- 1Business School, Ningbo University, Ningbo, China

- 2Economics School, Lanzhou University, Lanzhou, China

- 3Merchants’ Guild Economics and Cultural Intelligent Computing Laboratory, Ningbo University, Ningbo, China

In the context of striving to achieve the goals of “carbon neutrality” and “peak carbon dioxide emissions”, China’s green finance sector has experienced rapid development. Under the current Chinese system, the setting of economic growth targets by governments at various levels has had significant impacts on the output of microeconomic entities, the quality of regional economic development, and carbon emission efficiency. This paper employs the Super-SBM method and the entropy method to measure the carbon emission efficiency and green finance index of 30 provinces, municipalities, and autonomous regions (excluding Tibet) in mainland China from 2011 to 2023. It also constructs spatial Durbin models and panel threshold models to investigate the effects of regional economic growth targets and green finance on carbon emission efficiency. The findings reveal that green finance has played a significant role in enhancing carbon emission efficiency and that the development of green finance in one province exerts a significant positive spatial spillover effect on the carbon emission efficiency of neighbouring regions. In contrast, economic growth targets significantly inhibit the improvement of carbon emission efficiency. Furthermore, with respect to the threshold variable of economic growth targets, green finance has a significant nonlinear impact on carbon emission efficiency. The positive externalities of green finance are notably strengthened under high economic growth targets, thereby confirming the existence of the “total investment effect”.

1 Introduction

In recent years, the depletion of global energy resources, climate change, and environmental degradation have become increasingly severe, making green growth a critical issue for many countries and regions (Mardani et al., 2019). The use of clean energy has now become a major concern for every society due to its environmental, social, and economic benefits compared to conventional fossil fuels, further reinforcing the urgency of energy transition and emission reduction efforts (Rajah et al., 2024). The task of reducing carbon emissions also poses a significant challenge to China, leading to the proposal at the 2021 National People’s Congress and Chinese People’s Political Consultative Conference (NPC and CPPCC) sessions of the goal to “peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060” (Lin and Guan, 2023). This goal indicates that, as China’s environmental carrying capacity continues to decline, the traditional development model that disregards environmental costs is no longer sustainable. It is essential to fully consider carbon emissions as an undesirable output in total factor carbon productivity to avoid the past oversight of the substitution relationship between carbon emissions and labor, capital, and energy inputs, thereby comprehensively measuring the level and quality of regional economic development.

To achieve a comprehensive improvement in carbon emission efficiency, the Chinese government has increasingly focused on green finance as a key driver for promoting low-carbon economic development. This is because the enhancement of carbon emission efficiency must rely on capital markets to fully leverage the dominant role of capital in resource allocation, directing financial resources towards the green economy sector (Lee et al., 2023). According to data disclosed by the People’s Bank of China, by the end of 2020, the balance of domestic and foreign currency green credit in China reached 11.95 trillion RMB, ranking first globally. By the first half of 2021, the outstanding balance of green bonds exceeded 900 billion RMB, placing China second in the world. Although the development of the green finance industry is still in its early stages and has yet to exert a scale effect on the overall economic development, China’s substantial green finance volume can significantly influence the improvement of regional carbon emission efficiency. Moreover, the government has improved regulatory and legislative support measures for green finance, promoting orderly capital expansion within regions.

China’s current economic development is characterized by significant government intervention, with the behavior and performance of microeconomic entities significantly influenced by government actions. Over the long term, both economic governance practices and economic research in China have prioritized economic growth. The “Chinese-characteristic federalism” and “promotion tournament” derived from the Chinese system place economic growth as a crucial indicator of regional development (Yu et al., 2023). The setting of economic growth targets by governments at various levels in China has a long history. Although the 14th Five-Year Plan has downplayed the requirement for GDP to double, the setting of economic growth targets remains prevalent in annual government work reports at all levels. Chen et al. (2023) argue that the feature of “hierarchical subcontracting” of economic growth targets effectively allocates various economic resources to promote economic growth, improving overall output levels and living standards within regions. However, it is important to note that economic growth and economic quality are not equivalent. Under the Chinese system of “layered pressure,” there is a certain degree of incompatibility between the two (Luo et al., 2021). Local governments and officials, driven by their own promotion needs, tend to allocate policies and resources to mature, short-cycle, and high-short-term-return traditional high-energy-consuming industries, forming a “government-enterprise collusion” (Jia, 2024) to maximize economic growth benefits rather than providing public goods (Yin and Wu, 2022). This inevitably leads to a decrease in carbon emission efficiency, creating a “race to the bottom” trap.

Currently, China’s economic development has entered a new normal, with the central government placing increasing emphasis on improving the quality of economic development, especially under the constraint of achieving the “carbon neutrality” goal. The support for the green economy sector is gradually increasing, and China’s current economic capability is sufficient to provide resources and policy support to low-carbon industries represented by green finance. However, from the perspective of local government decision-making, the “competition for growth” tournament system still plays a significant role. Green finance, due to its technical complexity, long cycle, and low short-term returns, does not receive as much policy support and incentives compared to other traditional industries, which clearly contradicts the goal of high-quality economic development. Therefore, how to coordinate the relationship between economic growth targets, green finance, and carbon emission efficiency to achieve maximum benefits is a crucial issue. Given these problems, this paper uses panel data from 30 provinces, municipalities, and autonomous regions (excluding Hong Kong, Macao, Taiwan, and Tibet) in mainland China from 2011 to 2023, introducing the spatial Durbin model and panel threshold model to study the relationship between green finance and carbon emission efficiency under the constraints of provincial economic growth targets in China, as well as the spatial spillover effects among the three factors. The aim is to find policy pathways to coordinate the three factors and promote the improvement of economic development quality.

2 Literature review

2.1 Literature review on green finance and carbon emission efficiency

The body of international research on the impact of finance on carbon emissions is extensive, yet it has not reached a consensus. Some scholars argue that financial development can boost economic growth, thereby accelerating energy consumption and increasing carbon emissions, positing an inverted U-shaped relationship between financial development and carbon emissions (Salahuddin et al., 2015; Dogan and Seker, 2016). Other scholars maintain that financial development can facilitate corporate technological innovation, enhance societal environmental awareness, and accelerate industrial restructuring, leading to low-carbon social and economic development (Tamazian et al., 2009; Shahbaz et al., 2013). Yet another group of researchers points out that different segments within the financial industry have varying impacts on carbon emissions. Yan Chengliang et al. suggest that the scale of credit and actual foreign direct investment exhibit inverted U-shaped and U-shaped relationships with carbon emissions, respectively, while the financing scale of financial markets, competition in the financial sector, and market-oriented allocation of credit funds can reduce the intensity of carbon emissions (Yan et al., 2016).

With the rise and development of green finance, scholars have begun to focus on its influence on corporate investment and financing, energy conservation and emission reduction, and the quality of economic development. Xiu et al. found that green credit regulatory measures are beneficial for achieving energy savings and emission reductions under constraints of industrial growth (Xiu et al., 2015). Du Li et al. using a difference-in-differences model, demonstrated that the “pilot carbon emission trading scheme” policy effectively reduces carbon emissions. Beyond directly impacting carbon emissions, green finance can also improve regional economic development quality by promoting industrial structure upgrades and optimizing regional industries (Li and Lichun, 2019). Li Xiaoxi and Xia Guang’s research on existing green finance activities revealed that it plays a crucial role in financing channels for sustainable economic development (Li and Xia, 2014). Wang Yao et al. discovered that green finance optimizes regional economic structures, guides companies toward green production, and promotes green consumption, thus realizing sustainable economic development (Wang et al., 2016). Liu Xiliang et al. believe that green finance products developed for specific types of pollutants can encourage financial institutions to take on environmental responsibilities, thereby enhancing regional economic growth quality (Liu and Wen, 2019). Zhou Hanmei et al. employing spatial Durbin models and mediation effect models, found that the role of green finance in promoting high-quality economic development exhibits an inverted “U”-shaped non-linear characteristic, currently manifesting more as a facilitative effect (Zhou and Li, 2021). Recent studies have employed the Green Finance Reform and Innovation Pilot Zones as a quasi-natural experiment and found that the policy significantly improves urban carbon emission efficiency with a persistent dynamic effect. Mechanism analysis reveals that green innovation, expansion of financial supply, industrial structure optimization, and improvements in energy efficiency are the key pathways through which carbon emission efficiency is enhanced (Du et al., 2025).

In summary, the academic community generally agrees that green finance can effectively promote energy savings and emission reductions and improve the quality of regional economic development under certain conditions. However, further research is needed on the impact of green finance on carbon emission efficiency.

2.2 Literature review on economic growth targets constraints and carbon emission efficiency

From the perspective of China’s regional economic development issues, numerous scholars have investigated the relationship between government behavior and regional carbon emission efficiency. Key areas of focus include fiscal decentralization and environmental regulations. Wang Huachun et al. using a spatial Durbin model for empirical analysis, found that tax competition can enhance local green development efficiency but has negative spillover effects on adjacent regions (Wang et al., 2019). Li Guanglong et al. argue that environmental decentralization is beneficial for improving regional carbon emission efficiency (Li and Zhou, 2019), whereas Zou Xuan et al. found that supervisory decentralization had the opposite effect (Zou et al., 2019). In the context of fiscal decentralization, scholars hold divergent views. Some support the “Environmental Federalism” theory, with Tan Zhixiong and Zhang Yangyang employing an environmental DEA model to demonstrate that fiscal decentralization in China effectively promotes environmental protection (Tan and Zhang, 2015). Li Jinfa and Wang Qiuyue used a spatial Durbin model to show that fiscal decentralization positively influences regional green R and D investment, thereby promoting carbon emission efficiency (Li and Wang, 2020). Conversely, other scholars believe that the “race to the bottom” theory better fits China’s decentralized system. Zhu Wanli and Zheng Zhousheng’s empirical analysis of provincial panel data from western China (2000–2011) revealed that higher fiscal decentralization correlates with increased carbon emissions (Zhu and Zheng, 2014). Wang Juan and Zhang Kezhong found that China’s official promotion system means that increased fiscal decentralization does not reduce carbon emissions (Wang and Zhang, 2014).

