- College of Urban Development and Engineering, Ethiopian Civil Service University, Addis Ababa, Ethiopia

Throughout the world, poverty, income inequality and food insecurity in urban areas have continued to be pressing issues. As a solution, a productive urban safety net program has been launched to provide conditional cash transfers (CTs) to poor households since 2017 in urban areas of Ethiopia. This study examines the impact of CTs made by the program to beneficiary households on the financial inclusion options, participation in urban agriculture and levels of food security among women in Addis Ababa, Ethiopia. Random stratified sampling was used to select 278 women for questionnaire surveys. Mixed research, comparative impact analysis, food security index, Ordinary Least Square (OLS), Logistic, and Ordinal Probit regressions were applied. Results showed that 94% of respondents could have ownership of a bank account and participated in urban agriculture as additional income source only after receiving CTs from the program. This contributed to better access to other financial inclusion components such as saving, credit, mobile banking, advice on finance management, and farm incomes. The study found that 171 (61.5%) women households were food insecure, while 107 (38.5%) were food secure. The minimum, maximum, and mean K/calorie consumed by food-insecure female farmers was 674.6, 2082.1, and 1378 Kcals, respectively, while 2192.5, 5360.4, and 3776.6 Kcals for food-secure ones. Furthermore, mean calorie consumption of women also significantly varies with the type of urban agriculture they are involved in. Accordingly, among the food-secure women, the mean calorie consumption was relatively better in those involved in horticulture relative to animal husbandry. The OLS model indicate the coefficient of bank account ownership, amount saved in the last 1year, farm income and proportion of credit used for actual collection intention have a significant positive effect on food security index. The logistic regression model also confirmed that among the financial inclusion options, amount saved, advice on finance management, and proportion of credit used were the most significant predictors. The safety net program’s CTs have moderately improved financial inclusion for women and slightly increased food-secured women, but their overall contribution to food security remains inadequate, as a significant portion of women’s households still experience food insecurity and poor urban agriculture. The study implies urban planning and development policies still need to be more pro-poor, gender-sensitive & responsive & inclusive to bring majority of urban women households out of food insecurity by improving their nutrition calorie consumption & job via urban agriculture. Accordingly, it informs partners to revisit and expand the safety net program scope, consider more financial inclusion options and urban agriculture facilities, including soft loan provisions, grants, Agri-input, market links, training, incentives, and increasing CTs amount. Besides, business-to-business networking events among financial service providers is essential to create long-term partnerships to improve financial services, access to agricultural technology and income-generating job options including Agri-Micro Small and Medium Enterprises to urban poor, particularly women program beneficiary households. Organization of further research with wider scope is also necessary.

1 Introduction

According to Louis and Chartier (2017), smallholder farmers in developing countries face limited resources and low income, hindering their ability to scale operations and reducing agricultural production. Access to money and challenges, particularly in urban areas, are primary barriers to agricultural growth. Financial institutions, including commercial banks, development banks, credit cooperatives, microfinance institutions, and savings and loans institutions, provide funding for commercial agricultural output (Amoah et al., 2020; Mhlanga and Denhere, 2020).

Commercial banks, microfinance banks, registered cooperatives, and development banks are essential financial institutions for agricultural services, contributing to financial inclusion, poverty reduction, commercialization, food security, livelihood development, and reducing vulnerability of the low-income people, especially women (Dar and Ahmed, 2020; Demirguc-kunt et al., 2018).

Masiyandima et al. (2017) define financial inclusion as the provision of affordable financial services to low-income and unbanked individuals, requiring skills, knowledge, and confidence to access mainstream financial products. It involves various actors, including individuals, governments, and financial institutions, collaborating to enhance lives through social policies and financial products. This counters financial exclusion, where low-income individuals cannot access or afford essential services, thereby improving the lives of those unable to afford them (Mhlanga and Denhere, 2020).

According to World Bank (2018) and Olaniyi (2017), financial inclusion has been identified as a way to achieve the Sustainable Development Goals (SDGs) because it is crucial to strengthening people’s livelihoods and, consequently, reducing poverty, enhancing the involvement of households in income generating businesses such as urban agriculture and trade, improving food security, and improving food security, provides more evidence in support.

Financial inclusion enhances access to deposit facilities, improves financial intermediary capacity to mobilize savings, and fosters economic growth by enabling women farmers to invest in productive activities (Gebrehiwot and Makina, 2019). Access to a well-functioning financial system creates equal opportunities for socially and economically excluded people to integrate into the economy and contribute to economic development, ensuring the financial sector fulfills its responsibility for equitable growth, a key issue facing emerging and developing countries (Prymostka et al., 2020; Kaur and Kapuria, 2020).

When urban women farmers are excluded and marginalized from the financial system, the urban economy as a whole cannot thrive since they are the true foundation of the economy. Therefore, progress in financial inclusion serves as a unique channel that may be utilized to inform monetary policy and achieve its objectives (Anthonia, 2016; Riley and Crush, 2022; World Bank, 2018; Badmus, 2020).

Improving women’s access to financial services or financial inclusion is a proven strategy for contributing to women’s social and economic empowerment, as well as improving the livelihoods, food security, poverty escape and commercialization of their urban investment including the agricultural output in urban settings through improved urban agriculture (Badmus, 2020; HLPE, 2012; Devereux et al., 2006).

Financial inclusion allows women to access necessary inputs, labor, and equipment for agricultural or off-farm activities. However, urban areas often lack access to financial services, and these services usually do not benefit women. Sociocultural, economic, legal, and educational barriers also limit women’s access to these services, affecting sustainable development and hindering their participation in agricultural activities (Amurtiya et al., 2018; Etim et al., 2017).

According to Obisesan and Adeyonu (2018), food insecurity refers to the inability to obtain wholesome food in socially acceptable ways, affecting many women farmers, particularly those who farm rice and cassava. Developmental agricultural economics aims to find solutions to escape the semi-subsistence poverty trap faced by these farmers. Challenges include limited access to formal financial institutions, lack of financial literacy, cultural and social barriers, and limited economic opportunities. Without access to financial services, these farmers struggle to diversify income sources and improve their financial well-being, making them food insecure (Khan et al., 2021; Khan et al., 2018).

Poverty, income inequality, and food insecurity have been growing in major urban areas of developing nations due to various reasons, such as rapid urbanization. To address the significant problems such as financial inclusion, food insecurity, income inequality, and poverty in urban areas, the Ethiopian government initiated a safety net program in 2017 in collaboration with international partners, including the World Bank. Urban Productive Safety Net Program (UPSNP) is defined as a social protection system that is being implemented in the primary urban centers of Ethiopia, targeting chronic food-insecure households and providing cash for the beneficiary households primarily “for work” regularly for a 3-year period (Tareke, 2022a; FAO, WFP, UNICEF, 2019; Borku et al., 2024a; Derso et al., 2021).

The UPSNP, which is the first of its kind in urban areas, is a 5-year (i.e., 2017–2023) phase-by-phase program targeting 11 major cities in Ethiopia, including Addis Ababa. Being the capital city of Ethiopia, Addis Ababa is one of the most rapidly urbanizing cities in Africa (Tareke, 2022b; Tareke and Ashebir, 2023). This program has benefited from the country’s experience in delivering a rural, productive safety net over the past 10 years. The objective of the program or strategy was to alleviate urban food insecurity and address the increasing levels of vulnerability, inequalities, and poverty. This was expected to be achieved over a long-term period through a gradual roll-out plan in different phases, starting with big cities that have a population of over 100,000 people (Borku et al., 2024b; PSNP, 2014).

Cash transfers are an increasingly popular social protection mechanism used by UPSNP in many developing countries to improve food security and the nutritional status of urban beneficiary households from lower socioeconomic groups through enhanced investment in urban productivity, such as the urban agriculture sector. The overall objective of the UPSNP’s CT program can, therefore, be seen as preventing the intergenerational transmission of poverty. The primary type of CT program used primarily in developing countries is conditional CT (CCT). The number and size of CTs have increased noticeably in the last 20 years (Gilligan, 2013; Honorati et al., 2015).

To receive assistance, a conditional cash transfer program requires beneficiaries to undertake a specific activity, such as participating in public works or attending training sessions. After the condition is fulfilled, a monthly CTs are given to beneficiary households with no restrictions on how the cash is to be spent and no requirements beyond meeting the eligibility criteria, for example, being a low-income household (Borku et al., 2024c; FAO, WFP, UNICEF, 2019).

Even though the effects of rural safety net program on farmers and women communities’ food security and their contribution to enhanced agricultural output are widely studied, there is severe shortage of studies on the status and effects of the recently started safety net program in urban areas on urban agriculture, income, and food security of urban communities, primarily women.

The studies conducted so far on this topic have not addressed the impact of UPSNP and its CTs on financial inclusion, urban agriculture, and household food security in urban areas of Ethiopia and Africa, primarily from the perspective of women households. Thus, the gap in research, literature, and recent knowledge on this particular topic has motivated the author to conduct this study in Addis Ababa, where the problems continue to increase.

