- Institute of Agricultural Economics and Development, Chinese Academy of Agricultural Sciences, Beijing, China

The seed industry stands as a vital strategic sector critical to a nation’s agricultural security and food sovereignty. Researching the optimization of resource allocation within seed enterprises is pivotal for advancing national food security and agricultural modernization. Utilizing micro-survey data from China’s corn seed enterprises spanning from 2018 to 2022, this paper empirically analyzes the impact and mechanisms of capital resource mismatch and labor resource mismatch on the competitiveness of corn seed enterprises. The findings reveal that: (1) Capital resource mismatch hinders the enhancement of competitiveness among corn seed enterprises, whereas labor resource mismatch boosts their competitiveness. (2) The phenomenon of “financial ownership discrimination” persists, with capital resource mismatch impeding the competitiveness of non-state-owned corn seed enterprises; concurrently, the “incentive” effect of labor resource mismatch is more pronounced among state-owned corn seed enterprises. (3) In comparison to technology-oriented corn seed enterprises, capital resource mismatch has a significant positive influence on the competitiveness of basic corn seed enterprises, whereas labor resource mismatch has a notable negative impact. (4) The dual technical barriers posed by executives and employees alleviate the inhibitory effect of capital resources on the competitiveness of corn seed enterprises but simultaneously impede the promotional effect of labor resource mismatch. (5) In line with the mismatch effects observed at the micro-enterprise level, labor resource mismatch in the macro factor market also demonstrates a significant positive effect on the competitiveness of corn seed enterprises. Our research findings offer a specific business context for enterprise resource allocation strategies, facilitating the efficient operation of the seed industry system and promoting the healthy development of the seed industry.

1 Introduction

A perfectly competitive market structure can achieve Pareto optimality, efficient resource allocation, and the free flow of factor resources from inefficient to high-efficiency sectors through the mechanism of the “invisible hand.” However, its stringent assumptions mean it rarely materializes in practice, hindering the optimal allocation of factor resources. As a result, resource misallocation has emerged as a common economic phenomenon. Existing literature has documented the widespread nature of resource misallocation across economies worldwide (Lin et al., 2025; Easterly and Fischer, 1995; Banerjee and Moll, 2010). Analyzing resource misallocation at the industry level acts as a critical link connecting macroeconomic theories to micro-level industrial dynamics, enabling the decomposition of national “aggregate losses” into intra-industry “structural contradictions.” In the seed industry, resource misallocation exerts distinct impacts on industrial security: as a core segment of the agricultural value chain, the seed industry’s stability hinges on rational resource allocation and coordinated development across its segments, which in turn underpins the integrity of the broader industrial and supply chains. The seed industry is inherently both capital- and labor-intensive, demanding substantial inputs in both factors. Within the crop seed sector, the corn seed industry stands out for its high commercialization and representativeness. As one of the world’s largest corn producers and consumers, China’s annual corn output has remained stable at over 260 million tons, cultivated across more than 40 million hectares. Its yield and quality directly influence food security, feed supply, and stability across upstream and downstream segments of the industrial chain (National Corn Industry Technology System, 2020). Yet, China’s corn seed industry remains characterized by large scale but relative underdevelopment. In this context, improving resource allocation efficiency in the corn seed industry has become pivotal to addressing this challenge. Misallocation of capital, labor, and other factors not only directly impairs the competitiveness of seed enterprises but also risks jeopardizing the bedrock of national food security through transmission effects across the industrial chain.

Corn seed enterprises represent a critical segment of the seed industry. According to the Report on the Development of China’s Crop Seed Industry, these enterprises exhibit the highest commercialization rate among crop seed producers in China and constitute the largest proportion within the sector. The factor market—functioning as an allocative mechanism (Markman et al., 2009)—remains essential for enhancing enterprise competitiveness. During the 2021 review of the Action Plan for Seed Industry Revitalization, the Central Commission for Comprehensively Deepening Reform emphasized concentrating technological, financial, and human capital resources in key enterprises with competitive advantages. As a dual-factor intensive sector (capital and labor; Li et al., 2024), corn seed enterprises face constraints from inefficient resource allocation. This inefficiency creates rigidities in internal resource mobility, impeding sustainable development. Amid the transformation of the seed industry, resources like capital and labor are rapidly flowing into the sector. To what extent does improved resource allocation efficiency enhance enterprise competitiveness? What mechanisms drive this impact? Addressing these questions holds significant implications for advancing China’s dual priorities of seed industry revitalization and factor marketization reform in the 21st century.

Resource misallocation occurs when distorted factor prices impede market-driven allocation, deviating from Pareto optimality (Hsieh and Klenow, 2009). Current literature identifies three principal perspectives on its economic effects: Firstly, resource misallocation hinders economic output. Macro-level misallocation significantly reduces total factor productivity (TFP) through administrative monopolies that enable ownership discrimination (Brandt et al., 2013), regional market fragmentation (Young, 2000), and household registration restrictions (Reid and Rubin, 2003). At the micro level, it constrains technological innovation by creating technological disparities, suppressing R&D investment, and exacerbating financing constraints (Moll, 2014; Hottenrott and Peters, 2012; Greenwood and Jovanovic, 1990; King Robert and Levine, 1993; Huang et al., 2023). Secondly, resource misallocation exhibits a complex nonlinear impact on economic efficiency. Studies demonstrate complex nonlinear relationships—including inverted U-curves and threshold effects—between misallocation and economic performance. These manifest in firm productivity (Zajac and Kraatz, 1993), dual-directional factor agglomeration (Maskus et al., 2012; Guariglia and Liu, 2014), and production factor optimization (Shen et al., 2014). Thirdly, resource misallocation has minimal impact on economic efficiency. Some research suggests limited TFP impact: factor mismatch explains only minor TFP differentials (Yao, 2009), reallocation efficiency remains low (Moll, 2014), and structural dividends prove insignificant (Tu and Xiao, 2005).

Methodologically, most existing studies take a production efficiency approach, using models such as DEA (Data Envelopment Analysis) (Godoy-Durán et al., 2017), SBM (an extension of DEA) (Wang et al., 2020; Choi et al., 2018), and SFA (Stochastic Frontier Analysis) (Yang et al., 2020) to measure resource allocation efficiency. These studies largely center on macro-level performance metrics, including production frontiers and technological efficiency. In recent years, as research on resource misallocation has grown in prominence, scholarship in this domain has advanced, spurring diverse perspectives on resource allocation—such as quantity allocation, quality matching, and cost deviation. For example, indices like the employment mismatch index and skill mismatch index are used to measure the extent of quality mismatch within the labor force (Liu et al., 2022; Guvenen et al., 2020; Addison et al., 2020; Li and Zhang, 2023).

While existing literature has extensively explored the economic effects of resource misallocation in firms—laying a solid foundation for this study—several research gaps remain. Specifically, (1) most studies focus on how resource misallocation impacts the economic performance of industrial enterprises (Yuan et al., 2025; Wang et al., 2025), with far less attention to its effects on agricultural enterprises, particularly seed companies. Historically, China’s industrial development relied on an “urban–rural scissors gap” that extracted resources from agriculture, creating a significant competitiveness gap between seed enterprises and industrial firms. As rational resource allocation is critical to high-quality development in seed enterprises, misallocation directly affects their competitiveness. Investigating this relationship can thus reveal the inherent mechanisms of resource misallocation within seed enterprises, offering theoretical support for optimizing allocation strategies. Furthermore, (2) scholarship remains limited regarding “financial ownership discrimination” and technological heterogeneity in the seed industry. Due to differentiated access to financing, state-owned and private seed enterprises face markedly different levels of resource misallocation. Additionally, the corn seed sector encompasses diverse businesses with wide variations in technological capacity. A thorough analysis of how resource misallocation affects these enterprises’ competitiveness must therefore account for disparities in ownership structures and technological capabilities. Finally, (3) while some studies address resource misallocation from a managerial perspective, they overlook moderating mechanisms at the employee level. In firm research, employees— as key human capital—possess knowledge, skills, and abilities central to value creation. When misallocation hinders factor mobility, both executives and employees tend to develop technical barriers. It is thus imperative to examine how these “dual technical barriers” moderate the impact of resource misallocation on corn seed enterprises’ competitiveness.

Building on this, this study draws on micro-level survey data from corn seed enterprises covering 2018–2022 to empirically assess how capital and labor resource misallocation affect the competitiveness of such enterprises. It further explores the moderating role of dual technical barriers among executives and employees in shaping how resource misallocation influences the competitiveness of corn seed enterprises.