While the aforementioned studies explore various aspects of the relationship between government behavior and regional carbon emission efficiency, few address the interaction between economic growth targets and carbon emission efficiency. Existing research primarily examines the transmission mechanisms of economic growth targets on economic development. Hu Shen discovered that at the city level, economic growth targets are positively correlated with the scale of land transfers by local governments (Hu and Lü, 2019). Yu Yongze et al. noted that stringent economic growth targets formulated through “cumulative pressure” and “rigid constraints” suppress total factor productivity and export sophistication (Yu et al., 2019). Wang Xianbin et al. observed an inverted U-shaped relationship between economic growth target pressures and manufacturing production (Wang and Chen, 2019). Huang Jie et al. point out that the setting of economic growth targets has a significant impact on carbon emission efficiency. Stringent growth targets may lead to a resource allocation bias toward high energy-consuming industries, thereby reducing carbon emission efficiency. However, moderately set growth targets can help promote the development of green finance, which in turn enhances carbon emission efficiency (Huang et al., 2025a).

Studies discussing the relationship between economic growth targets and environmental quality often focus on economic development quality and pollution. Xu Xianxiang et al.’s empirical study indicated that for every one percentage point increase in the economic growth target, there is a corresponding one percentage point decrease in regional development quality (Xu and Liu, 2017). Zhou Ruihui et al. constructed an economic growth target pressure index and found an inverted U-shaped relationship between economic growth targets and urban green development (Zhou and Yang, 2021). Shen Weiteng et al. analyzed panel data from 48 coastal cities in China (2004–2017), revealing varied impacts of economic growth target constraints on nearshore pollution, with regional fiscal and promotion pressures influencing this dynamic (Shen et al., 2021).

In summary, existing literature discusses the relationships between economic growth targets and economic development as well as environmental pollution separately. However, limited research has been conducted on the interplay between economic growth targets and composite indicators of economic growth and carbon emissions, especially regarding green total-factor productivity where carbon emissions are treated as undesirable outputs. Given China’s current emphasis on achieving peak carbon emissions (“carbon peak”) and carbon neutrality (“carbon neutrality”), further research into this area is crucial.

2.3 Literature review on green finance and constraints of economic growth targets

Current research on the interaction between economic growth targets and the financial sector predominantly focuses on aspects such as financial market conditions, monetary policy, and corporate financial activities. In the domain of credit and monetary policy studies, Li Cheng et al. utilized quarterly data from 2001 to 2016 to demonstrate that under the constraints of economic growth targets, anticipated and unanticipated monetary policies have differential impacts on the scale of credit (Li et al., 2018). Ma Caoyuan et al. found that stringent economic growth targets can lead to an amplification of the “total investment effect” by monetary policy, thus causing monetary policy overshooting (Ma and Li, 2013b). Ren Xiaoyi et al. observed that under the orientations of “competition for growth” and “cumulative pressure,” economic growth targets adversely affect financial market stability; however, with China’s economy entering a new era, the negative impact of economic growth targets on financial markets has notably diminished (Ren et al., 2020). Xiong Xiaolian et al. through a system GMM model analysis, revealed that economic growth targets significantly impede the allocation of financial resources (Xiong and Chen, 2021). At the level of corporate financial activities, Huang Rong et al., using a sample of Shenzhen and Shanghai A-share listed companies from 2008 to 2018, found that economic growth targets reduce corporate cash distributions, with the “investment effect” being predominant overall (Huang et al., 2021). Wu Fei et al. argued that under the bias towards “competition for growth” and “cumulative pressure,” local economic growth targets drive corporate leverage (Wu et al., 2021). It is important to clarify that the “Total Investment Effect” broadly refers to the positive impact of the overall scale of investment on economic output growth. Essentially, as the aggregate investment within an economy increases, it typically enhances total production capacity, thereby promoting economic growth (Ma and Li, 2013a). Other studies have found that the impact of green finance on carbon emission efficiency exhibits regional heterogeneity. In cities with higher levels of financial development and stronger access to green finance, the positive effect of green finance on carbon emission efficiency is more pronounced. This suggests that the interaction between green finance and economic growth targets manifests differently across regions (Huang et al., 2025b).

The existing literature on the relationship between economic growth and the financial sector tends to concentrate on regional monetary policy and financial market conditions at the macroeconomic level, while focusing on corporate investment and financing activities at the microeconomic level. However, there is a scarcity of research examining the relationship between economic growth targets and the development level of regional green finance. Even less attention has been paid to the combined impact of both factors on regional environment and carbon emission efficiency.

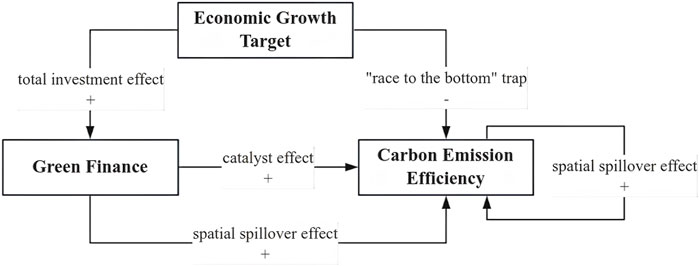

3 Theoretical mechanisms

In reviewing the aforementioned literature, it is evident that existing research primarily links green finance and economic growth targets with regional economic growth mechanisms and environmental conditions. However, when measuring the quality of regional economic development, most studies overlook the substitution relationship between carbon emissions and inputs such as labor, capital, and energy. Few studies incorporate the green total factor productivity (GTFP), which comprehensively measures the quality of regional economic development, into their evaluation systems. Additionally, research on the relationship between economic growth targets and the development of green finance is limited, and further discussion of the mechanisms underlying these interactions is needed. Given that the setting of economic growth targets is directly or indirectly related to industrial layout and economic orientation, it is essential to integrate economic growth targets, green finance, and carbon emission efficiency into a unified research framework. This approach will help elucidate the joint mechanism by which economic growth targets and green finance influence carbon emission efficiency. Specifically, the setting of economic growth targets can affect the allocation of resources and the direction of economic activities, which in turn influences the development of green finance and carbon emission efficiency. Furthermore, as China’s market economy develops, economic activities between regions have become more frequent. The flow of various economic factors across regions inevitably leads to spillover effects. Therefore, it is also necessary to discuss the spatial spillover effects of carbon emission efficiency, green finance, and economic growth targets.

3.1 Green finance and carbon emission efficiency

In the context of achieving “carbon peak” and “carbon neutrality,” green finance is expected to become a crucial tool for promoting low-carbon economic development. Zhang, T. argues that, similar to carbon trading, green finance is a significant measure for achieving “carbon peak” and “carbon neutrality” (Zhang, 2023). It can effectively guide the rational allocation of resources and leverage financial resources towards low-carbon industries and the green economy. Additionally, the development of green finance can optimize the existing industrial structure. Wang, H. et al. Suggest that, at the current stage, economic growth primarily relies on the optimization and upgrading of the industrial structure (Wang et al., 2023). Therefore, developing the green finance industry can generate positive externalities for the environment while increasing output, thus effectively promoting high-quality economic development. Despite the existence of “greenwashing” and “green drifting” phenomena in financial markets and the imperfect environmental and climate disclosure mechanisms in China, the green finance industry has not yet achieved its full potential. However, after several years of support and development, green finance should have established a significant position in China’s financial market, enabling it to effectively leverage its “catalyst effect” and enhance regional carbon emission efficiency. Based on the above analysis, this paper proposes the following hypothesis:

H1. Green finance has a significant positive impact on carbon emission efficiency in Chinese provinces.

3.2 Economic growth targets and carbon emission efficiency

Under the tournament-style official promotion system in China, economic performance is a critical indicator for officials’ promotions (Yin and Wu, 2022). Therefore, local governments strive to meet or even exceed their set economic growth targets, leading to a “layered pressure” and “rigid constraint” phenomenon across different levels of government (Shrawan and Dubey, 2022). High-energy-consuming industries often have relatively mature technologies and significant short-term economic benefits, whereas high-tech, clean technology, and green economy industries typically have complex technologies, long cycles, low short-term returns, and high policy risks. As a result, under the pressure of economic growth targets, policies and resources tend to favor the former, or the support for the former is greater. Consequently, under the pressure of economic growth targets, provincial development often falls into a “race to the bottom” trap, which is detrimental to the improvement of carbon emission efficiency. Based on the above analysis, this paper proposes the following hypothesis:

H2. Economic growth targets have a significant negative impact on carbon emission efficiency in Chinese provinces.

3.3 Economic growth targets, green finance, and carbon emission efficiency

Despite the tendency for “race to the bottom” competition among governments and officials under the constraints of economic growth targets, these targets significantly inhibit the improvement of carbon emission efficiency. However, the development of green finance is not necessarily incompatible with high economic growth targets. On the contrary, under the pressure of economic growth targets, governments seeking rapid economic development tend to expand the overall scale of investment and support, creating a “total investment effect.” Even if the government is more inclined to allocate the majority of resources to traditional industries for higher returns, at the current stage of China’s economic development, the government has sufficient resources to support the development of green industries. Furthermore, in recent years, the national government has explicitly supported the development of the green finance industry, and local environmental regulations have gradually been strengthened. Therefore, driven by the “total investment effect,” the green finance industry can obtain relatively more resources under the constraints of high economic growth targets. Given that the green finance industry requires significant investment and a longer cycle, the higher level of investment and support under high economic growth targets can lead to more robust development of the green finance industry, enhancing its positive externalities. However, the environmental benefits generated by the development of the green finance industry cannot fully offset the negative externalities caused by increased investment in traditional high-energy-consuming industries under high economic growth targets. Thus, although economic growth targets partially benefit the development of green finance, they generally inhibit the improvement of carbon emission efficiency. Therefore, coordinating the relationship between economic growth targets, the development of green finance, and the improvement of carbon emission efficiency to achieve maximum benefits is one of the key focuses of this paper.

Additionally, with the rapid development of the market economy, economic exchanges and activities among Chinese provinces have become increasingly close. The improvement in carbon emission efficiency in one province, accompanied by industrial optimization and ecological improvements, will inevitably promote the improvement of carbon emission efficiency in neighboring regions. The development of green finance in one province can positively influence the green industry development in surrounding provinces through investment and financing activities, thereby creating a significant positive spatial transmission effect on the carbon emission efficiency of neighboring regions. However, due to the constraints of local government administrative directives, economic growth targets often exhibit strong regional characteristics and do not have a spillover effect. Based on the above analysis, this paper proposes the following hypotheses:

H3. Economic growth targets have a significant positive impact on the development of green finance, and the effect of green finance on carbon emission efficiency is nonlinear. High economic growth targets can enhance the positive externalities of green finance, thereby strengthening its role in promoting carbon emission efficiency.

H4. The carbon emission efficiency of a province exhibits a significant positive spatial spillover effect, while the development of green finance in one province also has a pronounced positive spatial transmission effect on enhancing the carbon emission efficiency of surrounding regions.

The theoretical mechanisms diagram for all the above analyses is shown in Figure 1.

