- 1School of Economics and Management, Qilu Normal University, Jinan, China

- 2School of Economics and Management, Nanjing Forestry University, Nanjing, China

- 3Institute of Quantitative Economics and Statistics, Huaqiao University, Xiamen, China

Introduction: Digital transformation (DT) refers to the process of leveraging digital technologies to drive innovation in business models, thereby enabling enterprises to create greater value and deliver innovative solutions for efficient agricultural production.

Methods: Using data from 211 listed agricultural companies in China from 2009 to 2022, this study investigates the impact and pathways through which DT influences financial performance (FP), employing a range of methodologies. To enhance text mining accuracy, the research incorporates natural language processing (NLP) and large language models (LLM).

Results: The findings indicate that DT within agricultural enterprises’ production, purchasing, and sales departments significantly enhances FP. To address potential endogeneity concerns, robustness checks were conducted using propensity score matching (PSM), the Heckman two-stage model, and the two-stage least squares (2SLS) method. Mechanism analysis reveals that DT improves FP through three primary channels: reducing sales expenses, easing cost stickiness, and promoting breakthrough innovation. However, the positive effects of DT exhibit heterogeneity. These effects are more pronounced in non-state-owned enterprises, larger firms, and enterprises located in major grain-producing regions.

Conclusion: This study validates the necessity for enterprises to use digital technology to improve financial performance in the digital age. By expanding the measurement methods for DT, the research provides valuable insights for enterprises seeking to leverage digital tools to optimize agricultural production efficiency.

1 Introduction

Agricultural enterprises are important micro-subjects in promoting agricultural modernization. Over the past four decades, powered by the synergies of both demographic and policy dividends, China has achieved sustained economic growth, and emerged as the world’s second-largest economy (Deng et al., 2023). Despite its global prominence, China’s agricultural sector faces challenges, including its substantial yet not necessarily robust nature, suboptimal industrial structures, and lag in pioneering technology adoption (Zhang J. et al., 2025; Zhou et al., 2022). Due to the lag in the construction of agricultural information infrastructure and the low digitalization degree in rural areas, the digital transformation (DT) of agricultural enterprises has always been a weak point in the DT of Chinese enterprises. According to the “China Digital Economy Development Research Report (2023)” released by the China Academy of Information and Communications Technology, the penetration rate of China’s agricultural digital economy in 2022 is 10.5%, an increase of only 0.4%. Compared with other industries, whether it is the level of digitization, or the speed of digital development, agricultural enterprises have a significant lag. Compared with other enterprises, the production and operation of agricultural enterprises are faced with more realistic difficulties:

1. Agricultural products have obvious seasonality and regionalism, labor time is inconsistent with production time, production cycle is long, and they are susceptible to the influence of external climate environment, and there are more uncertainties than other industries.

2. The types of employees involved in agricultural enterprises are complex, and there are many front-line personnel in agricultural production. The overall digital skills and consciousness of employees are relatively scarce, and enterprise management and transformation are relatively difficult.

3. Agricultural enterprises have limited access to market information and financial resources, relatively long capital recovery cycle, and strong constraints on information resources and financing.

The application of digital technology can help agricultural enterprises to achieve large-scale, specialized and scientific production, improve the economic benefits of traditional agriculture, and is also an important driving force to promote rural economic development. It can be seen that accelerating DT is an inevitable trend for current and future agriculture-related enterprises to seek survival and development. Emphasized in China’s 14th Five-Year Plan is the accelerated digital evolution of the nation, necessitating the creation of a market-driven digital innovation ecosystem. This framework is envisaged to foster a deeper melding of novel information technologies and manufacturing processes, catalyzing an intelligent transformation spanning production, equipment, management, products, and service. Although Chinese enterprises undergoes digitization, ecological upgrading, and premium transformation, it also experiences pressures from the re-industrialization pursuits of developed nations and the ascendant trajectories of emerging economies (Westkämper and Walter, 2014; Szirmai and Verspagen, 2015). To improve the market competitiveness and sustainable operation of agricultural enterprises, and realize the core business of reversing the traditional primary agricultural product manufacturing and service, corporate managers need to seize the technology dividend and emphasize the comprehensive reform driven by intelligence, ecology and service. In order to achieve this goal, it is necessary to use modern digital technology to innovate and push forward the upgrading of the value chain and production chain.

The fourth industrial revolution, characterized by advanced technologies such as big data analytics, social media, and the Internet of Things (IoT), heralds a departure from conventional production and lifestyle norms, ushering in an era of bespoke, interconnected, and intelligent production (Shen and Zhang, 2023). Currently, the agricultural production and services are facing profound changes; from factory production processes and product design to technological R&D, user experience, logistics, and post-sales services, all elements are integrated into an intelligent network. The convergence of traditional business frameworks with digital intelligence has emerged as a focal point for enhancing the industrial workflow and propelling high-quality economic development (Zhang et al., 2022). The overall economic performance is an accumulation of myriad microactivities within firms (Yuan et al., 2024). To aptly understand the essence and practical benefits of DT, it is imperative to examine the fundamental entity of a firm and identify the intricate links to firm performance. This performance not only embodies the vitality and evolution of individual firms but also serves as a vital metric for the nation’s steady economic growth. In the digital age, facilitating firms to seamlessly shift from traditional to intelligent, networked production methodologies is a matter of shared interest for both scholars and industry professionals. An extensive examination of the relationship between DT and firm performance offers not just strategic insights for businesses but also robust decision-making tools for policymakers, steering the broader economic framework towards enhanced quality and sustainability.

Regarding the effectiveness of digitalization and its impact on enterprises, the existing researches mainly focus on enterprise performance (Ebhota et al., 2024; Vu et al., 2024), organizational structure (Verma et al., 2023; Cubillas-Para et al., 2024), employee management (Huang et al., 2024; Liu P. et al., 2024), strategic transformation (Jia et al., 2024; Gong and Yang, 2024), and environmental performance (Ren et al., 2023; Song et al., 2024). According to the conclusion of the existing literature (Sun et al., 2024; Lu et al., 2025), digitization can improve the production efficiency of enterprises, speed up the market response speed, and enable the transformation of innovation achievements, so as to promote the cost reduction and efficiency improvement of enterprises and improve the performance level. However, some scholars also put forward the “digital transformation paradox” (Guo et al., 2023; Li L. et al., 2024; Li et al., 2024b). Some scholars believe that due to the complex and multiple impact mechanism of digitalization on enterprise performance, certain preconditions must be met for the positive impact of digitalization input, especially the endowment conditions of digitalization and the stage of digital technology investment (Guo et al., 2023). Under many preconditions, only some enterprises can achieve significant results in DT, and some enterprises’ financial performance (FP) may decline. However, when analyzing the role of digitalization, the research objects of the existing literature are mainly manufacturing and service enterprises, and less attention is paid to the impact of DT of agricultural enterprises on their FP. The operation and management of agricultural enterprises have many unique characteristics, for example, the biological characteristics of production objects and the seasonal characteristics of business, which means that their business activities are affected by both natural risks and market risks. In addition, the development of agricultural enterprises is related to people’s food safety and national food security, and it cannot simply borrow the DT experience and research conclusions of industrial enterprises and service enterprises. While the significance of DT in bolstering firm performance is widely acknowledged, existing literature often remains segmented, primarily focusing on either broad regional or sectoral impacts without delving into the granular effects at the firm level. This article addresses this critical gap by leveraging advanced text mining techniques to construct a nuanced DT index for Chinese manufacturing firms. This innovative approach enables a detailed examination of how DT influences firm performance, uncovering the intricate dynamics between technological adoption and economic outcomes. The objectives of this study are as follows: (1) To analyze the influence of DT on FP in agricultural enterprises. (2) If DT leads to an increase in FP, is there heterogeneity in this positive effect? (3) How DT affects the production, marketing and business behavior of agricultural enterprises, thereby increasing FP. Overall, this study focuses on the influence and mechanism of DT on FP in agricultural enterprises. We comprehensively sorted out the impact of DT on agricultural production, agricultural product sales and technology research and development and explicit costs in the industry, and reached a positive conclusion.

The potential literature contributions of this study are as follows: (1) Different from previous literature evaluating other industries or industries, this paper uses advanced text analysis methods to extract keywords related to digital transformation from the operating annual reports of listed agricultural companies. The annual report issued by the enterprise every year is a summary of the work results of the past year and the outlook for the future work, which reflects the attention of strategic management to a certain extent. This method solves the technical complexity of corporate governance well and improves the accuracy of index measurement. We also use natural language processing and large language model to correct the defects of traditional text mining methods, and well deal with the emotional color and redundant information in the company’s annual report. (2) Systematically analyzes the impact of digital transformation on FP from the perspective of internal governance and external opportunities of the company, and reveals the “mystery” of how digital technology promotes efficient production of enterprises. This paper analyzes the impact of digital transformation on enterprise operation from three paths: labor cost stickiness, differentiated innovation and product sales, and identifies the mechanism and path for digital transformation to improve FP. (3) The heterogeneous impact of digital transformation on corporate FP is analyzed from the perspective of geographical location, business scale and ownership nature.

2 Theoretical mechanisms and research hypotheses

2.1 DT direct impact on firm performance

Digital transformation refers to the process by which an enterprise or organization transforms traditional business into digital business, using artificial intelligence, big data, cloud computing, blockchain, 5G and other digital technologies to improve business efficiency and quality. Generally speaking, it is to apply digital technology to all aspects of the enterprise, including business processes, organizational structure, product design, etc., to realize the digitalization, intelligence, and networking of the enterprise business. DT can help enterprises improve production efficiency, reduce costs, improve market competitiveness, but also to meet customer needs and improve customer experience. According to the white paper “The Impact of the Fourth Industrial Revolution on Supply Chains” released by the World Economic Forum, DT has reduced the cost of manufacturing enterprises by 17.6% and increased revenue by 22.6%, so DT has a very important role in reducing costs and increasing efficiency.

