- 1Faculty of Economics, Energy and Management Science, Makerere University Business School (MUBS), Kampala, Uganda

- 2Department of Geography, Norwegian University of Science and Technology, Trondheim, Norway

- 3United Nations Development Programme (UNDP), Kampala, Uganda

- 4Faculty of Environmental Sciences and Natural Resource Management, Norwegian University of Life Sciences, Ås, Norway

The study investigates the drivers and mechanisms of asset and resource stranding in the context of energy transitions. A systematic review approach was used to analyze existing studies, identify the drivers of energy resource and asset stranding, and examine their underlying mechanisms. The results show a regional bias, with most studies on stranded energy resources and assets conducted in Europe. Key factors influencing asset stranding are linked to policies, institutional frameworks, economic mechanisms such as shifts in investments toward clean technologies and divestment from fossil fuels and technological advancements related to increased accessibility of renewable energy technologies. Environmental risks also dynamically facilitate the stranding of fossil fuel assets. These findings suggest a critical research gap in understanding the drivers and mechanisms of asset and resource stranding in developing economies, particularly in Africa and Asia. Limited studies have explored asset-stranding dynamics in these regions, undermining the understanding of their unique challenges and opportunities for managing energy transitions effectively. Additionally, the interdependencies between these drivers and their cumulative effects remain underexplored, highlighting the need for more integrated and cross-disciplinary analyses. The findings of this study contribute to our understanding of asset and resource stranding and have implications for informing effective energy transition strategies in these less-studied regions.

1 Introduction

In the last decade, rising demands for the energy transition, which involves transforming from fossil fuel-based to renewable and low-carbon energy sources, has prompted increased research on climate change-related stranded assets (Bos and Gupta, 2018; Shimbar, 2021a; Shimbar, 2021b). Critically important for stakeholders like investors and countries, stranded assets, especially in the fossil fuel sector, pose a huge risk with losses estimated in trillions of dollars (Semieniuk et al., 2022; Hansen, 2022; Welsby et al., 2021). For instance, Semieniuk et al. (2022) show that there could be a loss of $1–$4 trillion from stranded fossil fuel assets globally. According to Welsby et al. (2021), staying within the Paris agreement’s 1.5°C limit would necessitate not exploiting around 60% of oil and fossil methane gas and 90% of coal resources, which could imply potential stranded resources for the oil, gas, and coal. Similarly, Grant et al. (2024) state that fossil fuels produce substantial CO2 emissions from power plants, leading to large-scale climate-related asset stranding.

Climate change asset stranding, which refers to the degradation or transformation of assets into liabilities due to climate change and the transition to a decarbonized environment (Caldecott et al., 2021; Weber et al., 2020), arises from transition risks and physical risks. Transition risks are defined as financial risks originating from economic transition in the climate change context, such as shifts in laws and policies, customers’ preferences, and innovative technologies. Physical risks, on the other hand, are the direct effects of climate change, for example, climatic events that result in adverse effects on properties and operations (D’Orazio and Popoyan, 2019). Further conceptualization of stranded assets is by Saltzman (2013) who defined them as investments that decline in their economic viability before the end of their useful life as a result of changes in legislation, regulations, market forces, or social attitudes. Similarly, the IEA (2013) posits that stranded assets refer to financial investments that can no longer yield attractive returns because markets and regulations have shifted as a result of climate policy. Lastly stranded resources refer to the fossil fuel reserves that cannot be utilized as a result of emission cut targets, and climate policies among others (Kefford et al., 2018). These wider definitions emphasize the fact that the concept of stranded assets can encompass any change in the market, society, or policy environment that disrupts asset values.

The implications of asset stranding are vast and concerning, especially as they regard the energy transition, financial system, society, and possibly other crises. First, Stranded fuel assets increase the difficulty in the development of renewable systems of energy since they consume money that might have gone towards investing in renewable energy (Curtin et al., 2019; Chevallier et al., 2021). Stranded assets deny governments and companies money by causing them to incur welfare compensation costs due to job losses, energy supply disruptions, decline economic development, and increased debt levels (Curtin et al., 2019; Green and Newman, 2017; Chevallier et al., 2021; Bos and Gupta, 2019; Caldecott et al., 2021; Hansen, 2022). Such loses occur billions of dollars, which burdens both public and private budgets (Hansen, 2022). This leaves less money available to fund renewable energy and develop renewable energy systems. Second, asset stranding can affect the speed and efficiency of the energy transition, which can slow down the process or raise costs if left uncontrolled (Kefford et al., 2018; Grant et al., 2024). Third, the value of fossil fuel assets might decline and undermine credit markets and portfolios leading to a system risk (Caldecott et al., 2021; D’Orazio and Popoyan, 2019). Fourth, societal concern refers to the challenges such as loss of jobs in the fossil fuel industries, declines in economic development in regions that rely on fossil fuel extraction, and high costs that governments incur in aid of welfare and transition (Gupta and Chu, 2018; Montt et al., 2018; Schlosser et al., 2017). Lastly, asset stranding impacts other crises, for instance, economic disparity, geopolitical conflicts regarding energy sources, the accomplishment of sustainable development goals, and so on (Overland, 2019; Kemfert et al., 2022). Collectively, these implications underscore the need for understanding the various factors that lead to asset stranding to avoid adverse consequences.

While climate-led asset stranding has been associated with wide-ranging implications, there is limited literature that focuses on analyzing the factors driving this occurrence, particularly from the perspective of the financial sector (Firdaus and Mori, 2023; von Dulong et al., 2023). To date, most prior literature discusses the outcomes and potential challenges that are related to stranded assets while discussing the environmental factors (Bos and Gupta, 2019; Caldecott et al., 2021). Although specific drivers, notably policy shifts and the emergence of new technologies and innovations, have been investigated, little research has explored the interrelationships among these drivers and the mechanisms through which they cause asset stranding (Shimbar, 2021b). Moreover, this review employs a cross-disciplinary framework that emphasizes institutional, technological, economic, environmental, legal, and social drivers to examine the factors influencing stranded assets and resources. This framework has not been utilized in prior reviews. This gap thus limits the ability to advance solutions to manage and adapt to stranding threats posed by the global transition to a low-carbon economy.

Some systematic literature reviews have sought to examine the various drivers behind asset and resource stranding in the transition to a low-carbon economy. For example, Weber et al. (2020) and Bos and Gupta (2019) highlight environmental regulations and market dynamics as key factors that cause stranded assets and resources in their discussion on the implications of stranded assets for climate change mitigation and sustainable development. In their paper, Curtin et al. (2019) also explained that policy shifts and technological advancements are a key determinant when quantifying stranding risks for fossil fuel assets and exploring their impact on renewable energy investments. Heras and Gupta (2023) focused on the Global South, identifying socio-economic and political drivers of fossil fuel asset stranding, while Shimbar (2021a) addresses environmental concerns as the cause of value destruction in carbon-intensive sectors. Lastly, Caldecott et al. (2021) and von Dulong et al. (2023) identify environmental drivers, societal challenges, and policy implications as the primary causes of asset and resource stranding. However, despite these contributions, existing systematic literature reviews still have gaps that need to be addressed. Many studies focus on specific drivers or regions, lacking a comprehensive analysis of the drivers and the diverse mechanisms in which they occur. Notably, these drivers have not been adequately examined in the African context, such as in Uganda, where unique socio-economic and environmental challenges exist. Additionally, the existing studies predominantly focus on developed economies, with scant literature on developing countries.

The novelty of the paper is that it offers a comprehensive analysis of the drivers of asset and resource stranding through a systematic review of global literature on asset and resource stranding because of the energy transition from 1984 to 2024, encompassing both developed and developing countries. It seeks to fill this gap by establishing the mechanisms through which these drivers operate across diverse regions, including underexplored areas like Africa. The study thus contributes to the current literature on energy transition by identifying and explaining the diverse characteristics and mechanisms of asset and resource stranding, thereby providing valuable insights that can guide the development of strategies for managing and mitigating these stranded assets and resources. In summary, this paper provides answers to the following questions. In summary, this paper provides answers to following questions.

RQ1: What are the comprehensive drivers of climate-related asset and resource stranding identified in the literature?

RQ2: Through what mechanisms or channels do these identified drivers operate to cause asset and resource stranding?

RQ3: What gaps exist in the existing literature regarding the drivers and mechanisms of climate-related asset and resource stranding?

The remainder of the paper is structured as follows: In Section 2, the approach to conducting the systematic literature review is outlined. Section 3 is, therefore, a synthesis section that summarizes the findings from the reviewed literature to the identified drivers of asset stranding and how they work. In Section 4, we tease out the results and discussion of findings. Last of all, Section 5 provides the conclusion which overviews the grants, and the paper’s main points.

2 Methods

2.1 Systematic literature review (SLR)

This paper used an SLR methodology to examine research conducted on asset and resource stranding because of the energy transition from 1984 to the present, covering 40 years. The objective was to identify the factors that result in asset and resource stranding due to the transition to a low-carbon economy and to examine the mechanisms through which these drivers operate. The research analysis of academic journal articles and other relevant literature sources. This study adopted the SLR approach because it provides a rigorous and structured approach to examining both peer-reviewed articles and grey literature, ensuring comprehensive coverage and minimizing bias (Higgins et al., 2019; Paez, 2017). This method allows for a transparent analysis that addresses predefined research questions using all available data sources, including non-traditional publications (Gusenbauer and Haddaway, 2020).

2.2 Material collection

To ensure that the systematic literature review aligns with the study’s goals, specific procedures were followed to carefully select appropriate records and articles for evaluation.