4 Measurement of carbon emission efficiency and green finance index in Chinese Provinces

4.1 Measurement of carbon emission efficiency

The concept of carbon emission efficiency was first introduced by Kaya (Nakićenović, 1997). The measurement of carbon productivity typically involves two approaches: single-factor carbon productivity and total-factor carbon productivity (TFCP). In the process of measuring TFCP, some scholars treat carbon emissions as an input factor, i.e., the environmental cost required to achieve growth (Gao et al., 2023; Song et al., 2023). Other scholars view carbon emissions as an “undesirable output” (Liu and Zhao, 2016; Li and Liu, 2022).

This paper adopts the perspective of Liu, C. J. and other scholars, treating carbon emissions as an undesirable output. The Super-SBM (Slacks-Based Measure) model is used to calculate the green total factor productivity (GTFP) as an indicator of carbon emission efficiency.

4.1.1 Construction of the Super-SBM model

The SBM model was first proposed by Tone (2001). This model introduces slack variables to address the limitations of traditional DEA (Data Envelopment Analysis) models, which do not account for the “slack” in input and output factors. By incorporating these adjustments, the SBM model provides a more precise assessment of efficiency. The Super-SBM model, an extension of the SBM model, was introduced by Tone (2002). The Super-SBM model effectively resolves the issue of the SBM model being unable to distinguish between efficient decision-making units (DMUs). Furthermore, compared to the single-factor carbon productivity model, the Super-SBM (Slack-Based Measure) model comprehensively considers multiple inputs and outputs, offering a more holistic evaluation perspective. Unlike Stochastic Frontier Analysis (SFA), which requires stringent assumptions about the error term, the Super-SBM model does not necessitate such strict assumptions, making it more suitable for multidimensional efficiency assessments. Therefore, this paper constructs the Super-SBM model to evaluate the efficiency of carbon emissions, which is expressed as follows:

In Equation 1:

Regarding the treatment of undesirable outputs in the Super-SBM model, this study adopts the framework of the Directional Distance Function (DDF) proposed by Tone (2001); Tone (2002), and integrates the methodologies of Liu and Zhao (2016) and Li and Liu (2022) to systematically address carbon emissions as an undesirable output. The core of the model lies in its directional optimization that explicitly distinguishes between desirable output (GDP) and undesirable output (carbon emissions): efficiency is improved by maximizing the slack variables (i.e., increasing redundancy) for desirable outputs, while undesirable outputs are constrained by minimizing their slack variables (i.e., reducing redundancy). The objective function is mathematically specified as follows:

In this formulation, the input slack variables

On the data processing side, provincial carbon emissions are calculated in strict accordance with the 2006 IPCC Guidelines for National Greenhouse Gas Inventories, employing a fossil fuel consumption and emission coefficient method:

where missing values are completed through interpolation to ensure data consistency and scientific rigor. In DEA Solver Pro 5.0, input variables (capital, labor, energy) are specified as “to be minimized,” the desirable output (GDP) is set “to be maximized,” and the undesirable output (carbon emissions) is set “to be minimized,” thereby explicitly defining the optimization direction of each variable. For example, if a province’s carbon emissions amount to one million tons, and its efficient Frontier benchmark is 0.8 million tons, the slack variable is

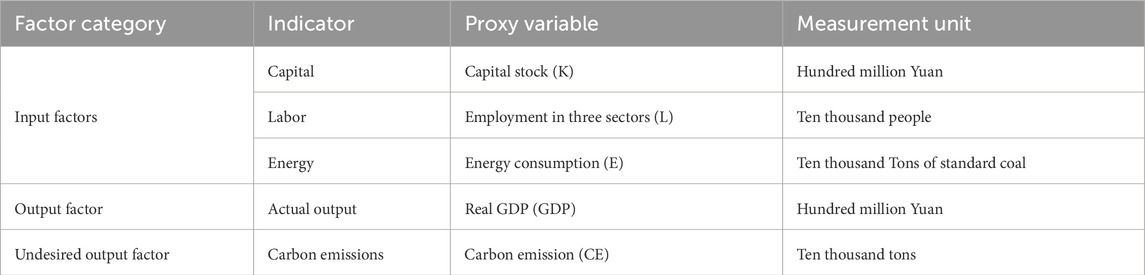

4.1.2 Data and indicator selection

This paper employs the Super-SBM (Slacks-Based Measure) model using DEA Solver Pro 5.0 software to construct a carbon emission efficiency measurement system, as shown in Table 1. The measurement system is applied to assess the carbon emission efficiency of 30 provinces, municipalities, and autonomous regions in mainland China from 2011 to 2023. The data sources include the China Statistical Yearbook, the China Energy Statistical Yearbook, and the statistical yearbooks of each province, municipality, and autonomous region.

4.1.2.1 Input factors

This paper adopts the method proposed by Liu, C. J. and other scholars to measure carbon emission efficiency. The input factors include capital stock, labor force, and energy consumption. Among these, the capital stock is calculated using the “perpetual inventory method” as referenced from Zhang, J. et al., with the base year set at 2006 and the unit being billion yuan (Zhang et al., 2004). The labor force indicator is measured by the total number of employees in the three major industries for the respective year, with the unit being ten thousand people. Energy consumption is selected as the indicator for energy input, with the unit being ten thousand tons of standard coal.

4.1.2.2 Output factors

The gross domestic product (GDP) of each province or region is used as the output factor indicator in this paper. Considering price changes, the base year is set at 2006, and the real GDP of each province or region over the years is adjusted using a deflator index.

4.1.2.3 Undesired output factors

In this paper, the carbon emissions of each province are taken as the undesirable output factor indicator for the Super-SBM model. Following the carbon emission estimation methods outlined in the “2006 IPCC Guidelines for National Greenhouse Gas Inventories” (Eggleston et al., 2006), this paper calculates the carbon emissions resulting from the consumption of fossil fuels across 30 provinces in mainland China, with the calculation formula presented in Equation 2.

where:

4.1.3 Measurement results

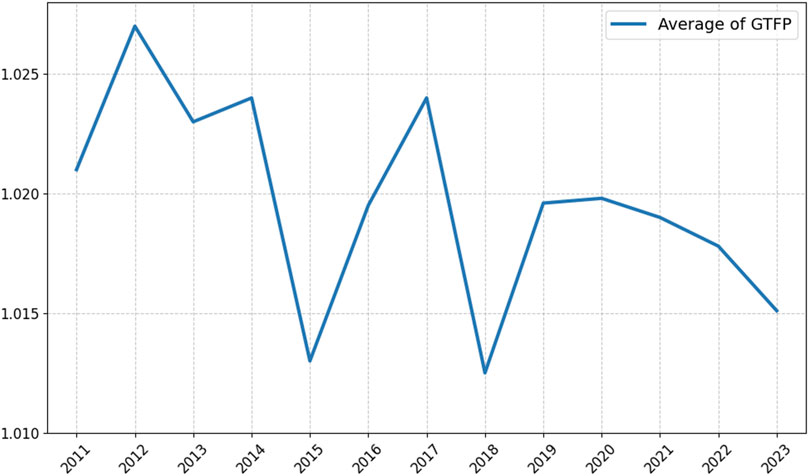

Figure 2 reports the average carbon emission efficiency of 30 provinces in mainland China from 2011 to 2023.

As shown in Figure 2, the overall trend of carbon emission efficiency in mainland China’s provinces from 2011 to 2023 is declining. There was significant fluctuation between 2014 and 2019, while after 2019, the changes in carbon emission levels in mainland China have become more stable. This indicates that the quality of economic development in mainland China has been gradually improving in recent years. However, to achieve steady improvements in carbon emission efficiency and realize green development, efforts must continue to focus on environmental protection and industrial structure upgrading.

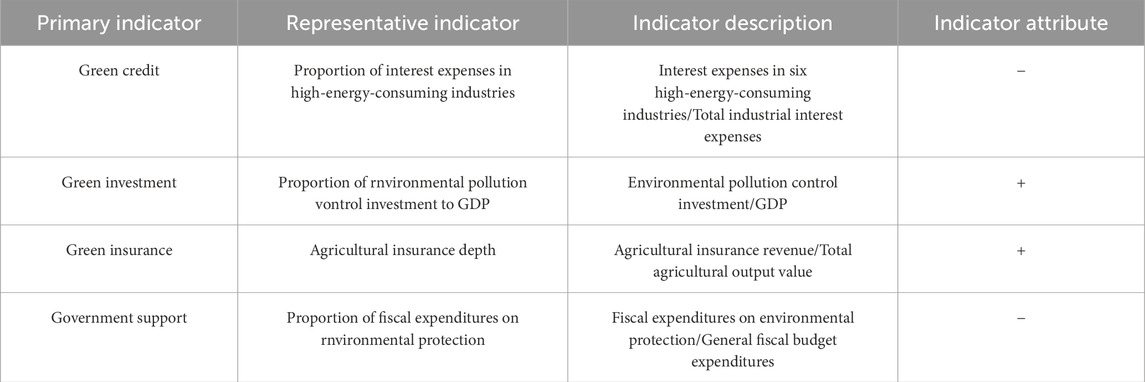

4.2 Measurement of green finance

4.2.1 Calculation method

The green finance system comprises four modules: green credit, green investment, green insurance, and government support. These modules form a comprehensive evaluation system for measuring the level of green finance development. The entropy method, grounded in information entropy theory, automatically assigns weights based on the distribution of data across indicators, thereby avoiding biases that can arise from subjective weighting. This method is applicable to various types of data and can handle both positively and negatively impacting indicators, making it suitable for constructing complex evaluation systems for green finance. Compared to subjective weighting methods such as the Analytic Hierarchy Process (AHP), the entropy method minimizes the influence of human judgment, enhancing the objectivity and reliability of the evaluation results. Unlike Principal Component Analysis (PCA), which requires dimensionality reduction, the entropy method directly computes weights using the original data, preserving the integrity of the information. Therefore, this paper adopts the entropy method to objectively assign weights to the indicators.

When applying the entropy method, it is first necessary to normalize the indicator data to determine the direction of the impact of each indicator on the entire system. When a single indicator has either a positive or negative impact on the indicator system, the calculation formulas are as follows:

In Equations 3, 4:

The calculation method for information entropy

Then, the formula for calculating the indicator weights is in Equation 7:

4.2.2 Composition of the indicator system

In recent years, the Chinese government has strongly supported the development of the national green economy and social sustainability. Green finance has become a crucial measure in promoting the growth of the green economy. Currently, China’s green financial products and services are primarily concentrated in areas such as green credit, securities, investment, funds, and insurance. Among these, green credit, green investment, and green insurance have seen relatively rapid development and account for the majority of the green financial market. Additionally, in recent years, the Chinese government has continuously increased its investment in environmental protection, ensuring the orderly development of the green economy through fiscal support.

