- 1School of Management, Henan Institute of Technology, Xinxiang, China

- 2Institute of Food and Strategic, Nanjing University of Finance and Economics, Nanjing, China

Examing the impact of China-US trade friction on China’s grain import resilience can provide valuable insights for China and other developing countries in achieving food security. On the basis of defining the theoretical connotation of China’s grain import resilience, this study employs data from 2013 to 2023 and applies a difference-in-differences (DID) approach to quantitatively analyzes the impact of China US trade frictions on China’s grain import resilience. The study shows that the trade friction between China and the United States has an obvious negative impact on the resilience of China’s grain imports. During the U.S.-China trade friction period, China’s grain import prices rose, price volatility increased, import volume declined, import tempo changed, and the degree of import diversification declined. This shows that China’s grain import resilience, recovery capacity and transformation and upgrading capacity need to be improved. Developing countries can enhance their food supply capacity by adopting measures such as diversifying import sources, expanding domestic production, promoting regional cooperation, and establishing strategic reserve systems. Specific strategies may include actively cultivating new trade partnerships, strengthening irrigation and water conservancy infrastructure, and modernizing grain storage facilities.

1 Introduction

The current landscape of international economic cooperation and competition is undergoing profound transformations. The Sino-US trade friction since 2018 has significantly impacted the stability of the global food supply chain, with measures such as tariff impositions and export restrictions further exacerbating volatility in the global food market. As the world’s largest food importer, China’s food industry has been notably affected by this trade friction. In response, China is actively working to enhance the resilience and risk resistance of its food supply chain to effectively mitigate the potential long-term challenges posed by the trade friction.

The concept of resilience thinking originated in ecology (Holling, 1973) and has since been widely applied across multiple disciplines, including ecosystems, regional economies, and industrial development. Similarly, the resilience of the food supply chain has garnered significant policy attention and academic discussion. Against the backdrop of profound changes in both domestic and international landscapes, the Chinese government has shifted its strategic focus in agricultural supply chain construction from emphasizing “stability” to enhancing “resilience.” The 2022 report of the 20th National Congress of the Communist Party of China explicitly called for “strengthening the resilience and security of industrial and supply chains.” This was further reinforced in the 2023 No. 1 Central Document, which emphasized “building a strong agricultural nation with robust supply security, advanced technological equipment, efficient management systems, strong industrial resilience, and competitive capabilities.” These policy directives underscore that enhancing supply chain resilience has become a core objective in China’s agricultural modernization efforts.

As for the concept of agricultural industry chain resilience, existing studies define it as the agricultural system’s capacity to withstand external shocks and rapidly recover from them (Lyu et al., 2025). In the context of the grain industry, resilience specifically denotes: the capacity to recover and even exceed pre-shock performance levels following disruptions (Ma et al., 2023), the ability to maintain supply chain continuity when confronted with internal and external shocks (Ansah et al., 2019), and the adaptive capacity and recovery speed of internal systems (Tendall et al., 2015). For China as a major grain importer, imports constitute a critical component of its grain industrial chain. However, current research on China’s grain import resilience remains limited, primarily focusing on influencing factors (Tian et al., 2024) and existing challenges (Zhang and Long, 2023). However, existing studies have rarely conducted quantitative analyses of grain trade resilience. Some research has proposed quantitative approaches to assess trade stability, which may inform resilience measurement. For instance: Export stability has been measured by the temporal persistence of trade flows (Hess and Persson, 2011); Trade stability has been evaluated through variations in trade values (Gnangnon, 2018).

Similarly, studies examining the relationship between trade frictions and grain import resilience are scarce. Chinese scholars have approached this topic through various lenses: food import security under current international circumstances (Wang and Wu, 2024), import risks induced by trade conflicts (Cheng and Zhu, 2020), and price/cost implications of imports (Adjemian et al., 2021). Against the backdrop of escalating U.S.-China decoupling risks and the normalization of great-power competition (Wang and Yang, 2025), the impacts of Sino-U.S. trade friction extend far beyond the two nations. These tensions have not only affected economic development in ASEAN and Brazil (Aslam, 2019; Rasador et al., 2024) but have also undermined the multilateral trade rule system (Bown, 2019). Compared to developed countries, developing nations often suffer disproportionately negative impacts from trade frictions. Analysis of global grain trade network resilience metrics reveals that developed economies demonstrate stronger pandemic shock absorption capacity, while smaller developing countries face persistent challenges (Zeng et al., 2025). Regional disparities in grain import costs emerge due to high production costs and trade conflicts, with Oceania, Central America, and landlocked African regions bearing the highest landed costs (Verschuur et al., 2025). Evidence from Bangladesh suggests governments must account for market instability and other factors affecting food system resilience (Ahmed et al., 2025). Recent research has also explored geopolitical conflicts’ impacts on food resilience in developing economies. Studies by Pan (2023) and Chen and Zhang (2024) reveal that geopolitical tensions have compromised food resilience in Indonesia and Russia, suggesting that developing nations should adopt more proactive measures to enhance domestic food security. These empirical findings demonstrate that developing countries should prioritize enhancing the resilience of their grain industries to strengthen their capacity to withstand trade frictions and geopolitical conflicts.

In summary, existing research has provided limited exploration of grain import resilience, leaving significant knowledge gaps in this field. Notably, three critical lacunae persist: the absence of a clear conceptual framework for grain import resilience, insufficient development of quantitative measurement indicators, and particularly scarce investigation into how trade frictions affect import resilience in developing economies. As the world’s largest developing country and top food importer, a systematic assessment of how trade frictions impact China’s grain import resilience holds dual significance: advancing theoretical frameworks while providing empirical foundations for other developing nations to enhance their import resilience. Compared to previous studies, this paper makes three key marginal contributions: First, it constructs a conceptual framework and quantitative metrics for import resilience; second, it employs difference-in-differences (DID) estimation to assess the magnitude of Sino-US trade friction’s impact on China’s food import resilience; third, it advances actionable policy recommendations to strengthen food import resilience in developing economies.

Following the introduction, Section 2 elaborates on the theoretical framework and impact mechanisms. Section 3 details the research design, while Section 4 presents the empirical findings. Section 5 provides an in-depth discussion, and Section 6 concludes with multilateral governance recommendations.

2 Theoretical analysis

2.1 Conceptualizing resilience in grain import systems

The concept of “resilience” encompasses not only the capacity to withstand and adapt to systemic shocks but also the ability to transition to a more desirable state (Hodbod and Eakin, 2015; Tendall et al., 2015). Supply chain resilience typically manifests through three core capacities: resistance, recovery, and transformation (Béné, 2020). Building on this framework, grain import resilience is defined as “the capacity of a grain import system to recover and transform in response to external and internal shocks and stressors.” Specifically, it reflects the system’s ability to maintain stable operations, recover to pre-shock conditions (Beyene et al., 2023), and achieve long-term adaptive upgrading (Nichols et al., 2022) when confronted with domestic or global disruptions. This resilience manifests in three dimensions: resistance capacity, recovery capacity, and transformative upgrading capacity. A highly resilient grain import system can rapidly restore trade to its original state or transition to an improved state following sudden shocks.

Grain import resistance refers to a nation’s capacity to maintain stable import operations amidst disruptions in international trade environments–such as geopolitical conflicts or natural disasters. For instance, during the Russia-Ukraine conflict when Ukrainian grain exports were severely disrupted, the European Union established a “Solidarity Lane” through Poland, Hungary, and Romania in May 2022. Approximately half of Ukraine’s grain exports were redirected through this land corridor, ensuring continued grain supplies to EU markets (Xu, 2024). Similarly, when soybean import prices surged due to droughts in South America, China stabilized domestic prices through strategic import pacing and reserve releases (NFSRA, 2022). These cases demonstrate that grain import stress resistance can be quantitatively measured through three key indicators: import volumes, import prices, and import price volatility.

Grain import recovery capacity denotes a nation’s ability to restore its import trade system to steady-state levels through adaptive adjustments following environmental shocks. Specifically, when abrupt disruptions sever existing trade relationships, entities with robust recovery capacity can rapidly establish alternative trade partnerships, smooth volumetric volatility, and rebalance import flows. For instance, when the 2022 Russia-Ukraine conflict drastically reduced Ukrainian wheat exports, Egypt mitigated the supply gap by increasing imports from France and Romania (FAO, 2023). This demonstrates that import volume volatility can serve as a measurable indicator of grain import recovery capacity.

As the breakthrough dimension of resilience, transformative upgrading capacity reflects dynamic adaptation process wherein the import system achieves efficiency gains and risk mitigation through structural optimization amid external shocks. Distinct from stress resistance capacities focused on short-term stabilization, this transformation capacity emphasizes systemic import system restructuring under protracted trade environment changes—converting external pressures into modernization drivers, most tangibly manifested through import diversification strategies. Economies with strong upgrading capacity can proactively develop superior alternative channels, diversify sourcing origins, and reduce systemic import risks. For instance, during the 2018 global rice price surge when traditional Philippine import sources (Vietnam and Thailand) imposed export restrictions, the Philippines secured rice import quotas through the ASEAN Emergency Rice Reserve Agreement with Cambodia and Myanmar. This strategic diversification stabilized domestic rice prices without triggering panic buying. Therefore, import diversification can serve as a measurable proxy for grain import transformation and upgrading capacity. This study employs the Herfindahl–Hirschman Index (HHI) to quantify diversification, where higher HHI values indicate lower diversification levels. The primary rationale for adopting HHI lies in its squaring calculation, which amplifies the weight of large supply sources, thereby more sensitively capturing the risks of “critical channel dependency.” Moreover, the HHI has been consistently employed by institutions such as the WTO and the EU to assess food market concentration, lending the metric greater universality and institutional validity.

2.2 The impact mechanism of trade frictions on food import resilience

Trade frictions undermine grain import resilience by distorting trade flows, exacerbating import dependency risks, and weakening supply diversification channels.

According to the theory of comparative advantage, grain trade should align with countries’ comparative advantages. However, trade frictions—particularly tariff barriers—artificially alter relative prices. Import tariffs elevate global grain prices (Bowm and Crowley, 2016), directly increasing consumer costs and inducing abnormal fluctuations in both import volumes and prices.

