- School of Economics and Management/Institute of Sustainable Development, Huzhou University, Huzhou, China

Context: Under the suppression of Trump 2.0 tariffs in the United States, fluctuations in agricultural product prices have become one of the significant risks to the security of China’s supply chain, especially for soybeans which are greatly affected by the US market.

Methodology: Based on the monthly data of international and Chinese soybean futures prices and spot prices from May 2008 to October 2024, this paper constructs a Bayesian VAR model to explore the transmission path of international price fluctuations to Chinese soybean futures and spot prices.

Innovation: Different from many previous studies, this paper adopts the Bayesian VAR model, which can alleviate overfitting more effectively than the VAR model, improve the prediction accuracy, and reflect the dynamic impact of price fluctuations more accurately.

Conclusion: The results show that fluctuations in international market prices have a significant price discovery effect on the Chinese soybean market, which can help participants in the upstream and downstream of the supply chain reduce the risk of price fluctuations in the short term. However, the hedging function of the futures market still needs to be improved in the long term.

1 Introduction

Both price fluctuations and environmental pollution pose significant risks to the security of the agricultural product supply chain (Huang et al., 2023; Lin et al., 2022; Xu et al., 2024; Xu et al., 2025). Since the advent of the Trump 2.0 era in 2025, the tariff-centered international trade environment has grown increasingly complex, intensifying the uncertainty and price volatility of agricultural markets and posing substantial risks to the security of China’s soybean supply chain. As the world’s largest soybean importer, China is heavily dependent on international markets, sourcing approximately 80 percent of its soybean imports from major producers such as the United States and Brazil. However, the trade conflict between USA and China since 2018 has not only driven up import costs, but also increased price volatility in China’s soybean market, affecting all sides of the soybean supply chain. Meanwhile, as an important tool for risk management, the role of the futures market in the soybean supply chain is becoming increasingly prominent. However, the development of China’s futures market is relatively late and there is insufficient price risk management. Therefore, how to effectively avoid the risks brought to the soybean supply chain by international price fluctuations through the price discovery and hedging functions of the futures market is a practical problem.

The unique seasonality, supply peaks and perishability of agricultural products make the management of agricultural supply chain more complex and challenging than that of manufacturing supply chain (Imbiri et al., 2021). The prices of agricultural products are highly susceptible to factors such as weather and natural disasters (Zia et al., 2022). Furthermore, changes in supply and demand, exchange rate fluctuations, policy adjustments, etc. will also have a significant impact on prices, making price fluctuations an inevitable source of risk in the supply chain. Especially under the high trade interdependence among countries and the impact of the novel coronavirus epidemic and other factors, the risks associated with agricultural product prices have also increased, attracting growing global attention to food security (Pu and Zhong, 2020; Laborde et al., 2020). Soybeans are one of the most important agricultural products. China is the world’s largest consumer and importer of beans. Consequently, fluctuations in international soybean prices directly influence soybean prices in China (Montanía et al., 2021; Zhang et al., 2021). In addition, fluctuations in energy prices also impact China’s soybean market. During periods of crisis, market efficiency tends to decline due to greater susceptibility to extreme events (Hu et al., 2024). For instance, the U.S.-China trade war, as a political and economic event, undermined the information dominance of the U.S. soybean futures market (Bandyopadhyay and Rajib, 2023; Adjemian et al., 2021), increased price volatility in China’s soybean market, and prompted China to accelerate the diversification of its soybean import sources (Wen et al., 2023). Additionally, it strengthened the co-movement between soybean prices and energy prices such as crude oil (Cheng et al., 2023). In this context, Han et al. (2013) examined the role of the Dalian Commodity Exchange (DCE) in the global price discovery process of soybean futures and found that the DCE’s soybean futures prices exert a significant influence on price discovery relative to the Chicago Board of Trade (CBOT).

The agricultural futures market plays the role of an “information center” in shaping price expectations in the spot market (Garcia and Leuthold, 2004). As early as 1983, Garbade and Silber (1983) pointed out that in markets characterized by rapid information dissemination and high liquidity, futures markets typically lead spot markets. In the international soybean market, Brazil has become the world’s largest soybean exporter, accounting for more than 40% of global soybean exports. However, the United States still plays an important role in the global soybean market. Changes in the futures price of soybeans in the United States will affect other markets and even drive up the price of soybeans in Brazil (Li and Hayes, 2017). Studies have found that the volatility of the U.S. soybean futures market significantly affects the Chinese market, which confirms the United States’ status as a global financial market leader (Fung et al., 2003). Such volatility transmission has been observed across all commodities studied (including soybeans, corn, wheat and sugar), especially in the soybean market (Jiang et al., 2017). The relationship between spot and futures prices of soybeans exhibits distinct characteristics across different market phases. Futures market typically plays a leading role in price discovery. In the price transmission process, the soybean futures market plays a leading role, particularly under conditions of high market liquidity, where futures prices often precede spot prices. The international soybean futures market exerts a significant price discovery effect on the spot price of Chinese soybean (Xu et al., 2019; Wu et al., 2024). The research finds that the role of the futures market in price discovery is enhanced during periods of market bubbles, while it weakens during periods of non-bubbles, indicating that market conditions have a significant impact on the effectiveness of the price discovery function (Li and Xiong, 2019). Gao et al. (2024) noted that China’s recent retaliatory tariffs on U.S. soybeans have strengthened China’s position in the discovery of soybean futures prices.

In recent years, fluctuations in commodity prices have led to an increasing income risk for farmers, and hedging in the futures market has been an effective coping strategy (Penone et al., 2021). Rutledge (1972) mentioned that hedgers use the futures market to mitigate risks associated with spot market price fluctuations. In order to attract speculative capital to match the trades of hedgers, a discrepancy between the futures price and the expected expiration price will arise (Li and Hayes, 2022). This means that soybean price risk can be reduced by hedging. Due to the multifractal characteristics of the soybean futures market, investors need to design effective hedging strategies to manage price risks and help them maintain stable returns during market fluctuations (Yin and Wang, 2021; Erasmus and Geyser, 2024). Tejeda and Goodwin (2014) compared the effectiveness of multi-product hedging strategies with single-commodity hedging and found that dynamic multi-product hedging can significantly lower risk, providing more effective risk management tools. Notably, some scholars have studied the risk transmission mechanisms between the most mature (U.S.) and the fastest-growing (China) commodity futures markets. Their research confirmed the dominant role of the U.S. agricultural futures market in price leadership, while also acknowledging the increasingly significant role of China’s futures market in price discovery (Ke et al., 2019).

