- 1Jiyang College, Zhejiang A&F University, Zhuji, China

- 2College of Economics and Management, Zhejiang A&F University, Hangzhou, China

In recent years, under the background of digital technology, agricultural supply chain finance (SCF) has ushered in new development opportunities and become an important lever to promote the development of the agricultural industry and achieve the goal of rural revitalization. Rapid and accurate risk assessment of agricultural supply chain finance can provide strong support for its sustainable development and agricultural production. This study selected 12 risk evaluation indicators and constructed a risk evaluation index system from four dimensions: industry risk, the credit risk of small- and medium-sized enterprises, core enterprise status, and supply chain operation status. Using the Grey–DEMATEL model to analyze the impact relationships and pathways among risk factors and identify key influencing factors. Combined with the ISM method, the comprehensive impact matrix and reachability matrix are obtained, and a hierarchical structure model of risk factors is established. To verify the effectiveness of the risk assessment method, D company was selected as the research object, and the constructed risk control model was applied to D company. Based on the results, strategies for preventing and controlling financial risks in the agricultural product supply chain are proposed from the aspects of enterprise credit risk prevention and control, establishment of digital platforms, and standardization of supply chain processes. Based on the Grey–DEMATEL–ISM model, effective evaluation of financial risks in agricultural product supply chains can be conducted.

1 Introduction

Accelerating the development of digitalization, building a digital China, and constructing a high-level socialist market economic system are one of the major decisions and deployments in the 14th Five-Year Plan period (Gu and Liu, 2018). In order to accelerate the process of digitalization, the state has proposed to promote the development of supply chain finance (SCF), develop fintech in a prudent manner, promote the digital transformation of financial institutions, and issue a series of policy support and guidance to achieve a virtuous circle of the economy and optimize the distribution of industries (Wang et al., 2018). To achieve a virtuous cycle of the economy and optimization of the industrial layout, a series of policy support and guidance have been issued by the state (Wu J. et al., 2023). In September 2020, the People's Bank of China and eight other departments jointly issued the Opinions on Regulating the Development of Supply Chain Finance to support the stable circulation and optimization and upgrading of the supply chain industry chain, which clearly puts forward the objectives of regulating the development of supply chain finance to support the stable circulation and optimization and upgrading of the supply chain industry chain, and puts forward the specific requirements for promoting the digital transformation of SCF. In August 2021, the General Office of the Ministry of Commerce issued the Circular on Promoting the Orderly Development of Supply Chain Finance and Doing a Good Job in Preventing and Controlling the New Crown Pneumonia Epidemic, requesting the competent departments in charge of commerce around the world to strengthen cooperation with financial institutions, with the aim of enhancing the availability of financing for small, medium and micro-enterprises and promoting the high-quality development of the real economy.

In recent years, under the promotion and application of digital financial technology, new forms of traditional SCF have emerged, such as SCF based on blockchain technology and big data risk control, which have helped inclusive finance achieve the goals of “universal” and “beneficial,” and provided financial support for stabilizing small- and medium-sized enterprises (SMEs) and safeguarded employment by providing financial support. The statistics report indicated that SMEs generate more than half of China's tax revenue every year and contribute more than 60% to the country's GDP (Song, 2019). Agricultural SMEs, as an important part of SMEs, are the mainstay of supporting China's agricultural development. However, the small amount of assets available for collateral, the vulnerability of agricultural products to natural disasters and the lack of standardized credit ratings can result in high credit risk and difficulty in obtaining bank support. While private capital and the risks of high financing interest rates, irregular operation, etc., leading to the demand for agricultural SMEs' funds being contrary to supply (Liu et al., 2011). The financial vulnerability of agricultural SMEs has further increased due to the normalization of epidemics and the economic environment in the past few years, which has led to the emergence of multi-point and decentralized outbreaks (Liang and He, 2023). All these factors have led to agricultural SMEs and farmers facing financing difficulties and inefficiencies. Supply chain financial services extend the credit advantages of core enterprises in the agricultural industry chain to the upstream and downstream of the agricultural industry chain, thus connecting the “three streams” of the entire industry chain, bundling the scattered, high-risk, low-return farmers, and agricultural SMEs with large-scale agricultural enterprises with strong strength, and contributing to the sharing of benefits and risks (Chen, 2023). In this way, it can effectively solve the financing difficulties of small- and medium-sized agricultural enterprises and farmers. However, in practice, due to the agricultural supply chain finance involves a number of subjects and links and the transferability of financial risks (Wu X. et al., 2023), once one of the links has problems, the whole supply chain will enter a stagnant state. In addition, due to the constraints of the specificity and complexity of China's agricultural production, the late start of the development of agricultural supply chain finance in China and the difficulty of expanding the scale of agriculture will threaten the agricultural production and constitute an obstacle to the stable development of the agricultural economy. Therefore, scientific and reasonable risk assessment of agricultural supply chain finance can more accurately understand the risk status of each link, provide a decision-making basis for all participants, and improve the efficiency and stability of the overall supply chain.

2 A literature review

Compared with traditional financial services, agricultural supply chain finance has more chain participants, complex business processes, and natural risk factors. In this case, it is necessary and urgent to study the construction of an agricultural supply chain financial risk indicator system and risk evaluation. It is important to select diversified evaluation indicators of the agricultural supply chain financial risk prevention system from multiple dimensions (Liu and Tan, 2022).

Scholars have selected different analytical methods for evaluating financial risks in agricultural supply chains. Early scholars used the analysis hierarchical process (AHP) method for risk evaluation, such as David and Marija (2007), who used the AHP and the frequency domain analysis (FDA) method for identifying and evaluating the financial risks of agricultural supply chains in response to the financial risk problems in the agricultural supply chain. Some scholars used linear causality to identify and evaluate the financial risks in the agricultural supply chain. Some scholars applied the linear causality modeling method to the study of agricultural supply chain financial risks. Xu (2016) used factor analysis to explore the degree of interaction between the public factors and the financial risk elements of the agricultural supply chain and constructed an online supply chain financial risk prevention model based on the analysis results. Yang and Fang (2017) studied different agribusiness financing modes from the perspective of SCF, constructed a linear regression model and effectively predicted the credit risk of agricultural SMEs' financing. Xu (2018) used the analytical idea of structural equation modeling to evaluate the risk of agricultural supply chain finance business and put forward risk prevention suggestions based on the evaluation results. Fang and Meng (2015) took 51 listed agricultural enterprises as research objects, constructed a logistic model to measure the default risk of agricultural enterprises, and provided a new reference program for banks' financing decision-making. Pan and Hu (2020) summarized the different risks generated by the characteristics of various agricultural supply chain financial models, selected representative enterprises for analysis using an explanatory structural model, and put forward corresponding risk prevention suggestions and realization paths based on the results. The results suggest corresponding risk prevention suggestions and realization paths. With the development of digital and intelligent information technology, experts and scholars have gradually introduced computer processing technology into supply chain financial risk research. Ann (2011) tried to apply intelligent decision support system computer technology to the study of agricultural supply chain financial risk management. Sun and Xu (2021) constructed a Genetic Algorithm (GA)-BP neural network risk evaluation model of agricultural supply chain and selected enterprise cases to verify the proposed risk assessment model. Wang et al. (2023) proposed a new measurement method based on the VaR risk measurement tool, MIDAS-SVQR, and they used the Kupiec test backtesting method to verify the accuracy of the model, which provided new technical support for supply chain pledge risk management. Li and Zhao (2020) established a system dynamics and structural equation model to study the evolution mechanism of credit risk formation in SCF and put forward relevant suggestions at the level of supply chain credit risk management based on the conclusions. In the process of exploring the internal structural layers and key influencing factors of complex systems, various methodologies such as Decision-Making Trial and Evaluation Laboratory (DEMATEL), AHP, and Interpretive Structural Modeling (ISM) have been extensively applied. From the perspective of identifying critical influencing factors, the DEMATEL method demonstrates remarkable advantages, while the ISM method excels in presenting logical hierarchies of influence. Therefore, to deeply dissect the specific relationships between influencing factors and their internal hierarchical structures, this study effectively integrates ISM and DEMATEL methods while incorporating Grey Numbers Theory, aiming to achieve more comprehensive and accurate analytical results. The DEMATEL–ISM approach has attracted significant scholarly attention in the field of supply chain risk assessment due to its capability to effectively evaluate the importance of risk factors and reveal hierarchical transmission relationships and internal correlations among these factors. Specifically, Diabat et al. (2012) pioneered the integration of ISM into supply chain risk factor evaluation by constructing a Structural Self-Interaction Matrix (SSIM) and progressively transforming it into a reachability matrix, providing an intuitive visualization of the interconnections among various risk factors. Based on the directed graph generated from the reachability matrix, researchers can accurately identify the most influential risk factors. Building on this foundation, Wu and Tian (2022) further employed a comprehensive AHP-DEMATEL–ISM method to conduct an in-depth analysis of risk factors in the prefabricated construction supply chain. They initially utilized AHP to assign weights to each risk factor, followed by calculating factor importance through DEMATEL and ISM methods to construct a hierarchical model. Song and Li (2023) applied the FUZZY–ISM method to analyze five major categories encompassing 16 risks within the cross-border e-commerce supply chain.

To summarize, experts and scholars have used different methods to assess the financial risk of the agricultural supply chain and have achieved certain results, which provide a solid foundation for the research of this study. However, some of the existing methods are still insufficient. On the one hand, the attributes of agricultural supply chain financial risk assessment indicators usually present complex non-linear relationships, so the relationship between quantitative data using traditional linear regression analysis methods often deviates from the actual situation. The initial weights and thresholds of the BP neural network are randomly selected, and the local results are prone to optimization problems, and there is no complete and unified theory to guide the selection of a suitable network structure. There is no complete unified theory to guide the selection of a suitable network structure. On the other hand, from the perspective of evaluation indexes related to supply chain financial risk, some evaluation indexes have missing data and insufficient information, and some indexes have a large number of fuzzy and uncertain phenomena. The indexes have the characteristics of “part of the in-formation is known, part of the information is not known” and “unclear connotation,” which can be seen in the entire supply chain financial risk assessment. That is, the indicator information is characterized by “some information is known, some information is unknown” and “unclear connotation,” so it can be seen that the whole agricultural supply chain financial risk evaluation system is a typical grey system. Given the prominent strengths of the Grey–DEMATEL–ISM methodology in revealing factor significance and interdependencies, it aligns well with the requirements of agricultural supply chain finance risk research. This integrated approach combines the advantages of Grey Numbers Theory and the DEMATELmethod to effectively address uncertainties and ambiguities inherent in agricultural supply chain finance. It enables quantitative analysis of relationships between risk factors and identifies critical influencing elements. Furthermore, the ISM method decomposes the intricate system into subsystems or components, constructing a hierarchical structural model that visualizes the layered relationships within the system in an intuitive manner. This provides decision-makers with a clear system structure visualization and actionable insights for formulating targeted risk prevention strategies. Therefore, this methodology is well-suited for agricultural supply chain finance risk studies, offering scientific evidence and decision-making support to stakeholders across the supply chain.