For agribusiness, DT is a dynamic and fundamental process of change. According to the Resource-based theory (RBT), the unique resources and capabilities of an enterprise are the core elements that determine its competitive advantage. Adhering to the resource-based view, enterprise managers build competitive advantages for enterprises through the accumulation of core resources. Key factors such as technological innovation, brand equity, organizational processes, and skilled labor force reveal differences in operational capabilities (Pelham and Wilson, 1996; Core et al., 1999). As a complex process, DT requires enterprises to not only possess technical resources, but also develop corresponding dynamic capabilities, such as data-driven decision making, rapid learning and iterative innovation capabilities, to capture new opportunities and address challenges brought about by changes in the business environment (Mikalef and Pateli, 2017). Resource orchestration theory integrates the conceptual framework of resource management and asset orchestration. It advocates the organic integration of resources and capabilities, the coordination of static resources and dynamic capabilities, and believes that integrating resources is more important than owning resources. The root cause of the low production efficiency, return on capital, and business capacity of agricultural enterprises is that there is no scientific arrangement of production factors such as natural resources and labor, capital, and technology, which makes it difficult to convert production factors into enterprise development advantages, and thus unable to connect and meet the diversified market needs to form their own core competitiveness. The maturity and application of digital technology provide a new application scenario for resource arrangement theory.

DT can help agricultural enterprises optimize the allocation of knowledge and technology resources, thereby improving the competitiveness of agricultural enterprises’ products and promoting the improvement of their economic performance. In traditional agricultural enterprises, the product research and development link is relatively closed, and the research and development efficiency is low. Based on digital technology, enterprises can collect, fully mine and use data in real time to improve the new product development process, reconfigure production lines and resources in a more flexible and effective way, so that products from design, creation, production, marketing to after-sales form a closed loop, improve product competitiveness, and enhance the FP of agricultural enterprises. DT can help agricultural enterprises integrate operational information, obtain information resources, improve their own information transparency and risk coping ability, better adapt to the market, and promote the economic performance of agricultural enterprises. The advantage of information digitization is that it can realize the flow of information across departments, mitigate the “island effect,” and promote the timely and dynamic synchronous sharing of information (Zhu et al., 2021). The decline in resource management ability and opportunity cost will translate into corporate benefits (Lanzolla et al., 2021). For example, DT can help agricultural enterprises save the market and industry information, competitors’ operation information, and upstream and downstream information of the industrial chain obtained during the operation process in the form of data, and predict the market trend based on this, so as to significantly reduce the operational risks caused by information asymmetry and environmental changes, and better obtain economic performance. In addition, digital technology can quickly sort out and screen valuable data resources according to the rules and information content of data, eliminate redundant information, help enterprises obtain highly valuable data information in a timely manner, ensure that business processing capacity matches information processing capacity, and thus improve the market competitiveness of enterprises (Chen and Kim, 2023; Nambisan, 2013).

Digitalization also improves the flexibility of production, optimizes production risk management, and indirectly reduces production costs by precisely controlling various elements in the production process. For example, in the procurement process, the establishment of a third-party professional platform facilitates the procurement business. All kinds of enterprises bring suppliers together through Internet technology platforms, which can realize more convenient procurement by suppliers and consumers of agricultural products in one platform, reducing procurement prices and expanding online procurement channels. In the production link, agricultural enterprises can not only use the Internet of Things, artificial intelligence, blockchain, industrial Internet and other technologies to achieve automatic control of crop growth process and product production process, but also use intelligent detection system and information management system to collect data from various production areas. Integrate databases of different levels and categories (such as agricultural biology, agricultural environment, and agricultural economy), conduct collaborative management of all kinds of databases at all levels, and then build a scientific agricultural planning system, agricultural expert system and agricultural simulation optimization decision system, combine the simulation of agricultural process with the optimization principle of agriculture, and provide support for enterprises’ production decisions and optimize resource allocation.

Finally, the application of Internet business model reduces the cost of information and communication between enterprises and users, and online remote guidance reduces the cost of human resources and time, and enhances the plasticity of enterprise activities. Digitalization realizes the transparency, circulation and sharing of information between enterprises, users, suppliers and other relevant parties in transaction activities, and reduces the costs of searching information, negotiating and signing contracts, supervising transactions and post-conversion (Müller et al., 2018). The decline in opportunity cost helps enterprises to make quick decisions and improve product liquidity, thus improving business performance.

In general, the DT of office processes and product manufacturing in agricultural enterprises has many benefits. DT not only builds a channel for rapid communication between producers and consumers and simplifies the feedback process of market consumption information, but also uses the agglomeration effect of cyberspace to strengthen the efficiency of resource allocation of enterprises (Pan et al., 2022). The digital innovation of agriculture-related enterprises can improve the FP through the innovation of production and sales models and the synergistic effect of internal clusters. Therefore, this paper proposes the first research hypothesis:

H1: The adoption of DT strategies by agriculture-related enterprise will significantly improve FP.

2.2 The path of impact of DT on firm performance

DT transcends the mere transition of offline tasks to online platforms or the rudimentary incorporation of networks, data, and technology into daily operations. It entails the comprehensive integration of digital management philosophies, innovative business models, and digital tools, with an emphasis on synergistic and efficient collaboration spanning research, production, supply, and marketing. Consequently, the influence of DT on firm performance manifests through various interconnected avenues (Soto Setzke et al., 2023). This article categorizes firm activities based on interactions within the firm’s internal and external value chains, encompassing customer-centric sales activities, production tasks related to hardware and equipment, and internal management undertakings. Fundamentally, the objective of DT is the seamless integration of intelligent, digital technologies into production, distribution, and management procedures (Nylén and Holmström, 2015). This paper posits the existence of three primary avenues through which DT impacts agriculture-related enterprise performance.

2.2.1 Channel for selling expenses

In order to accelerate the speed of capital circulation in the agricultural sector, enterprises need to invest a large amount of money in product sales. However, inefficient marketing programs will waste a lot of expenses for enterprises, and will not achieve a significant increase in agricultural sales. It can be argued that digital marketing, personalized push and expansion of sales channels are necessary conditions to improve the value conversion rate of marketing expenses. In today’s digital environment characterized by uncertainty and information glut, consumer needs have evolved to be more multifaceted and adaptable. According to the two-sided market theory, market transactions can occur only when both consumers and sellers are aware of sufficient benefits (Liu Y. et al., 2023). The traditional product sales model relies on intermediate dealers and retail sales. The multi-tiered approach to sales makes agribusinesses face significant time delays in responding to these changing consumer preferences. Inflexible supply and sales methods make it impossible for enterprises to adjust their sales strategies in time, which often leads to an increase in sales expenditure and is not conducive to consumers mastering product information. Digital initiatives offer new opportunities to improve marketing efficiency and reduce sales expenses.

There are many benefits to be gained from the DT of marketing and sales departments. In the sales process, the combination of online and offline digital sales model can expand the coverage of agricultural products market, timely solve various problems in the product sales process, improve transaction efficiency and profitability, and comprehensively improve the operation efficiency of enterprises, so as to obtain better economic benefits. In addition, agricultural enterprises can use digital information technology and Internet virtual platforms to collect and analyze the consumption characteristics and behavioral preferences of customers in different regions, customize differentiated sales strategies and product supply, promote marketing e-commerce, accelerate the development of new products and promote rapid product sales. This can reduce inventory pressure and sales expenses. The support of online platform, data network and digital technology helps enterprises to grasp the dynamics of the consumer market, so as to stratified the prices of different types of agricultural products, and realize rapid sales of agricultural products, quality and safety management and sales profit maximization through online and offline sales, intelligent warehousing, precise logistics distribution, and two-dimensional code traceability. Live delivery of goods has the advantages of three-dimensional rich form and strong sense of interaction and participation. It integrates vision, hearing and text, making it possible to sell agricultural products while broadcasting online. With the rapid development of modern digital equipment, mobile phone platforms and media platforms have risen rapidly. Using the network platform to expand the sales channels of agricultural products can promote the rapid sales of agricultural products, but also reduce the intermediate sales links, reduce circulation costs. Therefore, this study proposes a second research hypothesis:

H2: DT will reduce the expenditure of sales expenses and improve the efficiency of product sales, thus increasing FP.

2.2.2 Channel for cost stickiness

Cost stickiness refers to the asymmetry between revenues and costs, reflecting the disparity between costs and business volumes. In firms, resource redundancy and mismatches often result in heightened cost stickiness, subsequently reducing the efficiency of resource allocation and impacting firm performance (Zhang et al., 2019). According to the difficulties faced by agricultural production and company operation, we believe that the factors affecting cost stickiness are mainly information, high moral hazard and specialized assets.

DT alleviates information asymmetry. Traditional agriculture-related enterprise, by maintaining a distinct separation between production and marketing, inadvertently foster resource mismatches and squander resources. Information is the key factor influencing management decision. Management’s optimistic expectation caused by imperfect information is an important cause of cost stickiness. When managers cannot obtain enough market information, they tend to hold a more optimistic attitude towards the market in the face of declining business volumes, which will affect the management’s decision on cost adjustment and lead to cost stickiness. DT provides powerful information collection and analysis tools for enterprises, so that enterprises can more effectively collect customer, sales and market trends and other data, more accurate and comprehensive market analysis and forecast, and make more timely and reasonable cost adjustment decisions. Digital technology provides enterprises with powerful information collection and analysis tools, so that enterprises can more effectively collect customer, sales and market trend data, more accurate and comprehensive market analysis and forecast, and make more timely and reasonable cost adjustment decisions. The introduction of digital technology improves the decision-making efficiency of enterprise managers. The digital monitoring and feedback system enables enterprises to realize real-time monitoring and adjustment of production and operation, and managers can grasp the operation status of enterprises in real time and take immediate actions when problems are found, ensuring that the business process always has strong resilience (Lin et al., 2025).

