Abstract

Introduction:

It is important to enhance consumer trust in the product quality of a sustainable agricultural supply chain. However, the frequent occurrence of food safety problems in practice leads to a lack of public confidence in food safety. To tackle the challenge of quality distrust, we harness the synergistic potential of “GenAI + blockchain” technology among industry-leading agribusinesses.

Methods:

Three distinct models are constructed to explore the impact of various technological integrations, with a focus on analyzing inventory management, operational efficiency, and precision technology adoption using AnyLogic.

Results:

Our study reveals that (1) Integrating AI and blockchain technology can modulate minimum safety stock, catalyzing leapfrog revenue growth for enterprises. (2) Harnessing artificial intelligence can bolster the agricultural supply chain’s overall efficiency, but striving to achieve the highest possible accuracy is not feasible. (3) Gauging consumers’ premium for freshness aids companies in targeting key demographics and bolstering quality trust, thus fostering a stable upward trend in sales.

Discussion:

By demystifying the underpinnings of minimum safety stock adjustments and the subtle effects of precision technology, our study steers the crafting of advanced inventory strategies and astute technology decisions for innovative agribusinesses.

1 Introduction

In the traditional agricultural supply chain, enterprises exhibit substantial dependency on unidirectional supply chain relationships. This reliance is compounded by a conspicuous lack of consumer trust in the food production process and various facets of the production chain, particularly regarding issues such as environmental contamination and food spoilage (Danneels, 2004). To mitigate these trust deficits, disruptive technologies, notably blockchain (Tan and Saraniemi, 2023; Hou et al., 2024), are progressively being integrated into networked supply chains to predict changes in the freshness of agricultural products, thereby ensuring product quality, traceability, and comprehensive process transparency (Zhu et al., 2023). While blockchain technology holds significant promise in enhancing product traceability and authenticity, it does not constitute a panacea for all quality-related concerns. Enterprises may still encounter challenges in maintaining product quality, necessitating the implementation of additional quality control measures alongside the adoption of blockchain solutions. For example, incidents such as the Andre Group’s production of fruit and vegetable juices from rotten fruit in August 2024 and the smoking of wolfberries in Gansu underscore a pervasive lack of trust in product quality. Additionally, occurrences of adulterated onions and the presence of residual vegetable matter in Changsha, Guizhou, and other locations highlight the limitations of relying solely on blockchain technology to ensure the security and integrity of food traceability systems. Although blockchain technology provides robust assurances regarding the protection of digital data, it may not fully address fundamental challenges related to the safety and quality of the food items themselves. The deceptive appearance of products impairs consumers’ ability to accurately assess product quality, leading to uncertainty about their willingness to pay and potentially resulting in transaction failures.

To effectively enhance trust in product quality, an increasing number of leading agribusinesses are developing intelligent technology platforms for agricultural services. Emerging AI platforms, represented by Generative Artificial Intelligence (GenAI), are creating numerous application scenarios. For instance, the Zhengda Group in Thailand collaborated with Huawei Cloud Pangu’s pre-training Graph large model in February 2023 to achieve intelligent analysis of durian DM structured data, increasing the predictive accuracy of durian maturity from 50 to 91%;1 Similarly, Kraft Heinz plans to implement an artificial intelligence vision system in October 2024 to ensure natural product consistency from farm to tin, maintaining product freshness and high quality.2 Agribusiness leaders are leveraging GenAI technology to detect product quality and generate automated work instructions, aiming to develop high-quality, efficient production lines and ensure the sustainability of agricultural supply chains. Indeed, the integration of GenAI and blockchain technology facilitates precise and contemporaneous inventory data, enhances efficiency, and mitigates human error impacts. Blockchain technology offers a transparent, auditable view of the supply chain. When combined with GenAI’s rigorous product quality testing, it helps enhance consumer trust in product quality. For example, Juewei Food employs both GenAI and blockchain technology to understand real-time supply chain dynamics, facilitate chain-wide information sharing and collaboration, and improve food product quality and service levels. Given these developments, this study explores the complementary applications of blockchain technology for freshness prediction and GenAI technology for quality detection. The objective is to optimize the agricultural supply chain by ensuring the freshness of agricultural produce, thereby strengthening consumer confidence in product quality.

The extant research on blockchain and GenAI technologies in the agricultural supply chain is oriented toward assisting farmers in making accurate decisions and intelligent optimization in production, marketing, and financial matters (Holzinger, 2018; Hagras, 2018; Chen et al., 2023; Arora et al., 2025). Nevertheless, existing research has predominantly concentrated on the utilization of blockchain technology to enhance the comprehensive traceability and transparency of the supply chain (Matzembacher et al., 2018; Mangla et al., 2022; Madzík et al., 2025). Enhance the precision of blockchain technology in forecasting the freshness of products, thereby influencing product inventory and revenues in enterprises (Modak et al., 2024), and the deployment of GenAI technology for the monitoring of product quality (Ma et al., 2024). The impact of consumers’ willingness to pay on their returns as a result of using technology has been relatively overlooked. Furthermore, the real-time observation of changes in inventories and returns across actors in the agricultural supply chain remains unrealized. Based on this, we construct a baseline model without the use of technology, a Blockchain-coordinated model, and a collaborative model based on “GenAI + blockchain” technology to simulate the changes of inventory and income of various entities in the agricultural supply chain network over time. According to the different accuracy of technology use and payment willingness, reasonable technology use schemes are analyzed, and technology application methods that can accurately describe different demand conditions are proposed. AnyLogic software is used to simulate different technology integration degrees, and through the real-time changes of each main body’s inventory, freshness and income, the relationship between various decision-making processes can be better understood, and the minimum safety inventory of enterprises can be found more intuitively and easily. And analyze how the use of technology and consumers’ willingness to pay for products of different quality affect the overall benefits of enterprises and even agricultural supply chains.

Our study subdivides the precision degree of technology utilization within the agricultural supply chain, facilitating a more accurate understanding by enterprises of their technological needs under varying circumstances. This segmentation holds practical significance for enhancing consumer trust in product quality. Furthermore, the integration of “GenAI + blockchain” technology presents potential for leading agribusinesses to conduct real-time minimum safety inventory planning. It also addresses the limitations of blockchain technology in monitoring product quality and safety, thereby enabling enterprises to bolster consumer confidence in product quality. To address these points, this research seeks to answer the following questions: (1) how does the accuracy of “GenAI + blockchain” technology application at each stage influence the degree of product trust? (2) What are the impacts of implementing and integrating different technologies on the security stock and earnings of agricultural enterprises? (3) How does the integration of GenAI and blockchain technology affect consumers’ willingness to pay for freshness, and in what ways can it help enterprises improve efficiency?

Our study contributes to the literature by establishing technological synergy strategies for leading firms to improve quality trust, taking into account firms’ minimum inventory, technological precision, and payment sensitivity. The combination of GenAI and blockchain technologies offers potential for enhancing the overall quality and efficiency of the agricultural supply chain. The application of technology synergies can facilitate real-time monitoring of inventory and the formulation of minimum safety stock strategies by enterprises. Additionally, the integration of enhanced precision through technology can assist businesses in accurately targeting markets according to varying willingness-to-pay segments, improving quality and reliability, and achieving optimal returns.

The remainder of this research is organized as follows: Section 2 presents a review of the existing literature, offering a comparison to this thesis; Section 3 is concerned with the description of problems and construction of models; Section 4 conducts the model simulation and result analysis. A sensitivity analysis is presented in section 5, with a view to discussing the impact of inventory, technical precision, and payment sensitivity. In conclusion, the full text is summarized and pertinent recommendations are set forth in Section 6.

2 Relevant research

2.1 Research on product quality trust

Quality trust stands as a critical concern in the management of agricultural supply chains, shaping consumer perceptions regarding the safety and quality of agricultural products, and impacting the overall efficiency and profitability of the supply chain. Scholars have, in recent years, embarked on multifaceted research endeavors to understand how to establish and sustain quality trust within the supply chain. Paramount among these factors is the governance structure of the supply chain, which exerts a profound influence on the maintenance of agricultural product quality. Empirical research has underscored the benefits of robust collaboration among supply chain actors in bolstering product quality and reducing information disparities. Illustratively, the augmentation of information sharing and cooperative efforts can elevate the transparency of the supply chain, consequently bolstering consumer confidence in the products (Sun et al., 2021). Secondly, price, which is conventionally indicative of quality, can be rendered ineffective by information asymmetry. In response to this challenge, blockchain technology emerges as a novel solution.

