- School of Economics and Management, Shanghai Ocean University, Shanghai, China

How to optimize grain reserve management, reduce the cost of grain reserve, improve the efficiency of grain reserve and enhance the comprehensive strength of national grain reserve is a practical problem that the government and society pay close attention to. This paper innovatively proposes a two-way option grain reserve model, constructs a dynamic reserve system composed of government and grain storage enterprises, and uses mathematical modeling and optimization methods to explore the optimal option purchase quantity of the government under the two-way option reserve model, and simulates the sensitivity of government and enterprise decision-making parameters. The research shows that the two-way option contract signed by the government and enterprises can effectively reduce the cost of grain reserve and effectively balance the amount of static reserve and dynamic reserve. Under the condition that the total grain reserve remains unchanged, the relationship between the government's optimal grain static reserve and the government's optimal call option purchase and the call option strike price is determined. Depends on the difference of the sum of put option execution cost and reserve cost; The relationship between the government's optimal grain static reserve and the government's optimal call option purchase and the put option strike price depends on the difference between the sum of the call option execution cost and the reserve cost. The government's put purchase is an increasing function of the put strike price and a decreasing function of the two-way option premium and the possibility of grain utilization. Finally, on the basis of analyzing the potential risks in the process of implementing the two-way option of grain reserve, the paper puts forward countermeasures and suggestions. This study has very important theoretical and practical guiding significance for guiding financial institutions to launch financial products and services reasonably.

1 Introduction

Since 1955, China has established and continuously improved the grain reserve system, adopting the grain reserve mode of government reserve as the main and market regulation as the supplement. Its main goal is to cope with major natural disasters, wars and other emergencies, maintain social stability, protect the interests of farmers, calm prices, protect the stability of the grain market and ensure food security, so as to be prepared (Zheng and Pu, 2019). From the perspective of reserve management, grain reserve can be divided into static reserve and dynamic reserve. Static reserve means that the government purchases grain to reserve itself or entrusts the storage enterprises to reserve spot grain. Dynamic reserve means that the government and enterprises sign a contract, and the enterprises reserve grain. During the contract period, the right to use grain belongs to the enterprises. When the government produces demand, it buys and sells grain according to the price agreed in the contract, and the government gives the enterprises a certain contract fee as compensation.

Up to now, China's grain reserve system still has a series of practical problems (Kong and Chen, 2024). This is also a problem that the government has paid close attention to in recent years, so it needs continuous innovation in grain reserve management. Grain as a seasonal product (Payne and Peters, 2004), its long production cycle leads to seasonal supply characteristics, which increases the difficulty of grain reserve management. The government static reserve is an important channel for grain reserve, but not the only one. The greater the reserve of refined grain, the stronger the ability of food emergency security. However, if the government static reserve is simply increased, the food liquidity is poor, and it is difficult to meet the national requirements for refined grain reserve rotation at least twice a year. Different from the general commercial material reserve, the grain reserve has the characteristics of low demand probability, difficult to determine the demand, high cost caused by stock shortage, and strong timeliness. This requires the good use of market and government regulation means, without reducing the total amount of grain reserves, do everything possible to enhance the dynamic reserve capacity and reduce the cost of reserve. Therefore, this paper innovatively introduces option contract as a grain reserve innovation management tool, which has important theoretical and practical guiding significance for guiding financial institutions to launch financial products and services reasonably.

Option contract mainly exists to deal with risks. Option contract is a kind of financial derivatives contract, which gives the buyer of option the right to reorder or return some commodities that have been ordered within the validity period of the option contract. The underlying asset of an option can be a commodity, a stock, a foreign exchange, etc. The price of an option contract is called an option premium and is paid by the buyer to the seller. This paper constructs a dynamic reserve system composed of the government and grain storage enterprises, discusses how to reduce the cost of grain reserve through the two-way option reserve mode, discusses the government's two-way option purchase quantity and the optimal static reserve quantity under the condition of two-way option establishment, and puts forward countermeasures and suggestions for the potential risks in the implementation process. This paper innovatively proposes the two-way option grain reserve mode. During the transition period from normalization to emergency, it can not only deal with various emergencies, but also improve the flexibility and economy of grain reserve, enhance the dynamic reserve capacity, and realize more efficient and economical reserve management.

2 Literature review

2.1 Research on grain reserves

The Food and Agriculture Organization of the United Nations (FAO) defines food stocks as “the amount of food stored at the beginning of a new agricultural year from the previous year's crop harvest.” Because food production is subject to cyclicality and instability, and food demand is persistent and uncertain, in order to minimize the risks to people, food stocks are needed to balance food shortages caused by factors beyond their control (Jiang and Ji, 2024). Since the 1990s, with the development of China's socialist market economic system, China's grain reserve system has been gradually established and continuously improved, which has played a role in safeguarding farmers' interests and ensuring food security. This requires continuous improvement of the national reserve system and scientific adjustment of the structure, types and scale of reserves to improve the efficiency of reserves. From a macro point of view, improving the efficiency of grain reserves is reflected in ensuring food security, stabilizing market prices, responding to emergencies, optimizing the reserve structure, improving management efficiency, and enhancing national strategic capabilities. From the micro point of view, improving the efficiency of grain reserve is reflected in optimizing inventory management, improving storage conditions, strengthening supply chain management, risk assessment and response, and data-driven decision-making. From the perspective of food policy, most scholars focus on the two themes of loosening grain purchase and sale control and strengthening the construction of post-production service system. For example, Tong et al. (2019) and Tan et al. (2014) evaluated the effect of China's grain market regulation policies through policy operation mechanism and comparative analysis, and the research showed that China's grain market regulation policies could mobilize farmers' enthusiasm to grow grain and ensure food security. While ensuring the stability of food supply chain is the key premise to ensure food security, Wang and Gao (2023) believes that building a Chinese-style modern food supply chain is an inherent requirement and inevitable choice to seek happiness for the people and strengthen food security. In addition, with the rapid development of information technology, Song et al. (2023) analyzed the digital construction of production, transportation, storage, processing and marketing of food supply chain from two aspects of food supply chain security and emergency state of food security. Multi-subject information of food supply chain needs to be shared and interactive. In order to effectively improve the capacity of grain reserve; Qing et al. (2023) and Gao (2024) analyzed the internal mechanism and feasible path of food security under the background of “double cycle” to study how to improve the emergency food supply capacity. However, there are still a series of problems and contradictions in China's grain reserve system, such as how to balance food security and grain reserve efficiency. Cao et al. (2022), Gao and Gong (2012) discuss the development of China's grain reserve system, realistic challenges and improvement directions. Jiang and Rong (2024) and Li (2016) studied the efficiency of grain reserve management, and studied how to improve the efficiency of grain reserve management from the micro level of the tripartite game between the government, enterprises and society. At present, China's grain reserve is basically through qualitative and quantitative methods, such as game theory, social network analysis method (Liu et al., 2024), dynamic entropy weight method (Wang and Qu, 2024) and other methods to study grain reserve policy, grain supply chain and other topics.

Based on the findings of the above literature review, the current literature research points out multiple paths to improve the efficiency of grain reserve from the aspects of policy regulation, supply chain construction, digital technology application and management efficiency. However, there are relatively few literatures on how to innovate grain reserve management, improve grain reserve efficiency by optimizing grain reserve quantity and reducing reserve cost, especially the studies on how to improve grain reserve efficiency by introducing two-way option reserve model are still relatively rare.