2.2.1 Database selection

When selecting databases for the SLR, those that provide metadata and abstracts, including the DOI, publication year, journal title, volume, and issue number, were prioritized. This research used Google Scholar and ScienceDirect (Scopus) as sources of information because ScienceDirect (Scopus), as Chevallier et al. (2021) and Semieniuk et al. (2022) noted, offers more specialized and quality content relevant to the energy transition, while Google Scholar, includes a broader range of academic work such as grey literature and non-peer-reviewed materials, which provides a more comprehensive review (Aghaei Chadegani et al., 2013).

2.2.2 Selection of the journals and grey literature

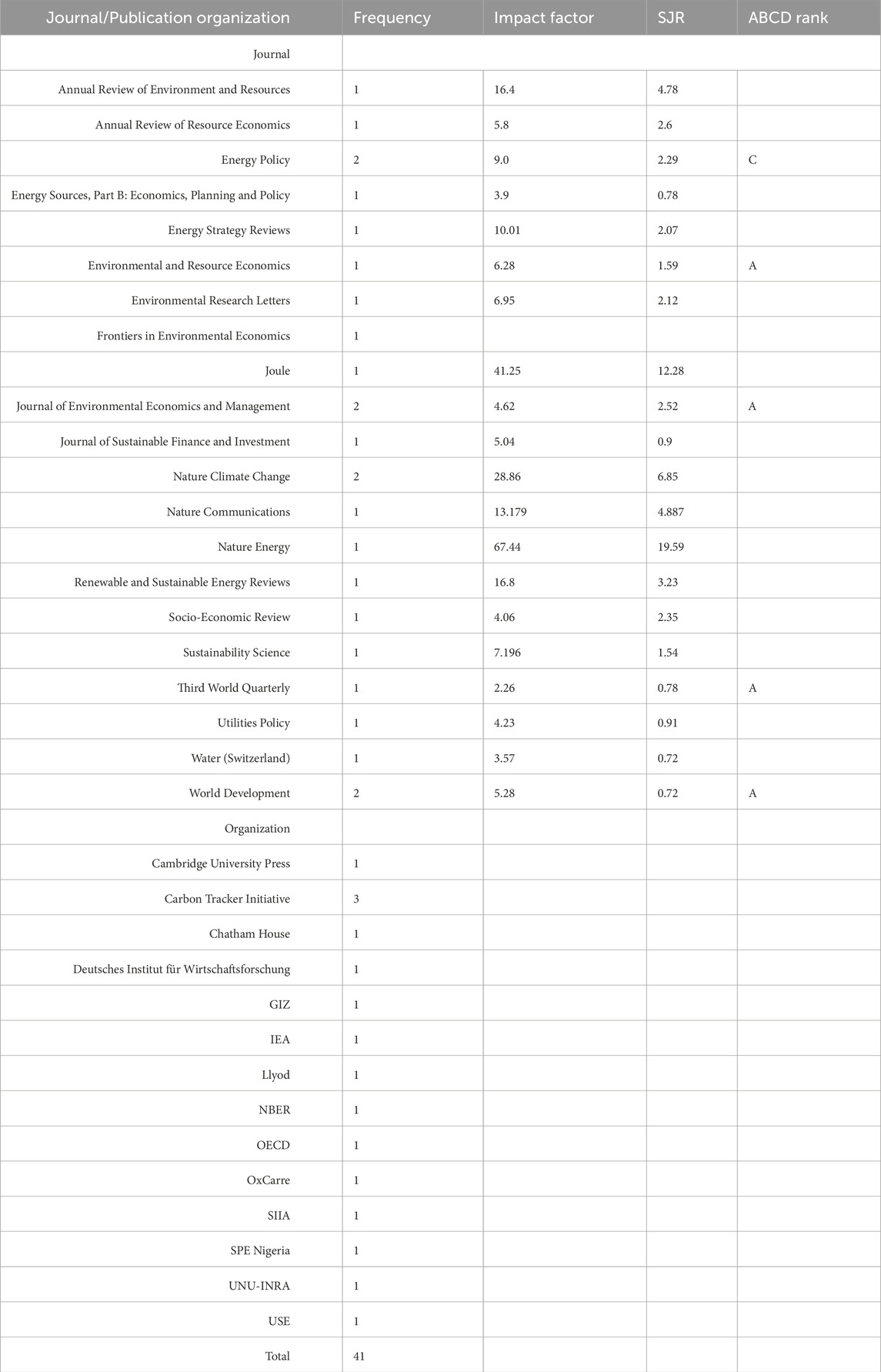

In selecting journals, we prioritized leading journal articles that are relevant to the study of asset and resource stranding resulting from the energy transition. We used a compilation of twenty-one high-quality journals to discover relevant works.

Periodicals categorized as A, B, and C were included based on the Australian Business Deans Council (ABDC) journal ranking, which prioritizes high-quality and influential sources. Where Clarivate Analytics categorization was insufficient, additional journals were identified using SCImago Journal Rank (SJR) and journal impact indicators, ensuring a comprehensive synthesis of insights, as applied by Heras and Gupta (2023) and Caldecott et al. (2021). Clarivate Analytics was found to be insufficient for systematic reviews in emerging fields like asset stranding because its emphasis on traditional citation metrics often limits the inclusion of region-specific or less-cited journals, which are critical for a comprehensive understanding of global issues like asset stranding (Gusenbauer and Haddaway, 2020). The decision to prioritize SJR over Clarivate Analytics for journal ranking in this study was informed by SJR’s capacity to account for citation context and its broader disciplinary inclusivity. This aligns with the cross-disciplinary framework of the review, which spans institutional, technological, economic, environmental, legal, and social drivers. Additionally, SJR’s reliance on Scopus, a larger and more diverse database than Web of Science (used by Clarivate Analytics), provides a more comprehensive representation of global research outputs (Bornmann et al., 2010).

Additionally, grey literature searches were conducted using Google Chrome search engine (Aghaei Chadegani et al., 2013; Mongeon, 2015). The grey literature used in this analysis was gathered from high ranking organizations such as the Organization for Economic Co-operation and Development (OECD), Cambridge University, The International Energy Agency, GIZ, and the Oxford Centre for the Analysis of Resource-Rich Economies (OxCarre). In addition, the analysis considered reports from organizations such as the National Bureau of Economic Research (NBER), Deutsches Institut für Wirtschaftsforschung, and United Nations University Institute for Natural Resources in Africa (UNU-INRA) that are relevant to the topic of asset and resource stranding. Grey literature was included as a source of timely, relevant insights not yet available in academic publications (Adams et al., 2016). Furthermore, grey literature helps bridge the gap between formal academic research and real-world applications, especially in fast-evolving sectors like energy transitions and asset stranding (Paez, 2017).

2.2.3 Content/material collection

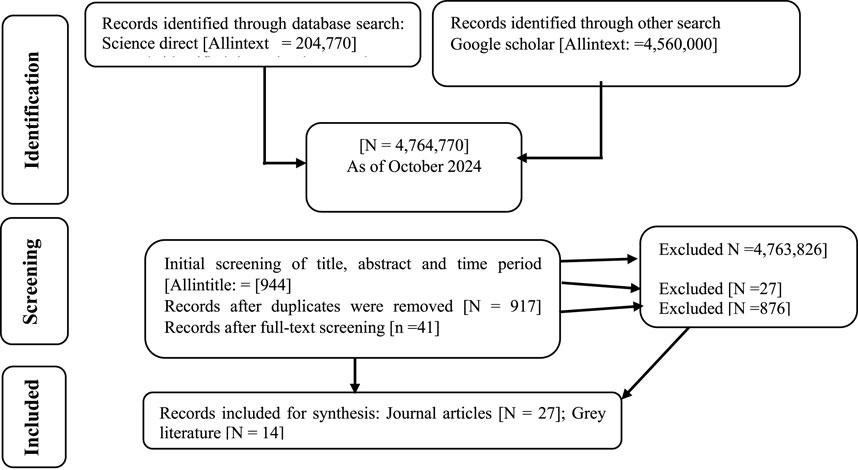

Before beginning the systematic article selection process, it is important to define the key search terms. In this study, we used several Boolean expressions: “Stranded assets”, “Stranded resources”, “Asset stranding”, “Resource stranding” “Stranded assets and resources”, “Asset and resource stranding”, “Stranded assets drivers”, “Stranded assets mitigation”, “Energy transition” AND “stranded assets”, “Energy transition” AND “stranded resources”, and “Energy transition” AND “unburnable carbon”. Figure 1 illustrates the outcomes of this search strategy as of October 2024.

2.2.4 Criteria for exclusion and inclusion

To ensure inclusion and diversity, the assessment includes works that were published or accepted for publication globally from 1984 to 2024. Articles and publications published in the English language and discussed the concept of stranded assets and resources resulting from the energy transition were considered. The researchers’ preference for the English language is due to their greater familiarity with the language. The review encompassed research and working papers on stranded assets and resources, including peer-reviewed articles, book chapters, and books.

In the identification phase, a comprehensive search of the Science Direct (Scopus) database yielded 10,843 records, while Google Scholar yielded 4,560,000 records. Afterward, the titles and abstracts of the literature were evaluated using the specified Boolean expressions (see Section 2.2.3) and the “Allintitle” function to confirm their adherence to the specified period (1984–2024). Using the exclusion and inclusion criteria the total number of qualified articles and papers in the literature pool reduced to 944. Afterward, the Mendeley software was used to remove duplicate entries, leading to a further reduction to 917 distinct records. In the final screening process, it was confirmed that the articles, book chapters, reviews, and books that were still relevant, adequately covered the determinants of asset and resource stranding because of the energy transition. Articles lacking coverage of this area were excluded, resulting in a final selection of 41 articles, comprising 27 journal articles and 14 grey literature sources. The exclusion criteria based on coverage area also eliminated earlier works before 2013 despite the search from 1984 because they looked at stranded assets and resources that were not due to the energy transition. Furthermore, articles investigating asset stranding in renewable energy were excluded. Systematic literature papers, conference papers, and technical reports were also excluded to avoid repetitive publications and information that is not dependable (Scherer and Saldanha, 2019).