In constructing the green finance indicator system, this study draws upon the conceptual framework of green finance discussed earlier and adheres to the principle of data availability. The evaluation system comprises four dimensions: green credit, green investment, green insurance, and government support. For green credit, the proportion of interest expenses in high-energy-consuming industries is selected as the representative indicator, with a negative attribute. This indicator reflects the extent to which financial institutions impose credit constraints on highly polluting industries; a lower proportion indicates a more effective reallocation of capital toward green sectors. Green investment is measured by the ratio of environmental pollution control investment to GDP, assigned a positive attribute, capturing the intensity of financial input in ecological improvement and the capacity for capital mobilization in promoting green transformation. Green insurance is represented by agricultural insurance depth, also with a positive attribute, as broader coverage reflects a more mature green risk protection mechanism and greater regional resilience to environmental shocks. Government support is assessed through the share of fiscal expenditures on environmental protection, assigned a negative attribute. Although a higher proportion indicates stronger policy support, it may also suggest an underdeveloped market mechanism, with green finance still heavily reliant on governmental intervention. Together, these four indicators comprehensively capture the development level of green finance from both market-driven and policy-driven perspectives. The Green Finance Indicator System for 30 Provinces in Mainland China is shown in Table 2.

4.2.3 Measurement results

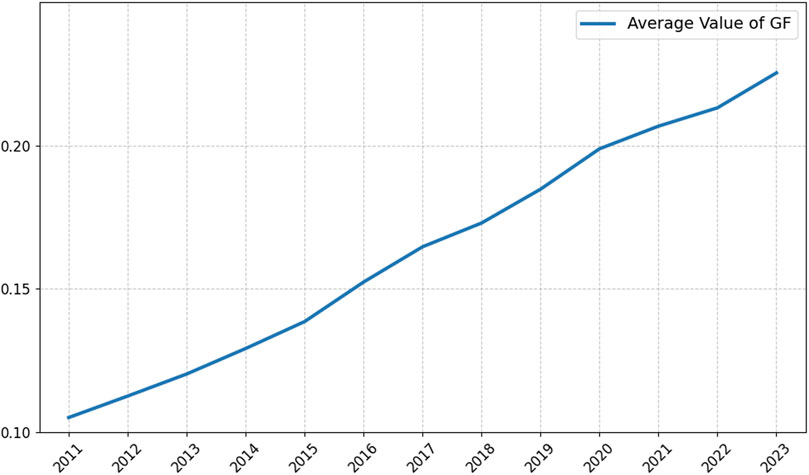

This paper constructs the aforementioned indicator system and employs the entropy method to measure the digital finance index for 30 provinces in mainland China from 2011 to 2023. The relevant data are sourced from the China Statistical Yearbook, the statistical yearbooks of each province, municipality, and autonomous region, as well as the China Insurance Yearbook. Figure 3 reports the average green finance index of 30 provinces in mainland China from 2011 to 2023.

Figure 3. Annual average values of the green finance index for provinces in mainland China (2011–2023).

The measurement results show that the green finance level in mainland China has exhibited a steady upward trend year by year. This indicates that under the guidance of green economic development and related policies in mainland China, the green finance industry has achieved significant progress.

5 Model construction, variable selection, and data sources

To validate the theoretical mechanisms and hypotheses of this study, we selected 30 provinces in mainland China from 2011 to 2023 as our research subjects. In the selection of models, spatial econometric models adequately account for spatial dependence and spillover effects among regions, revealing the complex spatial interactions between variables. Compared to Ordinary Least Squares (OLS), spatial econometric models effectively address issues of omitted variable bias and endogeneity, thereby enhancing the accuracy of estimation results. In contrast to other regional economic models such as gravity models, spatial econometric models focus more on the quantitative analysis of spatial correlations, making them particularly suitable for exploring the spatial effects among economic growth, green finance, and carbon emission efficiency. The panel regression model allows for the estimation of relationships between variables under different threshold values, facilitating the capture of structural shifts that occur with changes in key explanatory variables. This model is especially useful for evaluating differences in effects before and after policy implementation or across different stages of economic development, providing a scientific basis for policy formulation. Relative to simple linear panel models, panel regression models can better reveal nonlinear relationships, mitigating the risk of model misspecification. Compared to discrete choice models such as Logit or Probit, panel regression models are more appropriate for the nonlinear analysis of continuous variables, offering a more flexible methodological framework.

Therefore, we initially constructed a simple linear regression model to preliminarily analyze the impact of provincial economic growth targets and digital finance on carbon emission efficiency in China. Considering the dependencies between spatial units, we then built a spatial econometric model to further investigate the mutual relationships between digital finance and carbon emission efficiency under the constraints of economic growth targets, and to discuss the spatial spillover effects of the variables. Finally, we used economic growth targets as the threshold variable to construct a panel threshold regression model. This model aims to study the nonlinear impact of green finance on carbon emission efficiency under the constraints of economic growth targets, and to further explore the joint influence of economic growth targets and green finance on carbon emission efficiency.

5.1 Model construction

5.1.1 Construction of the simple panel regression model

To study the impact of green finance on regional carbon emission efficiency under the constraints of economic growth targets in 30 provinces of mainland China from 2011 to 2023, we constructed an econometric model as shown in Equation 8:

Furthermore, Model 2 (as shown in Equation 9) is obtained by incorporating the interaction term of the green finance index and economic growth targets into Model 1.

where:

5.1.2 Construction of the spatial econometric model

Spatial econometric models adequately account for the dependencies between spatial units, thereby correcting traditional econometric models. The constraints on economic growth targets and green finance in one region not only influence local carbon emission efficiency but also impact surrounding areas through spatial spillover effects. Therefore, this paper introduces spatial econometric models to examine the impact of economic growth targets and green finance on carbon emission efficiency across provinces in China from 2011 to 2023. Drawing on the research of LeSage and Pace (2009), this paper constructs the spatial autoregressive model (SAR), the spatial error model (SEM), and the spatial Durbin model (SDM) as Models 3 to 5, respectively.

In Equations 10–12:

5.1.3 Construction of the panel threshold model

To address the endogeneity issues present in the aforementioned models and to further investigate the impact of green finance on carbon emission efficiency under the constraints of local economic growth targets in China, this paper employs the nonlinear static panel threshold model proposed by Hansen (1999). In this model, the economic growth target (EGT) is used as the threshold variable, and the green finance index (GF) is the core explanatory variable. The model is specified as follows:

In Equation 13:

5.1.4 Spatial weight matrix

Given the frequent economic interactions among neighboring provinces and the presence of spatial spillover effects in carbon emission efficiency across adjacent regions, this study adopts a contiguity-based spatial weight matrix as the primary specification. In addition to contiguity matrices, alternative spatial weight structures based on economic distance or interregional trade intensity may offer distinct perspectives on spatial dependence. For example, an economic distance matrix can be constructed using indicators such as differences in GDP per capita, industrial structure similarity, or financial connectivity. These matrices are better suited to capturing non-geographic channels of interregional interaction, particularly in contexts where economic linkages extend beyond administrative boundaries. However, the adoption of such matrices requires careful consideration of data availability, definitional consistency, and theoretical justification. Within the context of China’s interprovincial policy diffusion and environmental governance, geographic proximity is often closely aligned with institutional coordination, infrastructure connectivity, and ecological zoning. Therefore, this study ultimately selects a contiguity-based spatial weight matrix. The matrix is defined in Equation 14:

5.2 Data and variable explanation

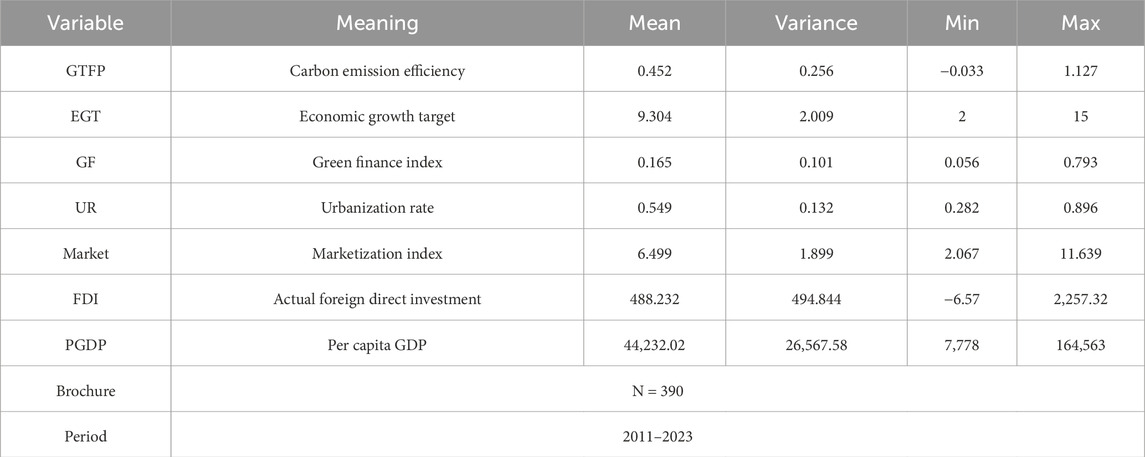

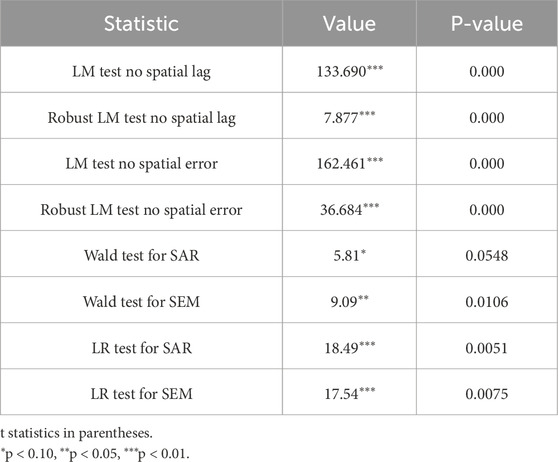

This paper examines the impact of economic growth targets and green finance on carbon emission efficiency in 30 provinces, municipalities, and autonomous regions of mainland China (excluding Hong Kong, Macao, Taiwan, and Tibet) from 2011 to 2023. Tibet was excluded primarily due to its distinctive economic development level, unique ecological environment, and data availability issues, which differ significantly from other provinces. Including Tibet could potentially affect the balance and robustness of the overall analysis. Although this exclusion may limit the generalizability of the findings to Tibet, it enhances the representativeness and applicability of the results for other regions in mainland China. Here, we explain the dependent variable, independent variables, and control variables, with descriptive statistics of the variables presented in Table 3.

