- College of Economics and Management, Huazhong Agricultural University, Wuhan, China

The China-Pakistan Economic Corridor (CPEC) with the objective of enhanced infrastructural development, trade cooperation, and regional economic prosperity is a pivotal project. This study investigates the patterns and prospects of CPEC on vegetable exports in Pakistan. We analyze a panel dataset of Pakistan's vegetable export destinations countries from 2003 to 2021. We preferred the Poisson Pseudo Maximum-Likelihood (PPML) as the state-of-the-art technique in the trade gravity framework for estimation. The findings revealed that Pakistan's economic activities with the countries linked with CPEC have grown. The total length of the road as a proxy of road infrastructure is a key factor in determining Pakistan's vegetable export performance. The importer countries' GDP and the legacy of colonial links also enhance Pakistan's vegetable export performance. Distance, contiguity, and language negatively affect Pakistan's vegetable exports. Additionally, rising domestic vegetable consumption has reduced export capacity while increasing imports. Moreover, we also found an inverse relation of vegetable exports to the countries that were part of Pakistan in the past. Finally, based on the findings of our estimates we put forth suggestions to respond to the vegetable trade deficit of Pakistan.

1 Introduction

The China-Pakistan Economic Corridor (CPEC), is known as the most ambitious project of the 21st century partnership between China and Pakistan (Hassan, 2020; Ahmad et al., 2024). CPEC links western parts of China to Pakistan's Gwadar Port. The geographical coverage of CPEC also includes Afghanistan and Iran (Escap, 2021). Launched in 2013, the project is divided into three phases with goals set for 2030. In the first phase spanning 2015–2022, CPEC priorities are the infrastructure, the port's development, and the energy sector. In the second phase spanning 2021–2025, CPEC brings efforts to revive the information and technology, industrial sector, and agricultural sectors, and develop Special Economic Zones in Pakistan. The road infrastructure spanning over 3,000 km is an integral part of the corridor by shortening the distance for trade. The economic corridor leads to alleviating poverty, expanded trade, and economic integration (Ullah et al., 2018; Rahman et al., 2021). The past decade has aroused tremendous debate, with a primary focus on the global economy, strategic relations, and geopolitics (Don McLain, 2019; Hussain and Jamali, 2019; Khan, 2020). However, one aspect that deserves a comprehensive investigation is its impact on agricultural trade performance (Irshad and Anwar, 2019; Asghar et al., 2021; Wen and Saleeem, 2021; Yar et al., 2021).

Globally agriculture significantly contributes to maintaining food stability and economic growth (Pawlak and Kołodziejczak, 2020). According to the Pakistan Economic Survey, 2022–2023 agriculture sector accounts for around 22.9 proportion of the GDP and contributes to the country's employment by creating 37 percent engagement (GoP, 2022-23). Pakistan's agriculture sector also contributes to food availability and supports the industrial sector by providing them with raw materials. This highlights the agriculture sector as the key area for growth, development, and economic reliance.

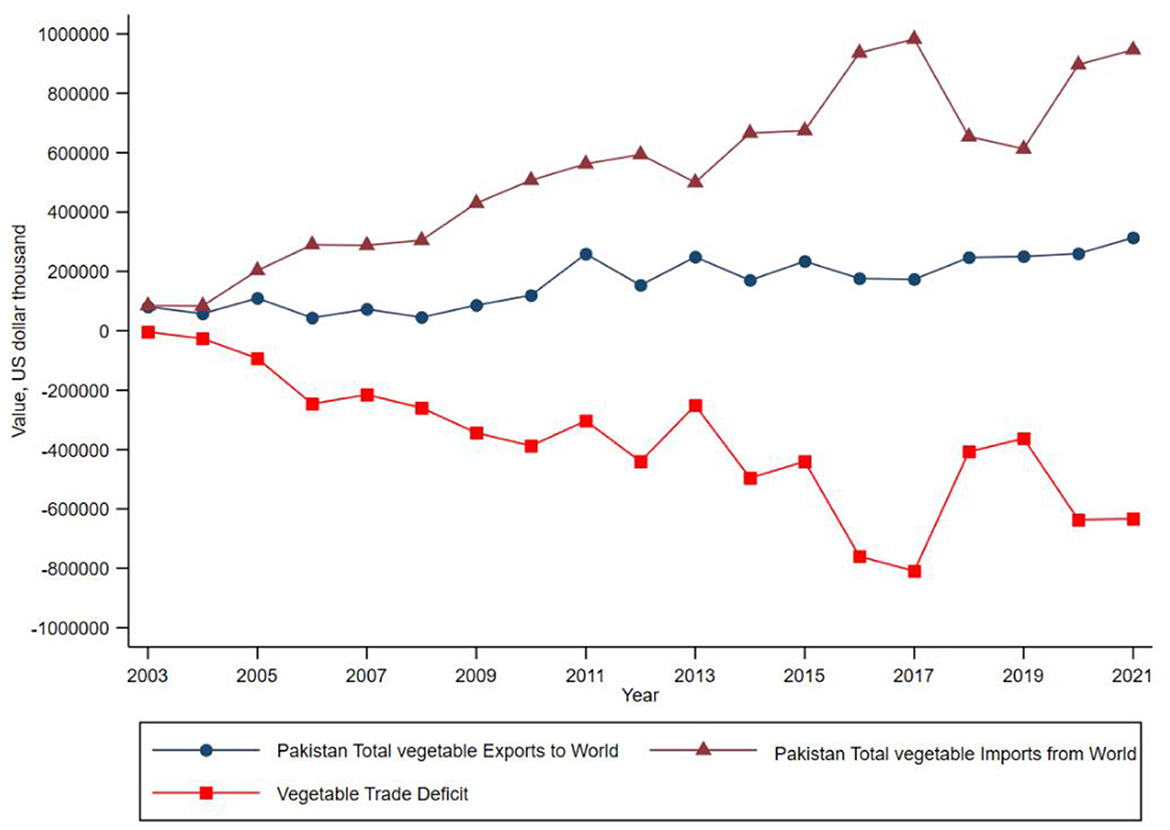

As of 2022, Pakistan has ranked as the 5th largest populated country with a population growth rate of 1.9 percent annually. The crops sector is of prime importance for feeding the 235.8 million population of the country. Among crops, vegetables with a diverse range of cultivation and being grown on small landholdings are of great importance in the agricultural sector of Pakistan (Khan and Chen, 2024). As of 2021, in Pakistan, vegetables are cultivated on 0.26 million hacter land with production of 4.3 million tons. Onions, tomatoes, and potatoes contribute 65 percent to the total annual production of vegetables (GoP, 2022). Despite the agriculture sector sustains Pakistan's economy, the vegetable sector faces a trade deficit in the international market (see Figure 1). Poor infrastructure for transportation, storage, and processing and the famine of knowledge about the markets are the key factors that undermine the performance of Pakistan's vegetables in the global market (Azam and Shafique, 2017).

Figure 1. The line graph illustrates the annual trend of Pakistan's vegetable exports, imports, and trade deficit in USD thousand from the year 2003 to 2021, based on data from ITC, Pakistan Bureau of Statistics, and authors' estimations.