The strategic trade theory posits that governments should intervene in international trade to maximize national welfare. When major grain-exporting countries simultaneously raise trade barriers, importing countries face deteriorating terms of trade, which exacerbates market volatility (Johnson, 1953), increases procurement costs (Martin and Anderson, 2012), and may trigger broader food security crises (Cheng and Zhu, 2020). This subjects import-dependent nations to abnormal fluctuations in both import prices and quantities.

The theory of economies of scale suggests that non-tariff barriers (NTBs) increase fixed costs (e.g., certification fees), thereby intensifying market concentration and making trade more reliant on a limited number of large firms (Krugman, 1980). Additionally, NTBs induce a “selection effect,” favoring high-productivity firms while reducing the number of exporters—a process that heightens supply chain disruption risks (Melitz, 2003). Consequently, import-dependent countries face heightened import risk concentration and diminished diversification.

2.3 Impact mechanisms of U.S.-China trade frictions on China’s grain import resilience

China is the world’s largest importer of agricultural commodities, with soybeans constituting its most imported crop at an external dependency rate of approximately 90%. China’s wheat and corn imports have consistently exceeded tariff-rate quotas (TRQs) during 2020–2024. Meanwhile, China’s soybeans, corn, and wheat imports demonstrate high concentration on a few major producing nations, with the U.S. serving as a pivotal agricultural trade partner. Consequently, U.S.-China trade frictions have significantly undermined China’s grain import resilience.

U.S.-China trade frictions significantly erode China’s grain import resistance capacity, manifesting in reduced import volumes, elevated import prices, and amplified price volatility. According to the theory of comparative advantage, U.S. measures such as tariff impositions and export restrictions against China have increased China’s food import costs. This exposes China to risks of rising import prices and insufficient import volumes, ultimately leading to decreased import quantities, higher import prices, and increased price volatility.

U.S.-China trade frictions disrupt China’s grain import rhythm, undermining its recovery capacity. China’s heavy reliance on the United States and other major producers for grain imports, coupled with U.S. export restrictions under strategic trade protection theory, has significantly deteriorated China’s import conditions. Given China’s limited capacity to identify suitable alternative sources in the short term, import volume volatility has become inevitable. Furthermore, seasonal production cycles exacerbate these disruptions. Even when alternative suppliers (e.g., Ukraine for corn) theoretically possess surplus capacity, asynchronous harvest periods between hemispheres prolong adjustment timelines. This structural misalignment transforms transient trade shocks into sustained import instability.

U.S.-China trade frictions have elevated China’s grain import dependency risks. According to economies of scale theory, US measures like tariff impositions and export restrictions against China have increased exporters’ costs, thereby concentrating grain trade among fewer multinational corporations. Furthermore, these frictions have reduced China’s US grain imports while increasing reliance on alternative producers like Brazil. Collectively, this has intensified China’s import dependency risks, diminished diversification, and manifested in rising HHI values in China’s grain import markets during the trade conflict period.

3 Empirical methodology

3.1 Empirical strategy and contextual background

The U.S.-China trade conflict entered an escalatory phase on March 23, 2018, when the U.S. administration imposed 25% tariffs on $60 billion worth of Chinese imports under Section 301 of the Trade Act of 1974. This unilateral action marked the onset of sustained bilateral trade tensions, which persisted until December 2018 when both nations temporarily suspended tariff escalations through the Buenos Aires Consensus. Subsequently, China’s soybean import prices and volumes exhibited significant fluctuations, with imports from the United States even plunging to zero—a development that substantially impacted China’s domestic soybean industry. The impacts on China’s soybean sector have exposed systemic vulnerabilities in developing countries’ food supply chains and their limited bargaining power in international trade. Therefore, examining how U.S.-China trade frictions affect China’s food import resilience essentially serves as a critical test of developing nations’ food import security capacity under trade conflicts. This inquiry provides insights into potential pathways for China and other developing countries to build greater autonomy within asymmetric dependency relationships.

The escalation of U.S.-China trade frictions in 2018 represents a quintessential exogenous shock. Following U.S. tariff impositions on Chinese exports, China’s retaliatory measures significantly distorted bilateral trade flows and price mechanisms between the two nations. The disruption of their historically stable commercial relationship provides a unique quasi-experimental setting. Soybean trade serves as an ideal natural experiment for three reasons:

Policy exogeneity: As a non-strategic commodity with no direct linkage to China’s industrial policy disputes, soybean tariffs (implemented July 6, 2018) represent an exogenous shock.

Market concentration: The U.S. supplied 34.4% of China’s soybean imports pre-conflict (Customs, 2017), creating measurable baseline dependence.

Substitution elasticity: Limited short-term substitutability (Brazilian soybean production cycles lag by 6 months) amplifies observable adjustment dynamics.

Thus, we employ a difference-in-differences (DID) design to isolate the conflict’s impact on import resilience metrics.

3.2 Econometric model and variable description

3.2.1 DID baseline model

Currently, there is limited research on the resilience of grain imports, with most studies relying on qualitative analysis. This study draws on the methodologies of Wei et al. (2025) and Zhu et al. (2025). Wei et al. (2025) employed a difference-in-differences (DID) approach, treating the establishment of China’s free trade zones as a natural experiment to analyze the resilience of China’s grain industry chain. Similarly, Zhu et al. (2025) applied the DID method, using the National Modern Agricultural Demonstration Zones as a quasi-natural experiment to examine the resilience of China’s grain production. Both studies utilized the DID framework to investigate the impact of policy shocks on the resilience of China’s grain industry. Building on these works, this paper constructs the following econometric model to verify the impact of Sino-US trade friction on the resilience of grain imports.

In Equations 1–5, the subscripts t denote time, in Equations 1, 3, 4, the subscripts i denote region, in Equation 5 the subscripts k denote region varieties. Variable Resl serves as the proxy for grain import resilience. In alignment with the definition of grain import resilience proposed in this study, five indicators are utilized to capture the five dimensions of resilience: import price (Resl1), import price volatility (Resl2), import volume (Resl3), import volume volatility (Resl4), and import source diversification (Resl5). Here, diversification is quantified using the Herfindahl Index of import markets. Drawing on the frameworks of Lin et al. (2023) and Li and Han (2020), control variables including China’s Gross Domestic Product (GDP), market share of exporting countries in China’s grain imports (pro), exchange rates (ex), and U.S. futures market prices (PUS) are incorporated. These variables collectively address the effects of China’s grain import demand, competitive dynamics of China’s import market, import costs, and global grain pricing mechanisms on resilience. Specifically: GDP reflects domestic demand for grain imports; market competition structure (pro) influences China’s bargaining power and supply accessibility; exchange rates (ex), adjusted by exporting countries, directly affect import costs; U.S. futures prices (PUS) act as a global benchmark for grain pricing. Given their theoretical and empirical relevance to China’s grain import resilience, these variables are integrated into the econometric model. Additionally, P denotes the soybean import price, ∆P represents the price difference between the top two importing countries, and fri is a policy dummy variable distinguishing the treatment group (fri = 1) from the control group (fri = 0). The time dummy variable captures the policy implementation period: the Sino-US trade friction began on March 23, 2018, and concluded in December 2018. Thus, time = 1 for April–December 2018, and time = 0 otherwise. The interaction term did (fri × time) quantifies the policy effect of the Sino-US trade friction. , , , denote residual terms, while i and t represent individual and time variables, respectively.

