- 1Faculty of Business and Communications, INTI International University, Nilai, Malaysia

- 2Department of Commerce, Alagappa University, Karaikudi, India

- 3Department of Visual Communication, Sathyabama Institute of Science and Technology, Chennai, India

- 4Faculty of Business and Communication, INTI International University, Nilai, Malaysia

- 5Faculty of Accounting, Zibo Vocational Institute, Zibo, Shandong, China

Fintech, or financial technology, is transforming the agriculture sector by enhancing access to capital, optimizing the utilization of resources, and promoting sustainable agriculture practices. This research assesses how fintech can promote sustainable agriculture in Tamil Nadu, India, through an analysis of how it influences climatic resilience, environmental sustainability, and financial inclusion. The research examines the impacts of fintech, mobile market access platforms, and precision farming technologies on agricultural sustainability and production by surveying farmers across the region. The findings indicate that farmers can embrace green farming methods, access broader markets, and acquire loans with greater ease using fintech, reducing resource wastage and enhancing economic stability. The effectiveness of fintech solutions is, nonetheless, significantly influenced by factors such as legislative support, infrastructural availability, and digital literacy. The research stresses that for the maximum benefit to small and marginal farmers, targeted digital literacy programs and increased fintech access are needed. For policymakers, financial institutions, and stakeholders in the agricultural sector, the findings of the research make valuable recommendations on the appropriate utilization of fintech technologies to address sustainability challenges and enhance rural economic development.

1 Introduction

Agriculture is the core of India’s economy, as this sector feeds nearly half of its population and contributes 17–18% to India’s GDP. The sector is still plagued by issues despite its importance, mainly due to dispersed landholdings, erratic weather patterns, wasteful use of resources, restricted availability of finance, and unstable market conditions. These factors also affect productivity and profitability of farmers beside impacting their output. Global movements toward sustainability and growing environmental concerns have made the need for creative, tech-driven solutions to remove these obstacles even more pressing (Arena et al., 2023; Shahbaz et al., 2013). Within the context of international development, fintech has emerged as a game-changer promoting financial inclusion, addressing income inequality, and propelling the United Nations Sustainable Development Goals (SDGs), specifically SDG 1 (No Poverty), SDG 8 (Decent Work and Economic Growth), SDG 9 (Industry, Innovation, and Infrastructure), and SDG 10 (Reduced Inequalities). Digital financial services like mobile money, microloans, and digital credit have shown great promise to empower underserved groups by enhancing access to formal financial systems (Azimi, 2022; Liu, 2021) In the developing economies, fintech fills structural gaps in conventional banking, particularly in rural and agricultural communities (Azmeh, 2025). In addition, recent international research corroborates that fintech innovations not only raise economic resilience but also facilitate eco-friendly practices (Demir et al., 2022; Morgan, 2022). By placing this research within this international context, we hope to provide region-specific findings from Tamil Nadu, India—a region that personifies the challenges and opportunities of agricultural digitalization in the Global South.

Financial technology, or fintech, is a revolutionary instrument that can solve a number of structural problems in the agriculture industry. Fintech can enhance the level of financial inclusion, resource usage efficiency, and help farmers convert to sustainable farming practices because it allows offering digitalized financial services that include crop insurance, microloans, digital payment, mobile banking, and e-market platform. Such services are precisely needed for small and marginal farmers as they often lack resources and access to traditional bank systems (Kumar and Parida, 2013). Being an agricultural state with a rich history and different cropping patterns, Tamil Nadu is witnessing a growth in the adoption of fintech solutions. The region’s agricultural ecosystem is characterized by heterogeneity in farm size, wealth, and access to technology, making it an ideal location to study how fintech can help advance sustainability (Maryam and Ahamad, 2021) states that fintech solutions have been shown to reduce transaction costs, increase access to finance and insurance, and facilitate environmentally friendly techniques such as sustainable water management and precision farming. The extent to which such benefits are realized is primarily contingent upon factors such as farmer awareness, technology infrastructure, and digital literacy.

Digital literacy is specifically beneficial in the adoption of fintech. More advanced levels of digital literacy enable farmers to make use of information in making decisions, access financial services, and navigate digital platforms. This ability does not only enhance the advantages of fintech in sustainable agriculture but also helps bridge the gap in digital exclusion, which often prevents underrepresented groups from accessing new technologies (Patel, 2019). The study aims to comprehend the economic, environmental, and social effects of fintech adoption in order to understand how it impacts the sustainability of agriculture in Tamil Nadu. The conclusions drawn from the study will provide insightful information that will help financial institutions, policymakers, and agricultural stakeholders create focused initiatives that will increase the use of fintech solutions and encourage sustainable farming methods in Tamil Nadu and elsewhere. The contribution of this research is the integration of fintech uptake and sustainability impacts in the case of smallholder farming in Tamil Nadu, India—a region very much neglected in previous research. While existing literature has examined fintech or sustainable agriculture as separate subjects, most have not considered their intersection point using micro-level primary data. Having used a stratified random sample of 670 farmers improves the findings’ robustness and representativeness. Moreover, the research considers not only economic effects, but also environmental and systemic sustainability aspects, providing a comprehensive view of how digital financial services affect rural agricultural systems. The incorporation of digital literacy as a moderating variable further enriches the analytical depth, rendering this study topical and policy-relevant. This study therefore addresses an important lacuna in empirical research by making region-specific observations with wider significance for digital transformation and inclusive development across the Global South.

In addition to artificial intelligence (AI)–based predictive tools, a number of other fintech solutions are revolutionizing agriculture. Blockchain provides secure and transparent records of transactions; mobile wallets and UPI-based platforms make rural transactions easy; and digital ledgers ease the bookkeeping of smallholder farmers. These technologies are being more and more incorporated into agri-fintech platforms to build trust, lower costs, and make farmers creditworthy.

2 Review of the literature

2.1 Theoretical framework: Rogers’ diffusion of innovation theory

Rogers’ Diffusion of Innovation Theory Rogers’ Diffusion of Innovation Theory presents a powerful framework for understanding the adoption of fintech in sustainable agriculture (Keyling et al., 2015) points out that farmers adopt innovations when they consider them easy to use, with relative advantages, and compatible with existing practices (Chawla et al., 2024) applied this theory to assess the diffusion of digital payment systems among farmers and identified that perceived usefulness is strongly influencing the adoption rates (The Dynamics of a Degenerate Epidemic Model with Nonlocal Diffusion and Free Boundaries - ScienceDirect, 2024) stated that the diffusion of fintech solutions in rural regions highly depends on social networks and peer influence. This aspect of the theory, emphasizing early adopters and opinion leaders, is particularly relevant to the promotion of fintech in agriculture.

2.2 Impact of fintech on sustainable farming

The revolutionary impact of fintech in sustainable agriculture is now increasingly acknowledged. It opens up loans, insurance, and market data for farmers, which are all important factors to increase sustainability and productivity. As Suri and Jack (Rao, 2025) have said, “Rural farmers who use mobile money are more financially resilient and have less poverty” (Mapanje et al., 2023) further elaborated on how fintech innovations enhance financial inclusion, which has a direct effect on agricultural productivity and reduces income inequality. Fintech enables sustainable practices by providing customized financial products, which lessens the environmental impact of farming operations, according to Anshari et al. (2019). Digital financial platforms, according to Mukhopadhyay (2020), “would make available real-time information that can help make effective decisions and thus largely reduce resource utilization inefficiencies.

In their 2022 study, Chatterjee and Singh (2022) probed how digital payment methods simplify transactions and ensure timely acquisition of seeds and fertilizers. Furthermore, (Jain and Gabor, 2020) examined the way fintech can reduce transaction costs and expand access of farmers to formal banking institutions. Fintech adoption promotes minimal environmental damage as it encourages climate-smart farming practices, as opined by Kumar and Parida (2013). Fintech platforms are instrumental in promoting sustainable land management techniques and crop diversification, according to Arora et al. (2018).

2.3 Sustainable development and agriculture

Sustainable agriculture largely benefits the rural areas because of its strong support toward economic development. Redesigning agricultural systems improves environmental results and strengthens rural livelihoods, observed (Kamilaris et al., 2019). In poverty-stricken areas with limited resources, sustainable agriculture methods implemented assure output while ensuring food security (found Jain and Gabor, 2020). The poverty rate drastically decreases in areas implementing climate-smart agriculture as the yield becomes stable, reports (Anshari et al., 2019).

According to Anifa et al. (2022), sustainable agriculture is that which enhances rural economies and creates employment opportunities in rural areas. The use of green techniques in agriculture increases both economic efficiency and environmental protection, according to Anshari et al. (2019). Green finance accelerates the adoption of environmentally friendly farming practices, thus enhancing long-term economic growth, according to Fintech Innovation for Smallholder Agriculture (2024).