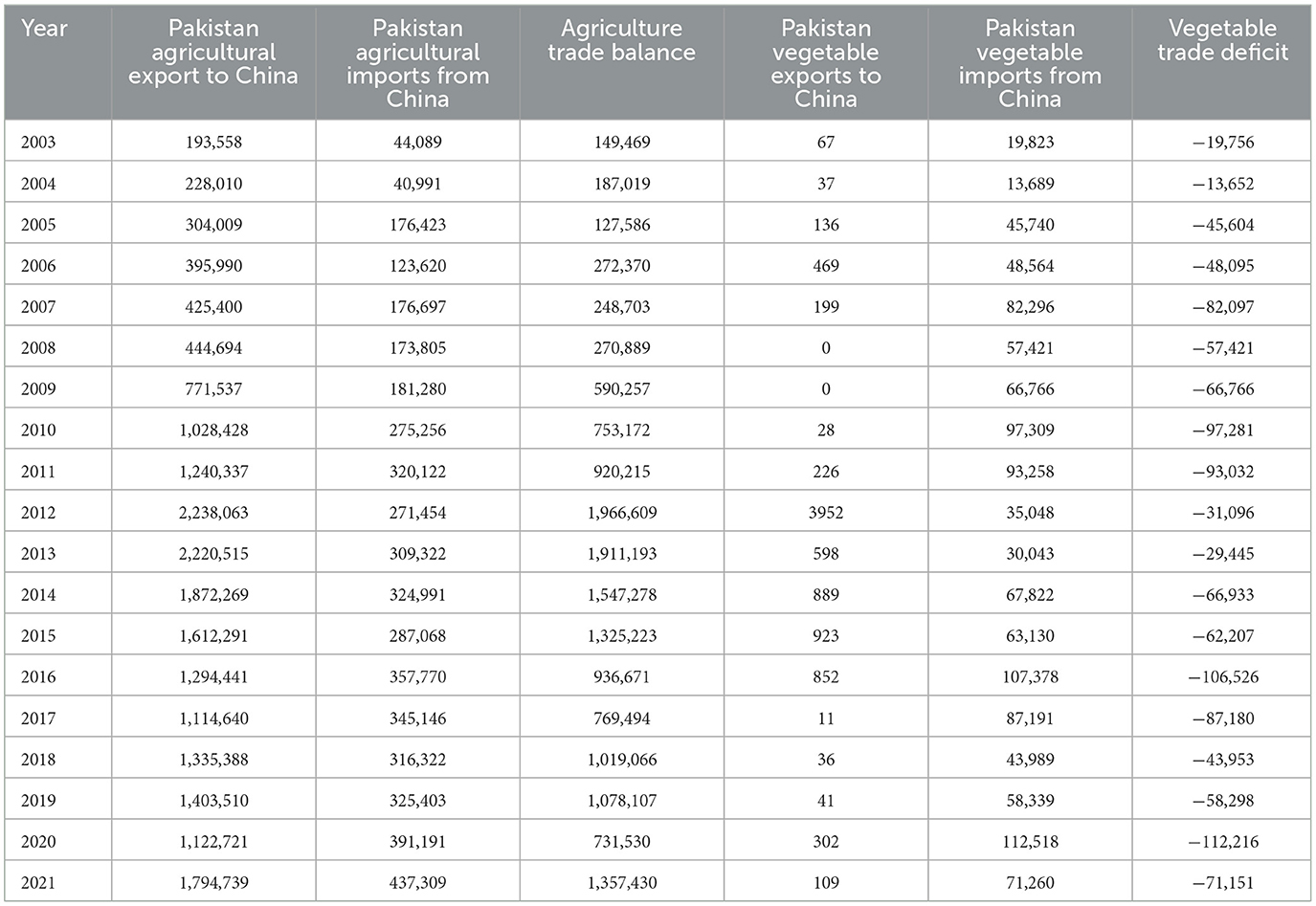

International trade leads to a prosperous economy and serves as a source of foreign exchange earnings (Frankel and Romer, 1999; Makhmutova and Mustafin, 2017; Khan et al., 2020). When it comes to Pakistan-China, China is not only Pakistan's very close ally but also the largest trade partner (Khan et al., 2024). China stands as the second top export destination of Pakistan (TDAP, 2022). Table A1 (Appendix) presents Pakistan's agricultural and vegetable dynamic with China. Pakistan's agricultural exports to China experienced tremendous growth during the period from 2003 to 2021. Pakistan's agricultural exports surged from 193,558 thousand US dollars in 2003 to 1,794,739 thousand US dollars in 2021, marking an 826% increase. Agricultural imports from China at this period also show substantial growth. Although, the overall trade trend is increasing and positive. However, the share of vegetable exports to China is tiny. The vegetable exports have grown from 67 thousand US dollars in 2003 to 109 thousand US dollars in 2021. At the same time, Pakistan's vegetable imports from China have also grown rapidly resulting in the trade deficit. Although China shares a border with Pakistan most of the trade activities rely on sea routes, which are not only costly but also time-consuming. The CPEC infrastructure is likely to reduce both shipping time and carriage costs leading to an increase in bilateral trade (Ali et al., 2022). The new route of CPEC from Kashghar, China to Gwadar will reduce the distance by about 80 percent (Shaikh et al., 2016; Lee et al., 2018). This will also enable Pakistan to export previously uncompetitive perishable agricultural harvests to the Chinese market. In the nexus of CPEC and trade, investigating the influence of CPEC on the agriculture industry in Pakistan is very important.

In the past decade, a vast literature about CPEC mainly focused on the global economy, strategic relationships, and geopolitical issues. For instance, Hali et al. (2015); Hussain (2017); Ahmed (2019); Don McLain (2019); Hussain and Jamali (2019); Khan and Liu (2019) addressed economic development in Pakistan, regional dynamics, geopolitical issues, and challenges of the CPEC. Ali (2018); Ali et al. (2018); Raza et al. (2018) studied the power and energy sector covered under the CPEC project. They determined that CPEC will help address Pakistan's energy shortfall. Boyce (2017); Garlick (2018) highlighted the economic, geographical, and security vulnerabilities confronted by CPEC in connecting China to the Indian Ocean. A major portion of the existing works places minimal focus on the CPEC and agricultural nexus, especially trade in perishable agricultural products.

We explore the contribution of the multi-billion-dollar CPEC on agricultural trade to fill this research gap. The enhanced road infrastructure under CPEC will reduce the trade cost and travel time to approach the Chinese market as well as other international markets. Thus, we will specifically investigate the transformative contribution of CPEC and road infrastructure to the vegetable exports of Pakistan. We will also examine the factors that determine the vegetable trade deficit.

This study has immense contribution in the following manners. First, to our knowledge, this is among the very first studies that evaluate the CPEC and agricultural trade nexus with a commodity-specific approach by addressing vegetable trade. Second, we utilize the total road length data of Pakistan as a proxy of the road infrastructure to find the effectiveness and implications of enhanced road infrastructure on the perishable agricultural produce of Pakistan (vegetables). Third, this study gives insight into the possible drivers that lead to Pakistan vegetable's trade deficit in the international market.

We structure this piece in the following manner. In section 2 of this article, we extend an overview of Pakistan's agricultural exports and discuss recent literature. Section 3 offers comprehensive pieces of information on the research approach and data utilized in the study. The results are given in Section 4. A comprehensive discussion of the findings is presented in Section 5 while Section 6 concludes the findings of the study.

2 Overview of Pakistan's agricultural exports

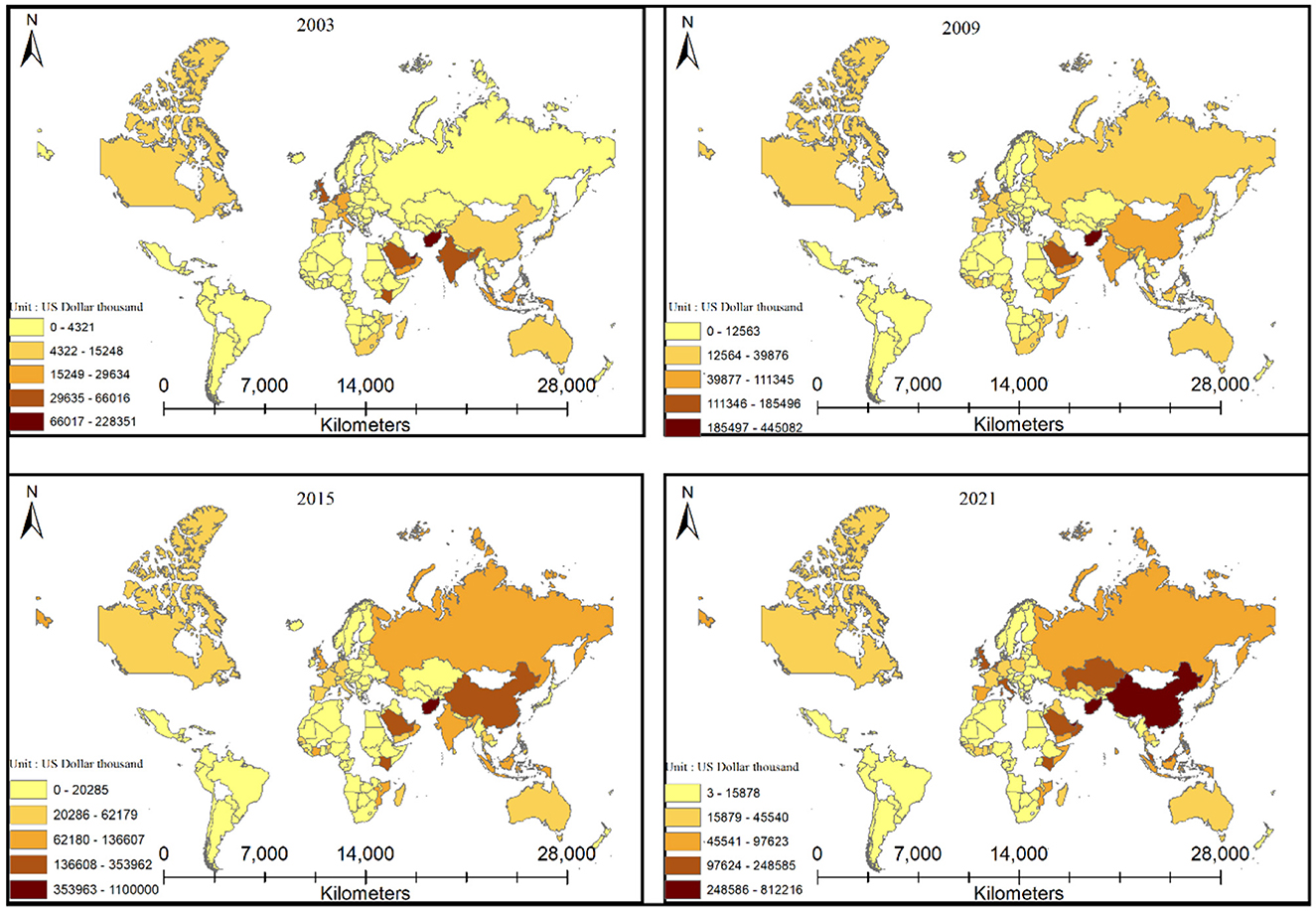

Pakistan exports agricultural commodities to a variety of countries, each contributing distinctively to its overall export volume. Pakistan agricultural exports in Figure 2, for the years 2003, 2009, 2015, and 2021 reveal an interesting trend in export destinations. One noticeable pattern is the increasing prominence of China as a destination market for the agricultural exports of Pakistan. The rising demand for Pakistan's agricultural harvests in the Chinese market, trade agreements between the two nations, and China's economic growth and development are all contributing causes to the rising export volumes to China. This pattern highlights how crucial China is as a market for Pakistan's agricultural produce and the necessity of ongoing cooperation and market presence in the rapidly expanding Chinese market. The statistics in Figure 2 clearly show a substantial growth in exports to China during the study period. The agricultural exports to China expanded from 8,923 (US dollars thousand) in 2003 to a staggering 812,216 (US dollars thousand) in 2021. This exponential growth highlights China's advent as a major destination for the agricultural produce of Pakistan and signifies the strengthening trade relationship between the two countries.

Figure 2. Map shows the distribution of Pakistan's agricultural exports to destination countries in 2003, 2009, 2015, and 2021. Data from ITC, based on the Pakistan Bureau of Statistics, is presented in USD thousands. Export values are indicated by color intensity, with darker shades representing higher export volumes (Basemap from Esri Garmin Map created in ArcMap 10.8).

Apart from China, other noticeable changes in export destinations include significant increases in export volumes to countries like India, the United Arab Emirates, and the United States. The agricultural export for these countries also observes a notable rise over the years, indicating a diversification of export markets for Pakistan's agricultural products. There are also shifts in regional trade patterns, Southeast Asian countries and the countries in the Middle East are emergent key destinations for Pakistan's agricultural produce. The observation reflects a strategic focus on expanding trade in these regions, possibly driven by growing demand, favorable trade agreements, and economic development in these countries.