Aligned with the several goals of the SDGs, particularly SDGs 1, 2, 5, 8, and 11, this study focused on the multidisciplinary and transdisciplinary issues our contemporary world faces, chiefly from the context of urban areas in the developing region. It linked the safety net program, financial inclusion, food security, urban planning, and agriculture issues, the cross-cutting gender topic, and the SDGs. The specific SDG goals related to no poverty, zero hunger, gender equality, decent work and growth, as well as sustainable and inclusive cities and communities, were used as frameworks for the study.

However, the impact of the urban safety net program, the status of food security and insecurity among urban beneficiary women households has not been assessed since the program’s start. This study aimed to address the knowledge that will help urban planners and policymakers evaluate and revisit program approaches in an urban setting, particularly from the context of women households involved in urban agriculture. Therefore, a key goal of this study is to contribute to the scaling up of the UPSNP, thereby helping to improve the food security status of low-income urban individuals, particularly women, through urban agriculture and other entrepreneurial ventures.

Given the newness and urgency of these issues, the following question is attempted to be addressed by this original study: Does urban safety net programs through cash transfers affect the financial inclusion, participation in urban agriculture, and food security status of low-income households, particularly women in key urban areas of developing economies, such as Addis Ababa, Ethiopia?

The general objective was to assess the effects of cash transfers from the urban safety net program on financial inclusion and food security of low-income households in Addis Ababa, Ethiopia, from the context of women participating in urban agriculture. Accordingly, the specific objectives were to:

i. Explore the economic effects of the urban safety net program’s cash transfers on the financial inclusion of low-income households, primarily women in Addis Ababa, Ethiopia.

ii. Estimate the effects of cash transfers of the urban safety net program on women’s involvement in urban agriculture.

iii. Evaluate the implications of cash transfers of the urban safety net program on levels of food security among urban women households.

iv. Identify the financial inclusion factors influencing the food security status of women households.

In general, the remaining sections of this paper are structured into major sections, including literature review, hypothesis, methods and materials, findings, discussions, and conclusions.

2 Review of related literature

2.1 Urban Productive Safety Net Program

Ethiopia’s government and social protection programs have made significant efforts to tackle poverty, food insecurity, and income inequalities. The first program, the Productive Safety Net Program (PSNP), was launched in rural areas, focusing on low-income households. Evidence shows that this program has improved food security and dietary diversity in low-income rural areas. PSNP plays a critical role in advancing food and nutrition security and livelihood targets for vulnerable communities, including women, the elderly population, people with disabilities, and children (Borku et al., 2024a; Burchi and Strupat, 2016; FAO, 2017).

Addressing food insecurity and income inequality has been successful; however, these issues remain among the top global problems, particularly in the urban areas of developing countries. In large cities like Addis Ababa, poverty rates are falling but not as rapidly as in rural and smaller urban centers (CSA and ICF International, 2015; World Bank, 2018; Cook et al., 2004).

Ethiopia’s government and development partners, including the World Food Programme and World Bank, have expanded the rural PSNP to urban areas to improve food security and stabilize assets for 10 million people. Launched in 2017, the UPSNP is a pilot project designed to help low-income urban households improve their nutritional status and address the underlying causes of food insecurity through aid in kind, such as food and cash (Development Initiatives, 2017; Porter and Goyal, 2016; FDRE, 2016).

According to the 2022 Urban Job Creation and Food Security Agency (UJFSA) of Ethiopia and WB reports, the components of aid were two types. The first type is direct or without precondition aid, such as aid in kind, including food, for low-income beneficiaries who cannot perform physical work due to age, health, or other physical inability reasons. The second component is conditional aid, primarily in cash (which is called a cash transfer), and it targets low-income individuals who can perform physical work or contribute at least 1 day per week and 4 h per day. Since this safety net program is productive, cash transfers (CTs) are conditional and only made when households contribute and participate in selected public works, such as solid waste collection, greenery maintenance, and water and soil conservation practices for at least 4 h per day.

CTs are monthly payments made to beneficiary households based on family size and total working hours. The minimum CT amount is 181 Ethiopian birr (ETB), or about USD 3.30, for a single-family size, which contributes 4 h to public works per day. For a two-family household, the amount is 1,446 ETB, equivalent to approximately USD 26.4. The calculation of monthly CTs is 181 ETB multiplied by the number of working days per month, depending on the family size. For example, a household with 1, 2, 3, and 4 family members is expected to contribute 4 h of public work for 1, 8, 12, and 16 day(s) per month.

The study of Tareke (2022a) found that female and male program beneficiaries received an average monthly cash transfer of 767.75 ETB (approximately USD 17) and 712.72 ETB (approximately USD 15.9), respectively, compared to only 55 ETB (USD 1.2). The study also found that female beneficiaries received a substantial amount of cash transfer or benefit per month, equivalent to that of male beneficiaries, and this amount was provided until they graduated and transitioned into small and microbusiness ownership. The UPSNP program, which lasted from 2017 to early 2023, involved beneficiaries being selected three times annually in three consecutive years. Each round of beneficiaries received CTs for 3 years and were then transferred into a private income-generating business. The program has been replaced by UPSNJP, an urban productive safety net job program, from 2023 to 2027, with additional components and increased targeted urban areas. Approximately 60% of the total beneficiary households are expected to be women.

Despite being established in Ethiopia for a long time and primarily targeting rural areas, the recent implementation of productive safety net programs in urban areas began in 2017. It targets chronically food-insecure households by providing cash or food for work, free, or a combination of both for 5 years (Borku et al., 2024d; Camilla et al., 2011; PSNP, 2014; Shigute et al., 2019). Food insecurity refers to a state in which individuals lack adequate physical, social, or economic access to sufficient, safe, and nutritious food that meets the dietary needs and food preferences for an active and healthy life (Napoli et al., 2011).

Consistent with most of the 17 SDGs of 2030, goals 1, 2, 5, 8, and 11, the strategy aimed to reduce urban food insecurity, hunger, and poverty through a gradual rollout plan in Ethiopia. The urban safety net program, the first of its kind in urban areas, is a 5-year, phase-by-phase government initiative targeting 11 major cities. The program is based on Ethiopia’s experience in delivering a rural productive safety net over the past decade, using a program Implementation Manual (PIM). The program aims to address increasing vulnerability, inequalities, and poverty in urban areas (Borku et al., 2024b; PSNP, 2014).

The program aims to streamline program implementation and management by providing guidelines and operating procedures for key institutions like the Ministry of Urban Development and Housing, UJFSA, and Labor and Social Affairs, as well as regional and city administrations and municipalities (Gilligan et al., 2008; Gilligan, 2013). Urban safety net initiatives are being implemented in developing countries, like Ethiopia, to provide income to individuals and households experiencing food insecurity, unemployment, or a decline in purchasing power. These programs include cash transfers, subsidies, and labor-intensive public works projects. They aim to help low-income households generate seed money or initial capital for new businesses and small and microenterprises, promoting sustainable livelihoods and food security [Khan et al., 2023; World Bank, 2018; Government of Ethiopia (GoE), 2016].

According to Borku et al. (2024c), Ministry of Agriculture (MoA) (2014), and Government of Ethiopia (GoE) (2016), Cash transfers (CTs) are the primary intervention in urban poverty reduction programs (PSNP) in Ethiopia, primarily focusing on Addis Ababa city, where two-thirds of the country’s low-income households and the majority of the urban population are located (Tareke and Baraki, 2024). CTs are expected to increase income, food access, and consumption, and serve as seed money for small and micro-businesses, including those owned by women, for low-income households in urban areas.

This study examines the impact of urban safety nets, particularly cash transfers, on food security and nutrition in Addis Ababa, Ethiopia, a city with a high rate of female-headed households, amidst debates about the effectiveness of cash transfers compared to in-kind aid.

This research, the first of its kind, examines the performance, impacts, roles, and challenges of the UPSNP, particularly the CTs, in urban women households in Ethiopia since 2017. It examines theoretical pathways that advocate cash transfers as a means to improve household income, access to financial inclusion services, such as savings, and involvement in urban agriculture, which are essential requirements for food purchasing and intake capacity, as well as diet diversity. These indicators are used to determine household food security, including access, availability, and utilization of food.

2.2 The Nexus between cash transfers and food security in urban areas

The Public Works Program (PWP) is a commonly used social protection or safety net instrument that provides support, primarily cash transfers, to working-aged people who are poor, unemployed or underemployed and working in low-productivity jobs (Bastagli et al., 2019; Anna, 2013). Cash transfers (CTs) are a popular social protection mechanism in developing countries aimed at improving food security for lower socioeconomic groups and preventing intergenerational poverty transmission. Conditional CT (CCT) is the major type used in developing countries, with the number and size of CTs increasing significantly in the last 20 years (Gilligan, 2013; Honorati et al., 2015).