2.4 Function of financial inclusion in rural farming

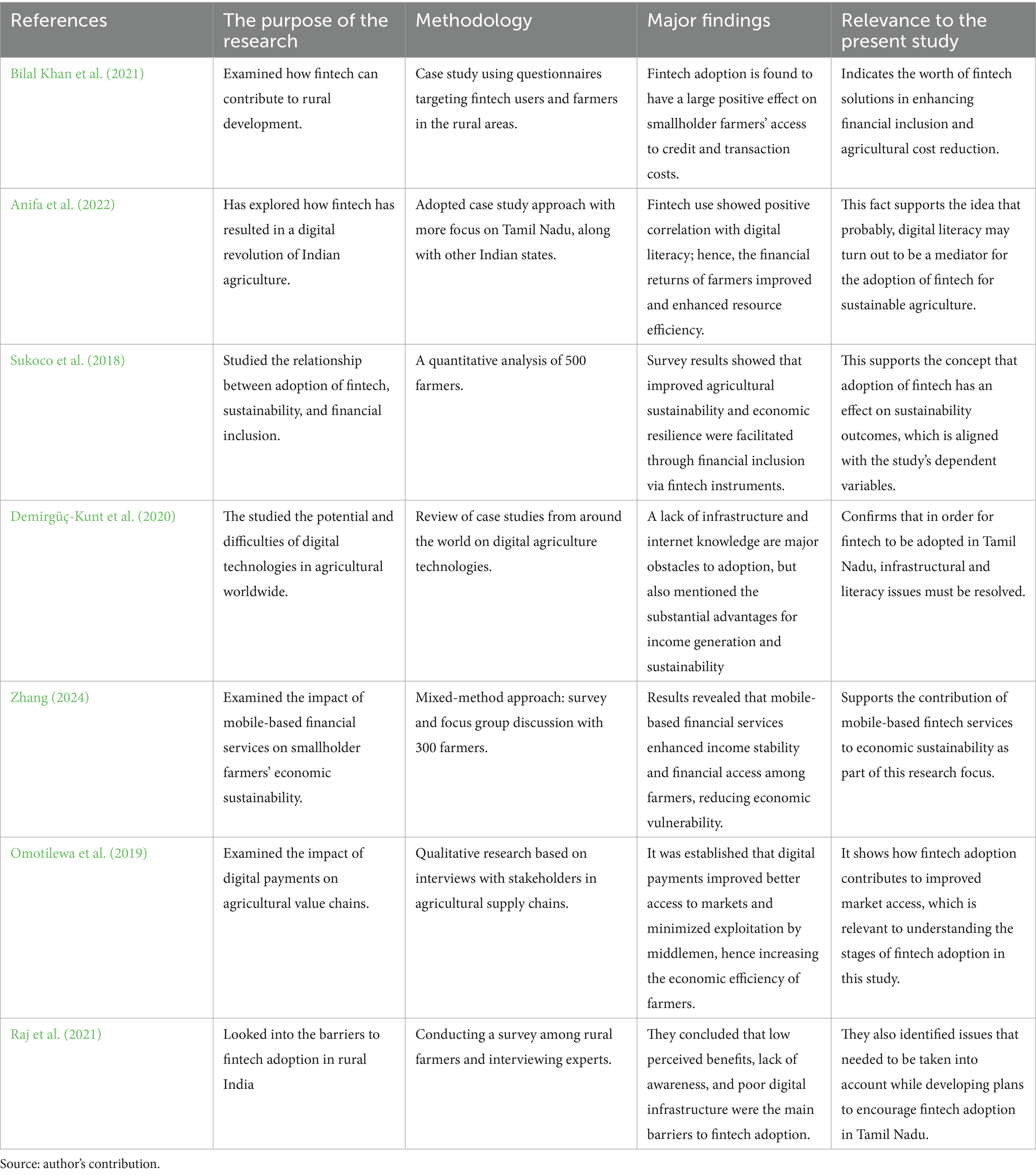

In rural agriculture, financial inclusion is essential since it helps close the gap between farmers and official financial institutions. Formal bank account ownership improves farmers’ capacity to invest in productive assets, according to Sharma (2025). The adoption of novel agricultural technologies is substantially impacted by financial availability, as demonstrated by Sadia (2018) and Bilal Khan et al. (2021) assert that financial inclusion raises agricultural output and rural infrastructure. See Table 1 shows the important literature collections related to the present study. According to McIntosh and Mansini (2025), mobile-based financial services can promote agricultural productivity and reduce the cost of transactions. According to Arner et al. (2020), inclusive financial institutions enable smallholder farmers by offering cheap financing and insurance (Fintech Innovation for Smallholder Agriculture, 2024; Zhang, 2024) established that financial inclusion through fintech improves the resilience of rural communities to economic shocks.

2.5 Emerging technologies in agri-finance

Recent fintech evolution has brought a variety of tools to complement AI-based predictive systems. For example, blockchain technologies have been employed to enhance supply chain traceability and guarantee equitable market prices (Vignesh et al., 2024). Mobile money apps enable instant payments and enhance access to credit (Chatterjee and Singh, 2022). In the same way, digital ledger apps enable farmers to keep track of records, which makes them more qualified to receive formal credit and insurance products (Hao et al., 2024). Each of these innovations combined lowers information asymmetry, reduces transaction costs, and enhances inclusion in the agricultural finance system.

2.6 Literature gap

Even though previous studies focus on the benefits of fintech and sustainable agriculture, there are still several limitations. First, the empirical data do not support the precise effect of fintech on the environmental quality of agricultural practices (Ghosh and Kulkarni, 2024). Second, nothing is known about how fintech can help farmers lower their carbon footprint (Chatterjee, 2024). There is a scarcity of literature on the moderating effects of socioeconomic factors in determining the adoption of fintech solutions in agriculture (Feyen et al., 2025). More importantly, rather than integrated fintech ecosystems, most of the research focus on standalone technologies. Another gap is geographical context because most of the research focus on developed nations with less focus on rural areas in Tamil Nadu, India (Bakhshi et al., 2024).

While an increasing amount of literature discusses the potential of fintech in enhancing financial inclusion and economic development, there has been a paucity of empirical studies testing its multi-faceted influence on sustainable agriculture at the micro-level, especially in rural areas of developing nations. For example, while Yang et al. (2023) highlight the promise of digital finance in fostering ecological sustainability in Chinese villages, similar data-driven research on the Indian agricultural sector is lacking. In the same vein (Malik and Kapoor, 2023) discuss how AI-driven tools facilitate environmental decision-making but note that rural implementation is still hindered by infrastructure and literacy challenges (Joshi, 2023) also emphasize that while fintech innovations can boost sustainable exploitation of resources, their reach and sustainability in low-income agricultural environments need to be examined further. Most previous studies have taken national or macroeconomic measures into consideration or sectors other than agriculture. In addition, there is no integrative model that considers economic, environmental, and systemic sustainability outcomes simultaneously, and the moderating effect of digital literacy, which is an important factor in the uptake of technology by smallholder farmers. This work fills these gaps by employing primary field data from 670 Tamil Nadu farmers to examine the causal link between fintech uptake and farm-level sustainability. It includes digital literacy as a moderator, adding new evidence on the potential for digital tools to shape development outcomes in a regionally contextualized and rigorously empiric manner.

2.7 Objectives

The objective of this study is to examine the role of financial technology (fintech) in promoting sustainable agriculture among smallholder farmers in Tamil Nadu, India. More specifically, the research aims at assessing how fintech innovations enhance economic efficiency, environmental sustainability, and systemic resilience in agriculture. By including digital literacy as a moderating variable, the study experiments with the impact of fintech adoption on the availability of credit, market integration, and the adoption of climate-smart agriculture. Drawing from empirical data from 670 farmers, the research seeks to provide actionable advice to policymakers, financial institutions, and stakeholders for enhancing digital financial inclusion and supporting sustainable rural development.

3 Research theories

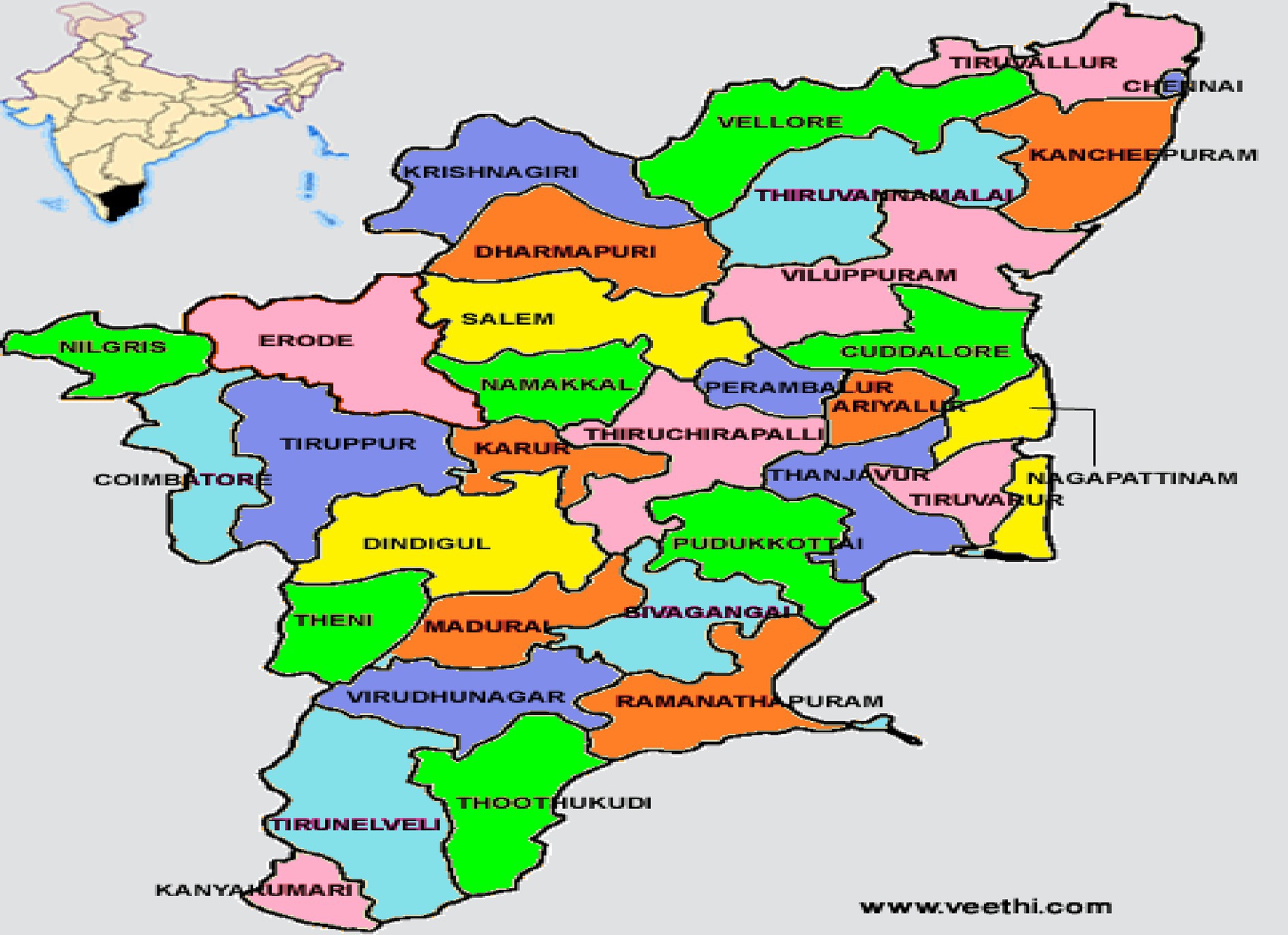

To ensure representation from a variety of areas and farm sizes, 670 farmers from all over Tamil Nadu were selected using a stratified random selection method (Figure 1), and their responses to structured questionnaires and interviews formed the primary source of data for this study. A sample size of 670 was selected to ensure that the research captures a wide range of views regarding the adoption of fintech and its impacts on sustainable agriculture, as well as provide strong statistical power for the research. Several areas were included in the design of the survey, such as questions on sustainable practices, usage of fintech, and demographic information.

Figure 1. Sampling area. Source: www.veethi.com.

To ensure comprehensive data collection, the questions included a combination of binary responses, open-ended questions, and Likert-scale items. Pre-testing was also conducted to enhance dependability and clarity of the questionnaire. Secondary sources of academic research, papers by fintech firms, and government reports were used to corroborate patterns and contextualize the primary data. The study’s results are reliable and reflective of the agriculture sector in Tamil Nadu because of the stratified sampling coupled with diverse sources of data. This section explains the comprehensive theories in detail.

3.1 How sustainable agriculture affects system stability, economic efficiency, and environmental quality

This section analyzes the potential impact of fintech adoption on several aspects of sustainable agriculture, such as system stability, economic efficiency, and environmental quality. The fintech solution is considered to have a revolutionary role in developing the practice of sustainable farming, as it is expected to provide farmers with better access to capital, risk management resources, and decision-making skills (Bharadwaj et al., 2025).

The following theories are developed to analyze these relationships:

H1a: Fintech adoption improves agricultural environmental quality.