DT mitigated the moral hazard of the principal agent. Principal-agent theory and information asymmetry theory hold that in the case of separation of management rights and decision-making rights, managers have more comprehensive information than owners. This asymmetry of information may increase the agency cost of enterprises (Chen and Xu, 2023). The application of big data analytics and artificial intelligence enables enterprises to have a more accurate and comprehensive understanding of various information, effectively alleviating information bias among clients, agents, and other stakeholders. DT is a strategic choice for enterprises to adapt to complex and multi-variable environment. This option not only helps enterprises to obtain internal and external environmental information, but also systematically controls the internal production management process. It can also help the manager to accurately and dynamically sense the hidden risk factors of the inner movement, and optimize the quality of the inner control (Ritter and Pedersen, 2020). In the digital context, every operation and management link of the enterprise can be recorded and restored by electronic technology, which makes the operation process of the enterprise more transparent and traceable. The improvement of such transparency helps the enterprise to better carry out internal supervision and management, and effectively restrain the behavior of the management. Reduce the negative influence brought by opportunistic behavior (Brodeur et al., 2021). For example, the application of big data analytics and artificial intelligence enables enterprises to have a more accurate and comprehensive understanding of various information, effectively mitigating information bias among clients, agents, and other stakeholders.

DT mitigated the cost stickiness generated by asset specificity. In the process of resource reduction, enterprises will pay certain adjustment costs, such as layoffs and equipment treatment in the process of resource reduction. Due to the existence of fixed costs and the irreversibility of capital, enterprises are difficult to adjust costs in a short period of time, resulting in cost stickiness. In the process of resource reduction, enterprises will pay certain adjustment costs, such as layoffs and equipment treatment in the process of resource reduction. Due to the existence of fixed costs and the irreversibility of capital, enterprises are difficult to adjust costs in a short period of time, resulting in cost stickiness. Under the influence of digital technology, enterprises can monitor operations in real time, evaluate internal business conditions and long-term strategic goals, and adjust asset allocation strategies in a timely manner. Through real-time data and feedback, enterprises can quickly find problems and take certain measures to reduce risks in the resource allocation process (Shahzad et al., 2024). Contemporary smart manufacturing technologies challenge the conventional labor-centric production model. They delineate labor into tangible and abstract categories, employ emerging technologies to supersede both physical and certain cognitive tasks, and aim for fully automated, staffless, and efficient production (Shen, 2024). Within this digital automation framework, replacing human labor with artificial intelligence and industrial robotics significantly trims the labor requirement for repetitive roles, liberating surplus labor and expanding the human capital contraction space (Shen and Zhang, 2024a,b; Hui et al., 2024). This approach attenuates labor cost stickiness (Loebbecke and Picot, 2015).

In summary, due to the advantages of DT in eliminating information asymmetry, asset specific cost and principal-agent risk, this study proposes a third research hypothesis:

H3: DT bolsters firm performance by curtailing cost stickiness.

2.2.3 Channel for breakthrough innovation

The essence of breakthrough innovation (BI) is the exploratory development of complex knowledge and multi-dimensional technology in order to realize the fundamental change of existing production technology, process flow and value creation mode. It is an innovation that transcends the original technical route and opens up a new technical field to provide new reference and reference for future research and innovation, which is especially important for enterprises to obtain a favorable competitive position in the market (Funk and Owen-Smith, 2016; Wang H. et al., 2025). Breakthrough innovations are more likely to create new markets and shape consumer preferences and behavior, leading to competitive advantage and profitable positions (Silva et al., 2017).

According to the basic resource theory, the effective absorption of external spillover knowledge can accelerate the interaction between internal knowledge and external knowledge, and promote the formation of heterogeneous resource advantage. Internal knowledge turnover and external knowledge acquisition are important resources and foundations for enterprises to implement breakthrough innovation (Forés and Camisón, 2017). Relying on digital technologies such as big data, DT enterprises can access vast amounts of new information and knowledge at a very low cost. By using digital tools, enterprises can realize the efficient deconstruction of unstructured and multi-modal data, providing favorable conditions for the flow of tacit knowledge and tacit knowledge that is difficult to code (Shen and Zhang, 2023). Therefore, DT can not only enable enterprises to use internal knowledge to achieve progressive innovation, but also facilitate enterprises to use internal and external heterogeneous resources to promote breakthrough innovation. In the innovation generation phase, DT enterprises can use digital technologies such as artificial intelligence to predict the maximum possible combination set of useful knowledge to avoid the knowledge inertia and knowledge burden of developers to impose subjective interference on innovative ideas. Data itself has non-competitive characteristics and the marginal value of non-diminishing characteristics (Verganti et al., 2020). Using digital tools, such as cloud computing, artificial intelligence and big data analytics, companies can tap into the information and value contained in their data. Therefore, compared with traditional enterprises, enterprises that implement DT strategies have more innovative resources and basic knowledge. Digital platforms and instant messaging tools allow businesses to quickly understand market needs. The two-way interactive process of value creation makes the innovation mode of enterprises gradually change from experience-led to data-led. This process greatly alleviates the information asymmetry faced by enterprises’ innovation activities (Demertzis et al., 2018), thus providing more favorable conditions for enterprises to choose breakthrough innovation models.

In the innovation realization stage, DT enterprises can use digital technologies such as digital twins, virtual reality and augmented reality to conduct simulation experiments to reduce research and development costs and achieve efficient innovation (Liu J. et al., 2023; Liu Y. et al., 2024). From the perspective of innovation efficiency, the implementation of DT can help clear the structural barriers to employees’ access to internal and external information resources, stimulate their potential to engage in R&D and innovation, and thus improve the innovation speed of digital enterprises. By accurately deconstructing and positioning the innovation process, digital technology promotes digital enterprises to turn to the precision innovation model, thereby improving the breakthrough innovation efficiency of DT enterprises. From an innovation management perspective, digital IP management tools help developers and managers monitor the entire process of patent development and application, ensuring that innovative proposals are systematically captured and protected as IP (Qiao et al., 2025). Therefore, this study proposes the following research hypothesis:

H4: DT can enable companies to achieve breakthrough innovation, resulting in improved FP.

2.2.4 Preliminary summary

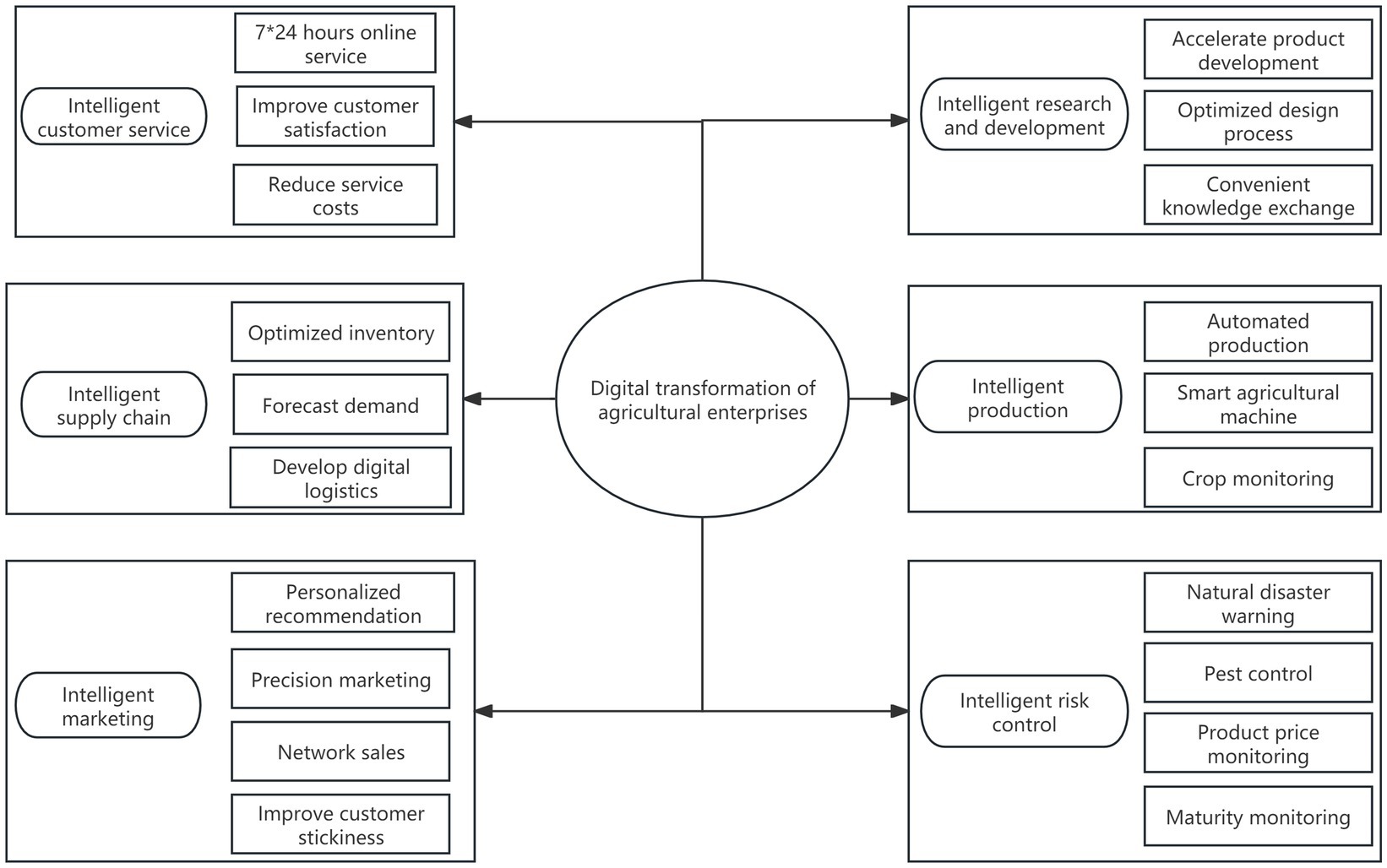

In general, agricultural enterprises adopt digital strategies to promote the digitalization and intelligent transformation of office processes, marketing, agricultural production, seed research and development, product harvesting, supply chain and sales, which helps to improve production efficiency and promote enterprises to win market share. This study summarizes the impact of DT on enterprises. As shown in Figure 1. It can be found that the impact of DT on enterprises is multiple aspects. The introduction and installation of digital equipment and software is an important way to increase FP in agricultural enterprises.