2.1 Composition of agricultural exports from Pakistan

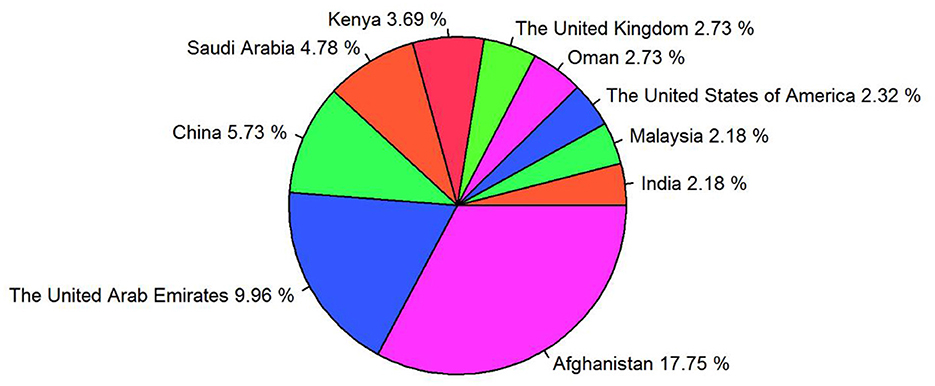

Figure 3, presents the percent contribution of the 10 key export destinations of Pakistan's agricultural produce from 2003 to 2021. Malaysia and India each account for 2.18% of the exports, indicating a tiny, yet consistent share of the total export volume. The United States of America has a slightly higher share at 2.32%, reflecting a marginally larger demand for agricultural products from Pakistan within its extensive market. Oman and the United Kingdom both contribute 2.73%, which highlights equivalence in their import volumes and a moderate, stable demand. Kenya stands at 3.69%, showcasing a distinct footprint in the agricultural import market in East Africa. Saudi Arabia's contribution at 4.78% signifies a higher demand in the Middle Eastern region, underpinning its role as a significant trading partner for Pakistan's agricultural exports.

Figure 3. Pie chart presenting Pakistan's top 10 agricultural export markets by percentage from 2003 to 2021, based on ITC data from the Pakistan Bureau of Statistics, with estimations by the author.

Further highlighting the regional demand distribution, China accounts for 5.73% of the agricultural exports from Pakistan. This substantial volume underlines China's considerable import capabilities and the two nation's solid bilateral ties. The United Arab Emirates (UAE) holds a significant portion of 9.96%, emphasizing its strategic position as a major hub for re-exports and consumption within the Middle Eastern market. Dominating the agricultural export destinations is Afghanistan, with a remarkable 17.75% share. This high percentage indicates an exceptionally strong bilateral trade relationship and a vital dependency on Pakistan for agricultural supplies. This diverse distribution of export percentages underscores the strategic significance of each market and reflects Pakistan's capacity to cater to the varying demands of different countries.

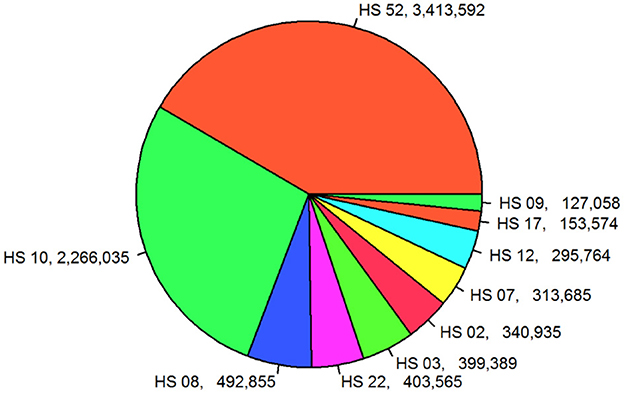

Figure 4, displays the diversity and scale of Pakistan's agricultural export portfolio. The top 10 agricultural exports of Pakistan in 2021 highlight the substantial contribution of HS 52 (Cotton), which dominates the chart with exports worth $3,413,592 thousand, making it the top export category. Trailing behind, HS 10 (Cereals) shows significant export numbers as well, totaling $2,266,035 thousand. Although significantly smaller compared to the top two categories, HS 08 (Edible fruits, etc.,) holds the third place with an export of $492,855 thousand. It is closely followed by HS 22 (Alcoholic and non-alcoholic beverages, spirits, and vinegar) at $403,565 thousand and HS 03 (Fish, shellfish, and other aquatic invertebrates) at $399,389 thousand. Next in line are HS 02 (Meat and edible meat offal) and HS 07 (Vegetables, roots, and tubers) with export values of $340,935 thousand and $313,685 thousand, respectively. Moderate contributions come from HS 12 (Oilseeds, nuts, grains, and fruits used for industrial or medicinal purposes) at $295,764 thousand, while HS 17 (Sugar and confectionery—sugar based) and HS 09 (Coffee, tea, herbal teas, and spices) represent the minimal level, with export of $153,574 thousand and $127,058 thousand, respectively.

Figure 4. Pie chart illustrating exports of Pakistan's top 10 agricultural products for the year 2021, based on ITC data from the Pakistan Bureau of Statistics, with estimations by the author. Export values are in USD thousands.

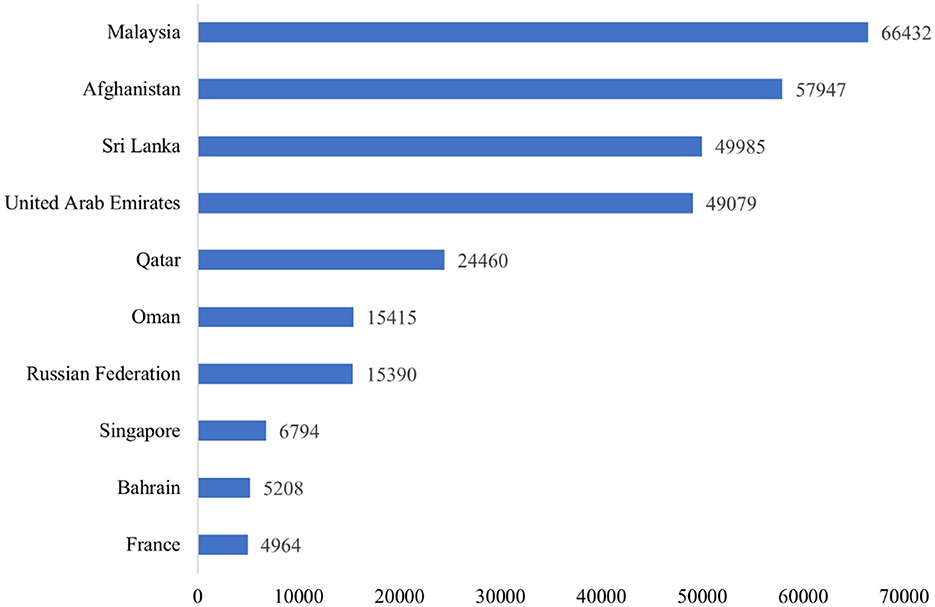

The export of HS 07 “vegetables roots and tubers (edible),” from Pakistan to various international destinations in 2021, reveals significant variability in import values, reflecting the diverse demand across these regions (See Figure 5). Malaysia stands out as the largest importer, with an import value of $66,432 thousand, indicating a strong market for these commodities. Afghanistan also exhibits substantial demand with an import value of $57,947 thousand. The markets of Sri Lanka and the United Arab Emirates display notable import values of $49,985 thousand and $49,079 thousand, respectively, suggesting significant consumption patterns in these countries. Mid-range importers include Qatar, Oman, and the Russian Federation, with values of $24,460 thousand, $15,415 thousand, and $15,390 thousand, respectively, denoting moderate trade volumes. Smaller yet consistent import volumes are observed in Singapore ($6,794 thousand), Bahrain ($5,208 thousand), and France ($4,964 thousand). This detailed statistic underscores the global distribution and economic importance of “vegetable roots and tubers (edible),” exports from Pakistan, highlighting diverse market penetration and the varying scale of dependence on these agricultural commodities across multiple regions.

Figure 5. Bar chart demonstrating Pakistan's top 10 vegetable (HS 07) export destinations for the year 2021, based on ITC data from the Pakistan Bureau of Statistics, with estimations by the author. Export values are in USD thousands.

2.2 Literature review

We provide a brief literature review of our study in this section. The literature review section comprises two parts. The first part gives insight into previous studies conducted on CPEC and the second part discusses the role of infrastructure in trade. To provide a deeper analytical foundation for Pakistan agricultural export performance, this literature review draws on core trade theories. The gravity model of trade posits that trade flows are determined by economic size and inversely influenced by trade costs, including infrastructure-related frictions (Anderson and Van Wincoop, 2003). In parallel, trade cost theory emphasizes the role of logistics, transportation, and institutional efficiency in shaping trade outcomes (Djankov et al., 2010). These theoretical lenses inform our assessment of how infrastructure development, including major initiatives under CPEC, has the potential to influence the spatial and temporal distribution of Pakistan's vegetable exports.

2.2.1 China-Pakistan economic corridor

CPEC's multifaceted and various trajectories have been the subject of interest for many researchers in the past decade (Sroosh and Sabir, 2013; Khalid, 2015; Ahmed, 2017; Sher et al., 2019; Kamran et al., 2021; Baig et al., 2023).

In this conjunction, Khan (2019) attempted to investigate the contribution of CPEC to regional connectivity and examine the challenges faced. Their results suggest transparency and the involvement of the stakeholders to obtain a positive effect on Pakistan and the South Asia region. Hadi et al. (2018) studied the potential role of CPEC in Pakistan. Their study concluded that CPEC will lead to prosperity, growth, and development in Pakistan. Spies (2021) explored the CPEC infrastructural development and investment. His study focused on the agricultural sector of Gilgit Baltistan, Pakistan. This study argues that, unlike the CPEC narrative, some agricultural exports are facing challenges like trade barriers and competition in Xinjiang, China. Ejaz et al. (2022) evaluated how CPEC's infrastructure could potentially influence Pakistan's trade volume. They employed the ARDL technique to estimate time series data spanning 1991–2020. Their results explain the positive connotation of the CPEC infrastructure with the trade volume of Pakistan. However, the results for some control variables were found insignificant. Likewise, Tabasam and Ismail (2019) examine the significance of transport infrastructure by employing the trade gravity model. Their study suggests that improving infrastructural connectivity enhances the agriculture trade by cutting transportation charges and time. Further, the study suggests that it is necessary to connect rural communities to highways if they are to benefit from CPEC. Some research examines how CPEC impacts the industrial sector of Pakistan. For instance, McCartney (2022) with theoretical and historical shreds of evidence to analyze the potential influence of CPEC on the industrial sector of Pakistan. Their findings revealed that CPEC has a supportive contribution to Pakistan's local employment. Their findings suggest that CPEC will shorten the trade routes to China, improve logistics, and make Pakistan's economy prosperous.

After thoroughly reviewing the literature we draw the following conclusions. Enhanced infrastructure is crucial for both domestic and international trade, more specifically for perishable agricultural commodities. Most of the previous studies are focused on regional connectivity, geopolitical issues, and other challenges faced by the economic corridor. Only a few of them attempted to find the contribution of CPEC to trade however they were limited to a specific area and varying outcomes. Hence we measure the contribution of CPEC to Pakistan's agricultural harvests with a focus on vegetable exports.