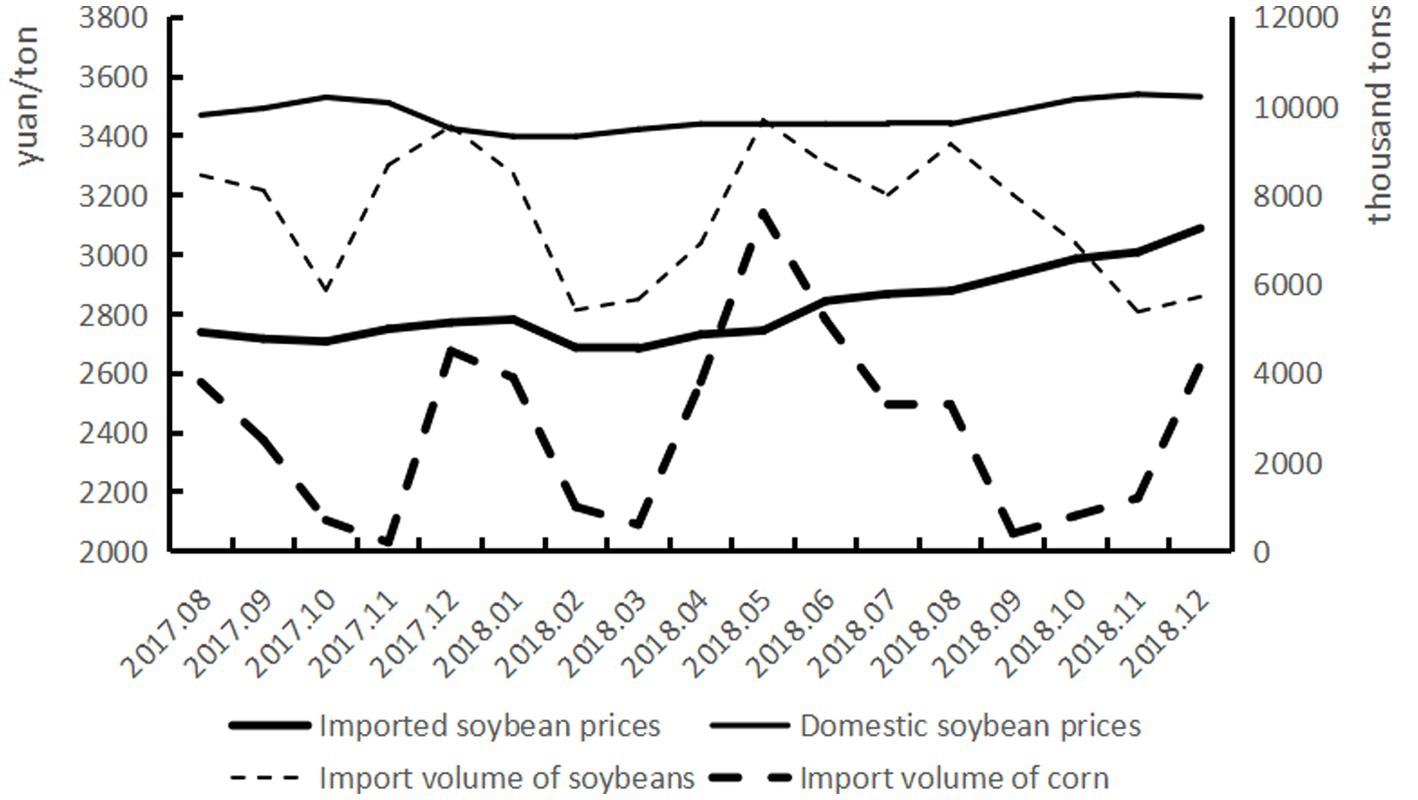

Regarding the specification of the DID framework: In Equation 1, soybean imports from the U.S., Brazil, and Argentina are designated as the treatment group, while domestic soybeans serve as the control group. The China-US trade friction specifically imposed tariffs on imported soybeans (treatment group), while domestic soybeans remained unaffected (control group). This natural experiment enables rigorous estimation of heterogeneous effects. Furthermore, as illustrated in Figure 1, their price trajectory closely mirrored that of imported soybeans prior to the Sino-US trade friction. Post-friction, imported soybean prices surged significantly, whereas domestic prices remained relatively stable, creating a divergence that satisfies the parallel trends assumption for DID analysis. For Equation 2, econometric testing reveals that imported and domestic soybean prices exhibited divergent trends prior to the policy intervention, violating the parallel trends prerequisite for control group selection.1 Consequently, only a time dummy variable is employed to isolate the impact of the trade friction on imported soybean price volatility. In Equation 3, the treatment group comprises soybean imports from the U.S., Brazil, and Argentina, while imported corn is selected as the control group. Given that both corn and soybeans are China’s primary agricultural imports, the selective imposition of tariffs solely on soybeans during the China-US trade friction creates a natural experiment. Using corn imports as the control group enables causal identification of tariff effects on import volume stability for soybeans. Furthermore, As shown in Figure 1, both soybean and corn import volumes followed similar trends pre-friction but diverged post-friction, fulfilling the DID parallel trends criterion. The experimental design in Equation 4 replicates Equation 3’s treatment/control structure, as both equations analyze import volume determinants. In Equation 5, the imported soybean market is designated as the treatment group, with the imported corn market serving as the control group, to further assess differential policy effects across commodity markets.

3.2.2 Dynamic effect model

On the basis of Equations 1, 3–5, this chapter uses event analysis to construct a dynamic DID model, as follows:

In Equations 6–9, represents the antecedent of the m (m = 1,…, M) period of the China US economic and trade friction; represents the lagged term of the n (m = 1,…, N) period of the China US economic and trade friction, with being other control variables that are the same as Equations 1, 3–5.

3.3 Data sources

The trade data used in this study were obtained from the official website of the General Administration of Customs of China. U.S. futures price data were sourced from the Bric Agricultural Products Database, exchange rate data from the World Bank’s official website, and China’s GDP data from the National Bureau of Statistics of China. Monthly GDP values were calculated based on quarterly GDP data and monthly industrial value-added figures. To address endogeneity concerns, import prices were replaced with a three-month moving average of consecutive price data. Logarithmic transformations were applied to relevant variables in econometric tests to mitigate heteroscedasticity. This study employs monthly data spanning 2013–2018. For Equations 2, 4, the data selection period was narrowed to January 2016–December 2018 to isolate the direct impacts of China-U.S. economic and trade frictions by minimizing interference from multi-factor fluctuations over longer time spans. Equations 3, 5 utilize data from June 2014 to December 2018 due to publication timeline constraints on corn import price statistics. Missing values were imputed using interpolation methods.

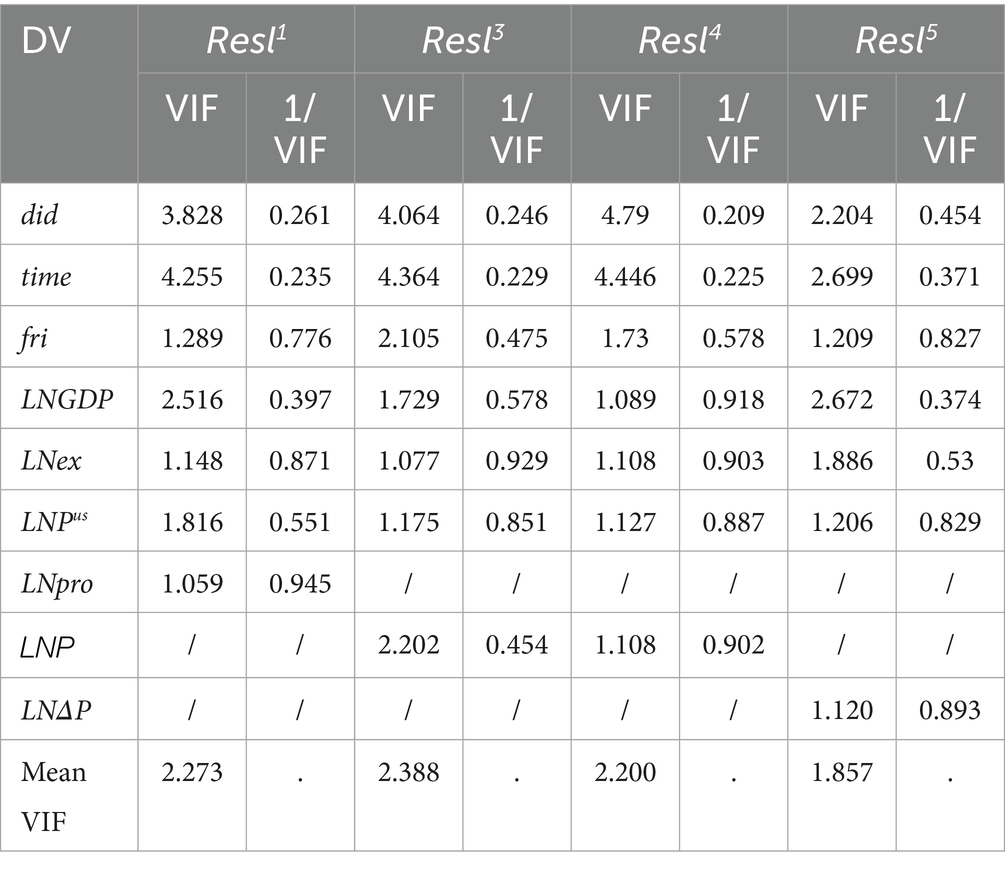

To address potential multicollinearity concerns, we conducted diagnostic tests using variance inflation factors (VIFs). Following conventional diagnostic thresholds, VIF values below 10 are generally considered indicative of acceptable collinearity levels. As shown in Table 1, all explanatory variables demonstrated VIF values under 5, substantially below the critical threshold. These results confirm the absence of significant multicollinearity among the selected predictors in our empirical framework.

