred option were developed and deployed. The InTIME Design Sprint preparation and workshops have some commonalities with the design charrette (Greru and Kalkreuter, 2017). The Transition Engineering approach has been applied to challenging issues in the fields of urban form (Bai and Krumdieck, 2020), personal transport adaptation to oil decline (Krumdieck et al., 2010), freight supply chains (Gallardo et al., 2021), agriculture (Ahrens et al., 2022), school transport (Ahrens et al., 2024a), residential energy access (Cherubini et al., 2024), and district heating (Andrade et al., 2022).

3.4 Co-design studios with oil industry experts

Preparation, conceptualization of new tools, and canvases for brainstorming co-design sessions were carried out with the InTIME Team at Heriot-Watt University. Background research and analysis were used to prepare the series of creative brainstorming activities with oil industry experts. The Transition Engineering project included informal one-on-one stakeholder clinic discussions, a wicked problem investigation (WPI), and Steps 1–6 of the InTIME Design Sprint.

The four oil industry experts came from different companies and positions, and all agreed on the urgency of reducing emissions. Expert One worked for an equipment supplier for offshore operations. Expert Two was a strategy leader for carbon and climate change for a major IOC. Expert Three was a long-time consultant for numerous IOCs on Safety, Environment, Security, and Sustainability. Expert Four worked in oil and gas finance. The participants agreed to tackle the wicked problem of viable energy transition business models for IOCs. These industry experts have a wealth of experience in the oil sector including work with senior executives of IOCs. The four experts were already known to the authors and will remain anonymous in this work.

A specific IOC was not officially engaged with for this work, rather the “toy model” method is used, involving an agreed theoretical IOC called “MUOC” (“Mock Upstream Oil Company”) that has all the attributes of IOCs familiar to the participants. The industry experts were asked to draw on their experience in the oil industry and take the perspective of stakeholders for this theoretical IOC. Prior informed consent was obtained from the oil industry experts to have discussions noted, anonymised, summarized, and contribute to publication.

This InTIME Design case study aims to explore the possibility of breaking through dissonance and initiating design in a space that is not currently seen in oil transition research. Due to the pioneering and exploratory nature of the study, this InTIME Design Sprint prioritized an in-depth study with a small number of industry experts rather than a shallower study of a wider range of participants. Such a prioritization can be seen within design science research (Boudier et al., 2023).

4 Results

4.1 Wicked problem investigation (WPI)

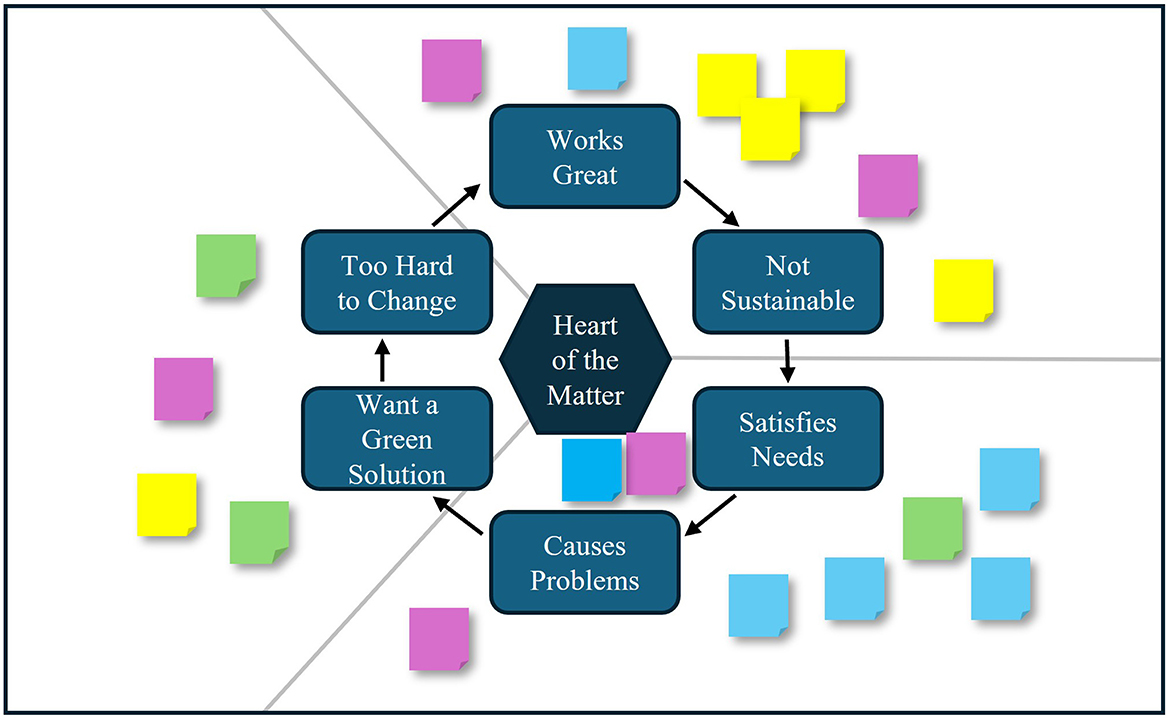

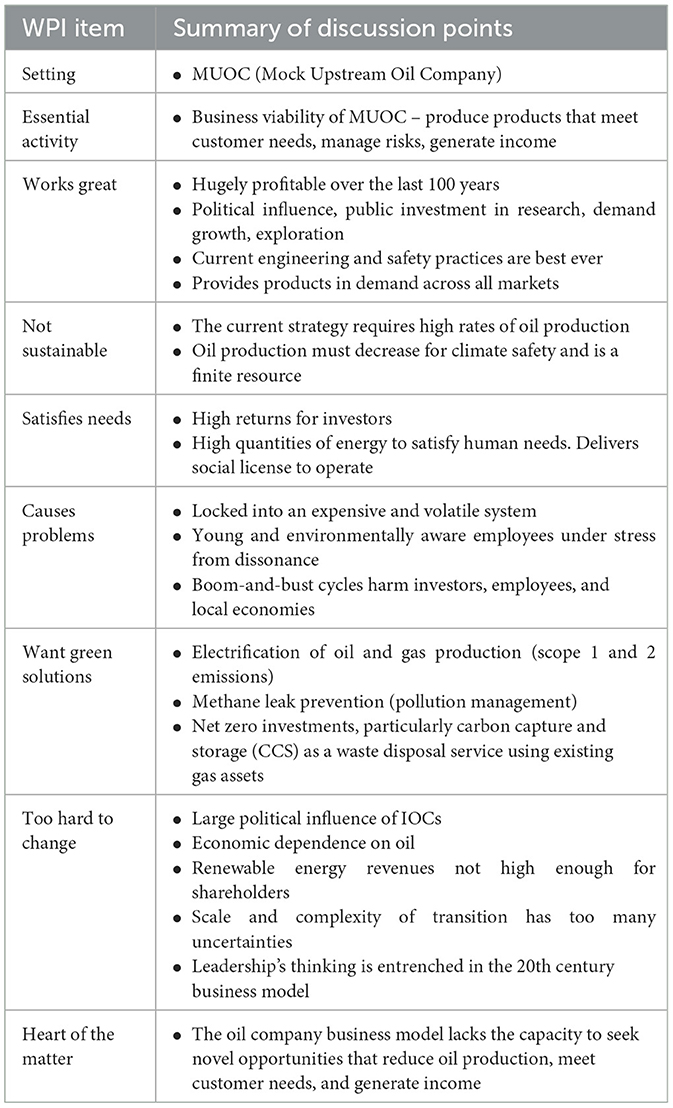

The WPI workshop was conducted with the industry experts and their discussions were recorded and the transcripts summarized. The system setting was agreed to be the theoretical oil production company, MUOC, which has a history and current business operations similar to the companies that the experts have worked in. The participants considered perspectives of a range of business stakeholders, including shareholders, business leaders, employees, contractors, and customers. The essential activity was agreed to be business viability of MUOC. Figure 1 illustrates the discussion canvas used in the WPI workshop highlighting the three paradoxes arising from six perspectives. Discussions were annotated in real time with sticky notes being placed near the relevant perspective. Note that each canvas segment emphasizes a wicked problem paradox pair.