2.2 Research on two-way option reserve

An option is a financial contract that gives the holder the right to reorder or return some ordered goods on or before a specific date in the future. Options are divided into American options and European options, the difference being that American options can exercise the right at any time, while European options limit the right to exercise for a specific period of time. The two-way option studied in this paper belongs to the American option. As a financial derivative, the call option gives the buyer the right to buy the commodity according to the contract price. A put option gives the buyer of a put option the right to return some of the remaining commodity over the life of the option contract. The combination of a call option and a put option forms a two-way option, which gives the buyer of the two-way option the right to reorder or return some of the ordered goods during the life of the option contract, while the premium is the fee paid by the buyer to the seller for the rights held by the option contract.

Option is usually used in the financial supply chain, mainly to reduce the supply chain due to product demand uncertainty, supply uncertainty, price uncertainty caused by the multi-source risk (Jiang and Liang, 2024), reduce the risk of multi-source risk to the buyer and seller brought profit reduction. Scholars have carried out extensive research on two-way option. Jin et al. (2020) and Wang et al. (2024) have carried out in-depth discussion on two-way option from basic concept to pricing model, risk management and hedging strategy, providing important reference and guidance for theoretical research and practical application of two-way option. Rabbani et al. (2015) proposed an option pricing model based on binomial tree to optimize the option price and the exercise price under four conditions, and the results show that there is a negative correlation between the option price and the exercise price. Wang et al. (2015) propose a pre-purchase model with option contracts (PPOC) model to address the immediate purchase or pre-purchase dilemma faced by the management of humanitarian operations. Tan et al. (2021), Xiang and Luo (2022) combined two-way option with risk avoidance to study how retailers optimize purchasing strategies to avoid risks under two-way option. Chen (2020) studied the optimal decision of retailers' mixed spot and option purchasing under risk avoidance, in order to reduce the risk of out-of-stock loss or product unsalable to retailers.

The application of option contracts and derivative instruments in agricultural supply chain risk management exhibits diversified and innovative characteristics. Against the backdrop of escalating trade frictions and market volatility, Xu et al. (2025) proposed the AERV model, which enhances implied volatility forecasting accuracy through multi-financial instrument data integration. Combined with the “insurance + futures” framework, this model effectively diversifies agricultural price risks. Empirical results demonstrate its significant role in stabilizing farmers' income. To address supply chain uncertainties, Chong and Xu (2018) and Yang et al. (2017) independently validated the value of put options and double-sided options in controlling perishable product inventory risks. Deng and Chong (2022) validated the value of call options, put options, and double-sided options in controlling perishable product inventory risks. Their findings revealed that dynamic adjustments to option premiums and strike prices can align the interests of supply chain participants, with double-sided options offering unique advantages by balancing shortages and surplus risks. In the context of green supply chains, Mohamad et al. (2021) further integrated call options with revenue-sharing contracts, demonstrating their capacity to achieve simultaneous environmental and economic objectives under demand volatility caused by the COVID-19 pandemic. For specialized scenarios, Yemei et al. (2022) designed an option-based coordination mechanism tailored to the perishability of festival foods, reducing waste costs by 27%. Technological innovations include Luo et al. (2024)'s early-stage crop identification model, which leverages Sentinel remote sensing data to achieve an F1-score of 0.97, providing precise data support for futures and insurance products. Meanwhile, Wang et al. (2021) analyzed the cost efficiency of China's live pig industry, highlighting that “insurance + futures” tools can mitigate efficiency losses under environmental regulations. Collectively, option-based instruments are reshaping risk management paradigms across agricultural supply chains through three pathways: risk reallocation, supply chain coordination, and technological advancement. This tripartite framework is redefining risk response strategies throughout the agricultural value chain. With the in-depth study of scholars on two-way option, two-way option has been gradually applied to supply chain management of emergency materials procurement. Meng et al. (2023) studied the optimal reserve decision of the purchaser and the parameter conditions required for supply chain coordination by establishing the emergency materials reserve model.

Based on the above literature review, Option-based instruments are redefining paradigms in agricultural risk management through three interconnected pathways: risk reallocation, supply chain coordination, and technological innovation. It is found that two-way options can help reduce the risks of product shortage and inventory overhang caused by the uncertainty of demand, supply and price in the supply chain, and improve the stability and efficiency of the supply chain. Two-way option has been applied to the supply chain of emergency materials procurement to optimize the procurement strategy. However, the research of two-way option in grain reserve management is still relatively rare. This study introduces the two-way option reserve model into grain reserve management, builds a dynamic reserve management system composed of the government and grain storage enterprises, and discusses how to reduce grain reserve costs through the two-way option reserve model and analyzes the conditions for reducing grain reserve costs under the two-way option reserve model under the condition that the total grain reserve remains unchanged. Under the conditions of the establishment of two-way option, the government's two-way option purchase volume and static reserve volume are analyzed by numerical simulation, and their application and effect in theory and practice are discussed. Finally, countermeasures and suggestions are put forward for potential risks in the implementation process.

3 Model analysis

3.1 Problem description

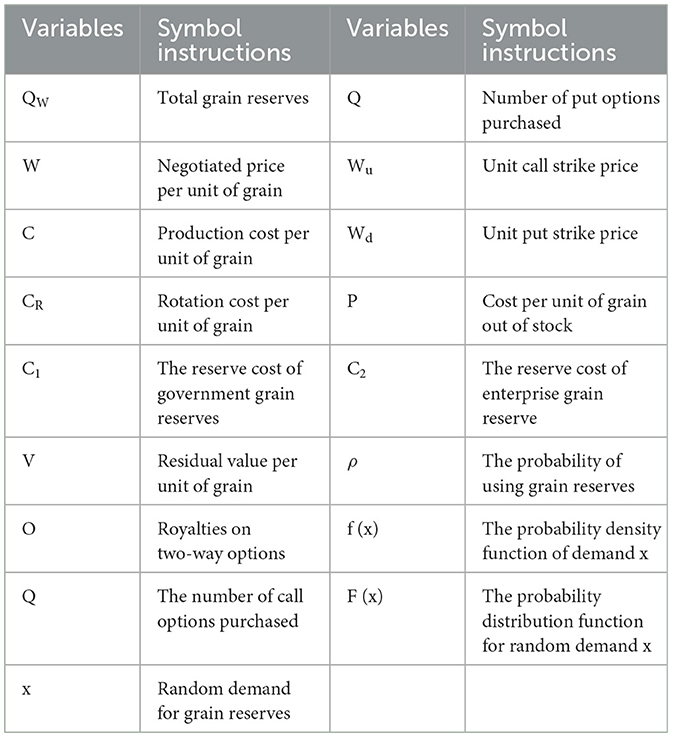

Government reserve mode is a non-option contract widely used in grain reserve procurement. The government purchases a certain amount of grain from grain storage enterprises at the agreed price for reserve. After the grain storage enterprises sell the grain to the government, neither party can adjust the quantity. The government bears all the risks of uncertain demand under the government reserve mode, while the enterprises do not bear any risks. For the enterprise, its profit depends on the quantity purchased by the government and the agreed price, and is not affected by other factors. The government has the economic motive to purchase the optimal quantity of grain reserves at the lowest cost, but the static reserve mode of the government can not effectively encourage enterprises to improve their profit level, and can not make the government reserve and storage enterprises reach the Pareto optimal. The relevant variables and symbol Settings of this study are shown in Table 1.