The inherent immutability and transparency of blockchain serve to authenticate agricultural products (Vazquez Melendez et al., 2024), thereby reinstating consumer confidence in price signals, optimizing supply chain efficiency, and harmonizing the interests of all supply chain stakeholders (Luo et al., 2024). The integration of blockchain technology within the realm of supply chain management (SCM) is attracting substantial interest, notably for its capacity to bolster transparency and foster consumer trust. Specifically, blockchain technology enables the traceability and authentication of the quality and origin of agricultural products, thereby fundamentally resolving concerns regarding the quality and safety of agricultural produce (Zhan and Wan, 2024). Beyond the deployment of technology, the trust among members within the supply chain plays a pivotal role in shaping confidence in organic products (Duong et al., 2024). Furthermore, traceability information is instrumental in bolstering consumer trust (Matzembacher et al., 2018). Blockchain-enabled food traceability systems offer substantial benefits in enhancing consumers’ intentions to select safe food options (Lin et al., 2021). During the process of purchasing and consuming food, consumers depend on specific information to evaluate food quality (Ladwein and Romero, 2021). Food certification emerges as a key determinant in building trust (Conroy and Lang, 2021), with a pronounced level of confidence in certified organic food chains and agricultural products (Murphy et al., 2022). Information sharing and the caliber of information significantly influence food quality (Juan Ding et al., 2014), and it is upon this trust that chain members operate to forge a secure and dependable supply chain (Fischer, 2013). Consumers’ perception and assessment of risks, mediated through shared information, directly affect their trust in the quality of food (Tan and Saraniemi, 2023). The depth of consumer trust is shaped by the intricate dynamics among the three pillars of food trust: search, experience, and credence attributes. Price reductions can undermine customer trust, whereas perceived quality assumes a pivotal mediating function (Bai et al., 2023). Regarding food safety, the implementation of blockchain technology to augment the efficiency, transparency, reliability, and traceability of the food supply chain is pivotal in developing a more robust and efficient system for ensuring food safety (Akram et al., 2024). Furthermore, blockchain serves as a tool for tracking goods, retrieving data, and managing data, all of which are critical for safeguarding food safety (Khan et al., 2022). The technical reliability, transparency, consensus standards, and traceability inherent in blockchain are acknowledged for their role in fostering sustainable development (Mangla et al., 2022). The advent of sophisticated technologies—including the Internet of Things, big data, and artificial intelligence—holds the potential to augment the operational efficiency and product quality oversight within the supply chain (Alvarez-García et al., 2024) to achieve sustainable development of the agricultural supply chain.

Scholars have extensively researched the issue of product trust within agricultural supply chains, with a primary emphasis on validating food authenticity through inter-stakeholder information sharing and leveraging blockchain technology for traceability. Yet, the dimension of consumer quality trust has remained largely unexplored. Scholars have posited that blockchain technology holds the potential to predict fluctuations in the freshness of agricultural produce, but its implementation in the agricultural supply chain has been predominantly directed toward maintaining product freshness and quality (Modak et al., 2024). In this study, we propose to evaluate product quality trust based on the freshness of products and delve into the multifaceted benefits of blockchain and GenAI technologies within the agricultural supply chain. Adopting a perspective aimed at enhancing trust in quality, our research assesses how these technologies can confer overall benefits to both enterprises and agricultural supply chains. This analysis aims to establish a rationale for the integration of technology within enterprises and among supply chain members, and to precisely articulate the influence of blockchain technology adoption on the operational performance of enterprises within the agricultural supply chain ecosystem.

2.2 Research on generative artificial intelligence (AI) in agricultural supply chain

The deployment of generative artificial intelligence (AI) within the agricultural supply chain represents a swiftly advancing domain, spanning the entire spectrum from cultivation to processing and distribution. Research has delved into harnessing generative AI technology to bolster the efficiency and effectiveness of agricultural supply chains. In this context, Interpretable generative artificial intelligence (XAI) stands out for its capacity to resolve issues by furnishing precise and comprehensible justifications for decisions rendered by AI (Holzinger et al., 2022; Schneider, 2024). Prior studies have demonstrated that artificial intelligence is capable of understanding and recommending management practices tailored to specific crops, taking into account variables such as weather patterns and soil moisture. This capability facilitates more enlightened decision-making and enhances crop productivity (Holzinger, 2018). Within the realm of agricultural production, artificial intelligence technology plays a pivotal role in aiding farmers to foster crop growth. Specifically, AI algorithms scrutinize sensor data, identify early indicators of crop diseases, and proffer targeted action plans to farmers (Hagras, 2018). Regarding the maximization of yields, the analysis of soil data and meteorological parameters, facilitated by the interpretation of foundational models and datasets, enables the formulation of strategies aimed at attaining peak yields. This approach aids farmers in making more facile and enlightened decisions (Chen et al., 2023). In terms of market management, AI and machine learning models predict crop yields and prices, aiding managers in making better market decisions, optimizing the logistics and distribution of agricultural products, and enhancing efficiency by reducing waste through the prediction of market demand and analysis of consumer behavior (Mwangakala et al., 2024). Additionally, GenAI plays a pivotal role in product quality control, including the detection of pollutants and risk assessment through the use of large language models (LLMs), addressing the shortcomings in food quality control (Ma et al., 2024). AI technology has already been successful in the fields of product development and freeze–thaw meat quality control (Qiao et al., 2024). Bayer Crop Science has developed Climate FieldView, a comprehensive agricultural platform that incorporates over 250 layers of data and billions of data points. The platform uses AI-powered recommendations to help farmers design and monitor their fields, increase crop yields, and reduce carbon emissions; thereby enabling more efficient, sustainable, and profitable farming practices (Angelov et al., 2021).

Furthermore, the integration of AI with different technologies can produce various effects. The combination of AI and big data can enhance the ability to resist food safety risks (Mu et al., 2024). Academic inquiry has delved into the combined potential of AI and blockchain technologies. The confluence of these technologies not only hastens the pace of product design, bolsters collaborative efforts, and optimizes manufacturing processes to shield the supply chain from counterfeiting and foster ethical consumption practices (Patel et al., 2024), but also plays a pivotal role in the early identification and mitigation of food safety risks (Chen et al., 2023). From a financial standpoint, IBM, in 2017, harnessed Food Trust blockchain technology coupled with an AI platform to facilitate swift transactions and enhance decision-making capabilities among small-scale coffee and cocoa farmers (Barbano, 2017).

Previous studies have shown that current research on AI technologies in agricultural supply chains tends to focus on helping farmers improve crop yields, make management decisions, or investigate single aspects of agricultural supply chain management. Research on “GenAI + blockchain” has focused on identifying counterfeit products and discovering safety hazards in the agricultural supply chain through blockchain traceability and the synergy between GenAI and blockchain technologies, but less attention has been paid to the area of quality trust. Therefore, based on the accuracy of blockchain technology for fresh produce prediction, we consider using the quality detection capabilities of GenAI to assist leading agricultural enterprises in achieving consumer quality trust, high-quality output in the agricultural supply chain, and double-layer safety detection for sustainable development.

3 Problem description and model construction

The quandary of quality trust within the agricultural supply chain exerts a dual impact: it undermines the operational efficacy of individual enterprises on the chain/network and concurrently diminishes the collective performance level of the entire chain/network, attributable to the interdependent nature of its members. The emergence of quality trust issues in leading agricultural enterprises is not only deleterious to their performance but also triggers oscillations in the interests of other chain constituents. To mitigate the occurrence of quality issues to the fullest extent possible, enterprises must endeavor to secure enhanced quality trust from consumers, thereby fortifying the integrity and reliability of the agricultural supply chain. We will delineate three models to facilitate a comprehensive comparative analysis, among which two embody technology synergy models that share analogous processes (illustrated in Figure 1).

Figure 1

The structure of the agricultural supply chain model operating under the auspices of technological synergy. Source(s): author’s own work.

