- School of Business, University of Jinan, Jinan, China

Agriculture constitutes an essential cornerstone of national security. The digital transformation of agricultural enterprises is a pivotal driver in promoting agricultural modernization, enhancing industrial competitiveness, and ensuring food security. This paper examines the impact of economic policy uncertainty on the digital transformation of agricultural enterprises, drawing on data from China’s A-share listed agricultural companies from 2007 to 2022. The research results indicate that: (1) Economic policy uncertainty significantly accelerates the digital transformation process of agricultural enterprises. (2) Mechanistic analysis reveals that, when confronted with economic policy uncertainty, agricultural enterprises are compelled to pursue digital transformation to mitigate market shocks, which result from decreased levels of risk-taking and investment efficiency. (3) Further heterogeneity analysis demonstrates that agricultural enterprises that are strategically positioned, face stronger financing constraints, occupy leading firm status, and focus on agricultural services are more inclined to undergo digital transformation under economic policy uncertainty. (4) By elucidating the compelling effects of economic policy uncertainty on the digital transformation of agricultural enterprises, this study validates the rationale for these enterprises’ adoption of digital strategies to mitigate the adverse effects of declining risk-taking levels and investment efficiency. Importantly, while the empirical context is grounded in China, the mechanisms and heterogeneity patterns identified—such as risk mitigation, financing constraints, and strategic positioning—offer implications for agricultural sectors in other regions navigating similar economic policy uncertainties. Ultimately, the conclusions drawn from this research seek to provide innovative strategies for agricultural enterprises to navigate the uncertainties of the external economic environment.

1 Introduction

In recent years, both domestic and international economic environments have become increasingly complex due to unilateralism, intensified trade frictions, and various uncertainties, such as extreme weather and sudden public health crises. Policy authorities have continuously introduced or adjusted economic policies, contributing to the prevalent theme of economic policy uncertainty. As a sector heavily reliant on policies, agriculture is particularly vulnerable to the effects of economic policy uncertainty, significantly affecting food trade and the agricultural supply chain. Within the context of the “new normal” economy, addressing the negative impacts of economic policy uncertainty has become a critical concern for all sectors of society. Agricultural digitalization, described as a “profound revolution in agricultural factors, production and management processes, and rural governance,” has the potential to revolutionize traditional agricultural productivity through digital technology (Ministry of Agriculture and Rural Affairs, 2019). This transformation is not only the key engine for increasing farmers’ income and revitalizing rural areas, but also the cornerstone for cultivating high-quality productivity (Ding et al., 2024). In this uncertain economic policy environment, agricultural enterprises should capitalize on opportunities for digital transformation, fostering advanced productivity and developing new competitive advantages through innovations in development models and organizational structures.

A review of existing studies reveals that economic policy uncertainty primarily impacts enterprises through investment efficiency and risk-taking capacity. On the one hand, economic policy uncertainty exacerbates market instability, prompting financial institutions to tighten financing conditions and increasing difficulties for enterprises in securing funding (Yan et al., 2023). Under constrained financial resources, management tends to adopt risk-averse strategies, significantly lowering enterprises’ risk-taking capacity. On the other hand, economic policy uncertainty worsens information asymmetry and moral hazard, thereby compromising the precision, objectivity, and timeliness of investments, which in turn reduces enterprise investment efficiency. The characteristics of agriculture-related industries and products—such as high sunk costs, extended return cycles, and significant cash flow fluctuations—make agricultural enterprises particularly sensitive to perceived changes in economic policy (Lin et al., 2024). Consequently, such elevated uncertainty will exert a wider influence on the risk-taking capacity and investment efficiency of agricultural enterprises.

Adopting digital transformation for both survival and advancement represents a proactive strategic hedge for enterprises to manage uncertain shocks. This paradigm shift transcends mere technological adoption, serving as an anticipatory mechanism to increase organization’s resilience against systemic risks. On the one hand, digital transformation can alleviate the financing constraints faced by agricultural enterprises and enhance their risk-taking capacity through data-driven financial hedging instruments (Zhao, 2024). On the other hand, digital transformation reduces information asymmetry between agricultural enterprises and external stakeholders through transparency mechanisms, improves internal control quality, and helps avoid inefficient decisions such as underinvestment (Lyu et al., 2023). Through digital transformation, agricultural enterprises can gain competitive advantages in value creation, strategic initiative, supply processes, and market agility, helping them withstand shocks to risk-taking capacity and investment efficiency caused by uncertainty.

In summary, research on economic policy uncertainty thus far has primarily focused on how manufacturing firms perceive policy changes. It is worth noting that although agricultural enterprises exhibit higher sensitivity to economic policy uncertainty, there is a relative scarcity of related studies. Therefore, it is crucial to undertake an in-depth exploration of the performance of agricultural enterprises and their coping strategies in this context. Has economic policy uncertainty become a key factor in fueling the digital transformation of agricultural enterprises? This question warrants rigorous investigation. To comprehensively analyze the multifaceted impact of economic policy uncertainty on the digital transformation of agricultural enterprises, this paper undertakes a comprehensive analysis from various perspectives, including whether agricultural enterprises are industry leaders and the specific industries to which they belong. The paper examines the vulnerabilities inherent in the agricultural sector and, from the perspective of negative shocks, explores how economic policy uncertainty serves as an internal mechanism that compels agricultural enterprises to undergo digital transformation by diminishing their risk tolerance and investment efficiency. In addition, the paper analyzes whether digital transformation can effectively mitigate the negative impacts of economic policy uncertainty on risk tolerance and investment efficiency. Finally, the possible heterogeneity of agricultural enterprises is thoroughly examined in relation to their strategic positioning, financing constraints, market position, and industry characteristics.

This study makes three key contributions to the specialized literature: (1) We establish a novel theoretical framework that identifies economic policy uncertainty as a catalyst for organizational change in agriculture, fundamentally reframing conventional risk management paradigms of agricultural enterprises. (2) We identify an internal compulsive mechanism in which economic policy uncertainty reduces the risk tolerance and investment efficiency of agricultural enterprises, thus forcing them to actively promote digital transformation, it’s a causal approach that not documented in agricultural enterprise research. (3) Our heterogeneity analysis based on leadership status and industry-specific characteristics provides actionable insights for targeted policymaking, bridging a critical research-practice gap through tailored interventions for agricultural businesses. Through this series of analyses and discussions, this paper aims to provide a more comprehensive set of coping strategies and targeted recommendations for agricultural enterprises in the face of economic policy uncertainty.

2 Theoretical analysis and research hypothesis

2.1 Economic policy uncertainty and digital transformation of agricultural enterprises

Economic policy uncertainty (EPU) reflects ex ante unpredictability regarding whether, when, and how governmental authorities might alter fiscal, monetary, or regulatory instruments. This decision-making ambiguity regarding the timing, nature, and scope of potential policy shifts will create a complex investment environment (Amarasekara and Iyke, 2022), complicate the strategic choices across competitive markets. On the one hand, economic policy uncertainty can induce economic volatility, heighten market risks, and intensify competition. Confronted with the risk of losing market share, agricultural enterprises must pursue digital transformation and leverage digital technologies to identify potential opportunities and threats in the competitive landscape to capture market power and excess profits (Jao et al., 2021). On the other hand, economic policy uncertainty can exacerbate financial frictions, leading to increased external financing costs for firms (Wen et al., 2021). Faced with profit compression due to rising costs, agricultural enterprises urgently need to deploy digital technology to mitigate financial risks, lower operational costs (Zhou and Li, 2023), and strengthen their ability to manage these impacts through the optimal allocation of production resources.

Specifically, digital transformation involves the iterative upgrading of technology and production models, as well as the continuous optimization of products and operational capacity, creating avenues for innovation in agricultural enterprises (Lin and Mao, 2023). Which can bring innovation space for agricultural enterprises. First, digital technologies, such as the Internet of Things (IoT) and Blockchain, enable agricultural enterprises to optimize the management of internal and external resources, enhance resource utilization efficiency, and minimize inventory backlogs and production waste. This not only reduces operational costs but also strengthens the core competitiveness of these enterprises (Xue et al., 2024). Second, sensor data and AI analysis enable agricultural enterprises to more accurately monitor production conditions, ensuring precision, real-time insights, and transparency in critical activities such as internal management, production processes, processing, and sales control. Crucially, these technological implementations represent strategic investments in organizational resilience, enabling anticipatory adaptation to volatility through data-driven scenario planning, enhances capital turnover, market responsiveness and investment efficiency across the industrial chain. Finally, digital technologies enhance the risk prediction capabilities of agricultural enterprises through artificial intelligence (AI) algorithms and big data models, boosting their confidence in managing market risks and providing more opportunities to capitalize on future growth prospects (Feng and Yu, 2025).

In the face of economic policy uncertainty, digital transformation offers technological solutions for agricultural enterprises to optimize business management, refine investment and financing structures, innovate organizational and production systems, and broaden their innovation and capability boundaries (Verhoef et al., 2021). This strategic orientation transforms digital transformation from a tactical tool into a systemic risk mitigation framework, allowing firms to reconfigure resources preemptively while maintaining strategic flexibility in turbulent environments. Accordingly, the following research hypotheses are proposed:

H1: Economic policy uncertainty will incentivize agricultural enterprises to carry out digital transformation.

2.2 Economic policy uncertainty, risk taking level and digital transformation of agricultural enterprises

The risk-taking level of an enterprise reflects the propensity of enterprises to pursue high-yield project investments and their willingness to assume significant risks. Chinese agricultural enterprises face unique constraints, their average total assets are substantially lower than those of national enterprises, resulting in limited internal resources. This resource scarcity exacerbates the negative impacts of economic policy uncertainty (EPU) on their risk-taking capacity through two distinct mechanisms. First, EPU amplifies financing constraints. The theory of financial friction (Bernanke and Gertler, 1989) argues that economic policy uncertainty amplifies financing constraints and reduces enterprises’ risk-taking levels by exacerbating information asymmetry and proxy issues. Agricultural enterprises typically possess low creditworthiness and insufficient collateral, making agriculture-related loans more vulnerable to default risks during policy instability (Yin et al., 2014). Banks’ “self-insurance” motivations during uncertain periods further reduce credit availability and intensify the financing constraints (Higgins, 2023). Consequently, it will create a capital constraint that exacerbates the imbalance in their internal resource allocation, then limits investments in high-risk and positive NPV projects (Ascui and Cojoianu, 2019). While digital transformation itself carries implementation risks (e.g., organizational resistance, technology adoption costs), agricultural enterprises choose to mitigation the long-term risk’s benefits outweigh the short-term transformation risks. Through the use of digital technologies, such as sensors and smart devices, agricultural enterprises are able to systematically integrate and generate detailed operational reports, thereby disclosing higher-quality information to the market. This information conveys positive signals to financial institutions, which can enhance agricultural enterprises’ opportunities for obtaining financing, thereby reducing financing restrictions and alleviate the high risk bearing. This aligns with growth option theory (Myers, 1997) suggesting digital transformation creates information value beyond immediate cash flows, enabling better assessment of future investment opportunities.

Second, EPU induces risk-averse managerial behavior. Economic policy uncertainty heightens agricultural enterprises’ sensitivity to high risk, managers tend to avoid high-risk/high-reward investments (Ölkers and Musshoff, 2024), consequently reducing their risk-taking level. Studies further suggest that collectivist cultures may exhibit stronger risk aversion (Ojala et al., 2018). This dual pressure of constrained capital and risk aversion creates a paradoxical situation where digital transformation emerges as a strategic response. Through the application of technologies such as real-time monitoring and big data models, agricultural enterprises can enhance the transparency of their internal processes, and facilitate managers have more comprehensive understanding of production and operational aspects, minimize the potential for opportunistic behavior, and optimize resource allocation to invest in high-yield projects (Tian et al., 2022).