2.2.5 Full article text review

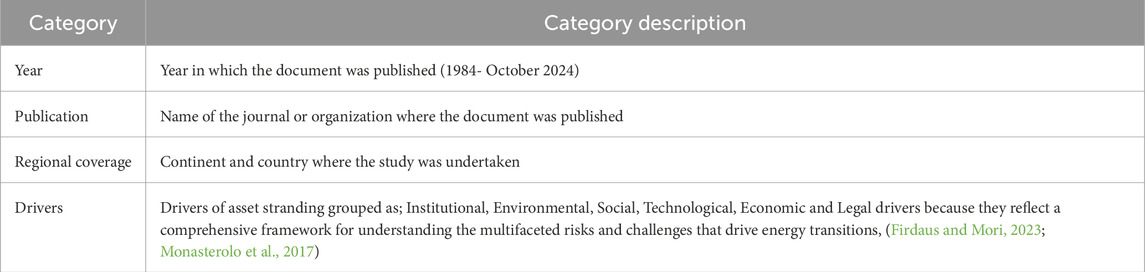

Table 1 presents a categorization of the main data extracted during the literature review.

2.2.6 Data charting

To analyze the 41 selected papers, an Excel spreadsheet was used and the findings were presented using graphs, tables and figures categorized by various dimensions, facilitating clear presentation, and understanding. The spreadsheet was structured to consistently record and classify different aspects of each study, covering all details specified in Table 1.

3 Synthesis of reviewed literature

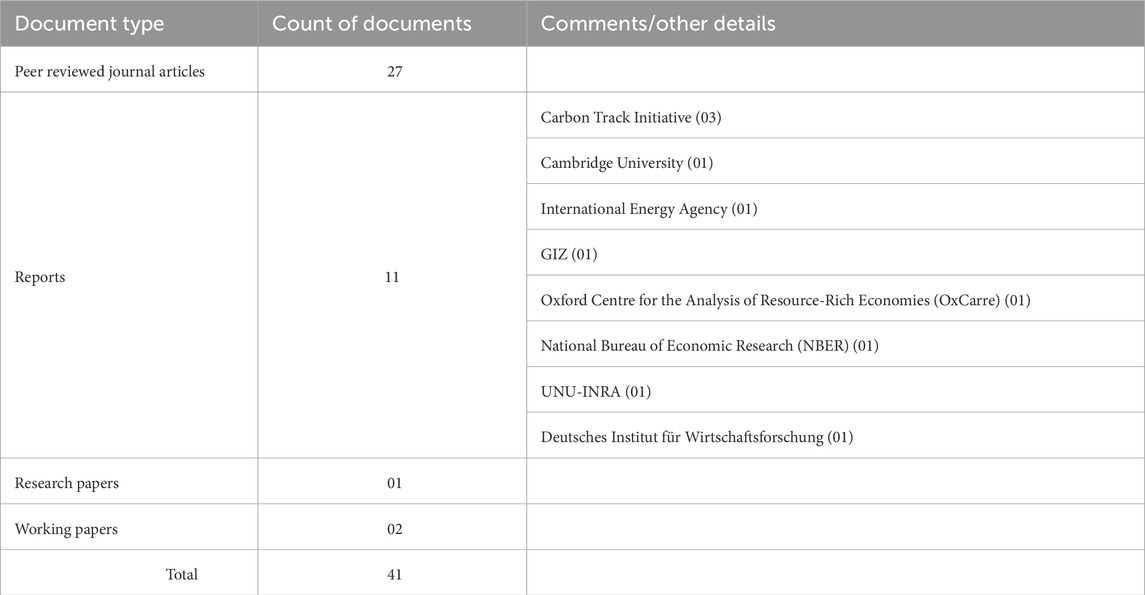

This section presents an examination of the 41 papers reviewed (refer to Table 2 for a summary of the analyzed papers). Out of the 41 papers, 27 are from Peer-reviewed journal articles, 11 are from reports, 2 are working papers and 1 is a research paper. A working paper is an early-stage research document not yet peer-reviewed or formally published. It presents preliminary findings to gather feedback and refine the analysis (Ansar et al., 2013) while a research paper is a finalized, peer-reviewed study published in an academic journal, ensuring its credibility (Rautner et al., 2016). Including both working and research papers is essential for a comprehensive review, as working papers provide timely insights and emerging ideas, while research papers offer validated findings and depth (Buhr, 2017; Bos and Gupta, 2019). In terms of the status of both the research and working papers, the research paper by Rautner et al. (2016) has undergone peer review and is recognized in the academic community (Rautner et al., 2016). The working papers by Breitenstein et al. (2020) and Atanasova and Schwartz (2019), are still working papers.

3.1 Sources of data

The papers selected for review were sourced from 21 journals and 14 reputable organizations (such as IEA, GIZ, OECD, and NBER) and that have researched asset and resource stranding (Table 3). The Carbon Track Initiative had the highest ranking with three papers, while Energy Policy, the Journal of Environmental Economics and Management, and Nature Climate Change each had two publications. Unlike other organizations, the Carbon Track Initiative has focused its efforts on studying asset stranding for several years, hence producing more articles than other organizations.

3.2 Distribution and evolution of the topic

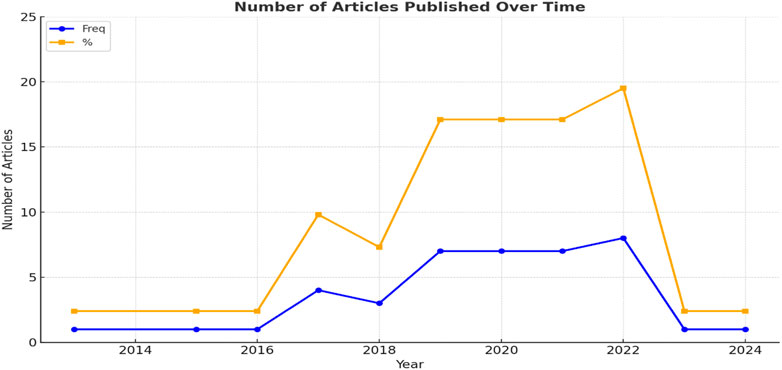

While we searched for articles over a span of 40 years, the results show that publication of literature on the asset stranding due to the energy transition only starts in 2013, implying that this is a relatively nascent field of study (Figure 2). Notably, in 2013, 2015, 2016 and 2023, only one article was published in each year, constituting 2.4% of the total. Nevertheless, in 2017, there was a significant rise to four articles, accounting for 9.5% of the total quantity. In 2018, the number of articles reduced to three, representing 7.1 percent of the overall total. In 2019, 2020 and 2021, the number increased to seven, accounting for 16.7 percent. In 2022 there was a further increase to eight articles accounting for 19% however in 2023 the articles reduced to one article and 2 articles in 2024. Overall, the number of publications on asset stranding resulting from the energy transition has shown a consistent increase, with the exception of a decrease in 2018 and 2023. The highest number of articles were published in 2022, whilst the lowest number were in 2013, 2015, 2016, and 2023. The rise in the number of publications from 2017-onwards shows a recent spark in interest in the topic of stranding and is linked to heightened attention to the implications of the 2015 Paris agreement climate measures, on the value of fossil-fuel resources and assets (Shimbar, 2021a).

3.3 Regional distribution of reviewed articles on stranded assets and resources

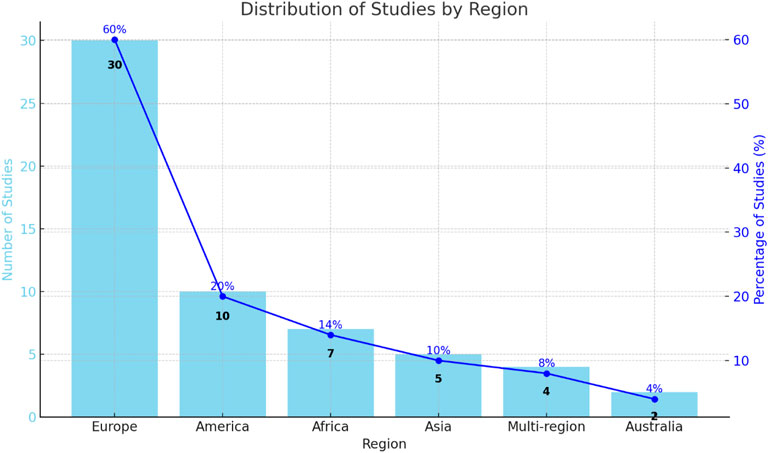

Figure 3 displays the geographical distribution of articles (or papers) on asset and resource stranding resulting from the energy transition. The European region dominates with 61.9%. This prevalence can be linked to the ambitious climate goals set by European Union member states, fostering a policy environment conducive to such research (Löffler et al., 2019). In addition, 19% of the studies self-identified as American, 7.1% as African, 4.8% as Asian, and 4.8% as having a mixed regional origin. Australia had the lowest representation, accounting for just 2.4% of the articles published during the research period. Given that many unexploited fossil fuel reserves are located in developing countries (BP, 2022), the predominant focus on Europe and America in the literature represents a significant gap. Yang et al. (2023) demonstrate that the spatial distribution of stranded fossil asset costs and benefits from climate change mitigation is highly uneven, disproportionately affecting developing countries with abundant fossil fuel reserves. Their study highlights that these nations face greater risks of asset stranding and bear a larger share of economic costs, underscoring the urgent need for more research focused on these regions to address this disparity.

