- 1Department of Economics, Kohat University of Science and Technology, Kohat, Pakistan

- 2Hungarian National Bank–Research Center, John Von Neumann University, Kecskemét, Hungary

- 3Vanderbijlpark Campus, Northwest University, Vanderbijlpark, South Africa

The study used a sample of 43 low and middle-income countries for the time span of 14 years, i.e., from 2005 to 2018 with the objective to analyze the global fossil fuel market. The novelty of the study lies in its variable product and process innovation, study sample as well as the methodology adopted by the System GMM model. The fossil fuels demand in terms of Domestic material consumption of fossil fuel is regressed against 4 Energy and innovation, social and economic variables. The study employed System GMM model for estimation of results and FMOLS for robustness check. The results reveal that estimates for lag fossil fuels consumption, fossil fuel price and GDP are statistically significant and positive while estimates for patents are negative. The study suggests that low and middle income countries’ Government should focus on product and process innovation as a critical element while structuring their policy for climate change mitigation.

1 Introduction

The world is experiencing climate change at a drastic level. According to the (World Meteorological Organization 2019), 2014–2019 are the record hottest 5 years on earth. The root cause of global warming is CO2 emission from the burning of fossil fuels in the energy sector (Aziz et al., 2013; Ahmad et al., 2022). The world has acknowledged the fact that reduction in energy consumption (EC) is foremost important for climate change mitigation (Zaharia et al., 2019). In 2015 the United Nations introduced a sustainable development strategy “The 2030 Agenda”. A set of 17 goals were documented for sustainable development among which number 7“Affordable and clean energy” directly referred to the energy sector. Since the industrial revolution, the use of carbon-intensive energy has put the planet further away from its climate goals thus policymakers shifted their focus to technological development and innovation in the energy sector as a remedy for the rapidly growing problem of CO2 emission (Grafström, 2017). As it is widely known that global warming has severe consequences, policymakers stress technological change in the field of renewable energy as one of the foremost solutions.

In this context, technology can bring hope for sustainable life on earth. It can be a source for overcoming most of the hardest challenges faced by our society, which can be climate change disease, and/or scarcity. Innovation is a powerful tool for advancing economic development and a better life for human beings (Schumpeter, 1942). The threat of climate change resulting from the increased use of energy and accumulation of large-scale greenhouse gases can be avoided through the development of advanced carbon-free technologies on a priority basis (Stern and Stern, 2007). Technology increases efficiency by increasing the level of production with a given amount of inputs as well as reducing the emission level. In other words, technology can comparatively lower the emission level of GHGs at the current consumption level or can increase the consumption level without altering the emission level of GHGs. (Del Río, 2004). According to the research conducted by (Choudhry et al., 2015), EC can be reduced by 10%–20% with operational improvement it can be further boosted up to 50% or more by investing in energy efficiency technologies. The development of low carbon or carbon-free technologies is one of the ways to limit the emission of GHGs and protect the climate (Stern and Stern, 2007). To achieve the goal of climate protection Governments are required to adopt a portfolio of policies to foster Technological innovation (TI) as well as the adoption of advanced technologies on a large scale at all levels including governments, firms, and individuals (Rubin, 2011). According to the report of the UN Economic and Social Council, there is significant progress in increasing renewable energy use in electricity. The renewable energy share in total EC increased from 16.4% in the year 2010% to 17.1% in the year 2018. The renewable energy capacity of developing countries increased by 7% over the year 2019. Thus, in the recent arena, most scientists are focusing on technologies as the most obvious solution toward carbon neutrality. Various firms and industries are investing in TI in all fields of life including energy, food and health.

Keeping in view the above discussion this paper aims at investigating the role of product and process innovation in fossil fuel demand. Since the world is transforming its energy sources from fossil fuel to low carbon energy it is a dire need to find out what role the product and process innovation play in moving the country toward a Carbon neutral nation. Nations are efficiently putting efforts to develop such technologies that can reduce fossil fuel usage and GHG emission from fossil fuels. There is an emerging trend of renewable energy which is a major substitute for fossil fuel energy. With an increasing demand for renewable energy or low carbon energy, a significant effect on the demand for fossil fuel energy. Most of the work done in earlier literature exposed several factors that have causal relationship with energy demand. To the best of the researcher knowledge product and process innovation has not been considered by the previous studies as an influencing factor for fossil fuel demand. The novelty of the study lies in its variable product and process innovation and study sample of 43 low and middle-income countries for 14 years, i.e., from 2005-to 2018 as well as the methodology adopted by the System GMM model. For a more detailed in-depth analysis, the study also conducted regional basis anatomy. The low and middle-income countries are divided into 6 regions to get more comprehensive results. The core objective of this study is a macroeconomic analysis of the fossil fuel market in LMICs. This study is in its true sense an evaluation step for finding out whether the efforts made by research development and innovation to reduce fossil fuel EC and climate change mitigation are successful or whether there exists any gap between the desired objectives and actual state. The results of the study will help policymakers, especially in low and middle-income countries to transform their energy sector or industrial sector and formulate policies for the industrial sector that contribute towards achieving the goal of carbon neutrality and thus improving the country’s status in terms of carbon-neutral nation.

The remainder of the study is organized in the following manner. The review of previous literature is given in the second section, the third section describes the methodology adopted to achieve the objectives of the study fourth section provides the results and discussion over the finding of the study at the last recommendations suggested by the authors are narrated.

2 Literature

Analysis of previous literature for this study can be classified into two categories. Firstly, the work done in the field of energy demand is analyzed and secondly, the role of innovation in energy demand is discussed.