This establishes a causal pathway through which economic policy uncertainty depresses corporate risk-taking level, prompting agricultural enterprises to adopt technological countermeasures. By embracing digital transformation initiatives, firms may mitigate decision-making biases and unlock value in constrained environments to respond effectively to adverse shocks. Accordingly, the following research hypotheses are proposed:

H2: Economic policy uncertainty will reduce the risk-taking level of agricultural enterprises and force agricultural enterprises to carry out digital transformation.

2.3 Economic policy uncertainty, investment efficiency and digital transformation of agricultural enterprises

Economic policy uncertainty affects an enterprise’s ability to judge the market direction, leading agricultural enterprises to make decisions that deviate from the optimal level of investment, thus reducing investment efficiency (Akron et al., 2022).

On the one hand, investment represents a hidden and irreversible cost. Agricultural production exhibits strong seasonality and externalities, making it uniquely vulnerable to EPU-driven fluctuations (Bloom, 2009). The waiting option theory suggests that when investments involve prolonged rights and price fluctuations, firms delay commitments to acquire information (Dixit and Pindyck, 1994). Heightened economic policy uncertainty causes significant volatility in investment yields, as firms struggle to forecast cash flows under ambiguous policy signals (Bonaime et al., 2018). Facing such conditions, agricultural enterprises may resort to short-term debt for long-term use (Li et al., 2022), a financing mismatch that violates the maturity matching principle (Brealey et al., 2020) exacerbates investment inefficiency. This aligns with behavioral theories of corporate conservatism under uncertainty, where managers prioritize liquidity over growth (Baker et al., 2016).

To avoid the trap of investment inefficiency, enterprises must accelerate their digital transformation and support scientific decision-making through digital technology. Artificial intelligence models, big data analysis, and automated algorithms can substantially enhance the efficiency of project decision-making and implementation in agricultural enterprises by gathering and analyzing comprehensive data and information in real time, systematically assessing the projected benefits of projects, and mitigating the risk of investing in projects with adverse environmental conditions or uncertain market outlooks (Autio et al., 2018). This approach helps minimize investment inefficiencies, mitigate the risk of default, and effectively hedge against the adverse effects of economic policy uncertainty. Empirically, digitally mature firms demonstrate faster investment adjustment speeds during EPU spikes (Guo et al., 2025).

Conversely, economic policy uncertainty can trigger price fluctuations in agricultural products, leading to inaccurate judgments of the expected sales growth rate of agricultural enterprises and resulting in inefficient investment behavior (Su et al., 2023). Blockchain technology, cloud computing, intelligent supply chains, and other advanced technologies have been increasingly adopted in the production and sales processes of agricultural enterprises. Strategic choice theory underscores that firms adopt digital tools not merely as reactive measures but as proactive strategies to reshape competitive landscapes (Child, 1972). Through technologies like data collection, analysis, simulation, and forecasting, firms can effectively reduce uncertainty and reactive behavior in production and pricing decisions, mitigates the reliance on experience-based and subjective judgments.

This establishes a causal chain where economic policy uncertainty impacts investment efficiency, agricultural enterprises seek measures to break out of the encirclement, choosing to adopt digital transformation to turn systemic risk into an opportunity for operational innovation to mitigate the shock. Accordingly, the following research hypotheses are proposed:

H3: Economic policy uncertainty will reduce the investment efficiency of agricultural enterprises and force agricultural enterprises to carry out digital transformation.

3 Research design

3.1 Data sources

This paper selects agricultural enterprises listed on the Shanghai and Shenzhen A-share markets from 2007 to 2022 as the research focus. Comparing to family farming and rural cooperatives, agricultural enterprises typically possess greater financial capacity and production scale, enabling them to allocate more resources toward the adoption and development of digital technologies to respond to the economic policy uncertainty. Based on this, the data processing steps are as follows: (1) Retaining only the sample of listed agricultural enterprises; (2) Excluding samples of companies delisted during ST, *ST periods; (3) Applying 1% two-sided shrinkage to the control variables to eliminate extreme values from the empirical analysis; (4) Eliminating samples with missing key variables.

In total, 350 listed agricultural enterprises comprising 2,588 samples were retained for the analysis. The microdata of listed agricultural enterprises is sourced from the Wind and CSMAR databases. The economic policy uncertainty index is derived from the EPU index, developed jointly by research teams from the University of Chicago and Stanford University. The word frequencies in the annual reports related to digital transformation were extracted from the Juchao Information Network.

For the selection of agricultural enterprises, this paper draws on the National Bureau of Statistics (NBS) Statistical Classification of Agricultural and Related Industries (2020) for the division of agricultural and related industries, excludes industries in which only some of the activities belong to the agricultural and related industries, and, referring to the study by Sun et al. (2022), defines the enterprises whose main business belongs to, or relies on, agriculture, forestry, animal husbandry, and fishery for the purpose of production, processing, and sales, or whose products are for use in the industry, as agricultural enterprises.

3.2 Variable setting and description

3.2.1 Explained variables

This study investigates the digital transformation of agricultural enterprises (DG) as a key explanatory variable. Initially, a word frequency analysis is conducted pertinent to digital transformation, and text analysis techniques are utilized to collect data on the digital transformation processes within agricultural enterprises.

Recognizing that digital transformation has primarily been implemented in production activities, we adopted the approach of Zhao et al. (2021) to identify keywords across four dimensions: digital technology application, Internet business model, intelligent manufacturing, and modern information system. Secondly, we crawled the annual reports of listed agricultural enterprises are crawled using Python software and converted them into TXT format. By employing a text analysis method and the Jieba library, we conducted a statistical analysis of the word frequency related to digital transformation digital transformation. Finally, we used the natural logarithm of (word frequency + 1) as our primary measure (DG).

3.2.2 Explanatory variables

Regional economic policy uncertainty (EPU) was employed as an explanatory variable in this study. The economic policy uncertainty index developed by Davis et al. (2019) was chosen for analysis. Unlike Baker et al. (2016), who assessed China’s economic policy uncertainty through the frequency of relevant terms in the South China Morning Post (SCMP), Davis et al. established a more robust index by concentrating on the terms “economic” and “uncertainty” as extracted from the Government Work Report. They utilized the Government Work Report to generate more accurate word frequency data for these terms and conducted their analysis using information from Guangming Daily and People’s Daily, which provide a more representative reflection of the Chinese context. To align with annual macroeconomic data, the monthly EPU index values were aggregated into annual figures using arithmetic averaging. Subsequently, the annual index values were divided by 100 to normalize the scale, enables the index to represent the relative intensity of policy uncertainty, where a value of 1.00 indicates the baseline uncertainty level equivalent to the average monthly frequency count of 100 mentions.

3.2.3 Intermediary variables

(1) Regarding the level of corporate risk-taking () referring to the practice of John et al. (2008) to measure the level of corporate risk-taking, the indicator is characterized by earnings volatility where ROA = earnings before interest and tax (EBIT) / (total Assets) and is the ROA adjusted by the average of the industry. In this paper, we take the three years (year t-1 to year t + 1) as the observation period, and calculate the standard deviation of on a rolling basis as a measure of the risk-taking level () of agricultural enterprises as shown in Equations 1, 2.

(2) Regarding investment efficiency, the degree of inefficient investment () s measured as an indicator, referring to Richardson (2006) model for measuring investment efficiency, which is widely used to measure the investment efficiency of A-share listed companies. The normal investment level of the enterprise is first estimated by regression analysis, and then the absolute value of the residuals of the model is taken as the degree of inefficient investment of the enterprise. The estimated model is:

The in Equation 3 represents new investment and is given by the equation Here, refers to research and development expenditures; represents Mergers and Acquisitions (M&A) gains and losses; denotes capital expenditures, including “cash paid for the acquisition and construction of intangibles, property, plant, equipment, and other long-lived assets,” as well as “cash from subsidiaries.” reflects replacement investment, which includes “depreciation of fixed assets, depreciation of producing biological assets, depreciation of oil and gas assets,” and “amortization of intangible and long-term assets.” captures gains from asset disposals, including “net cash recovered from the disposal of intangible, fixed, and other long-term assets,” and “net cash proceeds from the disposal of subsidiaries.” represents total assets at the start of the period.

The remaining variables in Equation 3 are defined as follows: refers to the cash and deposits with the central bank in the previous period; is the growth rate of operating income in the previous period; denotes new investment from the previous period; indicates the return on invested capital in the previous period; represents asset size in the previous period, where Size is ; reflects the firm’s age in the previous period. Additionally, and represent fixed effects for agricultural enterprises and for years, respectively.

In this paper, we perform an OLS regression on Equation 3 and refer to the absolute value of the regression residuals as , which serves as a measure of the degree of investment inefficiency of farm-related enterprises. Specifically, the smaller the absolute value of the residuals, the higher the investment efficiency of the enterprise. Therefore, if economic policy uncertainty positively affects inefficient investment, this suggests that increased economic policy uncertainty decreases the enterprise’s investment efficiency.

3.2.4 Control variables

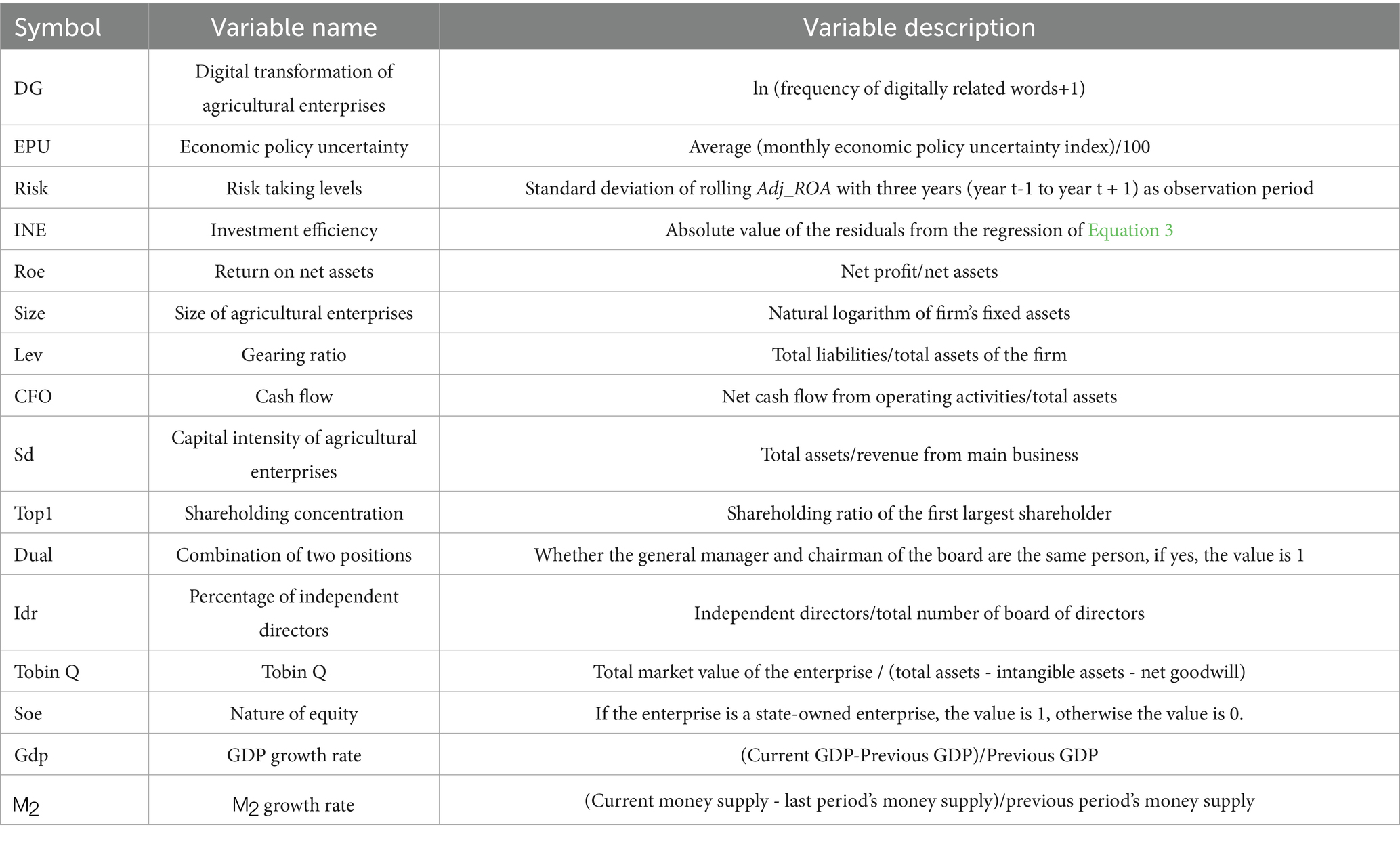

To mitigate the influence of extraneous factors on the digital transformation of agricultural enterprises, several variables have been included as control variables, drawing insights from established literatures. Because the variables that measure whether the general manager and the chairman of the board of directors are the same person and the proportion of independent directors reflect critical governance mechanisms that influence strategic decision-making under uncertainty (Hillman and Dalziel, 2003), the two variables of the integration of two positions (Dual) and the proportion of independent directors (Idr) are included in the control variables. State-owned enterprises possess institutional advantages in digital transformation through their access to policy support and scale efficiencies (Li et al., 2022), therefore include the nature of equity (Soe) as control variables. Other control variables include return on net assets (Roe), the size of agricultural enterprises (Size), gearing ratio (Lev), cash flow (CFO), capital intensity (Sd), shareholding concentration (Top1), Tobin’s Q (Tobin Q). In accordance with the methodology proposed by Peng et al. (2018), the analysis controls for the year-on-year growth rate of regional GDP and the growth rate of the money supply, rather than employing time fixed effects. The definitions and measurements of the relevant variables are presented in Table 1.