In these models, prominent enterprises in the agricultural sector facilitate the integration of technology platforms, which then enable members of the supply chain—including enterprises, distributors, retailers, and consumers—to utilize these platforms to facilitate the sale and transportation of agricultural products. The blockchain technology platform primarily provides freshness monitoring technology, and the “GenAI + blockchain” platform builds on this by adding quality detection capabilities. Supply chain participants engage in the sale of goods, enabling consumers to trace and evaluate the quality of their purchases, and to convey their willingness to pay. Against this backdrop, we construct two models. The first is a conventional supply chain model devoid of technological integration, whereas the second is a Blockchain-coordinated model. In the latter, enterprises implement a blockchain technology platform, facilitating other chain members to utilize this technology for offering freshness monitoring services and for the sale of products via blockchain technology. Furthermore, there is a spectrum of ways in which enterprises harness blockchain technology, with technological precision ranging widely, and scenarios where blockchain may be either entirely absent or inconsistently integrated within organizational structures. The deficiency of consumer trust in blockchain technology, evident in skepticism toward both the technology itself and the freshness of products, exerts a cascading impact on the effectiveness of its deployment. Even with the adoption of blockchain technology, its potential benefits may remain unfulfilled due to this pervasive consumer apprehension. In light of this, the third model integrates GenAI technology to forge a collaborative framework predicated on the “GenAI + blockchain” paradigm. This enables enterprises to establish high levels of consumer trust through the deployment of GenAI technology, thereby enhancing the overall efficiency of the chain.

This section presents an analysis of the impact of blockchain technology and AI-blockchain technology on the benefits of agricultural supply chains. To this end, we employ three simulation models, each corresponding to a specific level of technological precision: (1) a baseline model with traditional structure, (2) a collaborative supply chain monitoring model based on the freshness characteristics of blockchain usage, and (3) a resource-collaborative supply chain model based on GenAI + blockchain. given the particularities of the agricultural supply chain and considering the degree of integration efficiency of blockchain and GenAI + blockchain, this problem is addressed by varying the input parameters.

3.1 Parameter assumption

Hypothesis 1: In the simulation, it is set that the improvement of technical accuracy and cost increase linearly. This assumption is based on the realistic logic of AI model training. High-precision models require more data annotation and computing power investment. For example, when Kraft Heinz deployed an AI vision system, the cost increased as the accuracy improved.

Hypothesis 2: The model characterizes consumers' willingness to pay (WTP) for freshness using a piecewise function: WTP experiences a precipitous decline when product freshness falls below a threshold, while it increases linearly with freshness above the threshold.

Hypothesis 3: A truncated normal distribution is employed in the simulation to model retailers' daily demand, under the assumption that consumers purchase only a single product and there is no negative demand. This assumption aligns with the typical "single-day single-customer purchase limit" scenario for agricultural fresh products (e.g., vegetable purchase restrictions in supermarkets), which is consistent with consumers' real-world daily purchasing behaviors.

Hypothesis 4: The (s, S) ordering strategy is adopted, involving daily inventory reviews and safety stock maintenance, under the premise that enterprises possess real-time inventory monitoring capabilities. This assumption implies the real-time synchronization support of blockchain technology for inventory data, in line with practices with Charoen Pokphand Group, which has achieved inventory transparency through blockchain applications.

3.2 Baseline model without technology use

The agricultural supply chain under consideration comprises both production and non-production entities. Leading agribusinesses supply agricultural products to distributors, who are primarily responsible for transportation, delivery of orders, and ordering products based on the quantities requested by retailers. Retailers receive orders from consumers for stocking and delivering products. The daily lead count for each retailer is simulated using a truncated normal distribution, thus precluding negative demand. It is assumed that each consumer can claim only one item if the product is in stock; therefore, consumer waiting time follows a Gaussian distribution and is not expected to exceed a certain threshold. If the total consumer order amounts to a single unit, the retailer has the discretion to fulfill the order completely or not, depending on inventory levels. Order fulfillment, influenced by the number of potential customers and repeat purchases, may be complete or partial, contingent upon the retailer’s stock, allowing for partial shipments. Upstream entities in this agricultural supply chain do not incur backlog costs for directly shipped goods. Each participant can dispatch goods and receive orders from downstream entities or end consumers. Delivery times to partners are normally distributed, dependent on the total quantity in transit. The inventory of leading agricultural enterprises, the principal production entities, mainly consists of perishable fresh produce. Product pricing is primarily governed by the costs associated with agricultural production and consumer market demand. Given the importance of product freshness, it serves as the paramount criterion by which consumers evaluate products.

In this baseline model, holding costs are incurred on a per-unit and per-day basis due to the capital lock-in and inherent warehousing costs of the model. Inventory replenishment is conducted through the implementation of an order-to-stock strategy (s, S ordering policy), where inventory levels are subject to daily review to ensure a consistent and uninterrupted flow throughout the entire supply chain. Moreover, the determination of order points is calibrated to ensure that each unit is ordered on a daily basis under equilibrium conditions. We can accurately ascertain the costs associated with fixed and variable orders, as well as any preemptive orders that have been placed, taking effect instantaneously. Drawing from the research of Yang et al. (2024) and Wu et al. (2023), in conjunction with other pertinent literature, the parameter is set to , consequently defining the associated freshness function, denoted as . Herein, denotes the product’s initial freshness level. Considering the product under scrutiny is newly produced, the initial freshness is defined, denoted by , as follows. The parameter signifies the rate at which freshness decays, with being positive and its specific value derived from the unique attributes of the produce under consideration. The parameter denotes the duration of the transportation process. Given that the product is being transported with losses, the final volume of product sold is represented by the value of variable . The quantity of product in transit is denoted by the variable . A thorough examination of the literature, encompassing contributions from Yu et al. (2022), Ketzenberg et al. (2015), and Chen et al. (2016), underscores that logistics and freshness costs are pivotal determinants of the overall financial burden on supply chains. In addition, inventory expenditures account for a notable segment of the total costs within traditional agricultural supply chains. The central processes modeled in AnyLogic involve the transit of products among principal entities and inventory fluctuations, which are crucial for ascertaining the related cost implications. The logistics expenditure, which encompasses temporal costs, within the supply chain is represented by . Echoing the findings from Yang et al. (2024), the cost associated with freshness preservation stems from the endeavors to sustain product freshness, thereby warranting the incorporation of an extra freshness retention expense, signified by , alongside the previously mentioned costs. Inventory-related costs are designated as . Within the agribusiness sector, a specific subset of production expenses is recognized and labeled as . The variables , , , and correspond to the per-unit logistics, freshness preservation, inventory, and production costs of each item, in that order. The unit selling price for each participant in the supply chain is established in accordance with market pricing principles, exhibiting incremental increases as the product transitions through the supply chain, from the enterprise to the distributor, and ultimately to the retailer.

The production process associated with the enterprise is characterized by a normally distributed production time. Given that the set production capacity is finite, it follows that the number of products produced is also finite. The production process commences upon the arrival of an order at the receiving warehouse. The associated costs can be classified as fixed and variable. On a daily basis, each entity within the supply chain monitors and assesses pertinent data, including inventory levels, sales figures, and instances of stock shortages. Once all executable orders have been placed, the current inventory levels held by upstream subjects are compared with the expected quantities and the predefined target inventory levels. This allows the calculation of the order quantities and the associated revenues. Immediate shipment of orders is standard practice. The quantity of goods ordered from the upstream supplier is directly proportional to the number of orders placed, with a corresponding inverse relationship between the arrival of the shipment and the quantity of goods received. It is essential to monitor and record the relevant fixed and variable costs, production costs and transport costs. In consideration of the decline in quality that occurs during the course of the transportation process, the products are classified according to their level of freshness, with prices adjusted to reflect the differing levels of deterioration that occur in products with varying degrees of freshness. The selling price of fresh products is set at the highest level, designated as . Conversely, the price of products that have been tested and found to have a high loss of freshness is reduced to the second-highest level, designated as . The ultimate daily operational phase for each entity is the calculation of profit. The final aggregate profit for the agribusiness as Equation 1:

3.3 Blockchain-coordinated model

Drawing from the baseline model’s framework, this section delves into the pivotal parameters underpinning blockchain technology. The expense of integrating blockchain technology is predominantly contingent upon the accuracy with which it is deployed and the operational expenditures required for system monitoring and maintenance in real-world applications. The advantages of blockchain-facilitated orders may arise from enhanced product freshness surveillance and predictive analytics offered by a transparent platform, potentially elevating the fixed cost per transaction above that of the baseline model’s fixed order costs. Herein, we examine the principal benefits that blockchain technology confers upon each supply chain participant and assimilate these benefits into the tangible simulation model. The freshness of each member’s goods is employed as a benchmark for pricing, with the corresponding profits for each entity being meticulously calculated.

For enterprises, the most significant benefit of blockchain is its ability to track quality. The electronic tracking system utilizing blockchain technology plays a crucial role in tracing the supply chain of organic products and in timely monitoring and predicting product freshness through blockchain technology, thereby meeting the high-quality demands of agricultural products. For distributors, the primary role of blockchain is reflected in its ability to enhance transportation safety; blockchain technology can help reduce logistics costs and the risk of transportation damage, ensuring product quality and expanding the potential sales market. For retailers, the greatest advantage of blockchain lies in its traceability; through blockchain’s traceability capabilities, one can track all aspects of the entire process, ensuring product quality throughout.