This hypothesis, as reported by Bakhshi et al. (2024) and Zhang (2024), explains how the availability of financing for eco-friendly inputs and precision farming technologies enabled through fintech can reduce resource waste and deterioration of the environment.

H1b: Fintech implementation enhances farmers’ economic efficiency.

According to Bilal Khan et al. (2021) and Zhao et al. (2022), this hypothesis examines how fintech tools might improve market access, minimize transaction costs, and optimize financial resources-all of which increase farmers’ economic production and profitability.

H1c: Agricultural methods that use fintech are more stable as a system.

This theory further postulates that fintech can stabilize agricultural systems because it provides improved means for risk management, crop insurance, and financial planning that reduce susceptibility to climatic and market shocks (Omotilewa et al., 2019; Raj et al., 2021).

3.2 Tamil Nadu’s sustainable agriculture and fintech

This section explores how fintech is motivating farmers in Tamil Nadu to adopt sustainable farming practices. Fintech solutions are believed to enhance resilience to external shocks, reduce environmental impact, and enhance resource management through digital innovation (Kumar, 2025a). The following theories are proposed to test these impacts:

H2a: Fintech enhances farmers’ access to market data and financial services.

The hypothesis explores how farmers can better make decisions and achieve greater financial inclusion through the use of digital financial platforms to improve access to credit, insurance, and timely market information (Demirguc-Kunt et al., 2018; Kumar, 2025b).

H2b: The adoption of fintech reduces farming’s carbon footprint.

With resource monitoring systems and precision agriculture technologies, fintech tools will be able to help in the preservation of the environment by maximizing input utilization and minimizing waste and therefore reduce greenhouse gas emissions (Xing et al., 2022).

H2c: Farmers are more resilient to climate change when using fintech.

This hypothesis focuses on how farmers could employ fintech services, including weather forecasting, crop insurance, and risk management, in reducing the adverse impacts of climate variability and the sustenance of sustainable agricultural practices (Kumar, 2025a; Iftikhar et al., 2024).

4 Methods

4.1 Model building

To analyze how fintech may enhance sustainable farming practices in the state of Tamil Nadu, the study develops a model. The diffusion of innovation theory, which focuses on the factors influencing the adaptation of new technologies, developed by Diffusion of Innovations by Rogers (2003), is integrated into the model. It takes into account how the adaptation of fintech may benefit the farmers in terms of money, the environment, and society. The model framework considers both the direct and indirect effects of fintech on agriculture.

According to Anshari et al. (2019), it outlines the key forces behind adoption, which include socioeconomic characteristics, financial literacy, and technology infrastructure. Moreover, it depicts how fintech services such as crop insurance, digital payments, and microloan availability can improve agricultural sustainability. According to the model, the use of fintech leads to increased income generation, reduced transaction costs, improved market access, and environmentally friendly practices (Lavrinenko et al., 2023). Both mediating and moderating elements are included in the framework, such as government regulations and digital literacy (Wheeler, 2025). This enables the possibility of seeing variables and their connections in a broad context of rural agricultural growth. How these relationships are measured with actual data will be explained in the next sections.

4.1.1 Foundational structure

The conceptual framework relates the concepts of the adoption of fintech and the results in agriculture. Based on the framework, it is believed that in the agriculture sector, adopting fintech will improve its economic, environmental, and social sustainability (Sharma et al., 2024). According to several studies, perceived benefits, access to technology, and awareness about the digital tool are critical to the adoption of fintech among farmers (Schuetz and Venkatesh, 2020). These then affect the sustainable farming methods, which include improved crop yields, improved access to capital, and improved resource management. Moderating factors such as digital literacy, which influence the efficiency of farmers in using fintech tools, are also included in the framework (Demirguc-Kunt et al., 2018). Moreover, to consider external influences, control factors such as farm size, income levels, and education are included. This framework aims to provide a clear path from fintech adoption to sustainable agriculture with measurable outcomes in all sustainability dimensions. It gives the theoretical and visual representation of cause-and-effect linkages that will be empirically analyzed.

4.1.2 Mathematical model representation

The mathematical representation of relations in the conceptual framework forms a regression model. Such a regression equation generally, in its form, represents:

Where:

Yi refers to the sustainability outcomes (economic, environmental, and social) (Gautam et al., 2022).

X1, X2 and X3 are independent variables like fintech adoption, awareness, and digital literacy (Kshetri et al., 2023).

Wi is control variables such as farm size, income, and education (Allen et al., 2025).

β0 is the intercept, and β1, β2 and β3 represent the coefficients of the variables (Kamilaris et al., 2019).

γ represents the interaction terms (if any), and ϵi is the error term that captures unobserved factors (Feyen et al., 2025).

To introduce moderating effects, the model is expanded to include interaction terms:

According to Arena et al. (2023), this allows the study to assess how digital literacy influences the impact of fintech adoption on sustainability outcomes. According to Bishnoi et al. (2023), the model further includes multiple regression analysis in order to establish the significance of each variable and its impact on agricultural sustainability. The results are further confirmed through hypothesis testing and statistical estimation of the coefficients (Manobharathi et al., 2024).

4.1.3 Econometric justification and endogeneity control

This research uses sophisticated econometric methods to confirm reliable estimation of the fintech effect on sustainable farm output. Of these, the Two-Stage Least Squares (2SLS) estimator is used to correct for endogeneity bias, which in turn could be caused by omitted variable bias, measurement errors, or reverse causality—particularly in the fintech adoption and sustainability measure relationship. The main reason for applying 2SLS is to tease out the causal effect of fintech adoption by controlling for unobserved variables that might have a joint influence on both adoption and sustainability outcomes. Instrumental Variables (IVs) applied in the first stage are regional rate of internet penetration, distance to the nearest digital service facility, and availability of mobile signal—variables that influence fintech adoption but are plausibly exogenous to sustainability outcomes.

Moreover, to make the results more robust, we use the Generalized Method of Moments (GMM) that adjusts for heteroskedasticity and autocorrelation in residuals. This is particularly important considering the possible dynamic connection between previous farming results and the adoption of technology at present. The research also features standard validity and relevance checks for the instruments, including Hansen J-test for overidentification and first-stage F-statistic for weak instruments. Diagnostics affirm that the chosen instruments are exogenous and relevant. The survey design was pre-tested on a pilot sample of 35 farmers to improve question clarity, and steps were taken to secure response reliability through cross-checking during data collection and interviewer training.

4.2 Selection of moderating, control, independent, and dependent variables

The dependent variables in this study are the results of using fintech in agriculture sustainability. Sustainable social, environmental, and economic practices are some of them. According to Jiang et al. (2019), factors like income levels, cost reduction, and market access are used to measure economic sustainability. Water use, carbon footprint reduction, and environmental-friendly practices are some examples of the metrics that will measure environmental sustainability (Hashemizadeh et al., 2023). Access to social services, risk resilience, and financial inclusion are metrics used in measuring social sustainability (Finger, 2023).

Based on the studies of Anifa et al. (2022) and Rogers1985-libre.pdf (2024), independent variables include fintech adoption criteria such as awareness, usability, and the perceived benefits of fintech instruments to farmers. These elements would affect how much farmers use fintech services. The moderating element that affects how well fintech adoption works is digital literacy, as identified by Jiang et al. (2019). Sustainability outcomes are anticipated to be amplified by higher levels of digital literacy as a result of the impact of fintech technologies (Guo et al., 2022).

Age, income, farm size, and education can be used as control variables to ensure the controlling factors capture outside influences that can possibly influence the results (Arora et al., 2018). These controlling factors help one determine the exact impact which the adaptation of fintech has on sustainability (Lavrinenko et al., 2023).

4.2.1 Dependent variables

The three key dependent variables studied are social, environmental, and economic sustainability. Indicators of economic sustainability are the levels of income earned by farmers, savings, and cost savings from the use of fintech instruments such as digital payments and microloans (Raj et al., 2021). Environmental sustainability is measured by assessing the adoption of environmentally friendly farming practices and resource management improvements, such as crop rotation that is sustainable or uses less water, for example (Gautam et al., 2022).

According to Mapanje et al. (2023), social sustainability considers farmers’ integration into the official financial system, their increased access to financing and insurance, and their ability to withstand market shocks and climate change. Improvements in one of these dependent variables may have a favorable impact on the others because they are interconnected. For example, access to finance may lead to better farm planning that would allow farmers to invest in environmentally friendly farm practices (Deng et al., 2019). Model regression values are obtained based on particular questions asked within surveys related to these matters; they are used in turn to gauge each of the dependent variables.

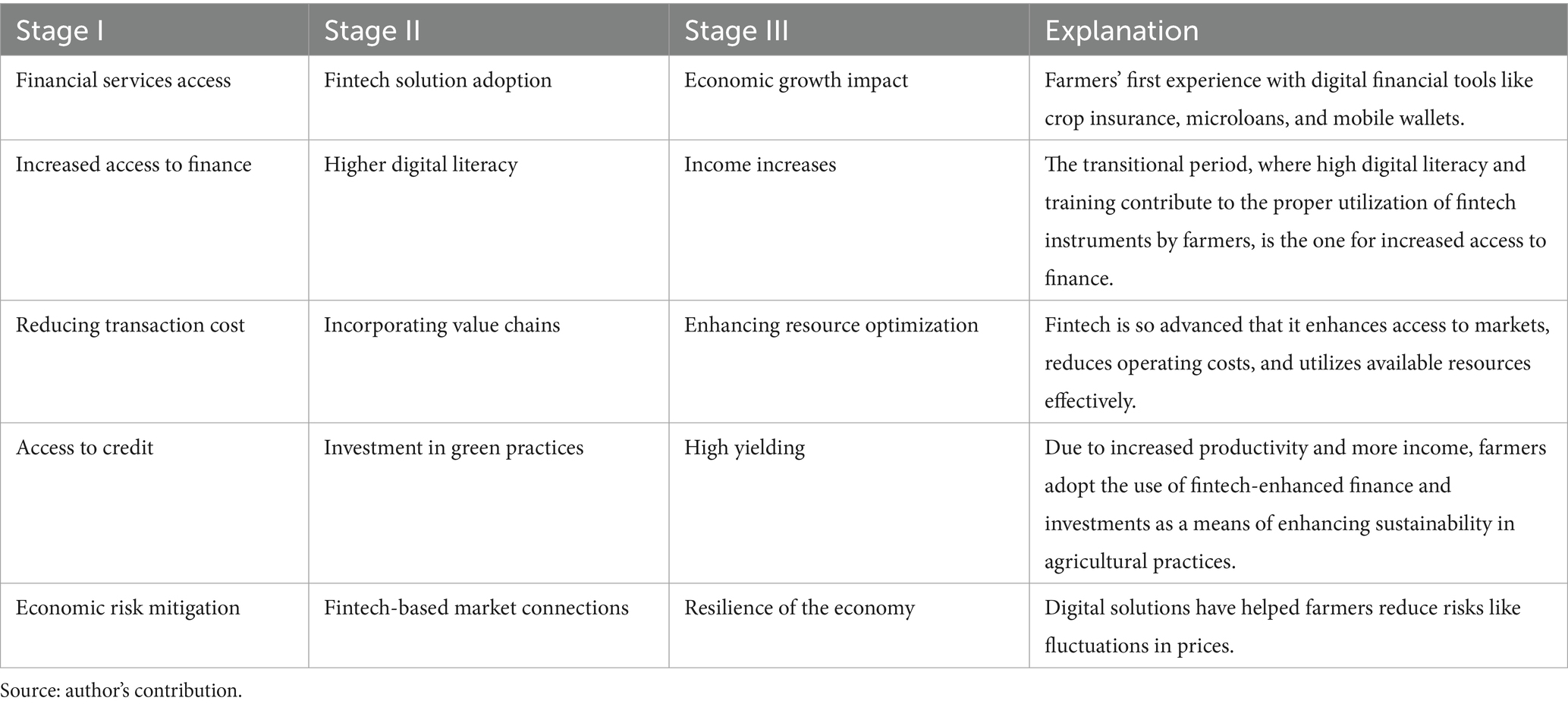

This Table 2 provides a clear track through the stages of fintech adoption and its quantifiable influence on sustainable economic growth in agriculture, according to Kanagavalli and Manida (2025) and Sarpong and Nketiah-Amponsah (2022).