3.3 Model selection

3.3.1 Benchmark regression model

To explore how economic policy uncertainty affects the digital transformation of agricultural enterprises, this paper constructs the following econometric model:

In Equation 4, t represents the year, and i represents the firm. represents all control variables, and represents the random disturbance term. Firm fixed effects are also included, but time fixed effects are not, in order to avoid the full covariance problem that could arise from the simultaneous presence of EPU and time fixed effects.

3.3.2 Mediating effects model

First, it is tested whether economic policy uncertainty reduces the risk-taking level () and investment efficiency () of agricultural enterprises:

Second, it is tested whether economic policy uncertainty mitigates shocks by reducing the level of risk-taking and investment efficiency of firms prompting agricultural enterprises to undergo digital transformation:

The control variables in Equations 5–7 are all consistent with the benchmark regression.

3.4 Descriptive statistics

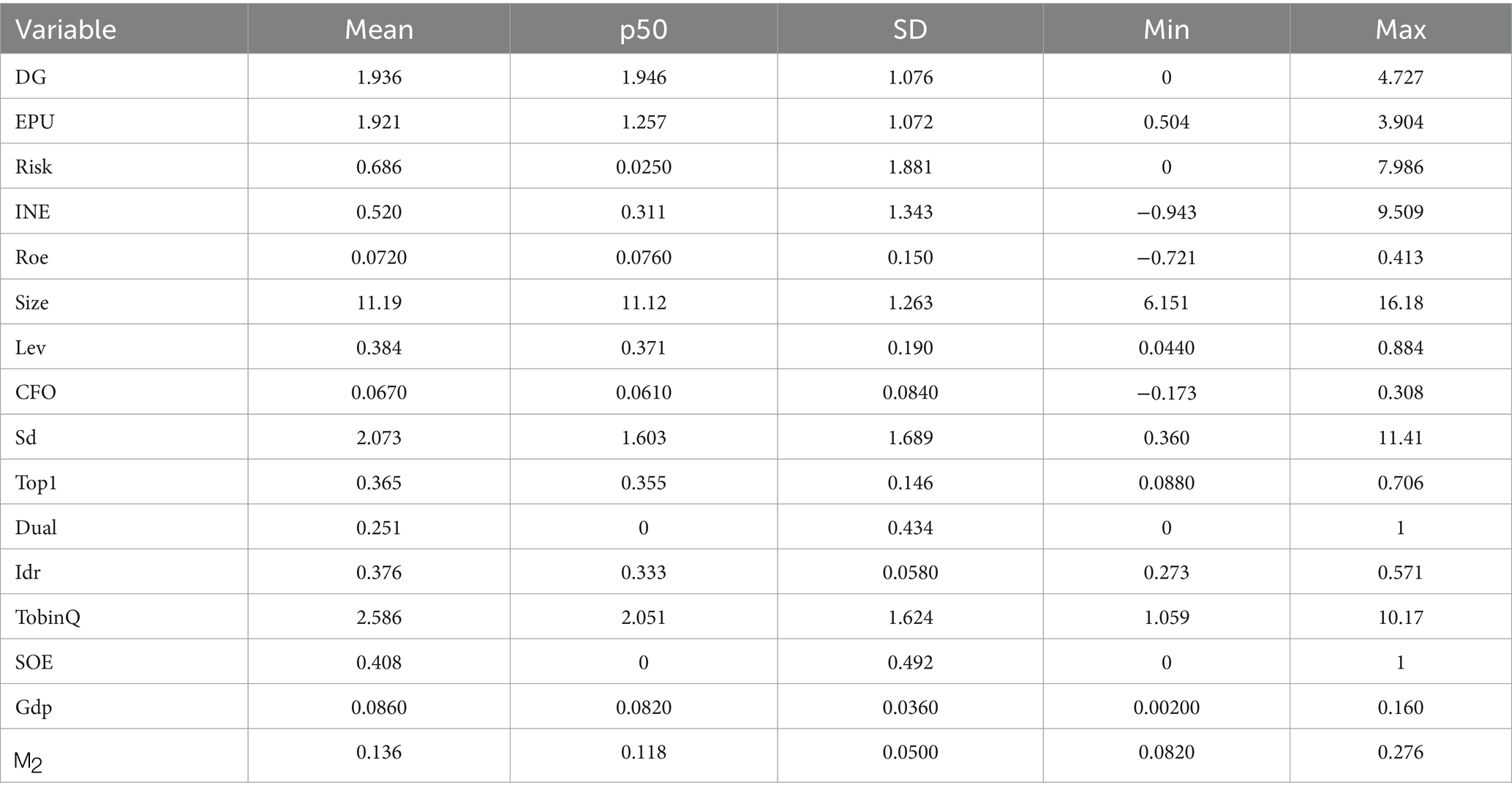

As can be seen from Table 2, a total of 2,588 observations were made during the sample period. The digital transformation level of agricultural enterprises showed a mean value of 1.936 (SD = 1.076), suggesting significant disparities in digital investment intensity across firms, with substantial potential for further technological adoption. EPU displayed notable volatility, with a mean of 1.921 (SD = 1.072) and values ranging from 0.504 to 3.904, reflecting the dynamic macroeconomic policy environment during the examined years. The average risk appetite of agricultural (Risk) listed companies stood at 0.686 (SD = 1.881), highlighting substantial heterogeneity in strategic risk-taking behaviors. The mean value of corporate non-efficiency investment (INE) exhibited a mean of 0.520 (SD = 1.343), indicating intense market competition and pronounced variations in resource allocation efficiency.

3.5 Correlation analysis

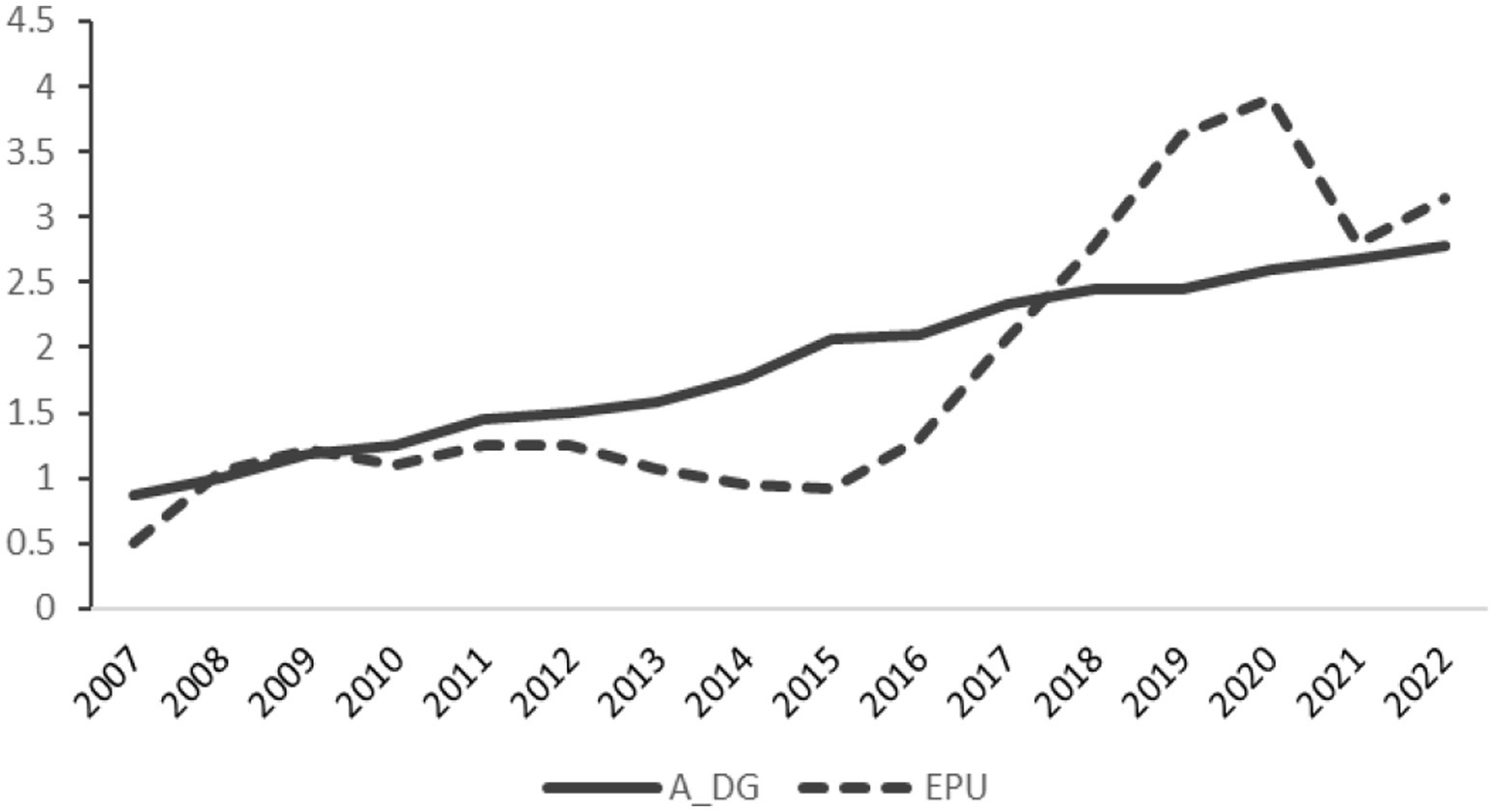

Figure 1 is the annual trend of China’s economic policy uncertainty index (EPU) and the average digital transformation of agricultural enterprises (A_DG). As shown in the figure, EPU has gradually climbed from the initial value in 2007 to the peak in 2022, showing an overall upward trend of volatility. A_DG has increased from the low amplitude in 2007 to the highest value in 2022. Moreover, there is a lag effect in the positive correlation between A_DG and EPU, for example, after the peak of EPU in 2015, the growth rate of A_DG accelerated in 2016. In addition, in years of sharp EPU fluctuations (such as 2020), the A_DG growth slope has not changed significantly, which may be due to the long-term nature of digital investment.

Figure 1. China’s economic policy uncertainty index and the average digital transformation of agricultural enterprises.