Conditional cash transfers (CTs) are assistance programs that require beneficiaries to undertake specific activities, such as public works or training. Once fulfilled, these transfers are given to vulnerable individuals without restrictions on spending or eligibility criteria. These programs focus on human capital development and typically target households with primary or secondary school-aged children (Pega et al., 2015).

CCTs aim to reduce short-term food insecurity by improving the immediate consumption levels and nutritional status of low-income households. Household food security is defined by the availability of resources to purchase adequate food for all family members, particularly cash income. Standard measures of household food security include spending on food, diet diversity, food frequency, consumption behaviors, and experience of food insecurity (Khan et al., 2023; Khan et al., 2021; Smith and Haddad, 2002).

In line with most of the 17 goals of the SDGs of 2030, the PSNP’s CT component can enhance food security and consumption by increasing household income. This can lead to increased food availability and access for the lowest-income households, enabling them to purchase food and increase their actual and share of expenditure on food. Additionally, increased income can improve food utilization and nutrition by enhancing the quality and diversity of daily meals (Smith and Haddad, 2002; Arnold and Conway, 2011). Cash transfers, part of a comprehensive intervention package, provide beneficiaries with knowledge, information, safety, and nutritional supplements, thereby addressing malnutrition and intrahousehold inequalities, primarily through women’s empowerment (Yoong et al., 2012; Hagen-Zanker et al., 2017).

Recent studies (Haushofer and Shapiro, 2013; IEG, 2014; Bastagli et al., 2019) demonstrate that CTs can significantly influence intrahousehold dynamics, particularly when distributed to female heads of households, enabling them to advocate for their preferences with higher control over resources. In many developing countries, food security has improved due to cash transfers (CTs), as most households allocate their income primarily to food. CTs provide dignity, choice, and flexibility to affected populations, making them more effective in achieving nutrition security for all, thereby improving dietary diversity (Gilligan et al., 2008).

Attanasio et al. (2005) found that increased income enabled households to overcome credit and saving constraints, leading to more profitable investments. They also found that CTs’ positive impact on hunger and food security is most evident in low-income countries, where poverty is often harsher. Similarly, the PSNP in Ethiopia has significantly improved the food consumption and security of over 7 million rural people who were previously dependent on relief (Gilligan et al., 2008; Baye et al., 2014). Studies by Khan et al. (2021) and Khan et al. (2018) also demonstrated that the safety net program is capable of enhancing food security, considering various challenges such as sociocultural barriers faced by women.

However, the studies conducted so far on this topic have not addressed the impact and contribution of such kinds of UPSNP and its CTs to household food security and financial inclusion in urban areas of Ethiopia and Africa, particularly from the perspective of women households.

3 Hypotheses of the study

Based on the theoretical and empirical literature, the following hypotheses were formulated and tested in this study:

HO1: Cash transfers of the urban safety net program significantly affect the financial inclusion and involvement in urban agriculture, but not the food security of women households.

HO2: Financial inclusion factors do not significantly influence the food security index of urban women farmers.

HO3: Financial inclusion factors do not significantly influence the food security status of urban women farmers.

HO4: Financial inclusion factors do not significantly influence the food security levels of urban women farmers.

4 Methods and materials

The study was conducted in Addis Ababa, the capital of Ethiopia, with a population of approximately 6 million and 11 subcity administrations. The target population of this study consisted of all low-income urban households in Addis Ababa, Ethiopia, who are beneficiaries of safety net programs, particularly women participating in urban agriculture. The list was obtained from food security and safety net program offices at the city and subcity levels. A sample size was drawn in a three-stage sampling process. The first stage involved the purposive selection of Addis Ababa city because it has the largest number of safety net beneficiaries and the highest proportion of urban farmers with access to higher agricultural credit provisions in the country. The second stage involved the purposive selection of one subcity, namely Yeka subcity, as this study builds upon previously conducted research in 2022 to address its research limitations.

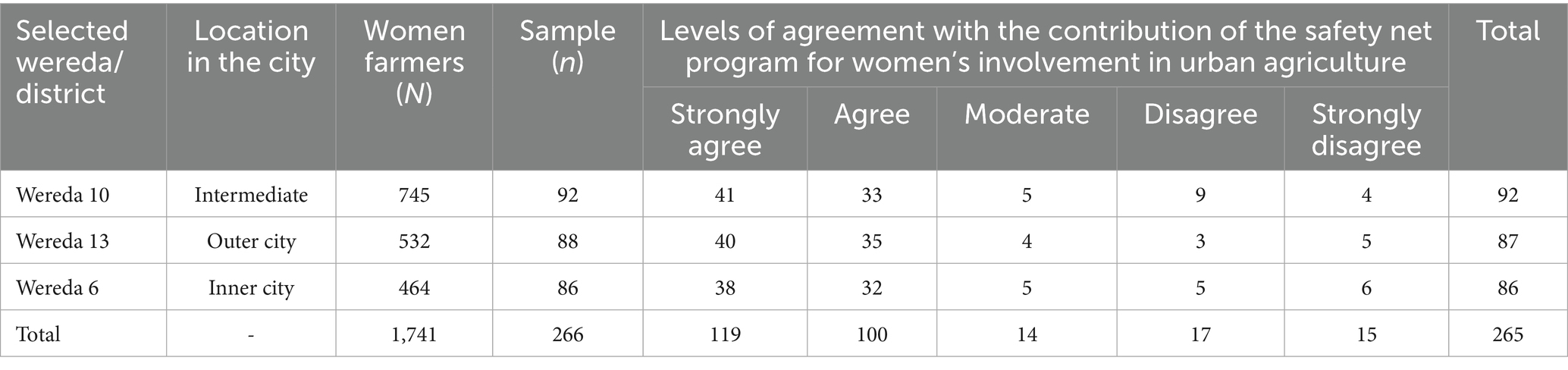

The third stage involved a total of three “wereda” or districts that were randomly and proportionally selected, particularly from the agricultural zones of the safety net program. To increase the representativeness, objectivity, and fairness of the sampling frame and design at the city level, the three weredas/districts were purposefully selected from inner-city, intermediate-city, and outer-city locations within Yeka subcity of the city. As indicated in Table 1, wereda 6, wereda 10, and wereda 13 were chosen from inner city, intermediate, and outer city locations, respectively. Finally, women participating in urban safety net and urban agriculture from the three locations were proportionally selected using stratified sampling from each wereda based on the sampling frame or list. Thus, the sampling design or frame of this study was aligned with the data sources, collection tools, and findings to address potential biases and provide robust evidence to support the conclusions.

Accordingly, the study determined sample sizes of 92, 88, and 86 women farmers using the Yamane (1967) formula at a 95% confidence interval (CI) level, resulting in a total of 266 urban women households. The study employed a mixed-methods research approach, combining quantitative and qualitative data, and used a cross-sectional survey to collect primary data. Well-trained enumerators gathered primary data from the selected sample of women households using a semi-structured questionnaire, and through strict control and care, they reduced the potential selection biases. Descriptive and inferential statistics were used to analyze data, including OLS multiple regression, binary logistics regression, and ordinal probit Regression to examine the financial inclusion factors influencing food insecurity among urban women farmers. Principal component analysis was used to achieve the last objective. Additionally, content analysis was employed to analyze the qualitative data, facilitating the triangulation of results.

4.1 Food security index

Food security research primarily uses two assessment techniques: estimating the annual output and consumption of women farmers’ families, and assessing the increase or depletion of food supplies. It assumes that any food that enters households and is not accounted for has been consumed. The alternative technique involves conducting a food consumption recall for each family member or the entire household, and then calculating the calorie content of each food type reported (Maxwell, 1996).

This study used a seven-day recall strategy. The recommended daily calorie intake of 2,100 kcal per person was utilized as the food security line. The women farmers’ consumption provided the calories needed by the households. The data were used to determine how much of each food item was consumed over 7 days by women farmers’ households. Using the nutritional composition table of regularly consumed foods in Ethiopia, the amounts were translated to kilograms, and the calories were calculated. By dividing the projected total calorie consumption for the home by the number of occupants, per capita calorie intake was obtained.

The household’s daily per capita calorie consumption was calculated by dividing the household’s total calorie intake by the number of people in the household. Families were considered to be food secure if their daily per capita calorie intake did not fall below 2,100 kcal, and food insecure if it did. The food security situation was binary, with 0 denoting food-insecure families and 1 denoting food-secure households. The study followed the model employed by Babatunde et al. (2007). Accordingly, it is expressed in Equation 1 as follows:

where,

Zi = food security status of the ith household, which takes values 1 for food-secure households or 0 for food-insecure households;

Yi = daily per capita calorie of the ith household;

R = recommended calorie intake by the number of people in the household (2,100 kcal);

Zi = 1 for Yi ≥ R; and

Zi = 0 for Yi < R, all other indices.

Head count method was used to measure food security status of the entire area under study and is expressed in Equation 2 (Babatunde et al. 2007) as:

where,

FII = food insecurity index;

FIH = number of food-insecure households; and

TH = total households under study.