3 Study design and data sources

3.1 Variable definition

3.1.1 Core explanatory variable

Digital transformation (DT). At present, the methods used to measure enterprise DT mainly include objective data analysis, time impact method and dictionary method. The first approach often measures a company’s DT by measuring its capital investment in digital technology software and hardware as a percentage of total assets, or by using survey data (e.g., industrial robot installation density, artificial intelligence software installations). Its disadvantage is that the statistical scope is limited and it is only suitable for measuring the non-human cost input of a specific digital technology. The second approach takes government pilot policies, such as “Broadband China,” “smart manufacturing” and “smart city” as policy shocks, and regards the affected enterprises as those with good DT degree. These policy shocks are also often used to solve the endogenous problems that exist when enterprises’ DT affects their behavior and performance. Its weakness is that it assumes that all businesses in the pilot region are equally affected by a particular digital technology policy. This assumption clearly does not correspond to reality. In fact, even in the pilot areas, not all enterprises will be affected by the policy. The main idea of the dictionary method is to build a dictionary of keywords containing various digital technologies, and then according to the number or proportion of these keywords appear in the “management discussion and analysis” section of the annual report of the listed company. The implicit assumption behind this approach is that a keyword that mentions a certain digital technology indicates that a company has undergone a DT. In the company’s annual business report, the manager will introduce the company’s performance in detail in the previous year and plan the future business strategy. Therefore, if the frequency of a specific word in the annual business report is very high, it means that the enterprise attaches great importance to the related field and is willing to invest more resources (Hu et al., 2023). At present, the dictionary method has been widely used in the research of enterprise management (Pollach, 2011; van Meeteren et al., 2022; Cano-Marin et al., 2023). Referring to the practice of existing literature (Wang E. et al., 2025; Chi et al., 2025), this paper uses dictionary method to measure the degree of DT of enterprises. According to the definition of digital technology, this paper selects 311 keywords related to digital technology from six dimensions of big data, artificial intelligence, mobile Internet, cloud computing, Internet of Things, and blockchain to build an evaluation dictionary. Because the traditional text analysis method cannot fully extract the information contained in the text, the accuracy of the analysis and the effectiveness of the index are low. In recent years, in the field of artificial intelligence and machine learning, natural language processing (NLP) technology has been widely used. In order to correct the shortcomings of the existing methods, this paper incorporates the large language model ERNIE to complete the text classification task based on the traditional text analysis methods (Jin et al., 2025).

3.1.2 Explained variable

Firm performance. In this study, we select the return on total assets, calculated by dividing the return on net profit by the end of total assets, after excluding non-operating income and expenses, as an explanatory variable to gauge firm performance.

3.1.3 Mediating variables

Drawing on pertinent research hypotheses, this research investigates the impact pathway of DT on firm performance by considering selling expenses, cost stickiness, and differentiated innovation as mediating variables. The specific procedure for constructing these indicators is as follows.

3.1.3.1 Selling expense

This paper measures selling expenses according to the proportion of net selling expenses to total expenses in the cash flow statement of enterprises.

3.1.3.2 Cost stickiness

In this paper, WEISS model is used to measure the profit relationship between sales and cost. The significance of WEISS model to measure cost stickiness is the asymmetry of cost change between the first quarter and the fourth quarter of a given year when sales volume increases and decreases. If the cost is sticky, it means that when the sales increase the cost increase should be larger than the cost reduction when the sales decline by the same margin, then the value of CS should be negative, and the smaller the value, the greater the cost stickiness. On the contrary, if the company’s cost is anti-sticky, it means that when the sales increase, the cost increase is smaller than the cost reduction when the sales decrease by the same margin. In this case, the value of CS should be positive, and the larger the value, the greater the cost anti-sticky. Its expression is as follows:

In Equation 1, is an individual firm, and denotes the quarter in which a firm’s operating income decreases, and the quarter in which its operating income increases, respectively; represent the amount of change in operating costs and operating income, respectively, over the quarter. In the empirical test, we take the absolute vale of to better test the mediating effect of cost stickiness in DT on firm performance.

Breakthrough innovation (BI). In this paper, patent technology dispersion is used to measure enterprise breakthrough innovation. Compared with the method that only uses the number of application and authorization of invention patent data, the dispersion of patent technology reflects the breakthrough of innovation from the perspective of the breadth and complexity of the technology contained in the patent, and can better reflect the basic knowledge involved in technological innovation. In this paper, based on the distribution information of IPC classification numbers on the large group level, patent technology dispersion is calculated according to the summation logic of Herfindahl–Hirschman index. The calculation formula is:

In Equation 2, is the proportion of each group calculated according to the IPC classification number of the patent. The larger the BI value, the higher the dispersion of the patent IPC classification number in each group level, which means that the technology used by the enterprise in the patent is more dispersed, the knowledge contained in the more complex, the higher the quality of the patent and the stronger the breakthrough. Since the patent classification number system of design is completely different from that of invention patent and utility model patent, and the level of independent innovation reflected by design patent is relatively low, this paper uses the number of invention patent applications and utility model patent applications of enterprises to measure BI of enterprises.

3.1.4 Control variables

Given the intricate interplay between macroeconomic and microeconomic factors that influence organizational outcomes, business performance and strategic decisions are also influenced by multiple dimensions. In order to reduce the endogeneity of missing variables, this paper sets a series of control variables from two perspectives of macroeconomic and micro individual market behavior. In order to ensure the rationality of the model setting, we refer to a large number of excellent research works (Xu et al., 2023; Vu et al., 2024; Zhang et al., 2024; Guo et al., 2025).

The study systematically mitigated the impact of individual differences on the accuracy of estimates by addressing key aspects including financial risk, institutional characteristics, and governance configurations. According to the operation behavior and main characteristics of the enterprise, this paper selects nine control variables: corporate size (CS), asset liquidity (AL), financial leverage (FL), asset-liability ratio (ALR), overhead ratio (OR), cash liquidity (CL), Tobin’s Q (TQ), ownership concentration (OC) and board size (BS). CS reflects the asset size of the enterprise. CR is the ratio of current assets to current liabilities. FL is the ratio of financial expenses to total revenue. Operating income includes net profit and income tax expense. ALR is the ratio of total liabilities to total assets of the enterprise. OR is the ratio of administrative expenses to operating income. CL is the ratio of operating cash flow to operating income. TQ is the ratio of a company’s market capitalization to its total assets. BS is the number of board members. OC is the share of stock held by the top ten shareholders. Since the strategic decision and business performance of agricultural enterprises will also be affected by local climate and consumer consumption power, this paper selects three variables as control variables according to the natural economic and social factors of the cities where the enterprises are located. They are rainfall, temperature and per capita GDP. Temperature and rainfall fully reflect the natural climate of the place where the enterprise is located, and they seriously affect the production and sales strategy of the enterprise. The per capita GDP of a city reflects the basic situation of economic development.

3.2 Data sources and descriptive statistics

This study focuses on agricultural companies listed on China’s A-share market. Specifically, it targets companies listed in the agricultural category of the Shanghai and Shenzhen A-shares market between 2009 and 2022. In order to exclude the negative impact of the financial crisis on enterprises, we set the starting year of the observation interval as 2009. Importantly, with the creation of the “Singles’ Day” shopping festival in 2009 by Chinese superstar Alibaba, the digitization of Chinese businesses has accelerated. Since data for 2023–2024 is not yet available, our deadline is 2022. The financial data utilized for the selected samples is sourced from the CSMAR and CNRDS databases. Moreover, the annual reports of these agriculture-related enterprise are acquired from Juchao Information Network and the WinGo financial text data platform. The sample selection process adheres to the following criteria: (1) Eliminating samples of listed companies with significant missing control variables; (2) Excluding companies with less than 1 year of listing; and (3) Removing ST, *ST, PT firms, as well as firms undergoing frequent industry changes during the sample period. It is worth noting that in the statistical sample of this paper, agricultural enterprises refer to enterprises whose business scope involves agriculture and its related supporting products. The samples of listed agricultural enterprises in this paper meet one of the following conditions: the proportion of main income from agricultural business of listed companies is greater than 50%; When the listed company is diversified, no one type of business income is greater than 50%, and the main income of agricultural business is the highest among all businesses, accounting for more than 30% of the company’s total operating income. According to the rules above, the study retained 14 years of balance panel data for 211 agricultural companies. In 2008, the whole world experienced the financial crisis, and China’s agricultural production was also spared the negative impact. Therefore, we set the time of sample samples as samples from some time after 2009. Currently, data for 2023 is not available, so 2009–2022 is appropriate.