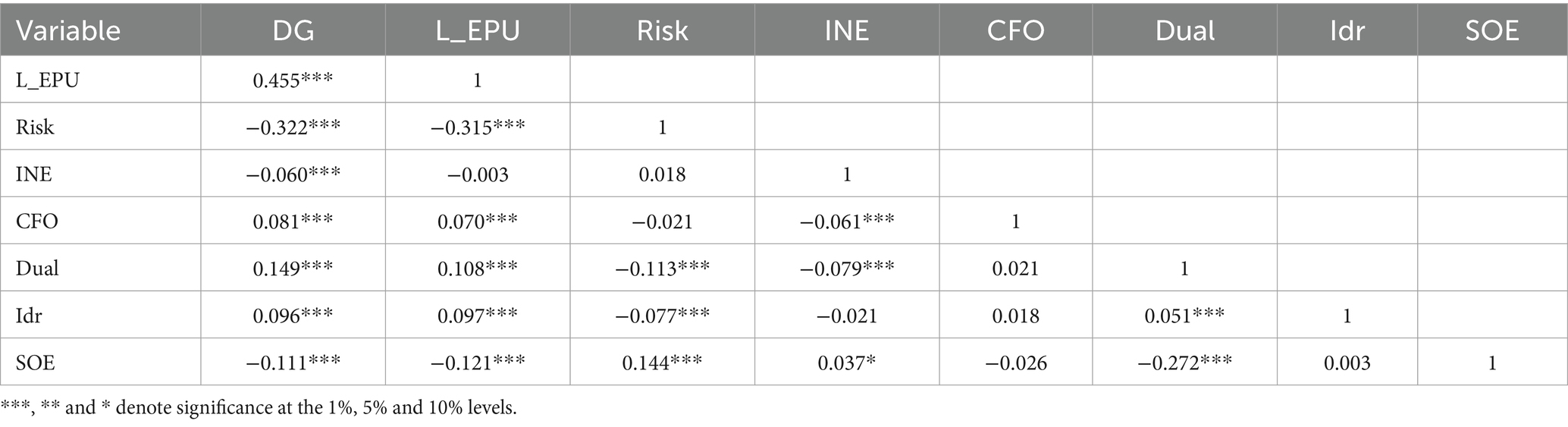

Table 3 reports the correlation coefficients between the primary and partial control variables. The correlation coefficients among the control variables are relatively low, suggesting a partial control of potential multicollinearity issues. The results show that there is a significant positive correlation between the digital transformation (DG) of agricultural enterprises and the economic policy uncertainty (L_EPU) in the previous year. In terms of the mediating effect, the level of risk exposure (Risk) presents a double negative correlation: first, enterprises with conservative risk appetite are more inclined to implement digital transformation (DG is negatively correlated with Risk); second, the increase in economic policy uncertainty (L_EPU) will inhibit the level of corporate risk-taking (L_EPU is negatively correlated with Risk). In addition, the negative relationship between digitalization and inefficient investment (INE) shows that technological innovation has significantly improved the efficiency of capital allocation by reconstructing agricultural production and operation models.

4 Analysis of empirical results

4.1 Benchmark regression

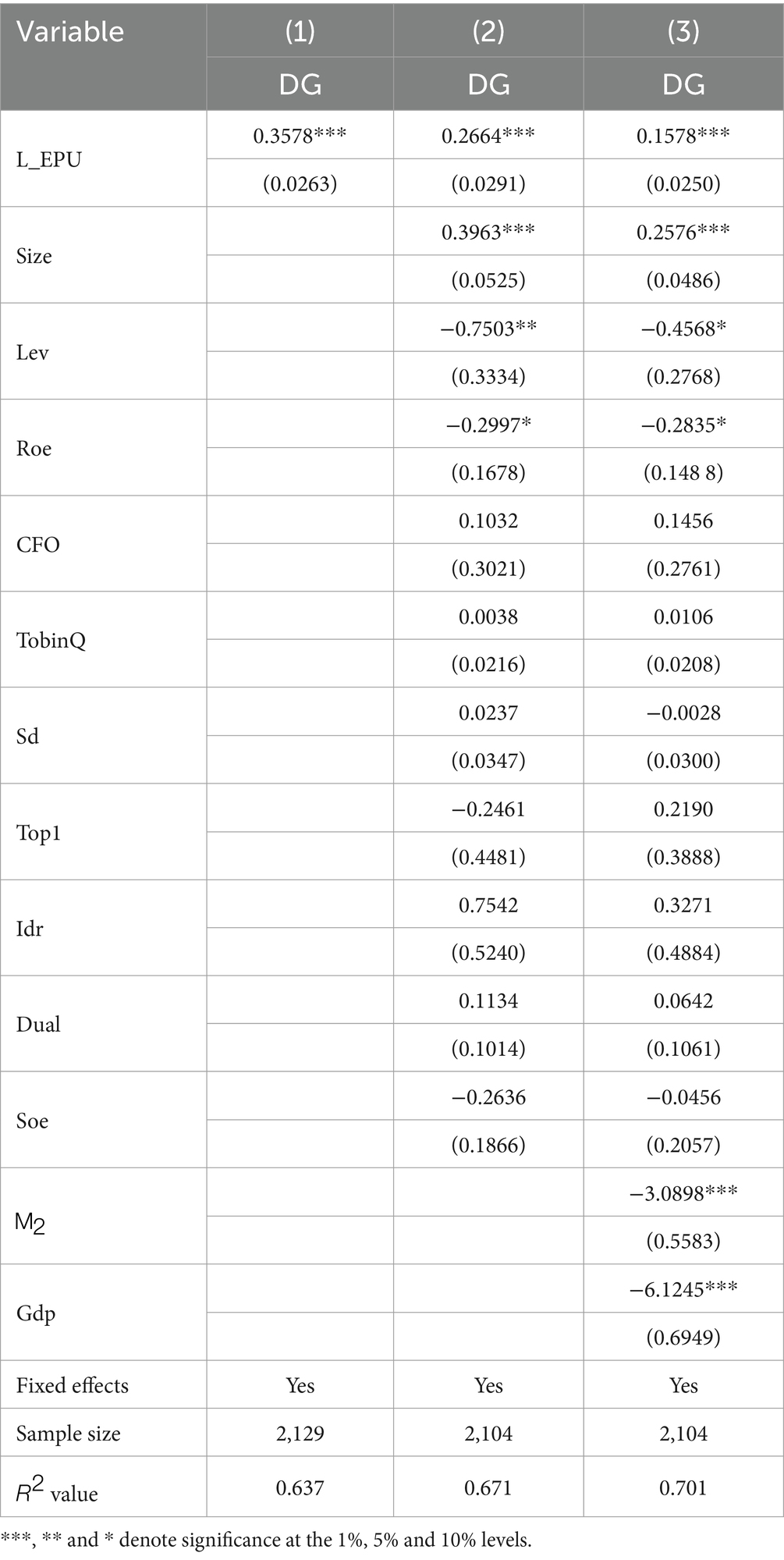

The benchmark regression of the relationship between economic policy uncertainty and digital transformation of agricultural enterprises is shown in Table 4. In model (1), where no control variables are added, the coefficient of economic policy uncertainty is positive and statistically significant. Model (2) shows the estimation results when only the control variables at the level of agricultural enterprises are added, with the regression coefficient of economic policy uncertainty remaining significantly positive. Model (3) reports the estimation results after all control variables are added; the regression coefficient of economic policy uncertainty is 0.1578, significant at the 1% confidence level. This suggests that economic policy uncertainty has a more positive than negative effect on the digital transformation of agricultural enterprises, and a rise in economic policy uncertainty incentivizes digital transformation. Hypothesis 1 is verified. Economic policy uncertainty provides opportunities for agricultural enterprises to achieve long-term development and secure prolonged profits through digital transformation, thereby offsetting the negative impacts.

4.2 Discussion of endogeneity problems

There are three factors that may contribute to the endogeneity problem: (1) There are omitted variables. (2) There may be errors in the measurement of variables. (3) Sample selection bias may exist. Therefore, this paper considers the possible interference of endogeneity problem and conducts the following sample treatment.

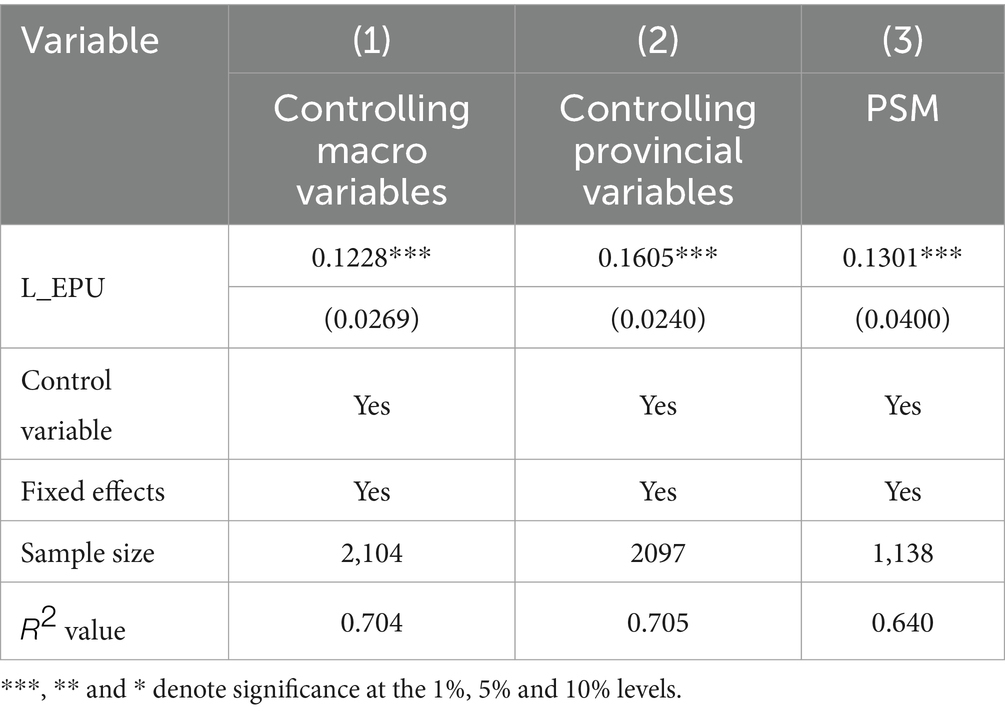

4.2.1 Adding control variables

In this paper, we control the price change (Fixinvest) with Fixed Asset Investment Price Index/100 and control the degree of marketization (Market) using the marketization index compiled by Wang et al. (2021). In addition to controlling the above national macroeconomic variables, the provincial level variables are further controlled by using the provincial RMB financial institution credit balance/provincial GDP to control the degree of financial intermediation uncertainty avoidance in the province (Finance), and by using the weighted average of government subsidies received by enterprises engaged in the digitization business in each province and the total assets of each enterprise to control the subsidies of digital enterprises at the provincial level (Lndesub). Table 5 Models (1) ~ (2) show the estimation results after adding the above variables.

4.2.2 Other uncertainty factors

Referring to the previous practice of mitigating the interference of possible omitted variables on the main findings, the difference between high and low digitization levels of agricultural enterprises is controlled by matching with 1:1 nearest-neighbor propensity score. The agricultural enterprises below 50% digitization word frequency of the sample are used as the control group, and the remaining sample is the experimental group, and the relationship between economic policy uncertainty and digital transformation of agricultural enterprises is tested by using the matched sample, and the regression results are shown in Table 5 model (3), and the main conclusions remain robust.