4.2.2 Independent variables

The independent variables of this research are the factors influencing farmers in adopting fintech. For instance, awareness, use, access, and benefit perception of fintech instruments are some of them. According to Hao et al. (2024) and Anifa et al. (2022), awareness is the extent to which farmers are aware of instruments such as crop insurance, mobile wallets, and literacy platforms. The term “ease of use” describes how simple these technologies are to use and how at ease farmers are with them (Iftikhar et al., 2024). Accessibility takes into account the availability of digital infrastructure, including mobile devices and internet access (Jayaraj and Sarkar, 2024; Saha et al., 2024). Farmers’ perception of the value of fintech in terms of increasing their revenue, cutting expenses, and opening up markets is measured using perceived advantages (Hinson et al., 2019). Opinions and experiences of farmers about fintech services are assessed using a combination of Likert-scale questions that measure these independent variables.

4.2.3 Moderator variable

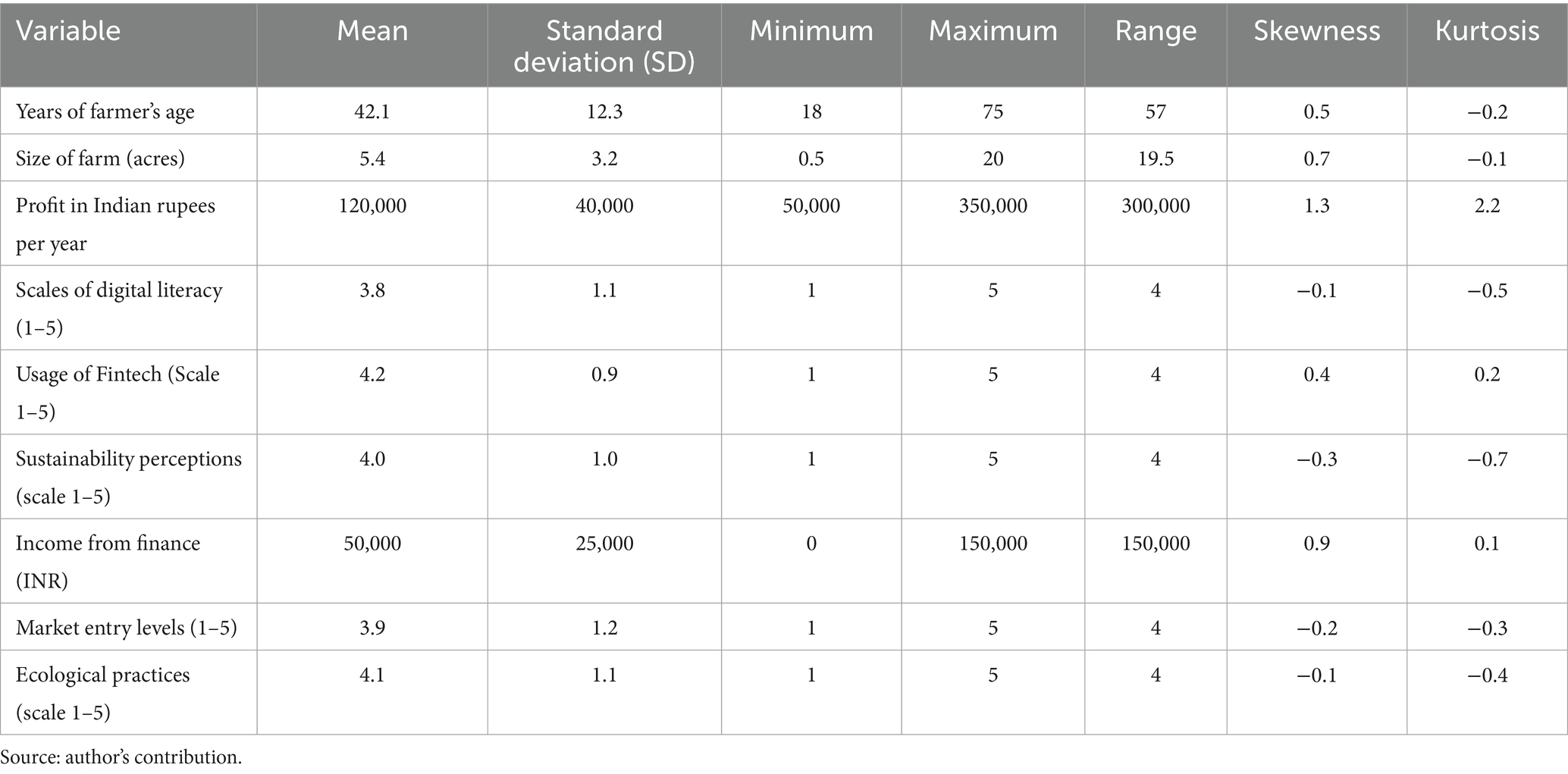

In this research, the moderator variable is digital literacy. Digital literacy means farmers can use smartphones and other applications effectively to get and make use of fintech (Kamilaris et al., 2019). Farmers with high digital literacy are likely to benefit more positively from the adoption of fintech since they can navigate the digital platforms more efficiently and gain access to a wide variety of financial services (Jain and Gabor, 2020). The questionnaire will have questions meant to determine the level of digital literacy among farmers in terms of their ability to use smartphones, apps, and online financial services. In regression analysis, the interaction term of variables between digital literacy and fintech adoption is used to model this moderating effect. The hypothesis is that the relationship between fintech adoption and sustainability outcomes would be stronger for digital literacy (Table 3) (Kocollari et al., 2022).

Table 3. Descriptive statistics: a summary of the key variables in the study on the role of fintech in sustainable agriculture.

4.2.4 Control variables

This study includes environmental and demographic variables as control variables since they may have an impact on the link between sustainability results and fintech adoption. Age, education, income, and farm size are some of these factors (Raj et al., 2021). Age is taken into consideration because elderly farmers could be less inclined to use fintech technologies due to their lower levels of digital literacy (Manobharathi et al., 2024). Since more educated farmers may be more likely to adopt new technologies, education level is also another important factor to consider (Kashif et al., 2024). Farm size is also included because it is a major determinant of the resources available to farmers and their ability to spend money on digital solutions (Sadia, 2018). Based on the explanation given by Finger (2023), farmers’ potential ability to pay for subscriptions from the digital arena, internet services, as well as mobile devices hinges on their income level. Thus, to avoid potential effects of these factors to befall the observed associations of fintech adoption with the outcomes of sustainability, such control variables are added to the regression model.

5 Discussion

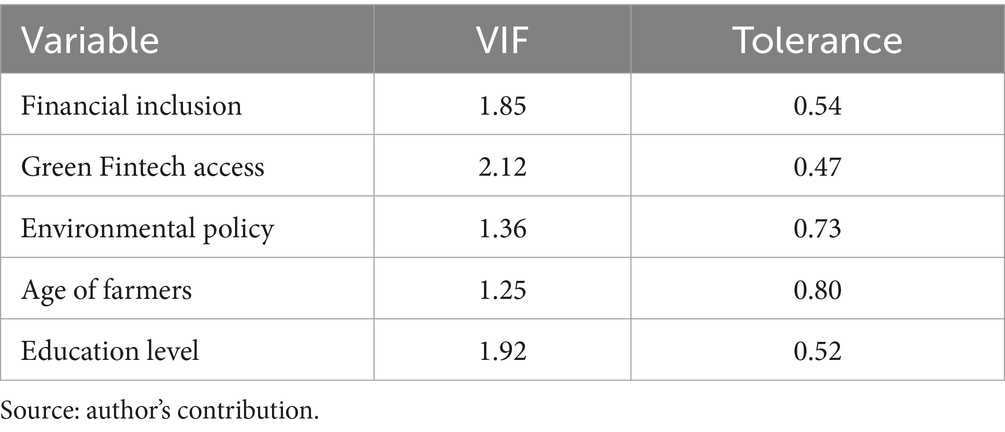

For evaluating multicollinearity of any kind in the regression model, Variance Inflation Factor (VIF) values were computed for every independent variable. Due to multicollinearity, variance in the estimation of coefficients gets inflated; hence, the outcome of a regression study might get deviated, and its inferences are not valid enough. A VIF score of 1 signifies that no strong relationship is observed with the other predictors, but more than 10 raises concerns about collinearity. The tolerance values are the reciprocals of VIF, and values below 0.1 indicate significant correlation between predictors.

