- Department of Horticulture, College of Agriculture and Natural Resources, Mekdela Amba University, Tuluawlia, Ethiopia

The global coffee market has experienced significant price volatility in recent years, with rising prices influenced by multiple factors, including climate change, supply chain disruptions, increased production costs, and growing demand. This review investigates the causes of global coffee price increases, focusing on their impact on Ethiopia’s coffee sector, a major player in global production and export. Climate change, through extreme weather events, has resulted in fluctuating yields and reduced productivity, threatening the stability of Ethiopia’s coffee industry. Supply chain disruptions, including labor shortages and shipping delays aggravated by the COVID-19 pandemic, have further strained the market. Moreover, rising input costs, particularly for fertilizers and labor, have added pressure on coffee producers. While the price surge presents opportunities for increased export revenues, particularly in specialty coffee, these benefits are tempered by the challenges of climate variability, labor shortages, and rising production costs. To enhance resilience and sustain growth, Ethiopia must prioritize climate-smart agricultural practices, technological innovation, and market diversification. Government support, including infrastructure development and financial services are essential to strengthen the coffee sector’s competitiveness and ensure long-term sustainability in the face of global market fluctuations.

1 Introduction

The global coffee market is a key component of international trade and economic stability, with coffee being the second most traded commodity in the world after oil (ICO, 2022). With an estimated annual trade volume exceeding 10 million tons and a market worth over $200 billion, coffee is not only a key consumer product but also a vital cash crop for many developing countries. In particular, Ethiopia stands out as both the birthplace of coffee and one of the largest producers and exporters globally, contributing significantly to its economy (Dida, 2022). Coffee accounts for around 30% of Ethiopia’s total export revenue, making it the primary agricultural export of the country (Tadesse, 2020). Ethiopia’s coffee is highly regarded for its distinct flavor profiles and high quality, with Arabica coffee representing approximately 60% of global production (International Trade Centre, 2021).

In recent years, however, coffee prices have experienced significant volatility, with global prices reaching historically high levels. This increase is attributed to a range of factors, including climate change, disruptions to supply chains, rising production costs, and surging global demand. These factors are not only affecting global coffee prices but also impacting coffee-producing countries such as Ethiopia, where coffee farming constitutes the backbone of rural economies and employment (Haji et al., 2021). For Ethiopia, the fluctuations in coffee prices present both opportunities and risks, particularly as the sector faces growing challenges from climatic shifts, labor shortages, and increased production costs. This review observes the factors driving the rise in global coffee prices, including climate change, supply chain disruptions, and increasing global demand, and assesses their impact on Ethiopia’s coffee sector. Furthermore, it explores opportunities for Ethiopia to diversify its markets, particularly in emerging regions, to strengthen its position in the global coffee trade.

2 Review methodology

This study employed a systematic review approach to gather and analyze literature on the global coffee market and Ethiopia’s coffee sector, following established guidelines for transparency, reliability, and comprehensiveness. The literature search was conducted using academic databases such as Google Scholar, Scopus, Web of Science, and Science Direct, along with industry reports from the International Coffee Organization, the International Trade Centre, and the Food and Agriculture Organization. Government publications and reports from the Ethiopian Coffee and Tea Authority were also reviewed. To ensure relevance, only peer-reviewed journal articles, reports, and publications from credible institutions published were included, with English-language sources prioritized.

Studies were selected based on their relevance to coffee price fluctuations, climate change impacts, supply chain disruptions, production costs, and market dynamics, while non-peer-reviewed sources, opinion pieces, and articles lacking empirical evidence were excluded. The search process involved predefined keywords and Boolean operators, using terms such as “Global coffee price fluctuations,” “Ethiopia coffee market trends,” “Climate change impact on coffee production,” “Supply chain disruptions in the coffee industry,” “Coffee production costs and economic implications,” and “Market diversification strategies for coffee exporters.” Identified studies were reviewed, and relevant data were systematically extracted, categorized, and synthesized into key themes, including climate change effects, supply chain issues, production costs, and market diversification strategies.