2.1 Literature in the field of energy demand

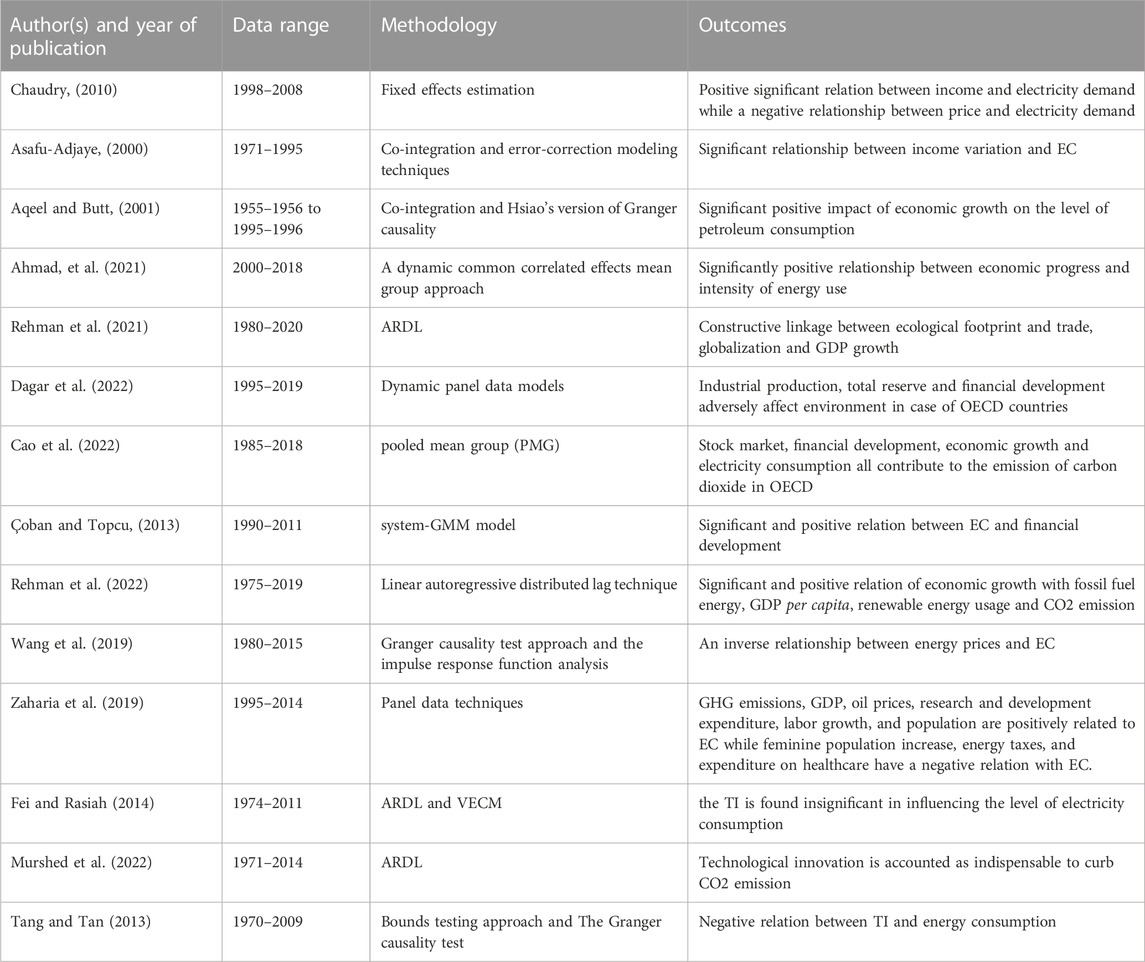

Among the earlier studies, (Pesaran et al., 1998), pointed out that one of the extensively researched areas in the field of energy economics has been the estimation of energy demand. The accurate estimate for energy demand is the key input for future analysis of EC and policy making. Energy demand estimation is popular due to its wide range of applications for important policy issues in the energy sector (Barker et al., 1995). Using the panel data set for the period 1998–2008 (Chaudry, 2010) attempted to estimate energy demand in Pakistan at the firm and economic levels. His findings showed a positive significant relation between income and electricity demand while a negative relationship between price and electricity demand. A significant relationship between income variation and EC is found by (Asafu-Adjaye, 2000) for India, Indonesia, the Philippines, and Thailand. Similarly, (Aqeel and Butt, 2001), stated that there is a significant positive impact of a country’s economic growth on the level of petroleum consumption of a country. Ahmad, et al. (2021) found a significantly positive relationship between economic progress and intensity of energy use. Rehman et al., 2021 and Khan et al. (2021) found a constructive linkage between ecological footprint and trade, globalization and GDP growth for Pakistan. Dagar et al., 2022 found that industrial production, total reserve and financial development adversely affect environment in case of OECD countries. Cao et al., 2022 found stock market, financial development, economic growth and electricity consumption all contribute to the emission of carbon dioxide in OECD countries in long as well as in short run. In the study conducted by (Mielnik and Goldemberg, 2002) a sample of 20 developing countries was taken for investigating the role of financial development on energy intensity. Financial development was measured through FDI and found to have a significant negative relation with energy intensity. Çoban and Topcu, (2013) used financial development, energy prices, and economic progress as influencing variables to study EC for EU27 countries. Their results revealed that for old member countries with a higher level of financial development there is an increasing trend of EC as compared to the new member countries with the less developed financial system; Rehman et al., 2022 studied Pakistan economy and found that economic progress of Pakistan is significantly and positively related with fossil fuel energy, GDP per capita, renewable energy usage and CO2 emission; Wang et al. (2019) used panel data on 186 countries for analyzing the impact of GDP, energy prices, and urbanization on EC between the years 1980–2015. The finding revealed an inverse relationship between energy prices and EC in low-and medium-income countries; Gorus & Aydin, (2019) investigated eight MENA countries for the existence of causal relationship between economic growth, energy consumption and carbon dioxide emission for the period 1975–2014. They found no casual relation between economic growth and CO2 emission and recommended conservation policies for these countries; Aydin, M. (2019) found bidirectional causality between non-renewable electricity consumption and economic growth for 26 OECD countries; Noor et al. (2023) found a negative effect of nonrenewable energy on sustainable development; Aydin, M. (2018) found a significantly positive long run relationship between natural gas consumption and economic growth for top 10 natural gas–consuming countries from 1994 to 2015; Zaharia et al. (2019) assessed the energy determinants for (EU28) intending to achieve sustainability in the energy sector. The study covered various aspects of sustainable development including social, economic, and environmental aspects. According to the results GHG emissions, GDP, oil prices, research and development expenditure, labor growth, and population are positively related to EC while feminine population increase, energy taxes, and expenditure on healthcare have a negative relation with EC.

2.2 Literature on role of innovation in energy demand

In recent times many countries of the world and organizations have committed terms of their contribution to the elimination of GHGs emissions. It has focused on the almost complete conversion of the energy system in at least 3 decades. With the help of innovation, the world is transforming archaic technologies in the energy sector into clean energy technologies. Innovations in the energy sector make electrical power a more reliable source of energy as well as provide solutions that are more consumer-oriented with more distributed resources. This attracts new investors to the market which puts more pressure on product and process innovation. Product innovation refers to the execution of a good or service that has significantly better features or desired uses (Oslo Manual §156). On the other hand, process innovation refers to the execution of significantly improved and new methods of production and/or delivery (Oslo Manual §163).

In their study of the Chinese economy Jin and Zahng (2014) evidence the role of TI in reducing fossil fuel consumption and environmental quality improvement. Investigating the nexus between fossil fuel-powered electricity usage and innovation Fei and Rasiah (2014) revealed that the TI is found insignificant in influencing the level of electricity consumption. Investigating the manufacturing industry of India Dasgupta and Roy (2015) concluded that technological progress will lead to reducing energy usage by inducing the efficiency of energy input. Murshed et al., 2022 found that in case of Argentina economy, technological innovation is accounted as indispensable to curb CO2 emission. According to a study by Karali et al. (2017) technological learning is expected to reduce the EC of the US iron and steel sector by 13% in 2050. In the study by Tang and Tan (2013) the nexus between electricity consumption, TI, energy prices, and economic growth is studied for Malaysia. The results revealed that TI Granger causes the consumption of electricity in Malaysia and has negatively related to electricity consumption. Irandoust (2016) studied the relationship between renewable EC, economic growth, TI, and CO2 emission and found that TI Granger causes renewable EC and leads to reduce the CO2 emission. Aflaki et al. (2014) found that TI positively relates to renewable energy diffusion. Sohag et al. (2015) used time series data from 1980 to 2012 for the Malaysian economy to empirically investigate the impact of TI on energy usage along with control variables, i.e., Trade openness, GDP per capita, and energy prices. The results revealed that TI can reduce the EC. Du and Yan (2009) studied the relationship between TI capacity and EC and found that TI capacity is inversely related to EC. Improvement in the TI can lead to reducing EC intensity. Table 1 report different studies done in this area with author names, year of publication, date range for the study, the methodology adopted and the major outcomes of each study.