Food insecurity gap measures the depth of food insecurity and is expressed in Equation 3 (Babatunde et al. 2007) as:

where,

FIGi = Food Insecurity Gap of the ith food-insecure household;

TCRi = Total Calorie Requirement for the ith food-insecure household;

TCCi = Total Calorie Consumption by the ith food-insecure household.

Hence, the total food insecurity gap is expressed in Equation 4 (Babatunde et al. 2007) as:

Squared food insecurity gap, which indicates the severity of food insecurity among the food-insecure households is given in Equation 5 (Babatunde et al. 2007) as:

4.2 Ordinary least squares multiple regression

The ordinary least squares (OLS) multiple regression model was used to analyze the first and fourth objectives. It estimated the impacts of CTs of UPSNP on financial inclusion options and also the effects of various socioeconomic and institutional factors on food security index of women farmers in the study area, this is in accordance with a study done by Atagher (2013). The generalized form of the model is given as in Equation 6:

where,

Y = food security index;

α = intercept of equation;

Σ = summation sign;

β = coefficients of the explanatory variables;

X = the vector of explanatory variables in the model; and.

e = error term.

4.3 The functional forms of the model

Three functional forms of the OLS model were fitted including linear, semi-log, and double-log. The equation of best fit was selected based on the magnitude of R2 and the statistical significance of the explanatory variables. The explicit forms of the functions are as follows:

where,

Y = food security index;

X1 = frequency of bank mobile application usage (continuous variable: number of times bank mobile application is used for a transaction);

X2 = ownership of account with commercial banks (continuous variable: number of accounts with commercial banks);

X3 = amount saved in the past 12 months (continuous variable in ETB);

X4 = means of saving (discrete variables: bank, home, and group of friends);

X5 = farm income (continuous variable in ETB);

X6 = professional advice on finance management (continuous variable: number of times received professional advice on finance management);

X7 = transport cost to financial institutions in a month (continuous variable);

X8 = level of savings with bank in the last 12 months (continuous variable);

X9 = proportion of credit utilized (measured in percentages);

X10 = access to insurance policy (dummy variable; Yes = 1, No = 0); and

e = error term.

4.4 Binary logistic regression model

The logistic regression was used to analyze objective (iv) (estimate the determinants of commercialization/food security status among urban women farmers in the study area). The model is specified in Equation 7 (Atagher 2013) as follows:

where,

ε - N (0, 1). Then Y can be observed as an indicator for whether this latent variable is positive;

Y = (Commercialized = 1, Not commercialized = 0);

X = vector of explanatory variables;

β = coefficients; and.

εi = random error.

The model is specified explicitly in Equation 8 (Atagher 2013) as follows:

The explanatory variables for women farmers are as follows:

X1 = frequency of bank mobile application usage (continuous variable: number of times the bank mobile application is used for a transaction);

X2 = ownership of account with commercial banks (continuous variable: number of accounts with commercial banks);

X3 = amount saved in the past 12 months (continuous variable: ETB);

X4 = means of saving (discrete variables: bank, home, and group of friends);

X5 = farm income (continuous variable: ETB);

X6 = professional advice on finance management (continuous variable: number of times received professional advice on finance management);

X7 = transport cost to financial institutions in a month (continuous variable: ETB);

X8 = level of savings with bank in the last 12 months (continuous variable: ETB);

X9 = proportion of credit utilized (measured in percentages); and

X10 = access to insurance policy (dummy variable; Yes = 1, No = 0).

4.5 Food security status

Y = food security status (food secure = 1, food insecure = 0);

X = vector of explanatory variables;

β = coefficients; and

εi = random error.

The model is specified explicitly in Equation 9 (Atagher 2013) as follows:

The explanatory variables for women farmers are as follows:

X1 = frequency of bank mobile application usage (continuous variable: number of times the bank mobile application is used for transaction);

X2 = ownership of account with commercial banks (continuous variable: number of accounts with commercial banks);

X3 = amount saved in the past 12 months (continuous variable: ETB);

X4 = means of saving (discrete variables: bank, home, and group of friends);

X5 = farm income (continuous variable: ETB);

X6 = professional advice on finance management (continuous variable: number of times received professional advice on finance management);

X7 = transport cost to financial institutions in a month (continuous variable: ETB);

X8 = level of savings with bank in the last 12 months (continuous variable: ETB);

X9 = proportion of credit utilized (measured in percentages); and

X10 = access to insurance policy (dummy variable; Yes = 1, No = 0).

5 Findings and discussions

5.1 Food security status and financial inclusion factors influencing the food security status of women farmers

5.1.1 Perception toward the contribution of cash transfers of UPSNP for the involvement in urban agriculture as a means of livelihood

As indicated in Table 2, the study achieved a 100% response rate, and out of the 265 study participants, approximately 119 and 100 showed a positive perception or agreement regarding the actual contribution of the cash transfer of safety net program to the involvement of women program beneficiaries in urban agriculture in the study area. This means that for the majority of women participants (about 83%), the urban safety net program, through its financial transfers, could play crucial roles for urban women households in increasing their monthly income as well as to participate in different kinds of urban agriculture such as horticulture and animal-husbandry, as their means of livelihood and generating income. The findings are almost similar among the three study sites. Most of the key informant interviews (KIIs) also confirmed that the financial transfers provided by the urban safety net program are helping beneficiary households, including women, by increasing their monthly income and enhancing their capacity to participate in income-generating activities such as urban agriculture in the city.

Table 2. Contribution of cash transfer of the safety net program to the involvement in urban agriculture.

Similarly, a study by Tareke (2022b) demonstrated that the financial transfers made by the urban safety net program to low-income households in Addis Ababa city helped increase their income, food expenditure, and intake capacity. Thus, it is easy to understand that the recently started urban safety net program in Addis Ababa city, Ethiopia, through its financial transfers, could play crucial roles not only in increasing the monthly income of urban women households but also the financial ability to participate in different kinds of urban agriculture such as horticulture and animal-husbandry, as their means of livelihood and generating income.

5.1.2 Food security status of urban women households

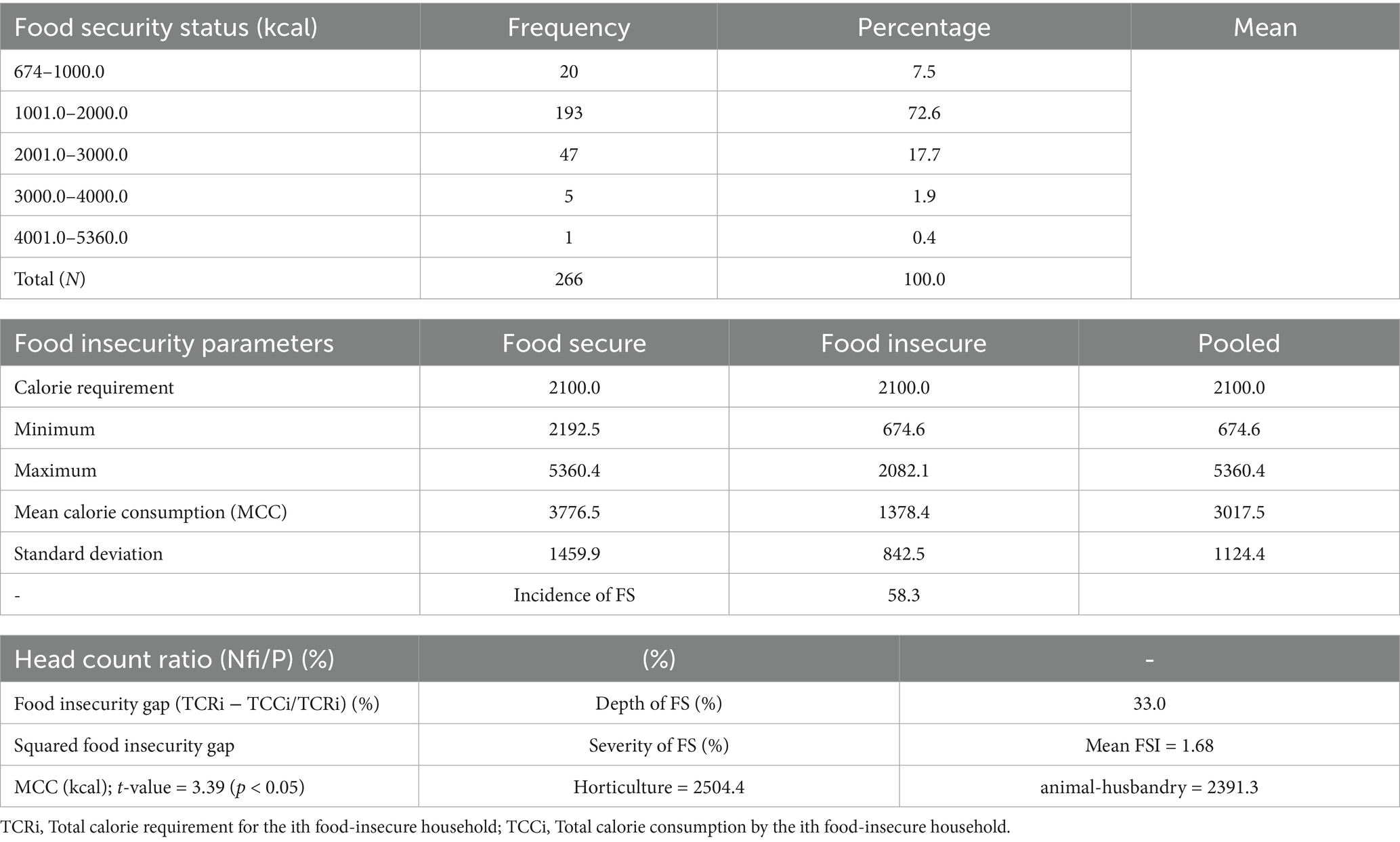

Table 1 presents the food security index for urban women farmers in the research area. The parameters for the two groups of homes under study are shown in the table along with their corresponding indicators. According to the USDA (U.S. Department of Agriculture) (2000) methodology, there were two categories in terms of food security: those who had access to enough food and those who did not. The food-secure groups consume 2,100 kcals or more per person per day, whereas the food-insecure groups, which are further divided into marginally, moderately, and severely food-insecure groups, consume 2,099 kcals or less per person per day, ranging from 1,800 kcals to 1,500 kcals, respectively.