In the static stockpiling model, the government buys QW units of grain from suppliers at a negotiated price of W for stockpiling before an emergency demand arises. Once the emergency demand is created, the grain is transported to the area of demand. If the emergency demand x is less than the amount of government reserves, i.e. x < QW, then the remaining quantity QW-x is processed with a residual value V, giving a residual value benefit of V (QW-x). If the emergency demand X is greater than the amount of government reserves, i.e. x > QW, then the government will incur a shortage cost P (x –QW). The profit of a grain storage enterprise is the difference between sales revenue and production cost, i.e., (W-C) QW.

From the normal state to the emergency state, after the emergency demand for food, the reserve grain is quickly transported to the emergency demand area, so the extra cost of delayed supplies will be incurred during the period when the reserve grain arrives at the designated demand place. Compared with this cost risk, the risk caused by the failure of the reserve grain to be deployed to the urgent place is more worrying. Therefore, the government pays special attention to how to improve the efficiency of grain reserve and reduce the cost of government reserve.

3.2 The optimal purchase amount of options under the dynamic reserve mode of two-way option contract

3.2.1 The mechanism of two-way option reserve mode

Under the condition that the total grain reserve remains unchanged and the interests of enterprises are not sacrificed, the cost of grain reserve is reduced through the combination of spot and futures. Figure 1 shows the operation mode of dynamic reserve of two-way option contract. Assuming that the total grain reserve remains unchanged, the government purchases the two-way option of enterprises at the beginning of the reserve period. If there is a demand for grain reserve, the government will first use the planned reserve; if there is still surplus grain reserve within the contract period, the government will execute the put option within the contract validity period; if the actual grain reserve of the government is not enough to meet the unexpected demand under abnormal conditions, the government will execute the call option; If there is no emergency demand for reserve grain, the government can execute the put option before the expiration of the contract. However, whether it is a call option or a put option, the government can not buy or sell more than the remaining amount agreed in the contract, the government has the right to choose whether to exercise the two-way option, and the enterprise has no right to force the government to exercise it.

This paper assumes that under the condition that the total grain reserve remains unchanged and the interests of the enterprise are not sacrificed, in order to reduce the cost of grain reserve, the government signs a two-way option agreement with the storage enterprise, agreeing to pay a certain option fee to the storage enterprise at the beginning of the period. The government has the right to require the storage enterprise to buy or sell the remaining quantity not exceeding the quantity agreed in the agreement according to the price agreed in the contract. In this way, the government not only reduces the cost of the reserve, but also provides compensation for the losses that the storage enterprises may suffer.

Demand for grain reserves is uncertain, as they are usually used to cope with major disasters or emergencies and to calm market prices. According to the principle of uniform distribution and exponential distribution, the grain reserve demand x (x > 0) is a continuous random variable, and its probability density function, cumulative distribution function and inverse function are f (x), F (x) and F −1 (x) respectively, where F (x) and F (x-1) are monotonic increasing functions, whose maximum value is U and average value is μ, F (x) ε (0,1] and continuously differentiable (John et al., 2020; Lodree and Taskin, 2008). Therefore, we use the exponential distribution to analyze the proposed model (Hu et al., 2020). It is assumed that the call option exercise price is higher than the agreed price and the put option exercise price, that is, the grain reserve left after the exercise of the option is recovered as a put option by the storage enterprise at a cost lower than the agreed price. Otherwise, the government and the enterprise will not be willing to sign the two-way option, and the production cost of each unit of grain is greater than the residual value of each unit of grain and less than the agreed price of each unit of grain, otherwise it cannot guarantee that the storage enterprise can obtain reasonable returns; The put option execution price is greater than the sum of residual value and royalty, otherwise it cannot meet the government's expectation to reduce the reserve cost, and it must ensure that the put option execution price is less than the sum of the agreed price and royalty, so as to ensure the interests of the storage enterprises.

3.2.2 Model construction of two-way option reserve mode

The expected cost of government when grain reserve is passive is as follows:

The first part (W-C) (QW-Q) is the sum of the procurement cost and storage cost of the government's reserve grain, the second part O(q+Q) is the cost of the government's purchase of the two-way option, the third part is the income obtained by the government's execution of the put option and the residual value income of the remaining reserve grain after all the execution of the put option, and the fourth partis the income of the government's execution of the put period. The fifth part is the cost of the government's execution of the call option, and the sixth part is the shortage cost when the government still cannot meet the emergency demand after the execution of all the call options.

When grain reserve is not passive, the expected cost of the government is as follows:

Therefore, the expected cost of the government over the entire reserve period is:

When the grain reserve is used passively, the expected profit of the storage enterprise:

The first part O(q +Q) is the two-way option income of the storage enterprise, the second part (W-C) (QW-Q) is the net sales income of the storage enterprise, the third part Q(C+C2) is the production cost and storage cost of the call option of the storage enterprise, and the fourth part is the income of the storage enterprise processing the number of call options when the demand for reserve grain x is 0 < x < QW-Q. The fifth part is the cost of the storage enterprise executing all put options when the grain demand x is 0 < x < QW-Q-q; the sixth part is the cost of the storage enterprise executing part of put options when the grain demand x is QW-Q-q < x < QW-Q. The seventh part is the income of the storage enterprise executing call options and the income of processing the number of remaining call options when the demand for grain reserve x is QW-Q < x < QW; the eighth part is the income of the storage enterprise executing all call options when the demand for grain reserve x is QW < x < U.

When grain reserve is not passive, the expected profit of the storage enterprise is as follows:

The first part (W-C) (QW-Q) is the net sales income of the storage enterprise, the second part O(q+Q) is the two-way option income of the storage enterprise, the third part Q(C+C2) is the production and storage cost of the call option of the storage enterprise, and the fourth part VQ is the salvage value income of the call option of the storage enterprise. The fifth part (QW-Q) (Wd-V) is the cost of the storage enterprise to execute the put option.

So the expected profit of the depositor over the entire reserve period is:

3.3 Conditions for the establishment of two-way option reserve model

Proposition 1: Only when A < B < ρ < 1 can the government have the incentive to sign two-way options, then the optimal static grain reserve, the optimal call option reserve and the optimal put option reserve of the government are as follows:

Proof:

Solve Equation 3 for the second derivative of Q, q:

Since B2-AC < 0 and A > 0, the government expects the cost function to have a minimum-cost procurement strategy.

Therefore, taking the first derivative of (3) with respect to Q and q, respectively and setting them equal to 0 yields:

From (10) +(11) :

Gets from (11) :

Hence:

3.3.1 When A=B, the government has no desire to enter into a two-way option

Proof: When A=B there is, there is . Hence . So we can conclude that q* = 0.

3.3.2 When A < B < ρ < 1, the government is willing to enter into a two-way option

Proof: when A < B < ρ < 1, because F(x)is a monotone increasing function, and B < ρ < 1, so . So q* and Q* both are >0. Therefore, it can be concluded that the optimal static reserve and the optimal two-way option purchase of the government are:

3.3.3 When 0 < ρ < A < B < 1, the government has no willingness to enter into a two-way option

Proof:

When 0 < ρ < A < B < 1, i.e., . Than but the distribution function F (x)≥0, so the two are mutually contradictory. Therefore, the proposition 1 is obtained.

3.3.4 The nature of two-way option reserve mode

It can be observed from proposition 1 that the government is willing to pay the royalty to purchase the two-way option only when the inequality between the royalty and the option execution price in the two-way option contract is satisfied. Otherwise, the government will not be willing to buy the two-way option, and the grain reserve mode changes from the dynamic reserve of the two-way option contract to the static reserve mode of the government. In addition, according to the optimal reserve decision in proposition 1, the following properties can be obtained.