4 Analysis of empirical results

4.1 Baseline regression results and analysis

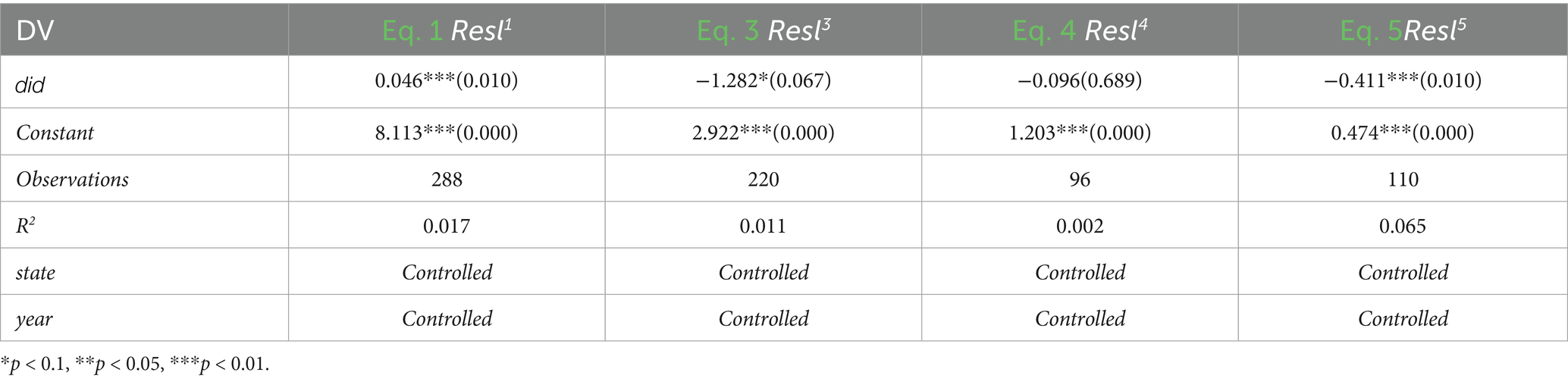

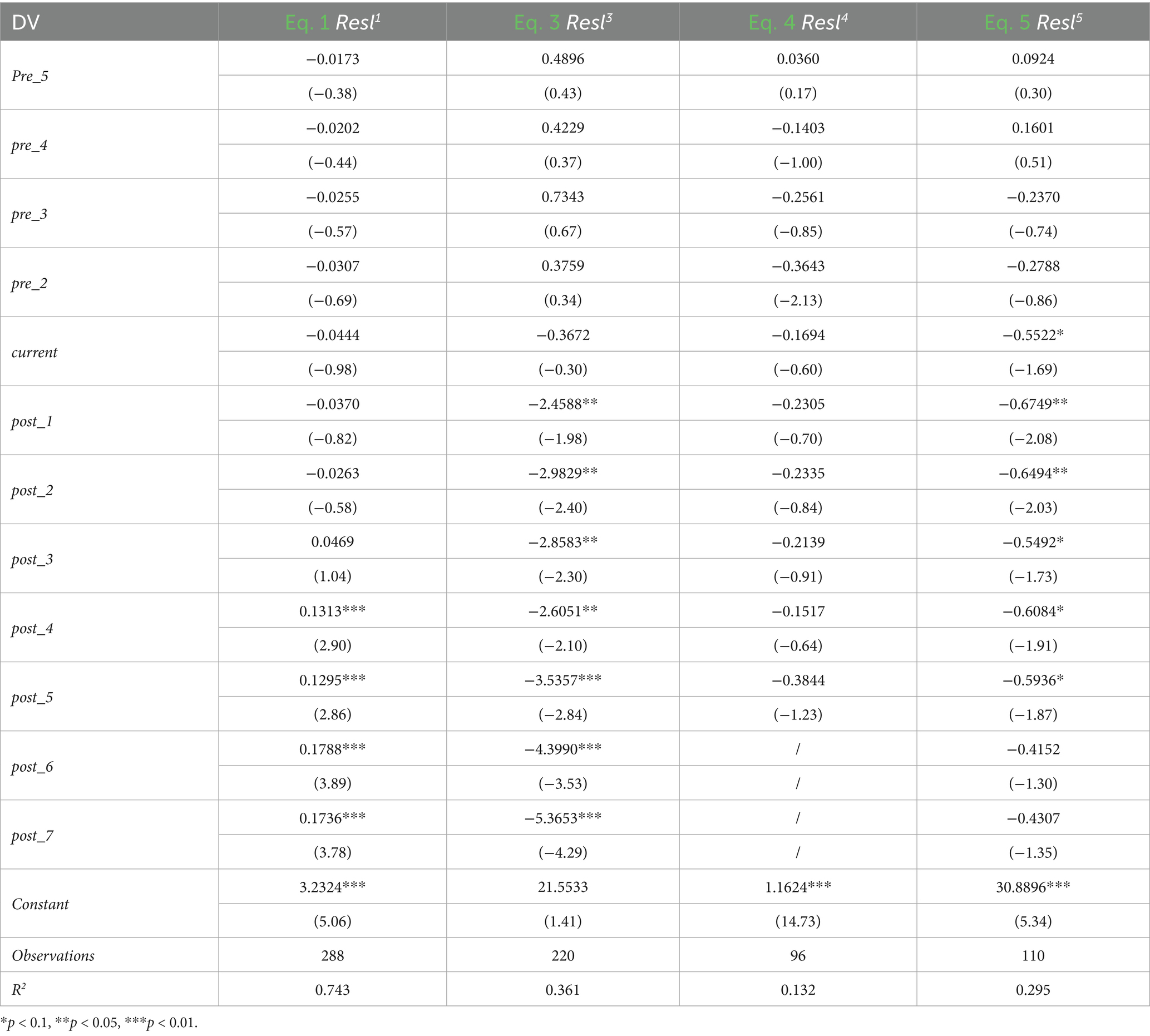

The econometric tests for Equations 1–5 were conducted in Stata 18.0 and the results are presented in Tables 2, 3. After controlling for region and year fixed effects, the coefficient on the core explanatory variable in Equation 1 equals 0.046 and is significant at the 1 percent level, indicating that Sino–US trade friction increases China’s soybean import price by an average of 0.046 units; this effect likely reflects the need to source soybeans from alternative suppliers whose higher production or transportation costs, combined with China’s lack of pricing power in the global market, drove up import prices. In Equation 3 the coefficient equals −1.282 and is significant at the 10 percent level, demonstrating that trade friction reduces China’s soybean import volume by about 1.282 units, plausibly because higher tariffs and non-tariff barriers on US soybeans sharply increased import costs and led firms to curtail purchases from the United States and similarly affected regions. The coefficient in Equation 4 equals −0.096 but does not reach statistical significance, suggesting that trade friction has no discernible impact on the timing of soybean imports, a finding that may reflect the masking effects of firms’ inventory strategies and seasonal demand fluctuations. Finally, the coefficient in Equation 5 equals −0.411 and is significant at the 1 percent level, implying a substantial decline in market diversification—as measured by the Herfindahl index—following the onset of Sino–US trade friction.

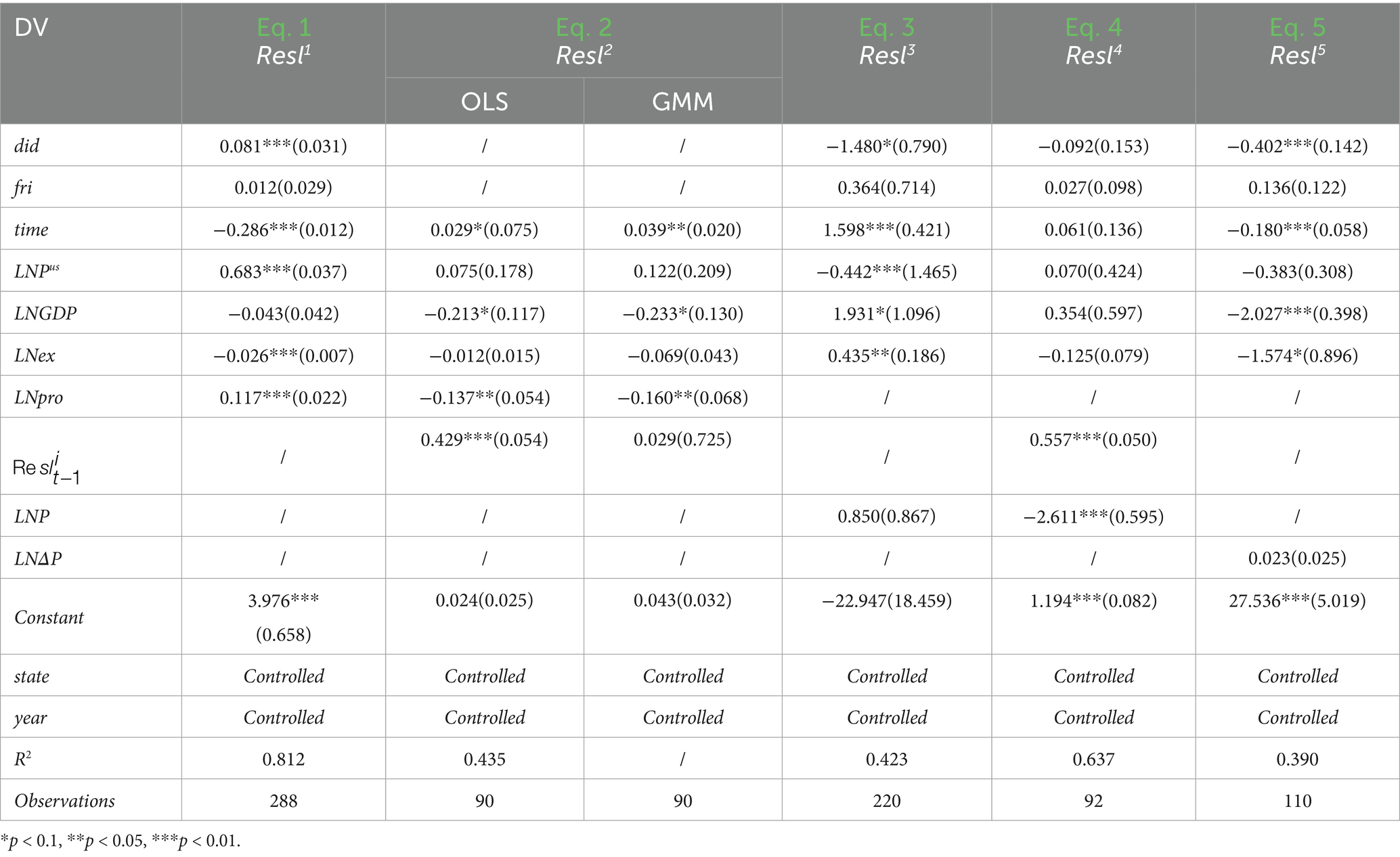

Table 3 employs a stepwise regression approach, with the inclusion of pertinent control variables, to examine in detail the impact of Sino–US trade friction on the resilience of China’s soybean imports. As shown in the table, the policy effect in Equation 1 is statistically significant at the 1% level with a positive coefficient, indicating that the China-U.S. economic and trade frictions significantly increased China’s soybean import prices. Since Equation 2 incorporates a first-order lagged variable, both panel OLS and system GMM methods were applied for estimation. The GMM approach effectively mitigates endogeneity issues and demonstrates higher efficiency. Results from both panel OLS and system GMM models in Table 1 confirm that the policy effect remains significantly positive, suggesting that the trade frictions notably amplified volatility in China’s soybean import prices. In Equation 3, the policy effect exhibits a statistically significant negative correlation at the 10% level, implying that the trade frictions substantially reduced China’s soybean import volumes. Equation 4 shows an insignificant policy effect, indicating no statistically significant impact of the trade frictions on the import timing rhythm of Chinese soybeans. Finally, Equation 5 reveals a statistically significant negative coefficient for the policy effect at the 1% level, demonstrating that the trade frictions significantly lowered the Herfindahl index of China’s soybean import market—thereby reducing the diversification level of China’s soybean import sources.

The findings collectively demonstrate that the China-U.S. economic and trade frictions exerted significant adverse effects on the resilience of China’s grain imports. Specifically, China’s soybean import prices surged markedly, price volatility intensified, import volumes declined substantially, and import diversification diminished, reflecting insufficient price resilience and industrial upgrading capacity in China’s grain import system. The vulnerabilities in price resilience and upgrading capacity primarily stem from China’s high external dependency on grain imports, concentrated sourcing channels, and limited pricing power in international markets. Equation 4 suggests that the trade friction had no statistically significant effect on the temporal pattern of China’s soybean imports. This resilience likely stems from import substitution: While China temporarily halted soybean imports from the U.S., the timing of the trade friction outbreak coincided with the harvest season of Brazilian soybeans (March annually). Consequently, increased imports from Brazil offset the reduced U.S. imports during March–September 2018, aligning with China’s typical seasonal procurement patterns. Although U.S. soybean imports remained suspended after September 2018, the December 2018 bilateral agreement to mutually reopen markets further mitigated disruptions to China’s soybean import rhythm. Notably, while the 2018 trade frictions did not significantly disrupt China’s soybean import patterns, potential future trade conflicts may still pose risks to the stability and diversification of China’s grain import strategies.