Most of the work done in energy demand analysis focused on the different determinants of EC. However, to the best of the researcher’s knowledge, it can be considered that this study is the first in its contribution to the literature for assessing the impact of product and process innovation on fossil fuels consumption in 43 low and middle-income countries.

3 Methodology

The intention of the researcher in this study is to find out what role did the product and process innovation played so far in the demand for fossil fuel throughout the LMICs. For the analysis, this study used balanced panel data for 43 LMICs for the time span of 14 years, i.e., from 2005 to 2018 from 6 regions.

3.1 Data and variables of the study

This study conducts the macroeconomic analysis of the fossil fuel market using balanced panel data for 43 LMICs. The categorization of LMICs is purely based on World Bank (2021) classification. The selection of 43 countries is based on the availability of data. Table 2 provides the detail for the selected countries from 6 different regions for analysis. The regional classification of the countries is purely based on World Bank regional (2021) classification.

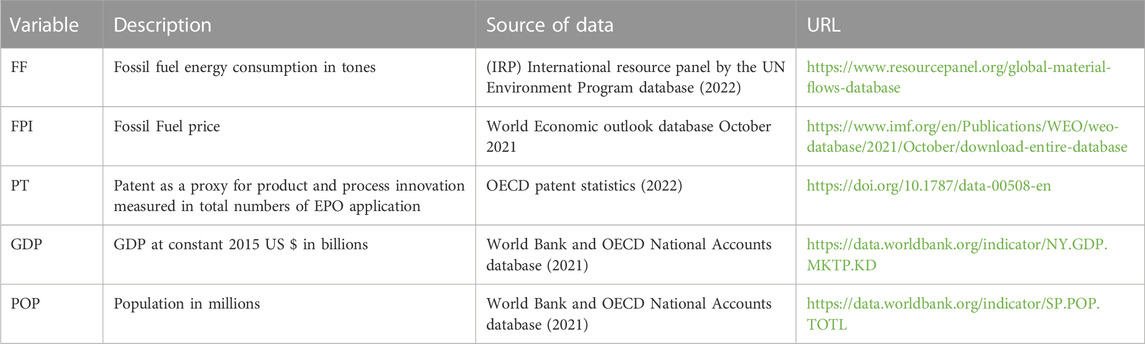

The study used fossil fuel consumption as the dependent variable to be studied. The data is obtained from (IRP) International resource panel by the UN Environment Program database. The data on Domestic material consumption of fossil fuel is estimated as (DMC = domestic extraction + imports–exports). To analyze the global fossil fuel market the Economic, social, Energy, and innovation variables are included in the study as influencing factors of fossil fuel consumption. The selection of variables is based on literature support. Data on the Fossil fuel price is obtained from the World Economic Outlook database in October 2021. This includes Curd oil, Natural gas, and coal price indices for the entire world. Data on GDP at constant 2015 US $ and population are obtained from World Bank and OECD National Accounts database (2021). A detailed description of the variables is given in Table 3.

3.2 Significance of the Variables and Hypothesis of the study

The instability of the energy prices in international market is another major concern in study of energy demand. Low- and middle-income countries are expected to suffer more as compared to high income countries from energy price volatility, because a large share of their national product depends on energy intensive manufacturing and the use of energy in low- and middle-income countries is less efficient (Aziz et al., 2013). Thus, price is important variable in predicting, explaining and modeling demand for energy. The first hypothesis of the study is that Fossil fuel price is significantly related with fossil fuel energy consumption. The excessive use of traditional energy resource (oil, gas, and coal) results in serious health, social and environmental issues. The use of product and process innovation helps in reducing the dependence on fossil fuels and puts positive impact on sustainable development of the economy. The second hypothesis of the study is that product and process innovation is expected to have a negative relation with fossil fuel energy consumption thus contributing positively to abandoning the fossil fuel energy demand and mitigating the climate change effect. Research and development expenditure has been extensively used as a proxy for innovation in previous literature (Mancusi & Vezzulli, 2010; Lööf & Nabavi, 2016). Recent literature, however, has questioned the suitability of research and development spending as a proxy for innovation on various grounds when studying small firms and emerging markets. According to Gorodnichenko & Schnitzer, (2013), the use of research and development measures is favorable for large firms moreover research and development do not always result in innovation as it is input rather than output oriented. This study uses patent counts as a proxy for innovation as it provides robust statistical evidence of technical progress. Patents follow an international standardized format (Rübbelke and Weiss, 2011). Approval of a patent application requires the investor to show the public something that is ‘novel’, ‘useful’, and ‘obscure’ which is not possible without an innovative step. A patent application must meet these criteria to get approved (Griliches, 1987; Hall and Ziedonis, 2001). Patent information is the best available source for analyzing innovation. (Grafström, 2017). According to Griliches (1998) “nothing else comes close in the quantity of available data, accessibility and the potential industrial-organizational and technological details”. Thus, current study uses patent information as a proxy for product and process innovation. Energy is a vital source that makes the world goes around. The ability of the economy to harness the energy resources for production process results in economic growth and development. According to the economic theory, output results from energy consumption directly or indirectly. The growing economies therefore consume more and more energy resources. Thus, the key factor for increased demand of energy is economic growth and development (Zahg et al., 2012: Lee and Chang, 2008; Apergis and Payne, 2009; Ouedraogo, 2013). So, the third hypothesis of the study is that GDP has a positive relationship with fossil fuel energy consumption. Another important determinant of energy consumption is ever growing population of low- and middle-income countries and the resulting demand for food, products and transportation. All such activities require a huge level of energy sources depletion. (Zaman et al., 2016; Khan et al., 2019; Dokas et al., 2022). The fourth hypothesis of the study is that population is positively related with fossil fuel energy consumption. Thus, GDP and Population are putting an adverse effect on reducing fossil fuel energy consumption.

To achieve the objective of empirically investigating the effect of product and process innovation along with control variables, i.e., Fossil fuel price, GDP and population on the demand for fossil fuel in 43 LMICs around the world is assessed. The following equation is designed for estimation:

Where FF denotes Fossil fuel consumption, FPI denotes Fossil fuel price, PT denotes patents count, GDP denotes gross domestic product, PP denotes population.

The selection of an appropriate technique for analysis is the key factor in any type of research. The traditional method of estimation such as OLS, GLS, maximum likelihood method, instrumental variable method cannot deal with the endogenous problems caused by the inclusion of lag dependent variable into the explanatory variables and leads to falsifying results. The GMM method is capable of dealing with heteroscedasticity and sequence-related problems and provides more efficient estimates relative to other methods. To estimate the given equation, this study employs the System GMM model as it has several advantages over other alternate techniques of estimation. Arellano and Bover (1995) and Blundell and Bond (1998) proposed this model. System GMM deals with.

• Country specific effect on time invariant variables

• Endogeneity problem when using lagged dependent variable

• Hetroscedasticity and autocorrelation problems

Moreover, this model allows for endogeneity in other regressors up to certain degree it also manages unbalanced panel data. (Harris & Mátyás, 2004), (Nickell, 1981), (Roodman, 2009), (Hsiao, 2022). Previous studies such Rasheed also used this model et al. (2022) and Khan et al. (2023).