Property 1: The relationship between the government's optimal grain static reserve and the call option strike price depends on the difference between the put option execution cost and the sum of the purchase cost and the reserve cost, the relationship between the government's optimal grain static reserve and the put option strike price depends on the difference between the call option execution cost and the sum of the purchase cost and the reserve cost, and the government's optimal grain static reserve has nothing to do with the royalties.

Proof:

Caused by:

Find the derivative of with respect to Wu and Wd:

Thus, property 1 is obtained: in the two-way option reserve mode, if the sum of purchase cost and reserve cost is greater than the put option strike price, then the optimal static reserve is an increasing function of the call option strike price, and vice versa, the optimal static reserve is a decreasing function of the call option strike price; If the sum of purchase cost and reserve cost is greater than the call option strike price, then the optimal static reserve is a decreasing function of the put option strike price, and vice versa, the optimal grain static reserve is an increasing function of the put option strike price.

Property 2: In the government two-way option reserve model, the government's put option purchase is an increasing function of the put option strike price, and a decreasing function of the two-way option royalty and the possibility of grain utilization.

Find the derivative of q* with respect to O, Wd and ρ:

Thus, property 2 is obtained: In the government's two-way option reserve model, the government's put option purchase is a function of the increase of the put option strike price, and a function of the decrease of the two-way option premium and the possibility of using grain. The higher the put strike price, the more put the government buys, and the higher the two-way option premium, the less put the government buys.

Property 3: The relationship between the government's optimal call purchase and the put strike price depends on the difference between the call execution cost and the purchase cost and the reserve cost; The relationship between the government optimal call purchase and the call strike price depends on the difference between the put execution cost and the purchase cost and the reserve cost.

Proof:

Find the derivative of Q* with respect to Wu and Wd:

Thus, property 3 is obtained: In the government two-way option reserve model, if the sum of purchase cost and reserve cost is greater than the call option strike price, then the government's optimal call option purchase is an increasing function of the put option strike price; conversely, the government's optimal call option purchase is a decreasing function of the put option strike price; If the sum of purchase cost and reserve cost is greater than the put option strike price, then the government's optimal grain static reserve is a decreasing function of the put option strike price, and vice versa, the government's optimal call option purchase is a decreasing function of the put option strike price.

4 Numerical simulation

Under abnormal conditions, the emergency grain demand and the reserve grain demand are similar to a certain extent and have strong correlation. Therefore, this study draws on the exponential distribution of the emergency material demand, assuming that the reserve grain demand follows the exponential distribution of [0, 20,000], with the mean μ = 2,000 (Hu et al., 2019; Tian et al., 2014; Zhang and Tian, 2011). According to the data information of reserve grain purchase price and reserve cost published on the national government website, the following related parameter assumptions are given: the government agreement price ω = 3,322 yuan/ton, the government unit storage cost C2 = 1.16 yuan/ton, C = 1 yuan/ton, the end of the grain salvage value V = 3,040 yuan/ton, and the expected unit grain market price p = 3,500 yuan/ton. In the case of using the two-way option contract procurement model, the sensitivity analysis of government and enterprise decision parameters is carried out.

4.1 Sensitivity analysis of government procurement decision

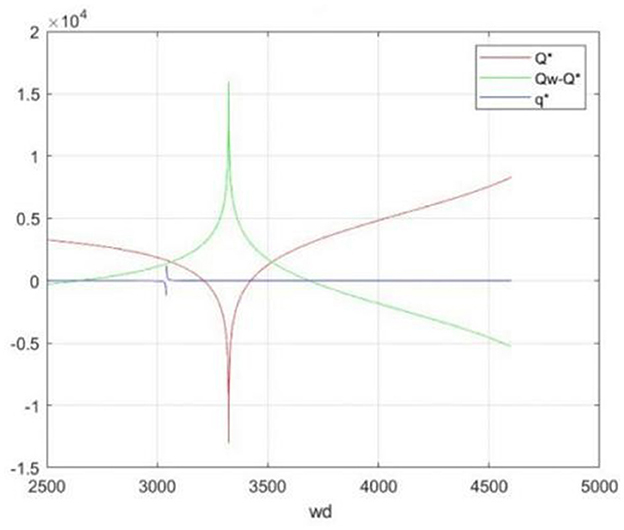

Figure 2 shows how the government's optimal grain static reserve, optimal call option purchase and optimal put option purchase change with the put strike price when ρ=0.3. It can be seen from Figure 2 that the changes of optimal grain static reserve and optimal call option purchase are opposite, which also confirms properties one and three: when the sum of purchase cost and reserve cost is less than the call option strike price, the optimal grain static reserve is an increasing function of the put option strike price, while the government's optimal call option purchase is a decreasing function of the put option strike price; When the sum of purchasing cost and reserve cost is greater than the call option execution cost, then the optimal grain static reserve is a decreasing function of the put option strike price, and the government's optimal call option purchase is a decreasing function of the put option strike price. The optimal put purchase of the government is near the horizontal axis, but not less than zero, indicating that the optimal put purchase of the government is not sensitive to the put strike price. For the government, under the condition that the total grain reserve remains unchanged, with the increase of the put option strike price, the government will increase the static reserve and reduce the futures reserve in order to increase the return from executing the put option and reduce the reserve cost. In other words, the government will reduce the call option reserve as the put option strike price increases to a certain value. The government starts to reduce the static reserve and increase the call option reserve, because after reaching a certain peak value, the sum of purchase cost and reserve cost is greater than the call option execution cost. In this case, the increase speed of total grain reserve cost caused by the government increasing the static reserve is greater than that of total grain reserve cost caused by the government increasing the call option reserve. Therefore, the government will reduce the static reserve and increase the call option reserve, thus reducing the reserve cost. The amount of put options purchased in the range of [3,200, 3,430] is negative. At this time, the government's grain reserves are static reserves, but this situation is not practical, because the reserves are non-negative. Different from Li et al. (2023), the optimal two-way option reserve varies with the change of call option strike price, while the optimal dynamic and static reserve in this paper changes with the change of put option strike price. This is because Li Jian's assumption is that the call option reserve is equal to the static reserve, and the total reserve is variable. Contrary to the hypothesis of this paper that the call option reserve and the static reserve are not equal and the total reserve is constant.