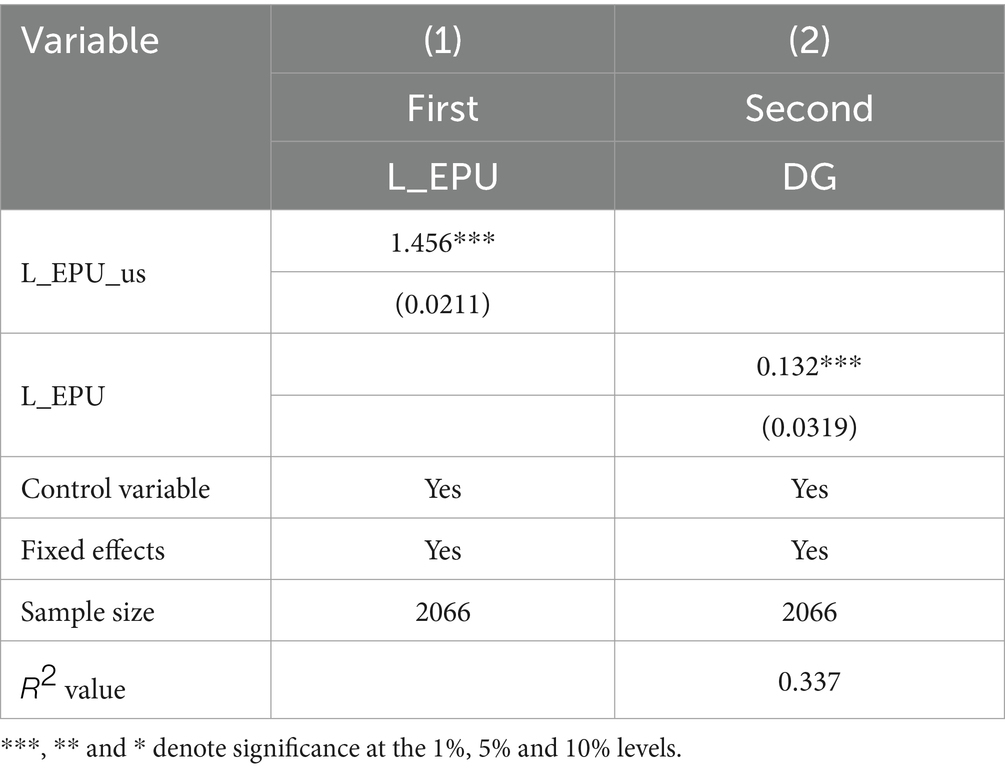

4.2.3 Instrumental variable approach

The US economic policy uncertainty (EPU_us) is set as an instrumental variable based on two aspects (Li et al., 2022). First, regarding relevance. The U. S. EPU influences China’s domestic EPU through international trade channels, fluctuations in bilateral trade volumes, supply chain disruptions, and exchange rate fluctuations will all affect domestic policy adjustments. Second, in terms of exogeneity, digital transformation decisions of agribusiness enterprises are mainly in response to the domestic regulatory environment and market conditions, rather than foreign policy shocks. This ensures that the IV meets the requirements for relevance and exogeneity. The model is re-estimated using the two-stage least squares method, and Table 6 model (1) reports the estimation results of the first stage with positive coefficients and passes the 1% significance test, while model (2) shows the estimation results of the second stage with the coefficients still significantly positive, which indicates that the model does not have the problem of weak instrumental variables.

After passing the above endogeneity test, economic policy uncertainty still has a positive impact on digital transformation of agricultural enterprises, indicating that the model in this paper is robust.

4.3 Robustness tests

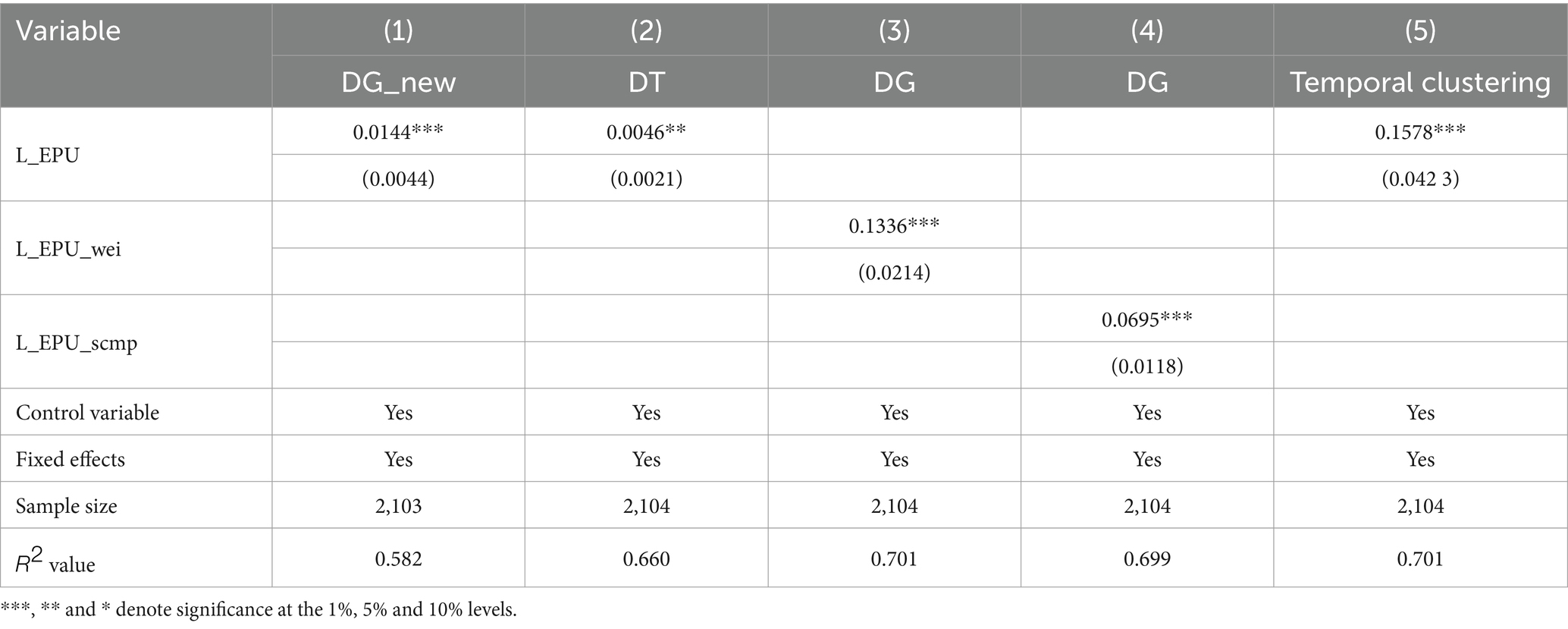

4.3.1 Replacing the explanatory variables

In order to avoid errors in measuring the digital transformation variables of agricultural enterprises, the digital transformation of agricultural enterprises (DG_new) is re-measured by (the digitization-related word frequency) / (total word frequency of the annual report), and considering that the value is very small, this paper enlarges it by 1,000 times to analyze it, and the results are shown in the model (1) in Table 7.

Further using the feature words constructed by Wu et al. (2021) from five aspects of artificial intelligence, big data, blockchain, cloud computing and digital technology, crawling the digital transformation word frequency of agricultural enterprises, and regressing its logarithmic value after adding one (DT) as an explanatory variable. As shown in Table 7 model (2), the estimation results are all consistent with the benchmark regression.

4.3.2 Replacement of explanatory variables

In order to avoid the regression estimation results being interfered by the economic policy uncertainty assignment method, the economic policy uncertainty characterization index is firstly replaced, referring to the practice of Li et al. (2022), using the weighted average method to re-measure China’s economic policy uncertainty index (EPU_Wei), and assigning a different weight to the index of each month, with 1/78 for January, and so on, with the 12 month The weight is 12/78, and the estimation results are shown in Table 7 model (3).

Replacing the uncertainty index again, the month-by-month EPU index calculated by Baker et al. (2016) is taken as the arithmetic mean, transformed into an annual index and divided by 100 to obtain the new economic policy uncertainty index (EPU_scmp), and the test results are shown by model (4) in Table 7, and the results are still robust.

4.3.3 Further consideration of time factor

In order to further eliminate the interference of the time trend on the estimation results, referring to the previous practice of cluster analysis from the time dimension, adjusting the standard error clustering hierarchy and fixed effects, the results are shown by the model (5) in Table 7, and the results are still significantly positive.

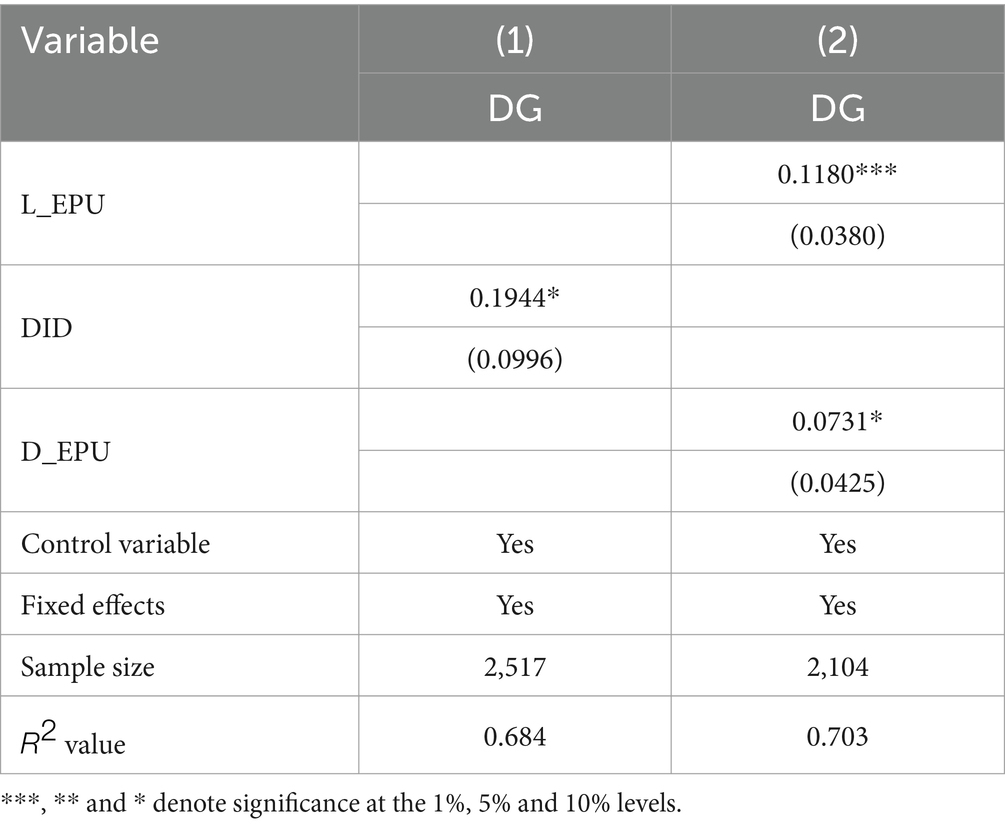

4.3.4 Exogenous policy shocks

The progress of digital economy development and the digital transformation of enterprises depend on the support of network infrastructure. Based on the “Broadband China” strategy, this paper constructs a multi-period double-difference model (DID) to test the effect of economic policy uncertainty on the digital transformation of agricultural enterprises. The model is set as Equations 8, 9:

where i represents the ith agricultural enterprises, subscript t denotes the year, and is the set of control variables. is the fixed effect of the control enterprise, and is the random disturbance term. In the formula , where denotes whether it is a treatment group or not, if firm i is located in a “Broadband China” demonstration city, otherwise ; denotes the year in which the province where the “Broadband China” demonstration city is located was approved. By setting the double difference term and the continuous variable interaction term, the “Broadband China” policy is interacted with the economic policy uncertainty as an exogenous shock and a lagged period, and it can be seen from the model (2) in Table 8 that the coefficients of are positive and pass the 10% significance test, while the coefficient of are significantly positive and pass the 10% significance test. This confirms that under the exogenous shock of the “Broadband China” strategy, economic policy uncertainty can significantly increase the willingness of agricultural enterprises to digital transformation. The results are consistent with the previous section after using the multi-period double-difference model.

4.4 Further analysis

4.4.1 The mechanism of economic policy uncertainty affecting the digital transformation of agricultural enterprises

Benchmark regression confirms that economic policy uncertainty promotes digital transformation in agricultural enterprises. The theoretical analysis suggests that economic policy uncertainty leads to a decline in risk-taking levels and investment efficiency. Thus, this section aims to test the forcing effect of economic policy uncertainty on digital transformation, as proposed in Hypotheses 2 and 3.