4 Results and discussion

This review aimed to provide a comprehensive assessment of factors that might cause energy assets and resources to become stranded, especially in the context of the global shift towards sustainable and renewable energy sources. In this section, we present the results and discuss the drivers, particularly explaining the mechanisms through which stranding could occur.

4.1 Drivers of asset and resource stranding

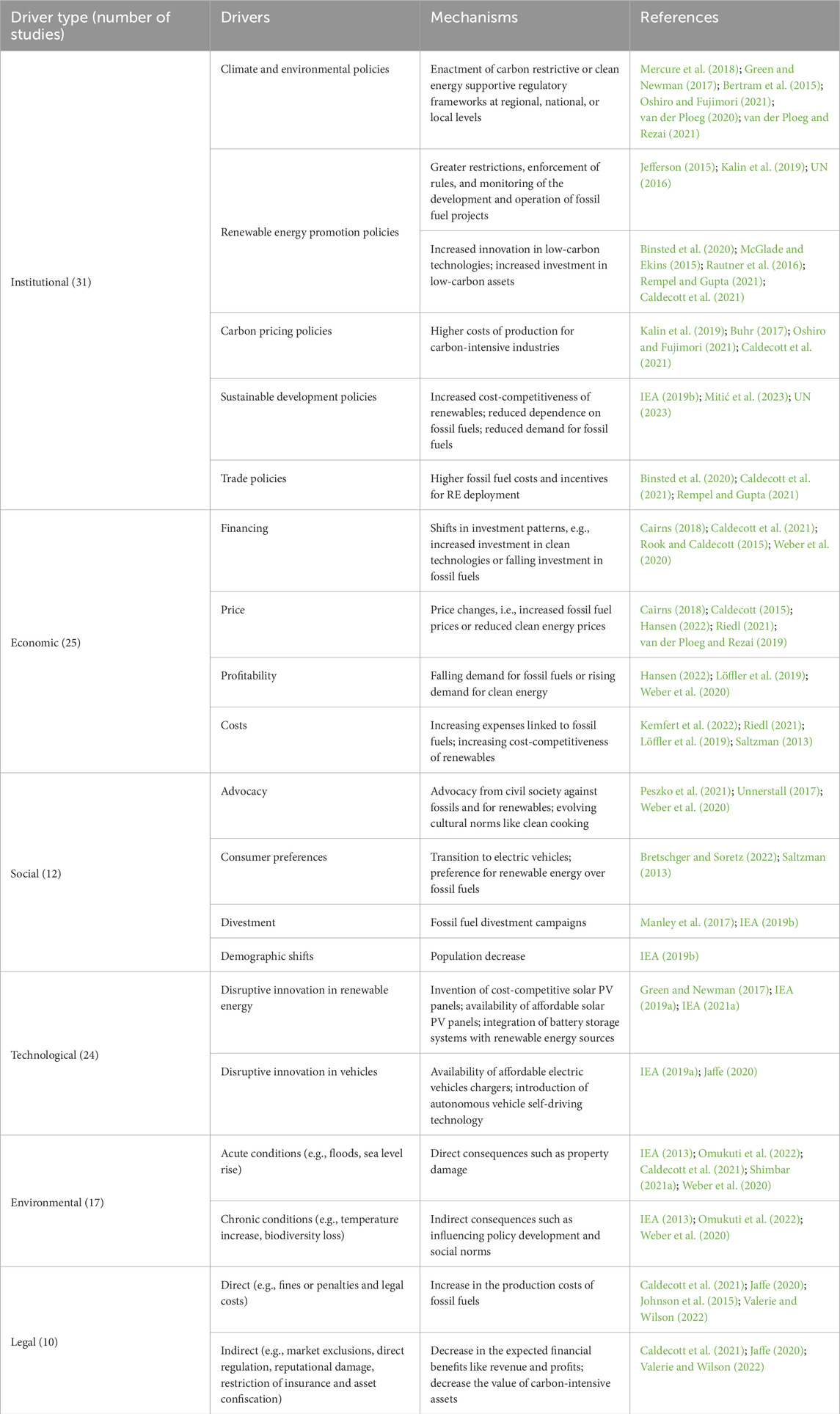

This study categorizes the drivers of asset and resource stranding into institutional, economic, social, technological, environmental, and legal factors (Table 4). Most (26.1%) of the studies reviewed focused on institutional factors as a driver of asset and resource stranding. Institutions can take the form of policies on climate and environment, carbon pricing, renewable energy promotion, trade, sustainable development, and incentives for renewable energy. Economic drivers were covered in 21% of the studies, and include financing, pricing, profitability, and cost considerations, while technological advancements in the form of innovations in renewable energy and vehicle technology account for 20.2%. Environmental factors covering acute and chronic environmental and climate changes1, social factors including advocacy efforts and certification schemes and legal aspects such as fines and penalties associated with fossil fuel activities accounted for 14.3%, 10.1%, and 8.4% respectively.

4.2 Results

4.2.1 Institutional factors

The institutional drivers that lead to asset stranding include climate and environmental policies, Renewable Energy (RE) promotion policies, carbon pricing, sustainable development policies, trade policies, and incentives for RE deployment. Climate and environmental regulations, such as those introduced by the Paris Agreement of 2015, call for the reduction of greenhouse gas emissions, thereby designating more than eighty percent of fossil fuel resources as ‘unburnable’ (McGlade and Ekins, 2015; Mercure et al., 2018; Caldecott and McDaniels, 2014; Rempel and Gupta, 2021). Moreover, carbon pricing policies like carbon taxes and emissions trading schemes raise the cost of doing business for firms dependent on carbon and force businesses to transition to low-carbon products, hence increasing the risk of stranding fossil fuel assets (Bertram et al., 2015; Oshiro and Fujimori, 2021; van der Ploeg, 2020; van der Ploeg and Rezai, 2021). Policies that support the growth of renewable energy sources, such as feed-in tariffs, tax incentives, and competitive renewable procurement, make energy from renewables more competitive compared to fossil fuels (Caldecott, 2015; Riedl, 2021). Sustainable development and trade policies, including the concept of green growth in global Sustainable Development Goals (SDGs) and trade measures like the EU’s Carbon Border Adjustment Mechanism (CBAM), further contribute to the shift towards cleaner energy sources (UN, 2016; Kalin et al., 2019; Peszko et al., 2021; Mitić et al., 2023; Weber et al., 2020).

The mechanisms through which these institutional drivers lead to asset stranding involve regulatory pressures and market transformations. Climate and environmental regulations render a significant portion of fossil fuel resources unusable, directly causing their stranding (McGlade and Ekins, 2015; Mercure et al., 2018). Carbon pricing increases operational costs for carbon-intensive firms, diminishing their profitability and prompting a transition to low-carbon alternatives (Bertram et al., 2015; van der Ploeg and Rezai, 2021). For instance, the EU ETS has led to fuel switching and the rejection of high-carbon projects, advancing low-carbon investments (Caldecott and McDaniels, 2014; Green and Newman, 2017). Renewable energy promotion policies enhance the competitiveness of renewables, shifting investments away from fossil fuels (Caldecott, 2015; Riedl, 2021). Sustainable development and trade policies decrease demand for carbon-intensive goods and incentivize innovation in renewable technologies, further reducing investments in fossil fuels (Peszko et al., 2021; Weber et al., 2020).

4.2.2 Economic factors

The economic drivers of asset stranding encompass changes in financing, pricing, profitability, and costs of both fossil fuels and renewables. A significant shift in funding that seeks to exclude fossil fuel projects often leads to their abandonment as investors opt for greener alternatives, especially in economically challenged areas like parts of Africa (Heras and Gupta, 2023; Weber et al., 2020). The financial landscape in countries like Uganda remains relatively unsuitable for energy diversification due to challenges in consumer affordability, funding, and distribution infrastructure (Friesenbichler and Meyer, 2022). Declining demand for fossil fuels, such as Australian coal affected by changes in China’s market preferences, impacts profitability (Oshiro and Fujimori, 2021; Weber et al., 2020).

These economic drivers lead to asset stranding through shifts in investment flows and market viability. The exclusion of fossil fuel projects from investment portfolios results in their abandonment (Heras and Gupta, 2023; Weber et al., 2020). Investors face higher risks when expected returns are not met because costs associated with fossil fuel resources outweigh demand and revenue, leading to stranded assets (Oshiro and Fujimori, 2021). The decreasing costs of renewable energy technologies—such as batteries, wind, and solar—divert investments toward renewables, further stranding fossil fuel assets (Kemfert et al., 2022; Cairns, 2018). Globally, nations like India, Brazil, Germany, and Morocco are increasing their use of renewable technologies due to decreasing costs and supportive clean energy policies (Poponi et al., 2021). These economic realities expose fossil fuel assets to volatility and long-term risks amid changing market trends and the growing affordability of renewable energy sources (Löffler et al., 2019; Saltzman, 2013).

4.2.3 Social factors

Social factors significantly contribute to asset stranding, driven by shifting consumer preferences, advocacy, fossil-fuel divestment campaigns, and demographic changes. As consumers increasingly prefer renewable energy and electric vehicles (EVs) over fossil fuels, the demand for fossil-based energy sources declines, reducing their profitability for investors. This trend is evident in countries like the U.S. and the EU, where the transition to EVs is expected to significantly decrease demand for internal combustion engine (ICE) vehicles. Notably, countries such as China, France, Germany, and India have set targets to phase out ICE vehicle sales by 2040 or earlier (Bank of England, 2015). Civil society advocacy and divestment campaigns, such as those led by Norway’s Government Pension Fund, are exerting pressure on companies to abandon fossil fuel projects, further contributing toasset stranding (Manley et al., 2017; Peszko et al., 2021). Additionally, demographic changes, including population decline, reduce overall energy demand, further accelerating the abandonment of fossil fuel resources (Weber et al., 2020).

