- Faculty of Humanities and Social Sciences, Macao Polytechnic University, Macao, Macao SAR, China

Introduction: The ready-to-cook (RTC) foods sector represents a rapidly growing industry where innovation patterns and technological evolution are pivotal for sustainable development. This study establishes a comprehensive “space-time-technology-network” analytical framework to systematically investigate China’s RTC patent innovation ecosystem.

Methods: We analyzed 1,180 patent records through an integrated approach combining time-series analysis, spatial distribution mapping, technology classification, and social network analysis to reveal multidimensional characteristics of RTC innovation.

Results: Our analysis identified three distinct evolutionary phases in RTC patents: an embryonic stage (2018–2021), a boom period (2022–2023), and a current adjustment phase (2024). Innovation activities demonstrated marked regional concentration, forming three primary clusters: the Pearl River Delta, Yangtze River Delta-Shandong, and Fujian-Hunan regions. Technologically, the sector is dominated by food processing & forming technology and packaging technology, which have evolved into a highly interconnected “small world” network structure. While enterprises constitute the primary innovation drivers (76.54%), the collaboration network remains notably fragmented. Knowledge flows occur primarily through three channels: intra-corporate group collaborations, industry-university-research partnerships, and regional industrial clusters.

Discussion: The RTC patent ecosystem exhibits four defining characteristics: explosive growth, regional agglomeration, multi-technology convergence, and fragmented collaboration networks. This study provides both a theoretical framework and empirical basis for understanding innovation dynamics of emerging food industries and offers valuable insights for promoting high-quality development in the RTC foods sector.

1 Introduction

With the rapid development of the global socio-economy, the acceleration of the urbanization process, and the continuous quickening of the modern life pace, people’s eating habits are undergoing profound changes. As a convenient dietary solution, ready-to-cook (RTC) foods is rapidly emerging and occupying an important position in the market (Wang et al., 2023). RTC foods refers to finished or semi-finished products with a certain shelf life, which are processed from edible raw materials. Its production process may involve various processing technologies such as precooking, quick freezing, and packaging, providing consumers with the convenience of being able to eat without or with only simple heating. The global RTC foods market is huge. According to the data from Euromonitor International, the retail value of RTC foods reached 92.2 billion US dollars in 2012 and is expected to maintain a growth trend in the coming years (Muhamad and Abdul Karim, 2015).

In the current context where industrial development is driven by technological innovation, patents have become a key indicator for measuring the innovation vitality and development potential of the RTC foods sector. Relevant research indicates that food patent analysis is of great significance for industrial development. An analysis of prebiotic and postbiotic patents found that the number of related patents increased significantly after 2013, demonstrating the importance of patent analysis in revealing the development trends in the food field (Zang et al., 2024). A study on food-related patents at the University of Brasília pointed out that patents are important tools for protecting innovation in the food industry, and universities play a crucial role in promoting food technology innovation (Neves et al., 2023). An analysis of the global innovation patent landscape of functional foods also highlights the value of patent analysis in understanding the development direction of the food field (Matin et al., 2024). As an emerging branch of the food industry, the patent situation of the RTC foods industry not only reflects the industry’s technological innovation level but is also closely related to the industry’s future direction. In-depth exploration of the current patent status of RTC foods helps to grasp the industry’s innovation dynamics and provides strong support for the industry’s sustainable development.

This study focuses on the patent innovation ecosystem of China’s RTC foods industry. It aims to reveal the internal laws and dynamic mechanisms of the industry’s innovative development by deeply exploring its spatiotemporal evolution, technological clustering, and collaborative network, thus providing crucial theoretical basis and practical guidance for the sustainable development of the industry. Although patent analysis research in the food industry has yielded fruitful results and provided important insights for understanding technology trends (Zang et al., 2024; Neves et al., 2023), existing studies generally share a fundamental limitation: the isolation of analytical dimensions. Previous research has tended to examine temporal evolution, spatial layout, technological structure, and collaborative networks as independent dimensions, failing to deeply reveal the complex intrinsic connections and systematic interactions between these dimensions. This perspective limitation has left a series of key questions unresolved: How does innovation agglomeration in specific regions (spatial dimension) shape patterns of technological convergence (technological dimension) and industry-university-research collaboration (network dimension)? Which core innovative entities and through what collaborative methods drive the explosive growth of an industry (temporal dimension)? These intertwined dynamic relationships are precisely the core of depicting the complete picture of an industrial innovation ecosystem, yet previous research has failed to provide an integrated analytical framework to answer these questions, thereby creating a significant research gap.

To fill this research gap, the core innovation of this study lies in constructing and applying an integrated “spatial-temporal-technological-network” four-dimensional analytical framework. This framework transcends the singular perspective of previous research by organically combining multiple key dimensions of industrial innovation ecosystems: in the spatiotemporal dimension, we examine the temporal evolution trajectory and geographical distribution characteristics of patent applications to reveal the dynamic development process and regional agglomeration patterns of industrial innovation; in the technological dimension, we deeply analyze the structural composition and evolution of key technology categories to identify technological breakthroughs and innovation frontiers; in the network dimension, we explore the collaborative innovation structure and knowledge flow pathways among industry, academia, and research institutions to uncover core innovative entities and their interaction mechanisms. Through this multi-dimensional, multi-level comprehensive analysis method, this study not only aims to fill the theoretical gap in existing literature regarding systematic understanding of innovation ecosystems but also strives to provide solid data support and decision-making references for technology path selection, regional layout optimization, and innovation ecosystem construction in the RTC foods industry.

2 Literature review

2.1 Technological frontiers: reconciling convenience with “fresh-like” quality

The contemporary RTC foods industry is shaped by a fundamental tension between consumer demands for ultimate convenience, which necessitates food processing, and a concurrent desire for natural, healthy products that challenge the very nature of processing (Leroy and Degreef, 2015). This paradox has catalyzed a wave of technological innovation aimed at a singular strategic objective: to systematically mitigate the negative attributes associated with traditional processing while retaining the benefits of safety and extended shelf-life. A dominant global trend has thus emerged toward “minimal processing” or “gentle processing” techniques, designed to deliver products that are convenient yet perceived by consumers as closer to their fresh, natural state (Rodgers, 2016). This pursuit is clearly reflected in the global innovation landscape, where research and development efforts are concentrated on technologies that can achieve preservation without aggressive thermal or chemical intervention.

A prominent example of such innovation is high-pressure processing (HPP), a non-thermal pasteurization method. As systematically reviewed by Nuygen et al. (2024), HPP demonstrates significant potential in compensating for the quality degradation often caused by salt reduction in ready-to-eat meat products. By applying intense pressure, HPP can ensure microbial safety and maintain desirable textural properties, thereby addressing a critical public health concern—high sodium intake—without compromising the sensory attributes that are crucial for consumer acceptance. Similarly, advanced drying technologies, particularly freeze-drying and its derivatives, represent another key pathway. Du et al. (2022) highlight the innovative application of freeze-drying in producing compound formula instant foods, where its ability to sublimate water at low temperatures maximally preserves heat-sensitive nutrients, flavors, and colors. This marks a significant technological shift from mere preservation to the active retention of nutritional and hedonic quality.

Beyond physical processing, emerging frontiers in nanotechnology and biocontrol are further aligning technological solutions with the consumer trend toward “clean labels.” Nanotechnology, for instance, enables the encapsulation of natural essential oils to serve as potent antimicrobial and antioxidant agents, effectively replacing synthetic preservatives and extending the shelf-life of products like meat emulsions (Hussain et al., 2025; Sharma et al., 2017). Concurrently, biocontrol strategies that utilize beneficial microorganisms, such as lactic acid bacteria, to inhibit pathogens like Listeria monocytogenes in ready-to-eat products, offer a biological preservation route that resonates with consumer preference for natural solutions (Martin et al., 2022). These global technological trajectories are strongly validated by the innovation patterns observed in China’s burgeoning RTC foods market. Our analysis of Chinese patent data reveals that “food processing & forming technology” and “preservation technology” are not only the two largest categories by patent volume but also form the most intensely interconnected cluster in the technology network. This indicates that Chinese innovators are heavily invested in precisely the same technical challenges that define the global frontier: developing sophisticated processing and preservation methods to deliver products that are simultaneously convenient, safe, and of high sensory and nutritional quality.

2.2 The evolving role of packaging: from passive container to active system

In parallel with advancements in food processing, the role of packaging within the RTC innovation ecosystem has undergone a fundamental transformation. It has evolved from a passive container, primarily tasked with physical protection, into an active, intelligent, and communicative technology platform that is integral to the product’s value proposition. As core processing technologies become more widespread, packaging is increasingly becoming the primary arena for brand differentiation and competitive advantage. This shift is well-documented in the literature, which distinguishes between active packaging, designed to dynamically regulate the internal environment to extend shelf-life, and intelligent packaging, which monitors food quality and communicates this information to the supply chain and consumers (Bumbudsanpharoke and Ko, 2022). These technologies directly address consumer anxieties regarding the freshness and safety of prepared foods, thereby fostering a new layer of trust.

The drivers of packaging innovation are twofold, encompassing both enhanced functionality and a growing sense of corporate responsibility. On one hand, technologies such as modified atmosphere packaging (MAP) and antimicrobial films are critical for extending the shelf-life of cook-chill foods, a necessity for modern retail logistics (Clodoveo et al., 2021). On the other hand, packaging innovation is increasingly being leveraged to respond to broader societal concerns, most notably plastic pollution and public health. This is exemplified by research into developing biodegradable and antimicrobial packaging to maintain the quality of fresh-cut products, a direct response to both environmental pressures and heightened hygiene awareness (Pietrosanto et al., 2022). Furthermore, the principles of the circular economy are being integrated into packaging design, with significant advances in the use of agri-food waste and by-products to create sustainable packaging materials, thus creating new value chains from former waste streams (Cristofoli et al., 2023).

This global emphasis on packaging as a strategic innovation hub is mirrored with remarkable intensity in the Chinese RTC foods sector. Our patent analysis reveals that “packaging technology” is the second-largest category by patent volume (350 patents) and possesses one of the highest technological diversity index (TDI) values (0.988) among all technical domains. The sheer volume of patents underscores the strategic importance of packaging, while the high diversity index indicates that Chinese firms are exploring a wide spectrum of innovative solutions. This vibrant and multifaceted innovation activity suggests that, consistent with global trends, Chinese enterprises view packaging not merely as a cost but as a critical tool to signal quality, enhance safety, communicate brand values, and secure a competitive edge in a rapidly crowding marketplace.

2.3 Consumer-driven innovation: the calculus of compromise

Innovation in the RTC foods sector is not merely a technology-push phenomenon but is fundamentally a consumer-pull process, driven by a complex interplay of sociodemographic, psychological, and ethical factors. Market segmentation based on sociodemographics reveals clear profiles of frequent convenience food users, who are often younger, male, and possess lower cooking skills, pointing to lifestyle and capability constraints as key drivers (Dittmann et al., 2024). However, a deeper analysis based on “food-related lifestyles” (FRL) shows that “convenience” is not a monolithic value; it is interpreted and weighed differently by distinct consumer segments, such as those who are health-conscious but time-poor versus those who are indifferent to cooking (Montero-Vicente et al., 2019). This highlights the need for nuanced innovation strategies that cater to diverse value systems.