Concerning the estimation of trade analysis various techniques are followed in the recent literature (Nuno-Ledesma and Villoria, 2019; Yu et al., 2020; Saeed et al., 2021; Douch and Edwards, 2022). Some researchers favored the trade gravity to estimate the trade flow (Irshad and Anwar, 2019; Guan and Ip Ping Sheong, 2020; Subhan et al., 2021; Yotov, 2022). With its simple and intuitive framework, derived from Newton's law of gravity, the model became a rational choice for economists (Anderson, 1979; Anderson and Van Wincoop, 2003).

2.2.2 Infrastructure

Plenty of literature exists that uncovers the role of infrastructure in the context of trade cost, trade volume, and economic growth (Aschauer, 1989; Day and Zou, 1994; Ejiogu et al., 2000; Nordås and Piermartini, 2004; Sun and Heshmati, 2010; Ismail and Mahyideen, 2015; Wang et al., 2020). The impact of infrastructure on trade performance is supported in the trade economics literature. According to the gravity model, reductions in trade costs, stemming from improved roads, logistics, and transit systems, tend to increase bilateral trade volumes. This is particularly pertinent for perishable products such as vegetables, where delays or inadequate transport infrastructure can result in quality deterioration and financial loss. Limao and Venables (2001) and Djankov et al. (2010) have shown that inadequate infrastructure significantly raises trade costs, reducing a country competitiveness. In Pakistan, recent road infrastructure investments particularly those aligned with the CPEC) have been designed to reduce internal transport bottlenecks, improve access to seaports, and facilitate regional connectivity.

In this instance, Di Stefano et al. (2021) assessed the influence of improved infrastructure under the Belt and Road (BRI) on trade flow. Their study utilized the gravity model for the countries that are participating in the BRI. The findings suggest stronger bilateral trade among the countries linked to BRI. Baniya et al. (2020) uncovered the infrastructural development resulting in enhanced transportation and trade in the BRI countries. They used the gravity equation for estimation. They found that BRI has enhanced trade by up to 4.1 percent. They further argue that countries that are well connected and products that rely on quick delivery benefit more from enhanced infrastructure. In the same context, Alam et al. (2019) compared the trade route of CPEC with the existing route for a container with a size of 40 feet. The outcomes revealed that CPEC road infrastructure has not only shortened travel time but also reduced cost. In the context of the BRI, Reed and Trubetskoy (2019) by employing the gravity equation explore the impact of transportation investment. Their findings in the context of infrastructure are more interesting and broader. They argue that improved infrastructure is not just limited to one country or area but they have a positive impact on various regions. Edwards and Odendaal (2008) studied how infrastructure like seaports and road networks affect trade between countries. They employed the gravity equation and found that investing in better road infrastructure can lead to more trade with other countries. Bougheas et al. (1999) enhanced the model by incorporating transportation costs. Their study results suggest that transportation costs and the quality of infrastructure are inversely related.

3 Research methodology and data statistics

This section outlines the primary methodology and model applied in this research, along with details regarding the dataset. Additionally, it includes a concise descriptive analysis of the dataset.

Drawing on literature we proceed with the trade gravity model. Characterized by Newton's law, the gravity model of trade explains that the trade turnover and the economic masses of countries have a direct relation. Countries with larger GDPs probably have more trade with each other. While the geographical remoteness between countries and trade volume has a negative relation. Geographically countries closer to each other are prospected to more trade with each other. In our case, we assume that the exports of the country are directly proportionate to their GDPs and inversely to their remoteness. The simplest gravity model of trade is illustrated as follows:

Where i and j are the exporter and importer countries, respectively. Exp represents the export volume from exporting to destination countries. GDPi and GDPj indicated the gross domestic product values of both i and j countries. The stochastic term is eij. The coefficients β and γ are to be estimated. Equation 1 after log transformation is given as follows:

Besides GDP and Distance, researchers commonly augmented the model with binary variables comlang (common language), contig (contiguity) comcol (common colonizer), colony, and smctry (same country before; Melitz, 2007; Trotignon, 2010; Jámbor et al., 2020). Likewise, some researchers augmented the model with the exchange rate, infrastructure, and population (Guan and Ip Ping Sheong, 2020; Hussain et al., 2020; Banik and Roy, 2021). Hence, we use the augmented model as shown in Equation 3, to find the association of CPEC with Pakistan's vegetable exports.

Where, LnVegExppjt represent Pakistan's vegetable exports to country j in year t. GDPpt represents the GDP of Pakistan in year t. GDPjt represent the importer's country GDP in year t. LnDpj is the distance between Pakistan (origin) and the importer country (destination). Comlang and Contig are the paired variables if Pakistan and the importer countries share a common language or border. Comlang_ethno means if at least 9% population speaks the same language. The dummy colony means that both countries were in a colonial relationship. Comcol denotes the common colonizer power. Smctry designates if the countries were the same nation in the past. The dummy variable cpec takes the value of one if the country j is associated with CPEC otherwise is zero. The CPEC variable is specified as a post-treatment dummy (2013 onward). Pre-2013 data are used to control for baseline trade patterns and improve identification, rather than to infer any impact of CPEC during those years. As the infrastructure is the fundamental focus of the CPEC we include the variable road which is the total length of road in Pakistan (exporting country). In the traditional gravity equation GDP is used as a proxy of the country's overall economic strength to show how much they want to buy and how much they want to sell. However, when studying a single product, it is better to understand how much the country produces and consumes that commodity (Scheltema, 2014). In our case, studying the vegetable negative trade balance of Pakistan, we add the domestic consumption of vegetable Cons to our model. β0 is a constant term, β1 … .β12 are the coefficients indicate how elastic the exports are concerning the independent variables. epjt represent the error term.

However, there are some common limitations in the specification of this model. The model becomes biased if there is zero trade (exports), of the undefined nature of the log of zero (Burger et al., 2009; Baldwin and Harrigan, 2011). Some studies noticed the problem of heteroskedasticity in the model (Stronge, 1978; Mnasri and Nechi, 2019). Linders and De Groot (2006) suggest that the zero trade problem can be effectively handled by either removing the zero flows or adjusting the observations with zero values by adding a small number. However, the exclusion of zero values from data results in the loss of key information, and censored data produces a biased coefficient (Eichengreen and Irwin, 1998; Martin and Pham, 2008; Philippidis and Resano-Ezcaray, 2013). Silva and Tenreyro (2006); Santos Silva and Tenreyro (2022) preferred PPML to address zero trade and heteroskedasticity. The recent literature mostly believes that instead of a log linearized model, PPML is more reliable (Lateef et al., 2018). Hence, we rely on the assessment from the PPML estimation technique.

3.1 Descriptive analysis

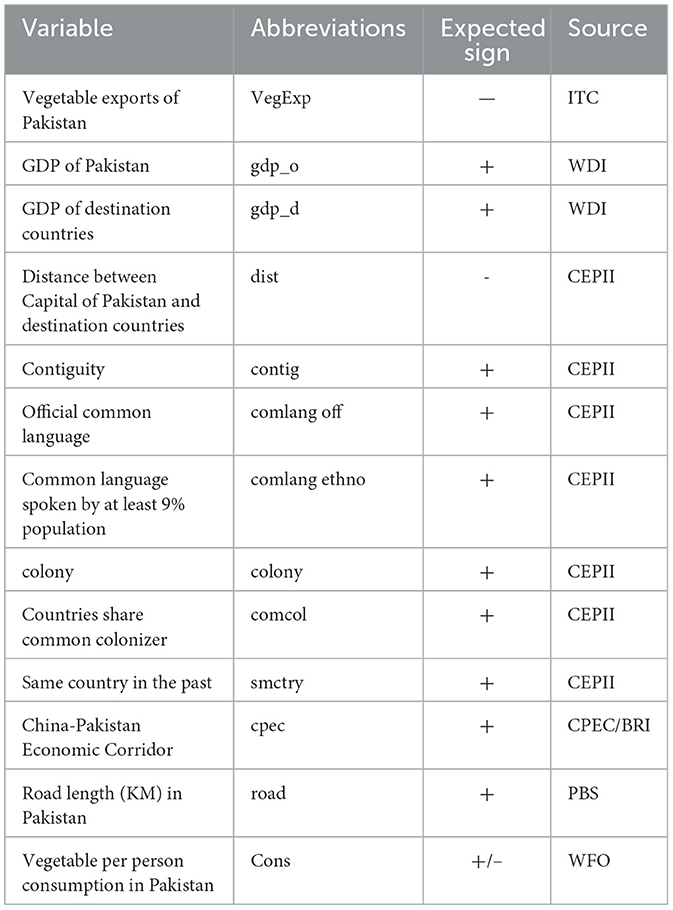

Reputable online databases serve as the main sources of data for this investigation. Based on data from the Pakistan Bureau of Statistics, the International Trade Center (ITC) published information on Pakistan's vegetable exports from 2003 to 2021. We use data from 2003 to 2021 to capture both the pre- and post-CPEC periods. The pre-2013 data serve as a baseline to control for existing trade trends and improve model precision, consistent with gravity model practice. CPEC is modeled as a post-2013 intervention, with no effects attributed to earlier years. Data from the World Development Indicators (WDI) was used to determine the GDP of Pakistan and its trading partners. Road length in kilometers was measured using data from the Pakistan Bureau of Statistics, while the Food and Agriculture Organization (FAO) provided the average annual vegetable consumption per capita. Furthermore, data on the distance between the origin country and the importer country, along with the dummy variables used in the model—such as Contig, Comlang, Comlang_ethno, Colony, Comcol, and Smctry were derived from the CEPII database. The list of all variables with their respective names, abbreviations, and anticipated signs is given in Table A2 (Appendix).