The expert participants agreed that, viewed from a wide angle, the story of the oil industry has been a huge success. Over the last 100 years, the industry has grown to an enormous size, provided valuable and reliable product to hundreds of millions of customers, and returned unparallelled profits to shareholders. They also agreed that the current level of oil production cannot continue indefinitely. Oil and gas are finite resources, and their long-term unsustainability is increasingly acknowledged within the industry, but it is not an immediate concern. The current system satisfies the needs of investors and consumers, but also causes harm to these groups through boom-and-bust cycles, lock-in, and environmental pollution. There is a range of silver bullet solutions which have been proposed for the system, but the required scale and speed of change seems unfeasible in a business sense.

The discussion points surrounding the paradoxes are summarized in Table 2. A common theme that kept occurring in discussions about these paradoxes was the business model of the IOC. It was clear that the unsustainability of the system is an issue, but any step toward this felt unthinkable under the current business model. The heart of the wicked problem was agreed to be that the business model lacks capacity to seek novel opportunities that reduce oil production, meet customer needs, and generate income. The business model of MUOC then became the focal point for the InTIME Design Sprint. Overall, the WPI exercise was successful in enabling discussions about the system while preventing the dialogue from “getting stuck” by revisiting problems or restating arguments surrounding a single perspective or talking point.

4.2 Step 1 – history

The focal point identified in the WPI, the IOC business model, provides the key design requirement for the InTIME Design Steps 1–6. In Step 1 of the InTIME Design Sprint research on IOC history focused on instances of business model change. Five periods of historical business model tension and change were discussed. The forced break-up of Standard Oil by the U.S. Supreme Court in 1911 was the starting point. This court-ordered business model change in compliance with anti-trust laws stands as a monumental intervention into private enterprise to ensure fair business practice and the consumer benefits of competition. It is clear in hindsight that this intervention did not cripple the oil business (Dalton and Esposito, 2011). The post-WWII oil production boom, brought about by opening of the East Texas oil field, essentially flooded the market, risking the viability of oil producers. This period saw business model change which coupled production and price control through the Texas Railroad Commission, together with the Interstate Oil Compact domestic production cartel (Childs, 1991). The answer to over-production was mass consumption, and extra-market collaboration of vertically integrated majors and National Oil Companies (NOCs). Through the “Seven Sisters” era the business model centered on dominance, putting pressure on policy to grow demand while collectively managing supply chains and setting prices. The 1970s oil crises marked the end of the IOC dominance, with the beginning of the OPEC era and oligopoly – the global interplay of IOCs, big consuming countries (e.g. USA), and OPEC NOCs. The business model change in the OPEC era saw disintegration of vertical integration (e.g. selling retail and refining) and IOCs changed focus to exploration and asset development in the North Sea, Alaska, the Gulf of Mexico and other challenging environments (Roncaglia, 2015). The final and most recent period of business model shift was government-enforced reform triggered by man-made disasters, largely in challenging technical and oligopoly environments. The safety transition in the oil industry is a business model shift that balances value of life with shareholder value. The OPEC era put pressure on the old business models and led to internal cost-cutting pressures, which in-turn increased risks through negligent operations and insufficient or delayed maintenance (Okoh and Haugen, 2013).

The workshops discussed tensions that existed during previous periods, the drivers of the tensions, the effect on the industry, and any learnings that can be drawn from the period. The free but guided dialogue around the five historical periods identified the tensions in play, and contemplated the ways that IOCs would have perceived the dissonances and resisted change at the time. Participants concluded that IOC business models have changed in the past, and that none of these changes would have been welcomed at the time. In hindsight, the business changes imposed by regulation or external forces were managed in a range of ways that maintained income, shareholder value, and kept product flowing. The experts concluded that regulation is essential for driving and managing change. The systems perspective of history suggests that the current energy trilemma is not an insurmountable challenge. Workshop dialogue notes are summarized in the Appendix.

4.3 Step 2 – present setting

The setting for the IOC business has been impacted by recent events, creating a heightened sense of strain amongst the participating experts. The surge of the children's “Strike for Climate” environmental movement in 2018 created a wave of declarations of “climate emergency” being passed by 1,195 jurisdictions and local governments by 2019 (Salamon, 2019). A activist hedge fund secured three seats on the board of ExxonMobil, sparking fears of shareholder takeovers within the oil industry (Henisz, 2021). The “global stocktake” agreed at the recent COP28 included the language of “transitioning away from fossil fuel energy systems” (Burnett, 2024). The COVID-19 pandemic greatly impacted oil industry profits through significantly decreased oil prices and oil consumption, and oil price volatility lasting well over a year (Bandyopadhyay, 2022; Shi et al., 2022).