The pathways through which these social drivers lead to asset stranding involve impacts on demand and investment behavior. Shifting consumer preferences reduces demand for fossil fuels, decreasing profitability and making fossil fuel investments less attractive (Bank of England, 2015). The transition to EVs isolates fossil fuel-dependent facilities such as refineries, as demand for ICE vehicles declines. Advocacy and divestment campaigns diminish financial support for fossil fuel projects, increasing the risk of stranded assets (Manley et al., 2017; Peszko et al., 2021). Finally, demographic shifts resulting in population decline further reduce energy consumption, leading to decreased demand for fossil fuel resources (Weber et al., 2020).

Social factors significantly contribute to asset stranding, driven by shifting consumer preferences, advocacy efforts, fossil-fuel divestment campaigns, and demographic changes. As consumers increasingly favor renewable energy and electric vehicles (EVs) over fossil fuels, the demand for fossil-based energy sources declines, reducing profitability for investors. This trend is evident in countries like the U.S. and the EU, where the transition to EVs is expected to significantly decrease demand for internal combustion engine (ICE) vehicles. Notably, countries such as China, France, Germany, and India have set targets to phase out ICE vehicle sales by 2040 or earlier (Bank of England, 2015). Civil society advocacy and divestment campaigns, such as those led by Norway’s Government Pension Fund, are exerting pressure on companies to abandon fossil fuel projects, further contributing to asset stranding (Manley et al., 2017; Peszko et al., 2021). Additionally, demographic changes, including population decline, reduce overall energy demand, further accelerating the abandonment of fossil fuel resources (Weber et al., 2020).

The mechanisms through which these social drivers lead to asset stranding include impacts on demand and investment behavior. Shifting consumer preferences lower the demand for fossil fuels, reducing profitability and making fossil fuel investments less attractive (Bank of England, 2015). The transition to EVs isolates fossil fuel-dependent facilities, such as refineries, as demand for ICE vehicles declines. Advocacy and divestment campaigns reduce financial support for fossil fuel projects, thereby increasing the risk of stranded assets (Manley et al., 2017; Peszko et al., 2021). Finally, demographic shifts, such as population decline, further decrease energy consumption, leading to reduced demand for fossil fuel resources (Weber et al., 2020).

4.2.4 Technological factors

Technological innovations, particularly in renewable energy and vehicle technologies, are key drivers of asset stranding. The mass production and affordability of solar photovoltaic (PV) panels, coupled with advancements in carbon capture and storage (CCS) and battery storage systems, are making renewable energy more cost-competitive, pushing investors away from fossil fuels (Green and Newman, 2017; IEA, 2019a). Countries like Japan and Germany, which lead in renewable energy technologies, have seen significant shifts in investment due to lower costs and increased generation potential of renewables (Jaffe, 2020). In vehicle technology, the widespread adoption of EVs is causing the stranding of assets along the ICE value chain. Several countries, including China, India, and Germany, have set ambitious targets to phase out ICE production and sales by 2030–2040, further accelerating this shift (Weber et al., 2020; Rempel and Gupta, 2021). Additionally, countries like Uganda are investing in e-mobility through initiatives like Kiira Motors, aiming to produce electric cars to reduce CO2 emissions (Okello and Reynolds, 2022).

The mechanisms through which these technological drivers cause asset stranding involve enhancing the competitiveness of renewable technologies and altering consumer demand. The affordability and efficiency of renewable energy technologies attract investments, leading to a shift from fossil fuels to renewables (Green and Newman, 2017; IEA, 2019a). Advancements in EV technology reduce demand for fossil fuels used in transportation, stranding assets in the ICE value chain (Weber et al., 2020; Rempel and Gupta, 2021). National targets to phase out ICE vehicles further accelerate the obsolescence of fossil fuel-dependent infrastructure (Jaffe, 2020).

4.2.5 Environmental factors

Asset stranding also occurs due to acute and chronic environmental conditions that directly cause property damage or influence policies. Acute events like floods, cyclones, wildfires, and storms, as well as prolonged environmental changes like increasing temperatures, are significant threats (Elasu et al., 2023; Shimbar, 2021a). These conditions have prompted asset stranding in destinations such as the Bahamas, Dominican Republic, Vietnam, and Australia. The financial cost involved in the destruction of property and depletion of asset value is evident in Colorado and Australia, where wildfires forced companies to divest from fossil fuels (Hoffart et al., 2022). Increased deaths due to temperature rises in countries like Italy, Spain, and Germany have also put pressure on countries globally to strictly follow agreements like the Paris Agreement, emphasizing the need to leave 60% of oil and gas underground to maintain temperatures below 1.5°C (IPCC, 2023).

These environmental drivers lead to asset stranding through direct impacts on physical assets and by influencing policy decisions. Acute environmental events cause immediate damage to infrastructure and assets, rendering them unusable and leading to financial losses (Hoffart et al., 2022). Chronic environmental changes raise awareness and urgency around climate action, prompting stricter regulations and policies that restrict the use of fossil fuels, thereby stranding associated assets (IPCC, 2023).

4.2.6 Legal factors

Direct and indirect legal actions contribute to asset stranding through penalties, fines, and market exclusion. Businesses that fail to adhere to stipulated environmental regulations or provide false reports on carbon output are likely to suffer losses when they are sued and forced to pay penalties and fines, reducing profitability and thus driving asset stranding (Caldecott et al., 2021). Legal costs, loss of reputation, and regulatory exclusions can worsen the asset-stranding issue, especially when consumers decide to stop consuming a company’s product due to the damage it causes (Johnson et al., 2015; Valerie and Wilson, 2022). An example is the PG&E case, where mismanagement during the Californian wildfires led to bankruptcy and stranded assets as the company faced legal action—the first climate change-related insolvency globally (Hoffart et al., 2022). Increasing litigation elevates project costs and exposes investors to public scrutiny.

The processes through which these legal drivers cause asset stranding involve imposing additional financial burdens and risks on companies involved in fossil fuels. Penalties and fines decrease profitability, making fossil fuel projects less viable (Caldecott et al., 2021). Legal challenges and reputational damage deter investors and consumers, leading to divestment and reduced demand (Johnson et al., 2015; Valerie and Wilson, 2022). Regulatory exclusions prevent companies from operating in certain markets, effectively stranding their assets as regulatory risks and market shifts persist (Hoffart et al., 2022).

The findings of this study provide a comprehensive analysis of the multifaceted drivers and mechanisms leading to asset stranding across institutional, economic, social, technological, environmental, and legal domains, highlighting the intricate interplay of policy, market, and societal factors shaping the transition away from fossil fuel dependency. In doing so, the study underscores the critical need to address regional research gaps, particularly in Africa and Asia, where the unique dynamics of asset stranding remain underexplored. Bridging these gaps is essential for developing targeted policies and interventions tailored to the distinct socio-economic and environmental challenges of these regions, fostering inclusive and effective energy transitions that leave no region behind in the global shift toward sustainability.

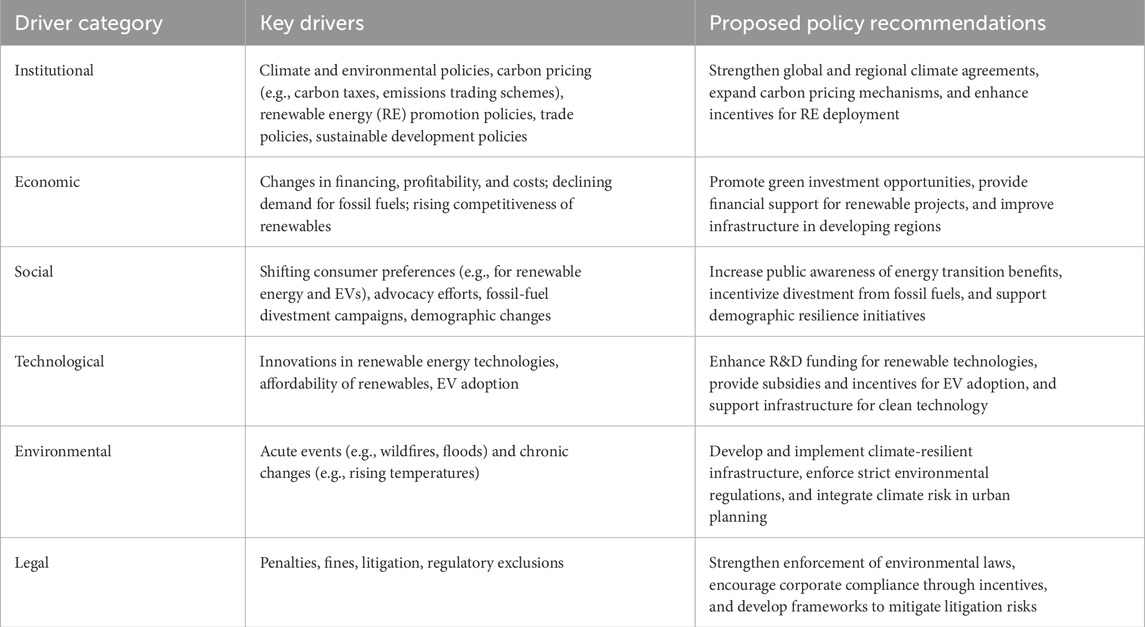

4.2.7 Summary of drivers and policy

Table 5 shows the summary of identified drivers and proposed policy recommendations.