Beyond practical considerations, the choice to consume convenience food is embedded in a complex psychological and cultural context. Research has identified the concept of a “moral obligation in meal preparation,” a social norm that can inhibit the adoption of convenience-oriented services, particularly within family settings (Roh and Park, 2019). This suggests that the decision to save time through RTC products is often accompanied by a sense of guilt or a perceived failure to perform care-giving duties. Wheeler (2018) extends this by analyzing the “moral economy” of ready-made food, arguing that products like meal kits succeed because they offer a compromise: they provide convenience while preserving the ritual and moral value associated with the act of cooking. This reveals that consumer purchase decisions involve a continuous “calculus of compromise,” where they dynamically weigh competing values such as time-saving, health, ethical concerns, and social identity.

To alleviate the anxiety arising from this compromise, consumers actively seek trust signals on product packaging. Studies show that for ready meals, consumers may even prioritize “clean label” claims (e.g., no additives, simple ingredients) over organic certification, as these messages directly address their underlying concerns about the health implications of processed foods (Uddin and Gallardo, 2021). The effectiveness of such communication is paramount, with front-of-pack nutritional information having the strongest influence on consumer perception and purchase intention (Biondi and Camanzi, 2020). This complex consumer calculus provides a powerful explanatory framework for the explosive growth in RTC-related patents in China since 2022. The surge in demand for convenience, accelerated by external shocks like the COVID-19 pandemic, was coupled with heightened health awareness. This created a massive market pull for innovations that could offer superior “compromise solutions,” directly fueling the patent boom in technologies aimed at producing healthier, safer, and more transparent RTC products.

2.4 The ultra-processed paradigm: controversy and reframing

A significant and contentious debate in food science and public health revolves around the concept of ultra-processed foods (UPFs). This debate provides a critical lens through which to evaluate the future trajectory of the RTC industry. The dominant critical perspective is anchored by the NOVA classification system, which categorizes foods based on their degree of processing. This framework has linked high consumption of UPFs to adverse health outcomes, such as obesity and non-communicable diseases, and has profoundly influenced national dietary guidelines and public policy discourse (Louzada and Gabe, 2025). This public health critique is echoed at the policy level, with studies across multiple countries highlighting the need for stricter government regulation on the formulation of processed foods to create healthier food environments (Pineda et al., 2022).

In contrast to this critical view, a counter-narrative is emerging from within food science, arguing that processing technologies themselves are not inherently detrimental. Instead, they represent a powerful toolkit that can be harnessed for positive outcomes. Capozzi (2022) posits that food processing holds immense potential for designing foods optimized for sustainable nutrition, particularly by upcycling by-products into nutrient-dense ingredients within a circular economy framework. Similarly, Forde and Decker (2022) argue that while some processing can have negative consequences, food formulation also presents a significant opportunity to apply modern innovations to improve the nutritional quality of the food supply and even design foods that mitigate overconsumption. This perspective advocates for a shift in focus from the degree of processing to the purpose and outcome of processing.

The tension between these two paradigms is starkly illustrated by the case of plant-based meat alternatives. These products, often marketed on health and sustainability platforms, are almost invariably classified as UPFs under the NOVA system due to the extensive processing required to mimic the texture and flavor of meat (Pontalti et al., 2024). This creates a paradox, raising critical questions about whether their long-term health impacts are genuinely superior and highlighting the “ultra-processing and ultra-formulation” that may compromise nutritional value (Xiong, 2023). This global debate is highly relevant to the analysis of China’s RTC patent ecosystem. While our patent data does not differentiate by “processing intent,” the controversy underscores the need for a more nuanced evaluation framework. The future challenge for the industry, both globally and in China, will be to demonstrate that its innovative capacity is being directed not just toward convenience and profit, but toward verifiably healthier and more sustainable food solutions, thereby reframing the very definition of “processed” food.

2.5 The patent-based innovation ecosystem and analytical framework

To systematically analyze the complex innovation dynamics discussed, this study adopts the lens of an innovation ecosystem. In the context of this research, a patent-based innovation ecosystem is explicitly defined as a dynamic and observable network composed of heterogeneous innovation actors (patent applicants), diverse technological domains (represented by IPC classifications), and the knowledge flows between them (evidenced by co-application relationships and technology co-occurrence). Patent data, as a formal and codified output of R&D activities, provides a unique and quantifiable proxy to map the architecture, evolution, and interactions within this system (Tseng et al., 2007). This approach allows for an empirical investigation of how different actors, such as enterprises, universities, and research institutes, collaborate and compete within and across various technological fields.

The validity of using patent data to explore innovation ecosystems is well-established. Collaborative patent applications, for instance, serve as a direct indicator of open innovation practices and knowledge sharing between entities, revealing the structure of industry-university-research partnerships (Ma and Liu, 2010). Furthermore, the analysis of patent citations, though not the focus of this study, is widely used to trace knowledge diffusion pathways and measure a firm’s reliance on external technological developments (Acosta et al., 2013). The convergence of multiple IPC codes within a single patent also signals technological integration, a key characteristic of a maturing innovation ecosystem where boundaries between distinct knowledge areas become blurred (Panetti et al., 2023). Thus, patent analysis offers a powerful methodology to move beyond anecdotal evidence and quantitatively assess the structural properties of an industry’s innovation landscape.

Building upon this theoretical foundation, and to address the research gap of dimensional isolation identified in the introduction, this study constructs an integrated “space-time-technology-network” analytical framework. This framework operationalizes the patent-based innovation ecosystem concept by systematically deconstructing it into four interconnected dimensions. It allows for a holistic analysis that not only describes each dimension—the temporal evolution, geographical clustering, technological structure, and collaborative network—but, more importantly, explores the intricate relationships between them. By examining how spatial agglomeration influences collaborative patterns, or how temporal shifts in patenting activity correlate with changes in technological diversity, this framework provides a comprehensive and dynamic understanding of the forces shaping the RTC foods industry in China.

3 Research methodology and data

3.1 Data sources and preprocessing

This study investigates patent data from China’s RTC foods industry to elucidate the technological innovation characteristics and development trends of this emerging sector through patent literature analysis. Data collection was completed in February 2025, with systematic searches conducted via the Dawei Patent Database, one of China’s authoritative sources for patent information that encompasses complete records of invention patents, utility model patents, and design patents filed with the National Intellectual Property Administration.

The research employed “RTC foods” as the core keyword for full-text searches across patent titles, abstracts, and claims fields, yielding an initial dataset of 1,401 patent records. To ensure data quality and research focus, the team implemented systematic screening criteria: (1) retaining only patents filed by Chinese applicants to concentrate on domestic innovation activities; (2) excluding patents with “rejected” or “withdrawn” legal status to guarantee valid technological innovations; and (3) removing peripheral patents not directly related to RTC foods technologies. This rigorous screening process resulted in 1,180 valid patent records forming the core analytical dataset for this study.

Each patent record contains the following key information dimensions: patent number, application date, publication date, applicant, inventor, patent type, legal status, IPC classification number, geographical location information (at the provincial and municipal levels), and technical abstract. To facilitate subsequent analysis, based on the IPC classification numbers, the patent technology fields are divided into five major categories: preservation technology, sterilization technology, processing technology, packaging technology, and other auxiliary technologies, laying the foundation for the clustering analysis of technological innovation.

In terms of the classification of patent applicants, this study divides innovative entities into five types according to the nature of the application entities: state-owned enterprises, private enterprises, universities, scientific research institutes, and individuals. Moreover, an applicant-patent bipartite network is constructed to provide data support for the subsequent analysis of the collaborative innovation network among industry, academia, and research institutions. Regarding geographical information, patents are coded according to the provinces and cities where the applicants are located, which is used for the analysis of the regional innovation pattern.

Through the above data acquisition and preprocessing work, this study has established an analytical dataset that comprehensively reflects the patent innovation activities of China’s RTC foods industry, providing a solid foundation for the subsequent analysis of spatiotemporal evolution, technological clustering analysis, and innovation network analysis.

3.2 Research methodology

This study adopts a cross-analysis framework of multiple methods, focuses on two key methods, namely the analysis of International Patent Classification (IPC) technical classification and the analysis of innovation collaborative networks, and systematically explores the characteristics and evolution laws of patent innovation in China’s RTC foods industry.

3.2.1 Analysis of IPC classification and technological clustering

The IPC system, as a globally recognized standard for classifying patent technologies, provides the basic framework for this study to analyze the structure of technological innovation in RTC foods. The IPC adopts a hierarchical classification structure, which is composed of Section, Class, Subclass, Main Group, and Subgroup. Through the IPC classification analysis of patents related to RTC foods, it is found that the patents for RTC foods are mainly concentrated in Section A (Human Necessities) and Section B (Operations; Transport), especially in technical categories such as A23 (Food or Foodstuffs; Their Treatment) and B65 (Transport; Packaging; Storage). This reflects the key layout of technological innovation in the RTC foods industry in the fields of food processing and packaging logistics.

This study establishes a multi-level analytical framework to systematically investigate the technological innovation structure of the RTC foods industry. First, based on IPC classification information of patents, relevant technological innovations are categorized into eight major domains: food processing & forming technology, packaging technology, raw material processing technology, preservation technology, logistics & storage technology, detection & analysis technology, intelligent systems technology, sterilization technology. Second, by examining the quantitative distribution and evolutionary trends across these technological domains, the Technological Diversity Index (TDI) is calculated to assess the diversification degree of innovation in RTC foods technologies (Kim et al., 2019). The TDI is computed as:

Among them, represents the number of patents in the i-th technology field, and P represents the total number of patents. A higher TDI value indicates greater diversification of technological innovation.

Finally, an IPC co-occurrence network is constructed to reveal the technological correlation structure. In this network, nodes represent IPC subclass. If two IPC subclasses appear simultaneously in a patent, a connection is established between these two nodes. The size of the node reflects the number of patents in the technical field, and the thickness of the edge reflects the co-occurrence frequency. By analyzing the community structure of the IPC co-occurrence network, closely related technological clusters are identified, and the characteristics of technological integration in the RTC foods industry are revealed.

3.2.2 Innovation actors and collaborative network analysis

To investigate innovation collaboration patterns in the RTC foods industry, this study employs social network analysis to construct and analyze an innovation actor collaboration network. The undirected weighted network is built based on patent co-application relationships, where nodes represent applicants (enterprises, universities, research institutes, or individuals), and edges connect nodes when two applicants have jointly filed patents, with edge weights corresponding to their co-application counts.