Building upon the aforementioned research, this study discusses the dynamic influence of international price fluctuations on the soybean market in China by combining the price discovery and hedging function of futures market. The innovations of this study are as follows: First, a Bayesian VAR model is innovatively constructed. This approach is rarely applied in prior studies, which predominantly use traditional VAR models. The Bayesian VAR model incorporates prior distributions to constrain parameter estimation, effectively mitigating overfitting, enhancing forecasting accuracy, and improving the modeling of parameter uncertainty. Second, the longitudinal scope and novelty of the data. Using international soybean futures prices and Chinese soybean spot prices from May 2008 to October 2024, this study provides a more dynamic reflection of the impact of international price fluctuations. For instance, this study finds that although hedging operations in the Chinese futures market can reduce the risk of fluctuations in spot prices in the short term. However, due to the liquidity of the Chinese futures market and the limitations of basis fluctuations, there is still room for improvement in the hedging effect in the long term.

2 Materials and methods

2.1 Theoretical analysis

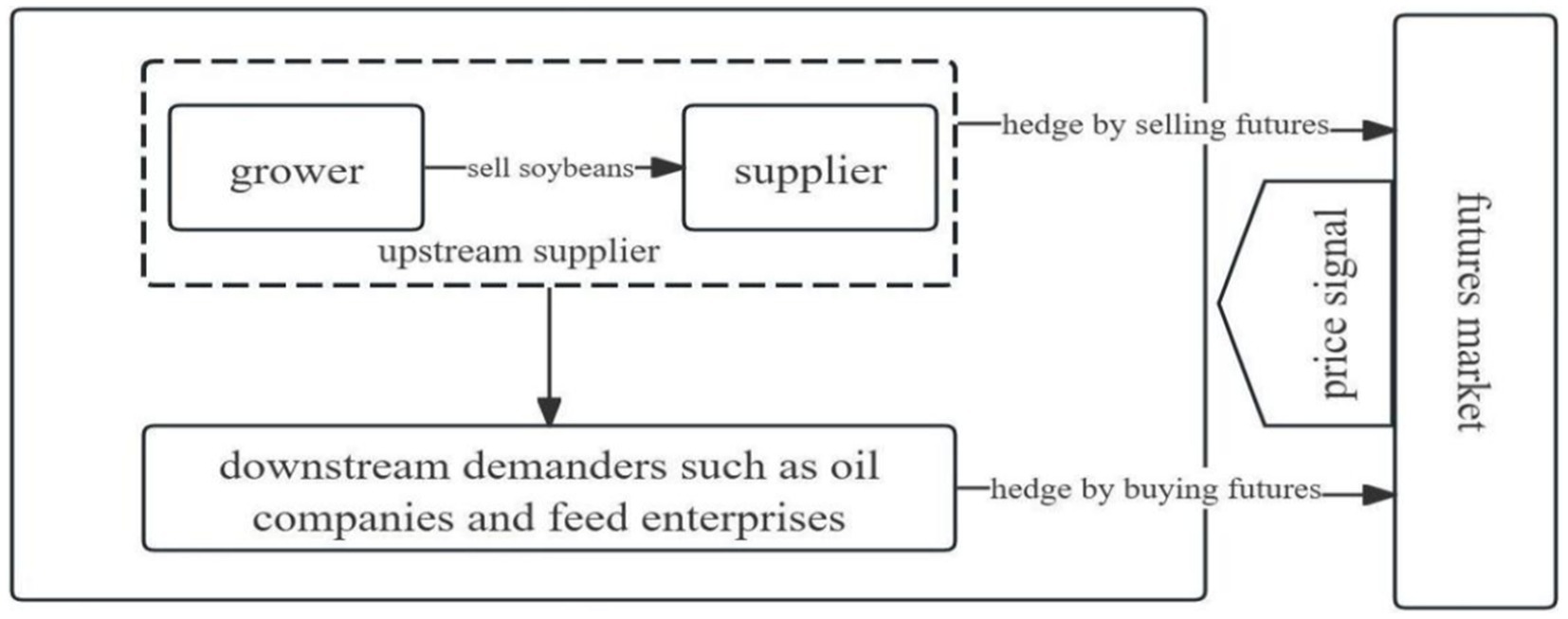

Price fluctuations are the main source of risk faced by participants in the upstream and downstream of the soybean supply chain. By taking advantage of the price discovery and hedging functions of the futures market, farmers and other suppliers can analyze price signals, hedge against price fluctuations in the spot market, stabilize profits and control costs.

2.1.1 Risk avoidance mechanism of upstream suppliers

As the production and supply link of the soybean supply chain, the main risk for upstream suppliers comes from the impact of falling soybean prices on planting income and inventory value.

Firstly, the price discovery function. The price discovery function of the futures market provides upstream suppliers with price expectations for the soybean market, enabling them to plan production and inventory reasonably. When futures prices indicate that they may rise in the future due to insufficient supply, growers can expand their planting area and soybean suppliers can increase their purchasing scale to seize the market opportunity first. On the contrary, price signals indicating a decline in prices can optimize resource allocation and avoid market risks.

Secondly, the hedging function. In the futures market, by establishing futures positions, suppliers can convert the risk of price fluctuations into a relatively controllable level of returns. When suppliers hold soybean inventories and predict a future decline in market prices, they can sell futures contracts in the futures market to hedge against the risk of a possible drop in spot prices in the future. If inventory prices fall, the profits in the futures market will make up for the losses in the spot market and ensure that inventory values are not affected by price fluctuations.

2.1.2 Risk avoidance mechanism of downstream demand side

The downstream demand side, as the final consumption link of the soybean supply chain, its main risk comes from the impact of market price fluctuations on raw material costs.

Firstly, the price discovery function. The price discovery function of the futures market provides the demand side with a clear global cost warning, helping them optimize their purchasing decisions and reduce price risks. When the futures price signal indicates that the future market supply and demand are tight and prices may rise, the demand side can purchase raw materials in advance to lock in low-cost supplies. When the signal indicates that the price may fall, the demand side can postpone the purchase to reduce the risk of high inventory squeezing the price.