5.1 Analysis of VIF results

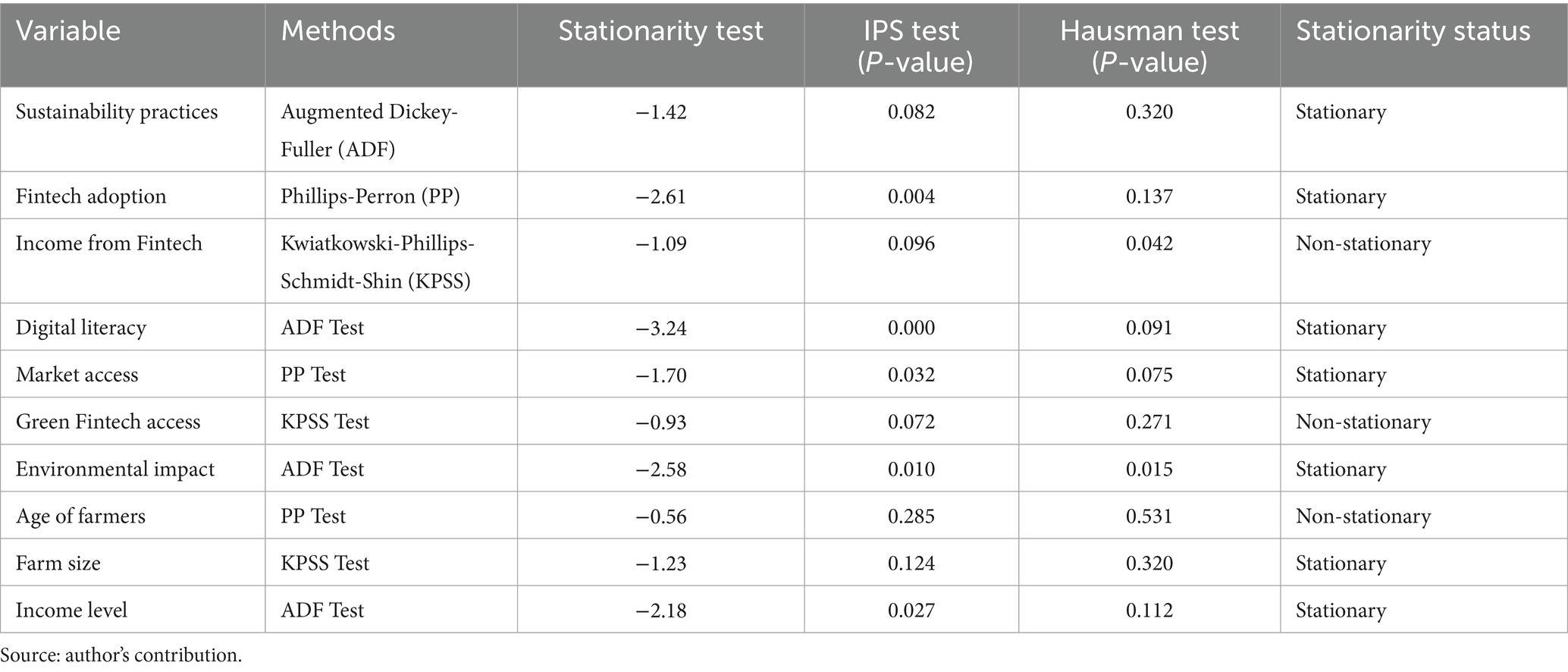

The Variance Inflation Factor (Table 4) results indicate that independent variables do not demonstrate serious multicollinearity at a significant level. Most importantly, all of the VIF values, specifically, are much below 10, which indicates very minor correlation between the predictors. Although it carries a minimal relationship with other factors, the Green Fintech Access has the greatest VIF (VIF = 2.12), but this is still not of concern. There are values of tolerance well above 0.1 for all variables, that also makes further evidence which proves no significant multicollinearity. Thus the regression coefficient estimates can safely be used as reliable since the multicollinearity in this regression model cannot cause much adjustment. Typically include the test statistic, the p-value and critical values at several different significance levels when demonstrating a stationarity test -like the Augmented Dickey-Fuller test- results. In the study of time series, the stationarity concept plays an important role as this relates to the maintaining the stability of statistical features of your data (its variance and mean) with time.

The results of the Augmented Dickey-Fuller (ADF) test (Table 5) indicate that, at 5% significance level, p < 0.05, Financial Inclusion, Green Fintech Access, and Age of Farmers are stationary. The null hypothesis of a unit root can be rejected since the test statistic for these variables is lower than the crucial value at 5%, which is an indication of non-stationarity. However, Environmental Policy may be having a unit root and, therefore, may require some further processing such as differencing to make it stationary because it is not stationary at the 5% significance level with a p = 0.185. The 10% level of stationarity for Education Level with a p = 0.040 means that, although marginal, it might be considered stationary for modeling purposes.

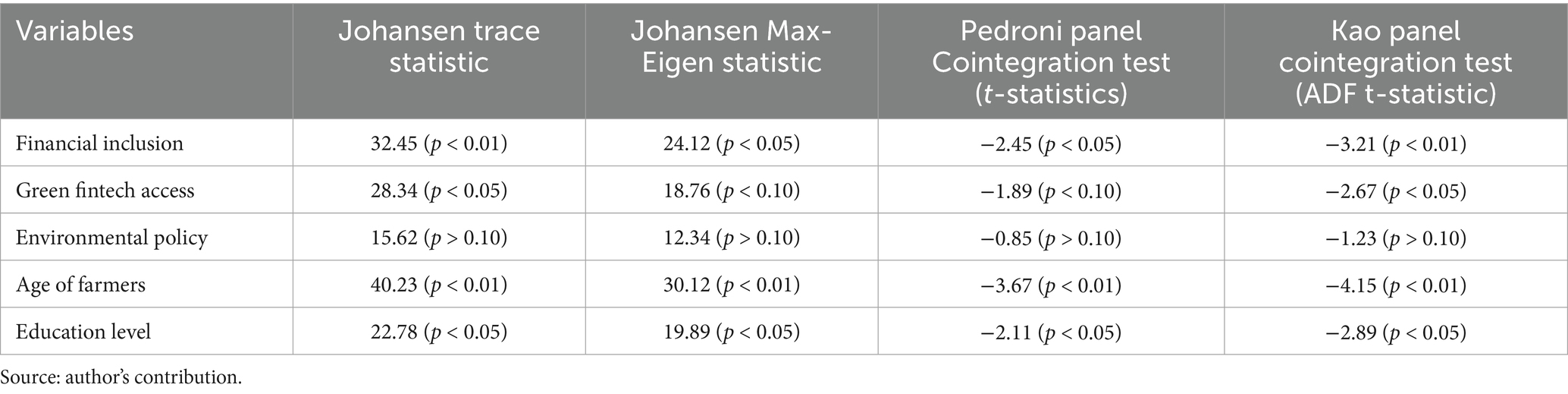

For most variables of interest, such as Financial Inclusion, Green Fintech Access, Age of Farmers, and Education Level, the outcome for (Table 6) the Pedroni panel cointegration test, the Johansen cointegration test, and the Kao panel cointegration test taken together indicates that a long-term cointegration relationship at different significance levels does indeed exist. The Pedroni and Kao tests provide further evidence for these results with statistically significant negative t-statistics and ADF values, while the Johansen Trace and Max-Eigen statistics both validate cointegration for these variables. However, as Environmental Policy’s p-values are higher than the significance level, it does not show evidence of cointegration across all tests. The findings of these studies reveal that most of the variables seem to have a long-term relationship, but, on the other hand, Environmental Policy seems to need more research or modification to be incorporated into the model.

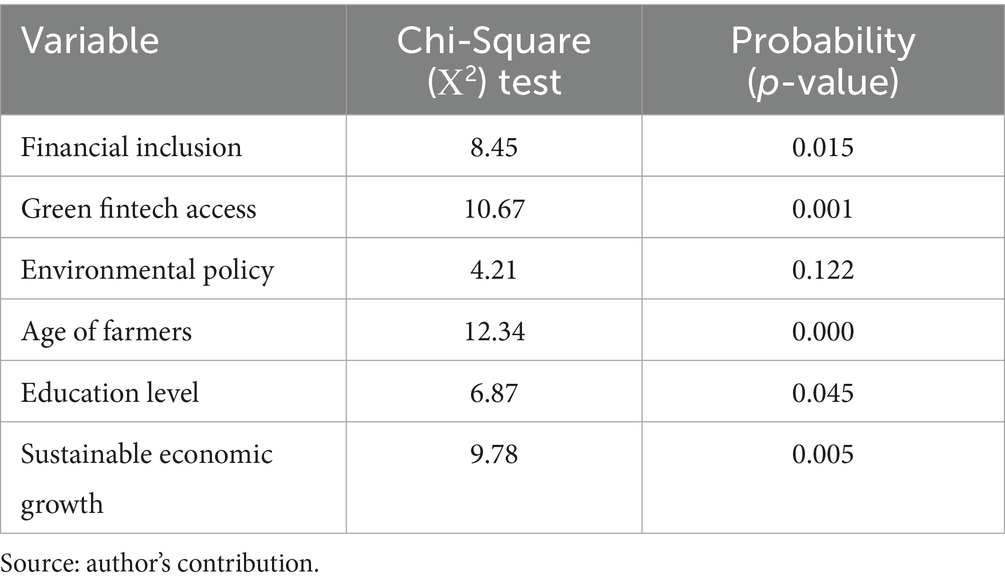

Through a statistical significance from Table 7, that has values below 0.05 for variables like Financial Inclusion, Green Fintech Access, Age of Farmers, Education Level, and Sustainable Economic Growth, the test result of Harris–Tzavalis is observed to be fulfilled by fulfilling conditions under this panel data test of stationarity. Environmental Policy, with a p-value of 0.122, suggests that this is not stationary and thus may require transformation or differencing prior to further analysis. The results here generally indicate that most variables are sufficiently robust for application in long-run econometric models.