4.2 Dynamic regression results and analysis

This section systematically examines the dynamic impact mechanisms of China-U.S. trade frictions on the resilience of China’s soybean imports based on Equations 6–9, while controlling for key variables consistent with previous specifications. The regression results are presented in Table 4. The empirical analysis reveals that the policy effects of trade frictions exhibit significant time-varying characteristics and indicator heterogeneity, which can be decomposed into three dimensions:

First, regarding the immediate effects of trade friction shocks, the 5 months preceding the trade friction outbreak showed no statistically significant impact on import resilience indicators except for the soybean import diversification index. A significant negative shock emerged on both import volume and diversification index immediately upon the friction’s initiation, demonstrating the direct structural reconfiguration effect of policy shocks on supply chains. Second, in terms of medium-term transmission effects, differentiated response patterns emerged across indicators: Import volumes exhibited progressively intensifying pressure, with impact magnitude significantly deepening several months post-friction; Import prices displayed significant positive fluctuations after an adjustment lag, showing persistent strengthening effects over time that confirm the existence of time-delay mechanisms in price transmission; The import diversification shock demonstrated convergent trends, reflecting market agents’ dynamic adaptive capabilities. Third, regarding structural transmission mechanisms, the empirical results indicate: Import rhythm adjustments failed to achieve statistical significance, closely related to the buffering effect of China’s strategic reserves and seasonal factors during the friction’s onset; The asymmetry in price transmission highlights China’s disadvantaged position in global soybean pricing power, with international futures market fluctuations demonstrating stronger explanatory power over domestic import prices than vice versa.

These findings yield crucial policy implications: First, the observed transmission lags provide critical time windows for establishing risk early-warning mechanisms; Second, the dynamic adjustment trajectory of import diversification underscores the necessity to strengthen market resilience through diversified supply alliances; Finally, the persistent intensification of price responses emphasizes the urgency to enhance pricing discourse power, warranting reforms in futures market mechanisms and innovations in reserve management systems. The conclusions provide theoretical foundations for improving agricultural trade risk prevention frameworks.

4.3 Robustness checks

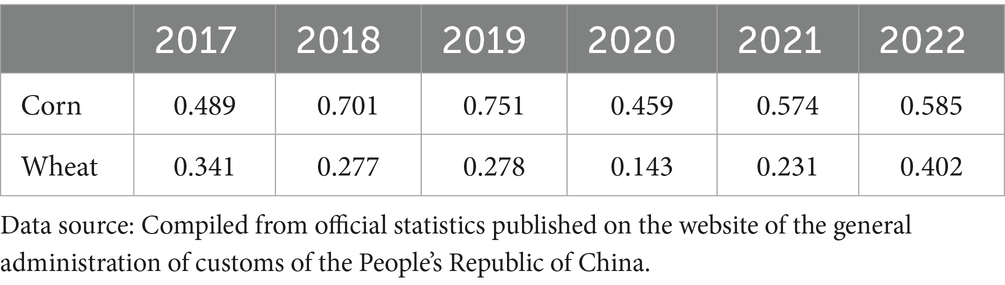

4.3.1 Parallel trend test

Before applying the difference-in-differences method, it is essential to confirm the parallel-trend assumption to ensure that treatment and control groups followed similar paths before policy implementation. To this end, we employ an event-study design, creating a sequence of period-specific dummy variables interacted with the onset of Sino–US trade friction. Figure 2 presents the parallel-trend test results, using the “pre_1” period as the reference. All estimated coefficients for import price, volume, timing, and market diversification oscillate around zero before the intervention, and their confidence intervals include zero. This demonstrates that, prior to the trade-friction shock, the trajectories of China’s soybean-import resilience indicators were statistically indistinguishable across treatment and control groups, thus satisfying the parallel-trend assumption and providing a valid foundation for subsequent difference-in-differences causal analysis.

Figure 2. Parallel trend test of China’s soybean import resilience. (a) Parallel trend test of import prices. (b) Parallel trend test of import volume. (c) Parallel trend test of Import rhythm. (d) Parallel trend test of import market diversification.

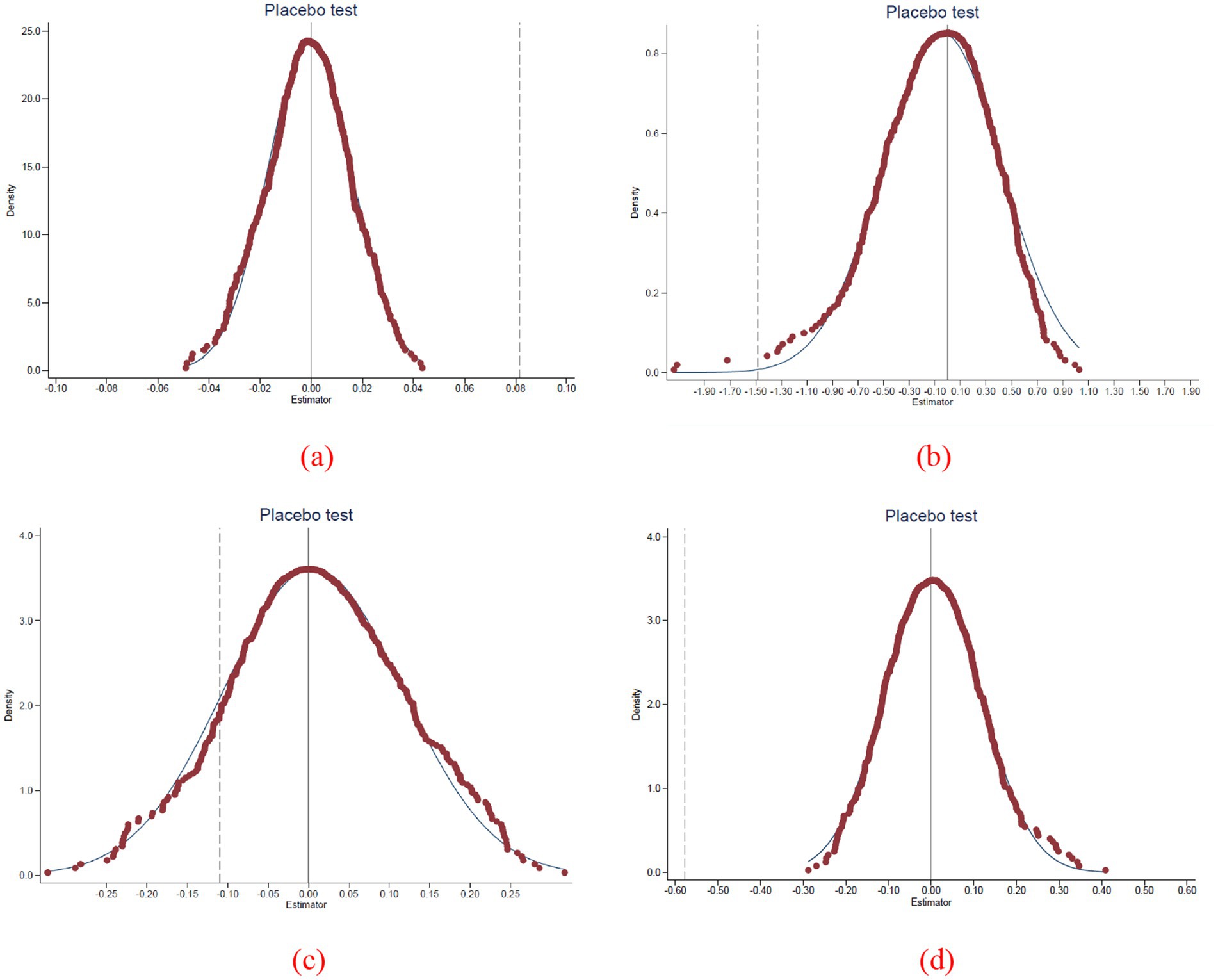

4.3.2 Placebo test

To ensure that the observed changes in China’s soybean import resilience are attributable specifically to the Sino–US trade friction rather than to other unobserved factors, we conduct a placebo test inspired by Ferrara et al. (2012) and Li et al. (2016). We begin by randomly assigning trade regions to “treated” and “control” groups and independently generating fake intervention dates, thereby creating two layers of placebo experiments. For each random assignment, we re-estimate the baseline regressions from Table 2 and record the significance of the difference-in-differences coefficient. We repeat this procedure 500 times to enhance statistical power and then plot the resulting distribution of estimated coefficients in Figure 3. Had unobserved confounders driven our results, many placebo estimates would lie significantly away from zero. Instead, the distribution of the placebo coefficients is tightly clustered around zero, demonstrating that our specification does not omit any major influences and confirming that the impact of Sino–US trade friction on China’s soybean import resilience is genuine and robust.

Figure 3. Placebo test of China’s soybean import resilience. (a) Placebo test of import prices. (b) Placebo test of import volume. (c) Placebo test of Import rhythm. (d) Placebo test of import market diversification.

5 Impacts of the new wave of economic frictions on China’s grain import resilience

The Russia-Ukraine conflict, which erupted in February 2022, triggered multiple rounds of Western sanctions against Russia, imposing severe restrictions on its participation in international trade. As both nations are critical global exporters of grain and energy, the conflict has escalated into a new wave of global economic and trade frictions, imposing significant shocks on global grain supply chains. This disruption is primarily manifested through three dimensions: heightened systemic fragility in global food networks, widespread supply chain blockages, and sharp price surges in key staple crops (Pan, 2023). Unlike the China-U.S. economic and trade frictions, China has not been directly involved in the Russia-Ukraine conflict. Nevertheless, its grain market has experienced significant volatility. It is therefore imperative to examine the shocks to China’s grain import resilience, as the findings offer valuable insights for developing economies seeking to enhance resilience and mitigate systemic risks amid global turbulence. Given that Russia and Ukraine are major exporters of wheat and corn, with Ukraine being one of China’s primary sources of corn imports and China having established wheat trade cooperation with Russia, this analysis focuses on wheat, and corn trade data to assess the impacts of the new economic frictions on China’s grain import resilience.