4.3 Discussion

This study identified institutional factors as the primary cause of asset and resource stranding, particularly climate change policies, renewable energy initiatives, carbon pricing, sustainable development, and trade policies. For example, the Paris Agreement of 2015 (Bos and Gupta, 2019) seeks to transition countries to low-carbon economies, which may result in fossil fuel assets being left behind. Similar to the findings of Caldecott and McDaniels (2014) and van der Ploeg and Rezai (2021), this research highlights that stringent environmental regulations and enforcement measures can compel firms to cease investments in carbon-based projects. Additionally, this review contributes to the literature by noting that renewable energy promotion policies, such as feed-in tariffs and renewable energy auctions, not only enhance the adoption of renewable energy sources but also actively lead to fossil fuel asset stranding by increasing market competition, as observed in Italy’s Conto Energia program (Poponi et al., 2021).

In terms of economic factors, this study aligns with the arguments made by Auger et al. (2021) and Caldecott et al. (2016), who suggest that decreasing profitability in fossil fuel-related activities, driven by carbon pricing policies (Carattini and Sen, 2021), can lead to investor exit and asset stranding. Consistent with the observations of International Renewable Energy Agency (IRENA) (2019), the study further corroborates that falling technology costs and the increased cost competitiveness of renewable energy sources are redirecting investments away from fossil fuels, leading to stranded resources, as seen in countries like India and Australia (Caldecott et al., 2016; IRENA, 2019). Moreover, the study reveals that in emerging market economies, especially across Africa, it has become more challenging to secure funding for fossil fuel infrastructure due to investors’ growing interest in green energy (ComeZebra et al., 2021). This emerging issue of declining fossil fuel profitability, driven by both market forces and policy shifts, coupled with difficulties in securing investment, presents a fresh perspective in the literature, which has typically focused on developed nations. Collectively, these findings suggest that asset stranding in these regions is more urgent and complex than previously understood. Furthermore, the research sheds light on the mechanisms by which falling renewable energy costs may accelerate the shift away from fossil fuels, addressing a research gap that has not been extensively explored in previous studies.

Social and technological factors also play crucial roles in asset stranding, with changes in consumer preferences, advocacy, and disruptive innovations acting as key drivers. For instance, civil society advocacy in Norway has directly threatened fossil fuel production (Weber et al., 2020), while Saltzman (2013) indicated that evolving cultural norms and consumer behaviors are reducing demand for fossil fuels. The transition to electric vehicles (EVs) in the United States of America and the EU (Bretschger and Soretz, 2022) exemplifies this shift. Technological advancements, such as the increasing affordability of solar PV panels and innovations in vehicle technology (IEA, 2020; Valerie and Wilson, 2022), contribute to asset stranding by displacing fossil fuel-based technologies, a connection that is less emphasized in prior research.

Legal factors contribute to asset stranding through both direct and indirect mechanisms, including litigation and regulatory changes. Legal actions against companies for environmental damage or regulatory violations can result in financial penalties and reputational damage, leading to asset abandonment (Bos and Gupta, 2018). This review extends the findings of Caldecott et al. (2021) by highlighting examples such as the Pacific Gas & Electric Company case in California, where legal liabilities led to bankruptcy and asset stranding due to climate-induced wildfires. This underscores the interplay between legal risks and physical climate risks, which is a relatively novel contribution to the literature.

Environmental factors, particularly acute and chronic climate conditions, directly impact assets through property damage and indirectly by influencing policies and social norms. Our review supports Caldecott et al. (2016) and Shimbar (2021b) in showing that extreme weather events can lead to immediate asset stranding. We further connect these environmental impacts to policy responses like the Paris Agreement, emphasizing how climate-induced urgency accelerates regulatory actions that strand assets (Binsted et al., 2020; Welsby et al., 2021). This holistic view adds depth to existing literature by linking physical risks to policy and social responses, an area that has been less integrated in previous studies.

Overall, this study adds to the existing literature by examining the comprehensive drivers of asset and resource stranding, categorizing them as institutional, economic, social, technological, legal, and environmental factors, and exploring the processes through which they occur. While many existing studies focus on specific aspects or geographical areas, this review takes a global perspective, offering fresh insights into how these forces operate in various contexts. As such, it enhances awareness of the multifaceted drivers of asset stranding, providing valuable insights for policymakers and investors.

5 Conclusion

The systematic literature review offers a comprehensive understanding of the drivers leading to climate-related asset and resource stranding, along with the mechanisms through which these drivers operate. The analysis identifies six broad categories of drivers—institutional, economic, social, technological, environmental, and legal—that collectively contribute to asset stranding through various mechanisms. Institutional drivers, such as carbon-restrictive regulations, renewable energy promotion policies, and international trade agreements, impose higher costs on carbon-intensive industries and create incentives for renewable investments, leading to asset stranding. Economic factors involve shifts in investment patterns, costs, and market demands, creating an increasingly challenging environment for the fossil fuel industry. Technological advancements in renewable energy and electric vehicle technologies enhance the competitiveness of clean energy sources, increasing the risk of stranded assets in fossil fuel sectors. Environmental drivers include acute climatic events and chronic environmental changes that directly damage physical assets or lead to stricter regulations. Social factors, like shifting consumer preferences toward renewable energy and advocacy efforts, reduce demand for fossil fuels. Lastly, legal factors, such as penalties, fines, and market exclusions, impose direct and indirect costs on carbon-intensive businesses, accelerating the stranding process.

Overall, this review provides valuable information to guide strategies for mitigating the risks of asset and resource stranding. By understanding the comprehensive set of identified drivers and mechanisms, policymakers and stakeholders can better align policies and investments to ensure a more balanced and sustainable global energy transition.

Despite these insights, several research gaps persist. There is a notable regional concentration of literature in developed regions, particularly Europe, with limited studies exploring asset-stranding dynamics in developing areas like Africa and Asia. Hence, future research needs to delve deeper into the complexities of asset stranding, particularly within underrepresented regions and through interdisciplinary lenses. This inadequate research undermines the understanding of region-specific challenges and opportunities for managing energy transitions effectively hence necessitating a need for more research in these regions. Furthermore, the interdependencies between these drivers and their cumulative effects remain underexplored, highlighting the need for more integrated and cross-disciplinary analyses. In addition, for oil and gas-endowed countries that are heavily invested and still investing downstream and upstream, there is a need to investigate mitigation strategies to reduce the stranded assets and resources and the potential uses of the anticipated stranded assets in the oil and gas sector.

One limitation of this review is the use of a systematic literature review method, which can introduce biases, particularly from limiters such as time, language, and other inclusion/exclusion criteria. These restrictions may lead to the exclusion of key publications. However, efforts were made to address these biases by extending the period of publications that covered 1984–2024, ensuring the inclusion of both foundational and contemporary studies. Additionally, reliance on broad databases like Google Scholar and Scopus was complemented by including grey literature, such as policy briefs, reports, and working papers, to capture diverse insights and reduce biases tied to publication patterns or indexing limitations. These measures enhanced the comprehensiveness and balance of the review.

Author contributions

RK: Conceptualization, Data curation, Formal Analysis, Investigation, Methodology, Writing – original draft, Writing – review and editing. MN: Conceptualization, Methodology, Supervision, Writing – review and editing. CN-J: Conceptualization, Supervision, Writing – review and editing. NM: Conceptualization, Supervision, Writing – review and editing. FW: Conceptualization, Methodology, Supervision, Writing – review and editing. MA: Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. We acknowledge support from the Norwegian Agency for Development Cooperation (NORAD) through the Norwegian Programme for Capacity-Building in Higher Education and Research for Development (NORHED II) Project on “Capacity Building for Socially Just and Sustainable Energy Transitions in East Africa (2021–2026).”

Acknowledgments

The authors also extend sincere gratitude to the reviewers for their insightful feedback, which significantly enhanced the quality of the paper.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2025.1441767/full#supplementary-material

Footnotes

1Acute conditions are more frequent and intense extreme events that are caused by event-driven hazards while chronic environmental conditions are the long-term changes in the mean and variability of climate patterns.

References

Adams, R. J., Smart, P., and Huff, A. S. (2016). Shades of grey: guidelines for working with the grey literature in systematic reviews for management and organizational studies. Int. J. Manag. Rev. 19 (4), 432–454. doi:10.1111/ijmr.12102

Aghaei Chadegani, A., Salehi, H., Md Yunus, M. M., Farhadi, H., Fooladi, M., Farhadi, M., et al. (2013). A comparison between two main academic literature collections: Web of Science and Scopus databases. Asian Soc. Sci. 9 (5), 18–26. doi:10.5539/ass.v9n5p18

Ansar, A., Caldecott, B., and Tilbury, J. (2013). Stranded assets and the fossil fuel divestment campaign. University of Oxford, 2–12. Available online at: https://www.smithschool.ox.ac.uk/research/sustainable-finance/publications/stranded-assets-divestment-campaign.pdf.

Auger, T., Trüby, J., Balcombe, P., and Staffell, I. (2021). The future of coal investment, trade, and stranded assets. Joule 5 (6), 1462–1484. doi:10.1016/j.joule.2021.04.009

Atanasova, C., and Schwartz, E. S. (2019). Stranded fuel reserves and firm value: The impact of climate policy on fossil fuel firms. Journal of Financial Economics 132 (2), 361–378. doi:10.1016/j.jfineco.2019.02.002

Bank of England (2015). The impact of climate change on the UK insurance sector: a climate change adaptation report. Bank of England Report, 3–7. Available online at: https://www.bankofengland.co.uk/report/2015/the-impact-of-climate-change-on-the-uk-insurance-sector.