3.3 Econometric models

In order to verify the impact of DT on FP of agricultural enterprises, according to the existing literature modeling ideas (Liu H. et al., 2023; Li et al., 2024a), the following panel data model is constructed in this paper according to relevant literature and research hypothesis 1:

In Equation 3, FP is the financial performance of the agriculture-related enterprise, DT is digital transformation, CV is the control variable, i is firm, t is the year, represents the firm’s individual fixed effect, is the time fixed effect, and is the random disturbance term. In addition, to explore the channels through which DT affects firm performance, this paper constructs the following equations:

In Equation 4, MV is the mechanism variable in this paper, and the meaning of the rest of the parameters is the same as in Equation 3. The two-stage mediation effect theory holds that if the regression coefficient of the core explanatory variable to the mechanism variable is significant, then the mediation effect is valid. The advantage of constructing only two equations for mechanism testing is that the endogeneity of multiple equations is well circumvented. In the second result, the causal relationship between the variables can be confirmed by the conclusions of the existing literature.

3.4 Research framework

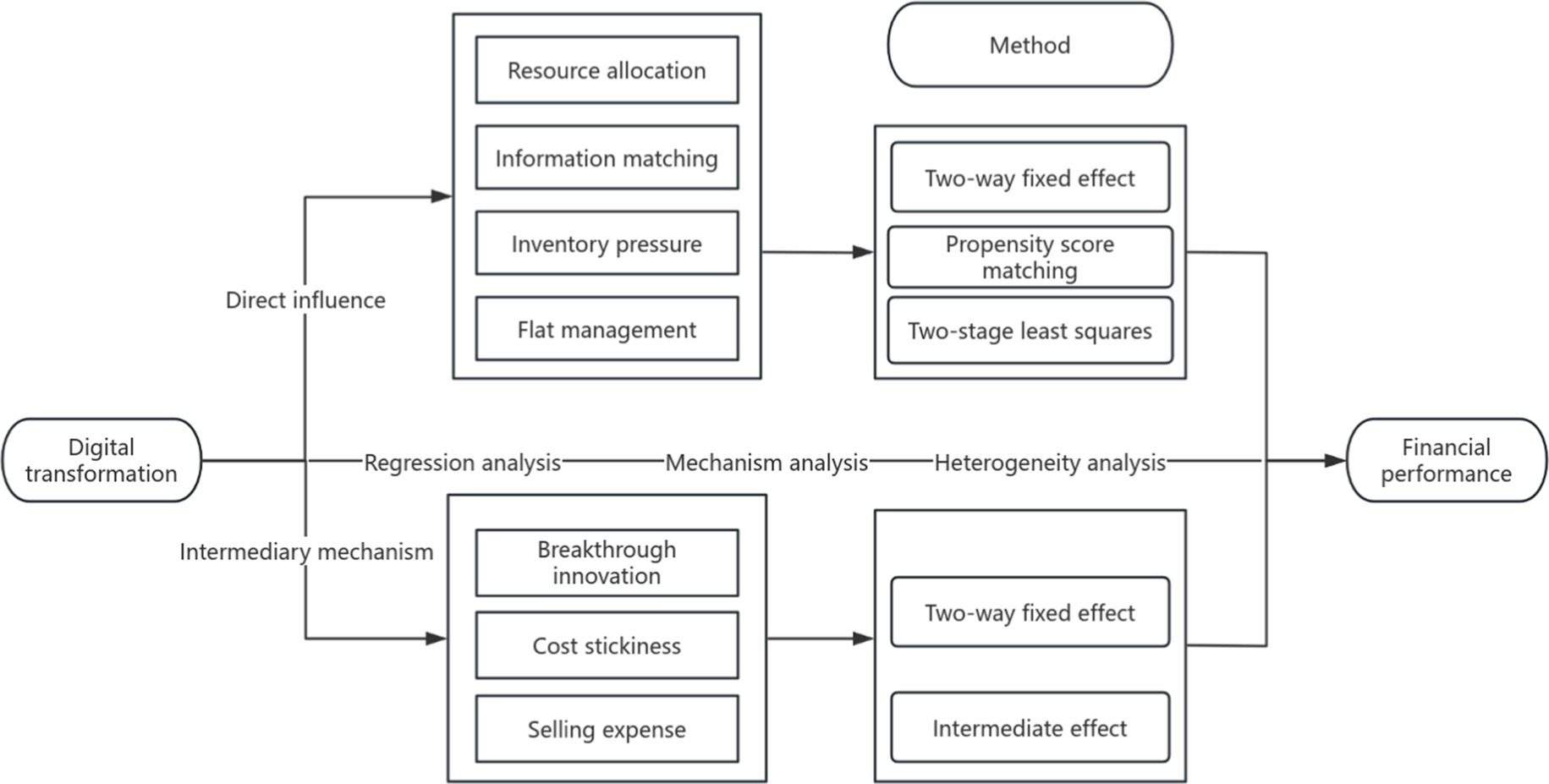

Based on the setting of relevant variables and models, the study draws the following flowchart. It helps researchers quickly understand the framework of the study and what needs to be achieved.

As can be seen from Figure 2, the impact of DT on the FP of agriculture-related enterprise is multi-faceted. It can help improve the efficiency of enterprise resource allocation, promote the matching of consumer and producer information, reduce inventory pressure and realize flat management. These gains are very effective in improving performance. In addition, it can also help enterprises achieve differentiated innovation, reduce the stickiness of labor costs and sales expenses of intermediary channels to improve performance. To analyze the impact of DT on agriculture-related enterprise, the study uses a panel data model. These methods include two-way fixed-effect models, PSM, and two-stage least squares.

4 Empirical results and analysis

4.1 Benchmark regression results

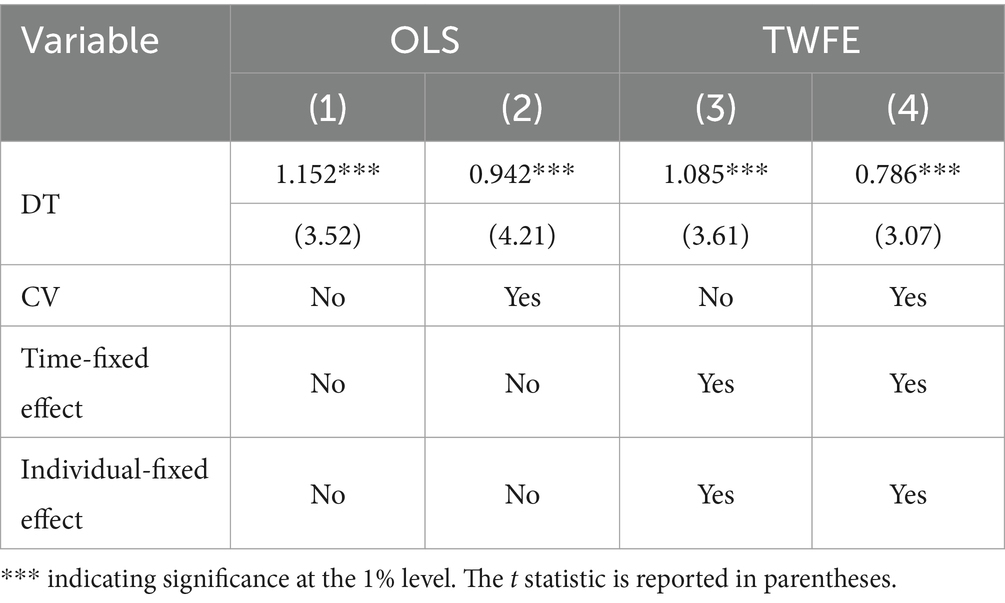

Building on the outcomes of the Hausmann test, our analysis employs a fixed effects model that factors in both time and individual effects within the regression framework. This model is also known as the two-way fixed-effect (TWFE) model.

Table 1 reports the baseline regression results of the impact of DT on agribusiness performance. As can be seen from Table 1, the results of columns (1) and (3) show that the regression coefficients of DT are 1.152 and 1.085 respectively, both of which are significant at the 1% level. This result implies that DT significantly increases FP in the absence of any control variables. We introduced control variables into the regression model, recognizing that the difference of firm specific attributes and natural characteristics can affect the accuracy of regression results. The results in columns (2) and (4) show that the regression coefficients of DT are 0.942 and 0.786, respectively, and both are significant at 1% level. The results show that DT can increase FP after taking into account natural features, urban economic development differences and firm specific factors. It is worth noting that while the positive effects persist, the size of the estimated coefficients has undergone an adjustment. This is because the number of relevant variables in the model has changed. One can assume that H1 has been vindicated.

In China, the typical representative of using digital technology to improve the company’s business performance and production efficiency is Beidahuang Agricultural Shares Friendship Branch. The digital information platform of “Beidahuang Agricultural Service APP” has been built to realize functions such as agricultural standard reminder, agricultural activity record, identification and suggestion of diseases, pests and grasses, and online field patrol guidance. The digital information platform planting management system can be used to develop year-round planting plans. Under the guidance of the overall plan, enterprises can realize the application of various systems such as accurate field patrol and leaf age diagnosis, and establish a farming calendar to guide farmers’ production. The digital information platform input all the land information of the branch company, including land attributes, contracted area and natural attributes, and form a comprehensive cultivated land database of the branch company combined with the plot portrait, which can facilitate managers to make quick decisions. On the production side, consider agricultural seeding and pest and disease solutions. The company applies digital technology to achieve intelligent seeding. The use of sensors and artificial intelligence can help managers determine crop planting varieties, the application of soil moisture meter to monitor soil temperature and humidity at different depths, and the combination of soil testing formula system to show soil nutrient content and soil type. The unmanned agricultural machine performs precision seeding and variable fertilization according to the prescription map. The quality inspection system monitors and feeds back information such as sowing amount, fertilizer amount, time and track in real time. In terms of grass damage, digital technology can accurately identify common weeds in dry fields such as knotgrass in corn fields, and the prescription map is sent to the plant protection drone for fixed-point precise weeding. Pest operation. Operators use intelligent sensing equipment such as bug detection and spore capture, drone patrol field pest identification, combined with technicians patrol field to achieve pest prevention and control.