The general equation of System GMM model is given as:

In above equation Xit denotes all the explanatory variables of the model, µit denotes disturbance term. ɛi represents fixed effect and ʋit is unusual shocks having an error component structure as given

From the initial conditions

And E (øi ∆Yi2) = 0.

The linear moment conditions under the assumptions are

To ensure the consistency of the system GMM estimator the problem of over-identification, that is, the restriction that the model instruments are exogenous to the group is evaluated using Hansen J Statistics, (Hansen, 2005), moreover Arellano-Bond test for serial correlation in error term is employed to analyze the AR (1) and AR (2) autocorrelations.

The dynamic panel data model for the study is specified by following equation

Where lnFFit is the log of fossil fuel consumption, lnFFi,t-1 Shows the lagged value of fossil fuel consumption, βs are the parameters to be estimated, Zi and ɛit represent country specific effect and disturbance term respectively and are independent with identical distributions (Zi ≈ IID (0,

Fully Modified OLS (FMOLS) technique is applied for ensuring the robustness of the model.

4 Results and discussions

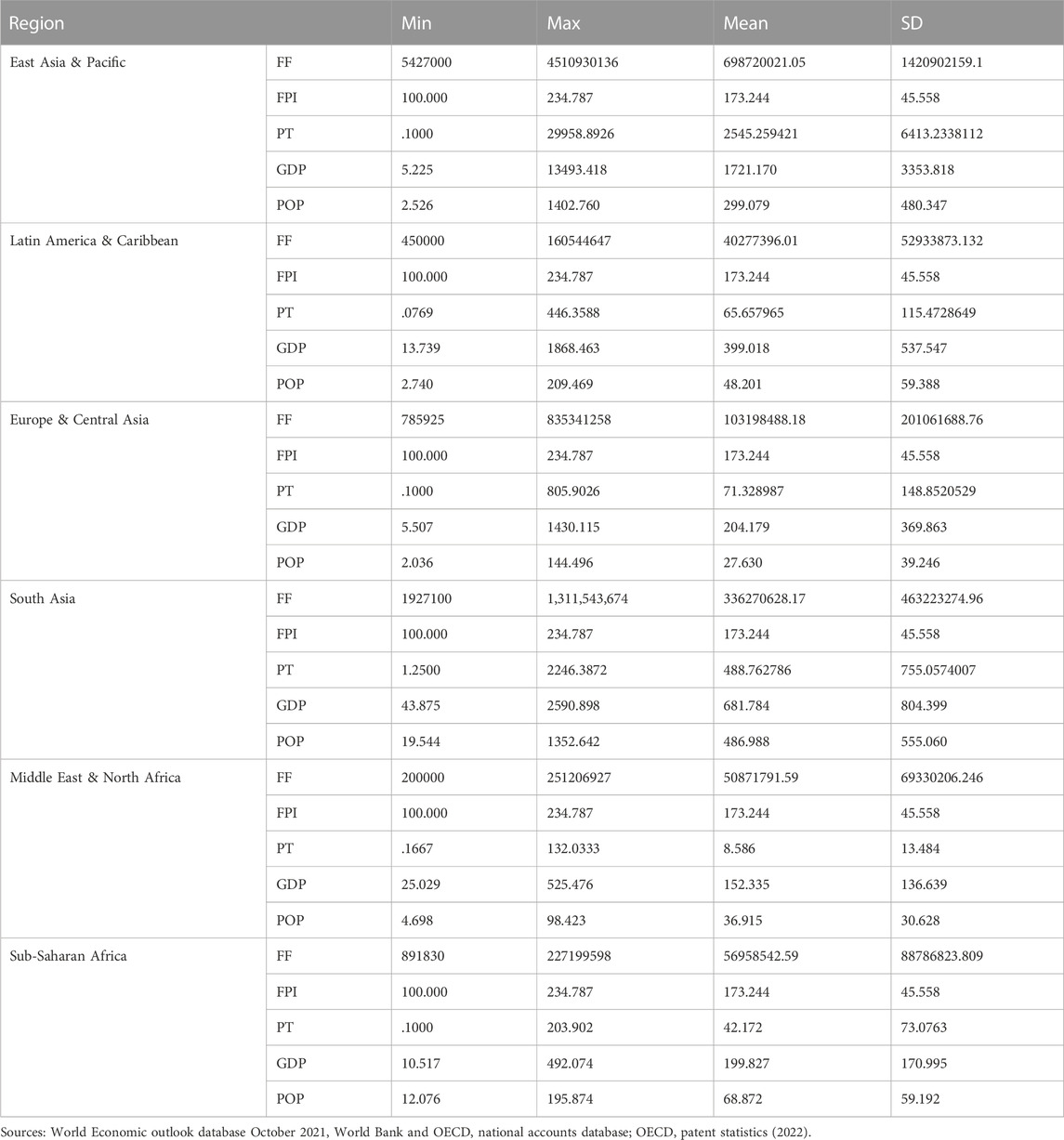

Table 4 presents the summary statistics of the variables used for the analysis. In total five variables are used including fossil fuel energy consumption, Patents, Fossil fuel price, GDP, and population. For descriptive analysis of Fossil fuel energy consumption is measured in kilotons. GDP is measured in constant 2015 US $ in billions and population is measured as the total number of residents in millions. Patents are estimated as total EPO applications. The data is analyzed for 43 LMICs from East Asia, Latin America, Europe, South Asia, the Middle East, and Sub-Saharan Africa based on World Bank regional classification. According to the results, East Asia and the Pacific have the highest average consumption of fossil fuels (698720.02) followed by South Asia, Europe & Central Asia, Sub-Saharan Africa, and the Middle East respectively. However, Latin America is the lowest average consumer of fossil fuel energy (40277.40).

According to the data on GDP East Asia and the Pacific are categorized as the highest GDP generator economy (1721.170 US$) followed by South Asia, Latin America, Europe, Sub-Saharan Africa, and the Middle East respectively. According to the data in terms of population, South Asia is the most populated region (486.988) followed by East Asia, Sub-Saharan Africa, Latin America, the Middle East, and Europe, respectively. The analysis revealed that East Asia and the Pacific have on average the highest numbers of patent applications filed at EPO (2545.26) followed by South Asia, Europe, Latin America, Sub-Saharan Africa, and the Middle East, respectively.

The objective of this study is to find out what role product and process innovation play in the demand for fossil fuels in LMICs around the world. To achieve the objective fossil fuels demand in terms of Domestic material consumption of fossil fuel is regressed against 4 Energy and innovation, social and economic variables. The study employed the System GMM model for the estimation of results.