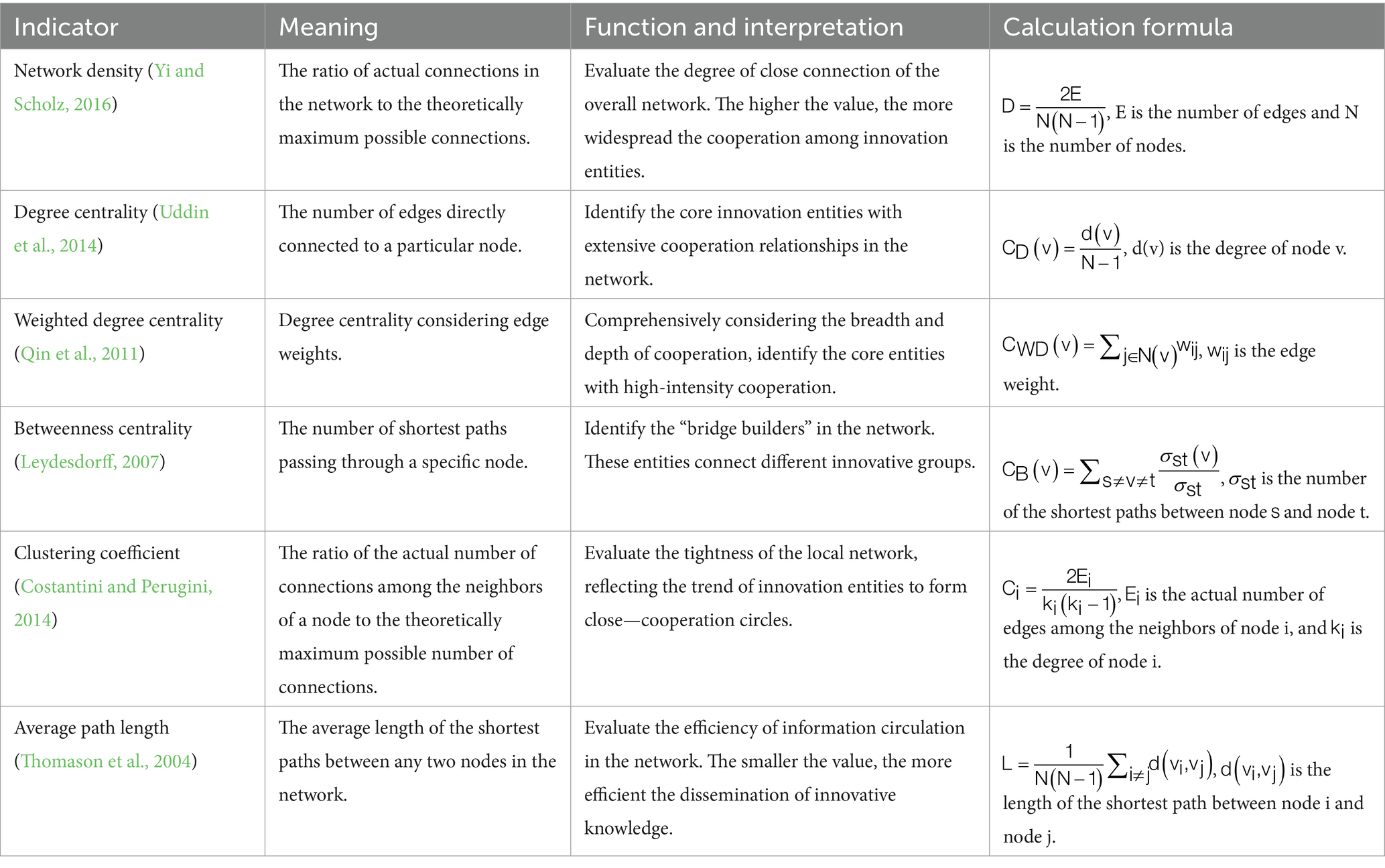

To characterize the collaboration network structure, we calculated multiple network metrics (detailed in Table 1), including network density, degree centrality, betweenness centrality, and clustering coefficient, to reveal both global structural features and key nodes. The computation of these metrics was conducted using Python (v3.9) with the NetworkX library, a standard tool for complex network analysis. To identify tightly-knit innovation communities, the Louvain community detection algorithm was applied (Chu and Ding, 2021). This algorithm was specifically chosen for its computational efficiency and robust performance in identifying community structures within large and potentially fragmented networks, which is characteristic of our dataset. Finally, all network visualizations presented in this study were generated using R (v4.2) with the ggraph and ggplot2 packages to ensure high-quality graphical representation.

4 Spatiotemporal evolution characteristics of RTC foods patents in China

With the rapid development of China’s RTC foods industry, related intellectual property protection activities also exhibit unique temporal and spatial distribution characteristics. This chapter systematically analyzes the evolution characteristics of patents in China’s RTC foods industry from two dimensions: time series and geographical space, revealing the dynamic change patterns of its innovation activities and the characteristics of spatial agglomeration.

4.1 Time series analysis: development trajectories of RTC foods patents

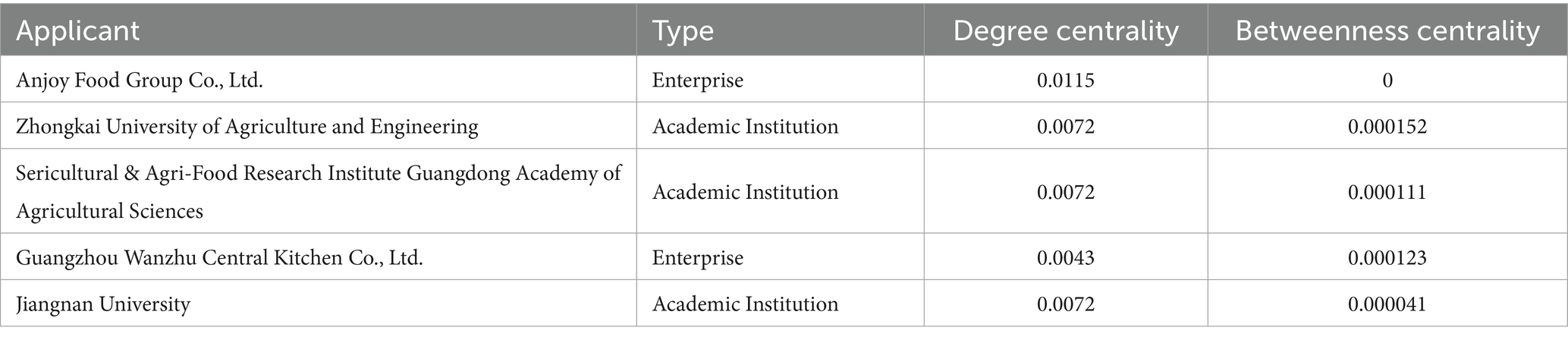

Figure 1 illustrates the quarterly trends in patent applications and grants, along with their growth rates, in China’s RTC foods sector. Temporally, the patent development has undergone a complete evolutionary process from emergence to rapid expansion and subsequent optimization.

Figure 1. Quarterly dynamics of RTC foods patents in China (2018–2025). (a) Number of patent applications and grants per quarter. (b) Quarterly growth rate of patent applications and grants.

During the initial phase (2018–2021), patent application activities exhibited low-frequency and fragmented characteristics, with quarterly filings ranging merely between 1 and 7. The substantial volatility in growth rates (e.g., 200% in 2018Q4 versus −85.71% in 2020Q2) primarily stemmed from the small baseline, where individual applications could cause dramatic percentage fluctuations. This pattern reflects the uncertainty and exploratory nature typical of emerging technological fields. Notably, granted patents remained virtually nonexistent during this period, indicating that RTC foods had not yet become a focal point for industrial innovation.

A pivotal transition occurred in 2022, with application volumes surging from 9 in Q1 to 92 in Q4, peaking at an 800% quarterly growth rate (2022Q1), marking the sector’s entry into an innovation boom phase. This shift correlated strongly with post-pandemic market expansion, changing consumption patterns, and accelerated capital inflows. Concurrently, patent grants demonstrated remarkable growth, escalating from 5 in 2022Q3 to 27 in 2022Q4 (440% growth), signifying the maturation of early-stage applications into validated intellectual property.

The year 2023 marked the peak period for RTC foods patents, with application volumes steadily rising to 180 by Q4, though quarterly growth rates progressively declined (from 68.54% in 2023Q2 to 7.14% in 2023Q4), signaling the market’s transition to a more rational development phase. Patent grants maintained stable growth during this period, increasing from 27 in Q1 to 85 in Q4, with relatively moderate growth rate fluctuations (declining from 103.7% in 2023Q2 to 21.43% in 2023Q4). This pattern reflects normalized examination cycles and the industry’s progression into a phase balancing both patent quality and quantity.

A distinct downward trend emerged in 2024, with patent applications decreasing from 127 in Q1 to 42 in Q4, maintaining negative growth for four consecutive quarters. In contrast, granted patents remained relatively stable, showing a slight increase from 98 in Q1 to 115 in Q4, with limited growth rate variations (peaking at 9.52% in 2024Q4). This divergence between declining applications and stable grants indicates an industry shift from extensive to intensive innovation strategies, where enterprises increasingly prioritize patent quality and technological substance over mere quantitative expansion.

4.2 Geographical distribution analysis: spatial patterns of RTC foods patents

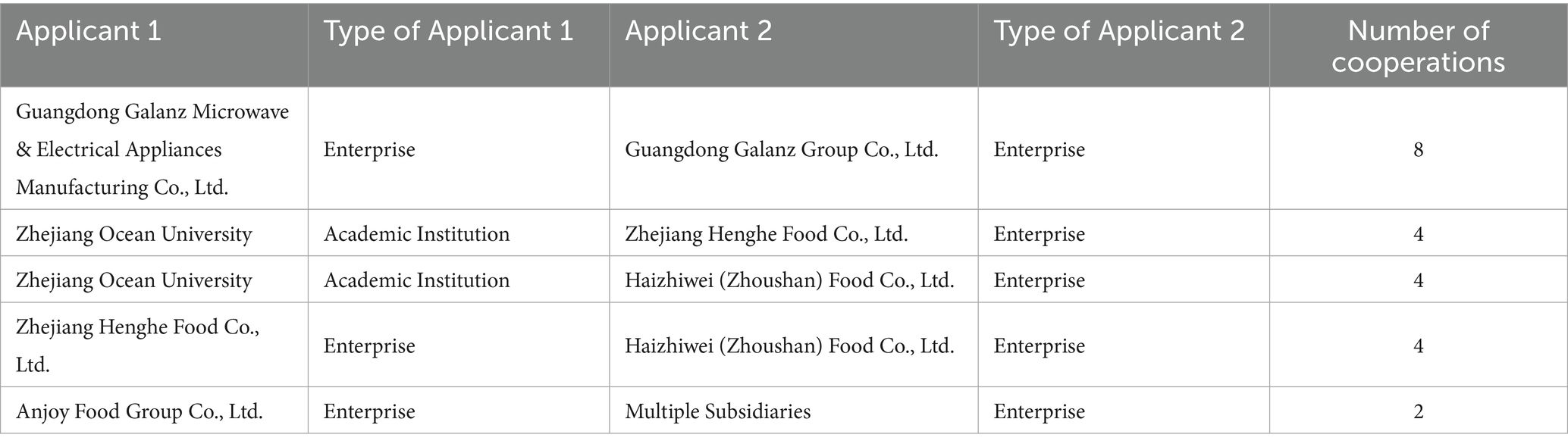

China’s RTC foods patents exhibit distinct spatial heterogeneity, with their geographical distribution providing critical insights into regional innovation disparities. Figure 2 presents spatial heatmaps of patent applications at both provincial and municipal levels, revealing pronounced spatial agglomeration patterns and significant regional development imbalances in RTC foods innovation.