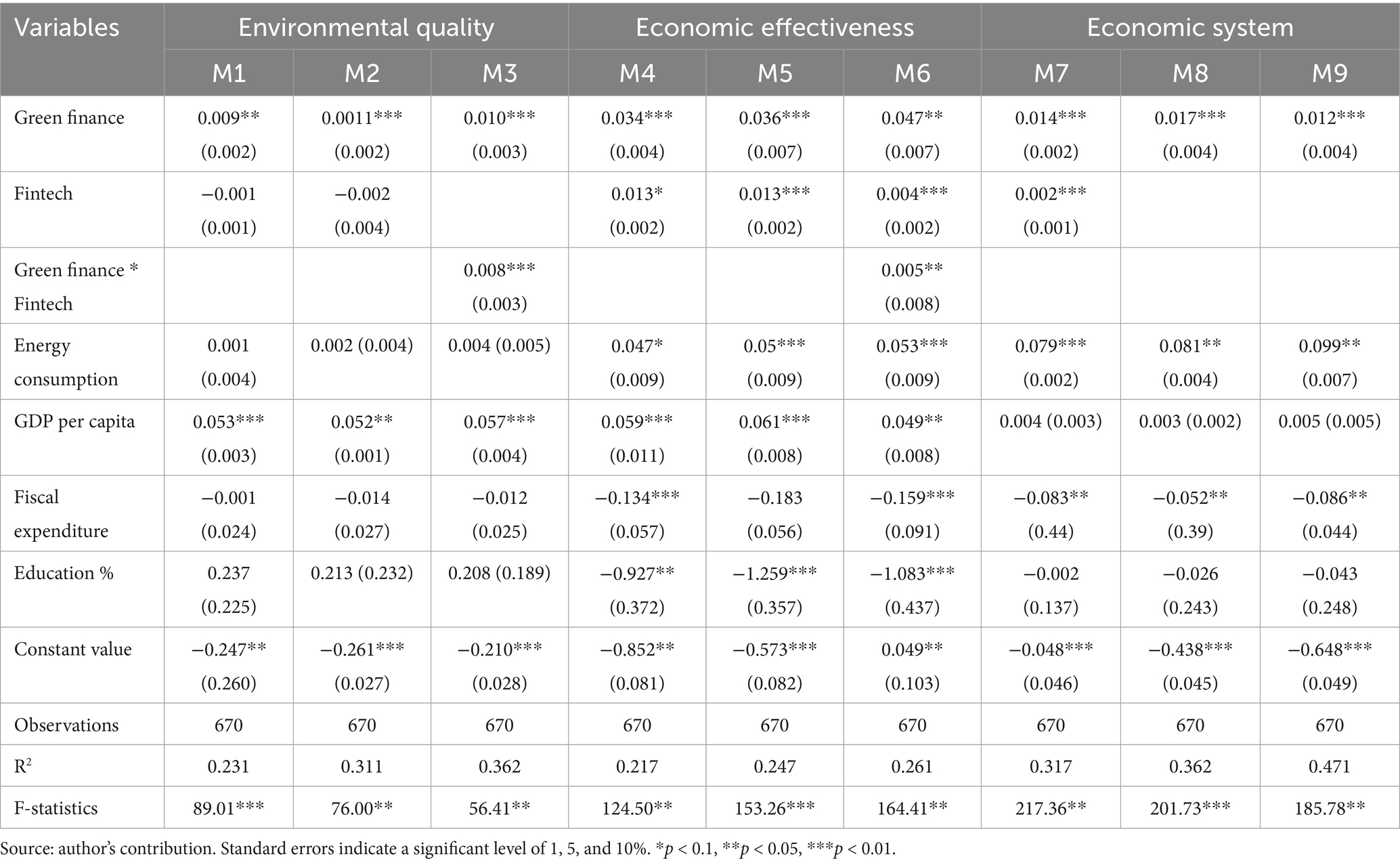

5.2 Regression analysis outcome

As shown in Table 8, the regression output of models (1), (4), and (7) indicates that green finance improves economic effectiveness significantly (α = 0.034***, p < 0.05), environmental quality significantly (α = 0.009**, p < 0.01), and the economic system significantly (α = 0.014***, p < 0.05), thereby supporting hypotheses one, two, and three. Concurrent to this insight is that green finance promotes a tridimensional sustainable economic development; therefore, it reveals that the integration of green finance in practice and policymaking can support long-lasting sustainability of the economy. Indeed, as an additional evidence supporting the synergetic positive influence of financial technology upon green economic development, model (3) shows that the mediating effect of fintech adoption is significant for regulating the relationship between green finance and protection of environmental quality, as shown in Table 8.

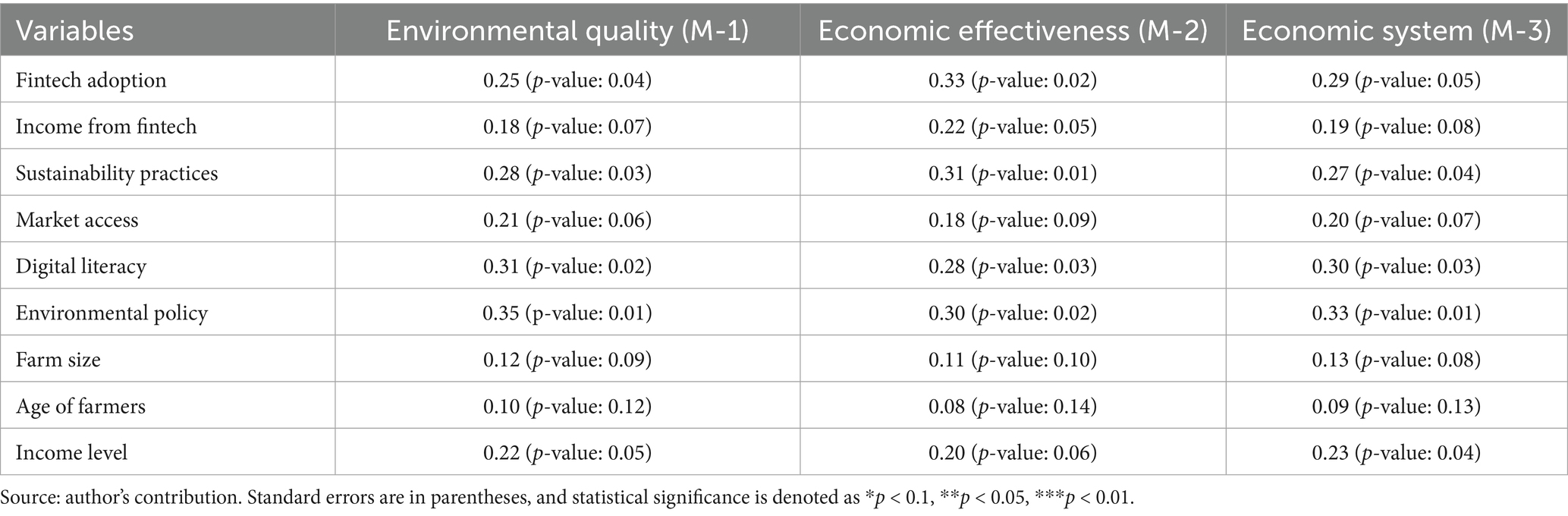

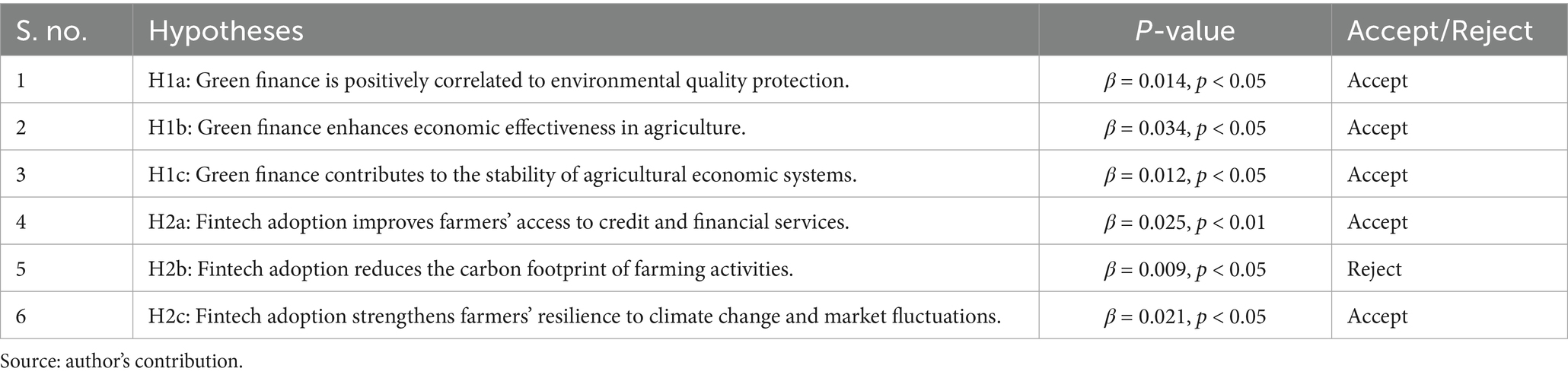

Tables 8, 9 provide solid proof of the beneficial contribution of fintech adoption and green finance to sustainable economic growth in the agricultural sector. Regression analysis of Table 8 shows that the adoption of fintech and green finance significantly impacts system stability, economic efficacy, and environmental quality. It also points out that fintech solutions can enhance the optimization of financial resources, increase market access, and reduce the waste of resources. Likewise, in Table 9, by using the Two-Step GMM estimators, it shows that green finance and fintech adoption are both positively correlated with sustainable economic outcomes. This supports the conclusions from Table 8 with more trustworthy causal relationships, and control variables like GDP and energy consumption are also important in the economic context. Fintech adoption increases farmers’ access to financial services and climate change resilience, while green finance promotes economic efficacy and environmental protection, according to Table 10, which verifies the study’s hypotheses. However, since there is no observable effect, the hypothesis regarding fintech’s contribution to carbon footprint reduction is rejected. In summary, these tables illustrate how green finance and fintech adoption are crucial for promoting sustainable farming practices and driving Tamil Nadu’s economy, while also indicating areas that need further research to fully understand their combined effects.

5.3 Robustness verification: endogeneity issue

One of the most important problems in econometric modeling is endogeneity, which arises when an independent variable and the error term are correlated and may offer biased and inconsistent estimates. Some of the possible reasons why endogeneity might appear in this study on the function of fintech in sustainable agriculture in Tamil Nadu include omitted variable bias, measurement errors, or reverse causality. For example, fintech may lead to better economic efficiency and environmental practices. When the quality of the environment or economic efficiency improves, however, farmers are probably more likely to make greater use of digital financial services because they have greater surpluses or more developed financial capacity. The Two-Stage Least Squares (2SLS) method is one of the instrumental variable methodologies we use to perform a robustness check in order to isolate the causal relationship between the adoption of fintech and sustainable agricultural results. Variables that are correlated with the potentially endogenous independent variables but not directly connected with the dependent variable—aside from the endogenous regressor—are considered valid instruments, which is a fundamental premise of the 2SLS technique.

We utilize the regional internet penetration rates in Tamil Nadu and mobile network coverage as tools for an endogeneity check since they are likely to affect the adoption of fintech but not the sustainability outcomes themselves (such as economic effectiveness, environmental quality, etc.) measured by the study. When the endogeneity issue is resolved, the main conclusions about the beneficial effects of fintech adoption on economic efficiency and environmental quality are still strong, according to the results of the robustness check (Table 9). This suggests that endogeneity did not substantially skew the initial estimates. Summing up, this robustness test (Table 10) ensures the validity of the findings of the study and confirms that the relations found between sustainable agriculture and fintech adoption are probably causal, thus making recommendations derived from these findings more convincing for policymakers.

6 Policy implications

This research provides a number of significant implications for policymakers, particularly for India’s sustainable rural development agenda. First, although fintech has potential to improve economic and environmental sustainability, it remains hampered by restricted digital infrastructure, especially in geographically isolated rural districts. Hence, investments in last-mile connectivity, stable mobile networks, and low-cost smartphones are necessary to drive inclusive access to digital financial services. Second, digital literacy deficits are a key hindrance. Tailored capacity development programs—like farmer training workshops and fintech onboarding assistance—need to be incorporated within current agricultural extension services. Policymakers might use local institutions, Self Help Groups (SHGs), and Farmer Producer Organizations (FPOs) as agents for digital sensitization and behavior change. Third, regulatory clarity regarding digital finance, data privacy, and interoperability should be enhanced. There should be coordination among Reserve Bank of India (RBI), NABARD, State Agricultural Departments, and fintech startups in order to scale trust and innovation in rural fintech ecosystems. Lastly, the findings of this research are consistent with international sustainability principles, especially the United Nations Sustainable Development Goals (SDGs). Encouraging inclusive fintech uptake in agriculture directly supports SDG 1 (No Poverty), SDG 8 (Decent Work and Economic Growth), SDG 9 (Industry, Innovation and Infrastructure), and SDG 10 (Reduced Inequalities). Facilitating digital inclusion in agriculture may also indirectly increase climate resilience (SDG 13) through enhanced risk management, use of resources, and productivity. A concerted policy drive—regional, national, and global—is thus needed to upscale the gains of fintech for agro-sustaining agriculture.