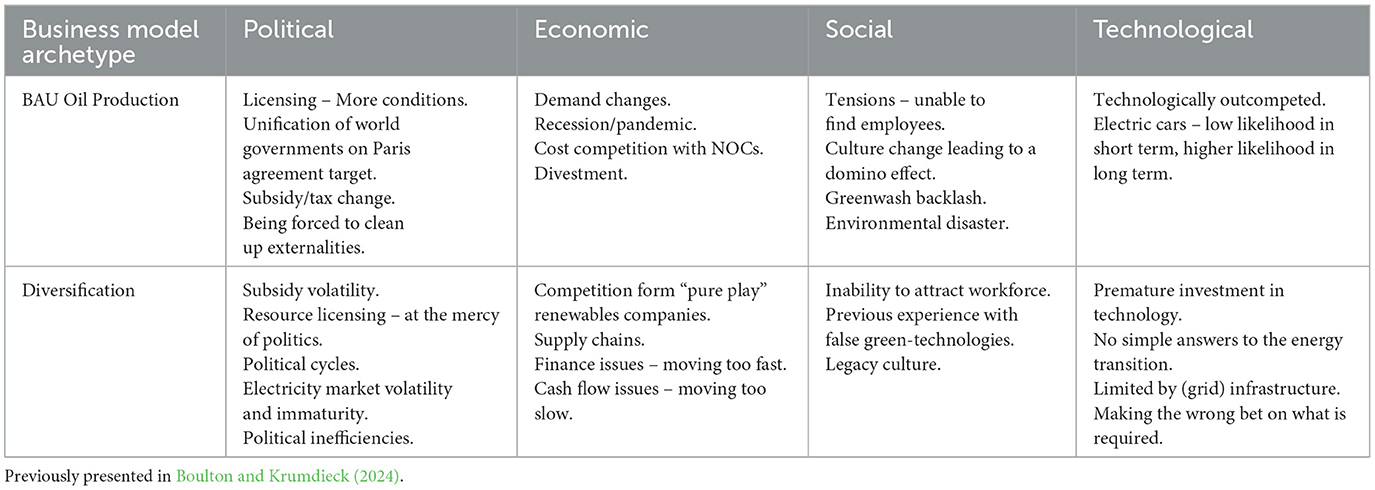

IOCs have increased their marketing and messaging about climate change but their scenarios and business models are still not aligned with climate-safe pathways (Shell, 2013; Tong and Trout, 2024). IOCs have pursued investments into alternative energy technologies, such as renewable energy generation, energy storage technology, and negative emissions technology (grouped here as energy transition investments), but these energy transition investments have declined in recent years. While these investments may appear as significant shifts in direction for an IOC, they are still relatively small in comparison to investment by IOCs in traditional oil and gas activities (IEA, 2020; Li et al., 2022; Midttun et al., 2022). Oil company climate strategies have been studied and differentiated by level of investment in renewable energy or associated green technology (Zhong and Bazilian, 2018; Pickl, 2019; Green et al., 2021). The classifications fall into two main business model archetypes, business-as-usual (BAU) and diversification. BAU has comparatively low, or non-existent, investment in energy transition assets, and is firmly committed to traditional oil and gas activities. BAU does include efficiency improvements in equipment and processes, and importantly, methane leak remediation and capturing natural gas rather than flaring. The diversification business strategy involves investment in energy transition assets while returns are highly reliant on traditional oil and gas activities. In recent years, there has been a noticeable shift from IOCs moving from diversification back to BAU oil production business models. This can be seen in oil majors abandoning interim transition targets and selling off energy transition assets (Bousso, 2023).

The workshop discussions with the industry experts provided context for the recent “green” business activities, and information about the state of the industry. Participants had experienced the atmosphere of increasing pressures to develop climate change targets and plans, while responding to pressures for high returns from shareholders. Participants agreed with the two business model archetypes, and all strongly felt that the diversification into biofuels, wind, solar, EV charging, hydrogen, and CCS were positive moves for their companies, and they were disappointed with companies that have made little to no diversification investments, such as North American oil majors ExxonMobil and Chevron. It was felt that the diversification strategy, and the marketing around it, helped to ameliorate some of the pressures, particularly amongst employees and new hires, public perception, and policy. Participants also acknowledged that the income from net zero ventures is not on par with the income from oil extraction. The participants had no knowledge of any initial investigations within their companies or others into reducing production as a business strategy.

4.4 Step 3 – future scenarios

There is limited literature on methods for engineering sense-checking of future business scenarios. Pierre Wack founded business scenario planning based on futurist thinking with a team at Royal Dutch Shell, starting with predetermined elements (e.g., things that have already happened) then purposefully considering different scenarios, assumptions, disruptions, and options through “re-perceiving” (Chermack and Coons, 2015). Scenario planning is understood to be a process of the mind, gaining insight and seeing future business strategy by working through five perception stages; “clutching at old realities, reasoning and emotion, reflection and inspiration, seeing and awakening and knowing and molding” (Patel, 2016). The Transition Engineering Step 3 approach is still developing but focuses on using analytical models to assess the trajectory of current scenarios and technology development plans against biophysical realities, and quantify future reduction of the unsustainable and harmful aspects of the wicked problem (Dale et al., 2012; Krumdieck and Page, 2013). The Step 3 analysis has some alignment with re-perceiving, aiming to gain collective agreement to move past current plans and strategies which have negligible likelihood of being feasible ways to resolve the pressures or resolve the wicked problem within the system constraints. Thus, the Step 3 in InTIME Design is referred to as “crash-testing” scenario assumptions. The method involves simple modeling to extrapolate business scenarios into the future, then comparing the resulting resource use to biophysical constraints and how the future pathway contributes to resolving some fundamental part of the wicked problem (such as the system's reliance on fossil fuel) (Ahrens et al., 2022, 2024). This is often initiated with “back of the envelope” calculations and utilizes further detailed calculations and modeling when required. This step can be informed by researching literature that performs similar calculations.

The two current business model archetypes, BAU and diversification, were investigated for Step 3 future scenarios. Initial attempts to “crash-test” these scenarios in the workshops struggled due to the range of hard to predict variables in a highly complex system such as the upstream oil market. The industry experts agreed that the BAU business model archetype would not result in climate-safe levels of oil production. However, there was no such agreement in the crash-testing of net zero investment options in the diversification archetype. Discussions focused on the relative likelihood of certain scenarios occurring, such as the prevalence of certain technology types, behaviors, or market structures. The industry experts often disagreed on the specifics of such scenarios, with the focus of the session inadvertently centring on these disagreements. These discussions were seen by all workshop participants as not contributing constructively toward the aim of the session. The workshop participants also pointed out that these disruptions were evidence of the dissonance in present in the system.

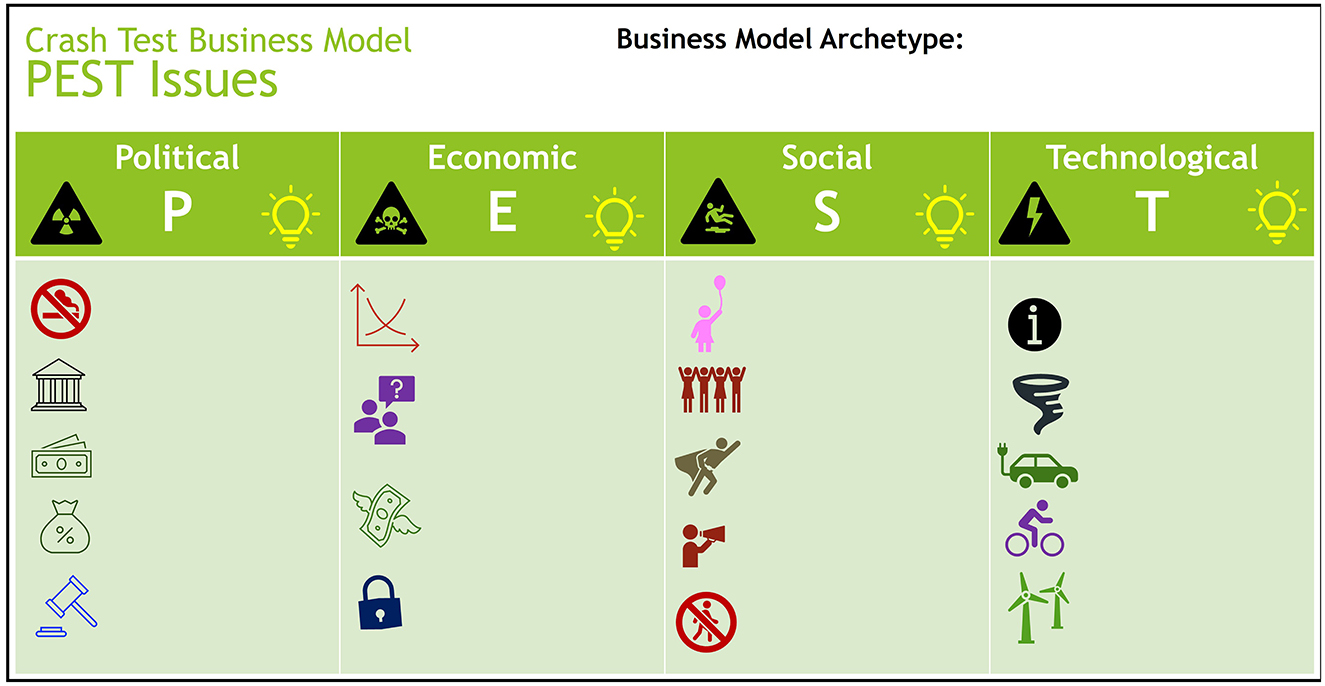

4.4.1 PEST analysis for future scenario crash testing

A PEST analysis tool was then employed to achieve the Step 3 objective of letting go of current solution thinking. PEST analysis is a common tool where risks and threats are identified and categorized under the prompt headings of “political,” “economic,” “social,” and “technological” (Aguilar, 1967). Using this more qualitative framework, the two business model archetypes were discussed into the future. Each business model was first assumed to be viable, and then the PEST prompt headings were used to brainstorm factors that could erode viability. Figure 2 presents the PEST analysis canvas used in the workshops and Table 3 presents the summarized results of the PEST analysis discussion points.