3 Analysis of agricultural supply chain finance risk factor identification

3.1 Supply chain finance models for agricultural products

The traditional conceptualization of agricultural supply chain finance has two major trends: “finance-oriented” and “supply chain-oriented.” Both view agricultural supply chain finance as a model of “commercial bank or financial institution plus industrial supply chain.” These views have been developed with the application of digital technology in agricultural supply chain finance and reflect the following limitations. First, the supply chain network structure is not taken into consideration when analyzing the funding issue. The digital supply chain has a mesh structure, with several businesses connected to one another at each node. This allows other businesses in the node to quickly take over an enterprise's responsibilities and reconnect the entire digital supply chain in the event of an issue. The role of banks and other financial institutions has evolved from that of mere capital providers to one of the stakeholders in the healthy growth and operation of the supply chain. In the process of financing partnerships with supply chain participants, the bank's ability to successfully integrate into the supply chain network has also emerged as a critical concern (Song and Chen, 2016). Second, the role of digital technology is becoming more and more important in the agricultural supply chain financial system. Traditional supply chain enterprises have only carried out preliminary informatization construction, resulting in the business systems of various departments within the enterprise being independent of each other. However, in order to realize the overall planning, design, and operation of supply chain activities on a digital platform and to make the operation data of the enterprises involved in the supply chain more transparent and standardized, the digital supply chain adopts a new generation of information technology as well as contemporary management concepts and methods. The so-called “decentralization” movement in SCF has resulted in a comprehensive network service platform taking the lead over the core agriculture firms as the primary credit holders.

Therefore, agricultural supply chain finance can be understood as follows at this stage. The basis and source of agricultural supply chain finance (APSCF) is supply chain finance (Jiang and Wen, 2021). APSCF is based on the real transaction of “three streams” in the supply chain, with leading enterprises of agricultural products as the core, through centralized credit granting and bundling of participants in the supply chain, scientifically and reasonably evaluating the financial products and services of agricultural products supply chain, and relying on the real transaction structure and process of the supply chain network, banks or financial institutions and lending platforms to provide financing business for the main bodies in need of funds in the supply chain, and meet the financing needs of the nodes of the supply chain. Banks or financial institutions, loan platforms, etc., relying on the real transaction structure and process of the supply chain network, provide financing business for the main body of the supply chain in need of funds to meet the financing needs of the main body of each node in the supply chain (Guo and Gu, 2022). In order to systematically solve the overall coordinated operation of the agricultural supply chain, banks or financial institutions should provide financial services to the nodes of the supply chain (Xia, 2023). The systematic solution to the overall coordinated operation of the agricultural supply chain. Through the support of digital technology, it realizes the optimization of the whole supply chain of agricultural products and the innovation of financial services and provides powerful support for the upgrading and transformation of the agricultural industry.

The agricultural supply chain finance operation model is shown in Figure 1.

3.2 Risk assessment indicator system for agricultural supply chain finance

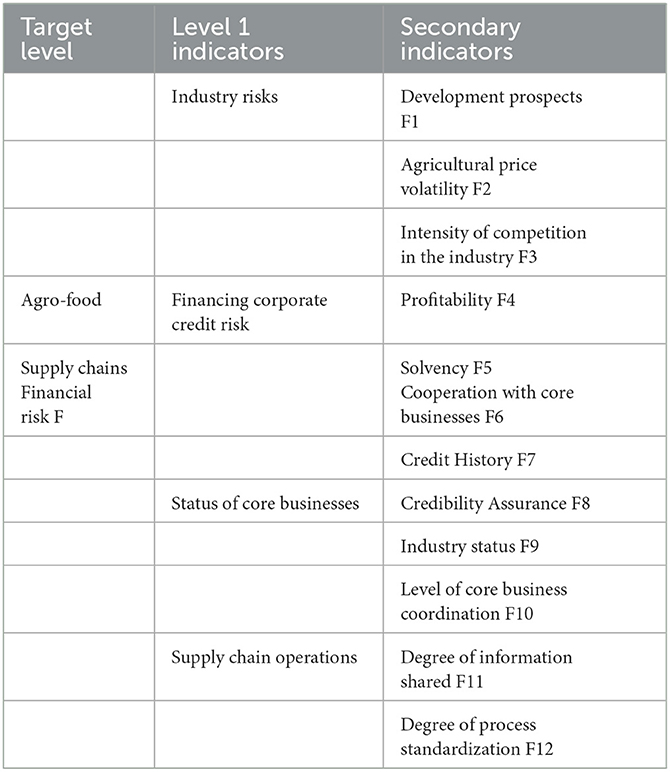

When conducting risk evaluation for agricultural supply chain finance, it is important to achieve the best possible results while saving costs. Therefore, it is crucial to grasp the key indicators from complex factors while ensuring comprehensiveness and accuracy. Based on previous research results, this paper preliminarily identifies and summarizes the risk factors of agricultural supply chain finance in four dimensions, including industry risk, the credit risk of micro, small- and medium-sized enterprises (MSMEs), the status of core enterprise, and operational status of the supply chain. Literature sources from core journals included in China Knowledge Network (CNKI) and Web of Science, and the publication year is 2015–2023. In the database of China Knowledge Network (CNKI), “Agricultural Supply Chain Finance,” “Supply Chain Financial Risk Evaluation,” and “index system construction” are used as keywords. In the Web of Science core collection, “agricultural supply chain finance” and “risk evaluation” are used as keywords. In order to ensure the rationality of selected indicators, relevant experts are invited to evaluate preliminary indicators, and on the basis of research results of scholars, some of the indicators are adopted for this study: F2 (price volatility of agricultural products), F5 (solvency), F10 (level of coordination of core enterprises), and F11 (degree of shared information), as shown in Table 1. On the other hand, six experts in the industry are invited to evaluate the indicators, including three agribusiness executives with more than 5 years of experience and three university professors with rich research experience in the field of SCF. Through the online interview format, the core question of the interview outline is: “Combined with your own work experience, what do you think are the key risk factors in agricultural supply chain finance risk?” On the premise of obtaining the experts' consent, the online recording function of Tencent Conference was used to record the entire discussion process, and after the meeting, we reviewed and sifted out the key contents, combined with the experts' comments and suggestions on the addition and deletion of indicators, and adjusted and supplemented them according to the actual situation. In order to adapt to the needs of risk assessment of different agricultural supply chain finance scenarios, this study combines with the operation mechanism of SCF. Therefore, indicators F1 (development prospects), F3 (industry competition), F6 (cooperation with core enterprises), F7 (credit history), and F9 (industry status) were obtained. This study selects 12 key indicators to construct the agricultural supply chain finance risk assessment index system, as shown in Table 1.

3.2.1 Industry risks

Once the macro-environment faced by all parties in the agricultural supply chain changes, it may impact on quality of assets, profitability, and debt-servicing capacity of the enterprises in the location. In turn, it impacts on the credit standing. Over the past few years, the impact of the epidemic on socio-economic activities has been mainly reflected in the financial sector, with financial markets and institutions in a period of high risk. The impact of COVID-19 is superimposed on the previous risks, thus significantly increasing the volatility vulnerability of the SCF industry (Wu et al., 2020). From the point of view of agricultural production activities, farmers planting, and breeding scale is generally small, seasonal, natural disasters, and other force majeure factors on agricultural production caused greater distress, and the market price of agricultural products is highly susceptible to greater volatility (Wang et al., 2013). Competition in the industry affects supply chain coordination in various ways, including changes in market demand, cooperative relationships between supply chain segments, and pressure on the level of supply chain coordination.

3.2.2 Credit risk profile of MSMEs

The credit risk of MSMEs with financing needs is often regarded as the “shock source” of credit risk in SCF (Li, 2020). Because of the holistic nature of the supply chain, credit risk can easily spread from a single enterprise to the entire supply chain. Profitability is an indicator of a company's profitability and capital appreciation and is often used to show a company's profitability over a specific period of time. Credit history is a direct indicator of a company's profitability (Wu and Huang, 2022). The credit history can directly reflect the creditworthiness of the enterprise, which is of great significance for banks and other financial institutions to refer to in their lending business. The solvency of the financing enterprise is one of the important indicators reflecting the credit level of the enterprise, which represents the ability of the enterprise to continue to develop. If the cooperative relationship between the financing enterprise and the core enterprise in the supply chain remains stable, and the number of times or the amount of cooperation between the two parties is large, meaning that the supply chain relationship is relatively stable, and the financing SMEs have the ability of stable operation and development.

3.2.3 Status of core businesses

The core enterprise refers to the enterprise in a dominant position, which can effectively organize and coordinate the allocation of resources among the members of the supply chain and enhance the overall efficiency of the supply chain. The core enterprise has a high credibility qualification by virtue of its larger scale and stronger business capacity. Credibility assurance is the foundation for the development of an SCF business, affecting the stability of the whole supply chain and the quality of external financial services. Core enterprises utilize their high-quality credit ratings to provide guarantees, prompting financial institutions to carry out financing business for SMEs. When SMEs are unable to repay their debts in accordance with the terms of the contract, they are given the opportunity to obtain financing from financial institutions through the credit guarantee of core enterprises. In addition, the ability of the level of coordination of the core enterprise determines whether the supply chain dominated by it will be more stable or not. The systematic coordination and integration of the core enterprise can effectively reduce the risk. On the contrary, the disorder and insufficient influence of the coordination of the core enterprise can also expand the supply chain financial risk (Peng, 2015).

3.2.4 Supply chain operations

Some member enterprises of agricultural supply chains lack the willingness to actively disclose internal information, which is mainly motivated by the purpose of protecting the privacy of enterprises, resulting in the risk of information asymmetry. Moreover, due to the relatively simple internal organizational structure of agricultural supply chain member enterprises, each functional department is responsible for more business content. It not only raises the information disclosure cost of enterprises but also makes it hard to achieve standardization in the existing information disclosure documents, preventing financial institutions from judging the real credit level of credit targets (Zhang, 2017). The degree of supply chain process standardization determines the efficiency and security of SCF, reduces transaction costs and risks, promotes the development and application of SCF, and enhances the overall efficiency of the industry.