Secondly, the hedging function. The actual risk management operations on the demand side of soybeans rely on the Chinese futures market, further locking in procurement costs and production profits through futures tools. By purchasing futures contracts, the future purchase price can be locked in advance, enabling the demand side of soybeans to stabilize profits amid the sharp fluctuations in raw material prices.

2.1.3 The coordination mechanism under the linkage of Chinese and international futures markets

The international soybean futures price reflects the global soybean market and the international supply and demand relationship. International futures prices influence the trend of Chinese futures prices through price transmission and guide the Chinese soybean market price. The Chinese futures market not only provides a reference for supply and demand through the price discovery function, but also uses hedging tools to help the upstream and downstream of the soybean supply chain lock in profits or costs. Through the coordinated operation of Chinese and international futures markets, the upstream and downstream of the soybean supply chain have effectively reduced the uncertainty risks of the supply chain and enhanced the overall stability and resilience. As shown in Figure 1.

2.2 Model construction-Bayesian-VAR model

This paper adopts the BVAR empirical method. The Bayesian Vector Autoregression (BVAR) model incorporates prior distributions to constrain parameter estimation, effectively mitigating overfitting, enhancing forecasting accuracy, and improving the modeling of parameter uncertainty. While the Vector Autoregression (VAR) model is widely used for forecasting macroeconomic variables, it tends to suffer from overfitting in high-dimensional settings. The introduction of Bayesian methods-particularly shrinkage priors-has demonstrated strong performance in improving predictive accuracy (Van der Drift et al., 2024). Moreover, BVAR models are more data-driven and offer greater flexibility, whereas DSGE models face limitations in handling high-dimensional data and lack model flexibility.

For a time series vector with k variables, The VAR (P) model can be expressed as Equation 1:

Where is a k × 1 vector representing the value of all variables at time t; is a k × k coefficient matrix for lag i; p denotes the lag order; c represents the intercept term; and is the error term assumed to be white noise.

In the Bayesian framework, the sum of and parameters are assigned prior distributions. Normal distribution or independent and identically distributed Gaussian distribution is typically selected as the prior. Common prior distribution forms include a Gaussian distribution (assuming parameters follow a zero-mean normal distribution) and a Wishart distribution for the prior of the covariance matrix .

In the posterior distribution, observed data are used to update the prior distribution to obtain the posterior distribution of the parameters. The posterior distribution represents the probability distribution of parameter values given the observed data (Equation 2).

Where is the posterior distribution of parameter , is the likelihood function, and is the prior distribution.

Common sampling methods include Markov chain Monte Carlo (MCMC) method, which is used to extract samples in the posterior distribution, so as to obtain the estimated value of model parameters and their uncertainty.

2.3 Data sources and sample description

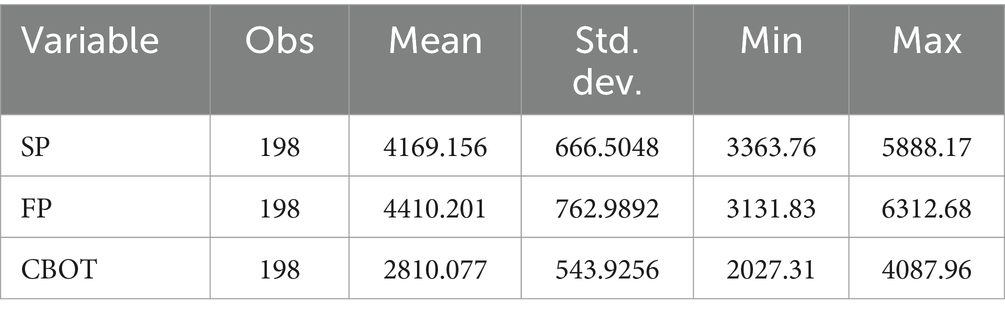

This study selects the closing price of yellow soybean No.1 futures from May 2008 to October 2024 as the sample of Chinese soybean futures price, the CBOT soybean futures closing price as the international soybean futures price, and Chinese soybean spot price as the soybean market price. All data are sourced from the WIND database. Among them, the CBOT soybean futures closing prices, originally quoted in cents per bushel, have been converted into yuan per ton based on prevailing exchange rates. The basic descriptive statistics of the core variables are presented in Table 1.

3 Results

3.1 Unit root test and granger causality test

3.1.1 Unit root test

ADF test is used to test the stability of each price series. The results indicate that all original sequences of China’s soybean spot price (SP), China’s soybean futures price (FP) and international soybean futures price (CBOT) are non-stationary, while their first-order differenced series reject the null hypothesis at the 1% significance level, thereby demonstrating stationarity. Therefore, the subsequent analysis utilizes the first-order differenced series of these three variables, denoting them with a ‘d’ prefix to indicate differencing.

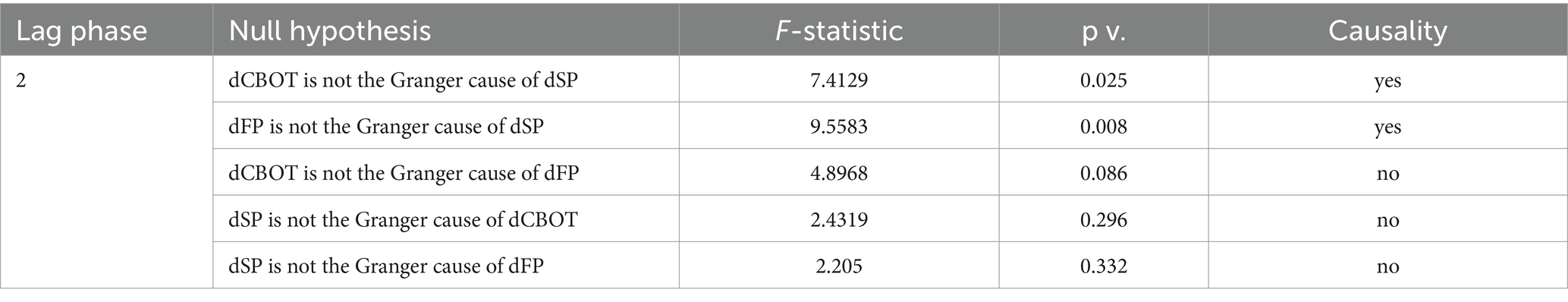

3.1.2 Granger causality test

The Granger causality test requires stationarity of time series data and is used to determine whether a time series can effectively predict another. In the Granger causality test, the selection of the lag length has an important impact on the results. When selecting the lag length, the minimum values of AIC and SC are primarily referenced, supplemented by subsequent test results to determine the most appropriate lag structure. Consequently, a lag length of two is selected, and the relevant test results are presented in Table 2.