Figure 2. The PEST Analysis canvas used in the future scenario workshop. Note that a separate canvas was used for each business model archetype analyzed.

Table 3. PEST analysis discussion points for business-as-usual (BAU) oil production and diversification business model archetypes.

While the specific likelihoods of scenarios occurring had not been agreed, the qualitative process of walking through the range of threats to business viability allowed the participants to build up their own mental profile of the relative pressures associated with each business model archetype. The PEST analysis tool was successful in allowing the future scenarios to be visualized broadly against feasibility and viability without discussions stalling on debating the likelihood of certain scenario factors. Each workshop participant was confident that these two business model archetypes would not resolve the wicked problem. The industry experts expressed that they were now willing to move past these two business model archetypes and explore for business models that would resolve the wicked problem.

4.5 Step 4 – path-break new century

The method for Step 4 is still developing but involves first agreeing on the necessary condition for a successful future where the wicked problem no longer exists. Participants are then asked to mentally move 100 years from now in a “path-break” exercise to creatively brainstorm a future where the wicked problem no longer exists. The participants quickly agreed that the one necessary condition for a successful future was a climate-safe emissions pathway, such as the pathways consistent with the goals of the Paris Agreement. However, initial attempts to establish what a viable future might look like for the theoretical oil company were unsuccessful in the workshop setting with the industry experts. Issues similar to those in the previous step were experienced where the industry experts had contrasting views about the likelihood of certain scenarios occurring in the future. These contrasting, and often strongly held, views created much discussion, and while the discussion was civil and interesting, it was off-topic for the session which aimed to explore what a “successful” future would look like for this system. This was a further example of the dissonance seen in the oil supply system, and how dissonance can easily derail efforts to find an opportunity space in a wicked problem system. In this particular session, even the acknowledgment amongst participants that we were in a cycle of offtrack discussion, and the fact that we had managed to navigate such discussion cycles successfully in previous steps, was insufficient to return discussions to the primary objective of the session. One of the experts expressed that they were unable to imagine any realistic scenario where oil production declined in line with climate safety requirements. This viewpoint was confirmed to be shared by the other experts. As per the outcome of Step 3, the experts agreed that current pathways were insufficient to resolve the wicked problem, but the experts were unable to mentally break from these pathways to imagine a viable future, let alone achieve the main objective of generating ingenuity for path-break thinking.

4.5.1 Sandbox methodology

A “sandboxing” approach was adapted into the Step 4 exercise to aid the industry experts in breaking from current paths and designing a path-break future. The sandboxing approach used in this work is similar to the policy sandbox approach where a theoretical test environment is imagined and experimented with (Financial Conduct Authority, 2015). By creating this theoretical no-consequence environment, and by encouraging any type of ideas in a state of imaginative play, sandboxing allows for the generation and development of concepts that people may not have previously heard of or imagined. The aim of the sandbox is not to create predictions or solutions, but to facilitate higher levels of creativity and brainstorming than when discussing a real environment. A visual sandbox canvas was created depicting a literal sandbox with buckets and shovels to build imaginary constructs. The walls of the sandbox were agreed to be the bounds of the play area. The first step of the sandbox session is to set the “boundaries” of the sandbox, the hard constraints that the future must have. These boundaries include the design constraints, such as the future being “successful” and climate-safe, but participants can also agree on additional or more detailed boundaries to focus the design process. Setting these boundaries ensures that problem solving efforts point toward a future where the wicked problem is resolved. In highly complex systems multiple sandboxes with different additional boundaries could be conducted to ensure breadth of the overall exploration while keeping individual sessions focused. All discussion points, even if they are conflicting, are noted and summarized. The final step of the sandboxing session is to pull out learnings about the system from the constructed “sandcastle” and agree on the themes present in the discussion points.

In the sandbox workshop session participants were asked to imagine a theoretical future 100 years from now where the oil production had indeed followed a climate-safe pathway. Participants agreed that out of bounds would be currently unknown technologies and apocalyptic social or political collapse. Participants were then asked to figuratively “enter the sandbox” and describe the system they see. Different components of the activity system, such as the built environment, transport network, manufacturing sector, energy system, and need-meeting activities of the general population, were used as prompts to guide the workshop discussions.