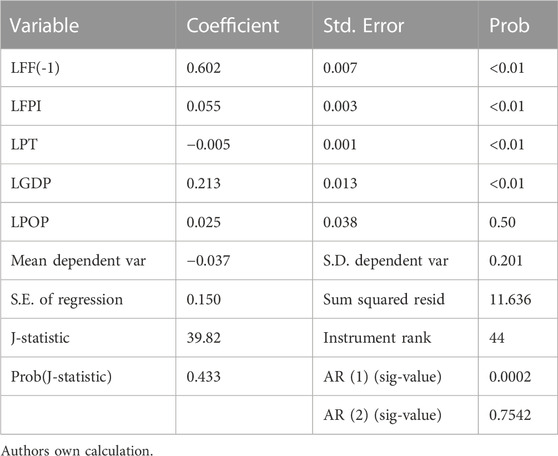

Table 5 presents the results of System GMM estimation. From the Hansen J Statistics, (Hansen, 2005), the null hypothesis of validity of instruments is not rejected so the System GMM estimator is proved to be consistent. The results confirm that AR (1) is present and AR (2) is absent in the data. The results reveal that estimates for lag fossil fuels consumption, fossil fuel price, and GDP are statistically significant and positive with values of (0.602), (0.055) and (0.213) respectively at 1% significance level while estimates for patents and population are negative. According to the results lag fossil fuel domestic consumption has a significantly positive impact on fossil fuels’ current consumption. It means the higher the consumption of fossil fuels in the previous period will significantly increase the consumption of fossil fuels in the current period. Contrary to the first research hypothesis a unique relation between fossil fuels price and fossil fuel consumption is evidenced which shows an increase in fossil fuels price will increase fossil fuels consumption. These results are in line with the study by Zaharia et al. (2019) who found a positive relationship between oil price and primary EC for EU countries, and a study by Phoumin & Kimura (2014) who found a positive price elasticity of demand for energy in China. This may be justified by the phenomenon that LMICs have an energy-intensive industrial sector thus for economic growth such industries need more energy and the price of energy continues to increase. Moreover, it is well known that energy is the basic material for growth and development therefore its demand is rigid (Saidi and Hammami, 2015). In the global energy system, fossil fuel still has and continues to play a dominant role. Thus, increase in the prices will not significantly reduce fossil fuel energy consumption.

According to the results, LMICs with high patent rates are found to have low fossil fuel consumption levels. This means that product and process innovation can lead to the abounding fossil fuel demand in the case of LMICs. Thus, the second hypothesis of the study that there is a negative relationship between product and process innovation and fossil fuel energy consumption was accepted. These results are supported by the studies of Jin and Zahng (2014), Karali et al. (2017), and Sohag et al. (2015). Improved technology usage at all stages of production and distribution allows higher efficiency of energy input. With product and process, innovation energy usage reduces at the current level of output or increases the level of production without altering the energy usage level. Improved energy efficiency due to product and process innovation reduces the EC intensity resulting in lower energy imports.

The results also show that countries with high GDPs consume more fossil fuels. The results show a positive relationship between GDP and fossil fuel energy consumption which can be interpreted as putting a negative effect on abandoning fossil fuel energy consumption. Hence the third hypothesis of the study that there is a positive relationship between GDP and fossil fuel energy consumption is accepted. These results are also supported by Zaharia et al. (2019) who found the same relationship for EU countries and with the studies by Ottelin et al. (2018), Lenzen et al. (2006), and Wiedenhofer et al. (2017). Our findings show a positive relationship between the population of a country and fossil fuel consumption for that country over time. Although the results are according to the theory, however these results are not statistically significant. Thus, based on insignificant results the fourth hypothesis of the study that there is a positive relationship between Population of a country and fossil fuel energy consumption is rejected for low- and middle-income countries under consideration. These results are supported by Dokas et al. (2022) who found insignificant relationship between population growth and electricity consumption.

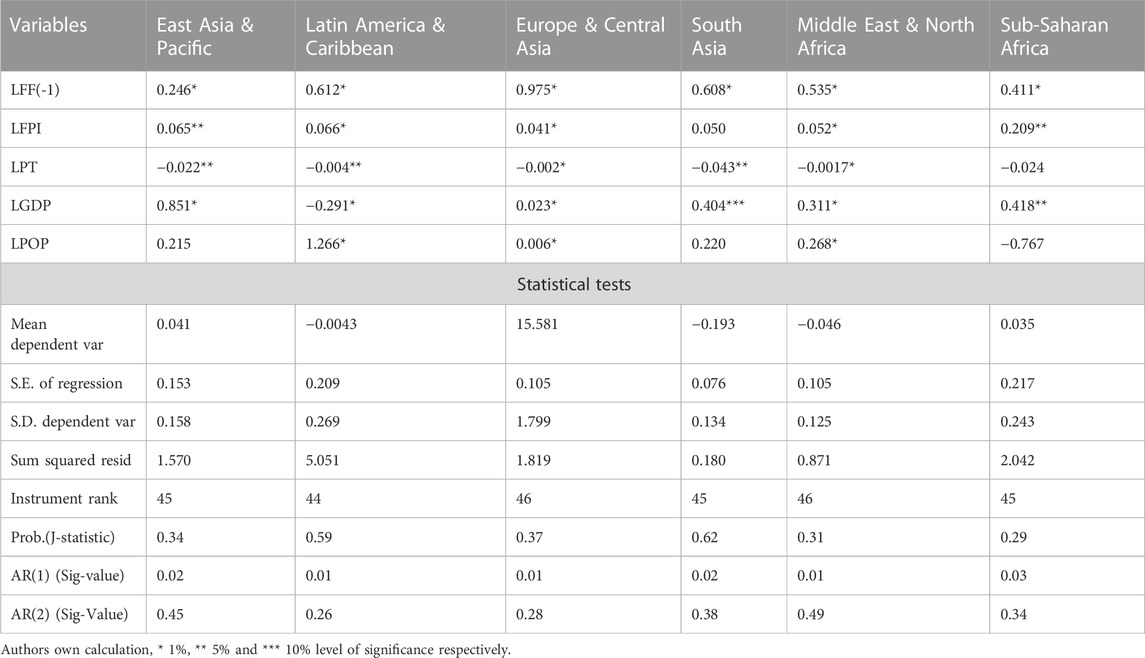

Table 6 shows the results of System GMM on a regional basis. The GMM estimators are found to be consistent for all the regions. Moreover, the presence of AR (1) is confirmed for all the regions and AR (2) is found absent from the data for all regions. The results show that lag fossil fuel domestic consumption has a significantly positive effect on current fossil fuel domestic consumption for all the regions under consideration with a value of (0.246)for East Asia & Pacific, (0.612) for Latin America & Caribbean, (0.975) for Europe & Central Asia, (0.608) for South Asia, (0.535) for Middle East & North Africa and (0.411) for Sub-Saharan Africa. Fossil fuel price is found to be significantly positive for East Asia & Pacific (0.065), Latin America & Caribbean (0.066), Europe & Central Asia (0.041), Sub-Saharan Africa (0.209), Middle East & North Africa (0.052) (Phoumin, & Kimura, 2014; Zaharia et al., 2019) and insignificant for South Asia (0.050). The variable patent has significantly negative results for all regions (Jin and Zahng, 2014; Karali et al., 2017; Sohag et al., 2015; Murshed et al., 2022) while insignificant for Sub-Saharan Africa with the values of (−0.022), (−0.004), (−0.002), (−0.043), (−0.0017), (−0.024) respectively. According to the results GDP is statistically significant and positive for all regions (Lenzen et al., 2006; Wiedenhofer et al., 2017; Ottelin et al., 2018; Rehman et al., 2021; Rehman et al., 2022) with values of (0.851) for East Asia & Pacific, (0.023) for Europe & Central Asia, (0.404) for South Asia, (0.311) for Middle East & North Africa, (0.418) for Sub-Saharan Africa except for Latin America & Caribbean where it is significantly negative (−0.291). The results of the population are significantly positive for Latin America and the Caribbean (1.266), Europe & Central Asia (0.006), and Middle East & North Africa (0.268) at 1% significance level (Dokas et al., 2022). However, for East Asia & Pacific, South Asia, and Sub-Saharan Africa it is found to be insignificant.

