- 1Institute of Food and Strategic Reserves, Nanjing University of Finance and Economics, Nanjing, China

- 2Jiangsu Modern Grain Circulation and Security Collaborative Innovation Center, Nanjing, China

Introduction: The food price support policy aimed at stability has become a key strategy for safeguarding food security. Since its implementation, wheat production in China has seen significant growth. However, the economic benefits from wheat farming have not increased in tandem, leading to the phenomenon of “increased production without increased income”. As a result, the effects of food price support policies on wheat production and the incentive mechanisms driving this change remain insufficiently studied.

Methods: This paper provides a comprehensive theoretical and empirical analysis of how food price support policies influence the incentive mechanisms driving wheat production, focusing on the mediating role of farmers' decision-making behavior. Based on Schultz's “rational man” principle of self-utility maximization, and from the perspectives of risk-sharing and cost-saving, the study divides the incentive mechanisms guiding farmers' production decisions into three areas: price stabilization, income stabilization, and comprehensive cost savings. Meanwhile, empirical connections between price support policies, farmers' decision-making, and wheat production are examined. Empirical tests are conducted using provincial panel data from 15 major wheat-producing provinces in China (2000–2021), employing dynamic difference-in-differences and mediation effect models.

Results: The study shows that the price support policy has significantly boosted wheat production. Dynamic effect analysis indicates that the policy has a short-term impact on improving wheat yield. Regional heterogeneity analysis reveals that provinces respond differently to the policy, with varying levels of sustainability in the increased wheat production. This variation is mainly due to differences in agricultural resource distribution and cropping structures across regions. Mechanism analysis suggests that the policy effectively incentivizes wheat production by stabilizing market price fluctuations, ensuring stable farmer income, and reducing overall production costs.

Discussion: Based on the above findings, it is recommended that, while continuing to implement the price support policy, more targeted policy adjustments be made to reflect the specific characteristics of different regions. Additionally, strengthening agricultural infrastructure, establishing diversified income subsidy mechanisms for farmers, and optimizing production input structures are essential for enhancing the long-term effectiveness and sustainability of the policy. The results of this study have important implications for policymakers, agricultural managers, and researchers, providing insights into improving sustainable food production in China and other regions with similar contexts.

1 Introduction

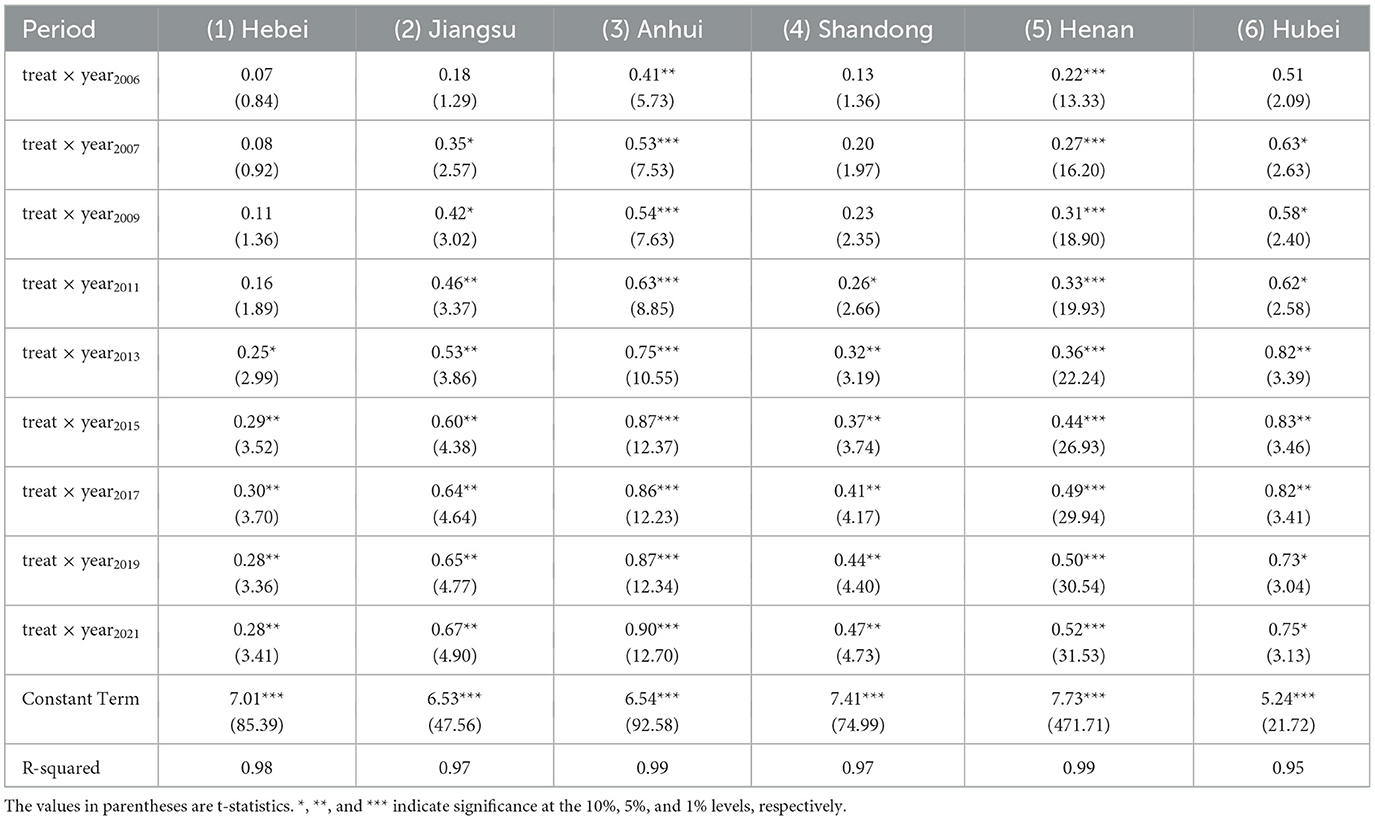

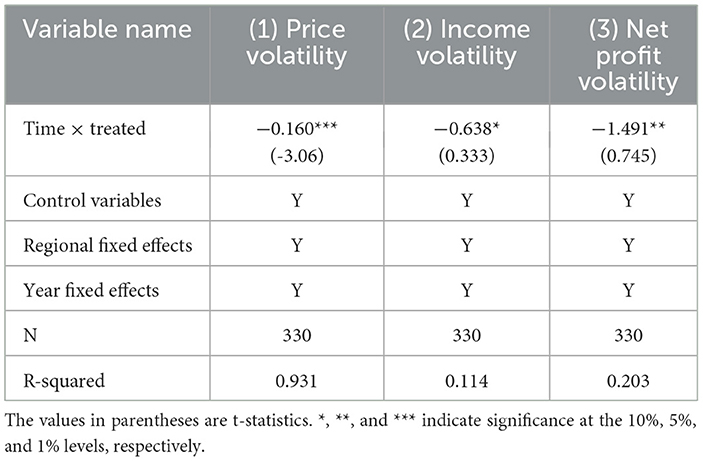

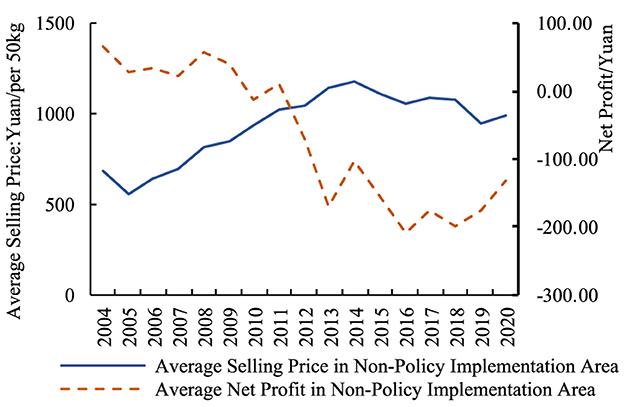

The stability of grain production has always been a cornerstone of China's food security strategy, directly linked to national sovereignty and macro-level regulatory capacity (Hatab et al., 2019; Meyer, 2020; Lang and Barling, 2012; Zheng and Zhao, 2025). Since 1998, China's grain output experienced a marked decline, dropping from 510 million tons to 430 million tons by 20031, raising urgent concerns about the reliability of grain supply. In response, the Chinese government launched a series of grain price support policies starting in 2004, including the Minimum Procurement Price. Among them, the wheat price support policy, implemented in key production regions since 2006, has played a vital role in securing staple food supplies. As a result, wheat output increased significantly, reaching 137.72 million tons in 2022, nearly 28 million tons more than in 1998, thus achieving a staged goal of “output stability”. However, growth in output has not been matched by corresponding economic gains. A prominent structural contradiction (“increased output without increased income”) has emerged, as farmers' net returns have remained stagnant or even declined relative to wheat market prices (as shown in Figure 1). The gap between net income from wheat production and the selling price continues to widen, placing greater economic pressure on farmers (as shown in Figures 2, 3). This discrepancy raises significant concerns about the sustainability of grain production and food security. Under such circumstances, why farmers continue to grow wheat remains an urgent and practical question. This paradox not only reflects the real incentive effect of the policy but also relates to the long-term sustainability of China's food security strategy. To address this puzzle, this study shifts the analytical focus to farmers' behavioral responses under the wheat price support policy. Rather than relying solely on traditional income-driven incentives, we propose a mechanism chain of “policy guarantee—expectation stabilization—rational choice” to explain why farmers retain their willingness to cultivate wheat, even when returns are limited. This behavioral perspective sheds new light on the foundations behind the “output-income decoupling” phenomenon and provides a theoretical entry point for further research on how such policies affect total factor productivity (TFP) and income distribution in the agricultural sector.

Figure 1. Comparison of average yield and profit between wheat policy implementation areas and non-policy implementation areas. Source: compilation of agricultural product cost-benefit data (2005–2021).

Figure 2. Revenue and prices in wheat policy implementation non-implementation areas. Source: compilation of agricultural product cost-benefit data (2005–2021).

Figure 3. Revenue and prices in wheat policy non-implementation areas. Source: compilation of agricultural product cost-benefit data (2005–2021).

Profound changes in the global landscape, coupled with the further deterioration of resources and the environment, pose serious threats to China's food security (Zhu et al., 2021; Nie et al., 2021; Du and Han, 2020; Mustafa et al., 2021; Abay et al., 2023; Simola et al., 2022; Alam et al., 2024). In response, the grain price support policy has gained significant attention as a critical measure. In response, the grain price support policy has gained significant attention as a critical measure. While conclusions vary, there is a general consensus that agriculture, being a vulnerable industry, requires policy support (Zhang et al., 2025; Nerlove, 1958; Yu and Jensen, 2010; Zhou and Shao, 2019; Kambali and Panakaje, 2022). The impacts of grain price support policies have changed over time. In the early stages, the policy of purchasing grain at guaranteed prices effectively stabilized farmers' planting expectations (Zhang and Chen, 2007; He, 2010; Rausser et al., 1986). It also reduced risks associated with price fluctuations and promoted grain production (Shi, 2007; Jiang and Wu, 2009; Wang and Li, 2012; Lin and Huang, 2021). However, over time, overregulation of grain prices caused market distortions (Jiang, 2018; DeBoe, 2020; Lankoski and Thiem, 2020), increased the state's financial burden, and weakened the incentive for reform among state-owned grain storage enterprises (Li and Zheng, 2014). Additionally, price distortions in both upstream and downstream grain further reduced the policy's benefits, lowering incremental income gains and creating a conflict between increasing production and raising income (Tong et al., 2019). Despite these negative effects, abolishing the policy could lead to a significant reduction in grain output in the short term, posing a major threat to China's food supply security (Li and Li, 2022). Therefore, the key to current policy adjustment lies not in whether to withdraw the policy, but in how to optimize its incentive mechanisms within the existing framework to enhance its effectiveness and sustainability.