In this collaborative model, each subject has its own transportation cost, inventory overhang cost and out-of-stock cost, but for the leading enterprise, the subject bears the technical cost. Each subject of the supply chain applies technology according to the blockchain technology platform introduced by the enterprise. The process time is normally distributed, and waiting time may occur because the transportation time may lead to changes in the free capacity between agents.

In this model, blockchain technology is employed primarily for the monitoring and prediction of freshness, the establishment of a freshness loss rating of , and the subsequent calculation of the freshness function . In the context of blockchain technology, the level of prediction accuracy indicated by represents the upper limit of the technology’s potential. In contrast, the extreme case of corresponds to a scenario where blockchain technology is not employed, while the extreme case of reflects a scenario where the technology is highly accurate in monitoring and predicting product freshness. The pricing paradigm applied within this model mirrors that of the baseline model, categorizing products based on the criterion of freshness. Nonetheless, the emergence of blockchain technology has precipitated a transformation in consumer preferences, particularly in their readiness to pay a premium for freshness. This change is most evident post-adoption of the technology. Ultimately, the sales performance of fresh products is encapsulated by the variable . This is where , denotes the strength of the effect of freshness on price (the strength of the willingness to pay for freshness on price). It can be seen that higher freshness increases the willingness of consumers to pay, thus supporting higher prices. denotes the amount of product being transported. The logistics cost in the supply chain is designated as , while the inventory cost is denoted as . The cost is attributed to alterations in the freshness of the product, which consequently give rise to fluctuations in the quantity of product in transit and in inventory. Consequently, the revenue generated by the model is represented by . Building upon the insights from Wu et al. (2023) research, it is inferred that the assimilation of an enterprise technology platform warrants the inclusion of a fixed technology cost, designated as .

Relative to the baseline model, the post-blockchain technology adoption profit for each participant is denoted by the expression . After incorporating all the relevant costs discussed earlier, the profit function can be simplified as Equation 2:

3.4 Collaboration model based on “GenAI + blockchain” technology

This section explores the differences between the simulation model based on blockchain technology and its key parameters. The cost of implementing “GenAI + blockchain” technology primarily depends on the precision of the technology and the operational expenses for monitoring and maintenance in practical applications. The benefits of “GenAI + blockchain” technology likely stem from its ability to help enterprises maintain freshness, assess product quality, and uphold superior product standards through GenAI, while blockchain ensures traceability and security across various chain entities. Leading enterprises drive the adoption of “GenAI + blockchain” technology, allowing other chain participants to utilize the platform to meet their specific application requirements. Consequently, a fixed cost per transaction is considered, which exceeds the fixed order cost characteristic of the baseline model.

In this section, we examine the primary advantages of “GenAI + blockchain’ technology for each member of the supply chain and integrate them into the concrete simulation model. Similar to the previous section, the freshness of goods for each member of the chain serves as a benchmark for price setting, and the related profit for each agent is calculated.

Enterprises stand to gain the most from GenAI technology through its intelligent detection system, which can automatically identify the appearance, size, color, and other attributes of agricultural products. This system compares these features against established standards to ascertain product quality. Such functionality not only enhances the speed and accuracy of agricultural product quality inspections but also safeguards the quality and safety of these products. Consequently, GenAI technology is poised to enrich human-machine interaction, while blockchain technology is well-suited to bolster transparency and traceability within the supply chain, ultimately reinforcing consumer confidence in the quality of the enterprise’s offerings. Distributors benefit from real-time data and intelligent monitoring provided by the technology platform offered by enterprises, which enhances the safety and reliability of transportation. This approach helps reduce logistics costs and mitigate risks of damage during transit, ensuring the preservation of product freshness and maintaining product quality. As a result, it strengthens market trust in the freshness of products. Blockchain is effectively utilized for tracking physical goods, while GenAI technology aids in data analysis, streamlining logistics, and ensuring product authenticity. The synergistic application of GenAI and blockchain, supported by real-time data and monitoring, provides superior tracking and security capabilities throughout the supply chain continuum. Retailers can leverage GenAI forecasting to more precisely anticipate market demand, thereby avoiding overstocking and maintaining superior product quality. The implementation of blockchain technology facilitates the documentation and monitoring of the product’s lifecycle, from production and transportation to sales, ensuring both product quality and safety. Concurrently, GenAI technology enhances the traceability and transparency within the supply chain. The convergence of GenAI and blockchain, with their real-time traceability, is crucial in fostering high consumer trust.

In comparison with the blockchain technology synergy model, this model incorporates additional factors related to the synergy between GenAI technology and other elements, with the aim of establishing a precise level of accuracy in GenAI technology detection. This is accomplished by adopting the methodology used in the freshness prediction model of blockchain technology, which is then extended to the GenAI technology quality detection model. The resulting model utilizes the symbols and to denote the accuracy level of GenAI detection. As in the baseline model, the selling price of the fresh product is set to , and the price of the detected non-fresh product is subject to a price reduction, which is set to . Thus, the total sales revenue for this model of technological synergy is denoted by signifies the magnitude of the influence that GenAI quality assessments exert on pricing, which corresponds to the consumer’s WTP for the product. In contrast, encapsulates the level of consumer trust in the product’s quality. The consumer’s initial lack of trust in the product has a detrimental impact on sales, reducing the overall value of the product. Conversely, the development of quality trust in the product, indicated by , has a positive effect on sales and the overall value of the product. This model analyses the impact of WTP intensity on the benefits of agricultural supply chains by influencing product pricing through the parameter . In this synergistic model, the enterprise’s use of GenAI technology for quality inspection is complemented by the capacity to predict market demand. This enables the timely conversion of demand into goods in transit, which represents the primary manifestation of the intelligent order-handling system. Furthermore, as a consequence of the implementation of the enterprise’s technological platform, the subject is required to integrate a fixed technology cost, designated as . Consequently, in comparison to the aforementioned two models, the profit function, designated as , of each subject is expressed as Equation 3:

4 Model simulation and result analysis

A stochastic discrete distribution is employed to model customers who express a desire to purchase a single product on a daily basis. These customers are willing to wait for their desired item if the corresponding retailer is out of stock. The term “holding costs” encompasses both physical storage costs and capital commitment costs. For the parameterization of the relevant costs, the variable transport cost is set at $0.5 per piece, as proposed by Wu et al. (2023), Lohmer et al. (2020) and other researchers. In the technology coordination model, additional parameters must be defined. In the Blockchain-coordinated model, the fixed cost per unit of each transaction between the distributor and the retailer is set at 50, while the enterprise, as the technology introducer, is responsible for bearing the technology introduction cost. In the “GenAI + blockchain” coordination model, it is postulated that the fixed cost per transaction is set to 100.

In the simulation study, the following aspects must be specified: the input parameters to be changed, the output parameters, the waiting time, and the time for the model to run. The predictive power of blockchain technology and the degree of efficiency of coordinated integration of “GenAI + blockchain” technology depends on the degree of willingness of consumers to pay for freshness, which includes not only the availability and perfect operation of the technology implementation, but also the speed of the underlying processes such as shipping, receiving and production. Set probabilistic processing times based on the overall process. Therefore, according to Charoen Pokphand Group Annual Report 2023, in the three models, the main body is divided into retailers , distributors and enterprise E, and the order cost per unit product is set , the inventory cost per unit product per day , logistics cost , freshness loss rate , freshness cost , , in this part, it is assumed that the acceptance level of freshness by consumers is medium , the accuracy of technology use by enterprises is , , And the cost of technology use in the “AI+ blockchain” collaborative model , in order to facilitate the analysis and comparison of the impact of technology use on inventory of the three models, the parameters in the three models are set to be the same, and the sales price in the three subjects are priced respectively, including the sales price per unit of product of the enterprise , the sales price per unit of product of the distributor , and the sales price per unit of product of the retailer ,. Measure the inventory change of each entity and the income within a year.