3 Causes of the global coffee price increase

3.1 Climate change: impact of extreme weather events

Climate change has increasingly become a critical challenge for coffee production worldwide. Coffee plants are highly sensitive to changes in temperature, rainfall patterns, and the occurrence of extreme weather events, such as droughts, floods, and frosts. These events can lead to reduced yields, altered growing seasons, and lower quality coffee beans, all of which contribute to price volatility in the global coffee market (Bilen et al., 2023). Recent high coffee prices in 2023 and 2024 were partly driven by climate anomalies in major producing regions. For example, Brazil, which produces about 40% of the world’s coffee, faced devastating frosts in 2021, followed by severe droughts in 2023. These conditions severely affected coffee harvests, particularly the Arabica variety, which is more susceptible to temperature fluctuations (De Freitas et al., 2024). The damage to Brazil’s coffee crops led to a sharp reduction in production, exacerbating global supply constraints and driving prices higher. Similarly, Ethiopia, with its diverse coffee-growing regions ranging from highland areas to lowland zones, is increasingly vulnerable to climate variability (Nigussie, 2024). Erratic rainfall and prolonged droughts in Ethiopia have led to fluctuating yields in recent years (Gomm et al., 2024). Furthermore, pests and diseases, such as coffee leaf rust and the coffee borer beetle, are expected to become more prevalent under changing climate conditions, further stressing the coffee supply chain (Bilen et al., 2023). These challenges underscore the pressing need for coffee producers to adopt climate-resilient farming techniques to mitigate the impacts of climate change on coffee yields.

3.2 Supply chain disruptions: effects of COVID-19, shipping delays, and labor shortages

The COVID-19 pandemic caused significant disruptions across global supply chains, including in the coffee industry. Shipping delays, port congestion, and logistical bottlenecks raised transportation costs, adding further pressure to the already strained coffee market (ICO, 2020; Global Coffee Report, 2021). The pandemic’s effects on transportation were especially felt during the height of lockdowns in 2020 and 2021, with a sharp decline in shipping efficiency leading to delays in the movement of coffee from producing countries to major importing markets (ICO, 2021). As coffee-exporting nations such as Brazil, Vietnam, and Colombia struggled to ship their products, the global supply of coffee dwindled, pushing prices higher.

In addition to supply chain disruptions, labor shortages have been another major factor affecting coffee production and processing. Many coffee farms, particularly those in Latin America and Africa, rely on seasonal labor for harvesting, processing, and packaging. Due to the pandemic, many workers were unable or unwilling to travel, while some countries implemented travel restrictions that further limited labor availability (ICO, 2020). This has led to delays in production and export, creating a supply–demand imbalance that has fueled price increases. The continued recovery from the pandemic in many parts of the world is still hampered by labor and logistical challenges. For example, labor shortages in key coffee-producing regions like Ethiopia have been compounded by rural–urban migration, as young people seek employment in cities rather than in agriculture (Devoney, 2023). Additionally, freight costs have continued to rise, contributing to the overall increase in production and transportation expenses. More recently, in 2023 and 2024, additional supply chain constraints have emerged due to geopolitical tensions, particularly the Ukraine-Russia war, which has affected the availability and price of key agricultural inputs, including fertilizers and fuel. The lingering effects of the pandemic, combined with these new challenges, have led to sustained price increases in the global coffee market.

3.3 Production costs: rising input costs

Rising production costs have been a critical factor driving up the price of coffee in recent years. The cost of inputs, such as fertilizers, pesticides, and labor, has increased sharply, which has added pressure on coffee farmers, especially those in developing countries who already face economic challenges. The global increase in fertilizer prices, driven by supply chain disruptions, rising fuel costs, and trade restrictions, has had a direct impact on coffee production (Saefong, 2024). Fertilizer shortages and price hikes have led to reduced application rates, which in turn may affect the quality and yield of coffee beans, thereby reducing the supply available for export and contributing to higher market prices. Labor costs have also risen across coffee-producing regions due to both domestic economic factors and the global impacts of the pandemic. In countries like Ethiopia, this has a significant coffee-growing sector, labor shortages and rising wage rates have placed additional strain on farmers (Charles, 2024). Rising labor costs are partially a result of a shrinking agricultural workforce, as younger generations increasingly leave rural areas in search of better-paying jobs in urban centers (UADA, 2023). Additionally, the Ukraine-Russia conflict has further exacerbated the situation by driving up fuel prices, which in turn affects the cost of coffee transportation and production (Ntah et al., 2023).

For Ethiopia’s smallholder farmers, who often struggle with low productivity and limited access to resources, the increased costs of inputs and labor are creating financial difficulties and undermining their ability to compete in global markets (Zerssa et al., 2021). Addressing these challenges will require policy interventions, such as subsidies for essential inputs, investment in sustainable farming practices, and support for mechanization to improve efficiency and reduce dependence on manual labor.