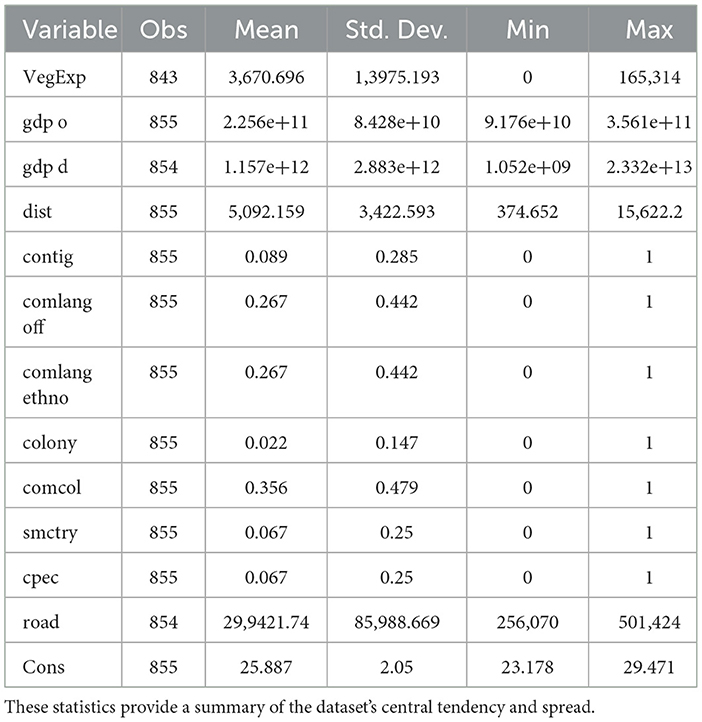

The basic statistical analysis is given in Table 1. The variable VegExp represents the vegetable exports of Pakistan with a mean value of 3,670.696. The standard deviation is 13,975.19. A zero value indicates that there are no exports in that specific period. The gdp_o indicates the GDP of Pakistan. The minimum value is 9.176e+10. The standard deviation is 8.428e+10. The highest GDP is in the year 2018. The gdp_d represents the destination country's GDP. We have 855 observations for the gdp_d with a mean value of 1.157e+12. The mutual distance between Pakistan and the importer country is indicated by dist which has a mean value of 5,092.159. All the dummy variables take the value of one and zero (1,0). contig (contiguity) is 1 if a county is sharing a border otherwise zero with its mean value of 0.089 which indicates that the countries in our dataset on average are not contiguous. The mean value of the comlang_off and comlang ethno suggests that 26 percent of countries in our dataset on average share a common official language. Likewise, the mean value of colony suggests that Pakistan exports a small proportion of vegetables to countries that were colonies. The mean value of smctry on average 6.7 percent of the export's destination countries was the same country in the past. The cpec variable represents the countries that are associated with CPEC. The road variable represents the road infrastructure of Pakistan in kilometers. The mean value of the road length is 299,421.74. The mean value and standard deviation of Consm variable are respectively 25.887 and 2.05.

Table 1. Descriptive statistics of variables, including key measures such as the number of observations (“Obs”) and standard deviation (“Std. Dev.”), which reflects the variability or dispersion of the data.

To conclude, our dataset comprises a diverse array of economic, geographical, and historical factors to achieve comprehensive findings. The variability in the selection of variables highlights the diverse characteristics of exporter and export destination countries.

4 Results

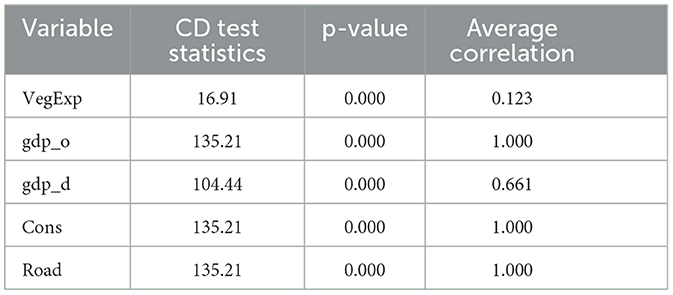

4.1 Cross-sectional dependence

We tested our time variant variables for cross-sectional dependence in our panel dataset using (Pesaran, 2004) Cross-sectional Dependence (CD) test. The null hypothesis of no cross-sectional dependence was strongly rejected across all variables, with CD test statistics ranging from 16.91 to 135.21 and p-values < 0.01 (Table A3 Appendix). These results indicate significant cross-sectional dependence among countries, suggesting that unobserved shocks or spillovers affect multiple countries simultaneously. Accordingly, we use estimation techniques robust to such dependence and cluster standard errors at the country level.

4.2 Gravity estimates

We report the estimated results of our gravity equation in this section. We interpret each variable included in the model.

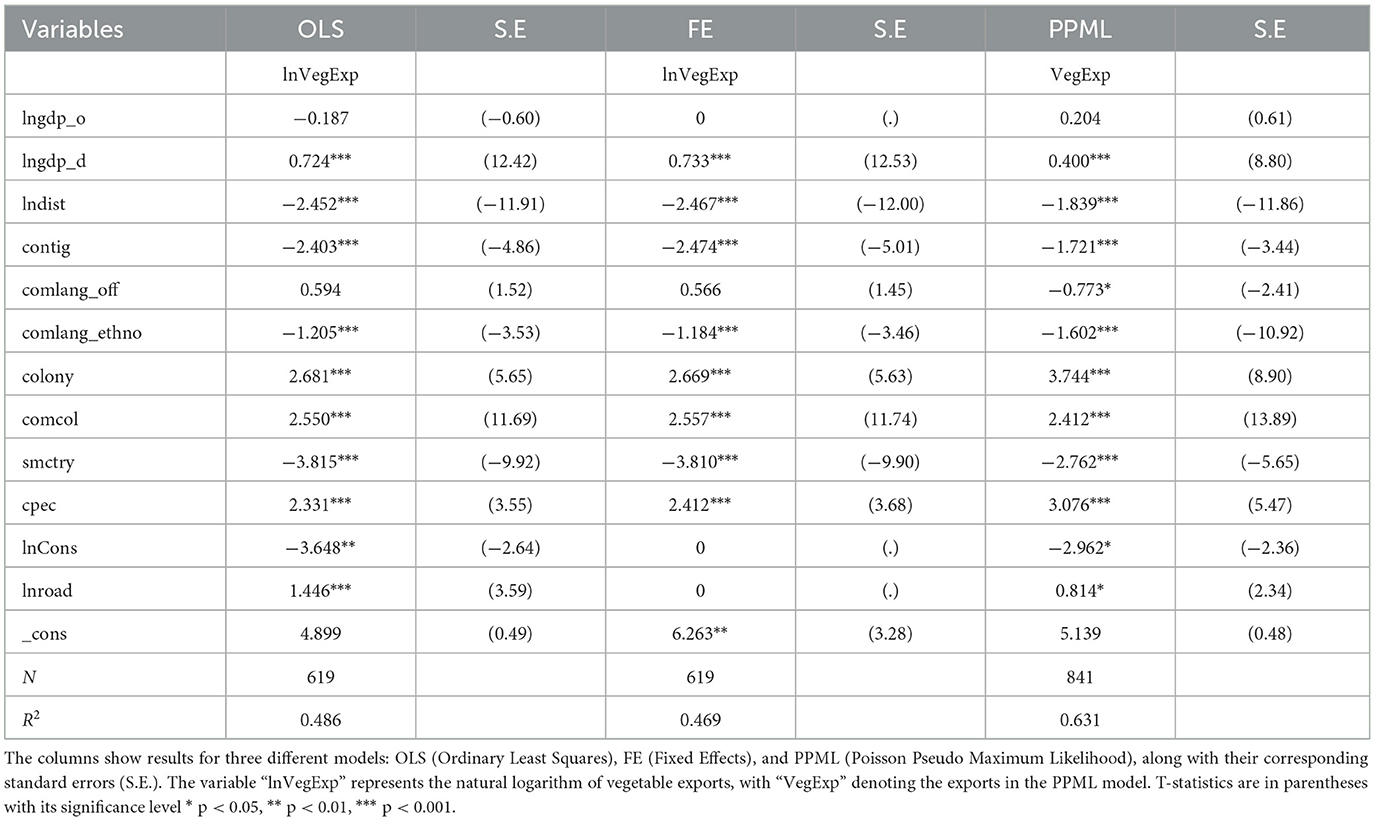

We use a panel dataset of vegetable exports from Pakistan to its export destination countries. The study period runs from 2003 to 2021. To find robust evidence from the selected parameters, we used three techniques to estimate our gravity equation as presented in Table 2. The results from the fixed effect mode and OLS estimations are presented for comparison. Unlike the fundamental OLS and fixed effect estimations, the PPML is estimated on levels without log transformation (Silva and Tenreyro, 2006; Santos Silva and Tenreyro, 2022). The results obtained from different estimation techniques exhibit some degree of sign similarities except for the GDP of Pakistan. However, as reported earlier the PPML (Silva and Tenreyro, 2006) addresses most of the challenges in the model, we base our estimations on the PPML technique presented in the third column of the table.

The key variable of interest in this work is cpec (China-Pakistan Economic Corridor). The variable is statistically significant at 0.001 percent. According to the findings, a one percent increase in the cpec is leading to an increase of 3.07 percent in the vegetable exports of Pakistan. This observation suggests a surge in economic activity in the countries associated with CPEC. Chaudhry et al. (2017) in their study also found a positive association of CPEC with the Pakistan trade. However, as the CPEC is a combination of multiple projects in three phases and infrastructure is an essential part of the corridor we control for the length of road in Pakistan. We found that the total length of roads in Pakistan significantly supports and enhances the vegetable exports of Pakistan. As the shelf life of the perishable products (vegetables in our case) is short, requires faster transportation and storage. The enhanced road infrastructure of the CPEC reduces the distance and increases market access. As earlier discussed CPEC road infrastructure has reduced the distance from Kashghar, China to Gwadar port, not only benefiting China but also providing fast access to Pakistan's exporters into the Chinese market. Moreover, we found that the domestic consumption of vegetables in Pakistan demonstrates a negative and statistically significant coefficient. An increase of one percent in the domestic consumption of vegetables results in a 2.96 percent decrease in the vegetable exports of Pakistan. This finding suggests that most of the vegetable production is absorbed domestically in own country, leaving fewer vegetables to export. At the same time, the rise in consumption triggers the vegetable imports of Pakistan, which in turn creates a vegetable trade deficit.

In contrast to common gravity findings, our estimates show that Pakistan's GDP (origin country) is statistically insignificant which means that the GDP of Pakistan does not clearly explain the exports of vegetables from Pakistan. As the GDP comprehensively measures and aggregates all the economic activities of a country, might not provide clear evidence of the demand and supply of a sector or product (Hummels and Klenow, 2005; Almeida et al., 2012; Scheltema, 2014). Therefore, to understand the strength of the economy we also add vegetable per capita consumption to our model. Pakistan's vegetable exports have a positive and significant association with the GDP of the destination countries (importer). GDPj is significant at 0.001 percent. One percent rise in the GDP of the importer countries accompanied a 0.40% increase in Pakistan's vegetable exports.