2 Theoretical analysis and research hypotheses

2.1 Characteristic facts of resource mismatches

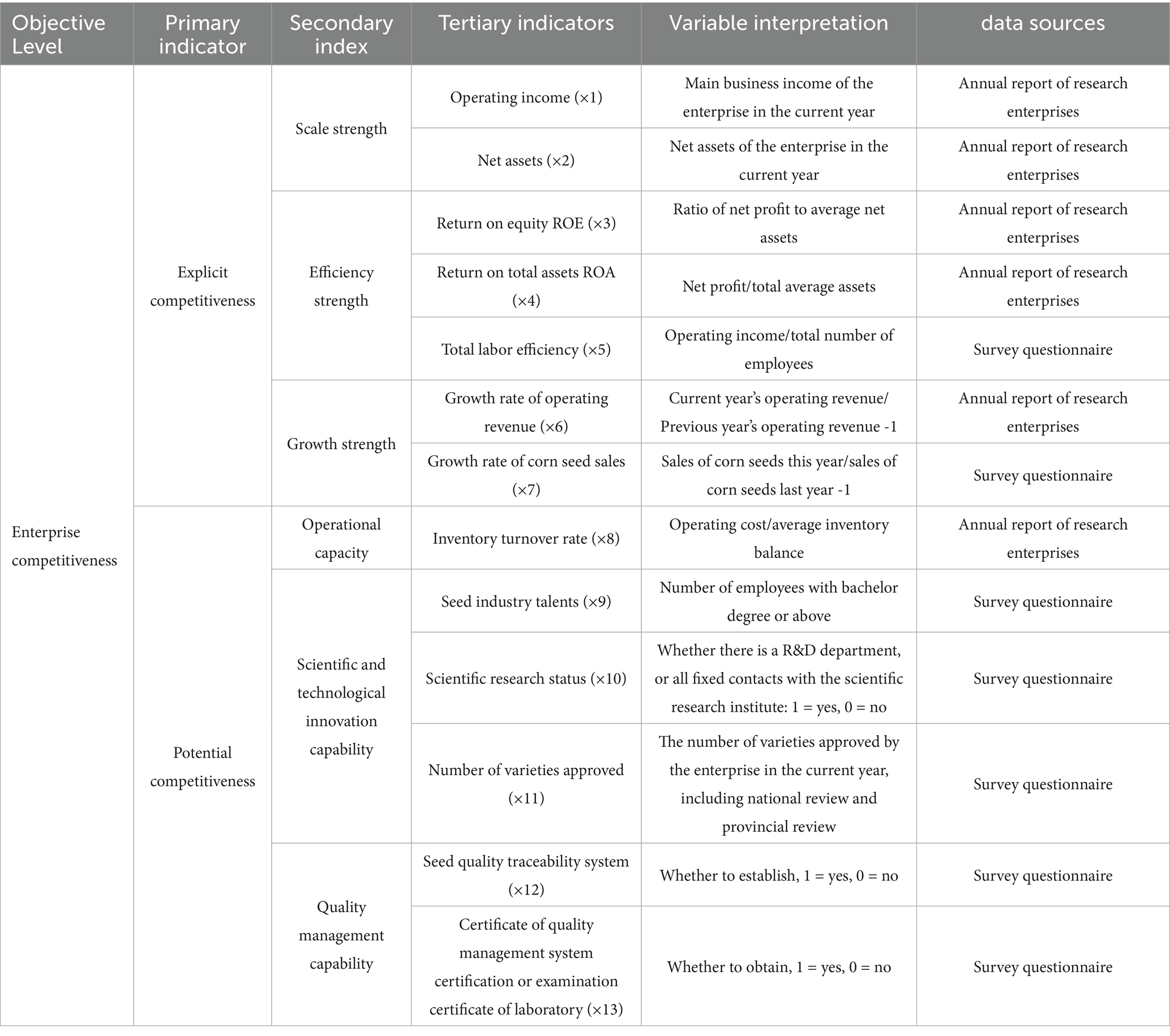

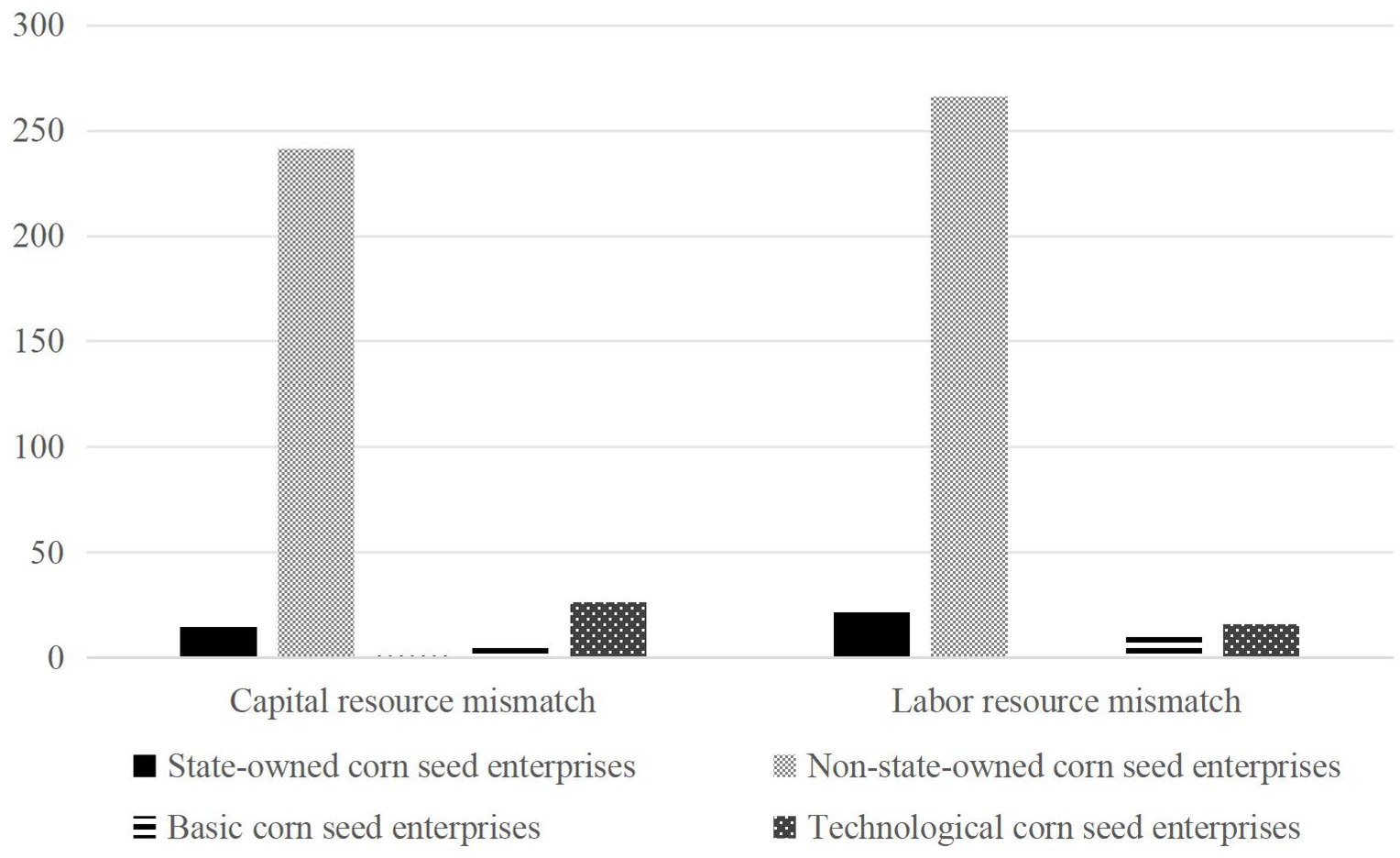

From Figure 1, it can be seen that from 2018 to 2022, China’s corn seed enterprises have varying degrees of resource mismatch in different ownership structures and technological levels. Firstly, in terms of ownership structure, the degree of mismatch in capital and labor resources was significantly lower in state-owned enterprises compared to non-state-owned corn seed enterprises. State-owned corn seed enterprises enjoyed greater support in terms of funding, credit, and other aspects, along with inherent policy advantages and preferential resource allocation. Secondly, regarding the technological level of seed industry enterprises, both capital and labor resource mismatches were more pronounced in technology-oriented corn seed enterprises than in basic corn seed enterprises. Technology-oriented corn seed enterprises required substantial investments in research and development (Huang, 2024), and the uncertainty surrounding the outcomes of new variety research and cultivation made capital acquisition more challenging, leading to capital resource mismatches. Additionally, these enterprises had a high demand for high-end scientific and technical talents, coupled with higher costs for labor screening and training, which increased the likelihood of labor resource mismatches.

Figure 1. Distribution characteristics of misallocation of resources in property rights and technological level of corn seed enterprises in China from 2018 to 2022.

2.2 Analysis of the impact of resource mismatch on the competitiveness of corn seed enterprises

2.2.1 Analysis of the impact of capital resource mismatch on the competitiveness of corn seed enterprises

The financial market in China is constantly expanding, but financial misallocation has led to increased financing costs for enterprises.1 This misallocation, arising from distortions in the financial market, suppresses the enhancement of corporate economic performance and prevents the financial market’s financing channels from effectively boosting enterprise competitiveness (Lv and Wang, 2019). Compared to other industries, the competitiveness of corn seed enterprises is more vulnerable to the effects of capital resource mismatch, ultimately hindering the advancement of their competitiveness (Figure 2).

Figure 2. The impact mechanism of mismatch of capital resources and labor resources on the competitiveness of corn seed enterprises.

Firstly, the mismatch of capital resources suppresses the investment of R&D capital by enterprises (Chen and Wang, 2025). Corn seed enterprises possess a dual externality stemming from both corn production and seed industry. The research and development of corn seed enterprises exhibits both public welfare and positive externalities. As a segment of agriculture, the seed industry inherently possesses positive externalities. The misallocation of capital resources will deprive “efficient but underfunded” enterprises of sustained and stable external financing, making it difficult to secure research and development funding (Barth et al., 2001; Akcigit et al., 2022). Simultaneously, the misallocation of capital resources can also hinder “inefficient yet well-funded” enterprises from leveraging their financing advantages (Souder and Shaver, 2010), thus preventing them from supporting high R&D investment. Consequently, the mismatch of capital resources results in the unreasonable allocation of R&D investment to the R&D process, which will undermine the ability of corn seed enterprises to launch competitive new varieties, particularly those with high-quality, high-yield, and strong stress resistance, whose market competitiveness will significantly decline.

Secondly, the mismatch of capital resources leads to a lag in the output of technological innovation in enterprises (Fan et al., 2022). The high risk associated with variety innovation in corn seed enterprises results in a lack of technical equipment support for their innovation outputs. Failure to promptly introduce advanced breeding technologies and equipment will significantly hinder their progress in areas such as genetically modified and gene editing technologies. With the deepening of the mismatch of capital resources, the risk of innovation activities stagnating due to financing gaps has multiplied for “efficient but low-funded” seed enterprises. On the one hand, this will greatly reduce the success rate of enterprise innovation (Kapetaniou et al., 2018); on the other hand, even if the innovation output is successful, insufficient supporting equipment such as fixed asset investment, intangible asset investment, and salary incentives caused by capital resource mismatch will greatly reduce the efficiency and quality of innovation outputs for corn seed enterprises. Although corn seed enterprises with “low efficiency but high financing” enjoy the advantage of lower financing costs, their inability to stimulate innovation vitality has led to excessive reliance on technology introduction or imitation. Over time, corn seed enterprises lagging behind their competitors in terms of technology will directly result in a decline in their market competitiveness. Especially for those who have lost the space for imitation and learning through external technological resources and need to shift toward independent creation, the mismatch of capital resources can suppress the implementation of activities such as production, operation, and enterprise competitiveness (Wang and Wang, 2023).

Furthermore, the mismatch of capital resources has hindered the expansion of enterprise scale. On the one hand, due to the inability of corn seed enterprises to invest sufficient funds in building production bases, expanding production capacity, and broadening market channels, it is difficult for them to achieve economies of scale and reduce costs. On the other hand, the mismatch of capital resources prevents financial markets from effectively allocating resources, sharing risks, and promoting investment activities among enterprises. Instead, it induces enterprises to pursue profits through arbitrage activities and rent-seeking behaviors (Claessens et al., 2008; Khwaja and Mian, 2005), which is even more detrimental to the healthy expansion of market share for corn seed enterprises.

Based on this, we propose the following research hypothesis:

H1: Capital resource misallocation negatively affects the competitiveness of corn seed enterprises.

2.2.2 Analysis of the impact of labor resource mismatch on the competitiveness of corn seed industry enterprises

In specific scenarios, the mismatch of labor resources can potentially spark an innovative atmosphere and competitive spirit within enterprises, thereby enhancing the competitiveness of seed enterprises. Firstly, corn seed enterprises have a high demand for composite talents who possess a blend of cutting-edge technology, knowledge, and skills. The mismatch of labor resources facilitates the aggregation of high-end talents, which in turn boosts the competitiveness of seed enterprises. According to the theory of human capital (Wößmann, 2003a), human capital serves as a crucial factor in economic growth and enterprise development (Zheng and Ning, 2024). High-end talents play a more significant role in economic development than capital and general labor (Xie and Zhou, 2014). The corn seed industry, characterized by its long research and development cycle and extensive application of cutting-edge technologies, represents a high-tech domain where major countries compete. High-end seed industry talents possess high technical and knowledge thresholds, coupled with solid professional knowledge. In particular, corn breeding research and development talents require not only a high level of professional knowledge and innovation capabilities but also extensive practical operation experience and problem-solving abilities. These professionals must master genetics, molecular biology, crop breeding, and other related fields, while also understanding the growth and development patterns, genetic characteristics, and associated cutting-edge technologies of corn. The mismatch of labor resources is more likely to attract a significant number of highly skilled talents with extensive professional knowledge, advanced skills, or unique experiences to enterprises. High-priced labor resources themselves constitute key resources for seed enterprises, and talent competitiveness forms a vital component of enterprise competitiveness. Specifically, this is reflected in two aspects. On the one hand, the influx of labor with higher costs means that high-quality labor resources favor seed enterprises, which will produce a “high salary effect.” On the other hand, given the high technical requirements of the seed industry, the “expert effect” can assist in establishing a positive brand image for seed enterprises, enhancing brand awareness and reputation, and strengthening their competitiveness.