This section provides a comprehensive risk assessment indicator system for agricultural supply chain finance, covering four major dimensions: industry risks, financing corporate credit risks, core business status, and supply chain operations. These 12 key indicators were selected based on literature analysis and expert evaluation, ensuring both theoretical rigor and practical relevance.

The selected indicators aim to capture the multi-faceted risks in agricultural supply chain finance. Industry risks (F1–F3) reflect macroeconomic and market fluctuations that may affect financial stability. Financing corporate credit risks (F4–F7) assess the creditworthiness and solvency of SMEs involved in SCF. Core business status (F8–F10) examines the role of leading enterprises in stabilizing the financial ecosystem. Finally, supply chain operations (F11–F12) focus on information transparency and process efficiency, which are crucial for reducing financial uncertainty.

Based on this indicator system, the next section will apply the Grey–DEMATEL method to determine the causal relationships among these risk factors and further analyze their hierarchical structure using ISM. This approach will provide deeper insights into the key risk drivers and their interactions, enabling more effective risk mitigation strategies.

3.3 Sample and data sources

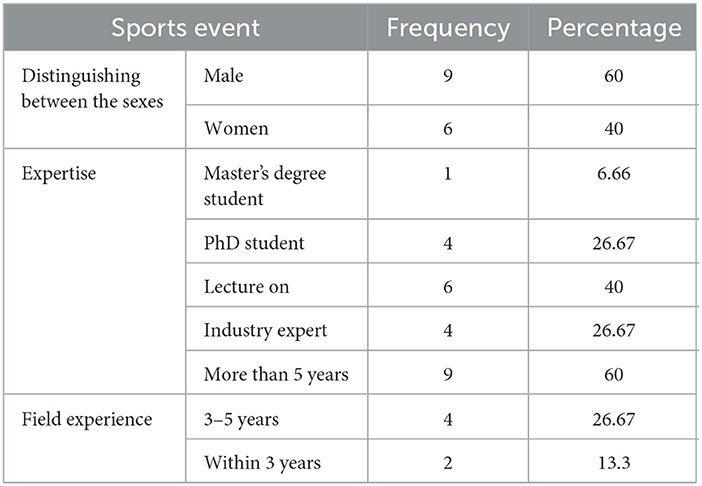

Based on the core design logic of the Grey–DEMATEL method, the research level of experts, and the research context of this article, a matrix scale was created to measure the 12 risk factors of agricultural supply chain finance summarized in the previous section. The scale was distributed to 15 master's, doctoral, and professor students with research experience in supply chain management and agricultural supply chain finance, as well as relevant experts in the industry. A total of 15 valid questionnaires were collected. The relevant information of the interviewees is shown in Table 2. The questionnaire results summarize and update the answers of each expert, collect opinions from the expert group, and then provide feedback to the expert group. After continuous revisions by experts, the results were summarized to reach a consensus.

The questionnaire included 12 key risk factors, and respondents were asked to rate their importance on a 5-point Likert scale (1 = not important, 5 = extremely important). To ensure the reliability and validity of the data, Kendall's W coefficient was used to measure the consistency of expert opinions. The iterative Delphi method was applied, where expert feedback was collected, revised, and re-evaluated multiple times until a consensus was reached.

The final collected data were normalized and used as input for the Grey–DEMATEL method, where the direct-relation matrix was constructed to analyze the causal relationships between risk factors.

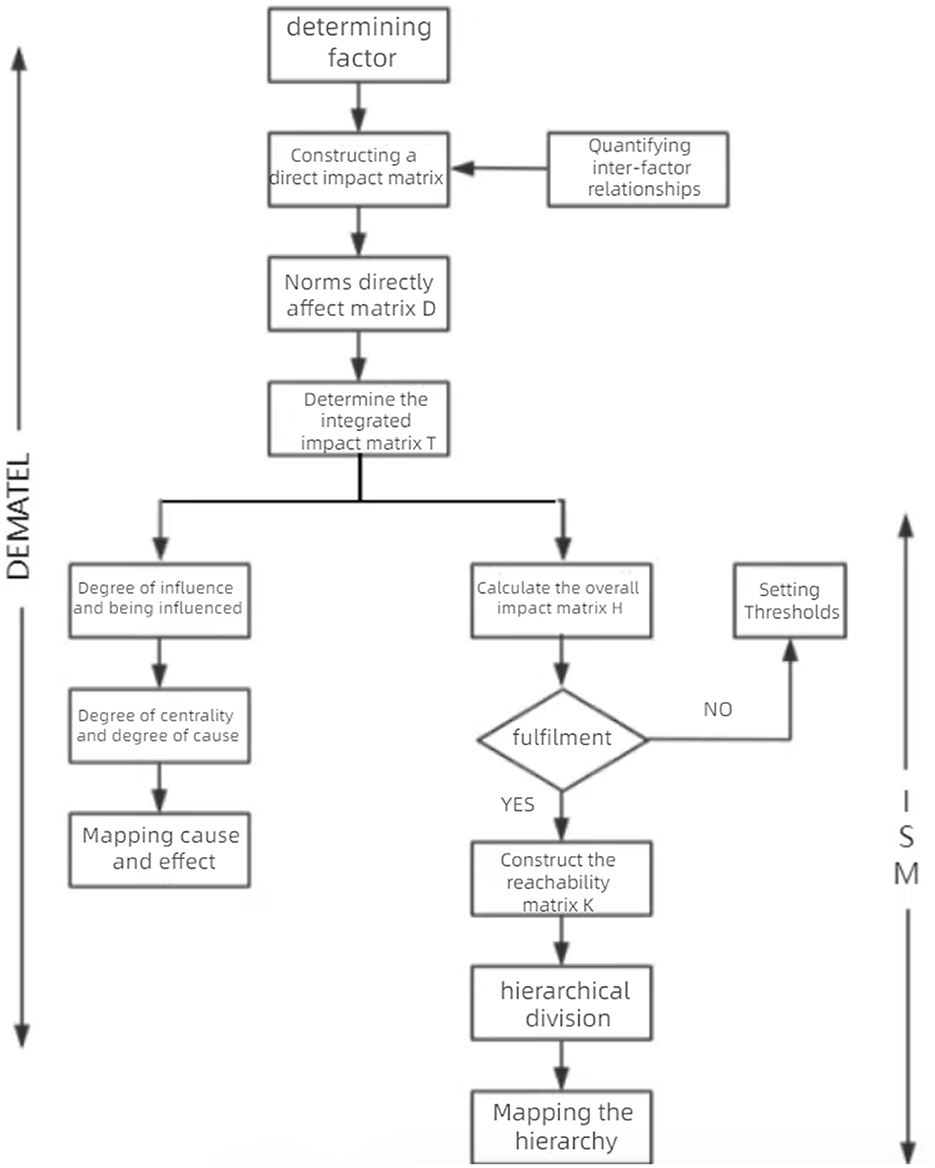

3.4 Introduction to the Grey–DEMATEL–ISM methodology

All types of supply chains have their unique structural characteristics, which reflect significant differences in participating entities, risk propagation mechanisms, and risk consequences. Therefore, when evaluating the financial risks of agricultural product supply chains, it is necessary to comprehensively consider the characteristics of the agricultural product supply chain (Shi et al., 2025), as well as the advantages and limitations of different risk assessment methods, in order to select the most suitable evaluation method. The evolution of supply chain risk assessment methods has gone from early experience dependence, gradually transitioning to data analysis, and now to comprehensive risk management. With the continuous advancement of technology and the deepening of management, various evaluation methods and models have emerged in the academic community, each with its own characteristics. Among the common risk assessment methods, methods such as the fuzzy analytic hierarchy process, fuzzy comprehensive evaluation, OWA operator, entropy weight Technique for Order Preference by Similarity to Ideal Solution (TOPSIS), and grey clustering can effectively evaluate the severity of risk factors, but they lack visual representation of the interrelationships between risk factors. Although the support vector machine algorithm is widely used for evaluating the overall risk of the supply chain, it has limitations in that it cannot rank risk factors or reveal the interaction relationships between risk factors. The ISM method can reveal the interactions between risks by constructing a risk hierarchy chart, making the hierarchy of risk factors clear at a glance. However, it cannot accurately reflect the importance of each risk factor from a numerical perspective. However, methods such as grey relational analysis have limitations in exploring the specific interaction mechanisms between risk factors in depth and have not provided a more detailed analysis. Therefore, in order to deeply analyze the specific relationships between influencing factors and their internal hierarchical structure, this study effectively combines ISM and DEMATEL methods and introduces grey number theory to obtain more comprehensive and accurate analysis results. Grey number theory is a method used to solve inaccurate and incomplete problems (Ding and Li, 2020). It has been widely studied in the field of philosophy and social sciences in recent years. The main advantage of this method is that only approximate ranges are chosen instead of exact values, providing greater flexibility and more realistic results for decision-making (Lin and Wu, 2008). The DEMATEL method is a technique based on graph theory and matrix principles for determining the interactions between factors in a system, also known as decision laboratory analysis (Theodora and Konstantina, 2023). The specific principle is to use the expertise and experience of experts and scholars in the relevant fields to analyze the relationship between the factors in the system of influencing factors. Thus, a direct influence matrix between the influencing factors is established. After the matrix operation, index values of the influencing factors are obtained. The feedback relationship between the factors and the importance of the factors are judged. Interpretative structural model (ISM) is a systematic method used to analyze the structure of complex systems, revealing the relationship between the internal elements of the system and the hierarchical structure of the system, which can clearly show the logical relationship among various elements of the system, the relationship between the interactions, and ultimately identify the key factors. It can effectively make up for shortcomings of the Decision Laboratory Method, which is unable to clearly define the internal structure and logic of factors about the system. The joint model of three methods is suitable for studying the complex dynamic relationship of agricultural supply chain financial risk factors. As shown in Figure 2, the research approach and detailed implementation steps are presented.