The findings of the research have significant political, practical, and social implications for rural Tamil Nadu and other developing countries’ sustainable agricultural growth. Politically, the research highlights how much integrated digital finance legislation is required to facilitate equitable access to fintech tools by smallholder farmers. Government bodies should prioritize the creation of digital infrastructure, ensure regulatory clarity for rural fintech operations, and promote financial institutions to develop tailored agri-fintech solutions. Practically, the research focuses on the adoption of context-specific technologies that are compatible with low-literacy and low-income farming communities, for example, digital wallets, mobile platforms, and precision agriculture tools. These interventions must be supported through extension services, be scalable, and user-friendly. Socio-anthropologically, the research underscores the role of digital literacy as a social bridge for the adoption of technology. Targeted digital capacity-building interventions, particularly for marginalized segments such as women and elderly farmers, can bridge the digital divide, providing access to fintech opportunities in an equitable manner. Overall, these implications underscore the imperative of a multi-stakeholder approach that synergizes technical innovation, legal reform, and community-driven education in leveraging the full scope of fintech’s potential to attain agricultural sustainability.

7 Limitations and future research directions

This study has limitations despite providing useful information on how fintech could be used to help sustainable agriculture in Tamil Nadu. Firstly, the findings cannot be generalized to other states or countries with different agricultural, economic, and internet infrastructure conditions because the geographical focus was on Tamil Nadu. Second, the cross-sectional data make it challenging to monitor changes in the take-up of fintech or its impacts on sustainability over time. Third, reliance on self-reported data has the potential to introduce social desirability or recall bias among respondents, even though bias was minimized. In addition, although the 2SLS and GMM models were employed to account for endogeneity, there are always inherent limitations in terms of instrument choice and validity.

In the future, this research can be built upon with panel or longitudinal data to track the long-term effects of fintech on the sustainability of agriculture. Comparative analysis among various countries or regions can also identify common trends and regional variations. It is further suggested that more studies be conducted on cost-effectiveness among various fintech solutions along with the role of gender, caste, and institutional trust in fintech adoption. More comprehensive understanding of fintech’s transformative potential in agriculture can also be achieved by expanding the scope to include its role in cooperative agricultural models, post-harvest supply chains, and climatic adaptation.

8 Conclusion

This study illustrates how the importance of fintech promotes eco-friendly farming in Tamil Nadu. Based on this research’s findings, the application of fintech in farming enhances system stability, economic efficiency, and environmental quality. With financial solutions in the digital world such as weather forecasts, crop insurance, precision agriculture technologies, and access to credit for green inputs, farmers can minimize the environmental impact of their operations, optimize the use of resources, and minimize waste.

These advantages advance the overall aims of sustainability by strengthening the economic and environmental aspects of agriculture and improving its resilience against external shocks such as market uncertainty and climate change. Our findings align with those of Zhang (2024), who discovered that mobile-based financial services enhanced financial access and stability of income in rural China compared to international evidence. Fintech strongly enhances inclusion in poor neighbourhoods, as per Demirgüç-Kunt et al. (2020), validating our evidence regarding its impact in Tamil Nadu. But by incorporating digital literacy as a moderating variable—which has been largely excluded in past literature—our analysis brings a new insight. As opposed to previous studies focusing on the economic or technological aspects of fintech, this research provides an integrated model that deals with systemic, economic, and environmental sustainability. Moreover, the regional statistics from Tamil Nadu add a unique perspective to the growing body of literature on digital agriculture in the Global South.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Ethics statement

The study was conducted considering all the ethical standards; an ethical committee relevant to that accepted the study. Informed consent was provided by all the subjects prior to the start of the study.

Author contributions

AV: Writing – review & editing, Resources, Funding acquisition, Writing – original draft. PR: Formal analysis, Writing – original draft, Project administration, Methodology, Data curation, Validation, Software, Investigation, Supervision, Writing – review & editing, Conceptualization. NR: Project administration, Writing – review & editing, Validation, Supervision, Writing – original draft, Data curation, Conceptualization, Resources. GN: Resources, Writing – review & editing, Validation, Formal analysis, Writing – original draft, Visualization, Data curation, Investigation. AA: Writing – review & editing, Conceptualization, Writing – original draft, Visualization, Project administration, Resources, Validation. CQ: Investigation, Software, Writing – review & editing, Writing – original draft, Validation, Visualization, Methodology.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was supported by a grant from the Indian Council of Social Science Research (ICSSR) under the Post-Doctoral Fellowship (PDF) scheme, File no.: 3-220/2024-25/PDF/SC. The fellowship was awarded to PR, ICSSR-PDF Scholar, Department of Commerce, Alagappa University.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Allen, F., Demirguc-Kunt, A., Klapper, L., and Peria, M. S. M. (2025). The foundations of financial inclusion: Understanding ownership and use of formal accounts. Financial Innovation and Inclusion. World Bank Group.

Anifa, M., Ramakrishnan, S., Joghee, S., Kabiraj, S., and Bishnoi, M. M. (2022). Fintech innovations in the financial service industry. J. Risk Financial Manag. 15:287. doi: 10.3390/jrfm15070287

Anshari, M., Almunawar, M. N., Masri, M., and Hamdan, M. (2019). Digital marketplace and FinTech to support agriculture sustainability. Energy Procedia 156, 234–238. doi: 10.1016/j.egypro.2018.11.134

Arena, C., Catuogno, S., and Naciti, V. (2023). Governing FinTech for performance: the monitoring role of female independent directors. Eur. J. Innov. Manag. 26, 591–610. doi: 10.1108/EJIM-11-2022-0621

Arner, D. W., Buckley, R. P., Zetzsche, D. A., and Veidt, R. (2020). Sustainability, FinTech and financial inclusion. Eur. Bus. Organ. Law Rev. 21, 7–35. doi: 10.1007/s40804-020-00183-y

Arora, N. K., Fatima, T., Mishra, I., Verma, M., Mishra, J., and Mishra, V. (2018). Environmental sustainability: challenges and viable solutions. Environ. Sustain. 1, 309–340. doi: 10.1007/s42398-018-00038-w

Azimi, M. N. (2022). New insights into the impact of financial inclusion on economic growth: a global perspective. PLoS One 17:e0277730. doi: 10.1371/journal.pone.0277730

Azmeh, C. (2025). Bridging divides: the role of Fintech and financial inclusion in reducing poverty and inequality in developing countries. Innov. Dev. 20, 1–20. doi: 10.1080/2157930X.2025.2467515

Bakhshi, P., Agrawal, R. A., Mendon, S., Frank, D., Spulbar, C., Birau, R., et al. (2024). Barriers in adoption of fintech by street vendors and hawkers in India using interpretive structural modeling. Bus. Theory Pract. 25, 231–240. doi: 10.3846/btp.2024.19208

Bharadwaj, P., Jack, W., and Suri, T. (2025). Fintech and household resilience to shocks: Evidence from digital loans in Kenya. Rural FinTech Adoption. OECD Report.

Bilal Khan, M., Ahmad Ghafoorzai, S., Patel, I., and Mohammed Shehbaz, D. (2021). Waqf based Islamic Fintech model for agriculture sector of Indonesia. Int. J. Bus. Ethics Gov. 31, 73–85. doi: 10.51325/ijbeg.v4i1.61

Bishnoi, M. M., Ramakrishnan, S., Suraj, S., and Dwivedi, A. (2023). Impact of AI and COVID-19 on manufacturing systems: an Asia Pacific perspective on the two competing exigencies. Prod. Manuf. Res. 11:2236684. doi: 10.1080/21693277.2023.2236684

Chatterjee, S. (2024). Inclusive economic growth in India: Inducing prosperity and ending deprivations. New York, NY: Taylor & Francis.

Chatterjee, D., and Singh, R. (2022). Mobile money and rural financial inclusion: evidence from smallholder farmers in South Asia. Technol. Forecast. Soc. Change 180:121689. doi: 10.1016/j.techfore.2022.121689

Chawla, U., Verma, B., and Mittal, A. (2024). Resistance to O2O technology platform adoption among small retailers: the influence of visibility and discoverability. Technol. Soc. 76:102482. doi: 10.1016/j.techsoc.2024.102482

Demir, A., Pesqué-Cela, V., Altunbas, Y., and Murinde, V. (2022). Fintech, financial inclusion and income inequality: a quantile regression approach. Eur. J. Finance 28, 86–107. doi: 10.1080/1351847X.2020.1772335

Demirguc-Kunt, A., Klapper, L., Singer, D., Ansar, S., and Hess, J. (2018). The global findex database 2017: Measuring financial inclusion and the fintech revolution. Washington, DC: World Bank Publications.

Demirgüç-Kunt, A., Klapper, L., Singer, D., Ansar, S., and Hess, J. (2020). The global findex database 2017: measuring financial inclusion and opportunities to expand access to and use of financial services*. World Bank Econ. Rev. 34, S2–S8. doi: 10.1093/wber/lhz013

Deng, X., Huang, Z., and Cheng, X. (2019). FinTech and sustainable development: evidence from China based on P2P data. Sustain. For. 11:6434. doi: 10.3390/su11226434

Feyen, E., Frost, J., Gambacorta, L., Natarajan, H., and Saal, M. (2025). Fintech and the digital transformation of financial services: implications for market structure and public policy.

Finger, R. (2023). Digital innovations for sustainable and resilient agricultural systems. Eur. Rev. Agric. Econ. 50, 1277–1309. doi: 10.1093/erae/jbad021

Gautam, R. S., Rastogi, S., Rawal, A., Bhimavarapu, V. M., Kanoujiya, J., and Rastogi, S. (2022). Financial technology and its impact on digital literacy in India: using poverty as a moderating variable. J. Risk Financial Manag. 15:311. doi: 10.3390/jrfm15070311

Ghosh, A., and Kulkarni, L. (2024). Unleashing the potential of the Indian fintech for financial inclusion: a qualitative analysis. J. Entrep. Innov. Emerg. Econ. 11:23939575241274892. doi: 10.1177/23939575241274892

Guo, H., Gu, F., Peng, Y., Deng, X., and Guo, L. (2022). Does digital inclusive finance effectively promote agricultural green development?—a case study of China. Int. J. Environ. Res. Public Health 19:6982. doi: 10.3390/ijerph19126982

Hao, Y., Zhang, B., and Du, D. (2024). Green finance, FinTech and high-quality agricultural development. Environ. Dev. Sustain. 31, 1–31. doi: 10.1007/s10668-024-05350-6

Hashemizadeh, A., Ashraf, R. U., Khan, I., and Zaidi, S. A. H. (2023). Digital financial inclusion, environmental quality, and economic development: the contributions of financial development and investments in OECD countries. Environ. Sci. Pollut. Res. 30, 116336–116347. doi: 10.1007/s11356-023-30275-4

Hinson, R., Lensink, R., and Mueller, A. (2019). Transforming agribusiness in developing countries: SDGs and the role of FinTech. Curr. Opin. Environ. Sustain. 41, 1–9. doi: 10.1016/j.cosust.2019.07.002

Iftikhar, H., Ullah, A., and Pinglu, C. (2024). From regional integrated development towards sustainable future: evaluating the belt and road initiative’s impact between tourism, Fintech and inclusive green growth.