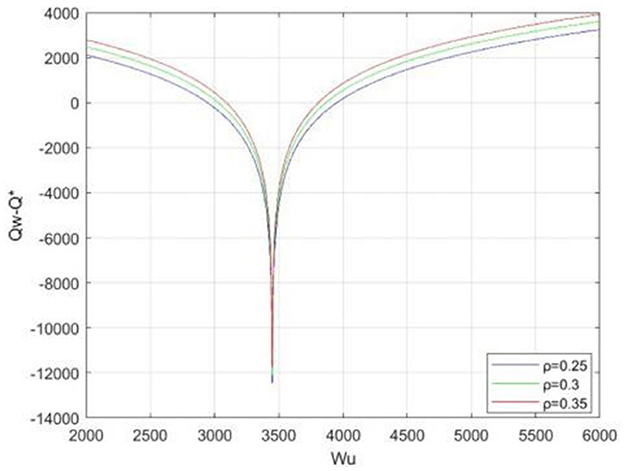

Figure 3 shows how the government's optimal grain static reserve changes with the call option strike price when ρ = 0.25, ρ = 0.3, and ρ = 0.35. As can be seen from Figure 3, when the call option strike price is in the range of [0, 2,950], the government's optimal grain static reserve decreases with the increase of the call option strike price. Since the total reserve is unchanged, the reduction of static reserve will inevitably lead to the increase of dynamic reserve. This is because when the sum of purchase cost and reserve cost is smaller than the put option strike price, even if the increase of the call option strike price leads to the increase of the two-way option cost, the total reserve cost caused by increasing the two-way option purchase is smaller than that caused by increasing the static reserve amount. The static reserve amount in the range of call option strike price [2,950, 3,950] is negative, which is inconsistent with reality, so the static reserve amount is meaningless in this range. When the call option strike price is >3,950 yuan, the optimal static grain reserve of the government increases with the increase of the call option strike price, while the increase of static grain reserve will inevitably lead to the decrease of dynamic grain reserve, because the sum of the negotiated price and reserve cost is greater than the put option strike price at this time, that is, the put option cannot fully cover the full cost of the static reserve. And the higher the strike price of the call option, the higher the cost of executing the call option by the government, that is, the higher the cost of increasing the purchase of two-way option. At this time, although the put option makes up a part of the cost, the cost caused by increasing the static reserve is smaller than the total reserve cost caused by increasing the dynamic reserve.

It can also be seen from Figure 3 that the higher the possibility of using grain reserves, the higher the static reserve of the government will be. This is because the frequent occurrence of natural disasters and other reasons will increase the possibility of using grain reserves, thus increasing the possibility of the government using static grain reserves and reducing the possibility of surplus grain reserves, thus reducing the risk of losses borne by the government. As a result, the optimal static grain reserve of the government will increase with the increase of the possibility of using grain reserve.

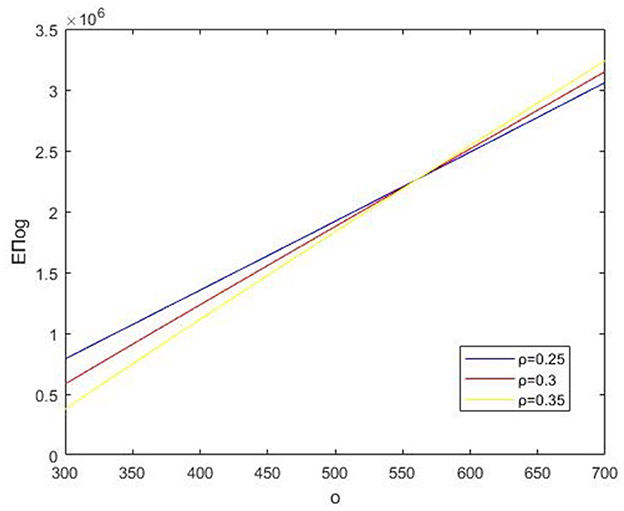

As can be seen from Figure 4, under the condition that two-way option is established, the expected cost of government increases with the increase of royalty. Generally speaking, the cost of two-way option is directly proportional to the royalty. The government hopes to protect grain reserves by purchasing options to prevent losses caused by price fluctuations, and such protection needs to pay a certain cost. Therefore, the increase of royalty will lead to the increase of the cost of purchasing two-way option by the government, thus leading to the increase of the total reserve cost of the government. And with the increase of ρ, the government is willing to bear the risk, or instability increases, the cost of buying two-way options will increase, the impact of royalty on the government's expected cost is more significant, because when the government's expected risk of food price volatility is higher, the price of two-way options will increase accordingly to cope with the higher risk. The cost curves of different slopes intersect at a point, where the government's cost of buying two-way option and the benefits brought by protecting grain reserves are equal to the equilibrium state. The government can balance risks and costs to maximize social benefits and make the optimal decision between risk control and cost.

4.2 Sensitivity analysis of enterprise pricing decision

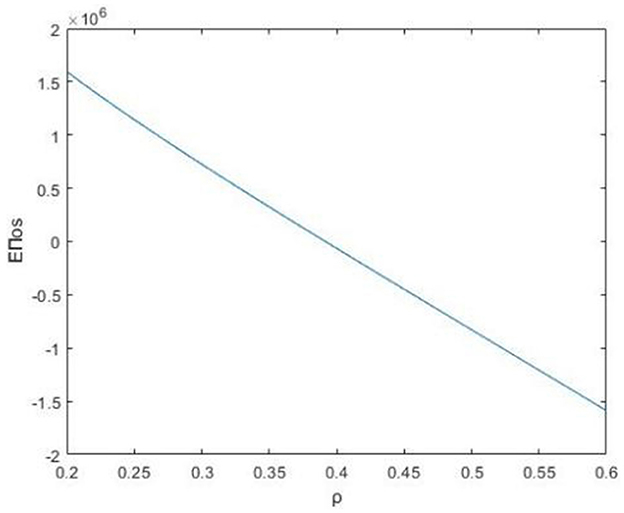

As can be seen from Figure 5, under the condition that the two-way option is established, the profit of the grain storage enterprise decreases with the increase of the possibility of grain being called, and when the possibility of grain being called is >0.355, the profit of the grain storage enterprise will be less than zero, which indicates that the frequent occurrence of natural disasters and other reasons will increase the possibility of grain reserve being used. Thus, the possibility of static grain reserve being used by the government is increased. According to proposition 1, the condition that the government is willing to sign the two-way option contract is A < B < ρ < 1, and the storage enterprise will not sign the two-way option contract with the government when the possibility of using the grain reserve is high. Because the two-way option contract reserve mode transfers the risk in the process of grain reserve of the government to the depositor, once the possibility of grain being used is too high, the depositor may suffer great losses; If the possibility of grain being called is moderate, both the government and the enterprise are willing to accept the reserve mode of two-way option contract, at which time the depositor can obtain the corresponding royalty income to make up for the loss caused by risk sharing. Therefore, the reserve mode of two-way option contract is suitable for areas where the possibility of grain being called is moderate or small.

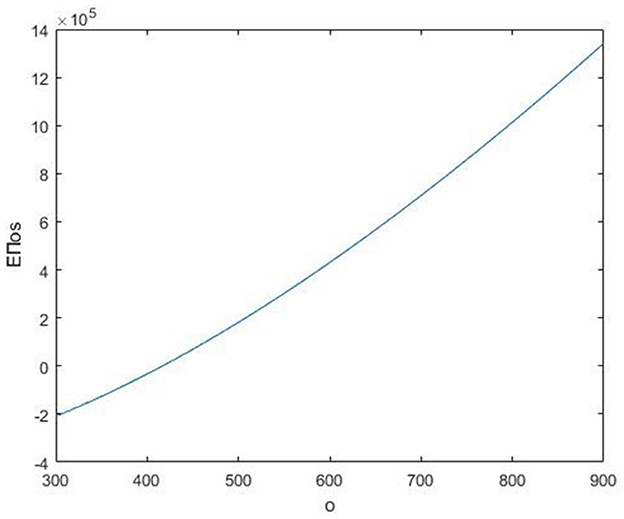

As can be seen from Figure 6, the expected profit of the depository enterprises increases with the increase of the royalty, which, like the conclusion drawn by Prasad and Jha (2022)., reflects the risk-reward trade-off faced by enterprises when considering two-way options trading. As the royalty increases, the risk taken by the firm decreases as the government pays more to buy the option, thus providing more protection for the firm. However, when the royalty is too low and the expected profit of the depositories is negative, even if the government is willing to sign the two-way option, the royalty can not make up for the losses caused by the risk sharing of the enterprises, so the enterprises lack the motivation to sign the two-way option contract with the government. Therefore, in the pricing decision-making process of the two-way option contract reserve model, the depositories should not only hope to maximize profits, but also pay attention to the establishment conditions of the reserve model, that is, the range of royalties when the government and the depositories reach the optimal reserve decision.