Bertram, C., Luderer, G., Pietzcker, R. C., Schmid, E., Kriegler, E., and Edenhofer, O. (2015). Complementing carbon prices with technology policies to keep climate targets within reach. Nat. Clim. Change 5 (3), 235–239. doi:10.1038/nclimate2514

Binsted, M., Iyer, G., Edmonds, J., Vogt-Schilb, A., Arguello, R., Cadena, A., et al. (2020). Stranded asset implications of the Paris Agreement in Latin America and the Caribbean. Environmental Research Letters 15 (4), 044017. doi:10.1088/1748-9326/ab7951

Bornmann, L., Mutz, R., and Daniel, H.-D. (2010). A reliability-generalization study of journal peer reviews: a multilevel meta-analysis of inter-rater reliability and its determinants. PLoS ONE 5 (12), e14331. doi:10.1371/journal.pone.0014331

Bos, K., and Gupta, J. (2018). Climate change: the risks of stranded fossil fuel assets and resources to the developing world. Third World Q. 39 (3), 436–453. doi:10.1080/01436597.2017.1374832

Bos, K., and Gupta, J. (2019). Stranded assets and stranded resources: implications for climate change mitigation and global sustainable development. Energy Res. and Soc. Sci. 56, 101215. doi:10.1016/j.erss.2019.05.025

BP (2022). BP statistical review of world energy 2022. 71st edition, 15–20. Available online at: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html.

Breitenstein, M., Nguyen, D. K., Walther, T., and Zörgiebel, S. (2020). Stranded asset risk and political uncertainty: the impact of the coal phase-out on the German coal industry. Energy Policy 144, 111705. doi:10.1016/j.enpol.2020.111705

Bretschger, L., and Soretz, S. (2022). Stranded assets: how policy uncertainty affects capital growth and the environment. Environ. Resour. Econ. 83 (2), 261–288. doi:10.1007/s10640-022-00648-6

Buhr, B. (2017). Assessing the sources of stranded asset risk: a proposed framework. J. Sustain. Finance and Invest. 7 (1), 37–53. doi:10.1080/20430795.2016.1204841

Cairns, R. D. (2018). Stranded oil of erewhon. Energy Policy 121, 248–251. doi:10.1016/j.enpol.2018.06.032

Caldecott, B. (2015). Stranded assets and the environment: what are stranded assets in the environmental context? SSEE 8–10. Available online at: https://www.smithschool.ox.ac.uk/publications/reports/stranded-assets-environment.pdf.

Caldecott, B., Clark, A., Koskelo, K., Mulholland, E., and Hickey, C. (2021). Stranded assets: environmental drivers, societal challenges, and supervisory responses. Annu. Rev. Environ. Resour. 46, 417–447. doi:10.1146/annurev-environ-011020-061111

Caldecott, B., Elizabeth, H., Cojoianu, T., Kok, I., and Pfeiffer, A. (2016). Stranded assets: a climate risk challenge. Inter-American Development Bank, 3–10. doi:10.18235/0000813

Caldecott, B., and McDaniels, J. (2014). Stranded generation assets: implications for European capacity mechanisms, energy markets and climate policy. Stranded Assets Programme, SSEE, University of Oxford, 5–15. Available online at: https://www.smithschool.ox.ac.uk/research/sustainable-finance/publications/stranded-generation-assets.pdf.

Carattini, S., and Sen, S. (2021). Carbon taxes and stranded assets: evidence from Washington State. SSRN Electron. J., 1–5. doi:10.2139/ssrn.3902297

Chevallier, J., Goutte, S., Ji, Q., and Guesmi, K. (2021). Green finance and the restructuring of the oil-gas-coal business model under carbon asset stranding constraints. Energy Policy 149, 112055. doi:10.1016/j.enpol.2020.112055

ComeZebra, E. I., van der Windt, H. J., Nhumaio, G., and Faaij, A. P. C. (2021). A review of hybrid renewable energy systems in mini-grids for off-grid electrification in developing countries. Renew. Sustain. Energy Rev. 144, 111036. doi:10.1016/j.rser.2021.111036

Curtin, J., McInerney, C., and Gallachóir, B. Ó. (2019). Financial incentives to mobilize local citizens as investors in low-carbon technologies: a systematic literature review. Renew. Sustain. Energy Rev. 102, 307–319. doi:10.1016/j.rser.2018.12.013

D’Orazio, P., and Popoyan, L. (2019). Fostering green investments and tackling climate-related financial risks: which role for macroprudential policies?. Ecological Economics 160, 25–37. doi:10.1016/j.ecolecon.2019.01.029

Elasu, J., Ntayi, J. M., Adaramola, M. S., and Buyinza, F. (2023). Drivers of household transition to clean energy fuels: a systematic review of evidence. Renew. Sustain. Energy Transition 3, 100047. doi:10.1016/j.rset.2023.100047

Firdaus, N., and Mori, A. (2023). Stranded assets and sustainable energy transition: a systematic and critical review of incumbents' response. Energy Sustain. Dev. 73, 76–86. doi:10.1016/j.esd.2023.05.007

Friesenbichler, K., and Meyer, I. (2022). Sectoral and environmentally friendly growth potential in Uganda. SSRN Electron. J., 8–15. doi:10.2139/ssrn.4112245

Grant, D., Hansen, T., Jorgenson, A., and Longhofer, W. (2024). A worldwide analysis of stranded fossil fuel assets’ impact on power plants’ CO2 emissions. Nat. Commun. 15 (1), 7517–10. doi:10.1038/s41467-024-52036-8

Green, J., and Newman, P. (2017). Disruptive innovation, stranded assets, and forecasting: the rise and rise of renewable energy. J. Sustain. Finance and Invest. 7 (2), 169–187. doi:10.1080/20430795.2016.1265410

Gupta, J., and Chu, E. (2018). Inclusive development and climate change: the geopolitics of fossil fuel risks in developing countries. Afr. Asian Stud. 17 (1–2), 90–114. doi:10.1163/15692108-12341381

Gusenbauer, M., and Haddaway, N. R. (2020). Which academic search systems are suitable for systematic reviews or meta-analyses? Environ. Evid. 9 (1), 1–14. doi:10.1186/s13750-020-00250-6

Hansen, T. A. (2022). Stranded assets and reduced profits: Analyzing the economic underpinnings of the fossil fuel industry’s resistance to climate stabilization. Renewable and Sustainable Energy Reviews 158, 112144. doi:10.1016/j.rser.2022.112144

Heras, A., and Gupta, J. (2023). Fossil fuels, stranded assets, and the energy transition in the Global South: a systematic literature review. Wiley Interdiscip. Rev. Clim. Change 15 (1), 1–23. doi:10.1002/wcc.752

Higgins, J. P. T., Thomas, J., Chandler, J., Cumpston, M., Li, T., Page, M. J., et al. (2019). Cochrane handbook for systematic reviews of interventions. 2nd ed. (Wiley-Blackwell), 120–150. doi:10.1002/9781119536604

Hoffart, F. M., D'Orazio, P., and Kemfert, C. (2022). Geopolitical and climate risks threaten financial stability and energy transitions. Energy Proc. 29, 1–9. doi:10.1016/j.egyr.2022.06.001

Intergovernmental Panel on Climate Change (IPCC) (2023). Climate change 2023: synthesis report. Contribution of working groups I, II and III to the sixth assessment report of the intergovernmental panel on climate change. 15–30. Available online at: https://www.ipcc.ch/report/sixth-assessment-report-synthesis-report.

International Energy Agency (IEA) (2013). Redrawing energy-climate map World energy outlook special Rep., 8–12. Available online at: https://www.iea.org/reports/redrawing-the-energy-climate-map.

International Energy Agency (IEA) (2019a). Technology innovation to accelerate energy transitions. 25–35. Available online at: https://www.iea.org/reports/technology-innovation-to-accelerate-energy-transitions.

International Energy Agency (IEA) (2019b). World energy outlook 2019, 50–60. Available online at: https://www.iea.org/reports/world-energy-outlook-2019.

International Energy Agency (IEA) (2021a). Net zero by 2050: a roadmap for the global energy sector. 10–22. Available online at: https://www.iea.org/reports/net-zero-by-2050.

International Renewable Energy Agency (IRENA) (2019). Renewable power generation costs in 2018, 18–28. Available online at: https://www.irena.org/publications/2019/May/Renewable-power-generation-costs-in-2018. .

International Energy Agency (IEA) (2020). Clean energy innovation: Accelerating technology progress for a sustainable future, 20–25. Available online at: https://www.iea.org/reports/clean-energy-innovation.