DT enables companies to gain more economic benefits. In terms of crop production, the use of digital operation means to real-time intelligent monitoring of corn, soybean growth and agricultural machinery operation progress, so as to formulate scientific agronomic measures, which can increase rice yield by 5% and increase the mu by 30 KG. Based on the average price of rice 2.52 CNY/kg, the increase of 75.6 CNY per mu was calculated. Second, smart sensors can timely monitor the occurrence of diseases, pests and grasses and natural disasters, which can reduce the loss due to disasters and ensure the normal production of rice, so that the use of fertilizer can be reduced by 3% per acre, the use of pesticides can be reduced by 4%, and the production cost can be reduced by about 35 CNY per acre. The third is the installation of intelligent control irrigation equipment, combined with the water demand model of rice crops, to achieve on-demand irrigation and drainage of rice, saving 30% of water, and saving 5 CNY per mu of crop production.

4.2 Robustness test

4.2.1 Propensity score matching

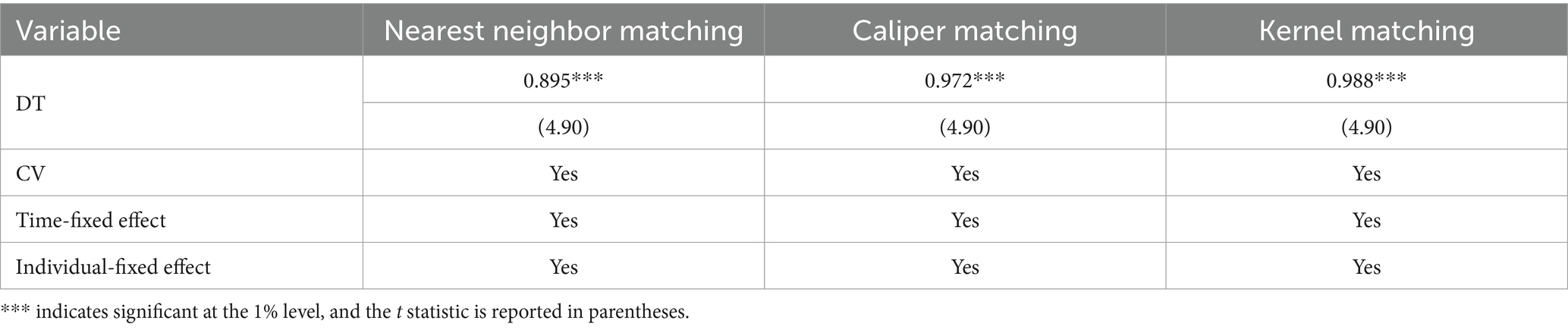

In this paper, propensity score matching (PSM) was used to solve the problem of sample selection bias. The core idea of this approach is to generate a pseudo-” random “sample in which the DT of the treatment and control groups is randomly assigned. Based on the observed differences between the two groups, they primarily capture therapeutic effects rather than company-specific characteristics. In the existing literature (Wei et al., 2025; Zhang P. et al., 2025), when analyzing DT and the business strategy and FP of listed companies, PSM is often used to eliminate sample selection bias. Based on the mean DT, we construct a binary dummy variable. The average annual level of industry DT is used as the classification standard, higher than the average is set as the treatment group, lower than the average is set as the control group. Other continuous variables in the baseline regression model, such as firm micro-characteristics and macroeconomic factors, are considered covariates for inclusion in the PSM. In order to ensure the robustness of PSM results, three methods are used in this paper. They are 1:1 ration nearest neighbor matching, caliper matching and kernel matching, respectively. For nearest neighbor matching, based on propensity score, this paper finds the object in the control group sample that is closest to the intervention group sample score forward or backward, and forms a pairing. According to the ideas of the existing literature (Wu and Liu, 2025), the range of caliper matching is set as 0.05, which means that the observation of matching difference of tendency score is 5% can be matched. For kernel matching, this paper pairs the estimated effect of the whole sample. The estimated effect was obtained by the weighted average of the scores of the experimental group and all the samples in the control group, and the weights were calculated by the kernel function. Subsequently, redundant samples are removed, leading to a consolidated dataset encompassing both experimental and control groups post-PSM matching. Based on paired samples and redundant samples deleted, the regression calculation of Equation 2 was re-performed in this paper, and the results in Table 2 were obtained.

The balance test shows that the standardization deviation of most covariables is less than 3%, indicating that there is no significant difference between the two groups of samples after matching, and the matching effect is good. It can be seen from Table 2 that the regression coefficients of DT for the three matching methods are 0.895, 0.972 and 4.0.988, respectively, and all of them are significant at the 1% level. This result means that the results after eliminating sample selection bias using PSM still confirm the positive effect of DT on improving the FP of agricultural enterprises.

4.2.2 Causal inference

There may be a double causality between DT and FP. For example, the better performing enterprises have more funds to introduce digital equipment and software, thus promoting DT. In the context of digital economy, in order to win the core competitiveness of the market, agricultural enterprises will take digital measures to improve office efficiency and production efficiency. For large enterprises, in the fierce market competition, in order to win more market shares, they not only need to focus on improving product quality, but also need to realize cost reduction and production efficiency improvement with the help of digital office processes. For example, in the research and development of crop varieties, enterprises use digital equipment to improve the research and development probability of excellent varieties. In the production process, automated monitoring equipment and the Internet of Things allow companies to accurately control fertilizer, pesticides, and irrigation water. In the sales link, the online platform has expanded the sales channels of agricultural products. Due to the rich returns brought by DT, enterprises with strong capital and good operating performance will choose digital strategies. In order to eliminate the bidirectional causality and potential measurement errors in the empirical model, this paper used the two-stage least square (2SLS) method to eliminate endogeneity.

Since the normal operation of digital equipment and software is highly dependent on network quality, this paper chooses the Internet broadband interface of the city where the company is located as the first instrumental variable. City broadband ports are integral components of the network infrastructure. The advancement of firm DT is, to some degree, influenced by the regional infrastructure of each area. Conversely, the progress of network infrastructure within each city proves to be more resistant to direct influence by any single firm. In addition, due to the influence of “peer effect” theory, this paper also chooses the annual mean value of DT as the second instrumental variable. In the regression calculation, in order to avoid the negative impact of over-recognition of IV on the estimation results, this paper constructs the IV interaction as a variable.

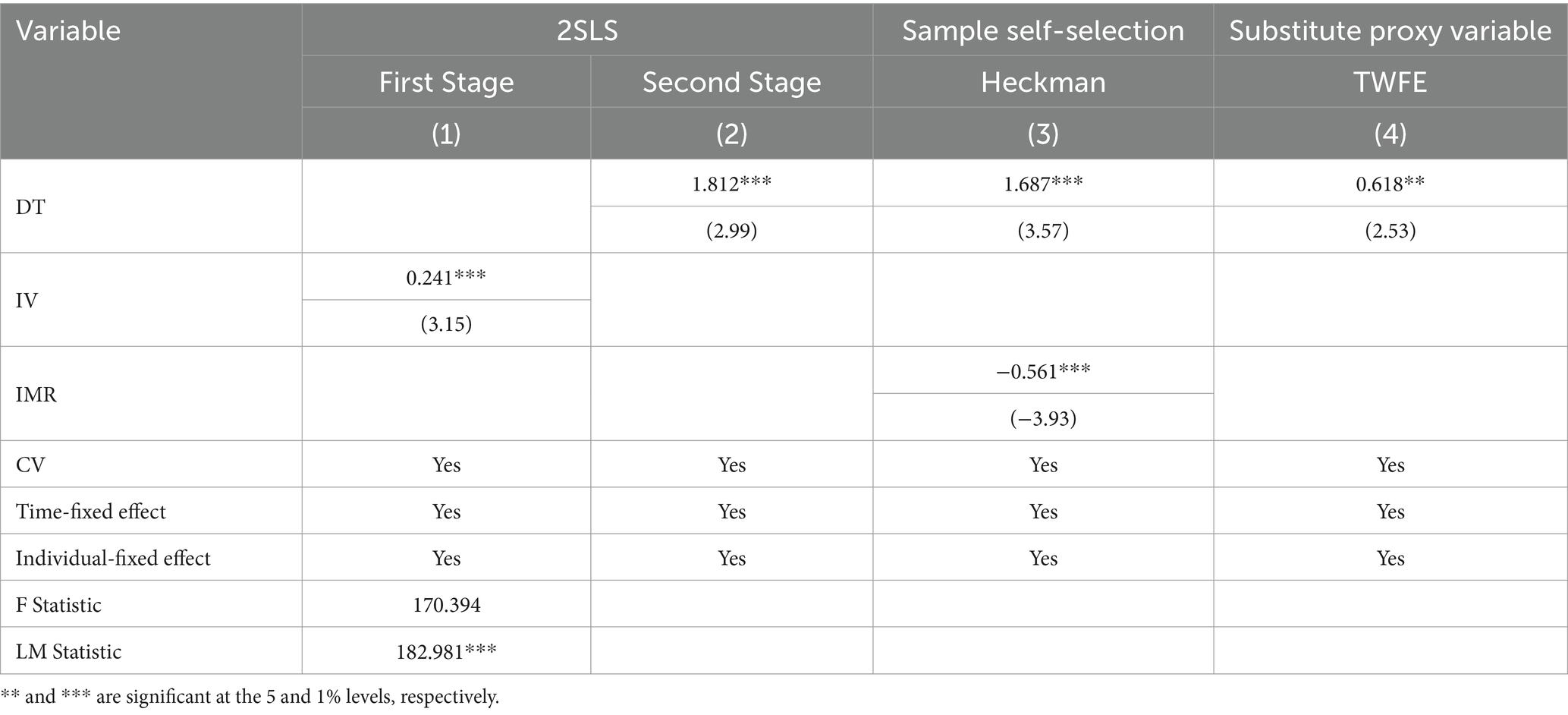

As can be seen from Table 3, the results of the first stage show that the F statistic is 170.394, which is much higher than the standard of 10% critical value, indicating that there is no threat of weak instrumental variables. The LM statistic is 182.981 and significant at the 1% level, meaning that the instrumental variable is cocoa identified. The results of the first stage show that the regression coefficient of DT is 1.812 and is significant at 1% level. The result is similar to that of the baseline regression, and the sign direction and significance of the regression coefficients maintain a high consistency. This result implies that after removing the potential endogeneity problem, estimates following the economic causal inference paradigm still confirm that DT will increases FP.