5 Risk analysis of two-way option grain reserve management

Through the above analysis, it can be found that although the two-way option grain reserve mode can reduce the cost of grain reserve and improve the efficiency of grain reserve, China's legal and regulatory framework can not fully adapt to the operation of two-way option. The government may face legal uncertainties and regulatory challenges when implementing the two-way option. The government needs to pay attention to many aspects of its expertise in options pricing, market forecasting and risk assessment when implementing two-way option grain reserves.

According to the research conclusion of Wang (2011) and Li (2024), there are mainly potential risks such as financial risk, market manipulation risk, operational risk, information asymmetry risk, legal and policy risk and moral risk when the government implements two-way option grain reserve mode. Financial risk mainly refers to the government signing option contracts, if the expected cost savings is not enough to offset the option costs and the additional costs that may bring, the government will face a higher risk; According to Black-Scholes option pricing theory, option prices are affected by a variety of factors, such as underlying asset prices, volatility, risk-free interest rates, etc. (Shi, 2024). Market fluctuations will lead to changes in underlying asset prices and affect option costs, so there are financial risks. In grain reserve options pricing, the Black-Scholes model exhibits high sensitivity to volatility. International grain price fluctuations impact domestic options pricing through three primary channels: 1) trade dependency transmission, 2) exchange rate leverage effect, and 3) policy intervention buffering. Market manipulation risk refers to the behavior of controlling market price by improper means, which violates the principle of market fairness and may lead to market failure and market manipulation risk. The 2010 Russian wheat export ban exposed risks of policy information opacity, while the 2019 Indian onion crisis revealed vulnerabilities in false information dissemination. Operational risk refers to the phenomenon that the operational complexity of two-way option contract increases the difficulty of its risk management. Risk management includes risk identification, risk assessment, risk control and risk monitoring and other links. The greater the uncertainty of two-way option operation, the greater the risk, which requires effective management and reduction of operational risk. Information asymmetry risk refers to the adverse selection and moral hazard caused by information asymmetry. For example, an enterprise may conceal unfavorable information to influence the government's decision making. Legal and policy risks mainly refer to corporate default. Changes in policies and regulations may lead to legal uncertainty and increase transaction costs and risks (Meng, 2023). For example, the contract law stipulates the legal effect and execution of contract terms, and the default may lead to legal action and compensation liability. Moral hazard mainly refers to that when the government provides financial subsidies, policy support and other guarantees to the depository enterprises, the enterprises may relax risk management, resulting in moral hazard.

6 Conclusion and countermeasure suggestion

This paper establishes a grain reserve model of two-way option contract, and draws the following conclusions: the introduction of two-way option contract is conducive to the government's grain reserve management, and the government controls the dynamic reserve amount and grain reserve cost by adjusting the quantity of two-way option adjustment. After the government determines the total grain reserve amount, it can adjust the static reserve amount and dynamic reserve amount upward and downward. The relationship between the government's optimal grain static reserve and the government's optimal call option purchase and the call option strike price depends on the difference between the sum of put option execution cost and reserve cost, and the relationship between the government's optimal grain static reserve and the government's optimal call option purchase and the put option strike price depends on the difference between the sum of call option execution cost and reserve cost. The amount of government put option purchase is an increasing function of put option strike price, and a decreasing function of two-way option premium and the possibility of grain utilization. This study provides a theoretical basis for the government to guide financial institutions to reasonably launch two-way option financial products and services. In order to effectively reduce the risk of two-way option grain reserve, this paper puts forward the following countermeasures and suggestions:

Formulate budget plan and emergency fund. Governments or reserve management institutions can hedge against international price volatility risks by utilizing cross-market options while analyzing cost-benefit boundaries, or establish volatility warning thresholds to enhance the practical operability of the model. The government needs to conduct regular cost-benefit analysis, understand the actual cost situation of its various business activities, evaluate the cost-benefit ratio of two-way options and adjust the strategy in time, formulate detailed budget plans and reserve emergency funds to cope with the fluctuations of the option market, so as to make scientific and reasonable decisions.

Market supervision should be strengthened. Establish and improve market supervision mechanisms to ensure the transparency and fairness of the two-way options market. It is recommended to embed blockchain platforms in grain reserve management systems, where blockchain records timestamps, participating parties, and transaction details for each option contract. Machine learning algorithms can analyze on-chain data (e.g., high-frequency low-price dumping patterns) to identify anomalies in real time and pinpoint manipulative entities. Third-party regulatory bodies should be integrated as nodes to construct a collaborative oversight network among “government-enterprise-third-party” entities, breaking data monopolies. By adopting zero-knowledge proof technology, enterprises can validate the authenticity of reserve quantities (e.g., compliance with standards) without disclosing specific figures, achieving both privacy protection and transparency. The regulatory authorities should strengthen the strict supervision of options trading and crack down on all kinds of illegal behaviors so as to maintain the normal order of the options market.

Standardize the two-way option operation process. Establish a sound two-way option operation procedure, clarify the business process and the division of responsibilities, and ensure the standardized and orderly operation. Regular two-way option operation training and emergency drills for relevant personnel. In addition, strengthening the construction and maintenance of information technology systems to ensure the stability and safety of the system is also an important means to prevent operation errors caused by technical failures.

Reduce information asymmetries. Implement a strict information disclosure system, and all enterprises participating in two-way grain reserve options are required to disclose key information such as their reserves, purchasing plans and sales plans, so as to improve market transparency and reduce information asymmetry. An independent third-party audit institution is introduced to regularly audit the financial status and operation process of enterprises undertaking two-way option grain reserve, ensure the authenticity and reliability of data, and improve the scientific and accuracy of decision-making.

Improve relevant laws and regulations. Improve the legal framework for two-way options, clarify the rights and obligations of all parties, strengthen the binding force of contracts, pay close attention to changes in relevant policies and regulations, flexibly adjust response strategies, seek advice from professional legal advisers, ensure that all operations comply with legal provisions, emphasize corporate social responsibility, and encourage enterprises to take the initiative to assume corresponding risk management responsibilities.

Multiple departments work together to govern. Relevant government departments, such as the National Food and Strategic Reserves Administration oversees grain reserve planning, dynamically adjusts reserve quantities, and supervises the execution of dual-option contracts. The Ministry of Finance formulates specialized budgets, allocates funds for options fees and emergency reserves, and reviews cost-benefit analysis reports. The State Administration for Market Regulation monitors futures market transactions, combating price manipulation and other violations. The Ministry of Agriculture and Rural Affairs coordinates grain production and reserve demand alignment, providing seasonal supply data support. The Ministry of Emergency Management participates in formulating emergency response plans and assesses the potential impact of natural disasters on reserve demands, should work closely together to form synergy and jointly deal with various risks. Establish a continuous improvement mechanism, regularly evaluate the effect of policy implementation, and adjust and optimize policies and measures according to the actual situation to ensure the efficient promotion of two-way option grain reserve management.