According to Table 2, both dCBOT and dFP are found to Granger-cause dSP at the 5% significance level, indicating a unidirectional relationship. Fluctuations in the futures market (including international and Chinese futures prices) significantly influence spot market prices, suggesting that price changes in the international and Chinese futures markets are transmitted to the soybean spot market through the futures market’s price discovery function.

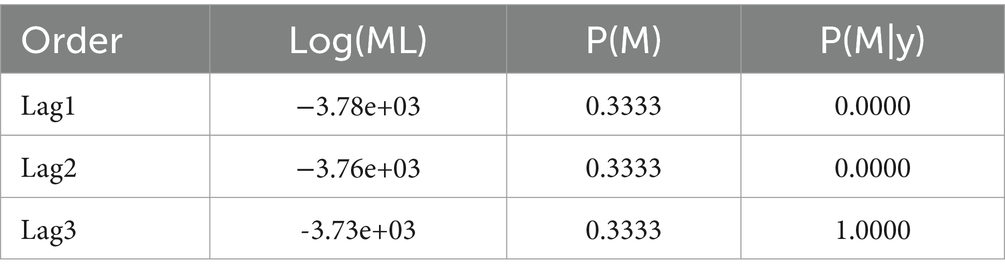

3.2 Lag order selection and MCMC stability test

During the construction of the BVAR model, it is necessary to specify prior distributions for the coefficients. This study adopts the conjugate Minnesota prior. The default prior assumes that only the first own-lag coefficient has a mean of 1, while all other coefficients have a mean of 0. Selecting the lag length is a critical consideration when establishing the model. Traditional methods, such as using the AIC standard method, may overestimate the number of lags. Therefore, this study employs the Bayestest model to compute the posterior probability of the model. It is assumed that each candidate model has an equal prior probability. According to Table 3, the model with three lags exhibits the highest posterior probability among the three considered models, thus, a third-order lag is selected for subsequent impulse response and variance decomposition analyses.