The specific steps are as follows:

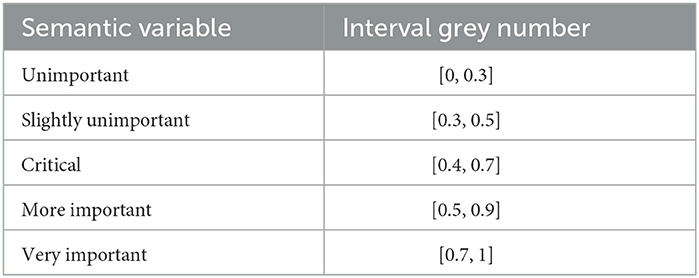

1. Construction of a risk factor indicator system. First of all, for 12 risk indicators, expert group members are invited to adopt the 0–4 scoring system to score the influence relationship among the 12 risk indicators in accordance with the steps of the Decision Laboratory Method (0 means “no influence”; 1 means “weak influence”; 2 means “moderate influence”; 3 means “strong influence”; 4 means “very strong influence”). Combining with the calculation steps of the grey number theory, a system of risk factor indicators is established (0 means “no influence”; 1 means “weak influence”; 2 means “moderate influence”; 3 means “strong influence”; 4 means “very strong influence”). Combining with the steps of grey number theory calculation, a matrix with strong and weak markers is established. The semantic variables of expert evaluation are shown in Table 3.

2. Construction of the grey number matrix. Due to the differences in the work experience, research field and subjective understanding of agricultural supply chain financial risk of different experts and scholars, the experts and scholars are given differentiated weights, and the specific weight semantic variables are shown in Table 4.

3. Calculating the direct influence matrix A. Following the steps of Equations 1–4, this study clarifies the grey number matrix, where k is the number of experts.

Normalizing the upper and lower bounds of the grey number.

Clearing value after normalization of the grey number.

Calculating the clarity value.

Calculating the total weight matrix of k experts, that is, the direct influence matrix A.

where .

4. Calculating the comprehensive impact matrix T. According to Equations 5, 6, the direct impact matrix of agricultural supply chain financial risk factors A is standardized to obtain standardized impact matrix D. Then, according to Equation 7, calculating the comprehensive impact matrix T(T = [tij]n×n). And calculating the influence degree Ri and the influenced degree Cj in the comprehensive influence matrix.

where tij indicates the degree of direct and indirect influence of the element Fi on the element Fj, I is the unit matrix.

5. Calculating the degree of influence Ri and the degree of being influenced Cj. The degree of influence Ri is the sum of the rows of the matrix D, which indicates the degree of influence of the factor Fi on the other factors. The degree of influence Cj is the sum of the columns of the matrix D, which indicates the degree of influence of the factor Fi on the other factors.

6. Calculating the degree of centrality Pi and the degree of cause Ei for each risk factor according to Equations 10, 11.

The sum of influence and influenced is called centrality Pi. The difference between the two is called causality Ei. The degree of centrality indicates the degree of importance and role of the factor in the system, while the degree of cause indicates the causal relationship among factors. There are positive and negative values for the degree of cause of an influencing factor. If positive, it indicates that the factor influences the other factors more than it is influenced by them. Thus, it is a cause factor, while the opposite is true for the effect factor.

7. Calculating the overall impact matrix H = T + I = (hij)n×n.

8. Determine the threshold λ and calculate the reachable matrix K. The threshold λ ε [0,1] is used to eliminate redundant information in complex systems. It can be divided into five types of threshold determination methods: expert opinion-based threshold determination method, simple statistics-based threshold determination method, statistical distribution-based threshold determination method, information entropy-based threshold determination method, and partial factor design principle-based threshold determination method. On the basis of analyzing the research progress and core mechanisms of the five threshold determination methods, it is pointed out through research that there are mainly shortcomings in the existing research process, such as strong subjectivity, low academic consensus, and poor universality of the methods. This article adopts the new method proposed by Sun (2018) for determining DEMATEL thresholds under traditional scales, and it integrates the idea of interval trapezoidal type-2 fuzzy numbers to propose an improved method for determining DEMATEL thresholds under complex system decision-making. This method judges the influence relationship between factors through linguistic variables and replaces traditional point estimation scale values with interval trapezoidal type-2 fuzzy numbers, thereby achieving accurate expression of judgment information. Due to the use of upper and lower trapezoidal membership functions to jointly reflect the preference judgment information of experts, interval trapezoidal type-2 fuzzy numbers not only better reflect the uncertainty and fuzziness of judgment information compared to type-1 fuzzy numbers but also fully utilize the judgment information of experts to more accurately evaluate the objective state of qualitative factors, thereby reducing the subjectivity of decision analysis.

If there is a pathway between the impact factor Fi and the impact factor Fj, then the factor kij = 1, and vice versa. The formula is shown in Equation 12. The reachable matrix K is got.

9. Hierarchy. Determining the set of antecedents Qi and the set of reachables Ri from the reachability matrix K.

where Fdenotes the set of factors Fi.

At that time, and ∀Fj ∈ Ri are the factors in the highest layer. Fj, which is stratified, is eliminated, and the above process is repeated. The risk factors of SCF of agricultural products are stratified sequentially.

10. The Cartesian coordinate system is constructed, and the influence relationship among factors is plotted, which is used to study the center-cause degree of agricultural supply chain financial risk factors. According to the distribution and ranking results of each factor in the coordinate system, the “four degrees” of each factor and the weights of the indicators are comprehensively analyzed to help identify the key factors in the agricultural supply chain financial risk and to put forward corresponding countermeasures and suggestions from the key factors.