Secondly, the misallocation of labor resources drives innovation in corn seed enterprises through the utilization of innovative technologies, innovative thinking, and other innovative resources, thereby enhancing their competitiveness. According to innovation theory, innovation is a crucial source for enterprises to gain a competitive advantage (Doh and Kim, 2014; Bhaskaran and Krishnan, 2009). Labor introduced at higher prices possesses stronger innovation capabilities, enabling seed enterprises to innovate and transform in areas such as corn breeding technology and management models. On the one hand, in terms of hard technologies such as corn breeding, high-end seed industry talents often possess cutting-edge knowledge systems, facilitating the introduction of advanced gene editing technology, molecular marker-assisted selection, and other methods. This significantly improves breeding efficiency and accuracy, transforms innovation capabilities into technological innovation achievements, and boosts the technological competitiveness of corn seed industry enterprises. On the other hand, in terms of soft power, such as the management model of corn seed enterprises, high-end seed industry talents excel at applying innovative thinking to advanced management models. This is conducive to the internal resource allocation of corn seed enterprises, enhancing operational efficiency, decision-making scientificity, and strengthening the adaptability and competitiveness of corn seed enterprises in the market.

Thirdly, the misallocation of labor resources not only allows corn seed enterprises to focus their manpower on responding to market changes in an uncertain environment, but also enhances their comparative advantages. The development of the corn seed industry is highly susceptible to natural factors like seasons and climate, resulting in significant uncertainty. Through the misallocation of labor resources, corn seed enterprises concentrate more human resources during critical periods, accelerate research and development and production progress, and seize market opportunities. Meanwhile, according to the theory of comparative advantage (Findlay, 1991), corn seed enterprises typically have strong comparative advantages in obtaining labor at prices higher than the industry average, such as expertise in specific subsectors of corn breeding. The mismatched labor comparative advantages can assist corn seed enterprises in surpassing competitors at specific levels and converting these advantages into competitive edge.

Based on this, we propose the following research hypothesis:

H2: Labor resource misallocation positively influences the competitiveness of corn seed enterprises.

2.3 An analysis of the moderating effect of technical barriers of executives and employees

Executive technical barriers refer to strategies that arise due to the constraints of short-term investment horizons. Employee technical barriers refer to the skill disparities arising from varying educational backgrounds among employees. Based on management decision theory (Antia et al., 2010), management typically prioritizes maximizing investment returns within their visible horizon when formulating investment decisions. Consequently, the allocation of enterprise resources heavily relies on the long-term investment orientation of executives (Martin et al., 2016). Based on the theory of human capital (Wößmann, 2003b), human capital, as a factor of production, can be enhanced through investments in education and other areas, thereby elevating human qualities and abilities and boosting production efficiency. Employees’ education and experience levels will affect the misallocation of resources during the execution of management decisions.

Executives serve as the decision-makers for corporate behavior, while employees are the executors of those decisions. The two occupy different positions of resource advantage within the enterprise. When resources are “misallocated,” hindering the normal flow of factors, high demands are placed on both management and highly skilled workers, which can easily lead to the formation of technological barriers. The strategic vision of executives represents their technological barriers. In the context of capital resource mismatch, when executives have a shorter investment horizon and exhibit a higher degree of technological barriers, they tend to prioritize stability. This approach can mitigate the negative impact of high capital costs arising from capital resource mismatch, thereby enhancing the competitiveness of seed enterprises. Therefore, executive technological barriers can help mitigate the negative impact of capital resource mismatch on the competitiveness of corn seed enterprises.

On the other hand, in terms of labor resource mismatch, if executives blindly pursue short-term, quick-return project investments, it can create a conflicting situation with the mismatch of enterprise labor resources. This is because labor resource mismatch often stems from high employment costs. Consequently, executive technological barriers can potentially hinder the positive impact of labor resource mismatch on the competitiveness of seed enterprises. For highly skilled workers, their significant advantage lies in holding a master’s or doctoral degree or possessing extensive work experience. Consequently, the stable technical barriers of employees, serving as advantageous resources within seed enterprises, will mitigate the negative impact of capital resource mismatch on the competitiveness of corn seed enterprises. However, a conflict often arises between the technical barriers of employees and the mismatch in labor resources. When the technical barriers of employees have not been established or are not fully developed, it indicates a scarcity of highly educated talent within the enterprise. At this juncture, the mismatch in labor resources creates an opportunity for seed enterprises to attract and incorporate talent. Once employees establish and solidify their technical barriers, excessive mismatch in labor resources imposes a significant burden on the salary costs of seed enterprises and often leads to issues such as unequal distribution among workers. Therefore, the technical barriers of employees can hinder the positive impact of labor resource mismatch on the competitiveness of seed enterprises.

Based on this analysis, we propose the following hypotheses:

H3: The technical barriers of executives contribute to mitigating the negative impact of capital resource mismatch on the competitiveness of corn seed enterprises, but they hinder the positive impact of labor resource mismatch.

H4: The technical barriers of employees help to alleviate the negative impact of capital resource mismatch on the competitiveness of corn seed enterprises, but they also impede the positive influence of labor resource mismatch.

3 Research design

3.1 Sample data

The data presented in this paper originates from a nationwide survey conducted by our research team on China’s crop seed enterprises between 2018 and 2023. With the assistance of local seed associations, 124 crop seed enterprises across 29 provinces (cities, autonomous regions) in China were surveyed on-site.2 The specific criteria for selecting corn seed enterprises are as follows: ① the main business income from corn seeds accounts for 50% or more of the company’s total operating income; ② when a seed enterprise operates multiple crop varieties, the sales volume or sales amount of corn seeds represents the highest proportion among all crop seeds and accounts for more than 25% of the company’s total operating revenue; ③ in alignment with the “shortcomings” category of the crop seed enterprises released by the Ministry of Agriculture and Rural Affairs in 2022, we ultimately identified corn seed enterprises with competitive advantages in scientific research, standardized production and operation, and a comprehensive data system. The survey data covers a period from 2018 to 2022,3 with an effective sample size of 300. The research data primarily originates from survey questionnaires. The author also manually collated some required indicators from the financial statements provided by seed enterprises. Data for a small number of listed companies was sourced from the CSMAR database, Wind database, and Choice financial terminals. Data related to innovation indicators was sourced from the China Research Data Services Platform (CNRDS), while data on production and operation metrics was sourced from platforms such as Qichacha and Tianyancha. All other data was collated by the author from publicly available information on enterprises. To prevent the influence of outliers on the regression results, a 1% tailing treatment was applied to the continuous variables.

3.2 Variable description

3.2.1 Explained variable

Competitiveness of Seed Enterprises: SEC. We selected the comprehensive index of seed enterprise competitiveness to measure the explained variable—the competitiveness of seed enterprises. Existing literature on the measurement of seed enterprise competitiveness can be categorized into two main approaches: single-indicator utilization and multi-factor index construction (Afanasieva et al., 2018; Tyukhtenko et al., 2021; Ivanova et al., 2018; Ni et al., 2020). Single indicators primarily consist of Asset Contribution Rate (ACR), Return on Equity (ROE), and Return on Total Assets (ROA). However, the use of a single indicator fails to comprehensively capture the competitiveness of seed enterprises from multiple perspectives. Therefore, academic research on enterprise competitiveness often relies on the “Monitoring System for Enterprise Competitiveness in China” proposed by Jin (2003). Jin Bei divides the indicators of enterprise competitiveness into evaluation indicators and analysis indicators. Evaluation indicators, specifically the explicit evaluation index, reflect the achievements or ultimate performance of competitiveness, while analysis indicators reveal the motivating factors or determinants of competitiveness.

The principles of objectivity, systematicness, and availability should be adhered to when constructing the competitiveness index for seed enterprises. On this basis, first, drawing from Jin Bei’s “Monitoring System for Enterprise Competitiveness in China,” this paper divides enterprise competitiveness into two primary indicators: explicit competitiveness and potential competitiveness, following a “result-oriented” and “cause-oriented” approach. Second, based on industry practices in the seed industry, this paper supplements, modifies, and further optimizes the enterprise competitiveness index system through in-depth research interviews with general managers, R&D managers, sales managers, quality management managers, and employees of corn seed enterprises. Third, the competitiveness index system for corn seed enterprises, encompassing secondary indicators such as scale strength, efficiency strength, growth strength, operational capability, scientific and technological innovation capability, and quality management capability, was established based on the assessments of experts and scholars from scientific research institutions. Fourth, the primary indicators of the three-level indicators are determined. Subsequently, we conducted a redundancy correlation analysis on the selected indicators.4 Finally, a comprehensive index system for measuring the competitiveness of corn seed enterprises is constructed. Table 1 shows the competitiveness evaluation index system of corn seed enterprises.

Subsequently, the global principal component analysis (GPCA) method was employed to compute the comprehensive score of enterprise competitiveness, yielding the following result: SEC = 0.296*X1 + 0.275*X2 + 0.267*X3 + 0.181*X4–0.038*X5 –0.041*X6 + 0.026*X7 –0.012*X8 + 0.062*X9 + 0.12*X10–0.006*X11 + 0.165*X12 + 0.054*X13. Drawing upon existing literature on the measurement of enterprise competitiveness (Ivanova et al., 2018; Tyukhtenko et al., 2021), we employed the return on equity (ROE) as an alternative indicator to test the robustness of our model.

3.2.2 Core explanatory variable

The core explanatory variables are factor resource mismatches, specifically capital resource mismatch (Kms) and labor resource mismatch (Lms). The measurement methods of capital resource mismatch can be categorized into two main types: direct and indirect methods. The direct method is primarily represented by the approaches employed by Lu (2008) and Shao (2010). Lu (2008) utilizes two proxy variables: the proportion of the four major state-owned banks in total bank credit and the deposit-to-loan ratio of state-owned commercial banks. Shao (2010), drawing from the definitions of resource mismatches proposed by Chari et al. (2007) and Song et al. (2011), believes that the level of financial burden borne by enterprises can serve as a metric for assessing the degree of capital (financial) resource mismatch. This metric measures the deviation of each enterprise’s cost of capital utilization from the industry average. The indirect method, on the other hand, focuses primarily on the degree of distortion in the pricing of financial resources and the dispersion in the marginal output of financial resources, with a particular emphasis on productivity losses within sectors.

The capital resource mismatch in this paper is defined as the inefficiency in capital allocation among enterprises resulting from credit rationing issues. Consistent with the research approach of Shao (2010), we adopt the measurement methods outlined by Shao (2010), Lv and Wang (2019) to assess the degree of capital resource mismatch. This is achieved by quantifying the deviation between each enterprise’s cost of capital utilization and the average cost of capital utilization within its respective industry. According to accounting standards, interest is not payable on accounts payable, therefore, the cost of capital utilization for enterprises is calculated by dividing interest expenses by the remaining total liabilities after deducting accounts payable. The industry average referenced here is determined by calculating the mean value across enterprises within each industry, based on industry classification standards (Equation 1).

Regarding the mismatch of labor resources, various measurement approaches exist in current research. These primarily involve indices such as employment mismatch, skill mismatch, and labor price mismatch. In terms of the employment mismatch index (also known as educational mismatch), common methodologies include job analysis, empirical statistics, and subjective evaluation. Drawing from relevant literature (Lv and Wang, 2019), this paper examines the mismatch of labor resources from a micro-level enterprise perspective, employing labor use cost as an indicator. The labor use cost for enterprises is represented by the ratio of “cash paid to and for employees,” as stated in the cash flow statement, to the number of employees. Similarly, the industry average is calculated based on the average value across enterprises within each industry, according to industry classification standards.