3.4 Global demand: increasing coffee consumption, especially in emerging markets

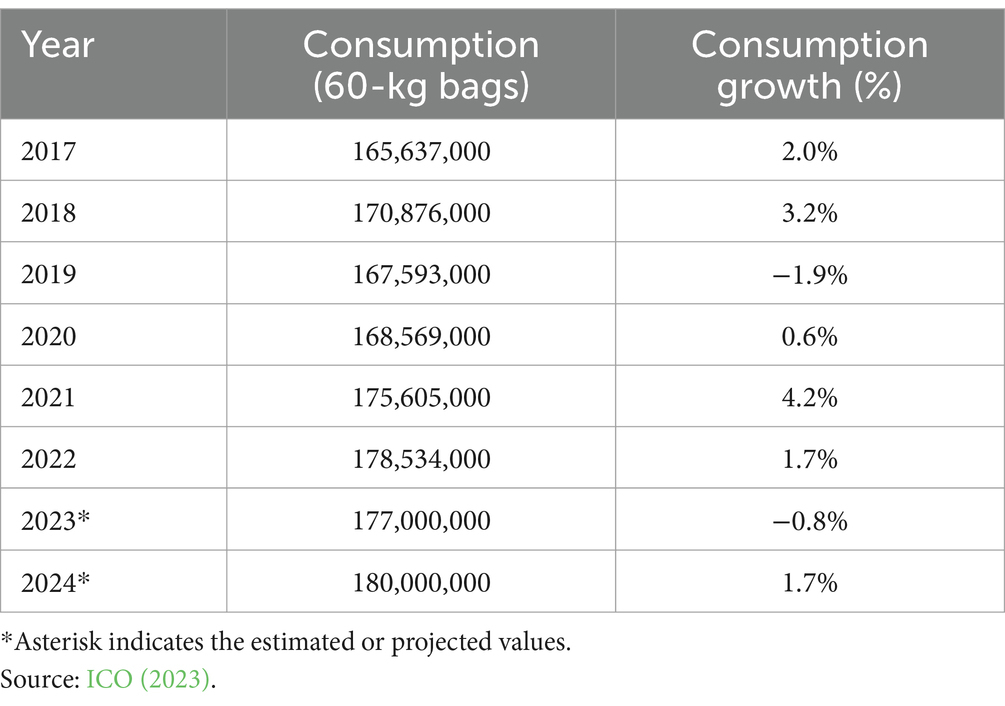

The growing global demand for coffee, especially in emerging markets, has also played a crucial role in pushing up prices. The coffee market is no longer solely dominated by traditional consumer countries like the United States and Europe; rapidly expanding economies in Asia, the Middle East, and Africa have led to an increase in global coffee consumption (Grand View Research, 2023). Global coffee consumption demonstrated an overall increasing trend from 2017 to 2024, despite periods of decline in 2019 and 2023, with the highest growth rate of 4.2% recorded in 2021 (Table 1). As middle-class populations in countries like China, India, and Vietnam continue to grow, their demand for coffee has surged (Charles, 2022). The increased consumption of coffee in these regions has driven a global shift in market dynamics, placing additional pressure on coffee production and supply. Data from the International Coffee Organization indicate that coffee consumption in China grew by more than 15% between 2020 and 2023, while India saw a 12% increase in the same period. These trends reflect changing consumer preferences and an increasing culture of coffee consumption in traditionally tea-drinking countries (Alfawaz et al., 2020). Ethiopia, as a major producer, stands to benefit from this rising demand, but only if it can enhance its production capacity and market penetration strategies.

Moreover, the rising demand for specialty coffee, driven by consumers’ increasing preference for high-quality, ethically sourced, and sustainably produced coffee, has further amplified price increases (Wu, 2025). Over the past decade, the specialty coffee sector, known for its premium coffees with unique flavor profiles, has grown considerably, especially in Western markets (Ponte, 2020). As a result, coffee producers, especially in countries like Ethiopia, are positioning themselves to cater to the premium segment, which often demands higher prices for superior beans and sustainable farming practices. However, the increased demand for specialty coffee also comes with its own challenges. For instance, ensuring the availability of high-quality beans while maintaining sustainability standards, such as Fairtrade certification, requires significant investment in farming practices, which further drives up production costs. With Ethiopia’s reputation for producing high-quality Arabica coffee, the country has an opportunity to capitalize on the specialty coffee market by improving its value chain, expanding direct trade agreements, and investing in branding efforts that highlight the uniqueness of Ethiopian coffee (Girma, 2021).