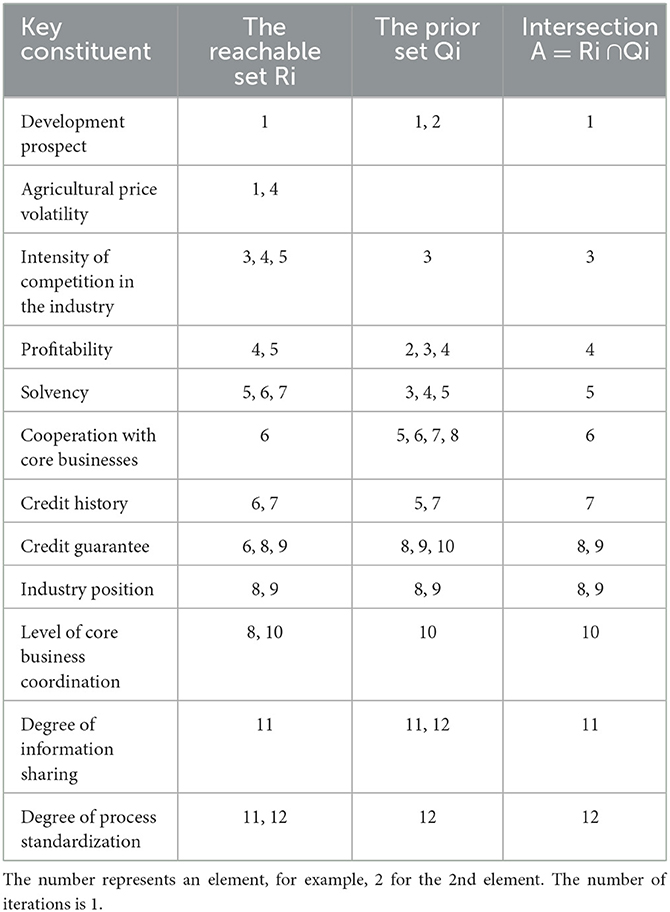

4 Analysis of empirical results

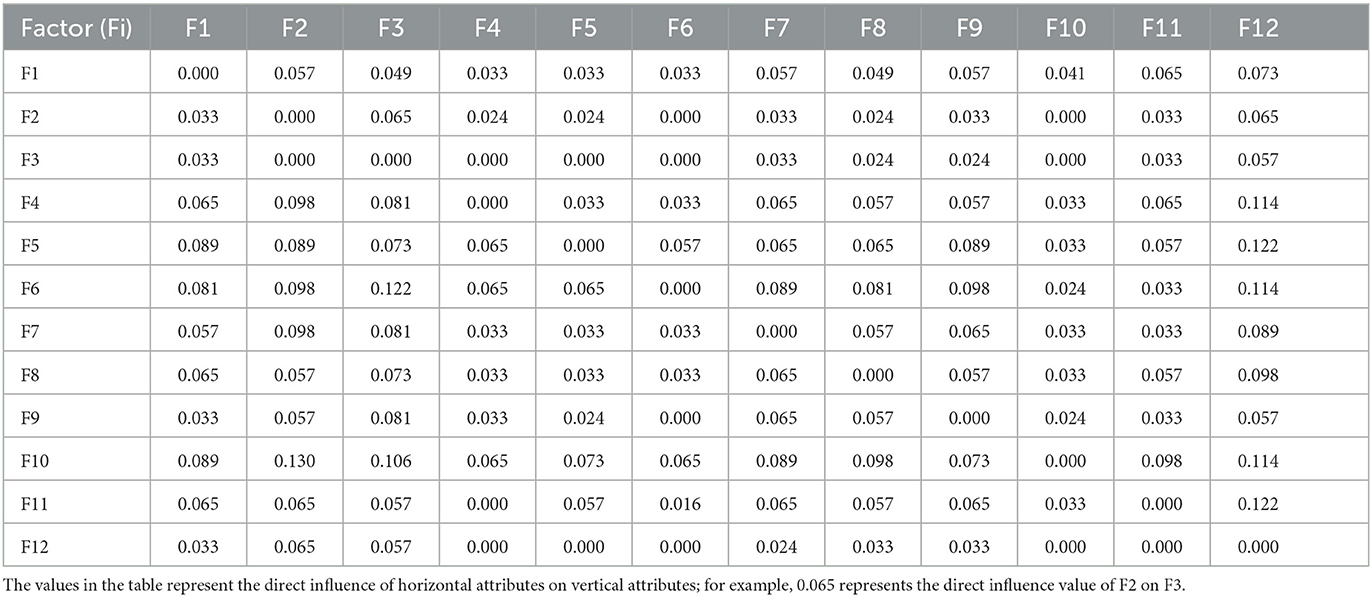

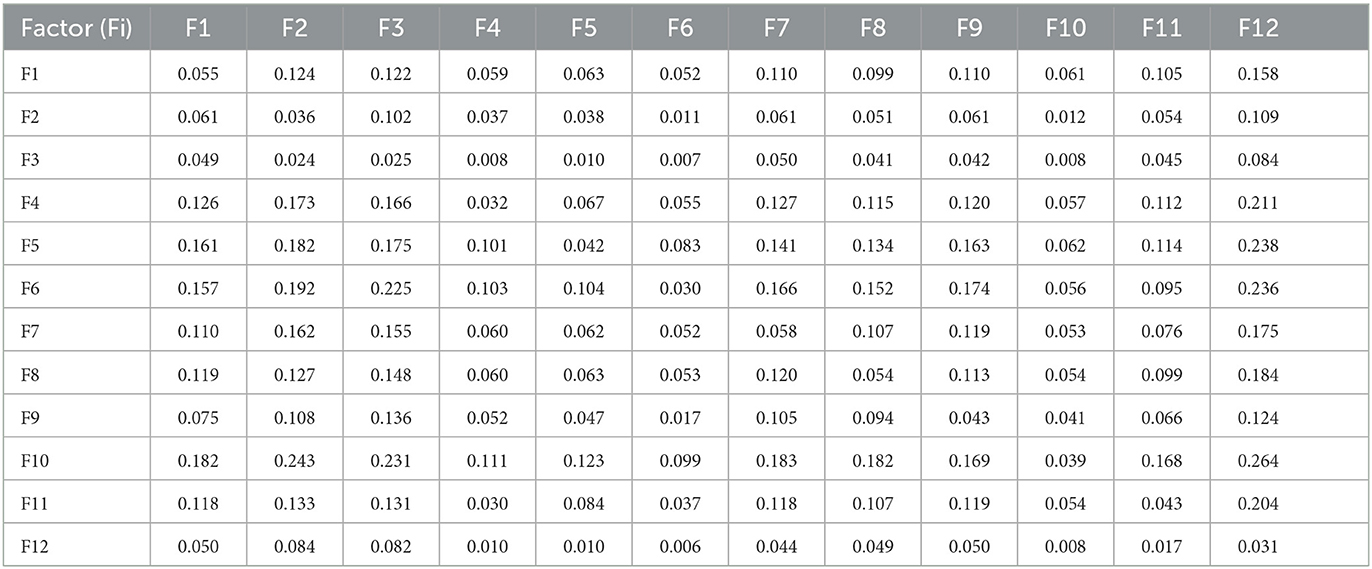

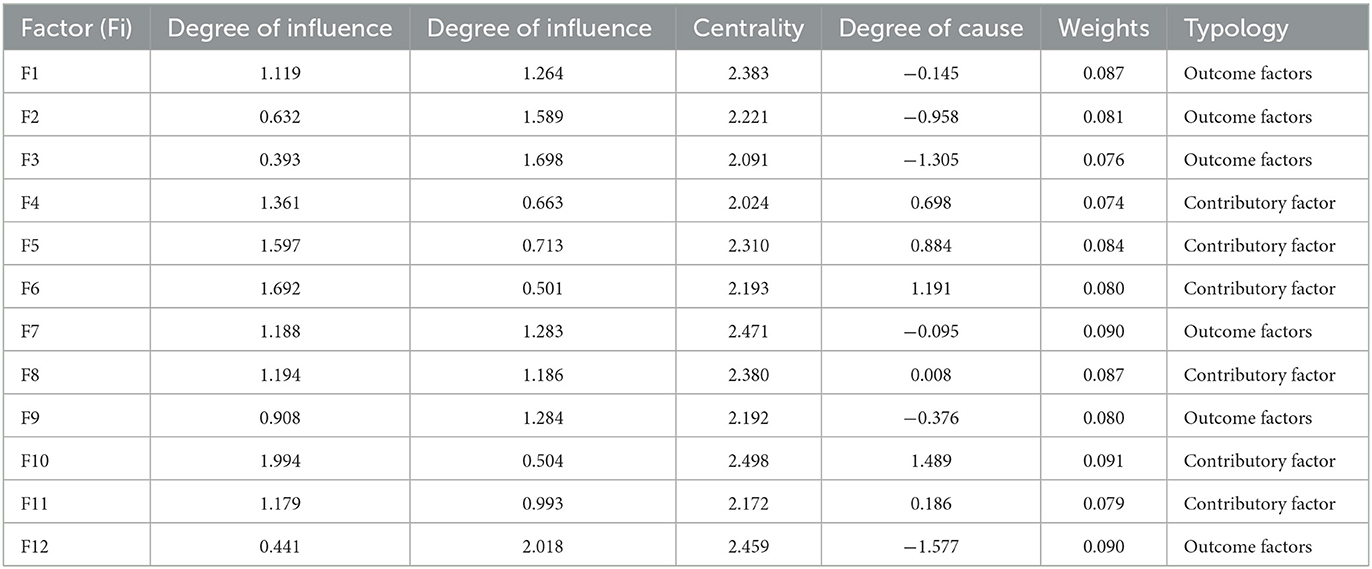

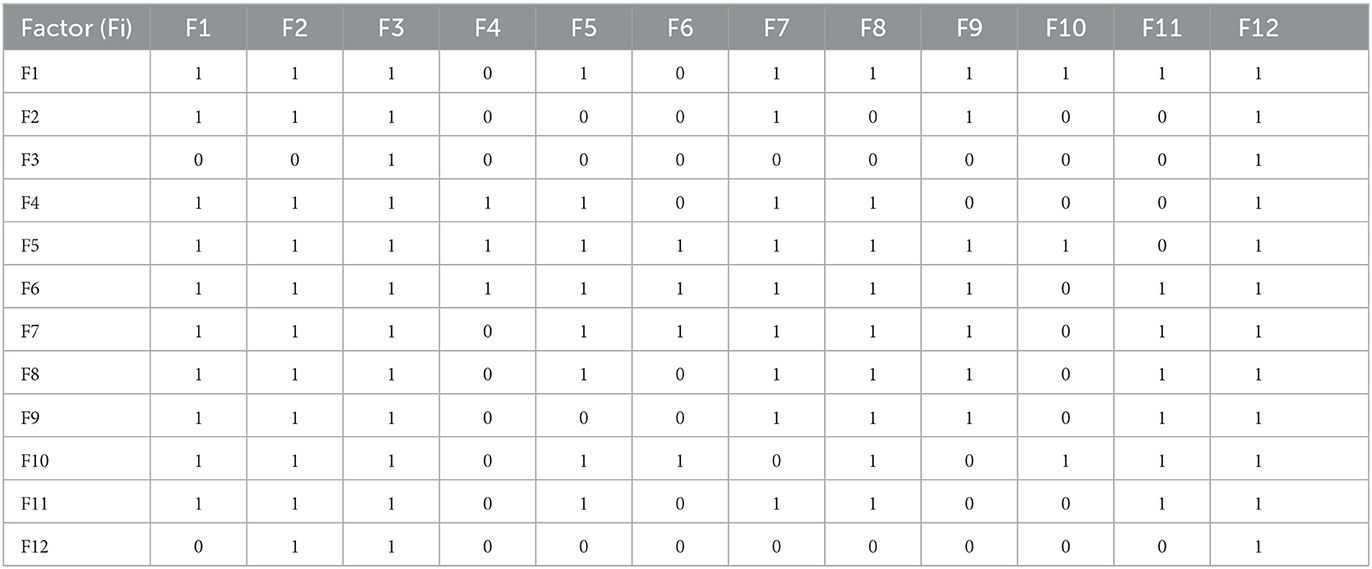

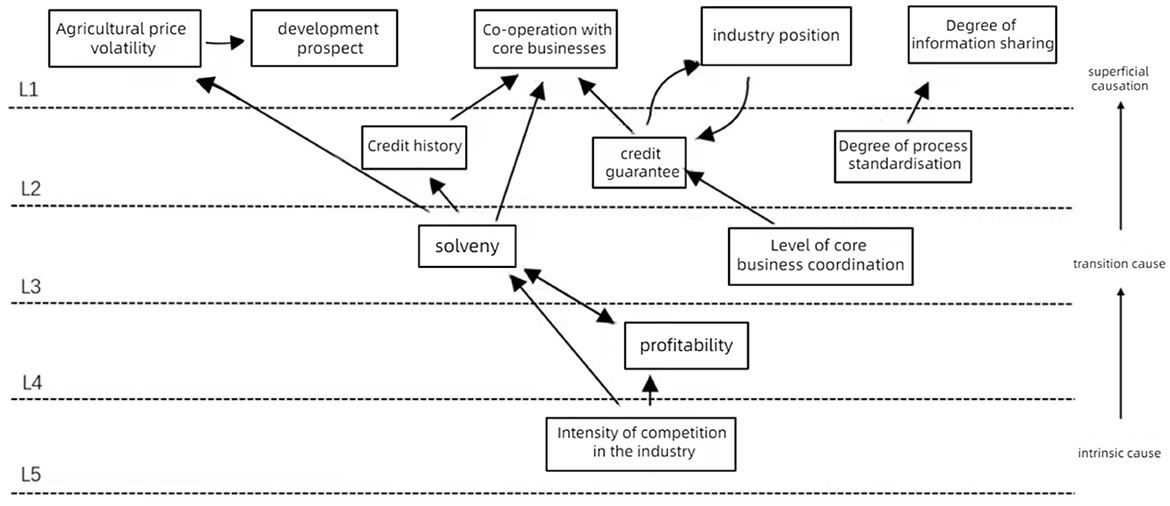

The original 15 experts' rating data are processed based on the above steps to obtain the direct impact matrix A. Different weights are assigned according to the research experience and years of working experience in the relevant fields of the expert group members, including [0.7, 1.0] (very important) for industry experts, [0.4, 0.7] (important) for professors, [0.5, 0.9] (more important) for PhD students, and [0.3, 0.5] (a bit unimportant) for master's degree students. Following the steps of the above formula, the standardized direct impact matrix D is calculated, as shown in Table 5. The integrated impact matrix T, and the DEMATEL calculated indicator values are derived using the SPSSAU software, as shown in Tables 6, 7. According to the steps of the maximum inter-class variance method: construct the comprehensive influence matrix T, and then transform the comprehensive influence matrix T into an ordered set T. Arrange the elements of the comprehensive influence matrix T in descending order to obtain an ordered triplet set ti, j, i, j. Then, divide the ordered set T into sub-datasets and . Take the first T elements in set t as the strong influence relationship set and the remaining elements as the weak influence relationship set . Calculate the inter-class variance between sub-datasets and , where the frequency of each element T appearing in the set is taken as its corresponding probability. Using t = 1 as the initial value, sequentially increase the elements in the strong influence relationship set , solve for the inter-class variance between different sub-datasets, select the maximum inter-class variance and its corresponding strong influence relationship set , and use the minimum influence relationship value in set as the threshold. According to the above steps, the threshold of λ = 0.06 is obtained, and the reachable matrix K is obtained, as shown in Table 8. According tokij in the reachability matrix K, determining the hierarchy of factors L1 {F2, F1, F6, F9, F11}}, L2 {F7, F8, F12}}, L3 {F5, F10}}, L4 {F4}}, and L5 {F3}}.