5.2.1 Dependent variable

Carbon Emission Efficiency: Measured using the Super-SBM method to determine the carbon emission efficiency of each province.

5.2.2 Independent variables

5.2.2.1 Economic growth targets

Following the research by Yu and Yang (2017), this study uses a dummy variable approach to define economic growth targets. Data on economic growth targets are obtained from the annual government work reports of 30 provinces in mainland China, and the wording used in these reports to describe economic growth targets is categorized. When phrases such as “above,” “ensure,” or “strive for” appear in the description of economic growth targets, it indicates a more stringent economic growth target setting, which is coded as 1. Conversely, when terms like “around,” “about,” “between,” or “range” are used, it suggests a less stringent economic growth target setting, which is also coded as 0.

5.2.2.2 Green finance index

Constructed through a green finance evaluation indicator system and measured using the entropy method.

5.2.3 Control variables

To control for other factors that might influence carbon emission efficiency, this study selects the urbanization rate (UR), marketization process (Market), actual foreign direct investment (FDI), and per capita GDP (PGDP) for the period 2010–2023 in 30 provinces, municipalities, and autonomous regions of mainland China (excluding Hong Kong, Macao, Taiwan, and Tibet). The marketization process (Market) is measured using the marketization index, following the research by Xiao and He (2015). Missing data are interpolated where necessary. All data are sourced from the China Statistical Yearbook, the China Marketization Index, and the statistical yearbooks of respective provinces and regions.

6 Empirical results and analysis

6.1 Analysis of the simple panel regression model

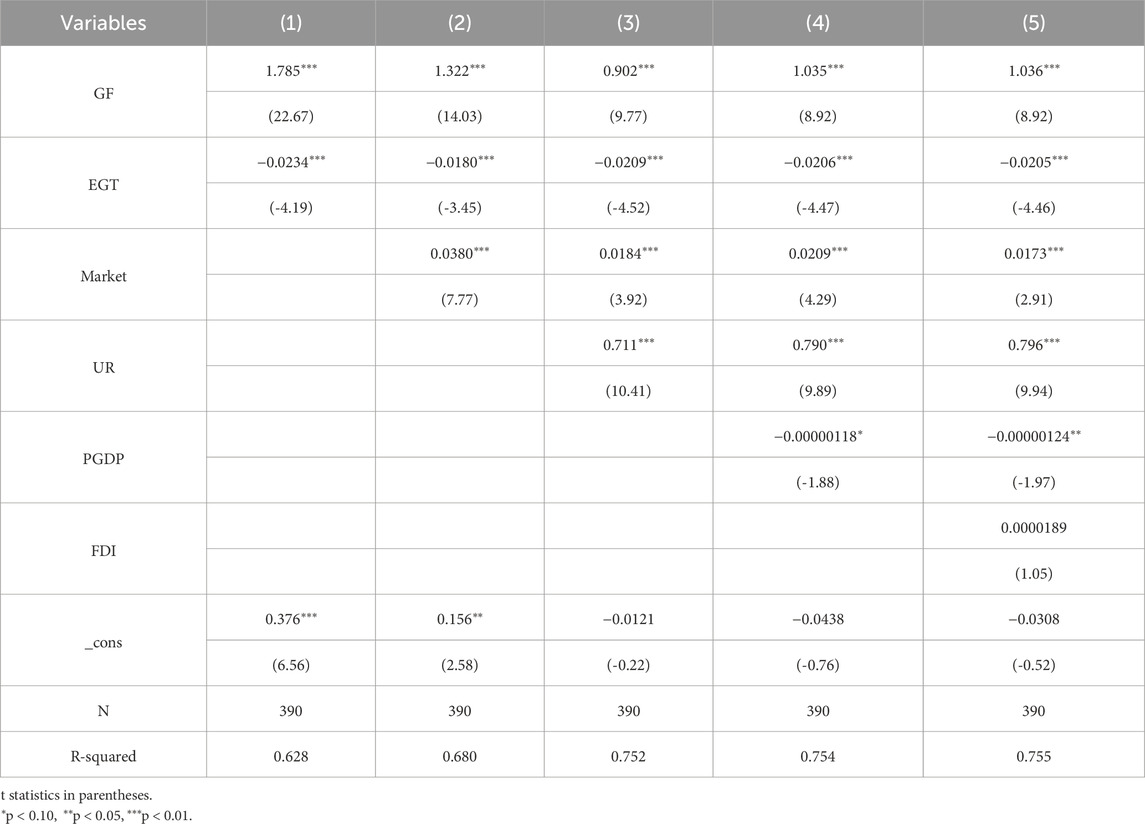

To initially explore the relationship between green finance, economic growth targets, and carbon emission efficiency, this study constructs a simple panel linear regression model for preliminary analysis. Table 4 reports the parameter estimation results of Model 1.

According to Table 4, the coefficients of the green finance index (GF) under different numbers of control variables are 1.785, 1.322, 0.902, 1.035, and 1.036, and all are significant at the 1% significance level. Therefore, it can be preliminarily concluded that green finance has a significant promoting effect on carbon emission efficiency. In Model 1, the coefficients of the economic growth target (EGT) under different numbers of control variables are −0.023, −0.018, −0.0209, −0.206, and −0.205, and all pass the 1% significance test. Therefore, it can be preliminarily concluded that economic growth targets have a significant inhibitory effect on carbon emission efficiency. From Model 1, this paper initially verifies the hypotheses presented earlier, namely, that green finance can effectively improve carbon emission efficiency and promote high-quality regional economic development by optimizing the industrial structure and reducing unintended outputs during the economic development process. On the other hand, economic growth targets, due to the existence of the “race to the bottom” effect, exhibit characteristics of “escalating pressure” and “competition for growth,” which significantly inhibit the optimization of the industrial structure.

Furthermore, the interaction term between the green finance index and the economic growth target was added to the model, and parameter estimation was conducted again. The results are presented in Table 5.

As shown in Table 5, the coefficients of the interaction term between the green finance index (GF) and the economic growth target (EGT) are all significantly positive at the 1% significance level. This indicates that the green finance index and the economic growth target have a significant joint positive effect on carbon emission efficiency. Therefore, it can be preliminarily inferred that the increase in economic growth targets can generate a “total investment effect,” thereby driving green finance to better exert its positive externalities.

6.2 Analysis of the spatial econometric model

6.2.1 Spatial applicability test

To initially assess the reasonableness of the model specification, this study draws on the research of Long et al. (2014) and uses the Global Moran’s I index to discuss the spatial clustering of the dependent and independent variables in the model. This index is used to test the spatial autocorrelation of the variables. The formula for the Global Moran’s I index is in Equation 15:

When the Global Moran’s I index is positive and closer to 1, it indicates high-high and low-low clusters, suggesting strong positive spatial autocorrelation. When the Global Moran’s I index is positive but closer to 0, it suggests the absence of spatial autocorrelation. When the Global Moran’s I index is between −1 and 0, it indicates negative spatial autocorrelation.

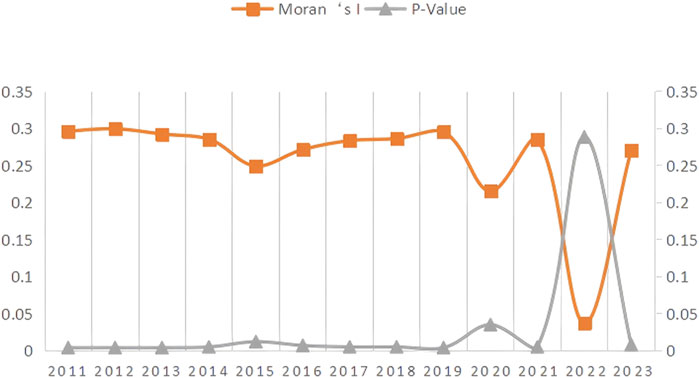

After calculation, the carbon emission efficiency of 30 provinces in mainland China from 2011 to 2023 only fails to reject the null hypothesis of no spatial correlation in 2022. For all other years, the null hypothesis of no spatial correlation can be rejected at the 5% significance level. The green finance index, however, rejects the null hypothesis of no spatial correlation at the 5% significance level for every year of observation, indicating significant spatial autocorrelation for this variable. The economic growth targets of the provinces, although not significantly spatially correlated in 2012–2014 and 2019, are significant in other years. This suggests that both the dependent and independent variables in this study exhibit strong spatial autocorrelation over the examination period, justifying the use of a spatial econometric model. Figure 4 reports the Global Moran’s I index and corresponding p-values for carbon emission efficiency over the examination period.

Figure 4. Global Moran’s I index and significance for carbon emission efficiency in Chinese provinces.

As shown in Figure 4, the observed values of carbon emission efficiency in Chinese provinces from 2011 to 2023, except for 2022, can reject the null hypothesis of no spatial correlation at the 5% significance level.