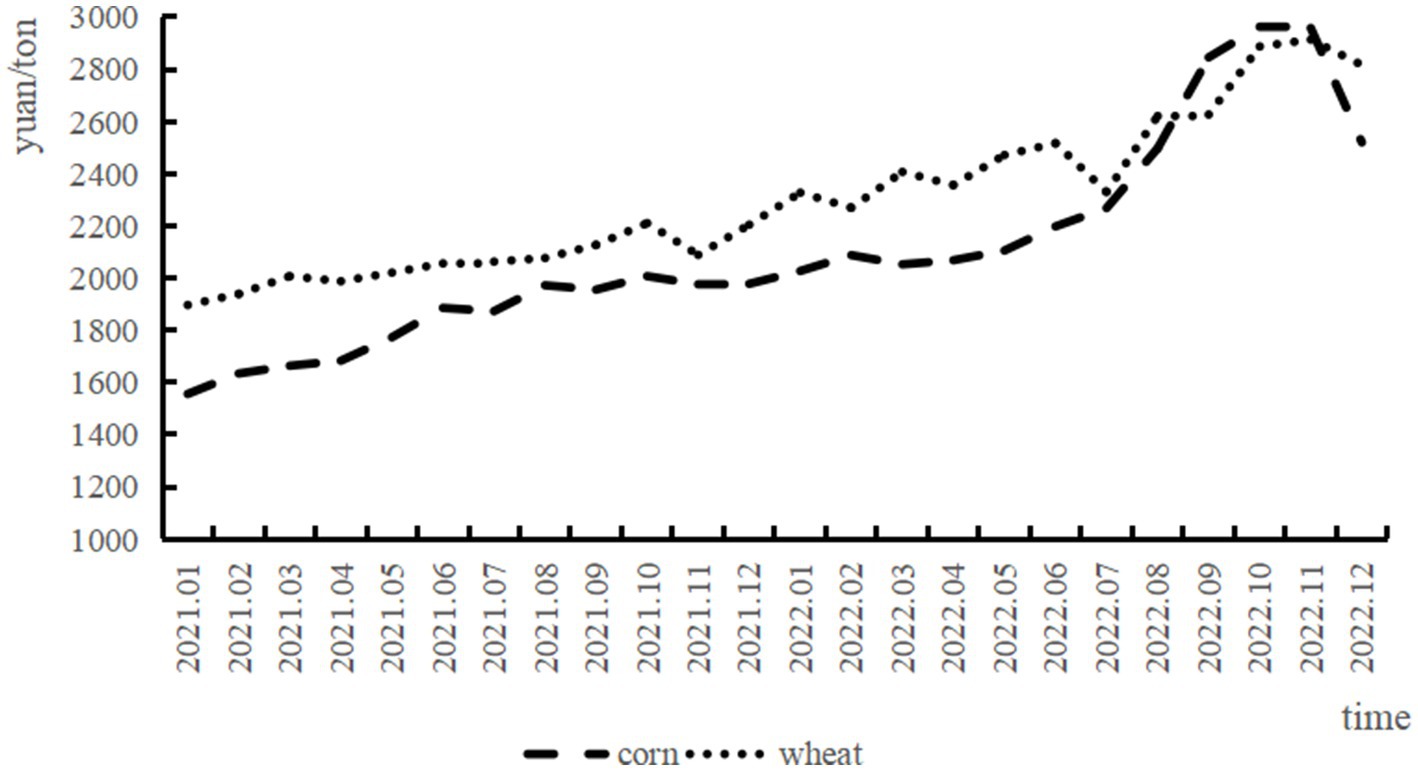

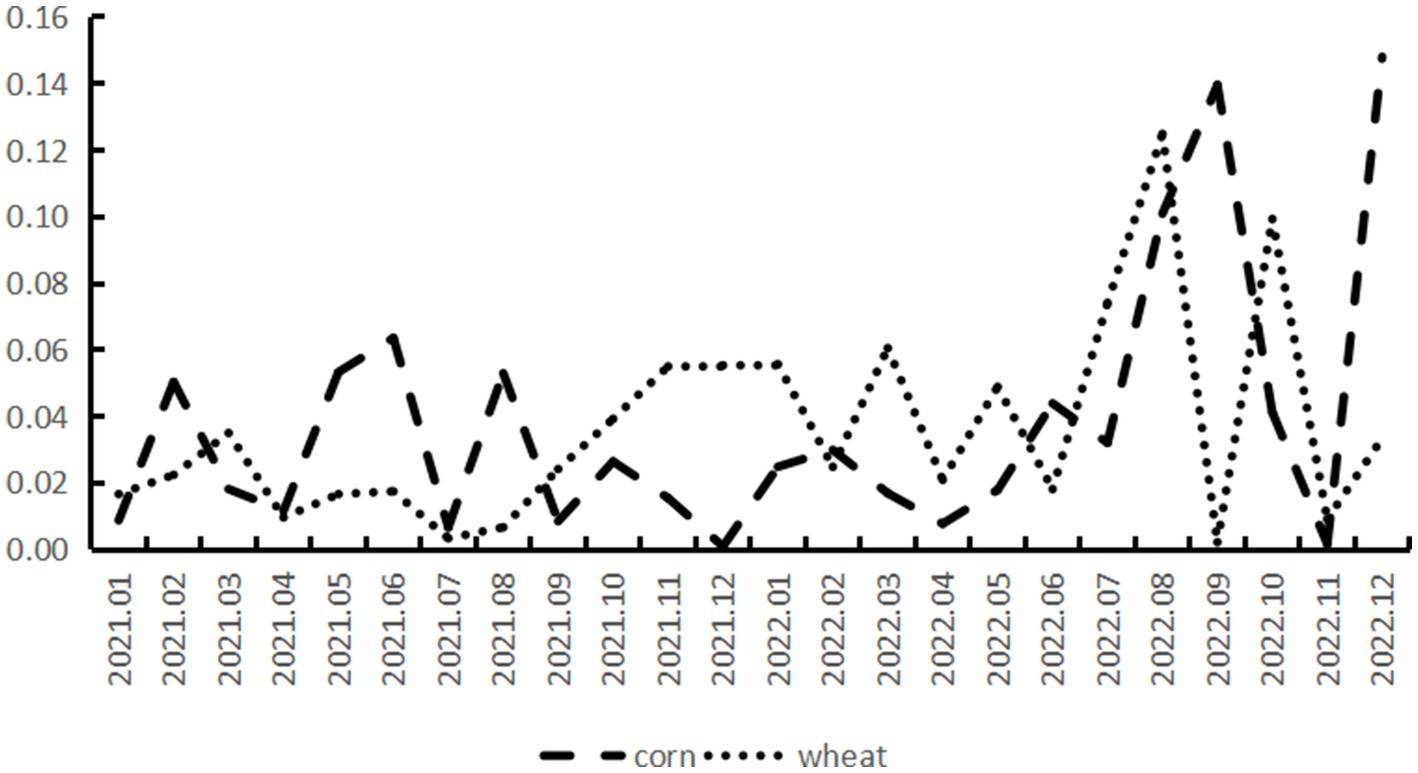

During the Russia-Ukraine conflict, China demonstrated weak resilience in grain import pressure resistance. As illustrated in Figure 4, following the outbreak of the Russia-Ukraine conflict in February 2022, China experienced marked surges in import prices for corn and wheat. Figure 5 further reveals that price volatility for imported wheat and corn notably intensified after the conflict began. Furthermore, following the outbreak of the Russia-Ukraine conflict, China’s wheat import growth rate narrowed significantly while corn imports declined substantially.2 These observations demonstrate that China’s grain import market experienced severe fluctuations during the conflict period, exhibiting inadequate pressure resistance capacity.

Figure 4. Import prices of China’s corn and wheat. Data source: official website of the general administration of customs of the People’s Republic of China.

Figure 5. Import price volatility of china’s corn and wheat. Data source: Official website of the general administration of customs of the People’s Republic of China.

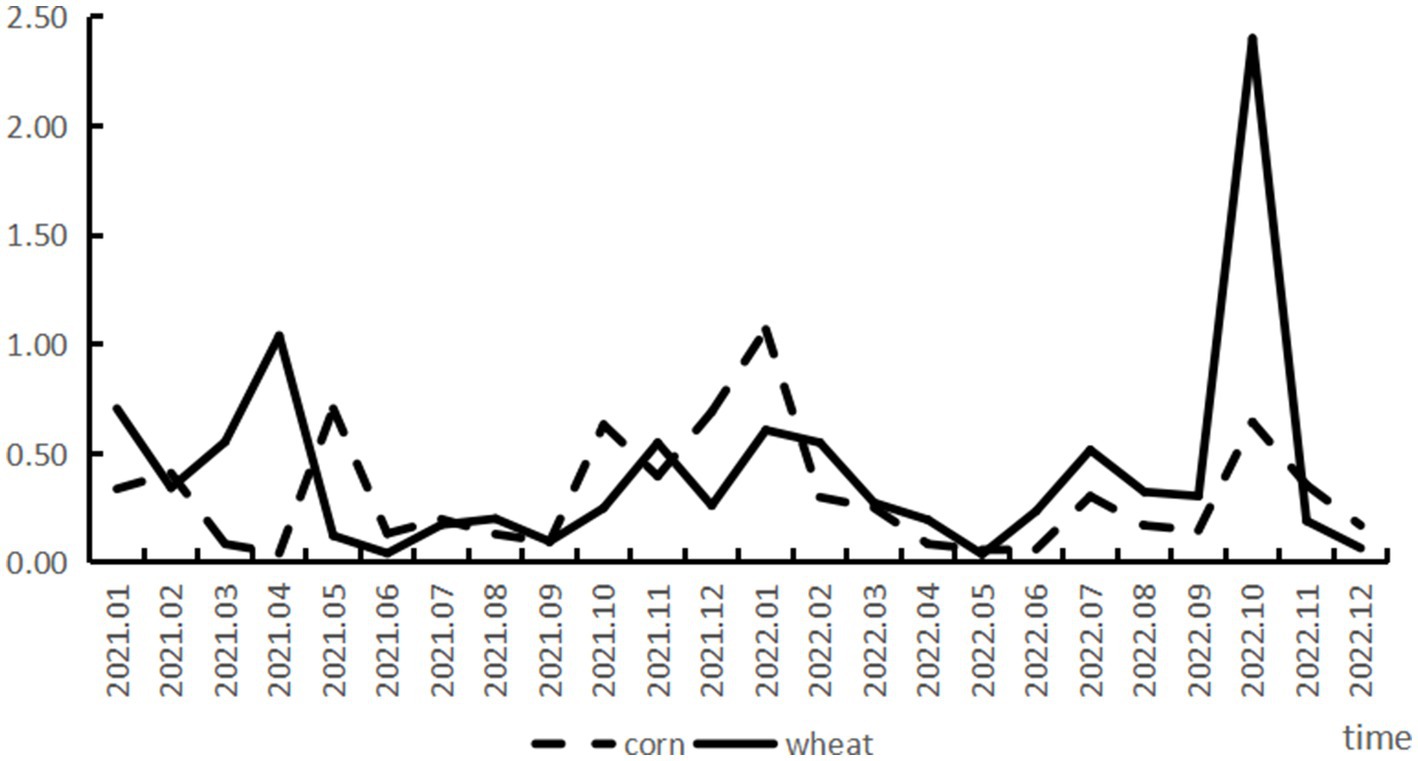

China demonstrated weak recovery capacity in grain imports during the Russia-Ukraine conflict. As illustrated in Figure 6, the volatility of China’s corn and wheat import volumes underwent significant changes following the conflict’s outbreak. With China’s corn imports showing a sustained decline, the import volume volatility initially decreased gradually, before experiencing renewed fluctuations after June 2022. Concurrently, wheat import growth slowed markedly, with import volume volatility reaching a distinct peak in October 2022. These patterns reveal substantial fluctuations in China’s grain import volumes during the conflict period, indicating limited import recovery capacity.