4 Impact of rising coffee prices on Ethiopia

4.1 Economic impact

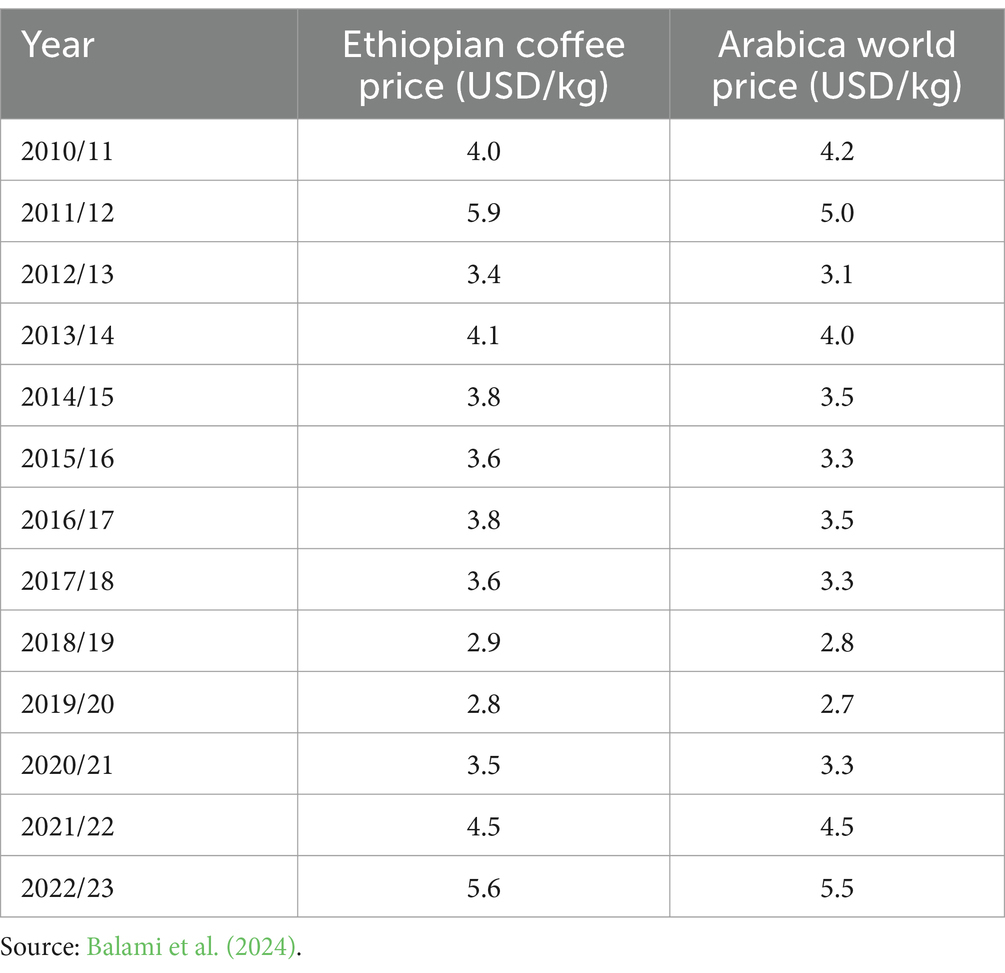

The rise in global coffee prices presents both opportunities and challenges for Ethiopia, where coffee remains a central pillar of the economy. Coffee is Ethiopia’s most important export commodity, accounting for over 30% of total export earnings and employing millions of smallholder farmers (Abate and Assefa, 2023). As global coffee prices rise, Ethiopia stands to benefit from higher revenues from coffee exports, which could significantly enhance its foreign exchange earnings and contribute to the broader economic growth of the country. For example, the 2021 surge in global coffee prices saw Ethiopia’s coffee export revenues increase by approximately 20% compared to previous years (Berhanu et al., 2021). Historical price trends indicate that Ethiopian coffee export prices have generally followed global Arabica price movements, with notable peaks in 2011/12 (USD 5.9/kg) and 2022/23 (USD 5.6/kg), reflecting periods of high international demand and price volatility (Table 2).

However, these benefits are tempered by the rising costs of coffee production, particularly as a result of climate change and escalating input prices. Inputs such as fertilizers, pesticides, and labor have become increasingly expensive due to global supply chain disruptions, inflation, and the rising cost of fuel (Sole et al., 2021). In Ethiopia, where smallholder farmers are the backbone of coffee production, these rising costs can significantly reduce their profit margins. Furthermore, as climate change leads to more frequent droughts, floods, and other extreme weather events, farmers are experiencing reduced yields, further aggravating the economic pressure they face (Tadesse et al., 2020). If farmers cannot absorb these additional costs or improve productivity, the potential revenue gains from higher coffee prices could be offset, leaving many farmers in financial distress.