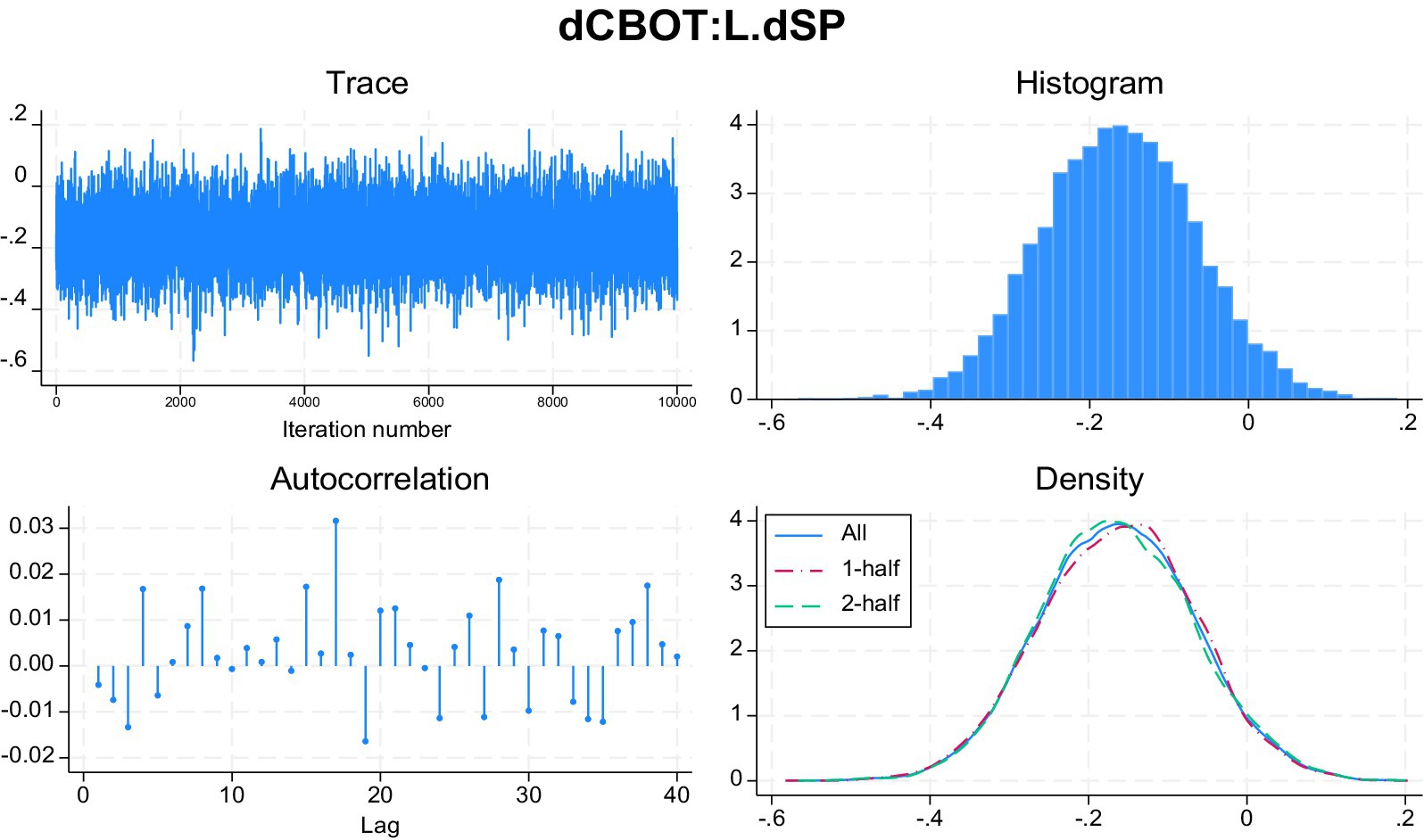

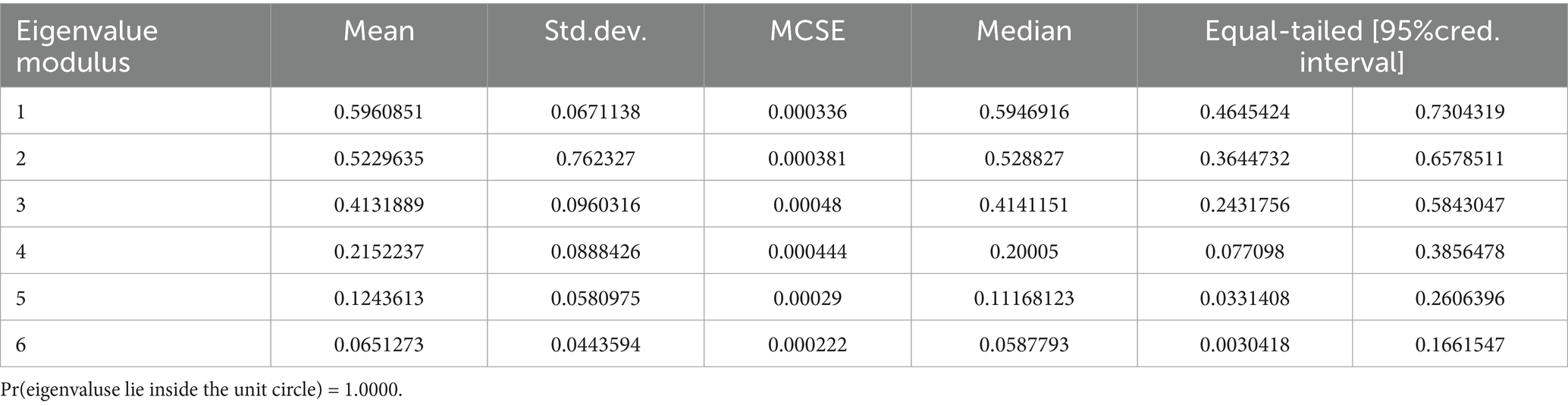

Prior to further analysis in the BVAR model, it is essential to verify the convergence of the MCMC sampling. According to Figure 2, the trace plot exhibit no apparent trends, and autocorrelation levels are low, indicating successful convergence of the MCMC sampling.

As shown in Table 4, the 95% confidence intervals for all eigenvalue moduli do not encompass values greater than or equal to one, confirming that all eigenvalues lie within the unit circle and that the system is stable.

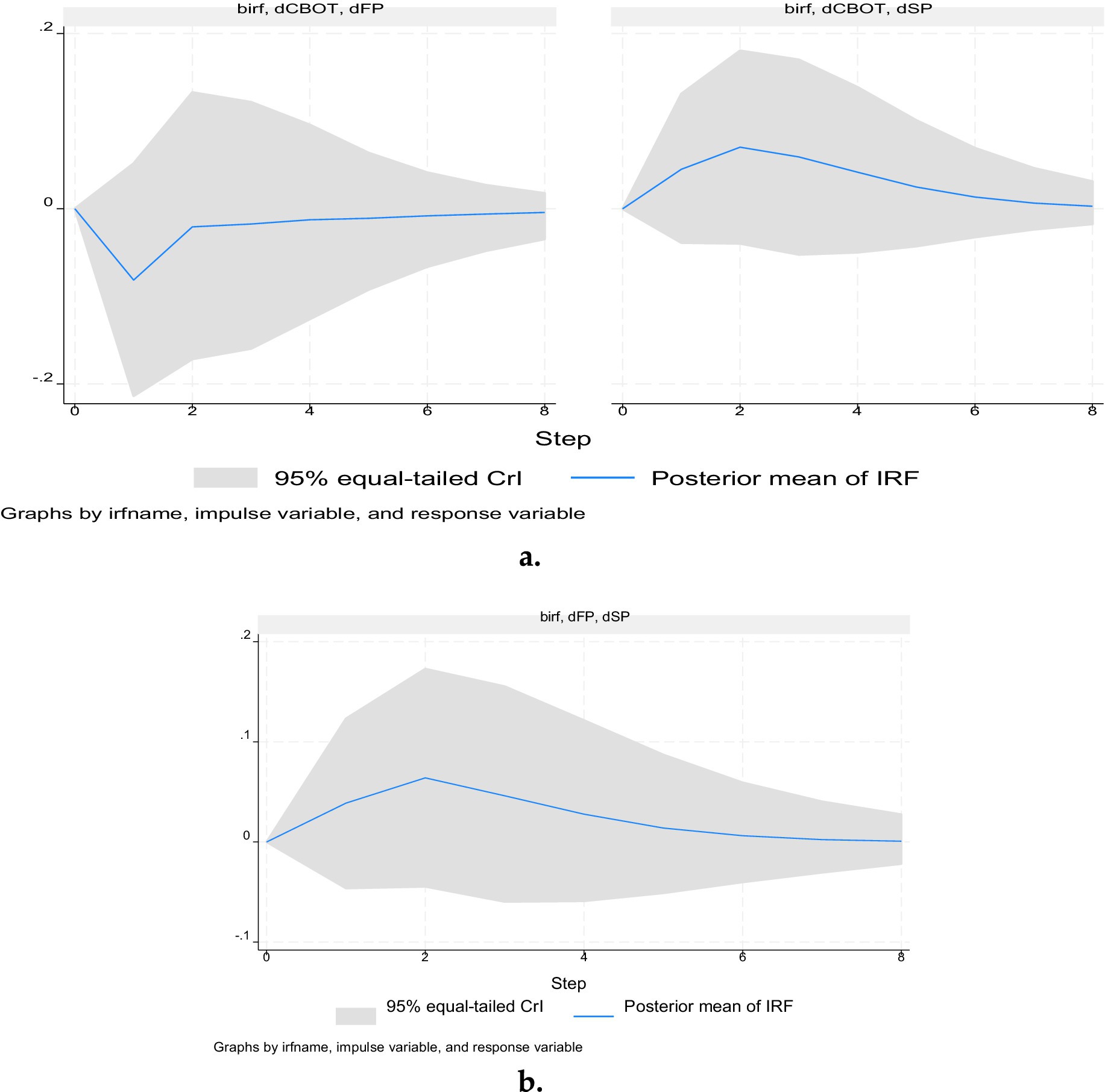

3.3 Impulse response analysis

It can be seen from Figure 3a that in the early stage of the international soybean futures prices shocks, China’s soybean futures prices (dFP) exhibit a significant negative response. In the initial phase of price decline, the magnitude of the negative response is large, indicating that international soybean futures fluctuations exert a short-term disturbance effect on China’s soybean futures market. Over time, this negative impact gradually weakened, and the response curve returned to near zero, indicating that China’s futures market absorbs and adjusts to international market shocks. The negative impact may reflect the excessive short-term sensitivity of China’s soybean futures market to international shocks, implying potential market instability or speculative behavior. These findings further confirm that the international soybean futures price (CBOT) has a significant influence on the Chinese futures price, highlighting the international market as a key external factor for China’s soybean futures market.