From a theoretical perspective, the realization of grain production and farmers' income growth hinges on the effectiveness of policy-driven incentive mechanisms. Existing studies have employed diverse empirical approaches to demonstrate that price support policies—primarily through government procurement at guaranteed prices—help stabilize price expectations, enhance farmers' willingness to cultivate, and consequently boost grain output. These findings offer key insights into how such policies support short-term supply stability (Ma, 2016; Zhang, 2013; Tian et al., 2022; Wu and Tan, 2013; Du and Mao, 2017; Li et al., 2019). However, these incentives often prompt farmers to rely on increasing traditional input factors rather than adopting technological innovations. Over time, this undermines the improvement of total factor productivity and weakens the long-term sustainability of grain development (Liao and Huang, 2019). Moreover, Prolonged “comprehensive market support leads to excessively stable grain prices,” which can weaken the regulatory function of market price mechanisms (Tu and Lan, 2013). Additionally, farmers' reliance on these policies may reduce their planting enthusiasm when the policy occurs (Cao et al., 2017). This dependence can also decrease market economic efficiency by increasing opportunity and transaction costs (Zhong and Qin, 2012; Chen et al., 2019).

Although existing literature has extensively examined the effectiveness of grain price support policies and the extent to which their objectives have been achieved, these studies provide only a partial foundation for understanding the mechanisms through which such policies influence wheat production. Due to differences in research perspectives, data sources, and policy indicator definitions, explanations of how policy incentives actually function remain limited. This gap is especially salient under current conditions, where income-driven incentives have weakened, making it more important to explore the micro-level pathways through which policies can still sustain grain production. This study focuses on the behavioral mechanisms behind wheat production increases driven by price support policies, aiming to identify the implementation pathways and underlying logic of the “production stability” objective. This serves as a theoretical basis for future research on improving production efficiency and increasing farmer income.

Building on the above issues and background, this study aims to systematically evaluate the impact of grain price support policies on wheat production in China from the perspective of long-term policy implementation, with a particular focus on the incentive mechanisms underlying their “production stability” effect. Specifically, the study develops a theoretical framework based on the assumption of rational farmer behavior to identify the policy's incentive pathways. It then applies a dynamic Difference-in-Differences (DID) model using provincial panel data from 15 major wheat-producing provinces in China from 2000 to 2021, to dynamically assess and test the long-term effectiveness of the policy. Compared with existing studies, this paper introduces the following improvements: (1) By utilizing a dynamic DID model, this study provides an unbiased estimation of the long-term effects of grain price support policies, overcoming the limitations of previous research that primarily focused on short-term effects. (2) It thoroughly explores variations in policy responses across different regions, finding that policy effects are relatively weaker in regions with diversified crop cultivation. This finding offers important evidence for making regional adjustments in future policy design. (3) The study highlights the importance of policy stability mechanisms in wheat production, providing empirical support for optimizing future policies. It emphasizes the importance of reducing market risks and ensuring reasonable income for farmers.

2 Policy background, theoretical analysis and research hypotheses

2.1 Background of the grain price support policy

The Grain Price Support Policy for wheat (officially implemented in 2006) is one of the core instruments within China's grain price support and regulation system. The policy is enforced annually from June 1 to September 30, with the activation date flexibly adjusted based on the dynamics of the wheat market price in a given year. Initially designed to stimulate grain production, the policy has undergone multiple rounds of market-oriented reforms. However, it has consistently retained its role as a “stabilization mechanism”, serving multiple policy objectives, including maintaining stable grain production, securing farmers' incomes, and mitigating price volatility.

From a policy objective perspective, the grain price support policy serves two primary goals. On one hand, it aims to safeguard farmers' returns from wheat cultivation, thereby guiding them to form stable production expectations and contributing to national food security. By setting a minimum procurement price in major wheat-producing regions, the policy encourages farmers to make rational production and operational decisions, ensuring that “grain cultivation does not incur losses and grain sales are not problematic”, thus maintaining their enthusiasm for wheat planting. On the other hand, the policy helps stabilize market prices. When market prices fall below the minimum procurement price, the government activates a contingency plan, authorizing China Grain Reserves Corporation to purchase wheat at the minimum price. This intervention anchors market prices closer to the policy benchmark, effectively curbing excessive price declines.

Since its implementation in 2006 the policy has covered six major wheat-producing provinces, i.e., Hebei, Jiangsu, Anhui, Shandong, Henan, and Hubei. Besides, this coverage has remained unchanged to date. Its primary beneficiaries are grain farmers who rely on wheat as their main source of income, particularly smallholder farmers. By reducing the price risks faced by farmers, securing their sales channels, and lowering post-harvest circulation burdens, the policy strengthens their confidence in wheat cultivation.

In terms of operational mechanism, the policy adopts a dual approach of “price floor and peak smoothing” to achieve the goals of stable production, supply security, and price stability. The “price floor” refers to government procurement at the minimum price when market prices fall below the threshold, providing a safety net for farmers. “Peak smoothing” is achieved by releasing grain reserves to adjust market supply and demand, thereby curbing excessive price increases. In addition, the policy includes supporting arrangements for grain purchase, drying, storage, and transportation, offering farmers end-to-end assistance. These measures alleviate concerns over post-harvest sales and storage, institutionally ensuring the continuity and stability of grain production.

2.2 The impact of price support policies on wheat production

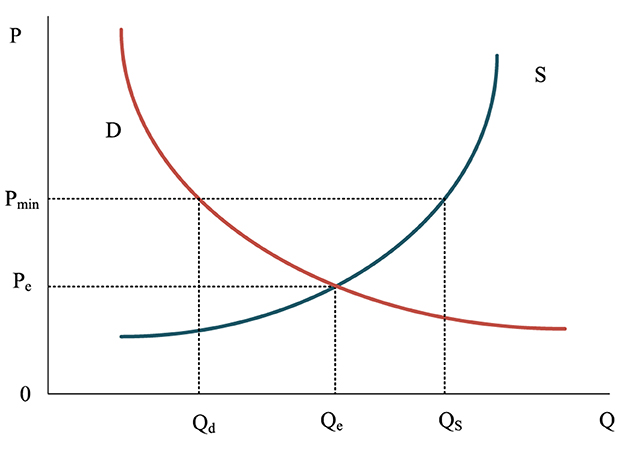

In a perfectly competitive market without government intervention, the equilibrium price Pe and equilibrium quantity Qe of wheat are determined by the intersection of the supply curve S and the demand curve D (as illustrated in Figure 4), achieving a Pareto-optimal allocation of resources. However, as a special type of commodity, grain markets often deviate from standard market dynamics due to characteristics such as long production cycles, strong price rigidity, and the coexistence of natural and market risks. In the context of China-characterized by a large population, limited arable land, and a dominant smallholder farming structure-individual farmers have weak risk resilience and are highly sensitive to price fluctuations.

To safeguard farmers' incomes and ensure food supply security, China has implemented the Minimum Procurement Price policy for wheat in major producing regions since 2006. The core logic of this policy lies in providing a price floor during market downturns to prevent the phenomenon of “low grain prices harming farmers”, thereby maintaining farmers' planting intentions and preventing a decline in output due to weak prices. The policy's operational mechanism can be further explained based on different market price scenarios: when the market price is equal to or higher than the support price Pmin, the policy is not triggered, and resource allocation is left to the market. In this case, although the policy does not directly intervene, it provides implicit assurance, stabilizing farmers' expectations and reducing the risk of withdrawal from wheat cultivation. When the market price falls below Pmin, the government activates the policy by purchasing wheat at the support price, which is equivalent to artificially increasing “government demand” at Pmin. This enhances demand elasticity in the market, preventing farmers from facing sales prices that approach or fall below production costs. As a result, the effective market price is supported at Pmin, and the supply quantity from producers becomes Qs=c+dPmin, meaning producers are willing to supply Qs units at this price. Conversely, private demand at Pmin is Qd=abPmin. Since the policy price is higher than the market-clearing price, excess supply arises, and the amount of government procurement equals Qexcess=(ca) + (d+b)Pmin, which is purchased at the support price and stored as government reserves.

Based on this framework, the positive effects of the price support policy on wheat production are primarily reflected in the following three aspects: first, the policy prevents production regression. By setting a minimum purchase price, the policy helps avoid situations where market prices fall below production costs, which could otherwise result in losses for farmers. Without such a policy, persistently low prices might force marginal producers to exit the market, leading to land abandonment and a substantial decline in long-term equilibrium output-posing a serious threat to the stability of the grain supply. The minimum purchase price policy ensures farmers' basic income, thereby stabilizing future planting area and maintaining production enthusiasm. Second, the policy stabilizes farmers' income expectations. Even when market prices do not fall below the minimum purchase price, the existence of the policy itself provides a safety net. This reduces farmers' perceived risks when making future production decisions and encourages them to maintain or even increase investment. Third, the policy helps mitigate abnormal market volatility. Grain acquired through government procurement is stored as reserves, which can be released through auctions or additional purchases during periods of abnormal price fluctuations. This reserve mechanism serves to smooth out extreme price swings in the market.

At a deeper level, the minimum purchase price policy for wheat is not merely aimed at achieving short-term Pareto efficiency. It is rooted in China's broader food security strategy. Given the structural constraints of a large population, limited arable land, and the tight balance between supply and demand, the fundamental rationale of this policy lies in ensuring staple grain self-sufficiency, enhancing supply chain resilience, and sustaining farmers' incentives to grow grain. Through a dynamic adjustment mechanism, the policy enables timely government intervention in cases of market failure or excessive volatility, thereby promoting structural stability and sustainable development in grain production. Accordingly, this study proposes the following research hypothesis:

H1: The price support policy has a positive and stabilizing effect on wheat production and helps maintain or increase wheat output.

2.3 Mechanisms of price support policies on wheat production

To better understand the phenomenon of “increased wheat production without corresponding income growth” under the price support policy, it is necessary to analyze how the policy incentivizes grain production from the perspective of farmers' decision-making behavior. Although Schultz's “rational peasant” theory (Schultz, 1961) is rooted in market economy assumptions, in China's government-intervened agricultural system, farmers' rationality is more accurately reflected as institutional choices under policy-driven expectations. That is, given the institutional guarantee provided by the price support policy, farmers tend to make risk-averse and stability-oriented production decisions. To systematically reveal the policy's incentive pathway, this study categorizes its underlying mechanisms into three types: the price stabilization mechanism, the income expectation stabilization mechanism, and the comprehensive cost reduction mechanism. Furthermore, it explores how these three mechanisms jointly contribute to the sustainability and stability of wheat production.