The distance variable (dist) represents the cost and time of transportation. Consistent with theory and literature, our estimates show a negative and statistically significant coefficient for distance at 0.001 percent. A one percent rise in the distance of the export destination countries results in a 2.45 percent decrease in Pakistan vegetable exports. Similarly, according to the gravity theory of trade proximity and contiguity are foretold to have a positive relation with the exports of one country. However, in contrast, to Pakistan vegetable exports we found a negative and significant association with the contiguity. This is probably because of the political disputes with India, and economic sanctions on Iran (Atif et al., 2017). Likewise, the variables representing the common official language are negative and significant at different levels. This means that Pakistan and its vegetable export destination countries mostly have different official languages. Historical colonial relations between the colony and the shared colonizer were predicted to positively impact Pakistan's vegetable exports. These variables have statistical significance. Pakistan is increasing exports to nations with colonial ties and those under colonization by the same power. Unlike the theory that countries engage in more trade with the economies that were formally the same country, we find a statistically significant and negative coefficient of smctry (same country in the past). This observation reveals that Pakistan has nominal exports to the countries that were previously part of Pakistan. As discussed earlier the controversies and strife with India might be making this variable statistically significant.

5 Discussion

This section provides a comprehensive discussion of the main findings derived from the study results. The discussion emphasizes the implications of CPEC, infrastructure, domestic consumption, and geopolitical factors on Pakistan's vegetable exports.

5.1 Role of infrastructure development in trade facilitation

Infrastructure development plays a central role in enhancing trade efficiency and competitiveness, as evidenced by the transformative impact of the China-Pakistan Economic Corridor (CPEC) on Pakistan's vegetable exports. CPEC's road infrastructure improvements have significantly reduced logistical barriers, particularly for perishable goods like vegetables that require rapid transportation and reliable storage facilities. The study shows a robust positive association between CPEC and export growth, highlighting the importance of connectivity in fostering trade. For instance, the Kashgar-Gwadar route has reduced transit times between Pakistan and key markets such as China, allowing exporters to capitalize on increased demand for fresh produce. This finding aligns with global evidence that better transportation infrastructure lowers trade costs, increases market access, and enhances competitiveness (Limao and Venables, 2001). The findings also align with previous studies. According to De Soyres et al. (2020) transport infrastructure development under the BRI has significantly reduced shipment time and trade costs, with estimated declines of 1.7–3.2% and 1.5–2.8%, respectively. (Tabasam and Ismail, 2019); Ali et al. (2022) suggests that improved transport infrastructure strengthens economic ties between Pakistan and China, with modest GDP growth, notable welfare gains, and significant trade increases, especially in agriculture, for Pakistan. For Pakistan, continued investments in transportation and logistics infrastructure are critical for consolidating these gains and ensuring the sustainability of export growth, particularly in the context of increasing competition in regional and global agricultural markets.

5.2 Balancing domestic consumption and export capacity

A critical challenge revealed in the study is the growing tension between rising domestic consumption and export capacity in Pakistan's vegetable sector. The significant negative relationship between domestic vegetable consumption and export volumes indicates a structural imbalance, where local demand limits the surplus available for international trade. This trend highlights the need for a more balanced production-consumption framework. With domestic consumption absorbing a substantial share of agricultural output, exports suffer, resulting in missed opportunities in lucrative foreign markets. As Ahmad et al. (2021b) documented, Pakistan has a comparative advantage in horticulture due to high domestic demand, favorable climate, and low-cost labor, but this is constrained as most produce is sold in local markets. Simultaneously, the increased reliance on vegetable imports to meet domestic demand exacerbates Pakistan's trade deficit, creating vulnerabilities in the country's agricultural trade balance. To address these challenges, Pakistan must prioritize measures to enhance agricultural productivity, such as adopting high-yield crop varieties, modern irrigation techniques, and post-harvest technologies. These interventions can increase the availability of surplus produce for export without compromising local food security. Additionally, fostering export-oriented production, supported by targeted subsidies and trade policies, can incentivize farmers to produce for international markets. Supply chain improvements, including better cold storage facilities and efficient distribution networks, are also essential to minimize post-harvest losses and ensure consistent export volumes. These strategies can help Pakistan strike a balance between meeting domestic needs and fulfilling export commitments, thereby achieving a more sustainable trade profile.

5.3 Geopolitical and historical dynamics in trade patterns

Geopolitical and historical factors significantly influence Pakistan's vegetable export dynamics, adding layers of complexity to the country's trade performance. Distance, as expected, negatively impacts exports by increasing transportation costs and transit times. However, the study's finding of a negative association with contiguity deviates from traditional expectations, revealing the role of political tensions in shaping trade outcomes. Pakistan's strained relations with neighboring countries such as India and Iran have constrained cross-border trade, reducing the benefits typically associated with geographical proximity. For example, long-standing disputes with India, coupled with economic sanctions on Iran, have limited market access and hindered trade opportunities in these neighboring countries (Kousar et al., 2023). Despite these challenges, CPEC's infrastructure investments offer a pathway to mitigate the impact of geopolitical constraints by facilitating access to alternative regional markets, particularly in Central Asia and China.

The influence of historical trade linkages further highlights the importance of leveraging institutional and cultural familiarity in export strategies. The positive relationship between colonial ties and vegetable exports underscores the enduring benefits of shared historical and trade networks. However, the negative association with former constituent regions, particularly India, underscores the detrimental effects of unresolved political conflicts on trade relationships. These findings emphasize the importance of adopting a multifaceted trade strategy that integrates infrastructural advancements with diplomatic efforts. Resolving political tensions with neighboring countries and fostering regional trade agreements can unlock significant export potential while leveraging historical ties can strengthen existing trade relationships. A holistic approach that addresses both logistical and geopolitical barriers is essential for Pakistan to optimize its vegetable trade and realize its full export potential.

5.4 Limitations and future research

With an emphasis on macro-level trade frictions such as distance, infrastructure, bilateral economic scale, governmental intervention, and infrastructure, this study draws on the gravity model to examine the factors influencing Pakistan vegetable exports. Smallholder farmers, who produce the majority of Pakistan vegetables, are not included in our micro-level data, nevertheless. This is an acknowledged limitation, especially considering that more than two-thirds of Pakistani farmers, who form the foundation of the rural economy, work on smallholdings of less than five acres (Mazhar et al., 2019). Among the most marginalized members in the vegetable supply chain, smallholders are not only the main producers but also frequently lack direct market access, relying on middlemen or commission brokers to reach markets (Ahmad et al., 2021a; Hassan et al., 2021). Smallholders could not benefit equally from increased export opportunities due to these structural limitations. Data on production costs, supply chain margins, and involvement in export-oriented value chains at the farmer level could be incorporated into future studies to support this strategy.

6 Conclusions and policy implications

This section offers an overview of the objective of the study, data, and estimation techniques. Next, we conclude all the findings and offer suggestions based on our estimations.

This study looks into Pakistan's vegetable trade deficit in the international market. We have attempted to investigate the role of CPEC in shaping the vegetable exports of Pakistan. We also enlighten the road infrastructure and other important factors that impact Pakistan's vegetable exports either positively or negatively. The study covers the period from 2003 to 2021. A panel data set of the Pakistan vegetable export destination was selected for investigation. PPML as the state-of-the-art technique in the gravity model of trade was preferred to achieve robust results.

Among the 12 predictors included in the model, six variables were observed to have an inverse relationship with vegetable exports of Pakistan. CPEC as the main variable of interest of study found to have a positive association. CPEC was initiated in 2013 and is still going through its second phase which will complete in 2025. Despite this, the project demonstrates that Pakistan's economic activities are grown with the countries that are linked to the corridor in either way. The road infrastructure plays a crucial role in the transportation of the perishable product. CPEC will add 3,000 KM of road infrastructure to Pakistan's road network in the form of motorways, highways, and expressways. Our findings witnessed that the road infrastructure has increased Pakistan's vegetable exports by providing fast connectivity and access to markets.

Moreover, we found, that though Pakistan as an agricultural country produces an attractive volume of vegetables, most of the vegetables are absorbed in its own country. Pakistan by fulfilling the domestic demand for vegetables leaves fewer to export and also triggers imports. The inverse relation of domestic consumption with vegetable exports is contributing to Pakistan's vegetable trade deficit.

Furthermore, the GDP fails to explain Pakistan's vegetable exports. The importer country's GDP positively influences vegetable exports. Vegetable exports are negatively impacted by characteristics including distance, contiguity, and shared language. The colonial connections boost Pakistan's vegetable exports. Having a history of colonialism or being same country makes market collaboration simpler. Contrary to expectations we find that Pakistan's vegetable exports to countries that were formerly the same country are very tiny.

To solve the challenge of Pakistan's vegetable trade deficit, increasing productivity with enhanced and modern farming techniques is the possible solution. By increasing the production, the country will able to meet the domestic requirements and export the surplus products. Nearest markets should be of primary concern in the exports of perishable products. The exporter needs to introduce Pakistan's vegetables to the Chinese market in Xinjiang which is easily accessible on the CPEC route instead of the sea route which is time-consuming and costly. Resolving strife and making healthy trade cooperation with India can provide and huge and accessible market with no language barriers.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Author contributions

HK: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Software, Visualization, Writing – original draft, Writing – review & editing. ZY: Formal analysis, Methodology, Software, Visualization, Writing – review & editing. QC: Funding acquisition, Project administration, Resources, Supervision, Validation, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work was supported by the National Social Science Fund of China (23BJY155), the Fundamental Research Funds for the Central Universities (2662024YJ004), and the China Agriculture Research System (CARS-26-06BY).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahmad, B., Anwar, M., Hammad, B., Mehdi, M., and Farooq, T. (2021a). Analyzing export competitiveness of major fruits and vegetables of Pakistan: an application of revealed comparative advantage indices. Pak. J. Agric. Sci. 58, 719–730. doi: 10.21162/PAKJAS/21.952

Ahmad, F., Gill, A. T., Hussian, Z., and Ismail, M. (2024). Pakistan-China relations in the 21st century: political and economy cooperation through the perspective of CPEC. Policy Res. J. 2, 1620–1629.

Ahmad, K., Afridi, M., Khan, N., and Sarwar, A. (2021b). Quality deterioration of postharvest fruits and vegetables in developing country Pakistan: a mini overview. Asian J. Agric. Food Sci. 9, 2321–1571. doi: 10.24203/ajafs.v9i2.6615

Ahmed, A. M. (2017). Sectoral Impacts of CPEC on Pakistan's Economy, CPEC: Macro and Micro Economic Dividends for Pakistan and the Region. Islamabad: Islamabad Policy Research Institute, 55–69.