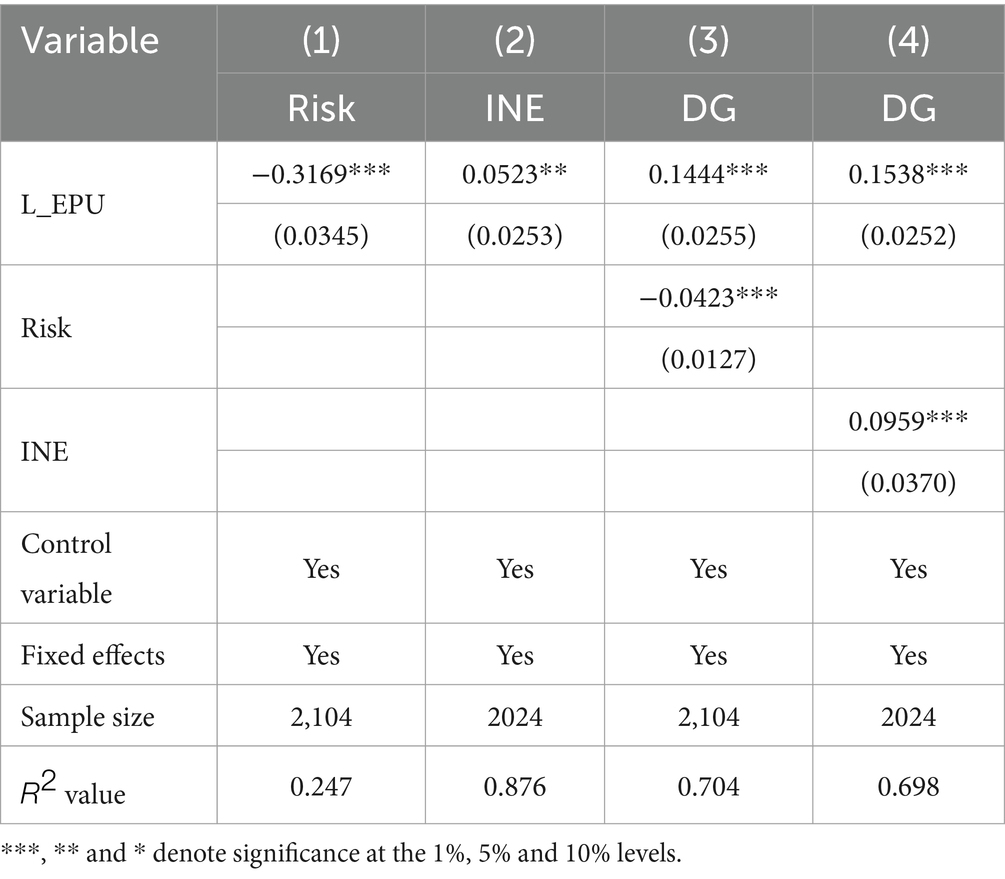

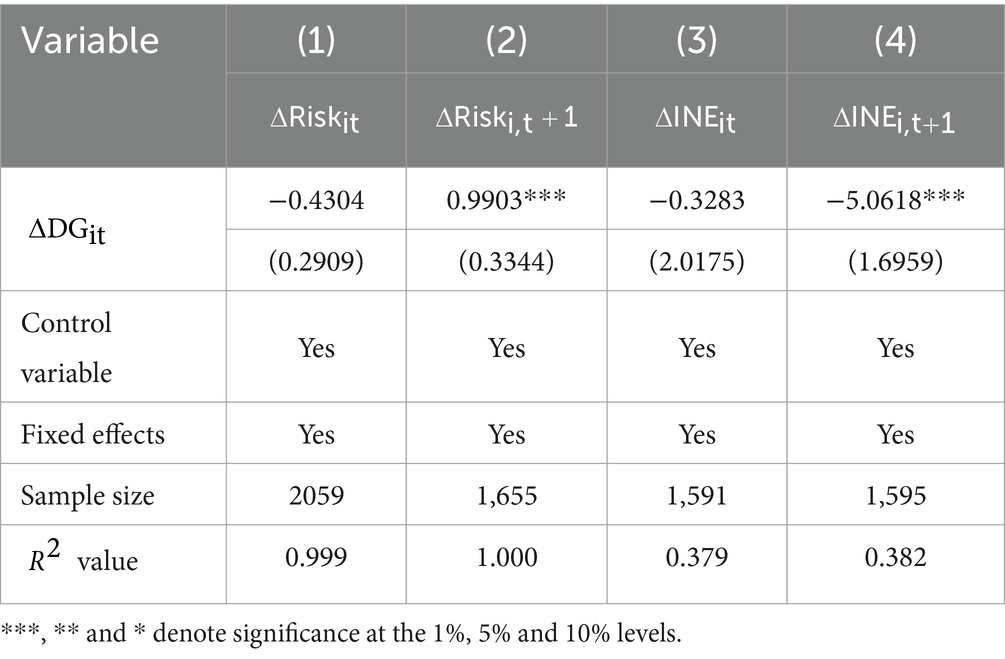

Model (1) in Table 9 shows that economic policy uncertainty negatively affects the risk-taking levels of agricultural enterprises and is significant at the 1% level. In other words, rising economic policy uncertainty significantly reduces the risk-taking levels of agricultural enterprises. Model (2) shows that the effect of economic policy uncertainty on inefficient investment in agricultural enterprises is significantly positive at the 5% level, indicating that rising economic policy uncertainty significantly reduces the investment efficiency of these enterprises. This indicates that when economic policy uncertainty is high, agricultural enterprises are less willing to take risks and become more vulnerable to external risks, resulting in a decline in investment efficiency. Model (3) shows that the coefficient of economic policy uncertainty (L_EPU) in the lagged period is significantly positive, while the coefficient of risk-taking levels is significantly negative. This suggests that increasing economic policy uncertainty reduces the risk-taking levels of enterprises, thereby forcing agricultural enterprises to pursue digital transformation. Model (4) indicates that the coefficients of L_EPU and inefficient investment in agricultural enterprises are both significantly positive, implying that rising economic policy uncertainty reduces investment efficiency, further driving agricultural enterprises to adopt digital transformation.

4.4.2 Digital transformation mitigates economic policy uncertainty shocks

The theoretical analysis in this paper argues that heightened economic policy uncertainty leads to a decline in the risk-taking level and investment efficiency of agricultural enterprises. To hedge against these risks, digital transformation operates as a dynamic capability-building process (Teece, 2018), enabling agricultural enterprises to reconfigure resources and enhance adaptive efficiency over time. Digital transformation’s impact on risk mitigation is a long-term process, aligning with the J-curve pattern of technology adoption observed in digital maturity studies (Brynjolfsson and McElheran, 2016). Initial investments in digital infrastructure (e.g., IoT, big data analytics) incur sunk costs that may temporarily exacerbate financial constraints. However, as firms accumulate digital assets and organizational learning matures, digital transformation enhances long-term strategic agility by fostering data-driven decision architectures and ecosystem-centric innovation (Autio et al., 2018).

Therefore, this paper employs a two-stage model to test the hedging effect of digital transformation in agricultural enterprises. First, the following regression equation is constructed using the differential form of economic policy uncertainty and digital transformation in agricultural enterprises as the change variable (Equation 10):

The fitted value of on the other hand, reflects the extent to which the digital transformation in agricultural enterprises is influenced by economic policy uncertainty. Subsequently, the model (Equation 11) is constructed to estimate the impact of the aforementioned changes in the digital transformation of agricultural enterprises on their risk-taking levels and investment efficiency.

The fitted value represents the fitted value of Equation 10. represents the difference between and , which, respectively, denote the changes in the level of risk-taking and the degree of inefficient investment in enterprises. The estimation results are shown in Table 10.

Table 10. Analysis of the impact of digital transformation on risk-taking level and investment efficiency.

The explanatory variables in models (1) ~ (2) in Table 10 represent the changes in enterprise risk-taking levels, both in the current and future periods. Digital transformation exhibits a significant positive effect only on changes in enterprise risk-taking levels in future periods. This is because investments in digital technology by agricultural enterprises create a short-term funding gap, temporarily reducing their risk-taking levels, though the effect is marginal. With the deepening of digital transformation, digital technology is more closely integrated with the business and management model of agricultural enterprises, and more transparent and reliable data and operating models not only enhance the ability of management to identify and prevent and control operational risks, but also enhance the ability of enterprises to attract external capital and venture capital.

The results from Models (3) ~ (4) indicate that the impact of digital transformation on inefficient investment in enterprises in future periods is significantly negative at the 1% level. Currently, the impact of digital transformation on enhancing investment efficiency in agricultural enterprises is not immediately evident. Only through long-term data analysis and predictive modeling can agricultural enterprises make more informed and precise investment decisions, thereby mitigating speculative investments and optimizing investment efficiency. In this manner, enterprises can not only sustain or expand their production capacity but also gradually lower unit production costs, thereby significantly bolstering their economic resilience, achieving sustained long-term growth, and maintaining heightened resilience and competitiveness in the face of economic policy uncertainties.

4.5 Heterogeneity analysis

In the benchmark analysis, the increase in economic policy uncertainty has a forcing effect on the digital transformation of agricultural enterprises. However, due to the existence of differences in market position and industry type, the responses made by agricultural enterprises under the impact of uncertainty are heterogeneous. Based on this, we attempt to examine the willingness of agricultural enterprises to adopt digital transformation to cope with economic policy uncertainty from the perspectives of strategic positioning of agricultural enterprises, corporate financing constraints, market dominance of firms, and types of agricultural enterprises, respectively.

4.5.1 Strategic orientation of firms

The strategic orientation of an enterprise dictates its approach to pursuing new products, entering new markets, and investing in uncertain and risky projects. Firms with an aggressive strategic orientation are more likely to make risky investments, allocate more resources to R&D, and actively pursue new product development and market opportunities. In scenarios where the benefits of enterprise digitization are uncertain, the decision of agricultural enterprises to pursue digital transformation becomes a crucial factor in their risk appetite. This paper refers to the study by Sun et al. (2016) on the strategic positioning of enterprises and classifies the sample into three groups: conservative, moderate, and aggressive strategies for heterogeneity analysis.

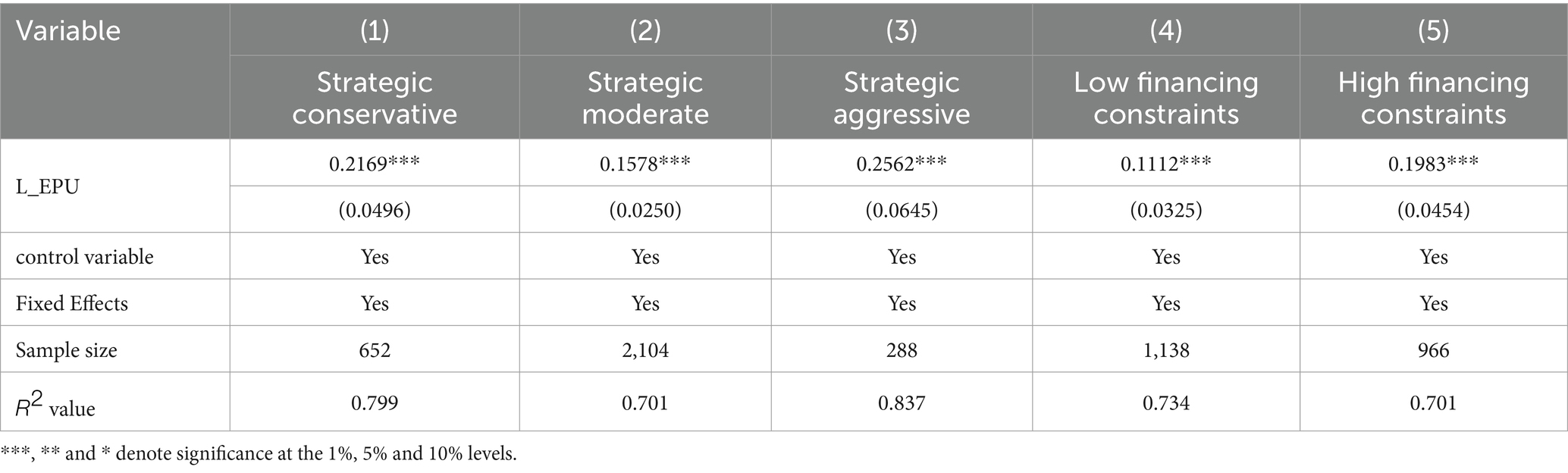

The results of models (1) ~ (3) in Table 11 indicate that agricultural enterprises with more radical strategic positioning are more strongly motivated to undertake digital transformation in response to economic policy uncertainty. This is because these firms are more willing to seize transformation opportunities embedded in uncertainty and act early to introduce digital technologies. Conversely, conservative firms may delay investments in response to uncertainty and hesitate to adopt digital transformation, potentially missing opportunities for a successful transition.