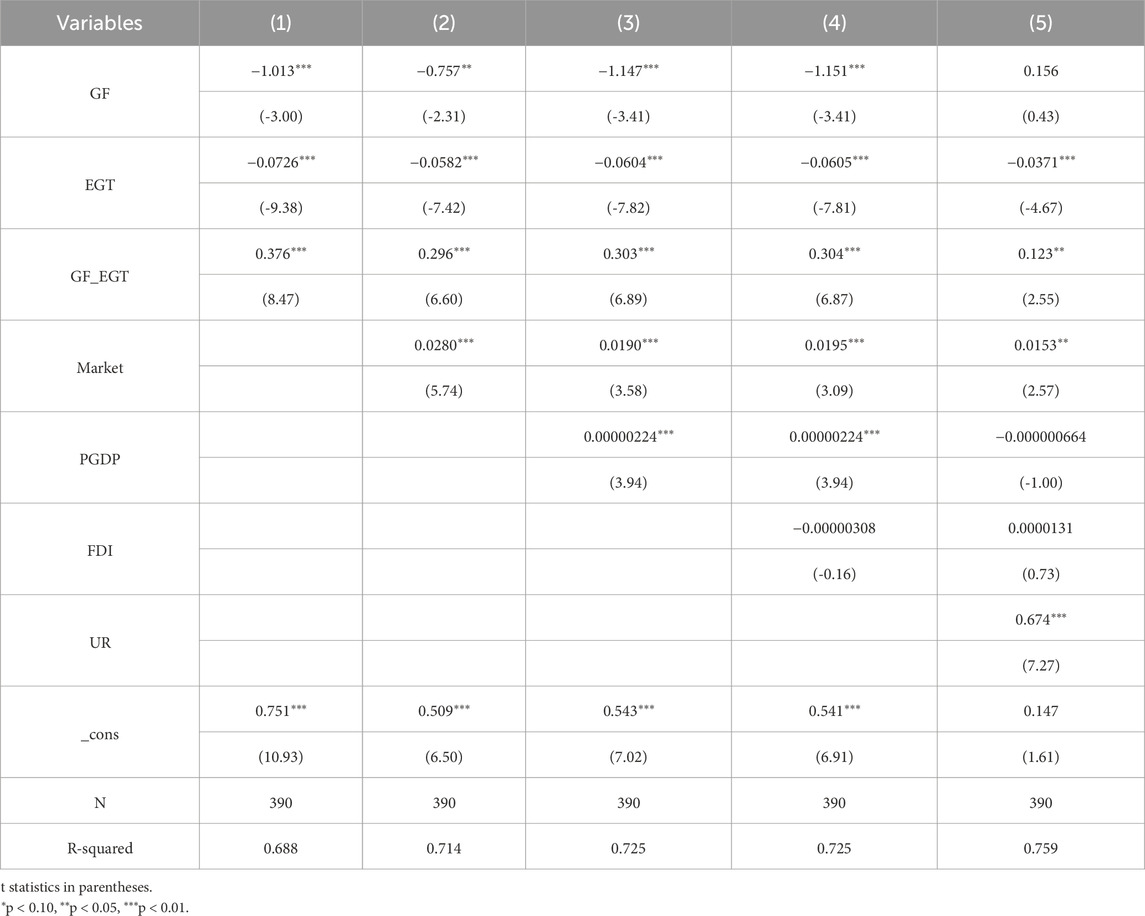

6.2.2 Identification, selection, and testing of spatial econometric models

This study will select an appropriate spatial econometric model from Models 3 to 5 and test its validity. Given that the spatial Durbin model (SDM) is a general form of both the spatial autoregressive model (SAR) and the spatial error model (SEM), we adopt the method proposed by LeSage and Pace (2009). Based on the OLS regression of the non-spatial panel model, we construct the Lagrange Multiplier (LM) statistic and its robust form (Robust LM) to test for the presence of spatial autocorrelation. The test results are presented in Table 6. Under the adjacency-based spatial weights matrix, both the spatial autoregressive model and the spatial error model pass the LM statistic and its robust form tests. Therefore, this study selects the spatial Durbin model.

To further validate the choice of the spatial Durbin model, we conduct a Wald test to compare the applicability of the spatial Durbin model with the spatial autoregressive model and the spatial error model. We also construct the Likelihood Ratio (LR) statistic to verify whether the spatial Durbin model can degenerate into the spatial autoregressive model and the spatial error model. Table 6 reports the results of these tests.

The test results show that the Wald test rejected the null hypothesis of choosing between the spatial autoregressive model and the spatial error model; therefore, this paper selects the spatial Durbin model as the superior choice. Moreover, the LR test results indicate that the spatial Durbin model does not degenerate into either the spatial autoregressive model or the spatial error model. Therefore, considering the above test results comprehensively, under the adjacency spatial weight matrix, this paper chooses the spatial Durbin model for analysis.

6.2.3 Regression analysis of the spatial Durbin model

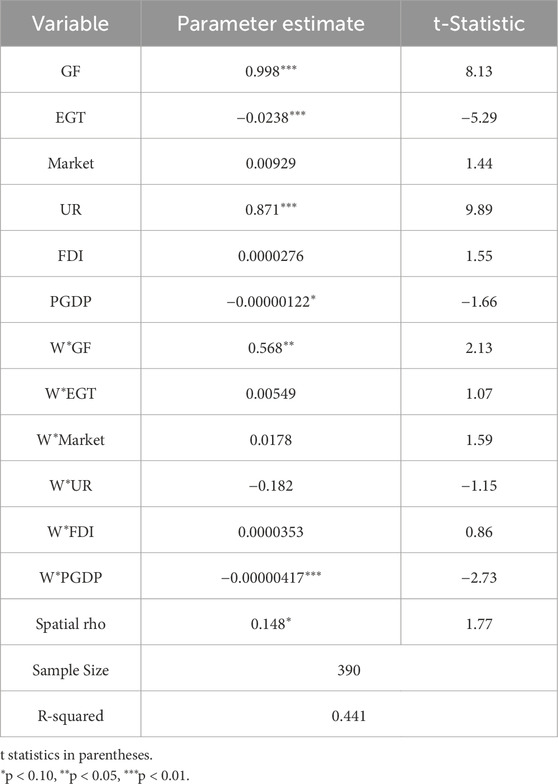

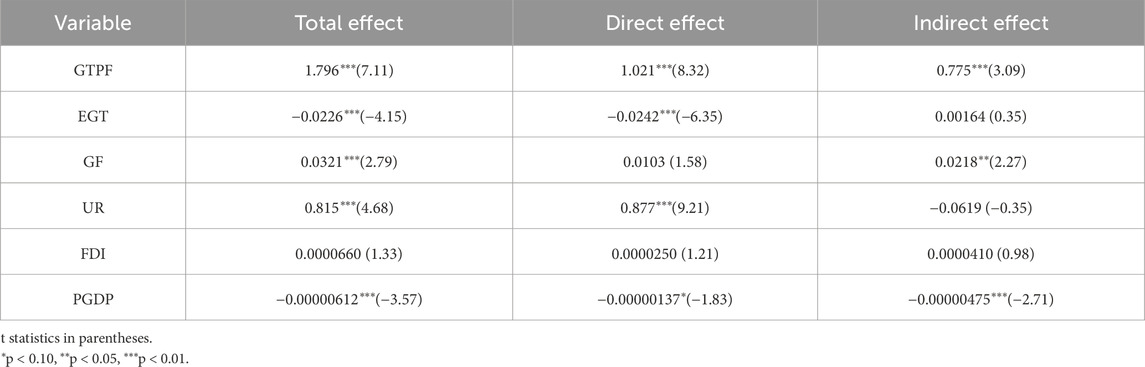

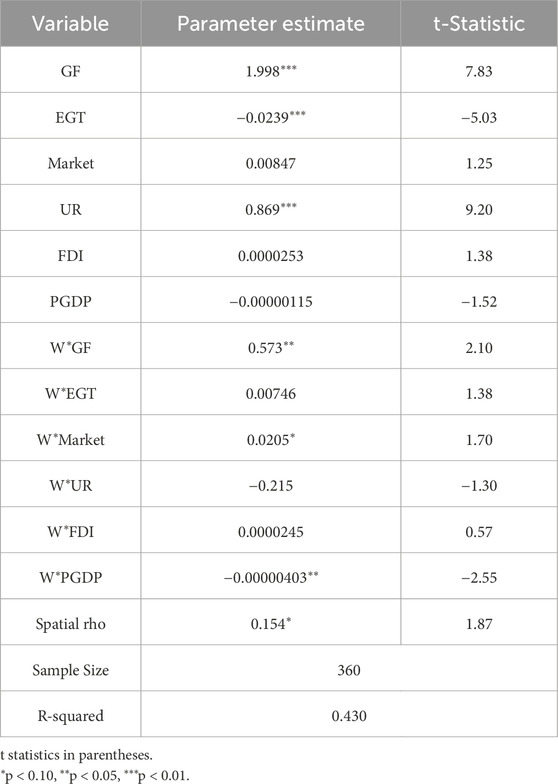

Based on the aforementioned theory, this study employs a fixed-effects spatial Durbin model for research purposes. Meanwhile, Stata 15.0 is used to estimate the parameters of Model 5, with the estimation results presented in Table 7.

According to Table 7, under the adjacency geographical spatial weight matrix, the spatial autoregressive coefficient is significant at the 10% level, with a value of 0.148. This indicates that carbon emission efficiency has a positive spatial spillover effect on itself, suggesting that due to frequent economic interactions between neighboring provinces, the carbon emission efficiency in Chinese provincial regions exhibits a pronounced suction effect. That is, the carbon emission efficiency of one province is positively influenced by that of its neighboring provinces. The reasons for this include the spillover of clean production technologies, the diffusion of green economic industries, and the nearby transition to a low-carbon environment associated with the improvement in neighboring provinces’ carbon emission efficiency, which promotes the enhancement of carbon emission efficiency in the home province.

Moreover, the coefficient of the Green Finance Index (GFI) is 0.998 and passes the significance test at the 1% level, indicating that the GFI has a significant positive impact on carbon emission efficiency, meaning that green finance can effectively promote the improvement of regional carbon emission efficiency. The coefficient of the economic growth target (EGT) is −0.0238, and it is significant at the 1% level, showing that EGT has a significant inhibitory effect on provincial carbon emission efficiency. This suggests that under the setting of overly rapid economic growth targets, Chinese provinces may fall into the trap of “competition for growth,” where the government tends to support the development of high-energy-consuming traditional industries within its jurisdiction and leans towards traditional financial sectors with higher returns, thereby suppressing the improvement of carbon emission efficiency. The estimation results from the Spatial Durbin Model (SDM) for the GFI and EGT are consistent with those from the two-way fixed effects model, verifying the correctness of theoretical hypotheses H1 and H2 in this paper.

The coefficient of W*GFI is 0.568 and passes the significance test at the 5% level, indicating that the GFI has a positive spatial spillover effect, and the development of green finance in neighboring provinces exerts a positive transmission effect on the carbon emission efficiency of the home province. This is because the development of green finance in surrounding areas can easily radiate and drive the development of green industries in the home province, thus forming a positive transmission mechanism for the carbon emission efficiency of the home province. The estimation result of W*EGT is not significant, suggesting that EGT does not have a noticeable spatial spillover effect. The reason for this is that EGT has strict territoriality; the economic growth target of one province only constrains economic activities within that province and has a weak constraint on the surrounding areas, making it difficult to form a significant transmission effect on the carbon emission efficiency of neighboring provinces.

6.2.4 Decomposition analysis of spillover effects in the spatial Durbin model

This paper uses Stata 15.0 to decompose the spillover effects in the SDM for further analysis, obtaining the decomposition results of direct effects, indirect effects, and total effects, as shown in Table 8.

As shown in Table 8, based on the adjacency geographical spatial weight matrix, the direct effect, indirect effect, and total effect of the Green Finance Index (GFI) on carbon emission efficiency are all significantly positive. This confirms that green finance not only has a direct positive impact on the carbon emission efficiency of the home province but also exerts a positive transmission effect on the carbon emission efficiency of neighboring provinces through economic activities. It is evident that vigorously developing green finance can effectively promote the improvement of carbon emission efficiency in Chinese provincial regions. Furthermore, when adjacent provinces collectively enhance their levels of green finance, a strong regional synergy effect can be formed, accelerating the development of regional green total factor productivity. In contrast, the economic growth target (EGT) has a significant inhibitory effect on the carbon emission efficiency of the home province, but its indirect effect is not significant, i.e., there is no spillover effect, which is consistent with the previous findings.