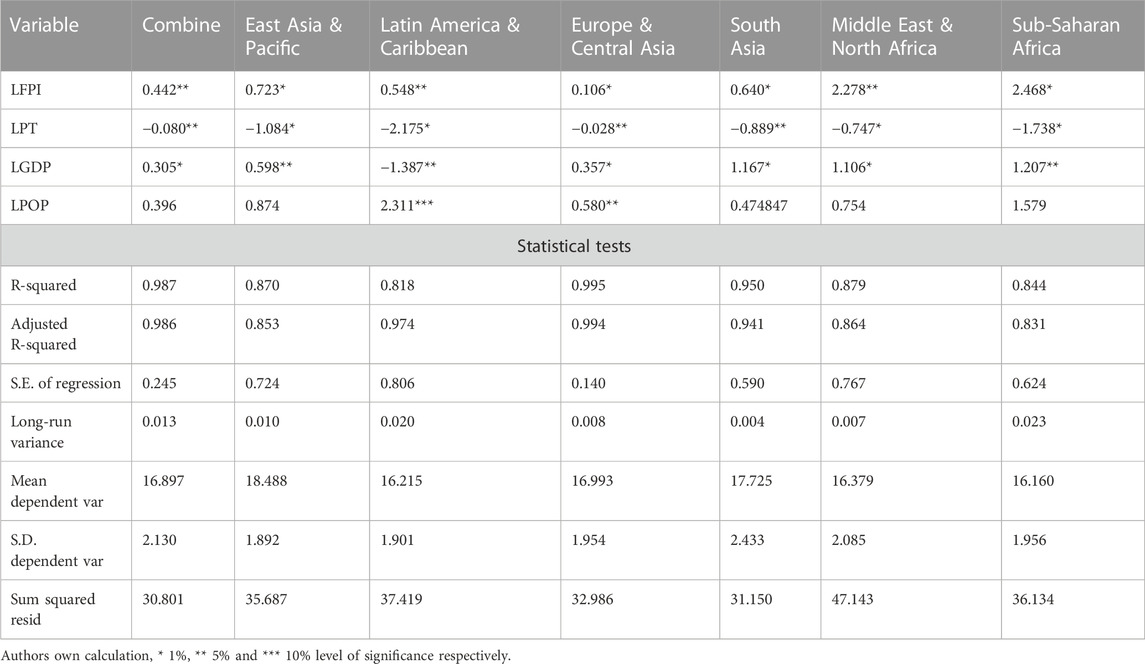

Table 7 shows the results of fully modified OLS method. The results verified the robustness of the model. The results revealed a positive relationship between fossil fuel price index and fossil fuel energy demand. The variable patent is found to have significantly negative relationship with fossil fuel energy demand for the combine results of 43 low and middle income countries as well as for all the regions separately. GDP is found to be significantly positive for all the regions except Latin America & Caribbean. Similar to the results of SGMM the variable population is according to the theory but found insignificant in most of the cases.

5 Conclusion and recommendations

This study attempts to investigate the role of product and process innovation in abandoning fossil fuel energy consumption in LMICs by utilizing balanced panel data for 43 LMICs for the period of 14 years, i.e., from 2005 to 2018 from 6 regions. For the analysis of the fossil fuel market the Economic, social, Energy, and innovation variables are included in the study as influencing factors of fossil fuel consumption. Fossil fuels demand in terms of Domestic material consumption of fossil fuel is regressed against 4 Energy and innovation, social and economic variables. The study employed the System GMM model for the estimation of results. The selection of the model is based on the belief that traditional methods of estimation such as OLS, GLS, maximum likelihood method, instrumental variable method cannot deal with the endogenous problems caused by the inclusion of lag-dependent variable into the explanatory variables and leads towards falsifying results. The GMM method is capable of dealing with heteroscedasticity and sequence-related problems and provides more efficient estimates relative to other methods. The results of the study provide the following conclusion:

The higher the consumption of fossil fuels in the previous period will significantly increase the consumption of fossil fuels in the current period. The demand for fossil fuel in LMICs is found to be rigid in terms of fossil fuel price. The LMICs with high patent rates are found to have low fossil fuel consumption levels. This means that product and process innovation can lead to the abounding fossil fuel demand in the case of LMICs. It is evidenced from the results that economic progress is the main determinant of fossil fuel energy consumption. GDP is found putting a negative effect on abandoning fossil fuel energy consumption. Based on findings the study suggests the following recommendations:

The LMICs should not use taxation policy to achieve the goal of EC conservation and environmental degradation control. Taxation can be an effective source of revenue generation for LMICs. It is also suggested for LMICs Government to focus on product and process innovation as a critical element while structuring their policy for climate change mitigation. Moreover, the IPC, EPO and USPTO are the main organizations for granting patents and global leaders in understanding pathways to meet climate goals and reducing GHG emissions. Therefore, such organizations should play their role while accepting patent applications by structuring standards to reduce the use of fossil fuel energy consumption and climate change mitigation.

6 Limitations of the study and future research direction

Due to unavailability of data on some variables, this study is limited to 43 low- and middle-income countries for the time span of 14 years, i.e., 2005 to 2018. Such study can be conducted in future for a larger number of countries for a larger time span as well as this study can be extended to higher income countries. This study can be conducted using other econometric techniques like ARDL model, Granger causality test approach, etc.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material further inquiries can be directed to the corresponding author.

Author contributions

Conceptualization, HT and AK; methodology, HT, AK, DK, and RM; software, HT and AK; validation, HT, AK, and DK; formal analysis, HT and DK; investigation, HT, DK, and AK; resources, RM; data curation, HT, AK, DK, and RM; writing—original draft preparation, HT, AK, and DK; writing—review and editing, HT, AK, DK, and RM; visualization, DK and RM; supervision, AK and DK; project administration, AK, DK, and RM; funding acquisition, RM All authors have read and agreed to the published version of the manuscript.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aflaki, S., Basher, S. A., and Masini, A. (2014). Does economic growth matter? Technology-Push, demand-pull and endogenous drivers of innovation in the renewable energy industry. HEC Paris Research Paper No. MOSI-2015-1070.

Ahmad, M., Li, H., Anser, M. K., Rehman, A., Fareed, Z., Yan, Q., et al. (2021). Are the intensity of energy use, land agglomeration, CO2 emissions, and economic progress dynamically interlinked across development levels? Energy and Environ. 32 (4), 690–721. doi:10.1177/0958305x20949471

Ahmad, S., Khan, D., and Magda, R. (2022). Assessing the influence of financial inclusion on environmental degradation in the ASEAN region through the panel PMG-ARDL approach. Sustainability 14 (12), 7058. doi:10.3390/su14127058

Apergis, N., and Payne, J. E. (2009). Energy consumption and economic growth: Evidence from the commonwealth of independent states. Energy Econ. 31 (5), 641–647. doi:10.1016/j.eneco.2009.01.011

Aqeel, A., and Butt, M. S. (2001). The relationship betwesen energy consumption and economic growth in Pakistan. Asia-Pacific Dev. J. 8 (2), 101–110.