Based on the food security groupings, the frequencies and percentages of women farmers were displayed. The lowest and maximum caloric intake of the women farmers’ food-secure and food-insecure groups were displayed (Table 1). The food insecurity gap was shown, demonstrating the prevalence, depth, and severity of food insecurity in percentages, as well as the average number of calories consumed and the food security score for each group.

5.1.3 Food security status and levels of women households involved in urban agriculture

To enhance the strength of the analysis tests, based on the statistical analysis, any variable with a p-value < 0.05 at 95% CI was declared significantly associated with food insecurity among women household. Model fitness was also assessed using the Hosmer–Lemeshow test, with a p-value > 0.05. As shown in Figure 1, the study assessed the food security status of women farmers in urban agriculture by analyzing food consumption within a 7-day recall period. The data was converted into K/calorie amounts and the number of calories consumed by a single adult equivalent. The required calorie intake for an active and healthy life was determined, with 2,100 kcal a day as a minimum threshold level (Smith et al., 2017). Therefore, women farmers were classified as having food security if their K/calorie consumption/acquisition was equal to or more than the threshold level, and as having food insecurity otherwise.

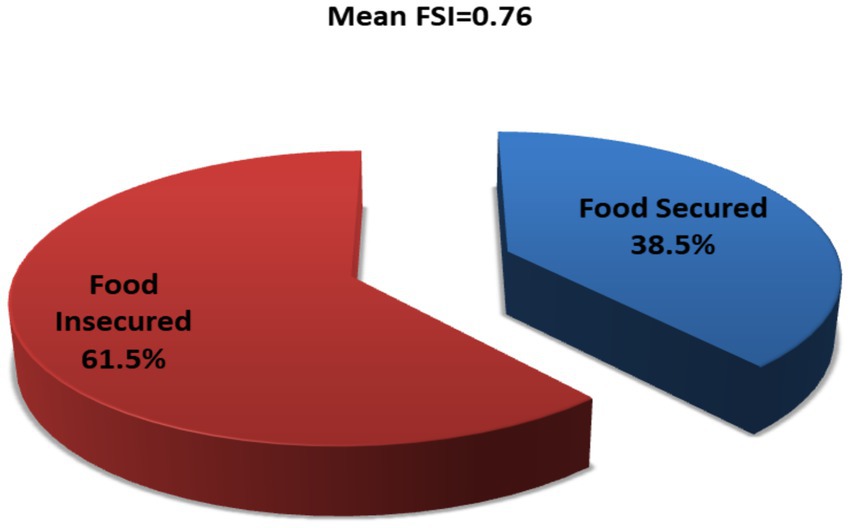

As a consequence, out of the 278 urban women households participating in urban agriculture, 107 (38.5%) had access to enough food, which helped them achieve a relatively “food-secure” status. In contrast, 171 (61.5%) did not have access and were classified as being in a “food-insecure” status. The lowest and maximum K/calorie ingested by a single adult woman farmer who was food insecure were 674.6 and 2,082.1, respectively, whereas those of the women farmers who were food secure were 2,192.5 and 5,360.4. As a result, the mean calorie levels for food-secure non-farm families were 3,776.6 Kcal and 1,378 Kcal, respectively. As a consequence, 1,459.9 kcals and 842.5 kcals, respectively, were found to be the standard deviation for households with food insecurity and those with food security. The head count ratio determines the proportion of households with deficits of 2,100 kcal per person per day. The percentage of women farmers who had daily caloric deficits of 2,100 kcal or greater is determined using the head count ratio. According to this finding, the majority (or 61.5%) of women households were food insecure as they were unable to meet their daily energy needs, whereas 38.5% were relatively food secure because they were able to do so on average (see Figure 1).

The food insecurity gap measures the mean depth of food insecurity among food-insecure households. It is the mean proportion by which the food security status of food-insecure households falls below the minimum level of calorie requirement. The results of this study indicated that food-insecure women farmers are 33.0% below the minimum level of calorie requirement, that is, 2,100 kcals.

The squared food insecurity gap measures the severity of food insecurity among food-insecure women farmers. It gives more weight to the average calorie shortfalls of the most food-insecure women farmers. Thus, it measures the squared proportional shortfalls from the minimum level of calorie intake. The drawback of this food insecurity index, according to Shemelis and Daniel (2023), is that it is difficult to understand. However, it can be claimed that in Addis Ababa city, the degree of food insecurity among women farmers is approximately 5.74%. According to the statistical test of significance, urban women involved in urban agriculture, such as horticulture and animal husbandry in the research area, consume substantially different amounts of calories on average (t-value = 3.39; p-value = 0.05).

This result is consistent with that of Ibok et al. (2014), who found that in Cross River State, 52.5% of urban food crop-producing households were food secure, while 47.5% were not. In their study on the impact of urban agriculture on household food insecurity in Ibadan city, Oyo State, Nigeria, Rose et al. (2020) observed that 62.5% of households were food secure while 37.5% were food insecure. Similarly, Idrisa et al. (2008) found that 42.5% of families in the Gwagwalada Area Council of the Federal Capital Territory, Abuja, Nigeria, were food secure, 27.5% were moderately food secure and just 30.0% were non-food secure in their research of the food security status of farmer households.

Good household incomes, a high level of education, as well as engagement in activities that diversify sources of revenue are factors that may contribute to the presence of food security among women households. According to FAO (2021), there is a correlation between education level and the likelihood of finding decent work. Thus, it may be inferred that women farmers may have had access to decent occupations, financial services, and various sources of income that would have allowed them to afford the correct kind and amount of food, improving their situation about food security. Adebayo et al. (2012) found a comparable outcome among farmers in both rural and urban areas in Kaduna State, Nigeria.

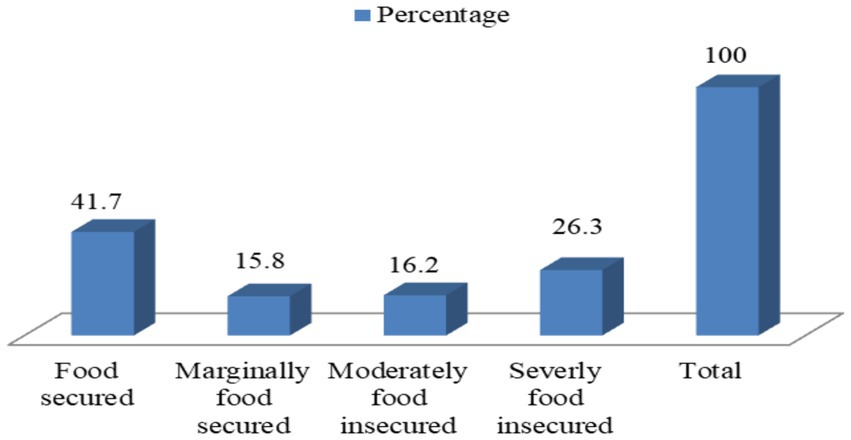

Figure 2 also illustrates the level of food security experienced by women who are safety net beneficiaries and involved in urban agricultural activities. According to the results, only a small percentage (15.8%) experienced slight food insecurity, 16.2% experienced moderate food insecurity, and 26.3% experienced severe food insecurity. In non-farm homes, the average calorie intake is 3,403.3, compared to 1,690.7 in households where food security is a concern. For women farmers who are either food secure or food insecure, the respective mean food security indices are 1.68 and 0.76. Furthermore, it is worth noting that during the survey, it was also found that the maximum and mean family sizes of women households involved in the safety net program were 3 and 2, respectively, which may have its own implications for the family planning practices and food security status and levels.