At the same time, this paper also considers that the indicators of resource mismatch should encompass both price and quantity. Given that the quantity factor ultimately reflects in price (Kang, 2014), it is reasonable to measure resource mismatch using price indicators. Additionally, domestic scholars Chen and Hu (2011) have refined the effect of resource allocation into factor quantity input and factor price, concluding that distortions in factor price have a more significant impact on actual output. Based on this, this paper primarily focuses on exploring the impact of factor price mismatch on the competitiveness of seed enterprises (Equation 2).

3.2.3 Moderating variables

This paper selects the technical barriers of executives and employees as the moderating variables. The technical barriers of executives are measured by the management investment horizon (MHi,t), as referenced in studies by Barth et al. (2001), Souder and Shaver (2010), Reilly et al. (2016), Cazier (2011), Ridge and Ingram (2017), and Antia et al. (2010). The calculation method involves taking the average age of the management team and their existing tenure, adjusted for the industry. On the other hand, the technical barriers of employees are represented by the human capital structure of the enterprise, specifically, the proportion of employees with a bachelor’s degree or higher (Equation 3).

3.2.4 Control variables

The competitiveness of seed enterprises may be influenced by various factors, including governance structure, profitability, and enterprise tenure. In this paper, we have chosen enterprise size (lnsize), board size (lnboard), fixed asset ratio (fixed), gross sales margin (sal ratio), selling expenses (sell), and intangible asset ratio (intan) as control variables.

3.3 Model construction

3.3.1 Global principal component analysis (GPCA)

We use SPSS software (20.0, IBM Corp., Armonk, NY, USA) to measure the competitiveness of seed enterprises using the global principal component analysis (GPCA) method. The Global Principal Component Analysis (GPCA) method integrates time series into principal component analysis by consolidating flat data tables from various time points into a unified three-dimensional time-series data table. It then applies classical principal component analysis to ensure the uniformity, integrity, and comparability of the data analysis. After reviewing the research findings in related fields, our manuscript draws on the experience of Li et al. (2024) in applying GPCA to competitiveness research, and refers to the detailed analysis steps of principal component analysis and GPCA models provided by scholars such as Yu (2012). Specifically, our manuscript adopts GPCA to evaluate the competitiveness of Chinese corn seed enterprises, with the following methods:

1. Establish a time-series three-dimensional data table: Assuming there are m enterprises and p identical competitiveness indicator variables, with observable raw data variables denoted as X1, X2,…, Xm, a data table for year t is established, denoted as Xt = (Xij)m*p. Observing these variables at T time points will generate T data tables, collectively referred to as the three-dimensional time-series data tables. These tables are sequentially arranged to form a large Tm*p matrix, defined as the global data table.

Each row of the matrix represents a sample, upon which principal component analysis is conducted.

1. Data standardization: The raw data undergoes non-dimensionalization to derive standardized values.

1. Calculate the Global Covariance Matrix.

1. Calculate eigenvectors, principal components, and their contribution rates.

1. Global principal component analysis is performed on the standardized variables to select principal components and determine the weights of indicators.

1. A comprehensive evaluation score function is constructed, utilizing the obtained principal components to classify and evaluate the samples. Here, q represents the sum of eigenvalues, and fi denotes the i-th principal component prior to standardization.

3.3.2 Two-way fixed effects model

To examine the relationship between resource mismatch and the competitiveness of corn seed enterprises, a benchmark regression model is established (Equation 4).

Where, SECi,t represents the competitiveness of corn seed enterprises, with Misi,t serving as the core independent variable of resource mismatch. This misallocation is specifically categorized into two core independent variables: capital mismatch (Kms) and labor mismatch (Lms). CVk denotes the control variables (see Table 2 for details), Ση represents the dummy variable controlling for time and industry-fixed effects, and ε stands for the random error. The subscript i indicates the specific enterprise, while t represents the year.

To explore the moderating effect of executive and employee technical barriers on the impact of resource mismatch on the competitiveness of corn seed enterprises, we introduced the interaction term of resource mismatch and moderating variables after centralized processing based on model (4), and constructed the following moderating effect model (Equation 5).

Where, Misi,t*Adji,t represents the interaction term of the core independent variable Misi,t and the moderating variable. Misi,t takes values of Kms and Lms, respectively. Before introducing the interaction term, Misi,t and Adji,t are centralized. To facilitate the interpretation of the results, the continuous variables in the control variables are also centralized (only affecting the constant term).