2.3.1 Price stabilization mechanism

One of the core functions of grain price support policies is to stabilize market prices and reduce the adverse impact of price fluctuations on farmers' production decisions. According to Schultz's theory of “rational choice”, farmers evaluate risks and returns based on market price signals when making production decisions, aiming to maximize their individual utility. Under this theoretical framework, price volatility directly influences farmers' planting intentions and resource allocation strategies. However, this assumption is built on the premise of a fully functioning market economy and does not fully align with the realities of China's policy-intervened agricultural system. In the context of China's current agricultural policy framework, farmers' rational choices are not solely based on market prices, but rather reflect a form of policy-induced institutional rationality. That is, guided by government-backed price floors and managed market expectations, farmers make production decisions that are still consistent with utility maximization, but within the constraints and incentives shaped by the policy environment.

In the absence of price support policies, wheat production in China would face the dual threats of natural and market risks, leading many farmers to opt for crops with more stable returns and controllable costs. China's price support policy aligns with farmers' rational tendency toward risk aversion and stability-seeking. Through a comprehensive mechanism that includes price guarantees, post-harvest services, and secure sales channels, the policy ensures that farmers can “plant with confidence, sell their grain, and avoid losses.” Specifically, when market prices exceed the minimum procurement price, the policy remains in a “latent state”, exerting no direct influence on market transactions. Yet, its long-term presence reinforces farmers' confidence in future price stability. When market prices fall below the minimum procurement threshold, the government initiates purchase operations through designated policy implementers, effectively acting as a “government demand floor” by buying grain at the set support price. Additionally, the government manages grain reserves through rotation mechanisms that adjust supply and demand, thereby dampening excessive market volatility and stabilizing price expectations. This institutional arrangement satisfies farmers' pursuit of income stability, sustaining their willingness to plant wheat and serving as a critical foundation for China's continued increase in wheat production over the past two decades.

From an international perspective, price support mechanisms are also widely embedded in the agricultural policy frameworks of other countries. For example, the United States implements price guarantees through the Farm Bill by setting target prices and compensating farmers via deficiency payments to secure their income. Similarly, the European Union's Common Agricultural Policy employs intervention prices and direct subsidies to mitigate sharp market fluctuations. However, compared to these approaches, China's policy places greater emphasis on a bottom-line stabilization mechanism, highlighting the government's role as the ultimate guarantor of food security. This reflects a comprehensive policy logic of “price stability—expectation stability—production stability”.

In summary, although China's agricultural policy operates in a different institutional environment from the one assumed in Schultz's theory, it effectively integrates policy-driven rational incentives with production behavior through institutional design grounded in rational choice. Accordingly, the following research hypothesis is proposed:

H2: The price support policy stabilizes and promotes wheat production by reducing market price volatility.

2.3.2 Income stabilization mechanism

Another core function of the grain price support policy is to guide and stabilize farmers' income expectations, thereby encouraging the continuation or expansion of grain production. According to Schultz's “rational choice” theory, farmers make production decisions based on their forecasts of future income, opting for strategies that maximize utility (Schultz, 1966). In theory, the more stable the expected income, the more confident farmers are in making investments, and the more rational their behavior becomes. Although this theory is grounded in the context of a market economy, in China's agricultural policy practice, farmers' expectations are no longer entirely dependent on market prices but are instead shaped by institutional arrangements such as price floors and expectation management provided by the policy framework.

In a perfectly competitive market, farmers' income is highly unpredictable, and such instability can significantly undermine their willingness to cultivate. In contrast, the Chinese government provides a stable price expectation for farmers by announcing the minimum purchase price and implementation plan in advance. This enables farmers to assess their potential income as early as the planting stage, thus informing their decisions on whether to plant and how much to plant. This “preemptive expectation stabilization mechanism” effectively reduces the decision-making risks caused by market price uncertainty and leads to behavior characterized by “institutional rational choice”. Although farmers still aim to maximize utility, the path to achieving this goal has shifted from being market-driven to being grounded in a rational expectation framework based on policy guarantees.

This mechanism, i.e., stabilizing farmers' expectations through policy guarantees and driving sustained investment via expectation stability, has broad international applicability. In the United States, the Agricultural Risk Coverage and Price Loss Coverage programs under the Farm Bill establish target prices and coverage thresholds to compensate major crop producers. The European Union's Single Payment Scheme stabilizes farm income through direct payments, while India implements a Minimum Support Price system coupled with crop insurance to protect smallholders against price volatility. Despite differences in design, these policies share a common objective: to mitigate the adverse impact of market fluctuations on farmers' expected returns and reflect a universal logic of using “expectation stability” to foster “rational behavior”.

In comparison, China's price support policy features a more rigid form of market intervention through “government procurement at floor prices,” which not only ensures price stability but also serves as a core institutional mechanism in the national food security strategy. The policy's logic is as follows: (1) stabilizing income expectations, (2) stabilizing planting decisions, and (3) stabilizing output supply. The above logic has contributed to the steady growth of wheat production and exemplifies an extended application of Schultz's “rational choice” theory under state intervention. Based on this, we propose the following hypothesis:

H3: Price support policies enhance farmers' willingness to grow wheat by stabilizing their income expectations, thereby stabilizing and promoting wheat production.

2.3.3 Comprehensive cost reduction mechanism

Grain price support policies enhance farmers' willingness to cultivate and invest by reducing the overall costs associated with grain production. Within the framework of Schultz's “rational choice” theory, farmers make crop choices based on input-output ratios, selecting production plans that maximize expected returns. While this theory emphasizes market-driven optimization, in China's institutional context, policy interventions have become a critical factor influencing production decisions.

In a market environment lacking policy support, farmers must independently bear the full range of production-related costs, including cultivation, drying, transportation, storage, and marketing. Faced with price volatility and natural risks, their production intentions tend to be conservative. The Minimum Purchase Price policy for wheat not only offers price guarantees but is also accompanied by a series of cost-reduction measures that provide end-to-end support across the production process. For instance, in some regions, “direct procurement and cash payment” mechanisms enable policy-designated entities to purchase grain directly from the field, thereby eliminating the costs and uncertainties associated with self-transportation and individual sales. Additionally, the government provides targeted subsidies and yield-based rewards to large-scale grain producers, further improving the economic viability of scaled farming. Although these policy measures extend beyond the “market rationality” paradigm emphasized in Schultz's theory, they still embody the same core principle: enabling rational decision-making through institutional support in high-risk agricultural environments.

Similar institutional arrangements are also evident in several emerging economies. For example, the Indian government reduces farmers' input burdens through subsidies on agricultural machinery and preferential electricity pricing for irrigation. In Brazil, the Food Acquisition Program allows the government to centrally purchase agricultural products while covering part of the downstream costs, such as transportation and sales, thereby easing farmers' burdens in the post-harvest stage. These international experiences suggest that reducing non-market production costs through institutional mechanisms has become a common approach in developing regions to support staple grain production. They also reinforce the applicability of the “rational choice” mechanism driven by cost considerations across different institutional contexts. Accordingly, this study proposes the following hypothesis:

H4: Price support policies enhance farmers' willingness to cultivate wheat by reducing overall production costs, thereby stabilizing and promoting wheat production.

3 Research methods and data description

3.1 Data sources

This study focuses on selecting major wheat-producing provinces based on the proportion of wheat production, research conventions, and data availability. Firstly, considering wheat planting area and output, the study selects 15 provinces and autonomous regions: Hebei, Jiangsu, Anhui, Shandong, Henan, Hubei, Shanxi, Inner Mongolia, Heilongjiang, Sichuan, Yunnan, Shaanxi, Gansu, Ningxia, and Xinjiang. These provinces accounted for 97.6% of the total wheat production and 97.5% of the total wheat planting area in China in 20212. Secondly, following established research conventions, these 15 provinces have generally been included in previous studies on wheat production. Finally, considering data availability, this study primarily uses data on wheat production inputs from the “Compilation of Cost and Benefit Data of National Agricultural Products”, which annually provides input-output data per unit area for these 15 provinces. Other agricultural statistics typically do not include this level of detail. Since the wheat price support policy was implemented starting in 2006, the sample window period is set from 2000 to 2021. Linear interpolation and mean methods are used to supplement the missing data. The outcome variables and some control variables are logarithmically transformed for analysis. Other relevant data used in this study are sourced from the annual “Compilation of Cost and Benefits Data of National Agricultural Products”, the “China Statistical Yearbook”, and the “China Rural Statistical Yearbook”.

During the data collection process, missing values for certain provinces were addressed using linear interpolation and mean imputation methods. Specifically, for variables with relatively continuous time series, linear interpolation was employed to estimate missing values based on adjacent time points. For variables that were unsuitable for interpolation or had missing values over a long time span, mean imputation was applied, whereby missing entries were replaced with the provincial mean of the variable over the available years. These imputation methods have been widely adopted in empirical studies in agricultural economics and help preserve the underlying structure of the dataset without introducing significant distortion. Additionally, to enhance the representativeness and robustness of the analysis, this study followed standard sampling criteria and selected major wheat-producing provinces that are highly representative within the national agricultural statistical system. To mitigate issues related to heteroscedasticity and scale differences, the dependent variables and several control variables were log-transformed.

3.2 Model specification

3.2.1 DID baseline model

This study uses the Difference-in-Differences (DID) method to thoroughly evaluate the impact of grain price support policies on wheat production. This method effectively controls for individual heterogeneity and time-varying factors, providing unbiased estimates of policy effects. The model is based on two key assumptions: (1) Randomness assumption: the implementation regions and timing of the wheat price support policy are assumed to be random. The policy is determined by the central government, and whether agricultural producers benefit from it depends on whether their province is included in the policy execution scope. (2) Homogeneity assumption: the trend of wheat production changes in regions where the policy is not implemented is expected to be consistent with the trend in regions where the policy is implemented, assuming no policy is in place. This study draws on the approach of Zheng et al. (2011), comparing the production change trends before policy implementation between regions where the policy was enforced and other major wheat-producing regions. If these trends are consistent, the homogeneity assumption is considered satisfied. Based on this research foundation, the production-enhancing effects of the wheat price support policy are evaluated.

Building on this, and referring to the research methods of Xx et al. (2020), this study introduces bidirectional fixed effects into the DID model to control for both individual and time-fixed effects. This approach addresses the issues of omitted variables and endogeneity, thereby reducing the interference from individual and time effects. The specific model setup can be written as:

where i and t represent provinces and years, respectively. Yit is the outcome variable, which denotes the wheat production situation. Yit includes total wheat output, sown area, and yield per unit area. The policy dummy variable Treatedi can be defined as follows: if province i is part of the wheat price support policy implementation area, then Treatedi = 1; otherwise, Treatedi = 0 if province i is not included. The time dummy variable Timet indicates the start of the wheat price support policy in 2006. Timet = 1 represents the years after policy implementation (2006 to 2021), while Timet = 0 represents the years before policy implementation (i.e., 2000 to 2005). Xit and Zit represent control variables related to provincial characteristics and market vectors, respectively. γt and δi account for regional and time-fixed effects, addressing issues related to omitted variables that remain constant over time or across individuals. The term ϵit represents the random disturbance. The parameters β0, β1, β2, and β3 are the coefficients to be estimated. Based on the fundamental principles of the DID model, this study focuses on the significance, sign, and magnitude of the interaction term coefficient β1. This coefficient represents the net effect of the policy on wheat production, after accounting for other confounding factors.

3.2.2 Dynamic effect model

Considering the phased reform characteristics of the grain price support policy during its implementation, as well as potential timeliness and lag effects, the baseline model can only indicate whether there is an impact on wheat production before and after the policy implementation. However, it cannot capture the dynamic impact of the policy on wheat production over time or reflect how the policy's effects vary across different years. To address this limitation, the study follows the event study methodology proposed by Jacobson et al. (1993), conducting empirical tests on the dynamic effects of the policy. The specific model is formulated as follows:

where Timet represents annual dummy variables, taking values for each year from 2003 to 2021. β1 is the coefficient of primary interest in this section, with the policy implementation year 2006 serving as the base year. Other variables is the same as in Equation (1).