7 Limitations of the study

In grain reserve options pricing, the Black-Scholes model assumes that the unit grain shortage price (P) is a fixed constant. However, in real-world markets, grain prices are shaped by dynamic factors such as supply-demand dynamics, policy interventions, and international market fluctuations, leading to time-varying characteristics. This rigid price assumption may undermine the model's ability to capture actual market volatility, particularly during unexpected events or long-term reserve scenarios, where ignoring price seasonality could result in cost estimation biases. Additionally, the study assumes that emergency grain demand follows an exponential distribution, with mean parameters derived from historical data. Yet, real-world grain demand is influenced by complex variables such as natural disasters, economic cycles, and sociopolitical stability, which often generate asymmetric or fat-tailed distributions. A single-distribution assumption risks oversimplifying how demand uncertainty impacts reserve decisions. Furthermore, the research focuses on a bilateral decision-making framework between governments and storage enterprises, overlooking interactions with external stakeholders like consumer behavior, financial market liquidity, and international grain trade. These oversights may limit the model's applicability in complex systems.

Future research could address these limitations through several pathways. First, integrating stochastic processes to model the dynamic evolution of grain prices could enable the development of a bidirectional options-based reserve decision framework under time-varying prices, enhancing adaptability to market fluctuations. Second, adopting mixed distributions or non-parametric methods to fit grain demand patterns, supplemented by machine learning techniques to uncover latent structures in multi-source data, could improve the model's precision in handling complex uncertainties. Third, expanding the framework to incorporate multi-agent interactions—such as financial institutions, international grain traders, and end consumers—could provide insights into combining bidirectional options with other financial tools (e.g., futures, insurance) and evaluate how cross-border grain reserve cooperation influences domestic food security. By refining these aspects, the model could achieve greater empirical relevance and policy relevance, offering a robust theoretical foundation for building resilient grain reserve systems.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found at: https://www.lswz.gov.cn/; https://www.grainmarket.com.cn/http://www.stats.gov.cn/; http://www.moa.gov.cn/.

Author contributions

QJ: Project administration, Methodology, Formal analysis, Writing – review & editing, Investigation, Writing – original draft, Funding acquisition, Supervision, Conceptualization. CC: Writing – review & editing, Conceptualization, Investigation, Formal analysis, Software, Methodology, Writing – original draft.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was funded by “China National Social Science Fund Project” Study on dynamic Optimization of urban Main and non-staple food reserve and supply system under nonnormal conditions” (22BGL274) and Modern Agricultural Industrial Technology System Construction Project (CARS-46).

Acknowledgments

The authors would like to express their gratitude for the financial support from “China National Social Science Fund Project” study on dynamic optimization of urban main and non-staple food reserve and supply system under abnormal conditions” (grant no.: 22BGL274), the Modern agricultural industrial technology system construction project (grant no.: CARS-46).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Cao, M. B., Huang, H. S., and Zhao, X. (2022). Evolution logic, realistic contradiction and optimization path of China's grain reserve system. Issues Agric. Econ. 25–33. doi: 10.13246/j.cnki.iae.2022.11.003

Chen, Q. C. (2020). Research on Mixed Spot and Option Purchasing Decision of Risk-averse Retailers Under Fuzzy Demand South China University of Technology.

Chong, W., and Xu, C. (2018). Joint order and pricing decisions for fresh produce with put option contracts. J. Oper. Res. Soc. 69, 474–484. doi: 10.1057/s41274-017-0228-1

Deng, J., and Chong, W. (2022). Option contracts in fresh produce supply chain with freshness-keeping effort. Mathematics 10, 1287–1287. doi: 10.3390/math10081287

Gao, F., and Gong, F. (2012). Operational effectiveness of China's grain reserves: an analysis based on country comparison. Learn. Explor. 83−87. Available online at: https://kns.cnki.net/kcms2/article/abstract?v=m17bUIR54SMPjY7cCYw1PShofTb0Q5EZx60iHqt9fj9qcKE5JvHqyNyXGZfGPiWI_K-XZIpHfuXuWqxtuj1om0kCJyQLStqYwERP433dYFXOhF77gJJDE636aLogLa3tSZE1GDbbF2oMCW8h1eKM4IdIf_T64aIoP-BwPjYAC2S172eWMMQlsfTkIMrzfVyW&uniplatform=NZKPT&language=CHS

Gao, Y. (2024). The internal mechanism and path selection of improving national food security capability under double cycle pattern. J. Agric. Econ. 122–124. Available online at: https://kns.cnki.net/kcms2/article/abstract?v=m17bUIR54SOcym6kkrY_bVrAQHKdmUs1LKuMo4KpHFltb4Jr81b_nytgjaUFNYblag08mM77FvI8ShoHJjEhpqbSYUMtNPERxWuuOdWn-le42JFjlWiNsBFtfzao3Qkcpi5tYNzZgSbVMP1w1YgR3AVebmqOk00D4vXiisIe_AOBEdk_I8C-nHifXifgWn9uuENCDKjsg5E=&uniplatform=NZKPT&language=CHS

Hu, Z. Q., Tian, J., and Feng, G. Z. (2019). Production model of emergency materials based on production capacity of suppliers. Oper. Res. Manag. 28, 100–108.

Hu, Z. Q., Tian, J., and Feng, G. Z. (2020). Put option contract based emergency procurement reserve model. China Manag. Sci. 28, 69–79. doi: 10.16381/j.cnki.issn1003-207x.2020.02.007

Jiang, L., and Liang, J. X. (2024). Network risk communication and intervention of complex supply chain under public emergencies. Comput. Eng. Appl. 60, 296–308. Available online at: https://link.cnki.net/urlid/11.2127.TP.20231024.1737.018

Jiang, Q. J., and Rong, Z. J. (2024). Independent supervision and incentive coordination: A study on social responsibility reserve management of food. Stat. Inf. Forum 39, 84–100. Available online at: https://link.cnki.net/urlid/61.1421.C.20240123.1412.002

Jiang, X. D., and Ji, F. L. (2024). Implications of grain reserve and circulation in Northern Song Dynasty on current food security in China. China Circ. Econ. 38, 26–37. doi: 10.14089/j.cnki.cn11-3664/f.2024.04.003

Jin, X. S., Yuan, W. Y., and Wu, J. (2020). Research on risk control of Supply chain finance based on Revenue share-two-way option contract. China Manag. Sci. 28, 68–78. doi: 10.16381/j.cnki.issn1003-207x.2020.01.005

John, L., Gurumurthy, A., Mateen, A., and Narayanamurthy, G. (2020). Improving the coordination in the humanitarian supply chain: exploring the role of options contract. Ann. Oper. Res. 319, 1–26. doi: 10.1007/s10479-020-03778-3

Kong, F. Z., and Chen, H. G. (2024). Research progress and prospect of rural labor transfer and food security: based on CiteSpace and NVivo visual analysis. J. Agric. Resour. Regionalization China 46, 1–18. Available online at: https://link.cnki.net/urlid/11.3513.S.20240716.1113.014

Li, J., Li, M. C., and Dong, X. P. (2023). Purchasing and reserving model of emergency materials based on two-way option contract. J. Syst. Manag. 32, 463–475. Available online at: https://link.cnki.net/urlid/31.1977.n.20220719.1651.004

Li, J. F. (2016). Experience of food reserve management system in developed countries. World Agric. 84-87+96+227. doi: 10.13856/j.cn11-1097/s.2016.01.017

Li, J. W. (2024). Study on the impact of China's crude oil option listing on the underlying futures price volatility. Price Theory Pract. 179−184+224. doi: 10.19851/j.cnki.CN11-1010/F.2024.02.044

Liu, W., Chen, J. M., and Zhong, Z. (2024). Study on the change of socialist food policy with Chinese characteristics and the evolution of cooperative network of policy entities: Based on the analysis of policy texts from 1953 to 2022. Think Tank Theory Pract. 9, 40–52. doi: 10.19318/j.cnki.issn.2096-1634.2024.03.05

Lodree, E. J., and Taskin, S. (2008). An insurance risk management framework for disaster relief and supply chain disruption inventory planning. J. Oper. Res. Soc. 59, 674–684. doi: 10.1057/palgrave.jors.2602377

Luo, J., Xie, M., Wu, Q., Luo, J., Gao, Q., Shao, X., et al. (2024). Early crop identification study based on sentinel-1/2 images with feature optimization strategy. Agriculture 14, 990–990. doi: 10.3390/agriculture14070990

Meng, C. C. (2023). Research on Judgment Basis of Authenticity and Forgery of Email. Shanghai: East China University of Political Science and Law.