5.1.4 Financial inclusion factors influencing the food security index of urban women farmers

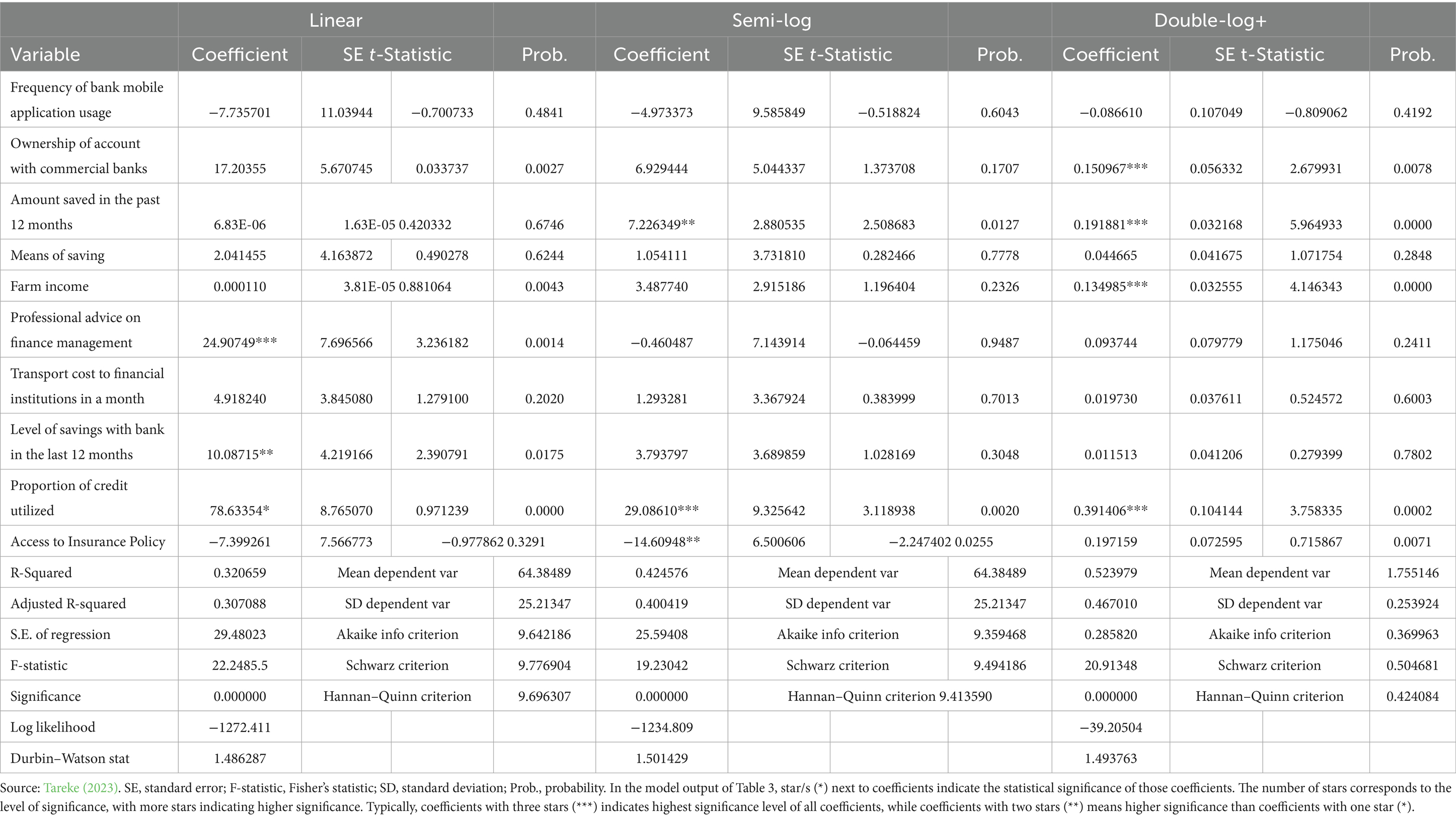

The study employed the OLS multiple regression approach to analyze the financial inclusion factors affecting the food security index of women farmers in the study area, as shown in Table 3. The double-log function was chosen due to its high coefficient of multiple determinations, lowest mean squared error, and significant Fisher’s statistic value. The coefficient of determination (R2) showed that 52.4% of the variability in the food security index among women farmers was attributed to the specified explanatory variables, indicating their importance as determinants (Table 3).

Table 3. OLS multiple regression of financial inclusion factors affecting food security status of women farmers.

The F-statistic value of 20.9 indicates that the data fits the model and that the independent variables are significant explanatory factors for variations in the food security index. The R2-value assumes all independent variables affect the model’s result, while the adjusted R2-value considers only those that significantly affect the model’s performance. To balance this, models are compared using different independent variables, as adjusted R2. Previous studies (Olayemi, 2012; Adetunji, 2015; Beyene and Muche, 2010) have shown that adjusted R2 increases as new variables improve the model more than expected by chance.

The Durbin–Watson (DW) statistic is used as a test for checking autocorrelation in the residuals of a statistical regression analysis. If autocorrelation exists, it underestimates the standard error and may lead us to believe that predictors are significant when, in reality, they are not. The value always lies between 0 and 4. If the DW statistic is substantially less than 2, there is evidence of positive serial correlation. As a rough rule of thumb, if DW is less than 1.0, there may be cause for alarm.

The DW statistic in the model was 1.49, indicating positive autocorrelation, which follows Cameron and Trivedi’s rule of thumb. The Akaike/Schwartz or Bayesian Information Criterion/Hannan-Quinn information criterion, which considers the lower values of these criteria, suggests that the model is the best to adopt. The Akaike/Schwartz or Bayesian Information Criterion/Hannan-Quinn information criterion values of 0.299297, 0.434015, and 0.353418 (<2) are the lowest among the other functional forms, indicating that this form is most suitable for this case.

The empirical results show that the coefficient of ownership of account with commercial banks (0.150967), amount saved in the past 12 months (0.191881), farm income (0.134985) and proportion of credit utilized for actual collection intention (0.391406) has a significant positive effect at various significant levels on food security index of urban safety net beneficiary women farmers in the study area.

The coefficient of ownership of accounts with commercial banks (0.150967) was positive and significant at a 1.0% alpha level, implying that the probability of women farmers’ food security increased with a rise in the level of ownership of accounts with commercial banks by 0.150967. This finding aligns with the prior expectation. Having a bank account provides a secure place to store and manage one’s money. Instead of keeping cash at home, which can be susceptible to theft or loss, women farmers can deposit their funds in a bank account. This reduces the risk of financial loss and ensures that the money earmarked for food expenses is protected. Also, bank accounts offer a convenient means for individuals to save money. By regularly depositing a portion of their income, individuals can build up savings over time. This can serve as a financial safety net during emergencies or periods of income fluctuations, ensuring that there are sufficient funds to purchase food even in challenging times. Similar results were obtained by the following studies (Olayemi, 2012; Adetunji, 2015; Beyene and Muche, 2010).

Bank accounts provide access to a range of financial services that can support food security. For example, individuals can use their bank accounts to receive wages, government benefits, or remittances, ensuring a steady flow of income for purchasing food and maintaining food security. Bank accounts also enable individuals to make convenient and secure payments for groceries and other food-related expenses, reducing the risk of loss or theft associated with carrying cash. According to Carbo et al. (2007), owning a bank account can improve access to credit facilities such as loans or overdrafts. This can be particularly beneficial for small-scale farmers or individuals engaged in food production activities. Access to credit can help them invest in agricultural inputs, equipment, or infrastructure, ultimately increasing their productivity and ensuring a stable food supply. Furthermore, according to Clement (2018) and Cook et al. (2004), bank accounts enable individuals to track their income and expenses, facilitating better financial planning and budgeting. By having a clear understanding of their financial situation, women farmers can allocate funds appropriately for food expenses, ensuring that they prioritize their nutritional needs.

In conformity, ownership of a bank account can contribute to financial empowerment by providing individuals with a sense of control over their finances. This empowerment can positively impact decision-making related to food choices, enabling individuals to make informed decisions about purchasing nutritious and diverse food items (Dereje, 2021).

It is essential to acknowledge that while bank accounts can contribute to enhancing food security, several barriers to access exist, including banking infrastructure, limited financial literacy, and affordability issues. Efforts to promote financial inclusion, enhance financial education, and address these barriers are crucial in ensuring that the benefits of bank account ownership translate into improved food security for women farmers in urban areas.

The coefficient of the amount saved in the past 12 months (0.191881) had a positive sign and was statistically significant at a 1.0% risk level. This result indicates that a unit increase in the amount of money saved by women farmers yearly increases food security by 0.191881. By saving money in banks, women farmers can build emergency funds that can be used during times of financial hardship or unexpected expenses. This can help protect against food insecurity during times of crisis, such as job loss or medical emergencies, by providing a safety net to cover basic needs like food.

According to Béné and Devereux (2023), saving money in banks can provide women farmers with the necessary capital to invest in agricultural activities. These women involved in urban agriculture, for example, can use their savings to purchase seeds, fertilizers, equipment, or livestock, which can increase their agricultural productivity and ultimately improve their food production and income.