3.3 Variable selection

3.3.1 Dependent variables

Following the research by Qian and Wang (2015), this study measures wheat production using three outcome variables: total wheat output, sown area, and yield per unit area.

3.3.2 Key independent variables

The core independent variable is the implementation of the grain price support policy. The variable for the wheat price support policy implementation year (i.e., Time) is set to 1 for the treatment group (years after implementation) and 0 for the control group (years before implementation). The variable for the wheat price support policy implementation region (i.e., Treated) is set to 1 for regions where the policy is implemented and 0 for regions where it is not.

3.3.3 Provincial characteristic control variables

Wheat production is influenced by factors such as farmers' decision-making behavior, agricultural infrastructure, technological advancements, and natural climatic conditions. To enhance the robustness of the empirical results, a set of provincial characteristic vectors, Xit, is included in the model as control variables. These variables encompass (1) Farmers' decision-making behavior: this includes the cost of wheat production (sum of costs for seeds, fertilizers, pesticides, machinery operations, rental operations, labor, and land), the average wheat selling price from the previous year, and the provincial agricultural product price index. (2) Agricultural infrastructure and technological progress: this includes the effective irrigation rate (the ratio of effectively irrigated area to the total cultivated land area) (Feng et al., 2012), agricultural machinery power per unit area (the ratio of total agricultural machinery power to total crop sown area), and the primary industry value ratio (the share of primary industry value-added in the regional gross domestic product). (3) Natural climatic conditions: this includes the disaster ratio (the ratio of the disaster-affected area to the total crop sown area) (Li et al., 2005), the average temperature of the provincial capital, total precipitation, and total hours of sunshine (Hou et al., 2015).

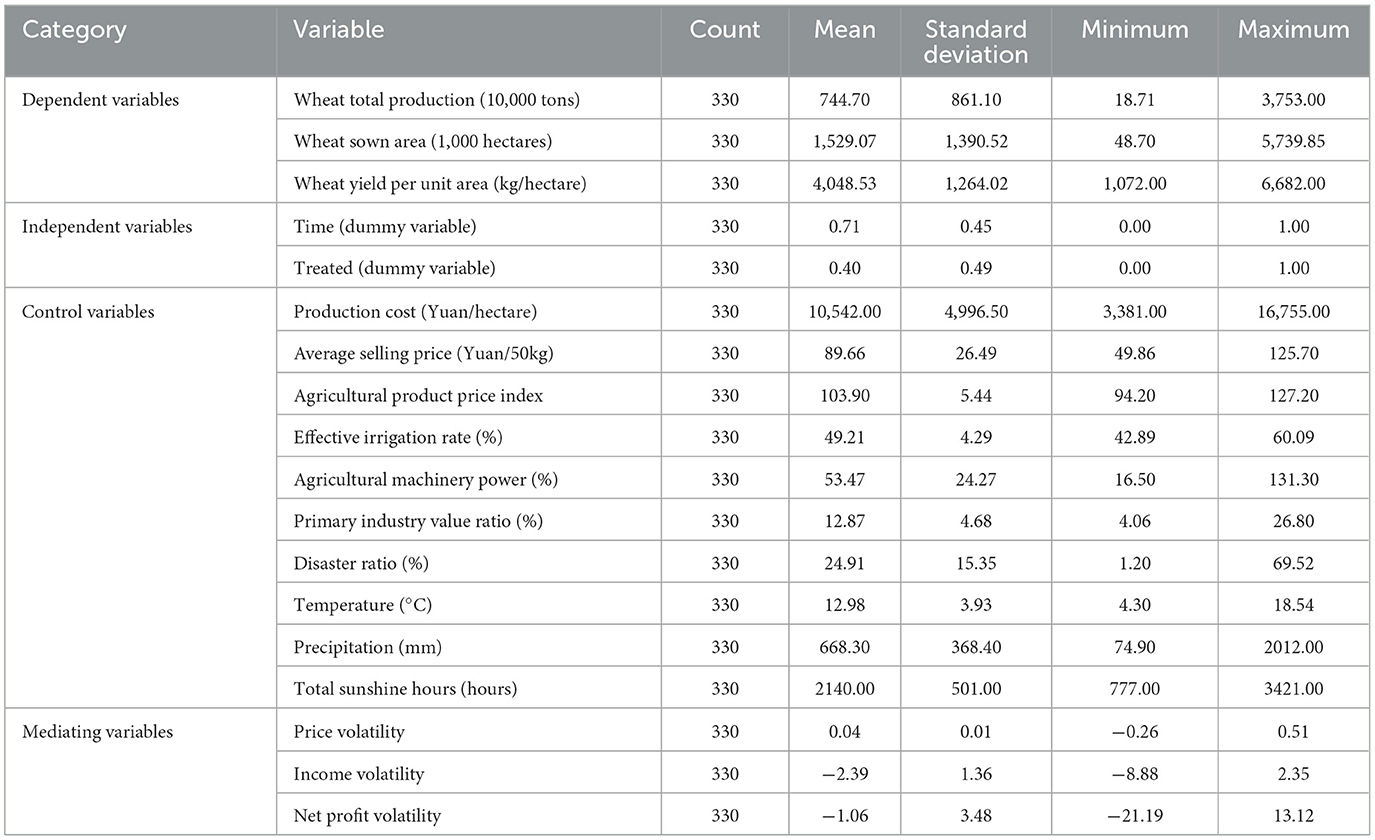

3.3.4 Mediating variables

The selection of mediating variables is crucial when studying the impact of grain price support policies on wheat production decisions. After the policy implementation, changes in wheat price volatility may directly influence production decisions, so the mediating effect of price volatility needs to be considered. Additionally, since producers are concerned about income changes, income volatility is used as a second mediating variable. To account for costs, net profit volatility is included to supplement this analysis. The specific definitions are as follows: (1) Price volatility: annual price data from provincial wheat-free markets is used, with the year 2000 as the base year. Prices are deflated using the regional Consumer Price Index (CPI), and the proportion method is employed to calculate annual price volatility (Ye and Shi, 2023). (2) Income volatility: production income is calculated by multiplying the average wheat selling price by the total output at the provincial level. The proportion method is then used to calculate annual income volatility (Wang et al., 2024). (3) Net profit volatility: using data on net profit per mu (a Chinese unit of area) for each province, the proportion method is applied to calculate annual net profit volatility. Analyzing these mediating variables provides a comprehensive understanding of how grain price support policies influence wheat production decisions. Descriptive statistics for the main variables are shown in Table 1.

When analyzing the mechanisms through which grain price support policies affect wheat production decisions, the selection of mediating variables is crucial. This study adopts two analytical perspectives—risk mitigation and cost reduction—to identify the pathways by which the policy influences stable and increased wheat production. Notably, the type of risk emphasized in this study is market-driven risk, referring to the uncertainties in wheat production caused by price volatility and income instability. Accordingly, the mediating variables related to risk focus on how the implementation of price support policies stabilizes market expectations and reduces volatility in prices and incomes, thereby affecting farmers' production behavior. Based on this framework, three types of mediating variables are constructed: (1) Price volatility: this variable reflects the degree of market price stability. It is calculated using annual wheat market prices at the provincial level. Prices are deflated using the 2000 base year and the provincial Consumer Price Index (CPI). The annual price volatility rate is then computed using the proportional change method, defined as the difference between the current and previous year divided by the previous year (Ye and Shi, 2023). (2) Income volatility: this measures fluctuations in wheat production income. It is calculated by multiplying the provincial average selling price by total production, and then applying the proportional change method to derive annual income volatility (Wang et al., 2024). (3) Net profit volatility: this variable serves as a proxy for overall production costs. Due to the unavailability of detailed provincial-level cost data for wheat production, this study uses annual net profit per mu to calculate volatility, again using the proportional change method. It should be noted that this proxy captures not only income fluctuations but also indirectly reflects the influence of cost variations on final profit. Therefore, net profit volatility is treated as a generalized cost indicator, emphasizing the intrinsic link between profit fluctuations and cost dynamics. These mediating variables help to clarify the behavioral mechanisms through which the price support policy influences wheat production decisions. Descriptive statistics for the main variables are reported in Table 1.

4 Empirical results and analysis

4.1 Changes in wheat production under grain price support policies

4.1.1 DID baseline regression results

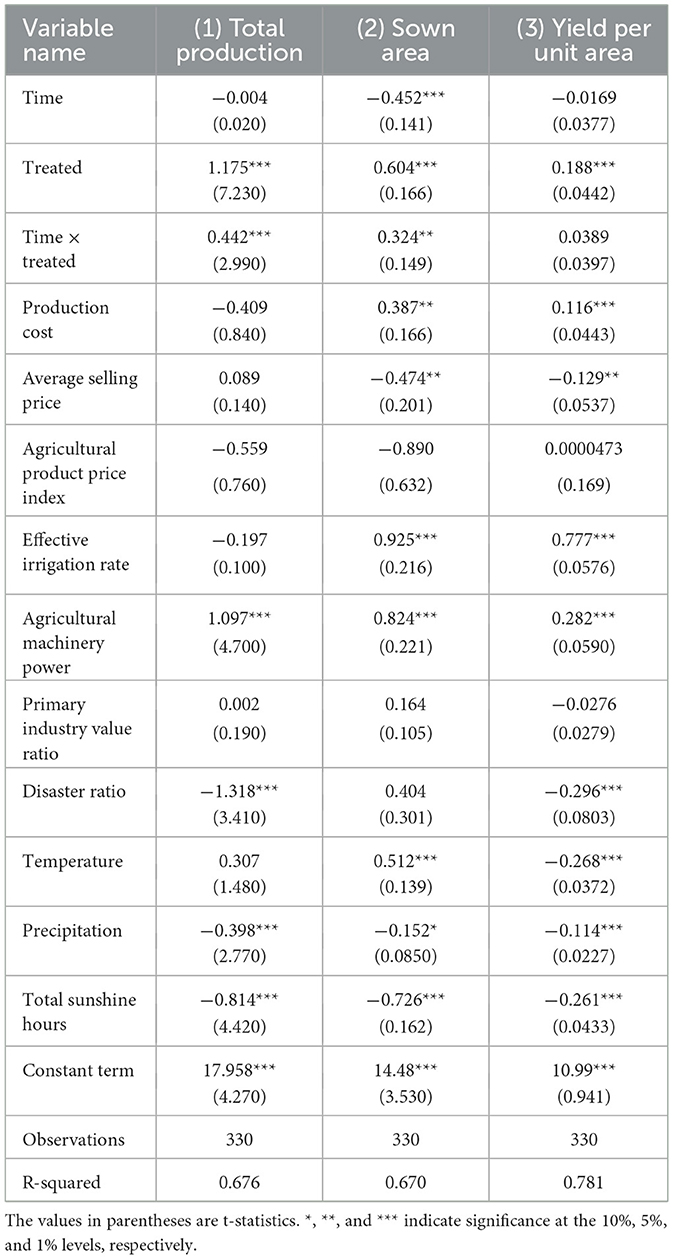

Table 2 presents the baseline regression results using the DID model, showing the positive impact of price support policies on wheat production. Based on the baseline regression results from equations (1), (2), and (3), the coefficient of the core explanatory variable Time×Treated for both wheat production and the sown area is positive and statistically significant at the 1% and 5% levels. More specifically, after the policy implementation, average wheat production increased by 4,420 tons, and the sown area increased by an average of 324 thousand hectares. The above result suggests that the policy primarily promotes production growth by expanding the wheat sown area. Although the coefficient of Time×Treated for wheat yield per unit area did not reach statistical significance, its positive value still indicates some effect in promoting yield improvement. These findings demonstrate that the price support policy has effectively enhanced wheat production, positively influencing market supply and price stability. Therefore, Hypothesis H1 is verified.