Jaffe, A. M. (2020). Stranded assets and sovereign states. Natl. Inst. Econ. Rev. 251, R25–R36. doi:10.1017/nie.2020.4

Jefferson, M. (2015). Energy policies for sustainable development - world energy assessment: energy and the challenge of sustainability. World Energy Assess. Energy Chall. Sustain., 416–454. doi:10.18356/946c9a8d-en

Johnson, N., Krey, V., McCollum, D. L., Rao, S., Riahi, K., and Rogelj, J. (2015). Stranded on a low-carbon planet: implications of climate policy for the phase-out of coal-based power plants. Technol. Forecast. Soc. Change 90 (PA), 89–102. doi:10.1016/j.techfore.2014.02.028

Kalin, R. M., Mwanamveka, J., Coulson, A. B., Robertson, D. J. C., Clark, H., Rathjen, J., et al. (2019). Stranded assets as a key concept to guide investment strategies for Sustainable Development Goal 6. WaterSwitzerl. 11 (4), 407. doi:10.3390/w11040407

Kefford, B., Ballinger, B., Schmeda-Lopez, D. R., Greig, C., and Smart, S. (2018). The early retirement challenge for fossil fuel power plants in deep decarbonisation scenarios. Energy Policy 119 (April), 294–306. doi:10.1016/j.enpol.2018.04.018

Kemfert, C., Präger, F., Braunger, I., Hoffart, F. M., and Brauers, H. (2022). The expansion of natural gas infrastructure puts energy transitions at risk. Nat. Energy 7 (7), 582–587. doi:10.1038/s41560-022-01026-2

Löffler, K., Burandt, T., Hainsch, K., and Oei, P. Y. (2019). Modeling the low-carbon transition of the European energy system: a quantitative assessment of the stranded assets problem. Energy Strategy Rev. 26 (August), 100422. doi:10.1016/j.esr.2019.100422

Manley, D., Cust, J., and Cecchinato, G. (2017). Stranded nations? The climate policy implications for fossil fuel-rich developing countries. OxCarre Policy Pap. 44, 1–24. doi:10.2139/ssrn.3264765

McGlade, C., and Ekins, P. (2015). The geographical distribution of fossil fuels unused when limiting global warming to 2°C. Nature 517 (7533), 187–190. doi:10.1038/nature14016

Mercure, J. F., Pollitt, H., Viñuales, J. E., Edwards, N. R., Holden, P. B., Chewpreecha, U., et al. (2018). Macroeconomic impact of stranded fossil fuel assets. Nat. Clim. Change 8 (7), 588–593. doi:10.1038/s41558-018-0182-1

Mitić, P., Fedajev, A., Radulescu, M., and Rehman, A. (2023). The relationship between CO2 emissions, economic growth, available energy, and employment in SEE countries. Environ. Sci. Pollut. Res. Int. 30 (6), 16140–16155. doi:10.1007/s11356-023-24867-4

Monasterolo, I., Zheng, J. I., and Battiston, S. (2017). Climate transition risk and development finance: a carbon risk assessment for the private sector. Sustainability 9 (11), 1980. doi:10.3390/su9111980

Mongeon, P. (2015). The journal coverage of Web of science and Scopus. Scientometrics 105 (1), 353–369. doi:10.1007/s11192-015-1745-3

Montt, G., Wiebe, K. S., Harsdorff, M., Simas, M., Bonnet, A., and Wood, R. (2018). Does climate action destroy jobs? An assessment of the employment implications of the 2-degree goal. Int. Labour Rev. 157 (4), 519–556. doi:10.1111/ilr.12096

Okello, G., and Reynolds, J. (2022). Pathways to e-mobility in Uganda. University of Cambridge Institute for Sustainability Leadership, 15–22. doi:10.17863/CAM.77802

Omukuti, J., Barrett, S., White, P. C. L., Marchant, R., and Averchenkova, A. (2022). The green climate fund and its shortcomings in local delivery of adaptation finance. Clim. Policy 22 (9–10), 1225–1240. doi:10.1080/14693062.2022.2121784

Oshiro, K., and Fujimori, S. (2021). Stranded investment associated with rapid energy system changes under the mid-century strategy in Japan. Sustain. Sci. 16 (2), 477–487. doi:10.1007/s11625-020-00895-w

Overland, I. (2019). The geopolitics of renewable energy: debunking four emerging myths. Energy Res. and Soc. Sci. 49, 36–40. doi:10.1016/j.erss.2018.10.018

Paez, A. (2017). Gray literature: an important resource in systematic reviews. J. Evidence-Based Med. 10 (3), 233–240. doi:10.1111/jebm.12266

Peszko, G., van der Mensbrugghe, D., Golub, A., and Chepeliev, M. (2021). “Low-carbon transition, stranded fossil fuel assets, border carbon adjustments, and international cooperation,” in The changing wealth of nations 2021: managing assets for the future, 225–269. doi:10.1596/978-1-4648-1570-8

Poponi, D., Basosi, R., and Kurdgelashvili, L. (2021). Subsidisation cost analysis of renewable energy deployment: a case study on the Italian feed-in tariff programme for photovoltaics. Energy Policy 154 (February), 112297. doi:10.1016/j.enpol.2021.112297

Rautner, M., Tomlinson, S., and Hoare, A. (2016). Managing the risk of stranded assets in agriculture and forestry. Research Paper: Chatham House, 12–20.

Rempel, A., and Gupta, J. (2021). Fossil fuels, stranded assets, and COVID-19: imagining an inclusive and transformative recovery. World Dev. 146, 105608. doi:10.1016/j.worlddev.2021.105608

Riedl, D., Grønbæk, L., Kronborg, C., Lauridsen, J. T., and Tepel, M. (2021). Kidney function, future health costs, and quality-adjusted life-years in kidney transplant recipients transplanted during the SARS-Cov-2 lockdown in Denmark – an observational study. Heliyon 7 (11), e08489. doi:10.1016/j.heliyon.2021.e08489

Rook, D., and Caldecott, B. (2015). Cognitive biases and stranded assets: detecting psychological vulnerabilities within international oil companies. 4–12. Available online at: https://www.smithschool.ox.ac.uk/research/cognitive-biases-and-stranded-assets.

Saltzman, D. (2013). Stranded carbon assets: why and how carbon risks should be incorporated in investment analysis. Gener. Found., 4–12. Available online at: https://www.genfound.org/research/stranded-carbon-assets/.

Scherer, R. W., and Saldanha, I. J. (2019). How should systematic reviewers handle conference abstracts? A view from the trenches. Syst. Rev. 8 (1), 4–9. doi:10.1186/s13643-019-0960-8

Schlosser, S., Kim, R., Lvleva, D., Wolters, S., and Scholl, C. (2017). From riches to rags? Stranded assets and the governance implications for the fossil fuel sector. Stoffers Steinicke, 5–10. Available online at: https://www.stofferssteinicke.com/from-riches-to-rags/.

Semieniuk, G., Holden, P. B., Mercure, J. F., Salas, P., Pollitt, H., Chewpreecha, U., et al. (2022). Stranded fossil-fuel assets translate to major losses for investors in advanced economies. Nat. Clim. Change 12 (6), 532–538. doi:10.1038/s41558-022-01299-2

Shimbar, A. (2021a). Environment-related stranded assets: an agenda for research into value destruction within carbon-intensive sectors in response to environmental concerns. Renew. Sustain. Energy Rev. 144, 111010. doi:10.1016/j.rser.2021.111010

Shimbar, A. (2021b). Environment-related stranded assets: what does the market think about the impact of collective climate action on the value of fossil fuel stocks? Energy Econ. 103, 105579. doi:10.1016/j.eneco.2021.105579

UN (2016). Sustainable development goals report 2016. Available online at: https://unstats.un.org/sdgs/report/2016/the sustainable development goals report 2016.pdf (Accessed June 30, 2025).

UN (2023). The sustainable development goals report 2023: special edition. Available online at: https://unstats.un.org/sdgs/report/2023/ (Accessed June 30, 2025).

Unnerstall, T. (2017). How expensive is an energy transition? A lesson from the German Energiewende. Energy, Sustain. Soc. 7 (1), 38–15. doi:10.1186/s13705-017-0141-0

Valerie, A., and Wilson, A. (2022). Stranded assets and the energy transition: evaluating country-level risk of fossil fuel stranded assets. Johns Hopkins University, 8–18.

van der Ploeg, F. (2020). Race to burn the last ton of carbon and the risk of stranded assets. Eur. J. Political Econ. 64, 101915. doi:10.1016/j.ejpoleco.2020.101915

van der Ploeg, F., and Rezai, A. (2019). Stranded assets in the transition to a carbon-free economy. Annu. Rev. Resour. Econ. 12 (December), 281–298. doi:10.1146/annurev-resource-110819-114539

van der Ploeg, F., and Rezai, A. (2021). Stranded assets in the transition to a carbon-free economy. SSRN Electron. J., 12–25.

von Dulong, A., Gard-Murray, A., Hagen, A., Jaakkola, N., and Şen, S. (2023). Stranded assets: research gaps and implications for climate policy. Rev. Environ. Econ. Policy 17, 161–169. doi:10.1086/720540

Weber, O., Dordi, T., and Oyegunle, A. (2020). “Stranded assets and the transition to a low-carbon economy,” in Sustainability and financial risks: the impact of climate change, environmental degradation and social inequality on financial markets. Editors M. Migliorelli, and P. Dessertine (Springer International Publishing), 63–92. doi:10.1007/978-3-030-60383-4

Welsby, D., Price, J., Pye, S., and Ekins, P. (2021). Unextractable fossil fuels in a 1.5°C world. Nature 597 (7875), 230–234. doi:10.1038/s41586-021-03821-8

Keywords: stranded assets, stranded resources, energy transition, drivers, mechanism, transition risk

Citation: Kemitare RG, Nantongo M, Nakakaawa-Jjunju C, Mukisa N, Wasswa F and Adaramola MS (2025) What drives asset and resource stranding in the transition from fossils to clean energy? a systematic review. Front. Energy Res. 13:1441767. doi: 10.3389/fenrg.2025.1441767

Received: 04 June 2024; Accepted: 10 June 2025;

Published: 07 July 2025.

Edited by:

Jin Hooi Chan, University of Greenwich, United KingdomReviewed by:

Hirdan Costa, University of São Paulo, BrazilFranziska M. Hoffart, Ruhr University Bochum, Germany

Copyright © 2025 Kemitare, Nantongo, Nakakaawa-Jjunju, Mukisa, Wasswa and Adaramola. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Rochelle Gladys Kemitare, Z2tlbWl0YXJlQG11YnMuYWMudWc=

Rochelle Gladys Kemitare

Rochelle Gladys Kemitare Mary Nantongo

Mary Nantongo Charlotte Nakakaawa-Jjunju2

Charlotte Nakakaawa-Jjunju2 Nicholas Mukisa

Nicholas Mukisa Francis Wasswa

Francis Wasswa Muyiwa S. Adaramola

Muyiwa S. Adaramola