4.5.2 Sandbox results

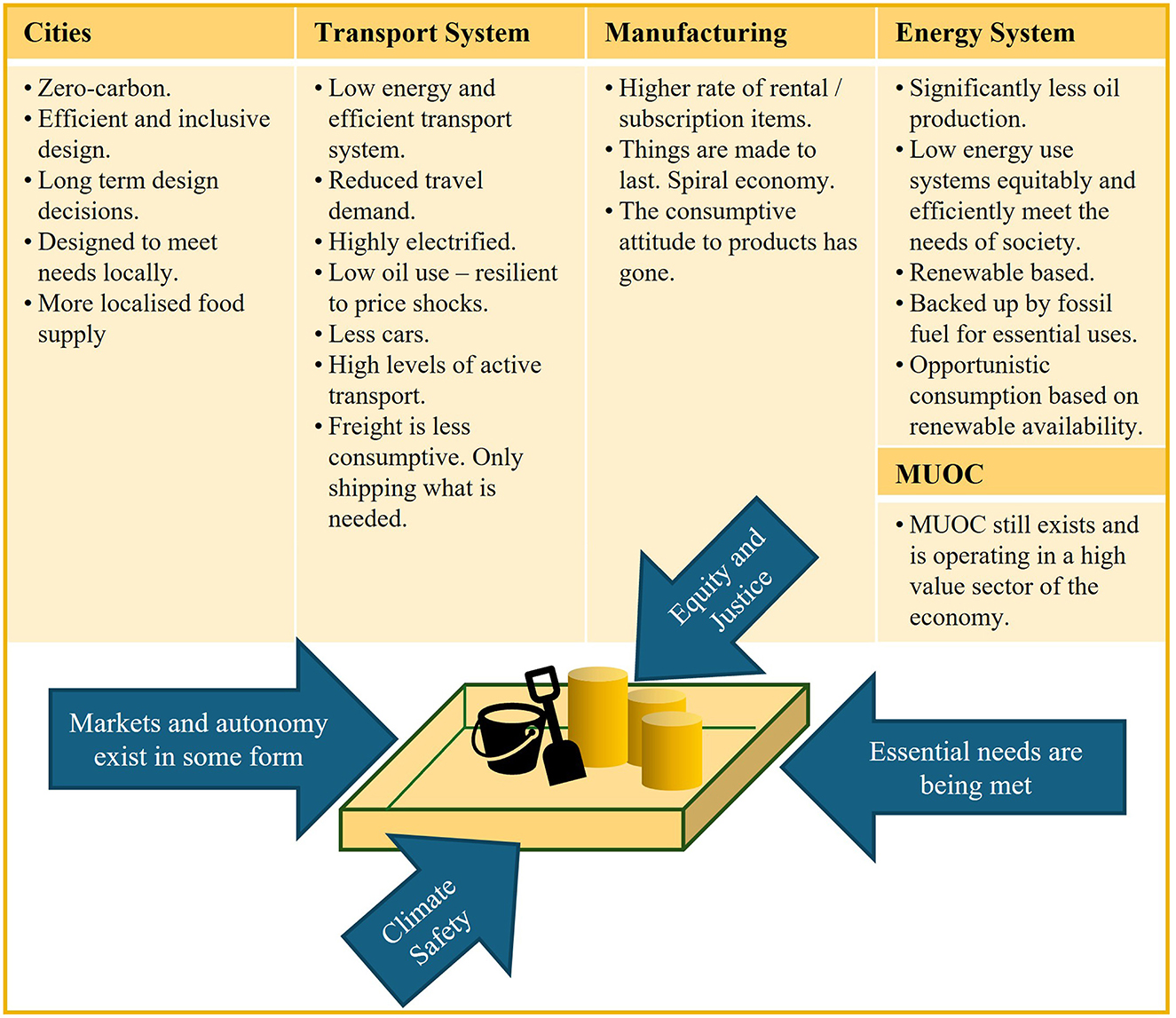

The sandboxing approach provided a fruitful and productive exercise, and resulted in a richly detailed path-break future system that could be used for the next steps. Figure 3 presents the summarized notes from the sandbox exercise with the industry experts. It is worth reiterating that a high confidence prediction of the future is not the intended outcome of Step 3 or 4 of the InTIME Design Sprint.

Figure 3. Summarized results of sandbox discussions with the industry experts as part of InTIME Step 4.

An initial set of sandbox boundaries were presented to the industry experts as a starting point for discussions. These included society's essential needs being met, law, order, and equity, and the environment being in a healthy state. These boundaries were slightly adjusted as experts discussed how they would like to focus this exploratory exercise until a consensus was reached. A boundary for “democracy” was expanded to “some form of autonomy exists” and the financial sector was further bounded with the inclusion of “no structural rewards for greed”. This led to the below list of boundaries for the sandbox, which are summarized by the four arrows in Figure 3.

• Global warming has been limited within a climate-safe range.

• A healthy environment and society exist.

• Science and engineering still exist and are valued by society.

• Fair governance institutions exist.

• Social equity and justice exist.

• Needs-meeting infrastructure exists to meet people's essential needs.

• Markets exist in some form.

• Individual autonomy exists in a culturally relevant form.

• There is no structural reward for greed.

Inside the sandbox, discussion largely fell within the categories of “cities,” “transport system,” “manufacturing,” and “energy system” as shown in in Figure 3. The industry experts agreed that in their theoretical sandbox 100 years from now, cities would still exist, but would look very different to today.

The sandbox cities were seen as being zero-carbon and with low energy demand. To achieve this, the industry experts saw these cities as needing to be well designed with a long-term view, efficiently organized, and designed to enable citizens to meet their needs locally. The experts also constructed these cities as being inclusive, where compact living and low energy use was planned in a way that would not disadvantage certain groups of the population. Common themes mentioned by the experts included the ability to live without a car and the presence of a more localized food supply network. References to 15-min city planning were often mentioned by the industry experts, e.g., being able to access essential services locally through active or public transport. There were conflicting suggestions about how a more localized food supply might be organized, such as whether it would be common to grow food at home or in community gardens. There was however agreement that people would not be entirely self-sufficient, and some form of farm network would exist that is well connected to local population hubs. Again, there were disagreements about how the agriculture systems would operate, such as the level of mechanization and automation, but common themes came up that agriculture would be efficient, low-carbon, more localized, and more seasonal.

There was a clear shared vision of the sandbox transport system being efficient, low energy, with reduced travel demand, low material consumption, and electric. To achieve this the industry experts saw the sandbox future as having few cars overall and a high level of active transport. For the remaining vehicles, there were conflicting thoughts on the dominant technology, whether all transport would be electrified, or whether a small number of fossil fuel powered vehicles would still exist to contribute to essential services. Freight shipping was viewed as essential, with an intermodal network that would be systemically organized and efficient. Long-distance freight would support essential needs by shipping goods that are valuable, necessary, transportable, and not possible to produce locally. One of the industry experts saw ships with slower shipping speeds to reduce energy consumption and another saw an end to the ubiquity of fresh produce being flown from all corners of the world all year round. There was agreement on the reduced role of air travel, but no agreement on the exact profile of this reduced role.

The sandbox manufacturing sector was imagined to be a link in a system. In this sandbox future, products are made to last, to be repaired, reused, and eventually recycled. People's attitudes to waste are different, not tolerating high levels of consumptive waste by design. An entirely circular economy was not deemed feasible (on account of energy constraints among other things), but an almost-circular or “spiral” economy was seen to exist in the sandbox. Subscription-based models for products were seen to be a factor that may encourage the longevity of products in their design and maintenance.

The society within the sandbox boundaries was imagined to function fairly, continuously adjusting to ensure environmental flourishing. The industry experts had common views that the energy system would have significantly less throughput of fossil fuels, be largely renewable energy based, and would be a low-energy demand system (e.g., operating with significantly less primary energy than most western societies are currently using). To fit within this low-energy and largely renewable energy system, the industry experts saw that energy use systems would be highly efficient, and society would be designed to make good use of intermittent renewable energy. The system would be equitable and energy use systems would be designed to ensure all members of society are able to meet their needs.

The sandbox energy system was agreed to be dominated by renewable energy technologies, primarily solar and wind power. There were differing views on the level and means through which this largely intermittent system was operated. Technologies discussed included grid batteries, hydrogen, biofuels, and some level of residual fossil fuel use. Another key difference between the visions of the industry experts was the level of fossil fuels and negative emissions technologies. Most of the oil industry experts saw no Carbon Capture and Storage (CCS) or Direct Air Capture (DAC) technologies present with none or very small levels of fossil fuel combustion. One oil industry expert saw relatively high levels of negative emissions technologies, encouraged through either a high carbon tax, or a “carbon take-back requirement” for fossil fuel producers, requiring producers to capture and store the emissions from their sold product. There was however, agreement from all industry experts that fossil fuel production had declined significantly.

When thinking about the role of the theoretical oil company MUOC in this sandbox future, there was a range of ideas from the oil industry experts, but some common trains of thought were followed. These thought chains included looking at the role MUOC may have in a significantly reduced oil sector, looking at how MUOC may diversify into other energy system roles, or how MUOC may switch to another non-energy system industry. Discussions focused on the industries that would have changed significantly in this sandbox and used these changes to theorize where MUOC may be operating and capturing value.

If MUOC was to remain in the oil industry once the industry had undergone a significant reduction in the throughput of oil, the oil industry experts saw the below examples as distinct business models which MUOC could occupy.

• Last man standing business model – MUOC could be one of the few remaining oil companies. MUOC might even be operating at a similar size to today depending on market share and oil price.

• Informed buyer of oil – in a future of reduced oil production, the cheapest or “best” oil might be being produced by a faraway NOC, but MUOC may be the importer and retailer of this easier to access oil.

• Oil grid operator – oil supply and consumption in the sandbox future could operate more like today's electricity grid (such as that of the UK) where there is a regulated and well-paid role for an entity to manage the supply and distribution of oil in an efficient manner.

• Petrochemicals – the primary use for the oil produced by MUOC could be in supplying feedstocks for the petrochemicals industry. These feedstocks could have a range of high value (and low quantity) applications in the sandbox economy.

The “last man standing” business model and the focus on petrochemicals could be seen as examples of the “BAU oil production” business model archetype for IOCs.