Ahmed, Z. S. (2019). Impact of the China–Pakistan economic corridor on nation-building in Pakistan. J. Contemp. China 28, 400–414. doi: 10.1080/10670564.2018.1542221

Alam, K. M., Li, X., and Baig, S. (2019). Impact of transport cost and travel time on trade under China-Pakistan economic corridor (CPEC). J. Adv. Transp. 2019:7178507. doi: 10.1155/2019/7178507

Ali, M. (2018). Pakistan's quest for coal-based energy under the China-Pakistan economic corridor (CPEC): implications for the environment. Environ. Sci. Pollut. Res. 25, 31935–31937. doi: 10.1007/s11356-018-3326-y

Ali, T., Huang, J., and Xie, W. (2022). Bilateral economic impacts of China–Pakistan economic corridor. Agriculture 12:143. doi: 10.3390/agriculture12020143

Ali, Y., Rasheed, Z., Muhammad, N., and Yousaf, S. (2018). Energy optimization in the wake of China Pakistan economic corridor (CPEC). J. Control Decis. 5, 129–147. doi: 10.1080/23307706.2017.1353929

Almeida, F., Gomes, M., and Da Silva, O. (2012). “Non-tariff measures in international coffee trade,” in Presentation, Record Appears in International Association of Agricultural Economists (IAAE) (Foz do Iguaçu). doi: 10.22004/ag.econ.126538

Anderson, J. E. (1979). A theoretical foundation for the gravity equation. Am. Econ. Rev. 69, 106–116.

Anderson, J. E., and Van Wincoop, E. (2003). Gravity with gravitas: a solution to the border puzzle. Am. Econ. Rev. 93, 170–192. doi: 10.1257/000282803321455214

Aschauer, D. A. (1989). Is public expenditure productive? J. Monet. Econ. 23, 177–200. doi: 10.1016/0304-3932(89)90047-0

Asghar, A. J., Cheema, A. M., Hameed, M. I., and Qasim, S. (2021). The Critical Junction Between CPEC, Agriculture and Climate Change. Lahore: LUMS Centre for Chinese Studies.

Atif, R. M., Haiyun, L., and Mahmood, H. (2017). Pakistan's agricultural exports, determinants and its potential: an application of stochastic frontier gravity model. J. Int. Trade Econ. Dev. 26, 257–276. doi: 10.1080/09638199.2016.1243724

Azam, A., and Shafique, M. (2017). Agriculture in Pakistan and its impact on economy. a review. Inter. J. Adv. Sci. Technol 103, 47–60. doi: 10.14257/ijast.2017.103.05

Baig, N., Khan, S., Bashir, I., and Ma, J. (2023). Does China Pakistan economic corridor become an avenue to achieve sustainable development goal no. 2 (food security) in Pakistan: under the condition of COVID-19? PLoS ONE 18:e0279520. doi: 10.1371/journal.pone.0279520

Baldwin, R., and Harrigan, J. (2011). Zeros, quality, and space: trade theory and trade evidence. Am. Econ. J. Microecon. 3, 60–88. doi: 10.1257/mic.3.2.60

Banik, B., and Roy, C. K. (2021). Effect of exchange rate uncertainty on bilateral trade performance in SAARC countries: a gravity model analysis. Int. Trade Politics Dev. 5, 32–50. doi: 10.1108/ITPD-08-2020-0076

Baniya, S., Rocha, N., and Ruta, M. (2020). Trade effects of the new silk road: a gravity analysis. J. Dev. Econ. 146:102467. doi: 10.1016/j.jdeveco.2020.102467

Bougheas, S., Demetriades, P. O., and Morgenroth, E. L. (1999). Infrastructure, transport costs and trade. J. Int. Econ. 47, 169–189. doi: 10.1016/S0022-1996(98)00008-7

Boyce, T. (2017). The China-Pakistan Economic Corridor: Trade Security and Regional Implications. SANDIA Report SAND2017-0207. doi: 10.2172/1344537

Burger, M., van Oort, F., and Linders, G.-J. (2009). On the specification of the gravity model of trade: zeros, excess zeros and zero-inflated estimation. Spat. Econ. Anal. 4, 167–190. doi: 10.1080/17421770902834327

Chaudhry, I. S., Gulzar, F., Ahmad, H. G., and Ur Rahman, S. (2017). Impact of China-Pakistan economic corridor (CPEC) on Pakistan's trade: empirical evidence from gravity model. Rev. Econ. Dev. Stud. 3, 29–38. doi: 10.26710/reads.v3i1.164

Day, R. H., and Zou, G. (1994). Infrastructure, restricted factor substitution and economic growth. J. Econ. Behav. Organ. 23, 149–166. doi: 10.1016/0167-2681(94)90064-7

De Soyres, F., Mulabdic, A., and Ruta, M. (2020). Common transport infrastructure: a quantitative model and estimates from the belt and road initiative. J. Dev. Econ. 143:102415. doi: 10.1016/j.jdeveco.2019.102415

Di Stefano, C., Iapadre, P. L., and Salvati, I.. (2021). Trade and infrastructure in the belt and road initiative: a gravity analysis based on revealed trade preferences. J. Risk Financ. Manag. 14:52. doi: 10.3390/jrfm14020052

Djankov, S., Freund, C., and Pham, C. (2010). Trading on time. Rev. Econ. Stat. 92, 166–173. doi: 10.1162/rest.2009.11498

Don McLain, G. (2019). The geopolitics of the China-Pakistan economic corridor(CPEC) and its security implications for India. Korean J. Int. Stud. 17, 337–353. doi: 10.14731/kjis.2019.12.17.3.337

Douch, M., and Edwards, T. H. (2022). The bilateral trade effects of announcement shocks: brexit as a natural field experiment. J. Appl. Econom. 37, 305–329. doi: 10.1002/jae.2878

Edwards, L., and Odendaal, M. (2008). Infrastructure, Transport Costs and Trade: A New Approach. Pretoria: Trade and Industrial Policy Strategies, 1–40.

Eichengreen, B., and Irwin, D. A. (1998). The Role of History in Bilateral Trade Flows, The Regionalization of the World Economy. University of Chicago Press, 33–62. doi: 10.7208/chicago/9780226260228.003.0003

Ejaz, A., Dilawar, K. Dr., and Faheem Ur, R. Dr. (2022). Impact of transport infrastructure development under BRI on trade: a case study of CPEC in the context of Pakistan. Int. J. Bus. Econ. Aff. 7, 39–48. doi: 10.24088/IJBEA-2022-73004

Ejiogu, E. O., Madonsela, N. S., and Adetunla, A. (2000). “The effect of transportation infrastructure on economic development,” in Proceedings of the 2nd African International Conference on Industrial Engineering and Operations Management Harare, Zimbabwe.

Escap, U. (2021). The Belt and Road Initiative for Seamless Connectivity and Sustainable Development in the Asia-Pacific Region. Available online at: https://hdl.handle.net/20.500.12870/409

Frankel, J., and Romer, D. (1999). Does trade cause growth? Am. Econ. Rev. 89, 379–399. doi: 10.1257/aer.89.3.379

Garlick, J. (2018). Deconstructing the China–Pakistan economic corridor: pipe dreams versus geopolitical realities. J. Contemp. China 27, 519–533. doi: 10.1080/10670564.2018.1433483

GoP (2022). Pakistan Export Strategy Fruits and Vegetables 2023-2027. Karachi: Trade and Development Authority Pakistan (TDAP).

Guan, Z., and Ip Ping Sheong, J. K. F. (2020). Determinants of bilateral trade between China and Africa: a gravity model approach. J. Econ. Stud. 47, 1015–1038. doi: 10.1108/JES-12-2018-0461

Hadi, N. U., Batool, S., and Mustafa, A. (2018). CPEC: an opportunity for a prosperous Pakistan or merely a mirage of growth and development. Dialogue 13:295.

Hali, S. M., Shukui, T., and Iqbal, S. (2015). One Belt and One Road: Impact on China-Pakistan Economic Corridor. Institute of Strategic Studies, p. 147–164.

Hassan, K. (2020). CPEC: a win-win for China and Pakistan. Hum. Aff. 30, 212–223. doi: 10.1515/humaff-2020-0020

Hassan, S. Z., Jajja, M. S. S., Asif, M., and Foster, G. (2021). Bringing more value to small farmers: a study of potato farmers in Pakistan. Manag. Decis. 59, 829–857. doi: 10.1108/MD-12-2018-1392

Hummels, D., and Klenow, P. J. (2005). The variety and quality of a nation's exports. Am. Econ. Rev. 95, 704–723. doi: 10.1257/0002828054201396

Hussain, M., and Jamali, A. B. (2019). Geo-political dynamics of the China–Pakistan economic corridor: a new great game in South Asia. Chin. Political Sci. Rev. 4, 303–326. doi: 10.1007/s41111-019-00128-y

Hussain, Z., Shahenn, W. A., and Raza, S. H. (2020). Trade, infrastructure and geography: an application of gravity model on Asian economies. Int. J. Transp. Econ. 47, 145–169.

Irshad, M. S., and Anwar, S. (2019). The determinants of Pakistan's bilateral trade and trade potential with world: a gravity model approach. Eur. Online J. Nat. Soc. Sci. 8:1.

Ismail, N. W., and Mahyideen, J. M. (2015). The Impact of Infrastructure on Trade and Economic Growth in Selected Economies in Asia (No. 553). ADBI Working Paper. doi: 10.2139/ssrn.2709294

Jámbor, A., Gál, P., and Török, Á. (2020). Determinants of regional trade agreements: global evidence based on gravity models. J. Int. Stud. 13, 44–57. doi: 10.14254/2071-8330.2020/13-1/3

Kamran, A., Syed, N. A., Rizvi, S. M. A., Ameen, B., and Ali, S. N. (2021). “Impact of China-Pakistan economic corridor (CPEC) on agricultural sector of Pakistan,” in Proceedings of the Fourteenth International Conference on Management Science and Engineering Management. ICMSEM 2020. Advances in Intelligent Systems and Computing, Vol. 1191 (Cham: Springer), 8–549. doi: 10.1007/978-3-030-49889-4_42

Khalid, R. (2015). China–Pakistan Economic Corridor (CPEC) Should be Supported by People to People Contacts. Islamabad: Institute of Strategic Studies.

Khan, H., and Chen, Y. (2024). Identifying the potential trade opportunities in the vegetable market between China and Pakistan. Pak. J. Agri. Sci. 61, 417–428. doi: 10.21162/PAKJAS/24.150

Khan, H., Chen, Y., and Lv, L. (2024). Does the China–Pakistan free trade agreement benefit the vegetable exports of Pakistan? A gravity estimation. Front. Sustain. Food Syst. 8:1362910. doi: 10.3389/fsufs.2024.1362910

Khan, H. U. (2020). BRI and CPEC: strategic and economic depth for Pakistan. South Asian Stud. 35, 217–236.