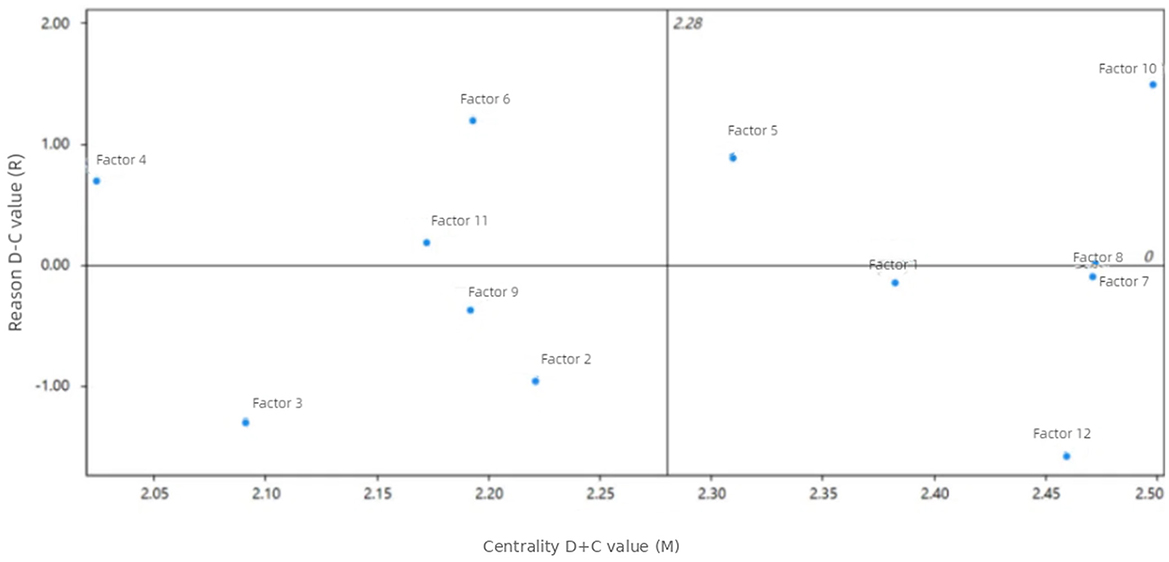

Based on the results of the DEMATEL calculation of the indicator values, the scatterplot of 12 attributes of data elements is plotted, as shown in Figure 3.

4.1 Calculate the relationship between the effects of factors

4.1.1 Impact analysis

The degree of influence of agricultural supply chain financial risk factors, as well as the top five rankings from large to small, is as follows: F10 (level of coordination of core enterprises), F6 (cooperation with core enterprises), F5 (solvency), and F4 (profitability). The level of influence degree indicates the degree of influence of this element on other elements. The larger the value of the element represents, the higher the degree of influence, reflecting the role of this element in the system and the importance of the magnitude and the higher the value, the higher the influence of the element, reflecting the role and importance of the element in the system. The coordination level of core enterprises has an important impact on agricultural supply chain financial risk by influencing information flow, resource integration efficiency, strategic synergy, risk control and market adaptability. Core enterprises utilize their high-quality credit ratings to prompt financial institutions to carry out financing business for SMEs. The stable operation of the supply chain and whether the upstream and downstream enterprises in the supply chain have a stable development environment are related to the profitability and repayment status of the enterprises. The frequency of cooperation between the financing enterprise and the core enterprise and the frequency of cooperation can reflect the closeness of the relationship between the enterprise and the core enterprise. Financing enterprises establish a solid cooperative relationship with core enterprises, so as to improve financing efficiency and enhance the stability of their own business.

4.1.2 Analysis of the degree of influence

F12 (degree of process standardization), F3 (intensity of industry competition), F2 (price volatility of agricultural products), and F9 (industry status) are the most highly influenced by all factors and are more susceptible to other factors. The degree of standardization of agricultural supply chain finance processes is affected by a variety of factors, such as the specificity of agricultural production, the diversity of participants, the lack of information sharing and transparency, the regulatory and policy environment, and technological applications and innovations, and the lack of uniform standards and norms. The intensity of industry competition is affected by environmental factors, such as economic environment, policy influence, market demand, and enterprises' own competitiveness, especially in the highly competitive agricultural industry, which requires agribusinesses to invest more capital to maintain their competitiveness, leading to an increase in the demand for enterprise financing and an increase in financing risk. In the case of increased competition in the industry, the price fluctuation of agricultural products increases, which in turn affects the value of collateral. In addition to market risk, the production activities of enterprises also have obvious geographical differences, seasonal characteristics and complexity, and agricultural products are vulnerable to natural disasters, changes in market supply and demand, and losses during transportation and storage, causing price fluctuations, which affect the quality of assets in agricultural supply chain finance and increase financial risks.

4.1.3 Cause degree analysis

The cause degree index is divided into positive and negative, with >0 being the cause factor and less than 0 being the result factor. Its factors act in the opposite direction of the impact on the agricultural supply chain finance characteristics are also different. Causal factors of agricultural supply chain finance risk factors (Ei>0) are F10 > F6 > F5 > F4 > F11 > F8 in order of magnitude, among which F10 (level of coordination with core enterprises), F6 (cooperation with core enterprises), and F5 (solvency) are the most dominant causal factors, which have more impacts on other factors. The result factors of agricultural supply chain finance risk factors (Ei>0) are F12 < F3 < F2 < F9 < F1 < F7 in order of size, and these factors are easily influenced by other factors. Among them, F12 (degree of process standardization), F3 (intensity of industry competition), F2 (price volatility of agricultural products), and F9 (industry status) are the most susceptible outcome factors to be influenced by other factors.

4.1.4 Centrality analysis

The significance of the center degree is the degree of importance of a certain element in the system; the size of the value reflects the effect of the influence of the element, which can effectively reflect the size of the role of each factor in the agricultural supply chain financial risk factors. The top five in order are F10 (core enterprise coordination level), F7 (credit history), F12 (process standardization degree), F1 (development prospects), and F8 (credit guarantee). The coordination level of core enterprises is specifically manifested in the management of transaction authenticity as well as the participation willingness of each node enterprise in the supply chain, and the timely identification, assessment and response to potential risks in the supply chain. Achieving resource integration and optimizing the allocation of supply chain resources. A long-term and stable strategic cooperative relationship with other members of the supply chain is established. Leading the development direction of the whole supply chain, extending its own technology, resources and other advantages to the whole supply chain, and improving the competitiveness of the supply chain and the ability to resist risks. Credit history is an important basis for evaluating the credit status of individuals or enterprises and has important reference value for financial institutions.

4.2 Hierarchy

4.2.1 Hierarchical division of risk factors

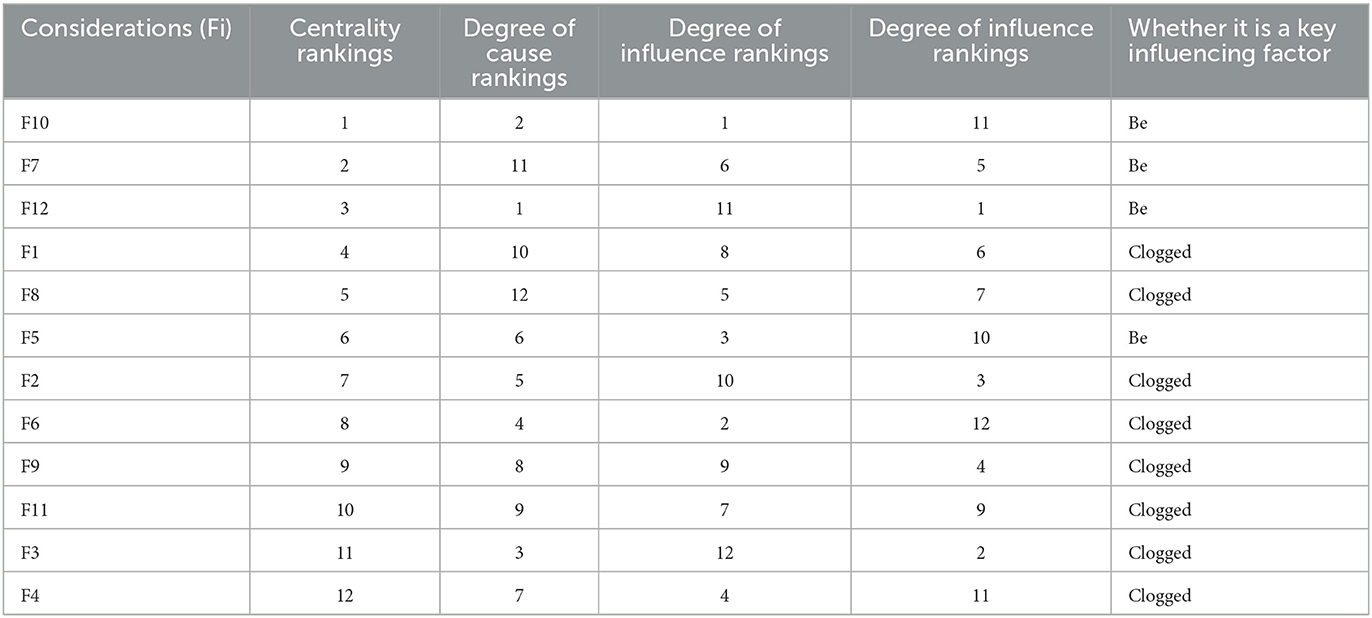

According to the reachable matrix K, this study analyzes the hierarchy of agricultural supply chain financial risk factors. The hierarchical structure of influencing factors is established as follows. According to Equation 13, the reachable set and the prior set of each factor are obtained from the reachable matrix K, and then the intersection of the two sets is obtained. The results are shown in Table 9.

According to the results of the hierarchical classification, the intensity of competition in the industry of L5 is the factor of the root cause layer of agricultural supply chain finance risk. The intensity of competition in the agricultural industry affects the market competition and price fluctuation of agricultural supply chain finance, participants' credit status, supply chain stability and risk management ability. The competition in the agricultural industry is intense, while the market price fluctuates greatly, and some participants may default or withdraw from the market due to poor operation or other reasons. Therefore, this jeopardizes the overall credit status and stability of the supply chain. There is a higher demand for the risk management ability of the participants. Among the transition causative factors of L4 and L2, the F4 profitability and the F5 solvency of the financing enterprises are the most closely related to other factors, as shown in Table 8. The centrality and causality of two factors are shown in Table 8, and the centrality and causality of twofactors are shown in Table 10. The two factors are also ranked higher in center degree and cause degree. Profitability and solvency are key factors in assessing the long-term stability and growth potential of financing enterprises. Financial institutions usually pay attention to the enterprise's gearing ratio, current ratio, quick ratio, and other indicators. These indicators can reflect an enterprise's asset structure, liquidity, and short-term solvency. Agribusinesses with strong solvency may be more likely to obtain financing methods, such as loans or bond issuance. Therefore, financing enterprises need to focus on improving their profitability and solvency in their daily operations, optimizing the financing results, and effectively reducing the risks caused by the surface-level causation in L1.