6.2.5 Robustness tests

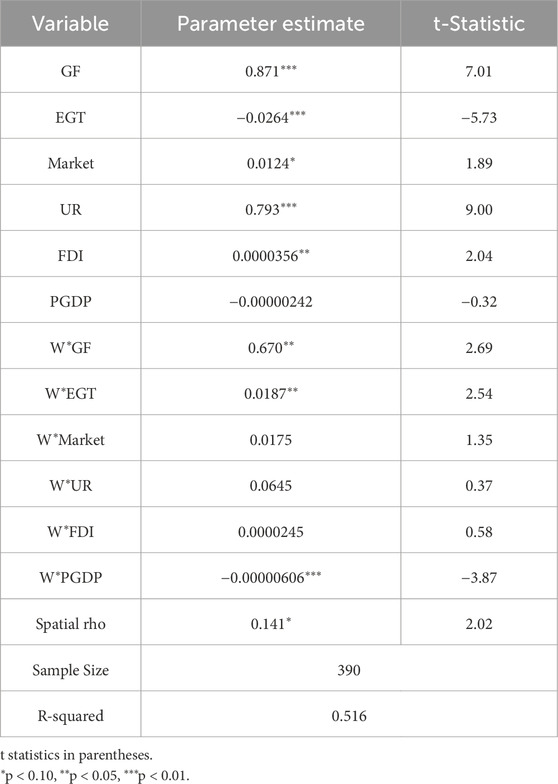

To corroborate the results of the Spatial Durbin Model (SDM), this paper conducts several robustness tests, including: adjusting the spatial weight matrix, excluding data from the first year, removing samples that might cause interference, considering the issue of omitted variables.

6.2.5.1 Adjusting the spatial weight matrix

According to the analysis in this paper, economic exchange activities between neighboring provinces are relatively close, and the explanatory variables in this study will generate spatial spillover effects among neighboring provinces. Therefore, this paper uses the adjacency geographical matrix as the spatial weight matrix. However, given that Hainan Province in China is an island without geographically adjacent provinces, and in reality, Hainan Province has close ties with the surrounding Guangdong Province and Guangxi Zhuang Autonomous Region, which may interfere with the analysis results of this paper. Hence, this paper adjusts the spatial weight matrix, setting Hainan Province as adjacent to Guangdong Province and Guangxi Zhuang Autonomous Region, respectively. The model 5 is re-estimated, and the estimation results are basically consistent with the previous ones. The analysis report is presented in Table 9.

6.2.5.2 Excluding data from the first year

Given that China’s current economic policies and development trends have changed significantly compared to the early period, earlier data may introduce bias into the model estimation. Therefore, this paper excludes the data from 2011 and re-estimates the model to verify its robustness. The estimation results are presented in Table 10 and are largely consistent with the previous findings.

6.2.5.3 Removing samples that might cause interference

This paper selects 30 provincial-level administrative regions in mainland China as samples. Among these, Beijing, Tianjin, Shanghai, and Chongqing are municipalities directly under the central government, which are either megacities or large cities in scale. These municipalities may differ from other provinces in terms of economic growth targets and the Green Finance Index (GFI). Therefore, this paper excludes the sample data from Beijing, Tianjin, Shanghai, and Chongqing, and re-estimates the model. The estimation results are presented in Table 11 and are largely consistent with the previous findings, further verifying the robustness of Model 5.

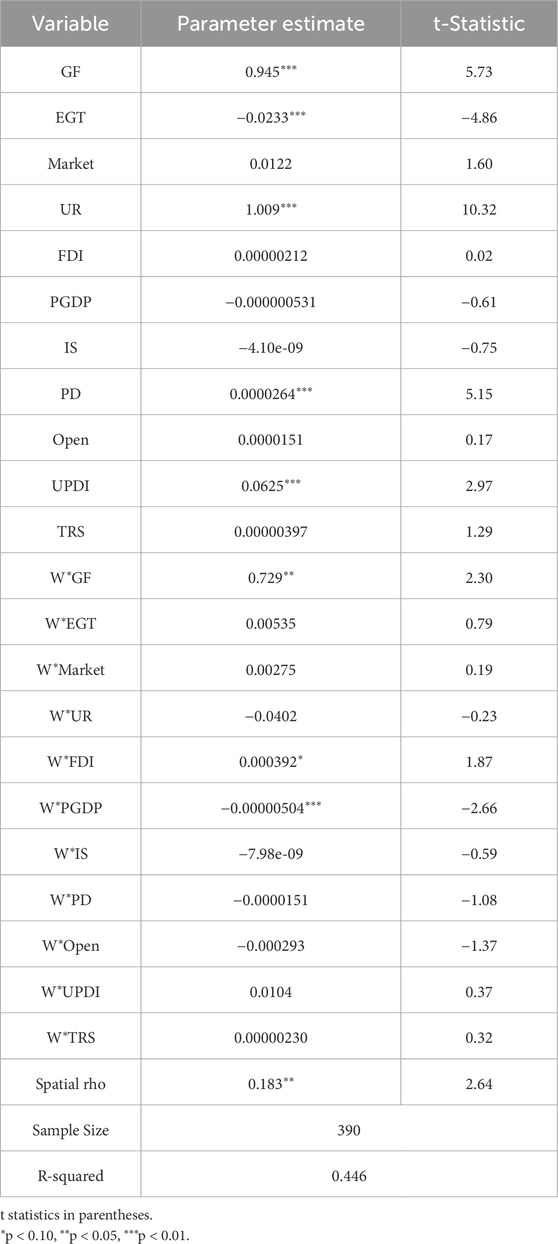

6.2.5.4 Considering the issue of omitted variables

In addition to the explanatory variables and related control variables mentioned above that affect carbon emission efficiency, other variables such as investment in science and technology (IS), population density (PD), openness to foreign trade (Open), urban and rural per capita disposable income (UPDI), and total retail sales of consumer goods (TRS) may influence regional green finance and carbon emission efficiency by affecting changes in regional industrial structure and overall technological levels. Therefore, this paper sequentially adds these variables to the original model and re-estimates it. The results are largely consistent with the previous estimates. Due to space limitations, Table 12 reports only the estimation results after including all omitted variables.

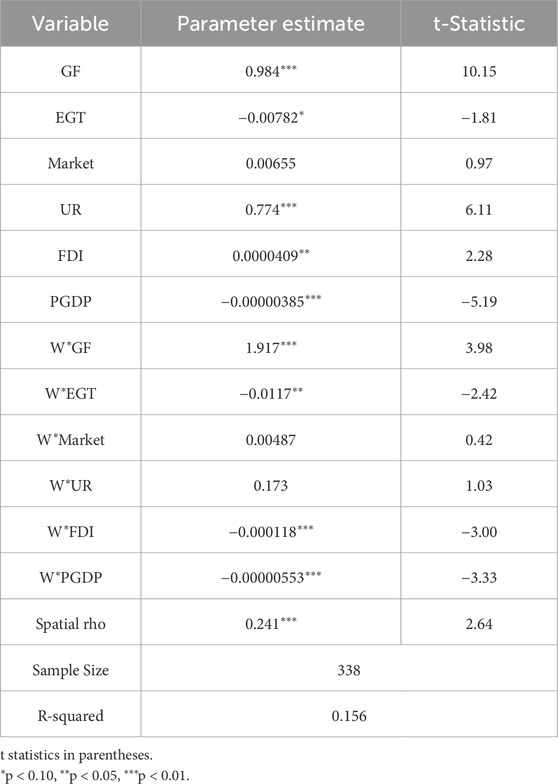

6.3 Analysis of the panel threshold model

6.3.1 Threshold effect test and determination of threshold values

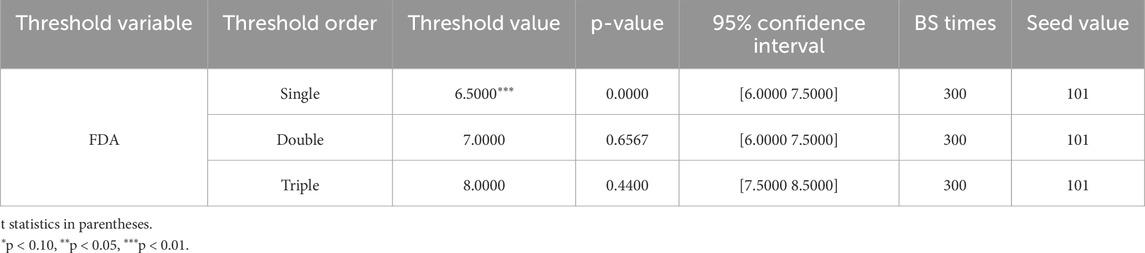

To address endogeneity issues and further explore the joint impact mechanism of economic growth targets and green finance on carbon emission efficiency, this paper selects the Green Finance Index (GFI) as the explanatory variable and the Economic Growth Target (EGT) as the threshold variable, constructing Panel Threshold Model 6. Using Stata 15.0, we conducted 300 bootstrap replications and performed a threshold freedom degree significance test for the threshold variable EGT under the assumption of no threshold effect. As shown in Table 13, the single-threshold effect test for Model 6 is significant, while the double-threshold and triple-threshold effects do not pass the significance test, indicating that the effective number of thresholds is 1.

6.3.2 Threshold regression results analysis

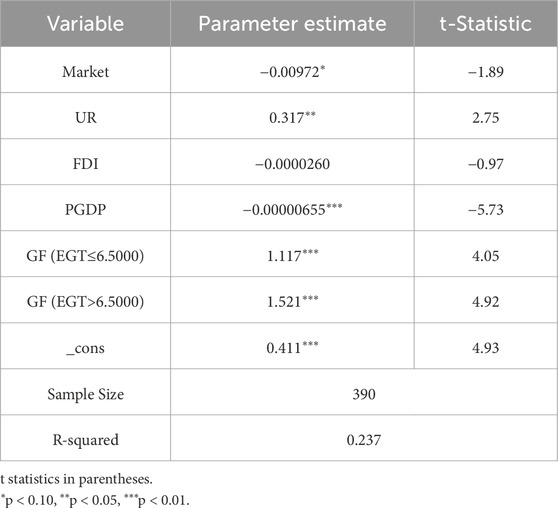

After the threshold effect test, the Green Finance Index (GFI) passed the significance test under the Economic Growth Target (EGT), confirming that the impact of green finance on carbon emission efficiency has a nonlinear characteristic. The parameter estimates for each variable are presented in Table 14.