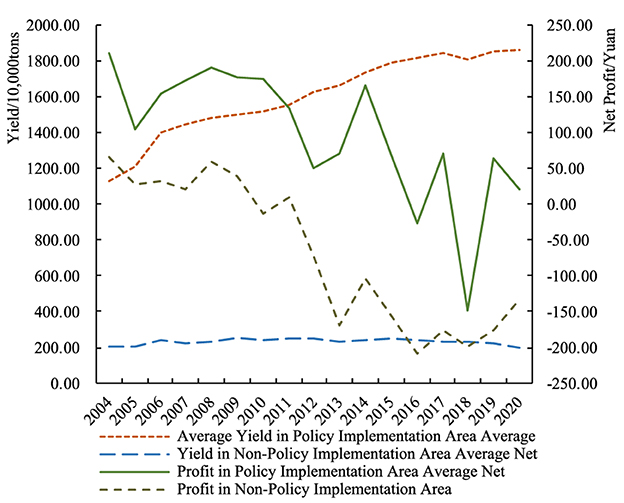

4.1.2 DID dynamic effect regression results

This section examines the differences in wheat production, sown area, and yield per unit area across consecutive years following the implementation of the grain price support policy. Model (2) is used while controlling for the same key variables as in the previous analysis. The regression results are presented in Table 3. From these results, it can be observed that, in the years following the policy implementation, the interaction term Time×Treated for both wheat production and sown area consistently shows positive coefficients that are statistically significant at the 1% level. This indicates that the policy has continuously promoted the growth of both wheat production and sown area over time.

Regarding the impact on wheat yield per unit area, the results exhibit a more complex dynamic effect. In the initial period (2006–2009), the policy's effect on yield per unit area was not significant. This may be due to producers needing time to adapt to policy changes and the lag period required for increases in production factors to translate into yield growth. In the mid-term (2011–2015), yields per unit area showed a significant increase, indicating that producers had begun to increase inputs such as fertilizers, pesticides, and irrigation. This period marks the gradual emergence of the policy's effects. However, in the later period (2017–2021), although yields per unit area still increased significantly in 2017 and 2019, the rate of increase diminished. By 2021, the increase in yield per unit area was no longer significant. This phenomenon may suggest that excessive input of production factors during the mid-term phase boosted yields in the short term. However, long-term overuse of these inputs could lead to resource depletion and environmental degradation (e.g., soil fertility decline and water resource depletion). These factors might inhibit improvements in the later stages.

4.2 Robustness check

4.2.1 Parallel trend test

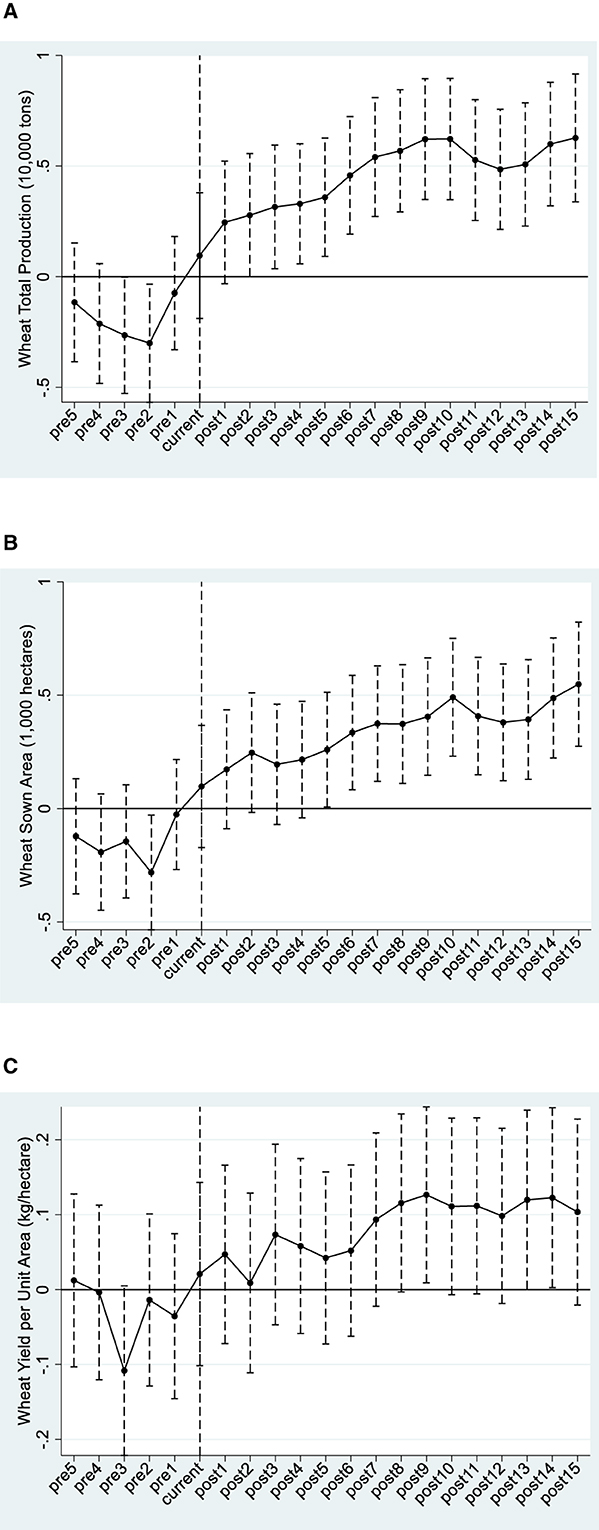

Before applying the Difference-in-Differences (DID) method, it is crucial to verify the parallel trend assumption to ensure that the treatment and control groups exhibited similar trends before the policy implementation. Figure 5 presents the results of the parallel trend test, using 2005 as the base year. The figure shows that, prior to the policy implementation, the coefficients for wheat production, sown area, and yield per unit area were mostly not significantly different from zero. This finding indicates that, before the policy implementation, wheat production conditions in both the treatment and control groups followed the common trend assumption.

Figure 5. Parallel trends test for wheat production, wheat sown area, and wheat yield per unit area. (a) Parallel trends test for wheat production per unit area. (b) Parallel trends test for wheat sown area per unit area. (c) Parallel trends test for wheat yield per unit area.

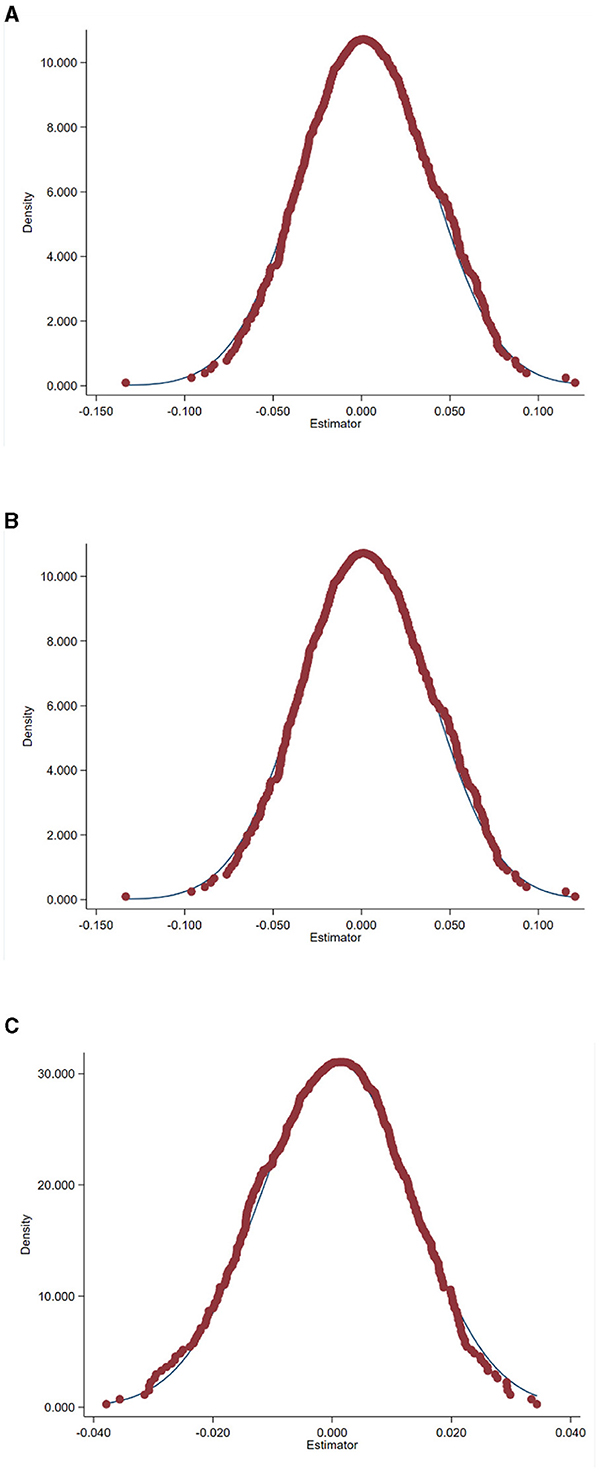

4.2.2 Placebo test

To ensure that the observed increase in wheat production is caused by the grain price support policy rather than other unobservable factors, we conducted a placebo test in our study. Following the methodologies in Ferrara et al. (2012); Li et al. (2016), this study randomized the treatment and control groups and performed baseline regressions to check the significance of key coefficients, thereby verifying the authenticity of the policy's impact. The specific steps are as follows: first, randomly “select” provinces for grain price support policy implementation and randomly assign policy implementation times to create two levels of random experiments. Next, regressions are performed as outlined in Table 1, using the probability of obtaining baseline regression coefficients from these false experiments to assess the reliability of the conclusions. To further enhance the effectiveness of the placebo test, the process was repeated 500 times. Finally, a distribution plot of the estimated coefficients for “Time × Treated” was generated to verify whether wheat production is significantly influenced by factors other than the grain price support policy. If the estimated coefficients of “Time × Treated” are distributed around zero under random treatment, it suggests that the model does not omit any sufficiently important influencing factors, implying that the policy effect is significant. As shown in Figure 6, it is evident that the estimated coefficients for wheat production, sown area, and yield per unit area are concentrated around zero. This finding indicates that the grain price support policy genuinely impacts wheat production, confirming the robustness of the conclusions.

Figure 6. Placebo test for wheat production, wheat sown area, and wheat yield per unit area. (a) Placebo test for wheat production per unit area. (b) Placebo test for wheat sown area per unit area. (c) Placebo test for wheat yield per unit area.