The reachability matrix shown in Table 8 provides insights into the hierarchical structure of risk factors in agricultural supply chain finance. By analyzing the relationships among these factors, we identify key drivers of risk propagation and system instability.

The results indicate that F3 (intensity of competition in the industry) serves as a root cause factor, influencing multiple downstream variables. Additionally, F4 (profitability) and F5 (solvency) exhibit high centrality and causality, indicating their critical role in financial risk stability.

The hierarchical structure derived from the reachability matrix suggests that industry competition, the financial health of SMEs, and core enterprise coordination are among the most influential factors in agricultural supply chain finance risk. This classification provides a foundation for constructing an interpretive structural model (ISM) to further analyze risk interactions. The hierarchical structure and reachability matrix provide a clear classification of risk factors in agricultural supply chain finance. As shown in Table 10, risk elements such as “Intensity of competition in the industry” (L5) serve as intrinsic causes, driving the financial conditions of SMEs. Meanwhile, factors like “Degree of information sharing” (L1), and “Agricultural price volatility” (L1) represent the ultimate consequences of these risks, as shown in Figure 4.

The solvency and profitability of enterprises, positioned at the transitional levels (L3–L4), play a crucial role in linking intrinsic risk factors with their superficial manifestations. These financial factors act as key determinants of risk propagation within the supply chain.

In the following section, we will conduct a detailed analysis of key risk factors to evaluate their impact on financial stability and risk mitigation strategies.

4.2.2 Analysis of key risk factors

The key risk factors are identified by combining the rankings of influence degree, influenced degree, cause degree, and center degree of influence, as well as the hierarchical structure of the ISM model. The key factor identification is carried out by the method that at least three of the four indicators are ranked in the top 50% of the agricultural supply chain financial system, and the key factors of the agricultural supply chain financial risk are finally identified, and the results are shown in Table 8, which are the level of coordination of the core enterprise (F10), the credit history record (F7), the degree of standardization of the process (F12), and the ability to repay the debt (F5), which indicates that these factors have a greater impact on the other factors have a greater impact and are in the key position of the whole factor system.

Specifically, the level of coordination of core enterprises (F10) and the degree of process standardization (F12) are ranked in the top 50% of the “four degrees” indicators, which are in the middle of ISM's explanatory structure model and are able to connect most of the factors. The level of coordination of core enterprises (F10) affects the stability and efficiency of the whole SCF; improving the degree of supply chain standardization (F12) is the core of reducing financial risks and improving the efficiency of financial services and is therefore recognized as a key factor. Debt-servicing ability (F5) and credit history (F7) rank relatively low in terms of the degree of cause and the degree of being influenced, but rank high in terms of the degree of centrality and the degree of influence. The solvency of a financing enterprise is an important aspect in assessing the financial health of an enterprise and is a key reference factor for financing institutions. Credit history affects firms' credit assessment and determines borrowing capacity. Their importance is also further reflected in the ISM explanatory structure model and therefore identified as a key factor.

5 Application case of financial risk assessment in agricultural product supply chain

D Enterprise was founded in 2015 and is headquartered in Hangzhou. It is a comprehensive enterprise with sustainable production and circulation of grain and agricultural products as its core. Through the full chain layout of “base planting-intensive processing low-carbon distribution,” enterprises can reduce resource consumption and postpartum losses and enhance the climate resilience of staple food and vegetable supply in the Yangtze River Delta region. Specific practices include building 2,300 acres of planting bases in Anhui, Yunnan, and other areas, adopting rice vegetable rotation and water-saving irrigation techniques to improve land use efficiency; The United Academy of Agricultural Sciences screens stress-resistant varieties to reduce dependence on external sources. In addition, two of the company's fresh-keeping warehouses use condensate water recovery devices to save 1,200 tons of water per year, and one freezer uses waste heat recovery to provide heating for the sorting workshop. D company also adopts the “base-community” direct supply model, achieving direct delivery within 24 h to 90% of communities in Hangzhou through its own logistics fleet, reducing carbon emissions in the circulation process by about 30%. As a comprehensive agricultural product enterprise, D company lacked systematic assessment and identification of potential risks in the early stage, lacked experience in risk management, and did not establish a dedicated department. In recent years, with the increasing awareness of risk prevention among management, enterprises have begun to build and improve risk management systems and warning mechanisms. During the epidemic, enterprises faced challenges such as market demand fluctuations and supply chain disruptions, resulting in a year-on-year decrease of 40% in sales and a record-high inventory backlog rate. Business was impacted, exposing the problem of insufficient risk management preparation.

To this end, D company accelerates the improvement of risk management, comprehensively sorts out and identifies potential risk points in business processes, and forms a preliminary system. However, the scope of risk management is not comprehensive enough, focusing only on production risks, market risks, and other aspects of risk control. Moreover, the risk management methods are not rigorous enough, and the control effect is limited. Based on the needs of enterprise risk management, after communication, D company adopts the agricultural supply chain financial risk assessment model constructed by this research institute for risk assessment and management. Following the model operation process, the enterprise conducts consultation and scoring of expert group members through a combination of online and offline methods. The expert group includes the heads of the sales, marketing, logistics, warehouse, and finance departments of the enterprise, production base managers and technical personnel (online), as well as seven university professors in the field of agricultural supply chain finance, to ultimately complete the risk assessment work. Obtain the initial evaluation matrix after integrating questionnaire data. Ultimately, key risk factors are identified based on the ranking of impact, influence, cause, centrality, and impact of risk assessment, as well as the hierarchical structure of the ISM model. Using the method of identifying key factors by ranking at least three of the four indicators in the top 50% of the agricultural product SCF system, the key factors of agricultural product SCF risk were ultimately identified, namely credit guarantee (F8), credit history (F7), process standardization level (F12), agricultural product price volatility (F2), and debt repayment ability (F5). This indicates that these factors have a significant impact on other factors and are in a critical position in the entire factor system, which is consistent with the key factor results identified by the risk control model in the previous section. This provides a basis for D enterprise to develop targeted agricultural product SCF risk prevention and control measures in the future. Based on the research results, this study provides reference opinions for D company from the following aspects: based on the research results, this study provides reference opinions for D company from the following aspects:

5.1 Enterprises standardize their own business management to ensure a good credit history

D Enterprise standardizes its own business management to ensure a good credit history record. Although SCF has been introduced as a financing model, causing financial institutions to no longer overly focus on the operational status of financing companies, companies with excellent credit records are still more favored by financial institutions. On the one hand, financing enterprises should continuously improve their management level, strengthen their awareness of financial risk control in daily operations, avoid high debt operations, optimize product portfolios, reduce costs, and enhance profitability based on actual conditions. On the other hand, enterprises should maintain a good credit record, repay principal and interest on schedule, and prevent overdue or default situations. At the same time, we should actively build a harmonious relationship between banks and enterprises, fully cooperate with financial institutions' post-loan management work, and provide accurate and timely information and data. Through the establishment of a mutual trust mechanism, both parties can jointly plan financing plans, risk management strategies, and post-loan management measures to ensure the safe and efficient use of credit funds. In addition, by introducing third-party credit rating agencies to conduct credit ratings on enterprises, objective and fair credit evaluations can be obtained, enhancing the credit image of enterprises and increasing the trust of financing institutions in enterprises.

5.2 Strengthening credit risk prevention and control of core agricultural enterprises

Financial institutions should conduct in-depth reviews of the authenticity of transactions and the credit status of core enterprises to ensure that the evaluation basis is sufficient and objective and should not slacken off on the review work because of their special status. In order to reduce credit risk, core enterprises need to build a sound internal control system to ensure the standardization and effectiveness of business processes. This includes improving the internal management system, strengthening the risk identification, assessment, monitoring and reporting mechanism, and enhancing the execution and effectiveness of internal controls. At the same time, it should also strengthen the management of suppliers and establish a scientific supplier evaluation and selection mechanism. When selecting suppliers, comprehensive consideration should be given to their product quality, price level, delivery stability, and after-sales service quality to ensure the stability and reliability of the supply chain. It is crucial to establish a set of perfect risk early warning mechanism centered on core enterprises. Through real-time monitoring of operating conditions and credit status of each enterprise in the supply chain, paying close attention to the development trend and potential risks of the supply chain, and taking effective measures to prevent and control. Through the introduction of advanced information technology, optimizing of business processes, upgrading the quality of personnel and other measures, which constantly improve and optimize its own credit risk prevention and control system.

5.3 Improving digital infrastructure construction and information sharing mechanisms

Improve the construction of digital infrastructure and information-sharing mechanisms. Give full play to the leading role of core enterprises in data resource processing and utilization, promote the upgrading of software and hardware infrastructure of upstream and downstream business entities in the supply chain, strengthen the construction of cold chain logistics facilities for D enterprise, and ensure the quality and safety of agricultural products during transportation and storage. By systematically optimizing the supply chain and ensuring that all facilities have interconnectivity and security protection capabilities, the informationization level of agricultural product supply chain management can be comprehensively improved. In terms of technological application, artificial intelligence technology is adopted to achieve intelligent decision-making in the supply chain. By using advanced algorithms and models to accurately predict demand, optimize inventory structure, and achieve automatic scheduling functions, the response speed and operational efficiency of the supply chain can be improved. In addition, core enterprises can establish a unified and open digital platform to closely connect all participants in the supply chain, achieve real-time information sharing and collaboration, and effectively reduce repetitive labor and resource waste. In terms of enhancing information credibility, technologies such as blockchain can be implemented to provide transparent and traceable transaction records. By leveraging the decentralized and tamper-proof features of blockchain, we ensure the authenticity and reliability of information in the supply chain, effectively address information asymmetry issues and reduce the risk of fraud and forgery.

5.4 Accelerating the standardization of supply chain processes and giving full play to the supporting role of agricultural insurance

Accelerate the standardization of supply chain processes and leverage the supportive role of agricultural insurance. First, specific agricultural supply chain standards should be formulated based on the characteristics of agricultural production and circulation, and a sound supervision system for agricultural product quality and safety should be established. Agricultural Internet of Things technology should be promoted to achieve real-time monitoring and full process monitoring of agricultural product production, processing, and circulation, ensuring the quality and safety of agricultural products. Second, actively building an agricultural information platform. Promote the integration of production and sales between agricultural enterprises and consumers and provide information services such as market analysis and price guidance to provide reference for platform users' decision-making. At the same time, Company D should actively participate in international agricultural cooperation and exchanges, introduce advanced international agricultural technologies and supply chain management experience, and improve supply chain standards and competitiveness. Finally, fully leverage the risk protection provided by agricultural insurance, diversify the risks brought by uncontrollable factors such as natural disasters and diseases, enhance the ability to resist risks to improve farmers' production enthusiasm and income levels, optimize the risk assessment mechanism of SCF, improve financing efficiency, meet the diversified needs of various entities in the supply chain, and promote the sustainable and healthy development of agricultural product SCF.