According to Table 14, the level of green finance development (GF) has exerted a significant positive impact on carbon emission efficiency both when the threshold variable is below and above the threshold value, thereby revalidating the hypothesis presented in the preceding sections. Meanwhile, when the economic growth target is below the threshold value, the coefficient of the green finance index is 1.117; however, this coefficient increases to 1.521 when the economic growth target exceeds the threshold value. This phenomenon can be attributed to the notable “support effect” and “investment effect” (Mohaddes and Williams, 2020) brought about by the increase in provincial economic growth targets: the higher the set economic growth target, the easier it is for enterprises to obtain government support, thus alleviating their financing pressures. At the same time, a high economic growth target also drives enterprises to increase investment, which in turn intensifies financial activities to secure funds. Under the influence of the “support effect” and “investment effect,” the financial industry as a whole will experience further development, and green finance, as an essential component of the financial sector, will advance to a higher level. Therefore, with the elevation of economic growth targets, the positive externality of green finance will be correspondingly enhanced, and its boosting effect on carbon emission efficiency will consequently become more pronounced.

However, it must be acknowledged that although the enhancement of economic growth targets can strengthen the positive externality of individual factors such as green finance and increase their contribution to the improvement of carbon emission efficiency, under the long-term guidance of high-speed economic growth targets, the “race to the bottom” in governmental decision-making behaviors will intensify, driving the rapid development of energy-intensive industries. Thus, the positive externality generated by the promotion of green finance due to high-speed economic growth at a local level is far from compensating for its overall strong negative externality. Hence, in the spatial econometric model discussed earlier, the economic growth target exhibits a significant inhibitory effect on carbon emission efficiency.

7 Conclusion and policy recommendations

7.1 Conclusion

This study employed the Super-SBM method to measure the carbon emission efficiency of 30 provinces, municipalities, and autonomous regions in mainland China (excluding Hong Kong, Macao, Taiwan, and Tibet) from 2011 to 2023, considering carbon emissions as an undesirable output. By constructing a digital finance indicator system and applying the entropy method, we obtained the green finance index for each province over the years. Initially, a simple linear regression model was established to preliminarily analyze the impact of provincial economic growth targets and digital finance on carbon emission efficiency in China. Subsequently, taking into account the interdependencies between spatial units, a spatial econometric model was constructed, and the spatial Durbin model was selected through testing to further investigate the relationship between digital finance and carbon emission efficiency under the constraint of economic growth targets, including the discussion of spatial spillover effects. Finally, by setting the economic growth target as the threshold variable, a panel threshold regression model was constructed to explore the nonlinear impact of green finance on carbon emission efficiency under the constraint of economic growth targets, and to further examine the joint influence of economic growth targets and green finance on carbon emission efficiency. The main findings are as follows.

(1) The development of green finance significantly promotes the improvement of carbon emission efficiency. In contrast, economic growth targets have a significant inhibitory effect on the enhancement of regional carbon emission efficiency. Moreover, the estimation of the interaction term coefficient between green finance and economic growth targets fully validates the significant positive impact of economic growth targets on green finance.

(2) Based on the analysis using the spatial Durbin model, green finance not only has a direct positive impact on the carbon emission efficiency within the province but also positively influences the carbon emission efficiency of neighboring provinces through economic activities, reaffirming the critical role of green finance in improving carbon emission efficiency. Conversely, the “race to the bottom” trap formed by economic growth targets negatively affects the improvement of regional carbon emission efficiency.

(3) The analysis of the panel threshold model further discusses the joint impact of economic growth targets and green finance on carbon emission efficiency. The results show that, regarding the threshold variable of economic growth targets, green finance has a significant nonlinear impact on carbon emission efficiency. Under low and high levels of economic growth targets, green finance positively influences carbon emission efficiency. Higher economic growth targets enhance the development of green finance and strengthen its externality through the “support effect” and “investment effect,” forming a “total investment effect.” However, the current promoting effect of higher economic growth targets on green finance is insufficient to offset the negative impact caused by the “race to the bottom.”

7.2 Policy recommendations

Empirical results indicate that green finance not only facilitates the allocation of more financial resources from capital markets towards low-carbon and high-tech industries, effectively achieving energy conservation and emission reduction, but also drives industrial structure transformation and upgrading. By supporting the research and development of high-tech and green technologies, green finance improves traditional production models characterized by high energy consumption and low output, ultimately leading to greater output with lower environmental costs in the long term. However, the characteristic of “incremental pressure” and “rigid constraints” associated with economic growth targets can trap regions in a “race to the bottom.” This phenomenon is partly due to the current tournament-style official promotion system and collusion between government and businesses, which hinder the high-quality development of regional economies. Additionally, green and low-carbon industries often feature complex technology, long cycles, and low short-term returns, making it more likely for governments to allocate more resources to traditional industries to achieve short-term economic benefits under limited resource conditions. Nevertheless, it should be noted that the setting of economic growth targets in China has partial positive implications for the development of green finance, as the “total investment effect” can drive green finance to better realize its positive externalities. Clarifying the relationships among these three factors and altering the path of economic development could maximize economic benefits.

Based on the above conclusions, the following policy recommendations are proposed.

(1) To mitigate the “race to the bottom” effect induced by economic growth targets, it is essential to advance the reform of the official performance evaluation system and establish a more scientific and comprehensive framework for assessing political achievements. Specifically, the weight assigned to regional GDP growth rates should be appropriately reduced, while key indicators such as green total factor productivity, carbon emission efficiency, and improvements in environmental quality should be integrated into the core of the evaluation system. This would promote a shift from evaluating officials based solely on GDP growth to emphasizing high-quality green development. In addition, a differentiated and classified assessment mechanism should be developed to set reasonable green development goals based on each region’s natural endowments, stage of development, and functional positioning, thereby avoiding uniform growth pressures that may trigger irrational competition. It is also recommended to introduce third-party institutions to conduct green performance evaluations, enhancing data transparency and the credibility of assessments. Furthermore, a balanced accountability and incentive mechanism should be established to strengthen penalties for environmentally harmful behaviors and to encourage local governments to prioritize ecological benefits and long-term interests in the pursuit of development.

(2) The central and local governments should strengthen support for the green finance industry, in line with the goals of “peak carbon emissions” and “carbon neutrality,” and fully leverage green finance as a critical tool in the carbon neutrality process. To achieve this, on one hand, policy incentives should be employed to scale up green finance. These include interest subsidies for green credit, tax exemptions for green investments, and risk compensation mechanisms for green bond issuance. Such measures can enhance the share of green finance in the capital market and regulate or eliminate financial practices that hinder high-quality regional development.

On the other hand, a scientific evaluation system for green finance should be established, and certification standards—represented by green bonds—should be promptly improved and unified. Furthermore, it is crucial to tighten supervision of “greenwashing” behaviors and impose legal penalties to maintain the integrity of the green capital market.

Given the current challenges facing green finance—such as technological complexity, long investment cycles, low profitability, high policy risks, and information asymmetry—governments should also formulate long-term development goals and implementation roadmaps. Specifically, a national-level Green Industry Development Fund should be established to attract social capital into green investment projects. This fund should prioritize areas like clean energy and energy conservation and emission reduction. Financial attractiveness can be further enhanced through mechanisms such as interest subsidies and risk-sharing arrangements. Additionally, a strict approval mechanism for green financial products should be enforced to prevent greenwashing, and enterprises that violate regulations should face legal penalties to ensure compliance.

(3) Given the partial promoting effect of economic growth targets on green finance, it is important to better coordinate the relationship between these two policy domains. First, green finance should be integrated into the macroeconomic policy framework, with regional green finance development plans aligned with local economic development strategies. Local governments should set quantitative targets for green finance alongside economic growth goals and guide resource allocation through fiscal subsidies and tax incentives. For example, while restricting investments in high-carbon industries, governments can offer interest subsidies and risk compensation mechanisms for projects that meet green standards to enhance the attractiveness of green investments. Second, a cross-departmental coordination mechanism should be established to ensure policy alignment among environmental, fiscal, and financial authorities, avoiding fragmentation and promoting systemic development of green finance. Additionally, governments should adopt flexible economic growth targets based on regional resource endowments, and implement differentiated support measures in regions with lower growth targets—such as dedicated green project subsidies, tax breaks for green bonds, and preferential interest rates for green loans—to reduce marginal financing costs and stimulate green investment. Infrastructure supporting green finance should also be enhanced, including standardized green classification systems, improved disclosure mechanisms, and robust risk assessment capabilities to ensure transparent and regulated operations.

(4) Given the threshold and spatial spillover effects of economic growth targets on green finance, policy design should be adapted to regional conditions. In regions with strong institutional frameworks and well-established green finance systems, efforts should focus on optimizing regulatory environments and legal frameworks to fully unlock the positive influence of economic growth targets. For instance, such regions could pilot comprehensive green finance reform zones, promote innovation in green financial products, and establish tools like carbon trading platforms and green insurance systems to support low-carbon transitions. In contrast, for regions with weak green finance foundations, the priority should be improving institutional quality and administrative capacity. This may include offering training in green finance, strengthening cooperation between governments, banks, and enterprises, and cultivating local green finance expertise to enhance investment capacity. Moreover, interregional collaboration should be strengthened by creating joint mechanisms for green finance development, such as mutual recognition of green credit standards and the development of shared information platforms. This can prevent regional fragmentation and promote policy coherence. By accounting for both threshold and spatial spillover effects, synergistic policy outcomes can be achieved across regions, enhancing the overall effectiveness of green finance in promoting sustainable development.

7.3 Research limitations

This study has two primary limitations. First, the contiguity-based spatial weight matrix primarily reflects geographical proximity, which may overlook deeper dimensions of spatial correlation, such as economic connectivity, trade intensity, or institutional similarity. Future research could construct more nuanced spatial structures to better capture the multifaceted channels through which green finance and carbon emission efficiency interact across regions. Second, although this study adopts a nationwide sample to reveal generalizable patterns, it does not conduct subgroup analysis between coastal and inland provinces. While the core mechanisms remain directionally consistent, future work could introduce finer regional typologies to uncover potential heterogeneity in spatial dynamics and policy impacts.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

JJ: Conceptualization, Data curation, Formal Analysis, Investigation, Methodology, Resources, Software, Validation, Visualization, Writing – original draft, Writing – review and editing. XY: Investigation, Resources, Writing – original draft, Writing – review and editing. KL: Conceptualization, Project administration, Writing – review and editing.

Funding