4.2 Opportunities

Despite the challenges, the rise in coffee prices presents several opportunities for Ethiopia’s coffee sector, particularly for farmers producing specialty coffee. Specialty coffee, which is grown in small quantities and often sold at premium prices due to its superior quality and unique flavor profiles, represents a rapidly expanding market. As global demand for high-quality coffee grows, especially in Western countries, Ethiopia’s renowned coffee varieties such as Yirgacheffe and Sidamo are in increasing demand (Markos et al., 2023). This growing demand for Ethiopian specialty coffee can provide farmers with higher prices for their produce, thus improving their incomes. In addition, the increase in coffee export revenues can provide the Ethiopian government with an opportunity to reinvest in the sector. The government can use the additional foreign exchange earnings to invest in infrastructure, agricultural development, and climate change adaptation initiatives that would benefit coffee farmers. For instance, investment in irrigation systems, roads, and storage facilities could help mitigate the impacts of climate variability and reduce post-harvest losses (Berhanu et al., 2021). Furthermore, these investments could help Ethiopia diversify its coffee exports by improving the quality of coffee produced in various regions, thus enhancing its competitiveness in the global market.

For coffee cooperatives and farmers engaging in sustainable and organic farming practices, the rise in coffee prices also presents an opportunity to access niche markets that are willing to pay premium prices for sustainably sourced coffee (Haji et al., 2021). These cooperative-based models, which emphasize social and environmental responsibility, are gaining popularity among conscious consumers, especially in Europe and North America. Therefore, Ethiopia’s coffee sector has the potential to grow both in volume and value by focusing on premium, sustainable coffee products.

4.3 Challenges

Despite these opportunities, several significant challenges must be addressed for Ethiopia to fully capitalize on the rising coffee prices. One of the most pressing challenges is the vulnerability of smallholder farmers, who represent over 95% of coffee producers in Ethiopia (Tadesse, 2020). These farmers often face significant barriers in accessing financial services, modern farming technologies, and inputs, making it difficult for them to improve productivity and cope with rising production costs. As climate change continues to threaten the stability of coffee yields, many farmers lack the resources or technical knowledge to implement climate-resilient farming practices (Kaba et al., 2021).

Labor shortages are another critical issue. As Ethiopia’s rural population ages and the younger generation migrates to urban areas for better opportunities, coffee production faces a significant labor gap (Gresser, 2021). The migration of youth to cities in search of better-paying jobs in sectors like manufacturing or services has led to a reduction in the available workforce for agriculture, which is labor-intensive, especially during peak coffee harvesting seasons (Agiboo, 2024). This shortage of labor can increase production costs and reduce the overall efficiency of coffee production.

Moreover, Ethiopia’s coffee farmers are highly exposed to price volatility in the global coffee market, which can lead to significant income fluctuations. Although rising prices are beneficial in the short term, global coffee prices are notoriously volatile, and factors like geopolitical tensions, supply chain disruptions, and global economic downturns can cause sudden drops in prices (ICO, 2023). This volatility is particularly problematic for Ethiopian farmers, who are highly dependent on coffee exports for their livelihoods (Worako et al., 2011). For instance, a sharp drop in coffee prices in 2019 led to significant losses for many Ethiopian coffee farmers, despite strong global demand for coffee. The lack of investment in rural infrastructure and climate adaptation measures has left Ethiopia’s coffee sector vulnerable to market fluctuations and climate-related risks. Without significant investment in both climate-resilient farming technologies and rural infrastructure, such as roads, irrigation systems, and cold storage facilities, Ethiopia’s coffee sector will continue to face challenges that limit its ability to benefit fully from rising coffee prices (Berhanu et al., 2021).

5 Future prospects for Ethiopian coffee

5.1 Sustainability and innovation

To capitalize on rising global coffee prices, Ethiopia must prioritize sustainability and innovation in its coffee sector. The adoption of climate-resilient agricultural practices is crucial for mitigating the adverse effects of climate change, which threatens coffee production. Climate-smart techniques, such as planting drought-resistant coffee varieties, efficient irrigation systems, and agroforestry models, can help ensure sustainable production under increasingly unpredictable climatic conditions (Girma, 2024). Studies have shown that intercropping coffee with shade trees enhances biodiversity and protects coffee plants from extreme weather conditions (Gresser, 2021). Additionally, selecting high-yielding cultivars can enhance productivity, ensuring that Ethiopia remains competitive globally.