Arellano, M., and Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. J. Econ. 68 (1), 29–51. doi:10.1016/0304-4076(94)01642-d

Asafu-Adjaye, J. (2000). The relationship between energy consumption, energy prices and economic growth: Time series evidence from asian developing countries. Energy Econ. 22 (6), 615–625. doi:10.1016/s0140-9883(00)00050-5

Assembly, U. G. (2015). Transforming our world: The 2030 agenda for sustainable development. 21 October 2015(Vol. 16301). A/RES/70/1.

Aydin, M. (2018). Natural gas consumption and economic growth nexus for top 10 natural gas–consuming countries: A granger causality analysis in the frequency domain. Energy 165, 179–186. doi:10.1016/j.energy.2018.09.149

Aydin, M. (2019). Renewable and non-renewable electricity consumption–economic growth nexus: Evidence from OECD countries. Renew. energy 136, 599–606. doi:10.1016/j.renene.2019.01.008

Aziz, A. A., Mustapha, N. H. N., and Ismail, R. (2013). Factors affecting energy demand in developing countries: A dynamic panel analysis. Int. J. Energy Econ. Policy 3 (4S), 1–6.

T. Barker, P. Ekins, and N. Johnstone (Editors) (1995). Global warming and energy demand (London: Routledge).

Blundell, R., and Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. J. Econ. 87 (1), 115–143. doi:10.1016/s0304-4076(98)00009-8

Cao, H., Khan, M. K., Rehman, A., Dagar, V., Oryani, B., and Tanveer, A. (2022). Impact of globalization, institutional quality, economic growth, electricity and renewable energy consumption on Carbon Dioxide Emission in OECD countries. Environ. Sci. Pollut. Res. 29 (16), 24191–24202. doi:10.1007/s11356-021-17076-3

Chaudhry, A. (2010). A panel data analysis of electricity demand in Pakistan. Lahore J. Econ. 15 (1), 75–106. doi:10.35536/lje.2010.v15.isp.a5

Choudhry, H., Lauritzen, M., Somers, K., and Van Niel, J. (2015). Greening the future: New technologies that could transform how industry uses energy.

Çoban, S., and Topcu, M. (2013). The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis. Energy Econ. 39, 81–88. doi:10.1016/j.eneco.2013.04.001

Dagar, V., Khan, M. K., Alvarado, R., Rehman, A., Irfan, M., Adekoya, O. B., et al. (2022). Impact of renewable energy consumption, financial development and natural resources on environmental degradation in OECD countries with dynamic panel data. Environ. Sci. Pollut. Res. 29 (12), 18202–18212. doi:10.1007/s11356-021-16861-4

Dasgupta, S., and Roy, J. (2015). Understanding technological progress and input price as drivers of energy demand in manufacturing industries in India. Energy Policy 83, 1–13. doi:10.1016/j.enpol.2015.03.024

Del Rio Gonzalez, P. (2004). Public policy and clean technology promotion. The synergy between environmental economics and evolutionary economics of technological change. Int. J. Sustain. Dev. 7 (2), 200–216. doi:10.1504/ijsd.2004.005371

Dokas, I., Panagiotidis, M., Papadamou, S., and Spyromitros, E. (2022). The determinants of energy and electricity consumption in developed and developing countries: International evidence. Energies 15 (7), 2558. doi:10.3390/en15072558

Du, X., and Yan, X. (2009)., 2. IEEE, 42–45.Empirical study on the relationship between regional technological innovation capacity and regional energy consumption intensityIn2009 Int. Conf. Inf. Manag. innovation Manag. industrial Eng.

Fei, Q., and Rasiah, R. (2014). Electricity consumption, technological innovation, economic growth and energy prices: Does energy export dependency and development levels matter? Energy Procedia 61, 1142–1145. doi:10.1016/j.egypro.2014.11.1041

Gorodnichenko, Y., and Schnitzer, M. (2013). Financial constraints and innovation: Why poor countries don’t catch up. J. Eur. Econ. Assoc. 11 (5), 1115–1152. doi:10.1111/jeea.12033

Gorus, M. S., and Aydin, M. (2019). The relationship between energy consumption, economic growth, and CO2 emission in MENA countries: Causality analysis in the frequency domain. Energy 168, 815–822. doi:10.1016/j.energy.2018.11.139

Grafström, J. (2017). Technological change in the renewable energy sector: Essays on knowledge spillovers and convergence. Luleå: Doctoral dissertation, Luleå University of Technology.

Griliches, Z. (1998). “Patent statistics as economic indicators: A survey,” in R&D and productivity: The econometric evidence (University of Chicago Press), 287–343.

Griliches, Z. (1987). R&D and productivity: Measurement issues and econometric results. Science 237 (4810), 31–35. doi:10.1126/science.237.4810.31

Hall, B. H., and Ziedonis, R. H. (2001). The patent paradox revisited: An empirical study of patenting in the US semiconductor industry, 1979–1995. RAND J. Econ. 32 (1), 101–128. doi:10.2307/2696400

Hansen, P. R. (2005). A test for superior predictive ability. J. Bus. Econ. Statistics 23 (4), 365–380. doi:10.1198/073500105000000063

Harris, M. N., and Mátyás, L. (2004). A comparative analysis of different IV and GMM estimators of dynamic panel data models. Int. Stat. Rev. 72 (3), 397–408. doi:10.1111/j.1751-5823.2004.tb00244.x

Irandoust, M. (2016). The renewable energy-growth nexus with carbon emissions and technological innovation: Evidence from the Nordic countries. Ecol. Indic. 69, 118–125. doi:10.1016/j.ecolind.2016.03.051

Jin, W., and Zhang, Z. (2014). Quo vadis? Energy consumption and technological innovation.Canberra: Crawford School of Public Policy, The Australian National University, CCEP Working Paper.

Karali, N., Park, W. Y., and McNeil, M. (2017). Modeling technological change and its impact on energy savings in the US iron and steel sector. Appl. Energy 202, 447–458. doi:10.1016/j.apenergy.2017.05.173

Khan, D., Nouman, M., Popp, J., Khan, M. A., Ur Rehman, F., and Oláh, J. (2021). Link between technically derived energy efficiency and ecological footprint: Empirical evidence from the ASEAN region. Energies 14 (13), 3923. doi:10.3390/en14133923

Khan, D., Nouman, M., and Ullah, A. (2023). Assessing the impact of technological innovation on technically derived energy efficiency: A multivariate co-integration analysis of the agricultural sector in South Asia. Environ. Dev. Sustain. 25 (4), 3723–3745. doi:10.1007/s10668-022-02194-w

Khan, M. K., Teng, J. Z., Khan, M. I., and Khan, M. O. (2019). Impact of globalization, economic factors and energy consumption on CO2 emissions in Pakistan. Sci. total Environ. 688, 424–436. doi:10.1016/j.scitotenv.2019.06.065

Lee, C. C., and Chang, C. P. (2008). Energy consumption and economic growth in asian economies: A more comprehensive analysis using panel data. Resour. energy Econ. 30 (1), 50–65. doi:10.1016/j.reseneeco.2007.03.003

Lenzen, M., Wier, M., Cohen, C., Hayami, H., Pachauri, S., and Schaeffer, R. (2006). A comparative multivariate analysis of household energy requirements in Australia, Brazil, Denmark, India and Japan. Energy 31 (2-3), 181–207. doi:10.1016/j.energy.2005.01.009

Lööf, H., and Nabavi, P. (2016). Innovation and credit constraints: Evidence from Swedish exporting firms. Econ. Innovation New Technol. 25 (3), 269–282. doi:10.1080/10438599.2015.1076196

Mancusi, M. L., and Vezzulli, A. (2010). R&D, innovation and liquidity constraints. Sevilla: InCONCORD 2010 conference, 3–4.