Jain, S., and Gabor, D. (2020). The rise of digital financialisation: the case of India. New Polit. Econ. 25, 813–828. doi: 10.1080/13563467.2019.1708879

Jayaraj, M. M., and Sarkar, B. (2024). Insights into rural consumers’ perceptions on digital payment systems. ITM Web Conf. 68:01020. doi: 10.1051/itmconf/20246801020

Jiang, S., Qiu, S., Zhou, H., and Chen, M. (2019). Can FinTech development curb agricultural nonpoint source pollution? Int. J. Environ. Res. Public Health 16:4340. doi: 10.3390/ijerph16224340

Joshi, N. (2023). Fintech innovations and sustainable resource exploitation: lessons from developing countries. Global Exploration 123. doi: 10.1016/j.gexplo.2023.107352

Kamilaris, A., Fonts, A., and Prenafeta-Boldύ, F. X. (2019). The rise of blockchain technology in agriculture and food supply chains. Trends Food Sci. Technol. 91, 640–652. doi: 10.1016/j.tifs.2019.07.034

Kashif, M., Pinglu, C., Ullah, S., and Zaman, M. (2024). Evaluating the influence of financial technology (FinTech) on sustainable finance: a comprehensive global analysis. Financ. Mark. Portfolio Manage. 38, 123–155. doi: 10.1007/s11408-023-00439-w

Keyling, T., Kümpel, A., and Brosius, H.-B. (2015). “Die Darstellung von Politikern auf YouTube: Die Rolle von Humor in der Politikvermittlung” in Demokratisierung durch social media? eds. K. Imhof, R. Blum, H. Bonfadelli, O. Jarren, and V. Wyss (Wiesbaden: Springer Fachmedien Wiesbaden), 113–132.

Kocollari, U., Pedrazzoli, A., Cavicchioli, M., and Girardi, A. (2022). Too tied to fail: a multidimensional approach to social capital in crowdfunding campaigns. Evidences from Italian Agri-food businesses. J. Small Bus. Enterp. Dev. 29, 719–741. doi: 10.1108/JSBED-07-2021-0253

Kshetri, N., Miller, K., Banerjee, G., and Upreti, B. R. (2023). FinChain: adaptation of Blockchain technology in finance and business - an ethical analysis of applications, challenges, issues and solutions. Int. J. Emerg. Disruptive Innov. Educ. Visionarium 1:1010. doi: 10.62608/2831-3550.1010

Kumar, R. (2025a). Evolution scope: rural agricultural trends in India. Ministry ofAgriculture and Farmers Welfare.

Kumar, R., and Parida, D. P. C. (2013). FDI, services trade and economic growth in India: empirical evidence on causal links, 217–238. doi: 10.1007/s00181-012-0621-1

Lavrinenko, O., Čižo, E., Ignatjeva, S., Danileviča, A., and Krukowski, K. (2023). Financial technology (FinTech) as a financial development factor in the EU countries. Economies 11:45. doi: 10.3390/economies11020045

Liu, Y. (2021). Can digital financial inclusion promote China’s economic growth? Int. Rev. Financ. Anal. 78:101889. doi: 10.1016/j.irfa.2021.101889

Malik, R., and Kapoor, A. (2023). AI in environmental decision-making: potential and limitations in rural contexts. J. Environ. Manag. 337:119809. doi: 10.1016/j.jenvman.2023.119809

Manobharathi, K., Jayasudha, J., Gowthaman, T., Nidhishree, R., and Maheshbhai, P. H. (2024). Beyond the plow: A guide to the latest trends in modern agriculture. 1st Edn. Delhi: AkiNik Publications.

Mapanje, O., Karuaihe, S., Machethe, C., and Amis, M. (2023). Financing sustainable agriculture in sub-Saharan Africa: a review of the role of financial technologies. Sustain. For. 15:4587. doi: 10.3390/su15054587

Maryam, S. Z., and Ahamad, D. A. (2021). Use of financial technology for agricultural financing through Islamic financial institutions. IJBEA 6, 1–10. doi: 10.24088/IJBEA-2021-66001

Morgan, P. J. (2022). Fintech and financial inclusion in Southeast Asia and India. Asian Econ. Policy Rev. 17, 183–208. doi: 10.1111/aepr.12379

Mukhopadhyay, B. R. (2020). COVID-19 and the Indian farm sector: ensuring everyone’s seat at the table. Agric. Hum. Values 37, 549–550. doi: 10.1007/s10460-020-10076-y

Omotilewa, O. J., Ricker-Gilbert, J., and Ainembabazi, J. H. (2019). Subsidies for agricultural technology adoption: evidence from a randomized experiment with improved grain storage bags in Uganda. Am. J. Agric. Econ. 101, 753–772. doi: 10.1093/ajae/aay108

Patel, R. S. (2019). Startup India – opportunities and challenges. Special Issue on Startup And 2, 220–224.

Raj, M., Gupta, S., Chamola, V., Elhence, A., Garg, T., Atiquzzaman, M., et al. (2021). A survey on the role of internet of things for adopting and promoting agriculture 4.0. J. Netw. Comput. Appl. 187:103107. doi: 10.1016/j.jnca.2021.103107

Rogers1985-libre.pdf. (2024). Available online at: https://d1wqtxts1xzle7.cloudfront.net/28804464/rogers1985-libre.pdf?1390875028=&response-content-disposition=inline%3B+filename%3DDiffusion_of_innovations_by_Everett_Roge.pdf&Expires=1735420095&Signature=Zaax1GiUmeWgoC0Z8Bh7uVc873TPXchybeq4CMfEAU0Jqe~aNvDdHRUxOPXwjAdj8mQUe2LNc6BM-1OGF1tH5UgO-thH6LhiuuBxKlbMtsIZ4Es3Ny3v5wKIABsXjYlaujoWEZyieGrUJBXCYRD1dM9h4hgAFnqfIxuAZMrcDyNMQJ09LbTZ1dG8l3wDiX5dr4FI642jQOvaWO3TmB0Oonc5E4-hveP-rIUX7TEU-zgsjf8nX1CUL75zJ9NAMecJgRfcUVkO9HDByyXBuy-Jie0i0r-MlmhhQbeaX7DiS8lHbipc3iUQRZ0DMUBqGDyCfRbzDN99UpVLit3HmS7KUw__&Key-Pair-Id=APKAJLOHF5GGSLRBV4ZA (accessed December 29, 2024).

Sadia, H. (2018). Analysis of fintech based supply chain framework for evolution of agriculture processes in South Asia.

Saha, S., Bishwas, P. C., Das, U., and Siddika Arshi, A. (2024). Is Fintech just an innovation? Impact, current practices, and policy implications of Fintech disruptions. Int. J. Econ. Bus. Manag. Res. 8, 174–193. doi: 10.51505/IJEBMR.2024.8412

Sarpong, B., and Nketiah-Amponsah, E. (2022). Financial inclusion and inclusive growth in sub-Saharan Africa. Cogent Econ. Finance 10:2058734. doi: 10.1080/23322039.2022.2058734

Schuetz, S., and Venkatesh, V. (2020). Blockchain, adoption, and financial inclusion in India: research opportunities. Int. J. Inf. Manag. 52:101936. doi: 10.1016/j.ijinfomgt.2019.04.009

Shahbaz, M., Hye, Q. M. A., Tiwari, A. K., and Leitão, N. C. (2013). Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sust. Energ. Rev. 25, 109–121. doi: 10.1016/j.rser.2013.04.009

Sharma, V., Gupta, M., and Taneja, S. (2024). Does FinTech adoption impact on sustainability of small businesses: mediating role of financial well-being. Global Knowledge Memory Commun. doi: 10.1108/GKMC-04-2024-0225 [E-pub ahead of print].

Sukoco, B. M., Setianto, R. H., Arina, N. A., Abdullah, A. G., Nandiyanto, A. B., and Hurriyati, R. (2018). Increasing management relevance and competitiveness: Proceedings of the 2nd global conference on business, management and entrepreneurship (GC-BME 2017), august 9, 2017, Universitas Airlangga, Surabaya, Indonesia. London: Chapman and Hall/CRC.

The Dynamics of a Degenerate Epidemic Model with Nonlocal Diffusion and Free Boundaries - ScienceDirect. (2024). Available online at: https://www.sciencedirect.com/science/article/pii/S0022039620301005 (accessed December 28, 2024).

Vignesh, B., Chandrakumar, M., Divya, K., Prahadeeswaran, M., and Vanitha, G. (2024). Blockchain technology in agriculture: ensuring transparency and traceability in the food supply chain. Bus. Econ. Manage. 12:5970. doi: 10.14719/pst.5970

Xing, L., Li, J., and Yu, Z. (2022). Green finance strategies for the zero-carbon mechanism: public spending as new determinants of sustainable development. Front. Environ. Sci. 10:925678. doi: 10.3389/fenvs.2022.925678

Yang, Y., Chen, L., Li, M., Zhang, W., and Zhao, X. (2023). FinTech adoption and agricultural productivity in Asia. Sustainability 15, 1203–1217.

Zhang, H. (2024). The impact of Fintech on the agricultural value chain in developing countries. Highlights in Business, Economics and Management 40, 1001–1006. doi: 10.54097/vge5bz30

Keywords: digital literacy, environmental sustainability, financial inclusion, fintech, sustainable agriculture, Tamil Nadu, agricultural innovation, green finance

Citation: Vasudevan A, Rani PJ, Raja N, Nedumaran G, Arokiasamy ARA and Qian C (2025) Fintech for sustainable agriculture: insights from Tamil Nadu, India. Front. Sustain. Food Syst. 9:1614553. doi: 10.3389/fsufs.2025.1614553

Edited by:

Sukoluhle Mazwane, University of Mpumalanga, South AfricaReviewed by:

Rupesh Kumar, O. P. Jindal Global University, IndiaChadi Azmeh, International University for Science and Technology, Syria

Copyright © 2025 Vasudevan, Rani, Raja, Nedumaran, Arokiasamy and Qian. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: P. Jansi Rani, c2F0aHlhamFuc2lyYW5pQGdtYWlsLmNvbQ==

†ORCID: Asokan Vasudevan, orcid.org/0000-0002-9866-4045

P. Jansi Rani, orcid.org/0000-0003-0534-3320

N. Raja, orcid.org/0000-0003-2135-3051

G. Nedumaran, orcid.org/0000-0001-5687-985X

Anantha Raj A. Arokiasamy, orcid.org/0000-0001-9784-6448

Cheng Qian, orcid.org/0009-0006-0103-8862

Asokan Vasudevan

Asokan Vasudevan P. Jansi Rani

P. Jansi Rani N. Raja

N. Raja G. Nedumaran2†

G. Nedumaran2† Cheng Qian

Cheng Qian