4.2.3 Heckman two-stage estimation model

The study used only a sample of listed agricultural companies. For listed companies, they have more financial funds and mature business profit models. However, due to the natural vulnerability of agriculture, there are still many small and medium-sized enterprises that may not have used DT to increase FP. For example, there are also some companies in the market that are highly focused on the application of digital technologies in the agricultural sector. These companies are not included in the statistical sample due to their single business and market share, but they have a comparative advantage in the digital field. In order to eliminate the bias caused by sample self-selection, the Heckman two-stage model is used in this paper. Whether an enterprise undertakes DT is decided by the enterprise itself, which is a self-selection behavior. Therefore, the processing effect model is further used to correct the possible self-selection bias. The model requires that at least one exogenous variable affecting the core explanatory variable be included in the equation and that the exogenous variable is not included in the main regression equation at the same time. The model is divided into two steps: In the first stage, the selection model is built with all the observed samples and the inverse Mills ratio (IMR) is calculated; In the second stage, the inverse Mills ratio was incorporated into the main regression model as a control variable to exclude selective bias (Heckman, 1979; Yang and Xu, 2025). In the selection model, this paper sets virtual variables of enterprise DT as explained variables. Consistent with the variable setting method in the PSM section, this paper still constructs a binary dummy variable: the observation value greater than the mean is set to 1, and the observation value less than the mean is set to 0. In accordance with the practice of the existing literature (Wu and Yao, 2023; Yang and Yang, 2025), this paper selected the number of executives with digital background (NEDB) in the company as the exogenous constraint variable, and then performs the Probit regression equation to obtain the results of the first stage. In the second stage, the inverse Mills ratio was added to correct the sample self-selection bias and then the regression was carried out.

As can be seen from Table 3, the results of column (3) shows that the regression coefficients of inverse Mills ratio (IMR) is −0.561 and pass the statistical significance test at the 1% level, indicating the existence of sample self-selection bias. After Heckman was used to eliminate sample selection bias, the regression coefficient of DT was 1.687 and significant at 1% level. The results are highly consistent with the results of baseline regression, which verifies the robustness of the result.

4.2.4 Replace the explained variable

Due to the existence of measurement errors, the estimated results of the model may also be biased. To strengthen the reliability of the results, this paper uses return on assets instead of return on profits. The return on net assets serves as an indicator of short-term profitability, encapsulating the diverse facets of a firm’s performance while remaining resistant to manipulation by its managers. The results in Table 3 were obtained by using TFE fitting to calculate the empirical model. As can be seen from column (4) in Table 3, the regression coefficient of DT is 0.618 and significant at the 5% level. This result implies that DT will significantly improve the return on assets. The new results reconfirm the robustness of the baseline regression results.

5 Mechanism analysis and heterogeneity test

5.1 Test of intermediate mechanism

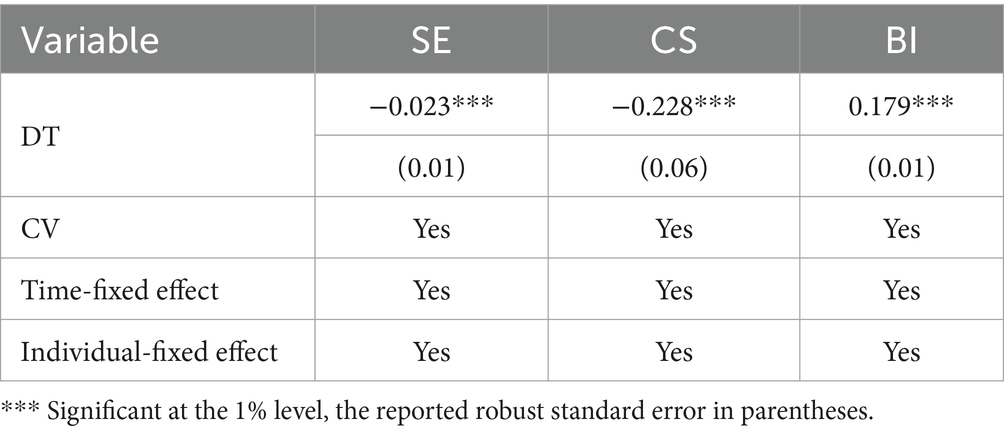

The results of baseline regression and robustness test both confirm the positive effect of DT on FP and verify the basic hypothesis of this paper. In order to verify the mechanism path of DT improving FP, combined with research hypotheses 2 to 4, this paper uses a two-stage intermediary effect model for analysis. This theoretical model emphasizes that the empirical part focuses on the influence of the core explanatory variables on the mechanism variables, instead of constructing three-paragraph equations to reduce the endogeneity of multiple equations. Therefore, this paper only needs to pay attention to whether the sign and significance of the regression coefficient of DT to the mechanism variable meet the expectation in the regression equation.

It can be seen from Table 4 that in the mechanism test, the regression coefficients of DT are −0.023, −0.228 and 0.179, respectively, and they are all significant at the 1% level. This result means that DT helps to reduce sales expenses, reduce explicit costs for the firm, improve substantive innovation capabilities, and ultimately increase FP. Hypotheses 2 to 4 of this paper were verified. From the perspective of enterprise cost stickiness, the use of digital technology in the production process can replace low-skilled workers and reduce salary payments (Shen and Zhou, 2024). AI technology also improves production efficiency and reduces the introduction of raw materials through efficient allocation and reuse of resources. From the perspective of technological innovation, DT is not only conducive to the rapid screening, sorting and analysis of existing stock knowledge, but also can give optimization suggestions, and improve the efficiency of R&D personnel to obtain external knowledge (Shen and Zhang, 2024b; Shen et al., 2023). The digital experimental platform provides BI with the conditions for simulation and data analysis, reducing the risk of innovation failure. Most importantly, digital platforms provide instant messaging facilities to facilitate the exchange of ideas between developers and market information. From the perspective of sales expenses, the precision marketing and digital customer service brought by DT improve the output utility of marketing programs and contribute to product sales. Smart logistics and smart supply chains enabled by digital technologies enable goods to be sold more quickly because they reduce inventory pressure and intermediaries.

5.2 Heterogeneity analysis

Since agricultural production and sales are affected by many aspects, the external influencing factors for agricultural enterprises to use digital technology to improve FP are also multiple aspects. In order to further clarify the impact of factor endowment differences or natural conditions on production and management, this paper conducts heterogeneity tests from three aspects.

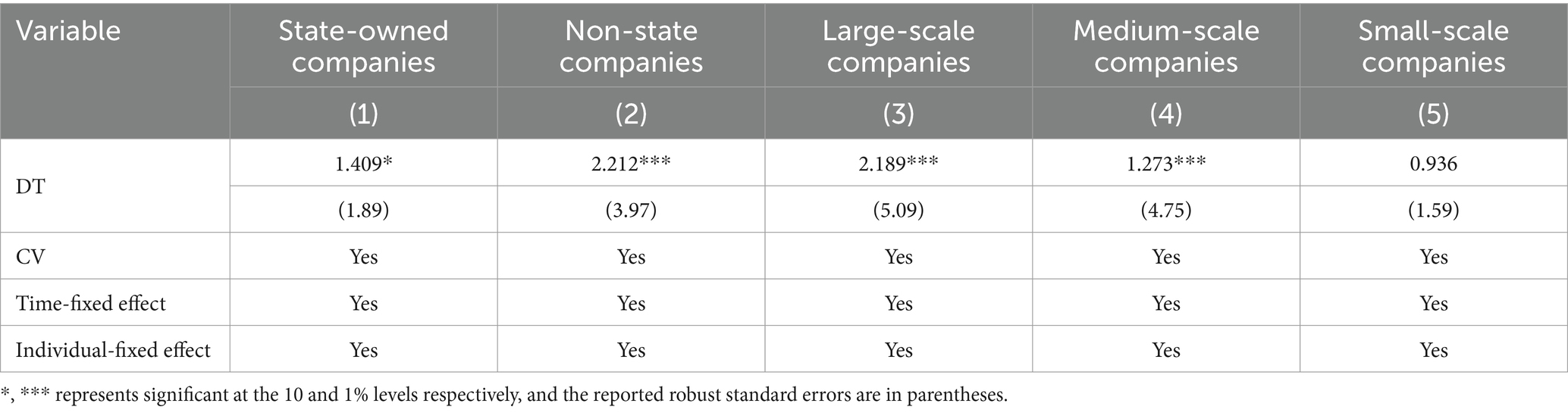

5.2.1 Heterogeneity of firm ownership

The heterogeneous effect of DT on firm performance is first examined in terms of firm nature, and the results are shown in columns (1) and (2) of Table 5. For different firm ownership, the positive impact of DT on firm performance passes the significance test, but the estimated coefficients are significantly larger for non-state-owned firms than for state-owned firms. The regression coefficients of DT in the two samples were 1.409 and 2.212, respectively.