4.1 Inventory comparison and analysis

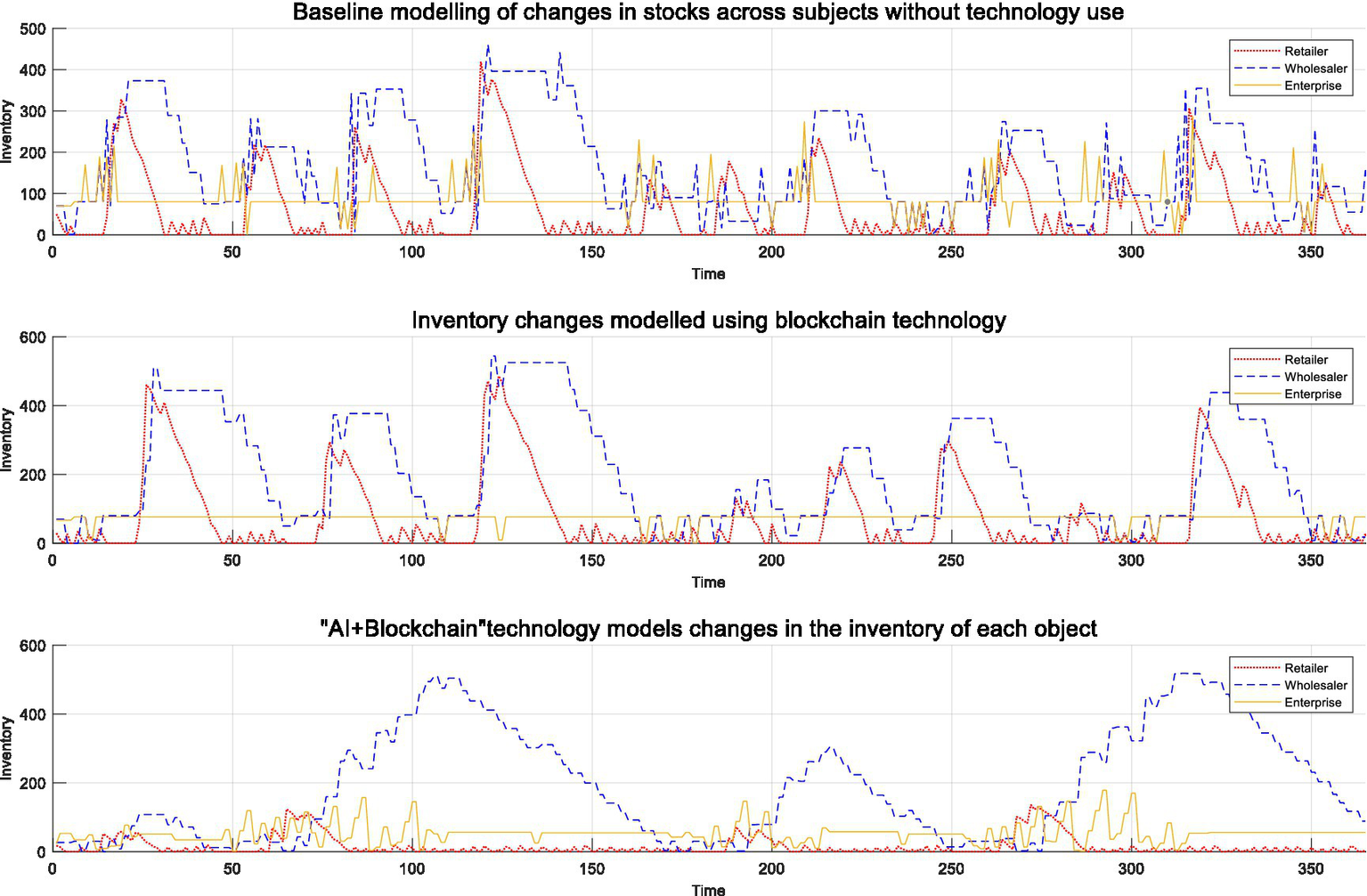

Set the simulation running time of the simulation model to 1 year, and get the inventory changes of each subject in the next year, as shown in Figure 2.

Figure 2

Comparative chart of inventory changes. Source(s): author’s own work.

Based on the inventory changes observed for each entity, several key insights can be derived:

The inventory variations across entities exhibit periodic fluctuations that align with the typical cyclical nature of agricultural supply chains. Notably, the introduction of blockchain technology leads to significant shifts in the inventory turnover rates among the three entities.

Blockchain technology plays a pivotal role in enhancing the inventory management of leading agricultural enterprises, enabling them to maintain minimal safety stock levels through collaborative efforts facilitated by this technology. In contrast to the baseline model, where enterprise inventories experience more pronounced volatility, the blockchain-enhanced model stabilizes these levels. This stability is further influenced by product freshness monitoring and predictive capabilities, resulting in less variable enterprise inventory levels, and instances where inventories are entirely depleted. Under the integrated “GenAI + blockchain” technology framework, retailers nearly achieve a state of “just-in-time” production and marketing alignment, anticipating demand and facilitating timely sales. Consequently, three distinct peaks in distributor inventory are observed, attributed to the seasonal nature of consumer demand influencing product availability. GenAI technology’s application here offers a clear advantage over previous models, revealing more defined patterns in consumer behavior. Thus, enterprise inventory analysis enables more precise demand forecasting and inventory control, minimizing surplus stock while preserving product freshness.

Comparing the baseline and blockchain collaboration models, a similar trend in inventory changes across different entities is evident. However, the initial inventory levels and reduction rates under the blockchain collaborative model differ, suggesting varying technological impacts on diverse entities. With the integration of “GenAI + blockchain” technology, inventory management becomes more efficient, slowing down inventory depletion rates. This indicates potential optimizations in inventory management and demand forecasting accuracy. Overall, the “GenAI + blockchain” model presents enhanced prospects for inventory optimization, mitigating excess inventory and waste through refined demand prediction and inventory strategies.

4.2 Revenue comparison and analysis

Daily profit calculation is made according to the transportation relationship between each subject, and the change of each subject’s income is obtained, as shown in Figure 3.

Figure 3

Comparative chart of changes in earnings. Source(s): author’s own work.

From the analysis of income variations across different models, several key insights emerge:

The synergistic application of technological innovations notably enhances the revenue profiles of all stakeholders, thereby augmenting the aggregate income within the agricultural supply chain. This improvement is most pronounced for enterprises, suggesting a potential link between enhanced product freshness and increased sales revenue. Specifically, heightened product freshness, facilitated by technology, likely attracts more consumers, driving up both sales volumes and revenues. In the context of the “GenAI + blockchain” integrated model, the observed revenue growth implies that technological interventions effectively guarantee product freshness. Should product freshness be assured, enterprises may justify premium pricing, which consumers are inclined to accept for fresher offerings. Blockchain’s role in enhancing supply chain transparency could bolster consumer confidence in product freshness, further augmenting their willingness to pay a premium.

Coupled with the preceding inventory assessment, GenAI appears instrumental in mitigating excess inventory and preventing stockouts. This is achieved through refined inventory management and demand forecasting, leading to improved product freshness and, consequently, a rise in consumer payment propensity. Nonetheless, the data indicates that blockchain technology’s primary beneficiary is the distributor, with relatively modest impacts on enterprises and retailers. This disparity might stem from the intermediary distributor’s heightened sensitivity to product freshness levels. Consequently, blockchain’s implementation ensures the integrity and traceability of inventory and freshness, thereby amplifying the operational efficiency of these intermediaries.

4.3 Comparative analysis of enterprise income

The three models will be evaluated based on their impact on the enterprise’s overall revenue. The results, presented in Figure 4, illustrate that the deployment of “GenAI + blockchain” technology has led to a substantial enhancement in the enterprise’s revenue, with a notable increase observed in the state. In the baseline model, the enterprise’s revenues exhibited the greatest initial cost inputs and the lowest revenue profile. When blockchain technology was employed, the initial costs were diminished, potentially benefiting from the blockchain’s capacity to reposition members of the chain promptly to facilitate the sale of goods. Although the initial cost of utilizing “GenAI + blockchain” has increased (the majority of this increase is attributable to the rise in technology costs compared to the costs associated with the first two models), the subsequent growth in revenues indicates that the integration of these two technologies significantly fulfills the freshness requirements of the marketplace and consumers, enhancing the quality and trust associated with the enterprise.

Figure 4

Comparative analysis of the benefits for the three modelled enterprises. Source(s): author’s own work.

5 Sensitivity analysis

This section conducts a sensitivity analysis to evaluate the influence of structural parameters on model output. Sensitivity analysis quantifies how variations in input values impact the model’s response, tailored to the specific objectives of the model. Various types of sensitivity analyses exist, each aligned with different analytical goals. In this study, we prioritize factors to examine the effects of distinct model parameters. Identifying key factors is crucial in this process; therefore, data on these critical parameters should be meticulously collected. To maintain computational feasibility, our focus centers on three primary structural parameters: minimum safety stock, detection accuracy of GenAI technology, and willingness to pay price.