Overall, considering the complexity and variability of SCF risks, as well as the particularity of the agricultural product industry, this study is only a preliminary exploration in this field. Although the Grey–DEMATEL–ISM method combines multiple analysis tools, there are still some research shortcomings. First, although the article verifies the effectiveness of the model of case analysis, in practical applications, more factors, such as enterprise size and regional differences, may need to be considered. These factors may have an impact on the application effectiveness of the model. Second, the financial risks of the agricultural product supply chain are dynamically changing, and the model may focus more on static risk assessment. How to make the model better adapt to the dynamic risk environment, concretize measures, and make them more operable is an area that needs further improvement in research.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Ethics statement

The studies involving humans were approved by Business School, Jiyang College, Zhejiang A&F University. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

XZ: Data curation, Methodology, Writing – original draft, Visualization, Funding acquisition, Conceptualization, Investigation. CY: Methodology, Software, Writing – original draft, Investigation, Formal analysis, Validation. PY: Supervision, Writing – review & editing, Software, Validation, Project administration, Resources. PZ: Writing – review & editing, Validation, Supervision.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work was funded by Major Humanities and Social Sciences Research Projects in Zhejiang Higher Education Institutions (Grant Number: 2024QN139), Key Project of Education Science Planning in Zhejiang Province (Grant Number: 2025SB133), and Special Funding Support from China Pearl University (Grant Numbers: JYZZ202509 and JYZY202502).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Chen, Y. (2023). Research on the innovation path of agricultural supply chain finance of commercial banks under the background of agricultural industry internet. Southwest Finance 98–108.

David, B., and Marija, B. (2007). Measuring the supply chain risk and vulnerability in frequency space. Int. J. Prod. Econ. 108, 291–301. doi: 10.1016/j.ijpe.2006.12.017

Diabat, A., Govindan, K., and Panicker, V. (2012). Supply chain risk management and its mitigation in a food industry. Int. J. Prod. Res. 50, 3039–3050. doi: 10.1080/00207543.2011.588619

Ding, Y. Y., and Li, Z. (2020). Research on identification of constraints of innovation and entrepreneurship education for college students in China based on Grey-DEMATEL. Hubei Soc. Sci. 151–157. doi: 10.13660/j.cnki.42-1112/c.015265

Fang, H., and Meng, F. P. (2015). An empirical study of credit risk in supply chain finance based on logistic modeling–taking agricultural listed companies as an example. J. Shanxi Agric. Univ. 14, 1158–1164.

Gu, N., and Liu, Y. (2018). Micro-analytical characterization of the development of rural inclusive finance in China. Agric. Technol. Econ. 48–59. doi: 10.13246/j.cnki.jae.2018.01.005

Guo, J., and Gu, L. Y. (2022). Can agricultural supply chain finance effectively ease the financing constraints of enterprises? - an empirical study on the participation of agriculture-related enterprises in precision poverty alleviation. Oper. Res. Manage. 31, 112–118.

Jiang, B. H., and Wen, T. (2021). Research progress of agricultural supply Chain finance (ASCF). Agric. Econ. Issues 84–97. doi: 10.13246/j.cnki.iae.2021.02.008

Li, G. R. (2020). Research on credit risk causation of agricultural supply chain finance: systematic framework and empirical analysis-780 survey data from five provinces and districts in the middle and upper reaches of the Yellow River. Finance Econ. Theory Pract. 41, 17–24. doi: 10.16339/j.cnki.hdxbcjb.2020.03.003

Li, G. R., and Zhao, S. X. (2020). Research on credit risk evolution mechanism and management of supply chain finance in the context of resumption of labor and production-based on SEM-SD model. Bus. Res. 112–122. doi: 10.13902/j.cnki.syyj.2020.05.013

Liang, Y. B., and He, J. (2023). Research on risk analysis and prevention of digital supply chain finance-based on the perspective of promoting financing of small and medium-sized enterprises. North Finance 58–62. doi: 10.16459/j.cnki.15-1370/f.2023.02.016

Lin, C. J., and Wu, W. W. (2008). A causal analytical method for group decision-making under fuzzy environment. Expert Syst. Appl. 34, 205–213. doi: 10.1016/j.eswa.2006.08.012

Liu, Q., Ying, C., and Wang, C. F. (2011). Research on the application of supply chain financing model in agribusiness. Agric. Econ. Issues 32, 92–98+112.

Liu, X. W., and Tan, X. X. (2022). Research on credit risk management of agricultural supply chain finance under the leadership of high-quality development. Agric. Econ. 104−105.

Pan, Y. X., and Hu, Z. R. (2020). Exploration of risk generating factors in agricultural supply chain finance - based on explanatory structural model. Rural Econ. 103–110.

Peng, L. (2015). The main features of agricultural supply chain financial risk and the basic principles of risk prevention. Financ. Theory Pract. 36, 20–24. doi: 10.16339/j.cnki.hdxbcjb.2015.06.004

Shi, X., Liu, Y., Ma, K., Gu, Z., Qiao, Y., Ni, G., et al. (2025). Evaluation of risk factors affecting the safety of coal mine construction projects using an integrated DEMATEL-ISM approach. Eng. Constr. Archit. Manage. 32, 3432–3452. doi: 10.1108/ECAM-02-2023-0103

Song, H. (2019). Development trend of supply chain finance in China. China Circ. Econ. 33, 3–9. doi: 10.14089/j.cnki.cn11-3664/f.2019.03.001

Song, H., and Chen, S. J. (2016). Evolution of supply chain finance and internet supply chain finance: a theoretical framework. J. Renmin Univ. China 30, 95–104.

Song, J. R., and Li, D. (2023). Risk analysis of cross-border e-commerce supply chain based on FUZZY-ISM structural model. Eng. Manage. Sci. Technol. Front. 42, 75–82.

Sun, J. (2018). Research on Threshold Determination Method for DEMATEL in Complex Systems (Master's thesis). Kunming University of Science and Technolog, Kunming.

Sun, Z. Y., and Xu, X. Y. (2021). Research on risk assessment of agricultural supply chain finance -based on GA-BP neural network model. Res. Tech. Econ. Manage. 78–82.

Theodora, K., and Konstantina, G. (2023). Examining the barriers to electric truck adoption as a system: a Grey-DEMATEL approach. Transp. Res. Interdiscip. Perspect. 17:100746. doi: 10.1016/j.trip.2022.100746

Wang, K. Q., Jiang, T., Liu, H. M., and Liu, G. C. (2018). Research on the efficiency of chinese rural financial institutions-based on the comparative perspective of listed agricultural commercial banks and village banks. Agric. Technol. Econ. 20–29. doi: 10.13246/j.cnki.jae.2018.09.002

Wang, L. K., Zhang, X. B., Qin, W. W., and Liu, C. (2023). A new method to measure the risk value of pledges in supply chain finance based on MIDAS-SVQR. China Manage. Sci. 1–13.

Wang, T., Lan, Q., and Chu, Y. (2013). Supply chain financing model: based on China's agricultural products supply chain. Appl. Mech. Mater. 380–384, 4417–4421. doi: 10.4028/www.scientific.net/AMM.380-384.4417

Wu, J., Yang, Y. X., Zou, L. X., and Ke, D. (2023). Research on blockchain-based information sharing model of agricultural supply chain finance for small farmers. Intell. Sci. 41, 97–106. doi: 10.13833/j.issn.1007-7634.2023.09.011

Wu, Q. L., and Tian, Y. C. (2022). Research on risk factors of prefabricated building supply chain based on AHP-DEMATEL-ISM model. J. Eng. Manag. 36, 29–34.

Wu, X., Zhou, X., and Sun, S. (2023). Research on evaluation of financial risks in agricultural product supply chains based on an improved DEMATEL Method. Agric. Rural Stud. 1:0005. doi: 10.59978/ar01010005

Wu, X. F., and Huang, X. (2022). Impact of industrial internet on the profitability of strategic emerging industries. Soft Sci. 1–16. doi: 10.13956/j.ss.1001-8409.2024.06.11

Wu, Z. Y., Zhu, H. M., and Zhu, J. S. (2020). Impact of the new crown pneumonia epidemic on financial operations and policy recommendations. Economy 1–6+137. doi: 10.16528/j.cnki.22-1054/f.202003001

Xia, K. (2023). Research on the logical basis, development trend and main models of agricultural supply chain finance in China. Financ. Dev. Res. 89–92. doi: 10.19647/j.cnki.37-1462/f.2023.04.012

Xu, P. (2016). Research on risk prevention of online agricultural supply chain finance under the perspective of factor analysis. J. Agric. For. Econ. Manag. 15, 674–680. doi: 10.16195/j.cnki.cn36-1328/f.2016.06.083

Xu, P. (2018). Research on agricultural supply chain financial risk prevention based on structural equation modeling. J. Southwest Univ. Polit. Sci. Law 20, 128–135.

Yang, J., and Fang, Z. H. (2017). Research on financing model and credit risk of agricultural small and medium-sized enterprises under the perspective of supply chain finance. Agric. Technol. Econ. 95–104. doi: 10.13246/j.cnki.jae.2017.09.010

Keywords: digital technology, agricultural supply chain, supply chain finance, risk evaluation, hierarchical modeling

Citation: Zhou X, Yang C, Ye P and Zhang P (2025) Research on risk evaluation of agricultural supply chain finance based on Grey–DEMATEL–ISM. Front. Sustain. Food Syst. 9:1609873. doi: 10.3389/fsufs.2025.1609873

Received: 11 April 2025; Accepted: 26 May 2025;

Published: 19 June 2025.

Edited by:

Sukoluhle Mazwane, University of Mpumalanga, South AfricaReviewed by:

Munibah Munir, Ibadat International University, PakistanUrmisha Das, Lincoln University College, Malaysia

Copyright © 2025 Zhou, Yang, Ye and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Peijie Ye, MTg4NjEyOTk3NzdAMTYzLmNvbQ==; Peicheng Zhang, MjAwMzAxMjBAemp5Yy5lZHUuY24=

Xi Zhou

Xi Zhou Chuang Yang2

Chuang Yang2 Peijie Ye

Peijie Ye