4.3 Heterogeneity analysis

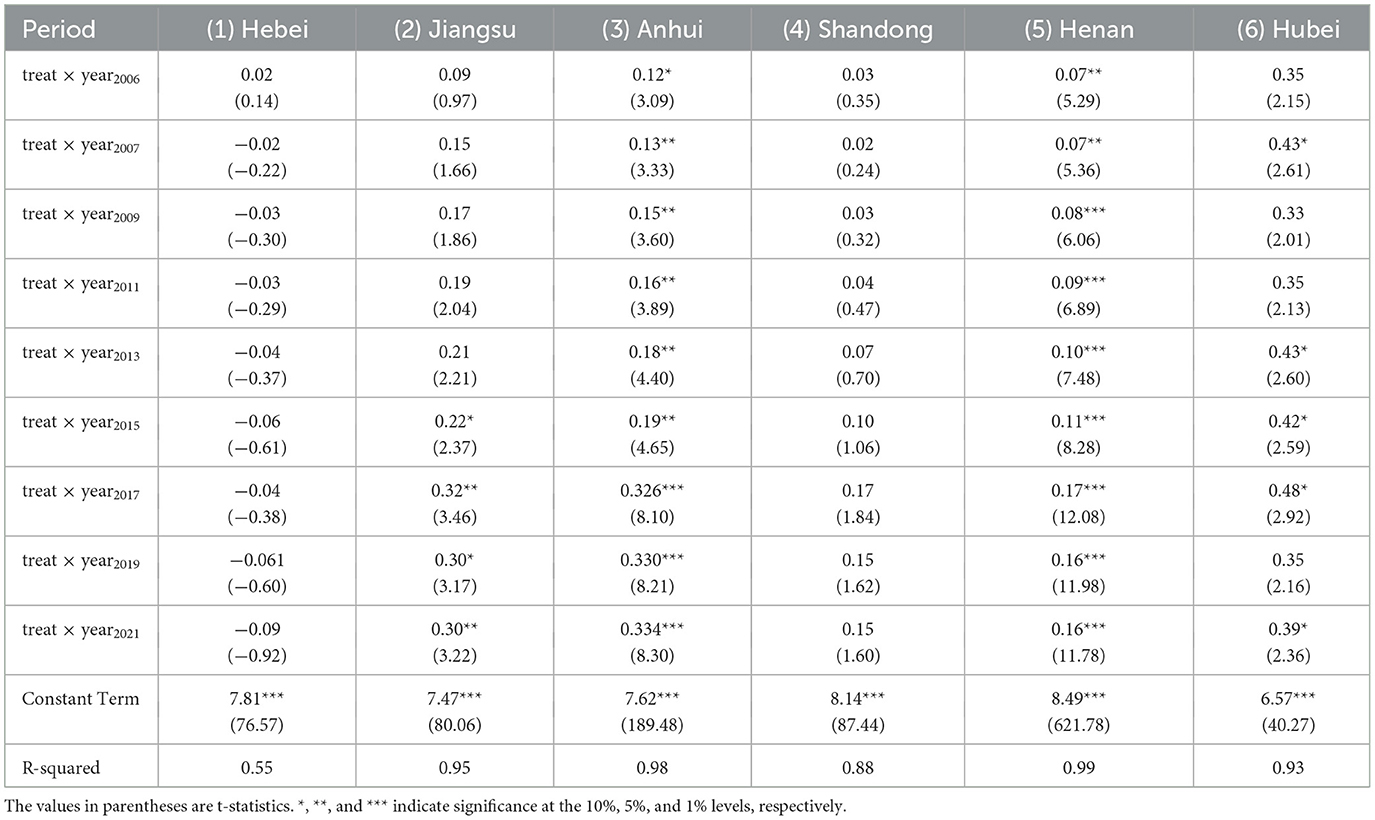

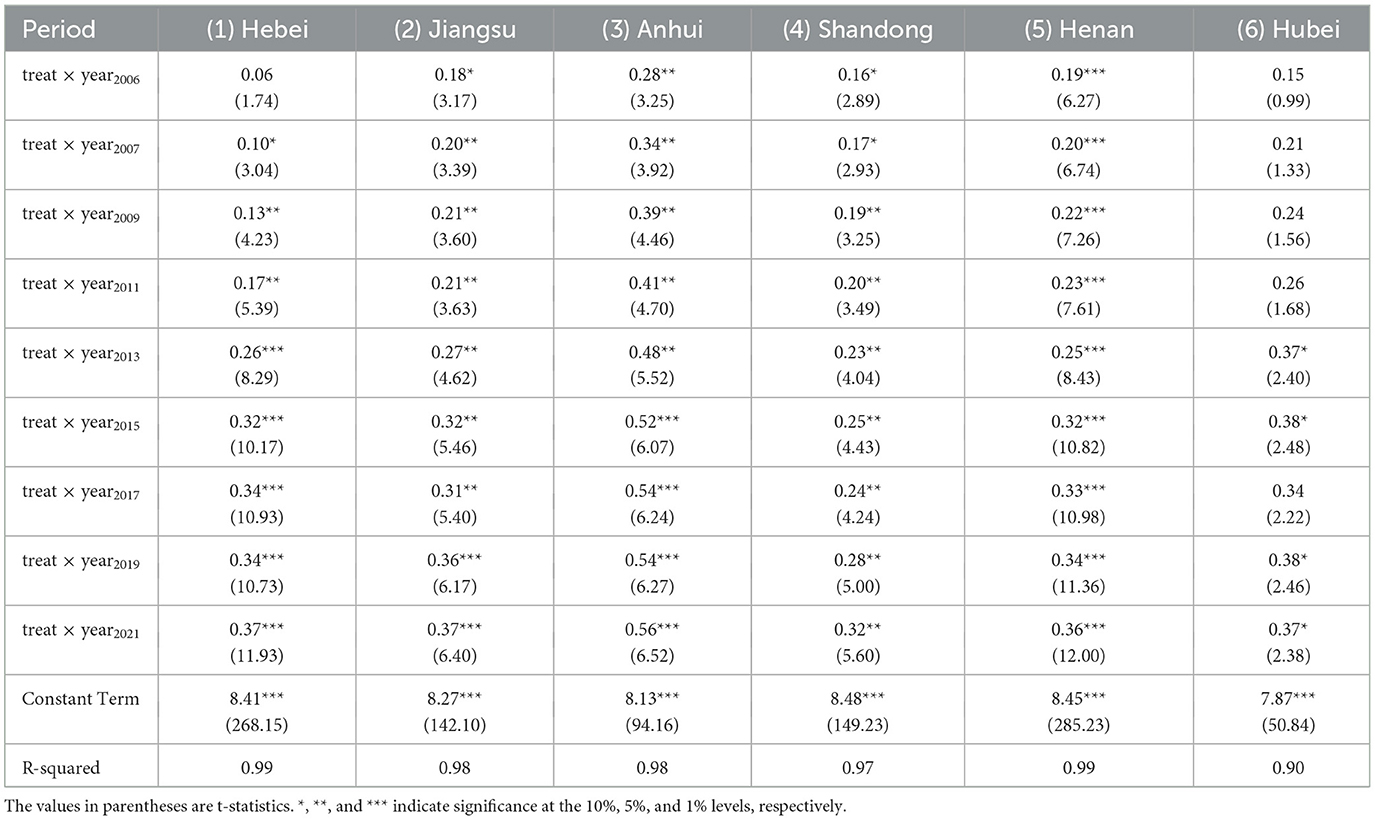

The above analysis has confirmed that the grain price support policy has played a crucial role in promoting wheat production. However, data indicates that the impact of the policy on wheat production varies across different implementing provinces. According to the data, from 2006 to 2021, the growth rates of wheat production in various provinces were as follows: Hebei Province, 23.5%; Jiangsu Province, 48.9%; Anhui Province, 63.9%; Shandong Province, 31.0%; Henan Province, 29.5%; and Hubei Province, 28.4%3. This variation suggests that the policy's impact is not uniform across different provinces, highlighting the need to further explore the reasons behind these differences.

Based on model (2), the impact of the grain price support policy on wheat production across different implementing provinces is examined. The results in Table 4 show that the grain price support policy positively influences wheat production in all provinces. However, the intensity and persistence of the impact vary among provinces. Anhui and Henan provinces consistently show strong positive effects across all years, with significant policy impacts. In contrast, the effects in Jiangsu, Shandong, and Hubei provinces gradually became significant after 2007, while the policy effect in Hebei Province only became evident after 2013. These differences are primarily related to the allocation of agricultural resources and the grain planting structure in each province. For example, Henan Province's wheat planting area accounts for 54% of the total grain planting area in the province, with its wheat production consistently representing over 20% of the national total4. There is no substitution relationship with corn, making the province highly sensitive to policy changes. Similarly, Anhui Province's grain planting conditions mirror those in Henan, leading to a significant policy impact. In Jiangsu, Shandong, and Hubei provinces, the policy effects gradually became significant after 2007. In particular, Shandong Province (characterized by favorable agricultural endowments and a well-developed supply of alternative crops) has seen farmers adopt highly diversified cropping structures. These include the cultivation of maize, soybeans, and various high-value cash crops. Such diversification reflects a rational strategy by farmers to manage income risks arising from market volatility and, in practice, dilutes the marginal incentive effect of the wheat price support policy. Specifically, farmers' planting decisions are shaped not only by wheat price fluctuations but also by relative prices, expected returns, and market demand across multiple crops, thereby reducing the responsiveness to single-policy signals. Moreover, in Jiangsu and Hubei, changes in rural labor structures and land transfer mechanisms have led some farmers to prefer crops that require less labor input and are more adaptable to market dynamics. This further diminishes the role of wheat as a dominant staple crop. In these regions, farmers tend to maintain diversified income portfolios by balancing returns from different crops and mitigating price risk, weakening their dependence on wheat cultivation. Under such conditions, while the price support policy provides a guaranteed price floor for wheat, its marginal influence on actual production incentives is considerably attenuated. Overall, the empirical findings suggest that in regions with diversified agricultural structures and higher degrees of marketization, the effectiveness of price support policies is substantially constrained. Future policy optimization should account for regional heterogeneity in farmers' production behavior. Introducing layered incentive mechanisms (e.g., crop-specific subsidies, agricultural insurance, or ecological compensation) could improve policy targeting and strengthen the adaptive and effective delivery of support to staple crop production.

According to the regression results in Tables 5, 6, there are significant differences in the impact of the grain price support policy on wheat sown area and yield per unit area across different provinces. Overall, the policy's effects on both wheat sown area and yield per unit area show consistency in most provinces. More specifically, the Anhui province and Henan province demonstrate significant and stable policy effects. The detailed analysis is as follows:

Table 5. Heterogeneity of the impact of grain price support policies on wheat sown area across different provinces.

Table 6. Heterogeneity of the impact of grain price support policies on wheat yield per unit area across different provinces.

(1) Henan and Anhui Provinces: the policy consistently has a significant impact on both wheat sown area and yield per unit area, which indicates a stable promoting effect on wheat production in these two provinces. (2) Jiangsu Province: the impact on the sown area became significant starting in 2015 and continues thereafter. (3) Shandong and Hubei Provinces: the significance of the policy effect on sown area is relatively low. However, these provinces show a stronger tendency to increase wheat production by improving yield per unit area. (4) Hebei Province: the impact on the sown area is not significant. The possible reason is the dispersed agricultural resources in the province, which limits the potential for expanding the sown area. However, the policy's effect on yield per unit area is more pronounced.

In summary, the grain price support policy significantly impacts the wheat sown area and yield per unit of area in various provinces. These differences are primarily influenced by factors such as agricultural production conditions, resource allocation, and market competition specific to each province.