This, in turn, can enhance food security not only for themselves but also for the larger community. Maintaining a good savings history and having a bank account can enhance an individual’s creditworthiness. This can make it easier for them to access credit from banks or financial institutions, which can be used for agricultural purposes or to start income-generating activities related to food production or processing. Access to credit can provide farmers with the necessary resources to expand their operations, invest in technology, or improve their farming practices, thus increasing their food production capacity. A higher amount saved in the bank can also contribute to overall financial stability. When women farmers have a financial cushion, they are less likely to face sudden financial crises or resort to harmful coping mechanisms, such as selling productive assets or reducing food consumption. By maintaining financial stability, individuals can ensure a consistent and reliable food supply for themselves and their families. This finding aligns with Fakayode et al. (2009), who found that households primarily save to maintain their food security.

The study found a significant positive effect of farm income (with a coefficient of 0.134985) on the food security of women farmers. This finding was consistent with previous expectations, suggesting that increased income, possibly due to higher yields, better credit access, or financial inclusion, can accelerate food security. High farm income can also directly and indirectly contribute to food security, as it encourages women farmers to invest in their agricultural activities.

They can purchase improved seeds, quality fertilizers, modern machinery, and advanced farming techniques. These investments can enhance agricultural productivity, leading to increased food production. With higher farm income, women farmers can also afford to adopt sustainable farming practices and invest in technologies that improve efficiency and reduce post-harvest losses. This, in turn, can contribute to a more secure food supply.

Furthermore, high farm income allows urban women farmers to have better access to crucial agricultural inputs and resources. They can afford to purchase high-quality inputs, such as fertilizers, pesticides, and irrigation systems, which can improve crop yields and overall productivity. Additionally, women households with higher incomes can access credit and financial services more easily, enabling them to invest in necessary resources for their farming operations. Access to inputs and resources can result in increased food production and improved food security.

In the view of Fayeye and Ola (2017), women households have the opportunity to diversify their agricultural activities with a higher income. They can allocate resources to grow a variety of crops or engage in livestock rearing, aquaculture, or other income-generating activities. Diversification can help mitigate the risks associated with crop failures, market fluctuations, and the impacts of climate change. By having multiple sources of income, women farmers can better sustain themselves during challenging times, thereby reducing their vulnerability to food insecurity.

The result conforms with Feleke et al. (2019), who found that higher farm income can lead to improved living standards for farmers and their families. It can enable them to meet their basic needs, including access to nutritious food, healthcare, and education. When women farmers have better access to essential resources, they can provide a more stable and healthier environment for their families.

This, in turn, contributes to improved overall food security within the household. A similar argument was made by Gebre (2012), who believed that increased farm income can stimulate local economies, particularly in urban areas where agriculture is a significant sector. A similar study by Tareke (2022a) also found that increasing the income of urban low-income households can enhance their food purchasing power, savings, and probability of participating in income-generating activities. When women farmers are involved in urban agriculture, they tend to have higher incomes and higher purchasing power, enabling them to buy goods and services from local businesses. This can create a positive economic cycle, leading to job creation, increased incomes for non-agricultural workers, and improved access to food for the local community.

Strong local food systems contribute to food security by reducing dependence on external food sources and promoting self-sufficiency. It is important to note that while high farm income can have positive impacts on food security, it should be accompanied by equitable distribution of resources, access to markets, and supportive policies to ensure that the benefits reach all stakeholders in the agricultural sector. Similar results have also been obtained by Gitu (2020), Abdullahi (2021), and Hadebe and Mpofu (2019).

The study found that increasing the proportion of credit used for its intended purpose (0.391406) is positive and statistically significant at a 1% probability level, leading to a corresponding increase in the food security of urban farmers by 0.391406. This aligns with a priori expectations and can be particularly beneficial for women farmers who obtain credit specifically for agricultural purposes, enabling them to invest in their farming operations.

This can include purchasing quality seeds, fertilizers, machinery, irrigation systems, and other inputs necessary for increasing agricultural productivity. By utilizing credit for its intended purpose, urban women farmers can enhance their production capacity, improve crop yields, and ultimately contribute to a more secure food supply. In the words of Hanson et al. (2021), credit utilized for its intended purpose by farmers can also be used to strengthen the agricultural value chain, which encompasses all the activities involved in bringing agricultural products from the farm to the consumer.

Women farmers can utilize credit to establish or improve post-harvest infrastructure, such as storage facilities, processing units, and transportation systems. By investing in value chain development, farmers can reduce post-harvest losses, improve the quality of their produce, and ensure timely delivery to markets. This can lead to increased income, improved market access, and enhanced food security. Similar results have also been obtained by Idrisa et al. (2008) and Irohibe and Agwu (2014).

5.2 How have CTs of UPSNP improved the food security of low-income urban people, primarily women?

The preceding study (Tareke, 2022b) confirmed that the food security of households improved primarily after receiving CTs from the urban safety net program, as the majority of households’ income is recently spent on food expenditures and intake in many developing countries, including Ethiopia. The key components of household food security, including food access, expenditure, and diet intake capacities of beneficiaries in post-CT years, were significantly improved.

In addition to the monthly CTs from the safety net program in urban areas, supplementary income could be obtained as a result of relatively better saving habits; participation in other income-generating activities, such as urban agriculture; access to financial inclusion options, such as agricultural credit provisions, bank account ownership and farm income; and relatively better family planning practices in this particular city, which contributed to the reducing trend of family size and dependency ratio. In this city, as a result of the financial benefits received from the safety net program, the involvement of women households in urban agriculture, including horticulture and animal husbandry, contributed not only to an additional source of income but also as a source of daily diets for their families.

In line with recent studies such as Borku et al. (2024a,b,c,d), Tareke (2022a), and Bastagli et al. (2019), the statistical and qualitative results of the current study indicated that these factors could contribute to the improvement in households’ food purchasing power, access and daily diet intake, which ultimately resulted in that relatively high proportion of households’ food security levels compared to other cities and the scenario or situation before 2024.

Unlike the food insecurity levels indicated by other studies conducted before (for example, 77.1% by Derso et al., 2021, and 75% by Birhane et al., 2014), the 61.5% food insecurity level (or 38.5% of the food-secure level) found in the current study in 2024 is either relatively higher or similar and consistent with other recent studies and reports. For example, Gebre (2012) showed that the food insecurity level was 58.1% in the city. Moreover, in 2018, the magnitude of food insecurity among populations in Eastern Africa was 62.7%. As a consequence of food insecurity in this region, nearly one-third of the population (30.8%) was undernourished due to a lack of sufficient calories (FAO, WFP, UNICEF, 2019).

It can be attributed to the government’s collaboration with the World Food Program (WFP) and development partners who have worked together to improve food security and stabilize assets for 10 million Ethiopian people through the UPSNP.

It is essential to note that the somewhat enhanced food security levels observed in the current study are specific to Safety Net Program (UPSNP) beneficiary households, excluding non-beneficiary households, and do not reflect the food security level of households in general. In addition, the beneficial households in this study are exclusively women, who have relatively better performance in the proper use of the monthly CTs, participation in income-generating activities such as urban agriculture, saving, food purchasing capacity, and others, compared to men’s households (Tareke, 2022b; Bastagli et al., 2019; Hagen-Zanker et al., 2017; Pega et al., 2015).

According to Yoong et al. (2012), AIR (2014), IEG (2014), and Rebecca et al. (2013), when females receive financial benefits or cash transfers, consumption decisions are often found to be more focused on children and investing in different types of assets compared to males. Providing economic benefits to females makes a difference. It significantly enhances females’ empowerment and decision-making power independently and jointly with their husbands in urban areas, which can at long last contribute to the enhancement of food security levels among women’s households (Yoong et al., 2012; Hagen-Zanker et al., 2017; Haushofer and Shapiro, 2013; IEG, 2014).

Being consistent with the evidence forwarded by prior studies (Borku et al., 2024c; Khan et al., 2021; Prymostka et al., 2020; Badmus, 2020), the findings confirmed that in addition to the monthly financial transfers of UPSNP received by beneficial women, the various financial inclusion options played significant roles in the involvement of women households in income-generating activities such as urban agriculture as well as the reduction of households’ food insecurity levels in the last few years, chiefly in Addis Ababa city, Ethiopia.