It was also suggested that in the sandbox future, MUOC may be occupying a role unrelated to oil, but still within the energy system, such as:

• Renewable energy provider.

• Electricity grid operator and/or retailer.

• Energy storage service provider – through technologies such as grid scale batteries or hydrogen energy storage.

• CCS service provider.

It was recognized that these are essentially the areas of interest under the current “diversification” business model archetype for IOCs.

It was also recognized that MUOC could have theoretically transitioned to any other sector in the economy. Discussions in this thought chain were focused on industries that are likely to have changed significantly in the sandbox and those roles in which MUOC's existing skill set may be best suited to. Roles discussed under this thought chain included:

• Transport system operator – MUOC taking a leading role in building and/or operating the low-oil and highly efficient transport system in the sandbox future.

• Large-scale engineering/project management firm–Much of what IOCs currently do involves large scale engineering projects. Perhaps in the sandbox MUOC has transitioned to performing engineering and project management services for non-oil systems.

A common theme that emerged for MUOC's potential role in the sandbox future was that of a system integrator, a role that ensures the efficient and successful operation of energy supply and end-use systems and the successful integration between system components, such as integration across a value chain. One industry expert saw this as a continuation of MUOC's current role in the oil supply system, where sometimes MUOC is the “doer,” conducting the engineering work, and other times they are “managing the doers”. The exact configuration of energy supply and use systems in the sandbox were seen as hard to predict, but experts saw that a systems integrator role would be an important and highly valued role in the sandbox future in order to achieve the high efficiency required. The industry experts saw that some form of rent could be charged for system integration services and that part of the wider picture for MUOC could involve owning the right infrastructure and land in the right places. The industry experts saw that a key capability for MUOC would be understanding the “energy or service whole system” and working out which role to play in this system to provide the best product and maximize their value and utilization of their skill sets and capabilities. This could involve one specific part of the system, multiple parts of the system, or in some cases the whole system. E.g., a combination of business models relating to oil and electricity supply, system integration, and the transport system. The oil industry experts also emphasized that adopting a long-term view would be important for MUOC in these roles.

The overarching theme to discussions about the role of MUOC in the sandbox future is that MUOC will be occupying a high value role within the economy. The range of suggestions for the role of MUOC in the sandbox future above are dependent on the industry or system component in question being of high value to the economy and containing high value capture opportunities for MUOC. For example, MUOC's involvement in the oil industry may be dependent on whether the residual amount of oil in the economy is being regulated for high value applications. If this small quantity of oil has high value applications, such as backing up essential services in a mostly renewable energy system, then the supply and management of that oil supply (and the wider value chain around it) could contain roles for MUOC that have high value-capture opportunities. If such high value applications for oil do not exist, then the oil industry experts saw MUOC as occupying a role in another high value part of the energy supply system or energy end use systems. The level of competition within a specific field was also discussed as a major factor influencing the ability of MUOC to find high value capture opportunities.