Figure 2. Presents a geographical heatmap of RTC foods patent distribution in China (2018–2025). (a) Provincial-level distribution: The color gradient represents the volume of patent applications across provinces, autonomous regions, and municipalities directly under the central government, with the darkest shade indicating Guangdong Province as the top applicant (197 patents). (b) Municipal-level distribution: The chromatic intensity corresponds to application numbers at prefecture-level cities, where Guangzhou City emerges as the leading innovator (53 patents), depicted in the deepest hue.

4.2.1 Provincial distribution patterns of RTC foods patents

The provincial distribution map (Figure 2a) reveals a distinct spatial pattern of “stronger innovation in eastern and southern regions compared to western and northern areas” for RTC foods patents. Guangdong Province leads the nation with 197 patent applications, followed closely by Shandong (168), while Zhejiang (108) and Fujian (94) rank third and fourth, respectively. Anhui (71), Jiangsu (66), and Hunan (62) also demonstrate considerable innovative capacity. Collectively, these provinces form China’s core innovation cluster for RTC foods technologies, accounting for 65.2% of the national patent applications.

The dominance of these coastal and eastern provinces is not coincidental but is rooted in a confluence of socioeconomic and industrial advantages that create a fertile ecosystem for RTC innovation. Guangdong, for instance, leverages its position as a leading economic powerhouse with a vast, affluent urban consumer market, a sophisticated food processing industry, and strong international trade links that facilitate technology adoption. Shandong, as a traditional agricultural and food industry stronghold, capitalizes on its abundant raw material supply and robust industrial base to drive innovation across the entire value chain. Similarly, provinces like Zhejiang and Fujian benefit from their dynamic private economies, well-established e-commerce ecosystems, and proximity to major consumer markets. This convergence of strong market pull (high consumer demand), industrial push (advanced manufacturing capabilities), and essential logistical support (developed cold chains) explains the pronounced spatial agglomeration of patent activities in these specific regions.

4.2.2 Municipal-level distribution characteristics of RTC foods patents

The municipal-scale analysis (Figure 2b) reveals more granular spatial distribution patterns. Guangzhou leads with 53 patent applications, followed by Hangzhou (47) and Foshan (44) in second and third positions, respectively. Fuzhou (42) and Changsha (41) also demonstrate strong innovation performance. Notably, Chongqing (34), Chengdu (33), and Weifang (31) rank sixth to eighth, indicating established innovation clusters in select central and western cities.

Three distinct categories of cities emerge as innovation hubs: (1) economically advanced regional centers (e.g., Guangzhou, Hangzhou, Shenzhen); (2) cities with traditional food processing expertise and industrial infrastructure (e.g., Foshan, Weifang, Hefei); and (3) provincial capitals (e.g., Fuzhou, Changsha, Chengdu). These municipalities have become crucial innovation platforms, leveraging their robust innovation ecosystems, skilled workforce, and industrial advantages to drive RTC foods technological development.

4.3 Geographical agglomeration analysis: regional characteristics and cluster formation in patent innovation

4.3.1 Regional agglomeration features of RTC foods patent innovation

An in-depth analysis of patent geographical distribution reveals three major innovation agglomerations in China’s RTC foods sector: (1) the Pearl River Delta core zone, (2) the Yangtze River Delta-Shandong region, and (3) the Fujian-Hunan corridor. The Pearl River Delta zone, centered on Guangzhou and Foshan, leads the nation in patent applications. This region’s innovation dominance stems from its comprehensive food processing industrial chain and substantial urban consumer markets. The Yangtze River Delta-Shandong region, encompassing Zhejiang, Jiangsu, and Shandong provinces, has developed an innovation network anchored by Hangzhou, Suzhou, and Jinan, specializing in production technologies and preservation innovations. The Fujian-Hunan corridor, with Fuzhou and Changsha as innovation hubs, excels in traditional food modernization and regional specialty RTC products.

These agglomeration patterns reflect the historical development trajectories and geographical advantages of China’s RTC foods industry. Coastal regions benefit from superior international technology exchange channels and more robust innovation ecosystems. Simultaneously, their higher urbanization levels and disposable incomes create larger consumer markets for RTC products, thereby stimulating continuous technological innovation in the sector.

4.3.2 Formation mechanisms and evolutionary trends of innovation clusters

The spatial agglomeration of RTC foods patents reflects regional integration of innovation resources and specialized division of labor. Our analysis identifies three primary drivers of this geographical clustering: (1) industrial foundations, (2) market demand, and (3) policy support. Guangdong’s leading patent position exemplifies this synergy, benefiting from its established food processing clusters, substantial urban consumer base, and strategic government backing for food innovation. Similarly, Shandong’s patent concentration demonstrates the successful integration of traditional agricultural processing strengths with technological upgrading.

Temporal analysis reveals distinct evolutionary phases in patent innovation. During 2018–2021, patent applications were sporadic, with only occasional filings from Hunan and Jiangsu provinces. The first significant surge occurred in 2022, followed by peak application volumes nationwide in 2023. This trajectory correlates strongly with post-pandemic market shifts, changing consumption patterns, and government policies promoting food industry modernization. Notably, Hunan Province emerged as an early innovator, initiating patent activities as early as 2018, demonstrating remarkable foresight in RTC foods technology development.

Despite evident regional disparities in RTC foods patent innovation, a nationwide synchronous development trend emerged during 2022–2023. While eastern provinces like Guangdong, Shandong, Zhejiang, and Fujian maintained quantitative leadership, central and western regions such as Sichuan and Chongqing demonstrated robust innovative growth. This pan-regional synchronization indicates that RTC foods technology has garnered nationwide attention as an emerging industry, with various regions actively developing specialized innovations based on local industrial advantages. The observed pattern suggests a potential diversification of future innovation landscapes across China’s geographical regions.

5 Structural analysis of technological innovation categories in RTC foods

5.1 Domain distribution and diversity characteristics of RTC foods technological innovation

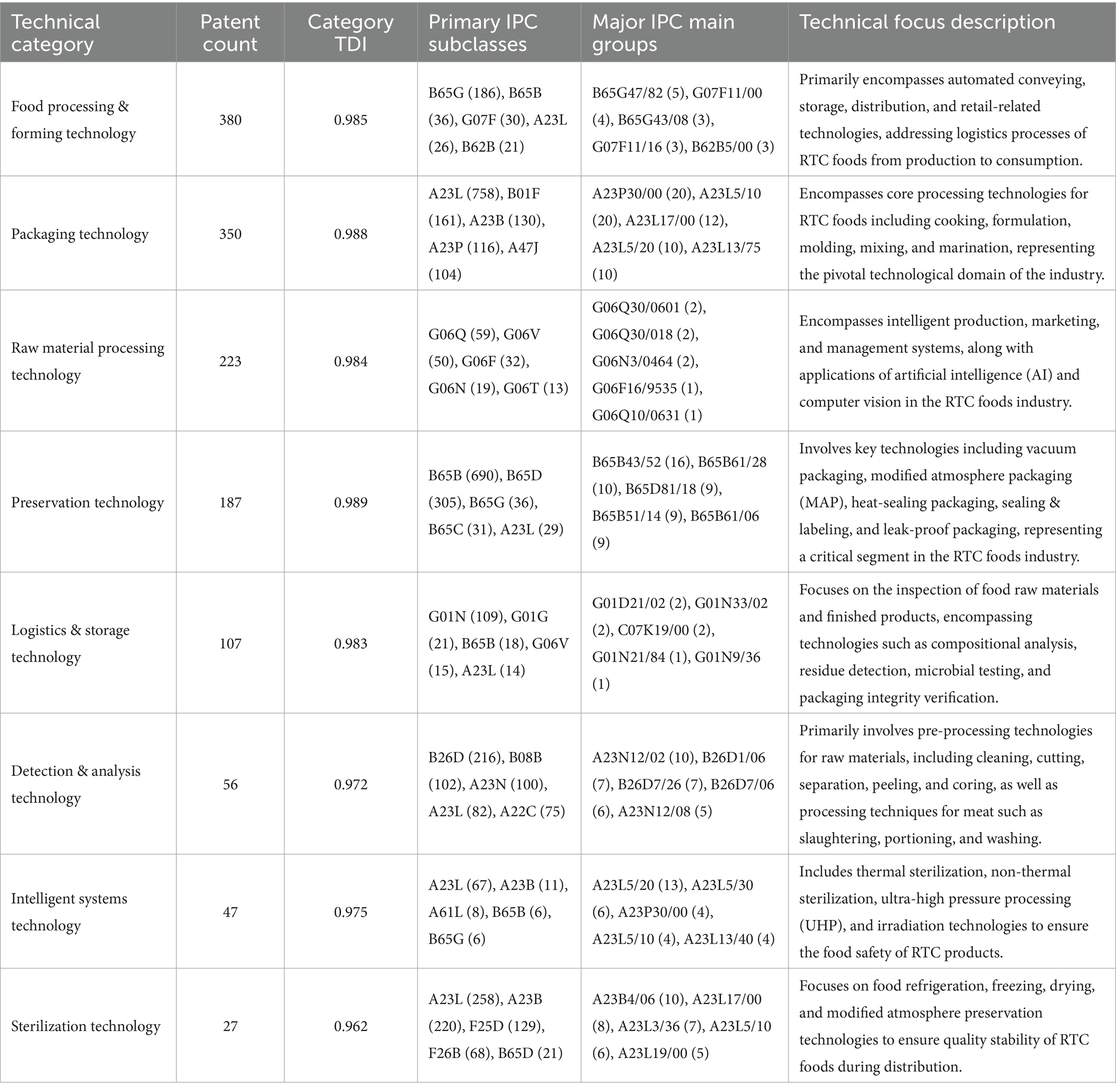

Based on the IPC classification system, this study categorizes RTC foods-related patent technologies into eight major domains, with their quantitative distribution, technological diversity, and core IPC compositions detailed in Table 2. The patent distribution reveals food processing & forming technology (380 patents) and packaging technology (350 patents) as the two dominant innovation areas, collectively accounting for over 50% of total patents, reflecting the industry’s primary focus on product preparation and preservation processes. Raw material processing technology (223 patents) and preservation technology (187 patents), serving as fundamental supports for upstream material processing and downstream quality assurance respectively, constitute approximately 30% of patents. Logistics & storage technology (107 patents) represent intermediate innovation activity as an extended industrial chain segment. Although detection & analysis technology (56 patents), intelligent systems technology (47 patents), and sterilization technology (27 patents) demonstrate relatively lower patent quantities, their strategic significance for food safety assurance and digital transformation remains substantial.

Table 2. Classification and characteristics of eight major technological domains in RTC foods innovation.