5.1 The impact of safety inventory on corporate earnings

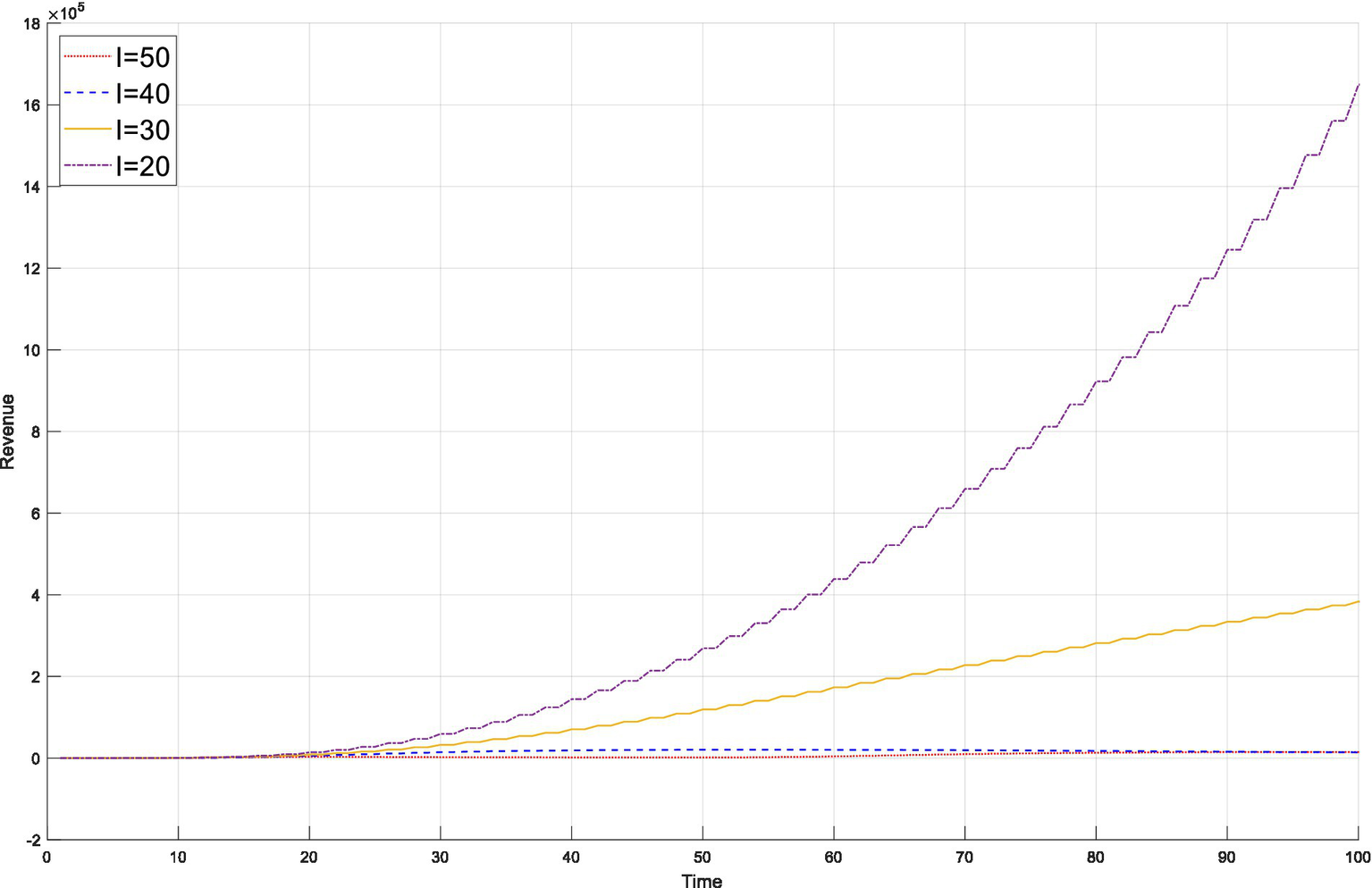

In the third technical collaboration model, in order to detect the impact of safety inventory on enterprise earnings, inventory float is carried out in units of 10 to measure the minimum safety inventory, as shown in Figure 5.

Figure 5

Safety stock sensitivity analysis. Source(s): author’s own work.

The results illustrated in the figure underscore the pivotal role of safety inventory in influencing enterprise profitability. Our simulation experiment reveals that a safety stock level of 30 facilitates sustained earnings growth for enterprises, thereby establishing the lower boundary of the optimal safety stock range at (20, 30). This insight into the potential scope for minimum safety stockholding informs further simulations, which indicate that setting the minimum safety stock at 27 triggers a notable leap in corporate earnings, highlighting a strategic threshold for maximizing financial performance. This can not only avoid the cost increase caused by inventory overstock, but also meet the fluctuations in market demand and maintain the freshness of products. Enterprises can combine the real-time inventory data tracked by blockchain with GenAI’s demand forecasting model to dynamically adjust safety stock and balance costs and benefits.

In the durian maturity prediction project jointly carried out by Charoen Pokphand Group and Huawei Cloud, the blockchain tracks the fruit growth data in real time, and the GenAI model analyzes indicators such as sugar content and hardness, reducing safety stock, lowering enterprise costs, and increasing enterprise profits. This is consistent with our verification results.

5.2 The impact of technical precision on earnings

In pursuit of enhancing consumers’ quality trust, enterprises have increasingly adopted blockchain technology. To further augment this trust, GenAI detection technology has been integrated into the system. By manipulating the detection accuracy of both GenAI and blockchain technologies, we categorized them into five distinct groups based on precision levels: high, medium-high, medium, medium-low, and low. This segmentation facilitated an investigation into the impact of varying degrees of technological detection accuracy on corporate revenue. The findings, depicted in Figure 6, reveal insightful trends regarding the relationship between technology precision and financial performance.

Figure 6

Sensitivity analysis of the degree of technical precision. Source(s): author’s own work.

As the deployment of GenAI technology intensifies, a concomitant linear uptrend in enterprise revenue is observed. Notably, when the precision of AI detection attains a threshold of 0.2, a multiplicative surge in revenue becomes evident. This positive correlation persists as AI detection accuracy escalates, propelling further enhancements in revenue performance. Nevertheless, beyond a precision level of 0.6, the rate of revenue growth experiences a deceleration, suggesting a saturation point in the benefits derived from heightened technological accuracy.

This analysis underscores the profound impact of technological precision on consumer satisfaction pertaining to product freshness. An augmentation in detection accuracy correlates directly with elevated consumer contentment regarding this aspect, subsequently bolstering consumer trust in quality. Nonetheless, it is imperative to acknowledge the inevitable escalation in technological expenditures accompanying such advancements. Conversely, deficiencies in technological precision precipitate a precipitous erosion of consumer confidence, highlighting the delicate balance between investment in AI precision and its resultant economic implications.

5.3 The impact of payment sensitivity on revenue

In addition, to better judge the impact of technology use on the quality trust of enterprises, a specific sensitivity analysis was conducted on the impact of consumers’ sensitivity to freshness price payment on the earnings of enterprises, and the impact of freshness payment sensitivity on the earnings of enterprises was examined with a fluctuation of ±20%, as shown in Figure 7.

Figure 7

Results of a WTP sensitivity analysis. Source(s): author’s own work.

Figure 7 illustrates that consumers’ WTP for product attributes significantly influences enterprise revenue. Notably, when consumer WTP for product freshness is low, heightened price sensitivity among this demographic ensues, precluding the firm from optimizing its revenue within this segment. Conversely, an elevated WTP signifies an opportunity for the company to capitalize on high-quality product demand, thereby maximizing income from this consumer group. This underscores the strategic importance of aligning product quality with consumer preferences to enhance profitability.

This result is consistent with the elevation in consumers’ willingness to pay a premium for traceable fresh durians subsequent to Charoen Pokphand Group’s adoption of “blockchain and GenAI” technologies, thereby validating the model’s sensitivity analysis finding that “the intensity of freshness-related payment willingness exerts a significant impact on revenue.”