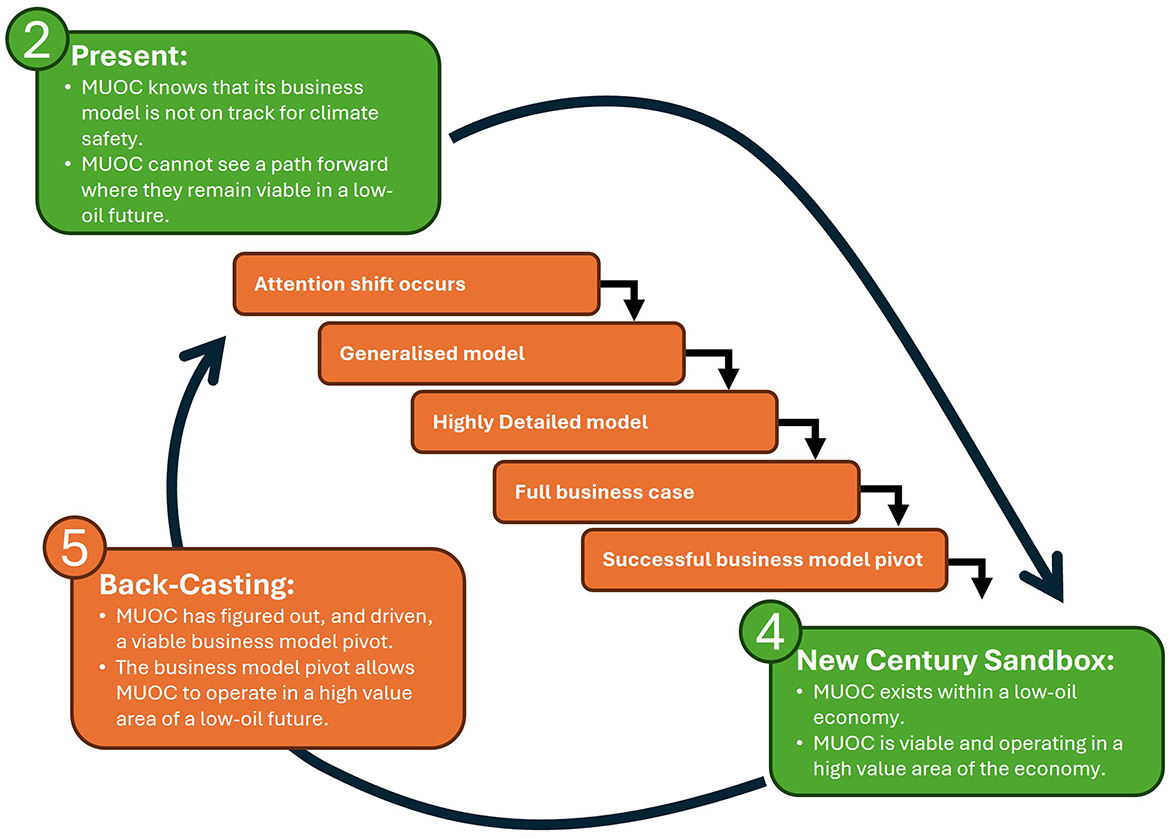

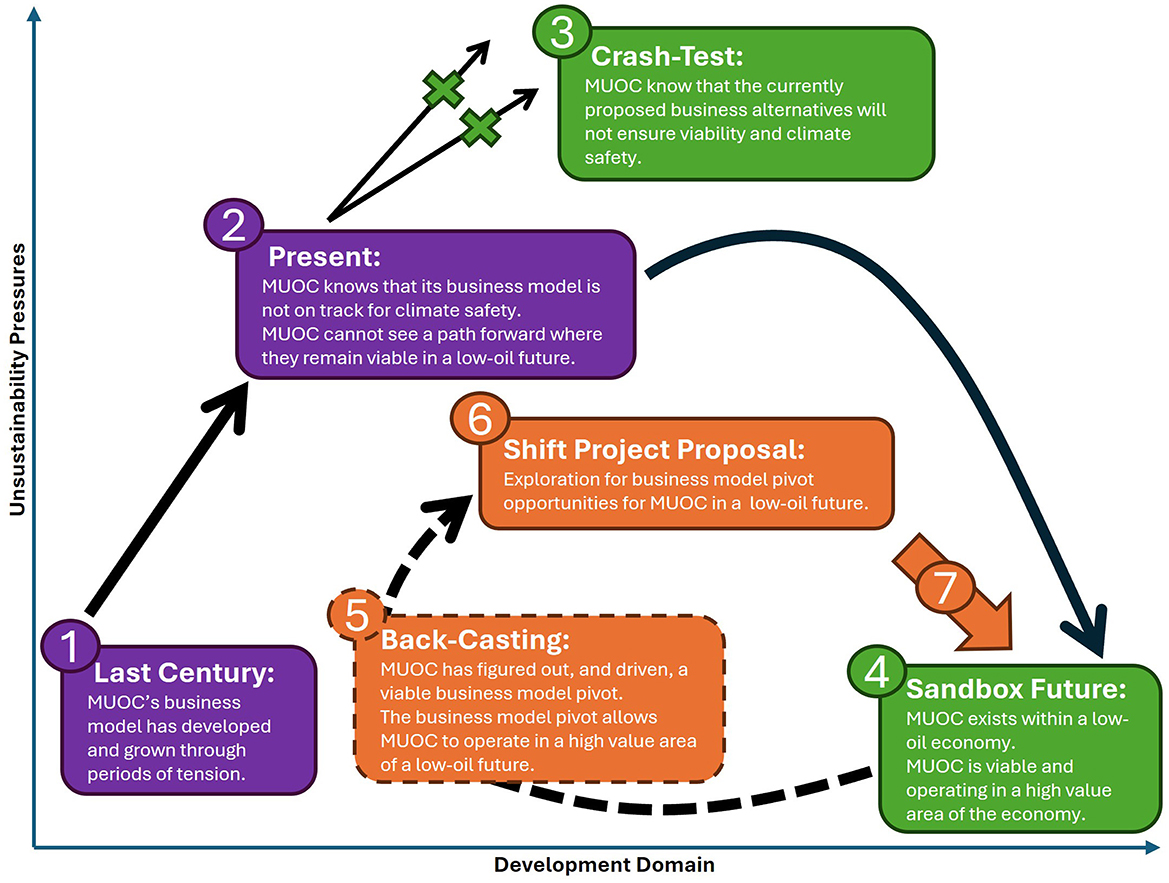

4.6 Step 5 – back-casting

Step 5 uses the re-perceptions generated in Step 4 and examines what the sandbox future has that current system does not have. The important difference between the InTIME Design back-cast and the conventional back-cast is that we are not setting a desired future and then looking at how that future can be attained (Robinson, 1982). This kind of linear thinking is antithetical to the invention space in which the inventor understands the predetermined elements, what is not possible, and how the necessary boundaries could be also a fertile opportunity space. We seek the inventive observation of the system-organizing element that makes the sandbox system work. That system element may exist in some form in other systems currently and could be borrowed or adapted. Or the system element may be entirely novel. Once the missing system element is identified, the back-casting step seeks a trigger that could underpin the invention, development, and commercialization (Krumdieck, 2019). The combination of the results from the InTIME Design Steps 3–5 represent the foresight of an opportunity space generated for IOC futures, demarcating an operating environment for an IOC that is profitable and feasible within a future that is climate safe and socially acceptable.

One of the key system elements in the low-oil sandbox future, is the business model of MUOC. It was decided in the sandbox session that MUOC would be occupying a high value role in the economy. The sandbox exercise gave some insights into how a low-oil future may operate and some suggestions for MUOC's role within this low-oil economy. However, when looking from the perspective of today's system, there are huge unknowns, and we cannot see what this specific role would look like or the specific pathway toward it. The industry experts expressed in previous steps that from the perspective of MUOC, they knew the current business model options would not result in a climate-safe future and yet they could not see another pathway where MUOC remained viable in a climate-safe low-oil future. This is the exciting invention space.

When comparing the MUOC envisioned in the sandbox (capturing value within a low-oil economy) to the MUOC of today (unable to see a low-oil future where the company remains viable) participants agreed that important changes have occurred. It was decided that the key attribute of the sandbox MUOC that is not seen in the current MUOC is that the MUOC in the sandbox has figured out what we cannot currently see. The outcome of the back-cast is that the sandbox MUOC has figured out what a successful low-oil future looks like, what a high value capture business model for MUOC looks like within a low-oil future, and how MUOC can drive the transition toward this reality.

The workshop continued with imagining the trigger and cascade of events for MUOC to develop the novel systems-element of a low-oil business model. The trigger list is not intended to be a full transition plan, instead it aims to provide a high-level appreciation for the many stages required to deliver a large scale business model change in a complex system. The proposed sequential list of triggers below starts with an attention shift of MUOC decision makers and concludes with the successful implementation of a business model pivot.

• Decision makers at MUOC have their attention shifted to the possibility that a successful future exists where the enterprise remains viable through production decline. Decision makers at MUOC are willing to commit resources to explore for this opportunity.

• MUOC have a generalized model which provides them with an understanding of the general dynamics of a viable future and their role within it. The generalized model also provides MUOC with a gauge for the size of the opportunity that exists which motivates further commitment of resources.

• MUOC have a highly detailed model of a specific business model pivot in a specific economy. The highly detailed model conveys specific implications, risks, and opportunities associated with the pivot.

• MUOC have a full business case for their business model pivot.

• MUOC execute a successful business model pivot. MUOC have realized a high value capture business opportunity in a low-oil future.

Figure 4 summarizes the back-cast showing how the details relate to InTIME Design Steps 2 and 4. Note that the spatial positions of the boxes in Figure 4 match the positions of these steps in the InTIME Design approach (see figure 2 in Ahrens et al., 2024).

4.7 Step 6 – shift project concepts

Research to support the shift project concept generation focused on historical or modeled business model shifts involving value capture from strategic peak and decline of the mainstay product. The oil industry-related literature around energy transition brought up the themes we have already discussed and showed that there is little evidence in literature for the type and scale of IOC transition envisioned in the sandbox future. A recent global survey of oil industry workers by Perrons et al. (2024) shows that the current oil industry view of innovation fits largely into what is described as BAU in this work e.g., improved efficiency, circular economy applied to decommissioning, and lower scope 1 & 2 emissions through technology innovation. Other literature discusses oil companies purchasing renewable and net zero technologies (Al-Fattah, 2013), but this is seen more to “cover all bets” than as a business model shift. Business model innovation, sustainable business model canvas, and circular economy in relation to oil production have been used to look at decommissioning rather than reducing exploration and new asset development (Basile et al., 2021). Outside the oil industry, there are examples of companies that followed a new strategy, but none of these involve purposefully constraining their core product to drive demand for their new product (Ludwig, 2023).

Undertaking a novel low-oil business model shift as indicated by the back-cast would be a colossal undertaking, requiring a large commitment of resources and unprecedented access to company knowledge. This undertaking would likely require a transdisciplinary team and direct collaboration with an IOC. As researchers, we can explore this unknown possibility using data, modeling, and visualization. Here, we present a shift project concept that provides the prospective evidence needed to start the undertaking. The shift project explores the transition opportunity for MUOC, where a viable low-oil future is also an optimal business strategy. Additional work around this shift project is also framed up. Finally, the shift project concept was presented to the oil industry experts for their review and reflections.

4.7.1 Shift project concept – toy model for prospecting

The shift project concept is to understand the customer needs of a low-oil future and reimagine investments for MUOC to capture value by providing those needs. To do this, the concept is to build an engineering toy model (ETM) of systems in a theoretical economy currently supplied with oil products by MUOC. An engineering toy model is an abstract and idealized version of a complex system (Reutlinger et al., 2018). ETMs are constructed with artificial data, but can be powerful tools to understand a system and system dynamics (Nguyen, 2020). The ETM can be used to experiment with low-oil transitions and value capture opportunities for MUOC. For the first stage of this model, the outcome is not expected to be a full business case, but rather the conceptualization of an inventive business model innovation and an understanding of the scale of potential value capture opportunities. The initial proposition is to develop this ETM for a hypothetical island economy where MUOC is the sole oil provider. This ETM shift project concept could be a revolutionary re-perception for IOCs to explore where no one has gone before – business model pivot opportunity that creates climate-safe future operations.