4.5.2 Corporate financing constraint

Referring to the SA index constructed by Hadlock and Pierce (2010) to measure financing constraints, , the samples were divided into two groups: low and high financing constraints, based on the median. Models (4) to (5) in Table 11 show that economic policy uncertainty prompts agricultural enterprises to make more effective digital investments when financing constraints are high. In periods of uncertainty, market expectations deteriorate, and agricultural enterprises facing significant financing constraints experience greater difficulty in securing loans, exacerbating liquidity crises. Consequently, these enterprises are more likely to pursue digital transformation to improve internal governance and enhance the efficient allocation of funds. At the same time, they seek to leverage digital platforms to increase transaction transparency, attract external investment, expand funding sources, and alleviate financing pressures.

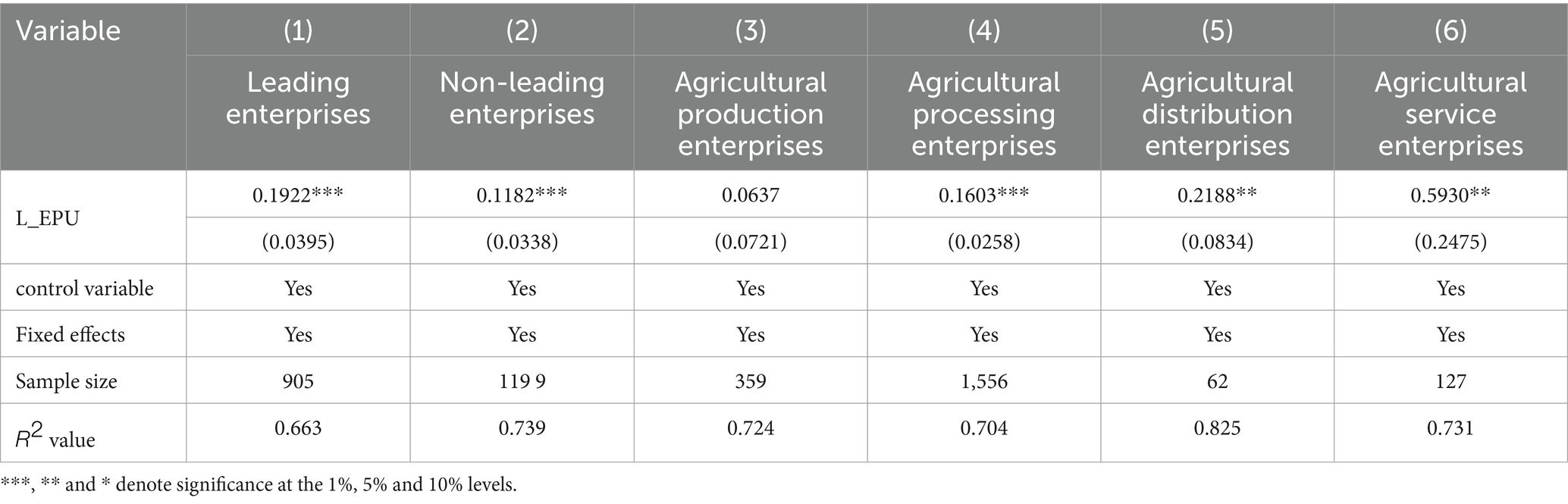

4.5.3 Market dominance

This paper measures the market dominance of agricultural enterprises by whether they are leading enterprises. As can be seen from model (1) and model (2) in Table 12, economic policy uncertainty has a stronger role in forcing leading agricultural enterprises to undergo digital transformation. This is because agriculture leading enterprises have high market share and high product market recognition, as well as larger scale and stronger assets, which can bear the uncertainty shock, on the basis of which they are more likely to invest in digital transformation. Moreover, leading agricultural enterprises have good reputation, are more likely to obtain financing, and are in a better position to make digital investments in an uncertain environment.

4.5.4 Industry type

In this paper, agricultural enterprises are categorized into four types: processing, production, service, and distribution enterprises. The empirical results, as shown in Table 12, Models (3) ~ (6), indicate that economic policy uncertainty plays the largest role in driving the digital transformation of agro-related service enterprises, followed by agro-processing and distribution enterprises, with the smallest impact on agricultural production enterprises. This is because service-oriented agricultural enterprises provide agricultural machinery, production inputs, sales, and agricultural technology services. Such enterprises tend to be larger and focus on improving production efficiency through digital transformation. Thus, under the impact of economic policy uncertainty, these enterprises are more inclined to adopt digital technologies to enhance product quality and efficiency. Agricultural processing and distribution enterprises, situated at both the production and consumption ends, face significant economic policy uncertainty. These enterprises improve production efficiency through digital upgrades in processing lines and logistics planning. However, due to the underdeveloped agricultural supply chain, the extent of digital transformation remains limited. For agricultural production-related enterprises, which benefit from more financial support policies and are generally smaller in scale, the impact of economic policy uncertainty is weaker. Due to limited internal capital, these enterprises face challenges in financing digital transformation, leading to lower willingness to undergo such changes.

5 Conclusion and policy recommendations

Agriculture is a cornerstone of the national economy, and its inherent vulnerability, coupled with its dependence on economic policies, makes agricultural enterprises particularly susceptible to fluctuations caused by economic policy uncertainty. Digital transformation has emerged as a crucial tool for enhancing enterprise value and fostering the development of new, high-quality productivity. Consequently, promoting the digital transformation of agricultural enterprises has garnered significant attention across various sectors in recent years. Using a sample of China’s A-share listed agricultural enterprises from 2007 to 2022, this study examines the theoretical framework of how economic policy uncertainty drives the digital transformation of agricultural enterprises. This analysis explores the impact of economic policy uncertainty on the challenges of financing, market friction, and investment risks, with empirical tests supporting these findings. Our findings align with prior studies on EPU’s dual role in incentivizing innovation while exacerbating operational risks, yet we extend this literature by contextualizing these dynamics within the agricultural sector’s unique constraints. The results indicate:

(1) Economic policy uncertainty has a significant positive impact on the digital transformation of agricultural enterprises, primarily by reducing their risk-taking ability and investment efficiency.

(2) Digital transformation can significantly enhance the risk-taking capacity and investment efficiency of agricultural enterprises over the long term, effectively mitigating the negative effects of economic policy uncertainty.

(3) The impact of economic policy uncertainty on the digital transformation of agricultural enterprises exhibits heterogeneity. Specifically, economic policy uncertainty exerts a stronger influence on the digital transformation of agricultural enterprises with more aggressive strategic positioning, higher financing constraints, and those in leading enterprise roles or involved in agricultural services. The findings offer practical insights for the government in formulating targeted policies aimed at mitigating the impact of economic policy uncertainty and promoting the digital transformation of agricultural enterprises. Based on the preceding analysis, the following policy implications are put forward.

Firstly, when formulating agricultural economic policies, the government should address the motivations of agricultural enterprises to pursue digital transformation in response to economic policy uncertainty. It should also increase investment in agricultural digital infrastructure, enhance policy guidance to align agricultural enterprises with more abundant technology, information, and human resources, and improve economic policies that encourage digital transformation. In an environment characterized by economic policy uncertainty, agricultural enterprises are at risk of reduced risk-taking and decreased investment efficiency. Therefore, in the context of macroeconomic regulation, the government should maintain financial system stability to broaden the financing channels available to agricultural enterprises. The government should also consider the potential impact of policy adjustments on the production and operational activities of enterprises, ensuring that the role of economic policy uncertainty in driving digital transformation is recognized through moderate policy intervention.

Secondly, the government should also consider the vulnerabilities of the agricultural system, its policy dependence, and the weak digital infrastructure of agricultural enterprises, and introduce targeted policies to guide these enterprises in adopting digital technology. Targeted tax incentives should be provided to agricultural enterprises that enhance investment efficiency and risk management through digital technologies. For instance, the “Agricultural Digital Innovation Reward and Subsidy Policy” was established to offer tax rebates or subsidies to relevant agricultural enterprises. In implementing policy subsidies for the digitalization of agricultural businesses, these subsidies should be more targeted toward enterprises with conservative strategic positions, low financing constraints, and non-leading roles, in order to alleviate their concerns about investment risks and accelerate the digital transformation of the agricultural sector. Moreover, the digital transformation of agricultural enterprises is a long-term, systematic process that requires substantial financial support, with patient capital (such as venture capital and private equity) playing a crucial role. Establishing a dedicated fund for digitalization or an industry-specific fund is essential to attract patient capital for investment in agricultural enterprises’ digital transformation projects, particularly during the early stages, when enterprises require long-term capital support for R&D, equipment procurement, and market expansion. The government should also provide tax exemptions, investment return incentives, and other supportive policies to leading enterprises, agricultural production, and digital demonstration enterprises, enabling them to play a stronger leadership role, accelerate the digitalization of the agricultural system, and foster a leap in rural productivity, thereby overcoming the challenges posed by economic policy uncertainty.

Thirdly, for agricultural enterprises, digital transformation can enhance their risk tolerance and investment efficiency, contributing to increased economic resilience in the face of economic policy uncertainty. Agricultural enterprises should proactively seize the opportunities presented by economic policy uncertainties and explore the integration of digital technology with operations and management. In fields such as data analysis, automation control systems, and Internet of Things applications, enterprise managers and technical personnel should undergo digital training, or digital technology professionals should be recruited. By enhancing employees’ capabilities in areas such as data analysis, intelligent production, and information technology applications, the digital transformation process of agricultural enterprises will be accelerated. Enterprises lagging behind in digital transformation should proactively learn from the successful digital transformation experiences of leading enterprises to enhance the efficiency of their own transformation efforts. Additionally, they should closely monitor relevant policies, adapting their digital transformation strategies accordingly, and seek governmental support to reduce transformation costs and enhance the likelihood of success.

6 Limitations and future research

While this study advances our understanding of EPU’s impact on agricultural digital transformation, several limitations warrant attention while suggesting practical research pathways. First, the sample focuses exclusively on China’s listed agricultural enterprises from 2007 to 2022. While listed firms dominate sectoral innovation, findings may not generalize to non-listed small and medium-sized enterprises, which constitute 95% of China’s agricultural enterprises. Sample selection bias could arise due to the exclusion of these smaller entities, which often face distinct financial and regulatory constraints. Second, the industry-specific focus on agriculture limits insights into cross-sectoral digital transformation patterns. For instance, manufacturing firms may adopt IoT and AI more aggressively than agricultural enterprises due to higher capital flexibility. Comparative studies across sectors are needed to validate the universality of EPU’s role. Methodologically, potential biases may arise from: (1) Sample selection bias due to excluding non-listed enterprises. (2) Measurement error in digital transformation proxies. The use of the word frequency as a proxy for digital transformation captures strategic orientation rather than actual digital infrastructure deployment. This proxy is thus biased by either understating or overstating the actual state of digital transformation in agricultural enterprises, as some companies may implement digitalization without explicit disclosures, while others may embellish reports without practical deployment.