In the initial stage, the spot price (dSP) of Chinese soybeans showed a significant positive response to the international futures price, which indicates that the spot market of Chinese soybeans is highly sensitive to the price fluctuations of the international soybean futures market. However, as time goes by, the positive response gradually weakens but still remains above zero. This reflects that the Chinese soybean market is highly dependent on the international market. Especially against the backdrop of a relatively high proportion of soybean imports, changes in international market prices have a significant external impact on China’s spot prices.

Meanwhile, it can be seen from Figure 3b that in the initial stage of the impact of China’s soybean futures price on China’s soybean spot price, China’s soybean spot price (dSP) showed a positive response, that is, the spot price increased with the rise of futures price, and the positive response amplitude reached the maximum at the initial stage, indicating that the futures market price fluctuation had a significant guiding effect on the spot market. With the passage of time, the positive impact gradually weakened, the response curve showed a trend of gradual decline, and finally approached zero. This shows that there is a significant price transmission mechanism between China’s soybean futures market and spot market. Fluctuations in futures prices will directly affect spot prices, reflecting the price discovery function of the futures market. This positive impact also shows that the futures market can guide the spot market to make pricing adjustments by reflecting future price expectations.

From the above impulse response diagram, it can be seen that the international soybean futures price (dCBOT) has a significant price transmission effect on the Chinese market, which is manifested in two direct and indirect paths: on the one hand, the international futures price (dCBOT) will directly affect the Chinese spot price (dSP); on the other hand, international futures prices are indirectly transmitted to Chinese spot prices (dSP) through Chinese futures prices (dFP). Among them, the impact of dCBOT on dFP is significant in the short term, and the positive impact of dFP on dSP is also obvious, indicating that the Chinese futures market plays an intermediary role in price transmission, which further verifies the price guidance and transmission mechanism of the international market to the Chinese market.

3.4 Variance decomposition analysis

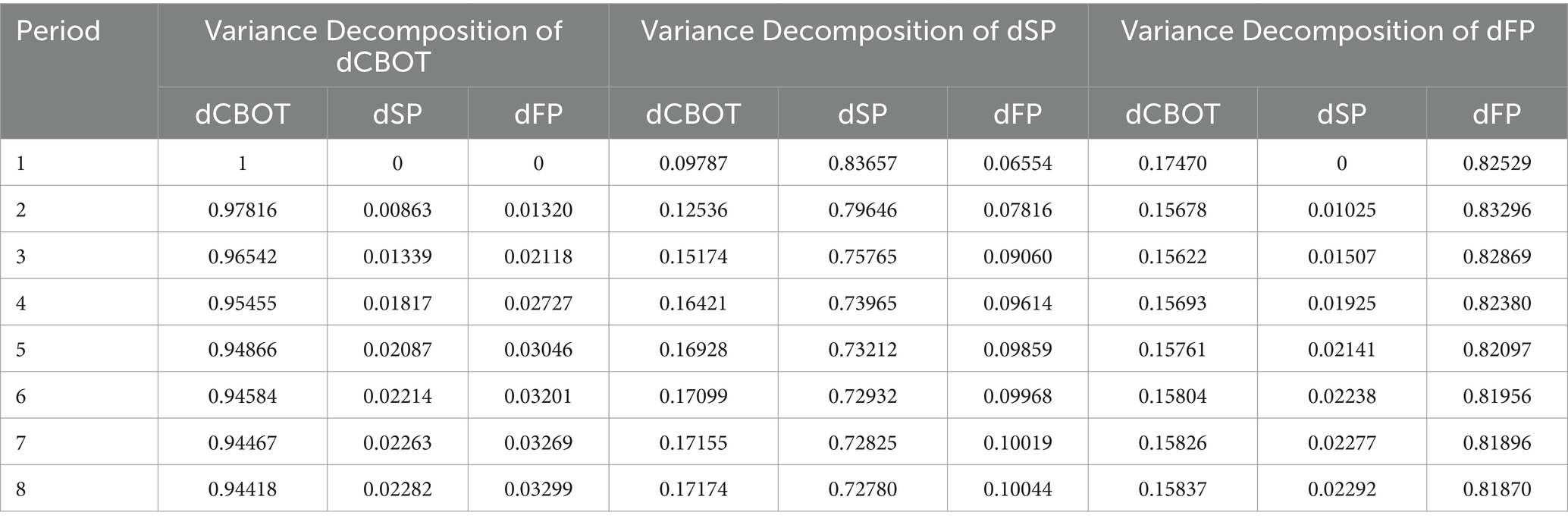

Table 5 indicates that the fluctuations of the International Soybean Futures Price (dbot) are less affected by external factors (dSP and dFP), which suggests that the prices in the international market (such as CBOT) are less influenced by the feedback from the Chinese market.

Firstly, the fluctuations of China’s spot price (dSP) were mainly explained by itself in the short term (the contribution rate in the first period was 83.66%), but as time went by, the contribution rate of its own shock gradually decreased (72.78% in the eighth period), indicating that the influence of external factors (dCBOT, dFP) on it gradually increased.

Secondly, the contribution of international futures prices to China’s spot prices gradually increased from 9.79% in the first period to 17.17% in the eighth period, indicating that the price transmission effect of the international market on China’s spot market has become more significant and gradually strengthened.

Thirdly, the contribution rate of futures prices to spot prices rose from 6.55% in the first quarter to 10.04% in the eighth quarter. This indicates that China’s futures market has a certain influence on the price guidance of the spot market, but it is lower than the direct influence of the international market.

3.5 Further analysis: verification of hedging function

In order to quantify the actual role of the futures market in reducing the risk of soybean price fluctuations, this paper estimates the hedging performance degree measured by the optimal hedging ratio (Equations 3, 4).

Among them, is the difference sequence of soybean spot at time t, which can be understood as the price yield of soybean spot, and is the difference sequence of soybean futures at time t, which can be understood as the price yield of soybean futures. c is a constant term, is the residual of the regression equation, b is the hedging rate.