4.7.2 Participant verification of the shift project concept

The proposed shift project concept of building the ETM for a hypothetical island country where MUOC operates as a NOC, but collaborates with IOCs, was presented to the oil industry experts. The oil industry experts expressed that they saw value in pursuing the proposed shift project concept and urged the authors to continue its development. The oil industry experts said that they were eager to continue supporting the ETM development and the next stages of the shift project. The oil industry experts were also highly supportive of plans to develop a formalized attention shift process for oil industry strategists, citing the importance of their own attention shift during the sprint.

Figure 5 presents a high-level summary of the InTIME Design Sprint results for the theoretical “Mock Upstream Oil Company” (MUOC) that was the subject of the series of workshop discussions with oil industry experts. The spatial layout of the steps relates to their position in the original InTIME Design approach figure (see figure 2 in Ahrens et al., 2024) and indicates the relative degree of unsustainability in the system over time. The participants agreed that the InTIME Design Sprint was significantly different from any strategy or visioning exercise they were familiar with. Reflecting on what they thought was possible, and what their attention was focused on at the start of the process, the experts agreed that they have arrived at a turning point at Step 6 that has shifted their perception.

Figure 5. High level overview of the InTIME Design Sprint results from the perspective of the theoretical IOC ‘MUOC'.

Step 7 is a foresight exercise that analyses system interactions like regulation and stakeholder responses as the business model pivot is undertaken. This paper did not have a workshop on this step.

4.7.3 Ask from the participants – attention shift process for IOC decision-makers

At the start of this InTIME Design Sprint, the oil industry experts were unable to conceive of a low-oil future for an IOC. By the end of Step 4 all oil industry experts were actively contributing to a positive foresight of an IOC's role within a viable low-oil future. The oil industry experts experienced a mindset shift and moved past the existing dissonance to a stage where they were able to generate this positive foresight. A further proposal of work to follow this sprint is the development of a formalized process which replicates, and improves on, this mindset shift to the possibility of an opportunity existing for an IOC within a viable low-oil future. The intended audience of the process would be decision makers at an IOC and the process should aim to move participants past the dissonance of current strategies and toward the development of viable low-oil futures. The development of such a process could build upon the structure of the InTIME Design Sprint used in this work, e.g., exploring the historical story and present state of the business model to generate collective system understanding, and exploring the future limitations of current strategies to re-perceptually move beyond them. Building on the success of the attention shift achieved in this sprint, the formalized attention shift process could be treated as a new InTIME Design tool and used for engaging with new stakeholders in the oil industry.

5 Discussion

5.1 Discussion of sandbox results

During the sandbox session, each participant built up a re-perception of a future that fit within the sandbox boundaries. These profiles included some must-have conditions to satisfy the boundaries, and a range of ways in which the activity system may operate within the conditions. The re-perceptions of each participant were not exactly the same, but common themes emerged from the discussions around them. The main outcome of this exercise is not only the common themes (summarized in Figure 3), but the fact that the oil industry experts were working on the design of a viable future at all. Before the use of the sandbox tool, the oil industry experts were unable to imagine any viable role for MUOC within an equitable and climate-safe future, which prevented them from working on the path-break design of this future. The use of the sandboxing tool was successful in breaking through the dissonance surrounding IOC futures, facilitating ingenuity generation by presenting plausible problems, and allowing the oil industry experts to break from current path biases and begin work on an opportunity space for IOCs in a climate-safe future.

In general, the industry experts were less confident in their ideas for the role of MUOC in the sandbox compared to the other discussion categories. E.g., the experts were more confident in their general vision of the sandbox future than they were for the specific role of MUOC within that sandbox future. A reason for this may be that the role of MUOC has an extra degree of freedom relative to the other categories, where the first degree(s) of freedom are the assumptions made about the built environment and economy of the future, and the second degree of freedom is the role that one entity occupies within that future. This may also explain the issues encountered when trying to “crash-test” the future scenarios of IOC business model archetypes in Step 3. Any ideas about the viability of MUOC's chosen business model not only rely on the assumptions made concerning the second degree of freedom (the niche MUOC occupies) but also rely on the assumptions made about the first degree(s) of freedom (the built environment and economy that MUOC exists within). In Steps 3 and 4, the qualitative tools of PEST analysis and sandboxing proved highly valuable in navigating discussions involving these complex and interdependent sandbox concepts. PEST analysis and sandboxing tools, used as part of InTIME Design for the first time in this work, are promising additions to future Transition Engineering work.

5.2 Transitions in existentially threatened industries

The authors are unaware of any other oil transition literature which uses participatory design processes to explore for strategies that resolve the dilemma of business viability and production decline. However, the learnings of this design sprint align with learnings from successful and unsuccessful transitions in other industries where the core product is existentially threatened. Strategic analysis of transitions in the photography and chemicals industries echo the importance of being able to move past the current business model in the process of purposefully exploring for business viability in a future where the core business declines.

The downfall of Kodak is often presented as a textbook example of a company failing to adapt to a new technology, but the main barrier to transition for Kodak was one of culture and not of technology (Hess, 2014; Prenatt et al., 2015; Anthony, 2016). Kodak had a very profitable business model built on high margins from film sales and chemical imaging. Kodak were also early movers in digital camera technology, investing heavily in research and development. Crucially, Kodak was unwilling to move past their historic business model and often attempted to make the new technology fit into the old business model, for example, hoping that digital cameras would result in a growth of photo printing (Prenatt et al., 2015; Anthony, 2016). Kodak were unwilling to accept that their historically very profitable core business product would decline and were unable to move past their current business model to explore truly disruptive futures.

Another industry which had an unsustainable core product was the CFC (chlorofluorocarbon) industry. DuPont was the largest producer of CFCs when their ozone depleting properties were brought to the forefront of public concern in the 1970s and 1980s. DuPont were able to look beyond their staple product, accept that it would decline, and use this transition as a way to secure a better strategic position for themselves in the long term. DuPont were heavily involved in the development of the Montreal Protocol which led to the worldwide phase out of CFCs in favor of HCFCs (hydrochlorofluorocarbons). DuPont not only saw an opportunity to sell a higher profit product, but the new regulated market for HCFCs favored larger producers, which squeezed out smaller competitors and resulted in DuPont gaining a larger market share (Maxwell and Briscoe, 1997). For the CFC transition, a profitable substitute product without the same unsustainability pressures was already available. For this reason the CFC transition is not entirely identical to the transition currently facing oil companies. However, the actions of Dupont during the CFC transition provides an example of how an organization can accept that their product will decline and play an active role in enforcing the decline of the unsustainable product in a way that presents a strategic opportunity for their business.

5.3 Implications

The work in this article takes on the monumental problem of climate safe strategies in the oil industry through the wicked problem of dissonance surrounding IOC futures. The InTIME Design Approach methodology was applied through a design sprint with oil industry experts and was successful in moving the sprint participants beyond the system dissonance. The participatory design sprint also facilitated the design of an opportunity space for IOCs, a bounded range of possible futures for IOCs which meet the requirements for climate safety, technical feasibility, and social acceptance, while also representing profitable business pivot opportunities. A shift project is then presented to explore this opportunity space. This shift project is a real project that an IOC could invest in to further explore business pivot opportunities which are consistent with the production decline required for climate safe pathways.