The possible reason for this is that a high percentage of state-owned shares in a state-owned firm means that it can own more resources and that the government has a greater say in the operation of the firm. However, since the government needs to consider not only profit but also many aspects related to livelihood issues in its decision-making, the decision-making is conservative and risk-averse. Therefore, the links in the implementation of the DT decision-making process are more and less efficient, and the introduction and deepening of intelligent technology will be hindered to a certain extent, resulting in the state-owned firm’s intelligent transformation, and DT motivation being insufficient. Compared to non-state-owned firms, state-owned firm DT has a lower effect on firm performance.

5.2.2 Heterogeneity in firm size

With the deepening of the industrial revolution and the intensification of international trade frictions, some agriculture-related enterprises in China are facing the dilemma of declining international market share due to the limited scale and lack of core competitiveness. To understand the variance in DT among firms of different sizes, these entities were categorized based on their employee count, followed by grouped assessments. As evidenced in Table 5, the coefficients for both large and medium-scale firms are positively significant at the 1% level. Notably, the coefficients for DT are higher for large-scale firms compared to their medium-scale counterparts, their regression coefficients were 2.189 and 1.273, respectively, signifying a more pronounced enhancement in firm performance due to DT for larger entities. As per the scale effect, an increase in firm size yields greater operational performance for equivalent levels of DT. While smaller firms, due to their nimbleness, can expedite decision-making processes in DT, thereby seizing initial opportunities, they often face challenges. These challenges stem from a shortage of specialized personnel adept in advanced digital technologies. Early-stage deployments might lead to underutilized machinery, and comprehensive machine maintenance often requires outsourcing, resulting in elevated management costs. These overheads counterbalance the potential benefits of DT, rendering its impact on the performance of smaller firms inconsequential.

5.2.3 Heterogeneity of grain functional zoning

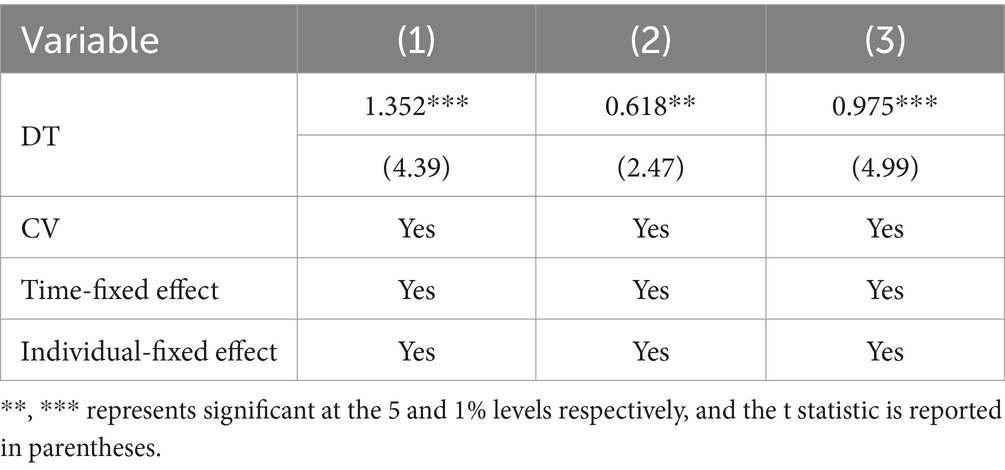

China’s extensive territorial expanse and diverse topography create significant climatic variations across the nation. The climate system is predominantly characterized by monsoon patterns, supplemented by temperate grasslands, arid desert conditions, and alpine climate zones in secondary distribution. Geographically, the eastern coastal regions feature expansive plains while the western territories are dominated by high-altitude plateaus and mountain ranges. Based on comprehensive assessments of terrain characteristics, climatic conditions, and economic development parameters, the Chinese government implements a strategic categorization of provincial jurisdictions into three distinct agricultural zones: (1) Core grain production bases; (2) Production-consumption equilibrium zones; (3) Primary grain consumption regions. The Core Grain Production Bases serve as the nation’s principal agricultural hubs, specializing in large-scale cultivation of staple crops including cereals, soybeans, tuber crops, and dairy production. Conversely, the Primary Grain Consumption Regions maintain minimal agricultural output for local subsistence needs, predominantly relying on interregional transfers and imports to satisfy urban food demands. Production-Consumption Equilibrium Zones operate under a self-sufficient paradigm, where agricultural output is calibrated to precisely meet regional consumption requirements without surplus distribution. In this paper, the functional areas of agricultural enterprises were identified according to the list of food functional zones and the registration place of enterprises, and then the TWFE model was used to test the heterogeneity.

As can be seen from Table 6, the regression coefficients of DT in the three functional zones were 1.352, 0.618 and 0.975, and were significant at the levels of 1, 5 and 1%, respectively. This result implies that the enhancement effect of DT on FP will not be affected by the opposite result due to the difference of food functional zoning. By comparing the regression coefficients of the three results, it can be found that according to the ranking of DT regression coefficients from large to small. They are core grain production bases, primary grain consumption regions and production-consumption equilibrium zones. Since the regression coefficients of column (2) and column (3) are close, we performed a difference test between the coefficients to verify the comparative nature of the regression coefficients. The results of Fischer combination test show that the coefficient difference between the two is 0.375 and significant at 5% level. This result implies that it is reasonable to directly compare the sizes of regression coefficients because the overlap of confidence intervals obtained by mean reversion is very small. Core grain production bases undertake the main grain production tasks in China, gathering a large number of agricultural enterprises and supporting suppliers. These areas have good natural endowments, flat terrain, fertile soil, and synchronous rainfall and heat, making food production very smooth. At the same time, because of the long history of planting in these areas, the operation of enterprises is more mature, and has formed a digital solution with market competitiveness. The good terrain creates good conditions for the application of digital equipment and software, and digital agricultural machinery, unmanned aircraft and intelligent harvesting tools are widely used. With the help of DT, the production efficiency and product excellence rate of agricultural enterprises have been greatly improved. Therefore, agribusinesses using agri-digital technology innovation can generate a substantial increase in revenue, or very low revenue if they do not pursue DT. The Production-consumption equilibrium zones are mainly located in the western region of China, where a large number of plateaus, mountains and deserts are distributed. The harsh climatic conditions make it difficult for digital equipment to be widely used in agricultural production. Harsh natural conditions make enterprises face high digital service costs, which limits the role of DT. In addition, due to the path dependence of traditional agricultural production methods, the DT of farmers, suppliers and producers in these regions is very limited.

6 Conclusions and implications

6.1 Conclusion

As a key unit of economic development, enterprise is a new engine to implement and lead the DT in the era of digital economy. In the era of digital economy, the use of digital technologies by market players is conducive to the development of sustainable technological solutions, smart cities and sustainable urbanization, sustainable consumption, etc. The more detailed specialization brought about by DT encourages organization members to focus on local innovation, and improve the overall innovation performance of the enterprise under the frequent interaction of data and digital technology. Therefore, the significance of digital economy and DT for enterprise transformation and upgrading is self-evident. However, what we need to pay attention to is whether the digitalization of enterprises at the micro level can enable all enterprises to enjoy digital dividends. Due to the fragility of agricultural production and the exceptionally long nature of crop production cycles, DT in agricultural enterprises requires additional attention. China is the largest developing country in the world, with a large population emphasizing the contribution of the agricultural sector. At present, China’s digital economic growth is booming, new models, new forms of business and new economy continue to pour into, and agricultural enterprises are also constantly changing in the digital wave. Exploring the DT of Chinese agricultural enterprises, the conclusions and results are helpful for other agricultural countries to develop their local agricultural economy according to local conditions.

This study takes listed agricultural companies in China as research samples and uses various techniques to investigate the influence and path of DT on FP. Our results show that DT provides innovative solutions for efficient production, precise control and smart purchasing in agricultural enterprises. With the help of DT, agricultural enterprises can achieve digital production and marketing, leading to an increase in FP. To verify the robustness of the results, the study used a variety of methods. (1) PSM and Heckman two-stage models were used to eliminate the negative effects of sample selection bias and self-selection bias on the estimation results. (2) Considering the bidirectional causality between variables, 2SLS is used to eliminate the endogeneity of the model. (3) We also used return on assets to replace the explained variable to control for the negative effects of measurement errors. The positive effect of DT on FP was confirmed by various methods. According to the existing literature (Song and Xiu, 2024; Wang D. et al., 2025), agricultural production is highly dependent on the natural environment, which not only faces natural risks, but also faces serious market supply and demand risks because of the long periodicity of food crop production, so DT is not conducive to increasing FP. Consistent with the results confirmed in the other literature (Qiu and Xu, 2022; Zhang and Yu, 2024; Sargani et al., 2025), the results of this study show that the advantages of digital production, flexible scheduling, and intelligent decision making brought by DT are important for improving FP.

According to the results of the two-stage intermediary effect model, DT can increase FP through channels that reduce sales expenses, promote breakthrough innovation and ease cost stickiness. However, the role of DT in promoting FP is heterogeneous. The decision-making process of non-state-owned enterprises is more flexible, making the role of DT more clear. Larger enterprises have good market competitiveness and strong capital, so as to obtain more digital dividends. The main grain producing areas have good production experience and supporting services, and the economic benefits obtained by agricultural production in DT are greater.

6.2 Management enlightenment