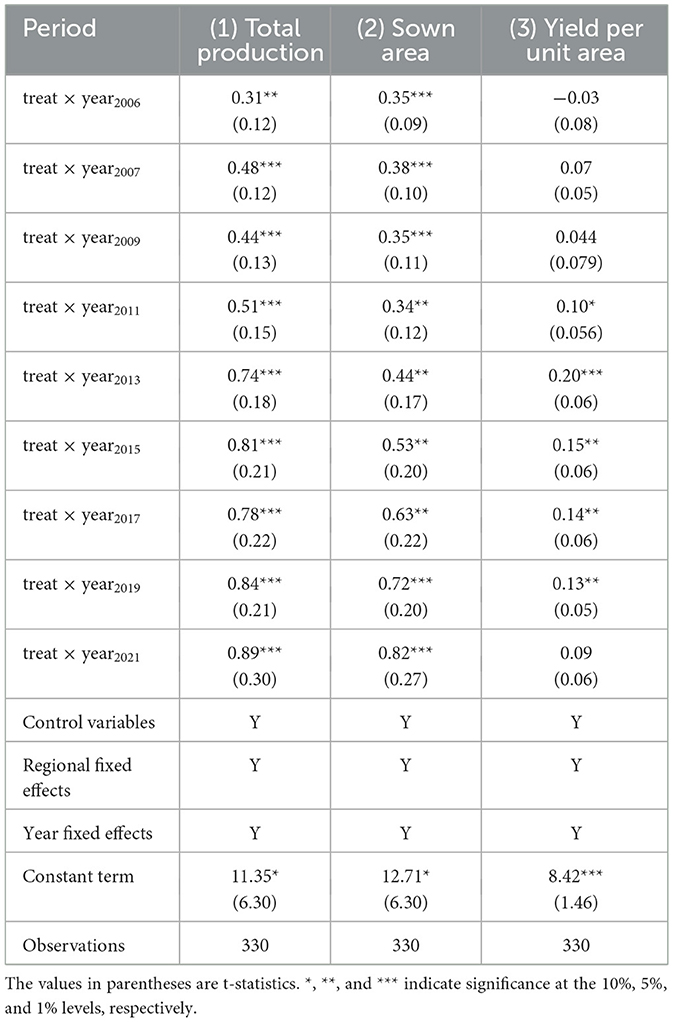

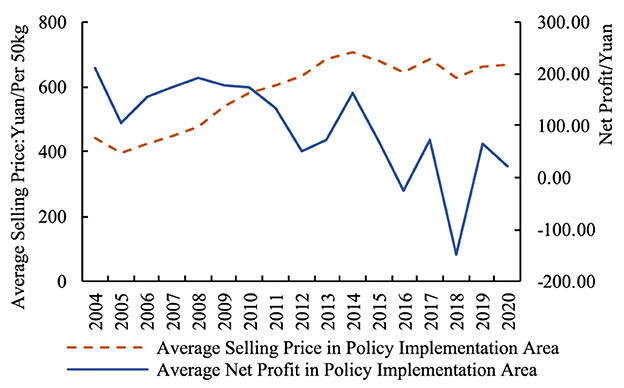

4.4 Mechanism testing

Based on the theoretical analysis, the grain price support policy may positively influence wheat production through mechanisms such as wheat market price stabilization, income stabilization, and comprehensive cost savings. To analyze these mechanisms and avoid issues like endogeneity bias, this study adopts the mediation effect research method suggested by Jiang Ting (Jiang, 2022). The mechanism testing is conducted by examining the impact of the core explanatory variable—the grain price support policy—on the mediating variables. The test results are shown in Table 7. Columns (1), (2), and (3) of Table 7 present the mechanism test results for price volatility, income volatility, and net profit volatility.

4.4.1 Price stabilization mechanism test

This study uses changes in wheat market prices to capture the volatility of price movements, which serves as a key indicator of market instability. Specifically, Column (1) of Table 7 presents the regression results, showing that the estimated coefficient is significantly negative at the 1% level. This finding suggests that the implementation of the grain price support policy has significantly reduced price volatility in the wheat market. By curbing excessive fluctuations in market prices, the policy helps mitigate the price risk perceived by farmers—namely, the uncertainty regarding future price levels that can affect their production decisions. A more stable price environment reduces uncertainty in expected returns and enhances farmers' confidence in wheat cultivation. Consequently, farmers are more willing to invest in productivity-enhancing inputs and techniques, which contributes to increased wheat output (Wang and Li, 2012). These results provide empirical support for Hypothesis H2, highlighting the importance of price support policies in stabilizing agricultural production through the reduction of market volatility and associated price risk. They also offer valuable evidence for refining future agricultural policy frameworks aimed at fostering production resilience.

4.4.2 Income stabilization mechanism test

This study uses changes in farmers' income to measure the impact of income volatility on their planting decisions. The specific results are shown in Column (2) of Table 7, where the estimated coefficient is significantly negative at the 10% level. This finding indicates that the policy effectively reduces income volatility for farmers, suggesting improved income predictability. Stable income allows farmers to make planting decisions within a more stable economic environment, thereby reducing risks associated with income uncertainty. This stability enhances farmers' enthusiasm for wheat cultivation and increases their willingness to invest in boosting wheat production (Liu et al., 2020). This mechanism underscores the critical role of grain price support policies in stabilizing grain production, confirming Hypothesis H3.

4.4.3 Comprehensive cost savings mechanism

This study uses the volatility of net profits from wheat cultivation to measure the impact of the minimum purchase price policy on farmers' overall costs. The specific results are shown in Column (3) of Table 7, where the estimated coefficient is significantly negative at the 5% level. This finding indicates that the policy significantly reduces the volatility of farmers' net profits. Despite the continuous rise in grain cultivation costs, which challenges the stability of wheat production net profits, the policy has effectively mitigated net profit fluctuations. This result suggests that by directly bearing a portion of the production costs, the policy has alleviated the financial burden on farmers and reduced their economic risks. Although the policy has not significantly increased farmers' cash income levels, it effectively lowers overall production costs by reducing net profit volatility, thereby enhancing farmers' enthusiasm for production. Additionally, the policy promotes large-scale farming operations, which help farmers utilize modern agricultural machinery more effectively and improve resource management efficiency. This approach not only increases overall wheat production efficiency but also reduces production costs (Jia et al., 2019). In the long term, the implementation of grain price support policies is crucial for enhancing agricultural production efficiency and ensuring food security, confirming Hypothesis H4.

5 Conclusion and implications

This study utilizes panel data from 15 major wheat-producing provinces in China from 2000 to 2021 and treats the wheat price support policy as a quasi-natural experiment. A difference-in-differences (DID) model is employed to systematically examine the policy's impact on wheat production and its underlying incentive mechanisms. The main findings are as follows: (1) The grain price support policy significantly increased wheat output, sown area, and yield per unit area. Among these, the growth in total output is primarily driven by the expansion of sown area. The policy effects remain robust across various specifications and sensitivity checks, suggesting that the policy provides substantive incentives for wheat production. However, it is worth noting that changes in climatic conditions continue to exert a significant influence on wheat production. (2) The policy incentives exhibit persistence over time. Despite ongoing agricultural market-oriented reforms, the price support policy continues to play a critical role in stabilizing and promoting wheat production. Its effect on expanding the sown area has shown a year-on-year increase, while its impact on yield per unit area appears more short-term and stage-specific. In the long run, excessive input use may lead to diminishing marginal returns on resources. (3) Heterogeneity analysis reveals that the policy is more effective in traditional wheat-dominant regions, whereas its impact is limited in provinces with more diversified cropping structures or a higher proportion of cash crops. This finding suggests that policy implementation should be more context-specific. Uniform promotion across regions may result in resource misallocation and policy inefficiency. (4) Mechanism testing: the mechanism testing shows that the policy significantly promotes wheat production through mechanisms such as stabilizing wheat market prices, stabilizing farmers' incomes, and reducing overall production costs. Income stability, in particular, has a more pronounced impact on production increases. As the costs of grain cultivation rise, future policy optimization should focus more on addressing the income issues of farmers to ensure sustained production incentives. (5) Caution is needed regarding the long-term externalities of price support policies. On the one hand, sustained price intervention may weaken the signaling function of market prices, undermining farmers' ability to adjust cropping structures in response to actual demand and reducing the efficiency of agricultural resource allocation. On the other hand, policy guarantees may create “path dependence”, leading some farmers to develop a reliance on fiscal support and dampening their intrinsic motivation for technological innovation, business model upgrading, and efficiency improvements. These potential impacts suggest that future policy design should balance short-term stabilization goals with long-term development incentives.

Based on the above findings, this study proposes the following policy recommendations: (1) Continue improving farmland infrastructure and strengthen agricultural technology and service support to reduce production risks. Efforts should be made to accelerate the modernization of farmland infrastructure, with a focus on enhancing key facilities for irrigation, drainage, frost prevention, and drought resistance, thereby improving regional disaster resilience and water resource efficiency. At the same time, investment in the development of new wheat varieties adapted to different ecological zones should be increased, with support for the promotion and application of stress-resistant, high-quality, and high-yield varieties. In terms of risk management, beyond the stabilizing function of price support policies, a comprehensive agricultural risk transfer mechanism should be gradually established. This includes optimizing insurance compensation procedures, expanding coverage, and improving farmers' awareness and participation. In addition, it is recommended that the government introduce agricultural service providers through public procurement to deliver integrated services such as sowing, harvesting, and storage. This approach can simultaneously reduce production costs, promote green transformation, and support the sustainable development of wheat production. (2) Optimize the incentive structure to enhance policy sustainability. Amid ongoing agricultural marketization reforms, grain price support policies continue to play a vital role in stabilizing and promoting wheat production, particularly by expanding sown areas. However, their positive effect on yield per unit area is mainly observed in the early stages of policy implementation. In the long run, excessive input by farmers may lead to declining resource-use efficiency and diminishing marginal returns. To address this, the incentive structure should be optimized by shifting the policy orientation from “income-driven” to “efficiency-driven”. A phased and differentiated subsidy mechanism could be introduced to encourage green investments and cost-saving practices such as fertilizer and pesticide reduction. At the same time, a dynamic adjustment and exit mechanism should be established to prevent over-incentivization and resource misallocation, thereby ensuring the long-term effectiveness and sustainability of the policy. (3) Establish a two-tier “central-provincial” decision-making system for grain price support policies to enhance differentiated responsiveness and implementation efficiency. Given the substantial differences across provinces in crop types, resource endowments, and consumption structures, greater policy adjustment autonomy should be granted to provincial governments under the unified national policy framework and overarching food security objectives. Provinces could flexibly adjust key parameters (e.g., the minimum purchase price level, activation timing, and procurement scale) based on the local dominant crop structure and the relative profitability of competing agricultural products. Meanwhile, a robust feedback and evaluation mechanism should be developed to dynamically adapt the support strategy. This would help avoid one-size-fits-all approaches that may lead to market distortions and resource misallocation, thereby enhancing overall policy effectiveness and the precision of agricultural governance. (4) Continue implementing and dynamically optimizing the grain price support policy to balance the dual goals of production stability and income growth. The grain price support policy has proven effective in stabilizing production; however, its prolonged application may lead to unintended externalities such as the distortion of market price signals. To address this, the market-based adjustment mechanisms should be further improved by enhancing the price discovery function of the grain futures market and establishing real-time monitoring systems for market prices and supply-demand dynamics. These measures will improve information transparency and dissemination efficiency, thereby guiding farmers toward rational expectations and enabling autonomous adjustments in crop structure. While maintaining stable production, greater emphasis should be placed on improving farmers' actual income levels. This can be achieved through diversified subsidy schemes (e.g., producer subsidies based on acreage or output, special subsidies for large-scale grain farmers, and incentives for scaled operations) to increase farmers' accessible cash income. At the same time, public financial investments should be coordinated to support green input subsidies and agricultural machinery service outsourcing, thereby reducing farmers' overall production costs. These efforts will jointly promote both yield enhancement and income improvement, ultimately advancing the efficient use of agricultural resources and the sustainability of grain production.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

SC: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. GL: Writing – review & editing, Conceptualization, Funding acquisition.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was funded by Key Project of National Social Science Late Grant of China (Grant No. 23FJYA001), the Open Project of Collaborative Innovation Center for Modern Grain Circulation and Security in Jiangsu Universities of China (Grant No. 20220101), and the 2021 Special Research Program for Doctoral Talents with National Special Needs (Grant No. BSZX2021-15).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^Data Sources: The data is sourced from the China Statistical Yearbook (1999) and the China Statistical Yearbook (2004).