Figure 6. Fluctuation rates in China’s rice and wheat import volumes. Data source: Official website of the General Administration of Customs of the People’s Republic of China.

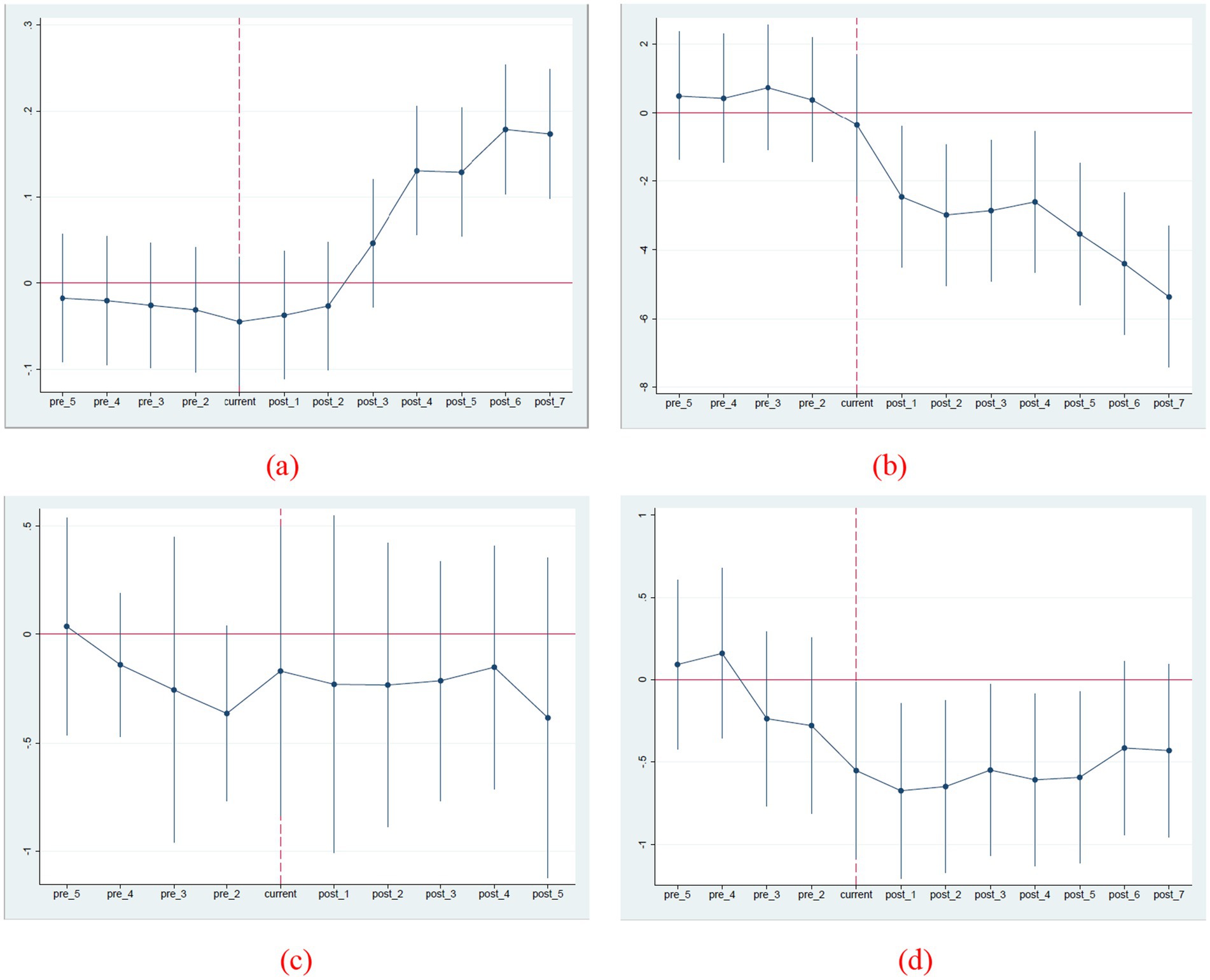

China exhibited weak industrial upgrading capacity in grain imports during the Russia-Ukraine conflict. As shown in Table 5, the HHI for China’s corn and wheat import markets increased in 2022, with a particularly pronounced rise in the wheat import market concentration. Following the conflict’s outbreak, China was compelled to expand corn imports from Brazil while increasing wheat imports from Australia and France, leading to greater concentration in its wheat and corn import markets. These developments reveal the negative impact of the new wave of economic and trade frictions on the diversification of China’s grain imports, thereby undermining its capacity for industrial upgrading in grain import markets.

In summary, the new wave of economic and trade frictions has indeed exerted significant impacts on China’s grain import resilience, as evidenced by suboptimal performance across three critical dimensions: resistance capacity, recovery capacity, and transformative upgrading capacity. This reveals that such resilience is influenced not only by direct trade conflicts between China and other nations, but also indirectly through global economic confrontations between third-party countries. The global grain market currently exhibits a structural dichotomy: production and exports are highly concentrated in a limited number of countries, while consumption and imports are geographically dispersed. This configuration exacerbates market vulnerability to external shocks, including export policy adjustments, oligopolistic practices among suppliers, logistical disruptions, and regional conflicts (Wang and Wu, 2024). Therefore, economic and trade frictions between major grain-producing nations inevitably generate spillover effects on global markets, exposing grain-importing countries to persistent external risks. Concurrently, many developing countries occupy a structurally disadvantaged position within the global grain market, rendering them particularly vulnerable in securing stable food supplies. This phenomenon underscores the inadequate import resilience of developing economies, which exhibit greater sensitivity to price fluctuations and more vulnerable supply chains—often trapped in the dual dilemma of “high import dependence coupled with low adaptive capacity.”

6 Research findings and policy implications

Against the backdrop of increasingly complex global dynamics, this study articulates the conceptual dimensions of grain import resilience, systematically examines the impact mechanisms of China-U.S. geo-economic tensions on grain import resilience, and quantifies these effects through a quasi-natural experiment design based on the 2018 bilateral economic confrontation. The principal findings are as follows:

First, grain import resilience constitutes a multi-dimensional construct encompassing shock absorption capacity, recovery capacity, and structural upgrading capabilities, which collectively safeguard national food security through their interdependent mechanisms. Second, the 2018 China-U.S. geo-economic tensions exerted significant negative impacts on grain import resilience. Empirical analysis reveals that during this period, soybean imports exhibited substantial price escalation, intensified price volatility, and notable declines in both import volume and source diversification, demonstrating deficiencies in price shock resistance and structural adaptation, though recovery capacity remained relatively resilient. Third, China’s grain import resilience faces compound risks from indirect spillover effects of global economic confrontations. The 2022 geo-economic turbulence triggered synchronized pressures across staple grains: price surges, amplified volatility, import contraction, disrupted procurement patterns, and reduced source diversification, collectively indicating systemic vulnerabilities in risk buffering, market rebalancing, and supply chain transformation that necessitate continued vigilance against international market instabilities.

As the largest developing economy, China’s experience with the U.S.-China geo-economic tensions provides critical insights into grain import resilience challenges confronting developing nations. Typically characterized by insufficient import resilience, developing economies face heightened risks of abnormal fluctuations in both import volumes and prices—along with increased import concentration—whether through direct bilateral trade conflicts or indirect global market disruptions. These findings underscore the imperative for China and peer developing countries to enhance grain supply chain resilience through the following strategic measures.

First, promote the diversification of import sources. Following the China-US trade friction, China has accelerated cooperation with emerging agricultural countries such as Brazil, Russia, and Southeast Asian nations to reduce its reliance on the United States. Following the outbreak of the Russia-Ukraine conflict, Egypt mitigated its supply gap by increasing grain imports from Romania and France (FAO, 2023). Therefore, developing countries should also actively explore new trade partners, strengthen agricultural collaboration with other developing nations, and formulate differentiated import strategies for various grain categories to avoid excessive concentration in a single product.

Second, promote the localization of production capacity enhancement initiatives. Developing countries should strengthen farmland water conservancy infrastructure by constructing irrigation systems and improving medium- and low-yield farmland. For instance, India has implemented the National Mission for Sustainable Agriculture (NMSA-RKVY), enhancing agricultural productivity and sustainability through the adoption of organic farming practices, precision agriculture technologies, and water-saving irrigation systems (Meng, 2025). Additionally, developing countries should promote agricultural technological innovation to enhance crop yields. The Indonesian government has forged public-private partnerships with agri-tech firms to deliver multimodal training programs for farmers. The adoption of novel technologies now constitutes the paramount pathway for enhancing the nation’s grain sector (Pan, 2023). Furthermore, developing countries shoul strengthen their enabling policy frameworks, exemplified by establishing agricultural insurance schemes and refining rural credit mechanisms. Illustratively, Brazil’s provision of diversified agricultural credit instruments has accelerated the industrialization and commercialization of large-scale farms, thereby boosting agricultural output (Meng, 2025).

Third, establish new regional cooperation models. Developing countries should actively enhance cooperation by establishing regional food trade alliances, such as the China-ASEAN Food Security Partnership, to facilitate market information sharing and coordinated emergency reserves. Furthermore, within frameworks like RCEP and BRICS, they should reduce tariffs on food imports, streamline inspection and quarantine procedures, and promote trade facilitation.