The Technological Diversity Index (TDI) exceeds 0.96 across all domains, indicating highly diversified innovation patterns within each technological sector. Preservation technology (0.989) and packaging technology (0.988) exhibit the highest TDI values, suggesting particularly diverse technical approaches likely attributable to their complex application scenarios and rapid technological iterations. Food processing & forming technology (0.985), raw material processing technology (0.984), and logistics & storage technology (0.983) maintain similarly high diversity levels, demonstrating broad innovation spectra. In contrast, sterilization technology show a comparatively lower TDI (0.962), potentially due to both limited patent volume and technical concentration on specific sterilization methodologies.

Analysis of major IPC subclasses reveals distinct cross-domain integration in RTC foods technological innovation. Food technology categories (e.g., A23L, A23B, A23P) and packaging/transportation categories (e.g., B65B, B65D, B65G) exhibit widespread distribution across multiple technological domains, demonstrating substantial convergence between food processing & forming technology and packaging technology. The IPC main group distribution further illustrates specialized technical features: food processing & forming technology primarily concentrate in groups like A23P30/00 (food shaping/processing) and A23L5/10 (physical treatment of food), while packaging technology predominantly cluster in B65B43/52 (container feeding devices) and B65B61/28 (packaging auxiliary devices). This coexistence of specialization and integration reflects the inherent complexity and systematic nature of technological innovation in the RTC foods sector.

The above-mentioned characteristics of patent distribution indicate that the technological innovation of RTC foods has formed a multi-level technological innovation system. This system takes food processing and packaging preservation as the core, uses raw material handling, preservation and anti-corrosion as the foundation, and is supported by logistics storage and transportation, testing and analysis, intelligent systems, as well as sterilization and disinfection. The high TDI values further confirm the diversified characteristics of the innovation paths within each technological field, providing a rich space for technological choices for the development of the industry.

5.2 Temporal evolution and diversification trends in RTC foods technological innovation

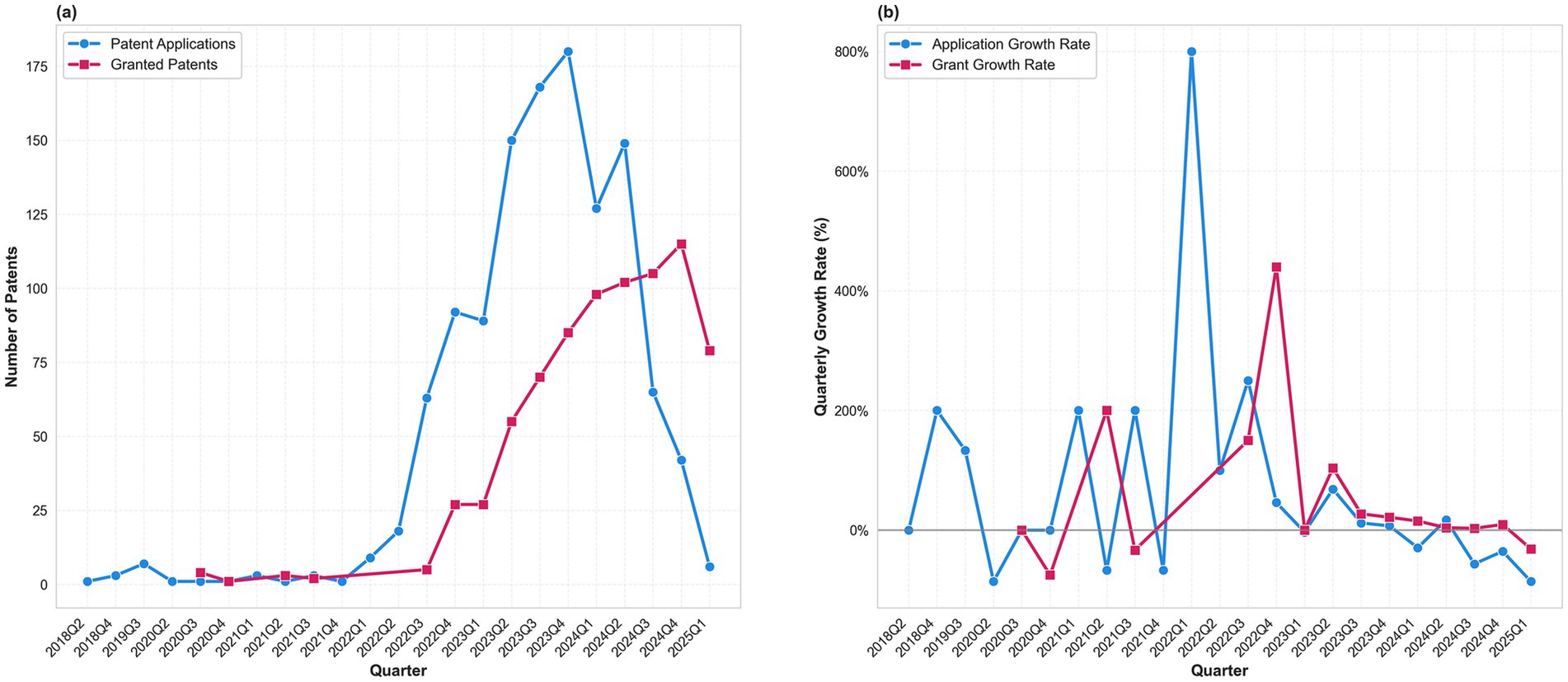

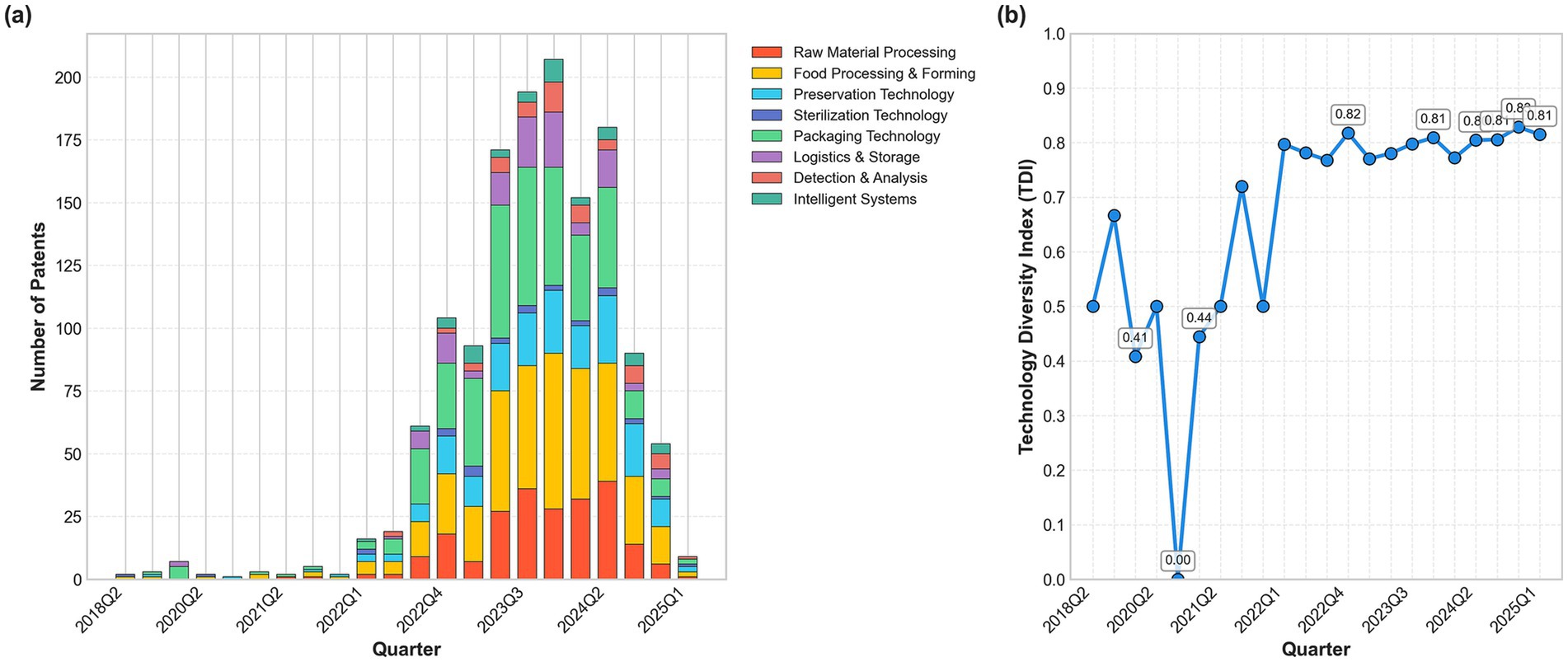

To elucidate the developmental dynamics of RTC foods technological innovation, this study analyzes quarterly trends in patent application volumes and temporal evolution of Technological Diversity Index (TDI) across eight major technical domains, with results presented in Figure 3.

Figure 3. Quarterly distribution and diversity evolution trends of RTC foods patent innovations. (a) Stacked area chart of quarterly patent distribution by technical domain. (b) Quarterly variation trends of the Technological Diversity Index (TDI).

As can be observed from Figure 3a, the number of patents related to RTC foods shows a significant growth trend, especially since 2022 when it entered a stage of rapid growth. During the period from 2018 to 2021, the quarterly number of patent applications was generally lower than 10, and technological innovation activities were relatively limited and scattered. Starting from the first quarter of 2022, there was a noticeable increase in the number of patent applications, and it reached a peak from the second quarter to the fourth quarter of 2023, with the number of patent applications in a single quarter exceeding 170. This stage can be regarded as an intensive period of technological innovation in RTC foods. Although the number of patent applications decreased in 2024, it still remained at a relatively high level, indicating that the technological innovation of RTC foods has entered a relatively stable development period. In terms of the technological structure, packaging technology and food processing & forming technology have always dominated throughout the observation period, accounting for approximately 55% of the total number of patents combined. This reflects that the innovation focus of the RTC foods industry revolves around the shaping of product forms and packaging for preservation, which is in line with the product characteristics and market demands of RTC foods. The proportion of raw material processing technology and preservation technology increased significantly after 2023, indicating that with the large-scale development of the industry, the processing of upstream raw materials and the extension of the shelf life have become new hotspots of technological innovation. Although the intelligent systems technology and detection & analysis technology account for a relatively small proportion, they have shown a steady growth trend since 2023, which reflects the development trend of the RTC foods industry’s transformation toward digitalization and intelligence.

Figure 3b shows the quarterly change trend of the Technology Diversity Index (TDI) for RTC foods. Generally speaking, the TDI value shows a fluctuating upward trend, gradually increasing from the range of 0.4–0.5 during 2018–2020 to the range of 0.75–0.83 after 2022. This evolution trend indicates that the degree of diversification of technological innovation in RTC foods has significantly increased, and the innovation structure has become increasingly rich. The first quarter of 2022 is a crucial time point when the TDI value first exceeded 0.75, which is highly consistent with the inflection point of the growth in the number of patent applications. This indicates that while the RTC foods industry has entered a period of rapid development, technological innovation also exhibits diversified characteristics. The TDI value was 0 in the third quarter of 2020 because there was only one patent application in that quarter, and a diversified structure could not be formed. The TDI value reached 0.83 in the fourth quarter of 2024, which is the highest value during the observation period. This indicates that although the number of patents decreased, the degree of diversification of technological innovation continued to increase, reflecting that the RTC foods industry has entered a stage of refined and diversified development.