4 Empirical results and analysis

4.1 Impact of resource mismatches on the competitiveness of corn seed enterprises

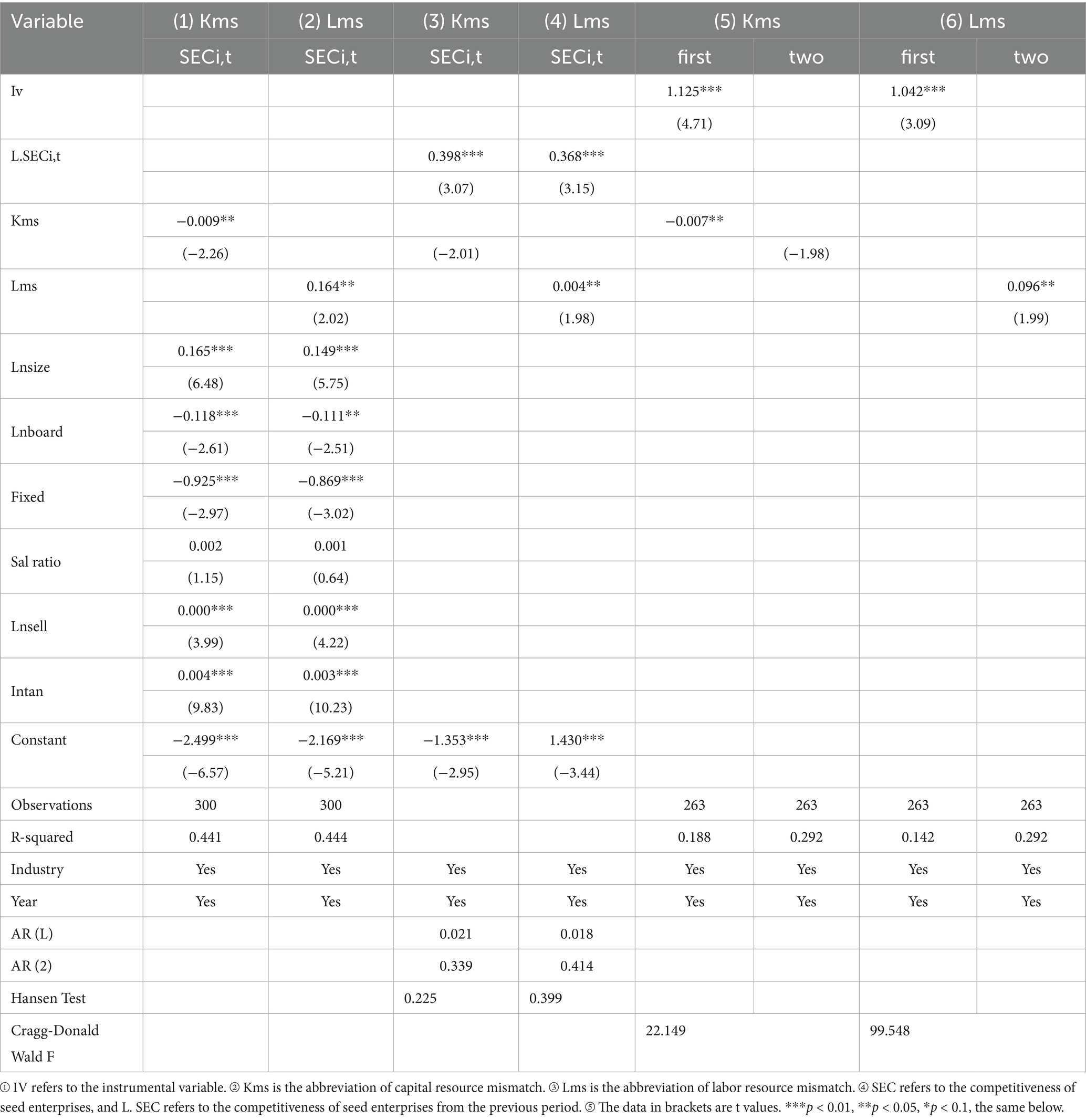

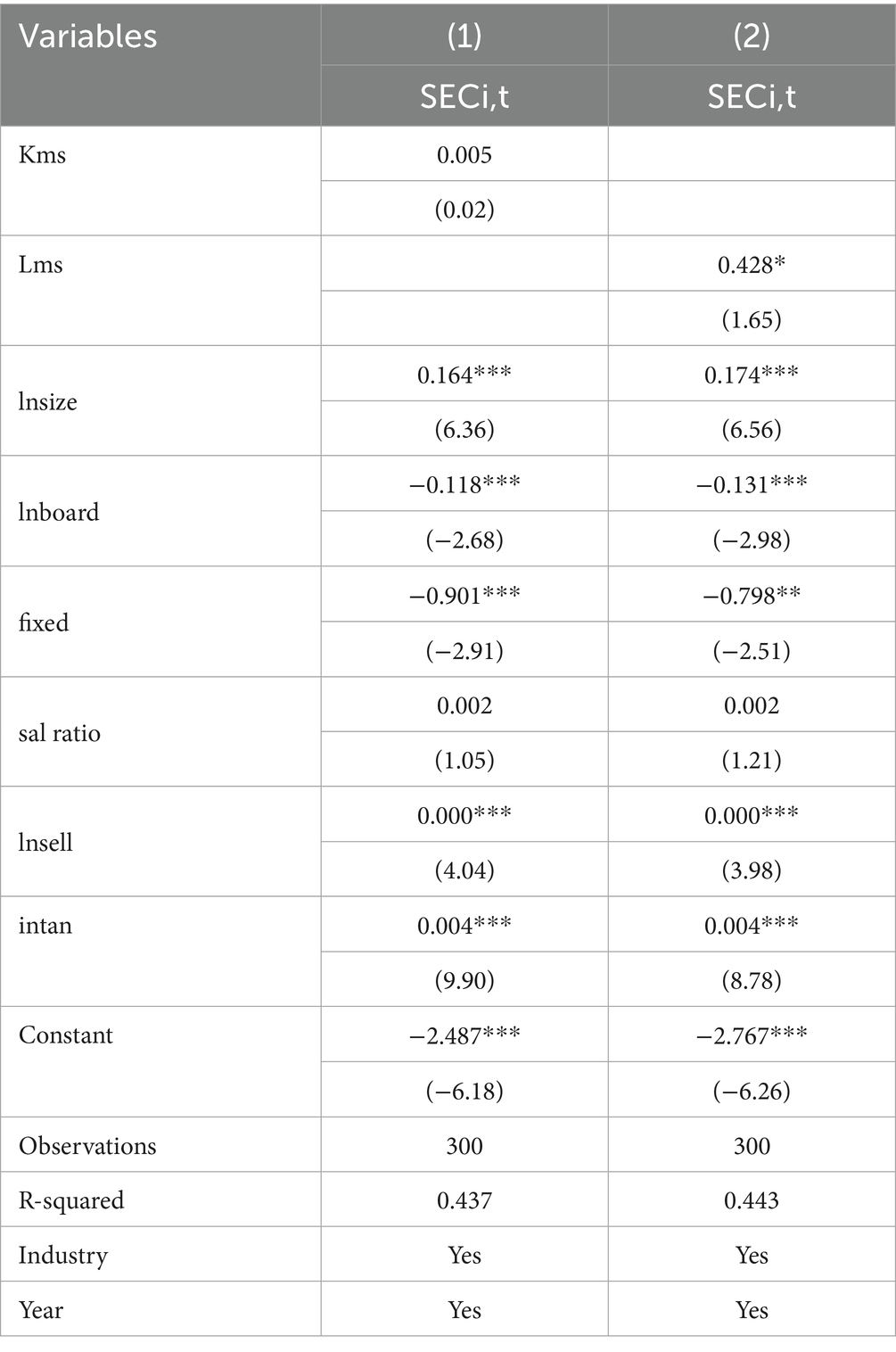

There are disparities in the effects of mismatches in different resource elements on the competitiveness of corn seed enterprises. Table 3 shows that mismatches in capital resources significantly hinder the enhancement of enterprise competitiveness, whereas mismatches in labor resources effectively shape and enhance it. As shown in Column (1), after incorporating both industry and time fixed effects into the model and controlling relevant influencing factors, there is a significant negative impact of capital resource mismatch on the competitiveness of corn seed enterprises, indicating that capital resource mismatch hinders the enhancement of competitiveness for corn seed enterprises, thus verifying Hypothesis H1. Similarly, column (2) reveals that mismatches in labor resources have a significant positive impact on the competitiveness of corn seed enterprises, suggesting that these mismatches contribute significantly to enhancing competitiveness. This validates Hypothesis H2.

Table 3. Benchmark regression results, System GMM, and 2SLS regression results concerning the impact of resource misallocation on the competitiveness of seed enterprises.

4.2 Dealing with endogeneity

Considering the potential issues of two-way causality and omitted variables between resource mismatch and the competitiveness of seed enterprises, it is imperative to address endogeneity. From the interactive logic between resource mismatch and seed enterprise competitiveness, we observe that resource mismatch can either facilitate or hinder the enhancement of enterprise competitiveness. Conversely, enterprises with robust competitiveness may be better positioned to mitigate capital misallocation (e.g., by securing bank credit). Meanwhile, labor mismatch, characterized by the clustering of highly skilled talents, can serve as both an outcome and a driver of competitiveness. Furthermore, factors such as governance structure may concurrently influence resource allocation and competitiveness. Although controlling variables such as board size can partially alleviate these influences, it remains necessary to address endogeneity through the use of systematic Generalized Method of Moments (Sys-GMM) and Two-Stage Least Squares (2SLS).

To ensure the robustness of the regression results, we incorporate lagged terms of enterprise competitiveness and adopt the System GMM estimation. The results in columns (3) and (4) indicate that there is no second-order autocorrelation in the model, and the Hansen test results show that the instrumental variables are valid. After controlling for the lagged terms and their endogeneity, capital resource mismatch and labor resource mismatch still have significant impacts on the competitiveness of corn seed enterprises. The coefficient of the lagged term for enterprise competitiveness is significantly positive, indicating the existence of circular cumulative causation in the competitiveness of corn seed enterprises. Additionally, we select the average level of resource mismatch among other enterprises within the same year and industry as the instrumental variable for enterprise resource mismatch. This is because resource mismatches among other enterprises within the same industry may lead to inefficiencies or overcapacity, resulting in increased competition within the industry and pressure on the resource allocation of the focal enterprise. However, they do not have a direct impact on the competitiveness of the focal enterprise. Columns (5) and (6) show that the Cragg-Donald Wald F statistic values for capital resource mismatch and labor resource mismatch are 22.149 and 99.548 respectively, which are significantly larger than the 10% maximal IV size value of 16.38 proposed by Stock and Yogo (2002), indicating that both pass the weak instrumental variable test.

4.3 Robustness test

4.3.1 Alternative measurement of explained variable

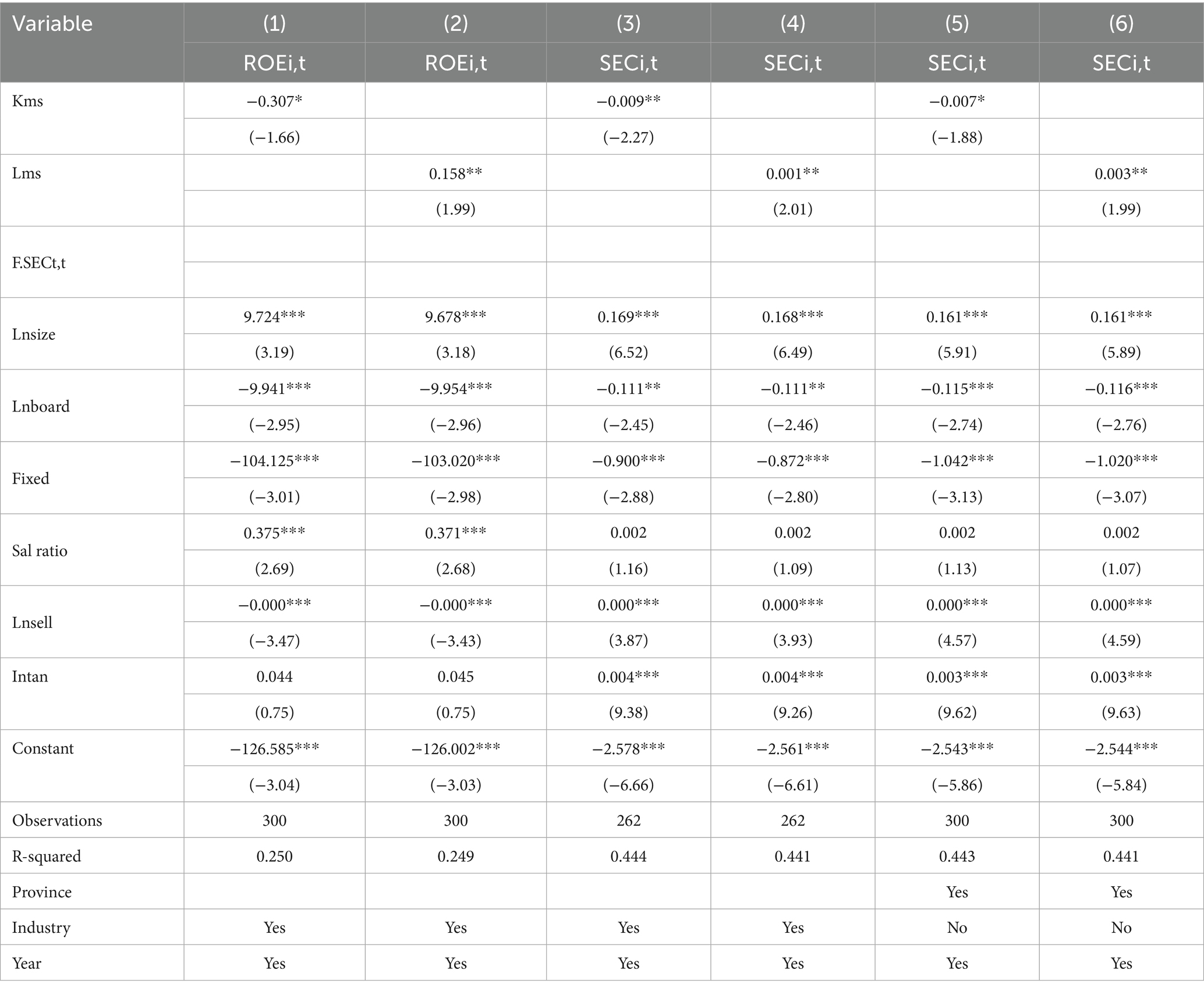

The difference in measurement methods of enterprise competitiveness may have an impact on the estimation results. In this paper, the company’s return on equity (ROE) is used to replace the explained variable to measure the competitiveness of corn seed enterprises (Pan and Zhang, 2023). The calculation method is: net profit divided by equity. The test results are shown in columns (1) and (2) of Table 4. The impact of resource mismatch on the competitiveness of corn seed enterprises remains unchanged after replacing the explained variable.

Table 4. Replace the measurement of the explained variable, exclude samples of enterprises where the technical barriers for employees are zero, and Present the robustness test results incorporating the interactive fixed effects of provinces and years.

4.3.2 Exclusion of enterprises with zero employee technical barriers

Considering that the dividend window period of China’s seed industry is still in the cultivation stage, the establishment of employee technical barriers necessitates a minimum of 5–8 years of R&D accumulation (according to the average level of the annual reports of seed enterprises). Currently, not all enterprises within the corn seed industry have constructed notable employee technical barriers. To mitigate the potential distortion of regression results by extreme samples, this study cautiously excluded enterprise samples with zero employee technical barriers, thereby controlling the influence of such extreme samples on the regression outcomes. The robustness test results in columns (3) and (4) of Table 4 are consistent with the benchmark regression results.

4.3.3 Incorporation of interactive fixed effects of provinces and years

In order to control the estimation error caused by regional development heterogeneity, the province-year interactive fixed effect is introduced. This setting can effectively capture spatial heterogeneity factors: ① dynamic adjustment of provincial seed industry support policies; ② the time-varying endowment characteristics of regional germplasm resources (for example, there are differences between Huang-Huai-Hai and southwest seed production bases); ③ the difference in supervision intensity of the seed industry market across provinces. The interaction effect between provinces and years is added to control the influence of factors that change with years at the provincial level, so as to alleviate the changes in the market environment of enterprises caused by resource mismatch. Columns (5) and (6) of Table 4 show the robustness test results, which are consistent with the benchmark results.