6 Conclusions and management implications

6.1 Conclusion

This study scrutinizes the prospective applications of Generative Artificial Intelligence (GenAI) and blockchain technologies within the realm of agricultural supply chain management, elucidating their implications for enterprise revenue enhancement. It theoretically explores the transformative potential of GenAI and blockchain integrations on agricultural supply chains, juxtaposing conventional models against collaborative frameworks underpinned by these advanced technologies. The central objective is to evaluate the viability of technology investments aimed at augmenting quality assurance and trust among enterprises.

The research substantiates that GenAI acts as a facilitative force in orchestrating blockchain technology, exerting a substantial moderating influence on enhancing agricultural supply chain efficiency and resolving quality trust dilemmas. The synergistic application of GenAI and blockchain empowers enterprises to fine-tune minimum safety stock levels, precisely target consumer demographics, and adapt pricing strategies, thereby maximizing returns. Findings suggest that in scenarios where consumer groups exhibit heightened price sensitivity or reluctance to pay premium prices, product pricing can be strategically adjusted. Conversely, for consumer segments characterized by lower price sensitivity or stringent demands for product freshness, technological optimization can be pursued to enable enterprises to attain optimal profitability. This technological convergence enables businesses to minimize safety stock requirements for profit maximization.

In terms of inventory dynamics, the implementation of “GenAI + blockchain” technology has notably enhanced enterprise inventory management efficiency, manifesting as more stable inventory levels and more precise fluctuation cycles. By integrating real-time inventory tracking via blockchain with GenAI’s demand forecasting models, enterprises can dynamically adjust safety stock, mitigating inventory backlog costs while accommodating market demand volatility. Optimizing the minimum safety stock triggers breakthrough revenue growth, evidencing that this technological synergy effectively balances costs and benefits, reduces inventory waste, and preserves product freshness.

At the revenue stratum, the profit enhancement enabled by technological synergy exhibits distinct hierarchical disparities. The “GenAI + blockchain” integrated model demonstrates the most pronounced enterprise revenue growth. Despite higher initial technical costs compared to the single-blockchain model, sustained post-implementation revenue growth indicates that this technology combination better satisfies market and consumer freshness demands, reinforcing quality trust. Here, GenAI’s precise quality detection and blockchain’s transparent traceability form a complementary mechanism, allowing enterprises to secure higher revenues through product freshness premiums. When GenAI detection accuracy surpasses a critical threshold, enterprise revenue experiences exponential growth, while growth rates plateau beyond an optimal accuracy ceiling, revealing an equilibrium point between technical precision and revenue maximization.

The introduction of GenAI detection methodologies offers novel solutions for enterprises. Contrary to prior theoretical assertions and discourse in existing literature, excessive predictive precision facilitated by blockchain may paradoxically impact enterprise profitability. To comprehensively gauge the role of GenAI and blockchain integration in agricultural supply chains, further theoretical, empirical, and quantitative inquiries are warranted. There is a pressing need for rigorous quantitative metrics pertaining to technology adoption, real-time empirical analyses, and conceptual explorations of factors influencing technology utilization. Future endeavors should also contemplate the overarching impact of “GenAI + blockchain” technology costs on enterprise or supply chain efficacy. Additionally, both conceptual and experimental examinations of GenAI and blockchain implementations in agricultural supply chains and production networks are imperative to unveil potential advantages and challenges.

6.2 Management insights

Agricultural supply chains stand apart from conventional supply chain frameworks due to their inherent complexity, a complexity stemming from the unique characteristics of agricultural products. This intricacy complicates the justification of increased technological investments for managers. Quantitative models, especially simulation models, prove valuable in assessing the effectiveness of dynamic strategies and establishing a robust basis for advancing supply chain management practices. This research consolidates the outcomes of quantitative assessments on diverse technologies and their integration, offering a comparative and analytical perspective that sheds light on effective management approaches.

The study’s findings underscore that incorporating blockchain technology into the supply chain can substantially reduce inventory buildup, boost the profitability of all participants, and decrease waiting periods. Moreover, the synergy between “GenAI + blockchain” technology holds great promise for significantly improving the real-time alignment of customer demand with production capacity, thereby safeguarding product freshness and fulfilling stringent quality standards. This dual-technology approach not only ensures product freshness and adherence to high-quality benchmarks but also fosters sustained profitability growth for leading agricultural enterprises.

The amalgamation of GenAI and blockchain technologies emerges as a potent strategy to bolster the resilience of agricultural supply chains. Nonetheless, it is imperative to meticulously quantify the costs associated with both implementation and operation, necessitating each supply chain entity to pinpoint its target customer markets precisely. Optimal profitability hinges upon tailoring the technology integration strategy to suit varying consumer segments and their respective service quality expectations. The efficacy of this solution is directly proportional to the accuracy in targeting the customer base and the precision of the applied technology.

Before implementation, a thorough process analysis and modeling exercise is indispensable, with a keen focus on precise process duration estimations. These insights should then inform quantitative decision-making processes. By integrating GenAI capabilities through technology platforms managed by enterprises, barriers to adoption within the supply chain are lowered, enhancing collaborative efficiency. The programmer’s chief aim revolves around ensuring process excellence, while routine audits and inter-chain member collaborations further reinforce process quality assurance, significantly influencing overall process efficiency.

Statements

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

SB: Conceptualization, Funding acquisition, Methodology, Resources, Supervision, Writing – review & editing. ZL: Formal analysis, Visualization, Writing – original draft, Writing – review & editing. WW: Formal analysis, Supervision, Writing – review & editing. NX: Conceptualization, Supervision, Writing – review & editing. MJ: Conceptualization, Software, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work is supported by the National Social Science Found of China [23BJY151].

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1.^Huawei. (2023, February 7). Tech that keeps Thai durian at top of market. https://www.huawei.com/en/media-center/our-value/using-tech-for-better-durian.

2.^Linkdood. (2024, October 12). How AI Helps Kraft Heinz Make Better Pickles and More. https://linkdood.com/how-ai-helps-kraft-heinz-make-better-pickles-and-more/.

References

1

AkramM. W.AkramN.ShahzadF.RehmanK. U.AndleebS. (2024). Blockchain technology in a crisis: advantages, challenges, and lessons learned for enhancing food supply chains during the COVID-19 pandemic. J. Clean. Prod.434:140034. doi: 10.1016/j.jclepro.2023.140034

2

Alvarez-GarcíaW. Y.MendozaL.Muñoz-VílchezY.Nuñez-MelgarD. C.QuilcateC. (2024). Implementing artificial intelligence to measure meat quality parameters in local market traceability processes. Int. J. Food Sci. Technol.59, 8058–8068. doi: 10.1111/ijfs.17546

3

AngelovP. P.SoaresE. A.JiangR.ArnoldN. I.AtkinsonP. M. (2021). Explainable artificial intelligence: an analytical review. WIREs Data Min. Knowl. Discov.11:e1424. doi: 10.1002/widm.1424

4

AroraN.ChakrabortyI.NishimuraY. (2025). AI–human hybrids for marketing research: leveraging large language models (LLMs) as collaborators. J. Mark.89, 43–70. doi: 10.1177/00222429241276529

5

BaiS.ZhangX.HanC.YuD. (2023). Research on the influence mechanism of organic food attributes on customer trust. Sustain. For.15:6733. doi: 10.3390/su15086733

6

BarbanoD. M. (2017). A 100-year review: the production of fluid (market) milk. J. Dairy Sci.100, 9894–9902. doi: 10.3168/jds.2017-13561

7

ChenW.LiJ.JinX. (2016). The replenishment policy of Agri-products with stochastic demand in integrated agricultural supply chains. Expert Syst. Appl.48, 55–66. doi: 10.1016/j.eswa.2015.11.017

8

ChenH. Y.SharmaK.SharmaC.SharmaS. (2023). Integrating explainable artificial intelligence and blockchain to smart agriculture: research prospects for decision making and improved security. Smart Agric. Technol.6:100350. doi: 10.1016/j.atech.2023.100350

9

ConroyD. M.LangB. (2021). The trust paradox in food labelling: an exploration of consumers’ perceptions of certified vegetables. Food Qual. Prefer.93:104280. doi: 10.1016/j.foodqual.2021.104280

10

DanneelsE. (2004). Disruptive technology reconsidered: a critique and research agenda. J. Prod. Innov. Manag.21, 246–258. doi: 10.1111/j.0737-6782.2004.00076.x

11

DuongC. D.VuT. N.NgoT. V. N.ChuT. V.PhamL. H. T. (2024). Who can you trust? The curvilinear effects of producer-retailer trust (im) balance in organic food consumption–the moderation role of trust in blockchain technology. J. Retail. Consum. Serv.81:104039. doi: 10.1016/j.jretconser.2024.104039

12

FischerC. (2013). Trust and communication in European Agri-food chains. Supply Chain Manag. Int. J.18, 208–218. doi: 10.1108/13598541311318836

13

HagrasH. (2018). Toward human-understandable, explainable AI. Computer51, 28–36. doi: 10.1109/MC.2018.3620965

14

HolzingerA. (2018). “From machine learning to explainable AI,” in 2018 world symposium on digital intelligence for systems and machines (DISA) (55–66). IEEE.