2. ^Data Source: Calculated based on data from the China Statistical Yearbook, the 2021 provincial wheat production proportion is calculated as follows:2021 Provincial Wheat Production Proportion=(Sum of wheat production/area of 15 provinces Total national wheat production/area in 2021) × 100%.

3. ^Data source: the original data is sourced from the China Statistical Yearbook. The wheat production increase ratio is calculated as follows: Wheat Production Increase Ratio (Wheat Production in 2021 for each province—Wheat Production in 2006 for each province Wheat Production in 2021 for each province) × 100%.

4. ^Data source: the original data is sourced from the China Statistical Yearbook. The proportion of wheat planting area to the total grain planting area in Henan is calculated as Proportion of Wheat Planting Area in Henan=(Wheat Sown Area in Henan/Total Grain Sown Area in Henan) × 100%; The proportion of Henan's total wheat production to the national total wheat production is calculated as: The proportion of Henan's Wheat Production to National Wheat Production (Total Wheat Production in Henan/Total Wheat Production Nationwide) × 100%.

References

Abay, K. A., Breisinger, C., Glauber, J., Kurdi, S., Laborde, D., and Siddig, K. (2023). The russia-ukraine war: implications for global and regional food security and potential policy responses. Glob. Food Secur. 36:100675. doi: 10.1016/j.gfs.2023.100675

Alam, M. F. B., Tushar, S. R., Ahmed, T., Karmaker, C. L., Bari, A. M., de Jesus Pacheco, D. A., et al. (2024). Analysis of the enablers to deal with the ripple effect in food grain supply chains under disruption: implications for food security and sustainability. Int. J. Prod. Econ. 270:109179. doi: 10.1016/j.ijpe.2024.109179

Cao, H., Zhang, Y., and Sun, H. (2017). The potential impacts of reforming China's floor price policies on grains. Chin. Rural Econ. 11, 33–46. doi: 10.20077/j.cnki.11-1262/f.2017.11.003

Chen, H., Li, N., and He, Q. (2019). The food security effect of the minimum purchase price policy—based on an analysis of sample data from hubei province. Rural Econ. 17–24.

DeBoe, G. (2020). “Impacts of agricultural policies on productivity and sustainability performance in agriculture: A literature review,” in OECD Food, Agriculture and Fisheries Papers, Vol. 141, 1–79. doi: 10.1787/6bc916e7-en

Du, R., and Mao, X. (2017). Estimating the effects of the policies applied in major grain producing areas based on synthetic control method. Chin. Soft Sci. 31–38. doi: 10.3969/j.issn.1002-9753.2017.06.004

Du, Z., and Han, L. (2020). The impact of production-side changes in grain supply on China's food security. Chin. Rural Econ. 2–14.

Feng, Y., Yao, S., and Guo, Y. (2012). Unit area crop yield response to effective irrigation in china based on a panel data model. Resour. Sci. 34, 1734–1740.

Ferrara, E. L., Chong, A., and Duryea, S. (2012). Soap operas and fertility: evidence from brazil. Am. Econ. J.: Appl. Econ. 4, 1–31. doi: 10.1257/app.4.4.1

Hatab, A. A., Cavinato, M. E. R., Lindemer, A., and Lagerkvist, C.-J. (2019). Urban sprawl, food security and agricultural systems in developing countries: a systematic review of the literature. Cities 94, 129–142. doi: 10.1016/j.cities.2019.06.001

He, W. (2010). The current situation, problems, and improvement strategies of China's minimum grain purchase price policy. Macroeconomics 10, 32–36+4.

Hou, L., Qiu, H., Wang, Y., and Sun, L. (2015). The impact of climate change on agricultural production in China–an analysis based on a multiple inputs and outputs production function. J. Agrotechnol. Econ. 4–14. doi: 10.13246/j.cnki.jae.2015.03.001

Jacobson, L. S., LaLonde, R. J., and Sullivan, D. G. (1993). “Earnings losses of displaced workers,” in The American Economic Review (New York, NY: JSTOR), 685–709. doi: 10.17848/wp92-11

Jia, J., Sun, Z., and Li, X. (2019). The impact of the reduction of the minimum purchase price on farmers' enthusiasm for grain planting—an empirical analysis based on a moderated mediation effect model. Rural Econ. 67–72.

Jiang, H. (2018). The implementation of grain policy and its involving effect from 2013 to 2017. Reform 64–74.

Jiang, H., and Wu, Z. (2009). Evaluation of the effectiveness of the grain subsidy policy in Miluo City, Hunan Province—based on farmers' survey data analysis. Issues Agric. Econ. 31, 28–32.

Jiang, T. (2022). Mediating effects and moderating effects in causal inference. China Ind. Econ. 5, 100–120. doi: 10.19581/j.cnki.ciejournal.2022.05.005

Kambali, U., and Panakaje, N. (2022). A review on access to agriculture finance by farmers and its impact on their income. Int. J. Case Stud. Bus. IT Educ. 6, 302–327. doi: 10.47992/IJCSBE.2581.6942.0166

Lang, T., and Barling, D. (2012). Food security and food sustainability: reformulating the debate. Geogr. J. 178, 313–326. doi: 10.1111/j.1475-4959.2012.00480.x

Lankoski, J., and Thiem, A. (2020). Linkages between agricultural policies, productivity and environmental sustainability. Ecol. Econ. 178:106809. doi: 10.1016/j.ecolecon.2020.106809

Li, G., and Zheng, Y. (2014). Food price regulation, system costs and social welfare: based on the analysis of two price policies. Issues Agric. Econ. 8, 6–15. doi: 10.13246/j.cnki.iae.2014.08.002

Li, J., and Li, X. (2022). Influence of the reform of minimum purchase price policy on China's food security—taking rice as an example. Chin. J. Agric. Resour. Reg. Plann. 43, 46–57. doi: 10.7621/cjarrp.1005-9121.20220306

Li, M., Li, Z., Wang, D., Yang, X., Zhong, X., Li, Z., et al. (2005). Impact of natural disasters change on grain yield in China in the past 50 years. J. Nat. Disasters 14, 55–60. doi: 10.3969/j.issn.1004-4574.2005.02.010

Li, P., Lu, Y., and Wang, J. (2016). Does flattening government improve economic performance? evidence from China. J. Dev. Econ. 123, 18–37. doi: 10.1016/j.jdeveco.2016.07.002

Li, X., Yuan, Q., and Han, Y. (2019). Analysis on the influence mechanism of price support policies on grain planting area in China—based on wheat provincial-level panel data. Chin. J. Agric. Resour. Reg. Plann. 40, 89–96. doi: 10.7621/cjarrp.1005-9121.20190113

Liao, J., and Huang, Q. (2019). Price support policy and grain sustainable development capacity: Natural experiment based on corn temporary purchase and storage policy. Reform 115–125.

Lin, W., and Huang, J. (2021). Impacts of agricultural incentive policies on land rental prices: new evidence from China. Food Policy 104:102125. doi: 10.1016/j.foodpol.2021.102125

Liu, Z., Han, Y., and Meng, T. (2020). The impact of reducing the minimum purchase price on farmers' enthusiasm for growing grain—an empirical analysis based on moderated mediation model. Mod. Econ. Sci. 42, 122–132.

Ma, X. (2016). Food security issues under the new situation. World Agric. 238–241. doi: 10.13856/j.cn11-1097/s.2016.08.041

Meyer, M. A. (2020). The role of resilience in food system studies in low-and middle-income countries. Glob. Food Secur. 24:100356. doi: 10.1016/j.gfs.2020.100356

Mustafa, M. A., Mabhaudhi, T., and Massawe, F. (2021). Building a resilient and sustainable food system in a changing world-a case for climate-smart and nutrient dense crops. Glob. Food Secur. 28:100477. doi: 10.1016/j.gfs.2020.100477

Nerlove, M. (1958). The Dynamics of Supply: Estimation of Farmers' Response to Price. Vol. 2. Baltimore, MD: Johns Hopkins Press.

Nie, C., Jiang, H., and Duan, J. (2021). Spatial pattern evolution of global grain trade network since the 21st century. Econ. Geogr. 41, 119–127. doi: 10.15957/j.cnki.jjdl.2021.07.013

Qian, W., and Wang, D. (2015). How to stabilize corn supply in China: an empirical analysis based on provincial dynamic panel data. J. Agrotechnol. Econ. 22–32. doi: 10.13246/j.cnki.jae.2015.01.003

Rausser, G. C., Chalfant, J. A., Love, H. A., and Stamoulis, K. G. (1986). Macroeconomic linkages, taxes, and subsidies in the us agricultural sector. Am. J. Agric. Econ. 68, 399–412. doi: 10.2307/1241453

Schultz, T. W. (1966). Transforming traditional agriculture: reply. J. Farm Econ. 48, 1015–1018. doi: 10.2307/1236629

Shi, Y. (2007). Analysis of China's minimum grain purchase price policy under the new situation. Issues Agric. Econ. 76–79. doi: 10.3969/j.issn.1000-6389.2007.06.016

Simola, A., Boysen, O., Ferrari, E., Nechifor, V., and Boulanger, P. (2022). Economic integration and food security-the case of the afcfta. Glob. Food Secur. 35:100651. doi: 10.1016/j.gfs.2022.100651

Tian, Q., Yu, Y., and Li, C. (2022). Research on the impact of minimum purchase price on rice market price expectation. J. Huazhong Agric. Univ. 114–122. doi: 10.13300/j.cnki.hnwkxb.2022.05.012

Tong, X., Hu, D., and Yang, X. (2019). Policy effects evaluation of grain minimum purchase prices: Evidence from the wheat. Issues Agric. Econ. 85–95. doi: 10.13246/j.cnki.iae.2019.09.010

Tu, S., and Lan, H. (2013). Price fluctuation, price regulation and the policy effects of china's important agricultural products. Reform 12, 41–51.

Wang, H., Li, G., and Hu, Y. (2024). Study on the reform of the purchasing and storage system, the impact of income uncertainty and stable mechanism of corn production: Empirical analysis based on 247 prefecture-level cities in main corn producing areas. J. Agrotechnol. Econ. 124–144. doi: 10.13246/j.cnki.jae.2024.06.005