Khan, S., and Liu, G. (2019). The China–Pakistan economic corridor (CPEC): challenges and prospects. Area Dev. Policy 4, 466–473. doi: 10.1080/23792949.2018.1534549

Khan, Z. (2019). The China-Pakistan economic corridor: economic rationale and key challenges. China Q. Int. Strateg. Stud. 5, 249–265. doi: 10.1142/S2377740019500131

Khan, Z. A., Koondhar, M. A., Aziz, N., Ali, U., and Tianjun, L. (2020). Revisiting the effects of relevant factors on Pakistan's agricultural products export. Agric. Econ. 66, 527–541. doi: 10.17221/252/2020-AGRICECON

Kousar, R., Shafiq, A., and Bhadra, S. (2023). Geopolitical dynamics and their impact on trade between India and Pakistan: a comprehensive analysis. Peace Rev. 35, 574–587. doi: 10.1080/10402659.2023.2269107

Lateef, M., Tong, G.-J., and Riaz, M.-U. (2018). Exploring the gravity of agricultural trade in China–Pakistan free trade agreement. Chin. Econ. 51, 522–533. doi: 10.1080/10971475.2018.1481008

Lee, P. T.-W., Hu, Z.-H., Lee, S.-J., Choi, K.-S., and Shin, S.-H. (2018). Research trends and agenda on the Belt and Road (BandR) initiative with a focus on maritime transport. Maritime Policy Manag. 45, 282–300. doi: 10.1080/03088839.2017.1400189

Limao, N., and Venables, A. J. (2001). Infrastructure, geographical disadvantage, transport costs, and trade. World Bank Econ. Rev. 15, 451–479. doi: 10.1093/wber/15.3.451

Linders, G.-J., and De Groot, H. L. (2006). Estimation of the Gravity Equation in the Presence of Zero Flows. TI Discussion Paper; No. 06-072/3. Tinbergen Instituut (TI). doi: 10.2139/ssrn.924160

Makhmutova, D. I., and Mustafin, A. N. (2017). Impact of international trade on economic growth. Int. J. Sci. Study 5, 140–144.

Martin, W., and Pham, C. S. (2008). Estimating the Gravity Model When Zero Trade Flows are Frequent. Faculty of Business and Law, School of Accounting, Economics and Finance, Deakin University.

Mazhar, M. S., Bajwa, B. E., McEvilly, G., Palaniappan, G., and Kazmi, M. R. (2019). Improving vegetable value chains in Pakistan for sustainable livelihood of farming communities. J. Environ. Agric. Sci. 18, 1–9.

McCartney, M. (2022). The China-Pakistan economic corridor (CPEC): infrastructure, social savings, spillovers, and economic growth in Pakistan. Eurasian Geogr. Econ. 63, 180–211. doi: 10.1080/15387216.2020.1836986

Melitz, J. (2007). North, south and distance in the gravity model. Eur. Econ. Rev. 51, 971–991. doi: 10.1016/j.euroecorev.2006.07.001

Mnasri, A., and Nechi, S. (2019). New Approach to Estimating Gravity Models with Heteroscedasticity and Zero Trade Values. University Library of Munich, Germany.

Nordås, H. K., and Piermartini, R. (2004). Infrastructure and Trade (No. ERSD-2004-04). WTO Staff Working Paper. doi: 10.2139/ssrn.923507

Nuno-Ledesma, J., and Villoria, N. B. (2019). Estimating international trade margins shares by mode of transport for the GTAP data base. J. Glob. Econ. Anal. 4, 28–49. doi: 10.21642/JGEA.040102AF

Pawlak, K., and Kołodziejczak, M. (2020). The role of agriculture in ensuring food security in developing countries: considerations in the context of the problem of sustainable food production. Sustainability 12:5488. doi: 10.3390/su12135488

Pesaran, M. H. (2004). General Diagnostic Tests for Cross Section Dependence in Panels. Cambridge Working Papers. doi: 10.2139/ssrn.572504

Philippidis, G., Resano-Ezcaray, H., and Sanjuán-López, A. I. (2013). Capturing zero-trade values in gravity equations of trade: an analysis of protectionism in agro-food sectors. Agric. Econ. 44, 141–159. doi: 10.1111/agec.12000

Rahman, I. U., Shafi, M., Junrong, L., Fetuu, E. T. M., Fahad, S., and Sharma, B. P. (2021). Infrastructure and trade: an empirical study based on China and selected Asian economies. SAGE Open 11:21582440211036082. doi: 10.1177/21582440211036082

Raza, H., Osama, A., and Hena, S. (2018). China Pakistan economic corridor (CPEC): the counter balancer of momentous energy crisis in Pakistan. Adv. Soc. Sci. Res. J. 5, 172–180. doi: 10.14738/assrj.57.4841

Reed, T., and Trubetskoy, A. (2019). Assessing the Value of Market Access from Belt and Road Projects. World Bank Policy Research Working Paper. doi: 10.1596/1813-9450-8815

Saeed, N., Cullinane, K., Gekara, V., and Chhetri, P. (2021). Reconfiguring maritime networks due to the belt and road initiative: impact on bilateral trade flows. Marit. Econ. Logist. 23, 381–400. doi: 10.1057/s41278-021-00192-9

Santos Silva, J. M. C., and Tenreyro, S. (2022). The log of gravity at 15. Port. Econ. J. 21, 423–437. doi: 10.1007/s10258-021-00203-w

Scheltema, N. (2014). A Gravity Approach to the Determinants of International Bovine Meat Trade. University of Pretoria.

Shaikh, F., Ji, Q., and Fan, Y. (2016). Prospects of Pakistan–China energy and economic corridor. Renew. Sustain. Energy Rev. 59, 253–263. doi: 10.1016/j.rser.2015.12.361

Sher, A., Mazhar, S., Abbas, A., Iqbal, M. A., and Li, X. (2019). Linking entrepreneurial skills and opportunity recognition with improved food distribution in the context of the CPEC: a case of Pakistan. Sustainability 11:1838. doi: 10.3390/su11071838

Silva, J. S., and Tenreyro, S. (2006). The log of gravity. Rev. Econ. Stat. 88, 641–658. doi: 10.1162/rest.88.4.641

Spies, M. (2021). Promises and Perils of the China-Pakistan Economic Corridor: Agriculture and Export Prospects in Northern Pakistan. Eurasian Geography and Economics, 1–27. doi: 10.1080/15387216.2021.2016456

Sroosh, M. N., and Sabir, M. Y. (2013). “New silk road initiative: economic dividends,” in Future of Economic Cooperation in SAARC Countries (Islamabad: Islamabad Policy Research Institute), 119.

Stronge, W. (1978). Heteroscedasticity and the gravity model. Geogr. Anal. 10:279. doi: 10.1111/j.1538-4632.1978.tb00657.x

Subhan, A. R., Santosa, B., and Soeharjoto, S. (2021). Bilateral trade flows among G7 member countries and Indonesia: gravity model approach. Media Ekonomi 29, 21–36. doi: 10.25105/me.v29i1.9108

Sun, P., and Heshmati, A. (2010). International Trade and its Effects on Economic Growth in China. IZA Discussion Papers, No. 5151, Institute for the Study of Labor (IZA), Bonn. doi: 10.2139/ssrn.1667775

Tabasam, N., and Ismail, N. W. (2019). Transportation infrastructure of Pakistans agricultural export. J. Dev. Agric. Econ. 11, 92–101. doi: 10.5897/JDAE2019.1053

TDAP (2022). Trade Development Authority of Pakistan. Available online at: https://tdap.gov.pk/wp-content/uploads/2022/03/Pak-China-Wrap.pdf (accessed October 6, 2024).

Trotignon, J. (2010). Does regional integration promote the multilateralization of trade flows? A gravity model using panel data. J. Econ. Integr. 25, 223–251. doi: 10.11130/jei.2010.25.2.223

Ullah, S., Hafeez, M., Aziz, B., and Ahmad, H. (2018). Pakistan-China regional trade potentials in the light of CPEC. Pak. J. Sci. Issu. 109–118.

Wang, C., Lim, M. K., Zhang, X., Zhao, L., and Lee, P. T.-W. (2020). Railway and road infrastructure in the Belt and Road Initiative countries: estimating the impact of transport infrastructure on economic growth. Transp. Res. Part A Policy Pract. 134, 288–307. doi: 10.1016/j.tra.2020.02.009

Wen, R., and Saleeem, H. (2021). The opportunities and challenges that the belt and road initiative brings: analysis from perspective of China-Pakistan economic corridor. Am. J. Ind. Bus. Manag. 11, 675–691. doi: 10.4236/ajibm.2021.116044

Yar, P., Khan, S., Ying, D., and Israr, M. (2021). Understanding CPEC's role in agriculture sector development in Pakistan: issues and opportunities. Sarhad J. Agric. 37, 1211–1221. doi: 10.17582/journal.sja/2021/37.4.1211.1221

Yotov, Y. V. (2022). On the role of domestic trade flows for estimating the gravity model of trade. Contemp. Econ. Policy 40, 526–540. doi: 10.1111/coep.12567

Yu, C., Zhang, R., An, L., and Yu, Z. (2020). Has China's belt and road initiative intensified bilateral trade links between China and the involved countries? Sustainability 12:6747. doi: 10.3390/su12176747

Appendix

Table A1. Pakistan's agricultural and vegetable trade with China from 2003 to 2021, based on data from ITC, Pakistan Bureau of Statistics, and the authors' compilation, with values in USD thousands.

Table A2. Description of all variables included in the model, abbreviated forms, expected signs, and data sources.

Keywords: agriculture, vegetables, trade, BRI, CPEC, infrastructure, gravity model

Citation: Khan H, Yan Z and Chunjie Q (2025) Roads, trade, and growth: PPML evidence on Pakistan's vegetable export performance. Front. Sustain. Food Syst. 9:1586707. doi: 10.3389/fsufs.2025.1586707

Received: 03 March 2025; Accepted: 02 June 2025;

Published: 02 July 2025.

Edited by:

Wenjin Long, China Agricultural University, ChinaReviewed by:

Meseret Chanie Abate, Hunan University of Science and Engineering, ChinaTayyab Raza Fraz, University of Karachi, Pakistan

Copyright © 2025 Khan, Yan and Chunjie. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qi Chunjie, cWljaHVuamllQDEyNi5jb20=; Humayun Khan, aHVtYXl1bmtoYW5AbWFpbC5oemF1LmVkdS5jbg==

Humayun Khan

Humayun Khan Zeng Yan

Zeng Yan