This paper uses the HE index proposed by Ederington to evaluate the hedging performance under the optimal hedging ratio. The HE index, also known as the Edlington index, is based on the principle of minimizing risk to measure the hedging effect. Specifically, the HE value reflects the degree to which the variance of the yield of the hedging portfolio is reduced compared to the variance of the spot yield without hedging when hedging through the use of futures contracts (Equations 5–7):

represents the variance of the return rate of the portfolio after hedging, is the calculated optimal hedging ratio, and is the variance of the spot return rate without hedging. The larger the value of the HE index, the more the variance of the combination after hedging is reduced, that is to say, the more the risk is reduced, the better the hedging effect is; on the contrary, the smaller the HE index value is, the smaller the degree of risk reduction is, and the hedging effect is poor.

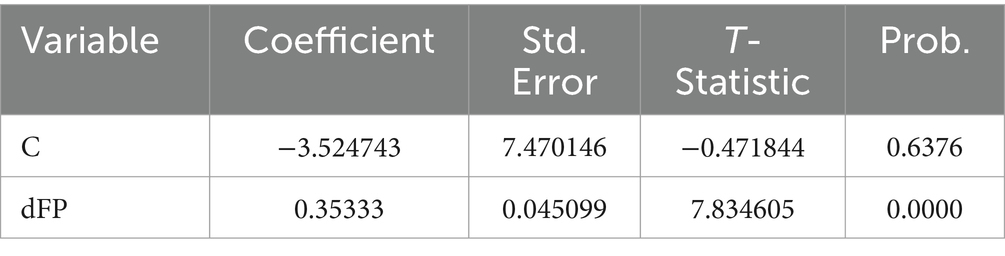

Among them, the first-order difference sequences of soybean futures price (FP) and soybean spot price (SP) are stationary sequences, so the OSL model is established directly. The regression results are as follows.

The expressions of dSP and dFP can be obtained from Table 6:

The results calculated based on Equation 8 show that after hedging through the futures market, the risk of spot price fluctuations is reduced by 23.94%. That is, although the futures market has played a risk-aversion function to a certain extent, its hedging effect is still not significant enough. Possible reasons include relatively low liquidity in China’s futures market, large basis fluctuations, and incomplete transmission of international market price fluctuations.

4 Conclusion

4.1 Main conclusion

Based on the role of futures market in China’s soybean supply chain, this paper discussed the mechanism and conduction effect of the price discovery and hedging function. The main conclusions are as follows:

First, the international soybean futures market reflects the changes in supply and demand in the global market and provides a price benchmark for the soybean supply chain. The research results reveal that international futures prices have a price transmission effect on China’s futures and spot prices. Furthermore, the impact on the spot price of soybeans has a strong external effect, which is manifested as direct transmission and long-term continuous influence. This conclusion reflects the high sensitivity of China’s soybean prices to the international market.

Second, the soybean futures market has a certain transmission effect on the spot price. Soybean suppliers can reduce the risk of soybean prices to a certain extent through the futures market, lock in the selling price and avoid the risk of price decline. However, the calculation results of Edlington show that although hedging operations in China’s futures market can reduce the risk of spot price fluctuations by 23.94%, due to the limitations of liquidity and basis fluctuations in the futures market, there is still room for improvement in the hedging effect.

4.2 Policy suggestion

The research conclusion reveals that the price discovery function of the soybean futures market has played a good role, but the hedging function needs to be further enhanced. Based on this, this paper puts forward the following suggestions.

Firstly, the government should actively promote the application of the “futures + insurance” model in the soybean supply chain. By promoting insurance companies and futures exchanges to design “futures + insurance” products for soybean growers, it is ensured that soybean growers can obtain stable income regardless of whether the price rises or falls. Meanwhile, as the government increases subsidies to growers, purchasing enterprises can also safeguard their own interests by lowering the purchase price and stabilize the soybean supply chain from the production end.

Secondly, the government should further improve the system of the soybean futures market. The research results show that there is a strong correlation between the international market and the Chinese soybean market, and the international futures price has a significant transmission effect on the price of Chinese soybeans. Therefore, by improving the futures market system, the role of risk management and price stability of the futures market can be strengthened.

Thirdly, the government should further strengthen the construction of the linkage mechanism with the international futures market. By establishing a data docking mechanism between the international futures market (such as CBOT) and the Chinese futures market (such as DCE), we can promote the real-time transmission of global supply and demand information in the Chinese market and help Chinese participants respond to international price fluctuations faster.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

XX: Writing – original draft. SC: Data curation, Writing – original draft, Methodology. LZ: Writing – review & editing, Project administration.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adjemian, M. K., Smith, A., and He, W. (2021). Estimating the market effect of a trade war: the case of soybean tariffs. Food Policy 105:102152. doi: 10.1016/j.foodpol.2021.102152

Bandyopadhyay, A., and Rajib, P. (2023). The impact of Sino–US trade war on price discovery of soybean: a double-edged sword? J. Futur. Mark. 43, 858–879. doi: 10.1002/fut.22415

Cheng, N. F. L., Hasanov, A. S., Poon, W. C., and Bouri, E. (2023). The US-China trade war and the volatility linkages between energy and agricultural commodities. Energy Econ. 120:106605. doi: 10.1016/j.eneco.2023.106605

Erasmus, M. C., and Geyser, J. M. (2024). Comparative analysis of futures contract cross-hedging effectiveness for soybean: models and insights. Agrekon 63, 319–336. doi: 10.1080/03031853.2024.2401787

Fung, H. G., Leung, W. K., and Xu, X. E. (2003). Information flows between the US and China commodity futures trading. Rev. Quant. Finan. Acc. 21, 267–285. doi: 10.1023/A:1027384330827

Gao, X., Insuwan, A., Li, Z., and Tian, S. (2024). The dynamics of price discovery between the US and Chinese soybean market: a wavelet approach to understanding the effects of Sino-US trade conflict and COVID-19 pandemic. Data Sci. Manag. 7, 35–46. doi: 10.1016/j.dsm.2023.10.004

Garbade, K. D., and Silber, W. L. (1983). Price movements and Price discovery in futures and cash markets. Rev. Econ. Stat. 65, 289–297. doi: 10.2307/1924495

Garcia, P., and Leuthold, R. M. (2004). A selected review of agricultural commodity futures and options markets. Eur. Rev. Agric. Econ. 31, 235–272. doi: 10.1093/erae/31.3.235