A comprehensive analysis shows that the technological innovation of RTC foods has gone through an evolutionary process from a single technology breakthrough to the collaborative development of multiple technologies. With the expansion of the industry scale and the diversification of market demands, technological innovation activities have been continuously deepened and expanded, forming an innovation pattern with food processing & forming technology and packaging technology as the core and the collaborative development of multiple technological fields. The steady increase in the technology diversity index reflects the continuous improvement of the technological foundation and the continuous expansion of the technological boundaries of the RTC foods industry, laying a solid foundation for the high-quality development of the industry.

5.3 Associated structure and fusion characteristics of technical fields

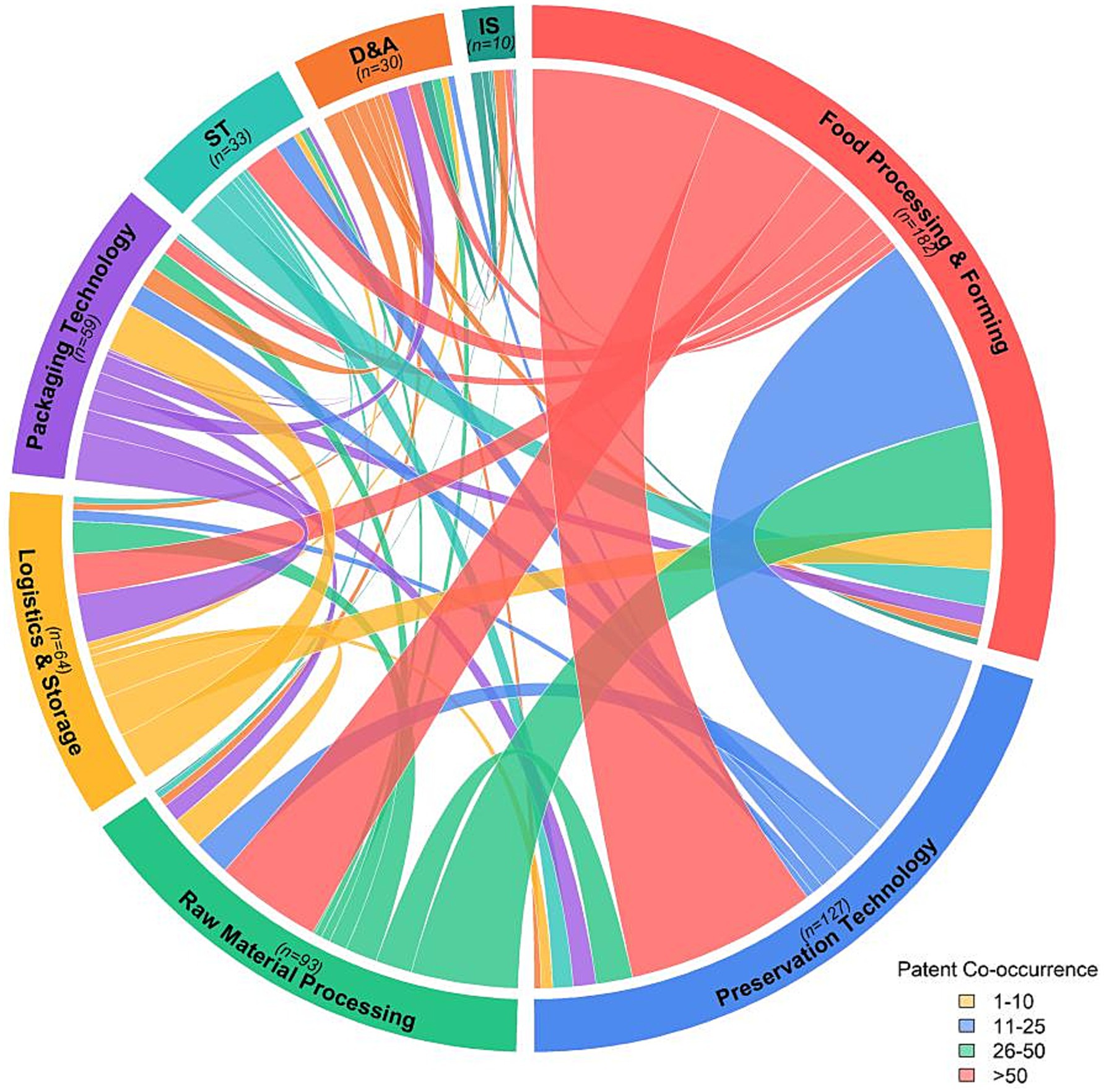

With the rapid development of technological innovation in the RTC foods industry, there are complex interrelationships and integration trends among different technological fields. Among the 1,180 RTC foods patents analyzed in this study, 247 (20.93%) were classified as multi-classified patents, that is, they involved two or more technological fields simultaneously. This proportion reflects the significant cross-field integration phenomenon existing in the technological innovation of RTC foods. As a direct manifestation of technological integration, the quantity and distribution of multi-classified patents can reveal the systematic characteristics of technological innovation in the RTC foods industry. To gain a deeper understanding of this technological associated structure, this study constructed an associated network of technological fields in the RTC foods industry, revealing the co-evolution and integration patterns among technologies, and further identifying key technological nodes and potential innovation opportunities.

5.3.1 Overall characteristics of the RTC foods technology association network

By analyzing the co-occurrence relationships of the IPC subclasses in the patents, this study constructed an associated network of technological fields in the RTC foods industry. As shown in Figure 4, the network is composed of 8 nodes representing technological fields and 24 connecting edges. The network density is as high as 0.857, indicating that a closely associated innovation ecosystem has been formed among various technological fields. The average clustering coefficient of the network is 0.895, the average path length is only 1.143, and the network diameter is 2. These indicators together show that the technological fields of RTC foods exhibit typical “small-world” network characteristics, that is, high clustering and short path lengths coexist. The high connectivity among technological fields (the number of connected components is 1) implies that the technological innovation in the RTC foods industry shows a significant integration development trend, and each technological field can quickly achieve the transfer and diffusion of knowledge and technology.

Figure 4. The associated chord diagram of technological fields in the RTC foods industry. Nodes represent different technological fields. The width of the connecting lines reflects the intensity of patent co-occurrence, and the numbers indicate the total quantity of patent co-occurrences in each technological field. D&A, Detection and Analysis Technology; IS, Intelligent Systems Technology; ST, Sterilization Technology.

As can be observed from Figure 4, the strongest technological association is formed between food processing & forming technology and preservation technology (with a co-occurrence intensity of 84), followed by the association between food processing & forming technology and raw material processing technology (with a co-occurrence intensity of 47). This indicates that in the technological innovation of RTC foods, processing and forming, preservation treatment, and raw material processing constitute the core technological chain, which jointly solves the key technical problems in the production of RTC foods.

5.3.2 Identification and characteristic analysis of key technological nodes

Through the analysis of network centrality indicators, the key nodes in the RTC foods technological innovation network can be identified. In terms of the degree centrality indicator, food processing & forming technology, raw material processing technology, and packaging technology all reach the maximum value of 1.0, indicating that these three technological fields have direct associations with all other technological fields and are at the core of the network. From the perspective of eigenvector centrality, food processing & forming technology (0.393), raw material processing technology (0.393), and packaging technology (0.393) also rank among the top, suggesting that these technological fields not only have extensive associations but also have closer connections with other important technological fields.

Based on the weighted degree analysis, food processing & forming technology (182), preservation technology (127), and raw material processing technology (93) dominate the RTC foods technological innovation network. As the core part of RTC foods production, food processing & forming technology have the most patent co-occurrences with other technological fields, reflecting their pivotal role in the technological innovation of RTC foods. In contrast, the weighted degree of intelligent systems technology is only 10, indicating that their degree of integration with other technological fields is still relatively limited. However, with the in-depth application of the concept of intelligent manufacturing, this field is expected to achieve leap-forward development.

5.3.3 Strength and significance of technological association edges

The associated intensity among technological fields not only reflects the degree of technological integration but also reveals potential innovation opportunities. By analyzing the edge betweenness centrality indicator, it is found that the edge connecting food processing & forming technology and intelligent systems technology has the highest betweenness centrality (0.065), indicating that this technological association plays an important “bridge” role in the entire network. Although the current co-occurrence intensity between these two fields is only 3, this association is of strategic significance for the digital and intelligent transformation of the RTC foods industry.

The edge connecting sterilization technology and food processing & forming technology has a relatively high co-occurrence intensity (16), but its betweenness centrality (0.055) is lower than that of the edge related to intelligent system technology. This reflects that although the traditional technological association is stable, its innovation potential may be relatively limited. In contrast, the association between detection & analysis technology and intelligent systems technology (with a betweenness centrality of 0.054 and a co-occurrence intensity of 5) shows good development momentum, indicating that the intelligent detection system based on sensing technology and data analysis is becoming an emerging direction of technological innovation in the RTC foods industry.

5.3.4 Technology clustering and convergence development trends

Through the analysis of the community detection algorithm, the technological fields of RTC foods can be divided into two main technology clusters. The first cluster includes food processing & forming technology, preservation technology, raw material processing technology, and sterilization technology, mainly focusing on the core production processes of RTC foods. The second cluster includes logistics & storage technology, packaging technology, detection & analysis technology, and intelligent systems technology, mainly concerned with the external support systems of RTC foods. This cluster structure indicates that there is a dual collaborative development model of “production core - support system” in the technological innovation of RTC foods.

As technological integration deepens, the boundary between the two clusters is gradually blurring. Although packaging technology belong to the support system cluster, they have formed stable associations with both food processing & forming technology (co-occurrence intensity of 8) and raw material processing technology (co-occurrence intensity of 8), reflecting the development trend of “integration of process and packaging” in the production of RTC foods. Similarly, the association between detection & analysis technology and preservation technology (co-occurrence intensity of 3) also indicates that the quality control of RTC foods is shifting from simple end-point detection to full-process monitoring.

In conclusion, technological innovation in the RTC foods industry exhibits characteristics of high interconnection and multi-field integration. In future development, food processing & forming technology, preservation technology, and raw material processing technology will still be at the core of technological innovation. Meanwhile, the deep integration of intelligent systems technology with traditional technological fields will become an important direction for the technological upgrading of the RTC foods industry.

6 Analysis of the structure of innovative entities and collaborative network in the RTC foods industry

The structure of patent applicants and their collaborative relationships reflect the basic characteristics of the industrial innovation network. In this chapter, by analyzing the type composition of patent applicants and their collaborative relationships, the organizational characteristics and evolution trends of the innovation system in the RTC foods industry are revealed, providing a new perspective for understanding the driving forces behind industrial innovation.