Meng, Q. C., Kao, Z. P., Guo, Y., and Bao, C. B. (2023). An emergency supplies procurement strategy based on a bidirectional option contract. Socio-Econ. Plan. Sci. 87:101515. doi: 10.1016/j.seps.2023.101515

Mohamad, D-B., Alireza, B., Amir, A., and Fariborz, J. (2021). Green supply chain management through call option contract and revenue-sharing contract to cope with demand uncertainty. Clean. Logist. Supply Chain 2. doi: 10.1016/J.CLSCN.2021.100010

Payne, T., and Peters, M. J. (2004). What is the right supply chain for your products? Int. J. Logist. Manag. 15, 77–92. doi: 10.1108/09574090410700310

Prasad, P. T. D., and Jha, J. K. (2022). Bidirectional option contract for prepositioning of relief supplies under demand uncertainty. Comput. Ind. Eng. 163:107861. doi: 10.1016/j.cie.2021.107861

Qing, P., Deng, X. X., Min, S., Li, J., Li, X.Y., Wang, Y.Z., et al. (2023). Research on resilience and risk management strategy of China's food security under the background of “double cycle. Eng. Sci. 25, 26–38. doi: 10.15302/J-SSCAE-2023.04.002

Rabbani, M., Arani, H. V., and Rafiei, H. (2015). Option contract application in emergency supply chains. Int. J. Serv. Oper. Manag. 20, 385–397. doi: 10.1504/IJSOM.2015.068523

Shi, Y. M. (2024). Hu Tao, champion of option group of the 14th futures real order competition: risk control is the key to the success of option trading. Futures Daily 2. 002. doi: 10.28619/n.cnki.nqhbr.2024.000958

Song, J., Zhang, F., and Wang, R. J. Z. (2023). Digital research on food security management in China in the new era. Grain Oil Food Sci. Technol. 31, 36–41. doi: 10.16210/j.cnki.1007-7561.2023.04.005

Tan, L. P., Song, P., and Yang, Q. F. (2021). Supply chain financing and coordination based on bidirectional options under risk aversion. Comput. Integr. Manuf. Syst. 27, 912–923. doi: 10.13196/j.cims.2021.03.022

Tan, Y. W., Yang, C. Y., Chen, D. W., and Zhang, P. J. (2014). Implementation performance and evaluation of food market regulation policies in China. Issues Agric. Econ. 35, 87–98+112. doi: 10.13246/j.cnki.iae.2014.05.014

Tian, J., Ge, Y. L., and Hou, C. C. (2014). Government-led emergency materials procurement model based on real option contract. Syst. Eng. Theory Pract. 34, 2582–2590.

Tong, X. L., Hu, D., and Yang, X. Y. (2019). Evaluation of minimum grain purchase price policy effect: A case study of wheat. Issues Agric. Econ. 85–95. doi: 10.13246/j.cnki.iae.2019.09.010

Wang, G. Y., Zhao, C., Shen, Y. Z., and Yin, N. (2021). Estimation of cost efficiency of fattening pigs, sows, and piglets using SFA approach analysis: Evidence from China. PloS one 16:e0261240. doi: 10.1371/journal.pone.0261240

Wang, J. J., and Qu, J. (2024). Study on the effect and regional differentiation of digital economy enabling resilience of food supply chain. J. Northwest Univ. Nationalities 138–154. doi: 10.14084/j.cnki.cn62-1185/c.20240204.013

Wang, L., Jin, Y. X., and Xiong, X. Y. (2024). Research on supply chain credit financing decision considering bi-directional option flexible order contract under the background of replacing business tax with value-added tax. J. Manag. Eng. 38, 66–80. doi: 10.13587/j.cnki.jieem.2024.05.005

Wang, X., Li, F., Liang, L., Huang, Z., and Ashley, A. (2015). Pre-purchasing with option contract and coordination in a relief supply chain. Int. J. Prod. Econ. 167, 170–176. doi: 10.1016/j.ijpe.2015.05.031

Wang, X. K., and Gao, H. W. (2023). Construction of modern grain supply chain of Chinese style in new era. China Circ. Econ. 37, 40–47. doi: 10.14089/j.cnki.cn11-3664/f.2023.07.004

Xiang, L., and Luo, J. R. (2022). Bidirectional option-based procurement management of risk averse Retailers. Sci. Technol. Ind. 22, 114–121. Available online at: https://kns.cnki.net/kcms2/article/abstract?v=m17bUIR54SOsBu70iTRzLRBGQ9UfyvfTm4ACq_dH0osd3aniV8Uvle5yI0lp3y_0jlsFj1RcdOnkpezWYIyeBta0mjU6wzsdfYWfxHV44abTBTJ2hTu1WuVE8jO0YBA0ngU1TUf5F5_ZM0S-OZ9rZO2gFihgvCMFv4q78PuvpXwpsID28Hcf6t7V0n35gkbqcfw5wikn5fk=&uniplatform=NZKPT&language=CHS

Xu, L., Wen, J., and Wu, G. Z. (2025). Management innovation and popularization of the “insurance + futures” model under the background of trade tensions - based on the associated enhancement relative valuation AERV model. J. Xihua Univ. 1−13. Available online at: https://link.cnki.net/urlid/51.1675.C.20250417.2118.002

Yang, L., Tang, R., and Chen, K. (2017). Call, put and bidirectional option contracts in agricultural supply chains with sales effort. Appl. Math. Model. 47, 1–16. doi: 10.1016/j.apm.2017.03.002

Yemei, L., Yanfei, S., and Shuang, L. (2022). Research on option pricing and coordination mechanism of festival food supply chain. Socioecon. Plann. Sci. 81:101199. doi: 10.1016/j.seps.2021.101199

Zhang, H. Q., and Tian, J. (2011). Procurement model of emergency materials based on capability option contract led by purchasers. Sci. Math. Syst. 31, 1317–1327. Available online at: https://link.cnki.net/urlid/41.1006.c.20191224.1115.016

Keywords: grain reserve, two-way option reserve, reserve cost, static reserve, dynamic reserve

Citation: Jiang Q and Chen C (2025) Research on dynamic optimization of grain reserves based on two-way options. Front. Sustain. Food Syst. 9:1596328. doi: 10.3389/fsufs.2025.1596328

Received: 19 March 2025; Accepted: 21 April 2025;

Published: 14 May 2025.

Edited by:

Guoli Wang, Tianjin University of Science and Technology, ChinaReviewed by:

Shanxue Yang, Xi'an University of Finance and Economics, ChinaYanfei Lan, Tianjin University, China

Copyright © 2025 Jiang and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Caixia Chen, Y2FpeGlhY2hlbjIwMjNAMTYzLmNvbQ==

Qijun Jiang

Qijun Jiang Caixia Chen

Caixia Chen