Fourth, establishing reserve systems. China’s quadripartite grain reserve system–integrating central government, local authorities, enterprises, and farm households–maintains coupled reserves of raw grains and processed grain products, effectively mitigating supply chain disruptions (Cheng and Zhu, 2020). Developing countries should establish robust grain reserve systems by defining reserve scales, rotation protocols, and emergency release procedures. Additionally, they should modernize storage infrastructure by enhancing ventilation and pest control functions in grain storage facilities. Promoting scientific grain storage equipment among smallholder farmers will further strengthen storage capacity to withstand sudden disruptions.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/Supplementary material.

Author contributions

DH: Writing – review & editing, Writing – original draft. YW: Writing – review & editing, Writing – original draft, Formal analysis, Software. S-SC: Writing – review & editing, Writing – original draft, Methodology, Software.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fsufs.2025.1593613/full#supplementary-material

Footnotes

1. ^This study also explored alternative controls, such as imported corn or wheat, but found inconsistent price dynamics due to China’s early market liberalization and high external dependence on soybeans, which amplify its sensitivity to global market fluctuations.

2. ^Calculated from official data of China’s general administration of customs.

References

Adjemian, M. K., Smith, A., and He, W. (2021). Estimating the market effect of a trade war: the case of soybean tariffs. Food Policy, 105:102152. doi: 10.1016/j.foodpol.2021.102152

Ahmed, Z., Kadir, A., Alam, R., Hafiz-al-Rezoan, H., and Laskor, M. A. H. (2025). The impact of staple crop price instability and fragmented policy on food security and sustainable development: a case study from Bangladesh. J. Discov. Sustain. 6:79. doi: 10.1007/s43621-025-00878-7

Ansah, I. G. K., Gardebroke, C., and Ihle, R. (2019). Resilience and household food security: a review of concepts methodological approaches and empirical evidence. Food Secur. 11, 1187–1203. doi: 10.1007/s12571-019-00968-1

Aslam, M. (2019). Us-China trade disputes and its impact on Asean. Transnatl. Corp. Rev. 11, 332–345. doi: 10.1080/19186444.2019.1691410

Béné, C. (2020). Resilience of local food systems and links to food security-a review of some important concepts in the context of Covid-19 and other shocks. Food Secur. 12, 805–822. doi: 10.1007/s12571-020-01076-1

Beyene, F., Senapathy, M., Bojago, E., and Tadiwos, T. (2023). Rural household resilience to food insecurity and its determinants: Damot Pulasa district, southern Ethiopia. J. Agric. Food Res. 11:100500. doi: 10.1016/j.jafr.2023.100500

Bowm, C., and Crowley, M. (2016). “The empirical landscape of trade policy” in Handbook of commercial policy, vol. 1, 3–108.

Bown, C. P. (2019). The 2018 us-China trade conflict after forty years of special protection. China Econ. J. 12, 109–136. doi: 10.1080/17538963.2019.1608047

Chen, H. X., and Zhang, Q. Z. (2024). The disruption risks and countermeasures of Russian's industrial chain under extreme sanctions and China's reflections. Russ. East Eur. Cent. Asian Stud. 5, 44–67. doi: 10.1080/10670564.2024.2358876

Cheng, G. Q., and Zhu, M. D. (2020). Covid-19 pandemic is affecting food security: trends, impacts and recommendations. China Rural Econ. 425, 13–20.

FAO. (2023). Egypt: Country brief on food supply and market conditions. Giews. Available at: https://www.fao.org/giews.

Ferrara, E., Chong, A., and Duryea, S. (2012). Soap operas and fertility: evidence from Brazil. Am. Econ. J. Appl. Econ. 4, 1–31. doi: 10.1257/app.4.4.1

Gnangnon, S. K. (2018). Impact of multilateral trade liberalization and aid for trade for productive capacity building on export revenue instability. Econ. Anal. Policy 58, 141–152. doi: 10.1016/j.eap.2018.02.002

Hess, W., and Persson, M. (2011). Exploring the duration of EU imports. Rev. World Econ. 147, 665–692. doi: 10.1007/s10290-011-0106-x

Hodbod, J., and Eakin, H. (2015). Adapting a social-ecological resilience framework for food systems. J. Environ. Stud. Sci. 5, 474–484. doi: 10.1007/s13412-015-0280-6

Holling, C. S. (1973). Resilience and stability of ecological systems. Annu. Rev. Ecol. Syst. 4, 1–23. doi: 10.1146/annurev.es.04.110173.000245

Johnson, H. G. (1953). Optimum tariffs and retaliation. Rev. Econ. Stud. 21, 142–153. doi: 10.2307/2296006

Krugman, P. (1980). Scale economies, product differentiation, and the pattern of trade. Am. Econ. Rev. 70, 950–959.

Li, G. S., and Han, D. (2020). Competition structure, market power and pricing right of food market–analysis of international soybean market. J. Int. Trade 453, 33–49. doi: 10.13510/j.cnki.jit.2020.09.003

Li, P., Lu, Y., and Wang, J. (2016). Does flattening government improve economic performance? Evidence from China. J. Dev. Econ. 1, 18–37. doi: 10.1016/j.jdeveco.2016.07.002

Lin, k., Gao, X., and Yang, C. H. (2023). Non-competitive input-output price model capturing the co-variation between domestic and international markets and its empirical application on the impact of the Russia-Ukraine war on China’s domestic price. Syst. Eng. Theor. Pract. 43, 2072–2086.

Lyu, Y. H., Yuan, J. W., and Zhang, S. Q. (2025). Agricultural industry chain resilience, regional differences and dynamic evolution. Stat. Decis. 41, 87–93. doi: 10.3390/agriculture14112034

Ma, J. K., Li, G. S., and Han, D. (2023). Digital economy empowering grain supply chain resilience: mechanisms and policy implications. Soc. Sci. Xinjiang 242, 46–54. doi: 10.20003/j.cnki.xjshkx.2023.01.006

Martin, W., and Anderson, K. (2012). Export restrictions and price insulation during commodity price booms. Am. J. Agric. Econ. 94, 422–427. doi: 10.1093/ajae/aar105

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71, 1695–1725. doi: 10.1111/1468-0262.00467

Meng, L. (2025). Adjustment and reform trends of agricultural policies in BRICS countries. J. Jiangsu Ocean Univ. 23, 124–132.

NFSRA. (2022). The foundation for adequate grain supply and stable prices remains solid. National Food and Strategic Reserves Administration. Available online at: https://www.lswz.gov.cn/html/mtsy2022/2022-02/28/content_269474.shtml.

Nichols, C., Janssen, B., Bearner, C., Farrington, T., Çakır, M., and Metcalf, S. S. (2022). Pivoting is exhausting: a critical analysis of local food system resilience. J. Rural. Stud. 96, 180–189. doi: 10.1016/j.jrurstud.2022.10.024

Pan, Y. (2023). Global political and economic risks and the resilience of food security in Southeast Asia: taking Indonesia as an example. Southeast Asian Stud. 1, 62–86. doi: 10.19561/j.cnki.sas.2023.01.062

Rasador, G. S., Franke, L., and Sindelar, F. C. W. (2024). Us-China trade war: an empirical evaluation regarding its impacts on Brazilian exports. Int. Econ. Econ. Policy 21, 883–906. doi: 10.1007/s10368-024-00625-9

Tendall, D. M., Joerin, J., Kopainsky, B., Edwards, P., Shreck, A., Le, Q. B., et al. (2015). Food system resilience: defining the concept. Glob. Food Secur. 6, 17–23. doi: 10.1016/j.gfs.2015.08.001

Tian, Q. S., Li, C. G., and Yu, Y. (2024). Resilience of major agricultural import relationships and its driving factors in China: based on the dual perspective of risk resistance and recovery. World Agric. 7, 45–57. doi: 10.13856/j.cn11-1097/s.2024.07.004

Verschuur, J., Vittis, Y., Obersteiner, M., and Hall, J. W. (2025). Heterogeneities in landed costs of traded grains and oilseeds contribute to unequal access to food. Nat. Food 6, 36–46. doi: 10.1038/s43016-024-01087-7

Wang, Y. N., and Wu, L. (2024). International situation, food security and China's plan in global perspective. Agric. Econ. Manage. 2, 13–24.

Wang, X. S., and Yang, H. (2025). Logic of U.S. trade policy and trend of U.S.-China economic and trade relations: trump's outlook on China policy. Intertrade 1, 5–16+46. doi: 10.14114/j.cnki.itrade.2025.01.007

Wei, C., Xiao, Y., Li, L., Huang, G., Liu, J., and Xue, D. (2025). After pandemic: resilience of grain trade network from a port perspective on developed and developing countries. Resour. Conserv. Recycl. 215:108119. doi: 10.1016/j.resconrec.2024.108119

Xu, W. H. (2024). Russia's international grain trade game on Black Sea grain initiative. J. Northeast Asia Stud. 6, 106–121+149. doi: 10.19498/j.cnki.dbyxk.2024.06.007

Zeng, H., Zhang, B., Yan, Y., and Huang, C. (2025). How pilot free trade zones affect food system resilience: quasi-natural experiment evidence from China. Front. Sustain. Food Syst. 9:1460485. doi: 10.3389/fsufs.2025.1460485

Zhang, Y. M., and Long, W. J. (2023). Challenges and countermeasures for improving the resilience of agricultural industry chain under the great food outlook. Acad. J. Zhongzhou 4, 54–61.

Zhu, J. X., Zhu, Z. Q., and Zhang, B. J. (2025). Can agricultural industrial park construction enhance the resilience of the grain production? —based on the quasi-natural experiment of National Modern Agricultural Demonstration Zones. World Agric. 3, 119–131. doi: 10.13856/j.cn11-1097/s.2025.03.0010

Keywords: trade friction between China and the United States, China’s grain imports, DID, resilience, developing countries

Citation: Han D, Wu Y and Si-Si C (2025) Trade war and grain import resilience: evidence from China’s response to U.S. Tariffs. Front. Sustain. Food Syst. 9:1593613. doi: 10.3389/fsufs.2025.1593613

Edited by:

Wenjin Long, China Agricultural University, ChinaReviewed by:

Seydi Yıkmış, Namik Kemal University, TürkiyeJustice Gameli Djokoto, Dominion University College, Ghana

Copyright © 2025 Han, Wu and Si-Si. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Chen Si-Si, Y2hlbnNpc2kxOEAxNjMuY29t

Dong Han

Dong Han Yuhui Wu1

Yuhui Wu1