Technological innovation also plays a key role in improving both the quality and quantity of Ethiopian coffee. Advances in processing methods, such as wet processing, fermentation control, and improved drying techniques, can help enhance the consistency and quality of coffee, particularly for the specialty market (Berhanu et al., 2021). Furthermore, precision agriculture tools, such as drones and soil sensors, can optimize irrigation, monitor soil health, and improve harvest timing, thereby reducing costs and increasing efficiency (Fisher and Abdul-Rahman, 2023). Ethiopia can also explore innovations in the value chain, particularly through coffee-related by-products such as coffee pulp, which can be used in bioenergy production, animal feed, or organic fertilizers (Tadesse, 2020). By adopting these practices, Ethiopia can not only boost its coffee revenues but also reduce its environmental footprint, fostering a more sustainable coffee sector.

5.2 Market diversification

Expanding Ethiopia’s coffee market base is essential to reduce dependency on traditional European and North American markets. Emerging coffee-drinking regions in Asia, particularly China and Japan, have experienced significant growth in coffee consumption, presenting an opportunity for Ethiopia to diversify its export markets (Tolesa and Tolesa, 2024). The rising demand for high-quality coffee in these markets, coupled with an increasing preference for specialty and organic coffee aligns well with Ethiopia’s reputation for unique and traceable coffee varieties (Mbakop et al., 2023; Ali and Tufa, 2024).

The African coffee market also presents growth potential. Many African nations, particularly in East Africa, are experiencing shifts in consumer behavior due to urbanization and rising incomes. Ethiopia could strengthen its position within Africa by promoting intra-African coffee trade and investing in local coffee markets, which could provide a stable buffer against global price fluctuations (Girmay, 2024). Moreover, Ethiopia could create incentives for coffee processing industries within the country, enhancing value addition and employment while reducing reliance on raw coffee exports. A robust domestic coffee market is another crucial strategy for mitigating risks associated with global price volatility. Initiatives such as strengthening Ethiopia’s coffee retail industry and promoting the country’s rich coffee culture could drive domestic consumption and create a stable revenue stream for farmers (OCFCU, 2024).

5.3 Government and institutional support

The Ethiopian government plays a pivotal role in shaping the future of the coffee sector. While several initiatives have been undertaken to enhance coffee production and export, further steps are needed to ensure long-term growth and resilience. Key policy interventions should focus on improving infrastructure, which is critical for both smallholder farmers and larger coffee cooperatives. The development of rural infrastructure, such as road networks, irrigation systems, and post-harvest facilities, is essential to reduce logistical costs, enhance coffee quality, and increase Ethiopia’s global competitiveness (OCFCU, 2024).

Equally important is providing farmers with training and financial access. Many Ethiopian coffee farmers, particularly those in rural areas, struggle to obtain credit and technical support, limiting their ability to invest in productivity improvements and sustainable practices (Berhanu et al., 2021). The Ethiopian Coffee and Tea Authority have initiated programs such as quality certification and farmer training, but these efforts must be expanded to reach a larger number of farmers, especially in remote regions, to maximize their impact (Berihun, 2024). Institutional support for research and development is critical for driving innovation in the coffee sector. Public-private partnerships focusing on climate-resilient coffee varieties, improvements in processing technologies, and enhanced value chains can foster sustainable growth. Such initiatives could also include promoting fair trade certifications and organic farming, allowing Ethiopian farmers to command higher prices while improving environmental sustainability (Dida, 2022).

6 Conclusion

The global rise in coffee prices presents both opportunities and challenges for Ethiopia, a leading coffee producer. While higher prices could increase revenues and improve farmers’ livelihoods, rising production costs due to climate change, input price hikes, and labor shortages may offset these gains. To secure its position in the global market, Ethiopia must adopt climate-resilient practices, invest in technological innovation, and diversify its markets beyond traditional European and North American regions. Additionally, strengthening the coffee value chain through local processing and value-added products, alongside supportive government policies, will be crucial for long-term sustainability and competitiveness. Ultimately, Ethiopia’s ability to navigate these challenges will determine its future success in the global coffee industry.

Author contributions

KM: Conceptualization, Methodology, Resources, Validation, Visualization, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abate, G. T., and Assefa, T. (2023). Smallholder coffee-based farmers' perception and their adaptation to climate variability in Ethiopia. Int. J. Climate Change Strategies Manag. doi: 10.1108/IJCCSM-12-2022-0531

Agiboo. (2024). The coffee crisis: impact on farmers, traders, and consumers. Available online at: https://www.agiboo.com/coffee-crisis-impact-on-farmers-traders-and-consumers/ (Accessed March 8, 2025).