6.1 Structural characteristics of the entities of patent applications

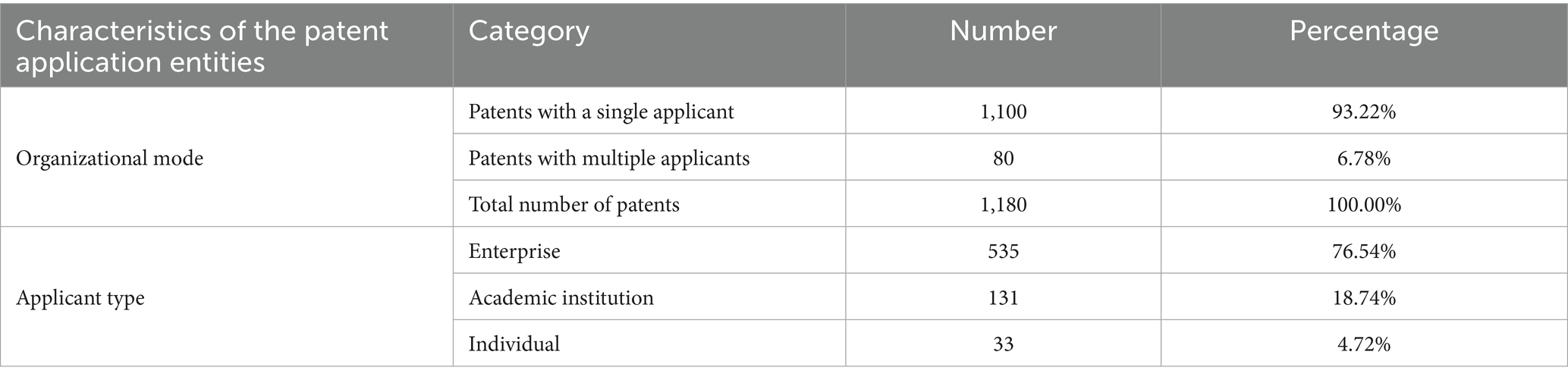

The organizational mode and type composition of patent applicants jointly reflect the internal mechanism and driving force of industrial innovation. Through a statistical analysis of the applicants of 1,180 patents related to RTC foods, this study reveals the structural characteristics of the innovative entities in the RTC foods industry, as shown in Table 3.

In terms of the organizational mode, the single-applicant mode occupies an absolute dominant position (93.22%) in the innovation activities of the RTC foods industry, while the proportion of patents with multiple applicants is relatively low (6.78%). This indicates that the technological innovation activities in the RTC foods industry are mainly driven by independent entities, and collaborative innovation has not yet become the mainstream mode.

In terms of the composition of applicant types, innovation in the RTC foods industry shows obvious characteristics of enterprise leadership. Enterprises account for 76.54% of the applicants, reflecting the market orientation of this industry. Academic institutions account for 18.74%, providing technical support in basic research areas such as food preservation technology and microbial control. Individual applicants account for 4.72%, mainly contributing to innovation in cooking techniques and seasoning formulas.

An innovative entity structure has been formed in the RTC foods industry, with enterprises as the leaders, academic institutions as the support, and individual innovation as the supplement. This structure is in line with the characteristics of the RTC foods industry as an applied technology field, but there is still much room for improvement in the degree of collaborative innovation among the entities. As the industry develops, the collaboration network among different innovative entities is expected to be further improved.

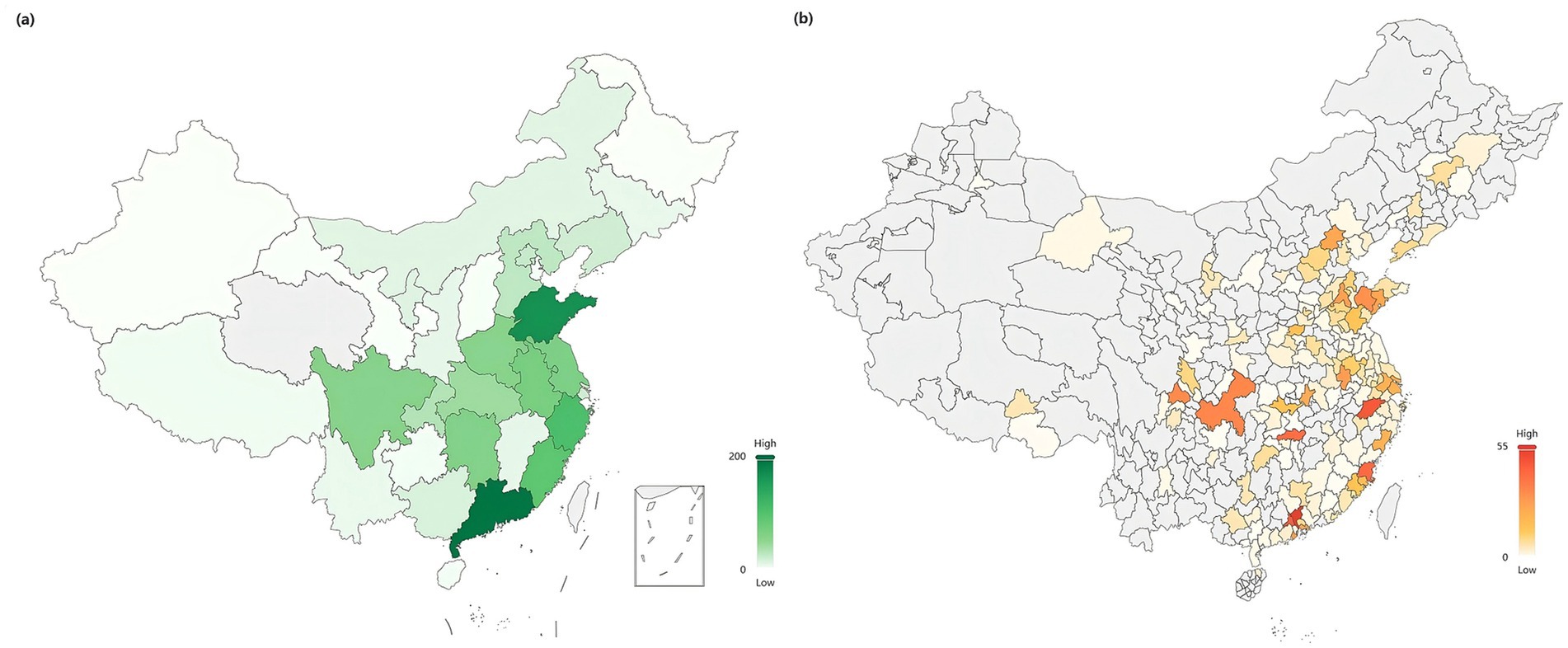

6.2 Structure and characteristics of the industry-university-research cooperation network

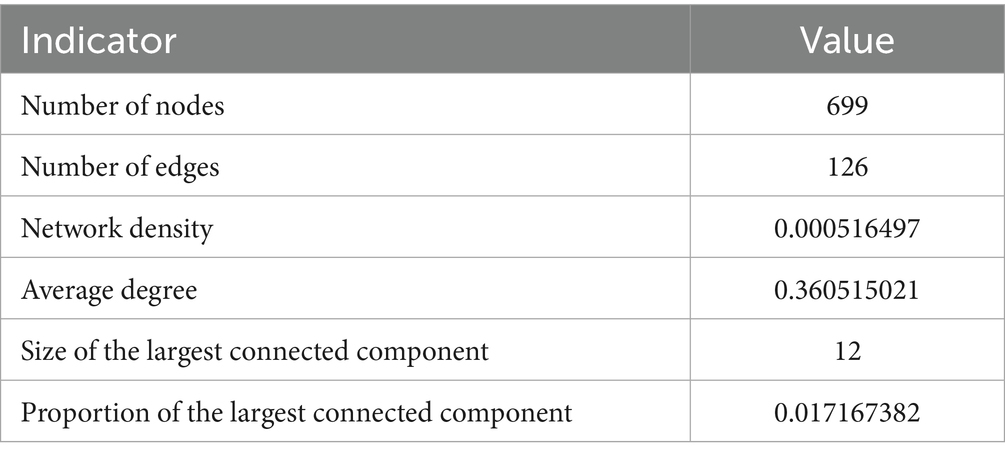

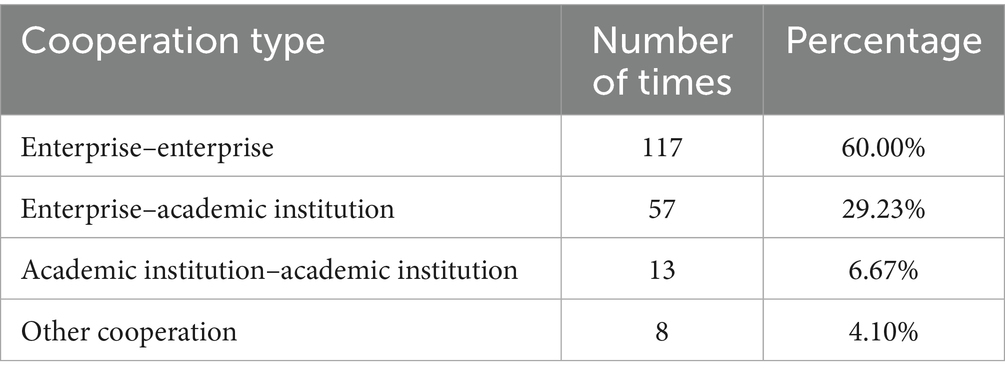

The collaborative relationships among the innovative entities in the RTC foods industry constitute the industry-university-research cooperation network. By using the social network analysis method to model the relationships of joint patent applications, Table 4 shows the basic indicators of the innovation collaboration network in the RTC foods industry. The innovation collaboration network in the RTC foods industry consists of 699 innovative entities (nodes), most of which are entities that apply for patents individually. The number of entities actually participating in the cooperation network is relatively small, which also leads to the highly fragmented characteristics of the network.

The innovation collaboration network in the RTC foods industry exhibits highly dispersed characteristics. There are a total of 699 innovative entities (nodes) in the network, but only 126 cooperation relationships (edges) are formed. Most of these entities apply for patents individually. The number of entities actually participating in the cooperation network is relatively small, which leads to the highly fragmented nature of the network and an extremely low network density (0.0005), indicating that most innovative entities have not established cooperation links. The average degree is only 0.36, meaning that on average, each innovative entity has cooperation relationships with less than 0.4 other entities. The largest connected component contains only 12 nodes, accounting for 1.72% of the total number of nodes, suggesting that the innovation network in the RTC foods industry is highly fragmented and large-scale collaborative innovation clusters have not yet formed.

The distribution of cooperation types is shown in Table 5. In the RTC foods industry, innovation cooperation is mainly dominated by cooperation among enterprises (60.00%), followed by industry-university cooperation (29.23%), and cooperation among academic institutions accounts for a relatively small proportion (6.67%). This structural characteristic indicates that innovation in the RTC foods industry mainly relies on industrial chain cooperation and market synergy among enterprises, while academic institutions mainly industrialize scientific research results through cooperation with enterprises.

6.3 Identification of core innovative entities and analysis of their influence

By calculating the network centrality indicators, the core entities and their influence in the innovation network of the RTC foods industry can be identified. Table 6 lists the innovative entities with the highest degree centrality and betweenness centrality.