5 Further analysis: the impact mechanism of resource mismatch on the competitiveness of corn seed enterprises

5.1 Heterogeneity analysis of the impact of resource mismatch on the competitiveness of corn seed enterprises

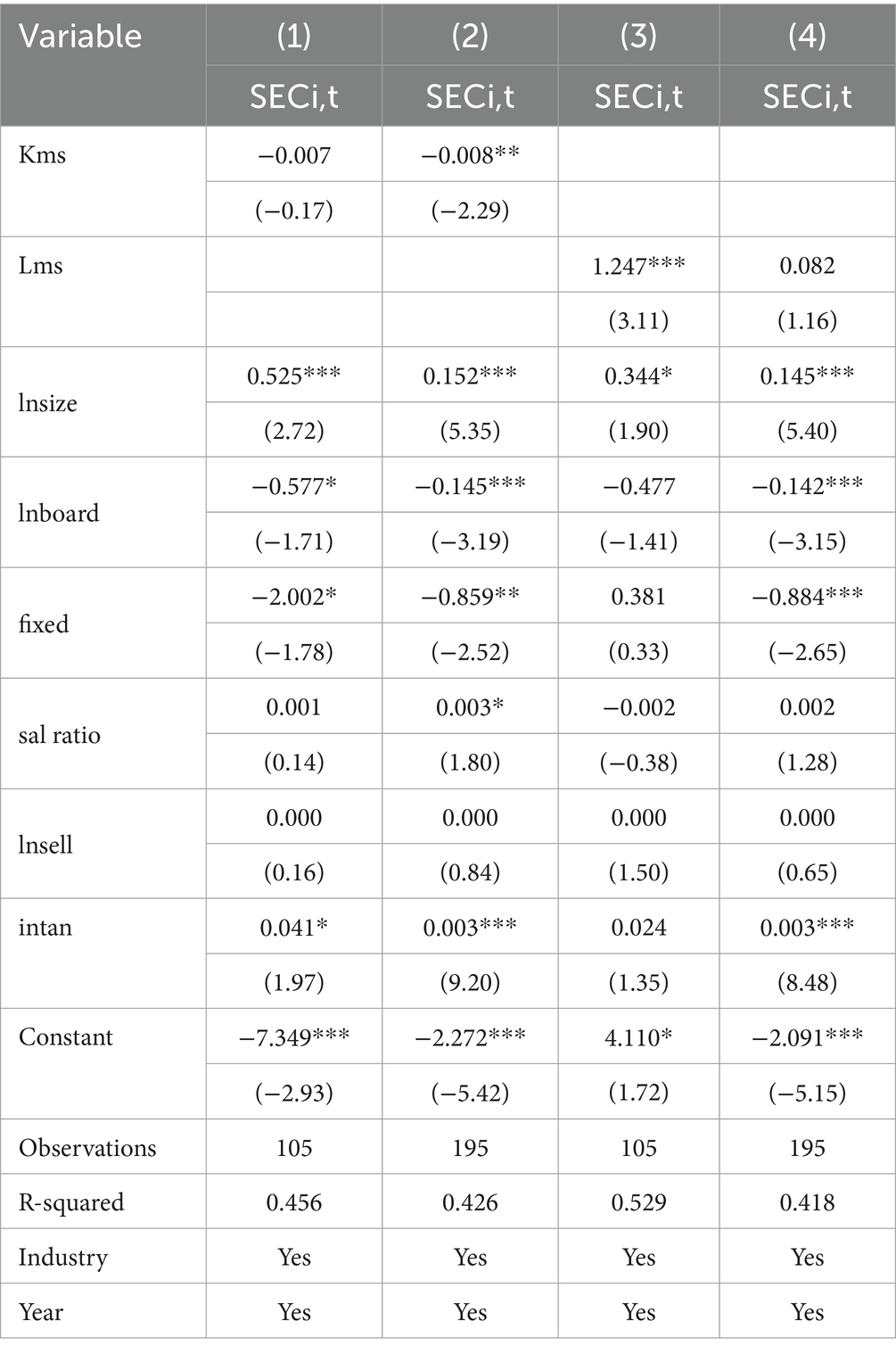

Under the current financial system in China, the diverse financial mismatches among enterprises with different ownership structures have always been a hot topic in academic research. To verify whether the financial mismatch of seed enterprises in China has an impact on the ownership structure, a dummy variable is established based on the nature of enterprise ownership, assigning a value of 1 to state-owned enterprises and 0 to non-state-owned enterprises. Table 5 regression results show that in terms of financial resource allocation, the Kms coefficient for the state-owned enterprise group in column (1) is not significant, while the Kms coefficient for the non-state-owned enterprise group in column (2) is significant. For non-state-owned seed enterprises, the higher degree of financial mismatch results in weaker incentives for enterprises to engage in independent innovation investment activities and enhance their competitiveness. Conversely, state-owned enterprises with long-term accumulation may be more capable of leveraging the “arbitrage” opportunities created by financial mismatch to generate profits. The impact of labor resource mismatch on the competitiveness of seed enterprises with different ownership structures is reflected in columns (3) and (4). The Lms coefficient for the state-owned enterprise group in column (3) is significant, while that for the non-state-owned enterprise group in column (4) is not. State-owned seed enterprises achieve monopoly power by establishing market entry barriers and controlling market entry prices, thus realizing the “double high” phenomenon of high profits and high welfare for employees. This exacerbates the mismatch of labor resources which in turn enhances the competitiveness of enterprises.

Table 5. Resource mismatch and competitiveness of corn seed enterprises: differences between state-owned enterprises and non-state-owned enterprises.

Table 6 shows the impact of resource mismatch on the competitiveness of corn seed enterprises with different technical levels. This paper employs industry coding to establish dummy variables, categorizing enterprises belonging to the primary industry as basic corn seed enterprises, and those belonging to the secondary and tertiary industries as technological corn seed enterprises. The objective is to examine the heterogeneity of the impact of resource mismatch on the competitiveness of corn seed enterprises. By comparing columns (1) and (2), it is evident that the weakening effect of capital resource mismatch on the competitiveness of basic corn seed enterprises is more pronounced compared to technological corn seed enterprises. Firstly, basic corn seed enterprises are more prone to financial challenges, including insufficient asset collateral, limited financing avenues, and lower technological and managerial capabilities, compared to technological corn seed enterprises. Secondly, the seed industry, inherently, is highly susceptible to natural factors. Climate changes (Yang et al., 2024), pests, and diseases exacerbate uncertainty and elevate financial risks for enterprises (Zhang and Lu, 2016). Furthermore, comparing columns (3) and (4) reveals that labor resource mismatch exhibits a notable “incentive” effect on basic corn seed enterprises. Technological corn seed enterprises typically enjoy technological support from entities and the internet economy, whereas basic corn seed enterprises lack such resources. Consequently, the marginal effect of labor resource mismatch is more prominent among basic corn seed enterprises.

Table 6. Resource mismatch and competitiveness of corn seed enterprises: between basic corn seed enterprises and technological corn seed enterprises.

5.2 Analysis of the adjustment mechanism for dual technical barriers of executives and employees

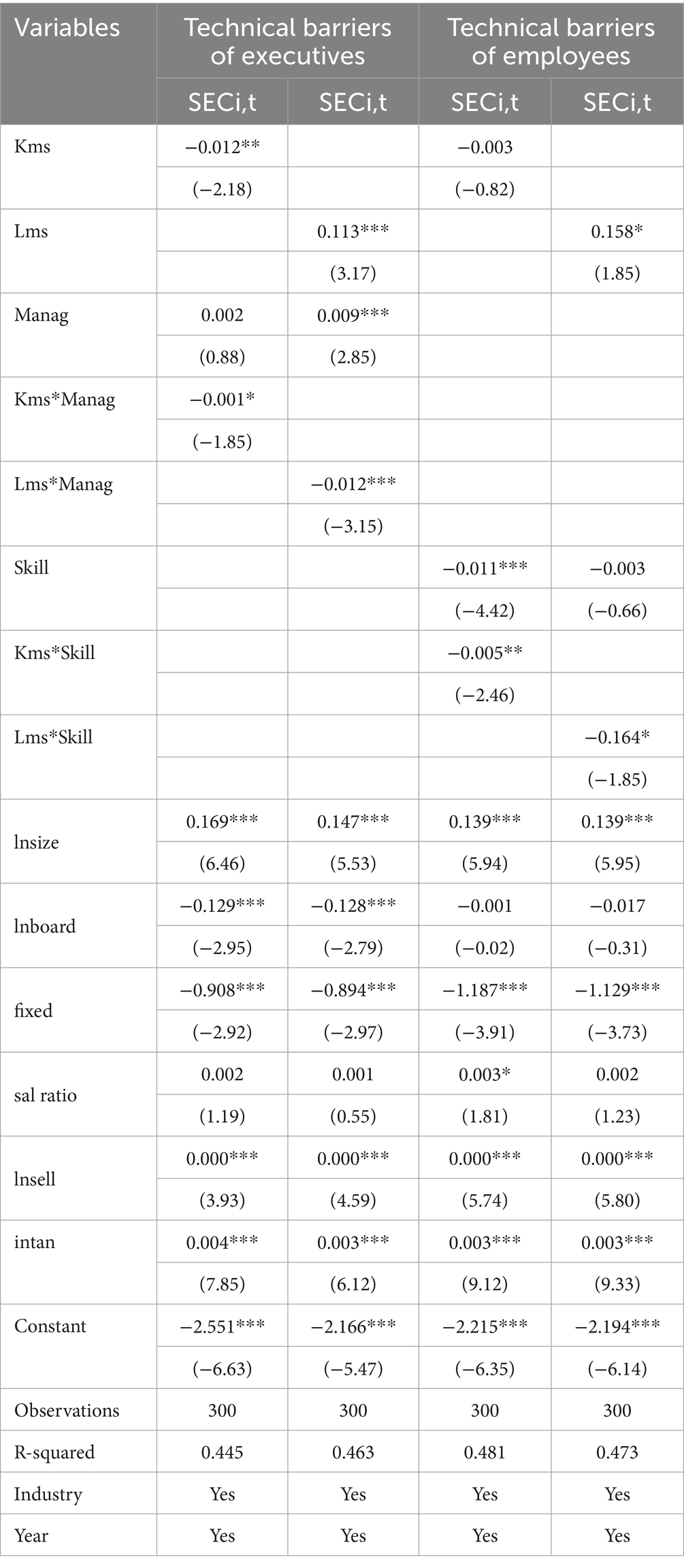

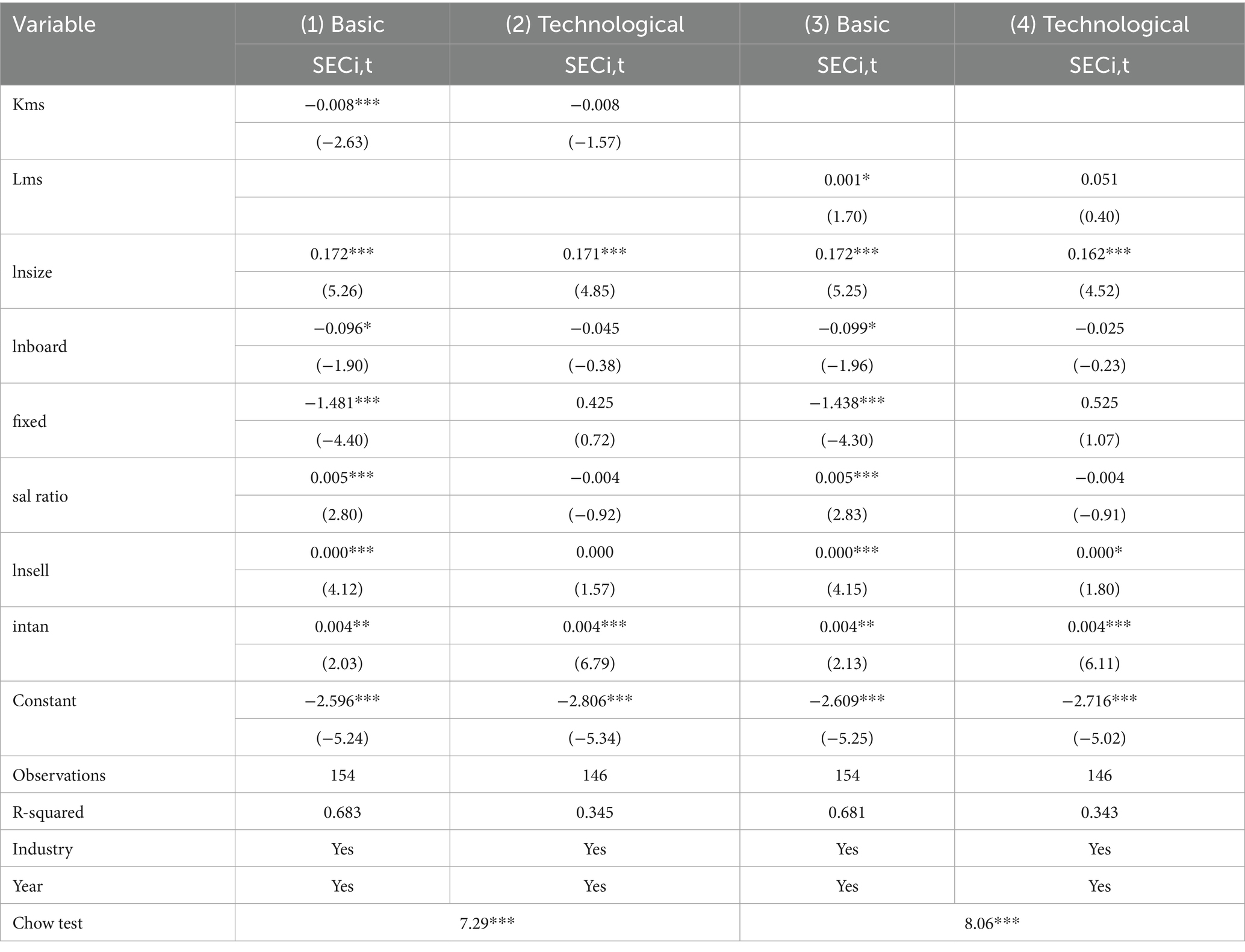

Table 7 demonstrates the moderating effect of technical barriers of executives and employees on the mismatch of capital resources, mismatch of labor resources, and the competitiveness of corn seed enterprises. The test results for executive technical barriers reveal that the coefficient of Kms*Manag is significantly negative (−0.001), while the coefficient of Lms*Manag is also significantly negative (−0.012). This indicates that as the technical barriers of executives increase, the inhibitory effect of capital resource mismatch on the competitiveness of corn seed enterprises is mitigated. However, simultaneously, the mismatch of labor resources exerts a negative impact on the competitiveness of these enterprises. These two findings collectively support research hypothesis H3. The test results for employee technical barriers further show that the coefficient of Kms*Skill is significantly negative (−0.005), and the coefficient of Lms*Skill is also significantly negative (−0.164). This suggests that employee technical barriers assist in reversing the negative impact of capital resource mismatch on the competitiveness of corn seed enterprises, yet they also contribute to the negative impact of labor resource mismatch on competitiveness. These findings jointly validate research hypothesis H4.

5.3 Expanded analysis of resource mismatch in the macro factor market

The preceding section primarily explored the impact of resource mismatch within enterprise organizations on the competitiveness of corn seed enterprises. When zooming out to the factor market, does resource mismatch at the macro environmental level have an impact on the micro entities of the corn seed industry? Which dimension of factor resource mismatch, macro or micro, has a greater impact on the competitiveness of corn seed enterprises? Therefore, drawing on the practices of existing literature (Chen and Hu, 2011; Bai and Liu, 2018), this paper utilizes data on capital input, labor input, and output from various provinces in China to measure the factor resource mismatch index for each province and investigate its impact on the competitiveness of the corn seed enterprises. The results presented in Table 8 indicate that capital resource allocation in the factor market has no significant effect on the competitiveness of seed enterprises, whereas labor resource mismatch exerts a notable positive influence on the competitiveness of corn seed enterprises.

Table 8. Effect of mismatch of factor market resources on the competitiveness of corn seed enterprises.

The positive impact of macro-level labor mismatch reveals that the flow of highly skilled talents across regions, exemplified by the phenomenon of “Peacocks Flying to the Southeast,” fosters the agglomeration of innovative resources within seed enterprises. This aligns with the micro-level “incentive effect of labor mismatch.” For instance, the phenomenon of “Peacocks Flying to the Southeast” portrays the movement of numerous highly skilled talents toward the relatively developed southeast coastal areas. From the perspective of the seed industry, this regional flow of highly skilled talents represents a manifestation of macro-level labor mismatch. The southeast coastal areas exhibit economic vitality, with more funds invested in seed industry R&D, well-developed infrastructure facilitating seed industry experiments, storage, and more, as well as an open market environment conducive to the expansion of seed enterprises. These advantages attract the inflow of highly skilled talents, allowing seed enterprises to accumulate a significant amount of innovative resources in the area. Talents bring advanced breeding technologies, cutting-edge scientific research concepts, and extensive industry experience, fostering knowledge sharing and technological exchanges among enterprises, and driving the concentration of seed industry innovation resources in specific regions. This suggests that when labor costs rise across the entire industry in the factor market, the labor costs of individual enterprises will also increase accordingly. Consequently, the impact of labor resource mismatch on the competitiveness of corn seed enterprises is not confined to non-state-owned enterprises but extends to the entire factor market.

6 Discussion

Countries around the world are increasingly focusing on the impact of resource mismatch in various industries (Ryzhenkov, 2016; Wei and Li, 2017). This paper empirically examines the impact and mechanisms of misallocated resources in the seed industry on corporate behavior using micro survey data from corn seed enterprises spanning from 2018 to 2022. The findings offer robust support for the national seed industry revitalization action plan and the global seed industry sustainable development strategy. Insights gained at the industry level complement national-level research by examining the micro-mechanisms of resource misallocation, which can provide information for policies in specific sectors (Gong et al., 2023). Compared with previous studies, our manuscript has marginal academic contributions in the following aspects:

First of all, this paper found that the mismatch of capital resources inhibited the competitiveness of corn seed enterprises. This conclusion verifies the research on the negative impact of capital resource mismatch on the high-quality development of enterprises [Qi et al. (2023), Kapetaniou et al. (2018), Hsu et al. (2014), Centre d'études prospectives et d'informations internationales (France) et al. (2006), and Aghion et al. (2012)]. That is, when capital resources are mismatched, it is easy to lead to inefficient utilization of resources, insufficient investment in innovation, and distorted investment decisions, thus hindering the growth of enterprise value. Consistent with the conclusion of Lv and Wang (2019), this study found that the mismatch of labor resources helped to promote the competitiveness of corn seed enterprises. The main reason is that, under certain circumstances, the mismatch of labor resources is conducive to the formation of high-end talent accumulation, innovative resource advantages, etc.

Secondly, based on the differences in ownership structure and technological level among seed enterprises, we further analyzed the heterogeneous impact of resource mismatch. We found that the phenomenon of “financial discrimination based on ownership” still persists, indicating that the negative impact of capital resource mismatch on the competitiveness of non-state-owned enterprises is more significant. This finding aligns with previous studies by Cull and Xu (2003), Du et al. (2008), Ge and Qiu (2007), and Chen et al. (2014). Additionally, the mismatch of labor resources exhibits a more significant “incentive” effect on state-owned corn seed enterprises. This conclusion differs from the findings of Lv and Wang (2019), primarily due to the “resource allocation advantages” enjoyed by state-owned maize seed enterprises and their relatively comprehensive talent reserve and training systems. Furthermore, our analysis delved into the impact of resource mismatch on the competitiveness of both basic and technological corn seed enterprises. We discovered that, compared to technological corn seed enterprises, capital resource mismatch has a significant “inhibitory” effect on the competitiveness of basic corn seed enterprises, while labor resource mismatch exerts a notable “incentive” effect. This understanding will assist basic corn seed enterprises in optimizing their financing channels, effectively addressing capital resource mismatch, and leveraging labor resource mismatch more effectively.

Third, the study revealed that both executive and employee technical barriers mitigate the negative impact of capital resource mismatch on the competitiveness of corn seed enterprises. However, the presence of both barriers can also obstruct the positive influence of labor resource mismatch on competitiveness, thereby enhancing the theoretical understanding of the economic consequences of resource allocation.

Fourth, Macro-level research is instrumental in identifying systemic risks and seizing opportunities. This paper further expands the scope of resource mismatch from micro enterprise entities to the entire factor market, exploring the impact of the macro factor market on the competitiveness of corn seed enterprises. The study also revealed that labor resource mismatch in the macro factor market significantly enhances the competitiveness of corn seed enterprises, similar to the mismatch effect observed at the micro level. This aligns with the findings of Schelling (1969) and Liu (2020), who emphasize the crucial role of labor resource mismatch in sustaining economic health. Collectively, these studies contribute to the evolving theory of human capital mismatch tolerance.

Fifthly, this paper innovatively examines the issue of resource mismatch within seed enterprises from the perspective of resource cost deviation, effectively complementing the research paradigms of quantity allocation and quality allocation in the existing literature, manifesting itself primarily in the following two dimensions: first, compared with the traditional resource allocation efficiency analysis method, the measurement approach grounded in cost deviation offers a more precise portrayal of the unique characteristics of seed enterprises. As a strategic foundational industry for the nation, the seed industry is characterized by a long acquisition cycle for germplasm resources, high risks associated with R&D investments, and stringent market access barriers. These factors contribute to significant cost disparities for enterprises in terms of capital raising and talent acquisition. We can effectively capture the structural misallocation characteristics of seed enterprises in the factor market by constructing indicators including capital cost deviation and human cost deviation. Secondly, the cost deviation measurement system used in this study boasts notable methodological strengths. Compared with the efficiency evaluation methods such as DEA (Data Envelopment Analysis) and SFA (Stochastic Frontier Analysis), which require intricate parameter settings, the cost deviation index not only has the advantages of a streamlined theoretical model and robust data availability but also features intuitive economic implications, facilitating interpretation by various stakeholders. Specifically, the deviation degree of capital cost directly reflects the extent of financing constraints faced by enterprises, while the deviation degree of human cost reflects the talent competition pattern. This transparent indicator design not only aids enterprise managers in formulating precise resource optimization strategies but also furnishes regulatory authorities with quantifiable decision-making grounds for establishing differentiated support policies for the seed industry.

The mismatch of seed industry resources can be extended to other agricultural sectors and analogous industries through pivotal avenues such as theoretical mechanism analogy, policy suggestion drawing, corporate practice benchmarking, and research methodology advancement, ultimately aiming to achieve widespread application and maximize the value of research findings. (1) In terms of theoretical mechanism comparisons, we will conduct an in-depth analysis of the theoretical mechanisms through which the misallocation of seed industry resources impacts corporate behavior, and clarify the role of capital mismatch and labor mismatch in the seed industry. These mechanisms will be compared with those in agricultural sectors like wheat and rice, as well as industries with comparable factor intensities, such as biotechnology and pharmaceuticals. These industries all necessitate investments in capital and labor, and share characteristics such as extended research and development cycles and high technological content. (2) Regarding policy suggestions for reference, for agricultural sectors such as wheat and rice, where planting is significantly influenced by natural conditions, support for agricultural infrastructure construction can be augmented within capital allocation optimization policies to mitigate the impact of natural risks on enterprises. For the biotechnology and pharmaceutical industries, given their stringent requirements for intellectual property protection, policies can be fortified to strengthen intellectual property protection and facilitate the rational allocation of innovative resources. (3) In terms of practical guidance for enterprises, successful cases of seed enterprises addressing resource mismatch are summarized to inspire these enterprises to draw upon the successful experiences of the seed industry, taking into account their own unique circumstances. (4) With regard to the expansion of research methodologies, this paper offers methodologies for studying resource mismatch, encompassing data collection techniques (such as enterprise surveys and industry statistics), variable measurement methodologies (including indicators for assessing capital and labor resource mismatch), and frameworks for model construction (such as benchmark regression models and moderation effect models). Depending on the characteristics of other agricultural sectors and analogous industries, these research methodologies can be suitably adapted and refined.