15

HolzingerA.SarantiA.MolnarC.BiecekP.SamekW. (2022). "Explainable AI methods-a brief overview,” in International Workshop on Extending Explainable AI Beyond Deep Models and Classifiers (13–38). Cham: Springer.

16

HouP.FengT.LiY.PengS. (2024). Blockchain adoption for product freshness traceability under platform competition. Int. J. Prod. Res.63:1. doi: 10.1080/00207543.2024.2377694

17

Juan DingM.JieF.PartonK. A.MatandaM. J. (2014). Relationships between quality of information sharing and supply chain food quality in the Australian beef processing industry. Int. J. Log. Manage.25, 85–108. doi: 10.1108/IJLM-07-2012-0057

18

KetzenbergM.BloemhofJ.GauklerG. (2015). Managing perishables with time and temperature history. Prod. Oper. Manag.24, 54–70. doi: 10.1111/poms.12209

19

KhanH. H.MalikM. N.KonečnáZ.ChofrehA. G.GoniF. A.KlemešJ. J. (2022). Blockchain technology for agricultural supply chains during the COVID-19 pandemic: benefits and cleaner solutions. J. Clean. Prod.347:131268. doi: 10.1016/j.jclepro.2022.131268

20

LadweinR.RomeroA. M. S. (2021). The role of trust in the relationship between consumers, producers and retailers of organic food: a sector-based approach. J. Retail. Consum. Serv.60:102508. doi: 10.1016/j.jretconser.2021.102508

21

LinX.ChangS. C.ChouT. H.ChenS. C.RuangkanjanasesA. (2021). Consumers’ intention to adopt blockchain food traceability technology towards organic food products. Int. J. Environ. Res. Public Health18:912. doi: 10.3390/ijerph18030912

22

LohmerJ.BugertN.LaschR. (2020). Analysis of resilience strategies and ripple effect in blockchain-coordinated supply chains: an agent-based simulation study. Int. J. Prod. Econ.228:107882. doi: 10.1016/j.ijpe.2020.107882

23

LuoM.LuoR.DaiY.LiJ.XuH. (2024). Research on dynamic pricing and coordination model of fresh produce supply chain based on differential game considering traceability goodwill. RAIRO-Operations Res.58, 3525–3550. doi: 10.1051/ro/2024058

24

MaP.TsaiS.HeY.JiaX.ZhenD.YuN.et al. (2024). Large language models in food science: innovations, applications, and future. Trends Food Sci. Technol.148:104488. doi: 10.1016/j.tifs.2024.104488

25

MadzíkP.FalátL.PakdilF. (2025). Exploring blockchain technologies in sustainable supply chains – unveiling the latent research topics using an AI approach. Int. J. Prod. Res.22, 1–27. doi: 10.1080/00207543.2025.2507800

26

ManglaS. K.KazançoğluY.YıldızbaşıA.ÖztürkC.ÇalıkA. (2022). A conceptual framework for blockchain-based sustainable supply chain and evaluating implementation barriers: a case of the tea supply chain. Bus. Strat. Environ.31, 3693–3716. doi: 10.1002/bse.3027

27

MatzembacherD. E.do Carmo StangherlinI.SlongoL. A.CataldiR. (2018). An integration of traceability elements and their impact in consumer's trust. Food Control92, 420–429. doi: 10.1016/j.foodcont.2018.05.014

28

ModakN. M.SenapatiT.SimicV.PamucarD.SahaA.Cárdenas-BarrónL. E. (2024). Managing a sustainable dual-channel supply chain for fresh agricultural products using blockchain technology. Expert Syst. Appl.244:122929. doi: 10.1016/j.eswa.2023.122929

29

MuW.KleterG. A.BouzembrakY.DupouyE.FrewerL. J.Radwan Al NatourF. N.et al. (2024). Making food systems more resilient to food safety risks by including artificial intelligence, big data, and internet of things into food safety early warning and emerging risk identification tools. Compr. Rev. Food Sci. Food Saf.23, 1–18. doi: 10.1111/1541-4337.13296

30

MurphyB.MartiniM.FediA.LoeraB. L.ElliottC. T.DeanM. (2022). Consumer trust in organic food and organic certifications in four European countries. Food Control133:108484. doi: 10.1016/j.foodcont.2021.108484

31

MwangakalaH. A.MongiH.IshengomaF.ShaoD.ChaliF.MambileC.et al. (2024). Emerging digital technologies potential in promoting equitable agricultural supply chain: a scoping review. Technol. Forecast. Soc. Change208:123630. doi: 10.1016/j.techfore.2024.123630

32

PatelD.SahuC. K.RaiR. (2024). Security in modern manufacturing systems: integrating blockchain in artificial intelligence-assisted manufacturing. Int. J. Prod. Res.62, 1041–1071. doi: 10.1080/00207543.2023.2262050

33

QiaoJ.ZhangM.WangD.MujumdarA. S.ChuC. (2024). AI-based R&D for frozen and thawed meat: research progress and future prospects. Compr. Rev. Food Sci. Food Saf.23:e70016. doi: 10.1111/1541-4337.70016

34

SchneiderJ. (2024). Explainable generative AI (GenXAI): a survey, conceptualization, and research agenda. Artif. Intell. Rev.57:289. doi: 10.1007/s10462-024-10916-x

35

SunY.ZhuZ.YangH. (2021). Fairness perception, trust perception, and relationship quality in agricultural supply chains. J. Food Qual.2021:8817003. doi: 10.1155/2021/8817003

36

TanT. M.SaraniemiS. (2023). Trust in blockchain-enabled exchanges: future directions in blockchain marketing. J. Acad. Mark. Sci.51, 914–939. doi: 10.1007/s11747-022-00889-0

37

Vazquez MelendezE. I.BergeyP.SmithB. (2024). Blockchain technology for supply chain provenance: increasing supply chain efficiency and consumer trust. Supply Chain Manag. Int. J.29, 706–730. doi: 10.1108/SCM-08-2023-0383

38

WuX. Y.FanZ. P.CaoB. B. (2023). An analysis of strategies for adopting blockchain technology in the fresh product supply chain. Int. J. Prod. Res.61, 3717–3734. doi: 10.1080/00207543.2021.1894497

39

YangX.LiuM.WeiJ.LiuY. (2024). Research on investment optimization and coordination of fresh supply chain considering misreporting behavior under blockchain technology. Heliyon10:e26749. doi: 10.1016/j.heliyon.2024.e26749

40

YuM.ChenY.YiZ.WangQ.ZhangZ. (2022). Benefits of market information and professional advice in a vertical agricultural supply chain: the role of government provision. Int. J. Prod. Res.60, 3461–3475. doi: 10.1080/00207543.2021.1924409

41

ZhanS.WanZ. (2024). Research of blockchain-embedded agricultural quality credit regulation influencing factors. Ind. Manag. Data Syst.124, 1701–1724. doi: 10.1108/IMDS-11-2023-0879

42

ZhuQ.SunY.ManglaS. K.ArisianS.SongM. (2023). On the value of smart contract and blockchain in designing fresh product supply chains. IEEE Trans. Eng. Manag.71, 10557–10570. doi: 10.1109/TEM.2023.3286883

Summary

Keywords

agricultural supply chain, quality trust, blockchain, GenAI, agent-based simulation

Citation

Bai S, Liu Z, Wu W, Xu N and Jiang M (2025) “GenAI + blockchain” to coordinate agricultural supply chains to improve quality trust: an agent-based simulation study. Front. Sustain. Food Syst. 9:1591350. doi: 10.3389/fsufs.2025.1591350

Received

11 March 2025

Accepted

08 July 2025

Published

17 July 2025

Volume

9 - 2025

Edited by

Siphe Zantsi, Agricultural Research Council of South Africa (ARC-SA), South Africa

Reviewed by

Tao Li, Shandong University of Technology, China

Soumitra Das, Indira College of Engineering and Management, India

Updates

Copyright

© 2025 Bai, Liu, Wu, Xu and Jiang.

This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wenya Wu, wuwenya2021@163.com

Disclaimer

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.