Alfawaz, H. A., Khan, N., Yakout, S. M., Khattak, M. N. K., Alsaikhan, A. A., Almousa, A. A., et al. (2020). Prevalence, predictors, and awareness of coffee consumption and its trend among Saudi female students. Int. J. Environ. Res. Public Health 17:7020. doi: 10.3390/ijerph17197020

Ali, A., and Tufa, H. (2024). Current status of specialty coffee production and market in Ethiopia: a review. Afr. J. Food Nutr. Res. 8, 45–60. doi: 10.20372/afnr.v2i1.844

Balami, K. G., Ketema, M., and Goshu, A. (2024). Ethiopian coffee export performance and diversification analysis. J. Equity Sci. Sustain. Dev. 7, 180–192. doi: 10.20372/mwu.jessd.2024.1561

Berhanu, B., Mulugeta, S., and Fikadu, T. (2021). The economic impacts of global coffee price fluctuations on Ethiopia’s export revenues. Agric. Econ. Rev. 48, 134–146.

Berihun, T. (2024). The economic impact of sustainability standards on smallholder coffee producers: evidence from Sidama region, Ethiopia (working paper). International Growth Centre. Available at: https://www.theigc.org/publications/economic-impact-sustainability-standards-smallholder-coffee-producers-evidence-sidama

Bilen, C., El Chami, D., Mereu, V., Trabucco, A., Marras, S., and Spano, D. (2023). A systematic review on the impacts of climate change on coffee Agrosystems. Plan. Theory 12:102. doi: 10.3390/plants12010102

Charles, R. (2022). Coffee consumption: will India catch up with China? Available at: https://intelligence.coffee/2022/08/coffee-consumption-india-catch-up-china/

Charles, S. (2024). Coffee buyers must adapt to a new era of pricing, not just a crisis. Intelligence Coffee Analysis. Available at: https://intelligence.coffee/2024/11/coffee-buyers-adapt-to-new-pricing-era/

De Freitas, C. H., Coelho, R. D., de Oliveira Costa, J., and Sentelhas, P. C. (2024). A bitter cup of coffee? Assessing the impact of climate change on Arabica coffee production in Brazil. Sci. Total Environ. 957:177546. doi: 10.1016/j.scitotenv.2024.177546

Devoney, M. (2023). What rural migration means for the long-term future of coffee production. Intelligence Coffee. Available at: https://intelligence.coffee/2023/06/rural-migration-coffee-production/

Dida, G. (2022). Coffee production: opportunities, challenges and genetic diversity in Ethiopia. Int. J. Res. Studies Agricul. Sci. 8, 1–9. doi: 10.20431/2454-6224.0803001

Fisher, M., and Abdul-Rahman, A. (2023). The impact of precision agriculture on sustainable farming practices: a review of technologies and practices for improving crop productivity. Agric. Syst. 203, 103513–103157. doi: 10.1016/j.agsy.2022.103513

Girma, B. (2021). Review on coffee production and quality in Ethiopia. Agricul. Forestry Fisheries 10, 208–213. doi: 10.11648/j.aff.20211006.11

Girma, B. (2024). Review on climate change impacts on coffee quality: synthesis, strategies, and sustainability. Am. J. Biol. Environ. Stat. 10, 1–7. doi: 10.11648/ajbes.20241001.11

Girmay, A. T. (2024). The role of coffee trade in shaping Ethiopia’s economic development from the 1960s to present. Law and Economy 3, 9–15. doi: 10.56397/LE.2024.09.02

Global Coffee Report. (2021). How COVID-19 has changed the coffee supply chain. Global Coffee Report. Available online at: https://www.gcrmag.com/how-covid-19-has-changed-the-coffee-supply-chain

Gomm, X., Ayalew, B., Hylander, K., Zignol, F., Börjeson, L., and Tack, A. J. M. (2024). From climate perceptions to actions: a case study on coffee farms in Ethiopia. Ambio 53, 1002–1014. doi: 10.1007/s13280-024-01990-0

Grand View Research. (2023). Middle East & Africa Coffee Market Size & outlook, 2030. Available online at: https://www.grandviewresearch.com/horizon/outlook/coffee-market/mea

Gresser, C. (2021). Labor migration and its impact on Ethiopian coffee production. J. Rural. Stud. 42, 89–98.

Haji, J., Fufa, B., and Wubneh, S. (2021). The future of specialty coffee in Ethiopia: a market analysis. Ethiopian Agricultural Review 36, 58–66.

ICO. (2020). Impact of COVID-19 on the global coffee sector: Survey of ICO exporting members. Coffee Break Series No. 3. International Coffee Organization. Available at: https://www.ico.org/documents/cy2019-20/coffee-break-series-3e.pdf

ICO. (2021). Coffee development report 2021: the impact of COVID-19 on the coffee sector. International Coffee Organization. Available online at: https://www.ico.org/documents/cy2022-23/coffee-development-report-2021.pdf

ICO. (2022). Coffee market report - ICO annual trade review. Available online at: www.ico.org.