Han, L., Liang, R., and Tang, K. (2013). Cross-market soybean futures price discovery: does the Dalian commodity exchange affect the Chicago Board of Trade? Quant. Financ. 13, 613–626. doi: 10.1080/14697688.2013.775477

Hu, X., Zhu, B., Zhang, B., and Zeng, L. (2024). Extreme risk spillovers between US and Chinese agricultural futures markets in crises: a dependence-switching copula-CoVaR model. PLoS One 19:e0299237. doi: 10.1371/journal.pone.0299237

Huang, J., Xu, X., and Zhao, T. (2023). The moderating effect of clean technology innovation in the process of environmental regulation affecting employment: panel data analysis based on 22 industrial sectors in China. J. Clean. Prod. 414:137672. doi: 10.1016/j.jclepro.2023.137672

Imbiri, S., Rameezdeen, R., Chileshe, N., and Statsenko, L. (2021). A novel taxonomy for risks in agribusiness supply chains: a systematic literature review. Sustain. For. 13:9217. doi: 10.3390/su13169217

Jiang, H., Todorova, N., Roca, E., and Su, J. J. (2017). Dynamics of volatility transmission between the US and the Chinese agricultural futures markets. Appl. Econ. 49, 3435–3452. doi: 10.1080/00036846.2016.1262517

Ke, Y., Li, C., McKenzie, A. M., and Liu, P. (2019). Risk transmission between Chinese and U.S agricultural commodity futures markets—A CoVaR Approach. Sustainability 11:239.

Laborde, D., Martin, W., Swinnen, J., and Vos, R. (2020). COVID-19 risks to global food security. Science 369, 500–502. doi: 10.1126/science.abc4765

Li, C., and Hayes, D. J. (2017). Price discovery on the international soybean futures markets: a threshold co-integration approach. J. Futur. Mark. 37, 52–70. doi: 10.1002/fut.21794

Li, Z., and Hayes, D. J. (2022). The hedging pressure hypothesis and the risk premium in the soybean reverse crush spread. J. Futur. Mark. 42, 428–445. doi: 10.1002/fut.22285

Li, M., and Xiong, T. (2019). Do bubbles Alter contributions to Price discovery? Evidence from the Chinese soybean futures and spot markets. Emerg. Mark. Financ. Trade 55, 3417–3432. doi: 10.1080/1540496X.2019.1608178

Lin, L., Yang, H., and Xu, X. (2022). Effects of water pollution on human health and disease heterogeneity: a review. Front. Environ. Sci. 10:880246. doi: 10.3389/fenvs.2022.880246

Montanía, C. V., Fernández-Núñez, T., and Márquez, M. A. (2021). The role of the leading exporters in the global soybean trade. Agric. Econ. 67, 277–285. doi: 10.17221/433/2020-AGRICECON

Penone, C., Giampietri, E., and Trestini, S. (2021). Hedging effectiveness of commodity futures contracts to minimize price risk: empirical evidence from the italian field crop sector. Risks 9:213. doi: 10.3390/risks9120213

Pu, M., and Zhong, Y. (2020). Rising concerns over agricultural production as COVID-19 spreads: lessons from China. Glob. Food Sec. 26:100409. doi: 10.1016/j.gfs.2020.100409

Rutledge, D. J. (1972). Hedgers' demand for futures contracts: a theoretical framework with applications to the United States soybean complex. Food Res. Inst. Stud. 11, 237–256. doi: 10.22004/ag.econ.135307

Tejeda, H. A., and Goodwin, B. K. (2014). Dynamic multiproduct optimal hedging in the soybean complex-do time-varying correlations provide hedging improvements? Appl. Econ. 46, 3312–3322. doi: 10.1080/00036846.2014.927571

Van der Drift, R., de Haan, J., and Boelhouwer, P. (2024). Forecasting house prices through credit conditions: a Bayesian approach. Comput. Econ. 64, 3381–3405. doi: 10.1007/s10614-023-10542-9

Wen, T., Li, P., Chen, L., and An, Y. (2023). Market reactions to trade friction between China and the United States: evidence from the soybean futures market. J. Manag. Sci. Eng. 8, 325–341. doi: 10.1016/j.jmse.2022.12.002

Wu, B., Wang, Z., and Wang, L. (2024). Interpretable corn future price forecasting with multivariate time series. J. Forecast. 43, 1575–1594. doi: 10.1002/for.3099

Xu, X., Lei, L., and Zhang, L. (2024). Validation of the environmental Kuznets curve: cases from countries along the belt and road. Environ. Res. Commun. 6:062001. doi: 10.1088/2515-7620/ad5701

Xu, Y., Pan, F., Wang, C., and Li, J. (2019). Dynamic price discovery process of Chinese agricultural futures markets: An empirical study based on the rolling window approach. J. Agric. Appl. Econ. 51, 664–681. doi: 10.1017/aae.2019.23

Xu, X., Zhong, Y., Cai, S., Lei, L., and Peng, J. (2025). Does air pollution aggravate health problems in low-income countries? Verification from countries along the belt and road. Sustain. For. 17:1796. doi: 10.3390/su17051796

Yin, T., and Wang, Y. (2021). Market efficiency and nonlinear analysis of soybean futures. Sustain. For. 13:518. doi: 10.3390/su13020518

Zhang, Y., Li, C., Xu, Y., and Li, J. (2021). An attribution analysis of soybean price volatility in China: global market connectedness or energy market transmission? Int. Food Agribus. Manag. Rev. 22, 15–25. doi: 10.22004/ag.econ.308824

Keywords: Bayesian-VAR model, soybean, price discovery, international price fluctuation, hedging function

Citation: Xu X, Cai S and Zhang L (2025) Dynamic influence of international price fluctuation on soybean market price in China: based on Bayesian-VAR model. Front. Sustain. Food Syst. 9:1594210. doi: 10.3389/fsufs.2025.1594210

Edited by:

Fuyou Guo, Qufu Normal University, ChinaReviewed by:

Hui Su, Hunan University of Finance and Economics, ChinaBinrong Wu, Hohai University, China

Copyright © 2025 Xu, Cai and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lingyu Zhang, emhhbmdsaW5neXVAempodS5lZHUuY24=

Xiaocang Xu

Xiaocang Xu Shuangshuang Cai

Shuangshuang Cai Lingyu Zhang

Lingyu Zhang