Manual, O. (2018). “Guidelines for collecting, reporting and using data on innovation,” in The measurement of scientific, technological and innovation activities. 4th Edition. 255p.[Consultado 29 agosto 2020] Disponible en. doi:10.1787/9789264304604-en

Murshed, M., Mahmood, H., Ahmad, P., Rehman, A., and Alam, M. S. (2022). Pathways to Argentina’s 2050 carbon-neutrality agenda: The roles of renewable energy transition and trade globalization. Environ. Sci. Pollut. Res. 29 (20), 29949–29966. doi:10.1007/s11356-021-17903-7

Nickell, S. (1981). Biases in dynamic models with fixed effects. Econometrica: J. econometric soc.1417–1426. Chicago, Illinois, USA: The University of Chicago.

Noor, M., Khan, D., Khan, A., and Rasheed, N. (2023). The impact of renewable and non-renewable energy on sustainable development in South Asia. Environ. Dev. Sustain. Springer. doi:10.1007/s10668-023-03210-3

OECD (2022). Patents by main technology and by international patent classification (IPC). Paris: OECD Patent Statistics. doi:10.1787/data-00508-en

Ottelin, J., Heinonen, J., and Junnila, S. (2018). Carbon footprint trends of metropolitan residents in Finland: How strong mitigation policies affect different urban zones. J. Clean. Prod. 170, 1523–1535. doi:10.1016/j.jclepro.2017.09.204

Ouedraogo, N. S. (2013). Energy consumption and economic growth: Evidence from the economic community of West African States (ECOWAS). Energy Econ. 36, 637–647. doi:10.1016/j.eneco.2012.11.011

Pesaran, M. H., Smith, R. P., and Akiyama, T. (1998). Energy demand in Asian developing economies. Oxford: Oxford University Press.

Phoumin, H., and Kimura, S. (2014). Analysis on price elasticity of energy demand in East Asia: Empirical evidence and policy implications for ASEAN and East Asia. ERIA Discuss. Pap. Ser. 5, 1–26.

Rasheed, N., Khan, D., and Magda, R. (2022). The influence of institutional quality on environmental efficiency of energy consumption in BRICS countries. Front. Energy Res. 10, 1602. doi:10.3389/fenrg.2022.943771

Rehman, A., Radulescu, M., Ma, H., Dagar, V., Hussain, I., and Khan, M. K. (2021). The impact of globalization, energy use, and trade on ecological footprint in Pakistan: Does environmental sustainability exist? Energies 14 (17), 5234. doi:10.3390/en14175234

Rehman, A., Ma, H., Ozturk, I., and Radulescu, M. (2022). Revealing the dynamic effects of fossil fuel energy, nuclear energy, renewable energy, and carbon emissions on Pakistan’s economic growth. Environ. Sci. Pollut. Res. 29, 48784–48794. doi:10.1007/s11356-022-19317-5

Roodman, D. (2009). A note on the theme of too many instruments. Oxf. Bull. Econ. statistics 71 (1), 135–158. doi:10.1111/j.1468-0084.2008.00542.x

Rübbelke, D. T., and Weiss, P. (2011). Environmental regulations, market structure and technological progress in renewable energy technology-A panel data study on wind turbines. Milano, Italy: FEEM Working Paper, 32.

Rubin, E. S. (2011). “Innovation and climate change,” in Innovation. Perspectives for the 21st century (Madrid: BBVA).

Saidi, K., and Hammami, S. (2015). The impact of CO2 emissions and economic growth on energy consumption in 58 countries. Energy Rep. 1, 62–70. doi:10.1016/j.egyr.2015.01.003

Sohag, K., Begum, R. A., Abdullah, S. M. S., and Jaafar, M. (2015). Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 90, 1497–1507. doi:10.1016/j.energy.2015.06.101

Stern, N., and Stern, N. H. (2007). The economics of climate change: The stern review. Cambridge University Press.

Tang, C. F., and Tan, E. C. (2013). Exploring the nexus of electricity consumption, economic growth, energy prices and technology innovation in Malaysia. Appl. Energy 104, 297–305. doi:10.1016/j.apenergy.2012.10.061

UN Environment Programme (2022). “Secretariat of the international resource panel,” in Global material flows database”A web page. Available at: https://unep-irp.fineprint.global/mfa4/export.

Wang, Q., Su, M., Li, R., and Ponce, P. (2019). The effects of energy prices, urbanization and economic growth on energy consumption per capita in 186 countries. J. Clean. Prod. 225, 1017–1032. doi:10.1016/j.jclepro.2019.04.008

Wiedenhofer, D., Guan, D., Liu, Z., Meng, J., Zhang, N., and Wei, Y. M. (2017). Unequal household carbon footprints in China. Nat. Clim. Change 7 (1), 75–80. doi:10.1038/nclimate3165

World Bank (2021d). World Bank country and lending groups” A web page. Available at: https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups.

World Bank (2021a). World development indicators” A web page. Available at: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.

World Bank (2021b). World development indicators” A web page. Available at: https://data.worldbank.org/indicator/SP.POP.TOTL.

World Bank (2021c). World development indicators” A web page. Available at: https://data.worldbank.org/country/XO.

Zaharia, A., Diaconeasa, M. C., Brad, L., Lădaru, G. R., and Ioanăș, C. (2019). Factors influencing energy consumption in the context of sustainable development. Sustainability 11 (15), 4147. doi:10.3390/su11154147

Zaman, K., Shahbaz, M., Loganathan, N., and Raza, S. A. (2016). Tourism development, energy consumption and Environmental Kuznets Curve: Trivariate analysis in the panel of developed and developing countries. Tour. Manag. 54, 275–283. doi:10.1016/j.tourman.2015.12.001

Keywords: fossil fuel, product and process innovation, carbon neutrality, low and middle income countries, system GMM

Citation: Taqqadus H, Khan A, Khan D and Magda R (2023) The impact of product and process innovation on abandoning fossil fuel energy consumption in low and middle income countries: consent towards carbon neutrality. Front. Energy Res. 11:1092178. doi: 10.3389/fenrg.2023.1092178

Received: 07 November 2022; Accepted: 11 April 2023;

Published: 24 April 2023.

Edited by:

Zbigniew M. Leonowicz, Wrocław University of Technology, PolandReviewed by:

Abdul Rehman, Henan Agricultural University, ChinaMucahit Aydin, Sakarya University, Türkiye

Vladimir Kral, VSB-Technical University of Ostrava, Czechia

Copyright © 2023 Taqqadus, Khan, Khan and Magda. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Dilawar Khan, ZGlsYXdhcm1rZEB5YWhvby5jb20=

Hafsa Taqqadus

Hafsa Taqqadus Alam Khan

Alam Khan Dilawar Khan

Dilawar Khan Robert Magda

Robert Magda