ICO. (2023). Coffee report and outlook December 2023. International Coffee Organization. Available at: https://icocoffee.org/documents/cy2023-24/Coffee_Report_and_Outlook_December_2023_ICO.pdf

International Trade Centre. (2021). Ethiopia’s coffee export trade and market trends. Trade Map. Available at: www.trademap.org.

Kaba, M., Tadesse, M., and Soloman, M. (2021). Climate change and its effects on Ethiopian coffee production. Ethiopian J. Environ. Studies 25, 213–221.

Markos, M. U., Tola, Y., Kebede, B. T., and Ogah, O. (2023). Metabolomics: a suitable foodomics approach to the geographical origin traceability of Ethiopian Arabica specialty coffees. Food Sci. Nutr. 11, 4419–4431. doi: 10.1002/fsn3.3434

Mbakop, L., Jenkins, G. P., Leung, L., and Sertoglu, K. (2023). Traceability, value, and Trust in the Coffee Market: a natural experiment in Ethiopia. Agriculture 13:368. doi: 10.3390/agriculture13020368

Nigussie, Z. (2024). Climate and coffee production in Ethiopia: a review. Int. J. Energy Environ. Sci. 9, 98–106. doi: 10.11648/j.ijees.20240905.12

Ntah, M. N., Nechifor, V., Ferrari, E., Nandelenga, M. W., and Yalew, A. W. (2023). The impacts of Russia's invasion of Ukraine on the Kenyan economy: evidence from an economy-wide model. Afr. Dev. Rev. 36, S136–S149. doi: 10.1111/1467-8268.12728

OCFCU. (2024). Success factors and benefits to members. Available online at: https://oromiacoffeeunion.com/success-factors

Ponte, S. (2020). The rise of specialty coffee: consumer demand and global supply chains. World Dev. 137, 105–118.

Saefong, P.M. (2024). Brace for pumpkin-spice sticker shock as robusta coffee prices hit record highs. MarketWatch. Available at: https://www.marketwatch.com/story/brace-for-pumpkin-spice-sticker-shock-as-robusta-coffee-prices-hit-record-highs-eb3cad22

Sole, S., Jones, A., and Patel, D. (2021). Rising fertilizer prices and their impact on coffee production. Agron. Econom. 32, 45–51.

Tadesse, G. (2020). Coffee export dependency and economic resilience in Ethiopia. J. African Econom. 29, 84–96.

Tadesse, T., Tesfaye, B., and Abera, G. (2020). Coffee production constraints and opportunities at major growing districts of southern Ethiopia. Cogent Food Agricul. 6, 1–35. doi: 10.1080/23311932.2020.1716800

Tolesa, S. F., and Tolesa, B. F. (2024). An examination of Ethiopian data on the coffee value chain from a systemic perspective. Int. J. Business Economics Res. 13, 142–151. doi: 10.11648/j.ijber.20241306.11

UADA. (2023). Farm labor and workforce challenges in U.S. agriculture. Economic Research Service. Available online at: https://www.ers.usda.gov/topics/farm-economy/farm-labor

Worako, T. K., Jordaan, H., and Van Schalkwyk, H. D. (2011). Investigating volatility in coffee prices along the Ethiopian coffee value chain. Agrekon 50, 56–72. doi: 10.22004/ag.econ.347279

Wu, B. (2025). Why people are paying $635 for this cup of coffee. Food & Wine. Available at: https://www.foodandwine.com/simple-kaffa-taipei-taiwan-11687167

Keywords: coffee price, Ethiopia, climate change, supply chain disruptions, production costs, specialty coffee, market diversification, sustainability

Citation: Massrie KD (2025) Why is the price of coffee rising globally? Future prospects for Ethiopian coffee. Front. Sustain. Food Syst. 9:1545168. doi: 10.3389/fsufs.2025.1545168

Edited by:

Dão Neto, Federal Institute of Education, Science, and Technology of Paraná (IFPR), BrazilReviewed by:

Alexander Da Silva Vale, Federal University of Paraná, BrazilGabriel Oliveira, Instituto Federal do Sudeste de Minas Gerais, Brazil

Copyright © 2025 Massrie. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Kelemu Dessie Massrie, a2VsZW11ZGVzc2llMjAxM0BnbWFpbC5jb20=

Kelemu Dessie Massrie

Kelemu Dessie Massrie