In addition, this paper also has some limitations. In this paper, we utilize currently prevalent methods for measuring micro-level resource mismatch. In recent years, in the macro and meso fields, the emergence of various measurement models for multi-dimensional resource mismatch has begun to gain popularity. However, due to challenges in theoretical modeling and the availability of pertinent data, such methods have not been applied in this paper. We are collaborating with researchers in related fields to explore measurement models for resource mismatch, and will consider applying them to our research as soon as possible in the future, in order to further supplement and improve the theoretical system in this regard.

7 Conclusions and policy recommendations

Based on panel data from China’s corn seed enterprises spanning 2018–2022, this paper examines the impact of capital resource mismatch and labor resource mismatch on the competitiveness of these enterprises. The key findings are summarized as follows: (1) Capital resource mismatch hinders the enhancement of competitiveness in the corn seed enterprises, whereas labor resource mismatch facilitates it. This conclusion remains valid after accounting for endogeneity and undergoing robustness tests. (2) The phenomenon of “financial ownership discrimination” persists, with financial resource mismatch suppressing the competitiveness of non-state-owned corn seed enterprises. Conversely, the mismatch in labor resources exhibits a more pronounced “incentive” effect on state-owned corn seed enterprises. (3) In comparison to technological corn seed enterprises, capital resource mismatch exhibits a significant “inhibitory” effect on the competitiveness of basic corn seed enterprises, whereas labor resource mismatch demonstrates a notable “incentive” effect. (4) The dual technical barriers posed by executives and employees partially mitigate the inhibitory impact of capital resource mismatch on the competitiveness of corn seed enterprises, but simultaneously hinder the promotional effect of labor resource mismatch. (5) At the macro level, resource mismatch may trigger systemic economic issues or present overall development opportunities. In the macro factor market, the mismatch of capital resources has no significant impact on the competitiveness of corn seed enterprises, but the mismatch of labor resources has a significant positive effect on it.

Based on this, the study proposes the following policy recommendations:

Firstly, given our finding that the misallocation of capital resources diminishes competitiveness by 0.009 units (p < 0.05), policymakers should implement targeted financial regulatory mechanisms. These include: (1) establishing differentiated credit evaluation criteria based on the technological capabilities of seed enterprises; (2) creating specialized financing channels for R&D-intensive seed enterprises; and (3) implementing risk-sharing mechanisms for innovative projects between banks and seed enterprises.

Secondly, to optimize the allocation of capital resources, the following measures should be taken: (1) establishing a national seed industry development fund with clear allocation criteria; (2) providing tax incentives for banks that offer preferential interest rates to certified seed enterprises; (3) implementing a credit guarantee system for seed enterprises with government support; and (4) developing performance-based financing mechanisms tied to sustainability indicators.

Thirdly, to strengthen human resource management, the following initiatives are proposed: (1) designing talent retention programs specifically for agricultural biotechnology experts; (2) fostering university-industry partnerships for seed technology education; (3) establishing regional talent exchange programs between state-owned and private enterprises; and (4) implementing a skills visa policy to attract international seed technology experts.

Fourth, advance the seed industry toward sustainable development of higher quality, including: (1) foster deep integration of various policy recommendations with the United Nations Sustainable Development Goals and national strategies such as “dual carbon” targets and “food security,” and ensure that the optimization of resource allocation always serves the shared goal of sustainable development; (2) optimize resource allocation strategies guided by environmental friendliness, and actively mitigate the negative ecological externalities that may be caused by the mismatch of capital and labor; (3) emphasize the long-term resilience of the seed industry ecosystem and establish a sustainable support system, such as the establishment of a mechanism for sharing germplasm resources to protect genetic diversity; (4) systematically integrate climate resilience factors into the entire process of policy design, and give priority to areas such as “research and development of extreme weather-resistant varieties” and “climate-adaptive planting techniques” in capital investment and labor training.

Fifth, adopt differentiated measures to address the resource misallocation of seed industry enterprises. Specifically, these measures encompass: (1) enhance the evaluation of labor allocation efficiency in state-owned enterprises (such as linking cross-departmental talent mobility rates with the performance evaluations of responsible personnel), and establish differentiated financing channels based on technical qualifications for non-state-owned enterprises; (2) allocate more R&D capital to technology-intensive seed enterprises (e.g., increase the proportion of R&D investment subsidies by 10%), and provide labor skills training focused on stable production capacity for basic enterprises (e.g., specialized courses on conventional breeding techniques); (3) In major production areas (such as Northeast China), focus on the cross-regional integration of capital and talent, while in less developed areas, give priority to ensuring the basic labor supply of basic enterprises; (4) Offer incubation support to startups in the form of a three-year tax exemption, and implement an incentive mechanism for mature enterprises that ties the “volume of innovation conversion” to financing levels.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors without undue reservation.

Author contributions

LL: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. XW: Conceptualization, Funding acquisition, Investigation, Project administration, Resources, Supervision, Validation, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was funded by the Agricultural Science and Technology Innovation Program of Chinese Academy of Agricultural Sciences (Grant No. 10-IAED-08-2025; No. 10-IAED-RC-04-2025), Strategic Study on Building China’s Capacity to Ensure Food Security Over the Next Five Years (Grant No. 2023-31-22).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^The source of misallocation of capital resources is distortions in the financial market, therefore capital misallocation is also known as financial misallocation.

2. ^It excludes Hong Kong, Macao, Taiwan, Tibet, as well as enterprises located in Tianjin and Chongqing, which are omitted during the selection process of corn seed enterprises.

3. ^Due to data availability constraints, some data for 2023 were not available at the time of the survey, thus excluding 2023 from the research timeframe.

4. ^Table 1 presents the results of enterprise competitiveness after eliminating indicators with high correlation following the redundancy correlation analysis. Prior to constructing the indicators, a correlation test is essential. In this paper, the Pearson coefficient is utilized to analyze the indicators. The analysis is conducted on the indicators of China’s corn seed enterprises from 2018 to 2022 using SPSS software. Typically, a Pearson coefficient value higher than 0.8 is considered to indicate a strong correlation between indicators. Based on the analysis results, a series of indicators with strong correlation, particularly in the financial aspect, were eliminated after thorough deliberations. The indicators that passed the test reflect the competitive strength of seed enterprises across various dimensions. Since indicators with high correlation are excluded to a certain extent, the remaining indicators can be considered representative.

References

Addison, J. T., Chen, L., and Ozturk, O. D. (2020). Occupational skill mismatch: differences by gender and cohort. ILR Rev. 73, 730–767. doi: 10.1177/0019793919873864

Afanasieva, N. V., Rodionov, D. G., and Vasilev, Y. N. (2018). System of indicators of coal enterprise competitiveness assessment. Revistas Espacios 39:10.

Aghion, P., Askenazy, P., Berman, N., Cette, G., and Eymard, L. (2012). Credit constraints and the cyclicality of R&D investment: evidence from France. J. Eur. Econ. Assoc. 10, 1001–1024. doi: 10.1111/j.1542-4774.2012.01093.x

Akcigit, U., Hanley, D., and Stantcheva, S. (2022). Optimal taxation and R&D policies. Econometrica 90, 645–684. doi: 10.3982/ECTA15445

Antia, M., Pantzalis, C., and Park, J. C. (2010). CEO decision horizon and firm performance: an empirical investigation. J. Corp. Financ. 16, 288–301. doi: 10.1016/j.jcorpfin.2010.01.005

Bai, J. H., and Liu, Y. Y. (2018). Can outward foreign direct investment lmprove the resource misallocation of China. China Ind. Econ. 1, 60–78. doi: 10.19581/j.cnki.ciejournal.20180115.002

Banerjee, A. V., and Moll, B. (2010). Why does misallocation persist? Am. Econ. J. Macroecon. 2, 189–206. doi: 10.1257/mac.2.1.189

Barth, M. E., Beaver, W. H., and Landsman, W. R. (2001). The relevance of the value relevance literature for financial accounting standard setting: another view. J. Account. Econ. 31, 77–104. doi: 10.1016/S0165-4101(01)00019-2

Bhaskaran, S. R., and Krishnan, V. (2009). Effort, revenue, and cost sharing mechanisms for collaborative new product development. Manag. Sci. 55, 1152–1169. doi: 10.1287/mnsc.1090.1010

Brandt, L., Tombe, T., and Zhu, X. (2013). Factor market distortions across time, space and sectors in China. Rev. Econ. Dyn. 16, 39–58. doi: 10.1016/j.red.2012.10.002

Cazier, R. A. (2011). Measuring R&D curtailment among short-horizon CEOs. J. Corp. Finan. 17, 584–594. doi: 10.1016/j.jcorpfin.2011.02.005

Centre d'études prospectives et d'informations internationales (France)Guariglia, A., and Poncet, S. (2006). Are financial distortions an impediment to economic growth? Evidence from China. CEPII. doi: 10.1097/00000441-200210000-00011

Chari, V. V., Kehoe, P. J., and McGrattan, E. R. (2007). Business cycle accounting. Econometrica 75, 781–836. doi: 10.1111/j.1468-0262.2007.00768.x

Chen, Y. W., and Hu, W. M. (2011). Distortions, misallocation and losses: theory and application. China Econ. Q. 10, 1401–1422. doi: 10.13821/j.cnki.ceq.2011.04.010

Chen, V. Z., Li, J., Shapiro, D. M., and Zhang, X. (2014). Ownership structure and innovation: an emerging market perspective. Asia Pac. J. Manag. 31, 1–24. doi: 10.1007/s10490-013-9357-5

Chen, B. C., and Wang, X. B. (2025). Innovation networks, key core technologies, and R&D resource allocation: based on an inter-regional and inter-technological knowledge spillover network model. J. Quant. Econ. Tech. Econ., 1–22. doi: 10.13653/j.cnki.jqte.20250709.001

Choi, Y., Yu, Y., and Lee, H. S. (2018). A study on the sustainable performance of the steel industry in Korea based on SBM-DEA. Sustainability 10:173. doi: 10.3390/su10010173

Claessens, S., Feijen, E., and Laeven, L. (2008). Political connections and preferential access to finance: the role of campaign contributions. J. Financ. Econ. 88, 554–580. doi: 10.1016/j.jfineco.2006.11.003

Cull, R., and Xu, L. C. (2003). Who gets credit? The behavior of bureaucrats and state banks in allocating credit to Chinese state-owned enterprises. J. Dev. Econ. 71, 533–559. doi: 10.1016/S0304-3878(03)00039-7

Doh, S., and Kim, B. (2014). Government support for SME innovations in the regional industries: the case of government financial support program in South Korea. Res. Policy 43, 1557–1569. doi: 10.1016/j.respol.2014.05.001

Du, J., Tao, Z., and Lu, Y. (2008). Bank loans and trade credit under China's financial repression. Available at SSRN 1495600.

Easterly, W., and Fischer, S. (1995). The soviet economic decline. World Bank Econ. Rev. 9, 341–371. doi: 10.1093/wber/9.3.341

Fan, X., Yu, C., and Bao, X. (2022). “Research on the impact of financial resource mismatch on the technological innovation of manufacturing enterprises based on model construction” in 2022 2nd international conference on management science and software engineering (ICMSSE 2022), (Amsterdam: Atlantis Press), 259–265.

Findlay, R. (1991). “Comparative advantage” in The world of economics (London: Palgrave Macmillan UK), 99–107.

Ge, Y., and Qiu, J. (2007). Financial development, bank discrimination and trade credit. J. Bank. Finance 31, 513–530. doi: 10.1016/j.jbankfin.2006.07.009