6 Conclusion

Worldwide, reducing urban poverty and food insecurity through inclusive, effective, and sustainable interventions by governments and actors has been widely advocated. Accordingly, the urban safety net program has been implemented primarily in developing regions to reduce poverty, food insecurity, and income inequality among urban populations, particularly women. The issue of the relevance and contribution of cash transfers of urban safety nets to support income improvement, financial services, and engagement in private business, such as urban agriculture and food security for women’s households, is relatively unexplored in developing economies, including Ethiopia. To inform urban planning and policy, the research aimed to empirically investigate the causal link between cash transfers, financial inclusion options, involvement in urban agriculture, income enhancement, and food security, primarily among women households in Ethiopia. A review of qualitative and quantitative concepts, along with any related analytical models, provided the basis for designing, implementing, and analyzing the empirical part of the inquiry. The research expanded our knowledge of this topic and compared it to findings from the literature based on the outcomes of the qualitative and quantitative surveys, as well as relevant statistical inferential analysis models such as OLS and logistic regression. The key findings of the current study largely confirm the hypotheses and conclusions of the preceding study (Tareke, 2022a) on this topic. In this subsequent research, it is clearly observed that the recently initiated urban safety net program, through its financial transfers, could play a crucial role for urban women households, not only increasing their monthly income but also enabling them to participate in urban agriculture, such as horticulture and animal husbandry, as a means of livelihood and income generation. However, through its financial transfers, the contribution of the urban safety net program to the food security status and level of its target groups, primarily urban women households, is not satisfactory. According to the food security index, a slightly higher percentage of people than usual experienced food insecurity. In the study area, the mean calorie consumption of women participating in various urban agriculture activities differed substantially.

The study implies that the proportion of credit used for actual collection purposes, the amount saved in the past 12 months, farm income, and the coefficient of account ownership with commercial banks all had significant positive effects on the food security index of women involved in urban agriculture in the study area, while the amount saved in the past 12 months, professional advice on financial management, and the proportion of credit utilized had significant negative effects at various significant levels.

Additionally, having an account with a commercial bank and the frequency with which one uses their mobile banking applications both had a significant impact on one’s degree of food security. The study found that the majority of urban farmers were food insecure. There needs to be soft loan provisions, grants, and incentives provided by the government, in addition to the financial inclusion policy, to help urban women involved in urban agriculture out of food insecurity.

The theoretical and practical implications of these findings are profound, particularly for the urban safety net, financial services, job creation, and food security policy in developing economies, using a relevant model. They underscore the urgent need for urban planners, policymakers, and decision-makers to consider the following issues: To reach the majority of food-insecure urban women households in the research region, the government should expand its urban safety net program to include livelihood empowerment and school feeding. The next step is to increase family planning education and awareness, as a larger reliance rate is anticipated to aggravate the food security situation for women farmers. Urban women, particularly those involved in the safety net program and urban agriculture, should be made aware of the need to have as many children as they can easily care for.

The study informs that due to cash transfers of the urban safety net program, women households involved in urban agriculture enjoyed financial inclusion components, but were still food insecure. The study also suggests that if the government and stakeholders offer work or business opportunities to people, primarily women, they will choose to work because most people are unaware that a business can make more money than a salary. This is because low-income individuals often remain in the low-income bracket, as they lack the training to recognize entrepreneurial opportunities. Entrepreneurial education and training should be prioritized because they help women to work for themselves, generating income and profit, rather than working for a salary or for others. Accordingly, profits can make women a fortune, but wages or salaries can provide a more stable support for women.

Moreover, the study contributes to the existing literature by highlighting the relevance of mixed design, OLS, and binary regression models in better understanding cash transfers of urban safety net programs and financial service options, as well as their implications for the food security of urban people, including women. Thus, the existing urban safety net programs, urban planning, and development policy need to be pro-low-income people, inclusive, gender-sensitive, and responsive through entrepreneurial-oriented approaches rather than direct aid. The study suggests revisiting financial inclusion options and considering soft loan provisions, grants, agricultural inputs, market links, training, incentives, and increasing the CTs amount to bring urban women households out of food insecurity by improving their nutrition and employment opportunities through urban agriculture and other businesses.

Although the sampling design could help select proportional and representative households from inner, intermediate, and outer-city locations or districts, and it is aligned with the robust analysis tools and findings, the study is not without limitations. The limitations of the current study relate to the fact that it focused on women households and was also confined to three districts/weredas of the city, due to financial, time, and other constraints. It would have been, however, better to include a certain number of men beneficiary households for comparative analysis. More importantly, a better generalization would have been possible had the data been collected from a higher number of districts or weredas in the city.

Despite some of the limitations mentioned above, the present study is capable of providing insights and making a contribution to the body of knowledge on the relationship between cash transfers of urban safety net programs, financial service options, and their implications on involvement in urban agriculture and food security in urban settings.

In conclusion, to make the safety net program and urban agriculture goals more effective, it is essential to carry out further research considering the gaps and to organize Business-to-Business Networking events among financial service providers to create long–term partnerships to improve financial services to low-income urban communities, particularly safety net program women households and agricultural micro, small, and medium enterprises. In addition to scaling up & expanding the achievements of this urban safety net program to reach more low-income women households, the provision of health and family planning services as well as and innovative agricultural practices such as Agri-tech, precision, regenerative, sustainable and climate-smart agriculture can make significant difference in the enhancement of urban agriculture and food security. Furthermore, as the safety net program’s cash transfer is a short-term solution, in the long run, other reliable privately owned businesses or shares, and access to land for production and product sale, will serve as a catalyst for life expectancy and well-being after or before the retirement of women households. These initiatives will assist urban women households in achieving the threshold to graduate from the UPSNP. Improved access to financial services plays a crucial role in achieving the goals of UPSNP and SDGs, including food security and sustainable urban development, primarily in developing regions.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Ethics statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent from the [patients/ participants OR patients/participants legal guardian/next of kin] was not required to participate in this study in accordance with the national legislation and the institutional requirements.

Author contributions

KT: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author declares that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abdullahi, G., (2021). Food insecurity and copping strategies of agro-pastoral household in Awbare Woreda, Somali region, Etihipia. A M.Sc. Thesis presented to the school of graduate student of Alemaya university. 93p

Adebayo, C. O., Sanni, S. A., and Baiyegunhi, L. J. S. (2012). Microcredit scheme impact and food security status of beneficiaries in Kaduna state, Nigeria: a propensity score matching approach. Afric J Agric Res 37, 5181–5197. doi: 10.5897/AJAR12.475

Adetunji, M. O. (2015). Analysis of food security status of fruit and vegetable marketers in Ibadan north L. G. Area, Oyo state, Nigeria. J. Emerg. Trends Econ. Manag. Sci. 6, 252–257.

AIR (2014). American Institutes for Research. Zambia's child Grant program: 36-month impact report. Washington, DC: American Institutes for Research.

Amoah, A., Korle, K., and Asiama, R. K. (2020). Mobile money as a financial inclusion instrument: what are the determinants? Int. J. Soc. Econ. 47, 1283–1297. doi: 10.1108/IJSE-05-2020-0271

Amurtiya, M., Yuniyus, D. G., Mark, P., and Zubaira, E. A. (2018). Analysis of rural farm households’ access to formal agricultural credit in Yola south local government area. Adamawa State, Nigeria: Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis.

Anna, M. (2013). Social protection and resilient food systems: The role of public works and resilient food systems. London, UK: Annual Report, Overseas Development Institute.

Arnold, C. T., and Conway, G. M. (2011). “Cash transfers: literature review,” in Policy division, DFID.

Atagher, M. M. (2013). Effects of Benue ADP’S cassava production technologies on the productivity and incomes of women farmers in Benue state. Nigeria: Department of Agricultural Economics, University of Nigeria, 2013.

Attanasio, O., Battistin, E., Fitzsimons, A., and Mesnard, V.-H. (2005). How effective are conditional cash transfers? Evidence from Colombia. IFS briefing note. London, UK: Institute for Fiscal Studies.

Babatunde, R. O., Omotesho, O. A., and Sholoton, A. (2007). Socio-economic characteristics and food security status of farming households in Kwara state, north Central Nigeria. Pak. J. Nutr. 6, 49–58. doi: 10.3923/pjn.2007.49.58

Badmus, O. (2020). Gender gap and credit use in smallholder agriculture in Nigeria. Available online at: https://ideas.repec.org/a/bjc/journl/v7y2020i9p355-362.html (Accessed 25 July, 2024).

Bastagli, F., Hagen-Zanker, J., Harman, L., Barca, V., Sturge, G., and Schmidt, T. (2019). The impact of cash transfers: a review of the evidence from low-and middle-income countries. J. Soc. Policy 48, 569–594. doi: 10.1017/S0047279418000715

Baye, K., Retta, N., and Abuye, C. (2014). Comparison of the effects of conditional food and cash transfers of the Ethiopian productive safety net program on household food security and dietary diversity in the face of rising food prices: ways forward for a more nutrition-sensitive program. Food Nutr. Bull. 35, 289–295. doi: 10.1177/156482651403500301

Béné, C., and Devereux, S. (2023). “Resilience, food security and food systems: setting the scene” in Palgrave studies in agricultural economics and food policy, Eds. C. B. Barrett, Cornell University, Ithaca, NY, USA and palgrave macmillan, Springer Nature Gewerbestrasse, Cham, Switzerland AG. 1–29.

Beyene, F., and Muche, M. (2010). Determinants of food security among rural households of Central Ethiopia: an empirical analysis. Zeitschrift Für Ausländische Landwirtschaft. 49, 299–318. doi: 10.22004/ag.econ.155555