Future research could extend this work through: (1) Conducting comparative analyses between listed agricultural enterprises and non-listed small and medium-size enterprises to identify how financial constraints, regulatory environments, and innovation capacities differentially shape digital transformation outcomes. (2) Expanding cross-country comparative studies, expand the geographical scope, and use cross-country datasets to compare digital transformation models under different policy regimes, compare China’s state-led digitalization with market-driven approaches in the U. S. (3) Employing mixed-methods approaches to measure agribusiness digitalization, improve the digital measurement methods of enterprises.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

WW: Funding acquisition, Supervision, Writing – review & editing, Project administration. JJ: Validation, Data curation, Formal analysis, Methodology, Software, Visualization, Writing – original draft, Conceptualization.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work was supported by the National Natural Science Foundation of China (No. 19CJY046).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Akron, S., Demir, E., Díez-esteban, J. M., and García-Gómez, C. D. (2022). How does uncertainty affect corporate investment inefficiency? Evidence from Europe. Res. Int. Bus. Finance 62:101752. doi: 10.1016/j.ribaf.2022.101752

Amarasekara, C., and Iyke, B. (2022). The role of R&D and economic policy uncertainty in Sri Lanka’s economic growth. Fin. Innov. 8:16. doi: 10.1186/s40854-021-00322-5

Ascui, F., and Cojoianu, T. F. (2019). Implementing natural capital credit risk assessment in agricultural lending. Bus. Strat. Environ. 28, 1234–1249. doi: 10.1002/bse.2313

Autio, E., Nambisan, S., Thomas, L. D. W., and Wright, M. (2018). Digital affordances, spatial affordances, and yhe genesis of entrepreneurial ecosystems. Strateg. Entrepreneurship J. 12, 72–95. doi: 10.1002/sej.1266

Baker, S. R., Nicholas, B., and Steven, J. D. (2016). Measuring economic policy uncertainty. Q. J. Econ. 131, 1593–1636. doi: 10.1093/qje/qjw024

Bernanke, B., and Gertler, M. (1989). Agency costs, net worth, and business fluctuations. Am. Econ. Rev. 79, 14–31.

Bonaime, A., Gulen, H., and Ion, M. (2018). Does policy uncertainty affect mergers and acquisitions? J. Financ. Econ. 129, 531–558. doi: 10.1016/j.jfineco.2018.05.007

Brealey, R. A., Myers, S. C., and Allen, F. (2020). Principles of corporate finance. 13th Edn. New York, NY, USA: McGraw-Hill Education.

Brynjolfsson, E., and McElheran, K. (2016). The rapid adoption of data-driven decision-making. Am. Econ. Rev. 106, 133–139. doi: 10.1257/aer.p20161016

Child, J. (1972). Organizational structure, environment and performance: the role of strategic choice. Sociology 6, 1–22. doi: 10.1177/003803857200600101

Davis, S. J., Liu, D., and Sheng, X. S. (2019). Economic policy uncertainty in China since 1949: The view from mainland newspapers. Working Paper Series. National Bureau of Economic Research (NBER). Working Paper No.: w26247.

Ding, K., Ma, Z. B., and Wang, T. (2024). Impact of rural digital economy on farmers’ income and its spatial heterogeneity. J Arid Land Resour Environ 38, 90–99. doi: 10.13448/j.cnki.jalre.2024.101

Dixit, A. K., and Pindyck, R. S. (1994). Investment under uncertainty. Princeton, NJ, USA: Princeton University Press.

Feng, X. C., and Yu, R. Q. (2025). How does digital transformation affect corporate risk-taking? Evidence from China. Int. Rev. Econ. Finance 97:103614. doi: 10.1016/j.iref.2024.103614

Guo, P. T., Bi, J. F., and Zhu, M. N. (2025). Enterprise digital transformation and investment efficiency: empirical evidence from listed enterprises in China. J. Asian Econ. 97:101892. doi: 10.1016/j.asieco.2025.101892

Hadlock, C., and Pierce, J. (2010). New evidence on measuring financial constraints: moving beyond the KZ index. Rev. Financ. Stud. 23, 1909–1940. doi: 10.1093/rfs/hhq009

Higgins, C. R. (2023). Risk and uncertainty: the role of financial frictions. Econ. Model. 119:106138. doi: 10.1016/j.econmod.2022.106138

Hillman, A. J., and Dalziel, T. (2003). Boards of directors and firm performance: integrating agency and resource dependence perspectives. Acad. Manag. Rev. 28, 383–396. doi: 10.5465/amr.2003.10196729

Jao, H., Yang, J. F., Wang, P. N., and Li, Q. (2021). Research on data-driven operation mechanism of dynamic capabilities based on analysis of digital transformation process from the data lifecycle management. China Industrial Economics. 11, 174–192. doi: 10.19581/j.cnki.ciejournal.2021.11.010

John, K., Litov, L., and Yeung, B. (2008). Corporate Governance and Risk Taking. J. Financ. 63, 1679–1728. doi: 10.1111/j.1540-6261.2008.01372.x

Li, Z. F., Chen, J. J., Lian, Y. J., and Li, M. J. (2022). Economic policy uncertainty and corporate short-term debt for long-term use. J. Manage. World 38, 77–143. doi: 10.19744/j.cnki.11-1235/f.2022.0013

Lin, Q., G/Z, Z., Shan,, G/W, W., Fu, W., Shan, Z., et al. (2024). Interplay between the agriculture firm’s guarantee strategy and the E-commerce platform’s loan strategy with risk averse farmers. Omega 127:103108. doi: 10.1016/j.omega.2024.103108

Lin, Q. N., and Mao, S. P. (2023). Independent innovation and transformation of scientific and technological achievements of enterprises: subsidies or policies. Stud. Sci. Sci. 41, 70–79. doi: 10.16192/j.cnki.1003-2053.20220222.004

Lu, J., Chen, Y., and Fang, Q. (2022). Promoting decision satisfaction: the effect of the decision target and strategy on process satisfaction. J. Bus. Res. 139, 1093–1104. doi: 10.1016/j.jbusres.2021.10.056

Lyu, K. F., Yu, M. Y., and Ruan, Y. P. (2023). Digital transformation and resource allocation efficiency of enterprises. Sci. Res. Manag. 44, 11–20. doi: 10.19571/j.cnki.1000-2995.2023.08.002

Ministry of Agriculture and Rural Affairs. (2019). Digital Agriculture and Rural Development Plan (2019-2025) [Official Planning Document]. Retrieved from: http://www.moa.gov.cn/nybgb/2020/202002/202004/t20200414_6341532.htm (Accessed March 27, 2023).

Myers, S. C. (1997). Determinants of corporate borrowing. J. Financ. Econ. 5, 147–175. doi: 10.1016/0304-405X(77)90015-0

Nuruzzaman, N., Singh, D., and Pattnaik, C. (2019). Competing to be innovative: foreign competition and imitative innovation of emerging economy firms. Int. Bus. Rev. 27, 1004–1015. doi: 10.1016/j.ibusrev.2018.03.005

Ojala, A., Evers, N., and Rialp, A. (2018). Extending the international new venture phenomenon to digital platform providers: A longitudinal case study. J. World Bus. 53, 725–739. doi: 10.1016/j.jwb.2018.05.001

Ölkers, T., and Musshoff, O. (2024). Exploring the role of interest rates, macroeconomic environment, agricultural cycle, and gender on loan demand in the agricultural sector: evidence from Mali. Agribusiness 40, 484–512. doi: 10.1002/agr.21891

Peng, Y. C., Han, X., and Li, J. J. (2018). Economic policy uncertainty and corporate financialization. China Industrial Econom. 1, 137–155. doi: 10.19581/j.cnki.ciejournal.20180115.010

Richardson, S. (2006). Over-investment of free cash flow. Rev. Account. Stud. 11, 159–189. doi: 10.1007/s11142-006-9012-1

Su, F., Liu, Y., Chen, S. J., and Fahad, S. (2023). Towards the impact of economic policy uncertainty on food security: introducing a comprehensive heterogeneous framework for assessment. J. Clean. Prod. 386:135792. doi: 10.1016/j.jclepro.2022.135792

Sun, J., Wang, B. Q., Cao, F., and Liu, X. Q. (2016). Does corporate strategy affect earnings management? J. Manage. World. 3, 160–169. doi: 10.19744/j.cnki.11-1235/f.2016.03.013

Sun, L. X., Wang, X. J., Jin, Y., and Mao, S. P. (2022). Evolution and promotion path of scientific and technological innovation ability of Chinese agricultural enterprises: empirical evidence from listed agricultural enterprises. Iss. Agricul. Econom. 12, 4–18. doi: 10.13246/j.cnki.iae.20221017.001

Teece, D. J. (2018). Dynamic capabilities as (workable) management systems theory. J. Manage. Organ. 24, 359–368. doi: 10.1017/jmo.2017.75

Tian, G. N., Li, B., and Cheng, Y. (2022). Does digital transformation matter for corporate risk-taking? Financ. Res. Lett. 49:103107. doi: 10.1016/j.frl.2022.103107

Verhoef, P. C., Broekhuizen, T., Bart, Y., Bhattacharya, A., Qi, J., Fabian, N., et al. (2021). Digital transformation: a multidisciplinary reflection and research agenda. J. Bus. Res. 122, 889–901. doi: 10.1016/j.jbusres.2019.09.022

Wang, X. L., Hu, L. P., and Fan, G. (2021). China’s marketization index report by province. Parent Organization: Chinese Academy of Social Sciences (CASS). Beijing, China: Social Sciences Academic Press.

Wen, F. H., Li, C., Sha, H., Wen, F., and Shao, L. (2021). How does economic policy uncertainty affect corporate risk-taking? Evidence from China. Financ. Res. Lett. 41:101840. doi: 10.1016/j.frl.2020.101840

Wu, F. J., Hu, H. Z., Lin, H. Y., and Ren, X. Y. (2021). Enterprise digital transformation and capital market performance: empirical evidence from stock liquid. J. Manage. World. 37, 130–144. doi: 10.19744/j.cnki.11-1235/f.2021.0097

Xue, Z., Hou, Y. J., Cao, G. Q., Hou, Y., Cao, G., and Sun, G. (2024). How does digital transformation drive innovation in Chinese agribusiness: mechanism and micro evidence. J. Innov. Knowl. 9:100489. doi: 10.1016/j.jik.2024.100489

Yan, Z. B., Zhang, Y. H., and Zhao, F. (2023). Economic policy uncertainty and enterprise risk: based on double mediating effect and double moderating. Soft Sci. 38, 1–11. doi: 10.13956/j.ss.1001-8409.2024.04.14

Yin, Z. C., Xie, H. F., and Wei, Z. (2014). Agriculture-related loans, monetary policy and default risk. Chin. Rural Econ. 3, 14–26. doi: 10.20077/j.cnki.11-1262/f.2014.03.002

Zhao, Z. R. (2024). Digital transformation and enterprise risk-taking. Financ. Res. Lett. 62:105139. doi: 10.1016/j.frl.2024.105139

Zhao, C. Y., Wang, W. C., and Li, X. S. (2021). How does digital transformation affect the total factor productivity of enterprises? Finance Trade Econom. 42, 114–129. doi: 10.19795/j.cnki.cn11-1166/f.20210705.001

Keywords: economic policy uncertainty, agricultural enterprises, digital transformation, risk-taking level, investment efficiency

Citation: Wang W and Jia J (2025) Study on the driving mechanism and risk hedging effect of economic policy uncertainty on digital transformation of agricultural enterprises. Front. Sustain. Food Syst. 9:1565343. doi: 10.3389/fsufs.2025.1565343

Edited by:

Sanzidur Rahman, University of Reading, United KingdomReviewed by:

Ismail Suardi Wekke, Institut Agama Islam Negeri Sorong, IndonesiaOtilia Manta, Romanian Academy, Romania

Roxana Voicu-Dorobantu, Bucharest Academy of Economic Studies, Romania

Copyright © 2025 Wang and Jia. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jingwen Jia, amlhancxNjI1QDE2My5jb20=

†These authors have contributed equally to this work and share first authorship

Wenwen Wang†

Wenwen Wang† Jingwen Jia

Jingwen Jia