In terms of degree centrality, Anjoy Food Group Co., Ltd. ranks first (0.0115), mainly due to the close patent cooperation network it has formed with its eight regional subsidiaries. By establishing a national innovation collaboration system, the group has achieved the integration and sharing of technological resources within the group, forming a large-scale patent layout strategy. Its subsidiaries are located in regions such as Taizhou, Guangdong, Shandong, Wuxi, Liaoning, Sichuan, Hubei, and Henan, indicating that the group has established a national-wide innovation network. The internal collaborative innovation model within enterprise groups is one of the prominent features of the innovation network in the RTC foods industry.

Academic institutions occupy an important position among the core innovative entities. Zhongkai University of Agriculture and Engineering, Guangdong Academy of Agricultural Sciences, and Jiangnan University all have relatively high degree centrality (0.0072). These institutions not only play a core role in the industry-university-research cooperation in their respective regions but also promote the transformation of scientific research achievements into industrial applications by establishing cooperation relationships with multiple enterprises. As a key institution in the field of food science, Jiangnan University has established cooperation relationships with multiple food enterprises and provided technical support in areas such as food preservation and processing technology. Zhongkai University of Agriculture and Engineering plays an important role in the RTC foods innovation network in South China.

Betweenness centrality reflects the bridging role of innovative entities in the network. Zhongkai University of Agriculture and Engineering (0.000152) and Guangdong Academy of Agricultural Sciences (0.000111) rank among the top, indicating that academic institutions play a key role in connecting different innovative entities and promoting the flow of knowledge. Guangzhou Wanzhu Central Kitchen Co., Ltd. stands out in terms of intermediary centrality among enterprises (0.000123), which reflects the pivotal position of this enterprise in the industrial chain, connecting upstream raw material suppliers and downstream channel enterprises.

In terms of the geographical distribution of the core innovative entities, the innovative entities in Guangdong region occupy an important position in the network, such as Zhongkai University of Agriculture and Engineering, Guangdong Academy of Agricultural Sciences, Guangzhou Wanzhu Central Kitchen, etc., indicating that a relatively active innovation ecosystem for RTC foods has been formed in this region. The innovative entities represented by Jiangnan University and Anjoy Food Group in Jiangsu region are also active, showing the development trend of regional innovation clusters.

Overall, the core innovative entities in the RTC foods industry present the structural characteristics of “enterprise dominance and academic support.” Large enterprise groups have formed highly concentrated innovation sub-networks through internal collaborative innovation, while academic institutions play a bridging role by cooperating with multiple enterprises, promoting the flow and diffusion of knowledge. However, the influence scope of the core innovative entities is still relatively limited, and the innovation leading effect covering the whole industry has not been formed, which is consistent with the overall dispersed and fragmented characteristics of the innovation network in the RTC foods industry.

6.4 Knowledge flow and technology diffusion paths

By analyzing the cooperation frequency and patterns among different innovative entities, the knowledge flow and technology diffusion paths in the RTC foods industry can be revealed. Table 7 shows the innovation cooperation relationships with the highest cooperation frequencies.

Based on the analysis of cooperation frequency, the knowledge flow in the RTC foods industry presents three main patterns: internal knowledge flow within groups, collaborative innovation among industry, university and research institutions, and collaboration within regional industrial clusters.

The internal knowledge flow within groups is the most prominent technology diffusion path (Leendert Aalbers and Dolfsma, 2015). The cooperation between Guangdong Galanz Group and its subsidiaries (8 times) and the extensive cooperation between Anjoy Food Group and its subsidiaries (both 2 times) have formed a close innovation network. These enterprise groups have achieved the rapid dissemination and application of technical knowledge within the group through the internal collaborative R&D mechanism. As a kitchen appliance manufacturer, Galanz’s innovative cooperation mainly focuses on RTC foods cooking equipment and kitchen appliance technology, while Anjoy Food focuses on the R&D and innovation of RTC foods products themselves. The internal knowledge flow within the group has effectively integrated the group’s resources and improved the innovation efficiency.

Collaborative innovation among industry, academia, and research institutions constitutes the second important path for knowledge flow in the RTC foods industry (Wu et al., 2022). Represented by the high-frequency cooperation (4 times) between Zhejiang Ocean University and Zhejiang Henghe Food, as well as Haizhiwei Food, the transformation and application of university research results to enterprises have been achieved through industry-academia cooperation. This model is particularly prominent in the field of marine food processing, where a positive interaction has been formed between the basic research of universities and the application needs of enterprises. Similar cooperations include those between Huazhong Agricultural University and Guigang Xinshiji Food, and between Zhejiang Marine Fisheries Research Institute and Zhoushan Marine Fisheries of China. All these indicate that agricultural universities and research institutions provide important technical support in the processing of specific raw materials for RTC foods.

Collaboration within regional industrial clusters is the third important knowledge-flow model (Sun and Cao, 2015). For example, the cooperation between Zhejiang Henghe Food and Haizhiwei Food (4 times), and that between Guangxi Gangfeng Food and Guangxi Guigang Gangfeng Agriculture and Animal Husbandry (3 times) indicate that relevant enterprises within the region have formed an industrial cluster effect through close cooperation. These regional collaborations are mostly concentrated among upstream and downstream enterprises in the industrial chain within a specific geographical area, such as seafood processing in Zhoushan and agricultural and livestock product processing in Guangxi. Regional agglomeration promotes the flow and sharing of tacit knowledge and accelerates the diffusion process of technological innovation.

A specialized cooperation network in specific fields has been initially formed. Taking marine food processing as an example, Zhejiang Ocean University, Zhejiang Henghe Food, and Haizhiwei Food have formed a relatively stable innovation network of “university-enterprise cooperation-enterprise collaboration,” focusing on the research, development, and application of processing technologies for RTC seafood products. Similarly, the internal innovation network of Anjoy Food Group focuses on the technology of quick-frozen prepared foods, and the cooperation among enterprises affiliated with Qingdao Haier focuses on the technology of cold chain preservation equipment. This knowledge flow network specialized in specific fields helps to form a synergistic effect of technological innovation.

From the perspective of geographical distribution, the knowledge flow in the RTC foods industry shows obvious characteristics of regional agglomeration. Regions such as Zhejiang, Guangdong, Shandong, and Chongqing have formed relatively active regional innovation networks. Taking Chongqing as an example, Chongqing Meixiangyuan Industrial Group has formed a close local innovation network with Juhui Chongqing Industrial Design Research Institute, Juhuo Food, and Juhui Food Technology. This regional agglomeration reflects the geographical proximity effect of innovation in the RTC foods industry. The close geographical distance facilitates face-to-face communication and promotes the effective transfer of tacit knowledge.

In general, the knowledge flow and technology diffusion in the RTC foods industry are mainly achieved through three paths: internal collaboration within enterprise groups, industry-university-research cooperation, and collaboration within regional clusters. However, the overall diffusion scope is limited, and a broad cross-regional and cross-disciplinary knowledge exchange network has not been formed yet. Enhancing the breadth and depth of technology diffusion and constructing a more open innovation ecosystem will become an important direction for the future development of the RTC foods industry.

7 Discussion

This study’s findings reveal a nascent but rapidly evolving innovation ecosystem for China’s RTC foods industry, characterized by explosive growth, distinct technological patterns, and specific structural weaknesses. This section discusses the broader implications of these findings, interpreting the technical clustering patterns in the context of industry trends and examining the profound influence of external shocks on the ecosystem’s development trajectory.

7.1 Technical clustering as a reflection of industry priorities

The pronounced clustering of patents in “food processing & forming technology” and “packaging technology” is a clear empirical reflection of the Chinese RTC industry’s current strategic priorities. As established in our literature review, the global industry is driven by the need to resolve the consumer paradox of desiring both convenience and “fresh-like” quality (Leroy and Degreef, 2015). Our findings show that Chinese firms are tackling this challenge head-on. The focus on processing and forming technologies directly addresses the core challenge of industrializing and standardizing complex culinary products, a prerequisite for scaling production. Concurrently, the intense innovation in packaging technology, which has one of the highest technological diversity indices, underscores its role as a key competitive battleground, consistent with global trends where packaging has evolved into an active system for quality management and brand communication (Bumbudsanpharoke and Ko, 2022).

This dual focus reveals an industry in a critical transition phase: moving from basic product creation to sophisticated value preservation and delivery. The strong connection between these two technical domains in our network analysis suggests a growing trend toward the “integration of process and packaging,” where product formulation and its protective environment are being co-designed from the outset. However, the relatively lower patenting activity in strategic areas like “intelligent systems technology” and “detection & analysis technology” points to a potential bottleneck. While the industry has made significant strides in mastering core production, the next wave of innovation, centered on digitalization, full-process quality control, and traceability, appears to be in its early stages. This indicates a gap between the current state and the future requirements for a fully modernized and transparent food system.

7.2 The influence of external shocks on innovation dynamics

The temporal analysis of patent applications, which identifies a dramatic surge starting in 2022, cannot be understood without considering the impact of the COVID-19 pandemic. This global event acted as a powerful catalyst, fundamentally altering consumer behavior and creating an unprecedented market shock. Stay-at-home policies and disruptions to traditional food service channels massively accelerated consumer adoption of at-home convenient meal solutions.

Our data provides clear evidence of this shock-induced innovation. The explosive growth in patent filings from 2022 to 2023 is not merely a sign of a growing industry but a direct response to a sudden and immense market pull. This aligns with the consumer-driven innovation theories discussed earlier, where external events can amplify the “calculus of compromise” (Wheeler, 2018), pushing consumers to prioritize convenience while simultaneously heightening their health awareness. The industry’s response—a flood of new patents—was an attempt to capture this historic market opportunity. The subsequent leveling-off and decline in applications in 2024, coupled with a steady rise in granted patents, suggests the ecosystem is now moving past this reactive phase into a period of consolidation and a strategic shift from quantity to quality, where innovators are likely focusing on more substantial, defensible inventions.

8 Conclusion

This study investigated the patent innovation ecosystem of China’s RTC foods industry through an integrated “space–time-technology-network” framework. Our analysis of 1,180 patents reveals an industry characterized by four defining features: explosive post-pandemic growth, significant regional agglomeration in eastern coastal provinces, a technological structure dominated by processing and packaging innovations, and a highly fragmented collaborative network.

8.1 Contributions of the study

This research offers two primary contributions. Theoretically, it validates a holistic, multi-dimensional framework for analyzing the innovation ecosystem of an emerging industry, moving beyond the isolated analytical perspectives common in prior patent research. By demonstrating the interplay between temporal shocks, spatial clustering, technological focus, and network structure, we provide a more dynamic and integrated methodological approach. Practically, this study presents the first comprehensive patent landscape of China’s RTC industry. It provides empirical evidence of the industry’s development stage, identifies key technological frontiers and bottlenecks, and maps the primary actors and their limited collaboration, offering actionable intelligence for firms and policymakers.

8.2 Policy implications

Based on our findings, we propose the following specific and actionable policy recommendations to foster a more robust and balanced innovation ecosystem: